Anyone who has purchased some sort of property should have a land contract form transferred to them by the seller. This is also called a land contract agreement and it’s a legally-binding document. With this contract, the seller has signified his intent to accept payments from a buyer for a property he owns. Once the buyer has paid the loan to the property in full, the seller transfers the property’s title to the buyer.

Table of Contents

- 1 Land Contract Forms

- 2 What is a land contract form?

- 3 Land Contract Agreements

- 4 How does a land contract work?

- 5 Land Contract Templates

- 6 What should a land contract include?

- 7 Land Contract Samples

- 8 Types of land contracts

- 9 Who pays property taxes on a land contract?

- 10 Is a land contract a good idea?

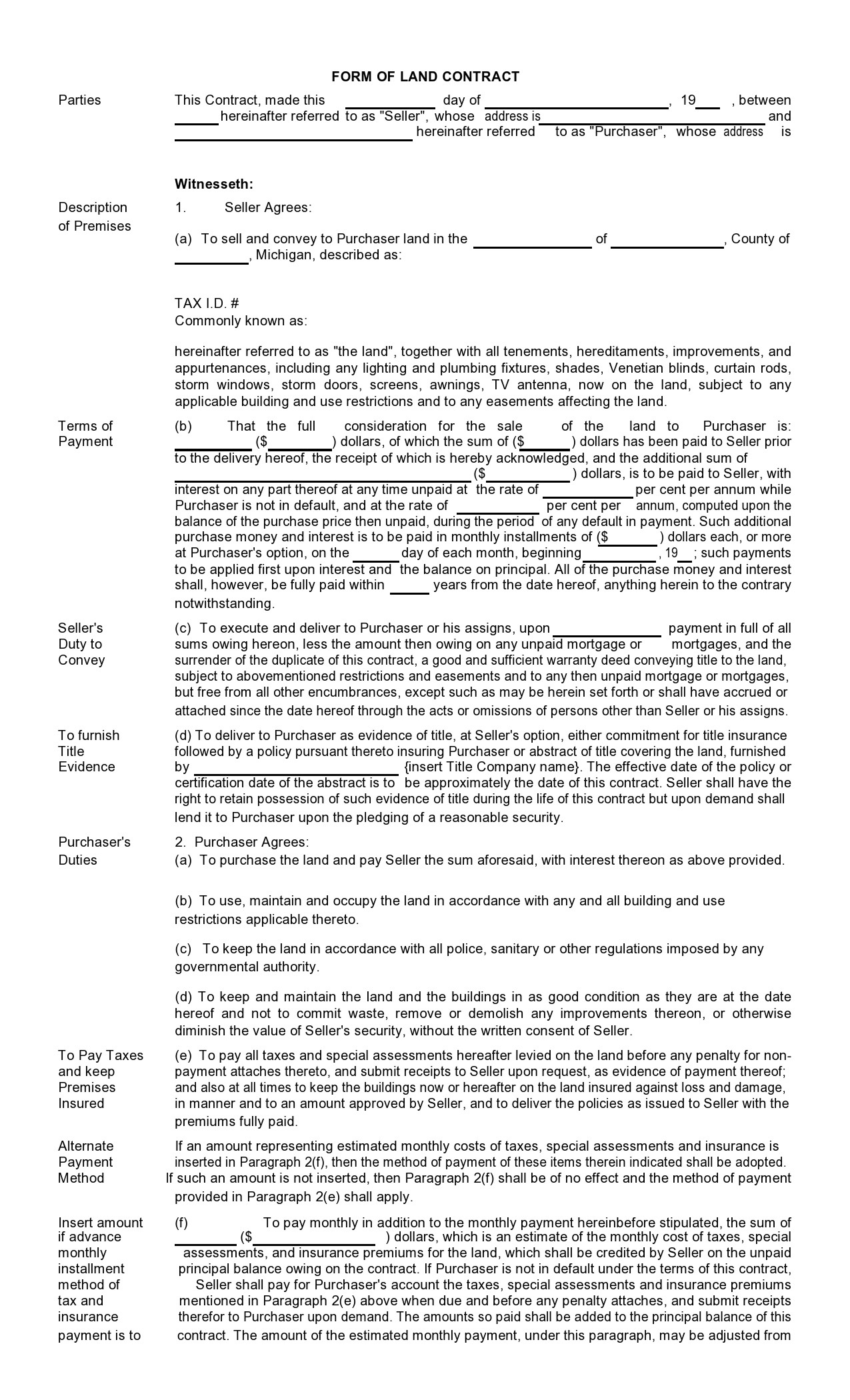

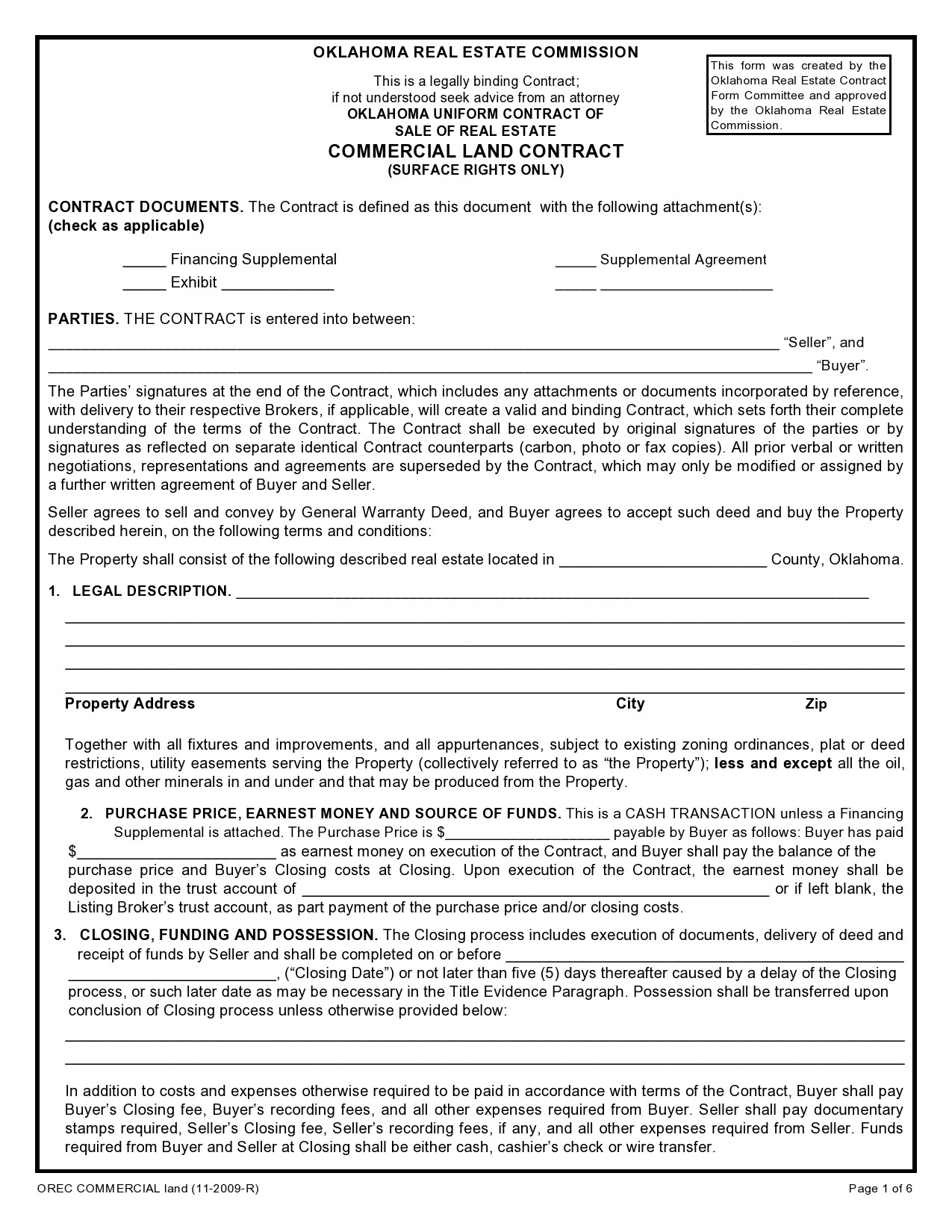

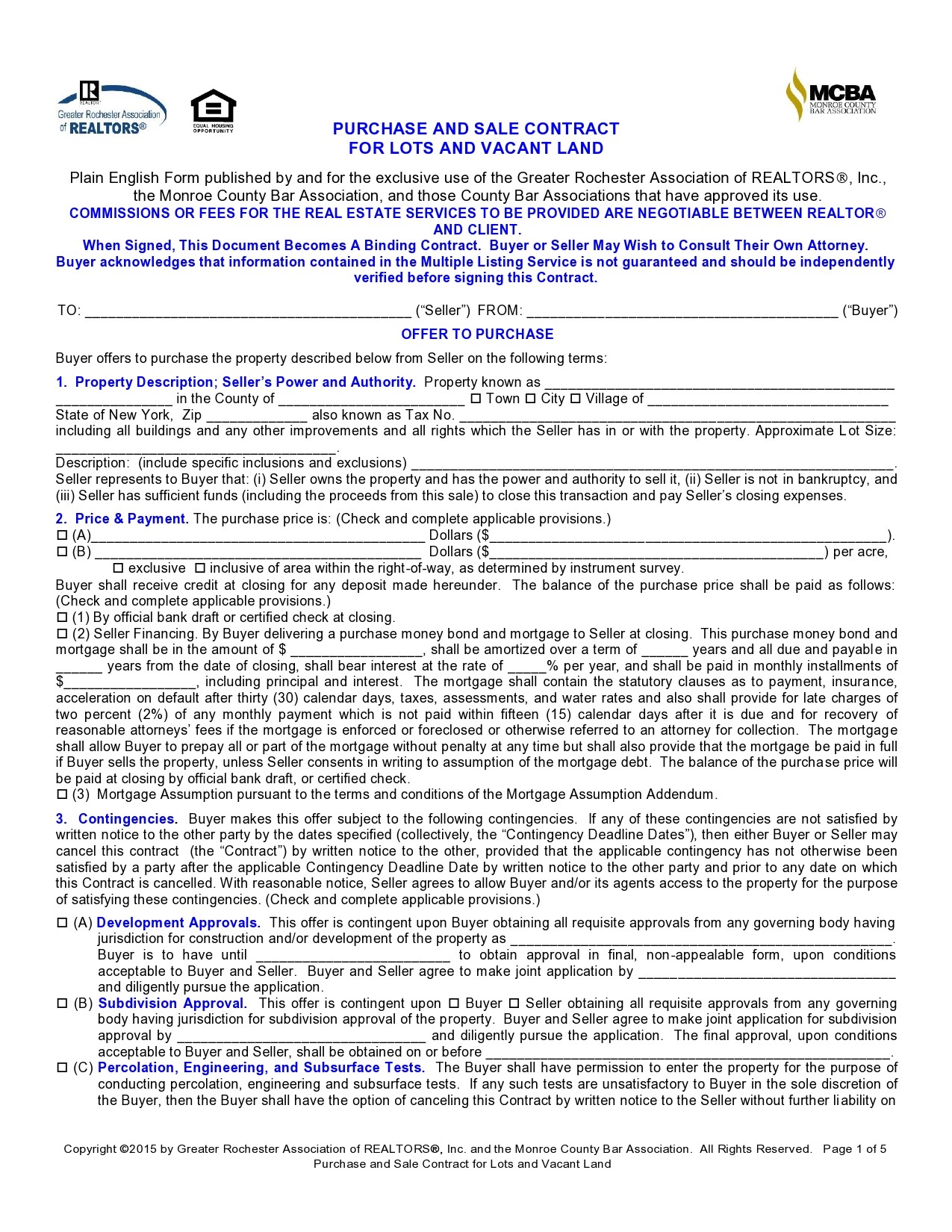

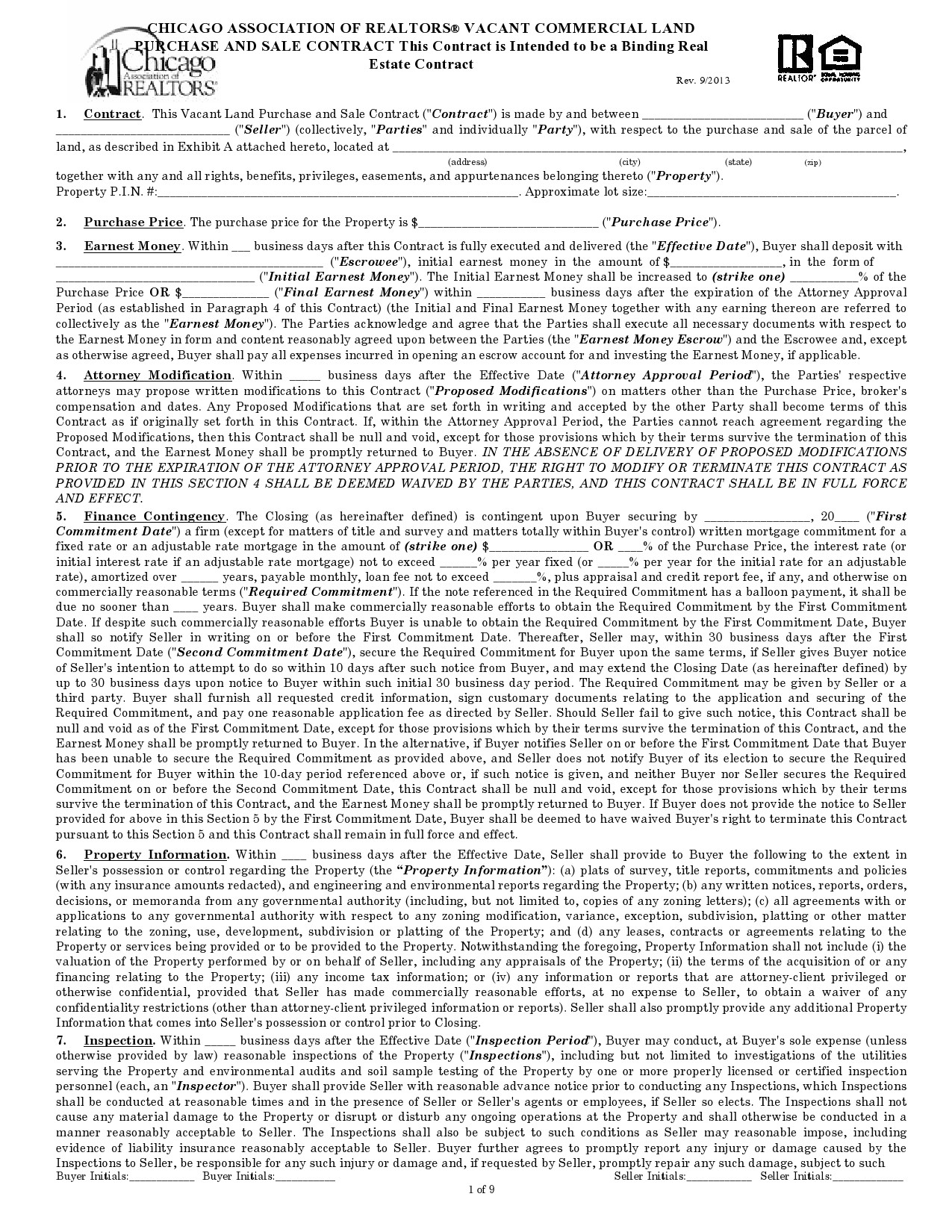

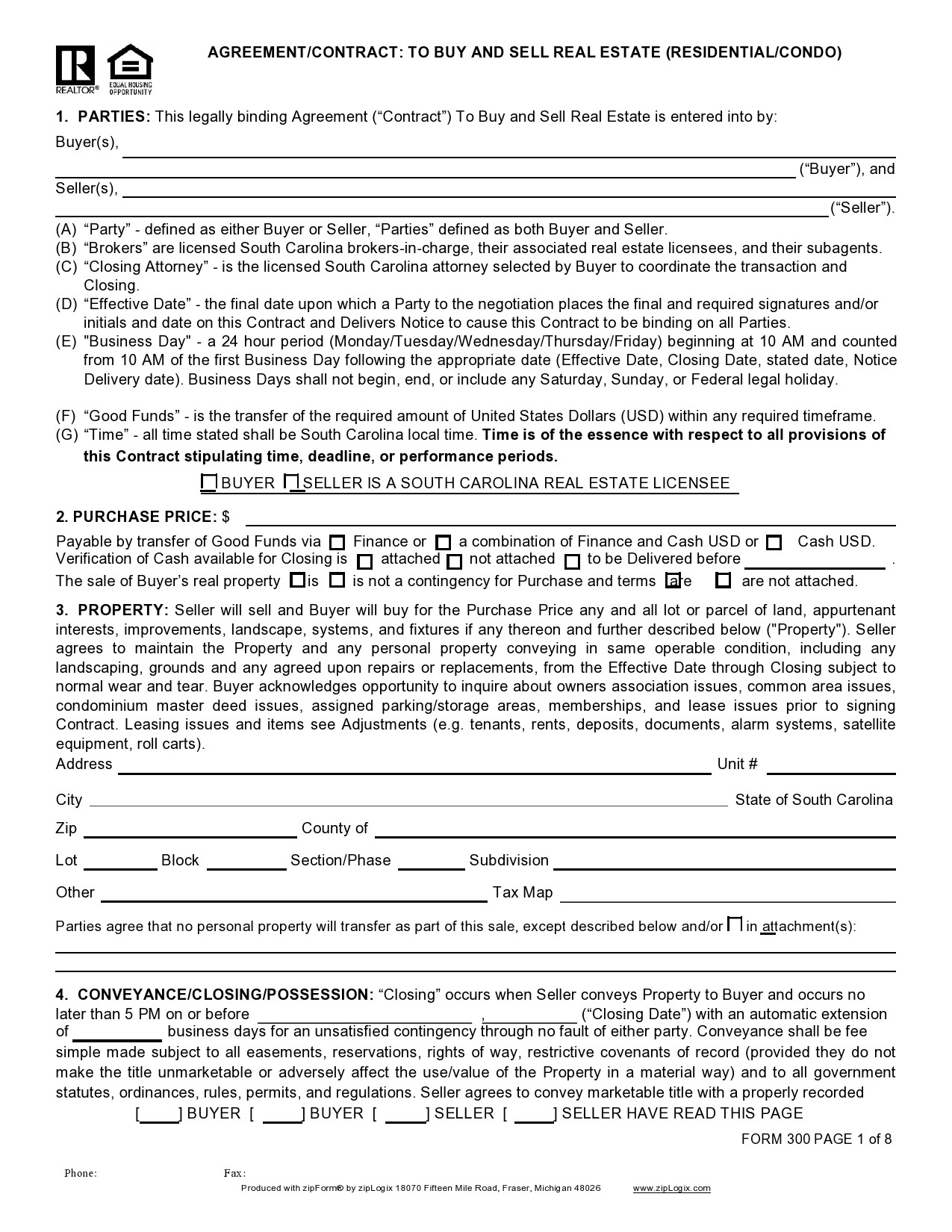

Land Contract Forms

What is a land contract form?

