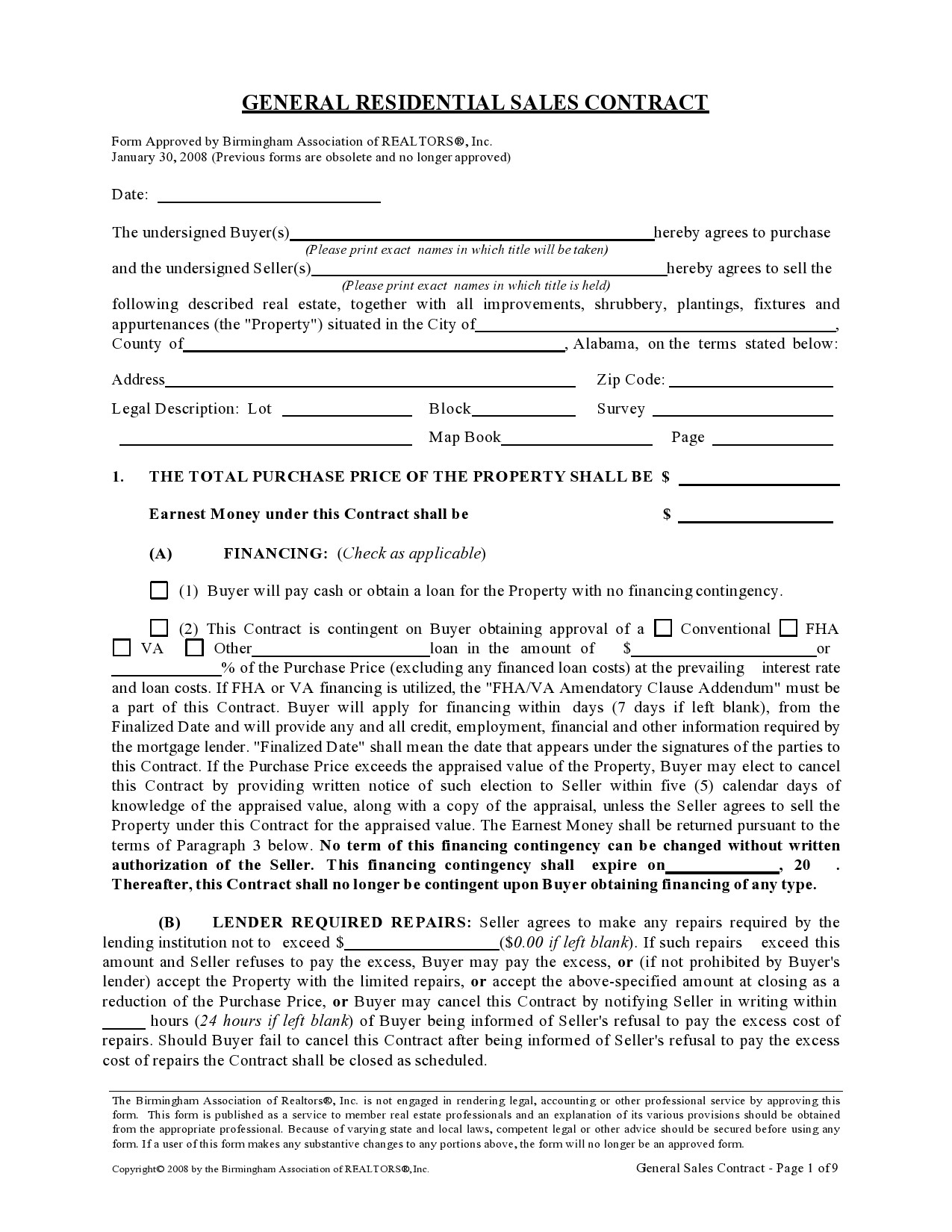

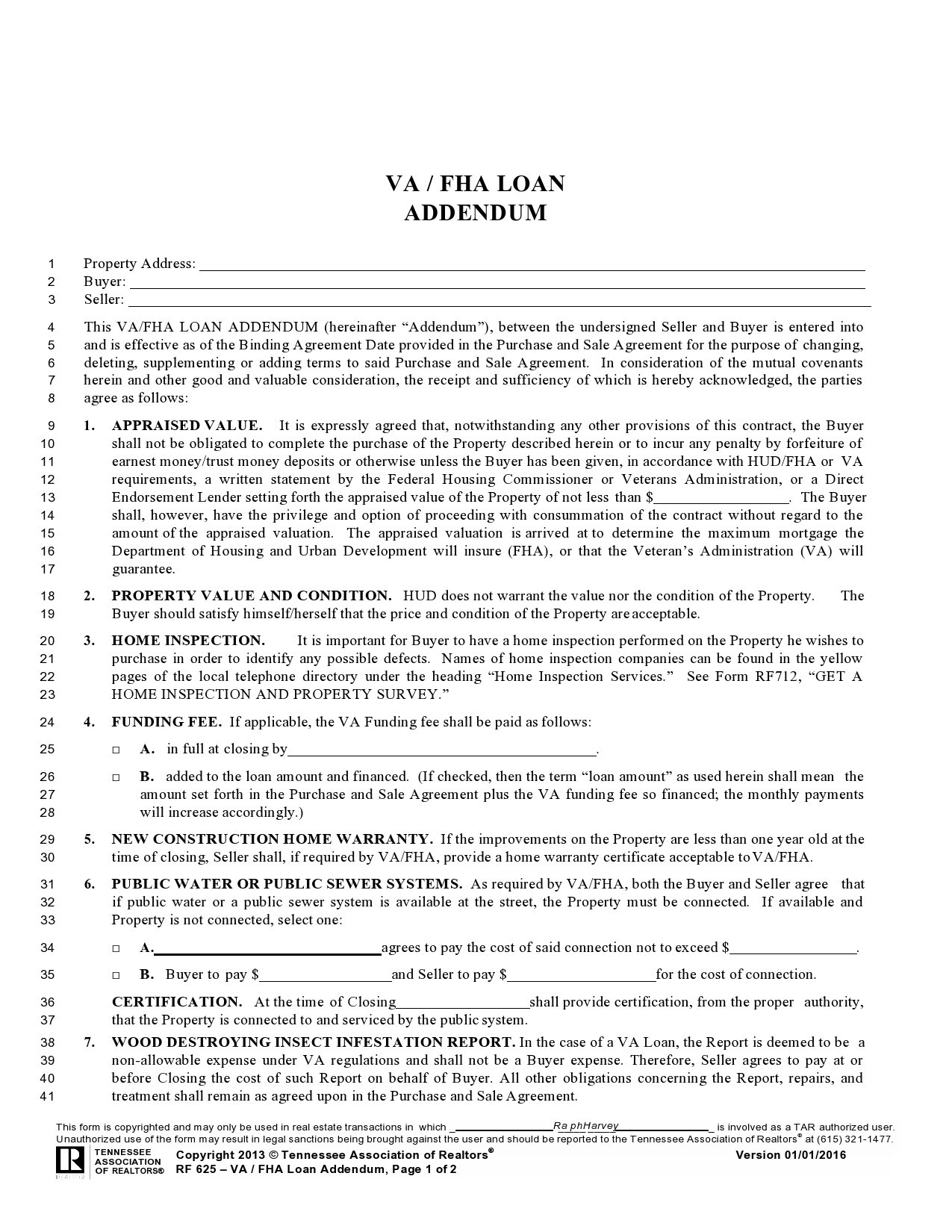

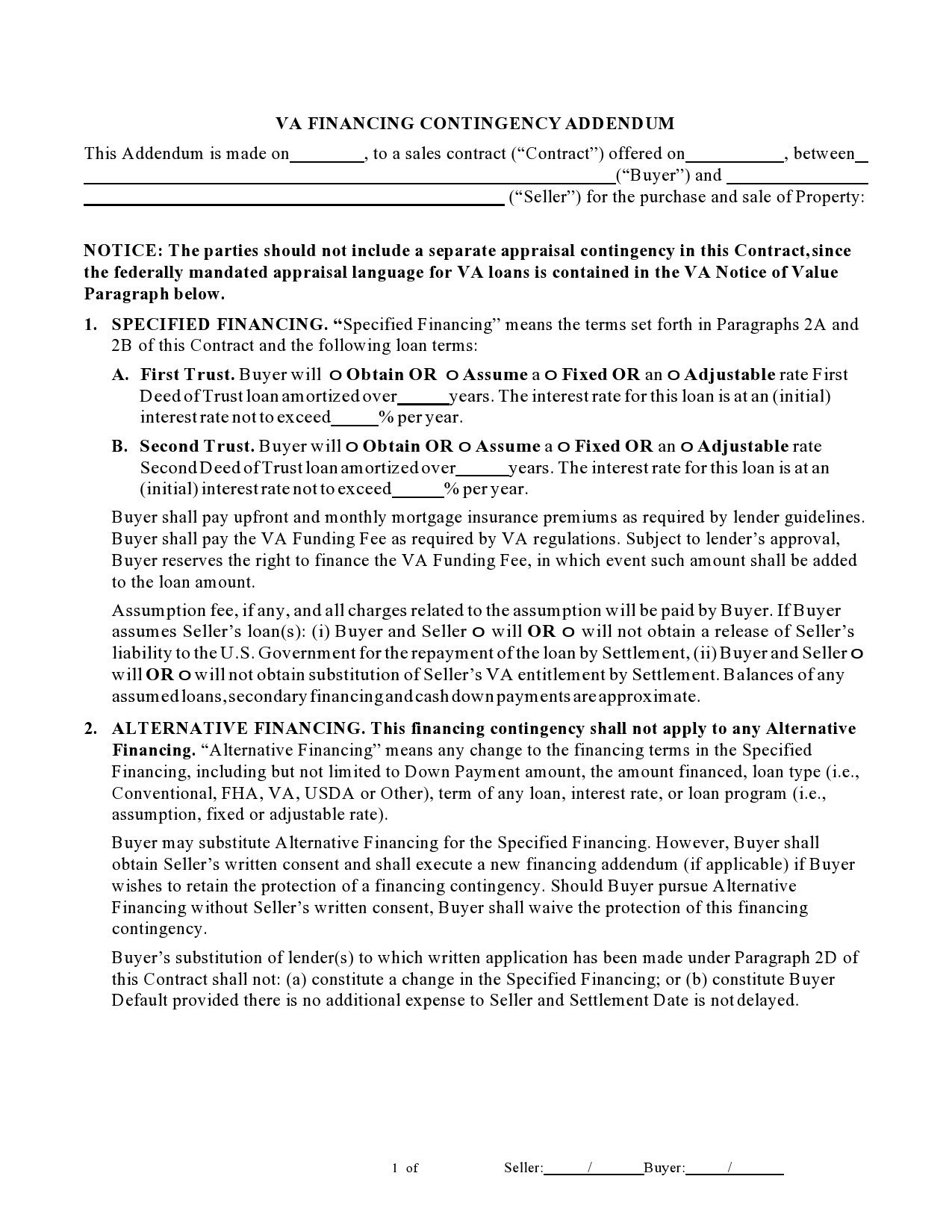

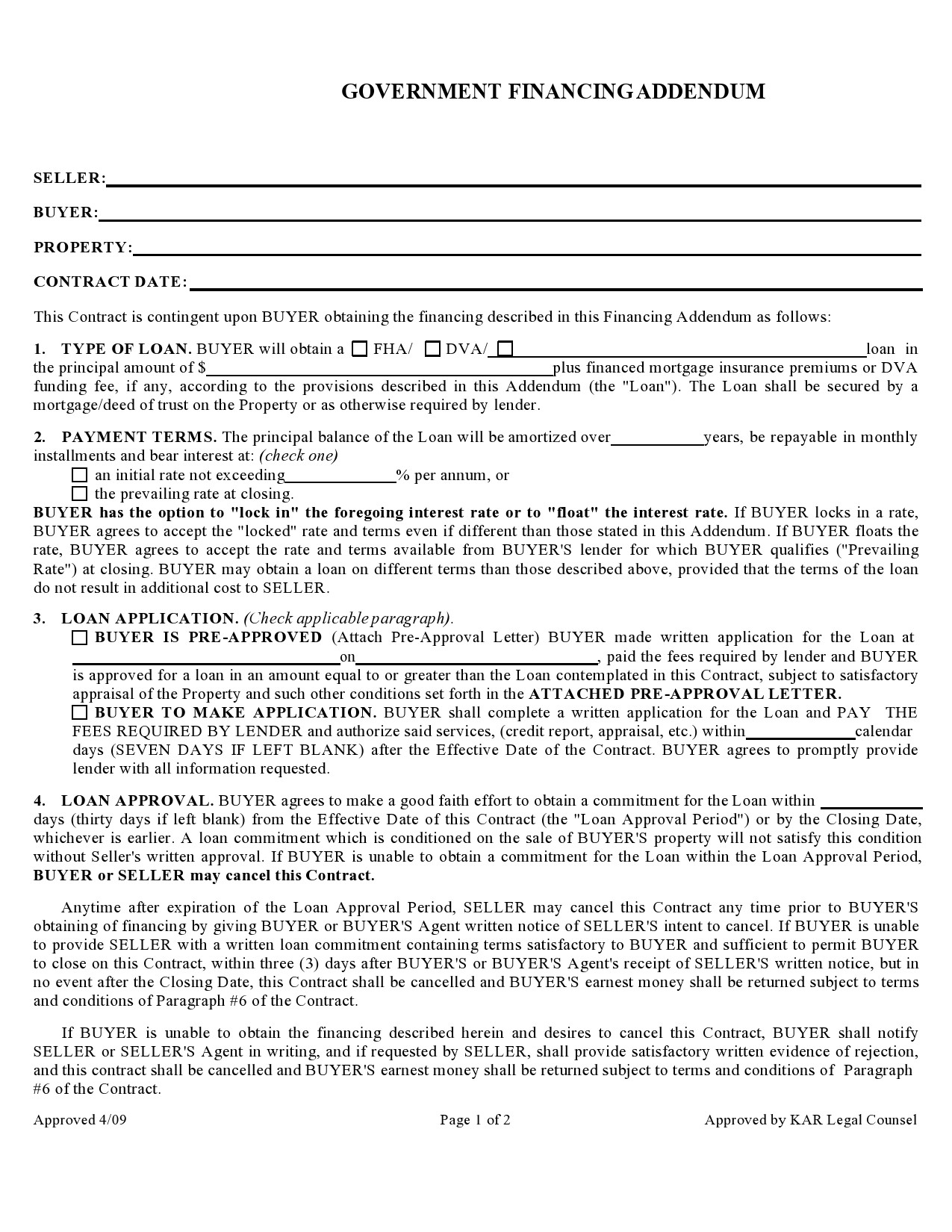

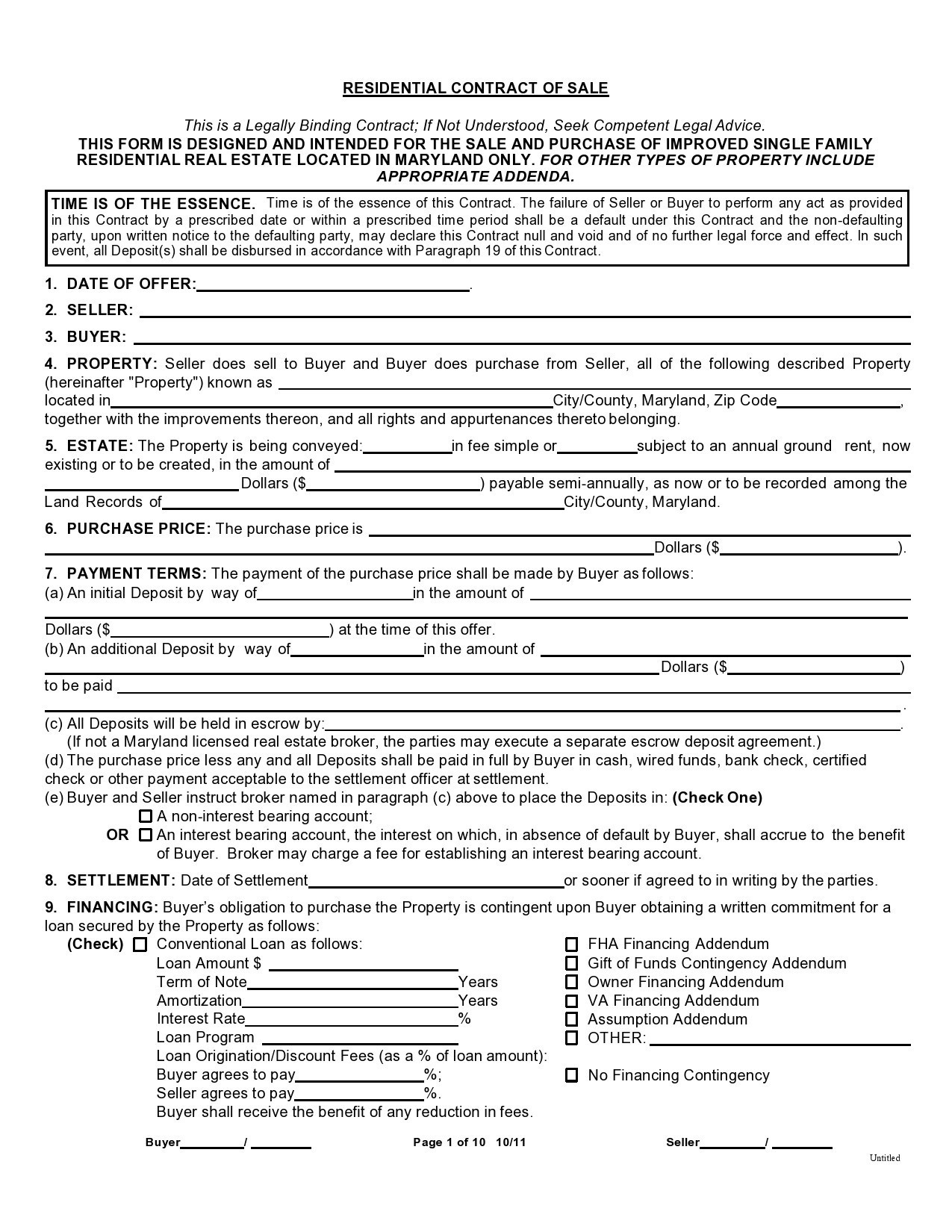

When purchasing a property in real estate, there are different financing options available to the buyer. The buyer may opt for conventional, self, or government finance. There are circumstances where the buyer lacks access to a traditional mortgage loan and the owner loaning becomes an option. The major advantage of the seller financing option is the quick processing time resulting from less paperwork, limited appraisals, and few or no closing costs. Another word for owner financing is to purchase money or seller financing and the key document involved is seller financing addendum.

