When an amendment is applied to a Liability Company (LLC) operating agreement, this internal, written document is created to identify which section or sections of the original LLC Operating Agreement have been altered. New sections might be added, sections might be removed, or the language and intention of the overall operating agreement could be altered entirely.

There are some basic rules that must be followed to make sure that these changes are done properly and that they are binding. You cannot just make changes to an LLC by typing up a quick note and calling it a day. All of the owners and operators that are involved in the LLC will need to agree on the operating agreement amendment as well. A single owner cannot unilaterally alter the LLC operating agreement without the knowledge of the other parties who are involved in the running or management of the business.

Table of Contents

- 1 Operating Agreement Amendment Templates

- 2 Potential Limitations to Amendment of an LLC Operating Agreement

- 3 How Do You Add an Amendment to an Operating Agreement?

- 4 Amendment to LLC Operating Agreements

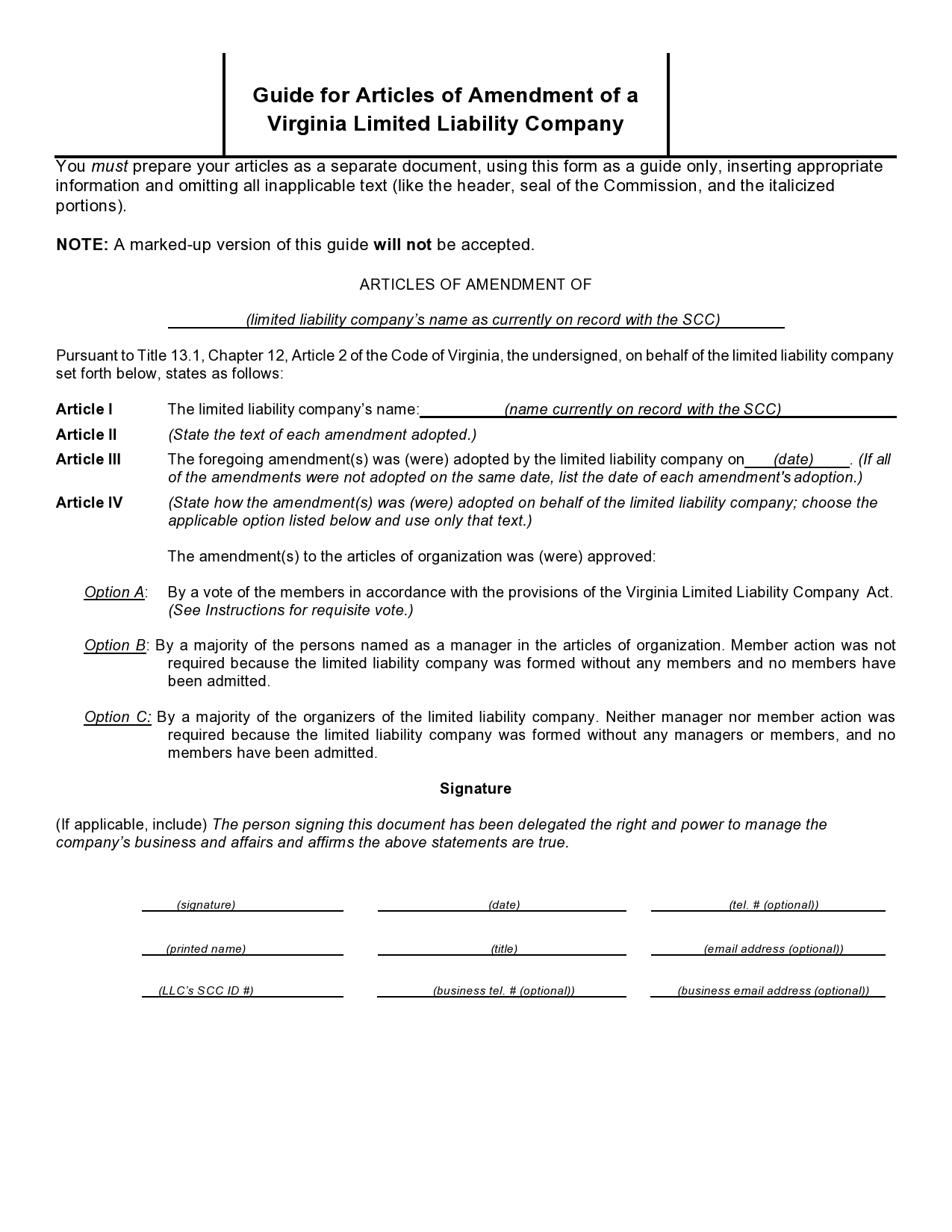

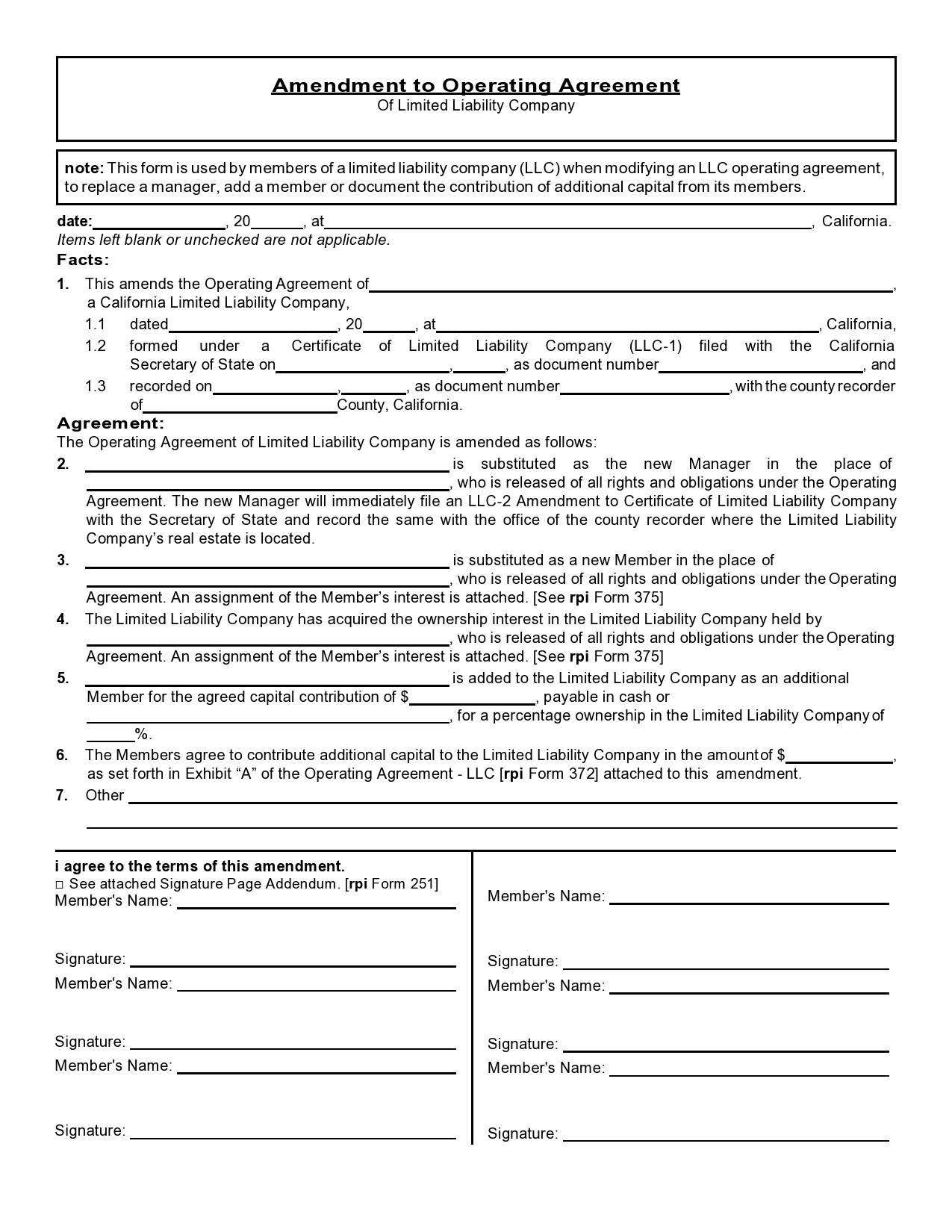

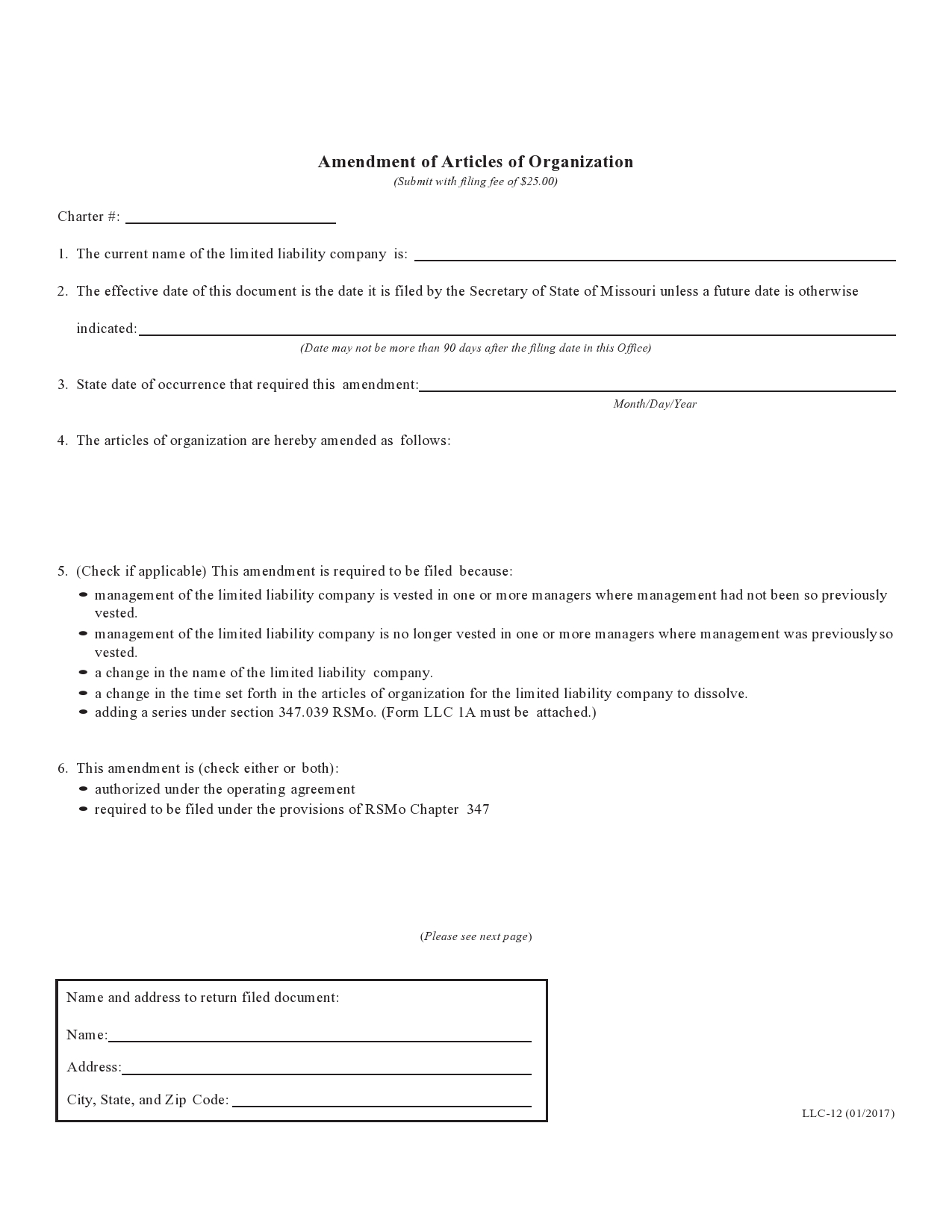

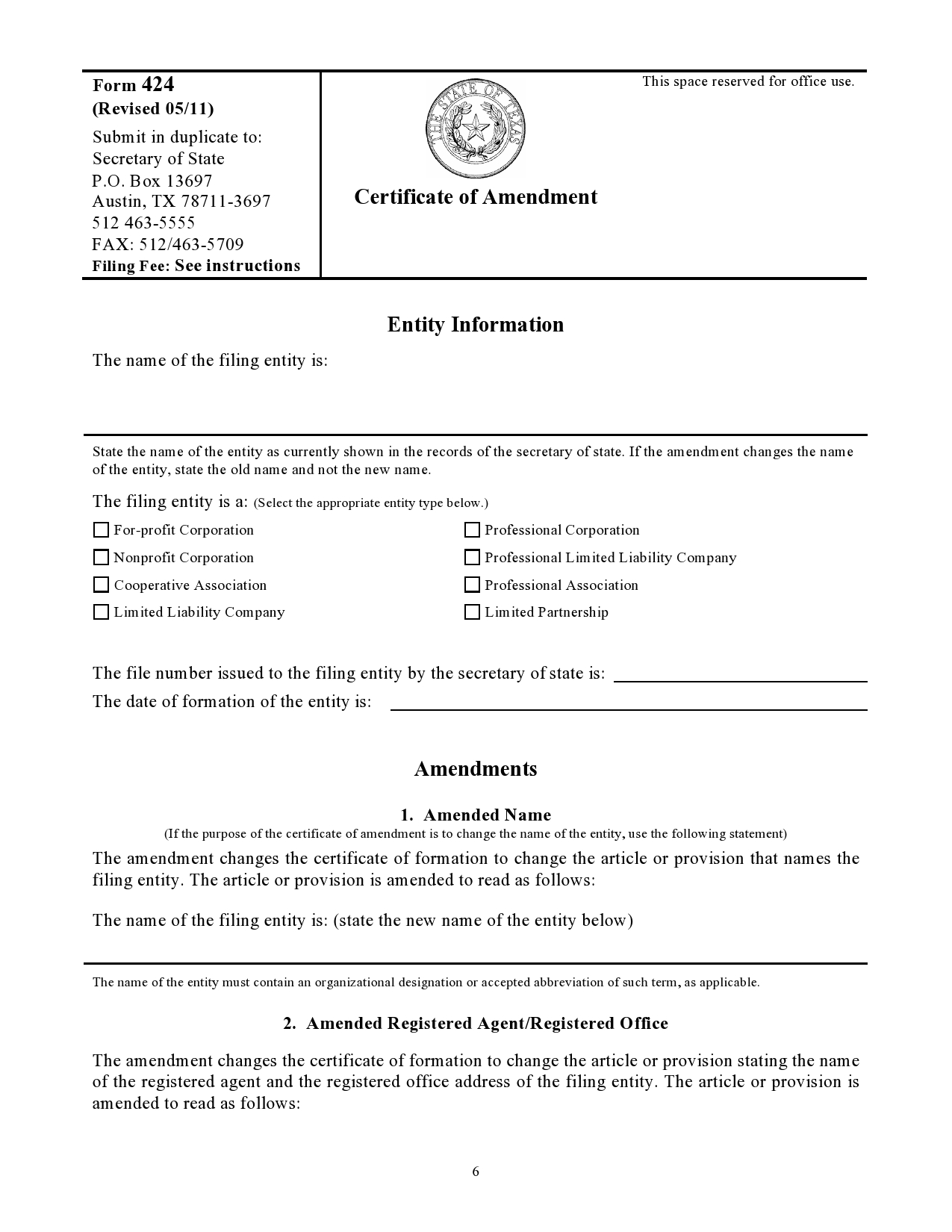

- 5 Are There LLC Amendment Templates That Can be Used?

- 6 What Does an Operating Agreement Amendment Need to Include?

- 7 LLC Amendment Examples

- 8 What Kinds of Changes Require an LLC Operating Agreement Amendment?

- 9 Are There Consequences For Not Using an Operating Agreement Amendment?

- 10 Operating Agreement Amendment Samples

- 11 How Does an LLC Manage Amendment Discussion?

