There are many ways that you can draft a payment contract template, and you need to know which segments of the contract must be in place for the payment plan to be binding. Payment plans are important for business functions, and you need your payment plan to be correct so that it protects the payment processes that you are using for your company.

Table of Contents

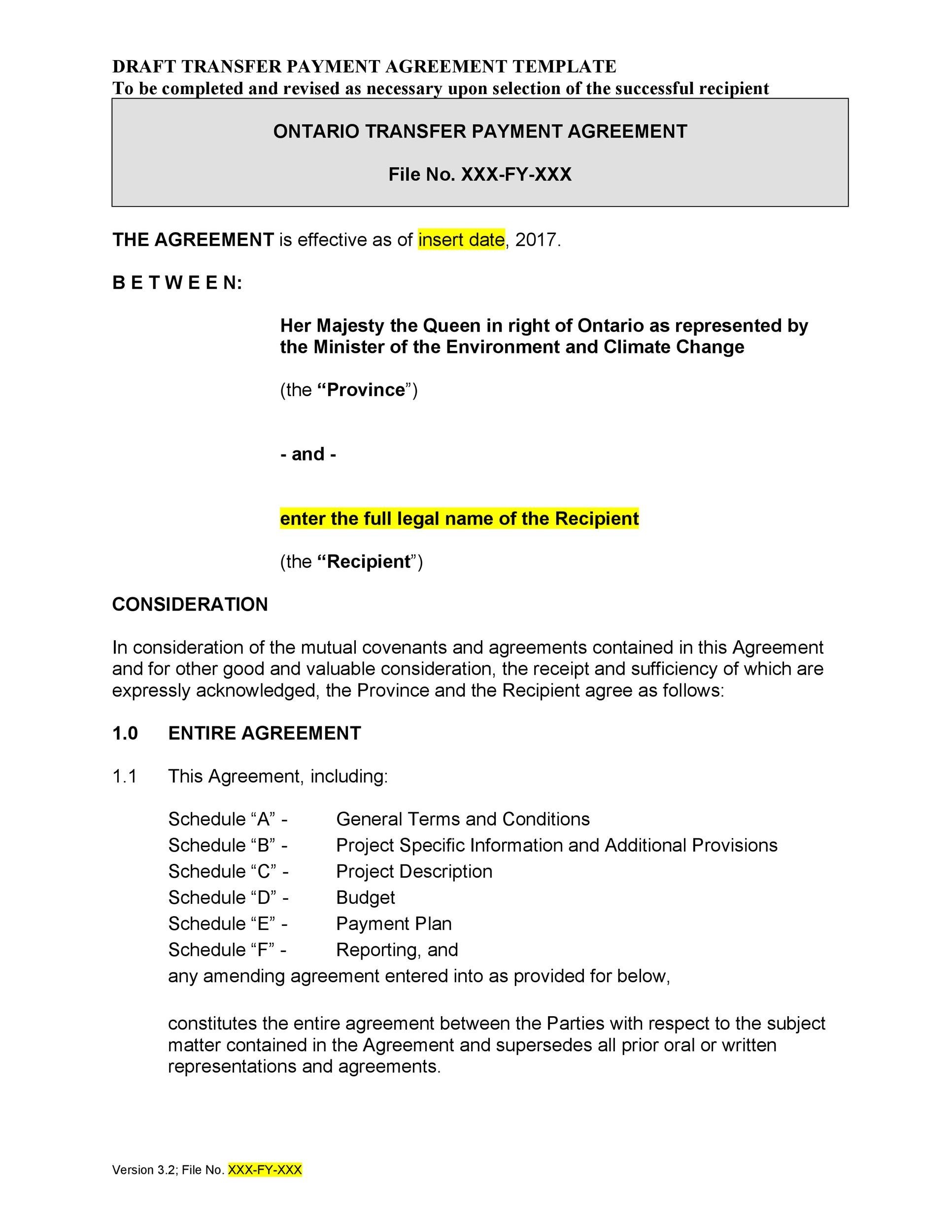

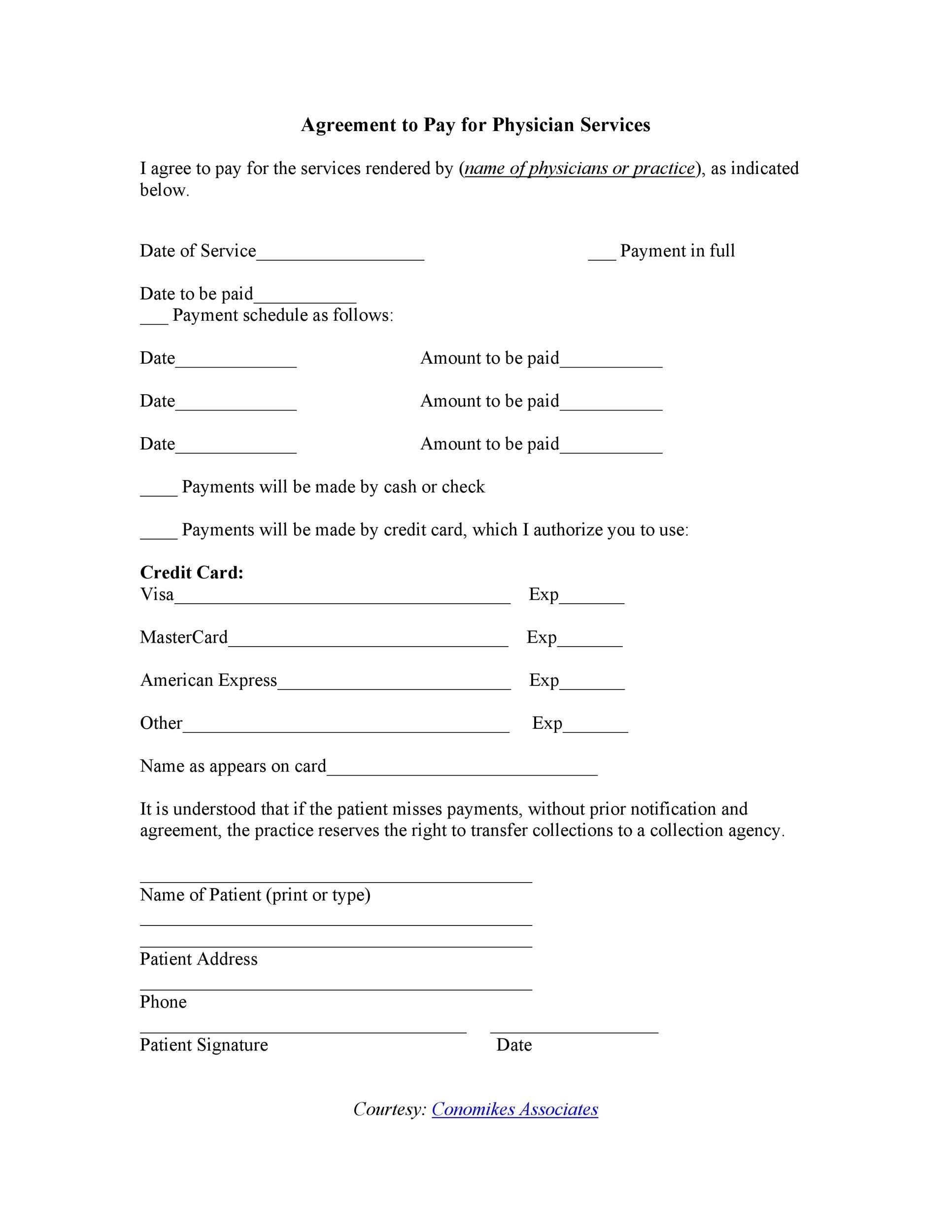

