In today’s fast-paced world, managing finances and planning a budget efficiently is crucial. One effective way to keep track of your bills and streamline your financial management is with a bill tracker template.

You can easily manage your monthly income, budget and bill payments with a bill tracker worksheet. If you’re in need of a budget planner that allows a comprehensive overview of your payments, cash flow, and bills, then a bill tracker spreadsheet can help you.

Table of Contents

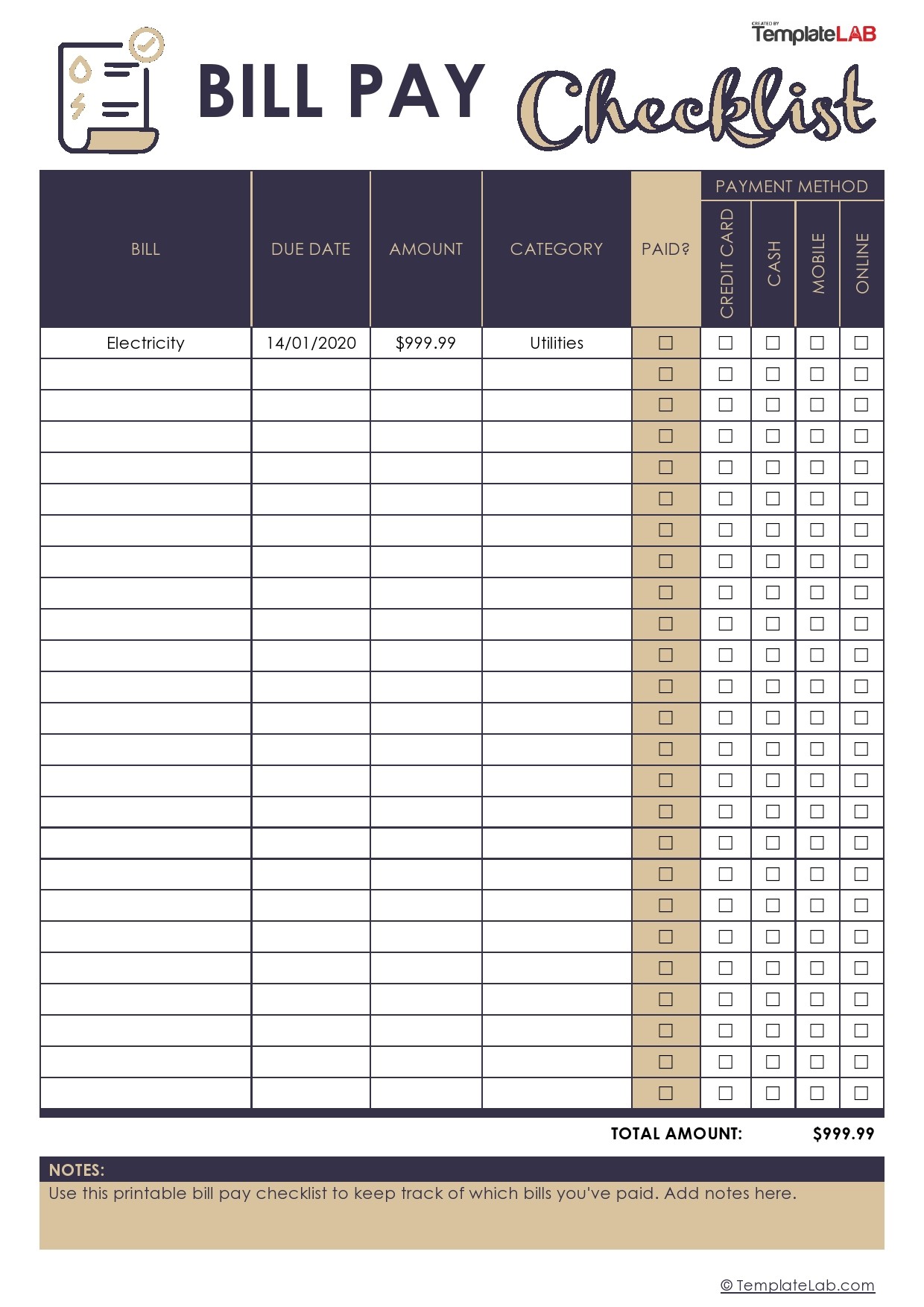

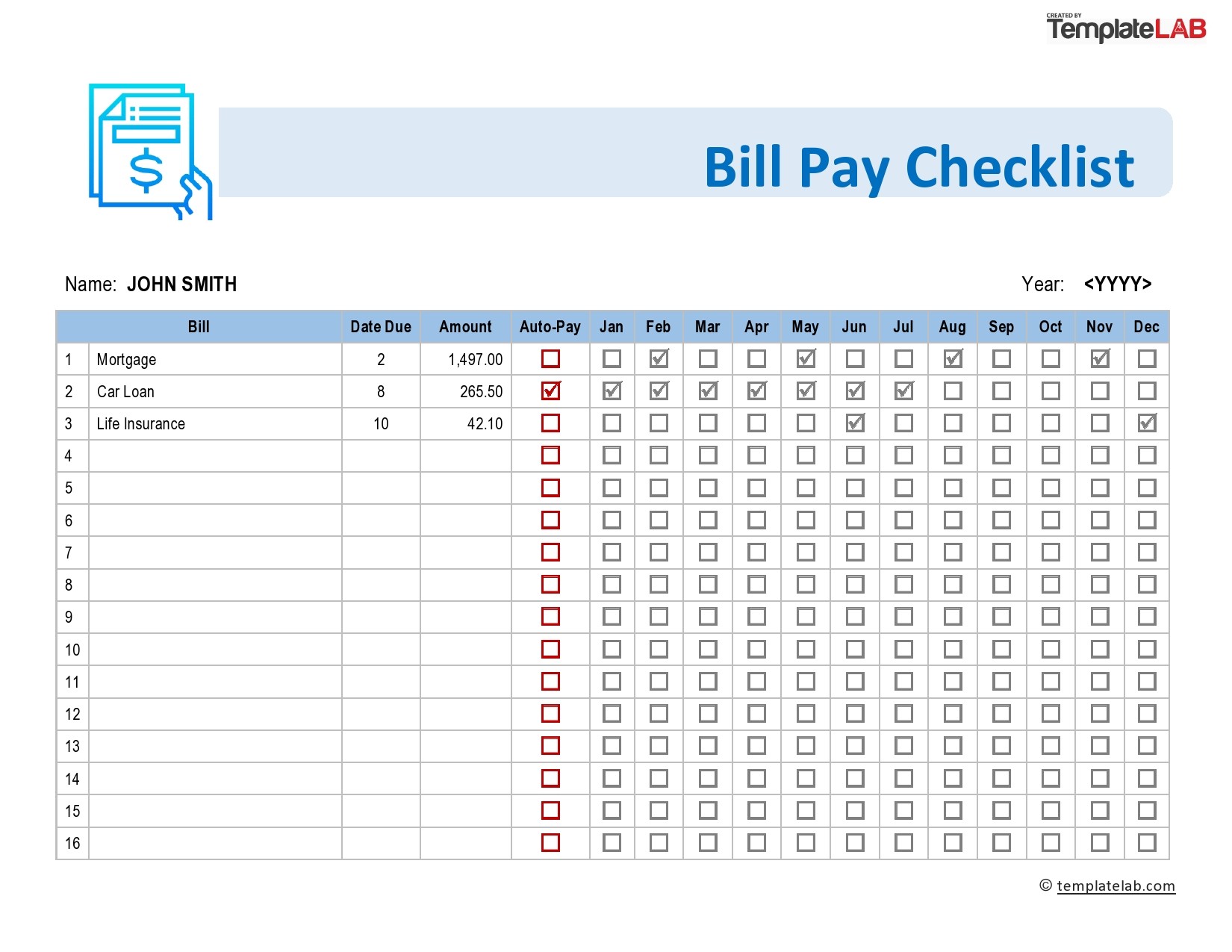

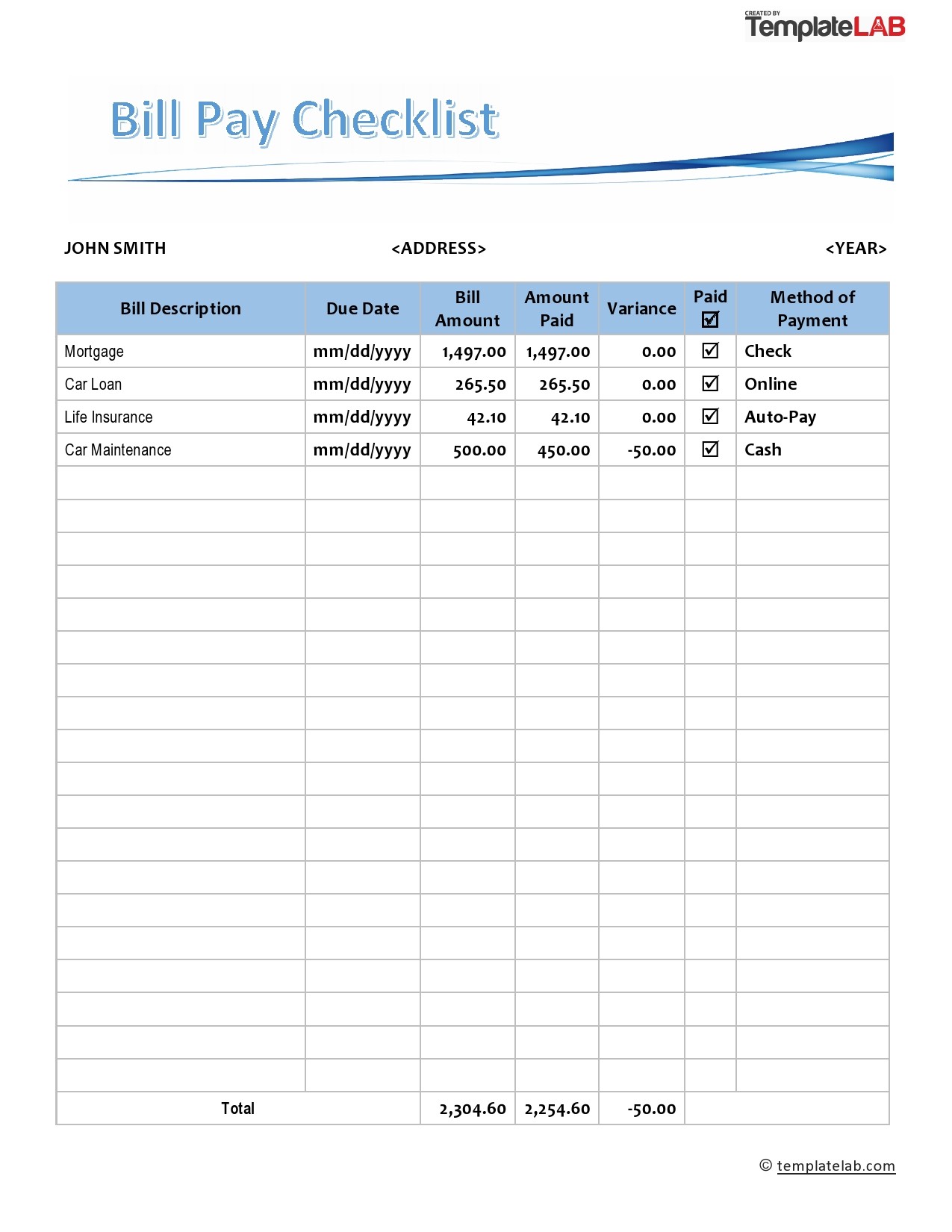

Bill Pay Checklists

What is a Bill Tracker?

A bill tracker worksheet is a tool designed to help individuals monitor and manage their money systematically. It typically takes the form of a spreadsheet or document, enabling users to input their bills, due dates, payment amounts, and additional information such as savings or a budget planner.

The beauty of a a bill tracker worksheet is that provides a clear snapshot of all your bills in one place, making it easier to plan and stick to a monthly budget. This means that you won’t be shocked by any overdue bills, and you can keep track of every bill payment due date at a glance.

