For most people, credit reports are the basis for judgment on how they deal with their financial affairs. It’s very important to maintain a good credit standing since any negative remarks in your report can affect your relationship with creditors. Should you get any negative remarks, you may ask your creditors to remove these by writing a goodwill letter example. Creditors don’t have an obligation to remove accurate negative items since they have internal agreements or policies with the credit bureau. But you can still write this letter to help improve your credit report.

Table of Contents

- 1 Goodwill Letter Templates

- 2 What is a goodwill letter?

- 3 Late Payment Removal Letters

- 4 Why do you need a goodwill letter?

- 5 When do you need this letter?

- 6 Goodwill Adjustment Letters

- 7 What to include in a goodwill letter?

- 8 Pros and cons of a goodwill letter

- 9 How do you write a successful goodwill letter?

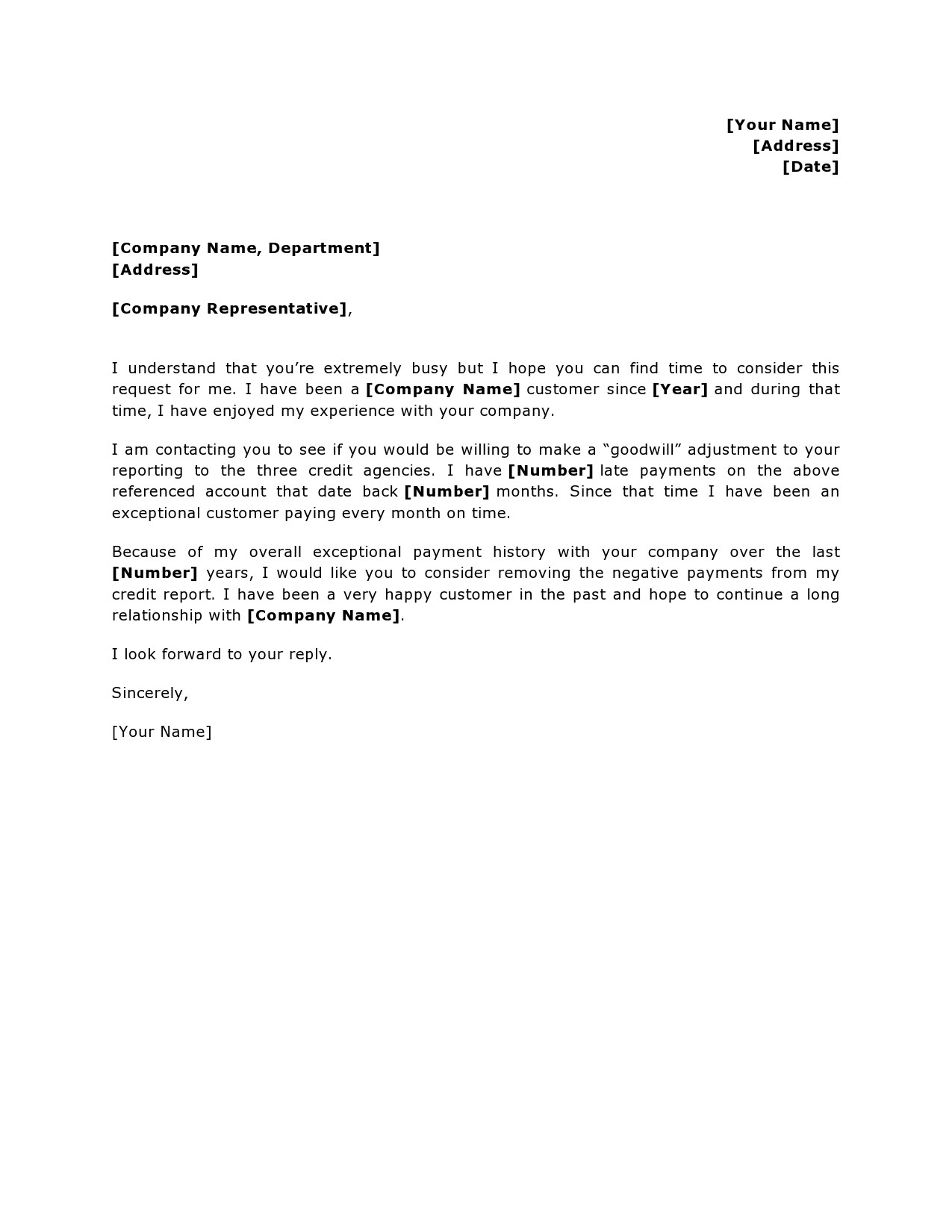

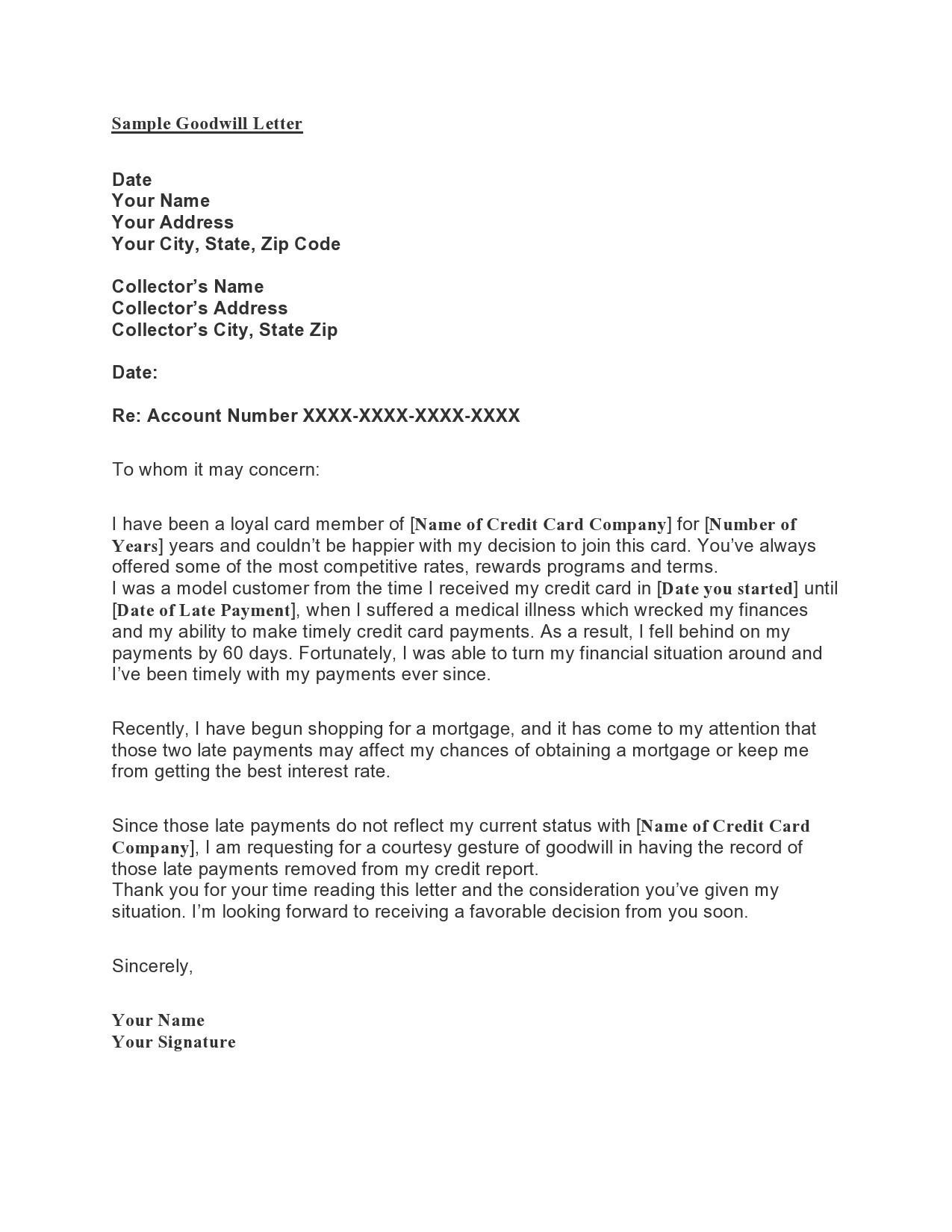

- 10 Goodwill Letters To Creditor

- 11 Can you email a goodwill letter?