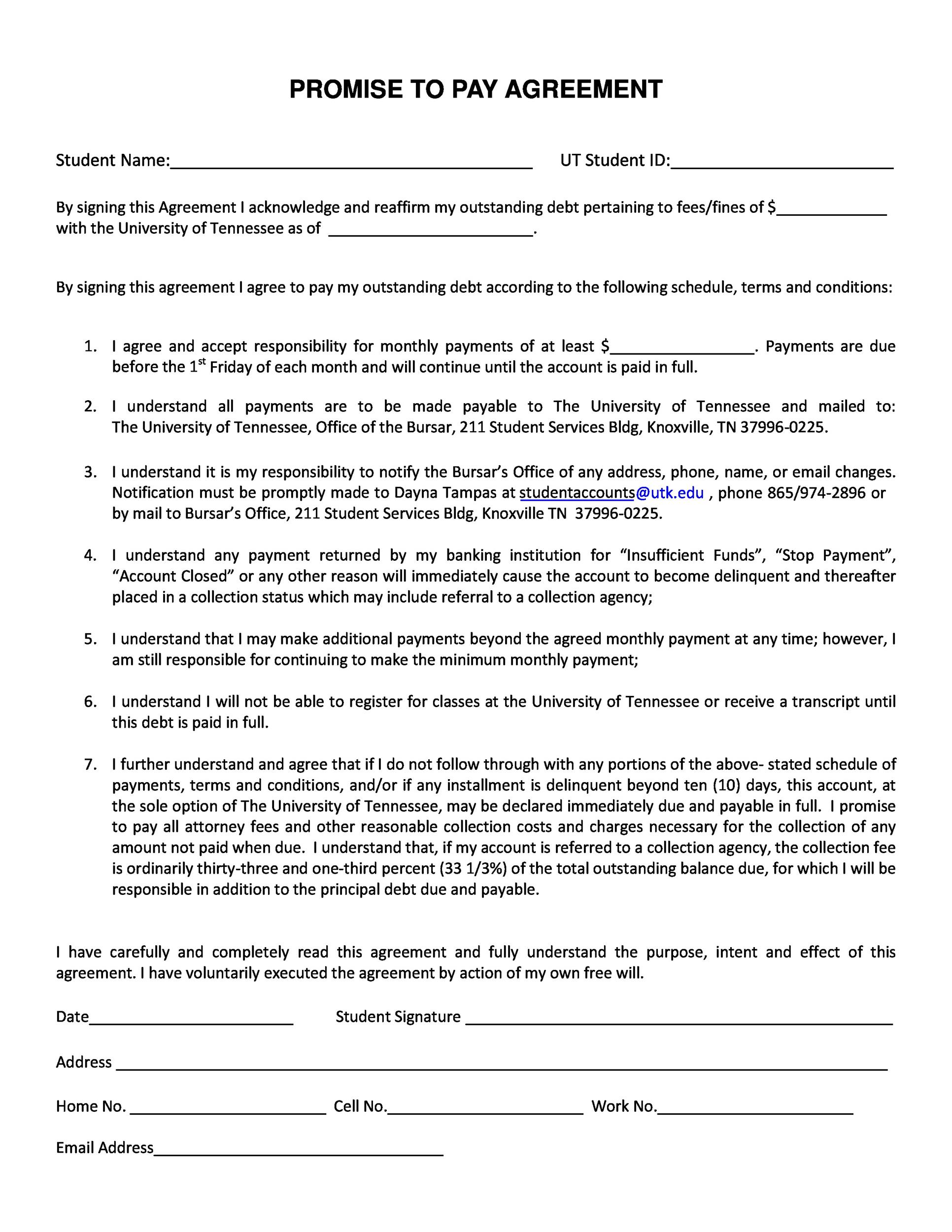

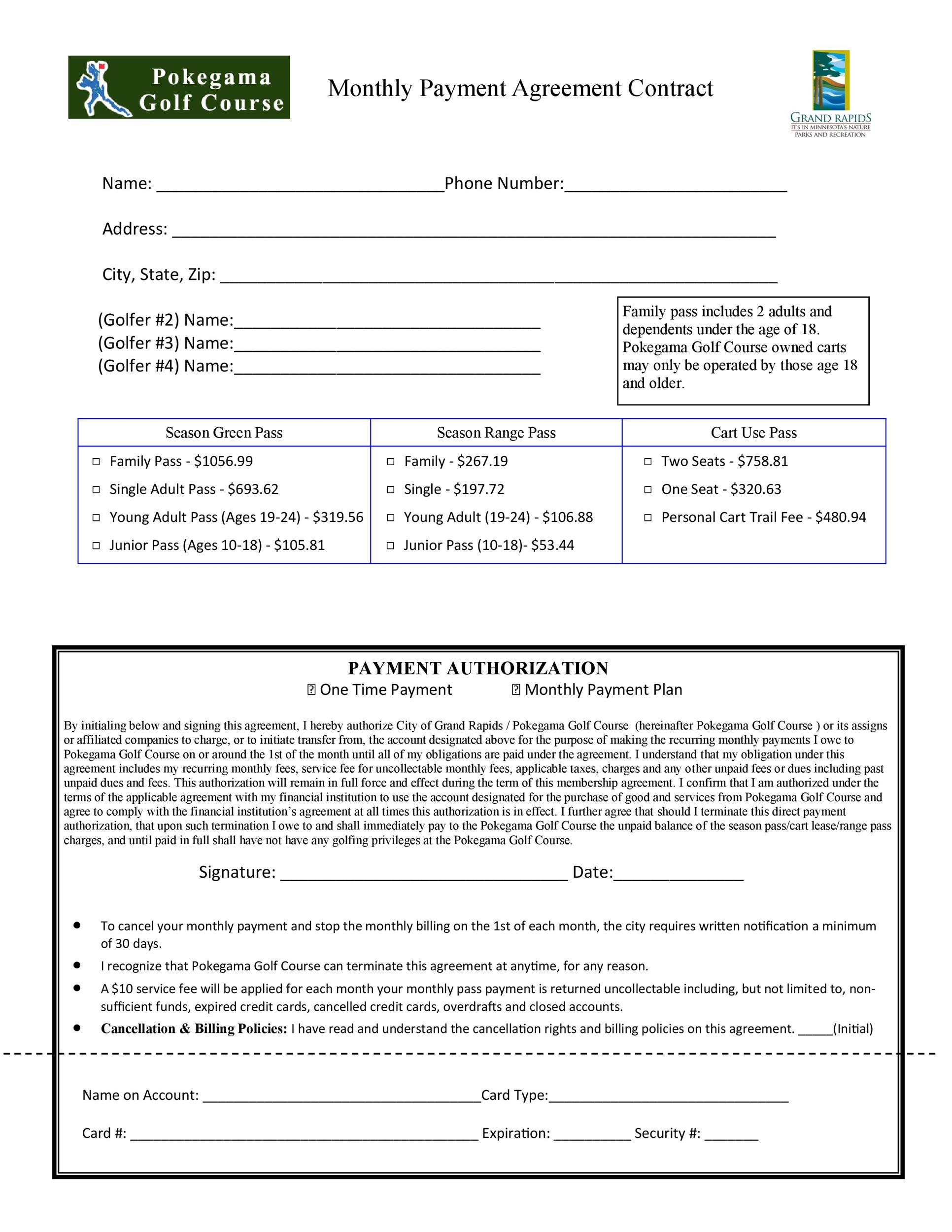

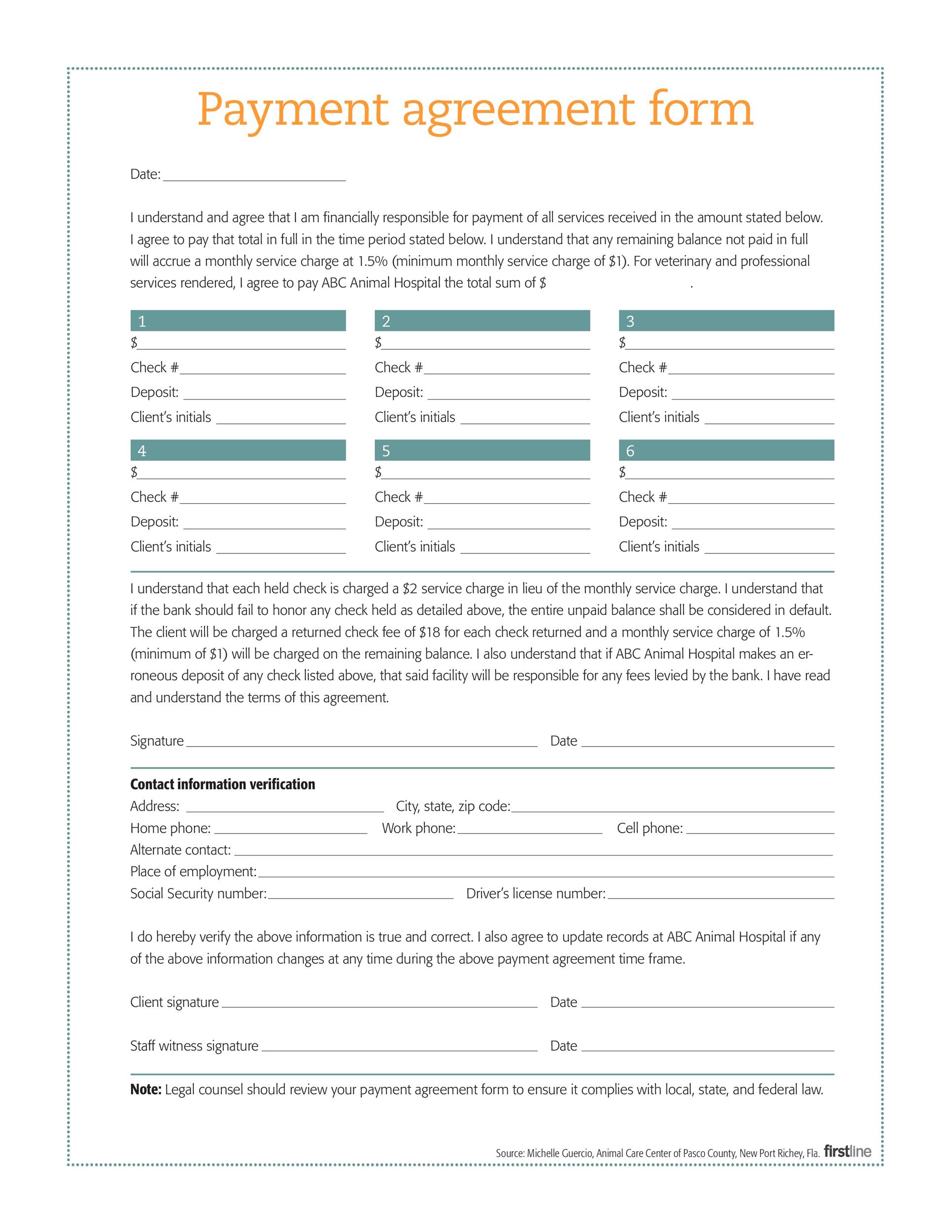

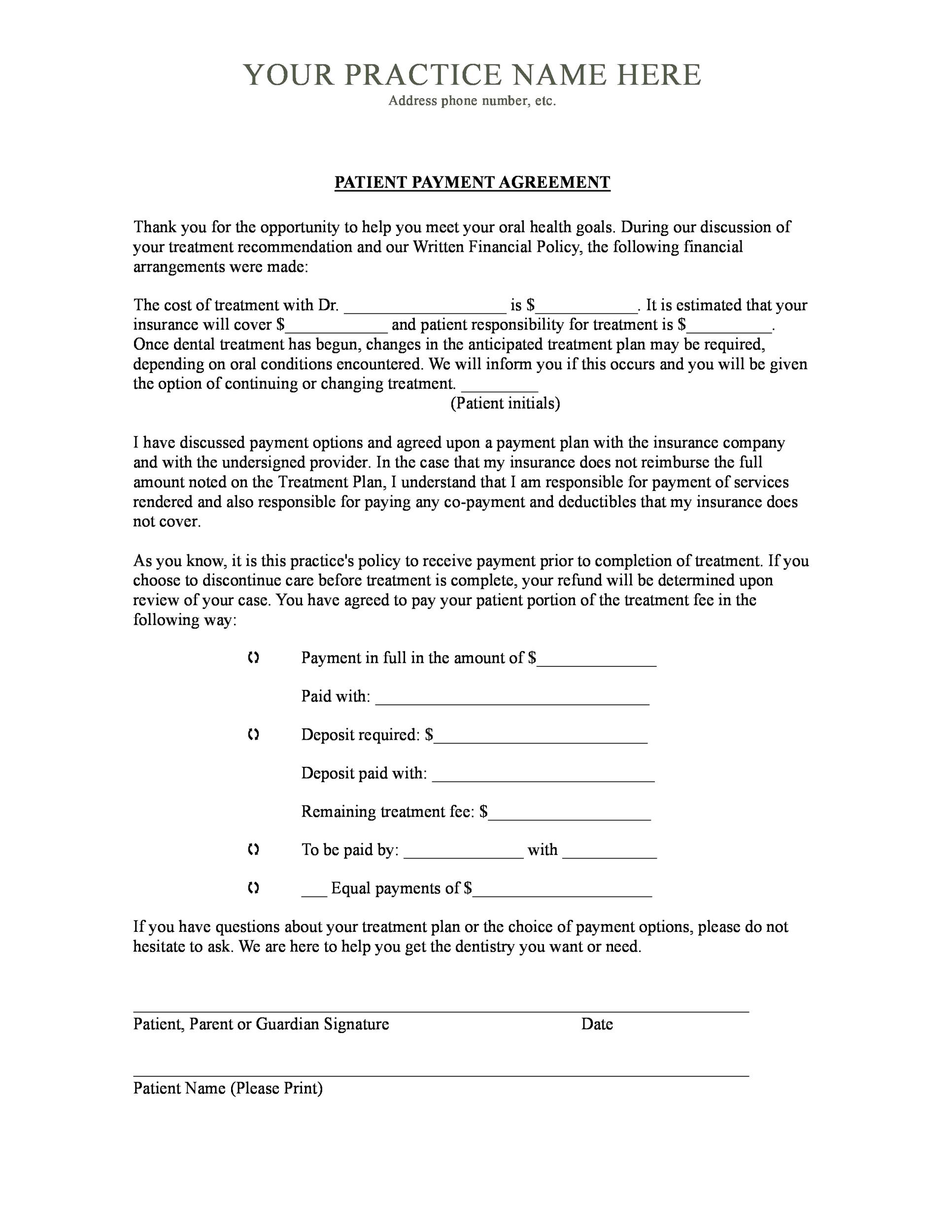

