Most people buy homes through mortgage when they cannot afford to pay the full cost of a home or property. Mortgages are advantageous in that they give borrowers longer payment periods. The borrower can use the property as they continue to pay their mortgage. Before a borrower gets a mortgage, there are several processes they have to fulfill. They must apply to receive a mortgage and the mortgage company sends their team on the ground to check the property. They also check their credit score and if they are okay, they prepare a preapproval letter.

Table of Contents

- 1 Pre Approval Letters

- 2 What is a pre-approval letter?

- 3 Pre Approval Letter Samples

- 4 Advantages of a pre-approval letter

- 5 How do you get a pre-approval letter?

- 6 How long is a pre-approval letter valid?

- 7 Fake Mortgage Pre Approval Letters

- 8 What should a pre-approval letter include?

- 9 Does a preapproval letter mean you are approved?

- 10 Conditions for loan denial after pre-approval

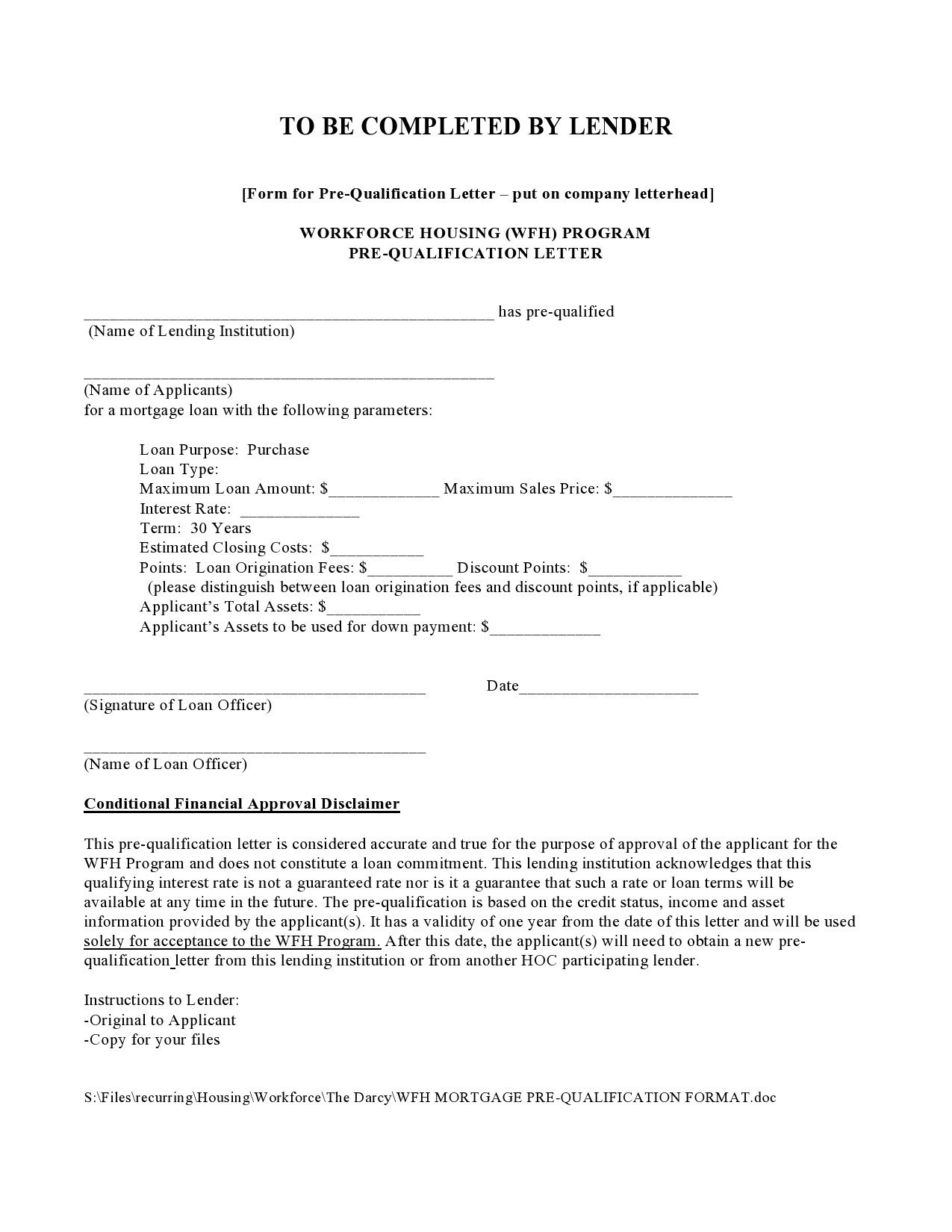

- 11 Pre Qualification Letter Samples

- 12 Verifying a pre-approval letter

- 13 Downloading pre-approval letter template

Pre Approval Letters

What is a pre-approval letter?

After a lender confirms all your documents and investigates the property you want to buy, they will give a pre-approval letter. It is a loan approval letter that states the amount of loan the lender is comfortable offering you.

The amount on offer depends on their judgment after scrutinizing your documents. The loan approval letter helps you adjust your preferences for a home. If the loan amount is lower, you can choose a less expensive home.

