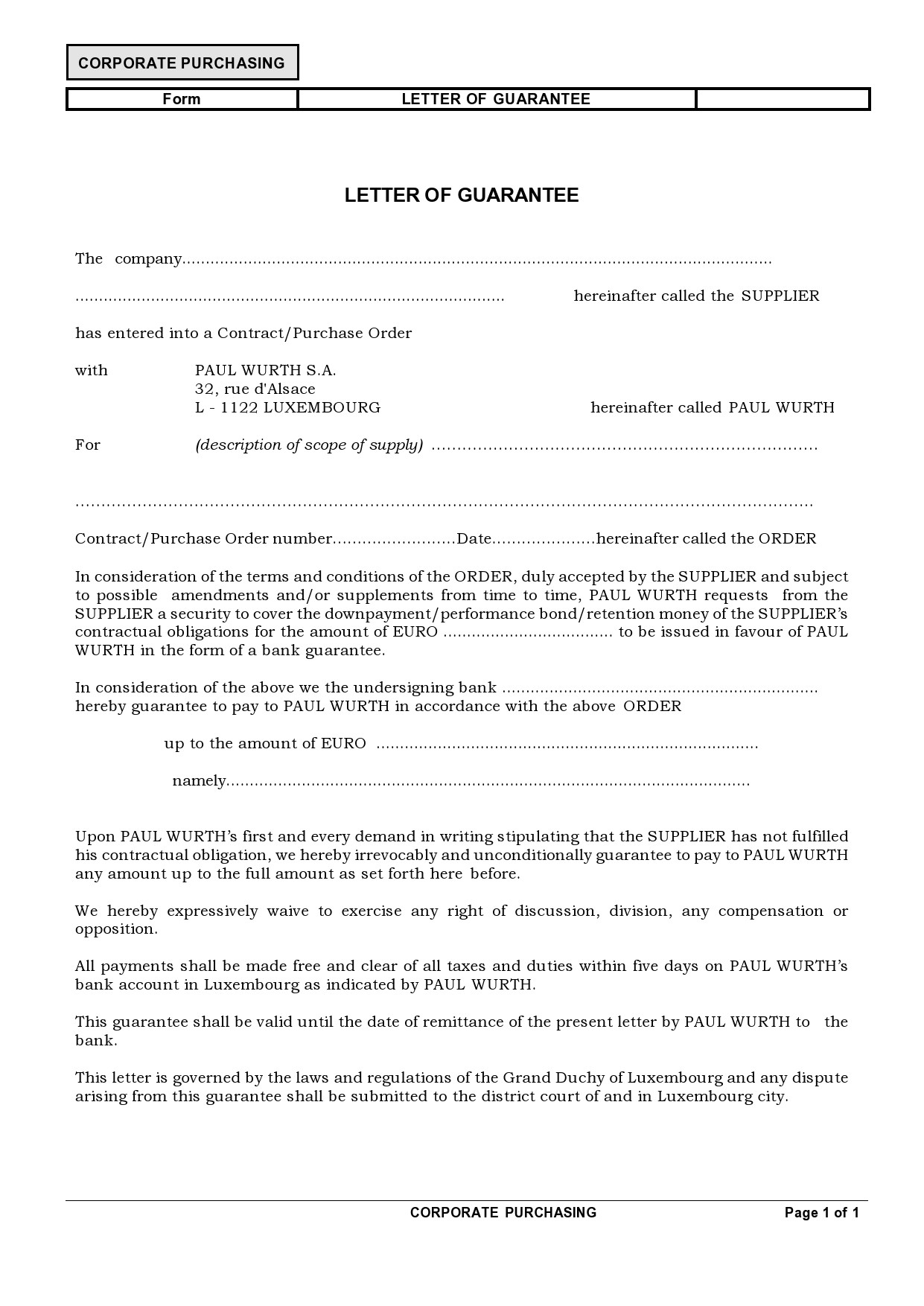

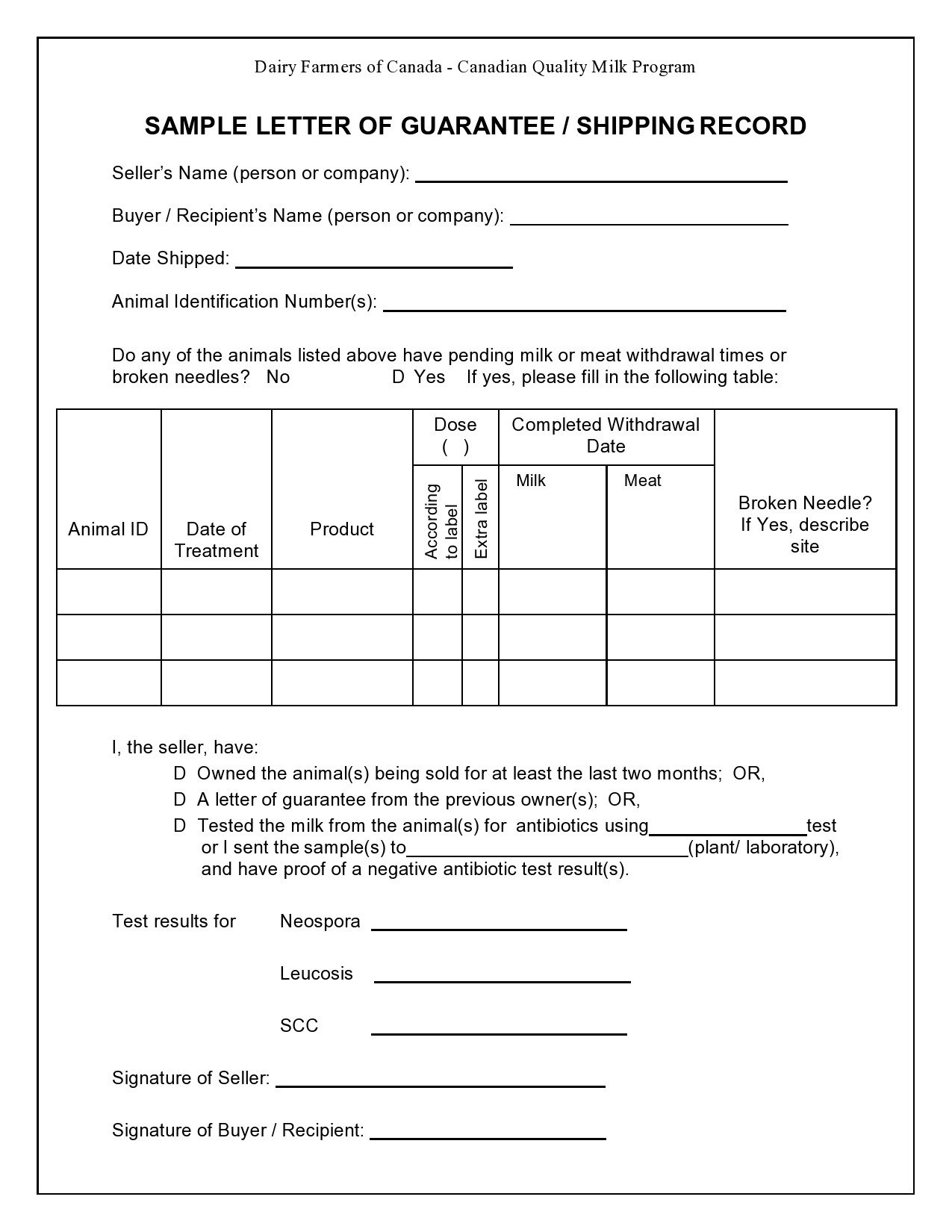

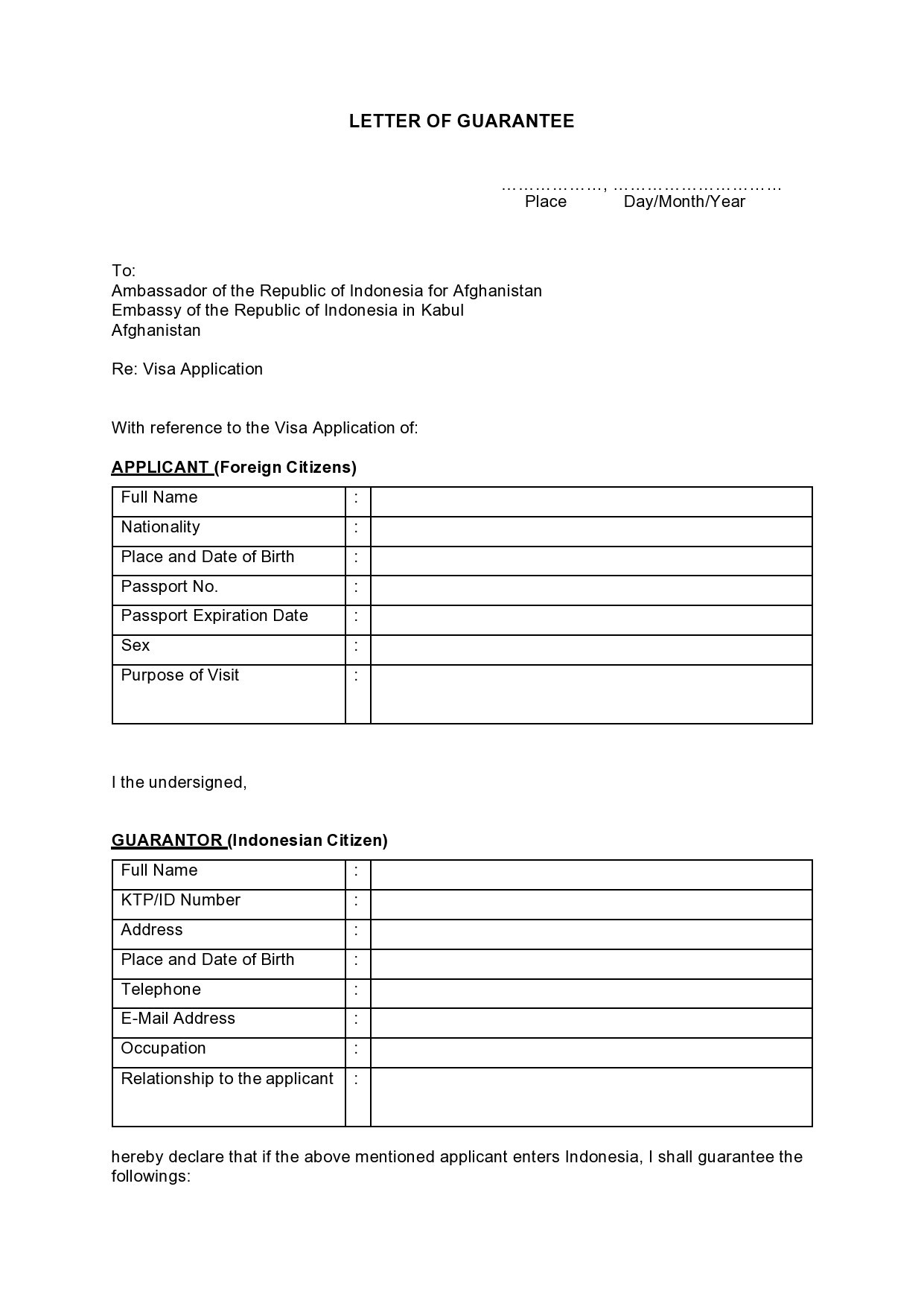

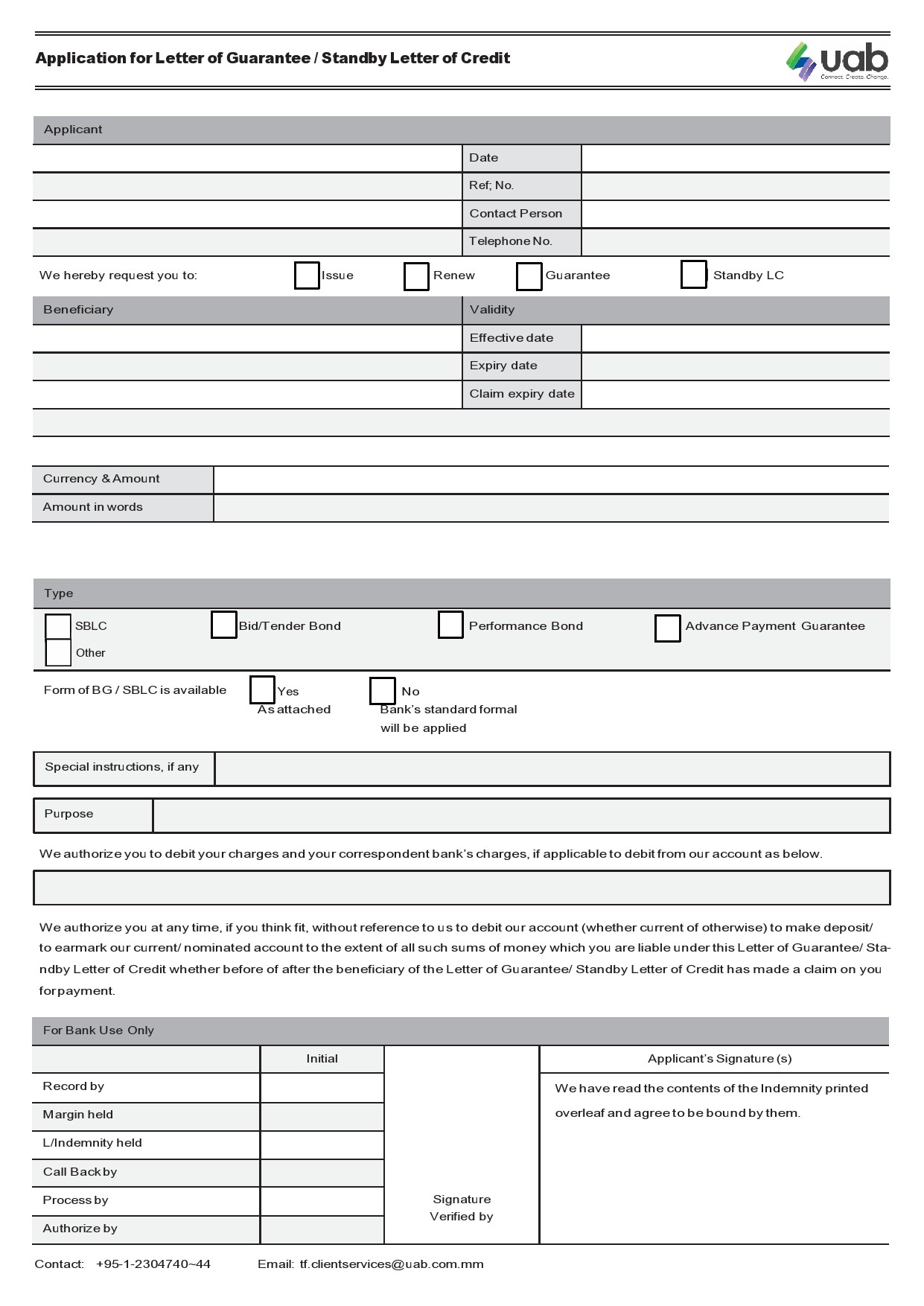

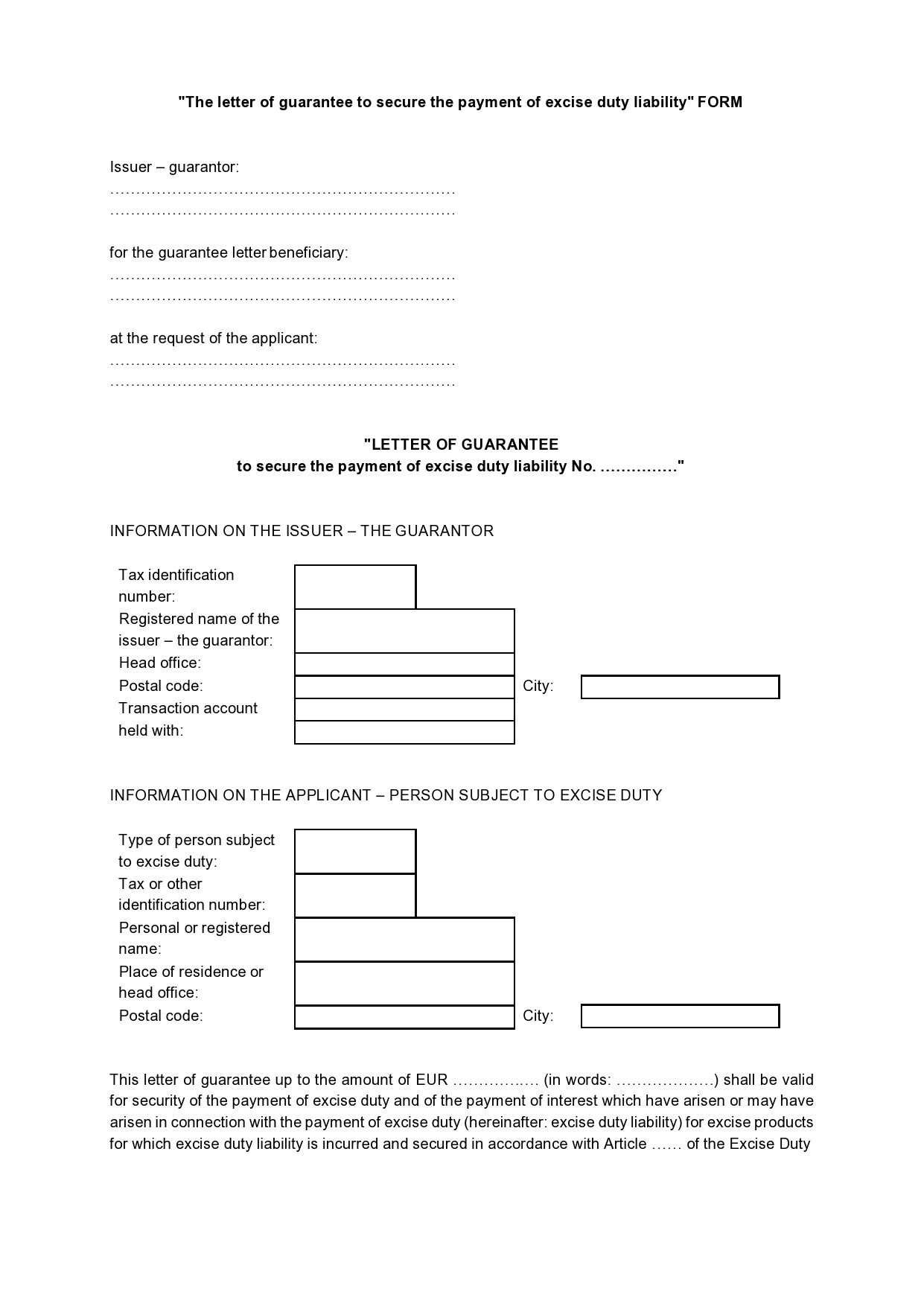

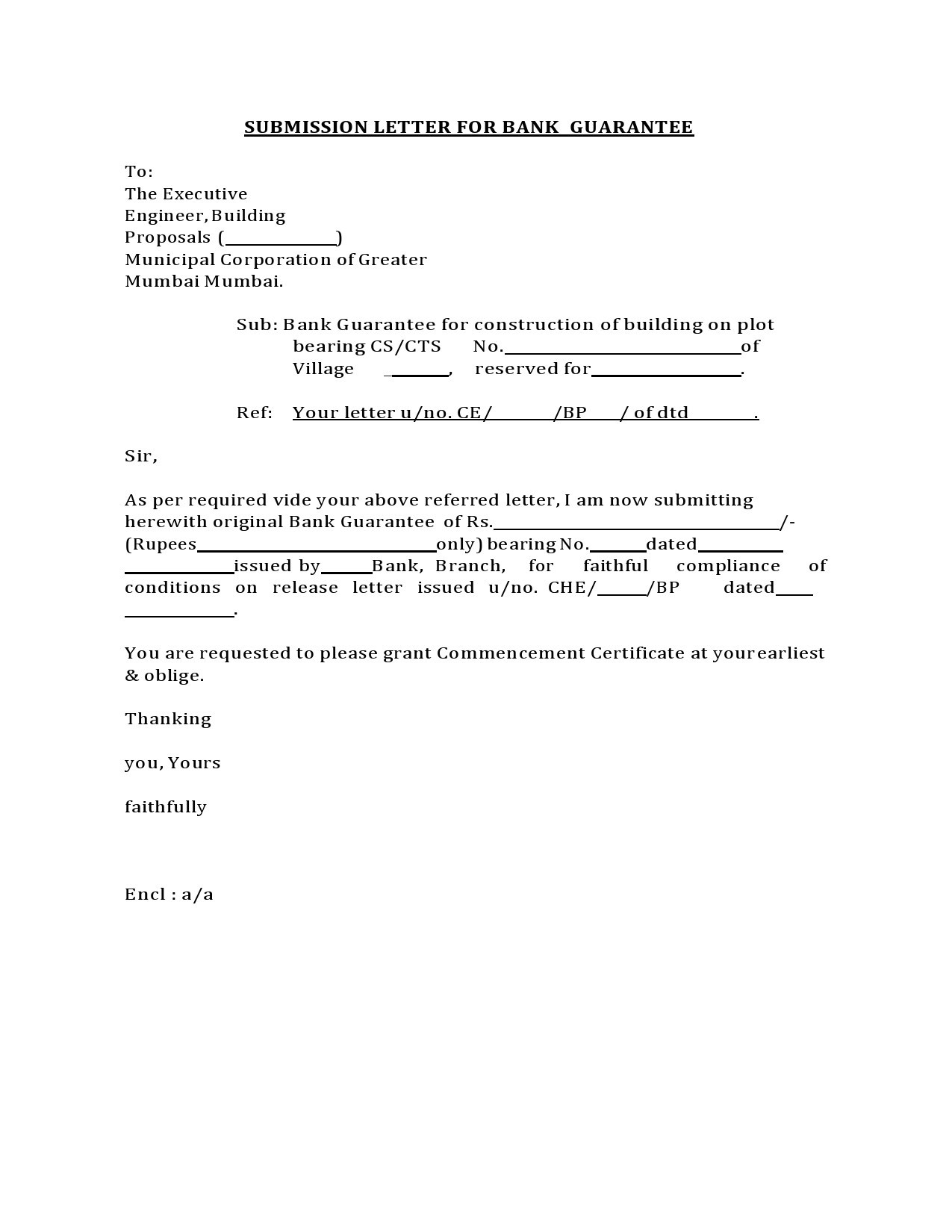

There are times when customers, especially those with good credit standings need to request a bank to provide assurance that they will fulfill their obligations of a contract they have entered into with a supplier. They can make this request through a letter of guarantee. You can also use this letter in construction and contracting, technology trade, financing, in the declaration of import-export goods, and equipment leases.