- 12 Creating Correct Amendments to Your LLC Matters

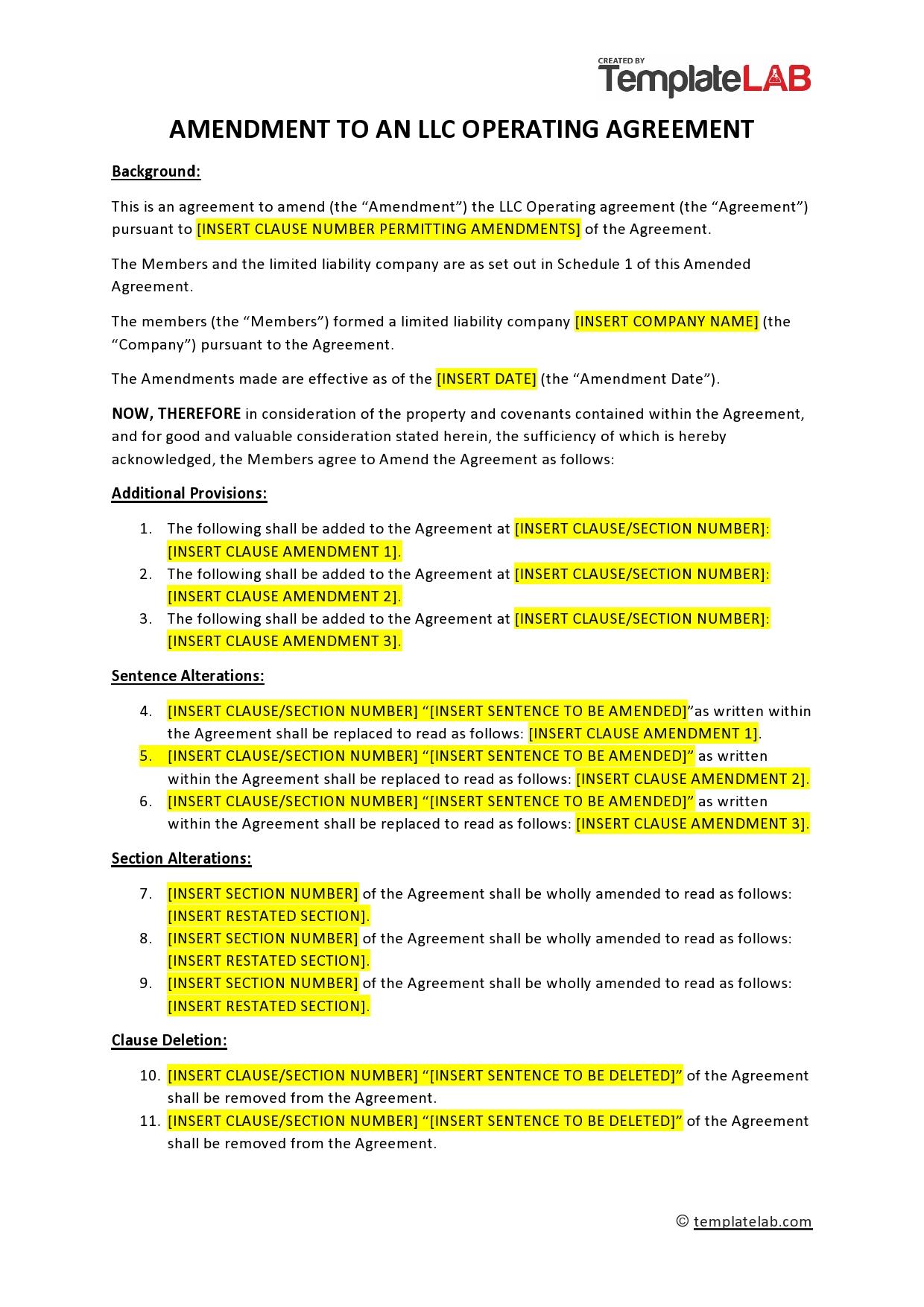

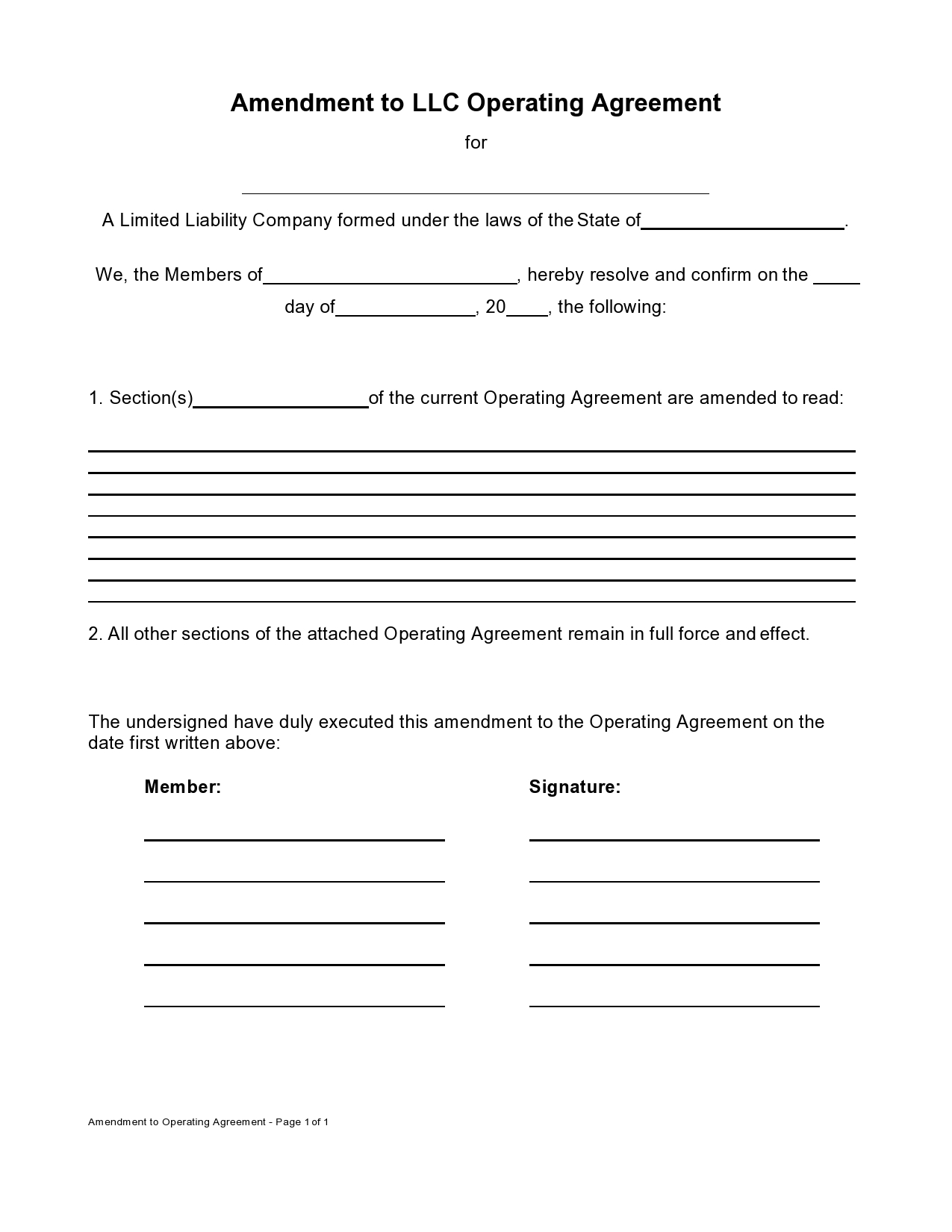

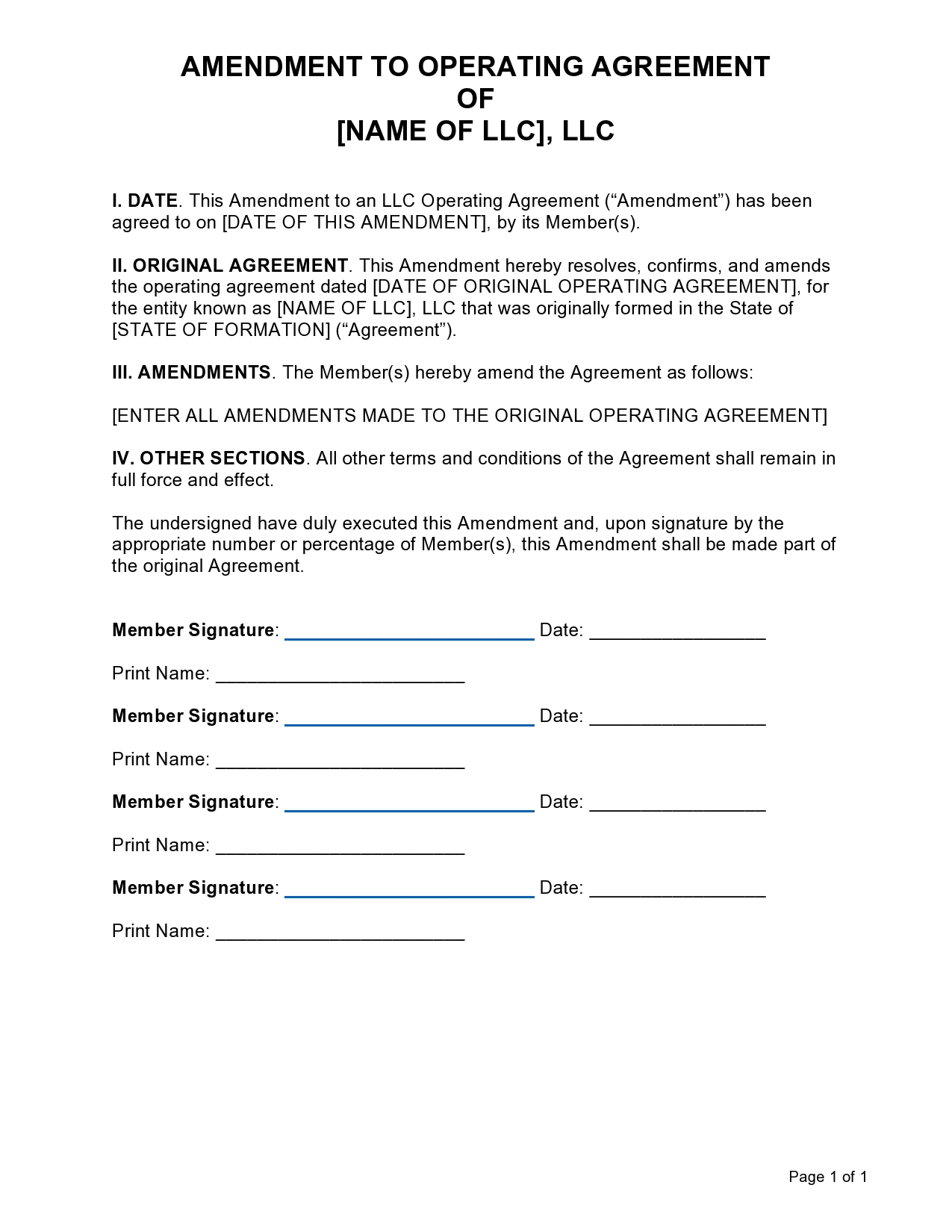

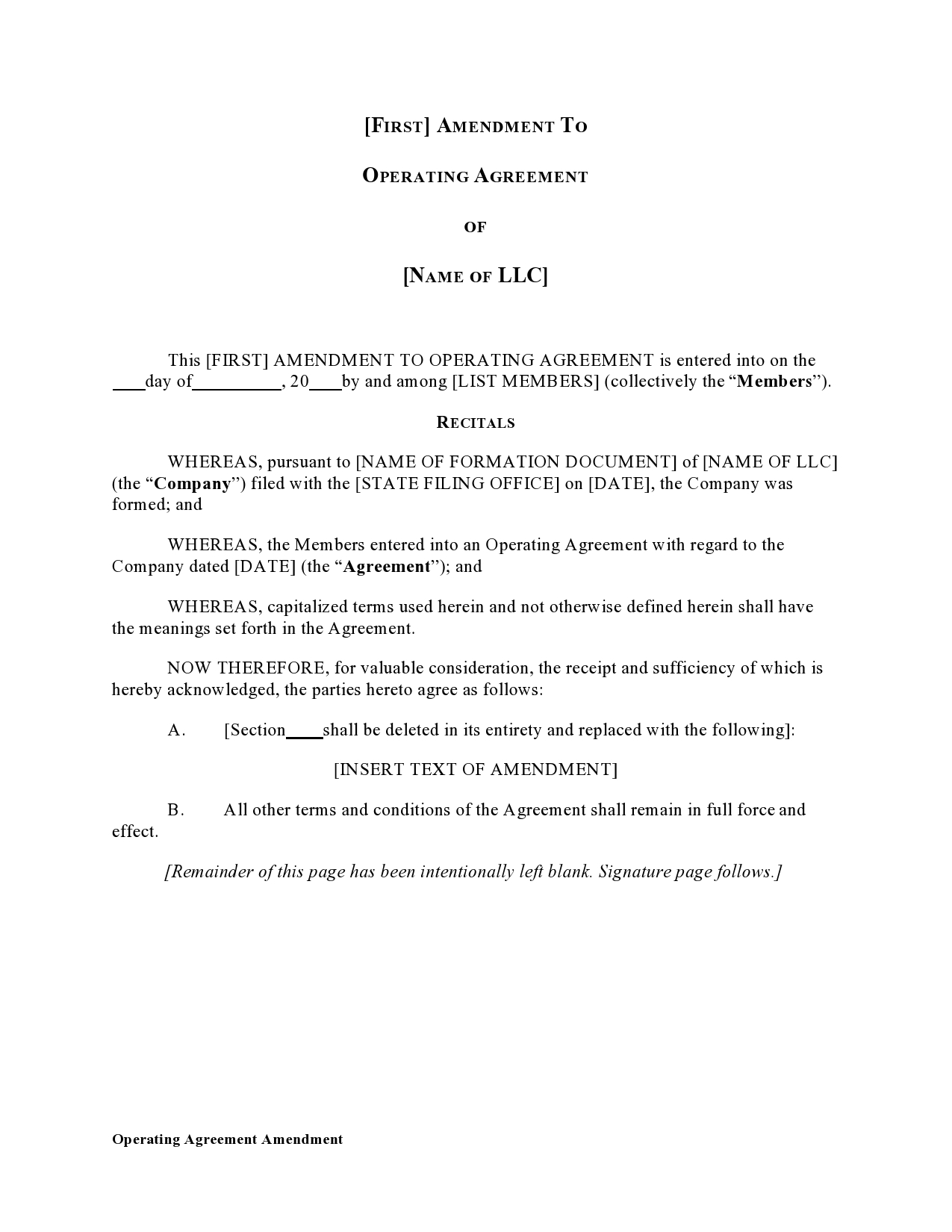

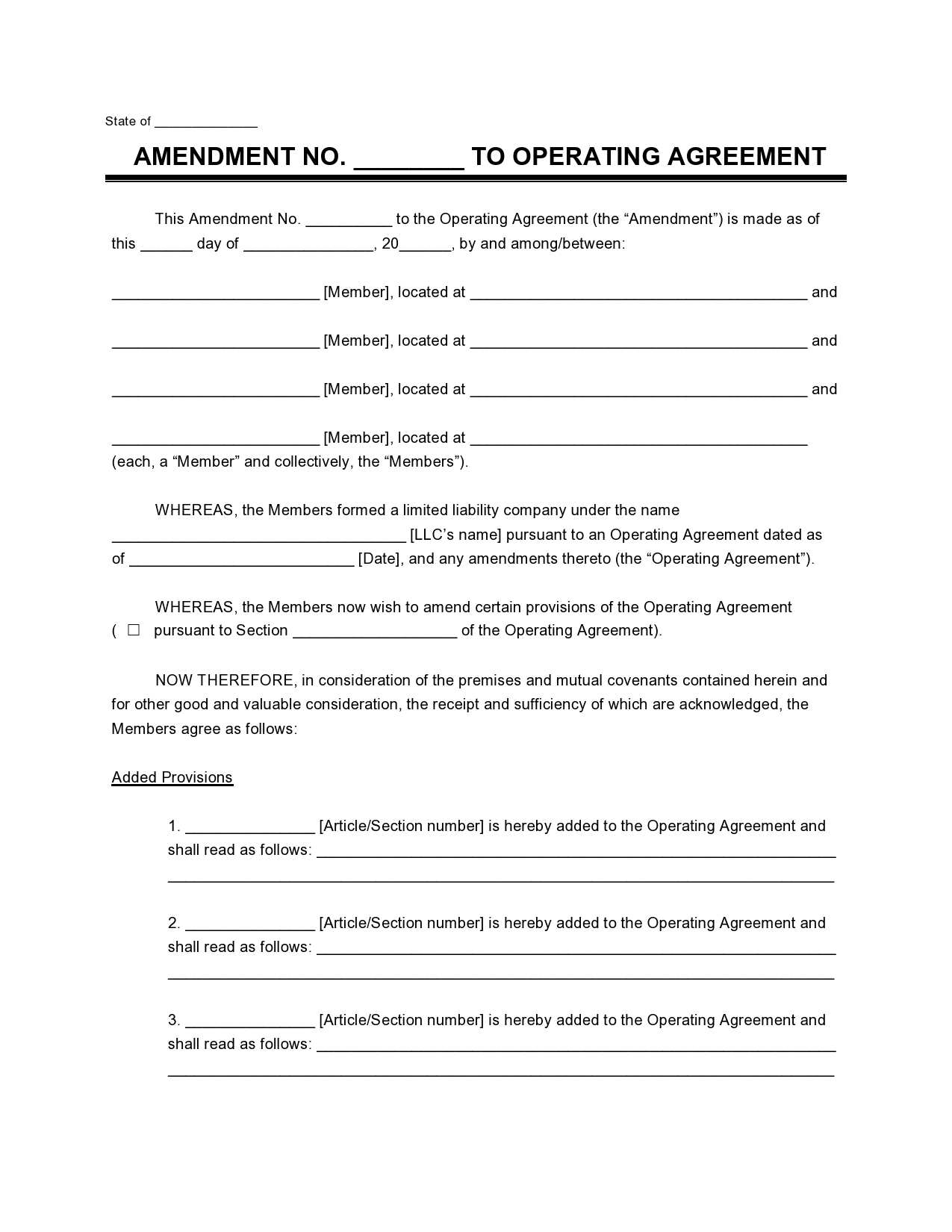

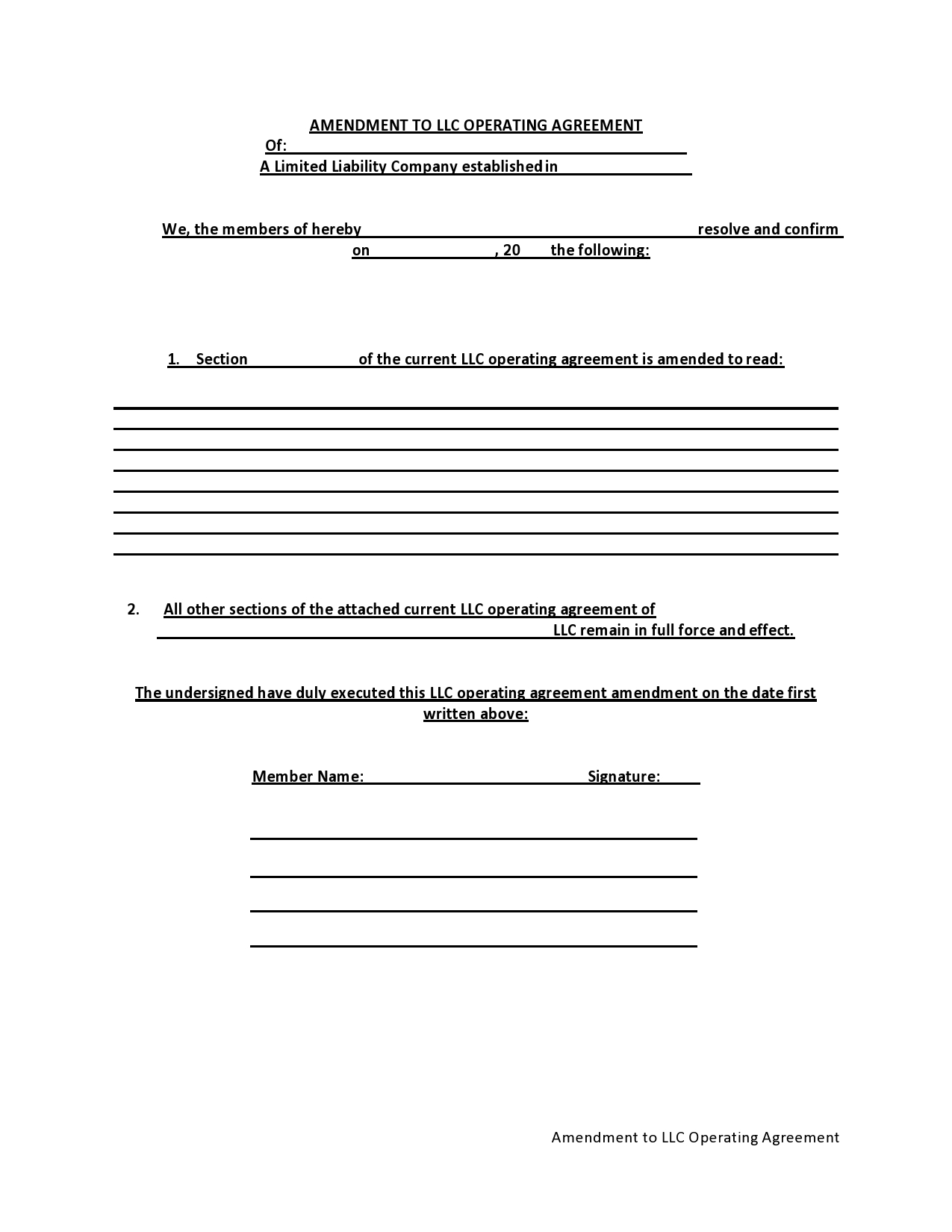

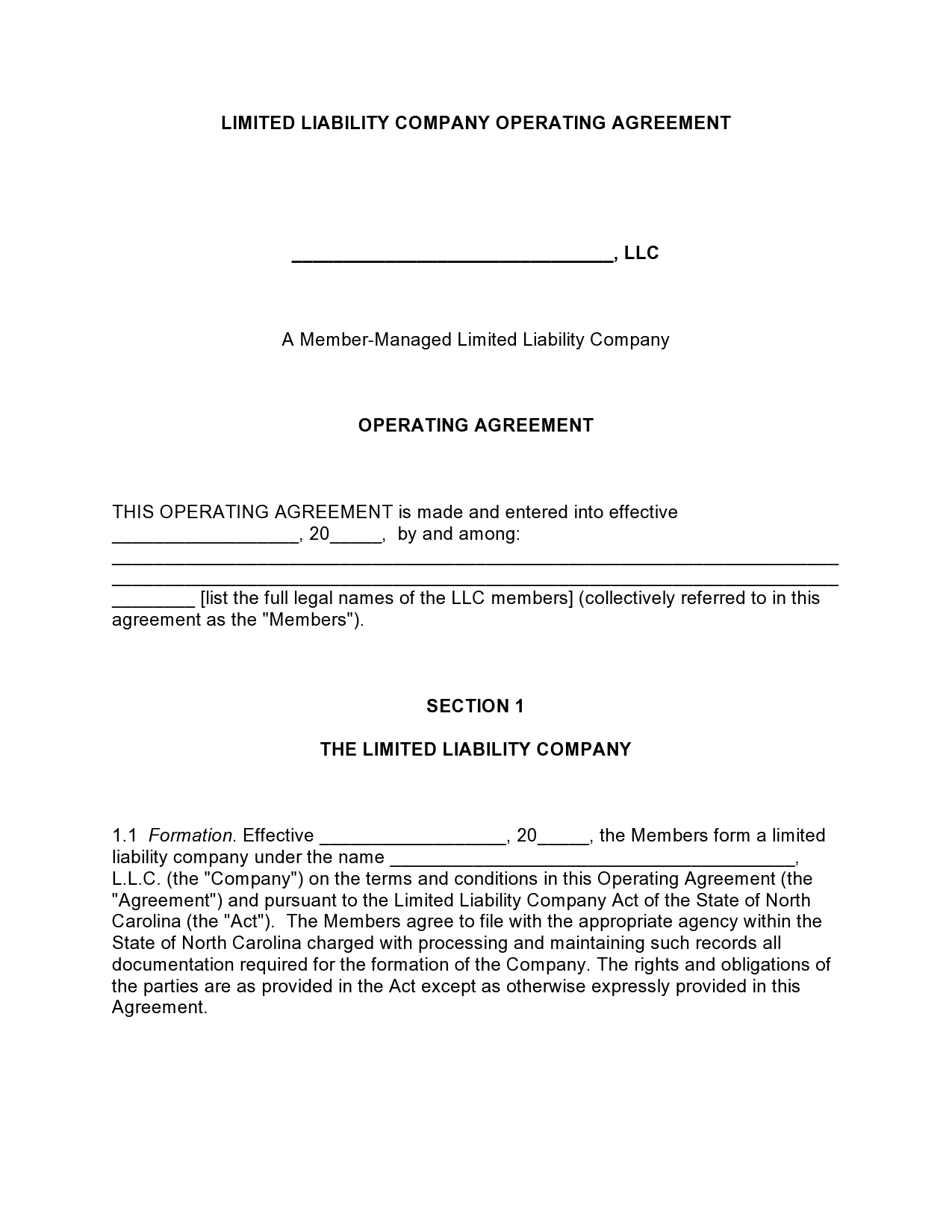

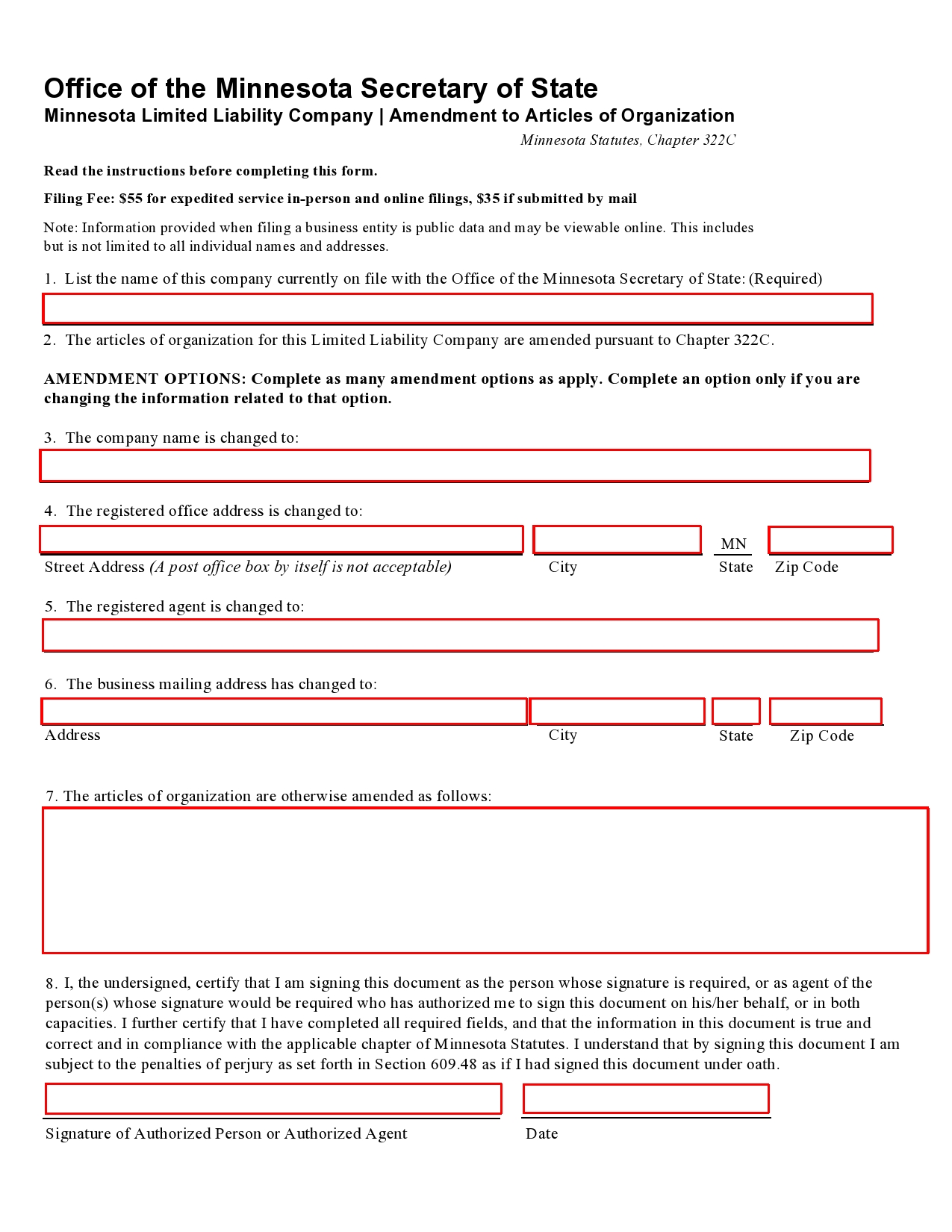

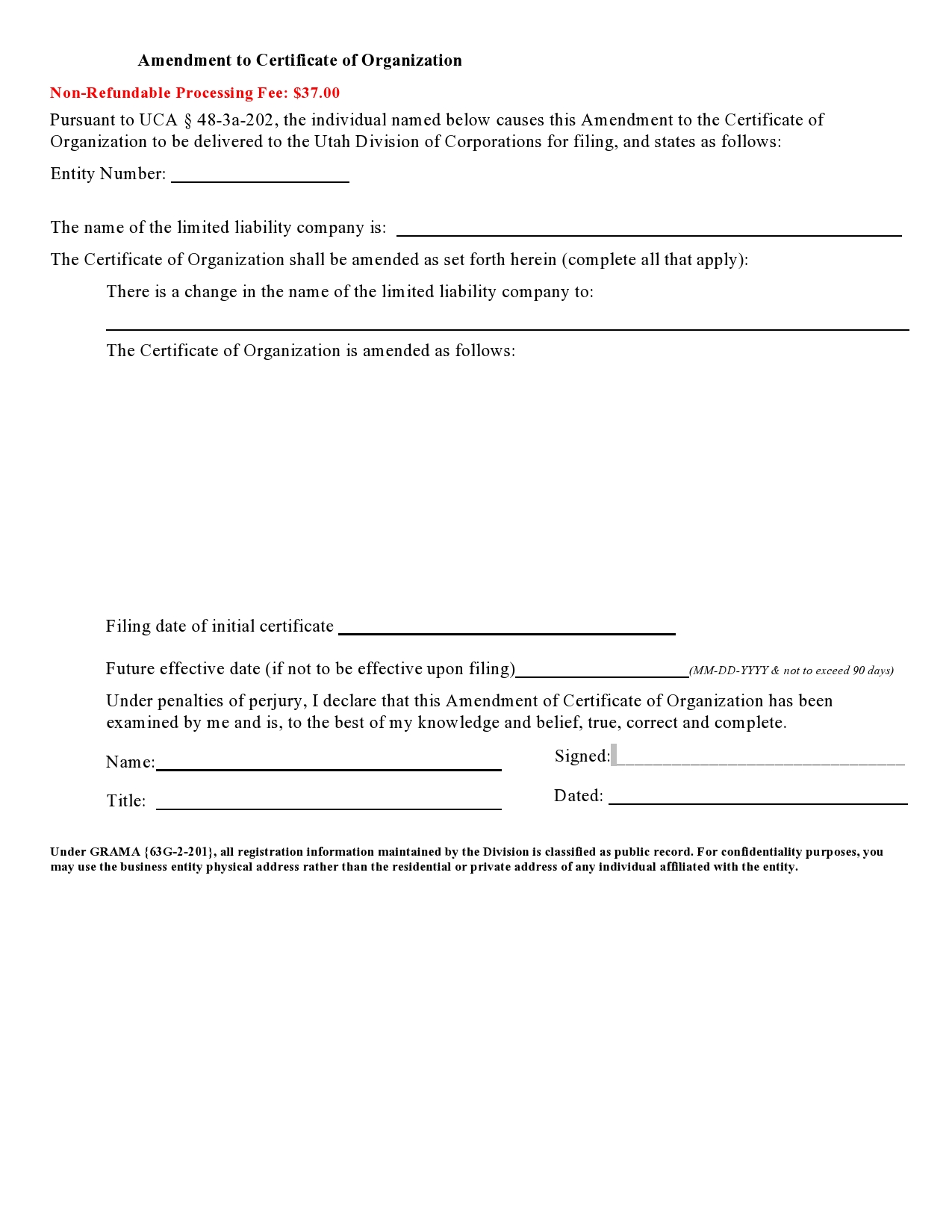

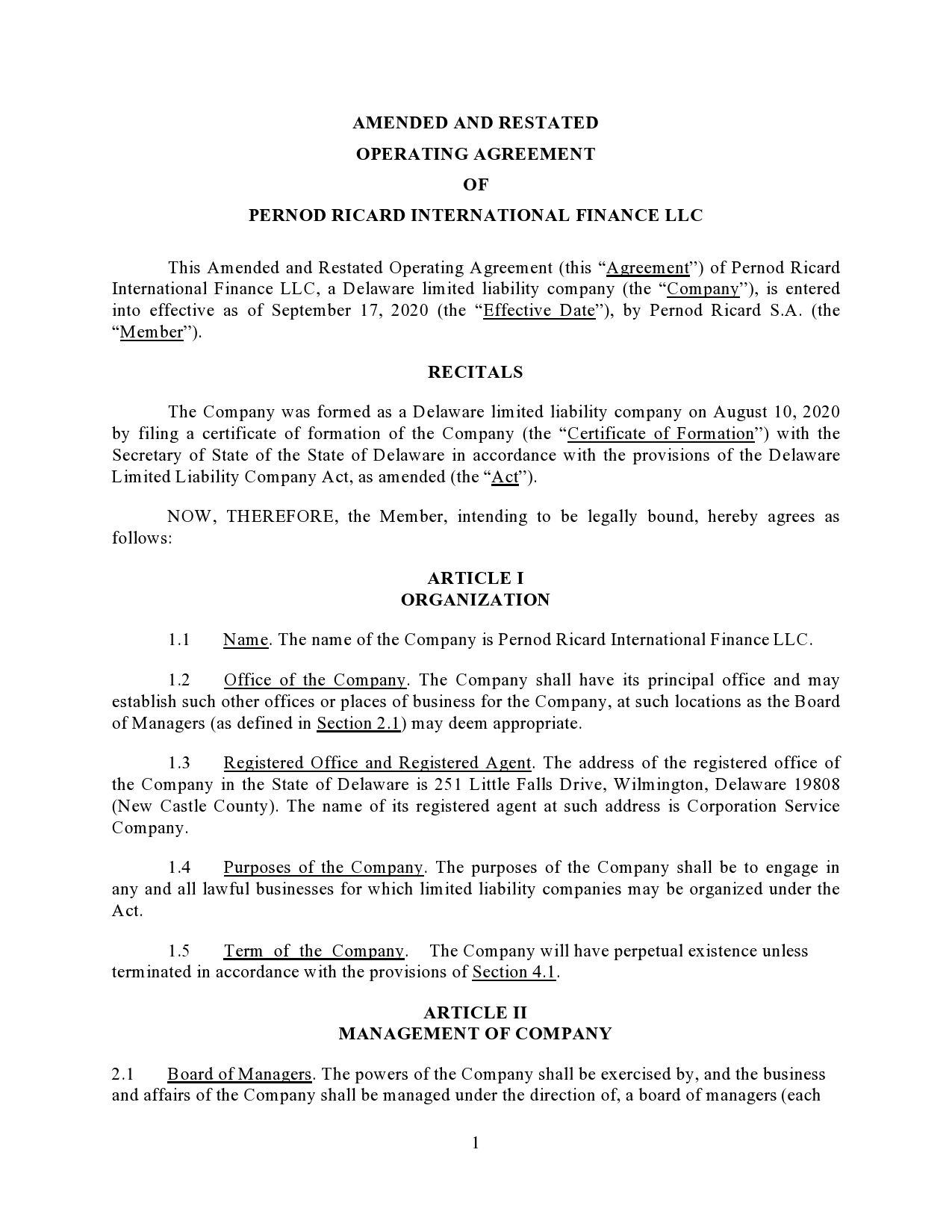

