Having a personal balance sheet template is a great way to keep track of everything you owe and own. With this information, you can make adjustments that could either increase your assets or make sure you aren’t drowning in debt. This document provides details on your liabilities and assets. But you can also use it with your partner (as a couple) or for a business. This is an important document you would use to assess your financial status. It can also help you keep track of your net worth so you can set financial goals. Another important purpose of this statement is for lenders to review when you apply for a loan, a credit, or a mortgage.

Table of Contents

- 1 Personal Balance Sheets

- 2 What is a personal balance sheet?

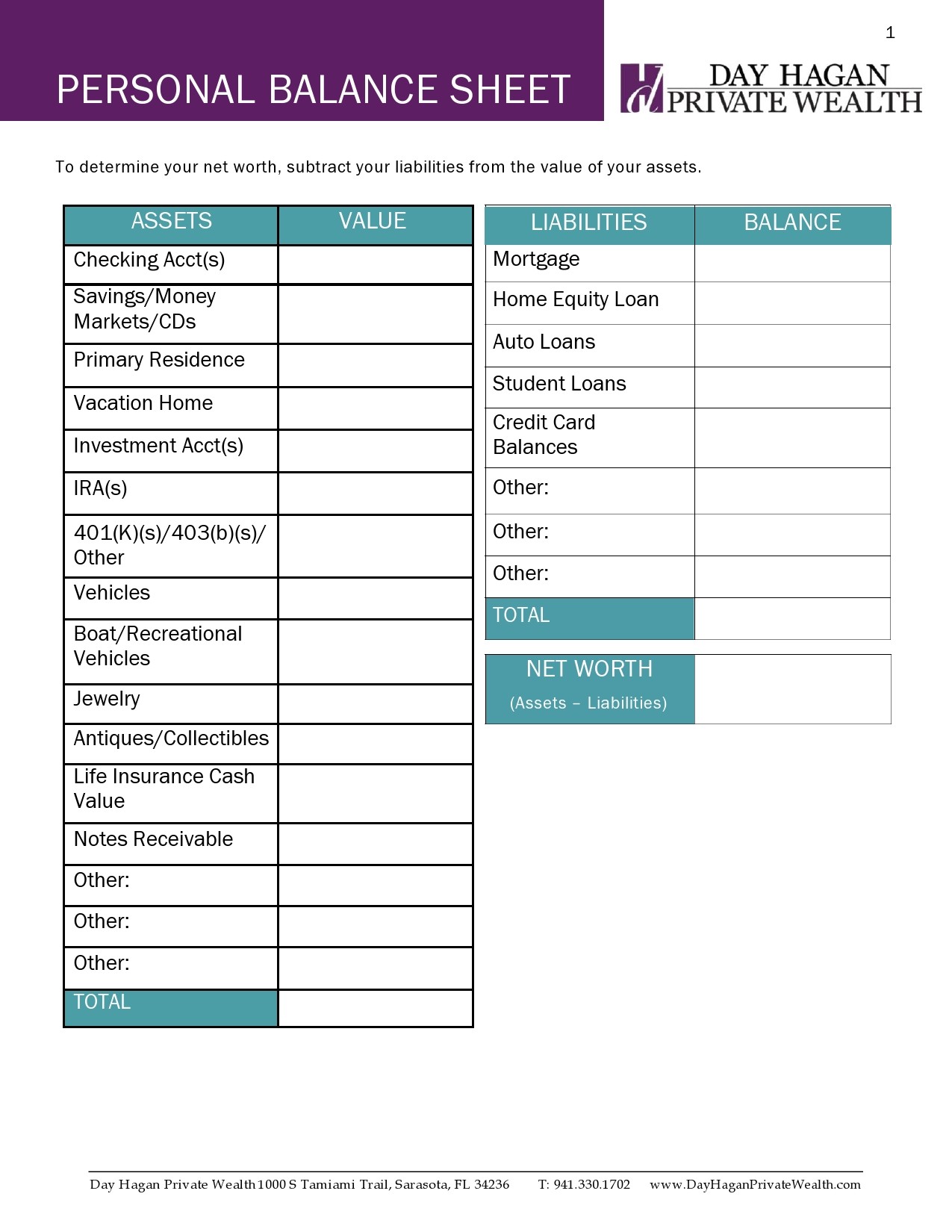

- 3 Personal Balance Sheet Templates

- 4 How does a personal balance sheet work?

- 5 What are assets and liabilities?

- 6 Personal Balance Sheet Examples

- 7 Why do you need this document?

- 8 How do you create a personal balance sheet?

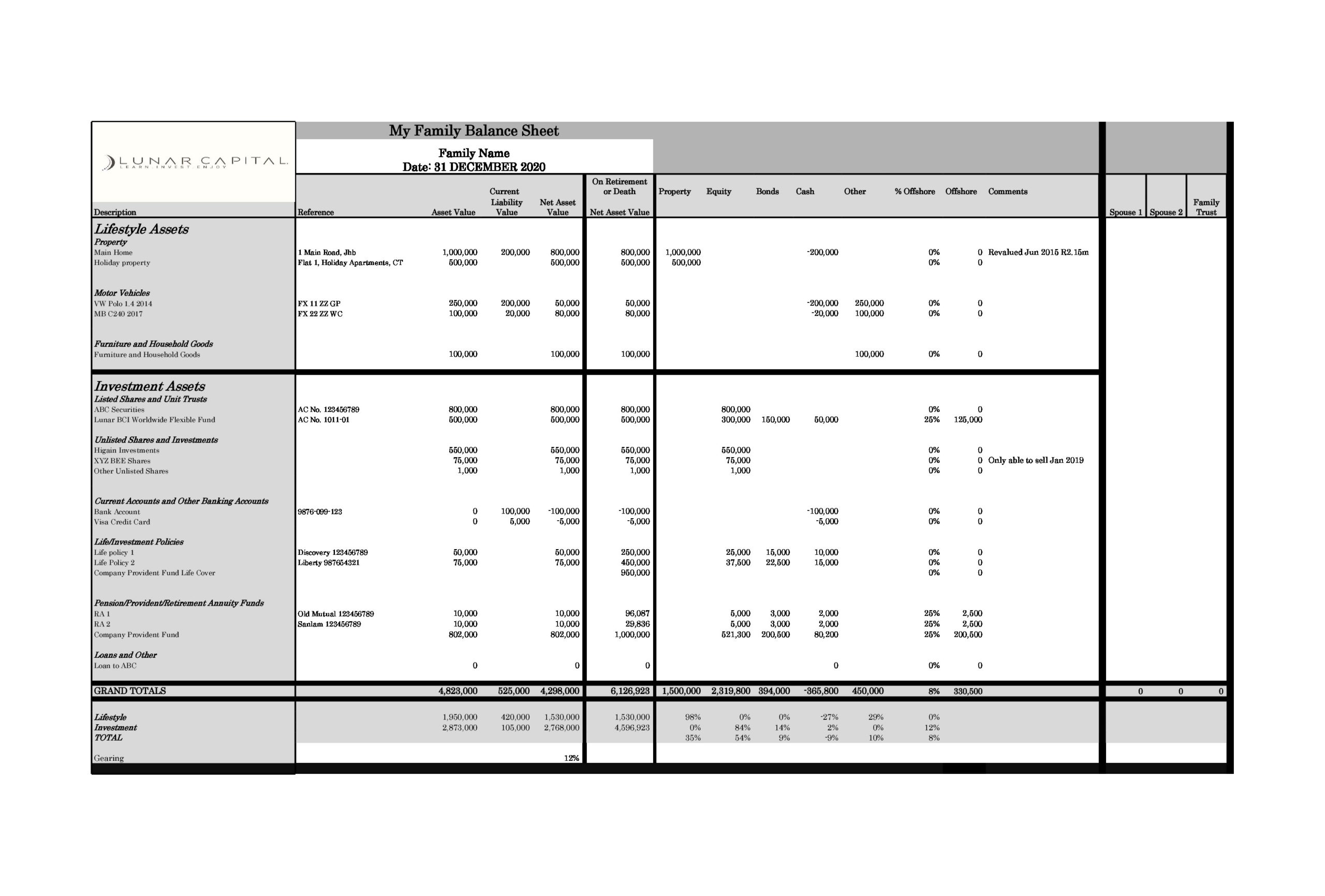

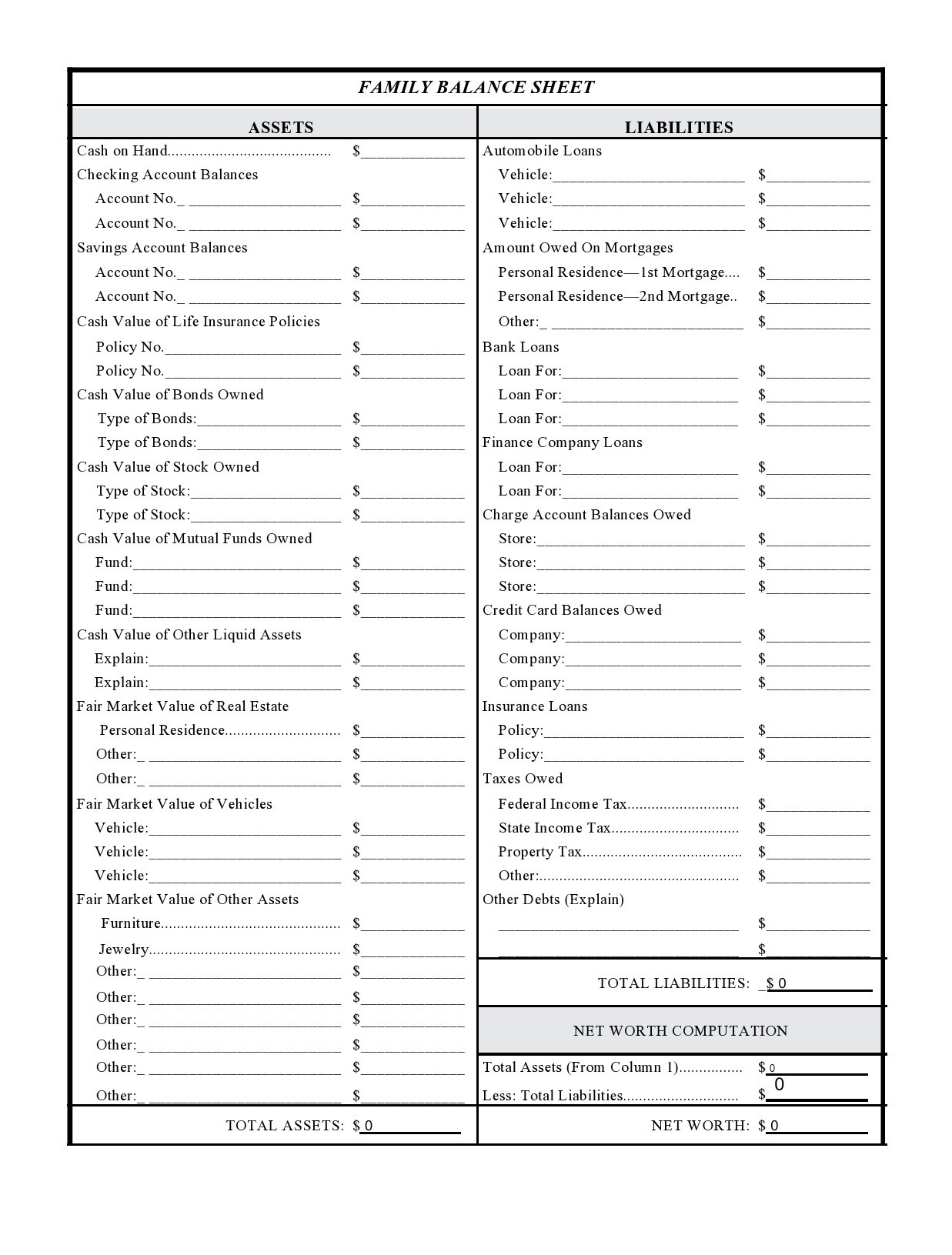

- 9 Family Balance Sheets

- 10 Assessing your personal balance sheet

Personal Balance Sheets

What is a personal balance sheet?

You can say that a personal balance sheet example is a list of everything that you owe and own at this moment or your liabilities and assets. This tool is an excellent way to organize your finances to make sure that you know where all your money is and that you’re also staying on top of your debts. Also, the balance sheet provides you with the information you need to make your financial status better by understanding what’s hurting or helping you financially.

You can also use the balance sheet to calculate your net worth. In analogy, your net worth is like home equity. For instance, you want to sell your home. The check that you get after settling your mortgage is the home equity. Imagine yourself selling and liquidating everything you own to pay off all your debts. What you will have is your net worth. You can calculate this using the following formula:

- Net Worth = Assets – Liabilities

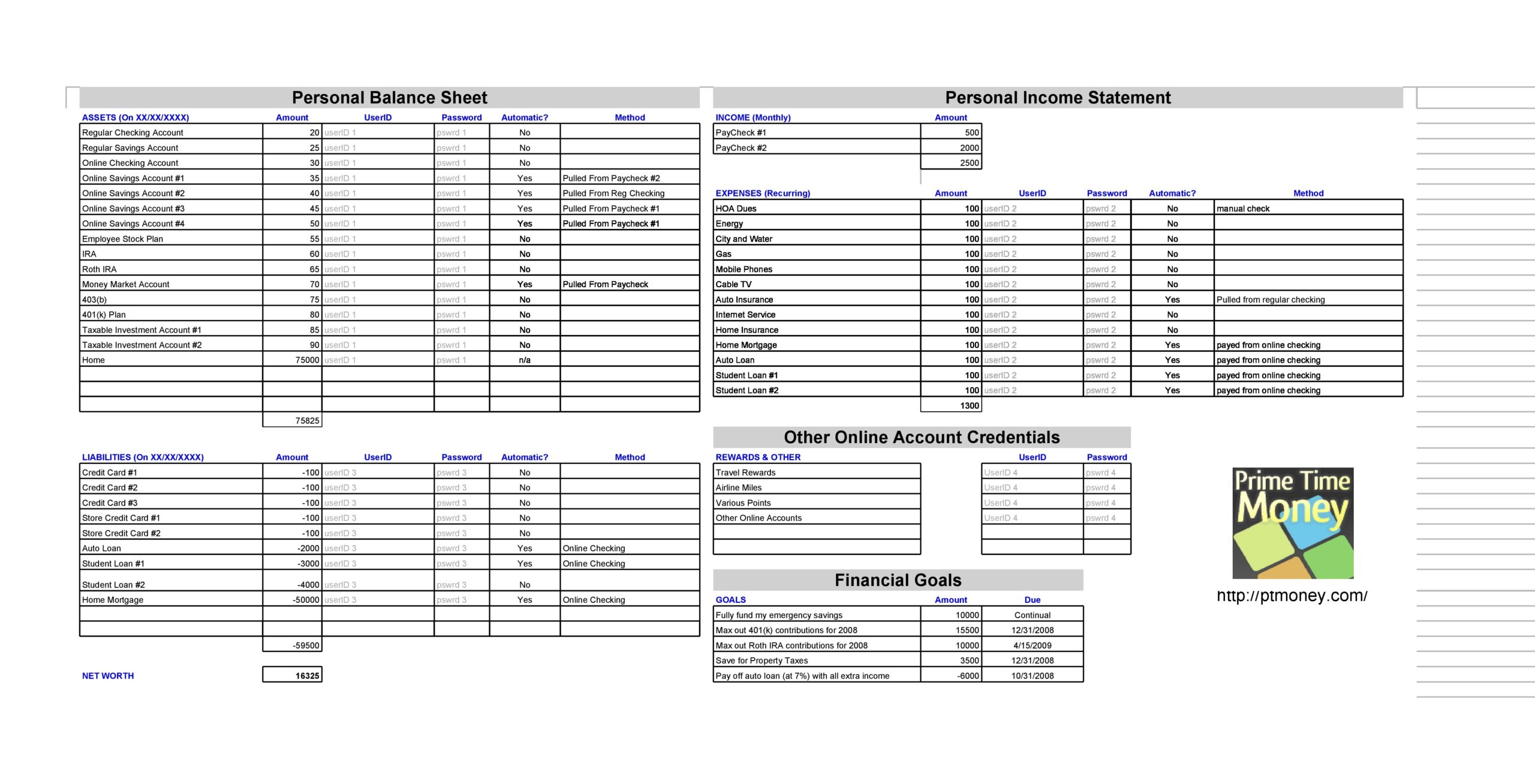

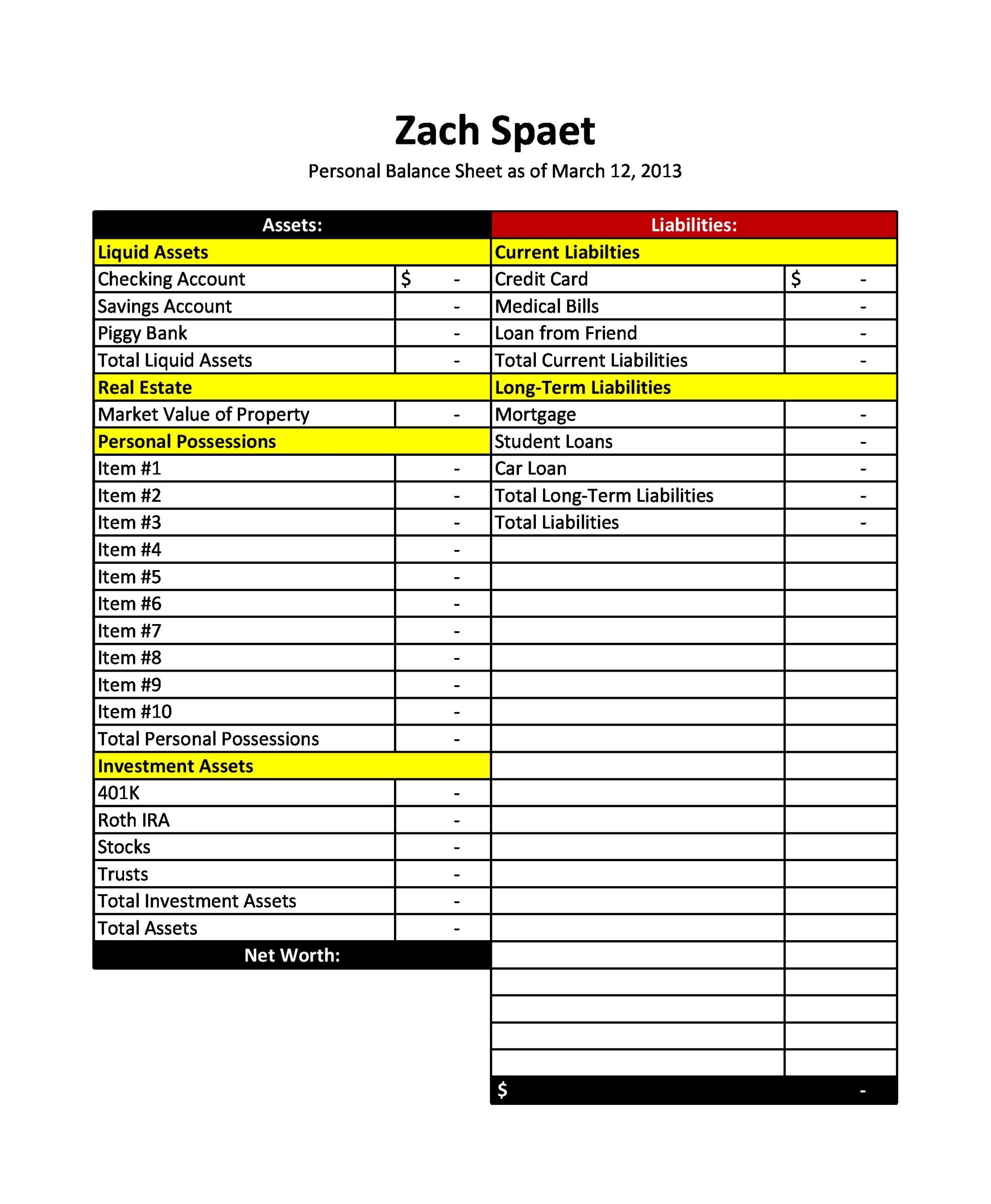

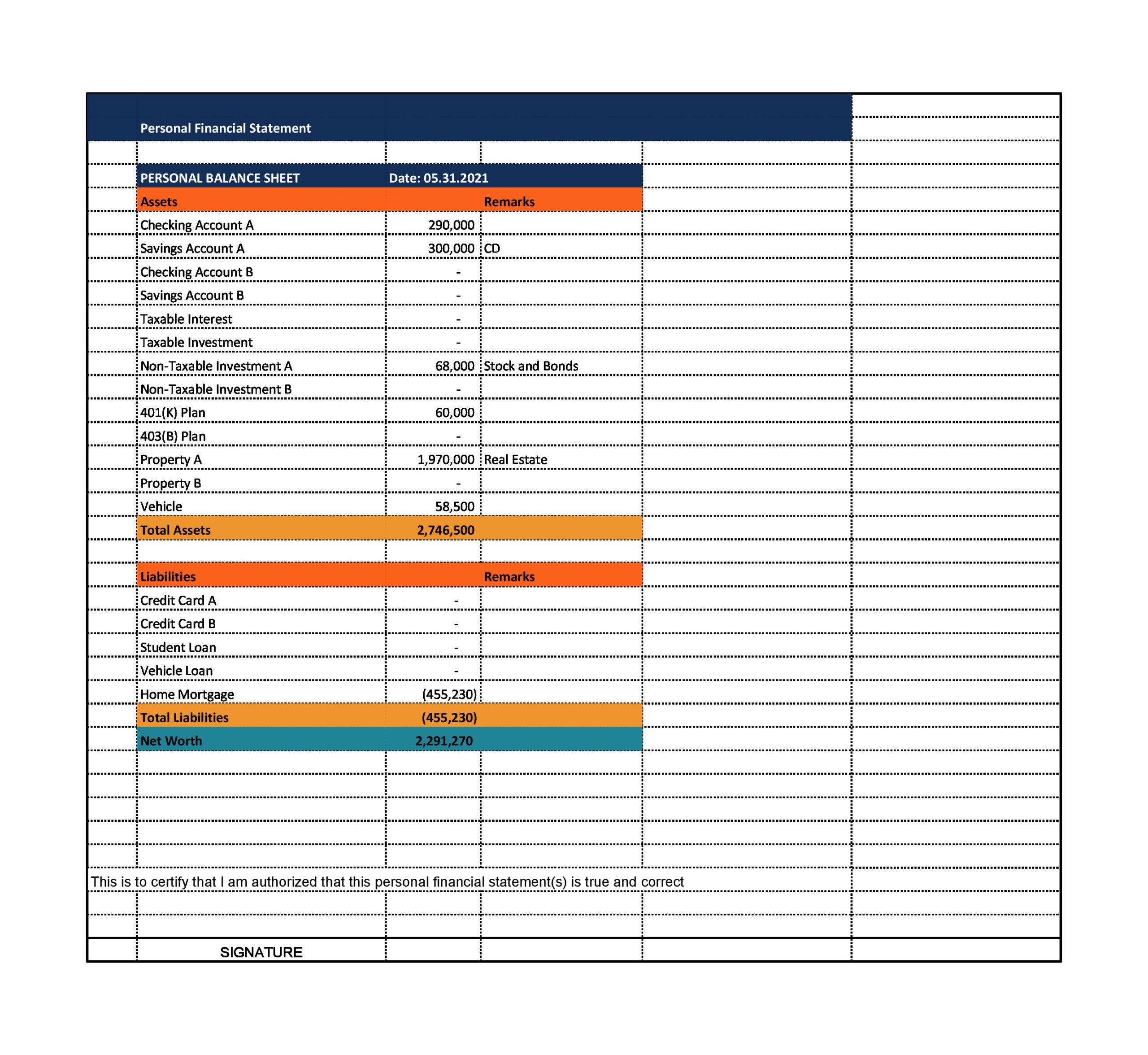

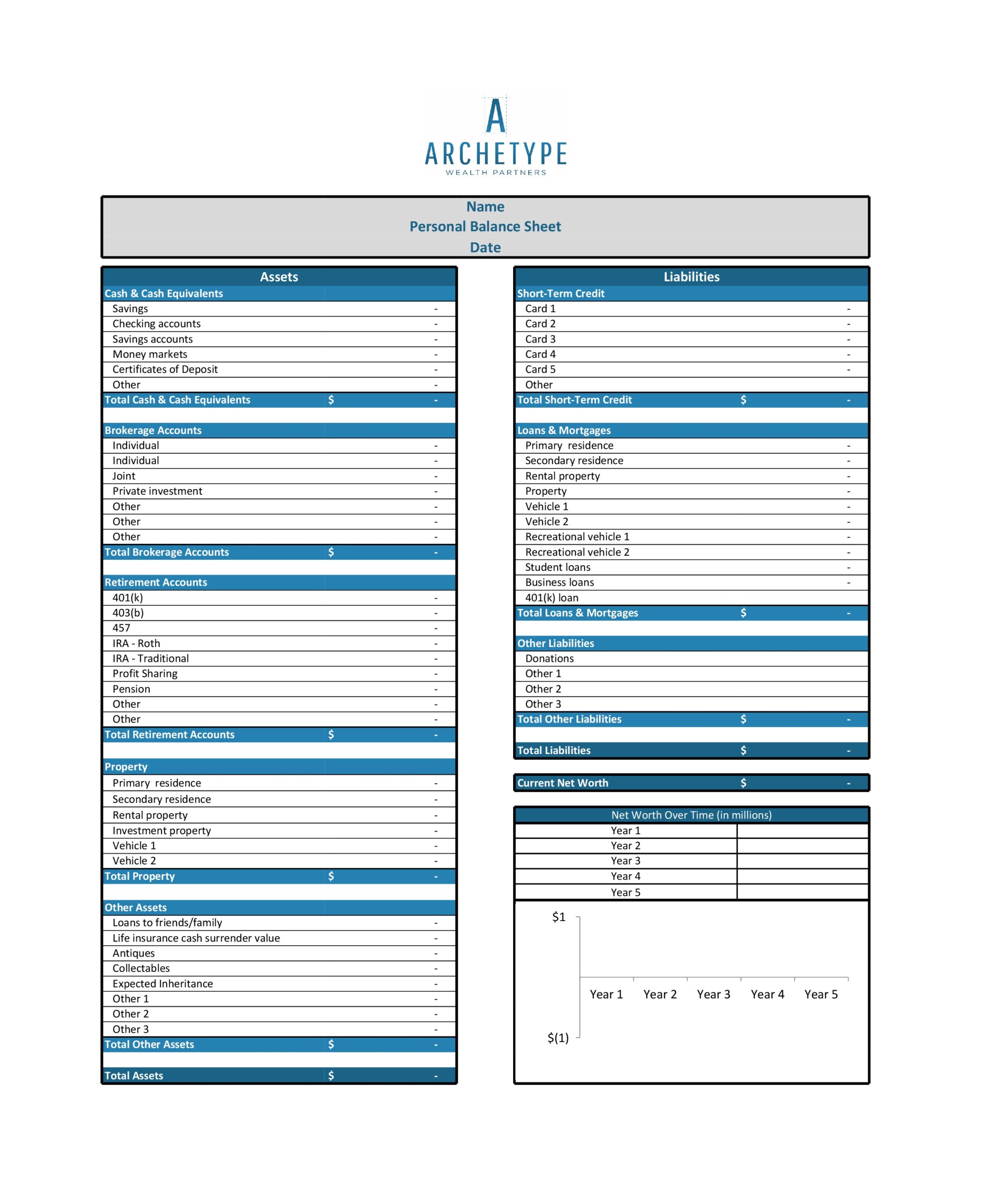

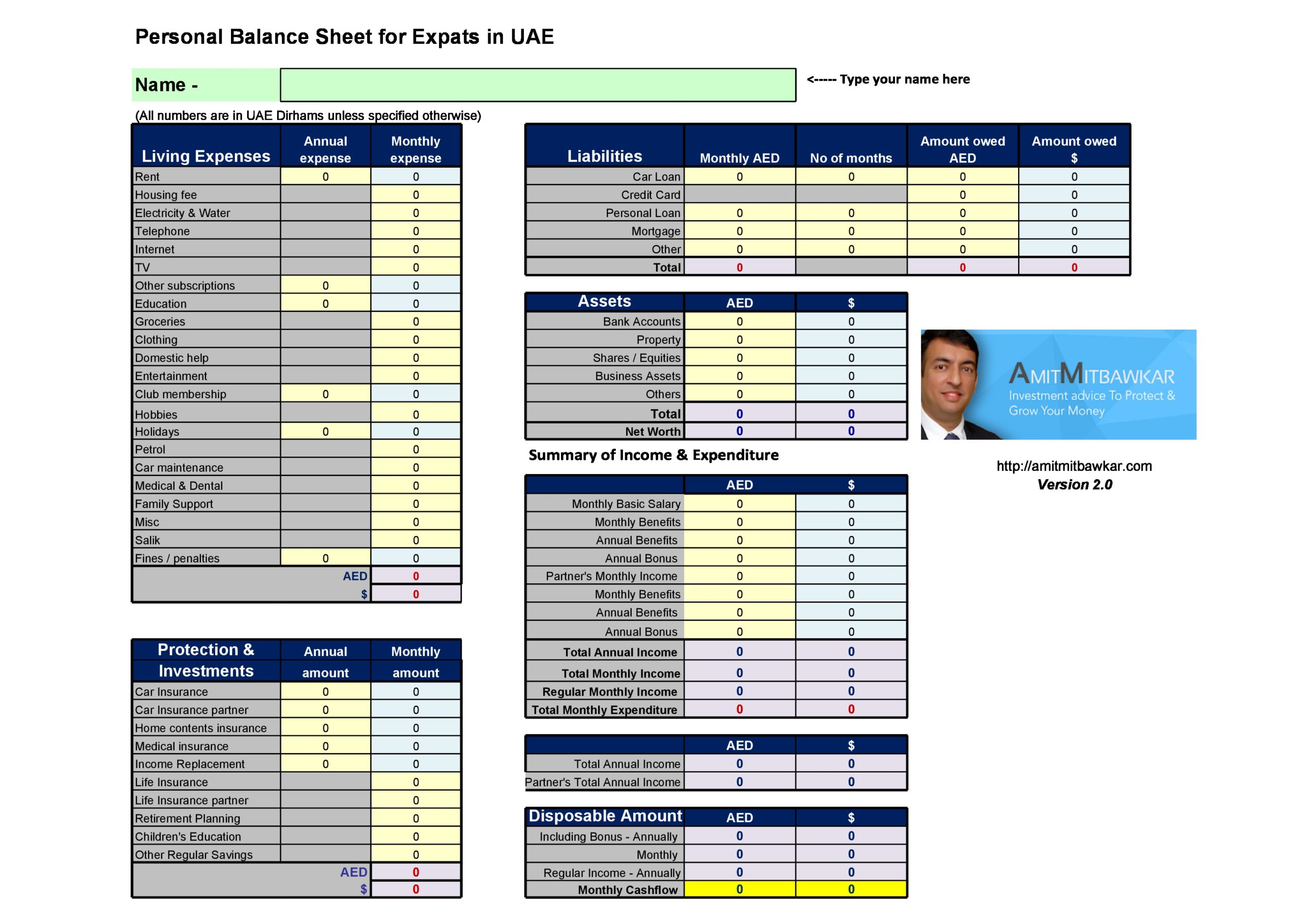