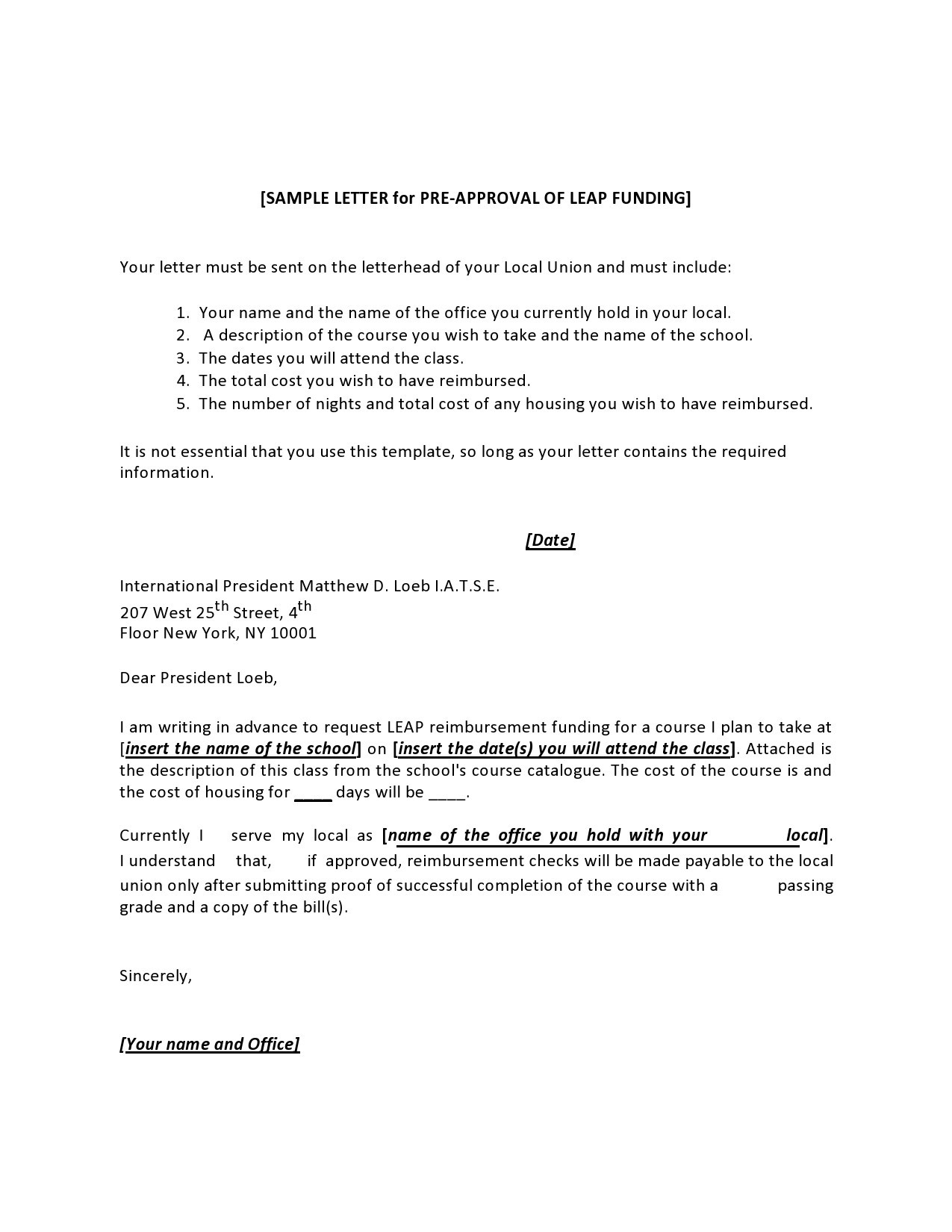

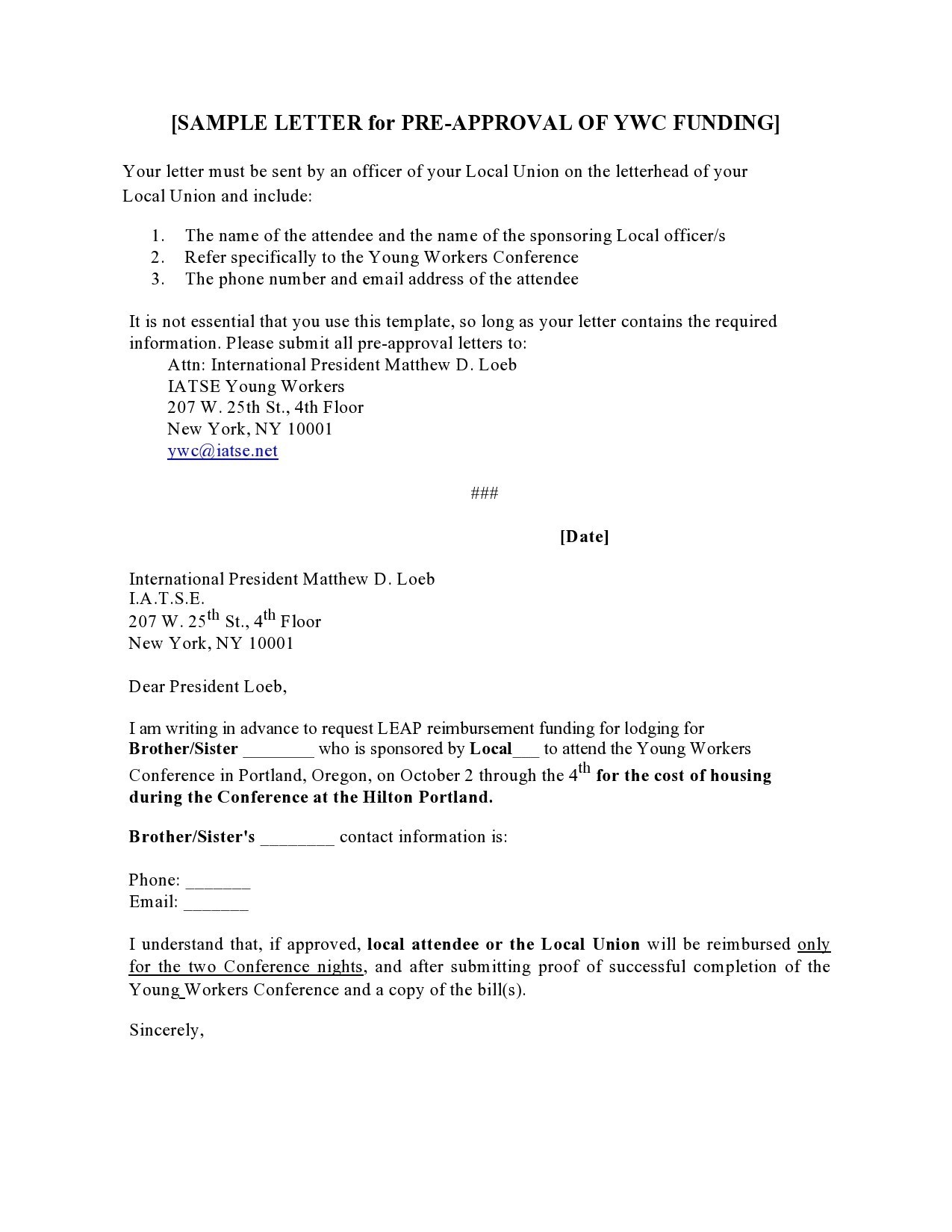

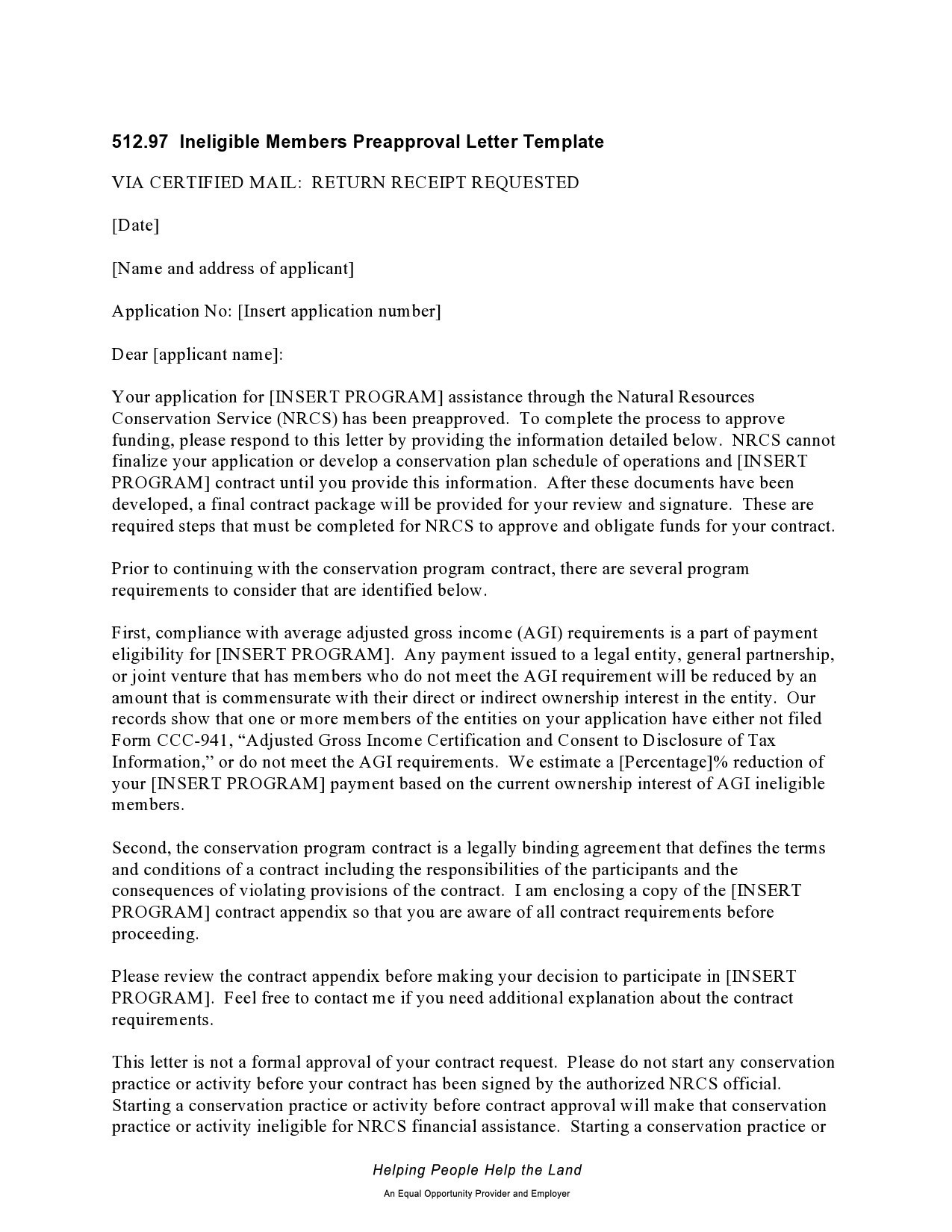

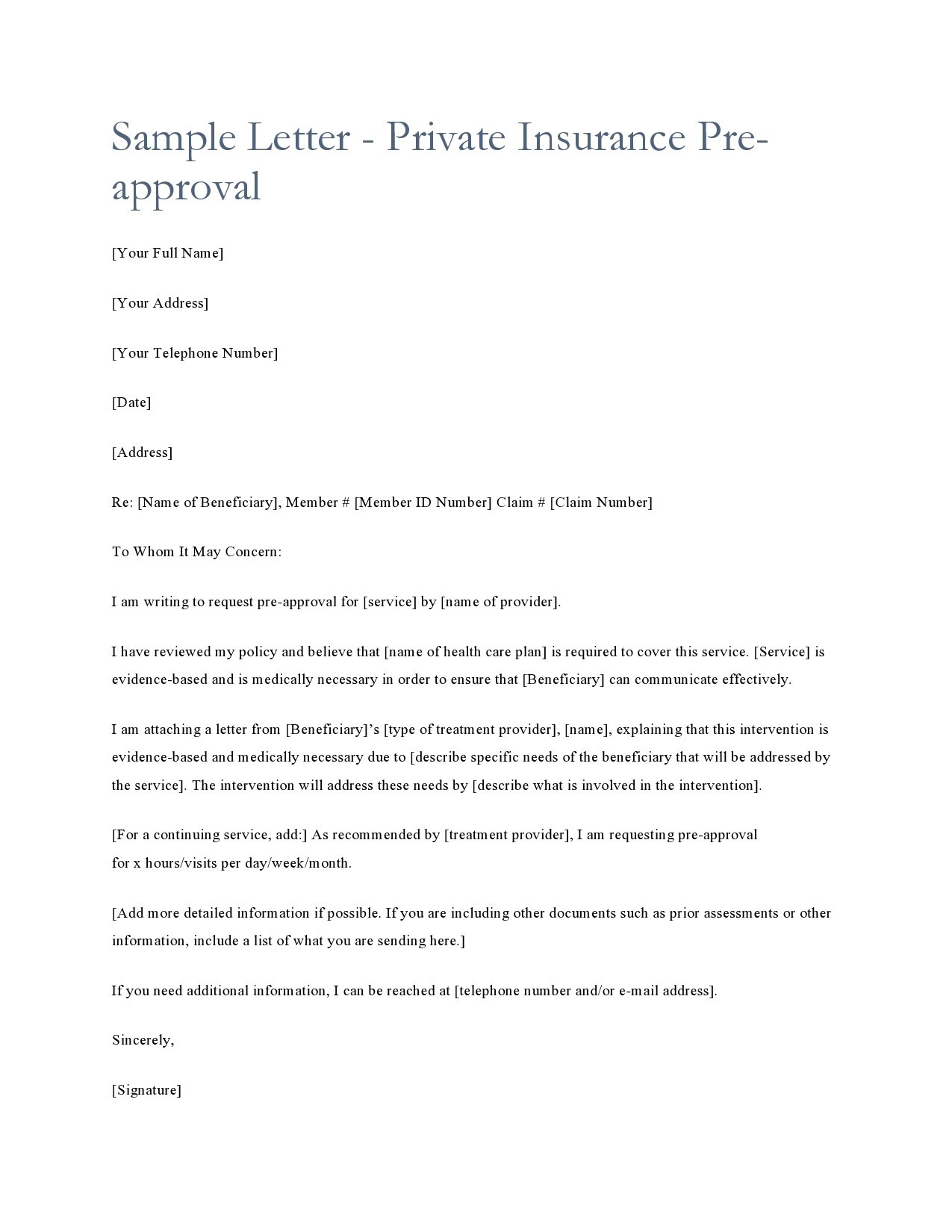

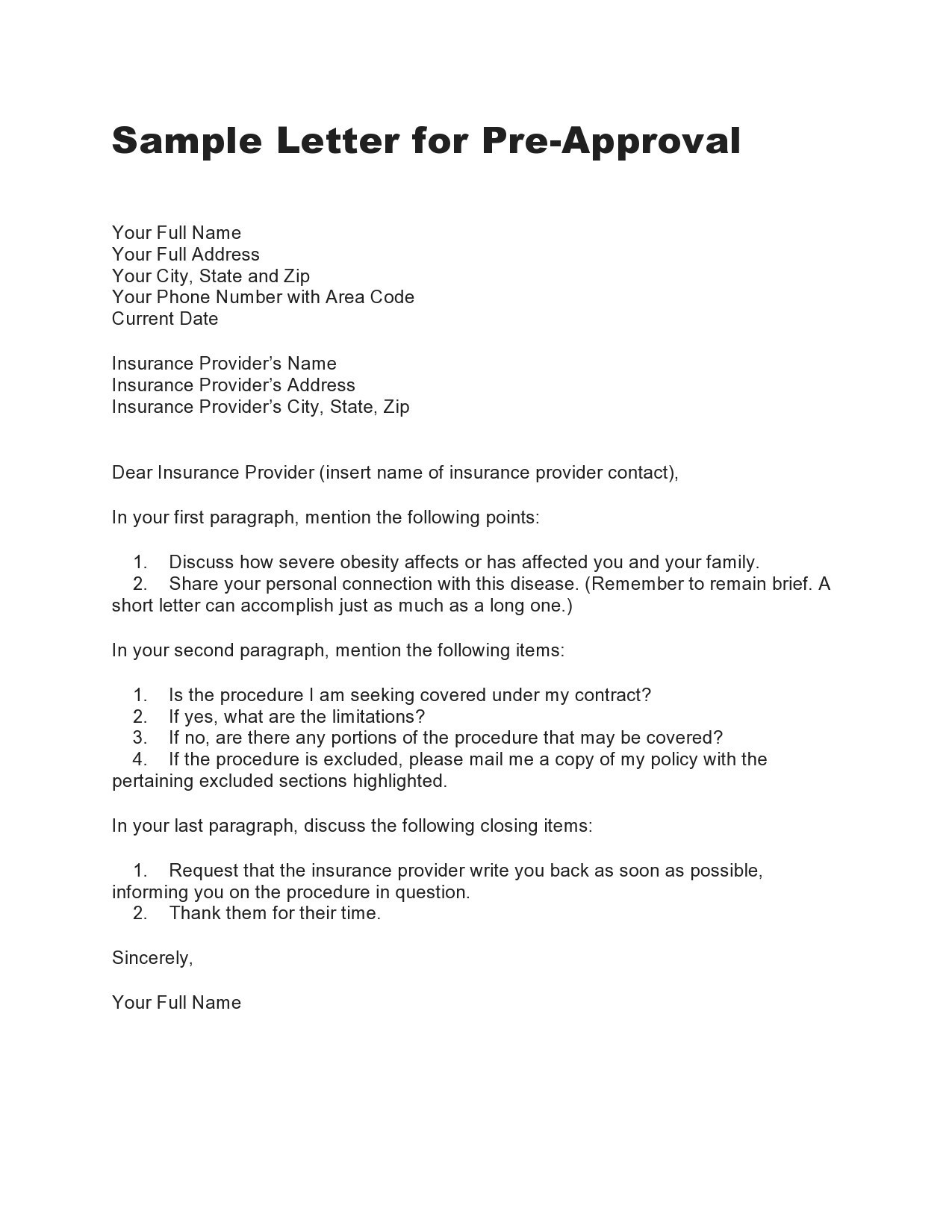

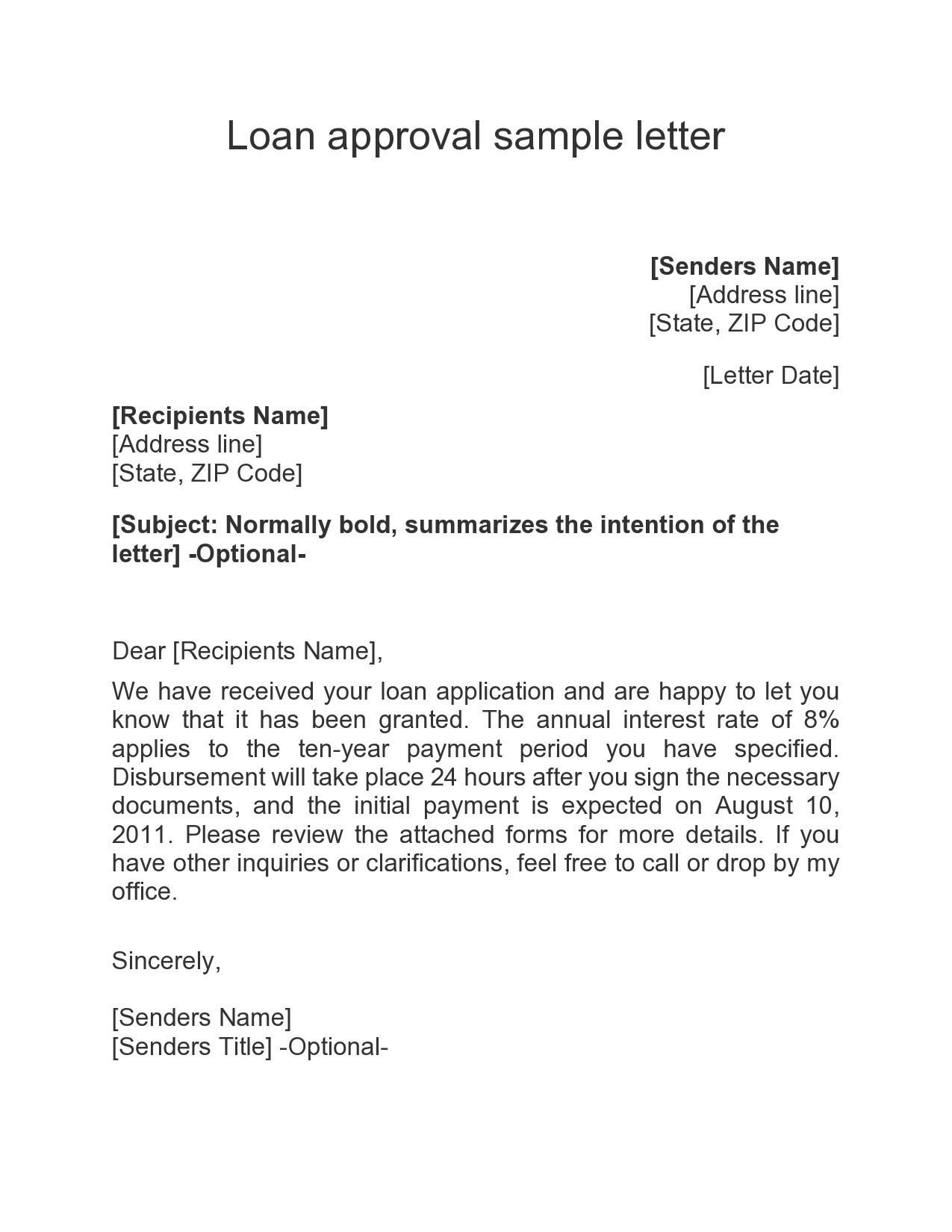

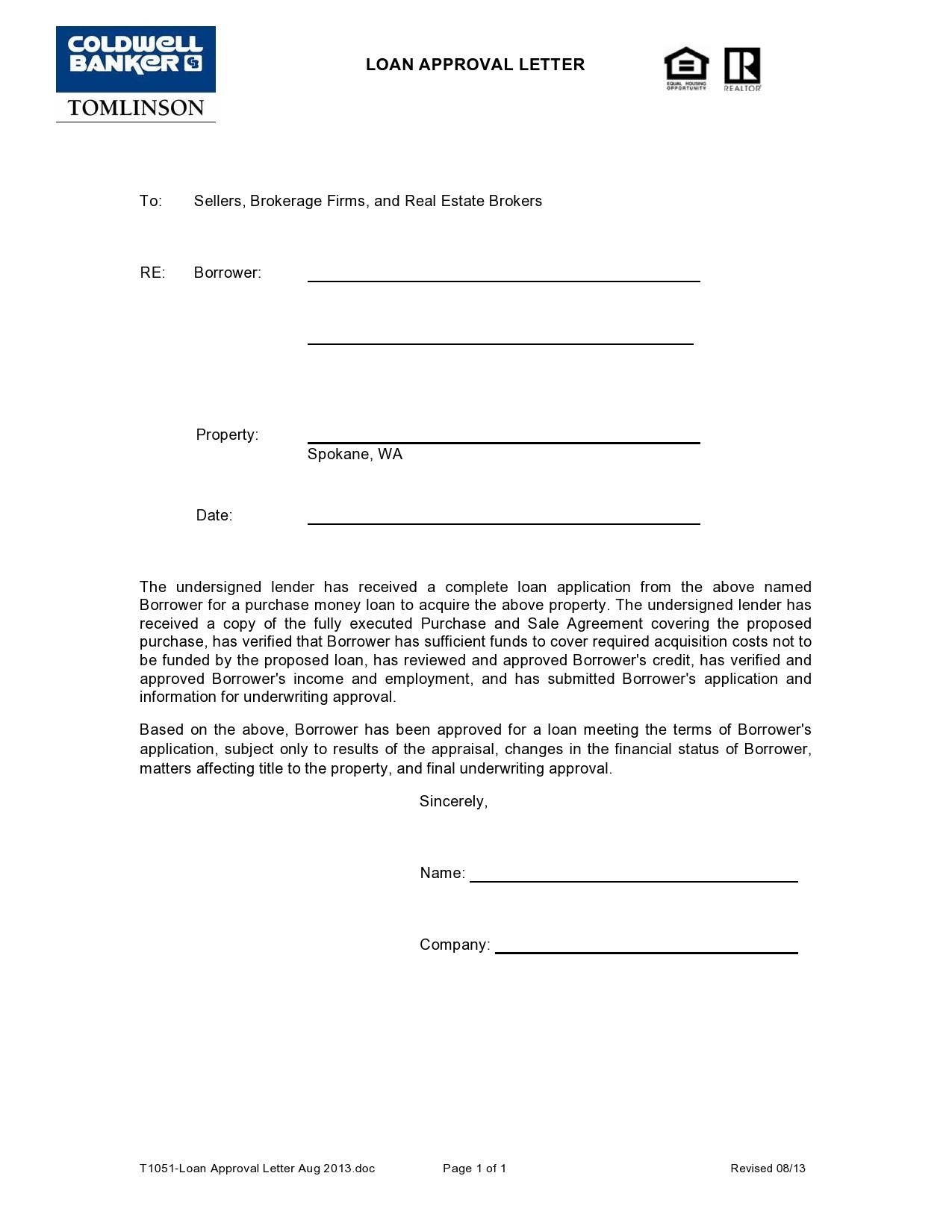

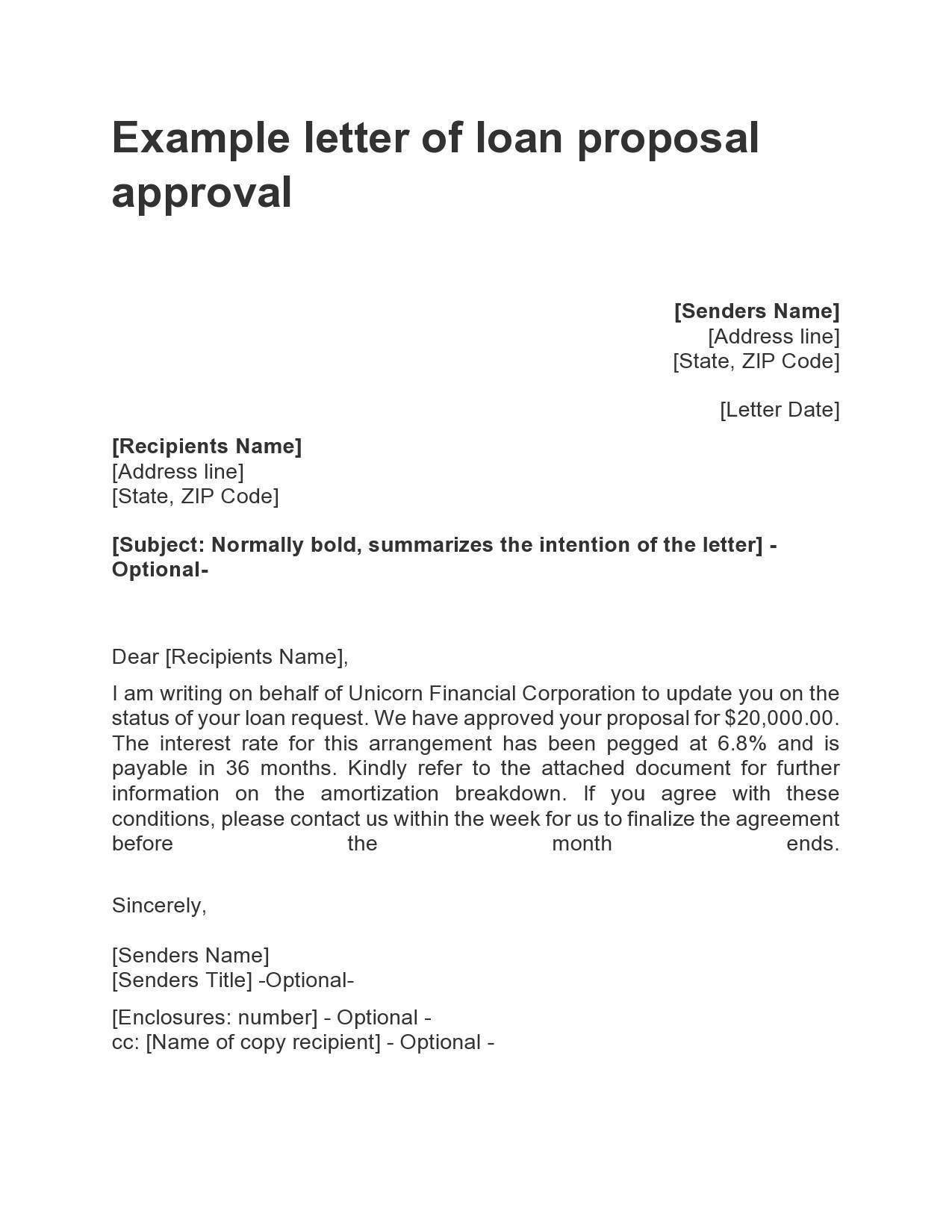

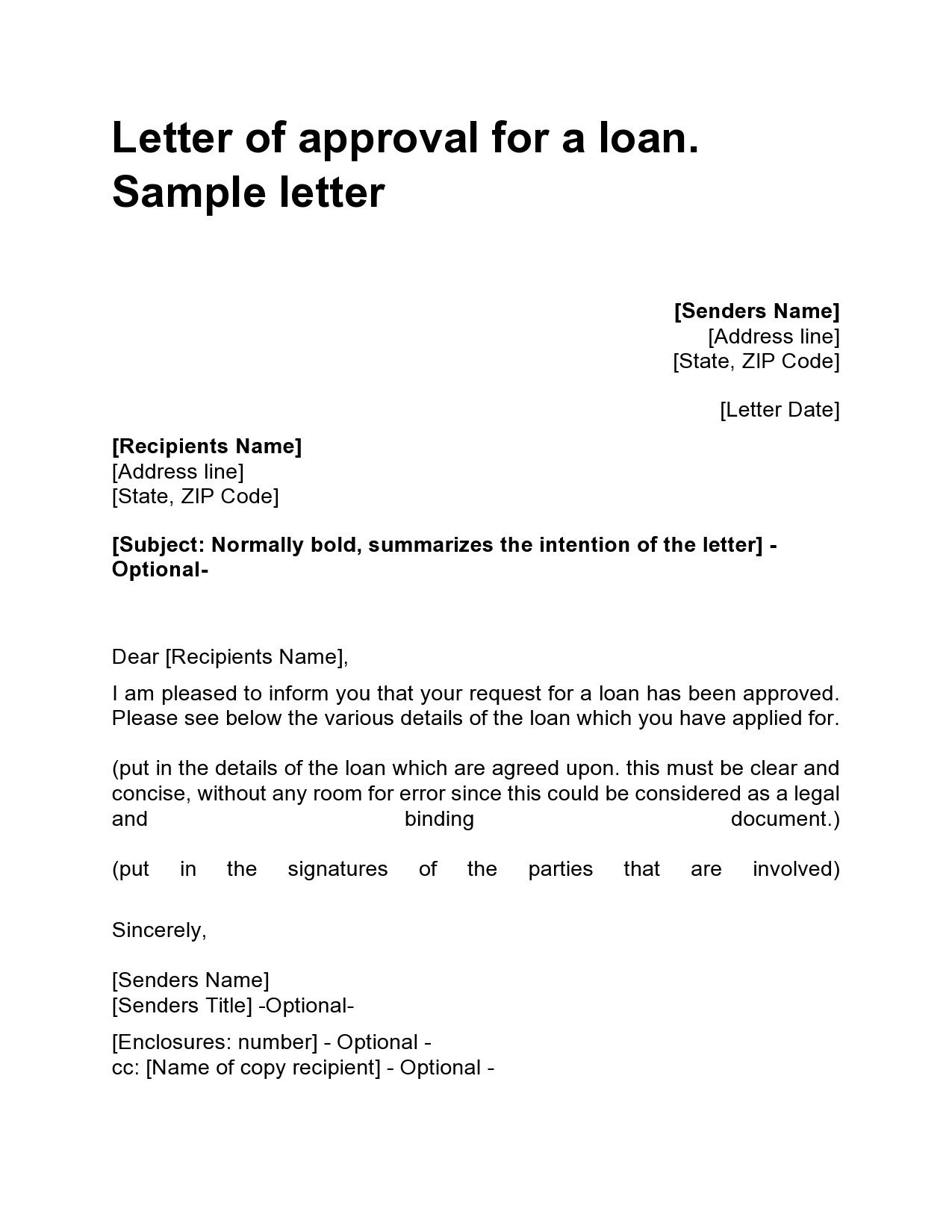

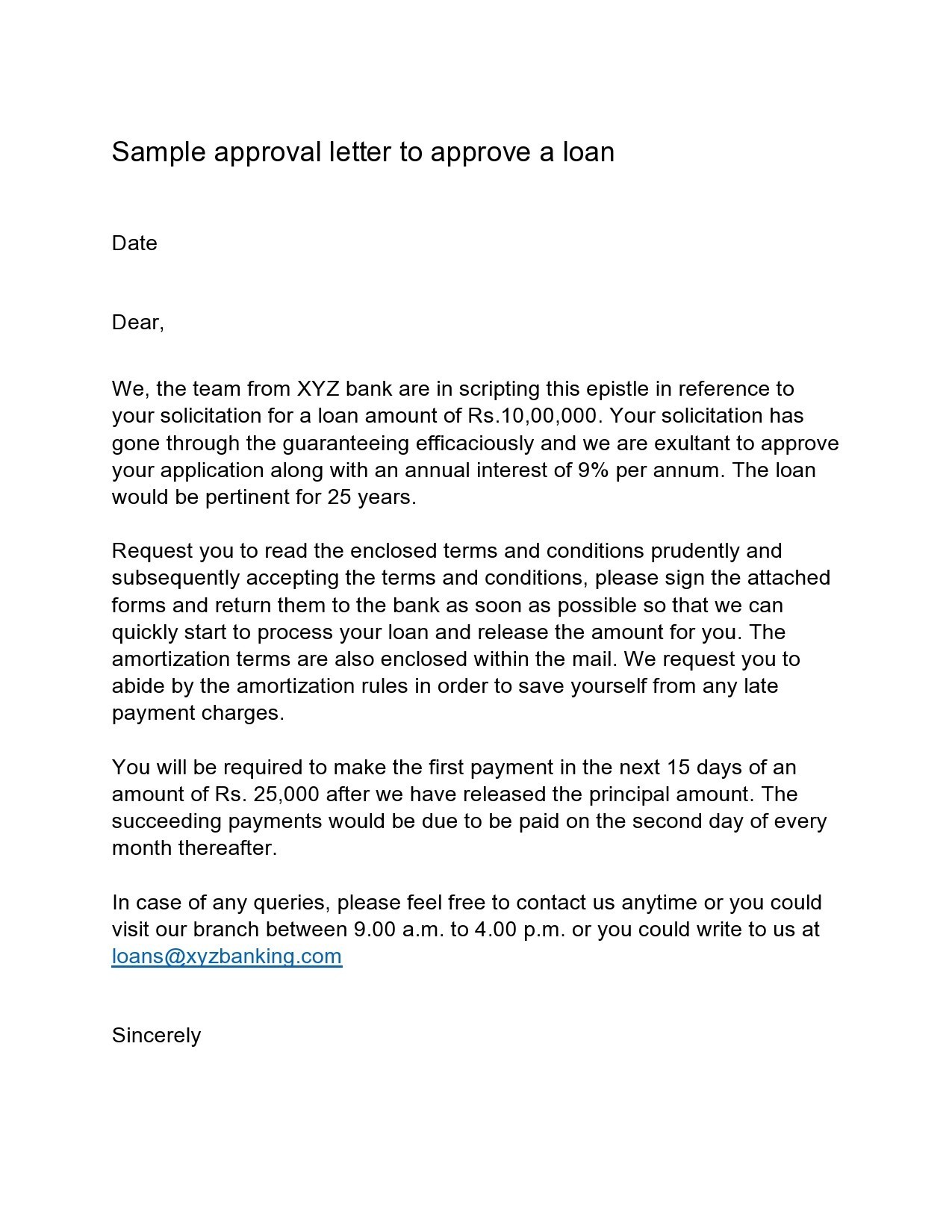

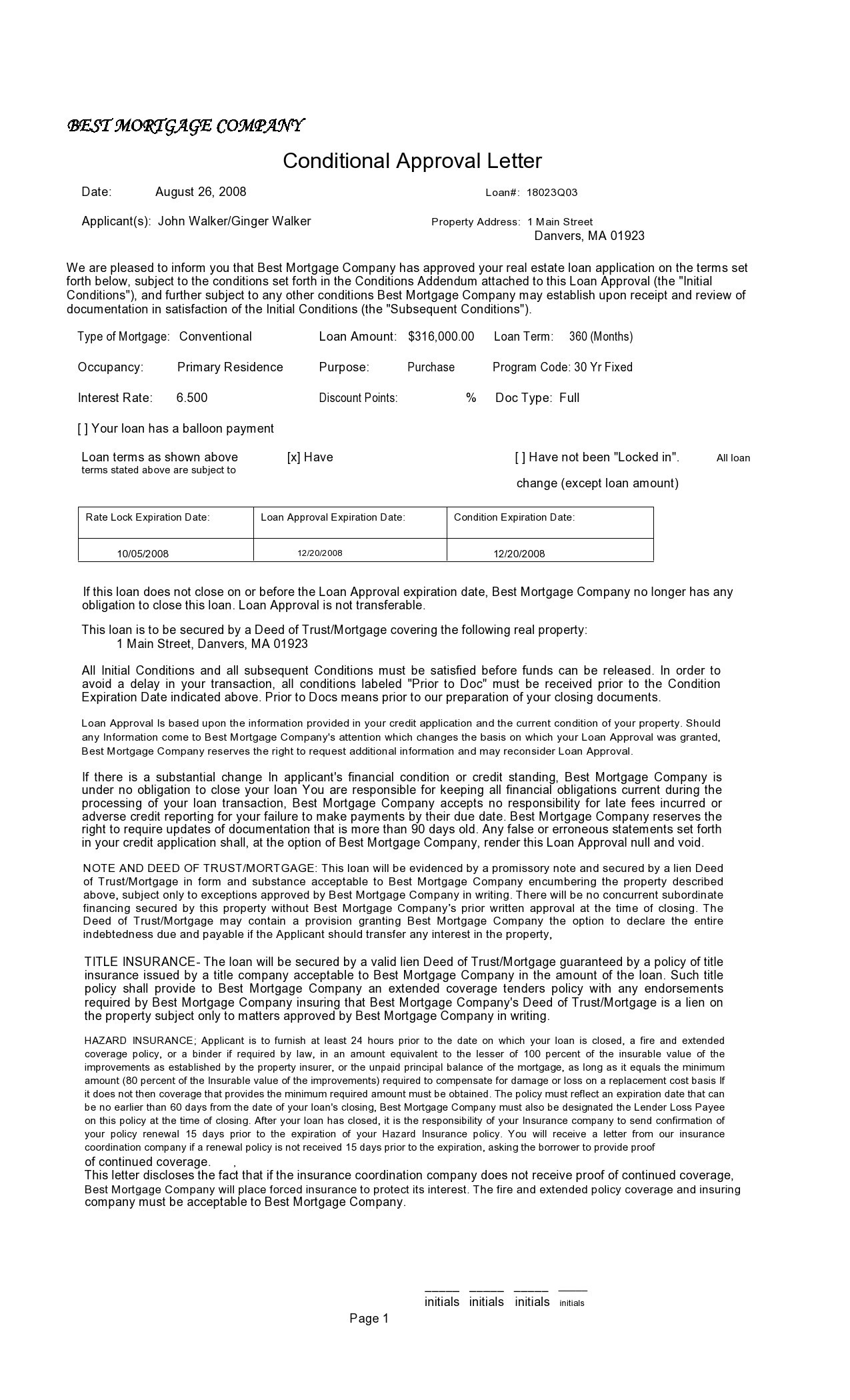

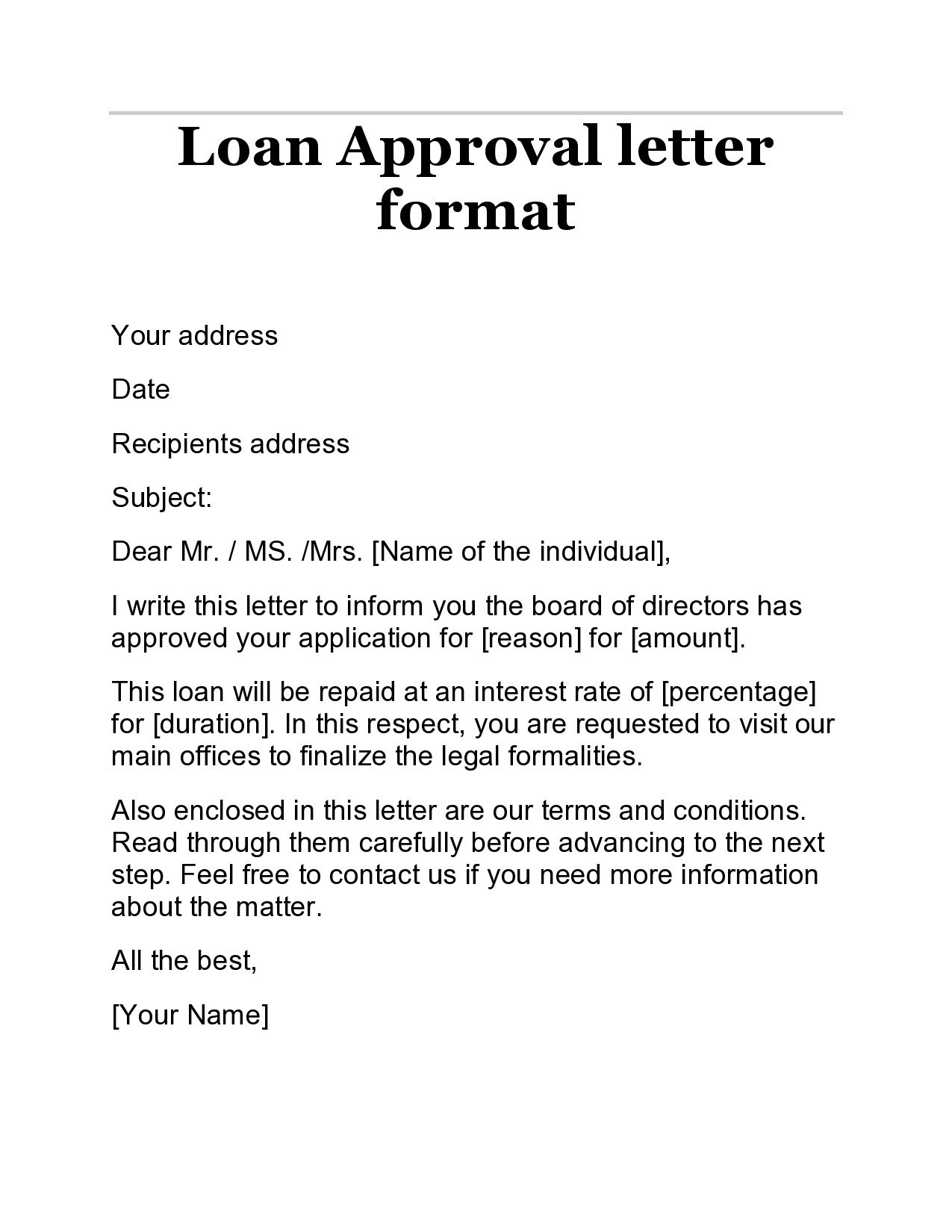

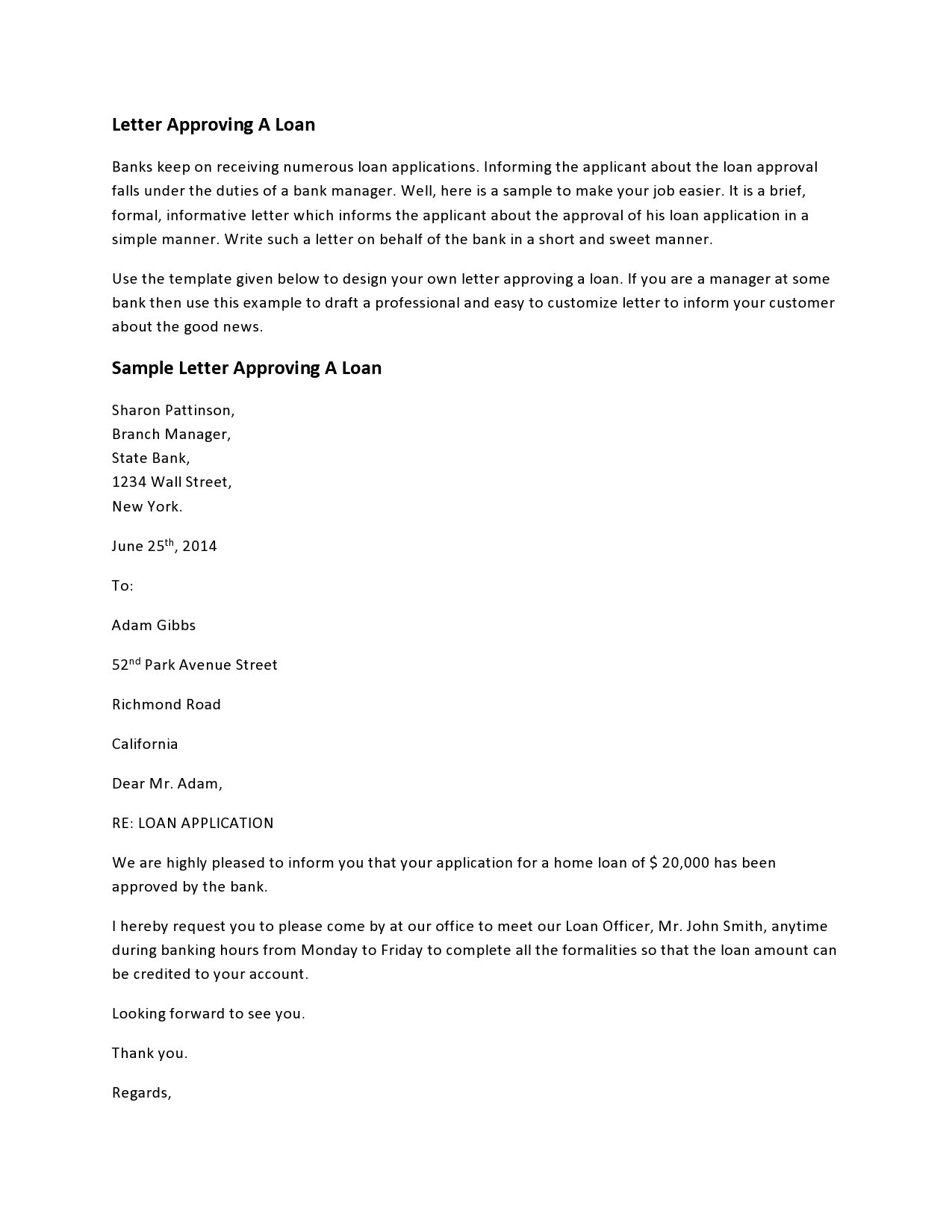

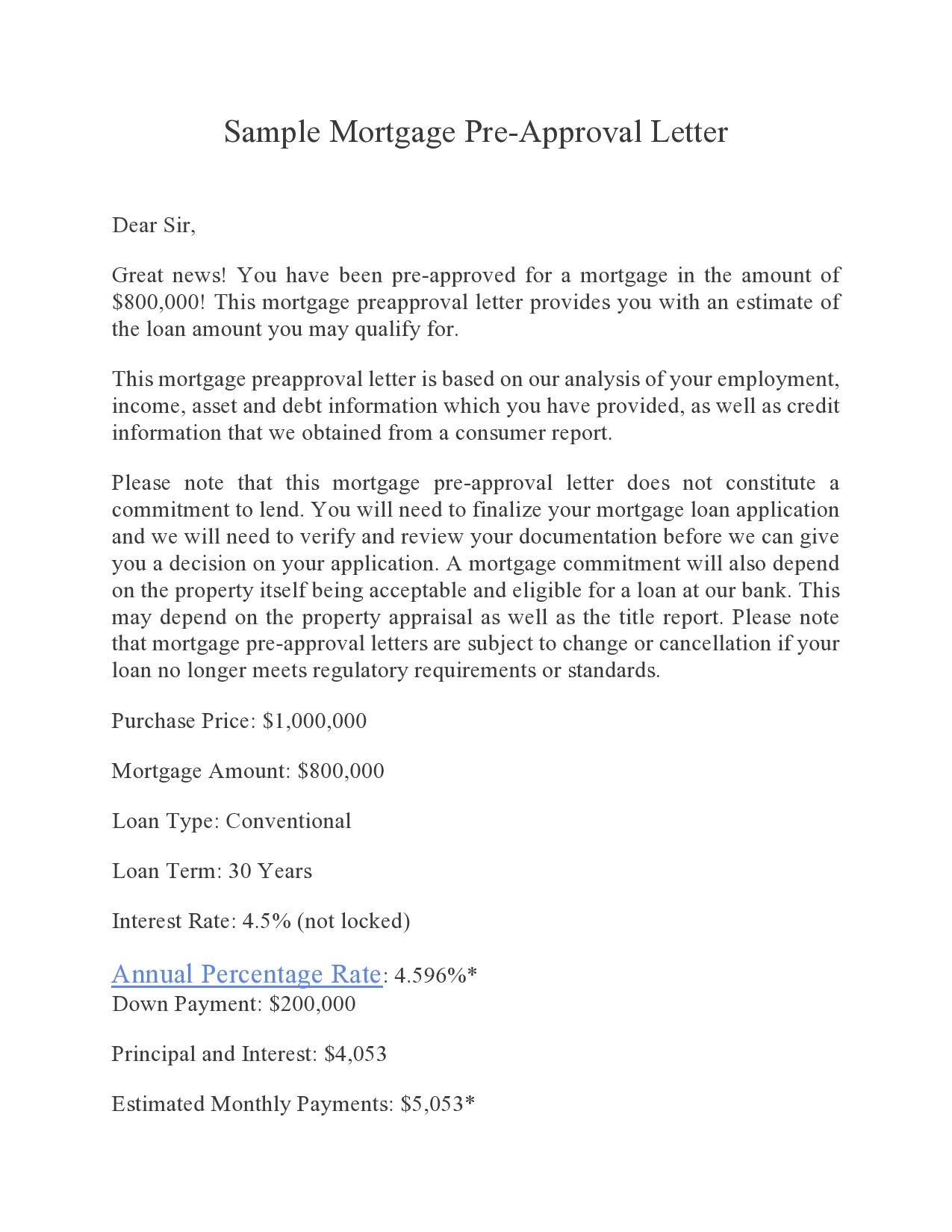

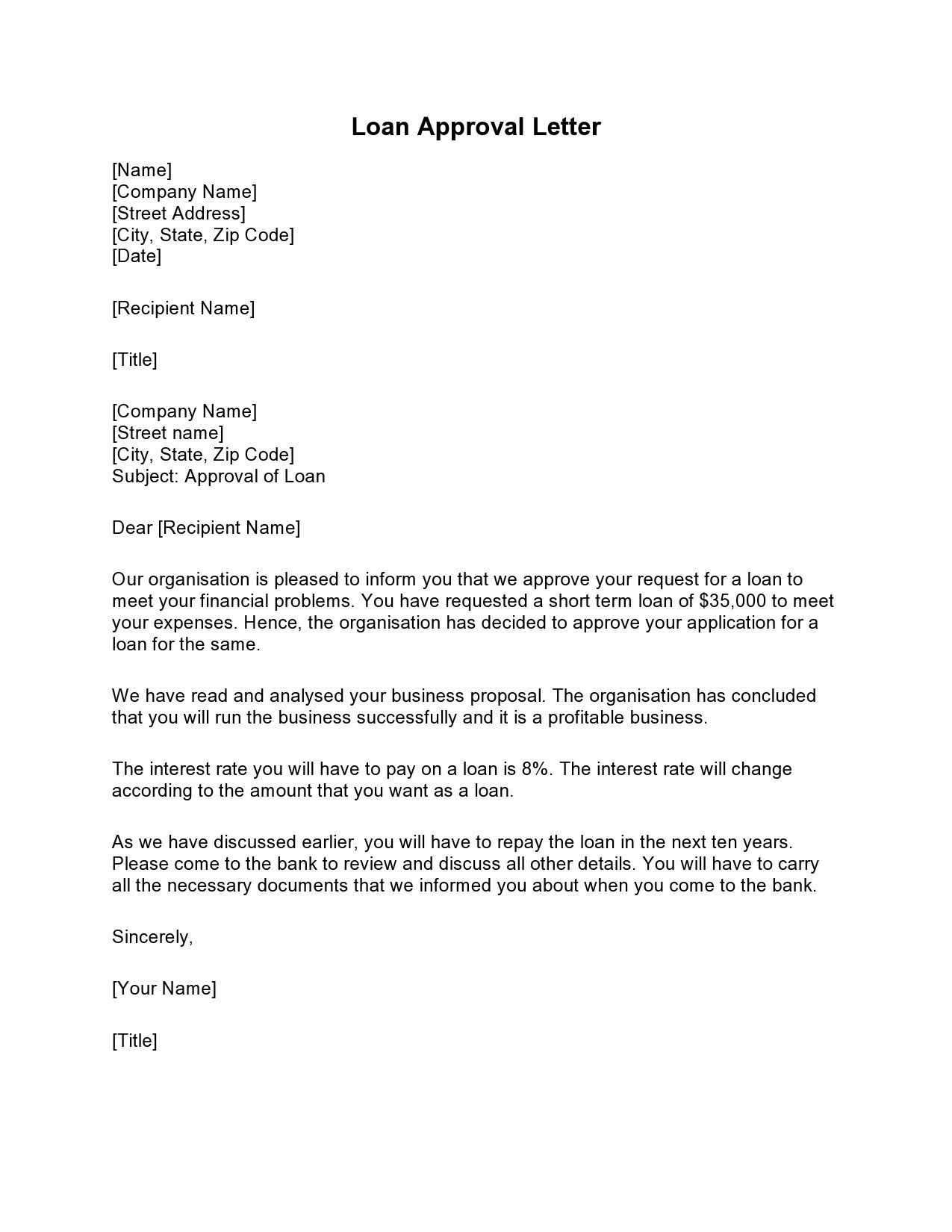

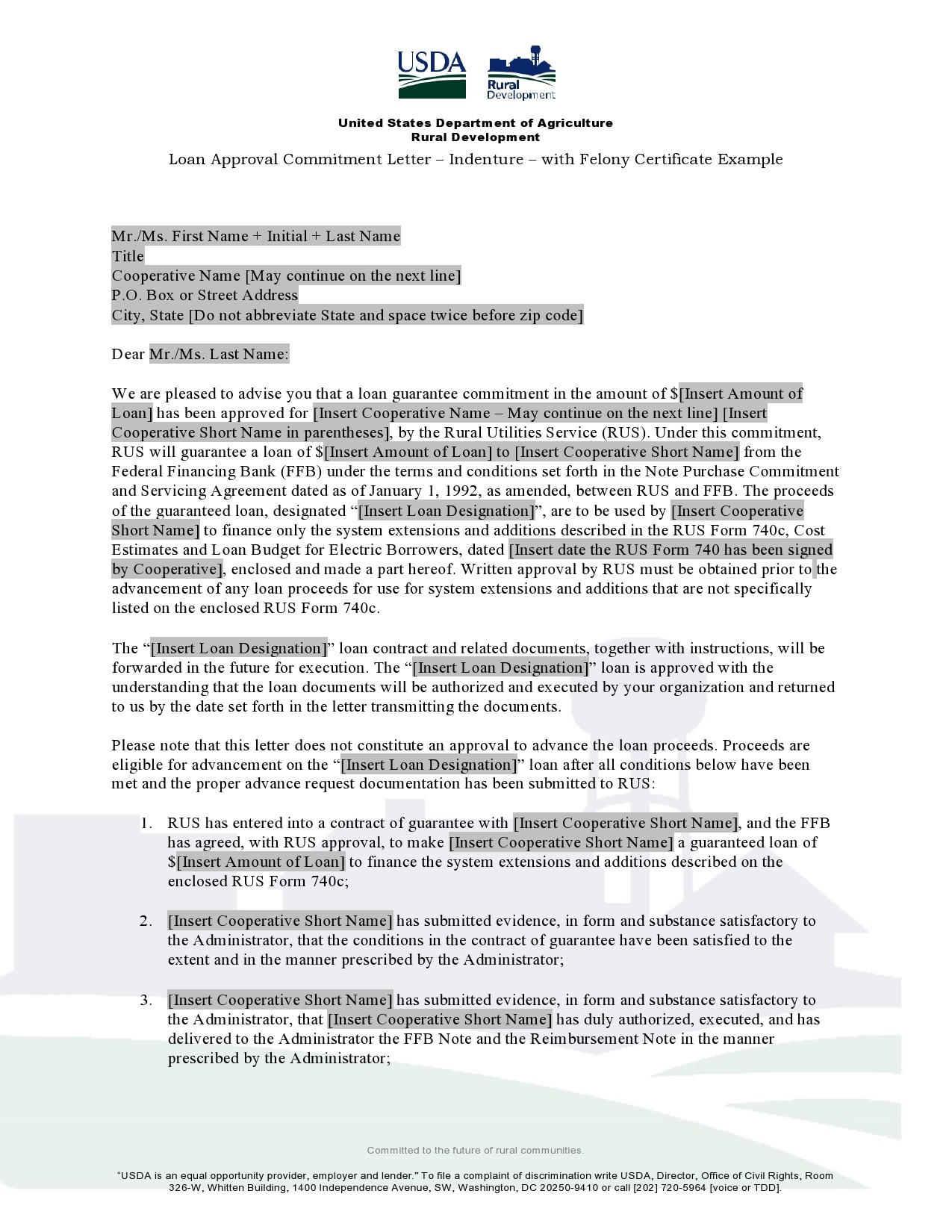

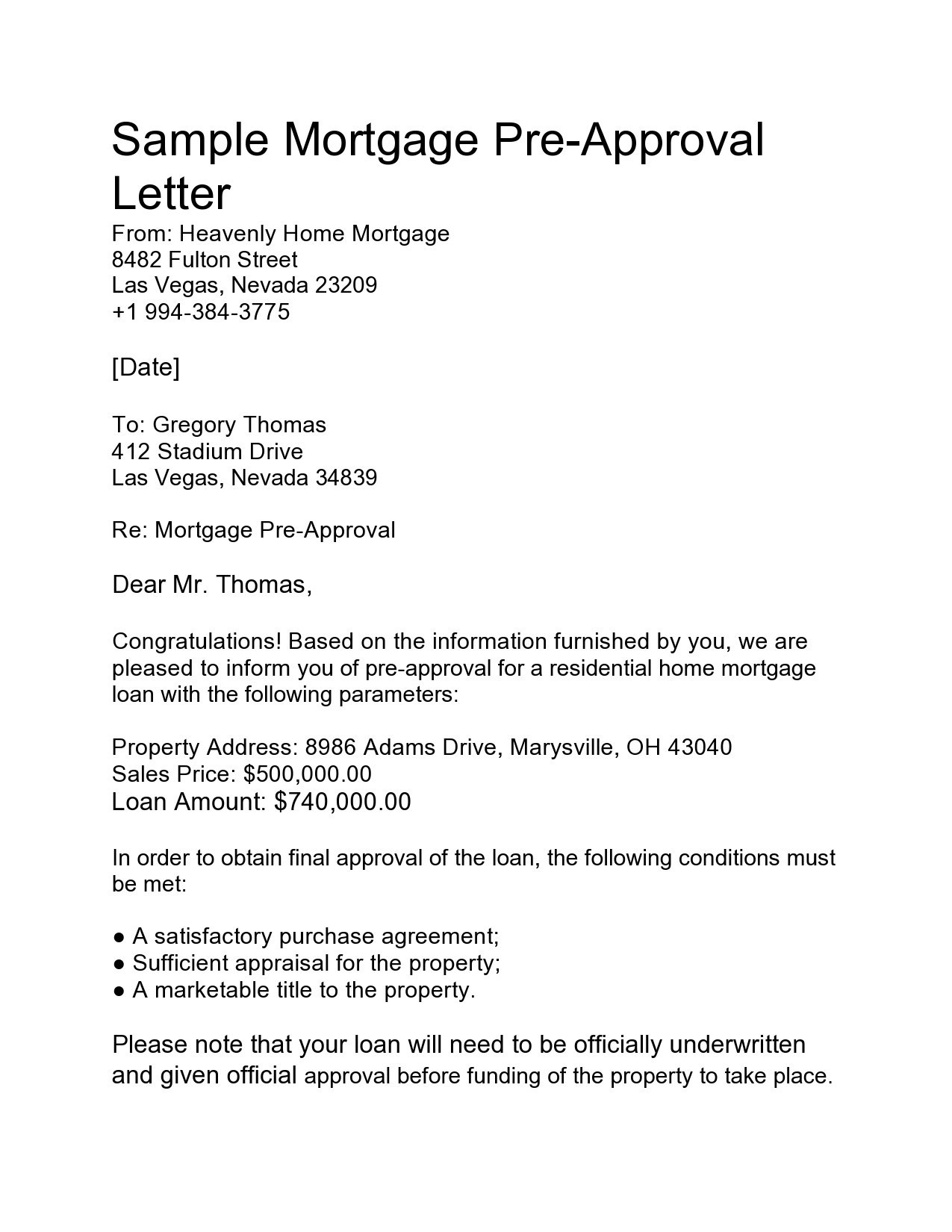

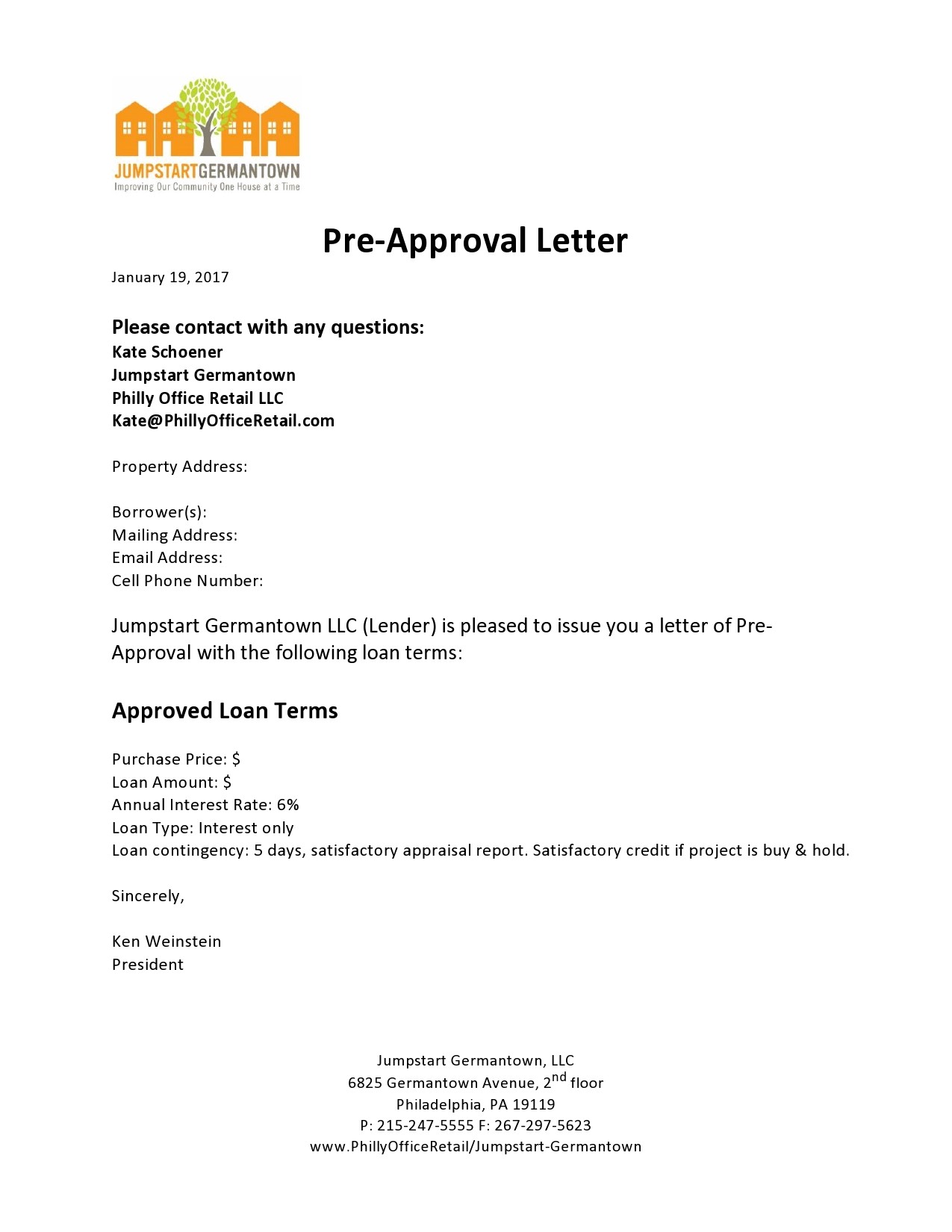

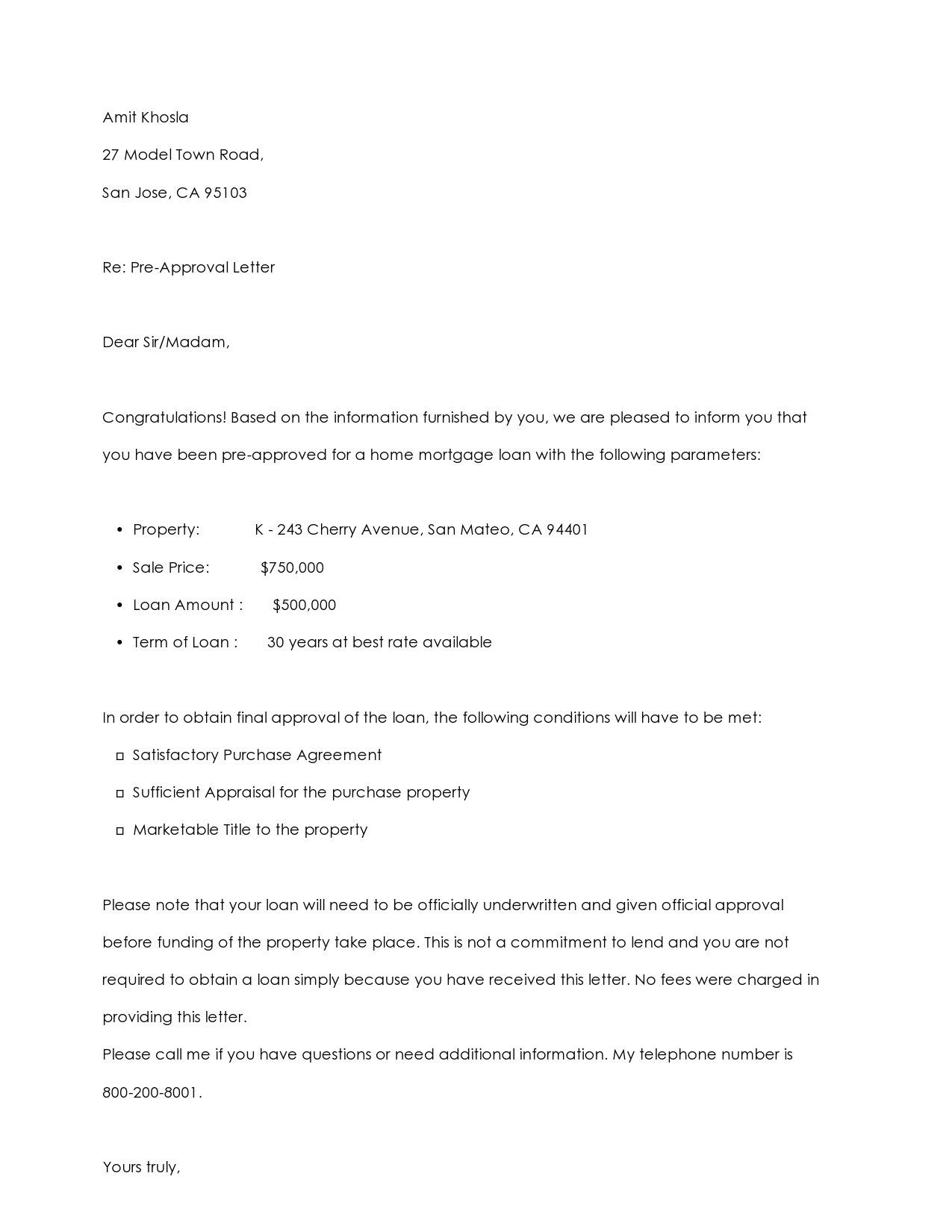

Pre Approval Letter Samples

Advantages of a pre-approval letter