Bill Calendars

When to Use a Bill Tracker Template

A bill tracker template can be a valuable tool in various financial situations. Here are some instances where using a bill tracker template can be particularly beneficial:

- Starting a New Budget:

If you’re in the process of creating a monthly budget, wanting to begin saving money more effectively, or trying to better manage your finances, a bill tracker worksheet can help you get organized and gain clarity on your monthly expenses. - Multiple Bills and Due Dates:

If you have multiple bills with different due dates, it can be challenging to keep track of them all. A bill tracker worksheet provides a centralized location where you can enter and monitor all of your bill payments, ensuring you never forget a due date. - Irregular Payment Dates:

Some bills may have irregular due dates, such as quarterly or semi-annual payments. A bill tracker template allows you to input these irregular payment dates and set reminders so that you won’t forget any important dates, allowing you to plan and budget accordingly. - Shared Finances:

If you share financial responsibilities with a partner, roommate, or family member, bill tracker spreadsheets can keep everyone informed about upcoming bills and ensure that payments are made on time. It promotes transparency and accountability in financial management. - Tracking Expenses and Identifying Patterns:

Using a bill tracker worksheet can help you track your expenses over time and identify patterns in your spending habits. You can essentially use a bill tracker worksheet as a budget planner to help you manage your finances. Tracking your spending can be valuable for making adjustments to your budget and finding areas where you can potentially save money. - Debt Repayment:

If you’re actively paying off debts, a bill tracker worksheet can help you stay on top of your repayment plan. By including your debt payments in the tracker, you can monitor progress, track interest charges, and ensure you don’t forget any payment dates. - Long-Term Financial Planning:

Bill tracker spreadsheets can also be useful for long-term financial planning. By keeping a record of your monthly bills and cash flow, you can analyze trends, identify areas for improvement, and make informed decisions about your financial future. Spreadsheets such as these are excellent if you’re trying to save money and budget more efficiently.

What to Include in a Bill Tracker Template

When creating your bill tracker template, it’s essential to include the necessary elements that will effectively track your bills and allow you to plan your budget, whether that’s on a monthly or weekly basis.

You can create bill tracker spreadsheets by hand, or, for an even easier approach, you can use a spreadsheet maker such as Google Sheets or Microsoft Excel. All of these features can be easily included using spreadsheet-making software.

Here are the key components to consider when designing your bill tracker spreadsheet:

