Engineers, doctors, surgeons, architects, marketers etc. are all great and reputable professionals but you will often find some of them drowning in debt or engulfed in other financial problems. This is mainly because their academic discipline has prepared them to perform a certain task impeccably but hasn’t prepared them to effectively manage their finances. If you dream to live your life without facing any financial difficulties then rather wasting your time sitting in the pews of church and day dreaming about financial paradise, you should hustle up start taking some actions. The first and the foremost thing you should do is to educate yourself about the basics of personal finance, so that at least you can calculate your own financial position and can then plan to improve it.

Table of Contents

When it comes to planning one’s life, most professionals find themselves uneducated about finance in order to make astute financial decisions for their future. This is where finance professionals, who know how the money works, have an unfair advantage. But the subject of money management and personal finance can easily be learnt by anyone.

We don’t mean that you need to become some finance geek in order to make good personal financial decisions, but at least you should know the basics of personal finance in order to avoid falling prey to greedy bankers who use complex terminologies that represents a very simple idea.

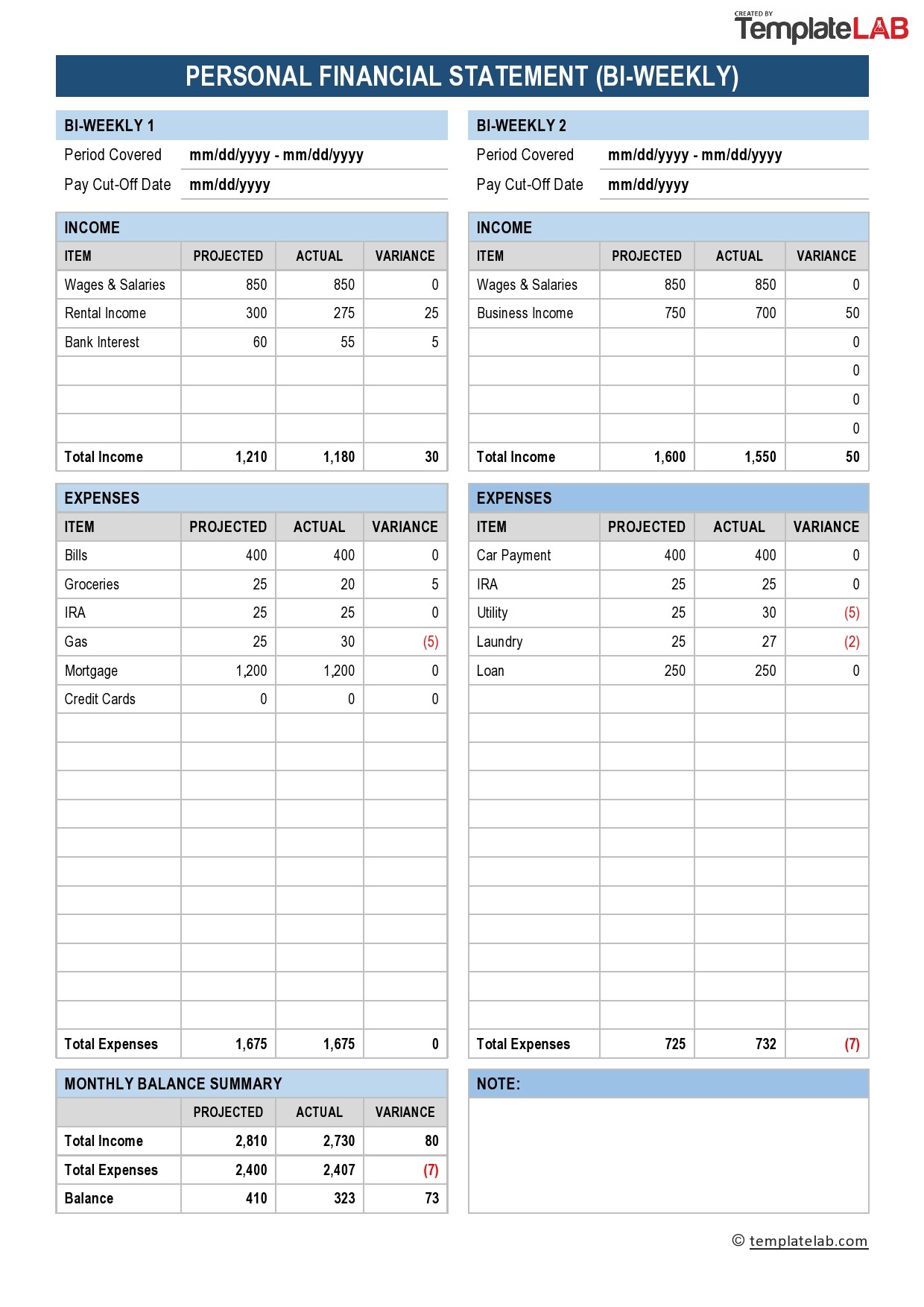

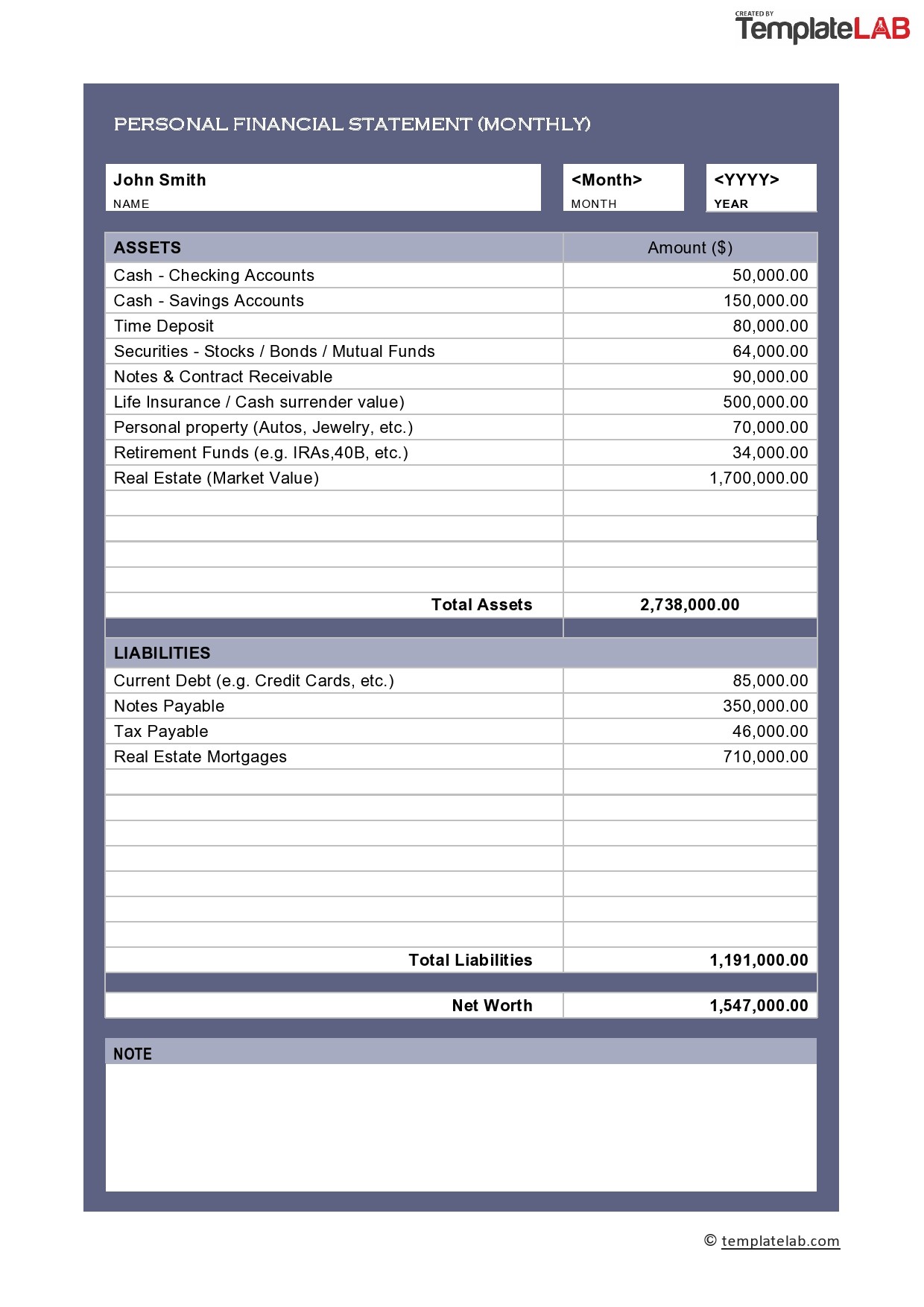

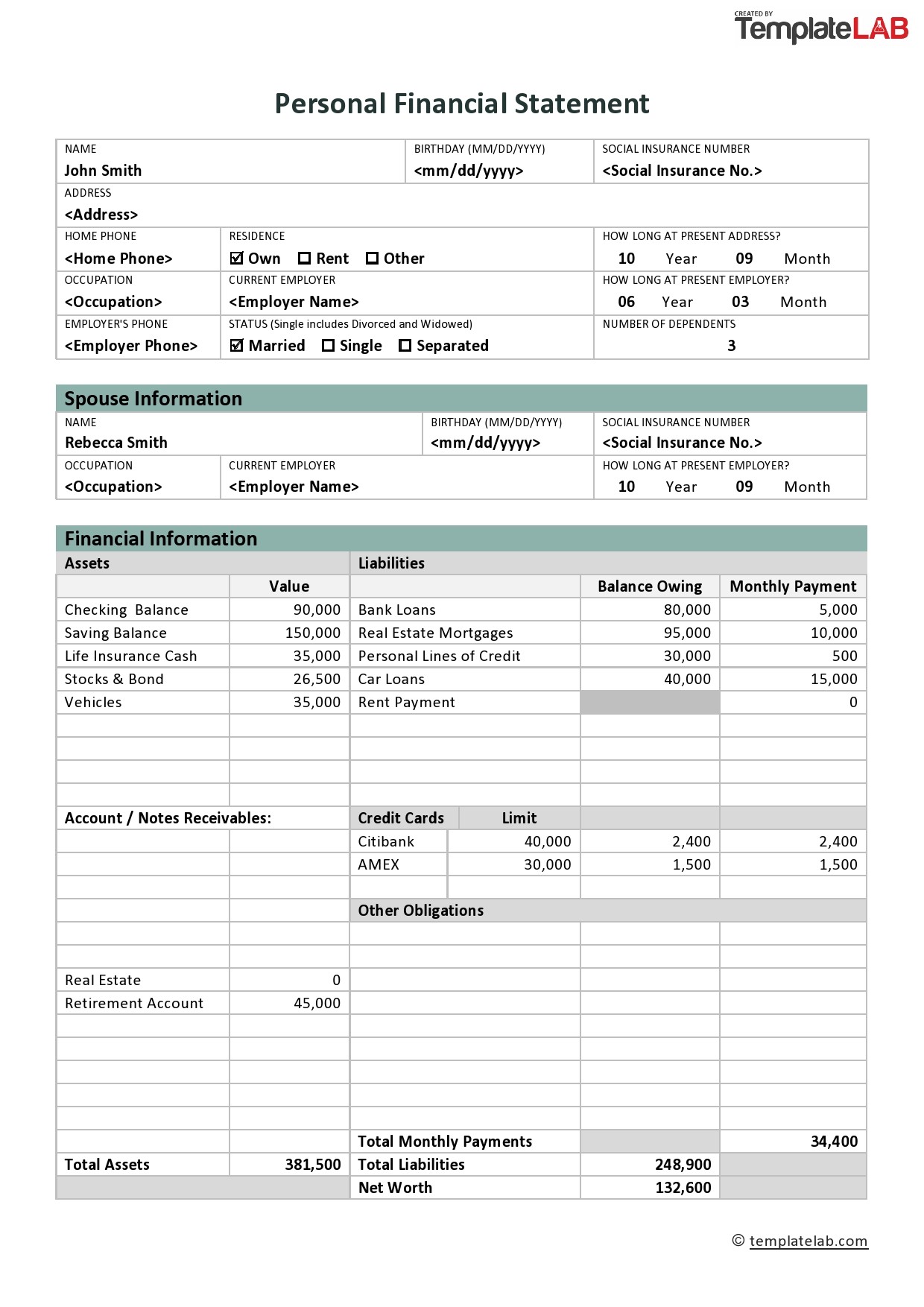

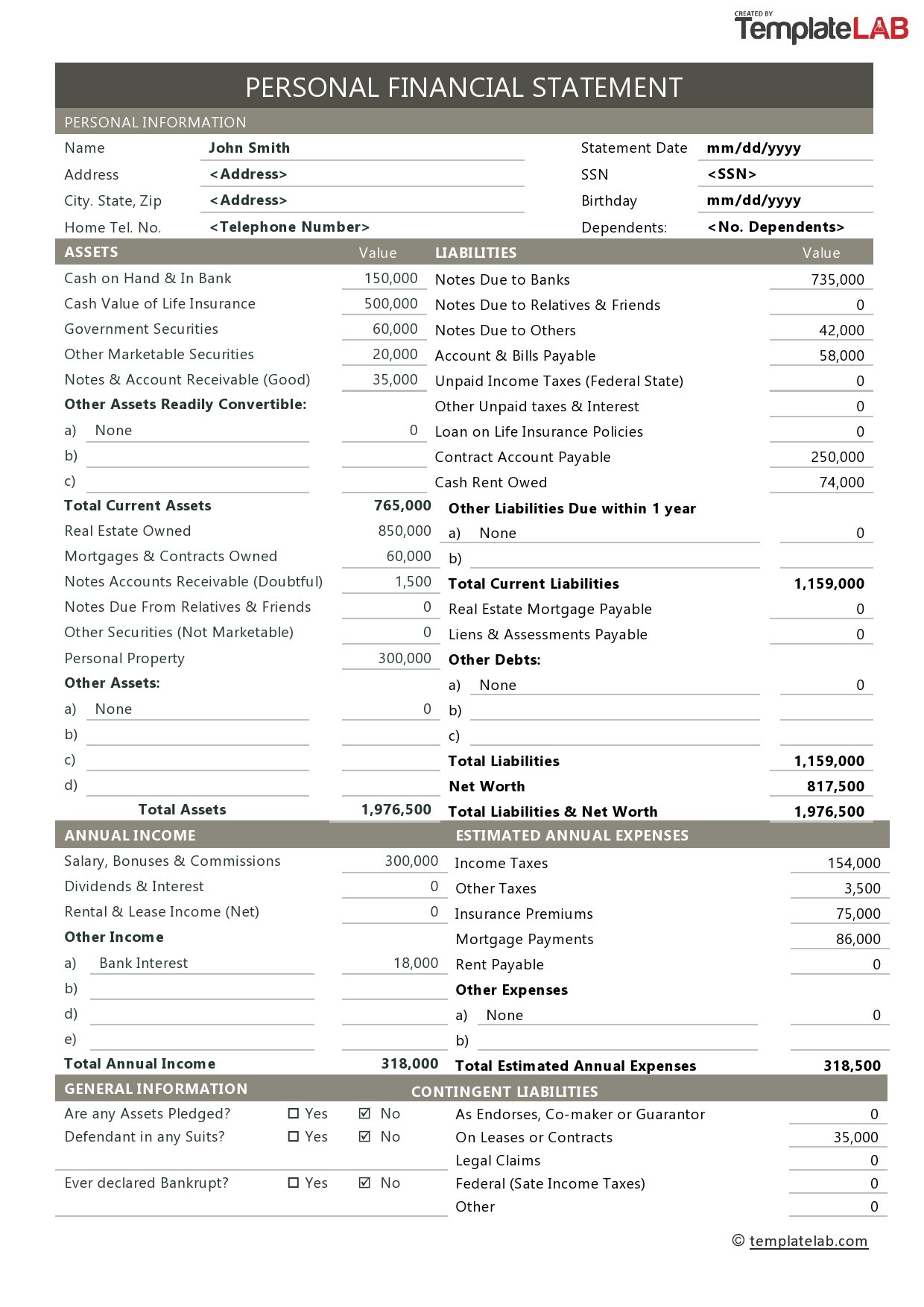

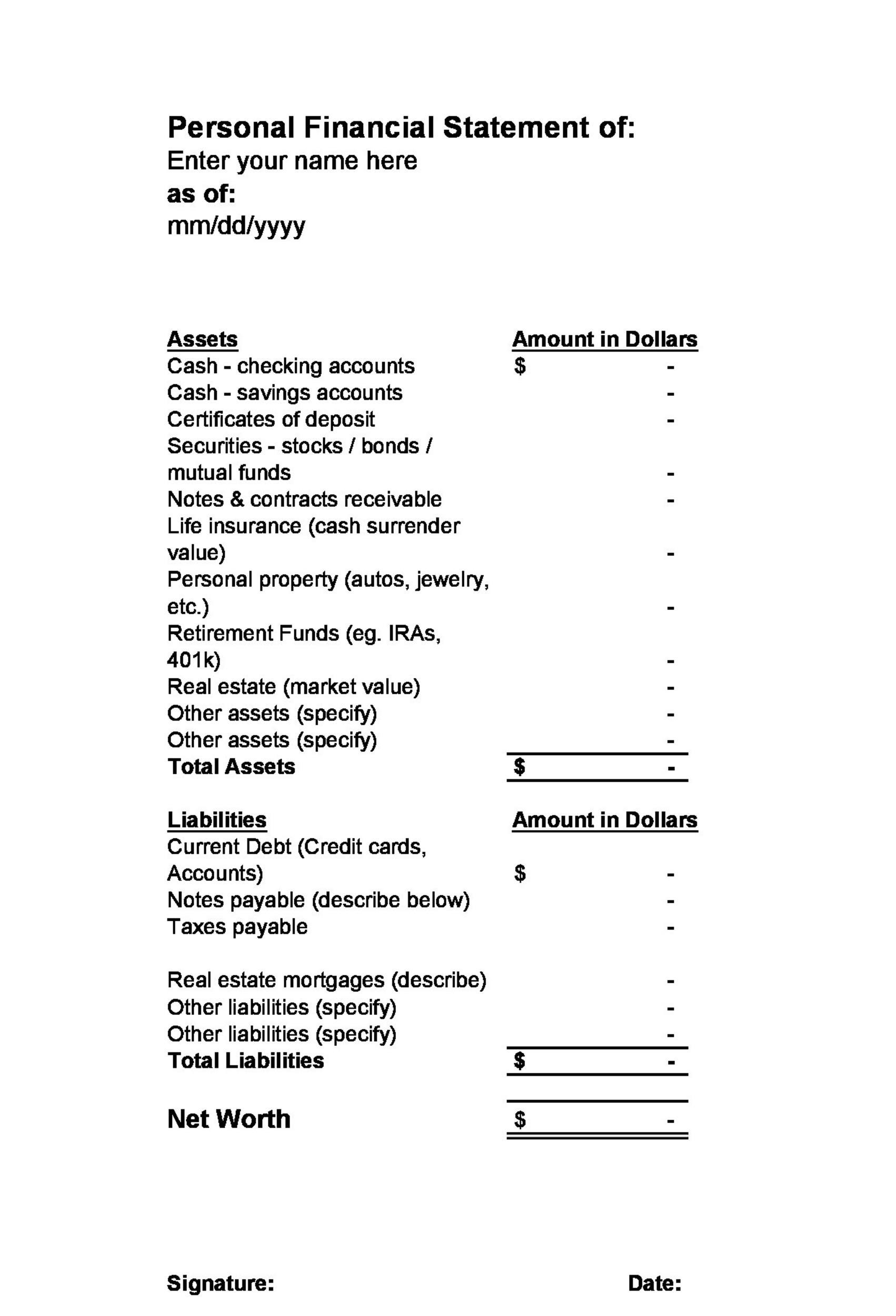

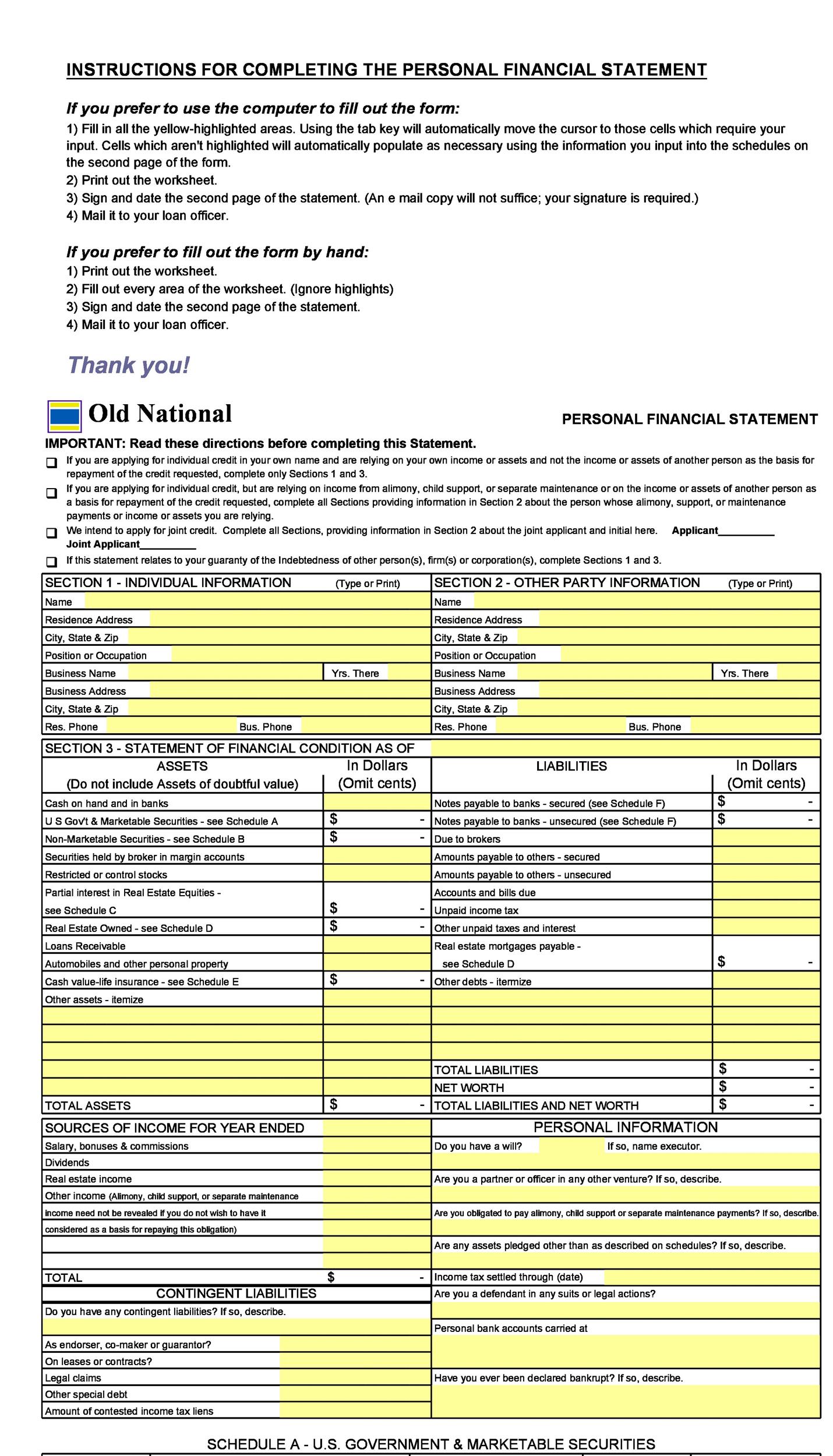

