If you need to write an IOU template, you probably have looked at basic IOU forms online to see what the IOU format should be. You might need to look at various IOU notes to be able to find out what the I owe you template you are writing should look like. You can choose to use an I owe you letter as well without impacting the enforceable nature of this document.

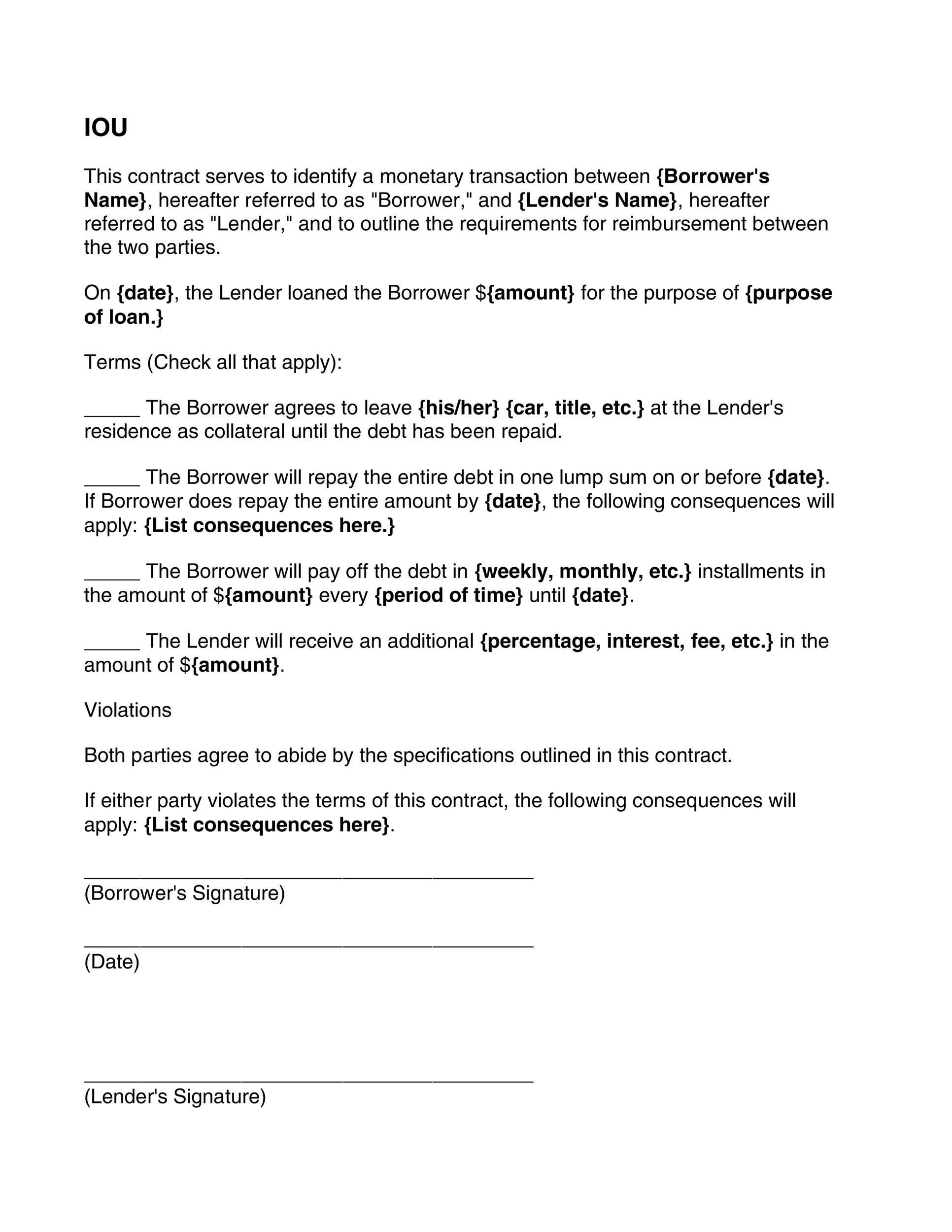

IOUs can be used for a variety of different situations where someone owes you money. These agreements are nearly always intended to be used in situations where someone is a borrower, and someone is a lender. The note makes sure that the borrower will promise to repay the amount borrowed in full. The terms and conditions of the loan transaction will be communicated in this document so that everyone is on the same page about the nature of the document.

Table of Contents

- 1 IOU Templates

- 2 What is an IOU?

- 3 What is the Difference Between an IOU, a Promissory Note, and a Loan Agreement?

- 4 When Should You Use an IOU?

- 5 “I Owe You” Letters

- 6 How do you write a simple IOU?

- 7 IOU Notes

- 8 Is a written IOU legal?

- 9 What happens if You Don’t Use an IOU?