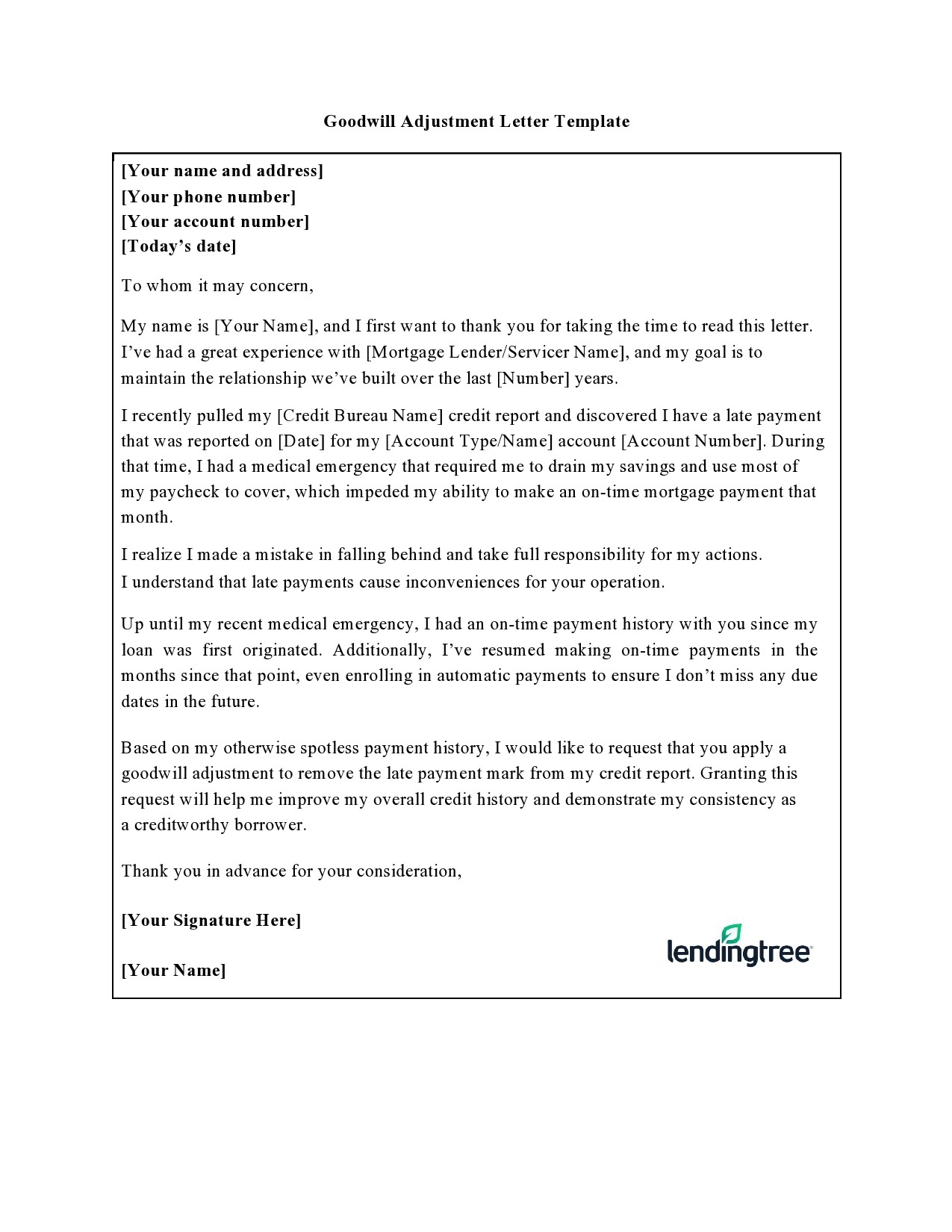

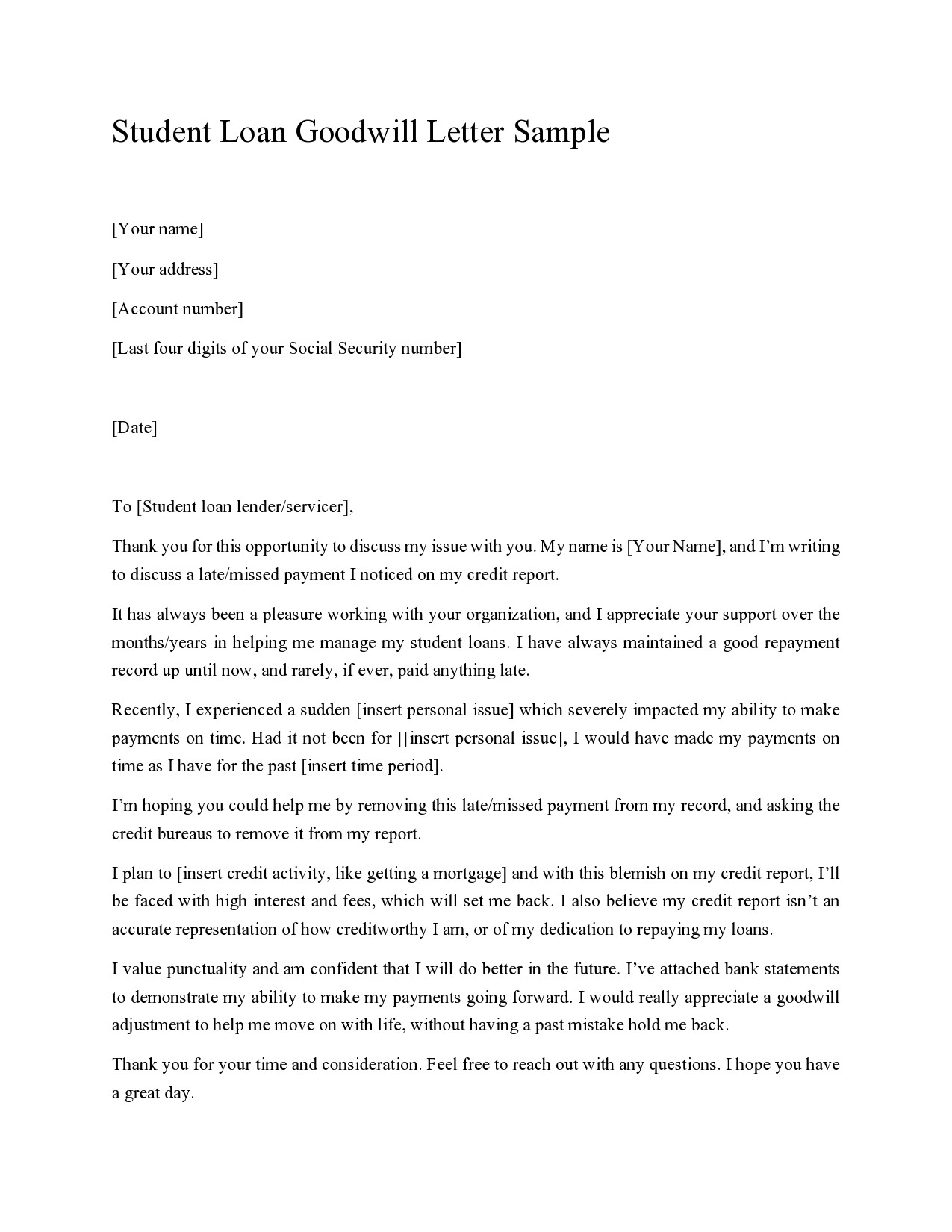

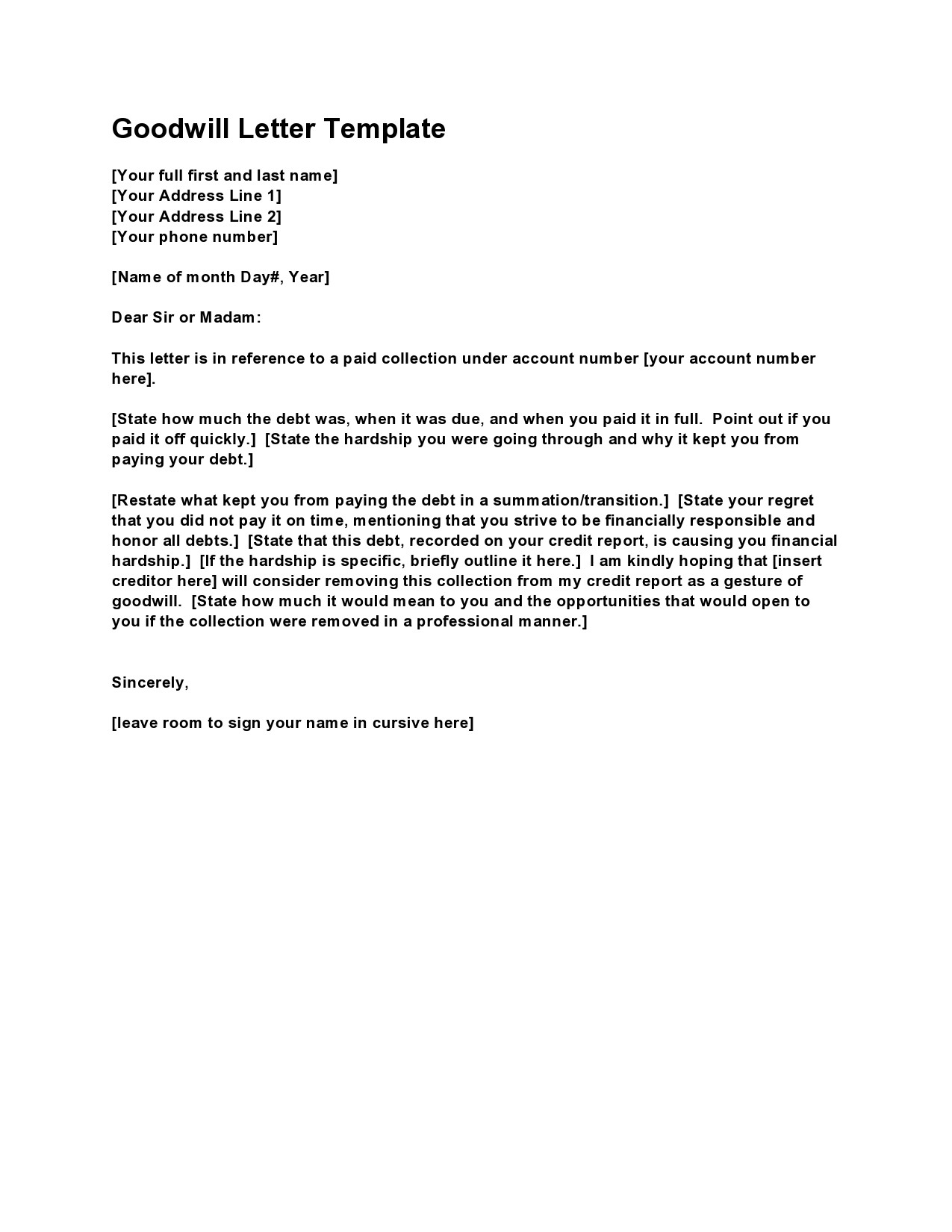

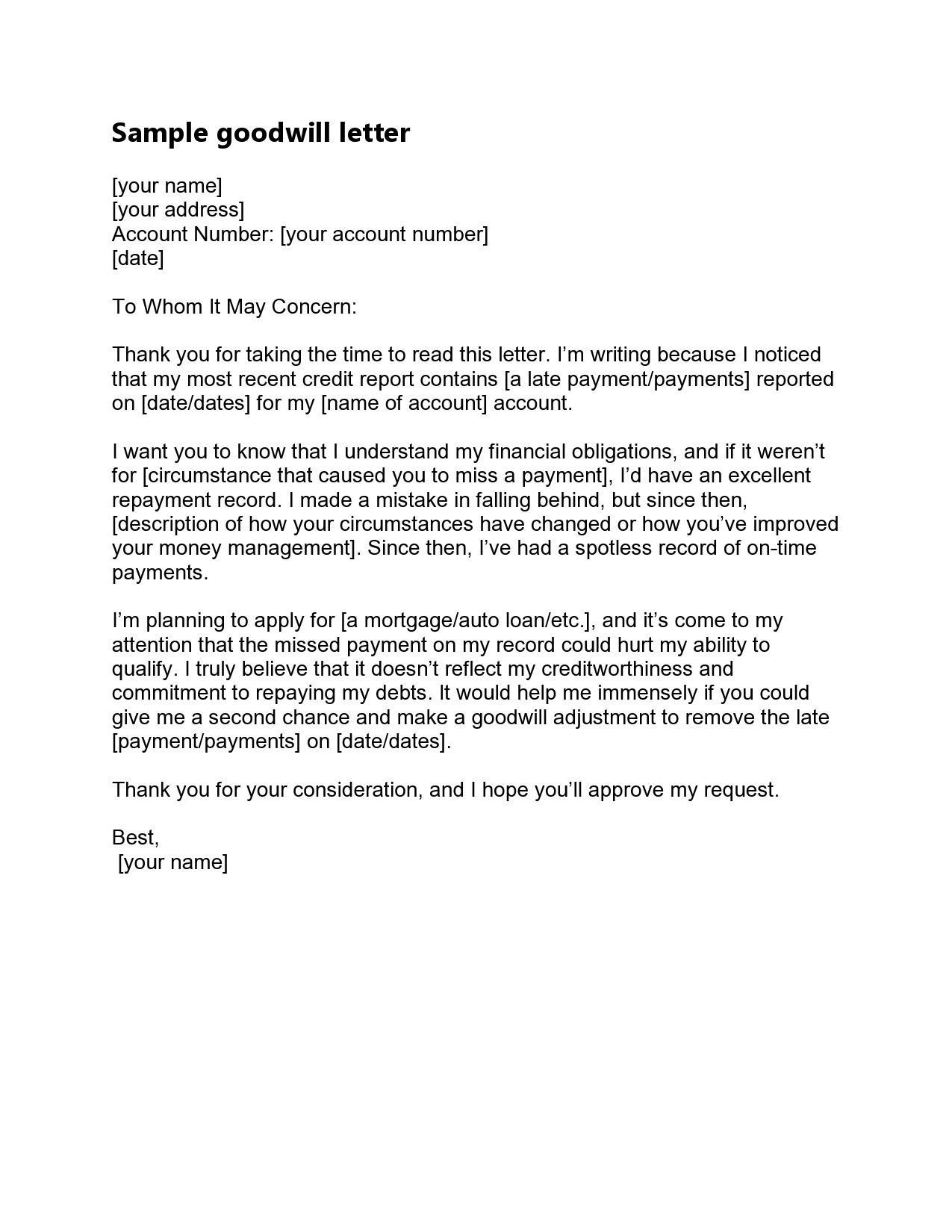

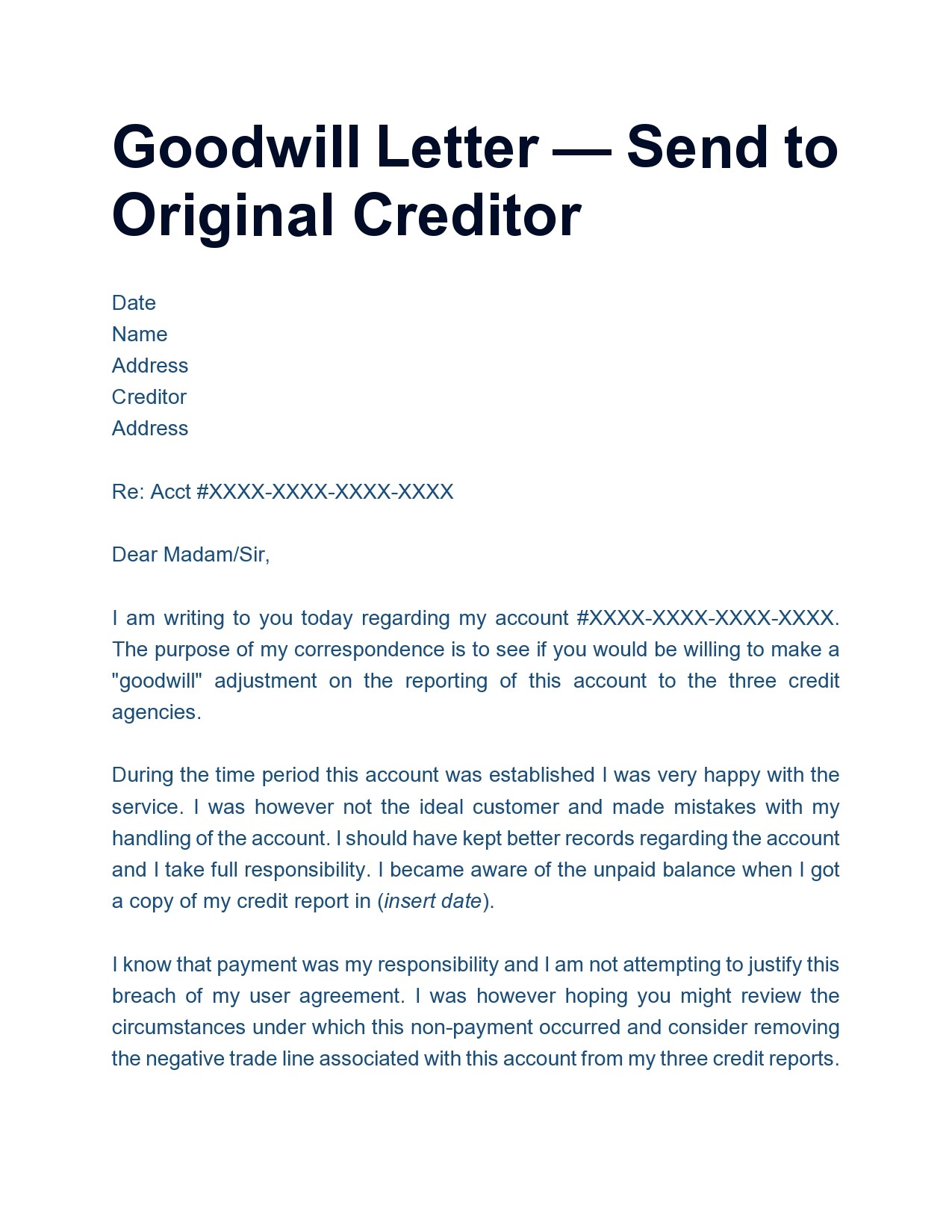

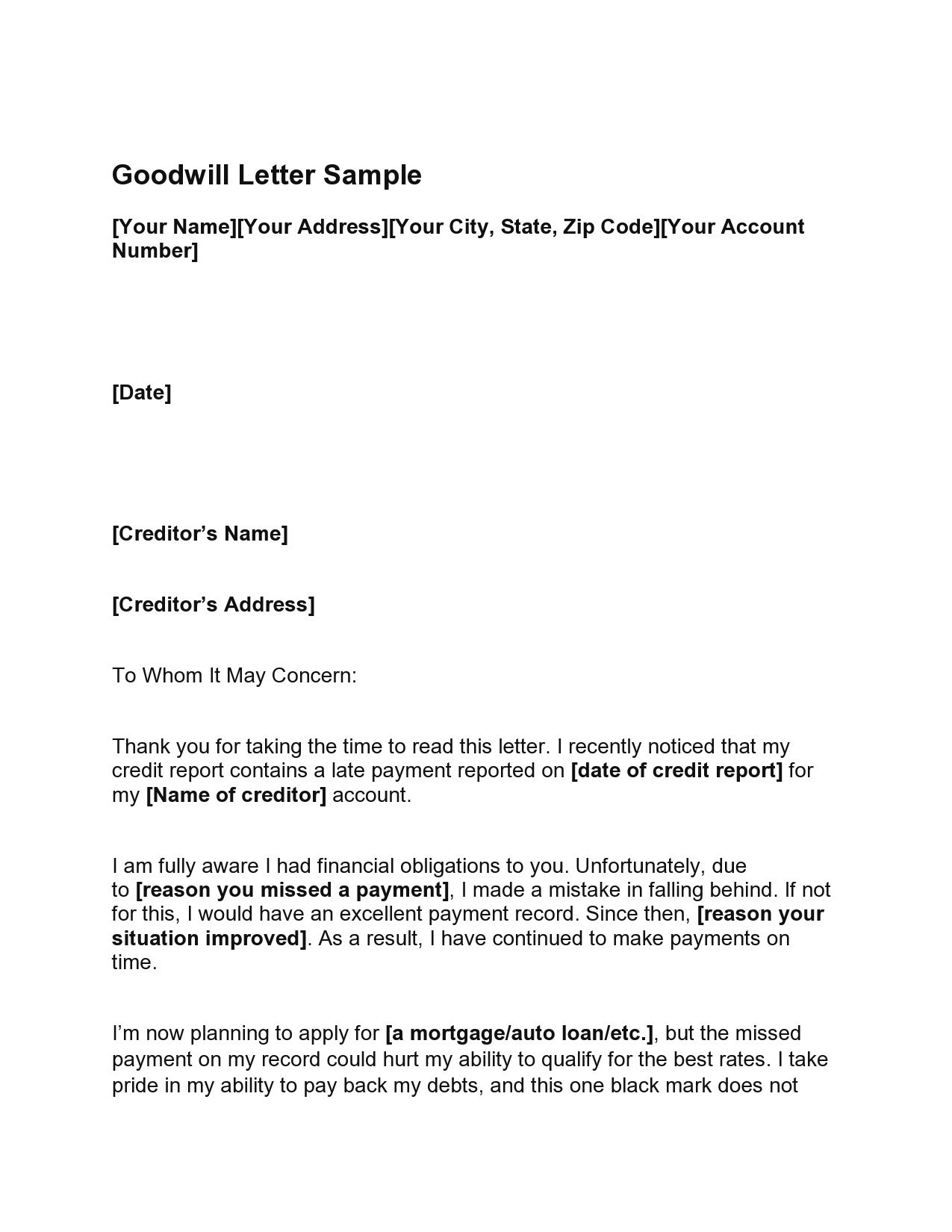

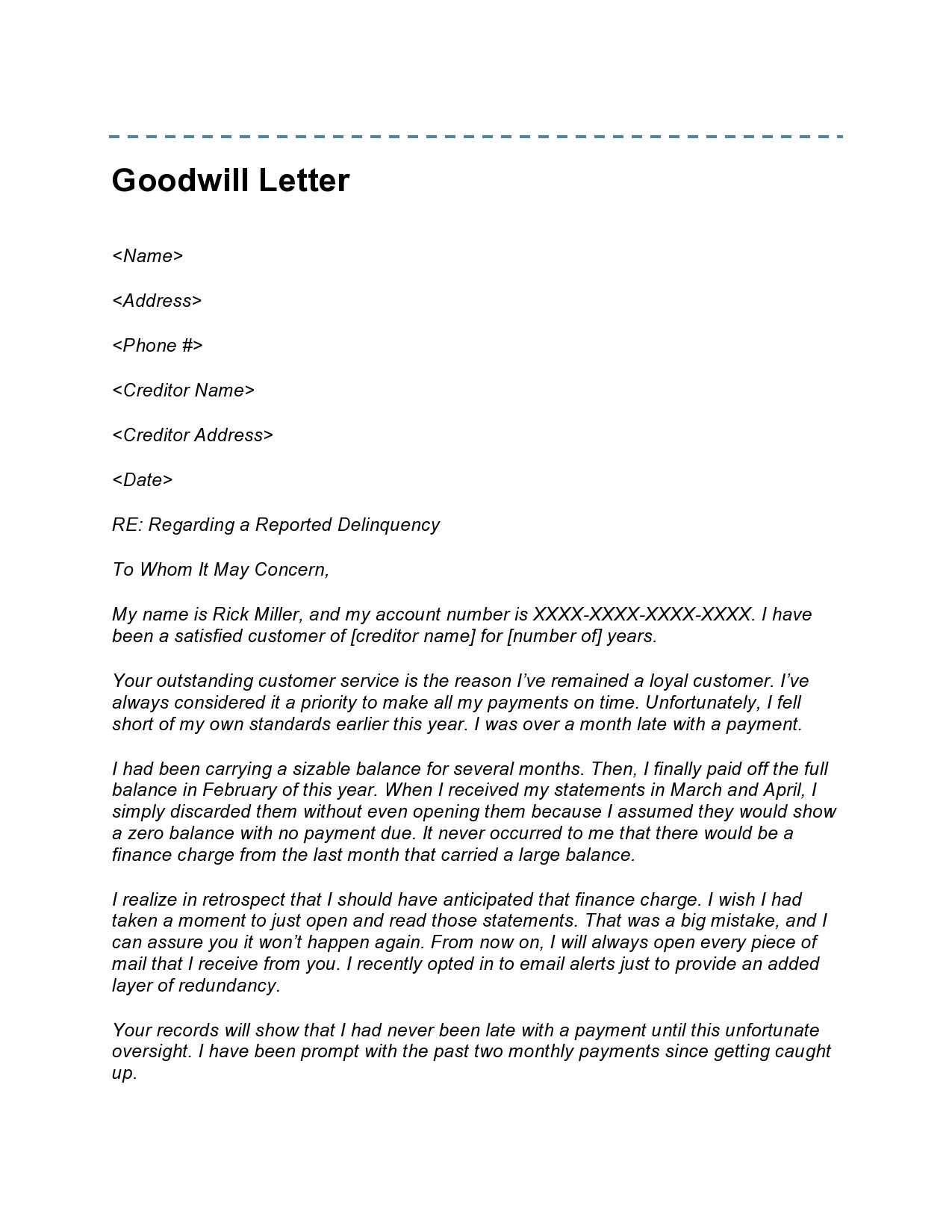

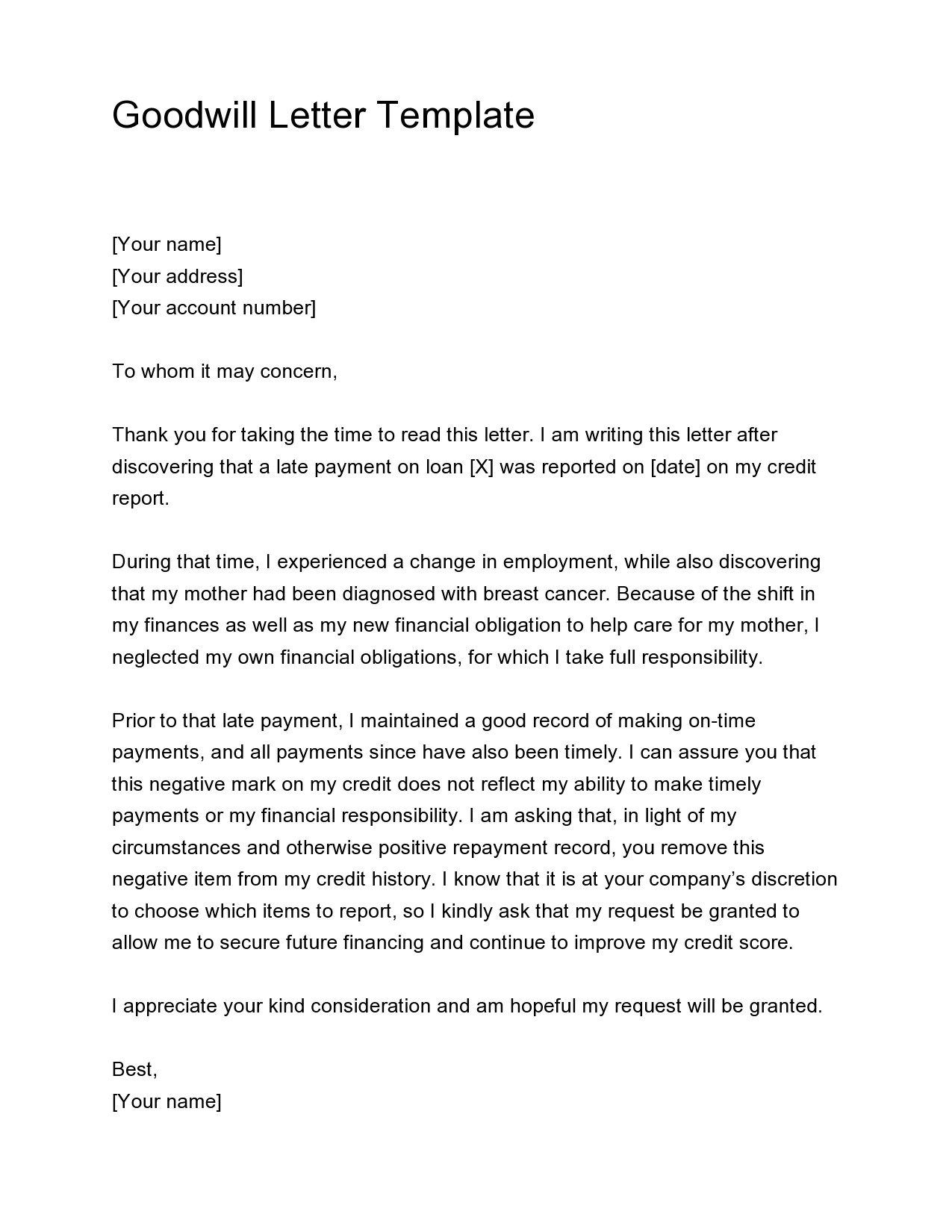

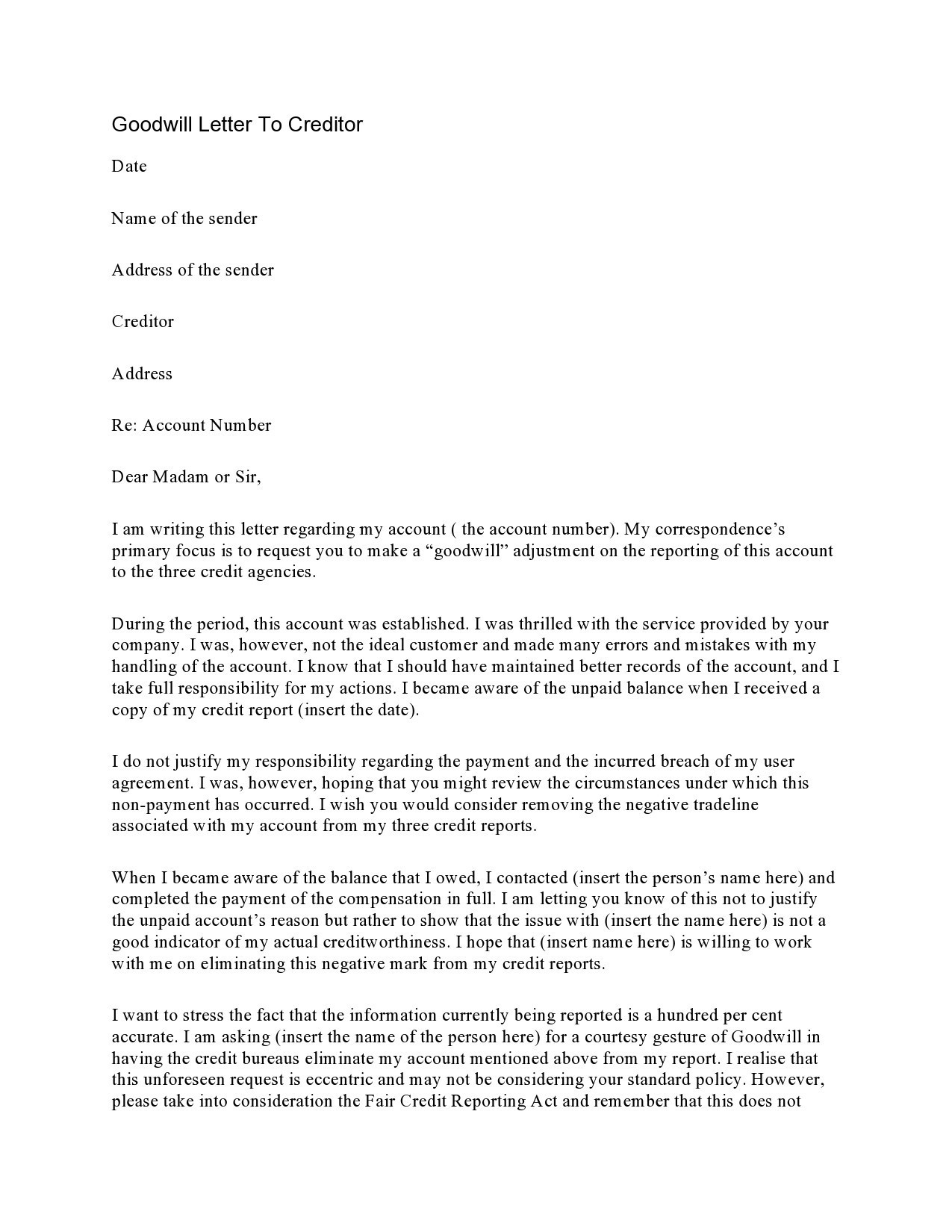

