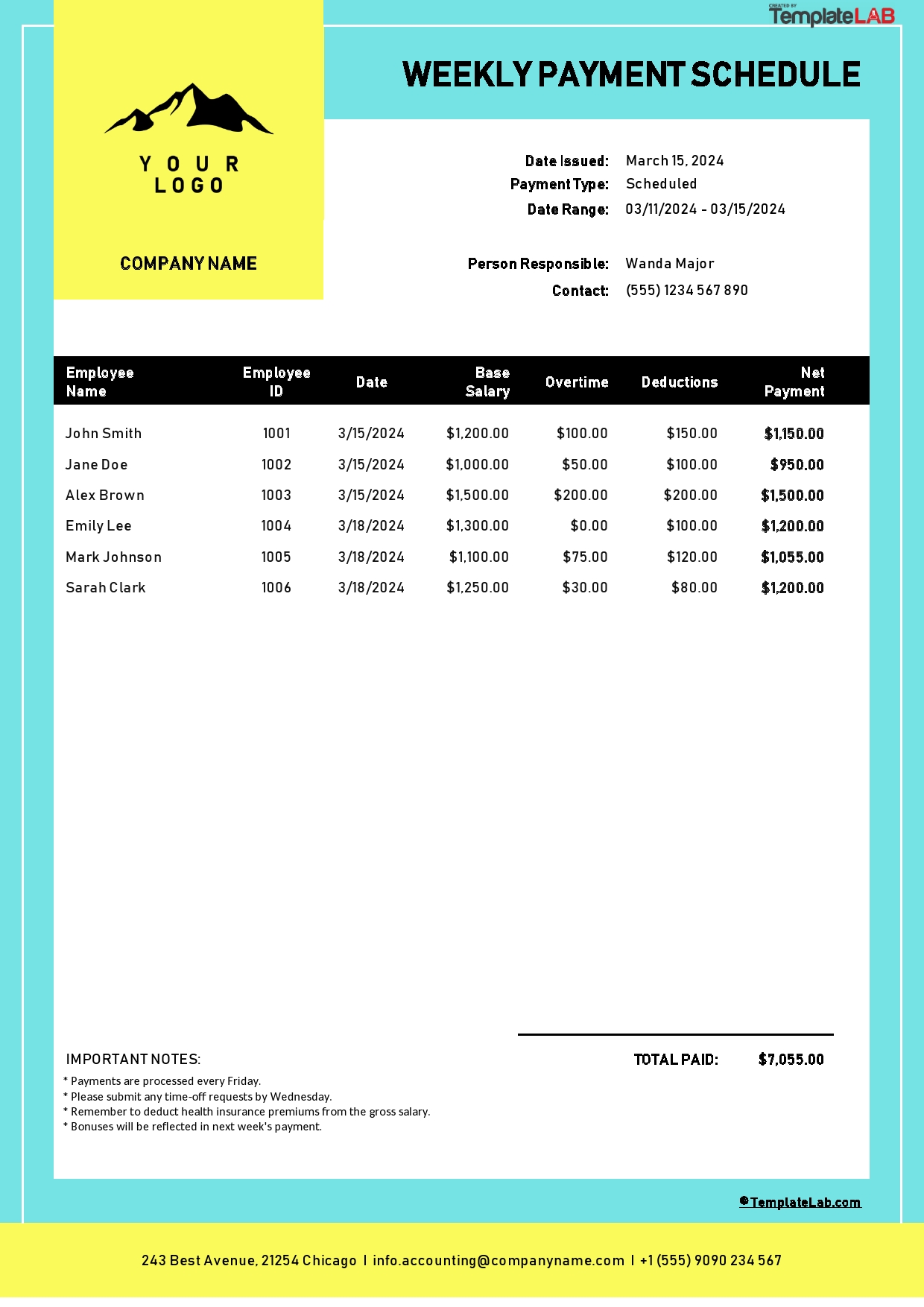

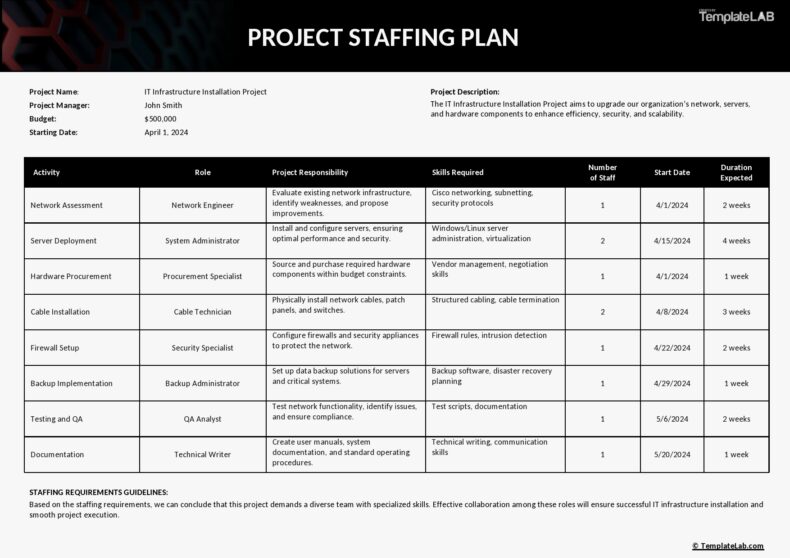

Large companies employ huge numbers of workers according to labor demands. Some individuals get contracted to make payments on behalf of another business. Each employee might have joined the company on varying dates making their paydays fall on different dates.

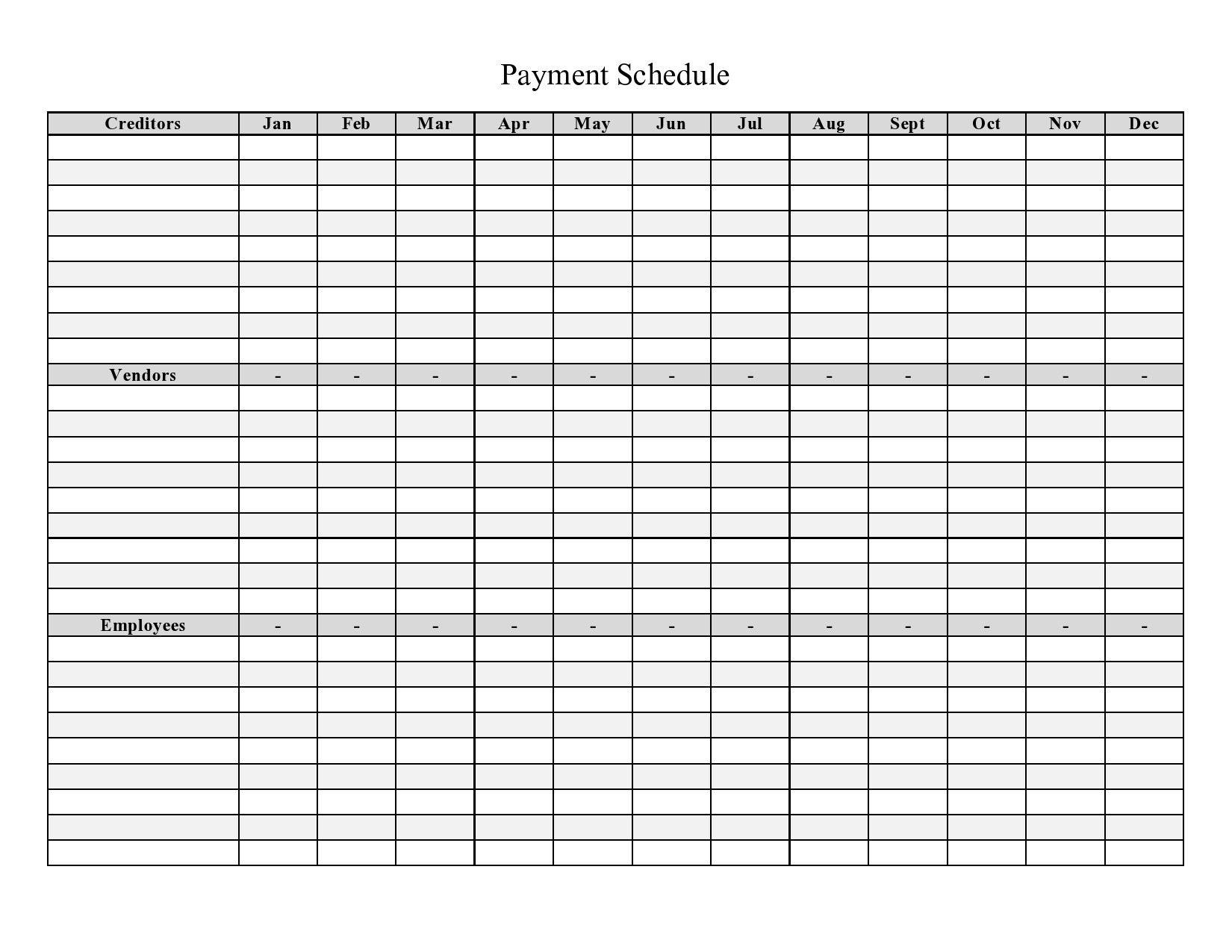

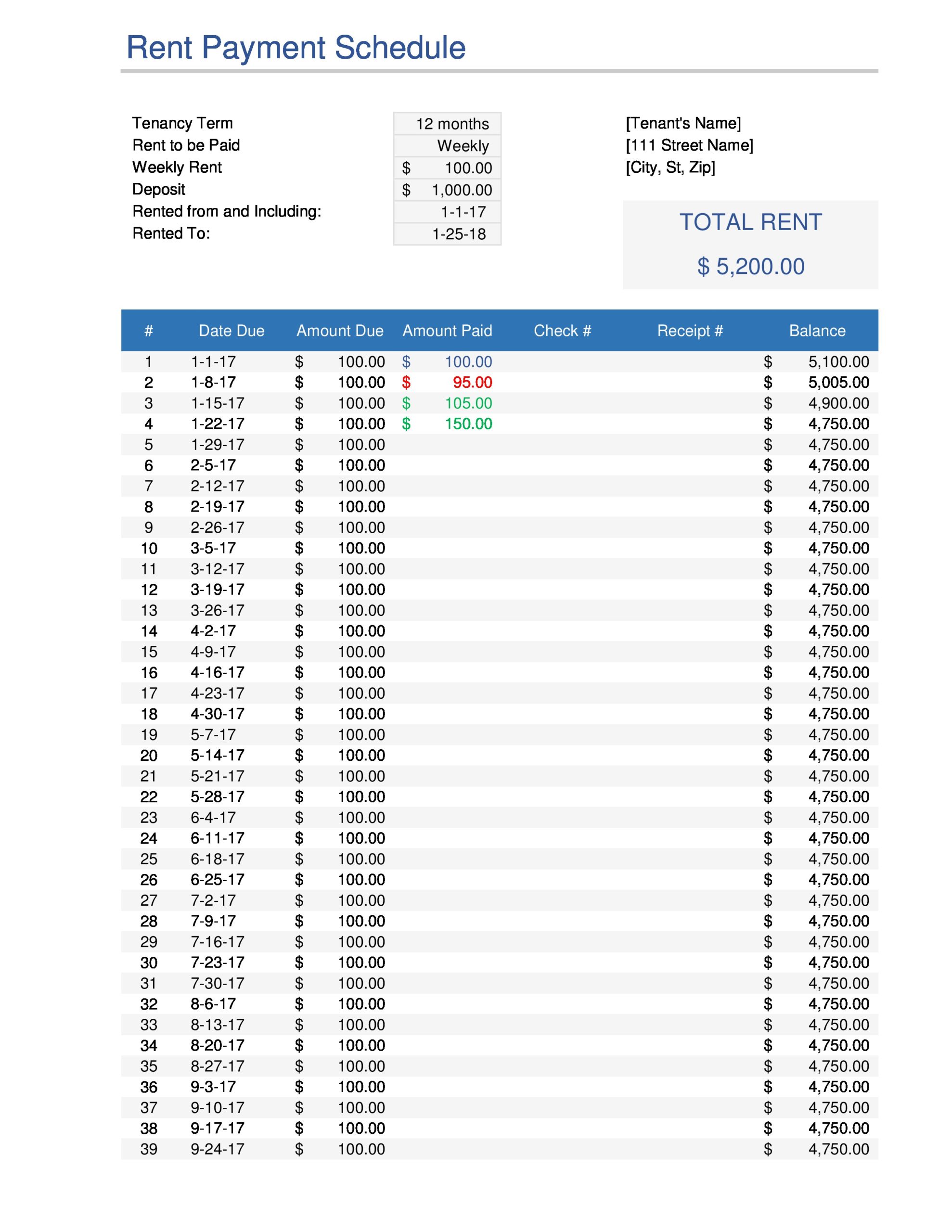

The best way to track records on which employee joined at what date, the amount due to them, how many workers were on duty at a certain date, and so on is by using a payment schedule that can be conveniently prepared using a payment schedule template.

Table of Contents

- 1 Payment Schedule Templates

- 2 Why is the payment schedule template important?

- 3 How is the payment schedule calculated?

- 4 Monthly Payment Schedule Templates

- 5 What is a payment schedule in construction?

