There are times when people get surprised with letters they receive from credit bureaus informing them about shortcomings. What is really annoying is the fact that these people have faithfully kept their credits clean. For this task, the best thing you can do is write a credit dispute letter requesting the removal of such inaccuracies or errors in your credit file.

Table of Contents

- 1 Credit Dispute Letters

- 2 What is a 609 dispute letter?

- 3 609 letter templates

- 4 What to include in your credit dispute letter?

- 5 Credit Report Dispute Letters

- 6 How does a credit report dispute letter affect your credit score?

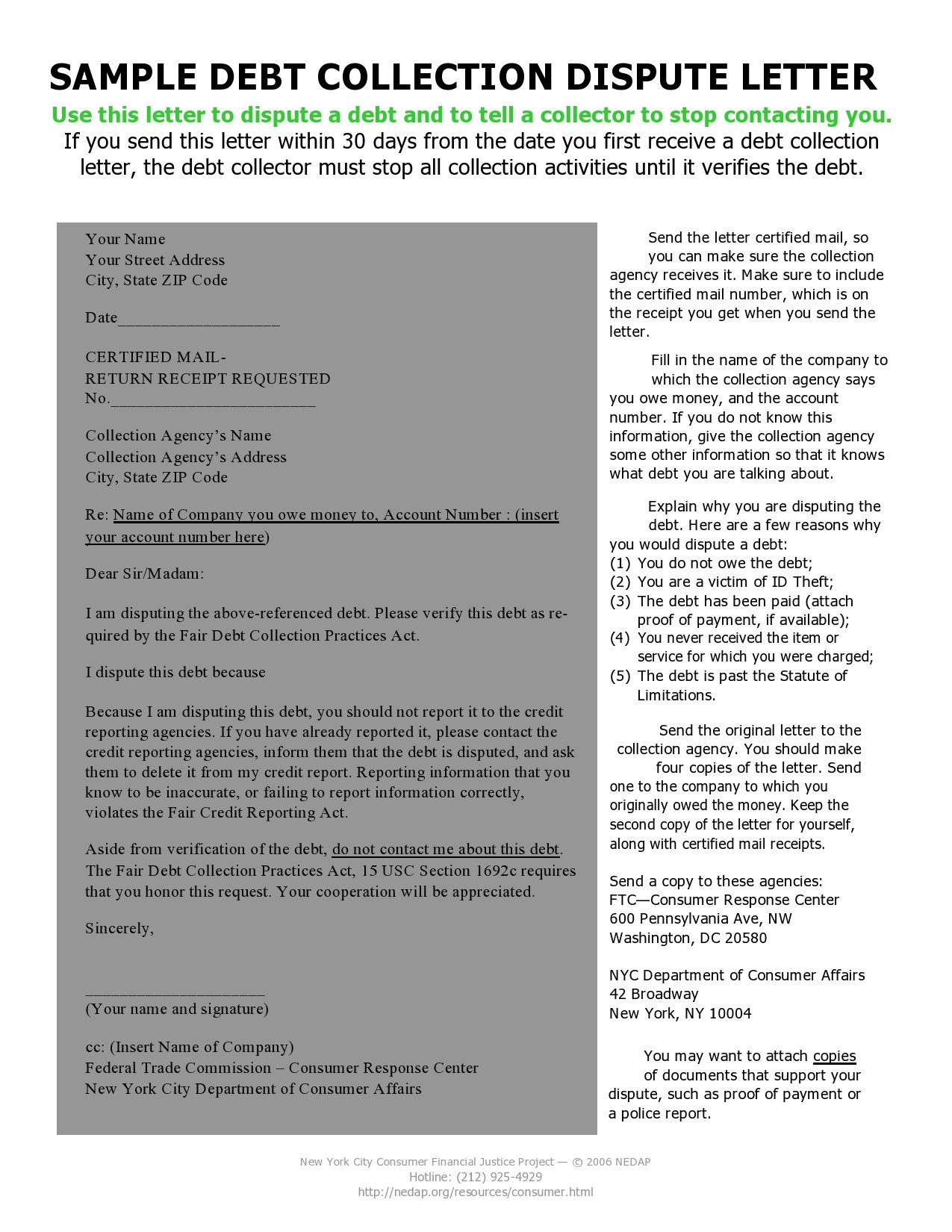

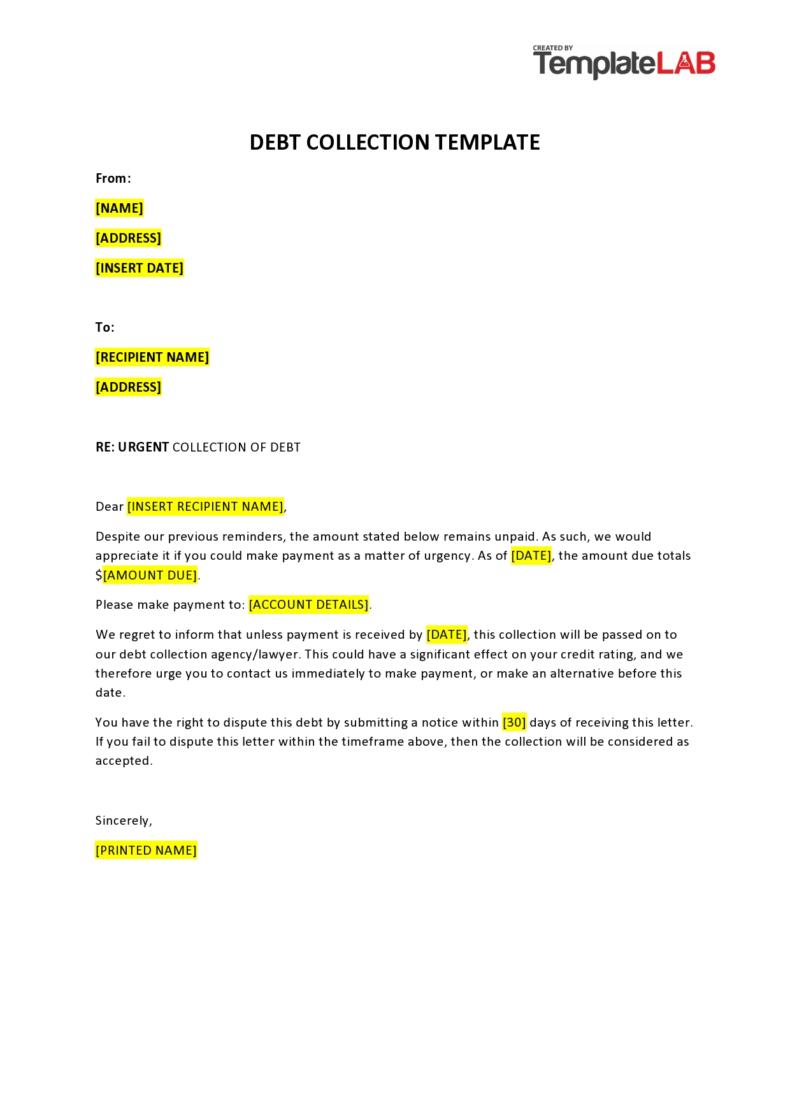

- 7 Dispute Letter Templates

- 8 The responsibilities of the credit bureau

- 9 What is the best way to dispute a credit report?

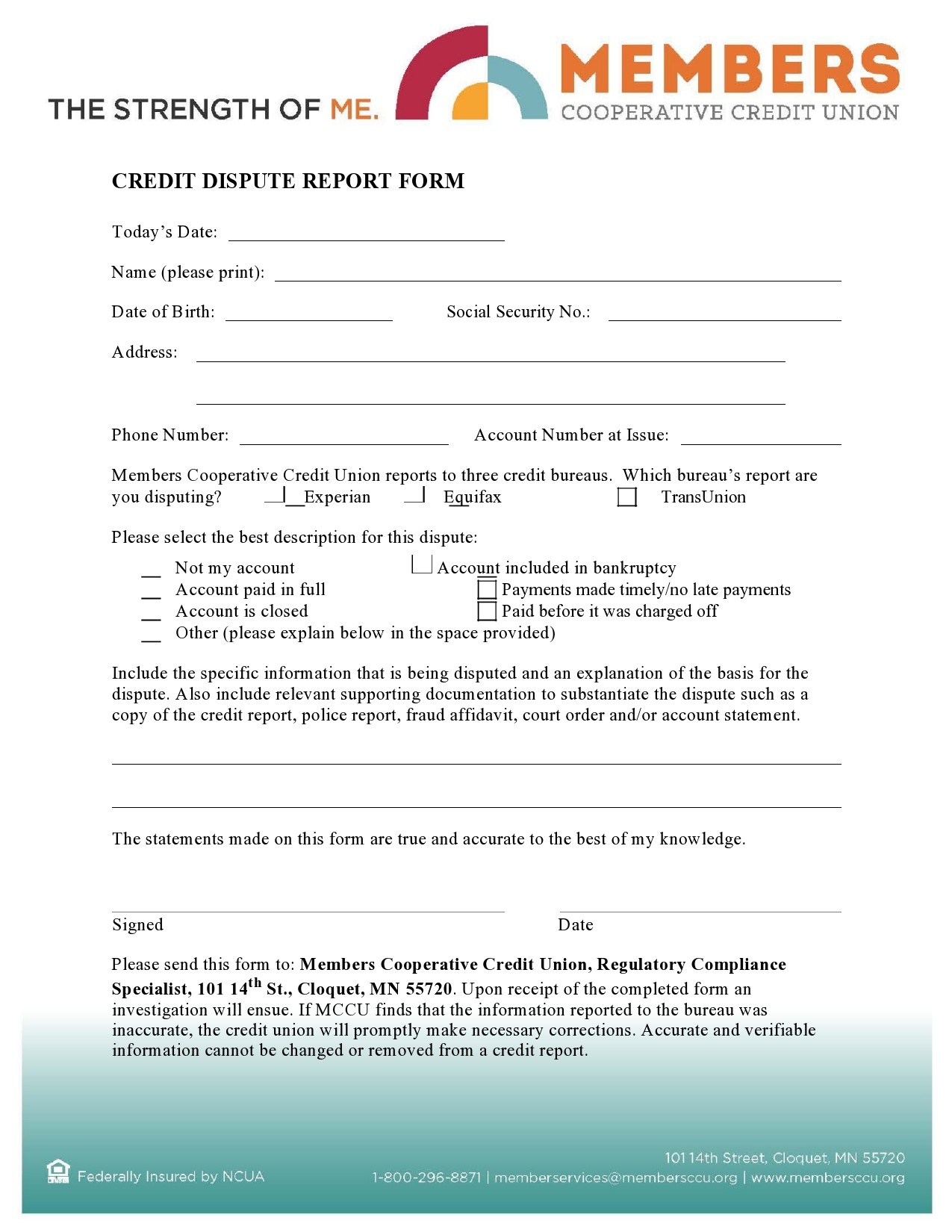

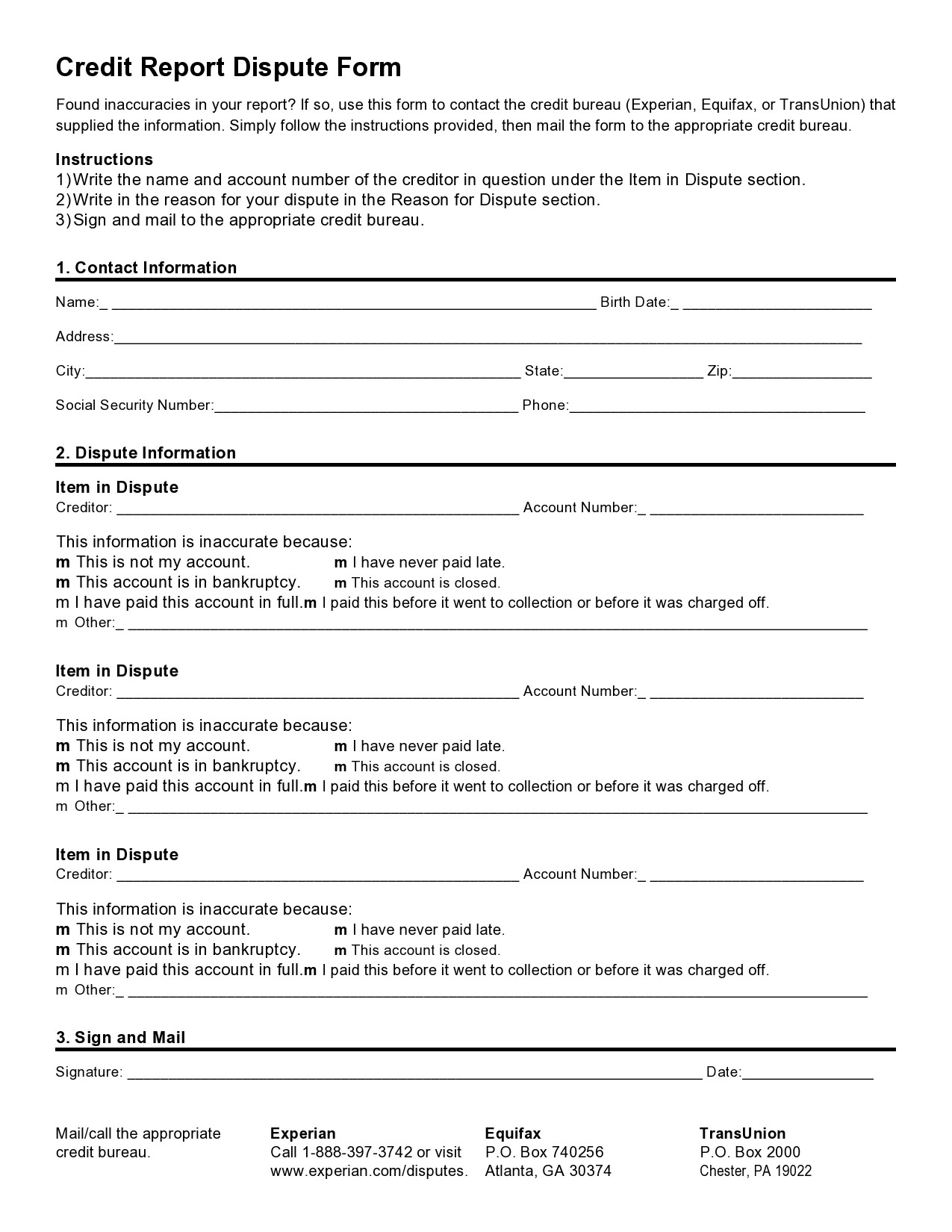

- 10 Credit Report Dispute Forms

- 11 Do 609 letters really work?

Credit Dispute Letters

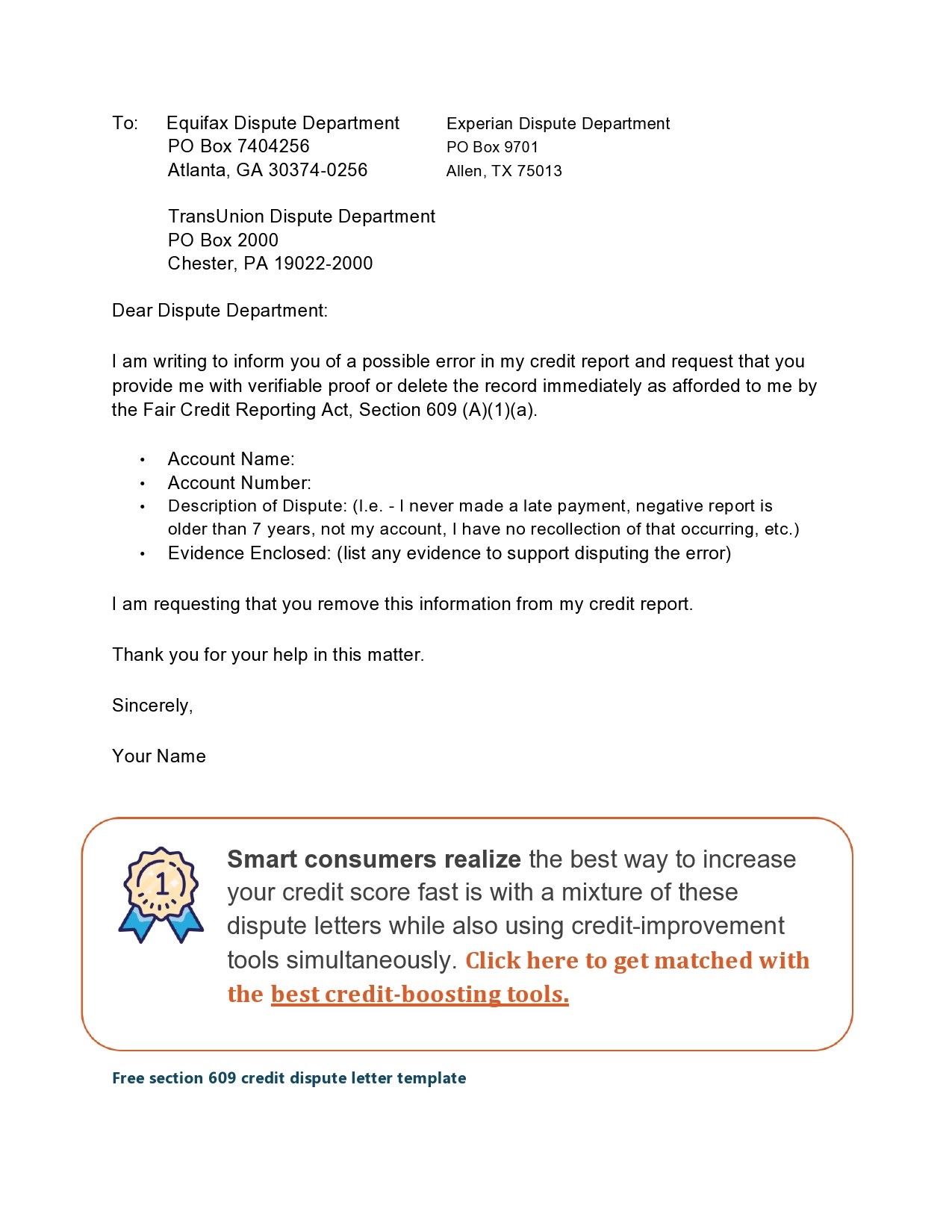

What is a 609 dispute letter?

