When you are writing a loan agreement template, you might want to look at some other samples of personal loan agreement documents. Loan contract templates can come in all shapes and sizes, so you need to be sure that you are looking at the right kind of loan agreement form when you are drafting anything from a basic loan agreement to borrowing money from a friend contract. The language and details of your loan agreement template matter if you want it to hold up legally, and the document needs to be clear enough that you can be sure you and the other party or parties involved understand its implications.

Writing a loan agreement template can be tough if you are not sure what needs to be included in this important document. This guide will help you to write an authoritative and effective loan agreement that can be used for a variety of different purposes and loans. The more detailed and correct your loan agreement document, the easier it will be to manage your loan while it is active.

Table of Contents

- 1 Loan Agreement Templates

- 2 What is a Loan Agreement?

- 3 Loan Agreement Forms

- 4 Can I write my own loan agreement?

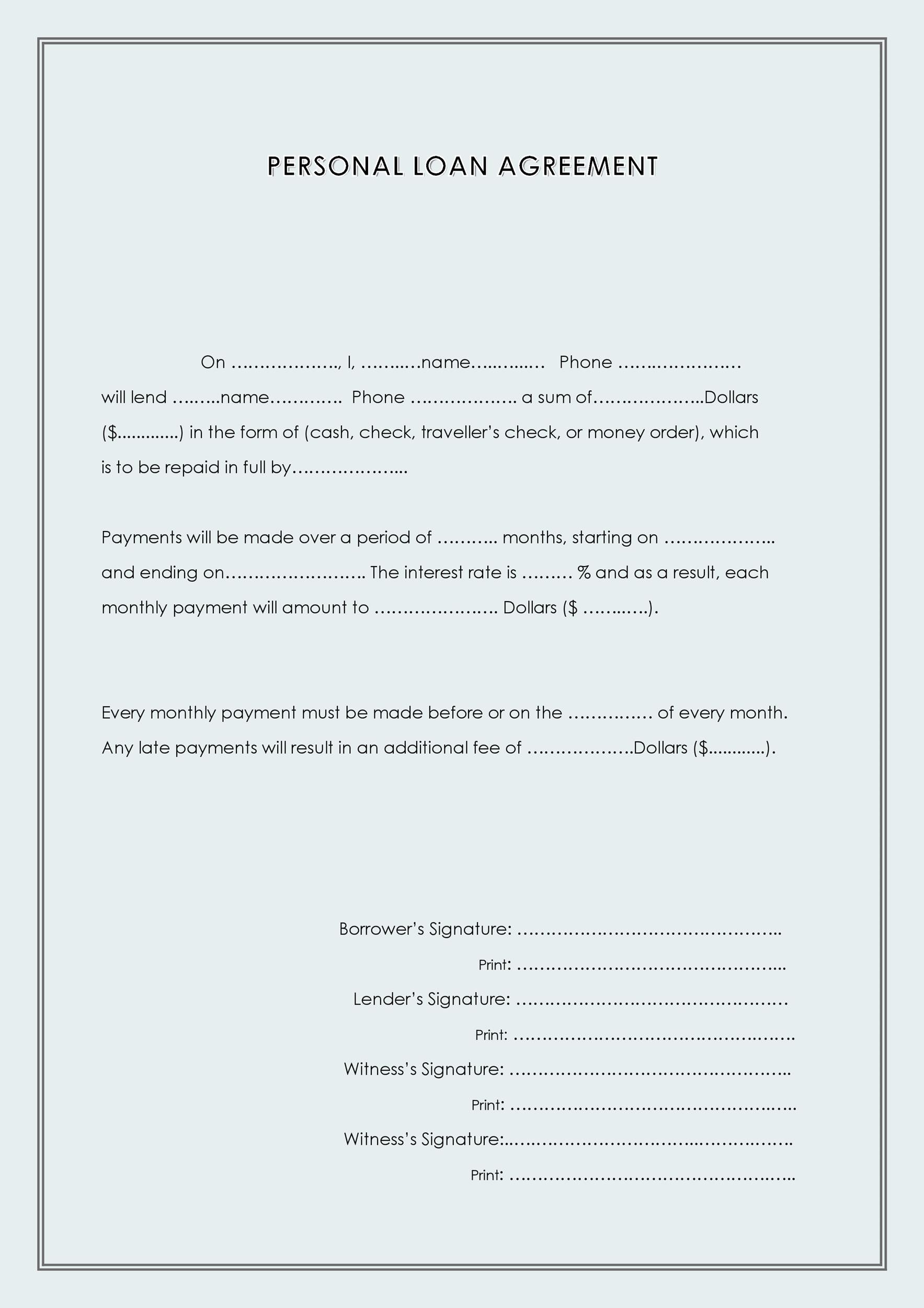

- 5 Personal Loan Agreements

- 6 How do I write a simple loan agreement?

- 7 Simple Loan Agreements

- 8 How do I write a loan agreement letter to a friend?