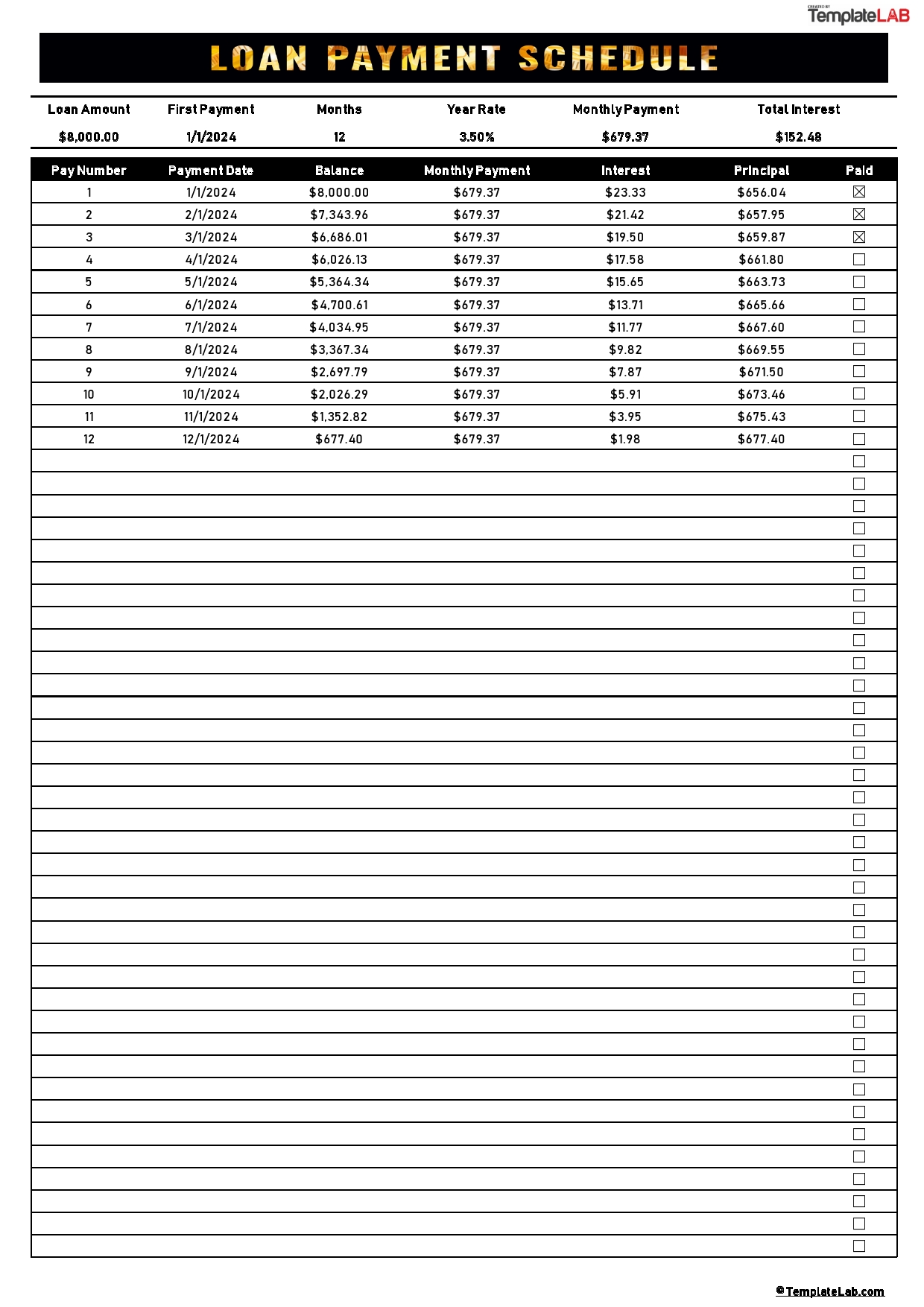

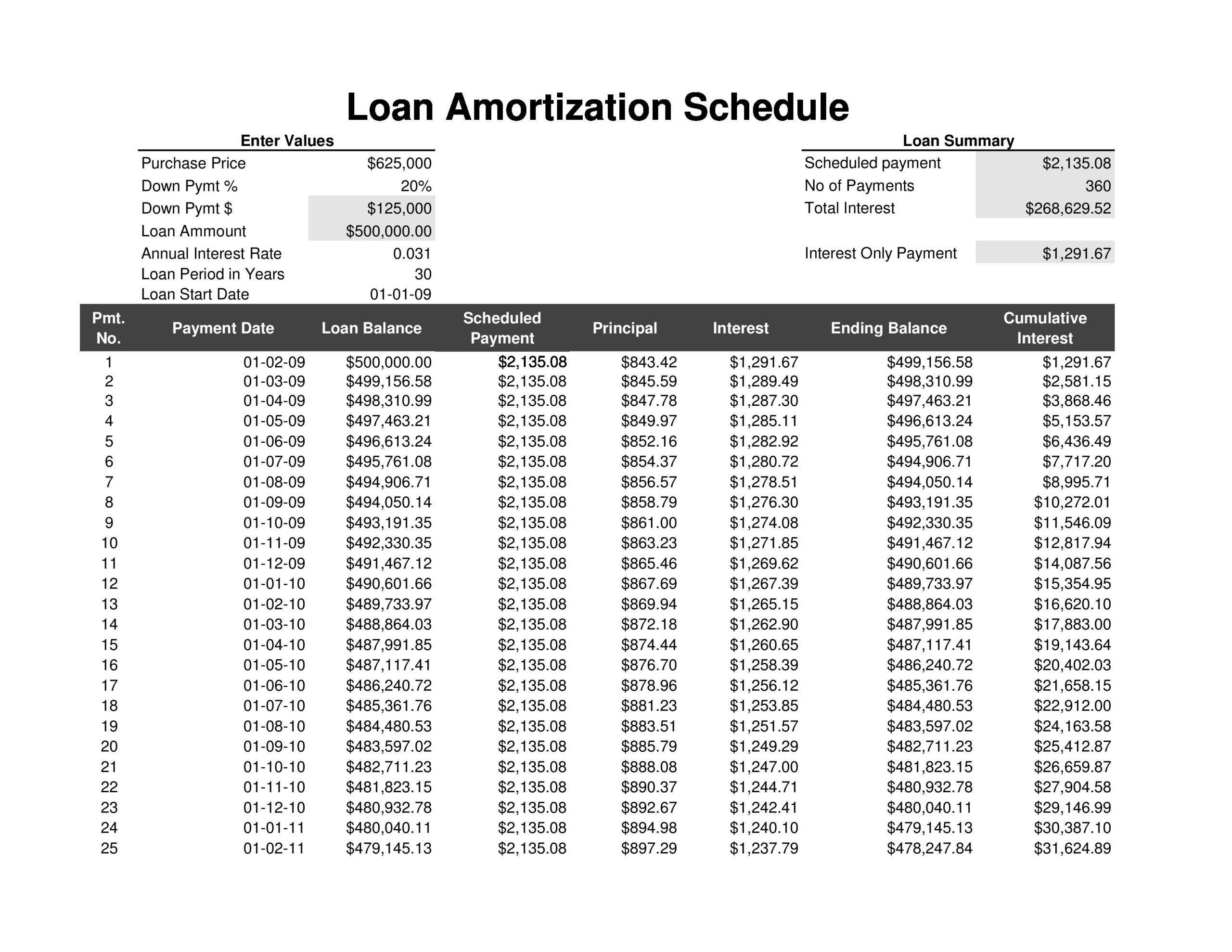

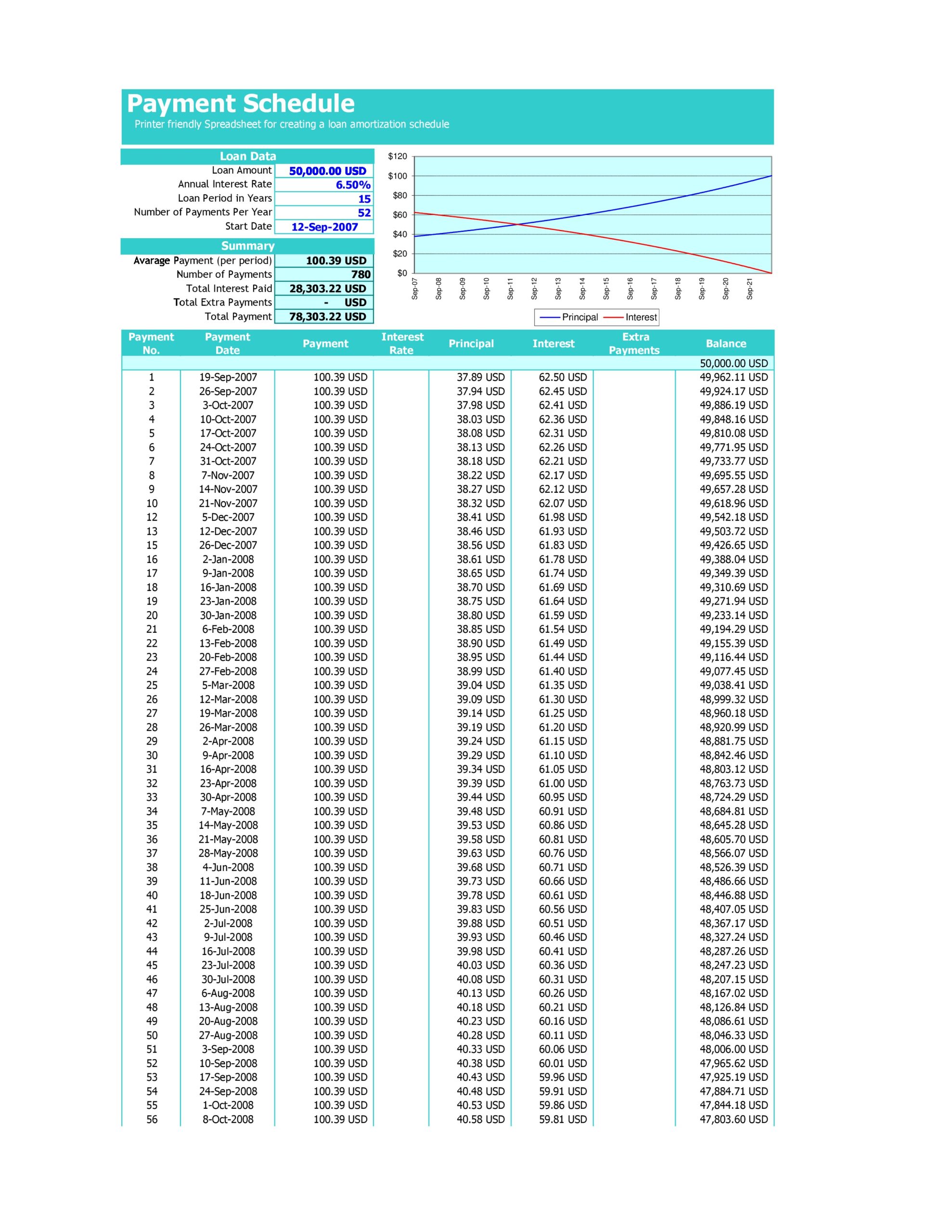

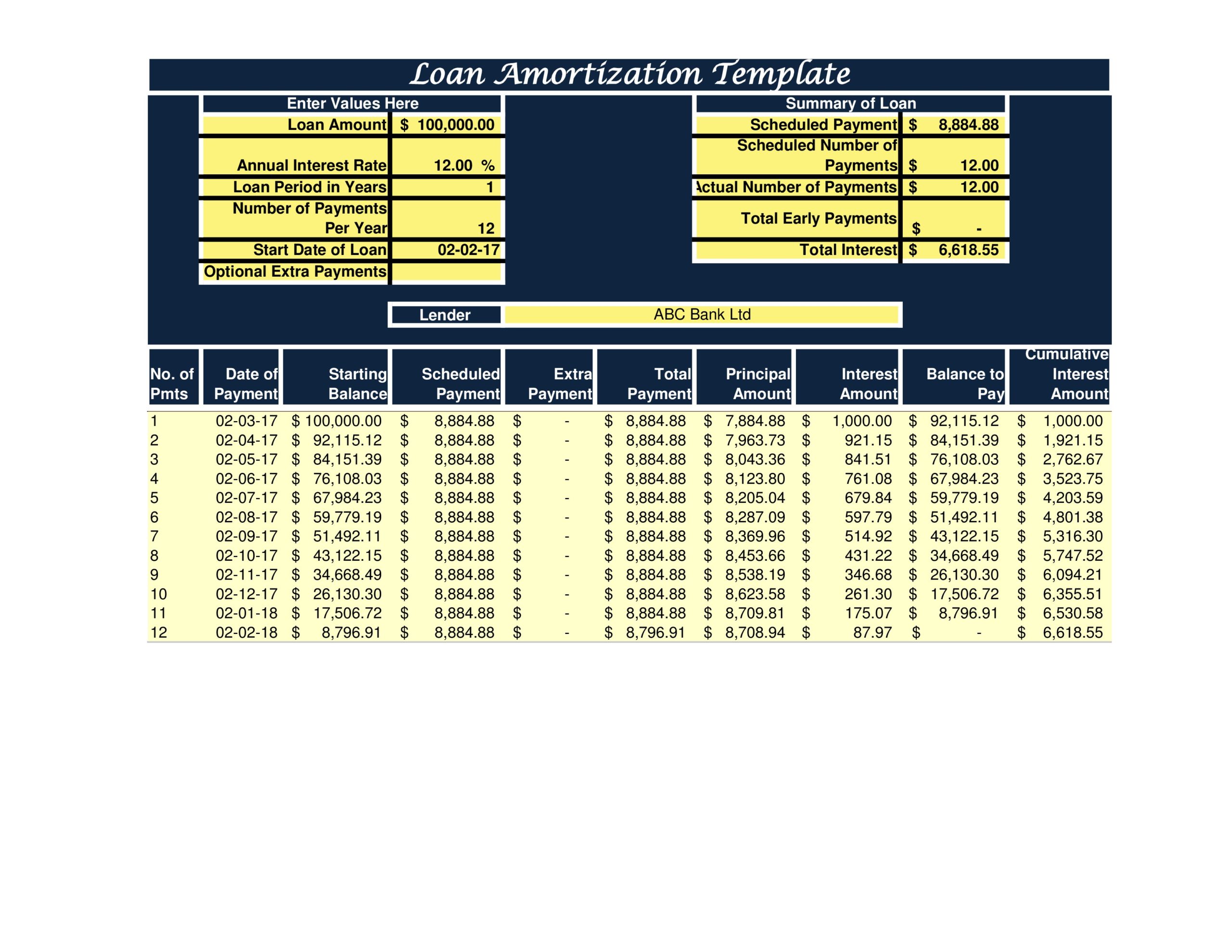

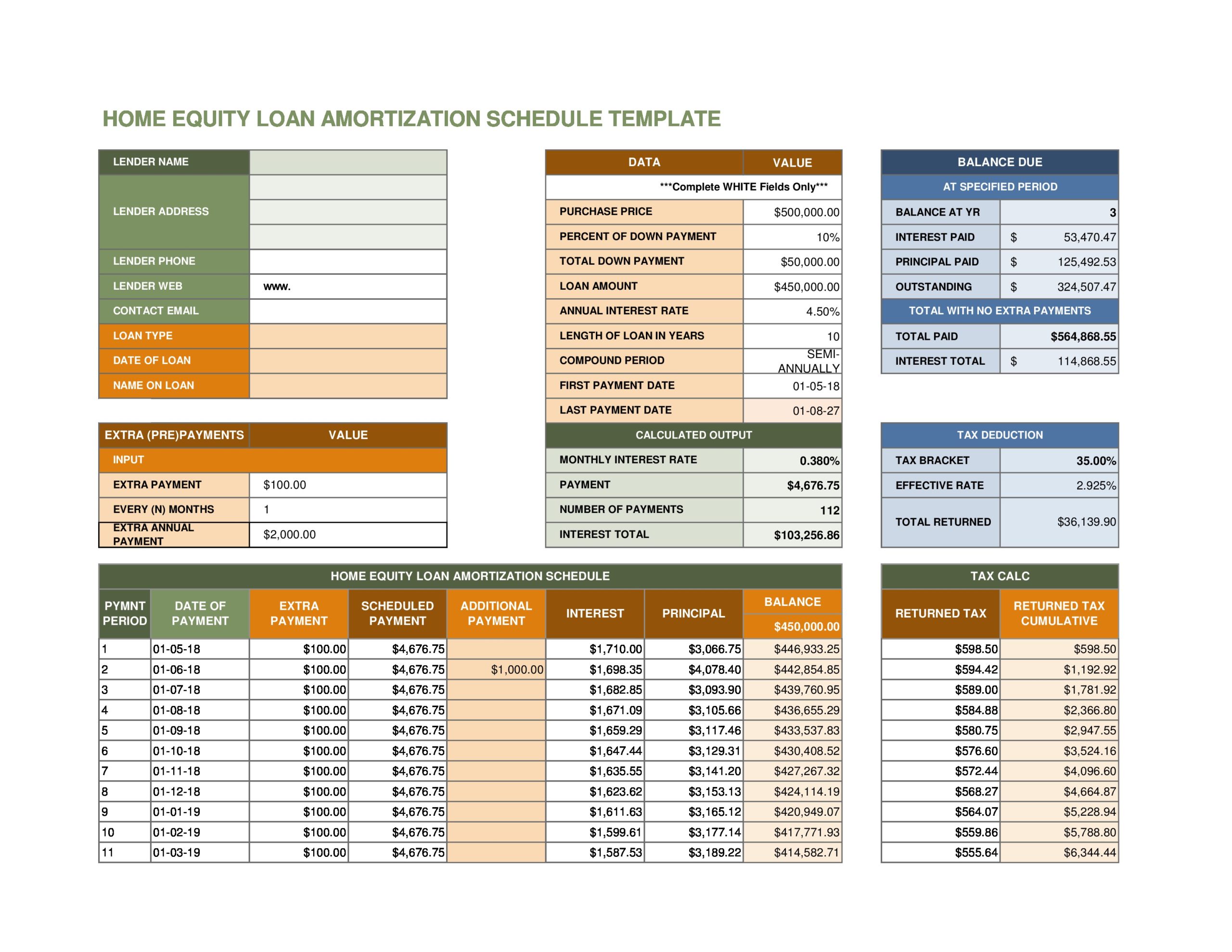

- 6 Loan Payment Schedule

- 7 Types of payment schedules

- 8 Pros and cons of payment schedules

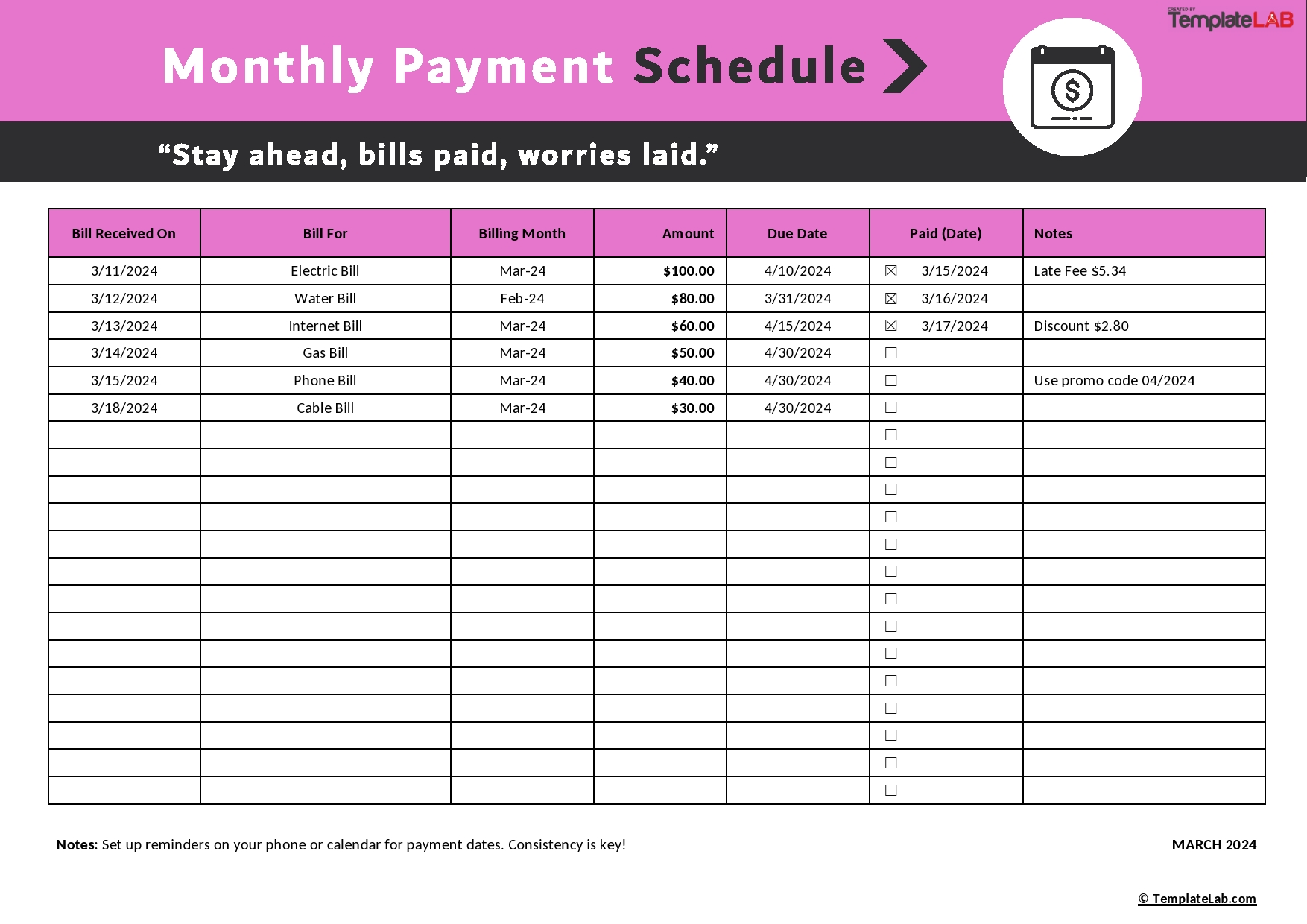

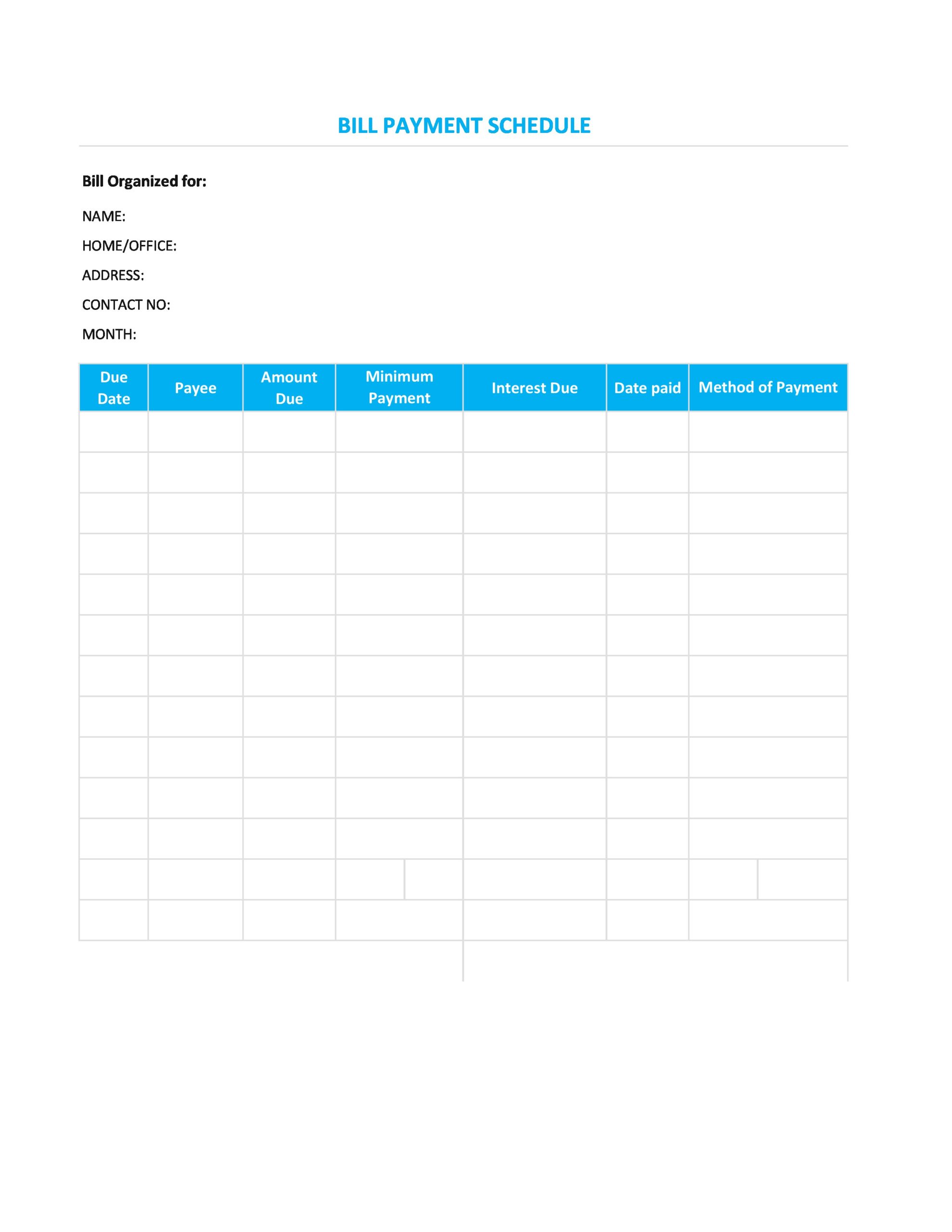

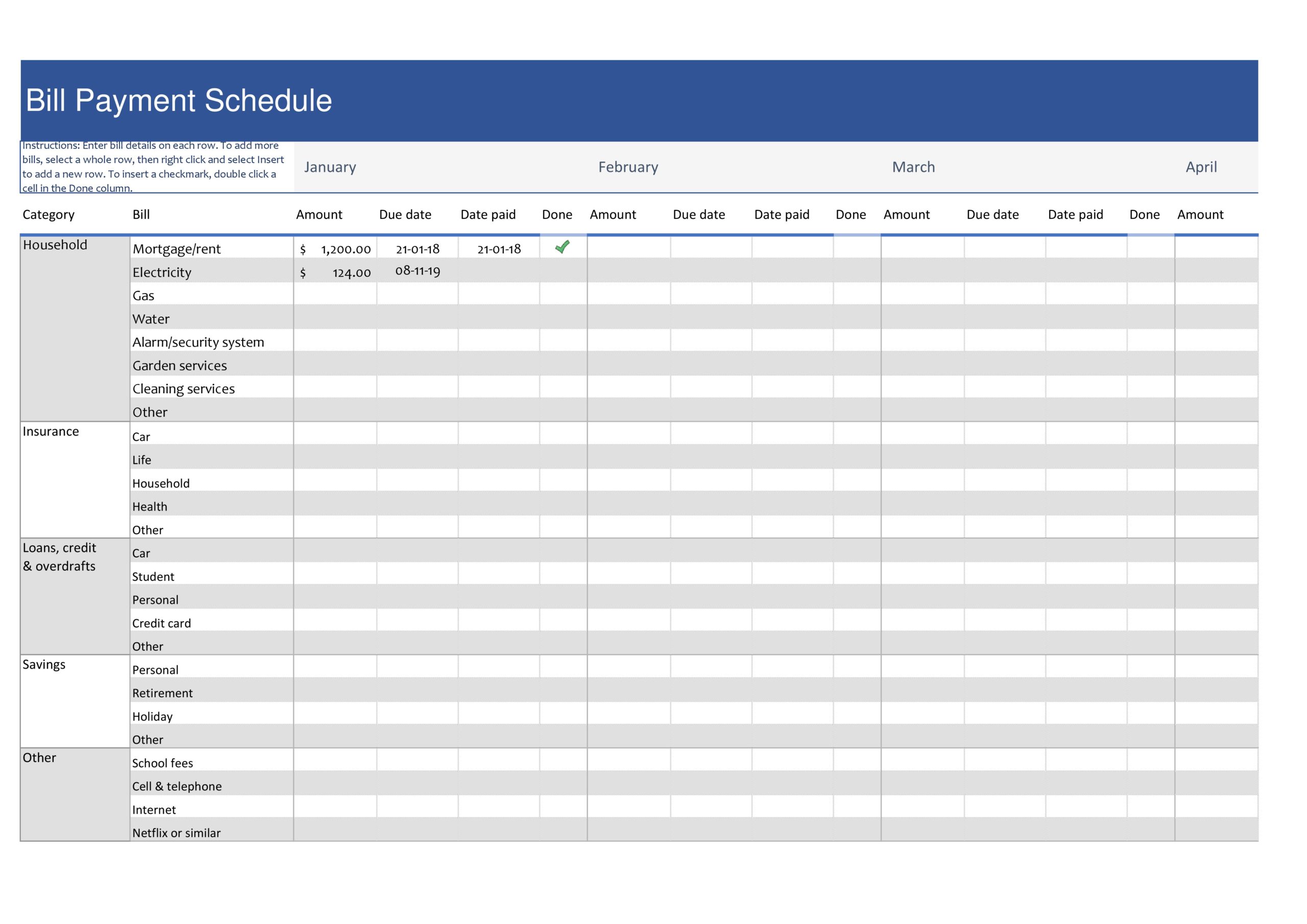

- 9 Bill Payment Schedule templates

- 10 Types of payment schedule templates

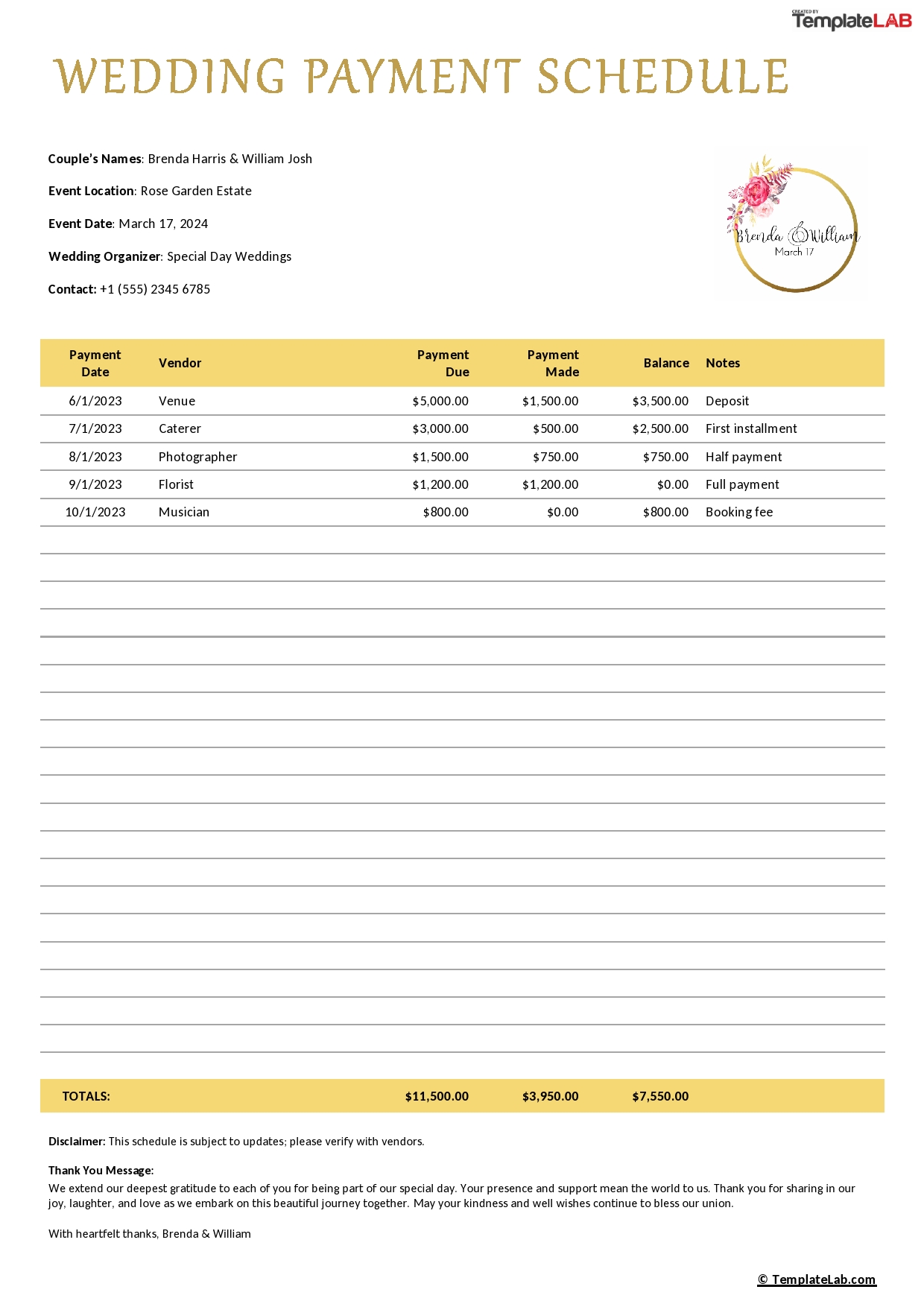

Payment Schedule Templates

Why is the payment schedule template important?