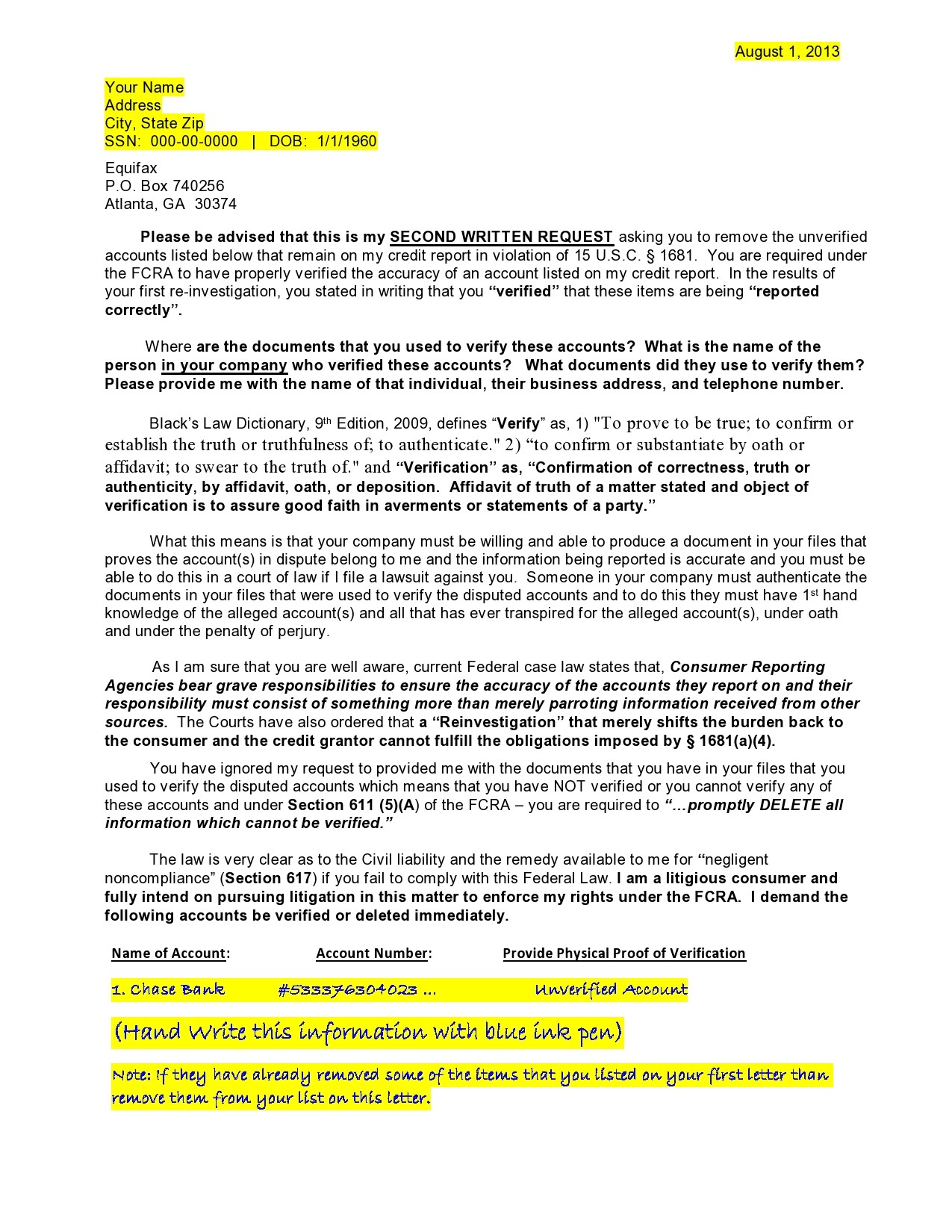

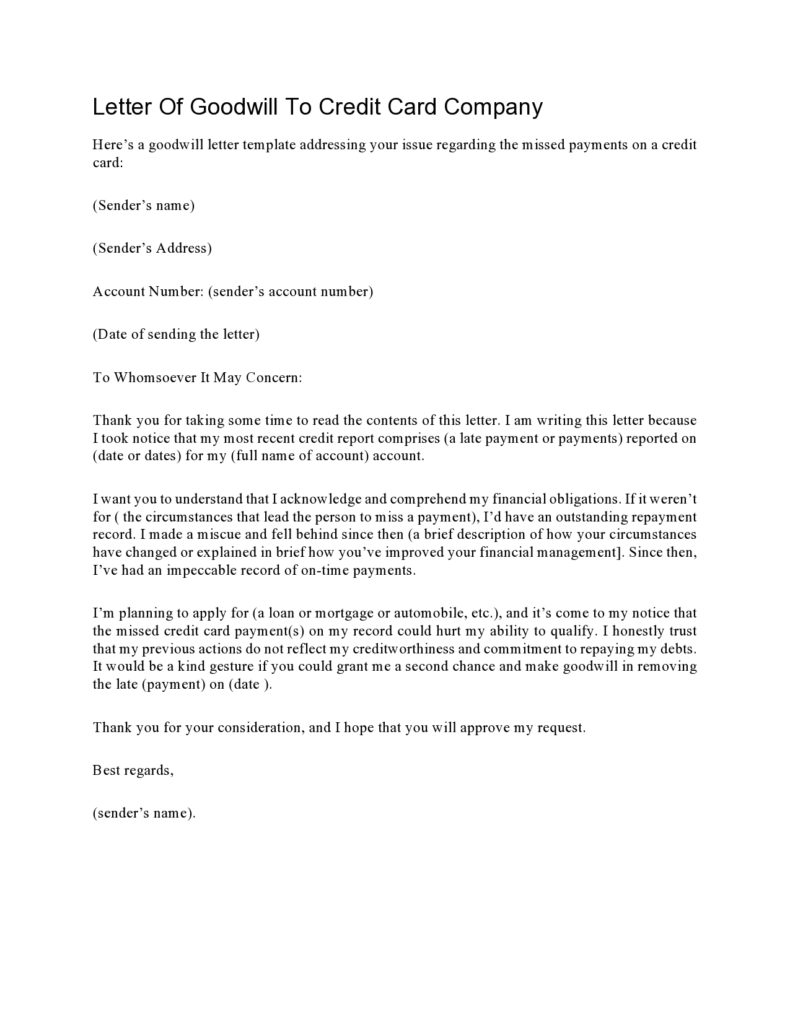

You don’t want to get your credit score down and find out that you have erroneous information on your credit report. The good news is, you can have this fixed by writing a 609 dispute letter template. This is a way of requesting that the negative information gets removed from your credit report even if it’s accurate.

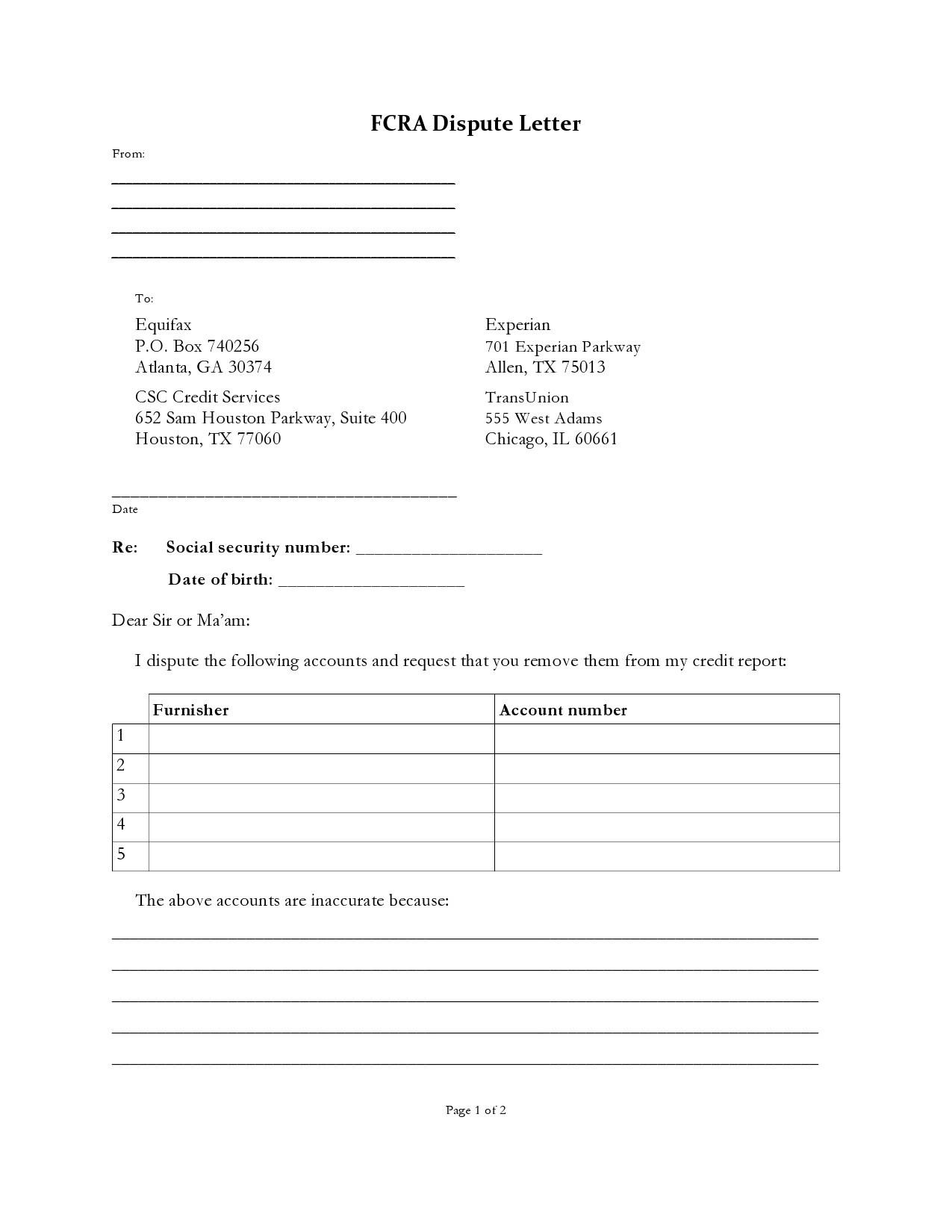

Section 609 of the Fair Credit Reporting Act has legal specifications that can save you a lot of trouble from getting tagged as a credit risk. Section 609 outlines your right to receive copies of your credit report and any information appearing on it.

The 609 letter template doesn’t state your right to dispute inaccurate information explicitly but it can assert your right to receive a copy of the information contained in your own credit file. Under Section 609, it’s stipulated that you have the legal right to ask for:

- All information in your own credit files.

- The source of the information.

- Each of the prospective employers who requested your credit report within the past 2 years.

- Businesses that have made soft inquiries within the past year.

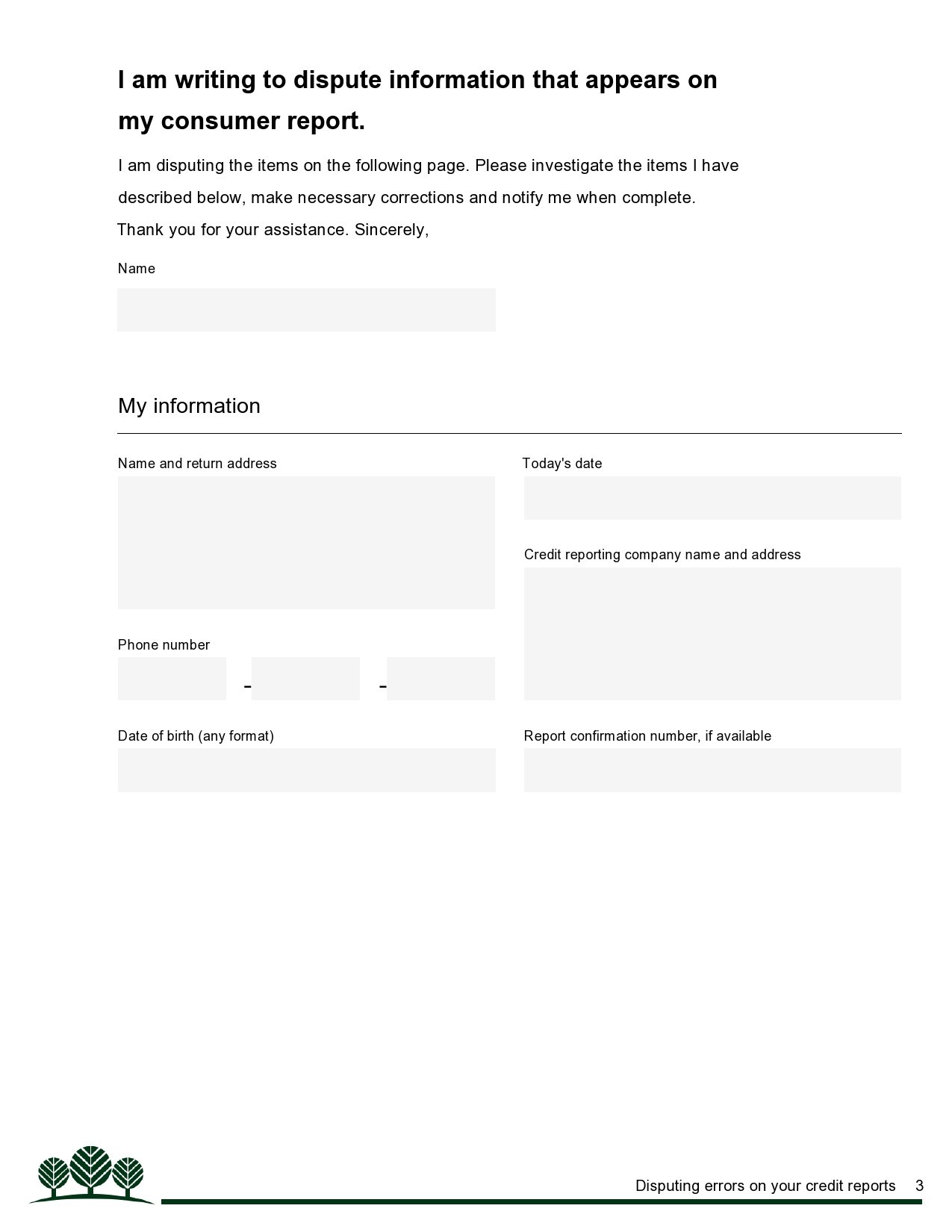

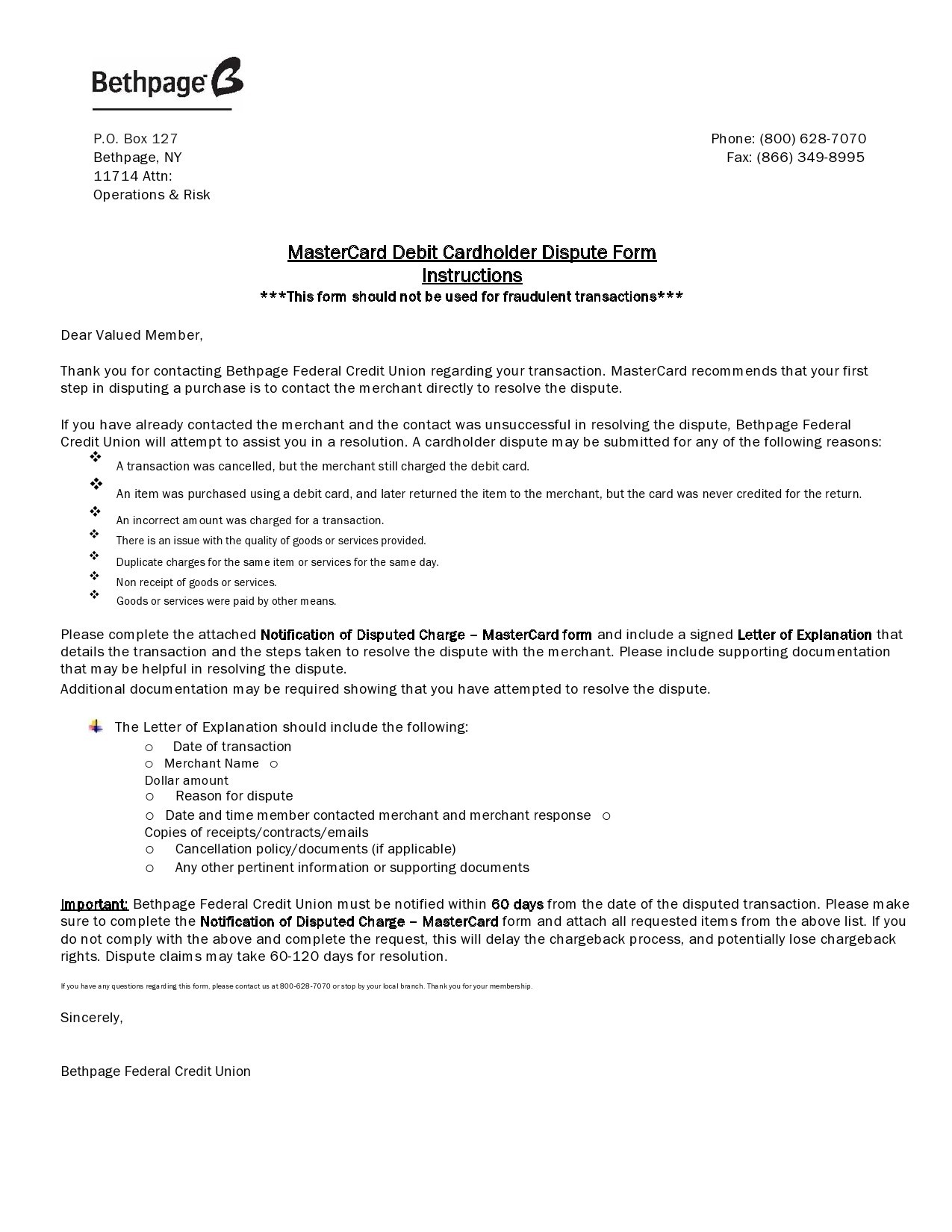

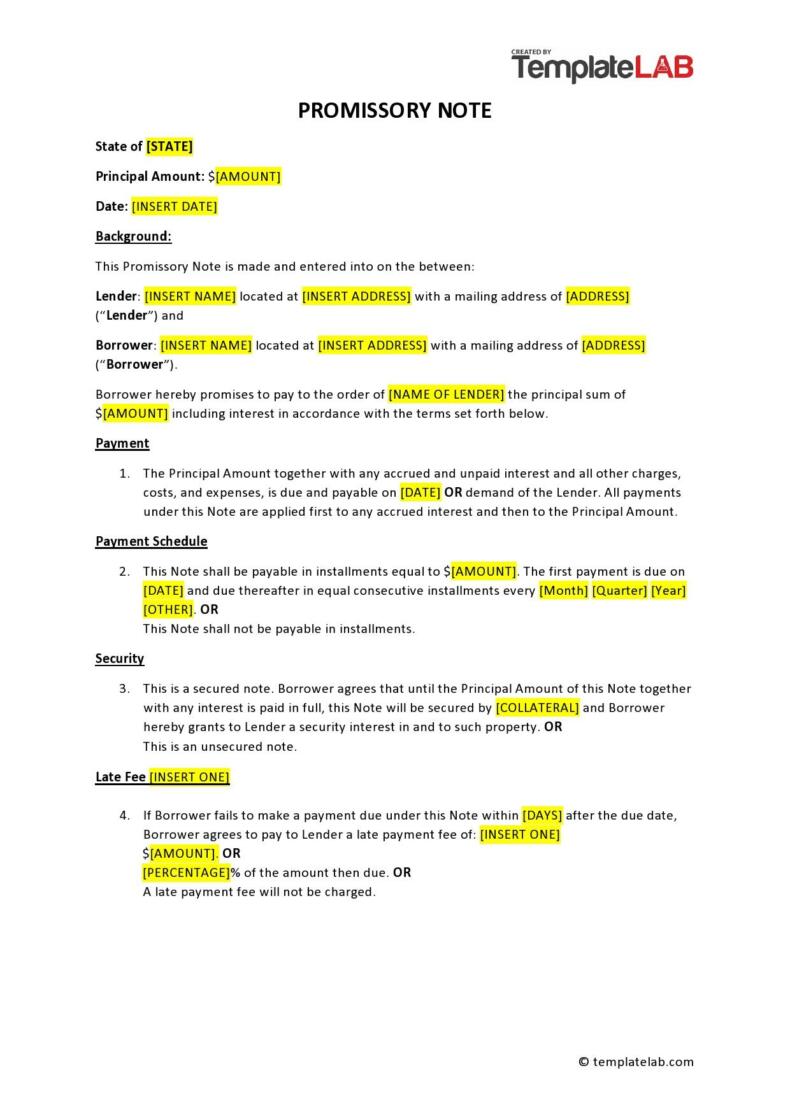

609 letter templates

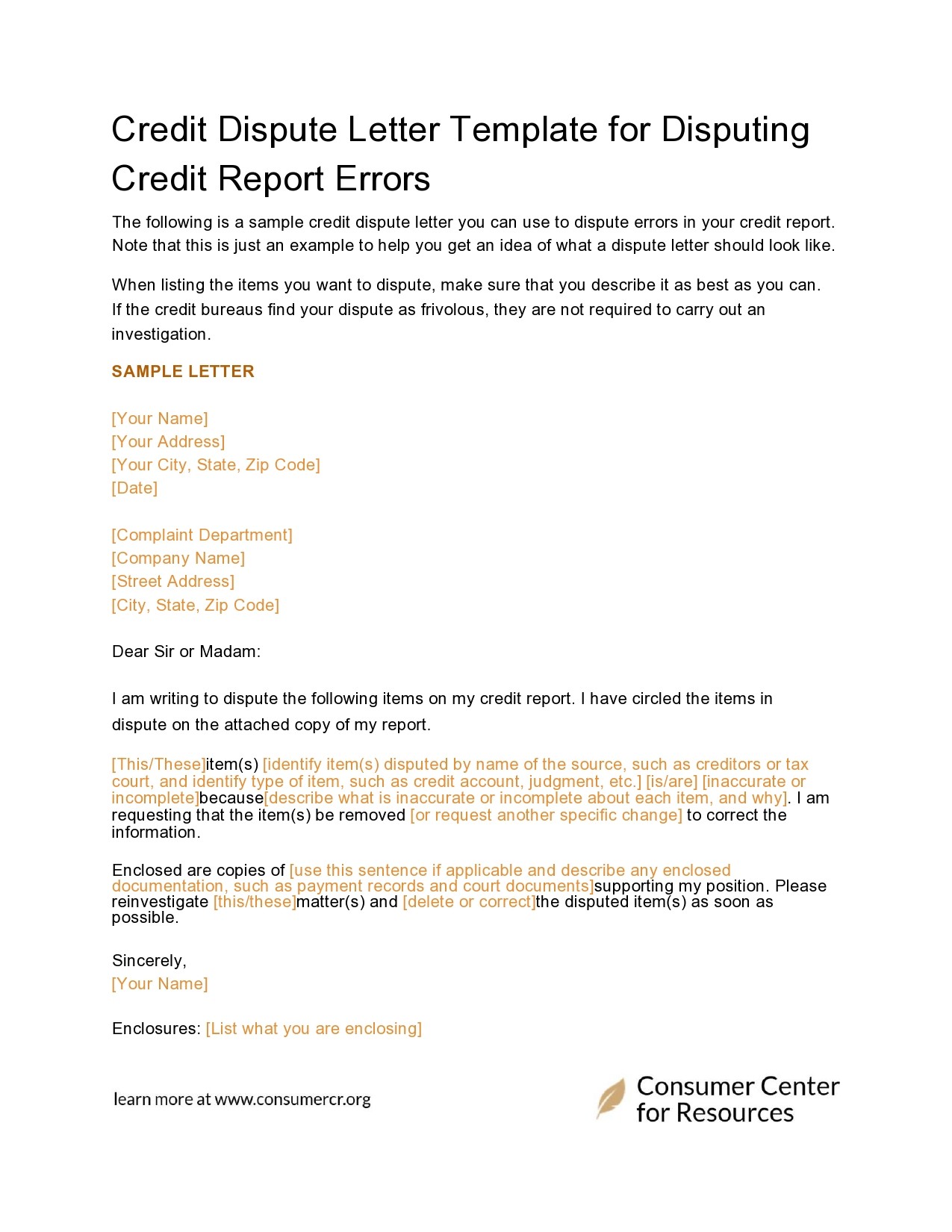

What to include in your credit dispute letter?