Your lender uses a pre-approval letter template to prepare your letter. Some lenders might give you a chance to negotiate for a better deal and others will not. The pre-qualification letter sample used could differ between different lenders but they serve the same purpose. They communicate to you the amount a lender is willing to give you. It gives you several advantages.

It gives you an idea of the budget you will work with

A lot goes into your choice of a home. You must decide where you want your home to be. Location largely determines the cost of your home. A home located in a city suburb might cost you lesser than a home located in an elite neighborhood.

If you had budgeted for a home that exceeds the amount the lender is willing to give you, you might want to look elsewhere for a cheaper home or get other funding sources to top up. Most borrowers will opt to look for a cheaper house.

It allows you to decide on the way forward

After you have been given the offer through a pre-approval letter, you have an option to take it or refuse it. Sometimes the offer you are getting can be too low to help afford a better house. You have a right to refuse the offer and look for another lender.

You get a better chance to negotiate

You may decide you are taking the offer but after negotiations, if the bank allows it. In the property market, you can decide to renegotiate with the seller to give you a lower price so that your mortgage will be enough to pay for it.

Since you know how much you can offer, you will have more confidence when negotiating. When the seller knows you have been pre-qualified, they will know they have a better deal and they would not like to lose. They will be willing to give a better offer too.

You become a more attractive buyer

The seller might have other buyers who are yet to get pre-approval. If you get yours earlier, the seller would prefer to work with you than those without pre-approvals. Any seller who knows a buyer has a pre-approval will treat them like a real buyer.

How do you get a pre-approval letter?

As much as the process might sound complicated, mortgage lenders make it a simple process. Any financial institution that gives loans will have a pre-approval letter sample for preparing pre-approval letters for their customers.

If you visit any institutional lender such as a bank, mortgage company, or credit union, they will give you a pre-approval letter if you have all the requirements to pre-qualify you. Some non-bank lenders will also give you mortgage pre-approval. These are institutions such as online lenders and other non-deposit-taking institutions.

Look for an institution that will give you a better offer. This is the process you will follow to get a loan approval letter.

Identify a lending institution

There are many types of lending institutions where you can apply for a mortgage and get pre-approved. Identify the institution you want to go visit and apply to. Since you are not sure if a certain institution will pre-approve you, apply to a least three to help you save time. Your documents will be processed around the same time instead of having to apply to one institution at a time. Each lending institution will ask you to provide the following documents.

Personal information documents

Your personal information documents are very important during the verification process.