- 9 Loan Documents Can Offer Protection for Various Loan Agreements

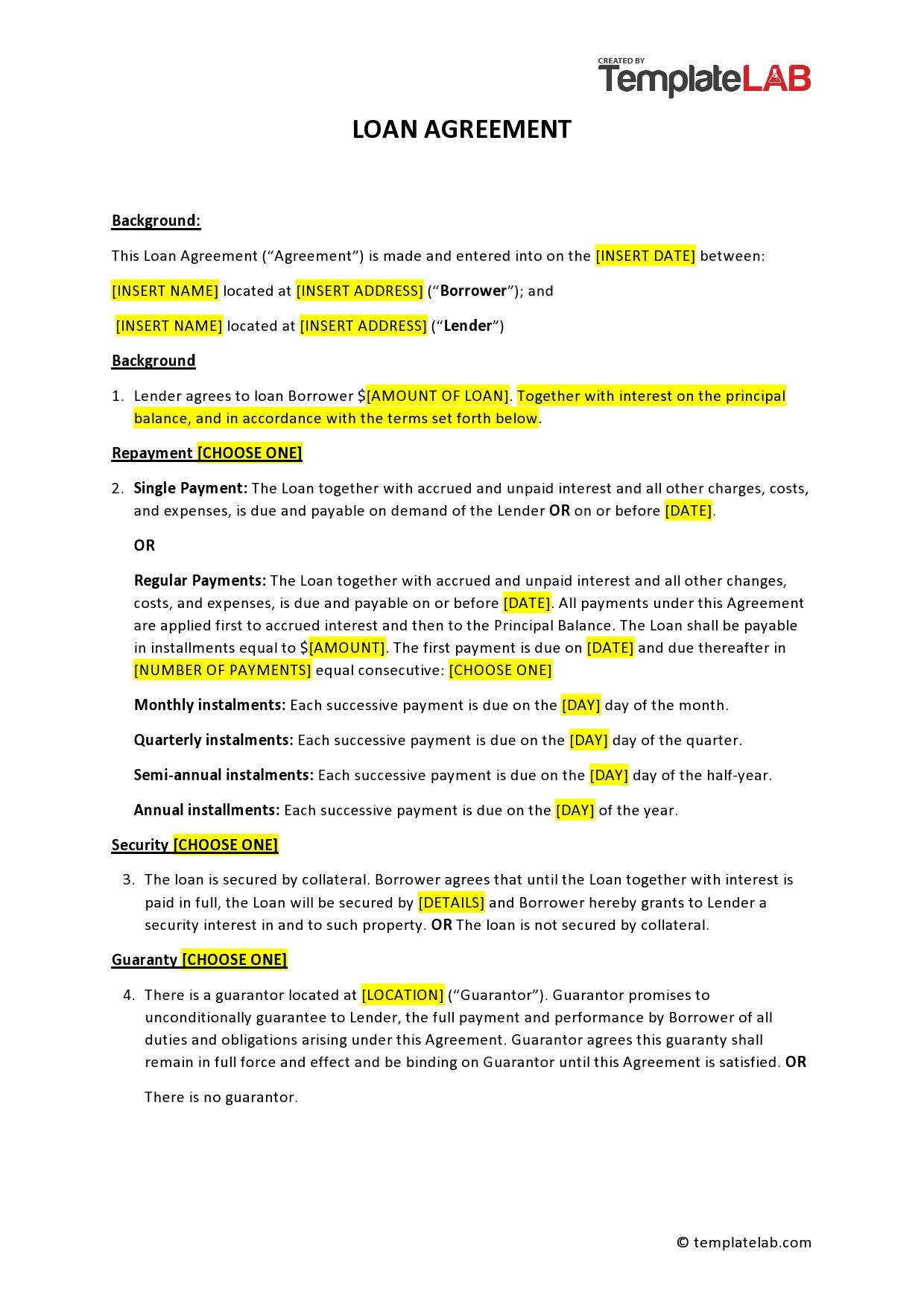

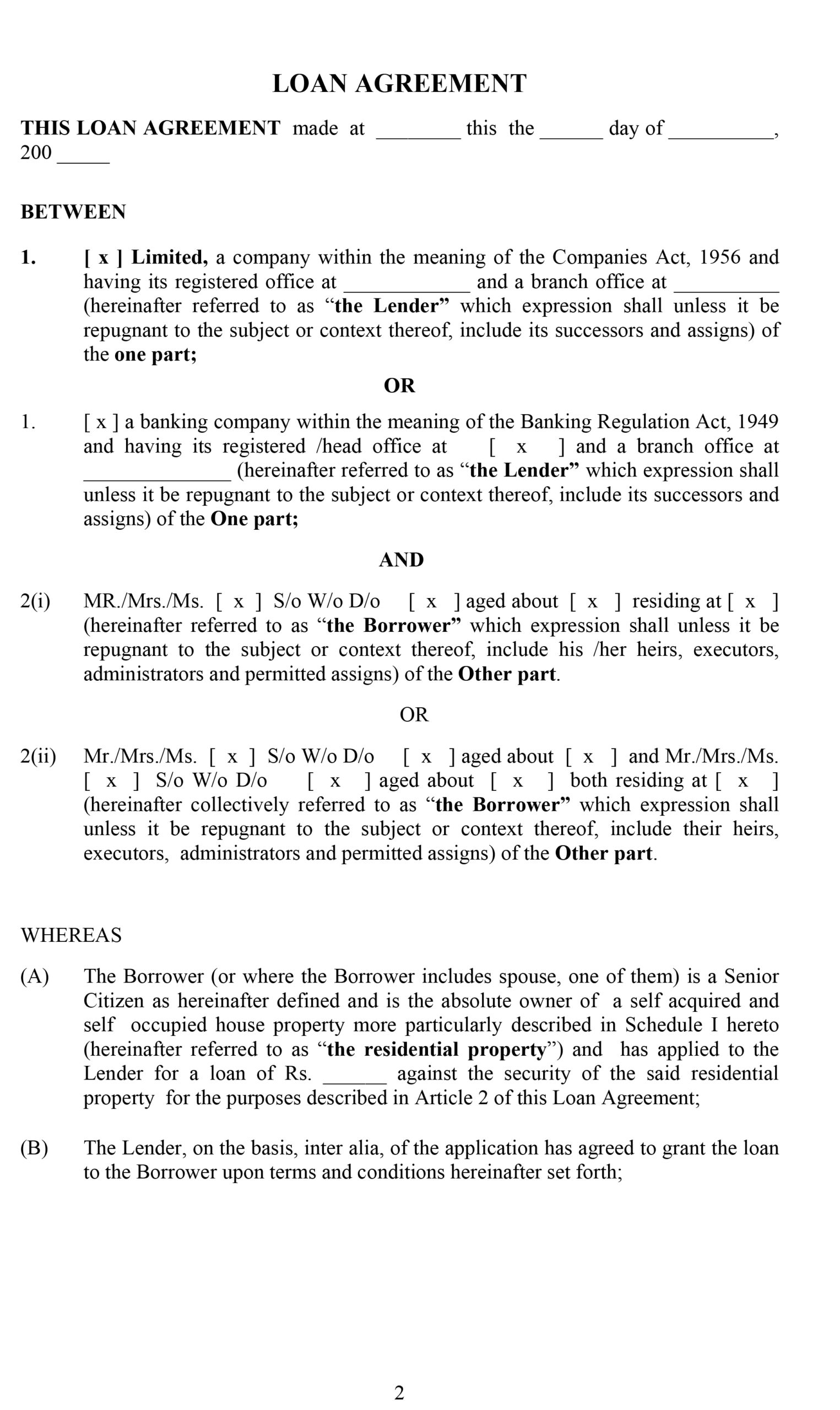

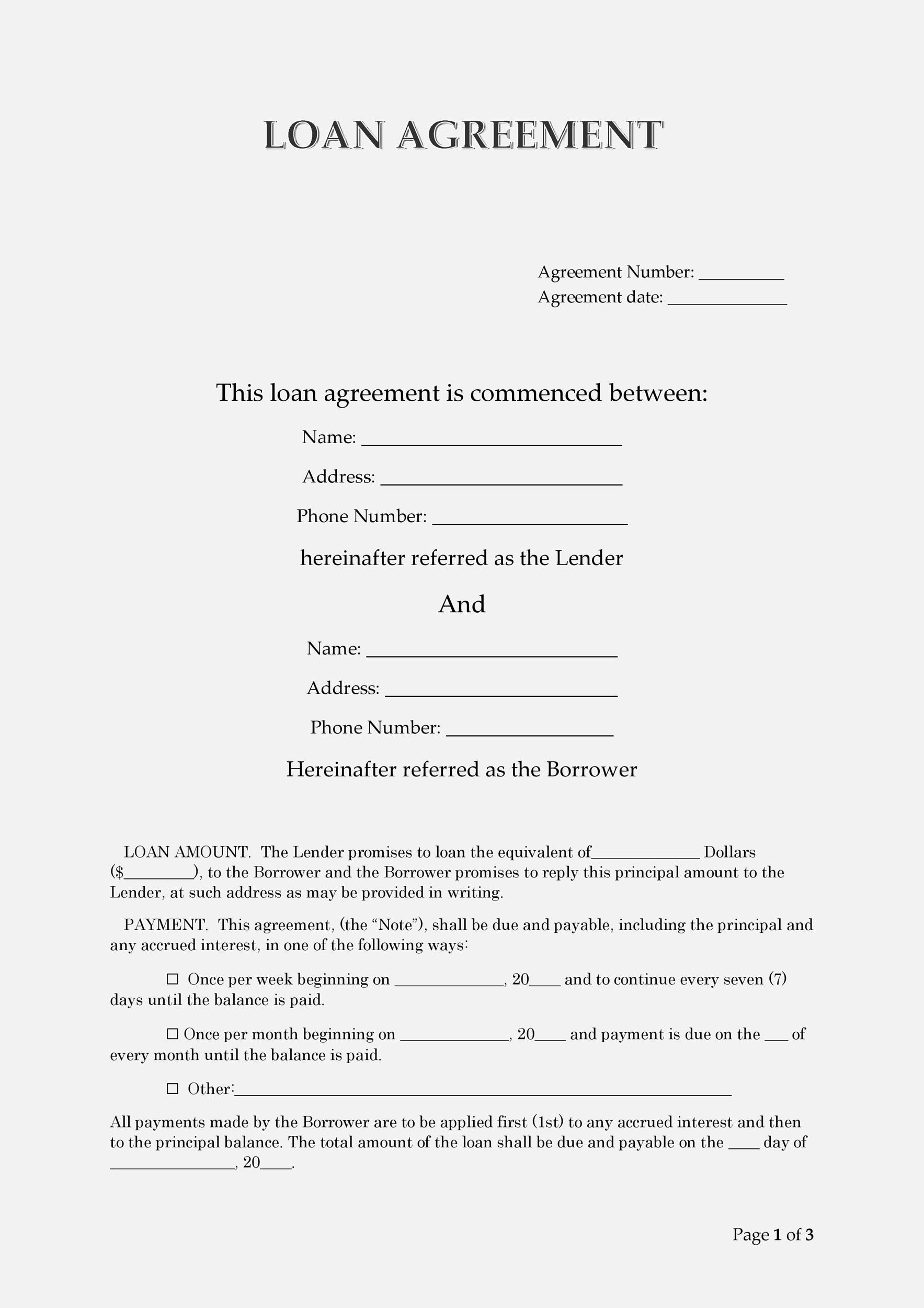

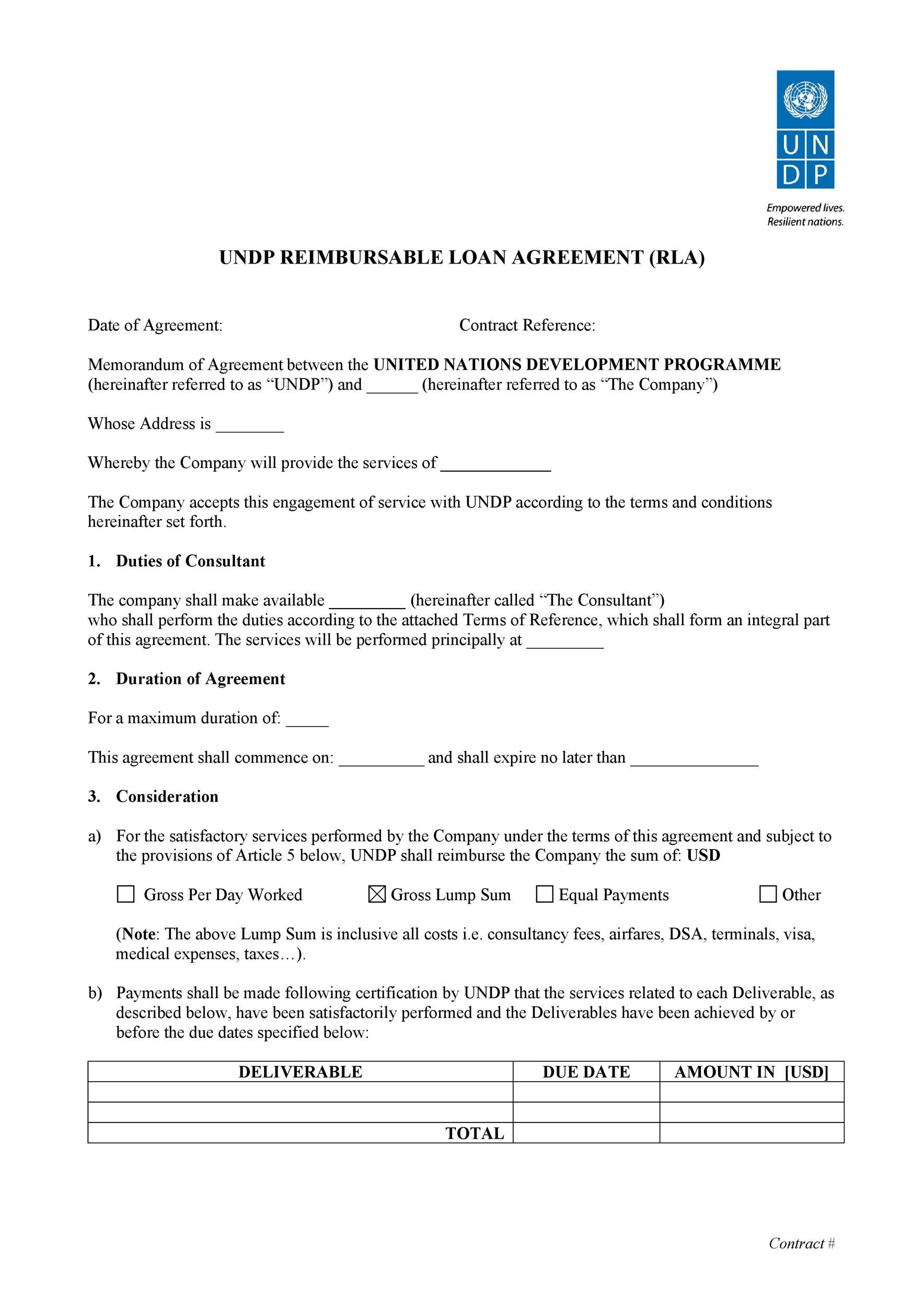

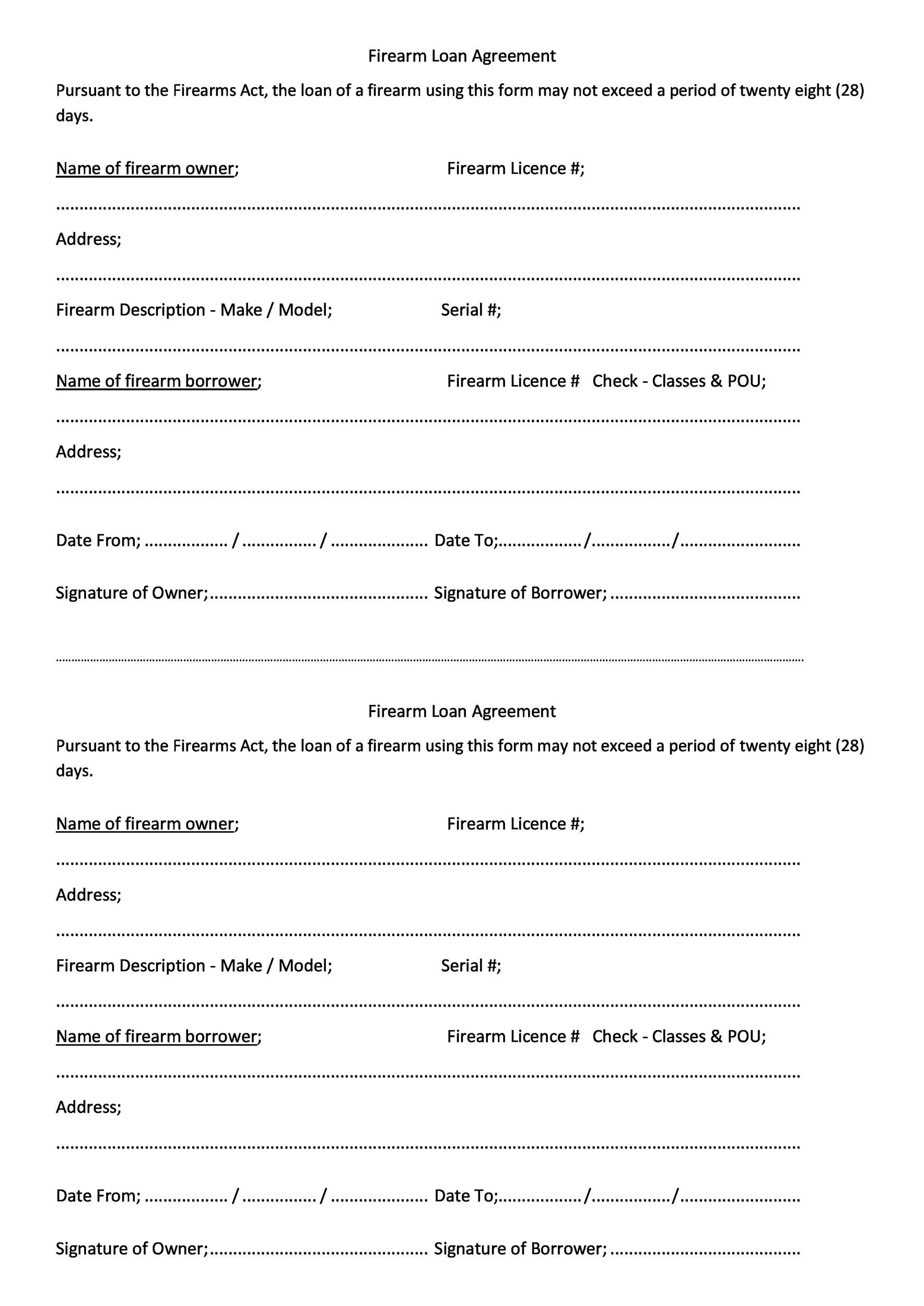

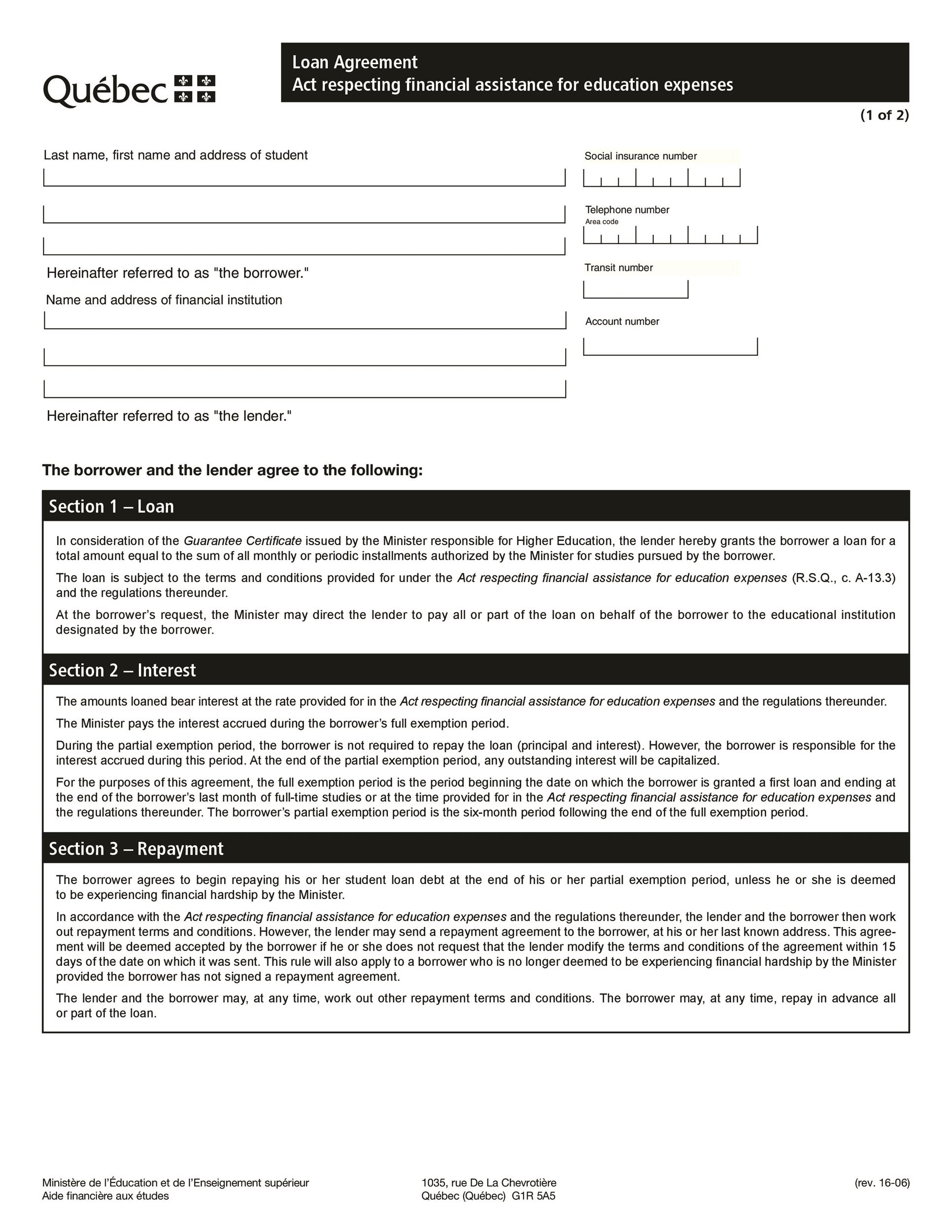

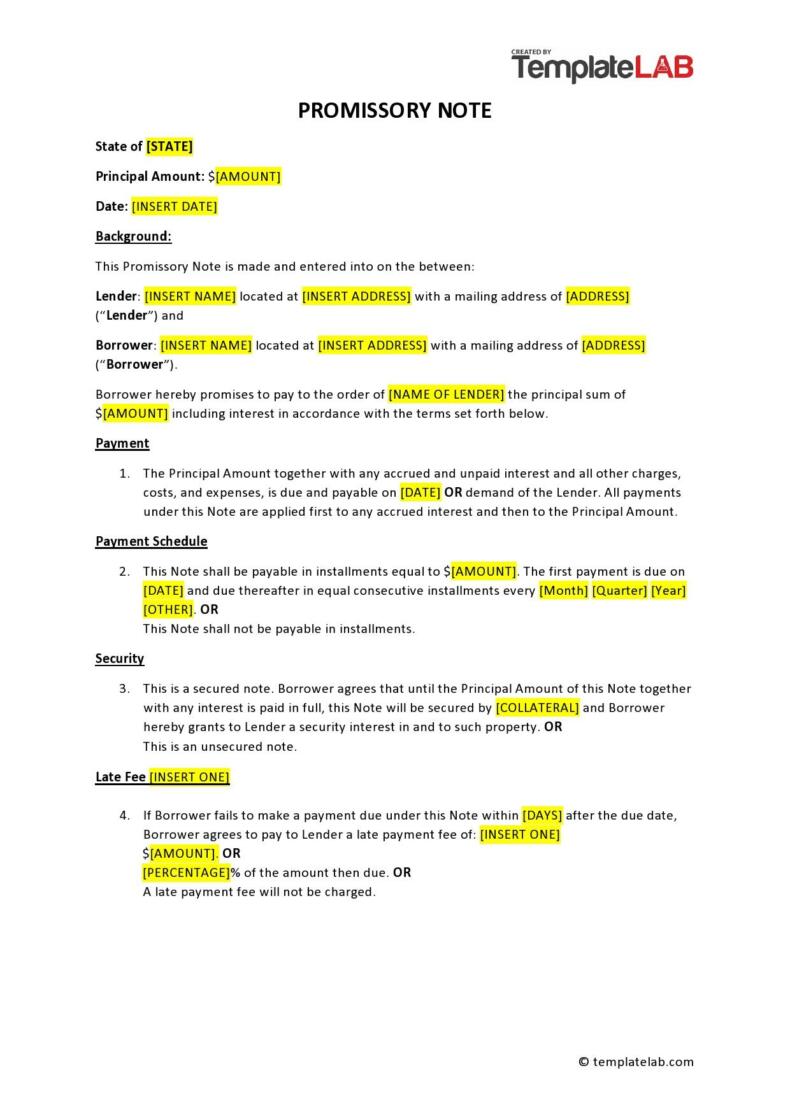

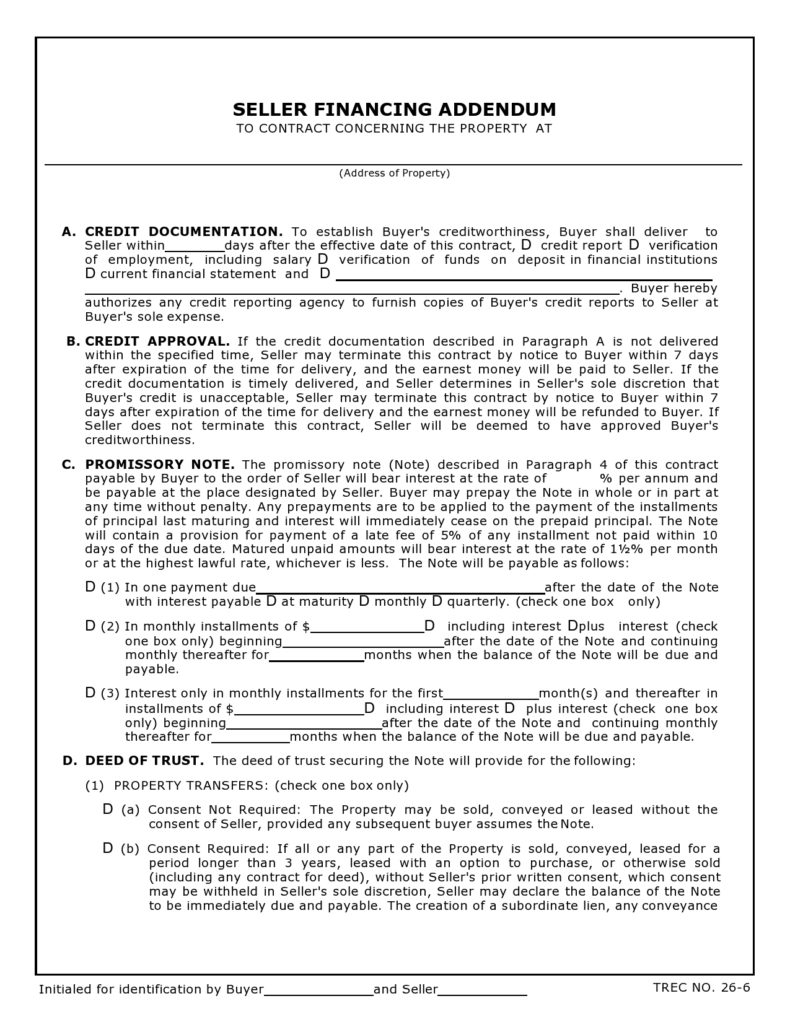

Loan Agreement Templates

What is a Loan Agreement?