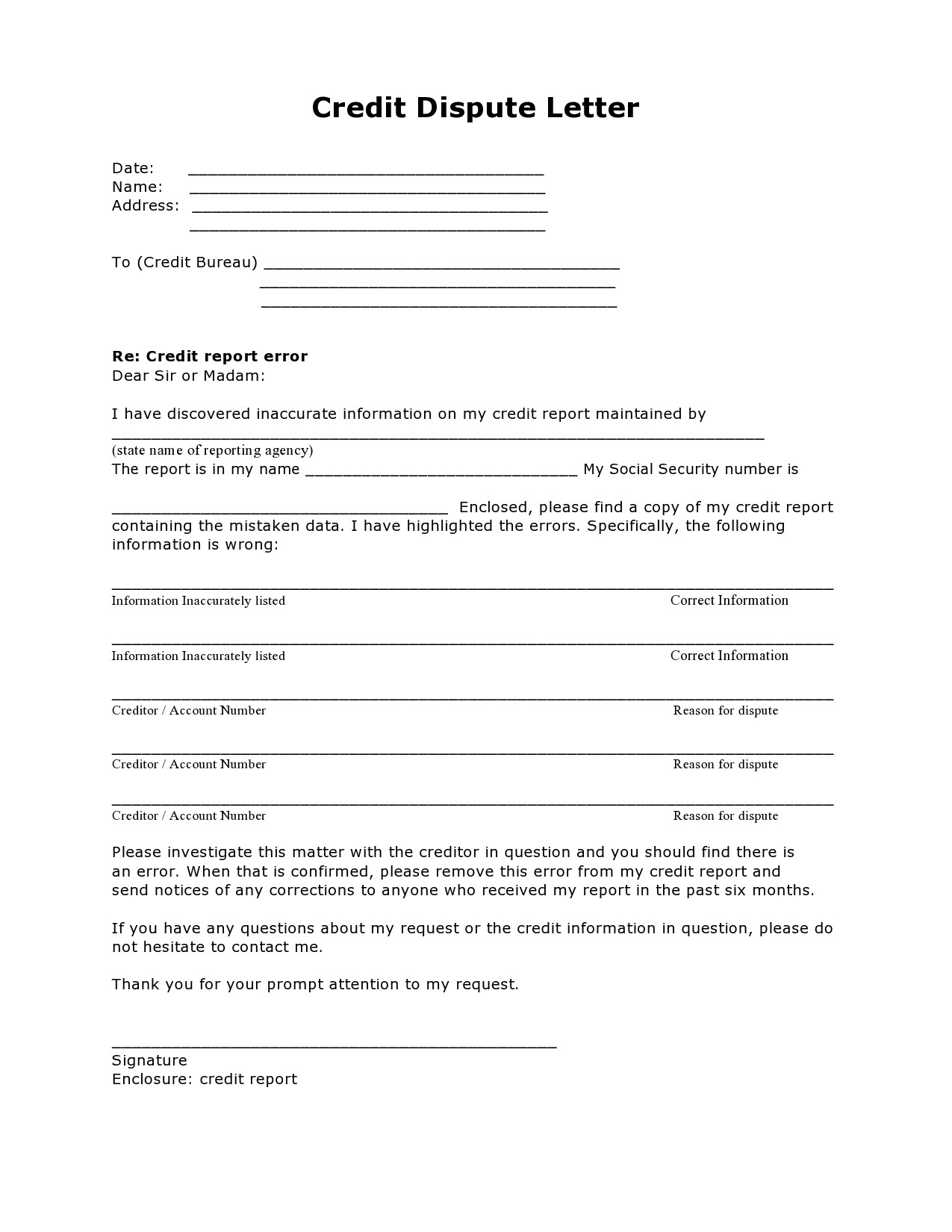

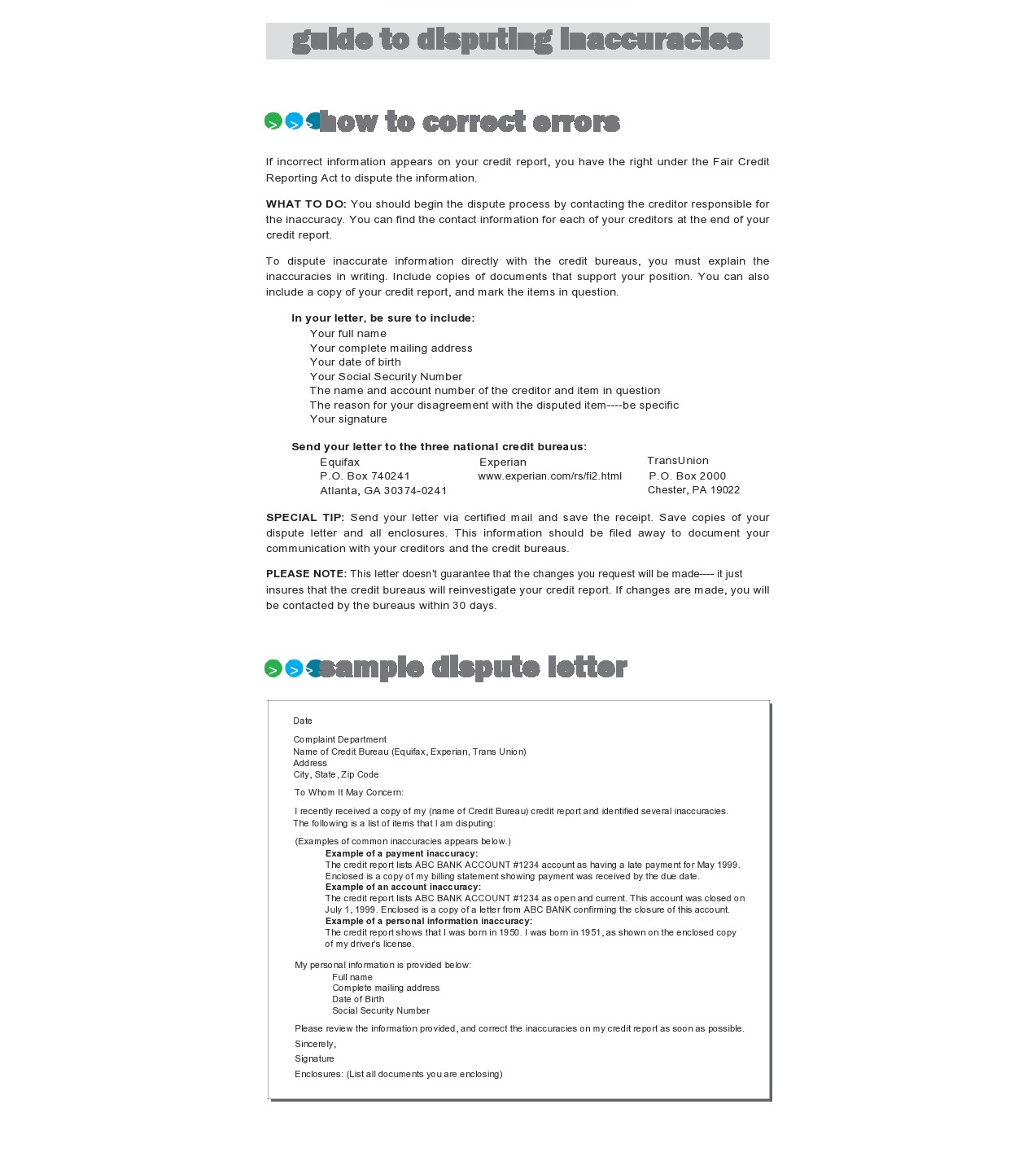

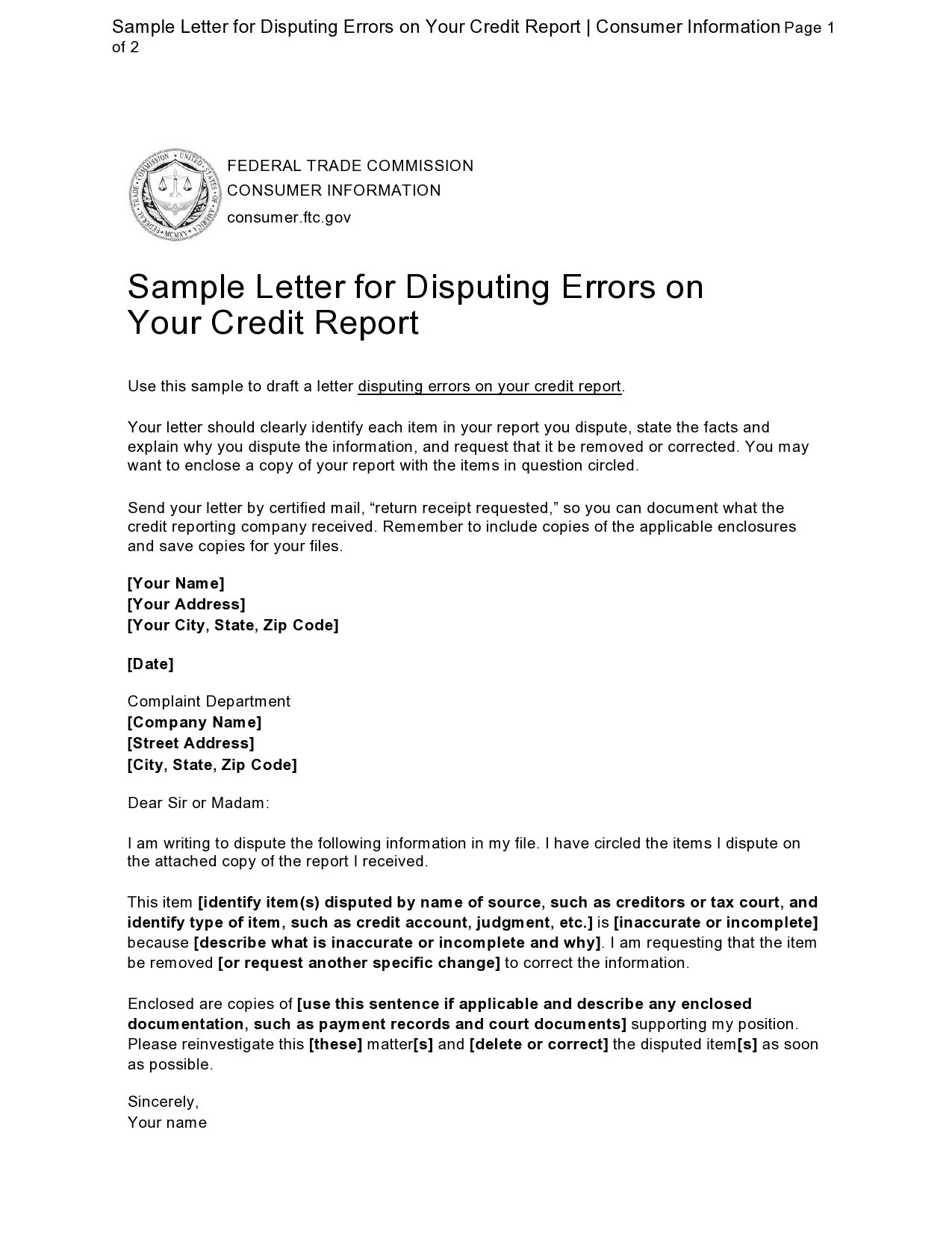

Before writing your credit dispute letter, you should first identify your credit report. This may sound so easy but it isn’t. This is a huge task because your credit bureau may possess information from so many people all over the country. After you have identified your report, you must provide information about what you think the error is along with an explanation of your dispute.