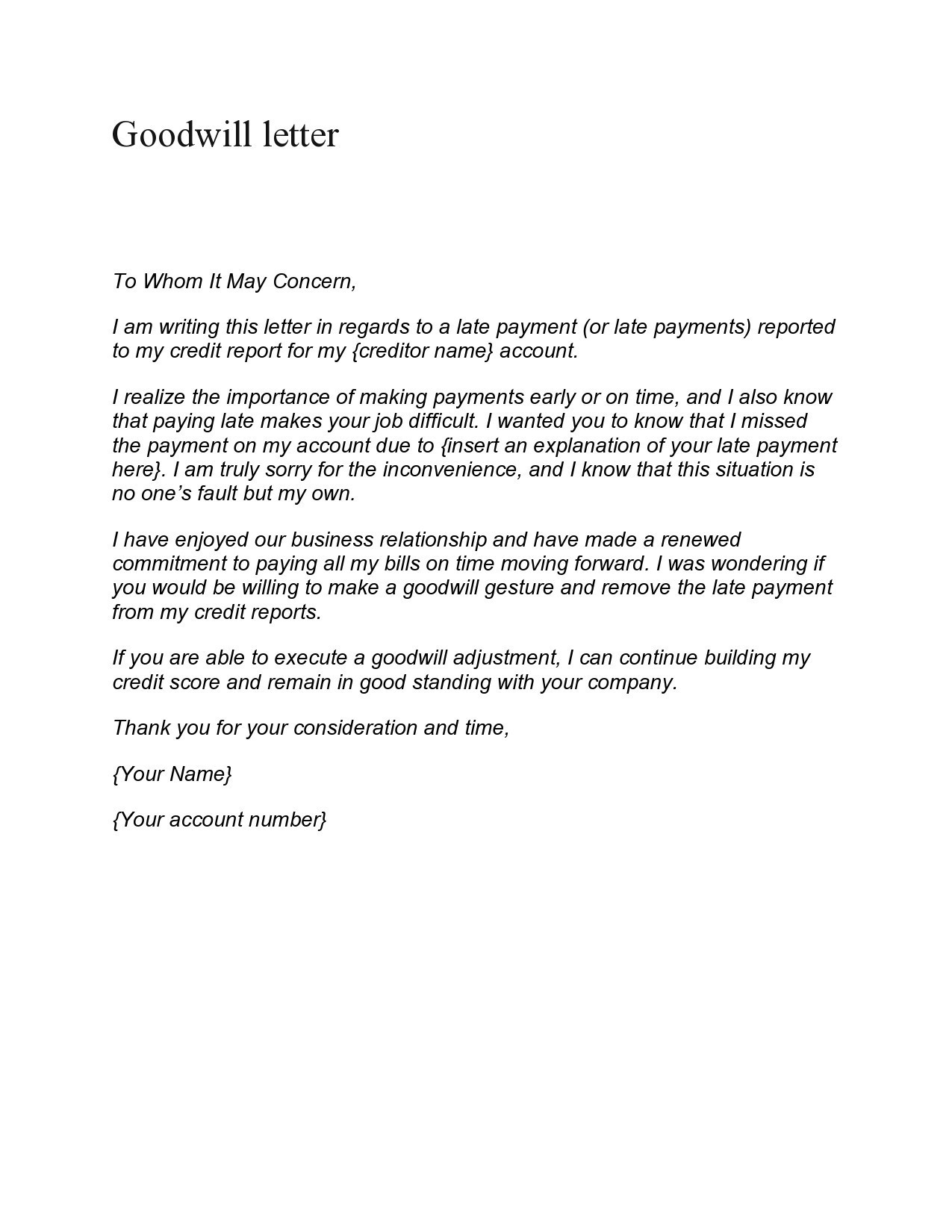

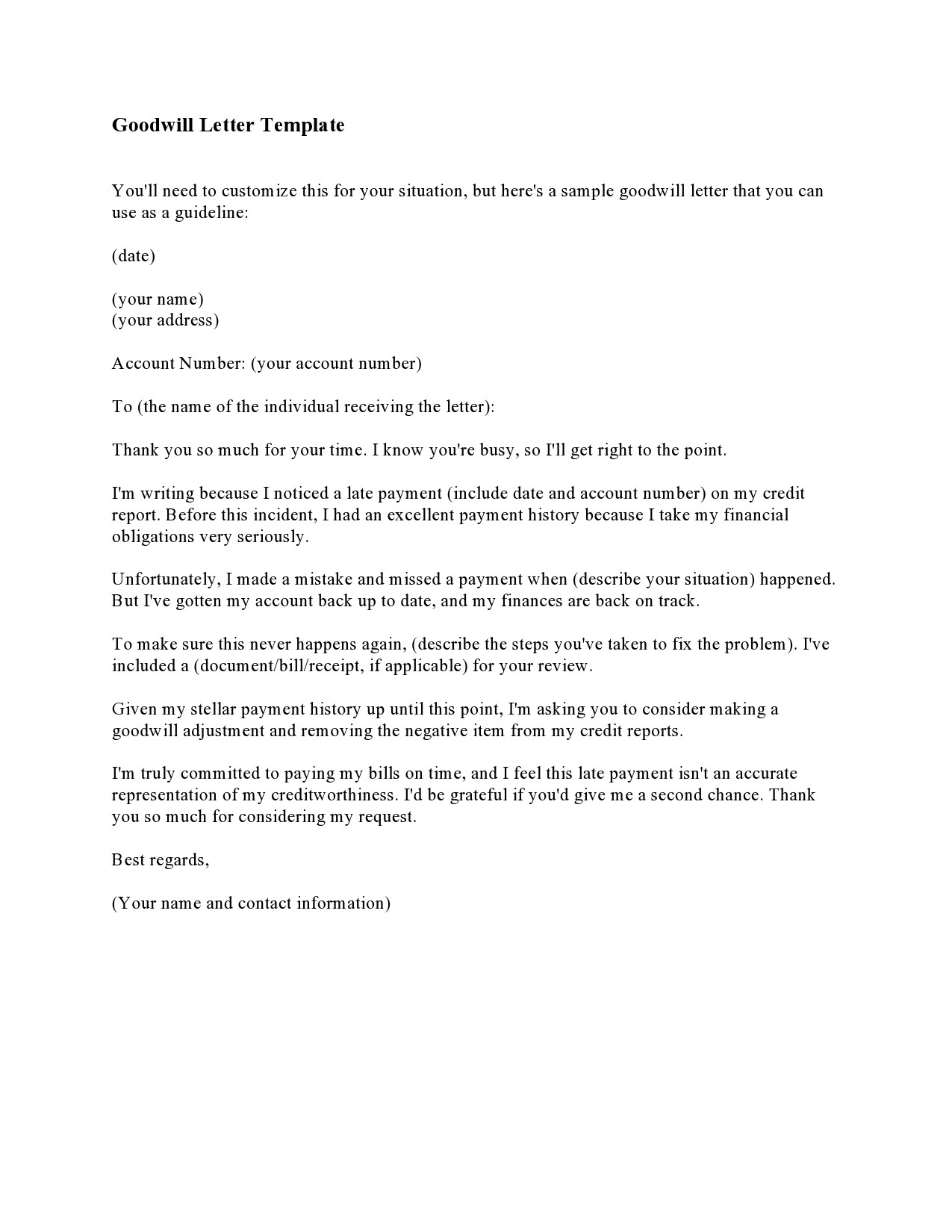

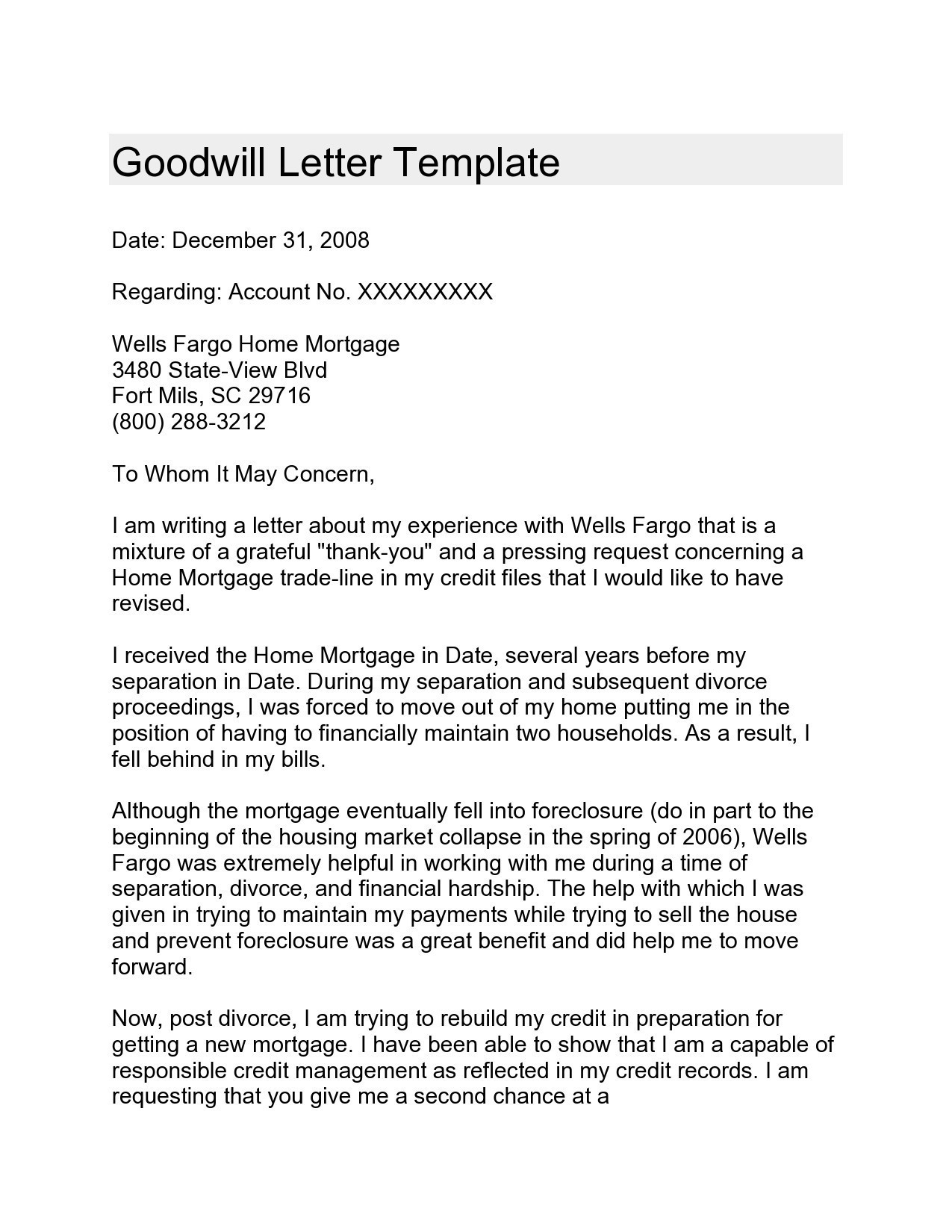

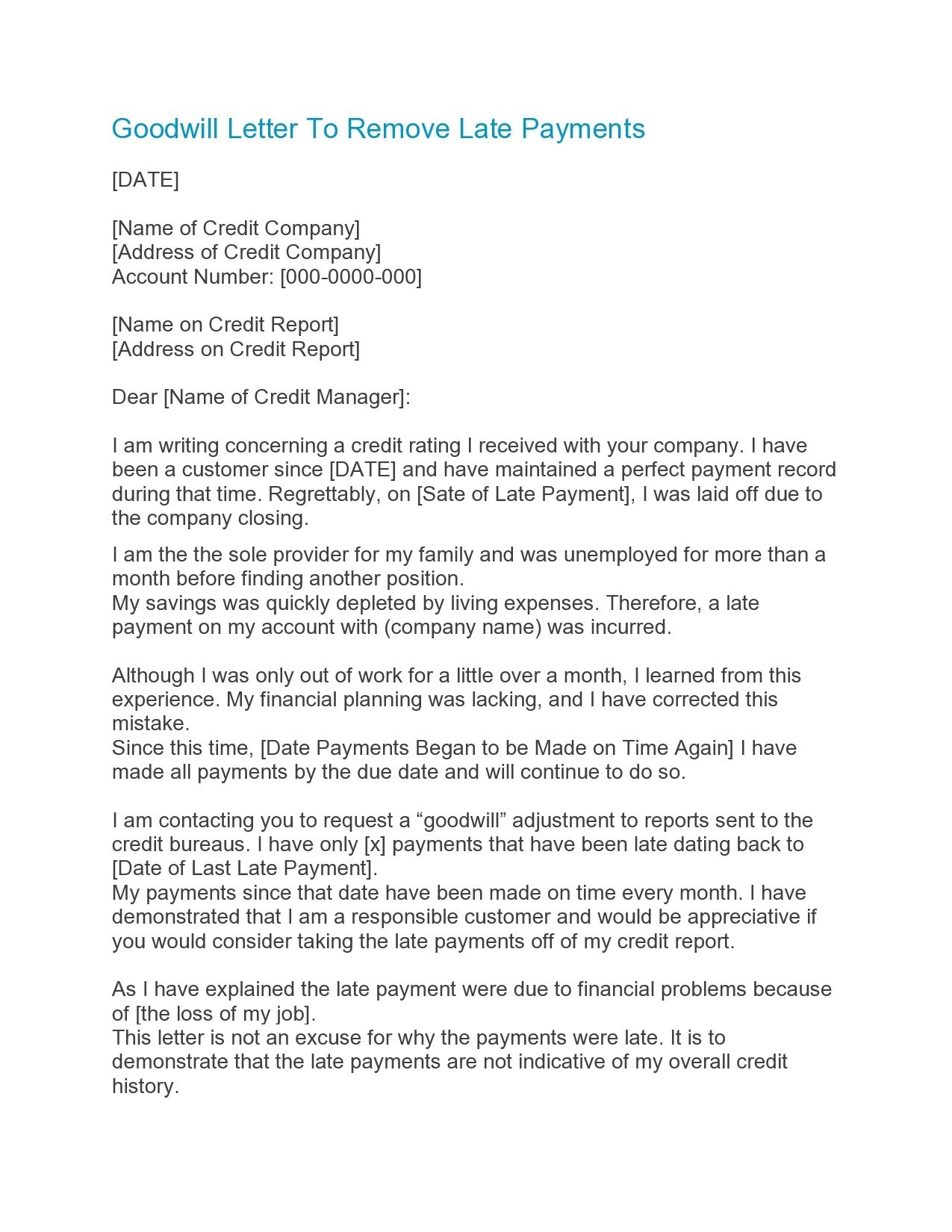

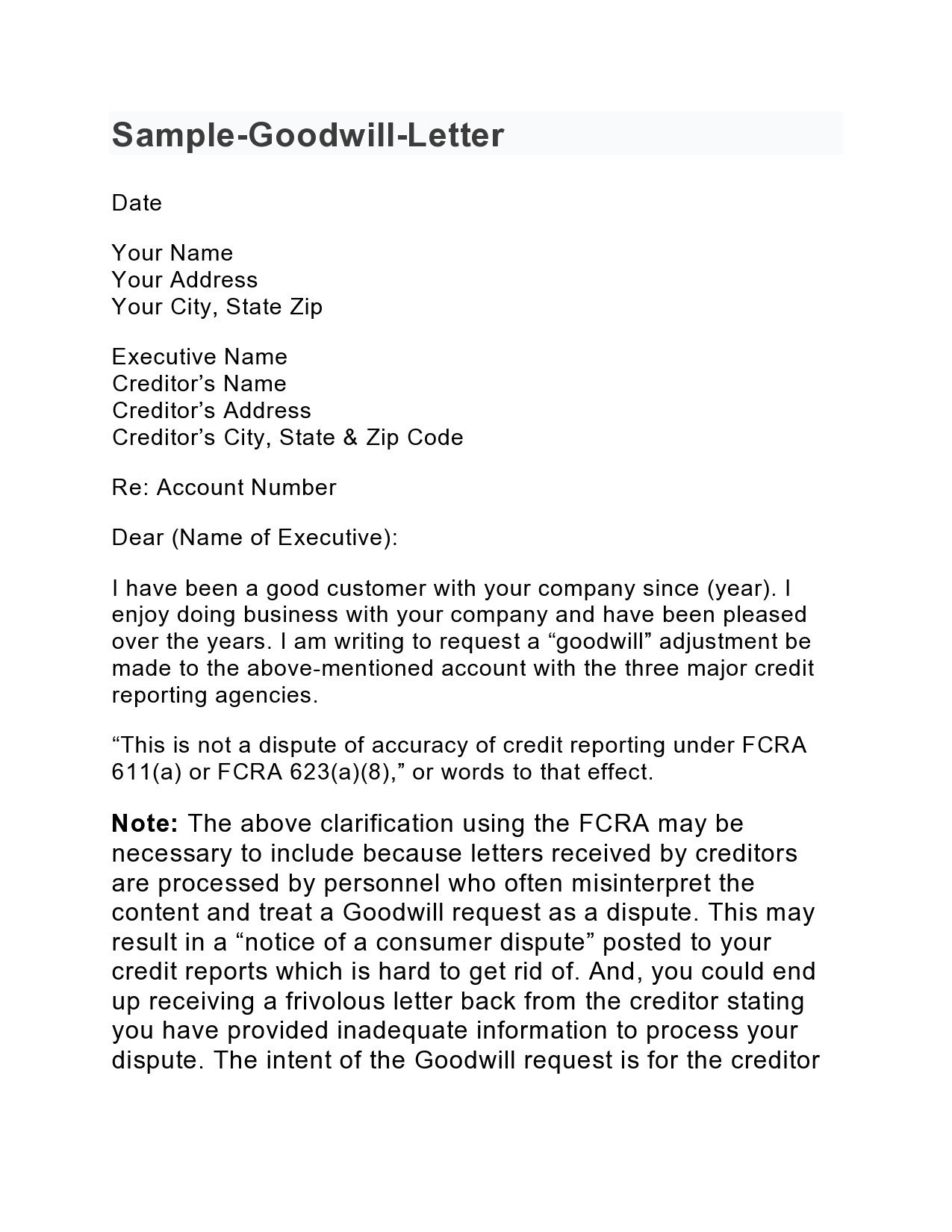

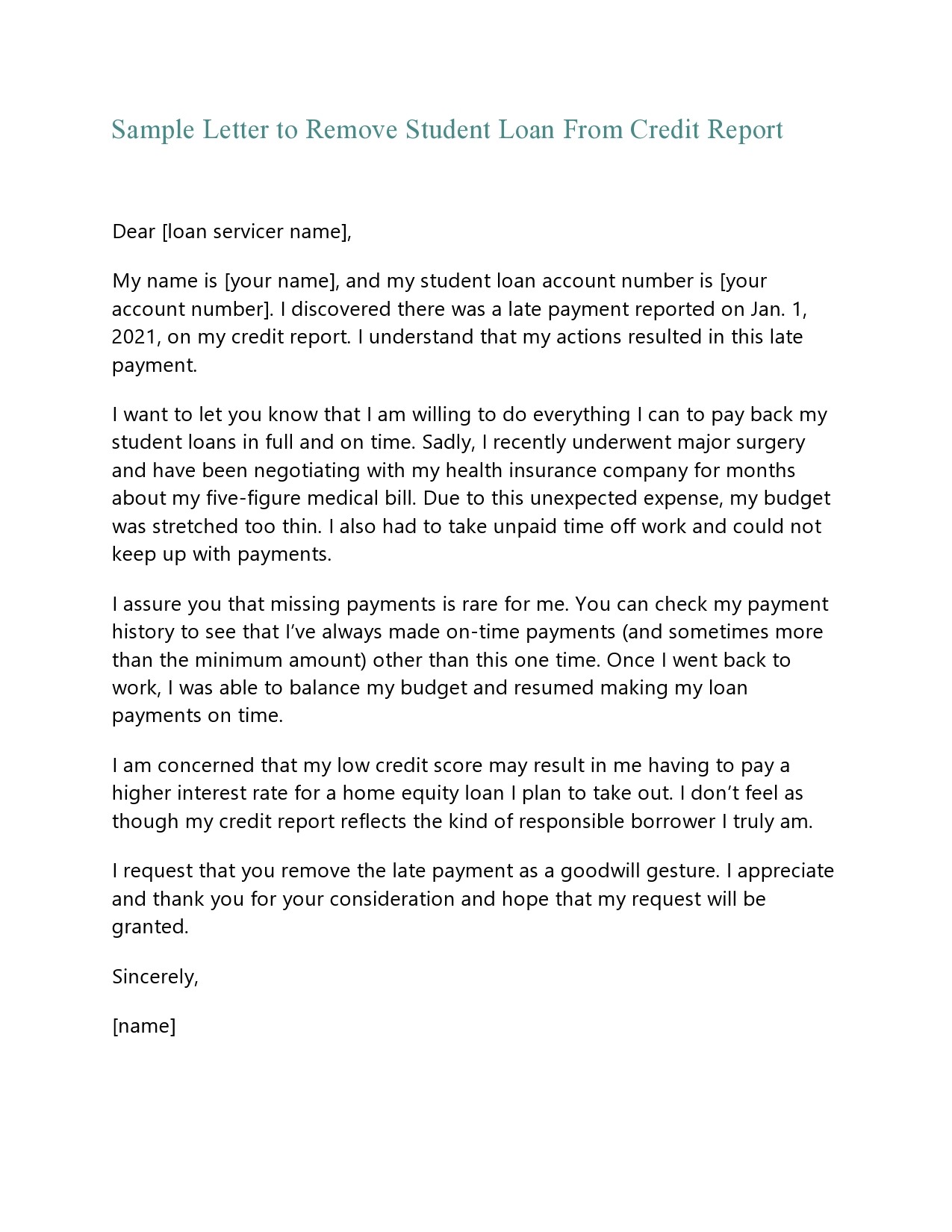

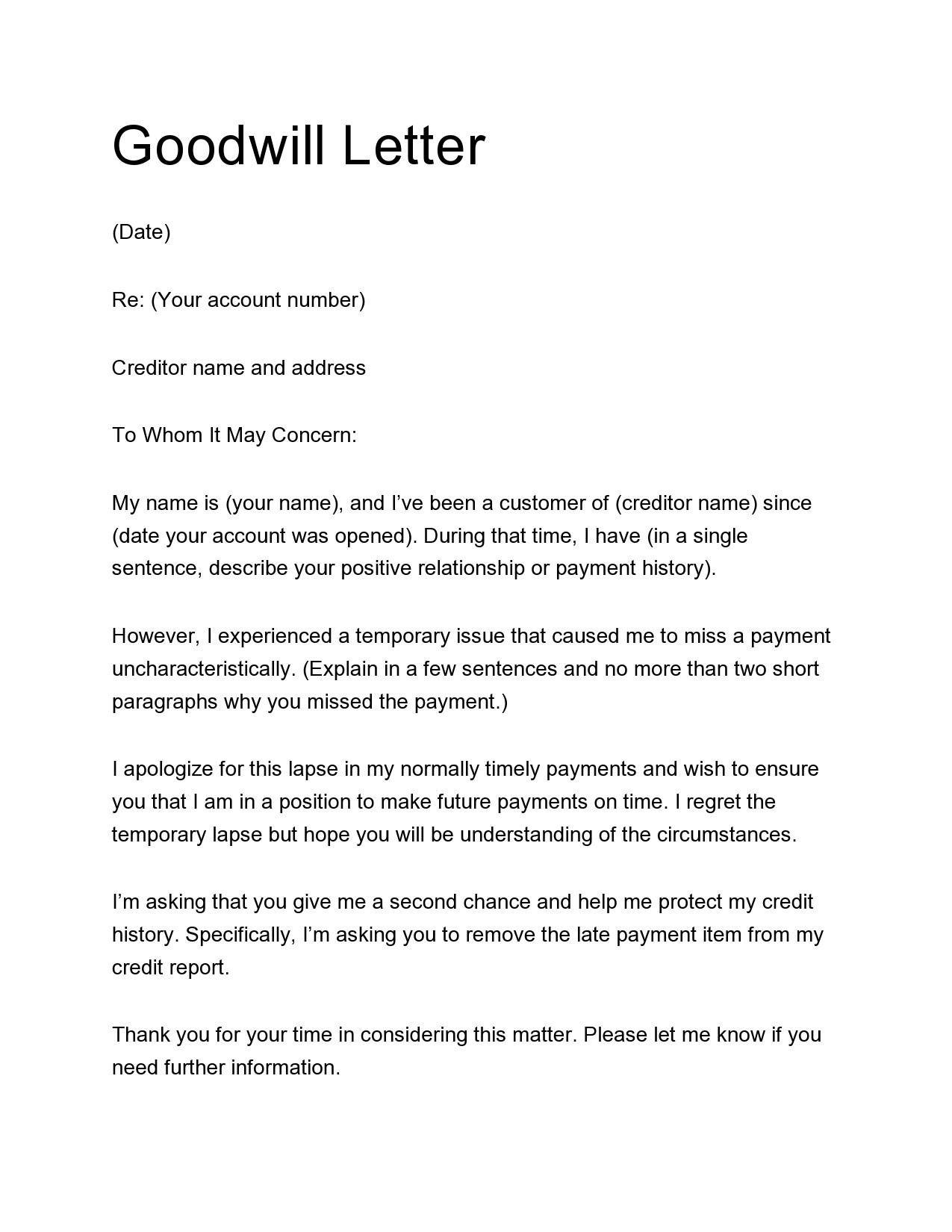

Goodwill Letter Templates

What is a goodwill letter?

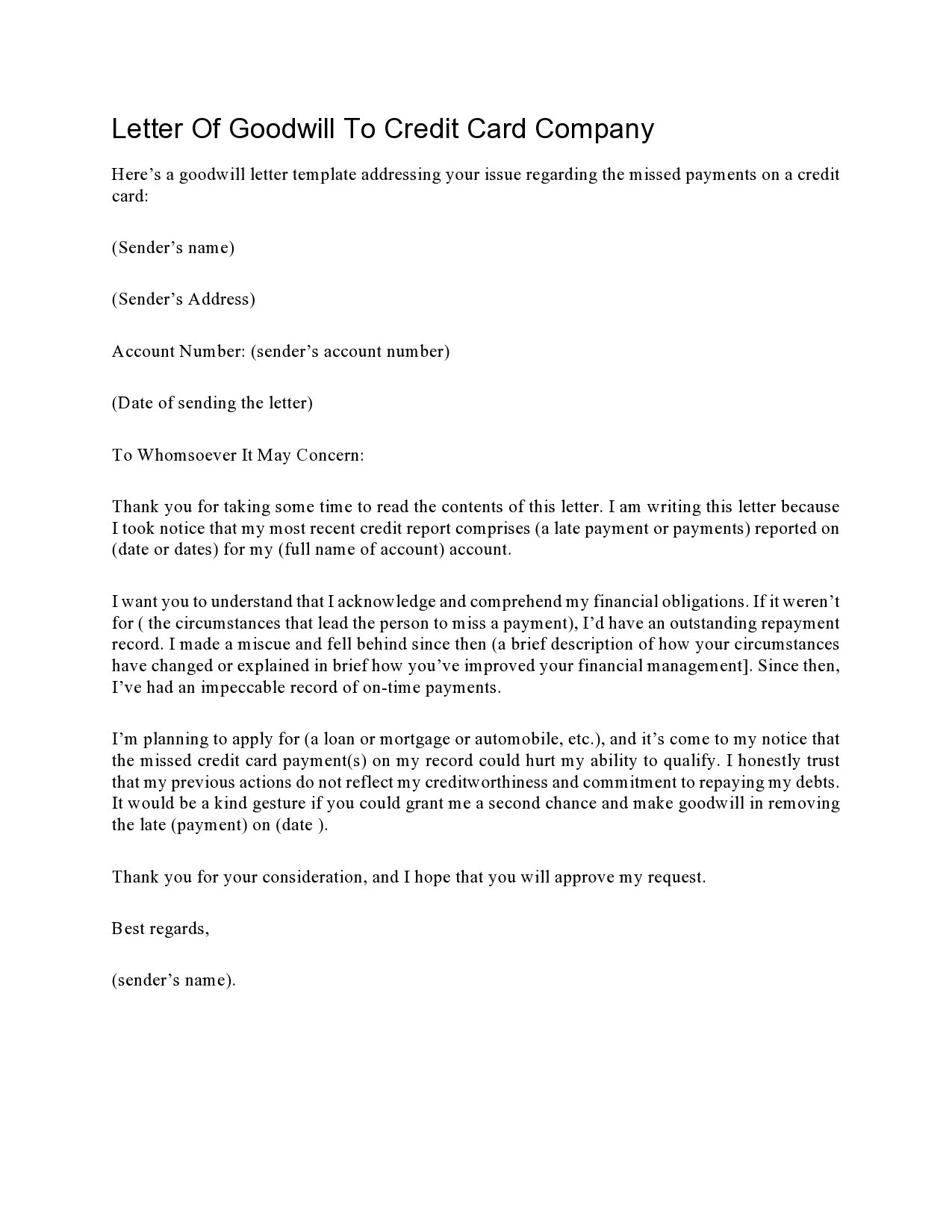

You may be very diligent when handling your finances. But there might come a time when you experience unexpected events that might temporarily put a dent in your credit. Some examples of such events are job loss and medical emergencies. When things like these happen, you might end up missing your credit card payments. If these delays extend to more than thirty days, you might get reported to the credit bureau.

