Every person or company starting from scratch needs credit to jump-start a business. You can do this through a business credit application. The information that you provide in this form will help a financing institution determine whether you’re reliable enough to pay back your debts.

Table of Contents

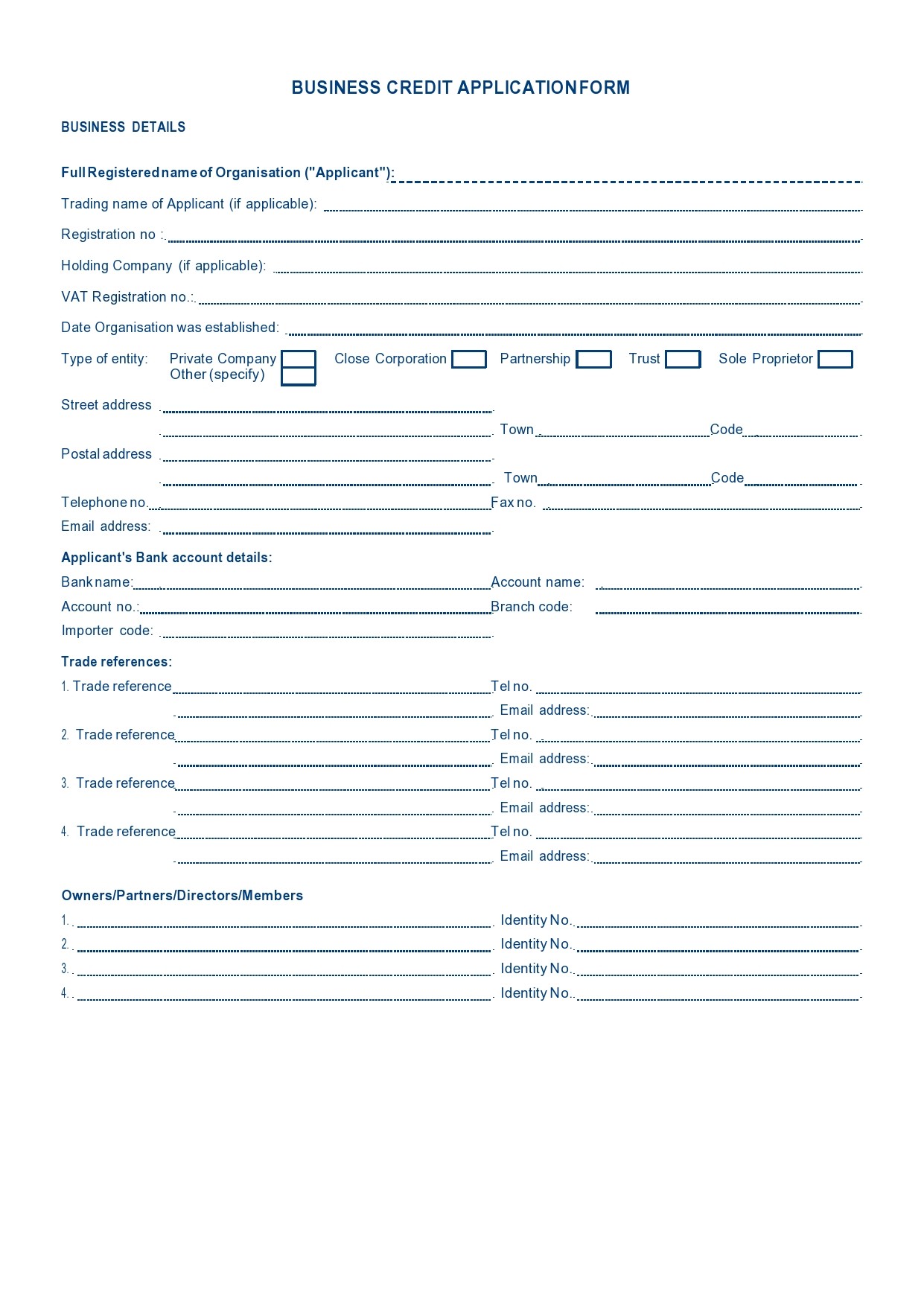

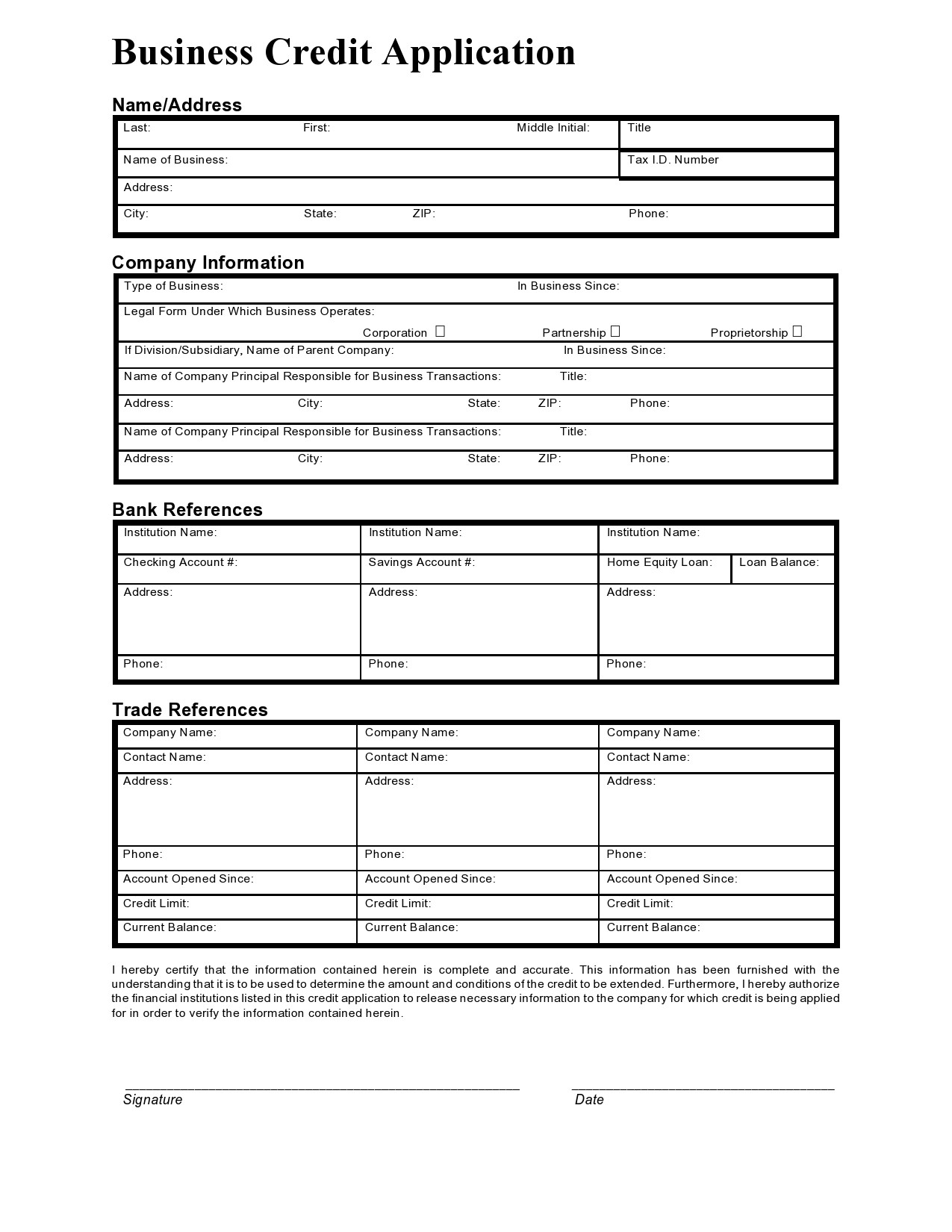

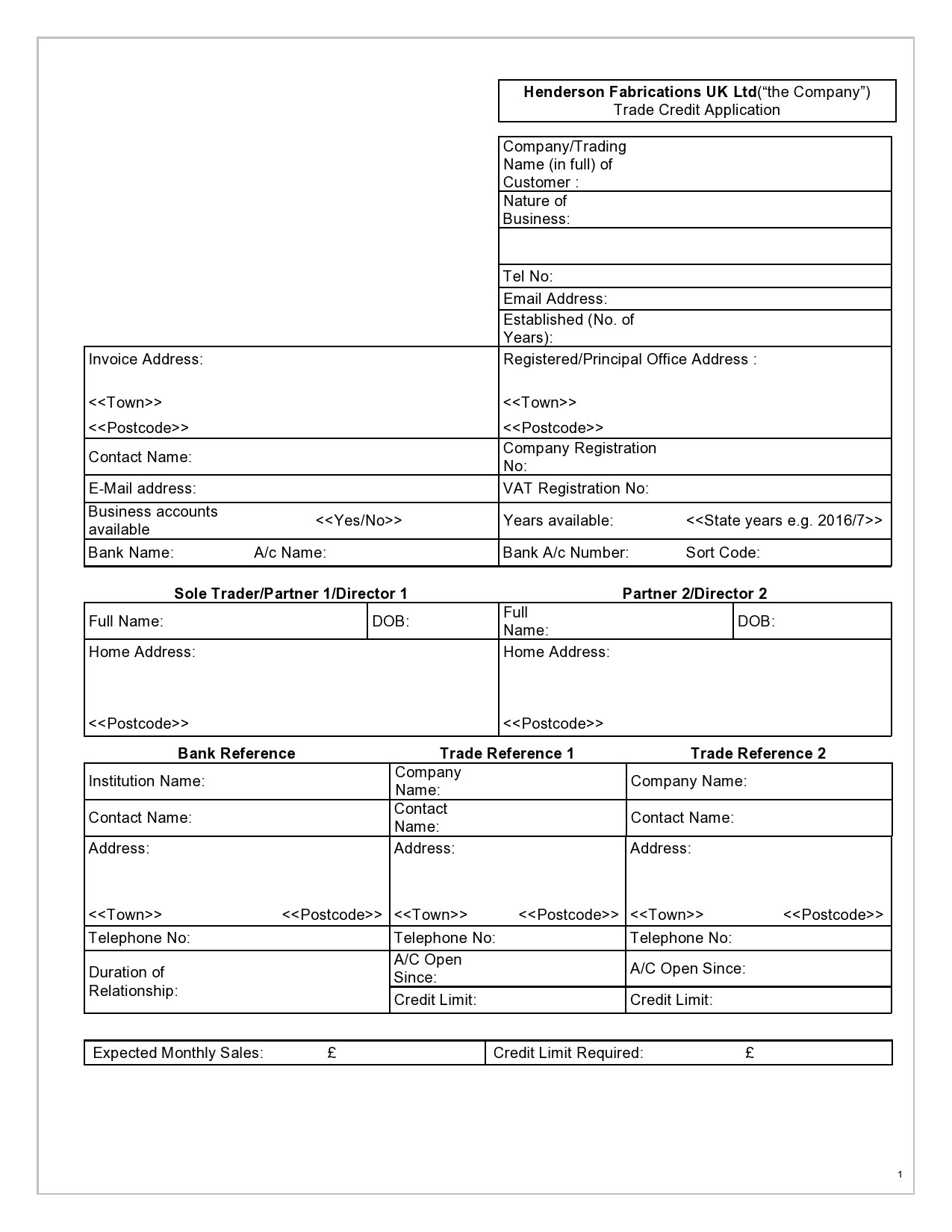