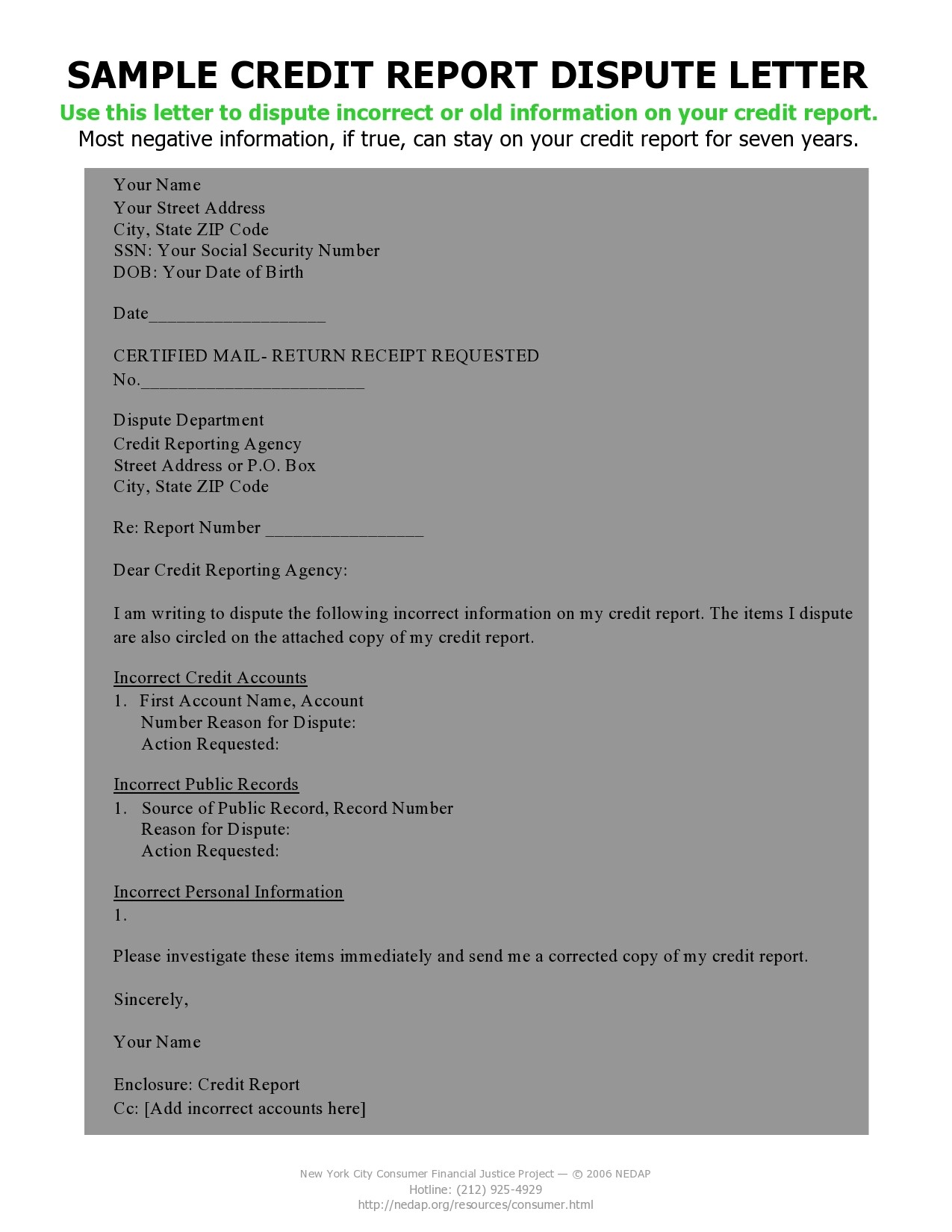

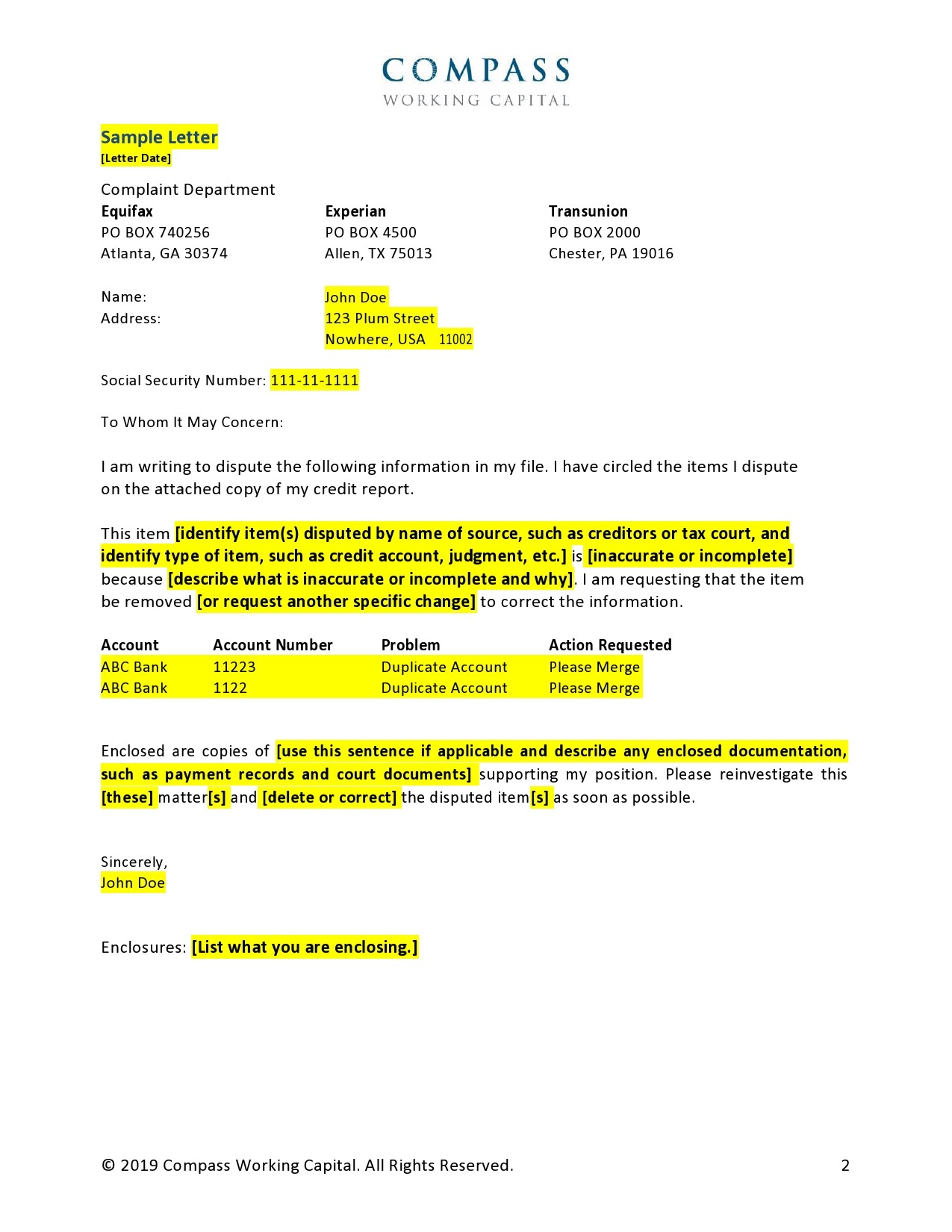

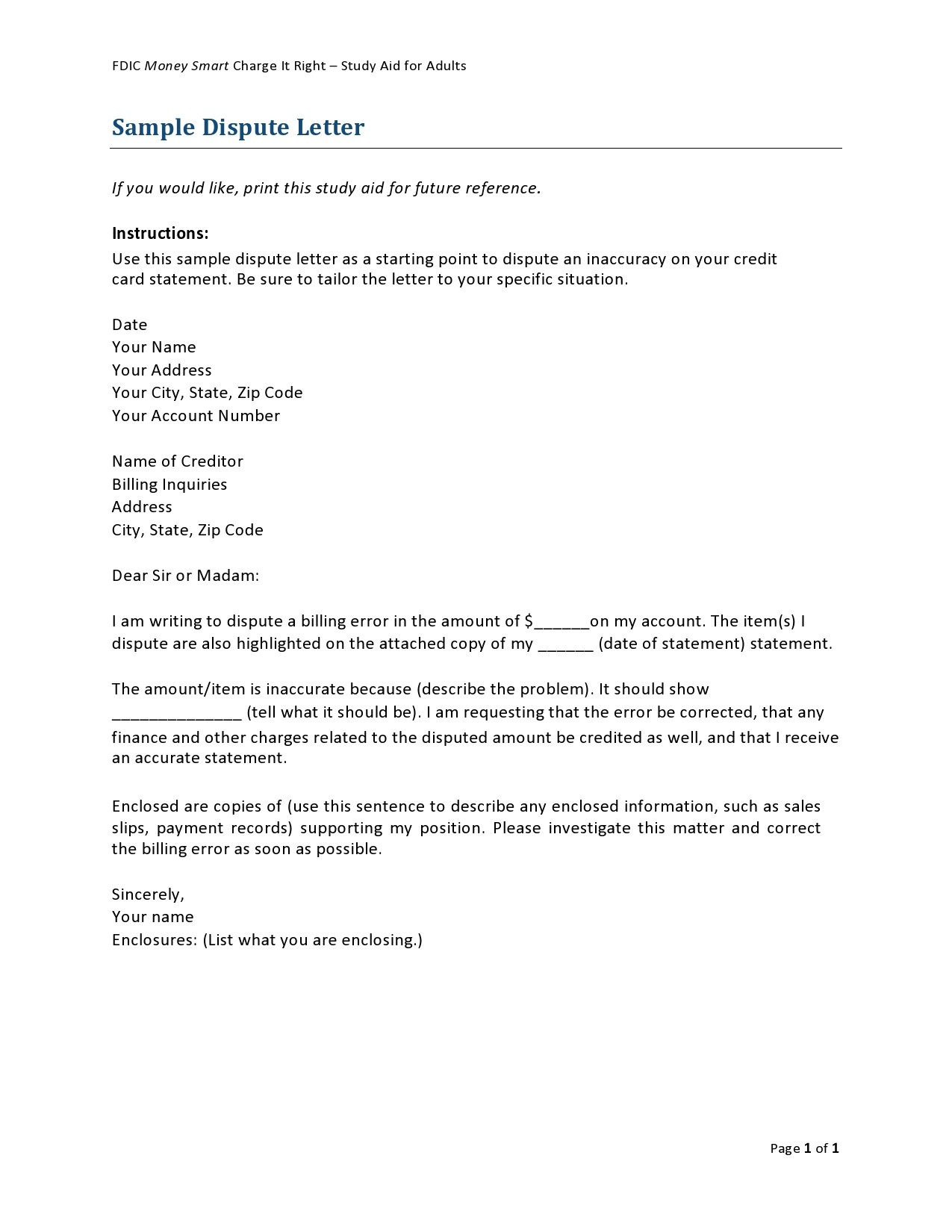

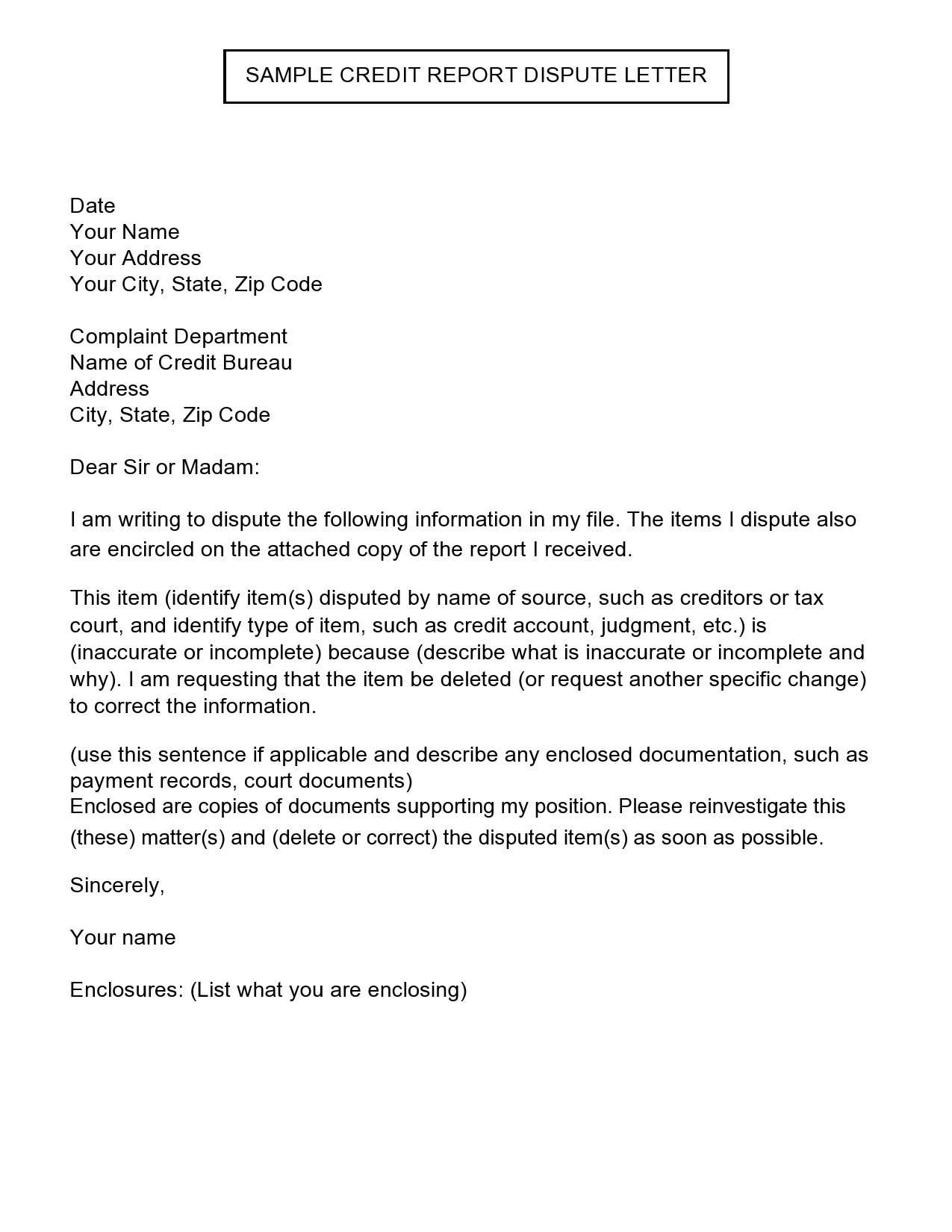

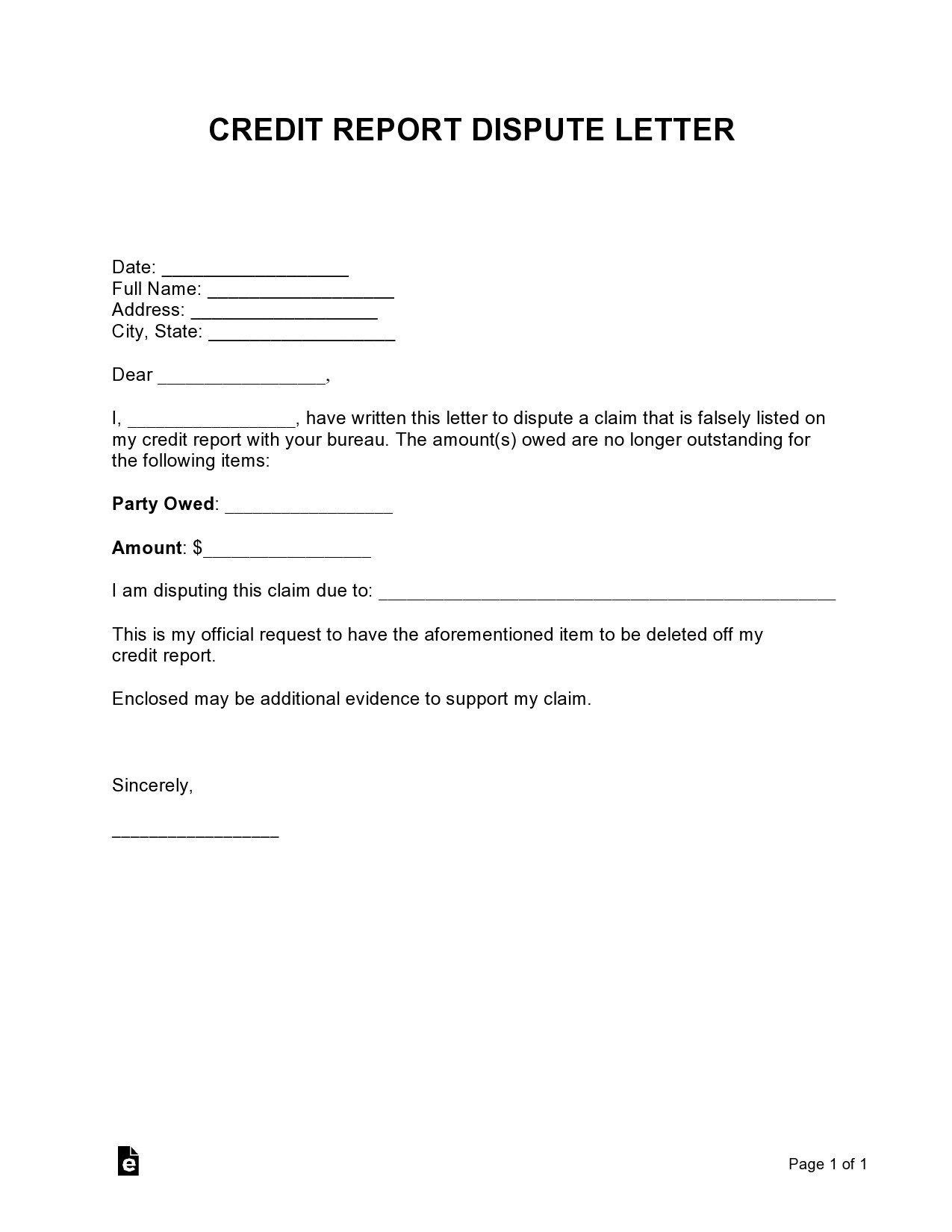

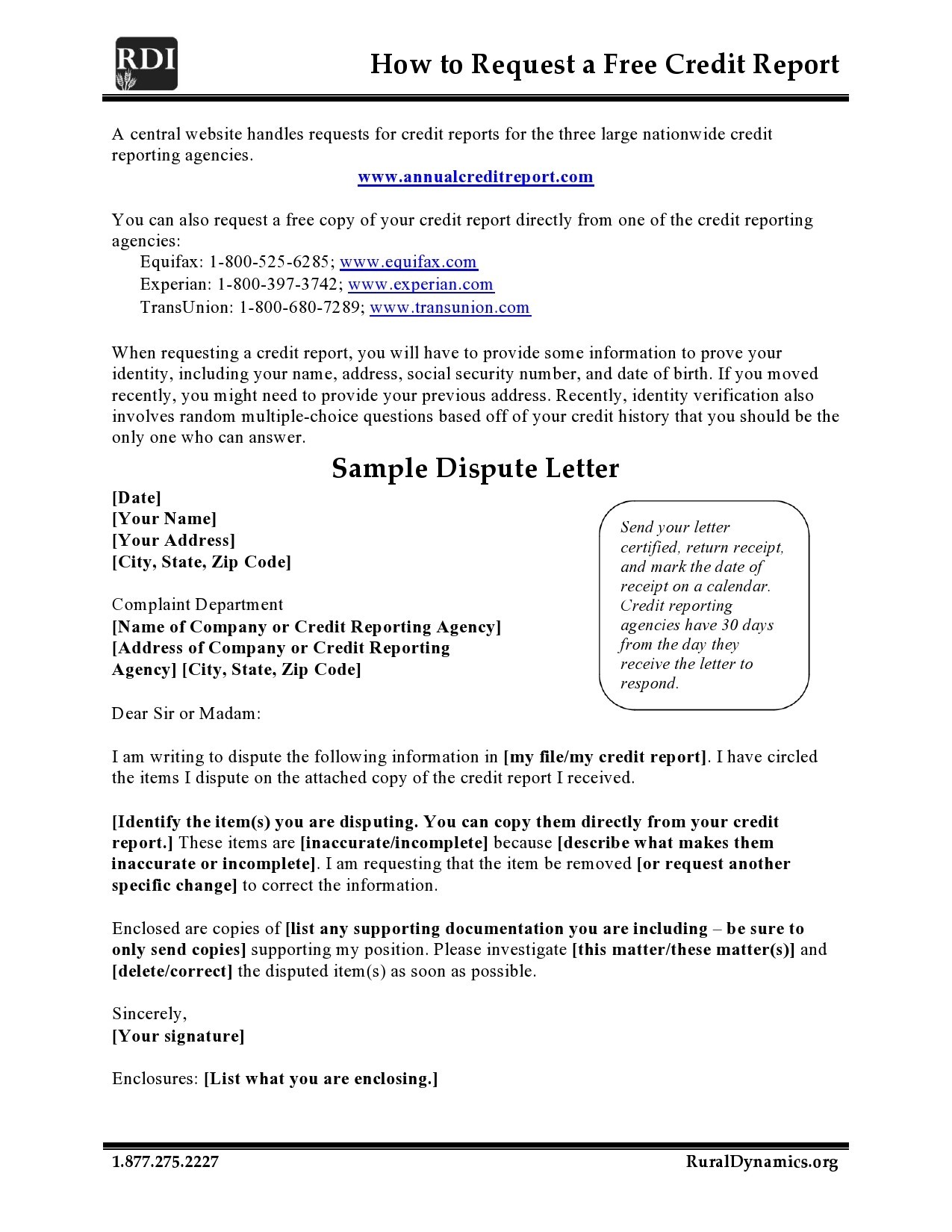

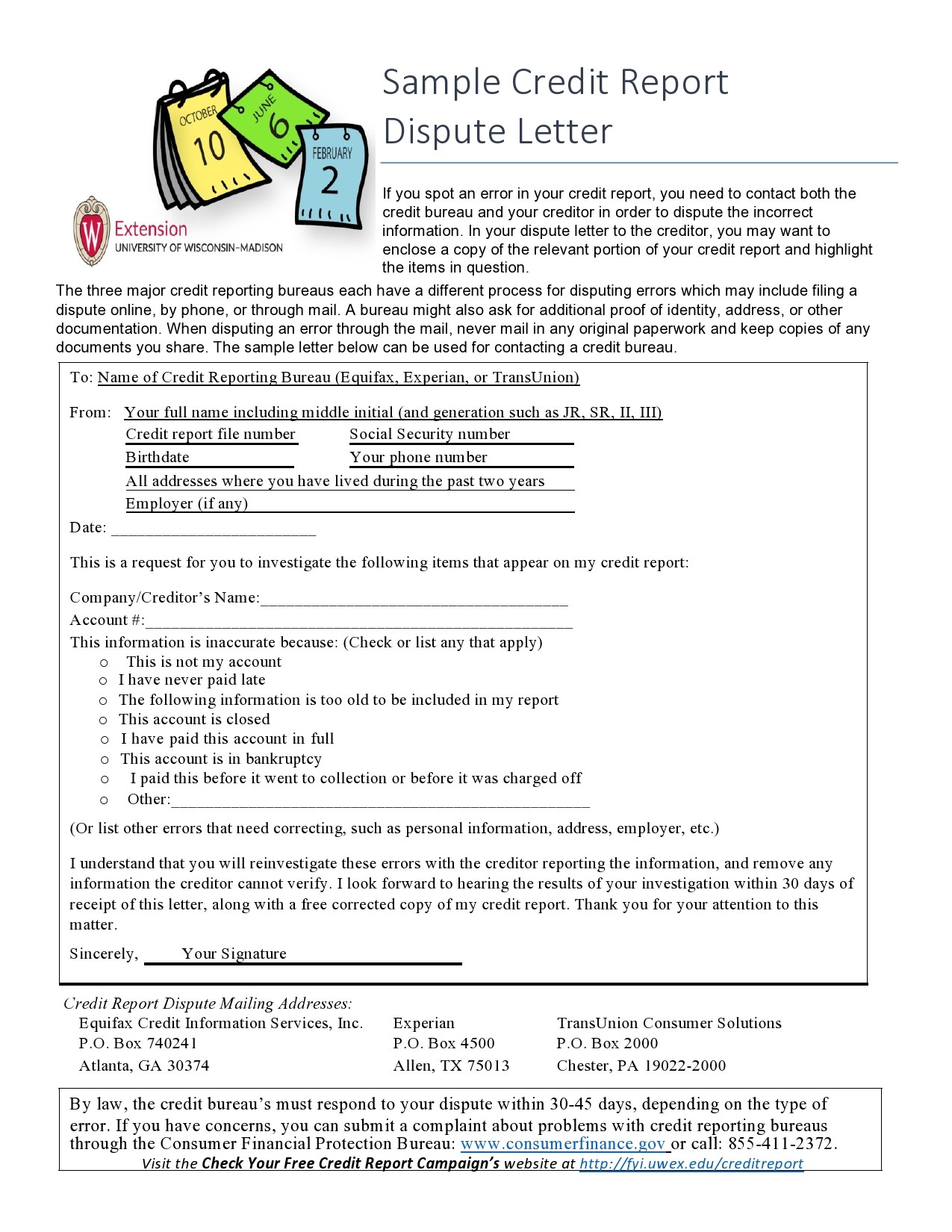

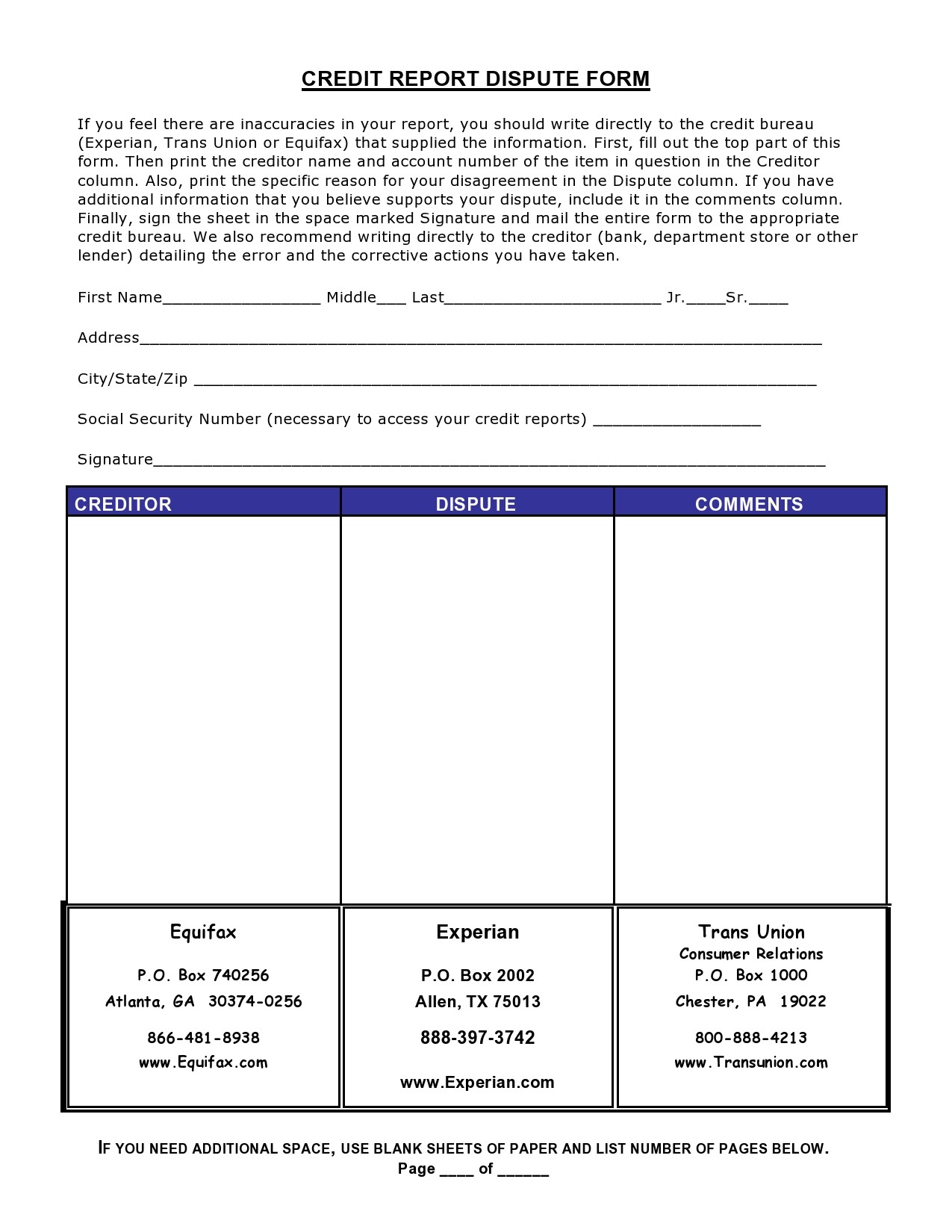

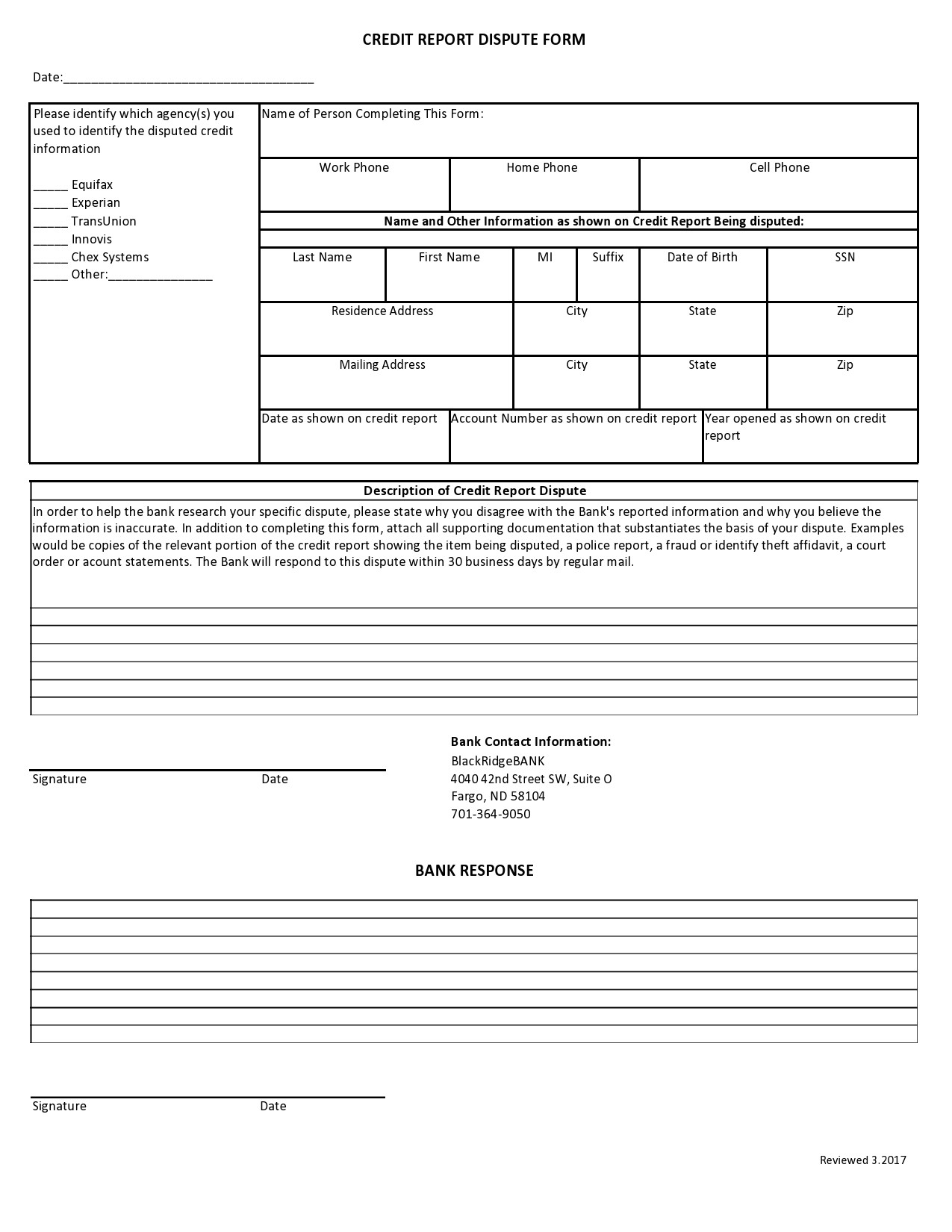

Lastly, your credit report dispute letter must have a request to remove a specific item from your credit report. Providing all the required information could make it easier for the credit bureau to decide faster on your case. Here are the basics you have to include in your dispute letter template:

- The date when you wrote the letter.