Table of Contents

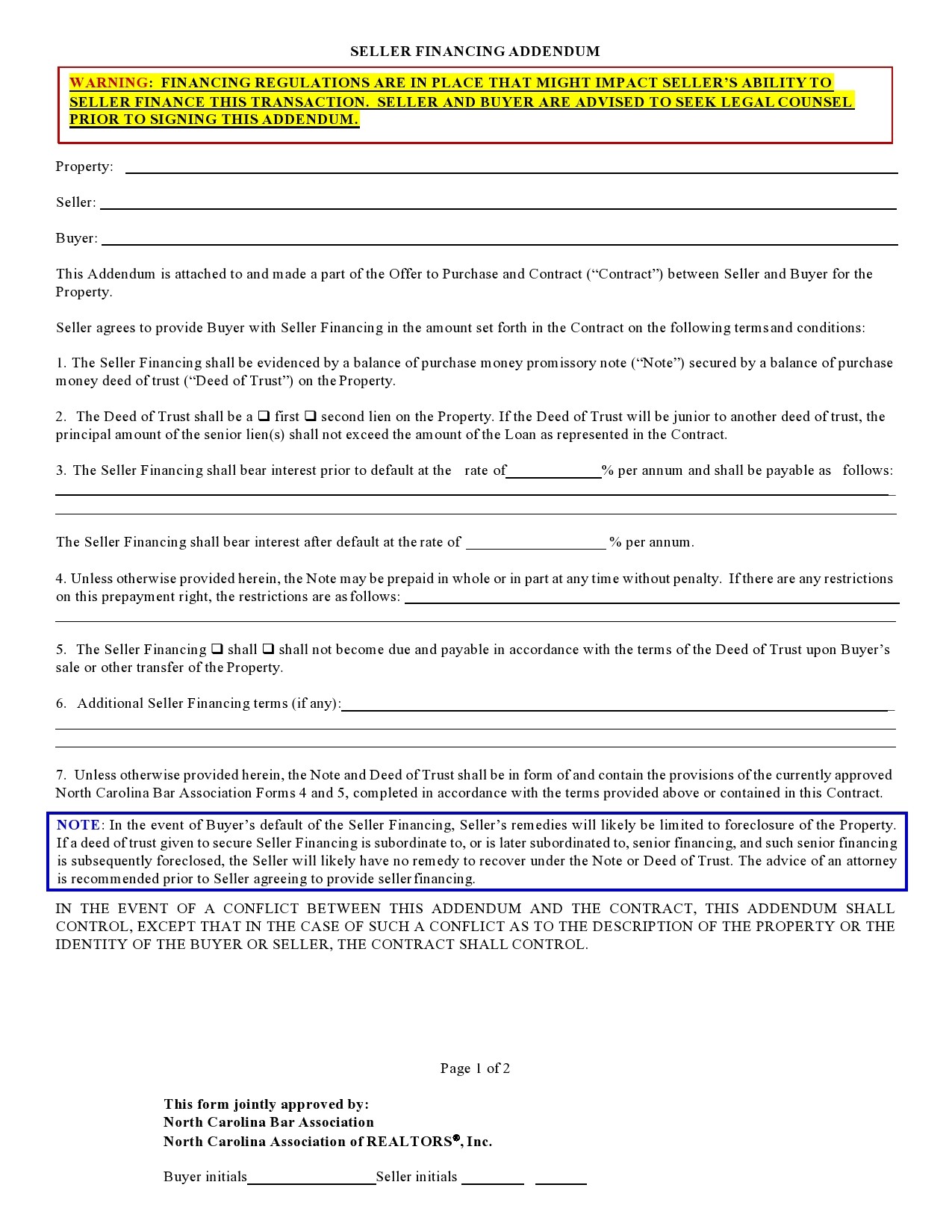

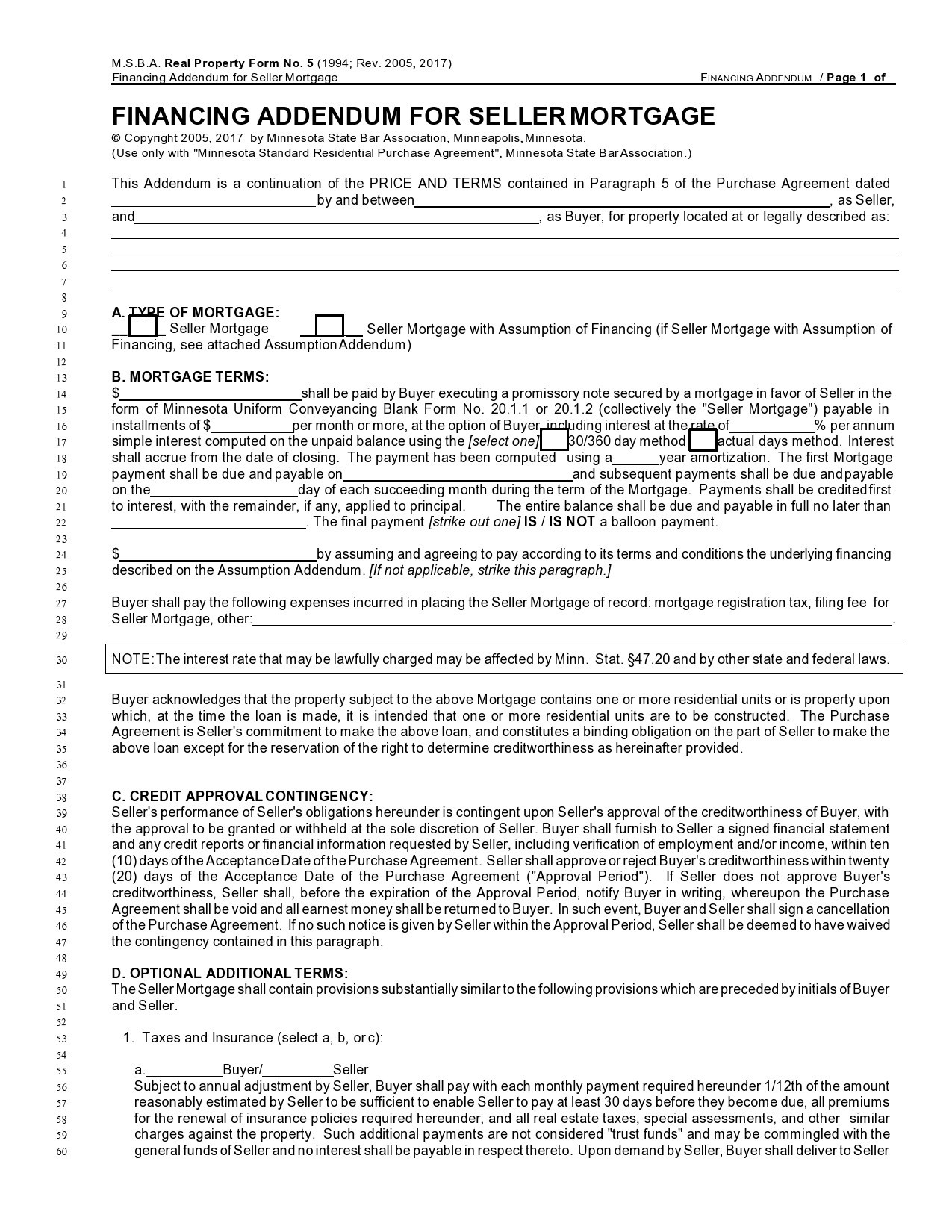

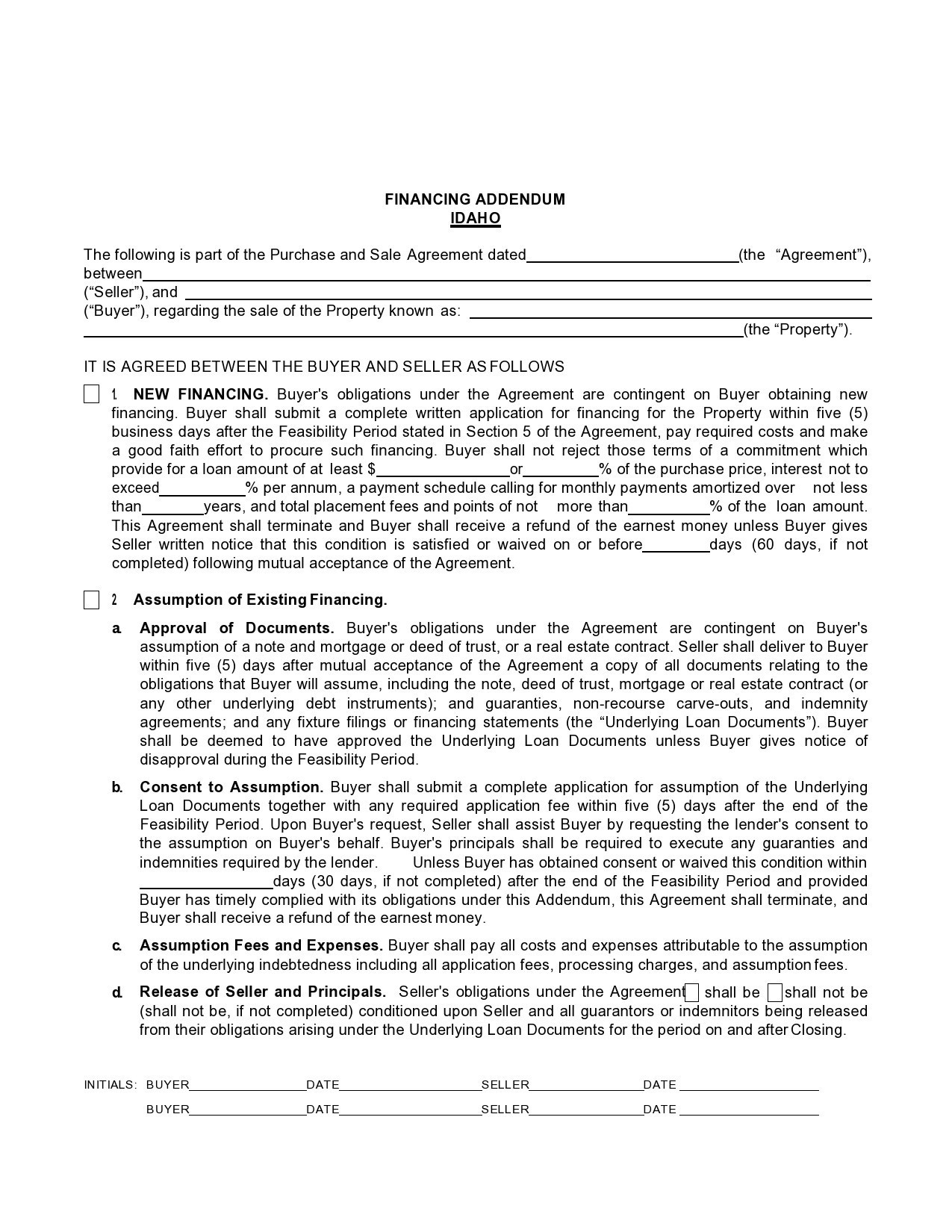

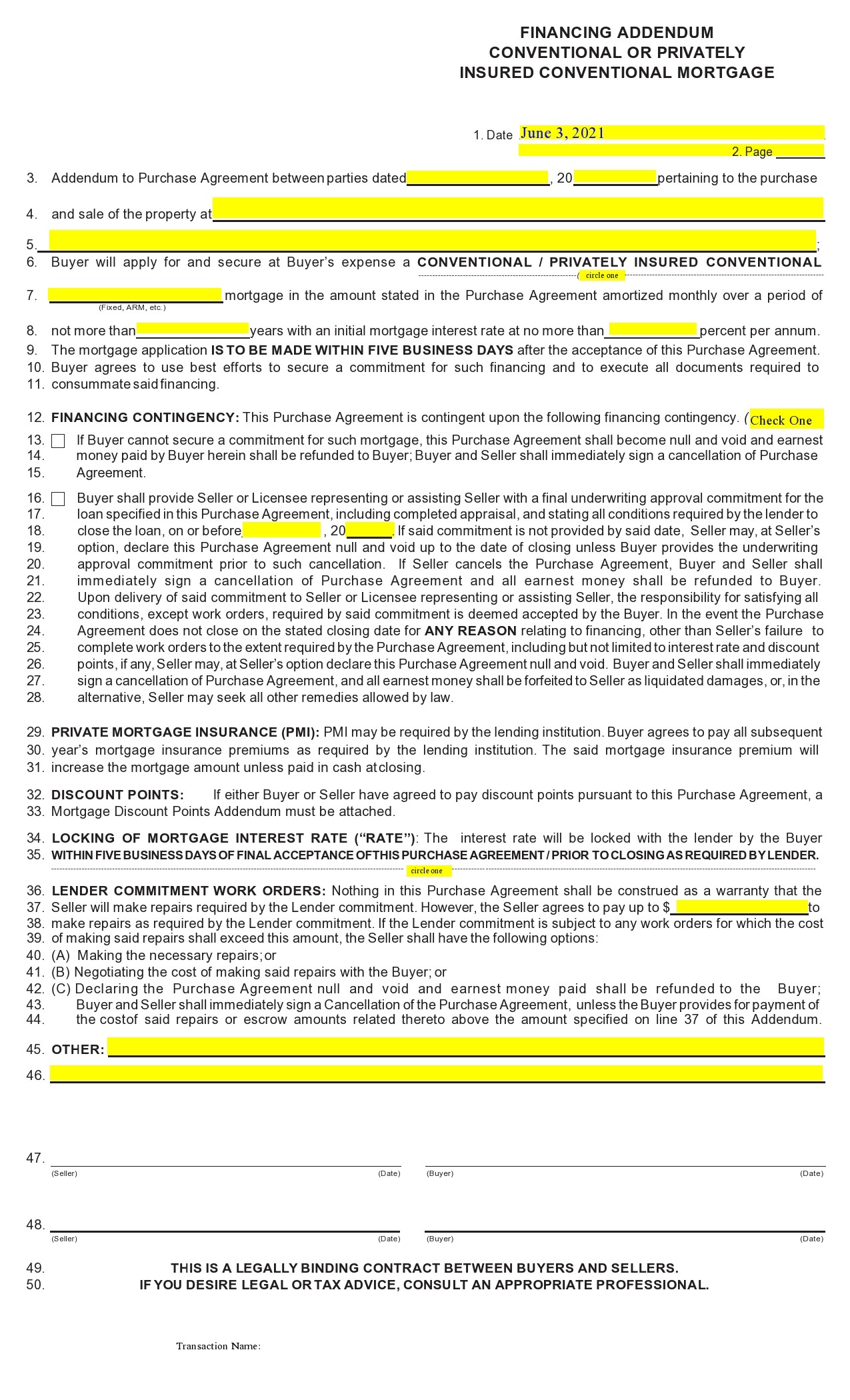

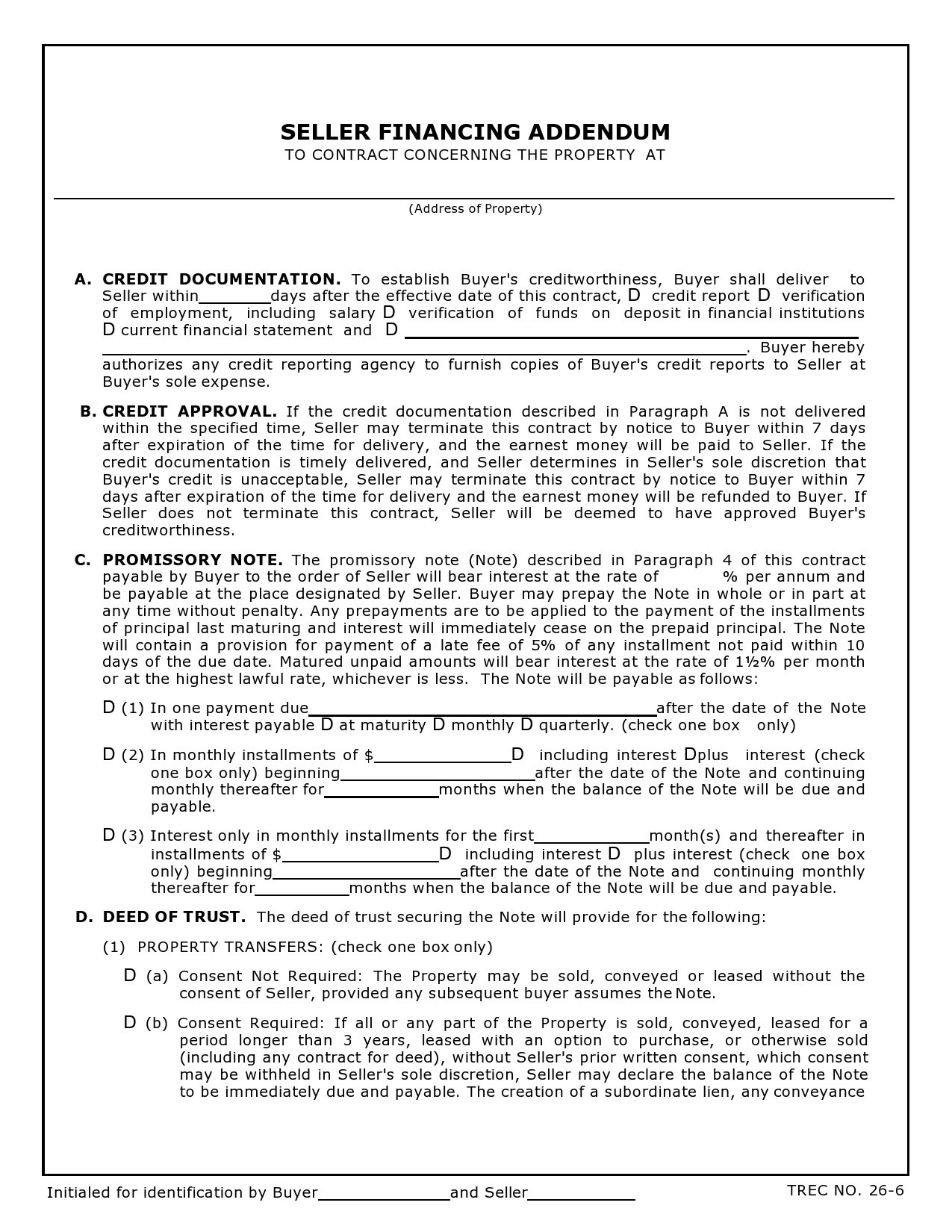

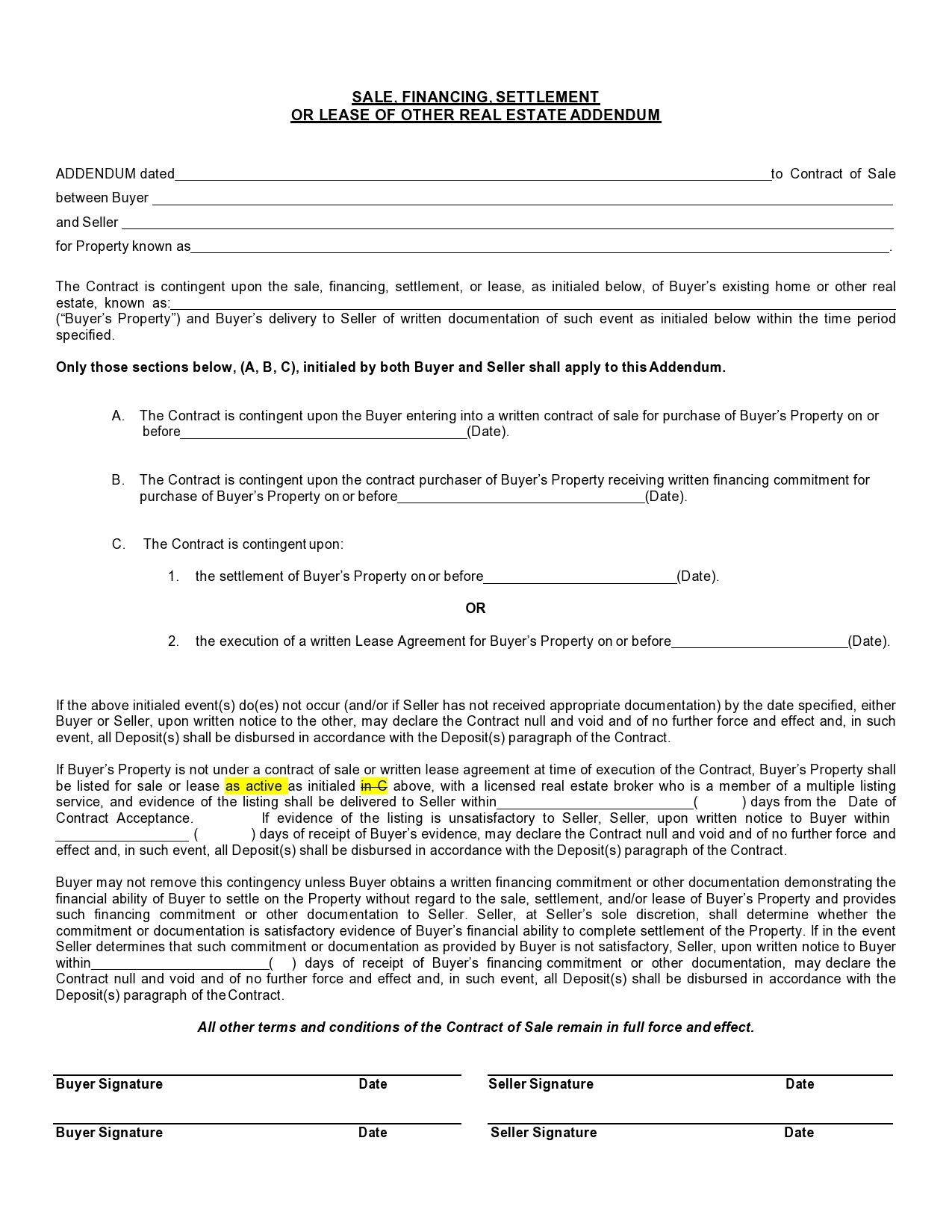

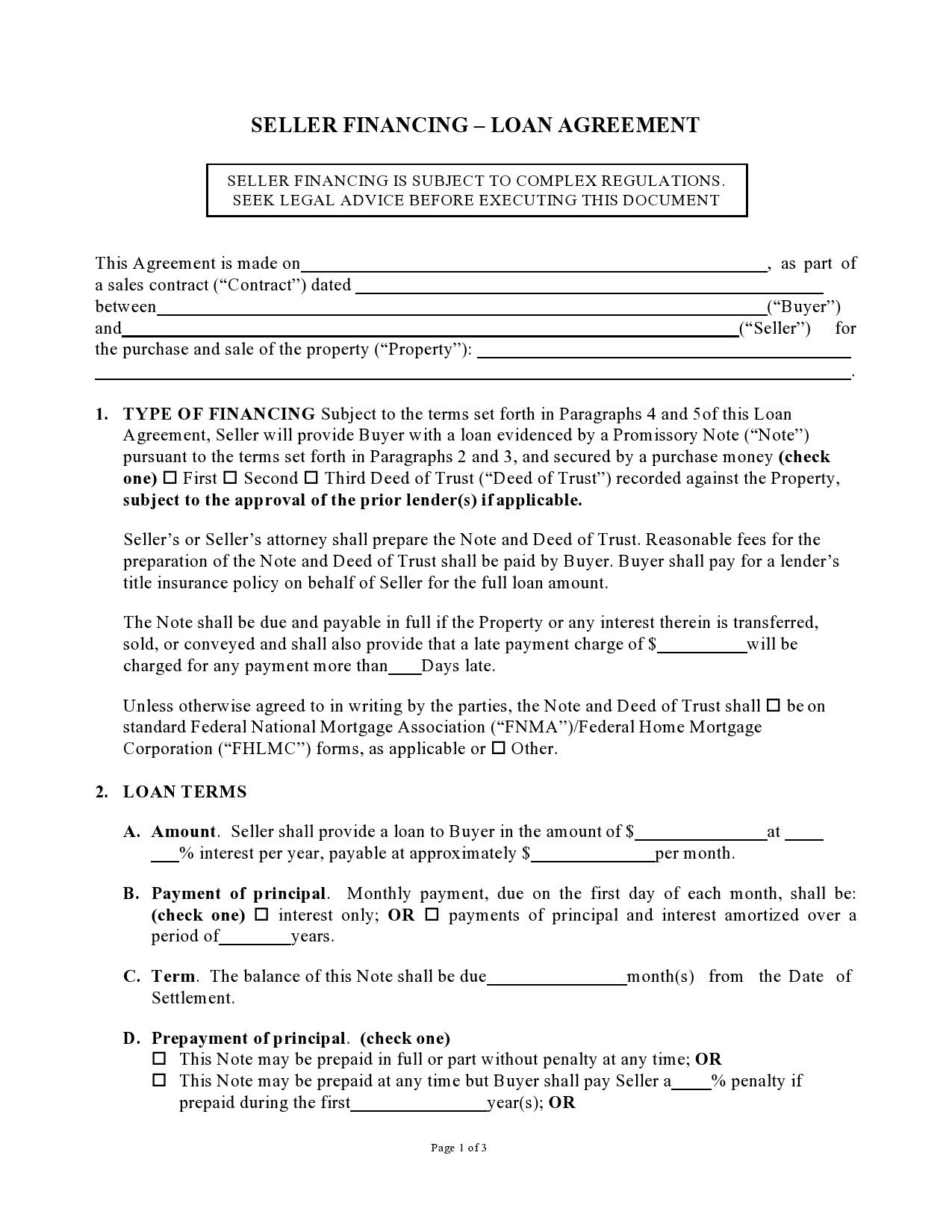

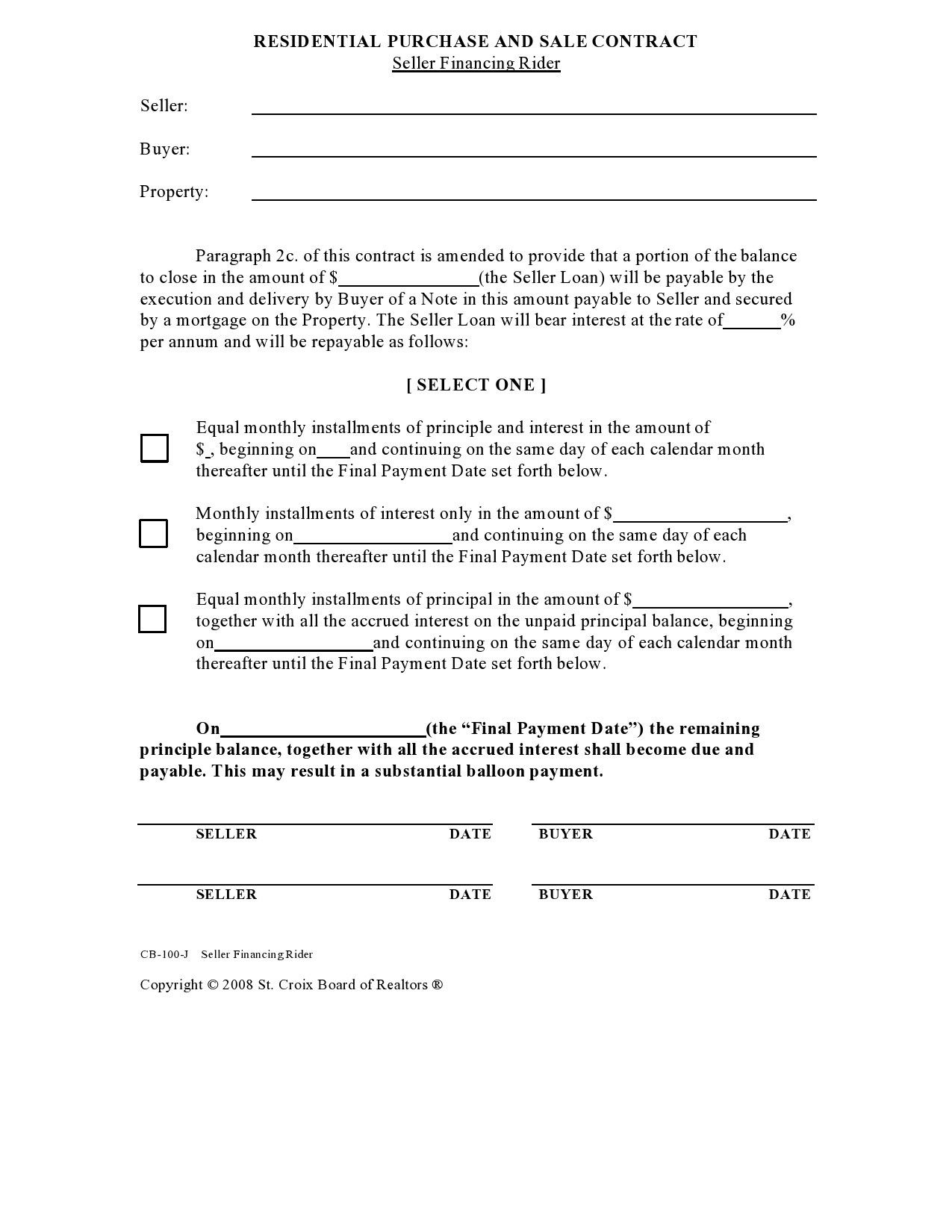

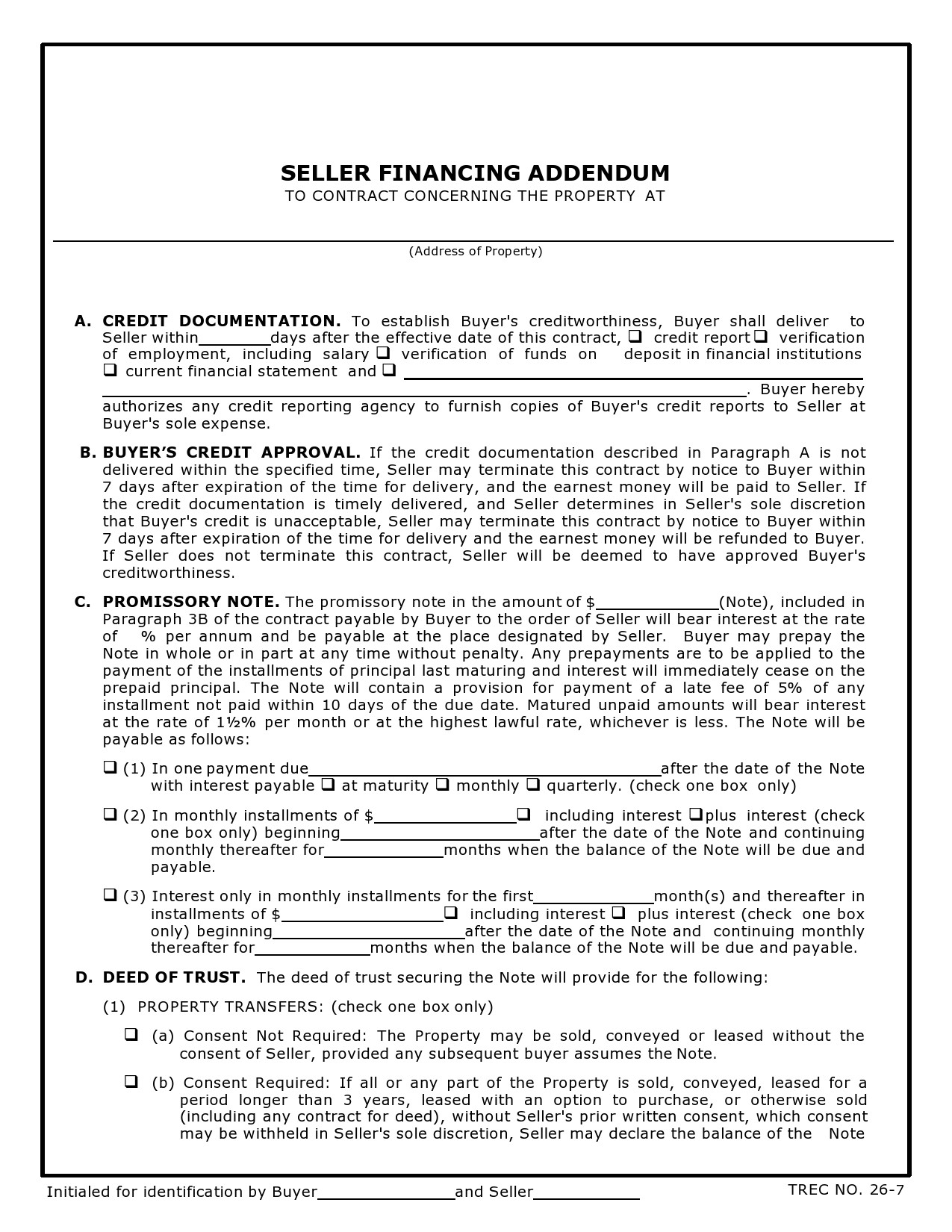

Seller Financing Addendum

Is owner financing a good idea?

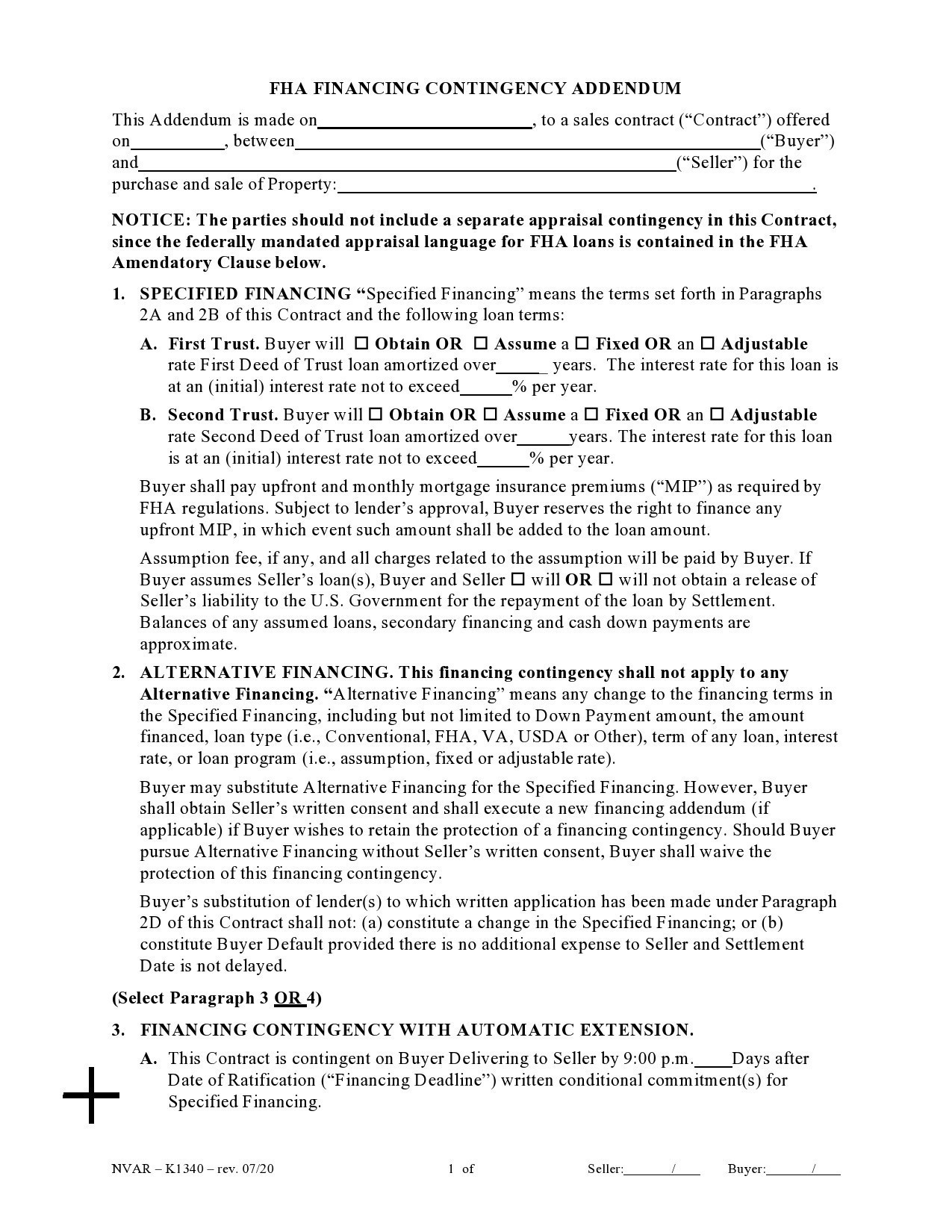

Although traditional mortgage loans are more common than purchase money, the second option is less cumbersome and benefits both parties (seller and buyer) considering the amount of time it takes to process the owner finance agreement.

Under the seller financing option, the real estate owner arranges mortgage financing and this gives the estate buyer an advantage of bypassing the processes of traditional mortgage lending.

The owner of the property and buyer reach a mutual agreement on the terms of the bidding contract like the rate of interest, monthly installments, payment timelines, and any other important factors that outlines the mortgage arrangements.

Other advantages of owner financing include:

- Faster contract processes

Buying your house through a financial institution involves long processes and paperwork. When buying through a bank loan, the mortgage officer will have to come and check the real estate before preparing the paperwork. After the mortgage officer, there will be the underwriters who have to come on behalf of the financial institution to assess the possible risks level involved, and finally, the bank attorney scrutinizes the paperwork to make sure every legal factor is considered and give priority. In an owner financing contract, there are only two parties involved who sign the agreement contained in the promissory note, like the payment period, the rate of interest, and the possible defaulting consequences. - Lower transaction costs

The seller financing agreement is made between two parties and it bypasses fees for underwriters, bank processing fee, and at times attorney fees if the two parties agree not to involve an attorney. This gives the two parties the advantage of lower transaction costs. - Sell an as-is basis

The real estate owner may not become obliged to undergo the costs of repairing the estate before selling and also retains in his custody the estate title deed up to the time he or she receives the full payment after which he or she transfers to the buyer, unlike in traditional banks where the deed is put under the bank’s custody and the estate owner is obliged by law to do repairs before selling the property.