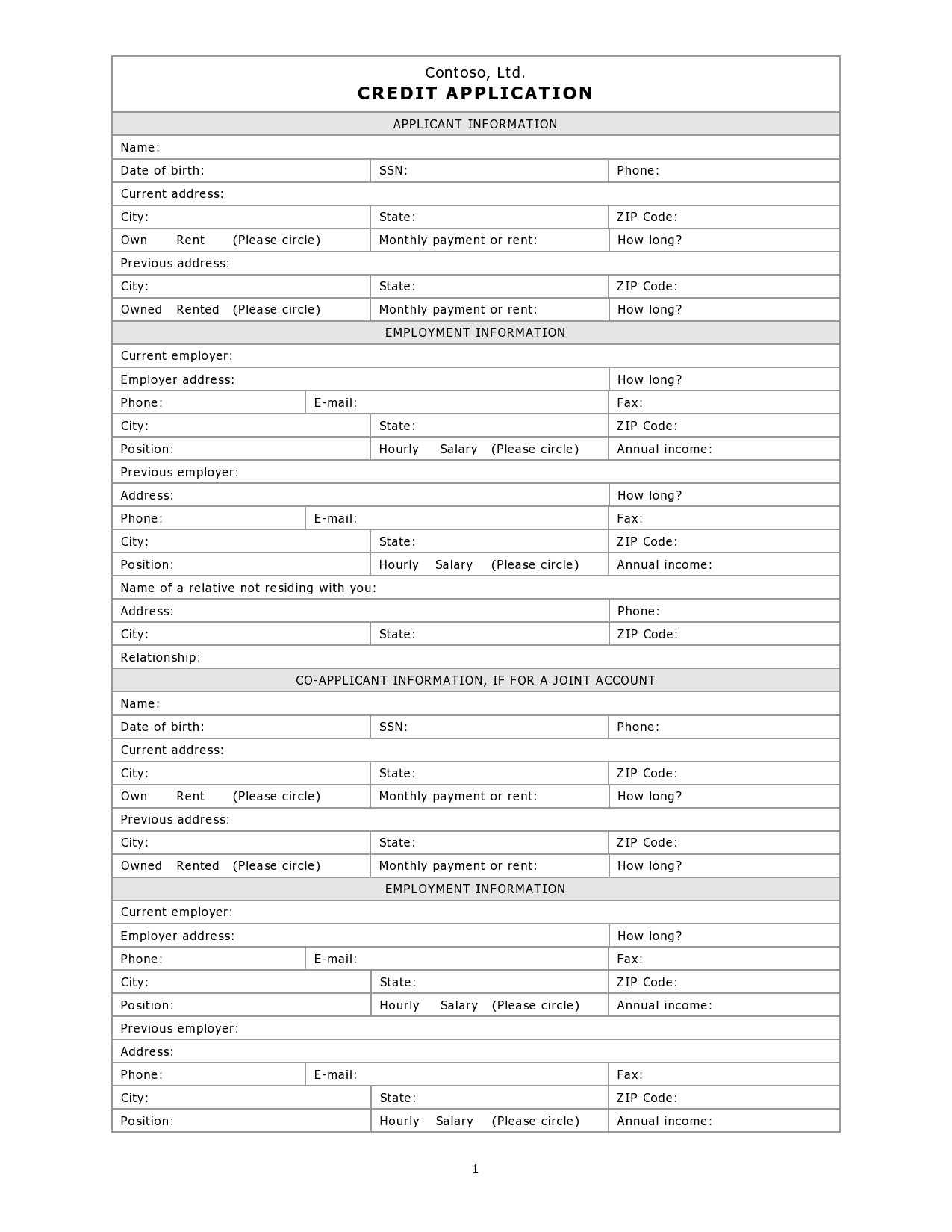

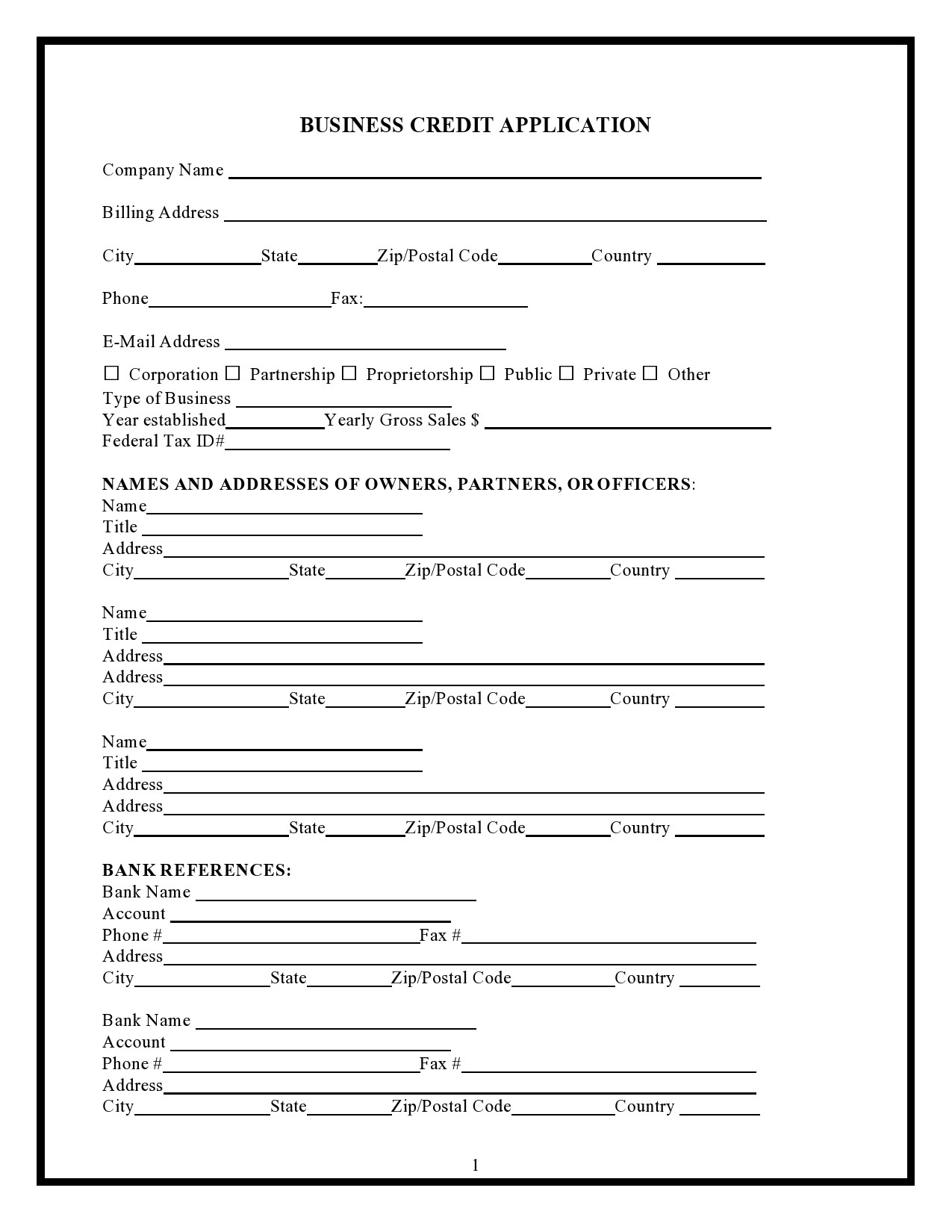

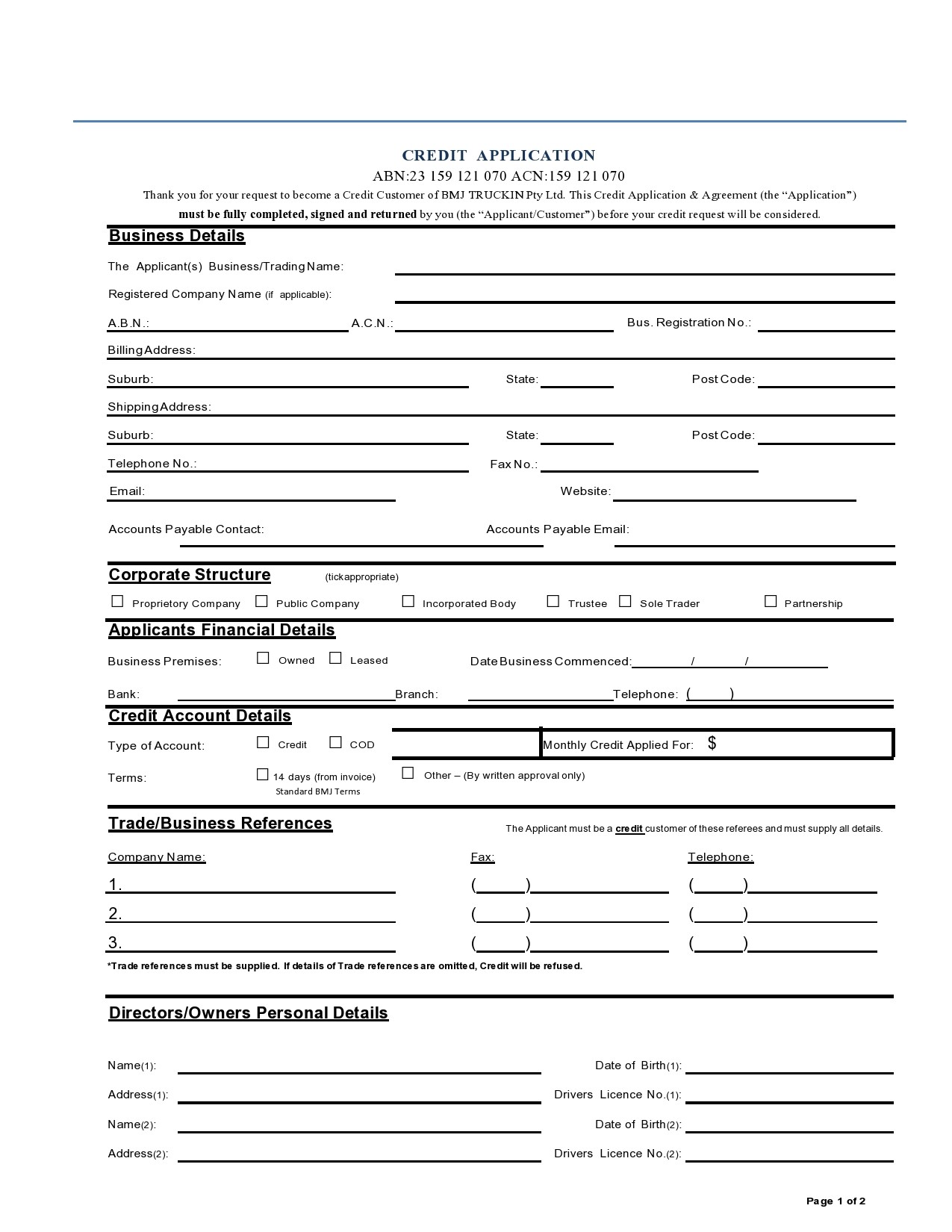

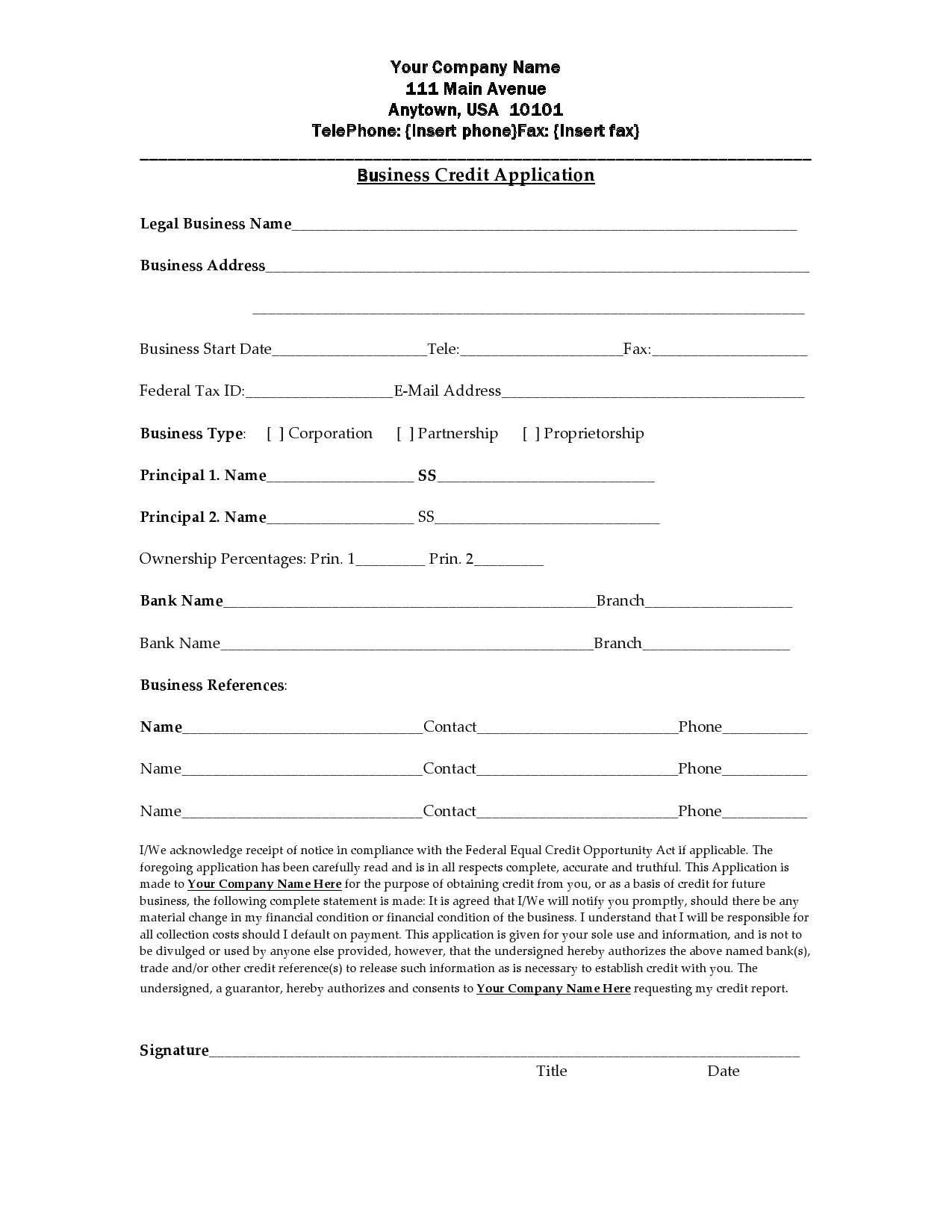

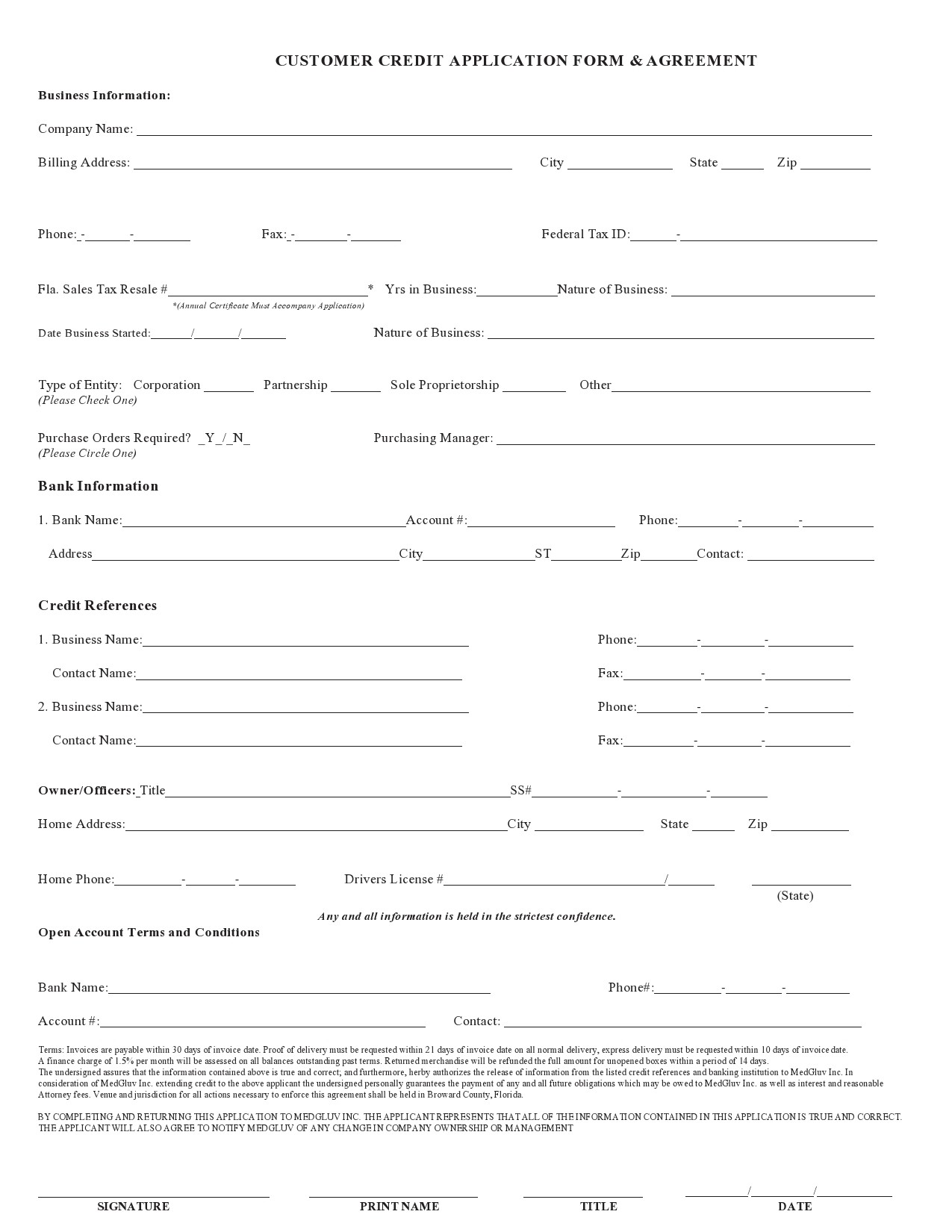

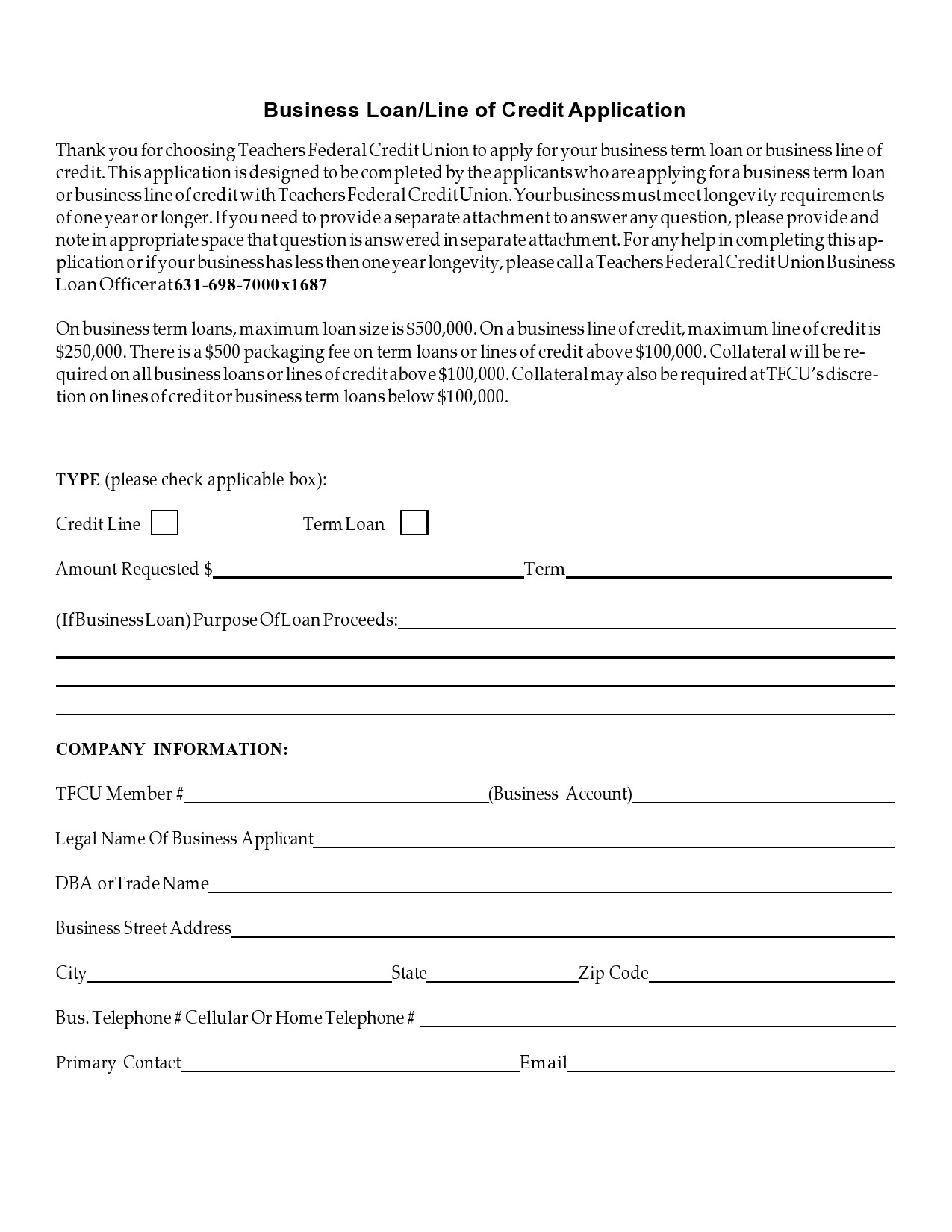

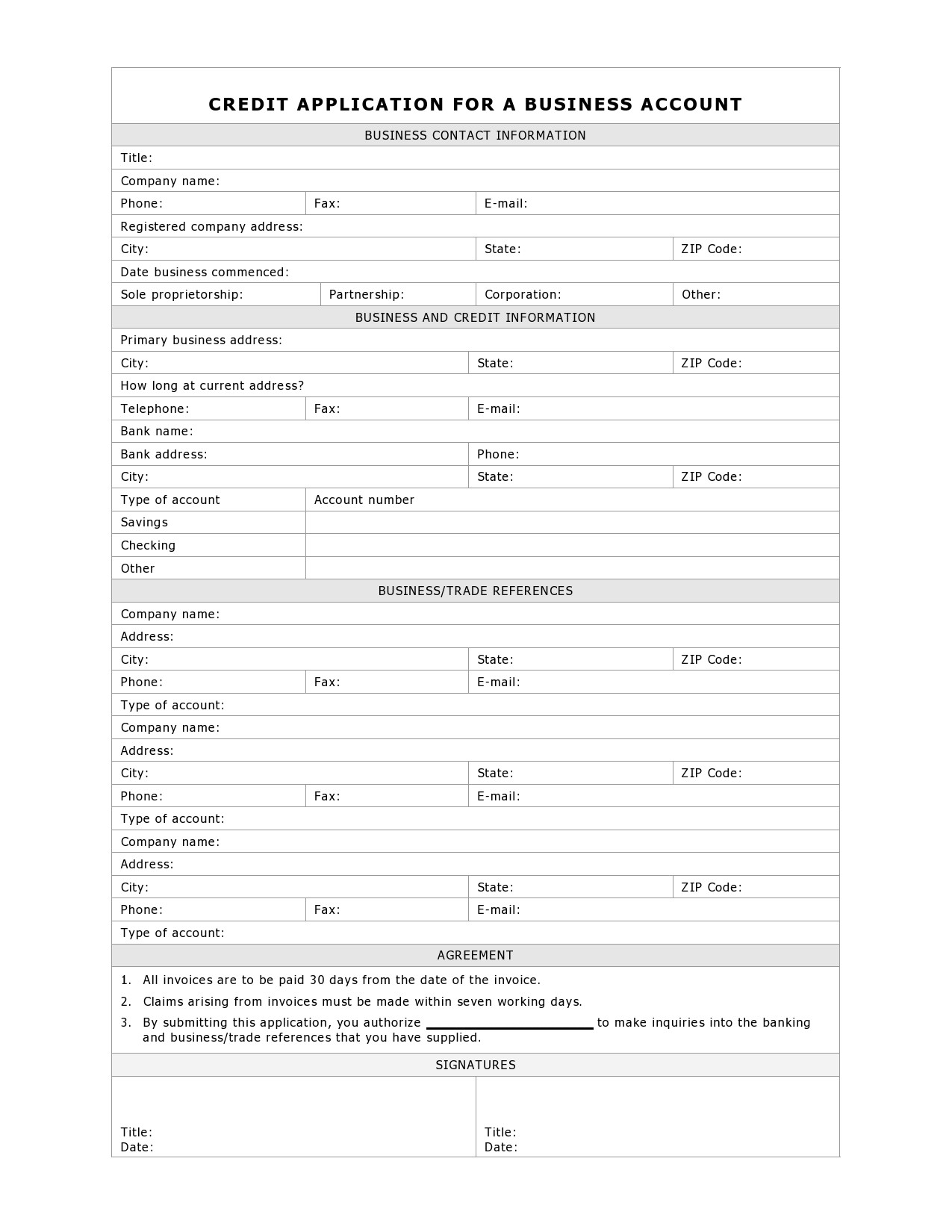

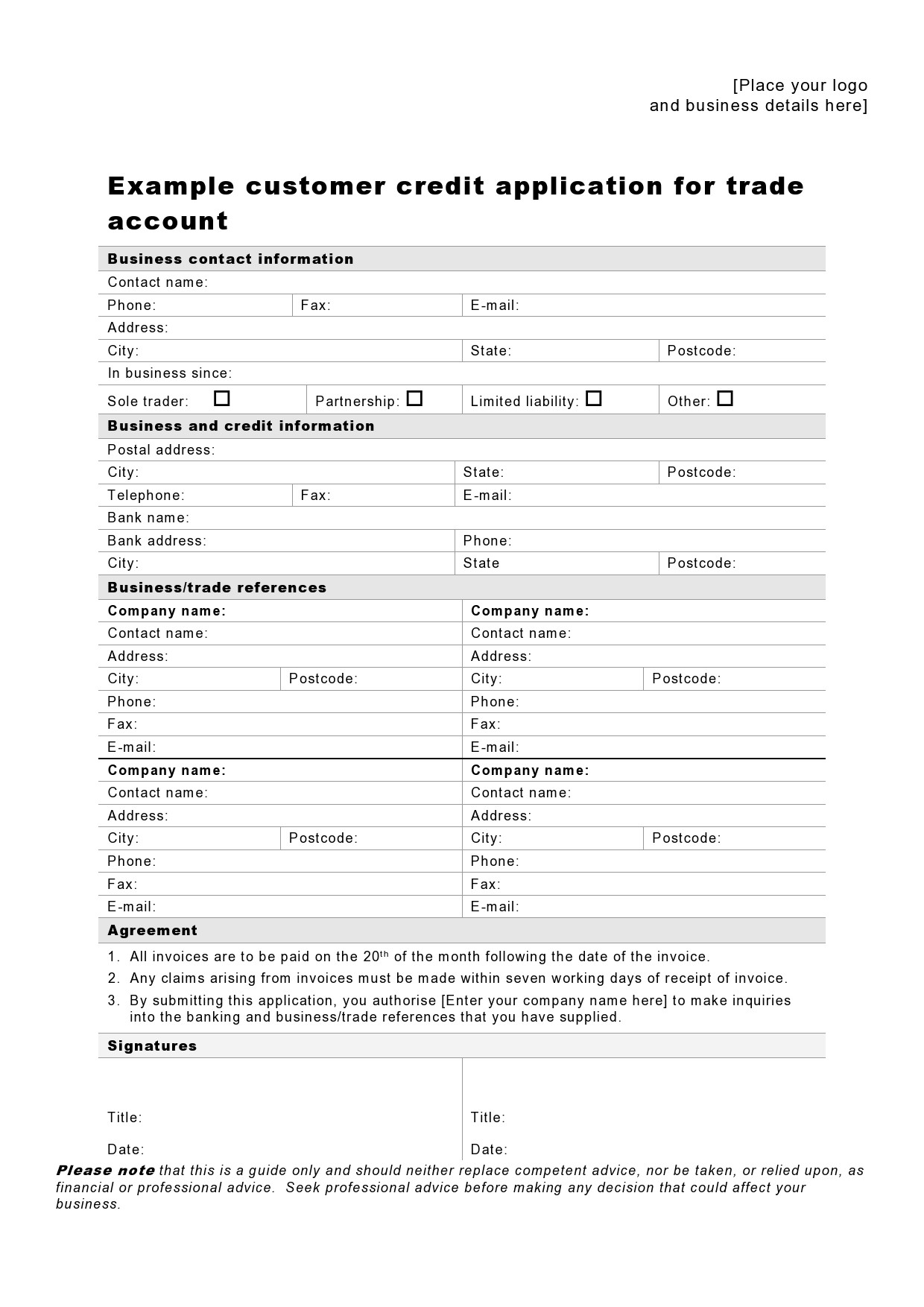

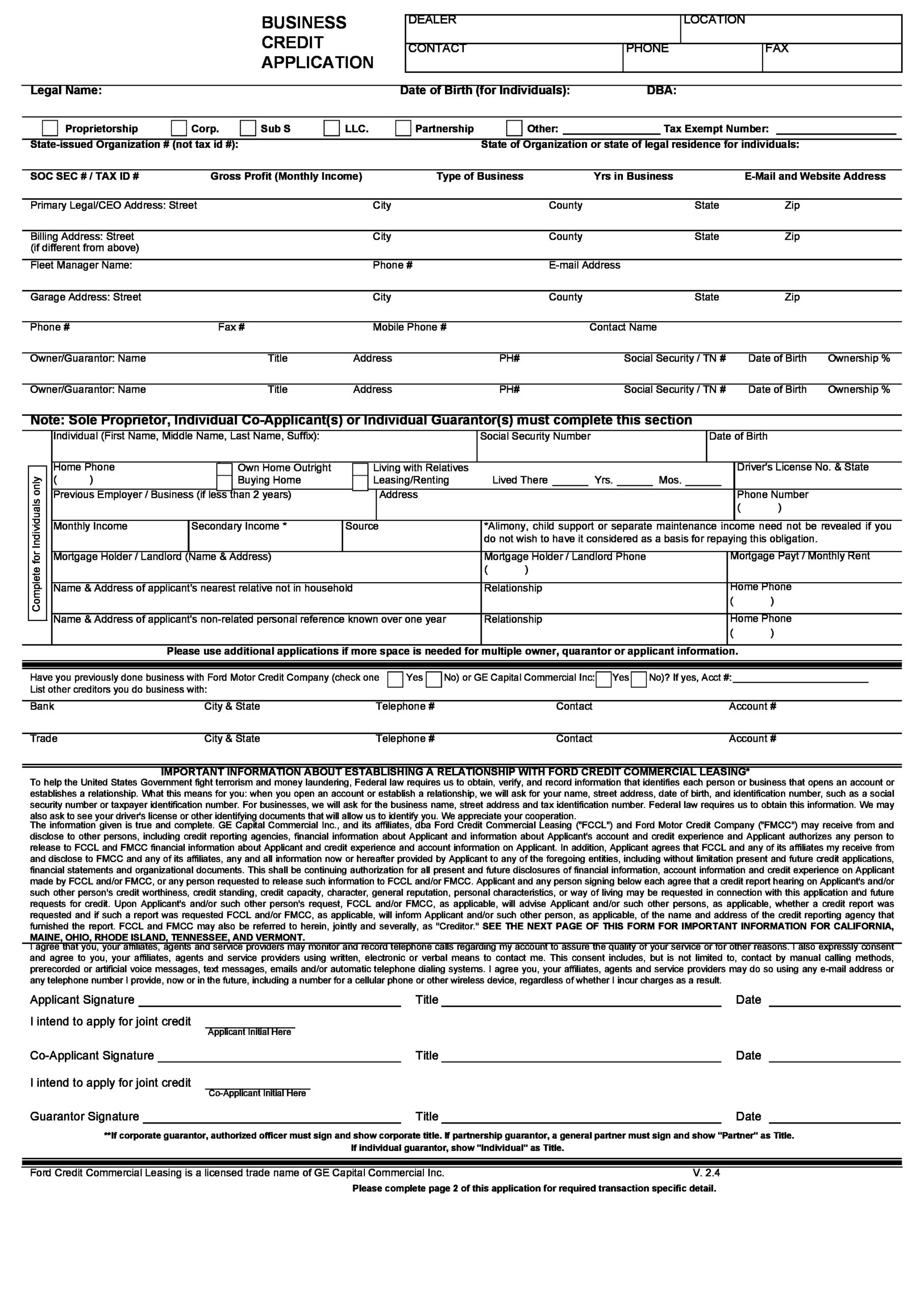

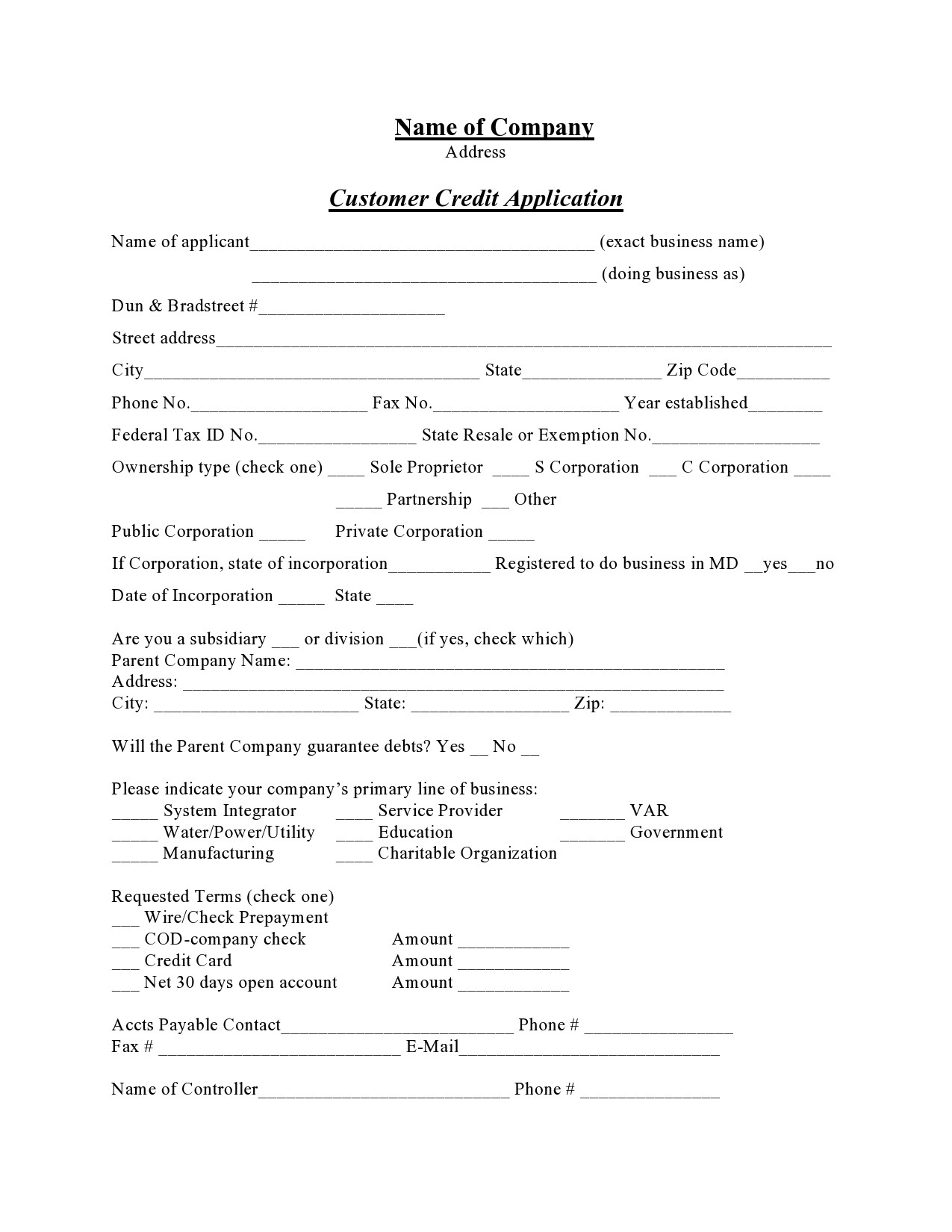

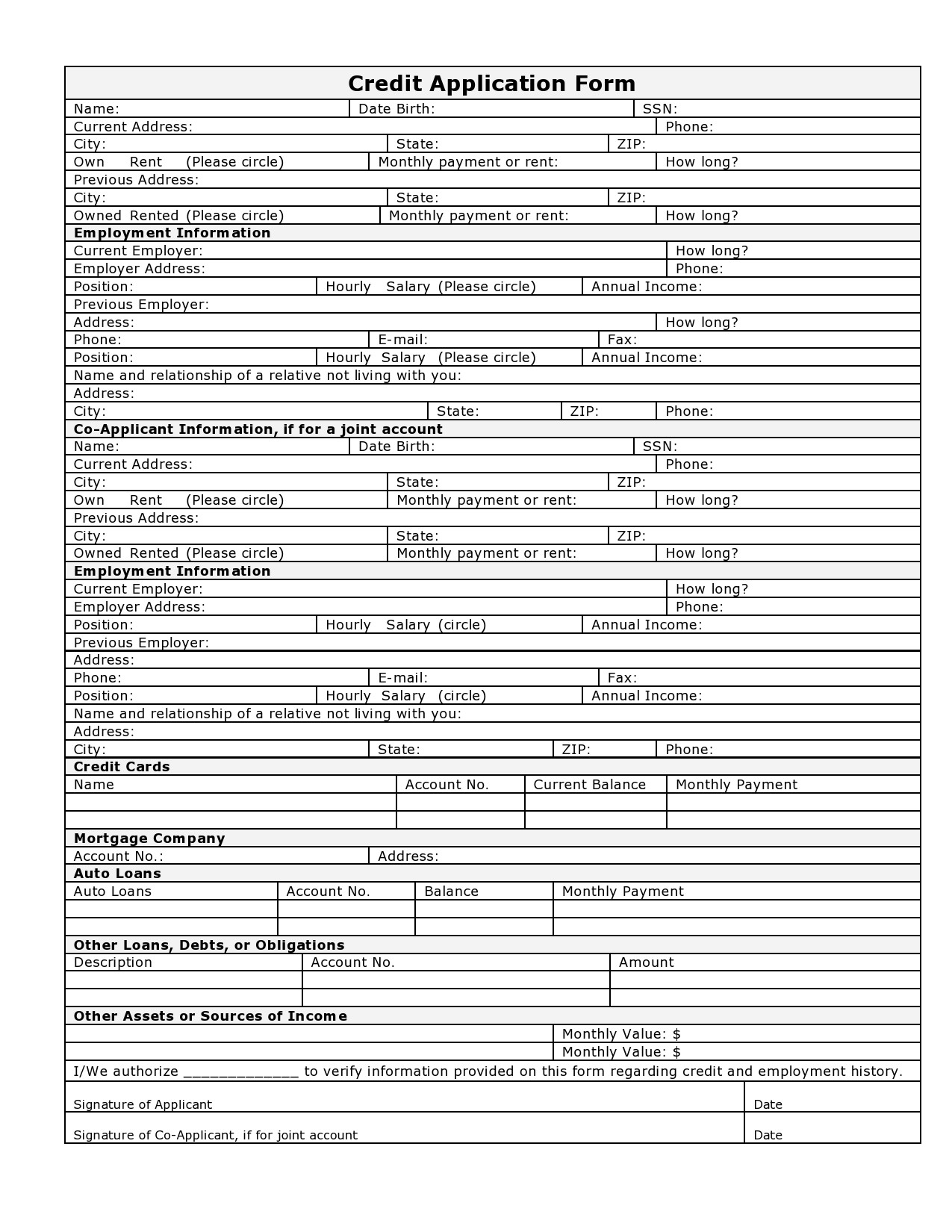

