As a business that is looking to move into a commercial property, either as an expansion, a move, or to help you start the business, you will need to fill out a commercial lease application. This application can seem very large, with the landlord asking for a lot of information to ensure your business finances are secure and you are able to make the rent each month.

Table of Contents

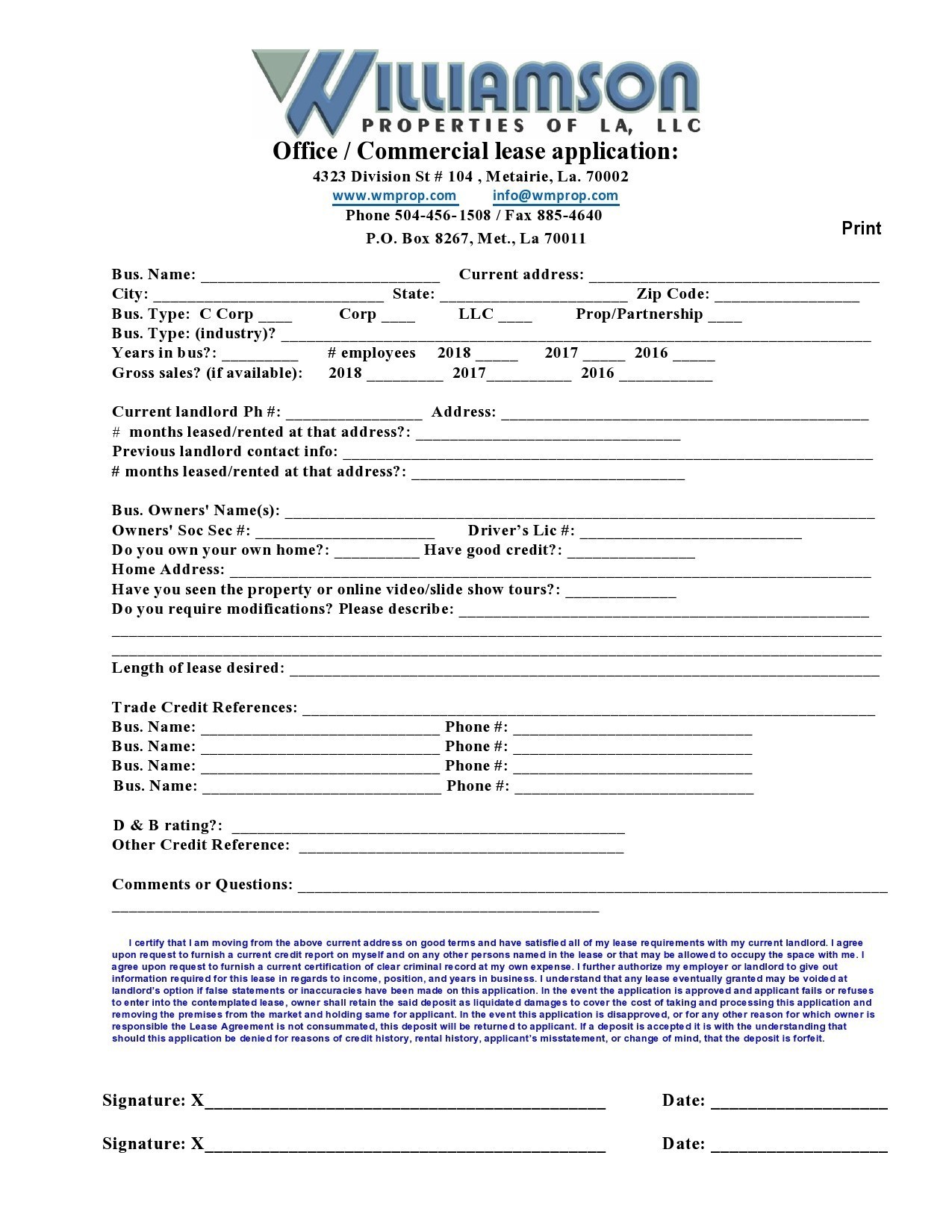

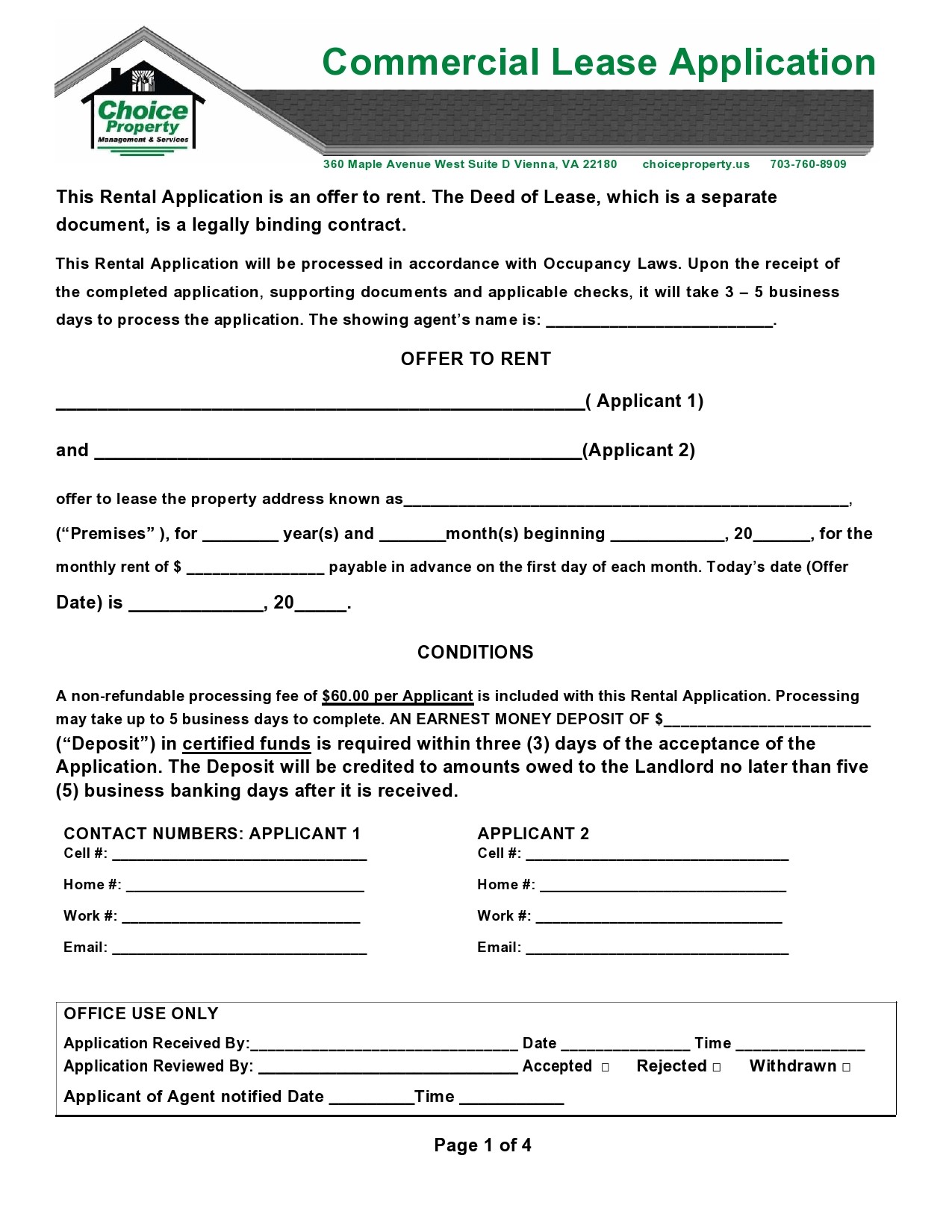

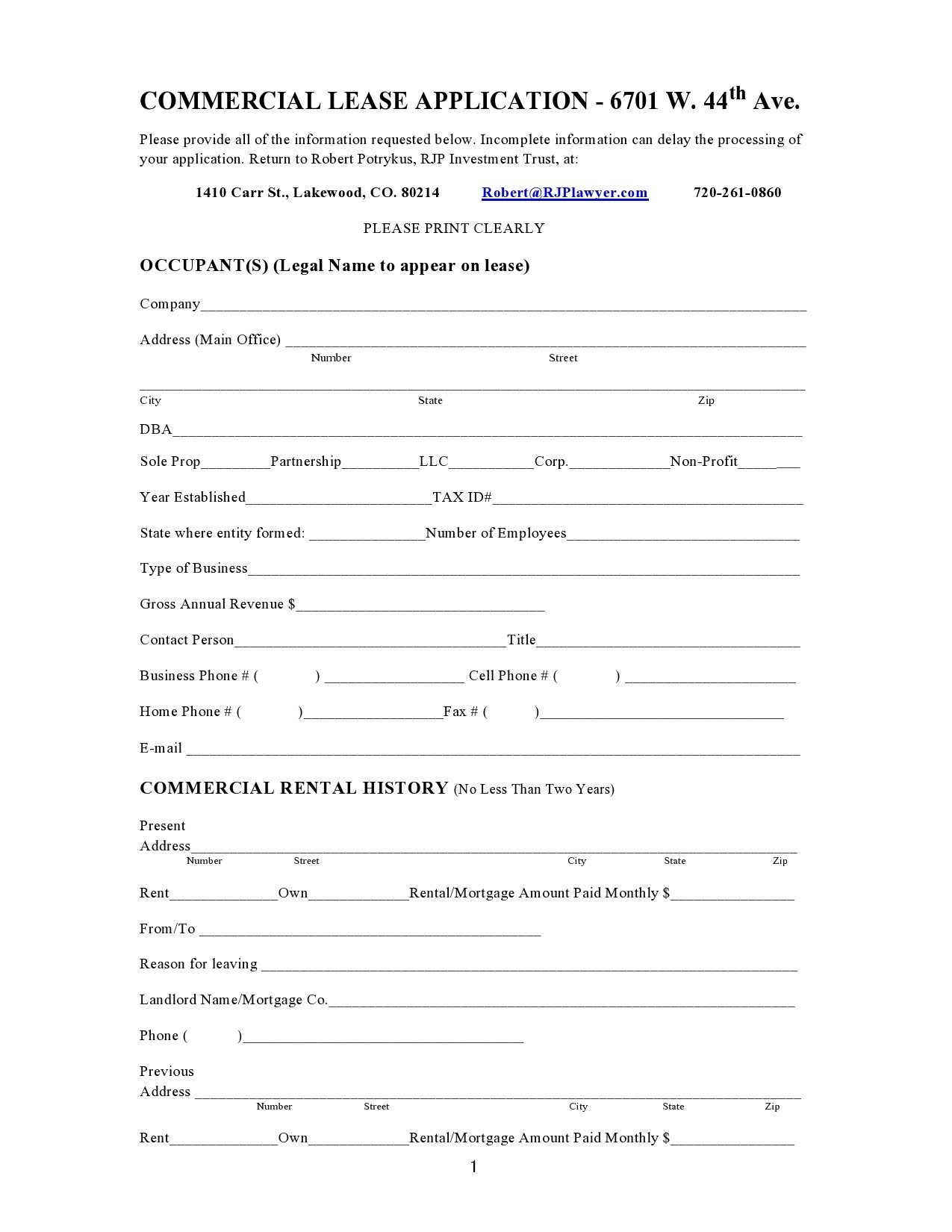

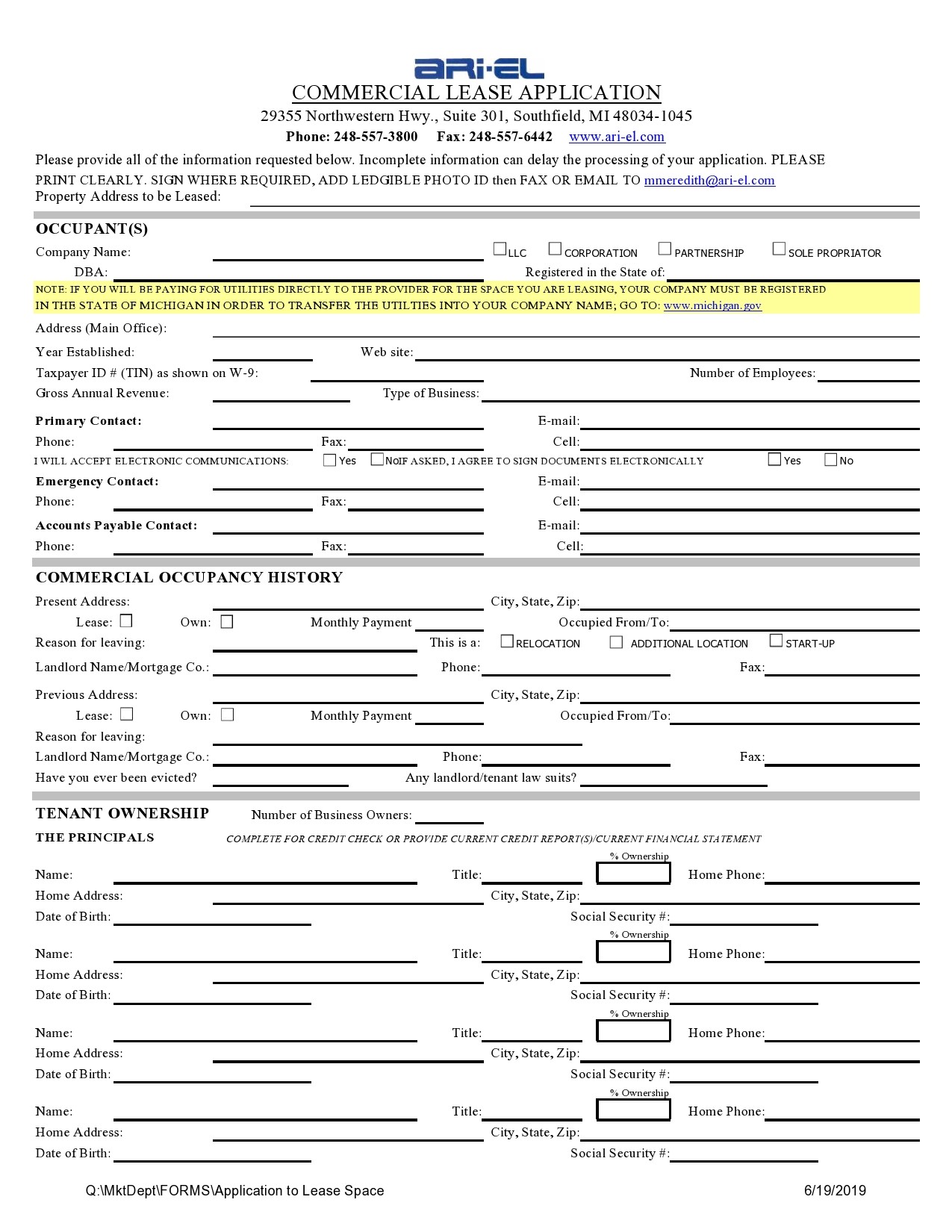

- 1 Commercial Lease Application Templates

- 2 What is a Commercial Lease Application?

- 3 When to Fill out a Commercial Tenant Application?

- 4 Commercial Rental Applications

- 5 Why is a Commercial Lease Application Important?

- 6 Commercial Tenant Applications

- 7 What Information is On a Commercial Lease Application Form?

- 8 Commercial Lease Forms

- 9 FAQs

Understanding what the commercial rental application is about will help you be prepared and can make it easier for you to get into the commercial property that is just right for your business.