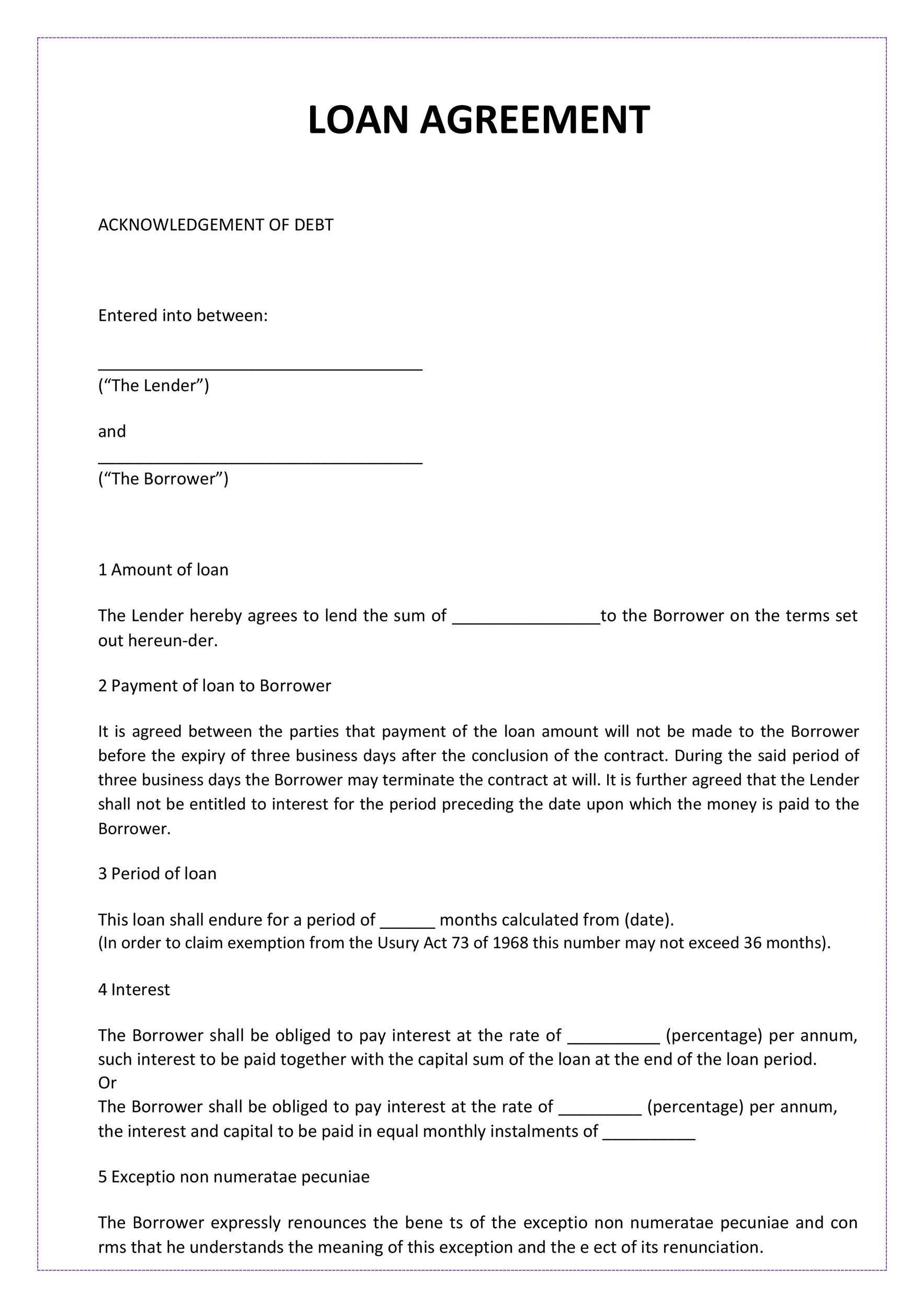

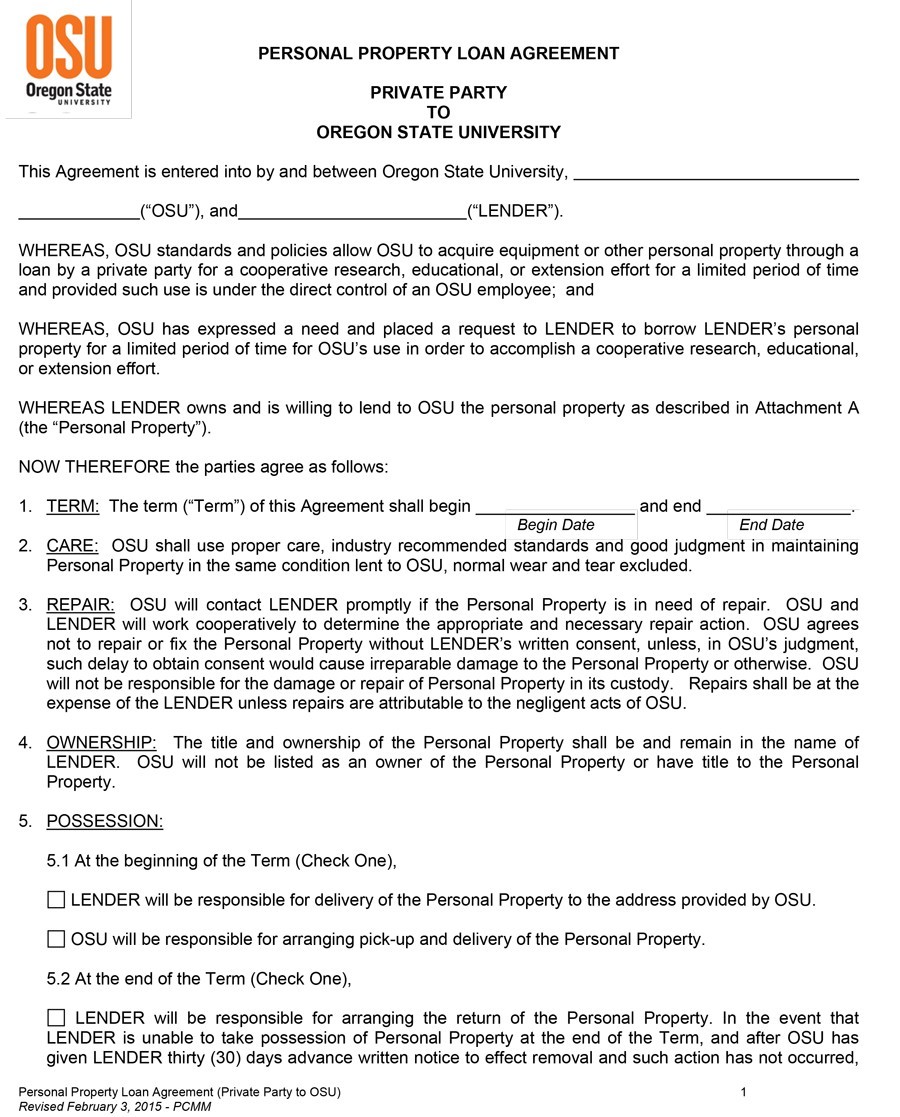

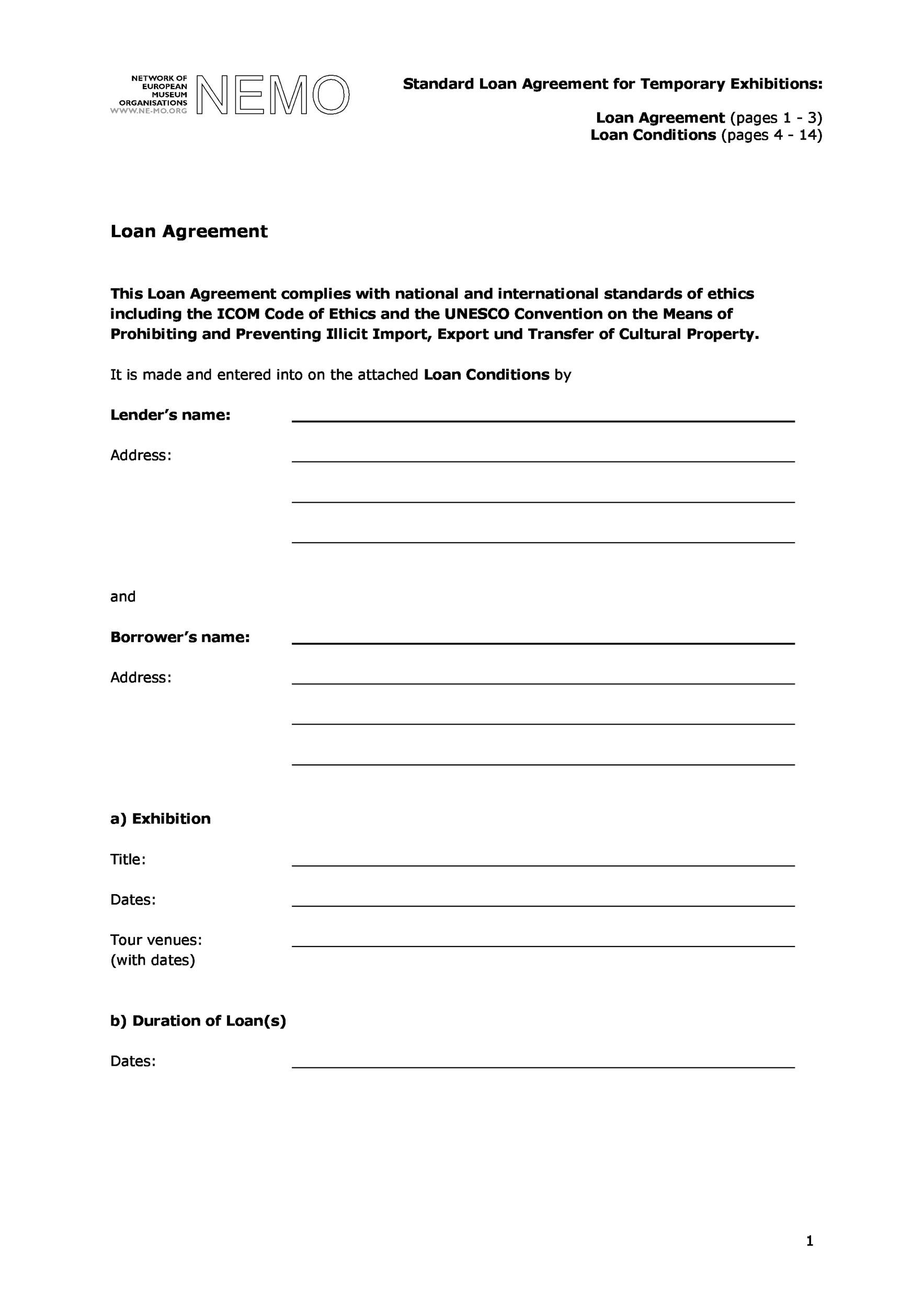

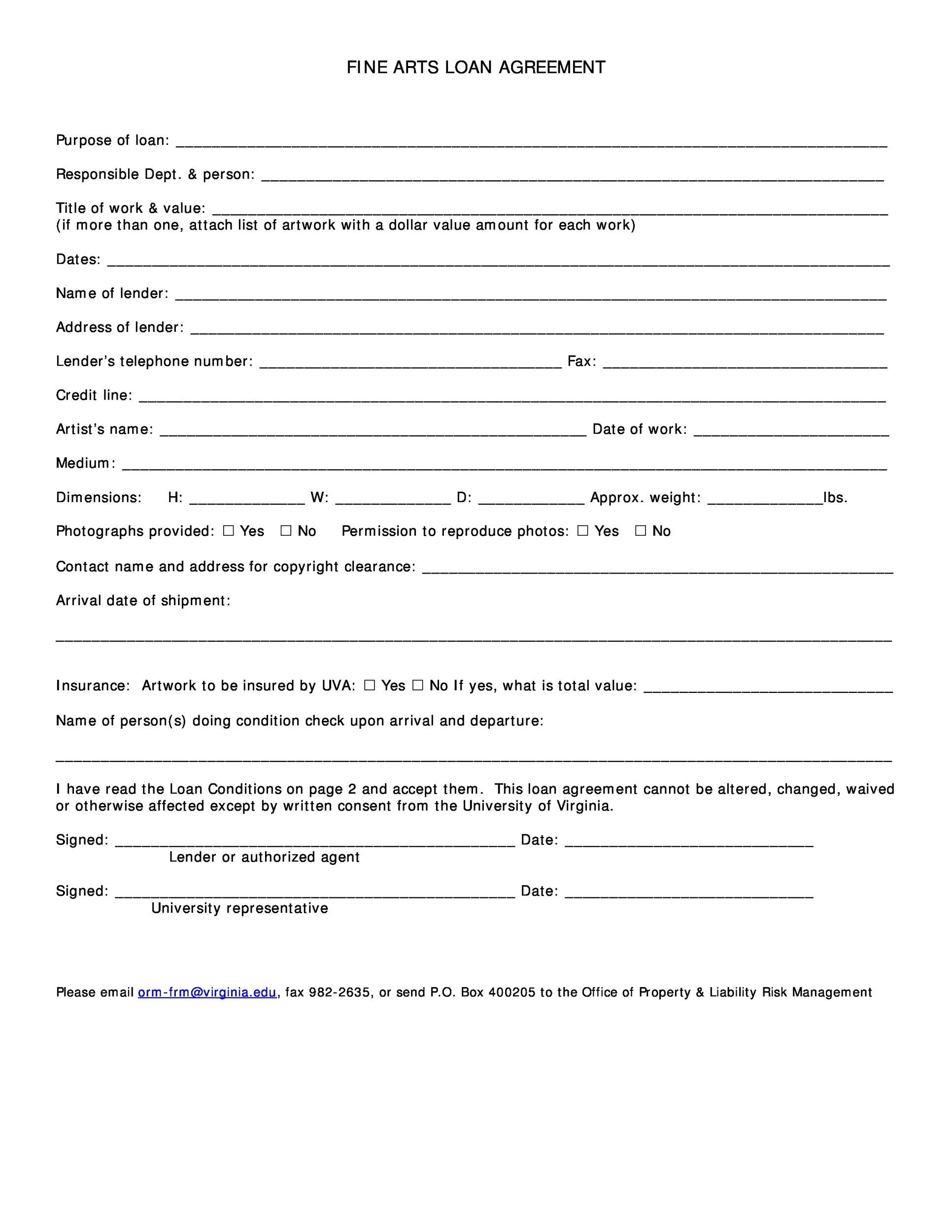

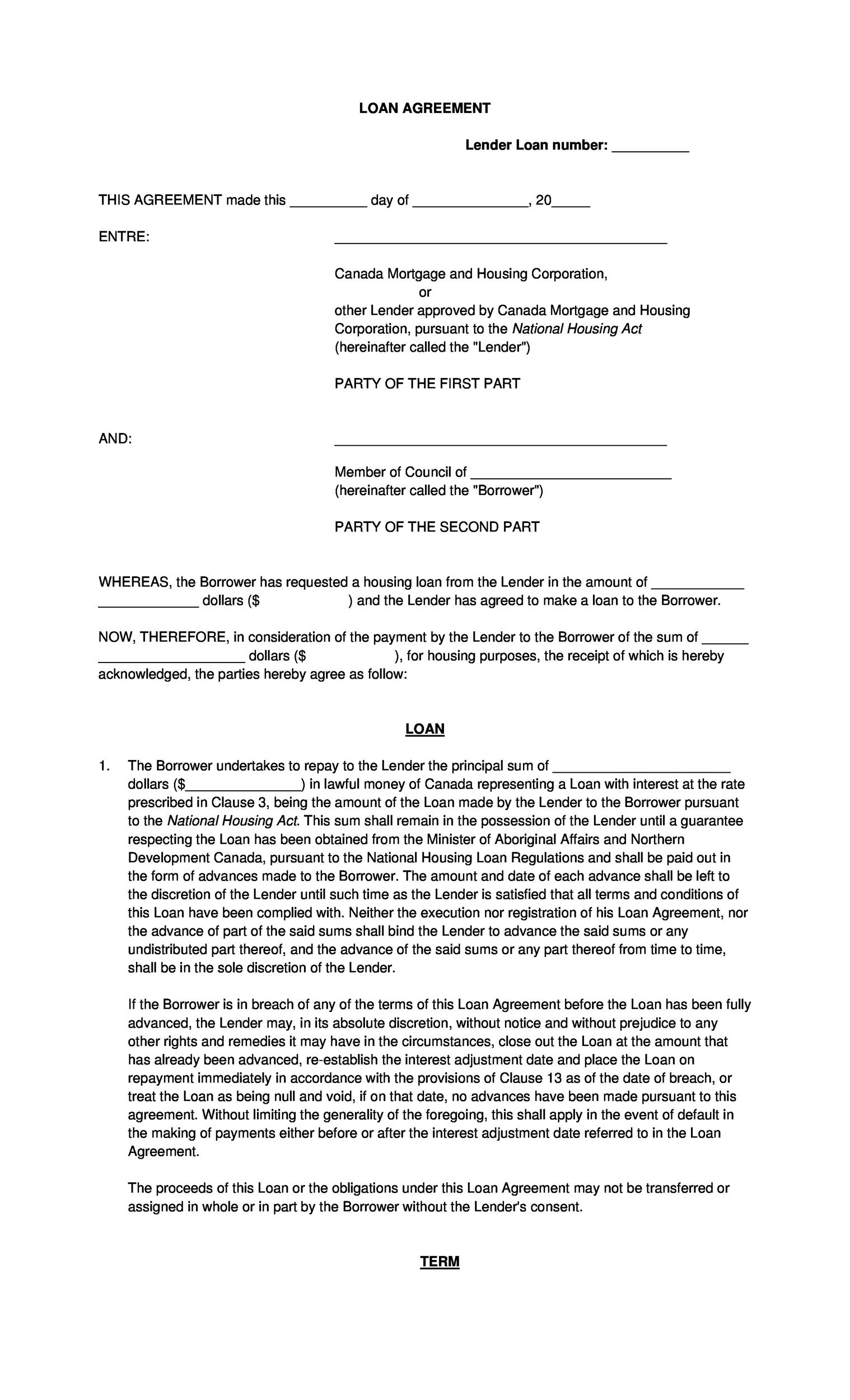

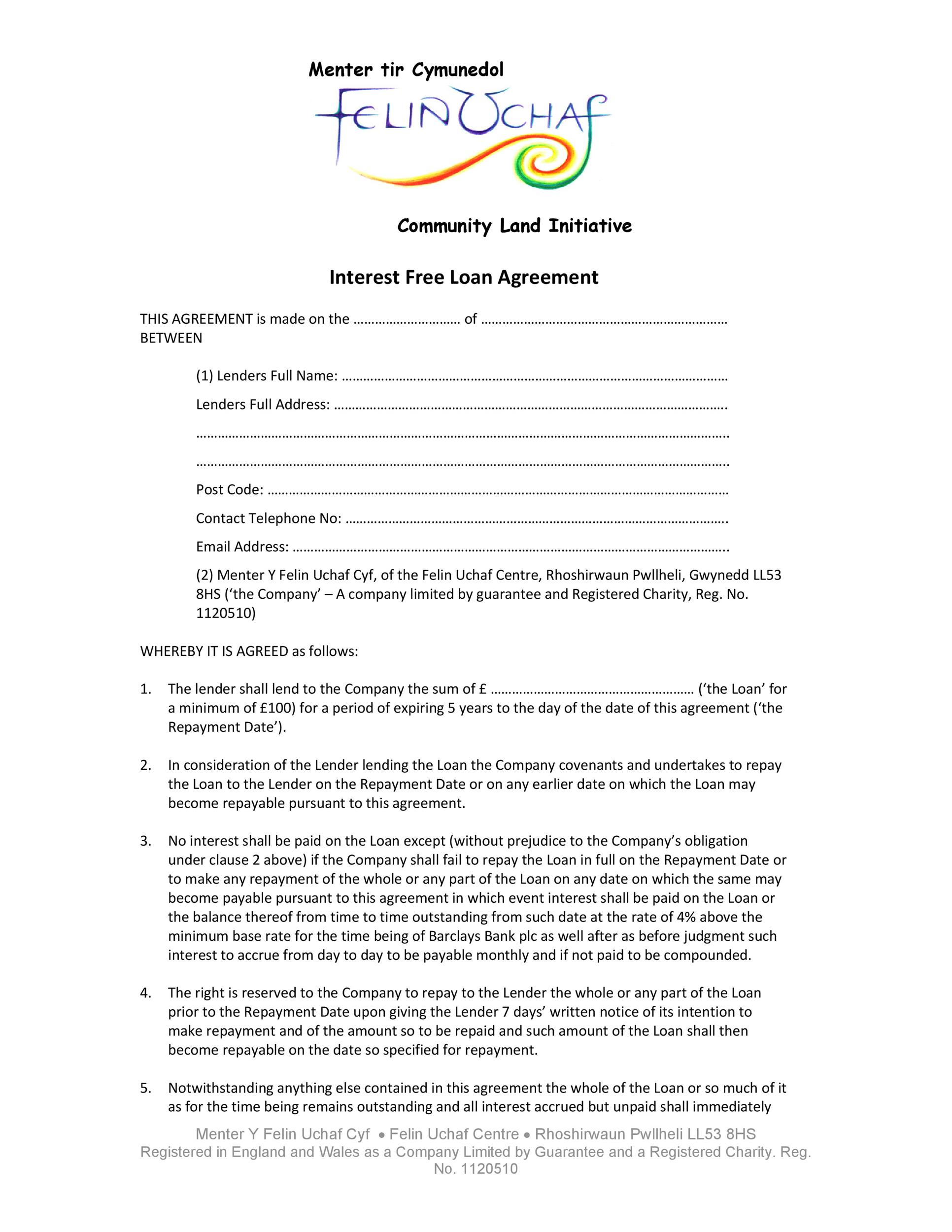

Loan agreements are legal contracts that are made between a borrower and a lender. This document tells both parties how much money is being borrowed and also sets the terms of the loan, from the payment schedule to the payment amount and more. Loan agreements can be used for a variety of different purposes to help make sure that your loan is repaid properly and that there are no issues between the parties involved in the loan.

Use a loan document for the following reasons:

- Lending or borrowing money from friends and family

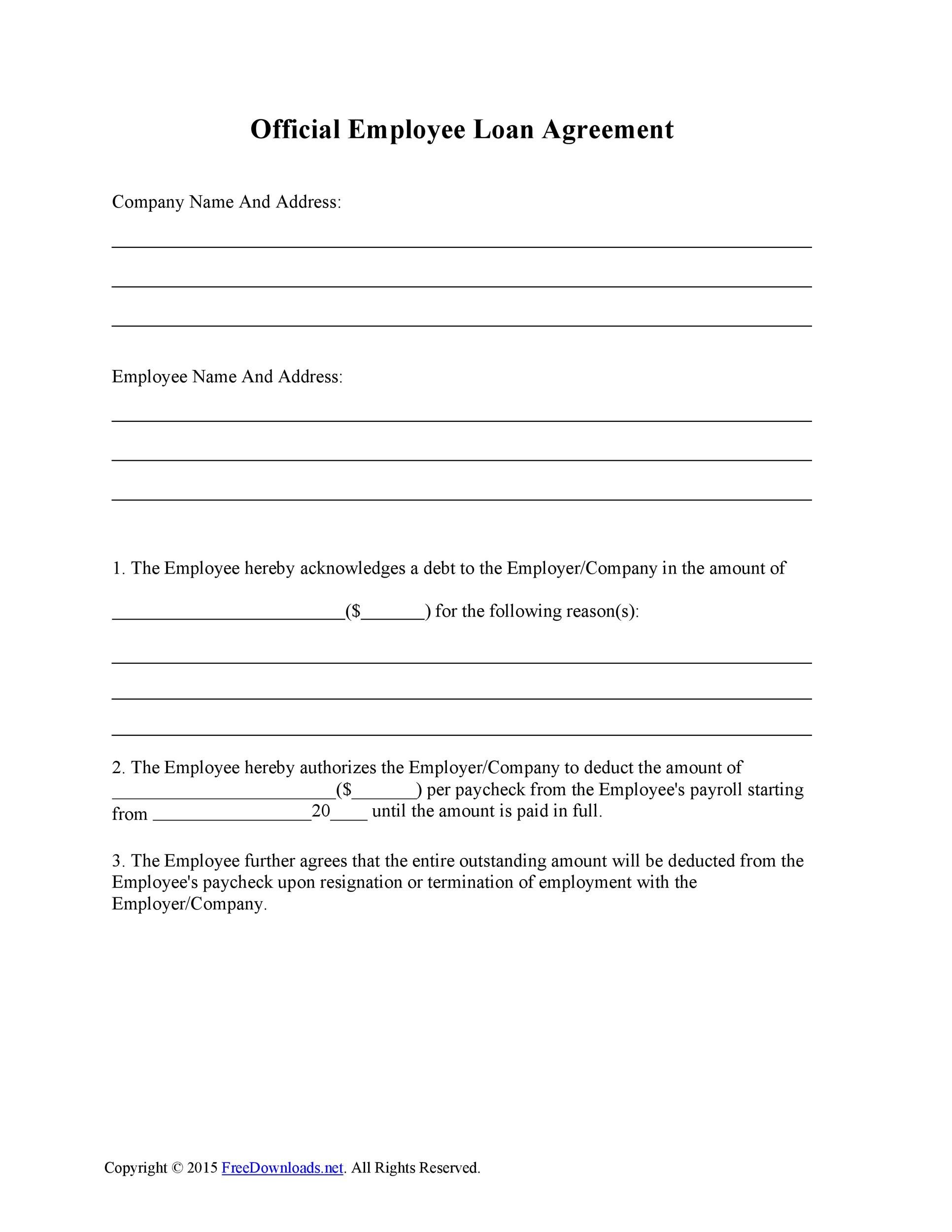

- Loaning money to someone that you work with

- Borrowing from a lender or institution

The loan agreement information that is included in this document should not be different, even if you are lending money to a friend or a family member. The document that you are creating is legally binding in either situation, just like when you enter into a loan with a lender or a business. It is important to remember that this is the case when you create a document like this since you will be forced to adhere to it just like the other party involved. You do not want to create a document that does not reflect the way that you want your loan process to proceed, especially if there is a dispute about the details of the loan that leads to a legal battle over the loan stipulations and requirements.

Other names for the loan agreement template that you are writing might be:

- Business loan agreement

- Loan contract

- Personal loan

- Promise to pay

- Secured or unsecured note

- Term loan

All of these names are legally acceptable, and they do not change the nature of the loan or the intentions of its creation. When someone signs a document with these names, they are still signing a legal loan document that can be enforced in a court of law. Do not worry about the name of the document and believe that it will impact the nature of the loan itself or the legal purposes of the document.