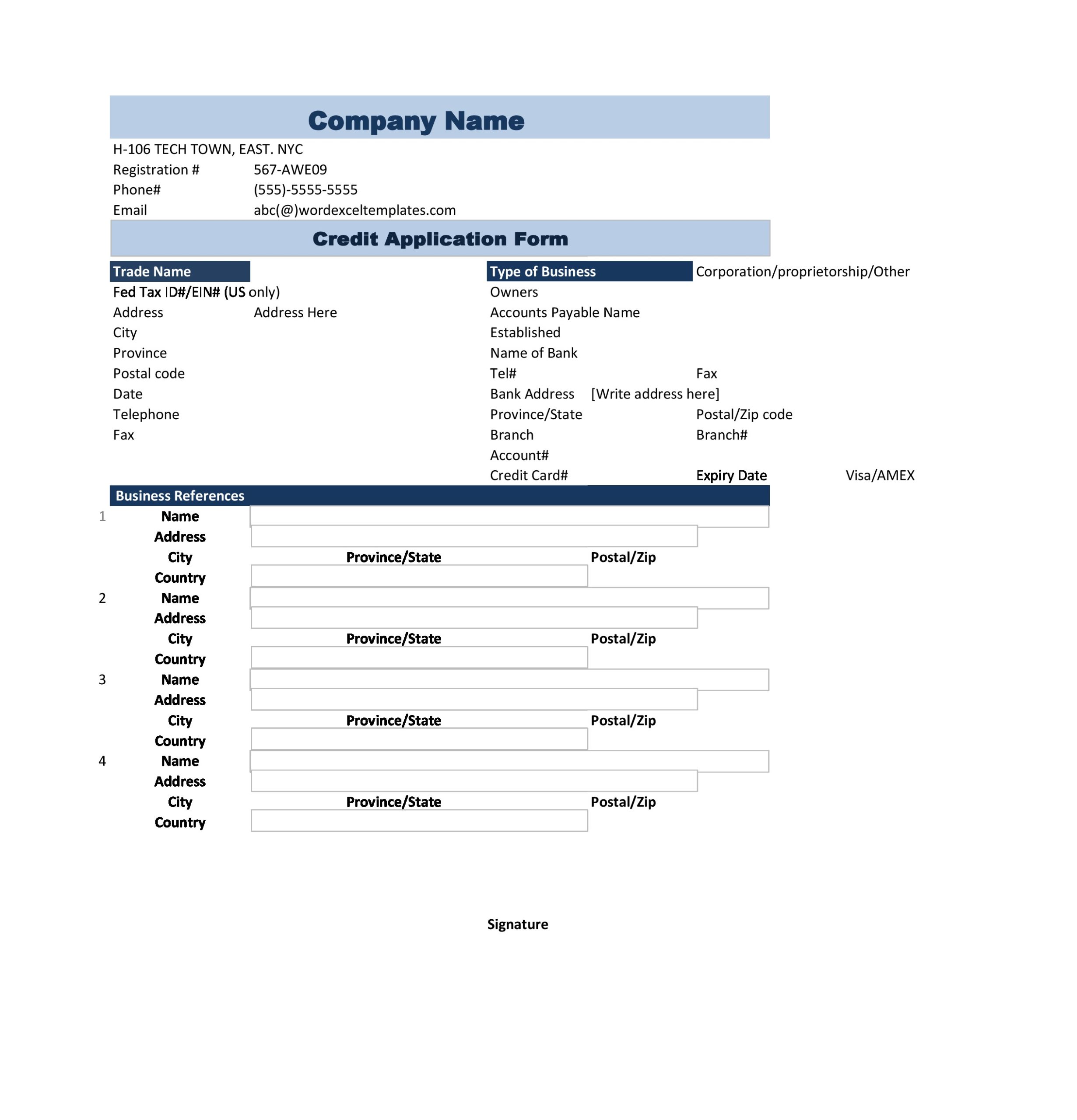

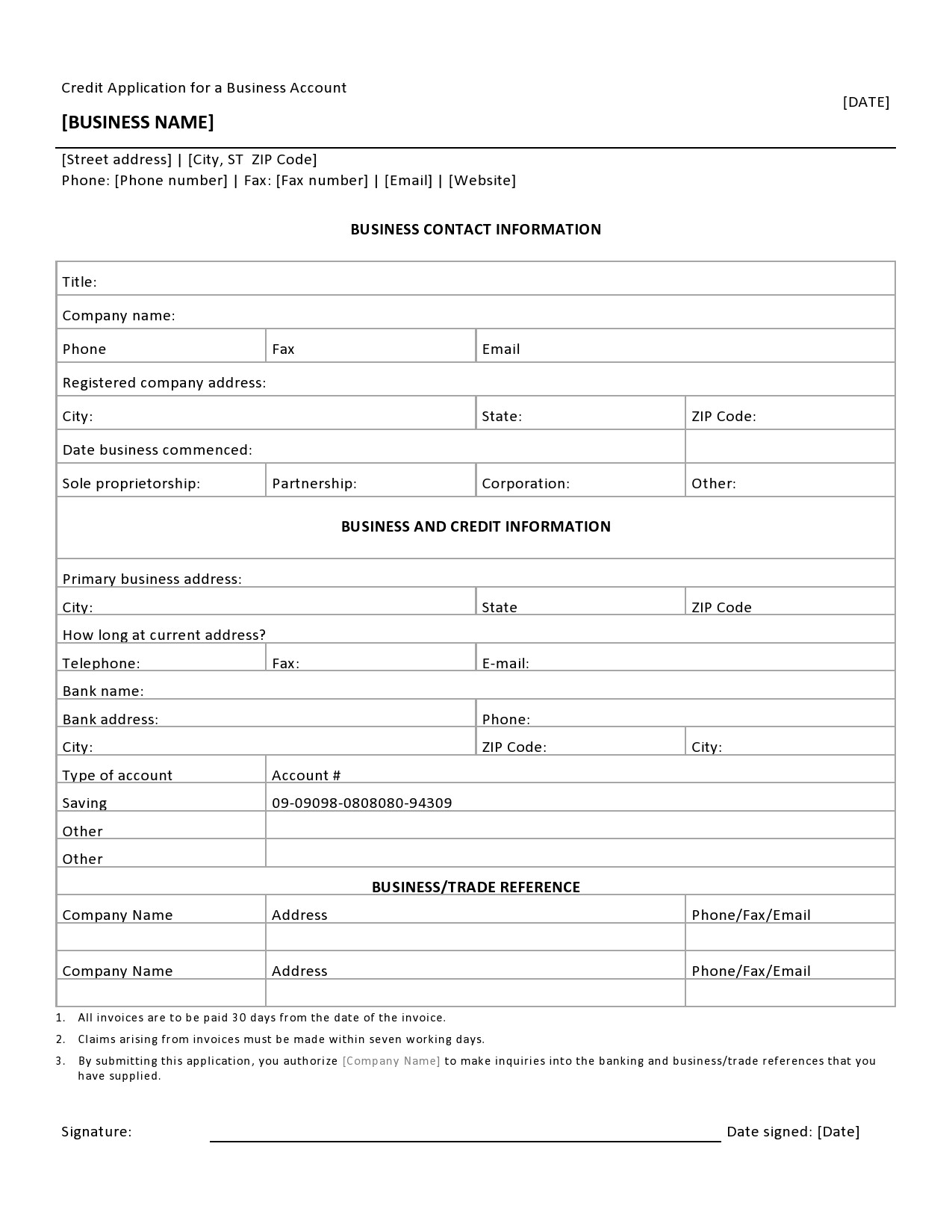

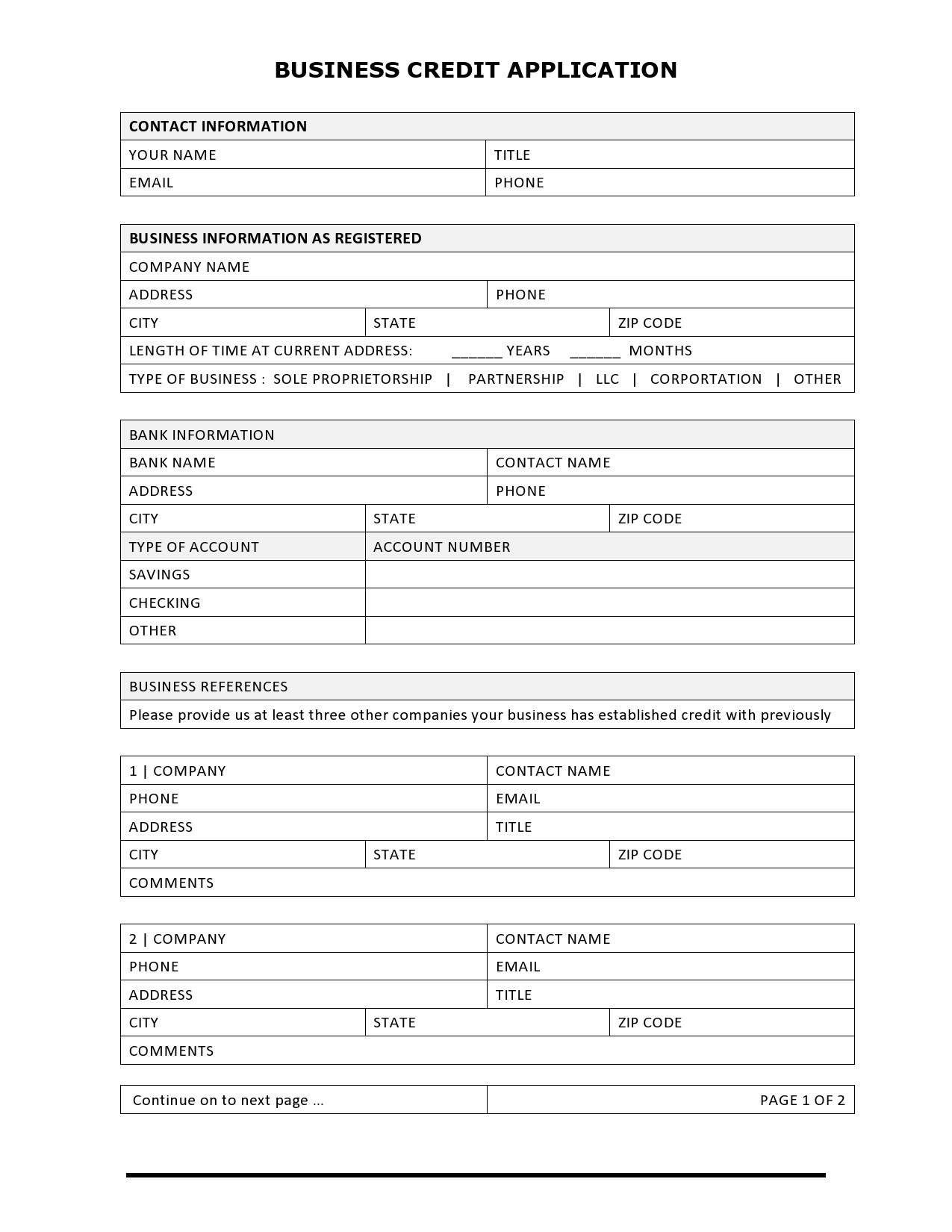

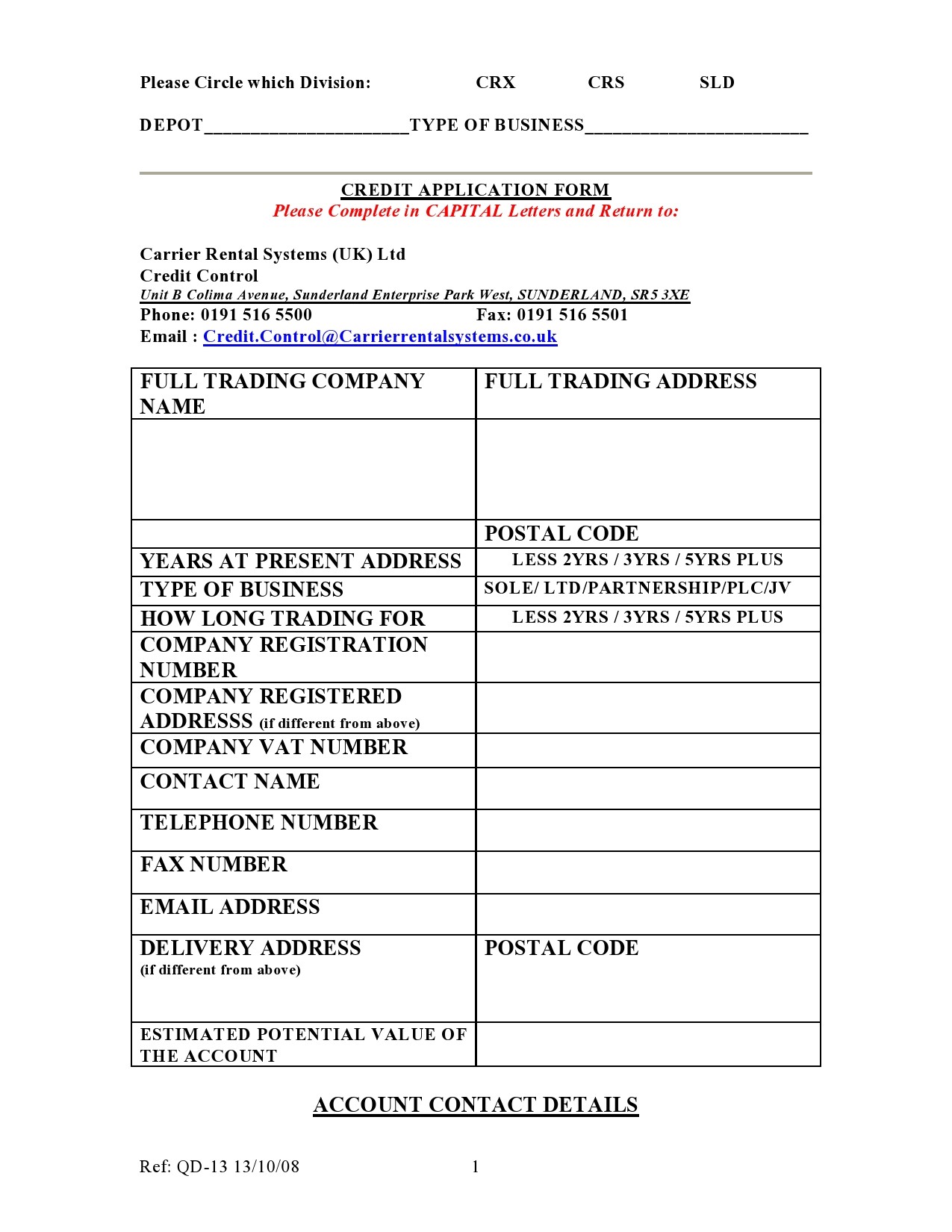

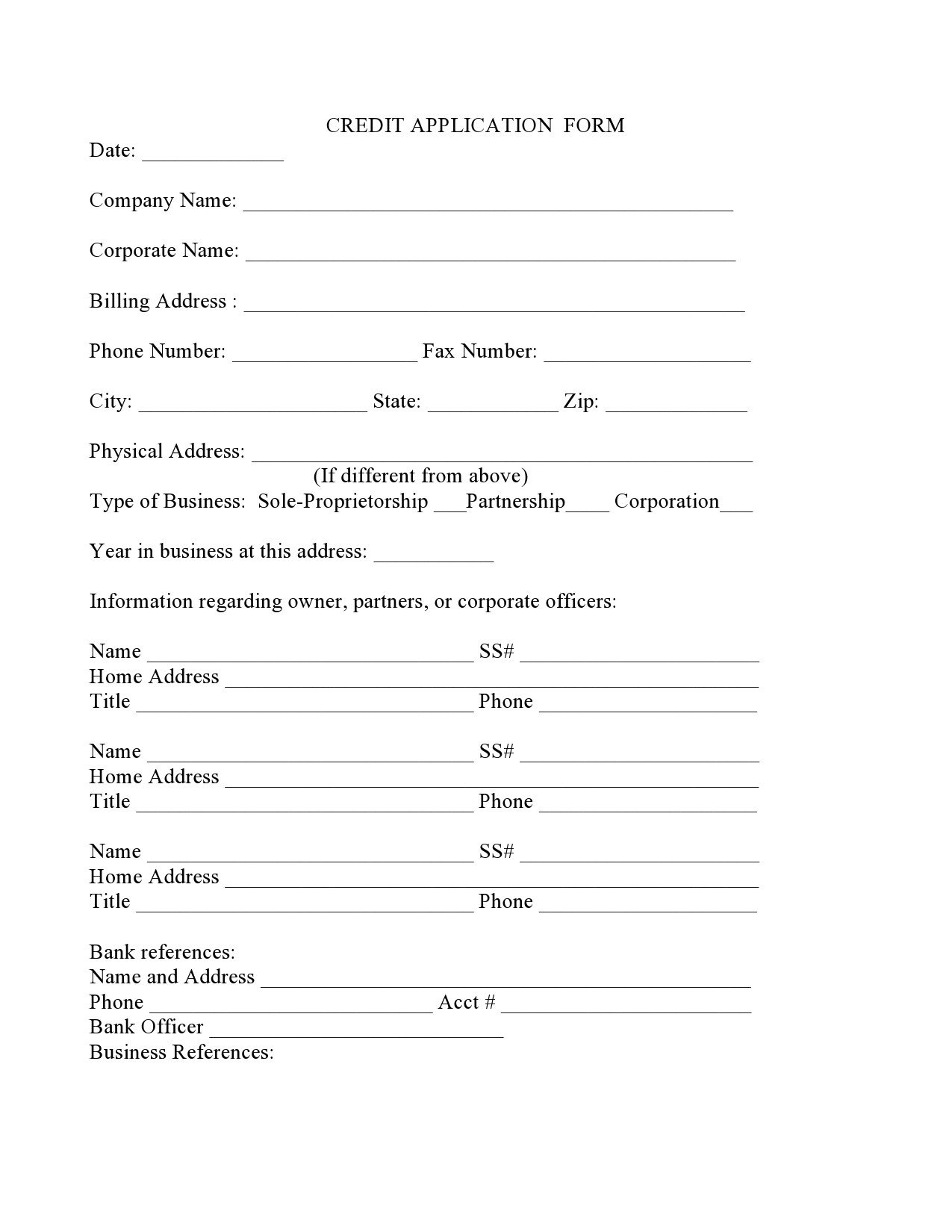

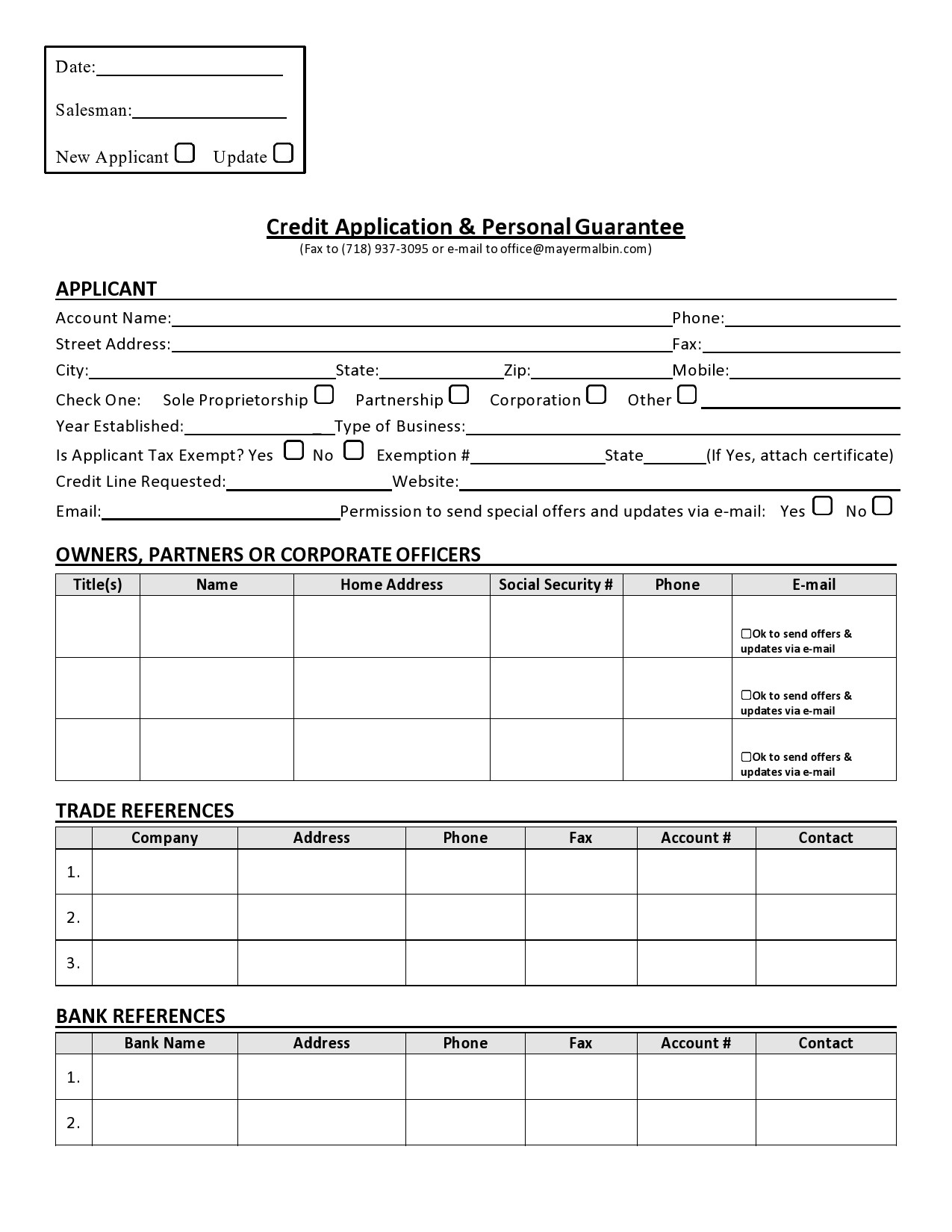

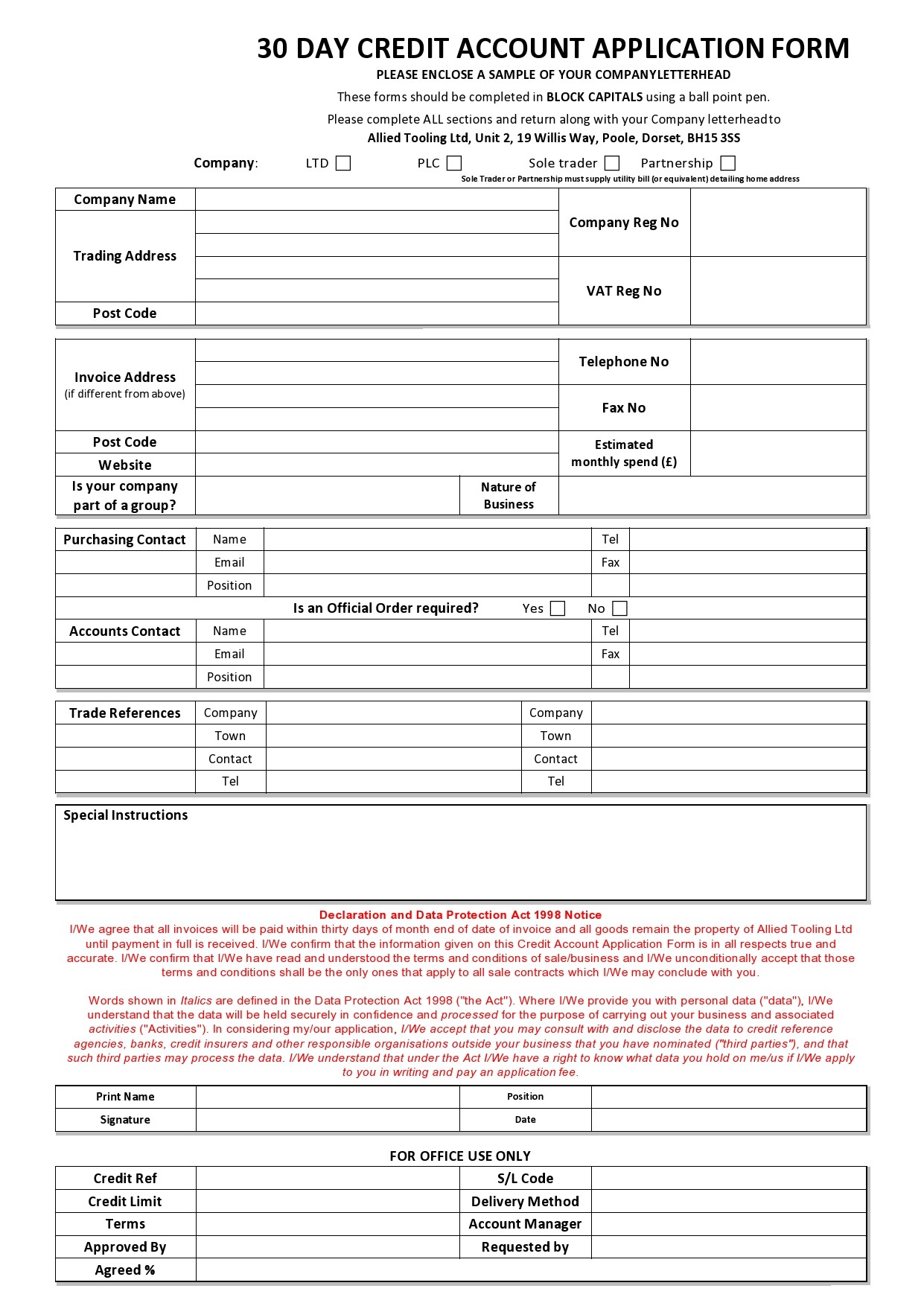

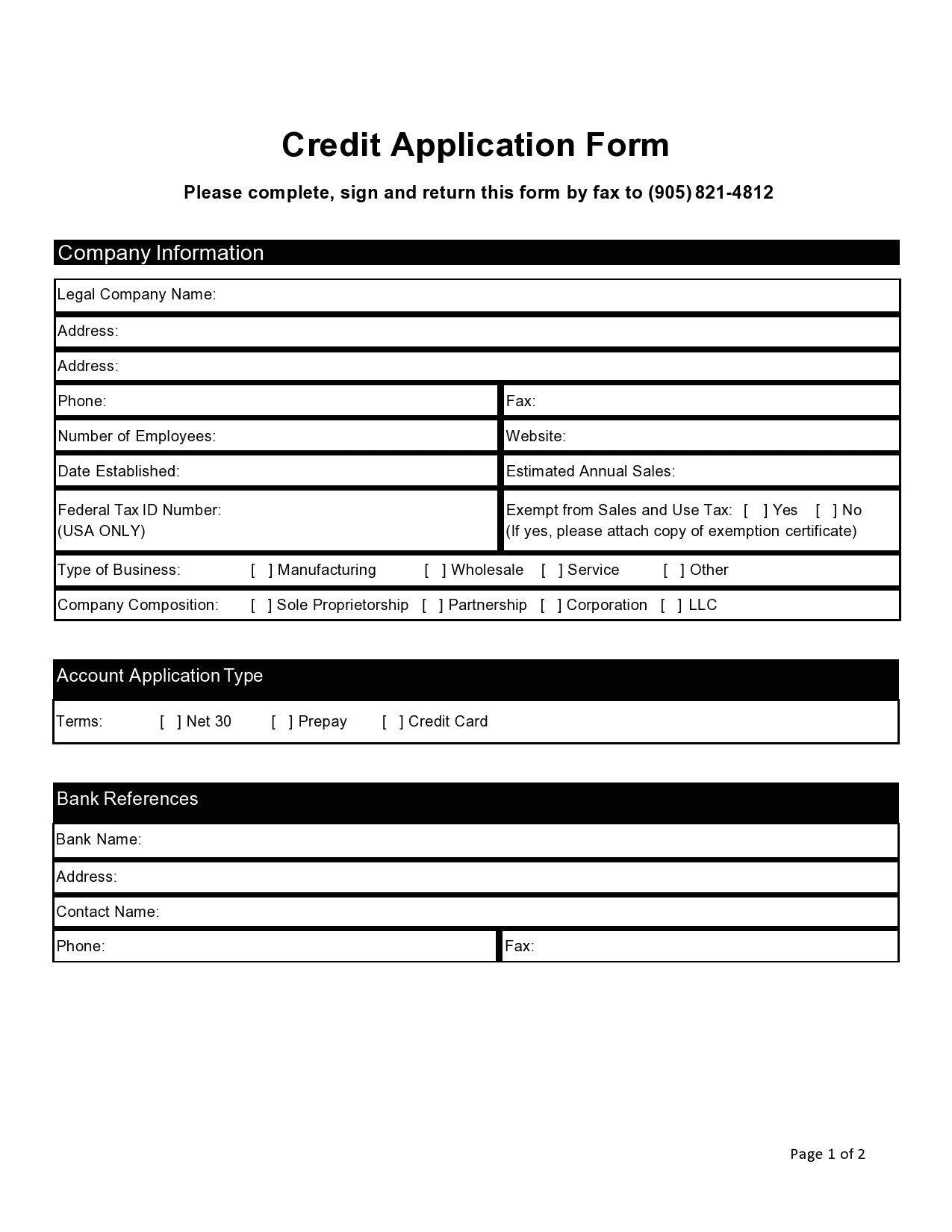

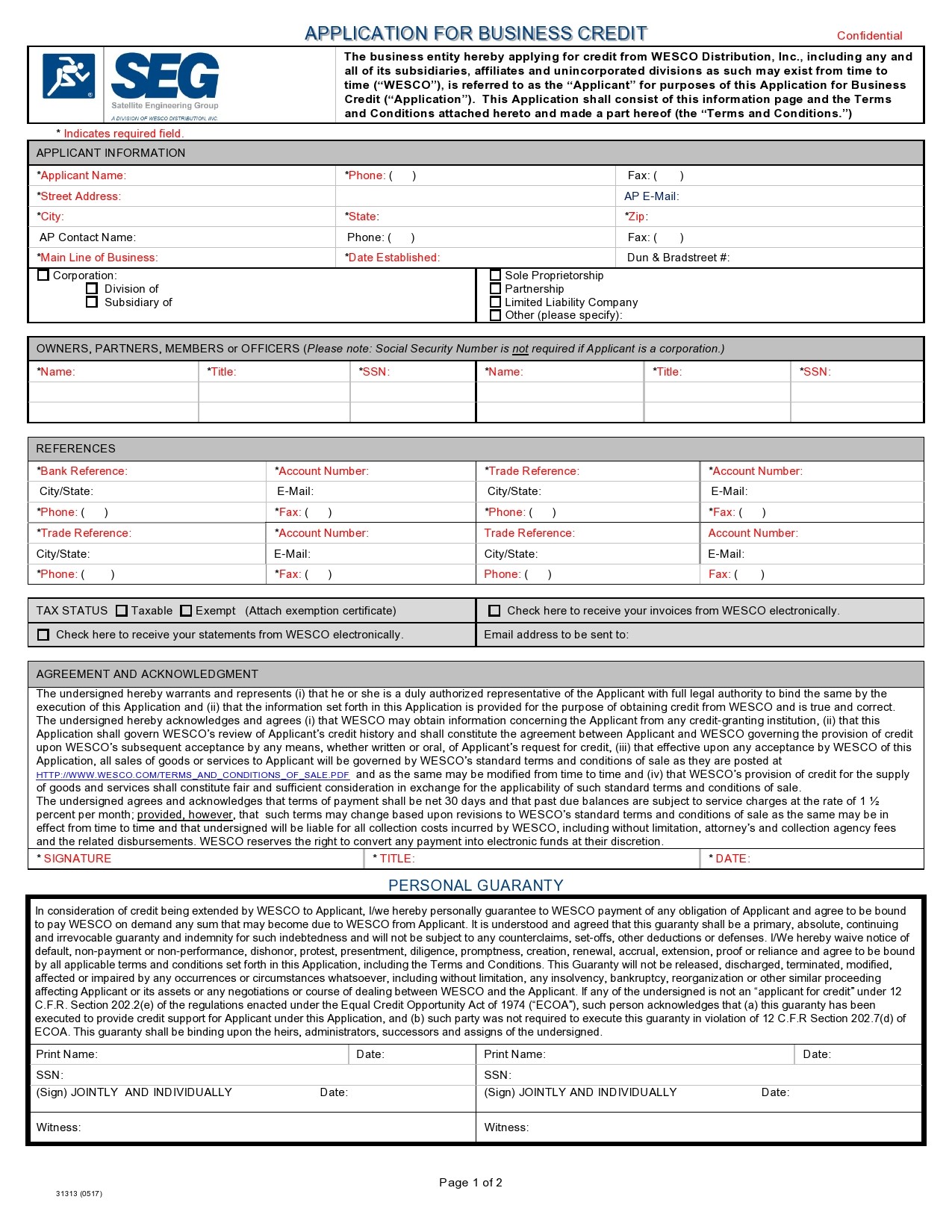

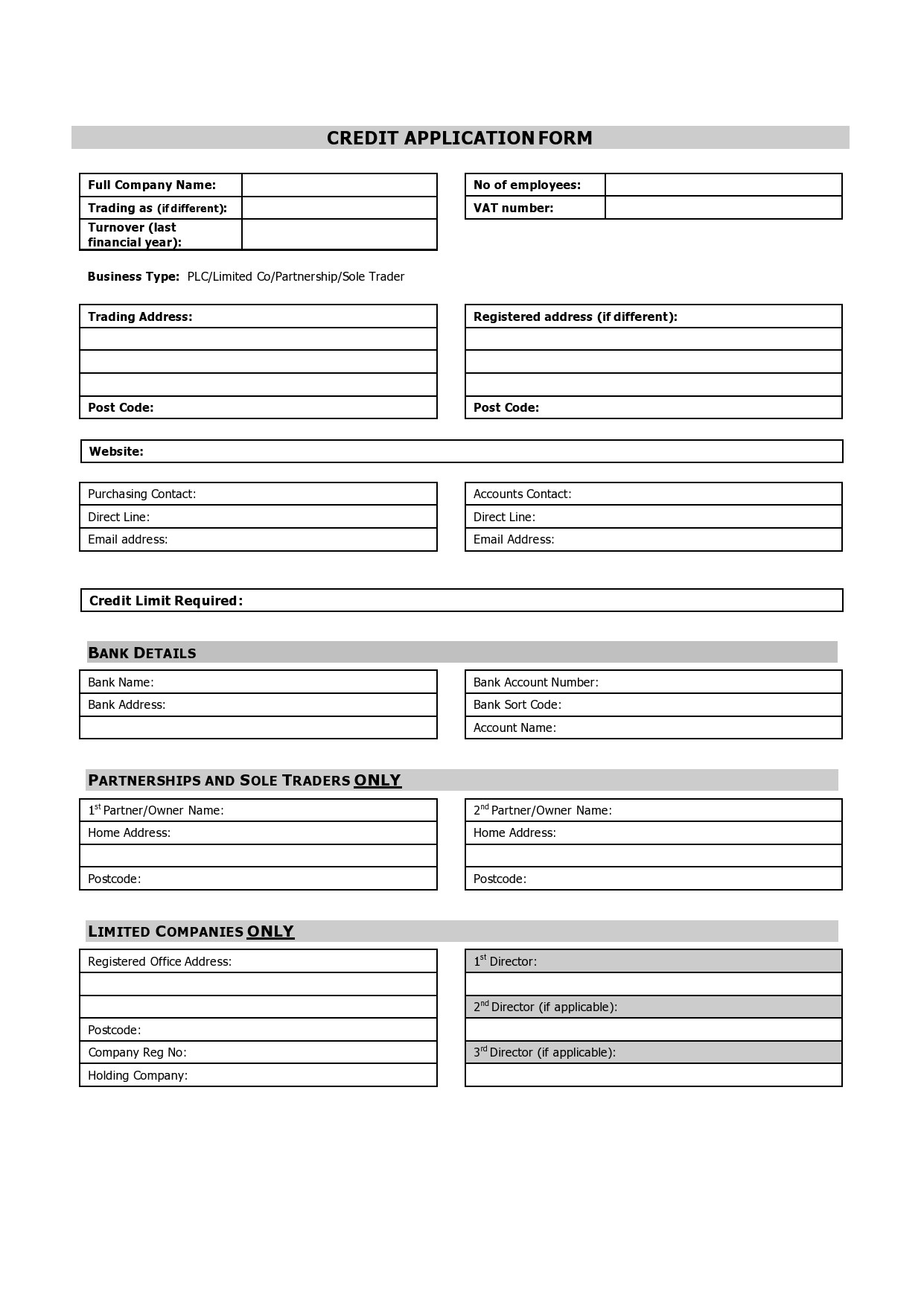