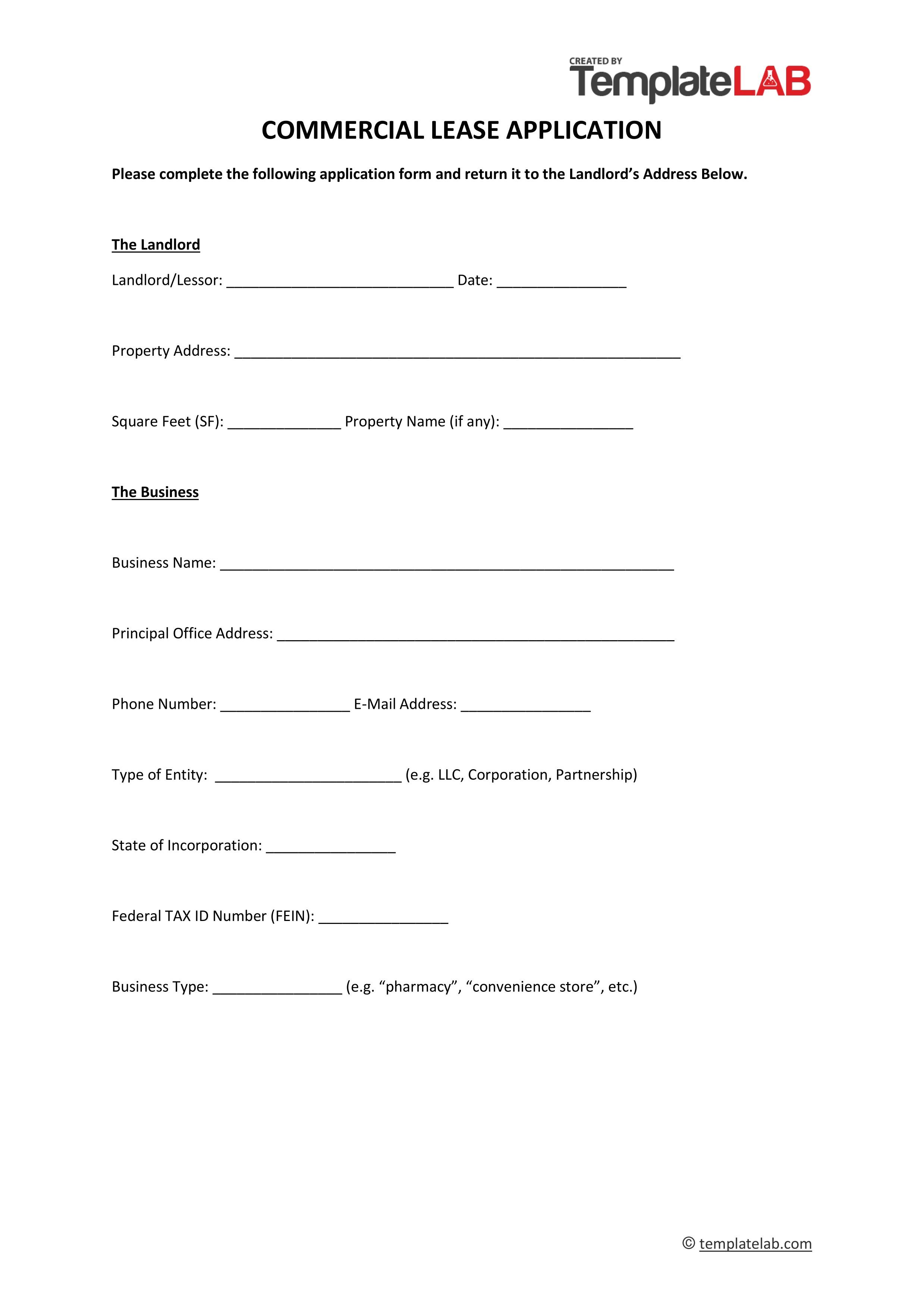

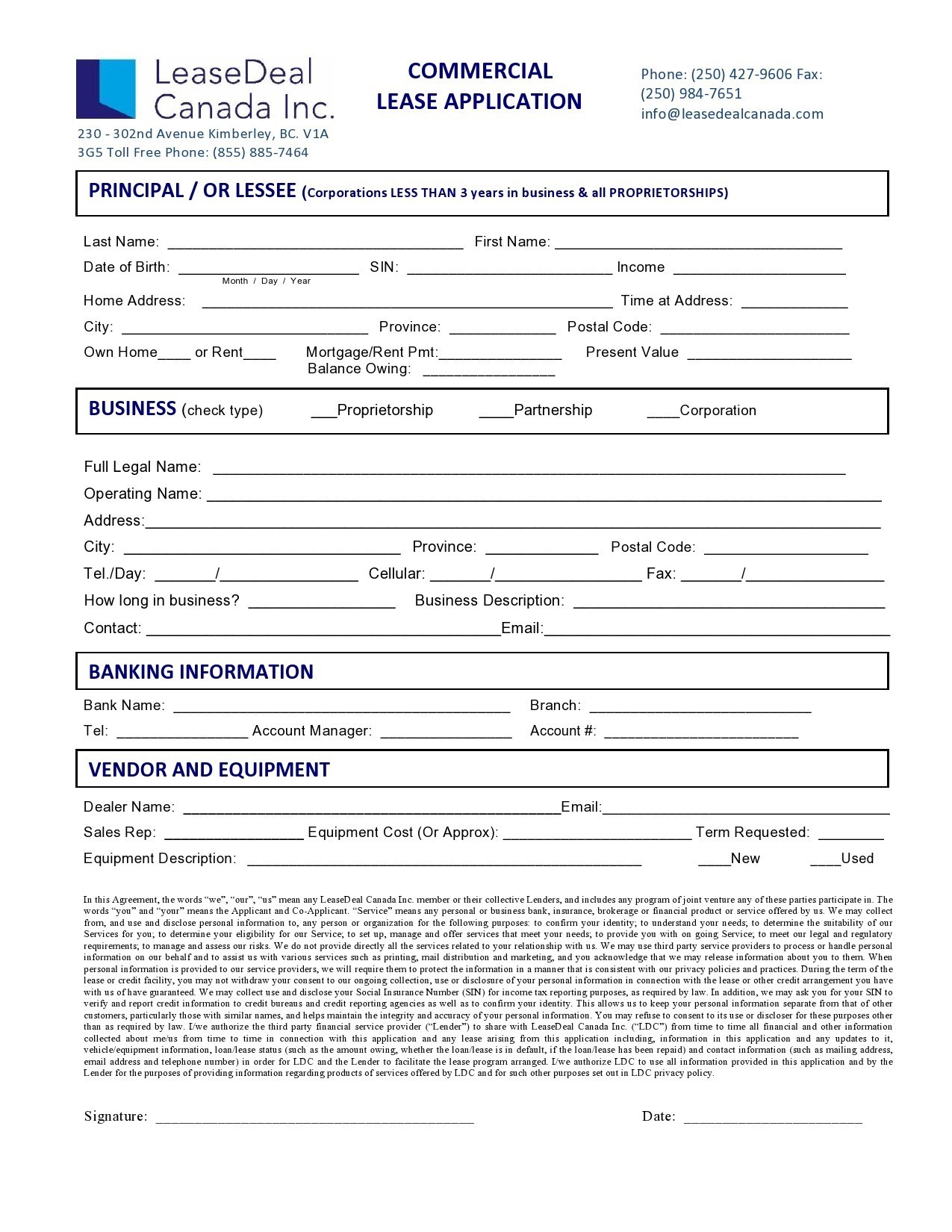

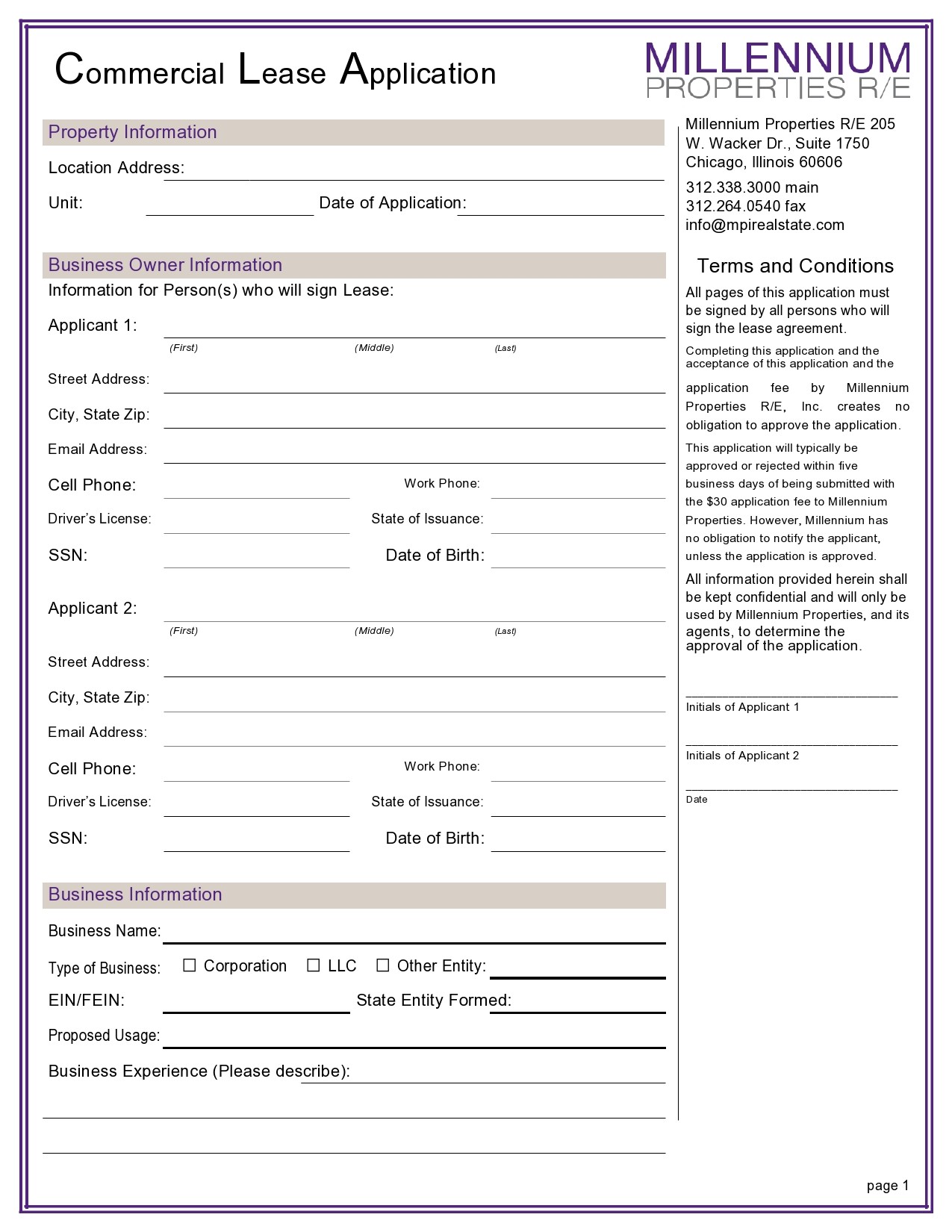

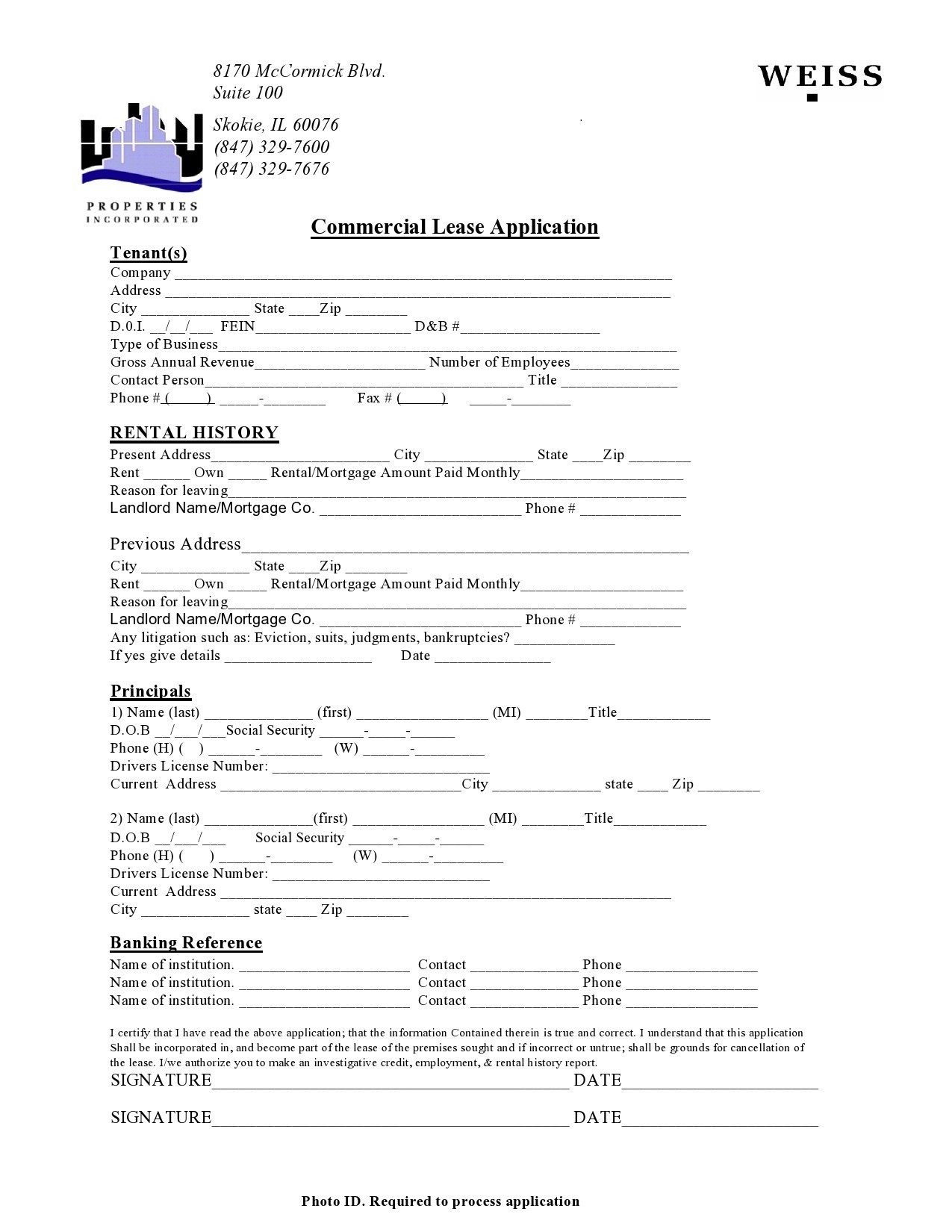

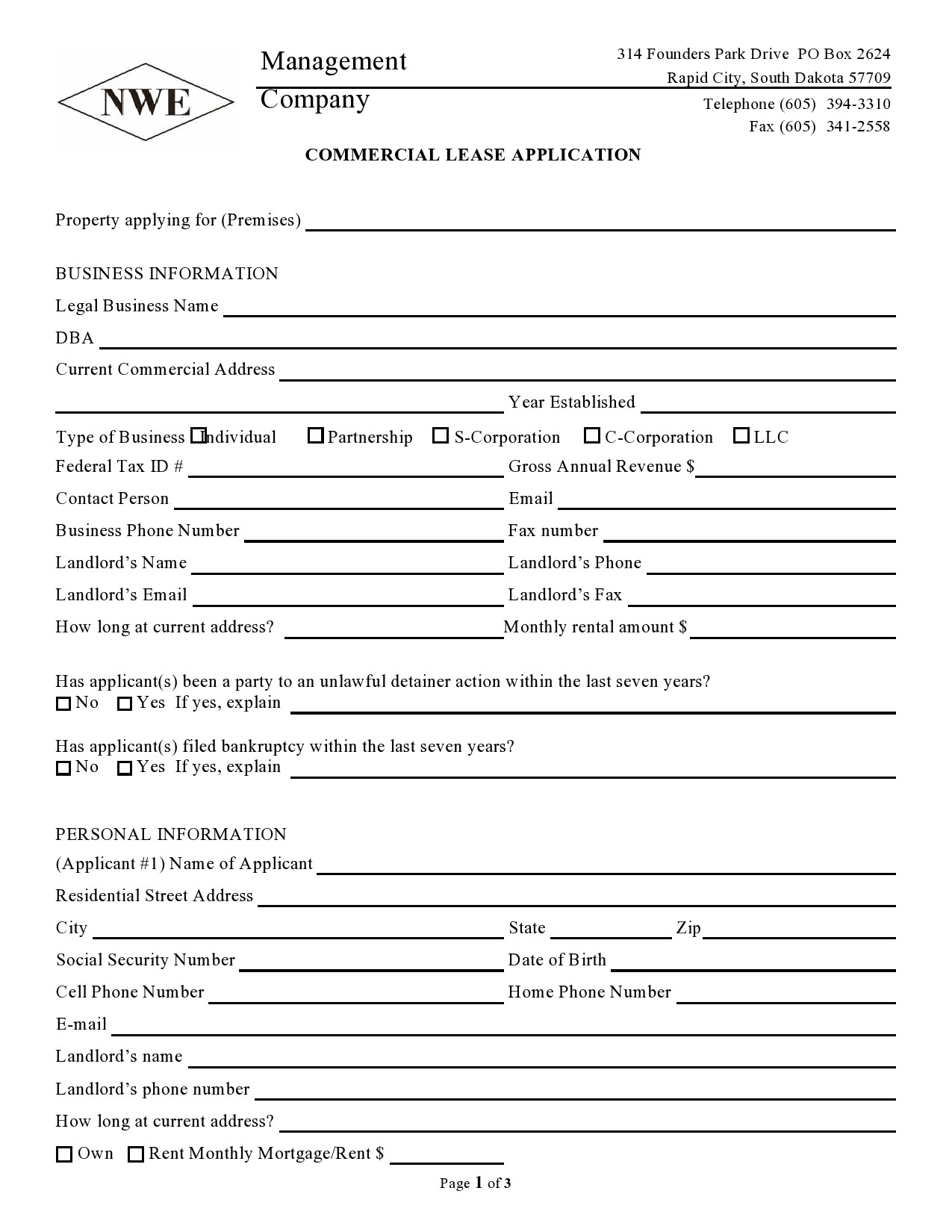

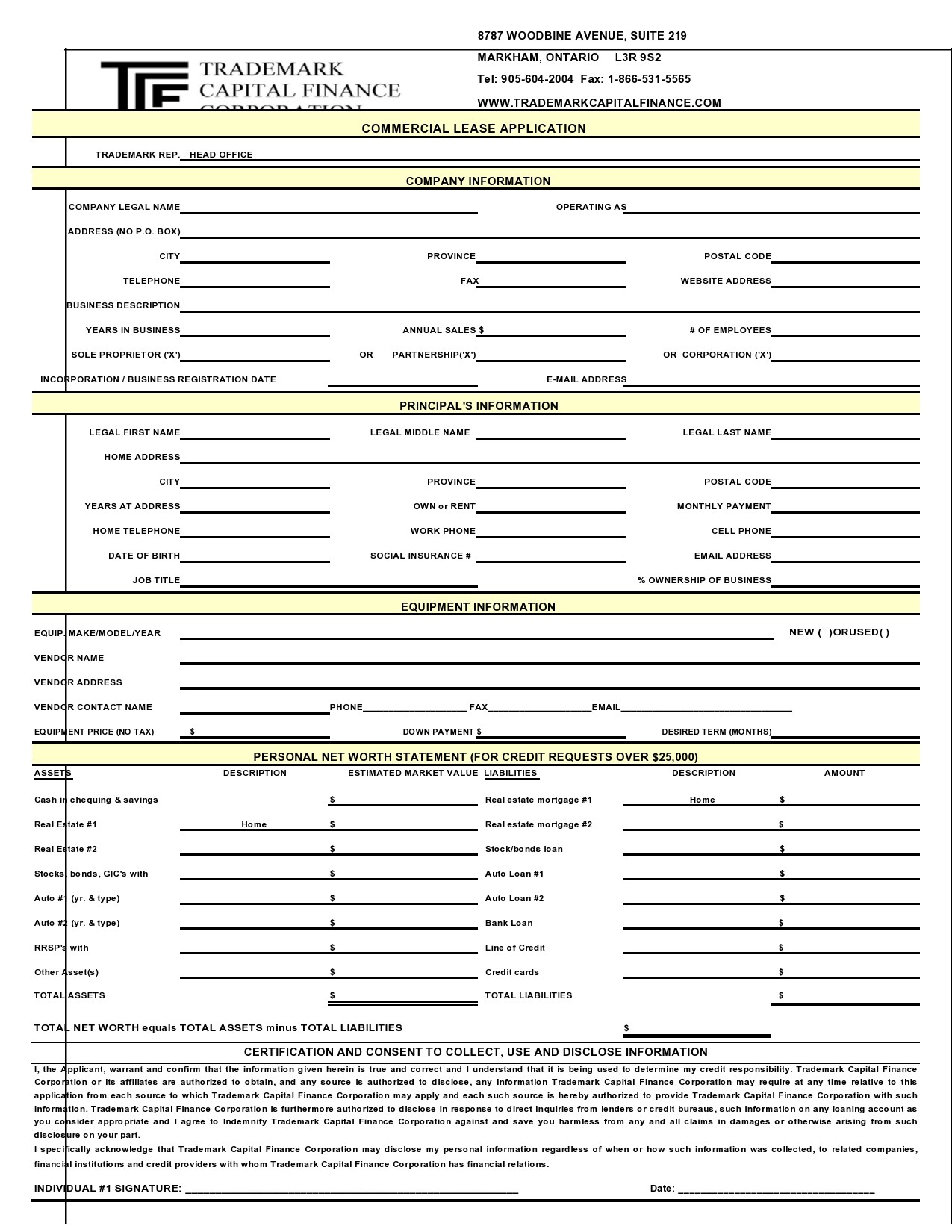

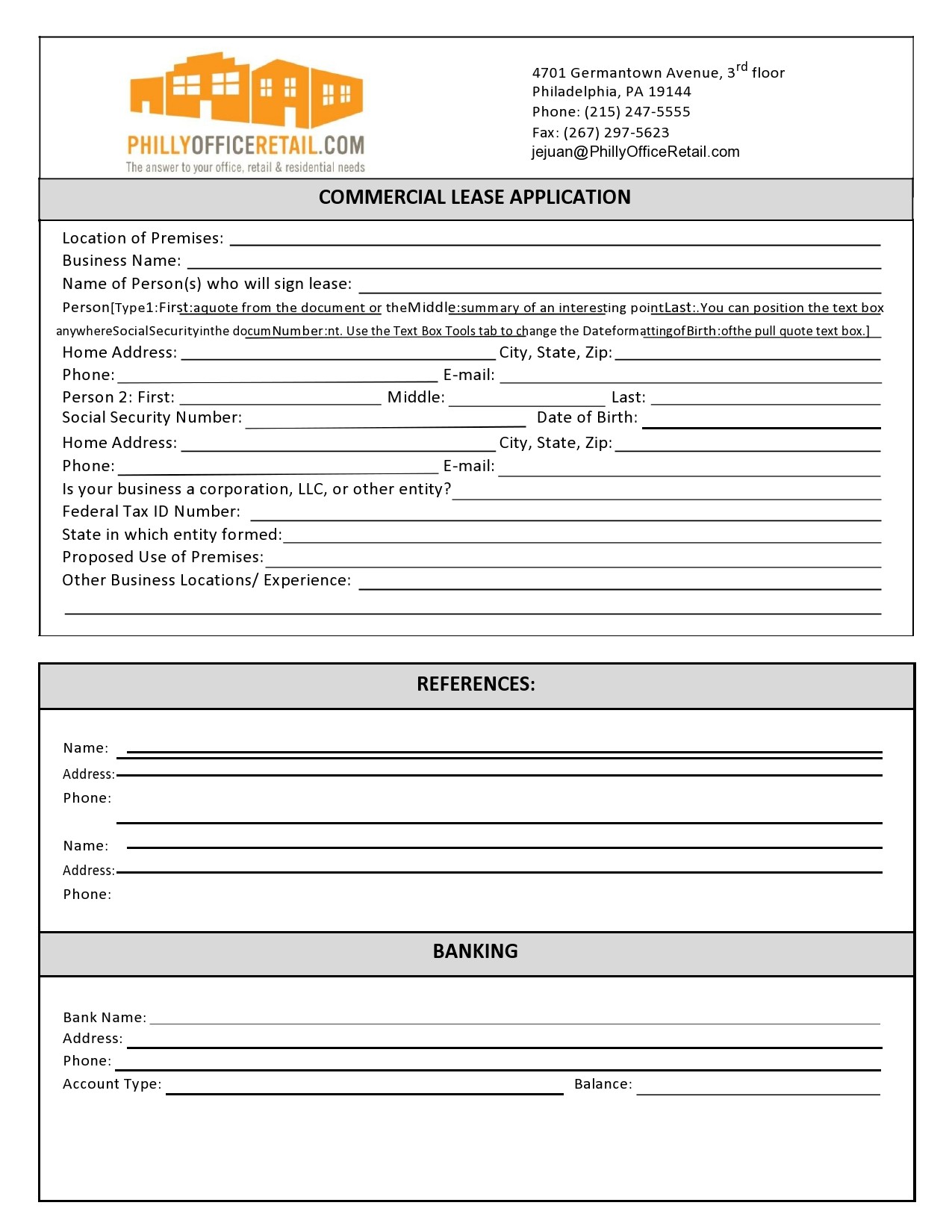

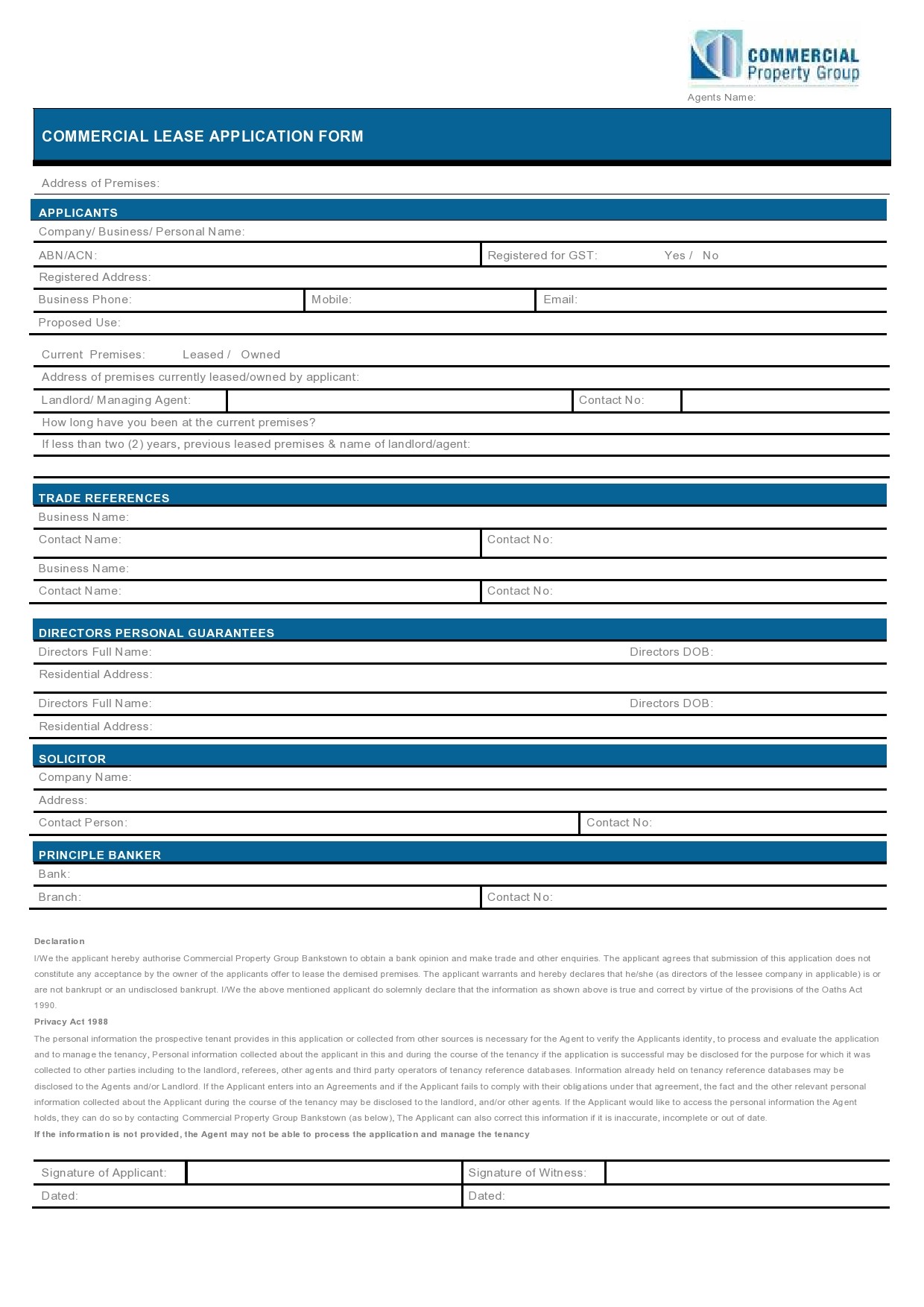

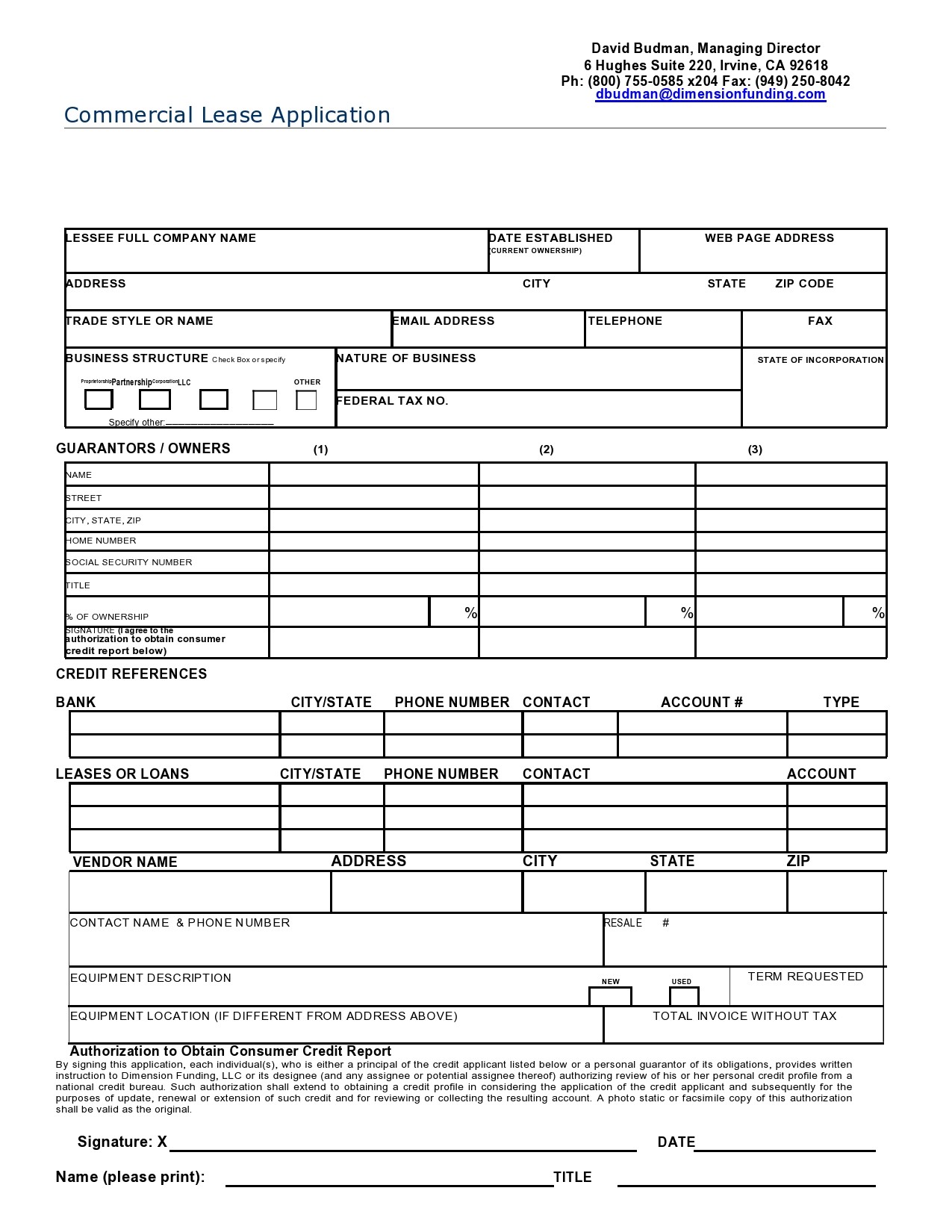

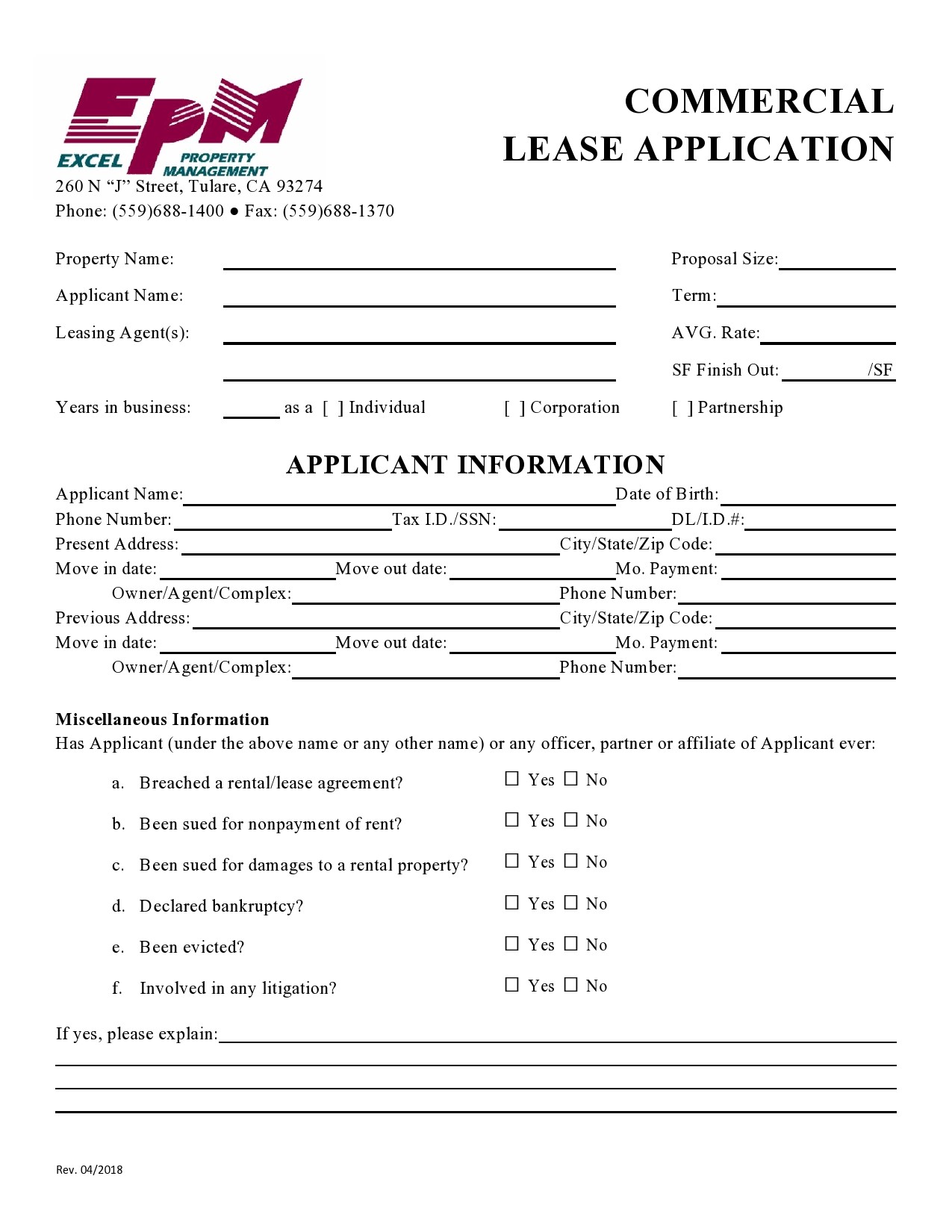

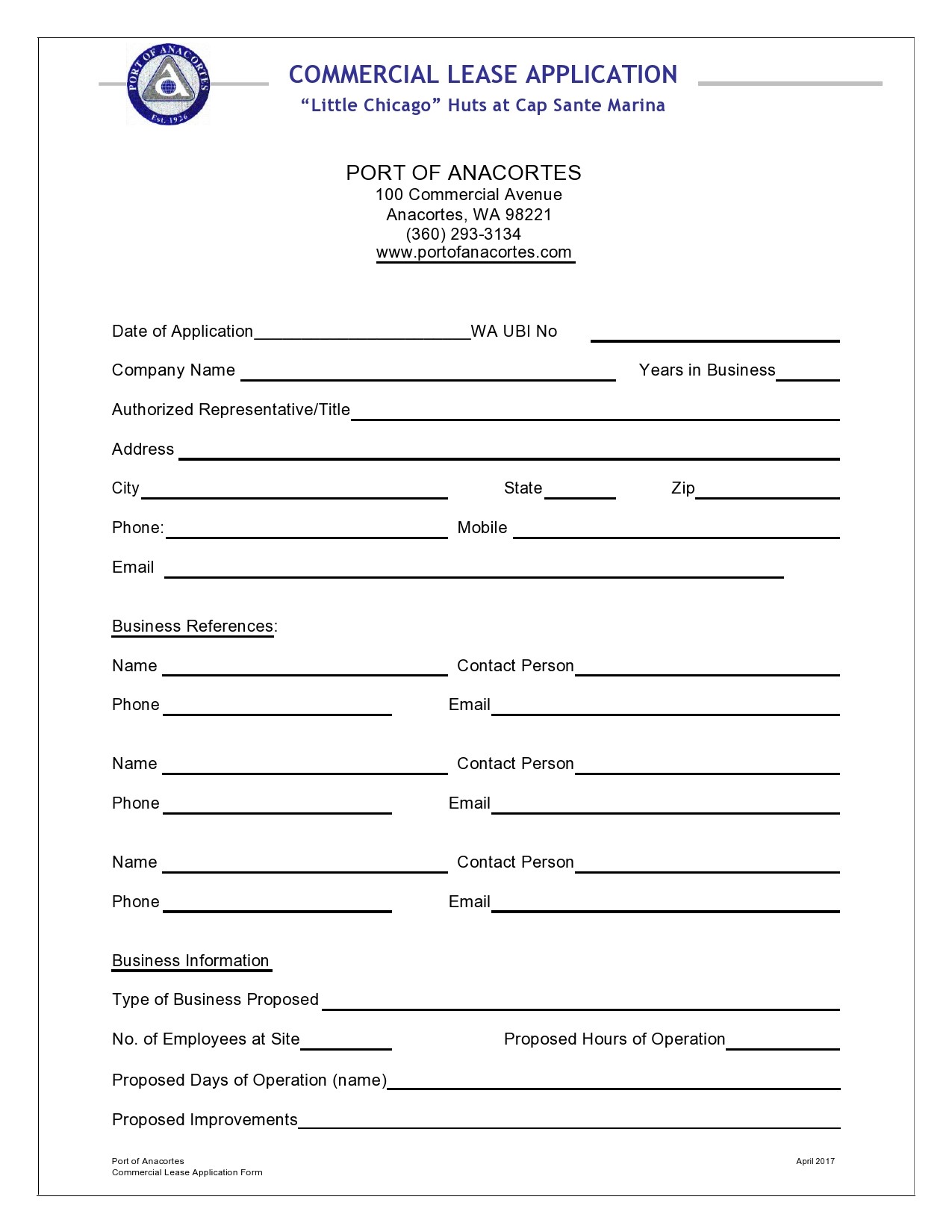

Commercial Lease Application Templates

By State

What is a Commercial Lease Application?

