Most homebuyers usually need a bank or a financial institution to help them provide the necessary funds. If you’re looking to purchase a home, you may need a third party financing addendum attached to your purchase agreement. It is a key document that outlines the terms of your loan.

Table of Contents

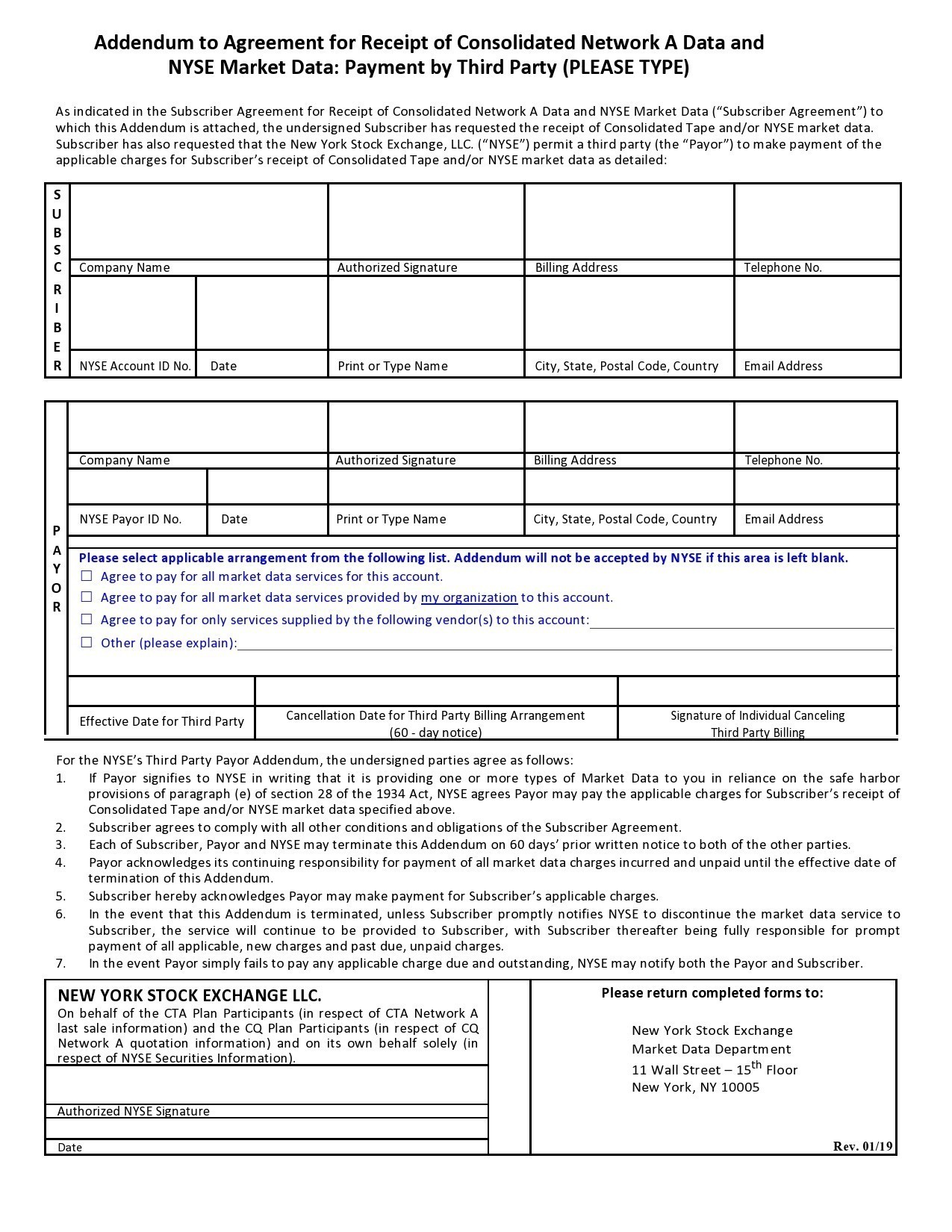

Third Party Financing Addendum

What is third party financing addendum?

As a prospective home buyer, you will apply for a mortgage. For this, you need to affix your signature on a third party financing addendum since this is part of the process. This document is a loan or credit agreement acquired from a person who is not the parent or main contributor.

