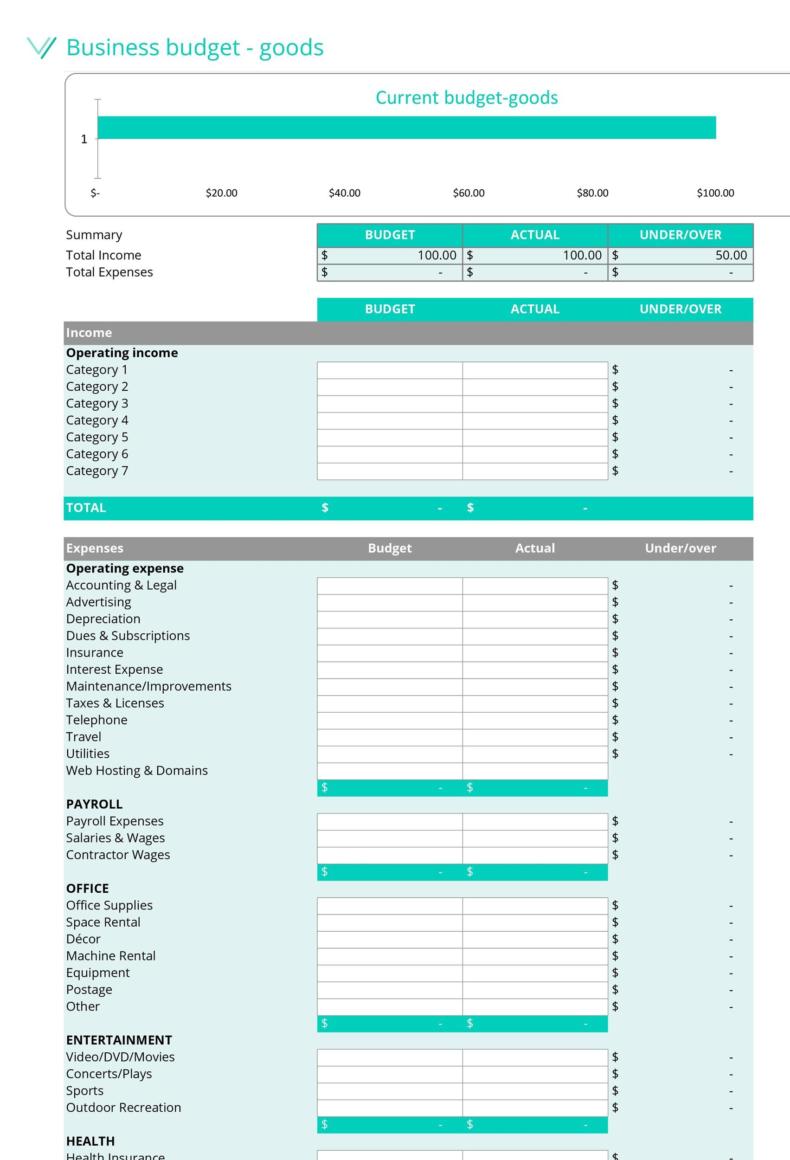

A startup budget template is an important document for anyone who wants to start a business. As you plan for any kind of business, one of the most important things to consider is the budget. You need money to get things going and to purchase everything you need for your new venture which is why a startup cost template comes in handy.