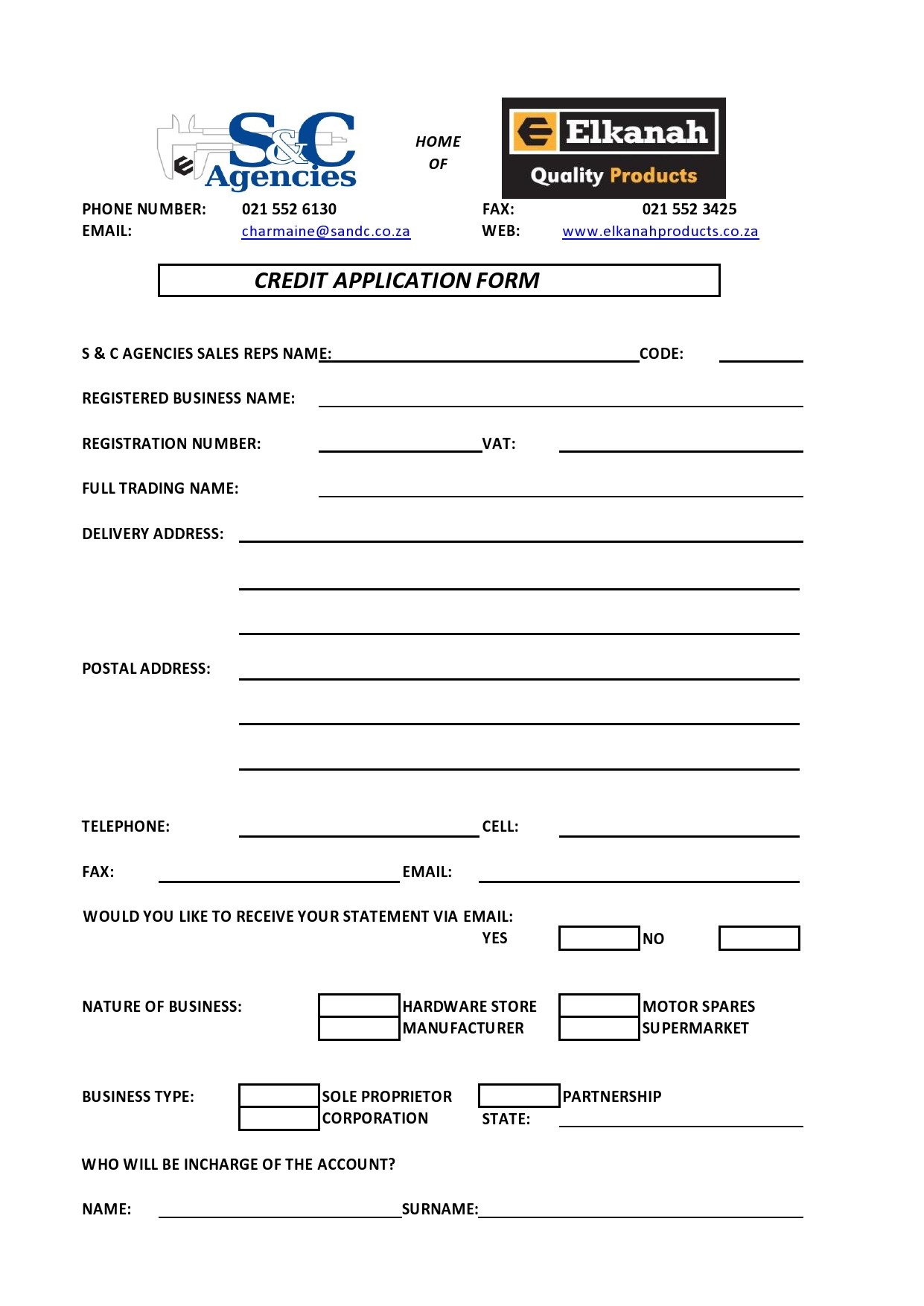

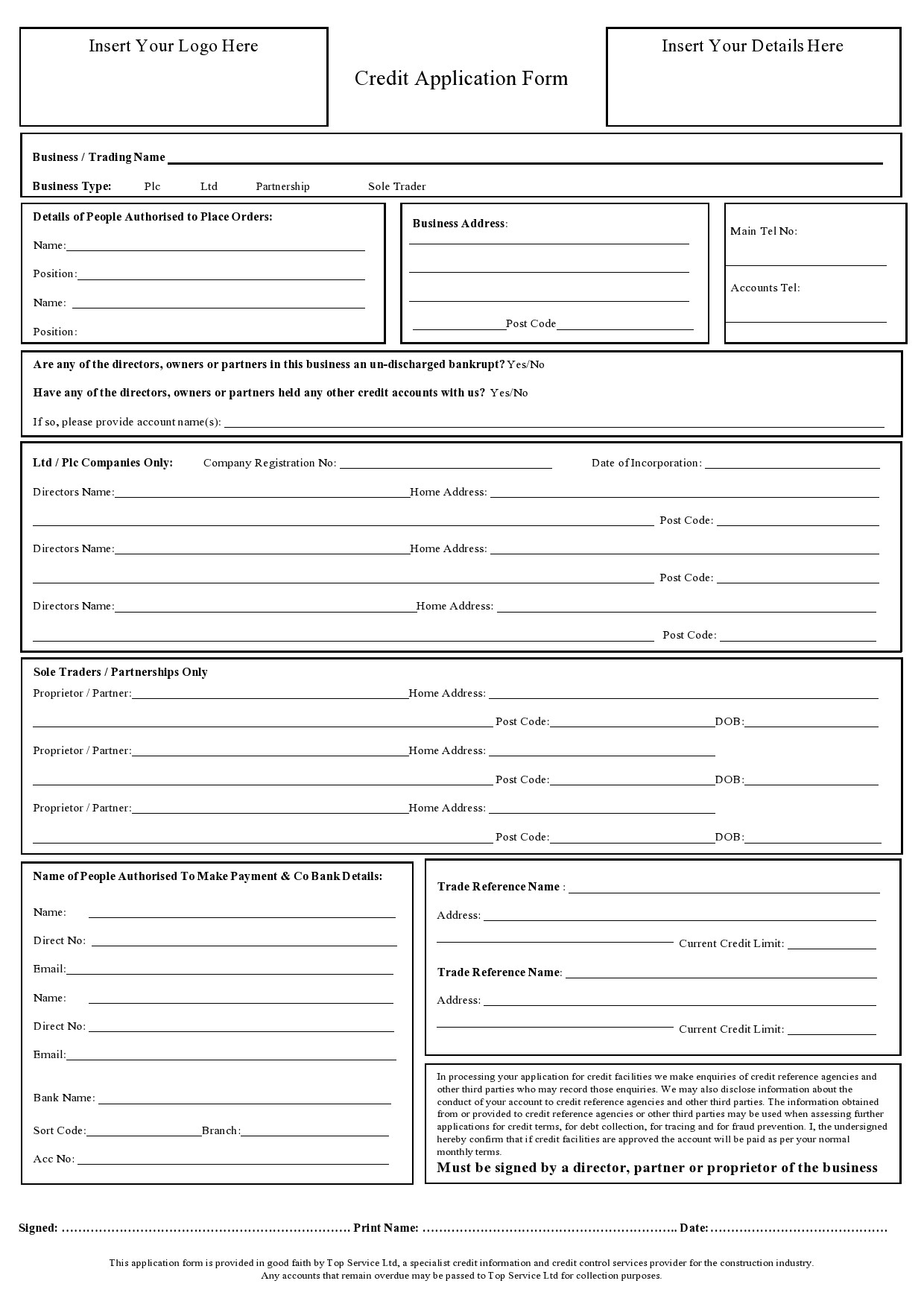

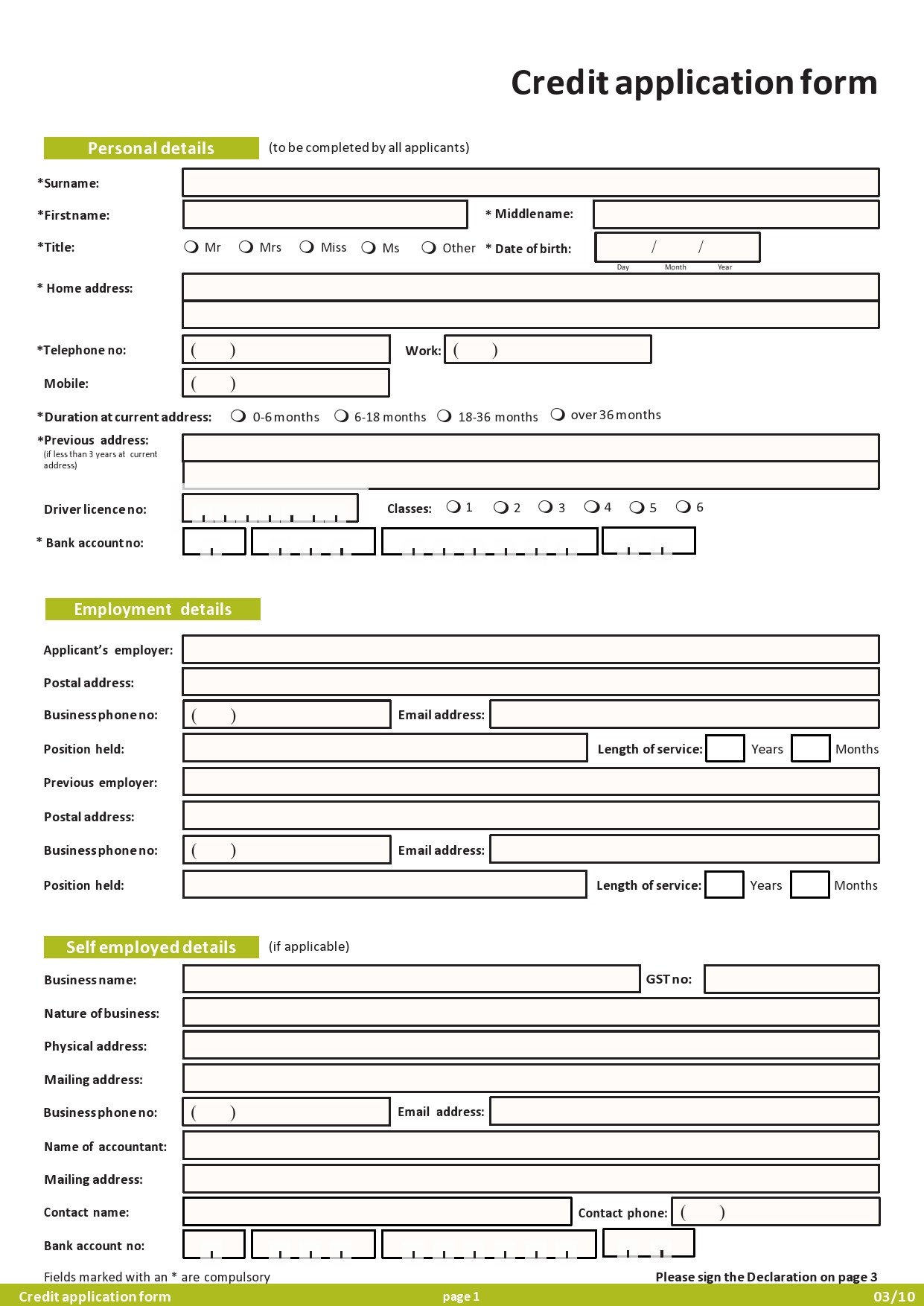

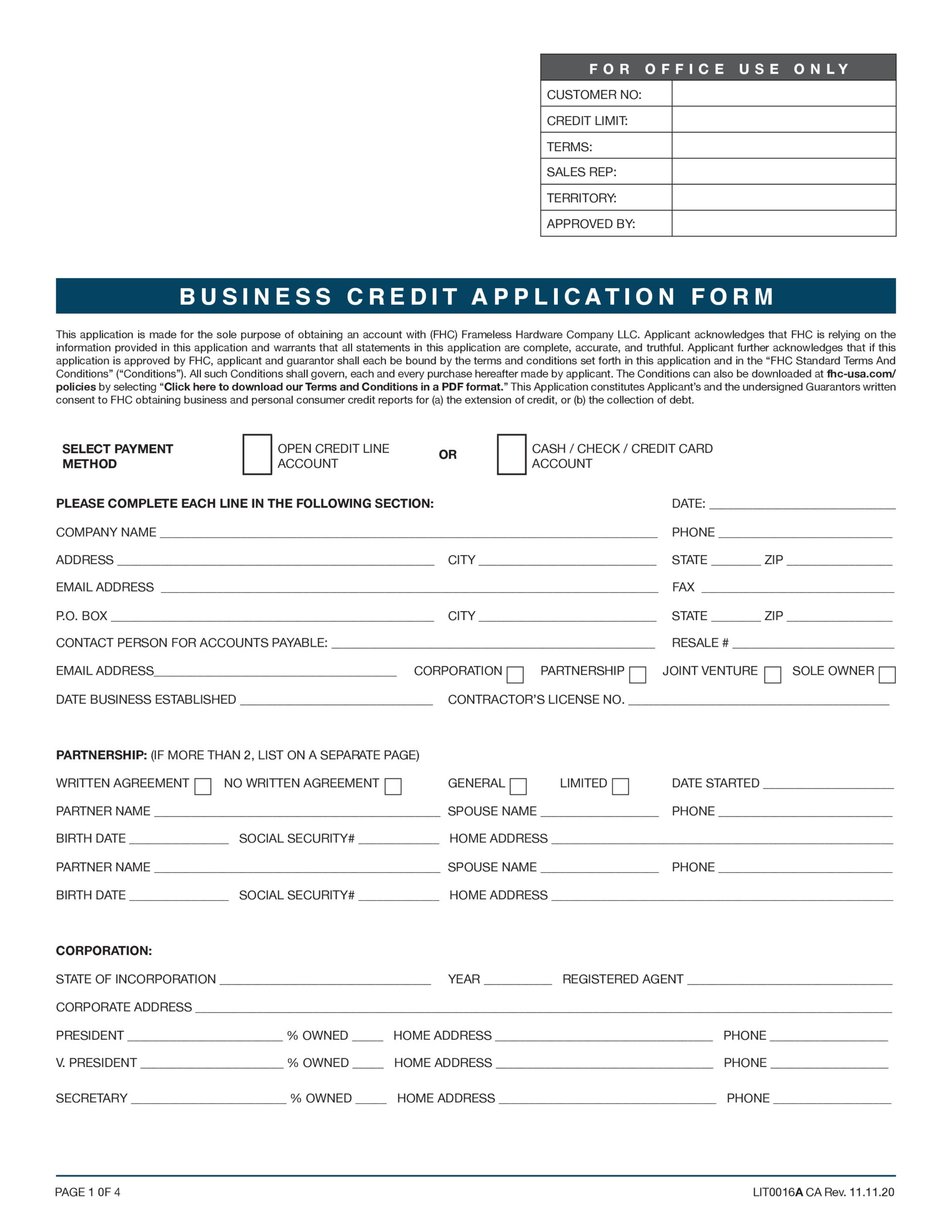

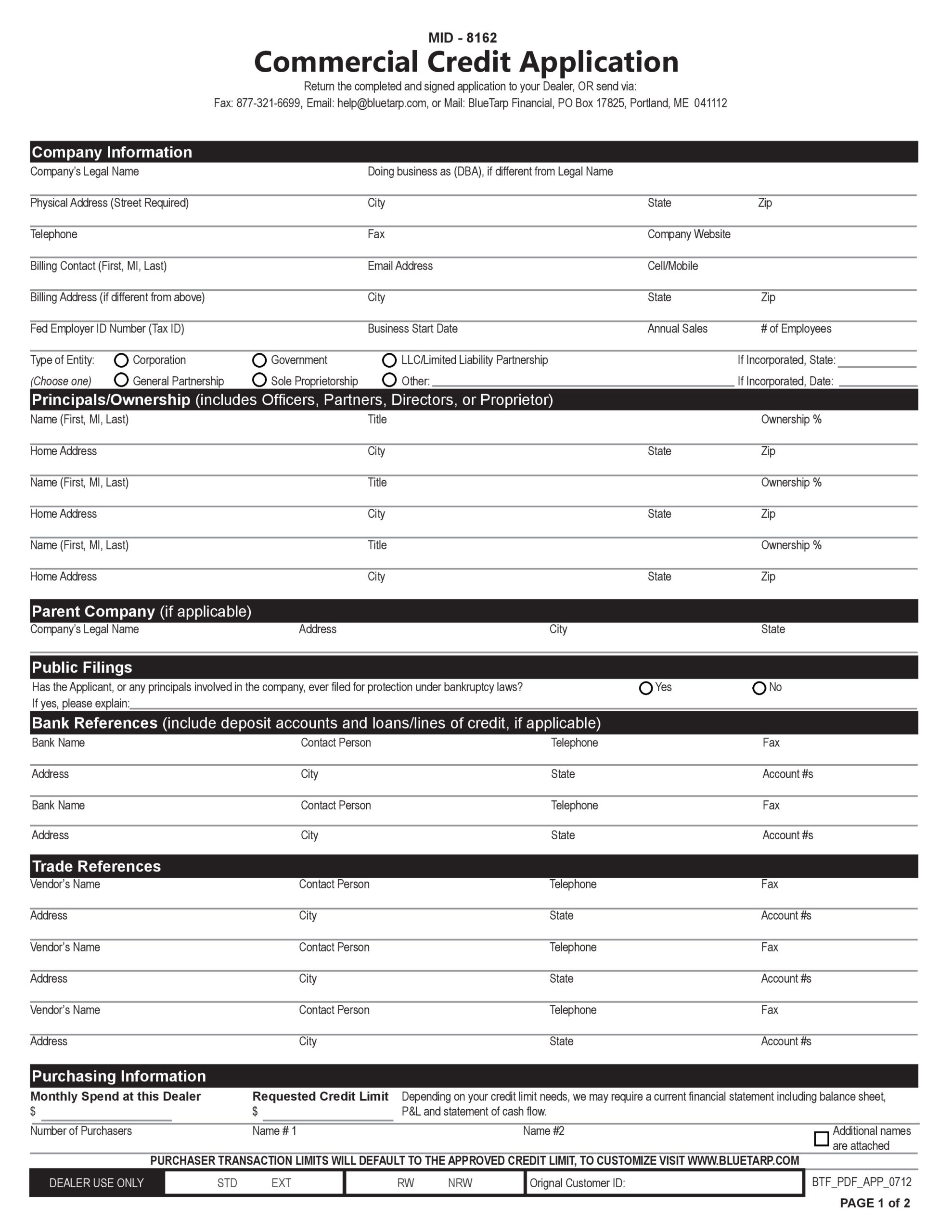

Business Credit Application Forms

What are credit applications?

Credit card applications are usually filed by prospective borrowers then submitted to lenders. There are two ways to submit these applications: through online or offline modes or in person at the premises of the lender.