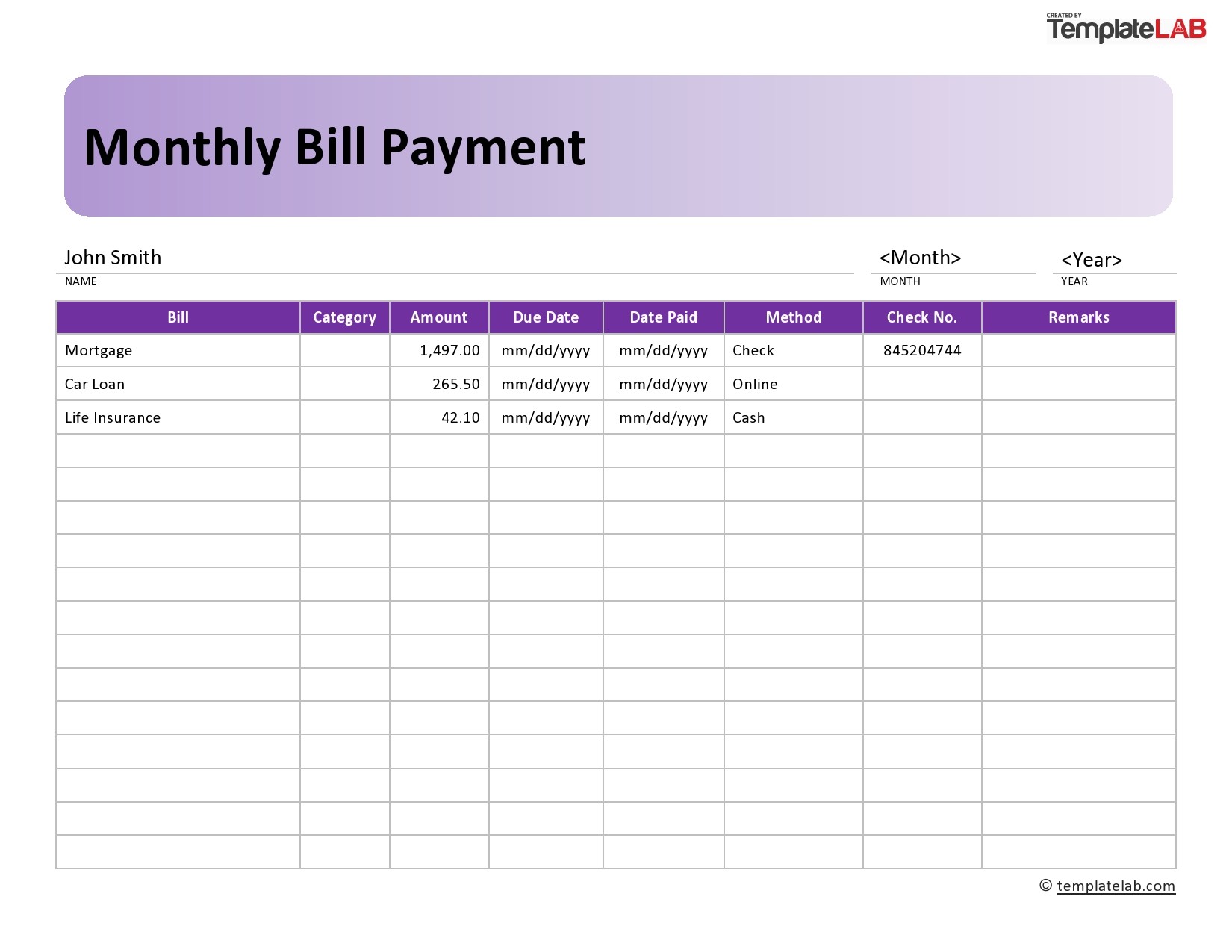

- Bill Details:

Bill Name or Description: Clearly label each bill or expense to streamline identification. For example, “Rent,” “Electricity,” “Phone Bill,” etc.