Table of Contents

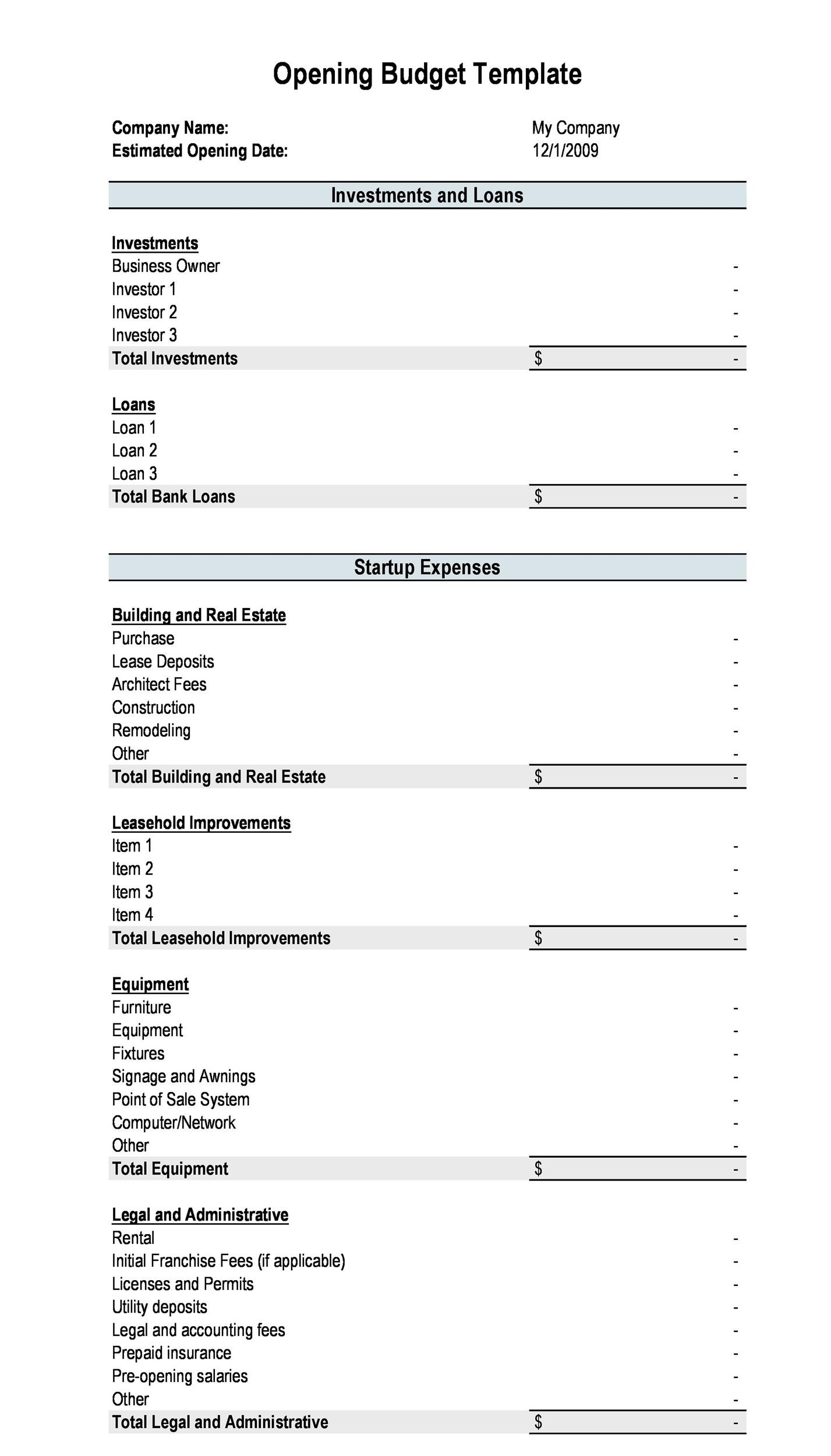

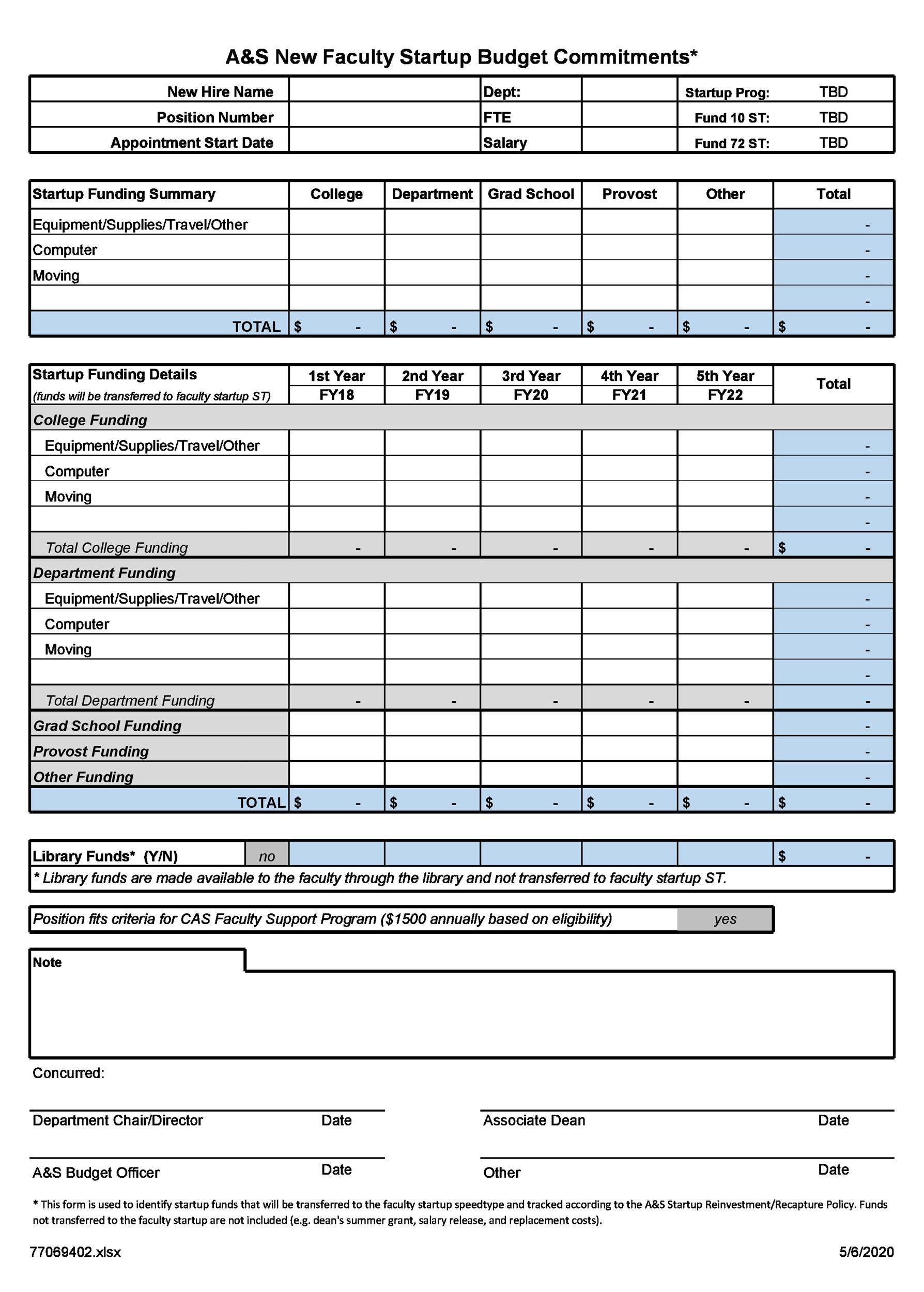

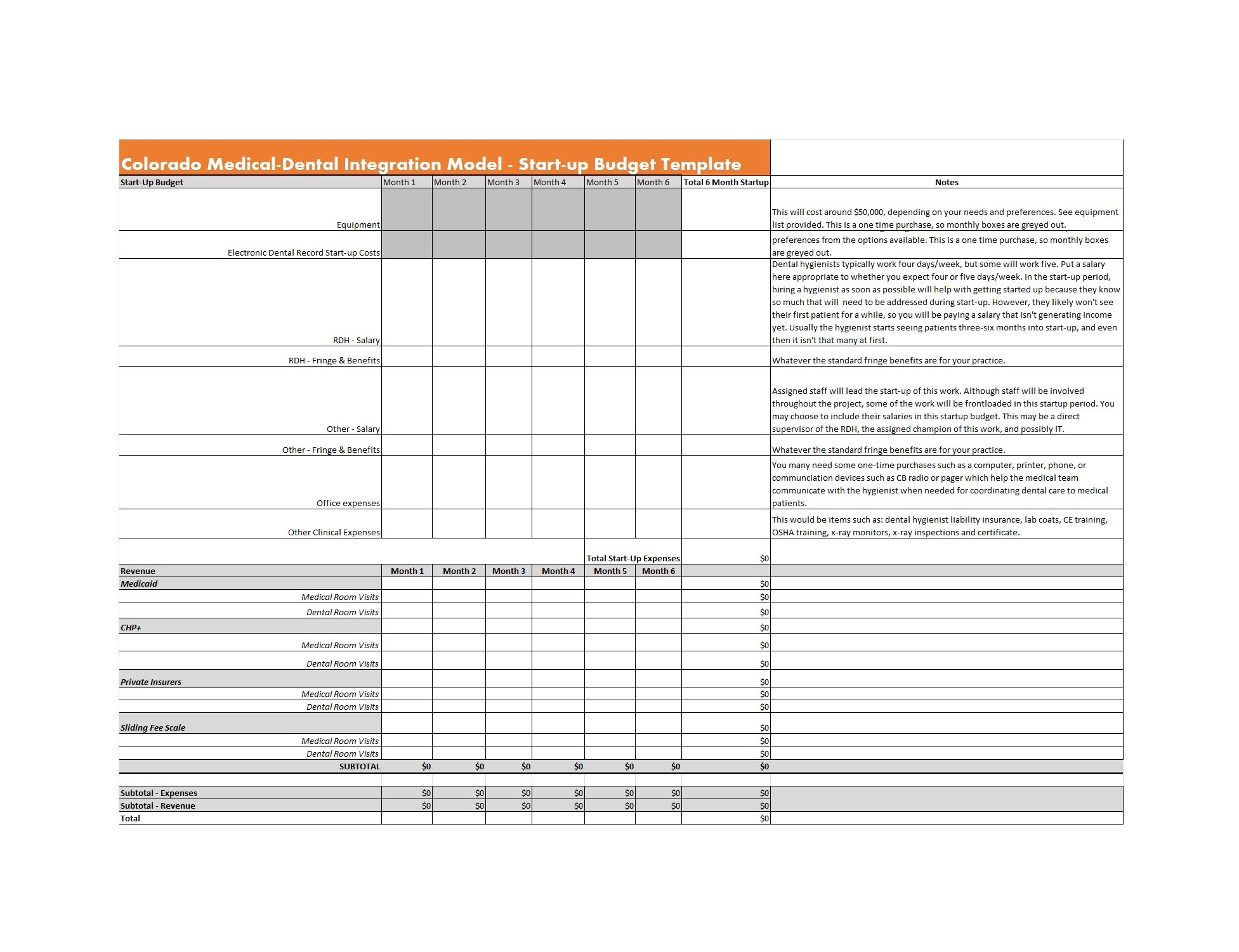

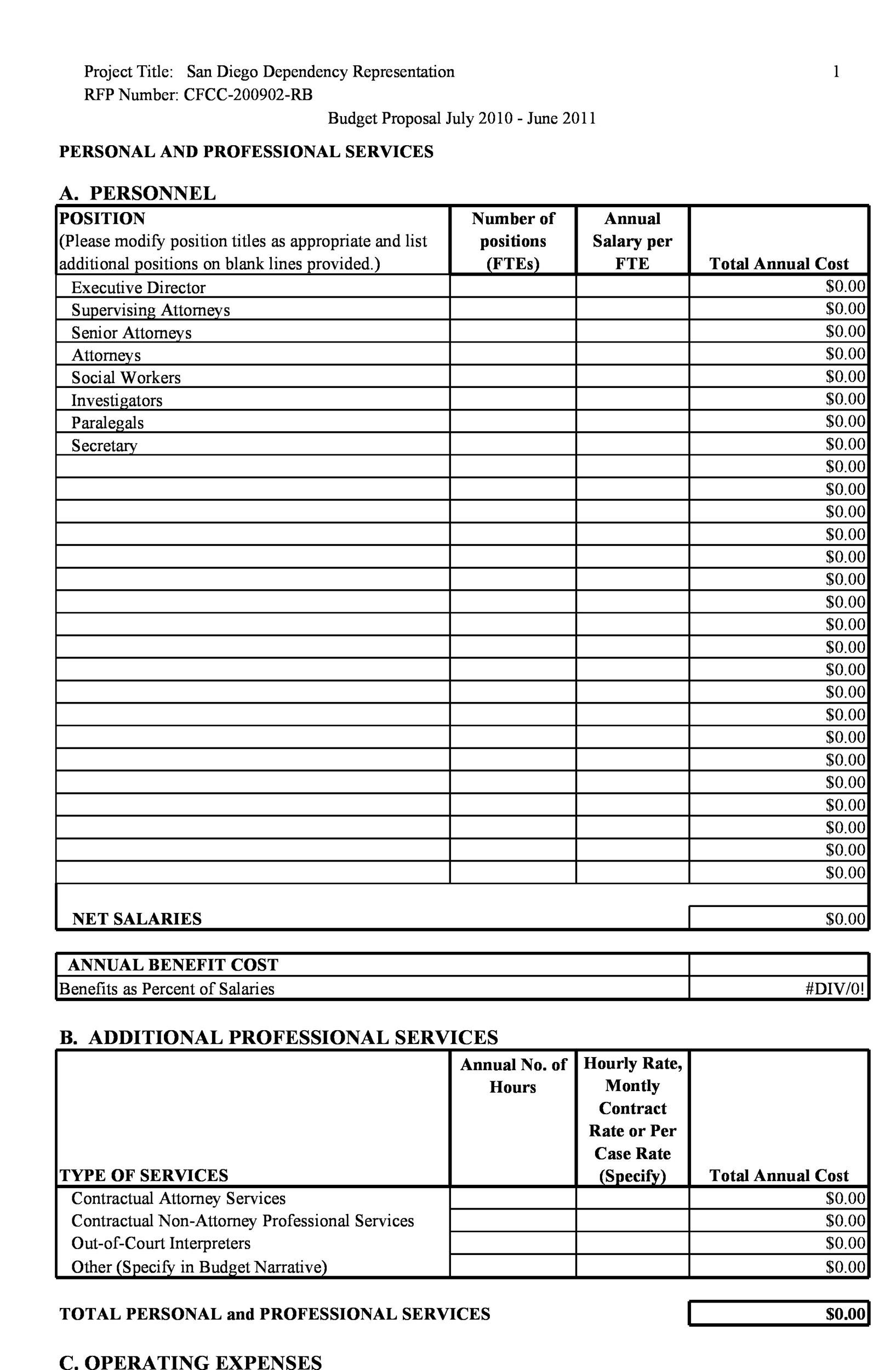

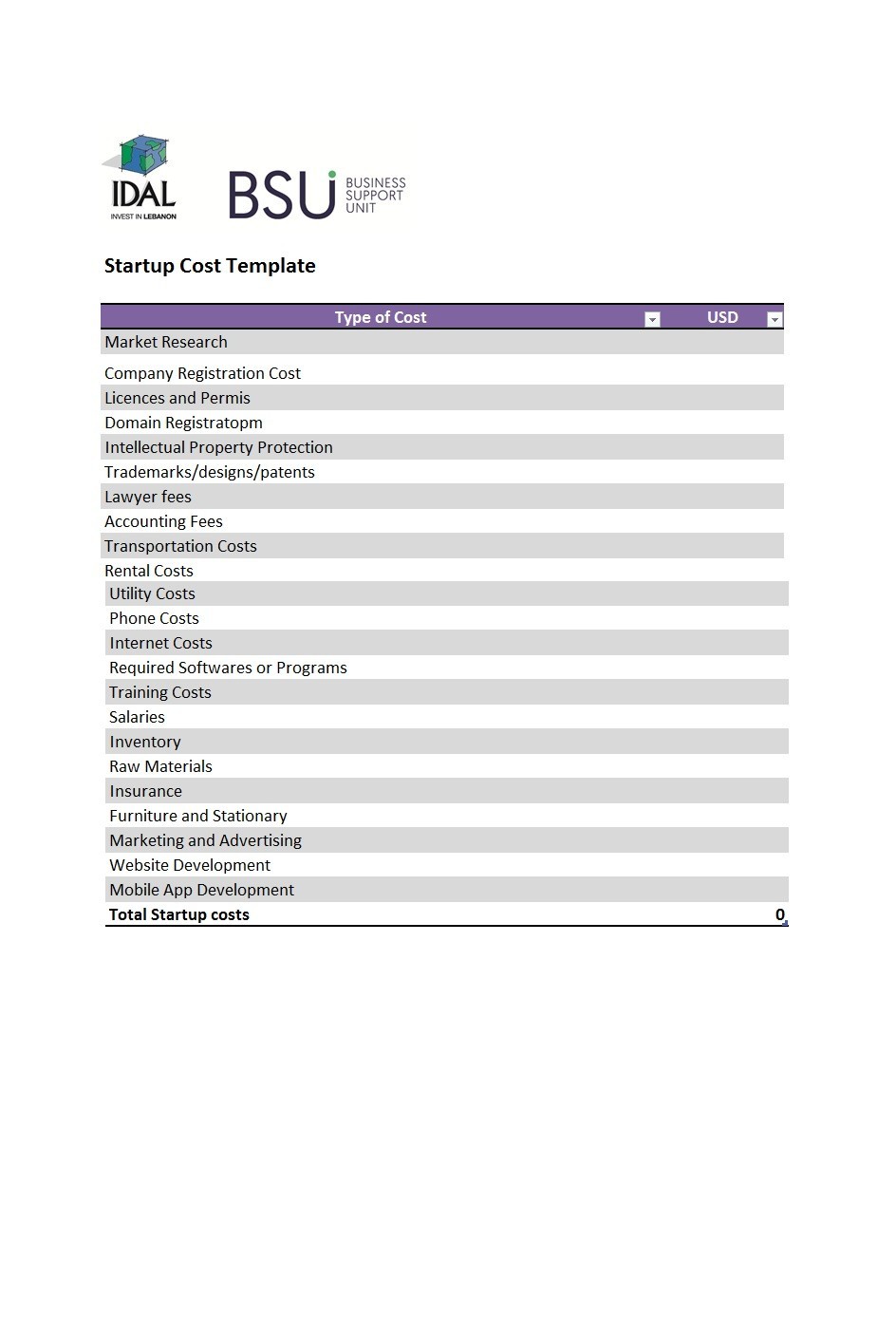

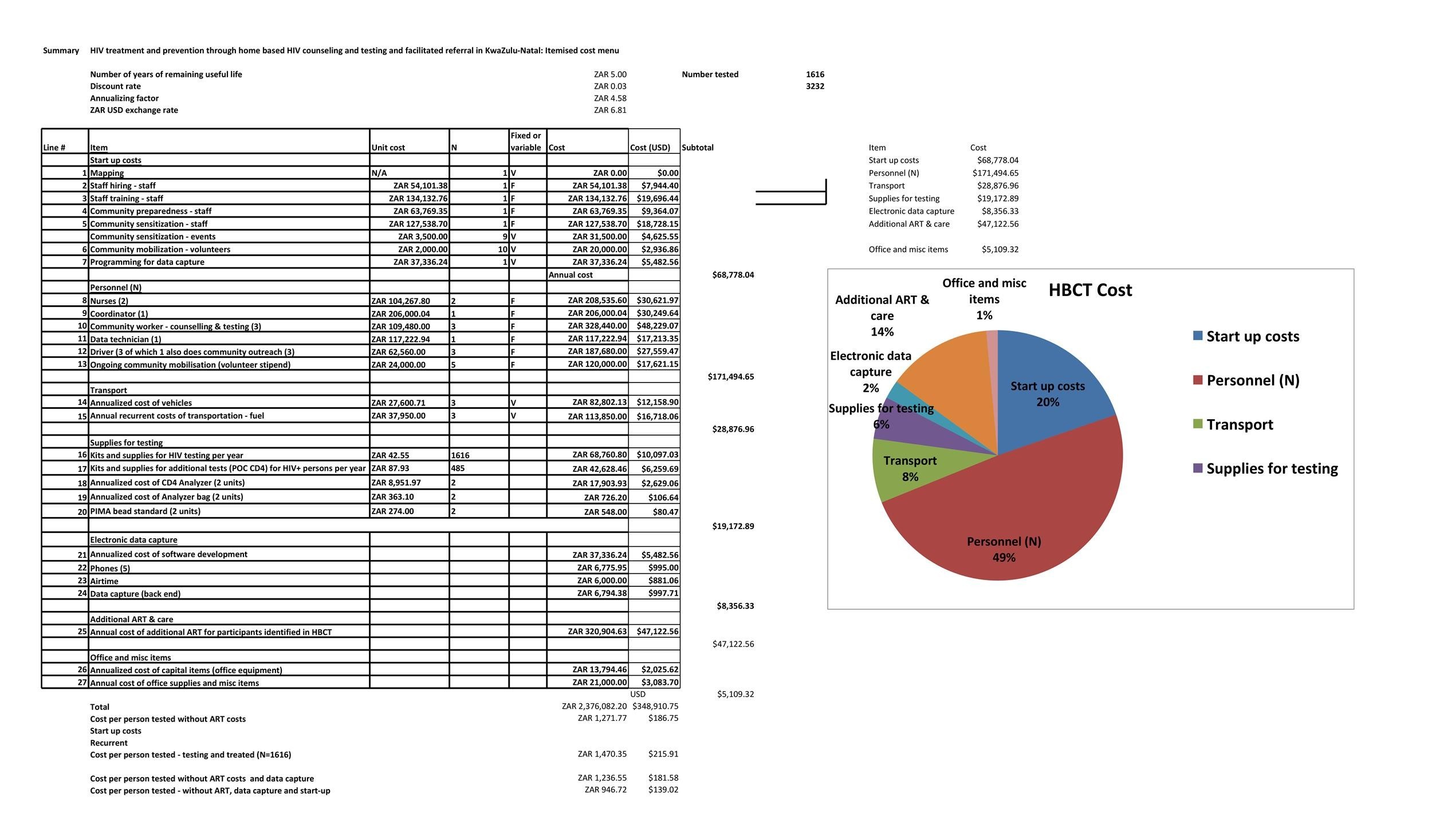

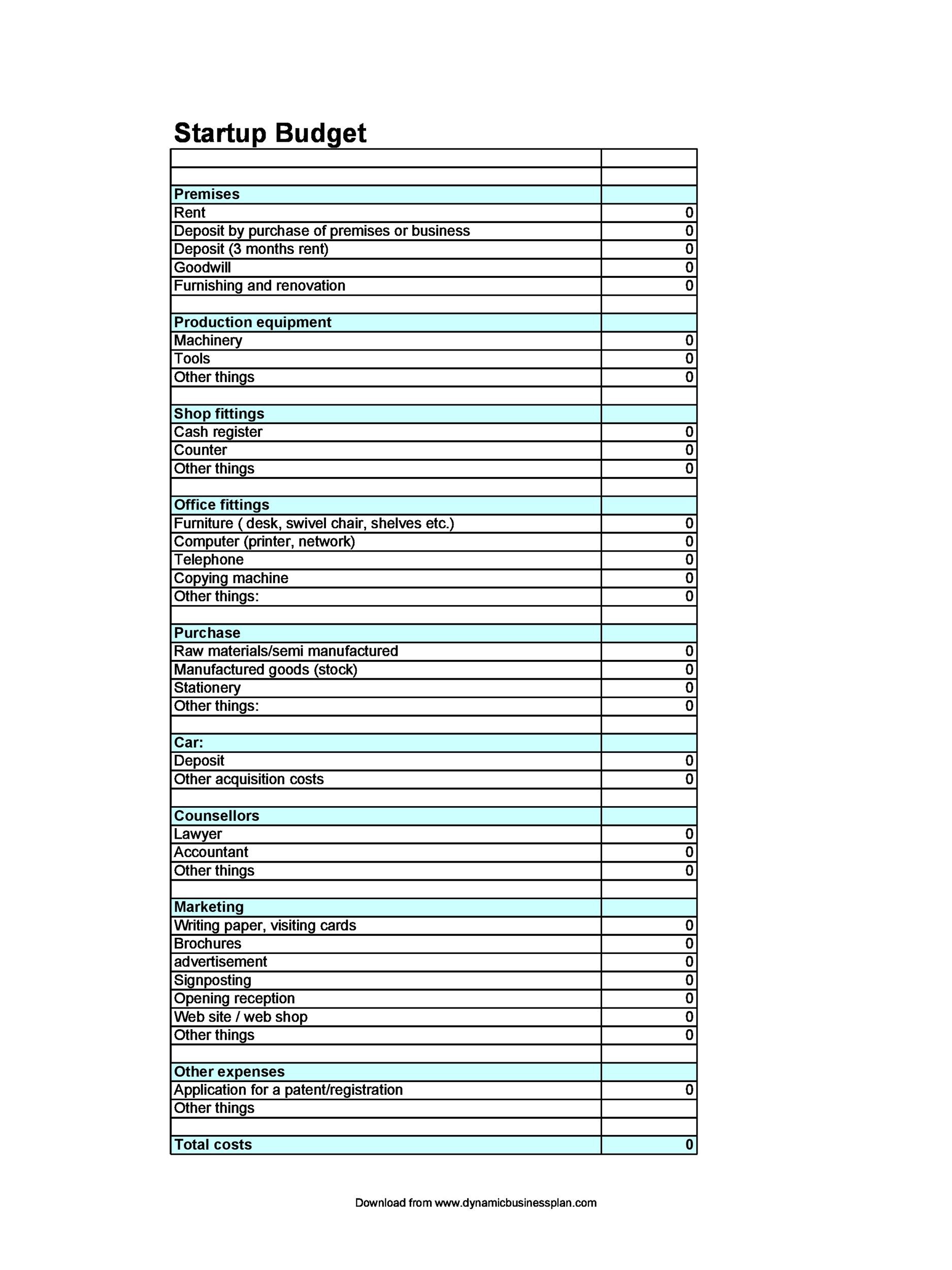

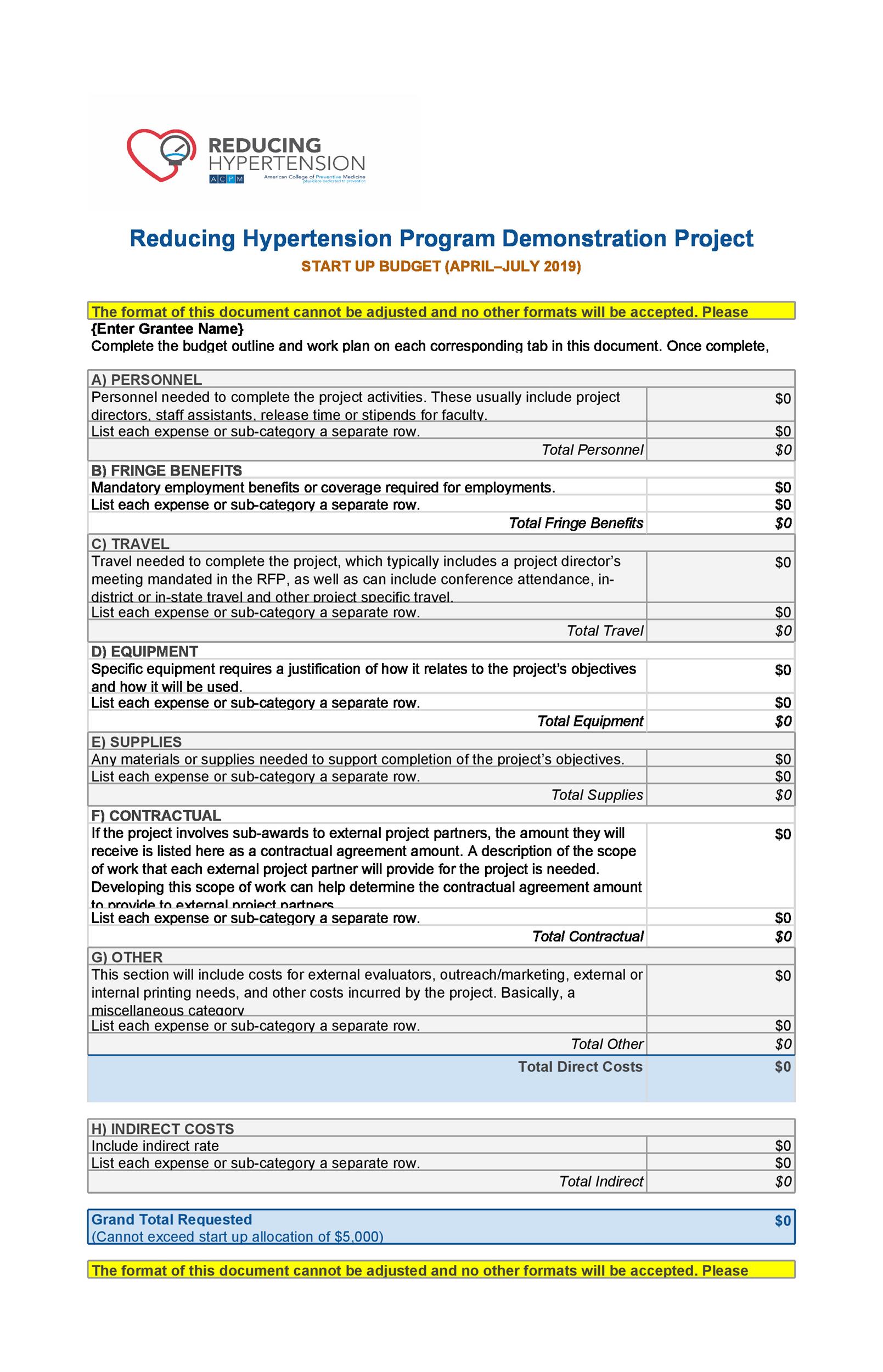

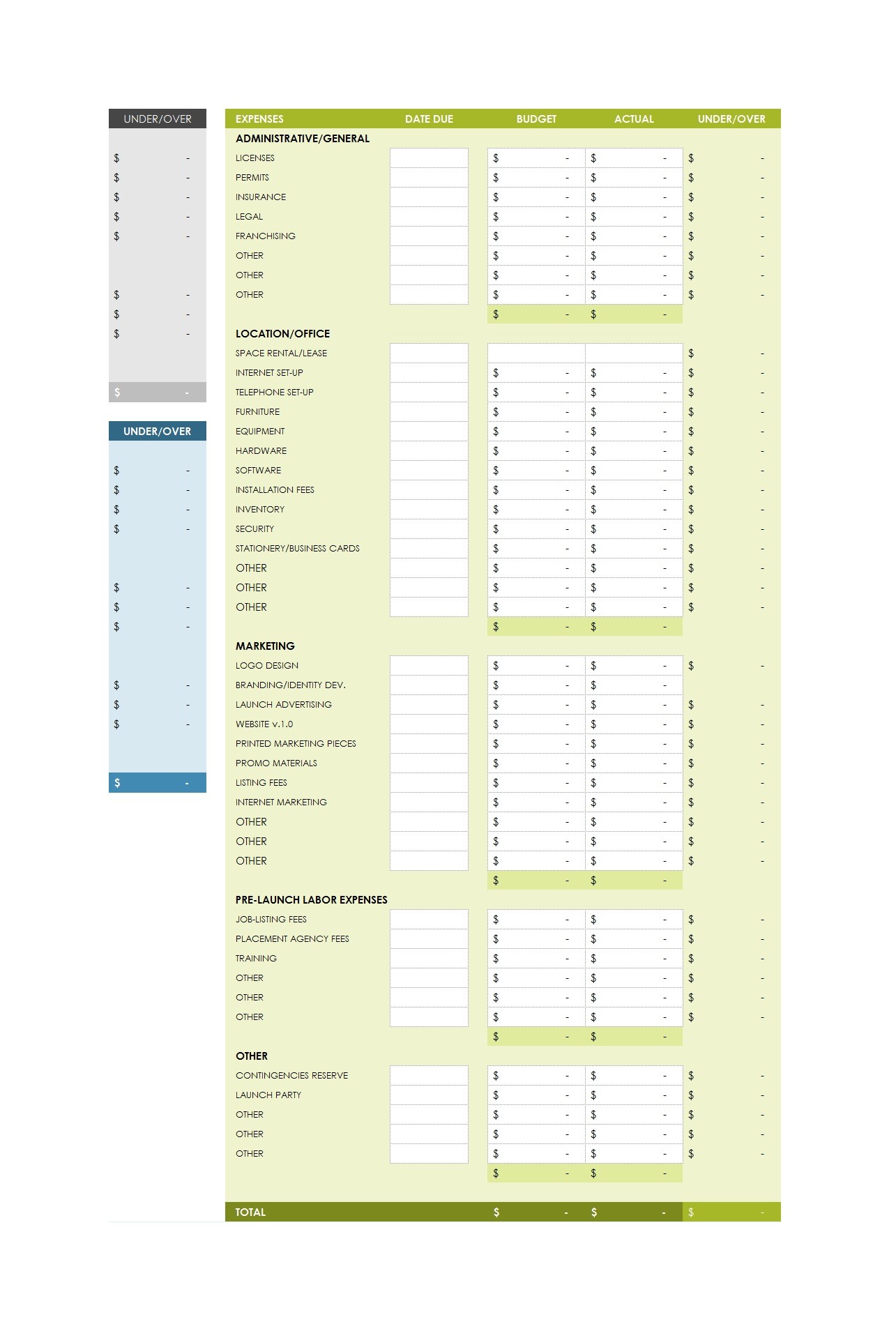

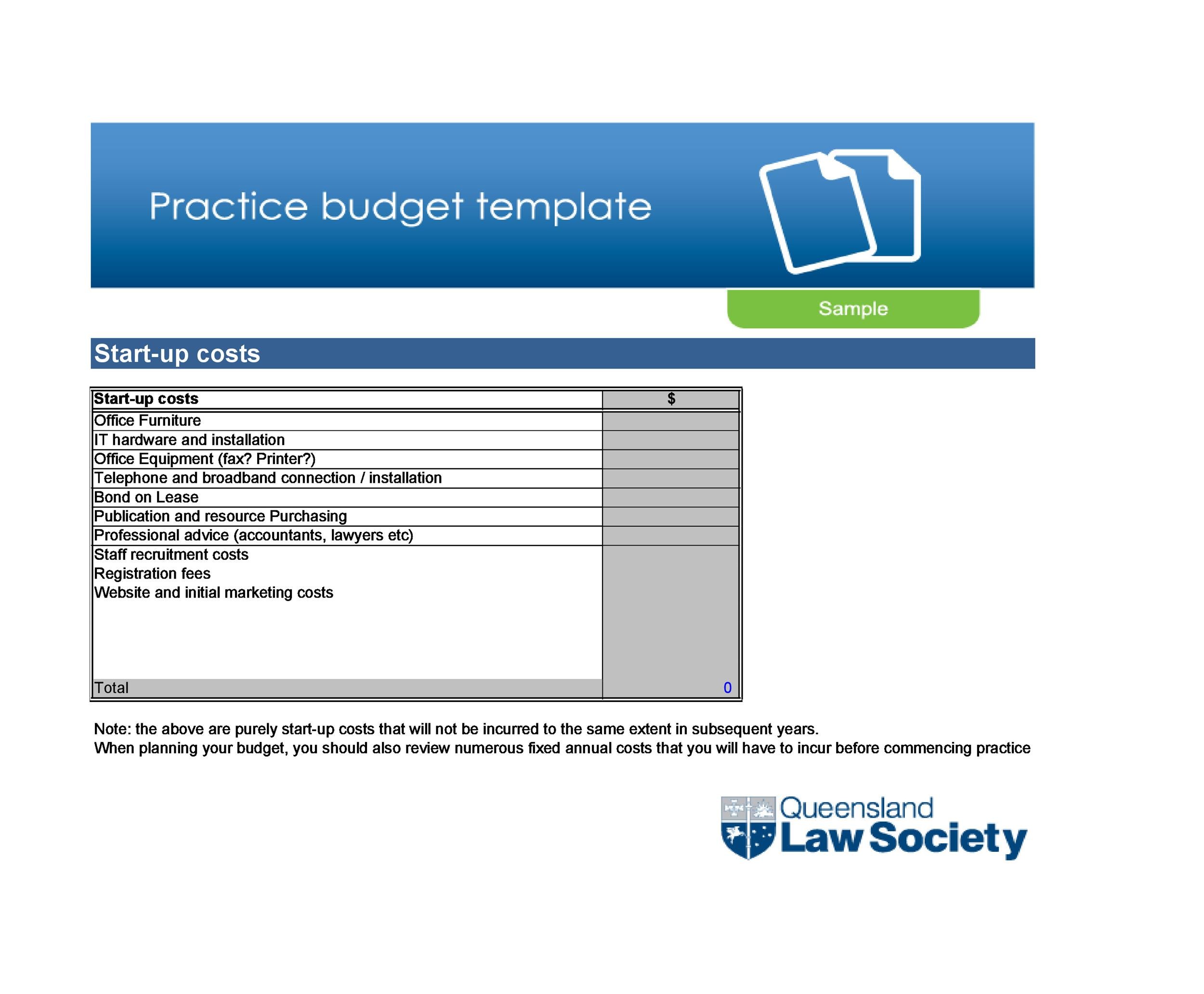

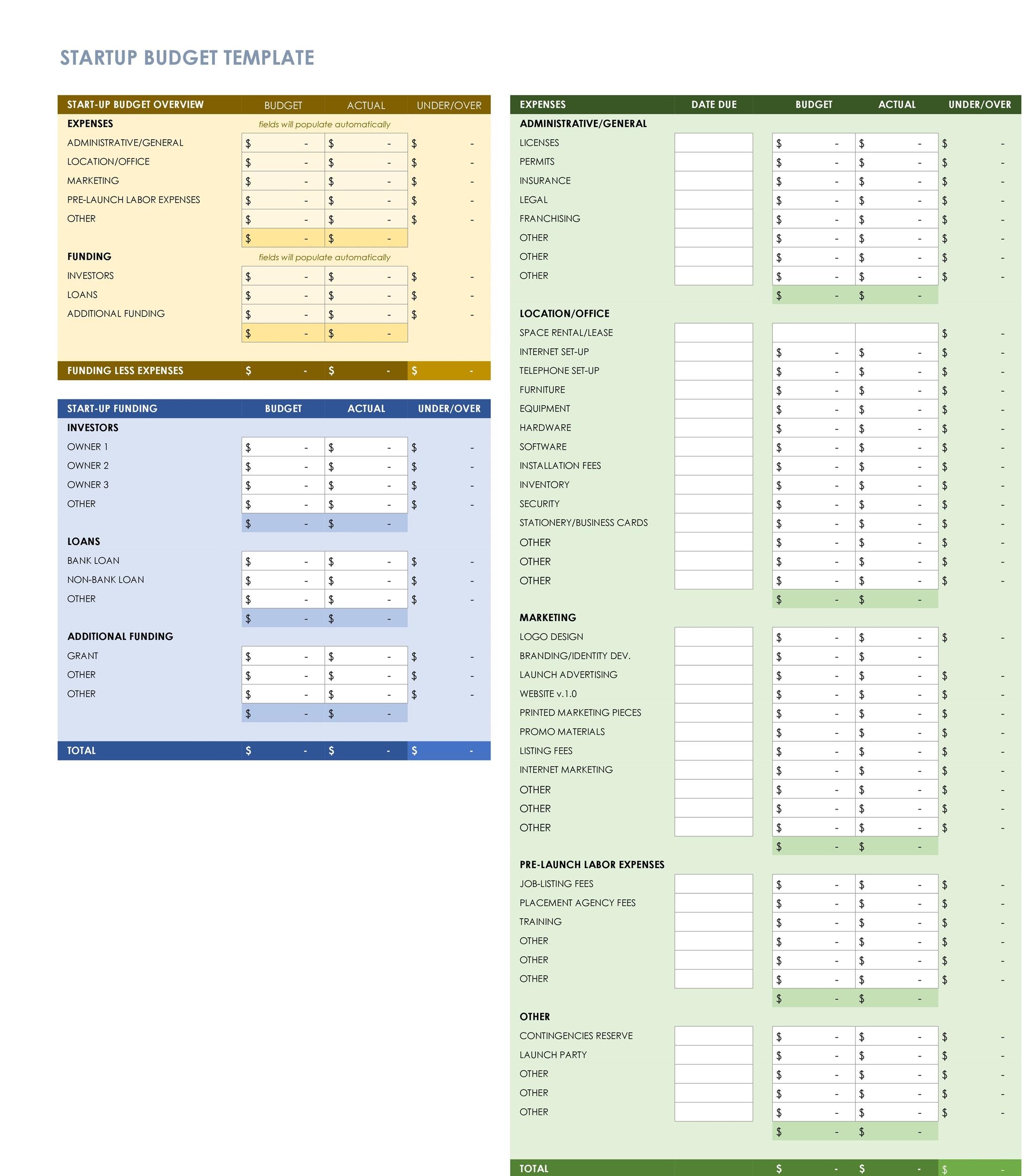

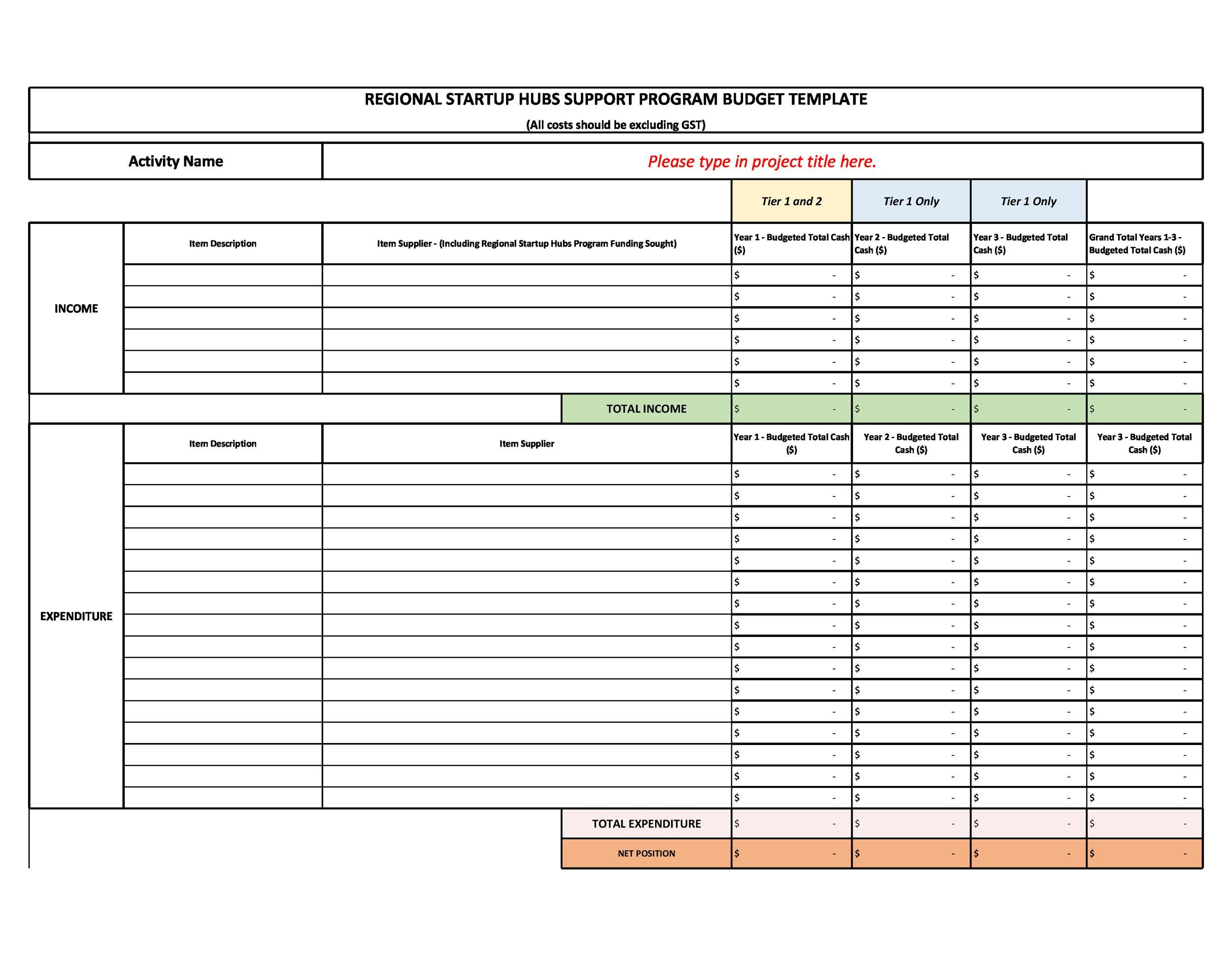

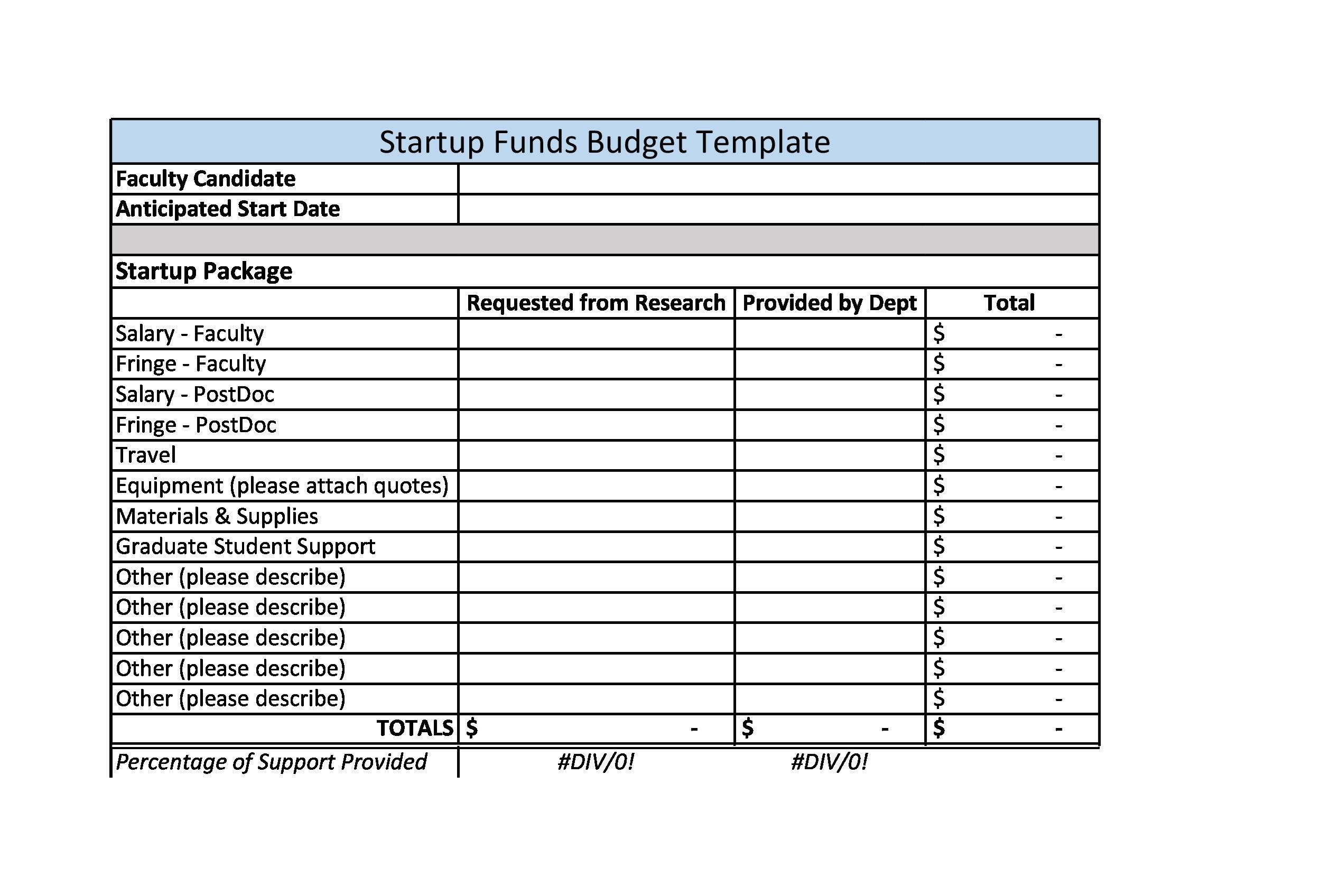

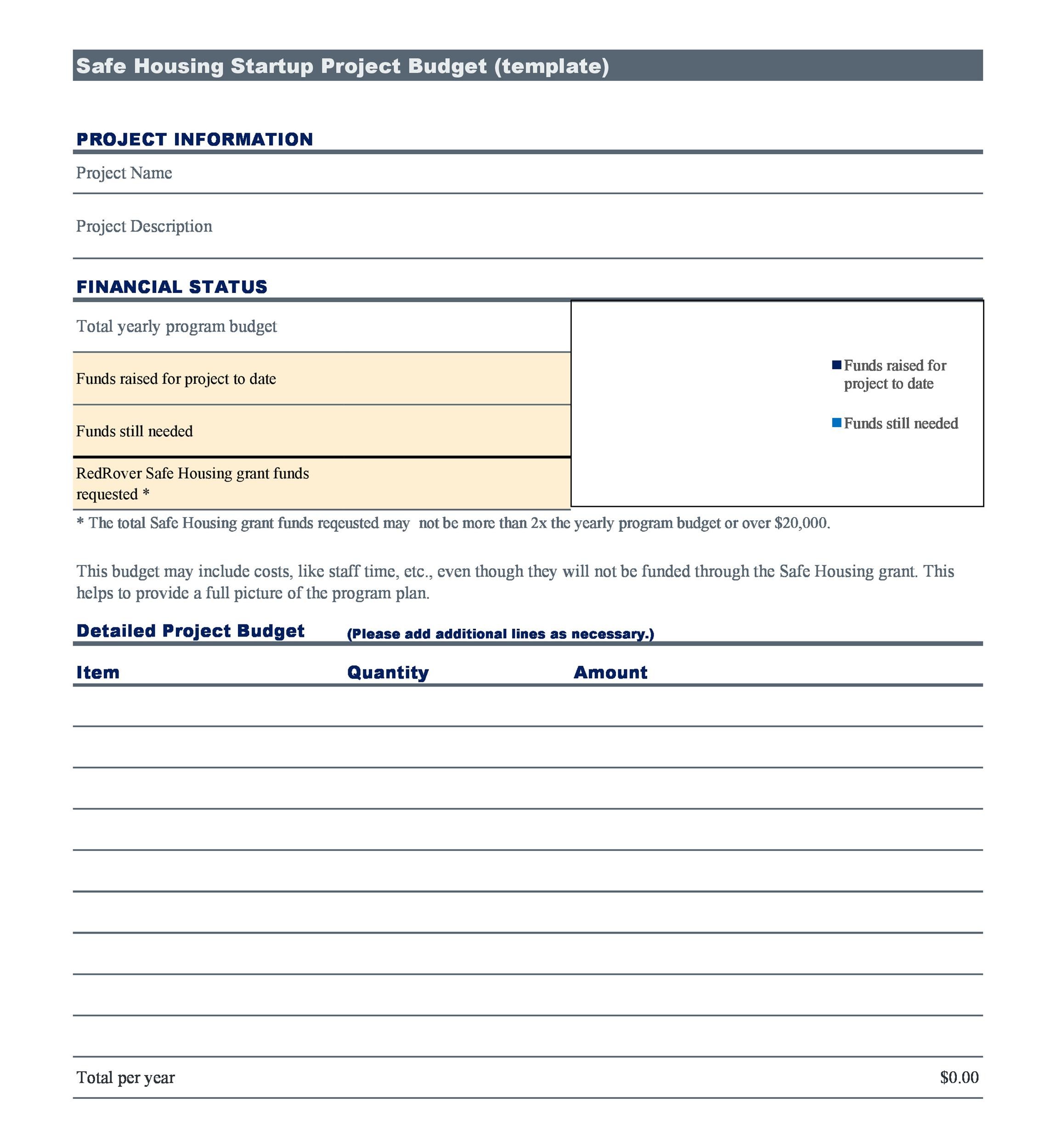

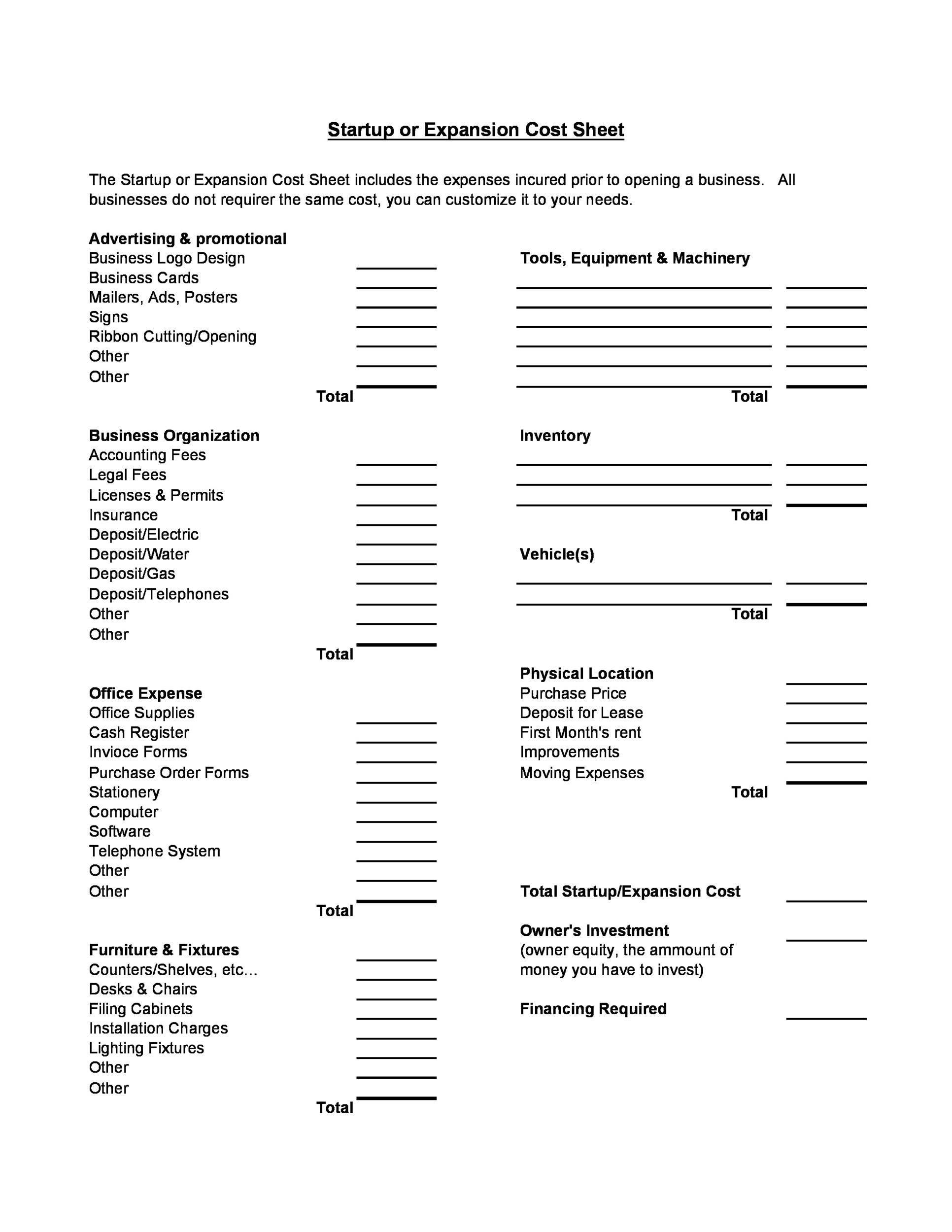

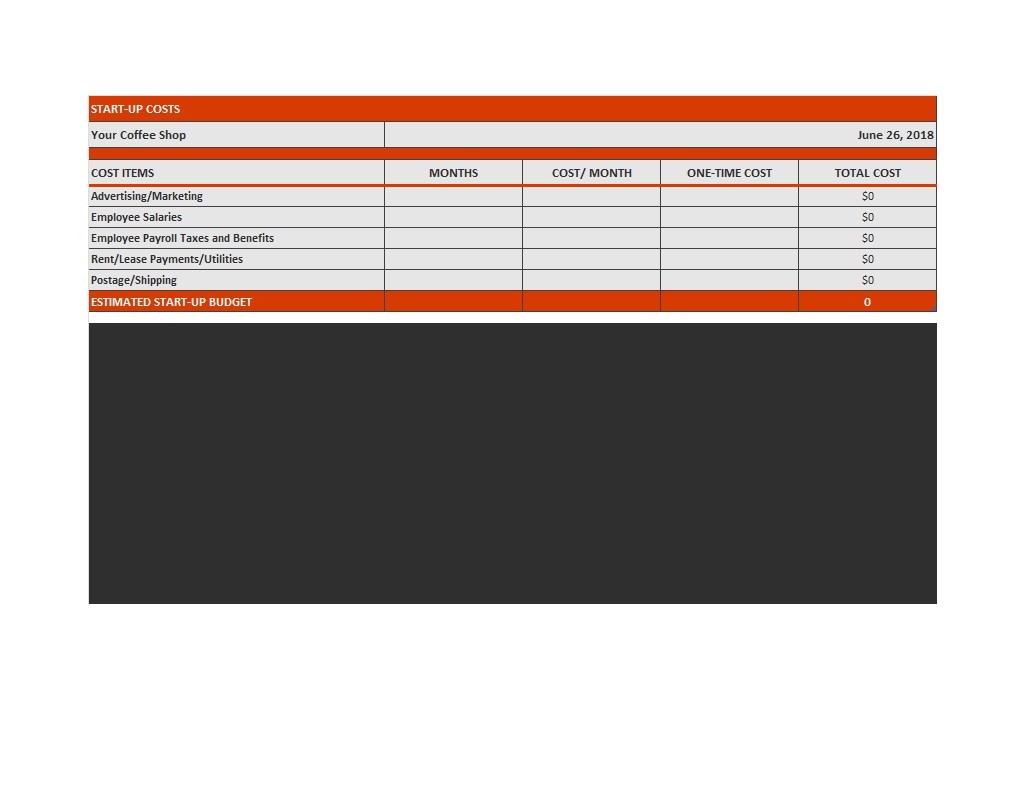

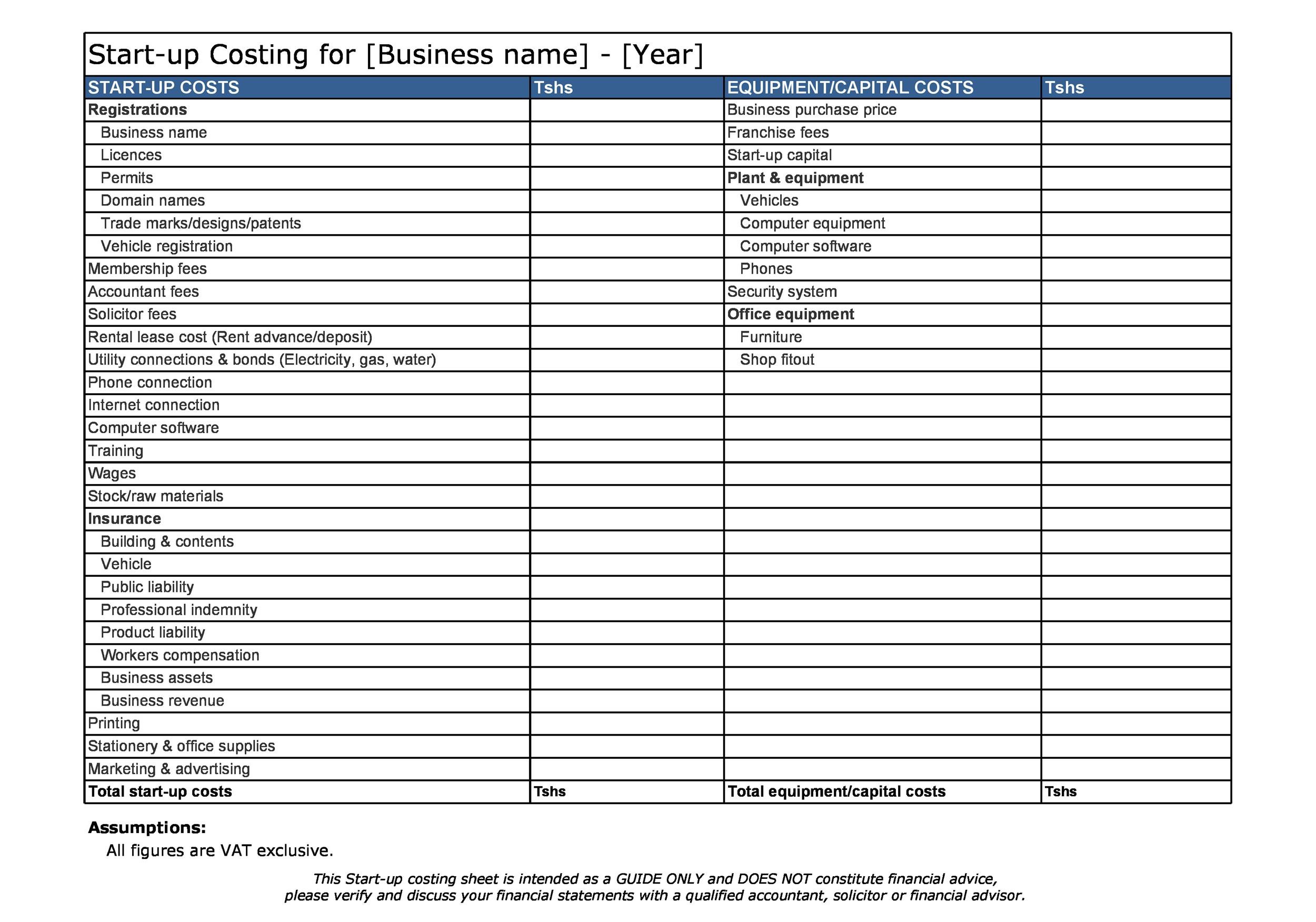