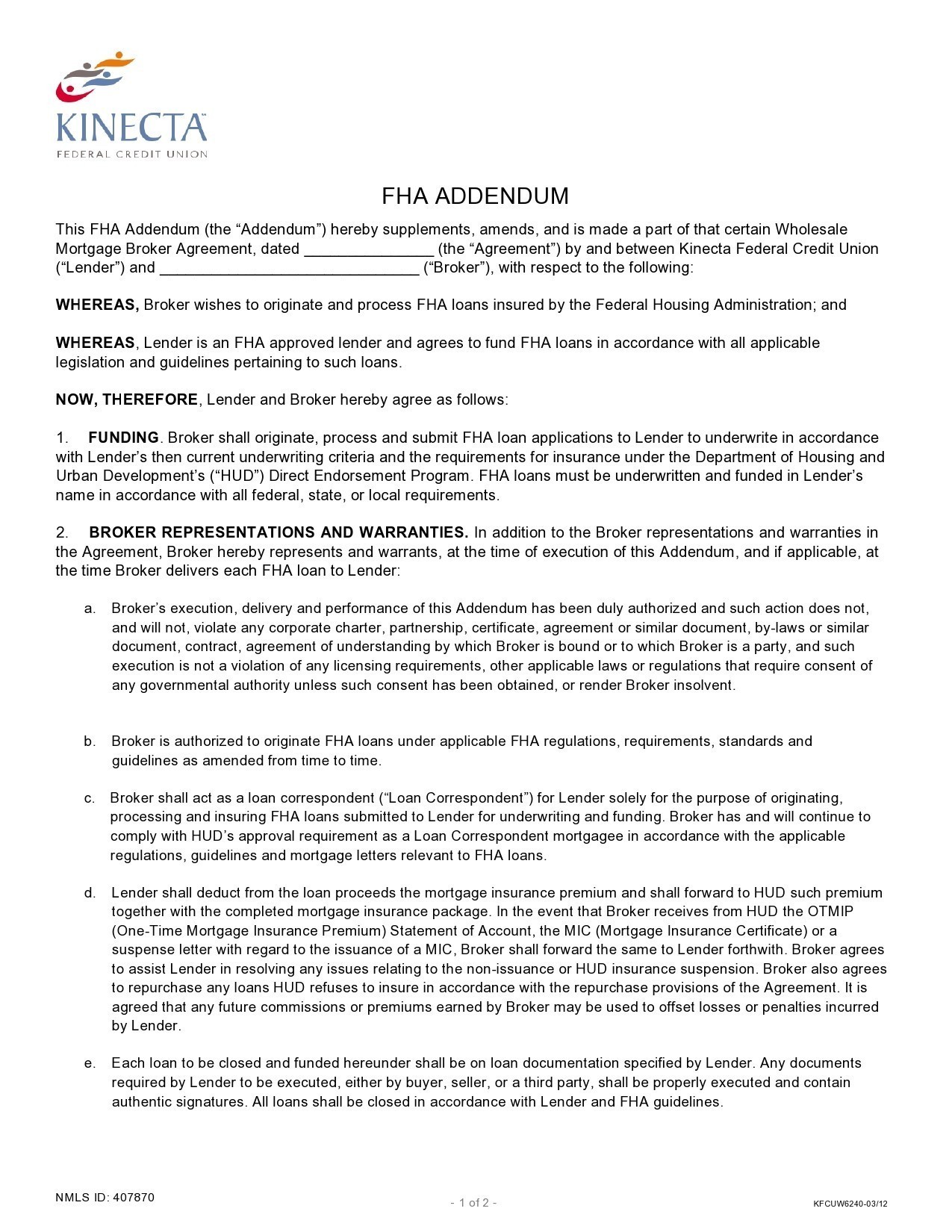

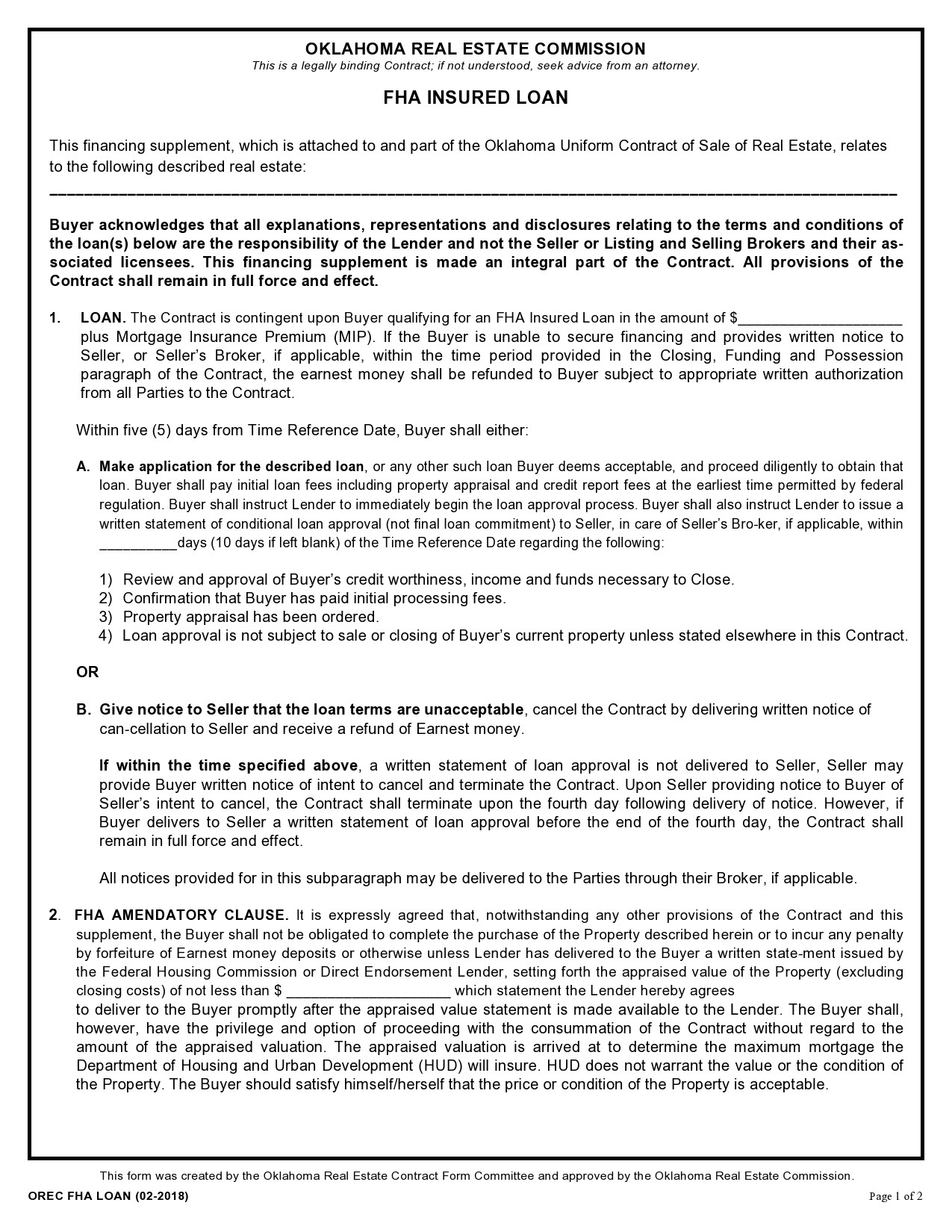

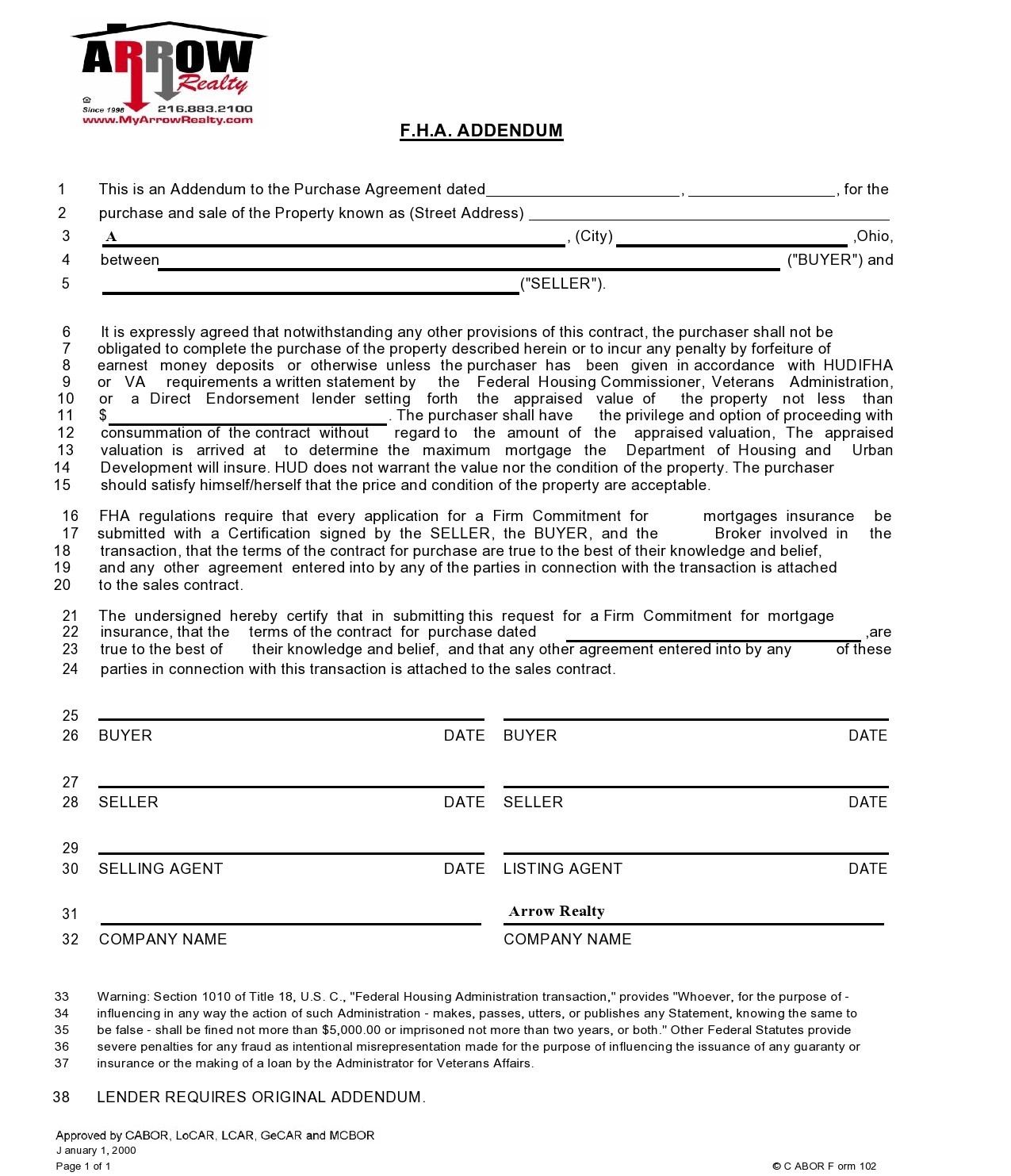

For instance, when purchasing a home, you may have to use a lender or another source to finance your payment for the home. The addendum, which is also known as an FHA addendum form is usually attached to the original sales agreement.

It outlines the terms of the mortgage loan that you will agree to so you can buy the property. In almost all cases, the sales agreement will depend on you getting a mortgage loan as stated in the addendum.