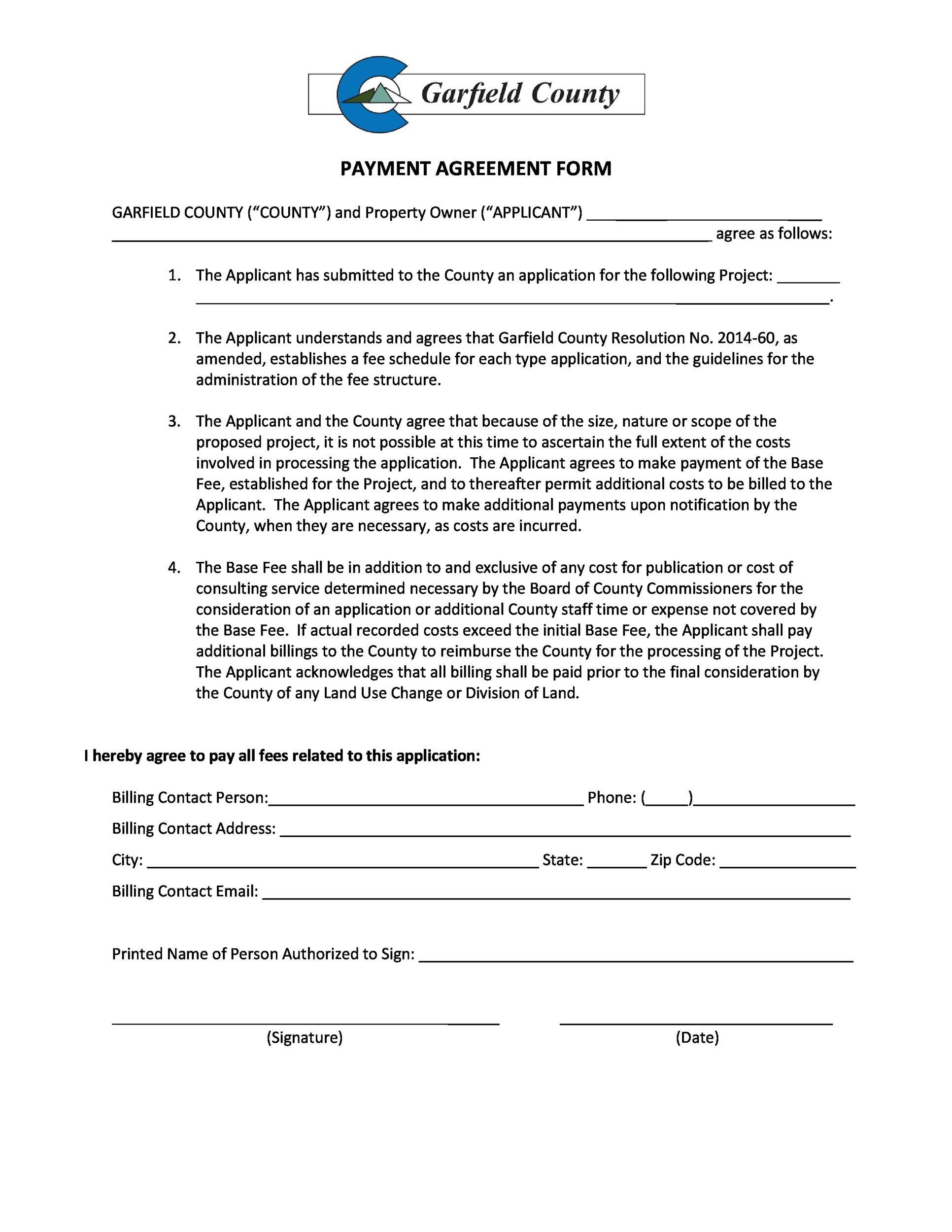

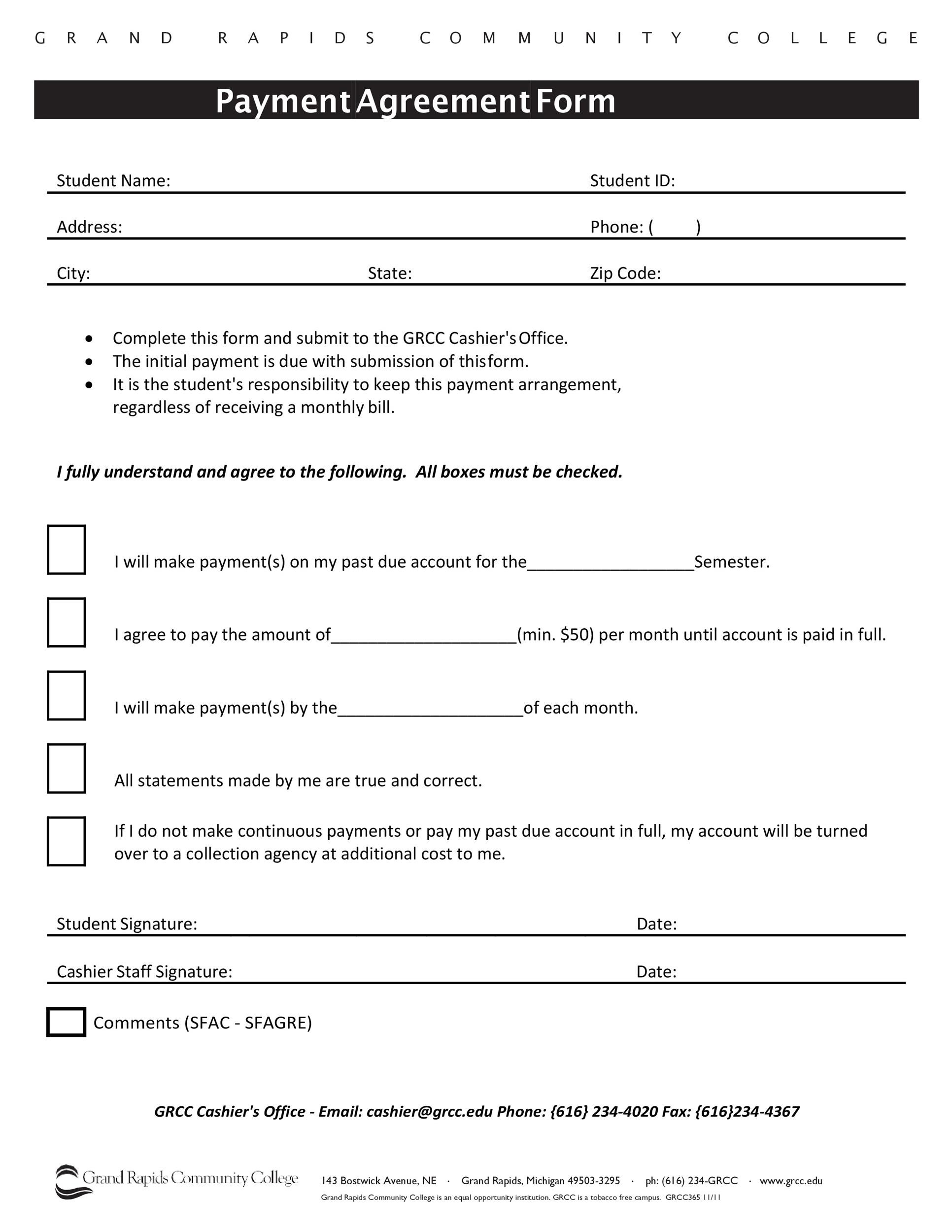

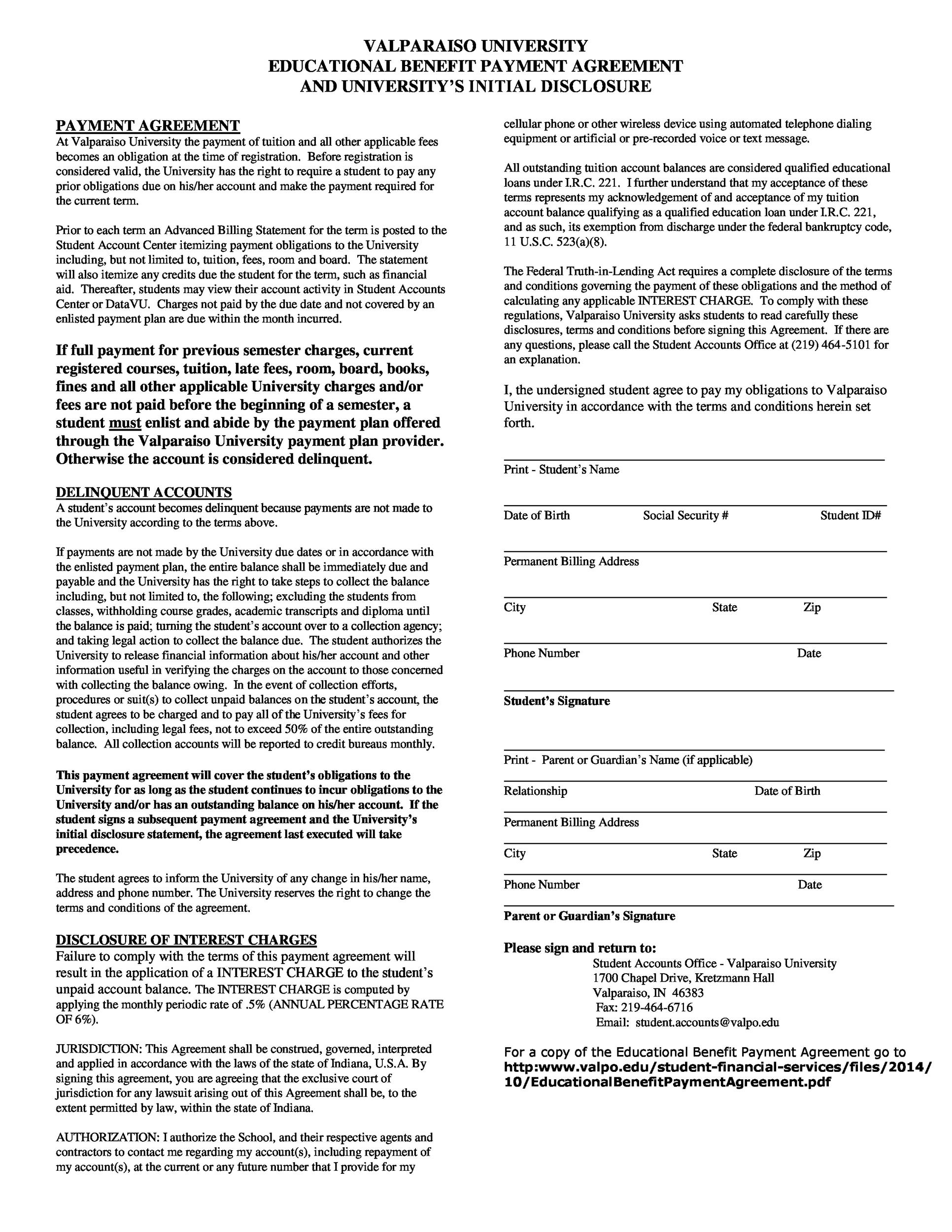