A land contract form is one kind of real estate transaction. Here, the seller offers the buyer a unique financing option. The latter then pays the former the price they had agreed-upon in installments for a set amount of time. These payments given to the seller are a combination of both the principal amount and interest – just like a typical house mortgage. Generally, a balloon payment comes into play at the end of the agreement.

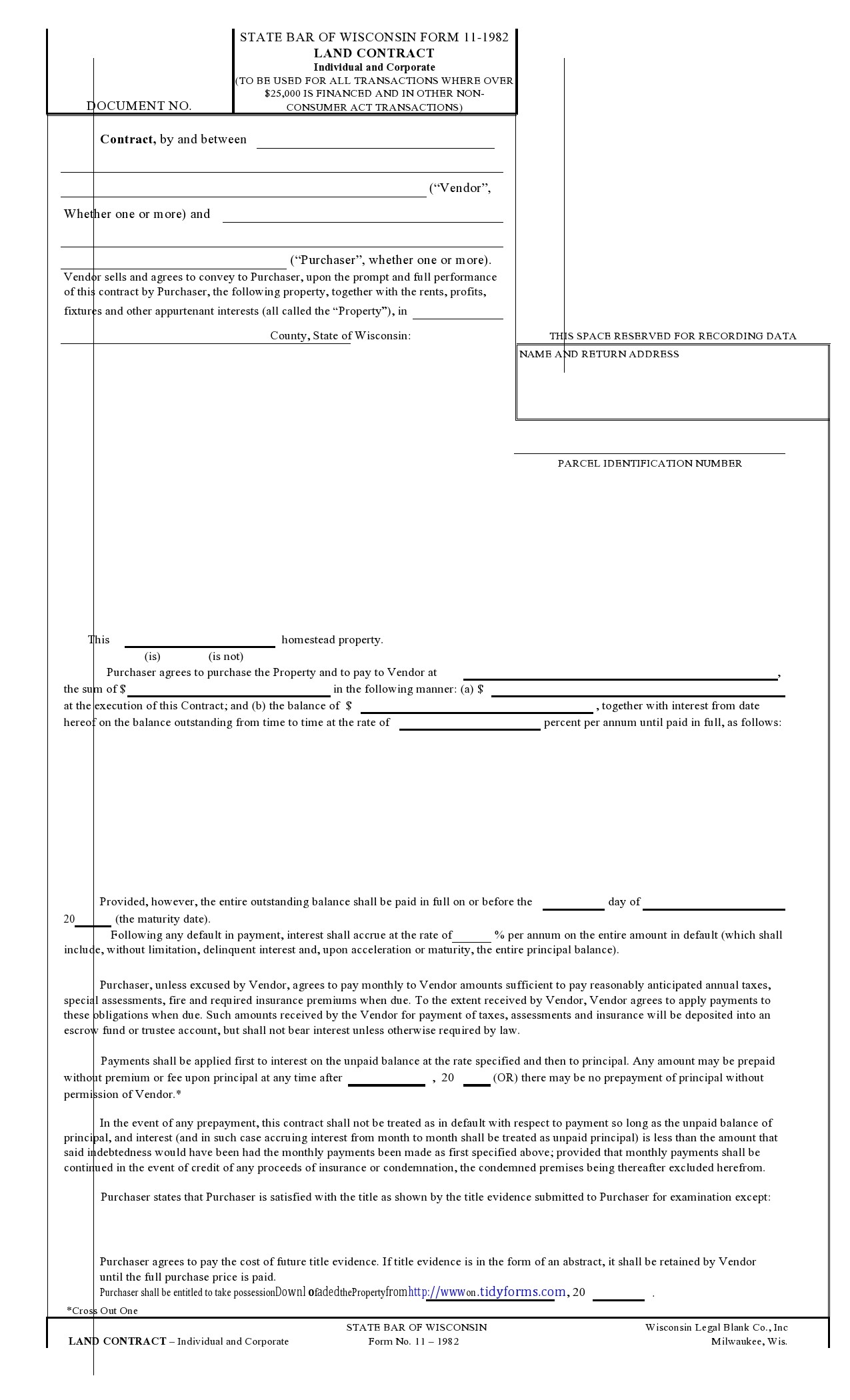

Land Contract Agreements

How does a land contract work?

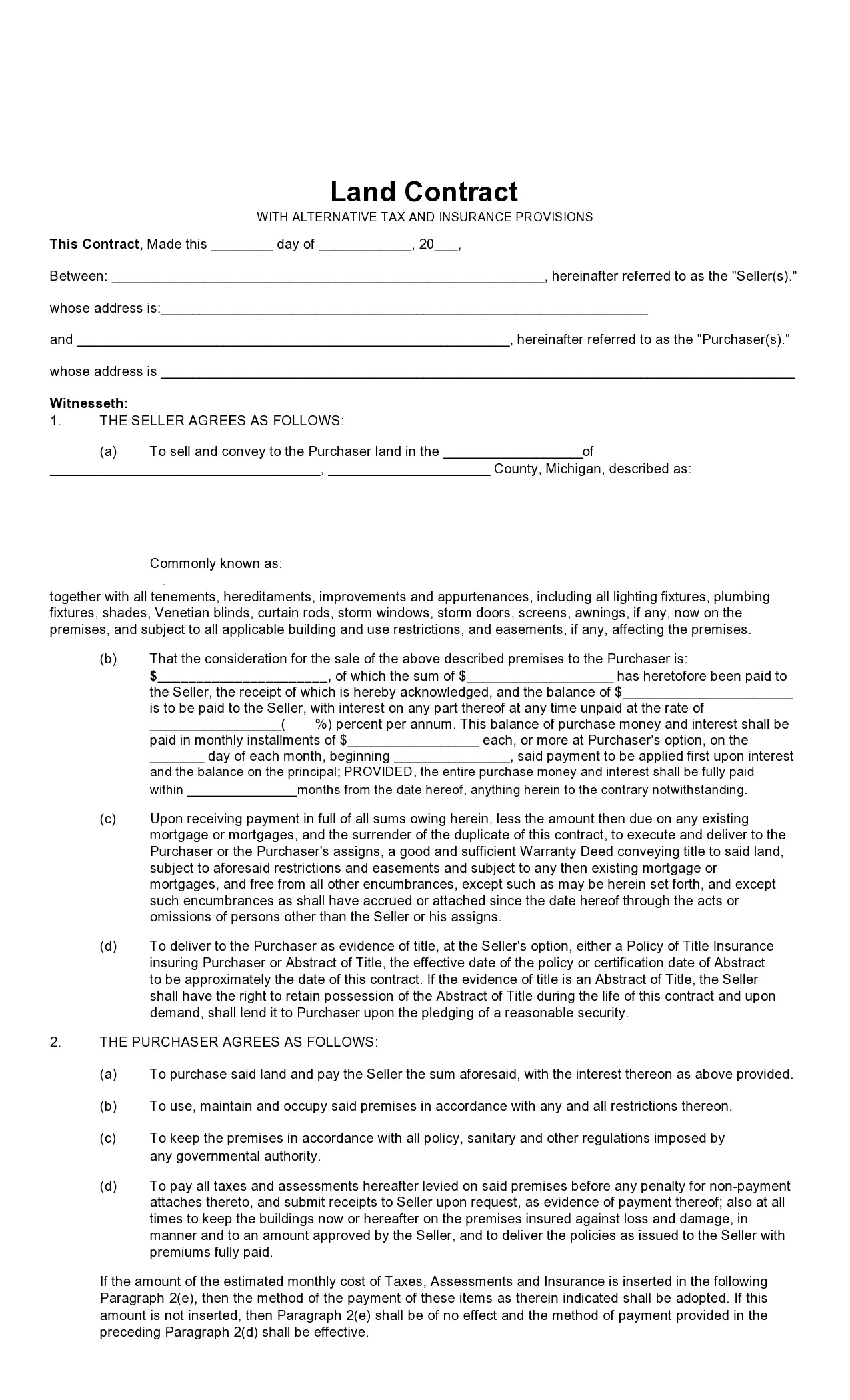

A land contract is a written legal agreement or contract used for the purchase of real estate like a house, a commercial building, an apartment building, a vacant piece of land or other real estate property. A land contract sample is a type of seller financing.

Although it’s similar in substance to a mortgage, it differs in the sense that instead of the buyer borrowing funds from the bank to purchase the property, the buyer makes real estate payments to the owner until the entire price gets paid in full. Both the buyer and the seller will affix their signatures on the land contract form which covers the terms and conditions they both agreed upon.

When all of the terms and conditions have been completely satisfied, especially the payment terms over the specified period of time, the property’s legal title then gets transferred by the seller to the buyer via some kind of deed like a warranty deed.

During the period that the buyer makes his payments to the seller, he’s considered to possess an “equitable title.”. As a holder of such title, the buyer has an interest in the property while the seller gets precluded from offering the property to anyone else.

The seller is also precluded from placing the property under any encumbrance or lien that interferes with the buyer’s interest. The property’s “legal title,” however, still belongs to the seller until the buyer makes the last payment as stipulated in the land contract agreement.

As soon as the buyer makes the last payment and all of the land contract’s conditions have been completely fulfilled, the deed of the property gets filed with the correct government office, usually a county registry of deeds. This action officially makes the buyer the new property owner.