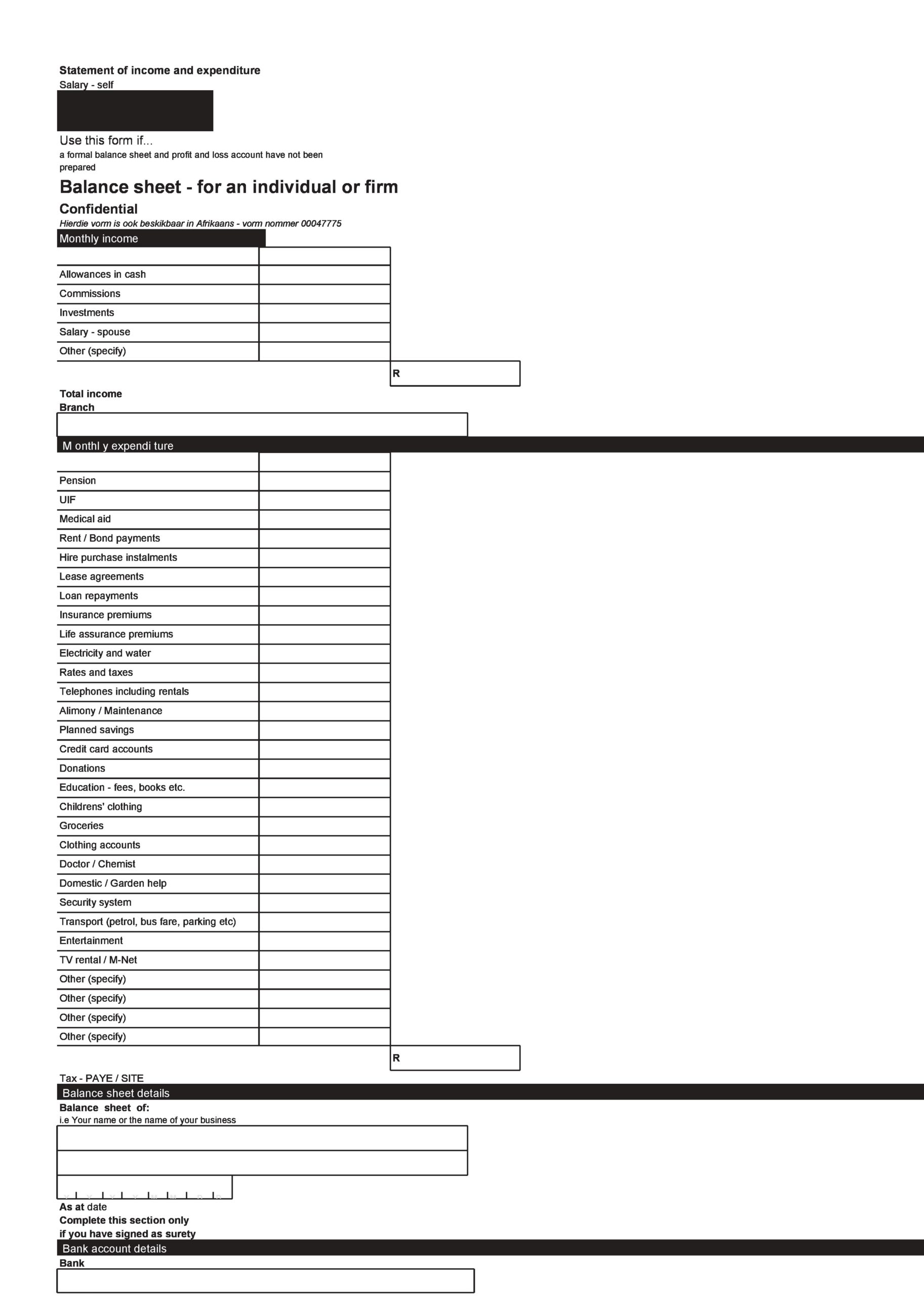

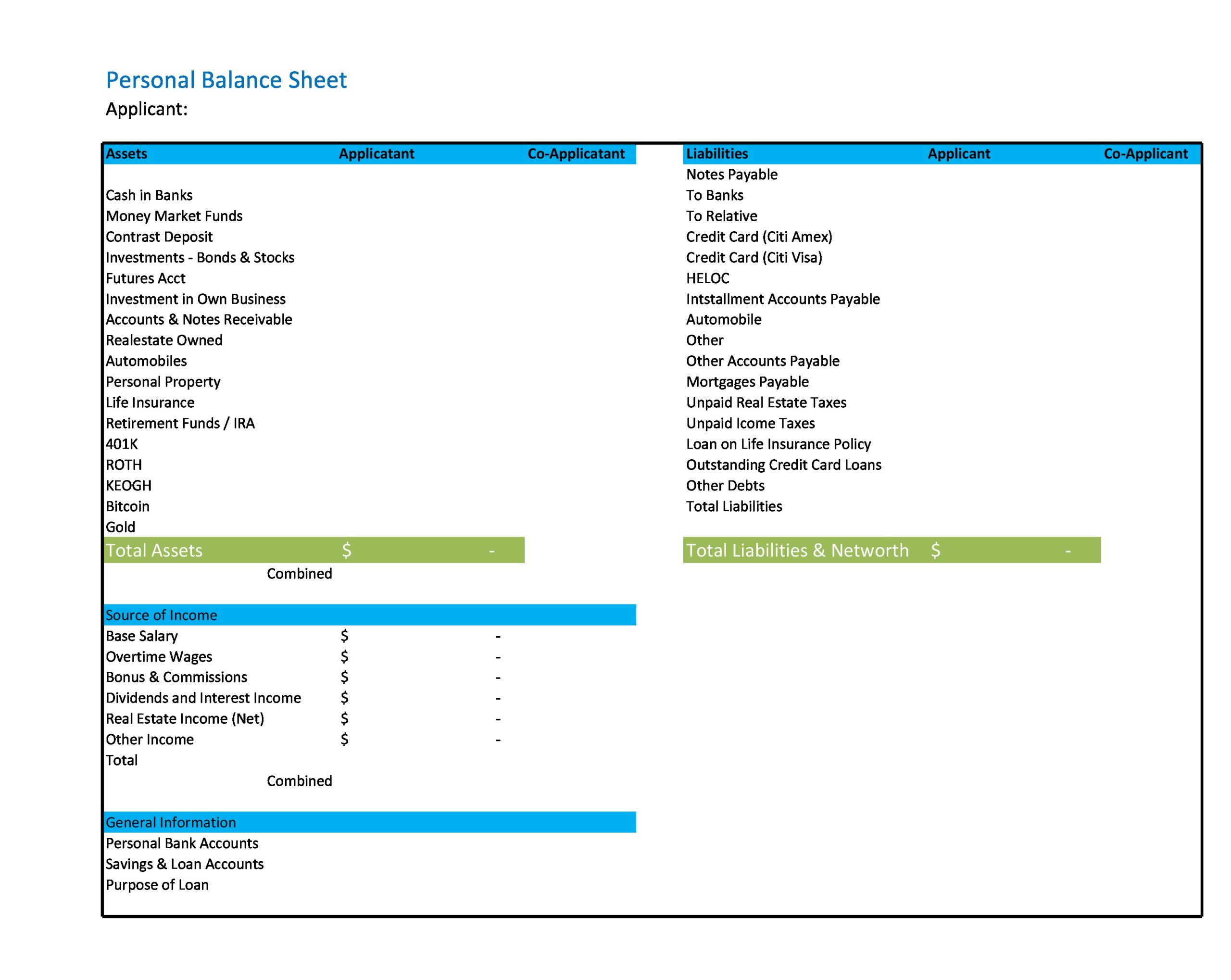

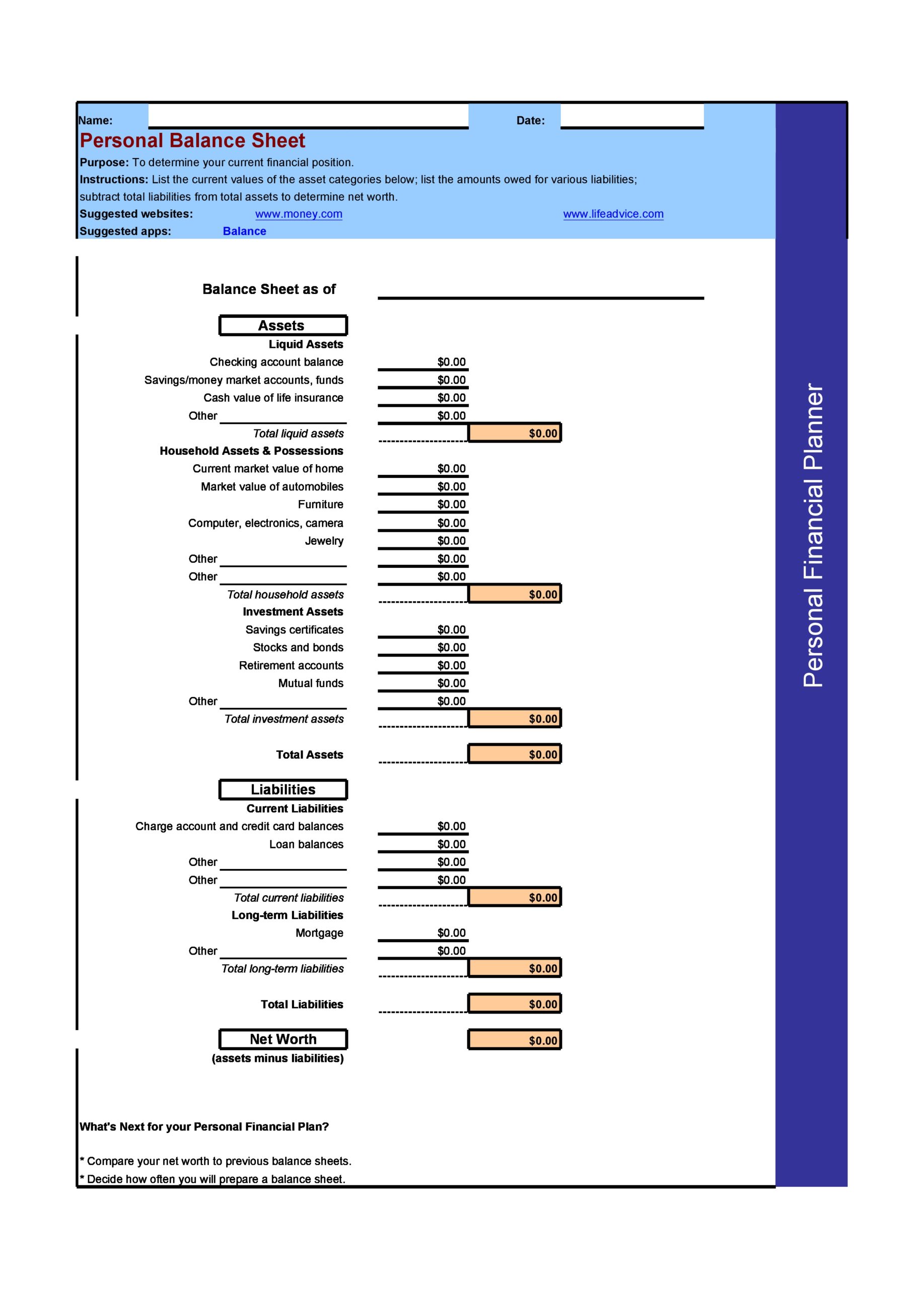

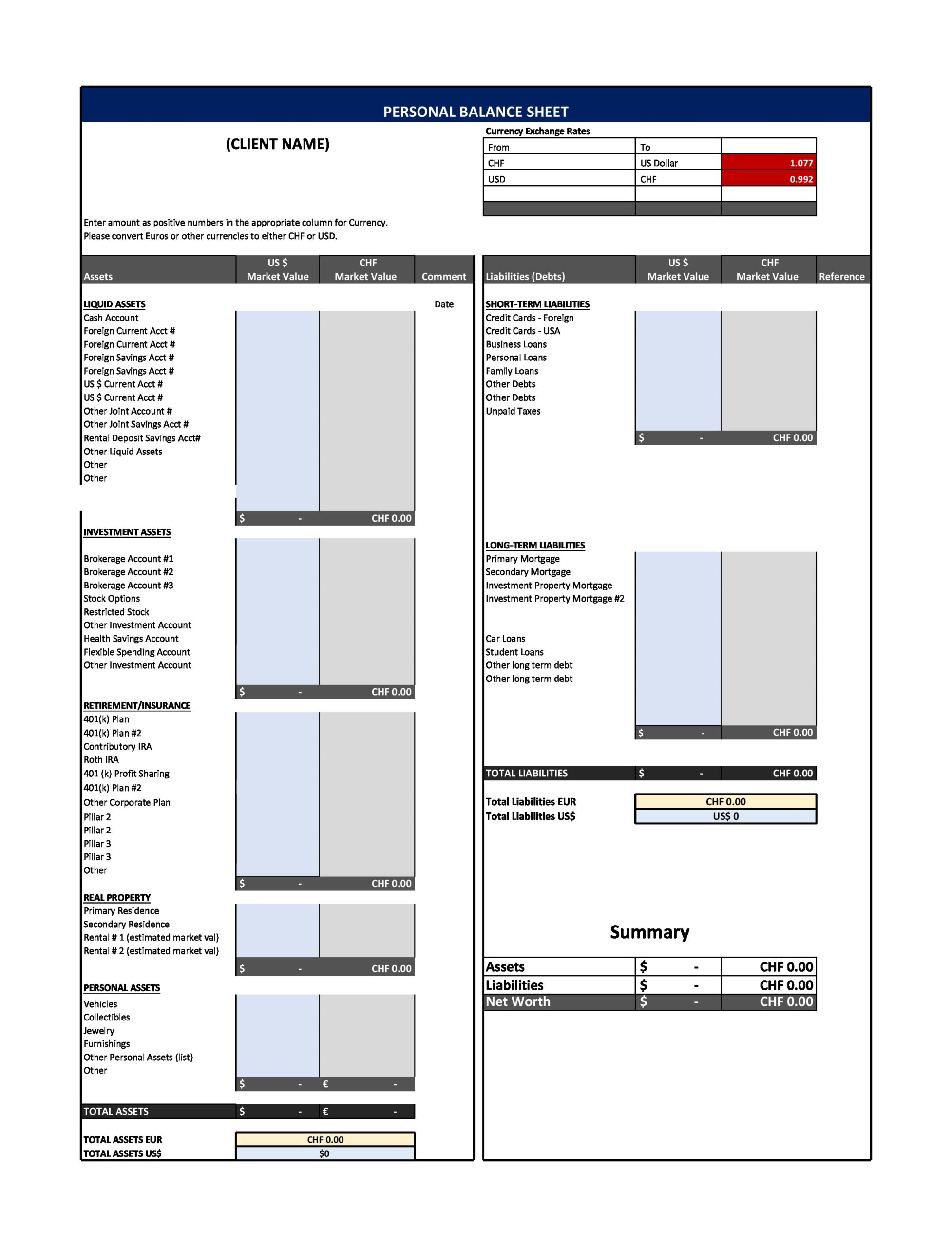

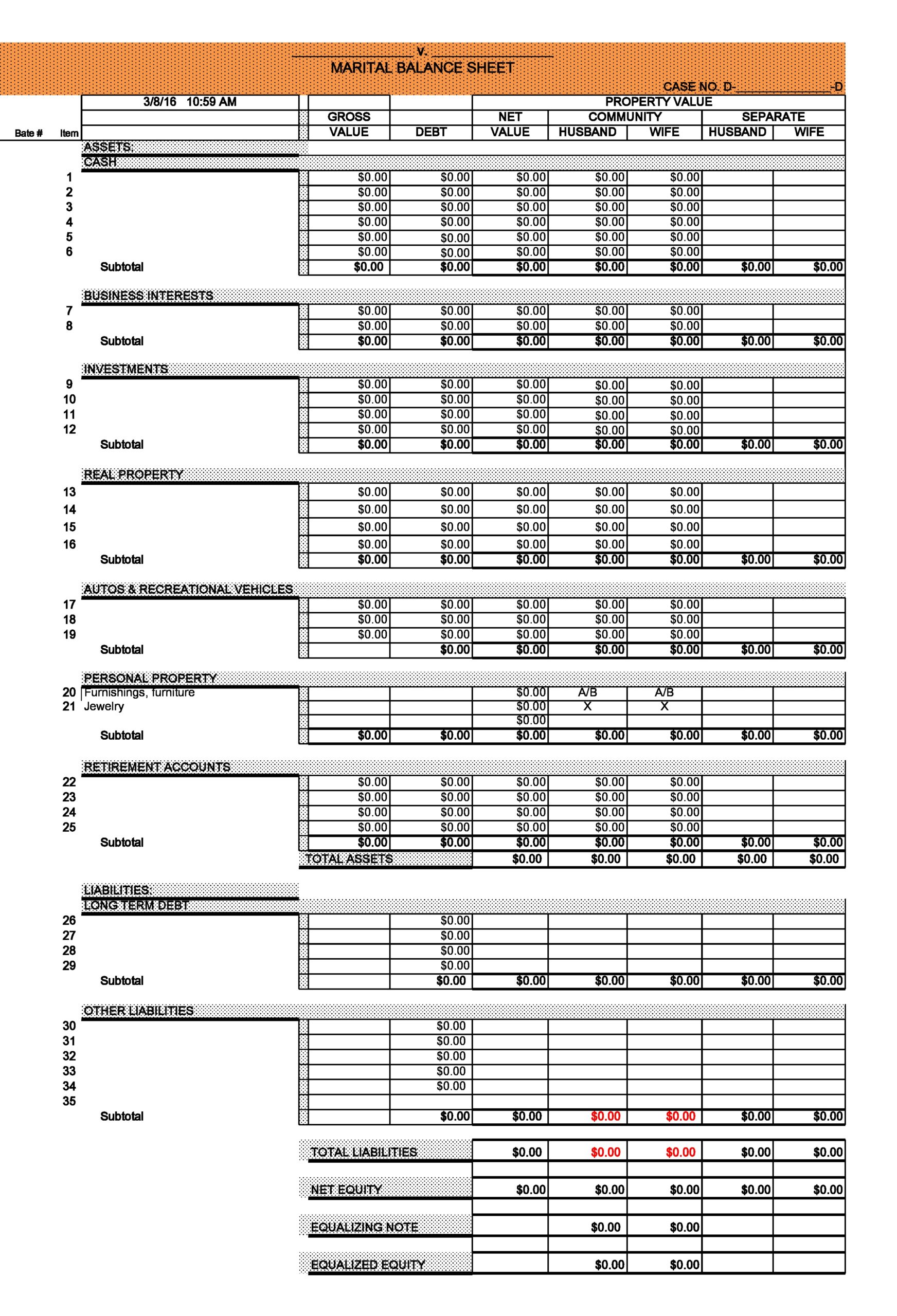

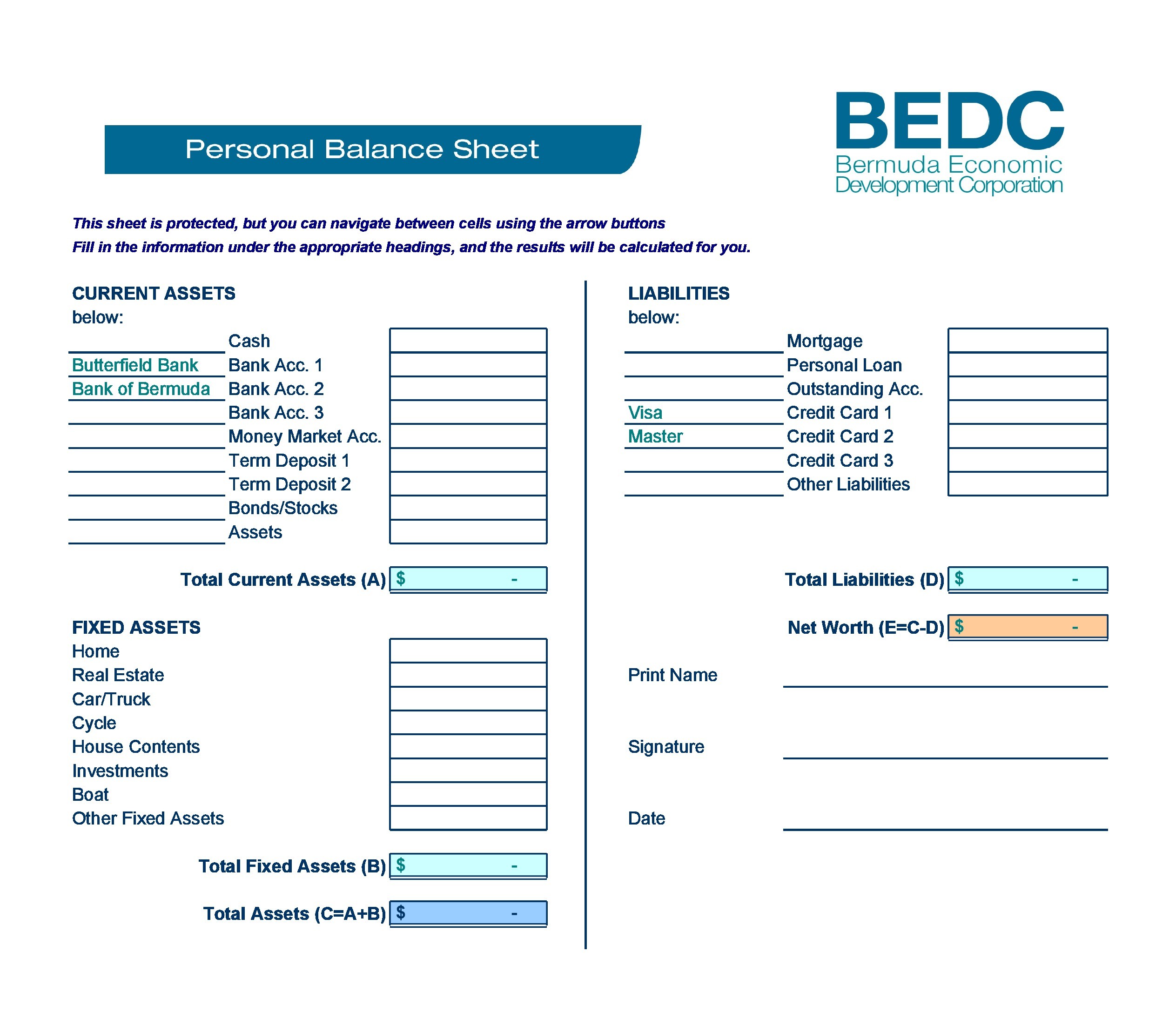

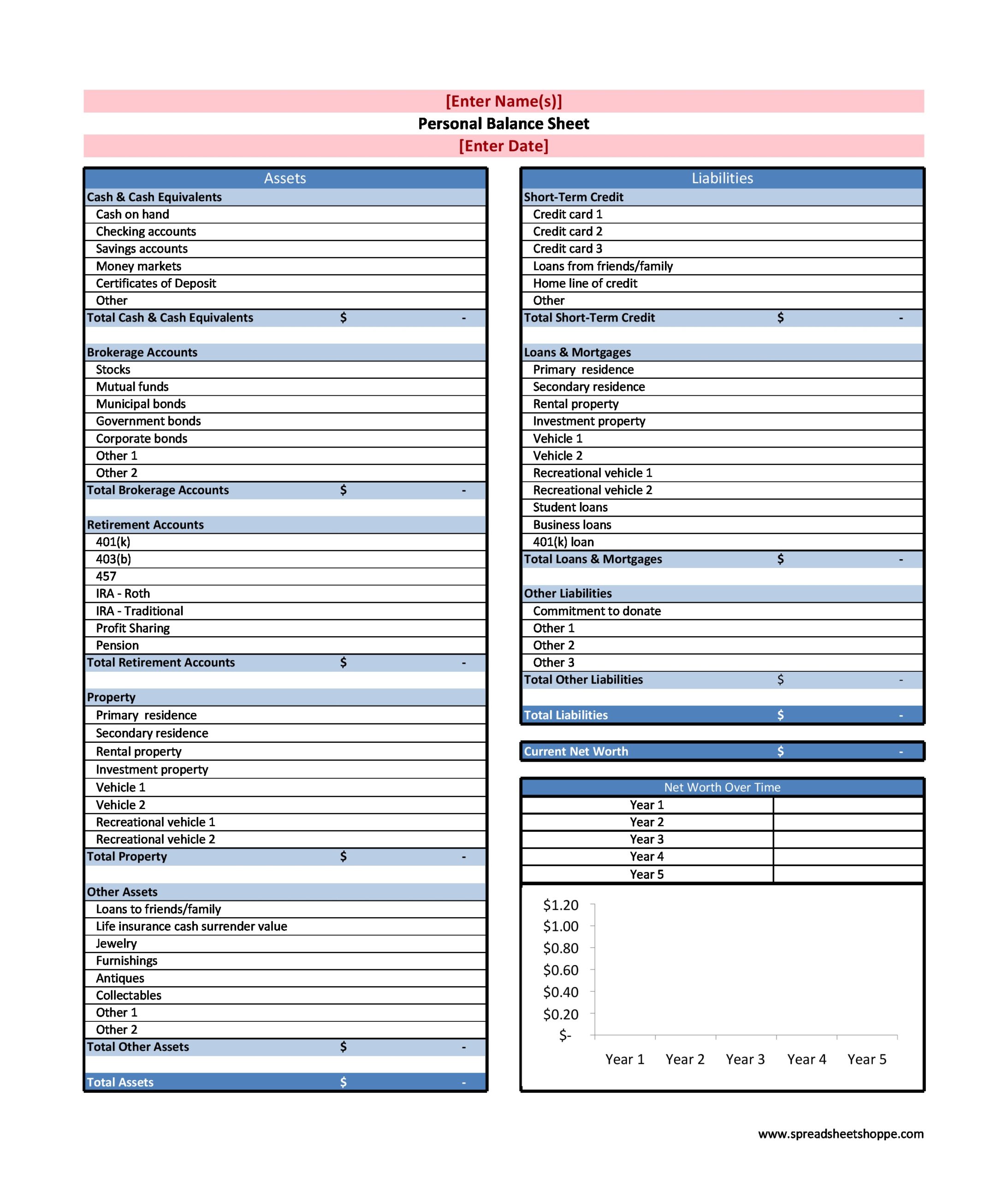