The credit application must provide all required details without which the lender cannot proceed with the process. There are some lenders who charge a small fee to process a business credit application irrespective of what you plan to use the loan for, it’s a requirement that you submit this application.

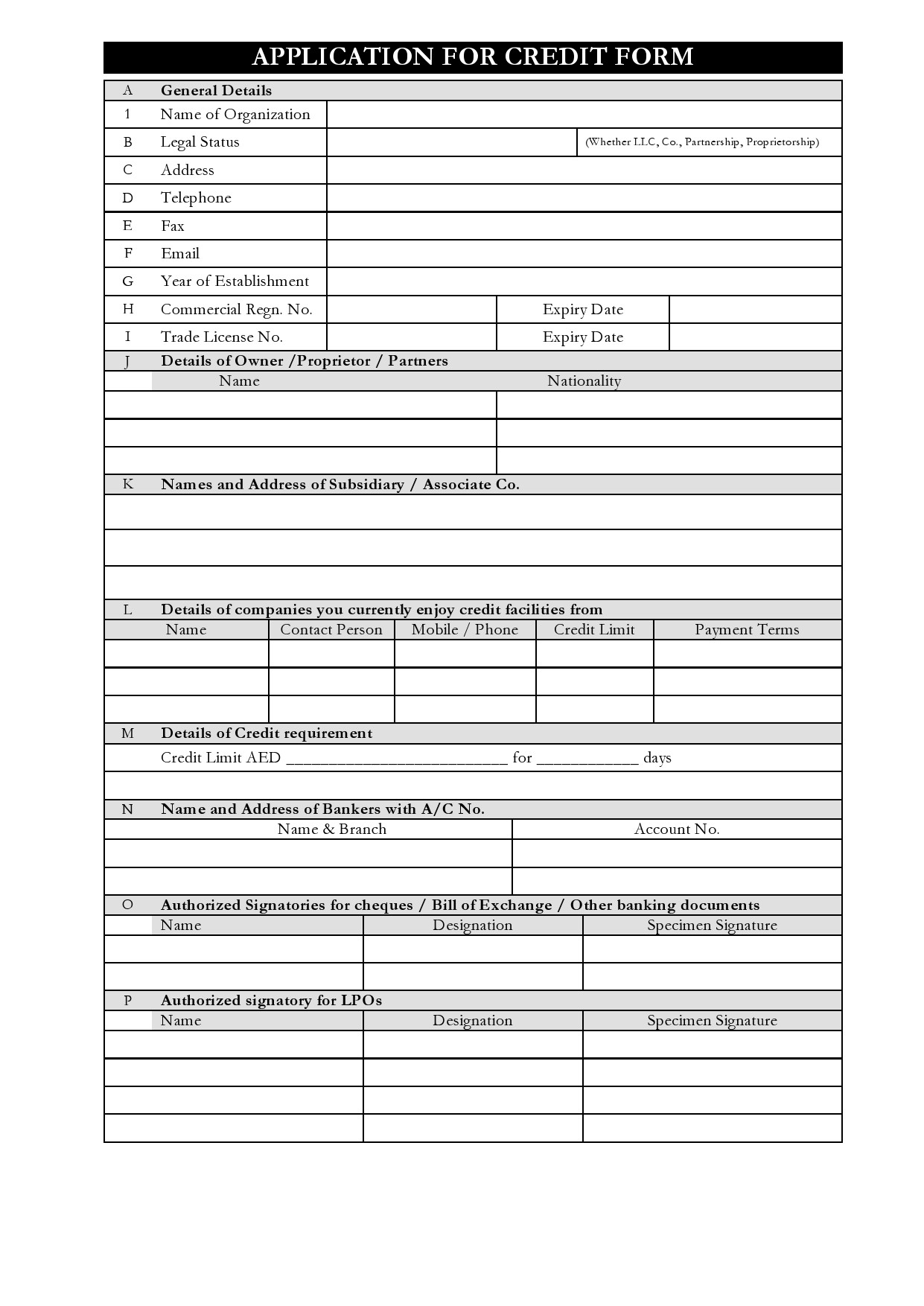

Business Credit Application Templates

What to include?