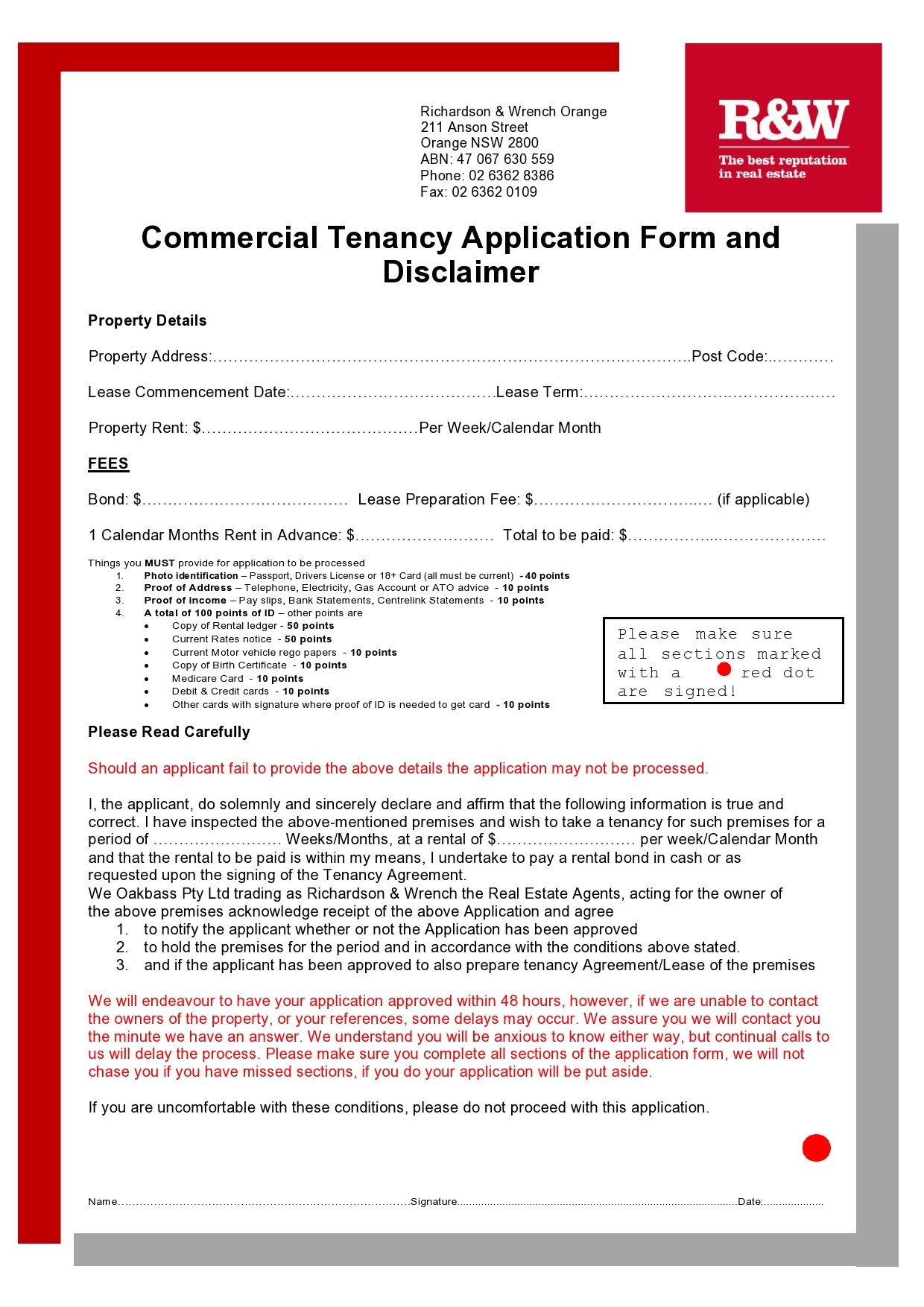

A commercial lease application is a document that a potential tenant is able to fill out in order to lease a property in which to run their business. The landlord is able to look at it to evaluate the creditworthiness of the tenant and see whether they are a good applicant to rent the property.

The application will include a lot of important information such as the income and business of the tenant. The landlord may choose to charge a fee, often between $50 to $200 for conducting the background check and credit check.