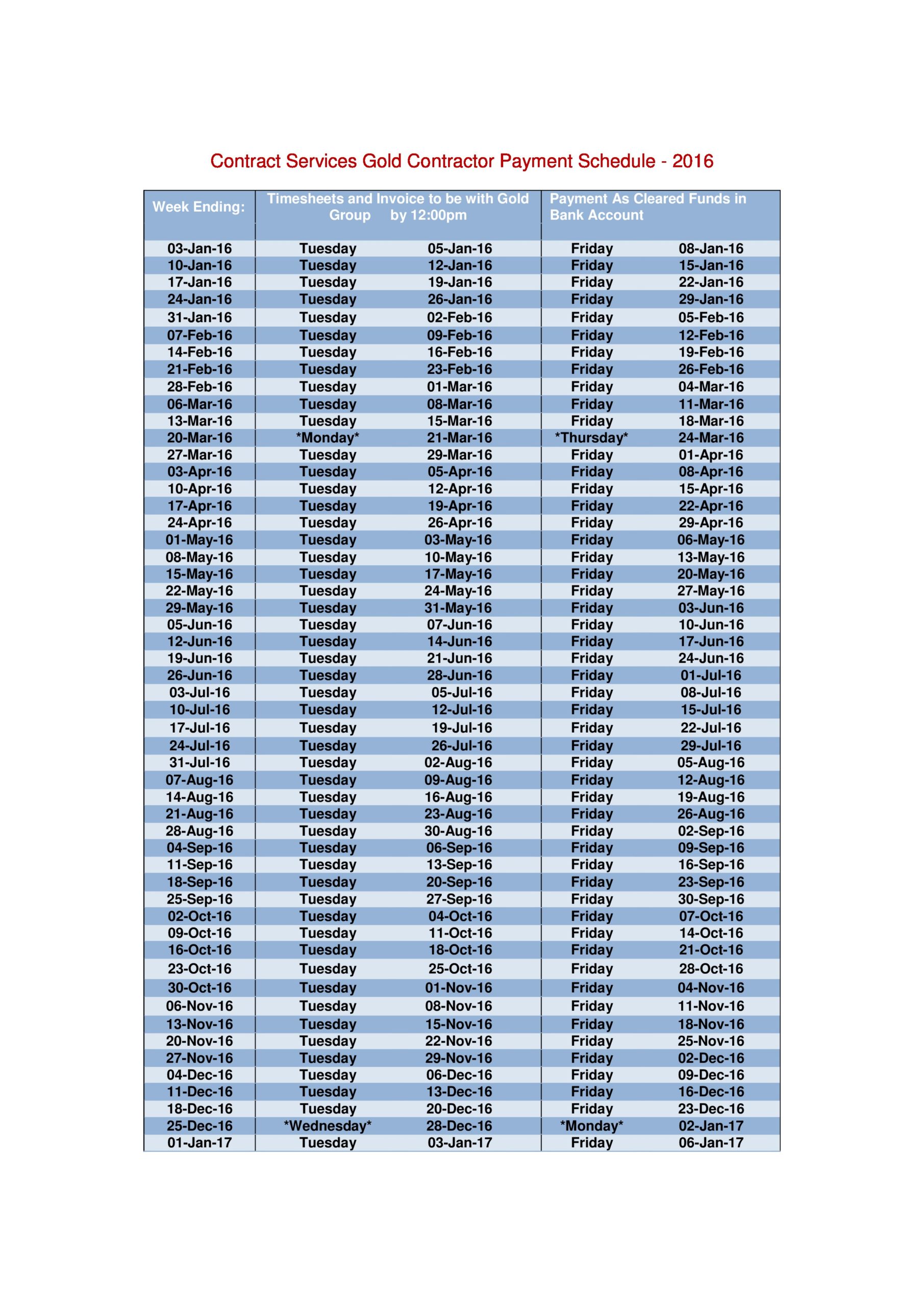

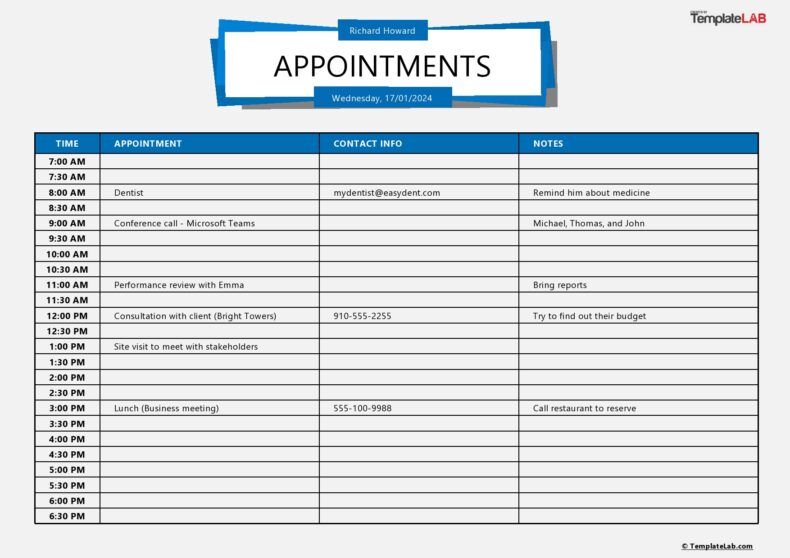

The schedule keeps records of your payments and shows the payment dates and amount. It is favored by employers who make payments to large numbers of employees and are also useful to people who manage loans, or bills at close intervals.

Employers capture the details of their employees so that none misses a payment on the date they should be paid. For example: if employee X joined company Z on the 20th of June, their information is entered into the template, starting with the date of employment.

Next, their salary is entered and the date they will be paid. Once that day falls due, the payment is processed and the worker paid.

How is the payment schedule calculated?

Start by drafting all the payment details the company is committed to. If it is employees, write down the name of every employee and note the date they joined the organization. Next, write down how much is the agreed payment for each employee according to the letter of employment.

Fill in the payment date for each employee and capture other details like overtime accrues, social security deductions, loan deductions, advances, among others. The employee will get their net payment on time. If the company has bills to pay, they can be captured in the bill payment schedule template.

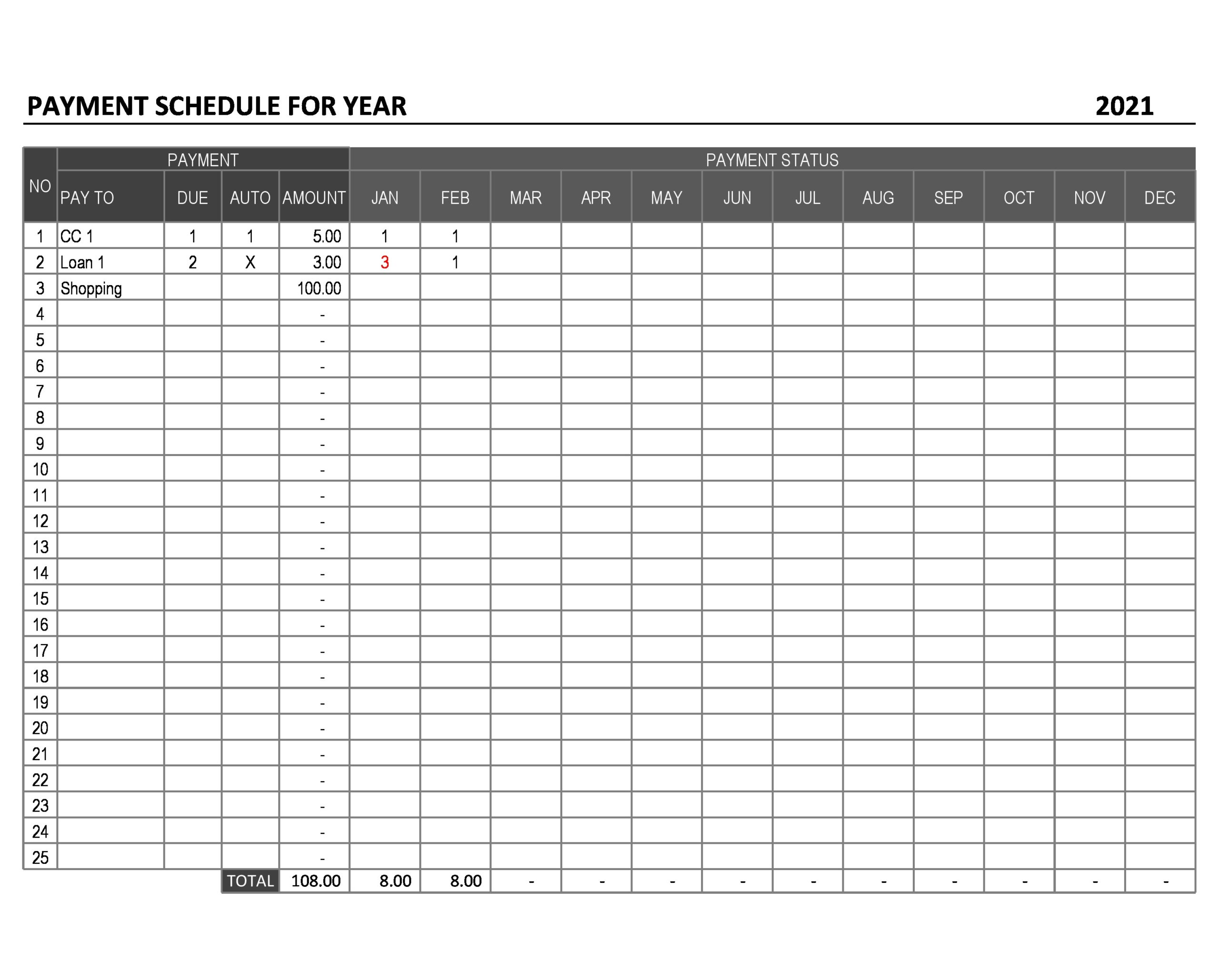

Divide the schedules according to the dates the payments are made which could be daily, weekly, fortnight, or monthly and match them with the names of the employees who receive payments on each specific date.

After your draft is ready, open your payment schedule template and begin keying in information by following these steps.

- Name your monthly payment schedule. Use the payment recurrences as the name which could include the names of the teams like Lab techs, managers, support staff, errand runners, and so on.

- Insert date. Insert the date when the first payment is made and the date when the last payment is made. The process works the same for daily, weekly, fortnight, and monthly payments. Owing to the difference in the number of days per month, chose a date that will work for every month. For example, if you choose the 31st of every month as the payment date, February will never have salaries paid as well as months that have 30 days. It will be better if you choose the 1st day or the 28th day of every month as the starting date and the 5th day of every month as the ending date.

- Insert a payment period. Insert payment periods according to the frequency of payments which could be every week, every two weeks, twice a week, or monthly. The template payment sheet is editable and can be adjusted anytime. Any monthly payment schedules that are no longer in use can be deleted and new ones created.