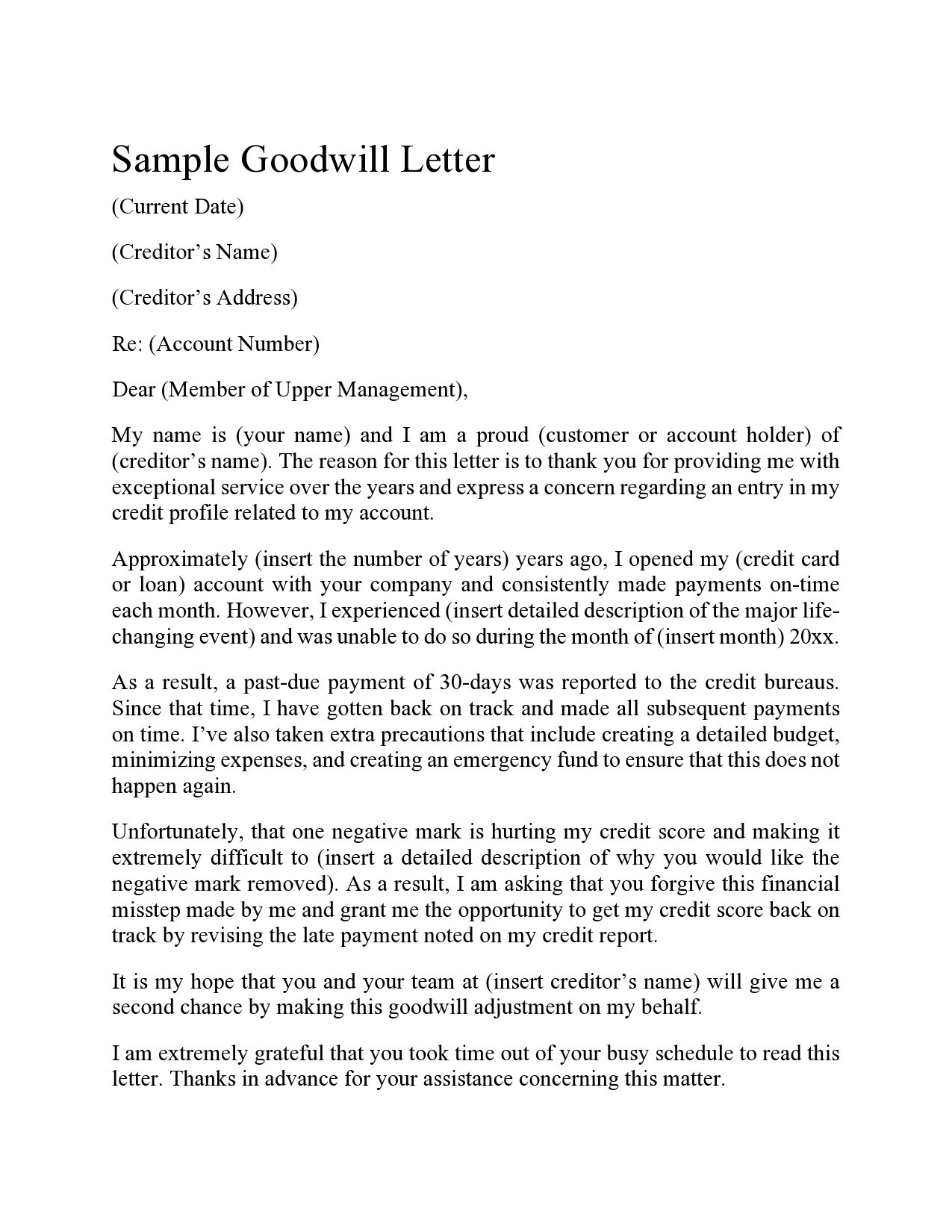

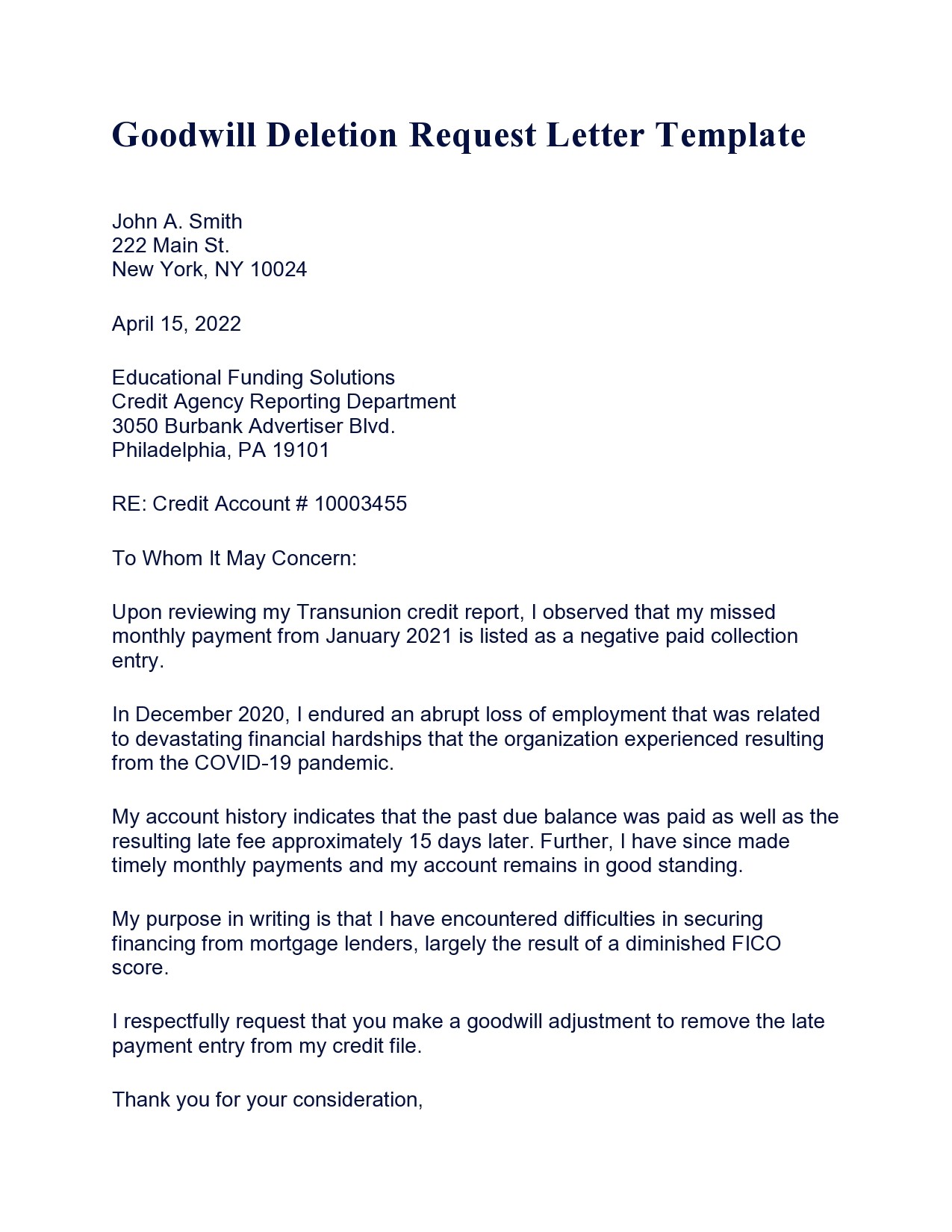

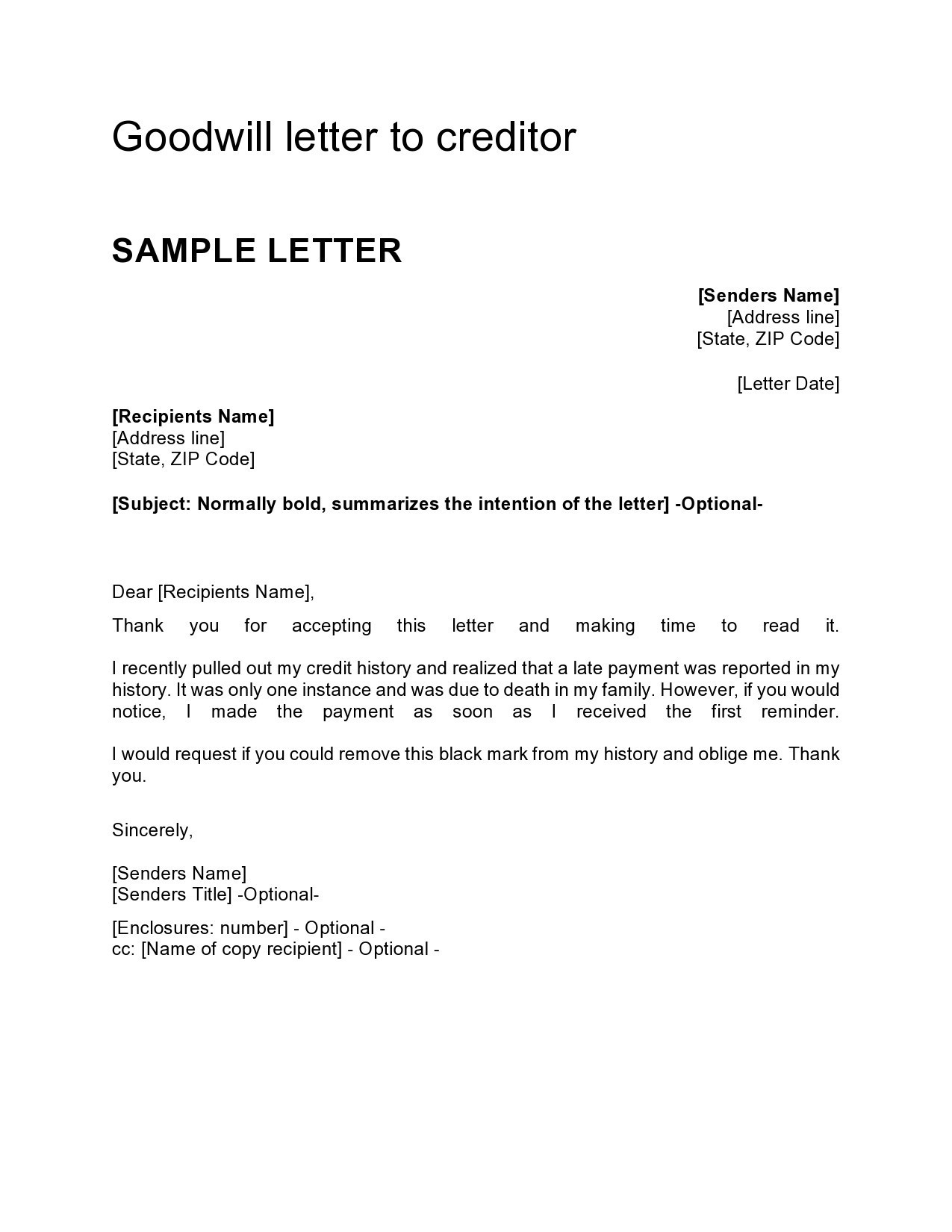

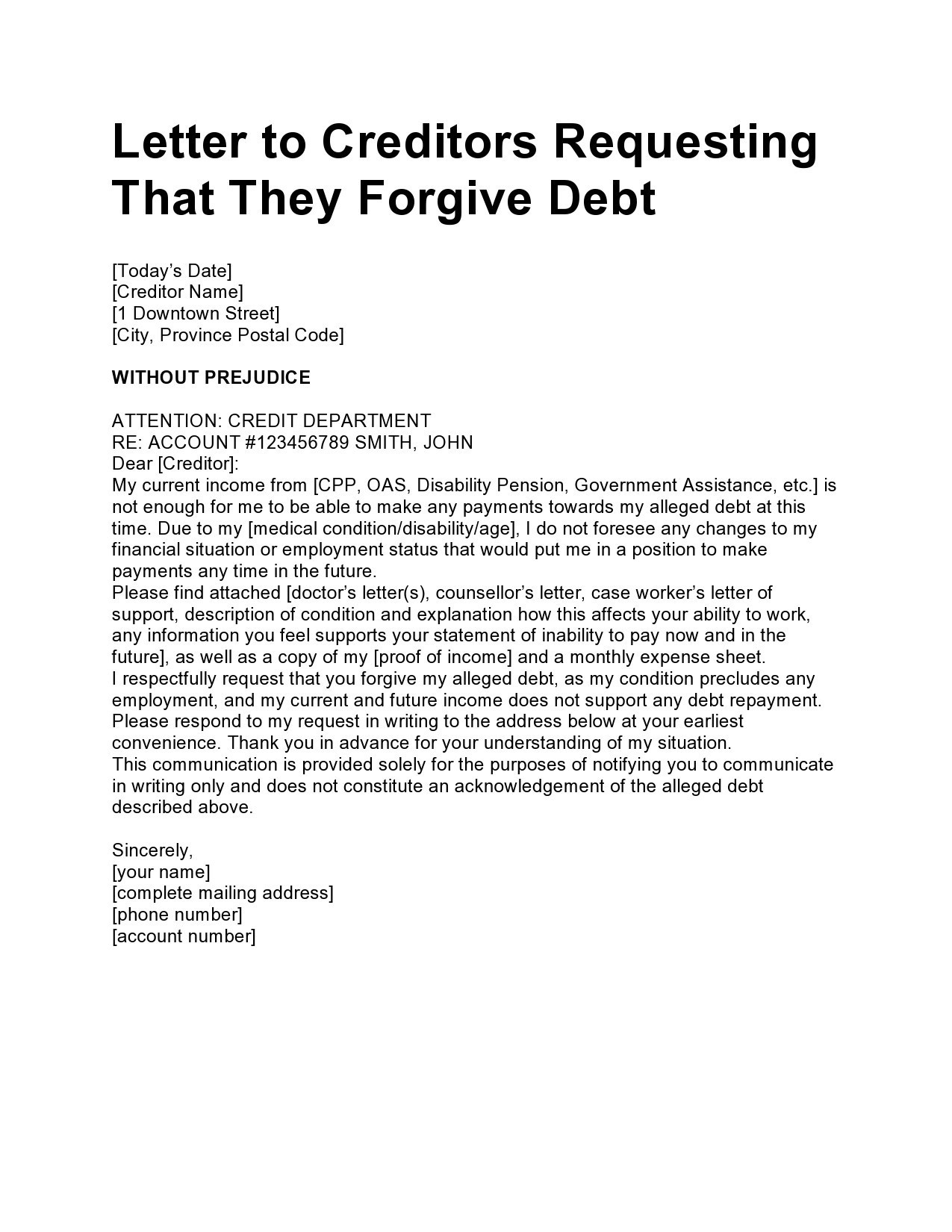

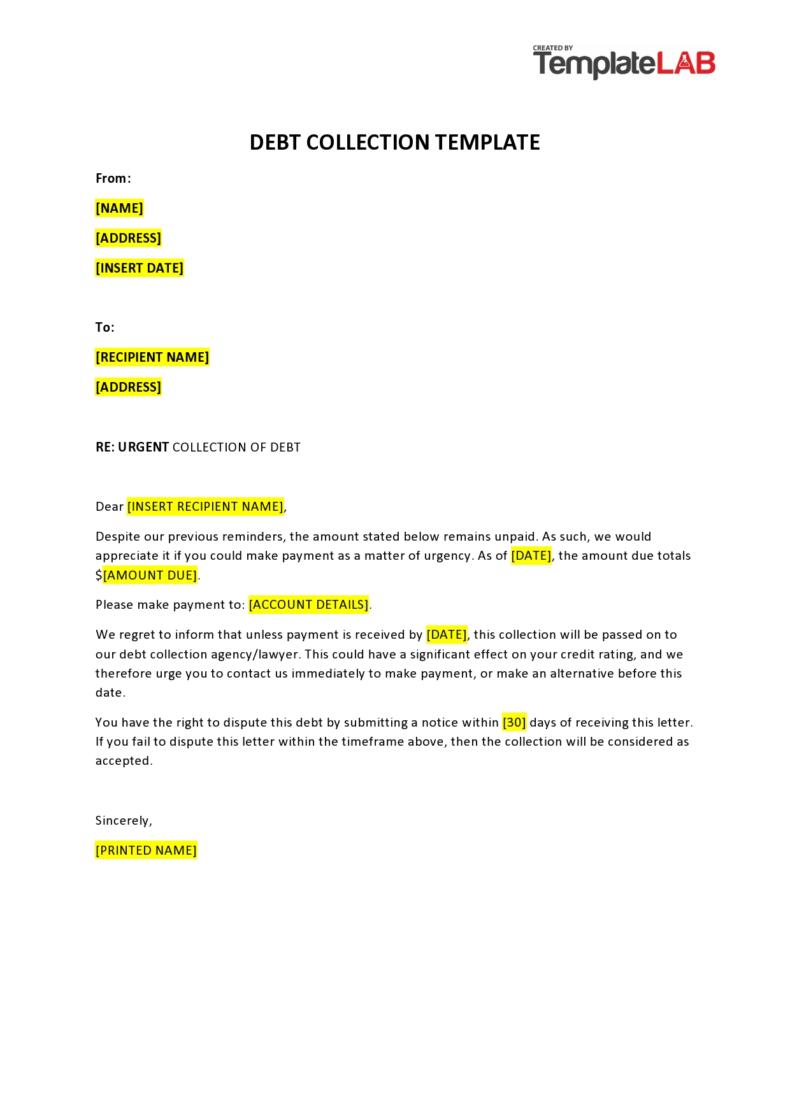

One way to avoid this is by writing a goodwill letter to creditor. The letter is an official document that you send to a creditor after they have reported something negative to the collection agencies or credit bureau. You would use this letter where you get reported accurately but the problem happened under unexpected or special circumstances.

For instance, you might have changed your address, which caused some communication issues. Some people change their residences without informing their creditors. This could result in undelivered mail or bills. You might also encounter these cases if you experienced an unforeseen injury or accident.

Your situation may lead to late payments too. If an overdue bill gets reported will affect your credit standing. When this happens, you should consider writing a goodwill letter addressed to your creditor who reported the negative item. Use the letter to explain the contributing factors that led to the delay and ask your creditor if they can remove the remark from your record.