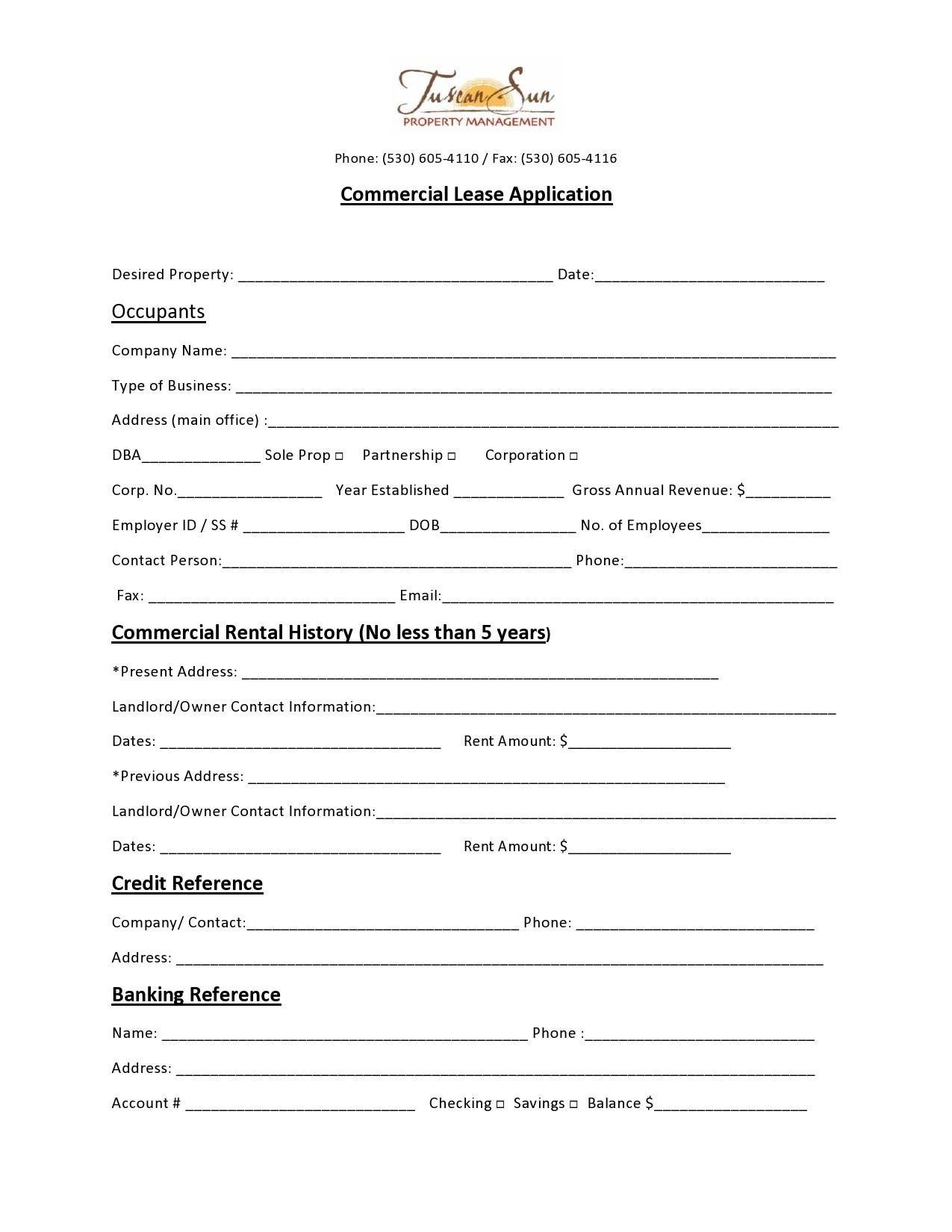

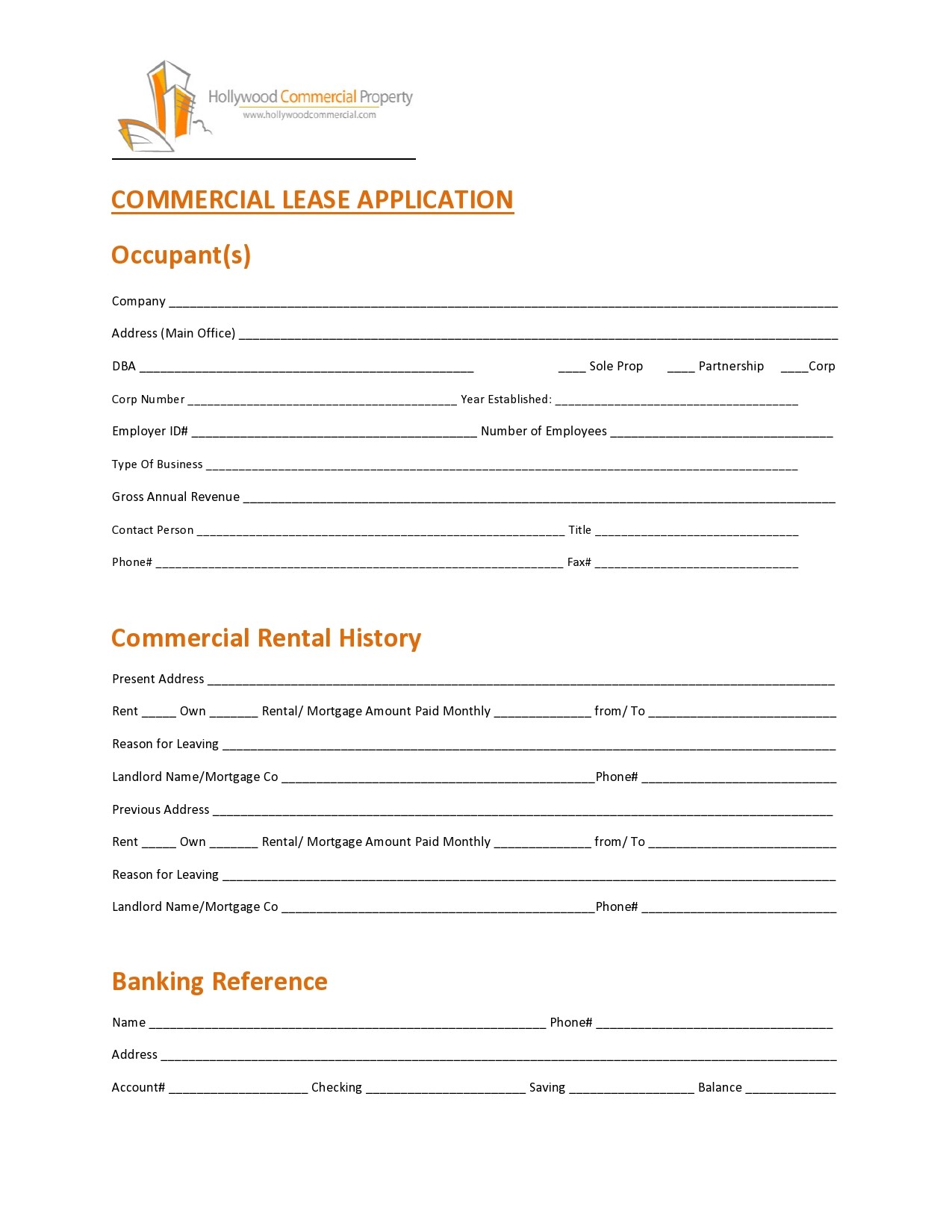

Some of the information that is included in the commercial rental application includes:

- Bank balances for the business

- Rental history if the business has rented out other properties.

- Gross income as well as expenses for the business.

- Information on whether any of the owners of the business are securing the lease with their own personal money.

The tenant will fill out the lease application with their interest in renting the property and all of the information that the landlord requests.

When to Fill out a Commercial Tenant Application?

Any time that a business entity wants to move into a new commercial property, either through relocation or an expansion, they will need to fill out a commercial rental application. This application is similar to what a tenant would fill out for a residential property, though the landlord is allowed to ask more financial questions and dig deeper into the finances for the commercial property.

The application can be quite long and may take the tenant more time to fill out than a traditional lease application. Once it is done, the landlord can conduct the necessary background and credit check to see whether they want to lend the property out.

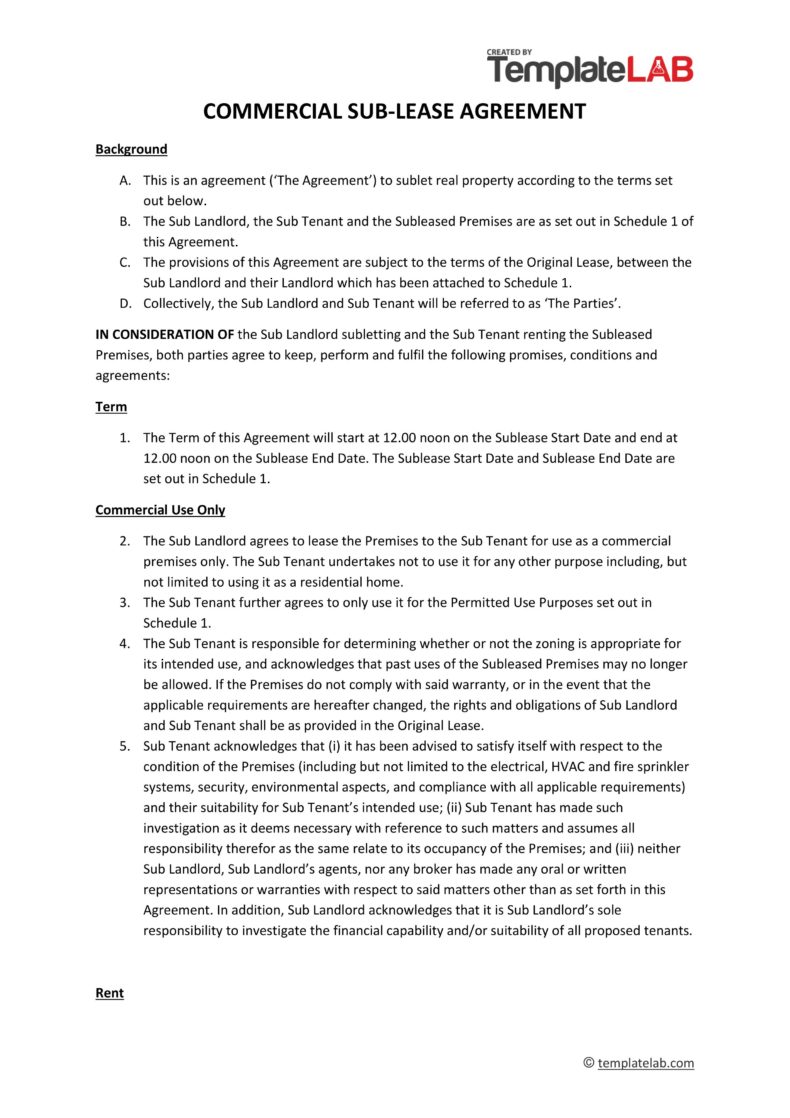

Upon approval, the landlord will be able to sign a lease agreement with the business entity, which outlines a few important aspects including:

- The length of the lease

- The amount of rent

- Any special rules

- Whether the tenant can make changes to the property

- When the rent is due

The tenant and the landlord will be able to discuss the specific rules and regulations in the commercial tenant lease when they get that far.

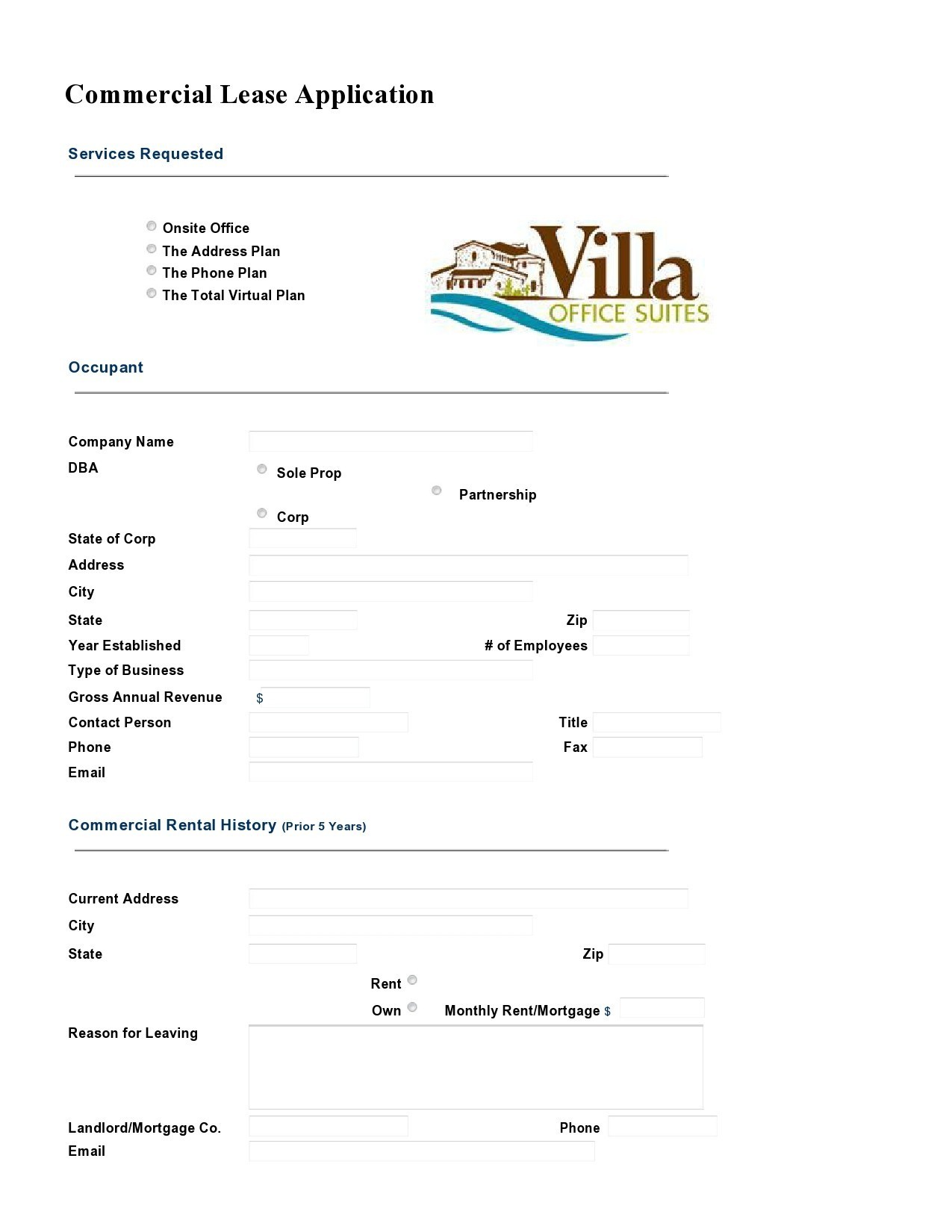

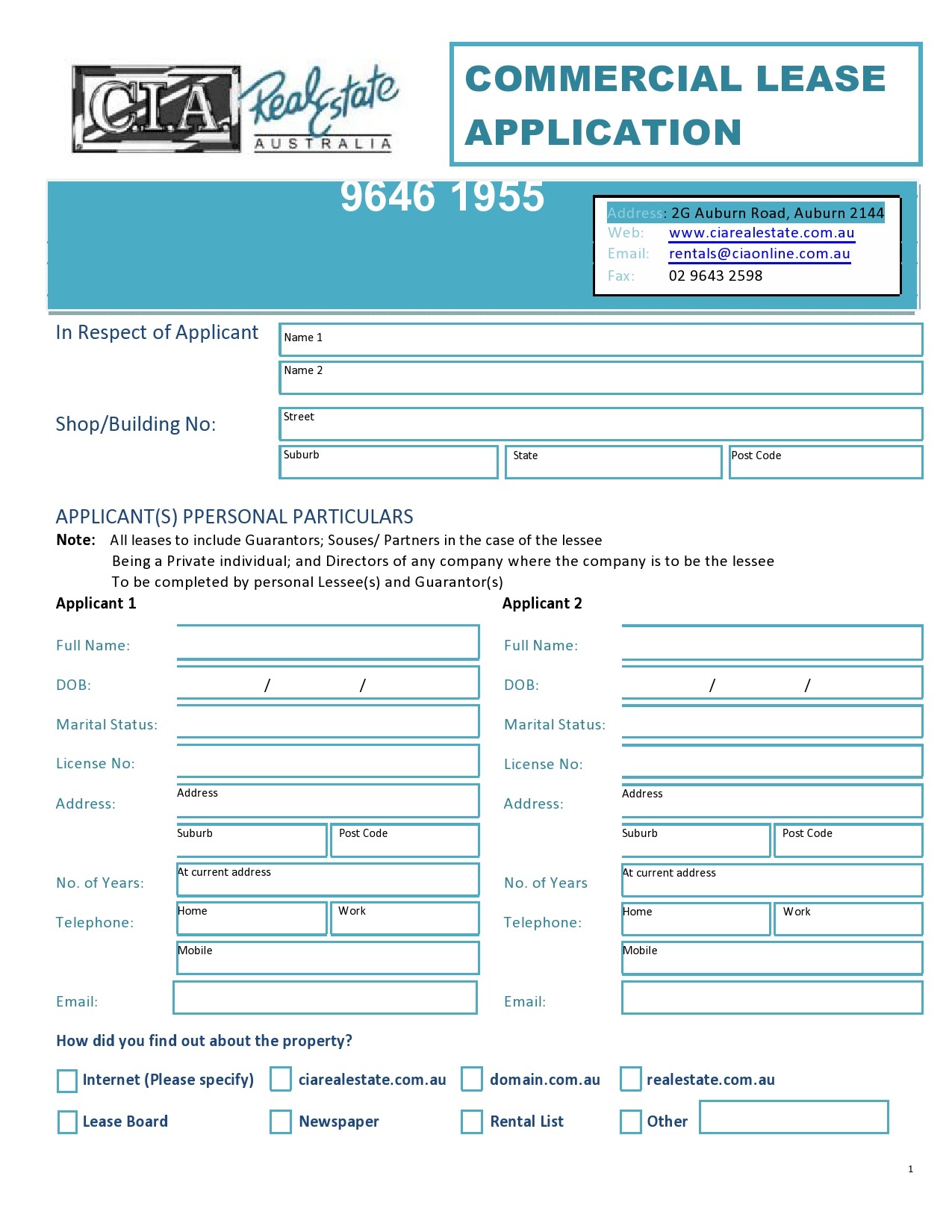

Commercial Rental Applications

Why is a Commercial Lease Application Important?

A commercial tenant application is important for helping protect the landlord and ensure that the business owner will be able to support the price of the rent and will stick around until the lease is done. It can be beneficial for the tenant as well, giving them some peace of mind knowing they can stay at the property or won’t have legal trouble.

There are a few benefits that both the tenant and the landlord can enjoy when it comes to a commercial lease form. These include:

- Minimize defaults: Using the commercial lease application form will allow the landlord to look at all the finances of their potential tenant. This can include gross income, cash flow, and expenses. The landlord can then sport some of the potential issues with the tenant, if any, and will eliminate some of the tenants who may cause problems early on.

- Reduce late payments: Late payments are often caused by an inability of the tenant to pay rent because they do not have the right funds. By using the lease application form process, the landlord can look over the finances of the tenant to determine how likely it is the tenant can pay the rent.

- Avoid legal issues: The landlord and the tenant may need to watch out for potential legal issues, most frequently with the payment. This can be avoided if a lease application form was used for the commercial property.

- Guarantee some peace of mind: The landlord will feel more confident in the tenant they choose for the commercial property if they take the time to have them fill this form out.

A landlord does not want to lease out their property to just anyone. They want to ensure the rent will be paid on time each month and the tenant will stay long-term. Having each tenant fill out a commercial lease application makes it more likely this will happen.

Commercial Tenant Applications

What Information is On a Commercial Lease Application Form?