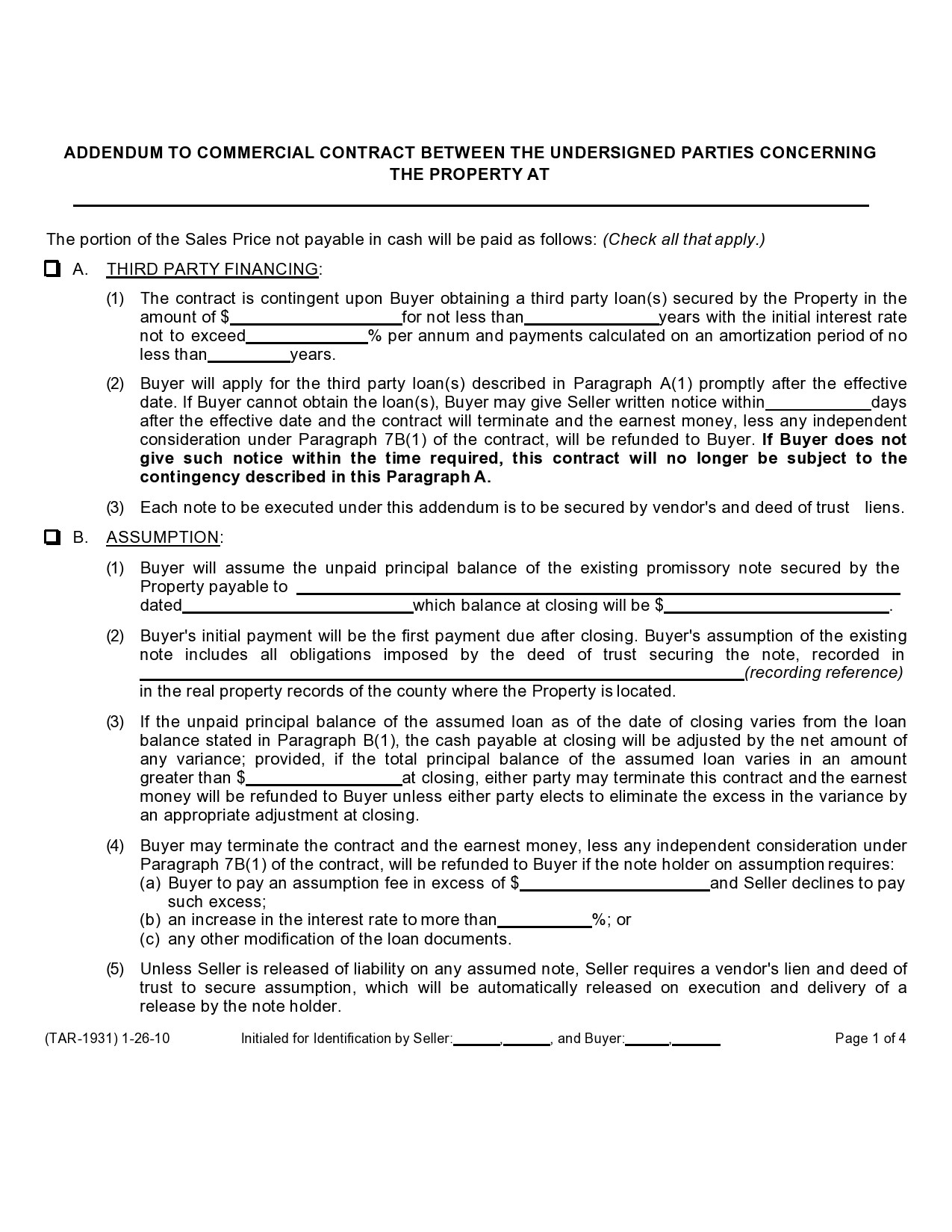

Owner Financing Contracts

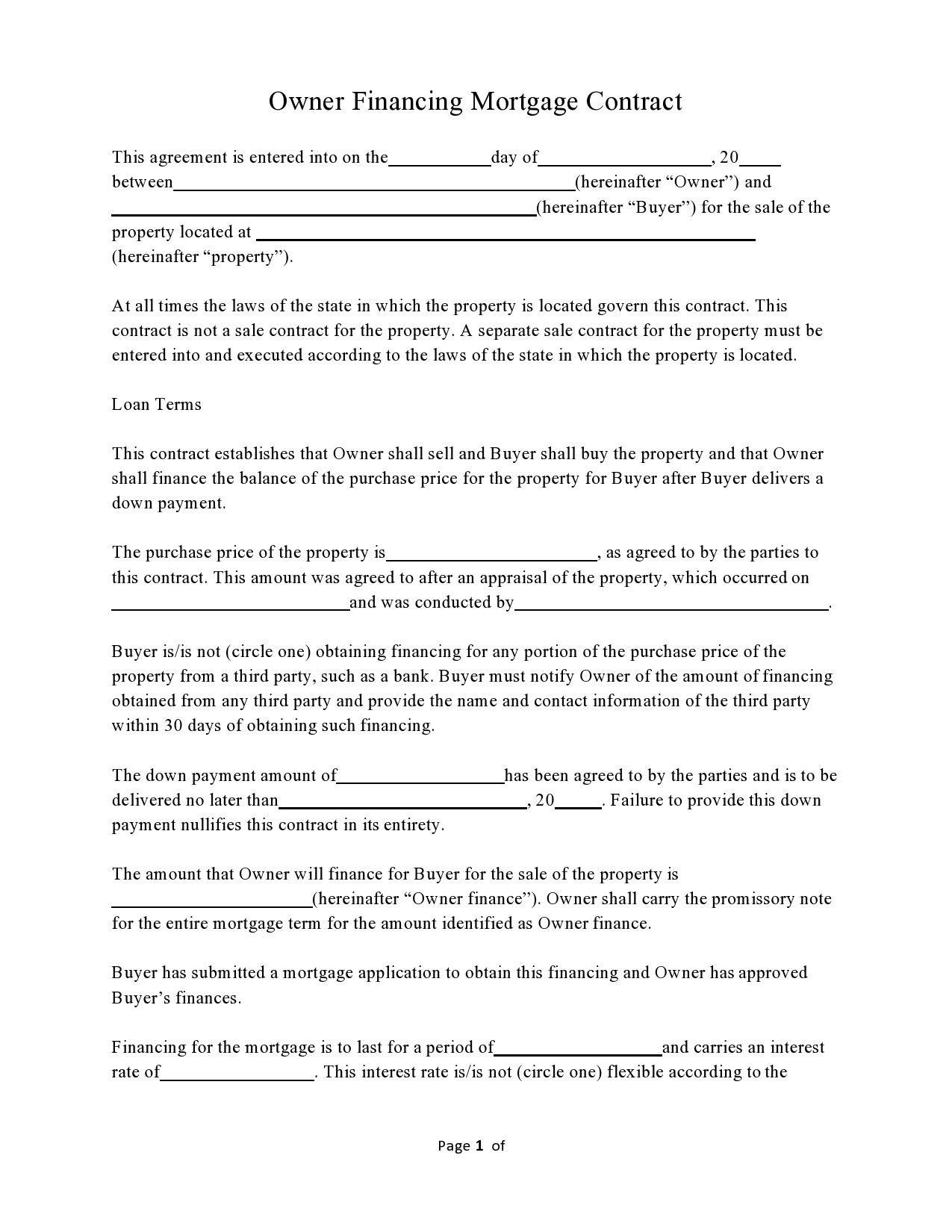

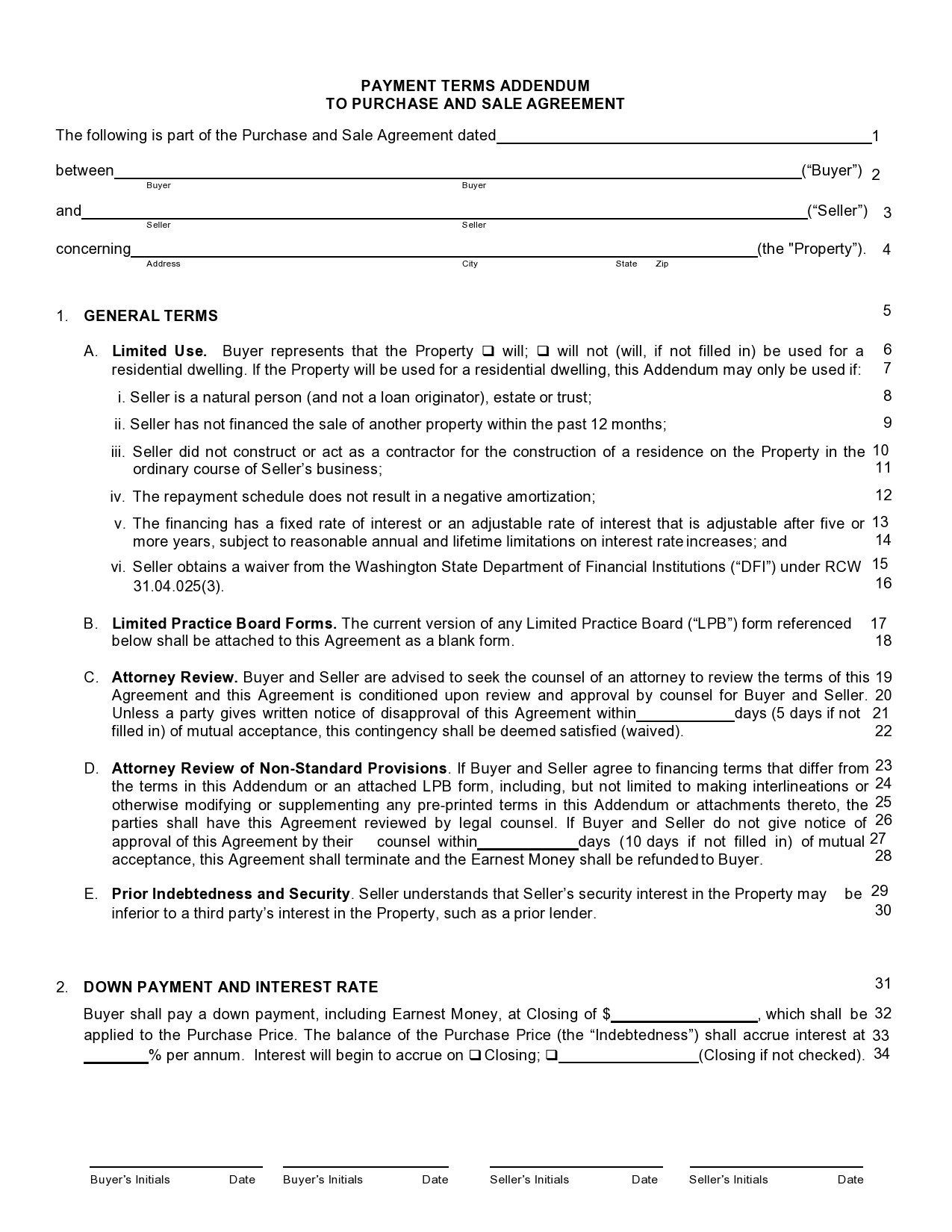

What are the typical owner financing terms?

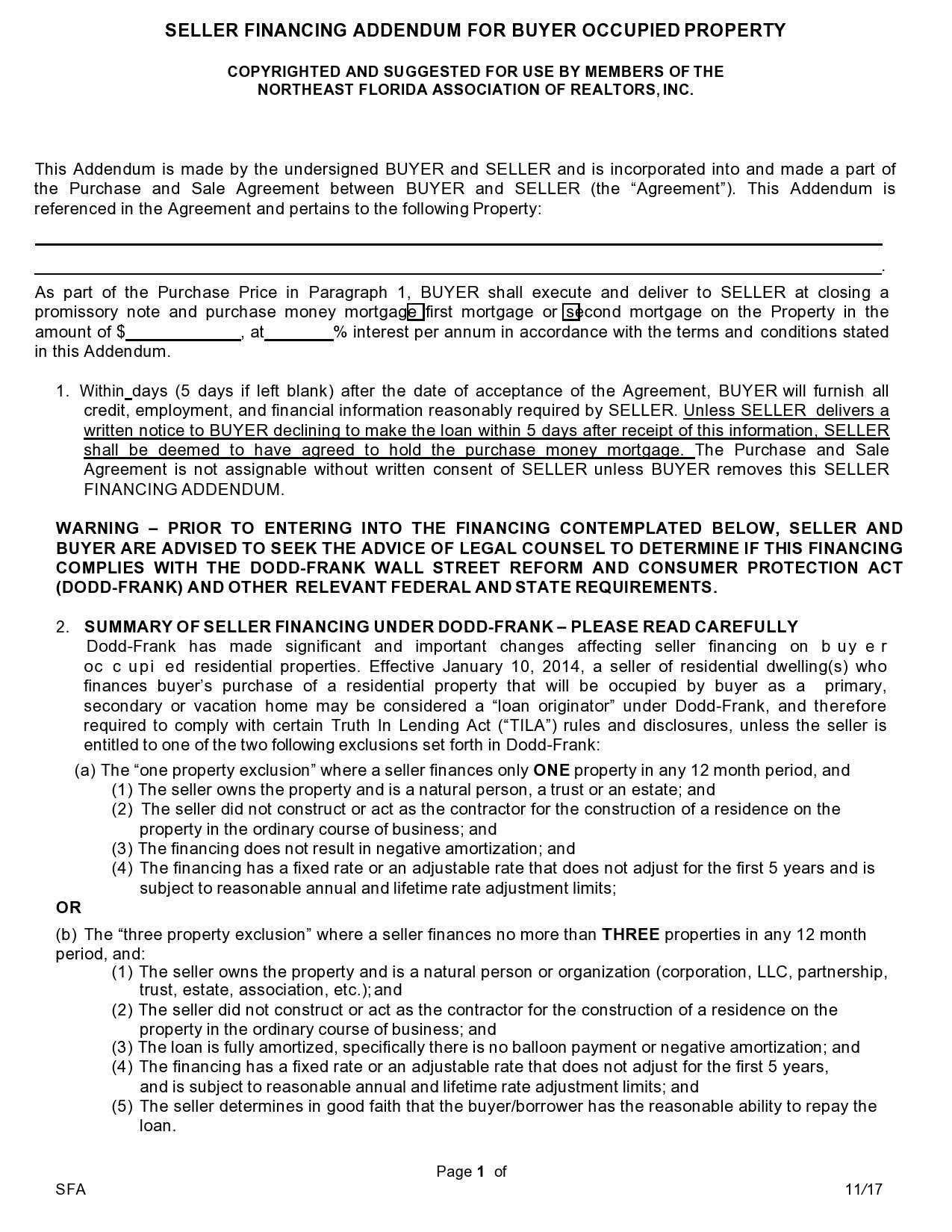

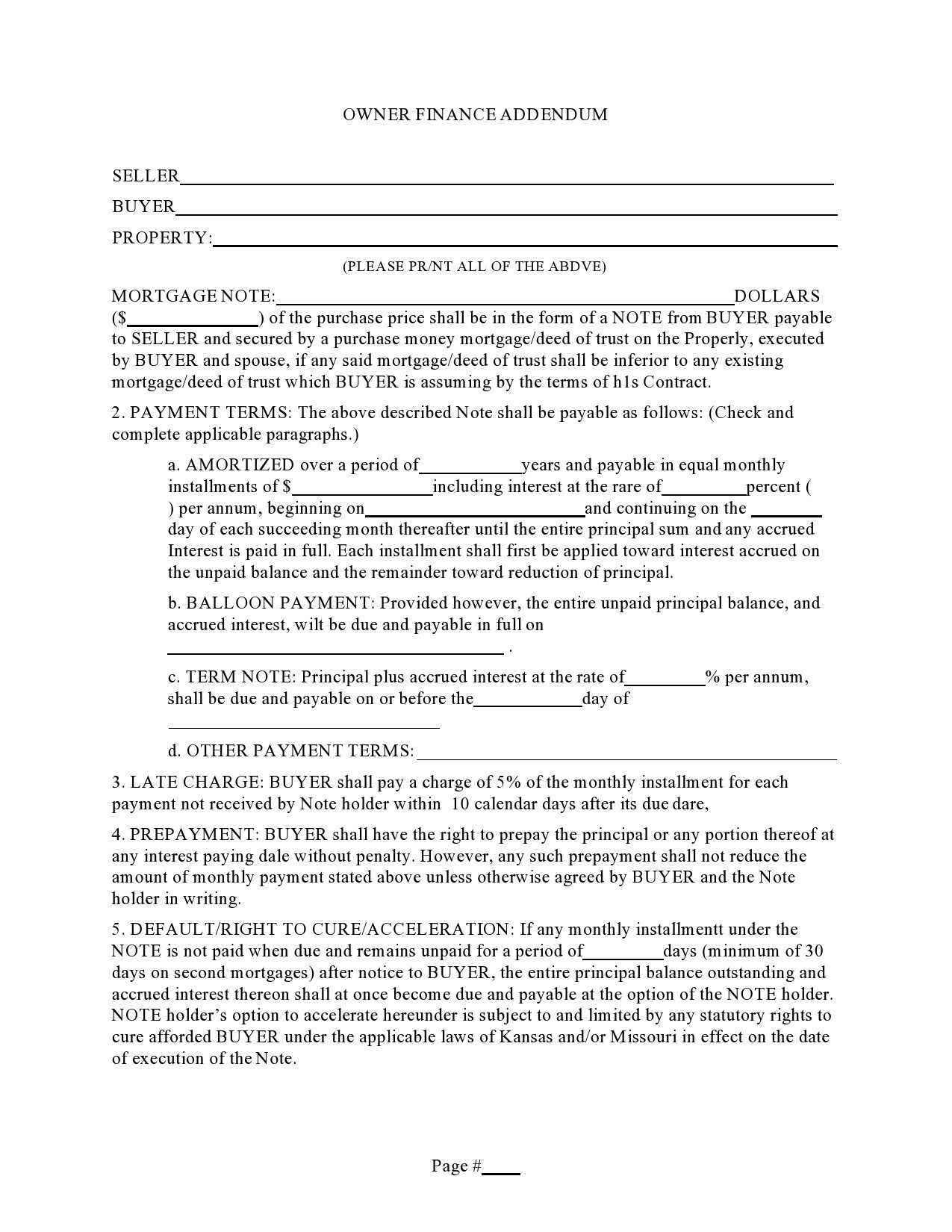

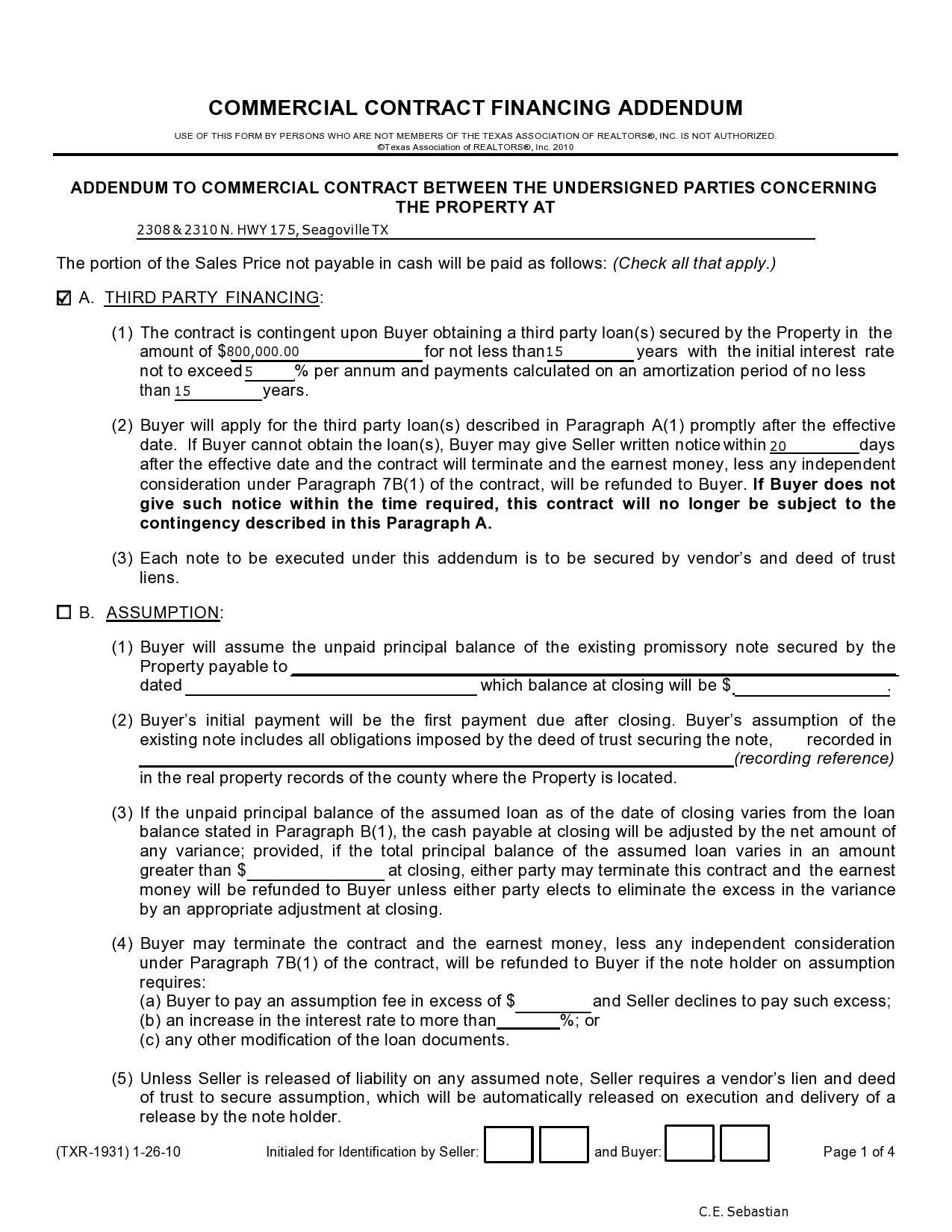

The terms contained in the owner financing agreement are agreed between the owner and the buyer and includes the down payment, repayment period, amount of interest, and if there is any, the balloon payment. The owner may draw the agreement terms himself or he may choose to involve the buyer, but in any case, the following factors must be included.

- Down payment Percentage

Mostly, the owner will ask for any amount between 10-20 percent of the total property value as goodwill on the part of the buyer to show that they are willing to commit themselves towards paying the installments. - Period of payment

Longer periods of payment will attract higher interest as compared to short periods of payment. In an owner financing arrangement, the period of payment can range anything between 10-30 years and will rarely exceed this period. Most property owners will favor balloon payments to shorten the period of payment. - Interest rate

Interest rates seem to be higher in seller-financed agreements because of the high risk involved in the transaction and could range between 4-10 percent and in some states where usury laws are reluctant on interest rates, the rate could go higher.

Before signing the purchase documents, the buyer must make sure they understand the interest rate they will be making and what the usury laws say as far as interest rates are concerned in their specific state.

The two parties can agree to settle on any of these three interest rates.

Fixed interest rate: The interest rate remains constant from the beginning to the end of the payment,

Adjustable-rate: The rate keeps changing over time, controlled by factors like inflation

Interest-only: The person buying pays the interest in installments and once through pays the remaining amount in a balloon. - Balloon payments

Owner financing contract template can include a selling condition known as balloon payment in situations where the seller is not willing to wait for 20 0r 30 years. The two parties agree and the buyer makes installments up to a certain period and then pays the remainder in full.