Table of Contents

- 1 Letters Of Guarantee Templates

- 2 What is a letter of guarantee?

- 3 Financial Guarantee Letters

- 4 How does it work?

- 5 Letter Of Guarantee Samples

- 6 What is the difference between letter of credit and letter of guarantee?

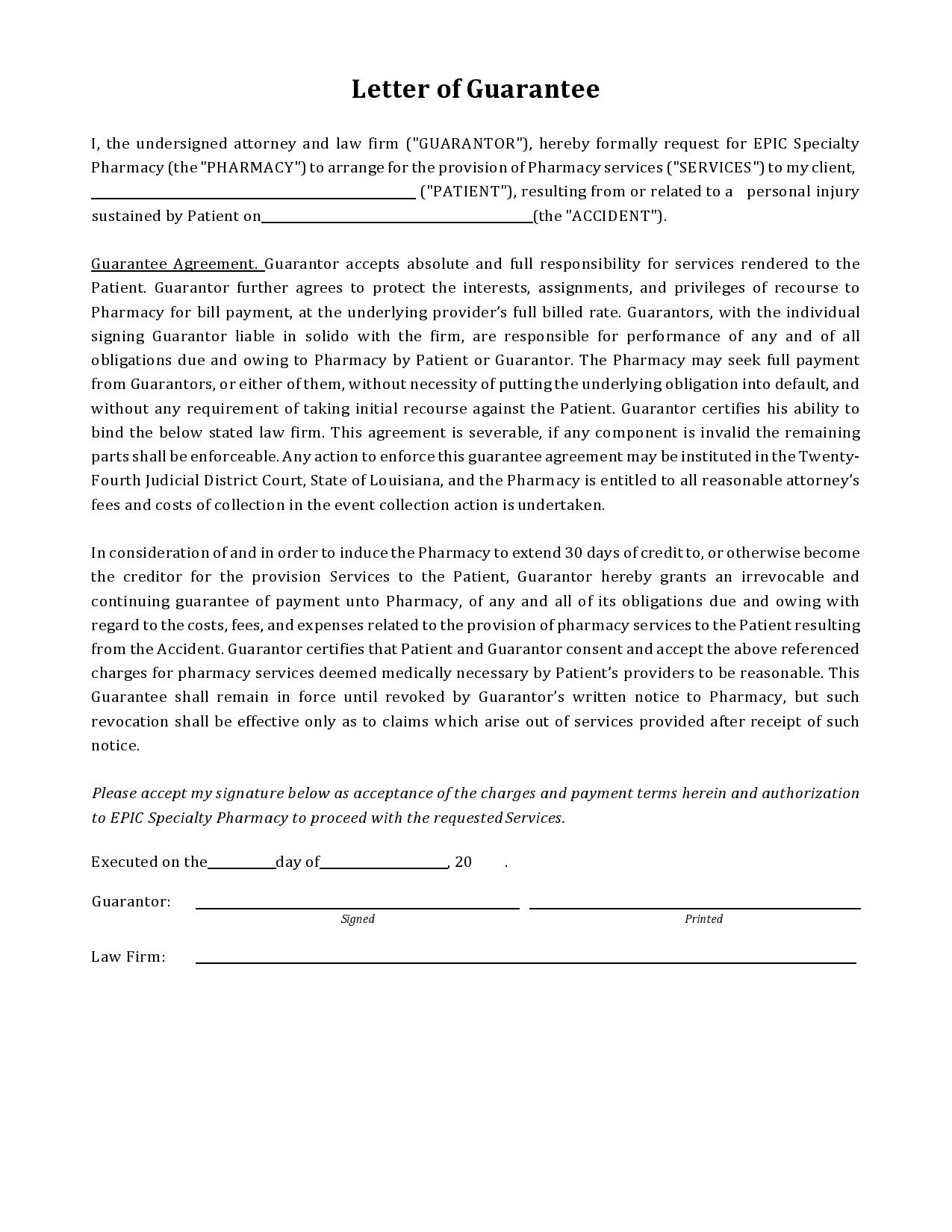

- 7 Insurance Letter of Guarantee

- 8 How do I write a letter of guarantee?