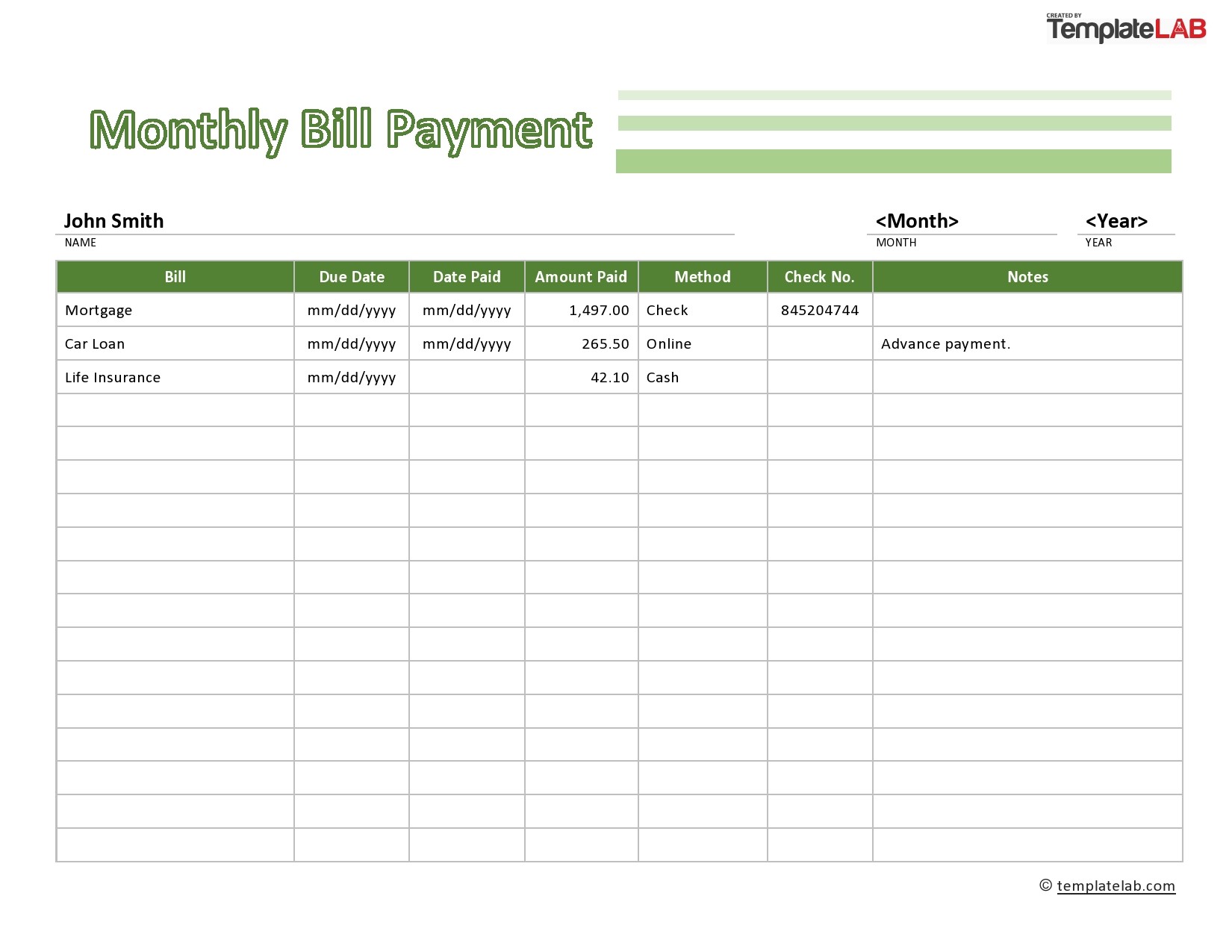

Due Date: Indicate the date by which payments must be made. This ensures you never miss a deadline and can avoid any late fees.

Payment Amount: Specify the total amount to be paid for each bill, including any additional charges or fees.

Method of Payment: Document how you plan to pay each bill, whether it is through cash, debit card, credit card, or online payment platforms.

Confirmation or Reference Numbers: Keep track of any relevant reference numbers or confirmations associated with monthly bill payments. This can be helpful for future reference or in case of any disputes. - Payment Status:

Paid/Unpaid Indicator: Mark whether a bill has been paid or persists as unpaid. This allows you to easily track which bills are outstanding.

Paid Date or Scheduled Payment Date: Record the exact date of payment or schedule future payment dates. Tracking payment dates can assist with cash flow management.

Late Payment Indicator: Track if any bills have been paid after the due date. This allows you to monitor any potential late fees and take necessary action to avoid them in the future.

Late Fee Assessment: Note down any additional charges incurred due to late payments. This helps you identify areas where you need to improve your payment discipline. - Account Information:

Account Name: Identify the account or service for which the bill is due. For example, if tracking your utility bills, the account name could be “Electricity Provider” or “Water Company.”

Account Number: Store the account number associated with the bill, making it easily accessible when needed. This can be helpful when contacting customer service or handling any billing inquiries.

Login Credentials (if applicable): Store usernames and passwords for online accounts. This saves time by having all the information in one place and ensures secure management of your account access details.

Contact Information: Include contact details of the biller, such as phone numbers or email addresses, for easy reference. This allows you to quickly reach out to the relevant parties in case of any issues or queries. - Reminders and Notifications:

Alarm or Notification Setting: Set reminders to ensure bills are paid on time. This can be in the form of reminders on your phone, email notifications, or using reminder apps.

Alert Preferences: Specify how you prefer to receive notifications, such as email, app notifications, or traditional mail. Choosing the most convenient method for you ensures you never miss important payment-related information.

Benefits of Using a Bill Tracker

- Improved Financial Management

A bill tracker provides an organized and comprehensive overview of your bills, enabling better financial management. With all the relevant details readily available, you can analyze your expenses, identify any unnecessary or excessive costs, and make informed decisions and adjustments to your budget accordingly. - Timely Payments and Reduced Late Fees

One of the primary advantages of using a bill tracker is ensuring timely payments. By keeping track of due dates and utilizing reminders, you can avoid missing deadlines and incurring unnecessary late fees or penalties. By paying bills on time, you maintain a good credit history and financial standing. - Enhanced Budgeting and Expense Tracking

A simple template facilitates effective budgeting and expense tracking. By recording your bills, payment amounts, and due dates, you can accurately plan your budget and allocate funds accordingly. This helps you prioritize your expenses, avoid overspending, and work towards achieving your budgeting goals. - Stress Reduction and Peace of Mind