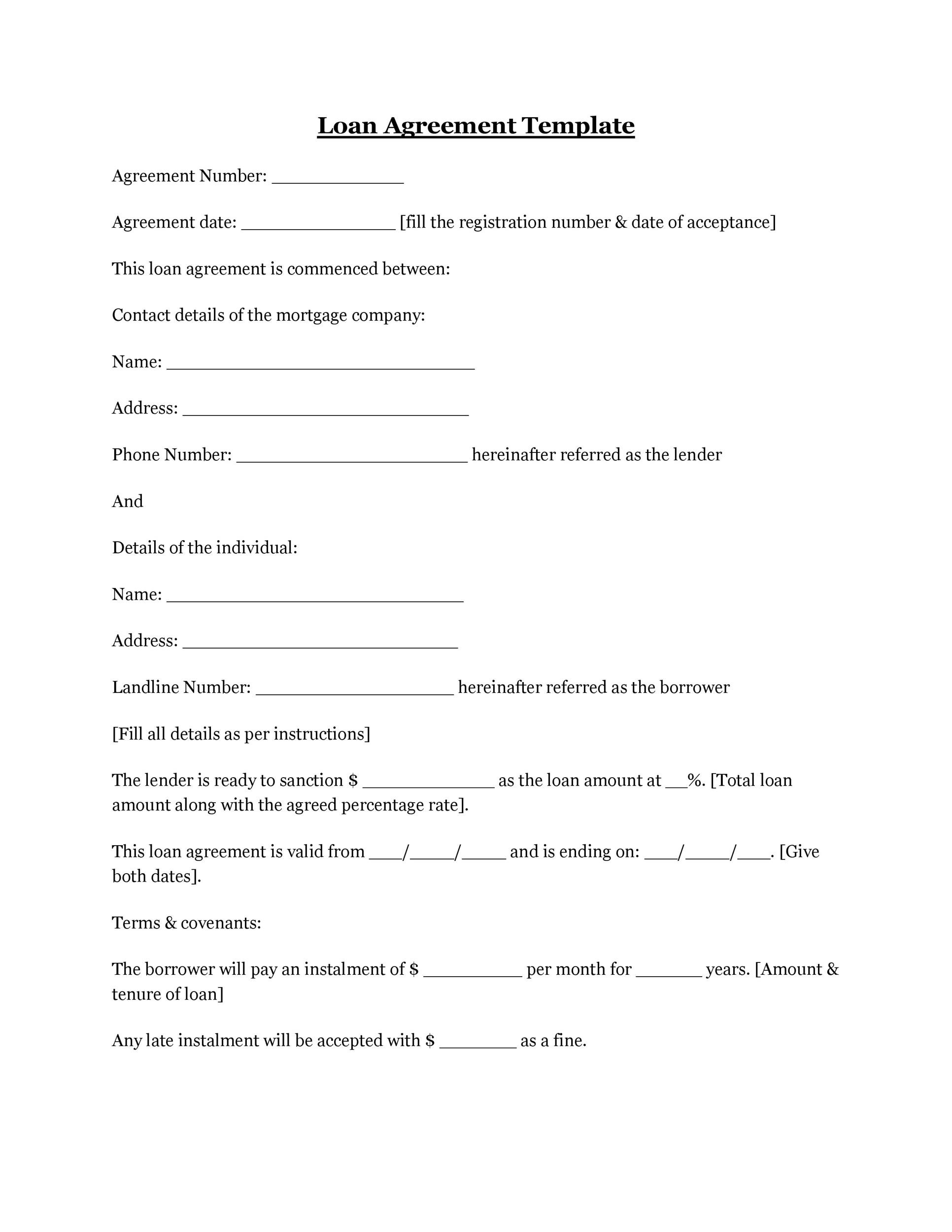

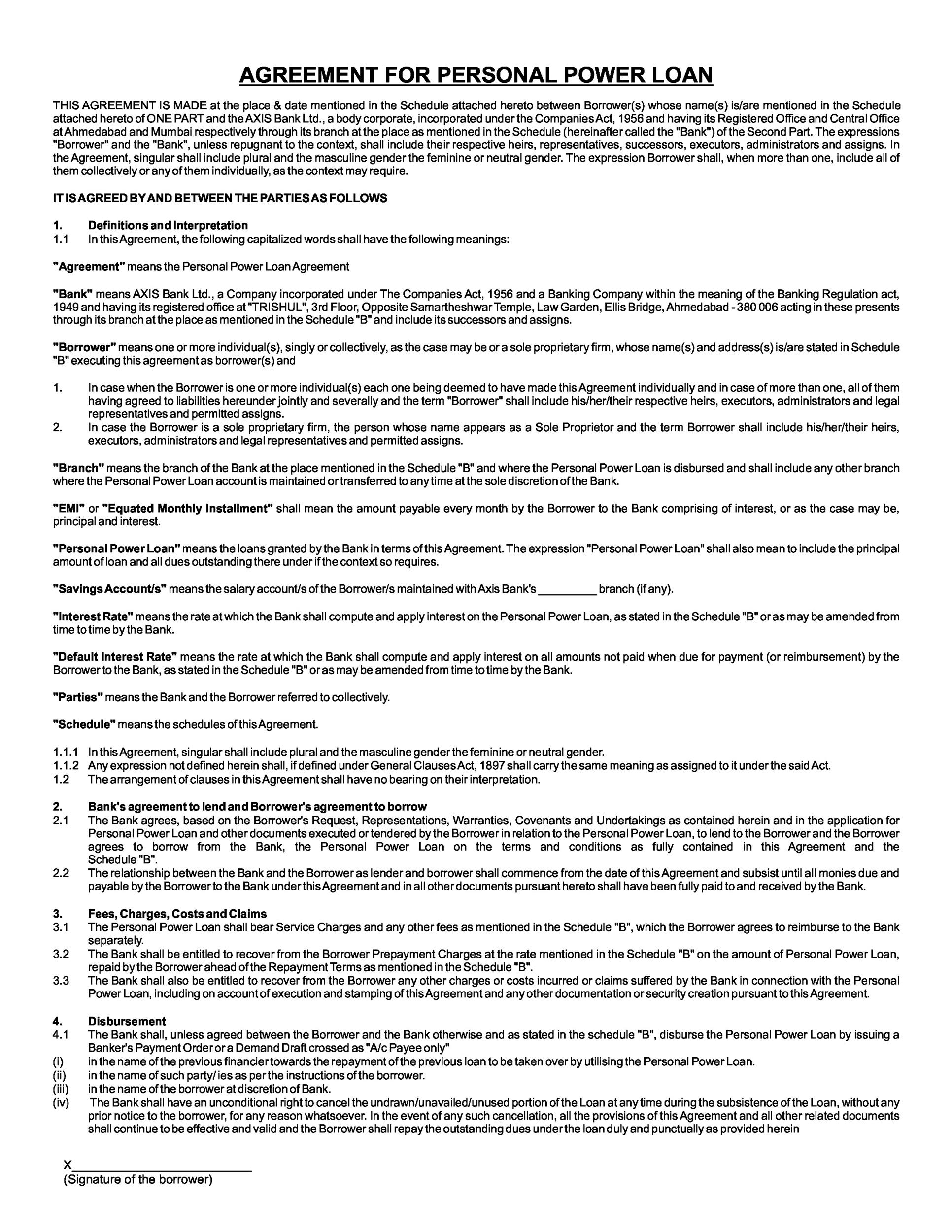

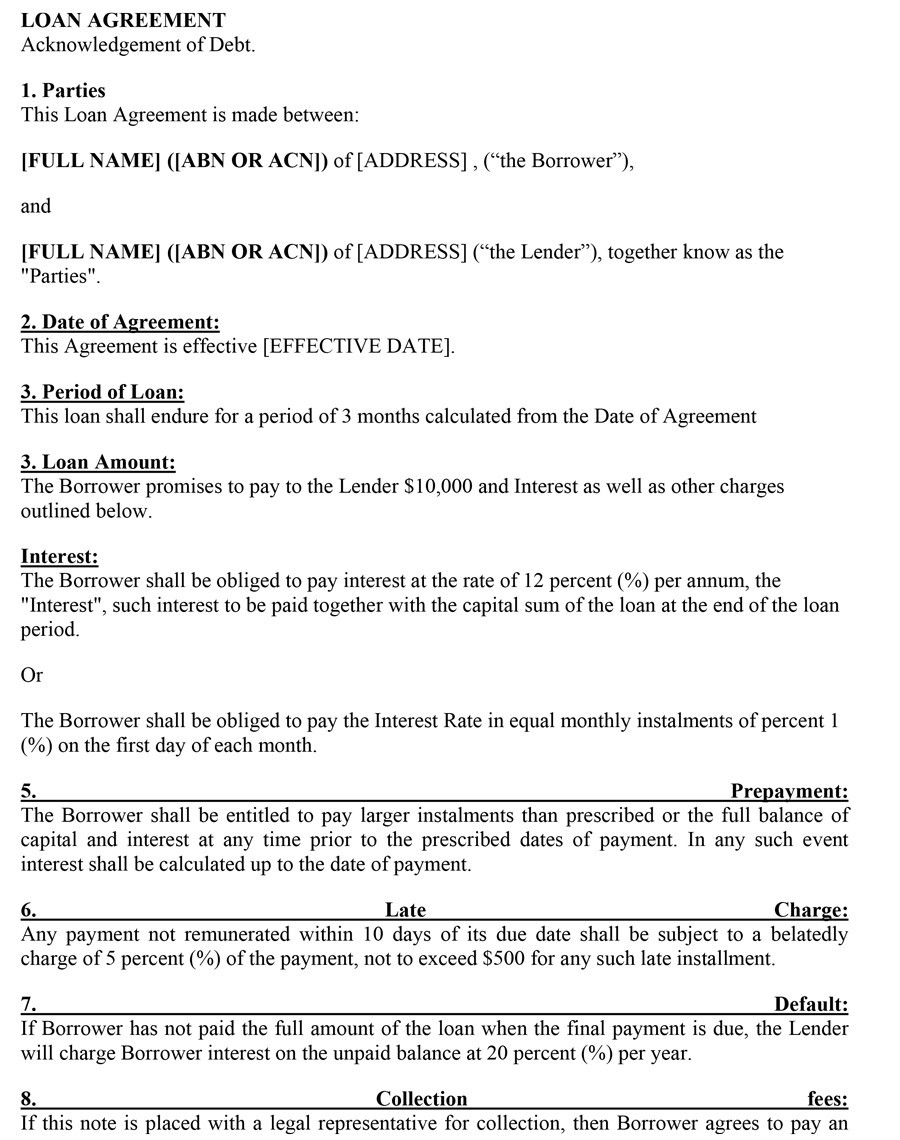

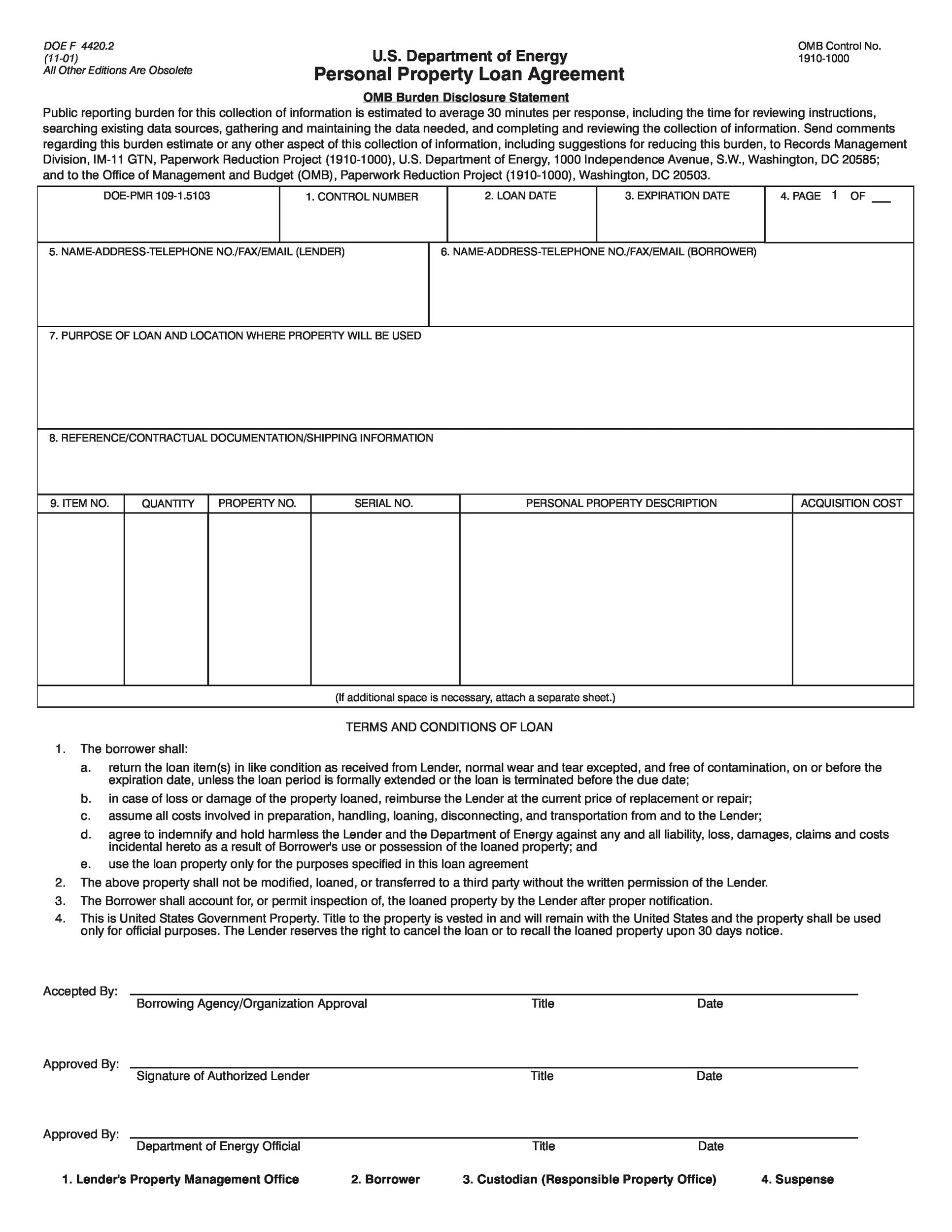

Loan Agreement Forms

Can I write my own loan agreement?

You can choose to write your own loan agreement. If you do so, you will need to be sure that all the right information is included in the document. Even if your loan document is written by someone who is not a lawyer or legal professional, you need to be sure that the document can be pointed at for guidance about the way that the loan process should proceed. Leaving any details unclear can lead to problems with the execution of the loan itself and can also cause issues if you need to enforce the loan document in a court of law.

Make sure as well that you resist the urge to handwrite your loan documents. While this does not make the loan invalid, it can make it hard to read the terms of the document and hard to make copies of the document as well. You will be better off avoiding handwriting any legal document that you enter into with another party to prevent problems with legible handwriting or the document from degrading over time and being hard to read.