- Make a copy of your national identification document

- Make a copy of your social security number

- If you recently changed your name due to marriage or divorce, provide supporting documents such as a marriage certificate or certificate of divorce

- Provide your credit check. It will help the lender check your credit background and your financial history

Details for your income information

You will be required to get certified copies of your bank statement. Most lenders will ask for statements that date back to two years.

- Provide information about all your sources of income

- Provide copies of your tax information

- Details for your asset information

This is information related to your assets other than your monthly income.

Before you visit your lending institution of choice, make sure you have these documents ready with you. Do copies of each and certify the ones that require certification by an attorney. It will help save you time for going back to prepare them once the bank asks you to do so.

Once the lender has all the documents, they will hand them over to an underwriter to advise them of the amount of mortgage you qualify for. If the underwriter or bank doesn’t have a lot of requests to process, your pre-approval letter can be ready within a few days.

How long is a pre-approval letter valid?

Once you get your pre-approval letter, you can begin your process of looking for the best offer from sellers. You will have time to negotiate and start preparing pre-purchase documents. Your mortgage pre-approval letter will be valid from about 60 days to 90 days.

This will give you time to search the real estate market for the best places to live, depending on the mortgage you are expecting to receive. If the period exceeds this time, you might be required to reapply. The second pre-approval might be affected if you have already big changes to your finances between that time.

Fake Mortgage Pre Approval Letters

What should a pre-approval letter include?