- 10 IOU Forms

- 11 Downsides to Not Using an IOU

- 12 IOU Documents Can be a Significant Benefit

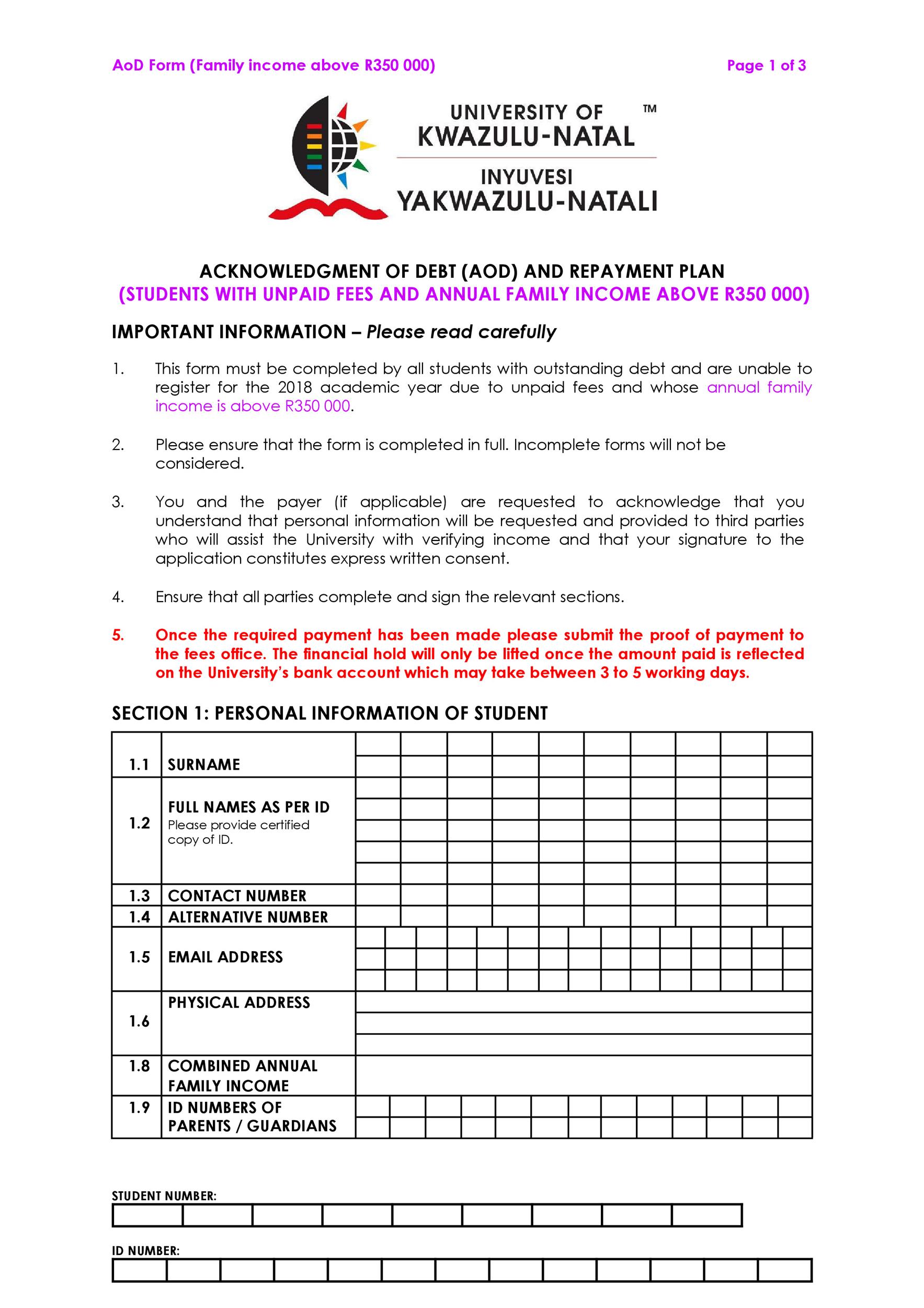

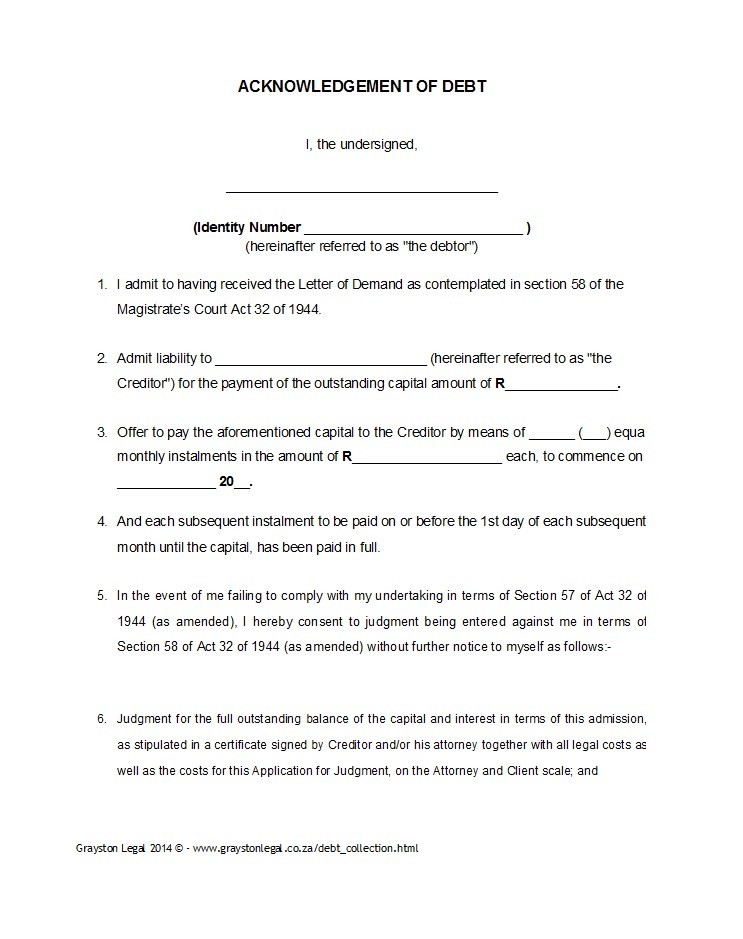

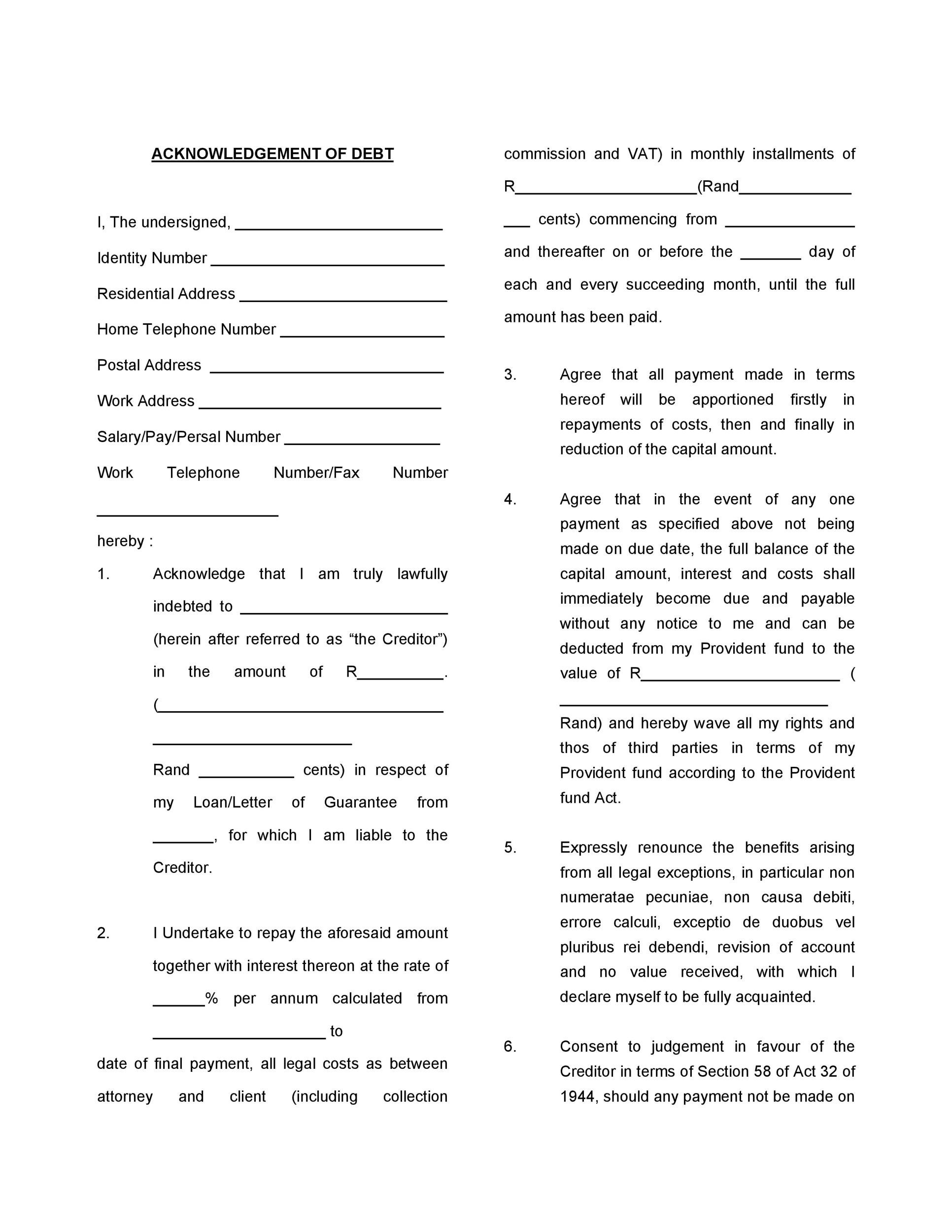

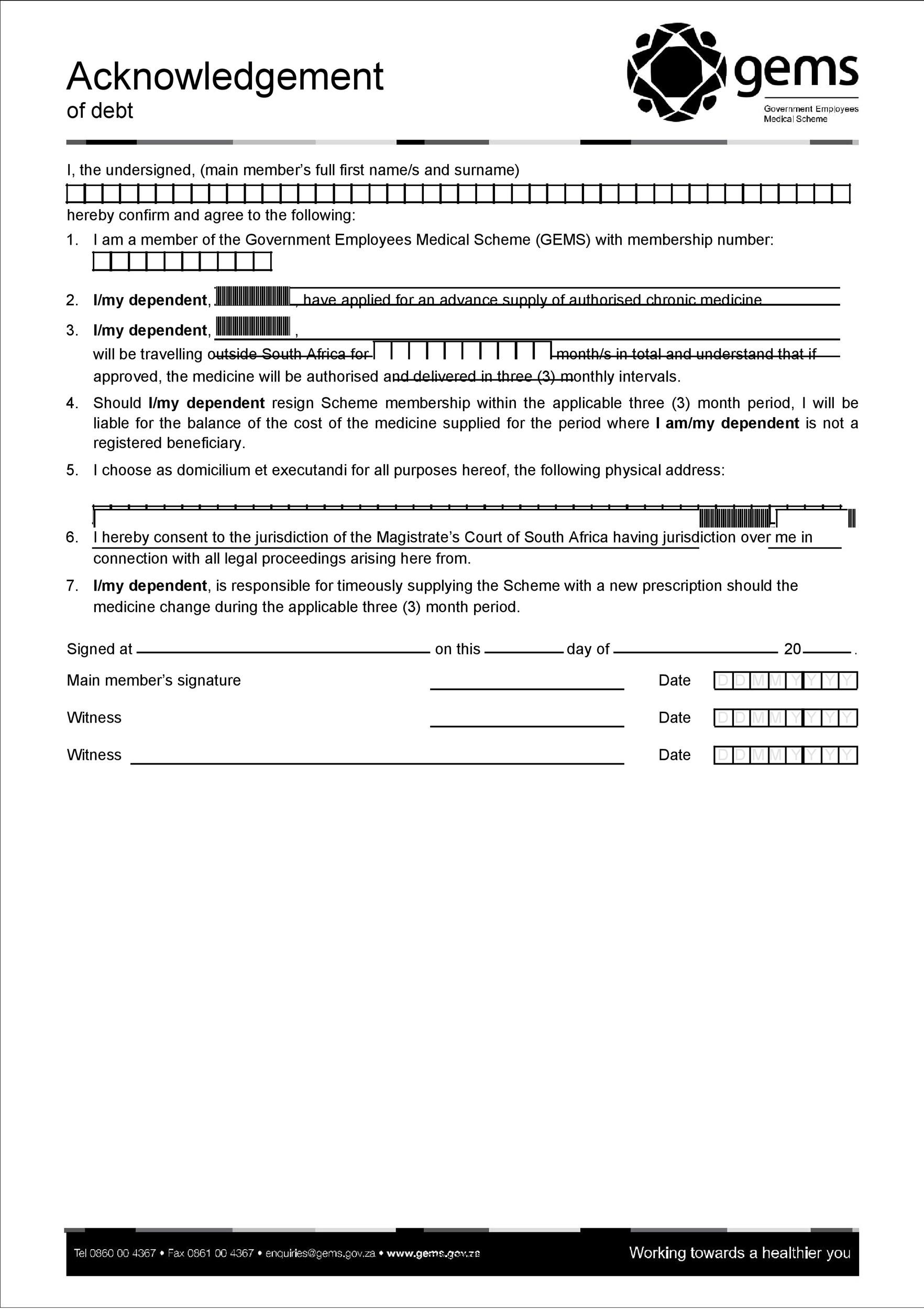

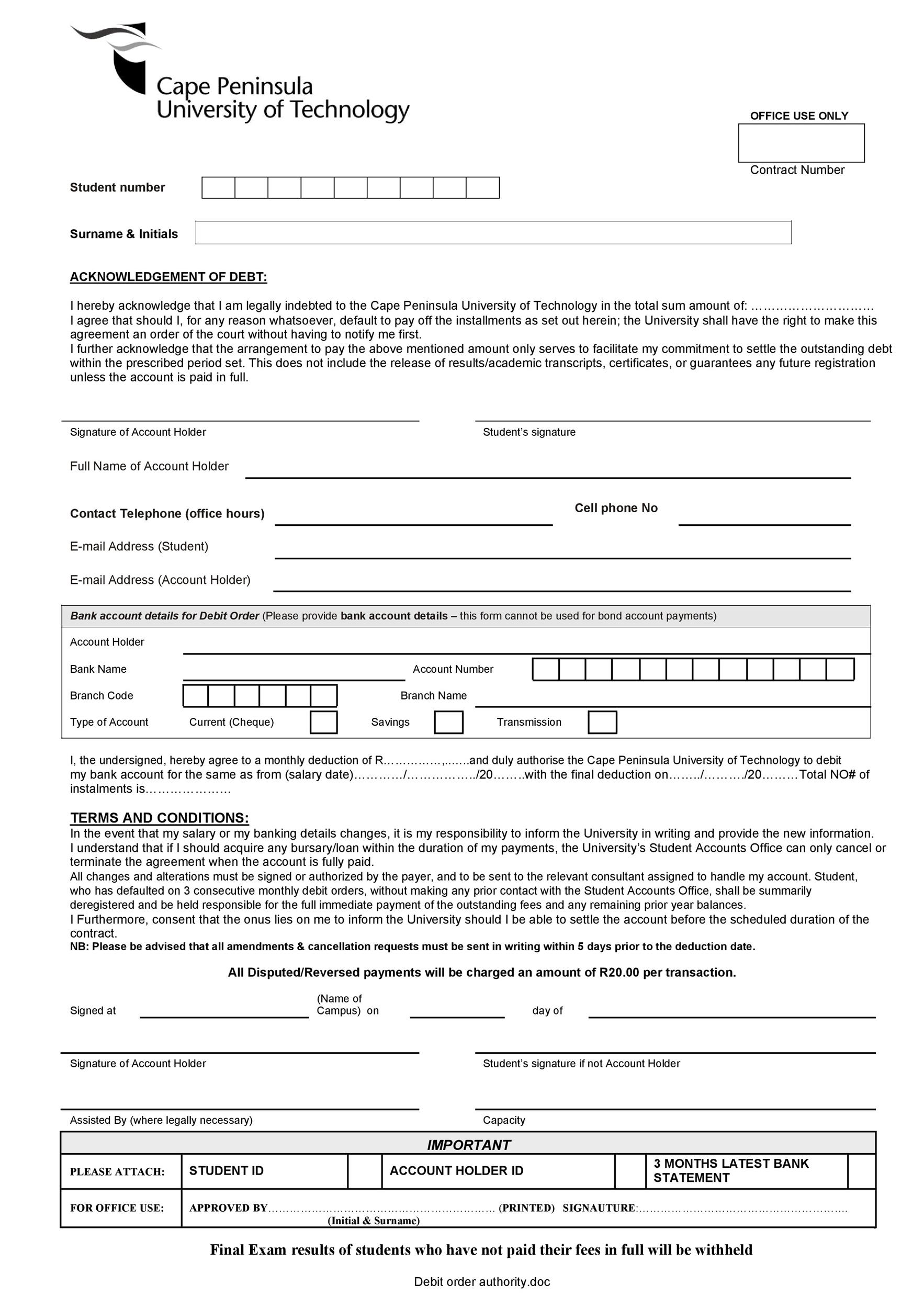

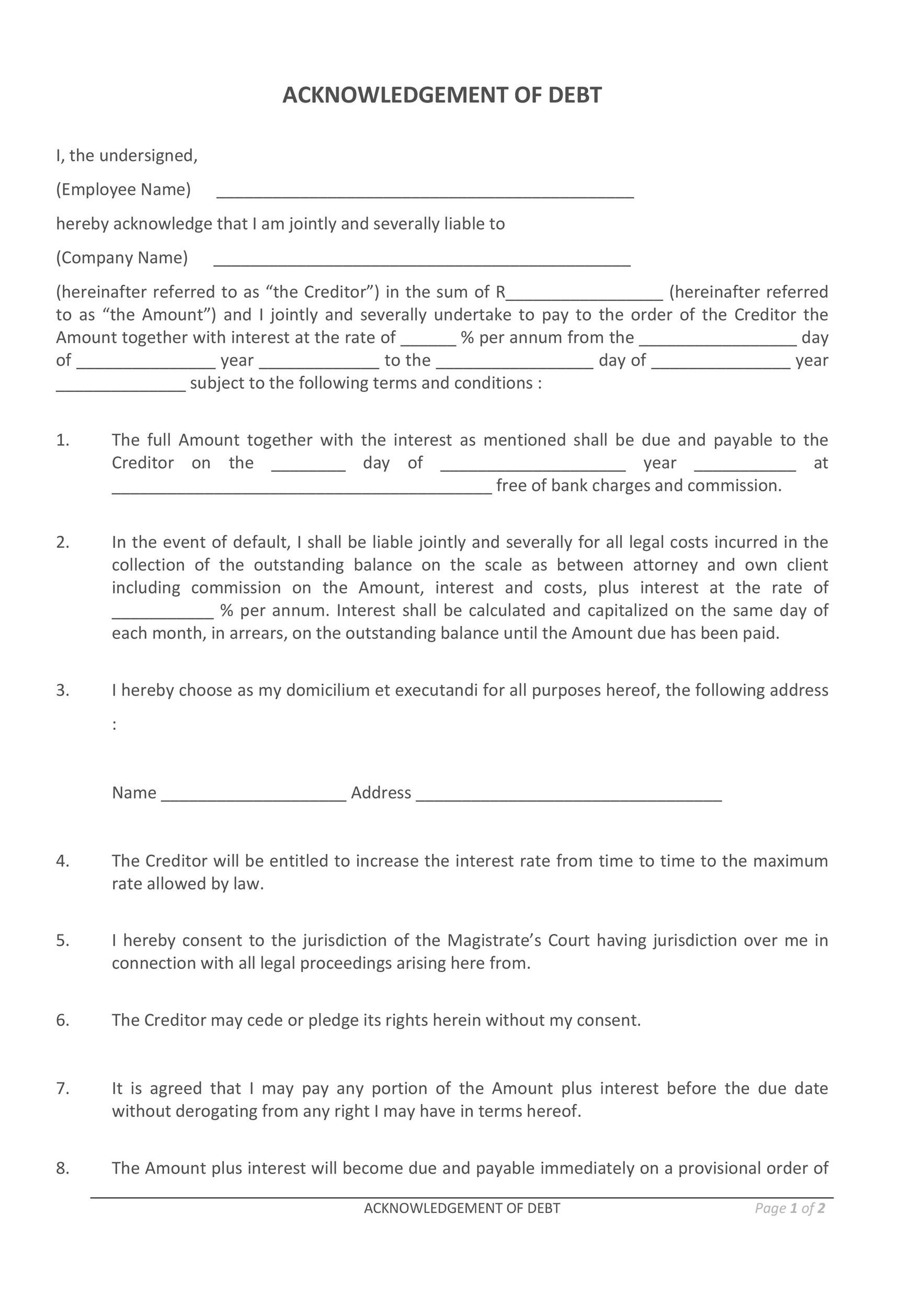

IOU Templates

What is an IOU?