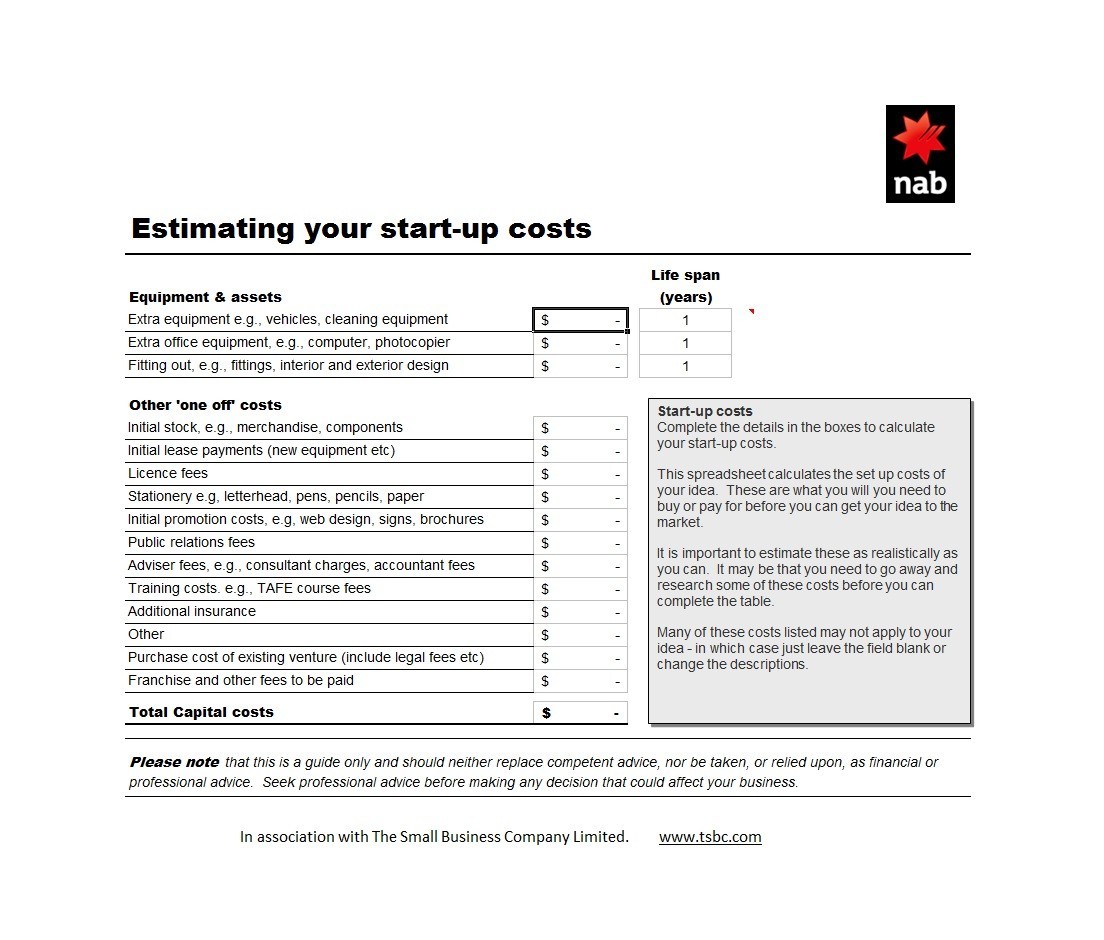

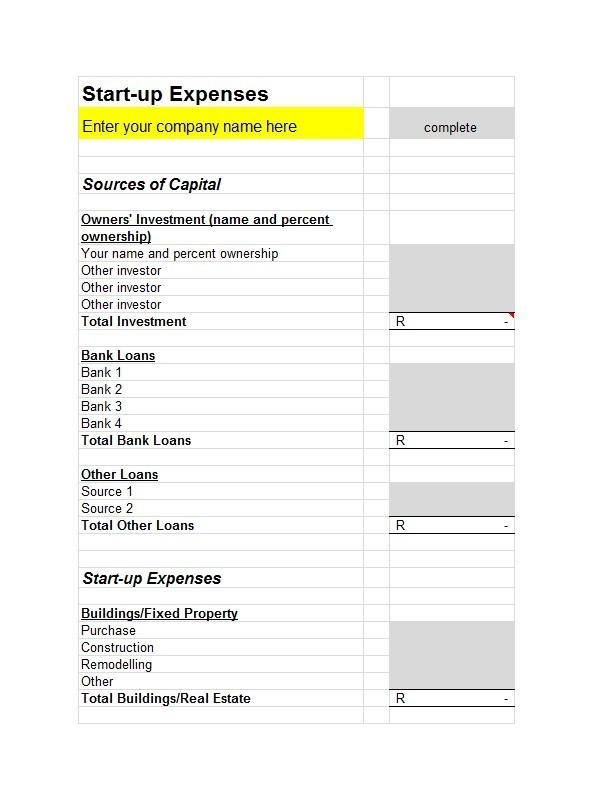

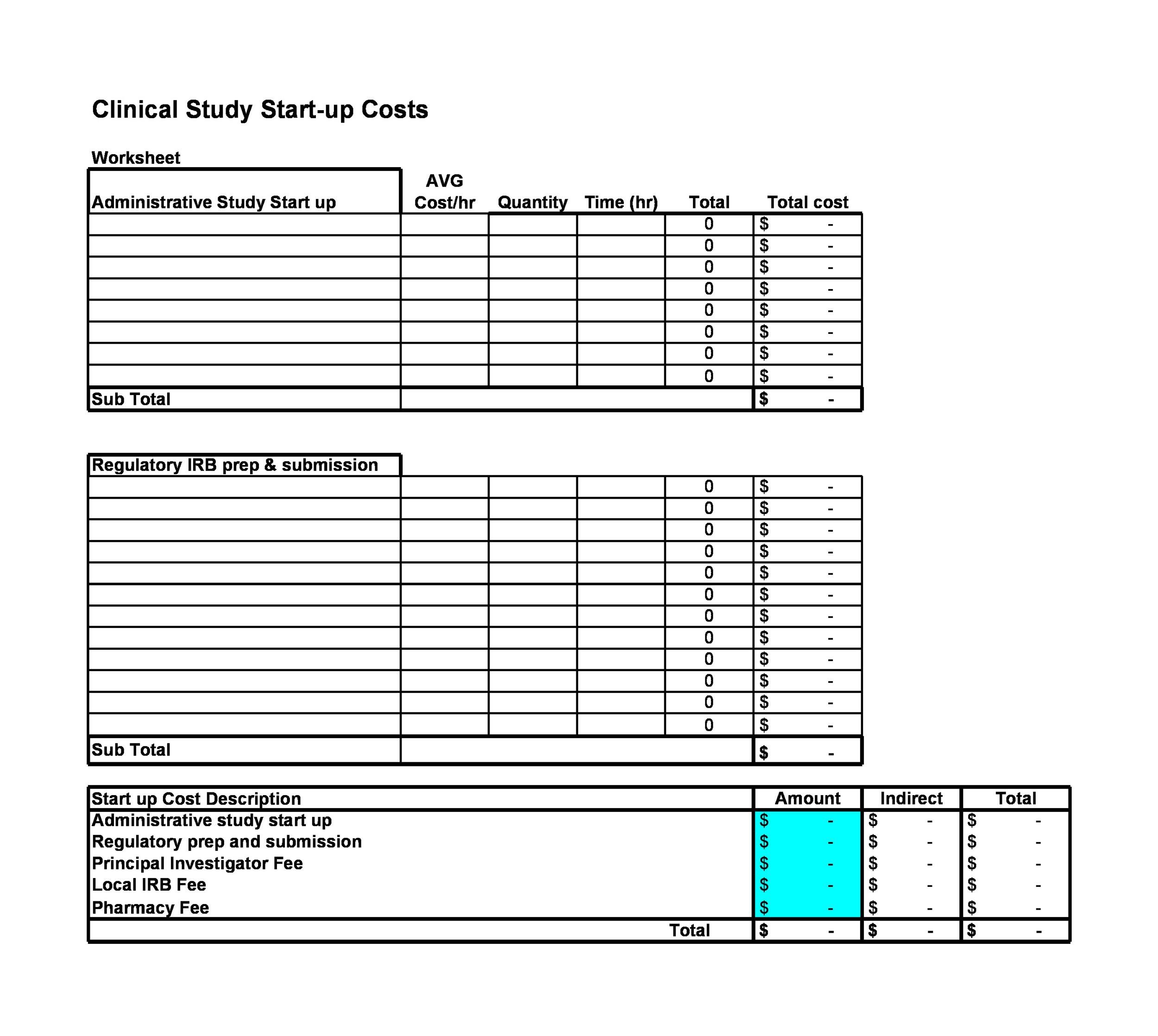

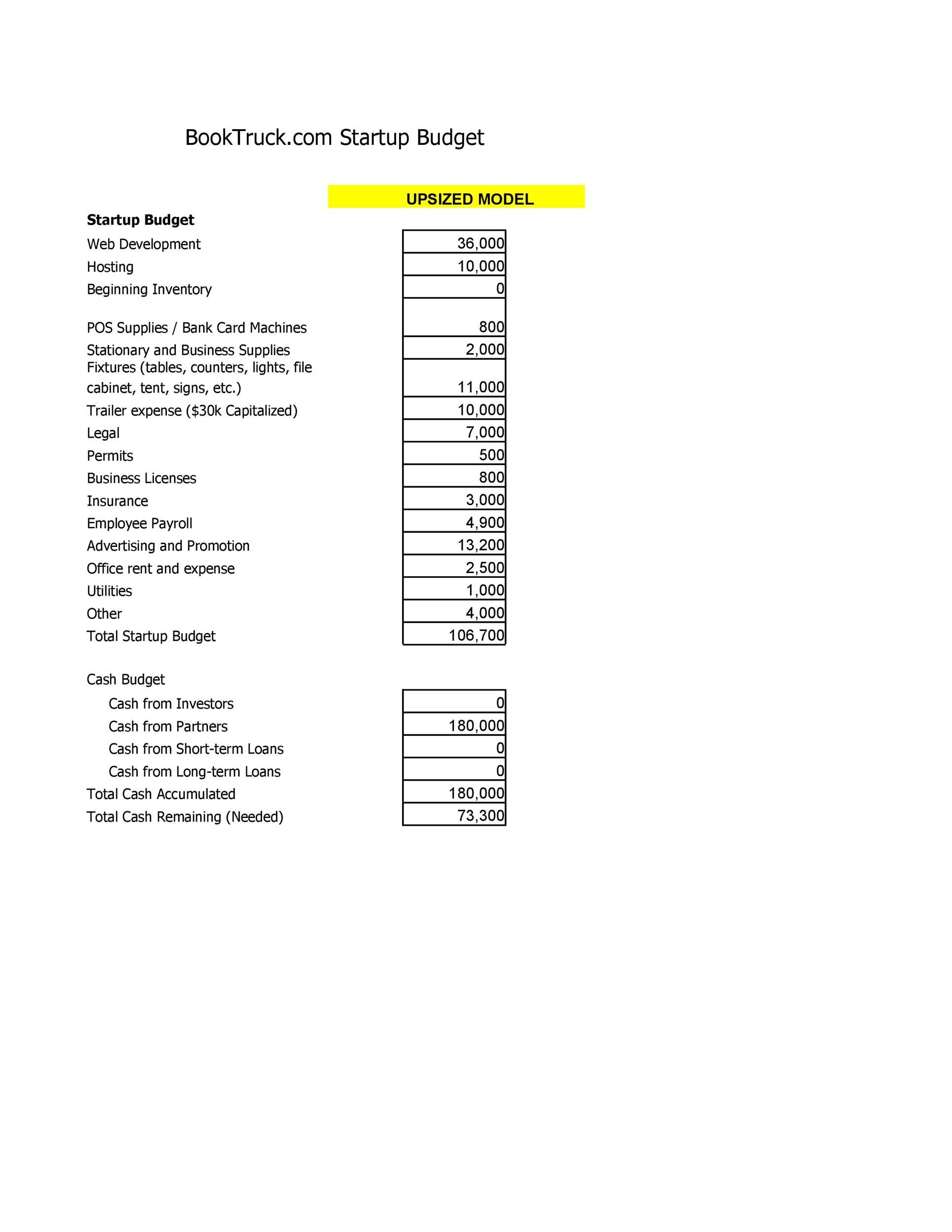

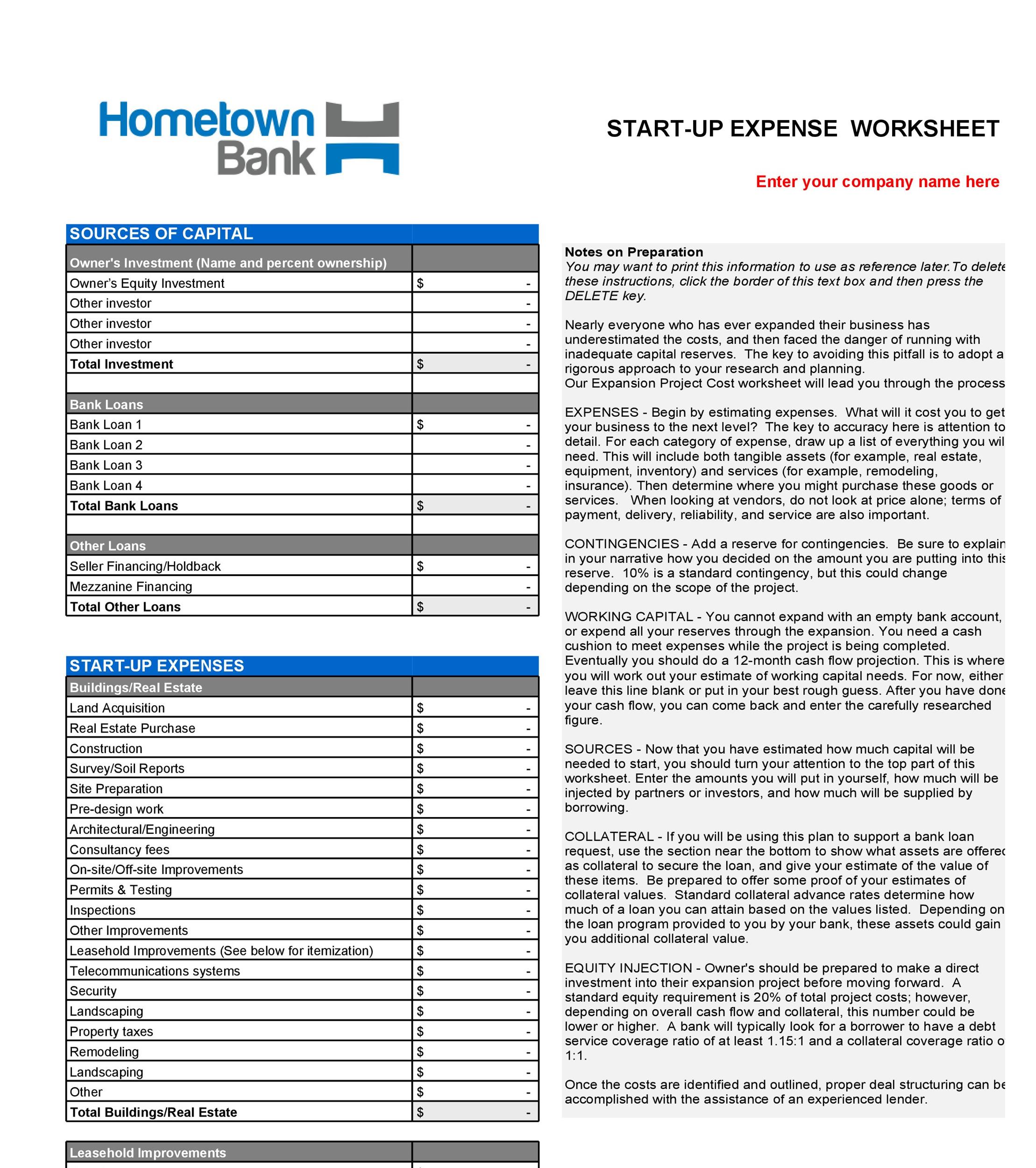

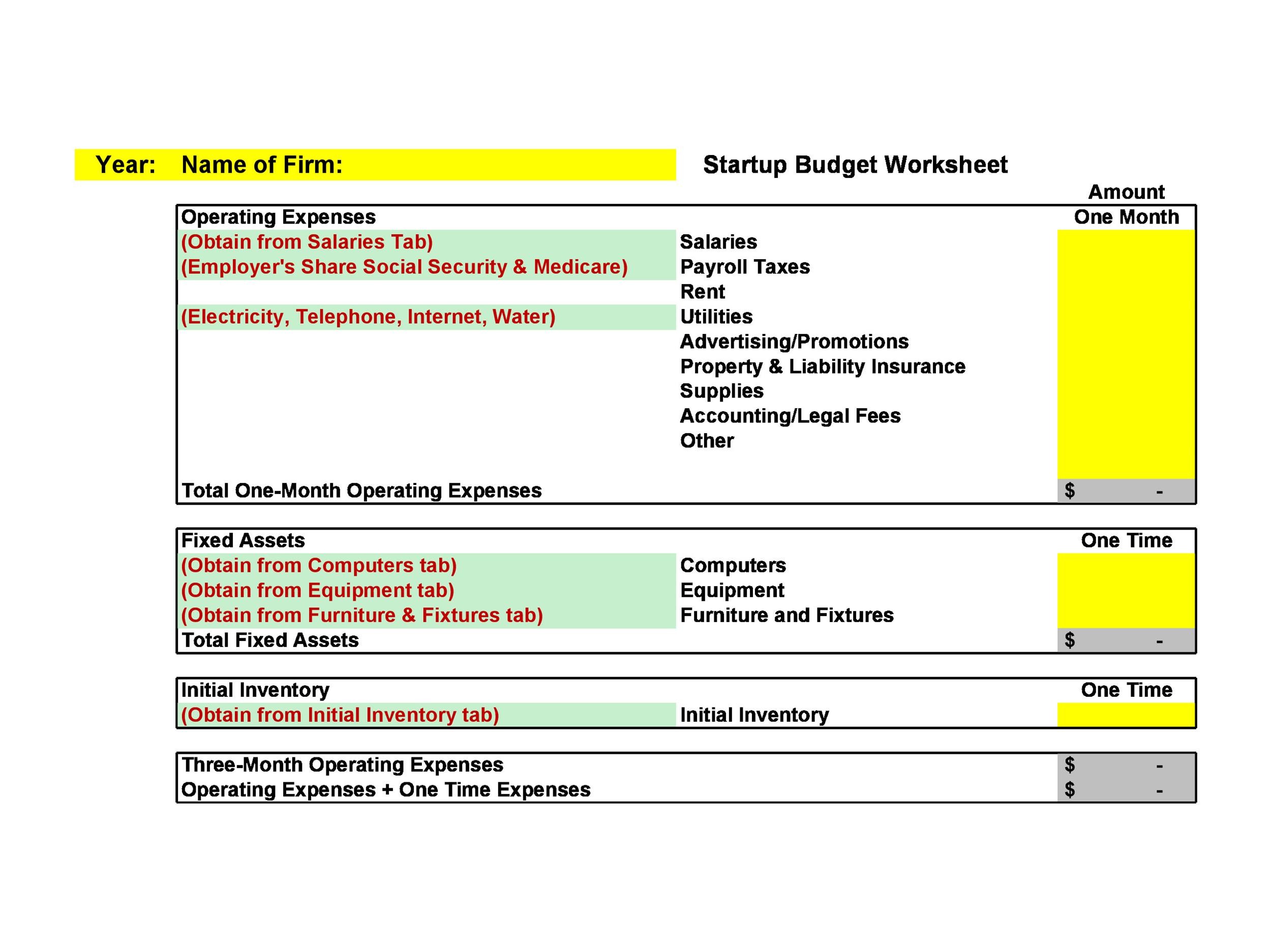

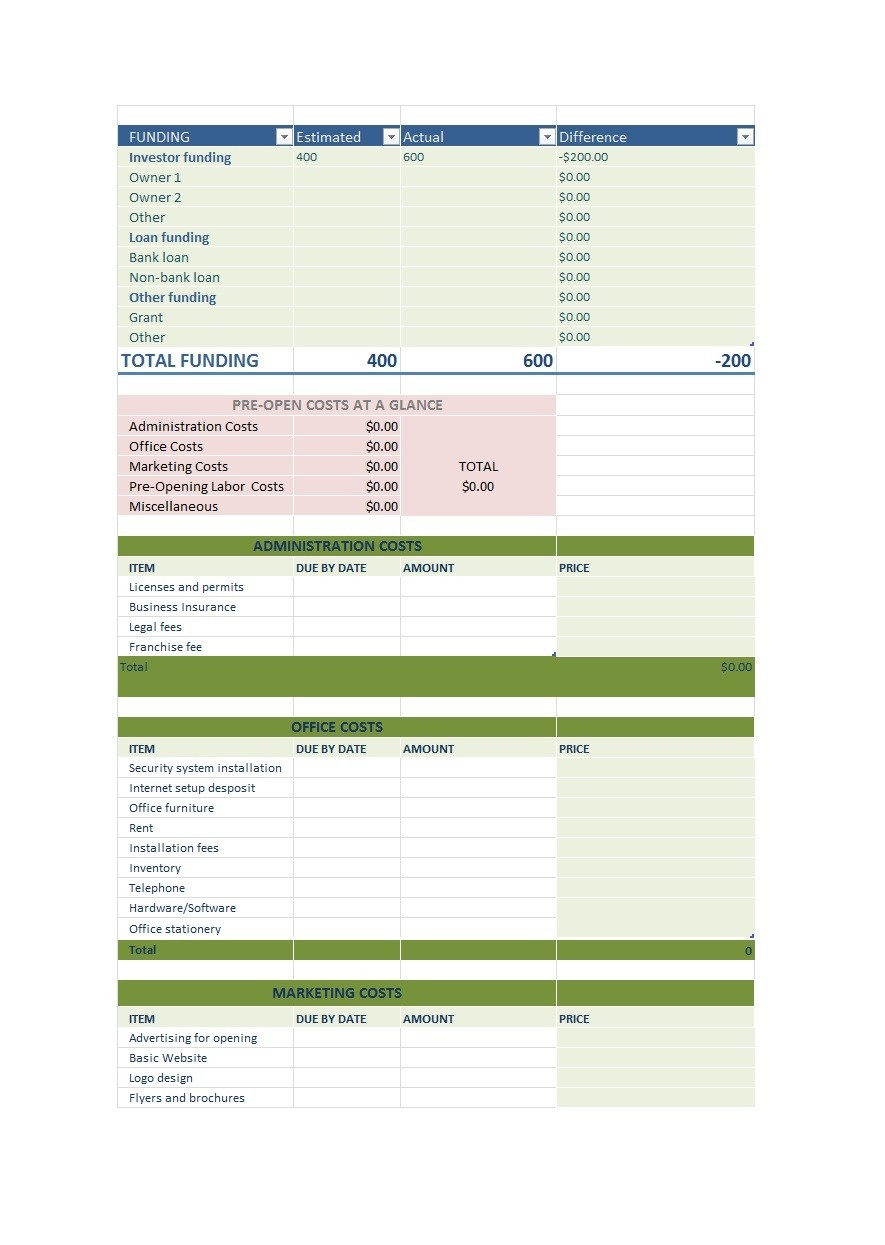

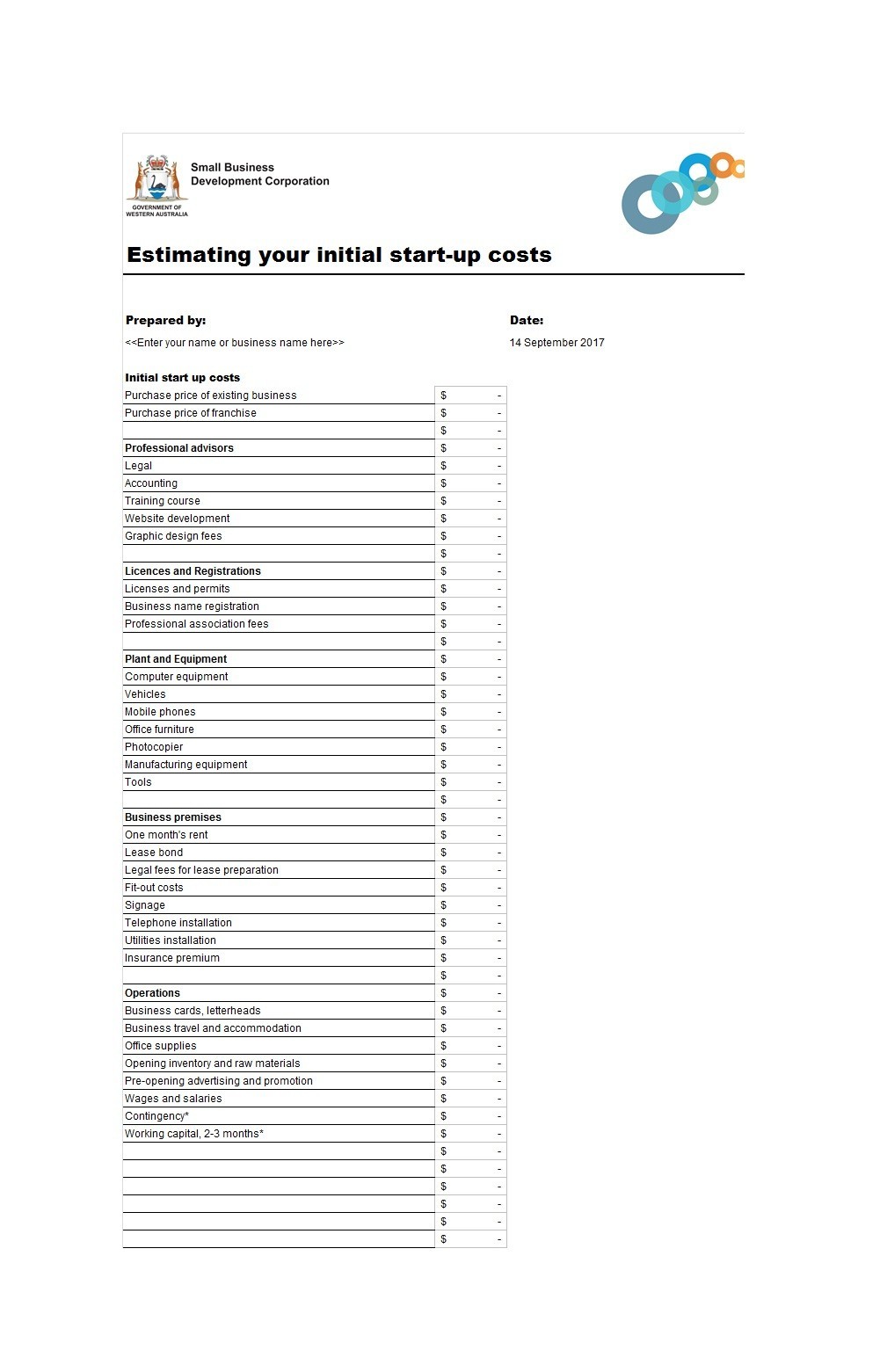

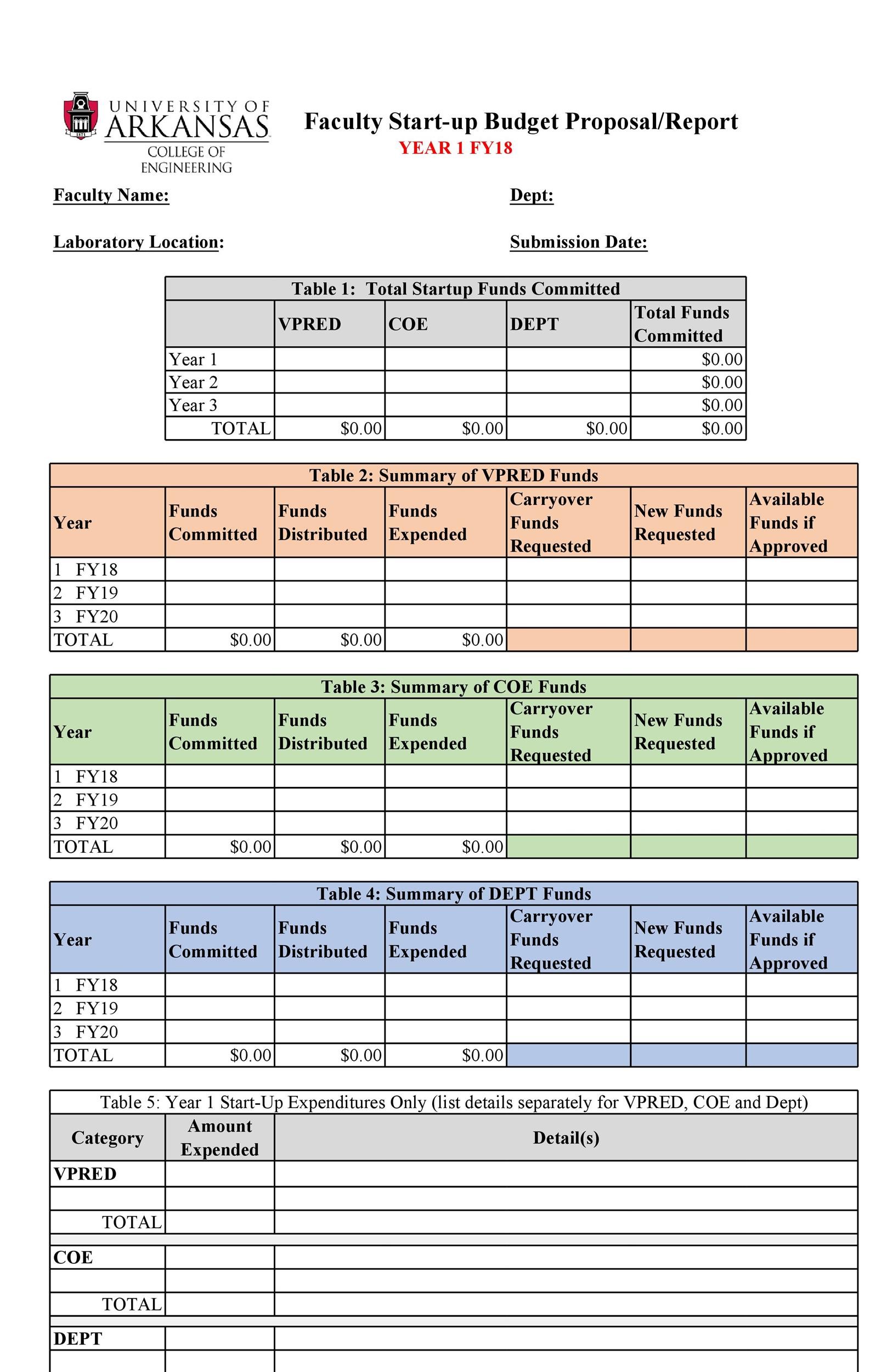

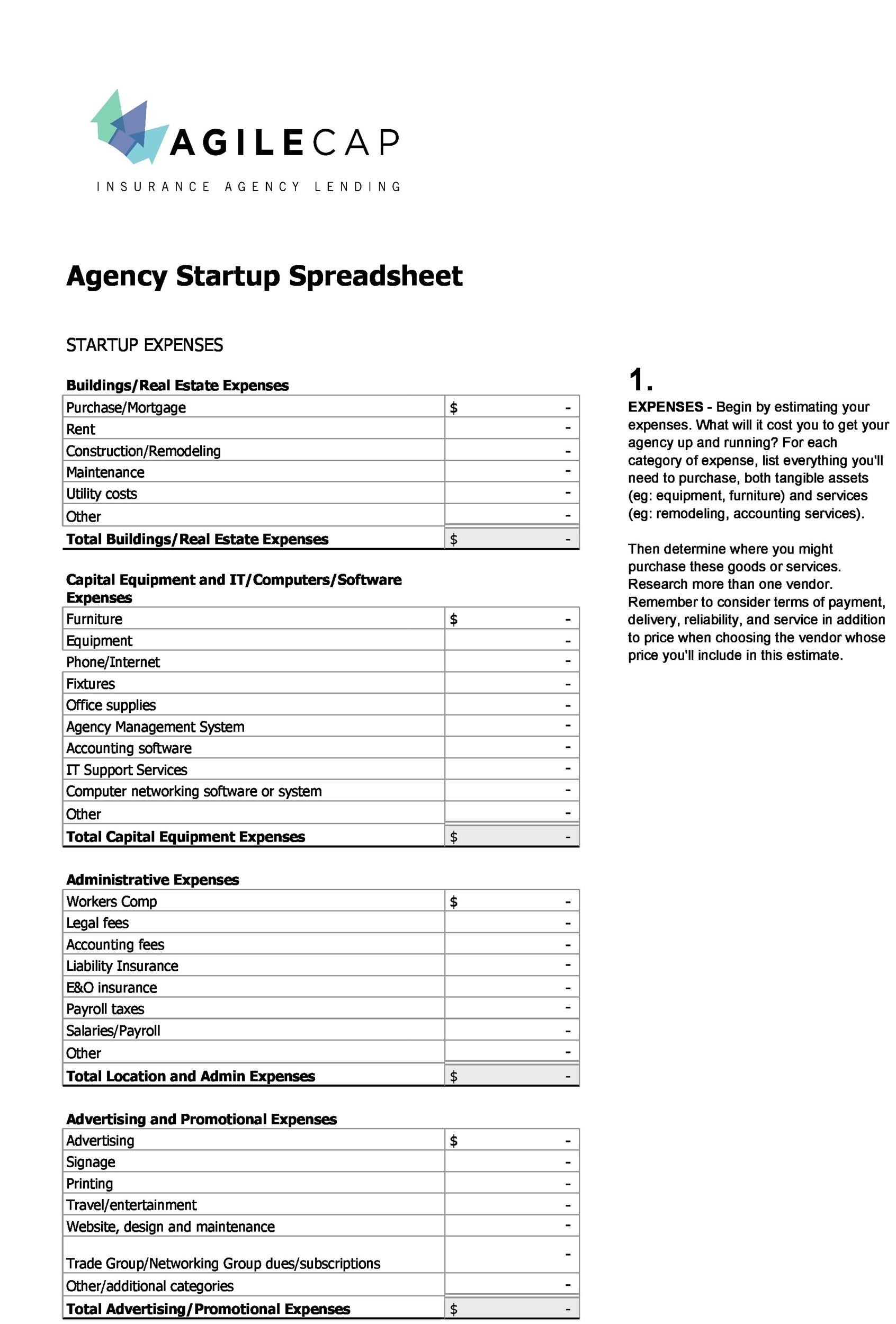

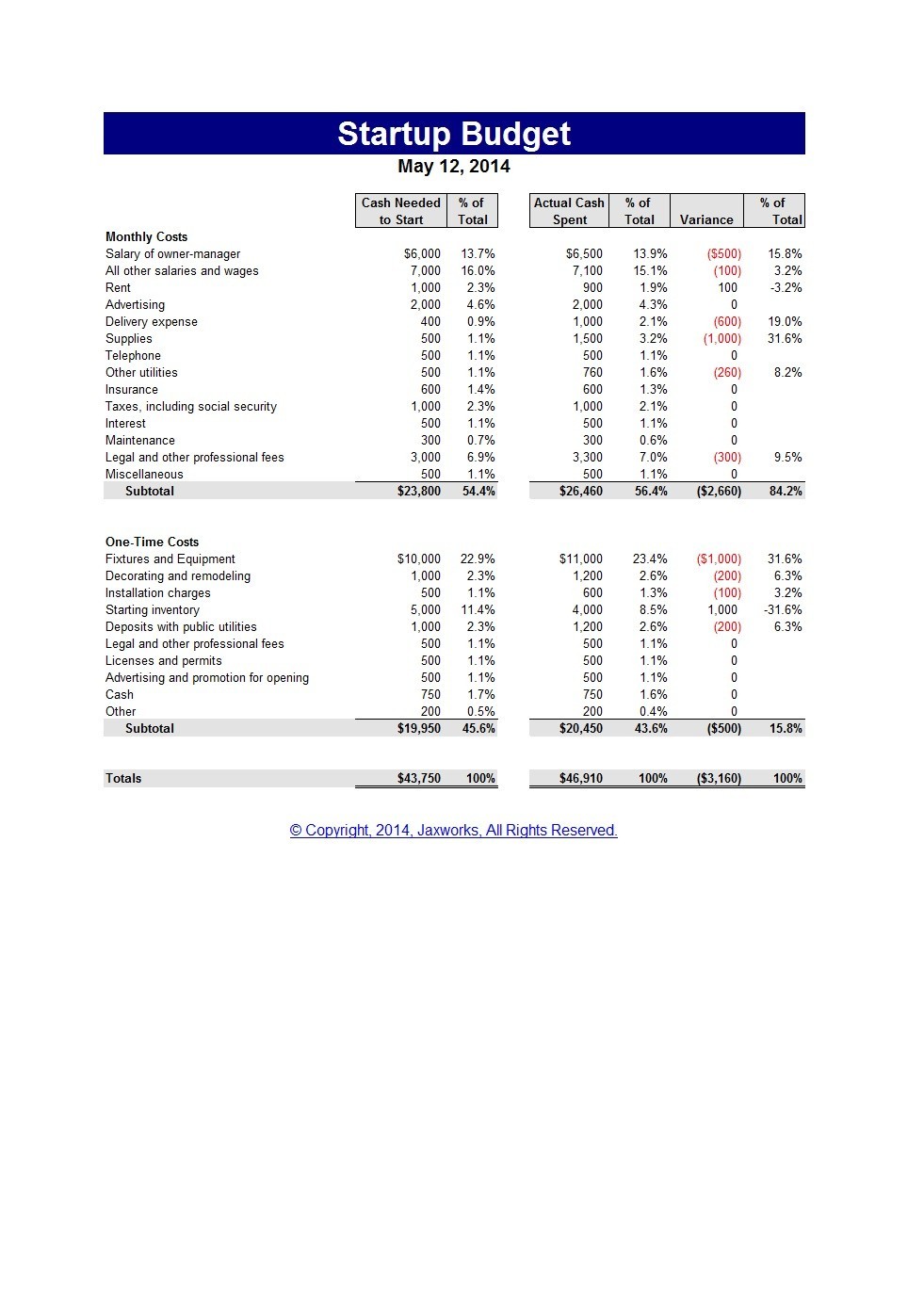

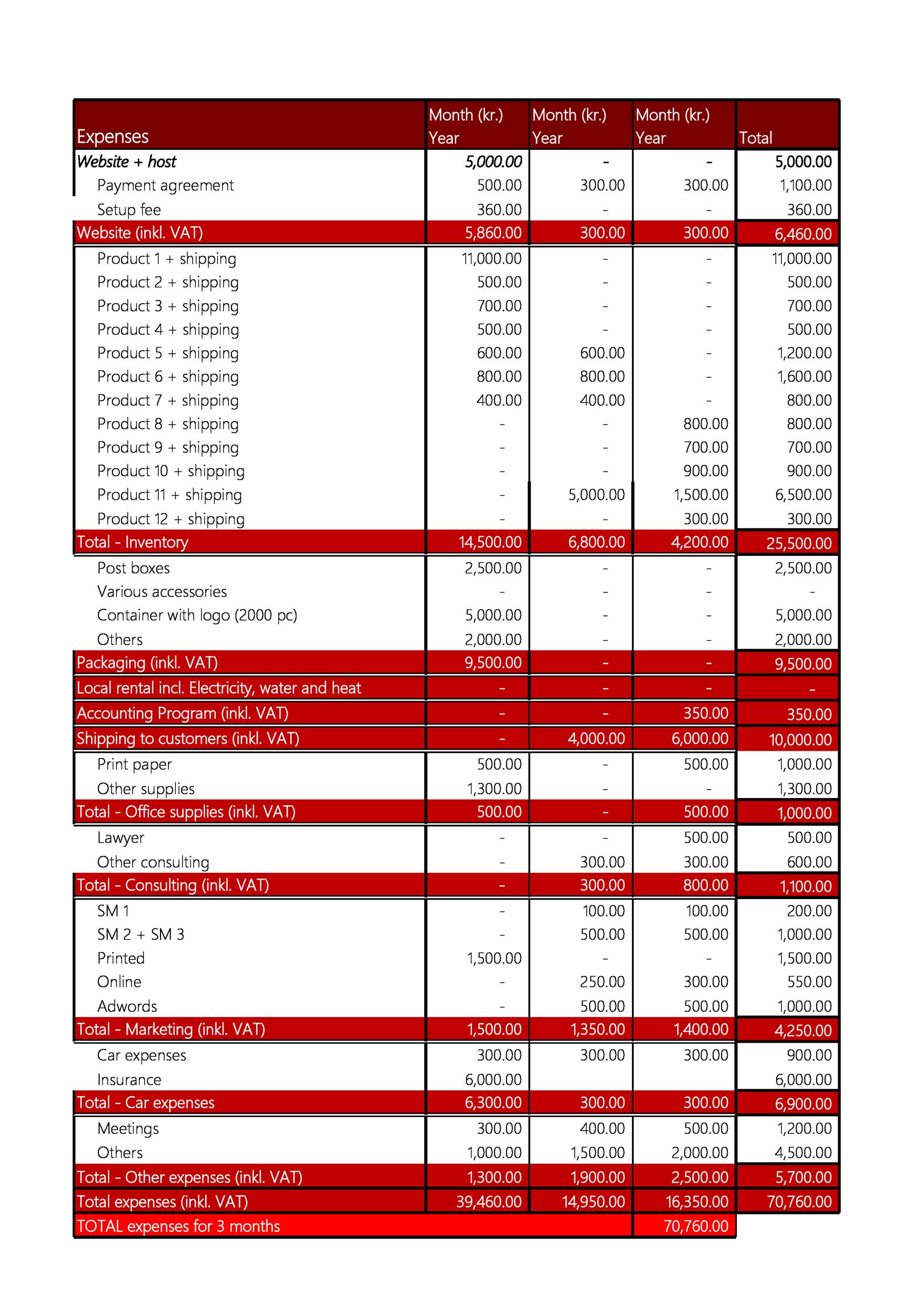

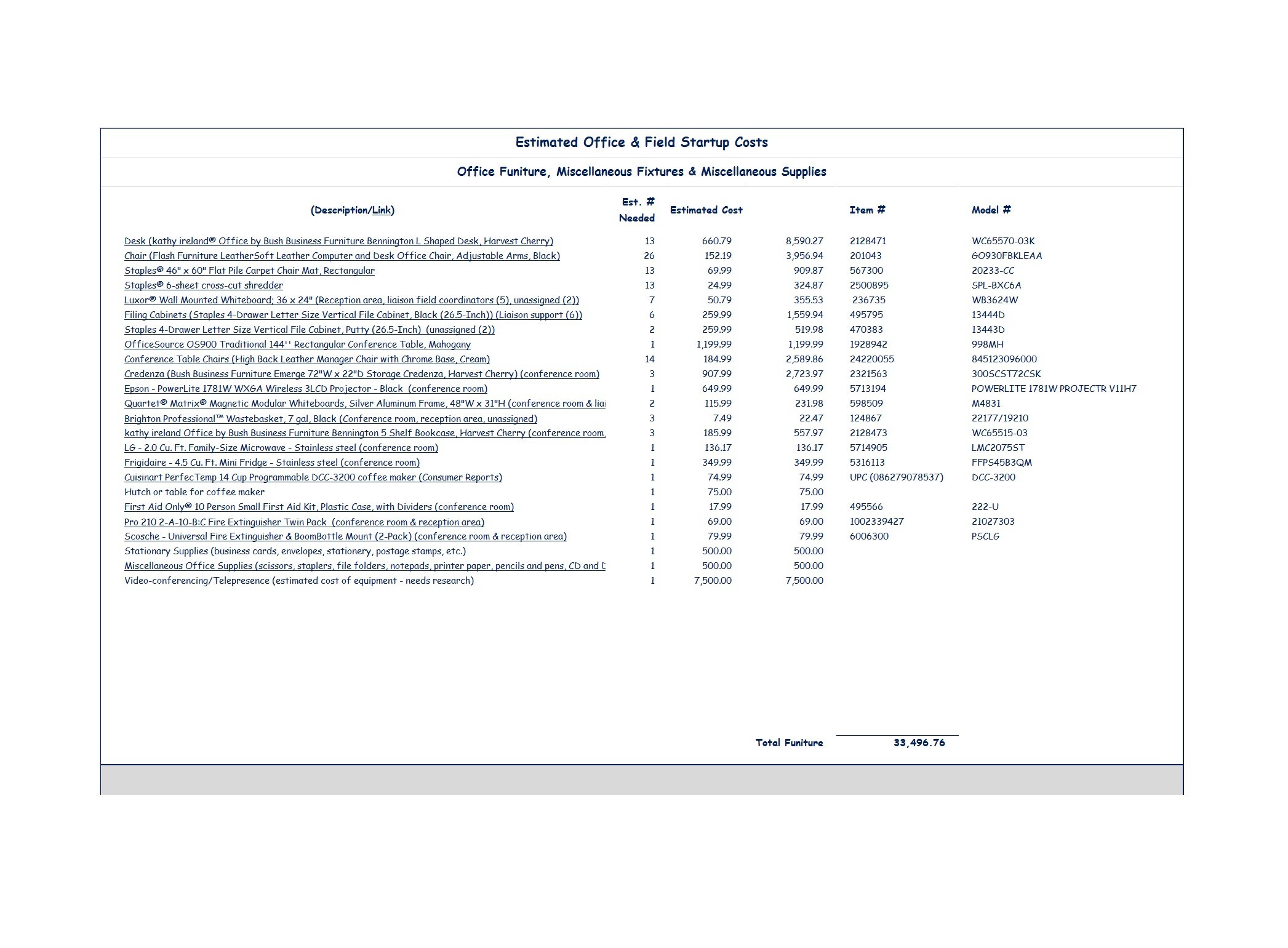

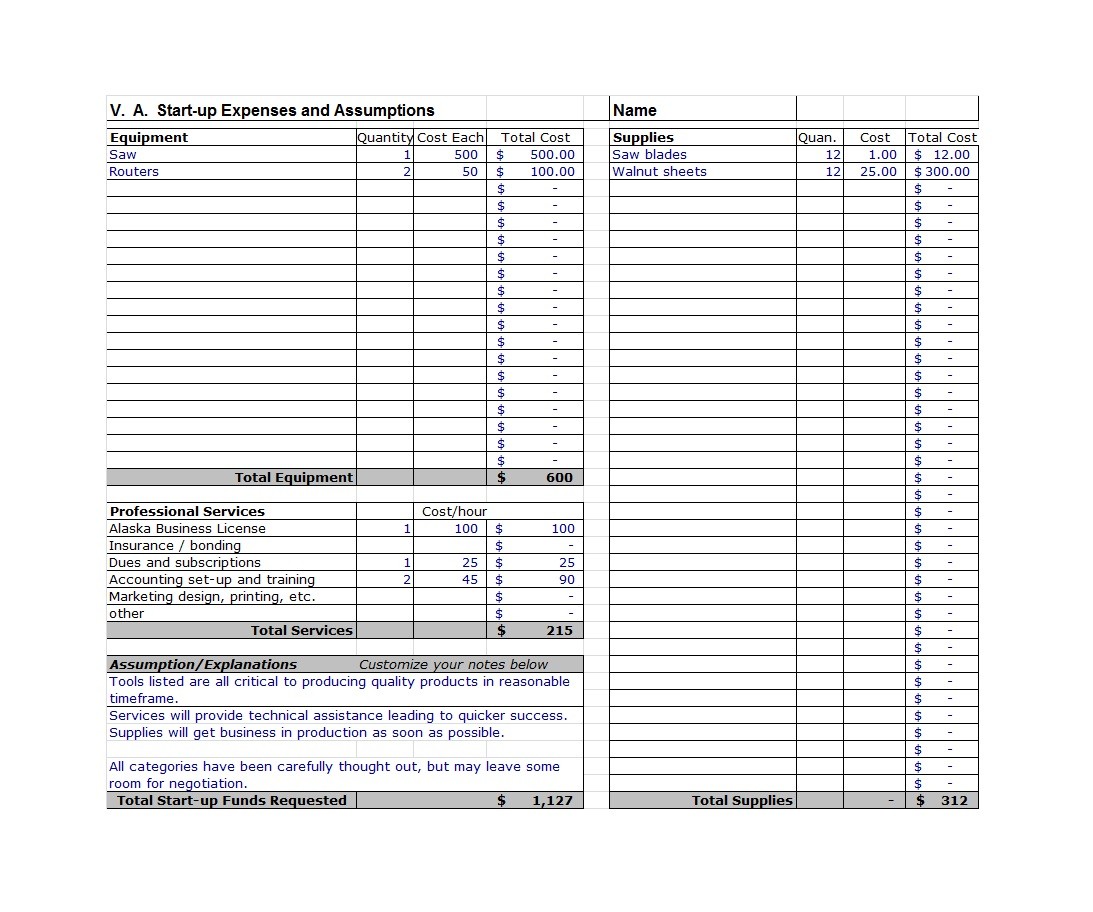

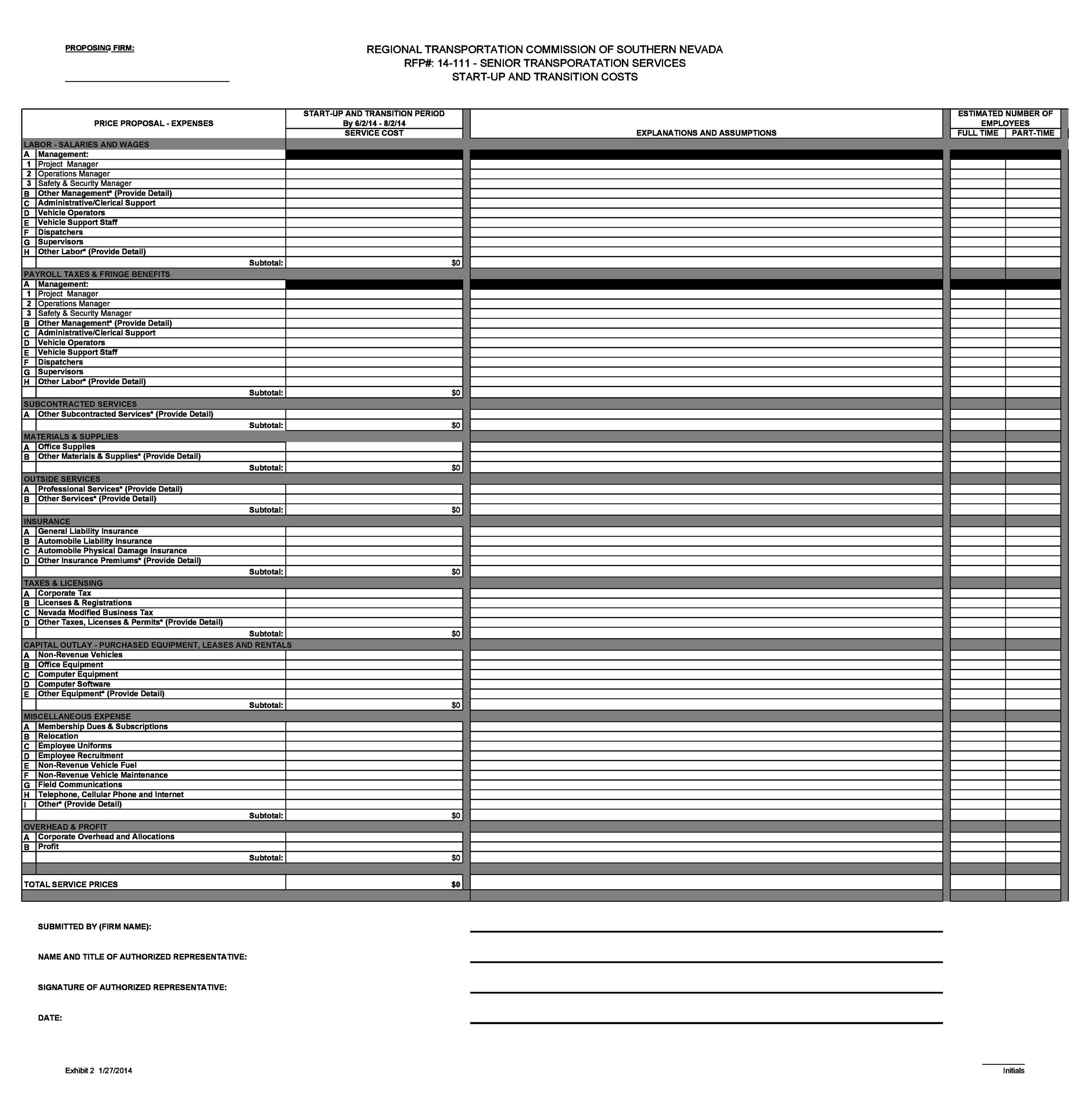

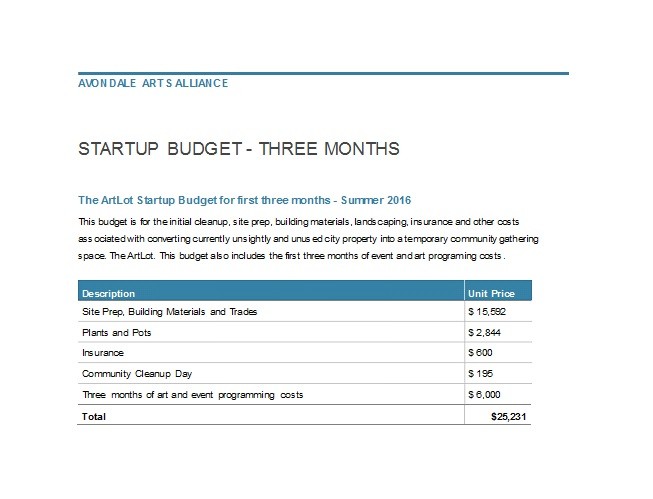

Startup Budget Templates

Types of businesses which need a startup budget