Seller Financing Contracts

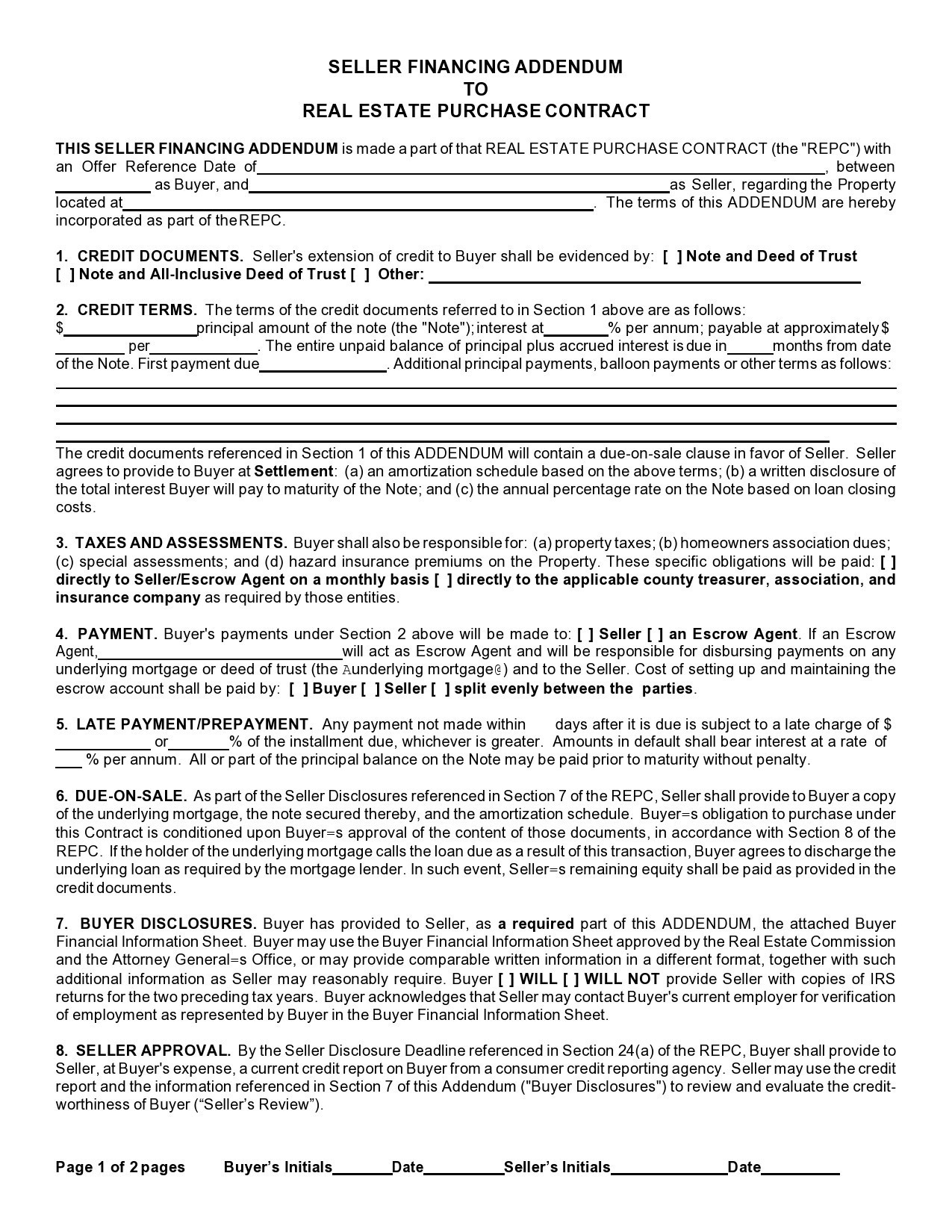

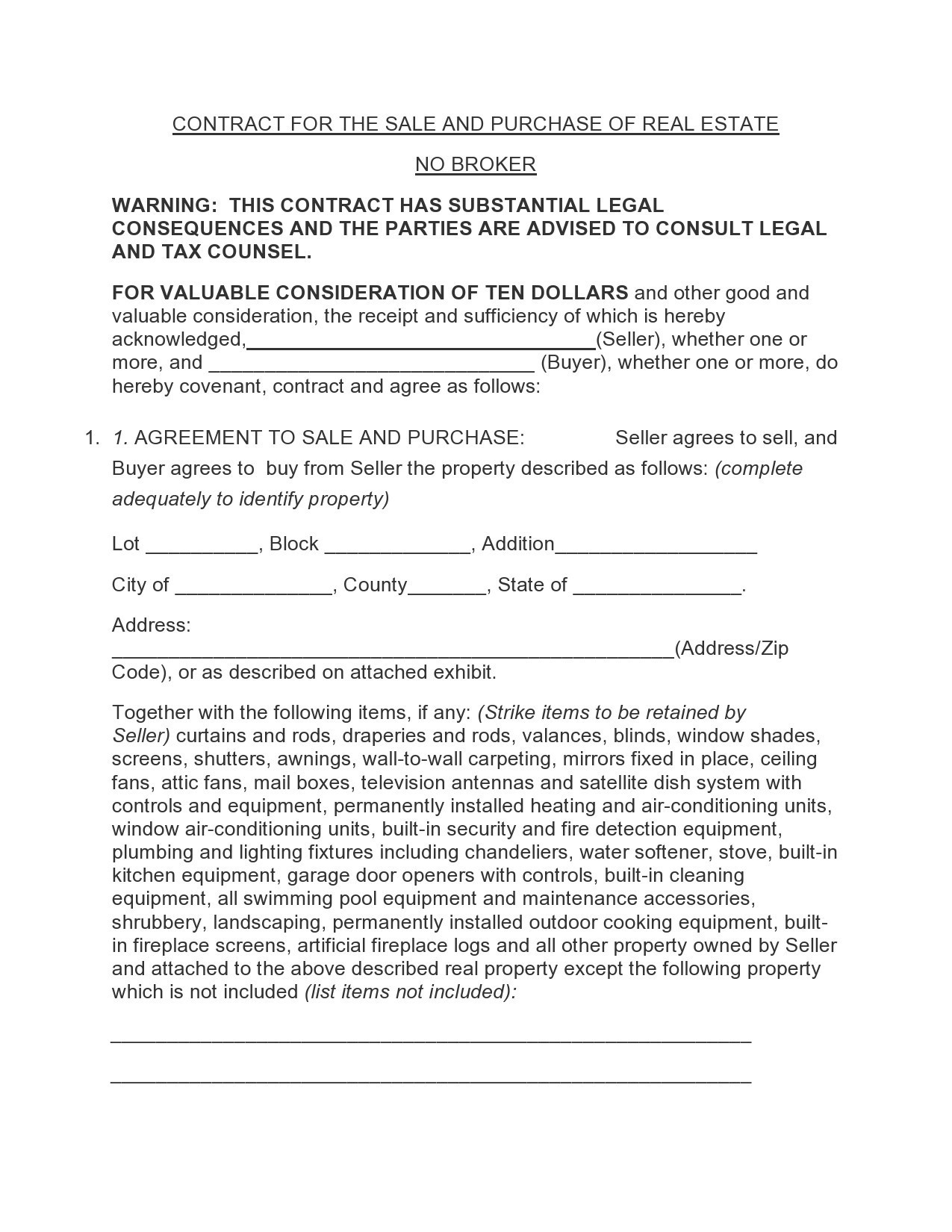

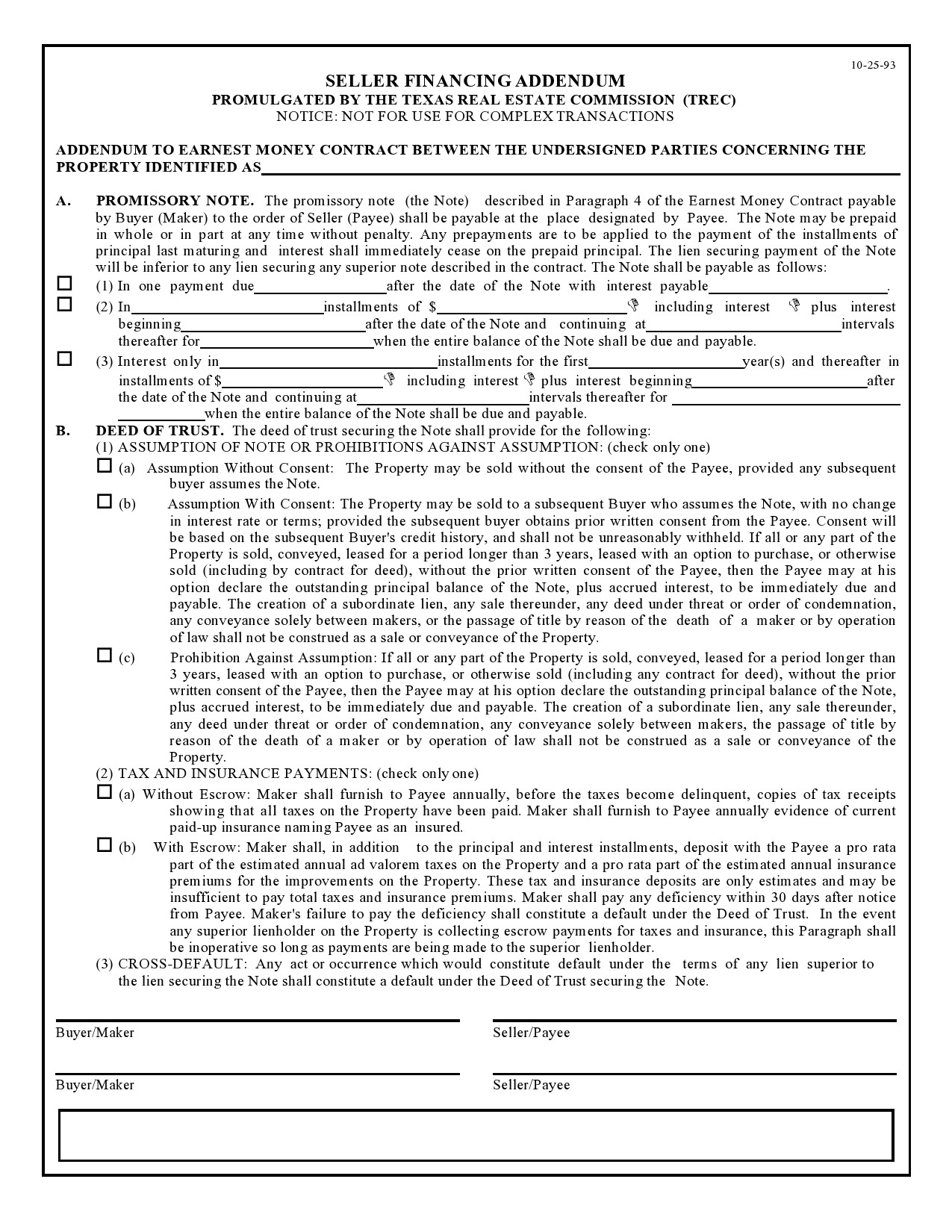

How do you structure an owner finance deal?

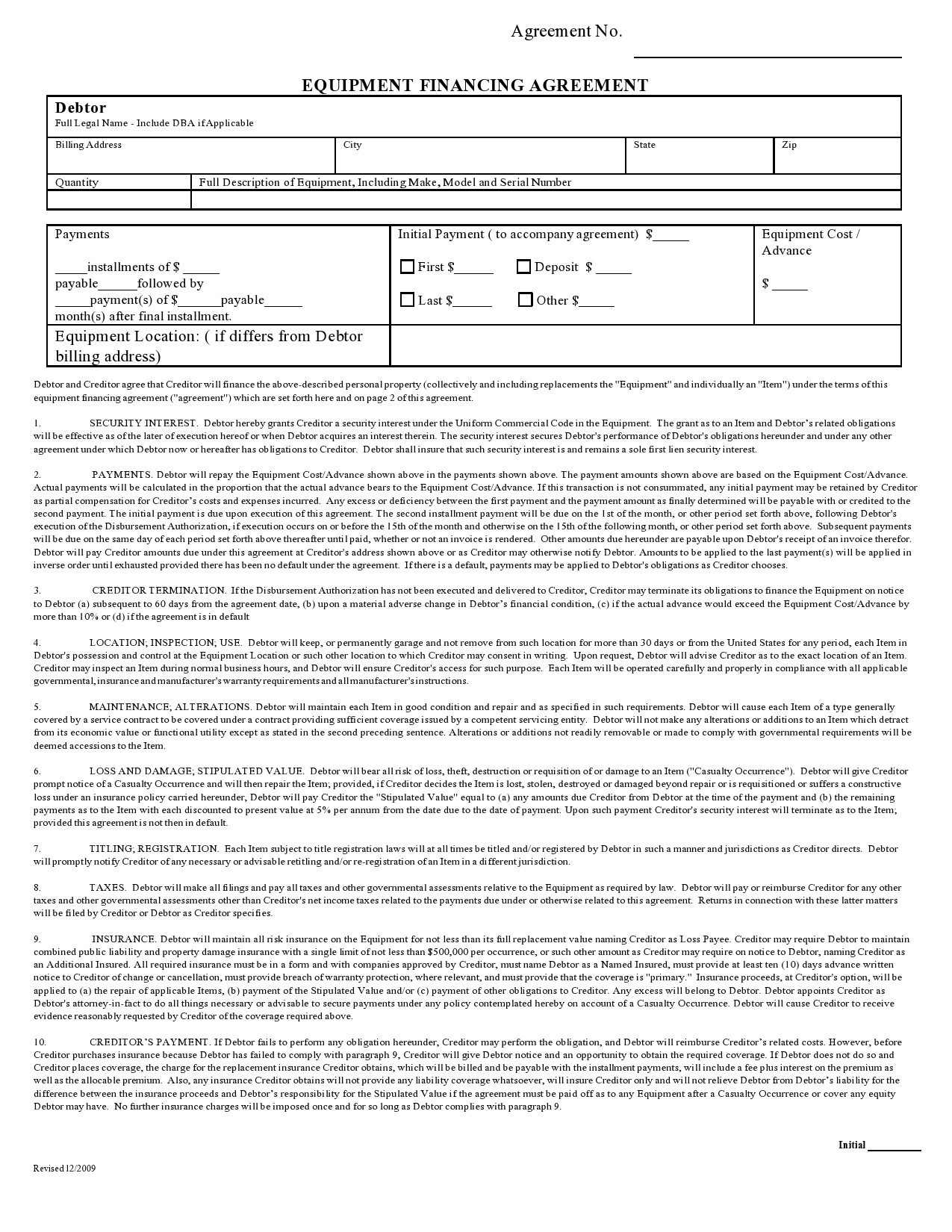

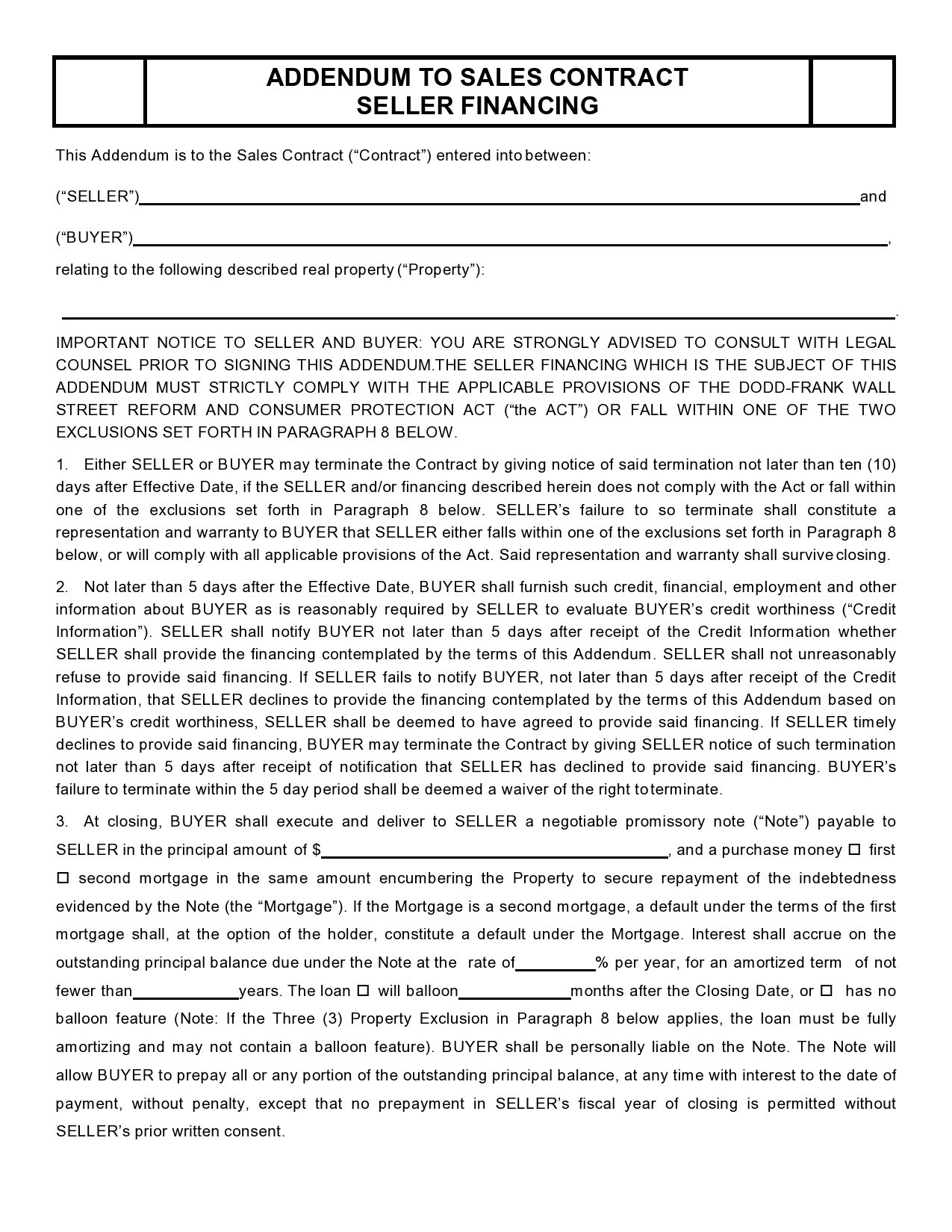

Your owner financing contract template is regarded as your security if the buyer defaults and it must be structured in a way that safeguards your interests.