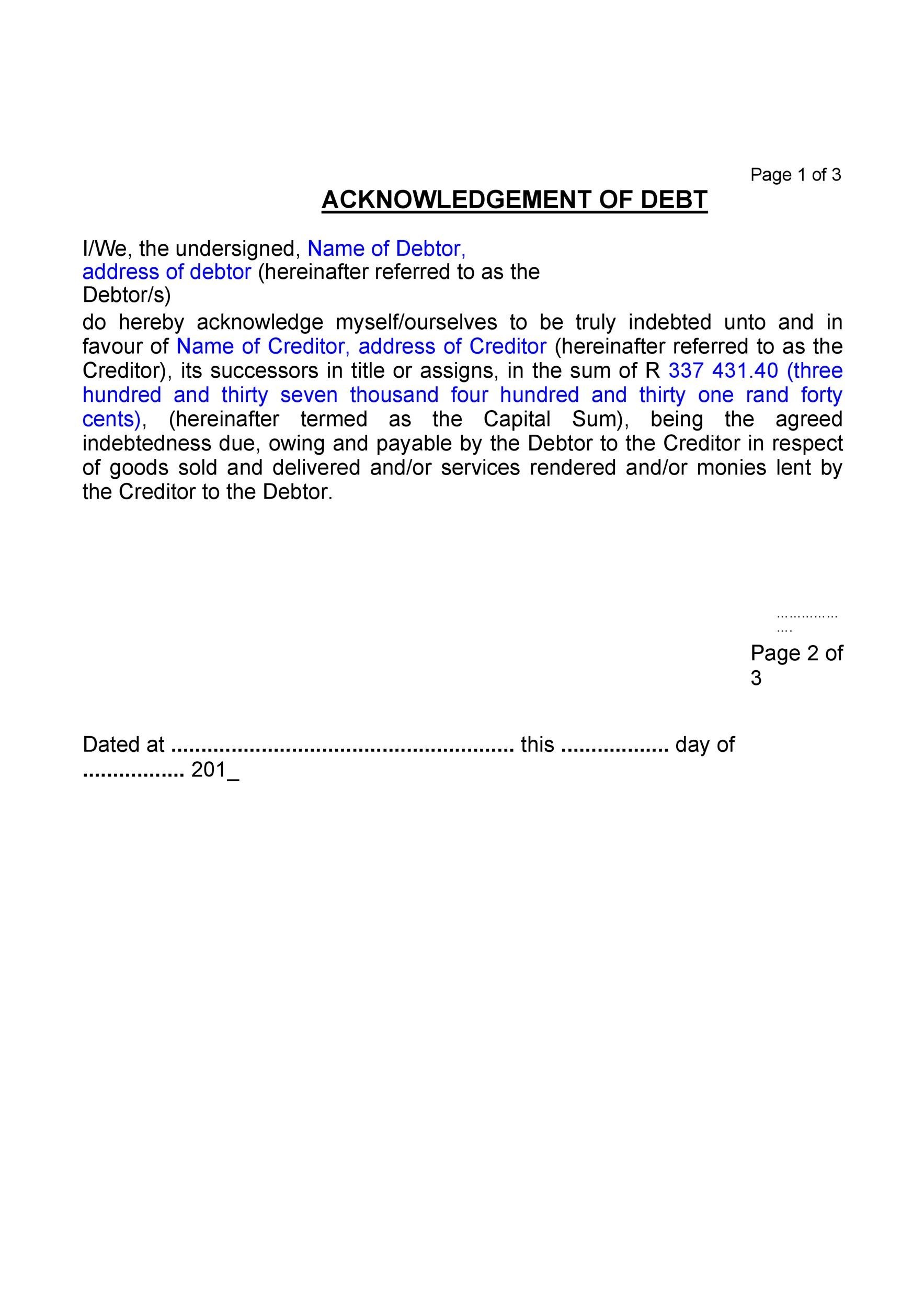

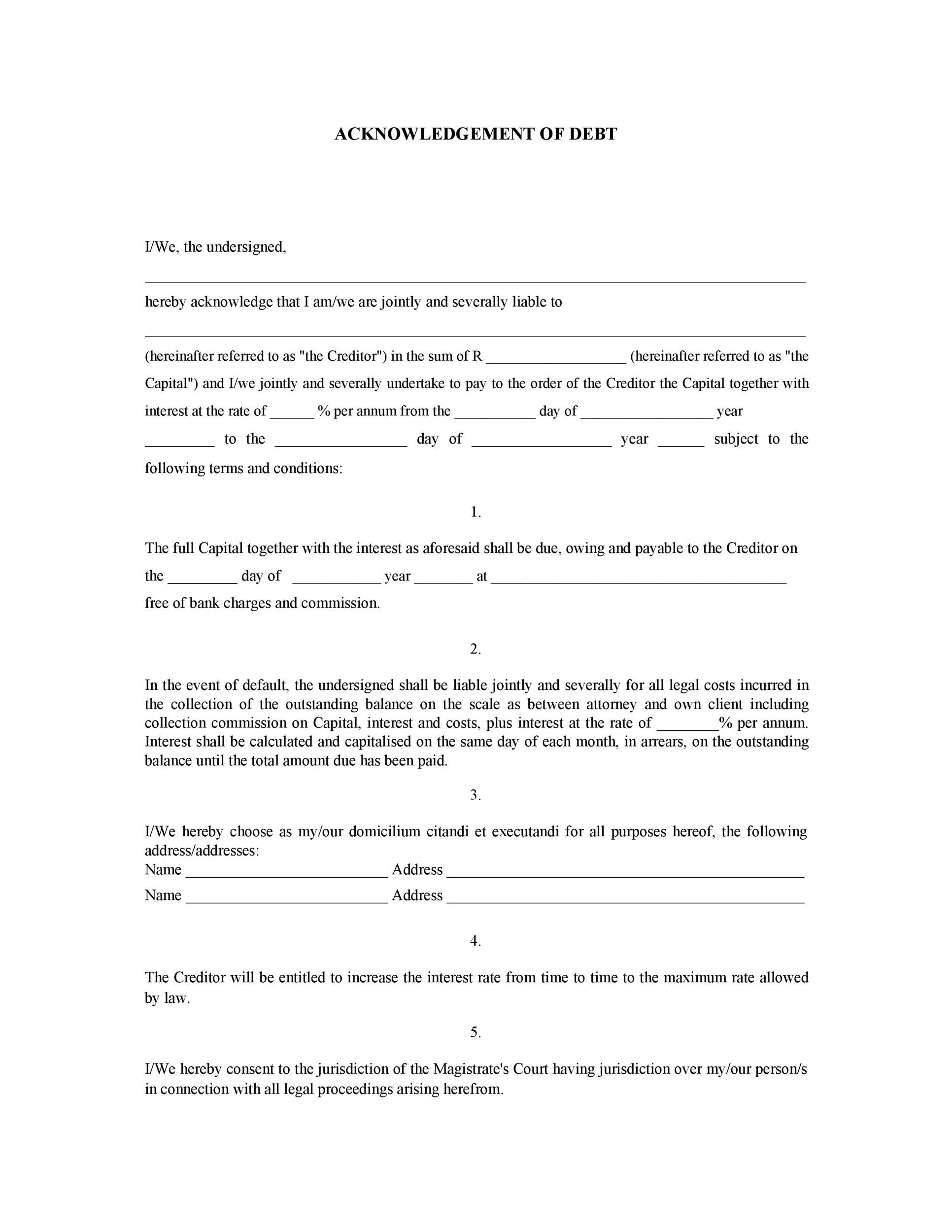

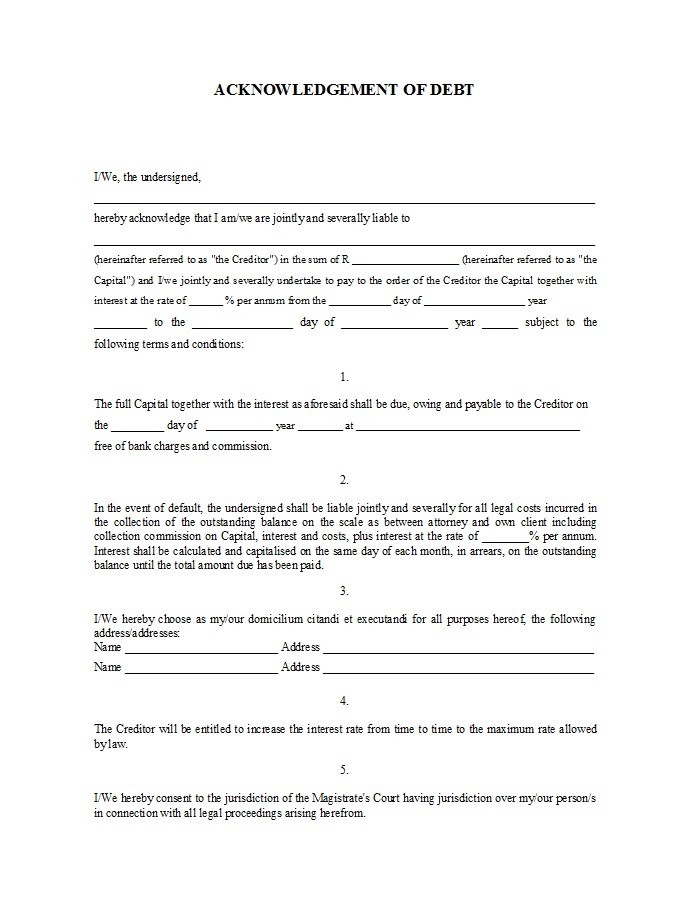

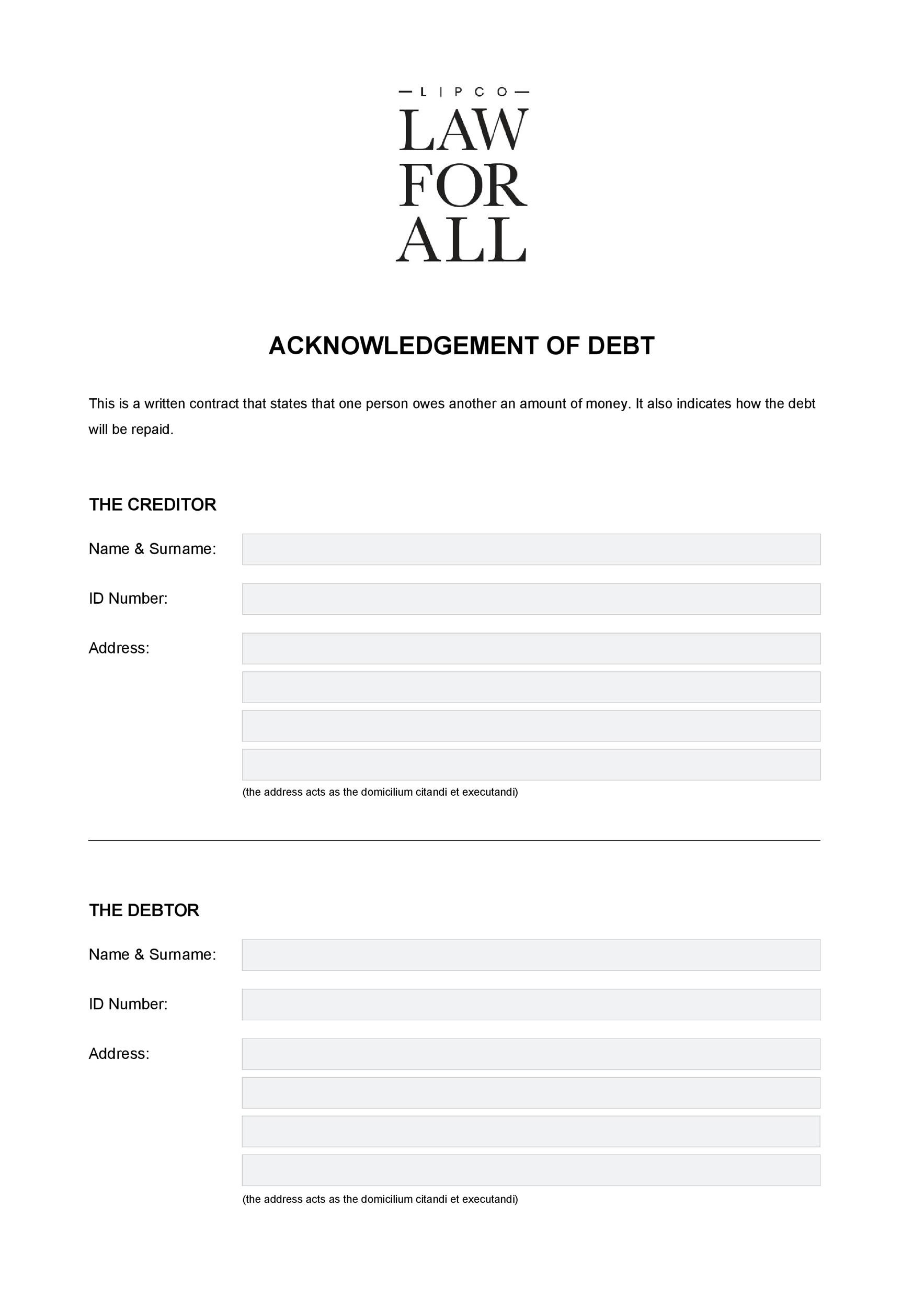

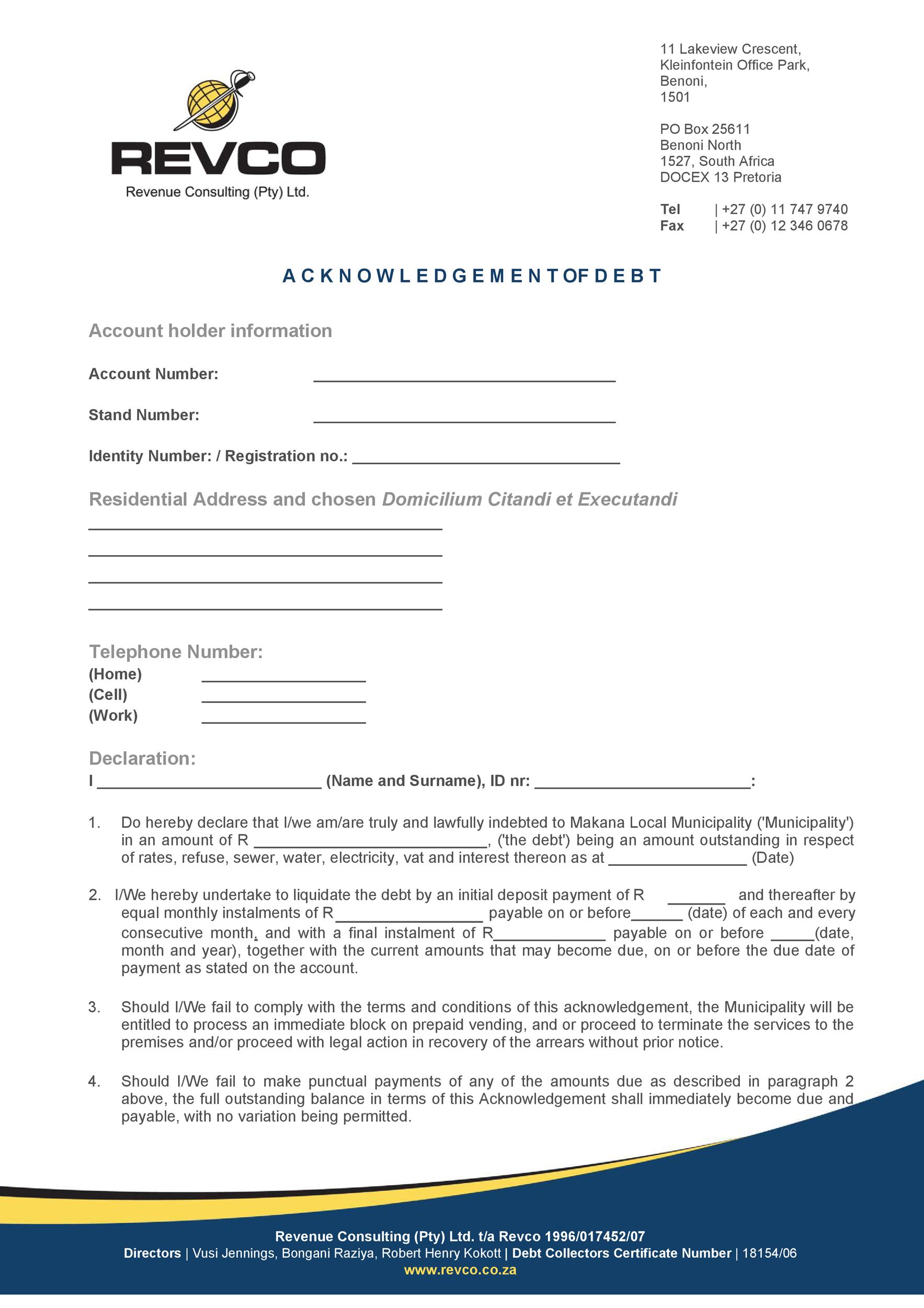

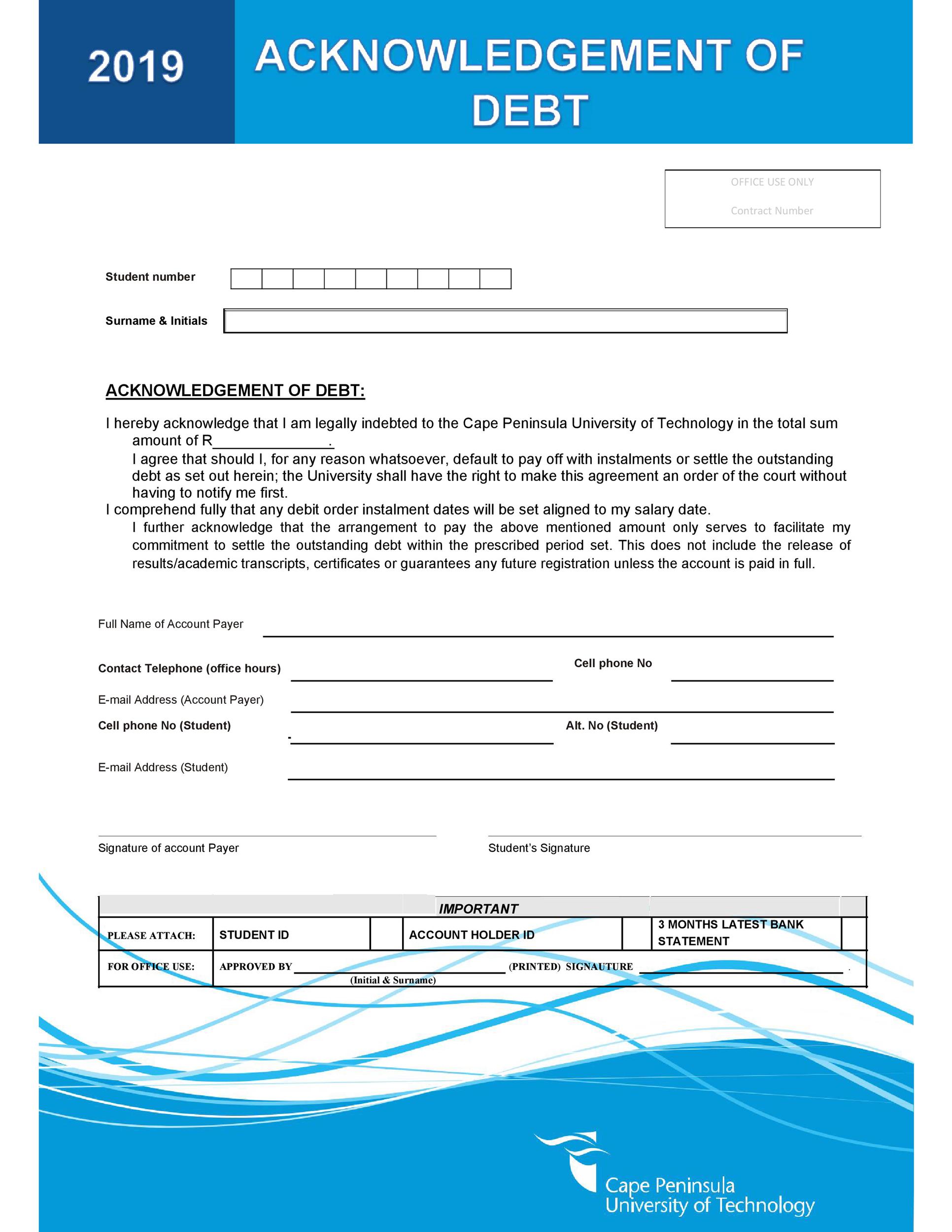

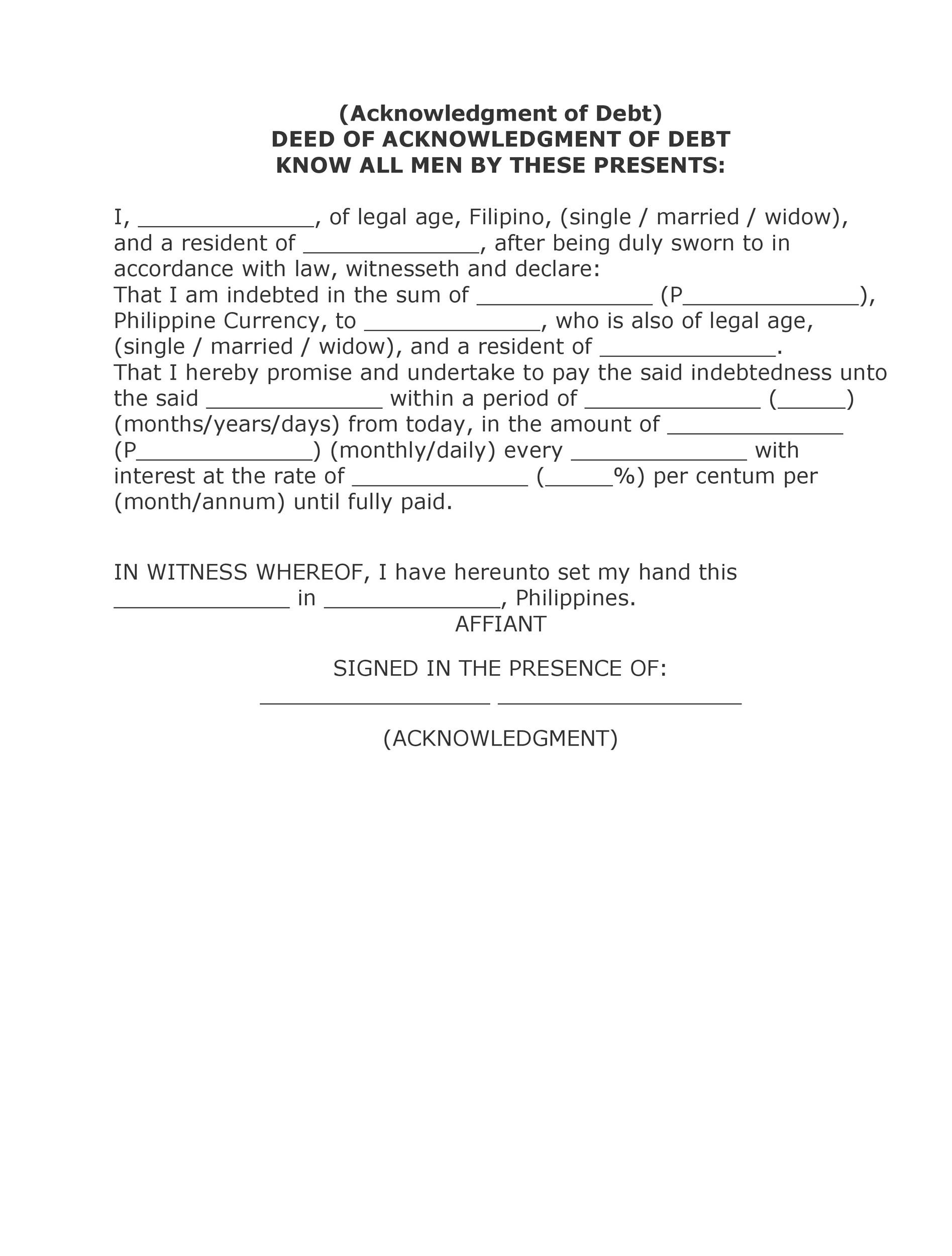

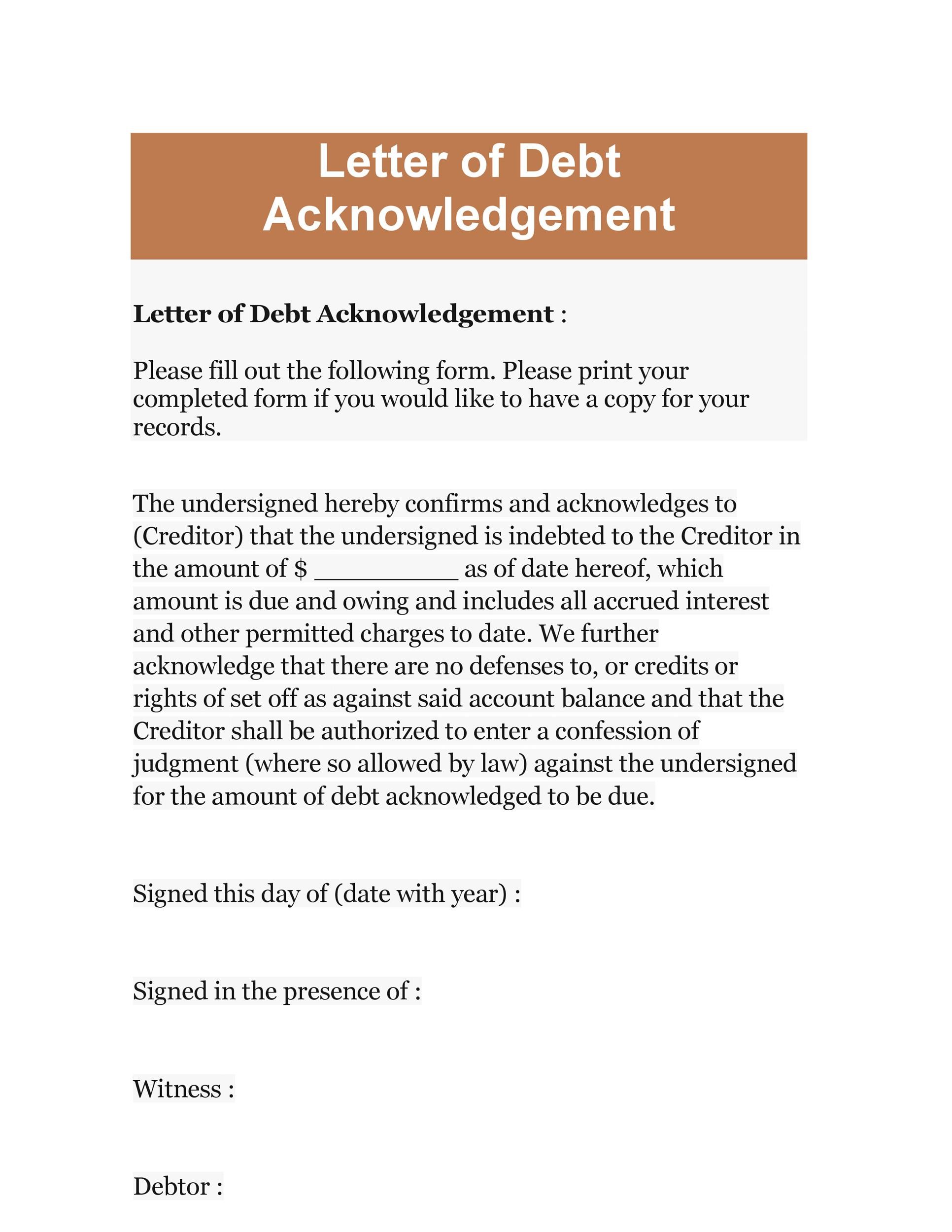

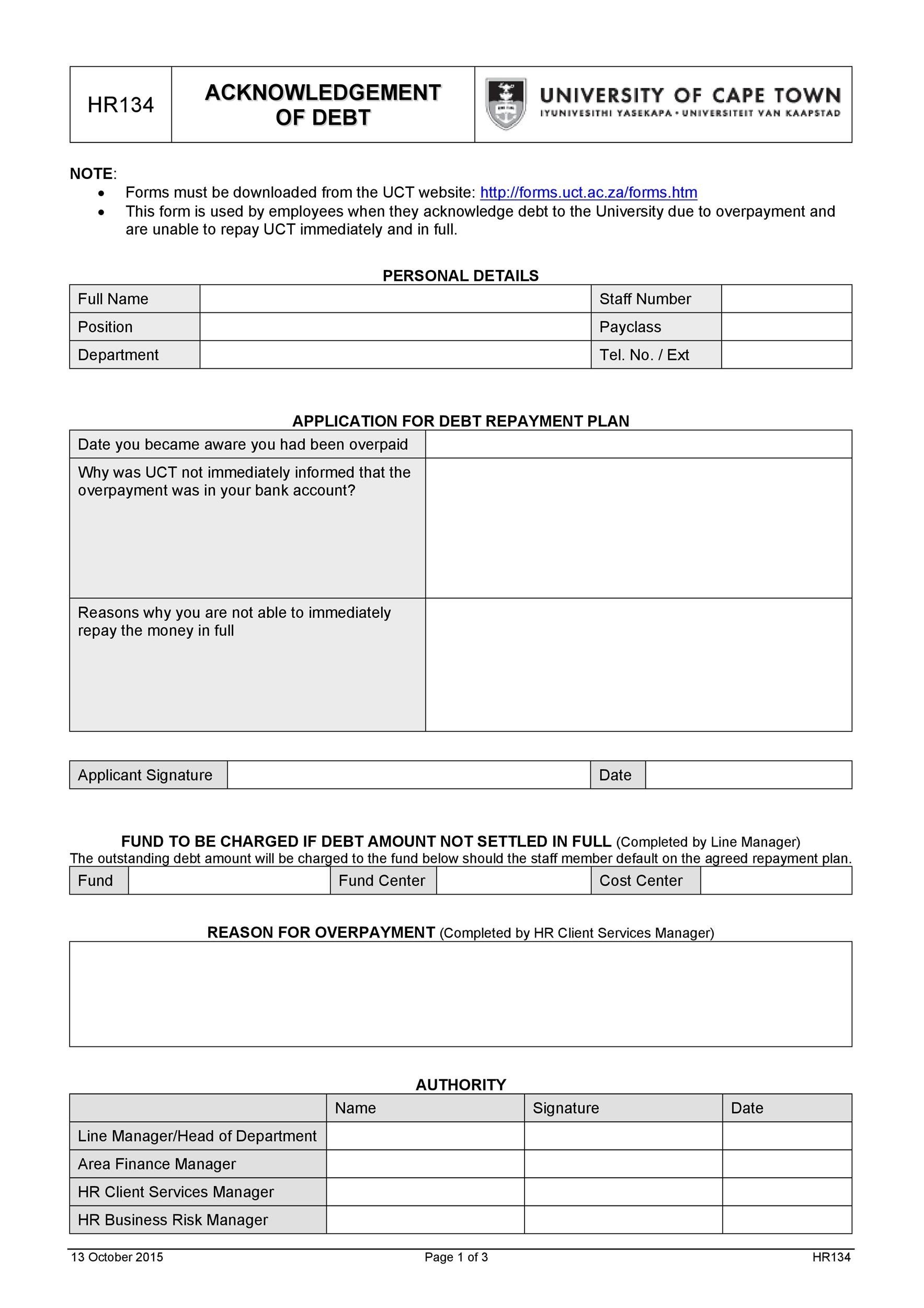

