When you are writing a mortgage deed, you might want to look at other mortgage agreement documents or a sample mortgage agreement to figure out what you need to include in this document. There are different mortgage note examples out there to look at, but you do need to be sure that you are looking at the right form of mortgage for your mortgage deed writing process.

Having the correct language and the right sections in place for your mortgage deed is important. This is a critical document and one that you cannot afford to write incorrectly. Having the right sections and the right information in this important document is required for your deed to be useful in defining the relationship between a borrower and a lender. Using this guide will help you to be sure that you are writing a mortgage deed that will work as intended when it is needed.

Table of Contents

- 1 Mortgage Deed Templates

- 2 What is a mortgage deed?

- 3 Mortgage Agreements

- 4 What is the difference between a mortgage and a deed of trust?

- 5 Mortgage Note Examples

- 6 Is a mortgage a deed or contract?

- 7 What is the difference between a judicial foreclosure and non-judicial foreclosure?

- 8 Mortgage Agreement Samples

- 9 How to write a mortgage deed

- 10 Mortgage Deeds Are Often Essential to Property Owners

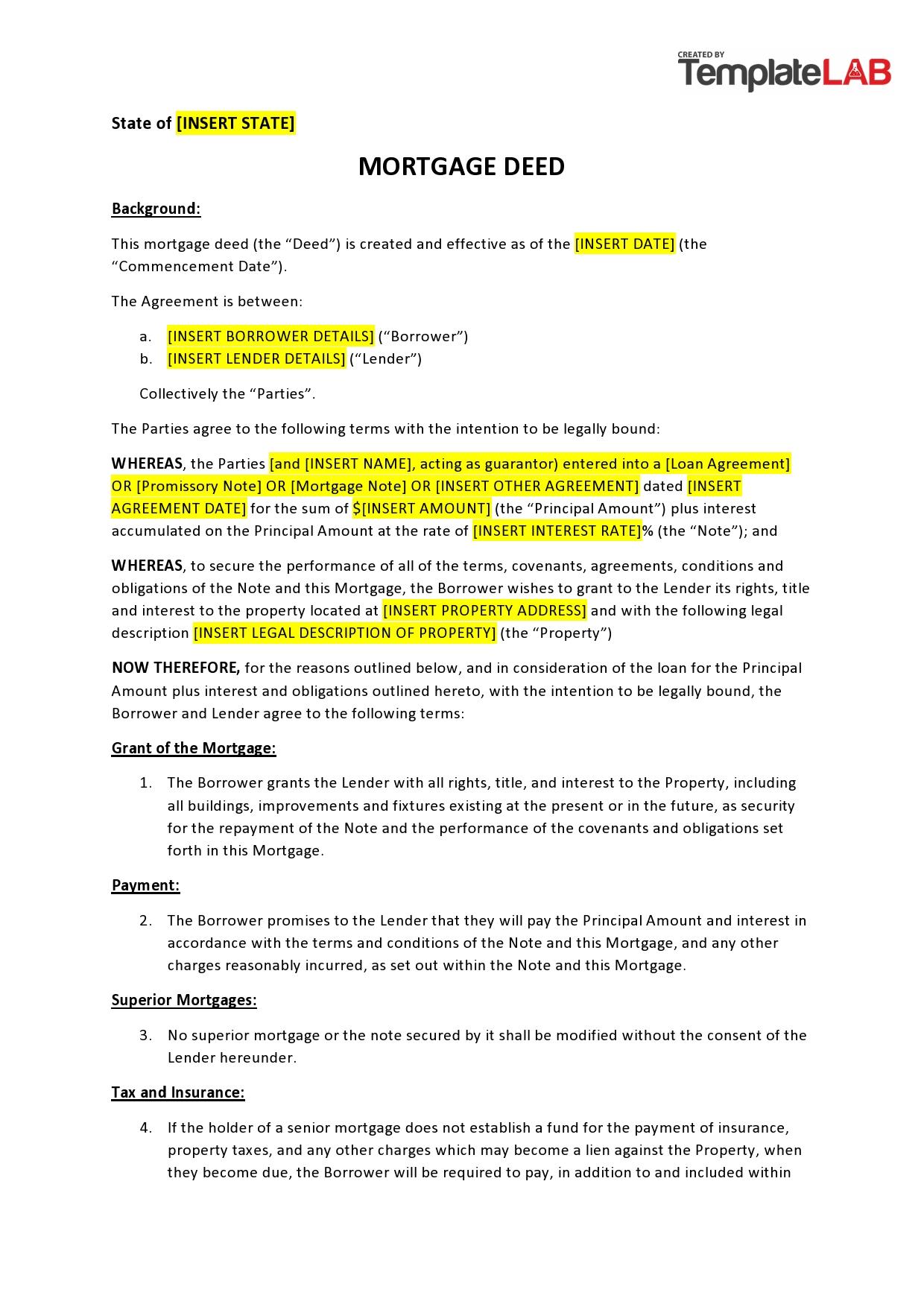

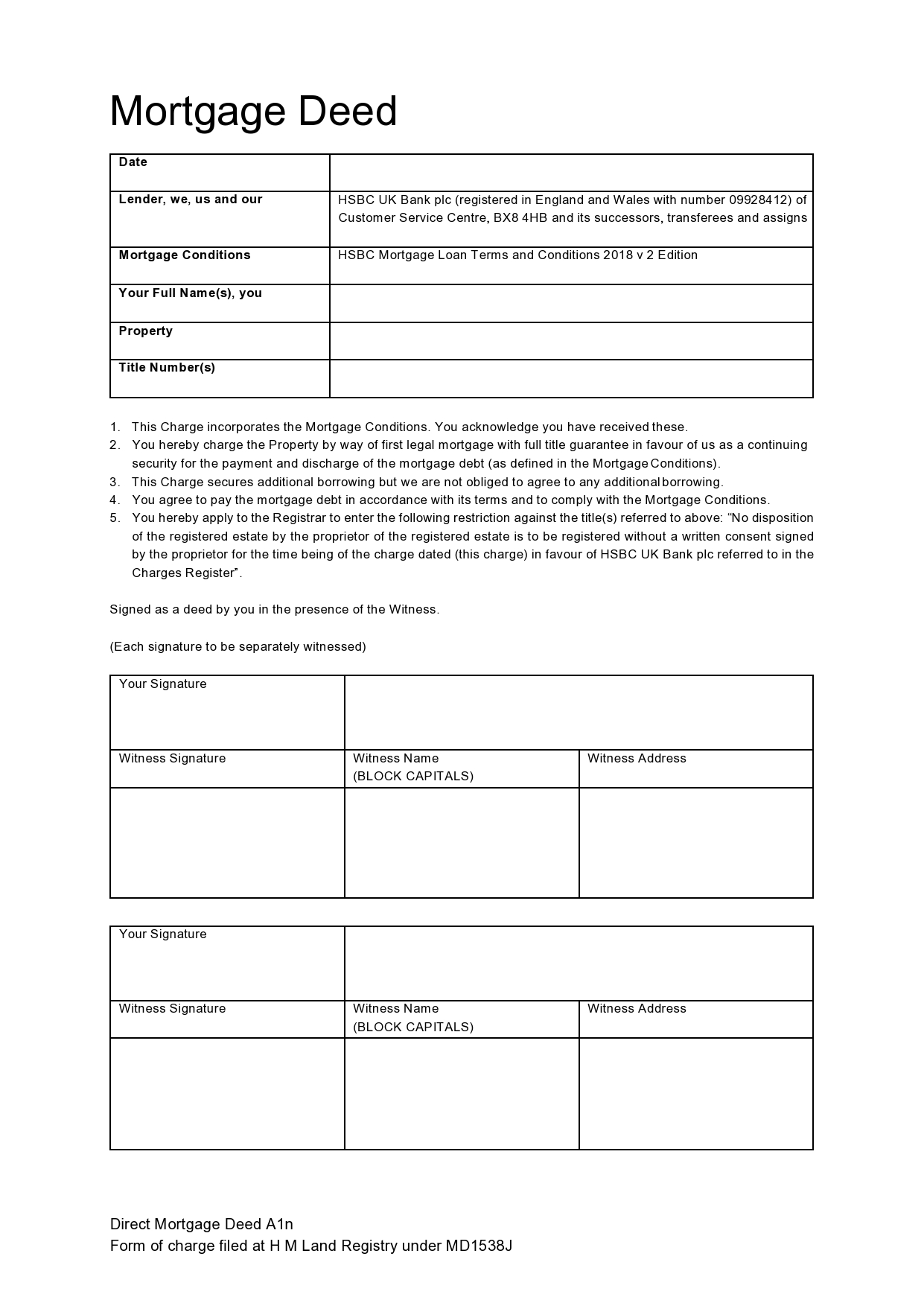

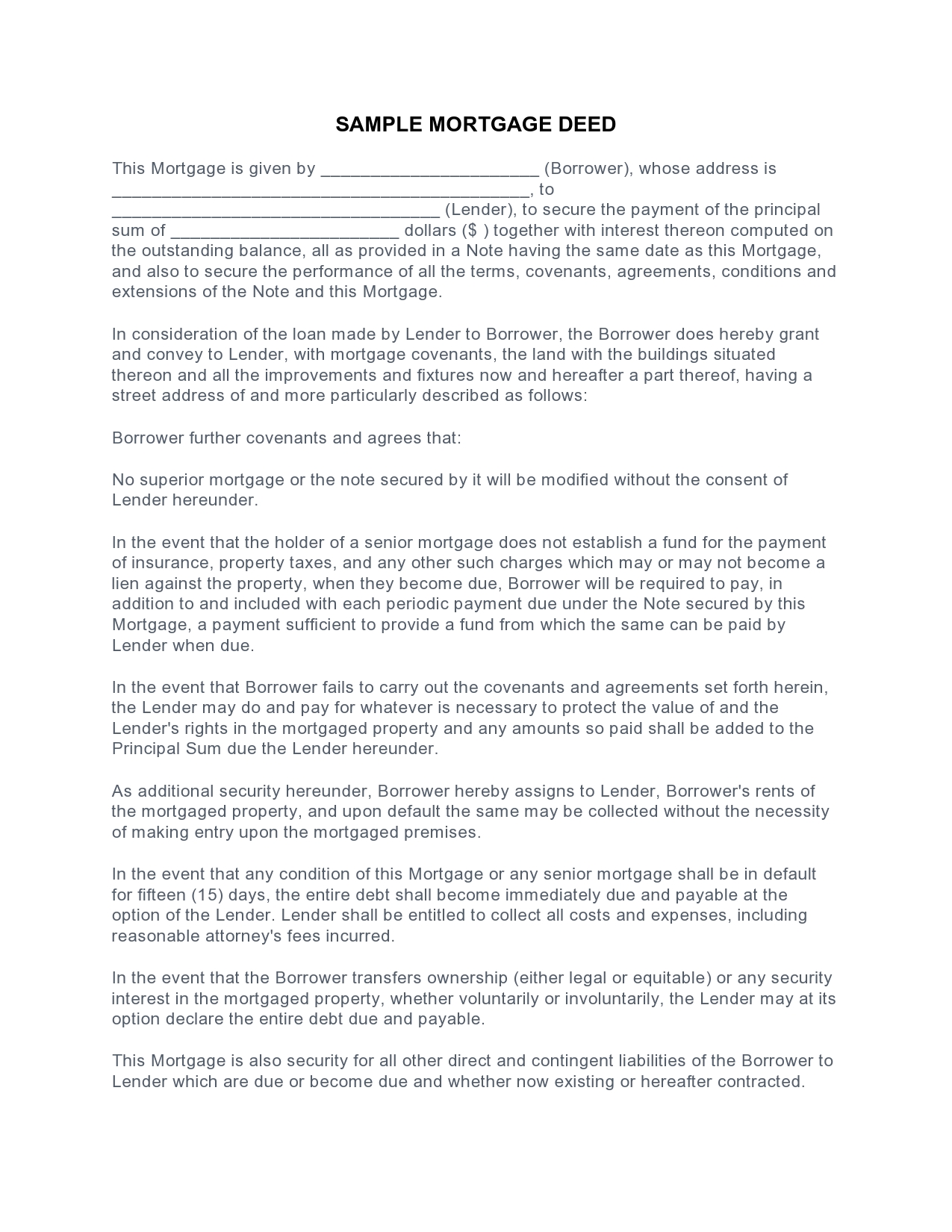

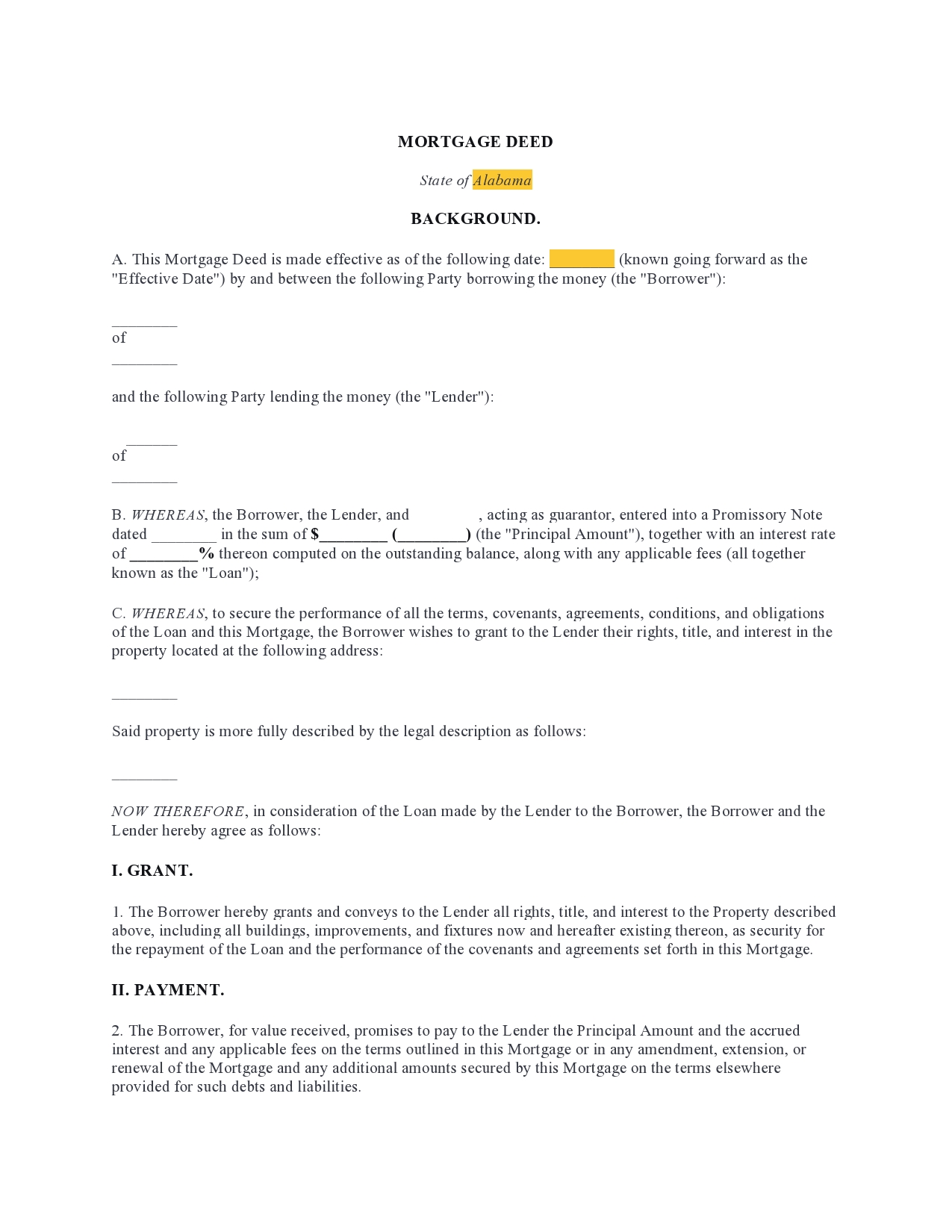

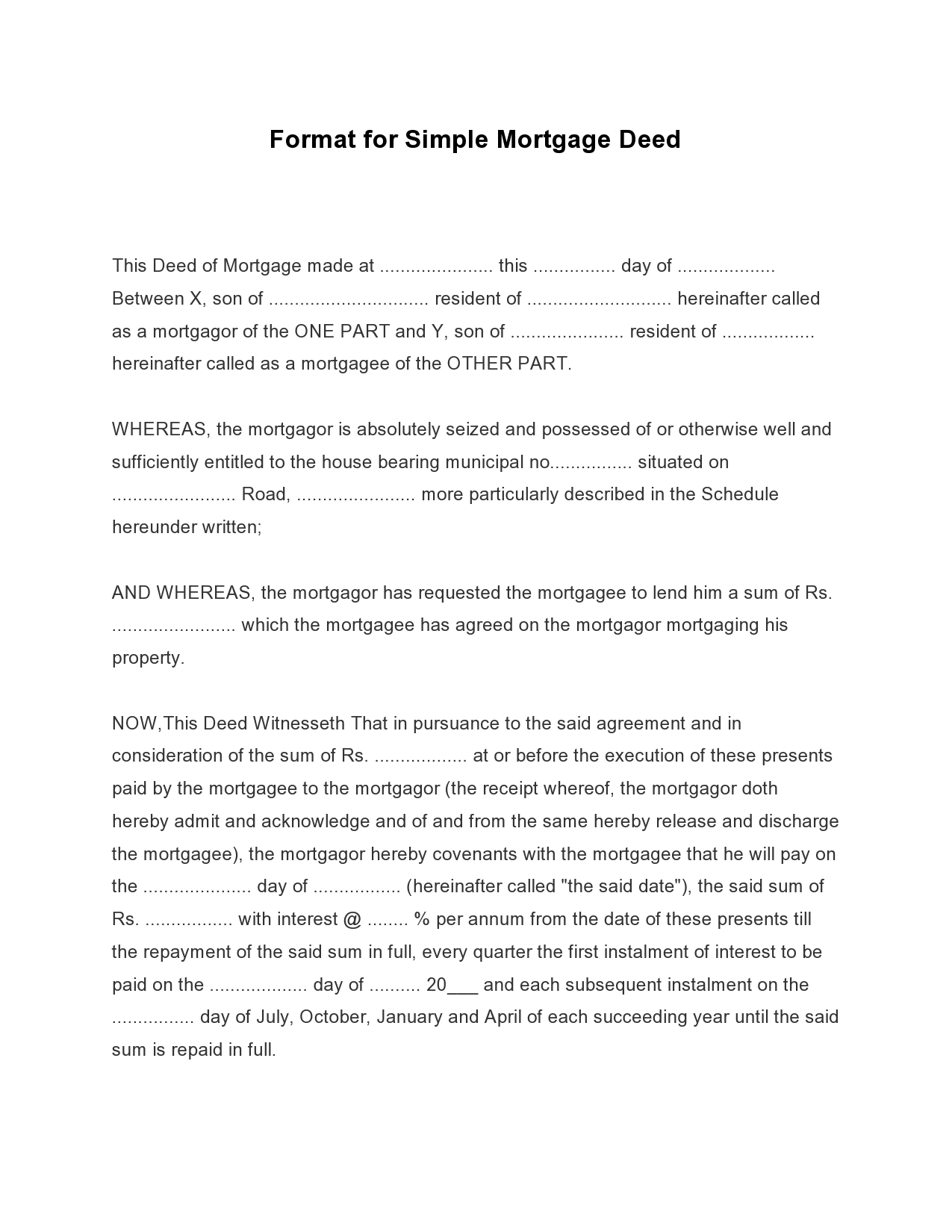

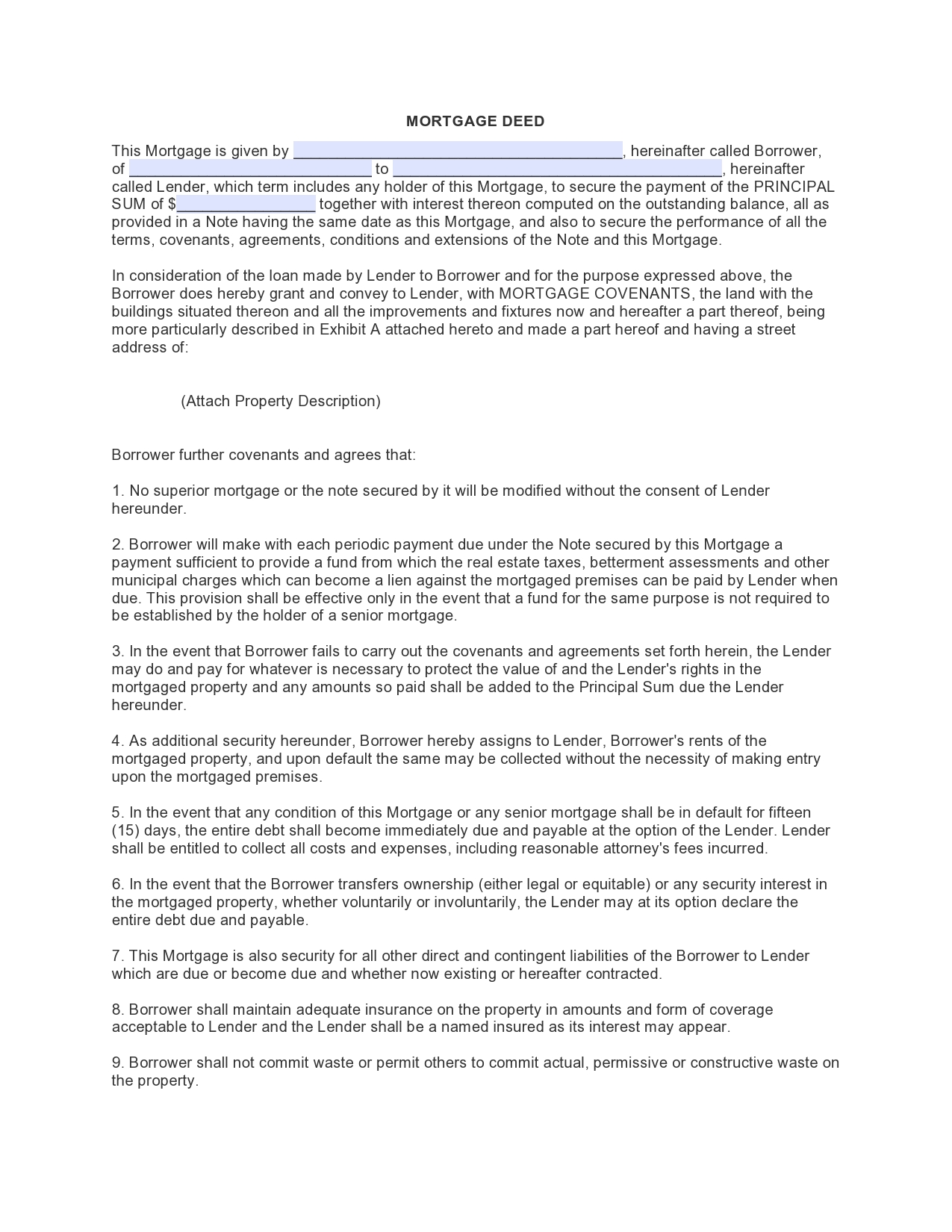

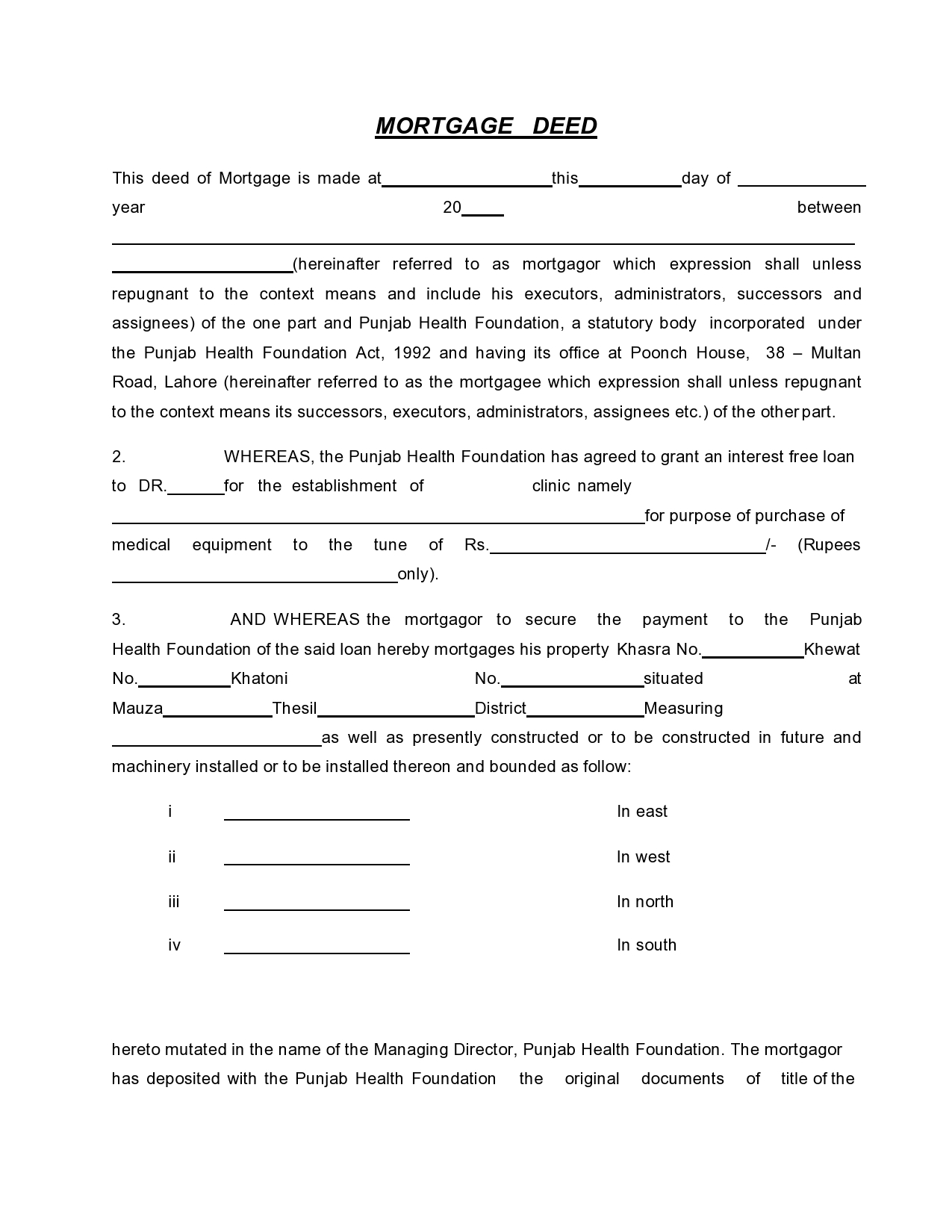

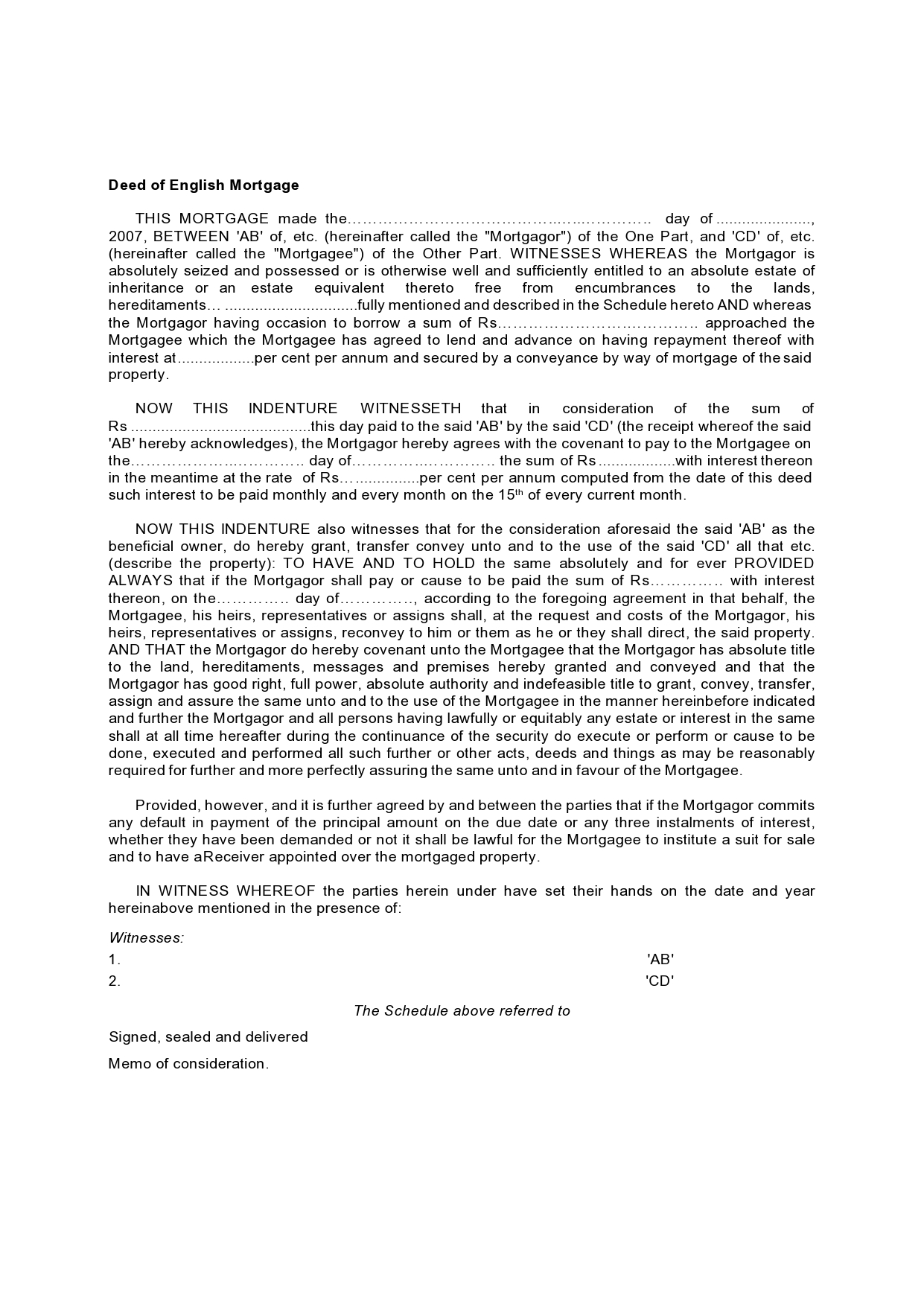