Monthly Payment Schedule Templates

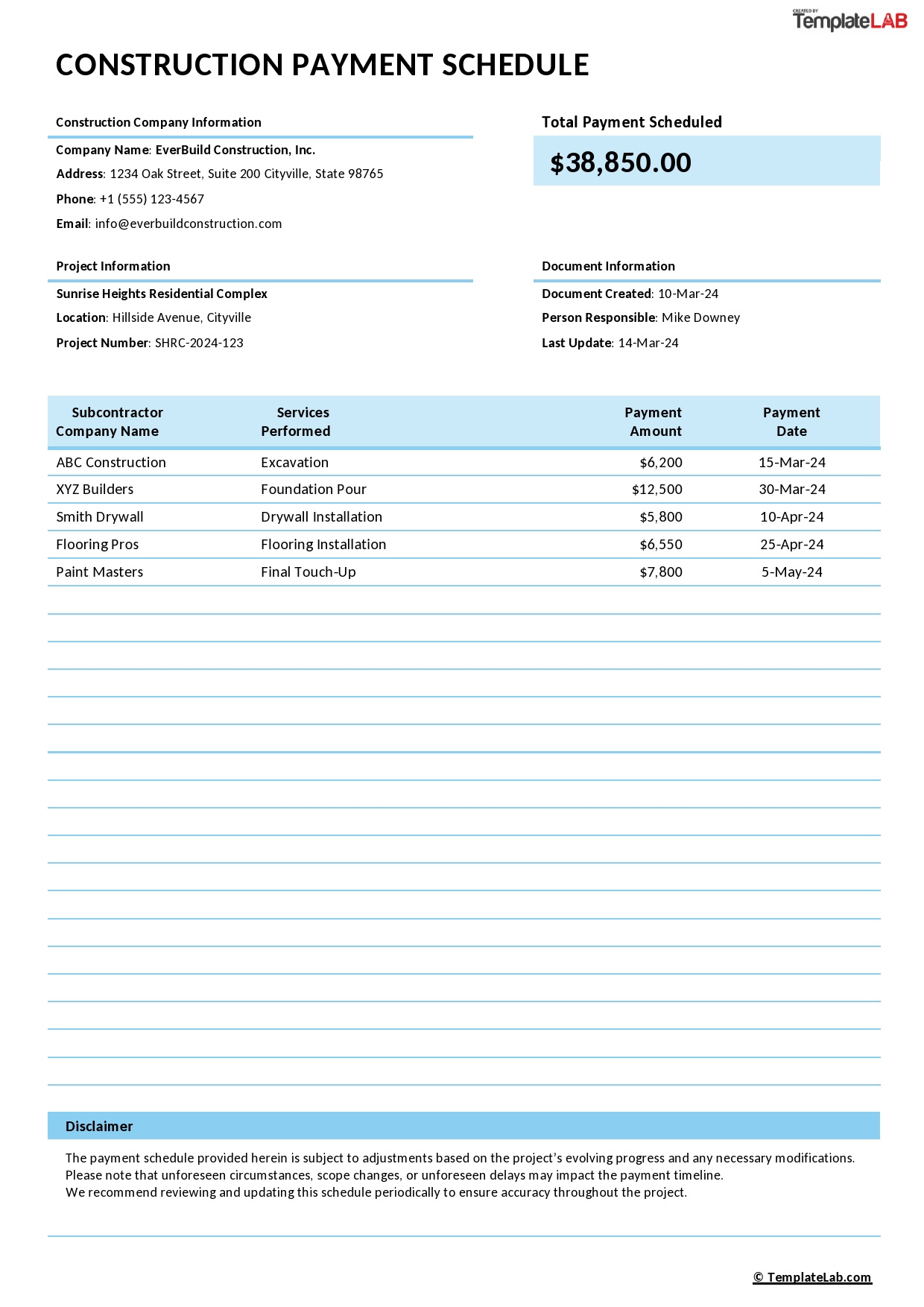

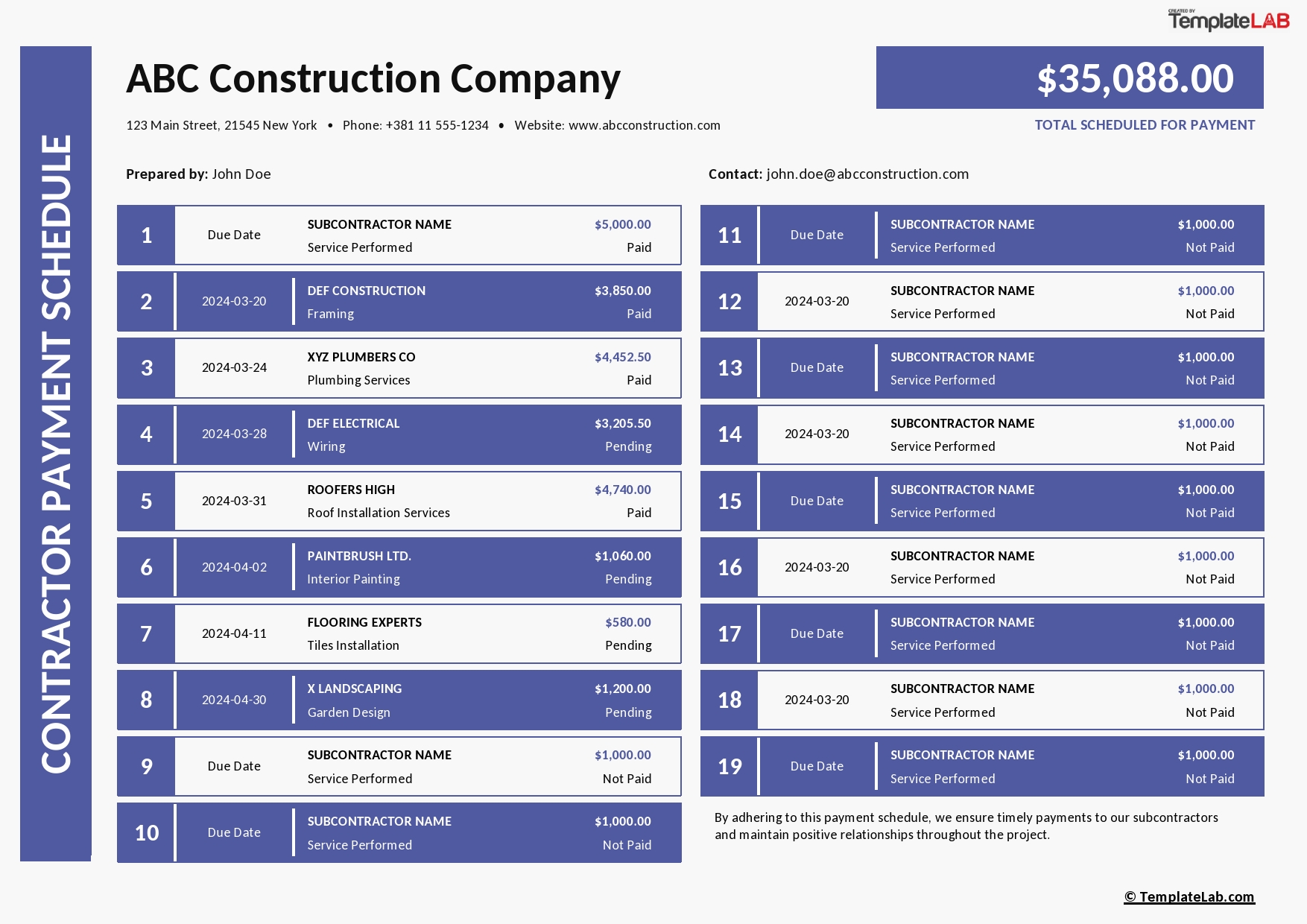

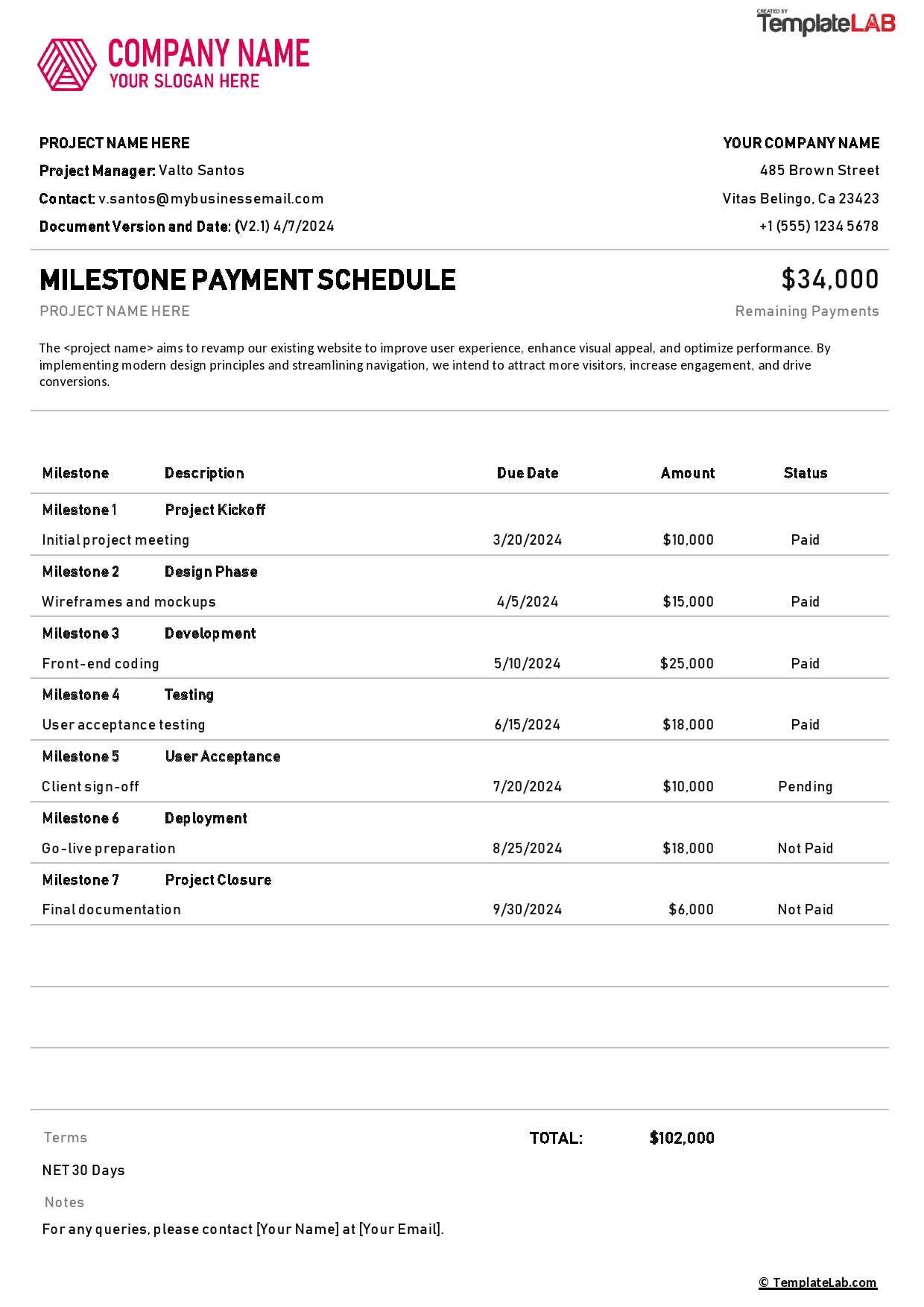

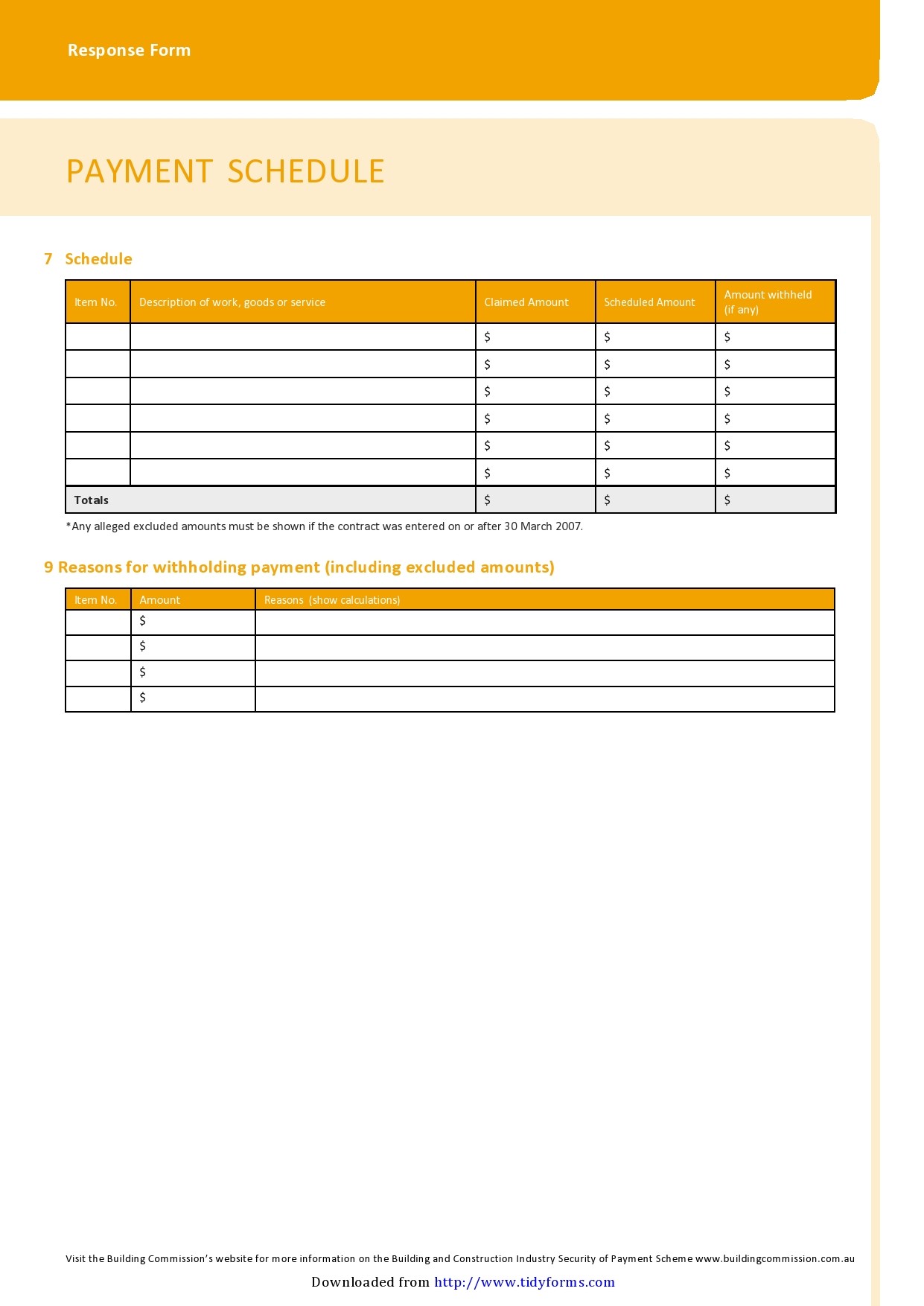

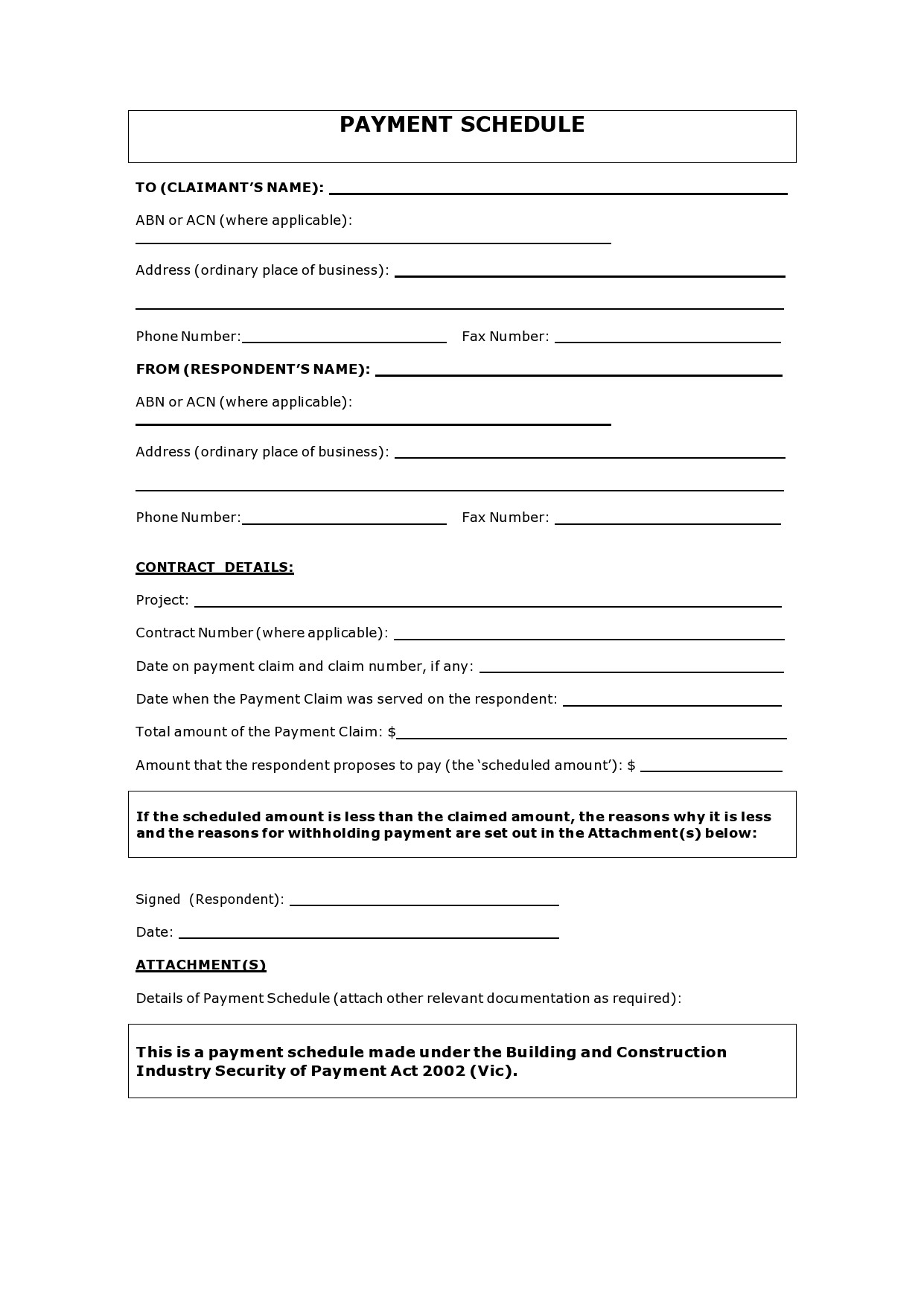

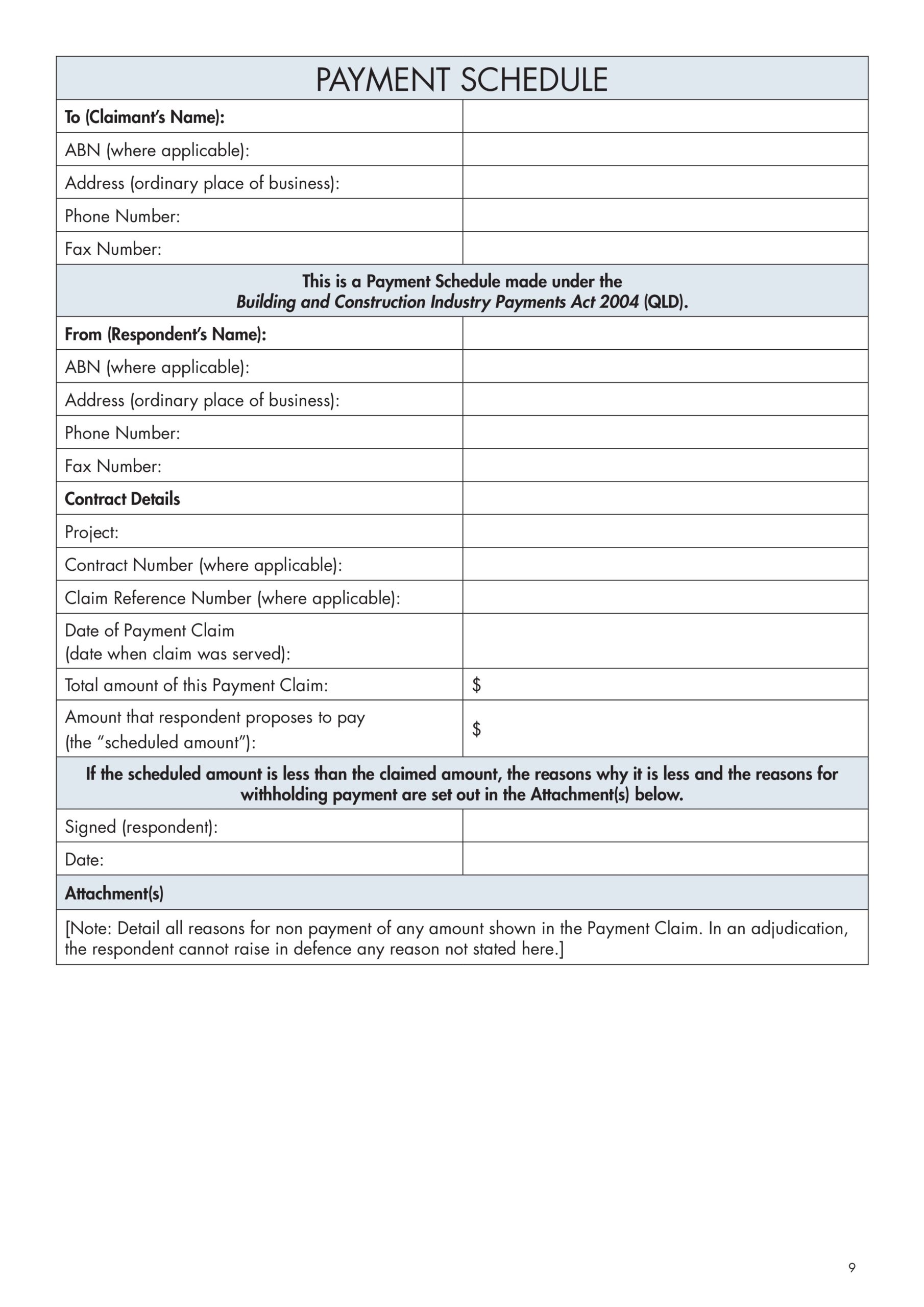

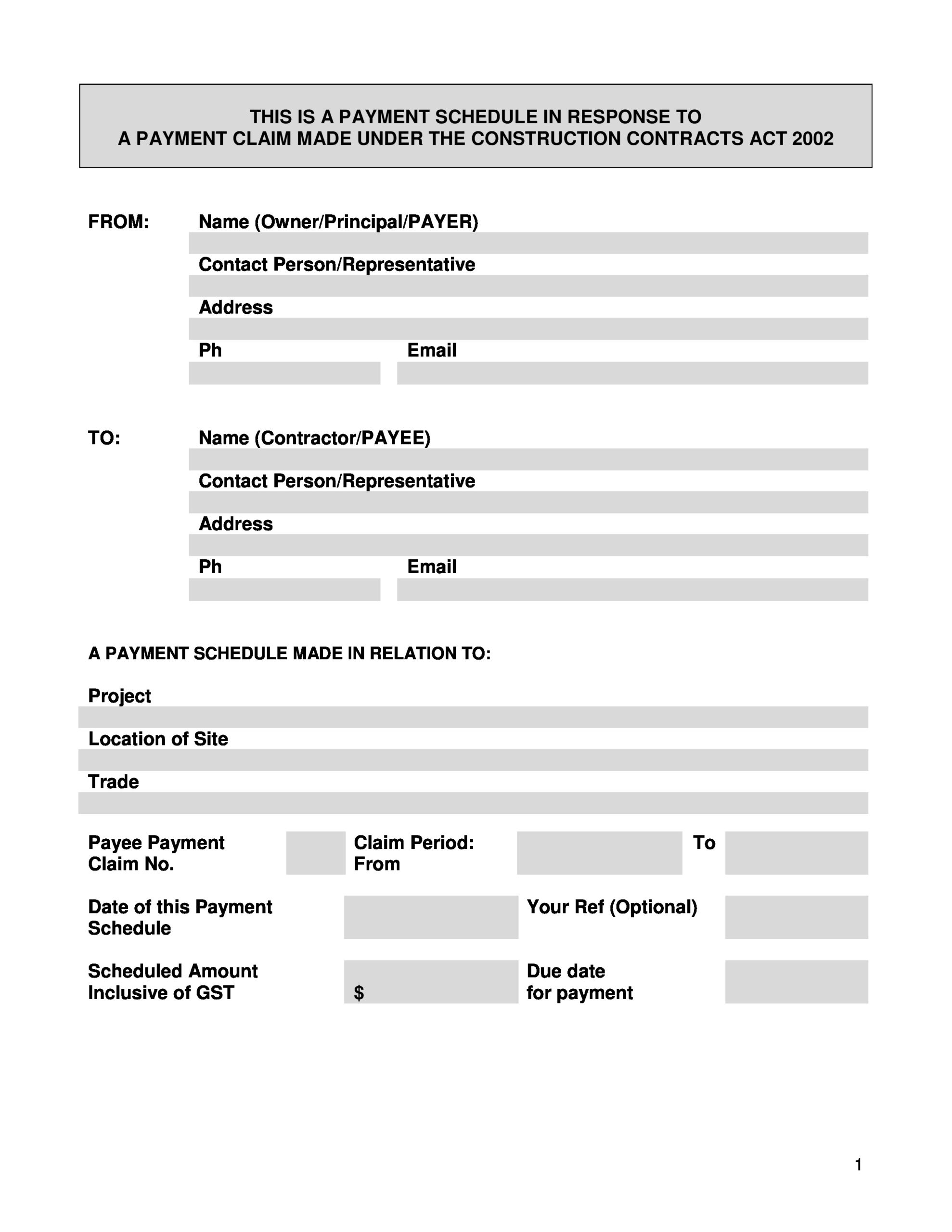

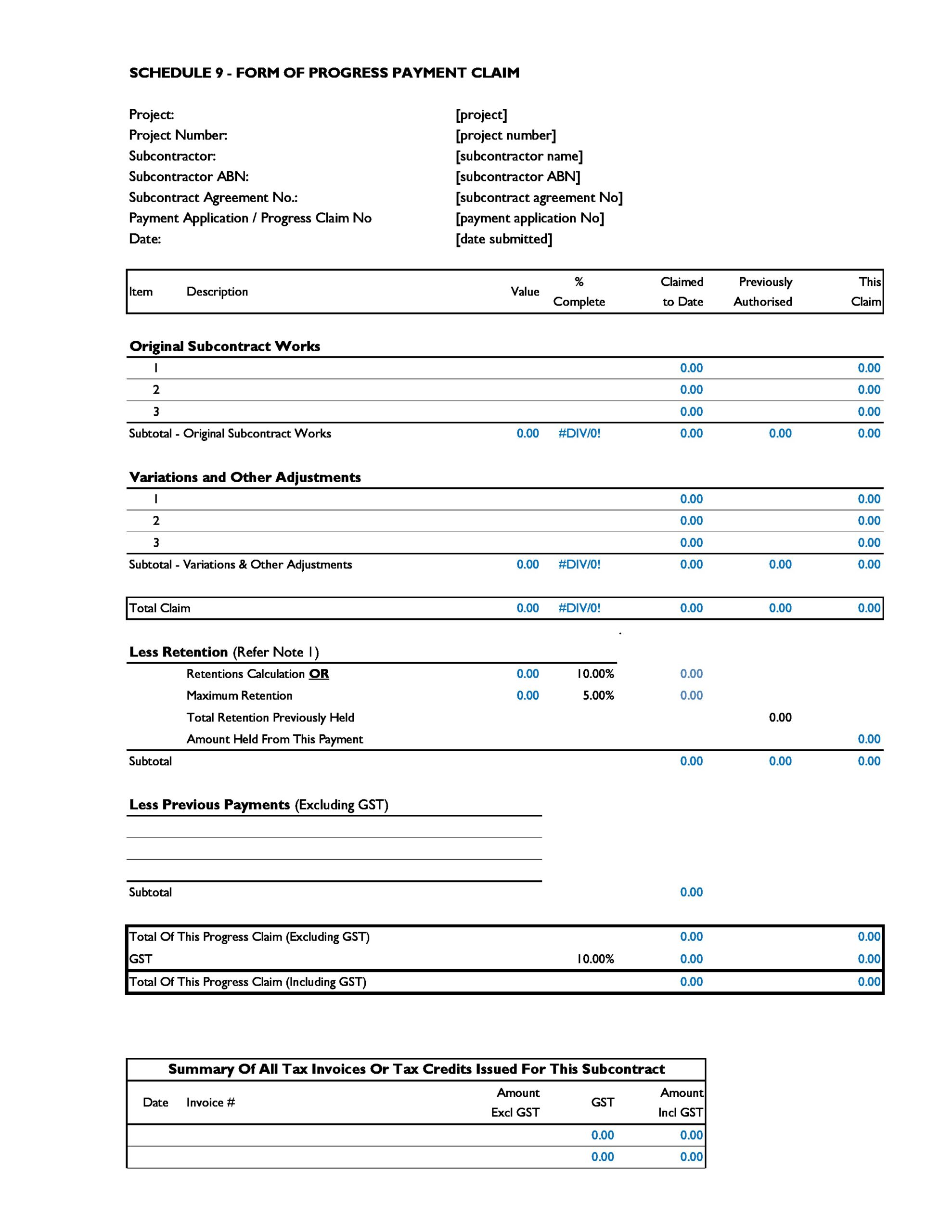

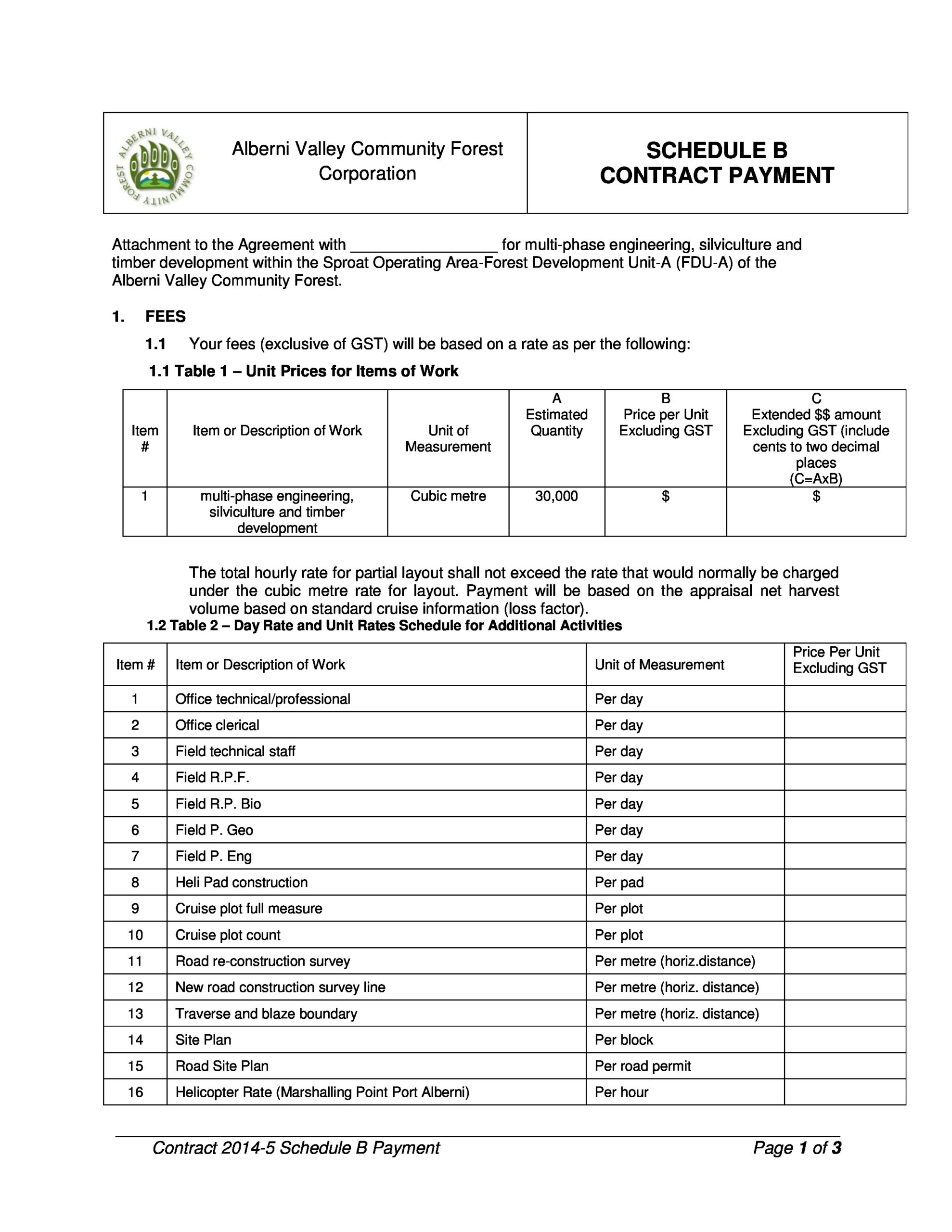

What is a payment schedule in construction?