This means that the sales agreement will become void if you cannot meet all of the terms of the addendum. There are different types of addendums you can use:

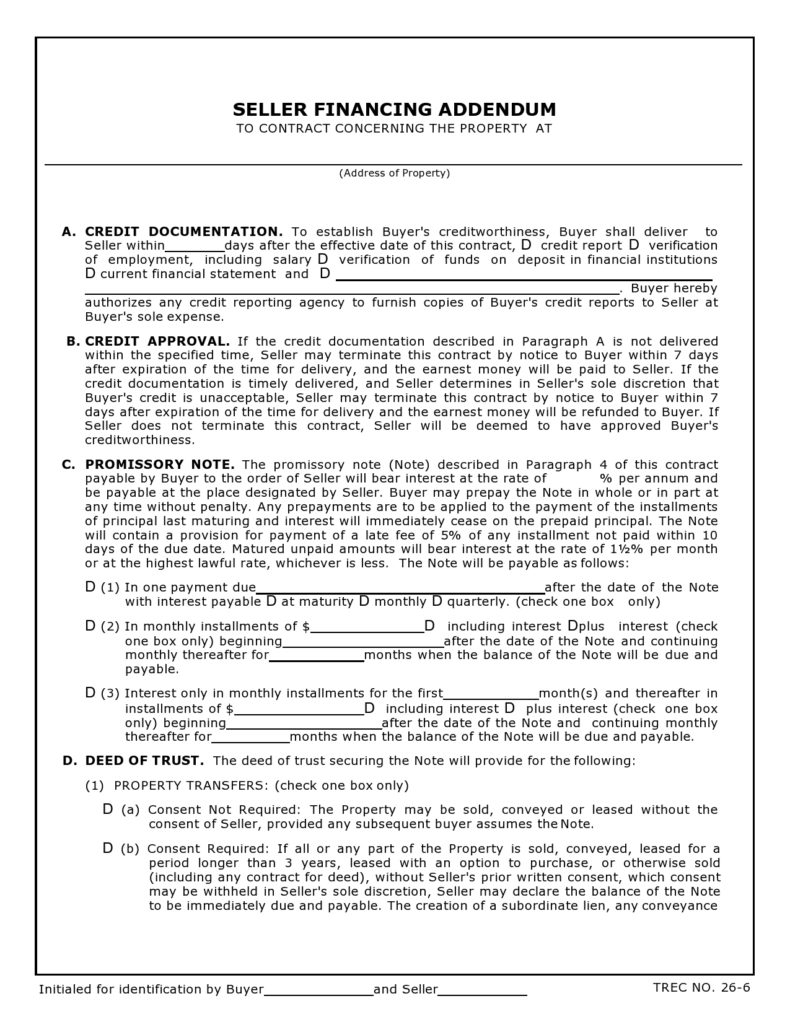

- Seller Financing Addendum

Use this when you need to obtain a loan from the person selling the property. - Conventional Financing Addendum