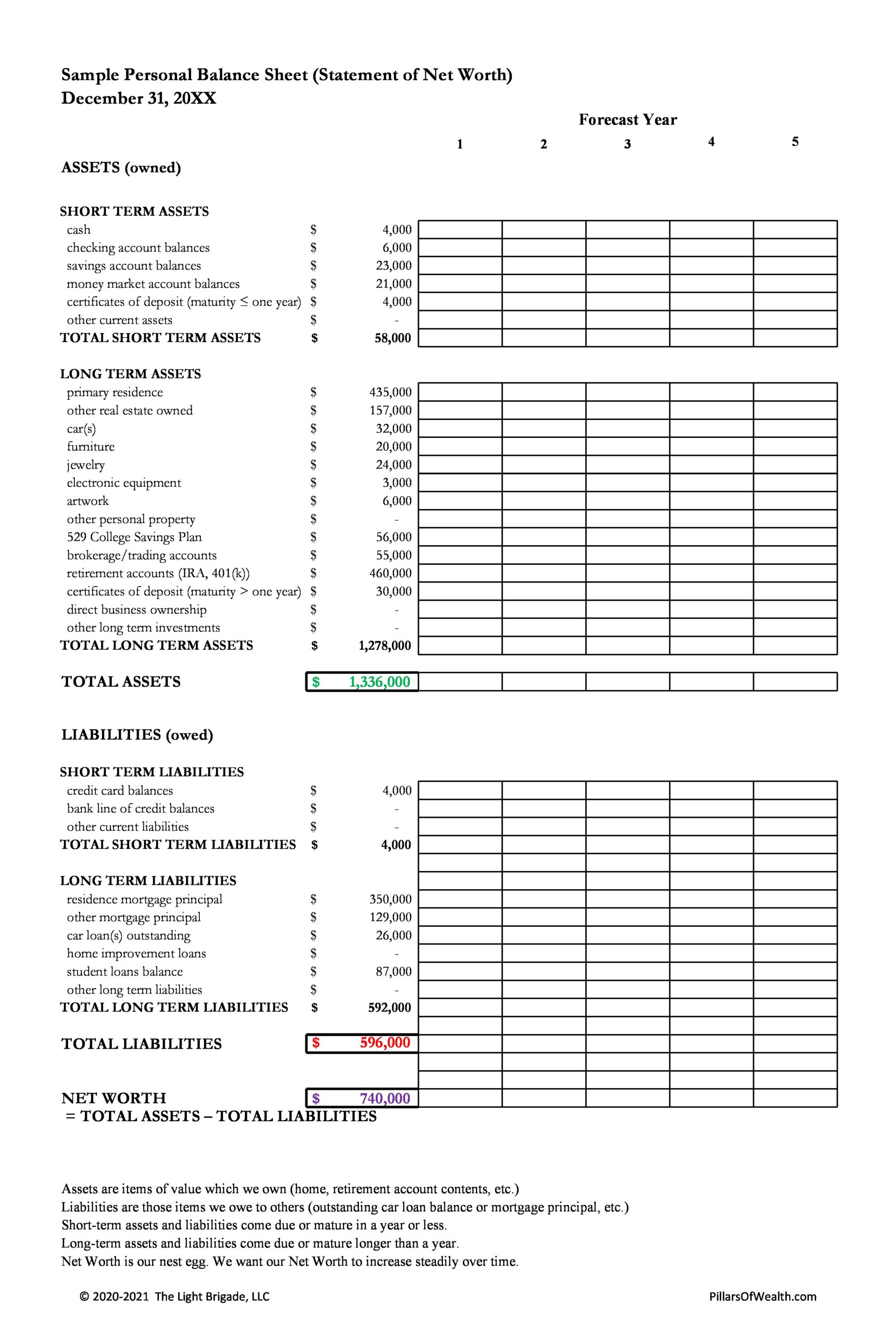

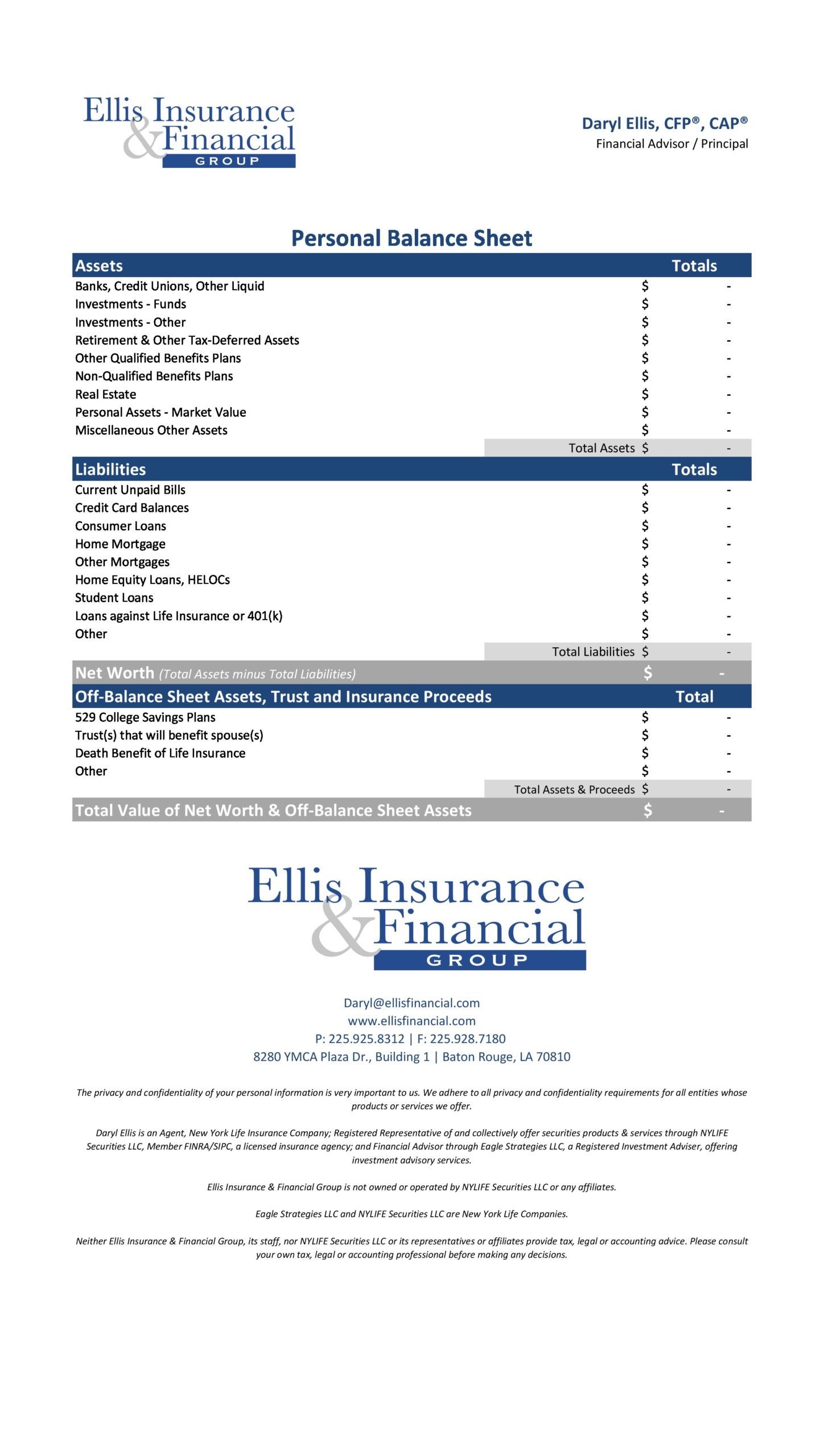

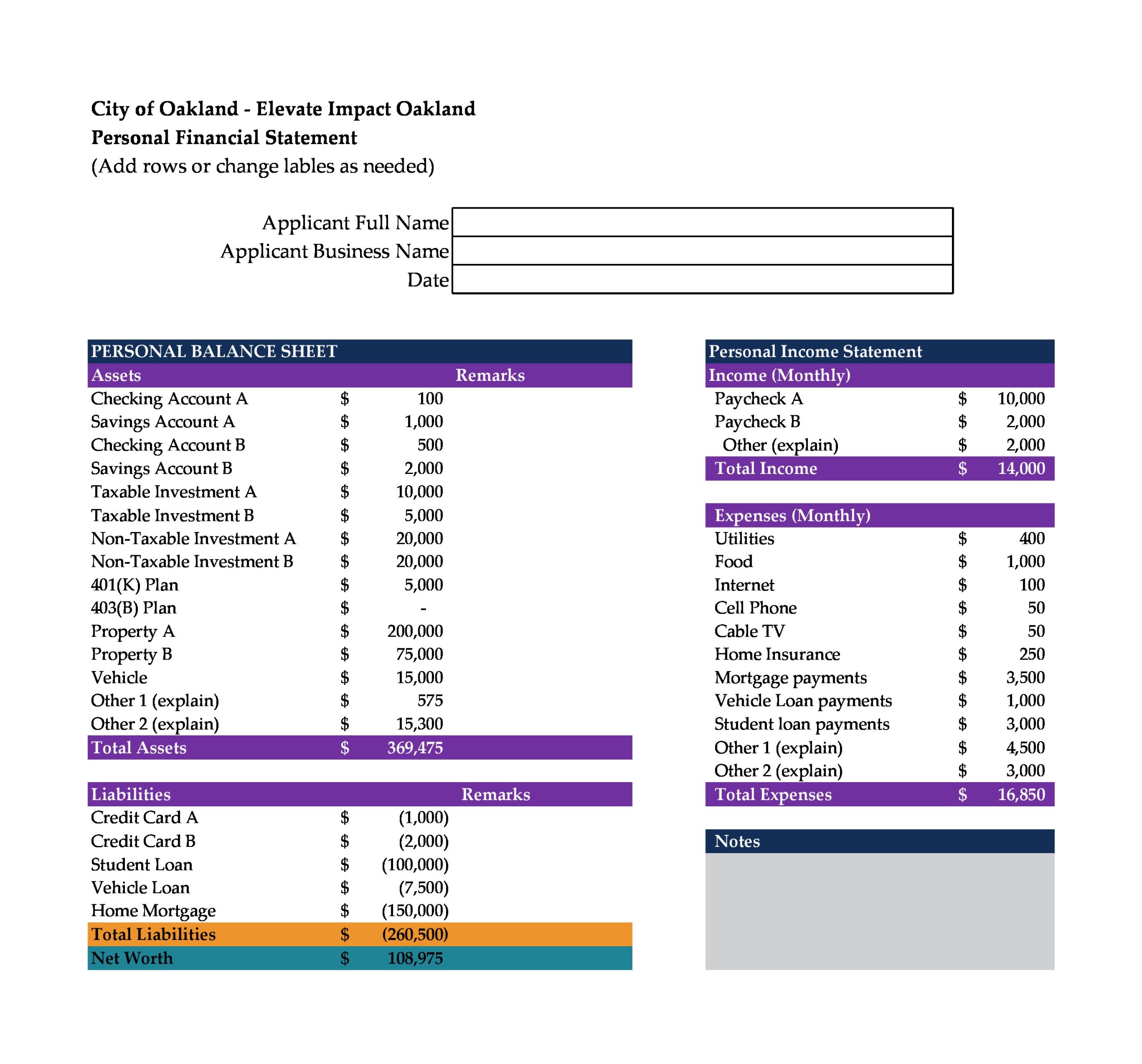

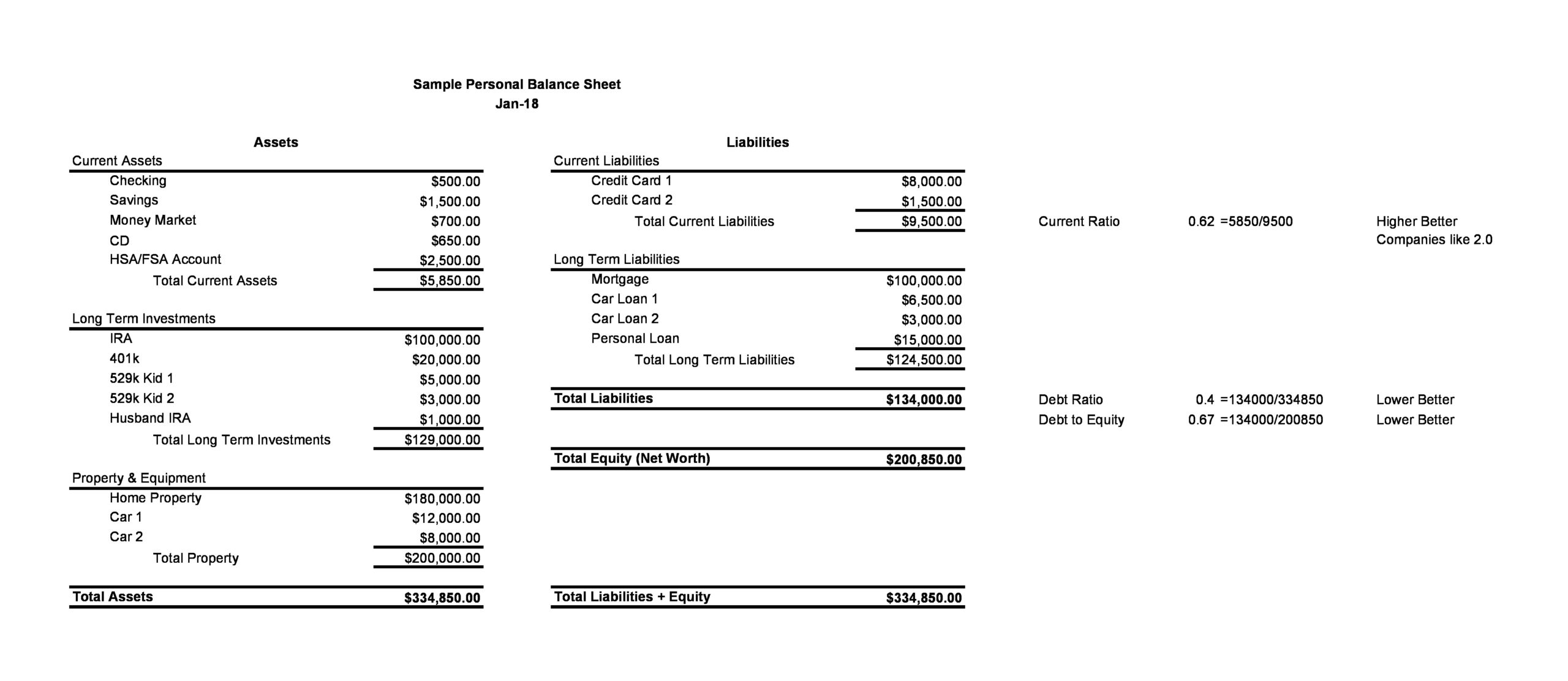

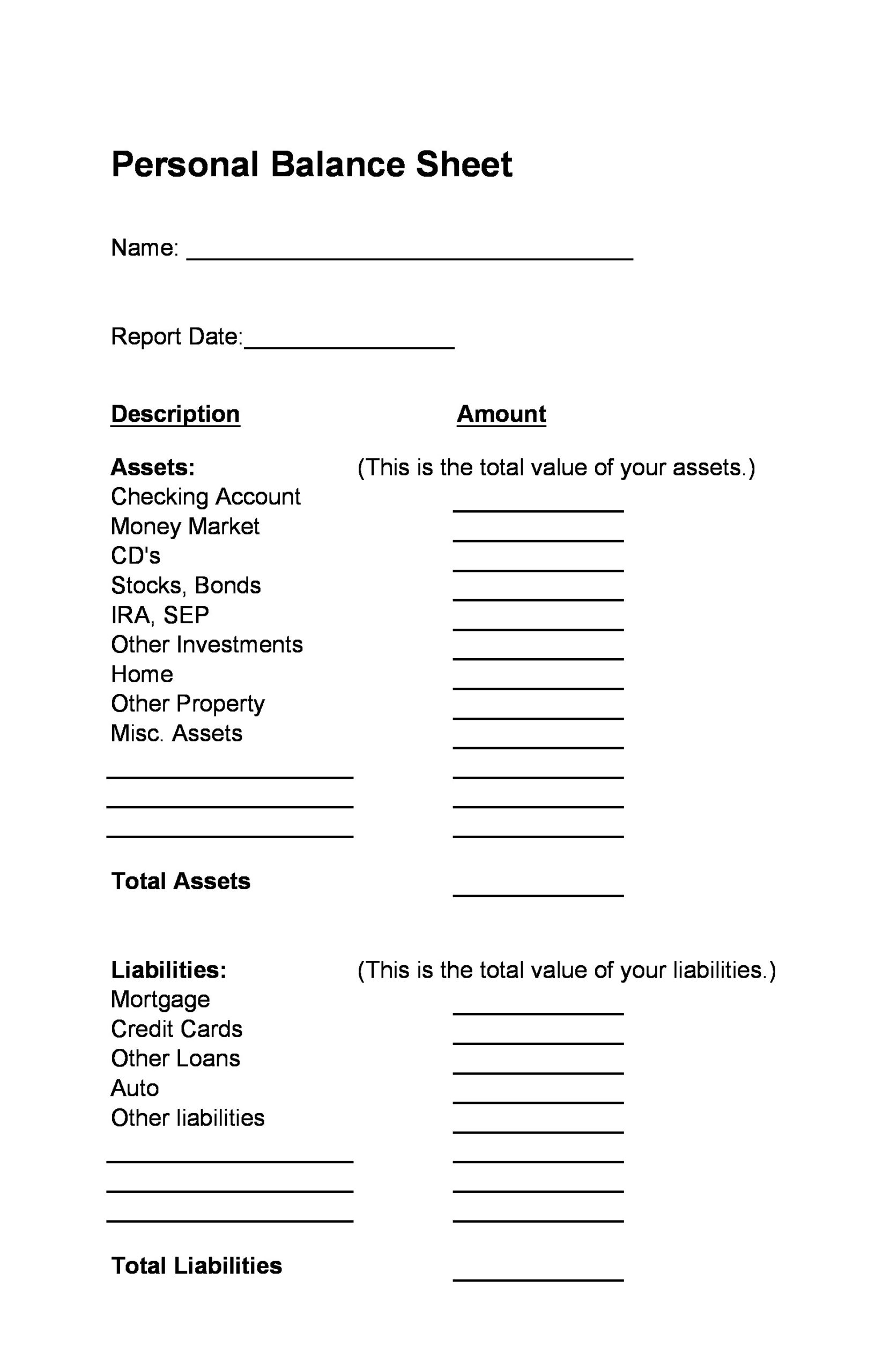

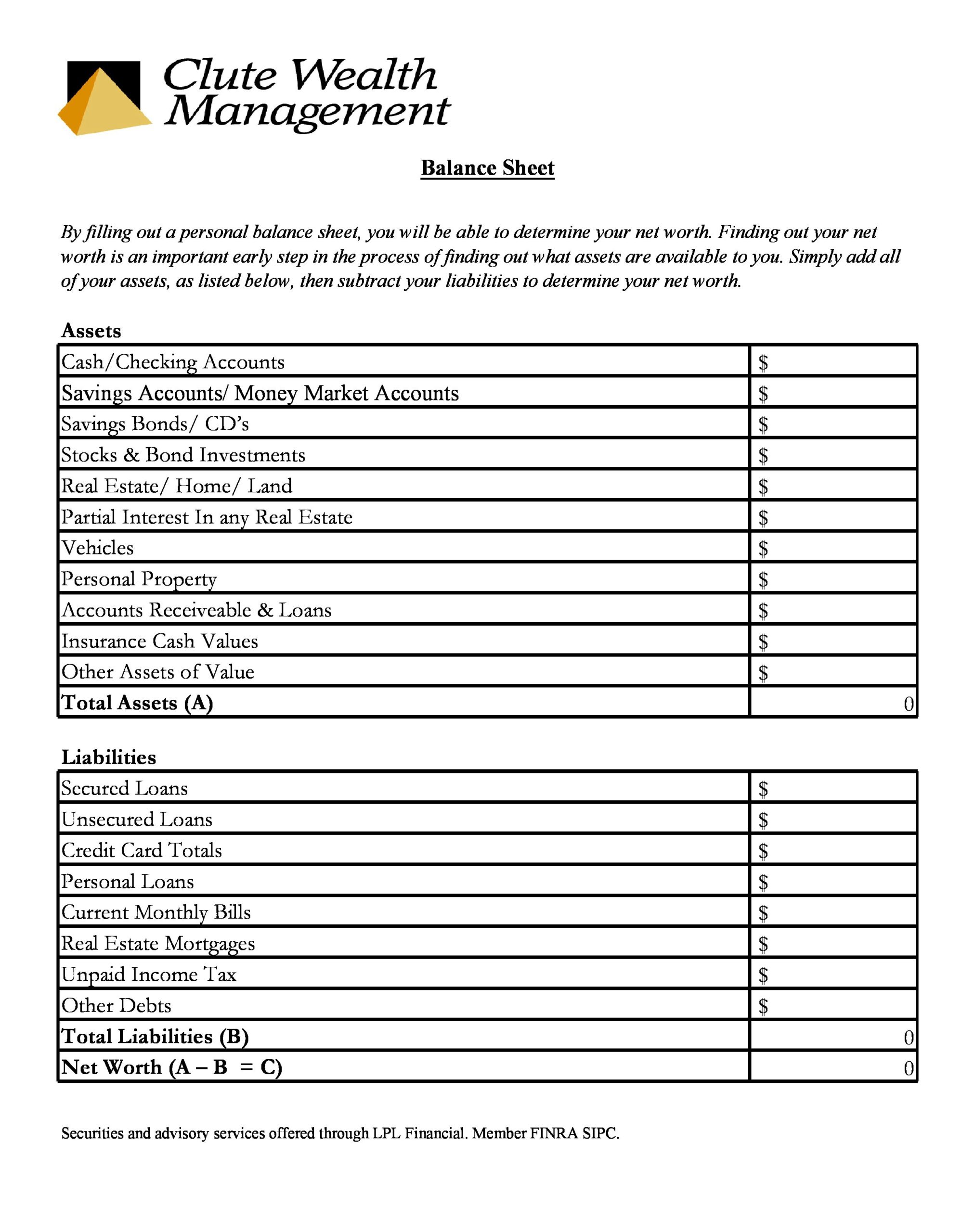