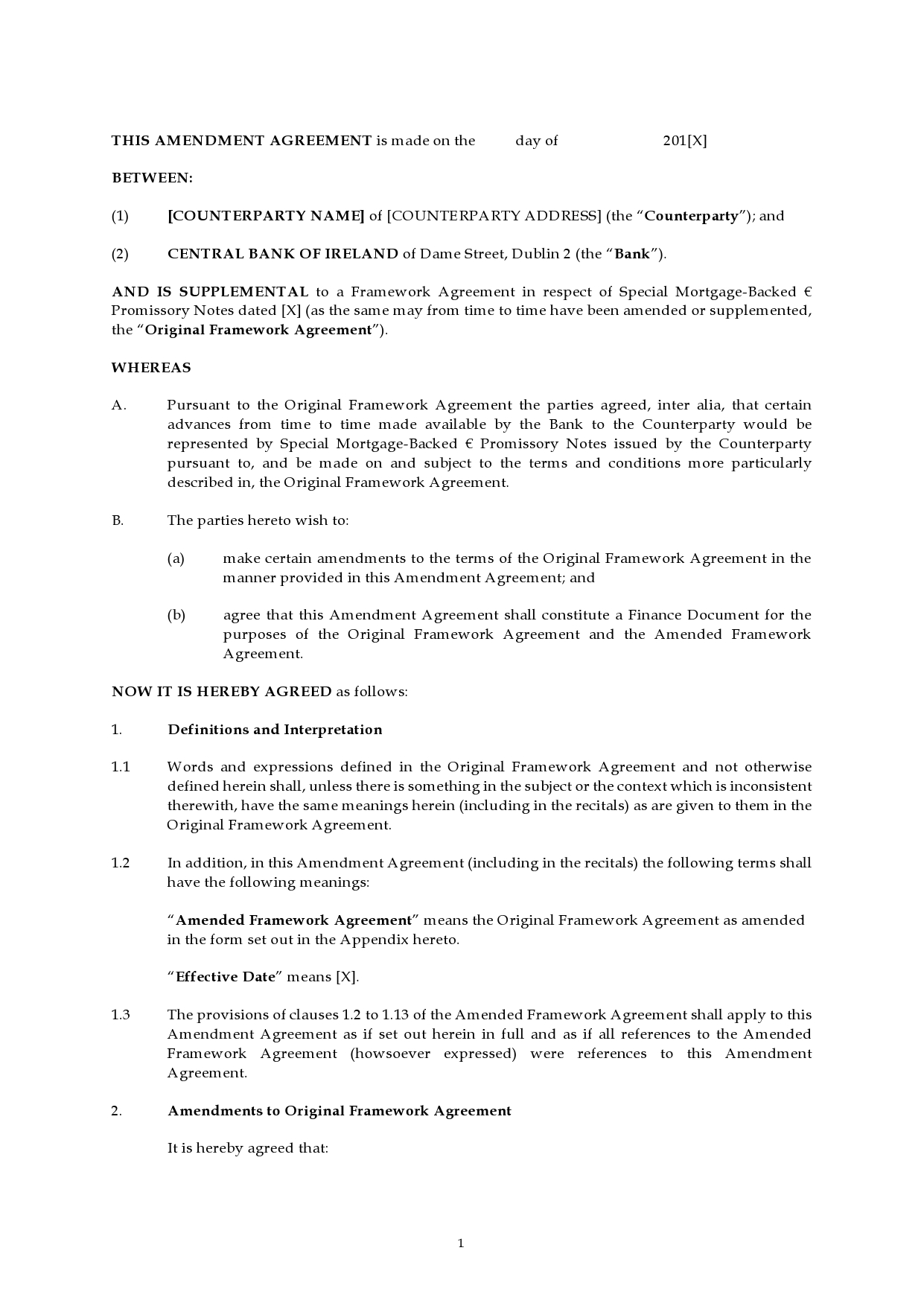

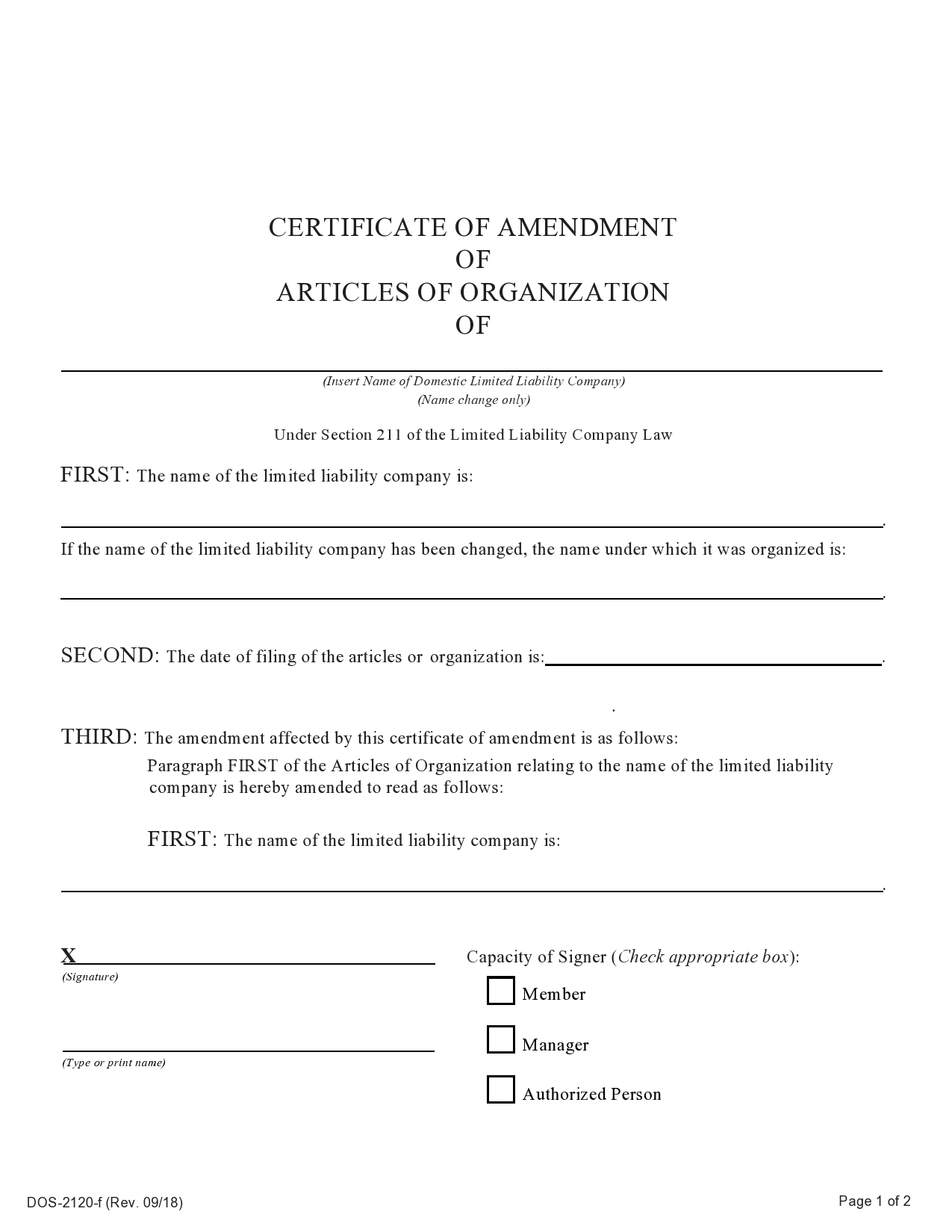

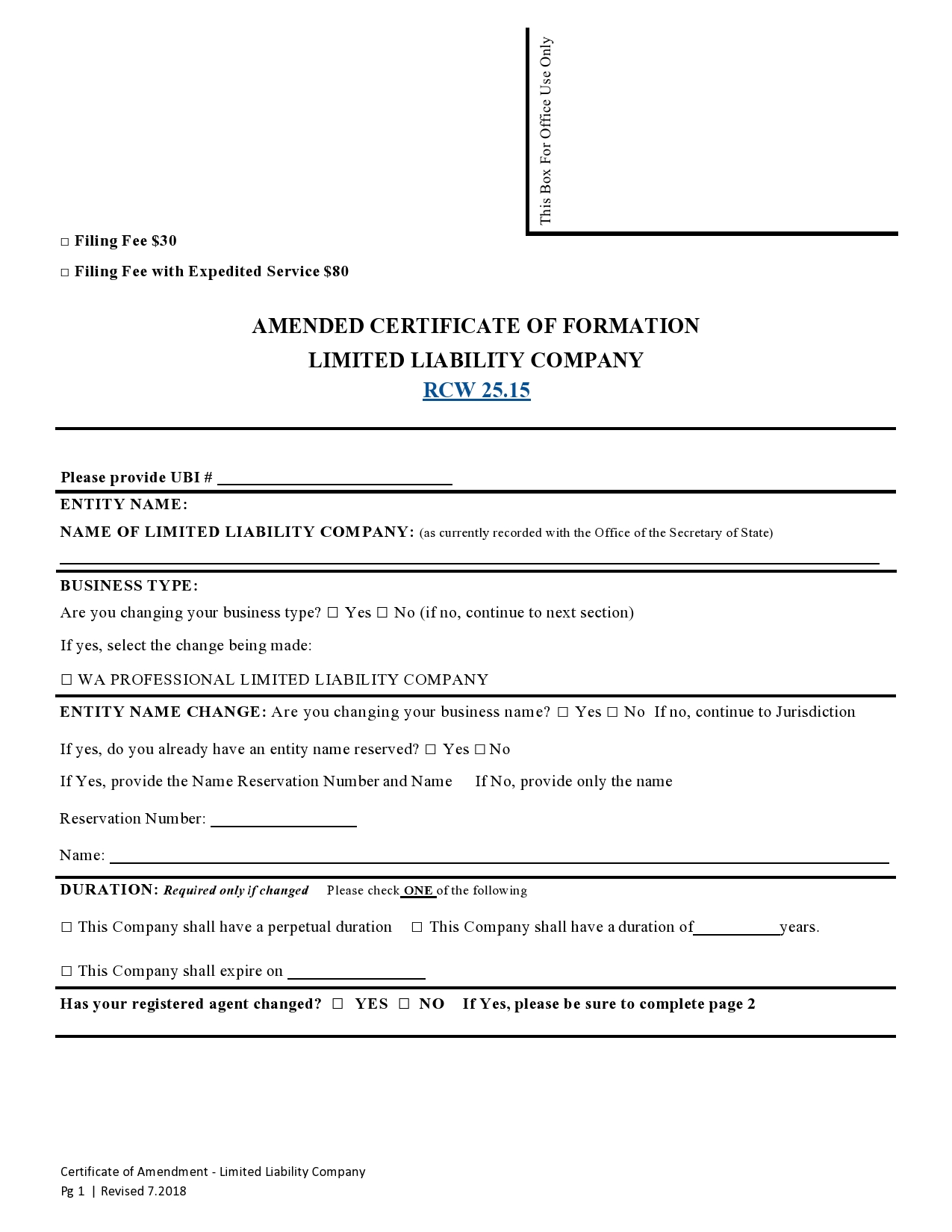

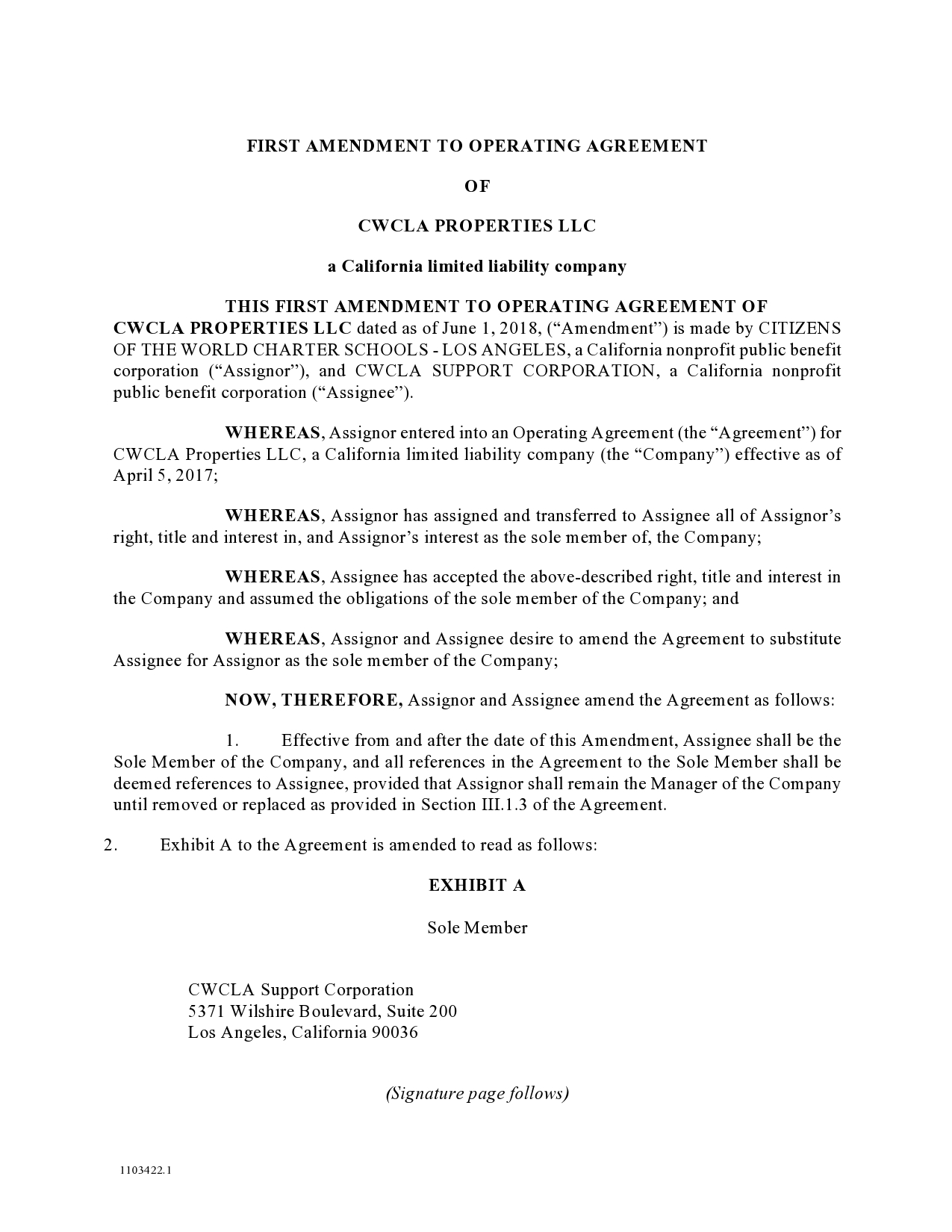

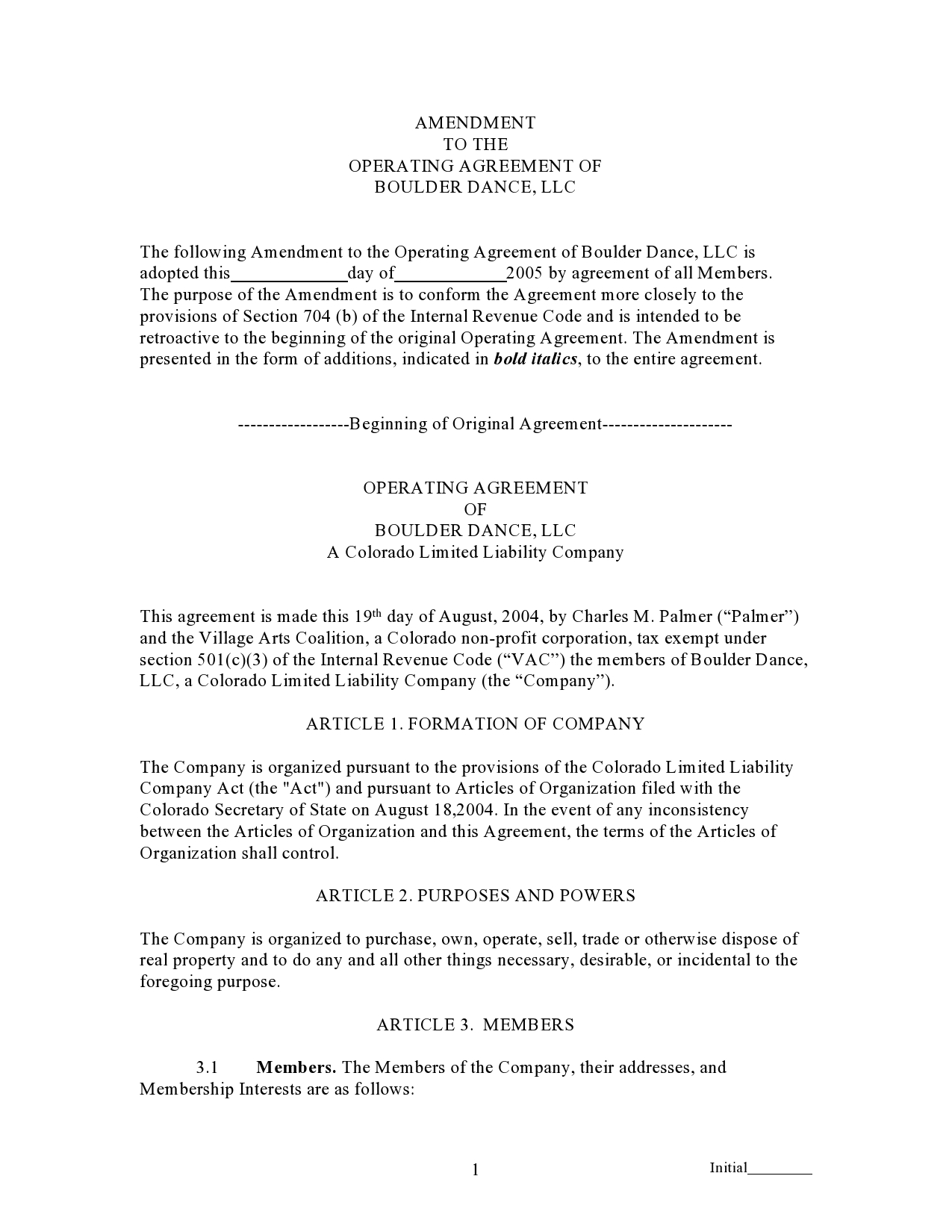

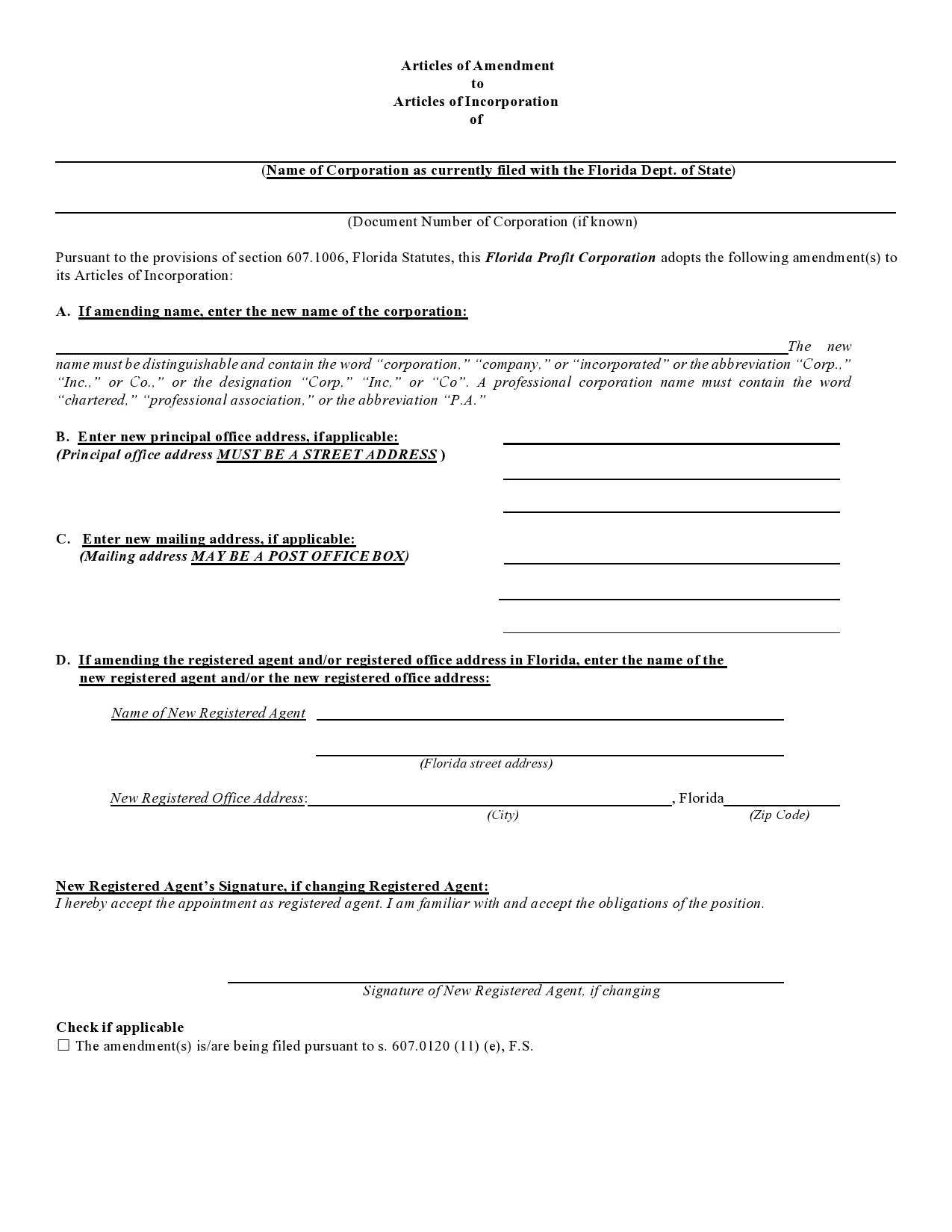

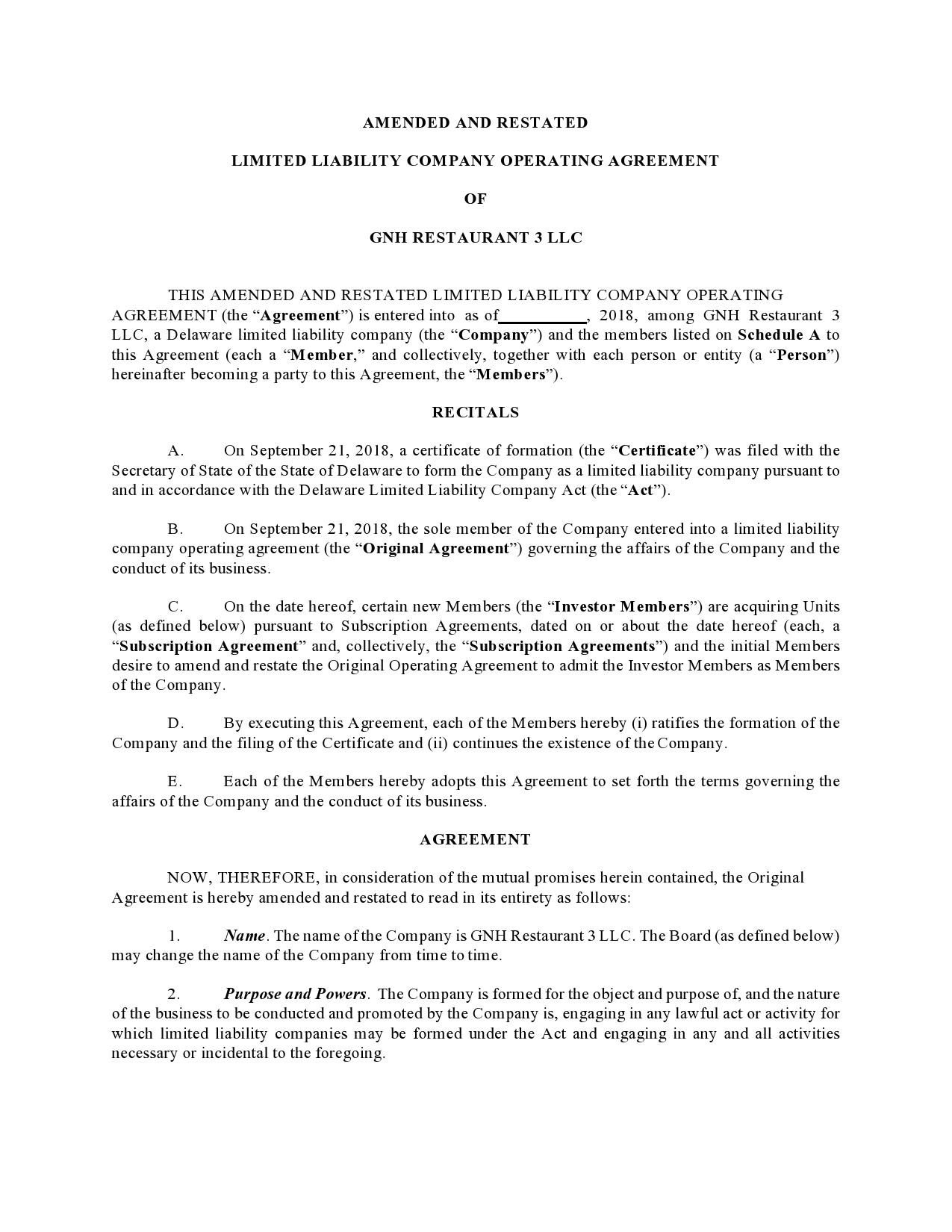

Operating Agreement Amendment Templates

Potential Limitations to Amendment of an LLC Operating Agreement

Limitations to an amendment can be quite common when LLCs are operated by more than one person, and there is more than one person with an ownership interest in the business. Operating agreements help eliminate confusion and conflict about how a business should be run and can make it much easier to co-own a business with other people. There are some common reasons that your LLC operating agreement might not be able to be amended:

- The LLC was written to include the statement that the operating agreement cannot be amended.