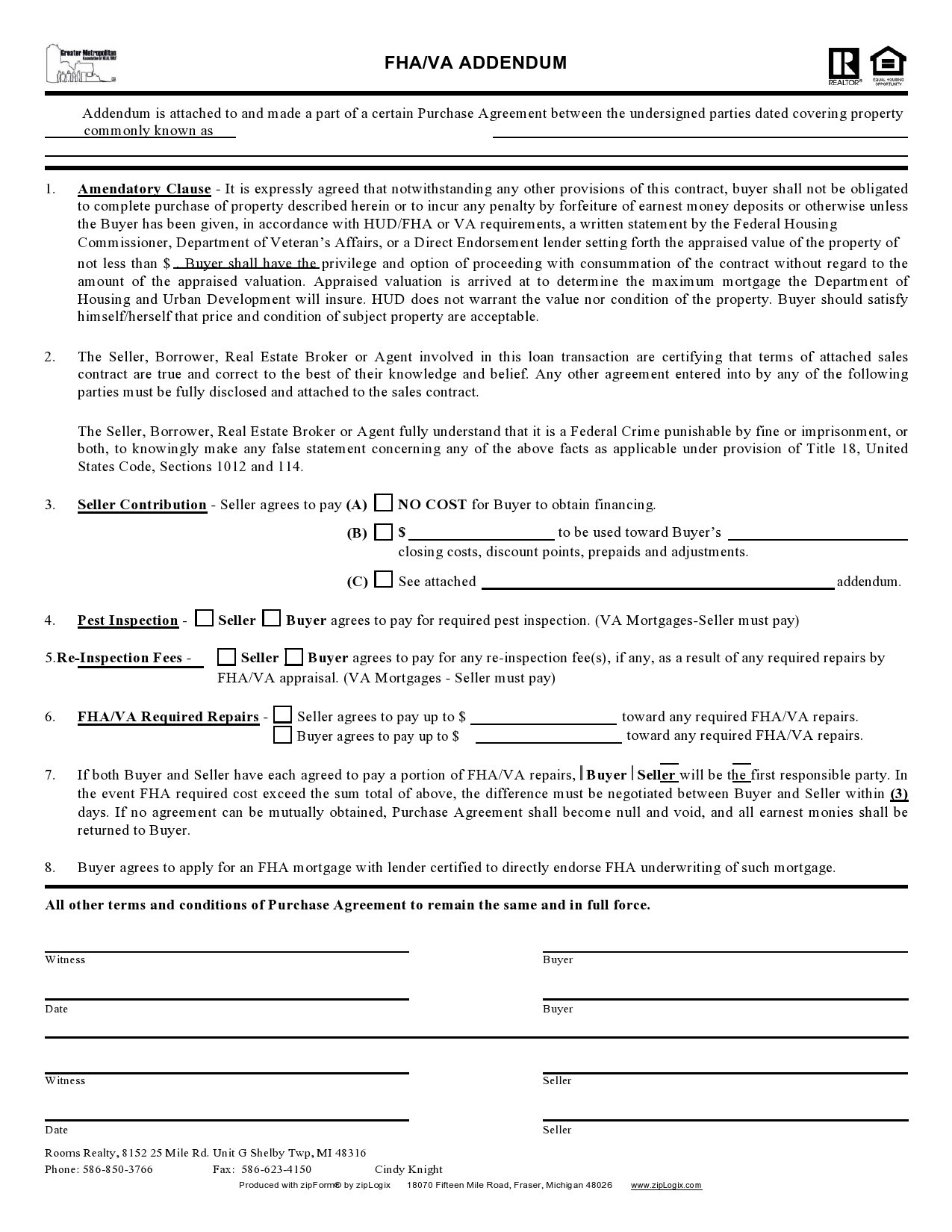

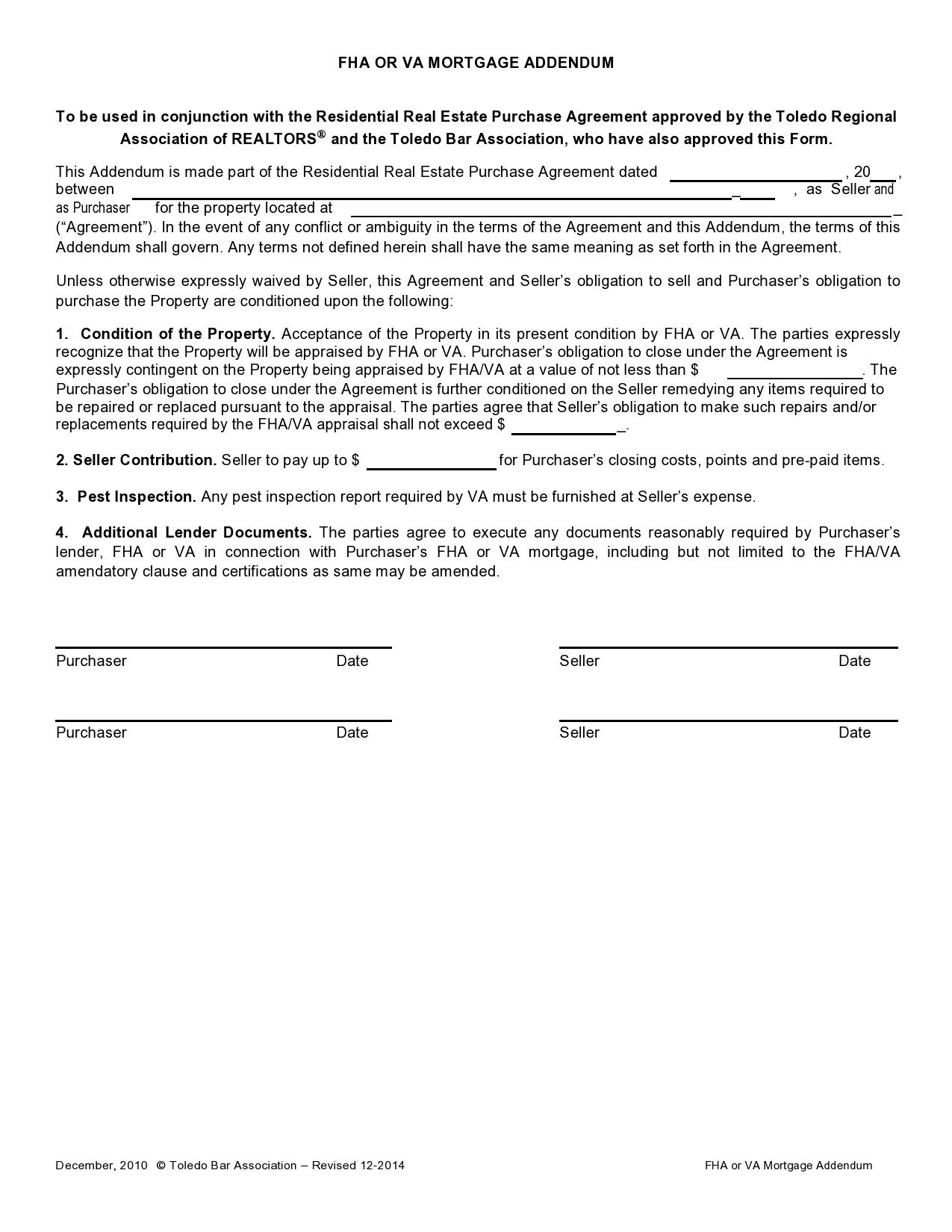

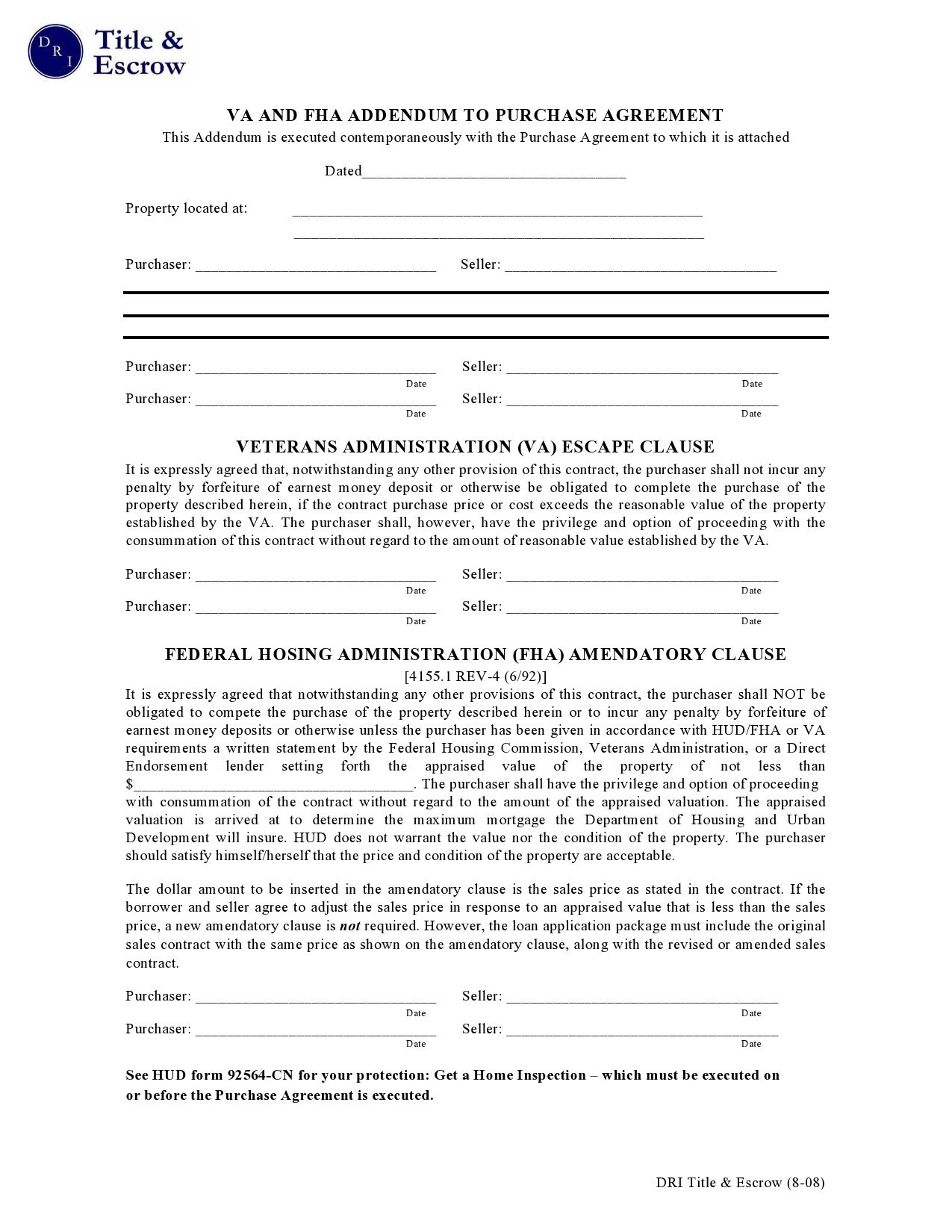

Use this to outline the money you need for closing. You can get this from the Association of Realtors. - FHA / VA Financing Addendum

Use this when your financing will come from an FHA or VA loan. - Reverse Mortgage Financing Addendum

You can use this if you’re aged 62 years old and above. It allows the seller to get funds in exchange for the equity of the property. - USDA Financing Addendum

Use this when purchasing a property in rural and suburban areas and you don’t qualify for a traditional loan.