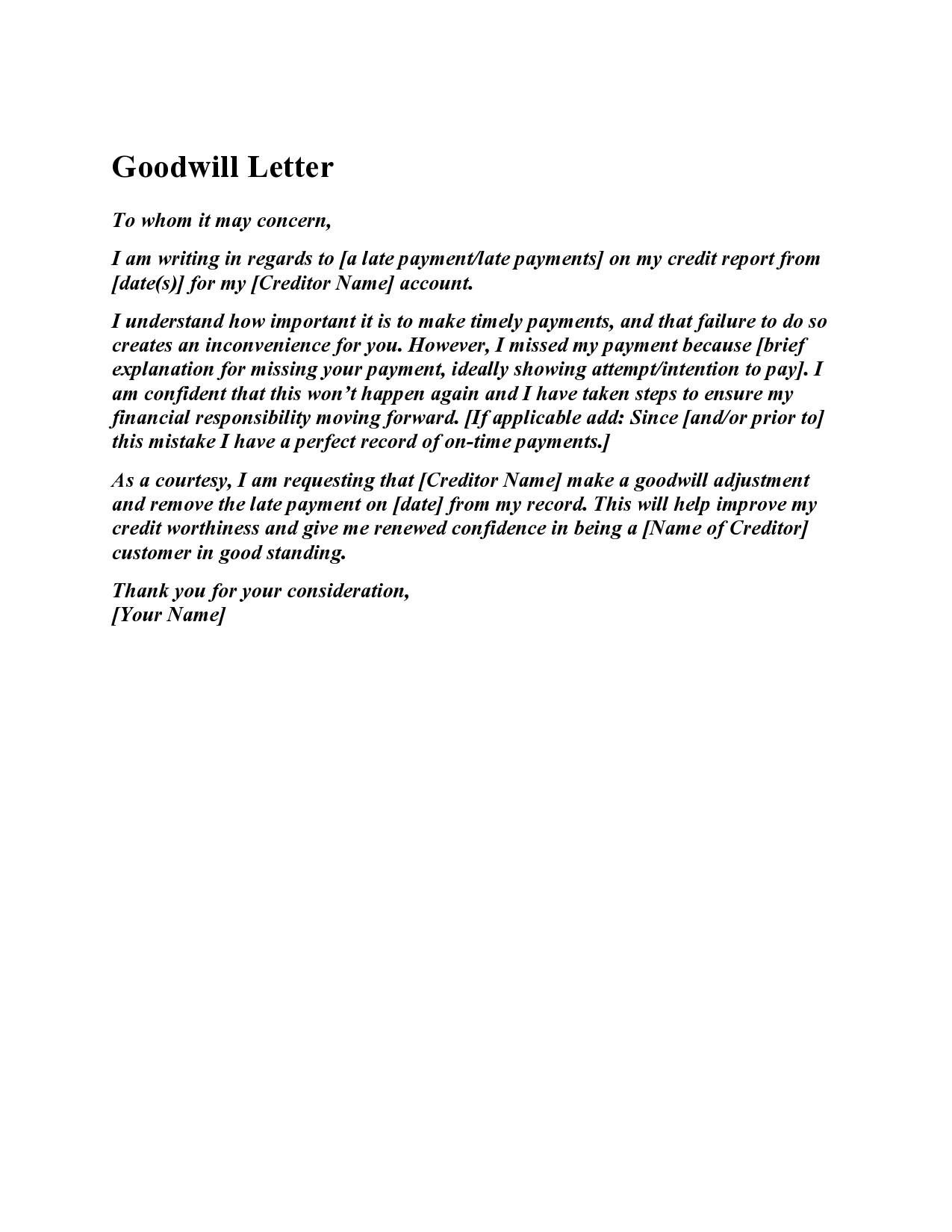

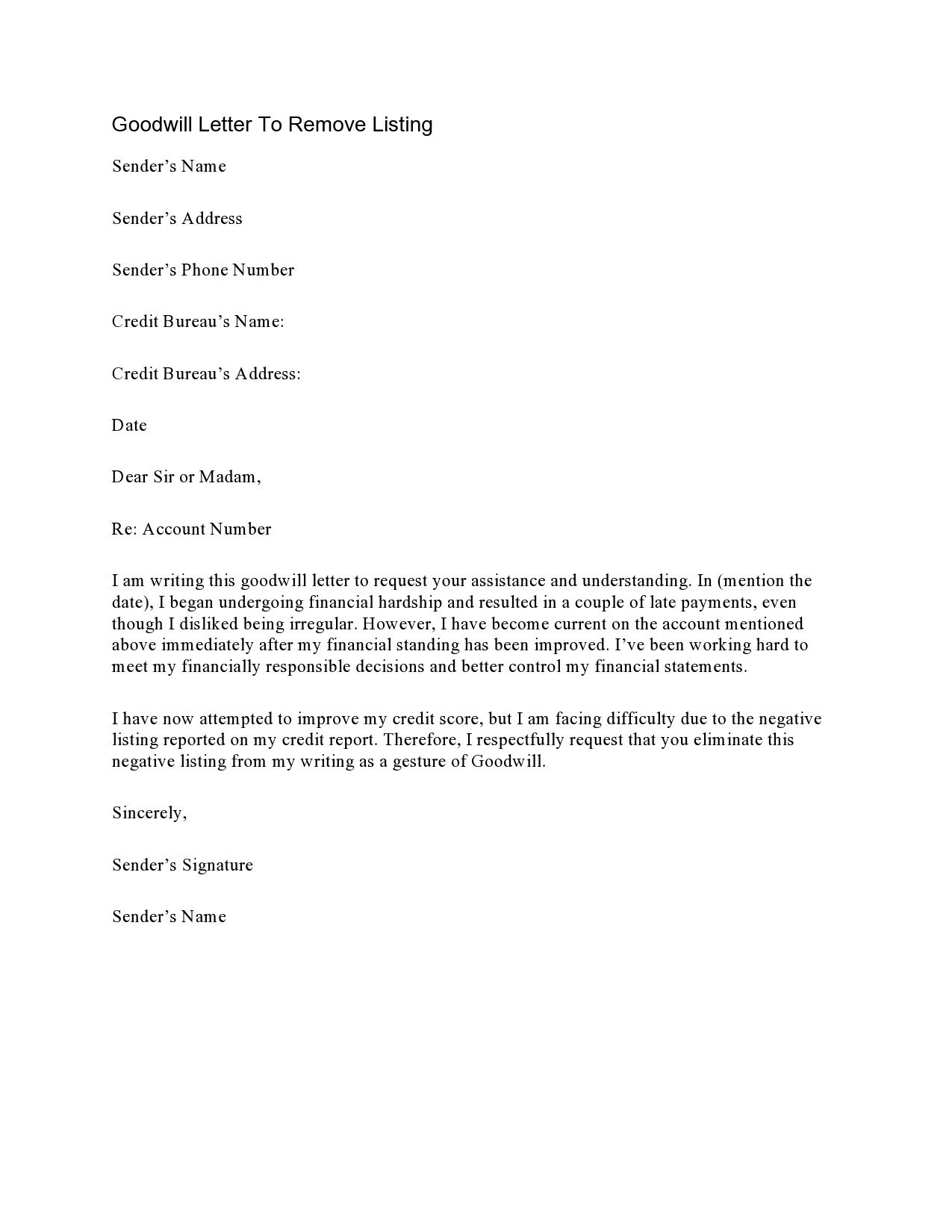

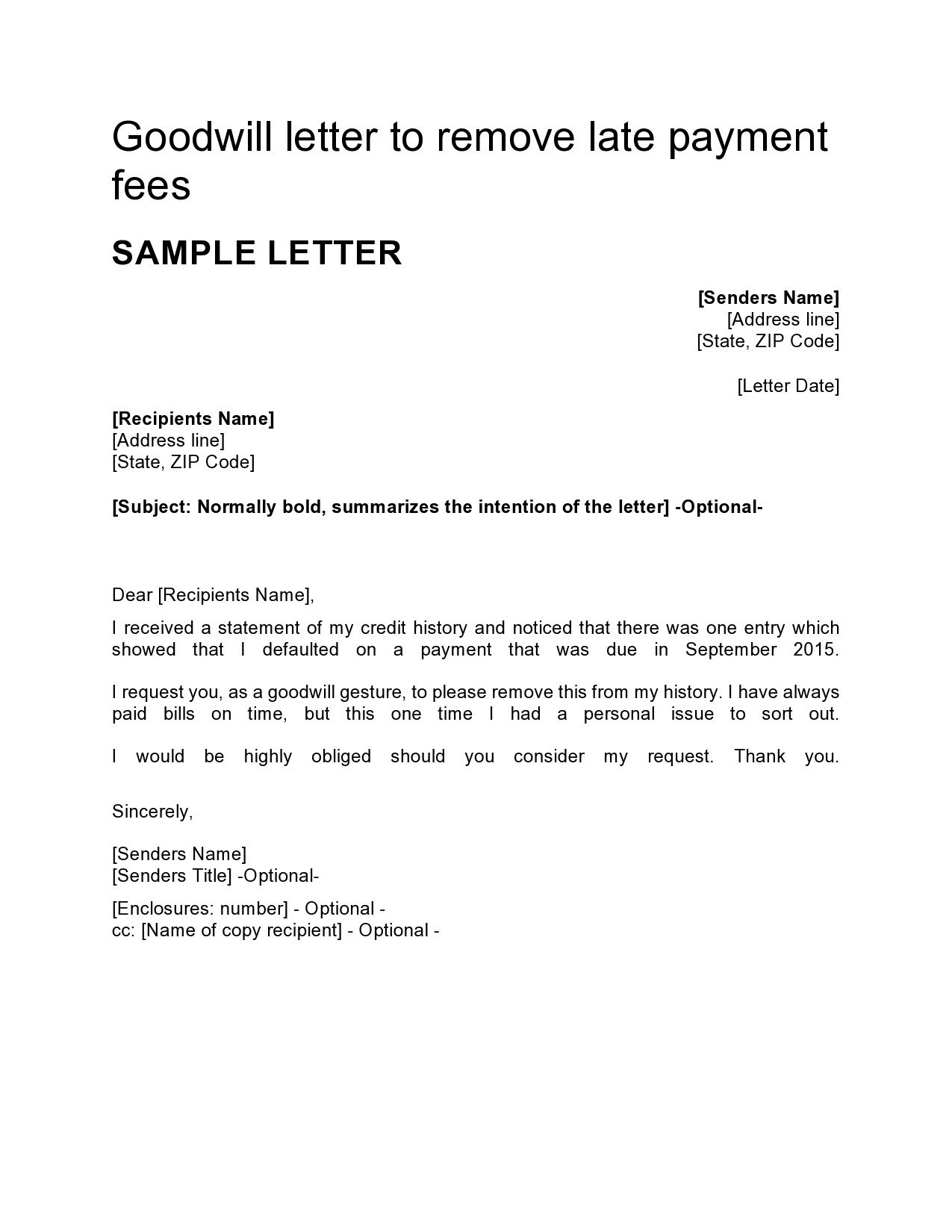

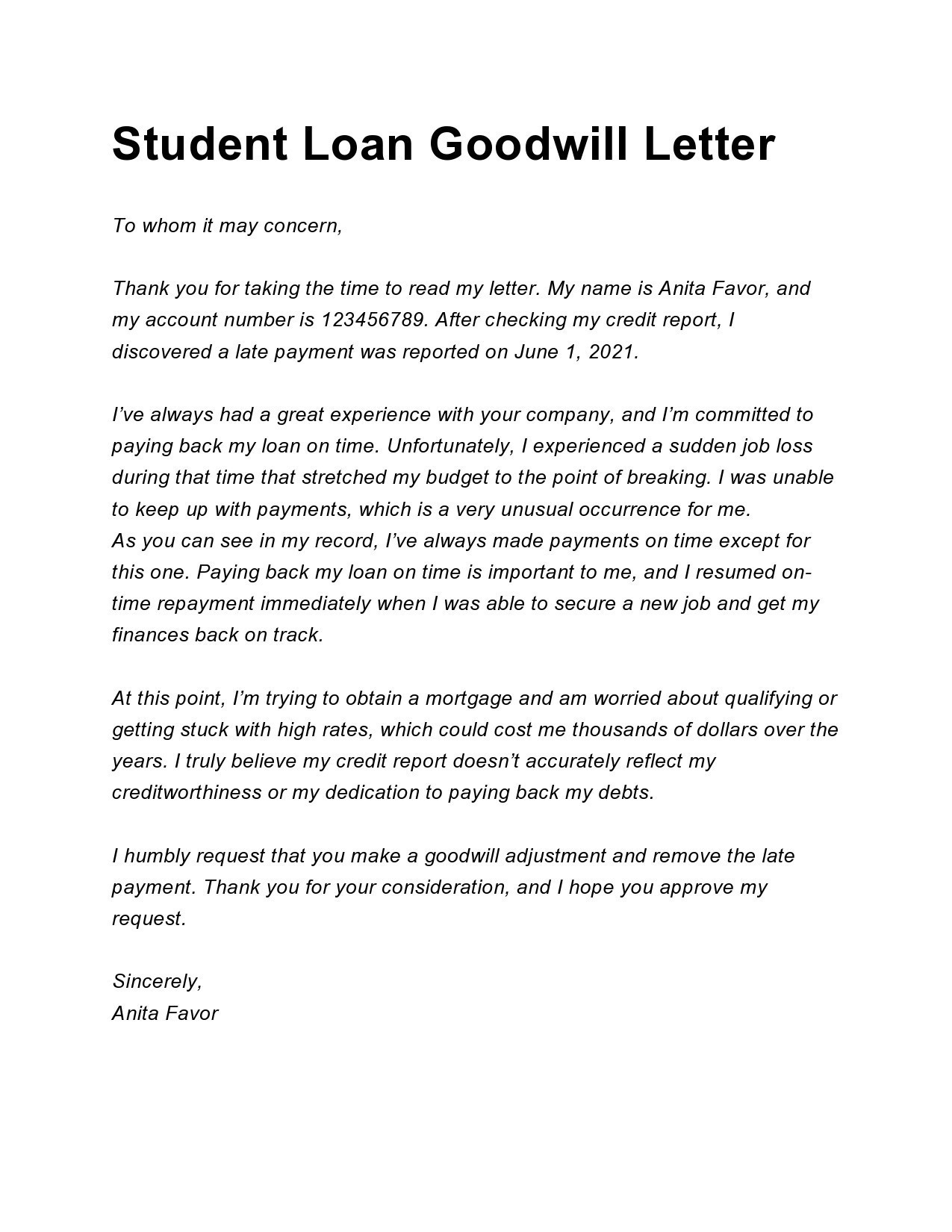

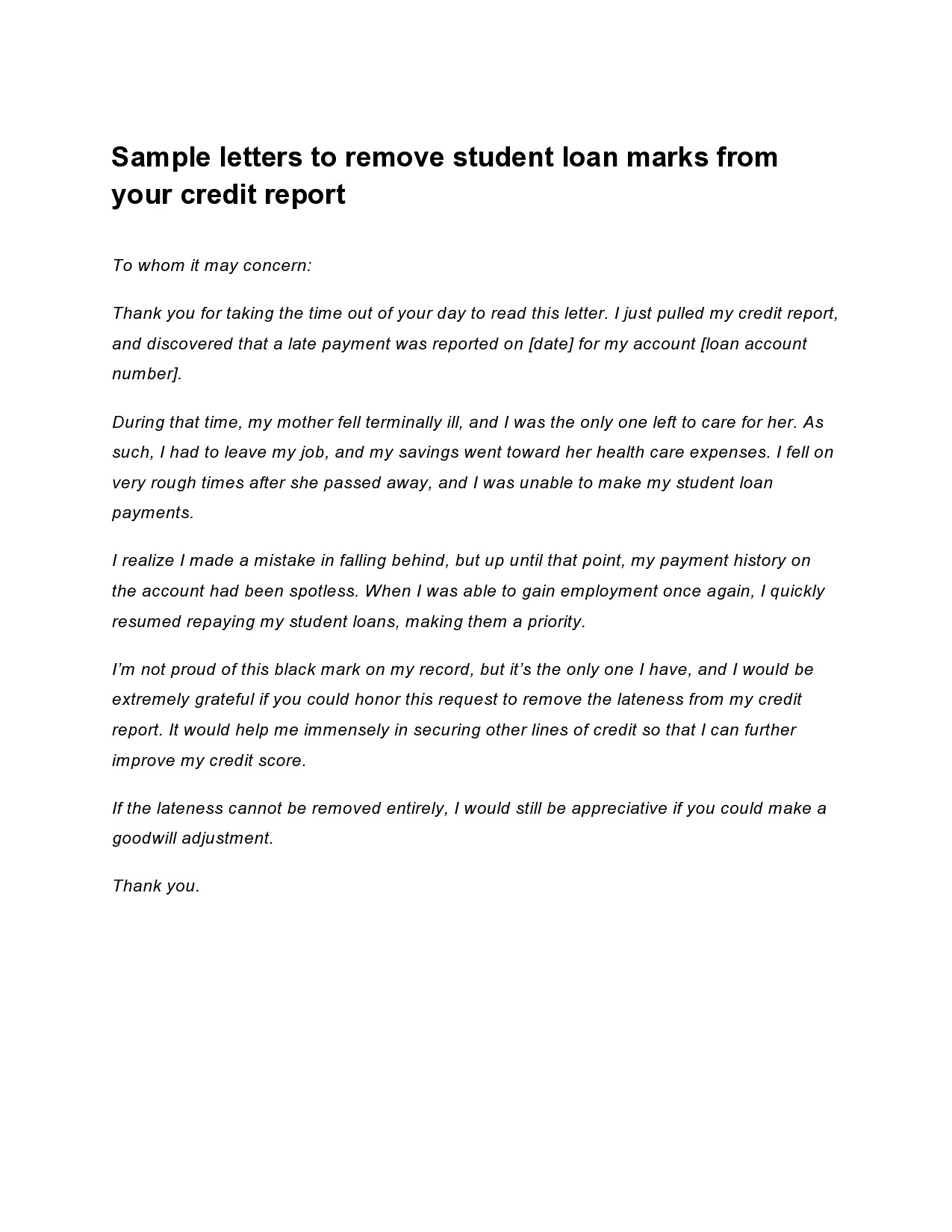

Late Payment Removal Letters

Why do you need a goodwill letter?

The main purpose of writing a goodwill or late payment removal letter is to ask your creditor to remove the negative mark from your credit report. The reason why they posted the remark may vary, although the most common ones are unexpected circumstance changes or financial issues. No matter what your reason is, your objective is to explain the reasons why you paid late or missed some payments, and why your creditor should remove the remark from your report.

But there might also be times when the negative remark on your report isn’t accurate. For instance, it says that you missed a payment when you didn’t. In this case, you should dispute the issue rather than write the letter. For a goodwill letter to be both convincing and strong, it should:

- Have a courteous and pleasant tone to gain empathy from your creditor.

- Show that you take full responsibility for your late or missed payments.

- Demonstrate that you will pay your bills on time from here on out.

- Explain the specific circumstance of the delay or show your recent track record of payments you made on time.

After writing the letter, send it to your creditor using the address that appears on your credit report or the official website of the creditor’s company. You might have to contact your creditor several times or follow up by calling them. Such persistence may help convince your creditor to grant the request you’ve made.

When do you need this letter?