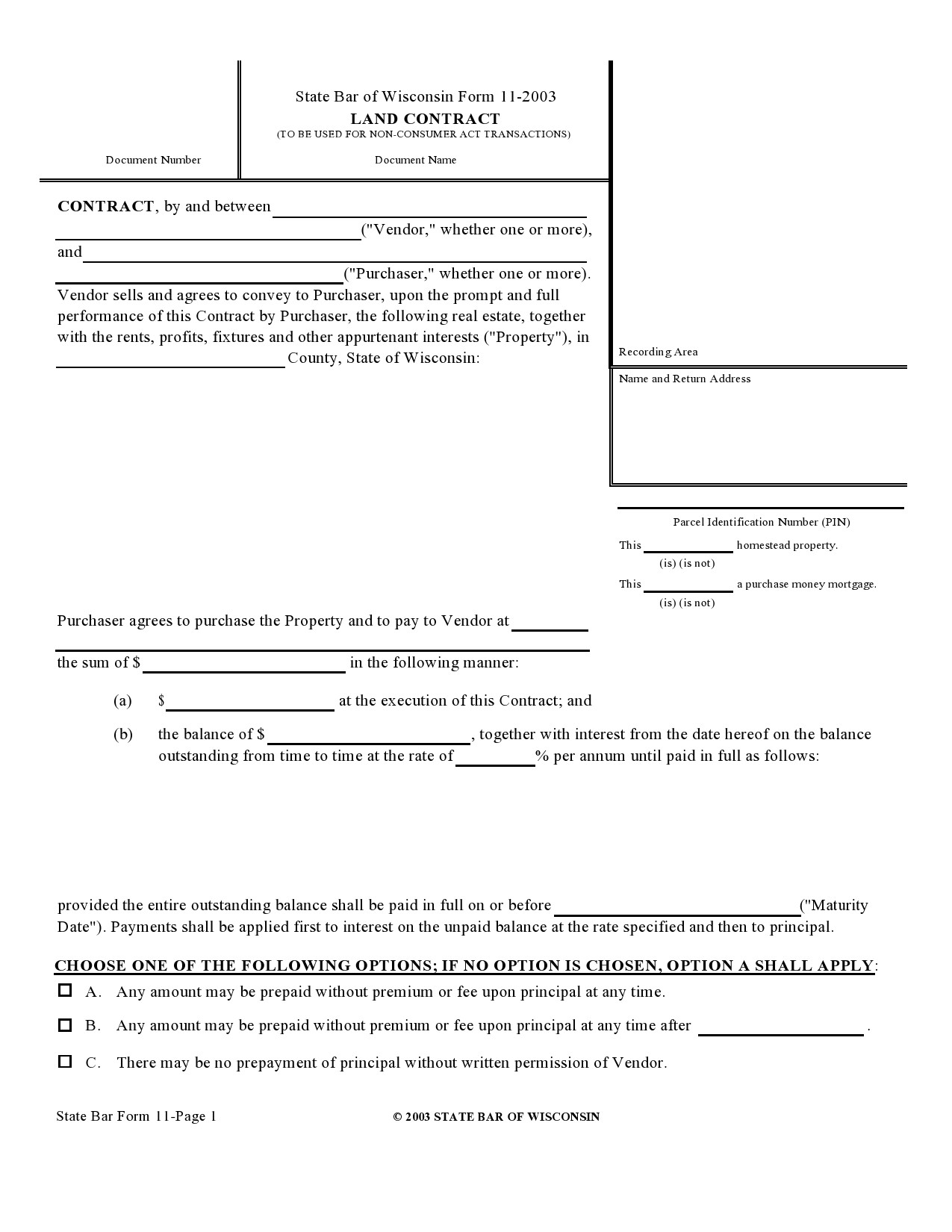

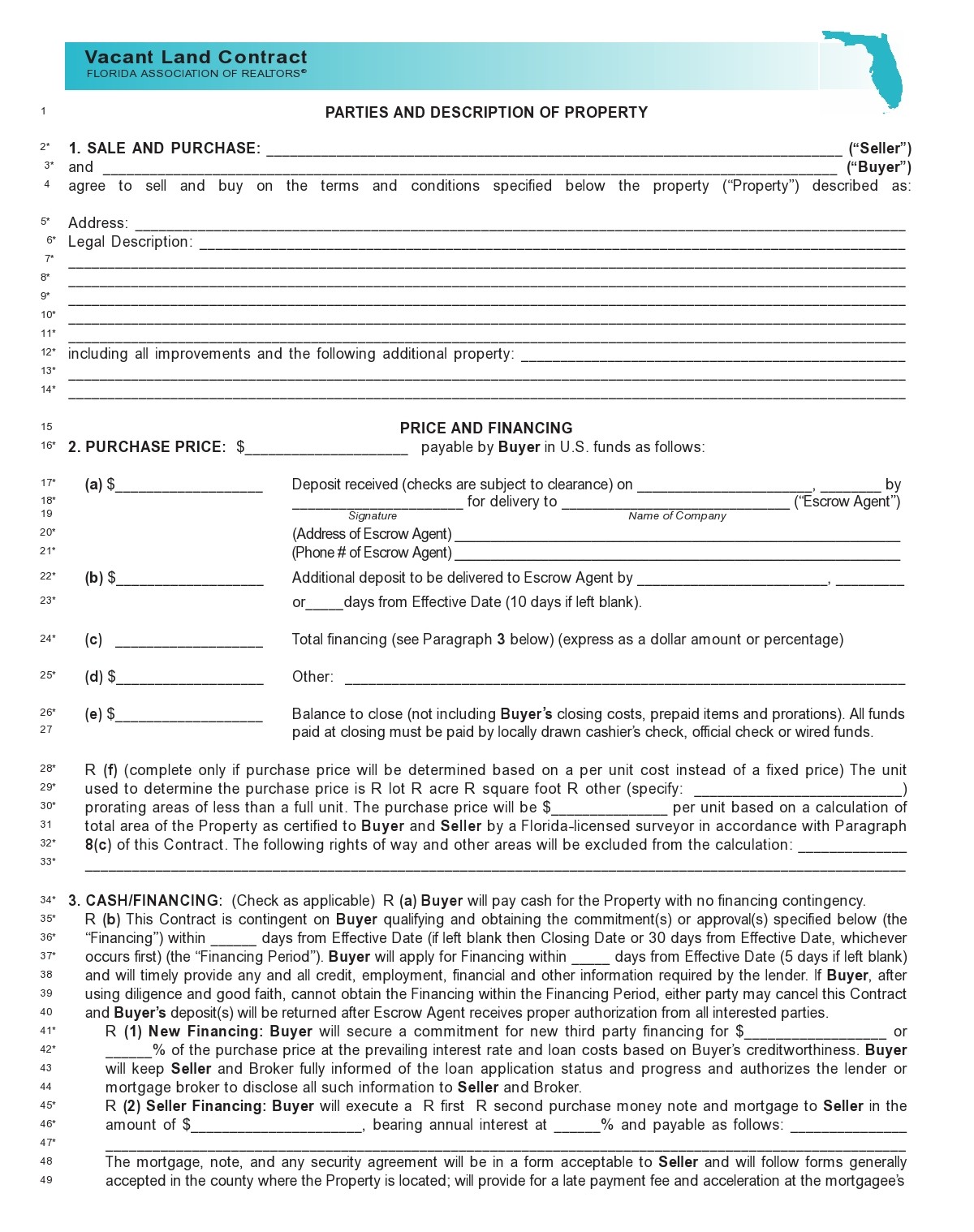

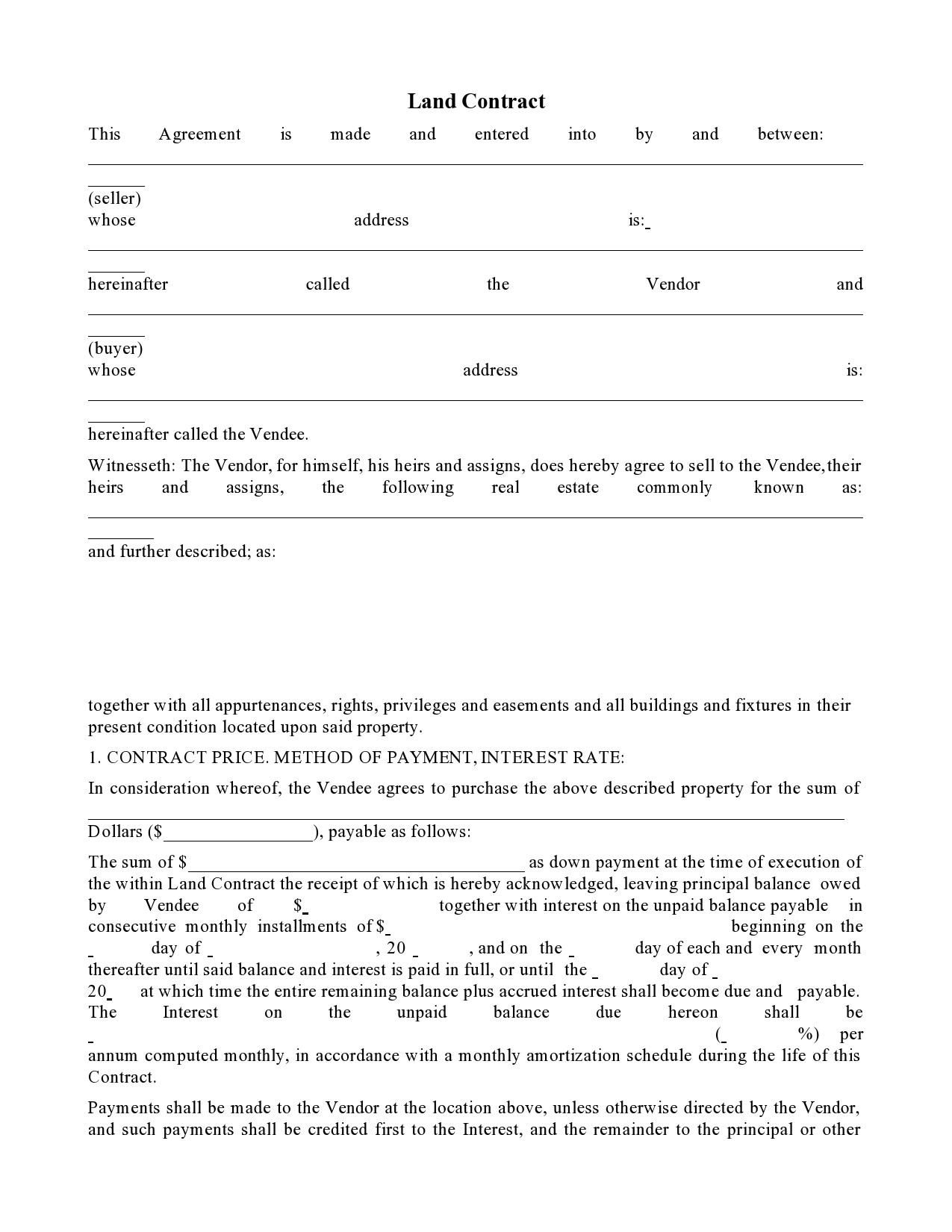

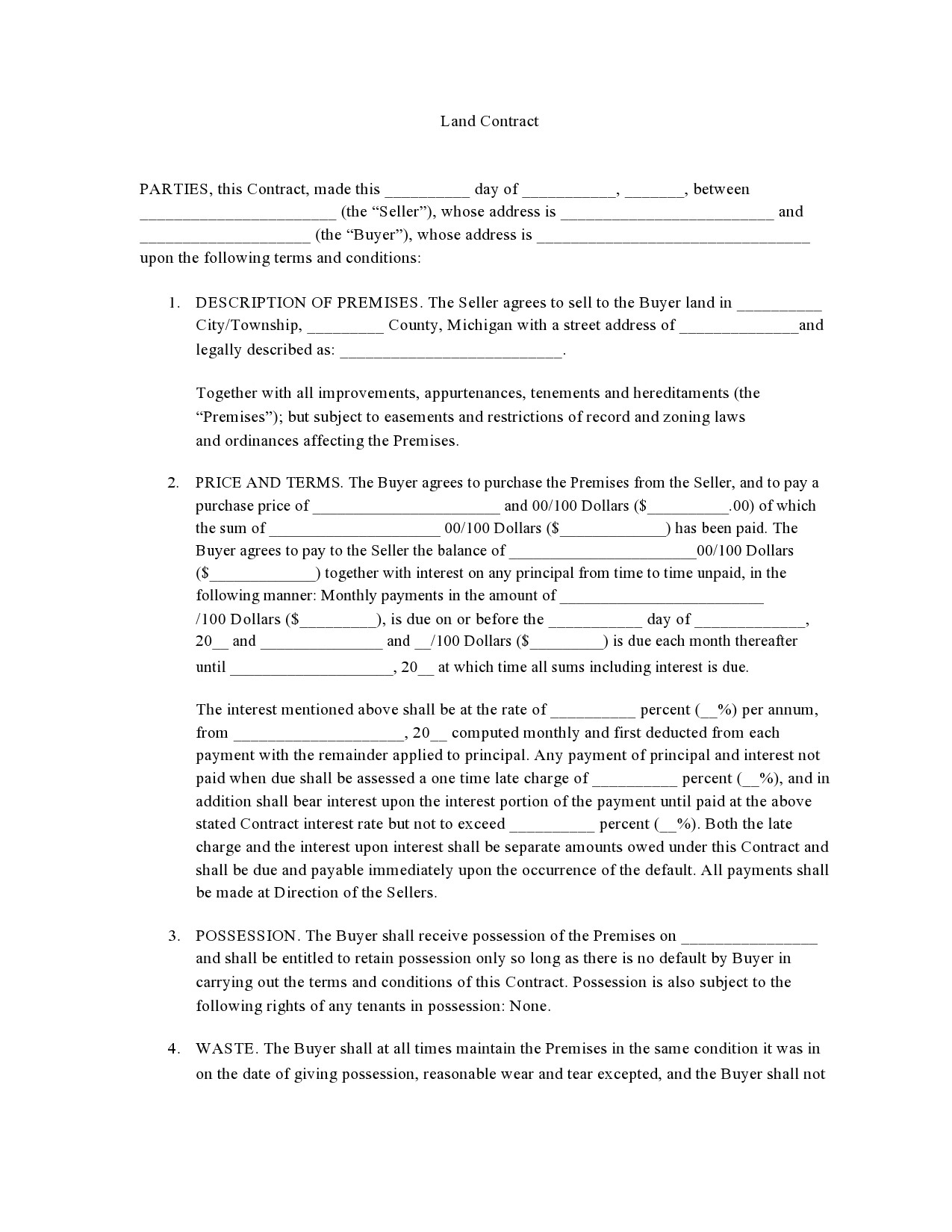

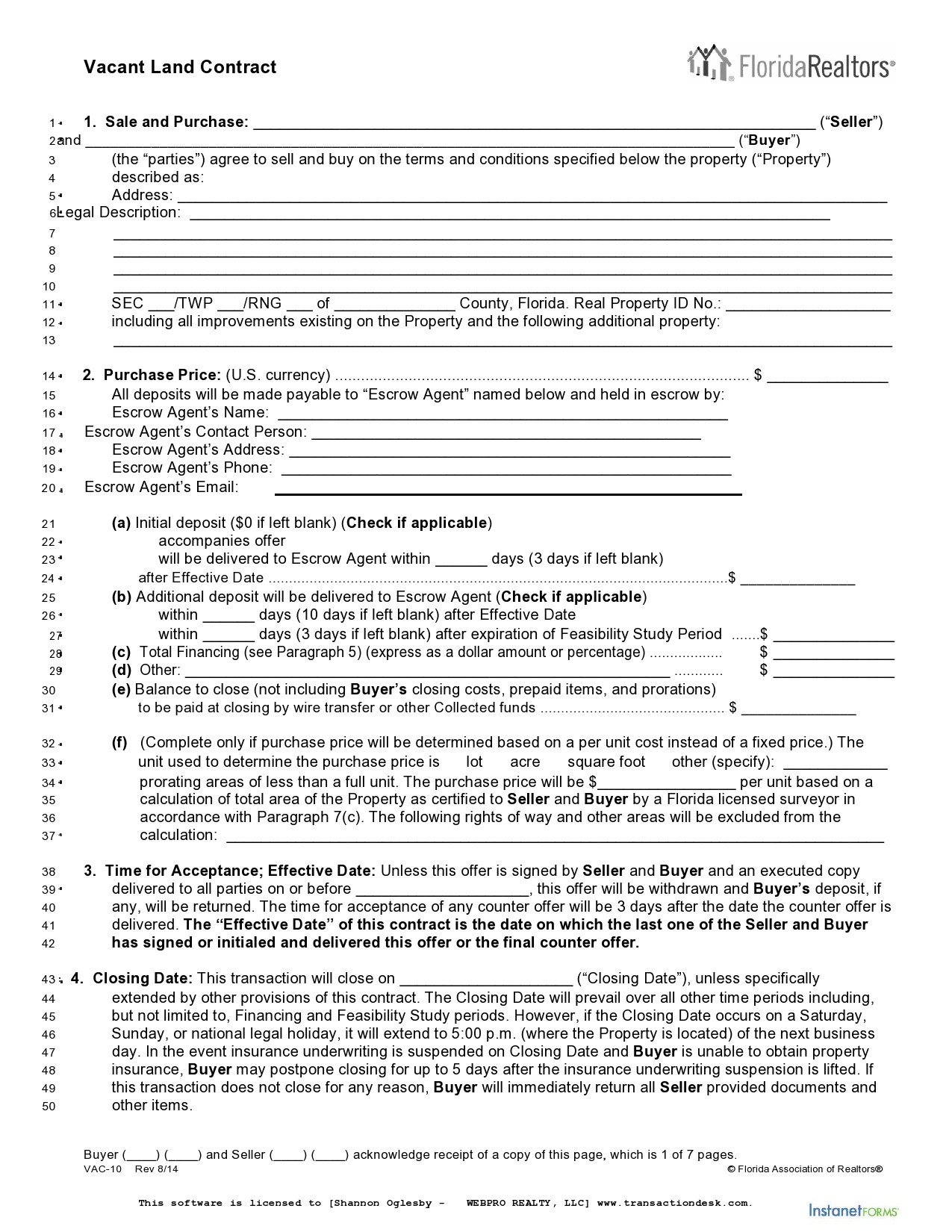

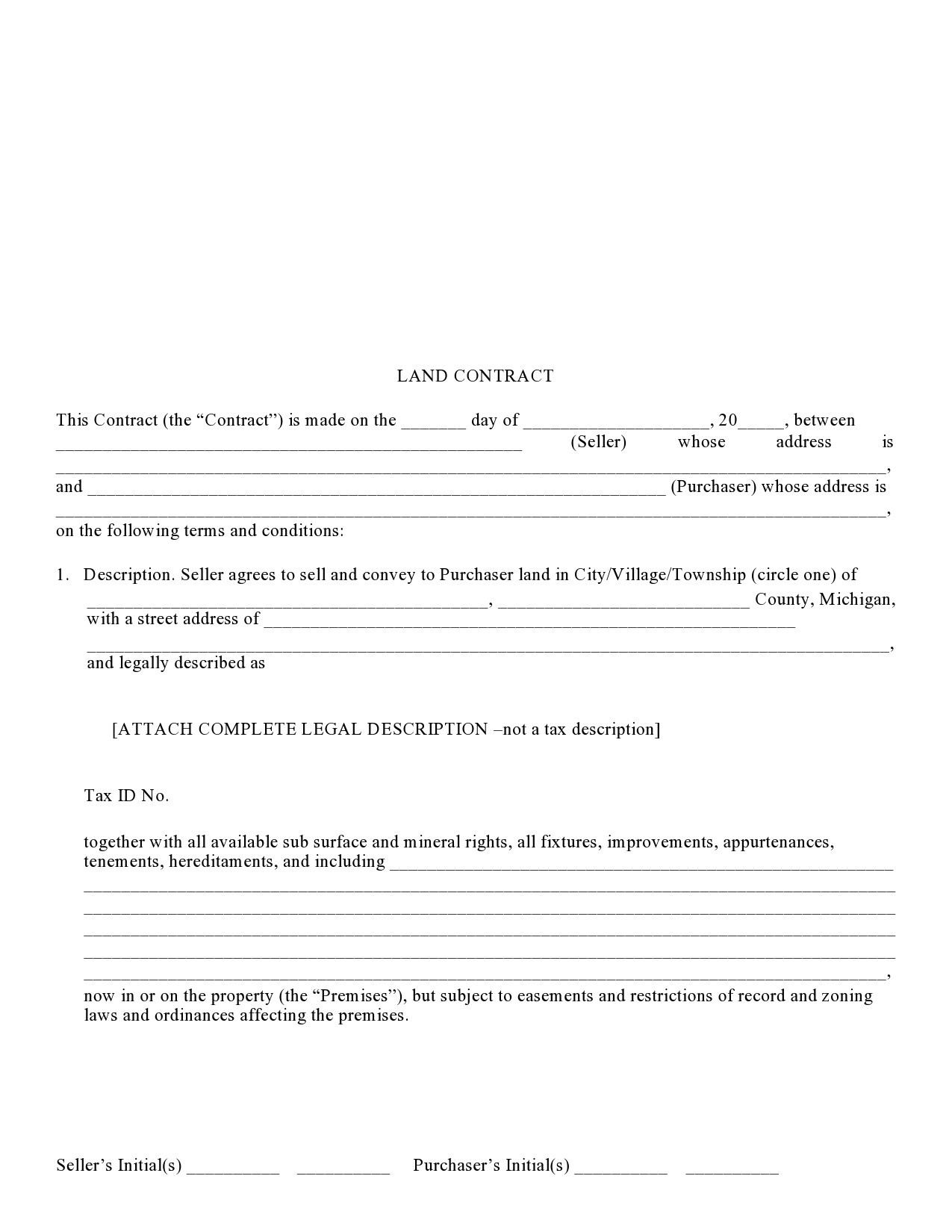

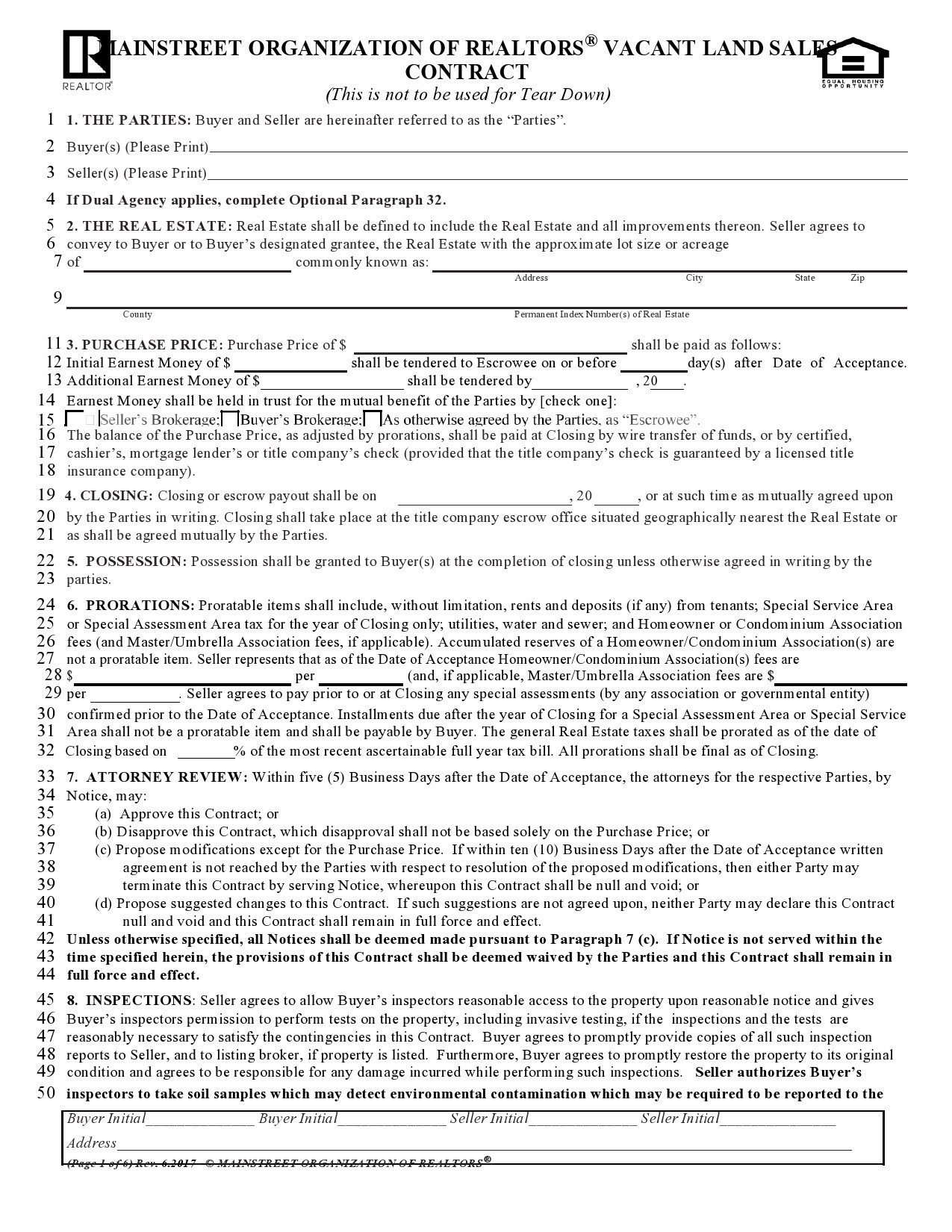