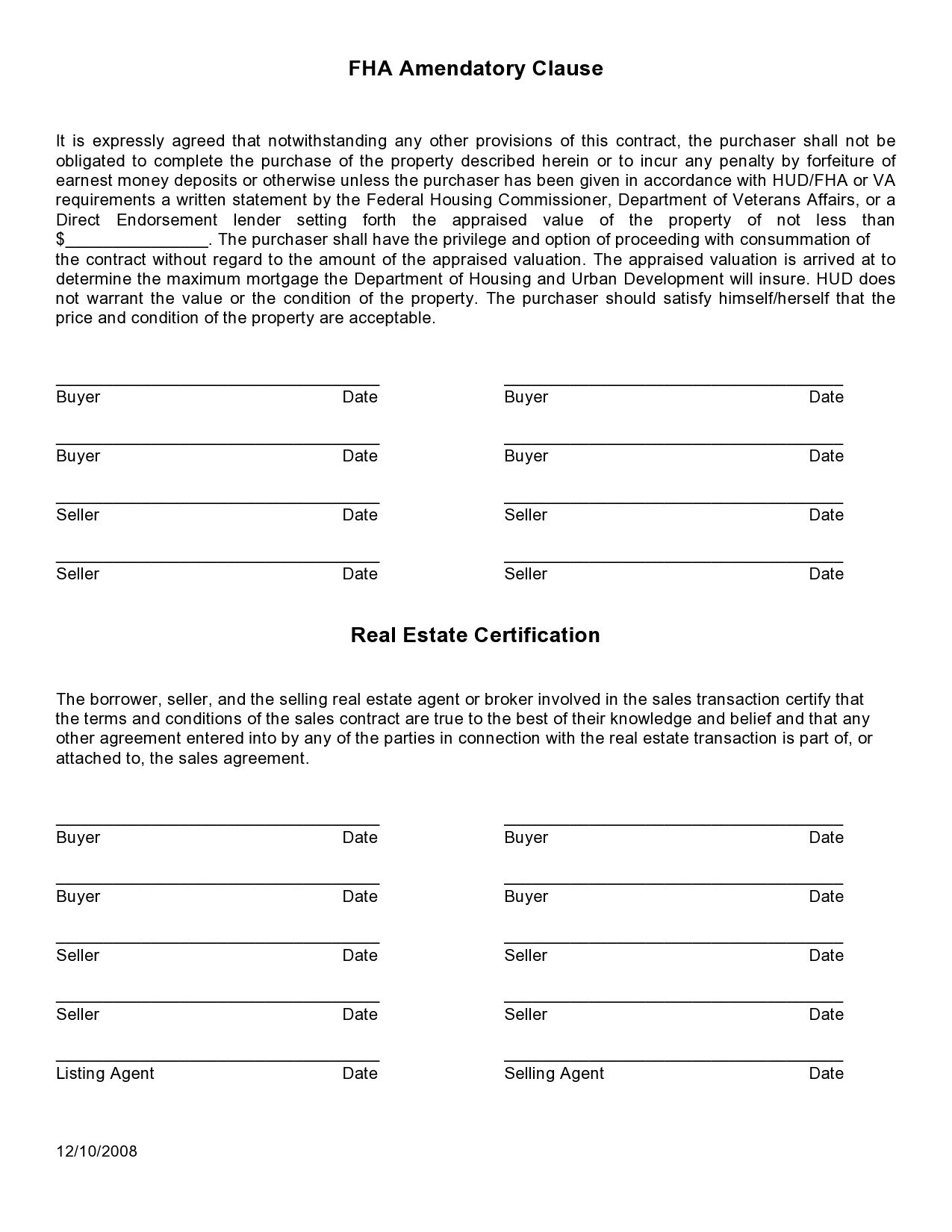

FHA Financing Addendum

How does it work?

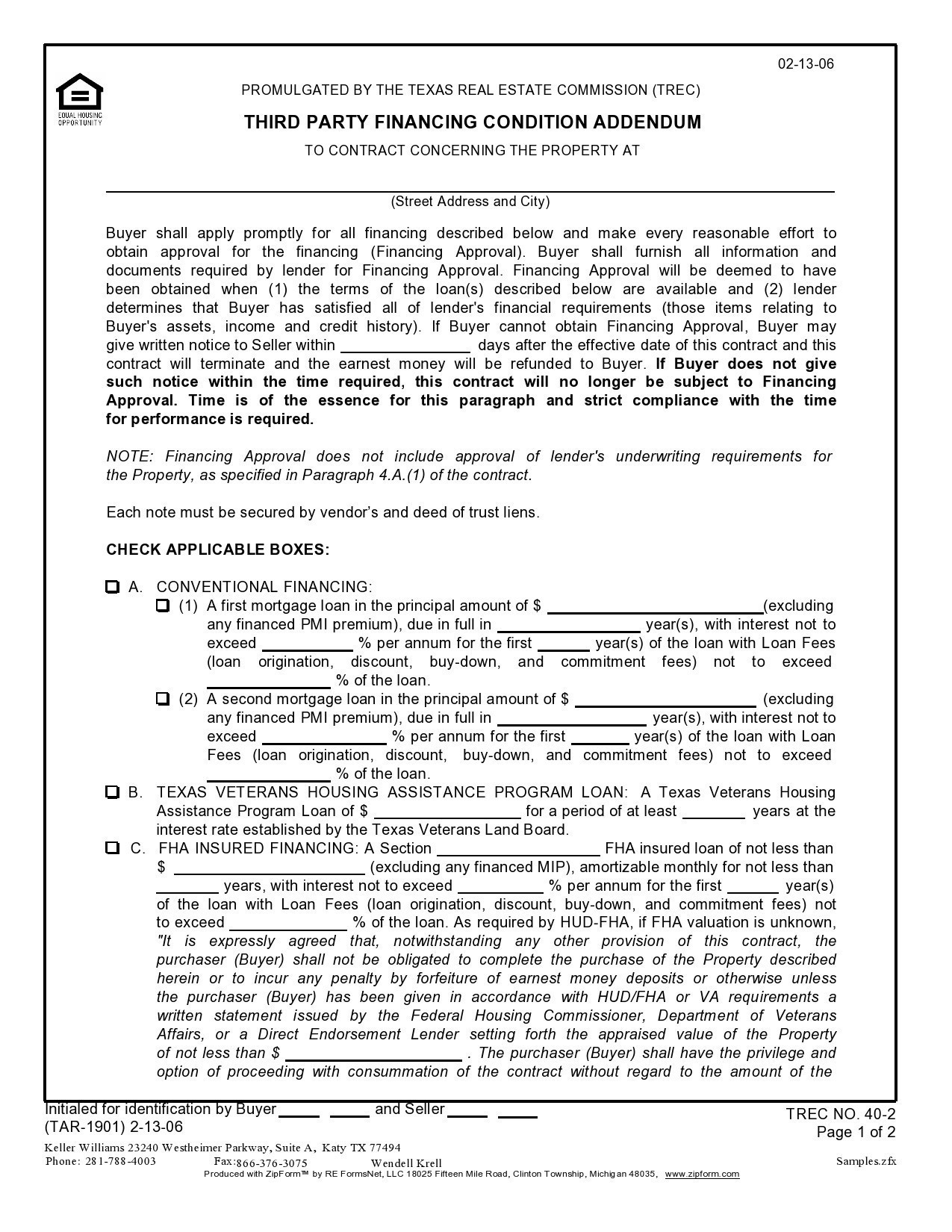

Before the year 2004, should you fail to get financial approval, the third party financing addendum poses no obligations on your part. The agreement can get terminated if the lender doesn’t agree to the deal.

But the revised third party financing addendum sample requires you to provide prior notice to the seller about your inability to get financing. Not giving notice will be a breach of contract. On the other hand, there are some contracts that can protect you in a different way compared to the third party or FHA financing addendum.

In these contracts, your protection will extend if the lender rejects your loan application because of underwriting requirements related to the property. However, in cases where the loan got rejected because your finances don’t meet the underwriting requirements, you won’t have any protection.

Take note of a significant clause in the addendum involving a period within which you should give a notice to the seller of your inability to finance the home. It’s logical to assume that the longer you delay the notice, the more time you will have to get your loan approved.

On the seller’s side, the earlier they receive the notice of your inability to finance, the sooner they can look for another buyer who is financially stable. This places both of you in conflict.

It is, therefore, important for you to be ok with the mutual agreement and cooperation with regards to the term decision as this will increase the chances of a successful agreement between you and the seller. But an argument between you might force the seller to look for other buyers to sell their home to.

What to include?