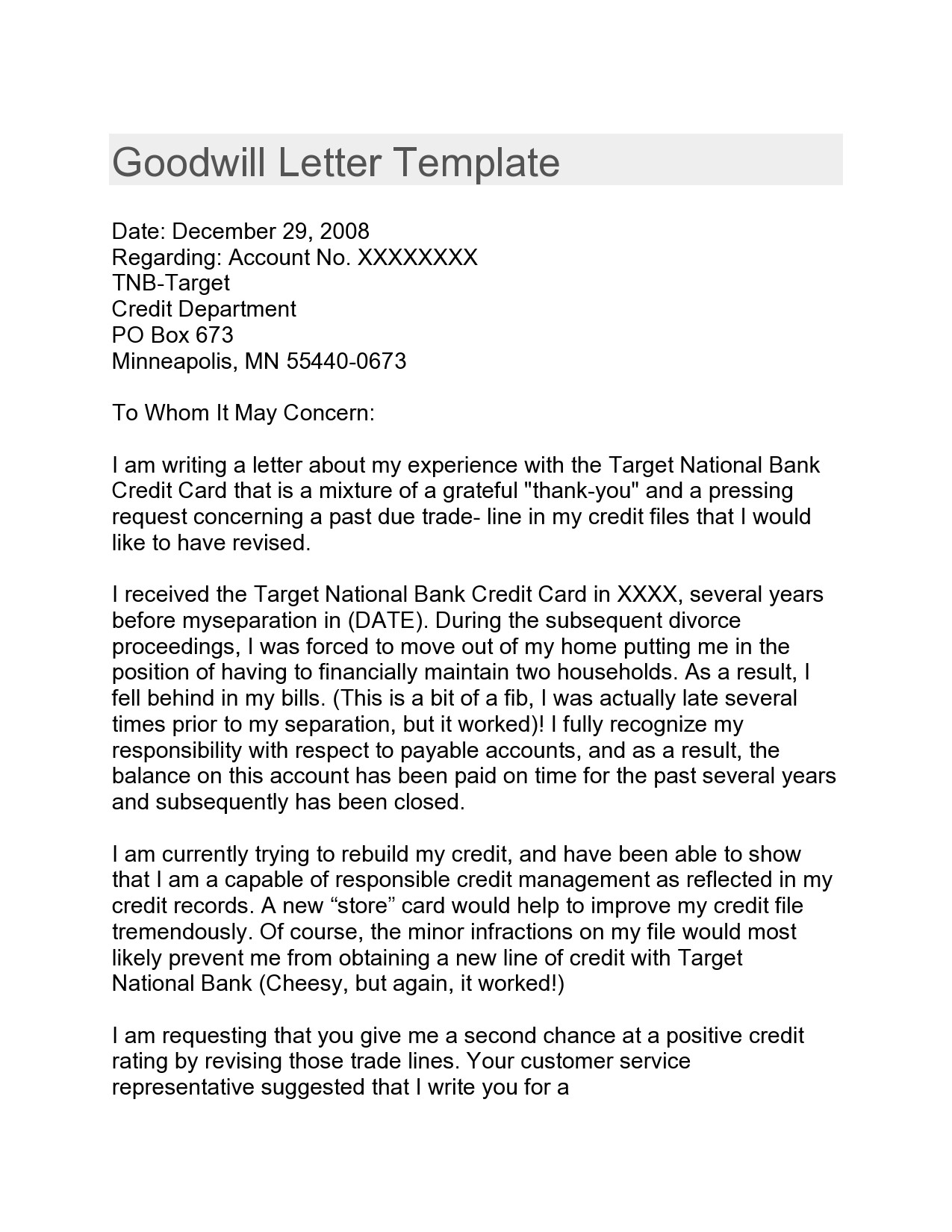

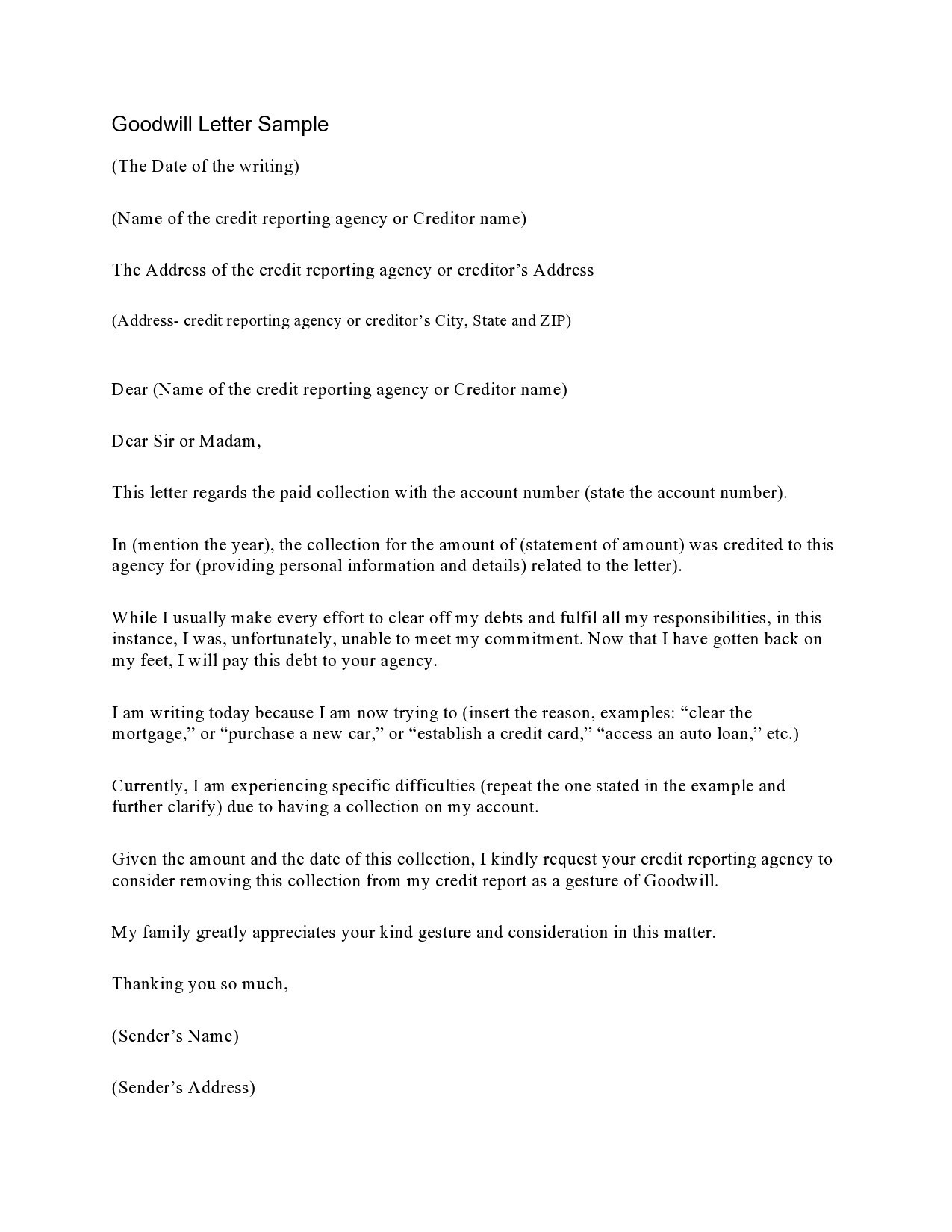

You should only write a goodwill adjustment letter in specific circumstances. For instance, if you have always made payments on time with only one or two late payments on your credit report, you would be a good candidate for writing this letter. But if you have a lot of negative remarks on your report and you consistently miss or make late payments, writing this letter might be a futile exercise as it won’t affect your credit report.

Also, remember that when writing a goodwill letter, set low expectations. Should your letter come through, you would be pleasantly surprised. If not, you won’t feel too affected. Remember that many goodwill letters don’t work since collection agencies have outstanding agreements with credit bureaus. These agreements prohibit creditors from removing collection accounts even after you have paid them.

The Fair Credit Reporting Act (FCRA) made it a requirement for lenders to report accurate credit information to credit bureaus. This means that if a creditor removes accurate information that they should report to the FCRA, the creditor may violate the FCRA requirements. Creditors and Information furnishers can’t use their creativity when it comes to the information they give to credit bureaus. They cannot omit information either lest they might face negative consequences like sanctions from the FCRA.

A goodwill letter also won’t work if you request for the removal of items on public records like judgments or bankruptcy. Credit bureaus regularly check the public database for bankruptcy filings. Since collection agencies and creditors provide this information to credit bureaus, you must send your goodwill letter to the bureau too. But credit bureaus disregard any letters if the request is for the removal of previous filings of bankruptcy.

Other public records like judgments or liens aren’t always reported by credit bureaus because of the National Consumer Assistance Plan (NCAP). But this could change since NCAP isn’t federal law. It’s just an initiative that was agreed upon by all of the major credit bureaus. If the major credit reporting bureaus stop supporting NCAP, using a goodwill letter requesting to have judgments or liens removed wouldn’t work since they’re similar to bankruptcy filings.

Goodwill letters are a handy tool you can use as part of your plan to repair your credit. After suffering from a setback or financial hardship where you missed payments, the goodwill letter, if approved, will help you get back on track. Having a good payment history with your creditors will also benefit you as this will make up 35% of your credit total score. Make it a point to pay more than the minimum amount every month and keep the utilization of your credit ratio below 30%.

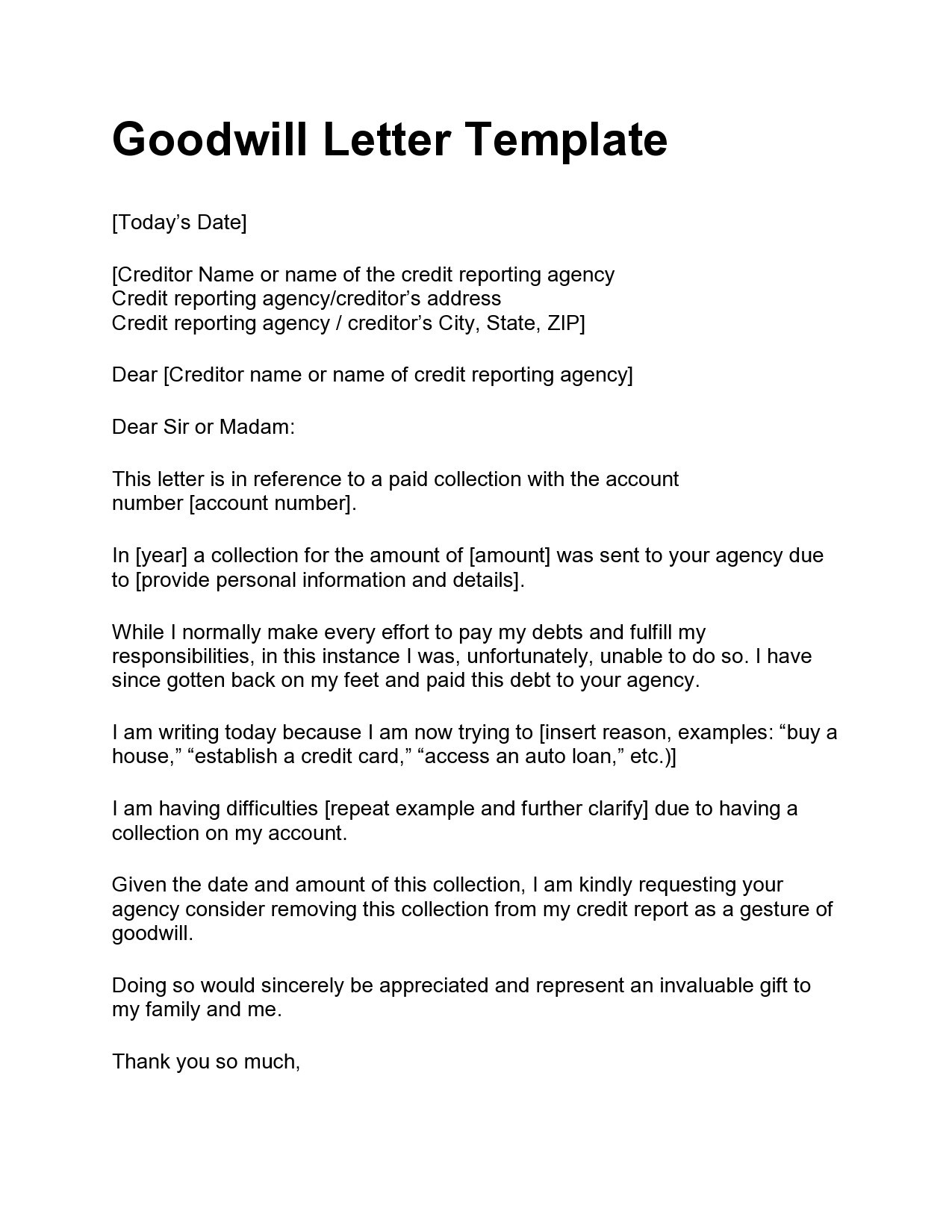

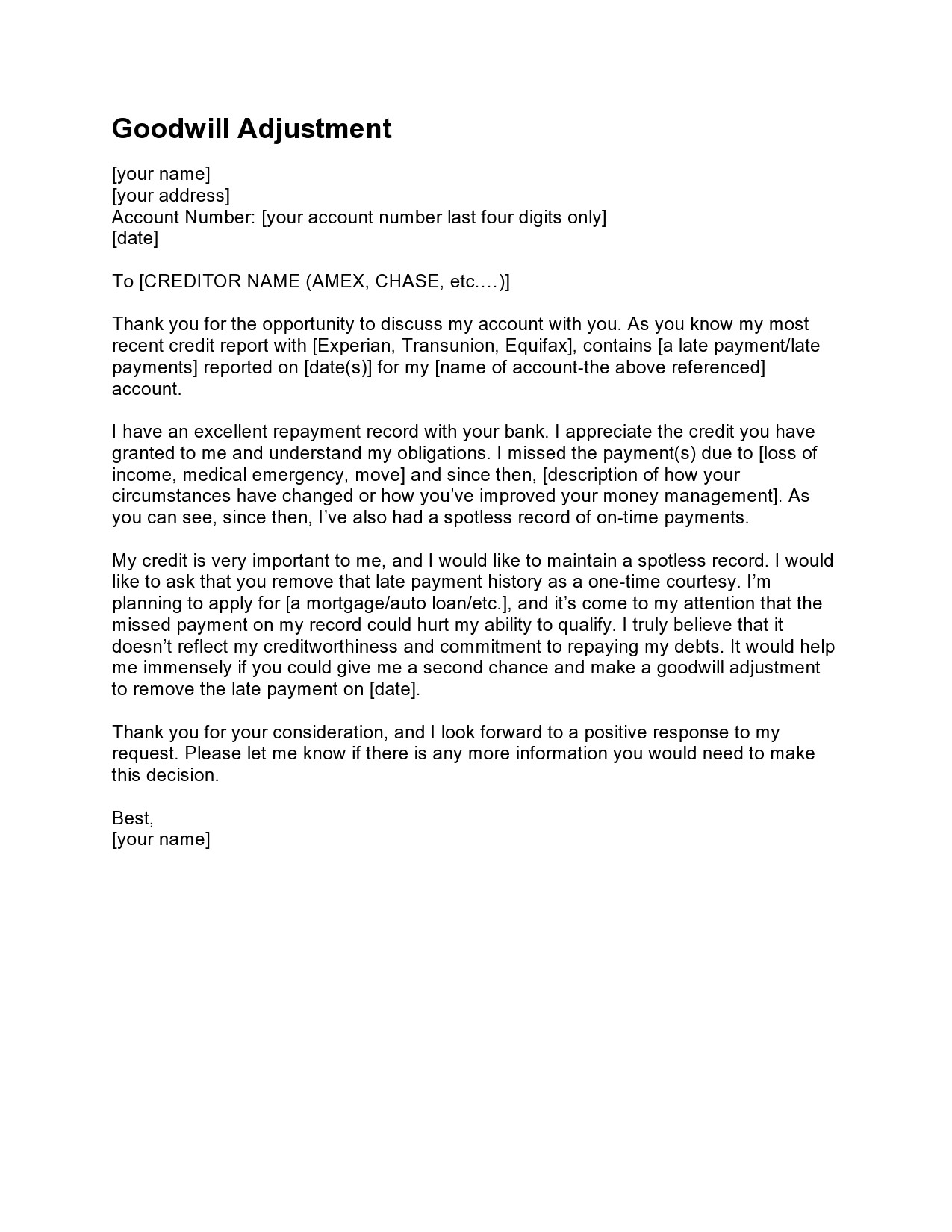

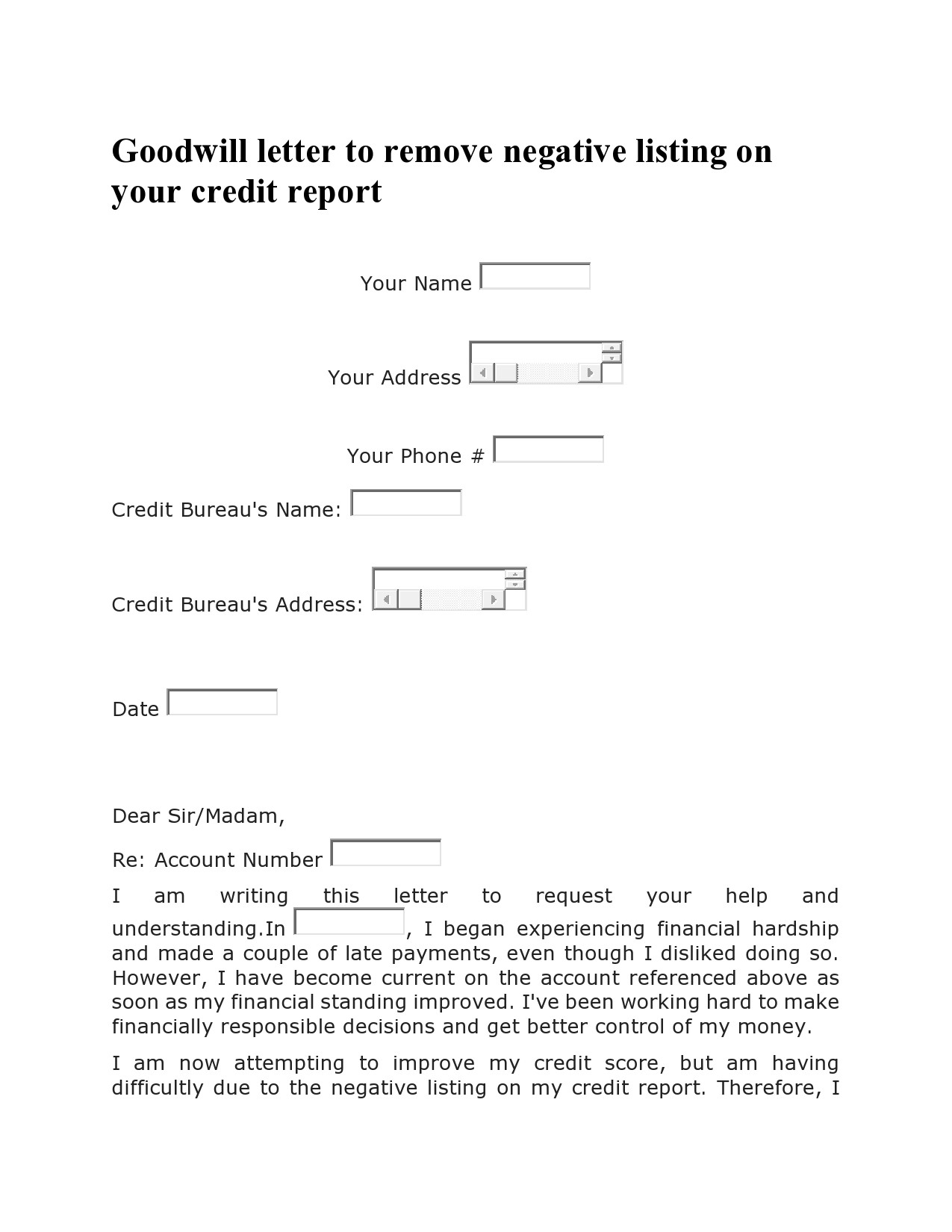

Goodwill Adjustment Letters

What to include in a goodwill letter?

When writing your letter, treat the process as any business correspondence. Keep your tone professional by making it concise and clear. It’s okay to provide details about your reasons for payment lapses but a good goodwill letter shouldn’t focus on emotional aspects. Your primary objective is to show your creditor that the issue at hand doesn’t indicate how you normally handle credit. A good letter should help show your creditor that you’re a valued client. It should encourage them to grant your request.