You may prepare the owner carry contract template or download a printable copy. It is advisable seeking professional help when drawing up an agreement that involves large sums of money. Your owner finance deal template must include the following details:

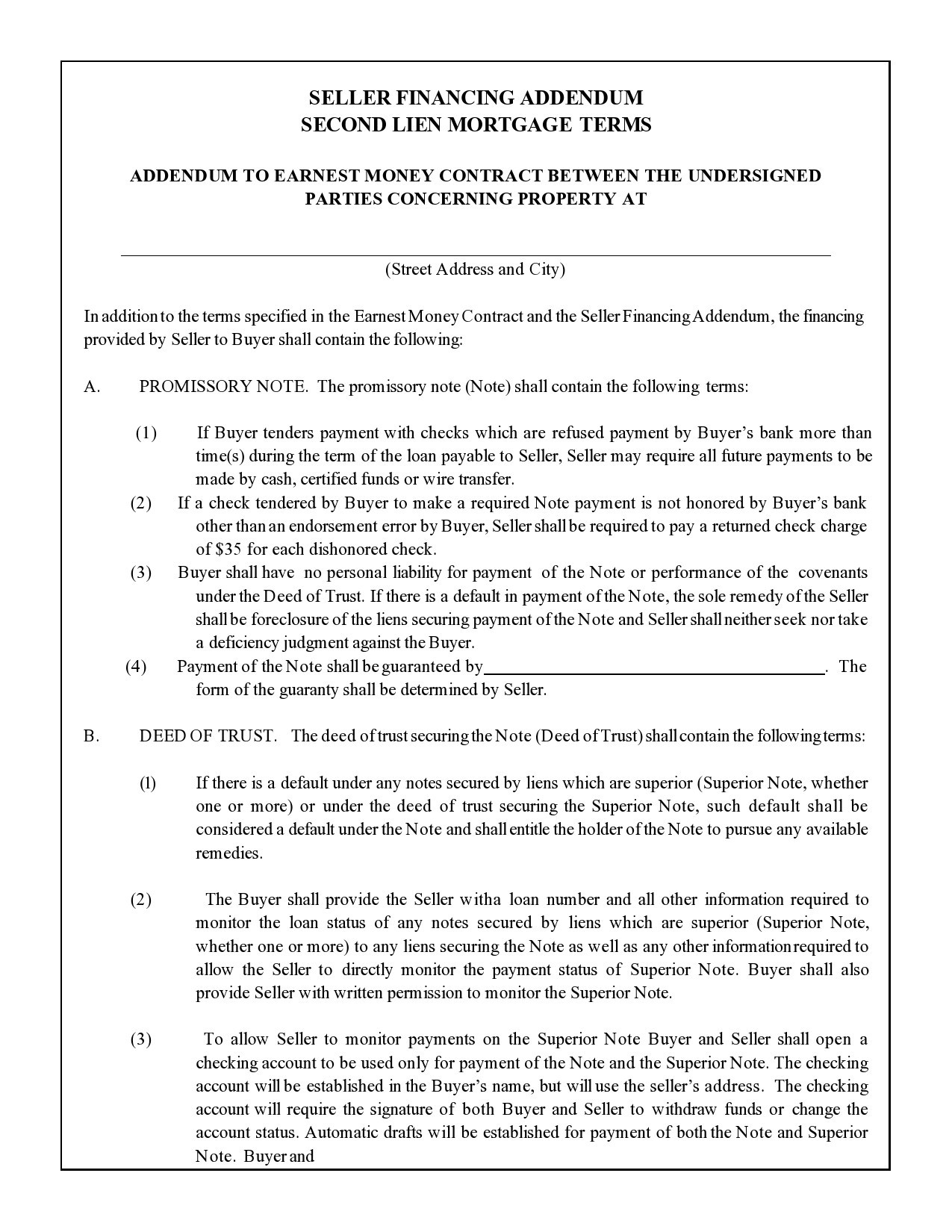

- Promissory note

The promissory note acts like a bank mortgage loan papers and is a binding legal document that spells out the agreement details of the property in question. Details of a promissory note include the following:

Date: when the agreement was written

Name of the seller, telephone contact, their physical and postal address

Name of the buyer, telephone contact, their physical and postal address

The property in question: The property number according to the deed details, its physical location, and details of the building.

Buying price: This is the selling price excluding any interest or additional fees like attorney fees or title transfer costs.

Down payment payable upon signing

Rate of interest: it can be any amount between 4-10 percent or higher.

Monthly repayments: monthly repayments can be made in equal installments throughout the repayment period.

The financier: the estate owner signs as the financier of the balance, also known as a financed amount.

Defaulting actions: these are consequences suffered by the buyer if they fail to make payments.

Allowance for modifications: circumstances may call for the need to modify the document terms such as death, natural catastrophes, long-term sickness, or national financial depression.

Attorney stamp and signature: If the two parties agree to involve an attorney.

Signatures of the owner, the buyer, and witness, if any. - Other important factors to consider

Your property is your collateral: in case of default, the deal lapses and you keep your property.

Retain the title: keep in custody your title deed and make transfer once the full payment has been made.

A balloon payment is advantageous: it hastens the contract period giving you the opportunity of recovering your financing quickly.

Lease option: you may lease out your property to the buyer and he pays you a down payment with a promise that he will buy the property once his lease expires.