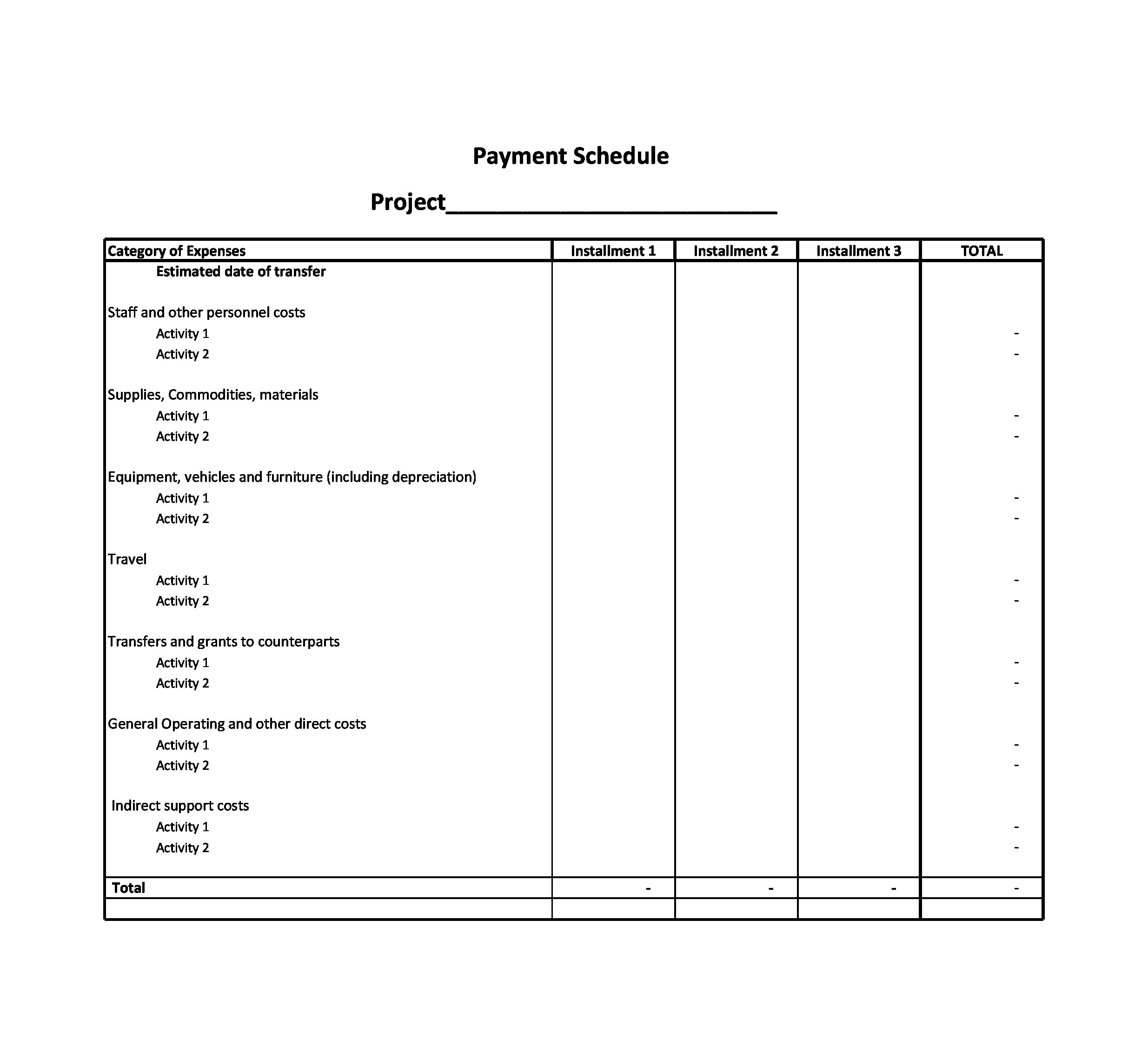

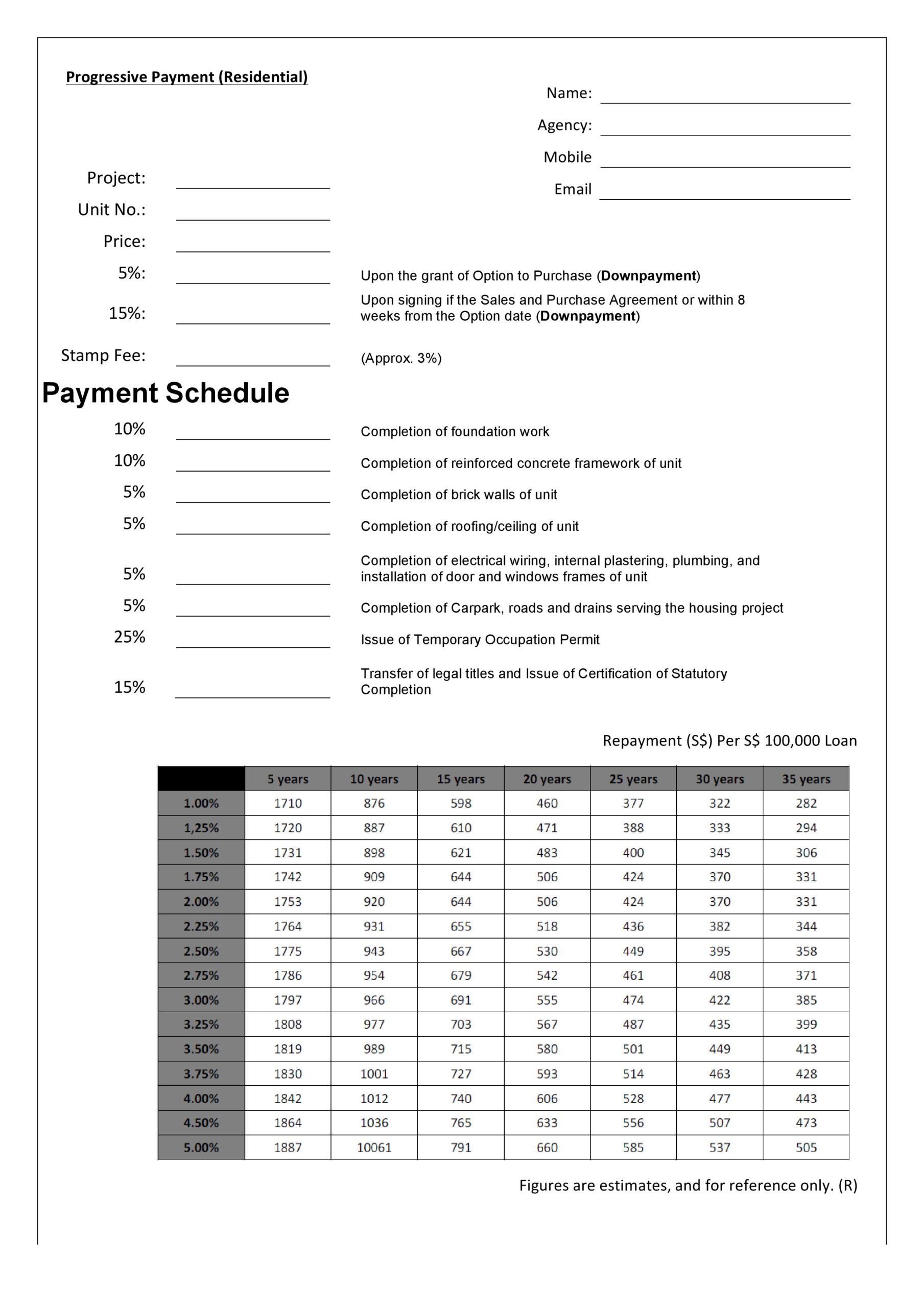

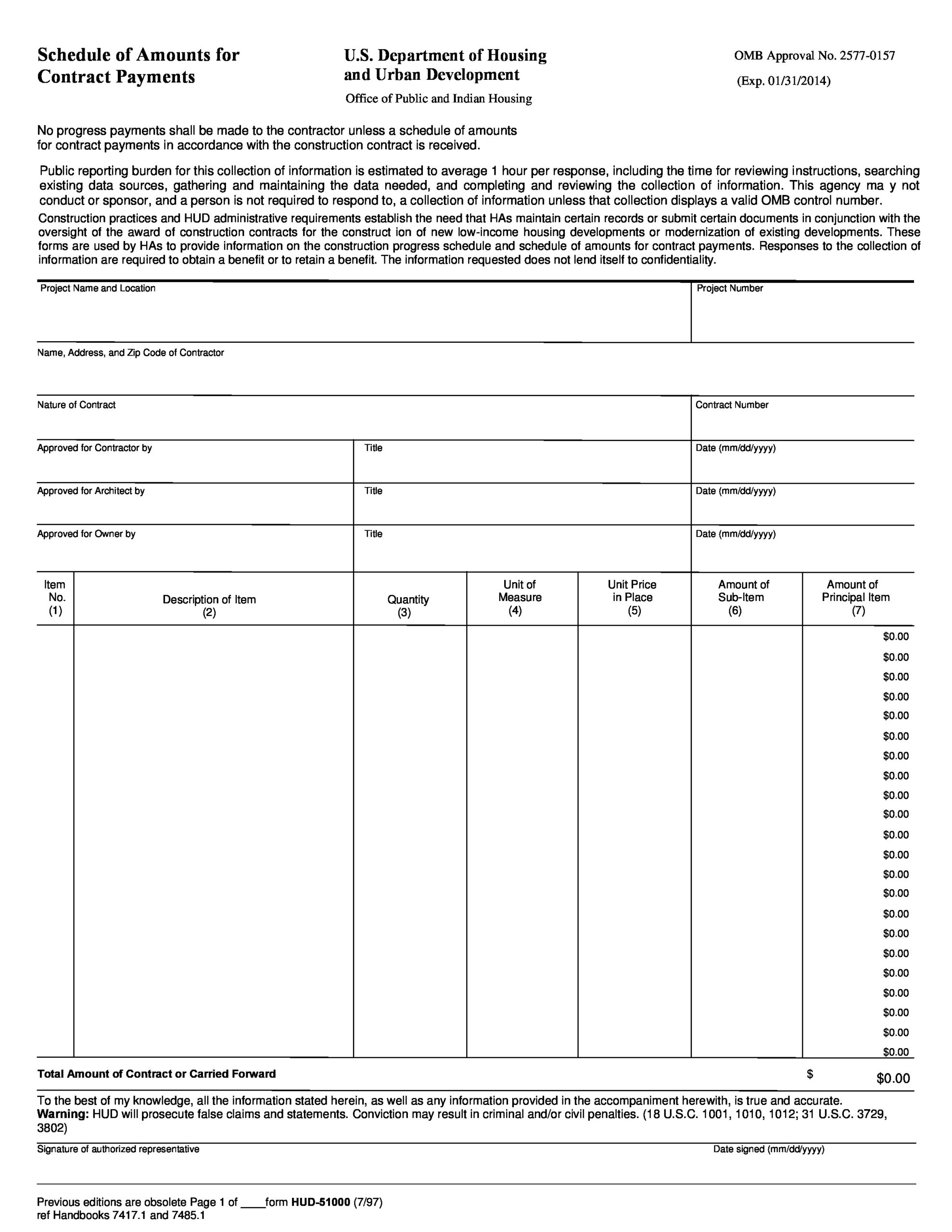

In the construction industry, contractors agree with their clients on the procedures of work, the timelines, milestones, and deliverables. According to the contract terms, a certain amount is paid at each phase of the project.

For example, a client could agree with a constrictor to pay a certain amount at the inception phase of the project, let us say, a house construction project. The contractor receives payment once the foundation is laid down.

As per the agreement, the contractor may receive another payment after completing the general structure of the building and another final payment once the finishing works are completed.

To help follow-up on the accomplishments versus payments, a payment schedule in construction is used. The schedule contains dates that show when a payment should be made, to who it should be made and the purpose of the payment.

What does a payment schedule in construction include?

The payment schedule includes the following.

- Date when the contract started

- The initial payment to be made

- The subsequent payment intervals following the initial one

- The agreed time when the project must be completed

- The total value of the project in terms of capital, material, and other resources

Something to take note of: sometimes circumstances may force the contractor to extend the contract period that had been previously agreed upon. It is, therefore, important to note a clause in the agreement that states if the payments will be stayed or executed in the case of a contract extension period.