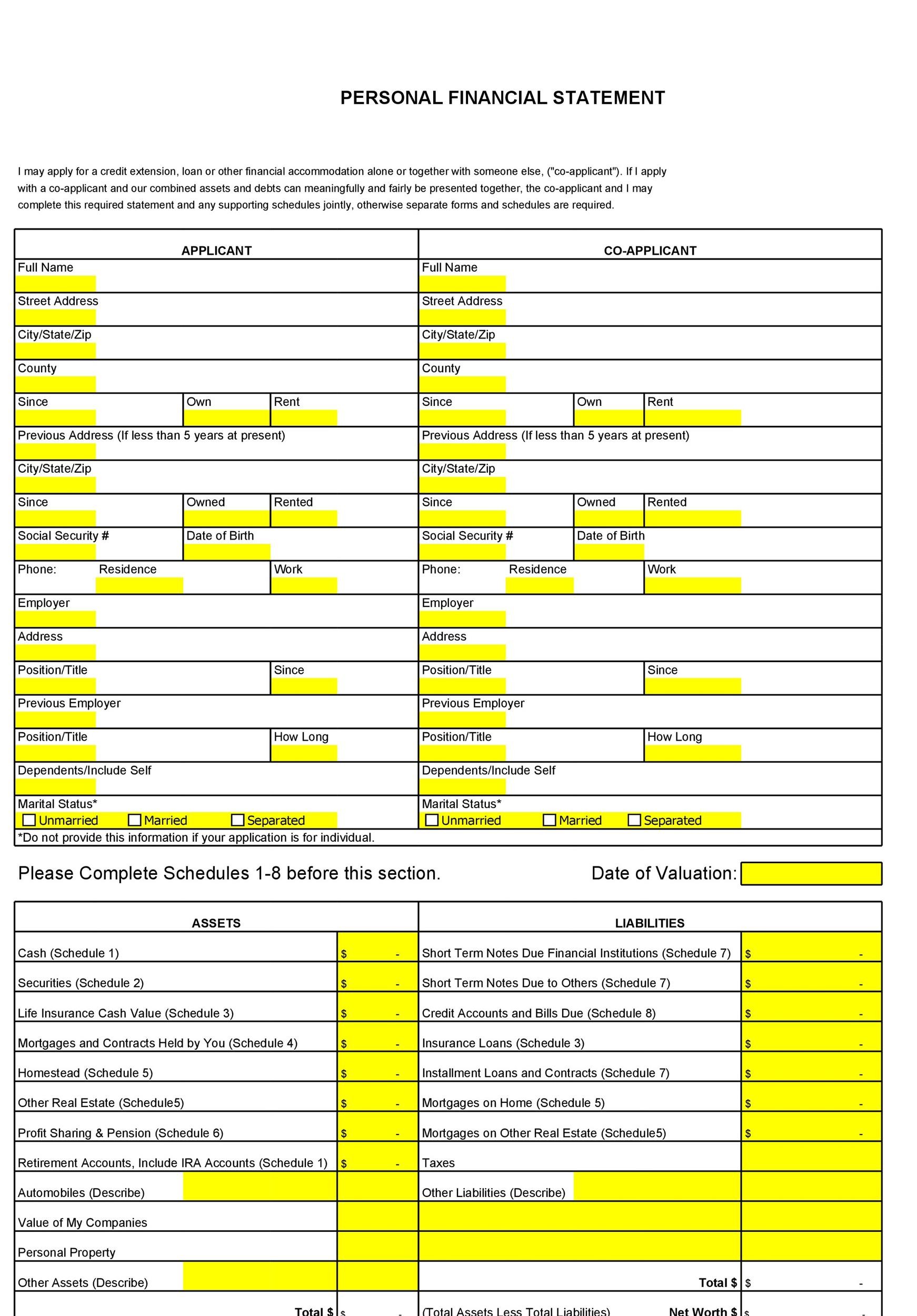

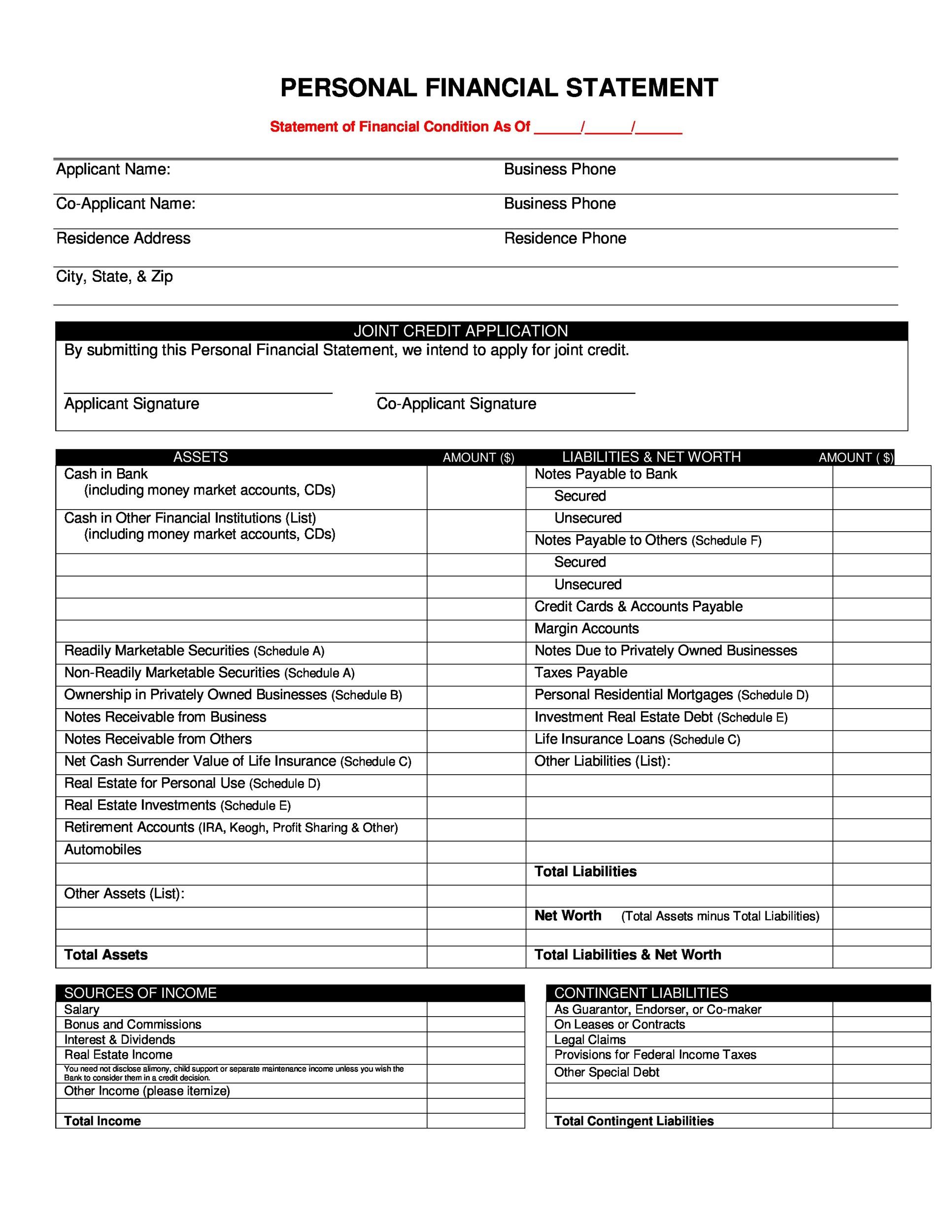

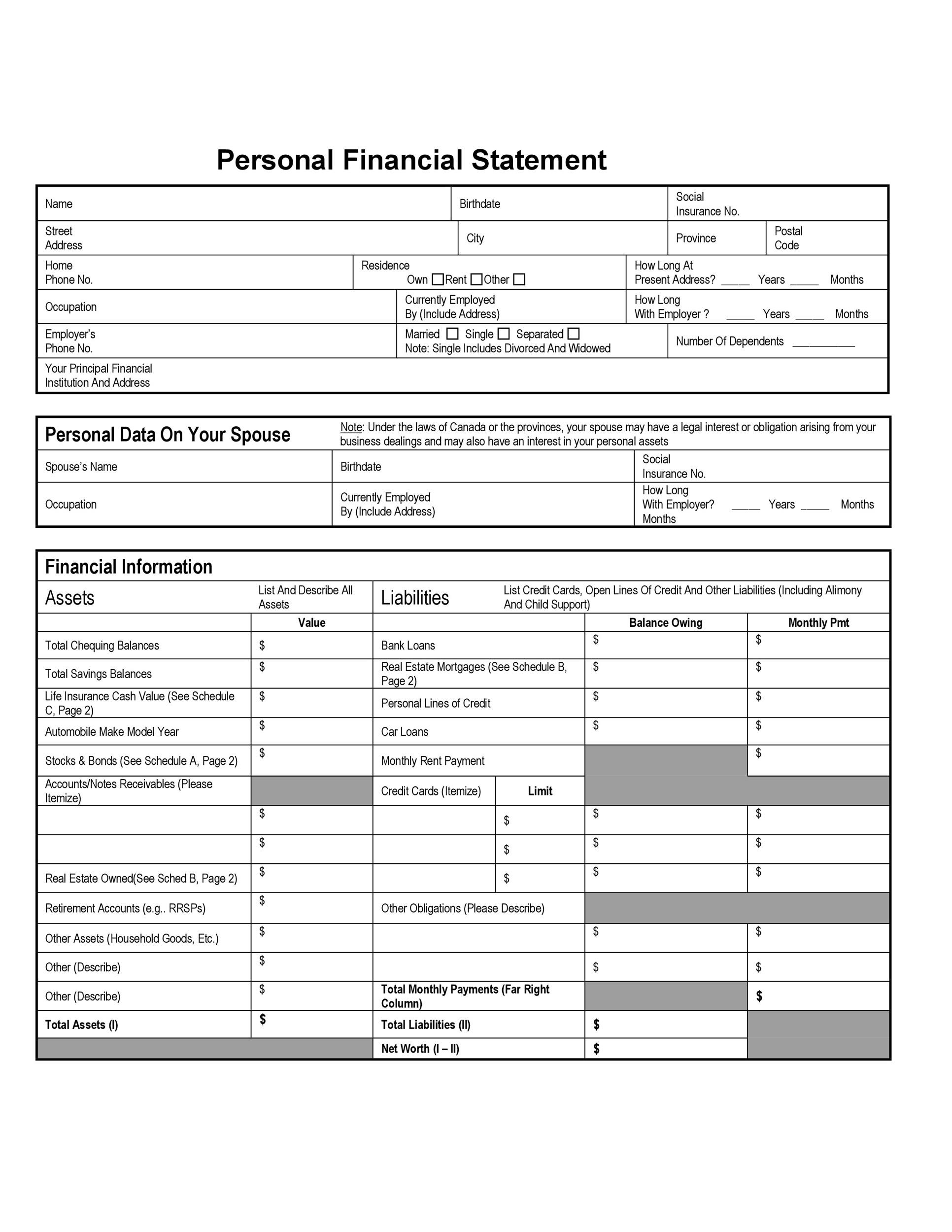

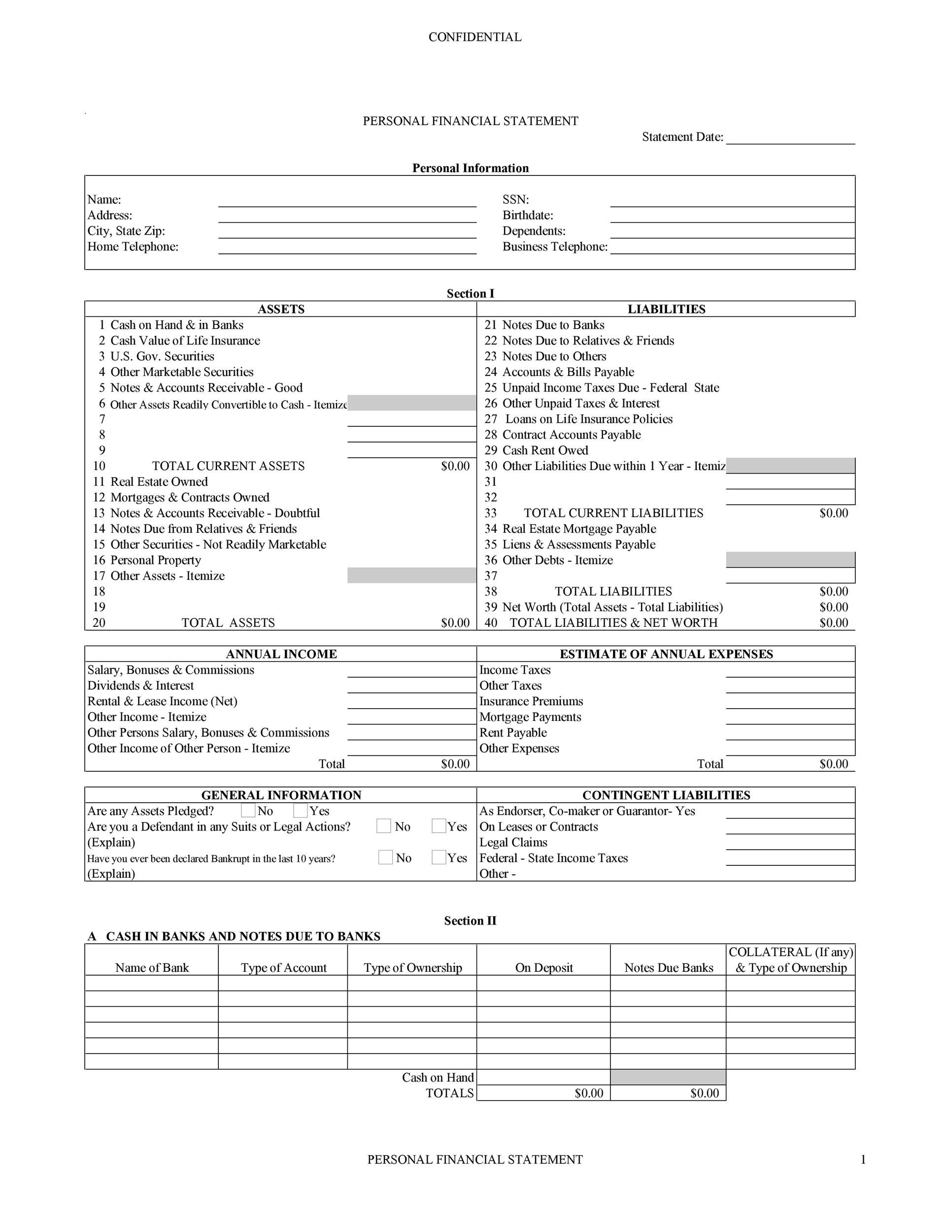

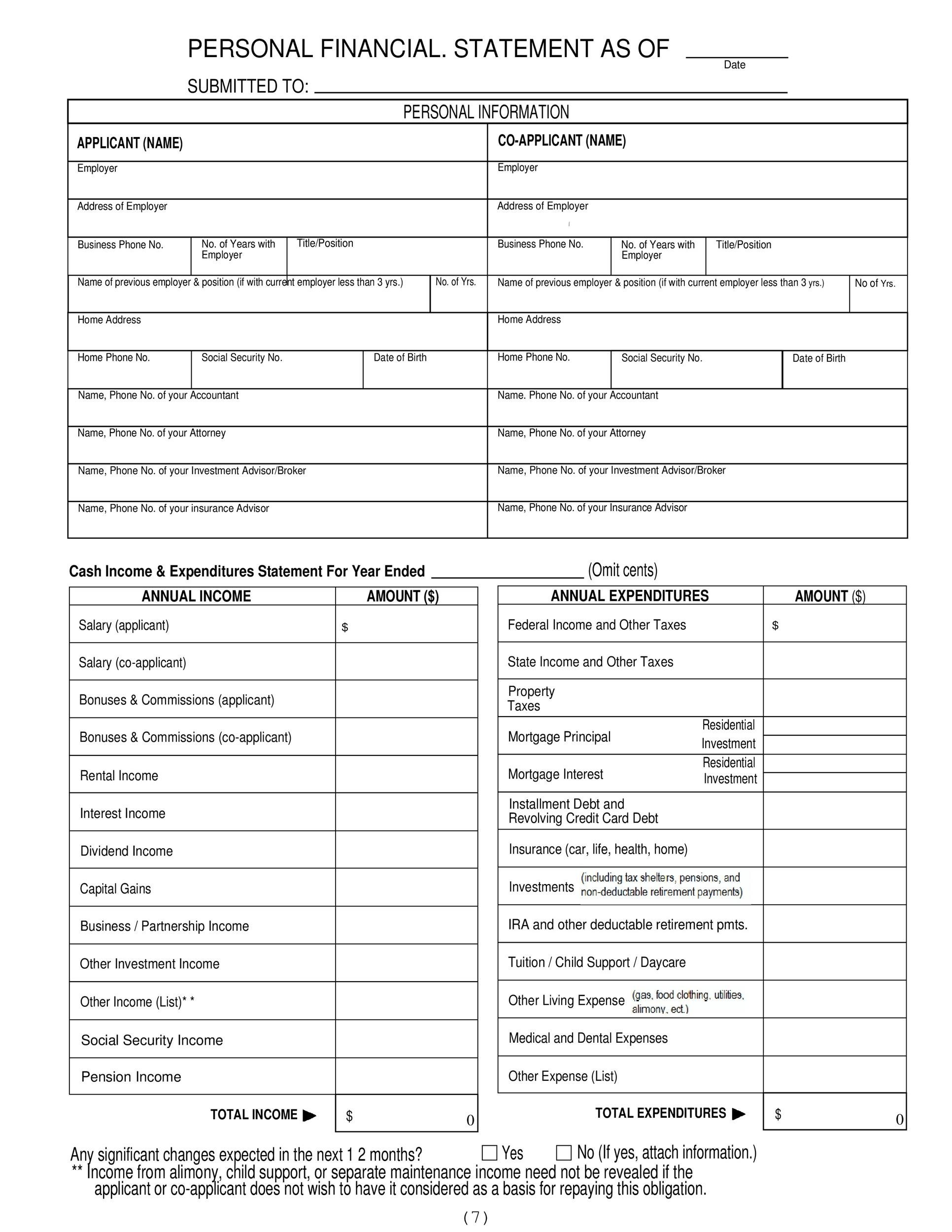

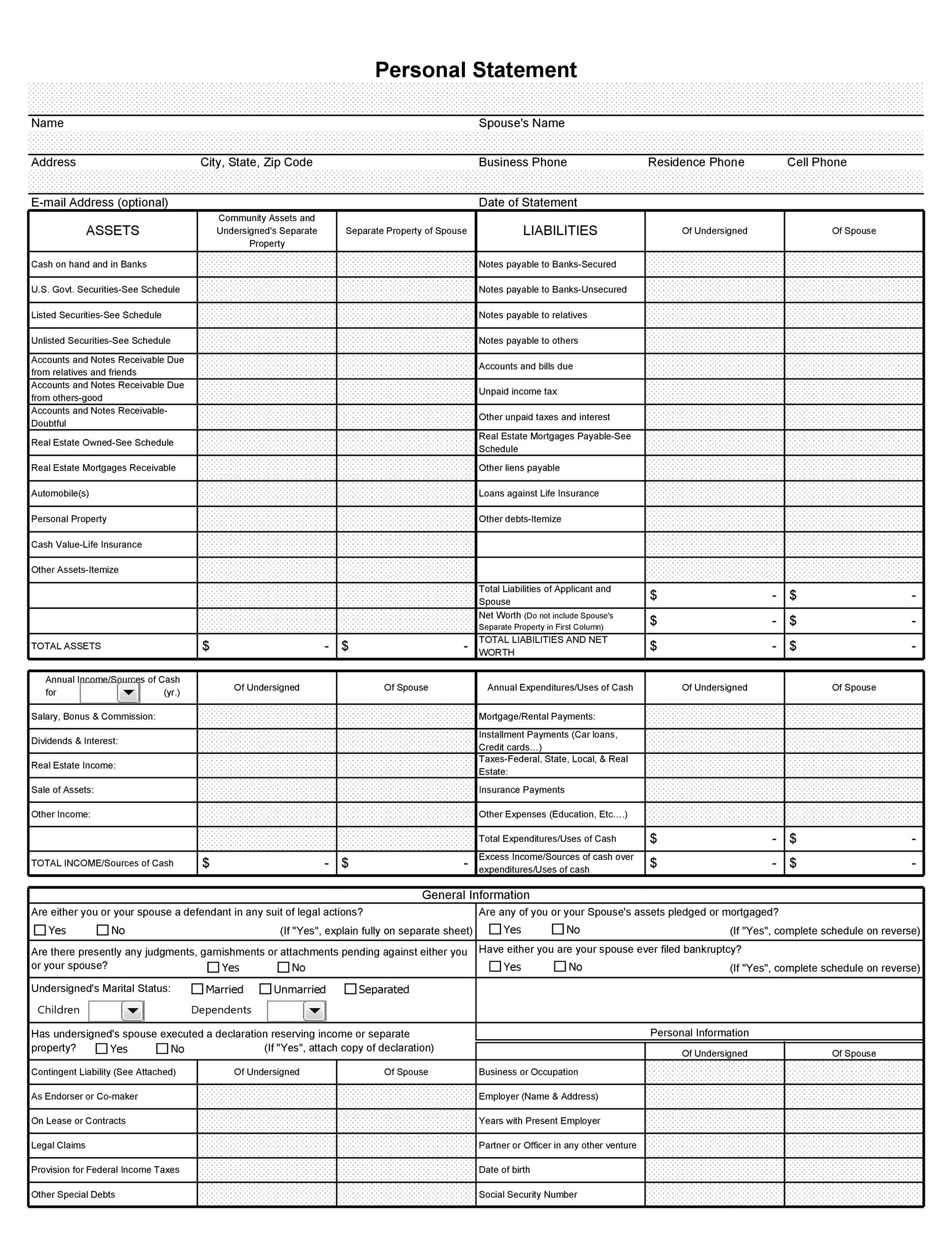

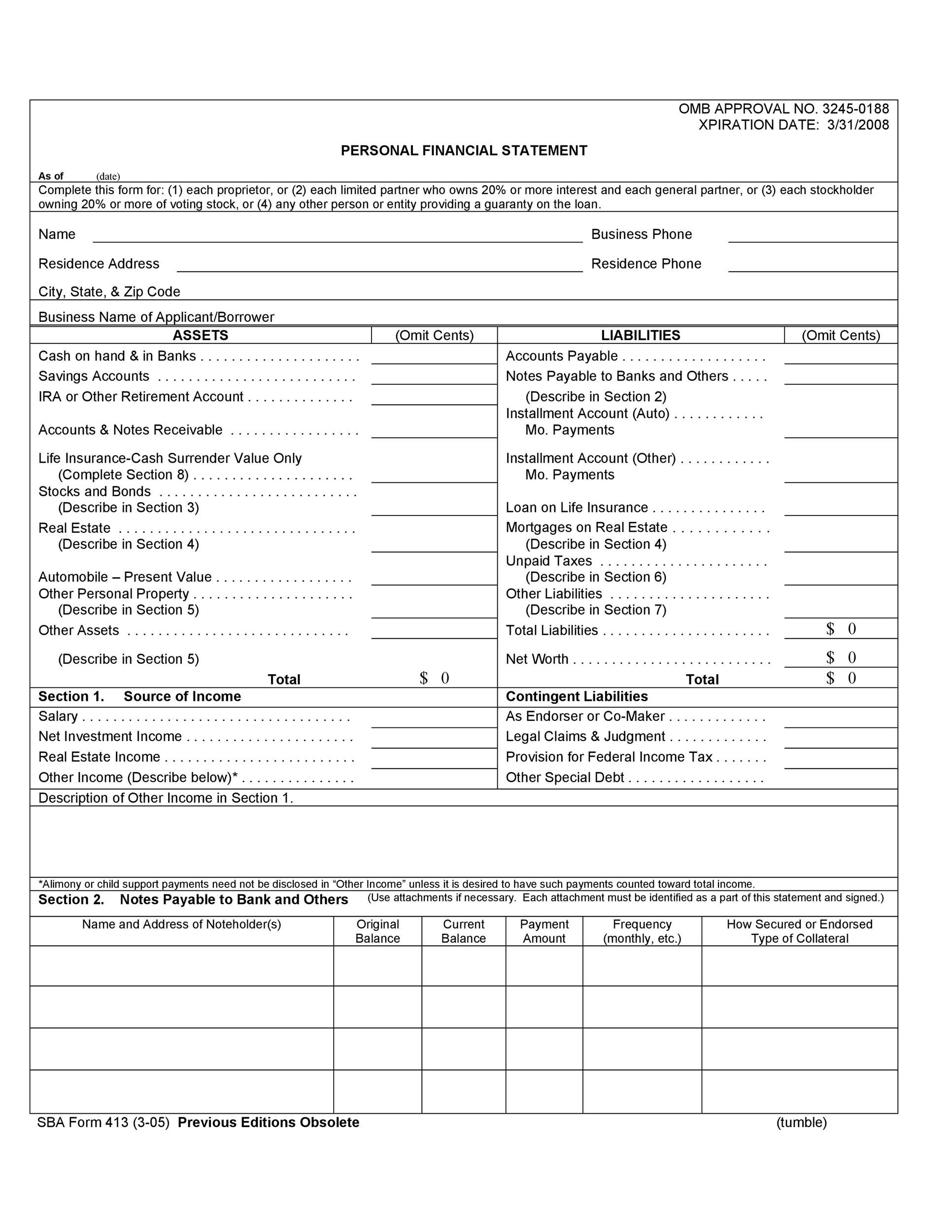

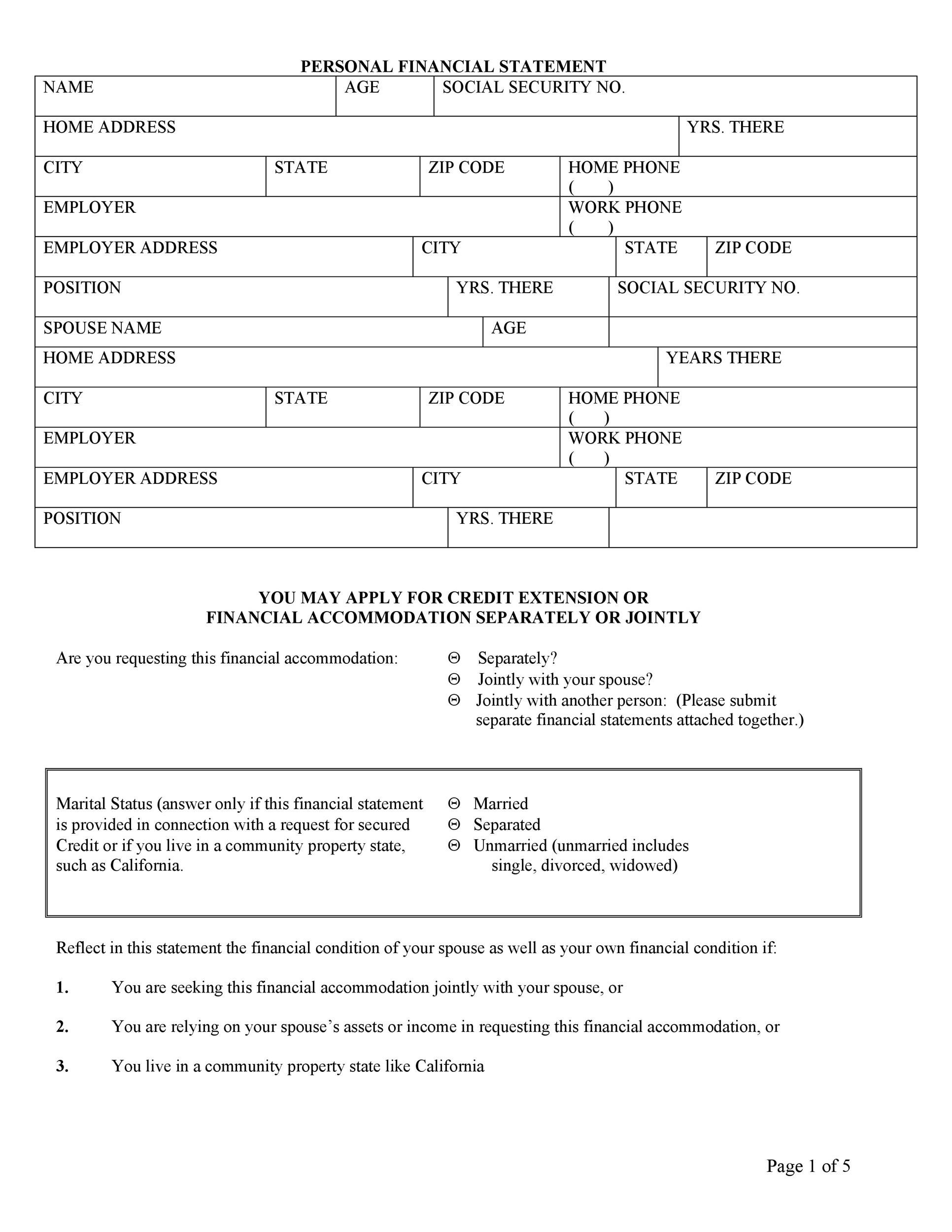

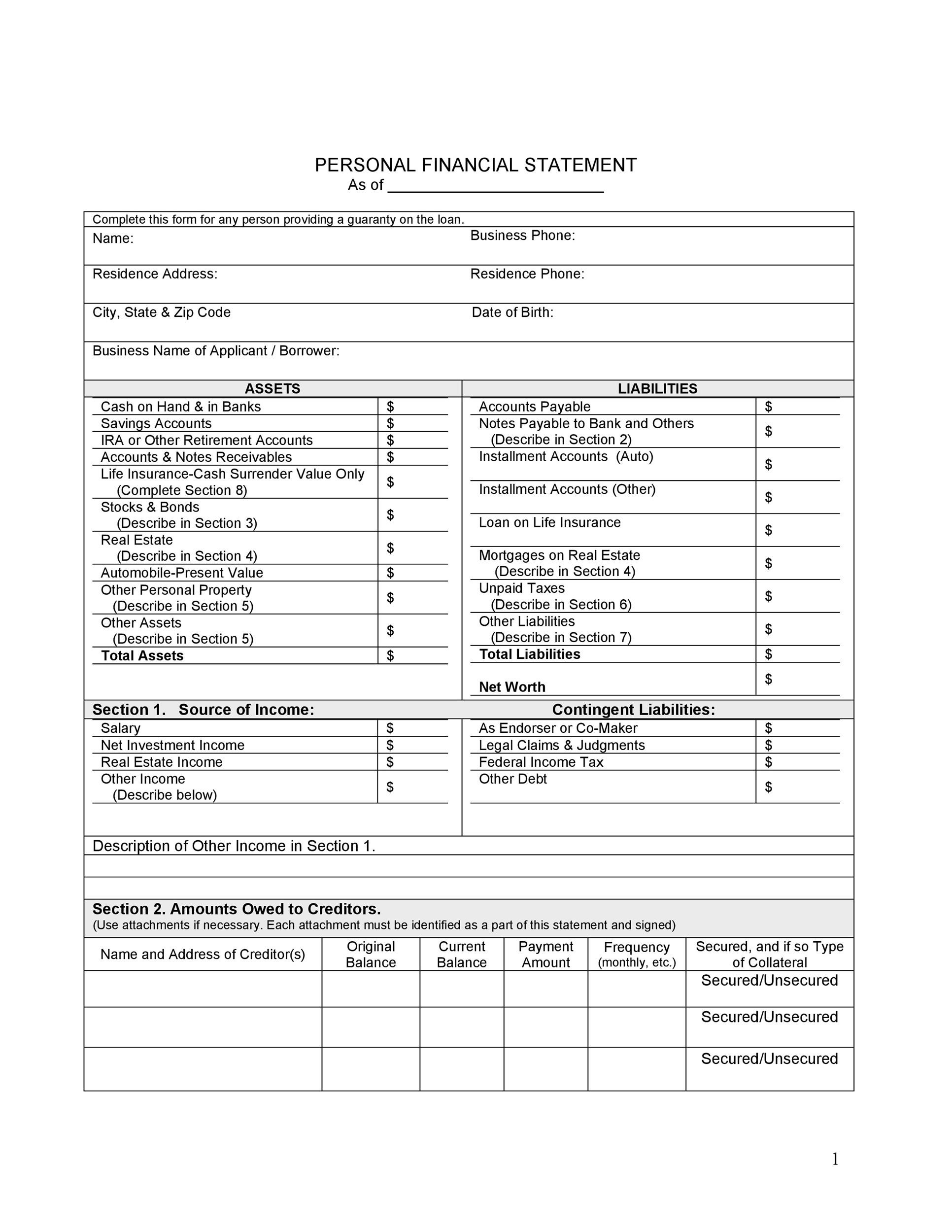

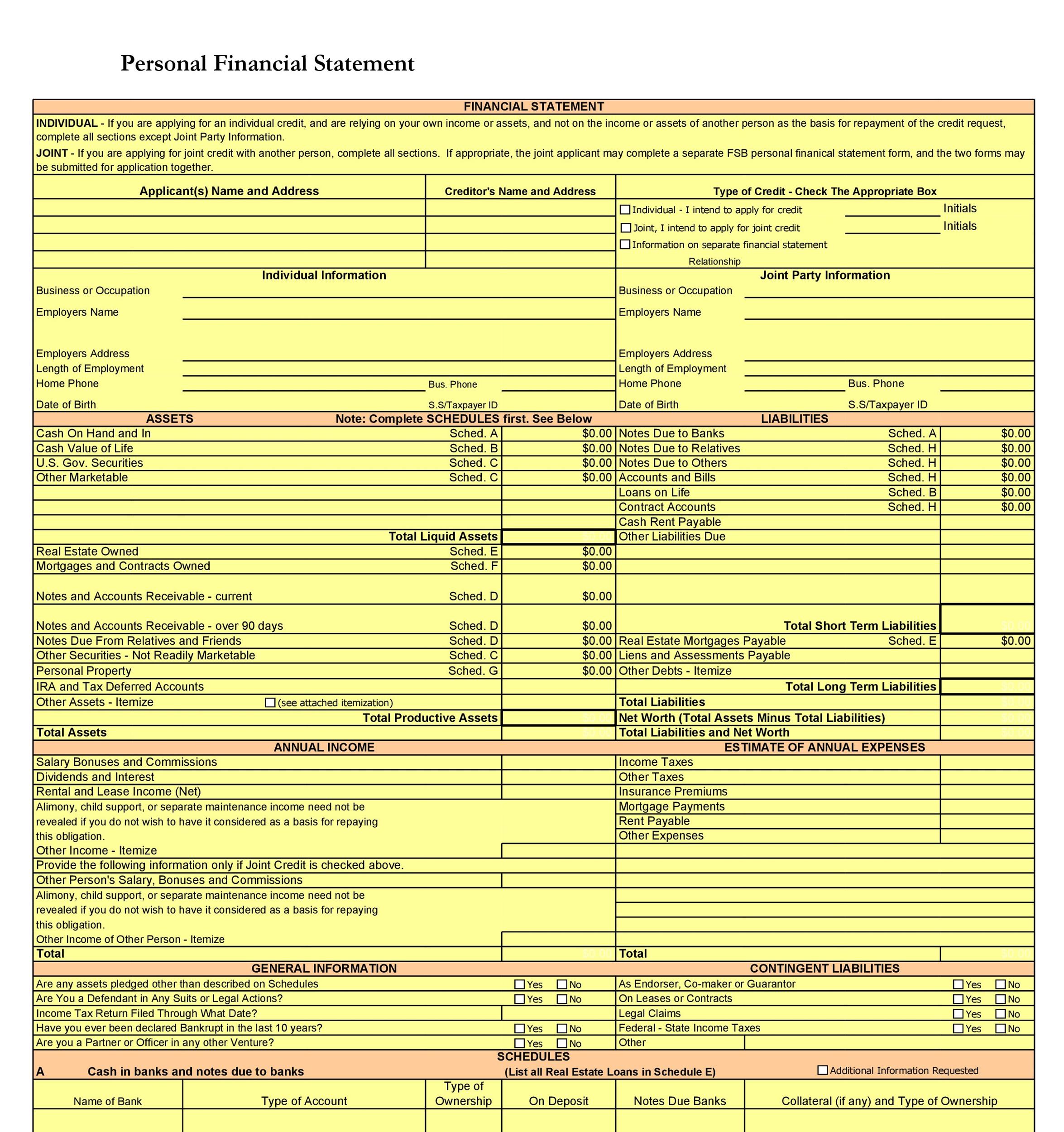

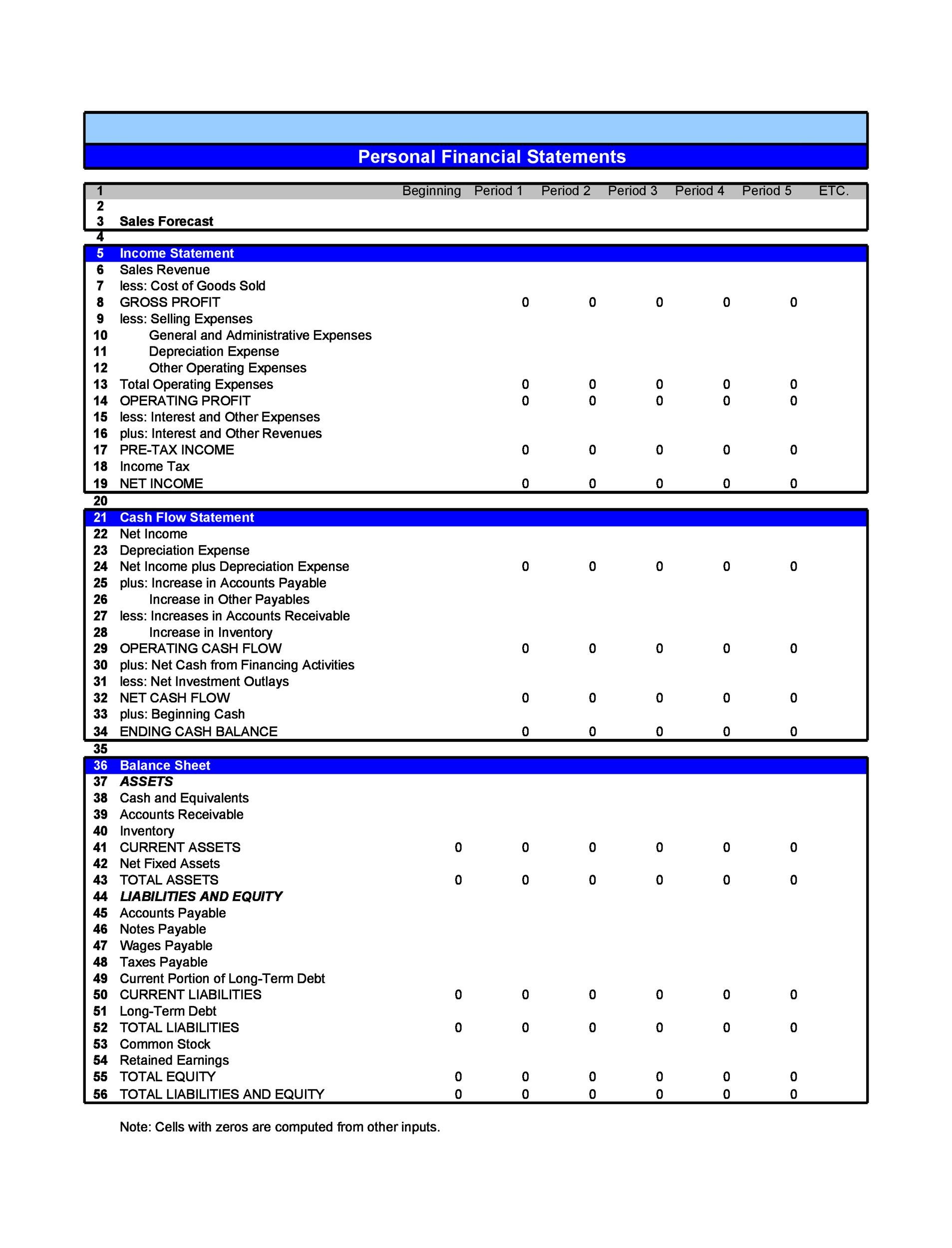

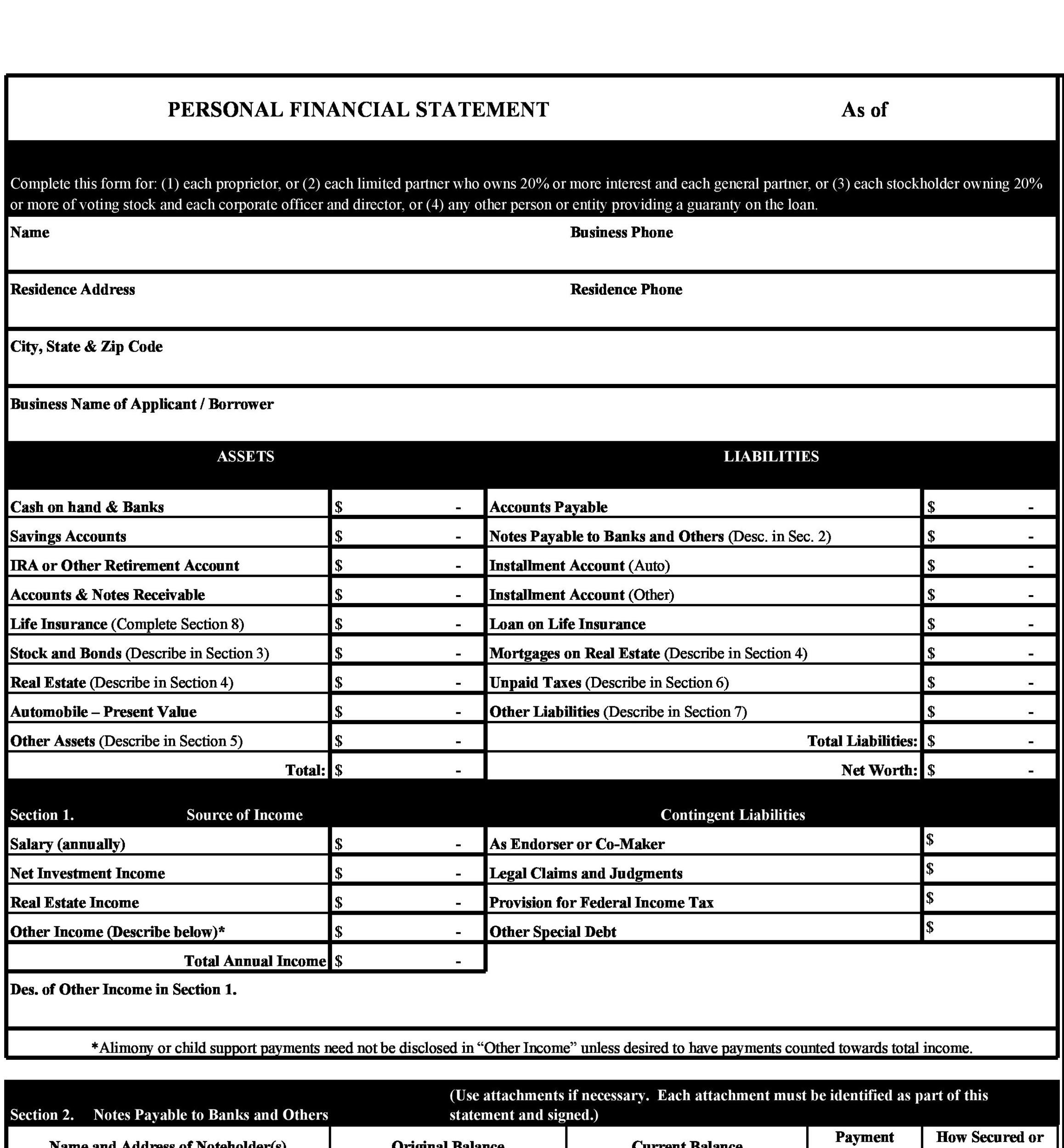

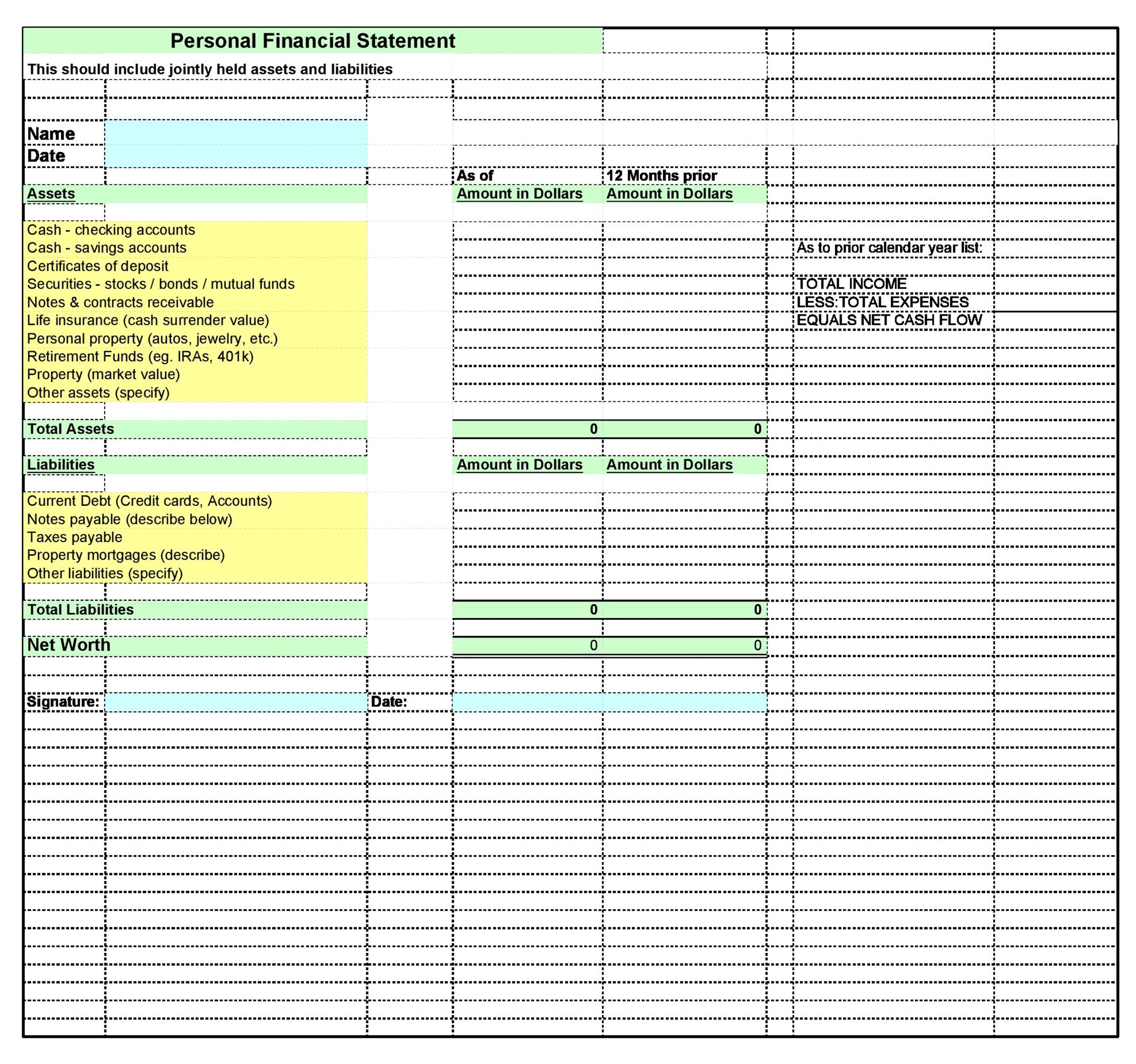

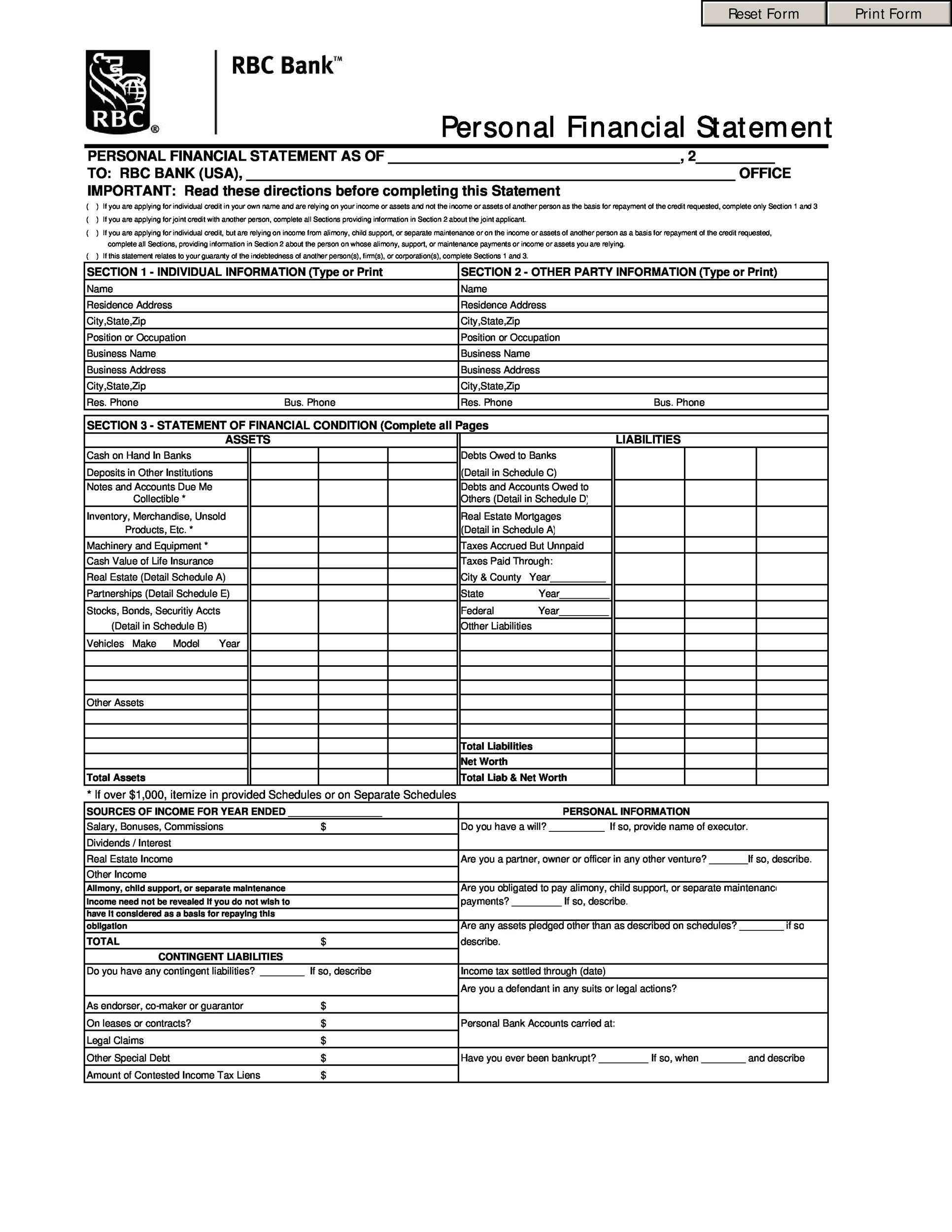

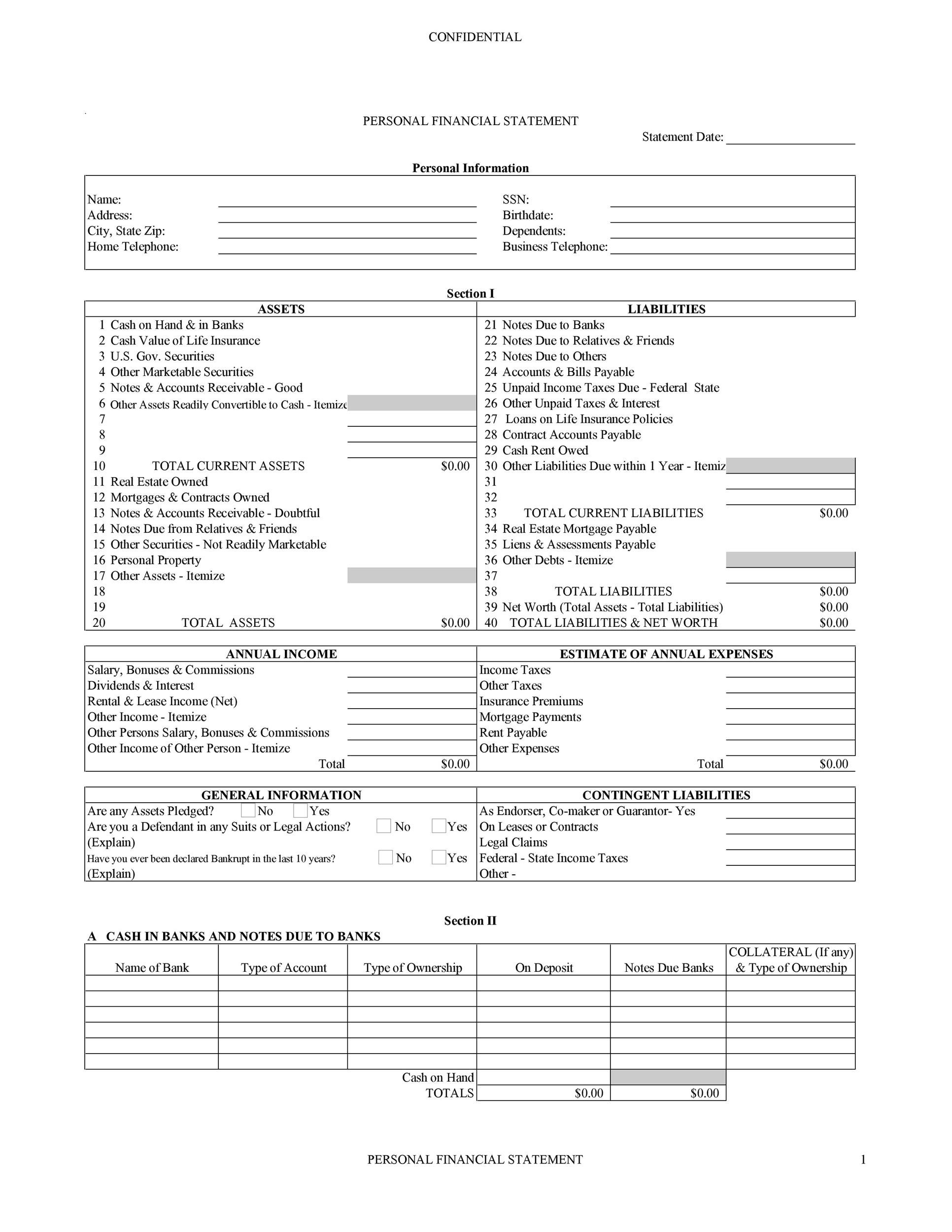

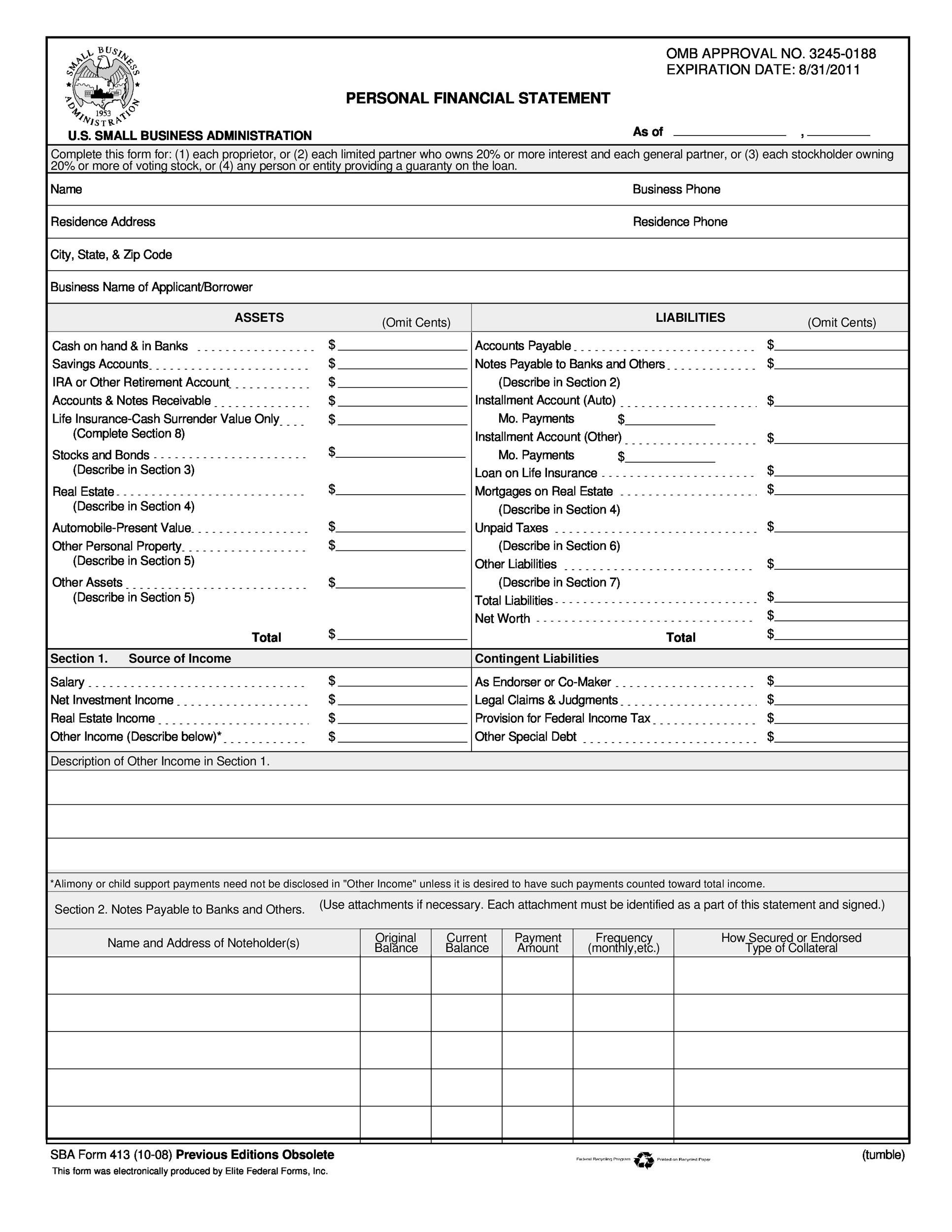

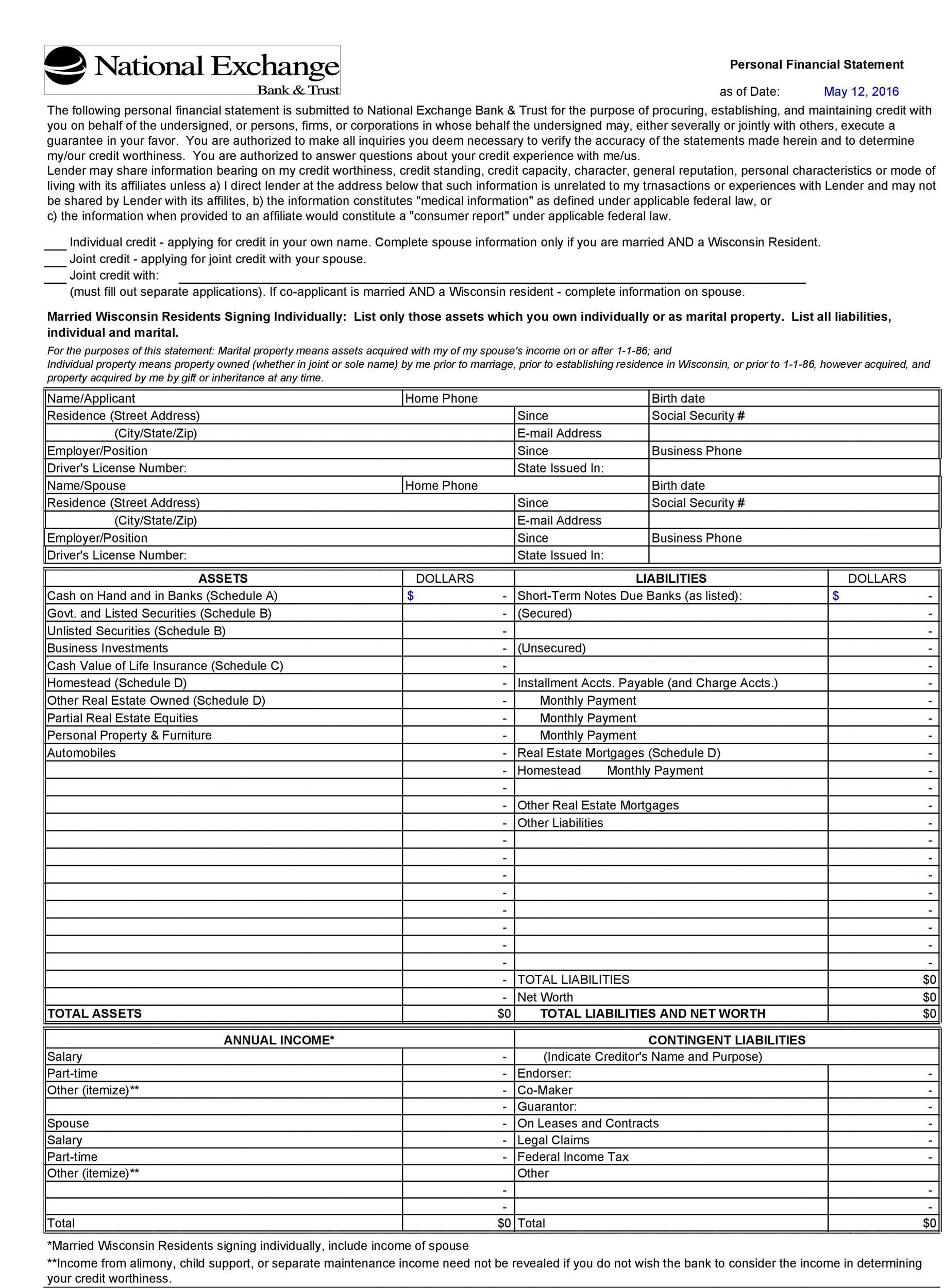

Personal Financial Statement Templates