- 9 Guarantee Letters For Payment

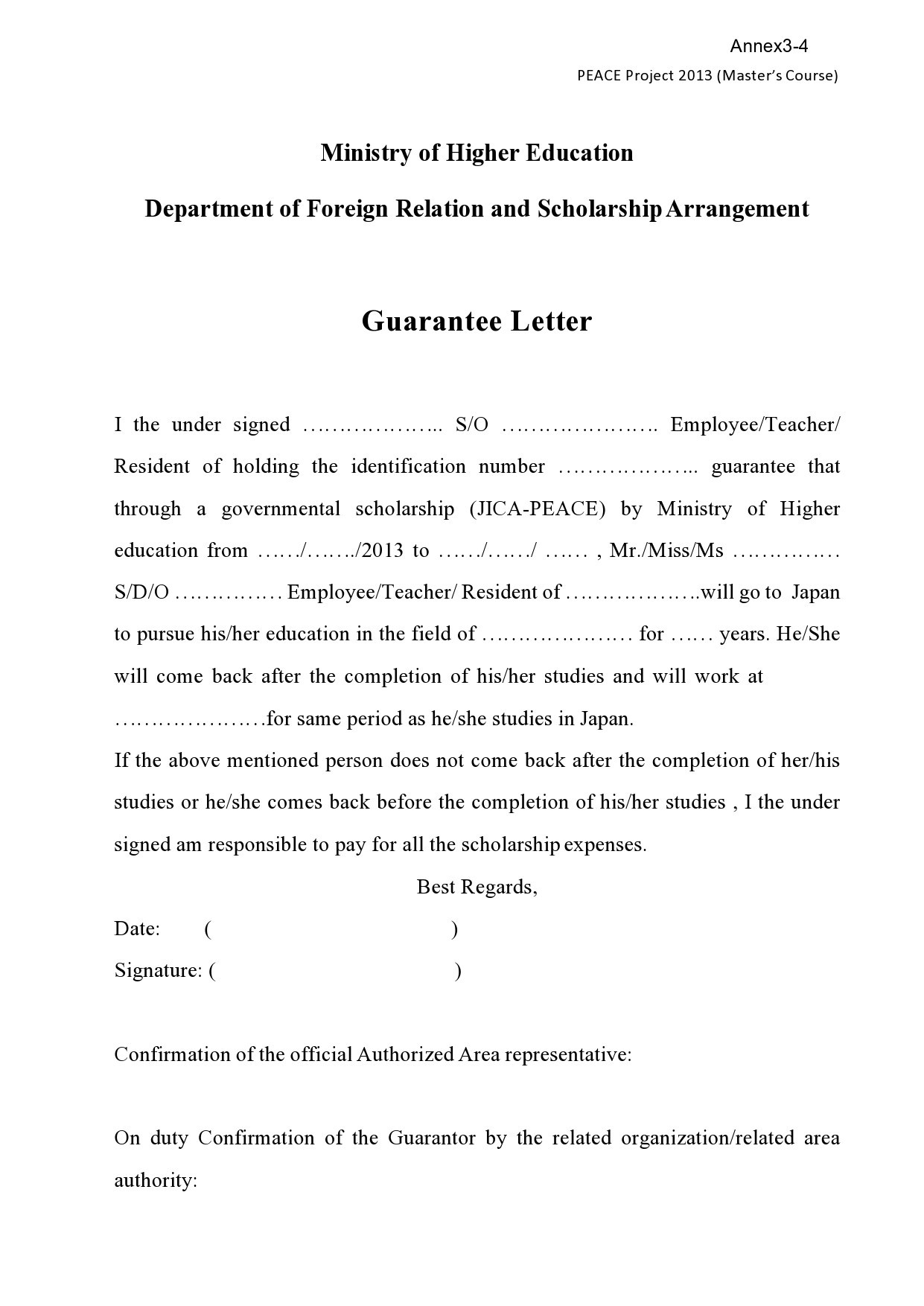

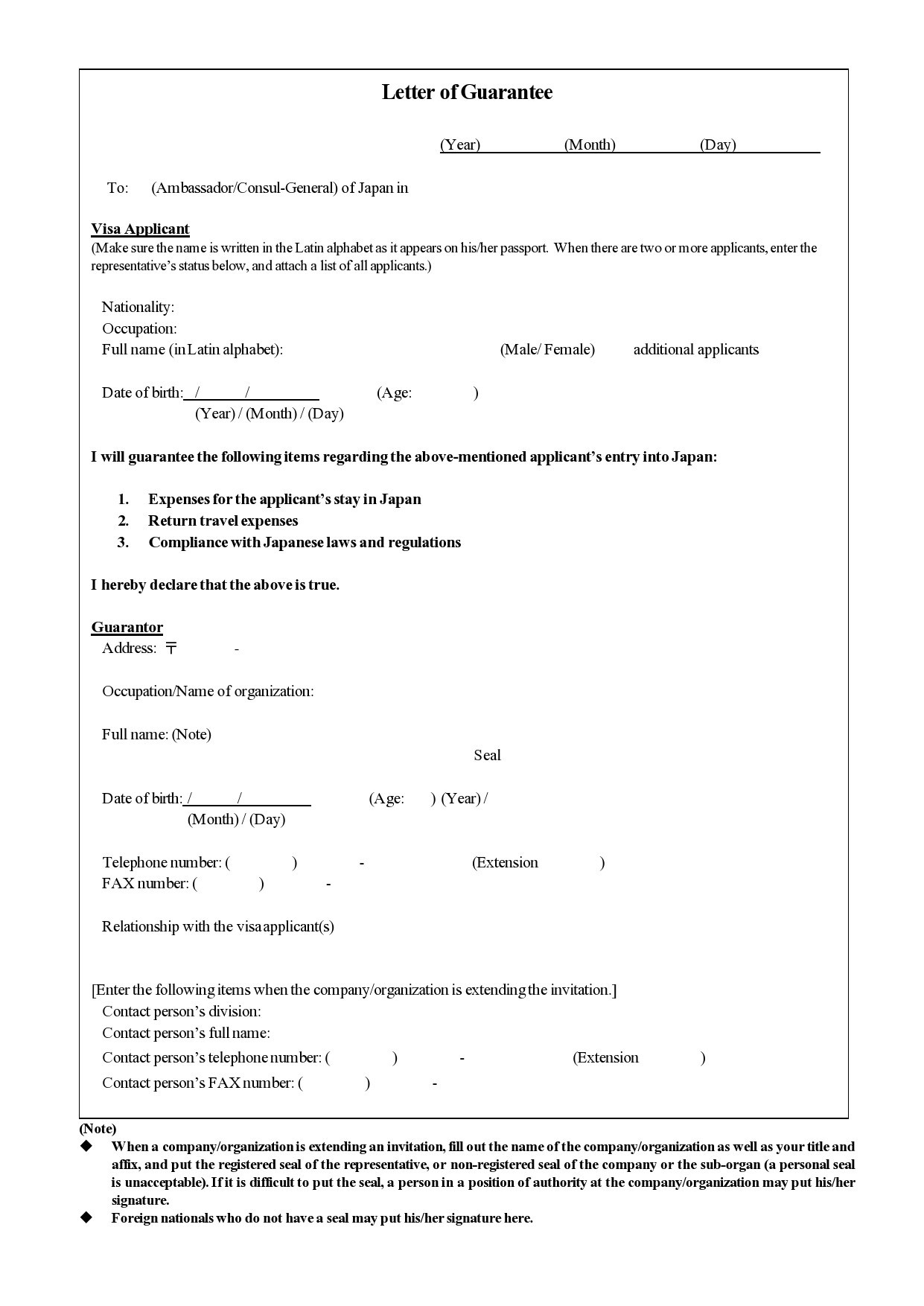

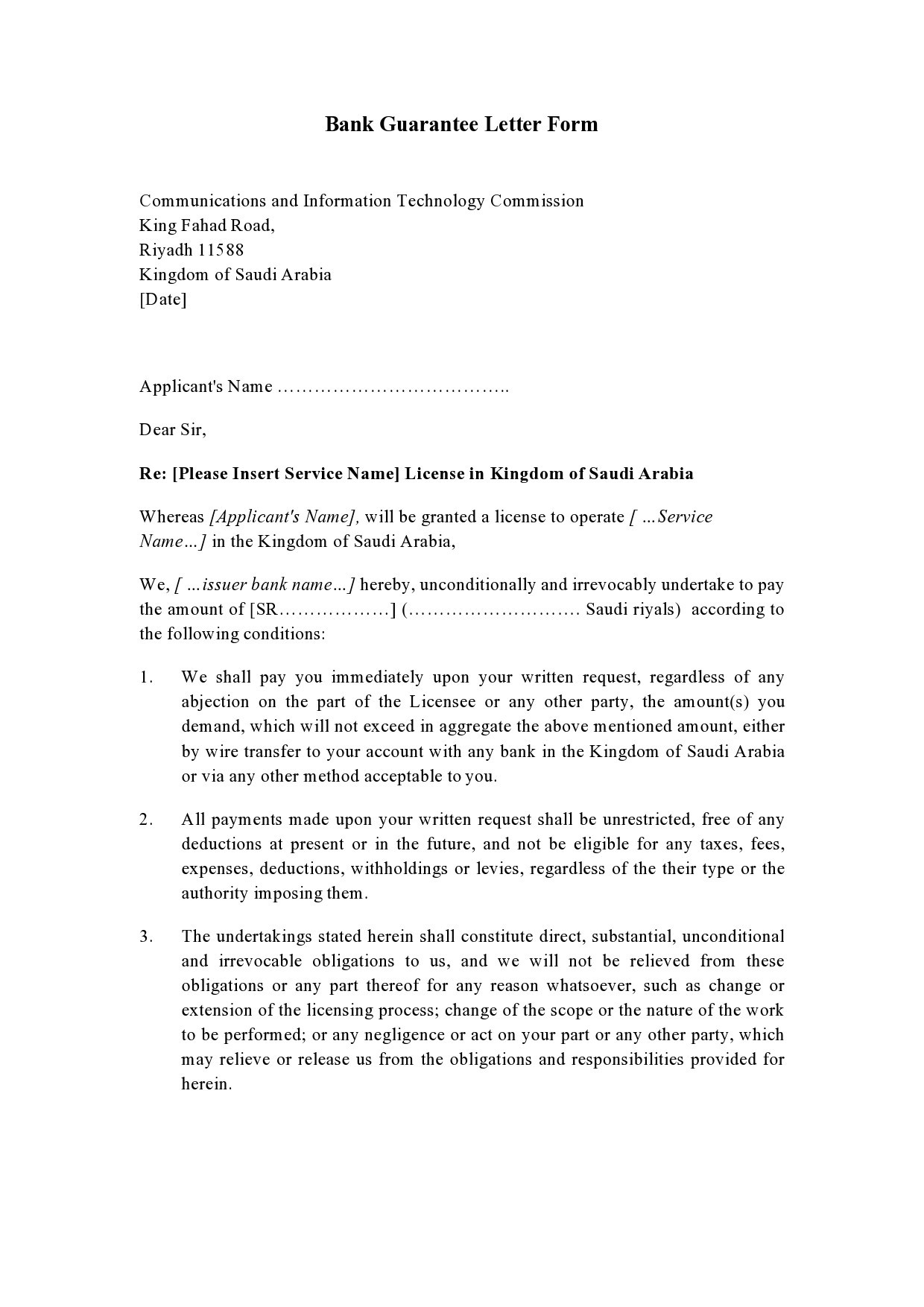

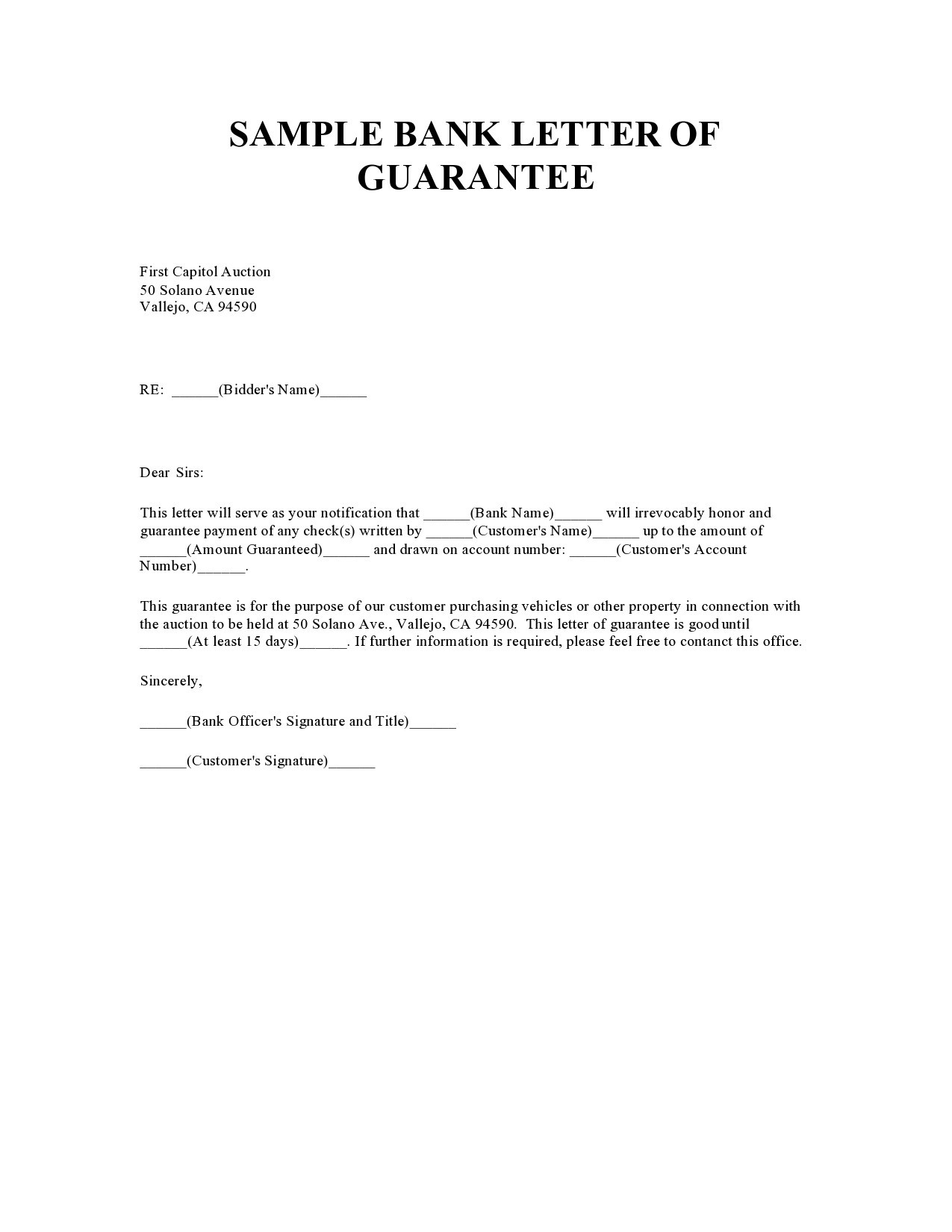

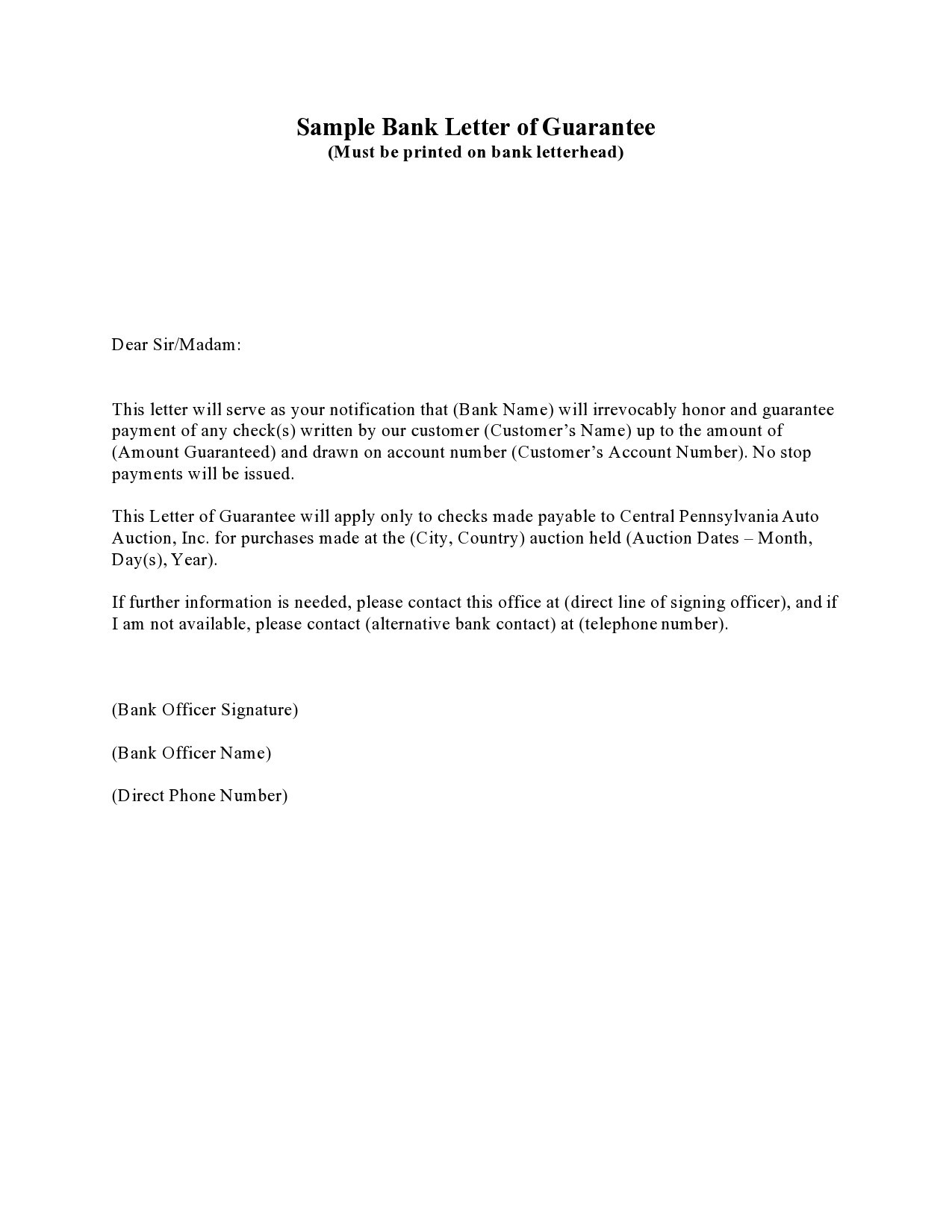

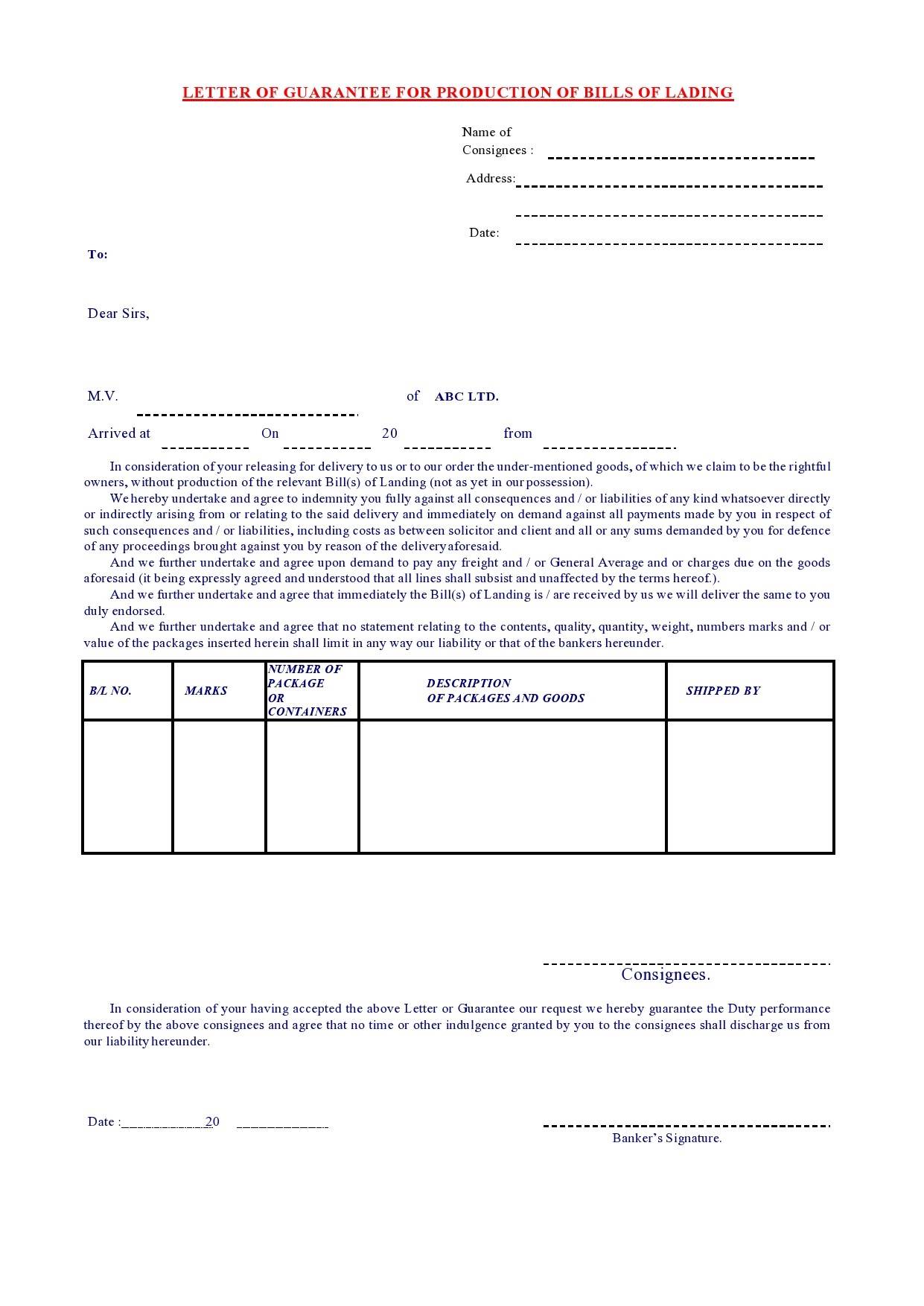

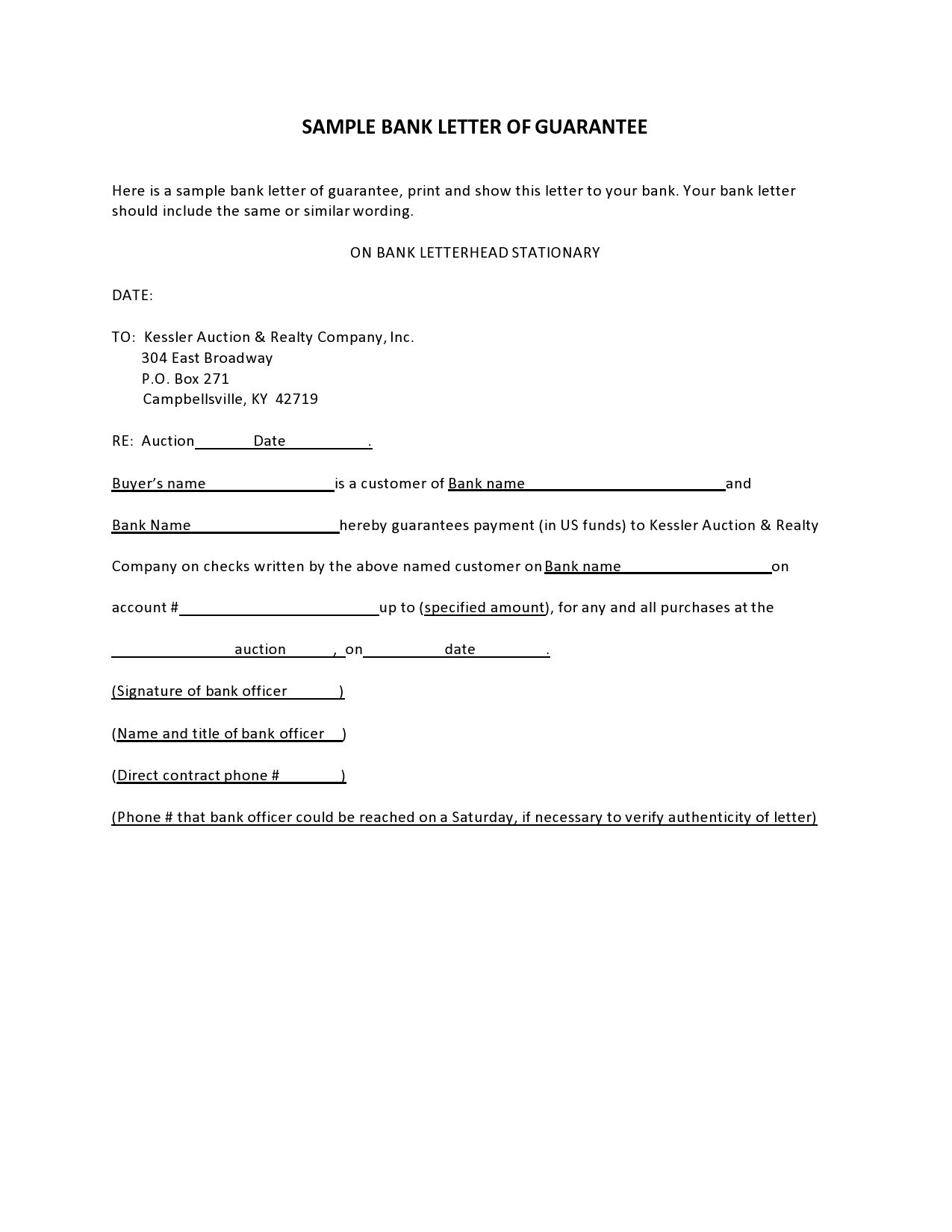

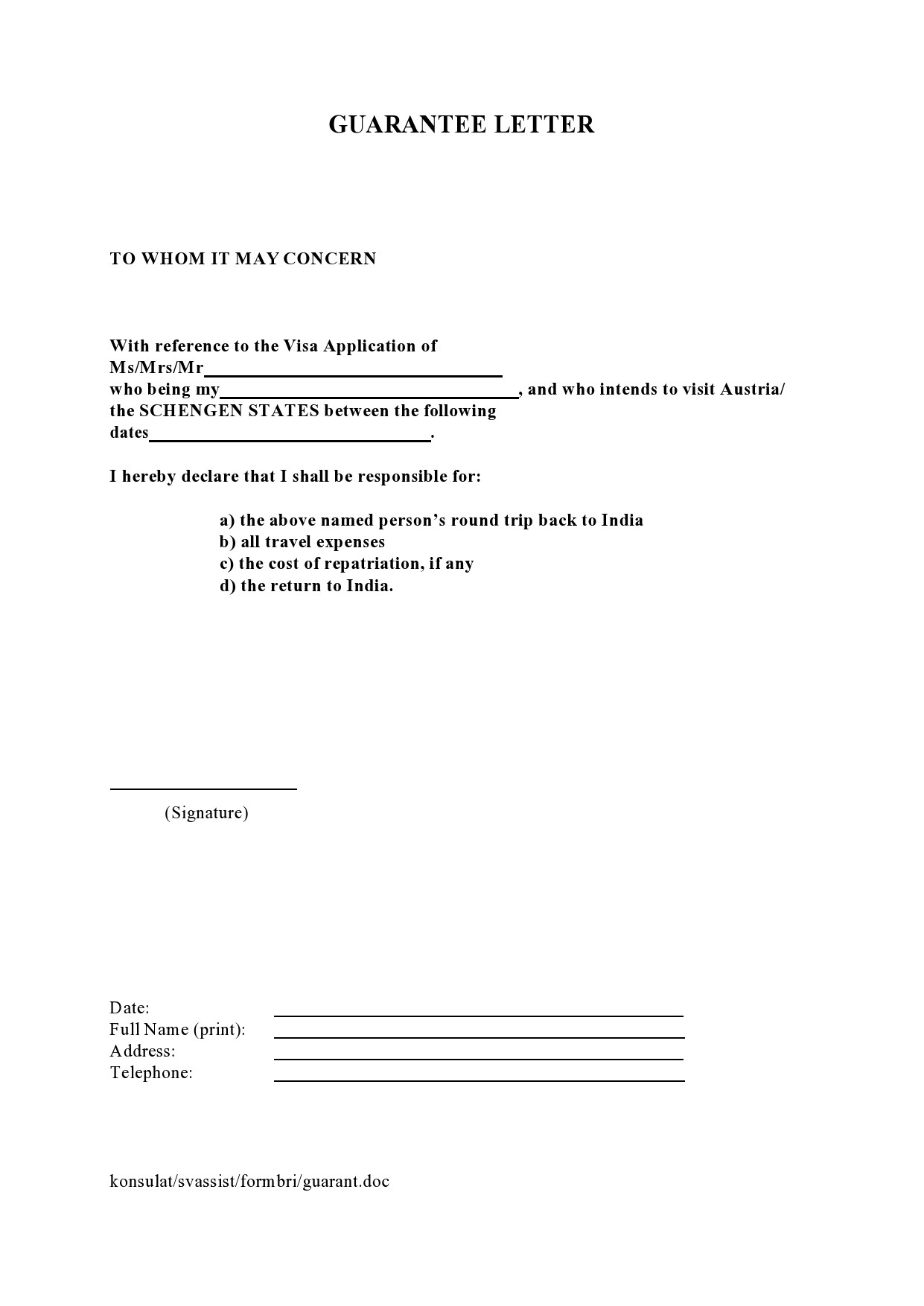

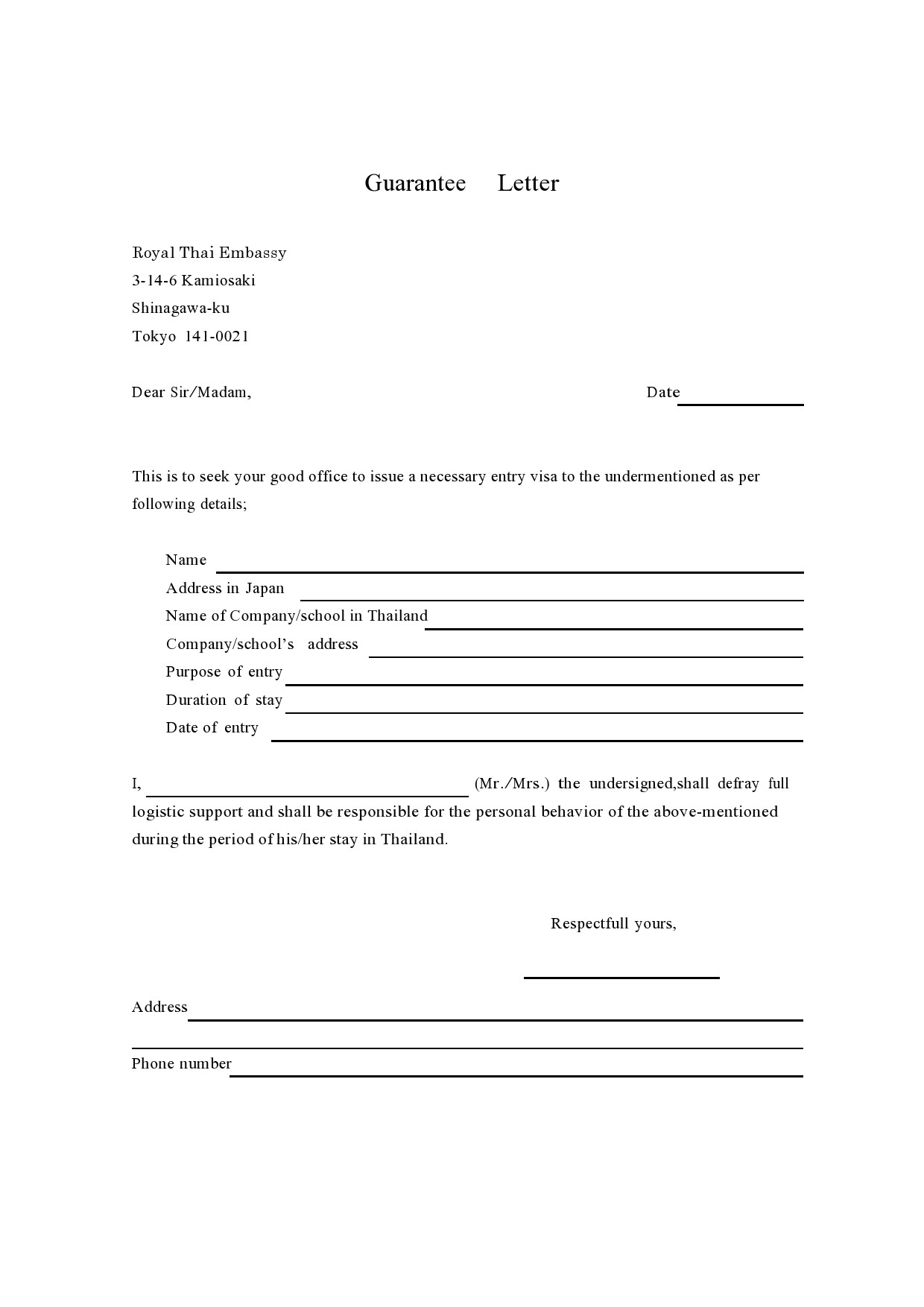

Letters Of Guarantee Templates

What is a letter of guarantee?

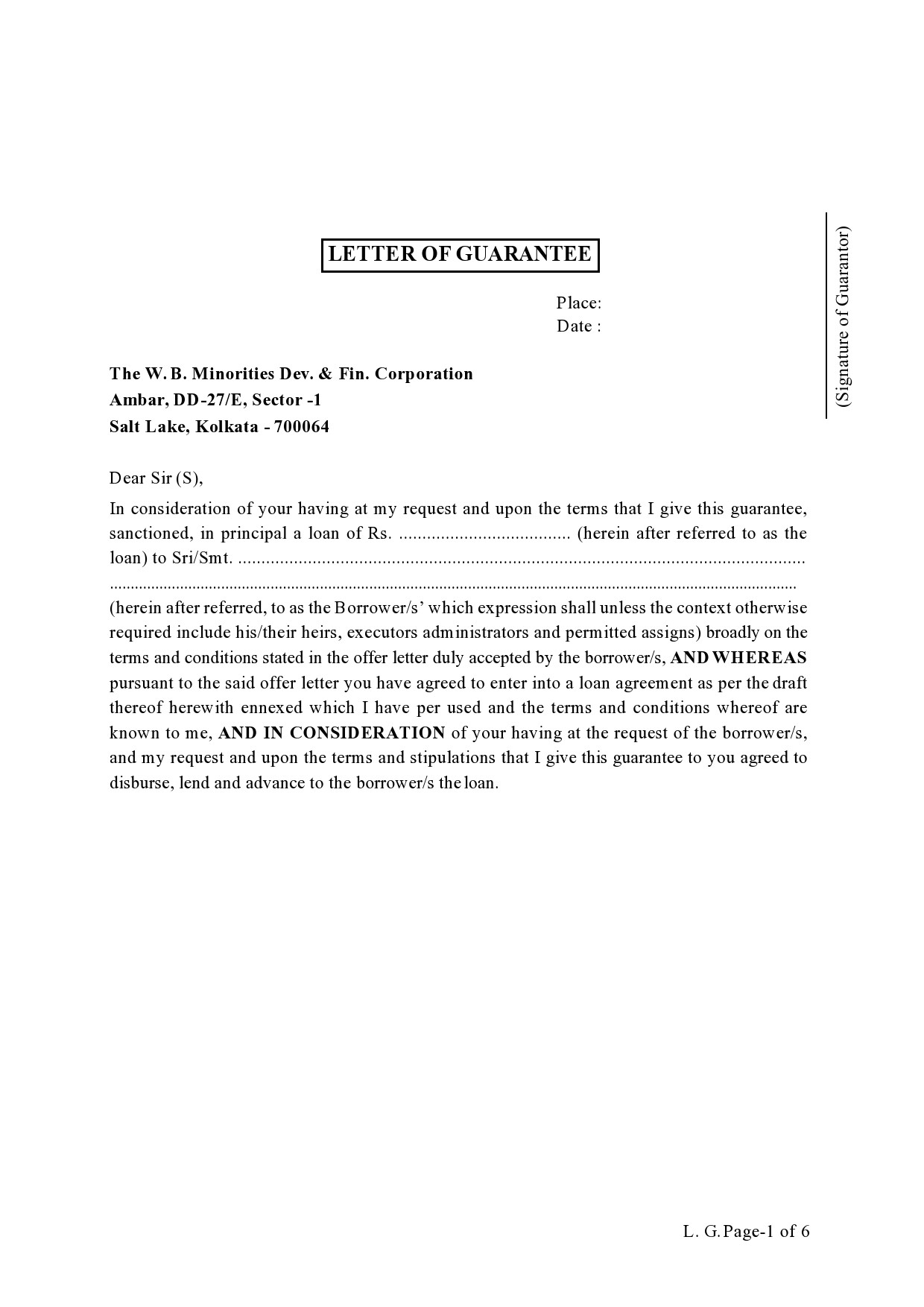

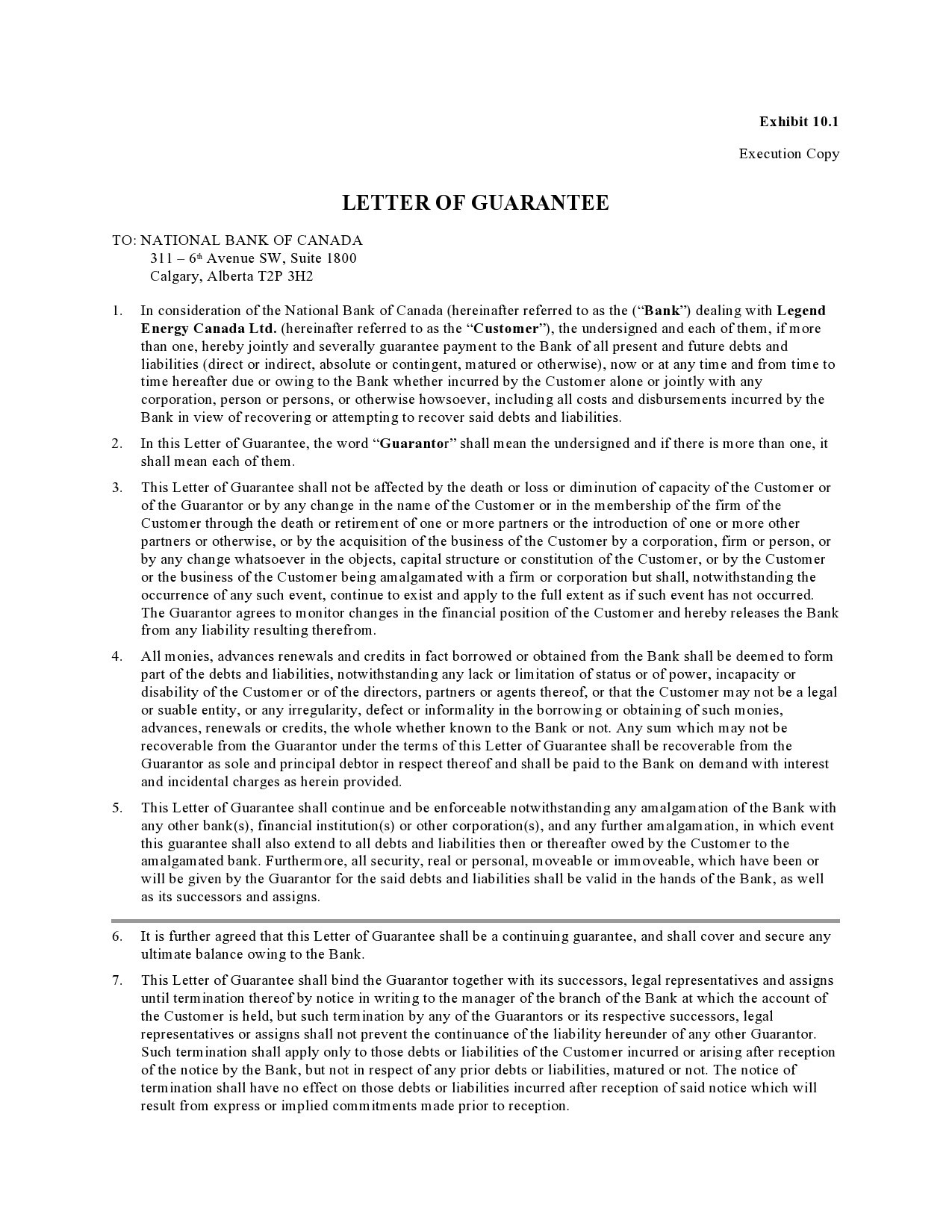

A letter of guarantee is a kind of contract usually issued by a bank on behalf of a client who has entered into an agreement to buy merchandise from a supplier. The letter informs the supplier that they will get paid even if the client of the bank defaults. To get this letter, you have to apply for it just like a loan.