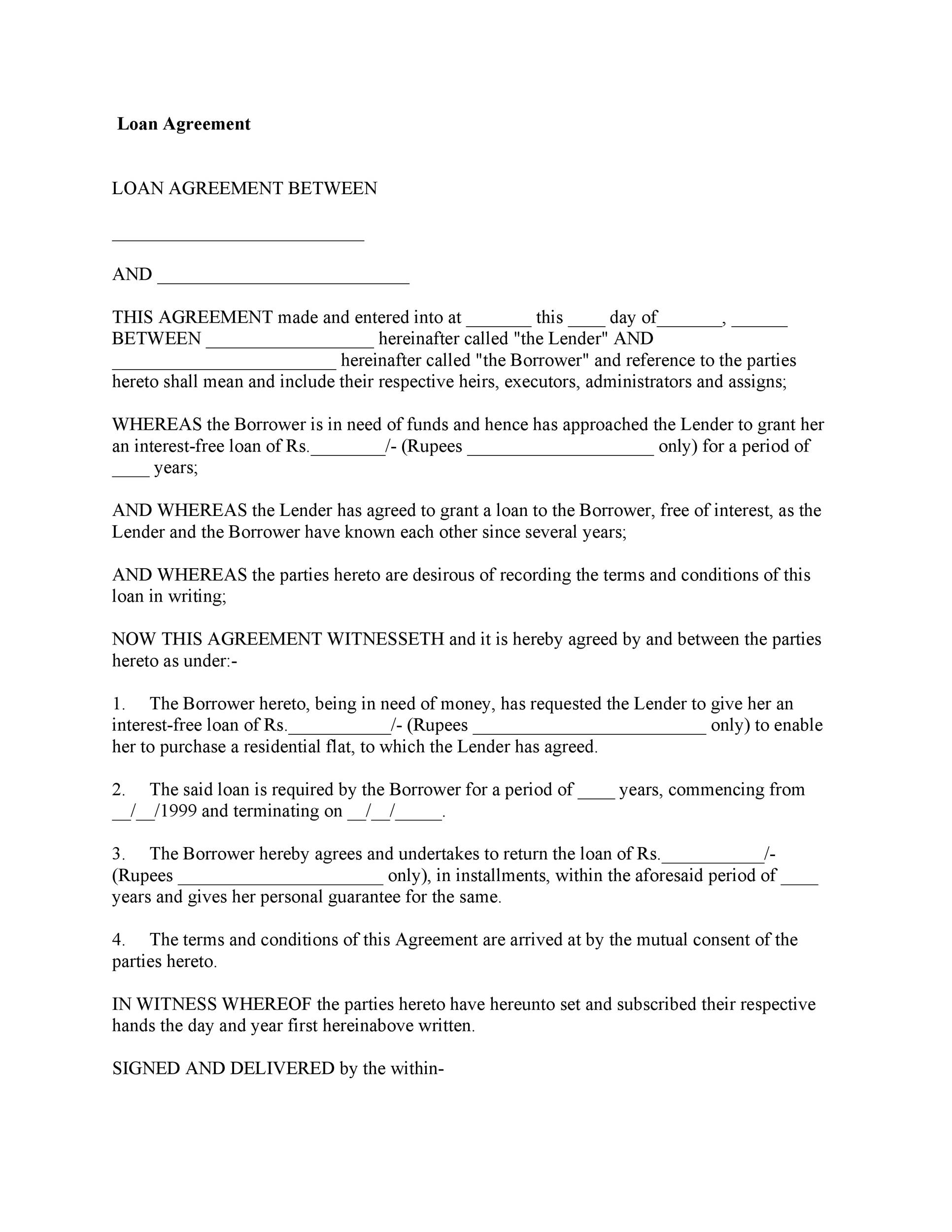

Personal Loan Agreements

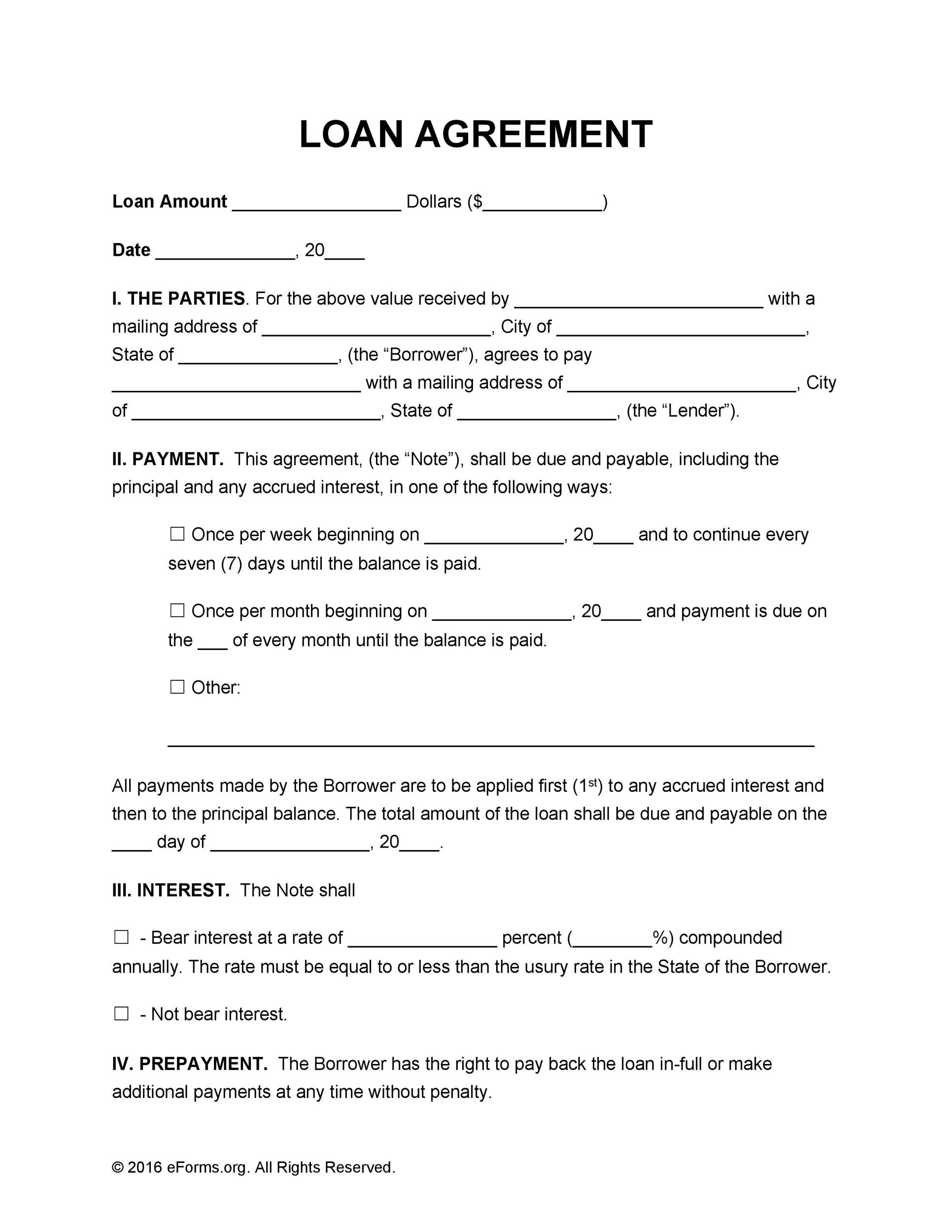

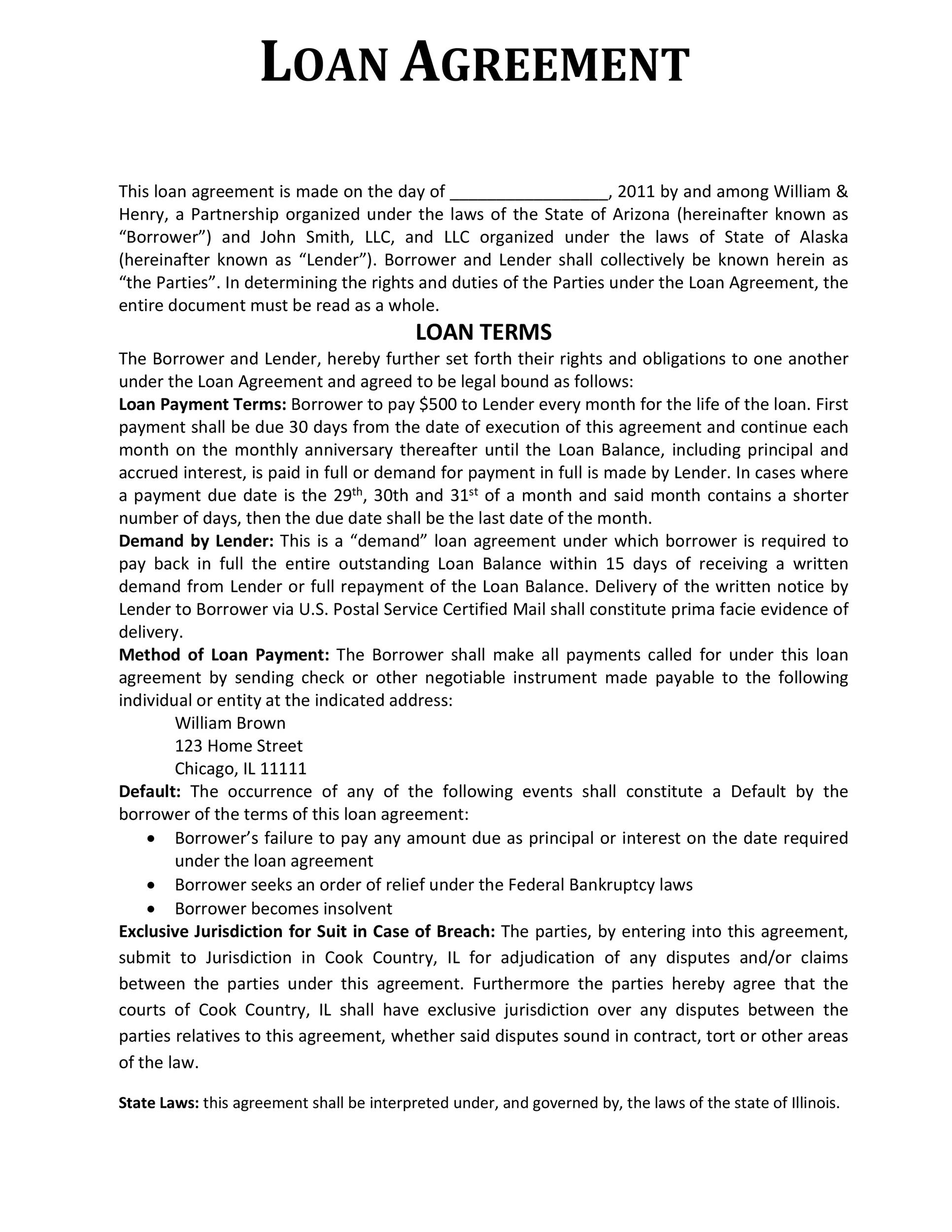

How do I write a simple loan agreement?