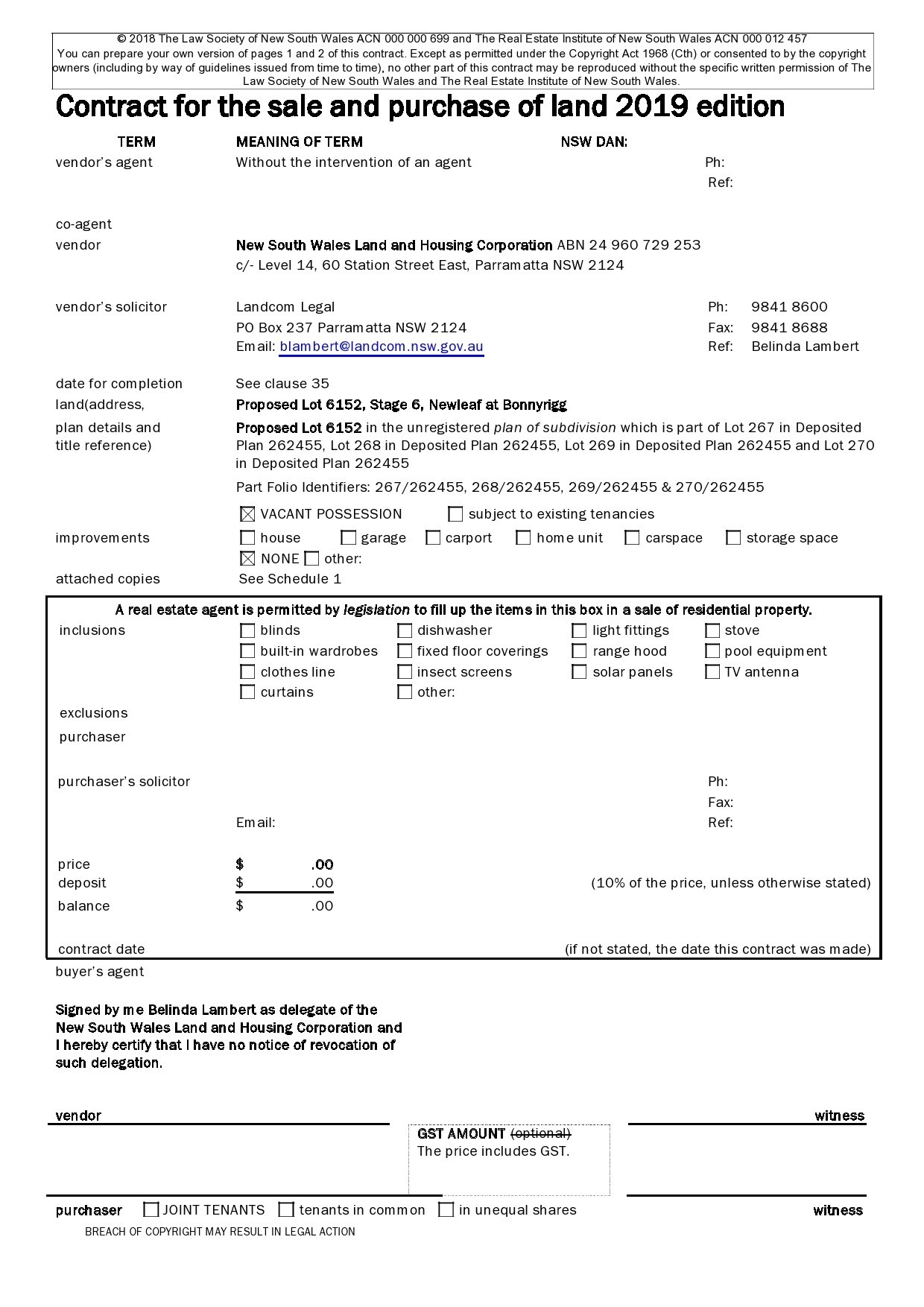

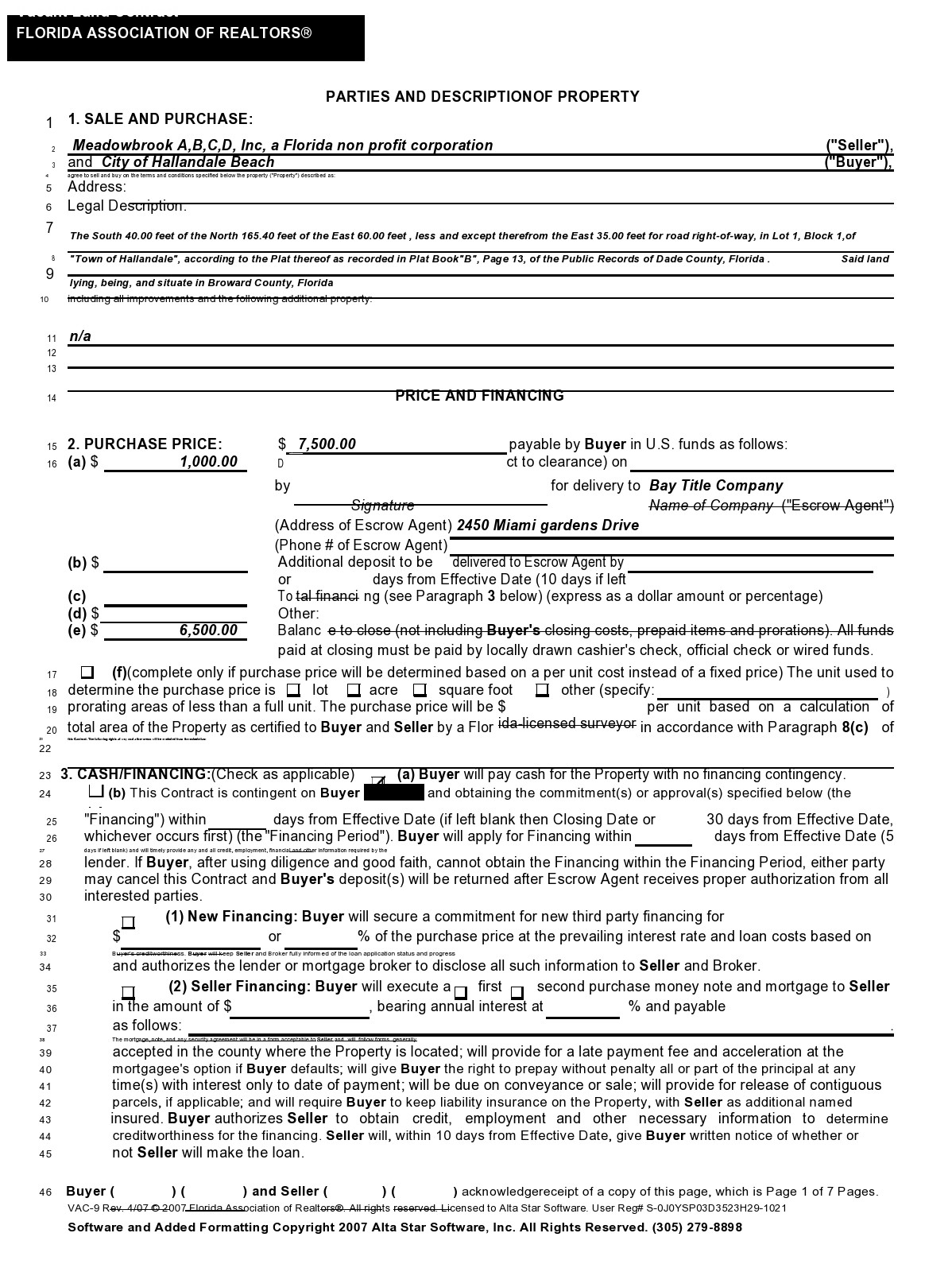

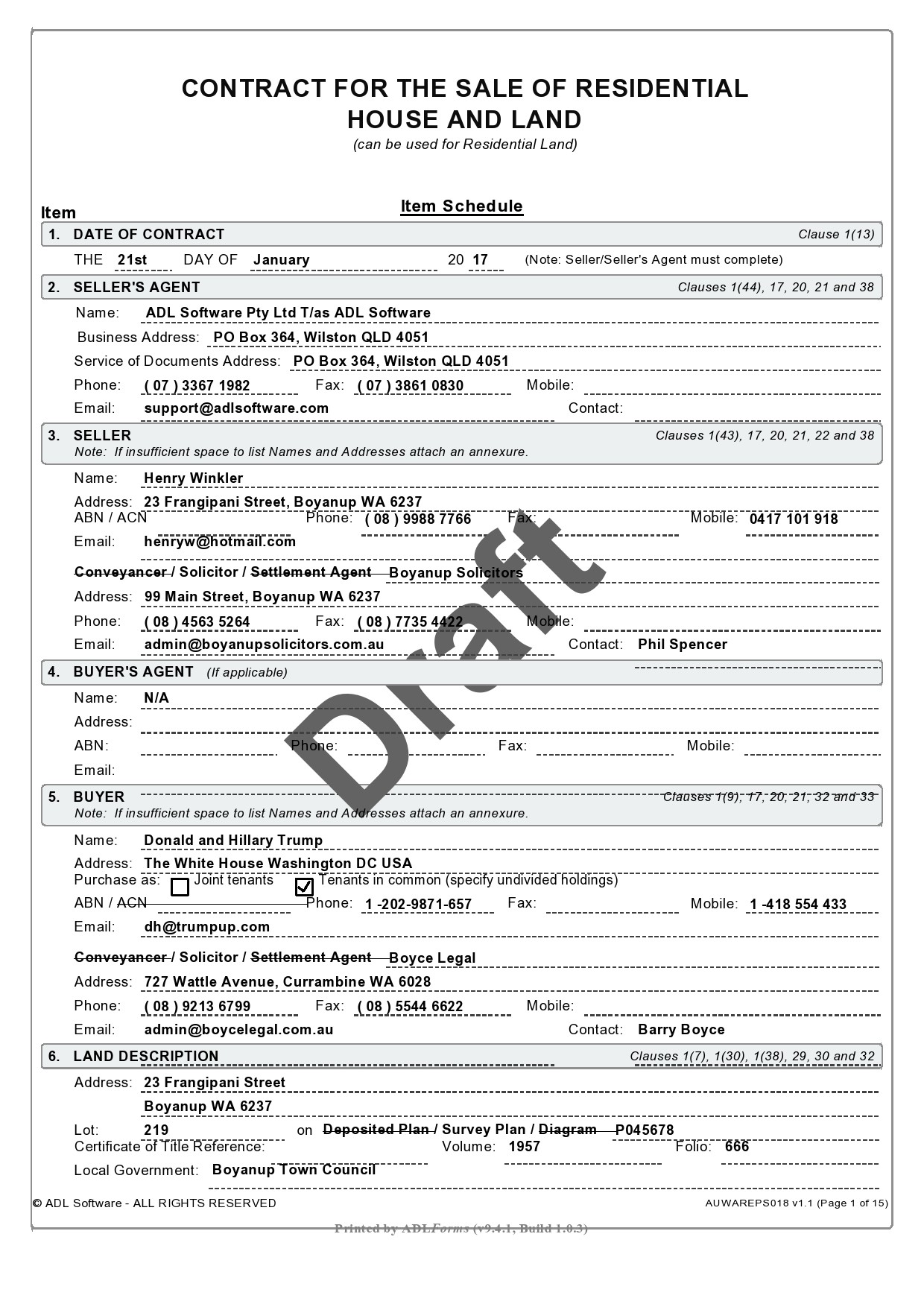

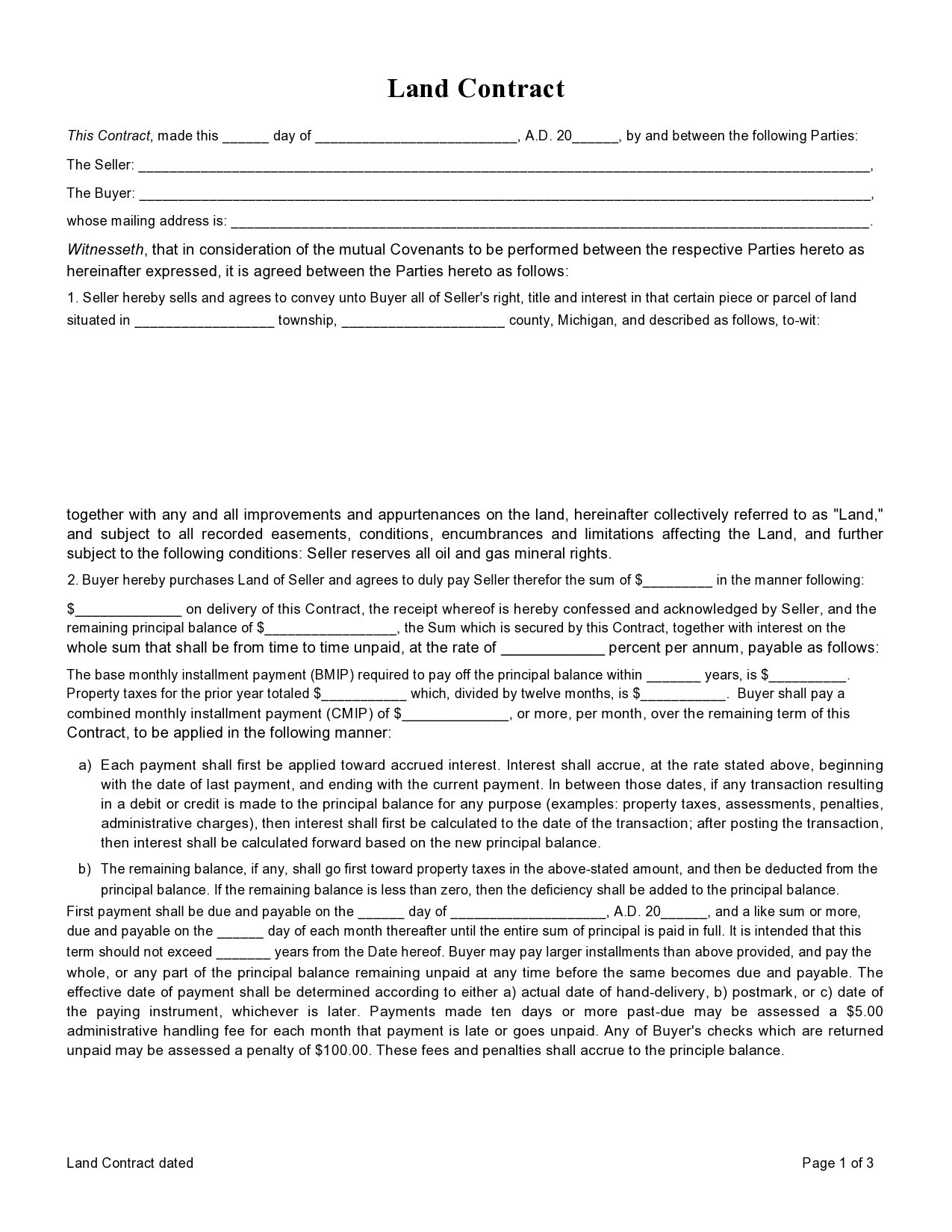

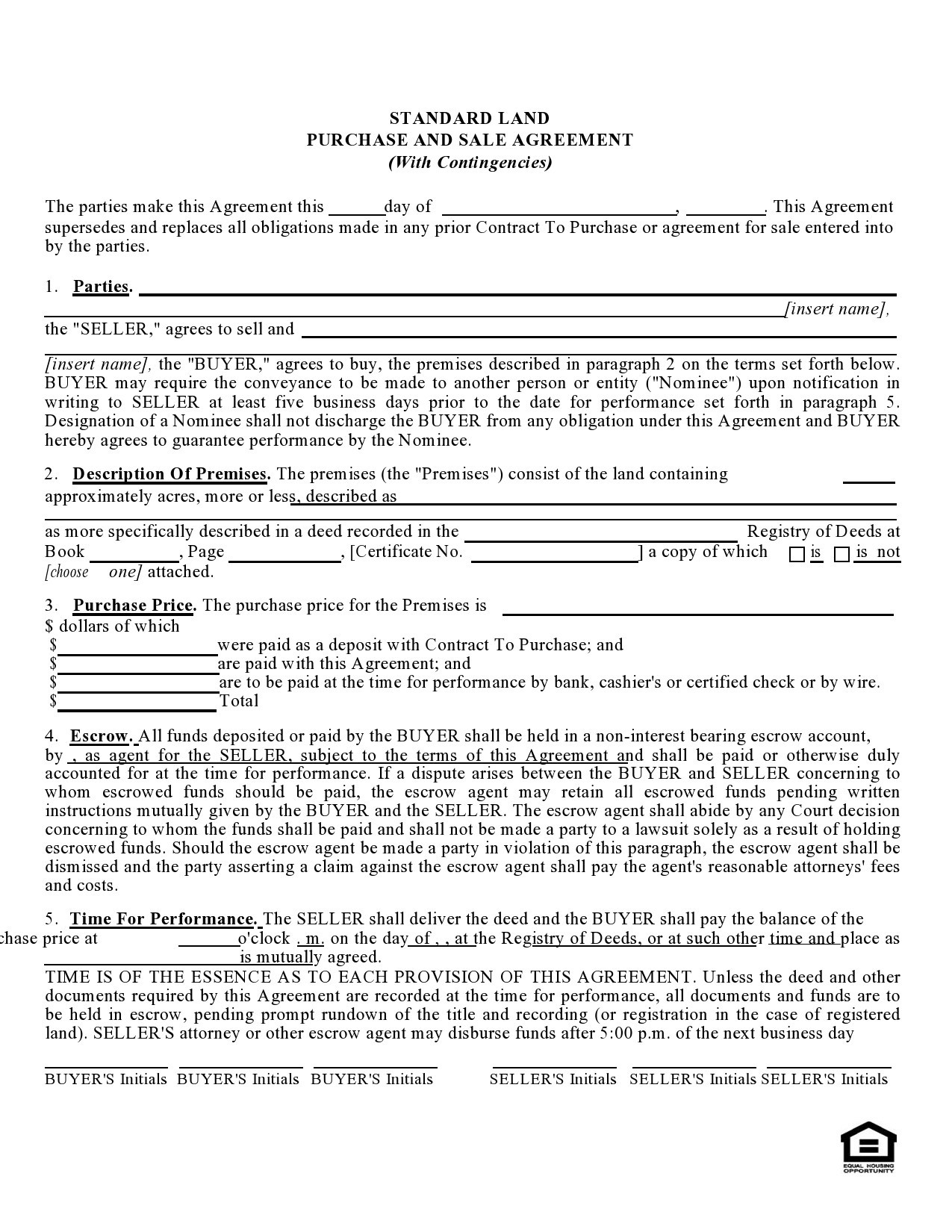

Land Contract Templates

What should a land contract include?