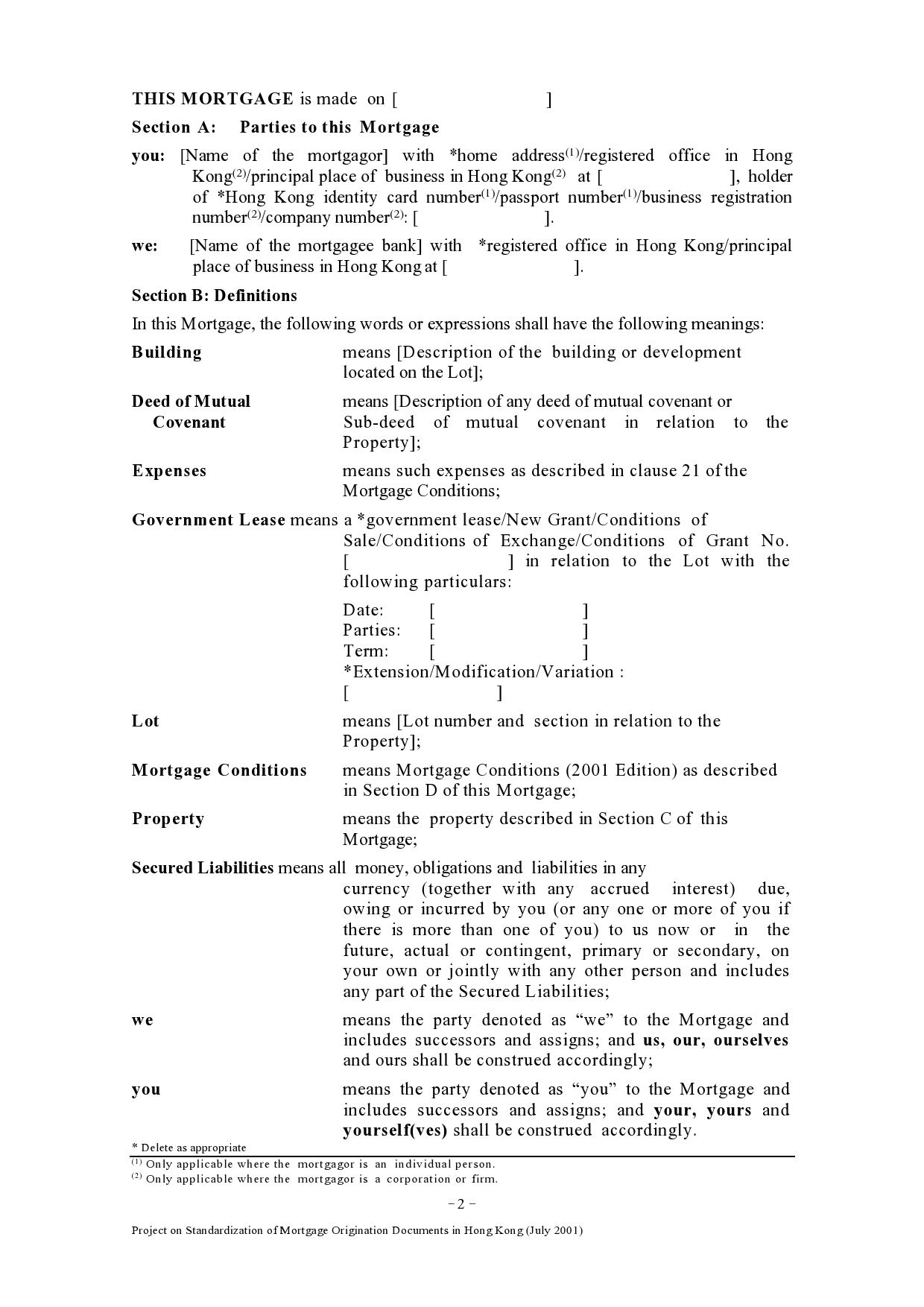

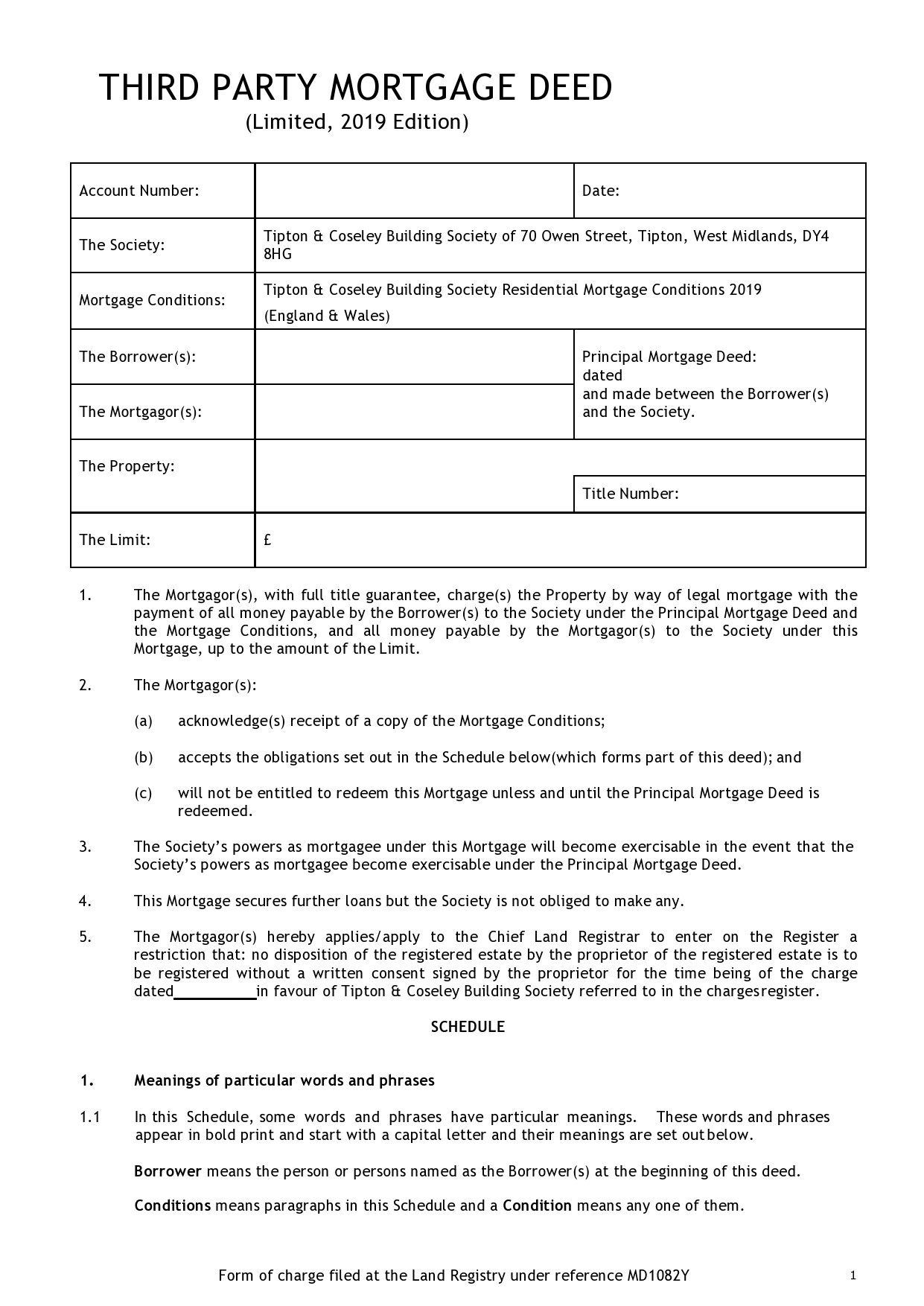

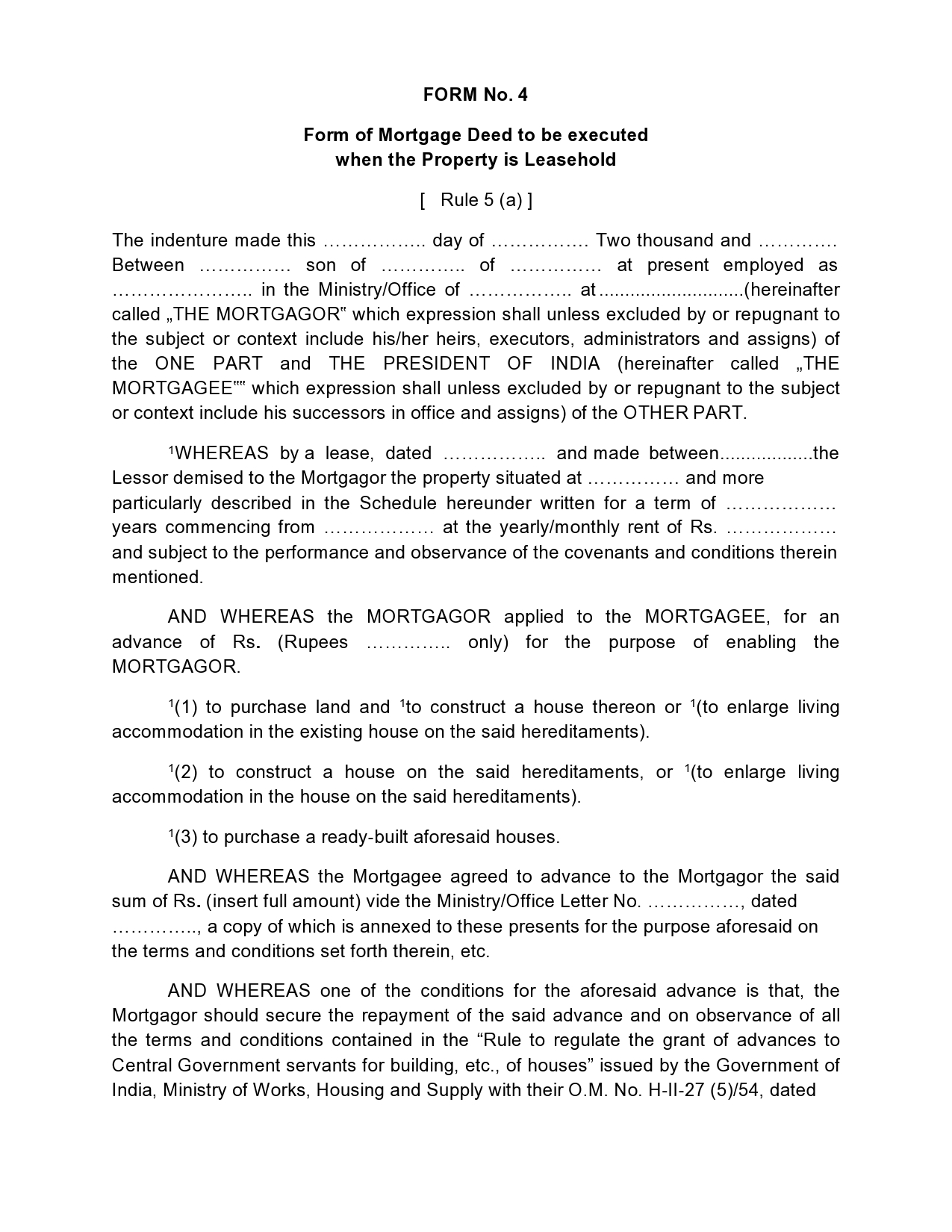

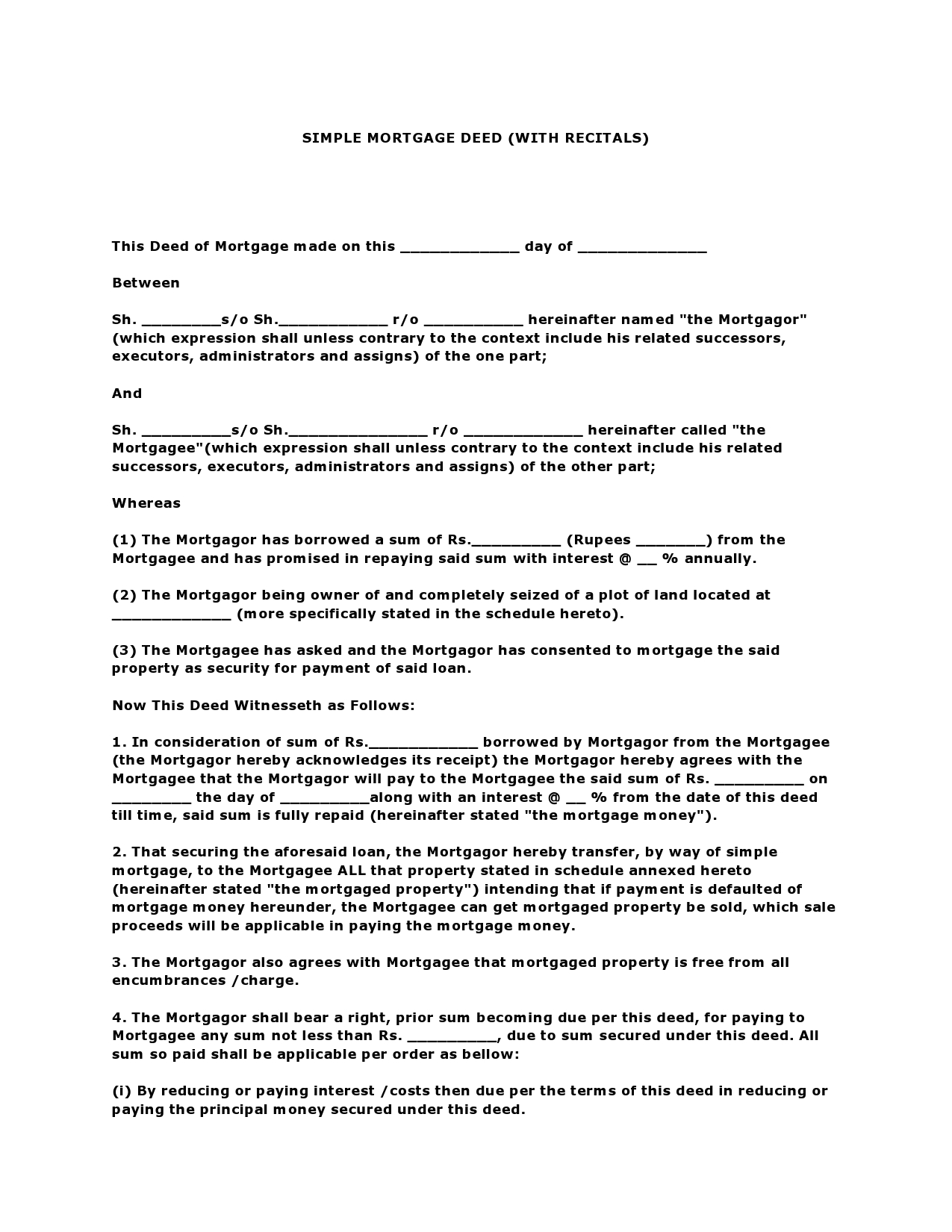

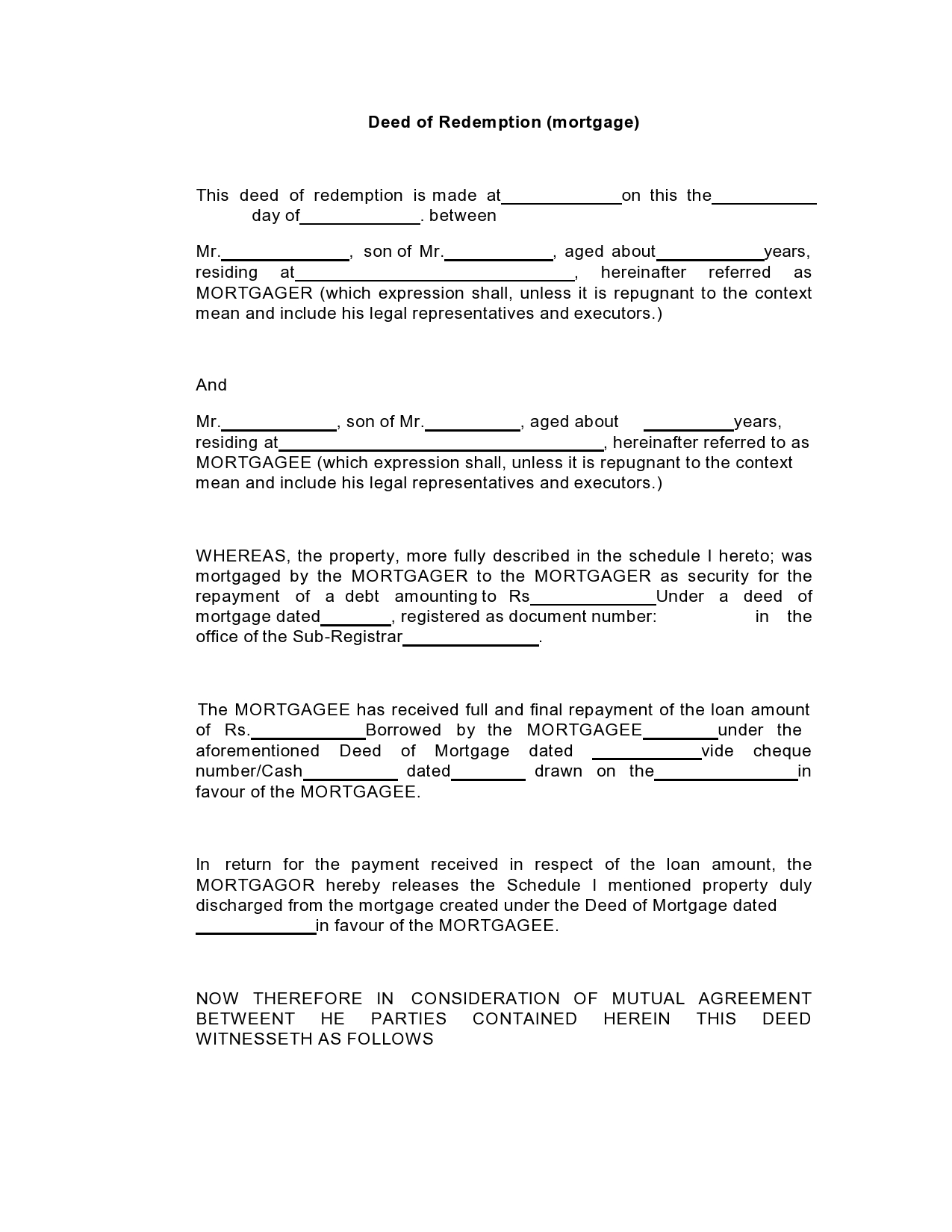

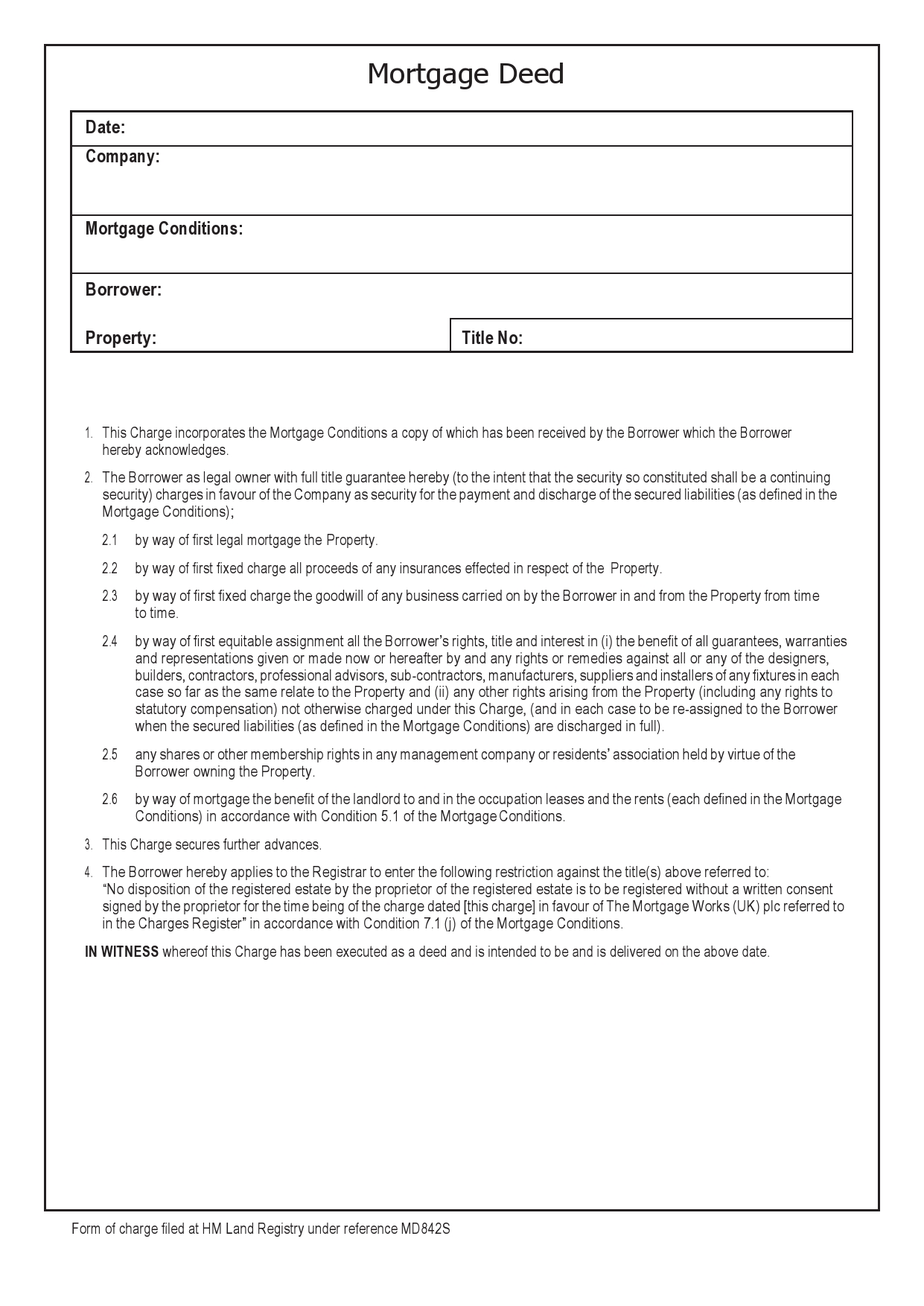

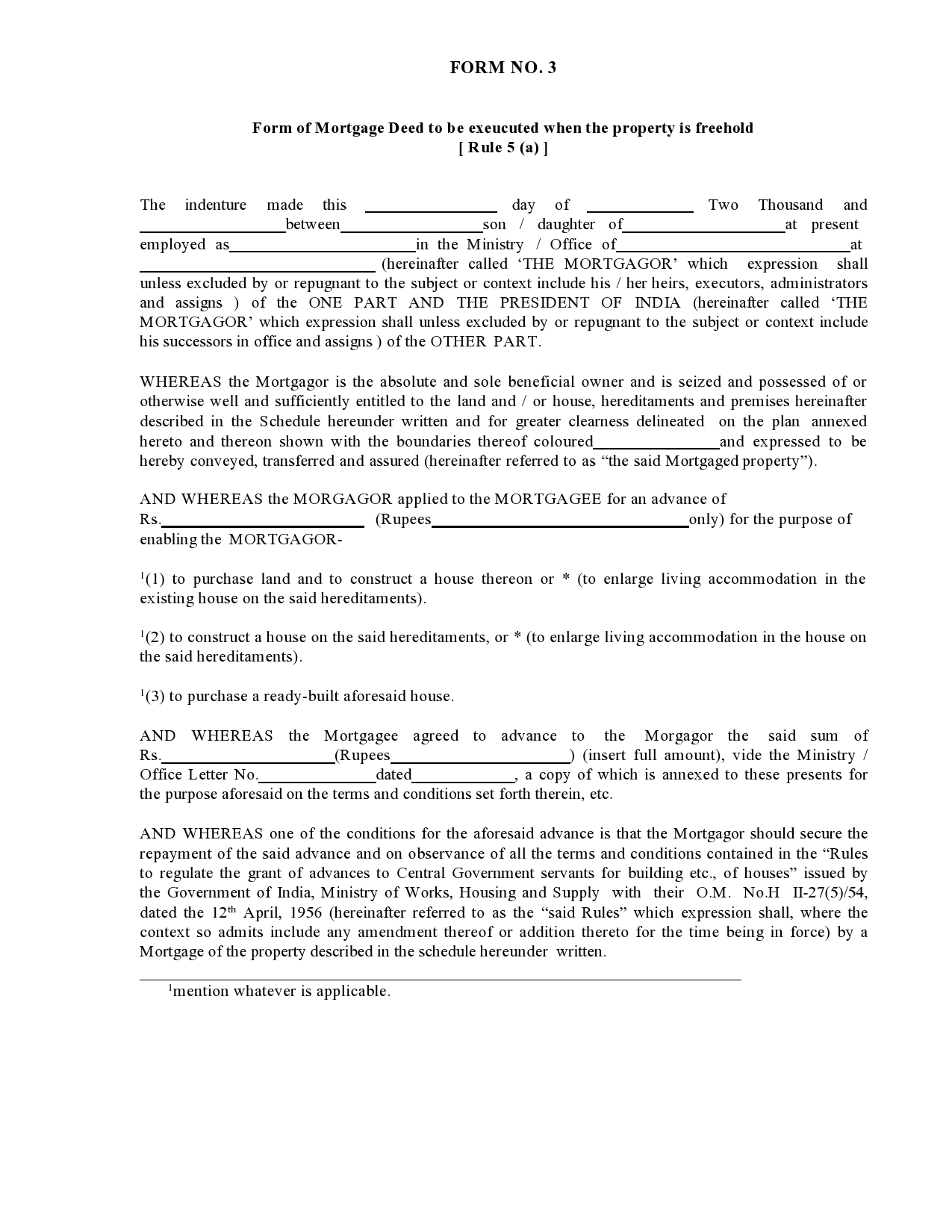

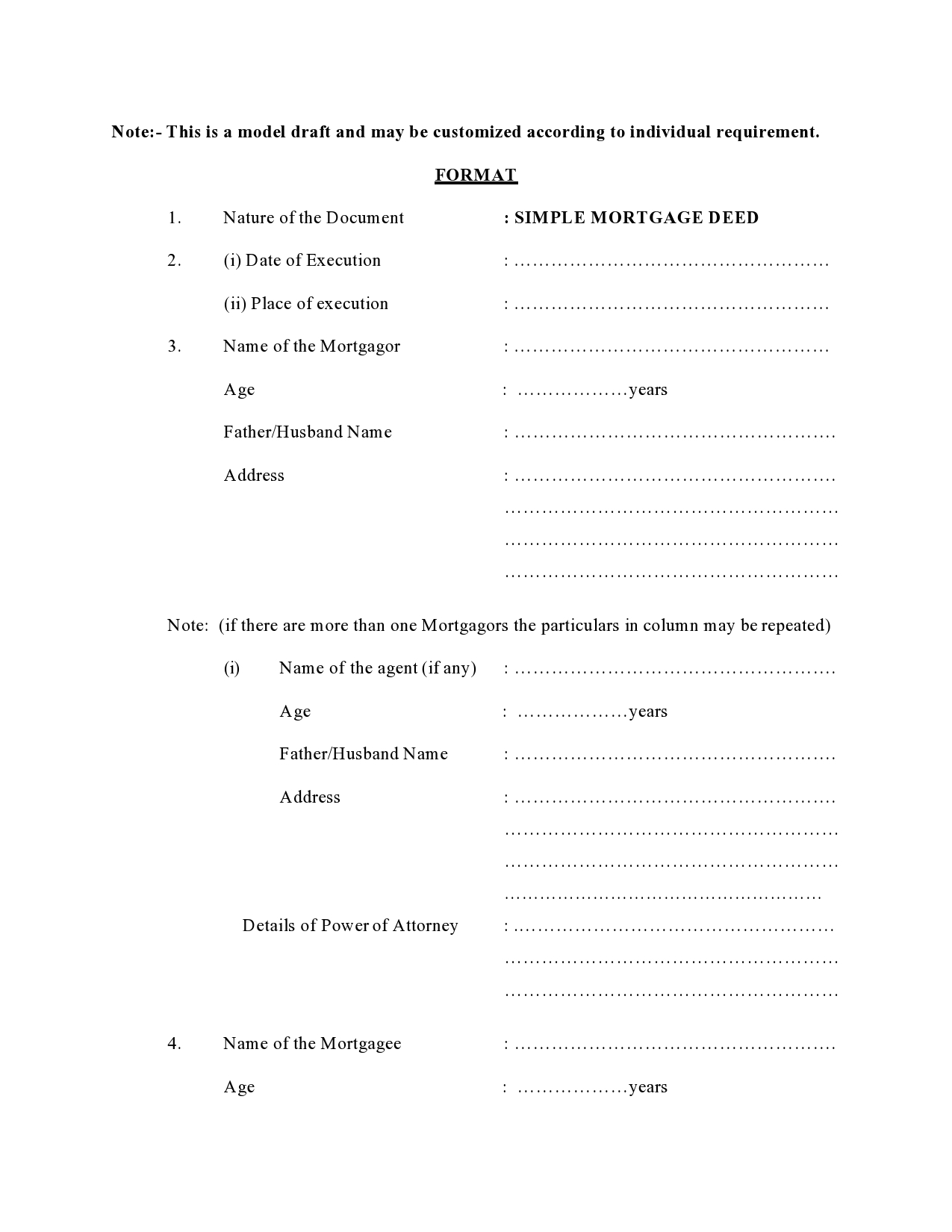

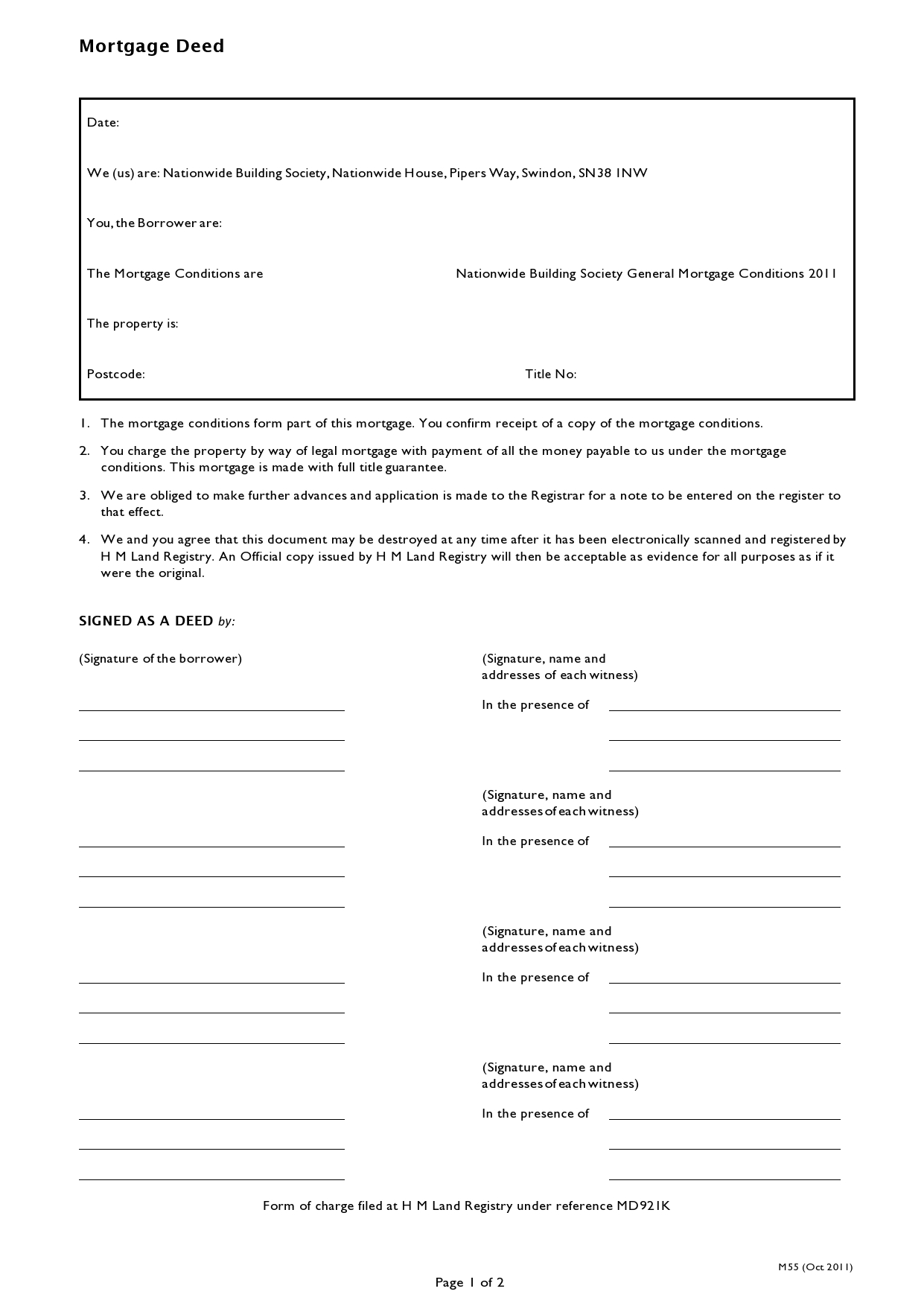

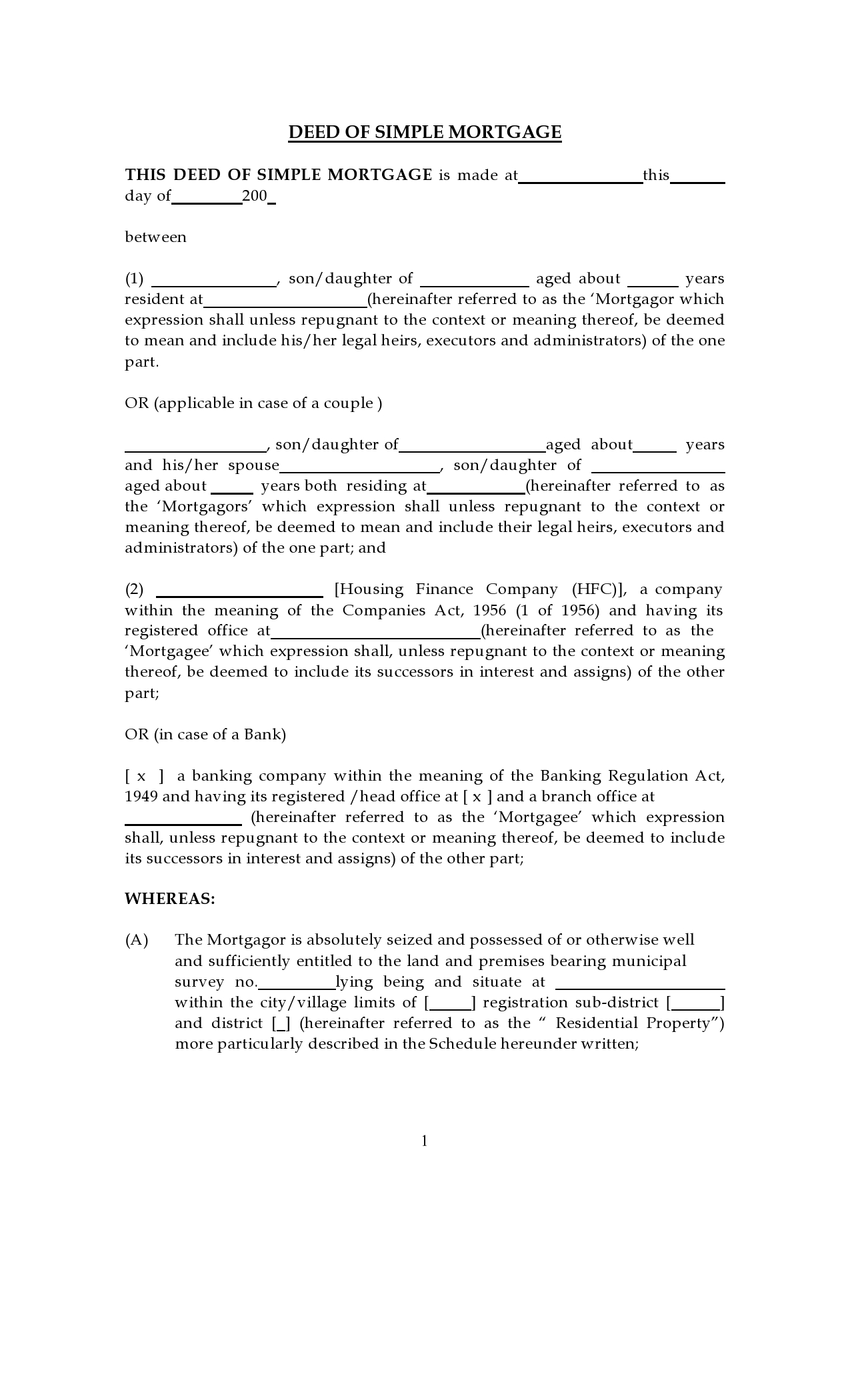

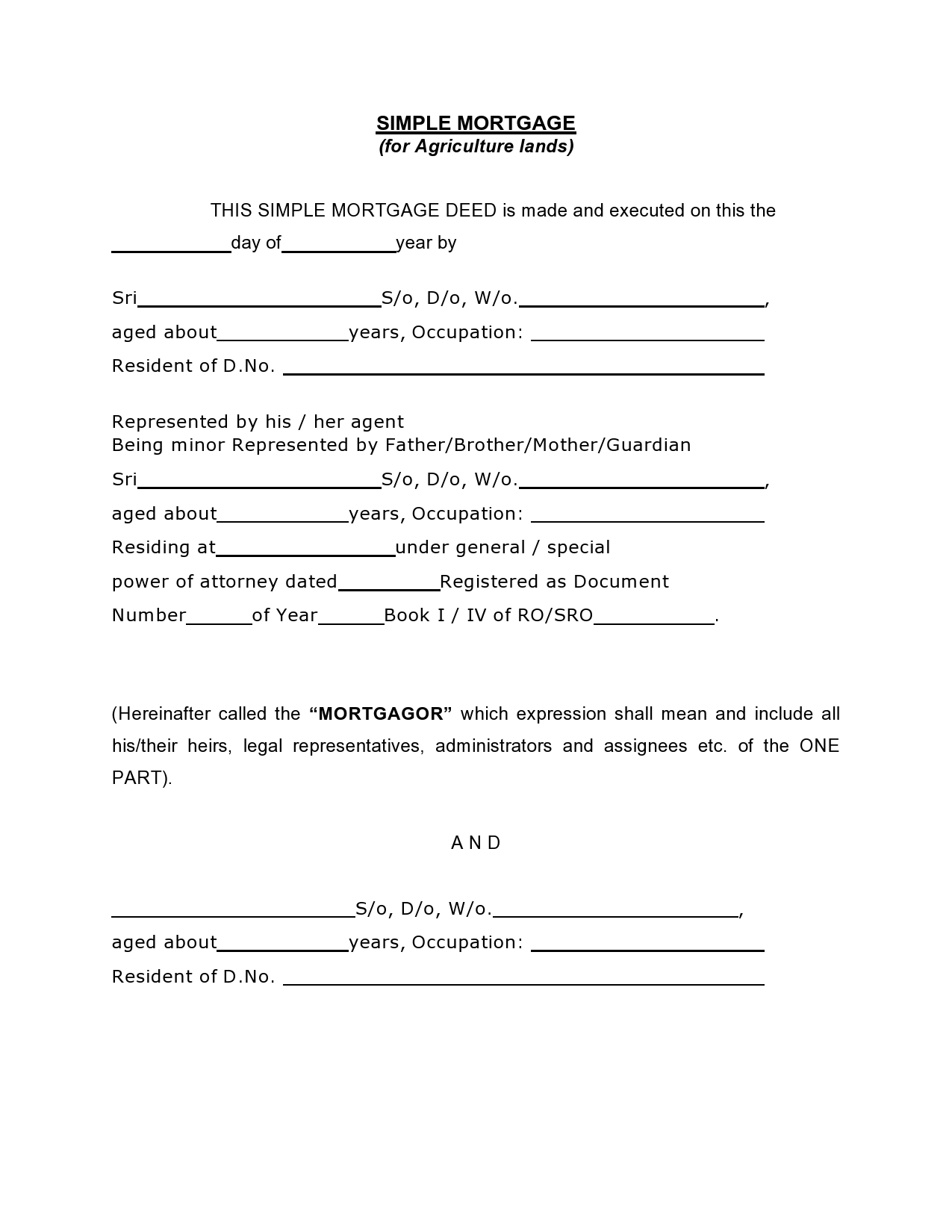

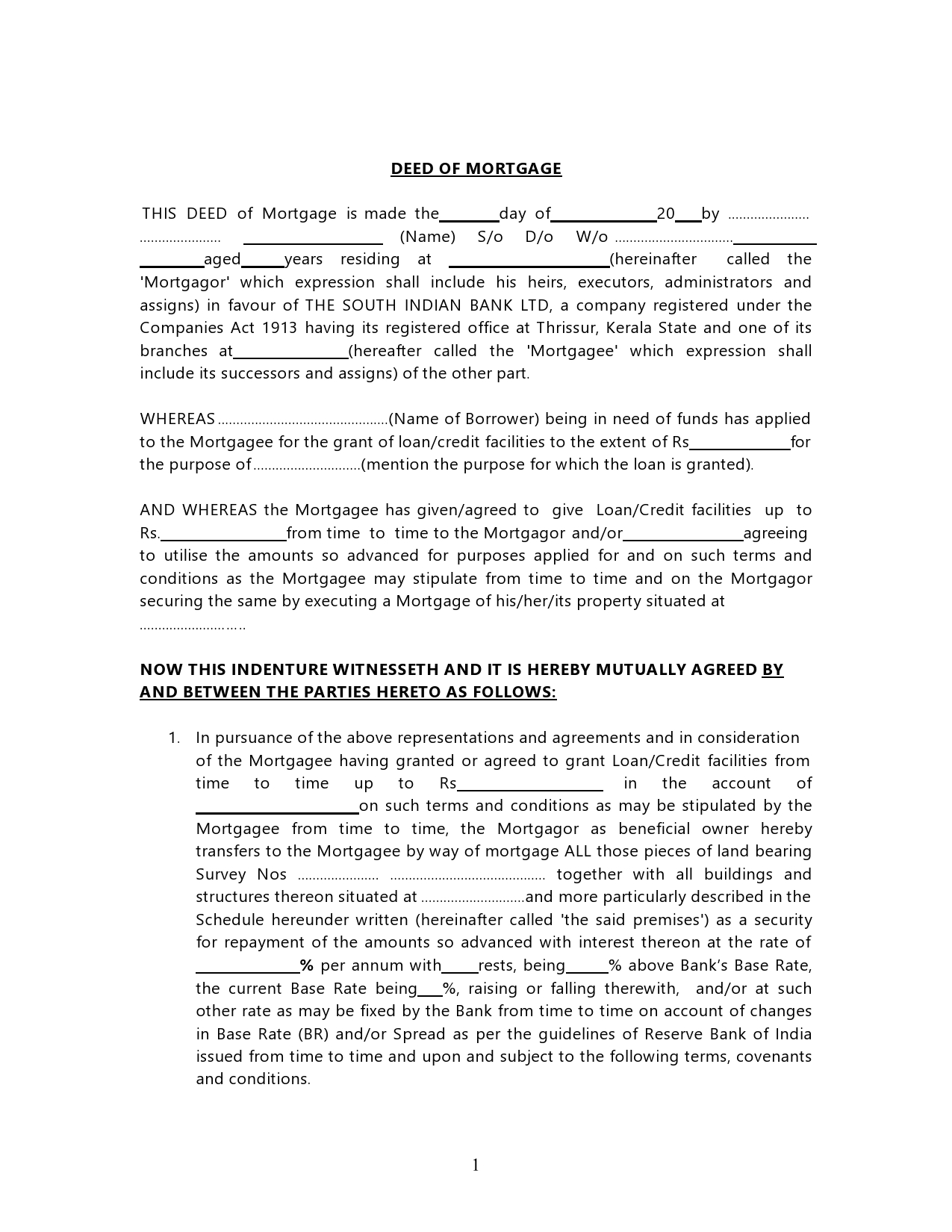

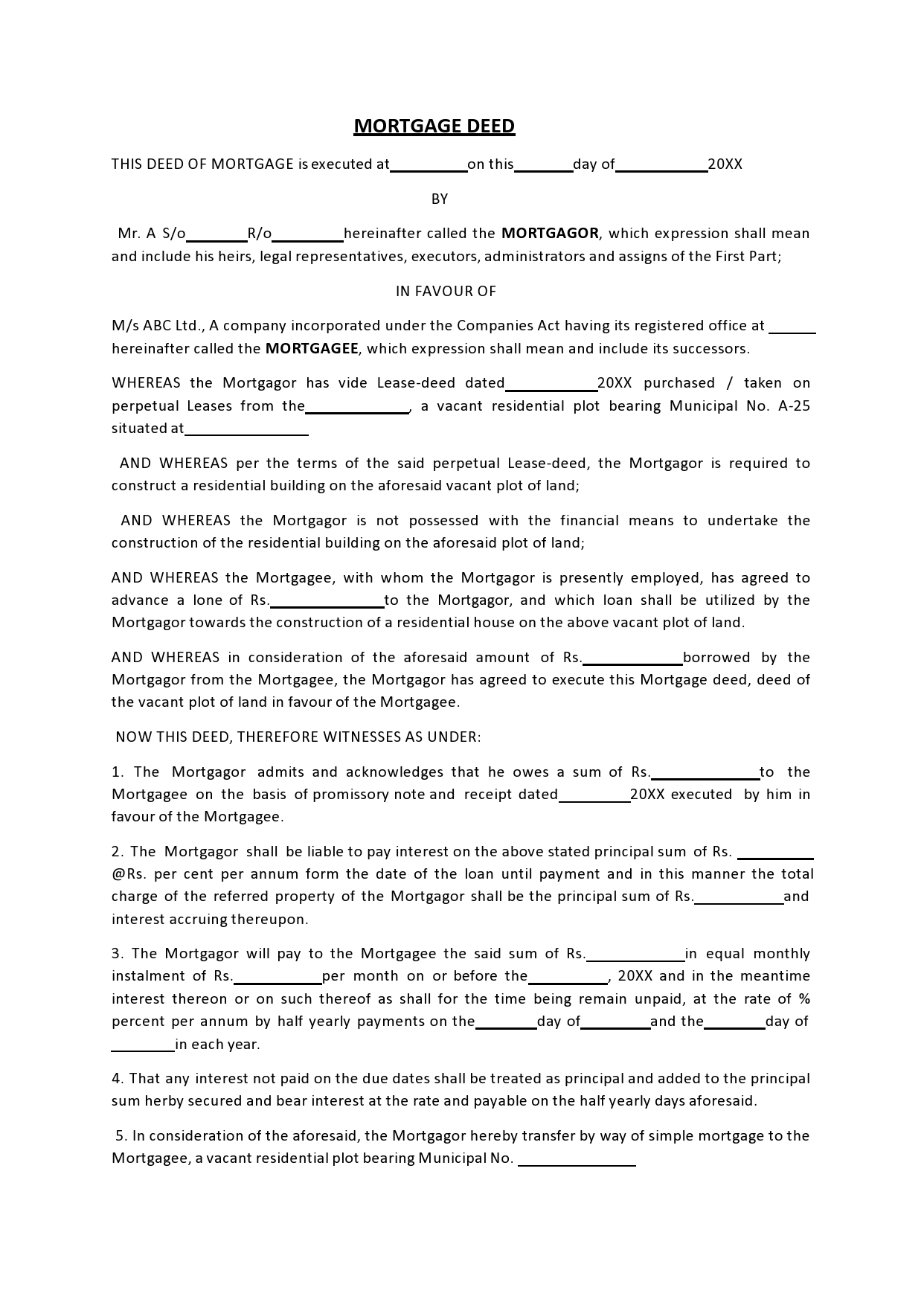

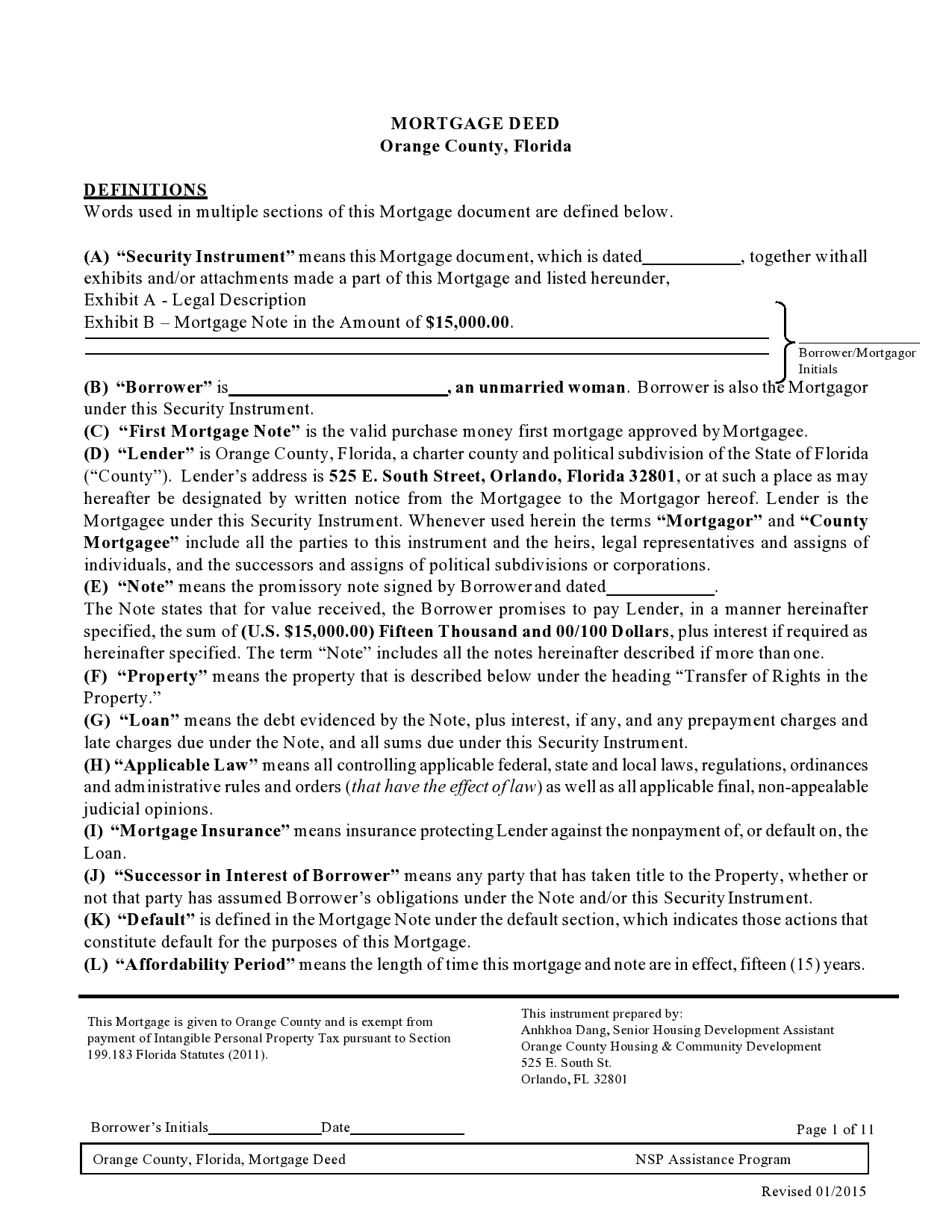

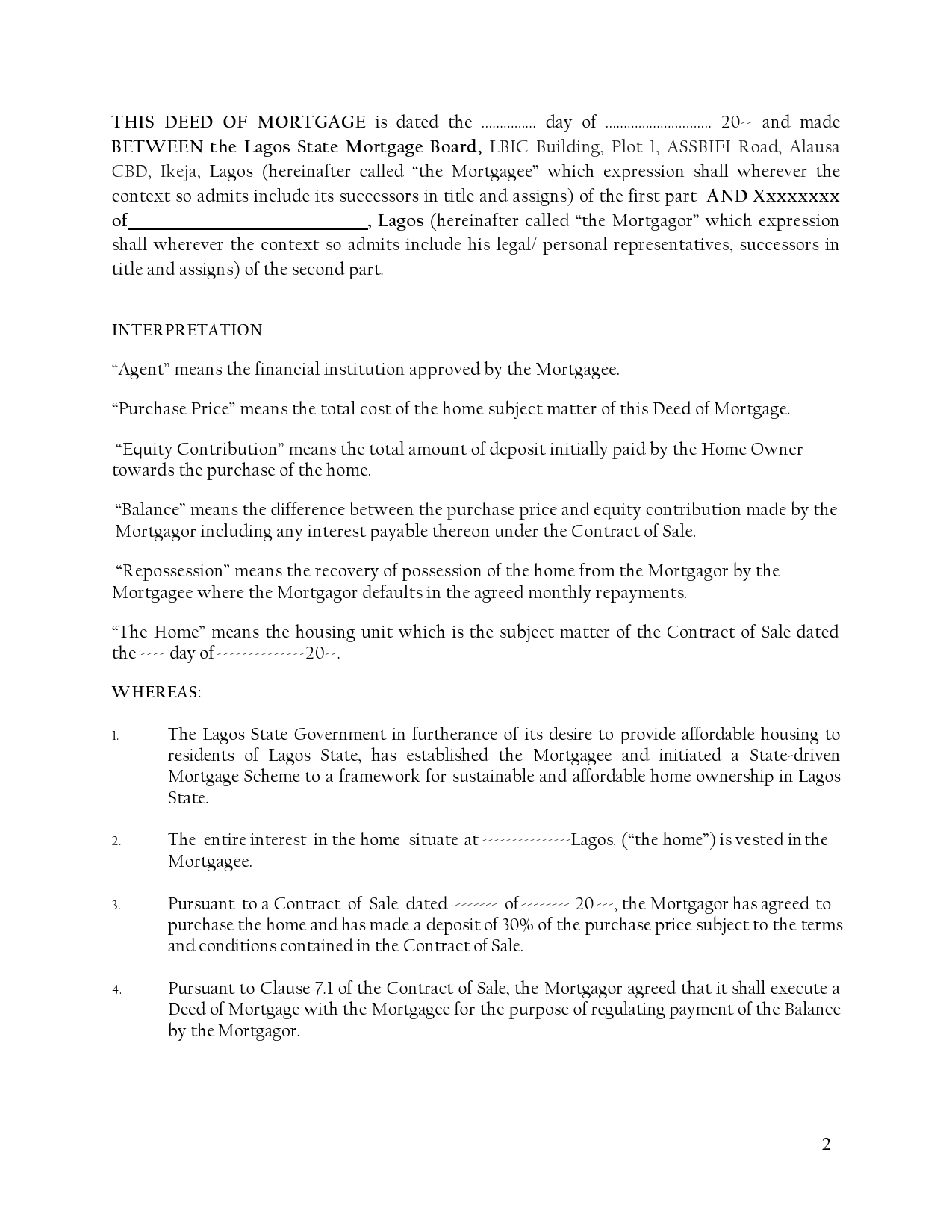

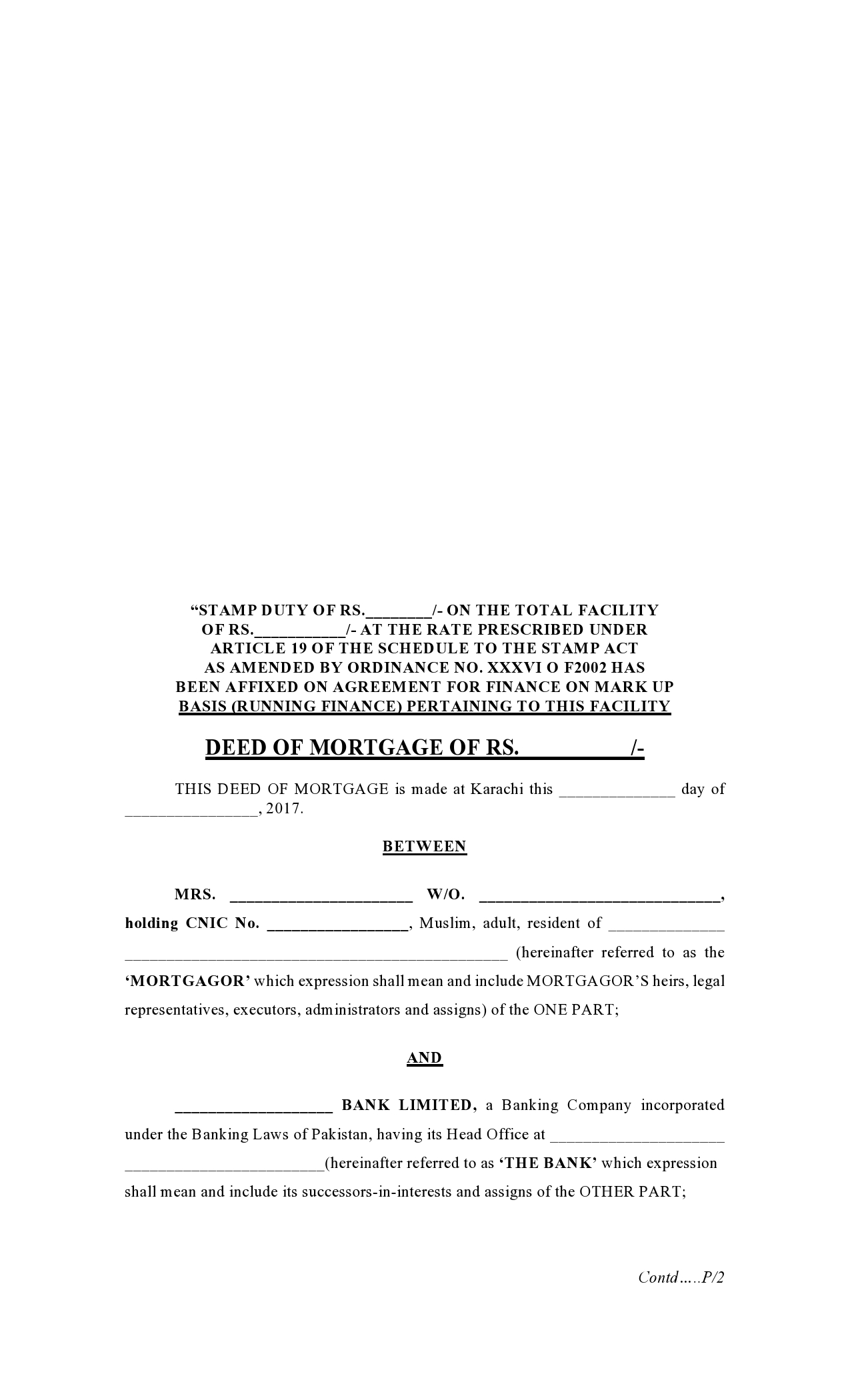

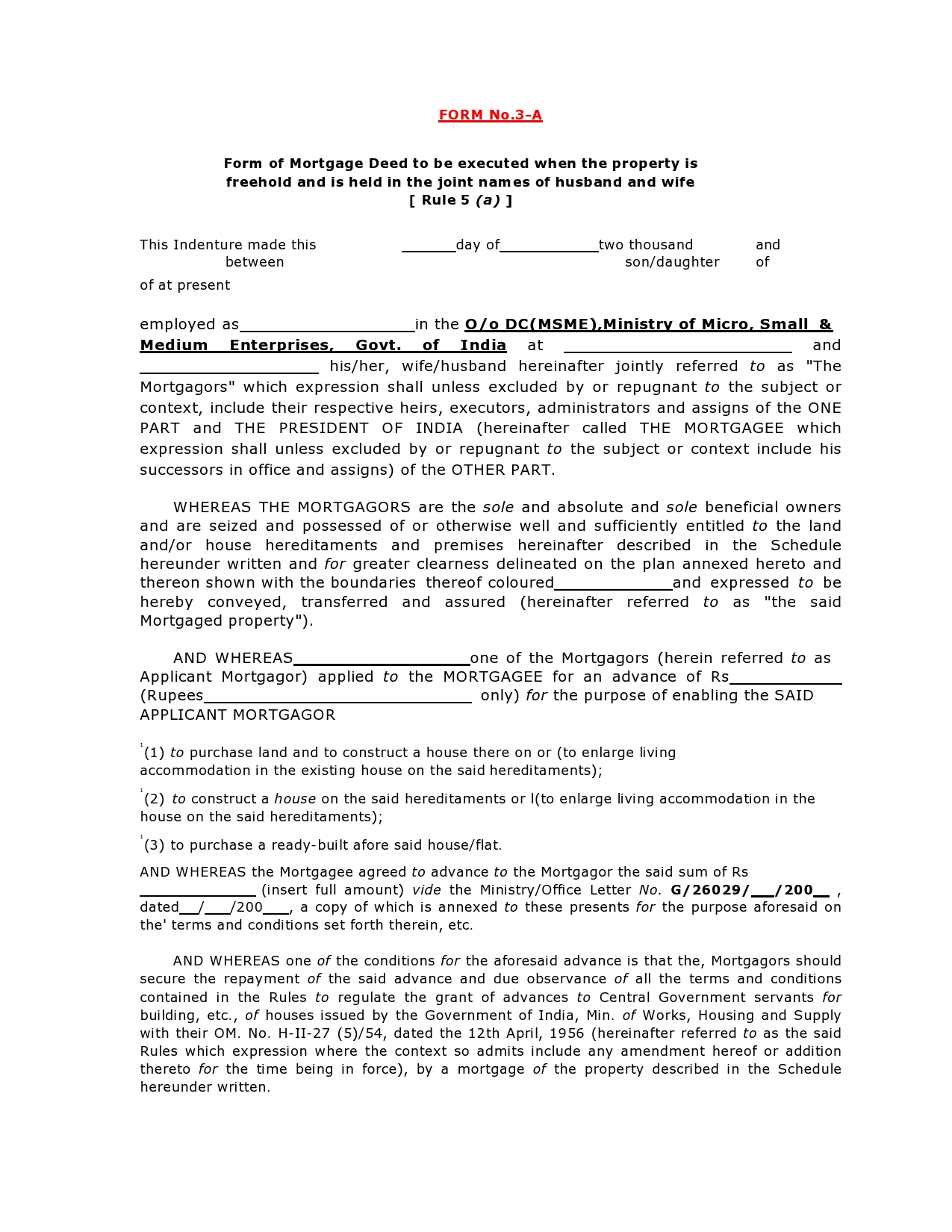

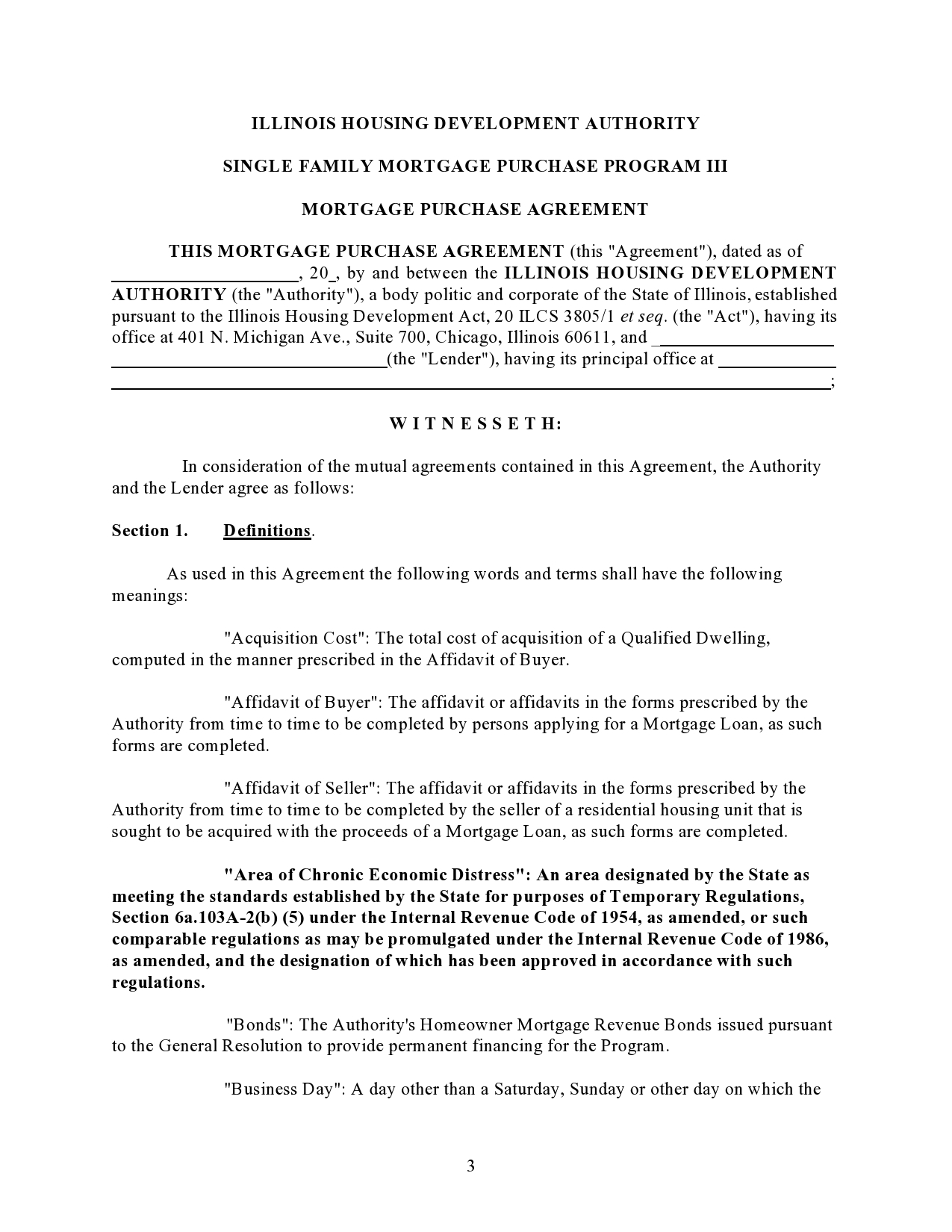

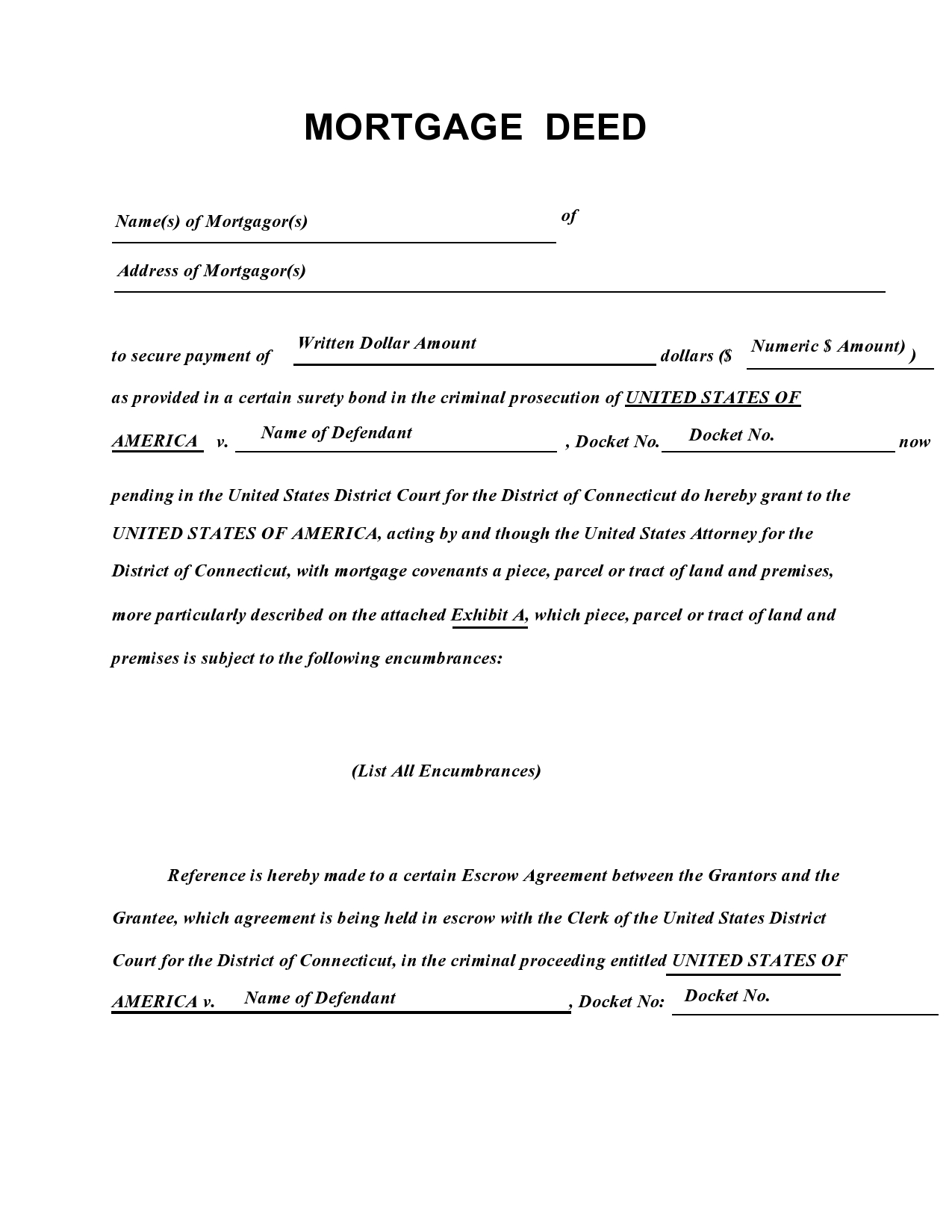

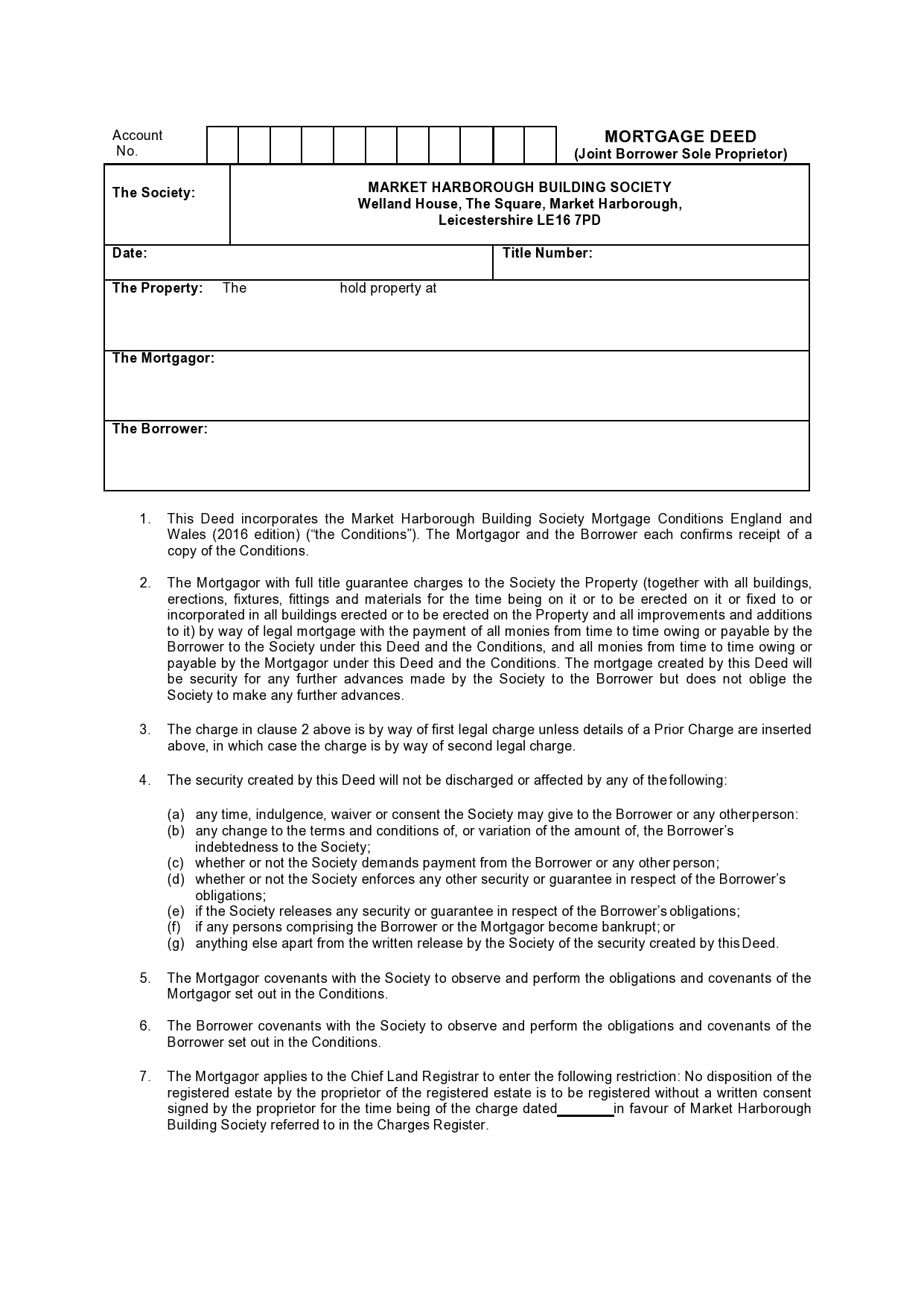