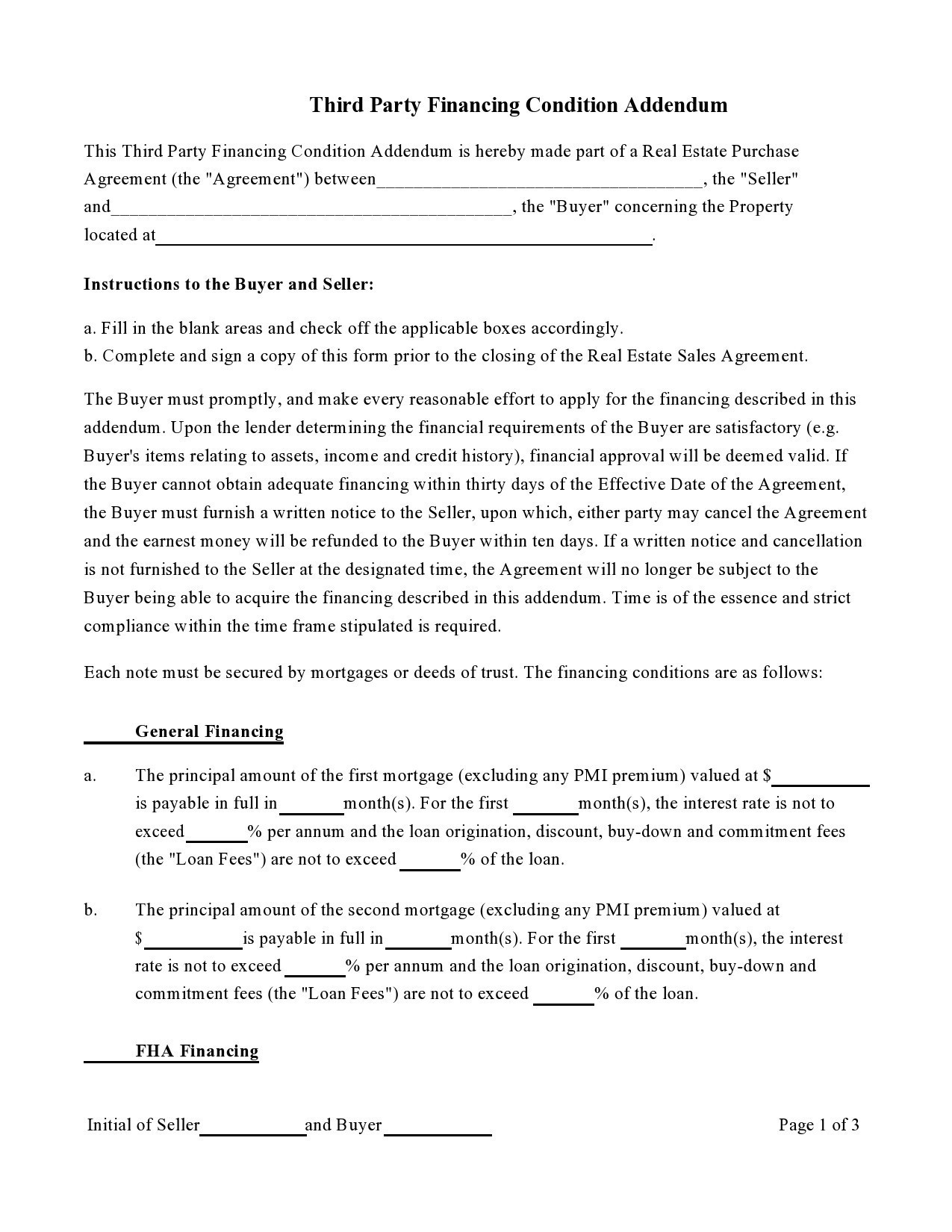

Depending on the terms and the types of financing, the contents of each third party financing addendum may vary. Whatever type it is, here are the most important elements that you should include in a third party or FHA financing addendum:

- Heading

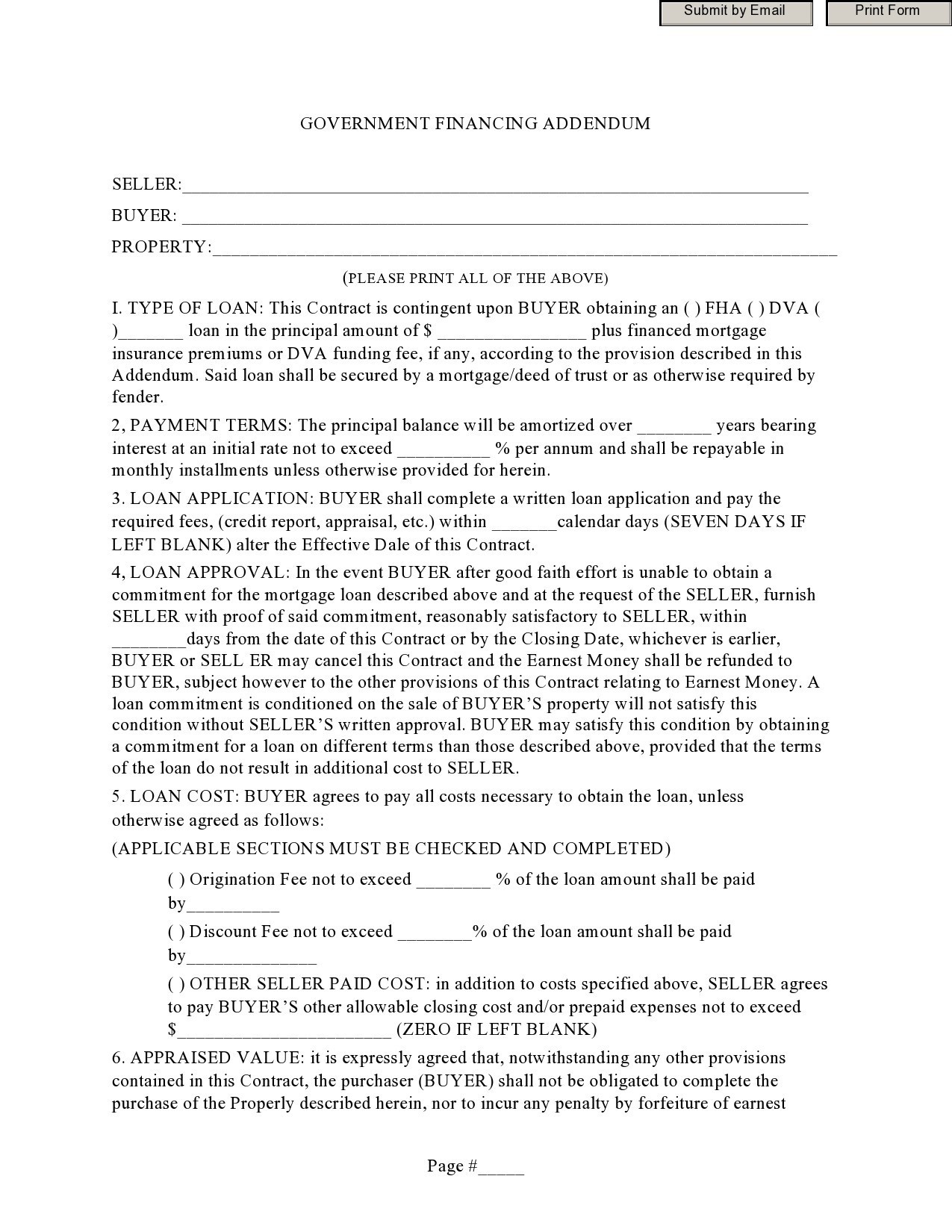

This is the first part of the document and it usually records the date of the original agreement that you had created the addendum for. It also introduces the involved parties. The legal names of both you and the seller should be here together with the complete address of the house. - Financing Type

This section of the FHA addendum form outlines the type of financing you will use. The different types are:

Conventional financing, which refers to a traditional mortgage. Specify the details of the addendum like the interest rate, the lifespan of the mortgage, the principal amount, and origination charges.

USDA financing, which will require details like the amortization or minimum monthly rates, the length of the mortgage term, the maximum interest rate, and the minimum amount you have guaranteed.

Reverse mortgage financing, which specifies the details about the mortgage term, interest rate, and the original mortgage amount.

FHA financing, which specifies the details on the monthly payments, the minimum account guaranteed, and the maximum interest rate.