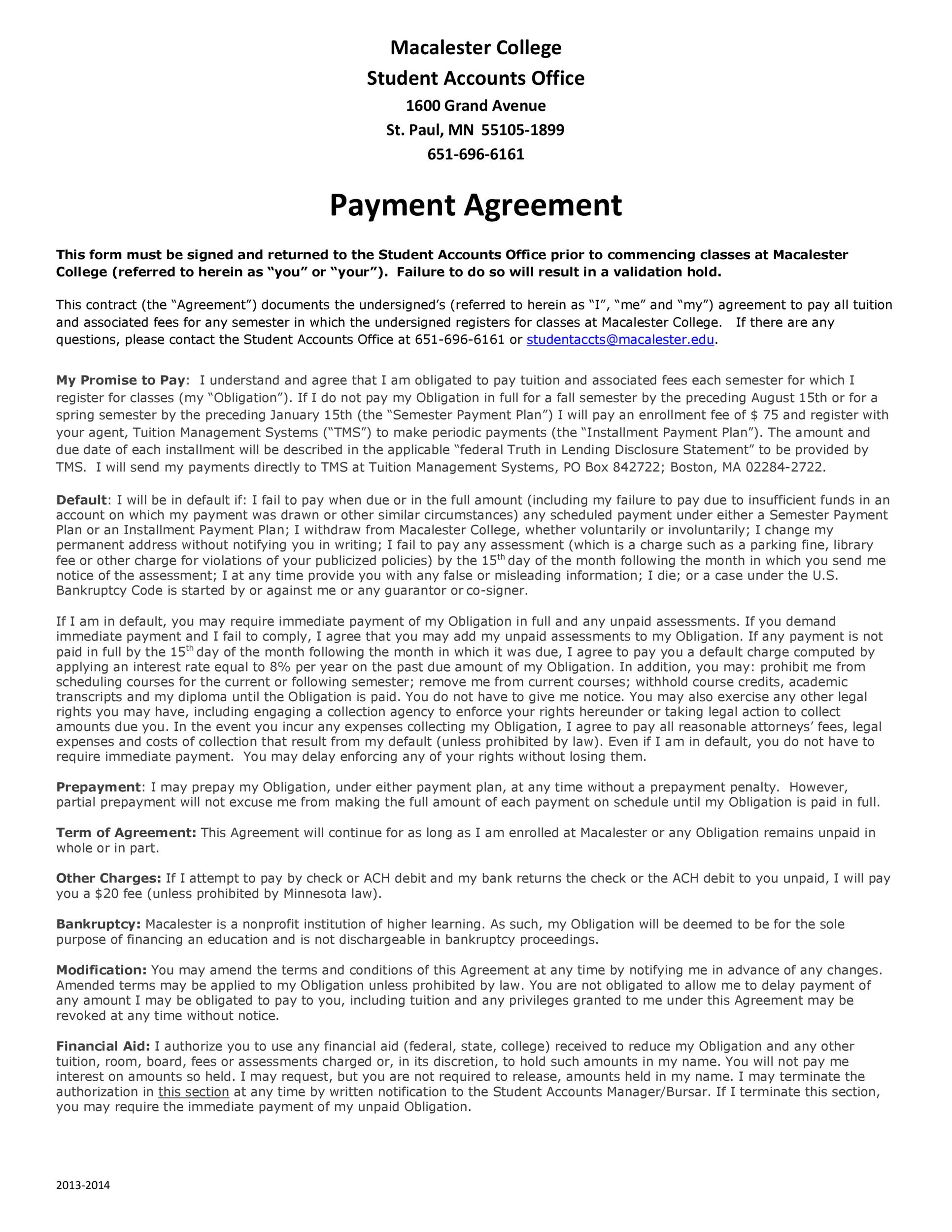

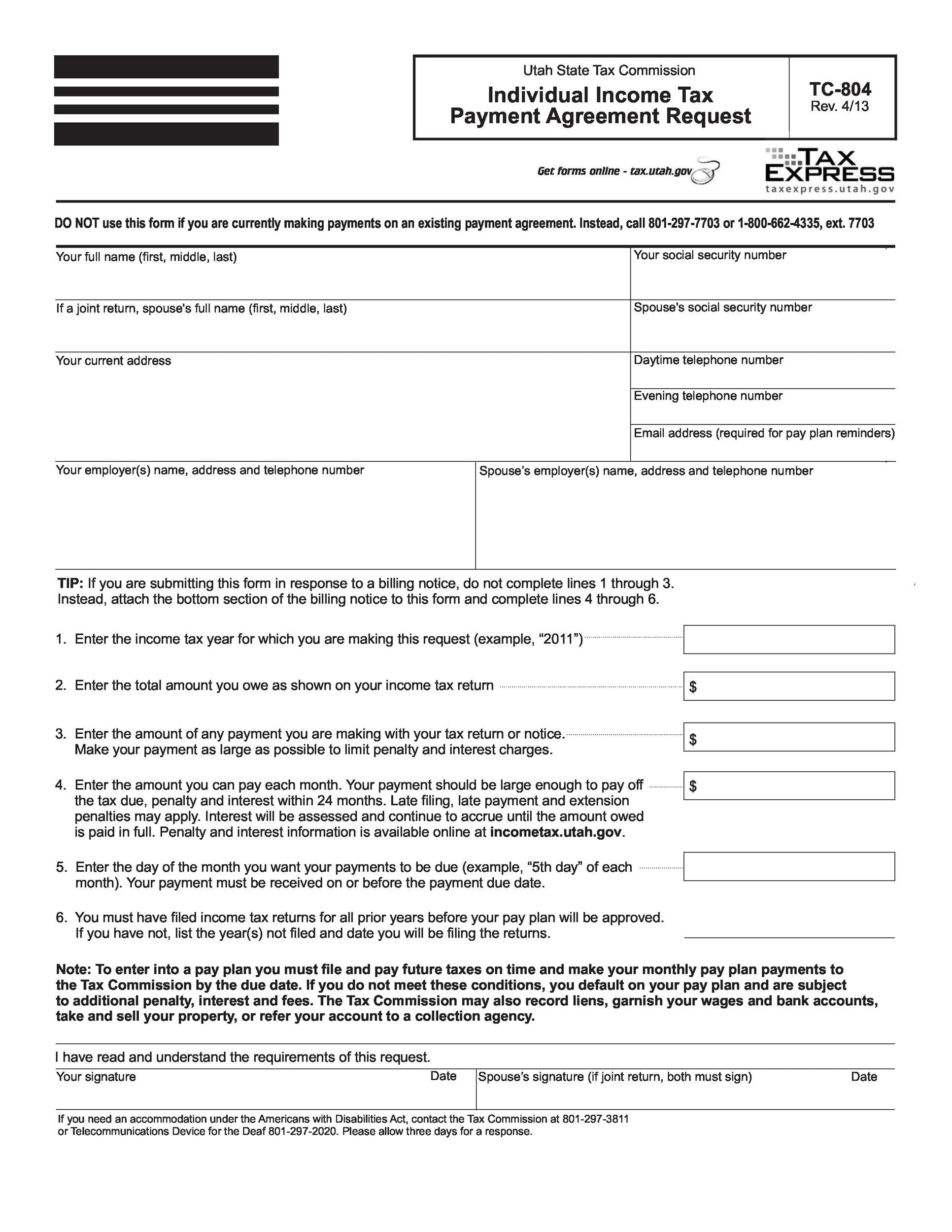

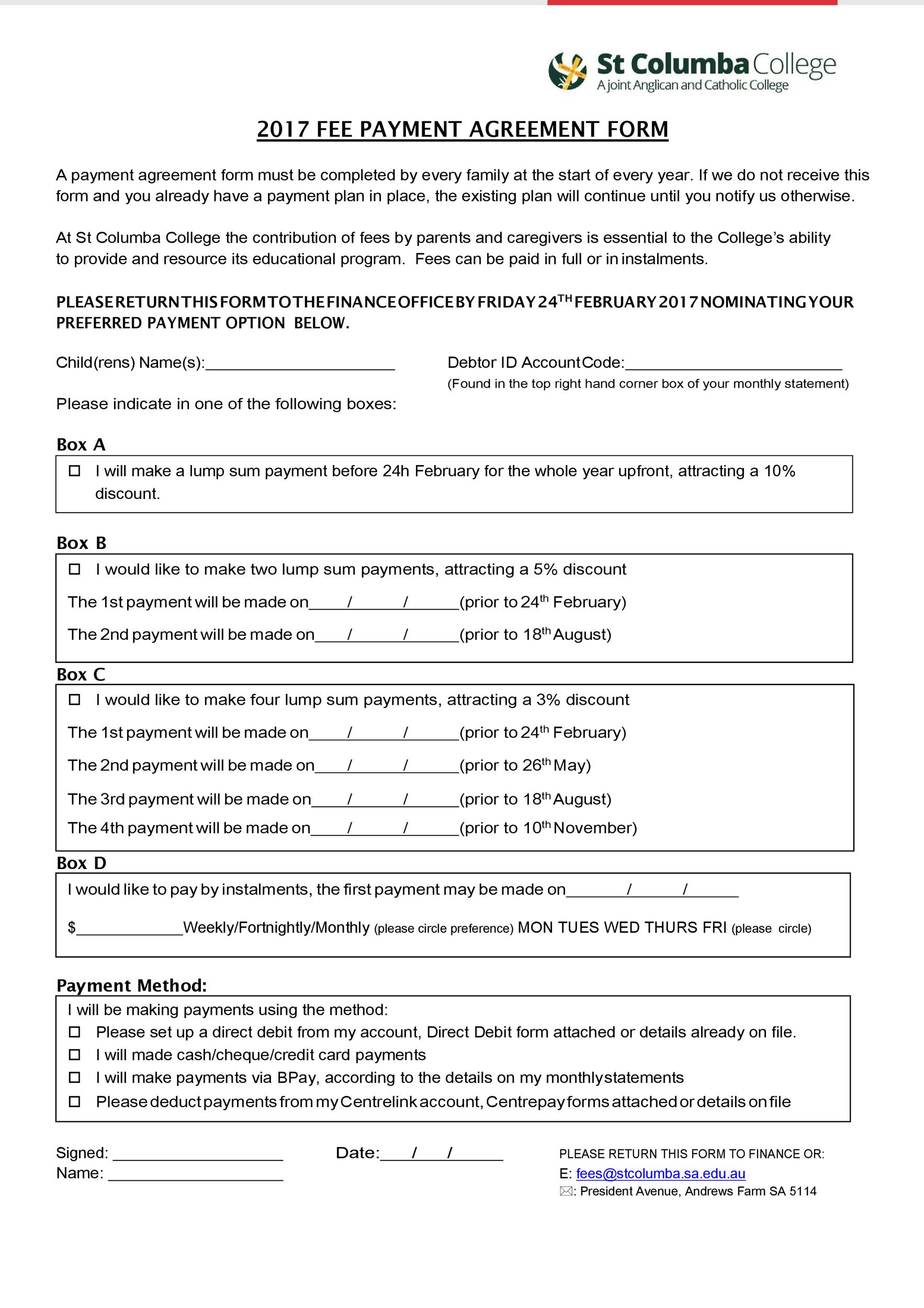

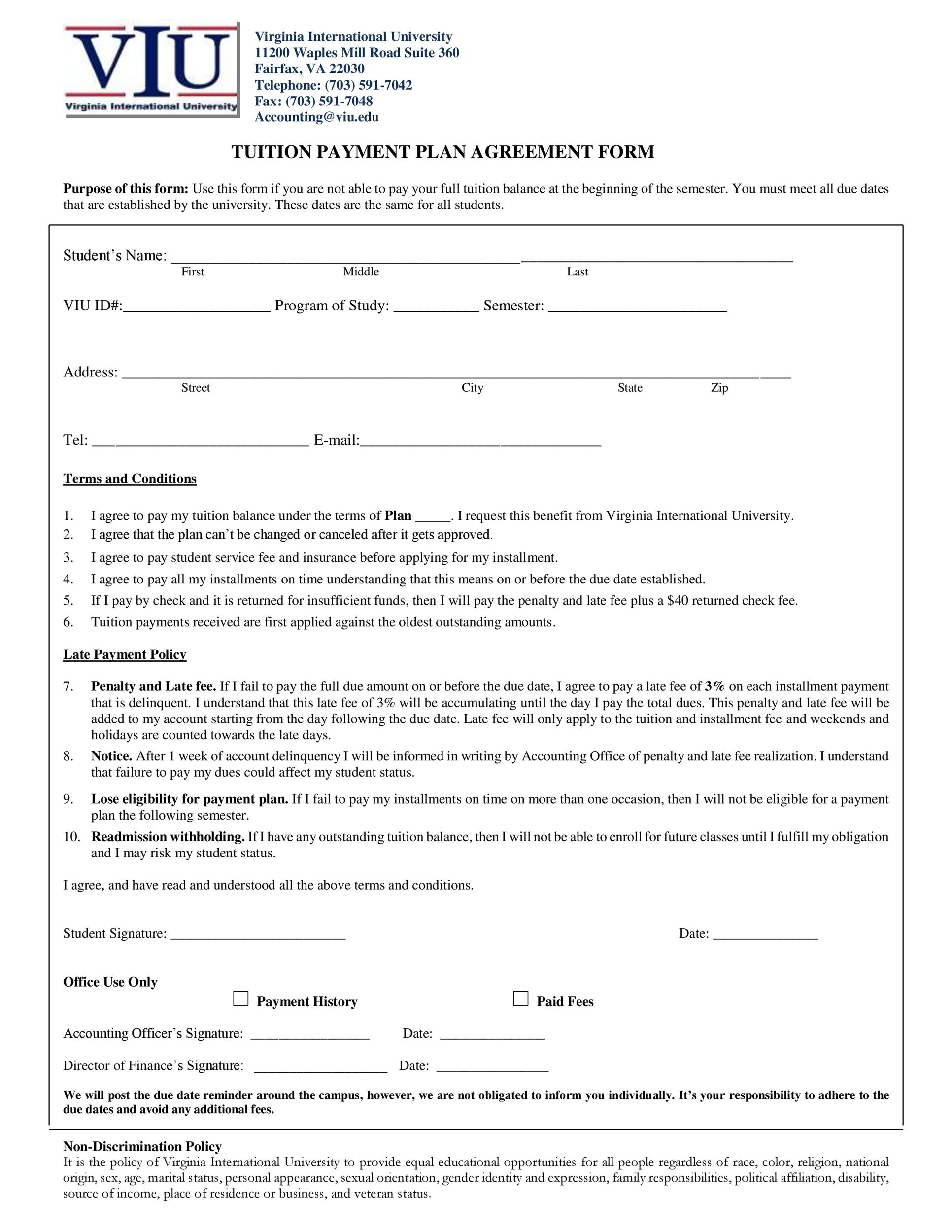