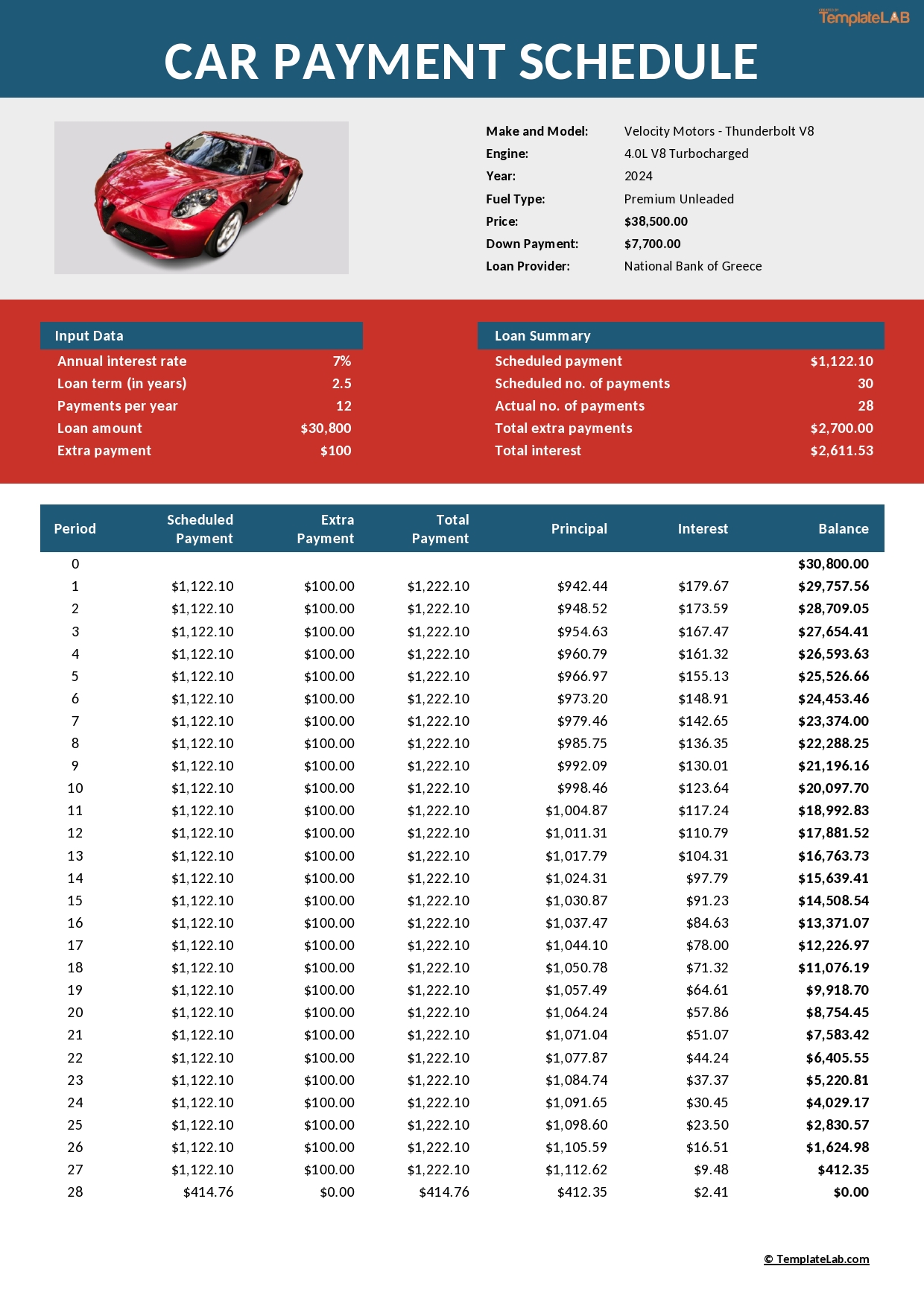

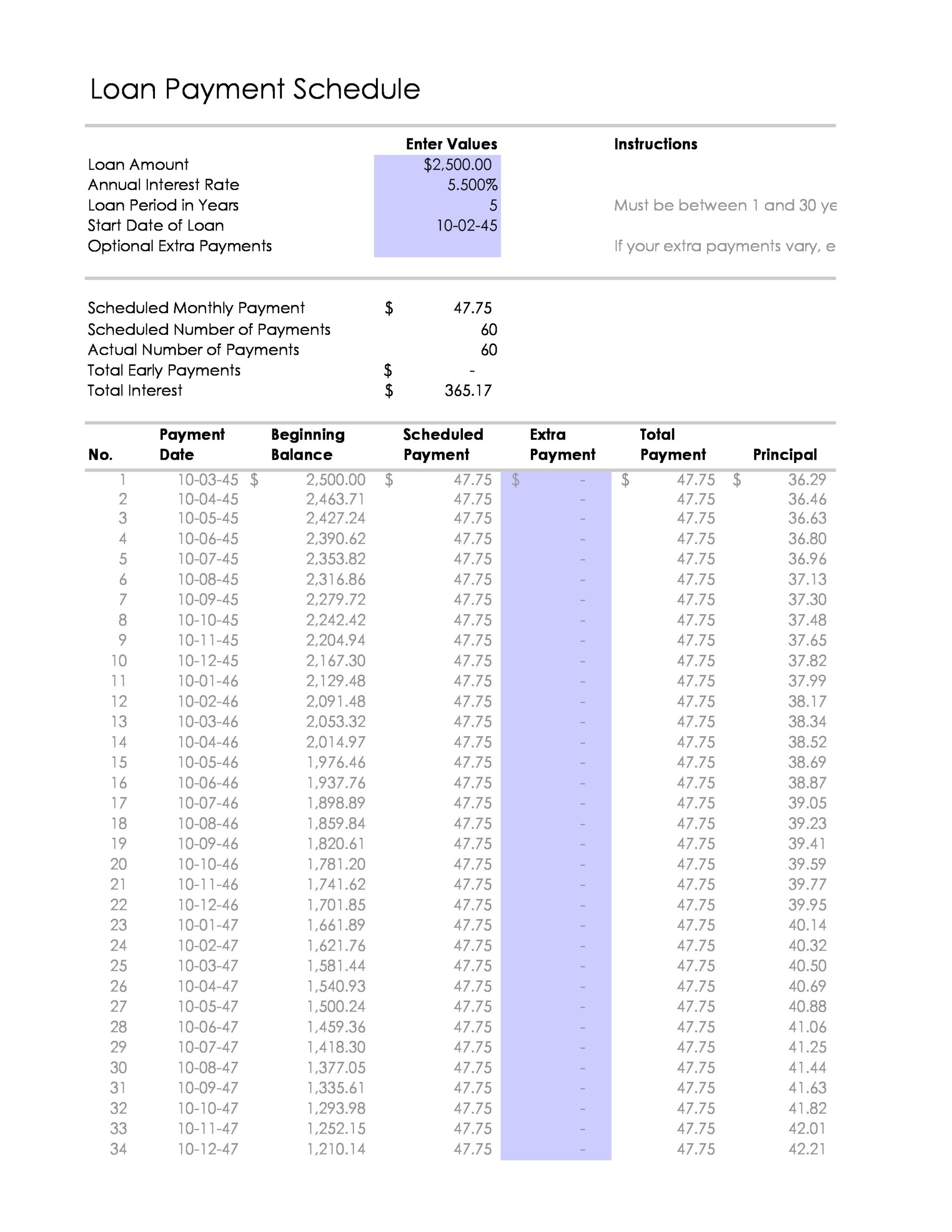

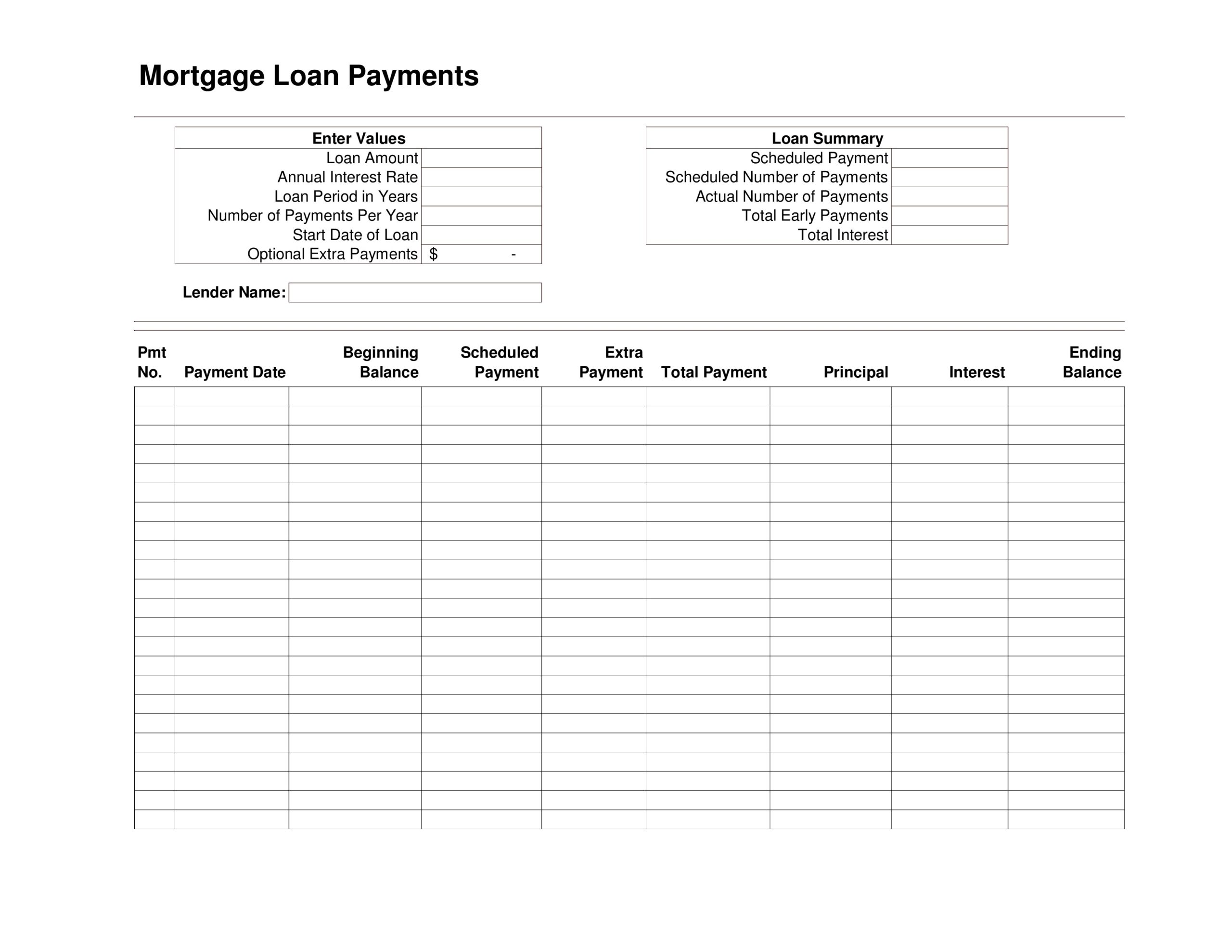

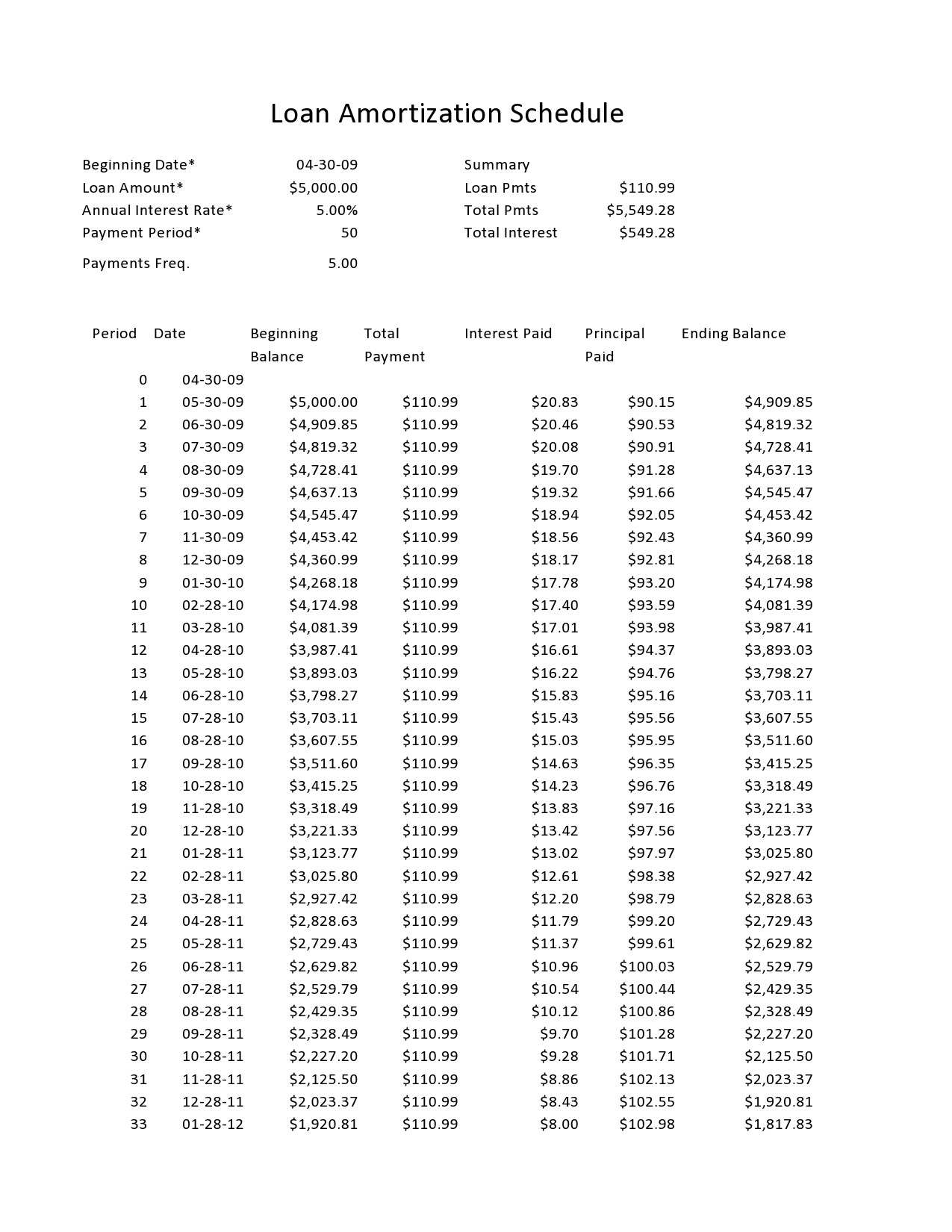

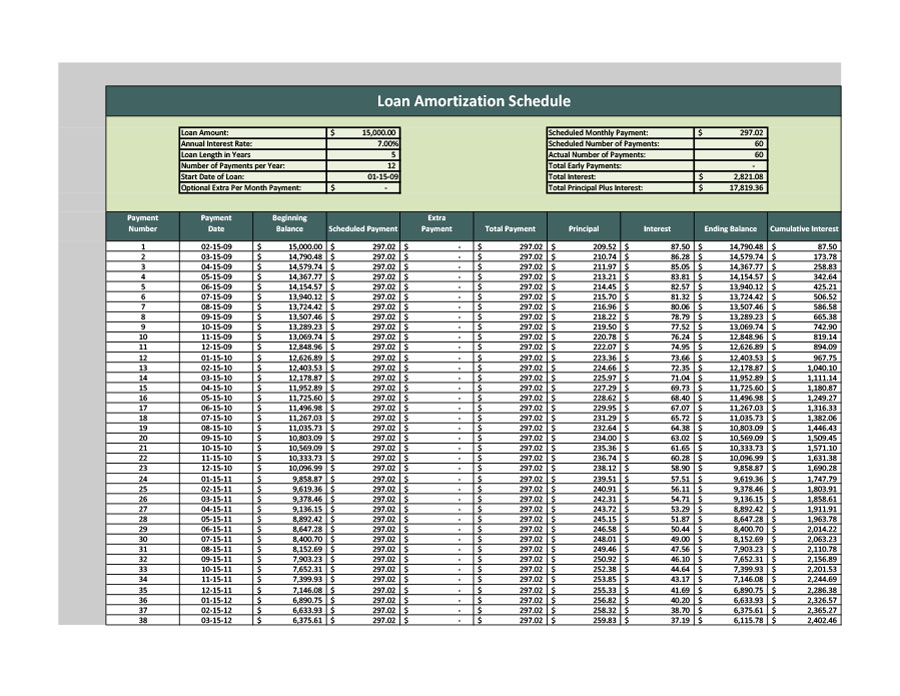

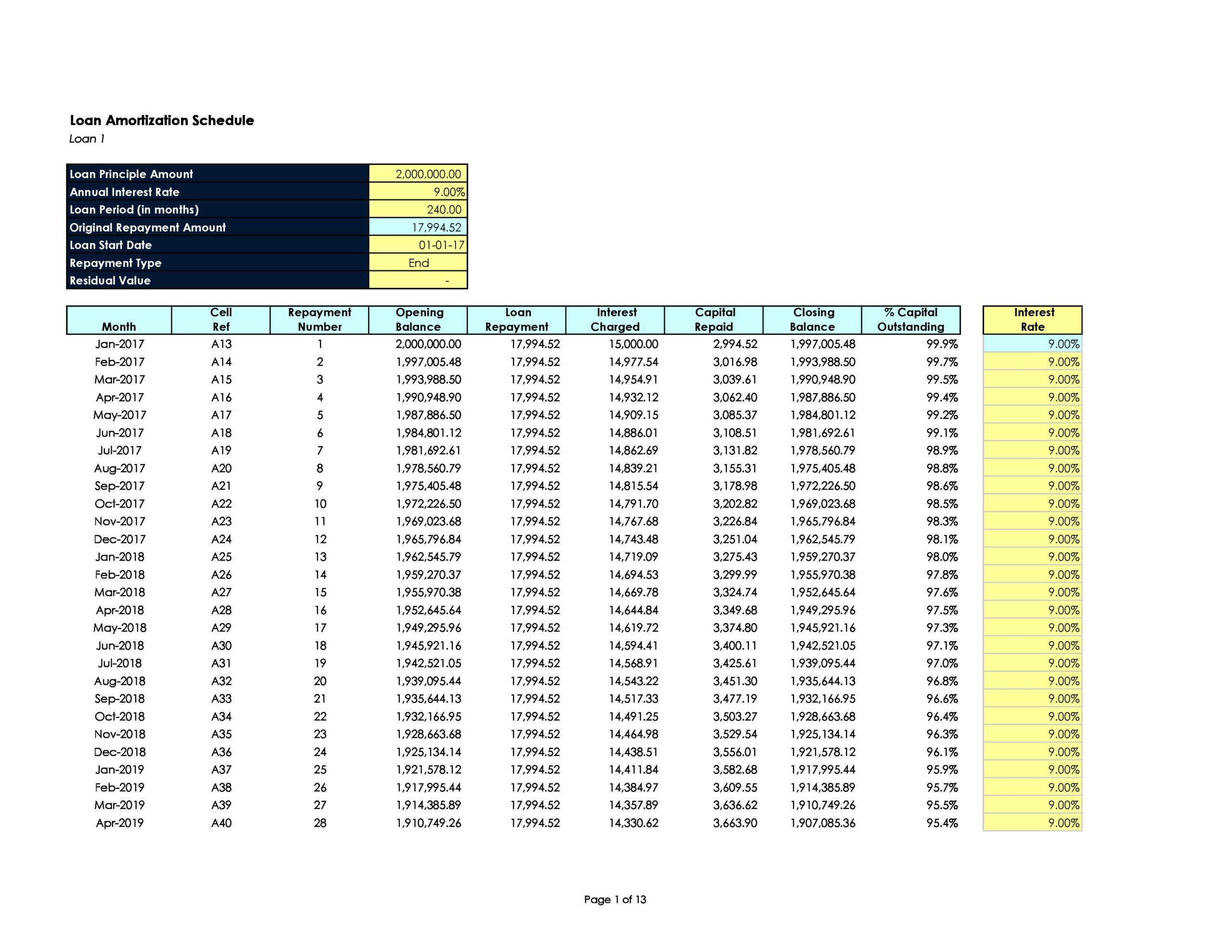

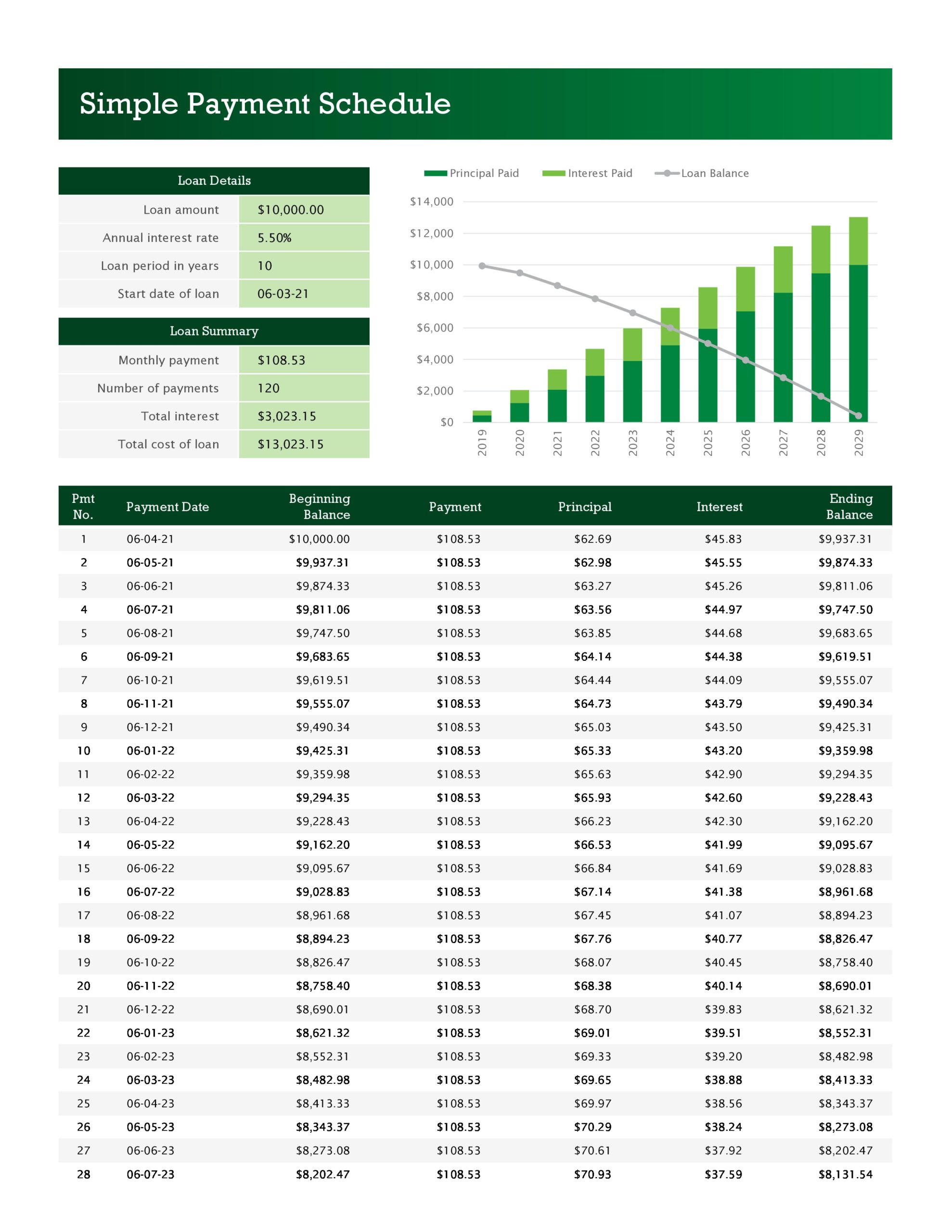

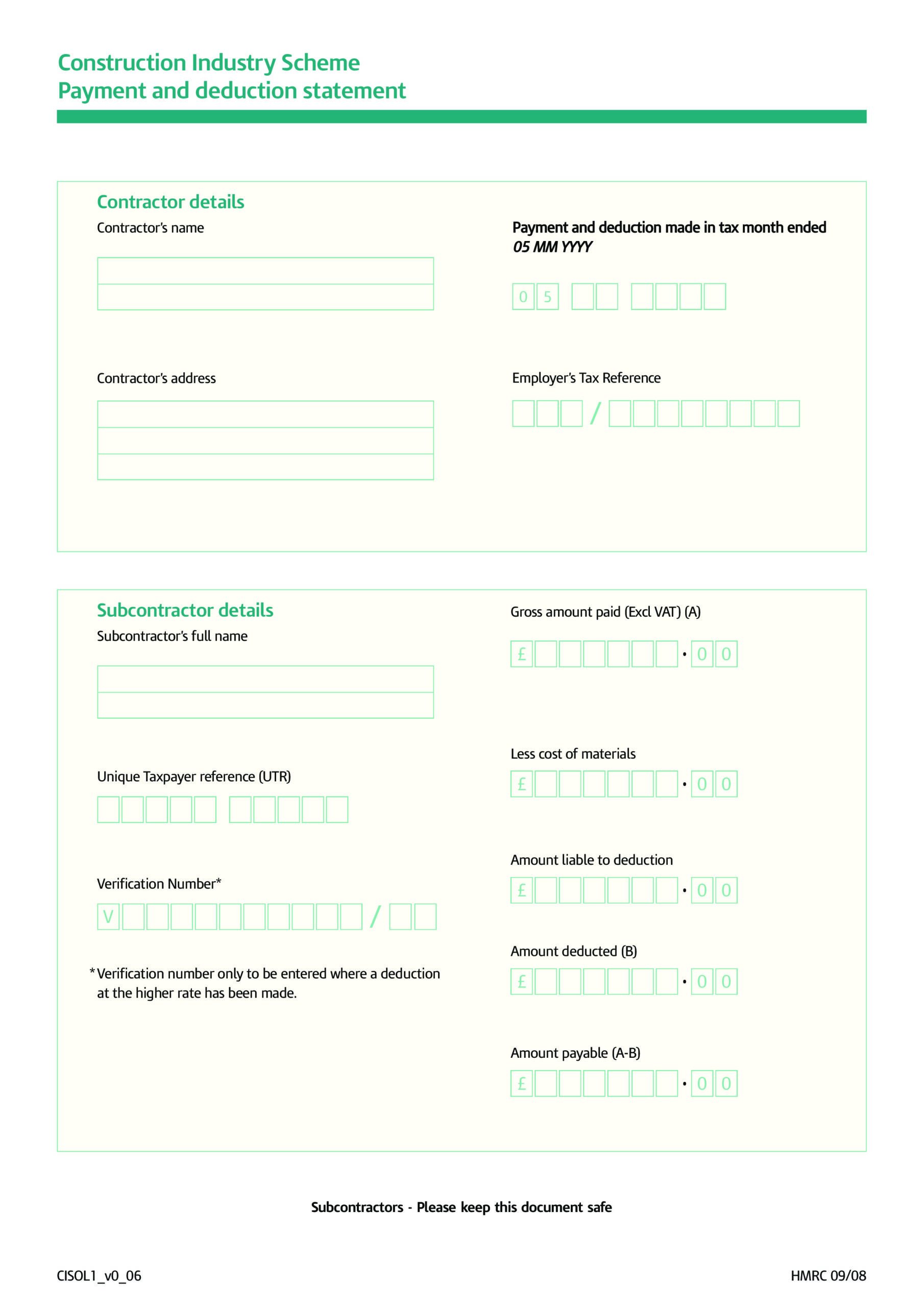

Loan Payment Schedule

Types of payment schedules

Pay schedules combine three factors namely:

- The name of the employee which the name of the person employed by the individual or an organization.

- The period of payment which defines the number of days entitled to an employee or the number of days the employee worked.

- The date of payment which is the date the employee is entitled to receive payment