If you’re thinking about starting any type of business, you should consider creating a startup budget template. Use it to estimate all of your startup costs before you begin. Whether you want to start a small business or a large franchise, you might find it difficult to cope with all of the business startup costs without this template.

Often, new business owners underestimate the expenses of starting a business which leaves them exposed to the risk of underfunding. If you want to avoid this issue, then you can either download or create a startup business plan template Excel for your business. Here are the types of businesses which would benefit the most from such a document:

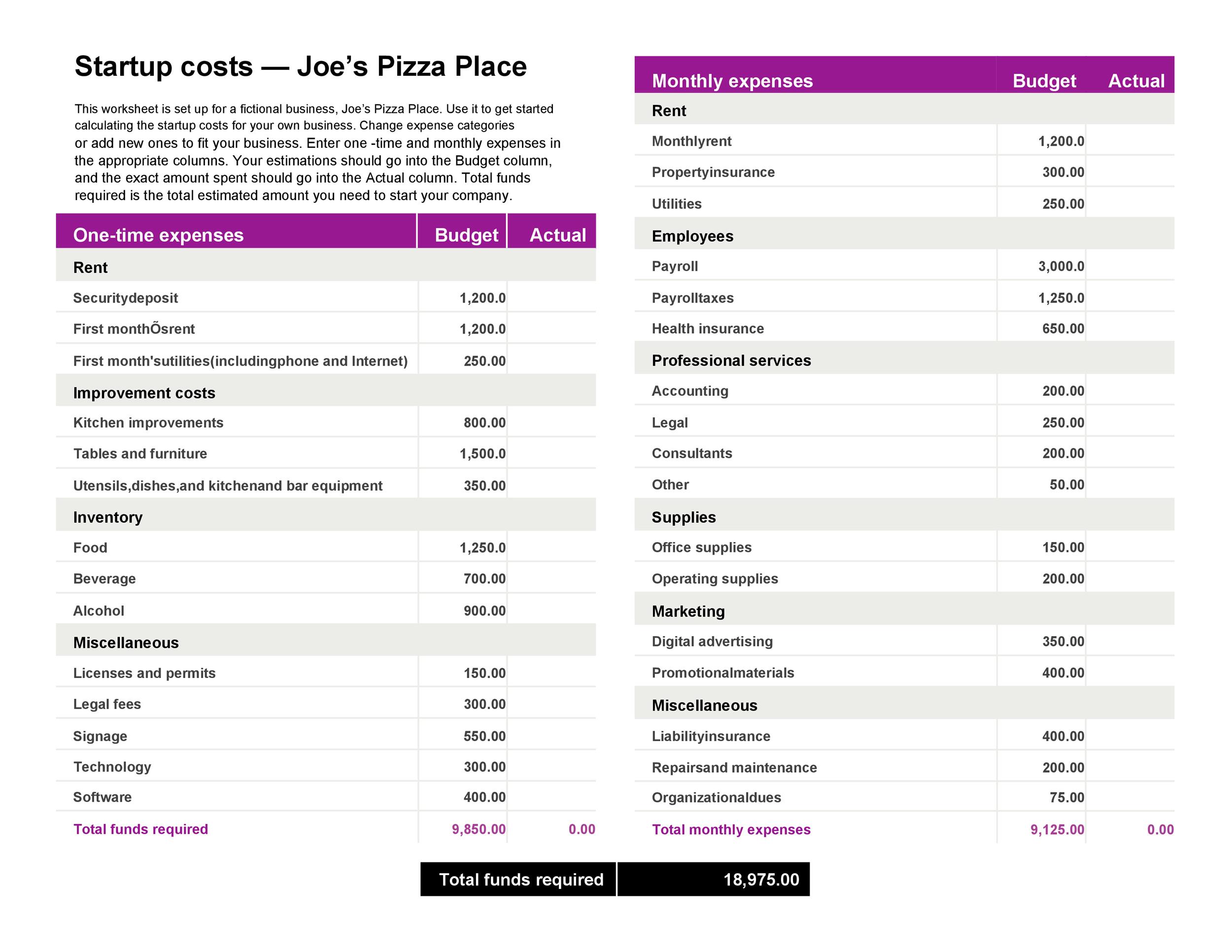

- Restaurant businesses

Opening a new restaurant can be a very costly endeavor mainly because you need a lot of specialized facilities and equipment for it. Whether you plan to purchase or lease everything you need, use the startup cost template to create a budget for your restaurant.

That way, you have a good estimate of how much you need to come up with for you to successfully open your food establishment. Apart from the facilities and equipment, include other costs like menu development, supplier sourcing, staff sourcing, cleaning costs, and more. - Home-based businesses

The great thing about this type of business is that there are several expenses you may forego. These include utilities, internet, furniture, and anything else you may already have in your home. Still, you should create a startup budget template for this type of business so you don’t end up overspending. - Online businesses

These types of businesses are relatively cheap compared to others, especially if you don’t require an external party to perform web development tasks. For this type of business, you can create a simpler template to include the few expenses like SEO, advanced hosting services, and more. - Franchise businesses

Although franchisors already provide you with information about the budget you need to start a franchise business, you may still want to create your own template to list all of your business startup costs. Here, you can include any expenses which aren’t part of the franchise agreement.