- The LLC can only be amended after a unanimous vote of the owners.

- The LLC can only be amended by a majority vote of the owners.

- The LLC can only be amended after the first year (or another set timeframe).

- The LLC can only be amended in a specific quarter of an operational year.

These considerations, when written into the LLC from the beginning, can greatly limit the power of any individual owner to alter anything to do with how the LLC is run. This can be a common stumbling block to LLC operating agreement alterations overall for any kind of business. LLC formation without a sole owner can require that all of the operational documents for the business are kept strictly up to date to eliminate confusion, power struggles, and problems with ownership rights.

How Do You Add an Amendment to an Operating Agreement?

The first thing that must be done when you are going to amend your LLC operating agreement is you need to make sure that all members have approved the changes and that there is an agreement about how the changes should be done.

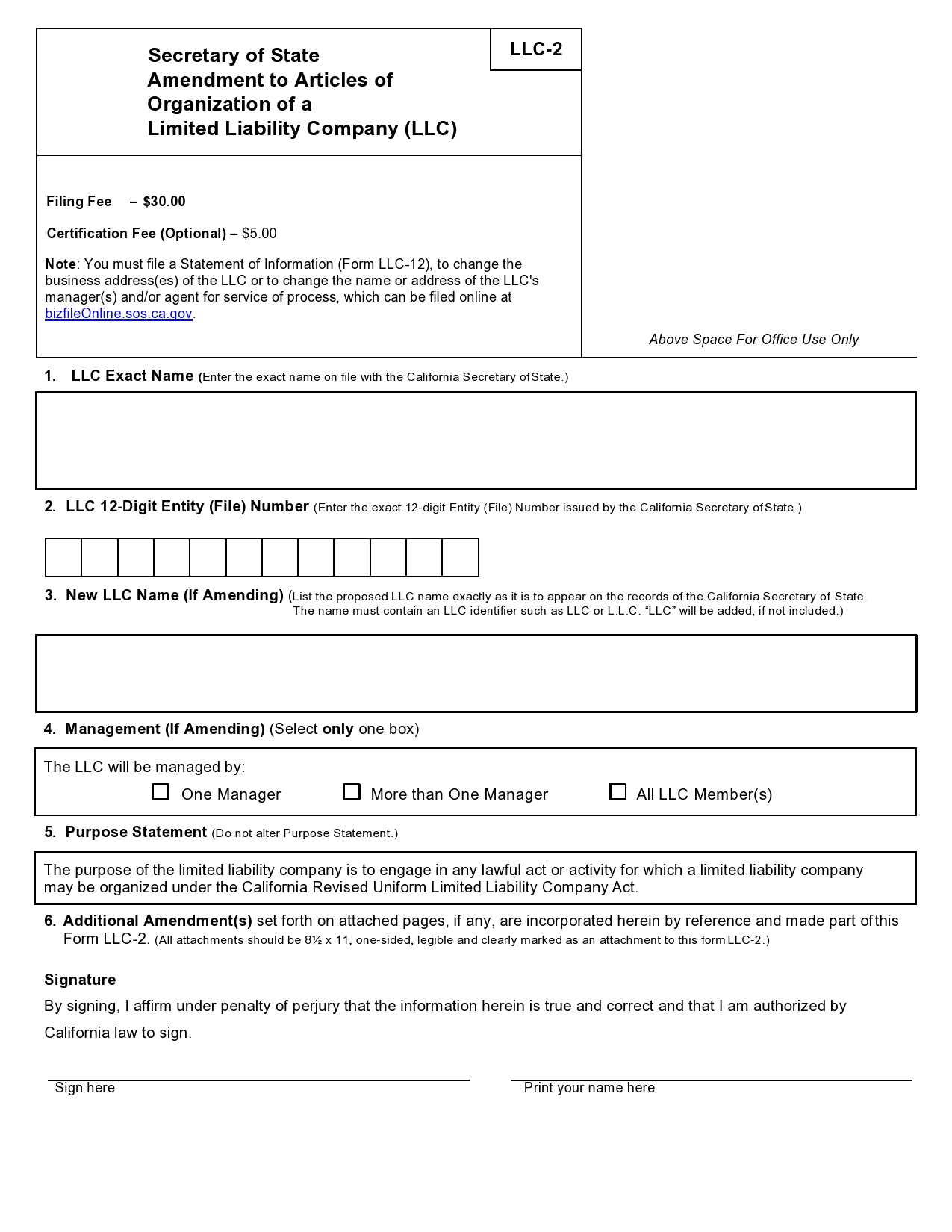

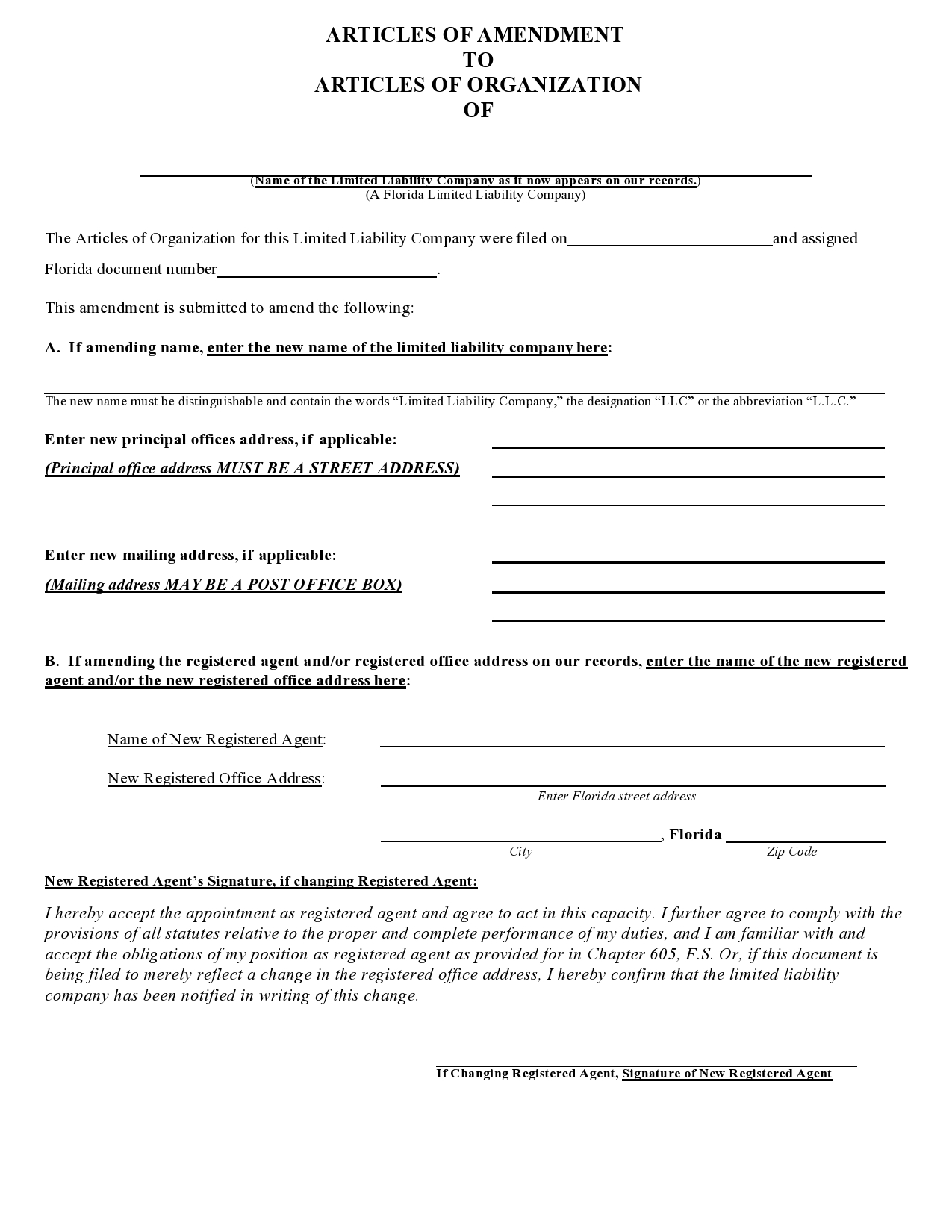

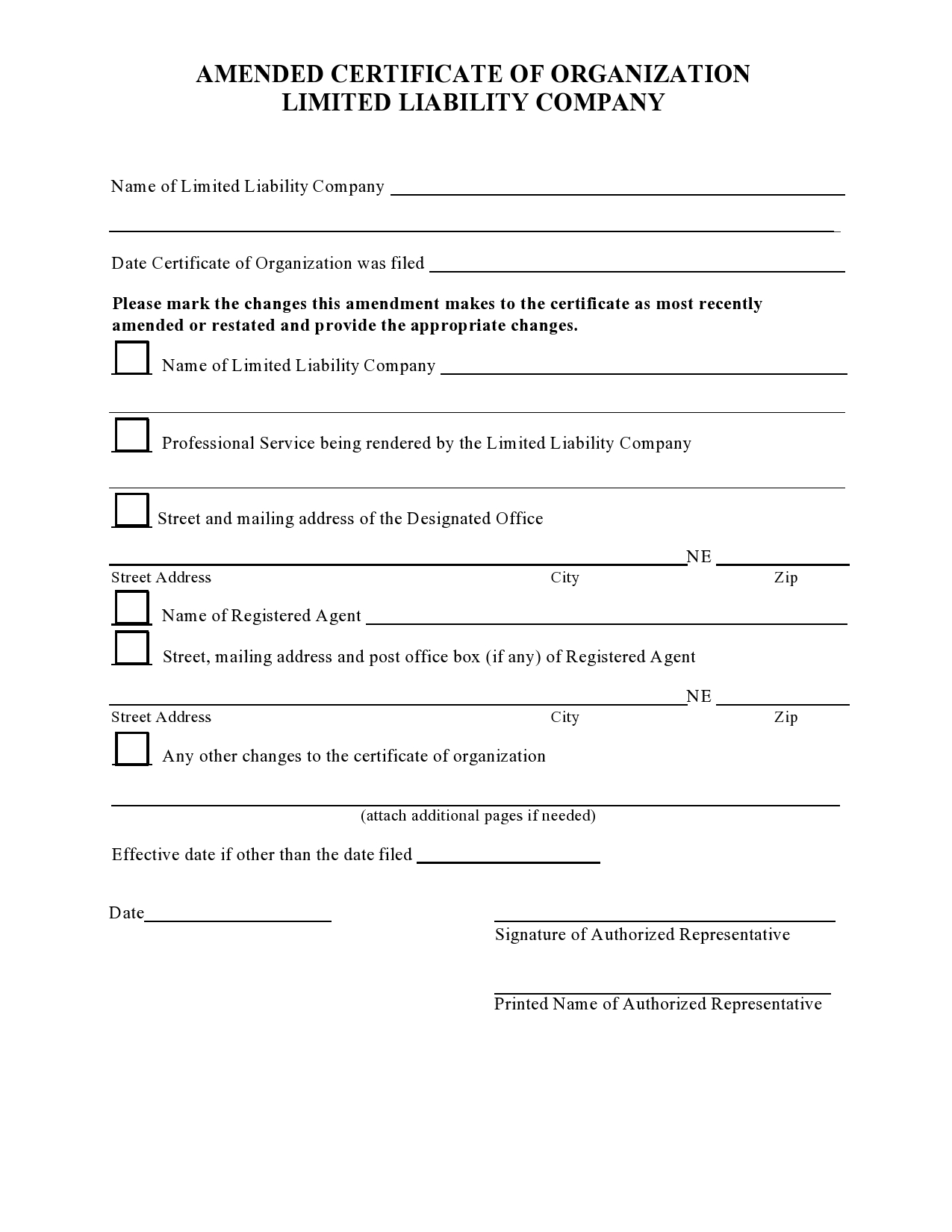

After the owners have agreed upon the alterations to the LLC, the proper process must be followed to draft a legal document that notes the sections that have been altered and what alterations have been made to the agreement. Make sure that you are aware of the regulations within your state for these changes. They need to meet the compliance and regulatory demands of the LLC operating agreement process within your state to be binding. Even if all the members of your LLC agree to the changes, a document that is not created and reported correctly can be invalid.

Some states require that you file an annual report for your LLC to change members of the LLC as well. Make sure that amendments that are done to your LLC’s membership are also compliant with state regulations and requirements. You do not want to improperly process changes of this significance and find out later that you have not made proper records of these changes.

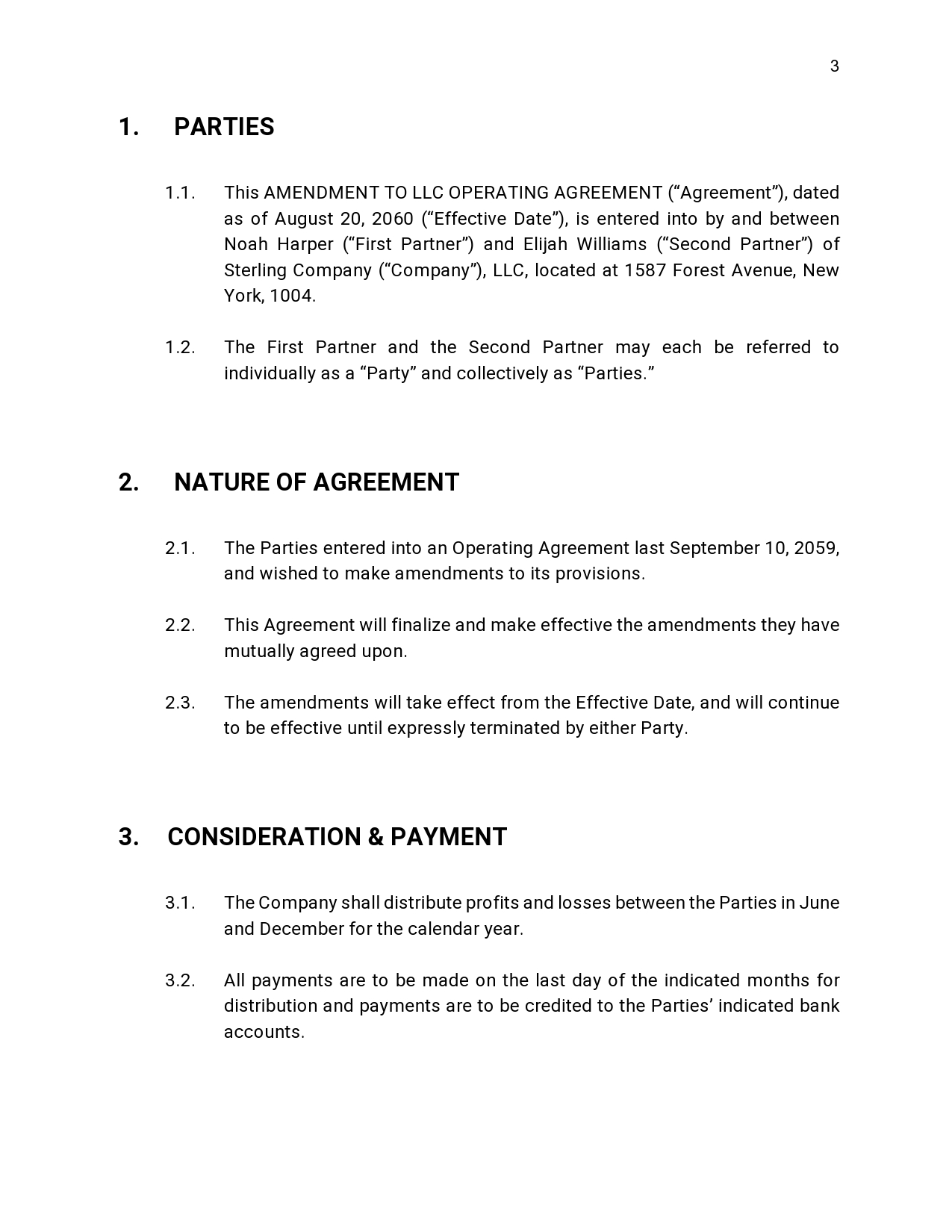

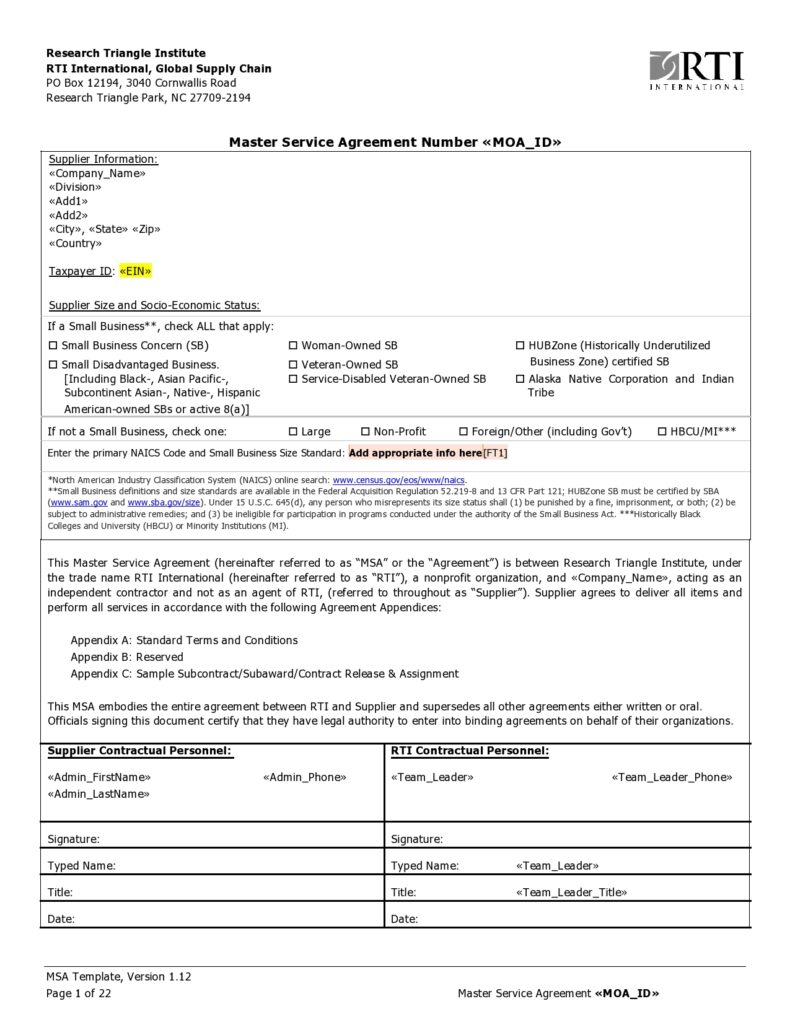

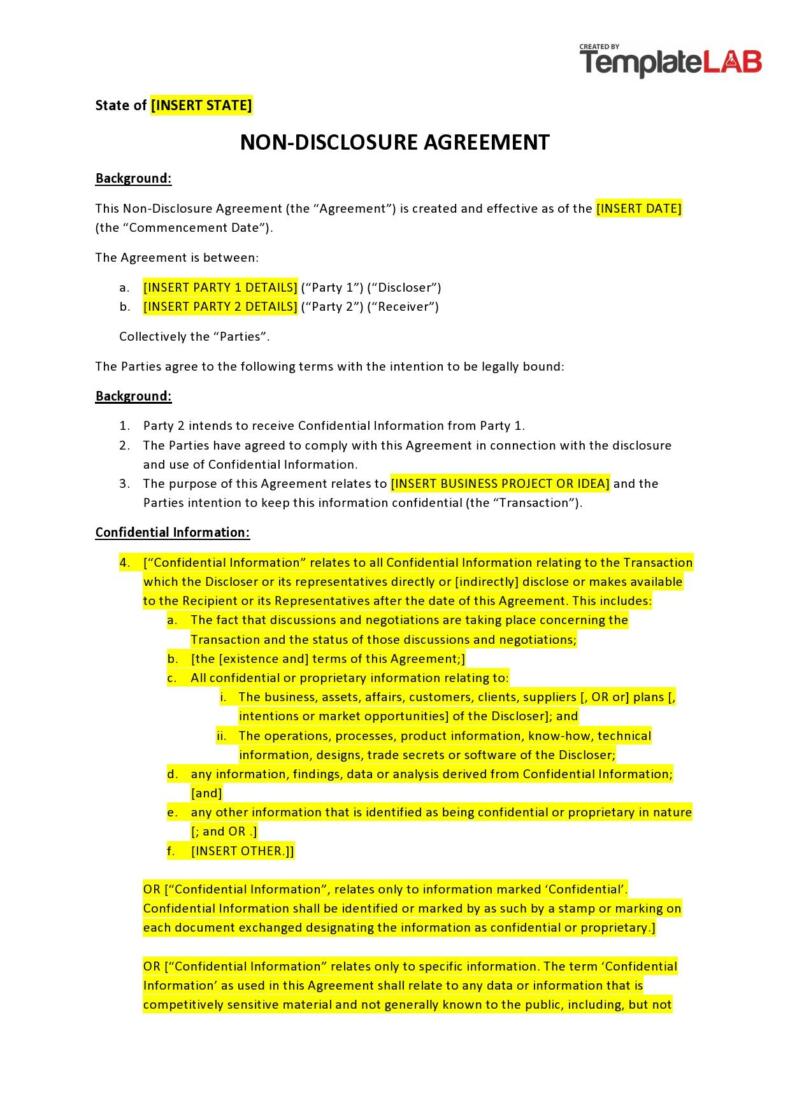

Amendment to LLC Operating Agreements

Are There LLC Amendment Templates That Can be Used?