Knowledge of personal finance equips and enables a person to not only face financial difficulties with courage but also solve them prudently. Having a basic knowledge of personal finance will make you feel more confident as you will be the one controlling and in charge of your own finances and not dependent on someone else.

Well, you may be thinking that if the education of personal finance is so important then why it isn’t taught in schools? That’s a great question pal, but unfortunately education planners of our country believe that there are many other important topics that should be taught in schools that’s why education of personal finance is neglected. Thus, whatever a child learns about personal finance and money, he learns from his home, and since most parents themselves are ignorant about the topic of money management and personal finance, this makes their children ignorant about this important subject too. This isn’t some hypothetical situation, it’s the reality of our country.

What Exactly is a Personal Financial Statement?

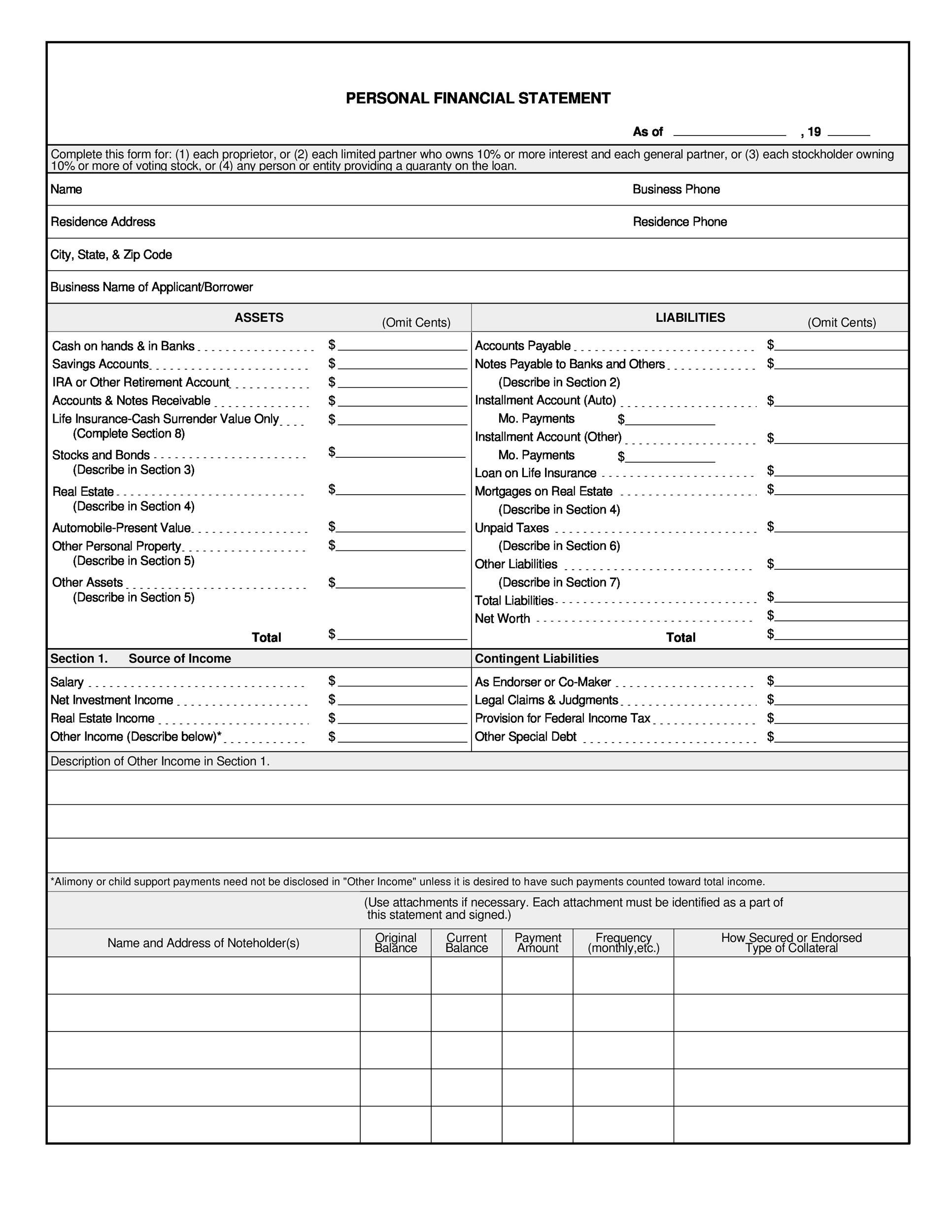

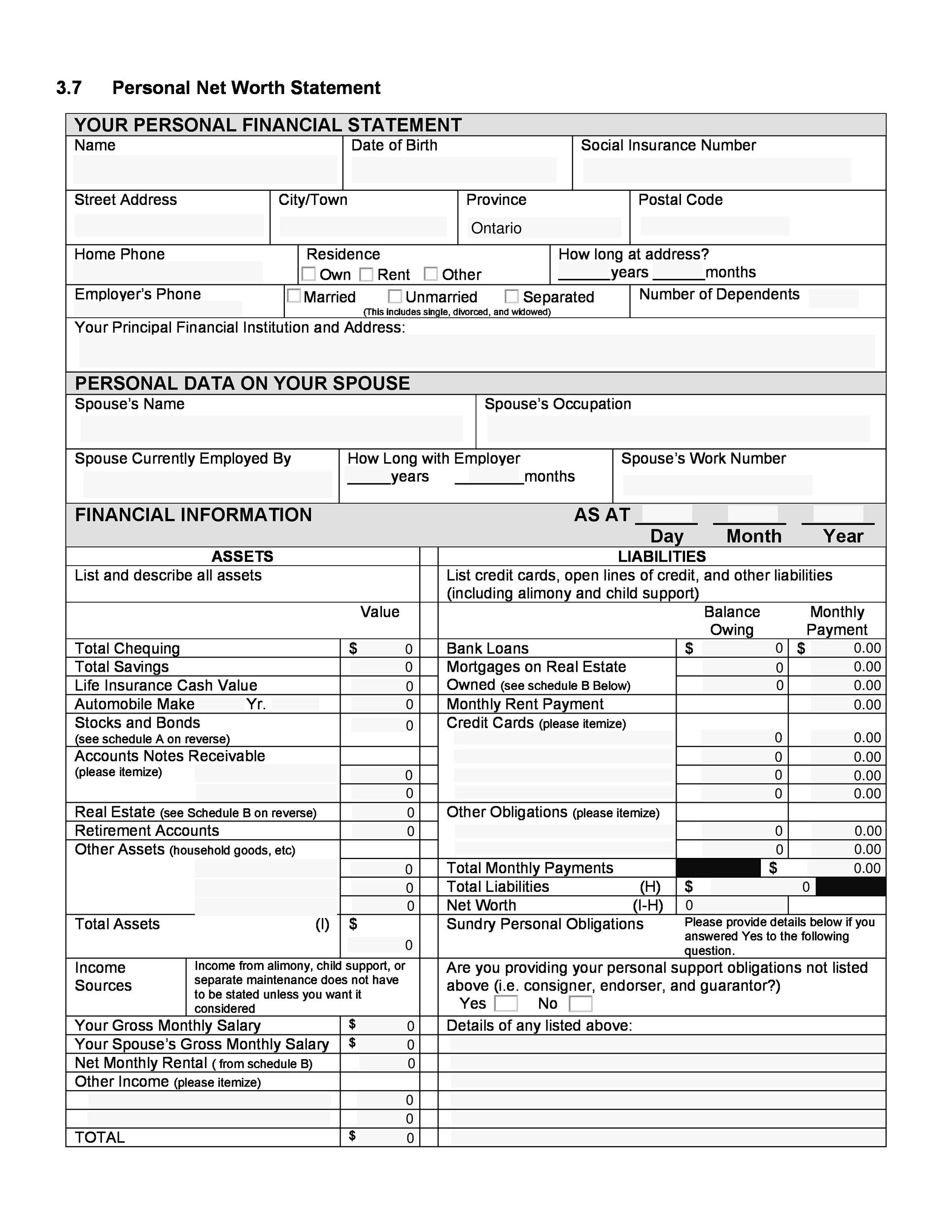

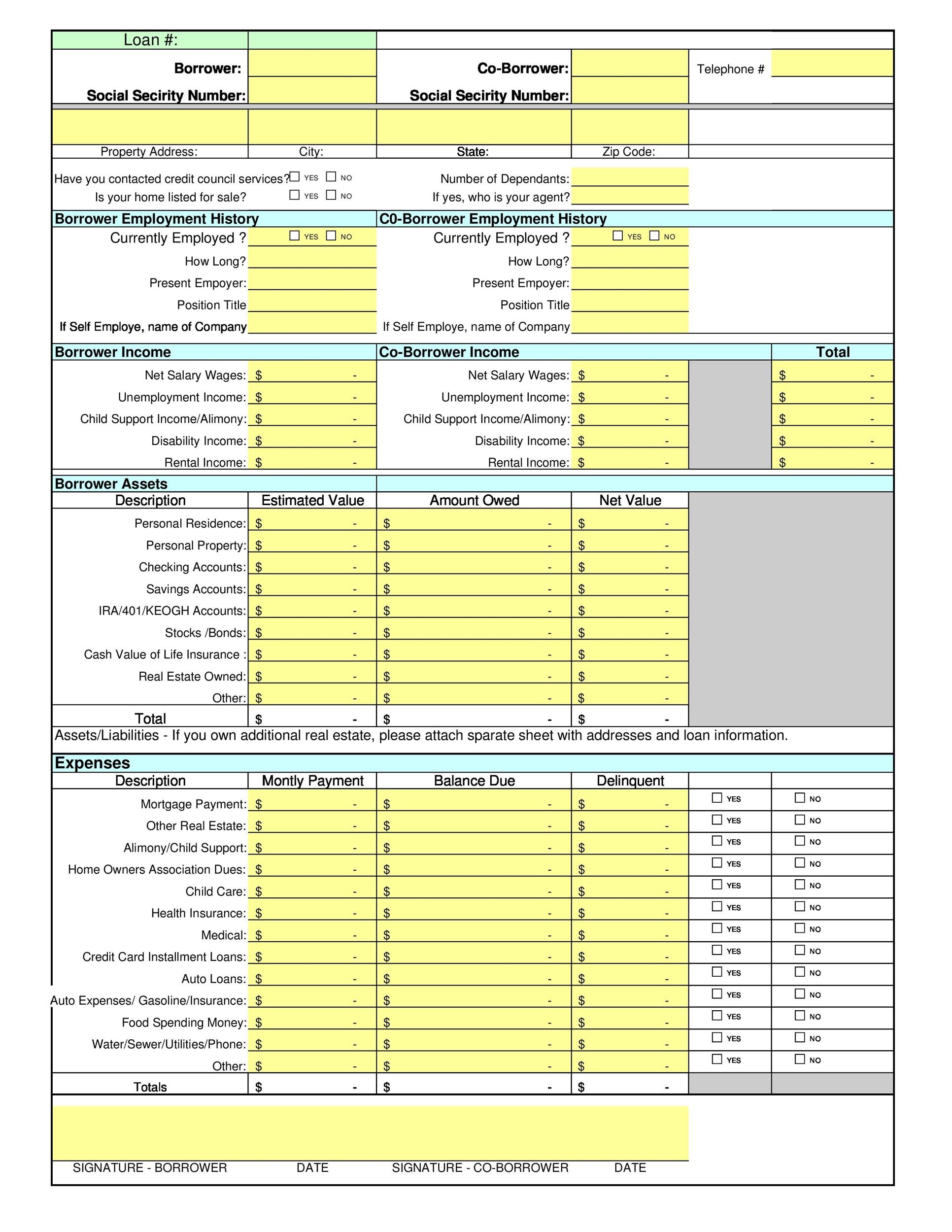

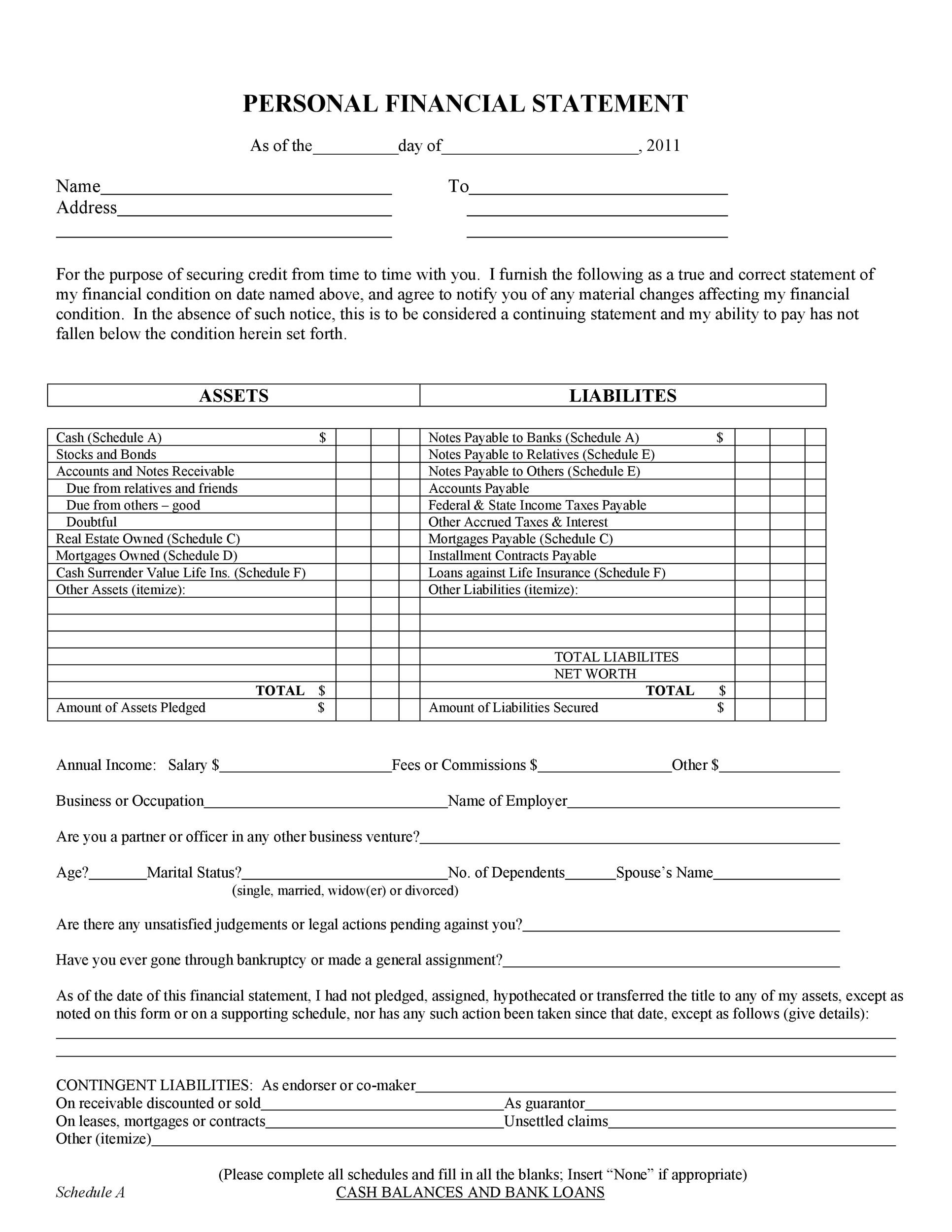

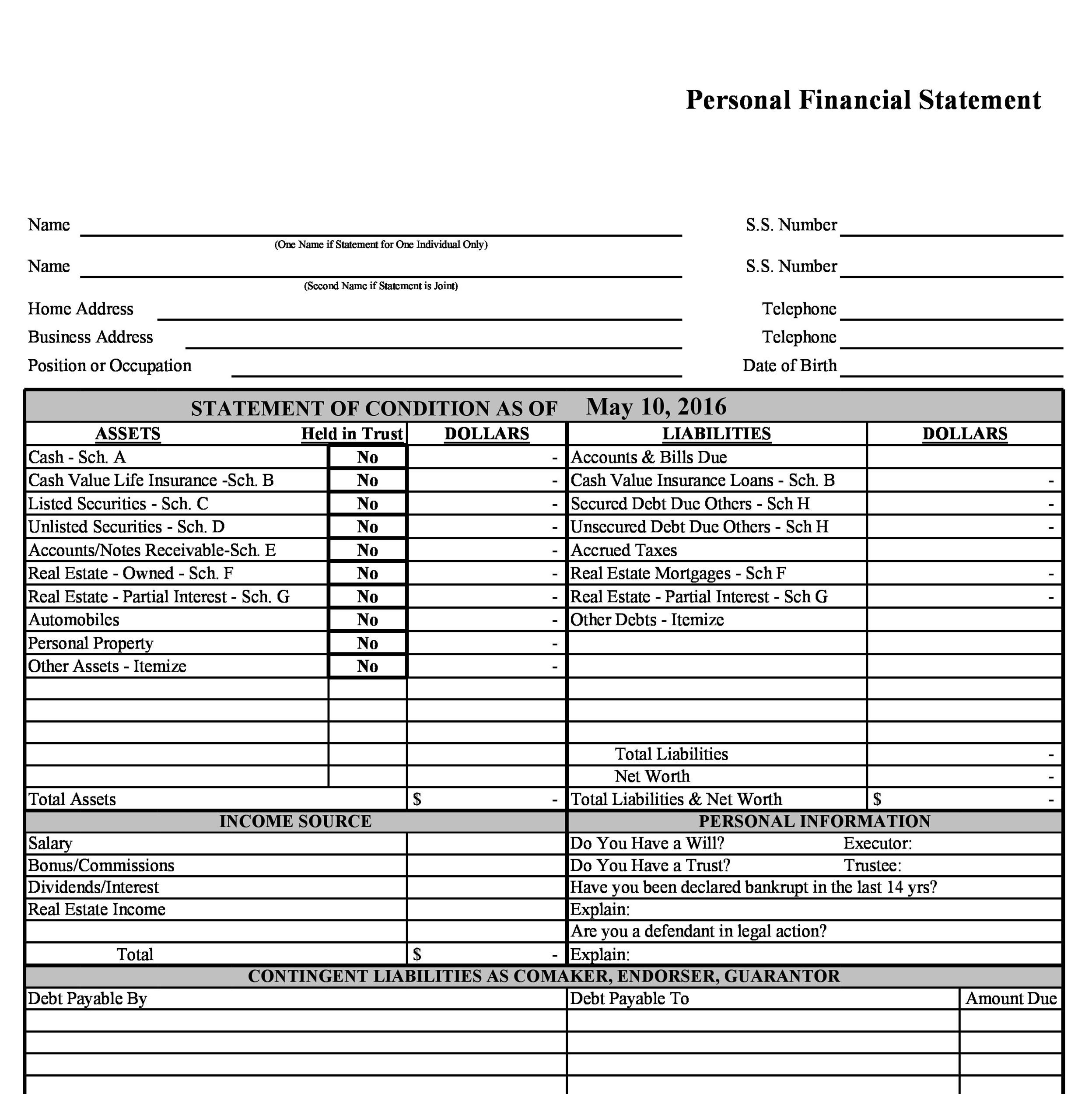

You may have heard about the term financial statements previously and you may have an idea that it is some sort of statements that lists down random numbers that are said to depict the financial standing of the company. Well, financial statements are not only for the companies, an individual can also have his/her own financial statements that are referred to as ‘Personal Financial Statements’. They are mainly used when a person is planning to apply for a loan.