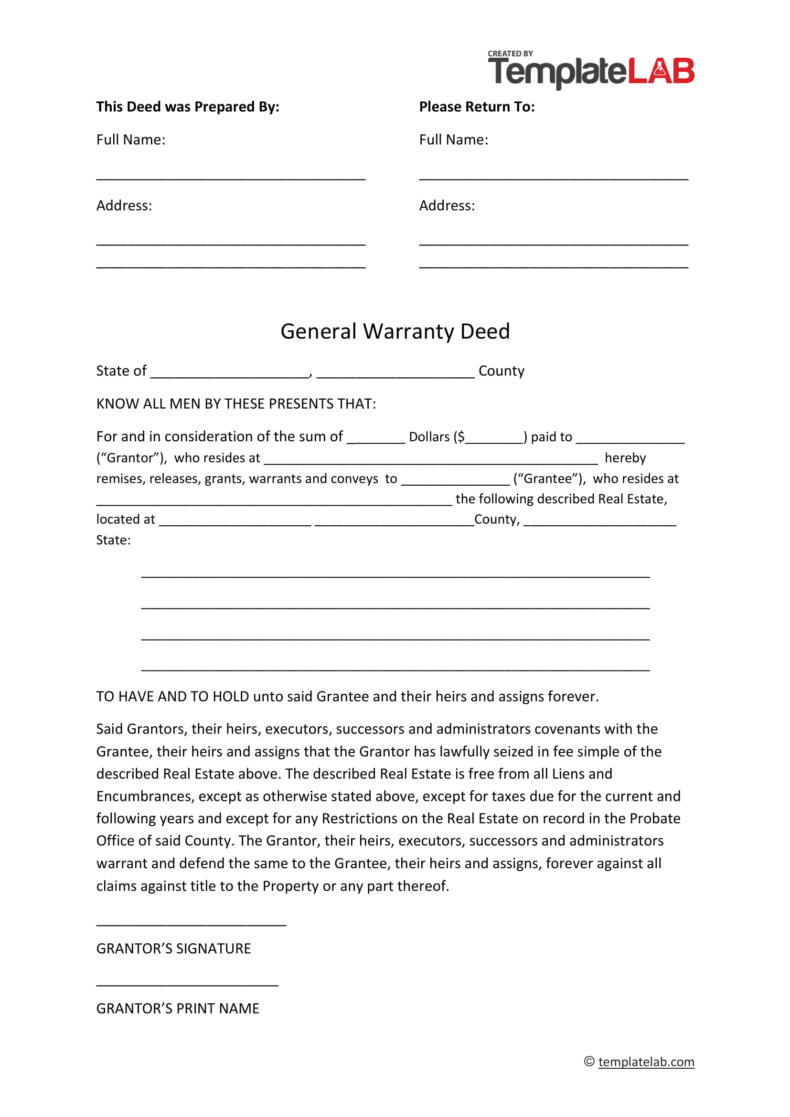

VA financing, which specifies the details of the loan term, the monthly amortization, the minimum amount guaranteed, and the interest rate. - Property and Lender Approval

There are cases where you need the lender’s approval to obtain financing. If so, you need to provide the date when you need this approval. Moreover, you will also have to provide the date that you will provide the property’s approval, which will come from the lender too. - Execution of Addendum

Both you and the seller must affix your signatures on the addendum along with your complete names and the date when you both signed the addendum.

FHA Addendum Forms

How do you fill out a third party financing addendum?

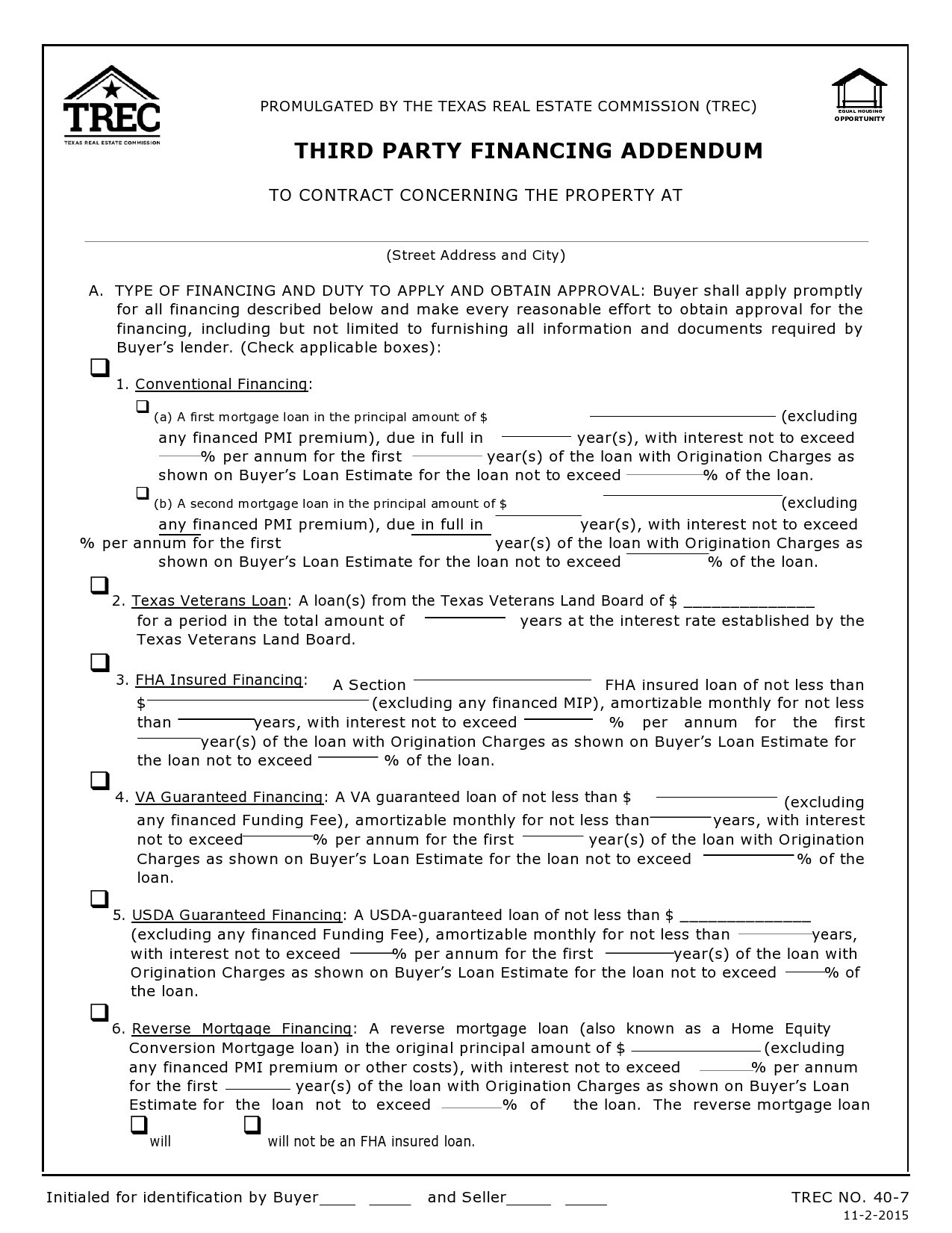

The last update on the third party financing addendum by the Texas Real Estate Commission was on the 1st of January, 2016. This new form comes with a number of that can impact you and the agreement you need when purchasing a new home.

A third party financing addendum example is an addendum to the One to Four Family Residential Contract that covers the financing of a home. If the terms of payment for the purchase of a home involves a cash transaction, then you won’t need this addendum.