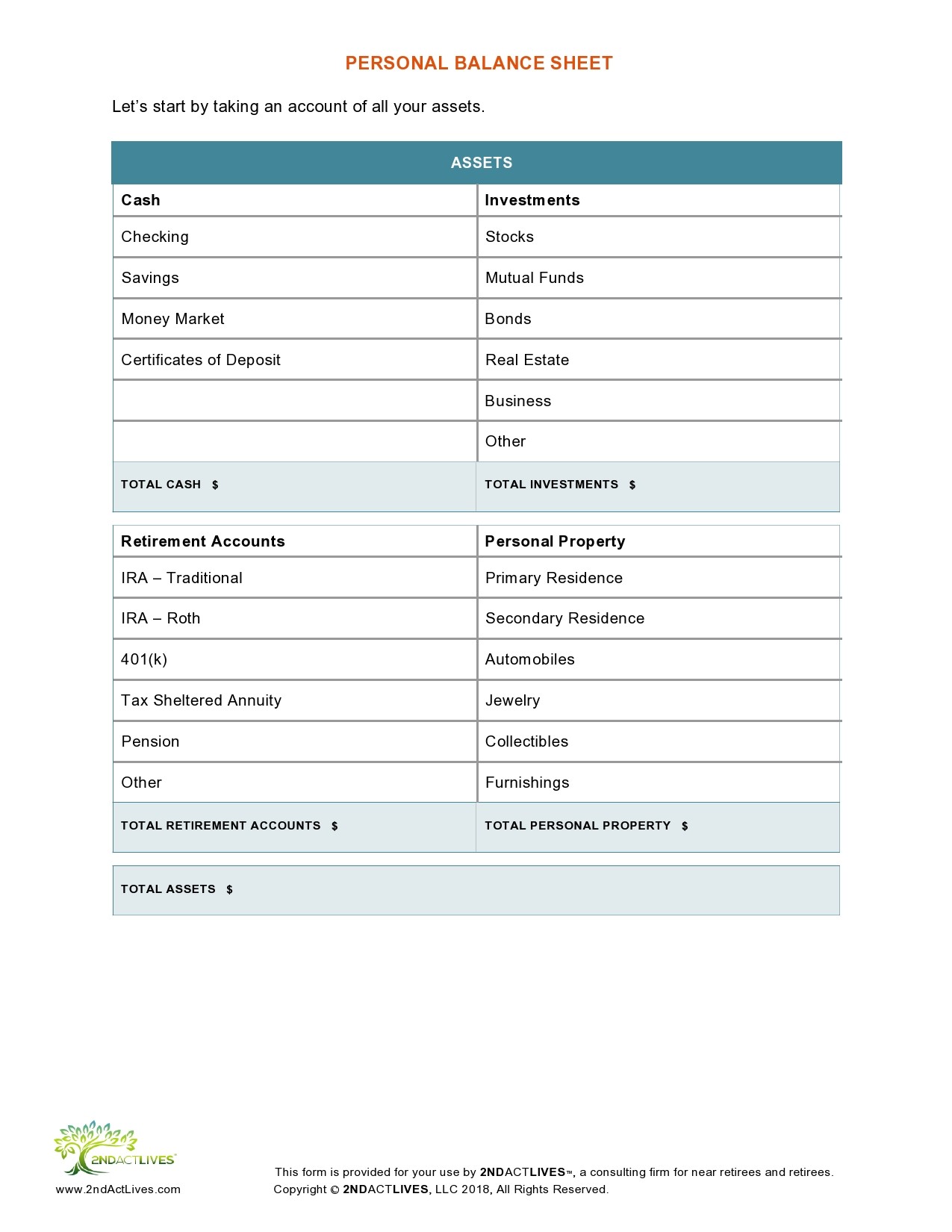

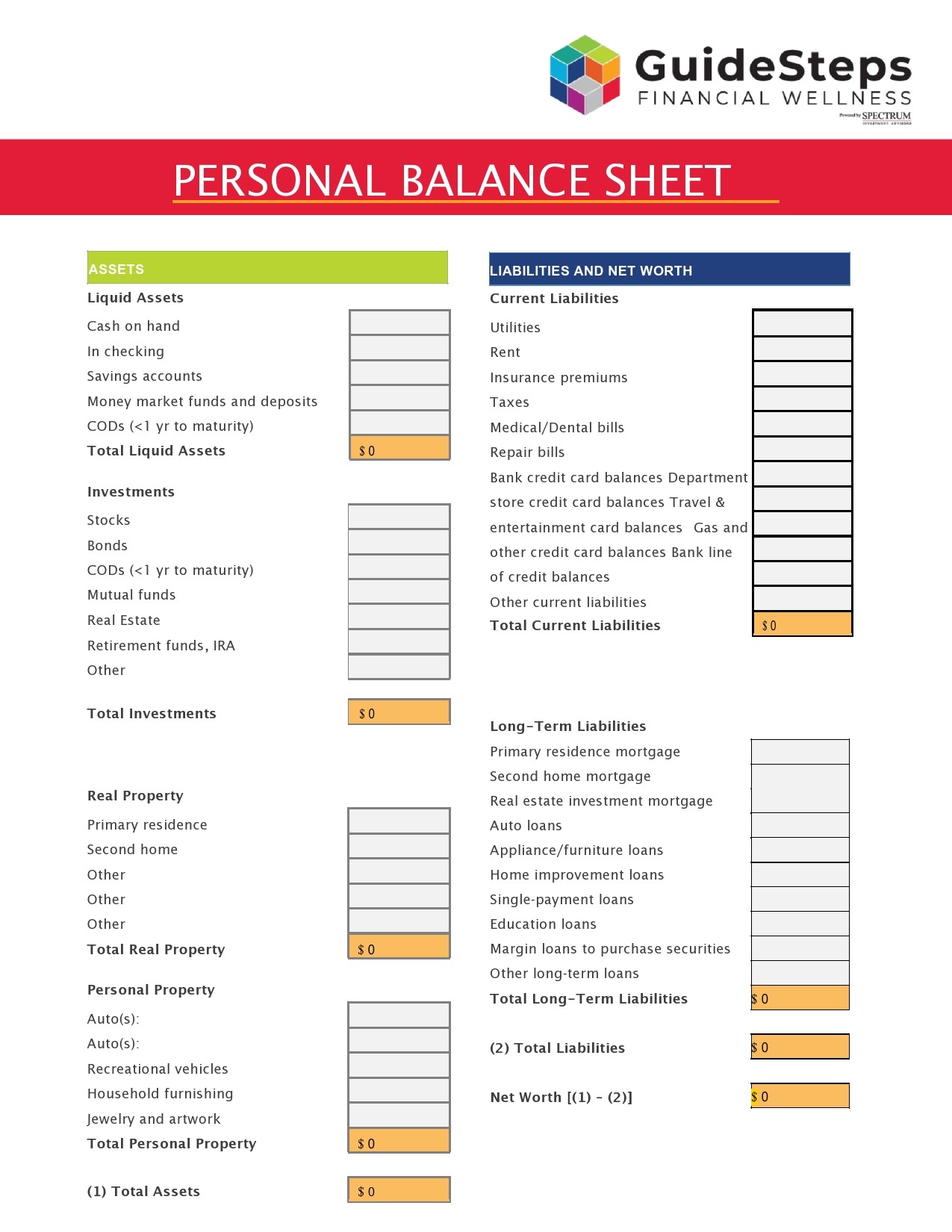

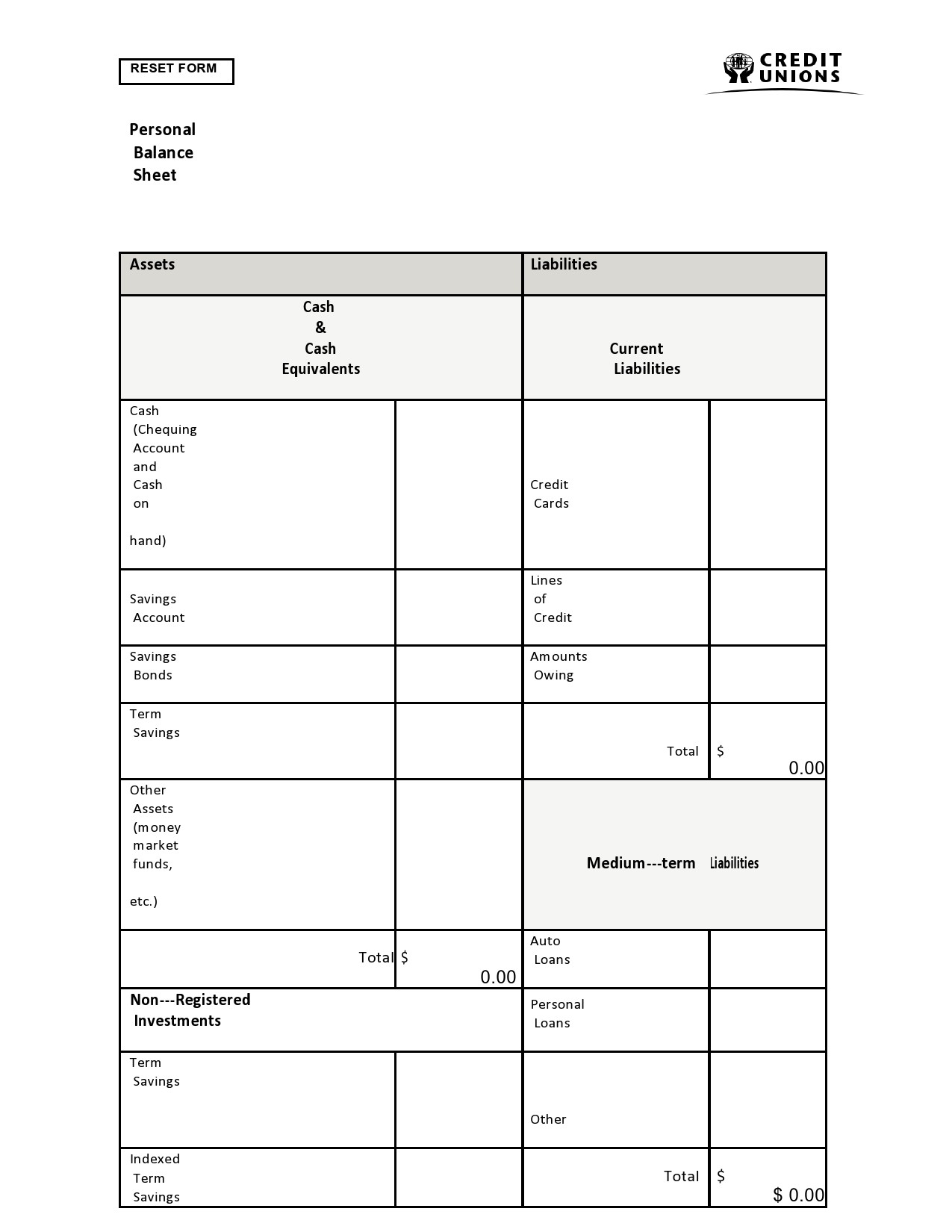

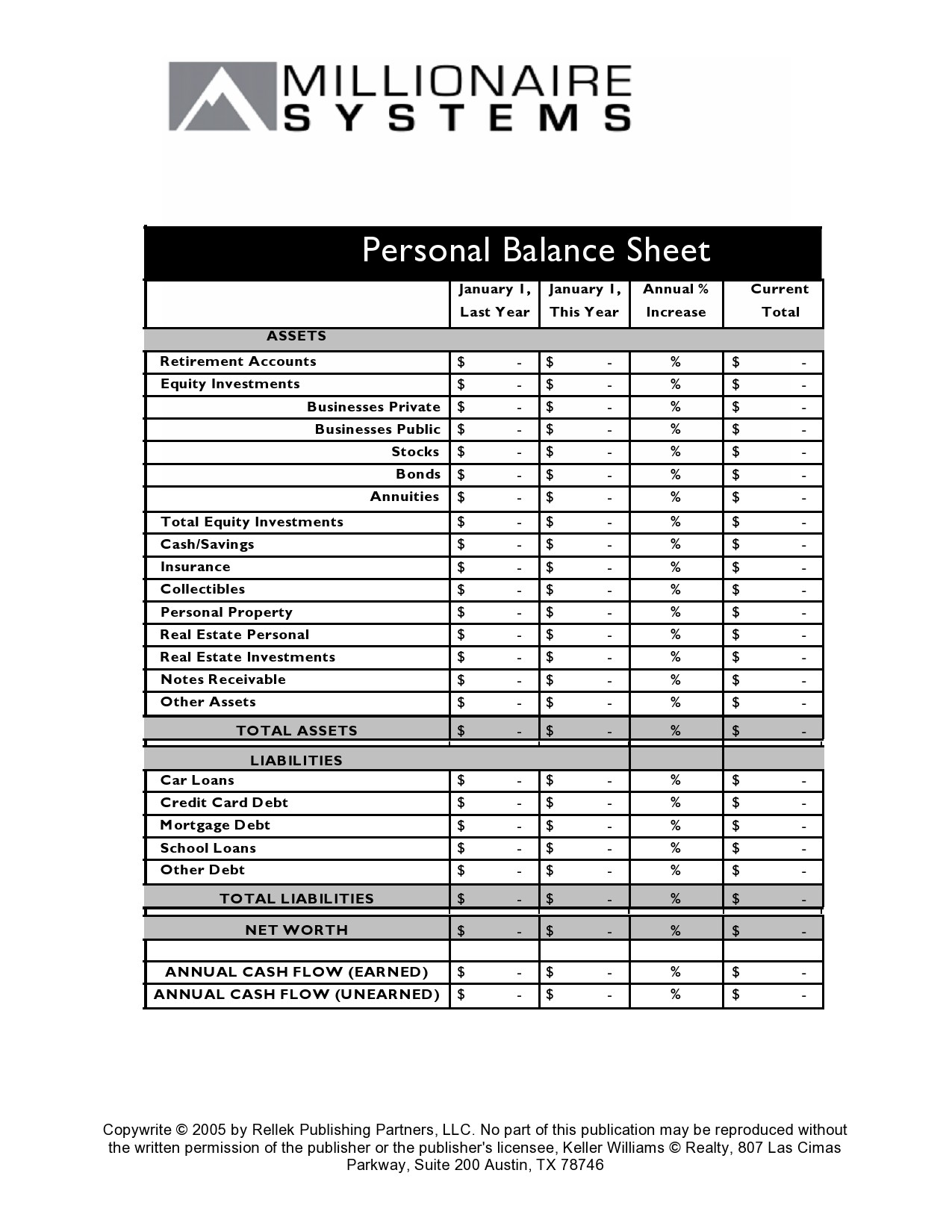

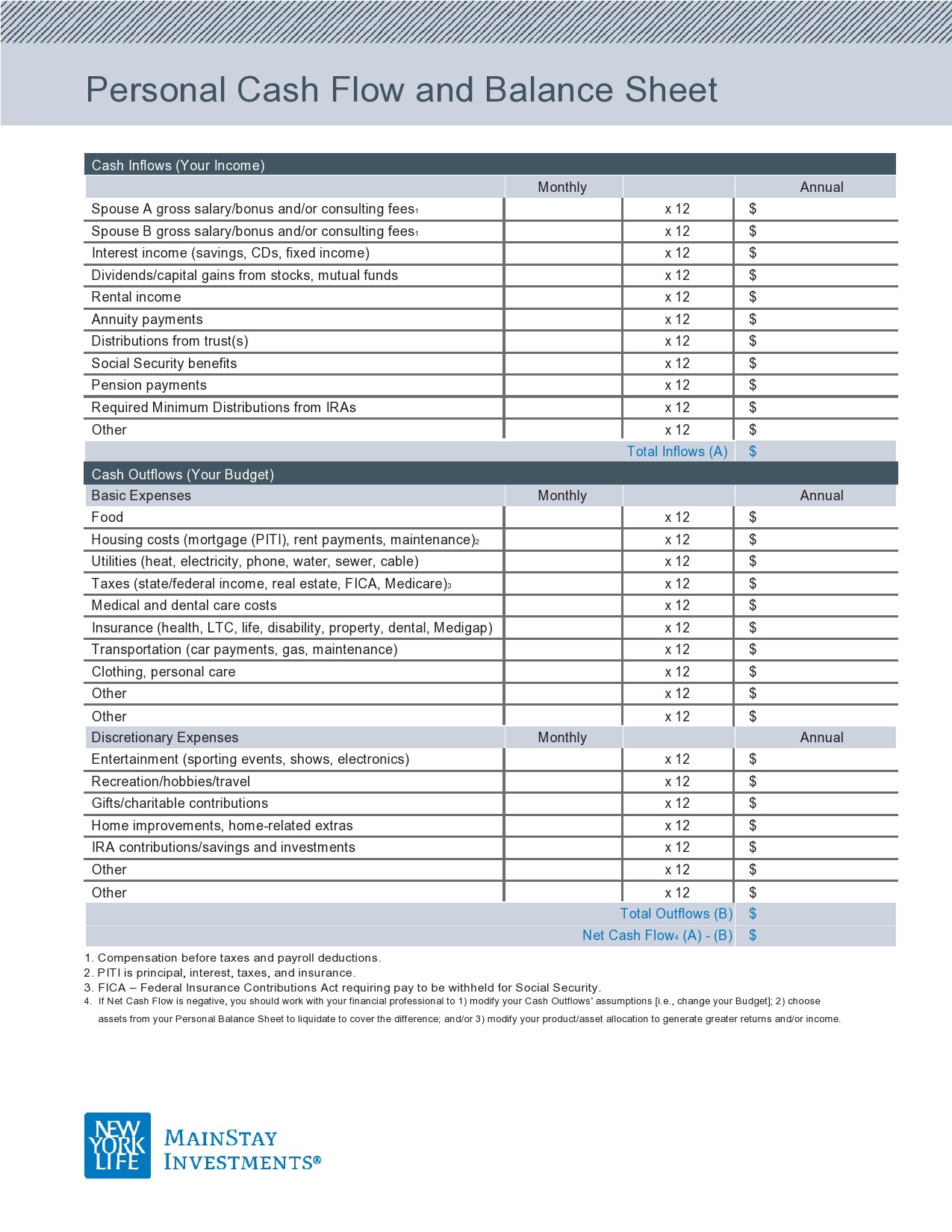

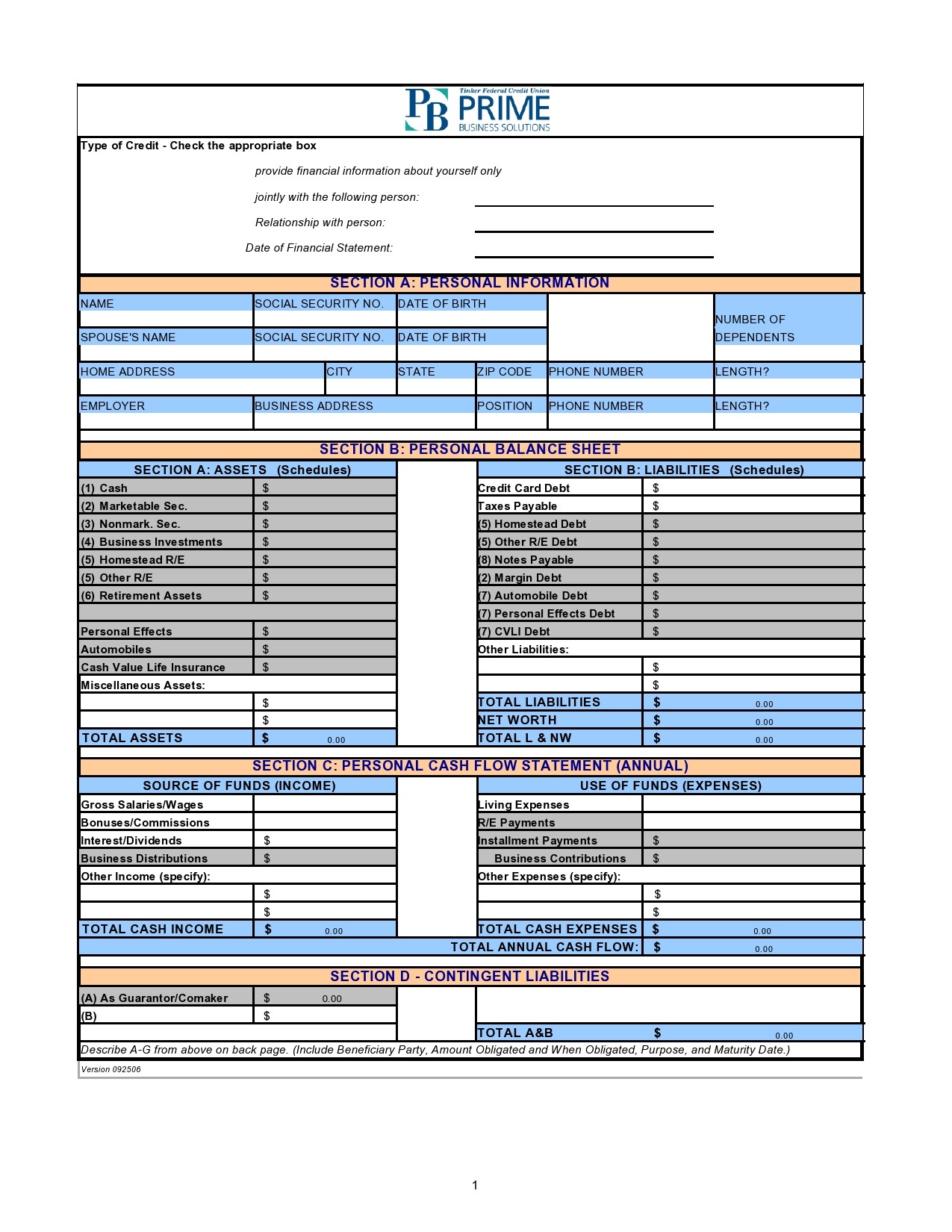