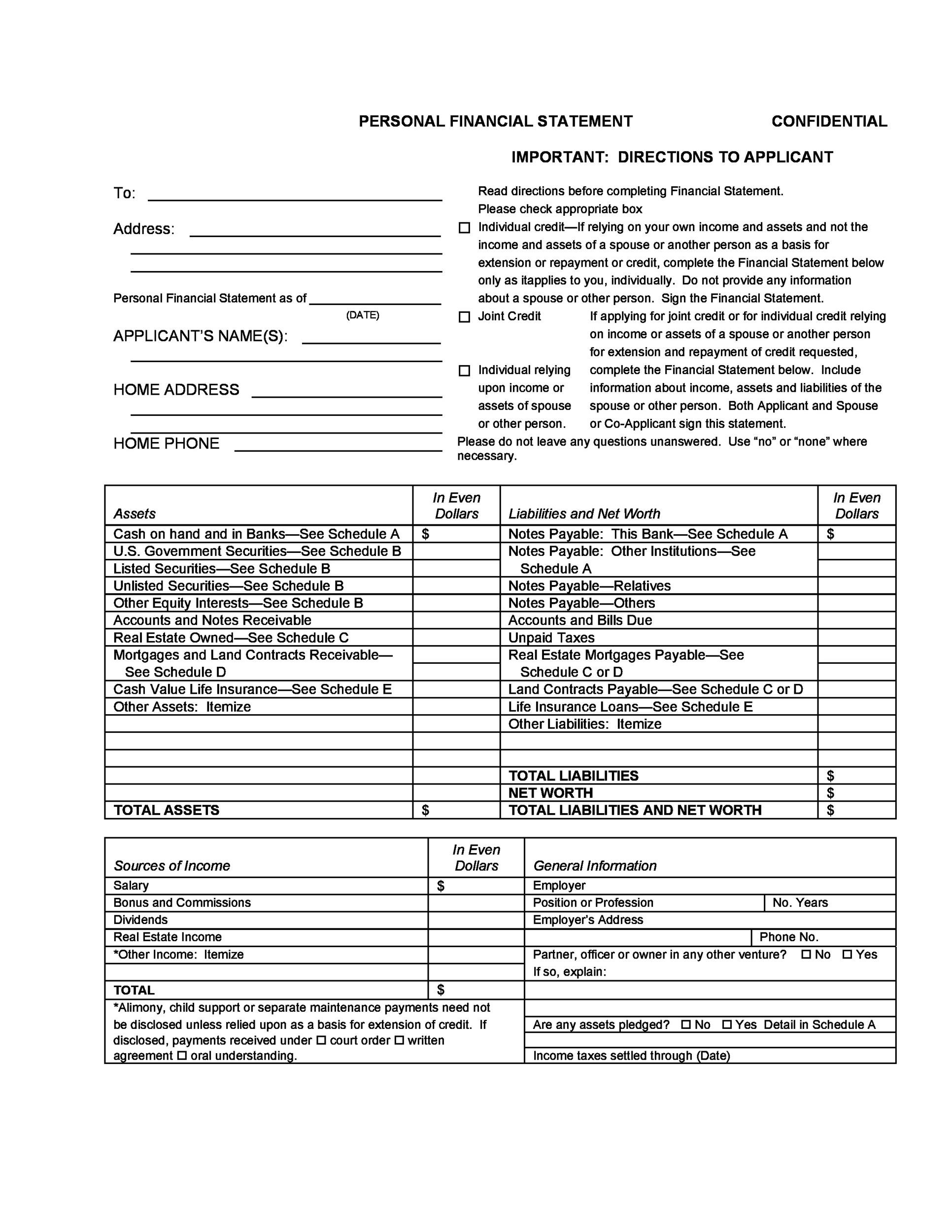

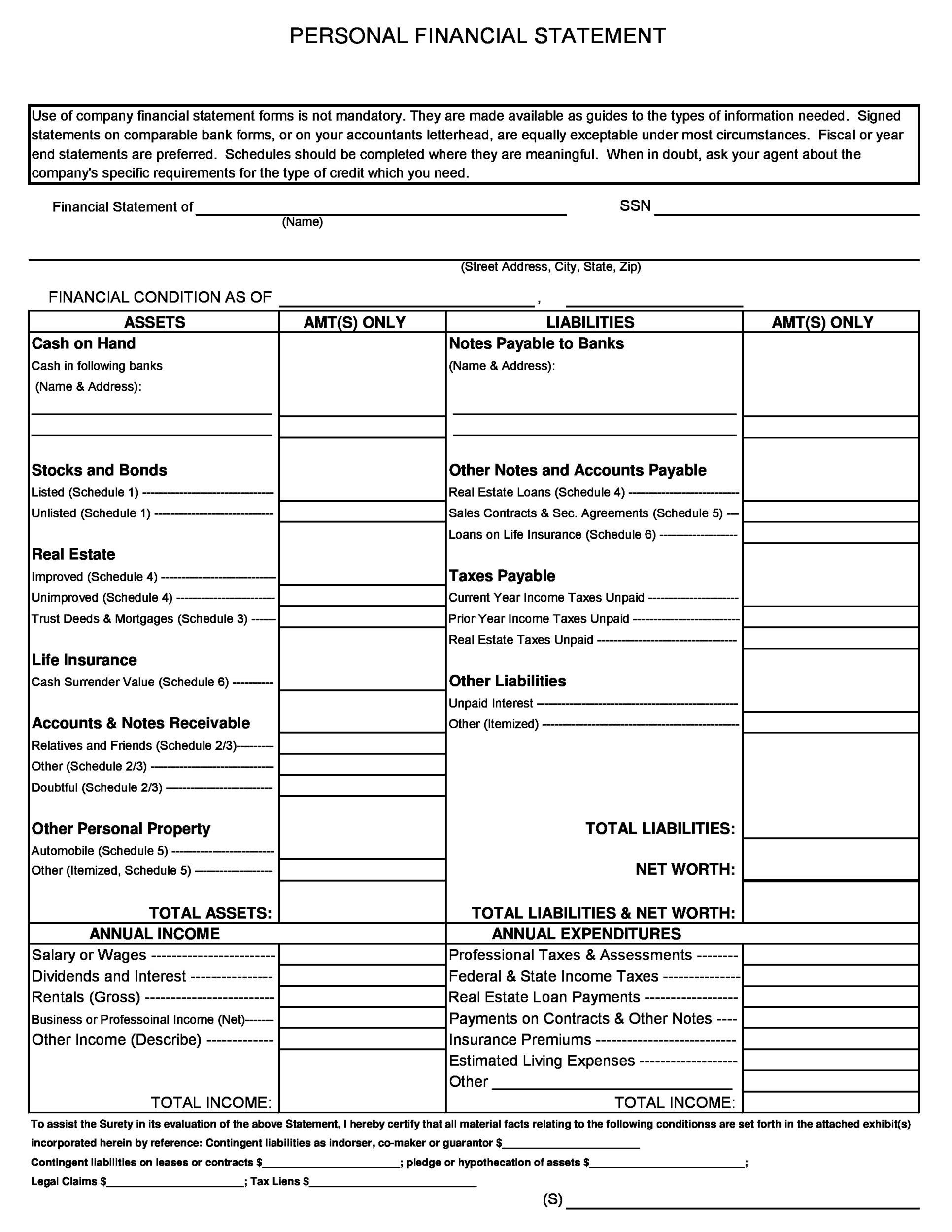

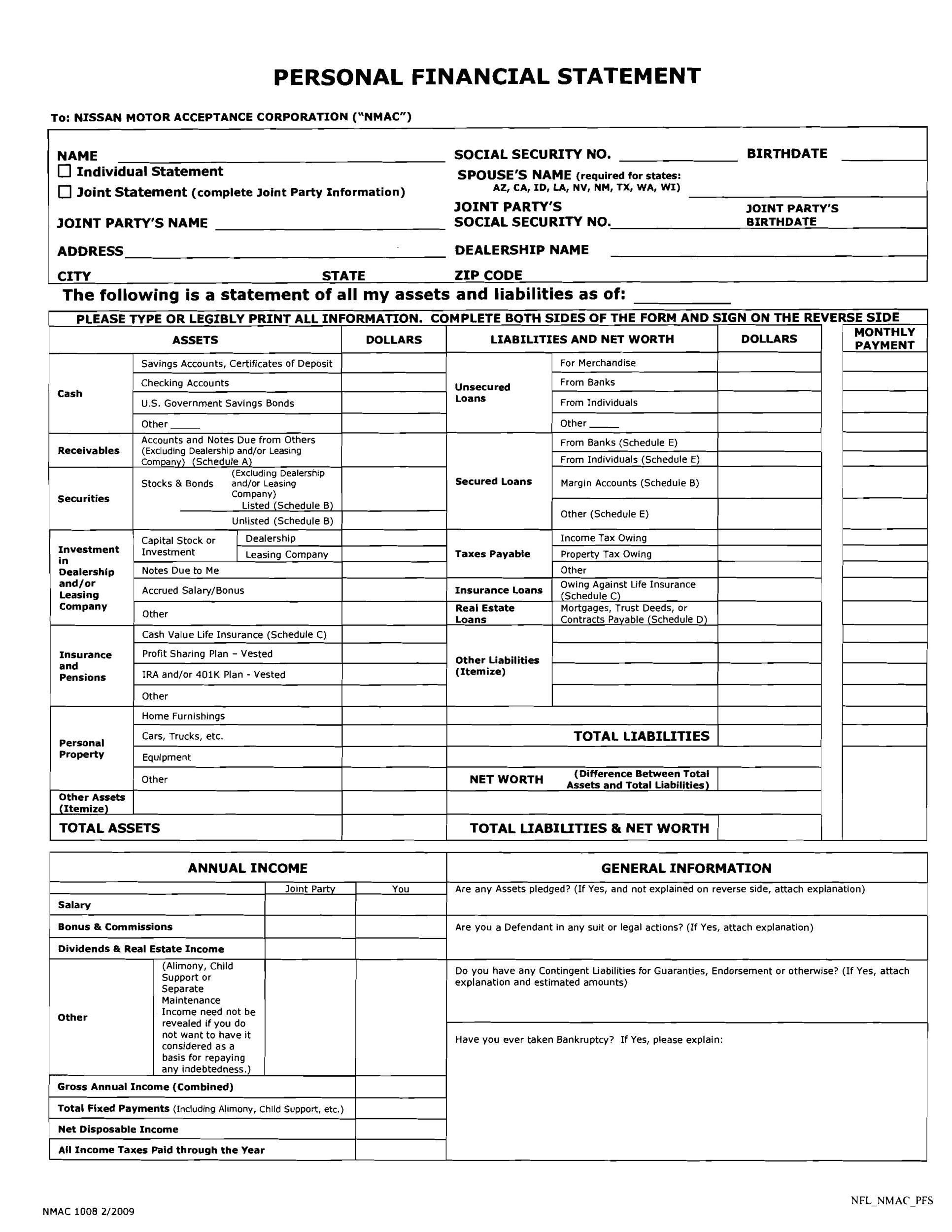

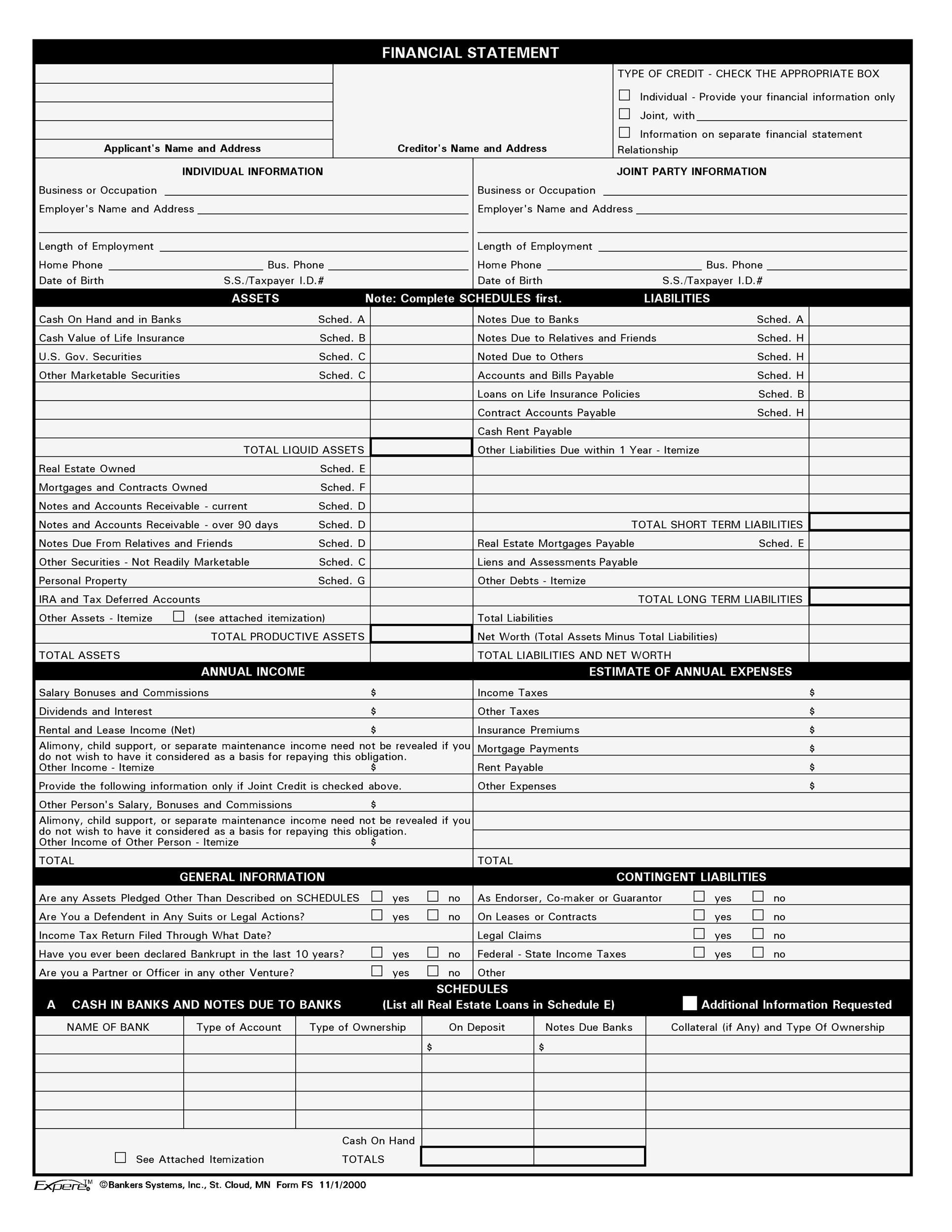

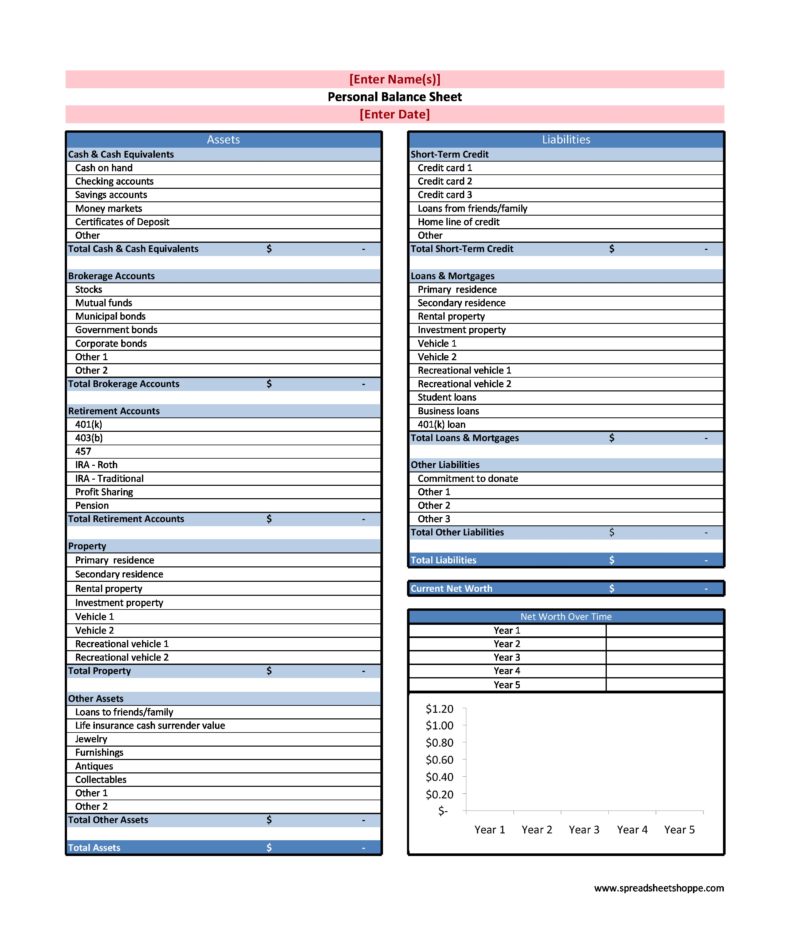

This document gives a holistic view to the credit officers of a bank or any lending institution about a person’s financial muscle so that the banker can make an informed decision about what should be the credit limit of a particular person. The most common sections in any personal financial statement template include information related to total assets and total liabilities.

Personal Financial Statement Forms

Uses of a Personal Financial Statement

Well, now you know what a personal financial statement is, it’s time to reveal some of its most common uses.

- It is used when applying for a loan

- It is used for effective financial planning

- It is used to determine the amount that you should save

When Applying for a Loan

You’d be fooling yourself if you believe that you will never need a loan. Your credit card in your wallet is a devise through which you will always remain balls deep in debt. Apart from this if you ever plan to attend a college you will need a loan or if you ever decide to start your own small business then you would be required to borrow money in order to guarantee smooth day to day operations of your business. For all this, Mr. Banker will require you to submit your own personal financial statement. After vetting this personal financial statement, the credit officer in a bank or any lending institutions will determine how much credit facility should be extended to your small business.