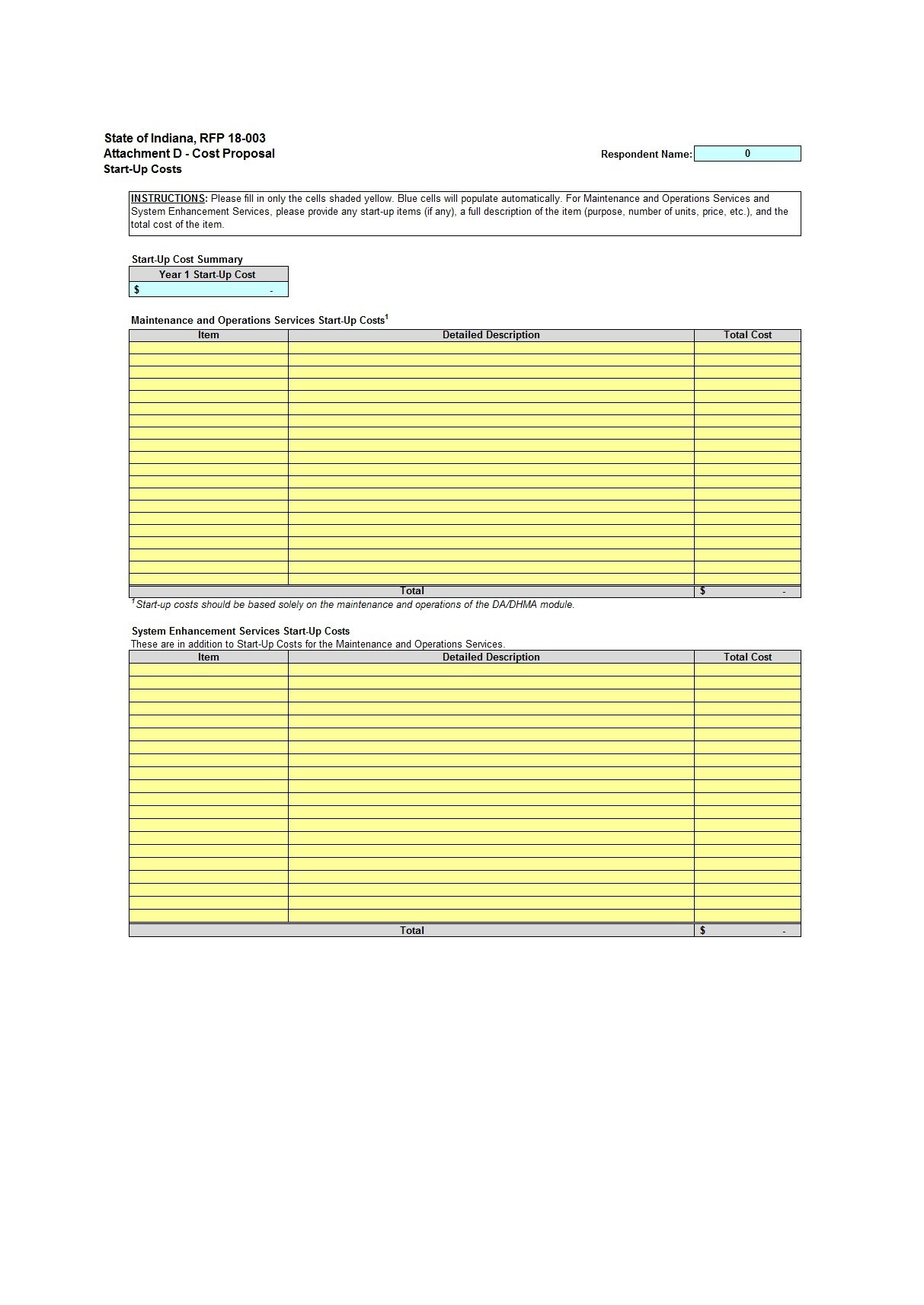

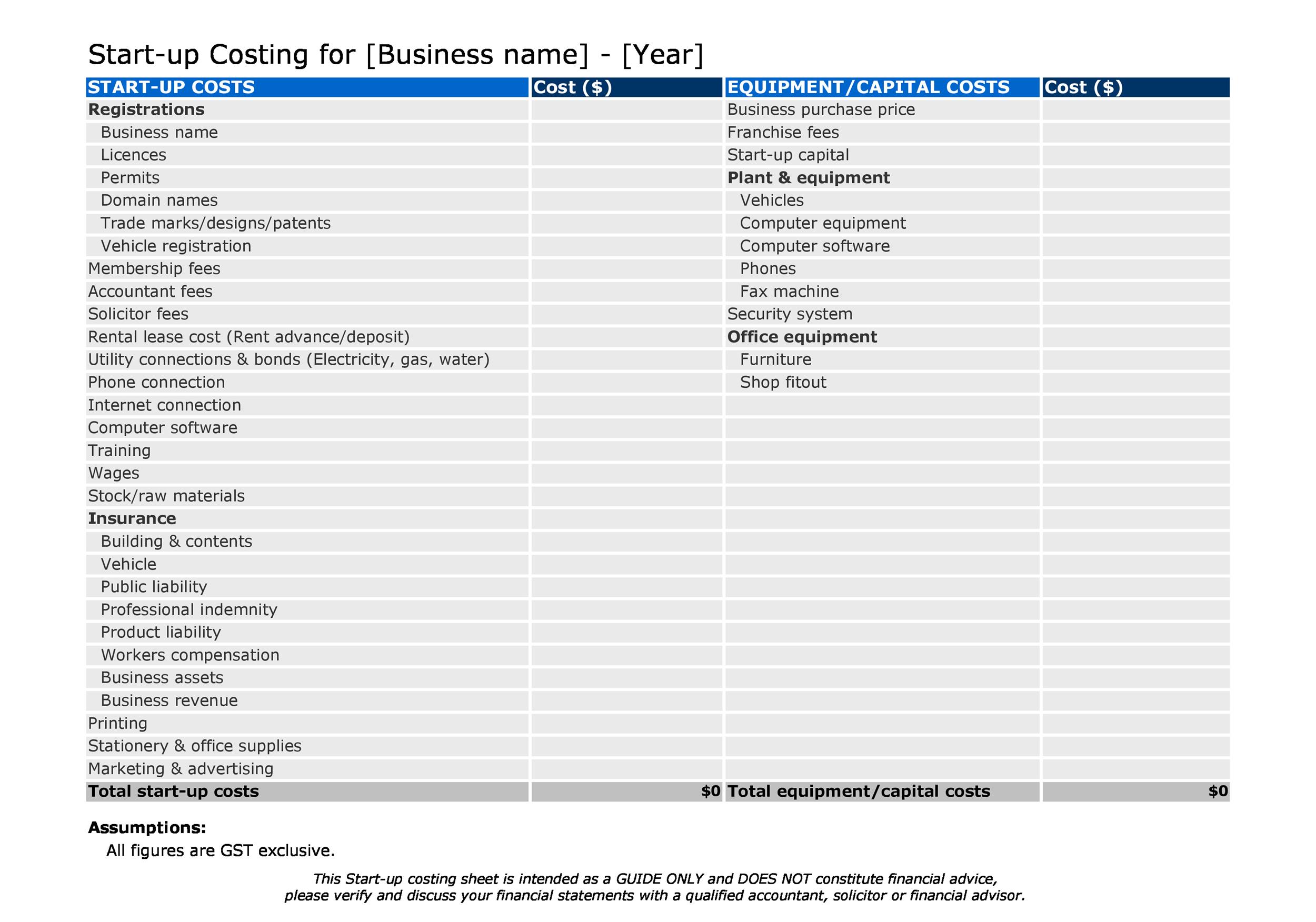

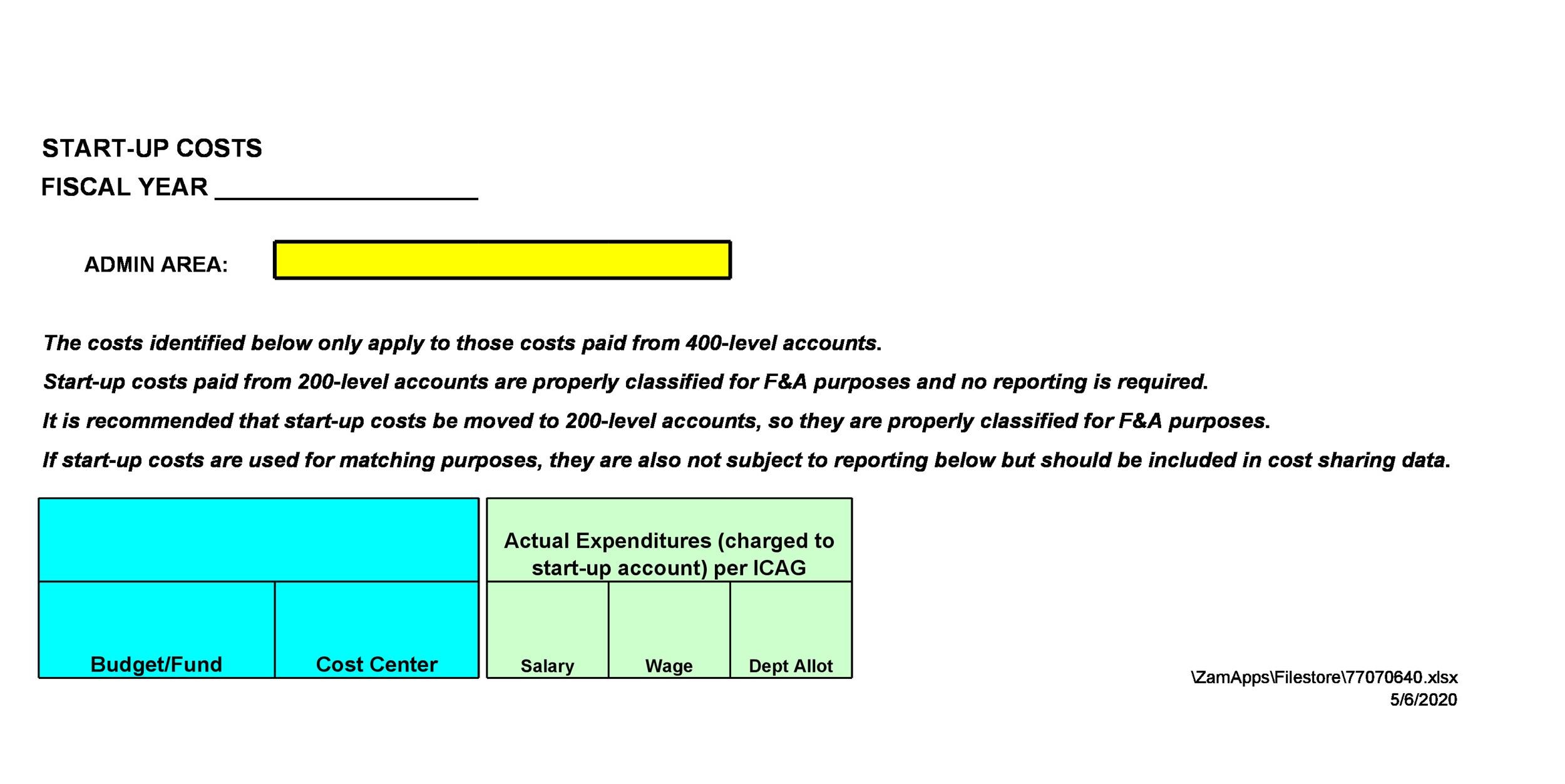

Start Up Cost Templates

Tips for creating your startup budget

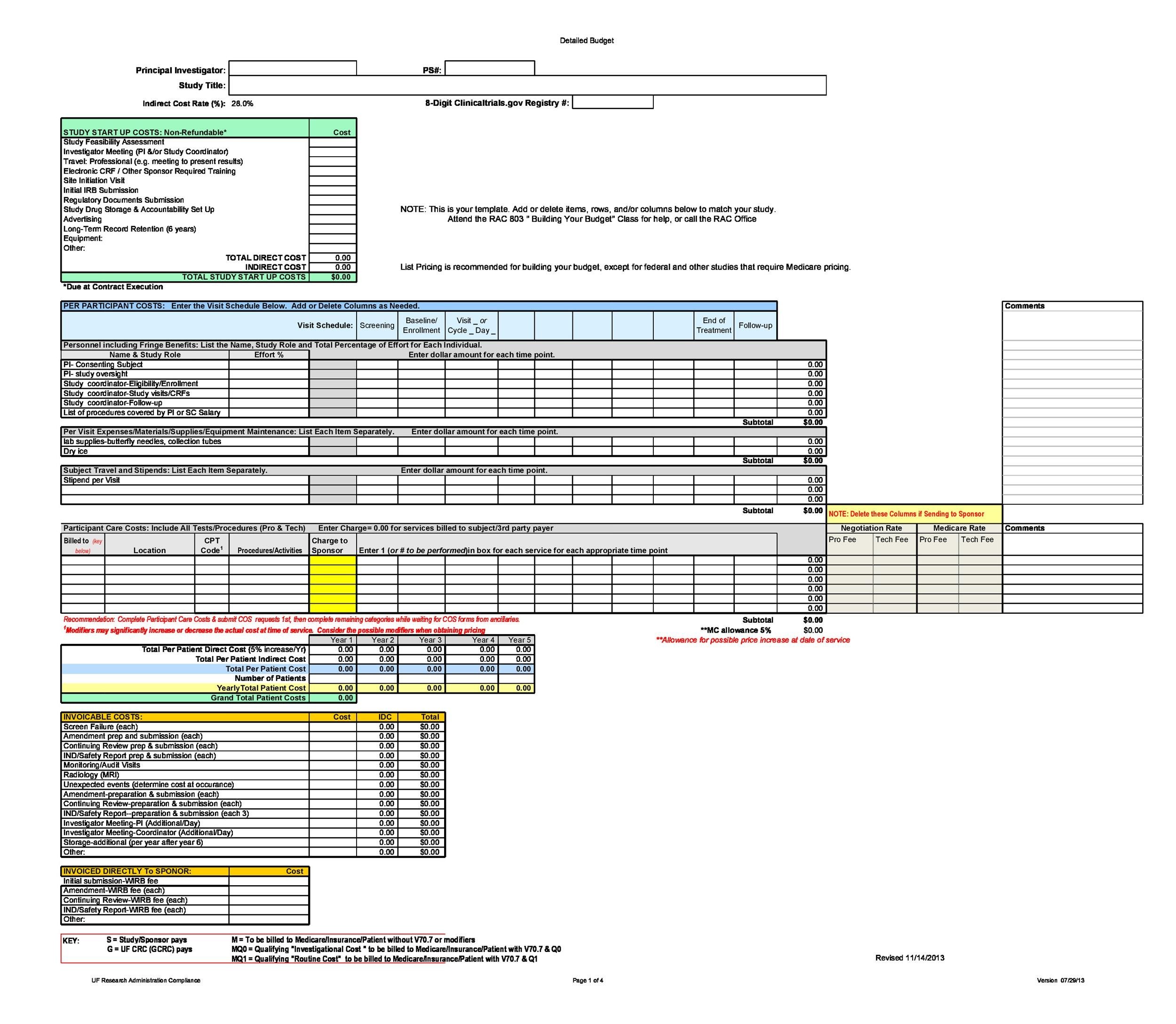

One of the first things you must do if you plan to open a new business is to create a startup budget template. You need to come up with a budget so you can see the expected expenses and income of your budget and its cash needs.

The budget is one of the most important components of any startup business plan. If this is your first time to start a business, then you won’t have any previous information to go on. So, you can either consult with another business owner you know or you can research to come up with estimates for your budget.

Before starting, think about why you need to create the budget. In this case, the budget is for your business startup. After this, you can start creating your startup business plan template Excel. Here are some tips to guide you:

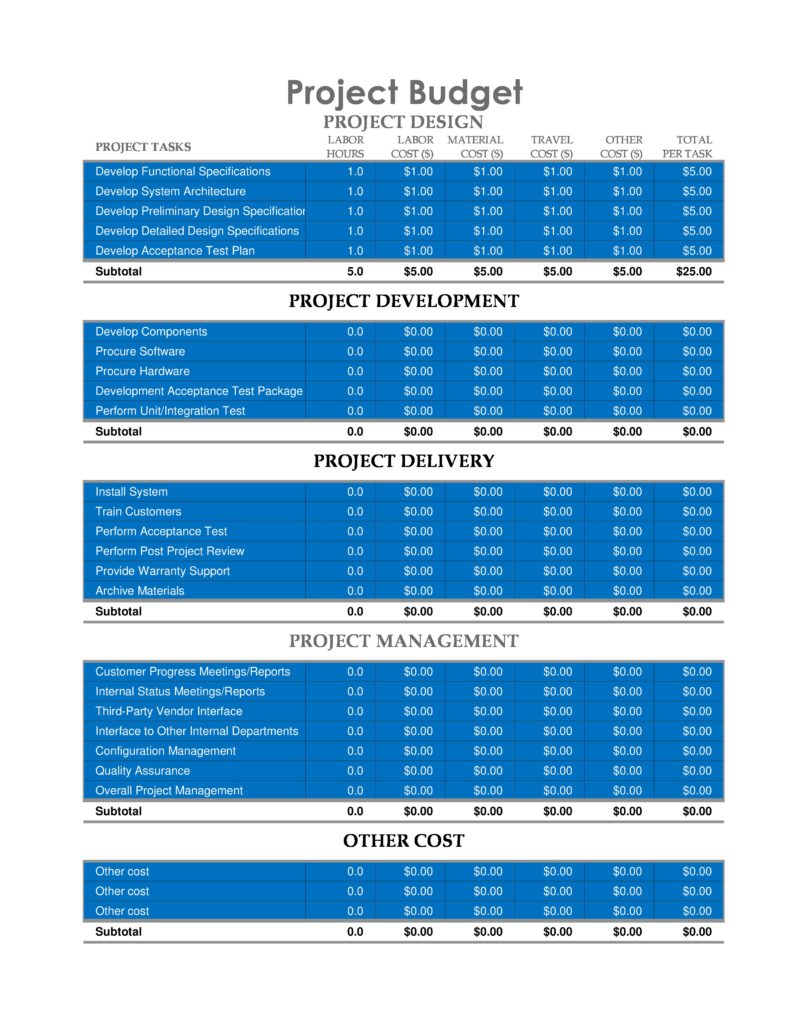

Plan the first day of your business startup

- Start by thinking about the first day of your business, the day when you will open your doors and start accepting customers. When creating the budget for this day, you can break down the information into four categories:

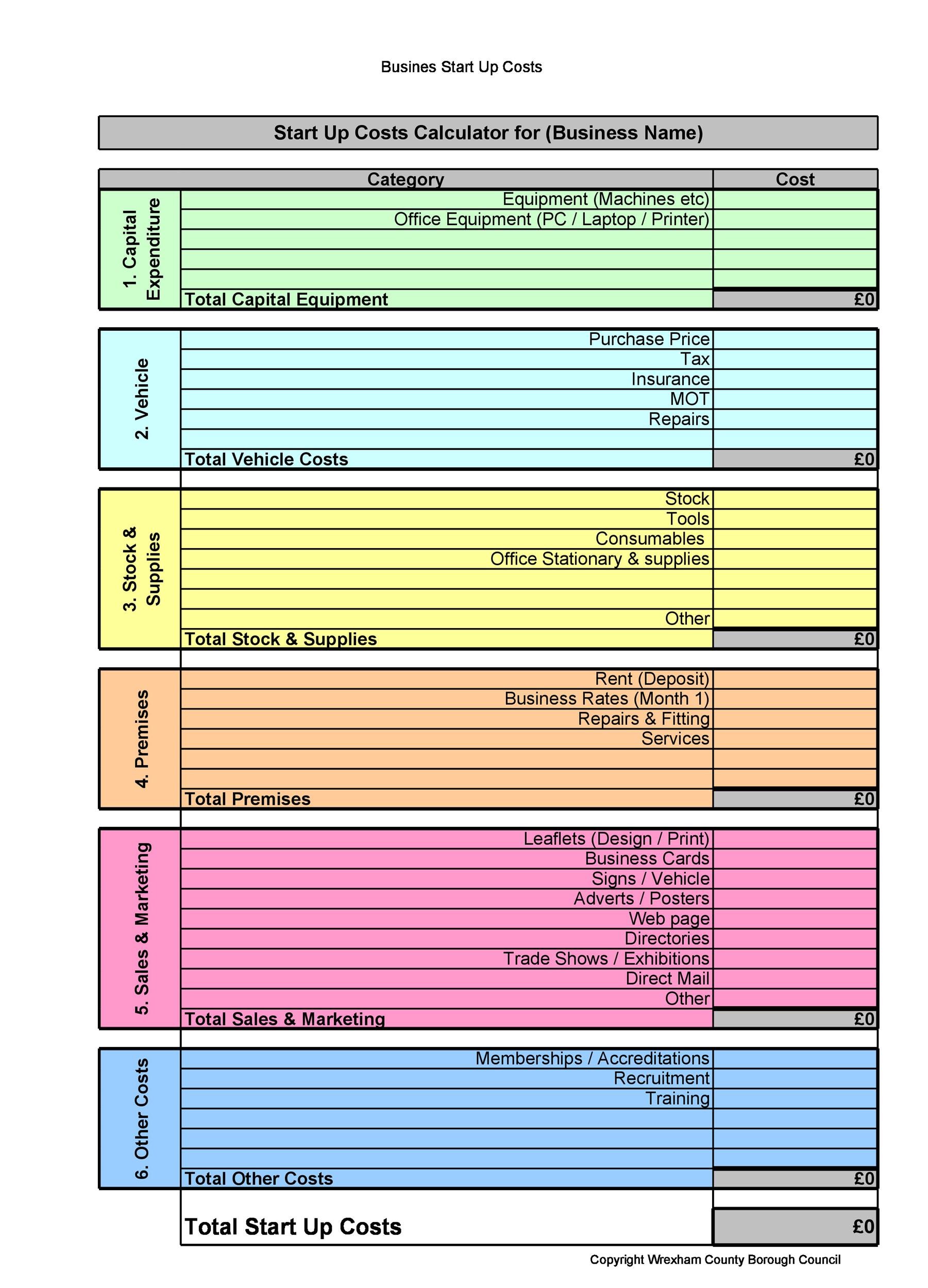

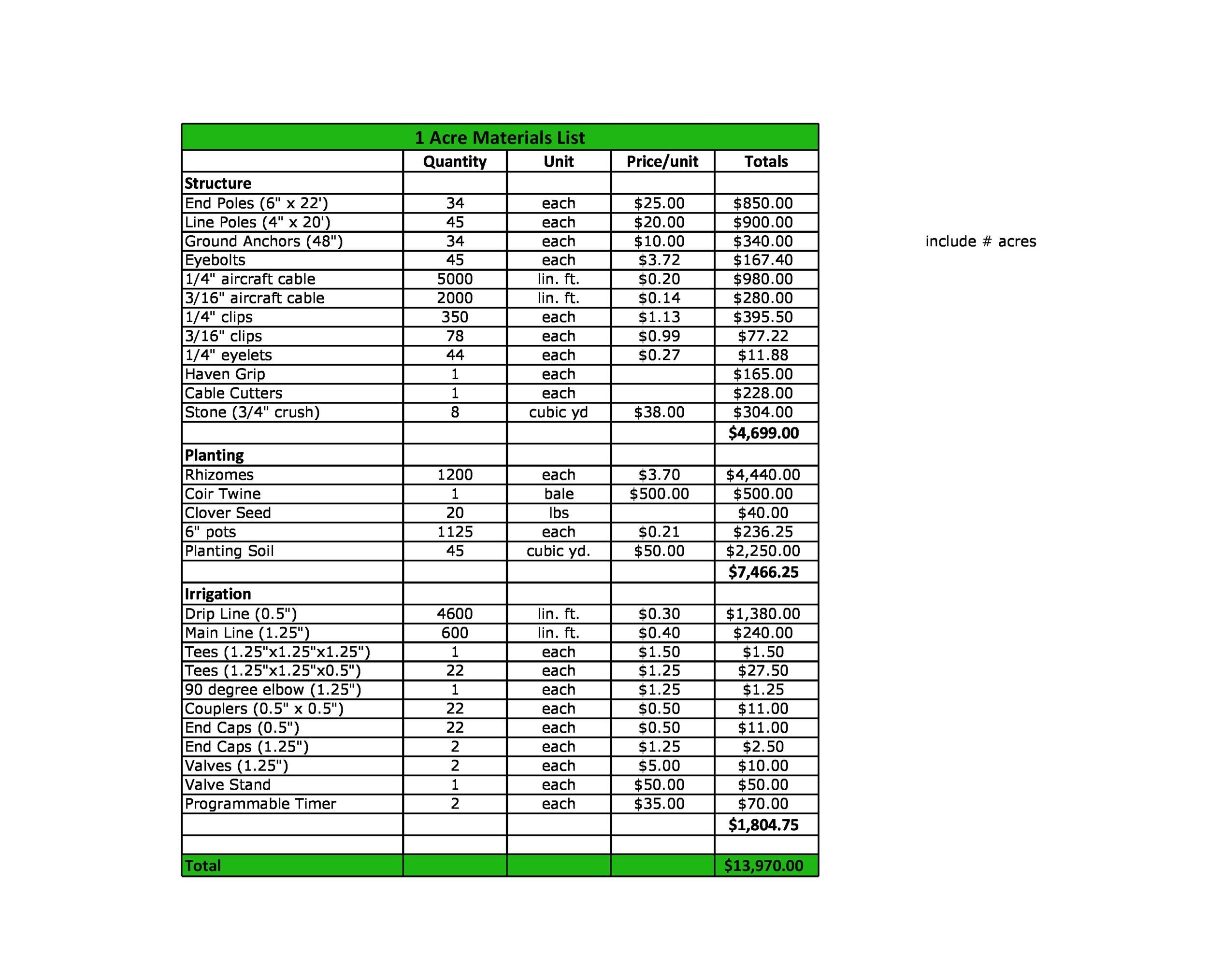

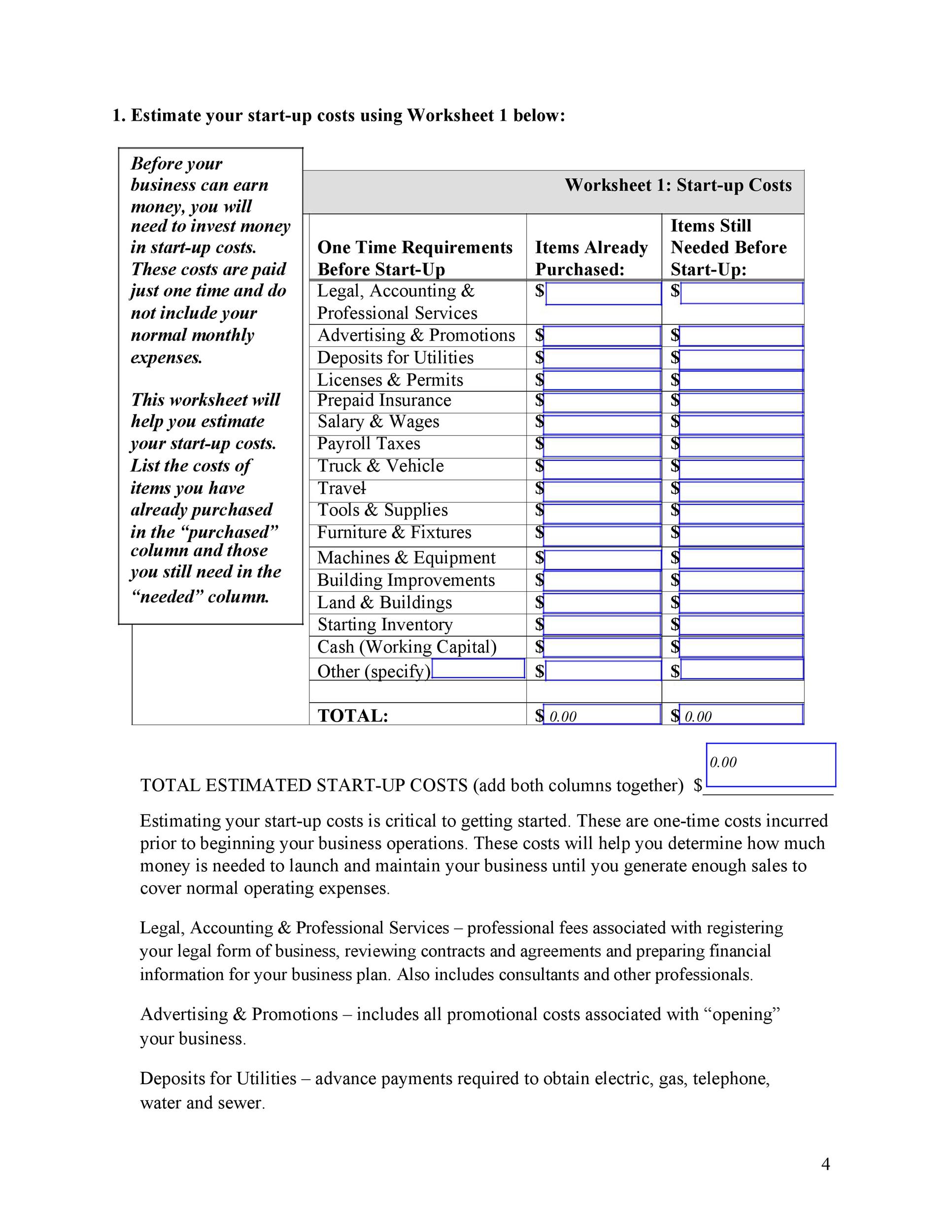

The facilities costs for the location of your business which includes the purchase or rental of the space, tenant improvements, signage, lease security deposits, and others.

Capital expenditures or fixed asset costs for vehicles, equipment, furniture, and others you need to start your new business.

Supplies and materials for you to get started on your business.

Other costs like accounting fees, attorney fees, permits and licenses, and others.