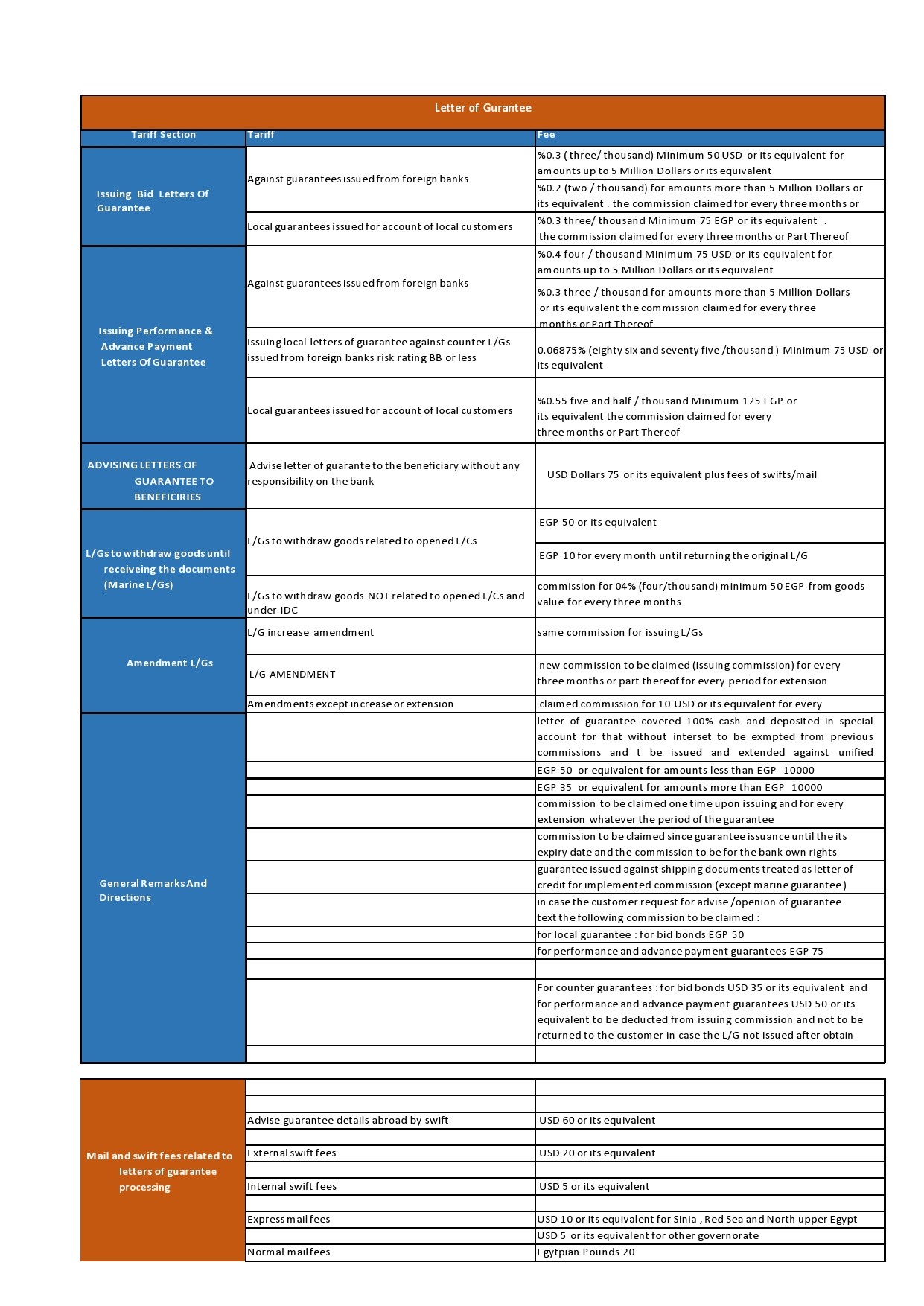

Banks usually choose who to issue their letters of guarantee templates to. If they feel comfortable that you’re trustworthy and have a good bank standing, then they will support you with the letter. Of course, there will be a yearly fee you would have to pay.

Banks can issue the letter for various situations. For instance, they can issue it on behalf of a call writer to guarantee that the writer owns an underlying asset. The bank, in turn, delivers the underlying securities if the call gets exercised. There are many other situations that may warrant this letter.

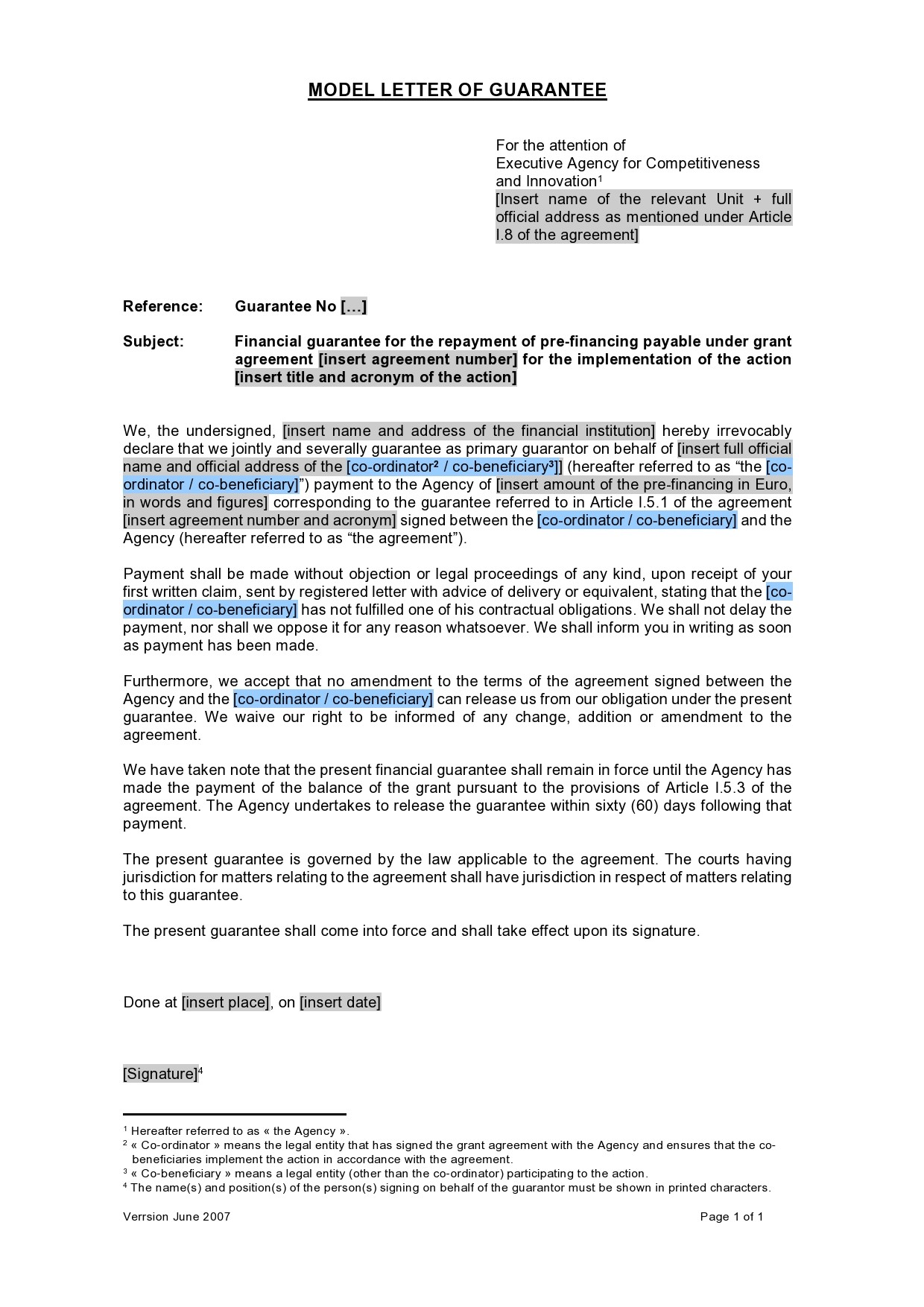

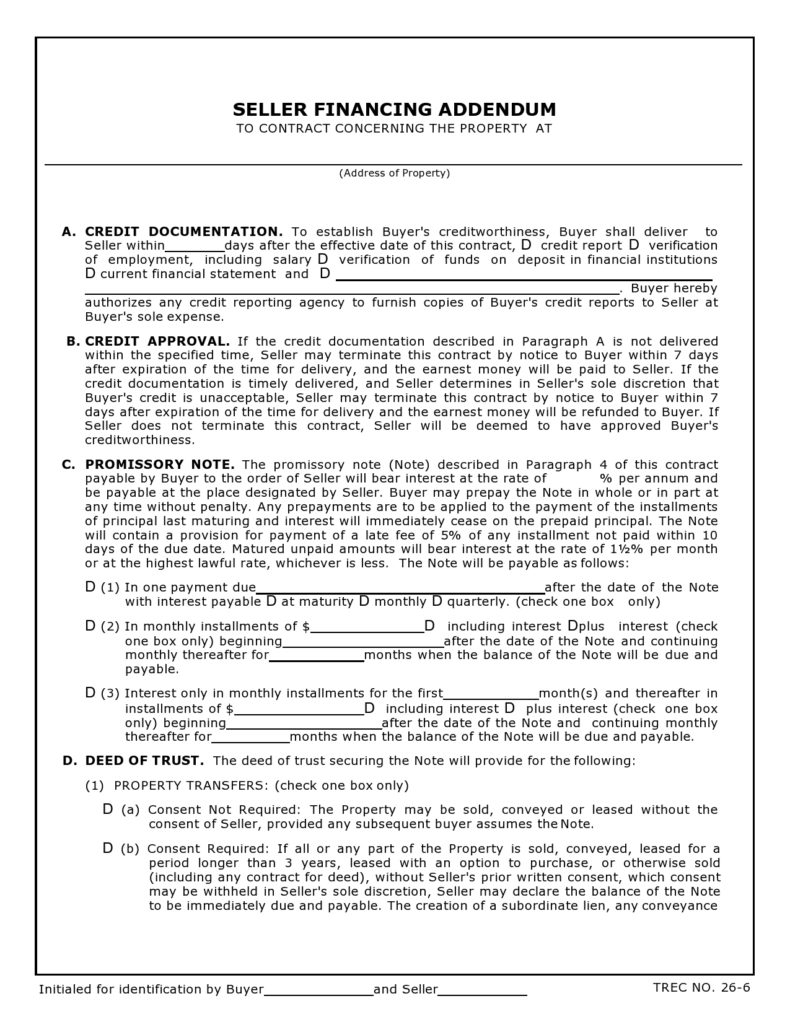

Financial Guarantee Letters

How does it work?

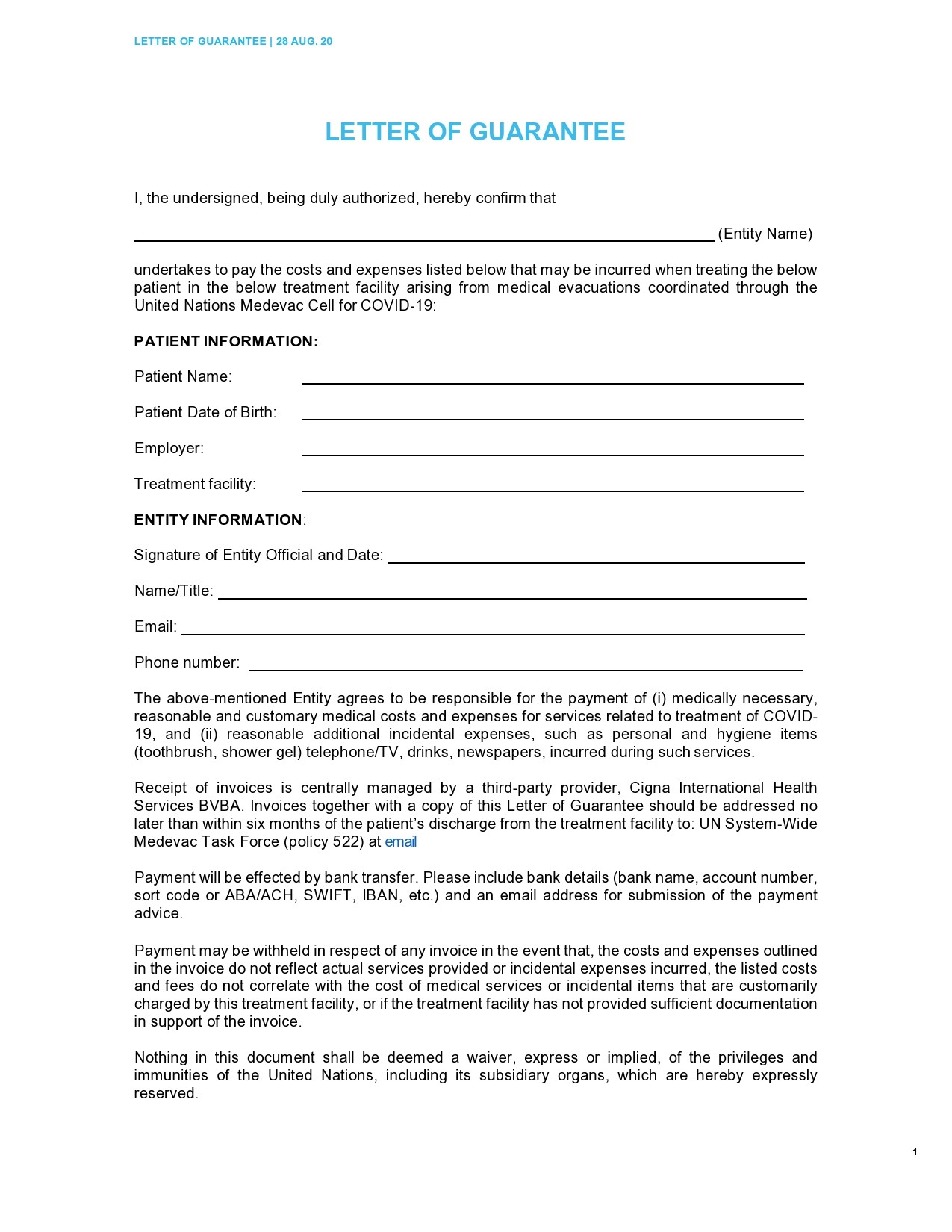

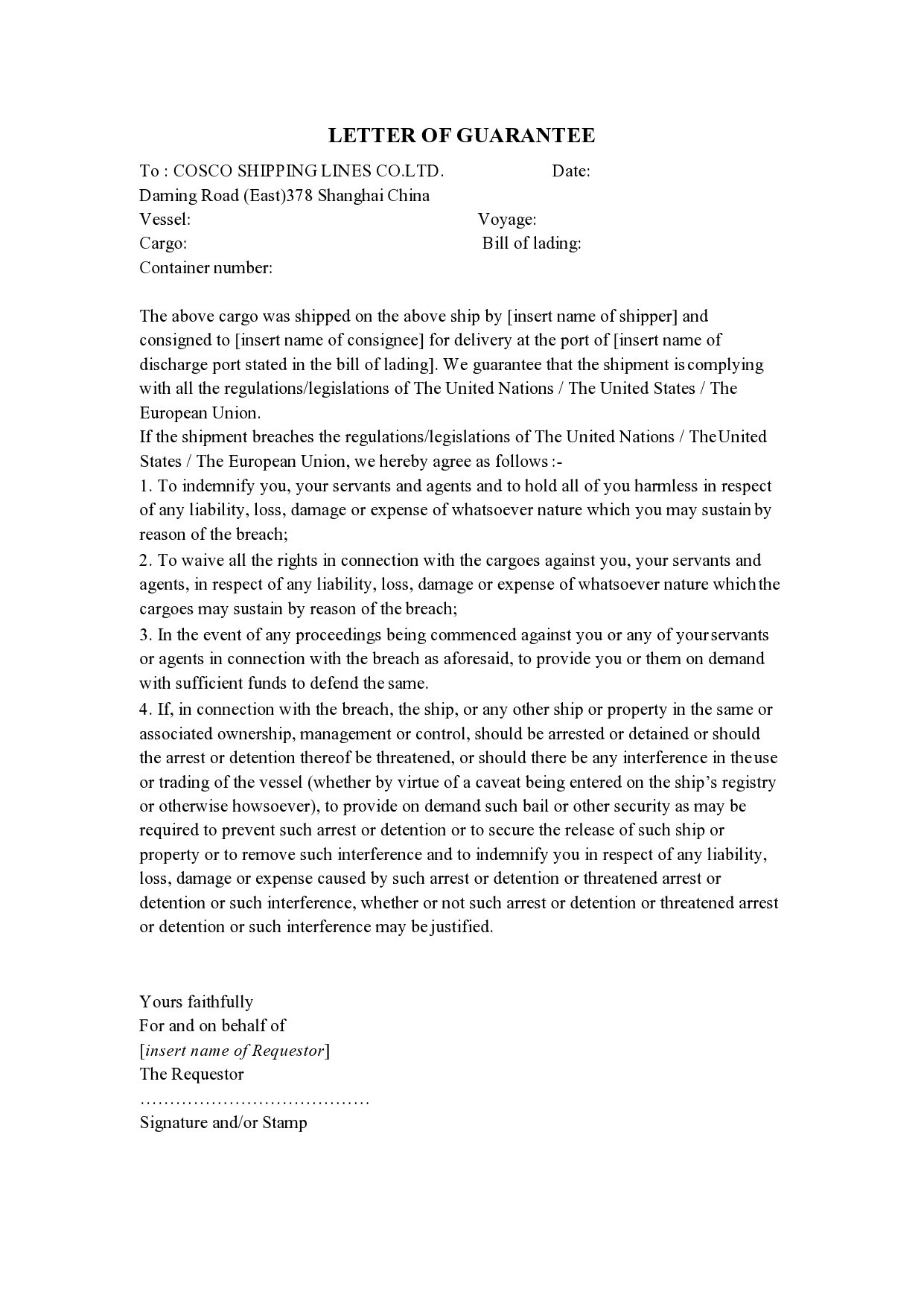

A letter of guarantee can help facilitate the fulfillment of transaction requirements when you’re involved with other businesses. For instance, if a supplier fails to provide the supply you ordered and you already provided advance paid to the supplier, you can receive the payment from the bank in case of the undelivered items.