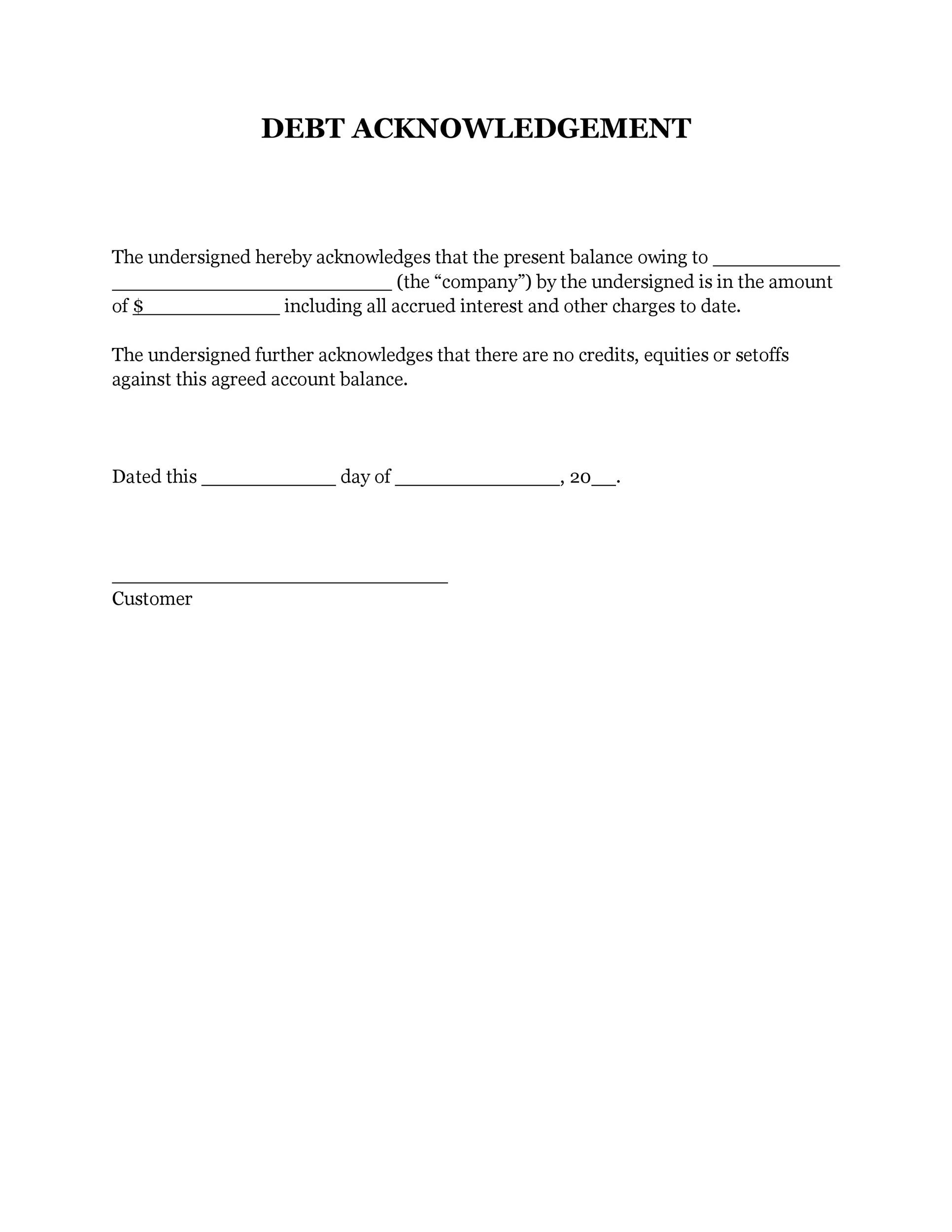

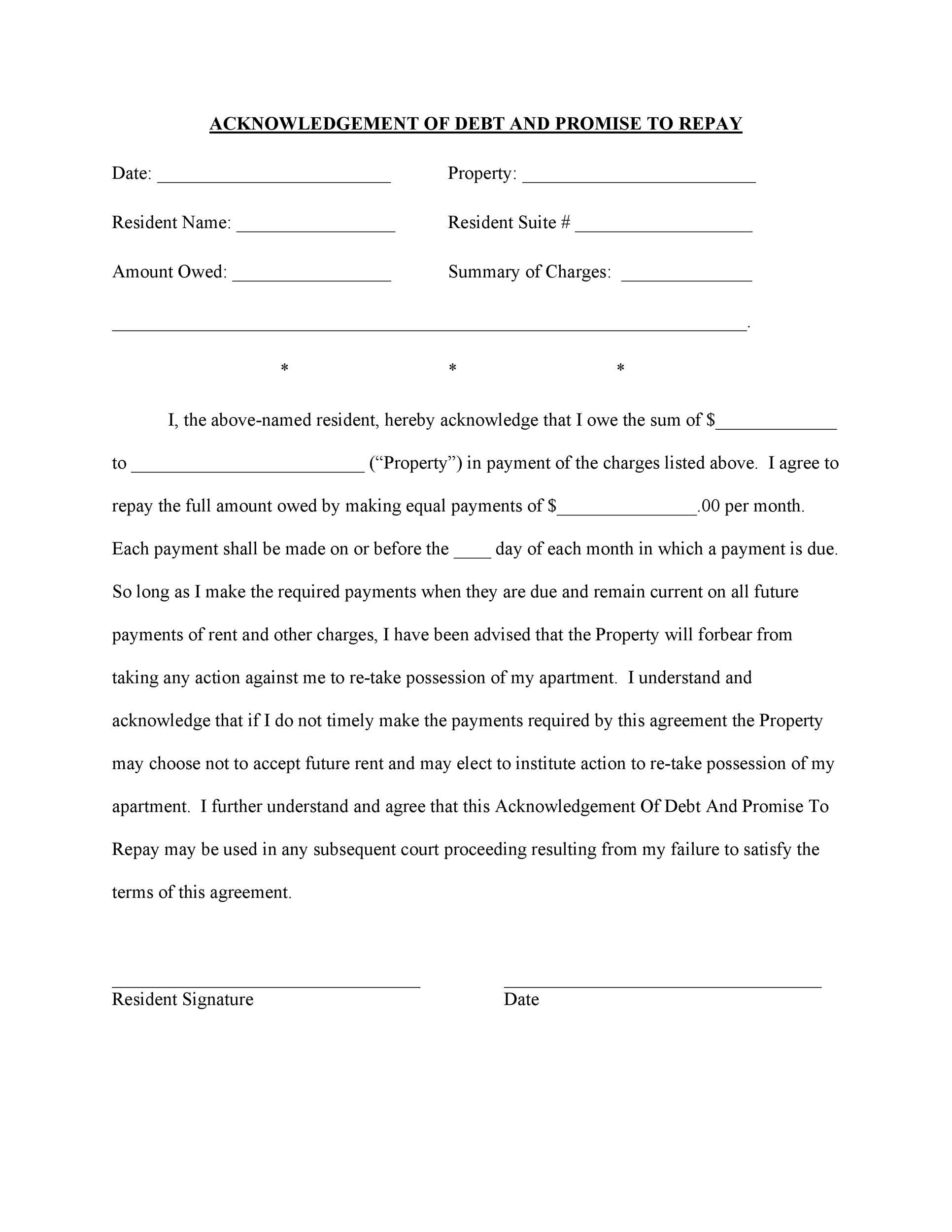

An IOU template is used to make a written acknowledgment of a debt and a promise to repay the debt owed. This document is used to create a legally binding relationship between two parties. Each party will have its own title within the document. Every document is made between a:

- A borrower and

- A lender

This document also goes by other names that do not impact the legality of the document. You can call this document by these other names as well:

- “I Owe You” Form

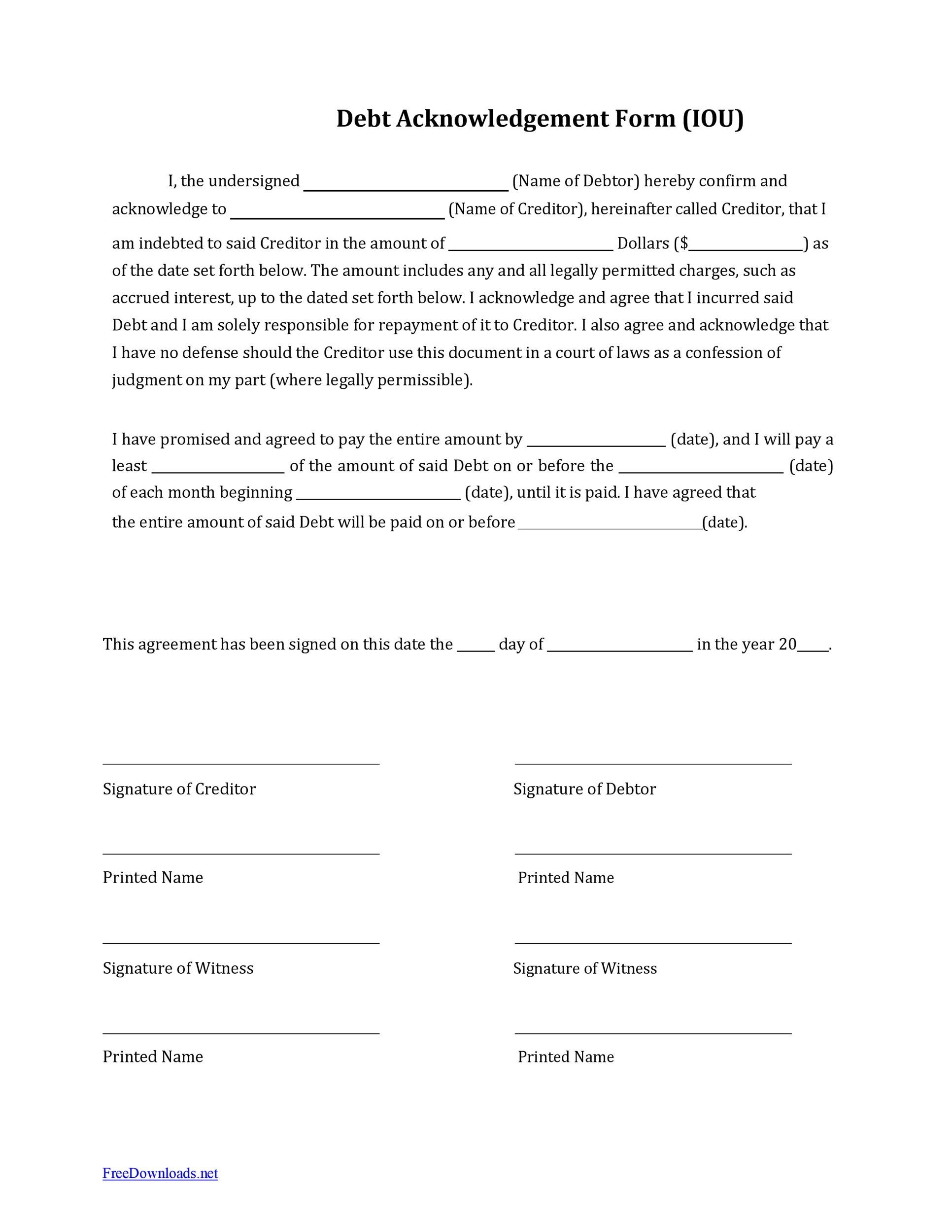

- Debt Acknowledgement Form

- Registered Warrants

All of these names can be used to describe this kind of document, no matter what the loan agreement or the nature of the agreement between the two parties in specific.

What is the Difference Between an IOU, a Promissory Note, and a Loan Agreement?

An IOU is a lot like a promissory note as well as a loan agreement. They are all agreements that are used to pay back money that is owed. This is not, however, a negotiable instrument, and it does not include details about repayment and the consequences of not repaying a debt.

An IOU is a promise to pay, but it does not offer information about the steps for repayment and the timeline to repay, and it is not legally binding. This is the key reason that an IOU is different than these other documents. You will not be able to use an IOU in court to enforce a loan or a repayment plan.

When Should You Use an IOU?

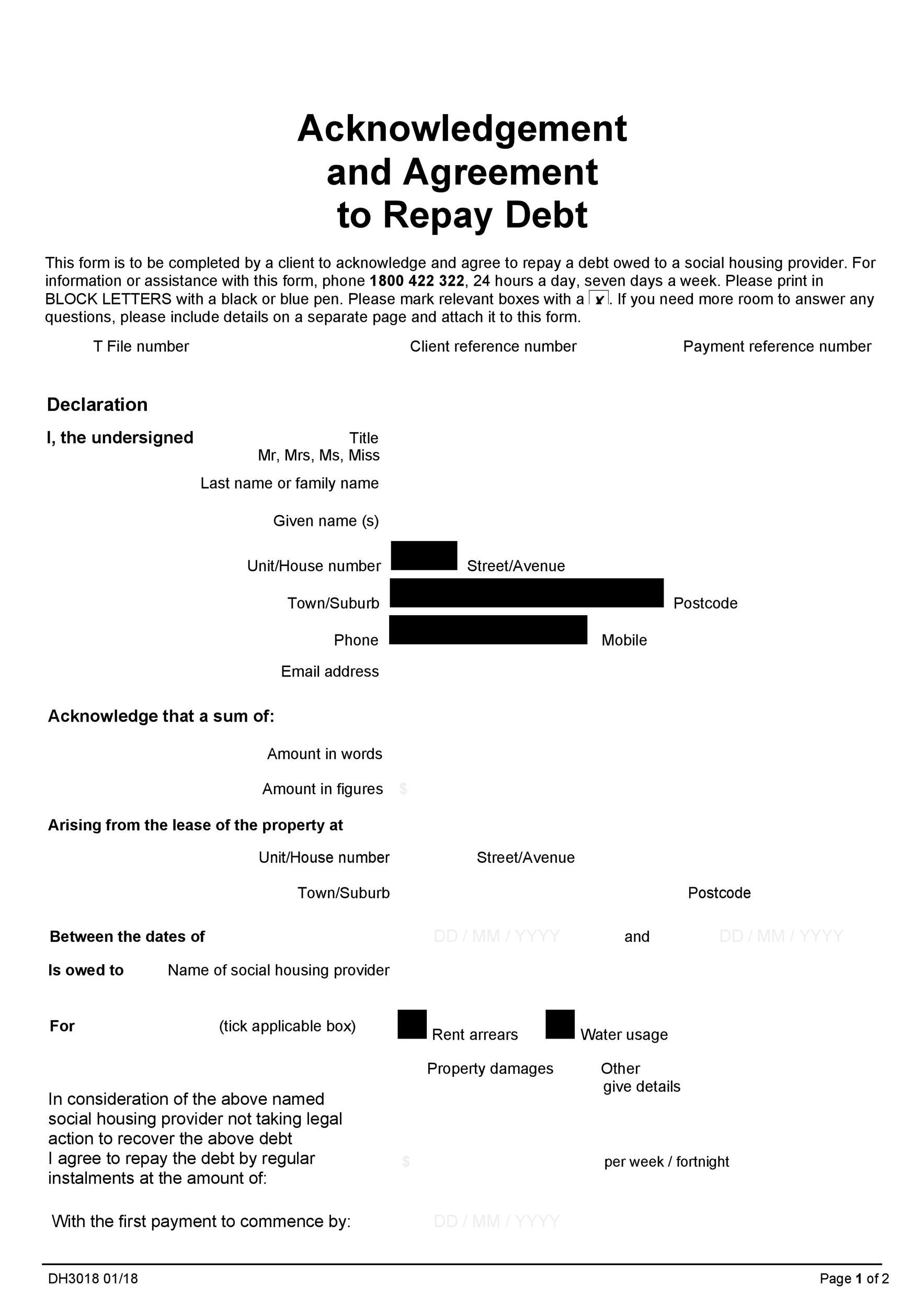

You should use an IOU when you want to record an amount of money that was loaned to someone. This will clarify when the loan should be repaid, but not many of the other details about the payment process. This is a document that you will use with family and friends, or maybe even colleagues, rather than for business deals or relationships.

You should only ever use the IOU in situations where you trust the person to whom you loaned the money to. You cannot enforce this repayment agreement in court, which makes it different from these other legal documents that are used for more formal loans and repayments.