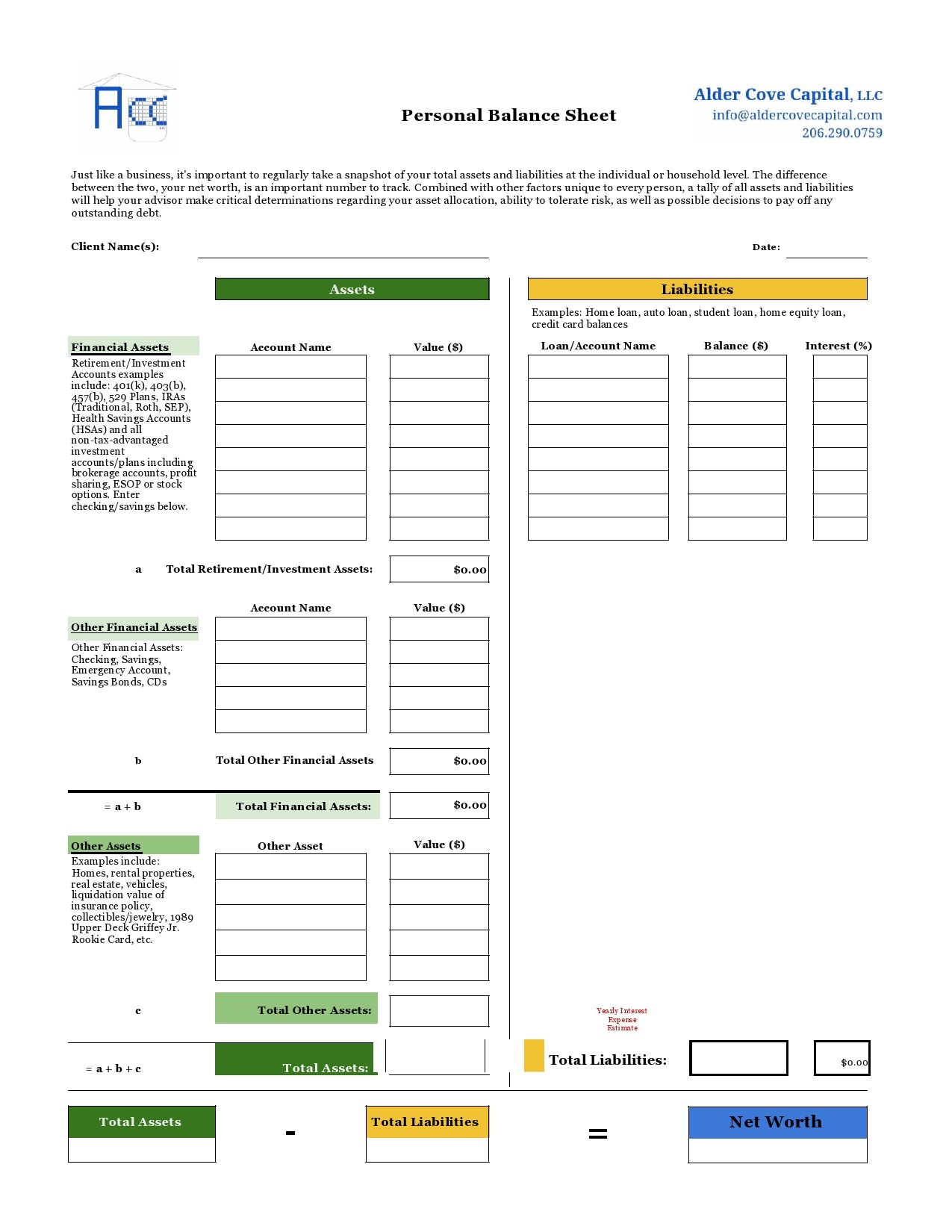

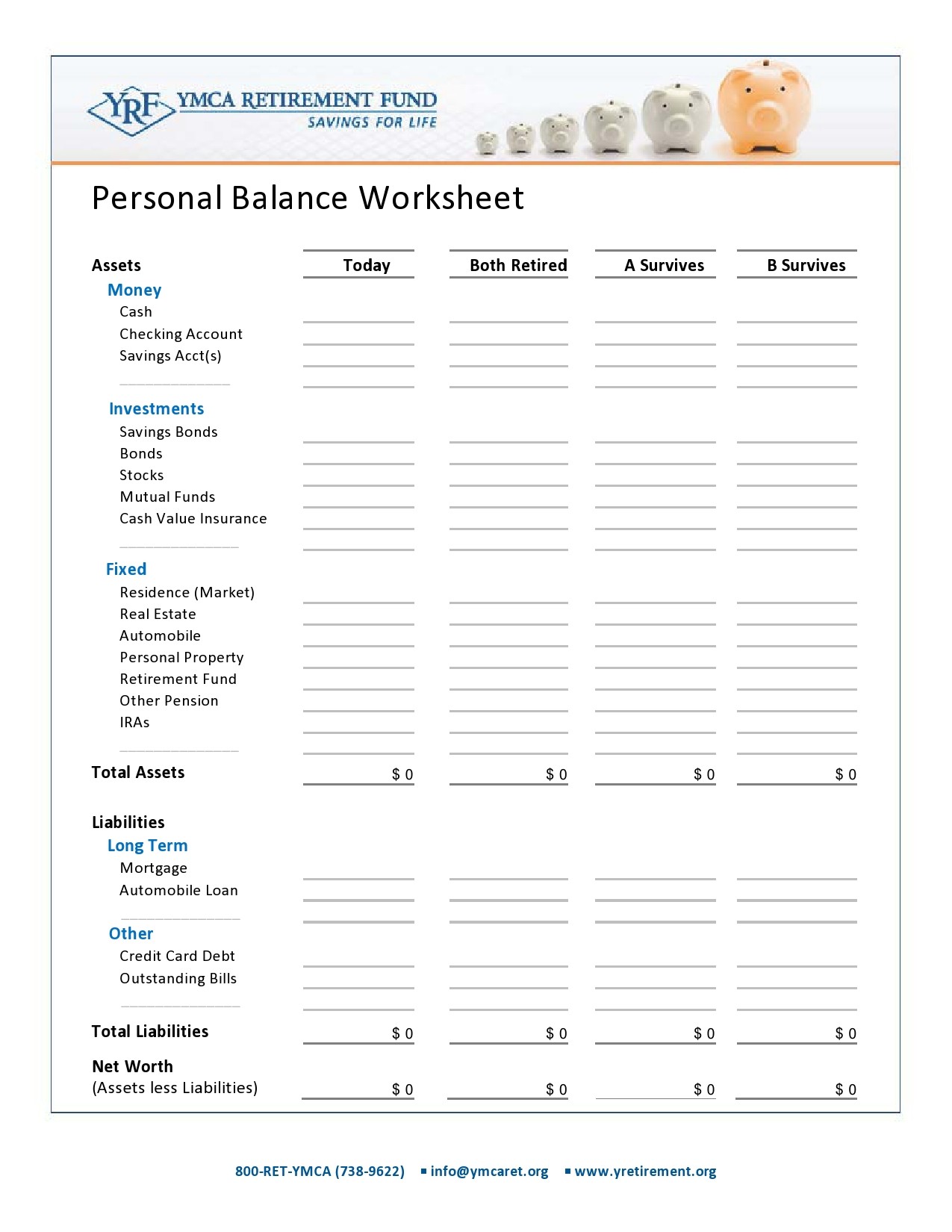

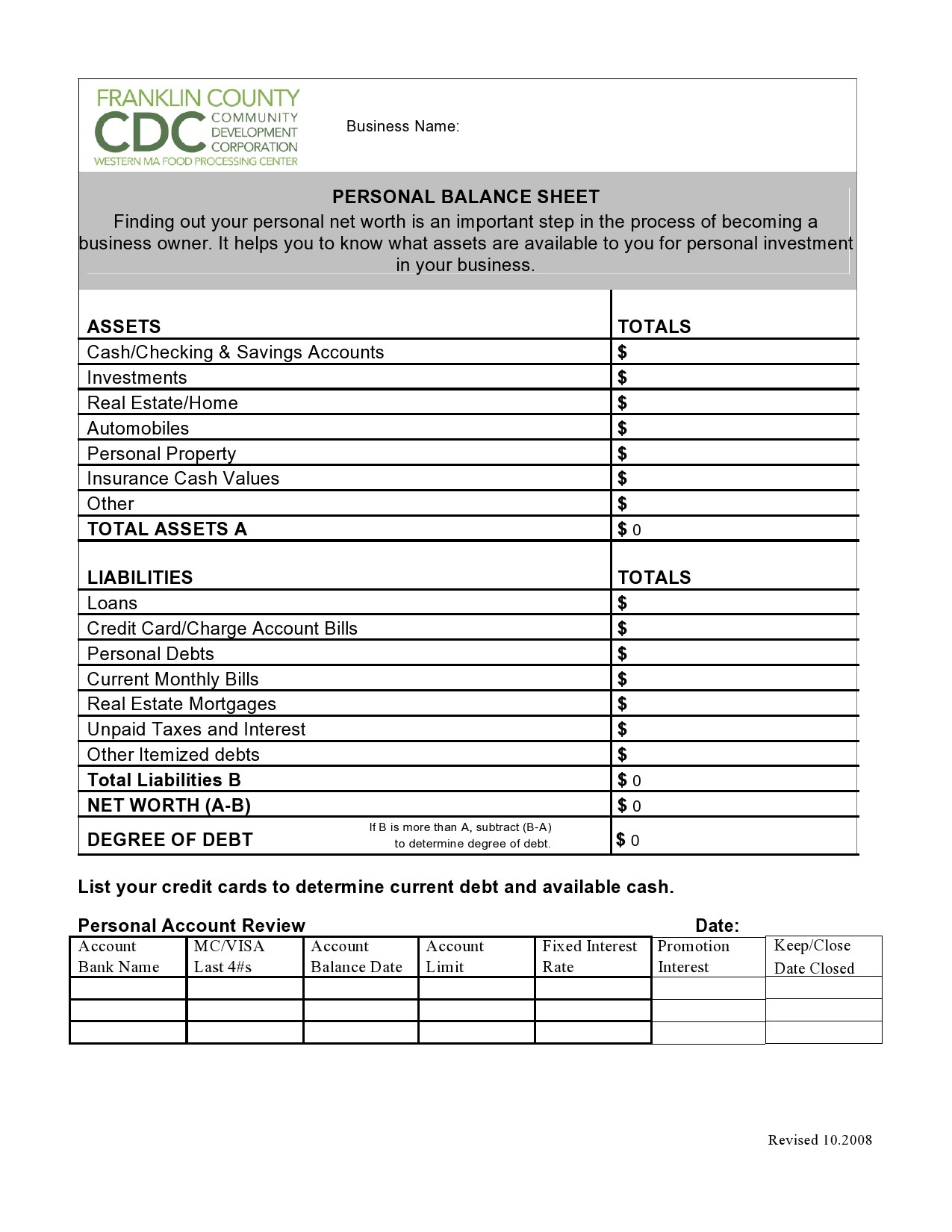

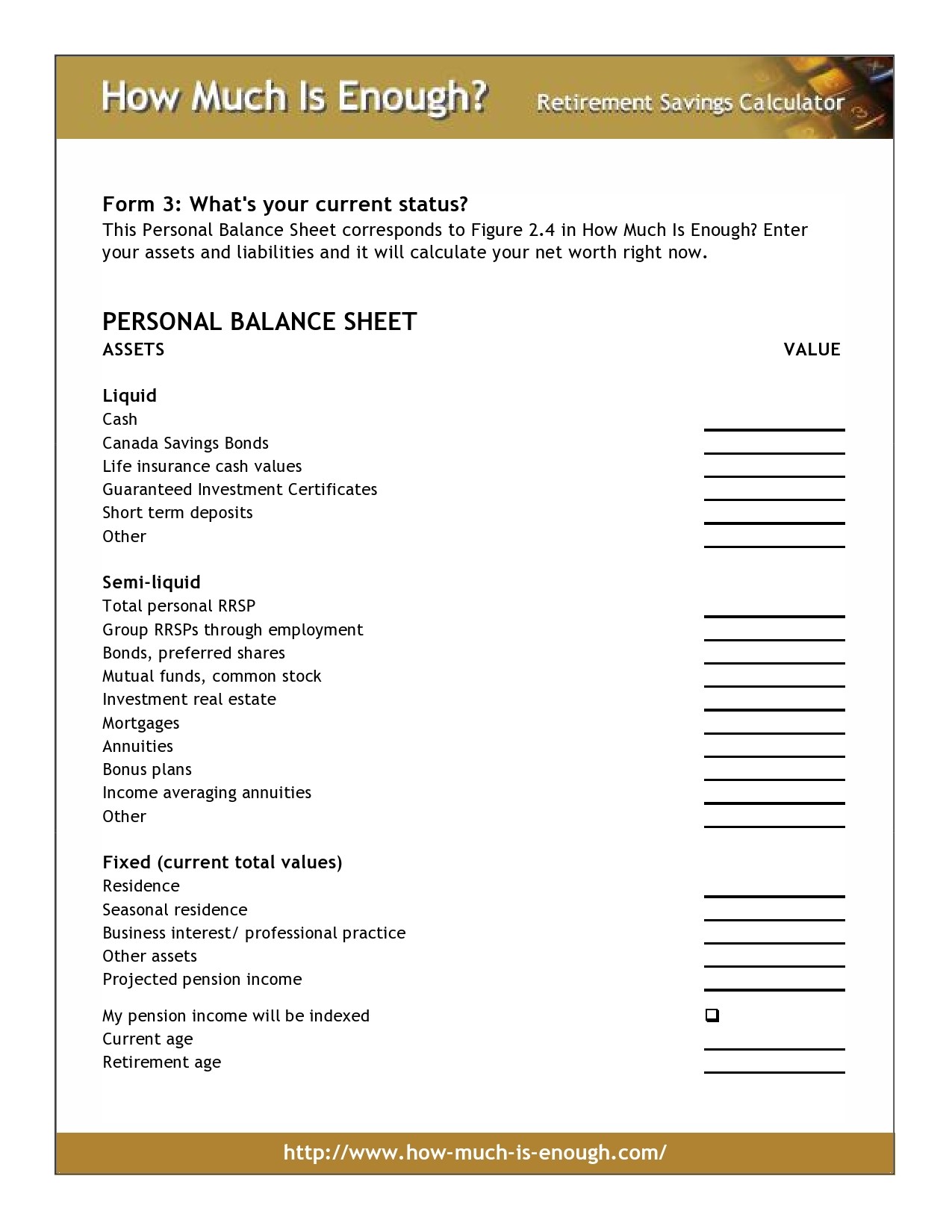

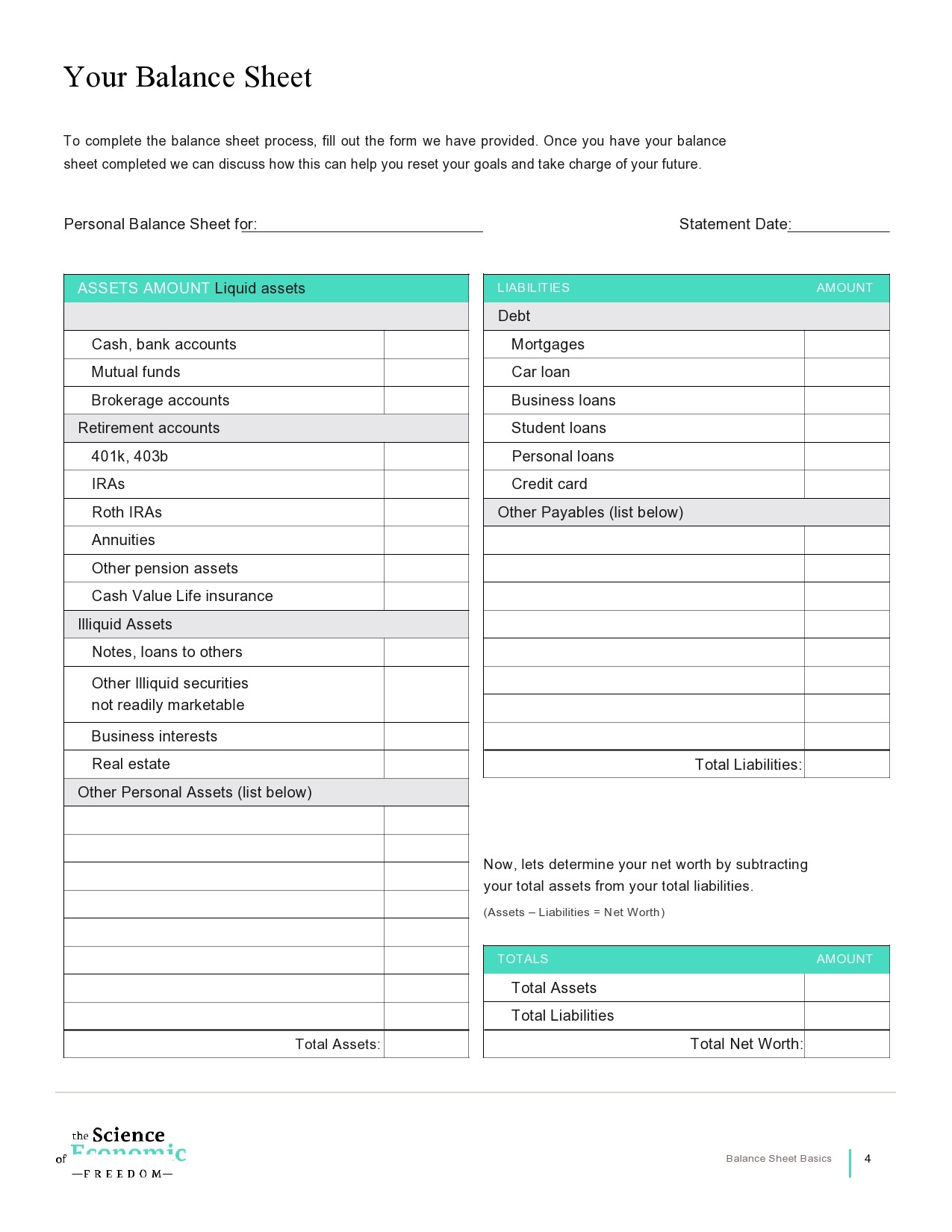

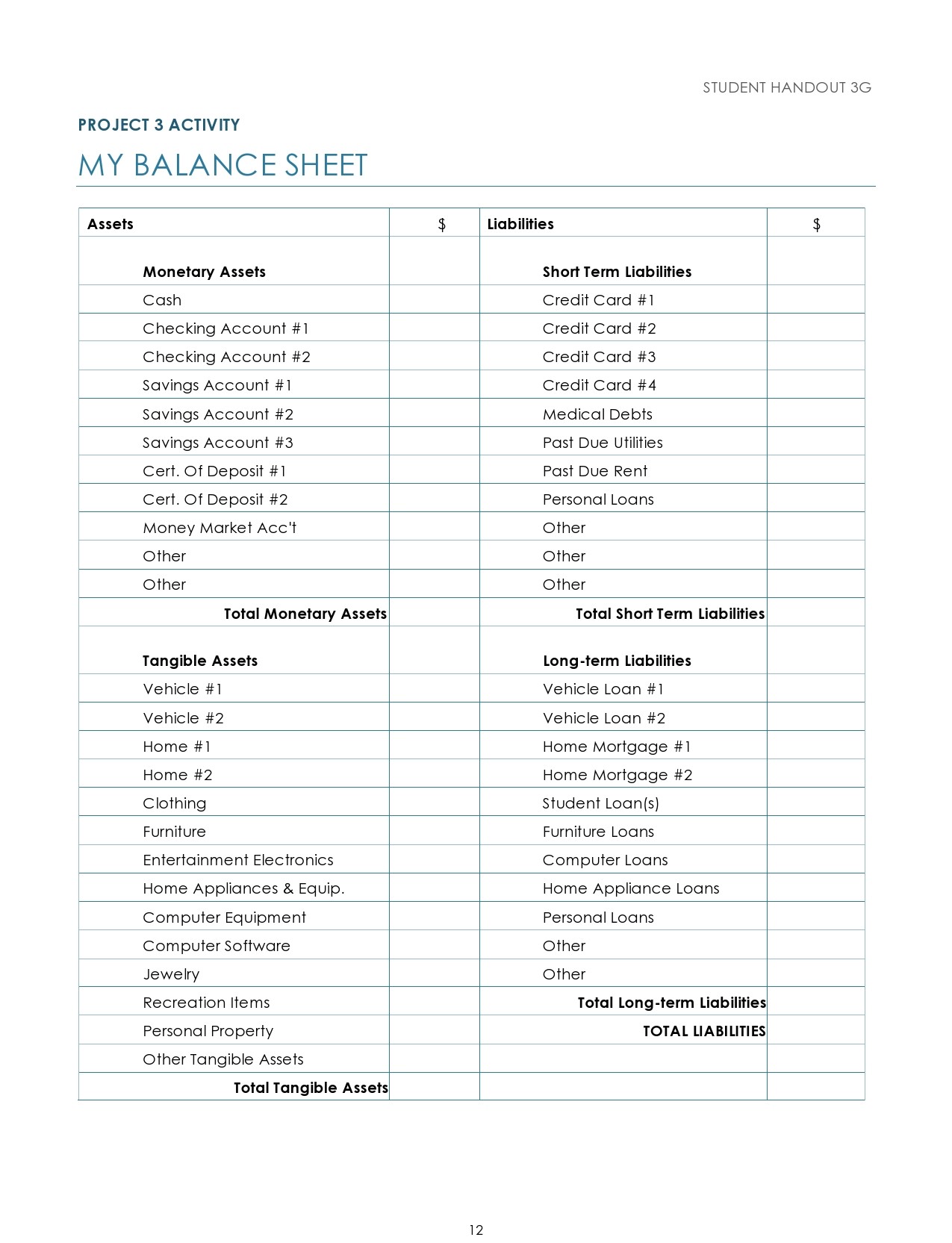

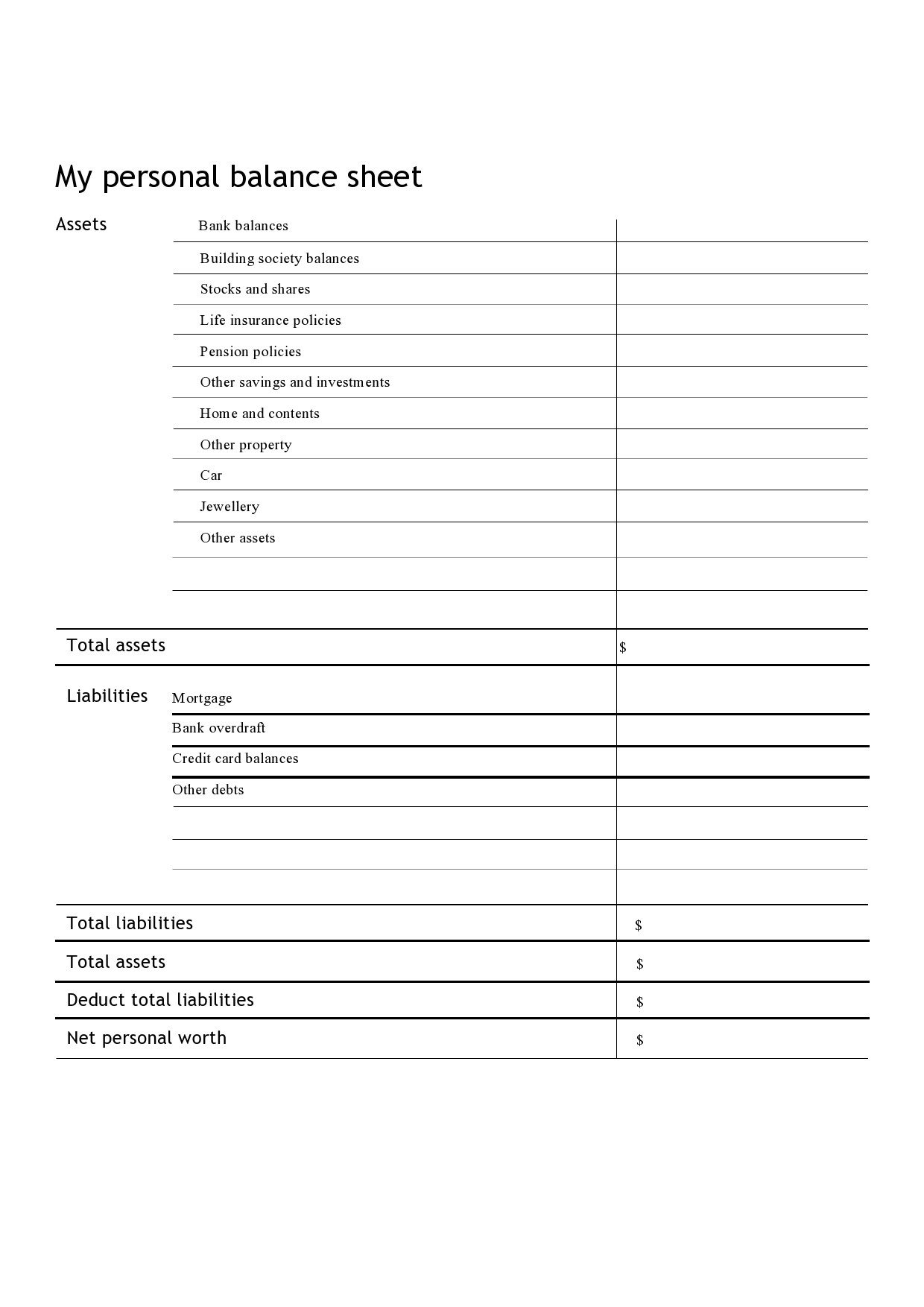