The signing of a land contract template by the buyer means the same thing as signing a mortgage. But it’s not the same as a lease contract form that’s designed for the rental of properties owned by a landlord. A land contract form is an agreement to buy the property without having to apply for a loan as the seller who provides the financing.

After the final payment, the seller must transfer the ownership to the buyer. A land contract sample the document that makes the transaction legally-binding and official. Land contract forms are also called agreement for deed, land installment contract, installment sale agreement or contract for deed.

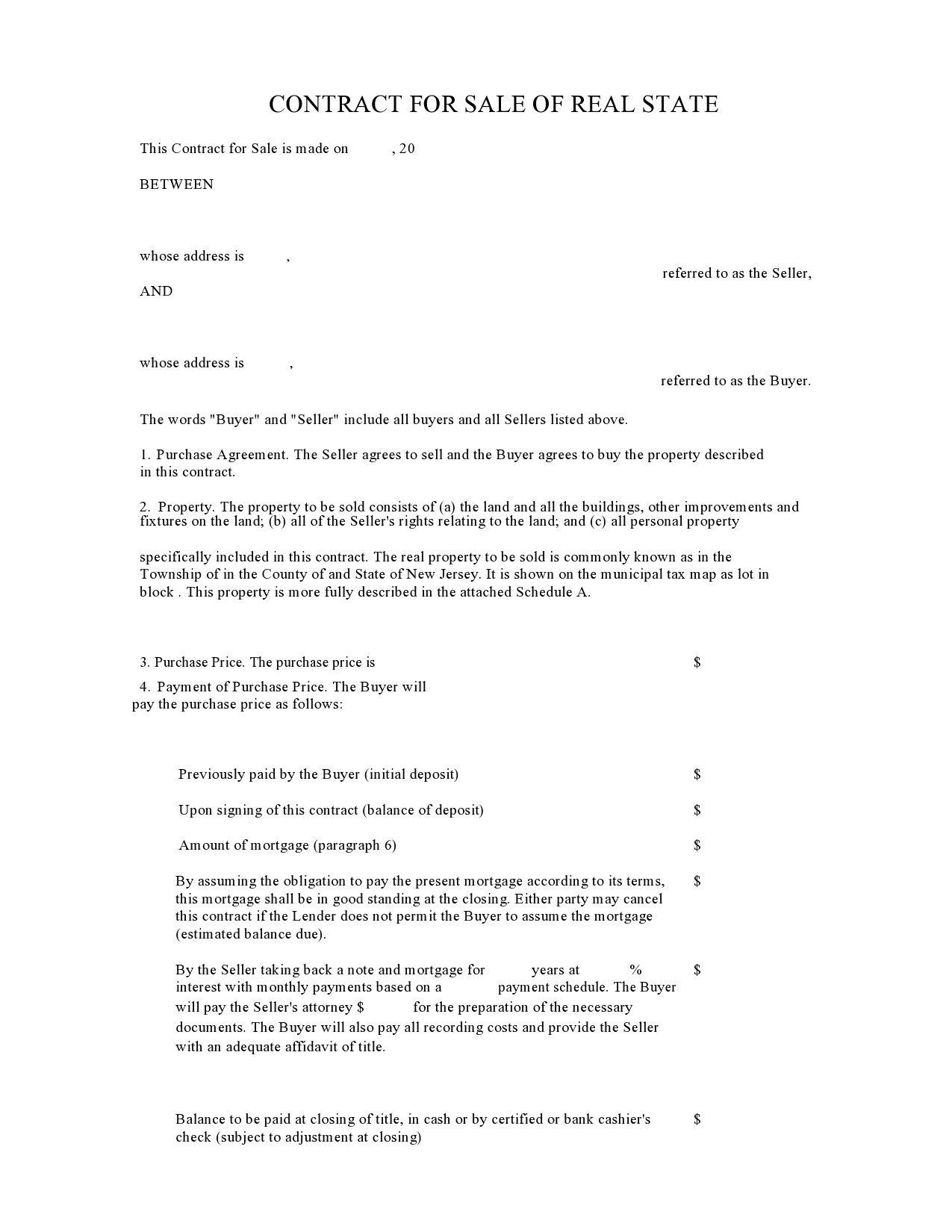

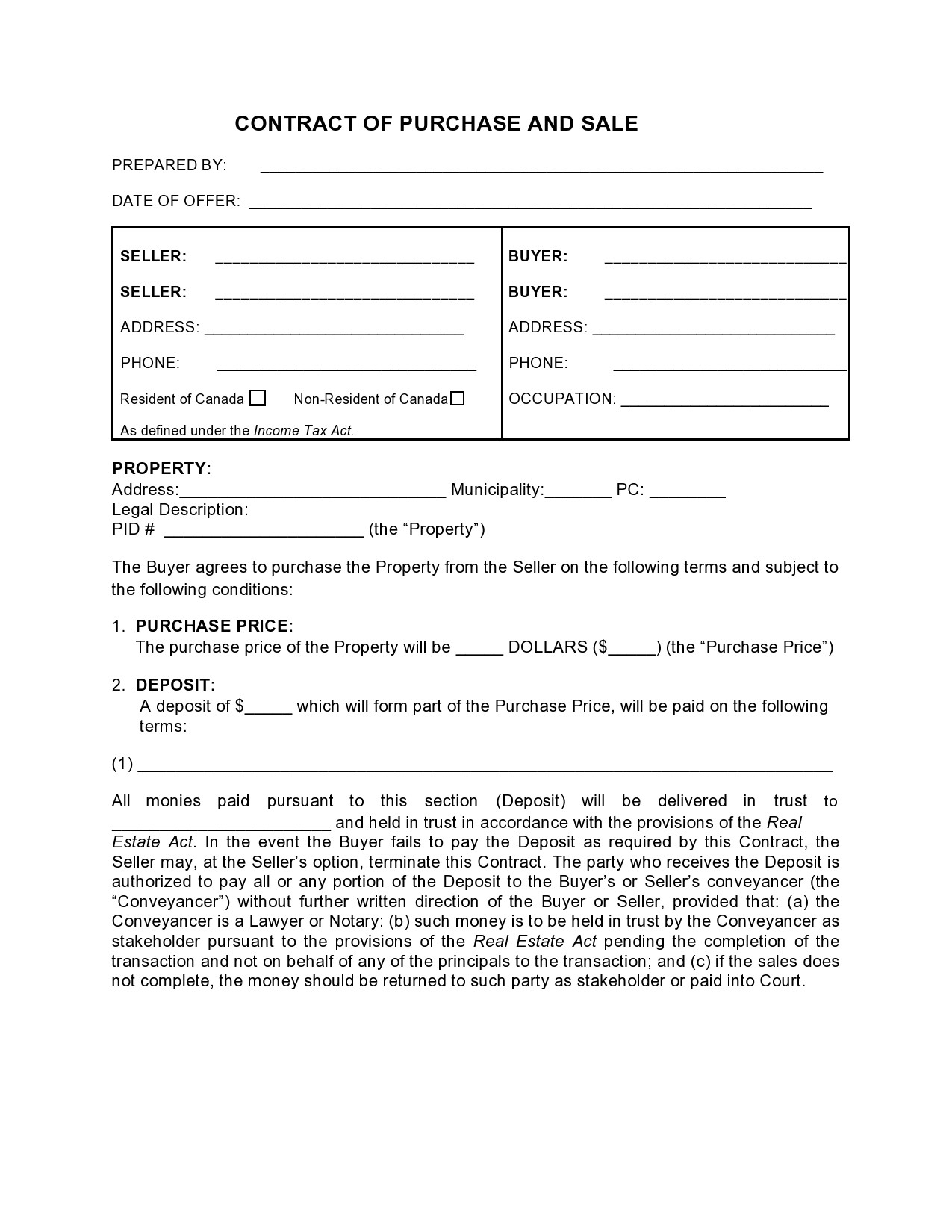

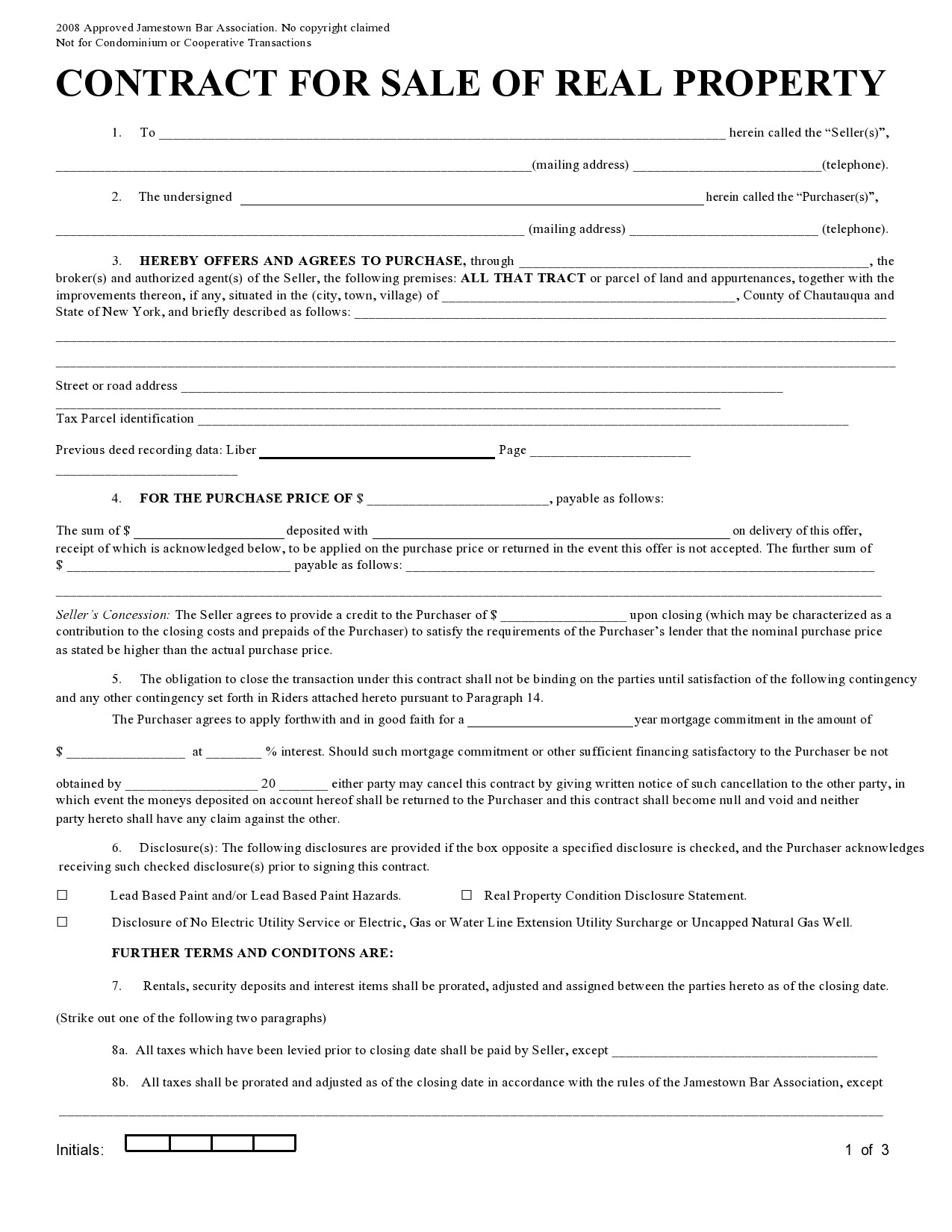

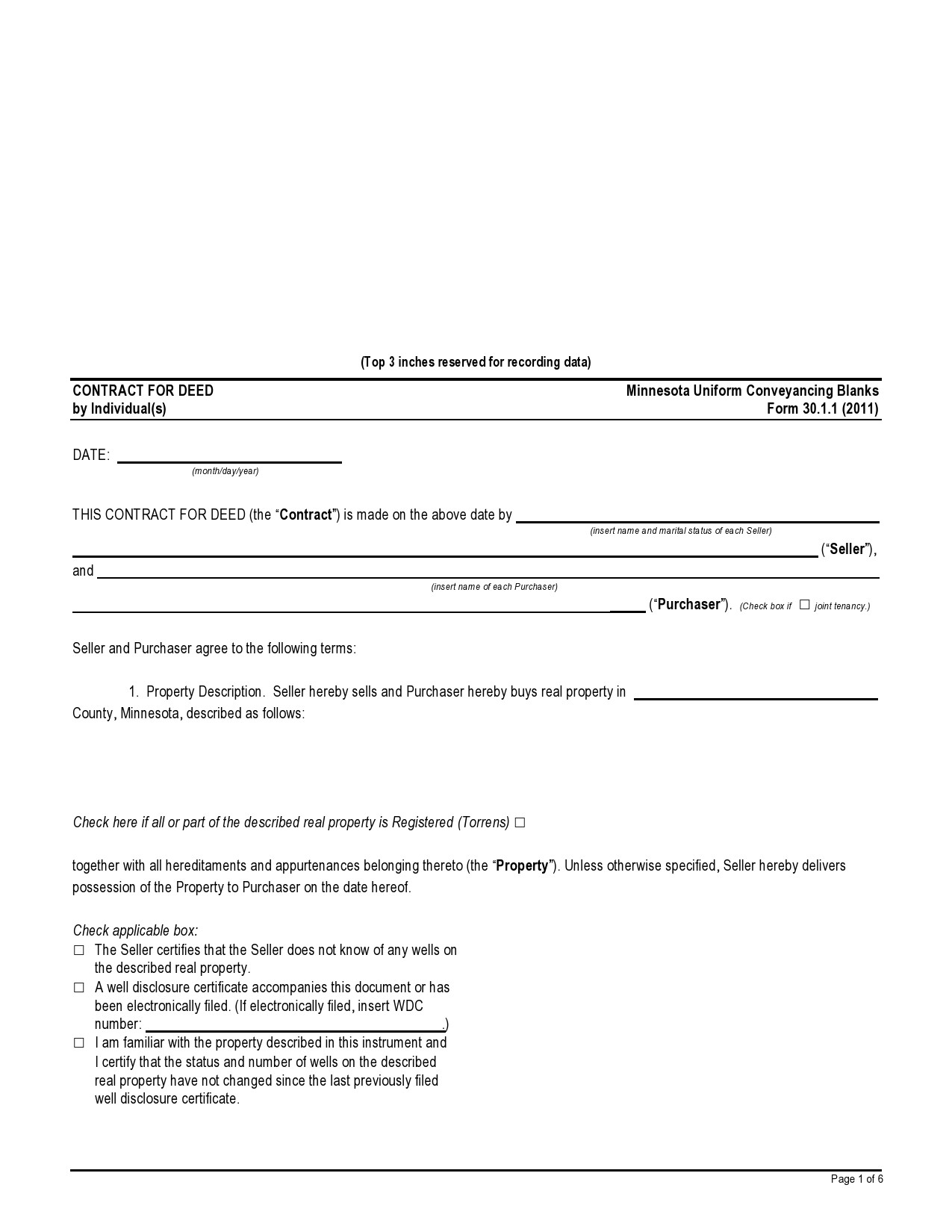

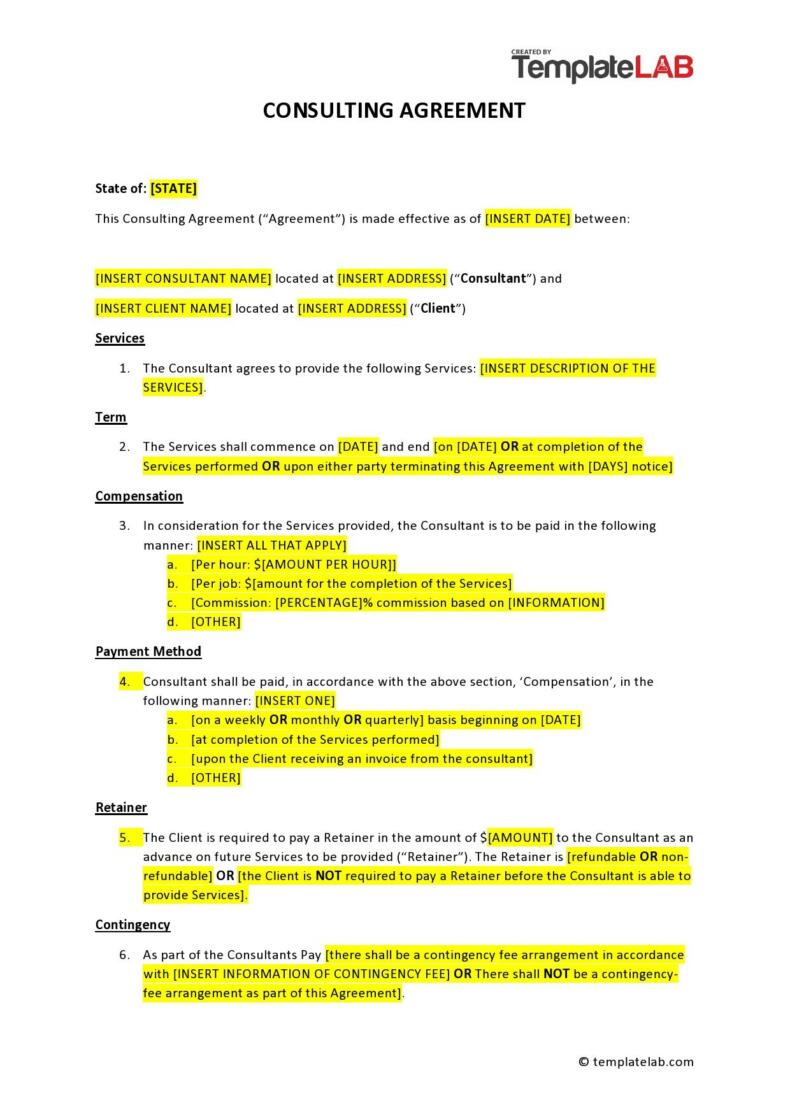

Like any other standard contract in the world of real estate, a land contract agreement includes the following details:

- The title or heading of the document.