While there are many LLC amendment templates out there to copy from for your LLC operating agreement changes, this can be a risky move to make. It is almost always a much better idea to make sure that you have a lawyer draft up the changes that need to be made to your operating agreement. This will eliminate possible errors that you might make when changing your operating agreement, and this will also ensure that the right operating agreement amendment process is followed for your state.

Being compliant with essential demands of state regulations and laws is critical, no matter how small or large your business is. There are many issues that can crop up for a business due to improper alteration of the LLC’s operating agreement that you will want to avoid. Businesses are governed by strict and specific rules for a reason, and you should be sure that you are not making errors that will threaten the longevity and well-being of your business over the long term.

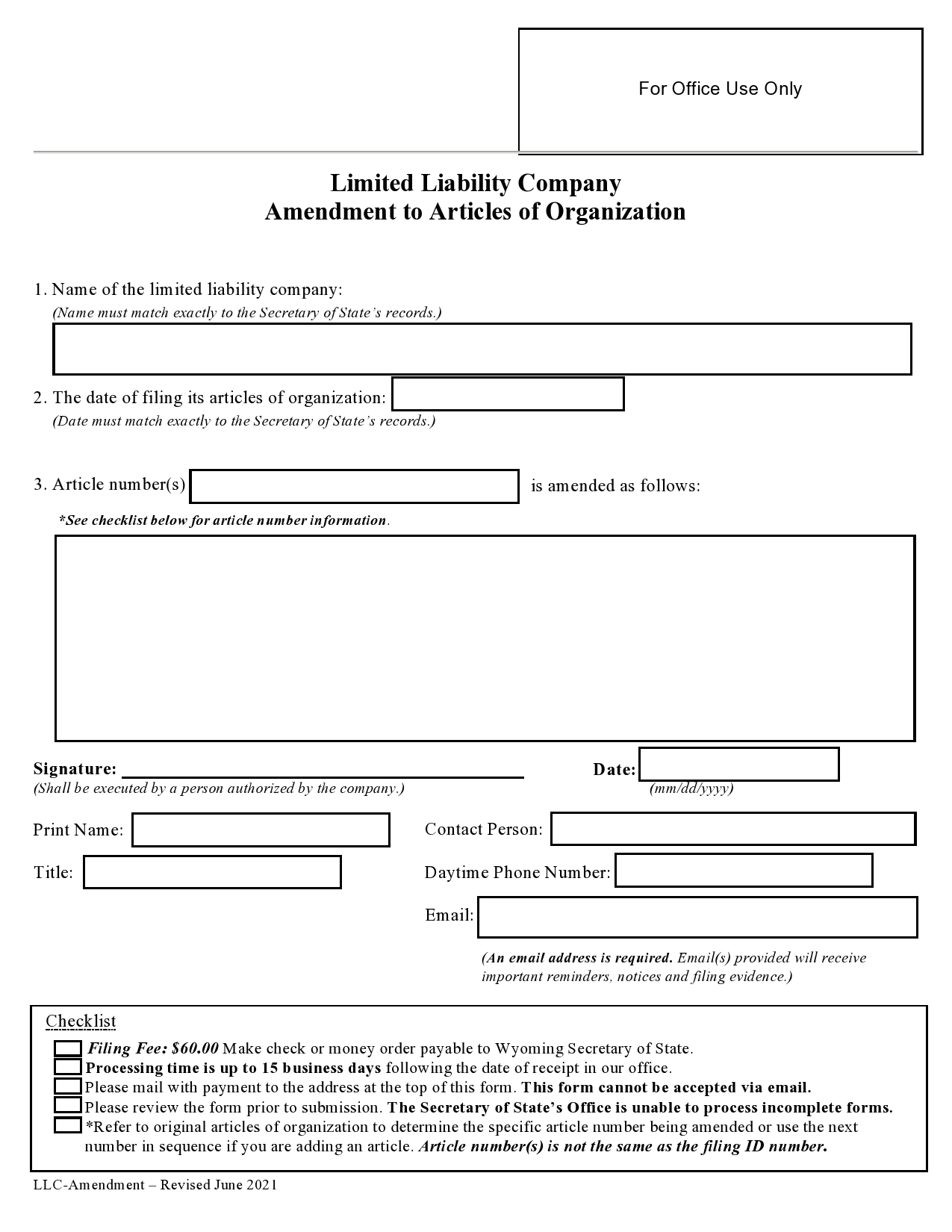

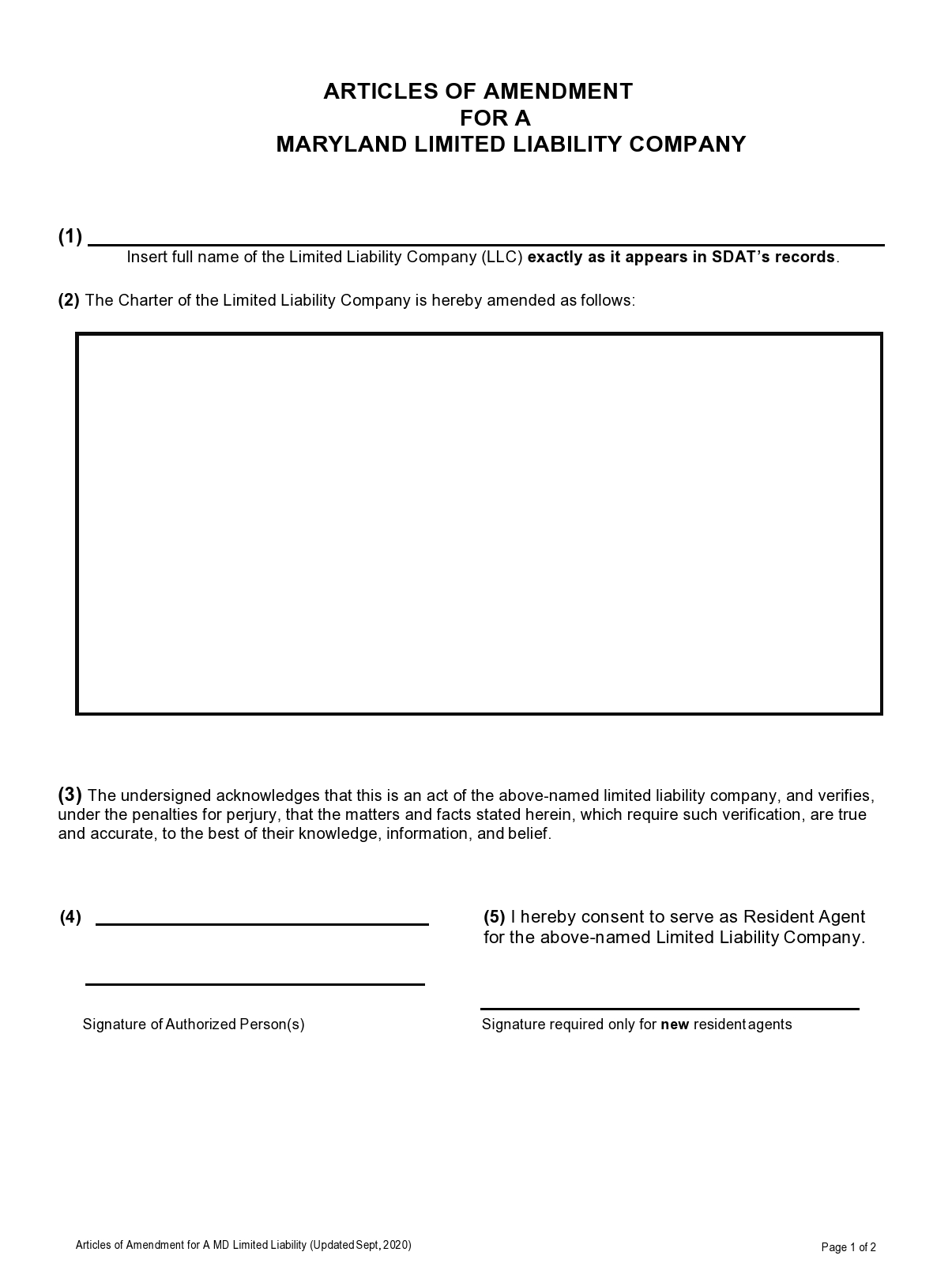

What Does an Operating Agreement Amendment Need to Include?

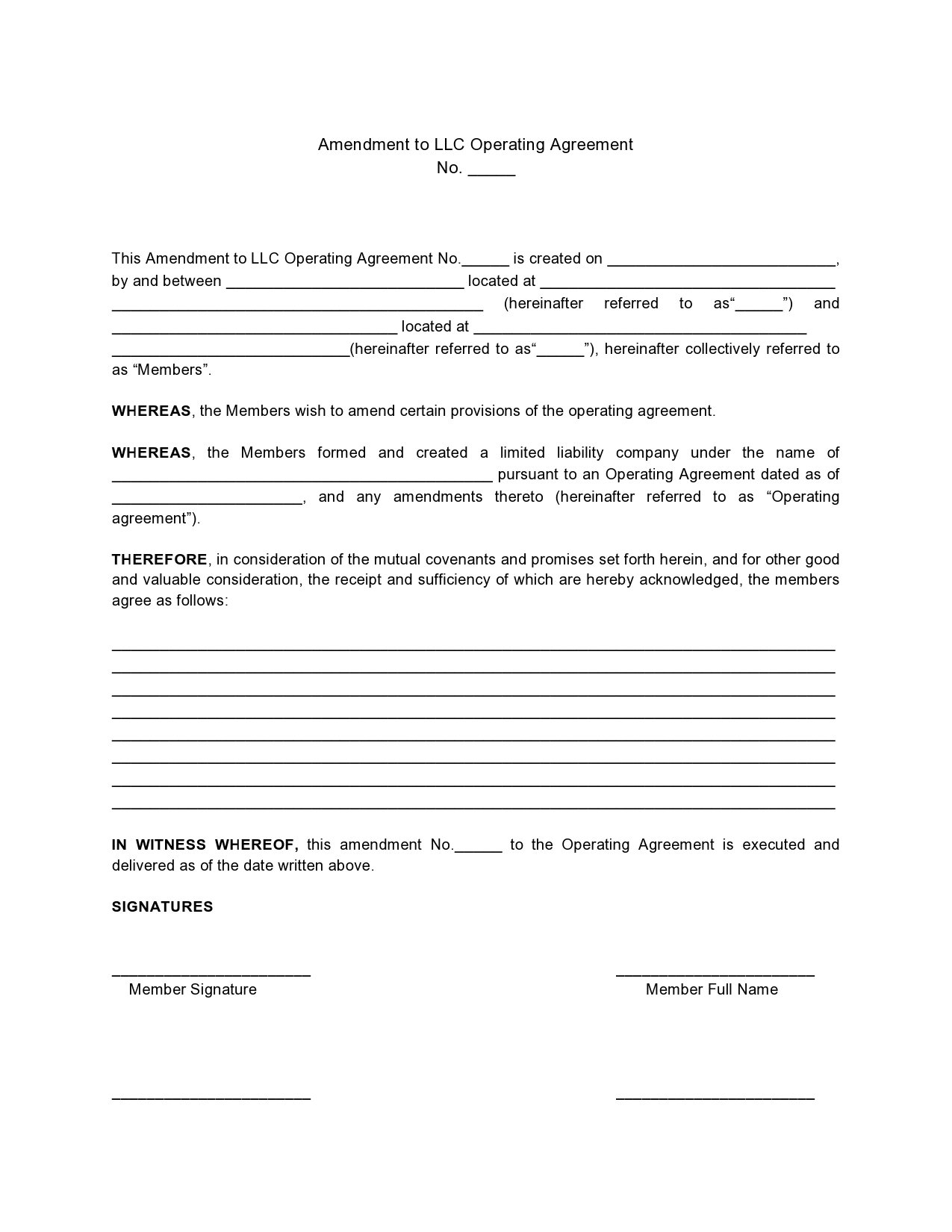

There are some things that must be included in every operating agreement amendment, no matter what kind of business you are operating or what state the business is located in. These items will need to be included in any changes or alterations that are made to any aspect of the operating agreement.

- The amendment number

- The names of the original LLC owners

- The names of the current owners

- The location of the business

- The provisions that are going to be amended or changed

- The provisions that will be eliminated or replaced

- The new provisions that are being added

- The date that these amendments will go into effect

- The signatures of the owners of the LLC

You might also need to include additional information in the operating agreement amendment. The governing law that determines how this change can be done could be referred to. This allows easy access and reference to the state laws which might apply in the case of a dispute regarding the amendment. You might also include the original amendment for reference. There can also be situations where you might want to have counterpart documents made and signed so that the other owners have their own copies of the change that has taken place to the LLC.