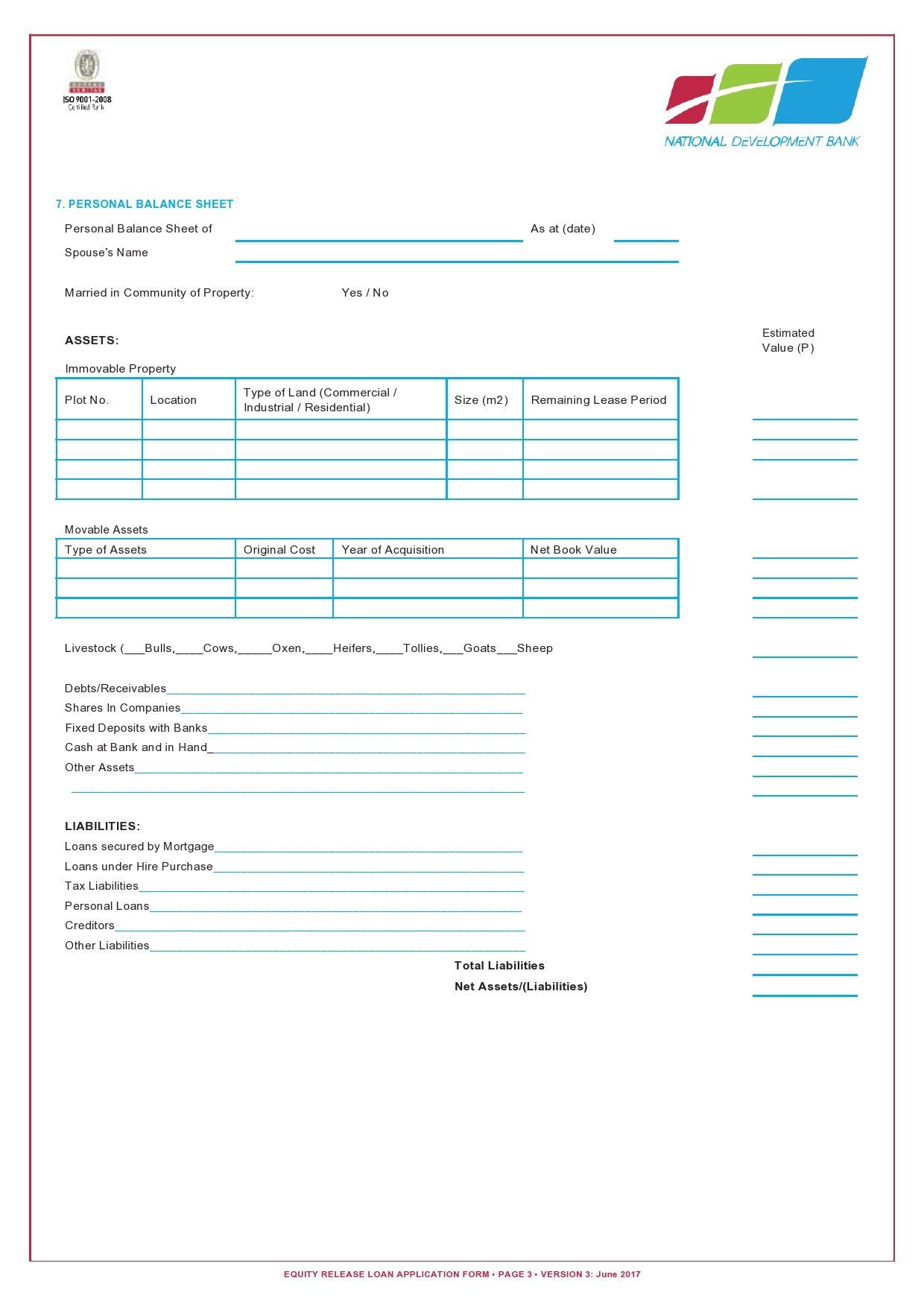

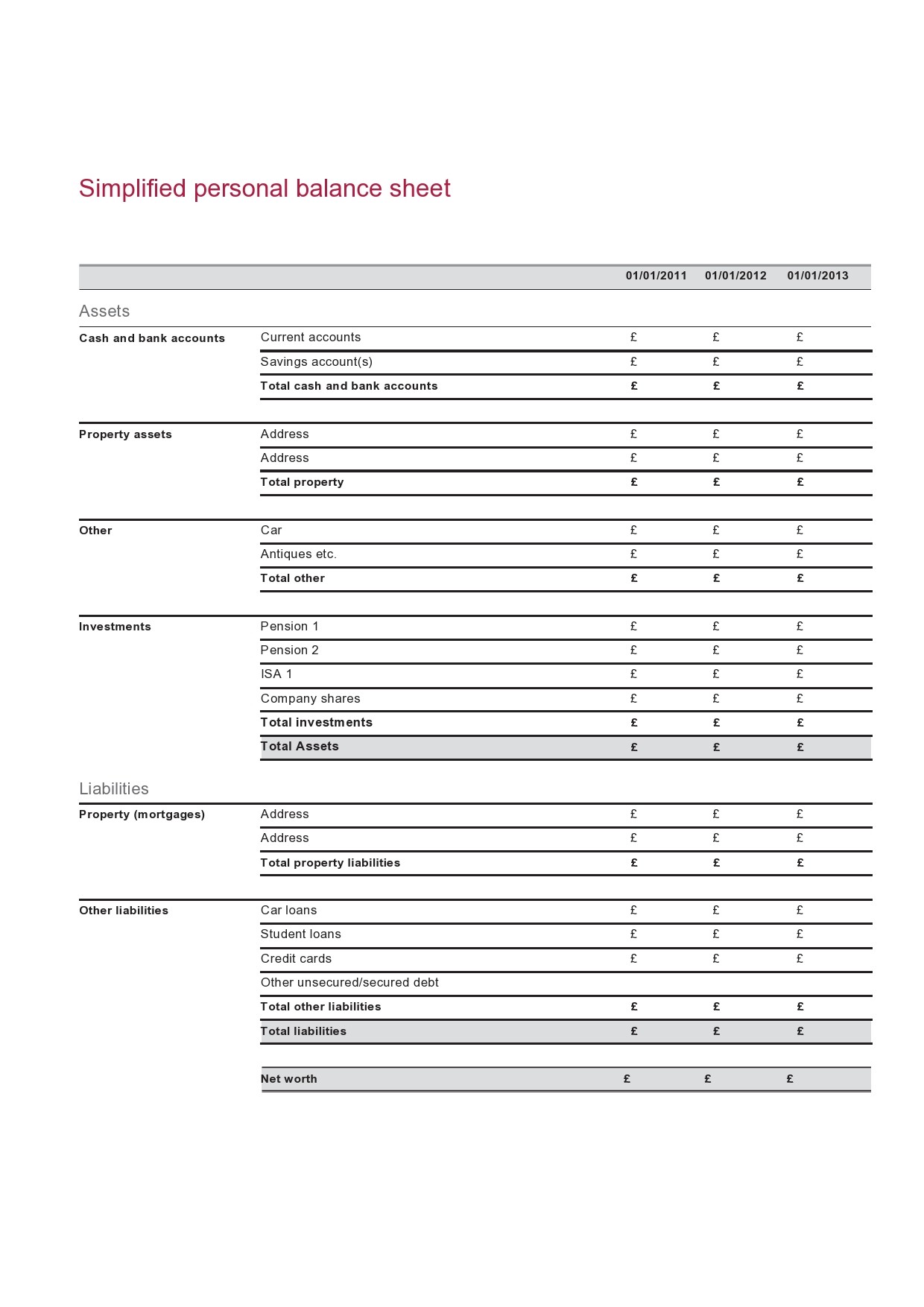

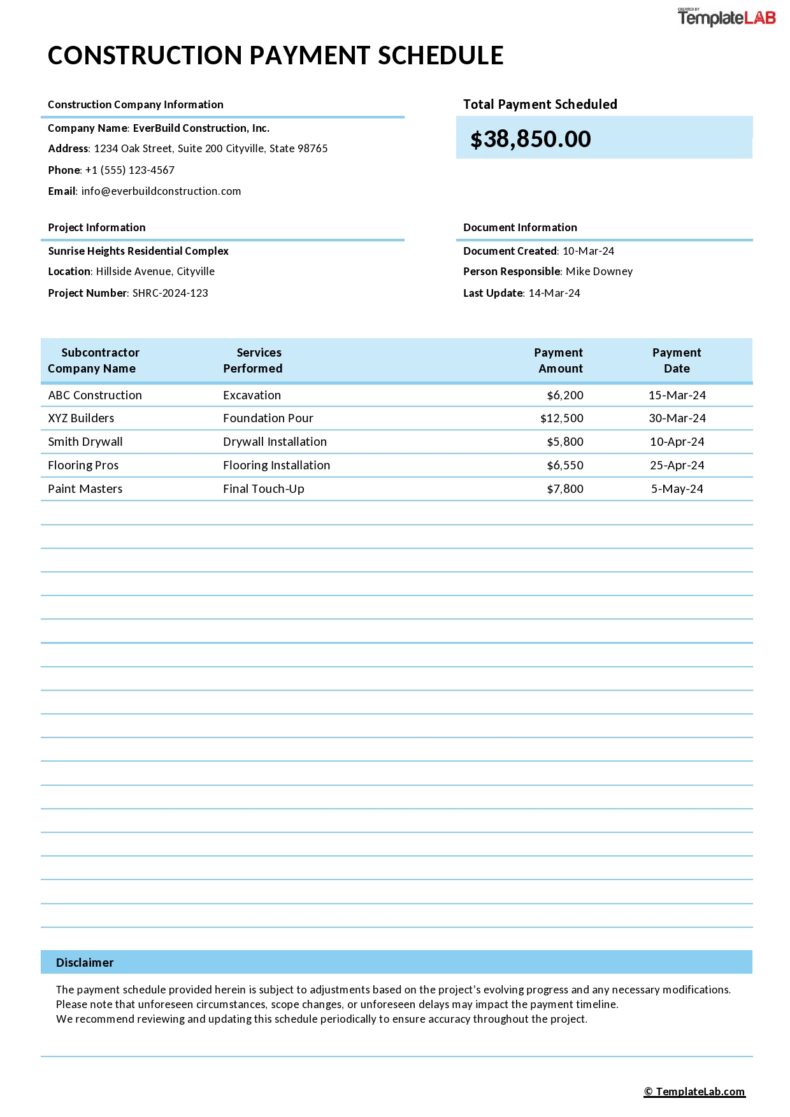

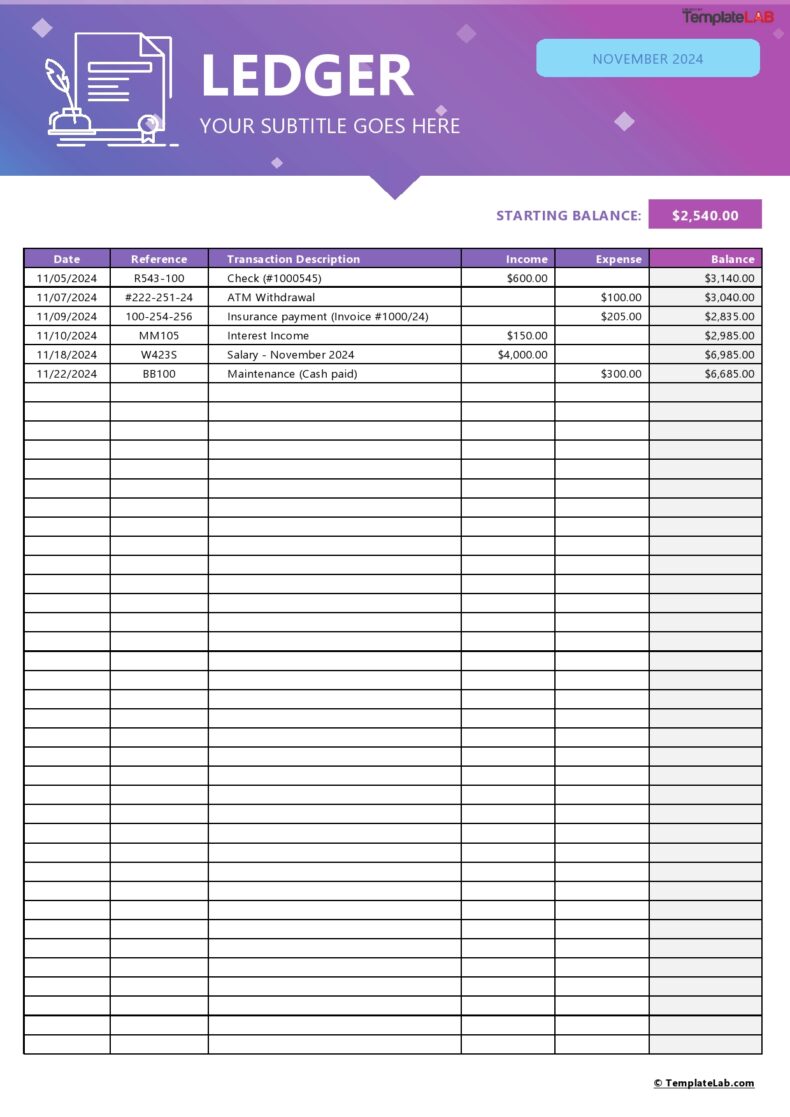

Personal Balance Sheet Templates

How does a personal balance sheet work?