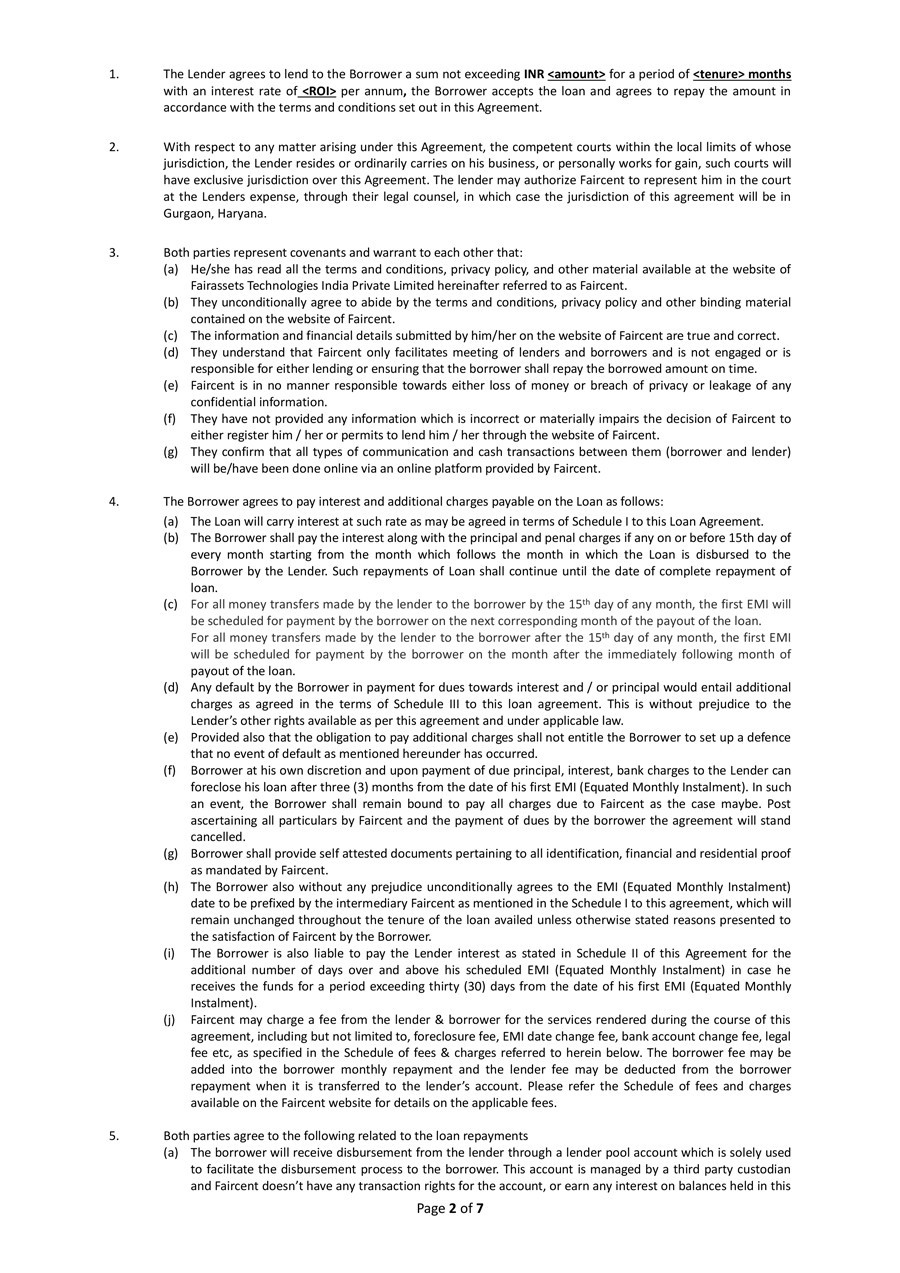

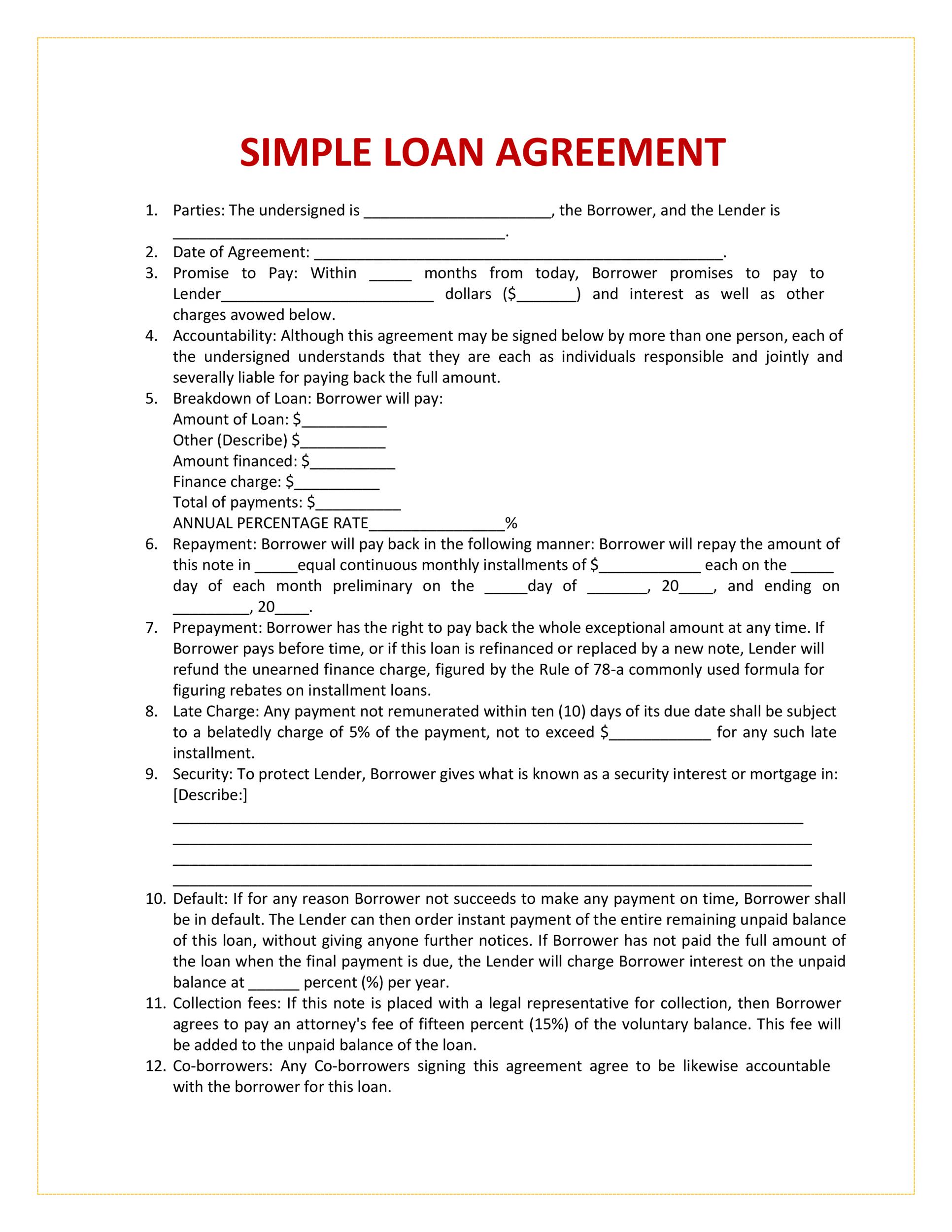

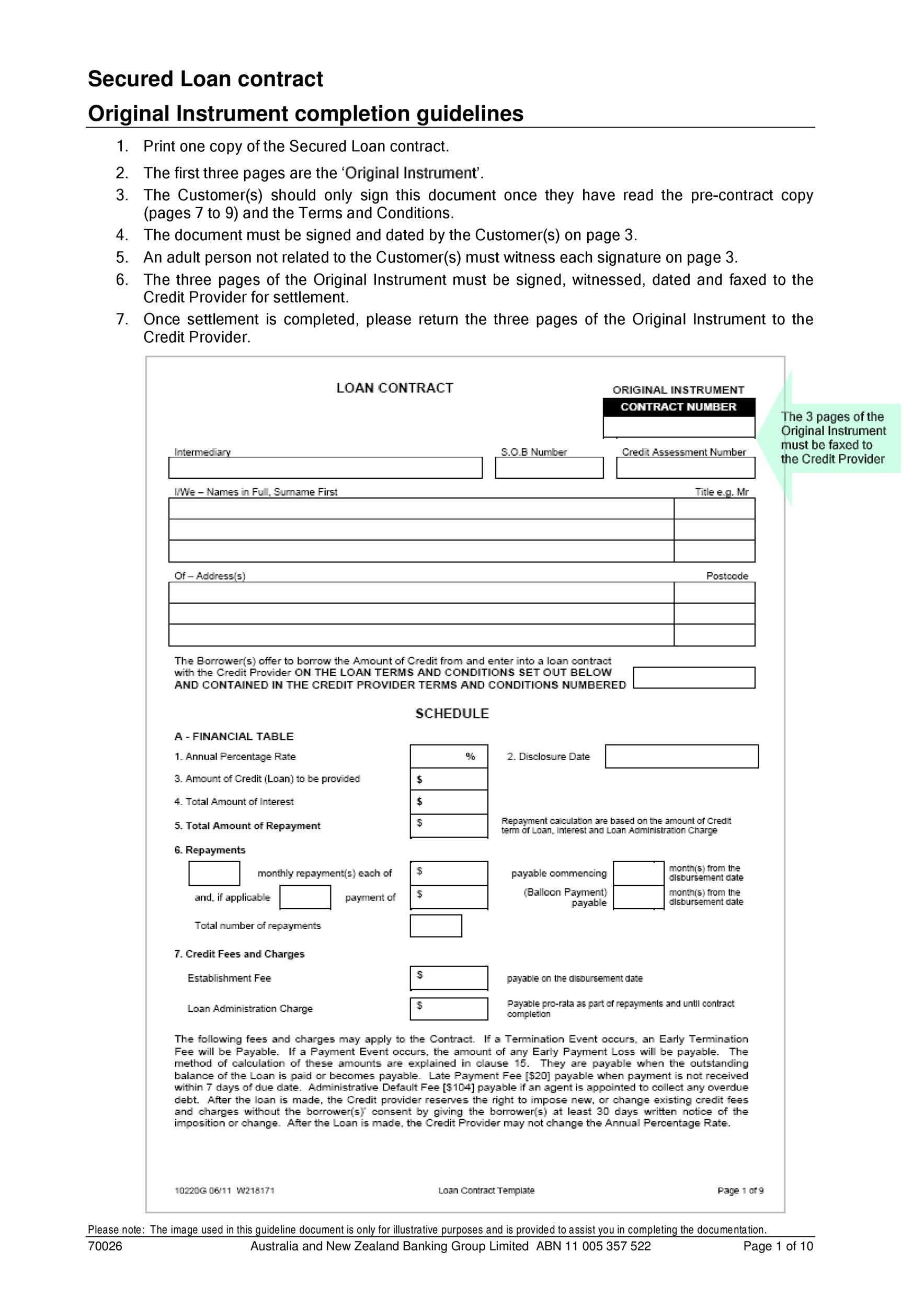

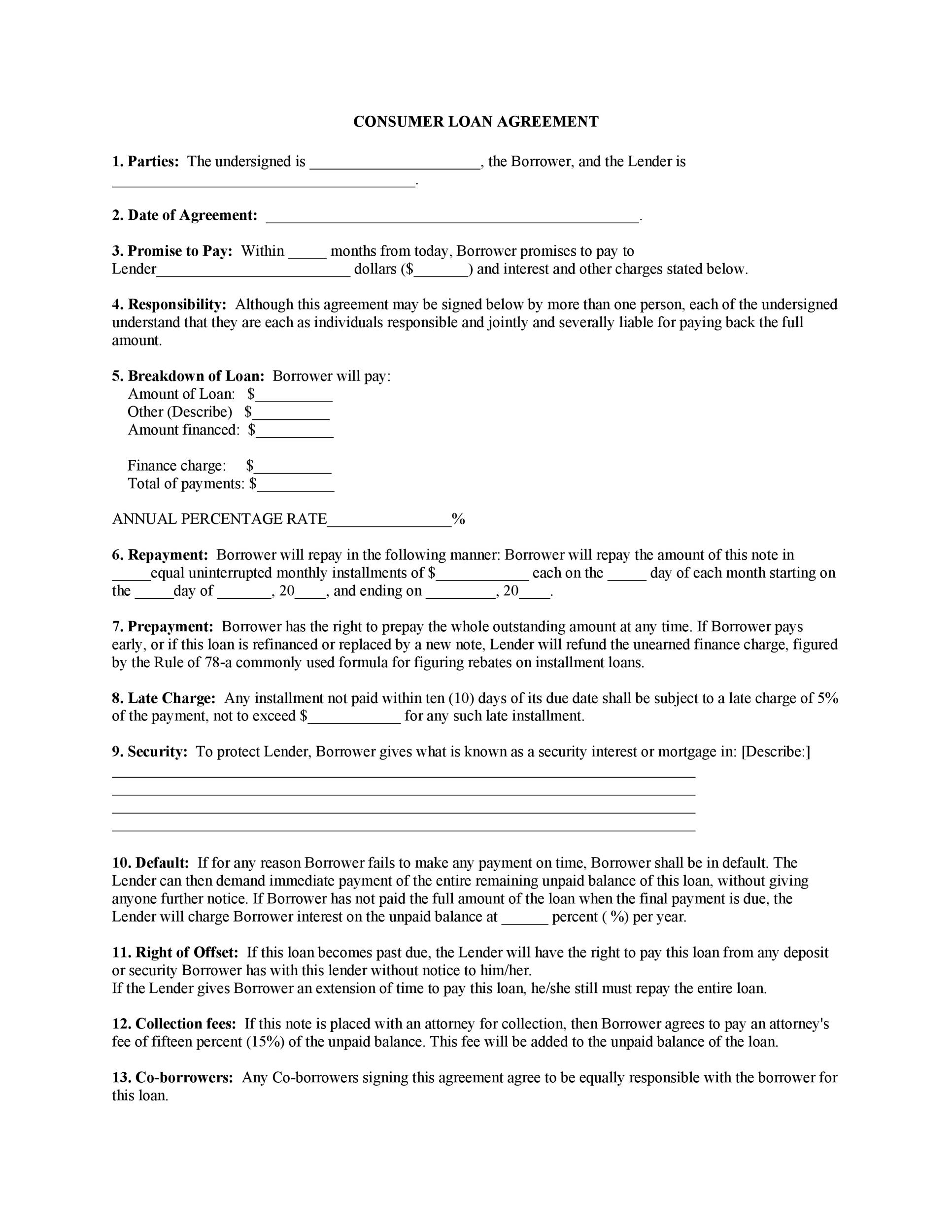

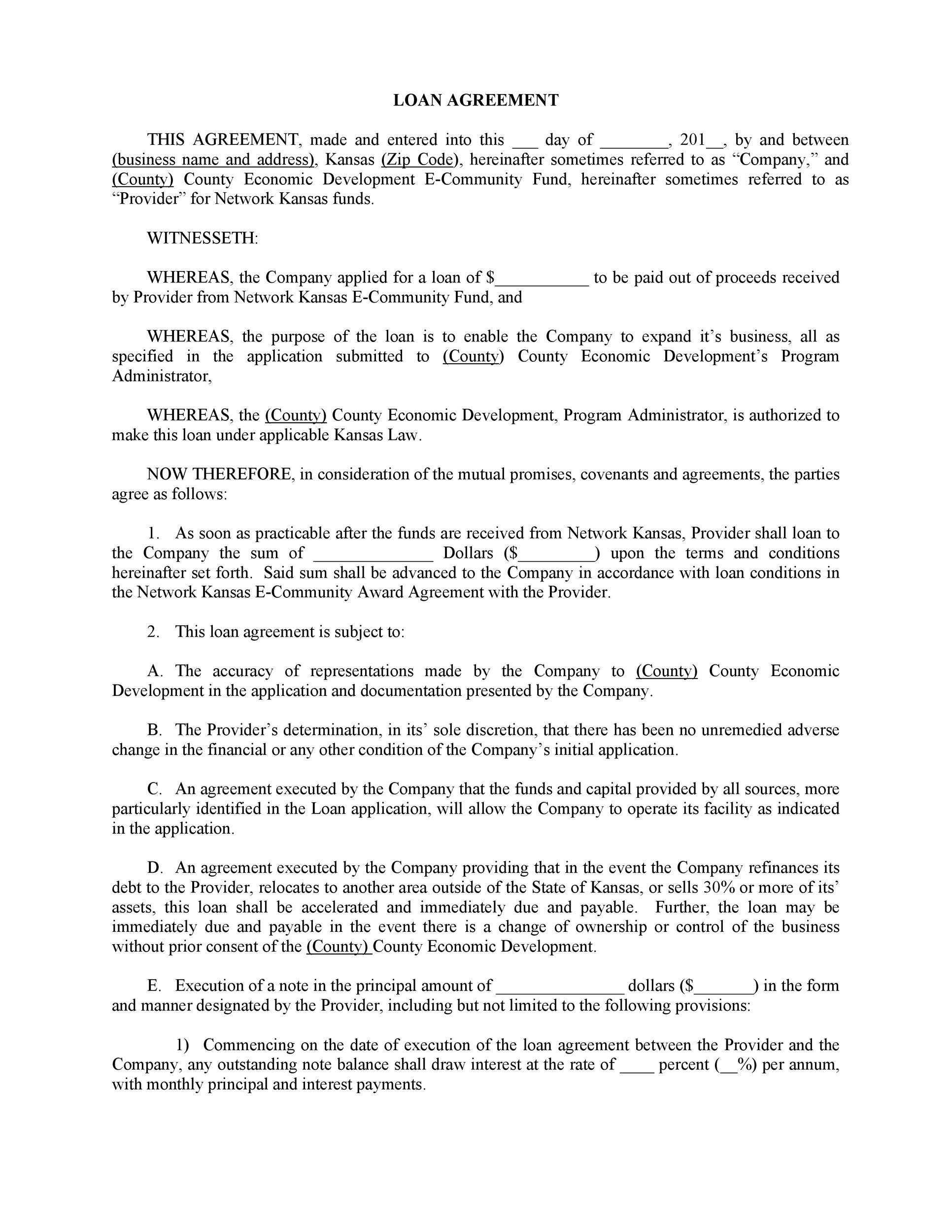

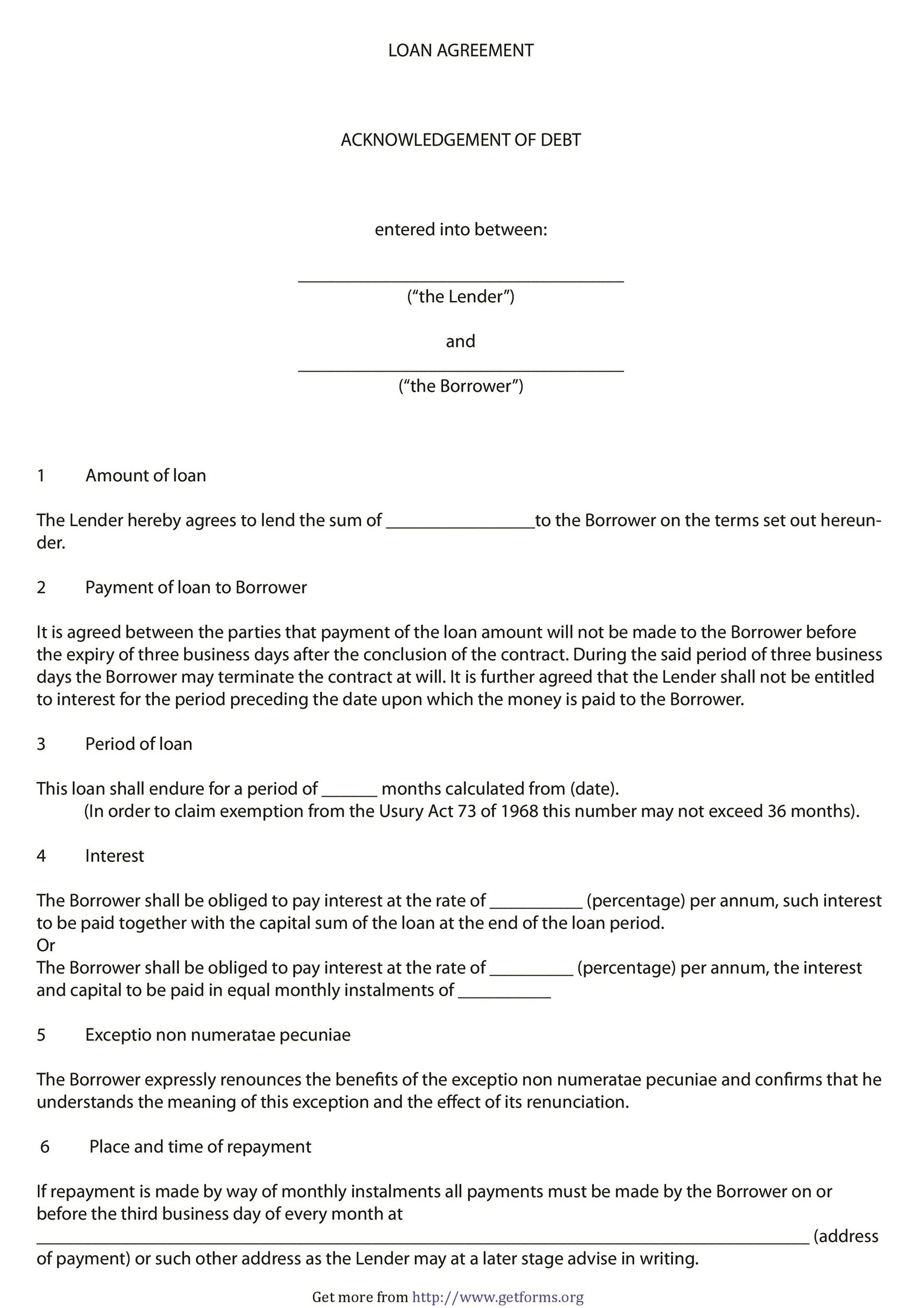

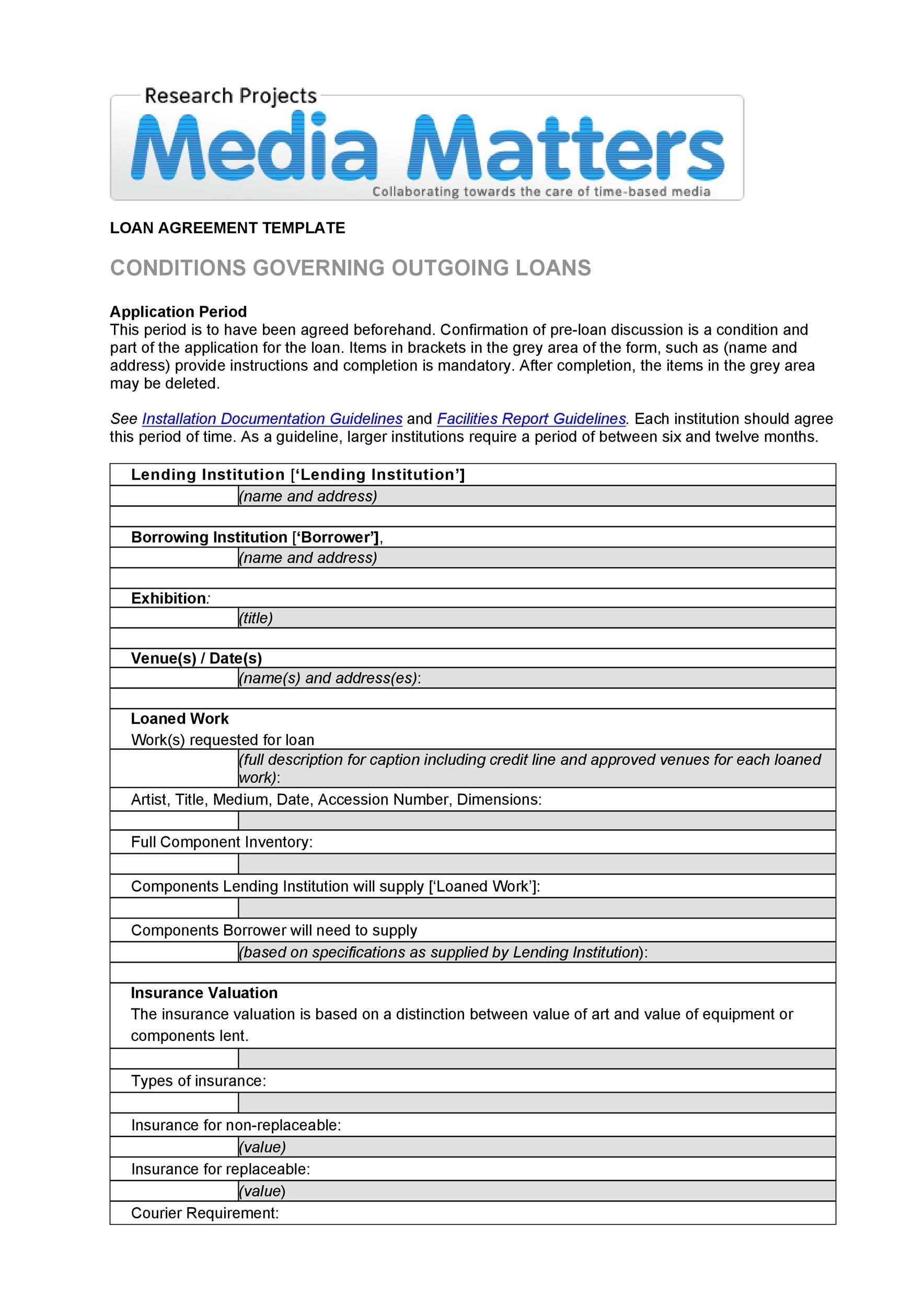

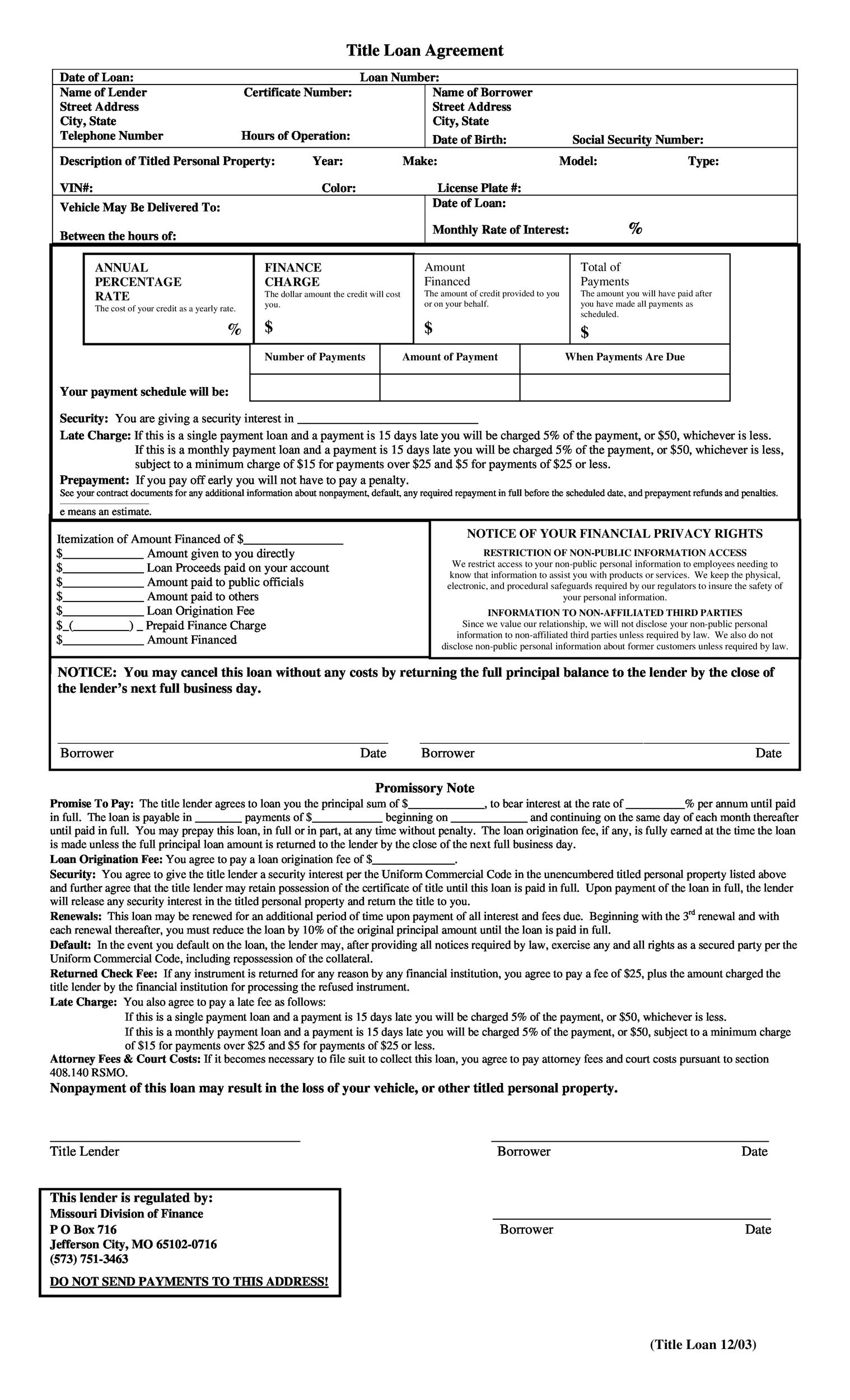

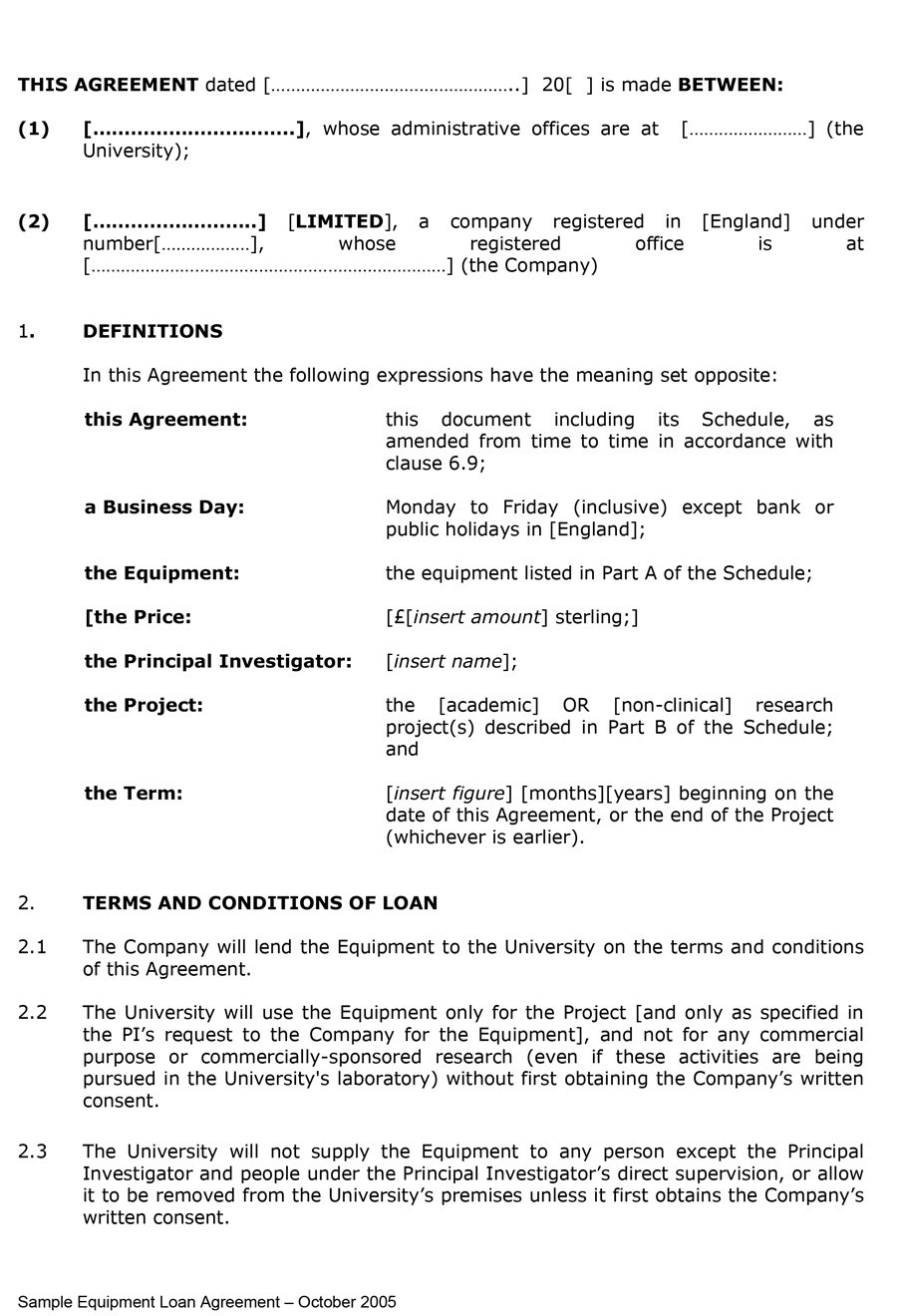

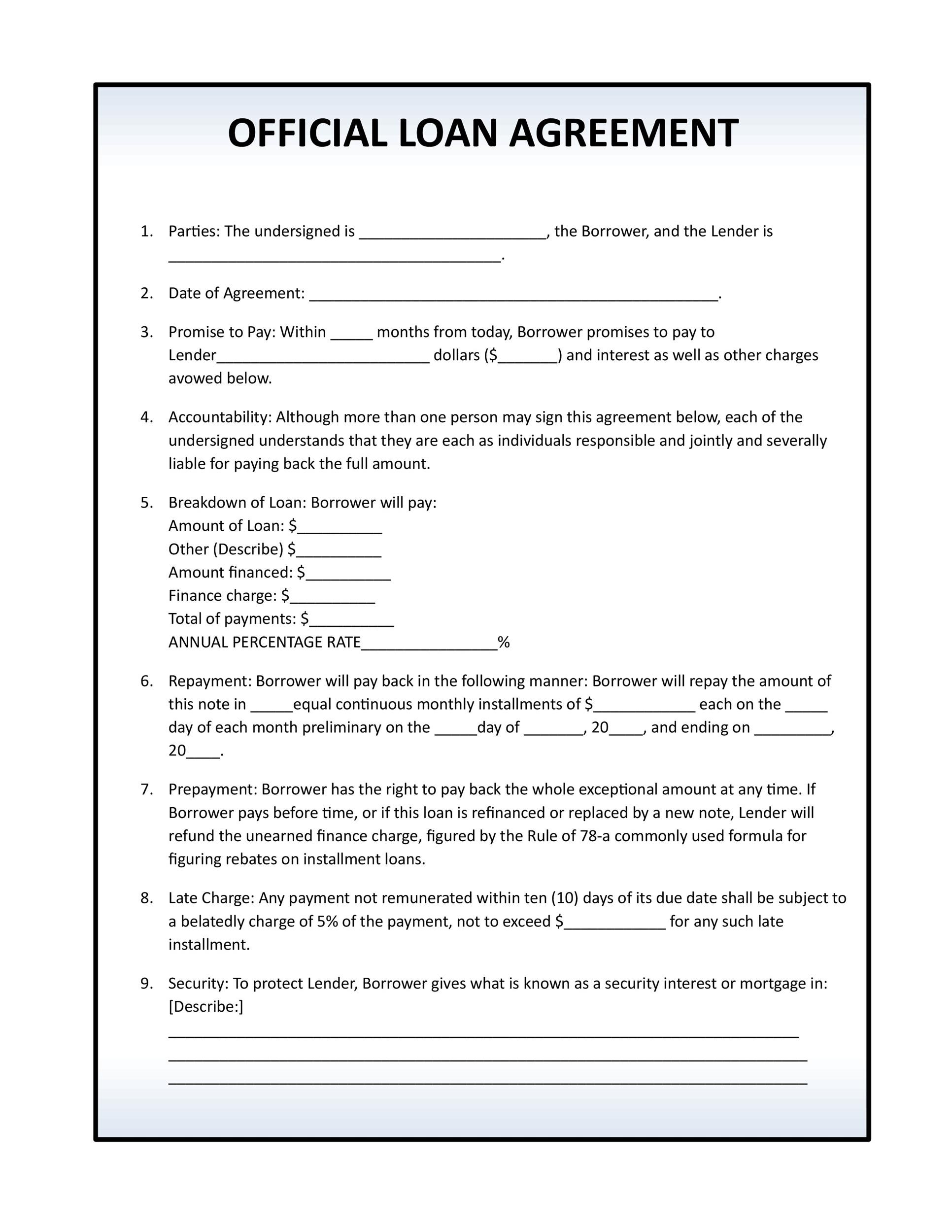

Simple loan agreements are the most commonly used for lending money or other kinds of loans related to loans that charge interest. You will use this kind of loan agreement template most often, even when dealing with businesses that you are entering into a loan agreement with. Having all the right information in your loan document is important, so you need to be sure that you are prepared to include all of the sections that make a loan valid and binding, as well as informative to both parties.

- Name the Parties Involved. The parties that are involved in the loan document need to be indicated by full legal name, and their addresses and contact information need to be included as well. Make sure that you do not use nicknames or other unofficial names, as this can invalidate the loan and make it unenforceable. If you are creating a loan document that binds you and various other parties, you need to indicate each unique party or business that is involved in the contract. Leaving out this information will mean that the person who is not named cannot be compelled to pay on loan should any kind of confusion arise.

Make sure as well that you are using the legal business name of the entity that you have entered into the loan with. This is important to be sure that you are not indicating another business entirely or that you do not invalidate the loan itself through this error. - Loan Amount. This information needs to be the loan total, not just the amount that was originally borrowed. If you do not require that interest or other fees and charges be applied, then you will just indicate the original loan amount here in this section. Most loans do charge interest, however, and there might be fees and other kinds of charges that are added to the loan’s total. Whatever amount you indicate here is the sum total of the loan that will need to be paid off by the party that is borrowing the money.