- The complete names, addresses, and signatures of the seller and buyer.

- An official description of the property as stated in a recent ownership affidavit. The buyer may request this from the recorder’s office on the area where the property is both registered and located.

- The payment terms of the agreement.

- The terms, limitations, and conditions of the agreement.

- The date of the agreement.

- The property’s date of conveyance as agreed upon by the buyer and seller.

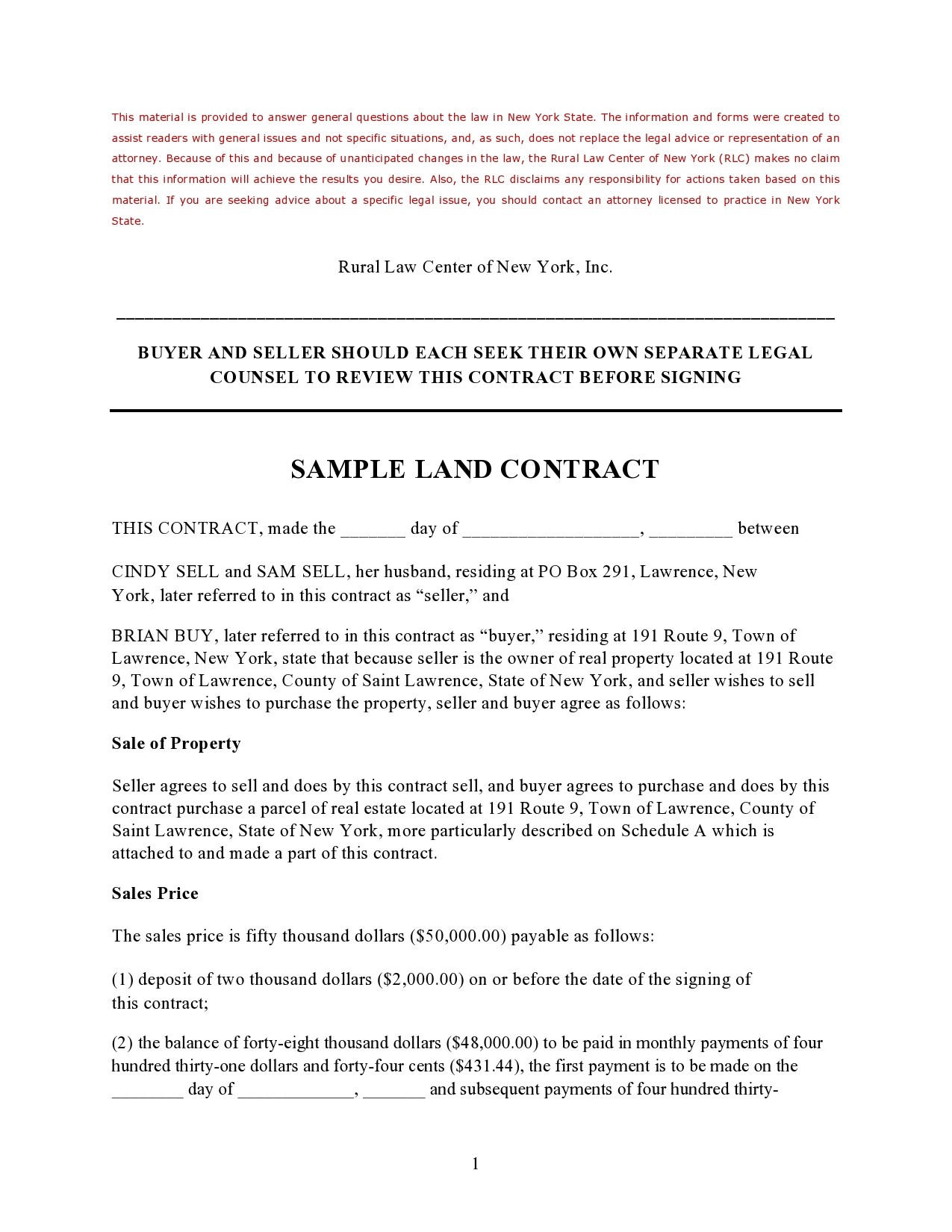

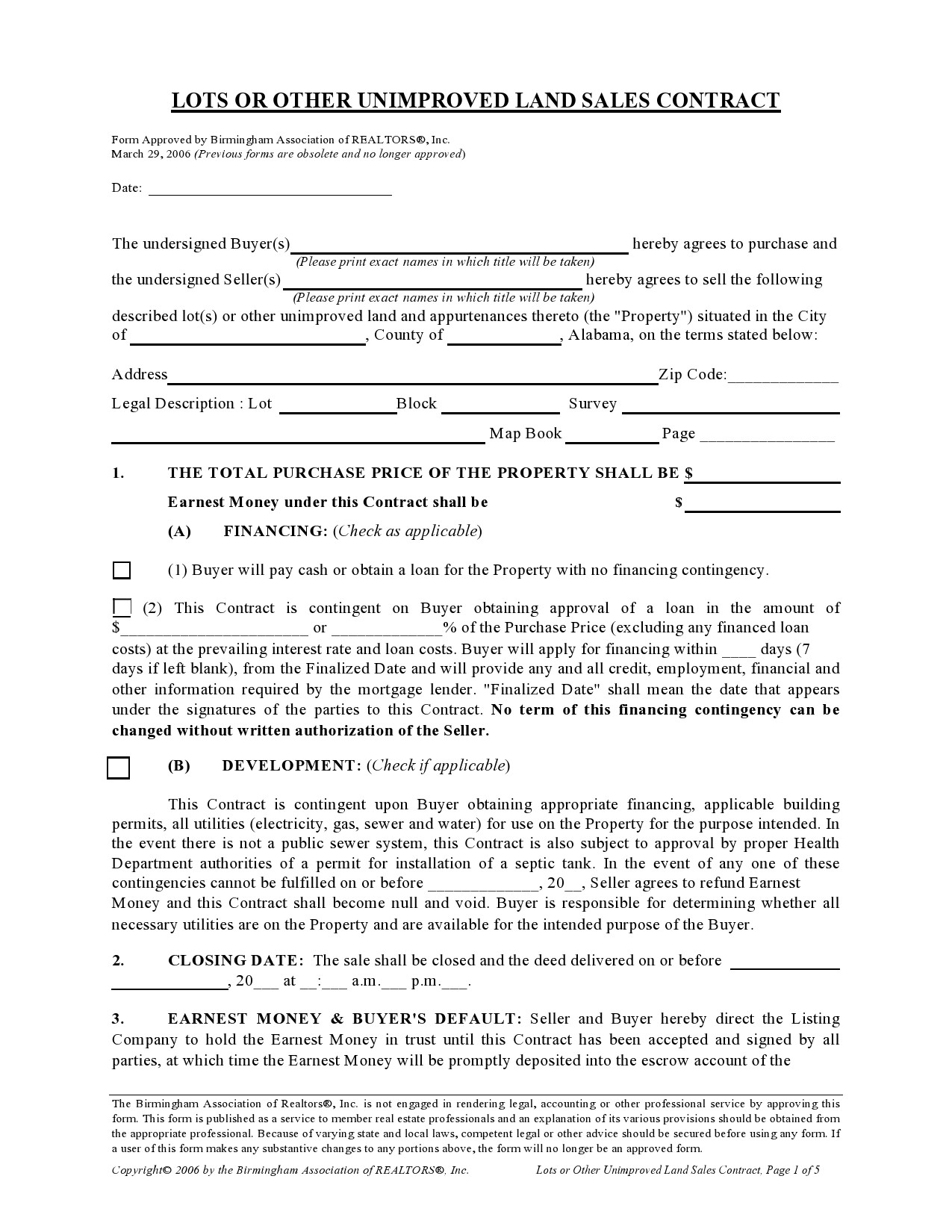

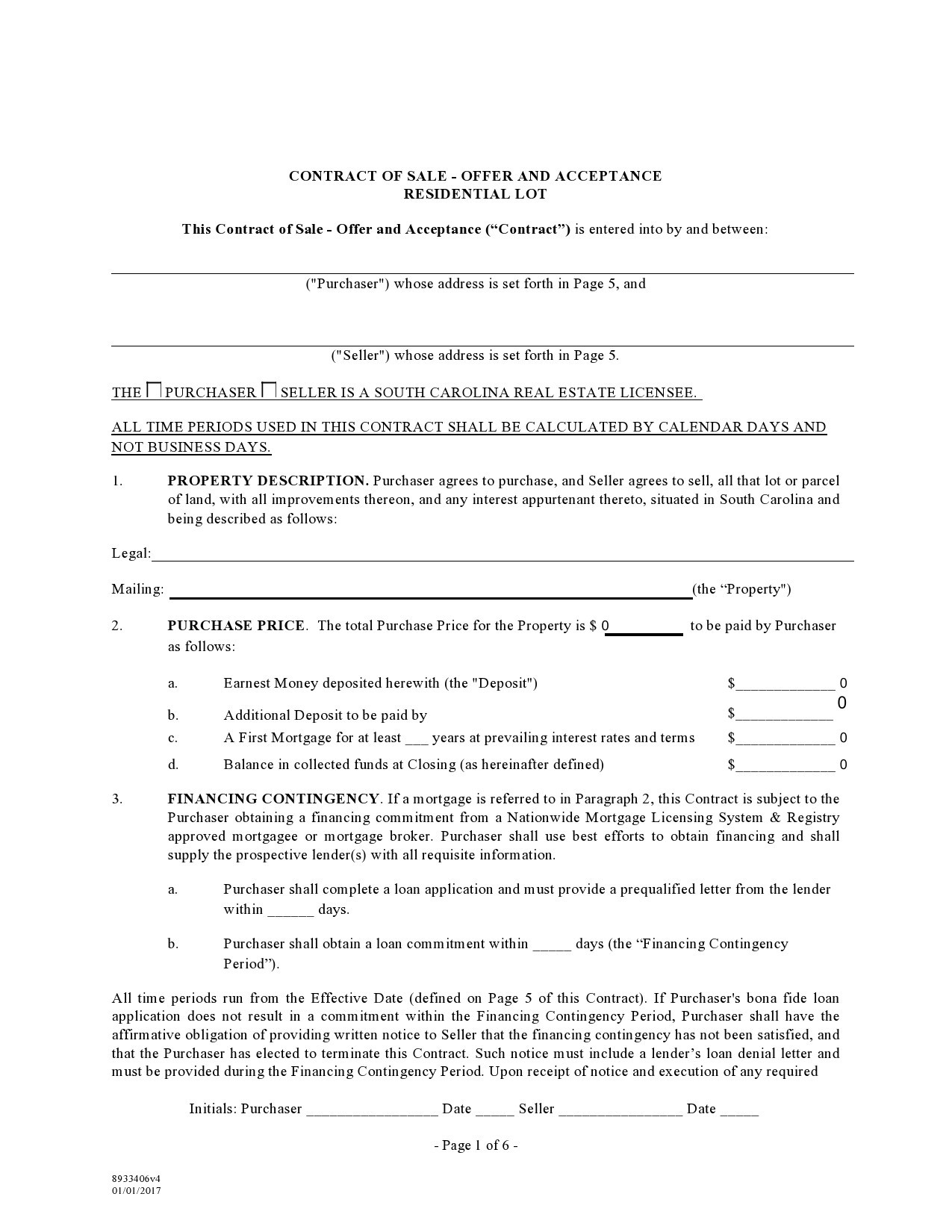

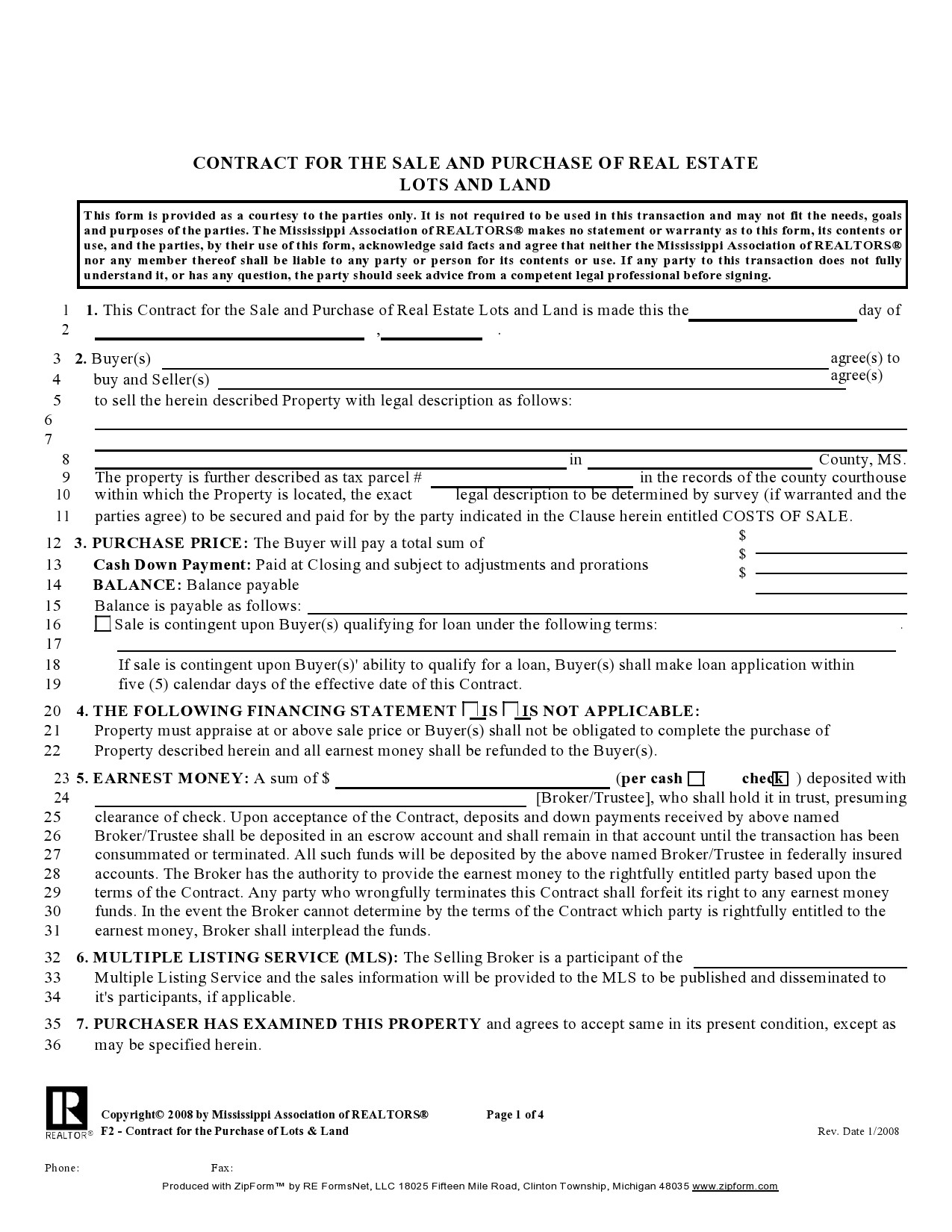

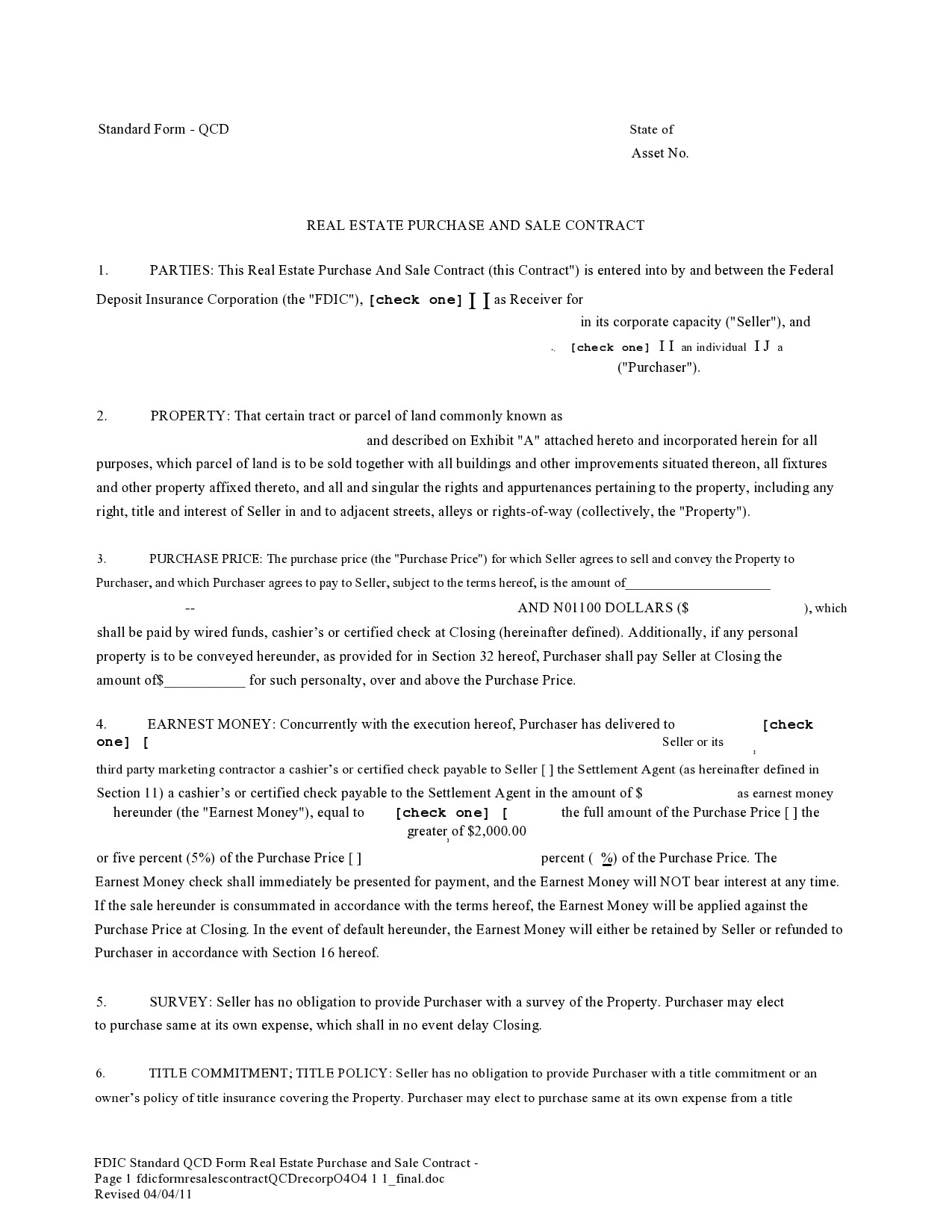

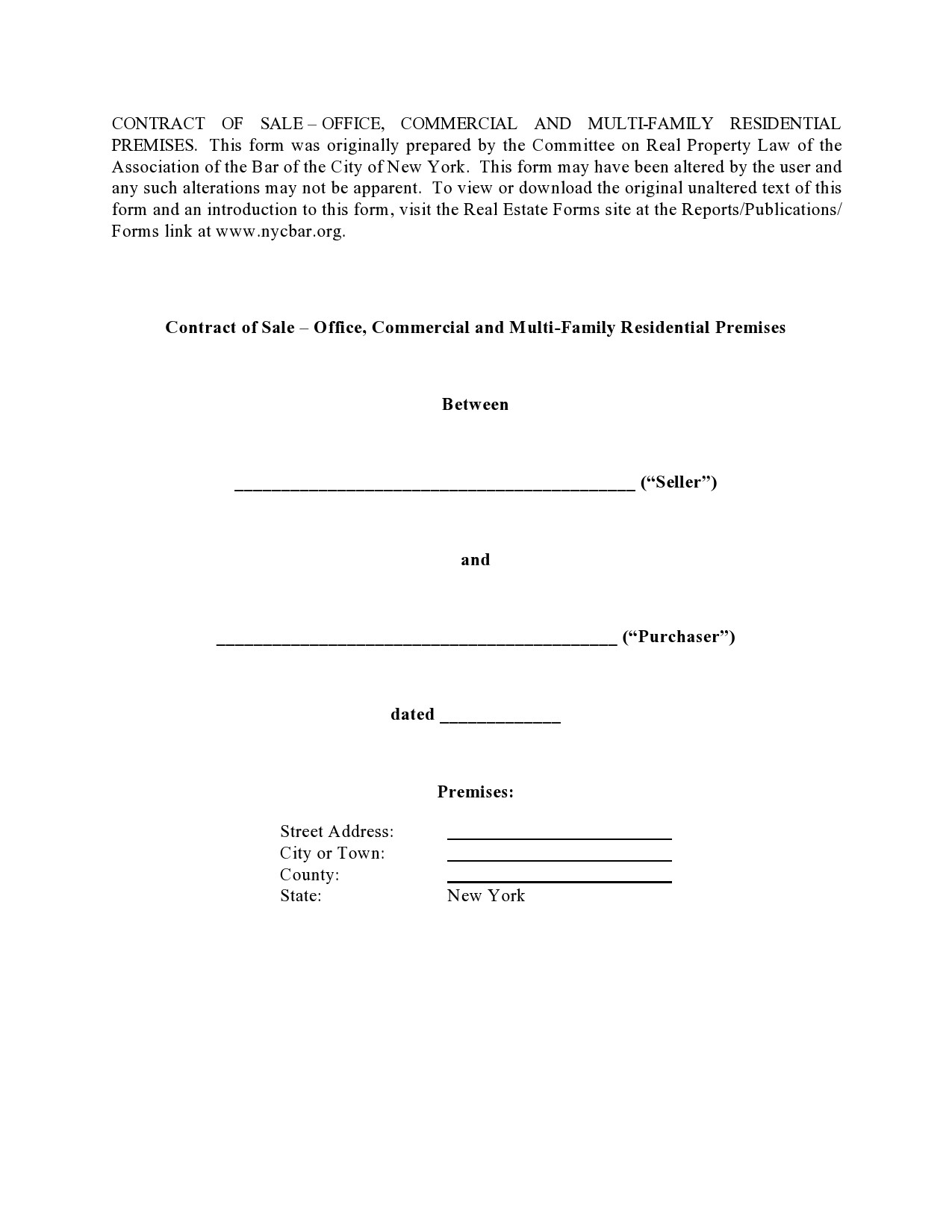

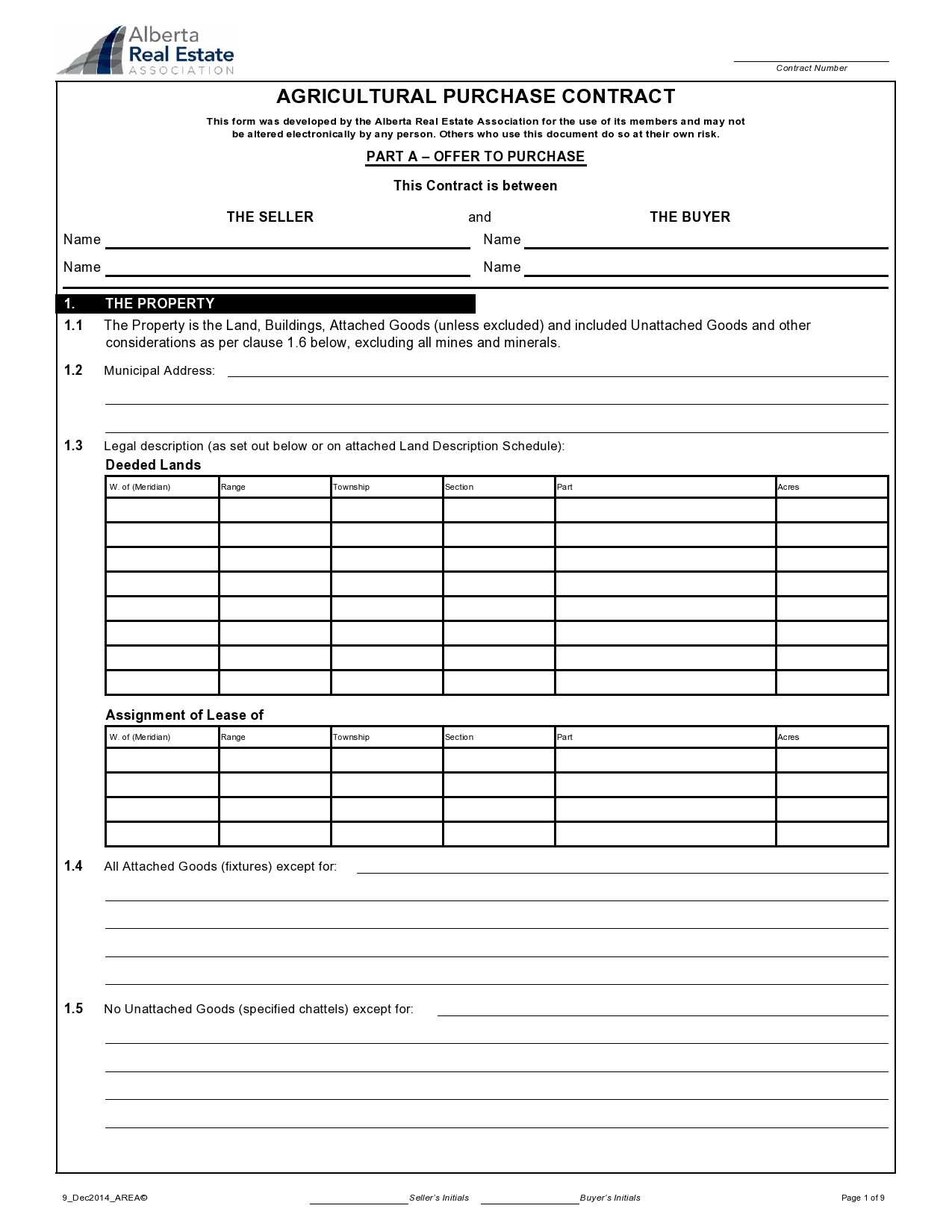

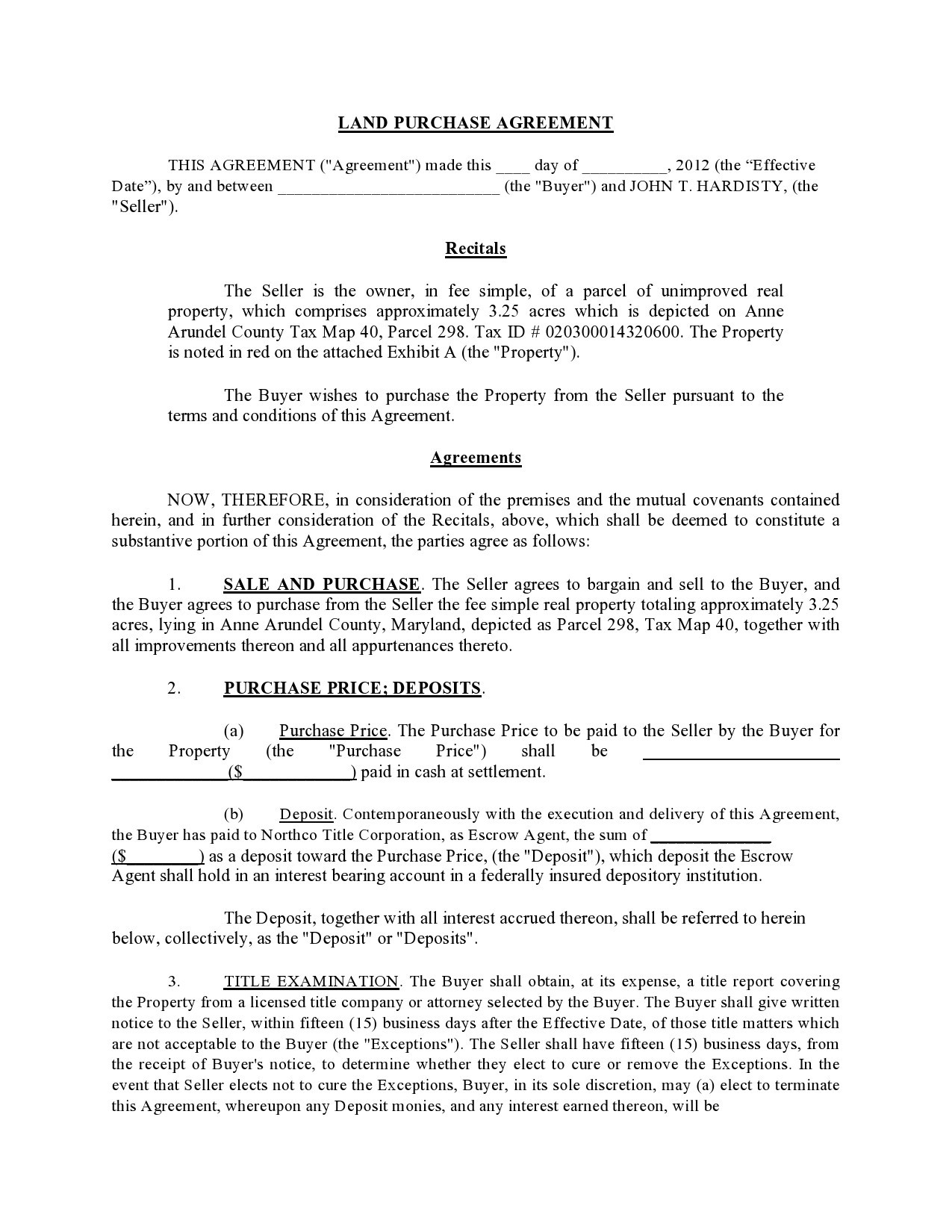

Land Contract Samples

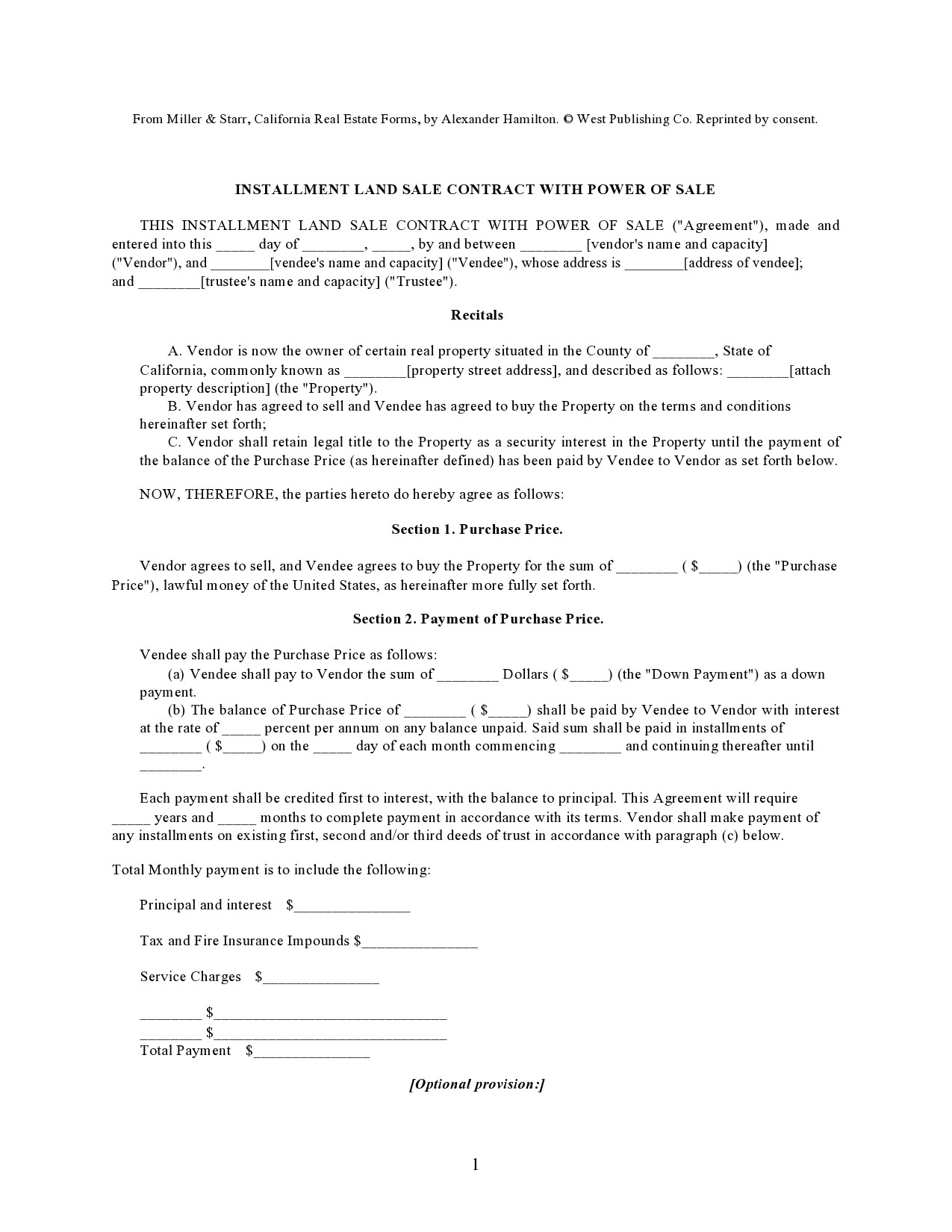

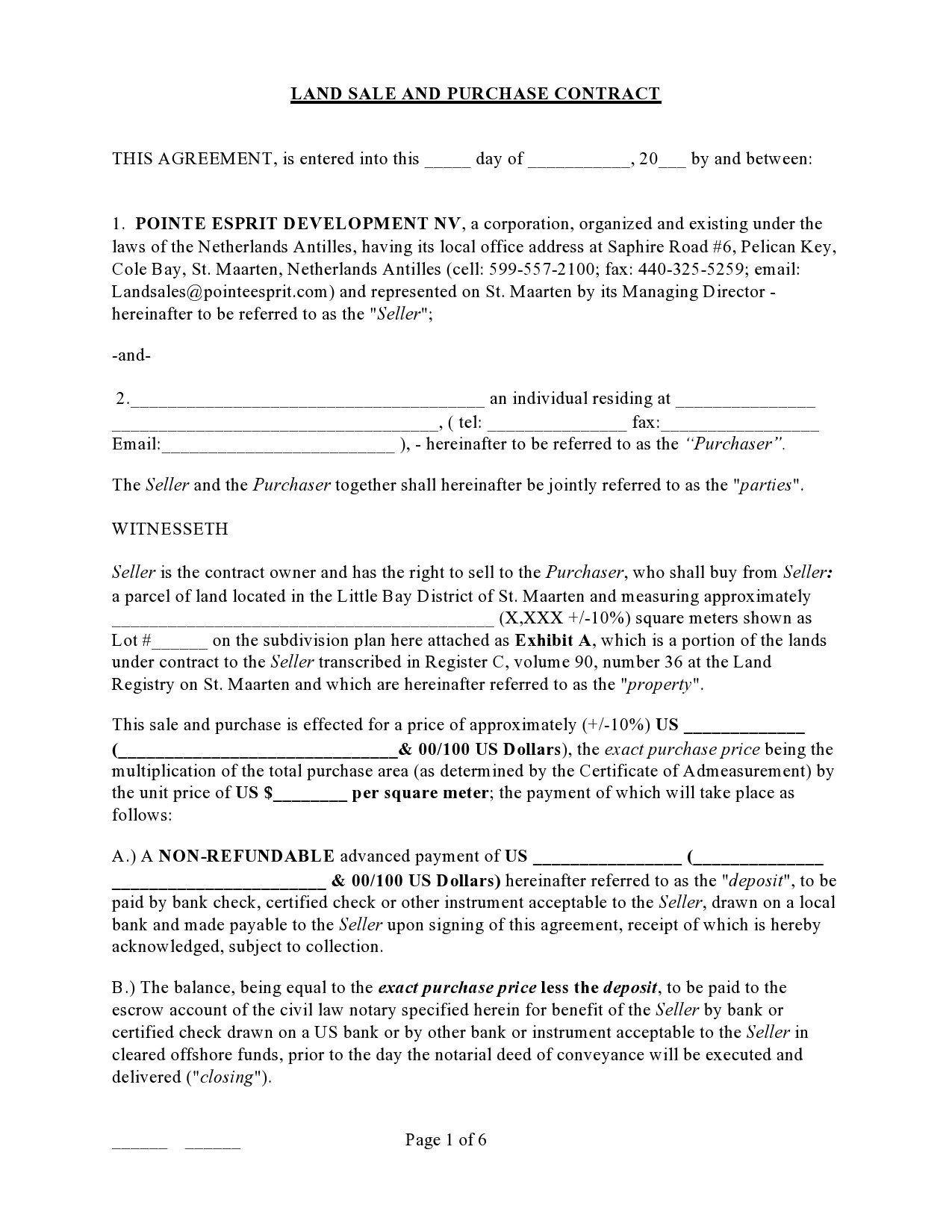

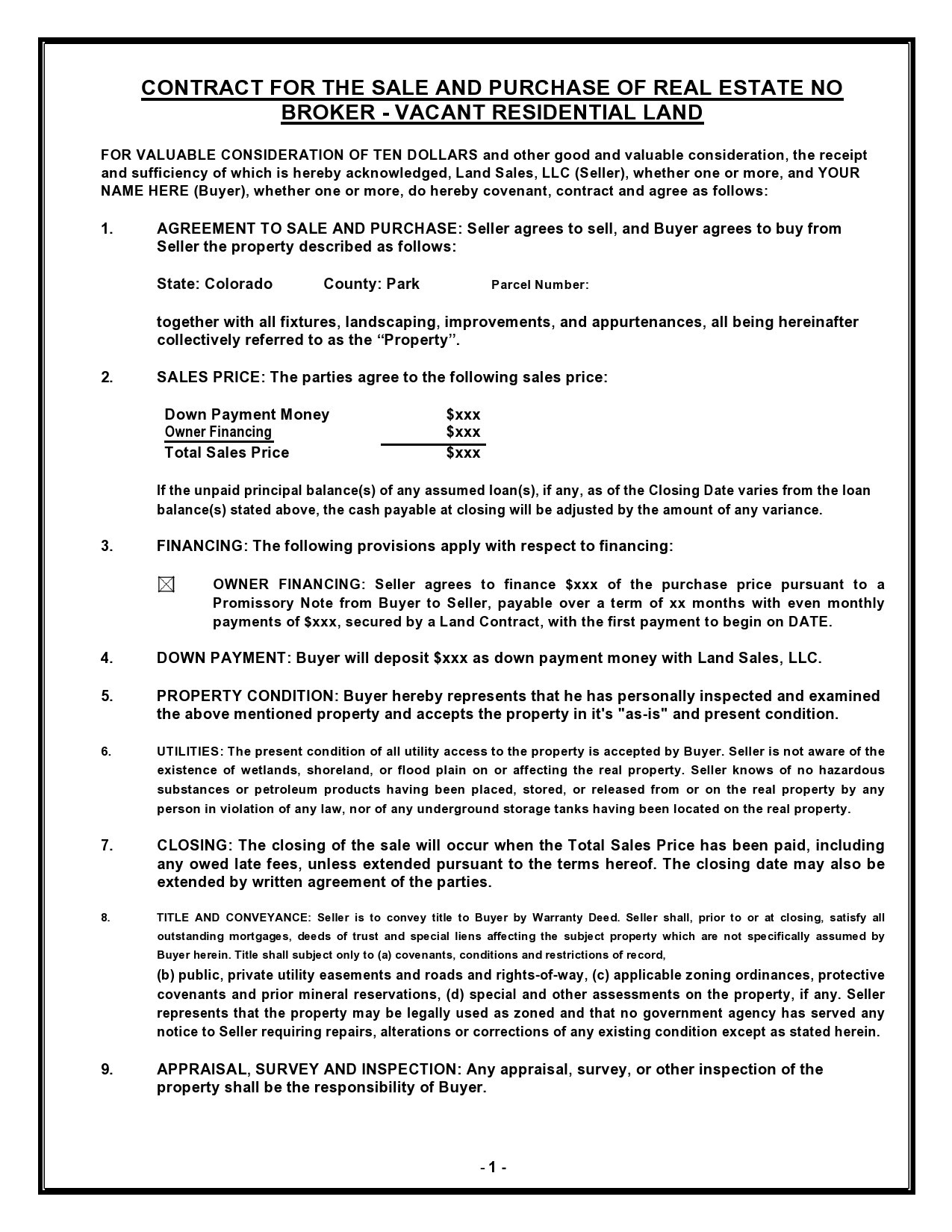

Types of land contracts

A land contract form is a contract between two parties – the seller and the buyer – regarding a specific piece of land. Property developers sell and advertise pieces of land just like real estate agents sell properties.

Moreover, most land contracts involve purchases financed by the sellers. There are some borrowers who buy lands and opt to finance their purchase through bank loans. To make things clearer, here are the most common types of land contract forms:

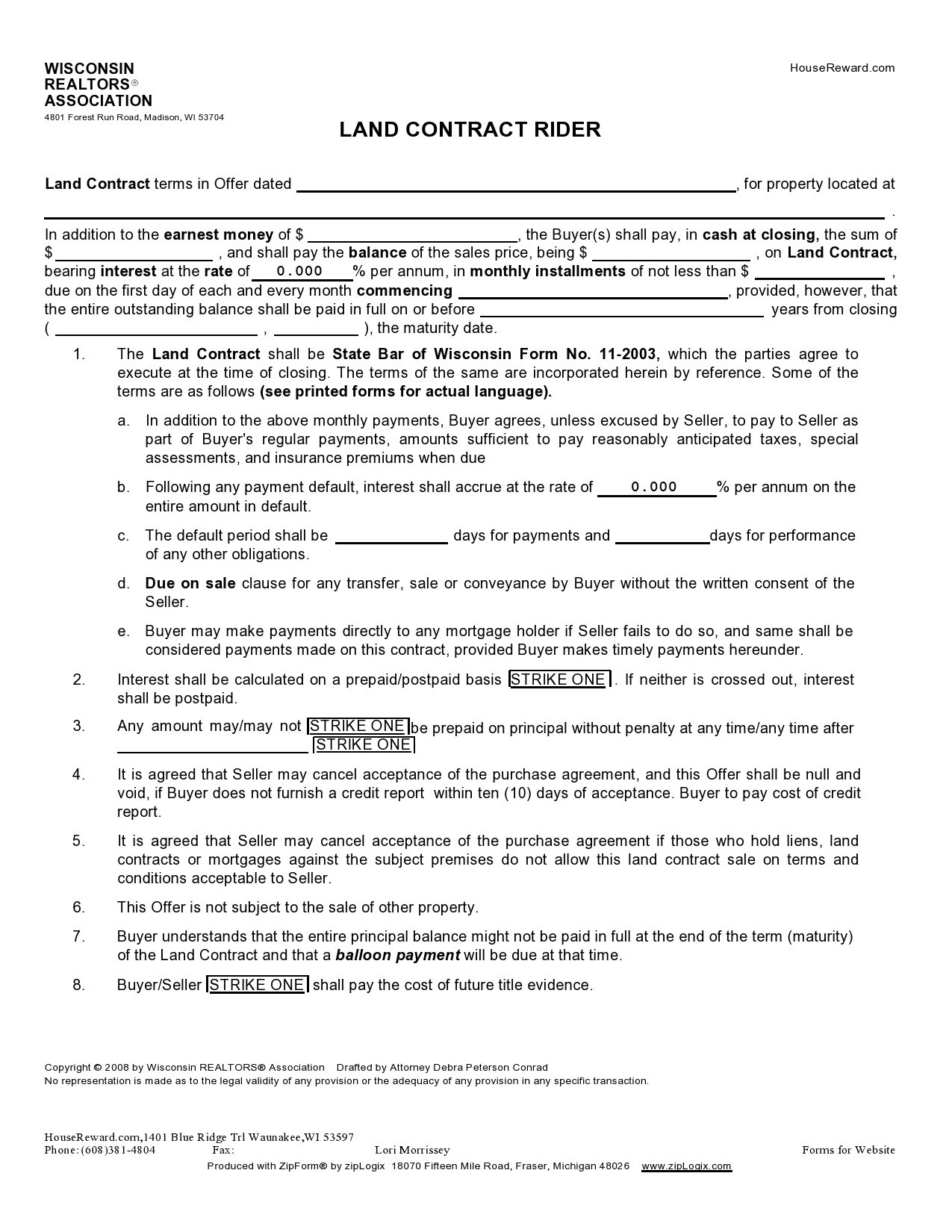

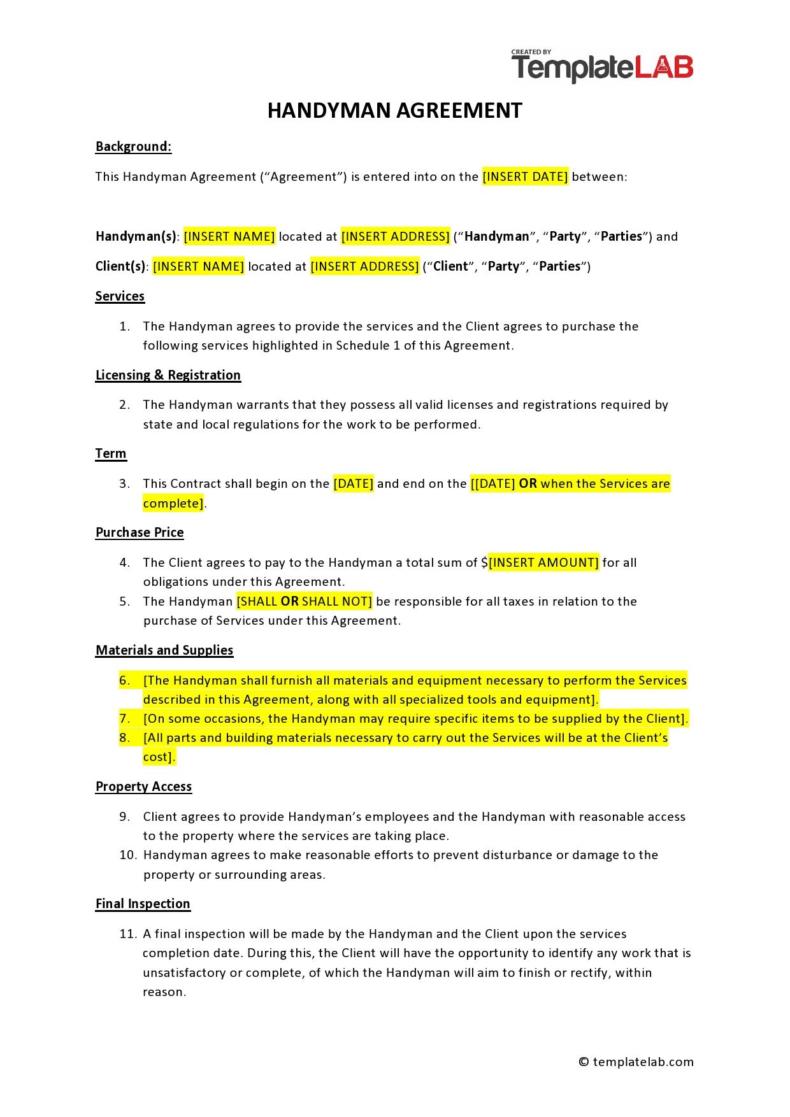

- Installment Sale Land Contract

The scenario for this land contract involves the title of the property staying with the seller or will get held in escrow with either a lawyer or title company. The buyer makes payments to the seller regularly but won’t receive the property’s title until the whole purchase price has been completely paid off. - Wraparound or All-Inclusive Land Contract

This agreement comes into play when a new mortgage for a buyer gets wrapped around an already existing mortgage that a seller still holds. This, of course, comes with a higher balance and bigger monthly payments.