But if the terms involve the securing of a loan to purchase a home, chances are, you will see this form when you meet with your real estate agent to come up with an offer. Third party financing refers to any loan that you takes to buy a house and this loan can be of several types:

- Texas veterans loans

- Conventional loans

- FHA loans

- USDA loans

- VA loans

- Reverse mortgages (although this isn’t often used to purchase homes, it is still possible to use one this

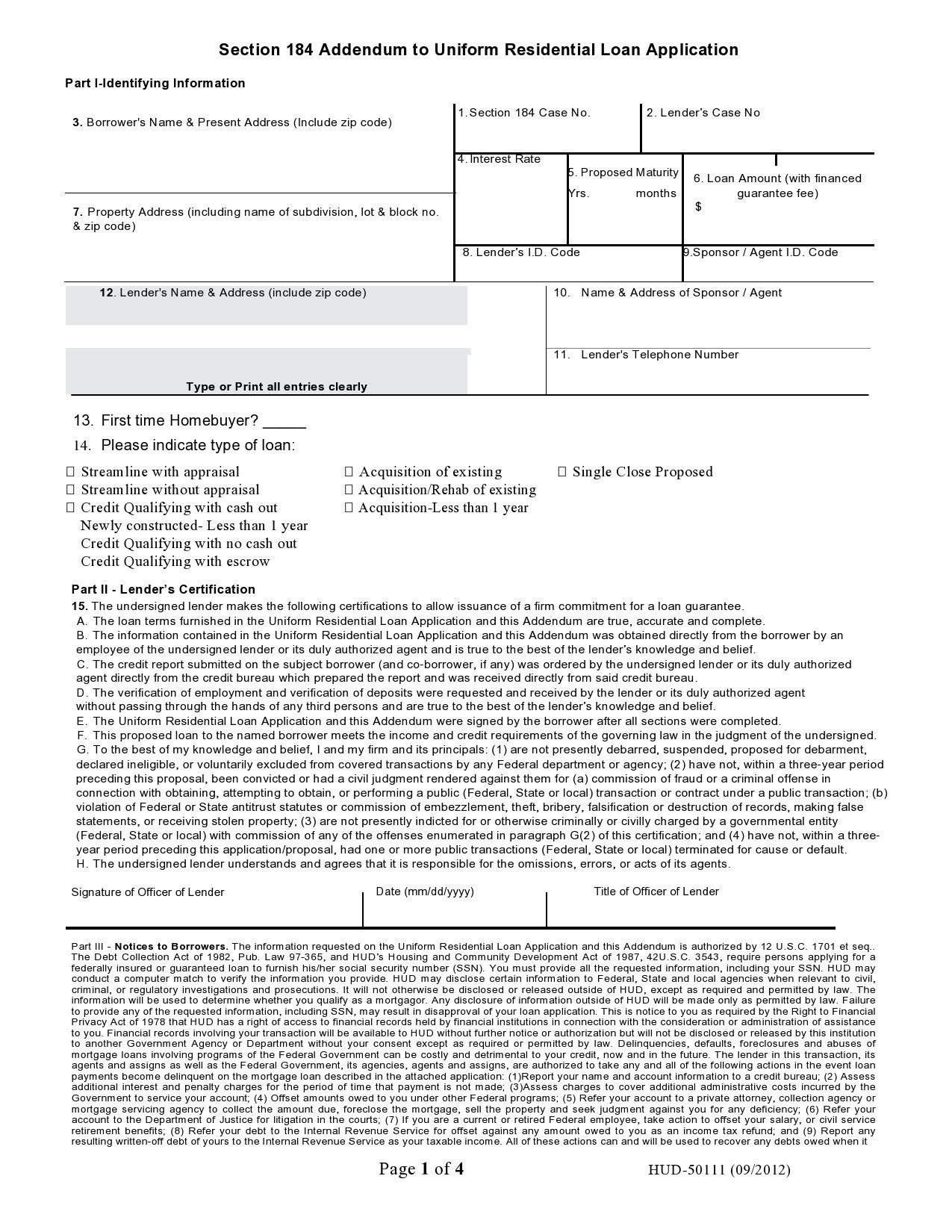

Since loans generally require approval by a lender in different forms, it follows that the third party financing addendum sample will depend on your contract’s approval process. This means that if you cannot obtain a loan, there are ways to get out of the agreement. Before you can fill out a form, you need to first understand the various parts first:

- The First Section

This part of the form outlines the type of financing you’re looking to get and it will require you to promptly apply for this financing. The next parts of the paragraph outline the different types of financing. For each of the loan types, you will have to outline the basic criteria for the loan you’re looking for including the amount of financing, the number of years of the loan or the duration, the origination fees, and the interest rate. - Approval of Financing

This will be officially considered obtained when you have also obtained the Property Approval and Buyer Approval. Here are some descriptions of these documents:

Buyer Approval: This is a contract that’s subject to you obtaining approval as a buyer.

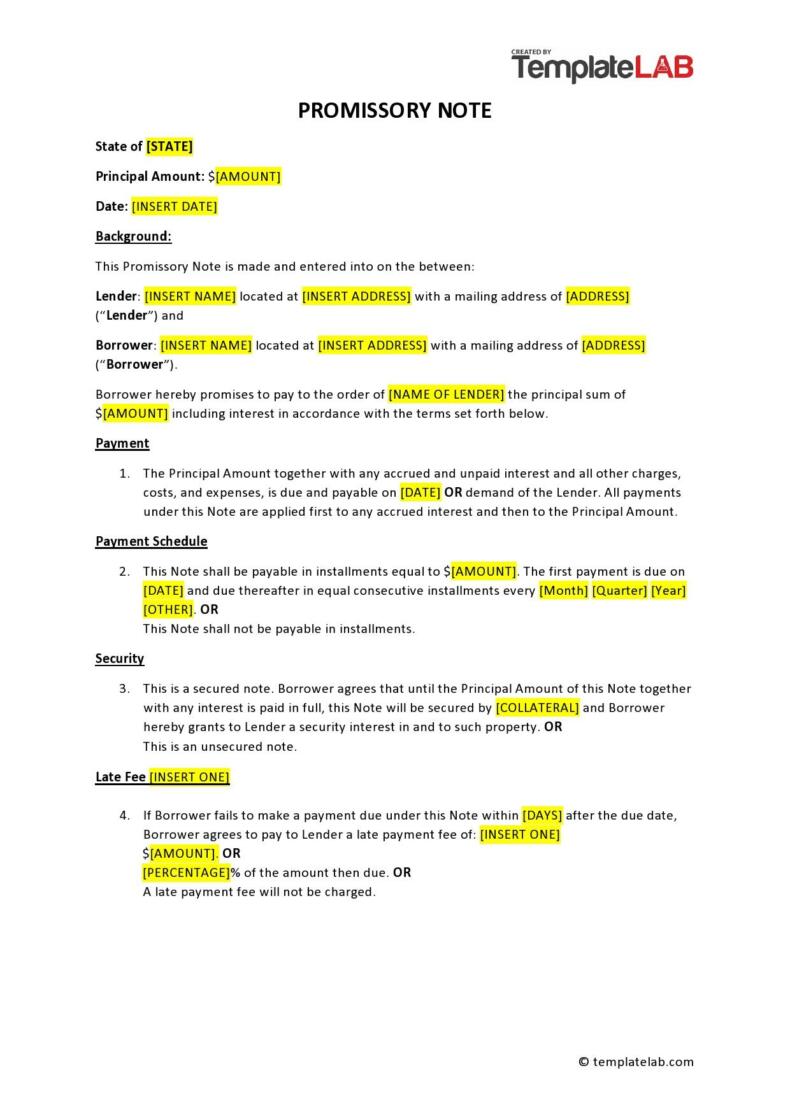

Property Approval: This will be officially considered obtained when the property for sale has satisfied the underwriting requirements of the lender for the loan including but not limited to insurability, lender-required repairs, and appraisal,. - Security

You must secure each of the required notes for financing as stated in the vendors and deed of trust liens. - FHA/VA Required Provision

If the financing involves VA financing or FHA insured, you and the seller should expressly agree upon this. For a VA or FHA loan, the appraised price of the property should be equal to or higher than the sales price stated in the agreement. - Authorization Release Information

As a buyer, you authorize your lender to give to the buyer, the seller, or your representatives the information relating to the status of the approval for your financing.

You and the seller will authorize your lender, escrow agent, and title company to disclose and provide a copy of the closing disclosures given in relation to the closing of the sale to your respective sales agents and brokers as identified on the last page of your contract. - The Last Paragraph

This provides authorization to the company, escrow officer, and lender to release important information to you and the seller along with your representatives and to provide copies of the new closing disclosures to all of you. Without this authorization, they can’t provide the information to all of the parties under the new regulations of the Consumer Financial Protection Bureau.