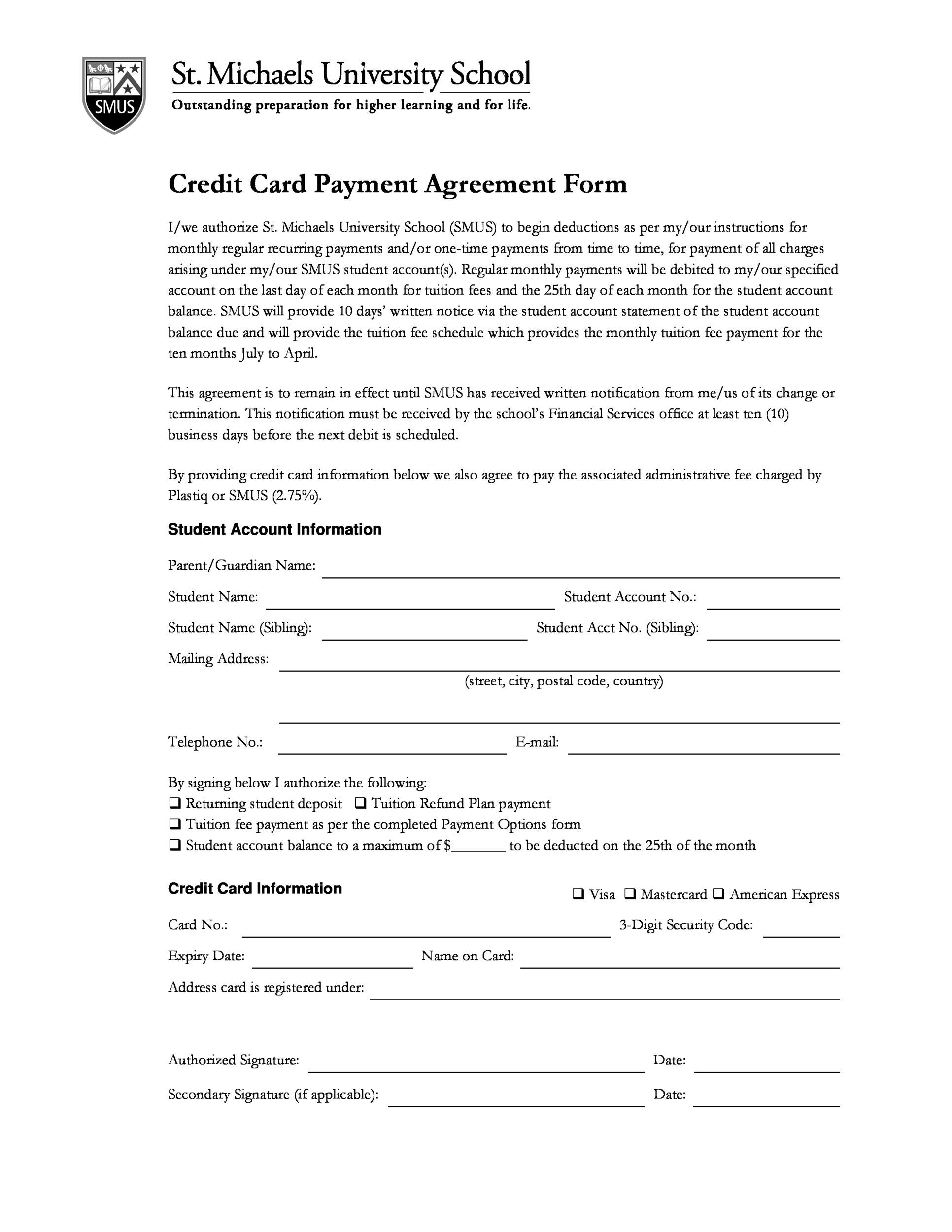

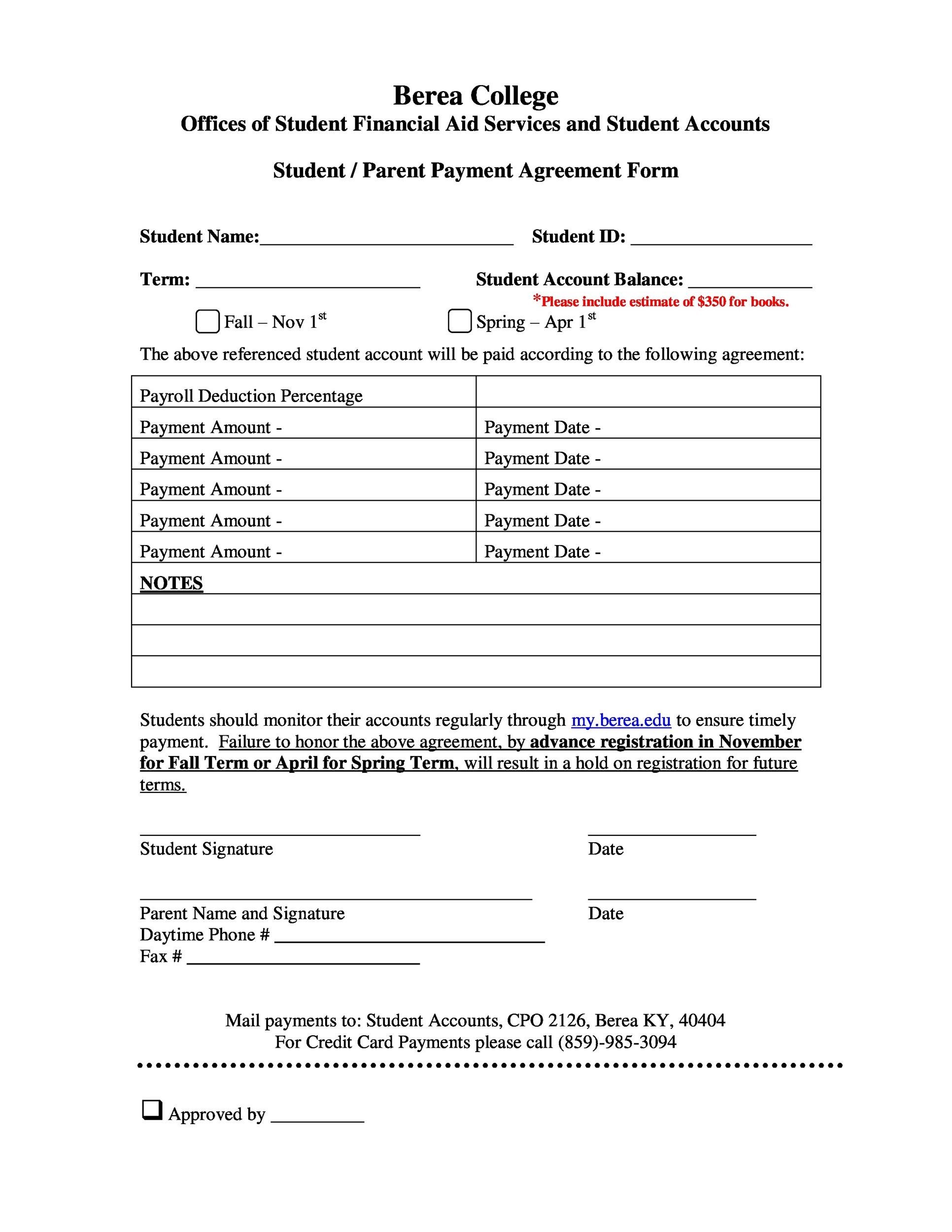

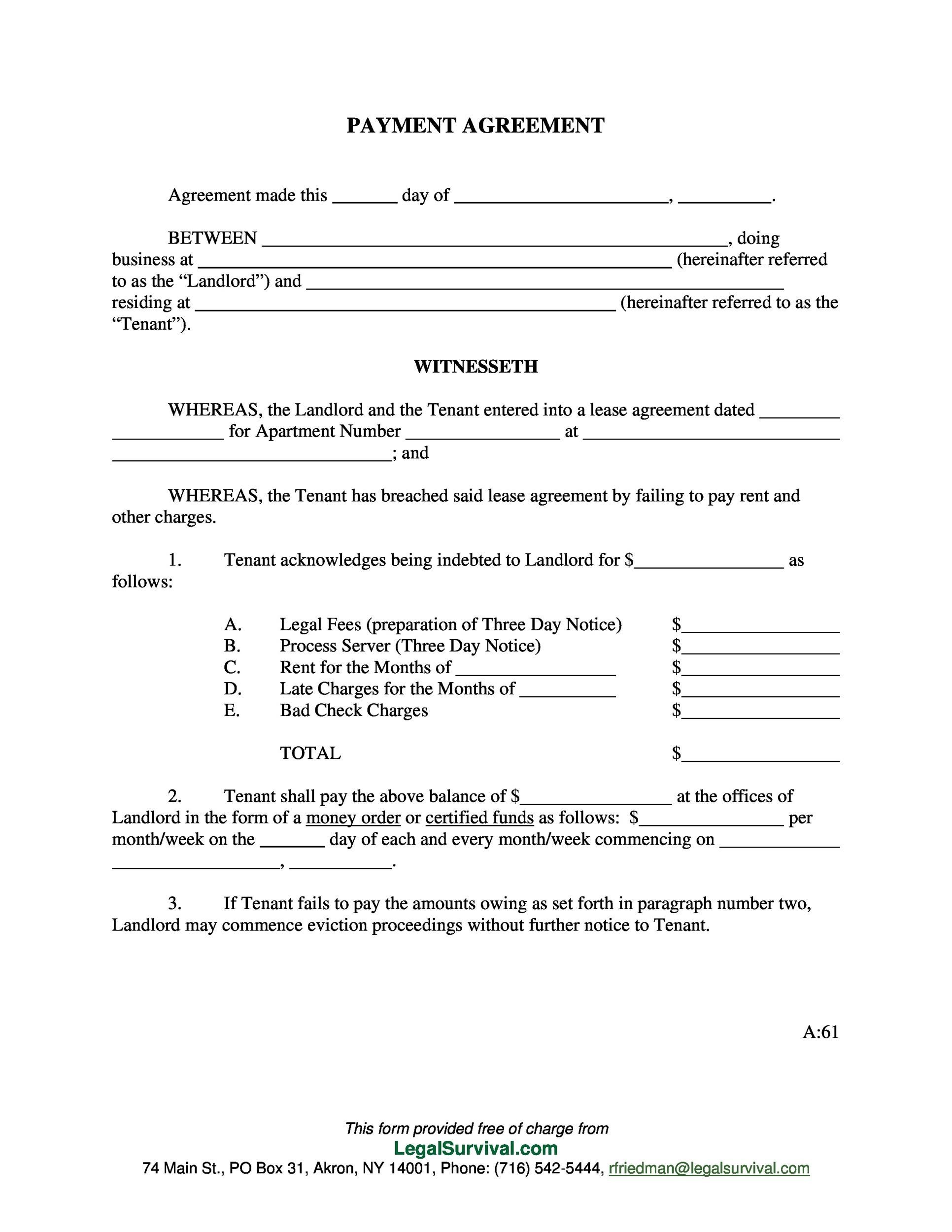