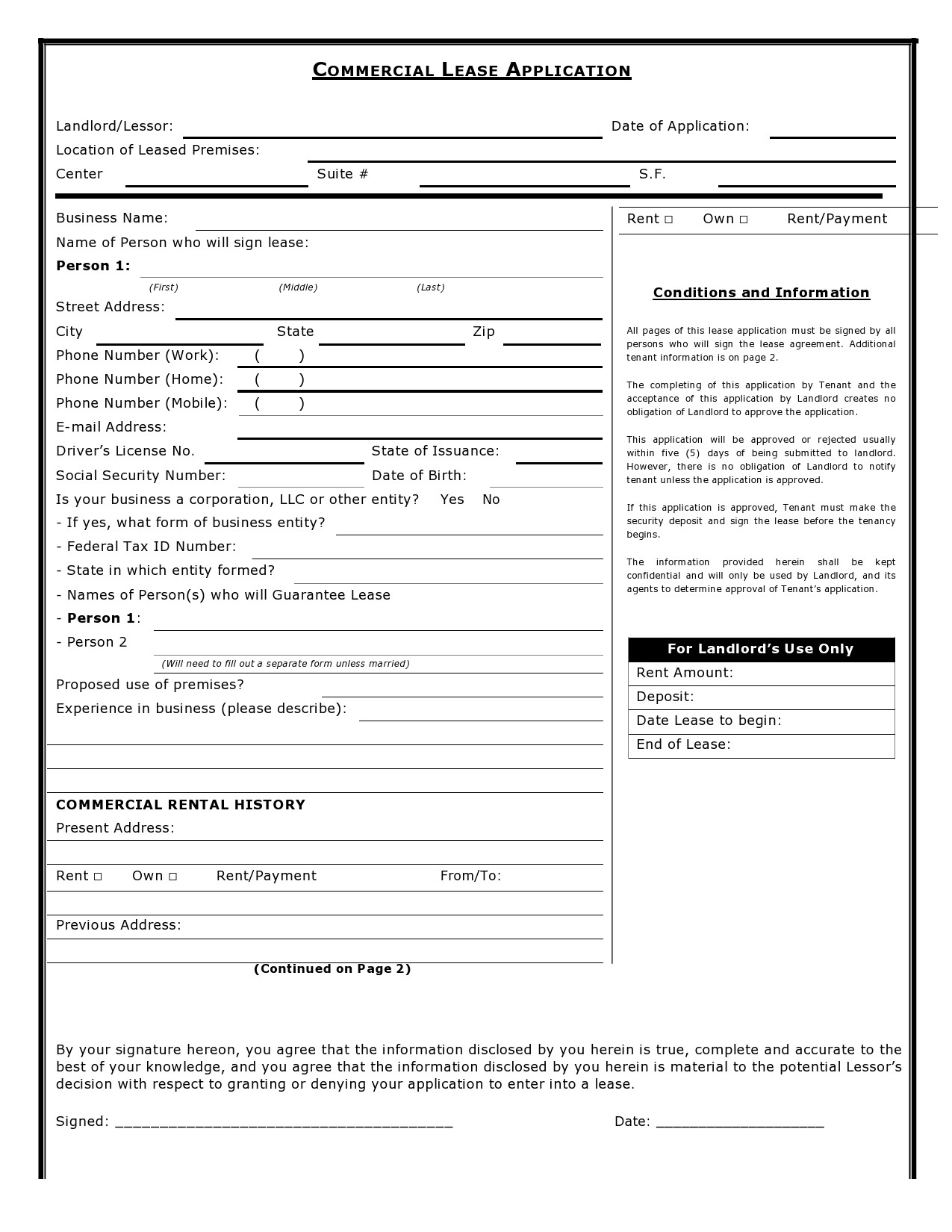

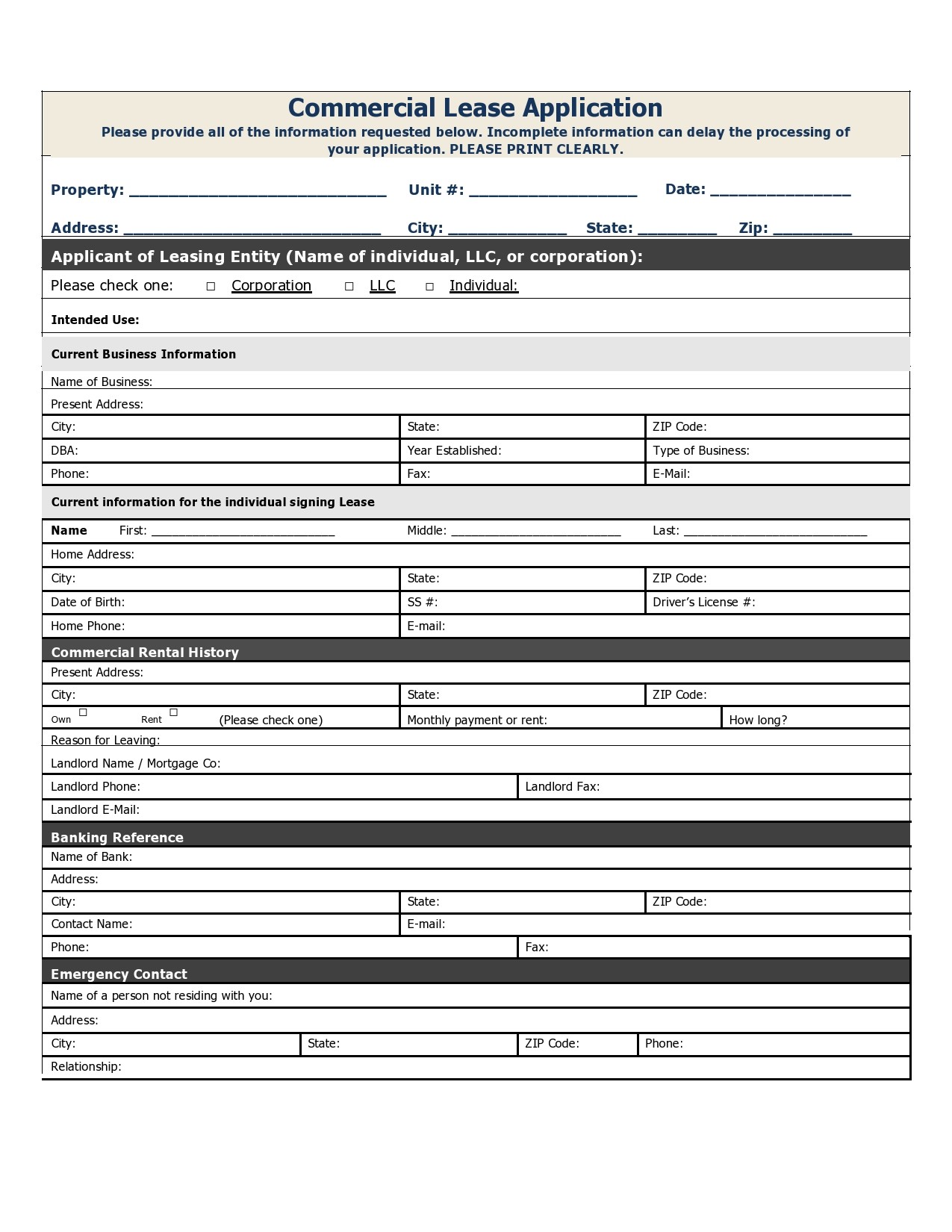

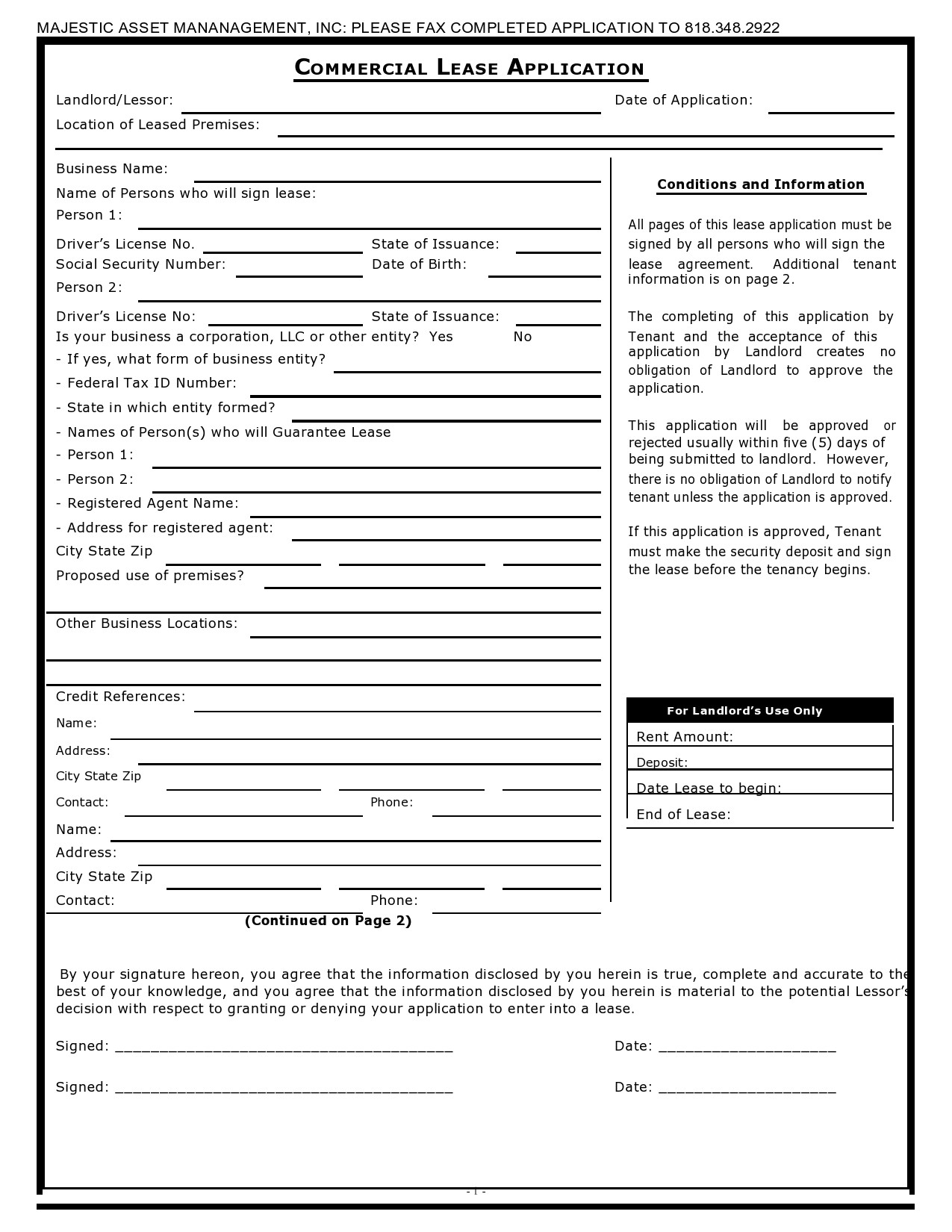

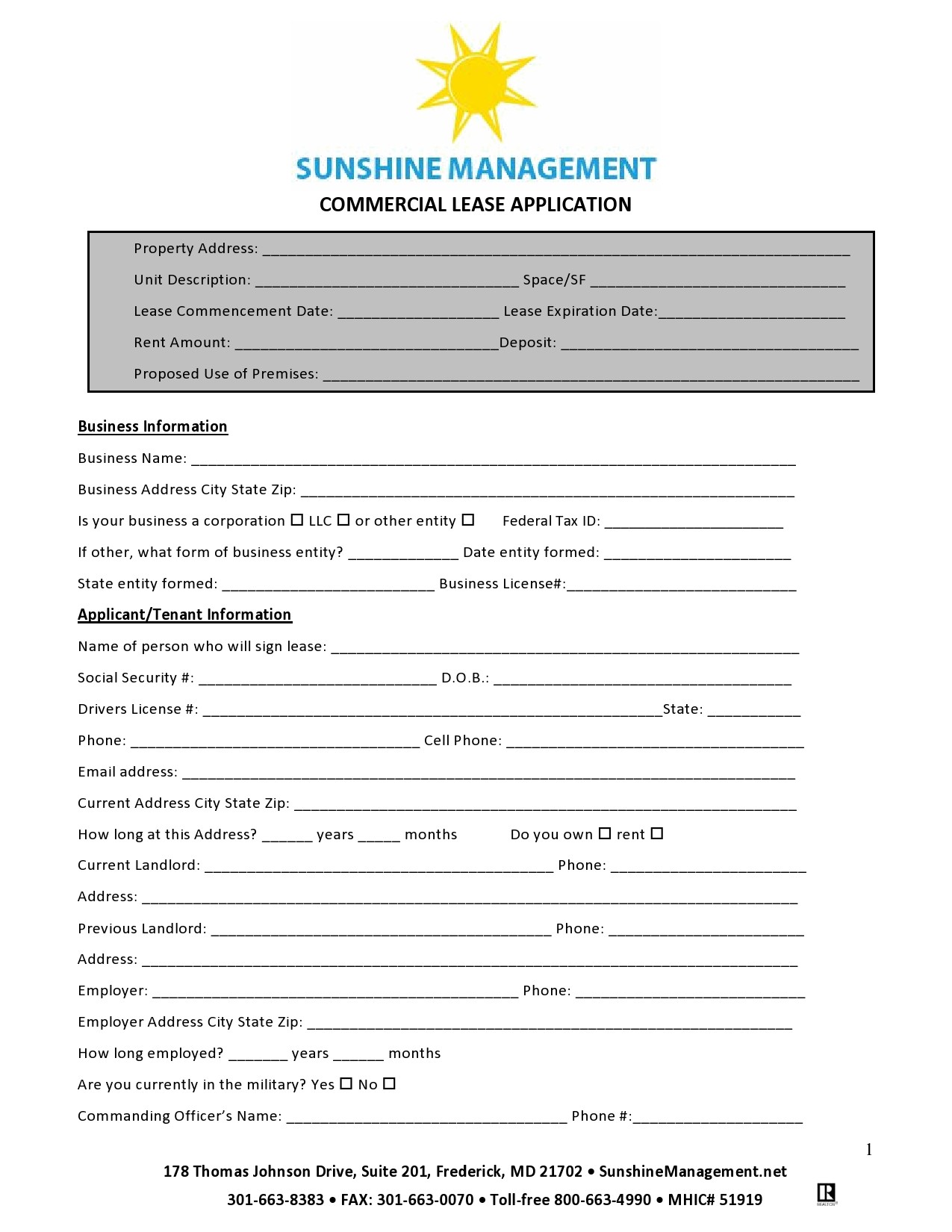

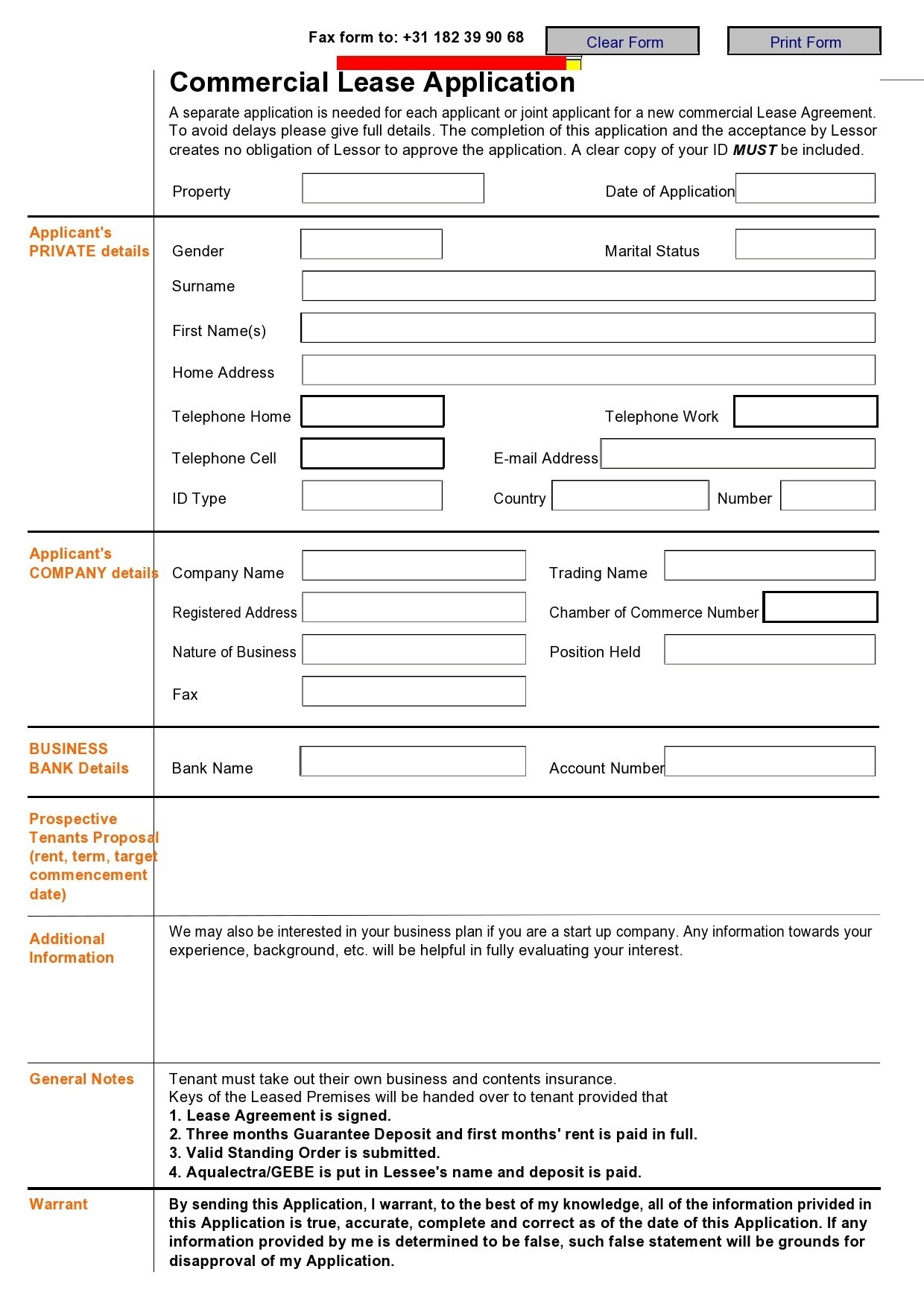

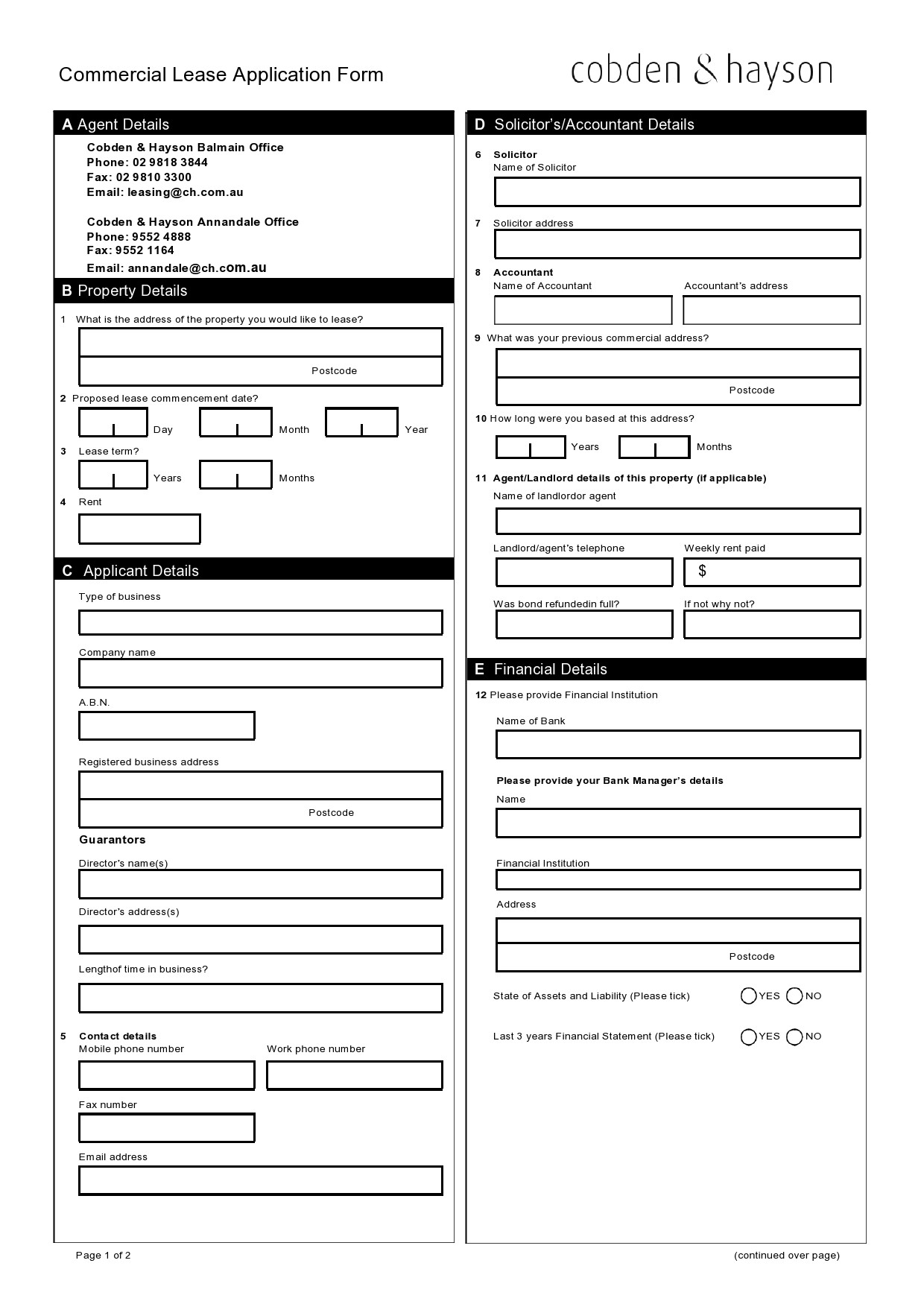

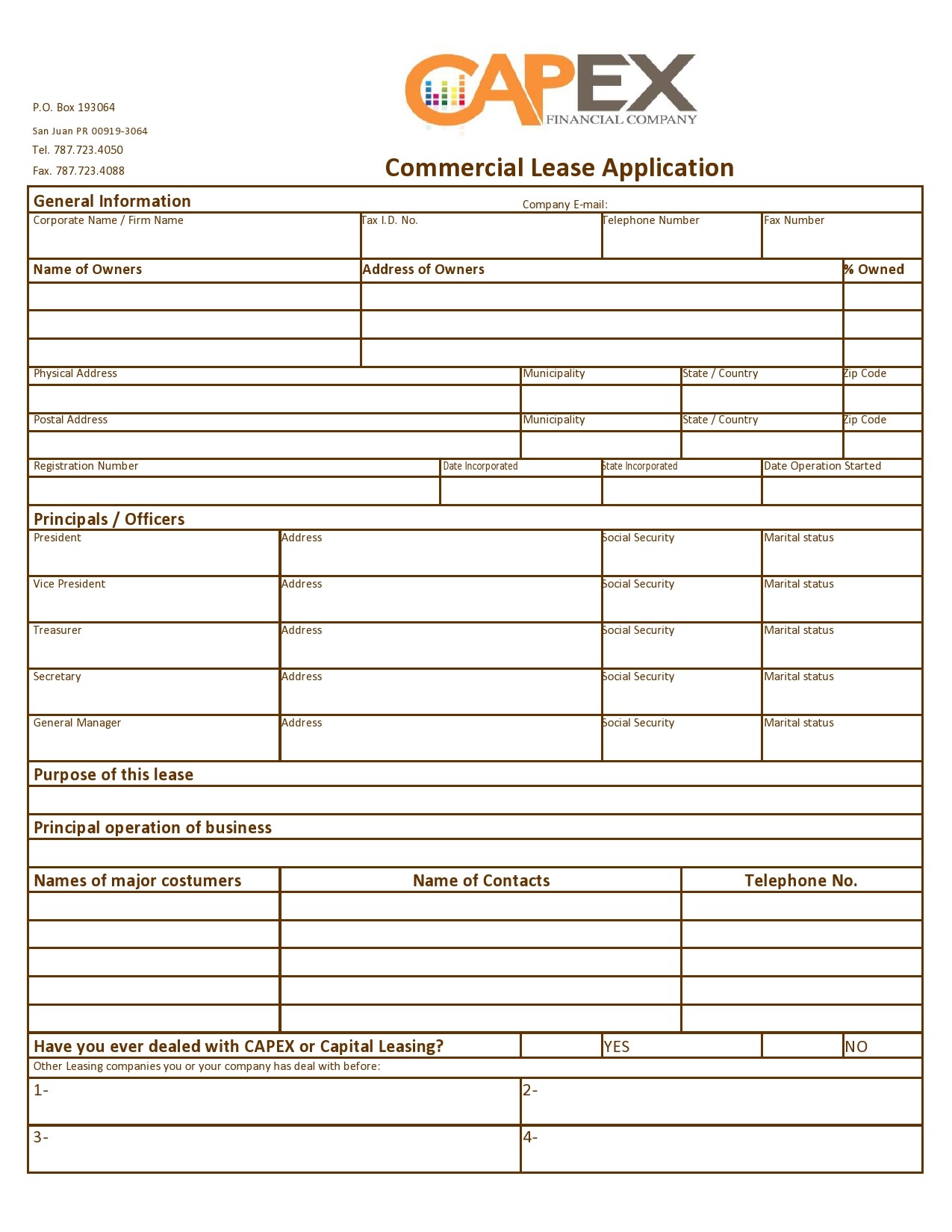

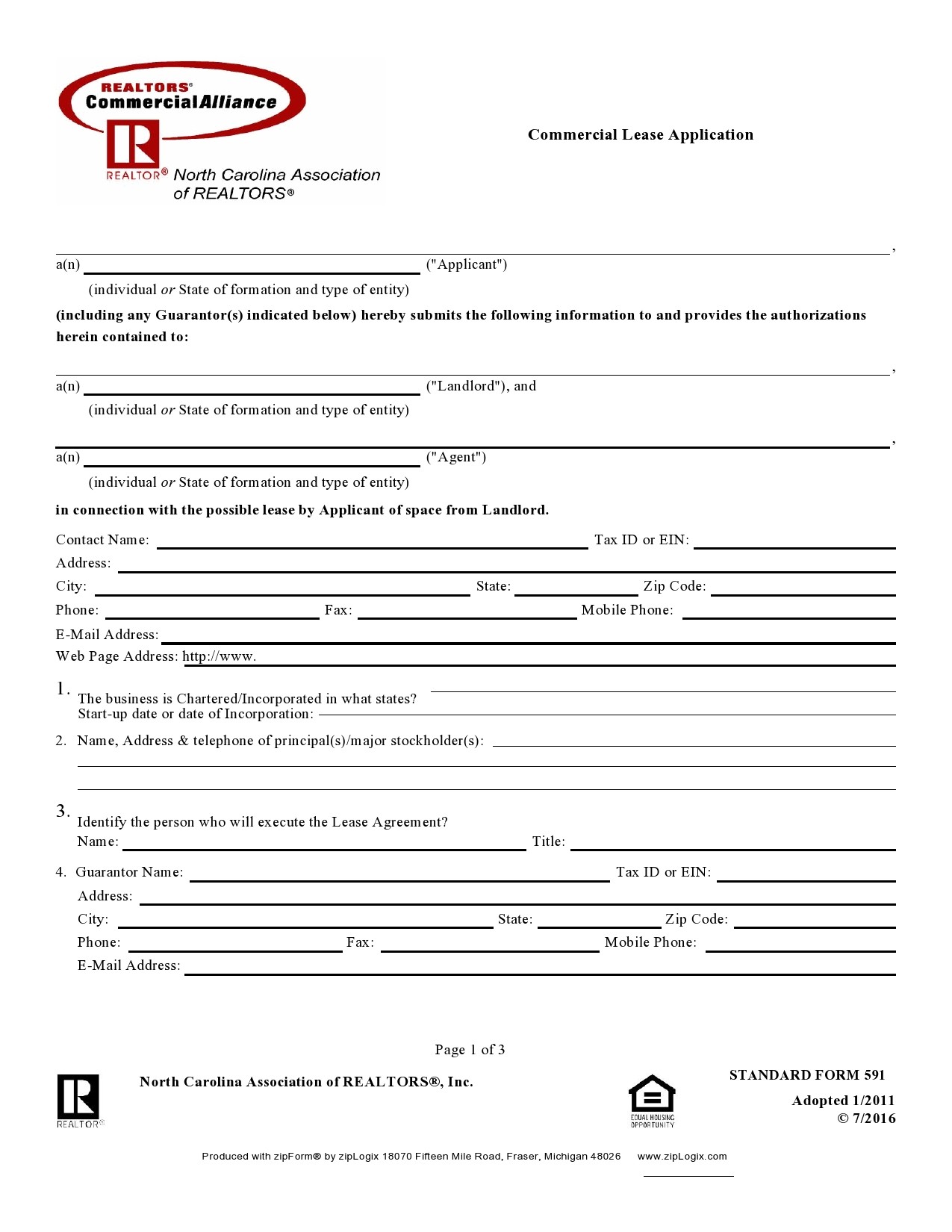

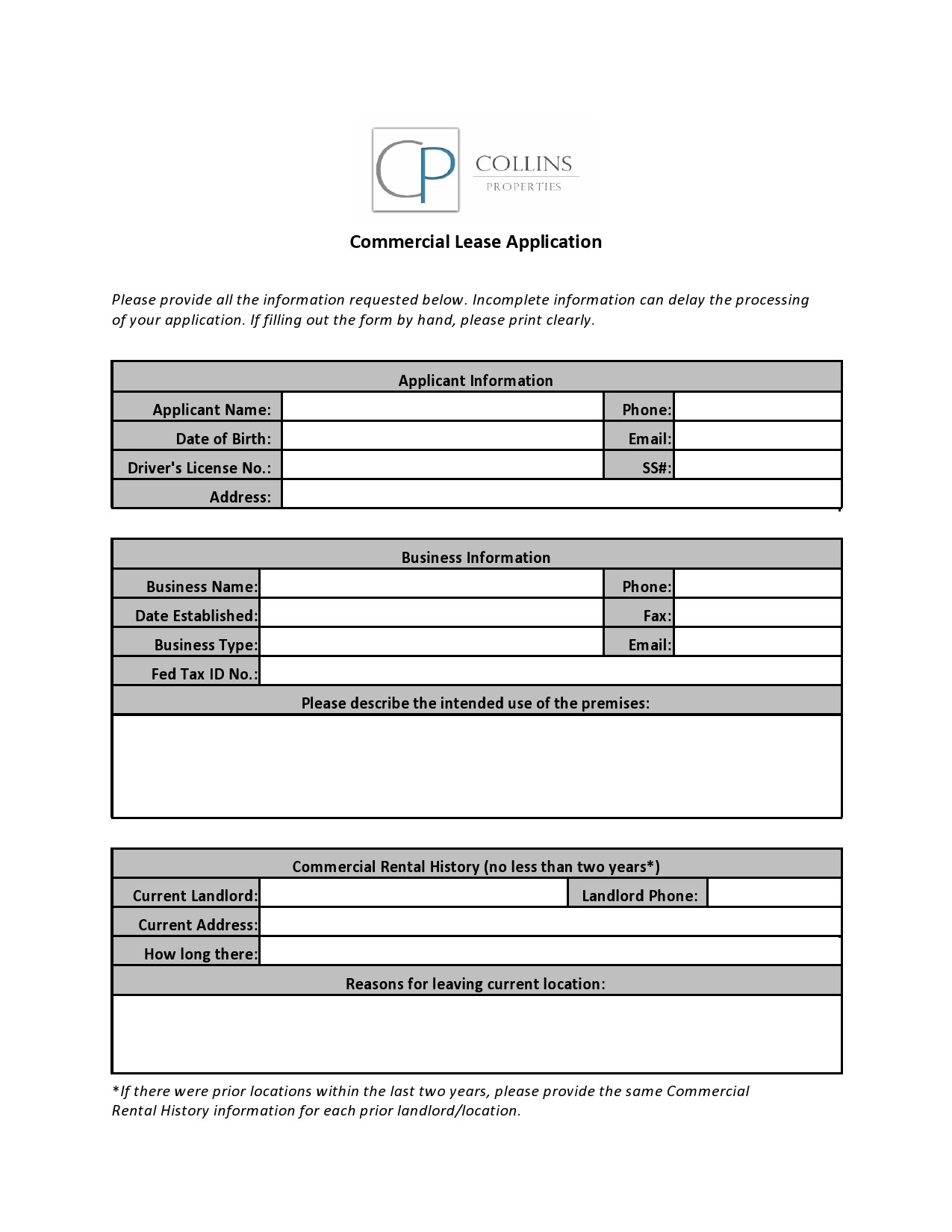