Presenting a business credit application is crucial in helping lenders manage and evaluate credit risks. If used correctly, lenders can identify companies to watch out for when extending credit.

Most companies rarely use business credit application templates and the few who do, usually won’t follow-up on these after filing or ask for additional information needed to completely understand the risk involved.

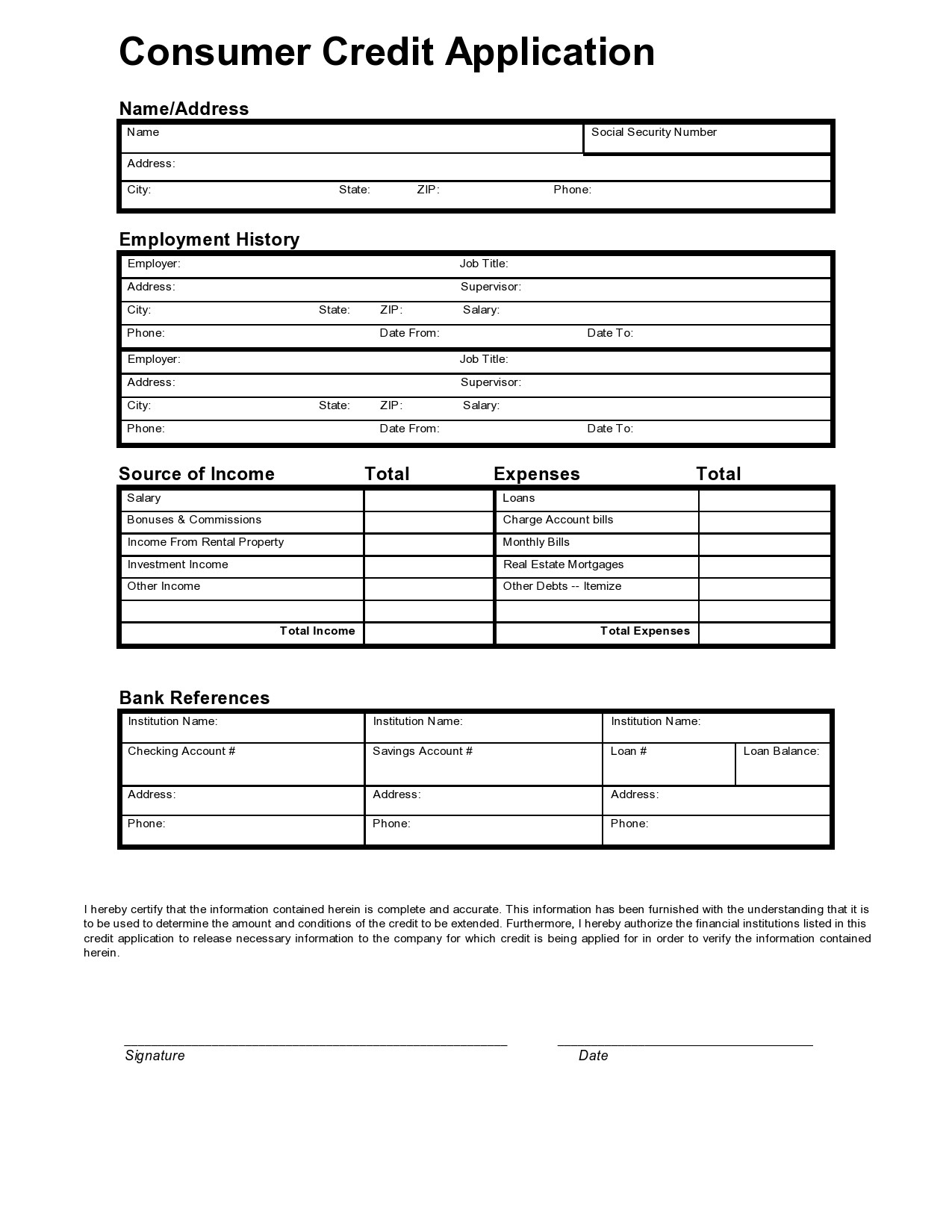

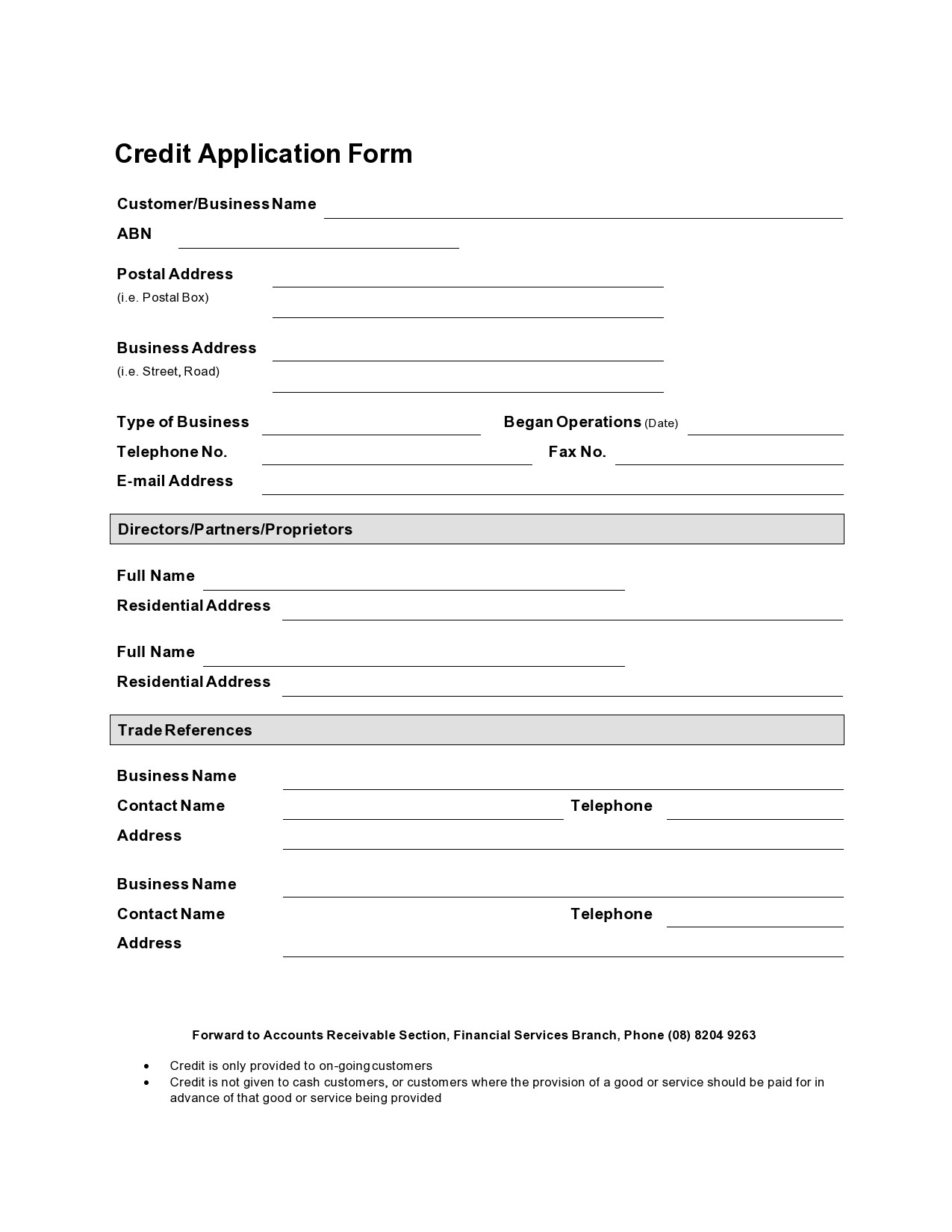

Your business or commercial credit application form can be as complex or as simple as you want it to be. In this form, you must include this information:

- The name of your business

- The address of your business

- Your business’ phone number

- The names of the principals

- The addresses of the principals

- The Social Security numbers of the principals

- The type of business you own

- The industry your business is in

- The number of employees your business has

- Trade payment references

- Bank references

- Personal or business bankruptcy history

- Any names under which your company does business

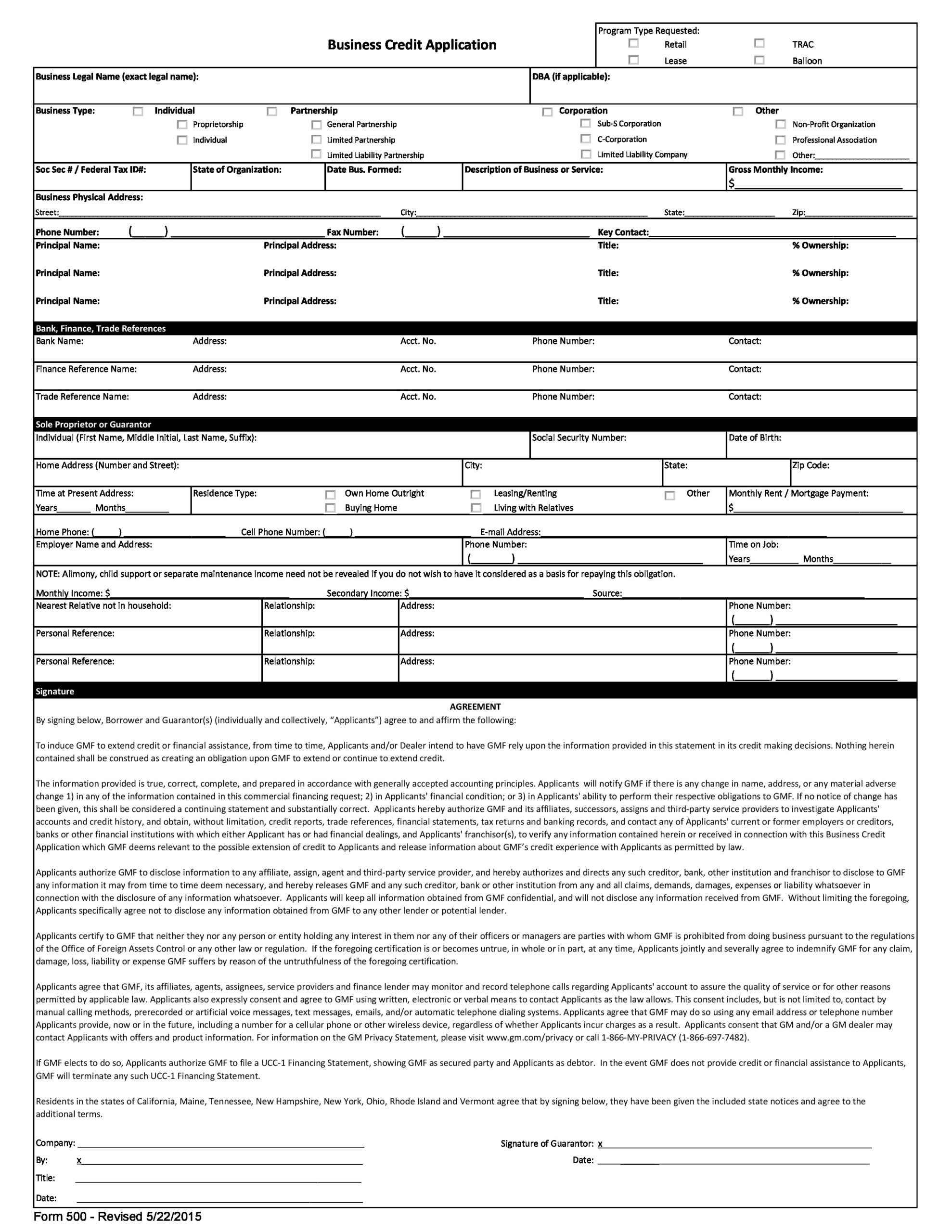

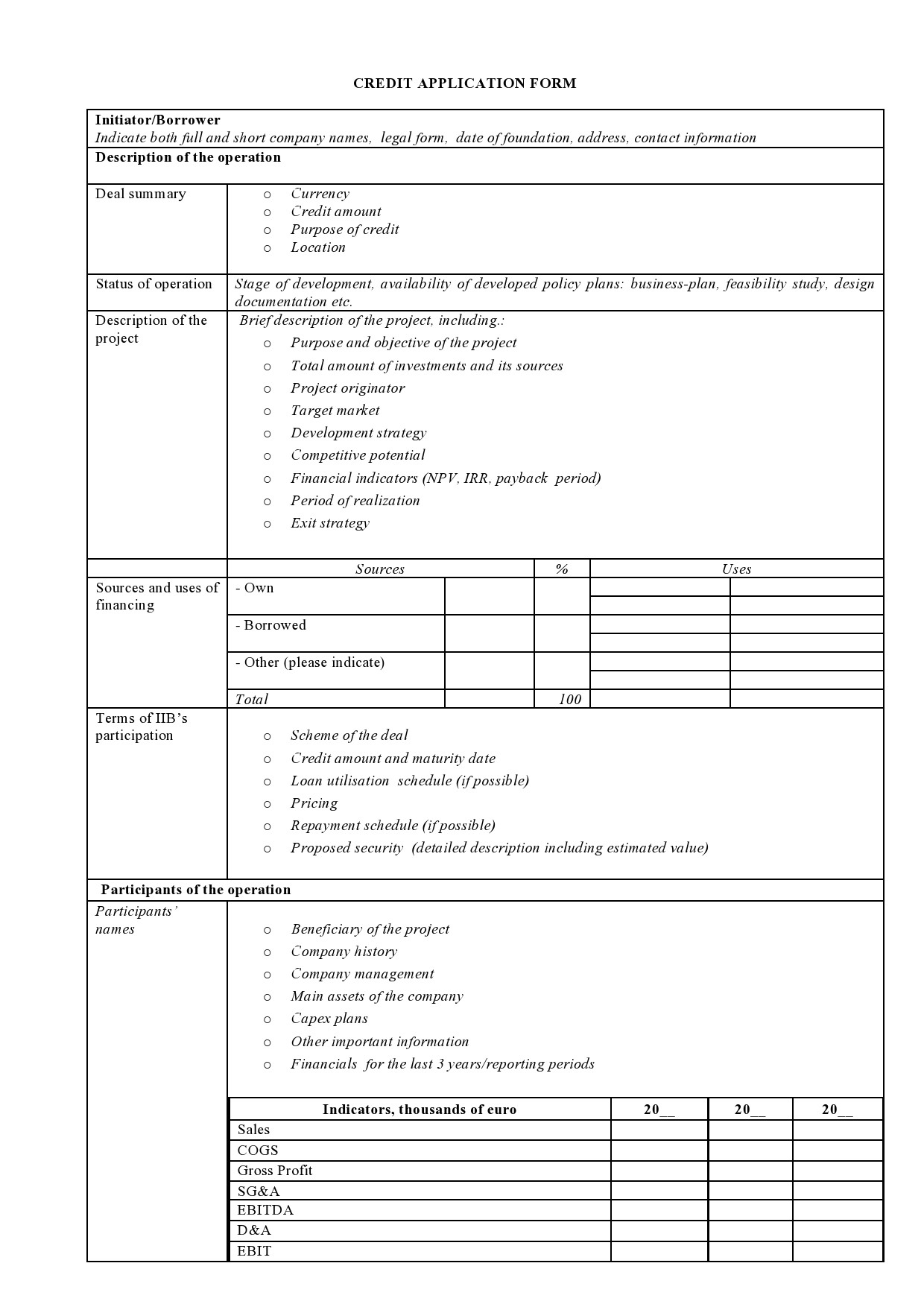

More comprehensive applications give lenders a better idea along with more confidence in their decision on whether to approve your application or not. Logically, you would have to provide more information. Comprehensive applications may ask you to provide financial details for them to assess the following:

- Financial Ratios

- Profitability

- Debt Levels

- Cash Flows

- Industry Evaluation

Lenders who don’t ask for financial information on an application can always purchase a credit report on you, which contains all the information they need. The downside to this is the cost, which could be quite pricey. This is why it’s better to create a comprehensive one than one that’s too simple.