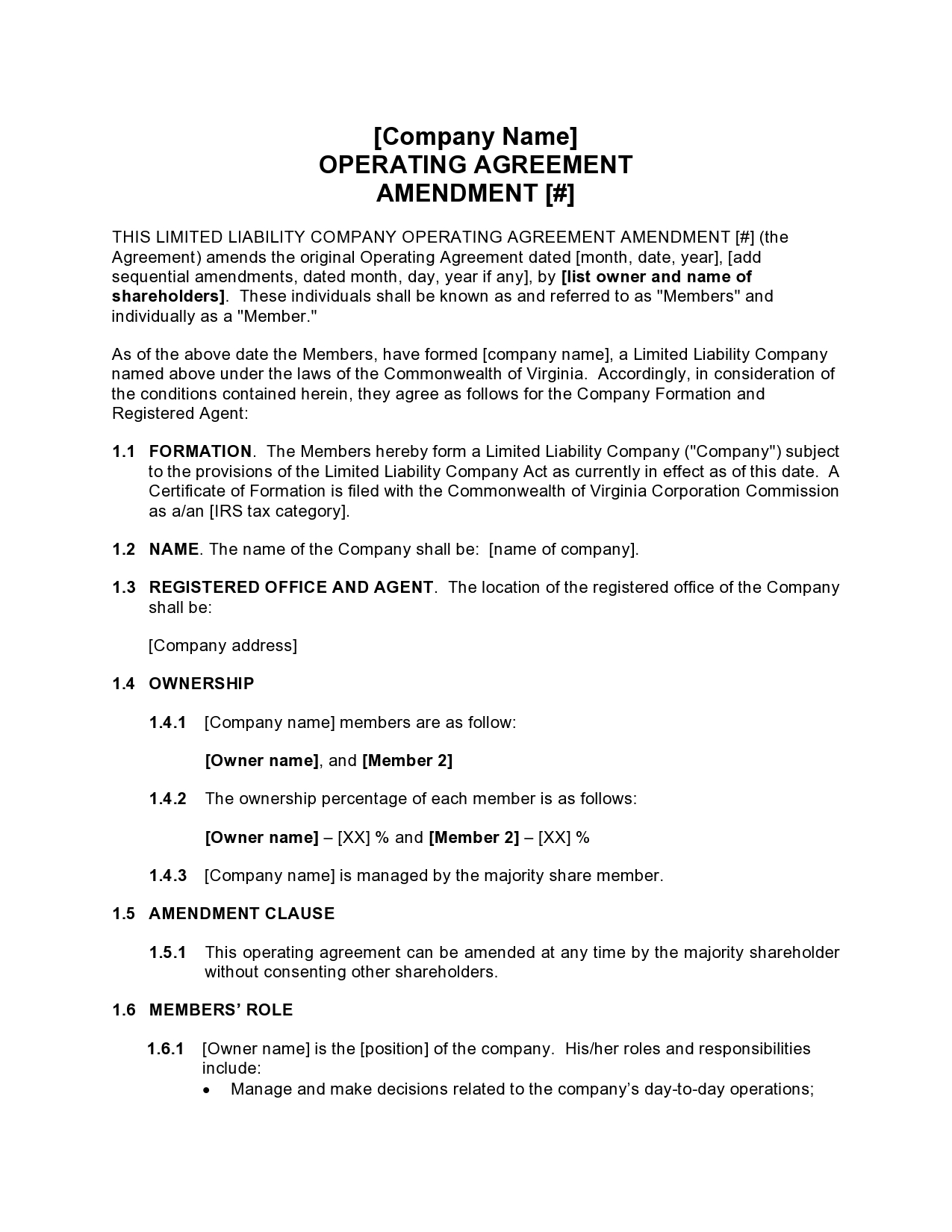

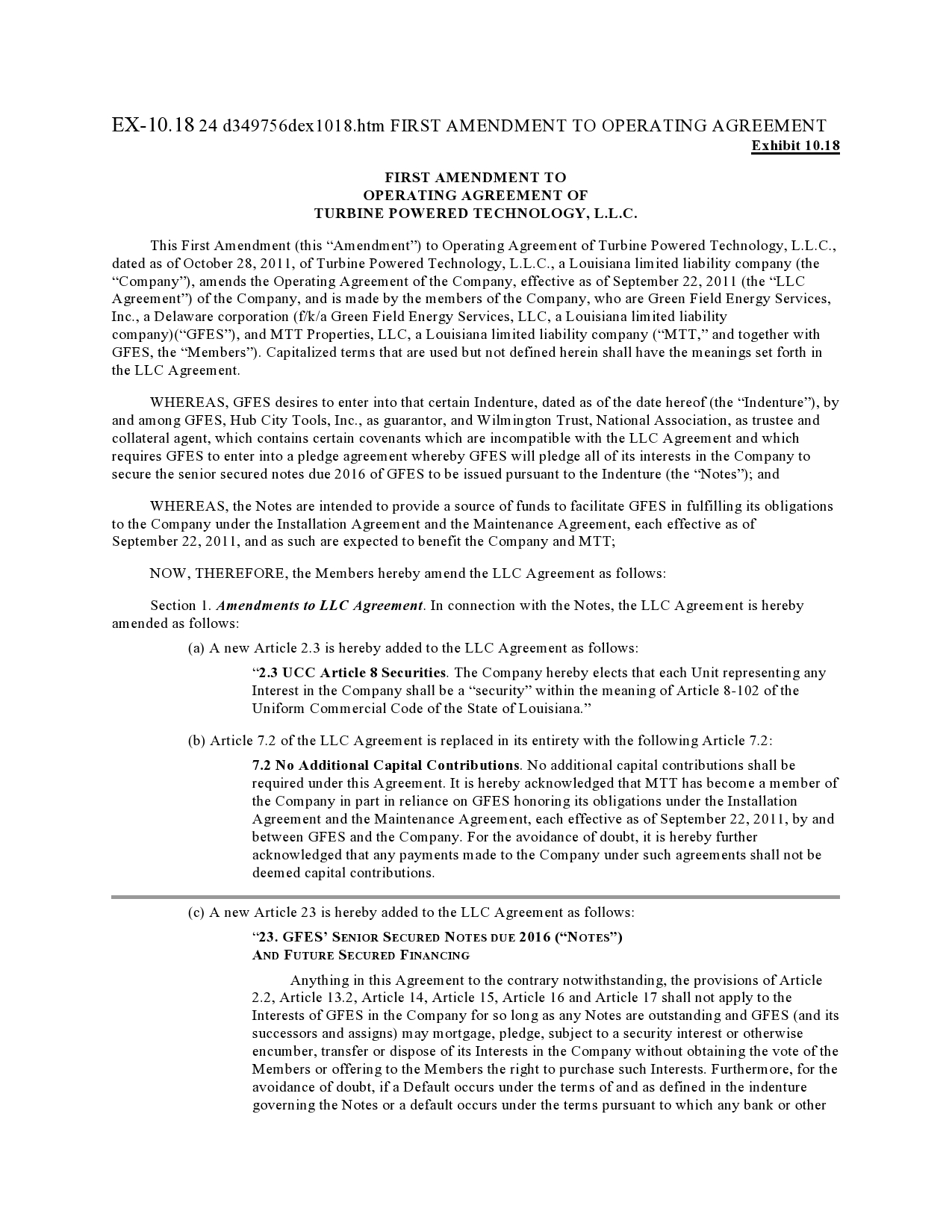

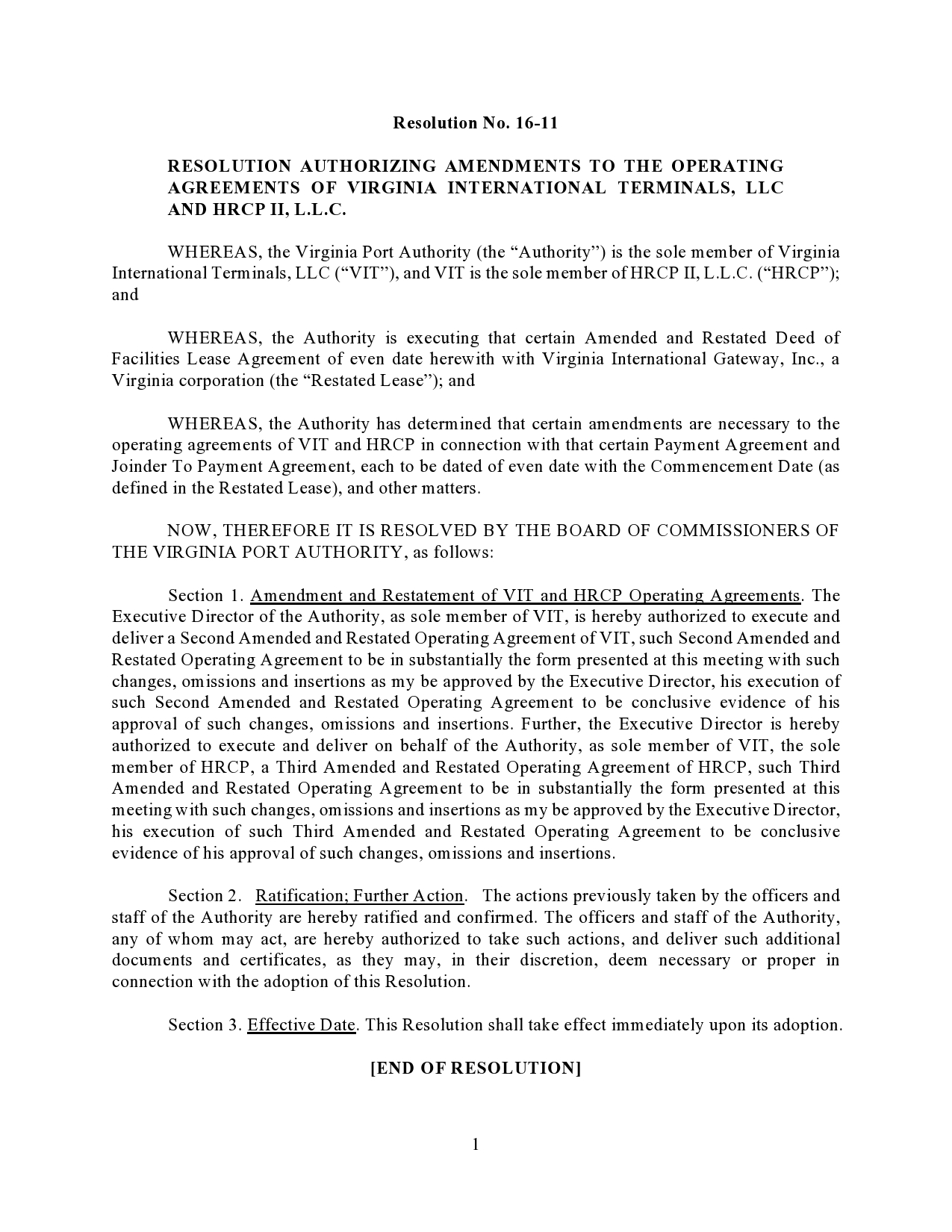

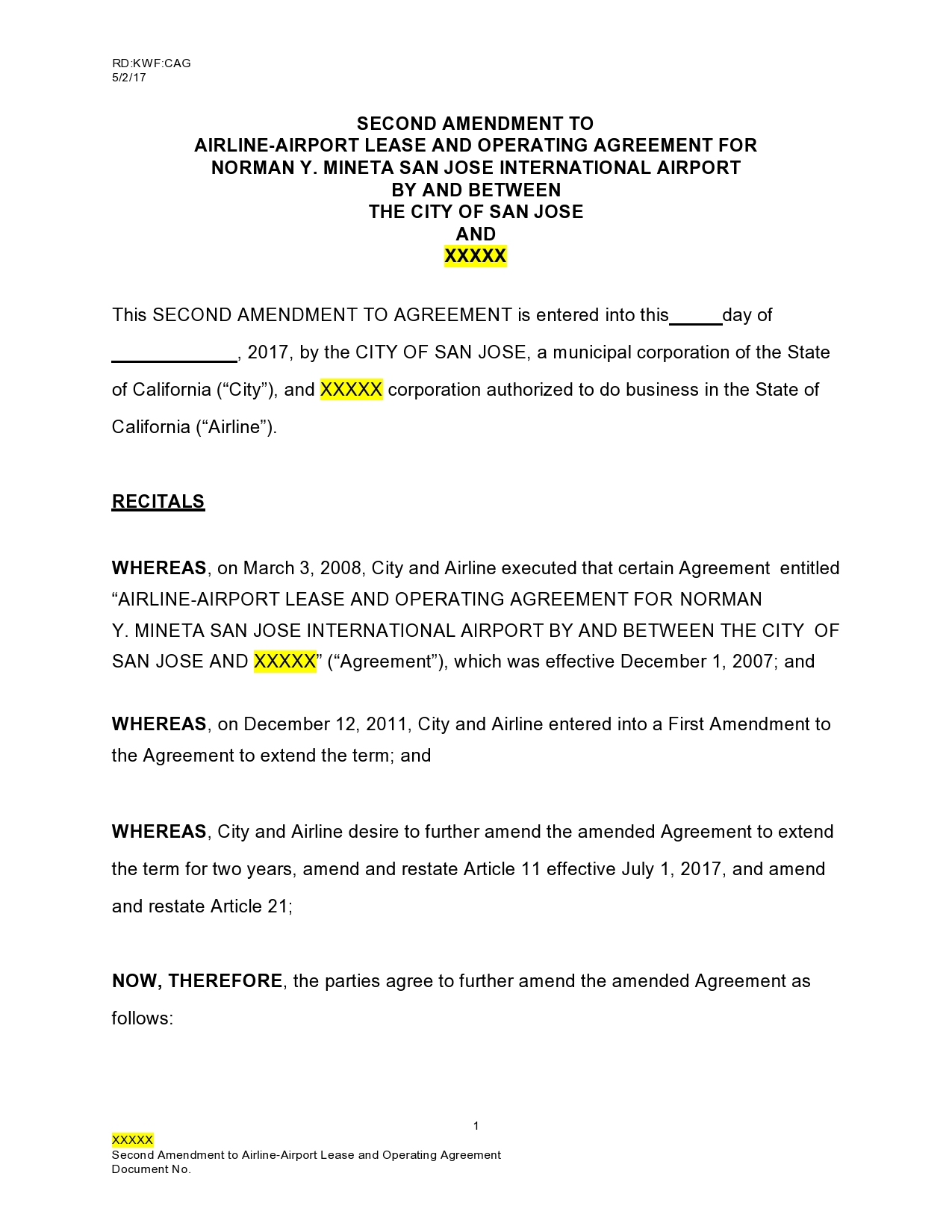

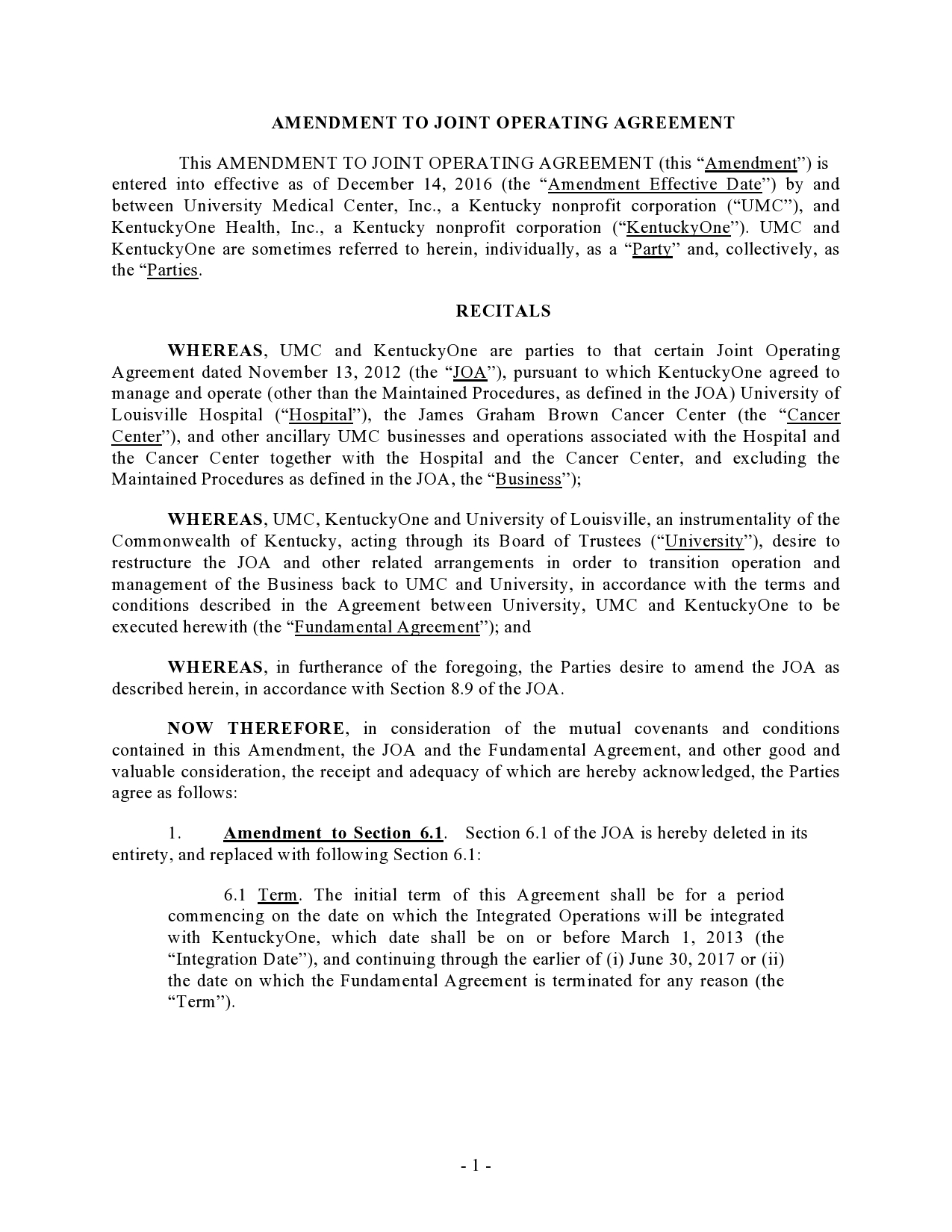

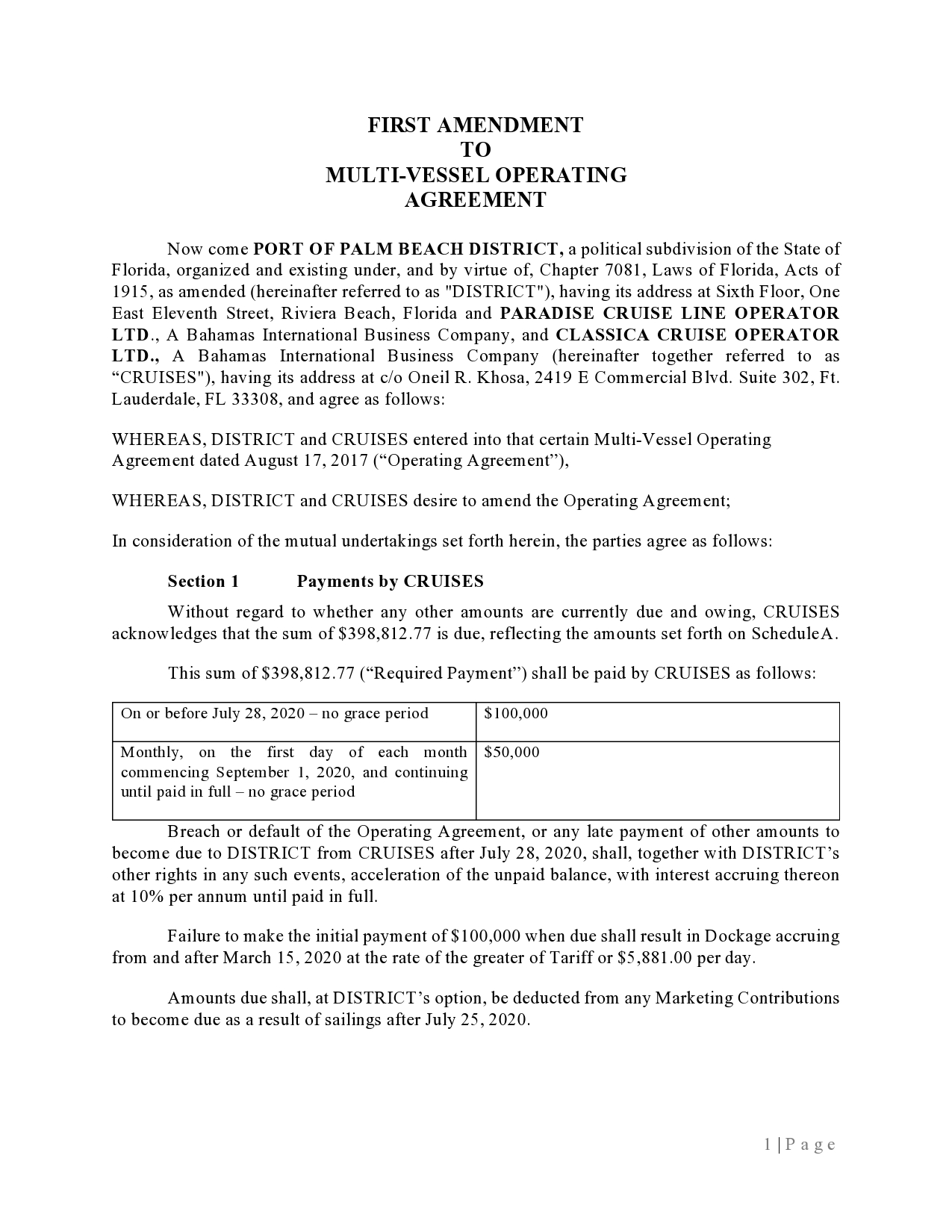

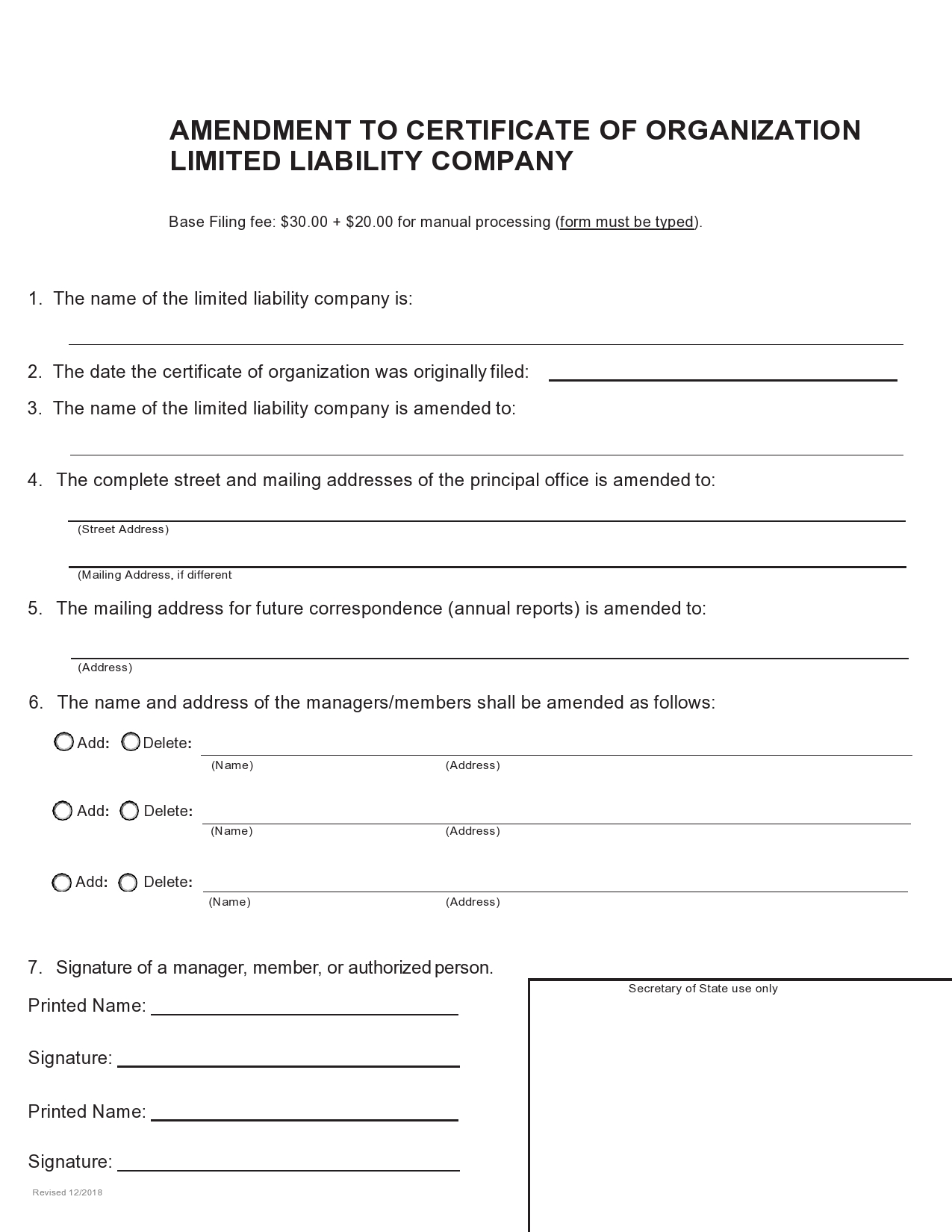

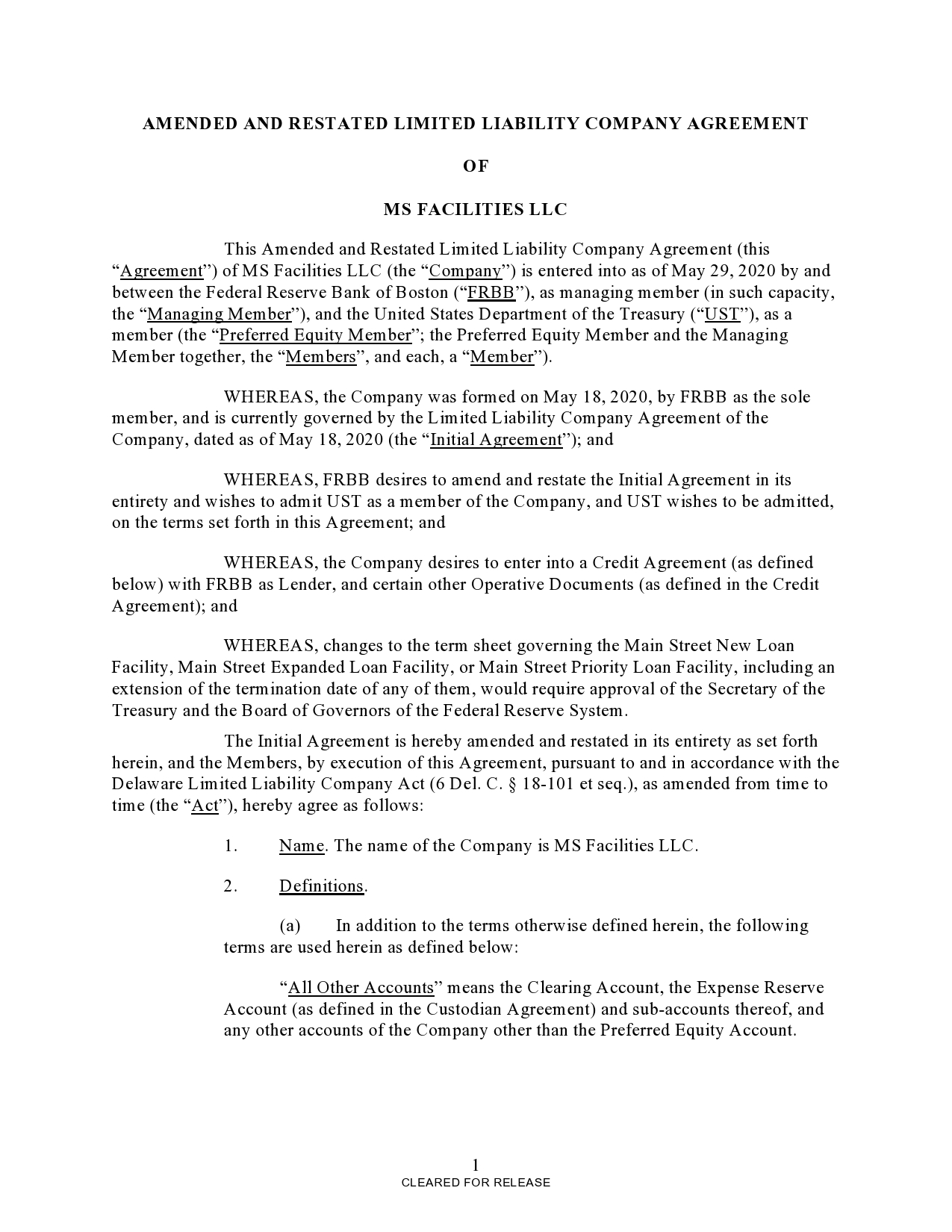

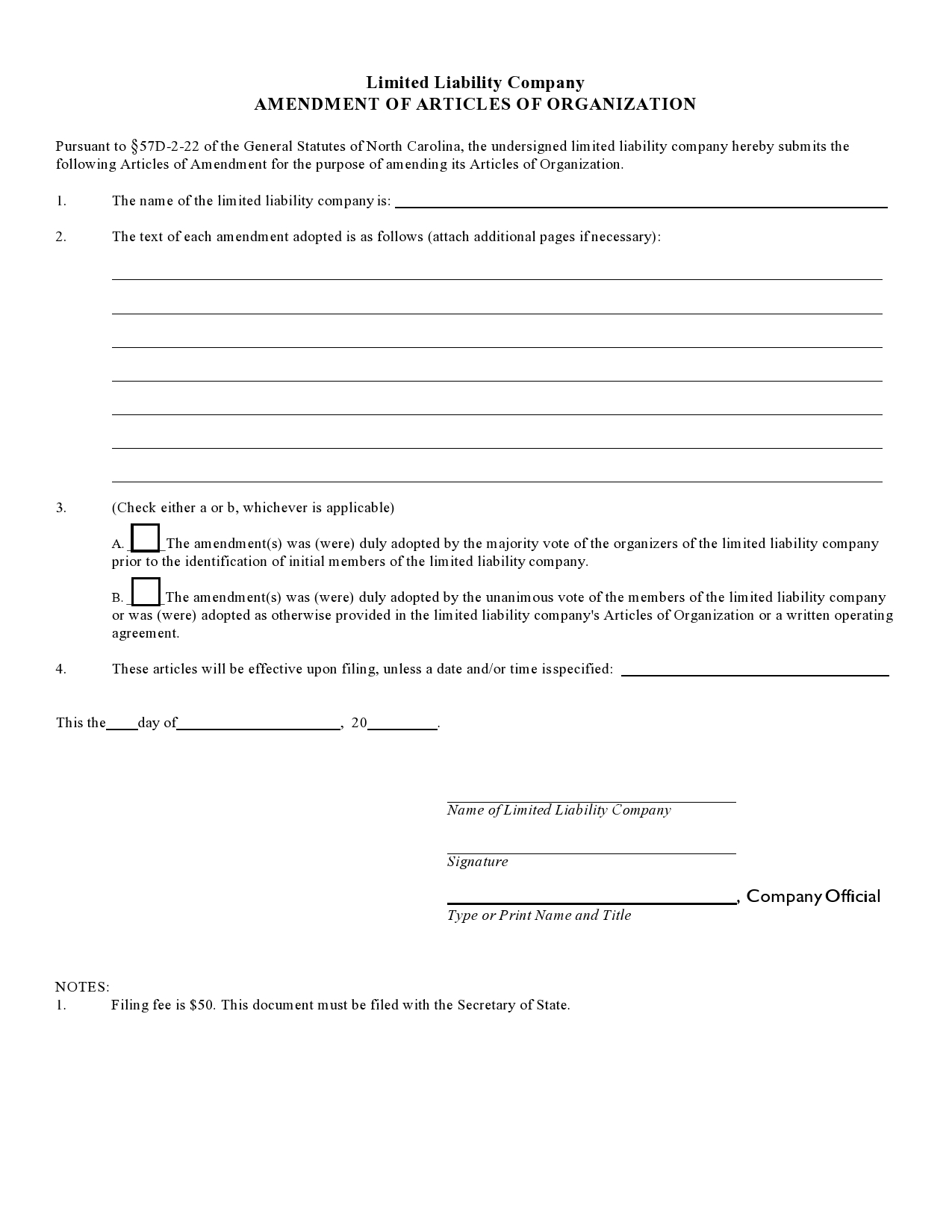

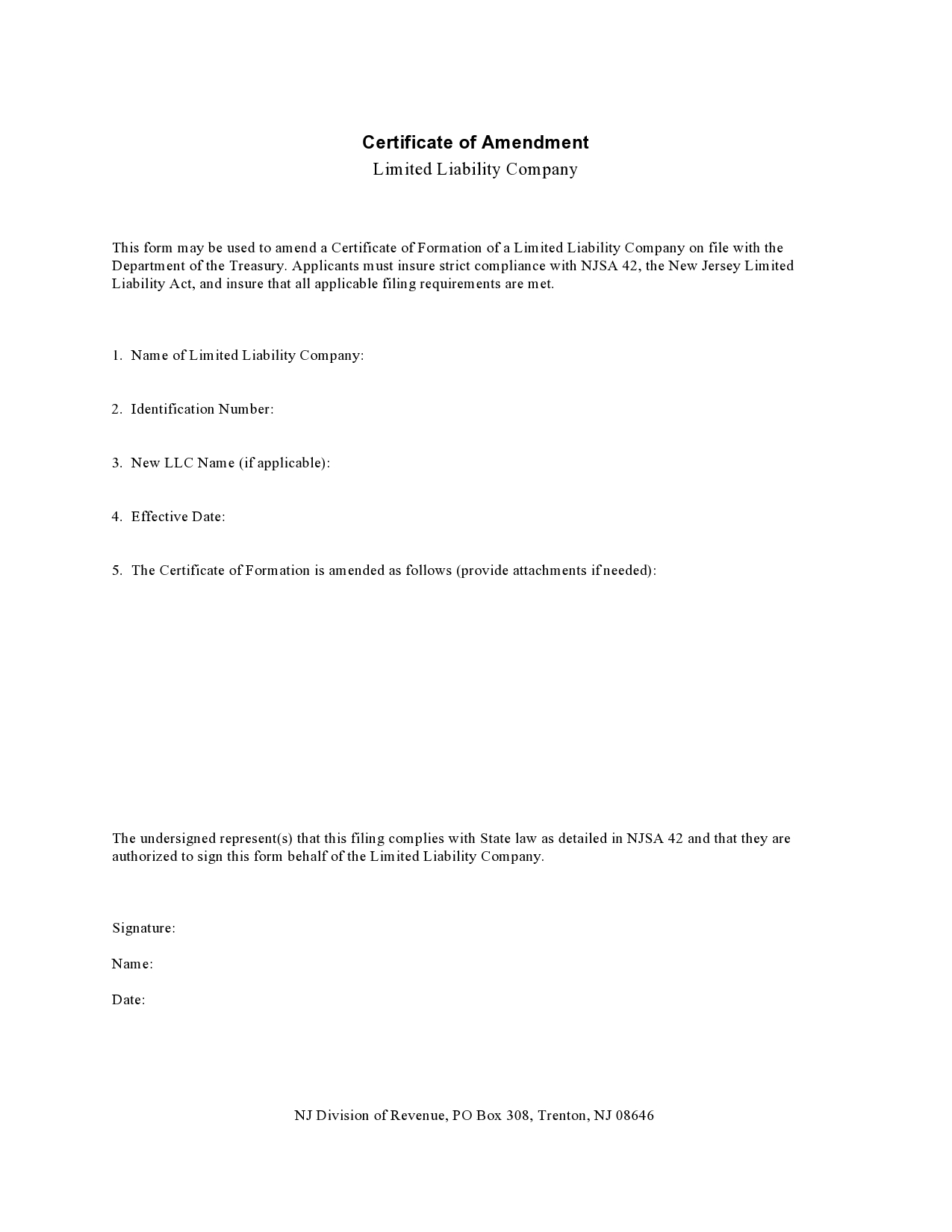

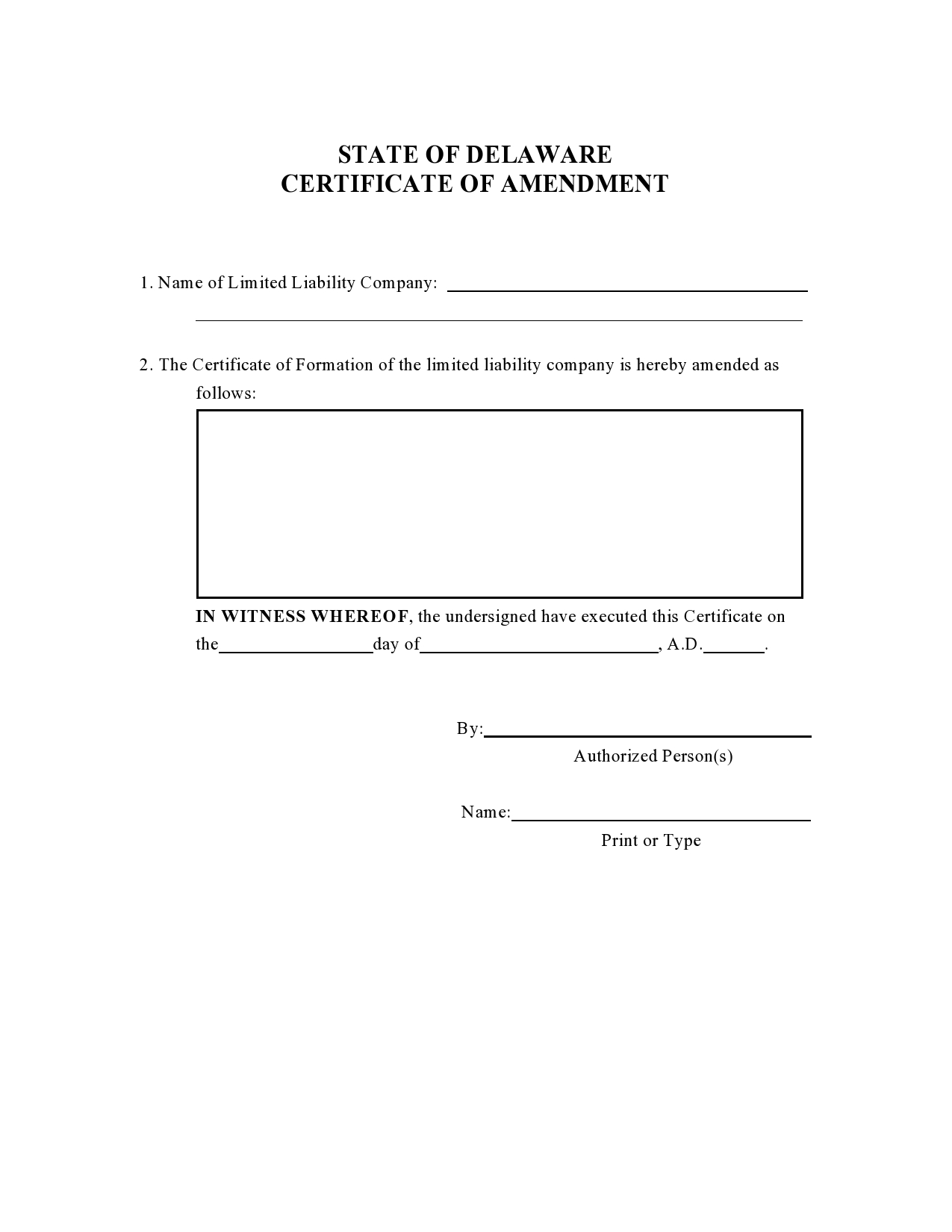

LLC Amendment Examples

What Kinds of Changes Require an LLC Operating Agreement Amendment?

The common changes that require an amendment are pretty self-evident. Changes like adding new owners or removing owners will obviously require that there is an LLC operating agreement amendment on file. Some of the other changes that might need to be documented in such a fashion can be alterations to how day-to-day operations are completed and changes to the hierarchical structure of the chain of command.

These changes can crop up quite commonly when businesses grow or expand into new areas of operation. You do not want to add any kind of business process or remove any kind of business process from your daily operational list without making an amendment to this essential document. It can be easy to forget that this document exists and to get caught up in the daily management of a business without thinking about the paperwork that must be done to support the legal operation of the business. This is one of the key reasons that many companies hire a skilled LLC lawyer to oversee the processes related to documentation and legal practice for a business.

When an owner leaves the business, a new owner is added, or a change of distribution and operation location are made, your operating agreement will need to be updated. You will also need to make changes when additional capital is invested in the business, when there is a change to the percentage of allocations for distributions, or when there is a change to the way that voting is done for your operation.

All managerial or financial alterations to your business will need to be documented in an amendment to your LLC. You need to be sure as well that these amendments include all the right information so that nothing is left up to chance. When the details of an operational change are not completed correctly or are not relayed properly and clearly in the operating agreement, disputes can be quite compromising for a business.

Are There Consequences For Not Using an Operating Agreement Amendment?

There are actually consequences that can be associated with not utilizing the proper amendment process. This document is one of the foundational items that is used to help resolve disputes that can crop up between owners or even employees and owners, and when it is not kept current, this can be problematic for many reasons. Issues related to the operation of your business or the rights of managers and owners can be complicated and can lead to costly legal battles when there is no clear documentation to support the right course of action.