- Your personal information including your full name, date of birth, contact details, and your account number.

- The contact details of the credit bureau.

- A short description of the error.

- Any documents to help you prove your point like court documents, payment records, and more.

- Instructions about your request to the credit bureau.

- A photocopy of your credit report where you highlighted the error.

- A scanned copy of any government-issued ID and a document that proves your home address.

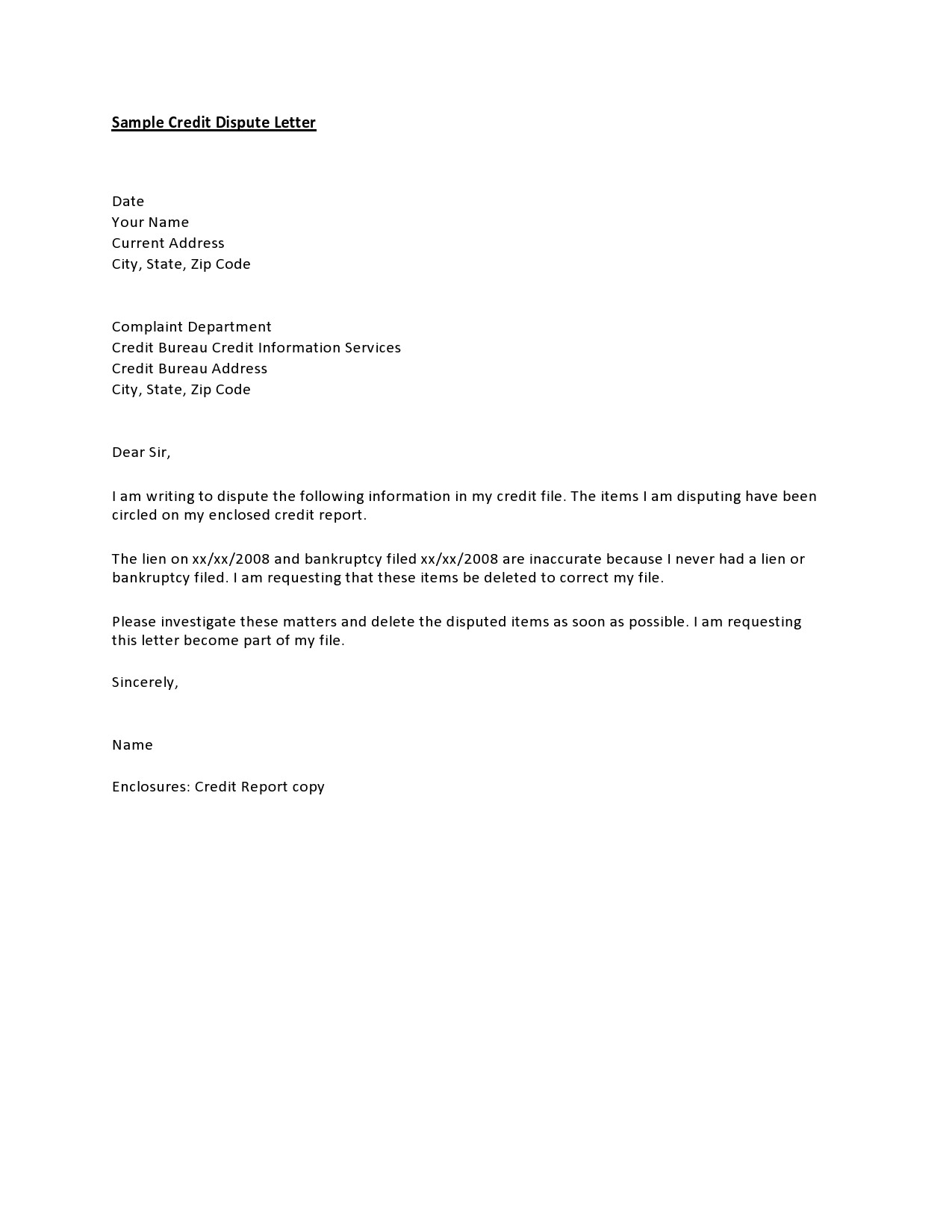

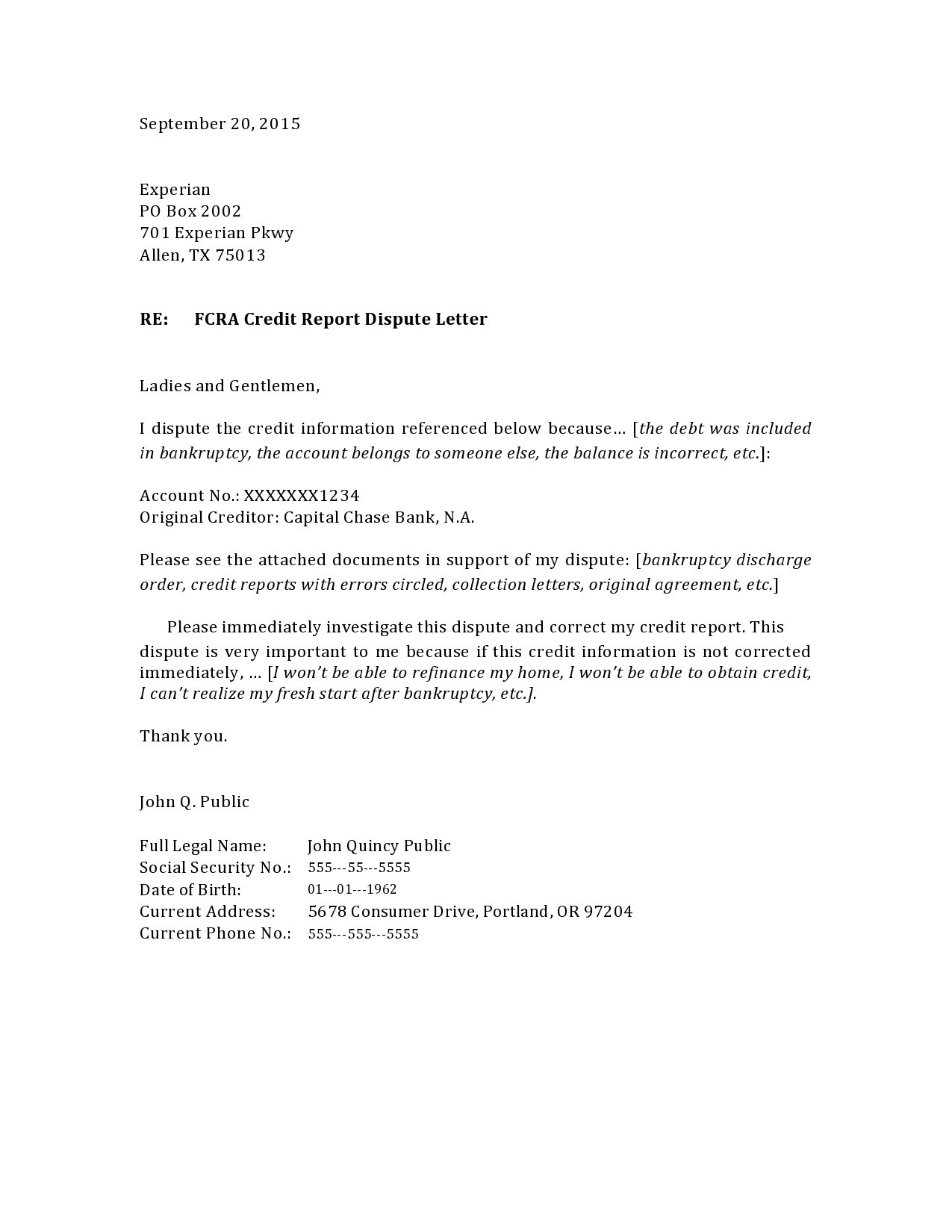

Credit Report Dispute Letters

How does a credit report dispute letter affect your credit score?