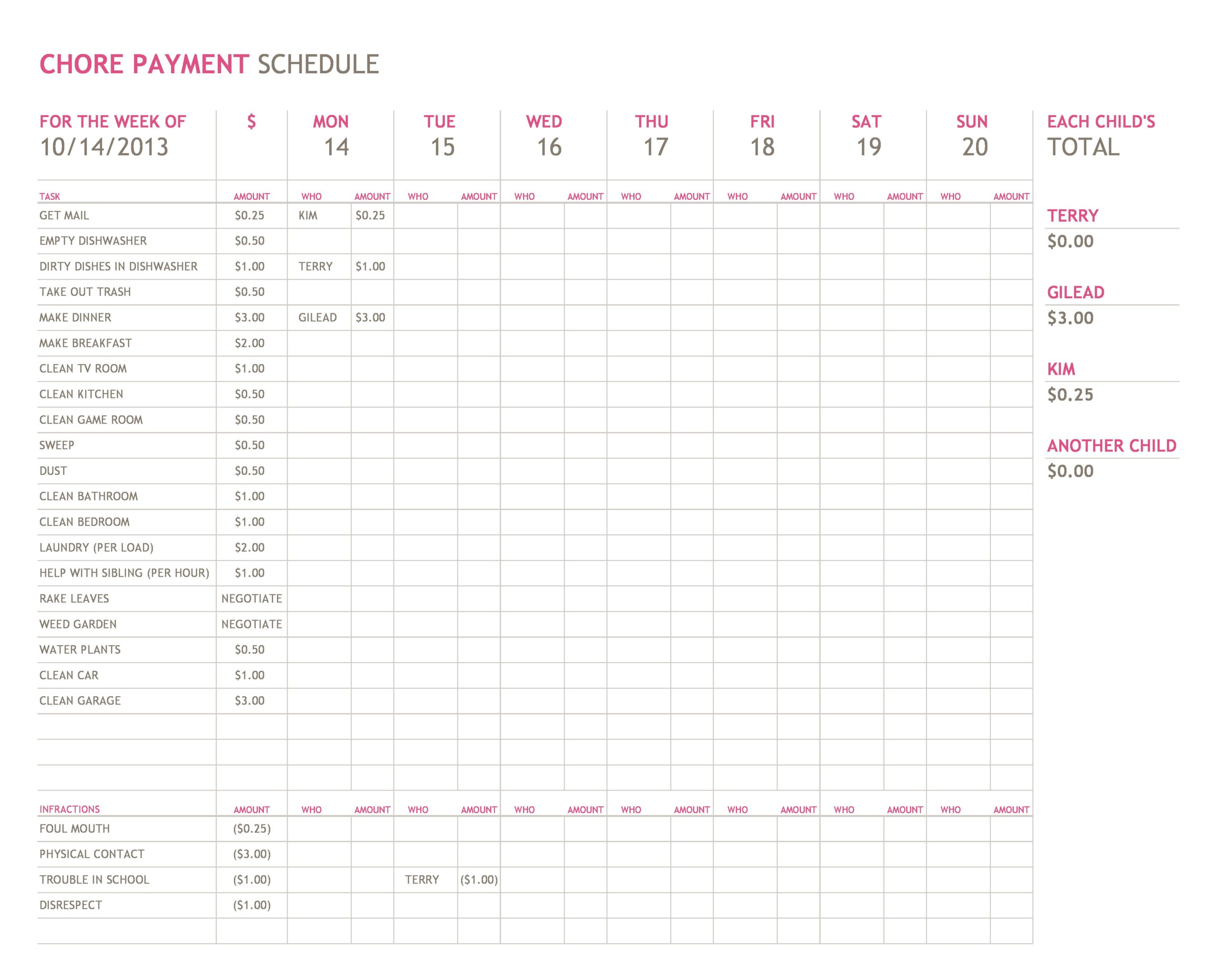

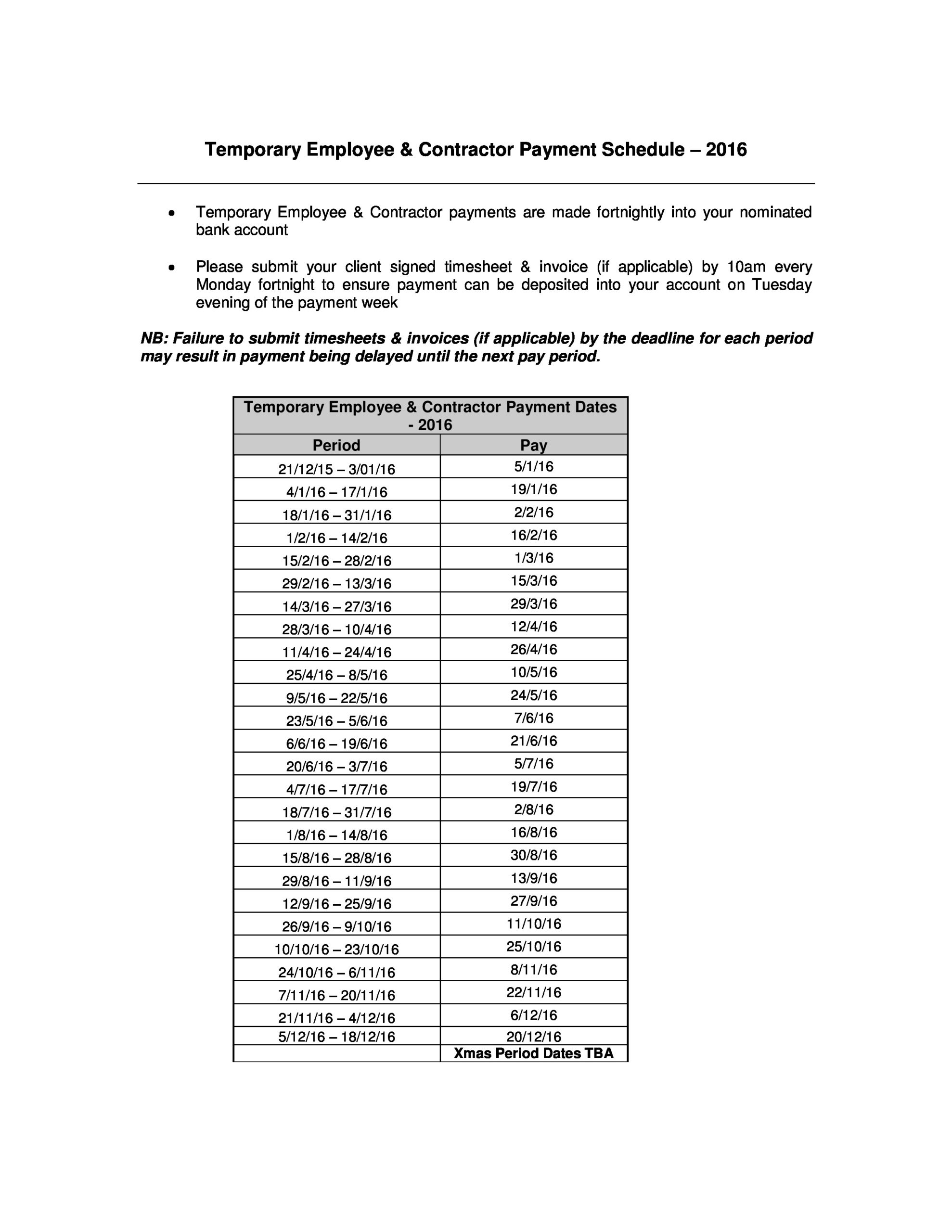

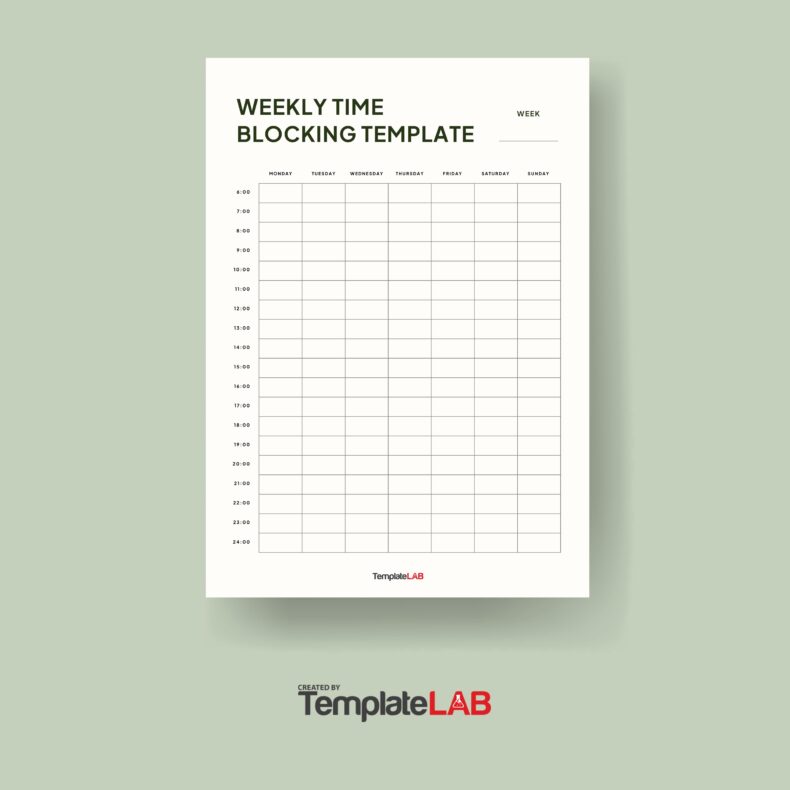

There are four types of payment schedules which can be contained in a contractor payment schedule or a monthly payment schedule.

- Weekly payments: Weekly payments are done at intervals of every seven days and a particular day is set during the week when the payment is done.

- Bi-weekly payments: They are payments done twice every seven days on certain set days

- Fortnights payments: They are payments made every fourteen days on a certain set date

- Monthly payments: These are payments made once every thirty days on a certain agreed date

Pros and cons of payment schedules

There are advantages and disadvantages associated with each type of payment. Below let us investigate each method.

- Weekly payments. This method is common with wage earners, freelancers, and contract-based workers. It is the most favored by workers who love receiving their pay often. On the other hand, it is disadvantageous to the paying entity because the cost of processing payments every week can be higher. Many online companies use the weekly payment method as their preferred method because their worker database may include a hundred thousand workers who work on different schedules attracting different payments.

- Bi-weekly payments. This method of payment is popular with workers who work on an hourly basis because their total work hours vary week after week and could total 40 hours in a given week, and twenty hours in another week. Its challenge is to the organization that incurs processing costs as well as gets in busy schedules, calculating the value of the payment due to each worker. One way for the organizations to cushion against payment processing losses is by charging the workers a payment processing fee which can be captured in the payment schedule template.

- Bi-monthly payments. This method is preferred by salaried employees who do not like waiting for thirty days to receive payments. Payments are usually made two times a month, mostly on the 1st day and the 15th day of each month. Companies favor this payment method because it is less costly.

- Monthly payments. This payment method is done once every month and it is the most preferred by employers because it costs the least in terms of processing costs. However, it is the least preferred by employees who feel the thirty-day waiting period is long.

Another disadvantage of this method is where the employees get to budget their salaries to sustain them over a thirty-day period which gets challenging at times.