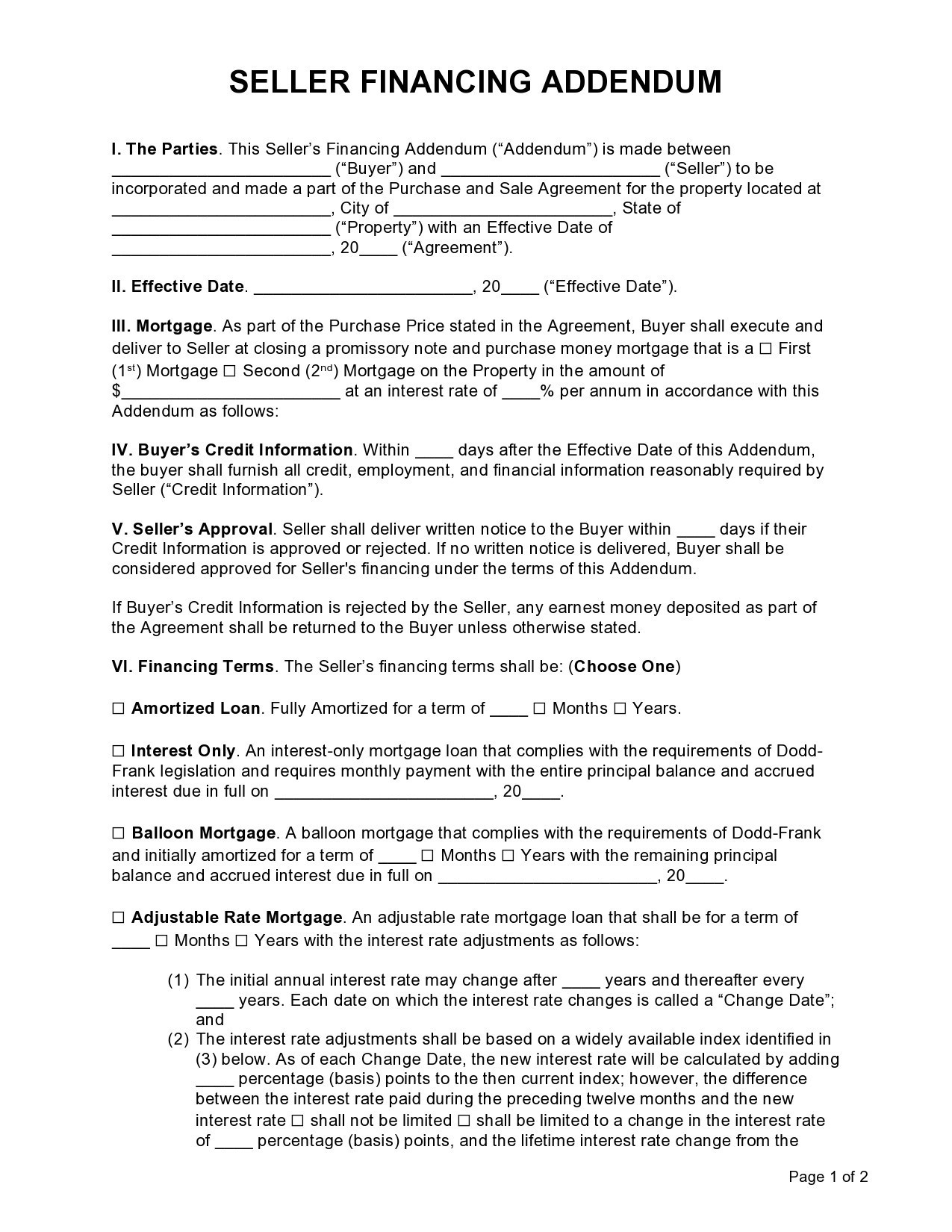

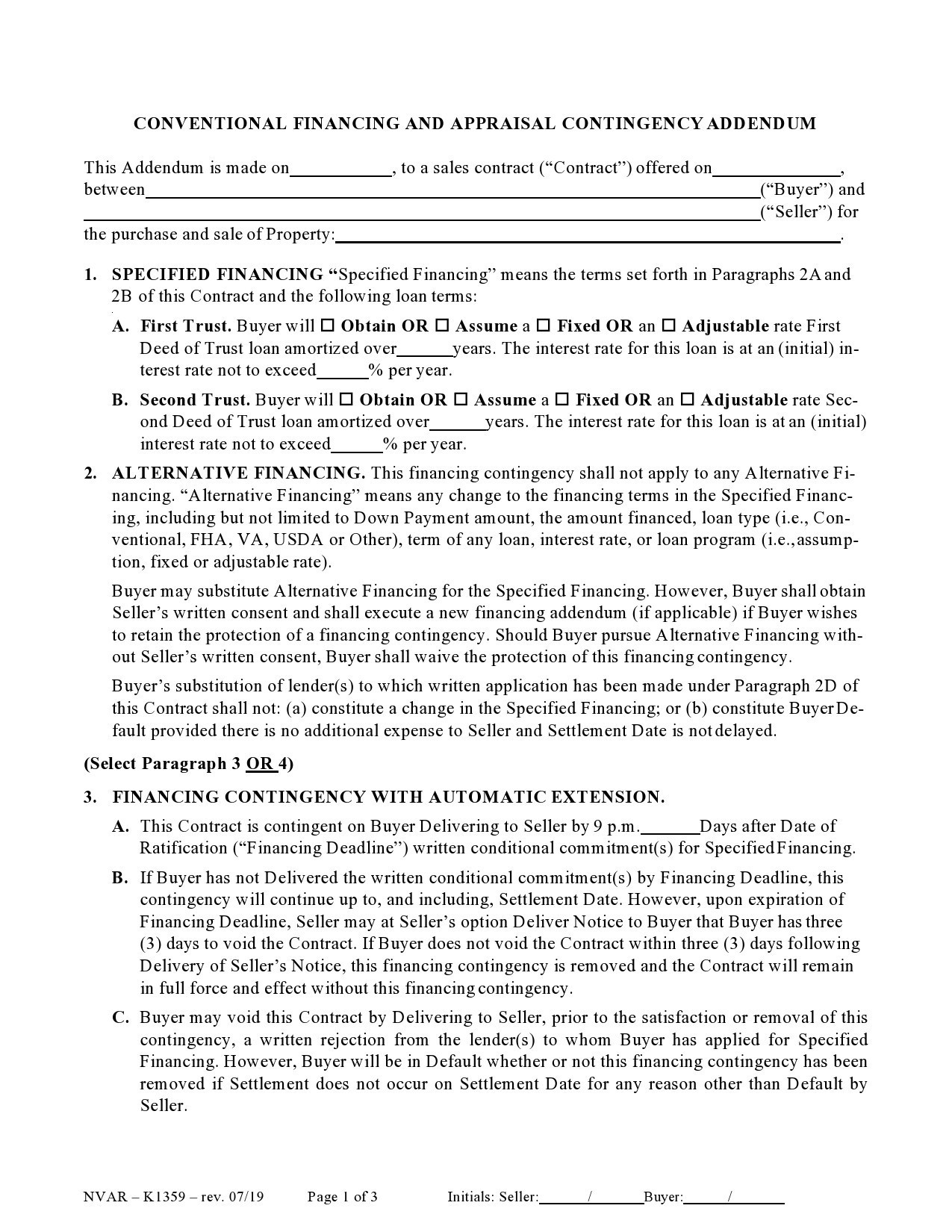

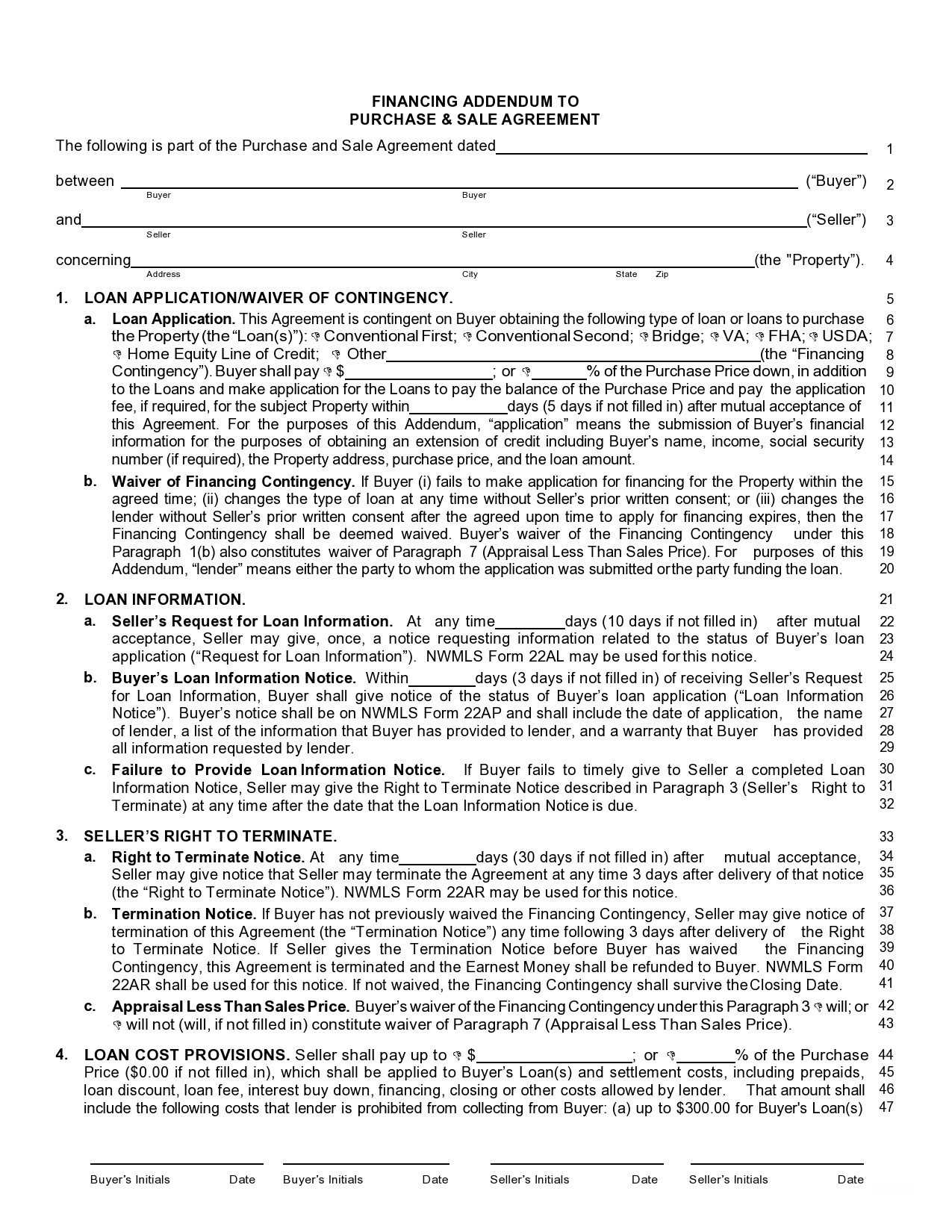

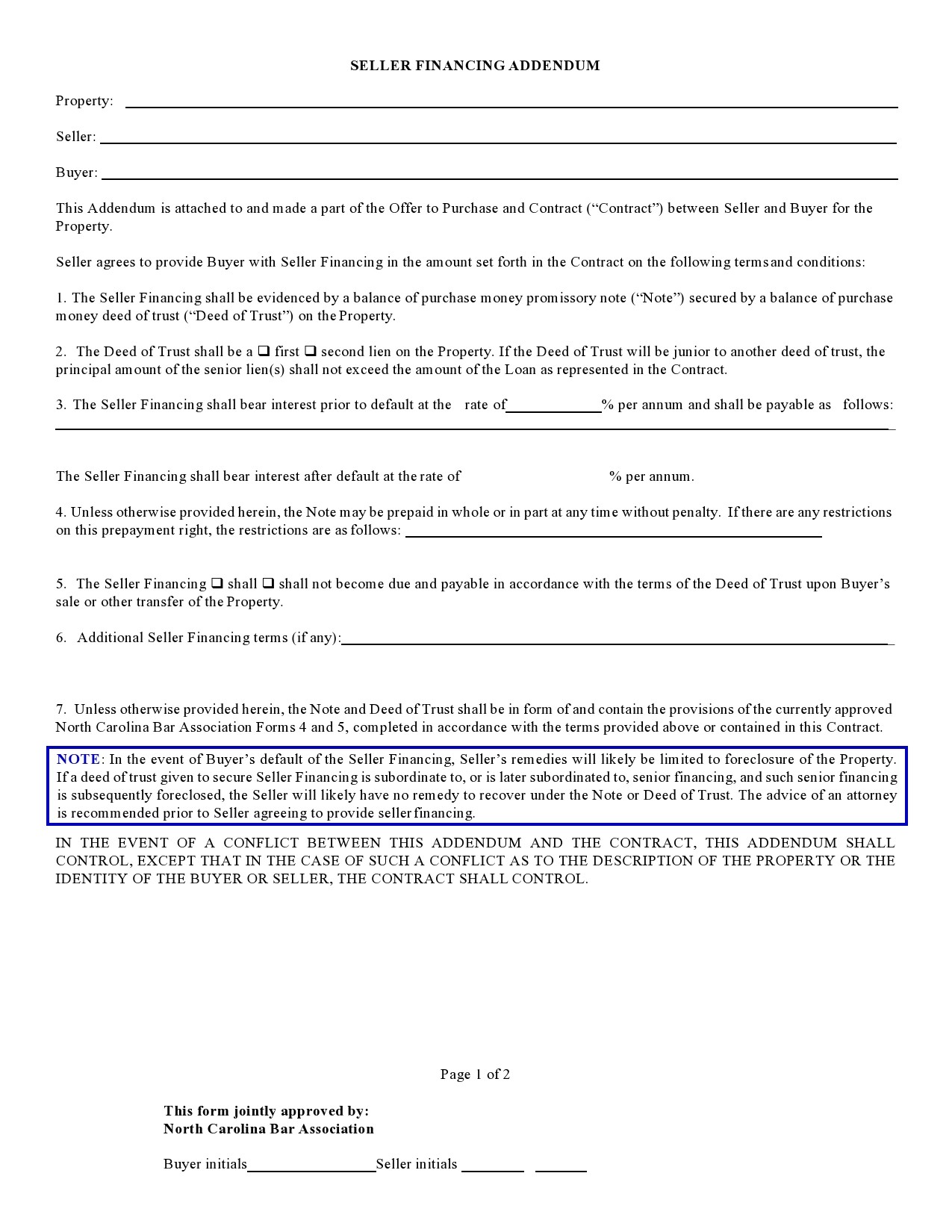

What is seller addendum?

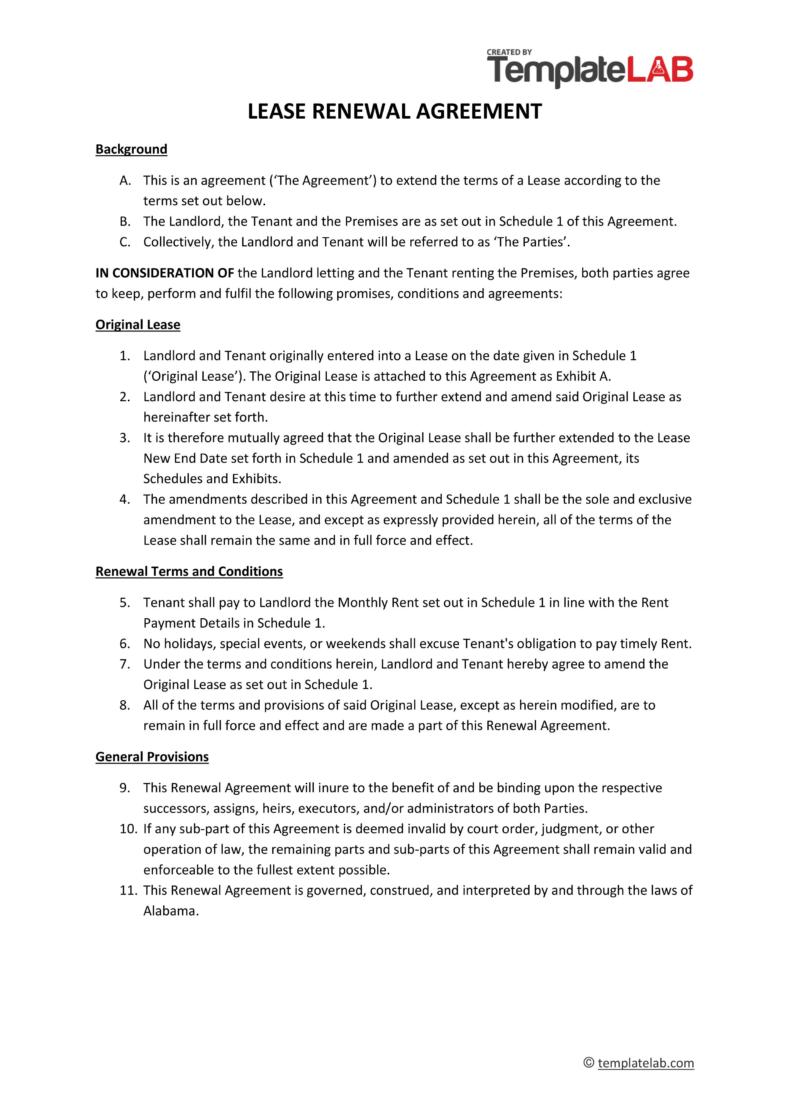

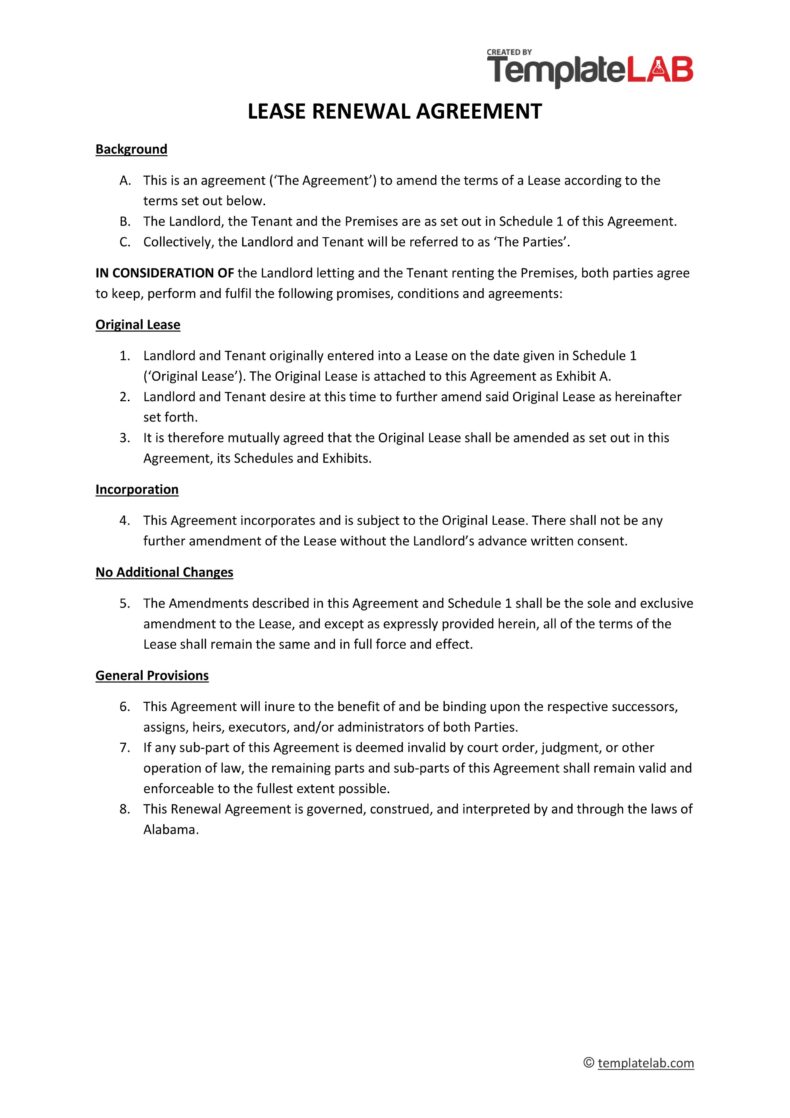

During the signing of the owner finance agreement, the real estate owner may attach an additional document on the agreement containing other terms that were not captured in the main document.

The seller financing addendum limits the liabilities of the seller during the sale process and after if the buyer discovers the seller failed to disclose some information concerning the property during the sale process. Additionally, the addendum may grant the seller rights to terminate the deal before maturity if the seller finds a better deal during the process.

On the part of the buyer, a seller financing addendum can give him or her the right to retain any valuables found in the house during the sale process and after. Some of the valuables could be fridges, cookers, furniture, or even hard cash that the buyer could find hidden in the property once they settle in.