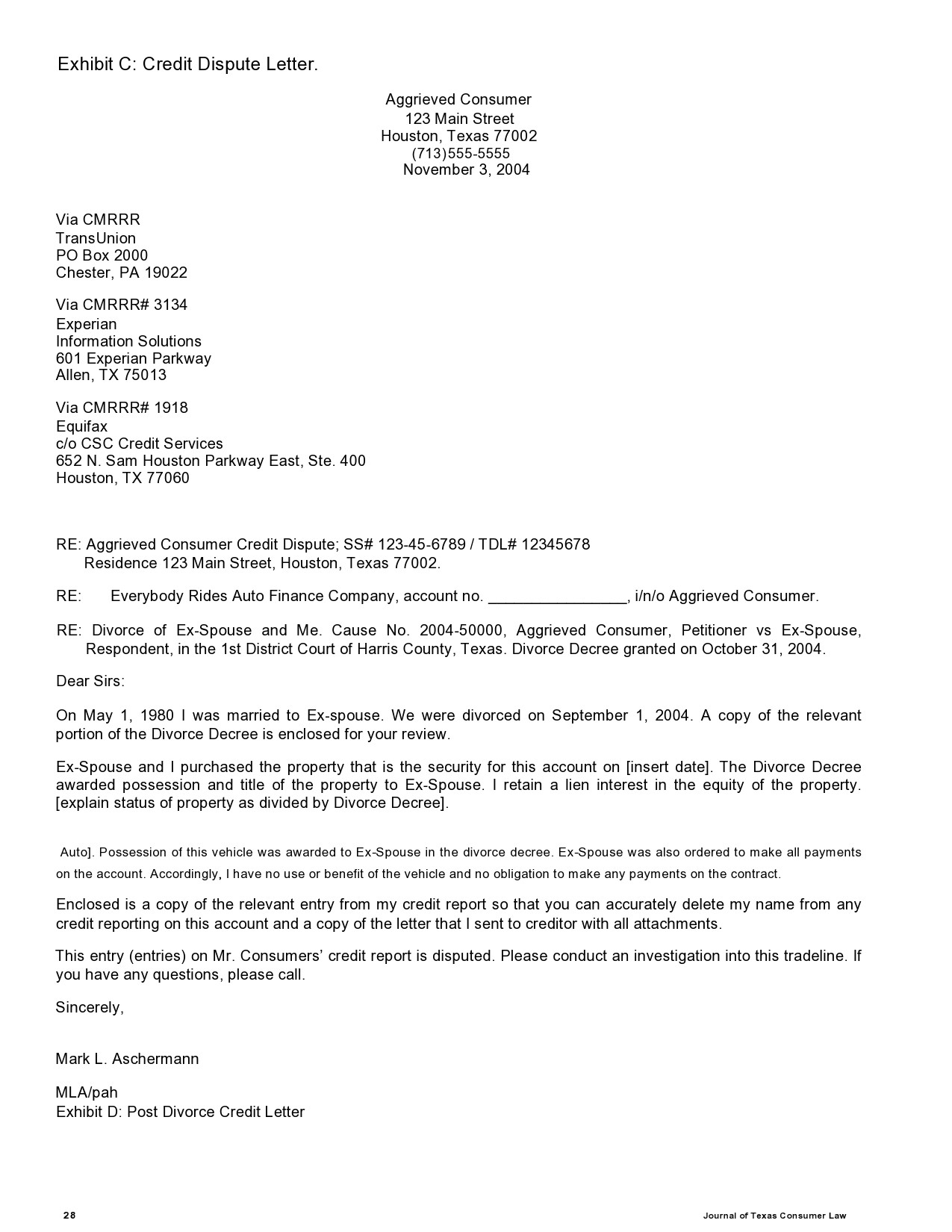

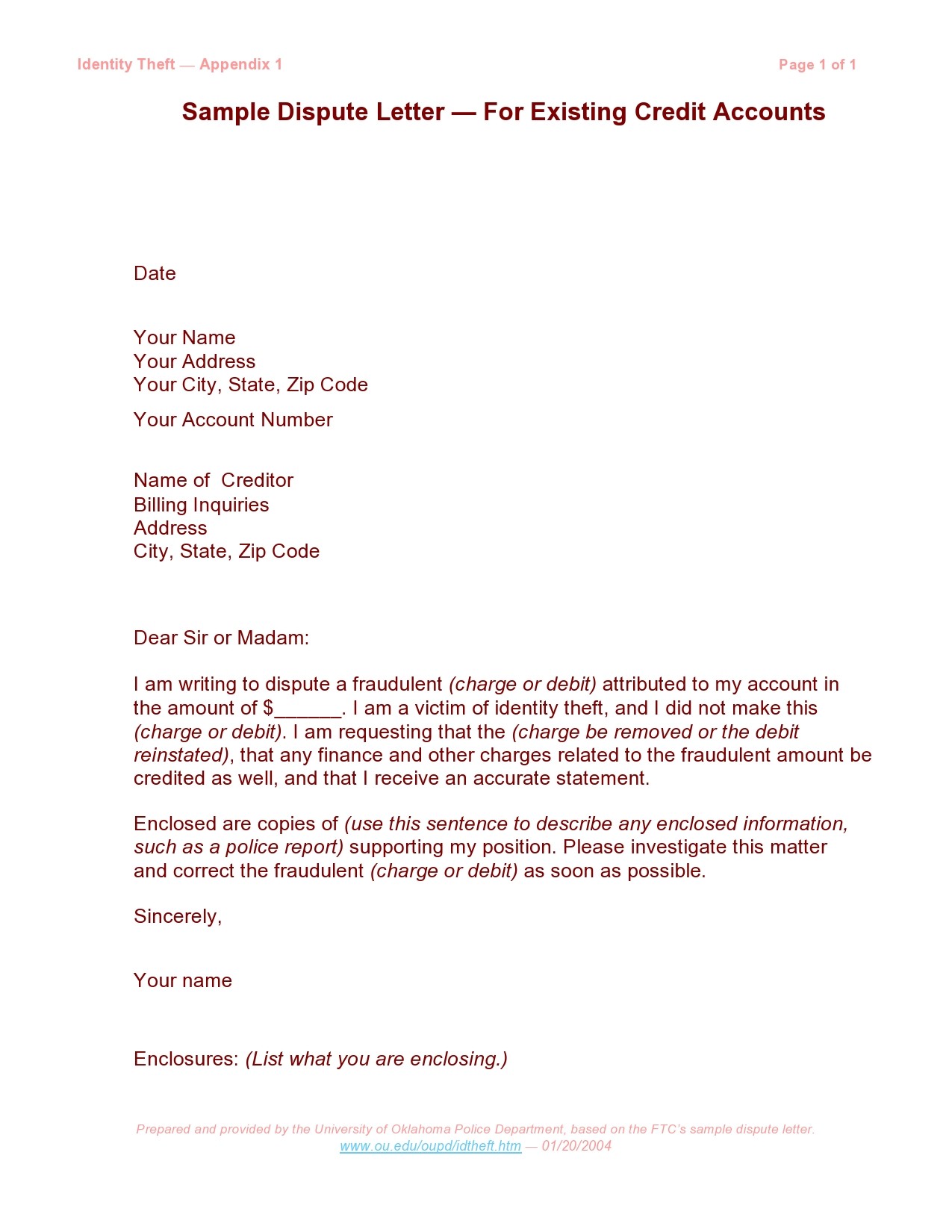

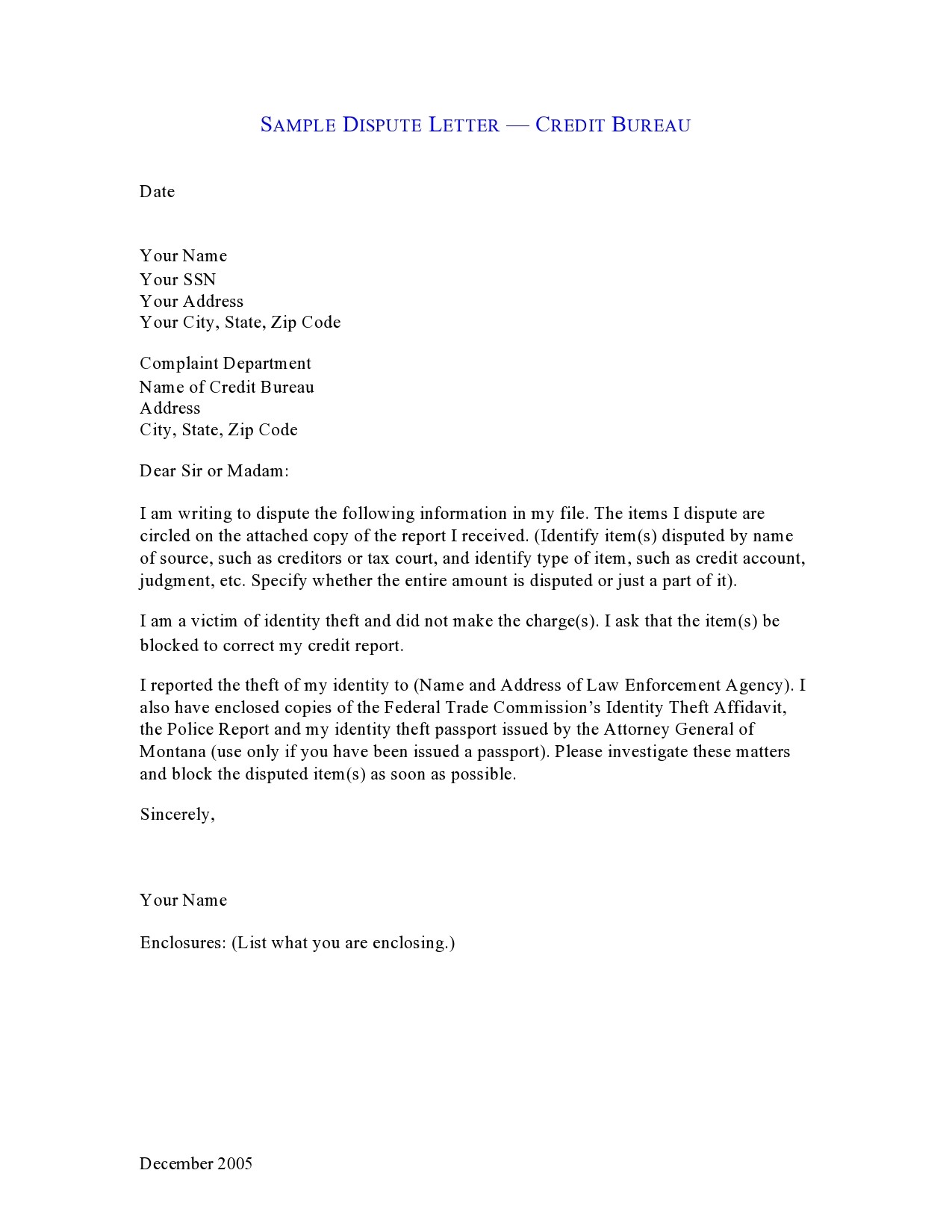

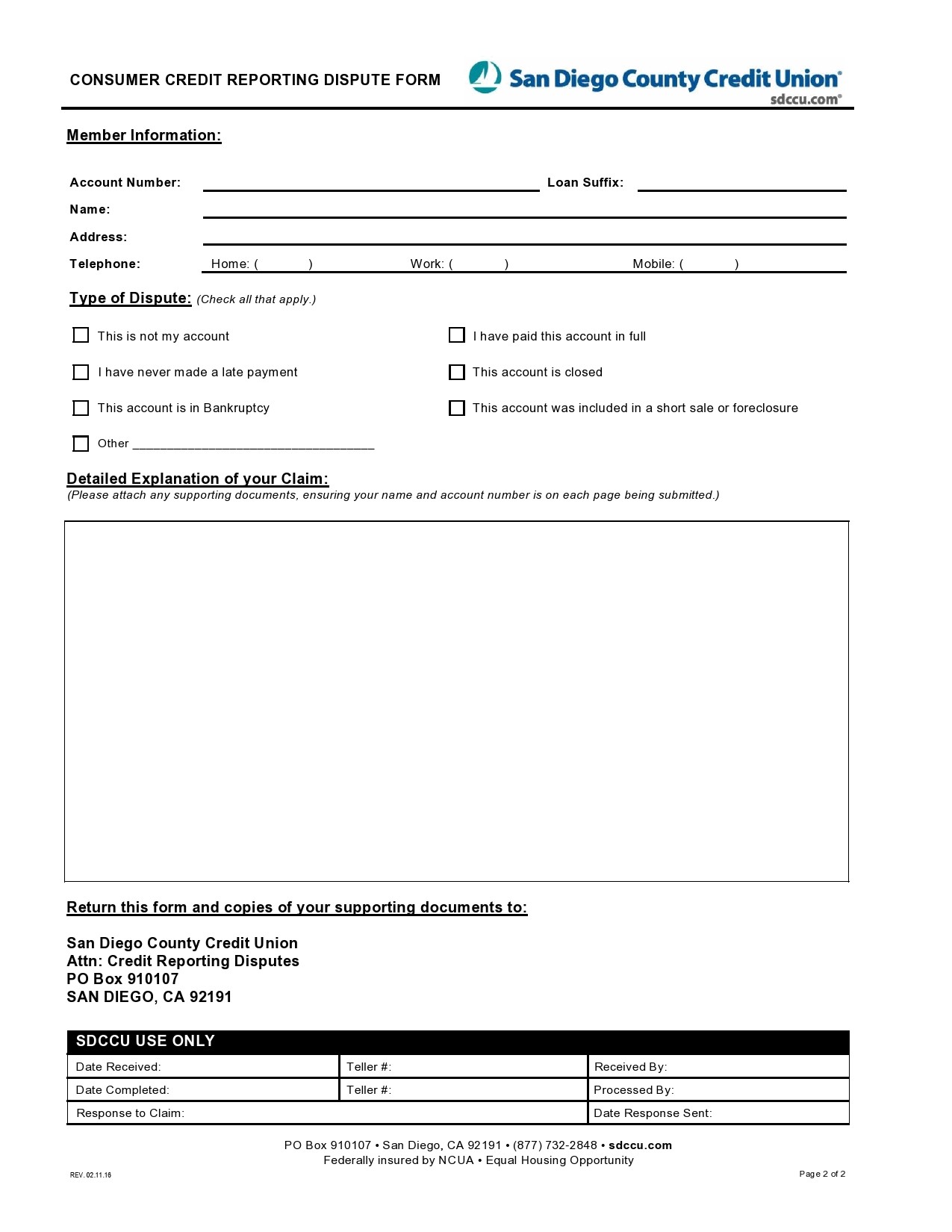

You don’t want anything to mess with your credit report and an error in it like a debt reported beyond the status of limitations, a credit card that’s marked as “closed” when it’s not or anything associated with identity theft could damage your credit score significantly. As a consequence, it will be more difficult for you to get approved when applying for a line of credit.

A credit report dispute form won’t automatically fix the issue. Moreover, there aren’t any guarantees either that the agency removes the item, especially in the absence of strong documentation to show that it is an error.

Writing a credit report dispute letter can cost more time until you have gathered the required documentation to make the case of the error in question. But your effort will be well worth it if the bureau corrects the error and your credit gets restored to its fair and accurate credit score.