- Repayment Details. This is the section of the document that is used to detail how the repayment process should be done. The repayment portion of the loan will need to be agreed upon by both parties before the loan is drawn up and signed. You can make this part of the contract as specific as you need it to be to ensure that the repayment of the loan is handled correctly and fairly between both parties.

Regular payments are the most common repayment option, and these are handled as a set number of payments over a stated period of time. The period of time can vary based on the way that the payment plan is arranged. You might expect to have the other party pay over a series of months, or maybe you will want to have a set number of payments delivered before a specific end date. Whatever the repayment arrangement needs to be, that information must be carefully laid out in this section of the contract.

Make sure that you also indicate clearly if you expect a single payment before the end date of the contract. This might be a due-on-demand statement that will make it clear that the borrower will pay all of the money owed all at once before the end date of the contract has arrived.

Regular payments are best handled with a quarterly or monthly plan so that the details of the loan are not confusing and do not lead to issues with repayment per the language of the loan document. - Loan Security. Many loans are secured with collateral that offers an equal value to the loan that has been made. This might be a vehicle or some other asset that has a readily assigned value. This helps to make it clear that the loan must be repaid by the end date of the contract, or the collateral can be seized by the party who is due money at that time. This is also a detail that must be mutually decided by both parties involved in a loan agreement. You cannot just name some item that you would like to have as collateral while you are writing up this section of the document. It is not lawful to do so and then try to take an item as collateral that was never talked about between the two parties involved in the loan.

- Co-Signer. The co-signer of the loan document is another party that is included in the loan document details to help secure payment. This person will be responsible if the first party that the loan was made with does not end up paying off the loan within the stated time frame. You do not have to have a co-signer for your loan document, but you might want one if you are not sure that the other party has a stable income or if they have some other challenges that might prevent repayment from taking place. This is quite common in banking loans but not as common in personally-drafted loans.