For Financial Planning

Financial planning is the difference between a penurious and a well off person. If you know nothing about your current financial situation or your net worth then it’s time that you set everything else aside and visit our website and download a personal financial statement’s template through which you can easily calculate your net worth. No need to be terrified, horrified and petrified if you find your net worth is in negative numbers, rather you should start taking steps to reduce your liabilities and increase your income generating assets. But remember, all this will start with correctly filling out a personal financial statement form.

For Saving Purpose

If you are not maintaining and updating your personal financial statement then we would like to inform you that it’s a perfect recipe for a failure because you will likely not be able to save money for the future. A personal financial statement will allow you to pay yourself first i.e. set money aside for your savings before you pay your bills or spend it carelessly. You will be well informed of the expenses and the uncovered liabilities and thus will be in a position to reduce it, so that you can save more. Remember, the money that you save and invest today will compound in the future.

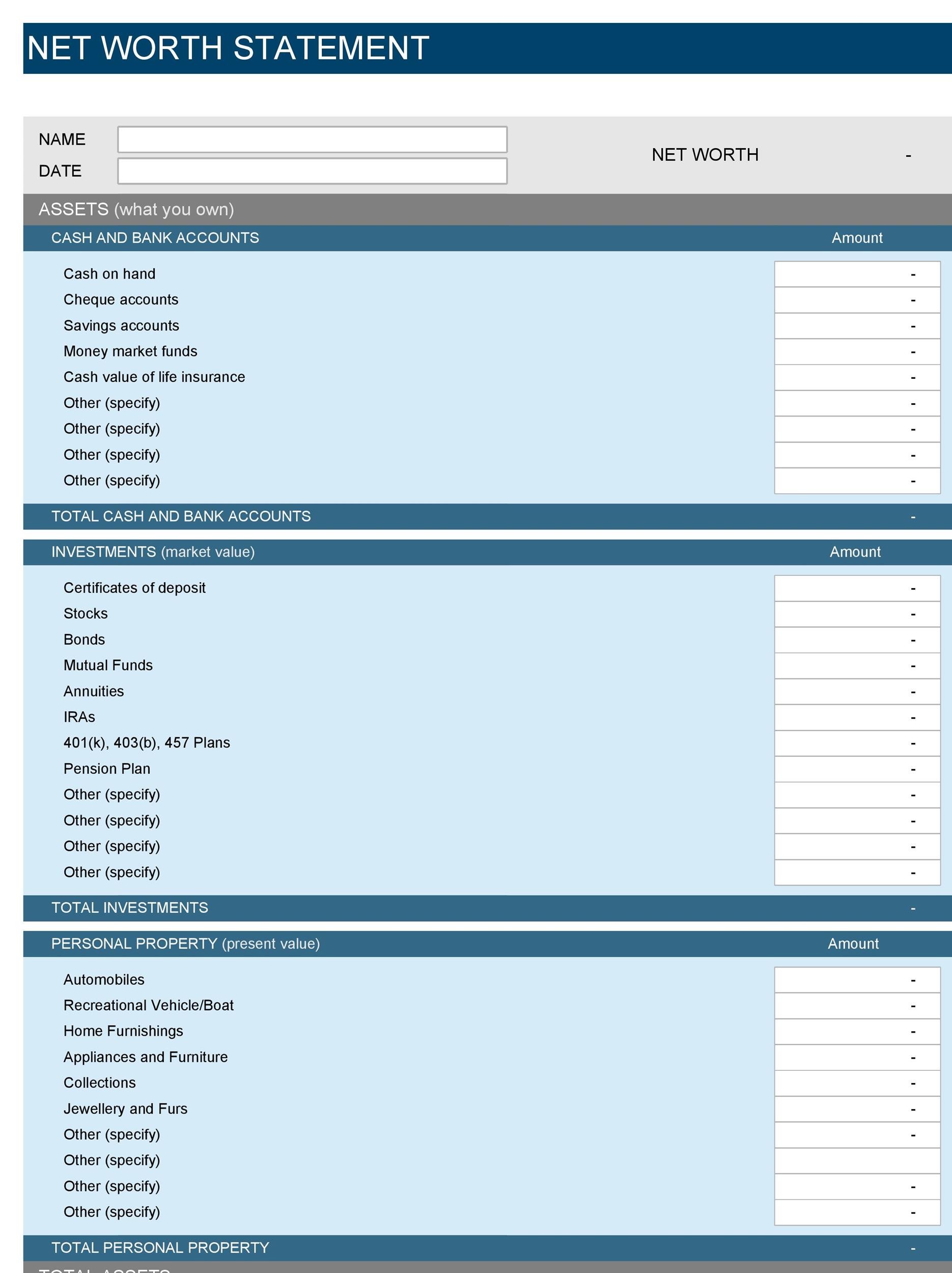

Personal Financial Statement Samples

Elements of a Personal Financial Statement Template

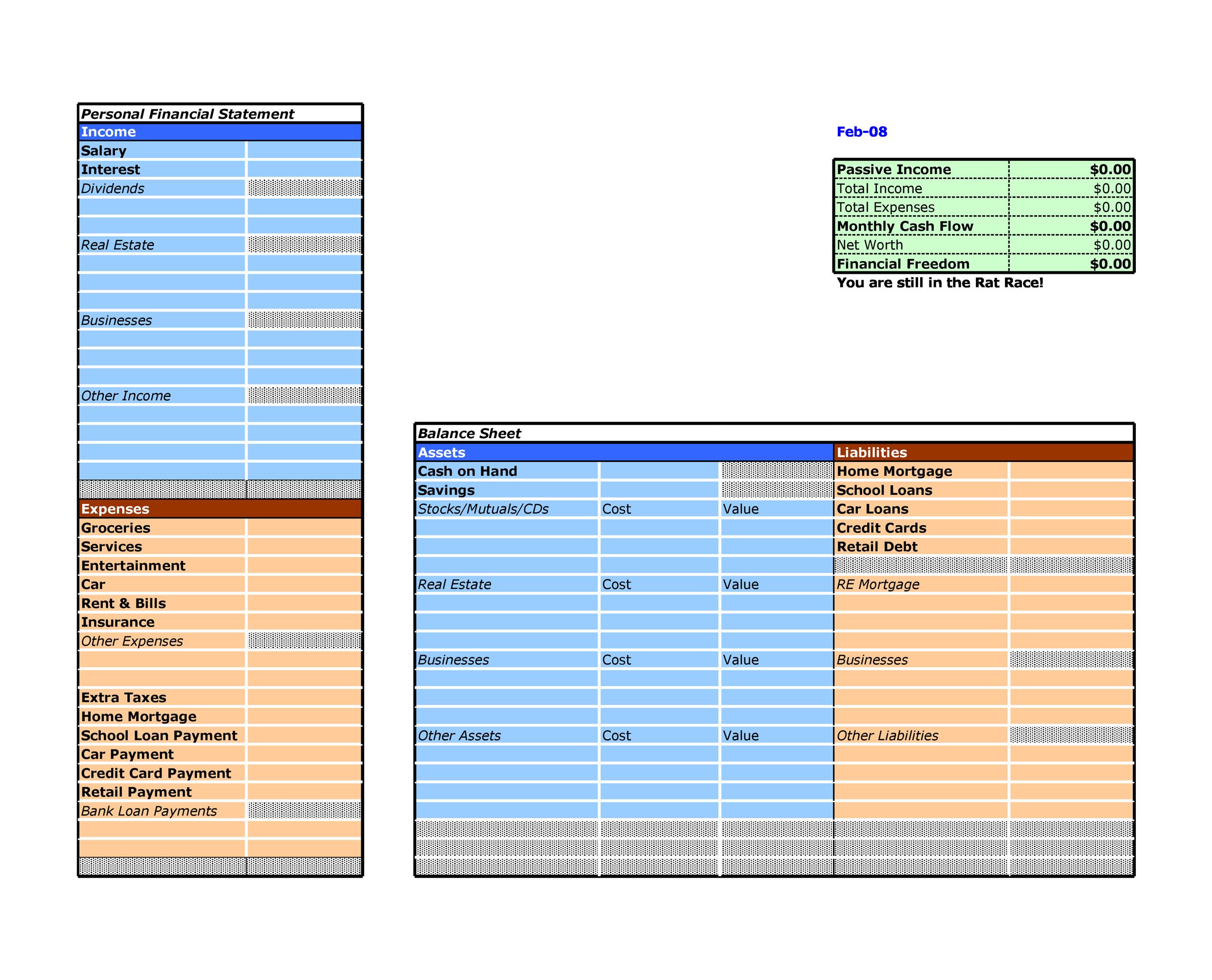

Rather than beginning from scratch for drafting your personal financial statement you can download a personal financial statement template from our website and can then enter all the numbers required after which you will be able to see your net worth at a particular point in time. Before you begin to use a particular template it is important that you know what sections a good personal financial statement template, one that give a true and fair view of a person’s financial standing, should have. Following are the four major sections that you will find in almost all personal financial statement templates.

- Assets

- Liabilities

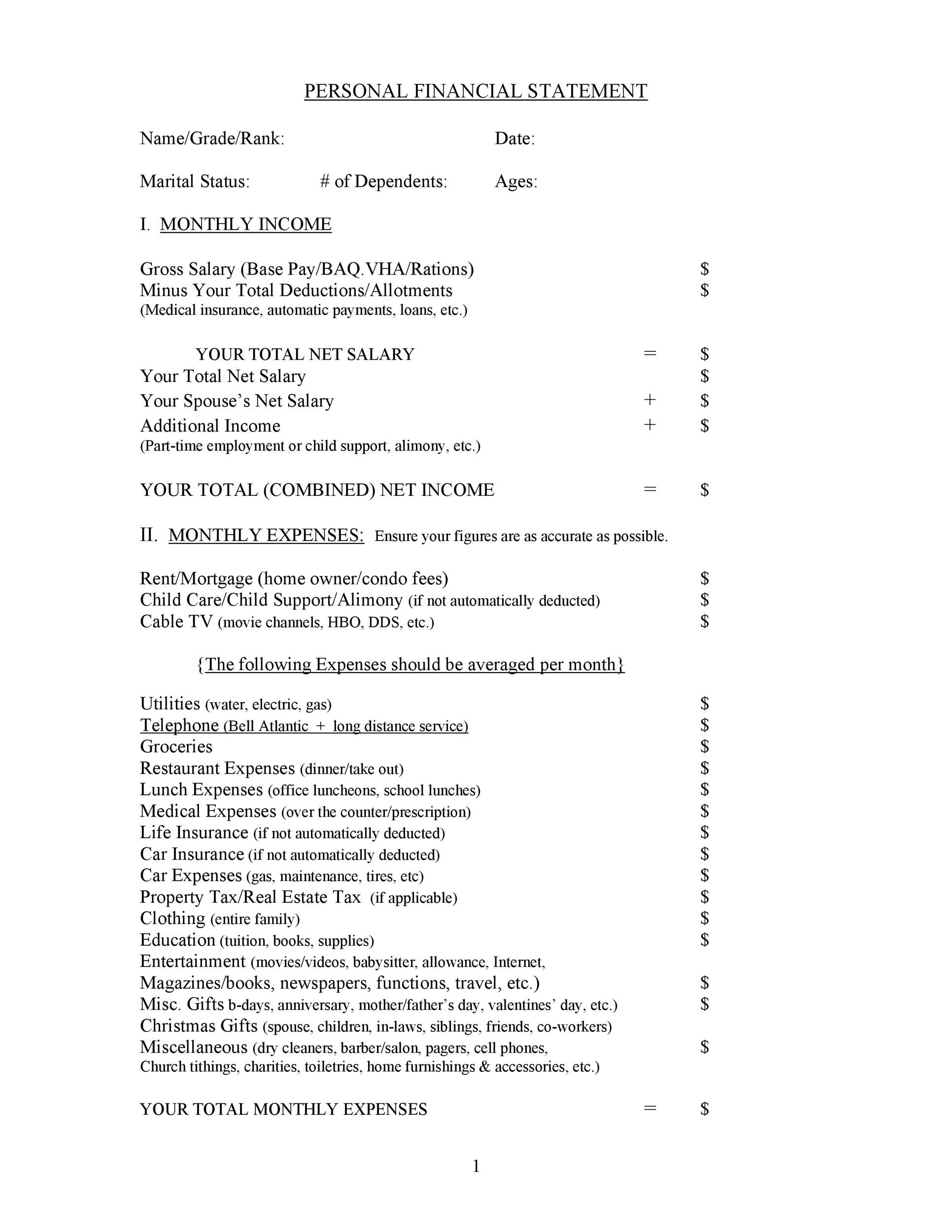

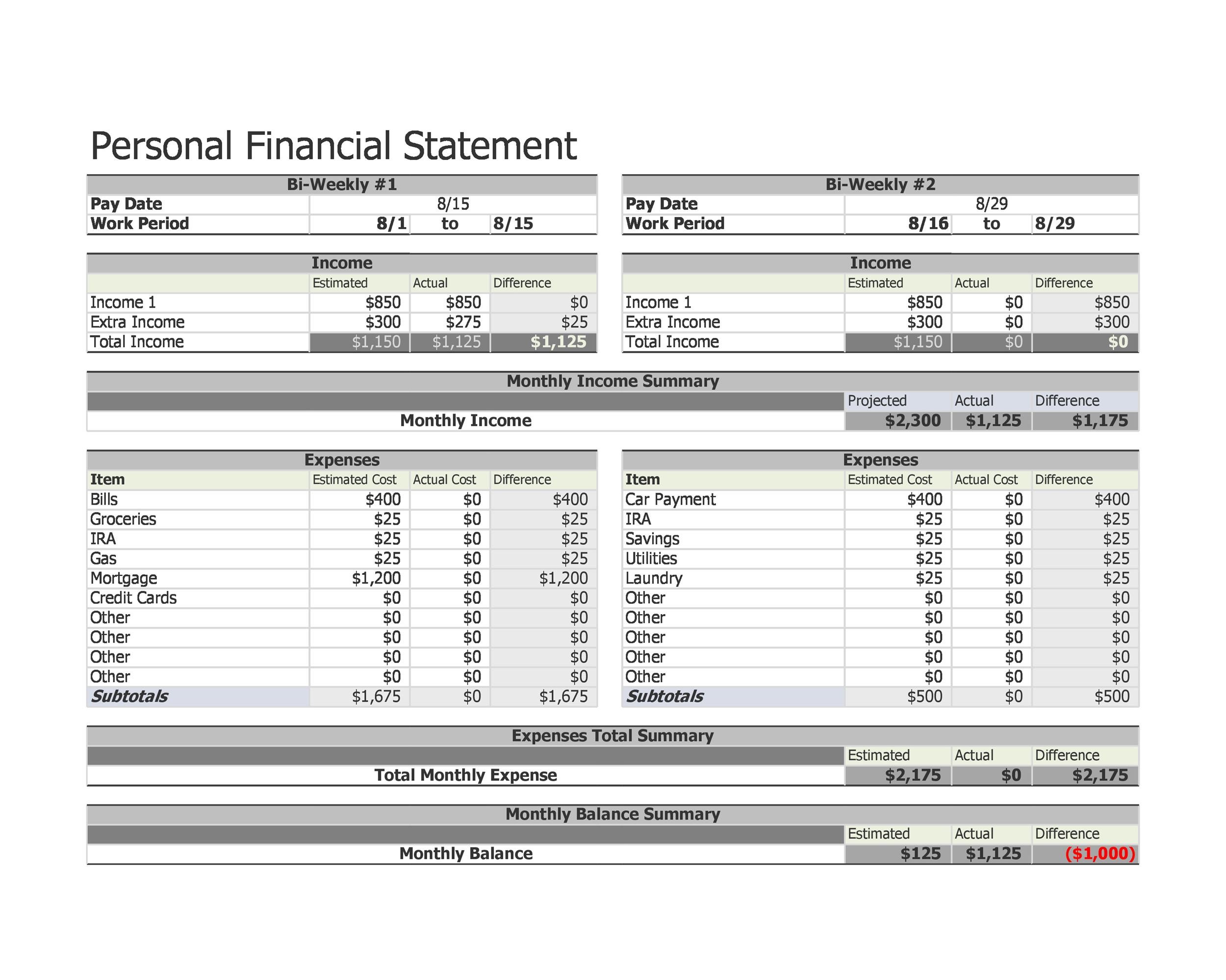

- Annual Income

- Expenses

Assets

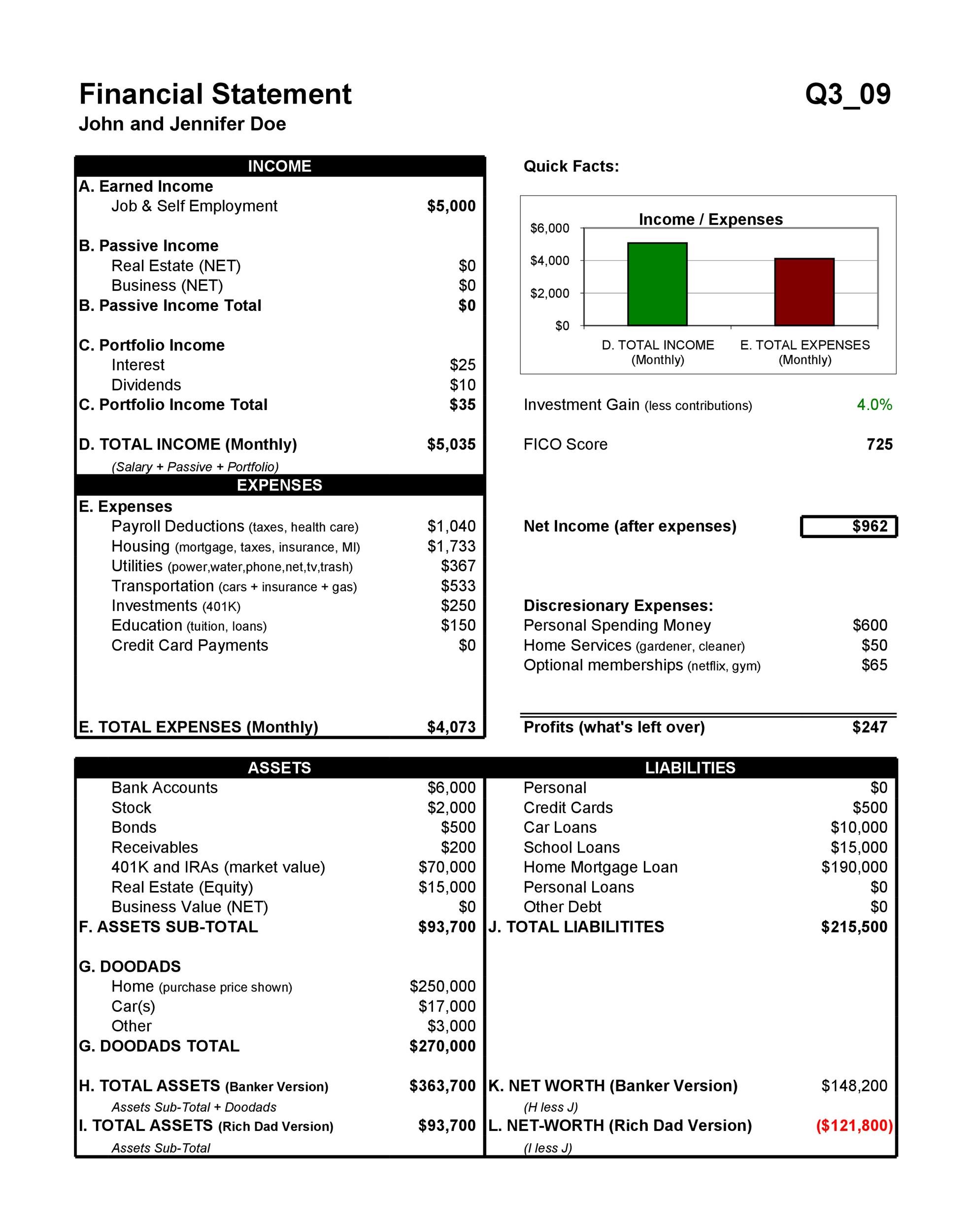

Every good personal financial statement will first list down all the assets that an individual possesses. You may be thinking that it’s too obvious, but it’s not. If we ask you what your most valuable asset is, what would you say? Well most household in US believe that their home is their most valuable asset that they have purchased. If that’s your answer too then you have no idea what asset means.

An asset is something that puts money into your pocket periodically and your home, according to this definition is not your asset because your home takes money out of your pocket through bills, taxes, renovation etc.