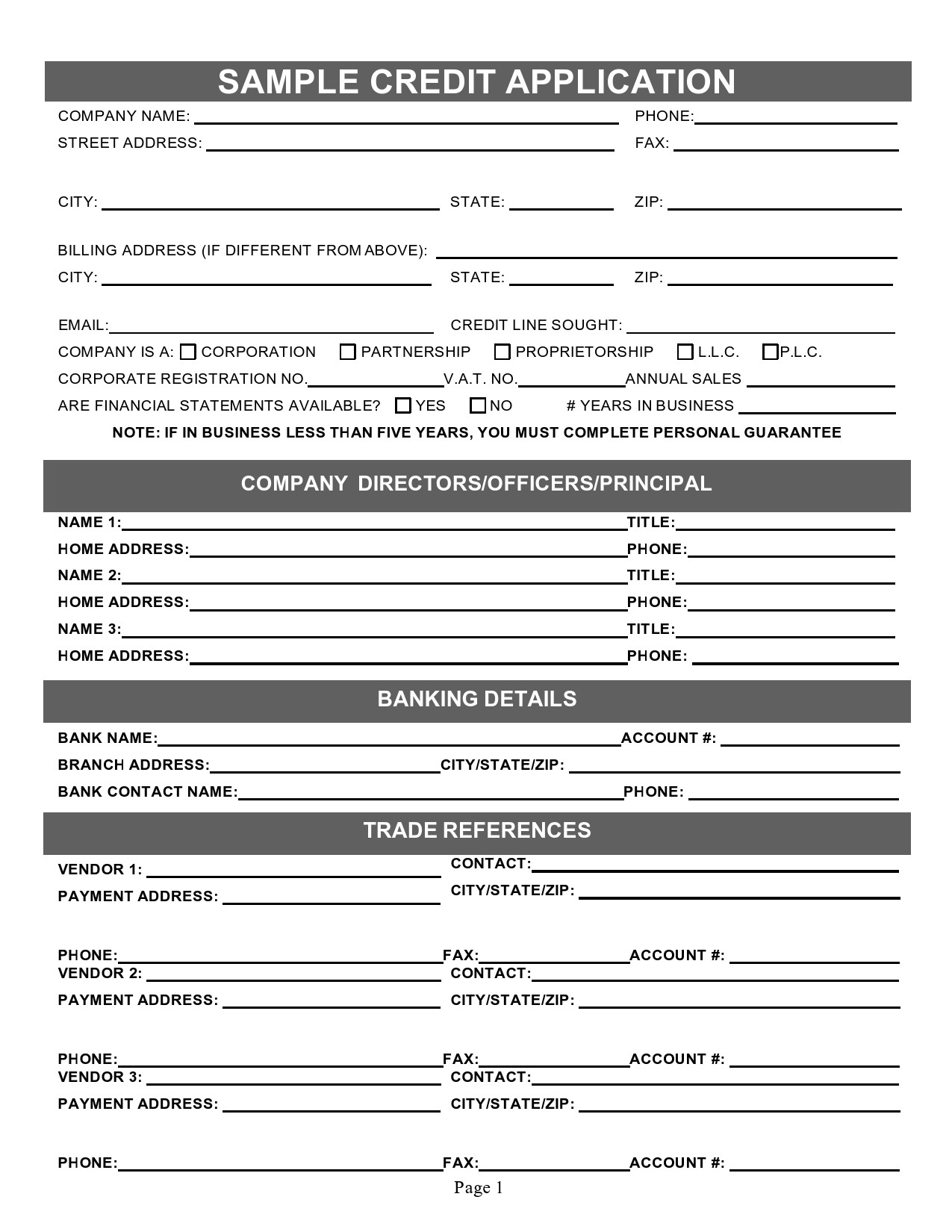

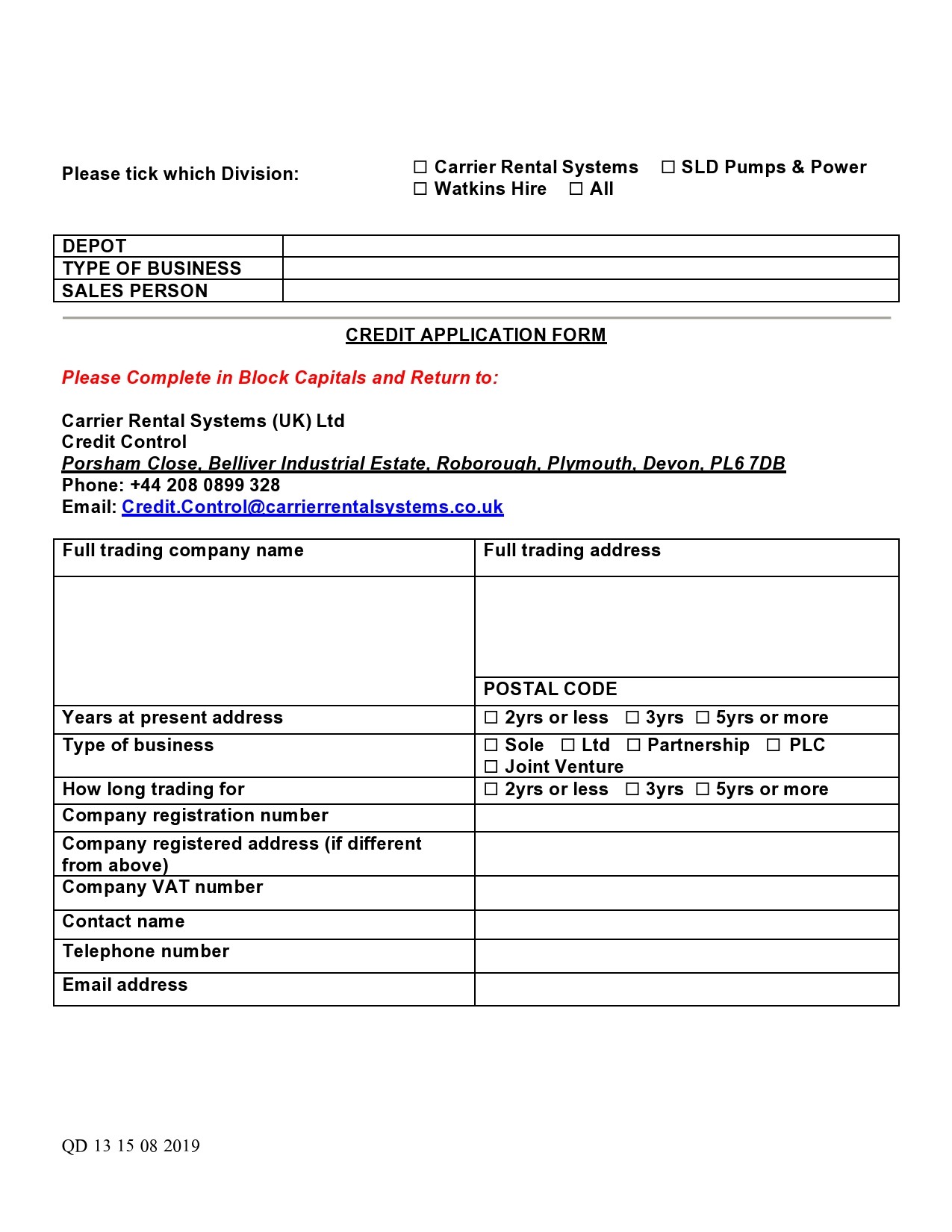

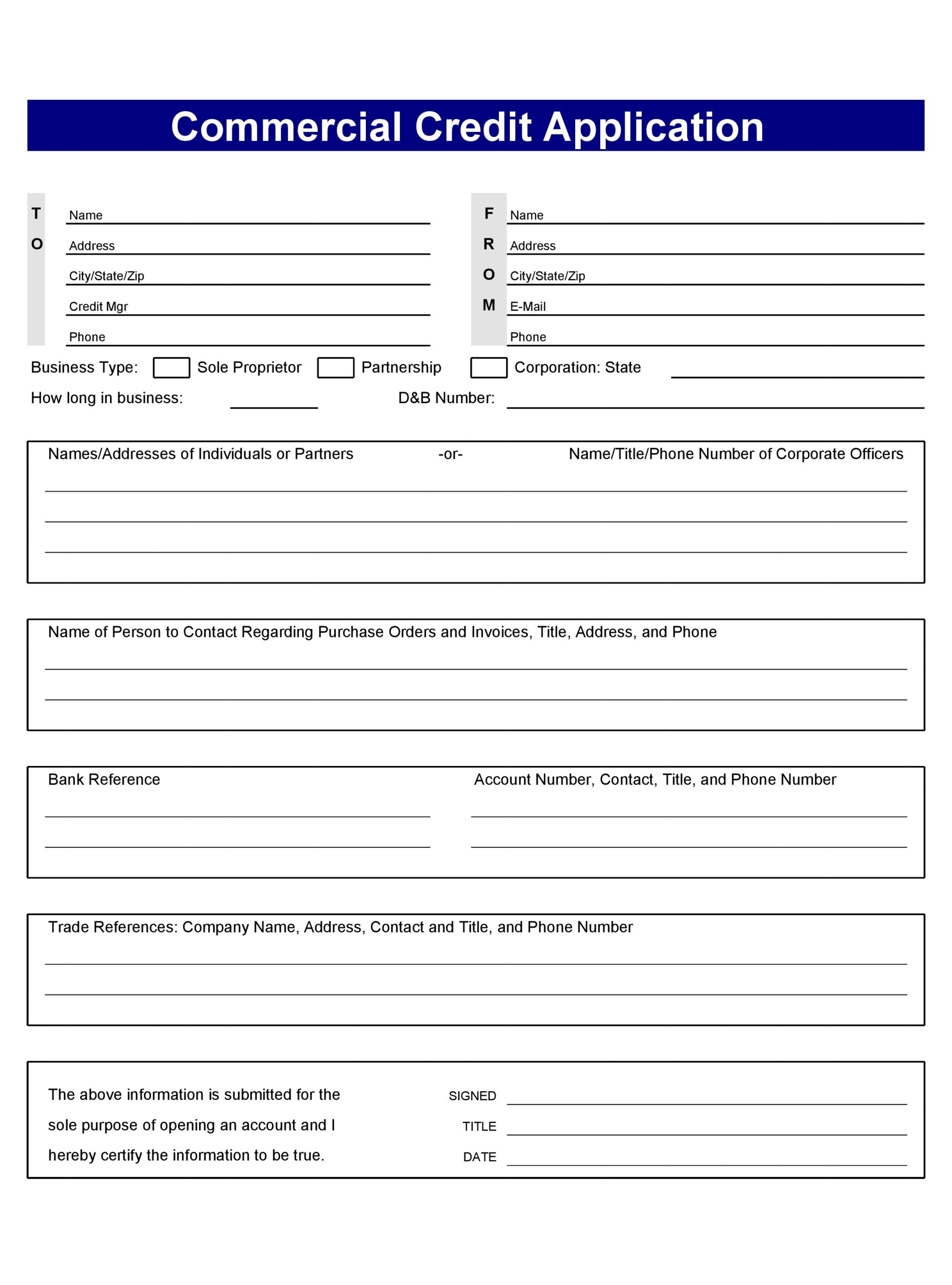

Commercial Credit Application Forms

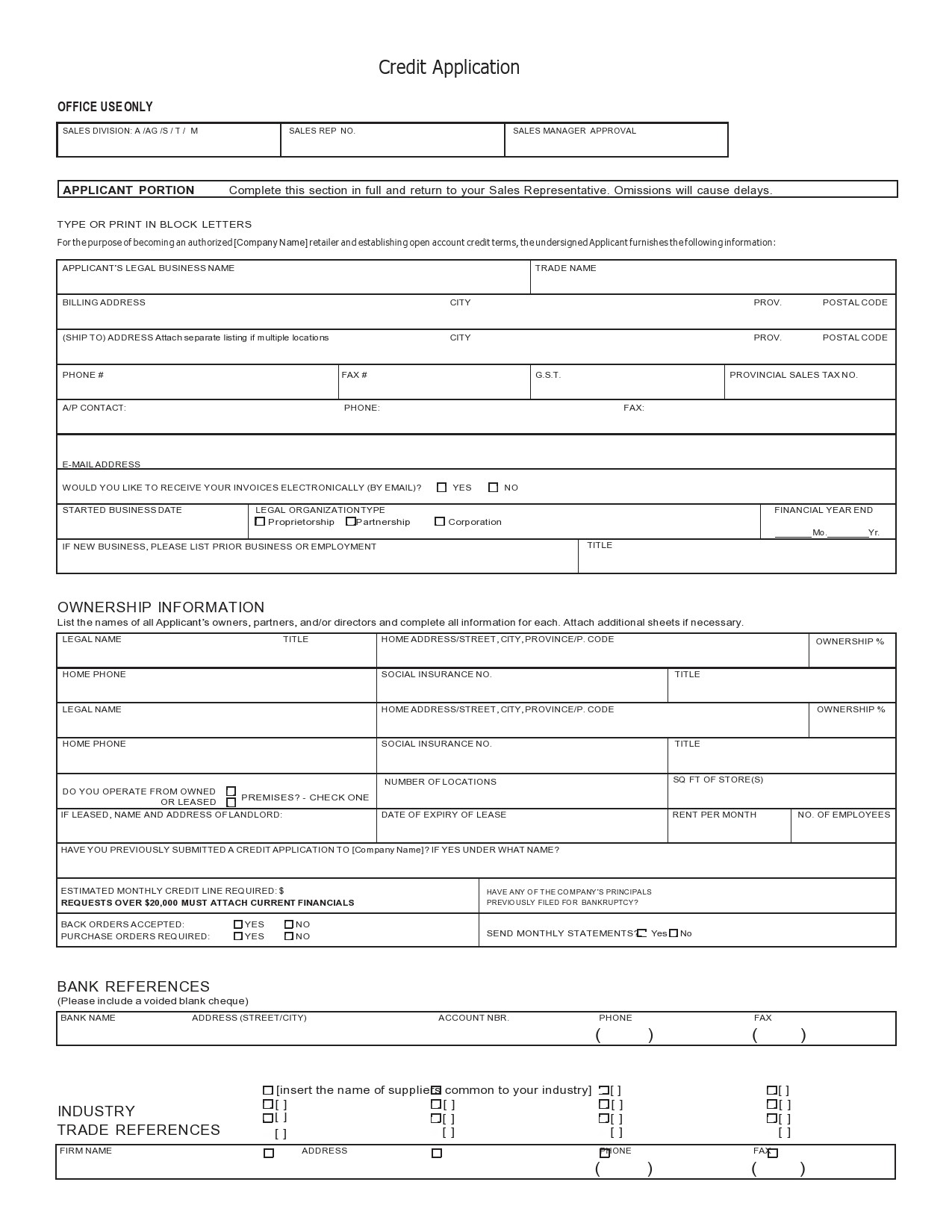

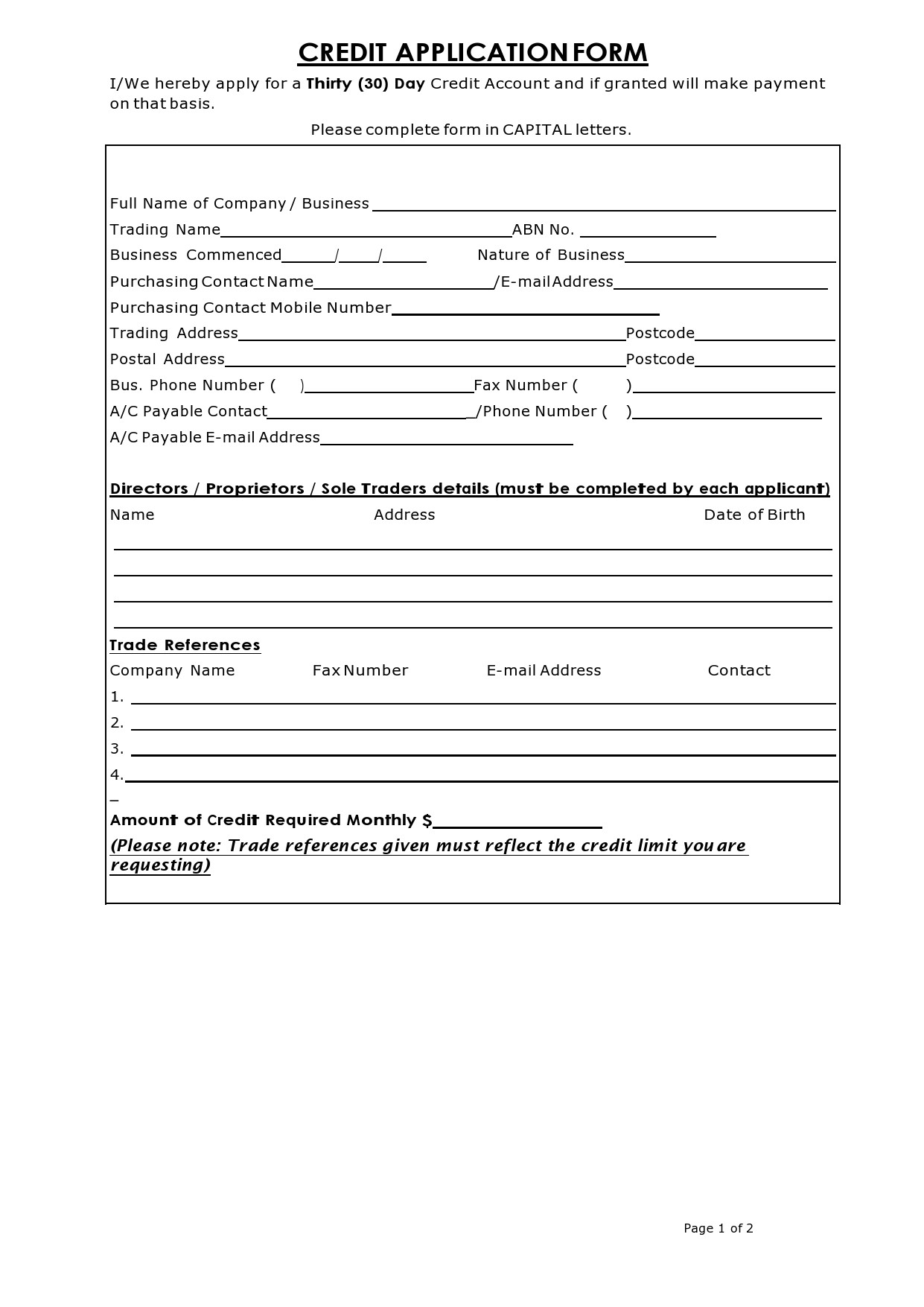

Making online business credit applications

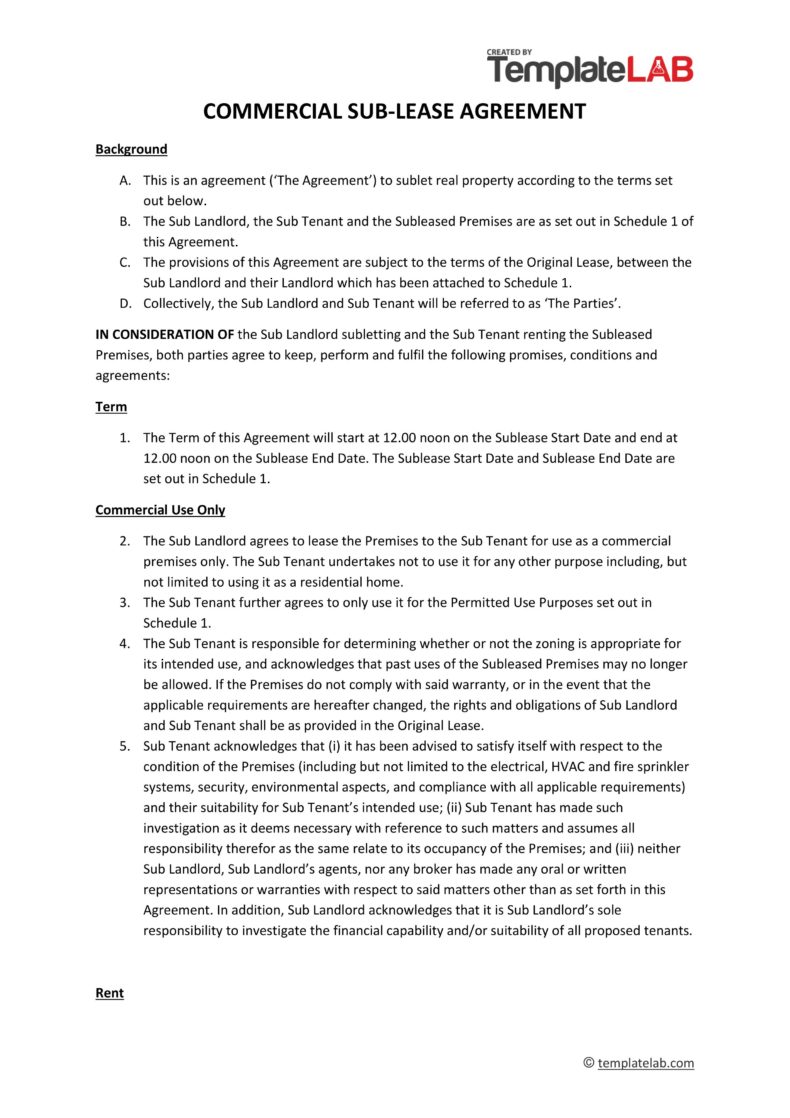

Nowadays, most companies have started using digital workflows to get rid of paper-based processes. You can now consider the same for applications for business credit. While many companies still use fax machines to accepting signed applications or accept these as emailed attachments, you can go with the times.

You can upgrade your business’ processes by using online business credit applications. Creating a blank credit application online can offer the following benefits:

- Vendor credit applications and other business forms make it easier for customers to get approved, place orders, and do business with you.

- These forms reduce errors made by credit teams and decrease turnaround times.

- If your company works in a high-volume industry, an online application form is almost a necessity.