- Interest Rate. The interest rate of the loan is what decides how much profit is made off of loaning the money to the borrower. This is a very common stipulation within the loan process because it helps make it worth providing the loan if you are the one loaning the money. Lenders often use fixed rate tables or risk-based pricing that is determined via credit scores to determine the rate that borrowers are offered. For personal loans that are being done between family and friends, a more casual process might be used to agree upon an interest rate for the loan amount.

- Fees and Repayment. If you are charging any kind of fee for the origination of the loan, or you will penalize the other party if they want to repay the loan early, you need to be sure that this information is included in this section of the document.

- Default Provisions. You will need to have a default provision in the document that indicates what will happen if the person who accepted the loan does not finish paying it off. This is key for the legal portion of the contract and must be included in every loan document.

- Signatures. All parties will need to sign the document and date the signature lines to make sure that the contract is valid and enforceable. You will want to be certain that this step is not missed so that your loan document is binding.

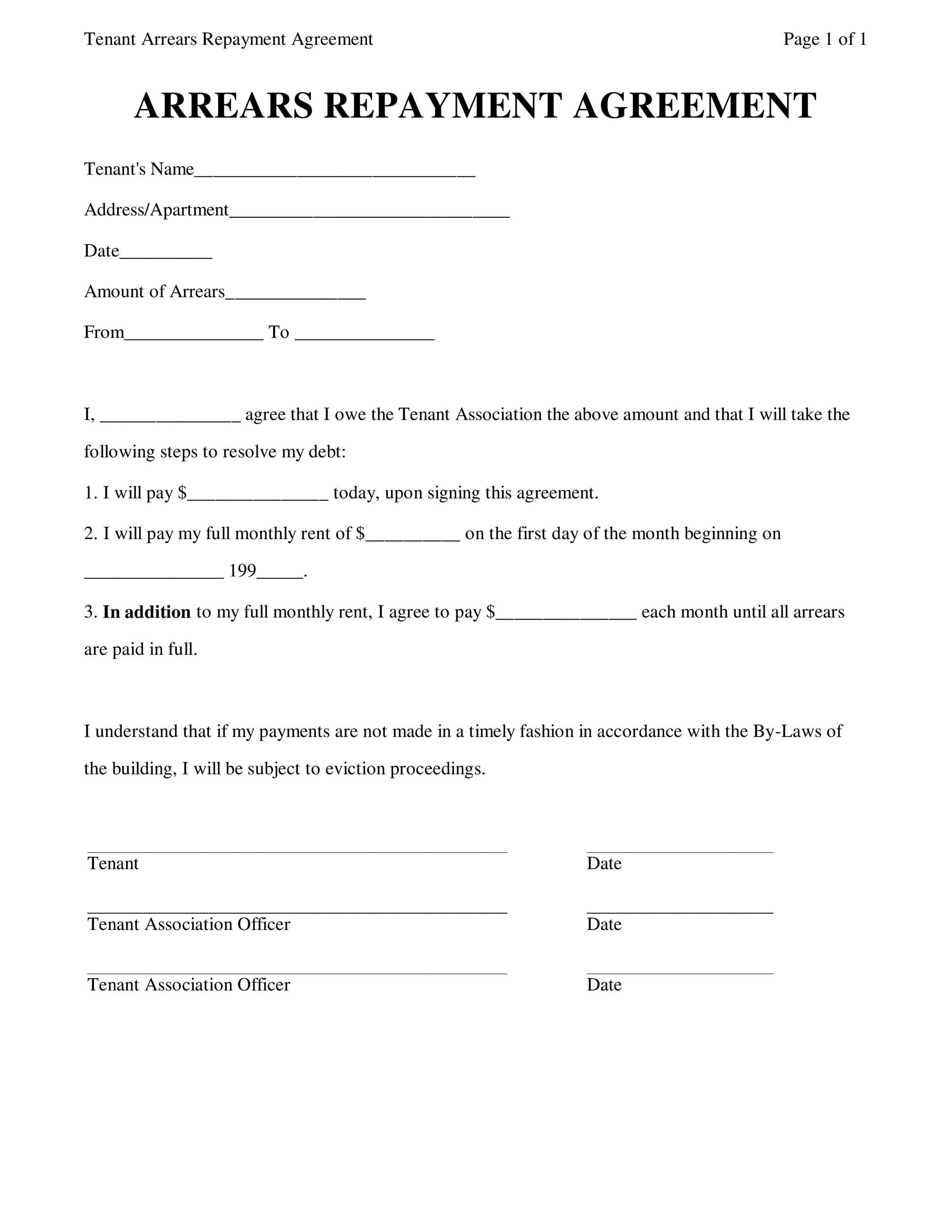

Simple Loan Agreements

How do I write a loan agreement letter to a friend?

A loan done between friends might not need to be as formal as other loan documents. Be sure that you do include all the above information, but you can keep the terms less impersonal and be less specific about any section that you think does not need the full legal treatment. It is always wise to assume that confusion can happen when money is involved and to err on the side of being more detailed rather than less detailed in the information that you provide.

Loan Documents Can Offer Protection for Various Loan Agreements

When you are going to lend someone money, you need to be sure that you create a loan document that indicates all the right information related to this loan. The more detailed your loan documents are, the better off you and your borrower will be if disputes should arise. You will find that loan documents might not seem like they are needed when you enter into a loan with a friend or with family, but having a loan document is almost always a good idea in case disputes take place.