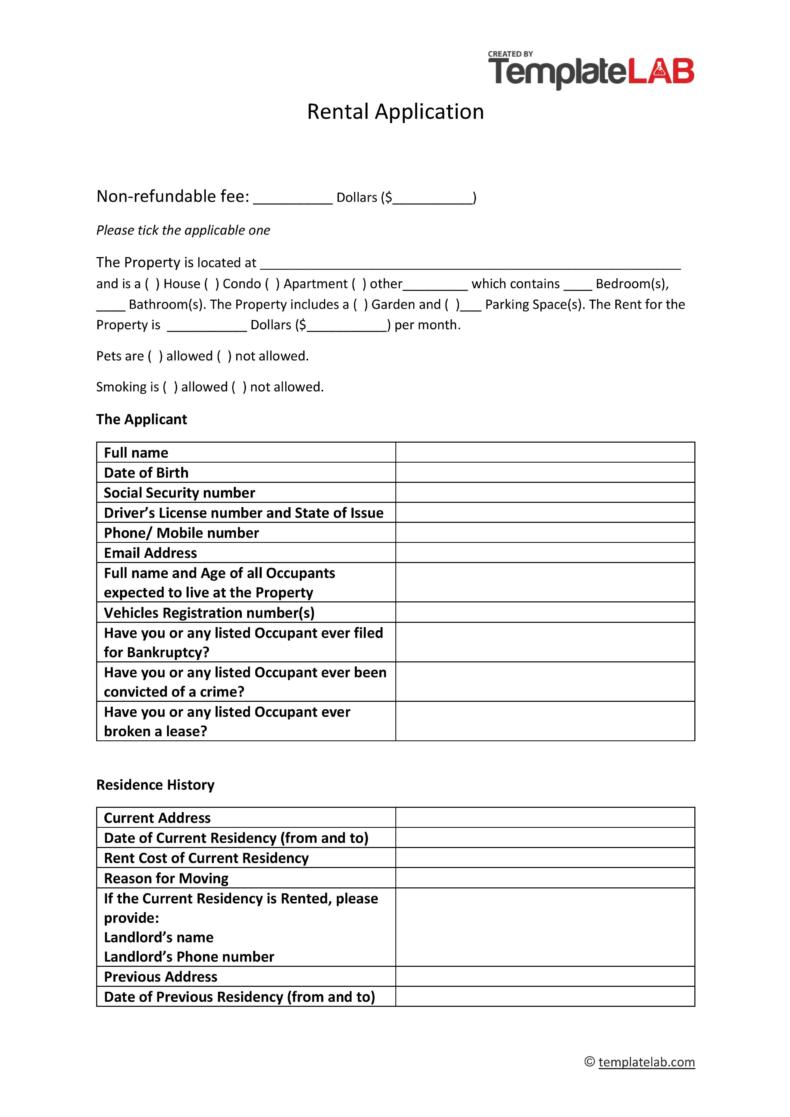

A commercial lease application form will be quite complex and can take some time for the business to fill out. The point is to ensure that the landlord picks the right tenant, one who will pay the rent each month will take good care of the property, and will not ruin the whole thing. Some of the information that is found on the form includes:

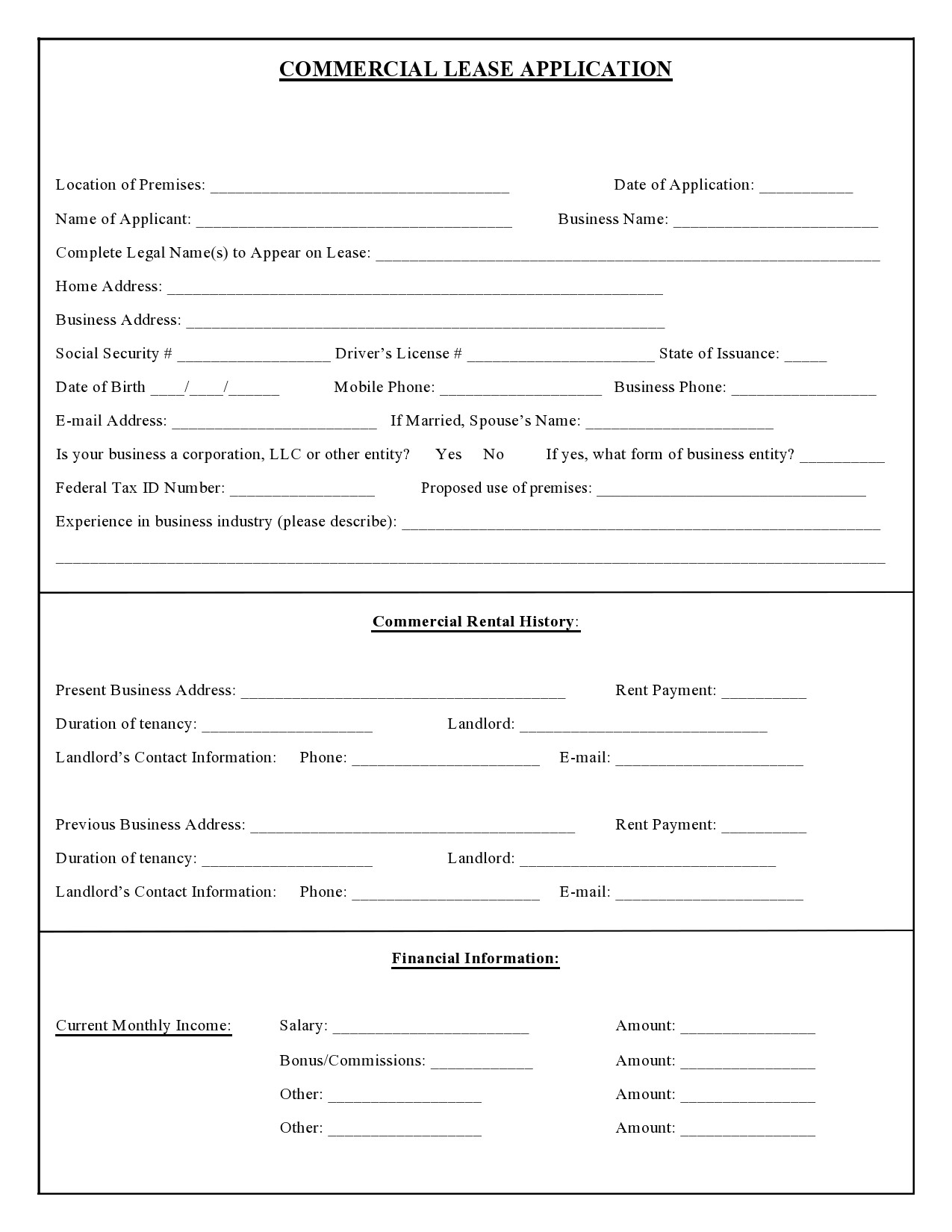

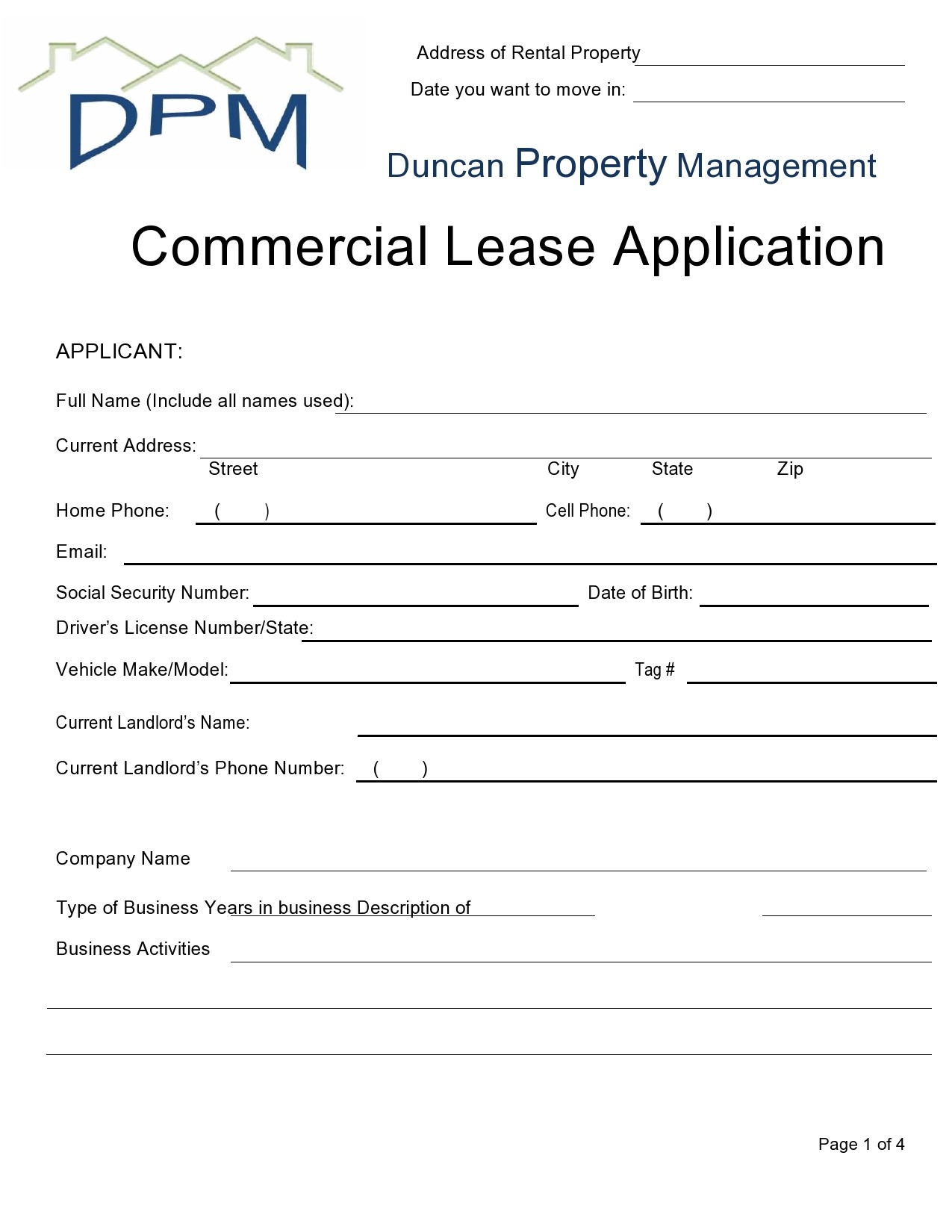

Lessor and Property Information

In the first section, the landlord information may be filled out to speed up the process. The tenant should review the information for accuracy. There should also be information about the property listed right under the landlord. Property information to include:

- The building number

- The street

- The unit number is required

- City, state, and zip code

The landlord may choose to add additional descriptive information about the property as well, including the square feet of the unit or the name of the property if it has one.

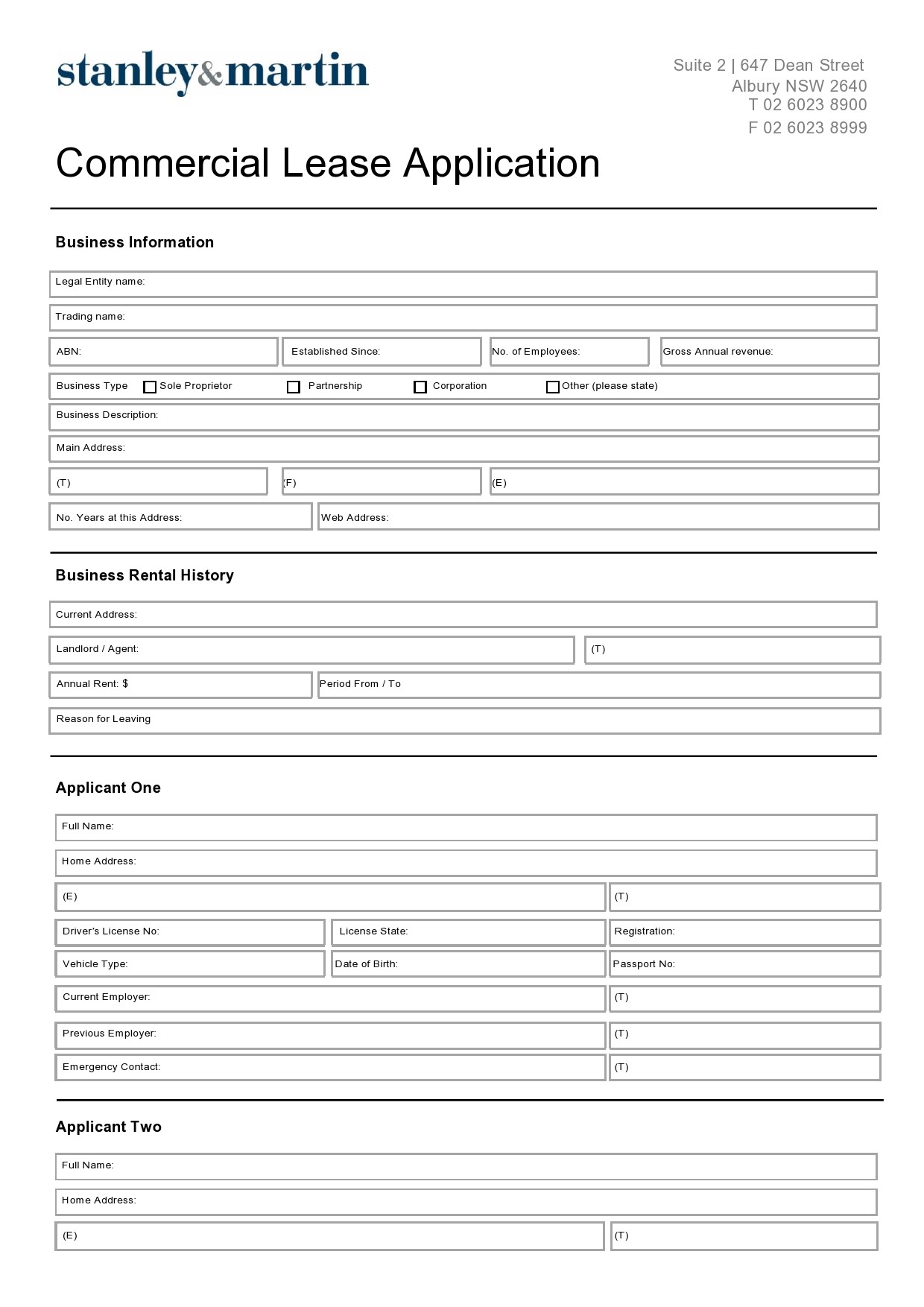

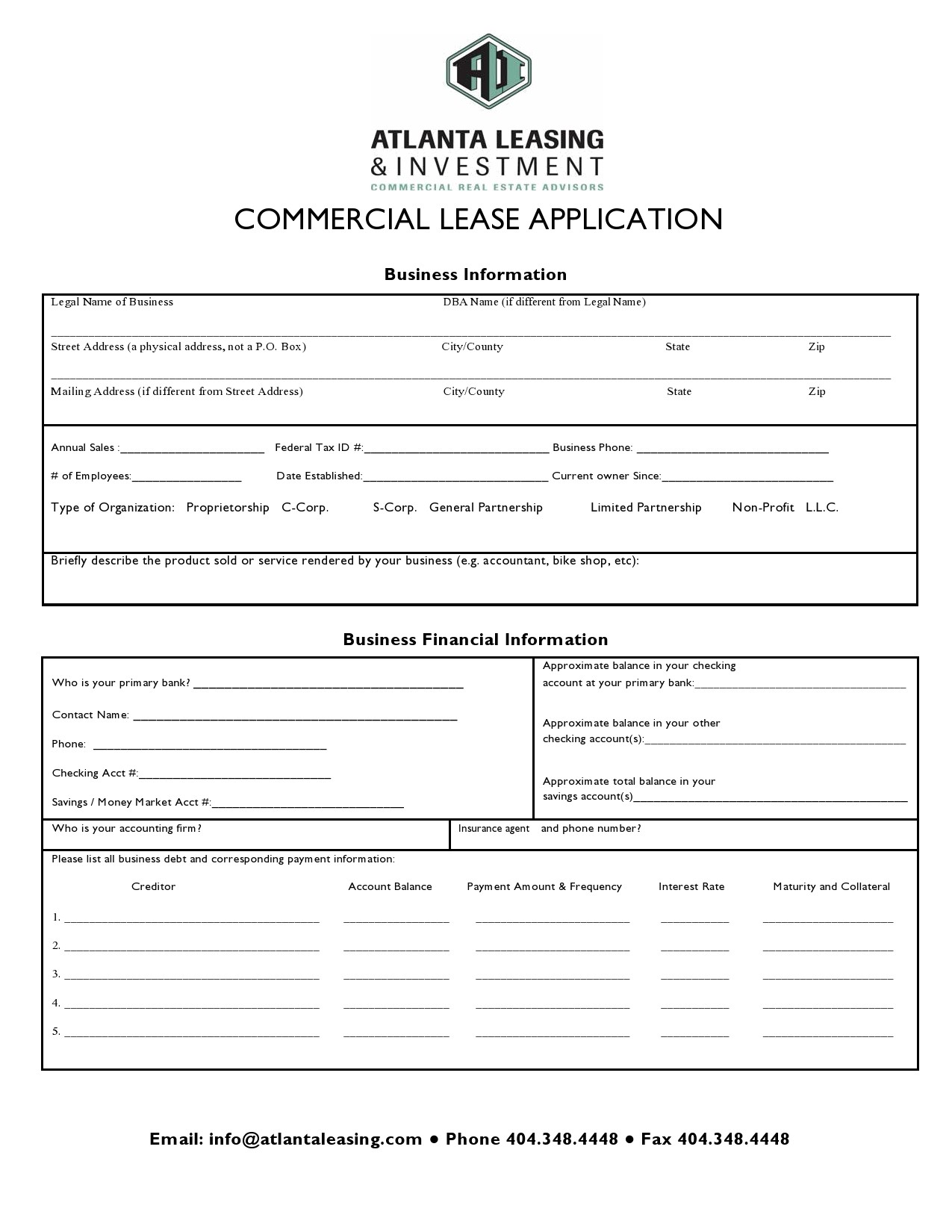

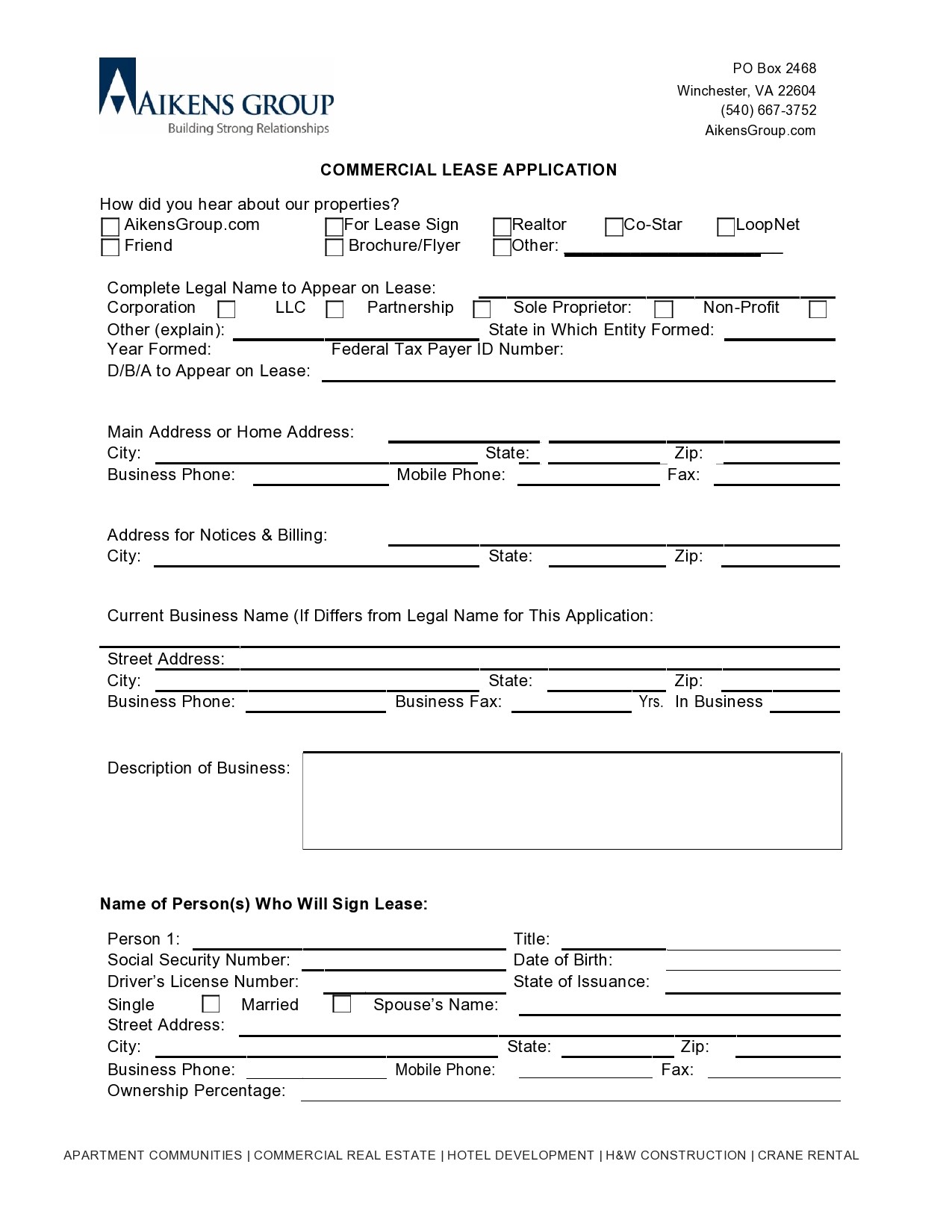

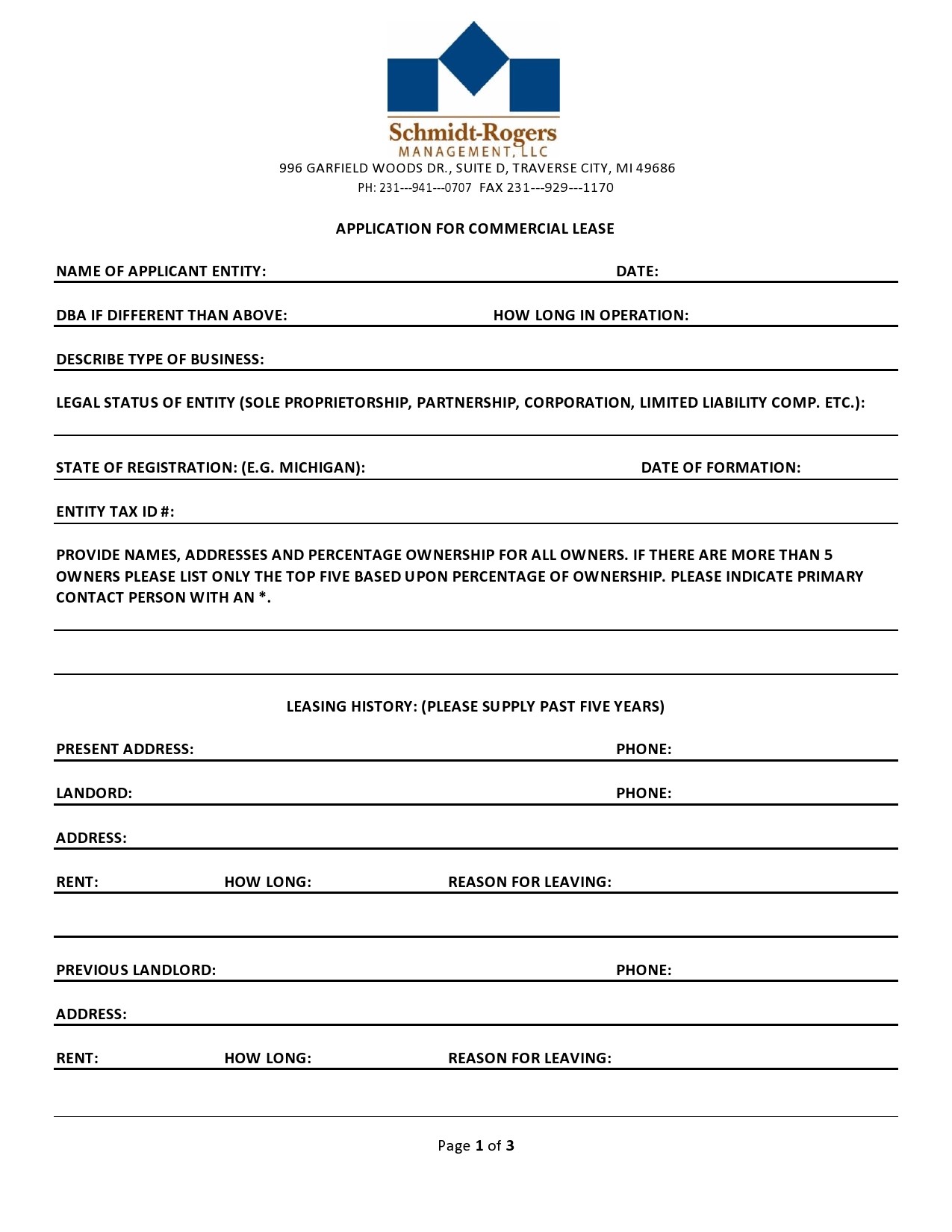

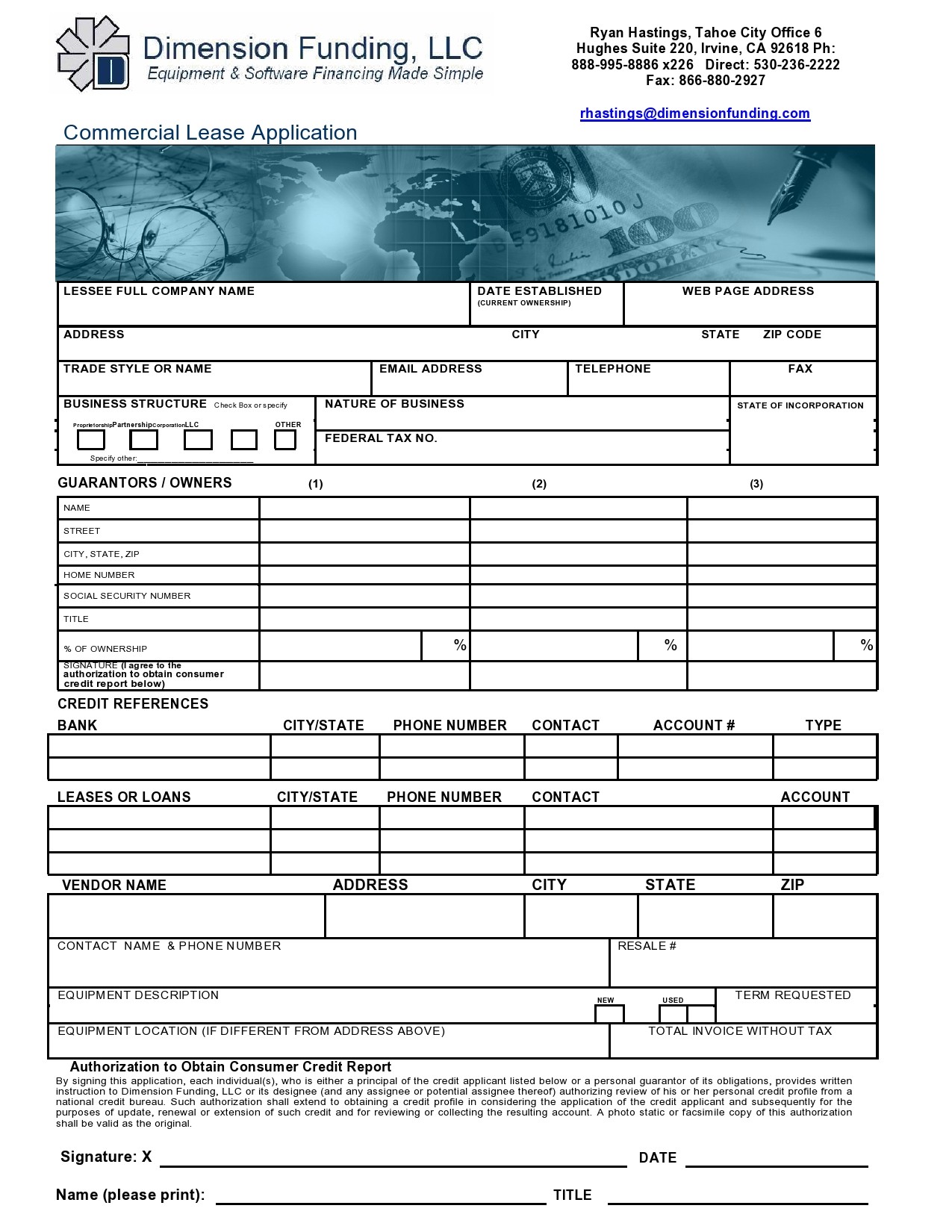

Business Information

In the second section, the business must include their business information as well. They need to use the space to record the full legal name of their business entity, including the legal suffixes, such as Inc. Corp, or Ltd that go with the name. Other information to include for the business information will be:

- The legal address for the business entity

- Phone number

- Business type

- Email address

- State of incorporation

- Federal Tax IS Number

Make sure to provide all of this information before submitting the application. Missing information can slow down the approval process and could result in you being denied.