Managing bills can be stressful, especially when multiple payments occur throughout the month. A bill tracker eliminates the need to remember every due date and worry about missing payments. By having a clear system that notifies you of upcoming bills, you can experience reduced stress and gain peace of mind. - Better Decision-Making

A money tracking spreadsheet will give you valuable insights into your spending habits and bill payments. This data allows you to make informed decisions regarding your budget, whether you decide to budget monthly or weekly. You can evaluate the necessity of certain bills, identify areas to reduce expenses, or negotiate better terms with service providers. - Improved Organization

With a bill tracker, all your bills and related details are stored in one place, promoting better organization. You no longer need to search through stacks of paper or numerous online accounts to find specific bills. This streamlined approach saves time and eliminates the risk of losing track of important payment information. - Flexibility and Customization

Creating your own bill tracker template allows for customization based on your unique needs and preferences. You can design the template to suit your financial situation, such as adding additional columns for tracking savings goals, budget planning, debt payments, or recording irregular expenses.

Monthly Bill Templates

How to Create a Bill Tracker Template

Creating a bill tracker template doesn’t require advanced technical skills or specialized software. You can easily create a bill tracker worksheet and budget planner using spreadsheet software such as Google Sheets or Microsoft Excel.

Here’s a step-by-step guide to crafting your personalized bill tracker:

- Choose the Right Software or Spreadsheet Application:

Select a software or spreadsheet application that suits your preferences and familiarity. If you have a Google drive account, Google sheets is a popular and easy choice to get started when creating your bill tracking worksheet. Other popular choices include Microsoft Excel or Apple Numbers. Ensure that the chosen software meets your requirements for creating and managing templates.

Using spreadsheet software such as this will enable you to create either one simple template, or several budgeting spreadsheets, so that you can easily access your budget, savings, and bill payments at a glance. - Determine the Layout and Structure:

Before diving into the template creation process, decide how you want your bill tracker to appear. Consider the number of columns and rows needed in the spreadsheet to accommodate the bill details and other relevant information. Allocate space on your spreadsheet for additional features if desired, such as graphs or summaries. - Start with a Basic Bill Tracker Template:

Begin by setting up the basic structure of your bill tracker template. Include column headers such as “Bill Name,” “Due Date,” “Amount,” “Payment Status,” etc. Leave room for additional columns that you may want to include later on the spreadsheet. - Add Bill Details Columns:

Customize your template by adding specific columns for bill details. Based on your requirements, include columns such as “Method of Payment,” “Confirmation or Reference Numbers,” “Late Payment Indicator,” etc. These additional columns provide comprehensive information and ensure nothing is overlooked. - Customize Formulas and Functions:

Utilize formulas and functions provided by your chosen software or learn basic formulas to automate calculations within your template. For example, you can use formulas within Google Sheets to calculate the total amount owed, track bill payment percentages, or project future payment schedules. Automating calculations within your spreadsheet saves time and minimizes errors. - Incorporate Visual Aids and Conditional Formatting:

Use visual aids such as color-coding, icons, or conditional formatting in your spreadsheets to make your bill tracker more visually appealing and easier to interpret at a glance. For example, use green to indicate paid bills and red for overdue payments. Conditional formatting can highlight upcoming due dates in yellow to grab your attention. - Test and Refine Your Template:

Double-check the accuracy and functionality of your bill tracker worksheet by entering sample data and testing calculations. Ensure that formulas are working correctly, and automatic calculations are accurately displaying results. - Save, Back Up, and Share Securely:

Save your spreadsheet on your computer or in the cloud to prevent data loss. Choose a location that is easily accessible, and where you can regularly save any updates or changes. Consider backing up your data in multiple locations to avoid any potential loss or corruption. If sharing the template, ensure sensitive information is adequately protected.

Utilizing a bill tracker worksheet is a simple yet powerful technique for streamlining your financial management. By keeping all your bills organized and easily accessible, you can improve financial management, make timely payments, and enjoy greater control over your budget.

You can download and print a bill tracking spreadsheet to provide you with a comprehensive overview of your finances. Start using a bill tracker spreadsheet today and experience the peace of mind that comes with effortless bill management.