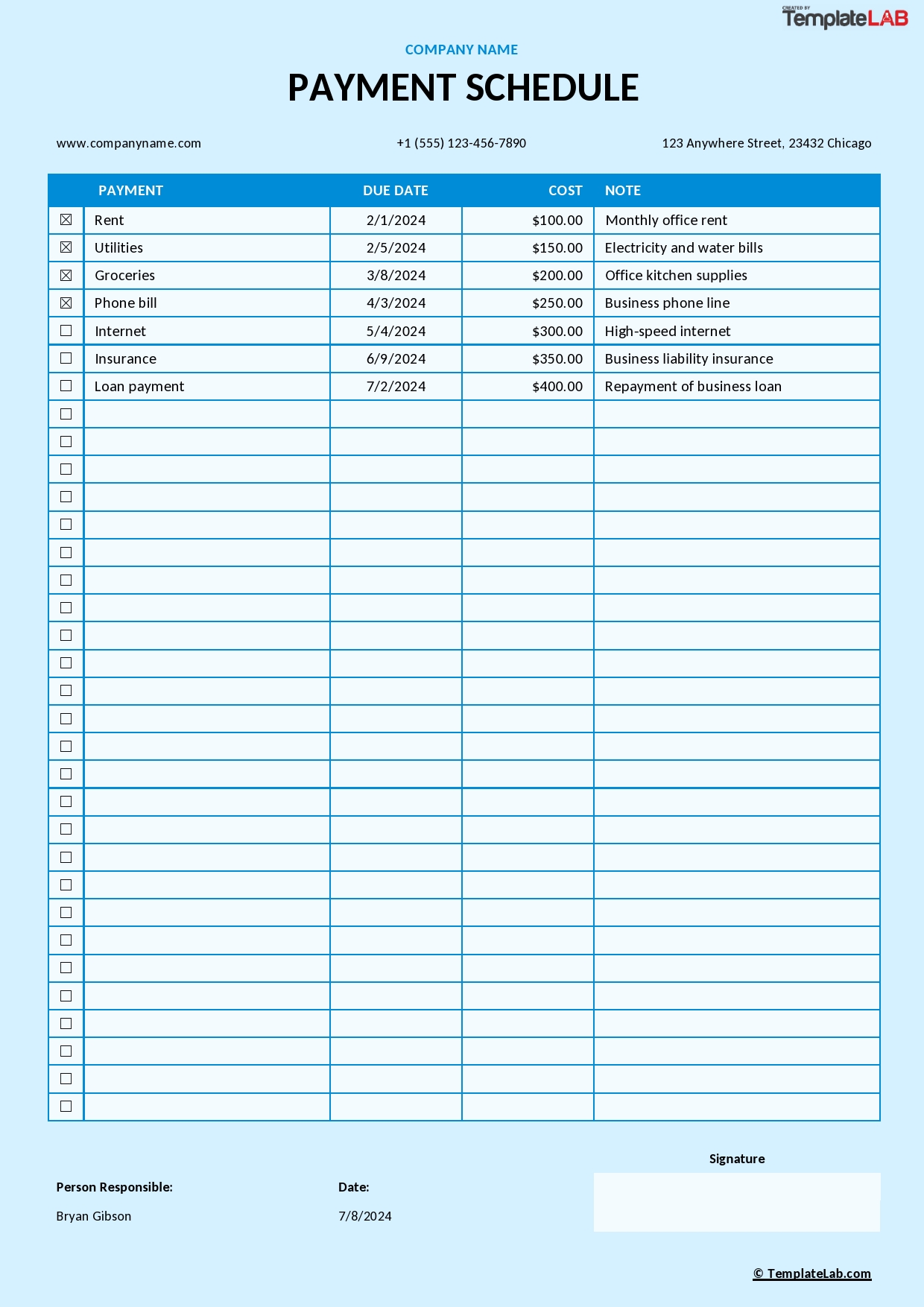

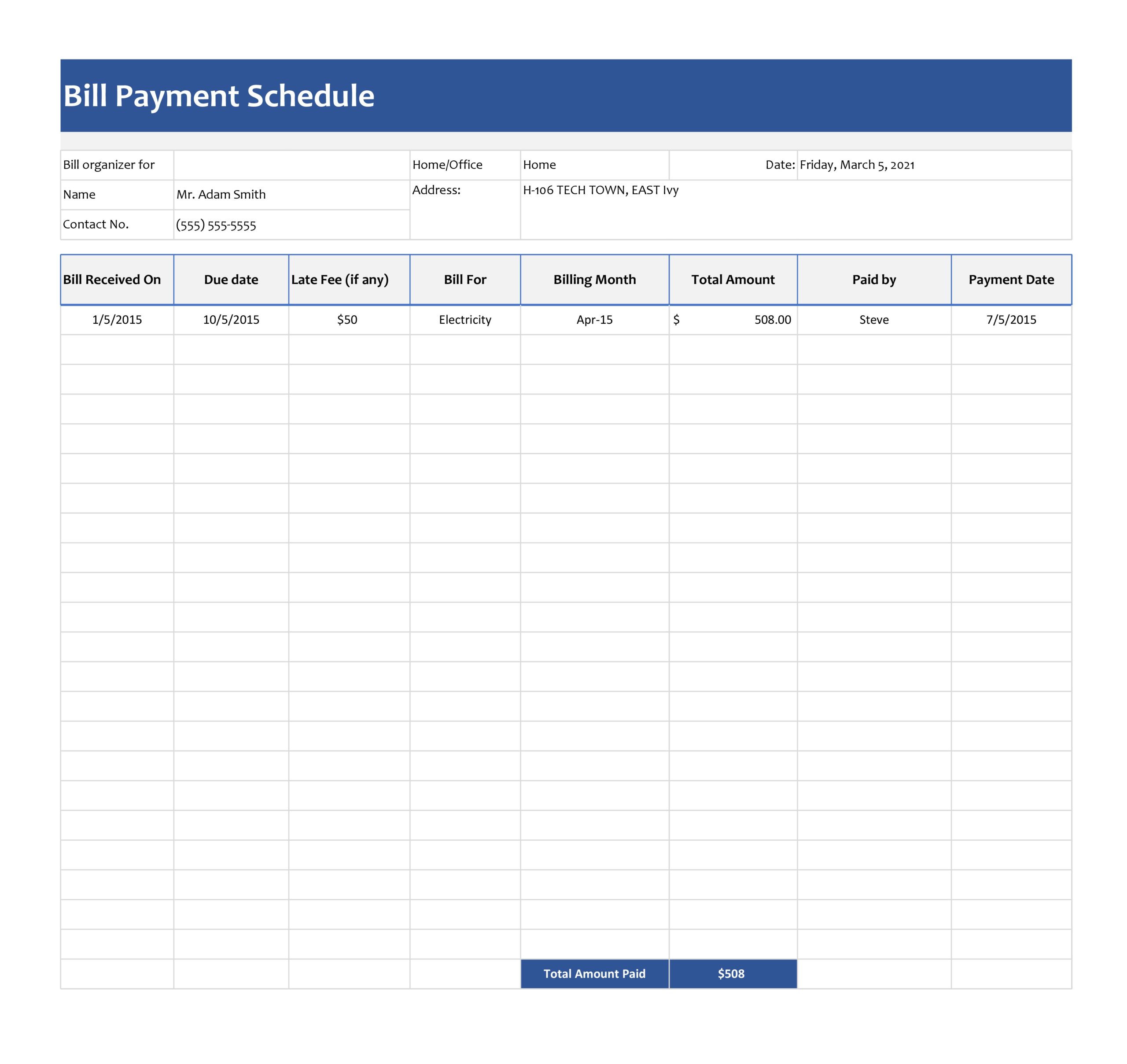

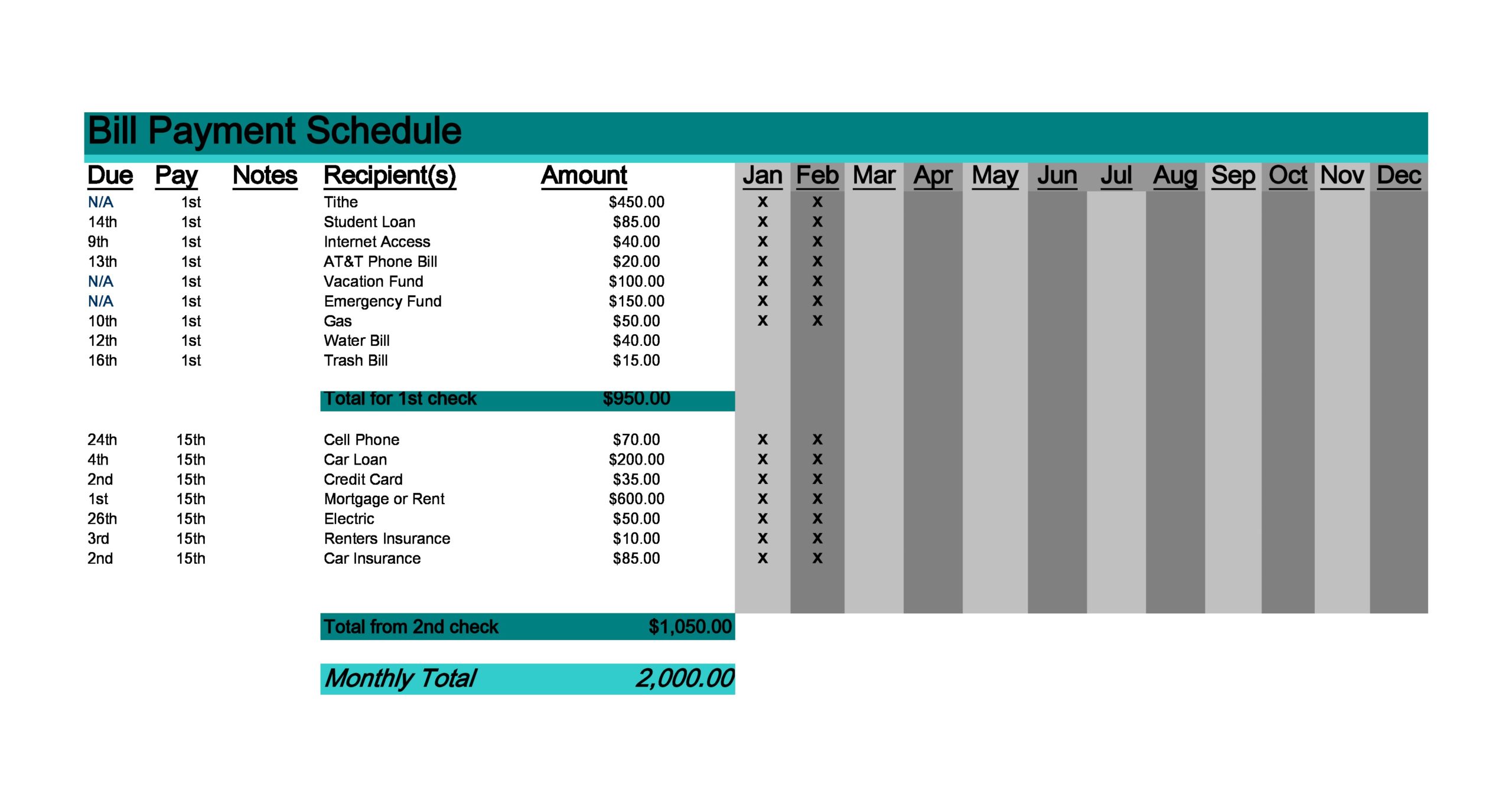

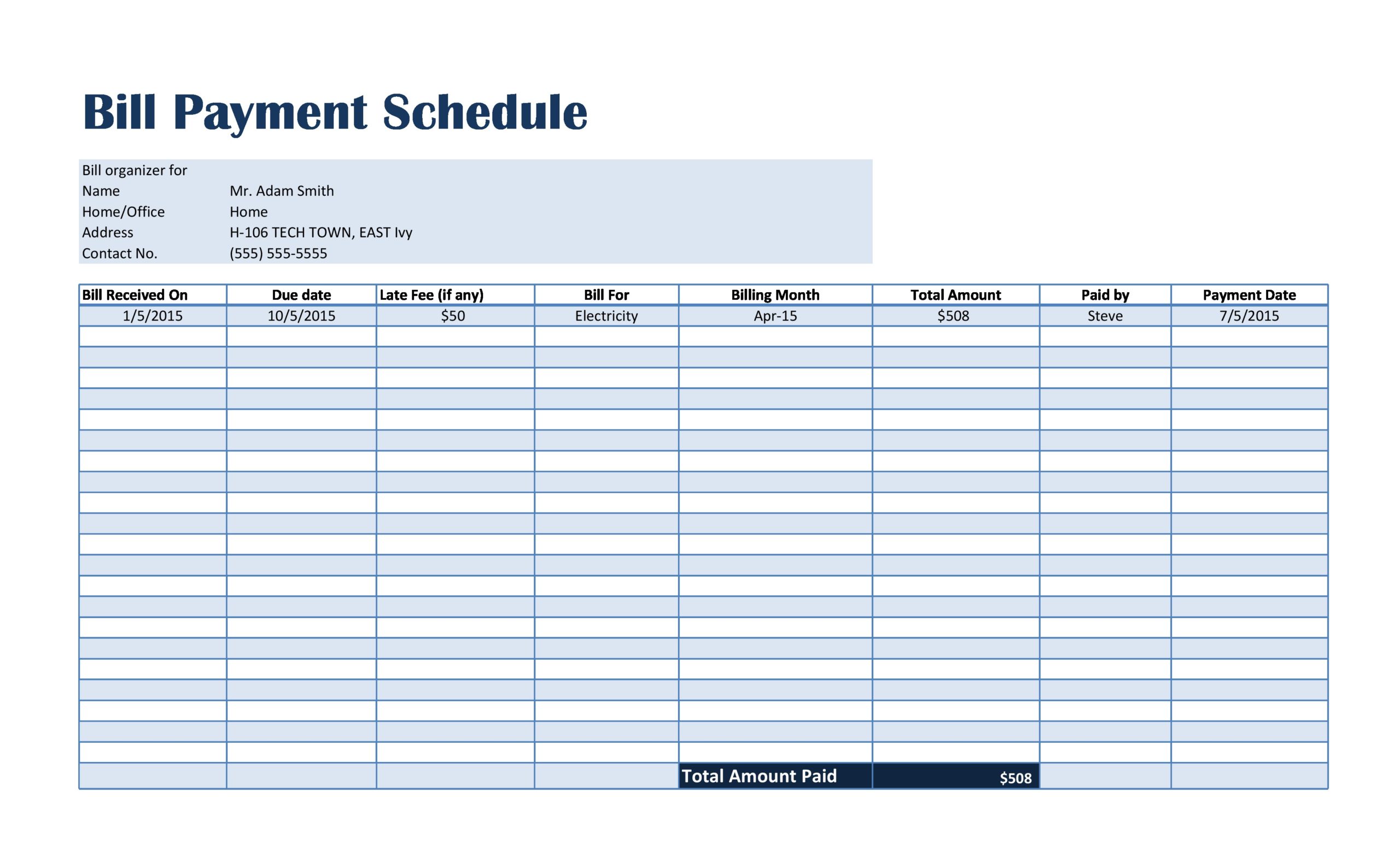

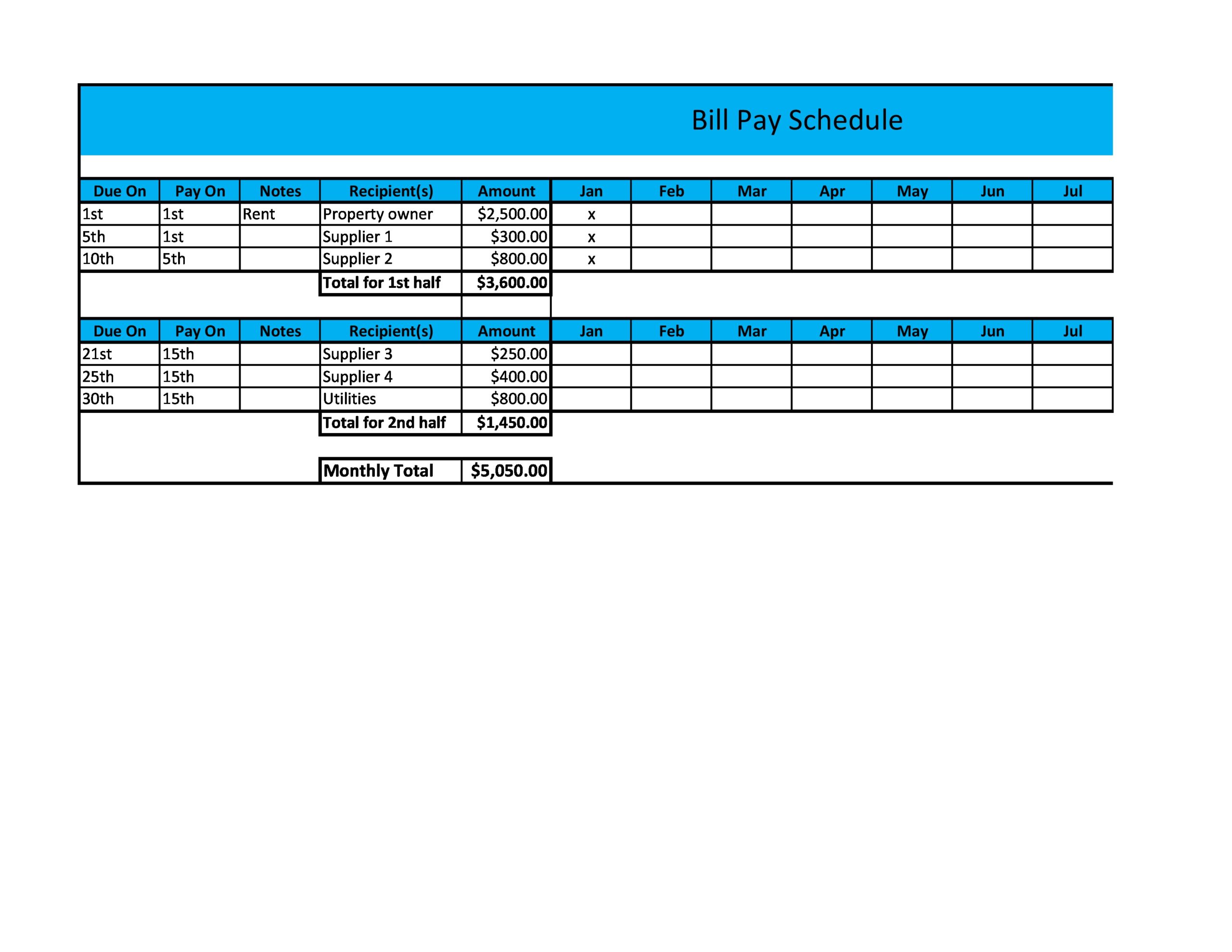

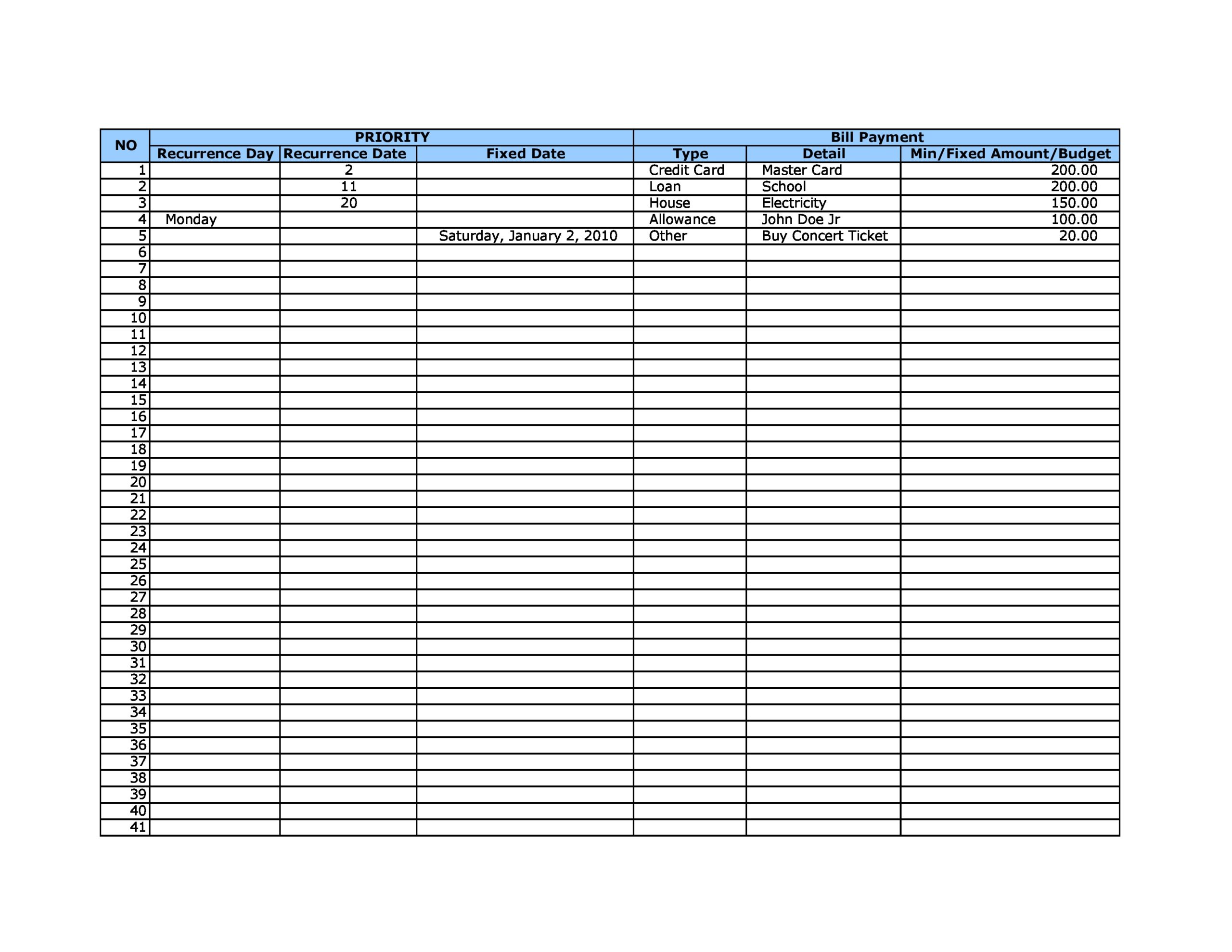

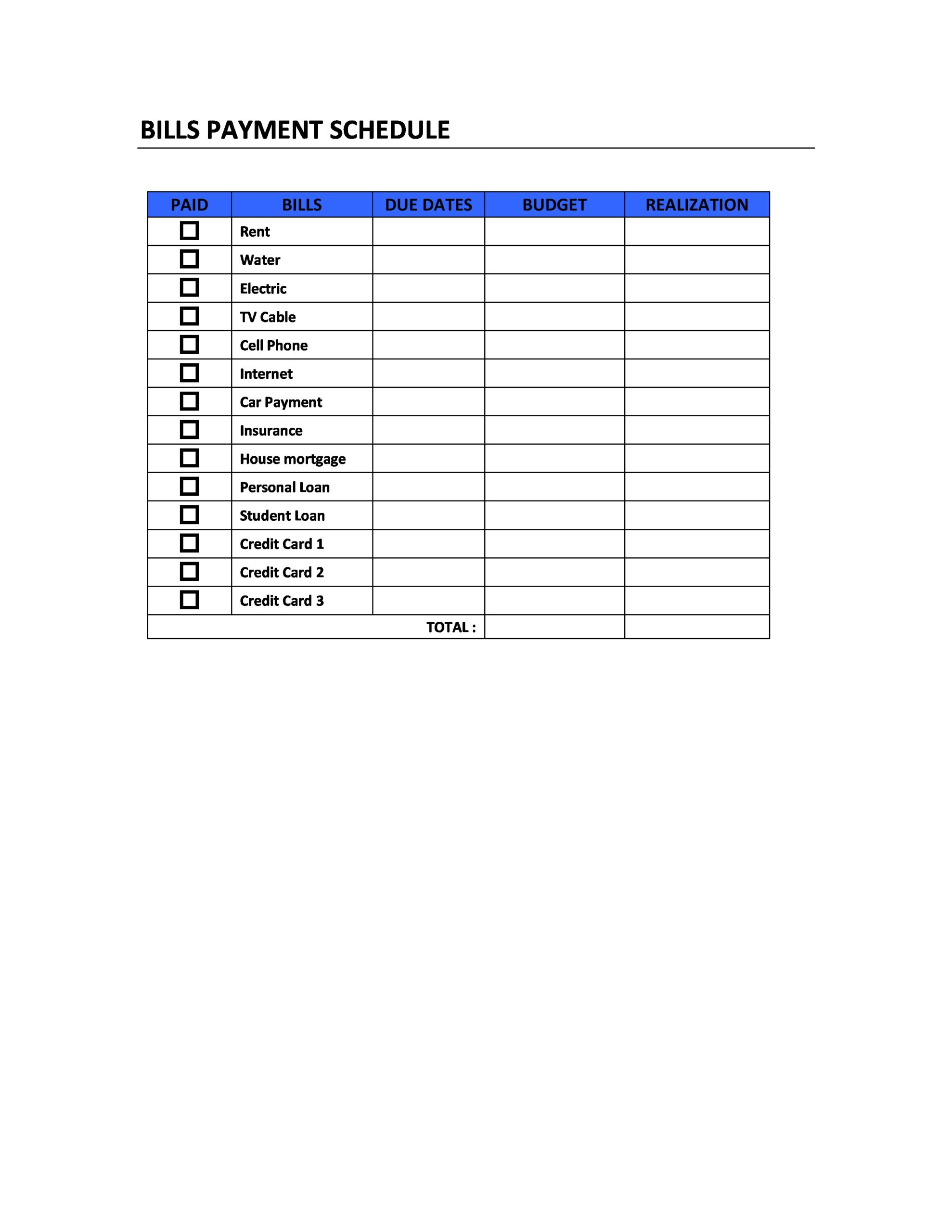

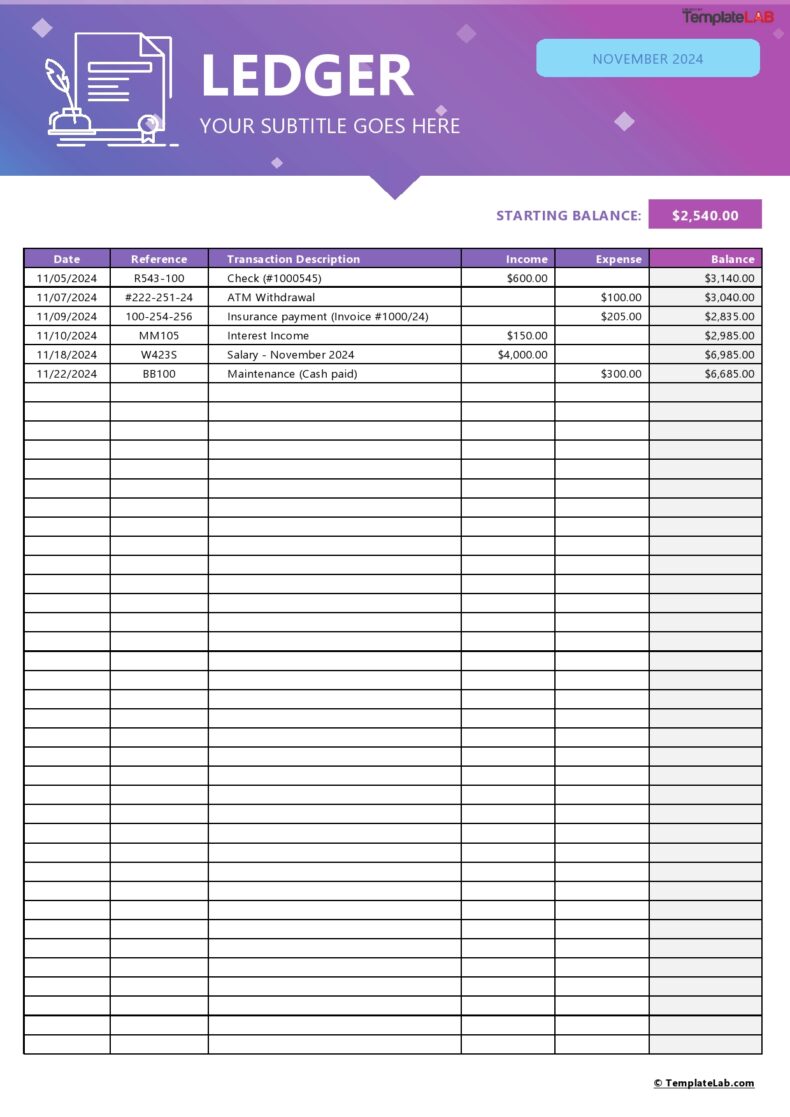

Bill Payment Schedule templates

Types of payment schedule templates

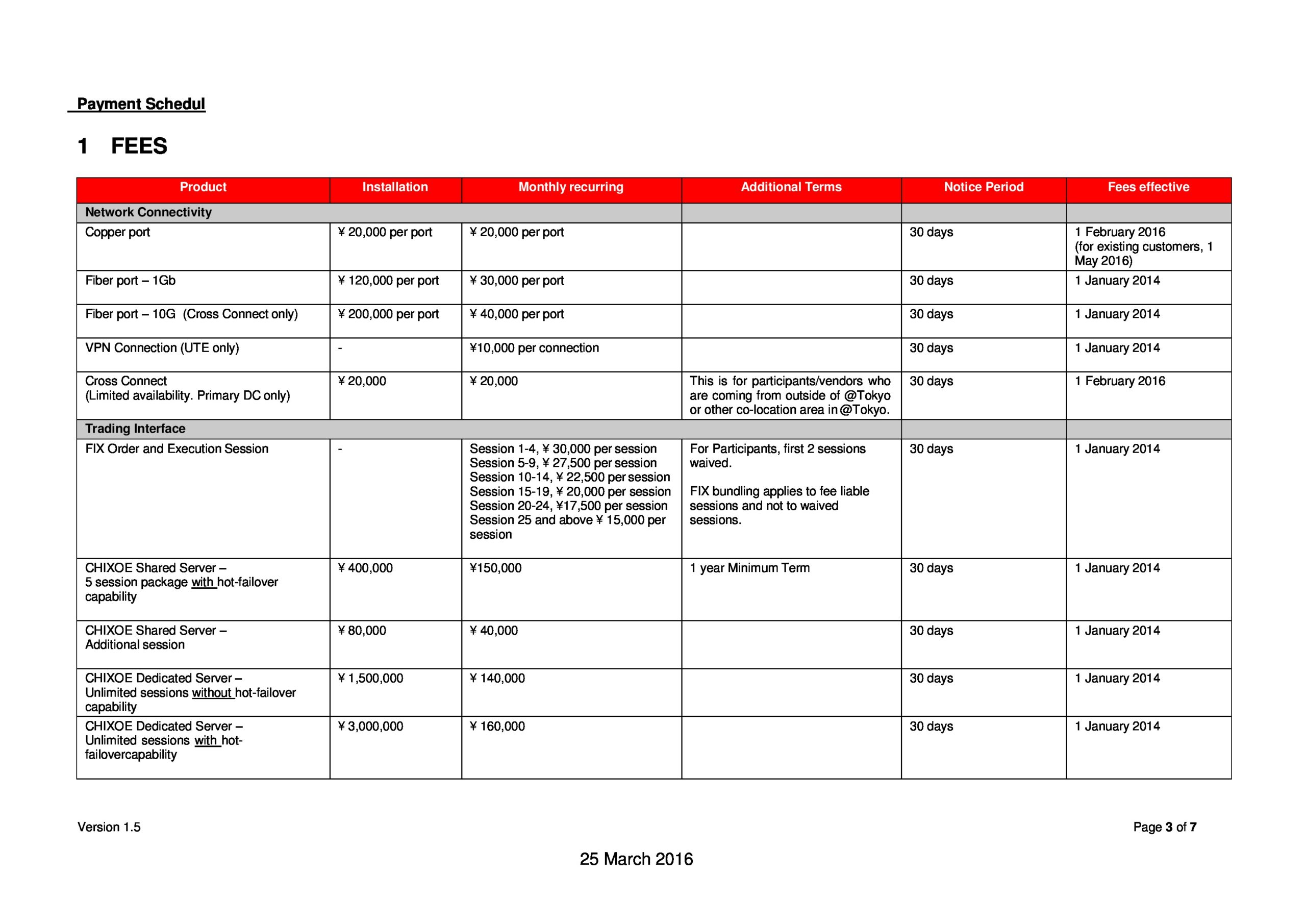

There are as many types of payment schedule templates as there are payments to be done. Although their similarity is different, their application is the same across the board, in that they help the payer prepare an organized payment list against his payment requirements. Below is a list of the different types of payment schedules.

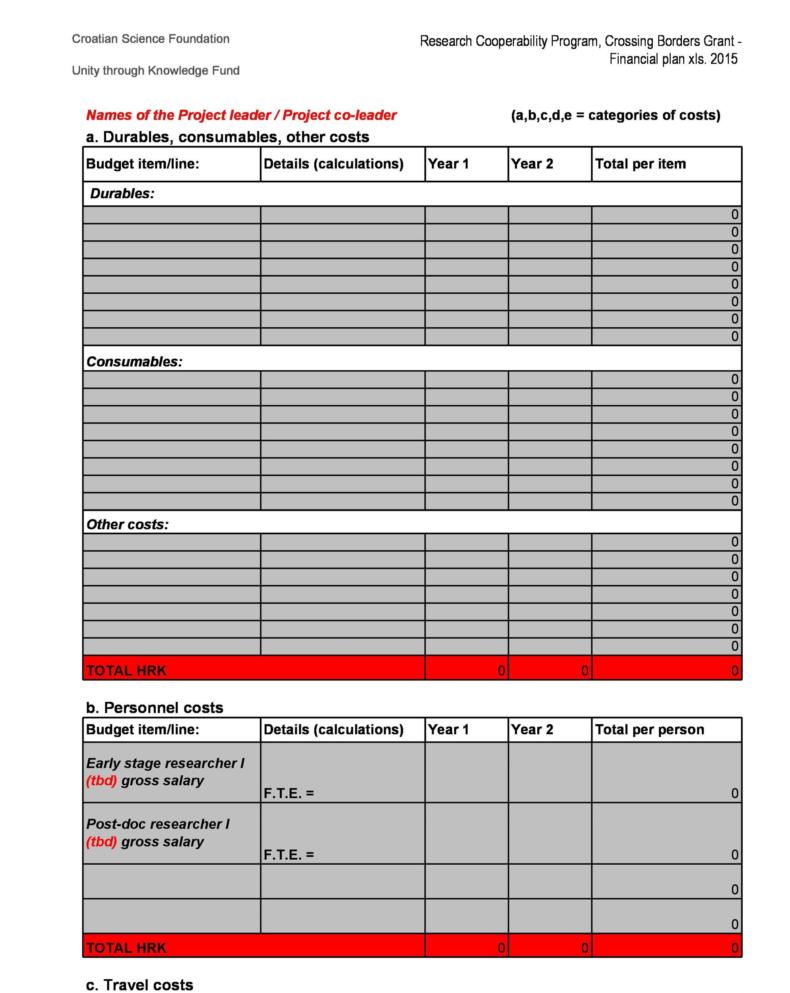

- Loan payment schedule template. This template is used to track the date that each loan falls under, the amount to be paid, the interest, and the company or individual who issued the loan. It is mostly favored by credit companies, mortgage companies, and shark tanks.

- Bill payment schedule template. This template is used to organize the various bills a company incur every month and the amount payable against each bill. It captures bills like water, electricity, telephone, sewerage services, garbage collection, and so on. The template lists the name of the service provider, the due date of payment, and the amount.

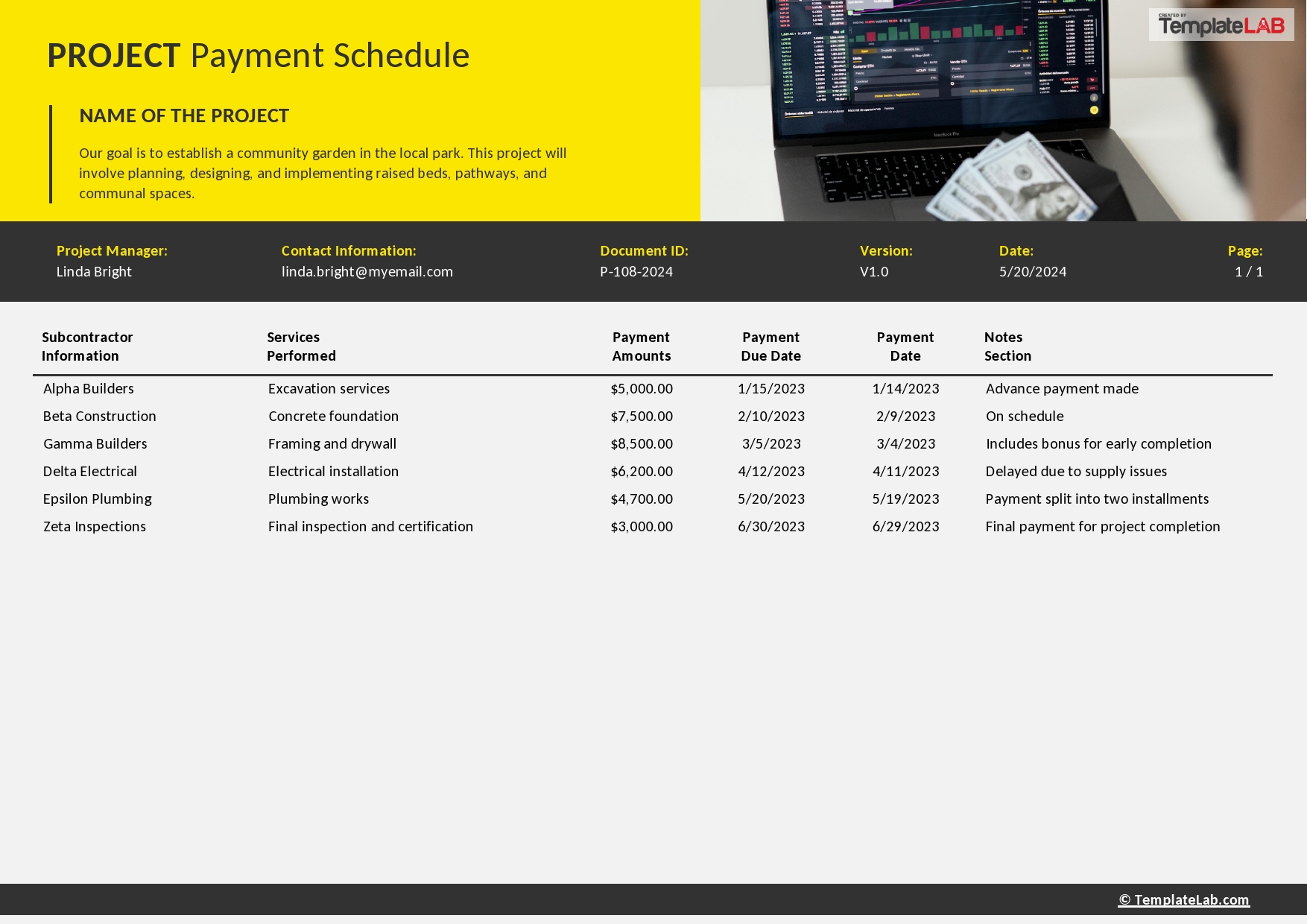

- Project payment schedule template. It’s used for organizing project payments as agreed in contract terms.

- Construction payment schedule template. It is used by contractors to make payments against project progression by phase and the total value of the said project.

Other types of payment schedules templates include:

- Mortgage payment schedule payment

- Excel loan payment template

- Building contract payment schedule template

- Freelance payment schedule template

- Printable project payment template and many more