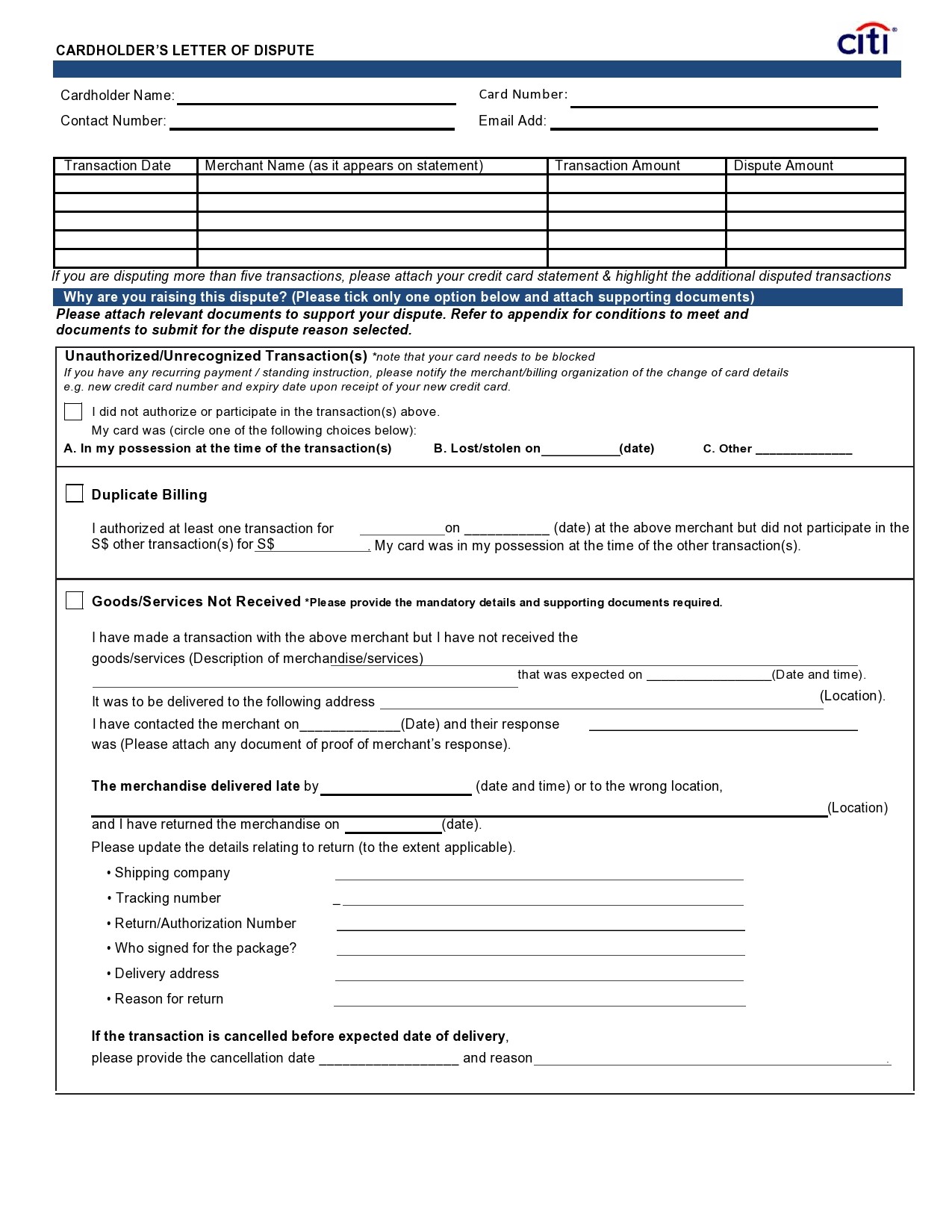

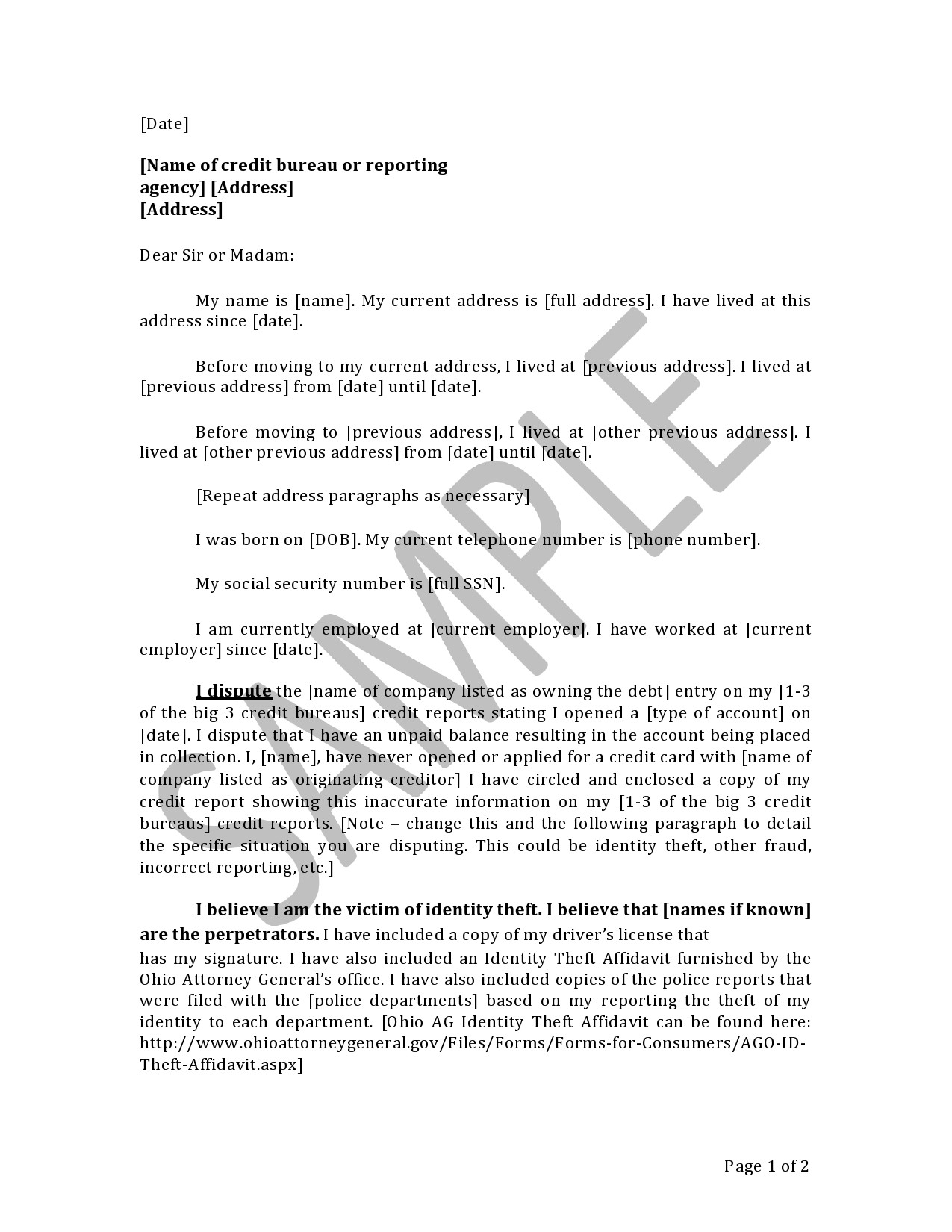

Dispute Letter Templates

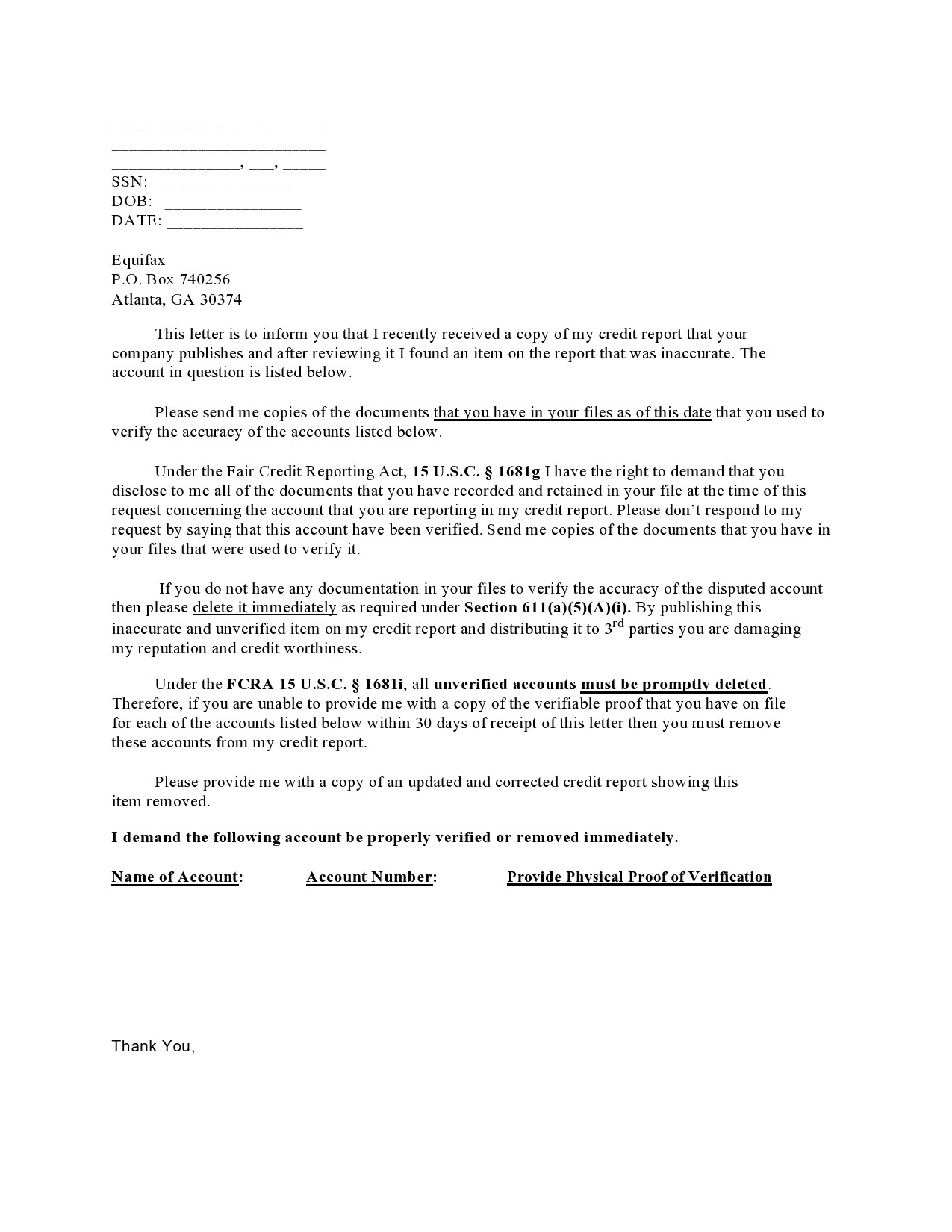

The responsibilities of the credit bureau

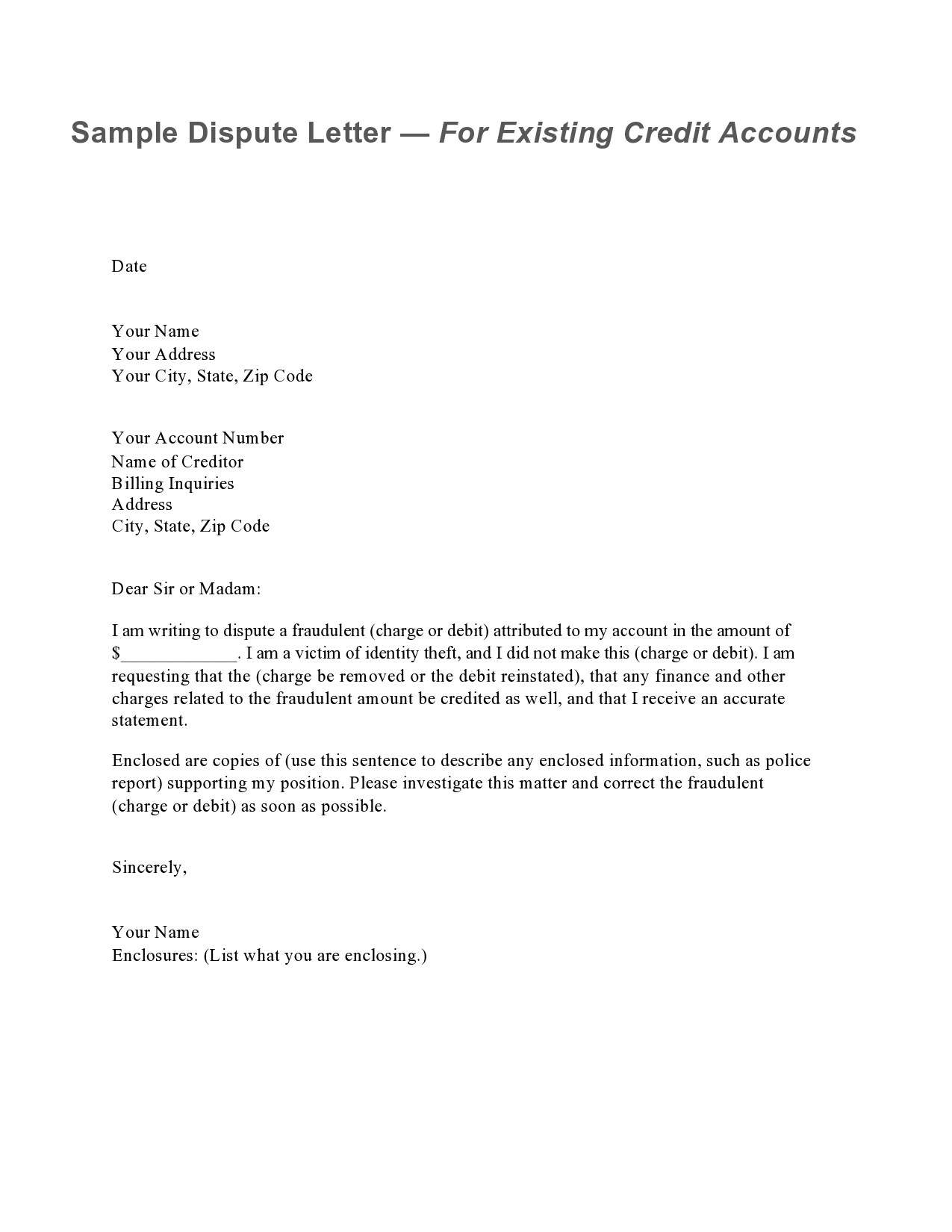

One of the main responsibilities of the credit bureau is to see to it that only verifiable and accurate information gets included in credit reports. The credit dispute letter is the main tool used in repairing credit. It’s part of the credit bureau’s job to collect credit information from consumers that can come from different sources.

This gathered information is then resold to businesses that need it for the evaluation of credit applications of consumers. All credit bureaus follow the Fair Credit Reporting Act that details what information furnishers and credit reporting agencies should and shouldn’t do when they report consumer information.

This is the best reason why using the credit report dispute letter can be your best option to fix your credit issues. Apart from the letter’s benefits, there are a few things you should also know about this letter:

- It allows you to exercise your right to make a request that credit bureaus provide all information included in your credit report.

- It allows you to assert your right to a comprehensive and accurate credit report that only includes verifiable information.

- Credit bureaus can remove information that’s outdated, erroneous, or unverifiable.

What is the best way to dispute a credit report?

Most of us have gone through the experience of getting inaccuracies in our credit reports, even when there aren’t any. The best defense for this is to know how to dispute the mistake. Should you discover anything in your credit report that really doesn’t belong there, here is what you should do:

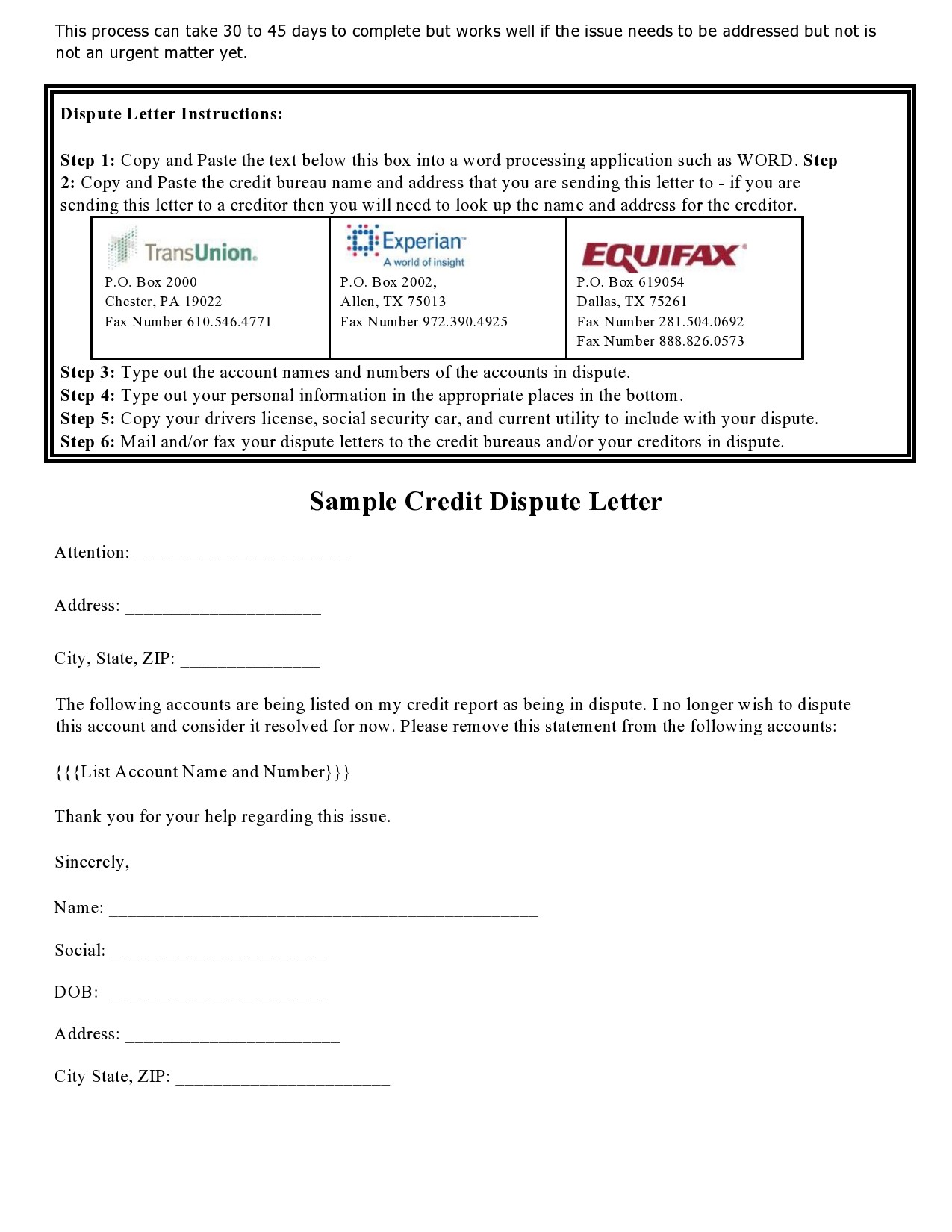

- Identify any errors in your credit report

Make it a point to always review your credit report regularly for incomplete or inaccurate information. You get 1 credit report for free from the 3 major credit bureaus in the USA at least one time each year. You may also subscribe to an online credit monitoring service to review your report every month. - Contact the source of your erroneous credit report

The next step is to get in touch with the company or the furnisher that provided you with inaccurate information. Verify their records to confirm the mistake. If there are any errors, you may already solve the issue. If not, contact the credit reporting bureau directly. - Dispute the errors on your credit report

According to the Fair Credit Reporting Act, the company that provides information about you to the credit bureau and the credit reporting bureau must accept any disputes given by consumers and rectify any incomplete or inaccurate information. Make sure to send a credit dispute letter to the company that provided you with inaccurate information and the credit reporting bureau. - Give them time to investigate

By law, credit reporting bureaus should investigate any disputed items. On average, the process takes less than a month. These groups must provide relevant information to the provider, meaning to the person who disputed the item.

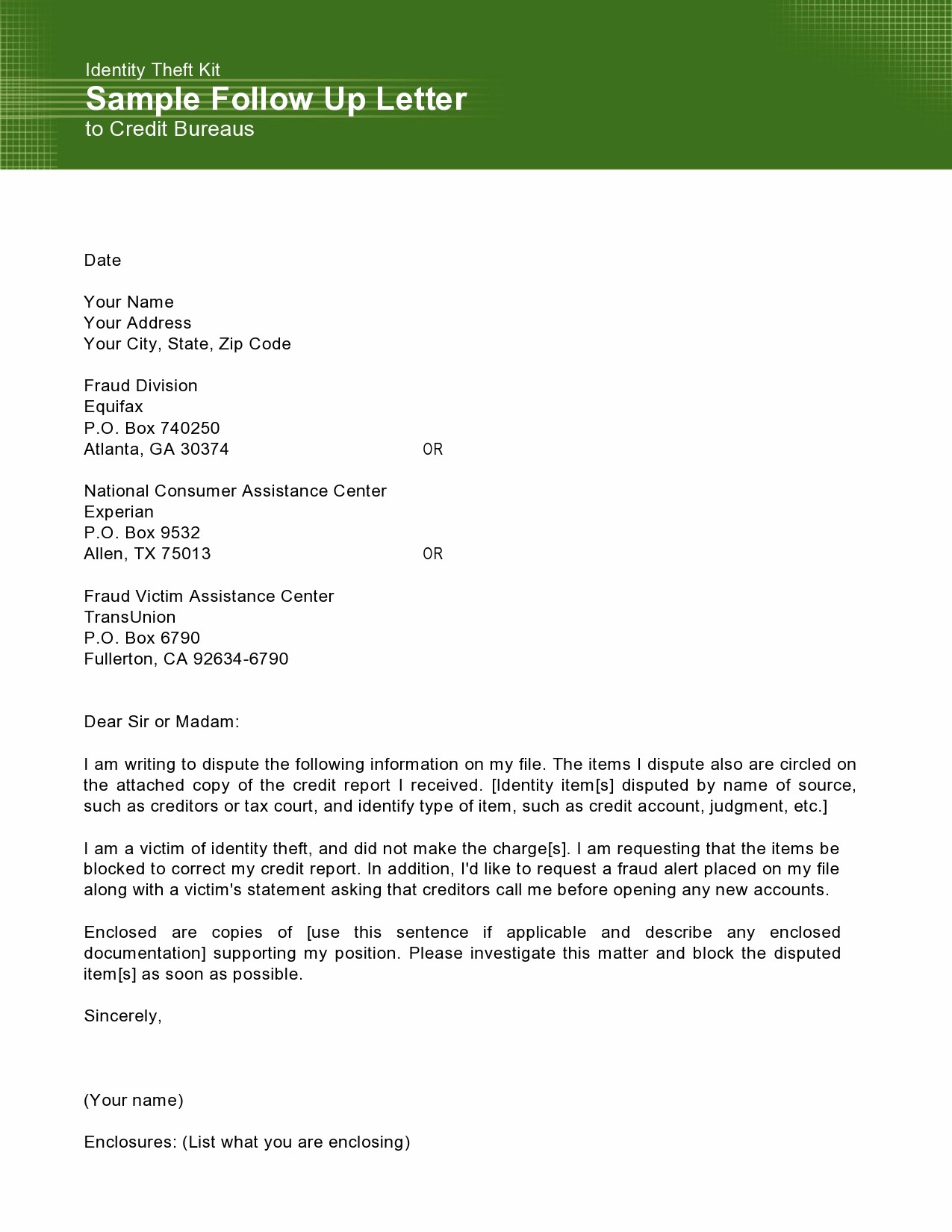

The provider should then investigate the issue after which, must report back to the credit reporting bureau. If the result proved that you’re right and it was an error on their part, the provider must then notify the 3 major credit bureaus so that they make the necessary corrections in your credit report. - Follow-up

After the completion of the investigation, expect the following:

A written report from the credit reporting bureau that contains the results of the investigation.

1 copy of your credit report given to you free-of-charge if there are any changes.

Should the furnisher continue to report the error, you can make a request with the credit bureaus for them to include your statement in your credit file that contains your dispute which should be part of your future credit reports. You can also ask the credit bureaus to send a copy of the corrected credit report to those who have recently received an erroneous copy of your credit report for a fee.