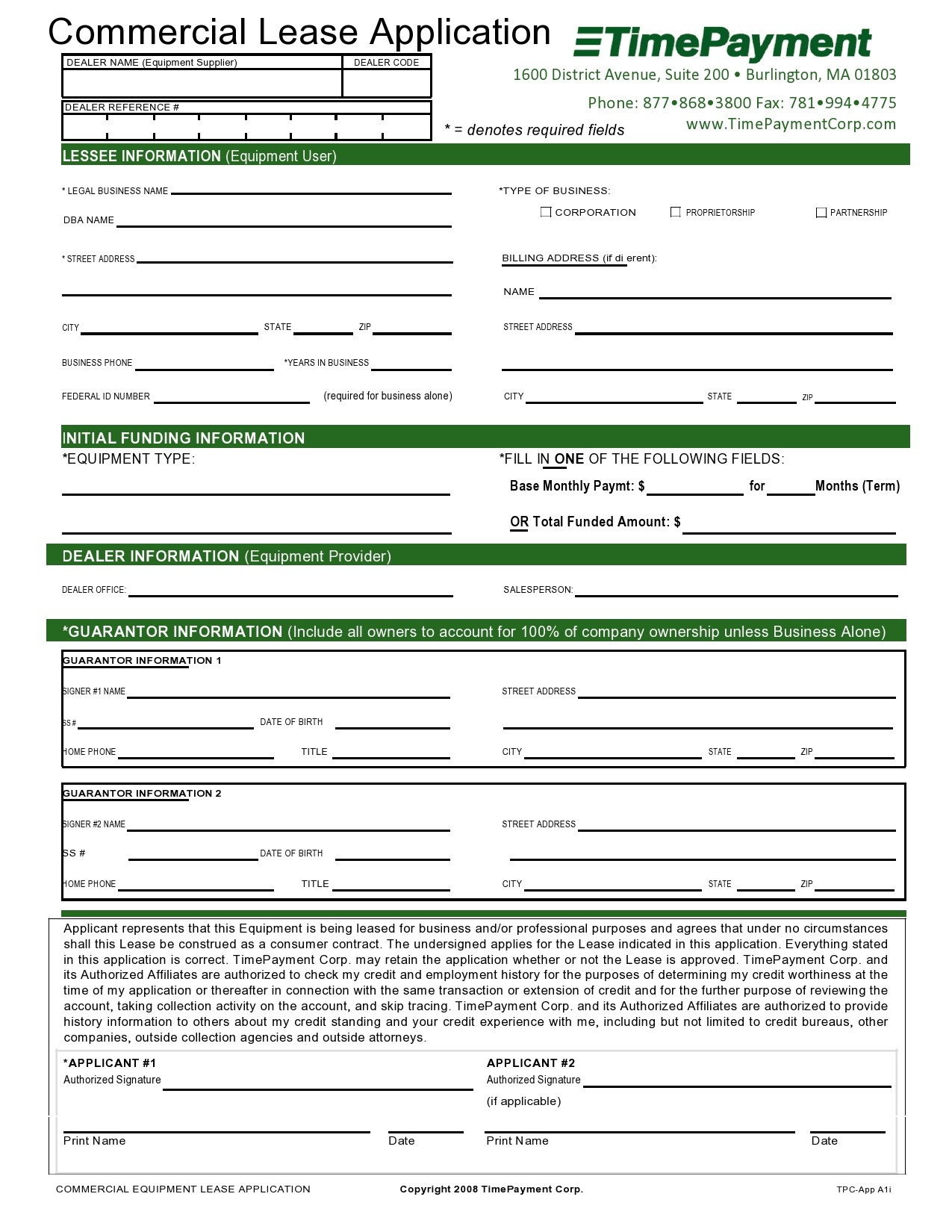

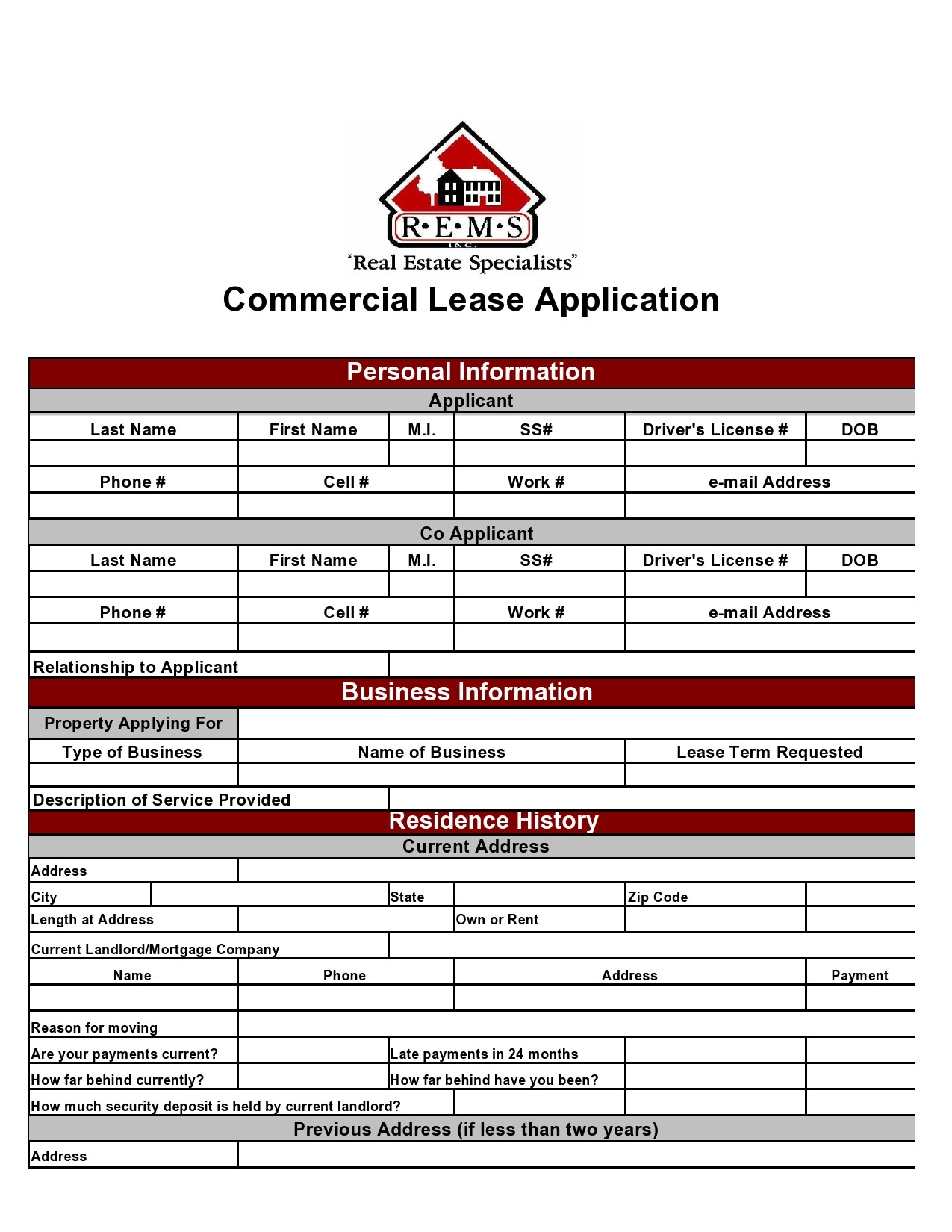

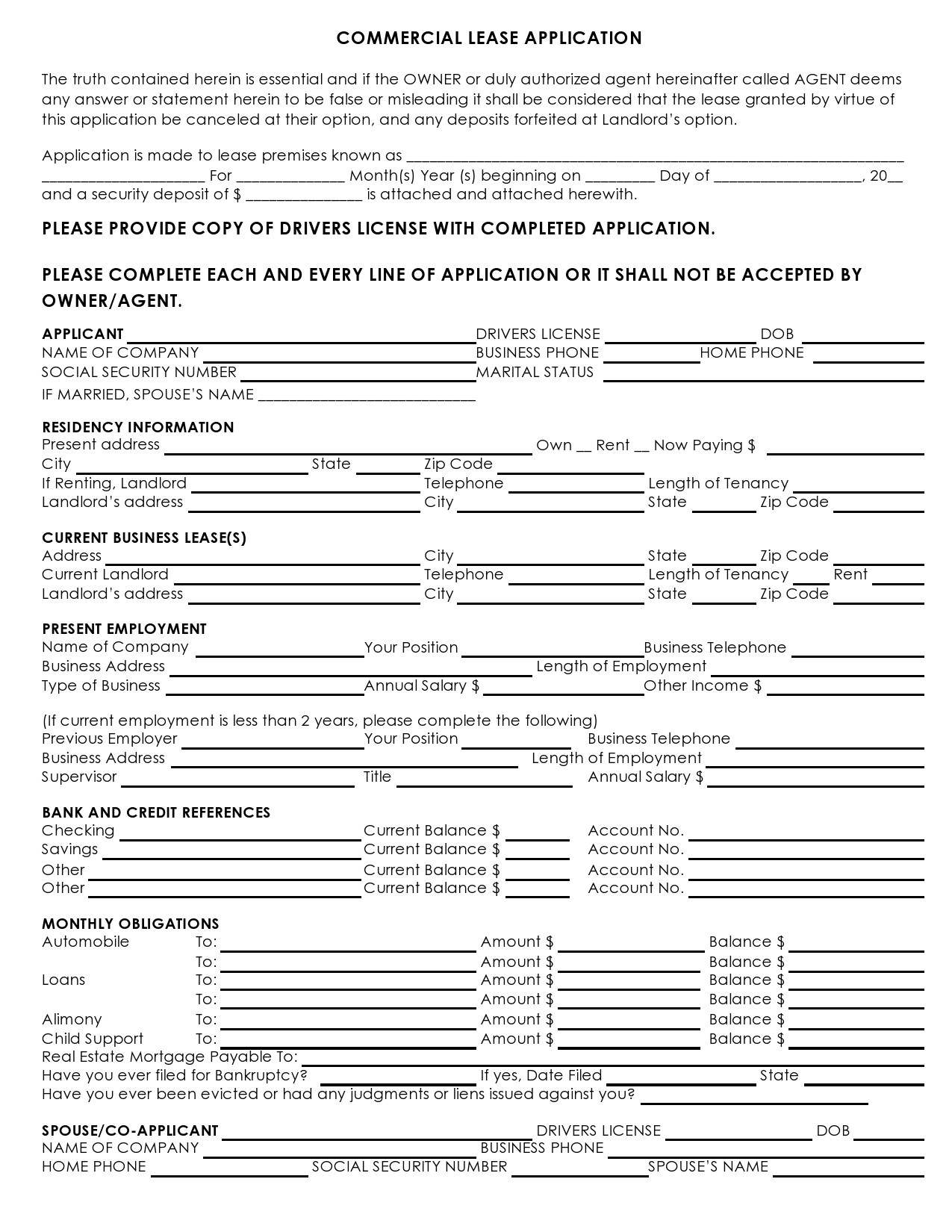

Tenant Information

While the business information is important for helping the landlord see which business is going to reside in the property, there will be tenants who run the business and will actually use the facility. The landlord will want documentation on the individuals who make business decisions for the business.

Most commercial property leases will have enough room for two individuals to be included. If more than two need to be added, then you can attach a sheet of paper with the additional information.

The landlord is likely to ask for a good deal of information on the tenants who will help run the business on the property. Some of the data they need include:

- The name of the owner or tenant as well as their ownership percentage and title.

- Driver’s license information like the number, state, issued date, and expiration date.

- Social security number of the tenant.

You must fill this information out for each individual who runs the business and will be considered one of the tenants of the property.

Guarantor for the Business

This is a short section that you can use to list out who is directly responsible for the business and will take all responsibility if something goes wrong with the property. This will include two lines, allowing the landlord to have two people who will guarantee the lease. You only need to write down their names here.

Report of Rental History

The landlord will want to know more about the past rental history of the business entity that would like to work with them. There is often space for three or four past rental properties. You must fill out the information as completely as possible. For example, if the business entity has only rented one other location, then only fill out one line.

Some of the information that you must include in this part of the application includes:

- Present address of the business

- The amount of rent a month

- The name of the current landlord and their phone number

- Any previous addresses

Fill this out for the rentals your business entity has enjoyed for the past few years so the landlord has places to check.

Credit References

The landlord will want some credit references for the business entity before working with the tenant. Most will request three credit references. The information you will need for each of your three business entity references includes:

- Name of the reference

- Address

- Phone number

- Email address

Monetary Status of the Business Entity

Towards the end of the commercial tenant application, the business entity will need to let the landlord know more about their monetary status. This will include their current monthly revenue along with the expenses that the business typically has during the month. There will be a blank space for the gross revenue and for the total expenses.

Business Entity Assets and Liabilities

The final section will help delve deeper into the financial situation of the business. The landlord will use this to determine whether the tenant has the right financial history to afford the property or if they have too many debts that this will be difficult.

The business should fill out as much information about its debt and assets as possible. The exact amount they have will depend on the type of business, their current growth strategy, and how long they have been in business. Some of the assets that you may include on the application include:

- Cash on hand or in a bank account

- Savings accounts

- Retirement accounts

- Accounts Receivable

- Stocks and bonds

- Real estate

- Vehicles

- Insurance cash surrender

- Any other debts and liabilities

This may seem like a lot of information just for an application, but it is done to protect the landlord and make sure they choose the right tenant to rent out the property to. With the right financials and a good background check, the landlord will have peace of mind that your business will be a good addition to that property.

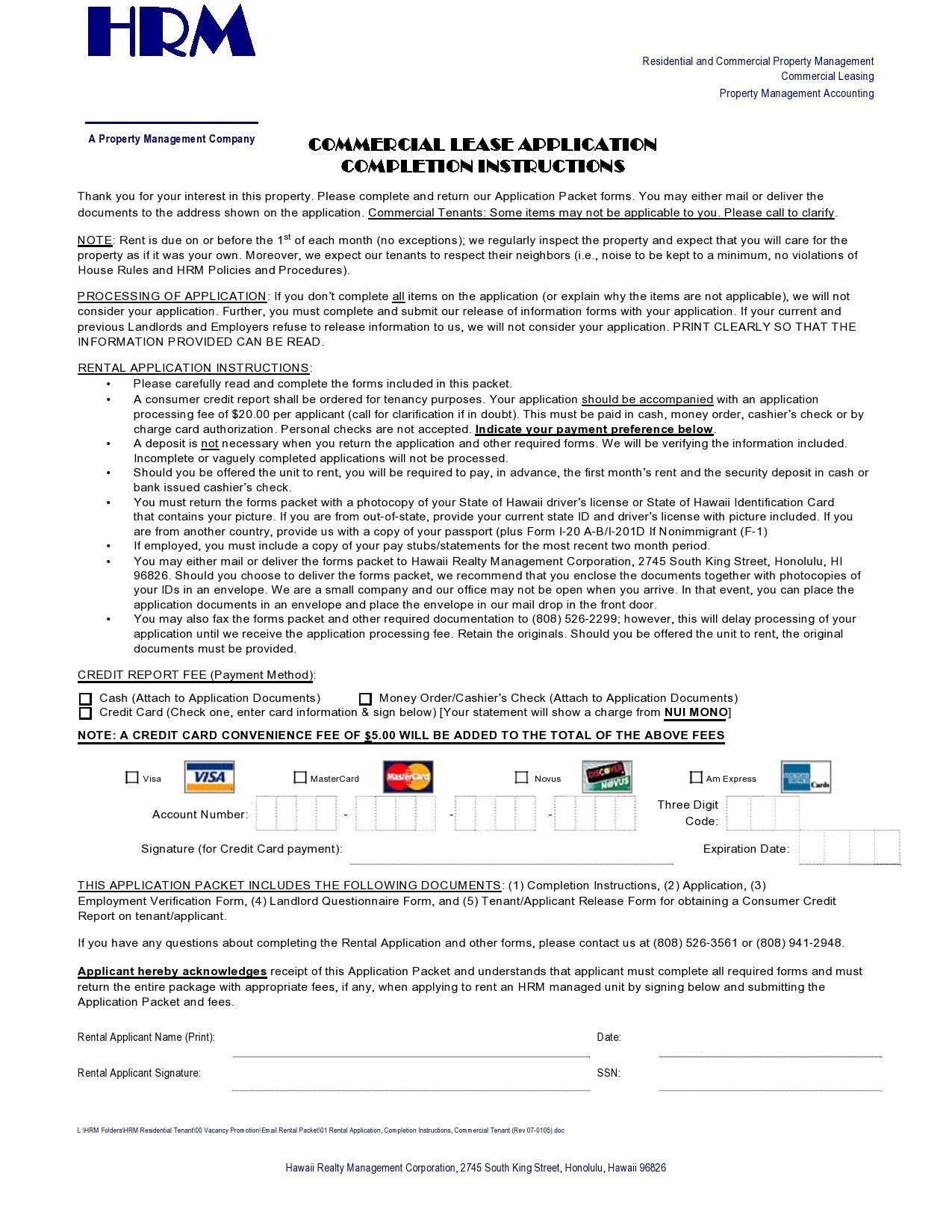

Commercial Lease Forms

FAQs

Do I need to fill out all of the information on the commercial lease application?

To be considered for a vacancy in the commercial property, you must fill out all of the requested information on the commercial lease application. If there are not many tenants applying, the landlord may take the time to ask for some of the information. When the landlord has many tenants to consider, they will likely discard your application, rather than take the time to work with you. Take the time to fill out the information to help you maintain your candidacy for the commercial property.

Is a background check done along with the commercial lease form?

Most landlords will take the time to run a background check on anyone who wishes to stay at their property. This allows them to see more about their financial and rental history. The tenant may try to hide things or omit them from the application form and utilizing a background check will protect the landlord from unscrupulous tenants.

Will the landlord run a credit check?

Most landlords will choose to complete a credit check on any potential tenant who wishes to rent from them. This ensures that the information on the application is accurate and that you are not trying to trick the landlord about your personal and financial information.