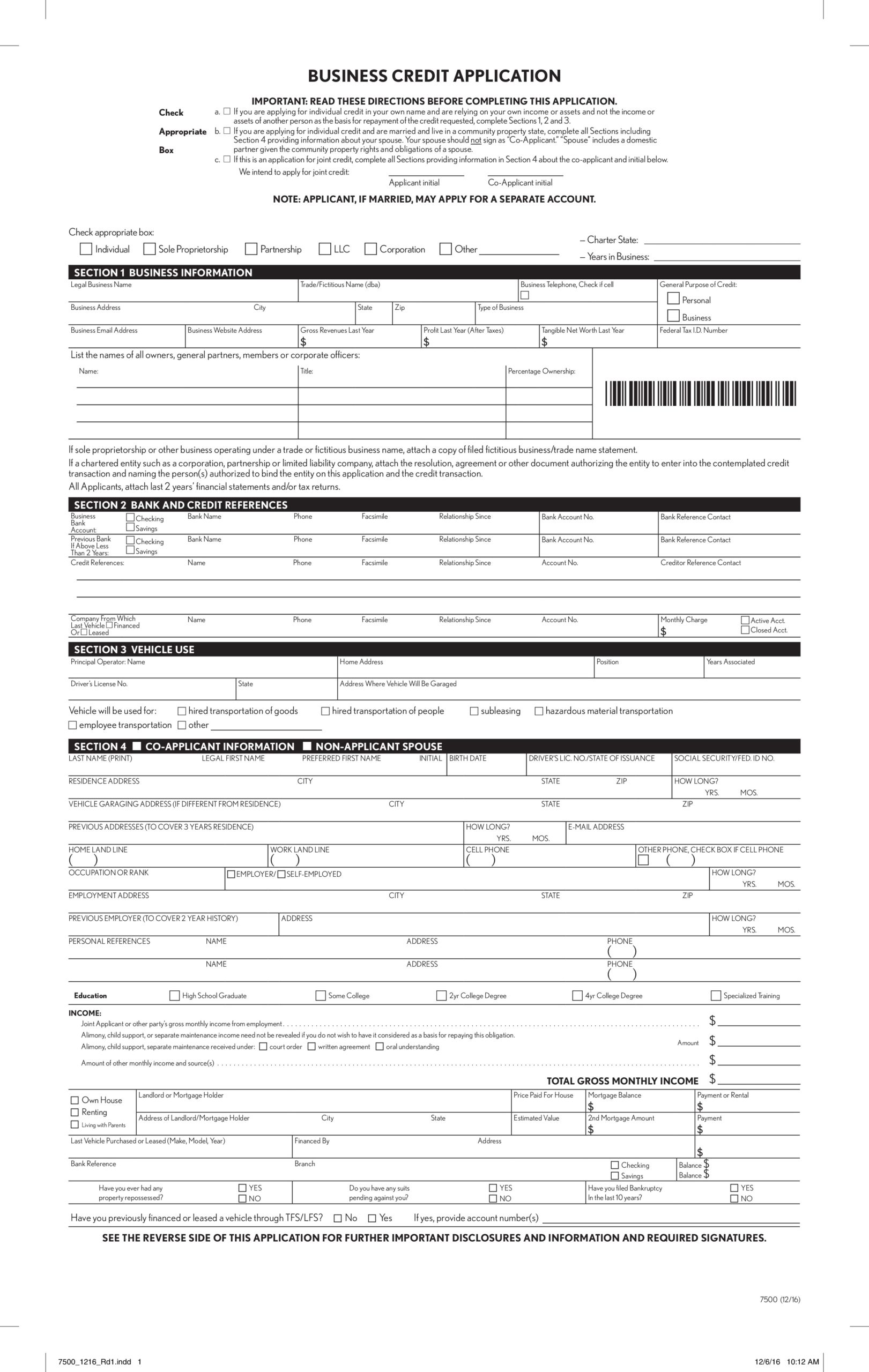

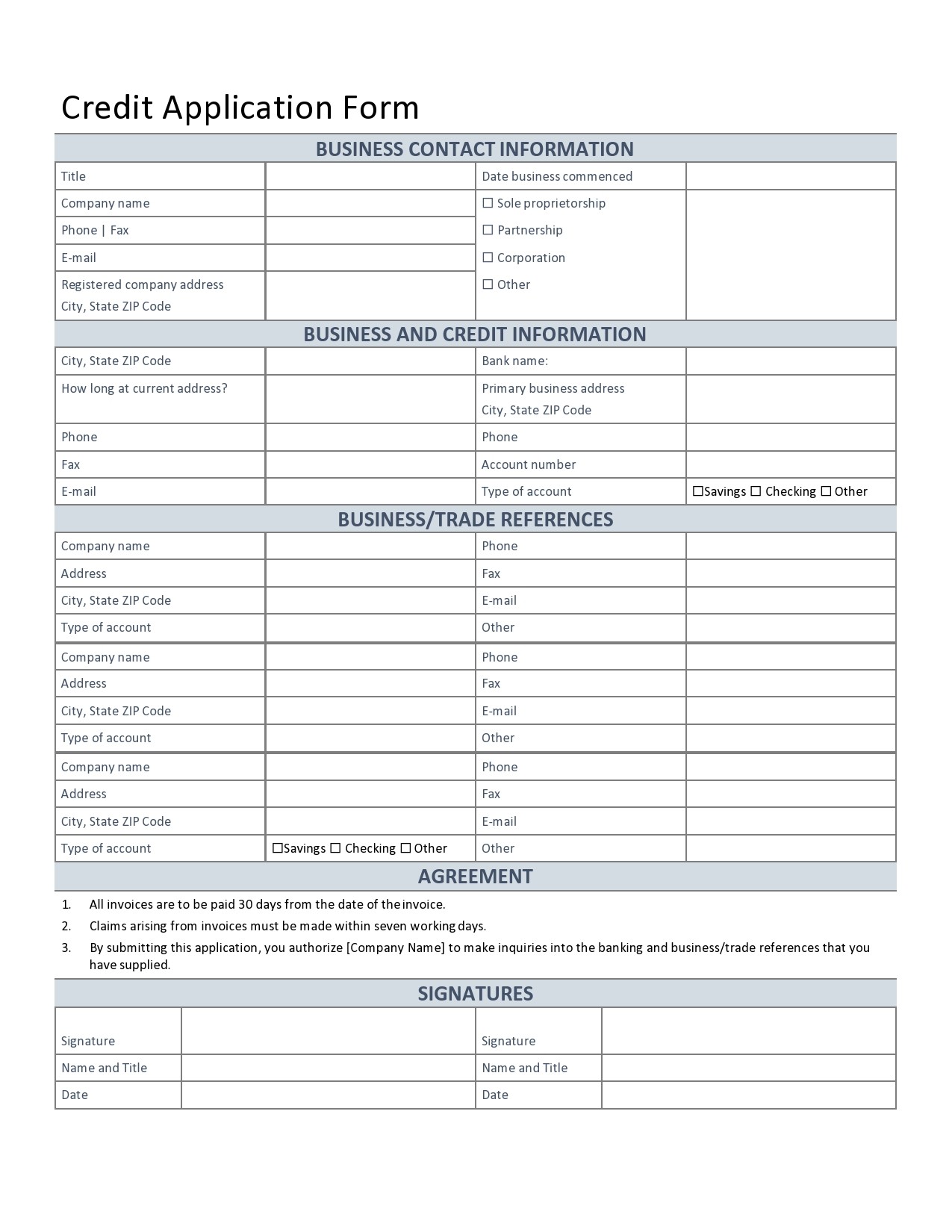

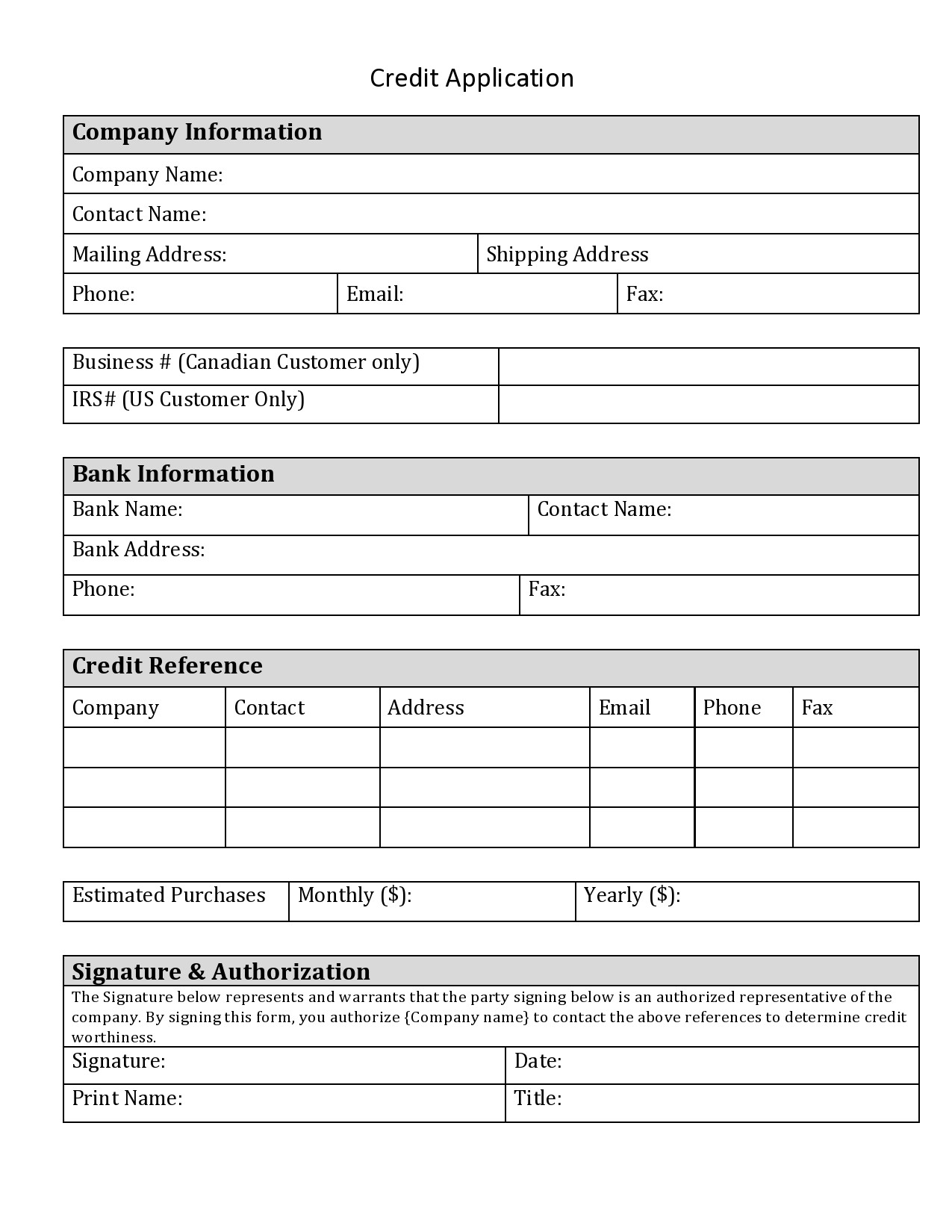

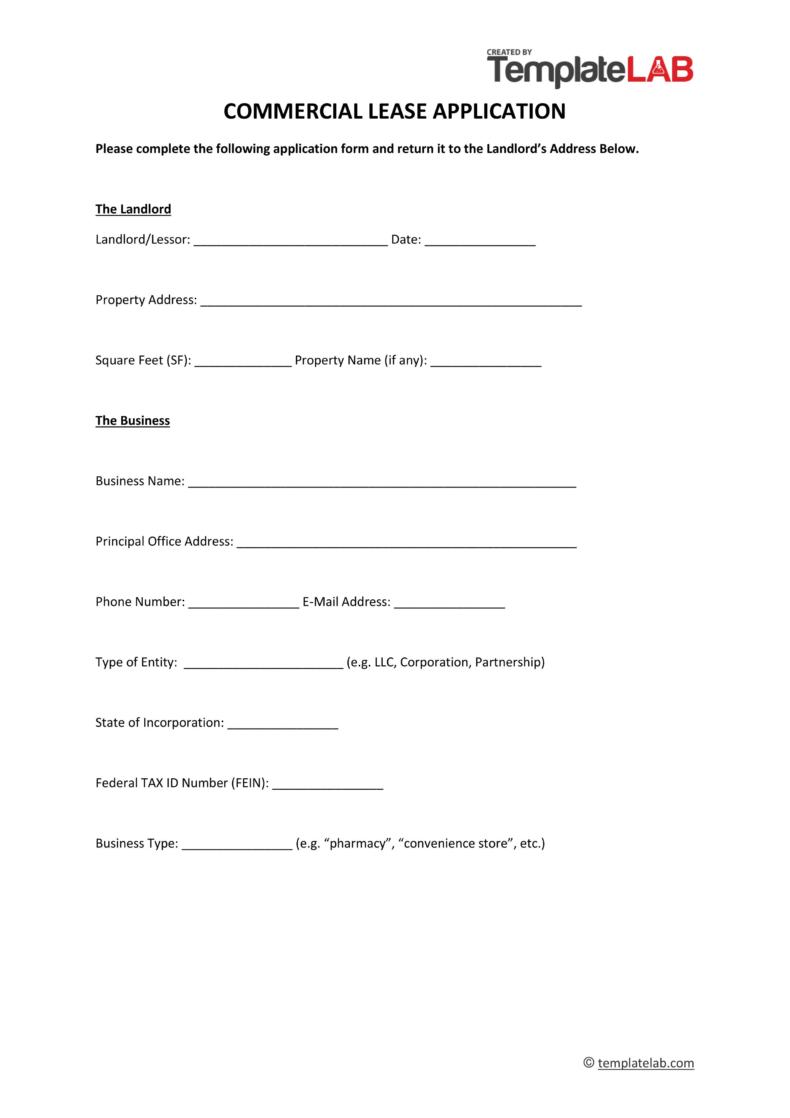

Consider including the following for creating an online business credit application form:

- Contact details

This part of the application requests basic information. The fields asking for pertinent contact details should be mandatorily filled. You need to know about your client’s company name, shipping and billing address, tax ID, purchaser’s contact details, the owner of the business, and information about the officers. - Business details

The next item is to learn about your client’s business. This includes their age, industry, parent company, legal status, and whether it’s exempted from sales tax or not. Your client also has to indicate the credit amount requested. Some fields you place here can be industry-specific. - Bank references

The information provided by banks is critical for any trade credit unless your client uploads these references along with their application. To check for bank reference, you need a signed agreement from your client. However, some applicants find it hard to get banks to provide financial statements. Keep this in mind too. - Trade references

You can require trade references from others in the same industry. For instance, if you’re a high-volume lumber distributor, you already know among your construction customers who can pay their obligations on time. Moreover, there are some companies that only accept specific types of trade references as they have a concern that the companies will only submit positive references.

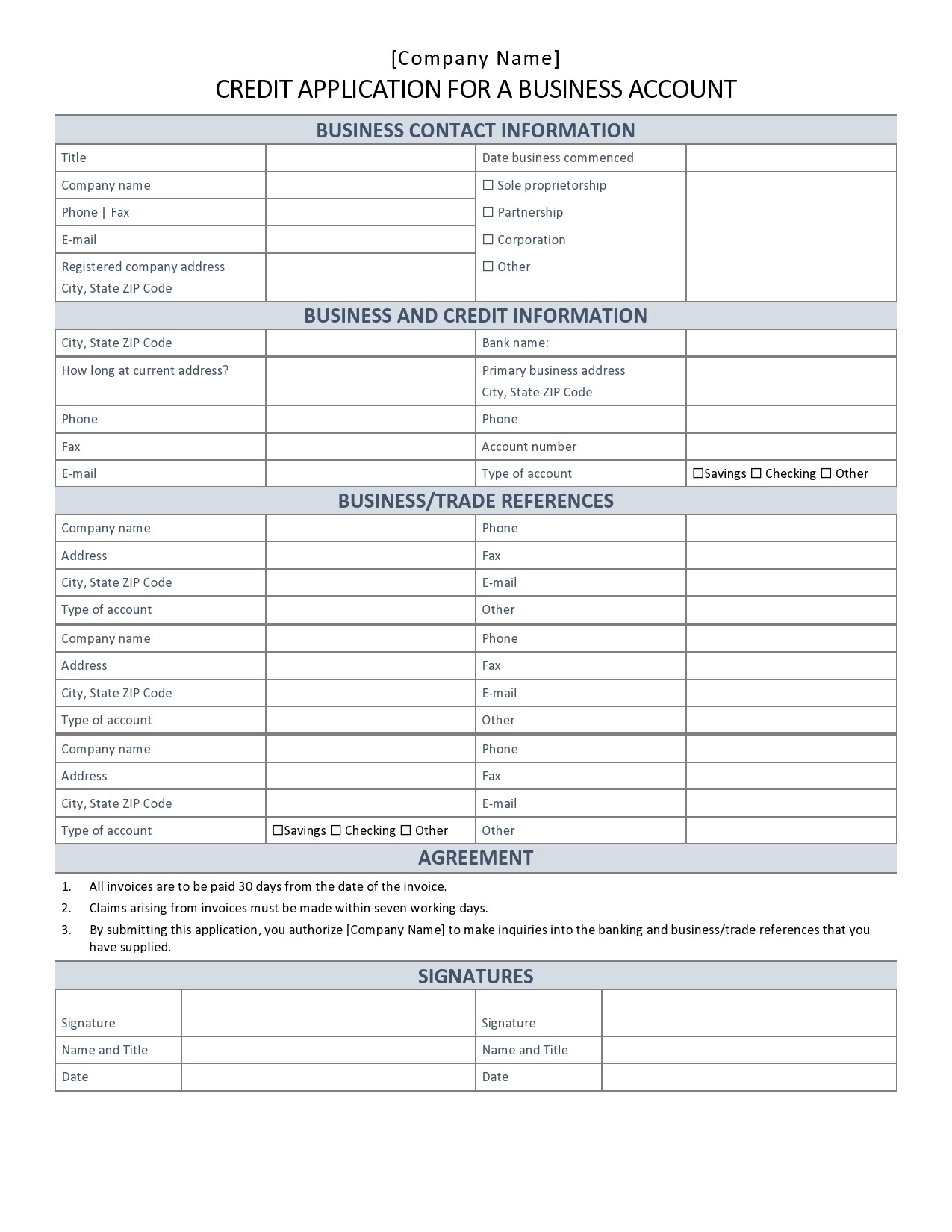

This is the main reason why most credit professional cross-check trade references that are self-reported against other payments found in the business credit reports of borrowers. You may want to consider practicing this too. - Financial Information

Always be as specific as possible when requiring financial information from your clients. In most cases, companies don’t ask for financial statements for smaller credit lines and if they do, they don’t expect audited statements. If you’re satisfied to just receive a recent statement reviewed by an accounting firm, make sure to state this in your application.

Otherwise, your clients might leave this part blank. Then you would have to follow-up the application manually. This defeats the purpose of the fast processing time that an online credit application should achieve. - Terms and Conditions

It’s essential for your customer to read and understand the terms and conditions in the application you have made. Unfortunately, not everyone goes through the terms and conditions because they just scroll to the bottom of the form then click the “accept” button.

Anything that involves terms and conditions gets finalized by your company’s legal team. There is, however, an opportunity here for your credit team to work with your legal team to improve the readability of this part of your form.

This will increase the likelihood that your clients will read and understand what you have written. For instance, you can request your legal team to put the most important information at the top like the late payment fees and other standard payment terms instead of starting with a paragraph about infringement.

Vendor Credit Applications

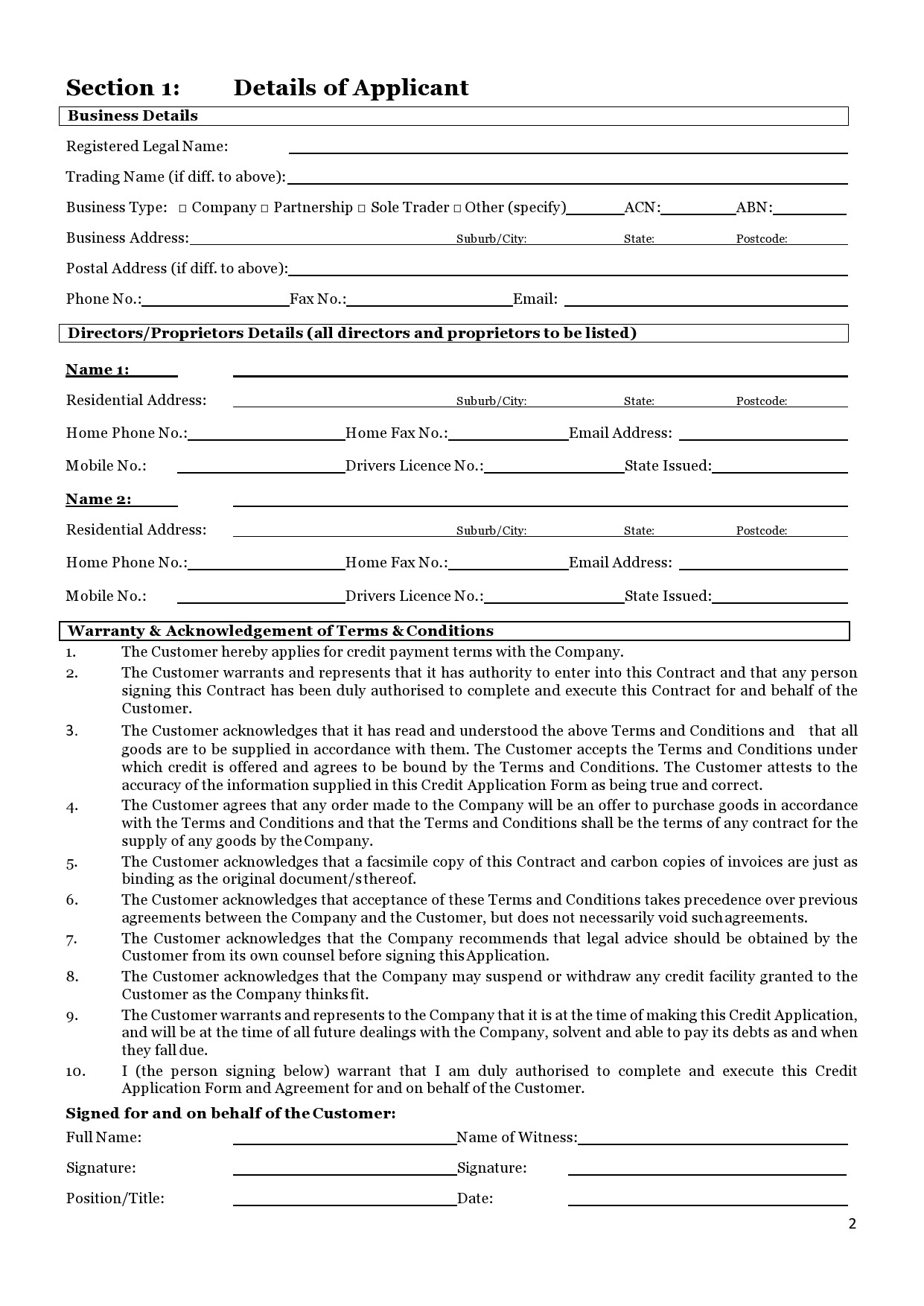

How do you fill out a business credit application?

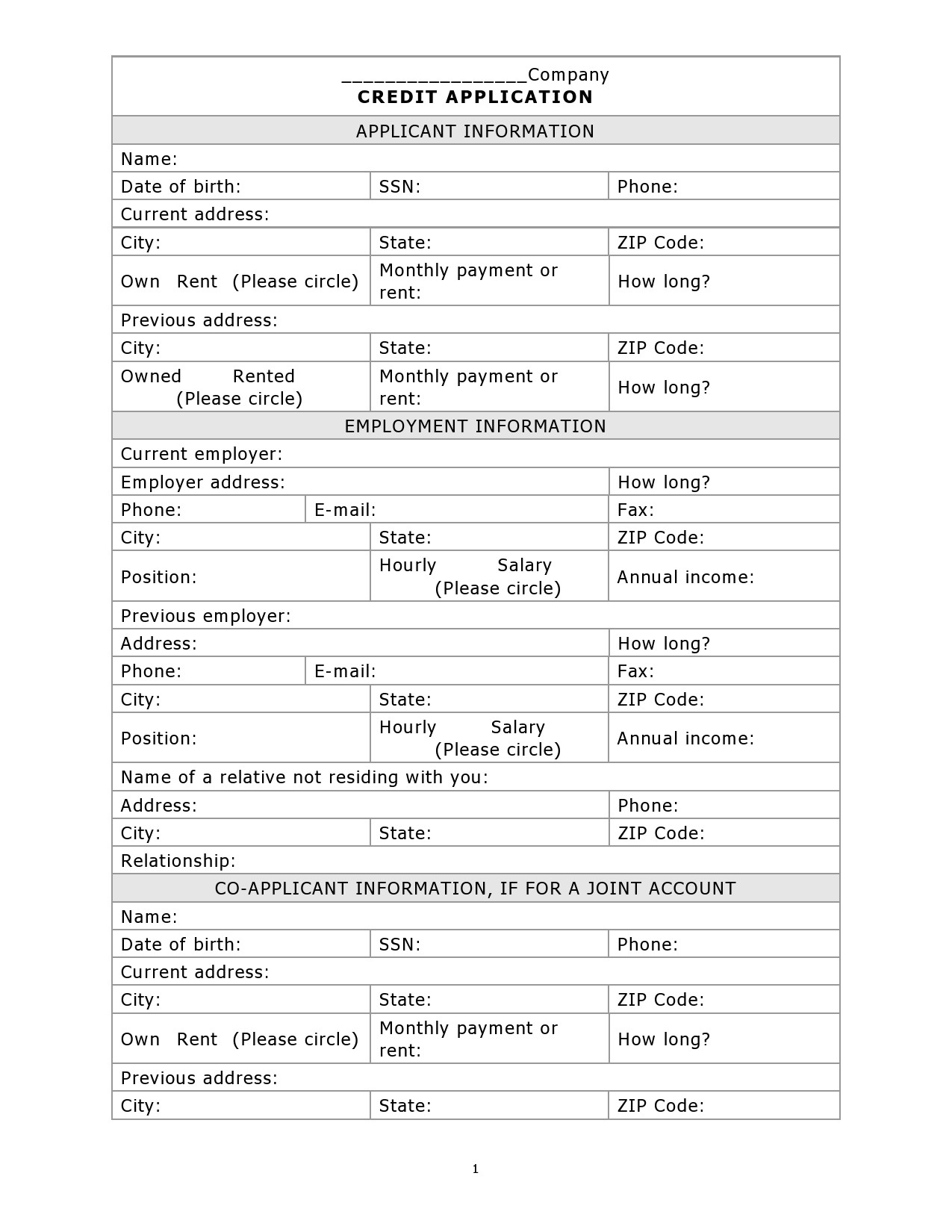

As a business owner, there may come a time when you will be the one who needs to fill up a business credit application form. Most business credit application templates ask for the same details with the main goal of determining whether you’re financially responsible and stable.

Still, have to read everything on the business credit application as you fill it up. This allows you to understand what’s written on these forms. Here are some steps to guide you when filling up applications:

- Go through the credit agreement carefully first

You can find this section at the bottom of the application form. It outlines the terms and conditions and it’s a requirement of the Federal Law Consumer Disclosure Act (FLCDA). This part explains the legally binding agreement between you and the lender. - Input your personal details

The application will ask for your personal details. From this, the lender will get to see how reliable you are. Usually, you would have to provide the following details:

Your complete name

Your complete business address

Your primary and secondary phone numbers

The number of years your business has been in operation

Your email address although sometimes, this is optional, but financial institutions that have gone paperless will make this a requirement

Your Social Security number to secure credit as the lender will use this for the purpose of identification and to obtain your credit history. - Provide your employment history

Typically, those who aren’t employed get denied when they apply for credit. But having a solid employment history shows that you’re responsible enough and you have the capacity to make the required payments on time. The longer you have stayed in the same job, the better. - Share the required financial information

Sharing details about your financial situation is one of the most crucial parts of the application. The lender wants to know that you’re financially stable and that part of your income will go to the payments you must make. You will also increase your chances if you have a high income, you own a house rather than renting, and you have several bank accounts. - Submit the completed application form

Before submitting your application, you need to review it first to correct any omissions or errors. Affix your signature to the application then add the date too. State that all of the information you have provided is correct. You can either mail the application or send it online. - Wait for feedback from the lender

There are a few possible outcomes for this kind of application. These include:

If you have done everything right, your application will probably get accepted and you will get the credit you have applied for within two weeks.

If the lender refers your application, this means they need more details before making a final decision. In such a case, the lender might contact you again.

If your application gets declined, you will receive a rejection letter. Here, you will find out the reason why your application got declined.