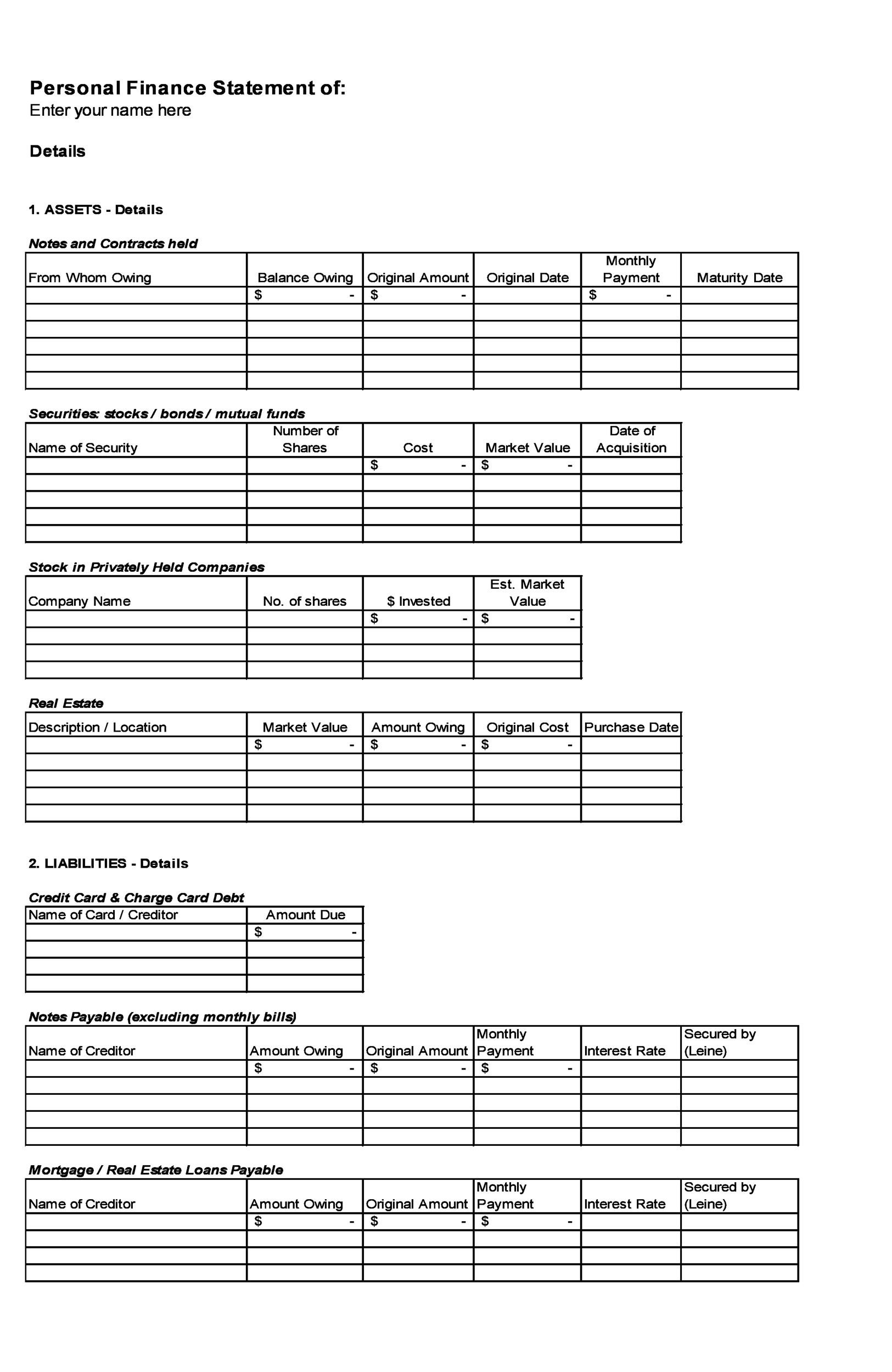

Items included in the asset column of your personal financial statement include cash that you have in the locker of your house and your bank balance. Also, the cash value of your investments in stocks, bonds or any other investment vehicle will also be recorded in the asset column of your personal financial statement.

If you own a property for investment purposes like for renting it out then you can also record the cash flow generated from such investments in the asset column of your personal financial statement. Also, other assets that are liquid and can be converted to cash readily can also be listed in the asset column of your asset.

In some personal financial statement templates you will see that there is a distinction between current and non-current assets. This distinction is not very important for you as a person. However, for the sake of your information, current assets are those that are liquid and can be converted to cash in a short period of time, while non-current assets are illiquid assets that do not have a vibrant and robust secondary market and therefore needs a large amount of time (weeks or sometimes even months) to be sold. A real estate is a perfect example of non-current asset. Now let’s move on to discuss the next section of a good personal financial statement template.

Liabilities

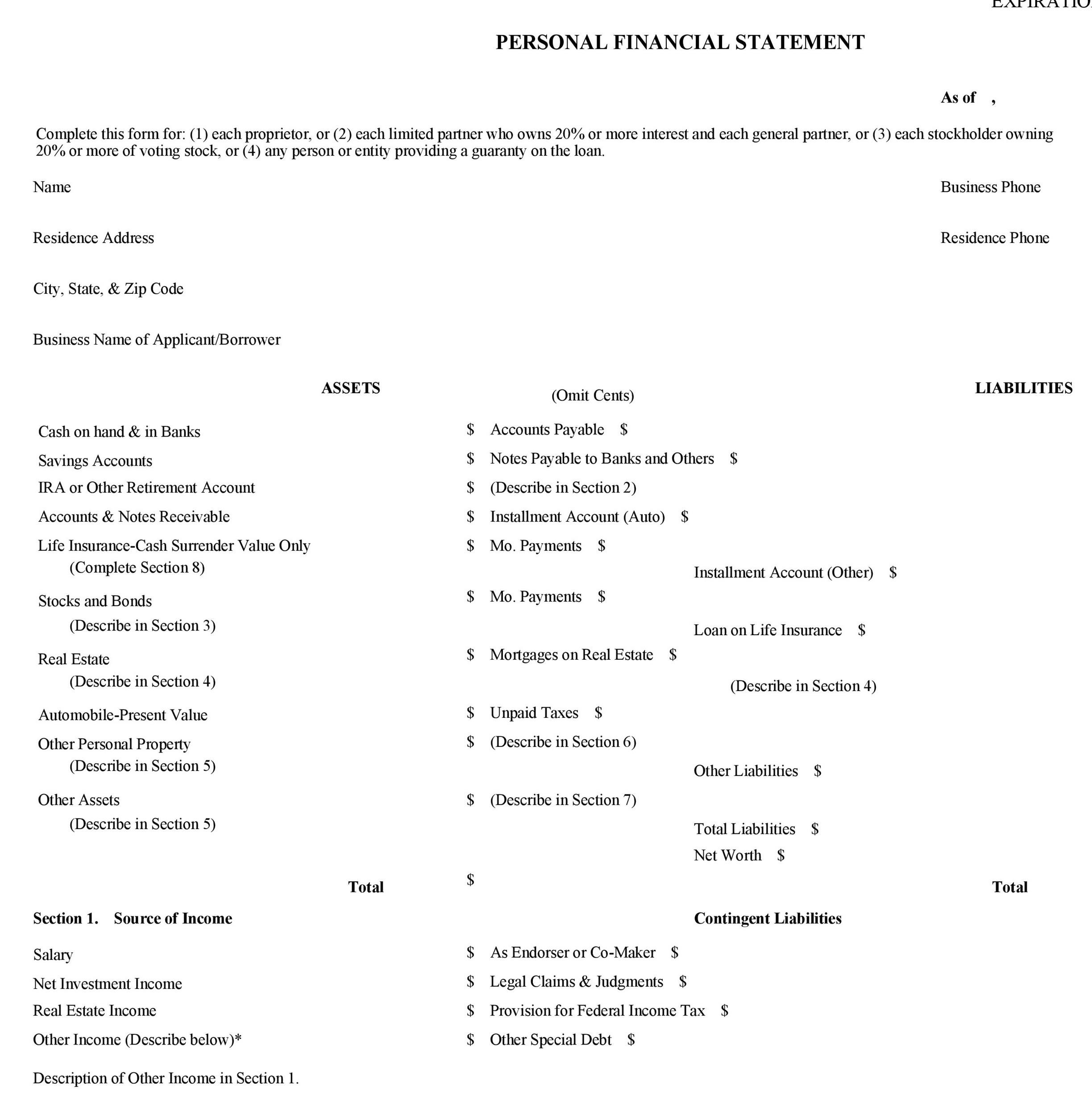

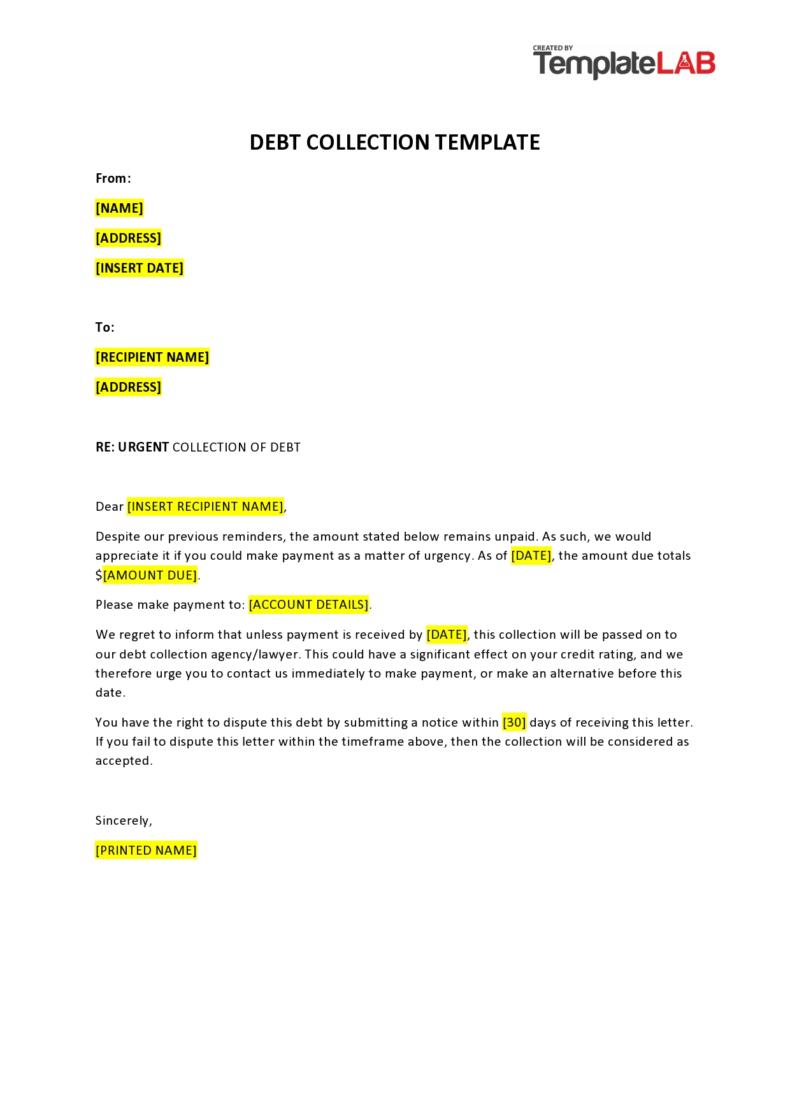

A liability is the amount of money that you have to pay i.e. the money that you owe. In this section you will list down all the sources to whom you owe money and also the amount that you owe. Loan taken out from a bank, taxes due, mortgage payments due and any other debts will be listed in the liability column of your personal financial statement. If you can’t remember your creditors then it’s better to use a personal financial statement template that already has some basic and obvious creditors listed in the template.

If you are living in a rented house then the monthly rent payments that you make is your liability that you have to pay, come what may. If you do not honor/settle your liabilities on time then it will adversely affect your credit rating. Nobody wants that.

Just as in the case of assets, liabilities too are divided into current and non-current liabilities. A current liability is the one that you have to settle within the time period of one year (short term) while non-current liabilities are ones that are due after one year (long term).

These numbers listed in your personal financial statement are used to calculate your net worth. It is done by first calculating your total assets and total liabilities and then subtracting your liabilities from your assets, in other words, you have to subtract the amount that you owe from the amount that you own. The figure calculated by this formula will give you your net worth. If it’s positive, congratulations on your good financial standing, however, if it’s negative then you got lot to look forward to.

Items present in the liability column of your personal financial statement are your insurance premiums, credit card bills, federal taxes, your upcoming mortgage payments, and/or any loan extended to you by the bank.

Personal Financial Statement Examples

Annual Income and Expenses

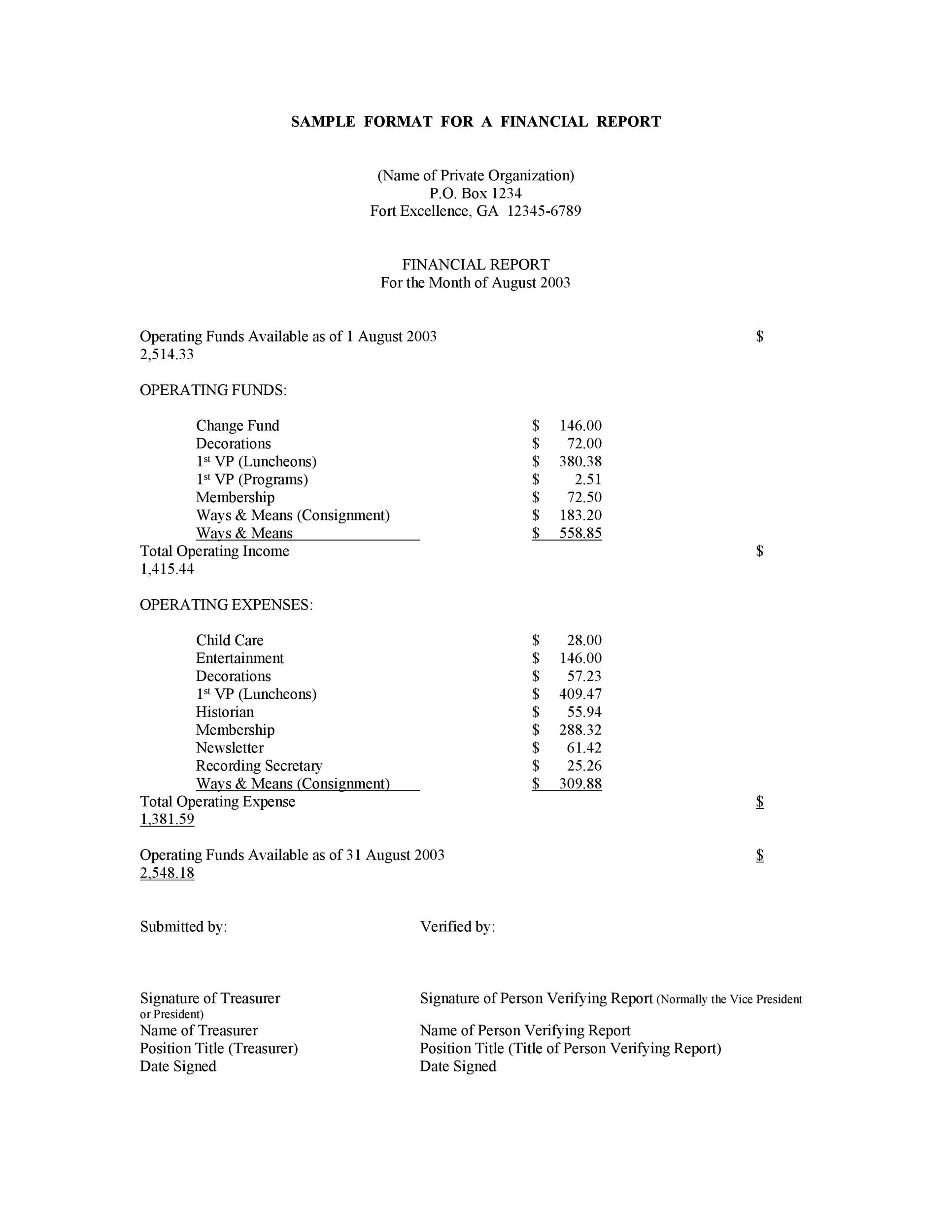

Apart from the assets that you own and the liability that you have to pay, a good personal financial statement will also factor in the annual income that you generate. Under this section, your take home salary, dividend income, rental income or any income generated from other sources will be mentioned.

Also the expenses that suck your income will be mentioned. These expenses will include the money that you spend on the purchase of household items. Also, you will find a section of contingent liabilities in a good personal financial statement template. Under this section you will mention the amount of money that you believe will be required to pay in case any unforeseen event happens. Examples include a surprise audit by IRS, a penalty awarded by the court in a law suit, damage to your property due to bad weather etc.

As evident from the above article that an education of personal finance is imperative especially in today’s era of high uncertainty in order to equip individuals to take control of their own finances. Personal financial statement template is a basic tool that will allow any individual to visualize his financial standing so that he can effectively plan for the future and his/her financial goals.

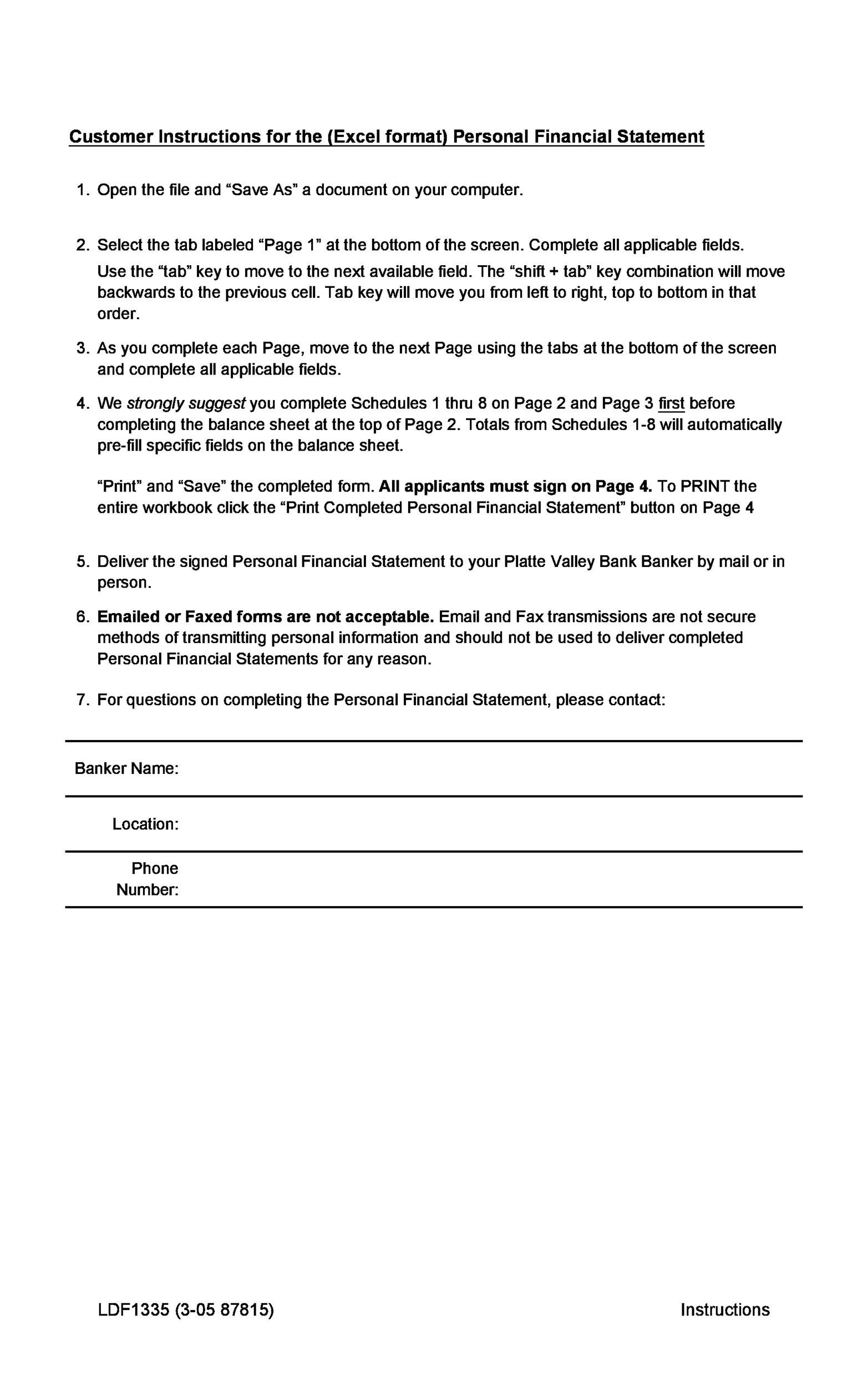

If you too believe that having a personal financial statement is essential then wait no more and click here to visit our website. On our website you will find dozens of personal financial statements template that you can download for free and chose the one that you are comfortable working with. We have a template of personal financial statements in excel as well as PDF format.