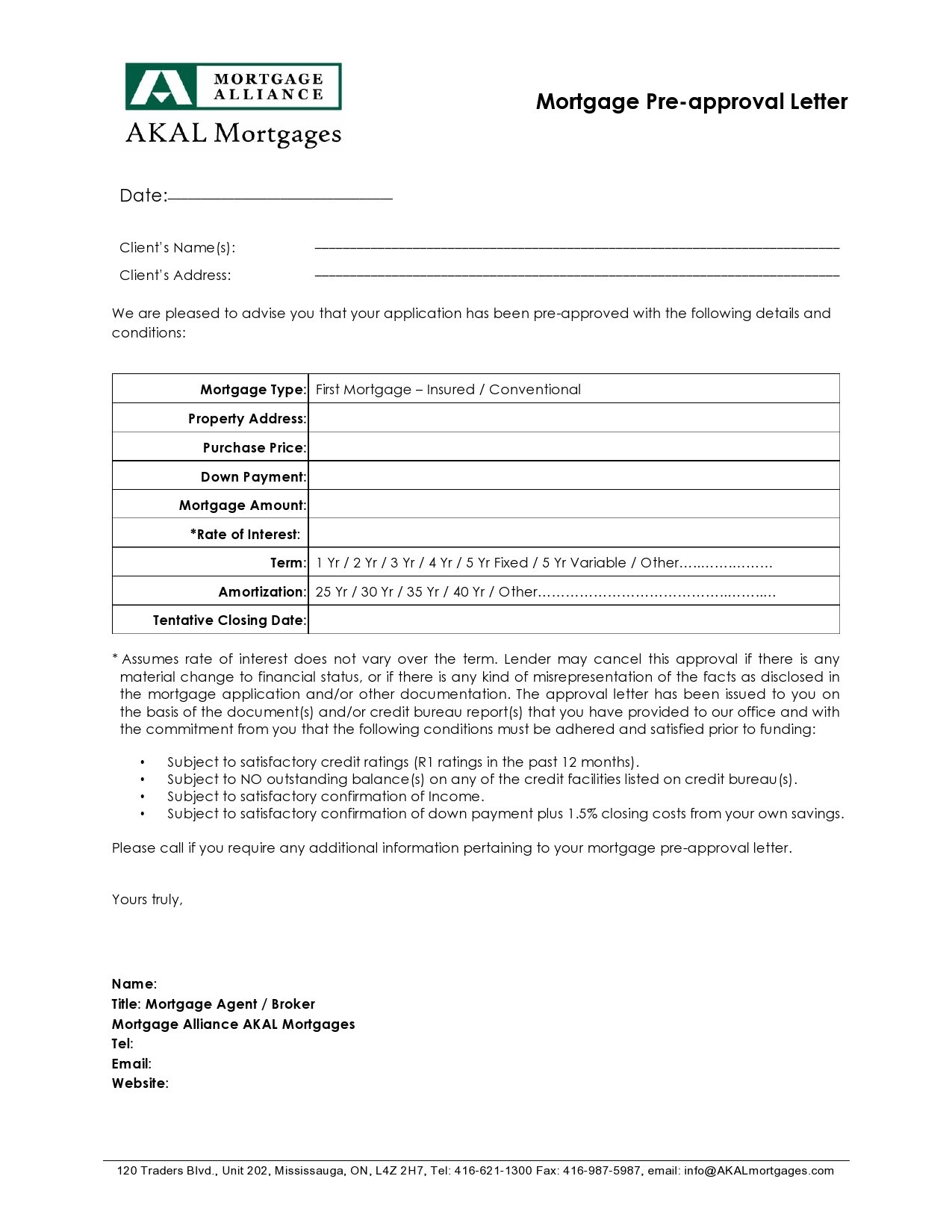

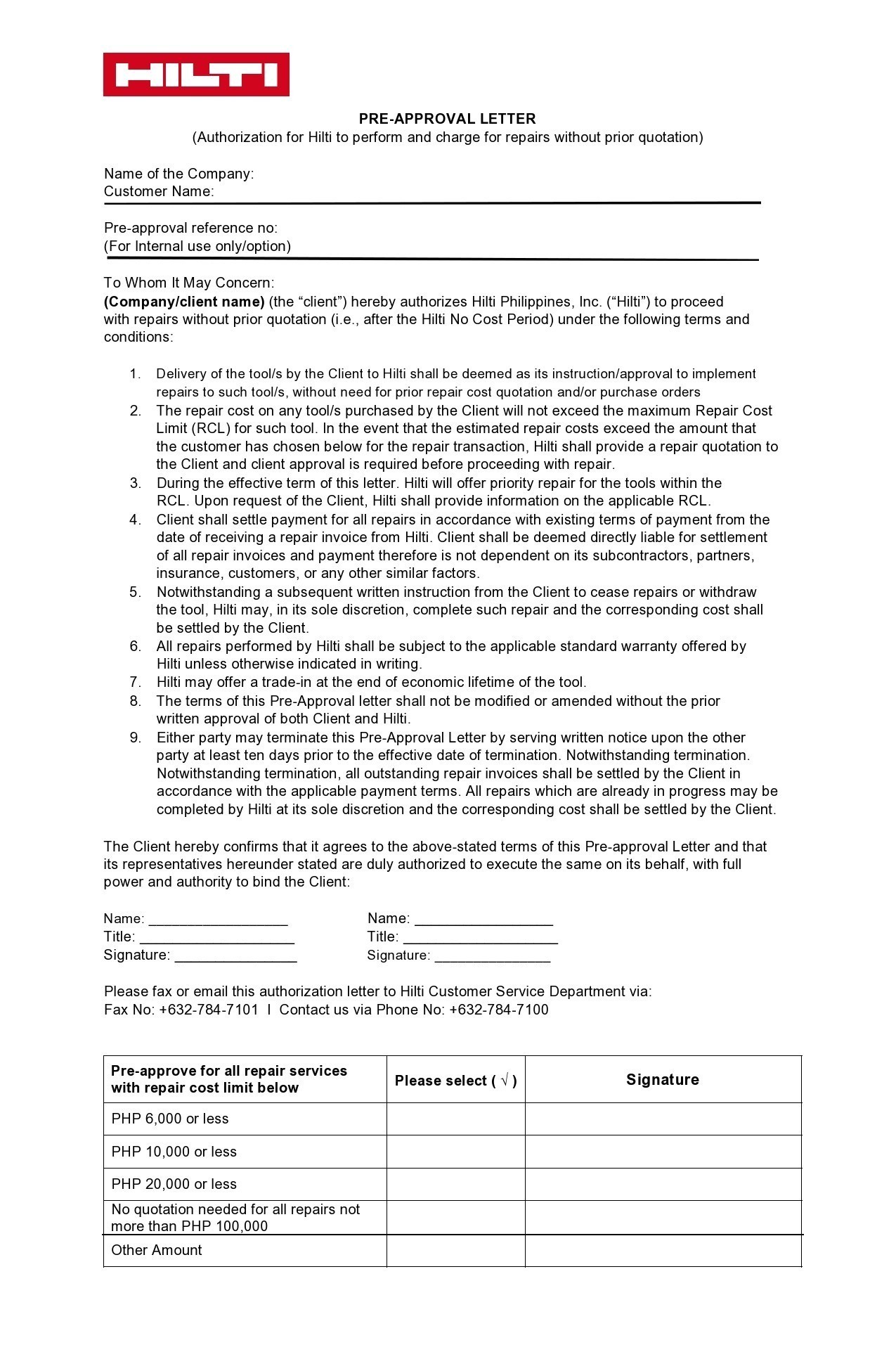

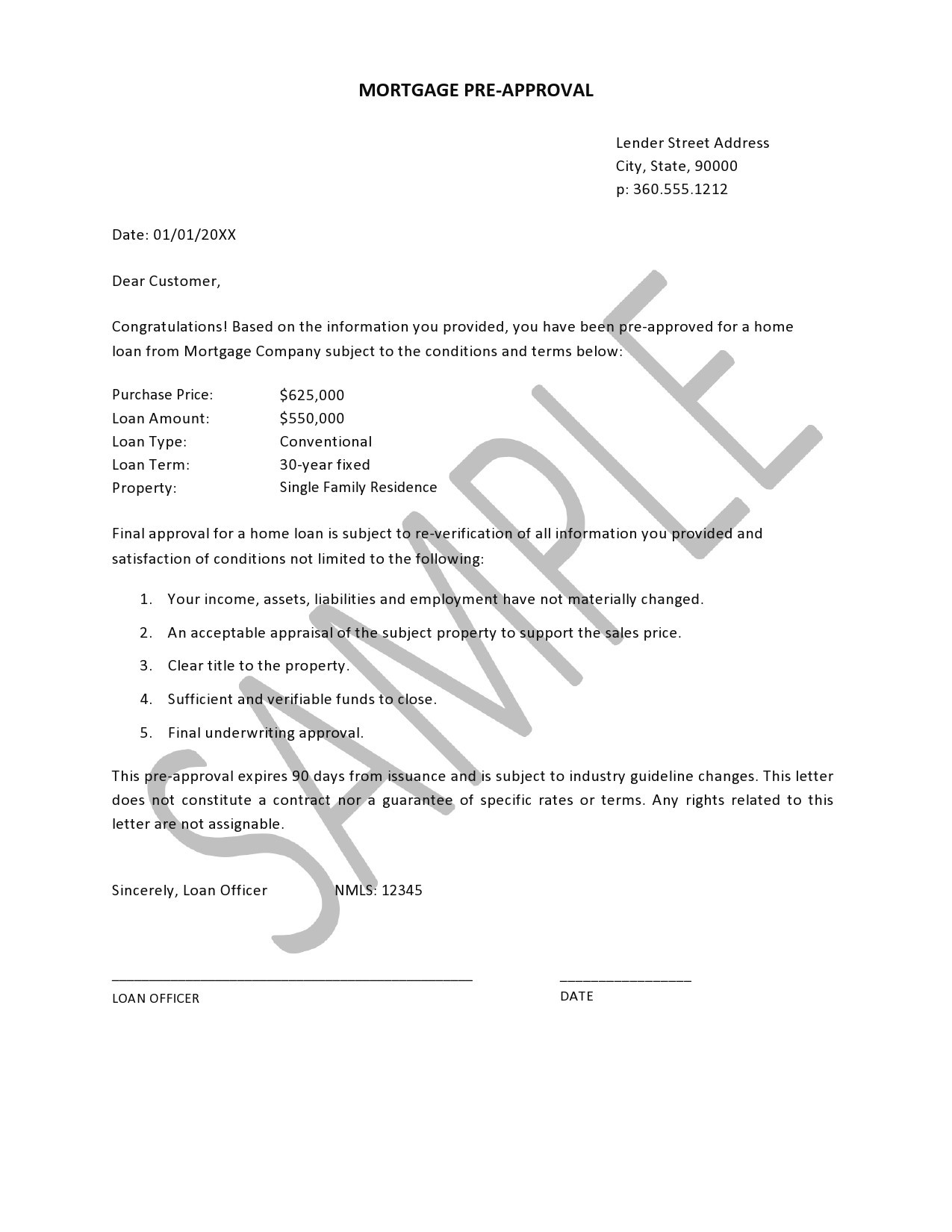

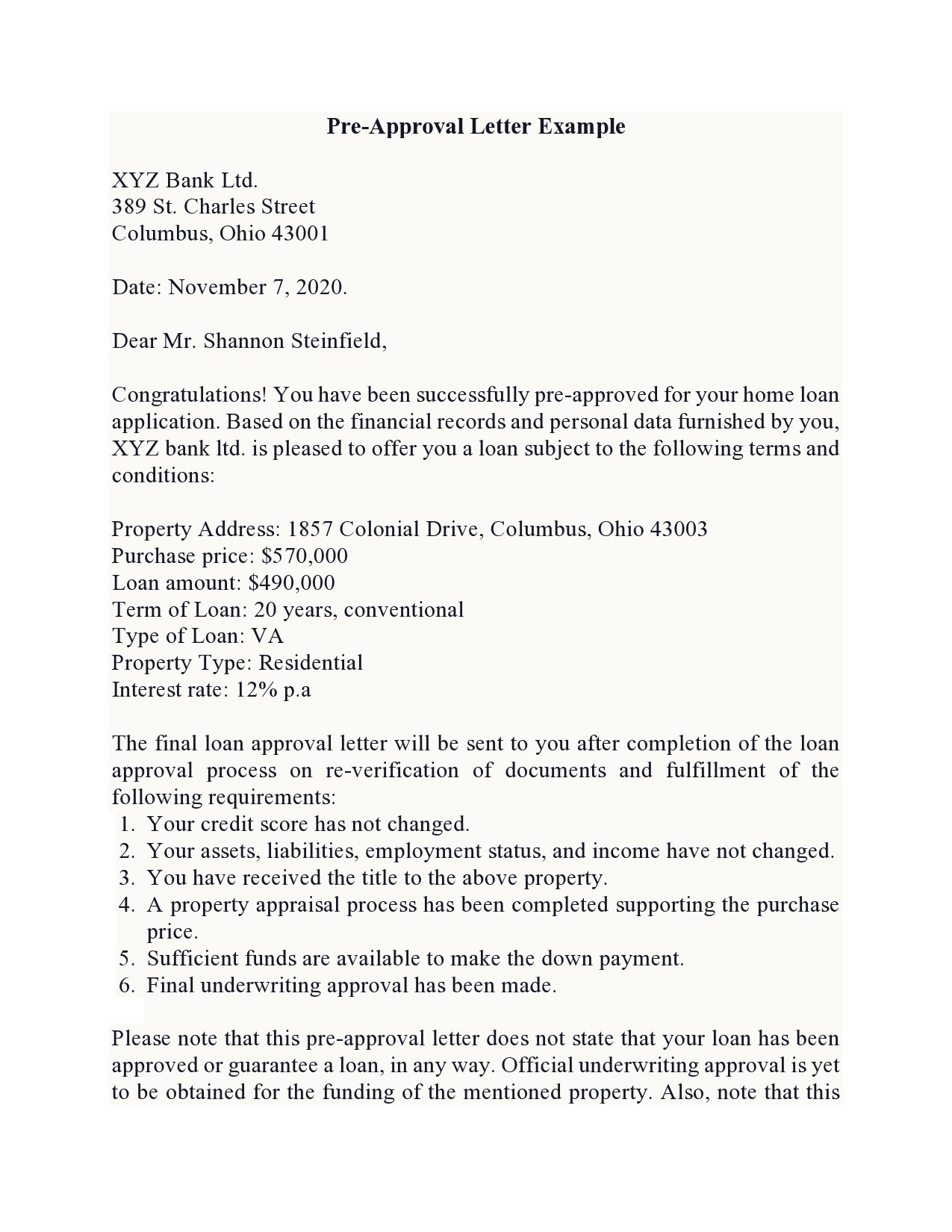

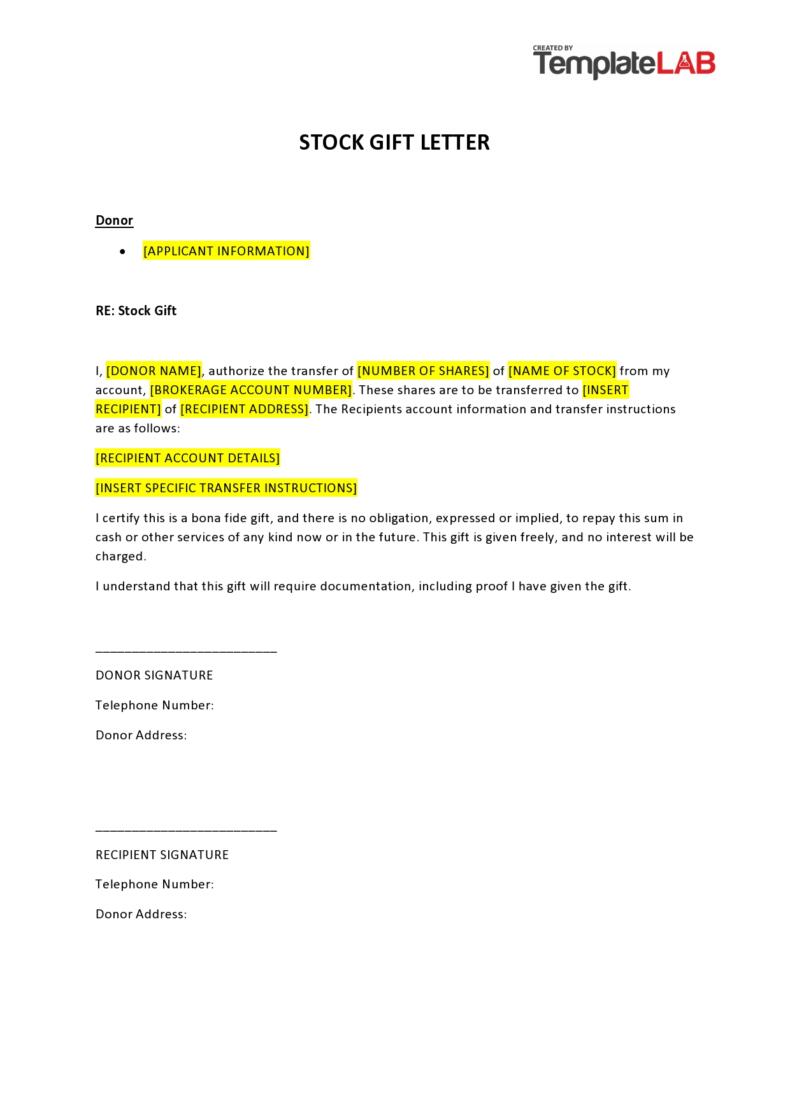

A lender uses a pre-approval letter template to prepare a detailed report about the amount of loan they can offer you. A pre-approval letter sample will contain the following details.

Name of the lender: This is the institution that is willing to offer you the mortgage

Contact information if the lender: Their contact information will include their physical address, postal address, telephone numbers, email address.

Date: This is the date when the pre-approval was given. The date helps sellers to know if the letter is still valid. From the date of issuance, the letter expires within 60-90 days.

Borrower’s name: This is the name of the person who applied for pre-approval

Purchase price: This is the amount the property will cost the borrower

Loan pre-approved: This is the amount of loan the lending institution is willing to give to the borrower

Loan term: Mortgages mostly range between 15 years to 30 years

Monthly payment: The amount of money the borrower will be paying to the lending institution every month until the last payment.

Loan program: A mortgage can either be conventional, FHA, or VA

Type of property: This is the type of home the borrower is buying such as a townhouse, single, family home, or condo.

The pre-approval letter is a legally binding document that a home buyer can use when negotiating for the purchase price of the property. It cannot be used to close the purchase deal because it’s not real money but a promise to get money.

It may contain clauses that give conditions for final approval, such as reverifying the documents to confirm if the borrower is still creditworthy. Some letters might also include details of the loan estimate such as the closing fees, recording fees, title fees, transfer fees, attorney fees, etc.

Does a preapproval letter mean you are approved?

After you become pre-approved, you will be almost certain that you will get a loan with the institution. This is one of the reasons sellers and their agents value a pre-approval letter. However, the lending institution doesn’t guarantee you the loan.

After getting the property you are certain is worth, the bank will have to reverify your documents. Your financial status might have changed within the 90 days, making you worth a lesser loan or not qualified at all. The lender might ask for more documents to help them scrutinize you more.

They might have a loophole that will make them deny you a loan for the sake of their interests. You cannot guarantee a seller that you have money to pay the house based on a pre-approval letter.

Conditions for loan denial after pre-approval

Several reasons can make a lender deny you a loan even after giving you a pre-approval.

Change of employer

One of the qualifications for getting a pre-approval is to have a steady job. If you have worked with an employer for two months, it cannot be termed as a stable job. You could still be under probation. If you are expecting a mortgage, you should not rush to change jobs while the mortgage process is ongoing.

Change of your credit score negatively

Within the 90 days when your pre-approval letter is still valid, you might miss a payment or two. This will make your credit score dip and negatively impact your chances of getting a loan.

The house fails to meet mortgage requirements

Lenders verify if the property you want to buy meets the mortgage threshold. It might have another ongoing mortgage. There could be a court case touching on the property. These are some of the issues that can cause you to be denied a mortgage.

Adding more lines of credit

Every line of credit you add increases your debt. This is a warning to lenders to deny you a mortgage. You should avoid incurring more debt when your mortgage is processing in on the course.

When your bank balance suddenly reduces

Your bank balance can reduce by a small margin which is understandable by the lending institution. However, you can withdraw a large amount of money that makes the institution question the motive and deny you a loan. Avoid withdrawing large amounts of money. Instead, try your best to bank more after getting approval.

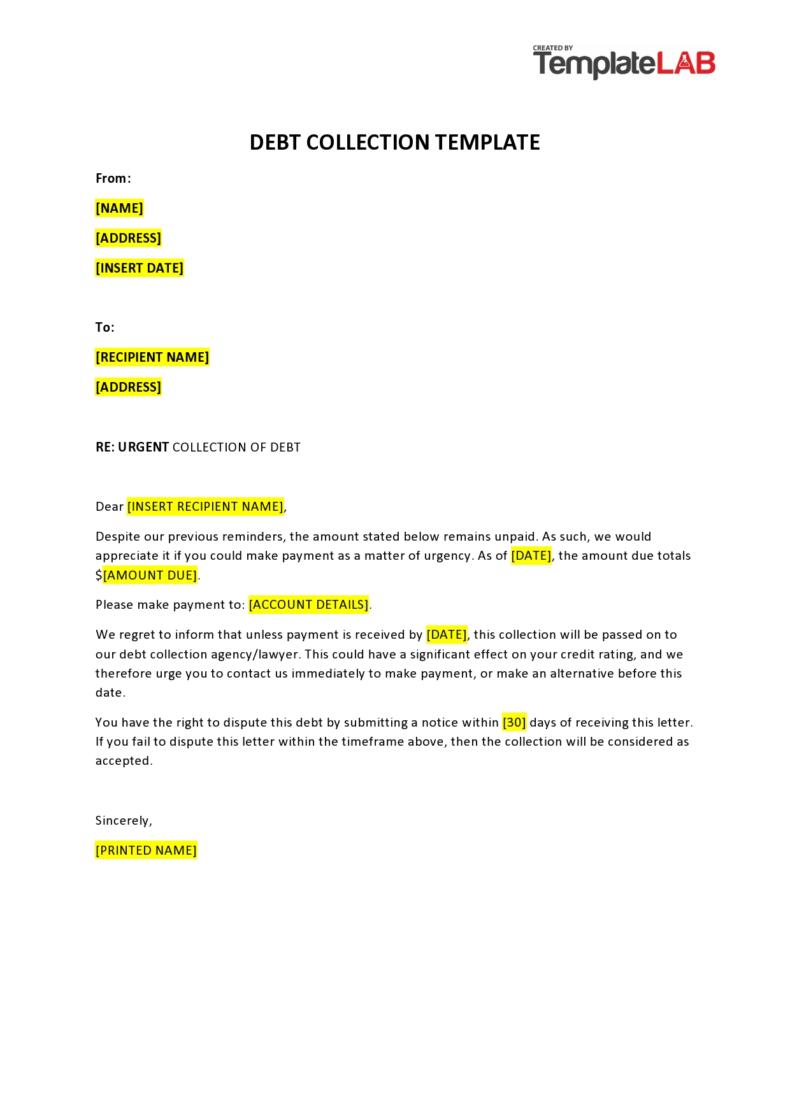

Pre Qualification Letter Samples

Verifying a pre-approval letter

A buyer might present before a seller a fake mortgage pre-approval letter. Although the letter doesn’t guarantee a loan, pre-approval letters are widely accepted in the real estate business. Sellers widely use them to start the home buying process.

If the seller realizes later the letter was a fake mortgage pre-approval letter, they will have wasted precious time and probably lost a client who could have given a better offer. To avoid this experience, sellers should first verify with the issuing institution if the letter is a fake mortgage pre-approval letter or genuine.

Downloading pre-approval letter template

You can get a pre-approval letter template online and edit it to meet your needs. You can also get a pre-qualification letter sample to inspire you on the details to expect in your loan pre-approval letter. A pre-approval letter sample may contain detailed information that can de be edited to include the details of the client you are serving.

Anytime you are presented with a pre-approval letter, you should verify it with the lending institution to confirm it is not a fake mortgage pre-approval letter. A genuine pre-approval letter template has the contact details of the lender that you can call or email to confirm the source of the letter.