Mortgage Deed Templates

What is a mortgage deed?

A mortgage deed is also called a mortgage agreement. This is a legal document that recognizes and defines a relationship between two parties. These two parties are the borrower and the lender that is involved in the mortgage relationship. Mortgage deeds also grant conditional ownership of a property or assets as a security interest against a loan. The borrower must repay the loan in order to regain full ownership of the item that was used as a security interest.

Mortgage deeds are not the same as these documents and might be used alongside them:

The loan agreement creates the actual loan itself, while a promissory note is used to create an agreement to pay that is not legally binding. Promissory notes are the same as IOUs and cannot be used in a court of law. Your mortgage deed and a loan agreement will be created to be legally binding, but they serve different purposes.

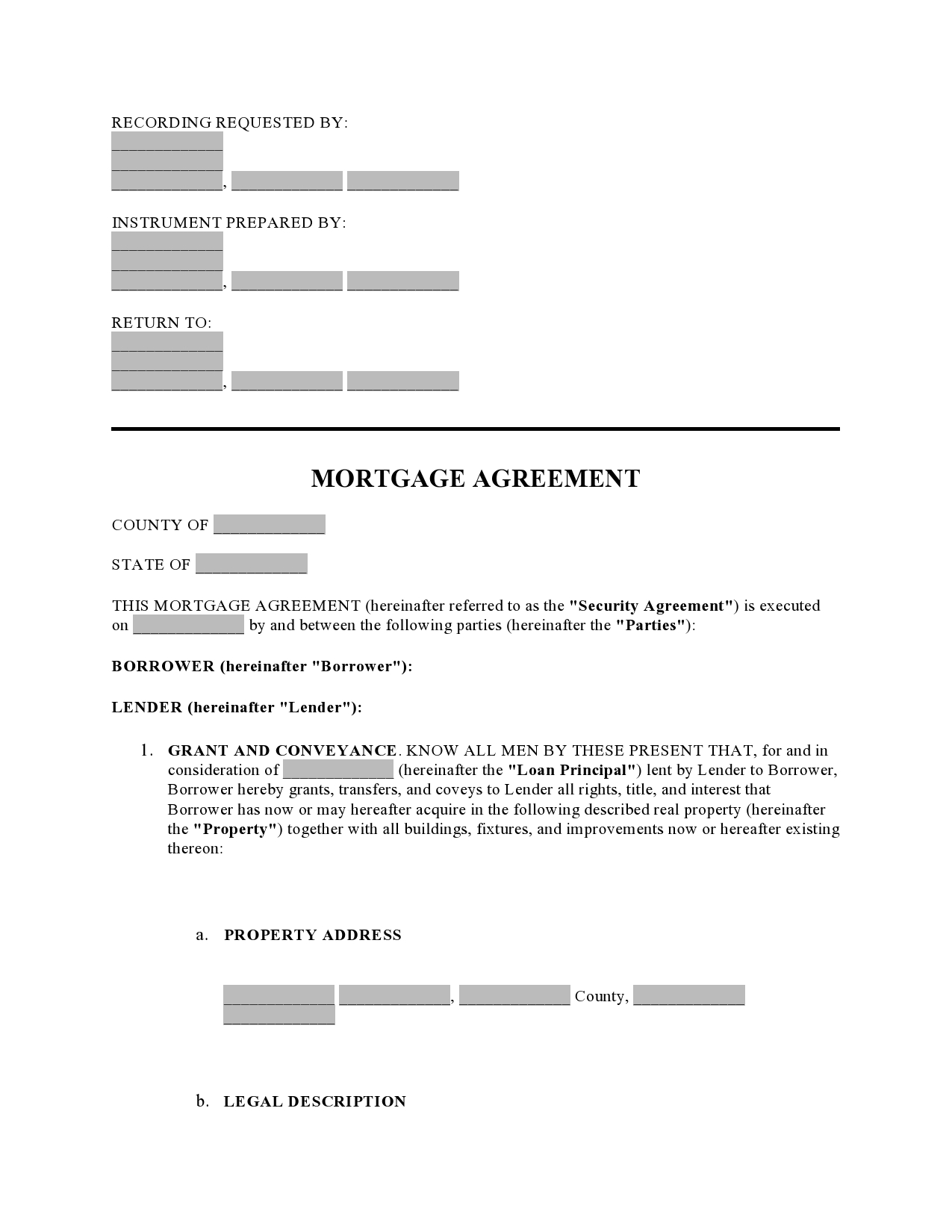

Mortgage Agreements

What is the difference between a mortgage and a deed of trust?

A mortgage deed and a deed of trust both create a lien on a property that secures the repayment of a loan. However, The agreement is between two parties in the case of a mortgage deed- the borrower and the lender. In the case of a deed of trust, the agreement is between the borrower, the lender, and the trustee.

Deeds of trust can be used in some states in place of mortgage agreements, and these terms can sometimes be used interchangeably. Mortgage agreements are essentially the same thing as a mortgage deed in that both of these documents allow lenders to initiate foreclosure proceedings through the court system. When you are looking at the differences between a deed of trust and a mortgage agreement, you need to be aware of these similarities and differences:

Mortgage agreement:

- Between a borrower and a lender

- Lender holds the title

- The borrower has the equitable title/right to the use of the property

- When the borrower defaults, the foreclosure is handled through the court system

- Between a borrower and a lender, and a trustee

- The trustee holds the title

- The equitable use and title of the property are held by the borrower

- If the borrower defaults on the loan, a non-judicial foreclosure sale is begun without a court order

You can see that there are advantages to the way that the mortgage agreement is constructed when it comes to owner control if something less-than-ideal should happen.