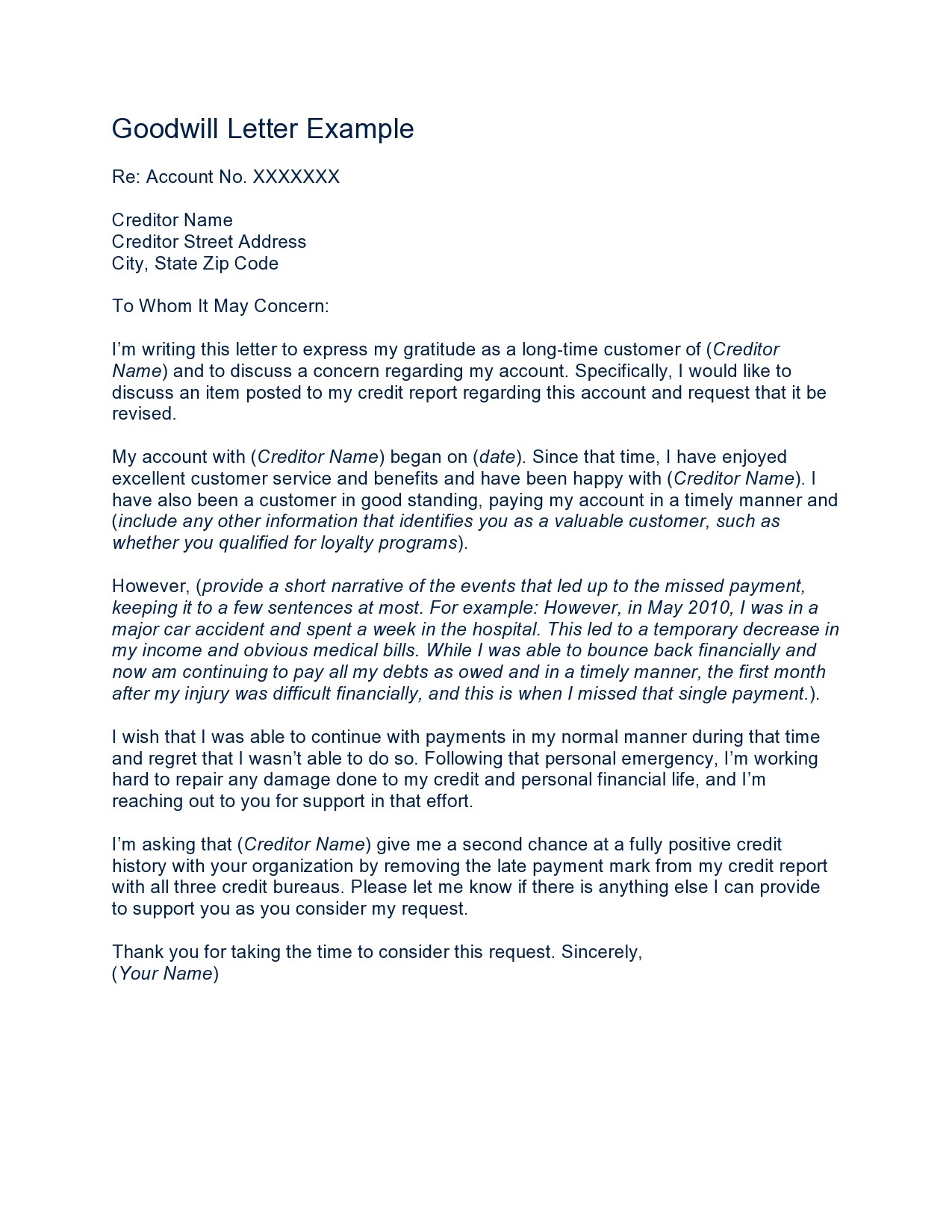

Don’t write a letter that will make your creditor feel sorry for you since you didn’t do anything wrong. Your letter should also include details that will help your creditor identify your account and the negative remark you’re referring to. Provide a brief description of why you believe the creditor should remove the negative mark. The information to include in your letter are:

- Your account number

- The date of the issue

- The type of issue

- Details about the negative remark

- Details about how long you have been part of the creditor’s company

- Details that show that you don’t usually miss or make late payments

- A sincere regret that the issue occurred

- A call to action where you explain what you’re requesting the creditor to do

Pros and cons of a goodwill letter

You need to consider the pros and cons of a goodwill letter before you write one. This will help you determine if a dispute letter would be more appropriate. There are times when a goodwill letter is your best choice. In such a case, you should focus on the future to rebuild your good credit rating. If the letter doesn’t work, consult a credit repair expert to help you write your letter. Here are the pros and cons of writing this letter:

Pros

Here are the benefits of writing this letter:

- Helps you get rid of negative items, whether accurate or not. If your creditor approves your request, they may remove the item in question.

- It’s a good one-time option. If it’s the first time you ever sent such a letter to a creditor before, it’s a good choice.

- It can help raise your credit score. If your creditor approves your goodwill letter, your credit score will improve when they remove the negative item.

Cons

However, there are some drawbacks to writing this letter too:

- It isn’t a guaranteed solution. Since you won’t have a guarantee that your creditor will accept your letter, you might end up with a credit score that’s severely damaged.

- It’s not that easy to write. Writing this letter is not that easy as it involves finding a template that works for you and finding the right words to use.

There are cases where you should write a dispute letter if a negative remark appears on your credit report:

- A dispute letter makes more sense if the negative items that got reported aren’t accurate. There are many ways to dispute inaccurate negative items but you must first identify the negative information. The best way to do this is by working with a credit repair expert or you can reach out to your creditor too.

- If you can’t dispute the negative remark but you want to start working on improving your credit.

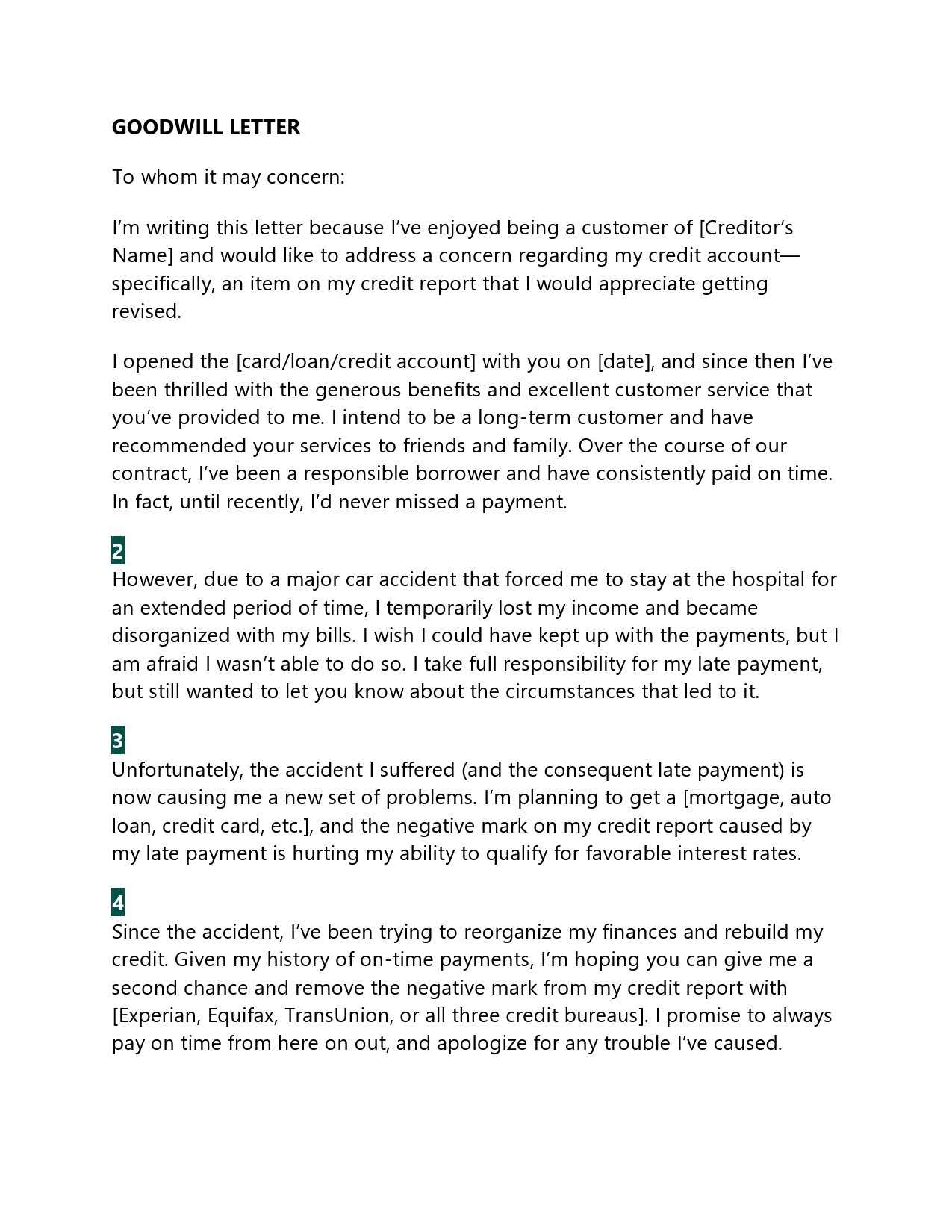

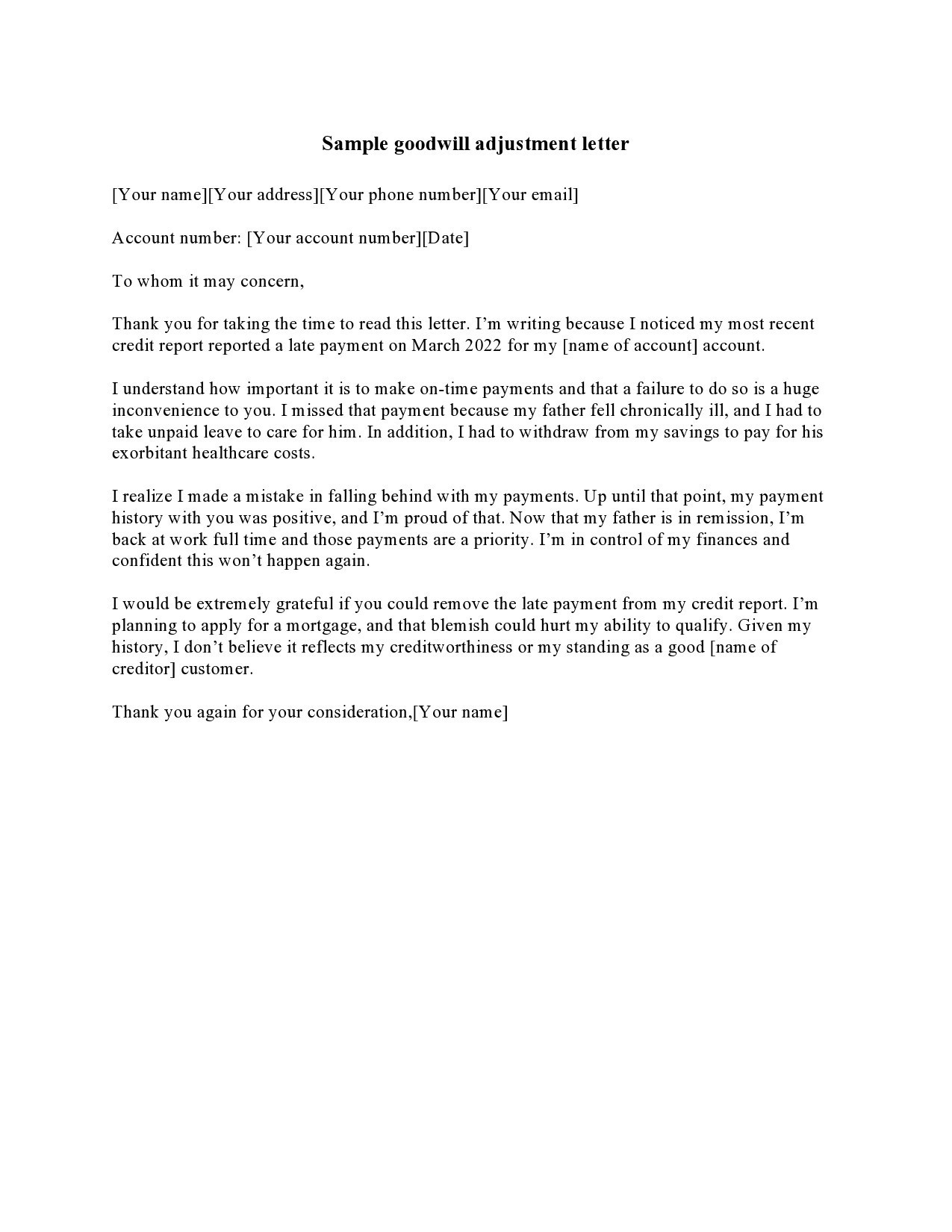

How do you write a successful goodwill letter?

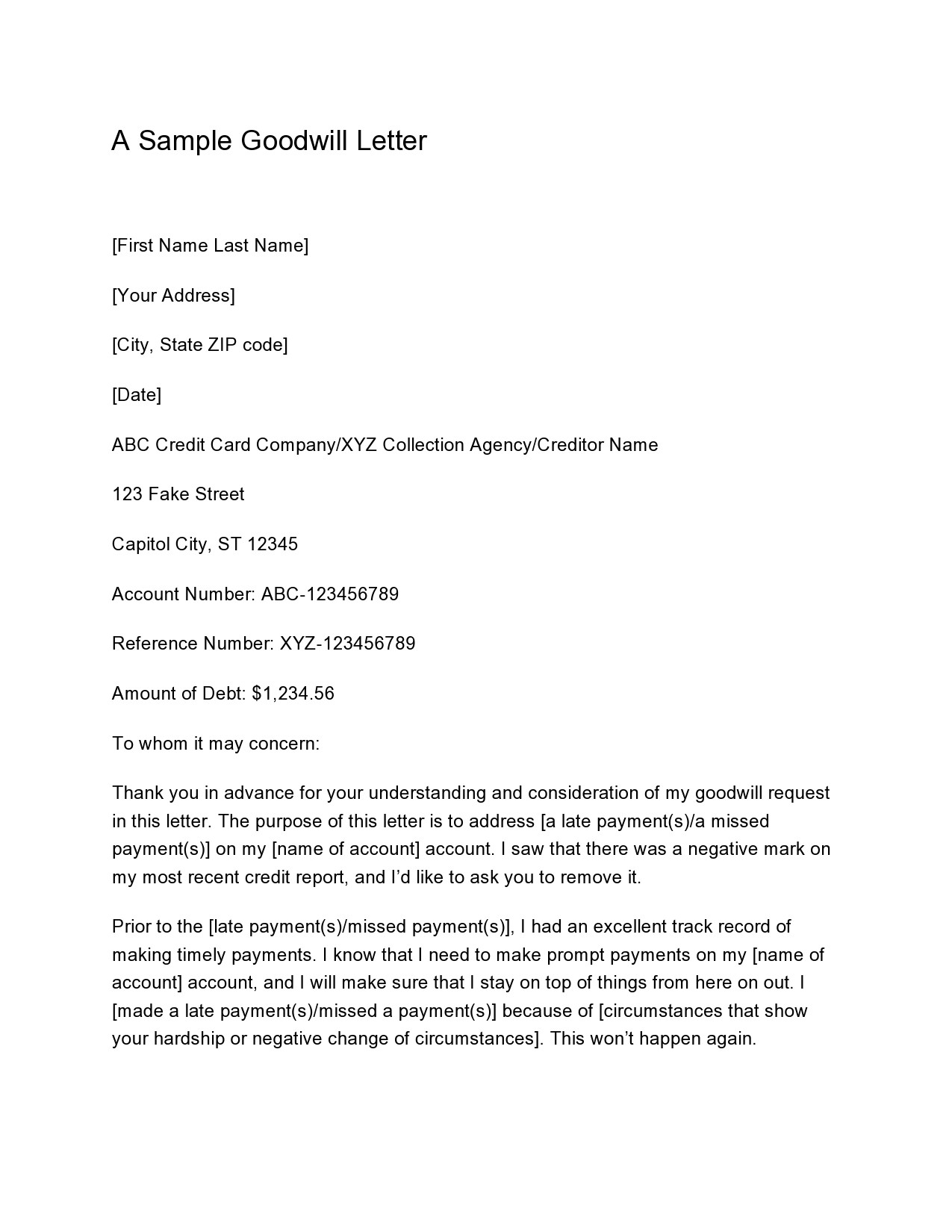

When writing a goodwill letter to your creditor, include as many details as possible. Providing enough information about your situation will most help convince your creditor to grant your request. Here are some things to remember to write a letter successfully:

- Use a sincere but professional tone. Since you made late payments, you must use a sincere tone in your letter. This will work better than using a frustrated or angry tone. Remember that you’re the one asking for a favor. Your creditor isn’t required to remove the negative remark from your record.

- Take full responsibility. The key to a successful letter is to provide a well-written explanation of the situation that caused you to miss or make late payments. Be both transparent and honest. You can also give a sincere apology. Taking responsibility for what happened will go a long way toward making your letter better.

- Provide proof and other relevant documents. If the creditor made a mistake, you must provide proof. There are also times when the creditor isn’t at fault but the credit servicer is. A simple typo can already cause confusion and misunderstanding. Try to reach out to your creditor first to talk about the error. Provide proof of your correspondence.

- Explain that what happened isn’t usual. Another objective of this letter is to build their trust in you. You can increase the chance of getting approved if your creditor finds out that you have always made timely payments. If it was the first time you made a late payment, your creditor would most likely grant your request.

- Keep it simple and short. Creditors have many responsibilities and reading lengthy letters isn’t one of them. Getting straight to the point in your letter is the most important thing you should do while writing. Statements that are too lengthy or even contain technical jargon won’t help your case.

Goodwill letters are not considered a legal way to communicate with your creditor. Because of this, you won’t find any specific department which you can address your letter to. Instead, you can search for the customer service address of your creditor on the official website of the company. This would give you an address to send your letter. You can find this information online but you can also find it on your monthly credit card bill.

Goodwill Letters To Creditor

Can you email a goodwill letter?

It’s recommended to send your goodwill letter through regular mail. If you send it through email, your creditor might not read your letter. When sending the letter, make sure to show politeness and professionalism. Explain what brought about your circumstance and what you’re hoping to achieve. Also, remember to thank the creditor for taking the time to read your letter.