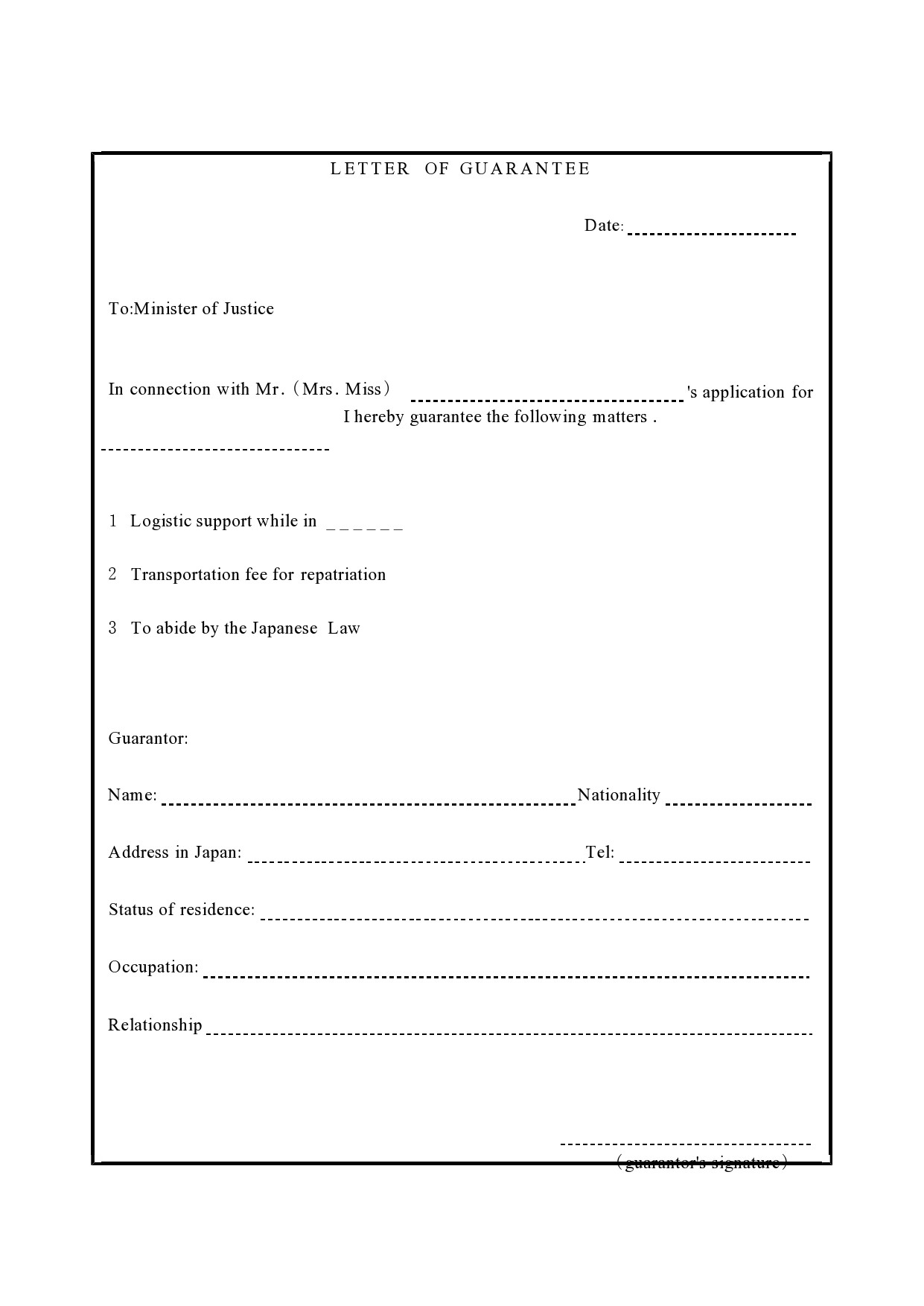

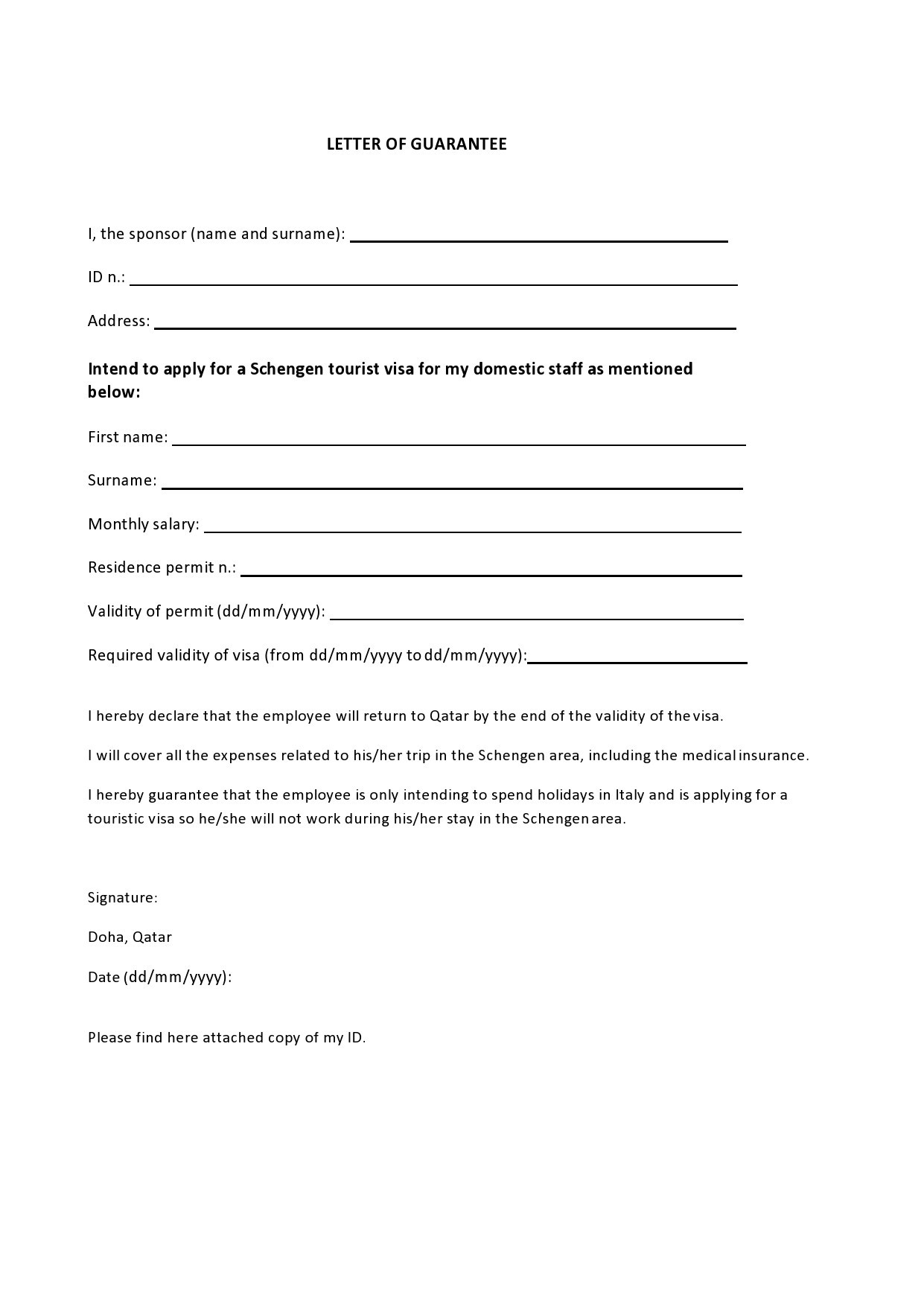

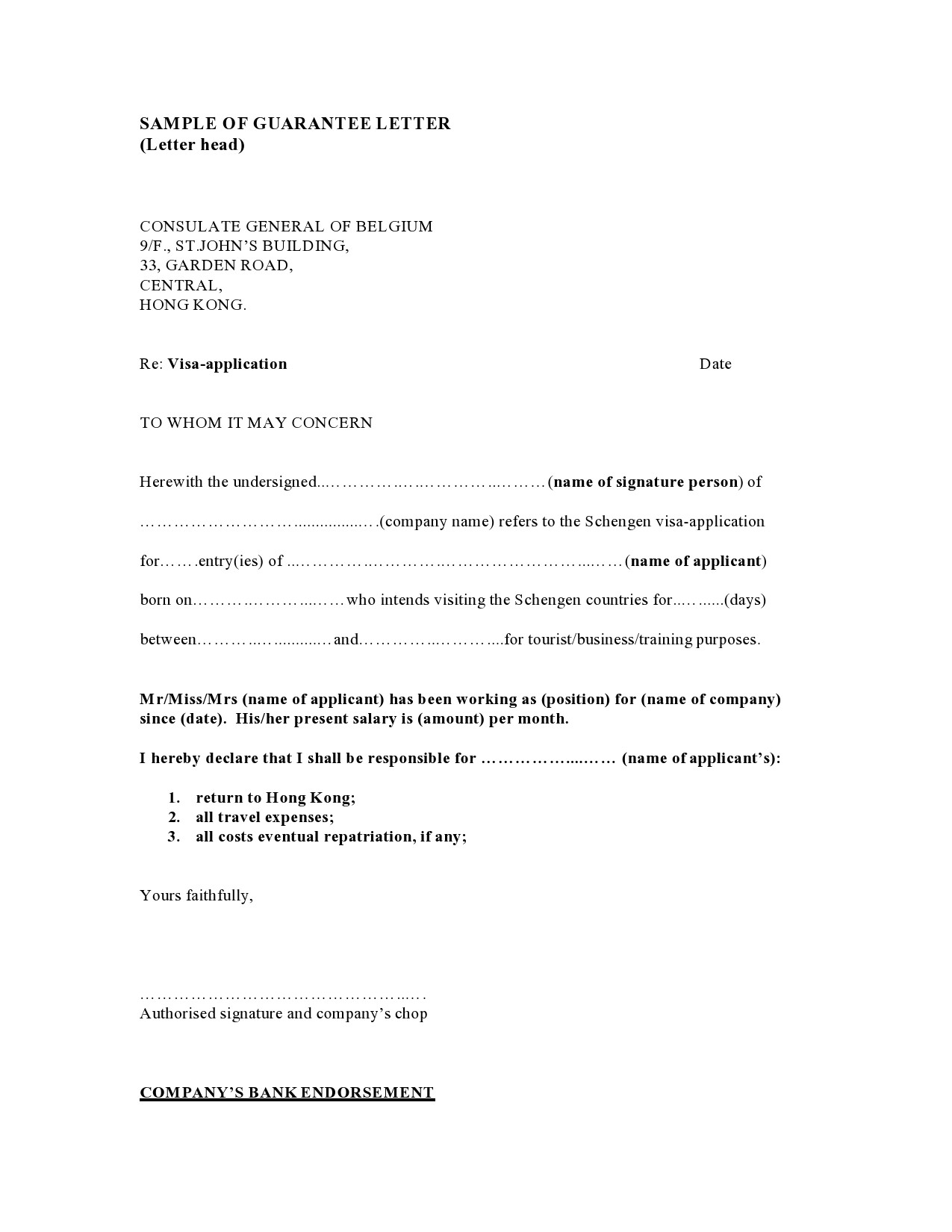

Another case where a letter of guarantee proves useful is on behalf of a parent willing to pay for the expenses of their child while they reside at a lodging within the campus for the purpose of attending school.

This letter should be properly formatted. You should type it since handwritten letters are not appropriate for business matters. Moreover, not everyone may understand a handwritten letter. The letter should have no errors, both in grammar and spelling.

You and the other party involved in the letter should agree to the terms and conditions stipulated in it. Should there be any difficulty in comprehending the letter’s contents, it’s recommended to consult with a lawyer to make things clearer for you.

Business transactions can become a lot easier and smoother with this letter. It’s very important to review your agreement, negotiate its terms, and meet with the institution so that there would be no confusion once the letter is in place.