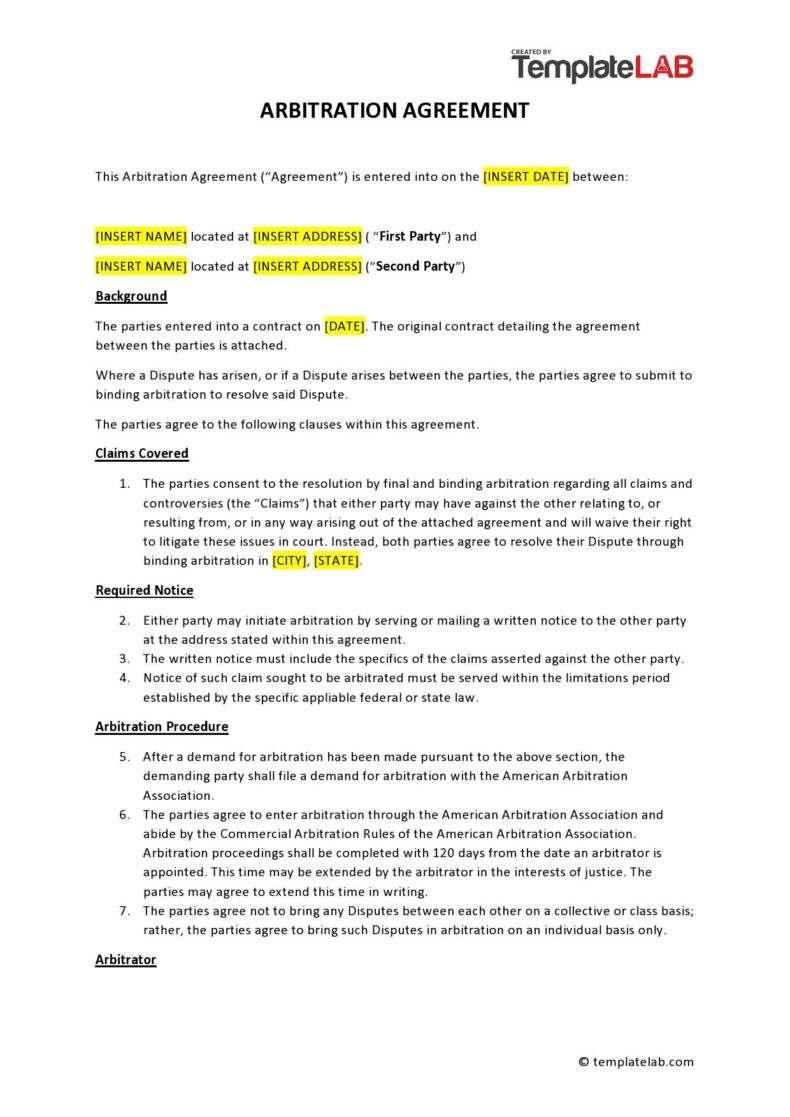

When you’re submitting a business loan request or a business plan to a lender, they will require you to submit a personal financial statement or even a family balance sheet. You might also need to provide a personal guarantee for the loan. You might even have to offer some of your assets to serve as collateral for the loan. If you do this, you must submit a personal financial statement. This will prove to the lender that you have enough assets to cover part of or the entire loan. The statement will also provide details of all the assets you have.

What are assets and liabilities?

An asset is anything you own that has value. These can come in the form of property or investments with significant value that you can use as collateral to get a loan. Remember that salaries and other types of income aren’t considered assets, although lenders will ask to see such information. You should list these separately so that the lender will understand your capability to manage your liabilities. Your assets include:

- Current assets. These are the assets that you can convert or liquidate into cash quickly, if necessary. You must have the ability to convert these assets in about 12 months or less. Some examples of current assets are checking accounts, savings accounts, certificates of deposit, and more.

- Investments. These are assets that you purchased with the expectation that they will generate income or you can sell them at a higher price in the future. Some examples of investments are bonds, stocks, mutual funds, and more.

- Retirement accounts. There are many kinds of retirement accounts and they all have their own policies. But they all have the same purpose – to provide you with an income source after you retire. Some examples of retirement accounts are IRAs, 401ks, Pension Plans, Roth IRAs, Employee Stock Ownership Plans, and more.

- Real estate. These are any properties you have purchased and have under your name. You can also use these as collateral if you need to.

- Business. Owning a business won’t exempt you from doing work. If you aren’t sure of the value of your business, it’s recommended to talk to your accountant or consult with a financial advisor to find out how to value your business.

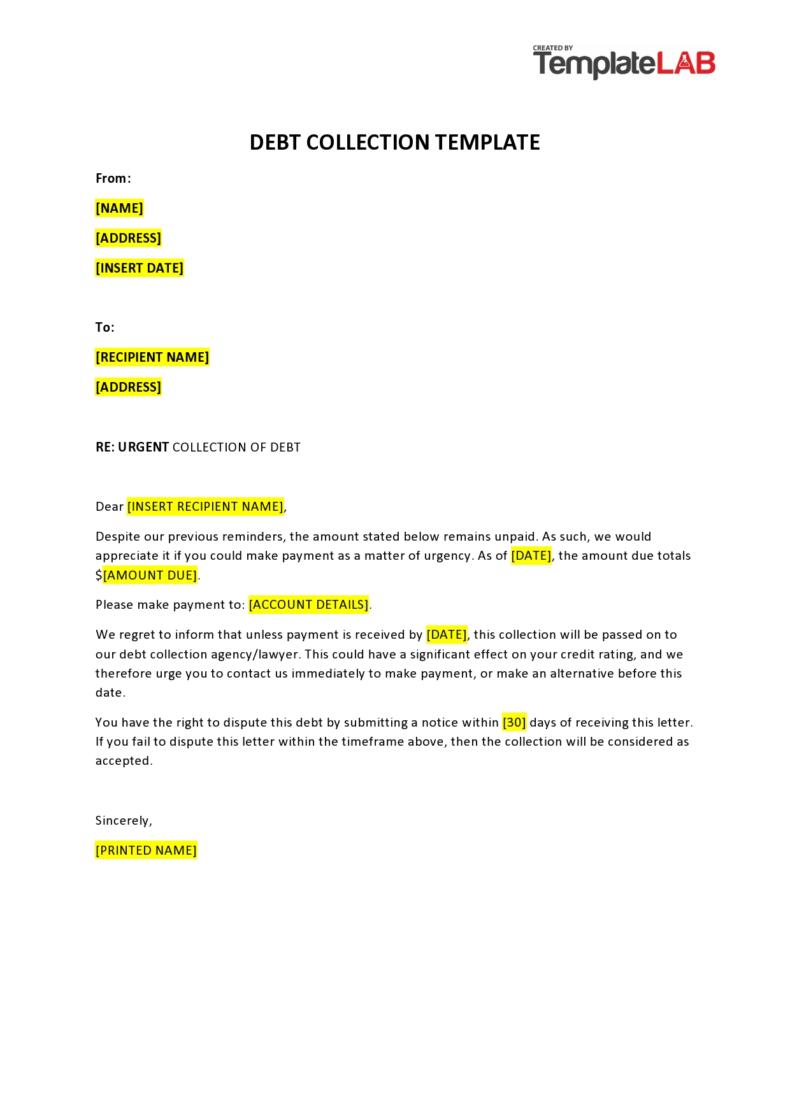

Liabilities are your accounts that come with a balance that you need to pay through regular instalments. Remember that monthly accumulated expenses like cable, utilities, cell phone, rent, insurance payments, food, and other living expenses aren’t considered liabilities. Here are examples of liabilities:

- Student loans

- Credit cards

- Unpaid taxes or medical bills

- Loans where you are the co-signor

- Vehicle loans or mortgages

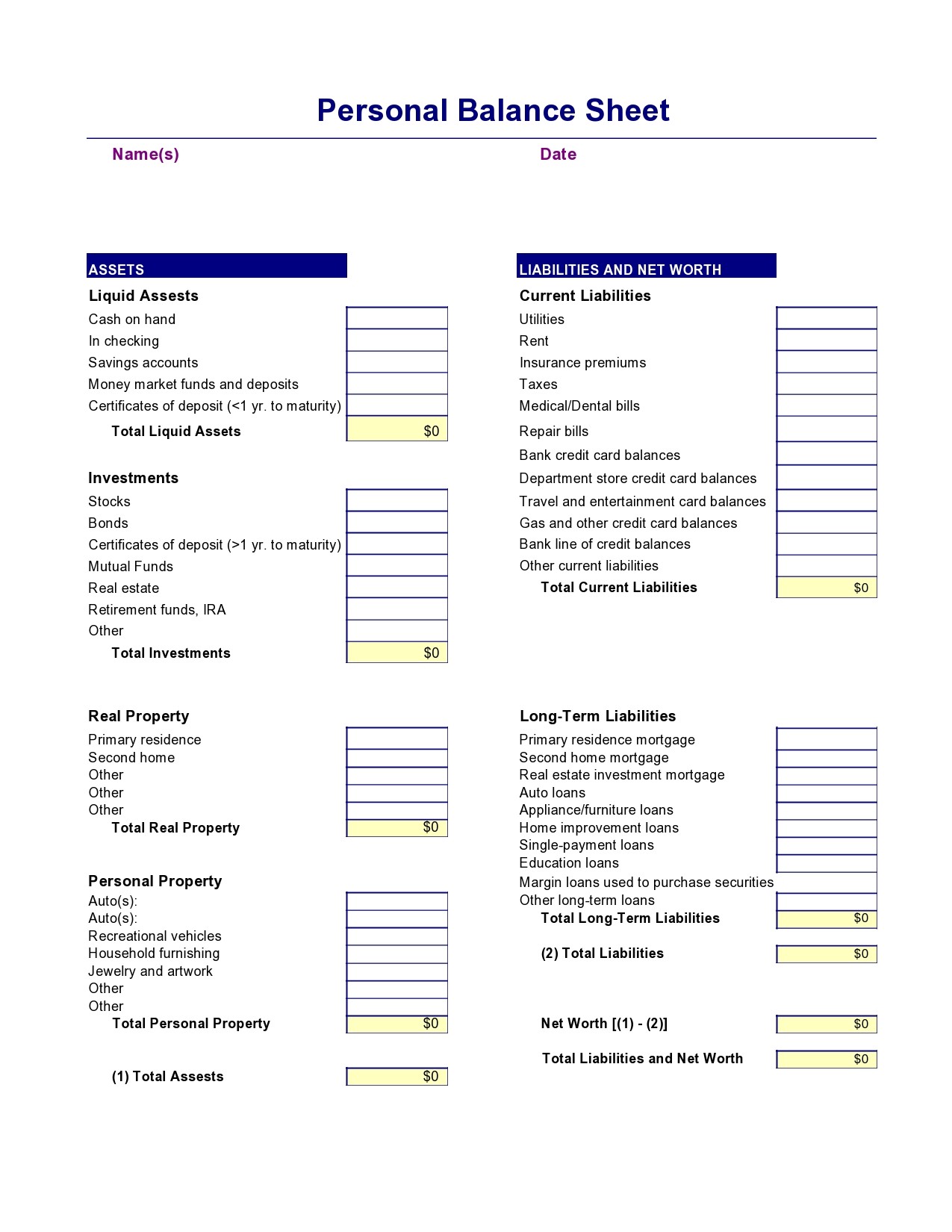

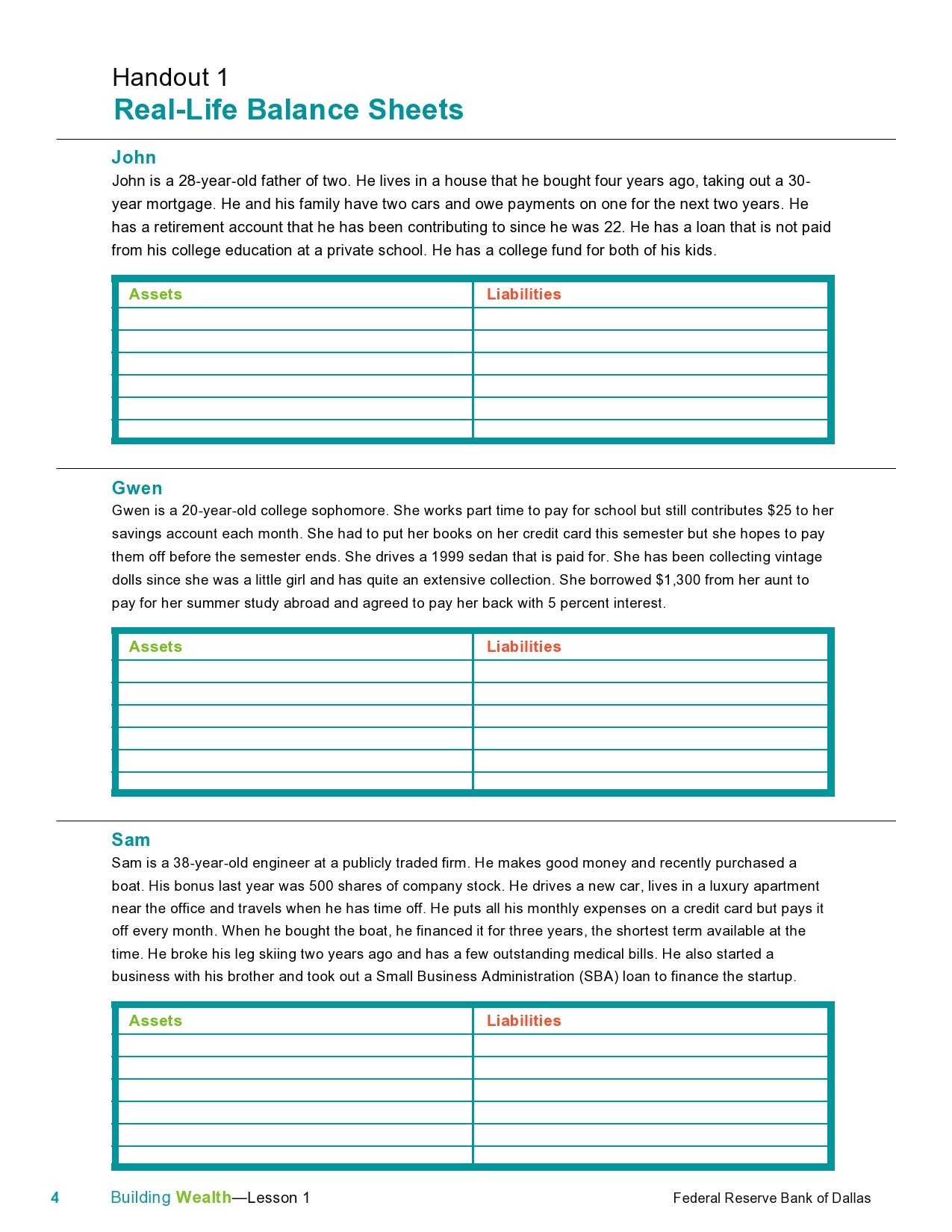

Personal Balance Sheet Examples

Why do you need this document?

It’s quite simple to create a home balance sheet or personal balance sheet. You just need organizational skills, time, and an understanding of basic arithmetic. First, you must know how to calculate your net worth. This is the difference between what you own (your assets) and what you owe (liabilities).

If you have begun keeping your balance sheet updated regularly, you will notice certain trends. This will help you stay on the right track towards meeting your retirement goals. For companies, keeping a balance sheet is standard practice. It’s even mandatory for some as part of yearly reporting. In this sheet, you would compare your assets against your liabilities, where the sum of your assets is always equal to the sum of your equity and liabilities.

A balance sheet is a popular tool for business organizations, but even for personal use, it’s equally useful. It will provide you with interesting insights into your personal life and personal finances. You could also create a holistic wealth overview to calculate our total assets by using the same formula. For a personal balance sheet, you don’t need to use the same visualizations or categorizations as corporate balance sheets. Corporate balance sheets come with standardization that is widely accepted and if you want to follow this method, you can choose to do so.

Having a personal financial statement will help you understand the overall state of your personal finance while allowing you to determine your net worth. This is also helpful when you apply for credit like a personal loan, business loan, or mortgage.

It’s important for you to come up with a personal financial statement to get an overview of your financial health. Even if you currently have a positive net worth, it isn’t a guarantee that you will get the loan you’re applying for. Also, take into consideration when applying for a loan all of your past debts and credit history.

Perhaps the biggest downside of a personal financial statement is that it is a one-time look at your financial health at a specific point in time. This means that if you want to see a positive change, you need to update the statement regularly. Fortunately, you can use online tools to automate your personal financial statements. If you want to do this manually, you can use a template.

How do you create a personal balance sheet?

A balance sheet is a tool that lists all of your liabilities assets to understand how much you’re worth. For companies, this statement is important for potential stakeholders to determine if they should invest in the company.

For your personal use, the statement will illustrate if you’re on the right track to accomplish your financial goals, like getting out of debt by showing how much or what you own, the debts you need to pay and how much your total worth is.

Modern technology has made it easier to create your own personal financial statements for your liabilities and assets. This statement is much better than a spreadsheet for budget and expenses because it will contain a list of all the big-picture things that you owe and own, not just what you spend money on each day. Although creating this financial statement might take more time and effort, it will be worth it. Here are the steps for making this document:

- Gather all of your financial documents

Keeping track of your expenses will give you an idea of where your money goes each day. You can also gather all of your monthly credit card and loan statements along with your investment and bank account balances to create a list of all your liabilities and assets. Remember that assets are the things you own that have value.

These may include any certificates of deposits, cash savings, retirement accounts, investment accounts, your home, other properties, jewelry, cars, and more. Your liabilities are the money you owe to a financial institution or another person and these may include student loan debt, credit card debt, mortgages, car loans, medical debt, personal loans, and more.

- List all of your liabilities and assets

After gathering all of your financial documents, you can either use an online template, a paper and pen, or an Excel sheet to make a list of all your liabilities and assets. Use two columns and jot down the value of each item so that you can get the sum totals for each column. Remember that all of the values you list down should be from the same day, week, or month so that the template will show the same point in time of your finances.

- Calculate your total net worth

Subtracting the total amount of your liabilities from the total amount of assets to get your net worth. The difference can either be a negative or positive value. Positive net worth is good news but a negative one is something you should worry about.

Although this shouldn’t be a cause for immediate concern, you should still look into it. Often, negative net worth can come from mortgage bills, student loan debts, and other liabilities. These could make your otherwise healthy financial outlook look bleak.

Checking your net worth regularly is the key to always having good financial health. Other factors include adding to your savings and paying off your debts. Should your net worth still show up as negative, this could indicate some kind of issue. Make it a habit to check your net worth at least once a year to make sure that things move in the right direction.

- Assess your personal balance sheet

After listing all of your liabilities and assets, it’s time to get the totals of each column. Subtract the total liabilities from the total assets to get your net worth. After this, you must take a closer look at each column to find out which item you can change to help you achieve your financial goals.

In terms of updating your balance sheet regularly, schedule a reminder to do this. That way, what your balance sheet contains will be the most updated information you can check to see if you’re on the right track.

Family Balance Sheets

Assessing your personal balance sheet

You can use your personal balance sheet to provide you with an overview of your wealth at a specific point in time. It is a condensed summary of all your liabilities, assets, and net worth. To assess this document, look at the following:

Assets

You may have different types of assets, including.

- Liquid assets are the things you own that you can sell or turn into cash easily without losing value. These can be money market accounts, checking accounts, cash, or savings accounts. You may also include certificates of deposits in this category, although not in all cases. Most CDs charge a fee for early withdrawal, which would cause your investment to lose some value.

- Large assets include your high-value properties like cars, houses, artwork, furniture, and boats. When including these in your personal balance sheet, make sure to include the market value for each of the items. If you cannot find their market value, go online and search for similar items, then use the most recent sale prices.

- Investments include stocks, bonds, real estate, and mutual funds. You should include your investments at their current market value too.

Liabilities

Liabilities refer to everything that you owe. These may include current payments or bills or those you still owe on some of your assets like houses, cars, credit card balances, and loans.

Net worth

After calculating the difference between your assets and liabilities, you will determine your net worth. There are two ways to increase your net worth – decrease your liabilities or increase your assets. You can increase your assets by increasing your income or increasing the value of your existing assets. Just make sure you don’t end up increasing your liabilities too.