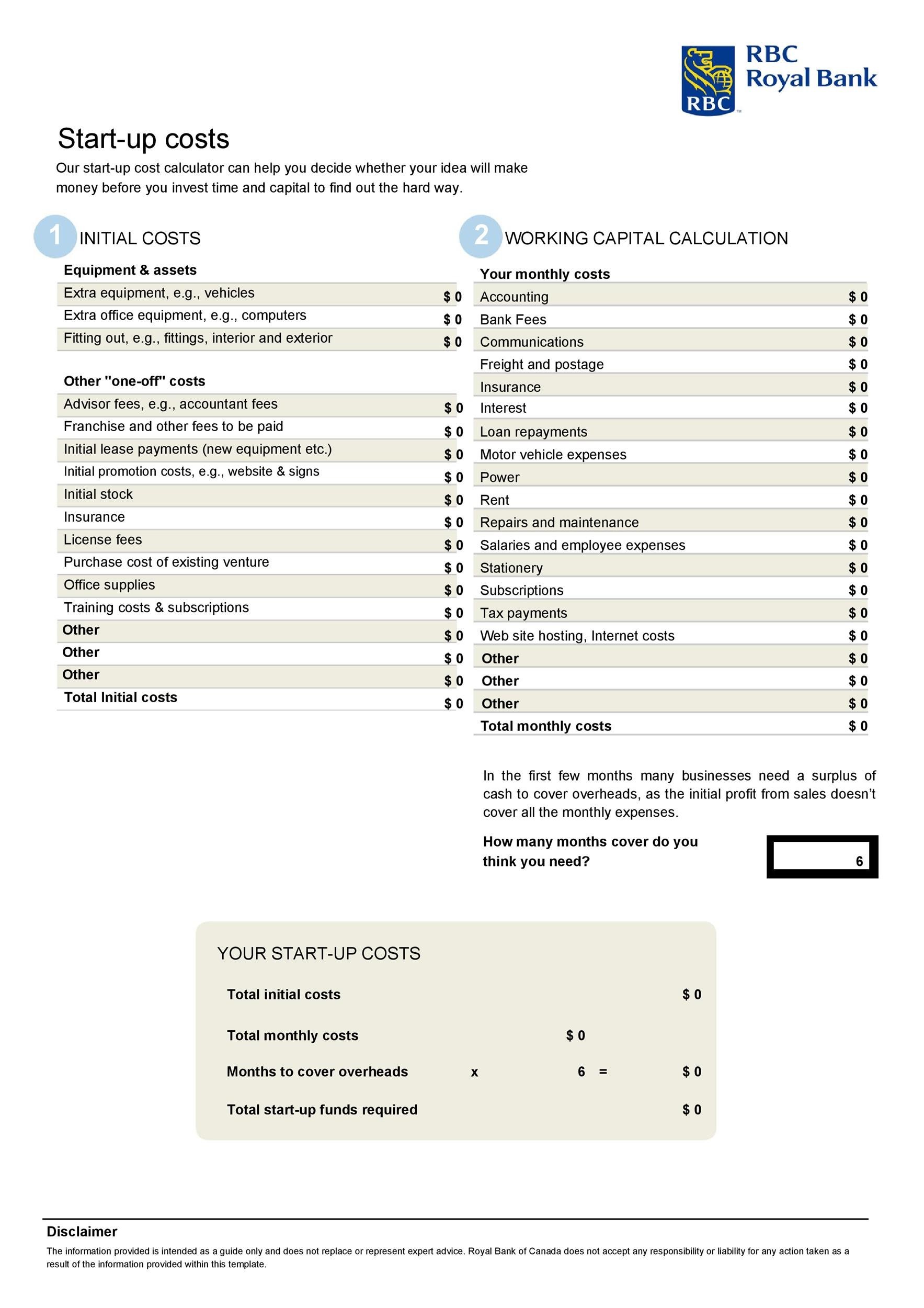

Estimate the variable and fixed expenses for each month

- Gather the information you need regarding monthly fixed expenses. These refer to the expended which don’t change no matter how good or bad your business is.

- Then include the variable expenses on your startup budget template. These refer to the expenses which may change depending on the performance of your business.

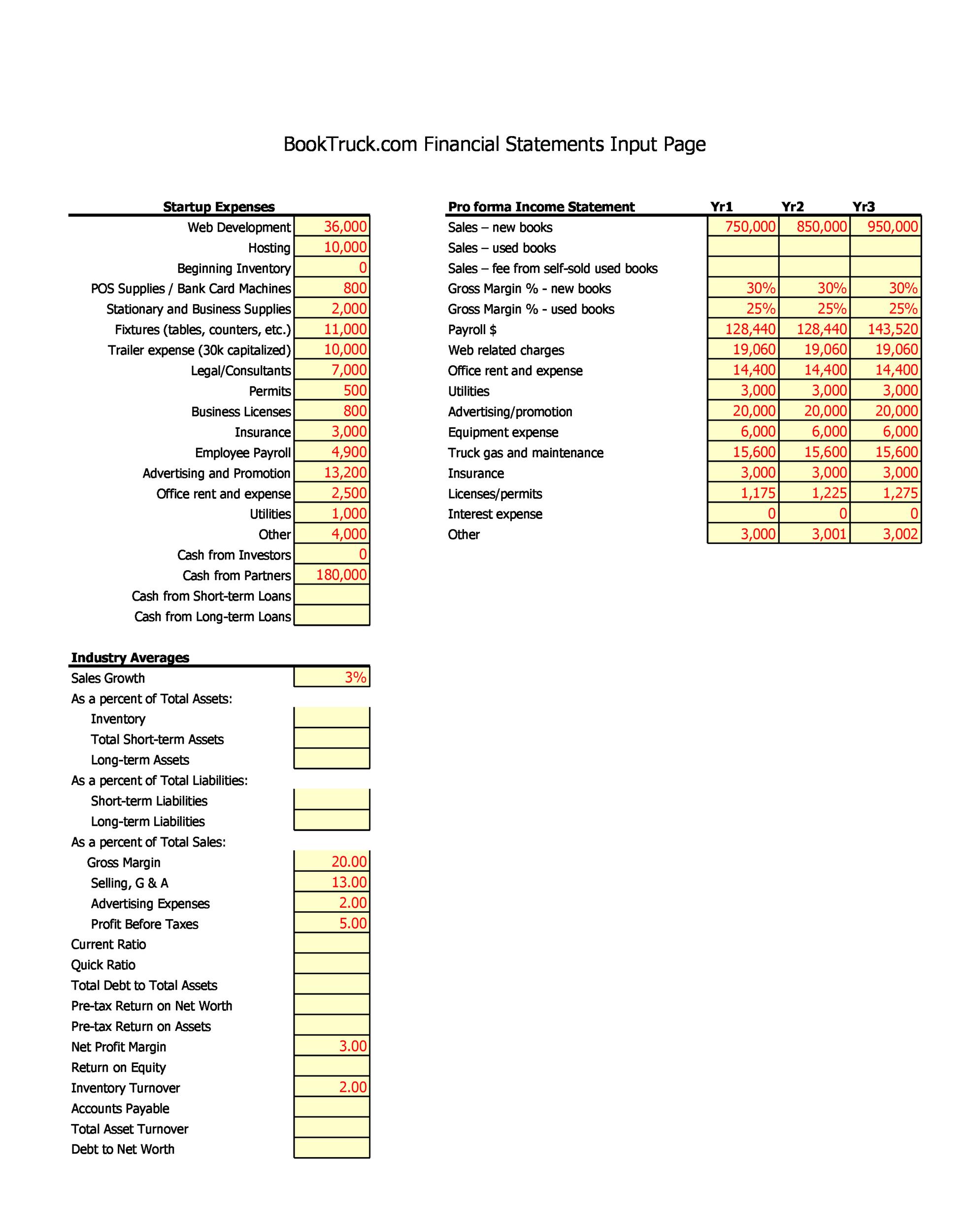

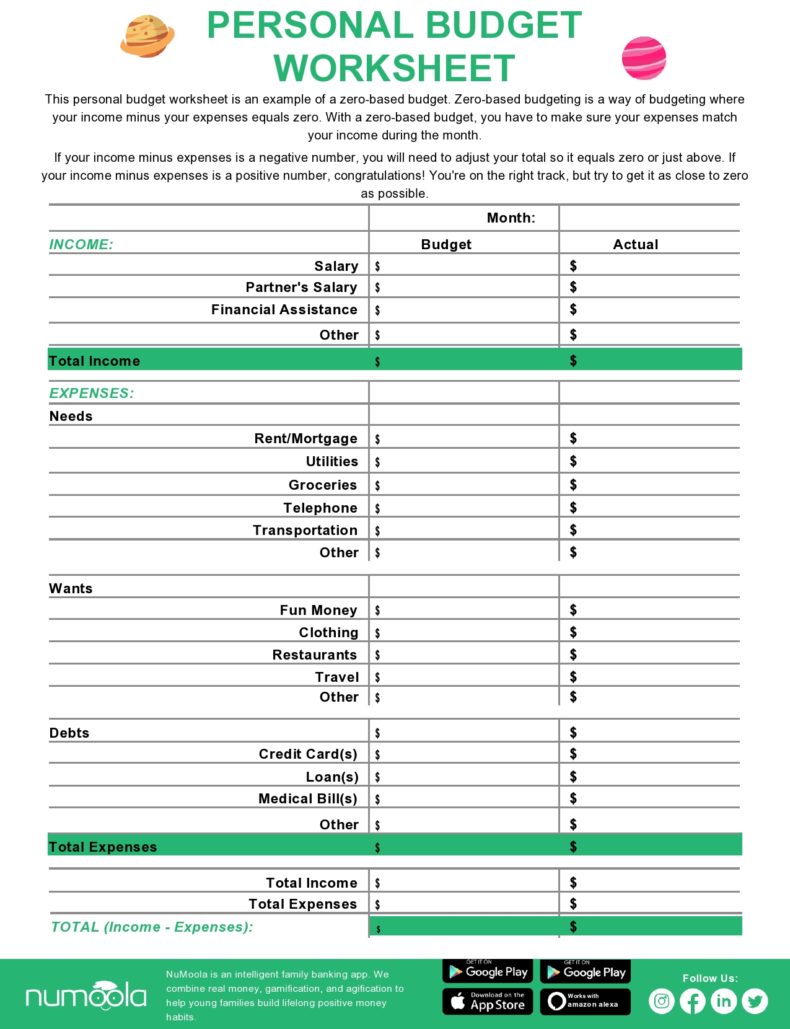

Estimate the sales each month

- Among all the information in your budget, this is the most challenging to estimate since you don’t know what the sales will be for your business. To make it easier for you, you may want to perform these sales projections:

The best-case scenario wherein you show the most optimistic estimate for your business’ sales for the first year.

The worst-case scenario wherein you show the least optimistic estimate where your business only makes minimal sales.

The most likely scenario where you show an average estimate. If you have any lenders, this is the sales projection you must show. - When you make any changes to your sales figures using these scenarios, you can start seeing the result in your cash balance every month. The cash balance provides you with information about your business’ cash needs along with the amount you must borrow for your working capital.

- If you want to be as realistic as you can, assume that you won’t collect all sales. Depending on the type of business you start and your customers’ payment methods, you might have a collections percentage that’s either smaller or bigger.

Create your cash flow statement

- To do this, combine the total sales, total collections, and total costs for each month.

Business Start Up Costs

Using your startup budget

The key to creating a well-made startup cost template is to look at the details. To do this, you need to do a lot of detailed research by searching online, calling providers and suppliers, and making a list of all the estimates. You can also download a startup business plan template Excel which already comes with cost estimates.

After creating the template for your business startup costs, you can start using it. Here are some pointers to help guide you:

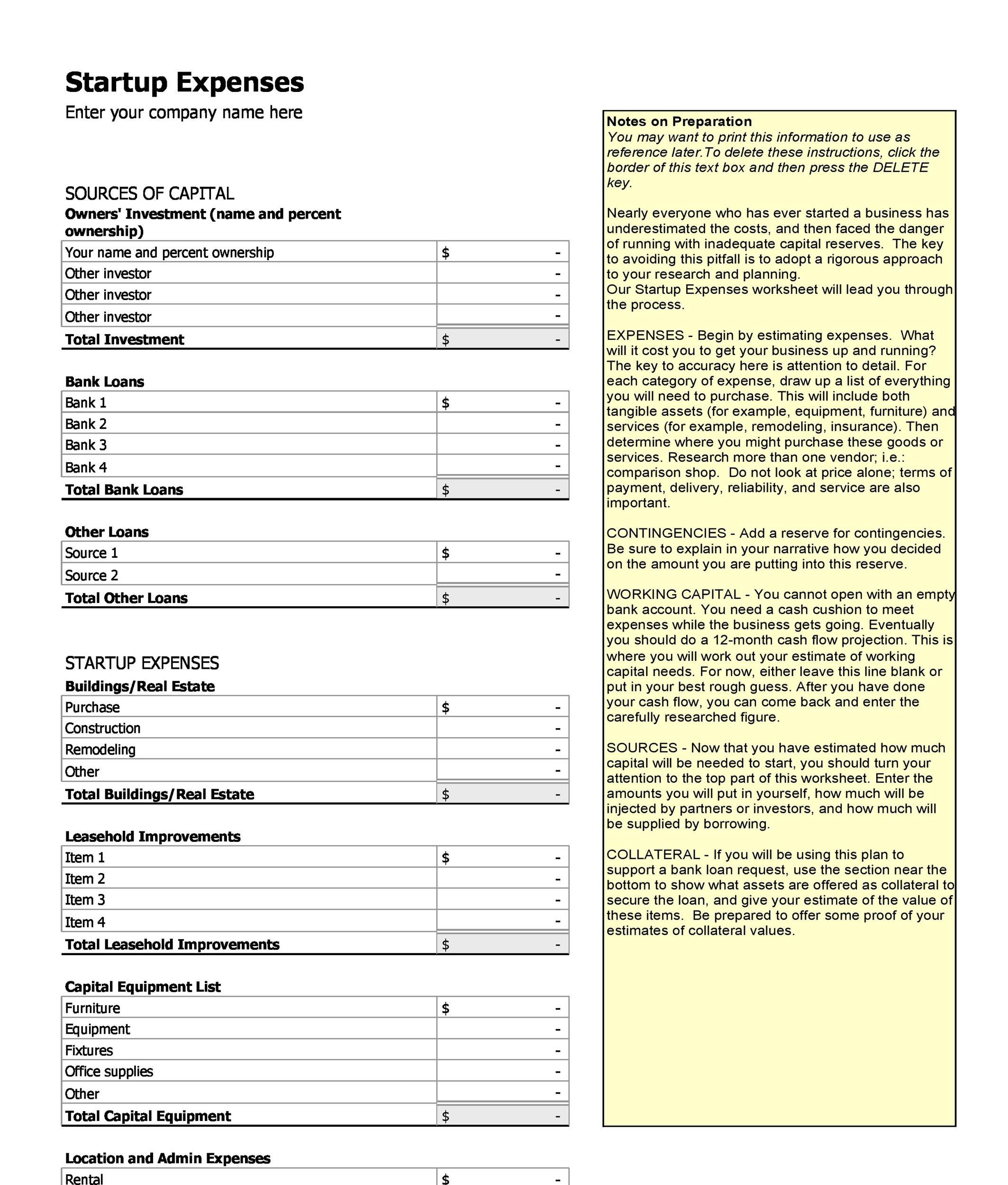

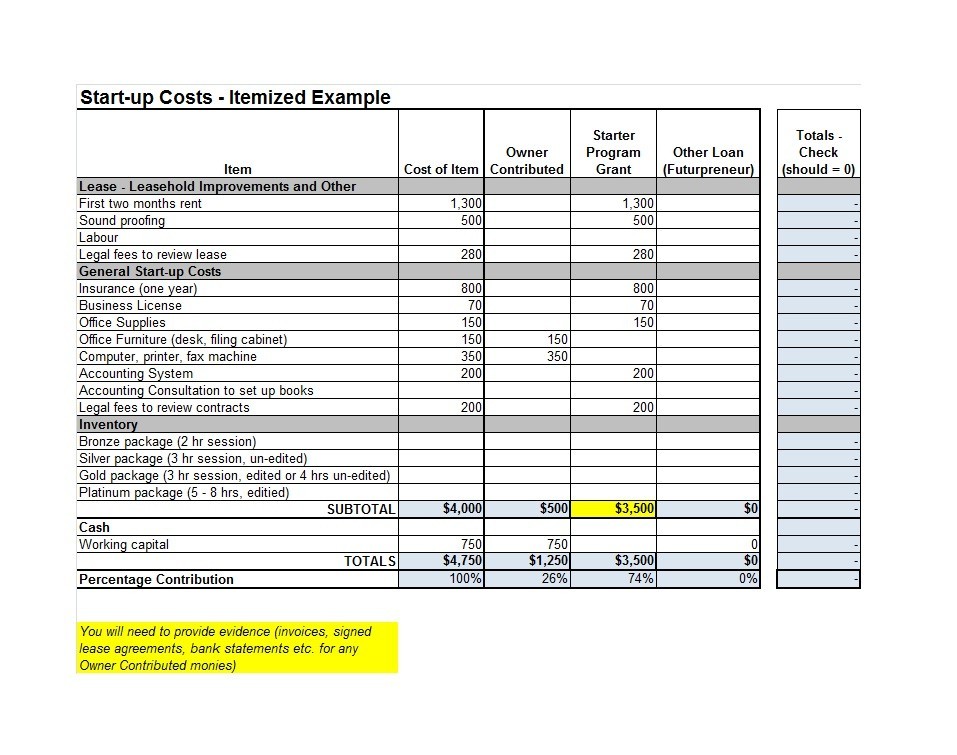

- Funding sources

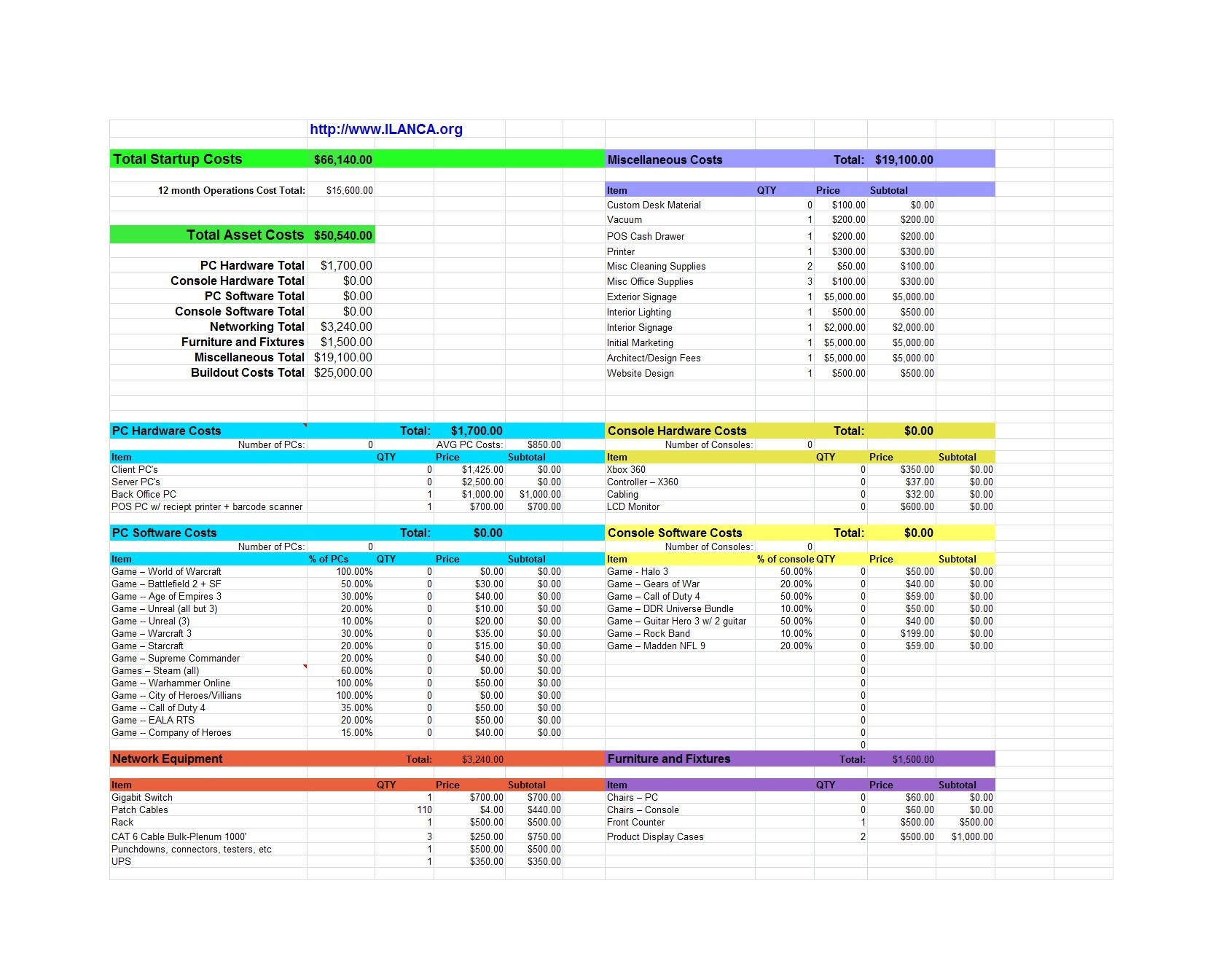

Start writing on your template by making a list of all the funding sources you plan to use for your business. This includes any money supplied by investors and owners or funds available from various lines of credit like bank loans. You may also consider selling your assets, grants, and endowments as funding sources. - Fixed costs

After you’ve listed all of the funding sources for your business, you can continue by entering any estimated fixed costs. These are one-time costs which are commonly associated with starting your business off to get it up and running. These costs include purchasing assets, stocking up on your business’ inventory, leasing space, and so on.

The two main aspects of fixed costs are your Working Capital and your Reserve for Contingencies. No matter what type of business you start, you must have a Contingency Fund as there always will be last-minute fees and costs. Think about the risks of the type of business you’re starting and estimate your contingency funds accordingly.

Make sure that you include a sufficient Working Capital to fund the normal operations of your business as it grows. Keep in mind that a significant amount of time might pass between when you make a sale and when you receive the payment.

You need enough of working capital so you can continue purchasing your inventory items and pay your bills while you wait for the payment from the customers. A lot of businesses fail because they don’t have enough of working capital. - Monthly costs until your business become profitable

Some entrepreneurs don’t understand that businesses never become profitable on the first day. If you want to have a better estimate of the actual cash you need, you should estimate the operating costs of your business each month. This helps you estimate the number of months it might take before you see profits coming in. - Ready, set, go!

After inputting all of the required information in your startup budget template, you can start performing calculations to get the totals. This helps you determine whether you have a deficit or a surplus in your funding.

If you have a deficit, you must think about ways to scale back some of the costs or look for more funding sources. If you have a surplus and you’re sure about the calculations and estimations you’ve made, then your business is good to go! - Keep things in check

Most of the time, new business owners end up spending more than that they had planned. You can avoid this by creating a budget and using the template as a reference to keep everything in check. As you dole out money, list down the actual costs on the template to see that you don’t overspend.