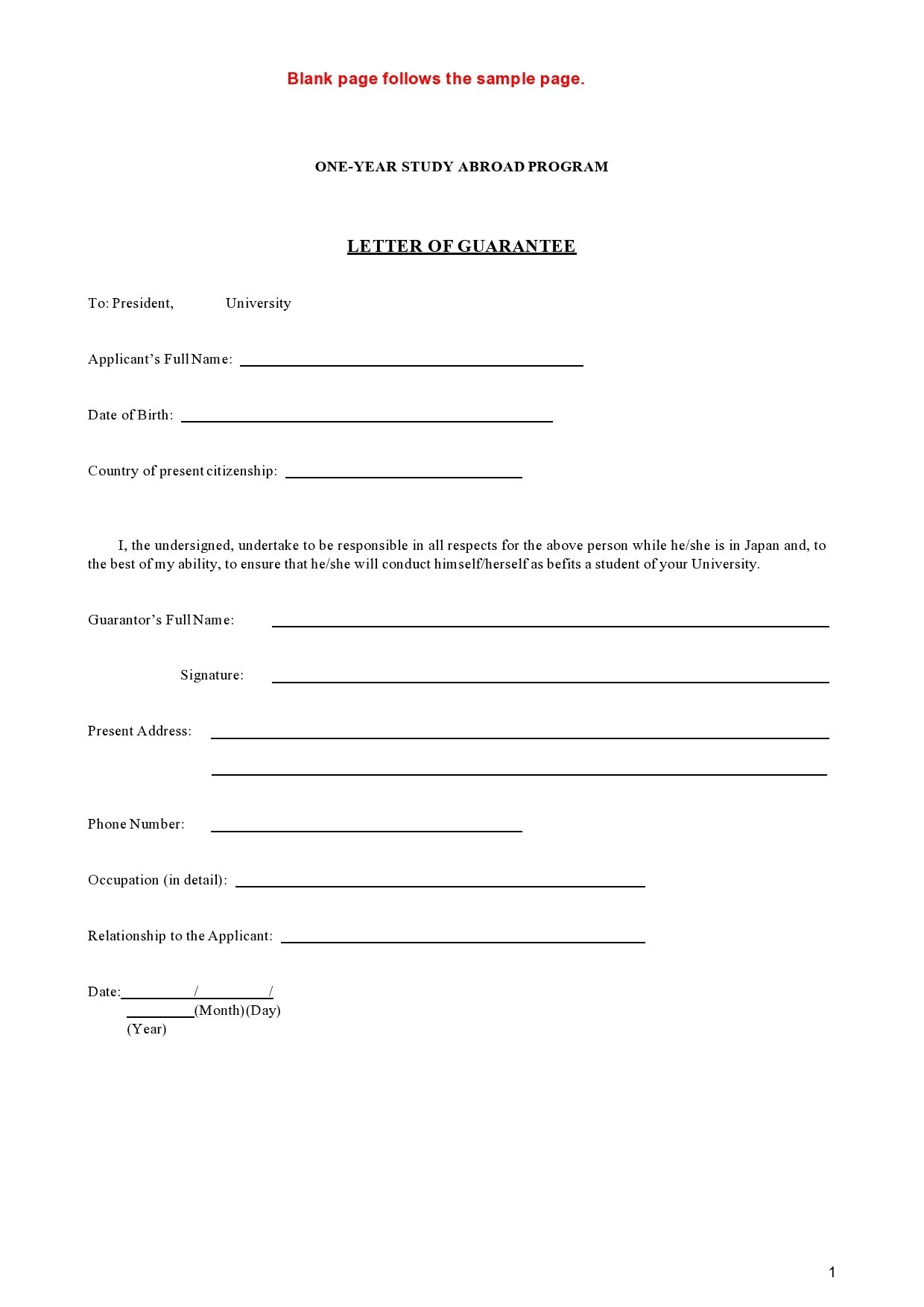

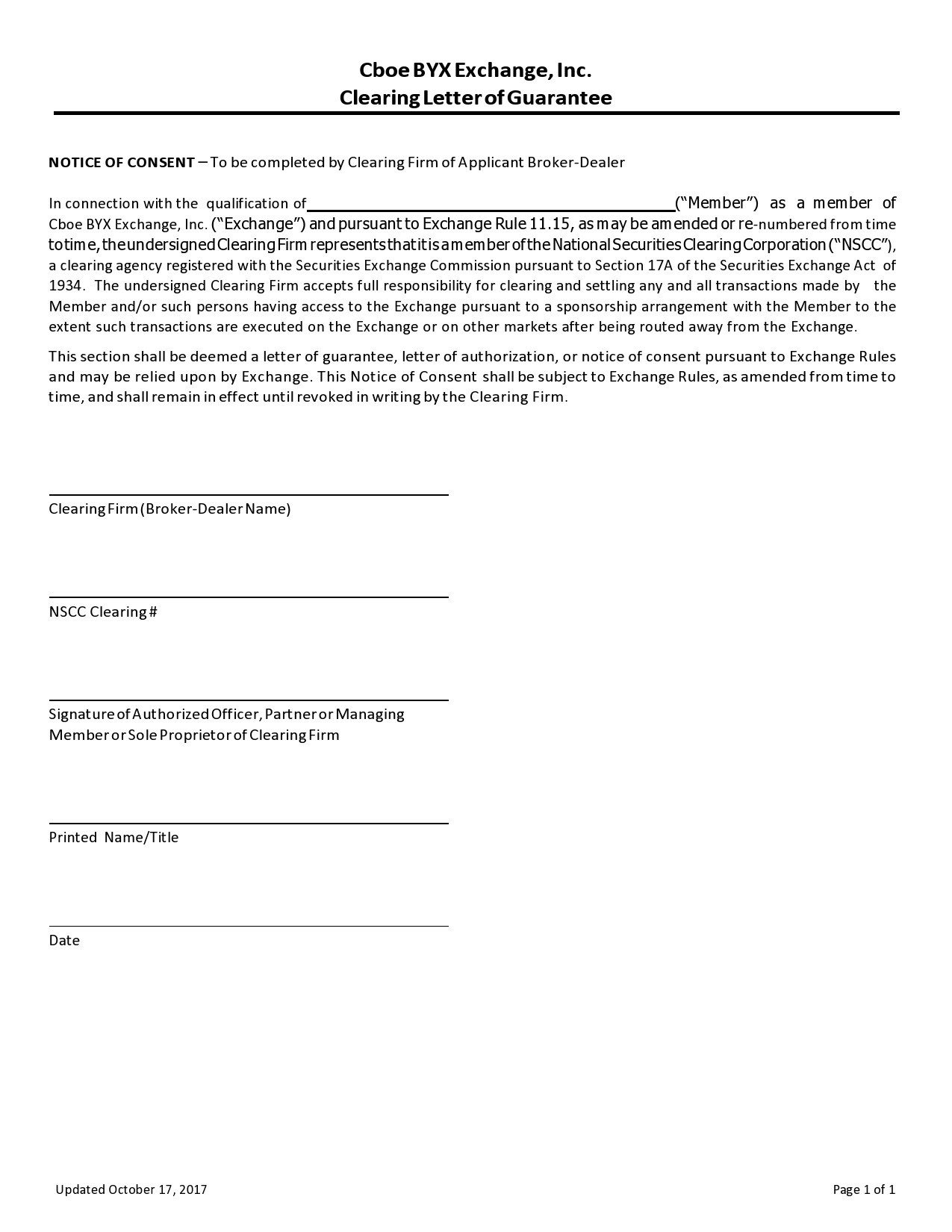

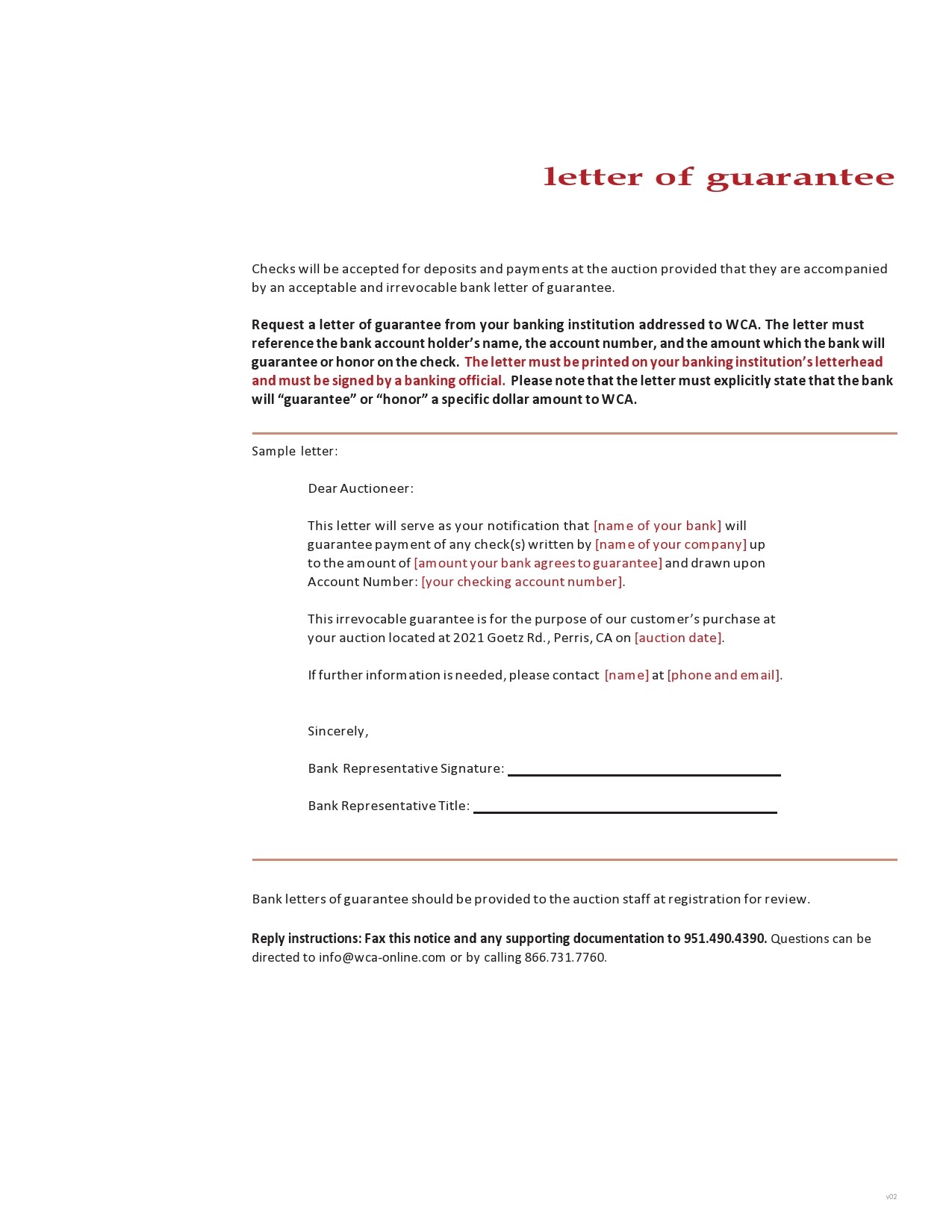

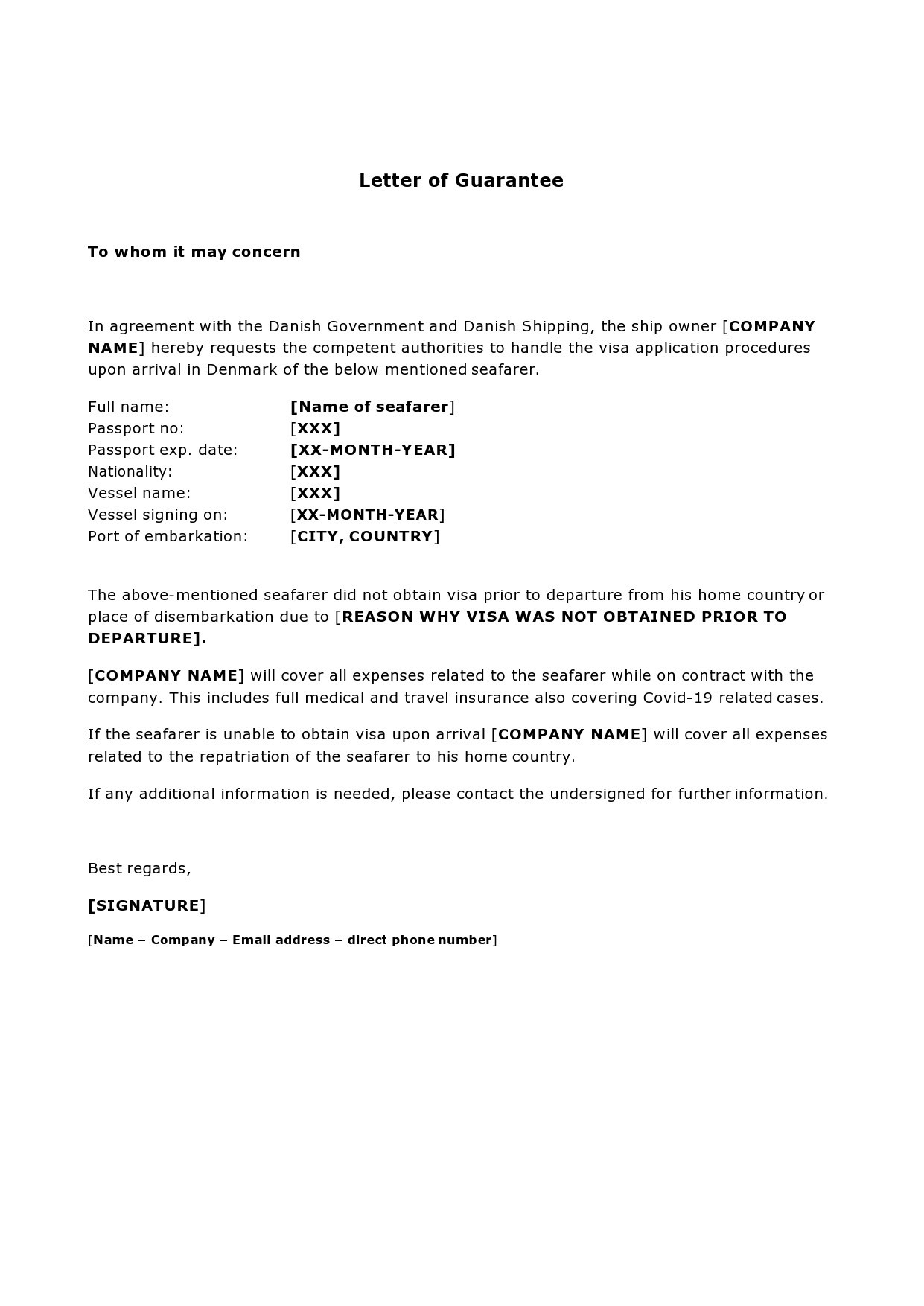

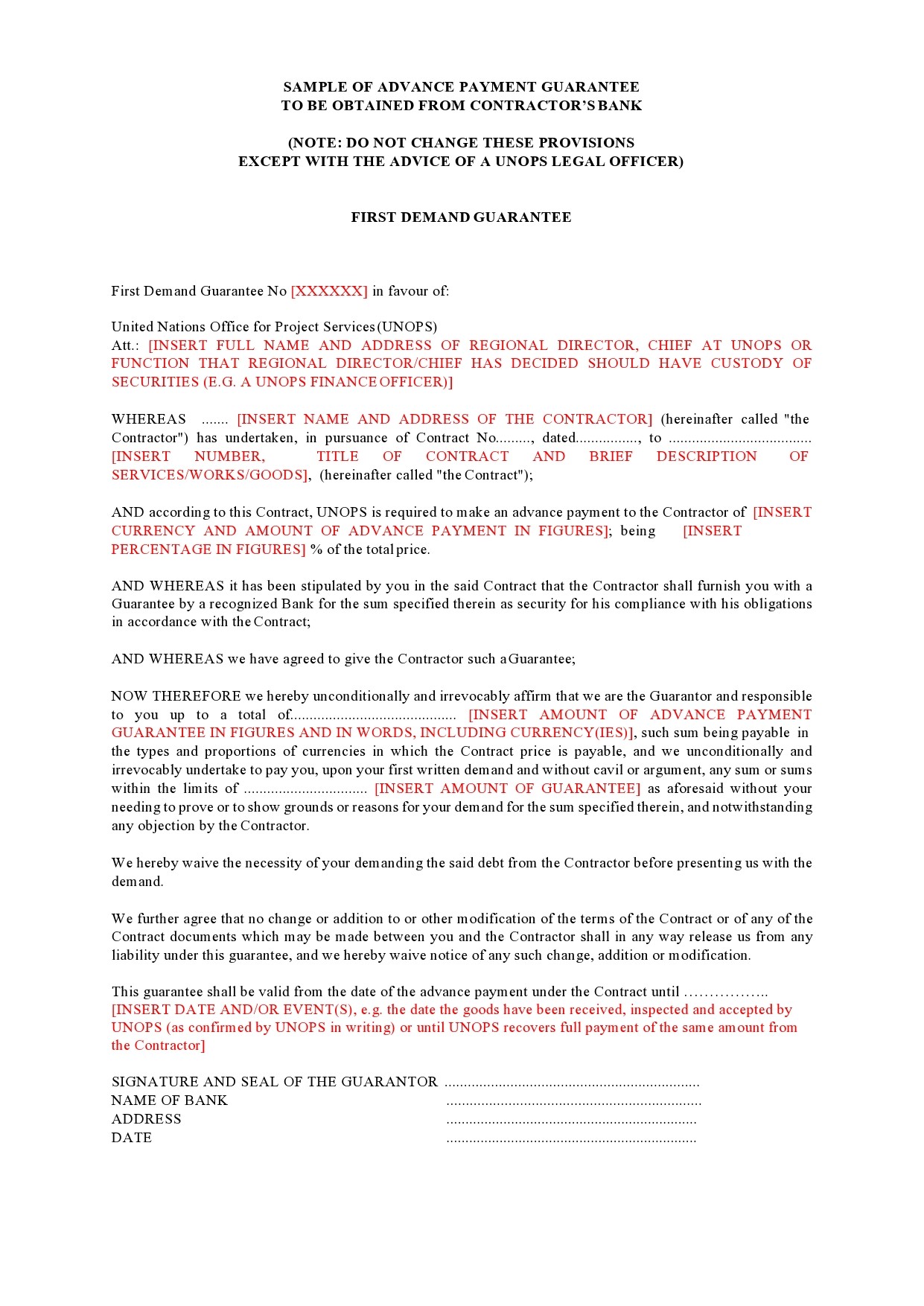

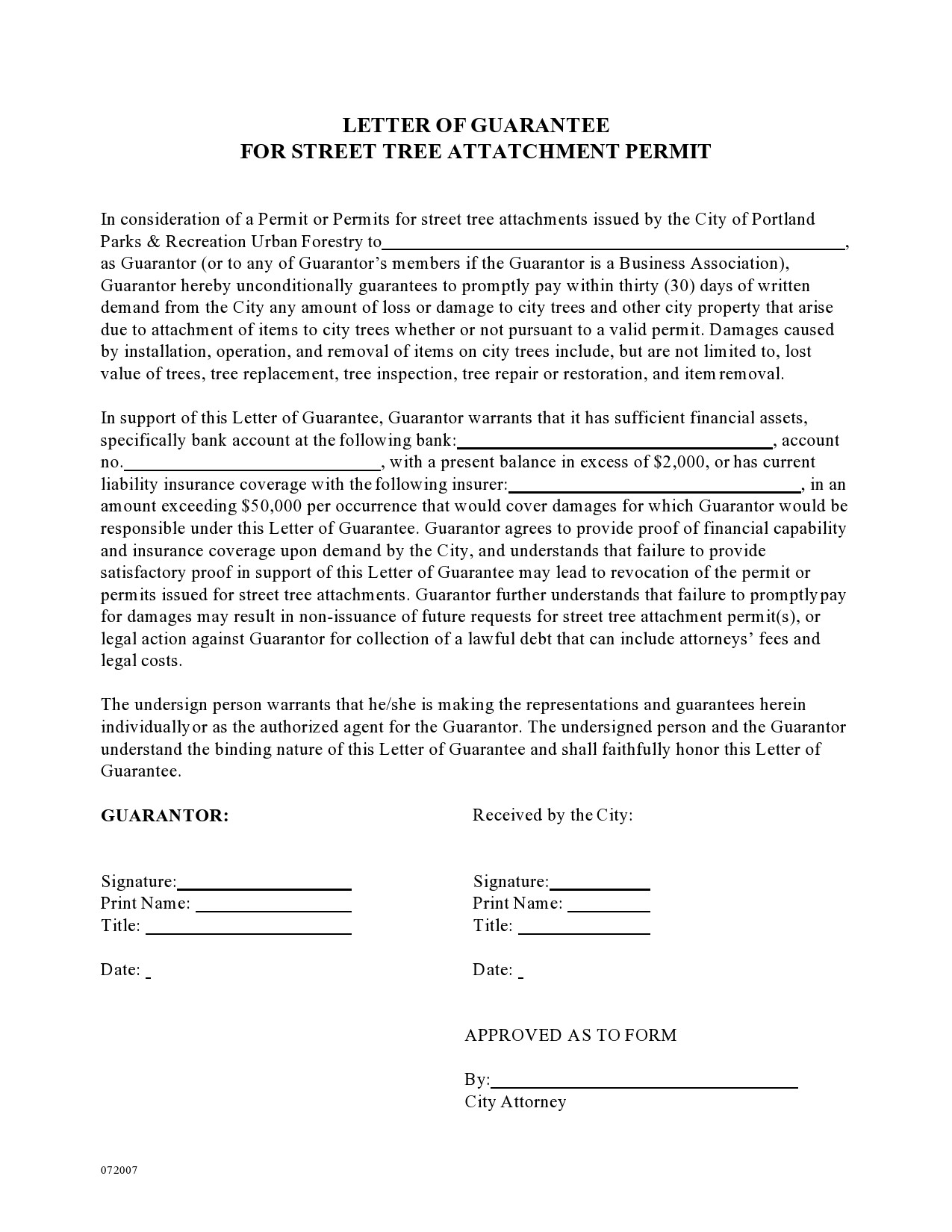

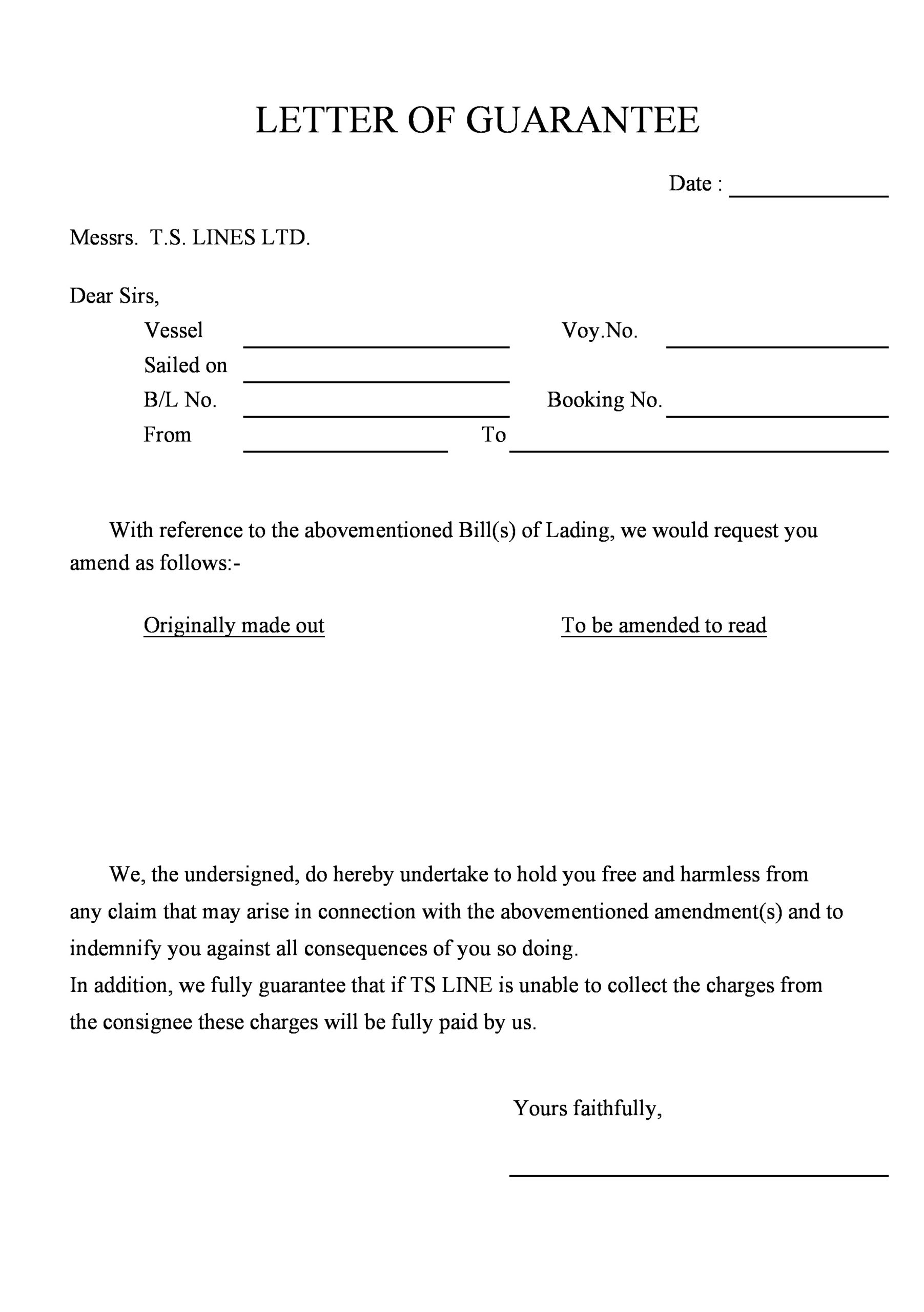

Letter Of Guarantee Samples

What is the difference between letter of credit and letter of guarantee?