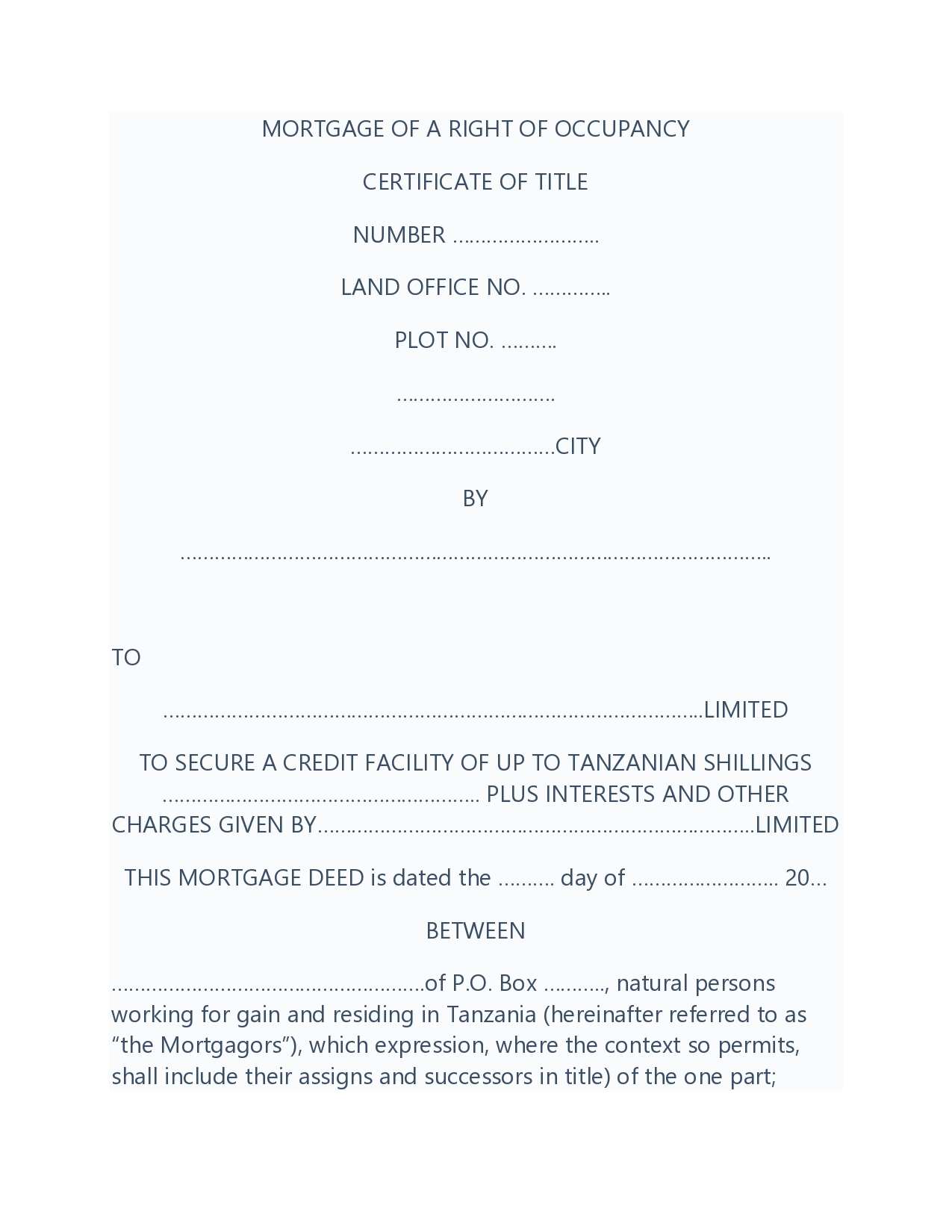

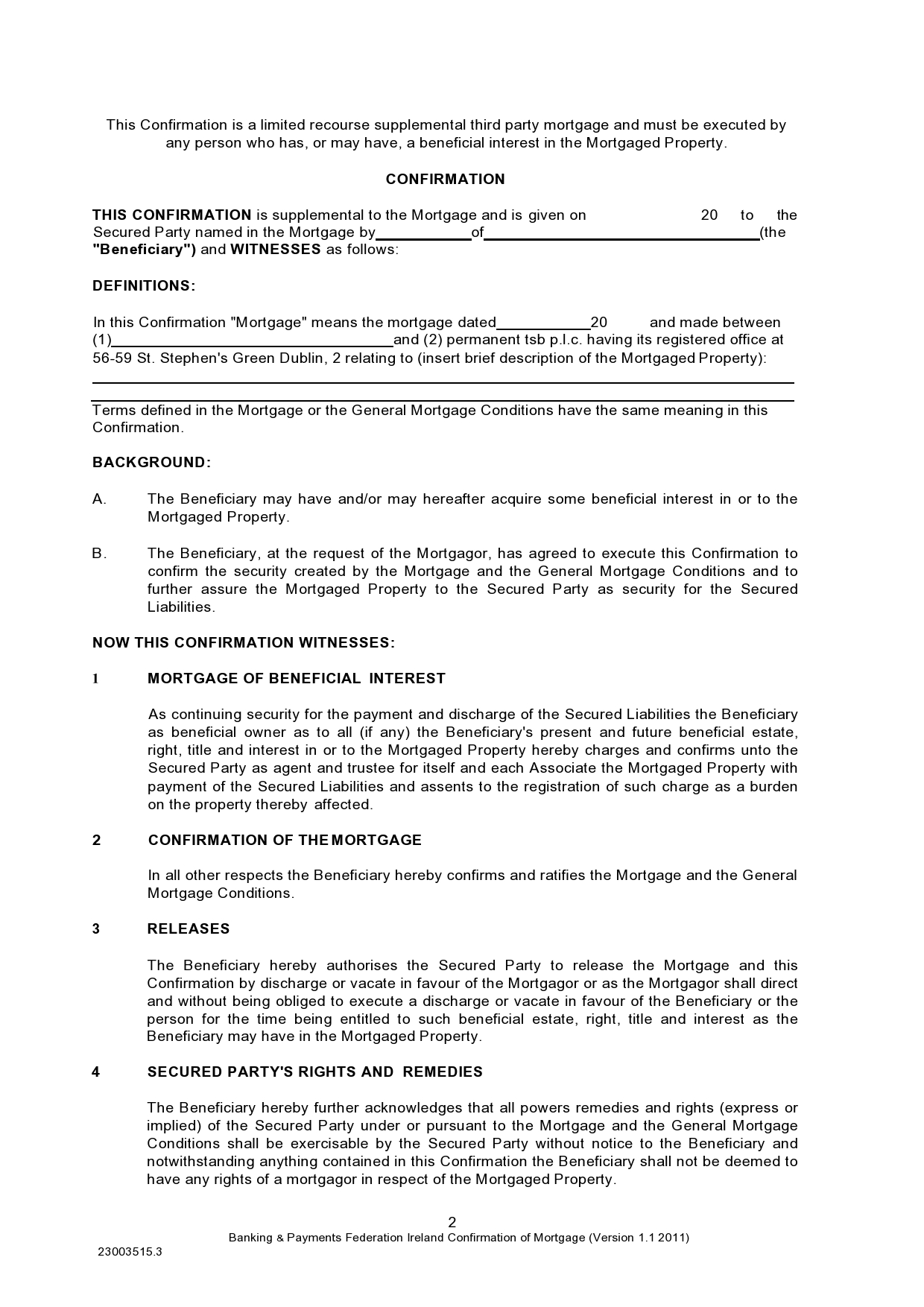

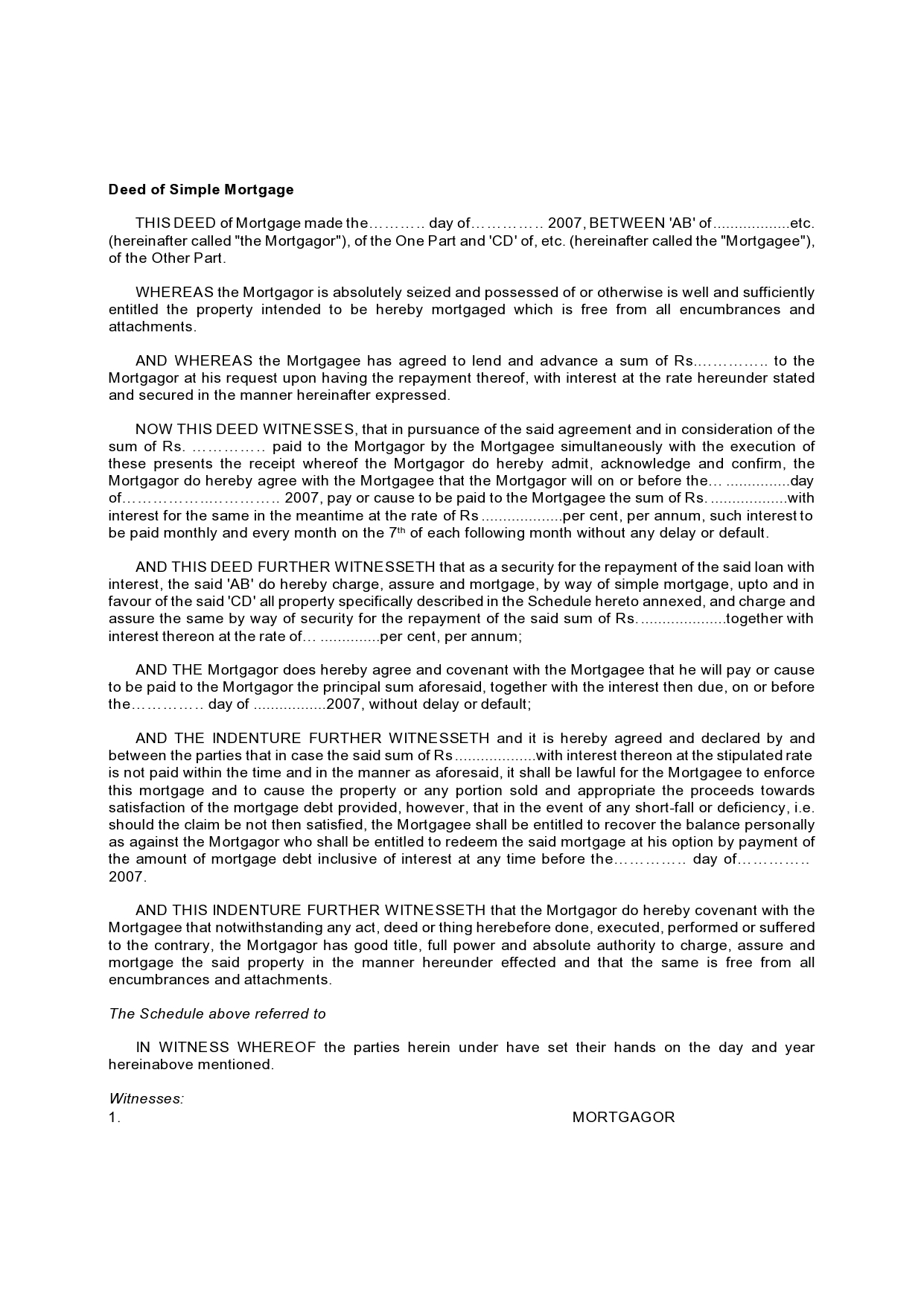

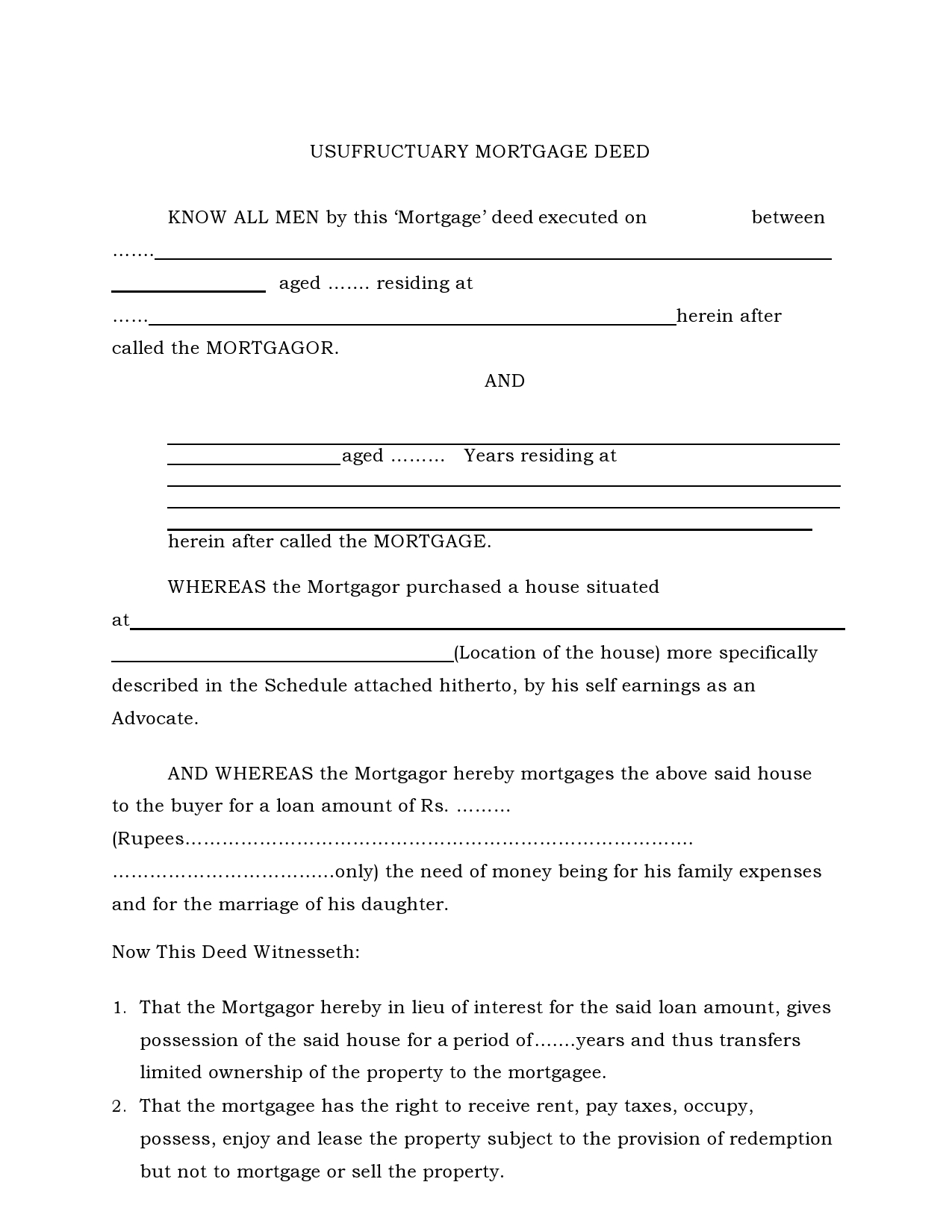

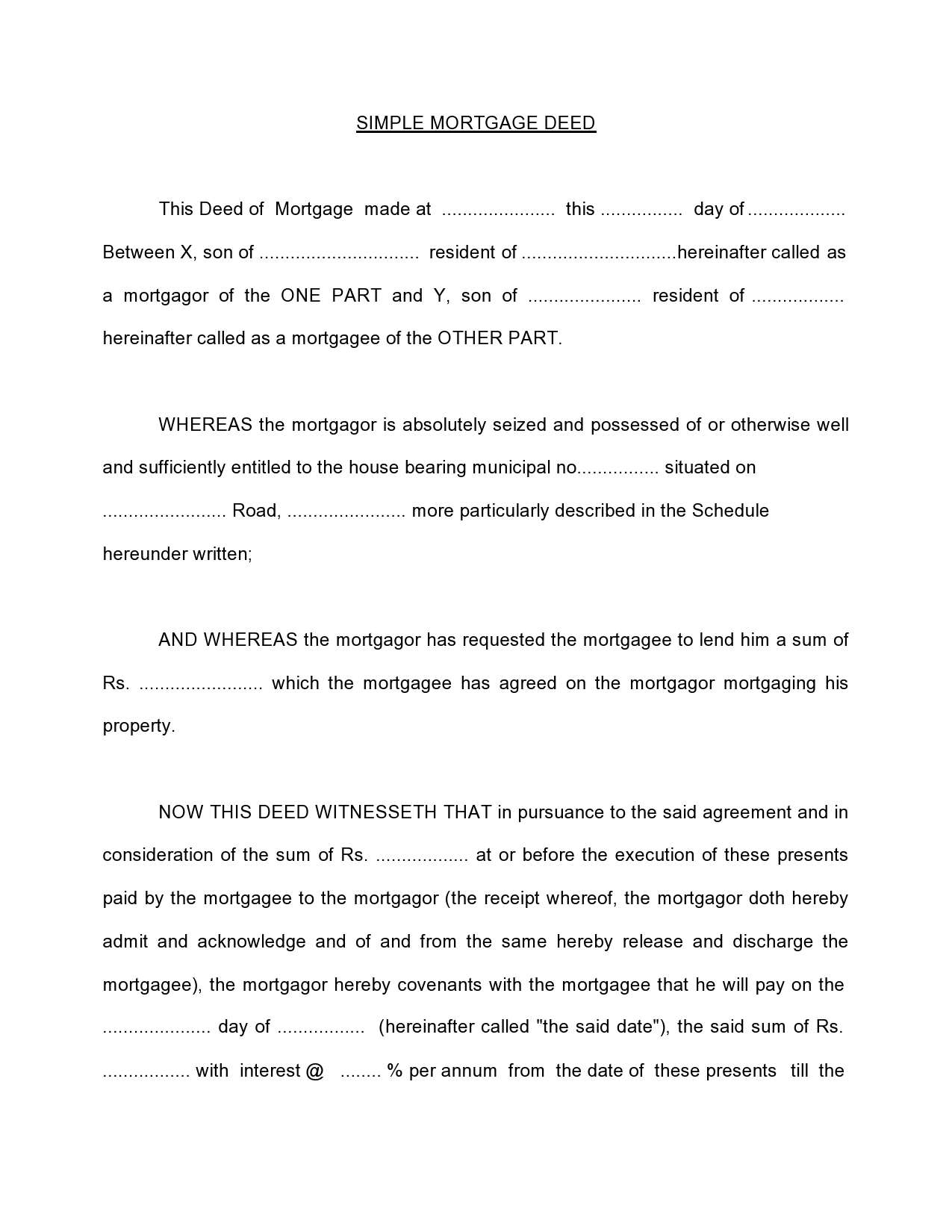

Mortgage Note Examples

Is a mortgage a deed or contract?

A mortgage is a legal contract that states that you will put real estate as security for a loan. Deeds of trust are also legal documents that promise the same thing but with a few additional stipulations. Deeds are different because of the additional party that has an interest in the property. Mortgages are just between a lender and the borrower without a third party involved with their own additional interest in the property.

What is the difference between a judicial foreclosure and non-judicial foreclosure?

Judicial foreclosure is done without a power of sale clause. This clause is present in a deed of trust agreement because of the third party’s interest in the property. The power of sale clause allows for the sale of the property in a non-judicial foreclosure.

Both kinds of judicial foreclosure are lender’s remedies when the borrower defaults. Mortgage agreements allow the lender to hold a foreclosure sale only after they have filed a complaint and received a judgment from the court. Foreclosures can take as long as a few years, which is why many people would prefer to have a non-judicial foreclosure.