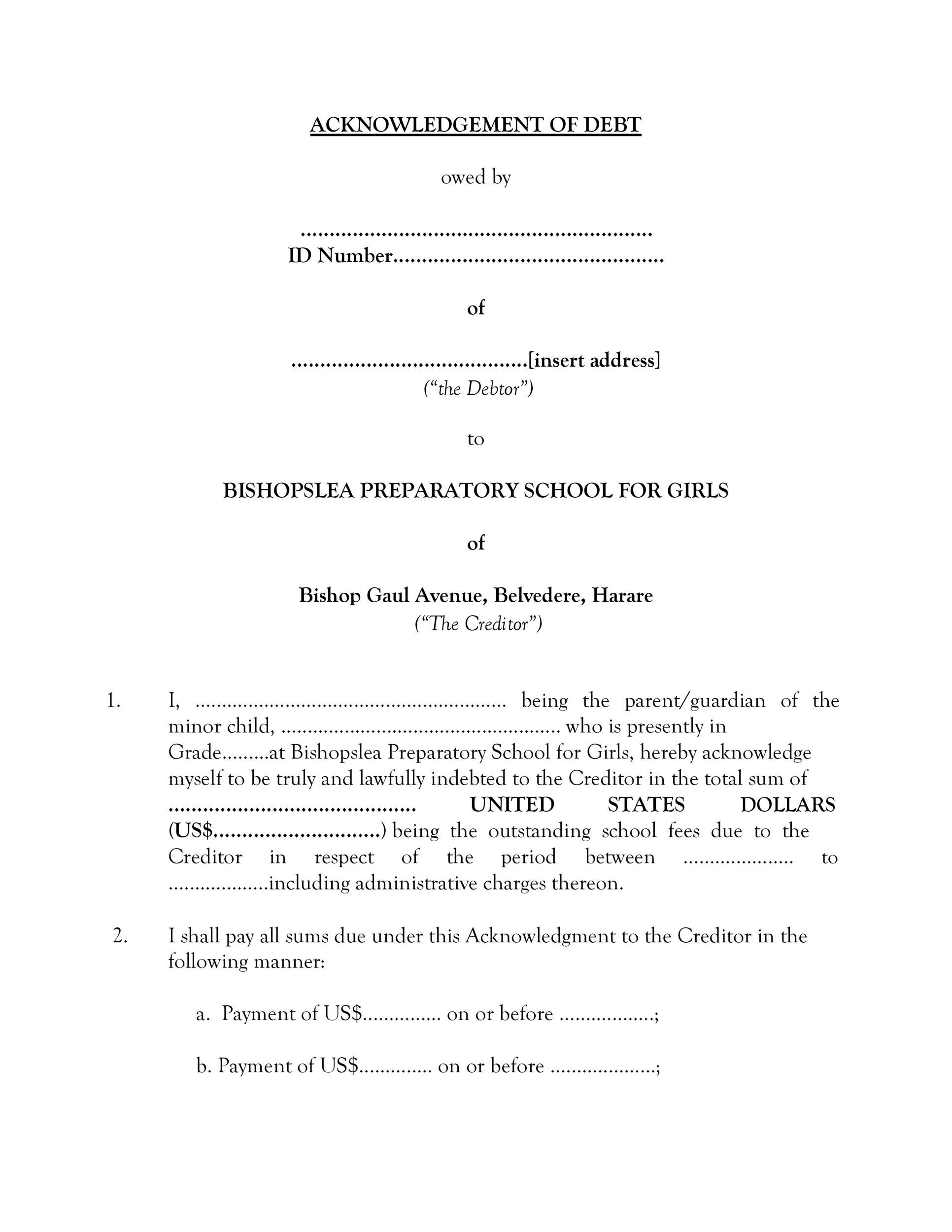

“I Owe You” Letters

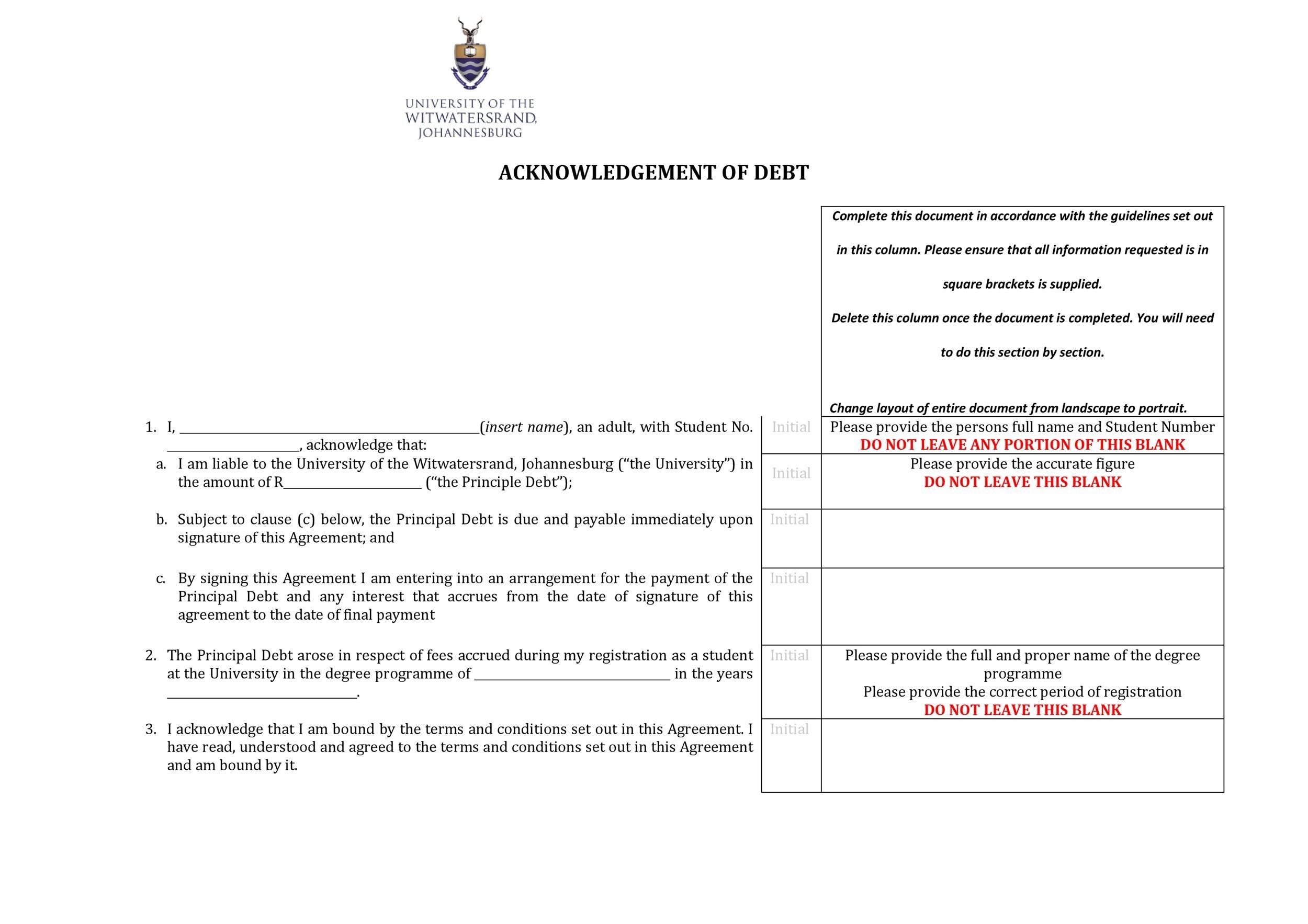

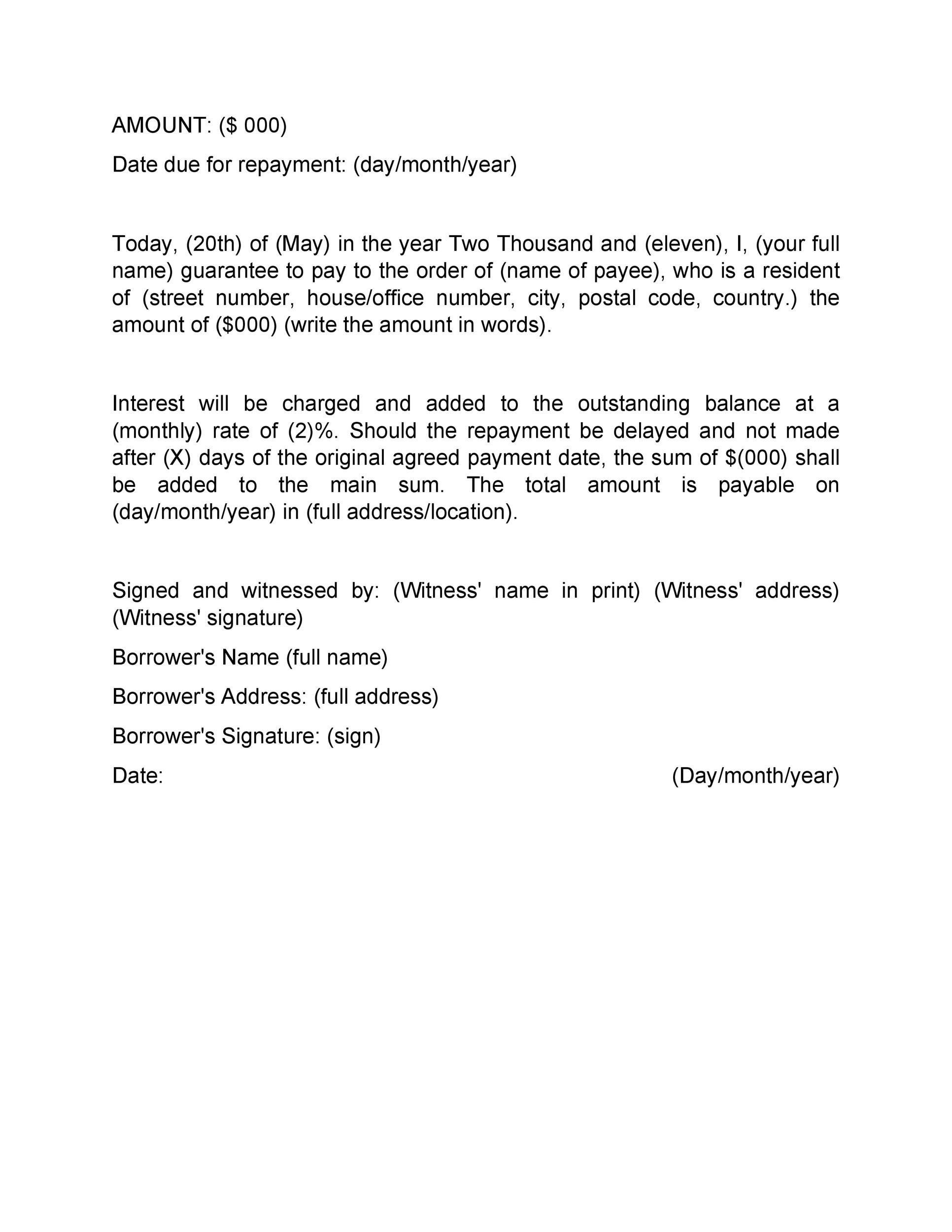

How do you write a simple IOU?

Writing a simple IOU is very straightforward. You are mostly documenting the agreement between you and another party with regard to borrowed money. You are not writing a formal repayment plan, a formal loan document, or any other kind of legal document when you draft an IOU. IOUs are used for personal reasons and are not intended to be used to enforce a legal payment agreement of any kind.

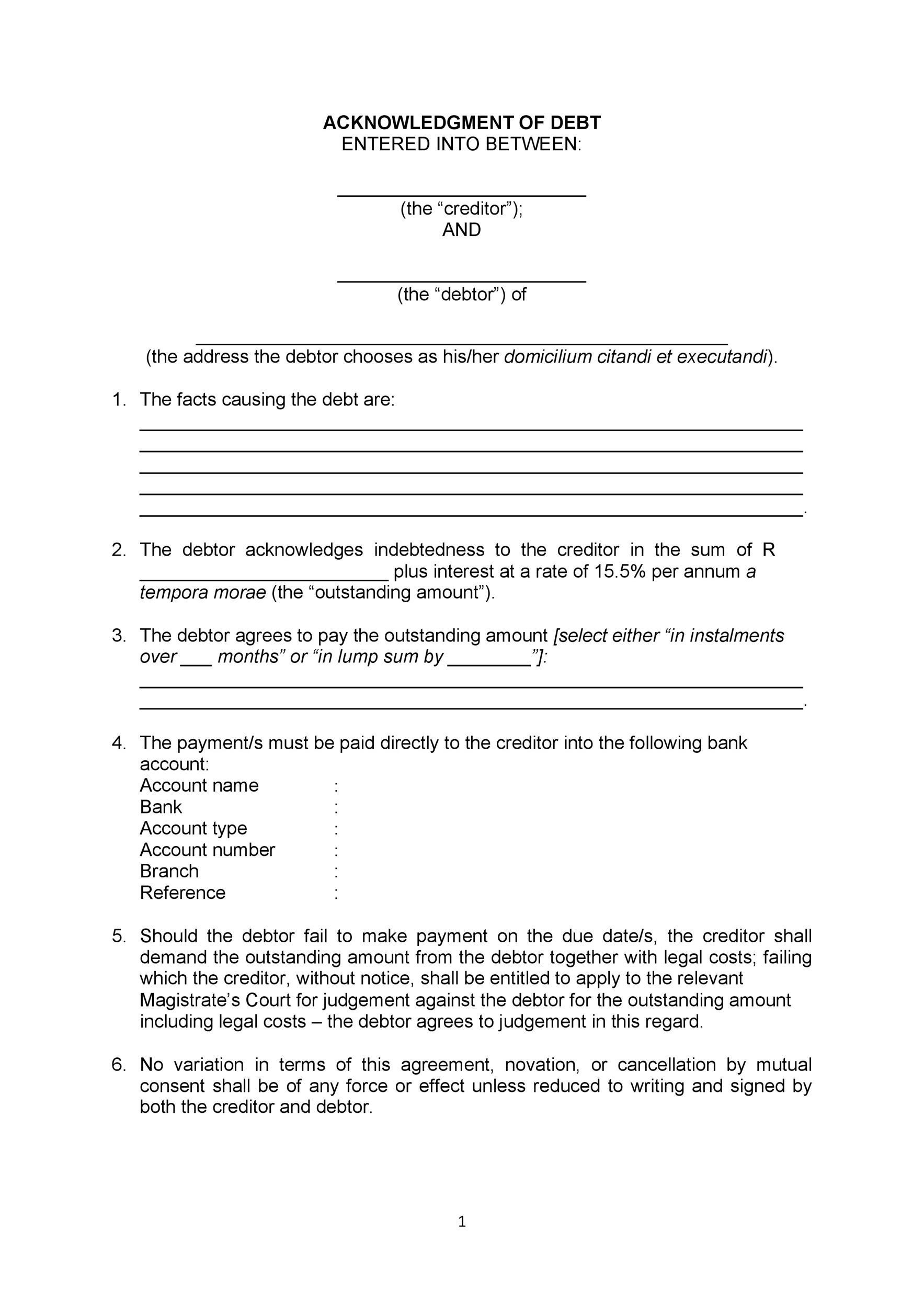

Simple IOUs can be written to just state the amount of money that was loaned and the date by which it was to be repaid. The names of both parties who are involved in the agreement need to be listed, and you should put contact information on the form. You need to list the addresses of each party and contact information for both as well.

Both the lender and the borrower need to sign the document and put a date next to their signature as well. This does not make the document legally enforceable, but it does indicate that both parties are aware of the agreement and its nature.

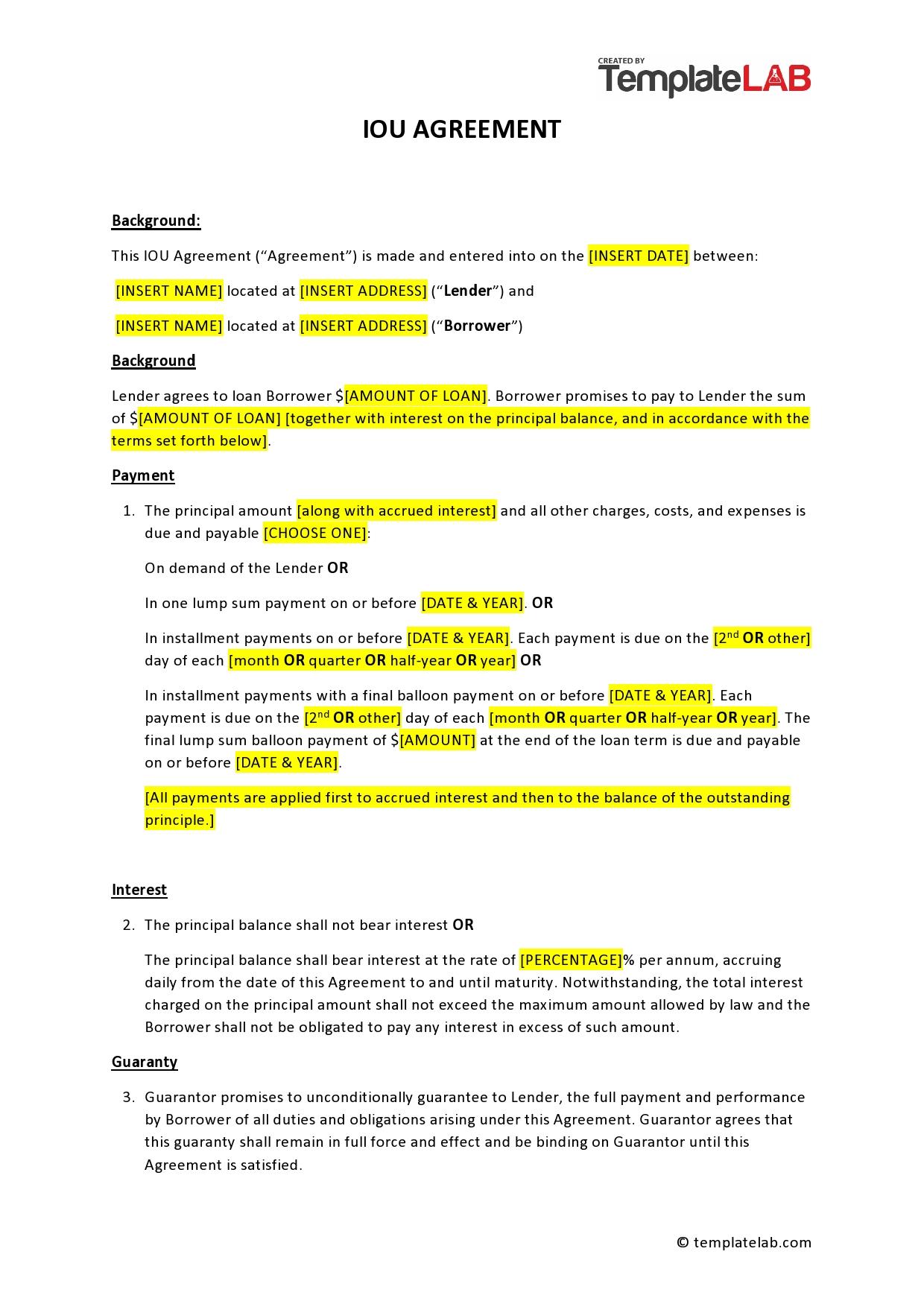

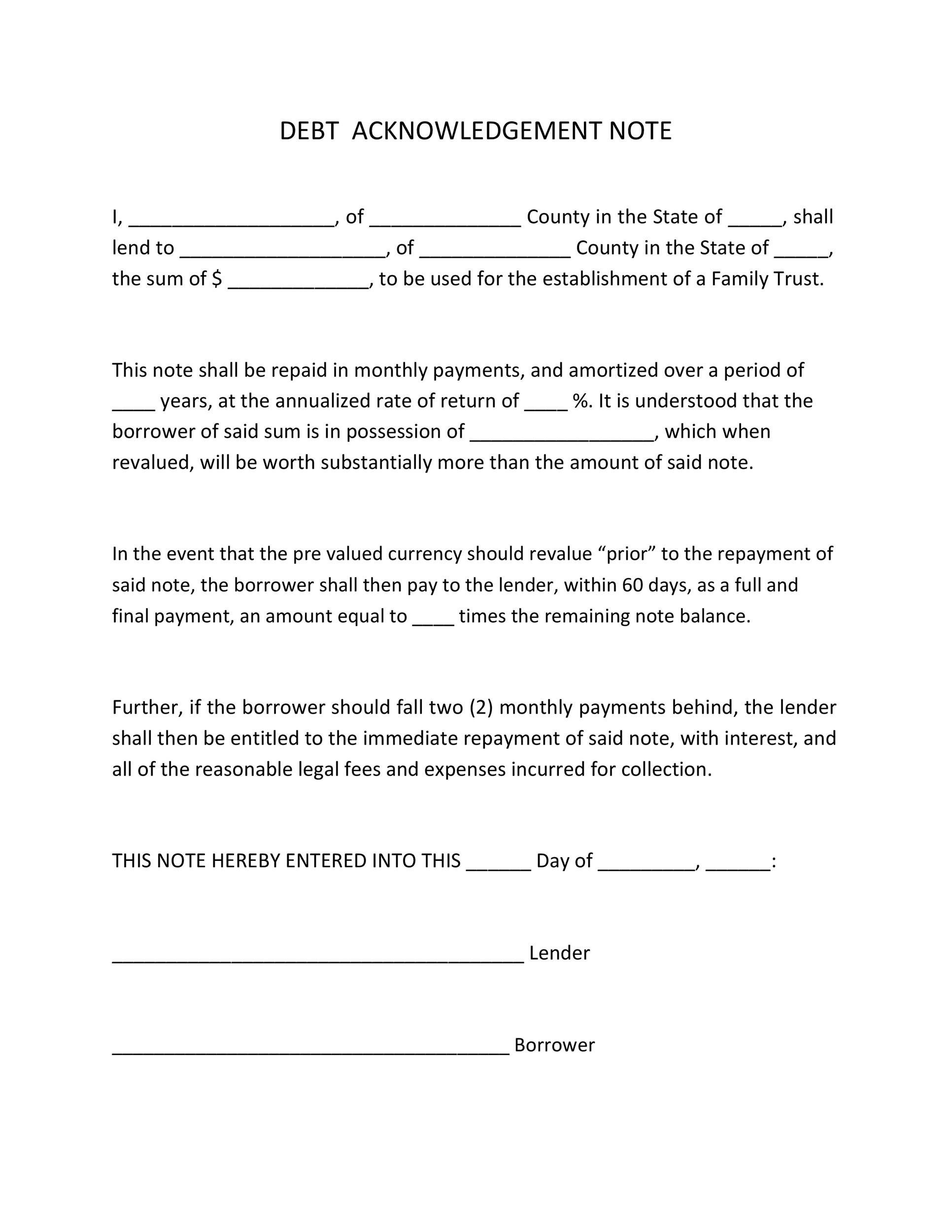

A good IOU document will start out with a statement of the date of the agreement. The date is always a good idea to indicate when the document was put in place. This is helpful if there is a final repayment date that is to be enforced within the agreement. You will need to put the total loan amount in this part of the document as well.