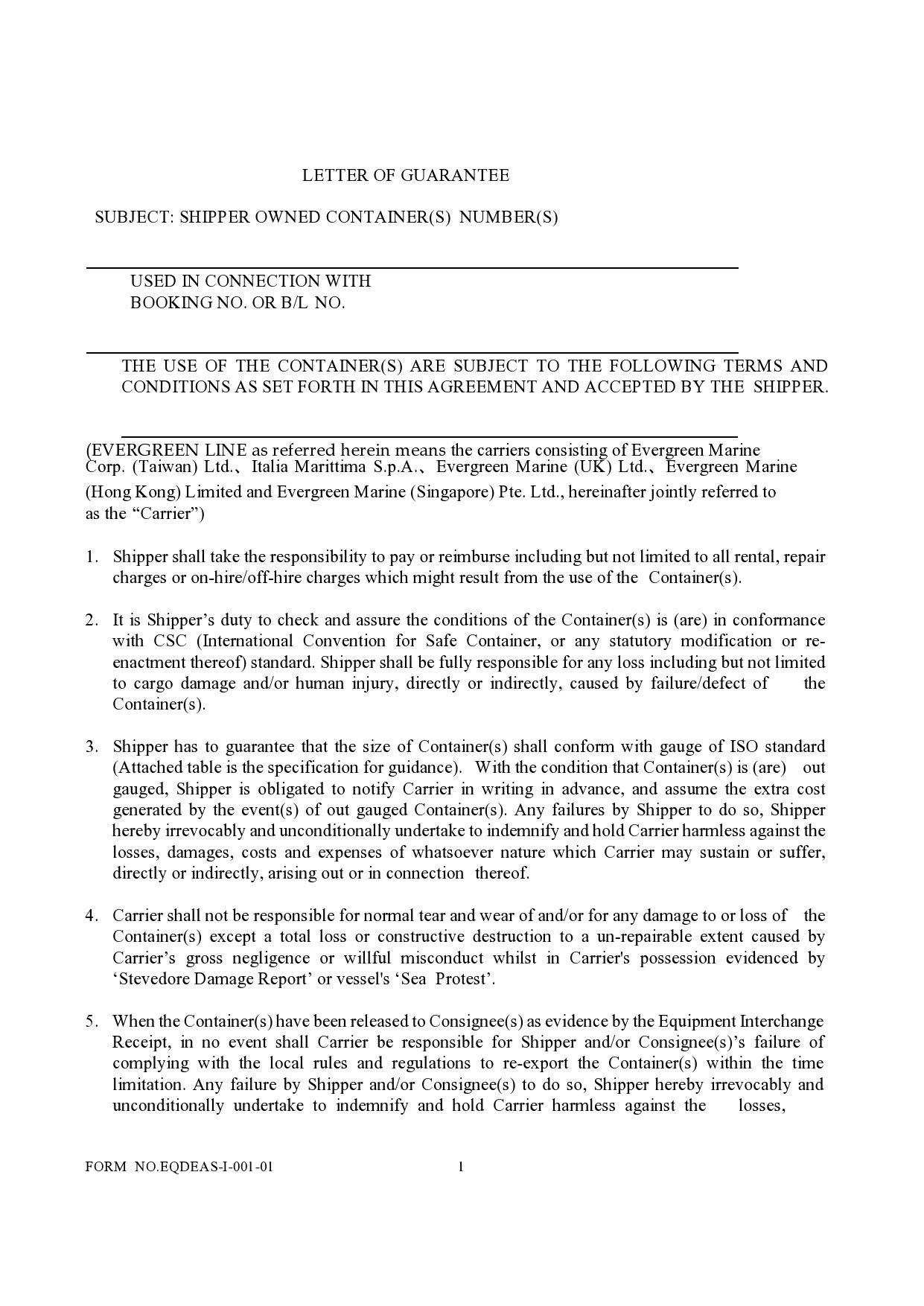

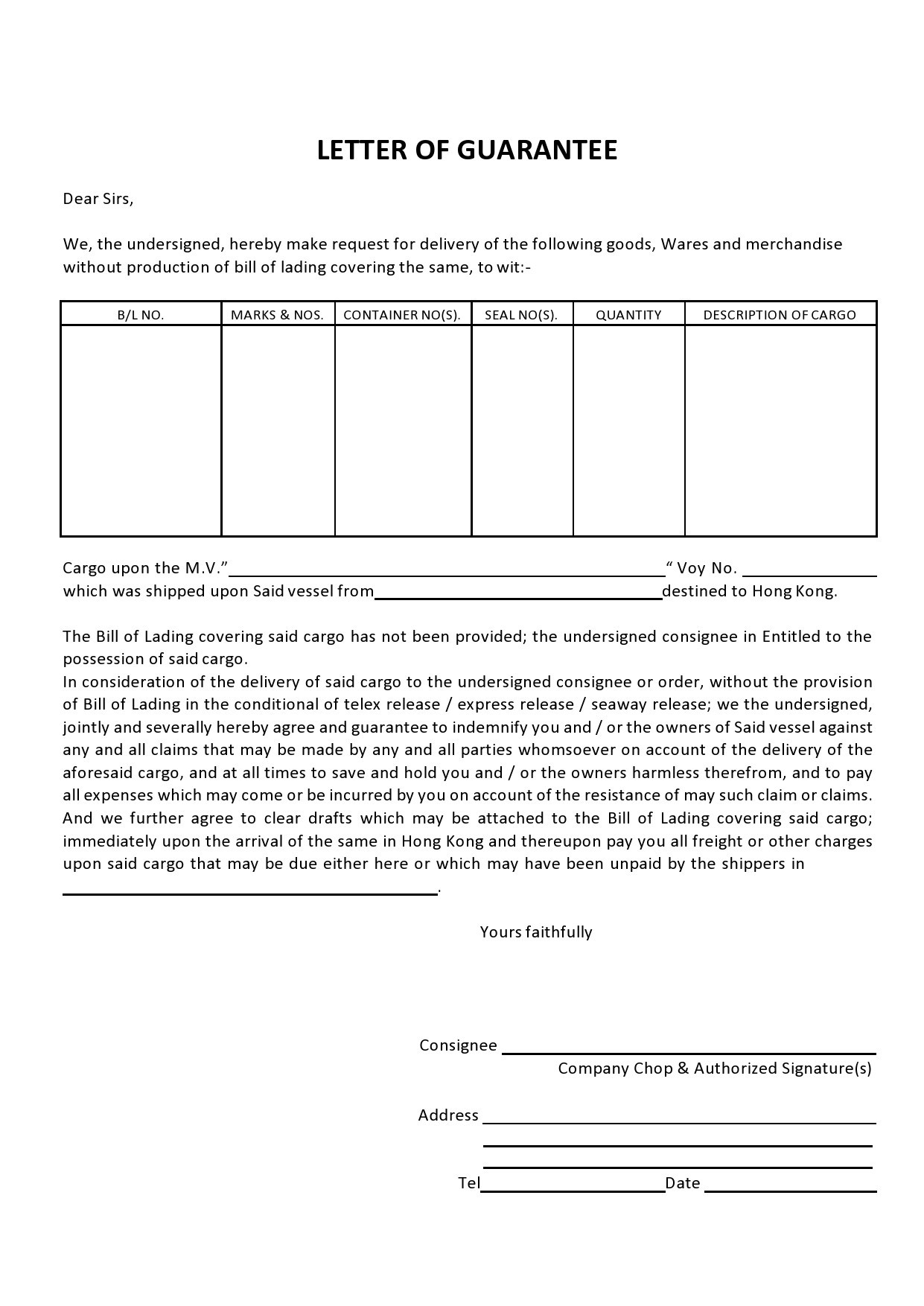

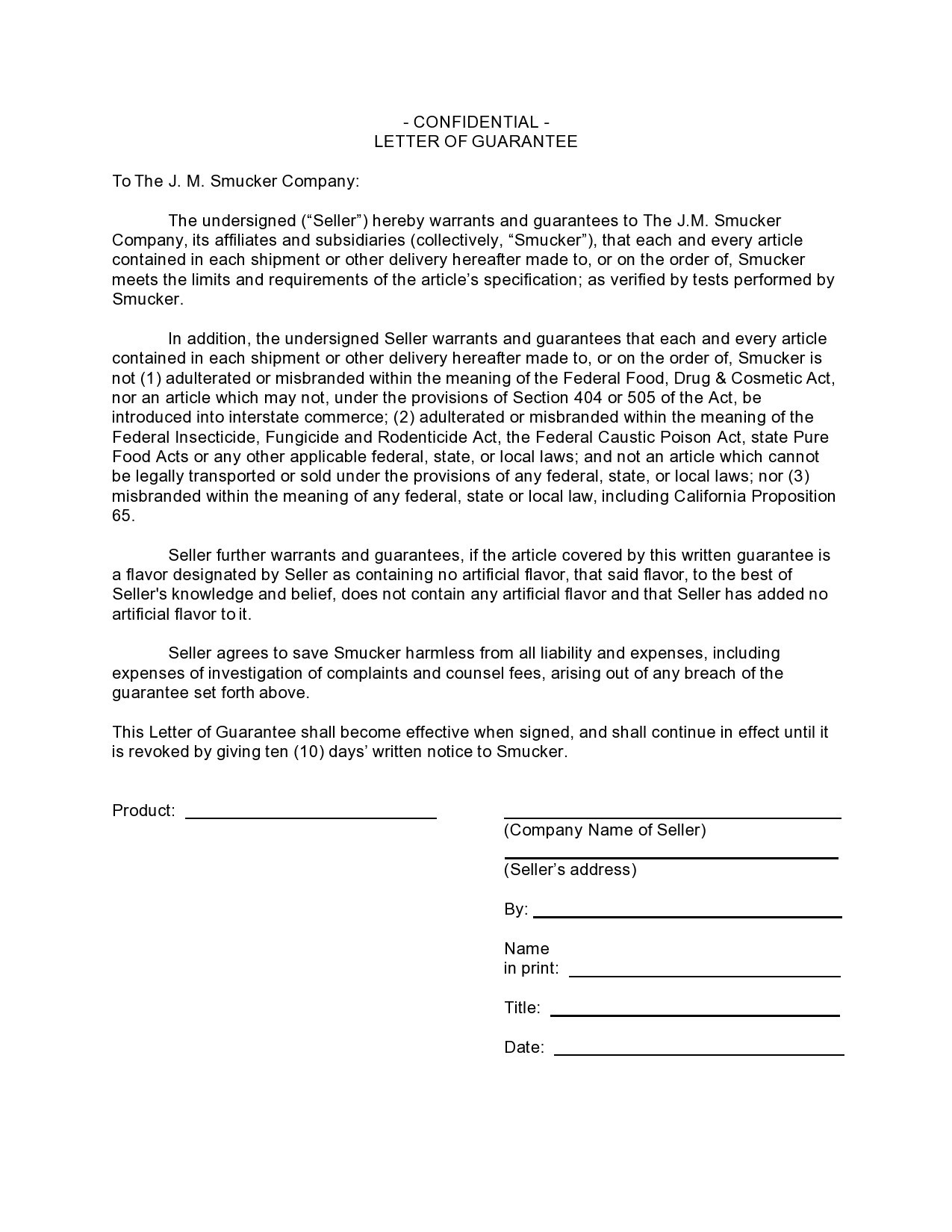

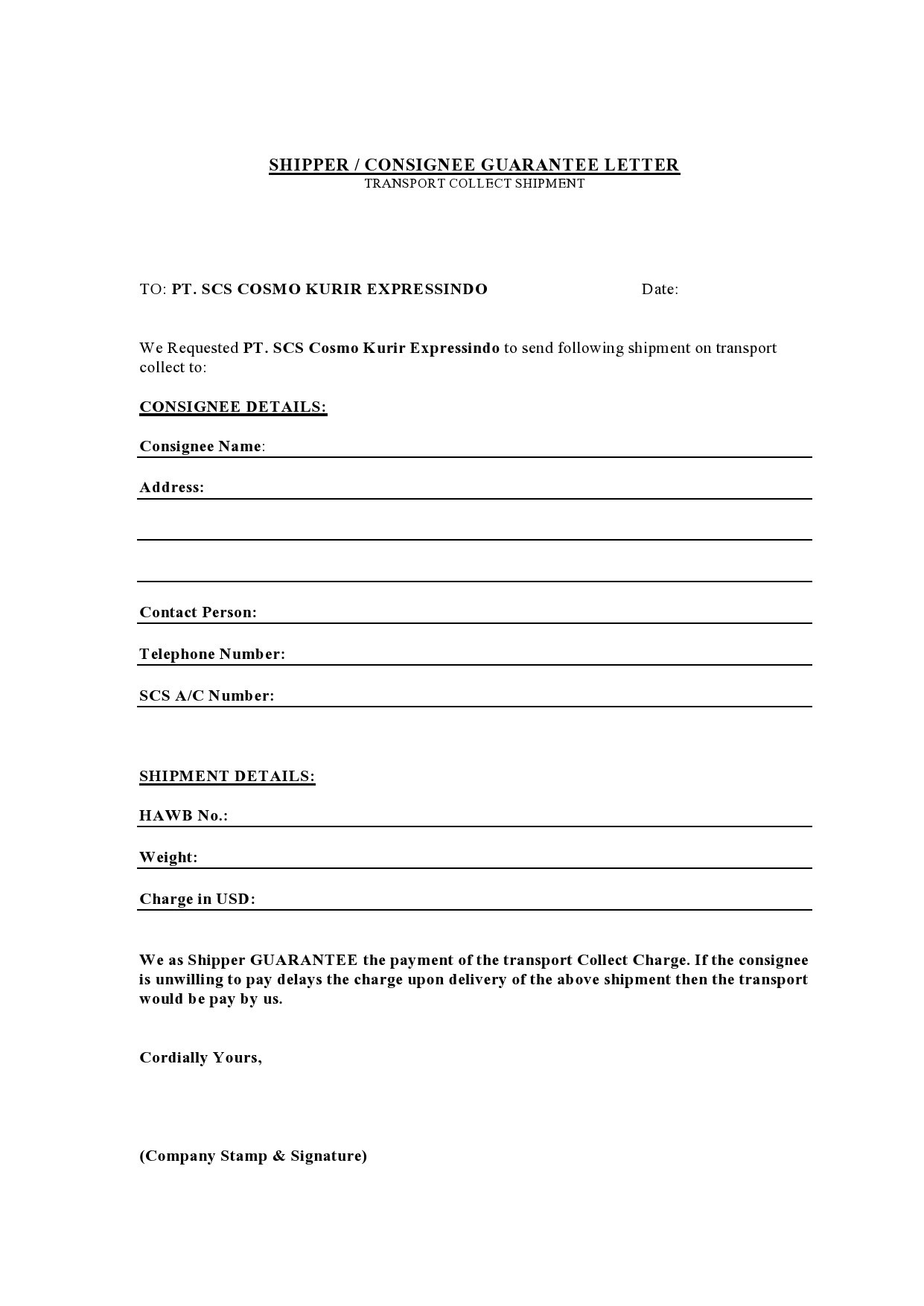

You can use both of these letters in some transactions to force payments. Without these, it may become very difficult for you to receive payments for delivered shipments. The difference between these two letters matters depending on whether you are a receiver or a shipper in the transaction.

- Letter of Credit

It often involves a leap of faith when a seller sells products to a customer as they may never know if the customer will pay for the shipment as promised. To be in a safer situation, you as a seller should request a letter of credit from the customer. This requires the customer to go to the bank.

The letter issued by the bank specifies that the bank will pay after you submit the letter and proof of delivery. The purpose of the letter of credit, therefore, would eliminate any financial risk to you since the payment comes from a third party, not the customer. - Letter of Guarantee

This letter acts as a letter of credit except for one important difference – the letter of guarantee pays either party, should either one of you not fulfill the requirements of the transaction. For instance, you have already paid the supplier for a shipment before the goods get delivered and you don’t receive the product.

But before you send your payment, you can ask the supplier for this letter. With this letter, the bank should reimburse you for the product that wasn’t delivered. The purpose of the letter in this example is to entitle you to reimbursement without having to go to court if the supplier cannot provide proof that the goods got delivered.

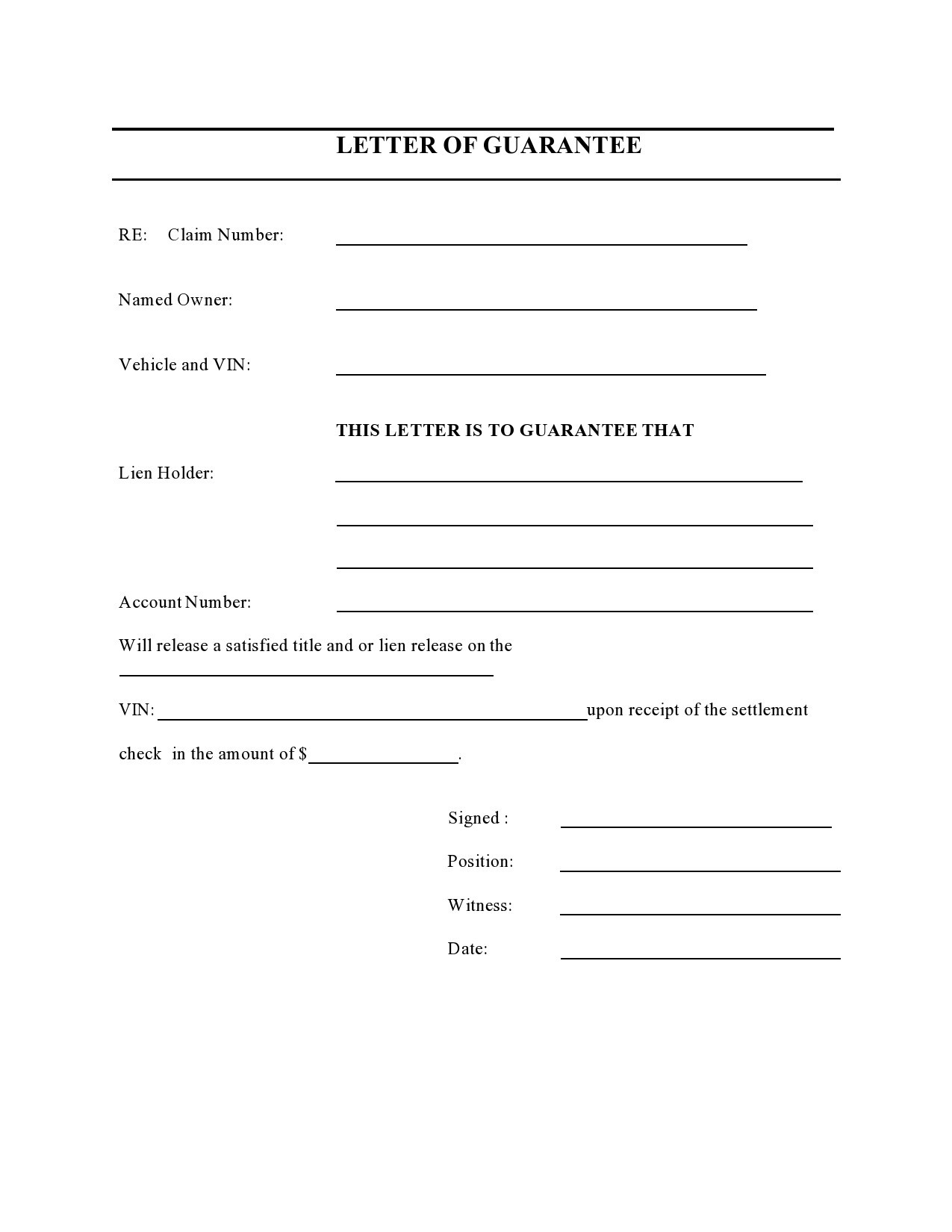

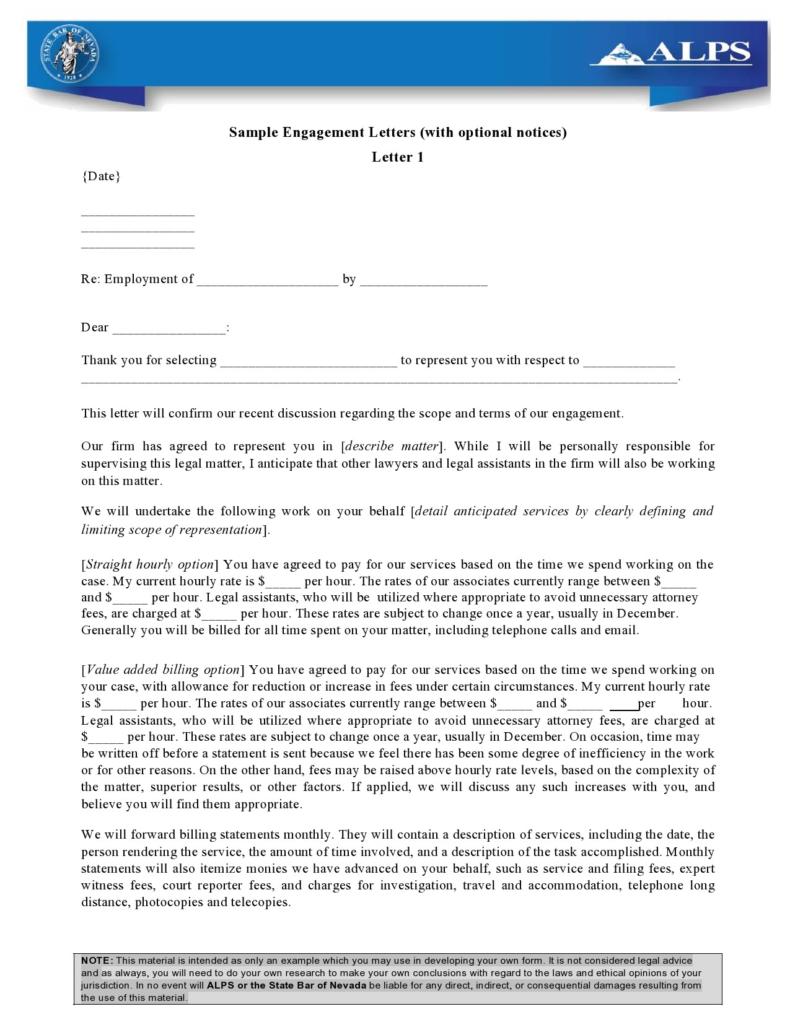

Insurance Letter of Guarantee

How do I write a letter of guarantee?

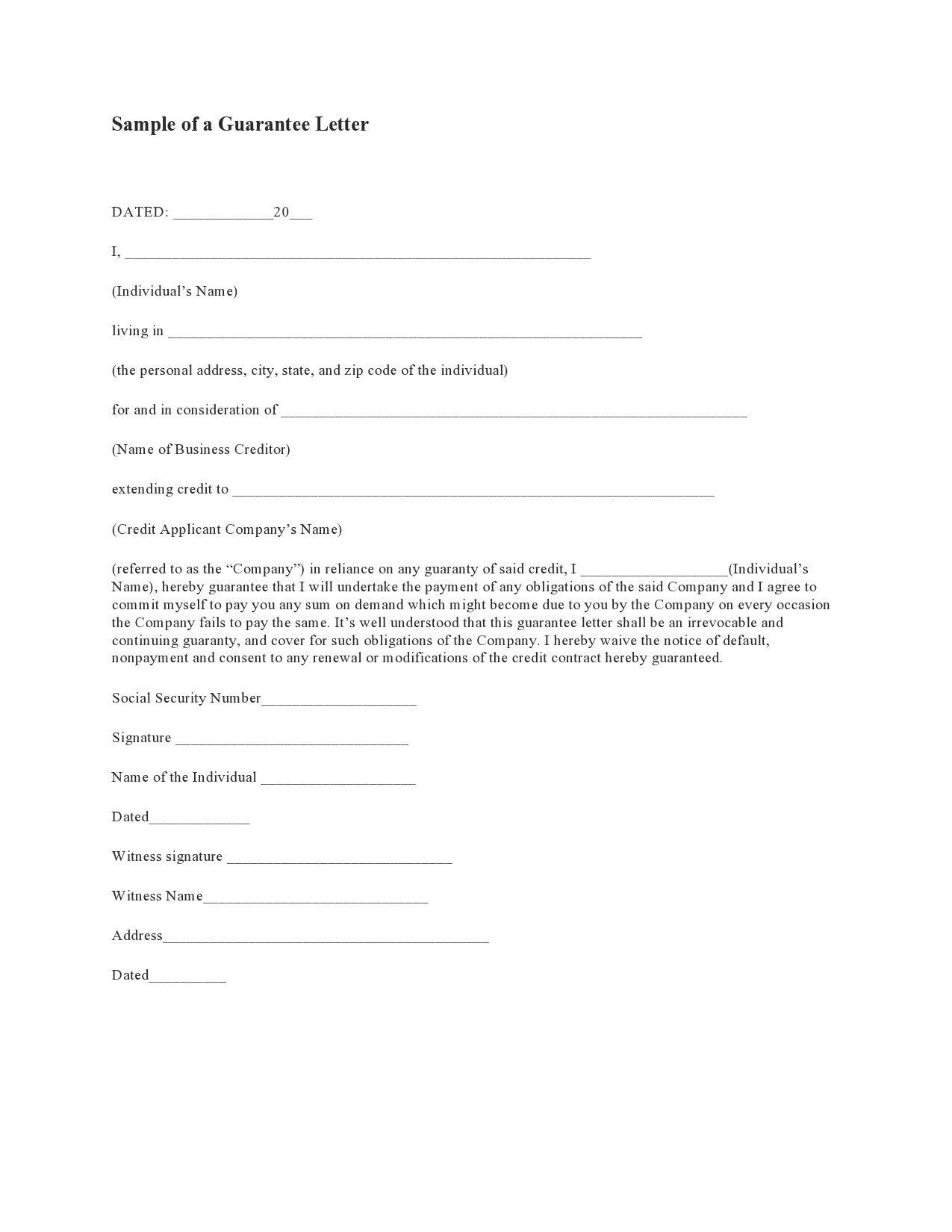

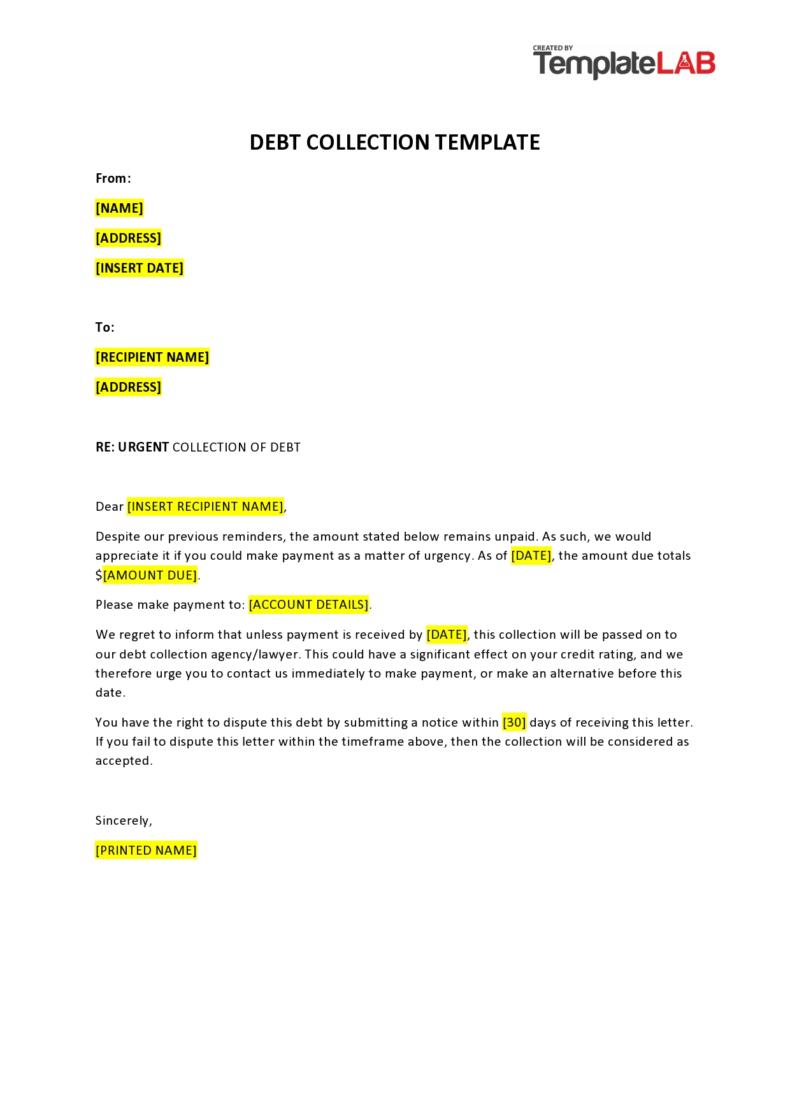

The issuance of a financial guarantee letter means that a business or person will take over the financial responsibility for another person or business, should either party forfeit on an agreement. These letters are commonly used for various financial transactions.