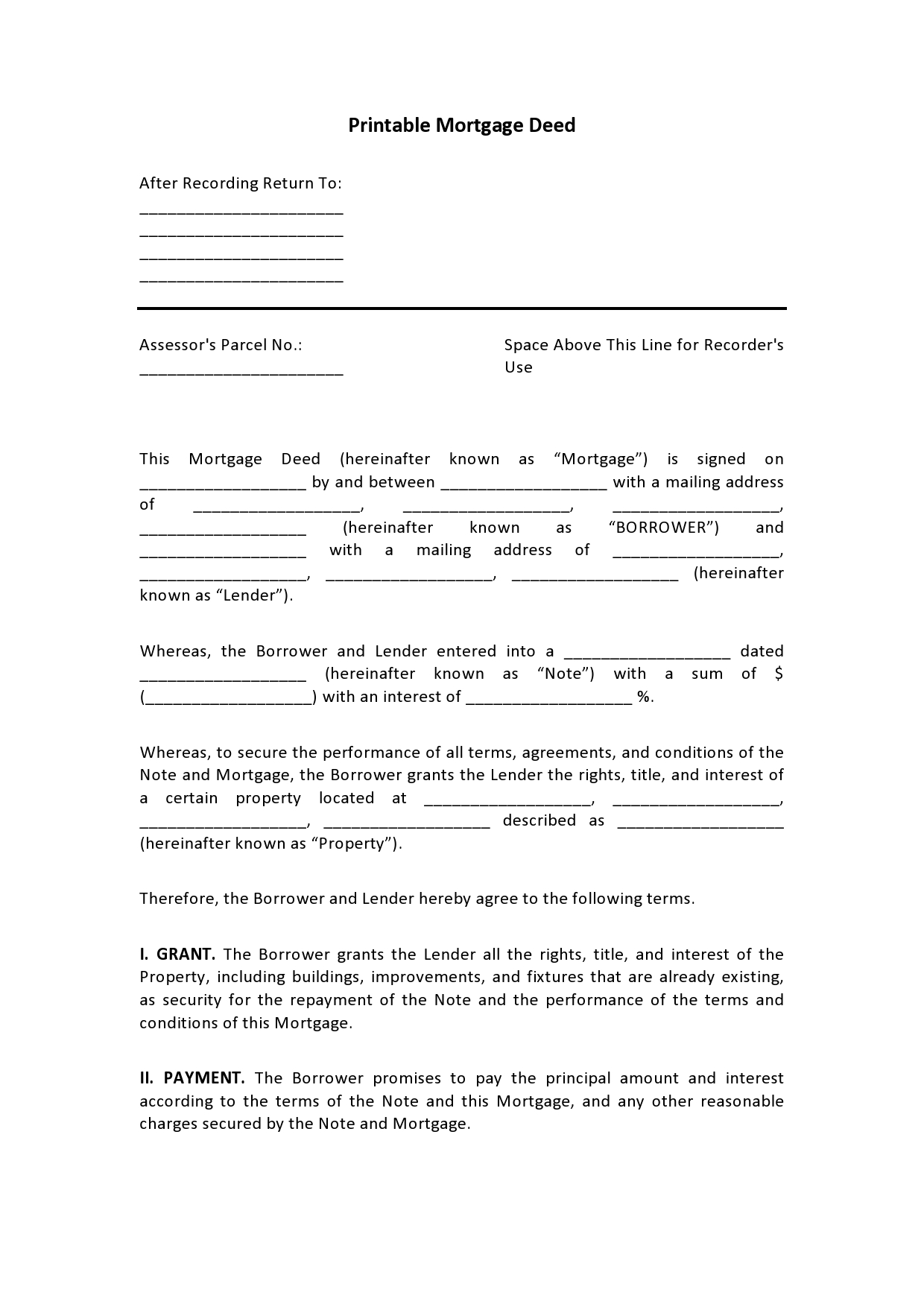

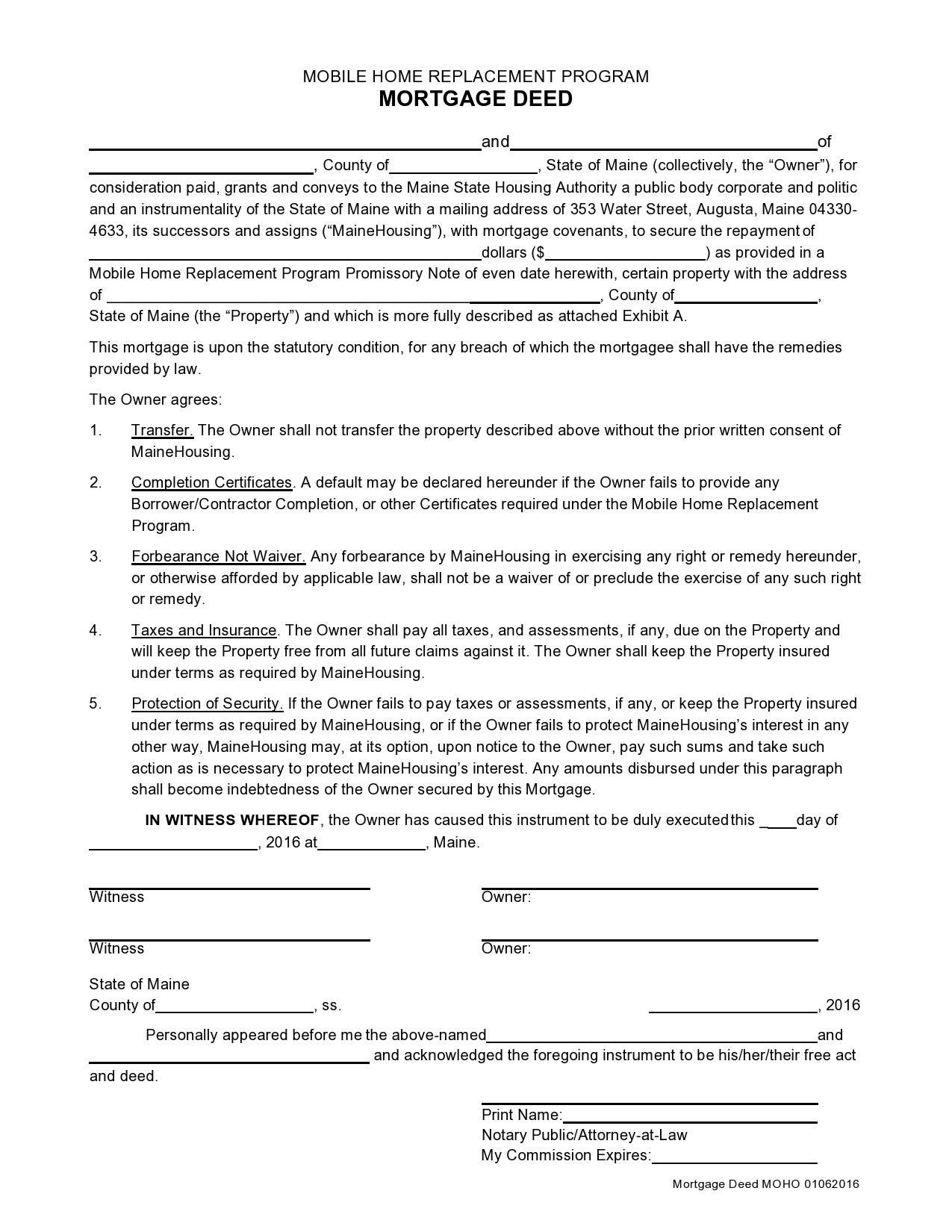

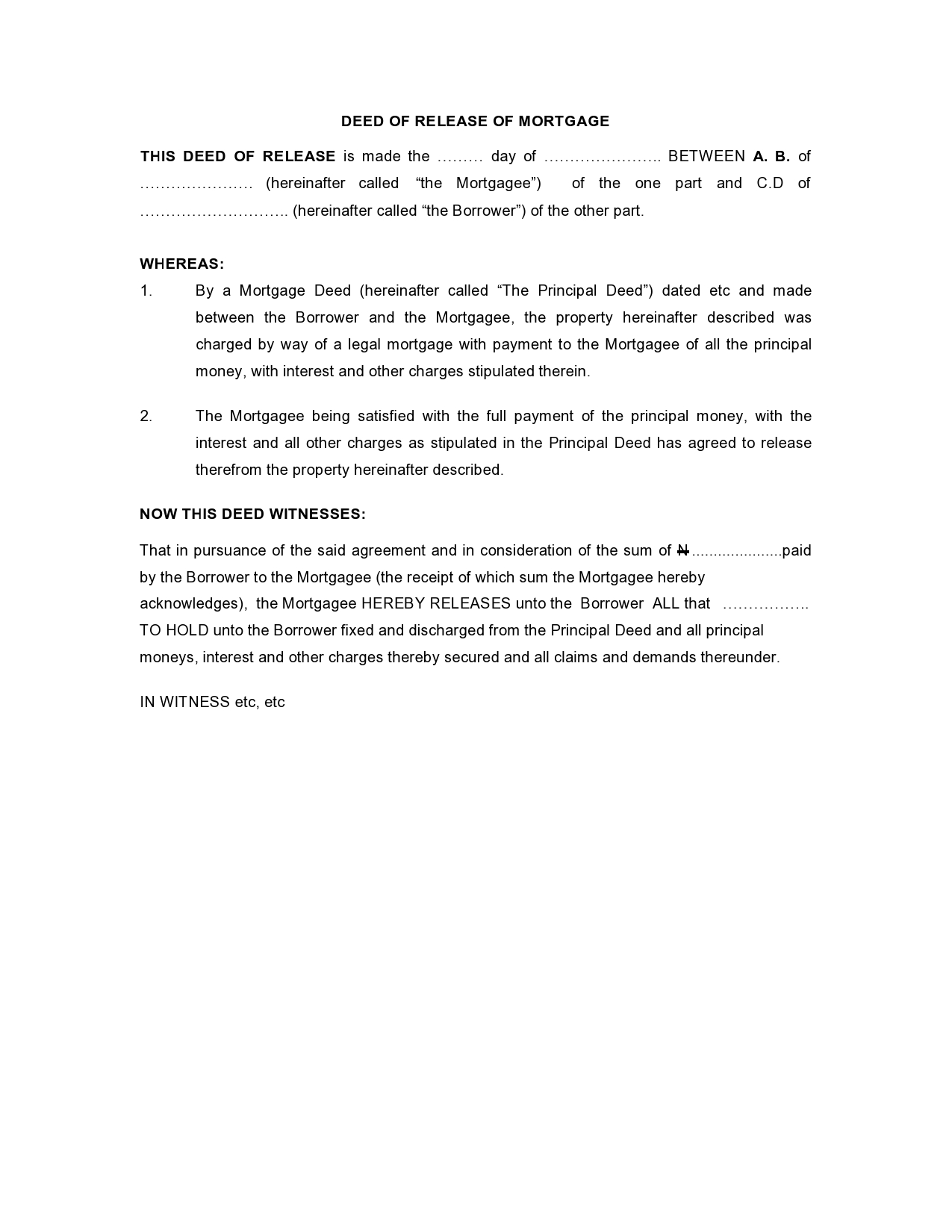

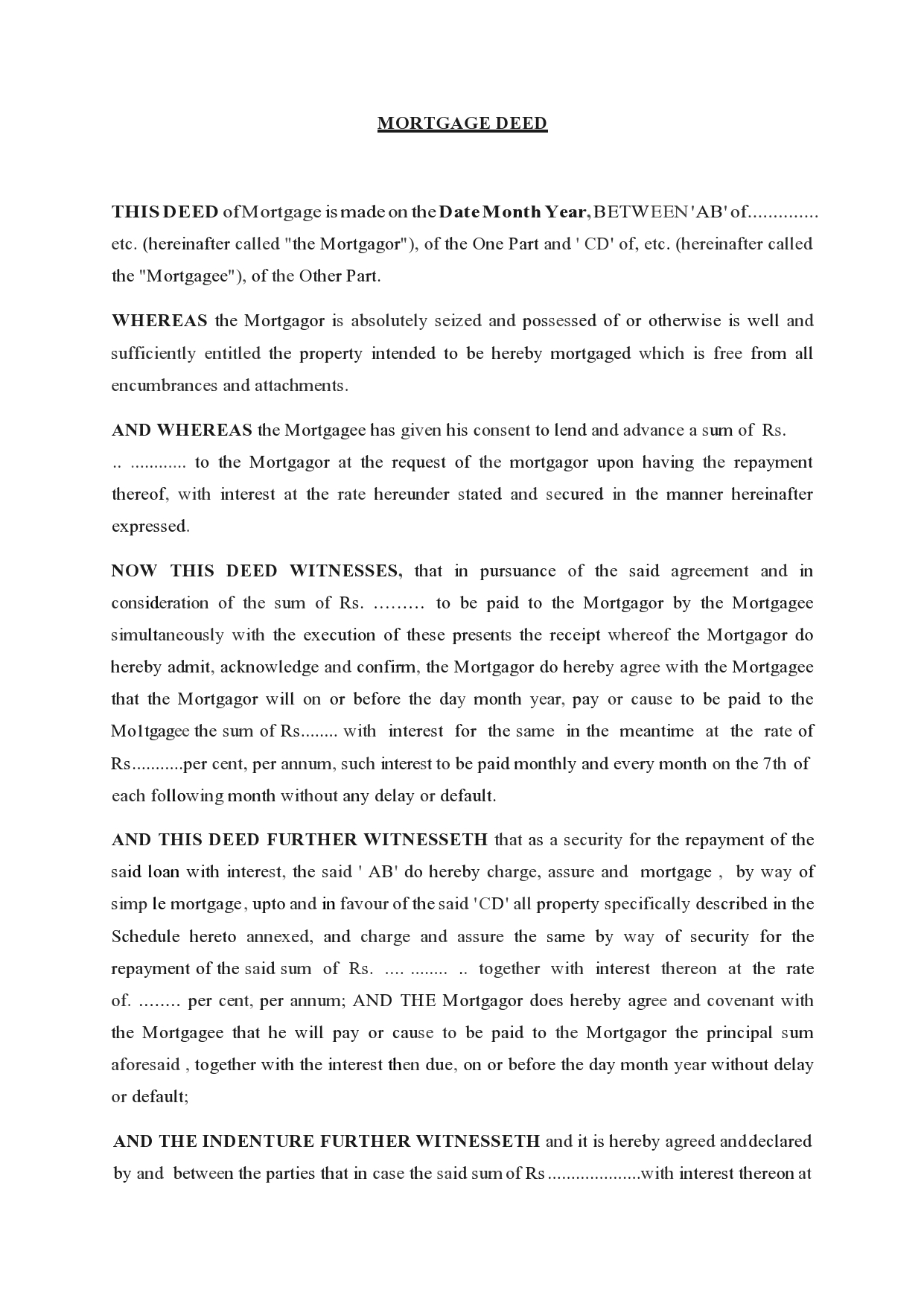

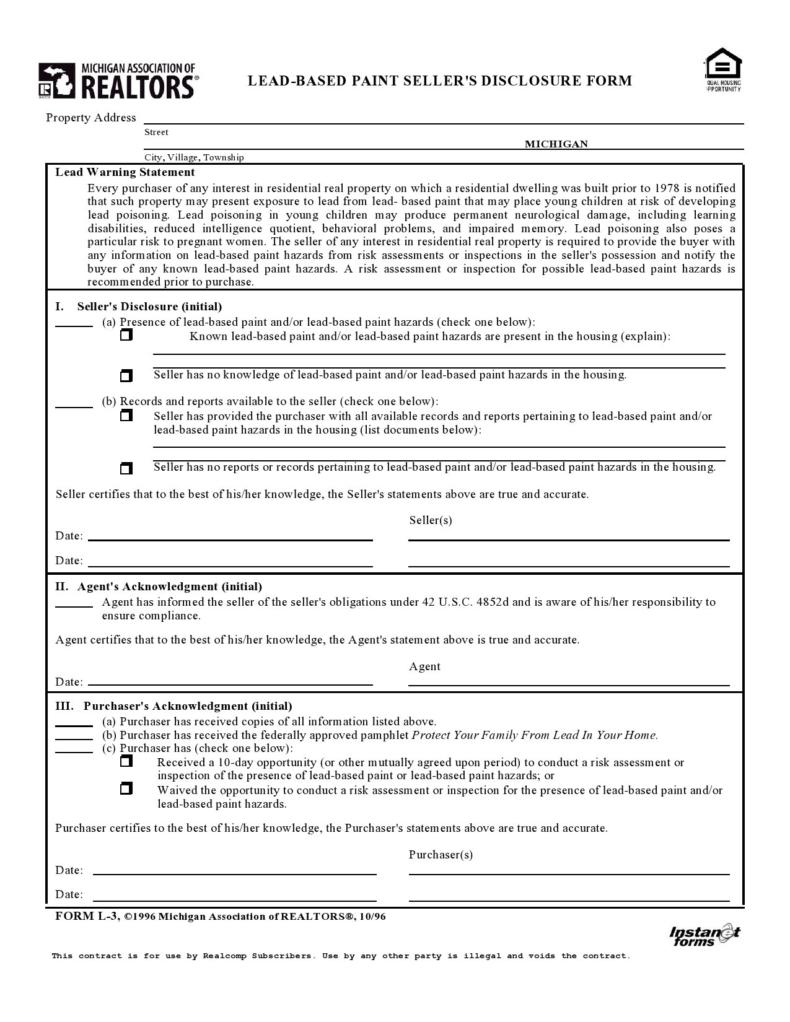

Mortgage Agreement Samples

How to write a mortgage deed

Mortgage deeds address the relationship between the lender and the borrower so that both parties are clear about their responsibilities and rights. Writing this document correctly is important if you want to be sure that you can use your mortgage deed in the situations that it is made to address, such as foreclosure.

- Who is Involved in the Contract: The borrower and the lender both need to be listed on the mortgage deed. You will need to use the full legal names of both parties. No nicknames are allowed. Make sure that the address and contact information for each party are listed as well. The more information that is included in this part of the document, the better so that the correct parties are properly described. You will need to be sure that there is room to have signatures at the bottom of the document and that witnesses and a notary will also have space to sign, but these other parties do not need to be indicated in this part of the document.

- Information About the Property: The property information needs to be clear in this section of the document. This is the exchange for the principal plus interest, and it is what grants the lender legal title or ownership of the property while the borrower repays the loan in question. The information about the property needs to be accurate for this document to be legally binding, so this section cannot be missing. You will want to put the address of the property as well as a description of what the property is like in this section at a minimum. If there is land that is associated with the property, you will also want to indicate that this asset is part of the property loan and the mortgage deed. The information that is included in this part of the mortgage deed will be useful in the future when the loan is paid off or if there should happen to be a foreclosure sale that must be done when the loan is defaulted upon.

- End of the Agreement: The end date or the ending actions that will make the contract complete need to be listed in this part of your mortgage deed document. You will usually just indicate that this agreement is complete when the loan is paid in full, but there could be other arrangements that you want to have in place that have to do with satisfying the loan as well. Anything that must be done to complete the loan process and finalize the end of the mortgage deed’s purpose must be laid out here so that both parties are aware of what is required.

- Principal and Interest: Home loans always have some principal amount that is due to satisfy the loan, and there will be interest that must be paid back as well during the life of the loan. The interest is the reward for the lender for servicing the loan and granting it in the first place. This interest is linked with the interest rate on the loan, so there will need to be some calculations that determine what the total interest will be during the life of the loan. Principal and interest are part of nearly every kind of loan that exists, and familiarizing both parties with interest and why it is charged in such a manner on this loan is important. New home buyers might not be aware of the impact on the total cost of their mortgage that interest will have. Having the facts laid out on paper about the total interest and what it will amount to will help to eliminate confusion and hard feelings about the interest that is being charged down the road.

- Assigned Rents: If the borrower is leading out the property while they are paying on the mortgage deed, the rent amount needs to be included in this document. This is a major factor in paying off the mortgage deed’s associated loan, and the rent amount can often be linked directly with the payment that is being made on the loan. The rents assigned to the property can also end up being paid to the lender in the instance of foreclosure.

- Covenants: The borrower will need to promise ownership of the property and authority over the property to the right parties in the case of a default on the loan. This will be the lender until the loan is satisfied. This section does not have to be included, but there are instances where this clarification is necessary.

- Maintenance of the Property: Borrowers are required to keep the property in good condition and to keep insurance in place to protect it while the loan is in place. This is one of the most common requirements of any loan of this nature, and the mortgage deed is no different. If you do not have insurance in place for your property while there is a loan on the asset, this can lead to losses that cannot be recouped by you or the lender.

- Payment: If you want to indicate how the payments will be made to satisfy the mortgage deed, you can indicate the way that you expect this part of the transactional process to be done each month or each quarter, etc. The more clarity that exists about the way that payments will be made, the more likely it will be that you and the lender are on the same page about the repayment of this loan. This is not always required as many lenders will accept money in any format that it is offered to them, but if there are required ways that you should make the payment each month, then this must be laid out in the document clearly.

- Signatures: The signatures of the borrower and the lender need to be at the bottom of the document, and there need to be witness signatures as well. A public notary will also need to witness the signing and indicate their own stamp and signature. These signatures must all be present for the document to be legal and enforceable. You cannot opt not to exclude any of these signatures if you want your mortgage deed to be valid and useful to you.

Mortgage Deeds Are Often Essential to Property Owners

If you are buying a property and you want to have some protection from the long-term foreclosure process as well as have a clear and accurate description of the relationship between you and the lender, this is the right document for your needs. You can draft your own mortgage deed, but you do need to be sure that all the right information is included in it for it to be an effective document that you can use in a court of law or during a dispute with the lender.

Mortgage deeds can be used in some places in place of mortgage agreements, so in some states, this document will be used for the same purpose. Mortgage deeds are a required document in some states, so you will need to be sure that you know how to draft this kind of document and that all of the right information is included in it when it is completed and signed.