The buyer would make monthly payments to the seller based on the purchase price of the mortgage from the bank. The seller, in this case, gives the title of the property to the buyer then extends his mortgage. Then the proceeds go to the monthly payments on an existing mortgage.

One type of wraparound contract is the All-Inclusive Trust Deed. In this agreement, the seller deeds his property to the buyer then the seller takes a note. In this method, the buyer gives the seller payments on the note. Then the seller, in turn, gives payments on an existing mortgage. If there is any extra, the seller gets to keep it. - Straight Land Contract

For this contract, there will be no difference between the amount paid by the buyer to the seller and the amount that the seller pays to an existing mortgage. Thus, this is also called a mirror wrap since the mortgage of the buyer mortgage “mirrors” the seller’s existing mortgage.

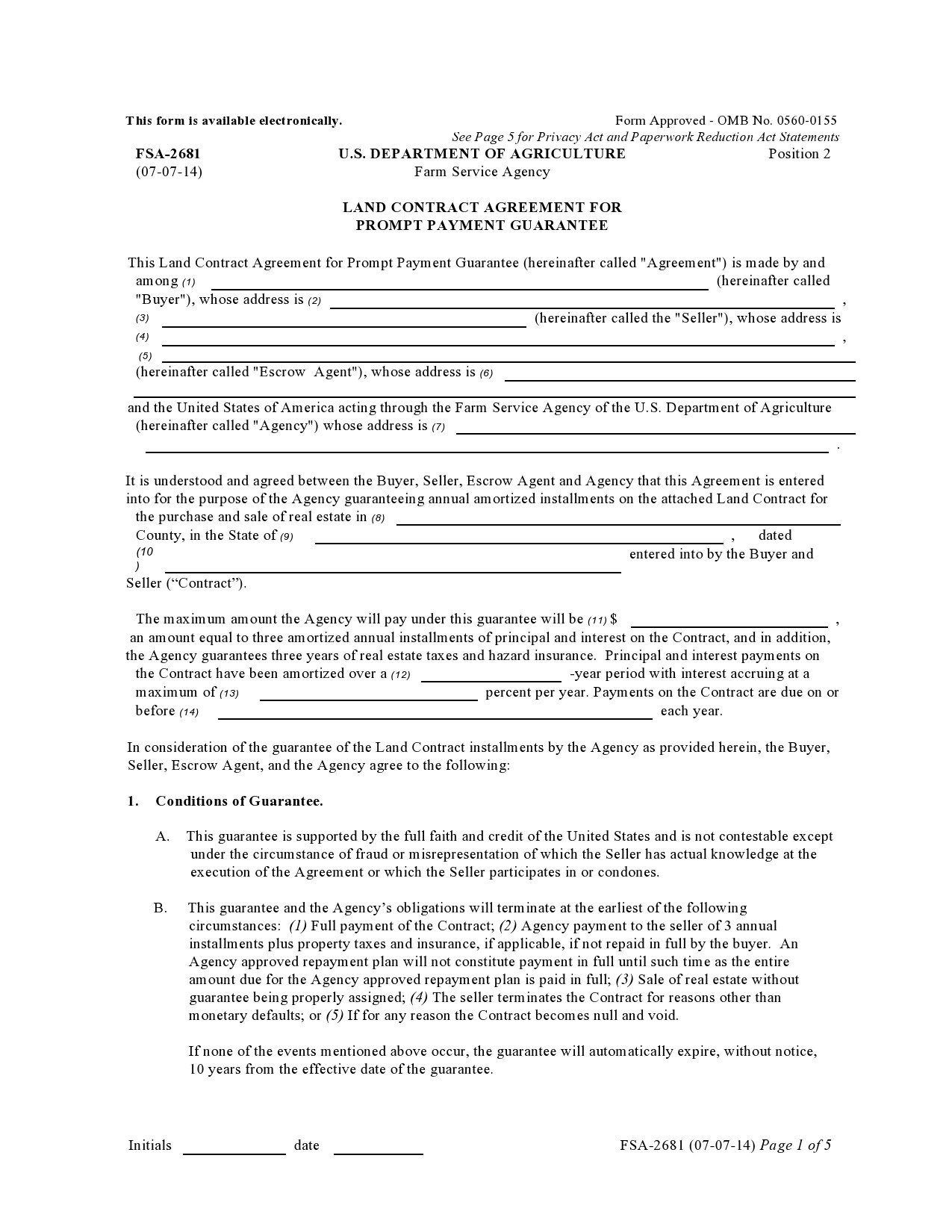

Who pays property taxes on a land contract?

During the duration of the land contract agreement, the seller would receive monthly payments consisting of the principal amount and interests. Escrow here may get established too, so that the insurance and tax payments given by the buyer will go into an account so that the payments are automatically made when the due date comes. Alternatively, the buyer may choose to pay insurance and tax bills independent of the escrow.

Is a land contract a good idea?

One thing good about a land contract form is that it is relatively straightforward. It involves the buyer giving a down payment to the seller for the property while the seller assumes the role of the bank as he will finance the balance of the property’s purchase price. Both parties negotiate together to determine the interest rate at the time of the purchase.

Generally, it will be the seller who assumes the loan for a set amount of time until a balloon payment would come into play. To find out if such an agreement is a good idea, one must look at the pros and cons:

Pros:

- This contract allows the buyer who isn’t able to get traditional financing to buy the property. Banks usually give a loan to a buyer if he qualifies for it. To qualify, the buyer must deal with any credit issues he has like reducing his debt-to-income ratio. The buyer also has to save up for a down payment on such a loan. If not, then a land contract can be an alternative option.

- A land contract is always a win-win situation for the seller. He receives rent for the property for an agreed-upon period of time then sells the property for an agreed-upon price. Should the buyer fail to pay on time, the seller has the right to evict him.

- With high interest rates and tight credit, there will be fewer buyers in the market. This situation is highly appealing to buyers who, under normal conditions, cannot buy a property.

Cons:

- Unless the seller is the outright owner of the property, he may still make payments to a financial institution. If he cannot make his payments regularly, the property could get foreclosed upon by the lending institution and the poor buyer will end up with no property and a worthless document.

- Land contracts generally cover a myriad of issues like what will happen if the market significantly depreciates or appreciates before the balloon payment’s due date. Since a land contract is more complicated than the standard way of home purchase, careful considerations must go into coming up with the terms and conditions of the binding agreement.

- Land contracts can, at times, be very ambiguous. For instance, a buyer moves in, confident that the home is now his and had all the intentions of purchasing it. He may spend years making renovations on the property to suit his lifestyle, making improvements, and even extension. When the due date of the balloon payment comes and the buyer cannot secure a loan to pay, the buyer loses “his property” while the seller ends up with a modified property.