It is essential for you as a guarantor to understand all of the terms you will agree to and that the guarantee letter for payment you create will solidify these terms in writing. When you submit this on another’s behalf, this is like making a significant financial commitment. Here are the steps for writing a letter of guarantee:

- Reviewing your agreement

You need to feel comfortable with the terms before you agree to compose the letter. Request a copy of the agreement so you can evaluate the risks involved when guaranteeing a financial transaction. You should study very well whether or not you can actually afford to pay the debt should the person you’re guaranteeing defaults on his payments.

You may have to meet and speak with the institution requiring your guarantee. Meeting them would be the best time to ask any questions or clarifications you might have about the terms of the agreement. This ensures that you won’t get yourself into a risky financial situation in the future.

Meeting them is a good opportunity to negotiate the terms of the agreement. If you wouldn’t want to take any financial responsibility for the agreement as is, it won’t hurt to try to negotiate the conditions you don’t agree with. - Formatting your letter

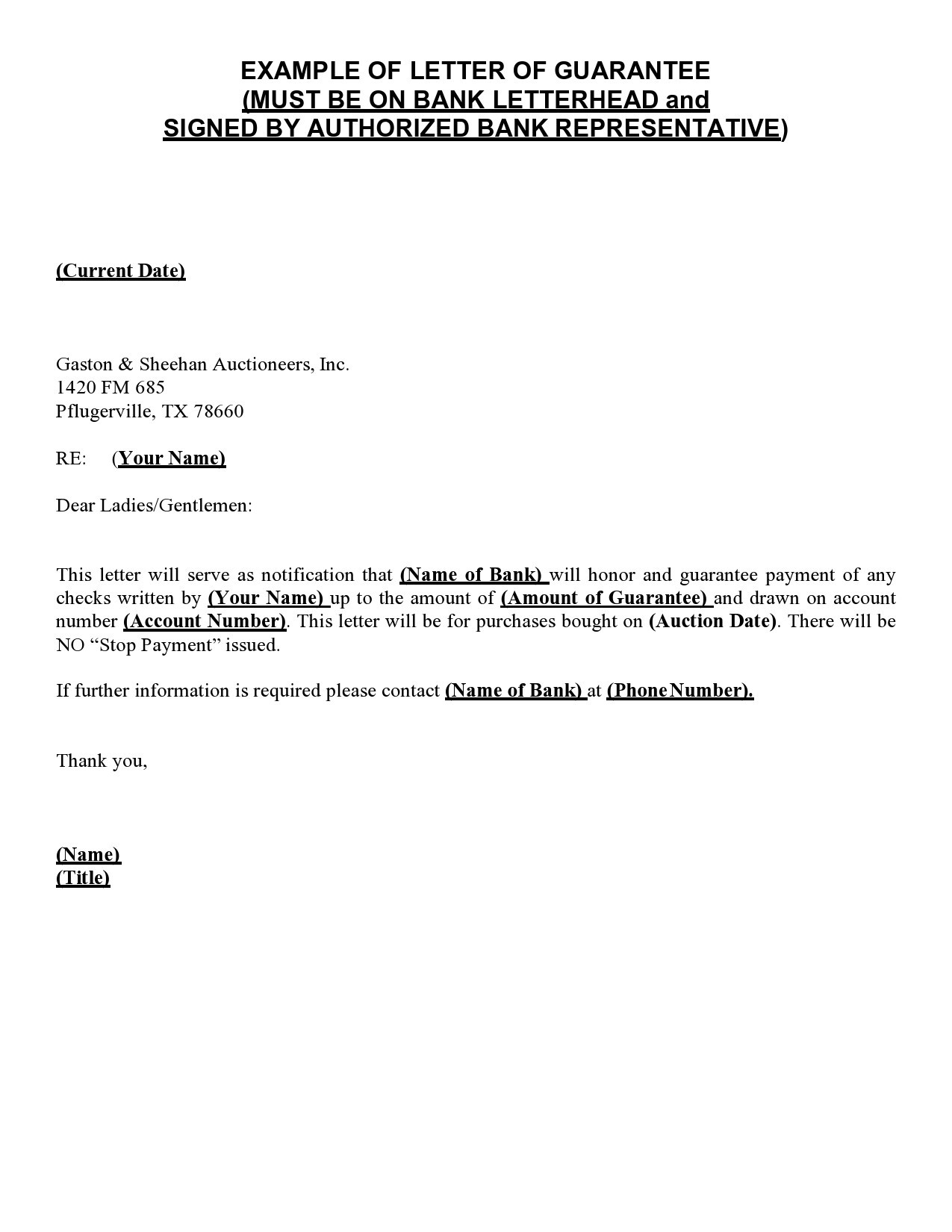

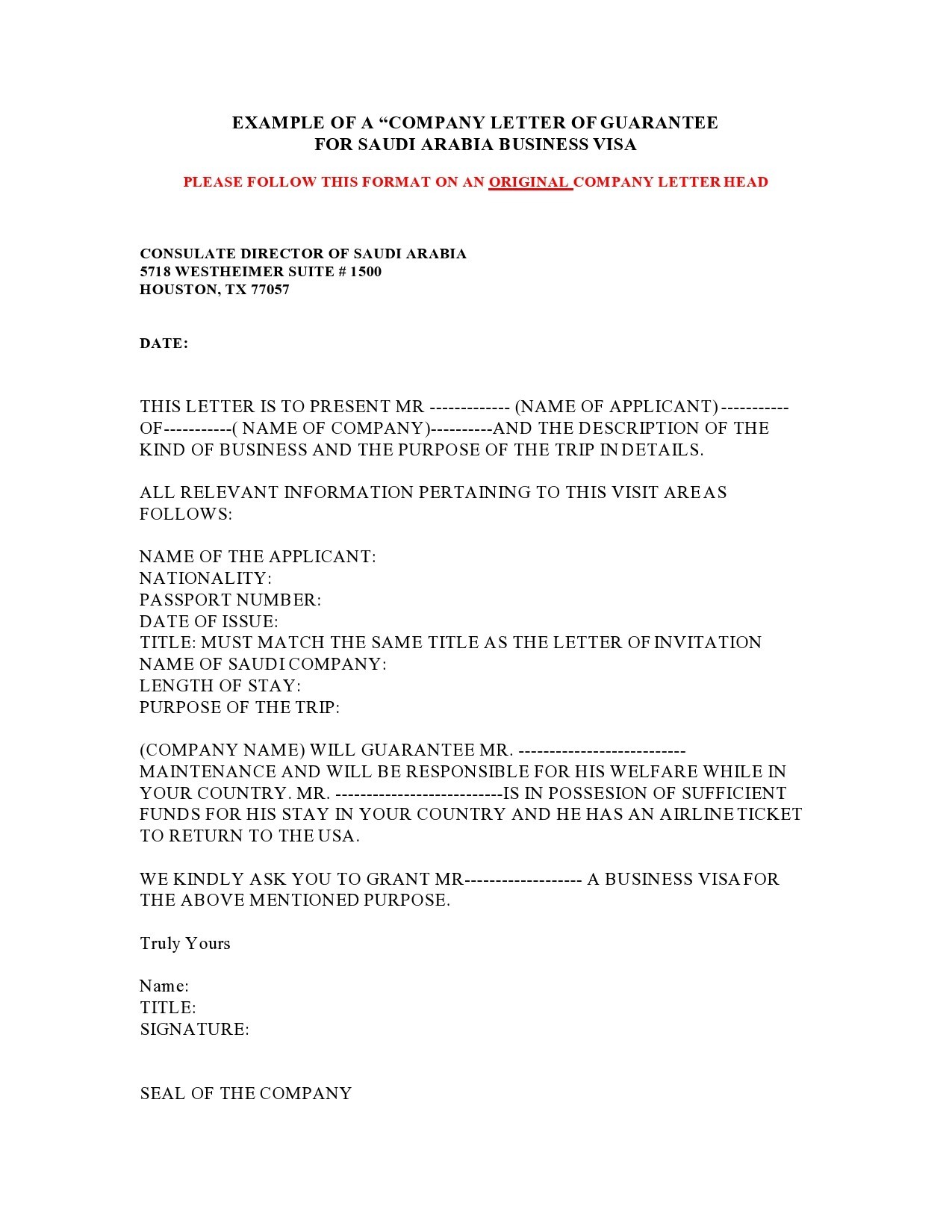

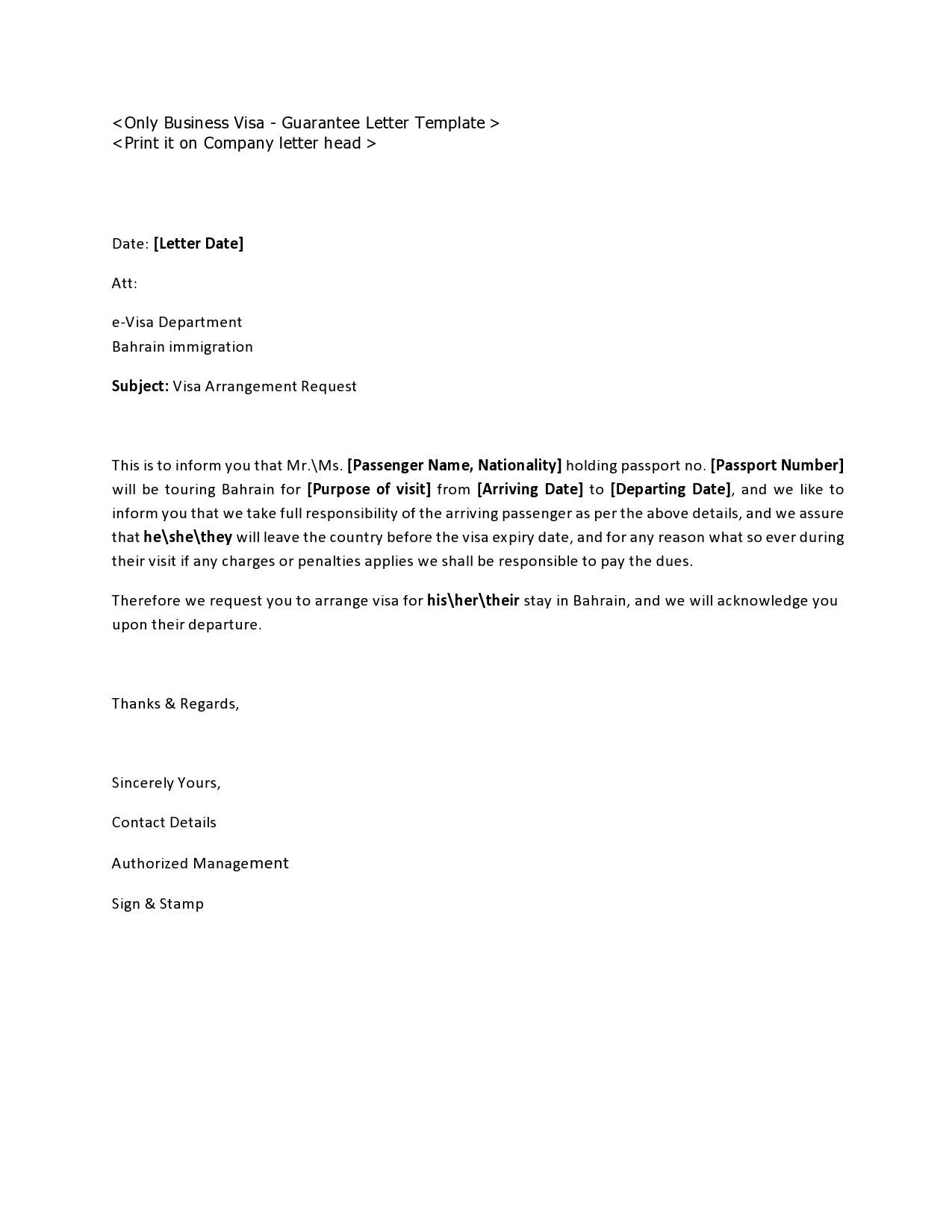

It’s recommended that you type the letter instead of writing it down. Using a word processing program, open a new document. Start by entering the date of the letter on either the top right or top left of the document. Also, include your complete name, address, phone number, and email address at the top.

Input in the address of the company requiring your guarantee – not the company officials you have dealt with. Remember to always maintain an official, straightforward, and formal tone throughout your letter. - Writing the content of your letter

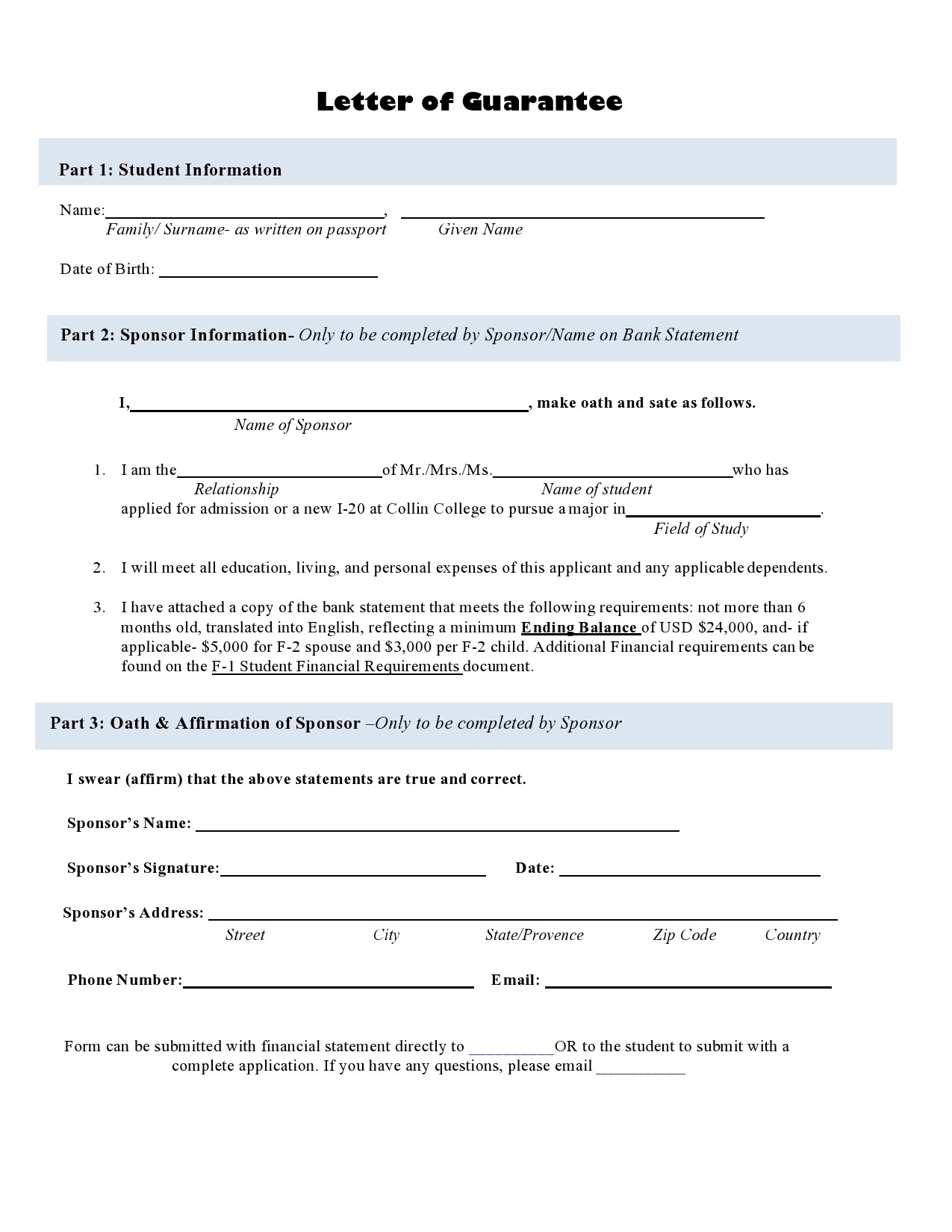

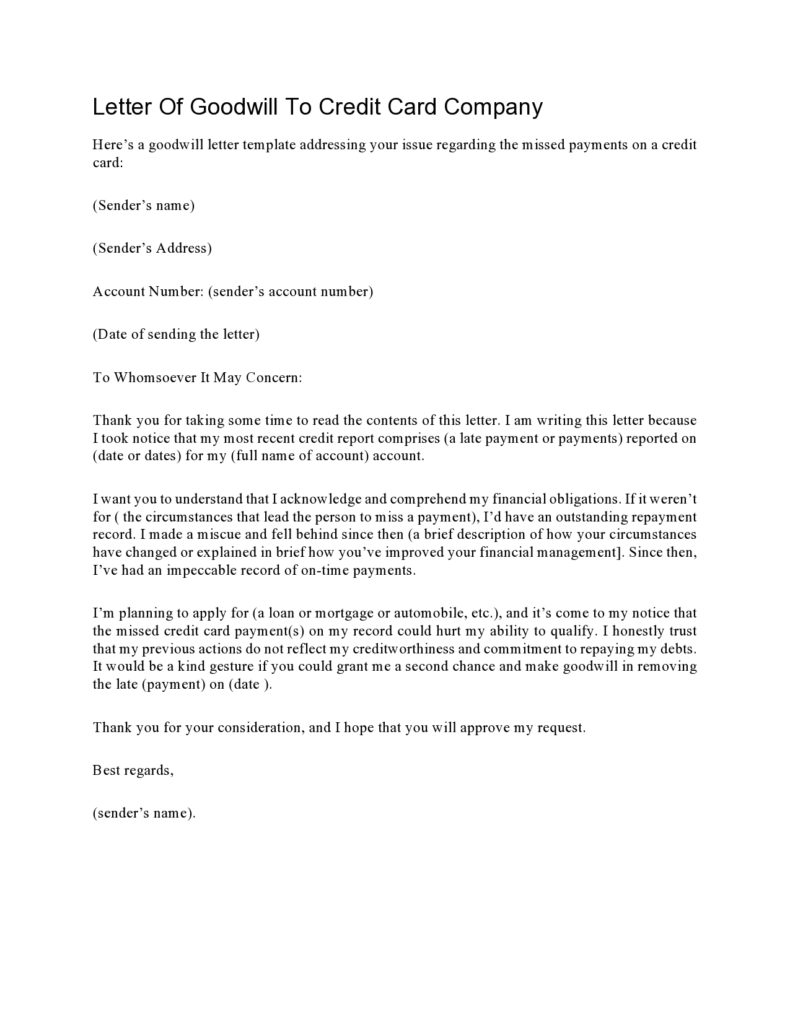

The first paragraph of your letter’s body is where you identify yourself and your relationship to the person you’re guaranteeing. It’s in this section where you will explain to the reader why you’re willing to take on the responsibility on another person’s behalf.

Using your own words, state what you’re guaranteeing, whether it is a house loan, a rental agreement, a business deal, or a visa application. Plainly state what you’re agreeing to as this will be the basis of the terms you’re comfortable with. This will also make it clear to the reader what you have agreed to.

Provide an explanation of why your letter is a necessity. This may be an optional addition to the letter but it can still serve a purpose of clarifying for the reader any special circumstances that you would like to address. Again, just state this in a quick and simple manner to make it effective.

You can conclude your letter by adding a concise and clear statement that summarizes what your letter covers. In the end, state your complete name, the complete name of the person you’re signing for, and the transaction that you will guarantee. For these details, be as specific as possible.

The company may request you to provide additional information and this may include your annual income, bank account number, home address, social security number, date of birth, and more.

You have to be absolutely sure that they need this information before including such details in your letter. Keep in mind that you should practice caution when providing this type of sensitive information and with certainty about the trustworthiness of the institution you’re submitting it to. - Finishing your letter and submitting it

After you have finished writing the letter, make sure that it has no errors, grammar, and spelling-wise. It is also a good idea to ask another person to proofread the letter first in case you missed any errors. If possible, have a professional proofread it so that you can feel confident when you submit.

You should print this letter on a company or personal letterhead. For a bank guarantee letter, this is necessary. Even if you’re not from a bank, a letterhead looks more professional for any type of letter.

You will also need the services of a notary public who will witness your signature, then place their signature and stamp in the letter. You have to wait before signing and dating your letter by hand and in the presence of the notary public.

Leave some space in your letter for the notary’s signature and stamp when formatting the letter. Lastly, make copies of the letter for yourself before submitting it. This is very important so you can always refer to it to know what you have actually agreed to.