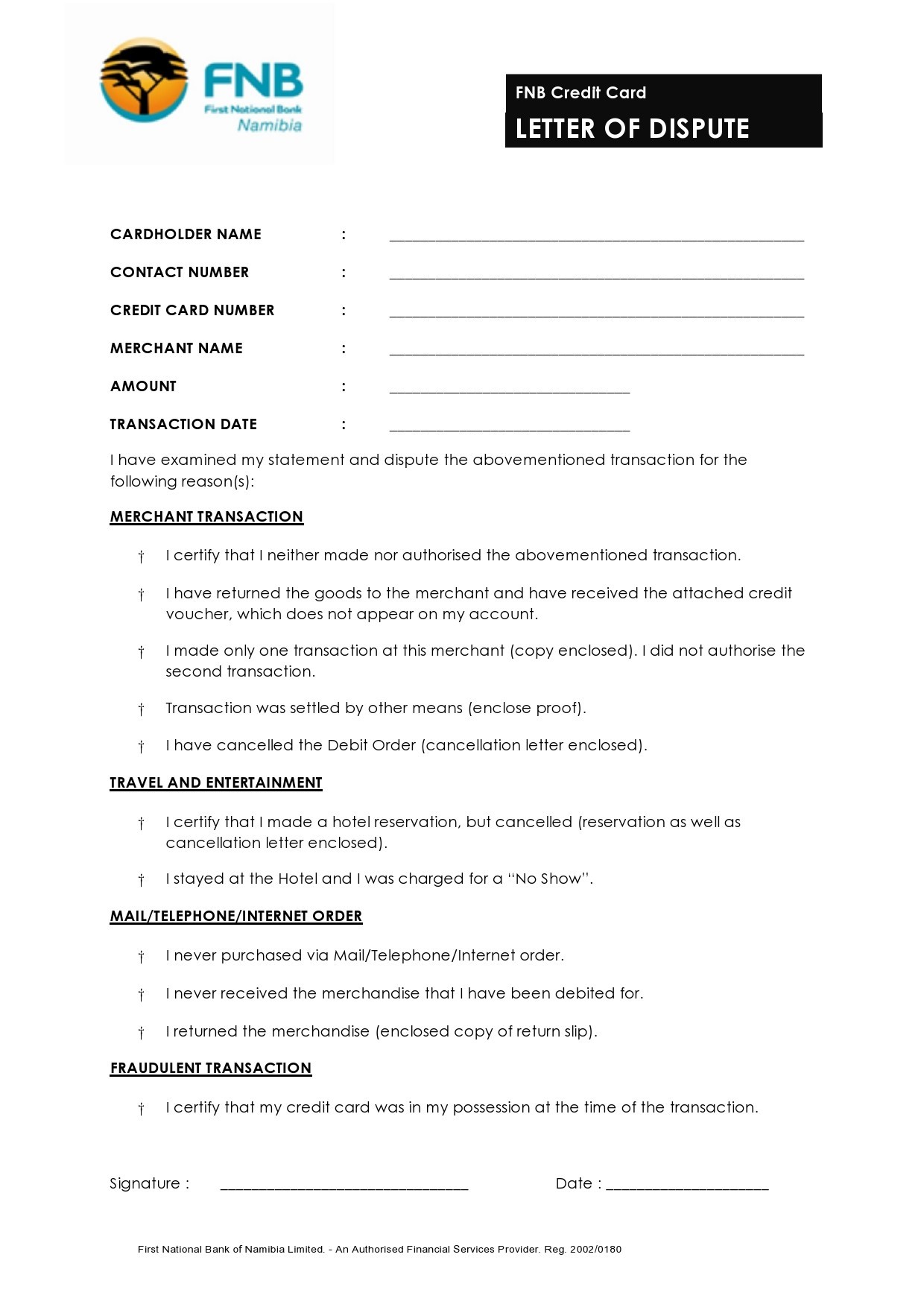

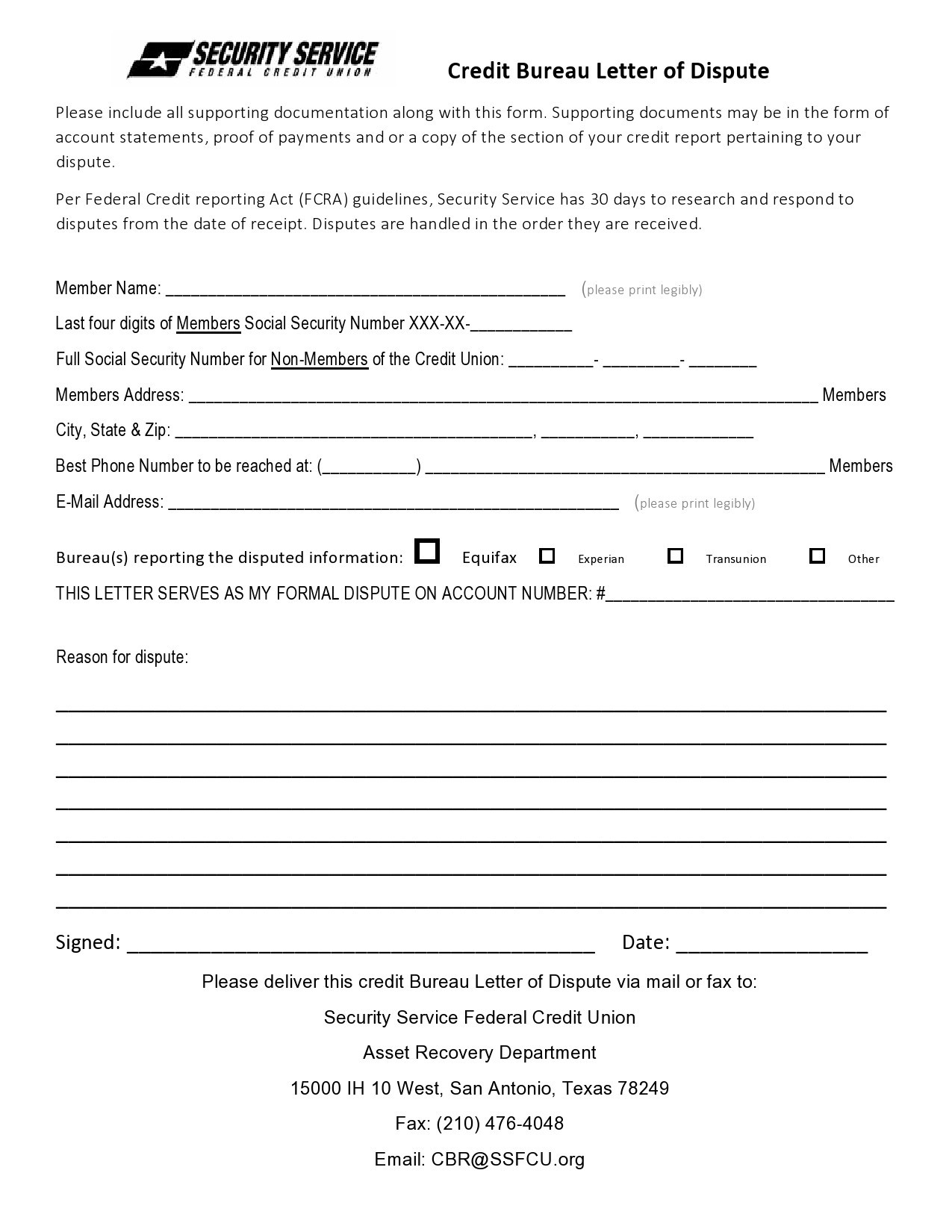

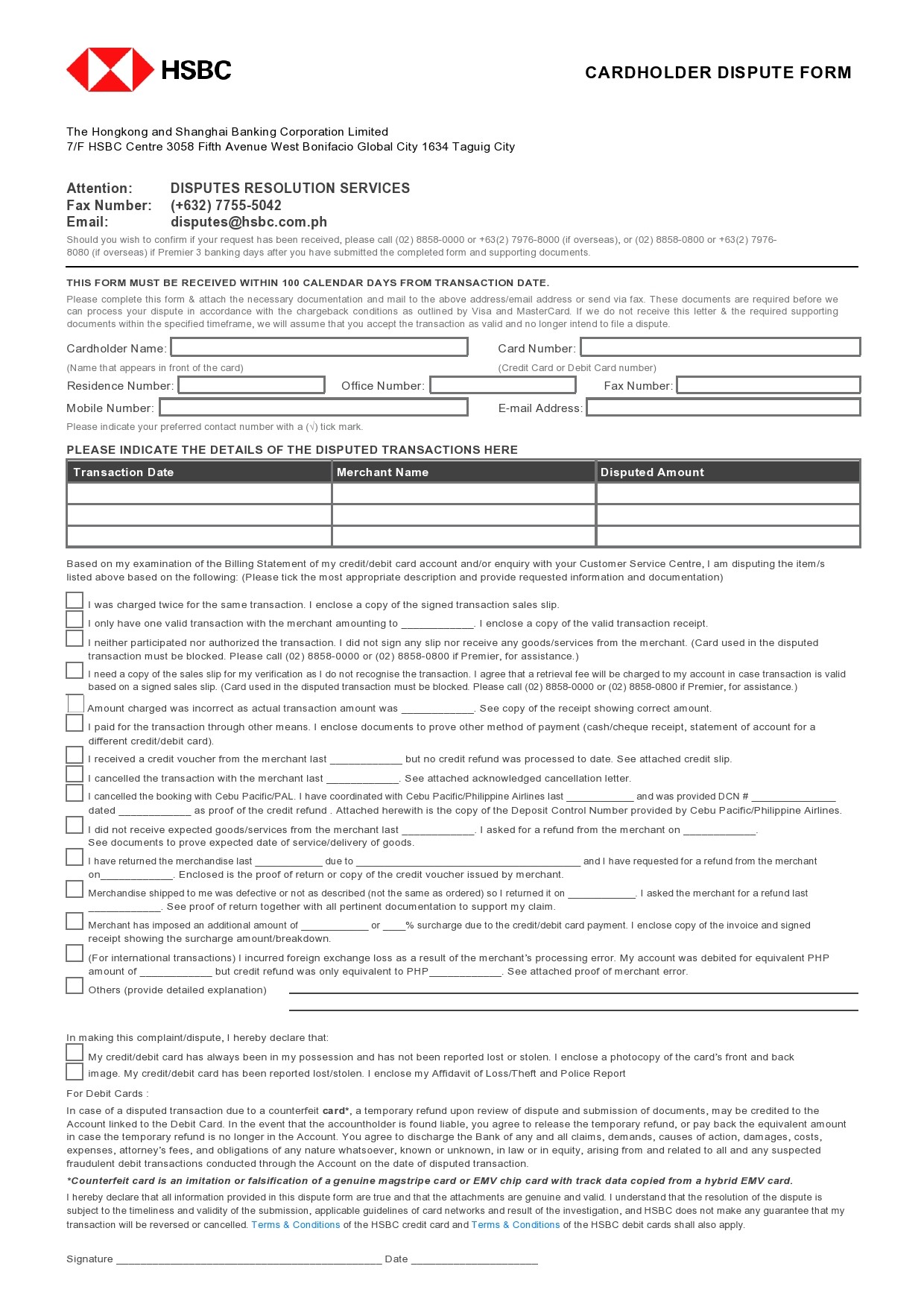

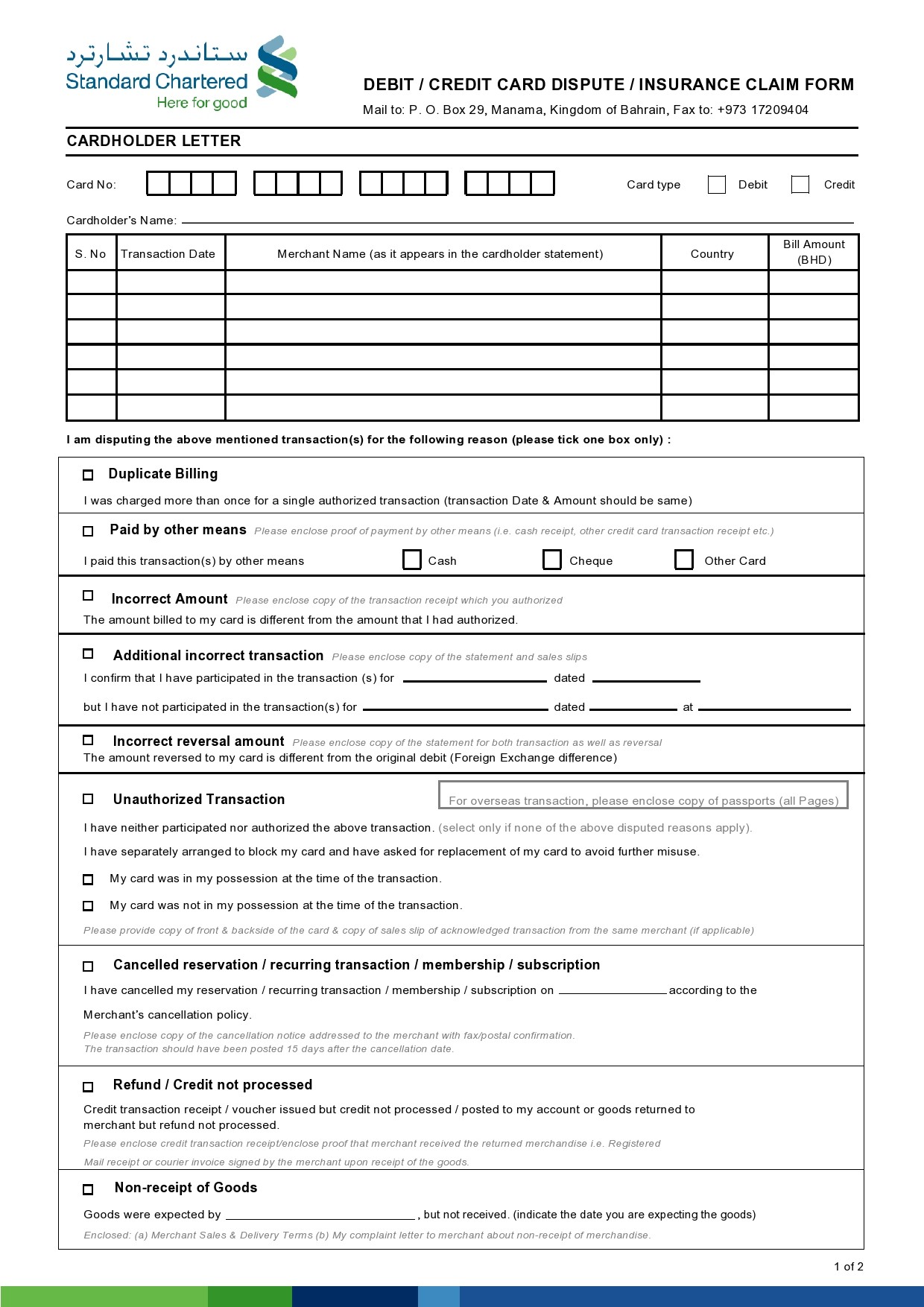

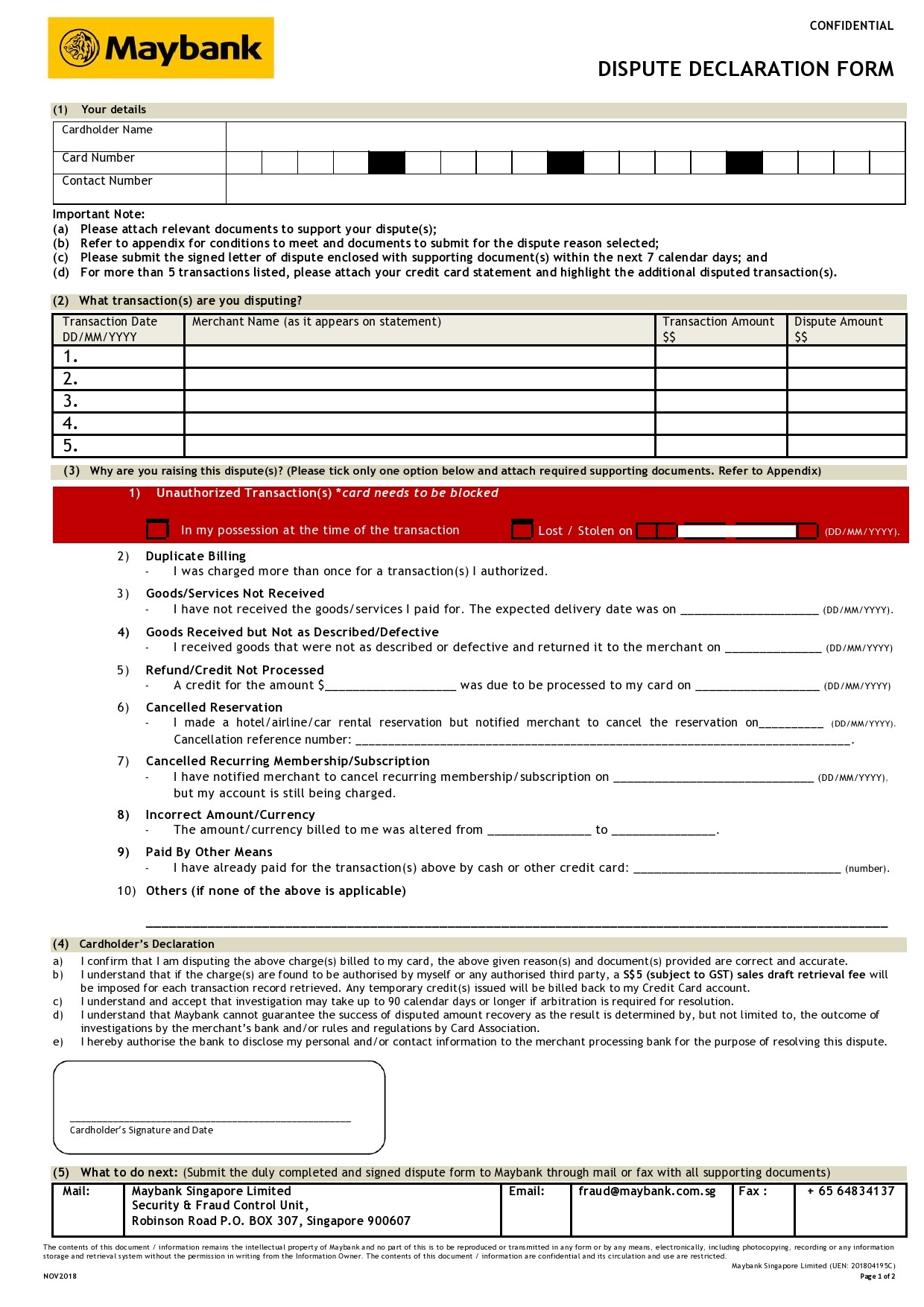

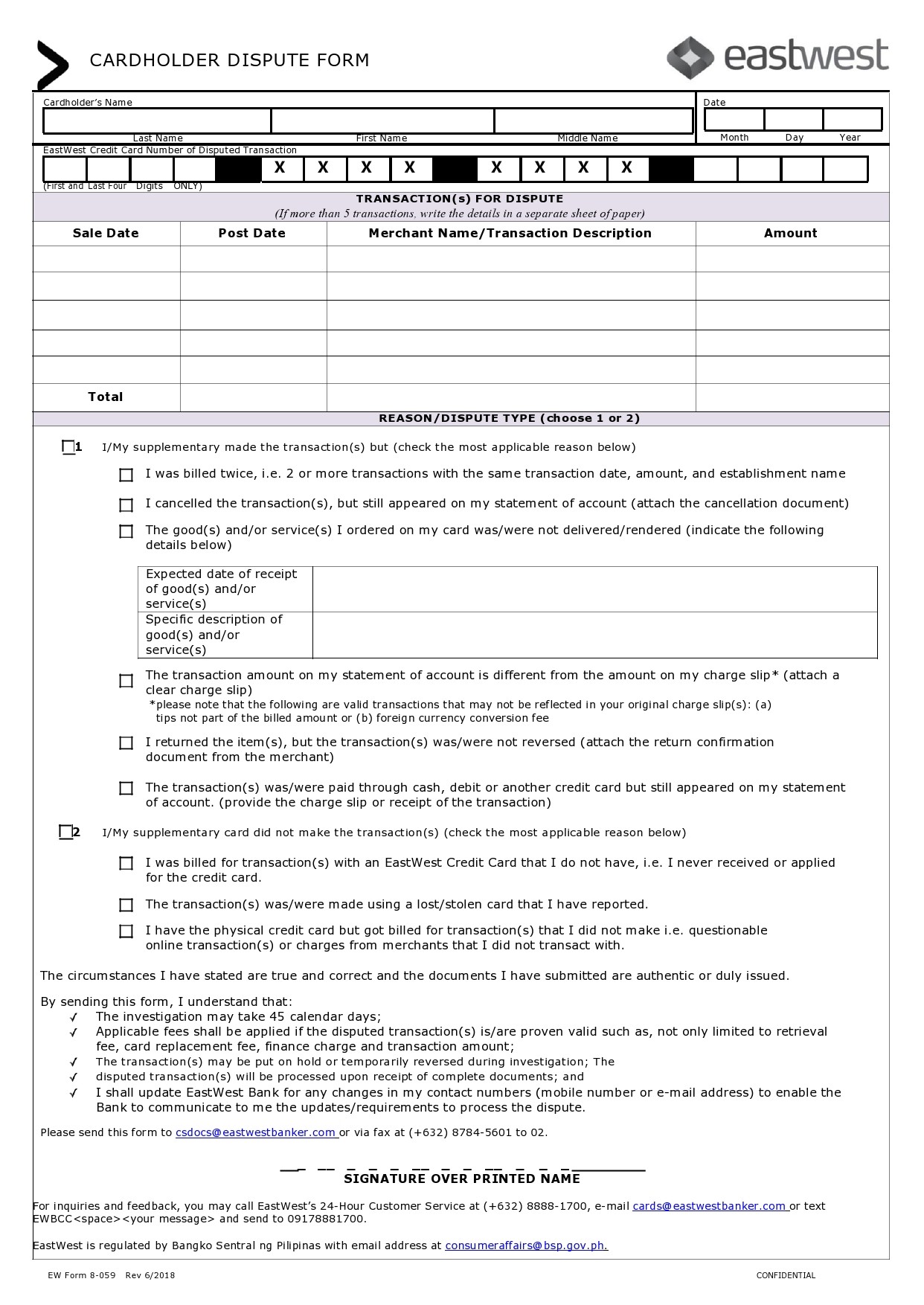

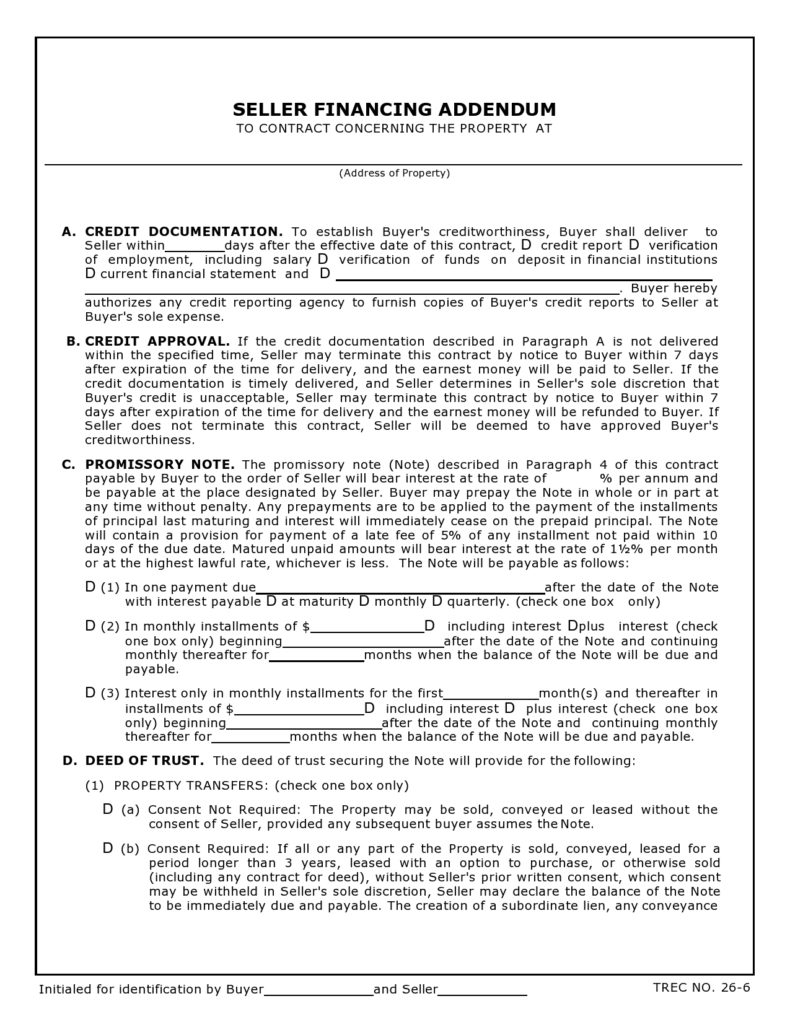

Credit Report Dispute Forms

Do 609 letters really work?

A 609 letter is also a credit dispute letter. However, in general, when someone a person an item in their credit report, they do this based on inaccuracy including errors in data management, identity, balances or reporting account statuses.

You can start the process by disputing the item directly with the credit reporting bureau. Each of the three credit bureaus has a link where you can dispute any of the credit items. You can do this online or you may submit your dispute in writing using a dispute letter template. In some cases, the credit reporting agency removes your item after the first dispute although it’s more often that you will have to follow-up to keep the process going.

Sadly, there isn’t always a guarantee that you’ll get a negative item removed through this process. But based on feedback, consumers have greater luck using the 609 letter as part of their process to fix their credit score. This could be because most creditors gather information online without providing all the necessary disclosures and paperwork they’re supposed to.

Many of these creditors known that consumers can use this loophole later, however, they probably figure that the effort and time they’re saving is worth the risk. If you’re one of many who have worked to repair your credit, boost your credit score or you have 1 or 2 stubborn items that you cannot remove from your credit report, and the standard methods of settling disputes haven’t worked in your favor, then the 609 letter may just be your solution.