You can make a simple statement such as, “for value received, the undersigned____ (“the borrower”) promises to pay _______________________(“the lender”) the sum of $______.

You can add information about interest and fees if these are involved in the agreement. Add any terms that you are planning to try and enforce in this section of the document as well. While these cannot be legal terms for the IOU, you can still set out ideas about the right way to manage the repayment process. This will help to be sure that you and the other party are on the same path about the way that the agreement is to be executed.

Add any payment information that you think is relevant as well. These might be requirements for payment by check or in cash, as well as dates of payment or the final date of payment. You can also indicate if there will be a balloon payment or some other really unique arrangement made between the two of you as well.

You cannot name governing laws in this document since this document is not enforceable in a court of law. There are no rules or laws that govern this kind of agreement, so you cannot lean on laws that are not related to this kind of contract to try and make your IOU enforceable at the level of a legal document. Loans and other kinds of legal documents are enforceable by law, and this is the correct document for your use if you are trying to be sure that your document will be legally binding.

Remember that there are limitations to the IOU document that you might have put in place, and do not use this document if it is not a stern enough document for your use. This is one of the key errors that many people make about how IOUs can be used, and there are often issues that crop up when people think that these documents can be enforced legally.

Making an IOU between people that you are friends with does not give you the ability to bring them to court if they do not honor your payment agreement in the end. This is not the right document for your needs if you think that you might need to be able to try and collect payment due to confusion between you and the other party or an unwillingness of the other party to pay you back.

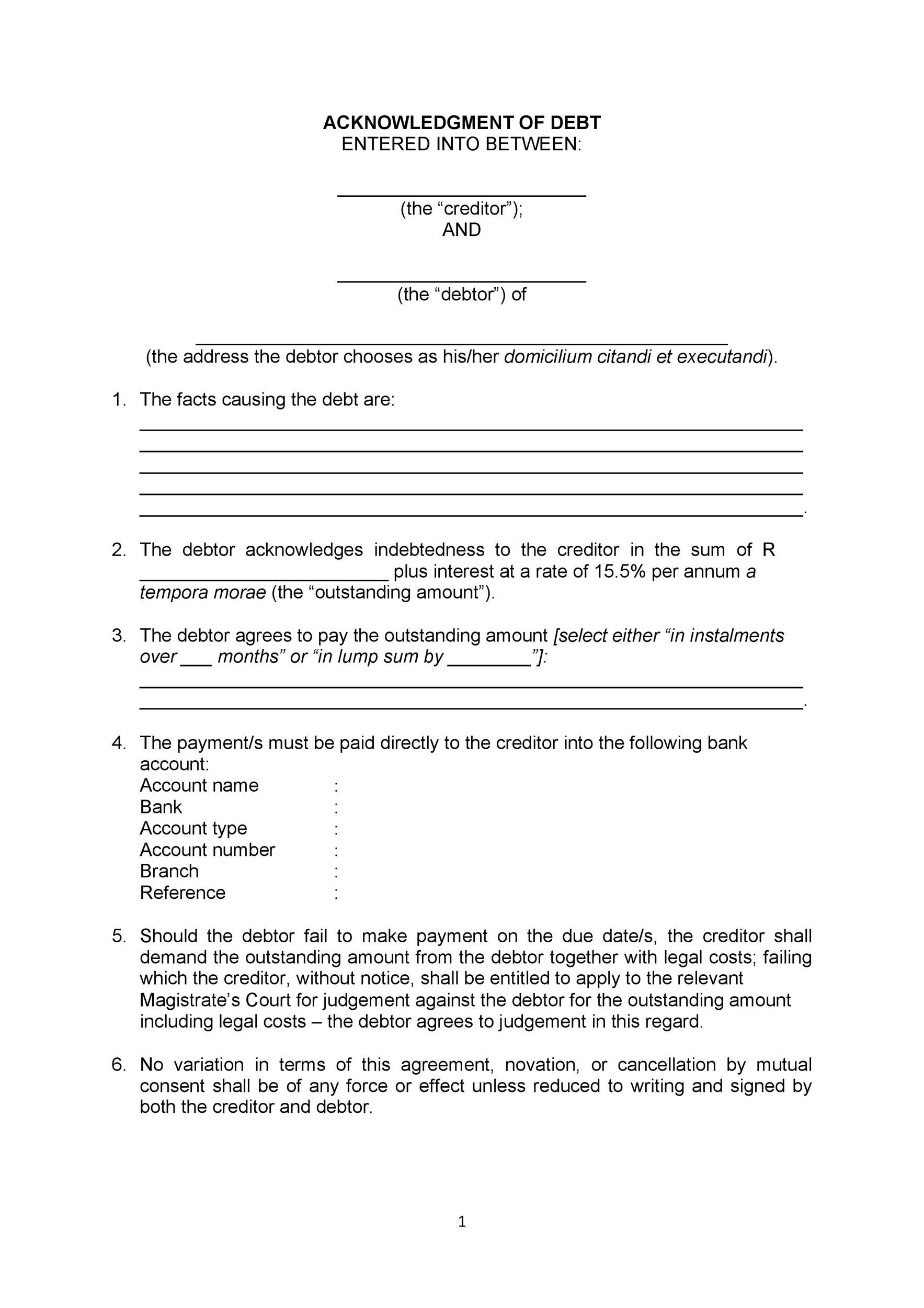

IOU Notes

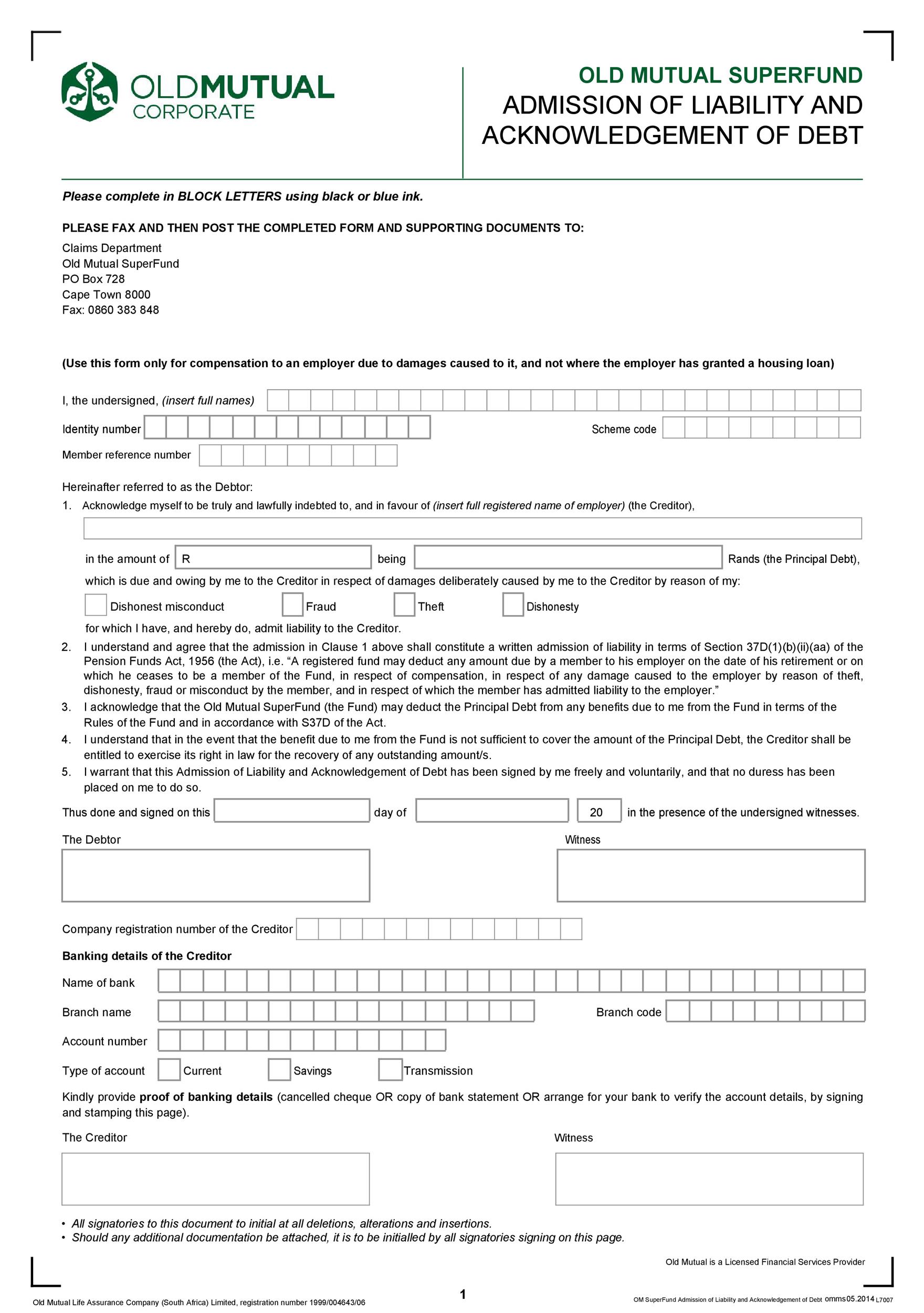

Is a written IOU legal?

No IOU document is actually legally binding. You cannot use an IOU in court, and you cannot point to it to compel someone to pay you back. This is why you need to be sure that you only enter into this agreement with someone that you trust very much. You cannot do anything to make this document legal. Loan documents and repayment agreements are legally binding, but IOUs are not.

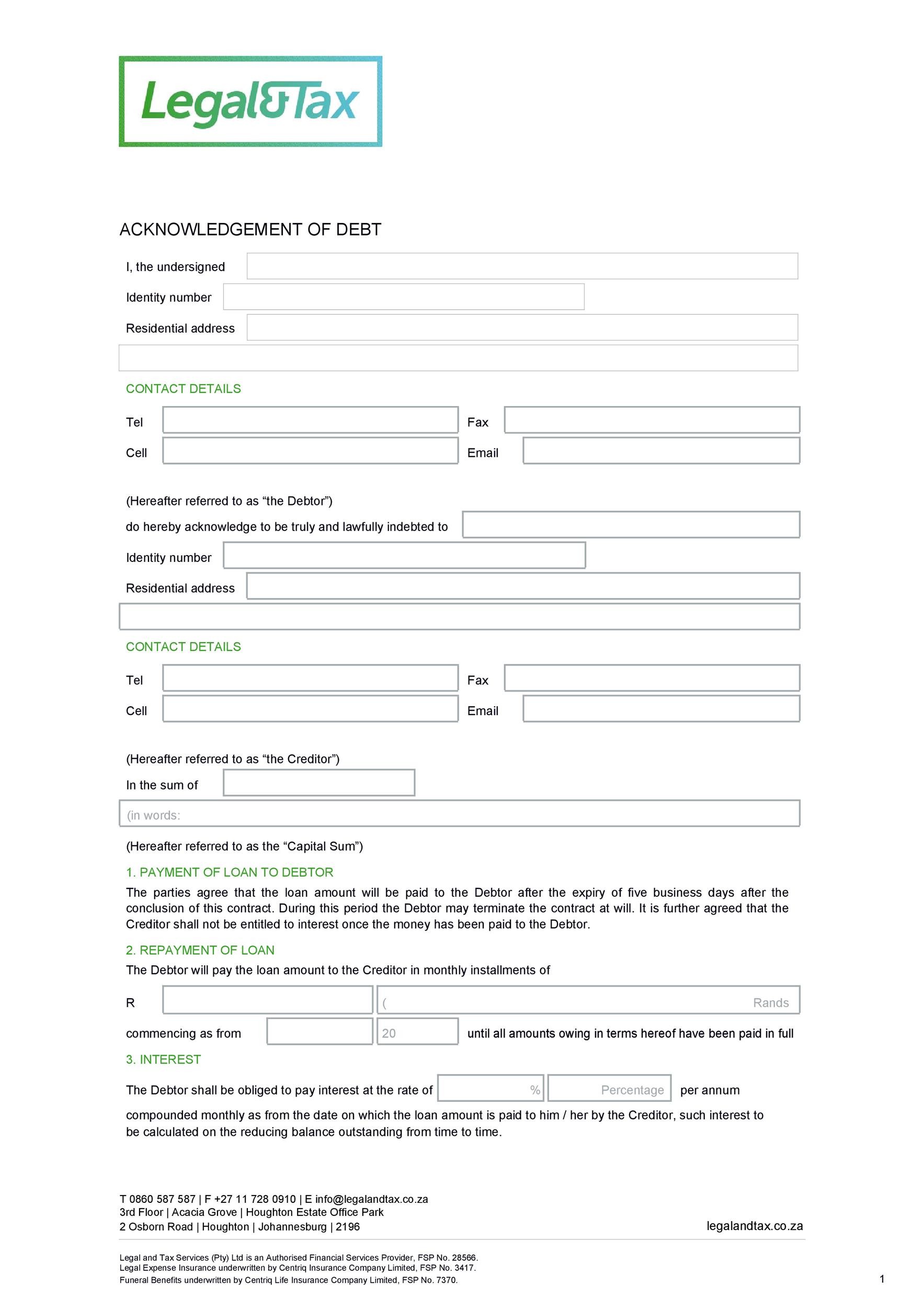

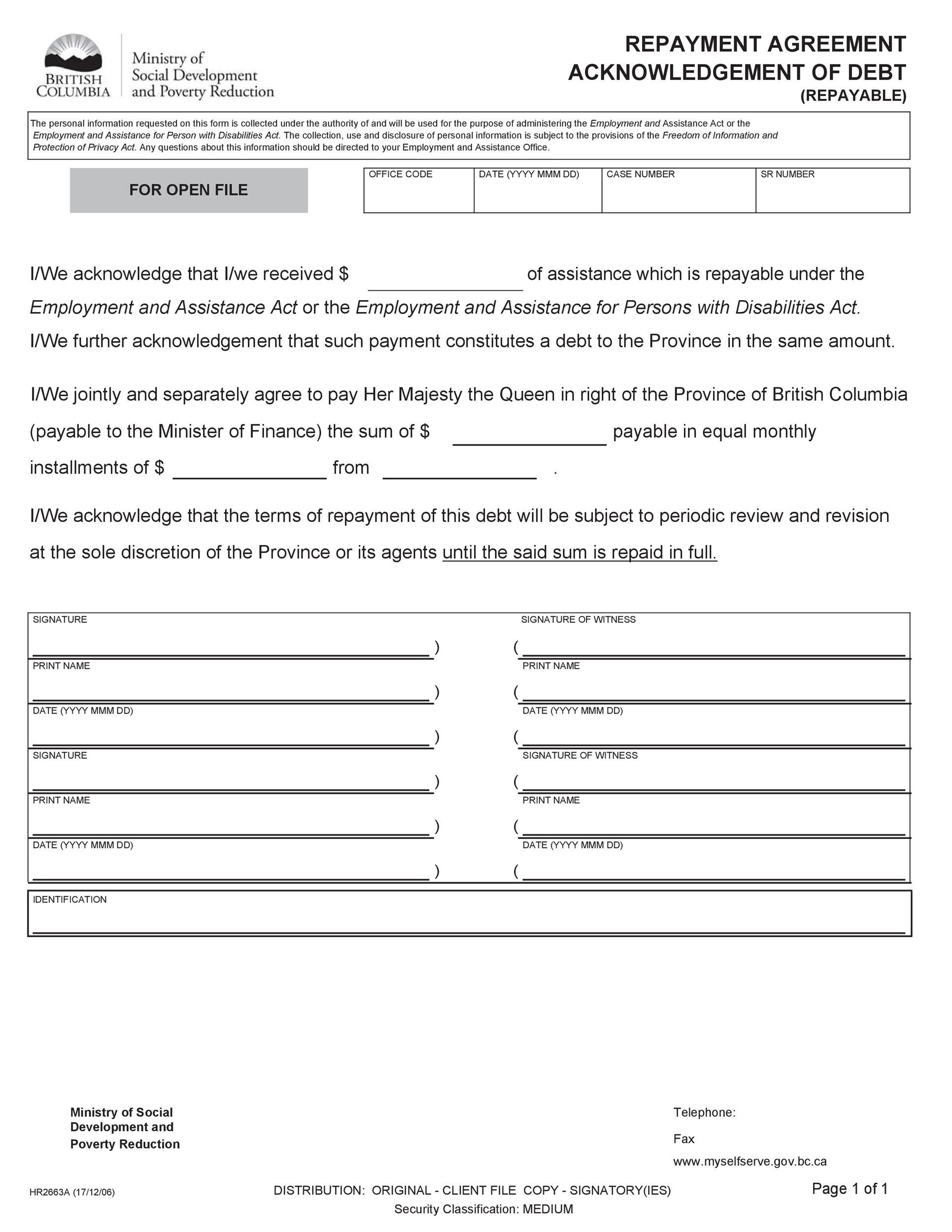

IOUs do not include some key information that would make them legally binding. You will find that documents that can compel someone to repay a lender will have some items in common. These documents will have the following added components that are not in the IOU document:

- Steps for repayment

- Timeline to repay

- Legally binding language

- Signature of the borrower

- Signature of lender

- Installment payment information

- Consequences of default

What happens if You Don’t Use an IOU?