New partners might not be entitled to their fair share of the ownership of the business if you are not filing proper amendments when ownership changes are made. Funds might also not be legally handed over to the right parties when the operating agreement is not designed correctly to reflect changes to the way that your LLC operates. There can also be issues related to the veto power of an owner if the LLC documentation is not updated to remove specific owners from considerations like this.

LLCs that are not properly protected by correct operating agreement documents can be at risk of being dissolved or shut down. It is always wise to err on the side of caution and to document more of the information related to your business operating agreement rather than less. Disputes surrounding business ownership and management can be quite contentious, and there is no reason to open your business up to problems that cannot be resolved without lengthy legal disputes.

Operating Agreement Amendment Samples

How Does an LLC Manage Amendment Discussion?

The best way to handle LLC operating agreement amendments is to make sure that your company has at least one annual meeting devoted to the possibility that alterations need to be made to the operating agreement. These meetings need to be open to all owners of the LLC, and there should be an open forum for discussion about alterations to the way that the business operates. You will need to be sure as well that you are aware of the way that your LLC management structure operates.

LLCs can be member-managed or manager-managed. These two unique management styles will necessarily change the way that your operating agreement works and the process of making amendments. If you do not have a lawyer to speak with about how these two different management styles can impact amendments to your operating agreement, you should consider securing one today. There is no exchange for expert legal advice when it comes to operating a business, and you will be much less likely to have trouble with the way your business is operated and managed when you are supported by a legal professional when these decisions need to be made.

Creating Correct Amendments to Your LLC Matters

When you have an LLC operating agreement that needs amendments, it can feel quite daunting to make these alterations on your own. While there are templates out there that can help guide the proper documentation creation process, there are many arguments against going it alone for this process. Lawyers versed in LLC and business law can help you to draft effective and compliant amendment documents that will not cause you trouble down the road if there are disputes about the way that your business is being operated.

Particularly with regard to major changes to operation locations, owners, and management structures, following the right amendment documents can make a big difference in the outcome of your amendment efforts. Making sure that your LLC operating agreement amendments are handled properly for your business type, and your state is critical to business success. Make sure that you follow this guide to ensure that your business operations are protected by a correct set of LLC amendments.