Before signing the owner financing contract template, the buyer must read and understand the terms in detail because the addendum terms and style of language can easily override the main document. It is important to seek help from an attorney in interpreting the seller financing contract before appending your signature.

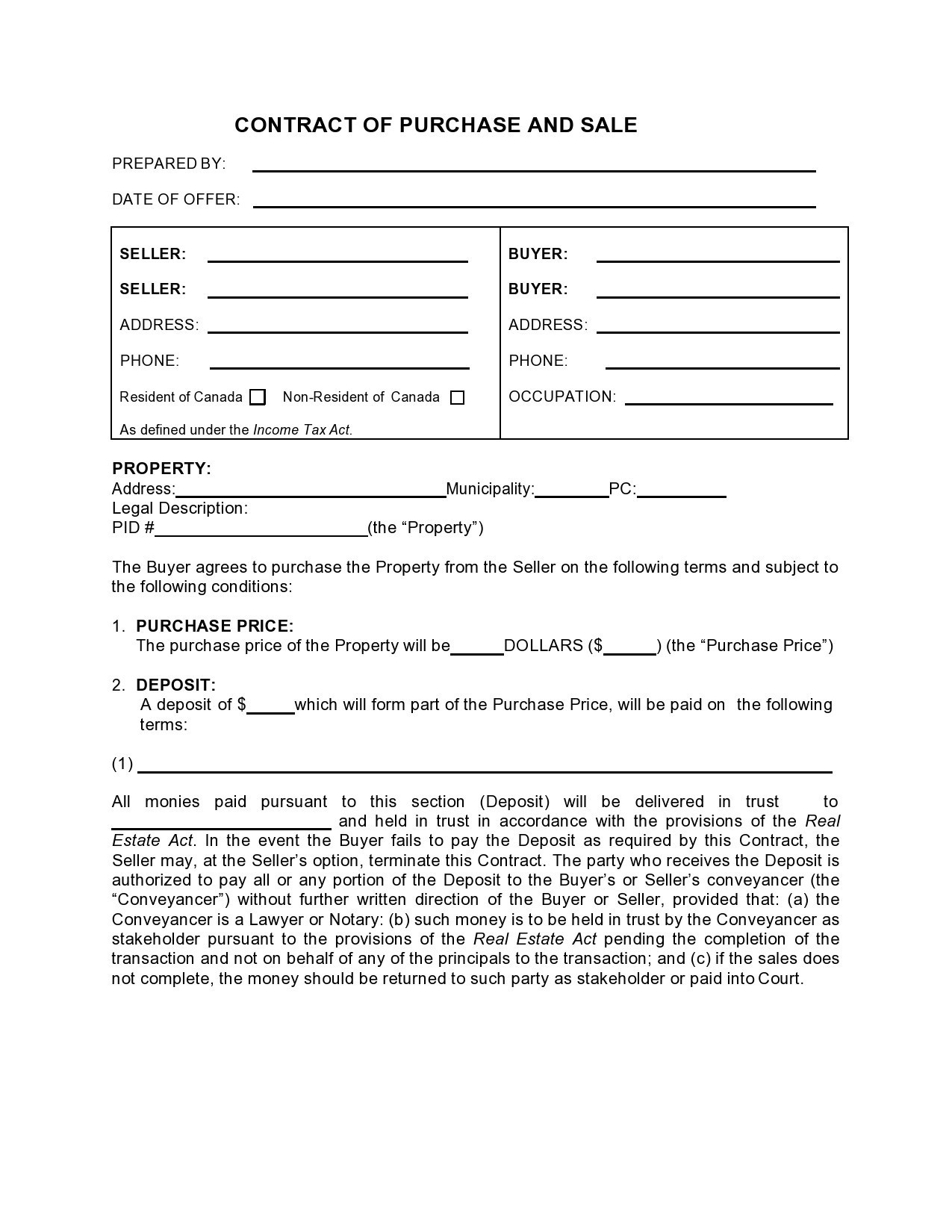

Owner Finance Agreements

Who holds the title in seller financing?

One of the components in an owner financing agreement is the seller agreeing to loan the property cost either in full or in part to the buyer. The real estate owner will old as collateral his or her property and can only do the transfer once the full installments have been made. As a result, the real estate owner keeps into custody the title because it is the only collateral they have in possession.

As part of the agreement contained in the promissory note, the real estate owner states that the title deed shall be held in custody by themselves until the full payment is received from the buyer, after which the deed shall be transferred to the name of the buyer. If the agreement is broken through defaulting, the real estate owner has all rights to retain the property or dispose it to another willing buyer.