When you don’t have an IOU agreement in place, you will be creating a verbal agreement. This is never a great idea unless you are very sure that you can trust the person to whom you are lending money. Verbal contracts will still need to have various elements that are discussed. The offer and its acceptance will need to be talked about. You will need to be sure that you also discuss the way that the payment will need to be made. You can also chat about a repayment end date. This will not be enforceable, of course, but it is always good to talk about the details of this agreement with the person that you are lending money to. You will need to be able to count on the other person being clear about the details of the agreement that you have made so that the agreement is likely to work out.

IOU agreements add an extra layer of communication between you and the other party. You can at least point to the document if there is a dispute in the future about the nature of what you have agreed to. The IOU will offer some of the basic details about the nature of the agreement that is in place by verbal discussion.

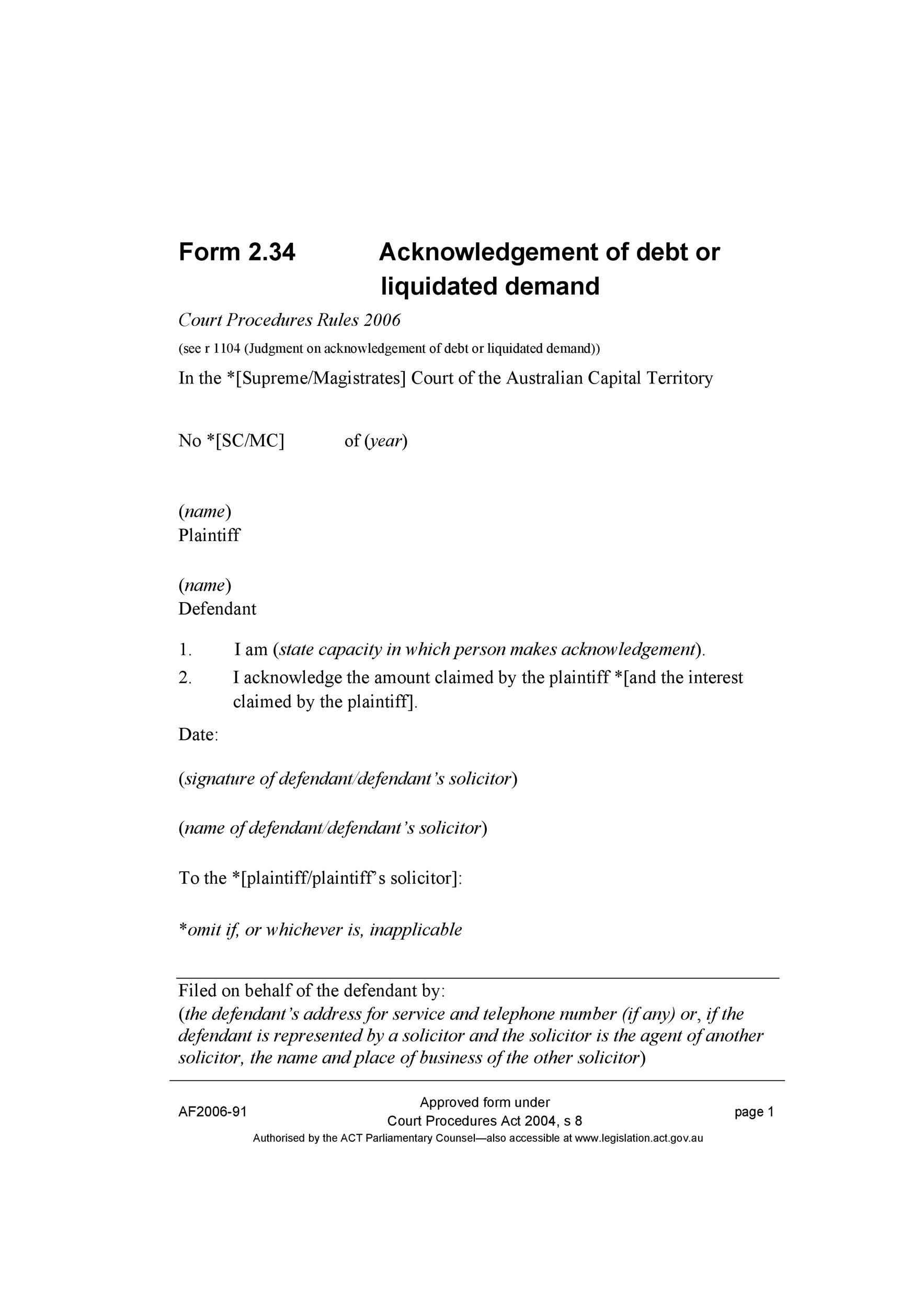

You cannot take this document to small claims court, nor can you enforce an agreement between friends in court. Legal documentation is required to be sure that your agreement can be enforced. While you can create this document for the sake of clarity, you cannot use this document for anything legal. The reality is that you can skip creating an IOU if you want since it is not a document that can be used in court, but you might want to create one to help clarify your agreement better. This is a document that can be very useful outside of a court of law, but it is not required for this kind of agreement between friends and family.

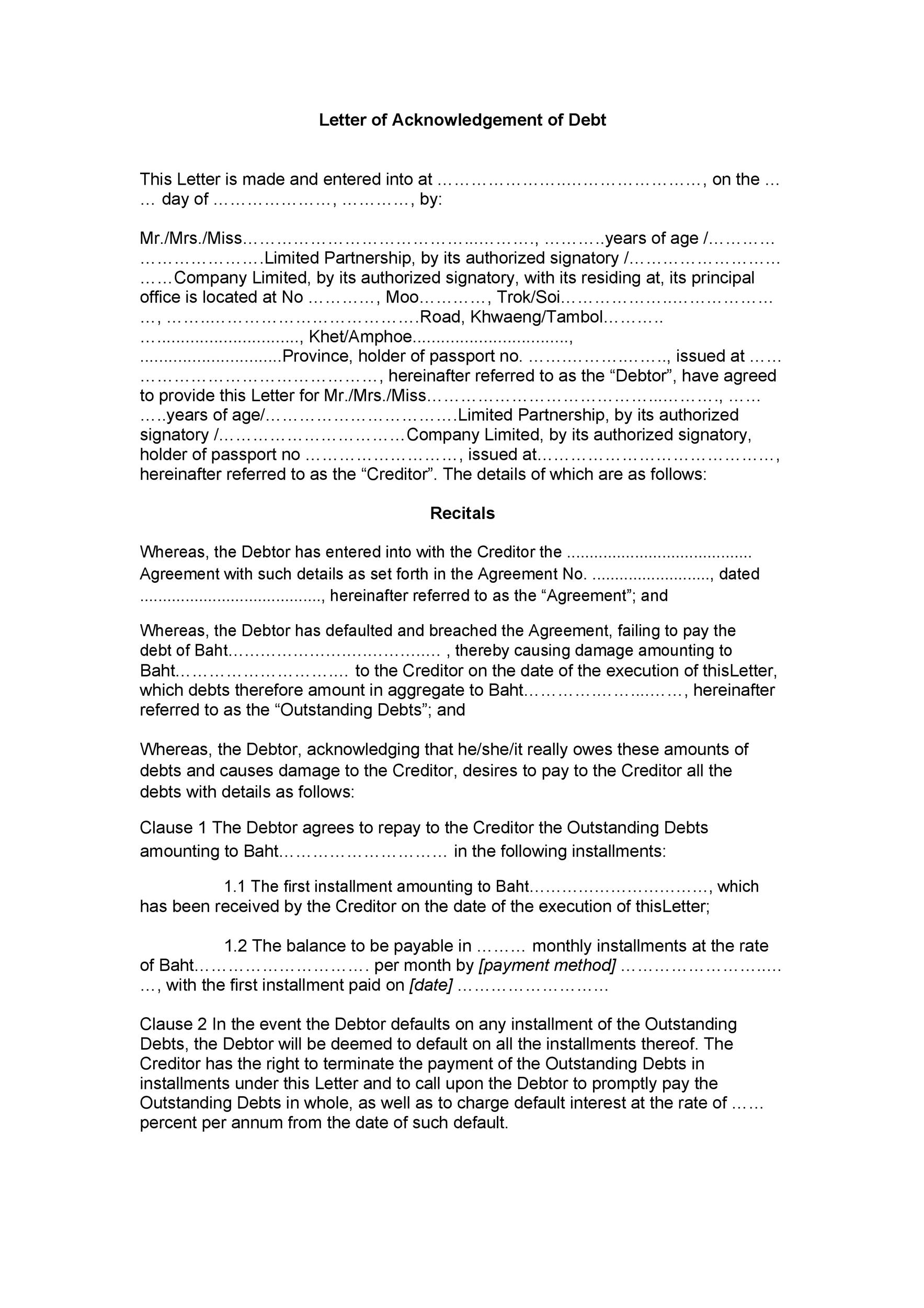

IOU Forms

Downsides to Not Using an IOU

There are downsides for both of the parties involved in an IOU. The downsides are the same for both parties involved in the agreement. This is why this kind of agreement can be tenuous for both parties.

Lender:

- Not legally enforceable

- Lawyer will be needed to defend any issue with payment

- Likely unable to recover money that has been unpaid

- Loss of trust between borrower and lender

- Personal well-being threatened by lack of clarity between the two parties involved in the agreement

Borrower:

- Unpaid expenses

- Lawyer fees to resolve disputes

- Loss of trust and happiness

- Inability to pursue money that might not have been paid or that might be involved in some other dispute

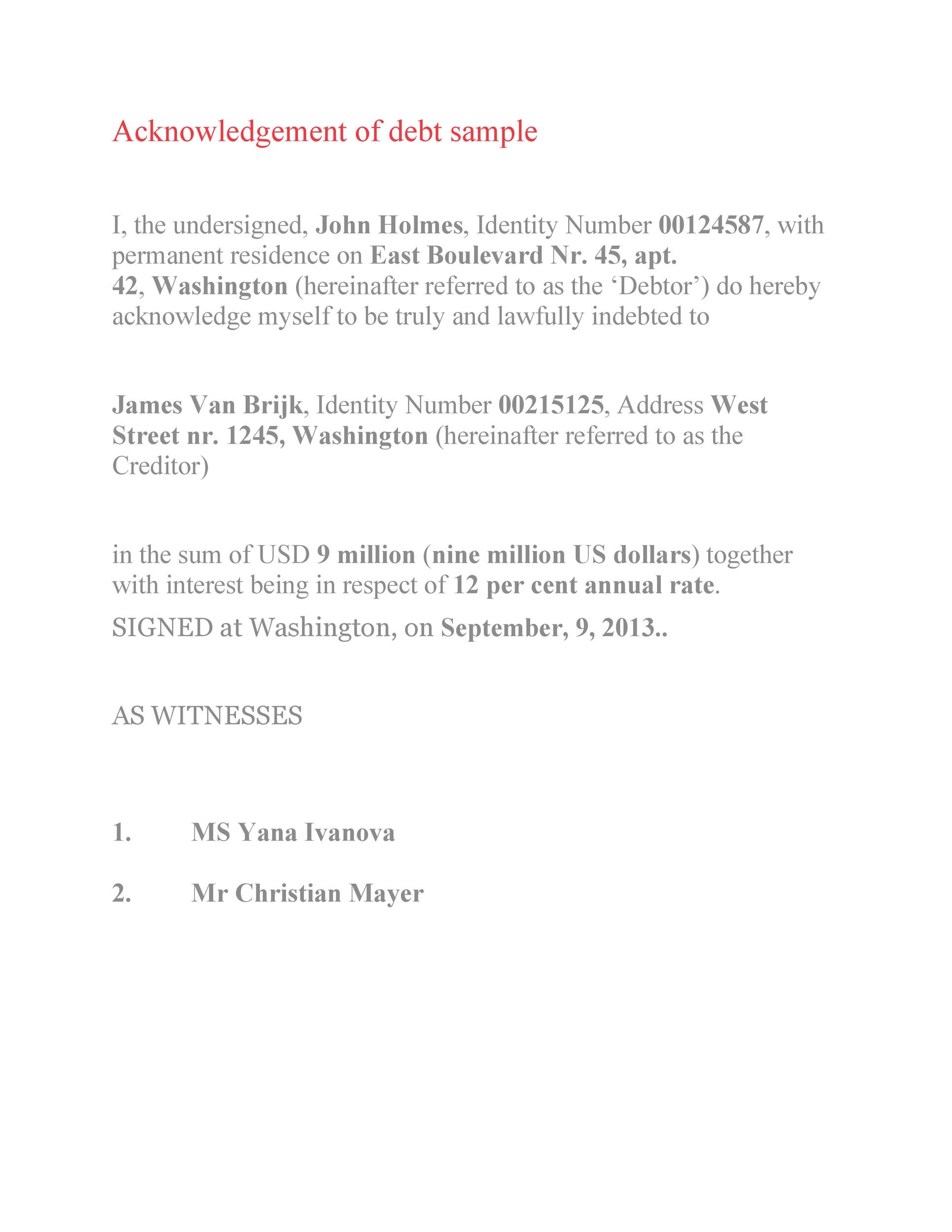

IOU Documents Can be a Significant Benefit

If you have entered into an agreement with someone like a family member or a friend and money is involved, you will want to make a document that will keep things clear between the two of you. You cannot enforce this document in court, but the details being laid out in paper format can help keep things clear between the two parties that are involved in this agreement. IOU documents can be a big help for a variety of reasons, but they are not actually required for this kind of agreement.

IOU documents can include the total amount of money that needs to be repaid as well as the names of both parties that are involved in the agreement. You can go so far as to include the information about how payment needs to be made and by what date. This document can be used as evidence in small claims court in some cases, but if you are worried about repayment, you will need to create a loan document or a repayment document instead. IOU documentation can be a big help, but you should never consider it legally binding in any way.