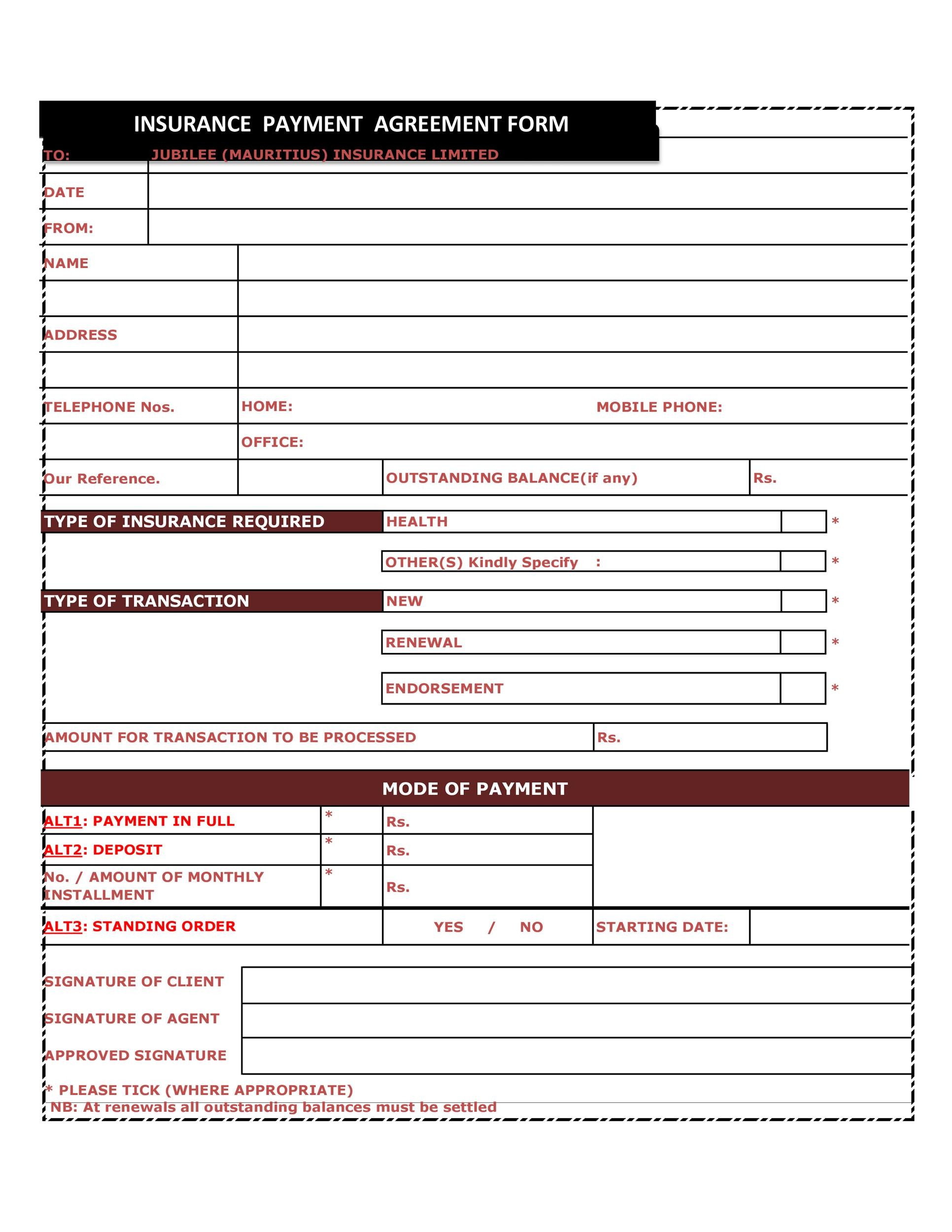

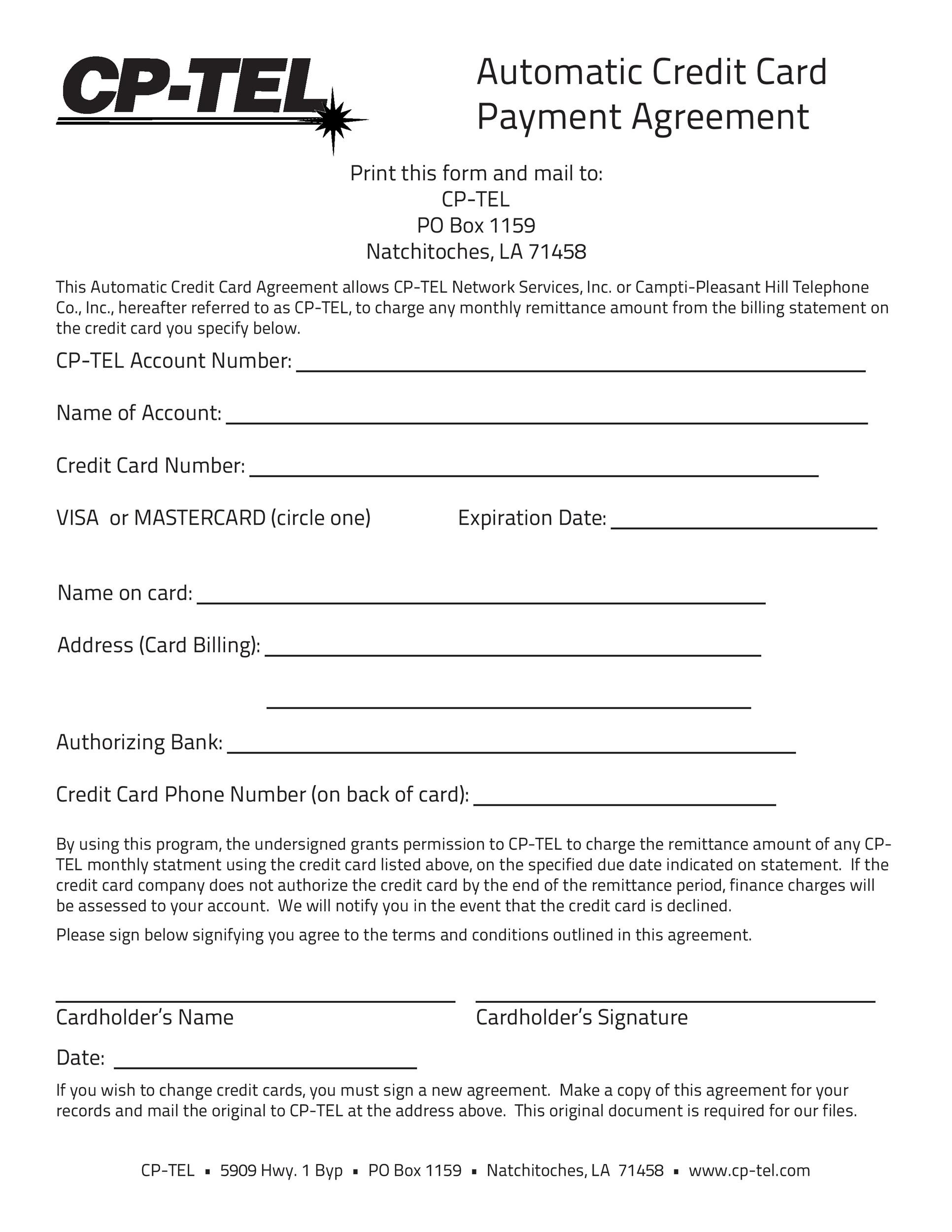

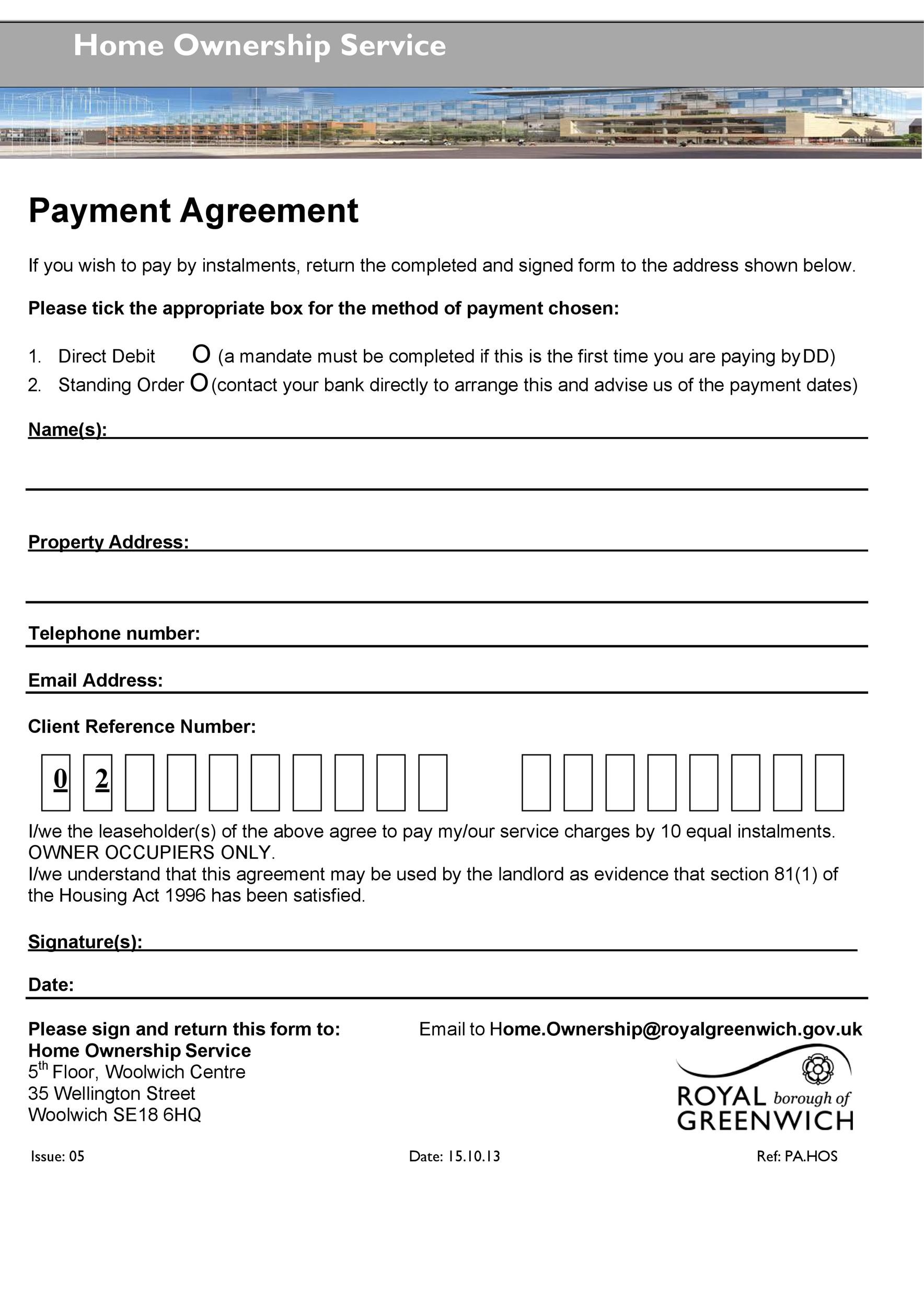

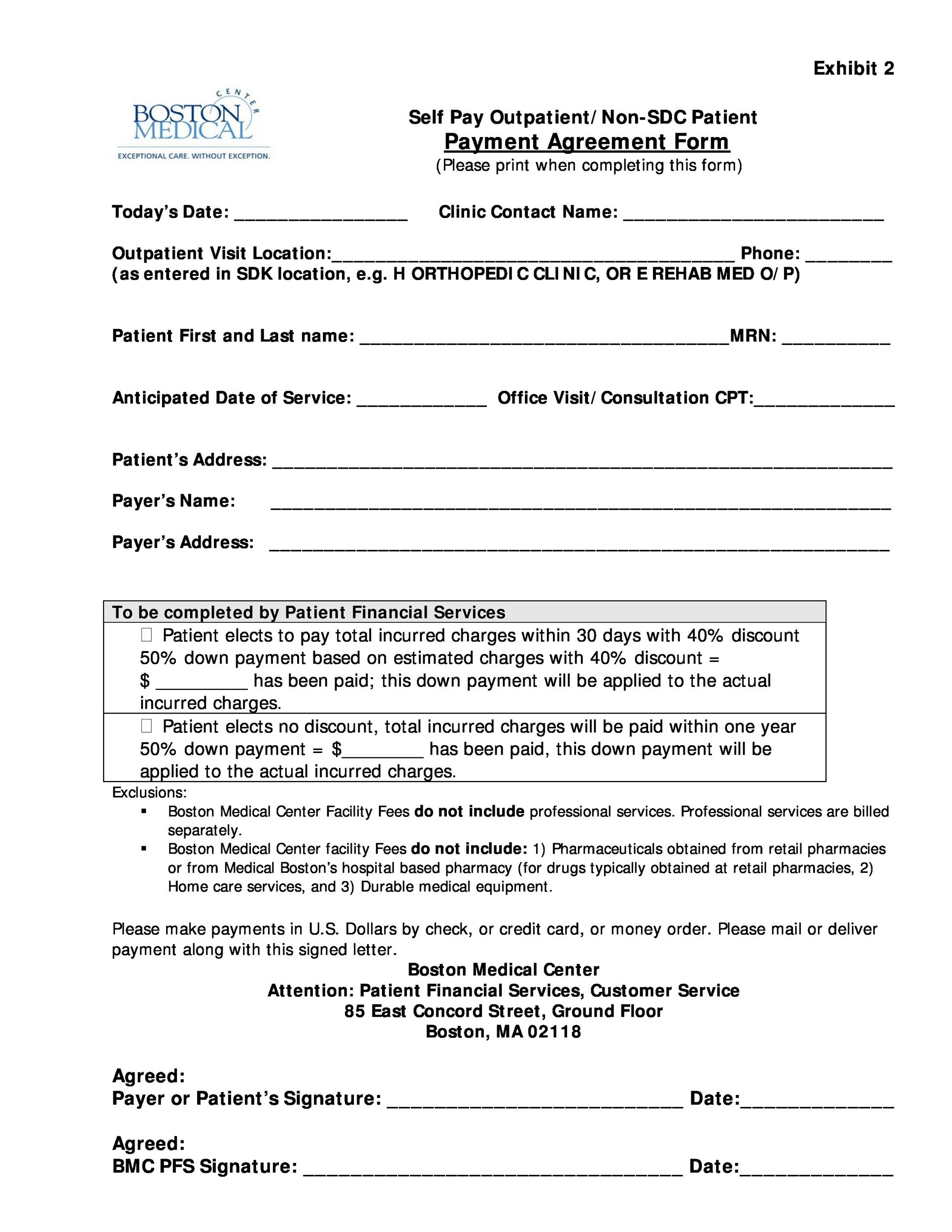

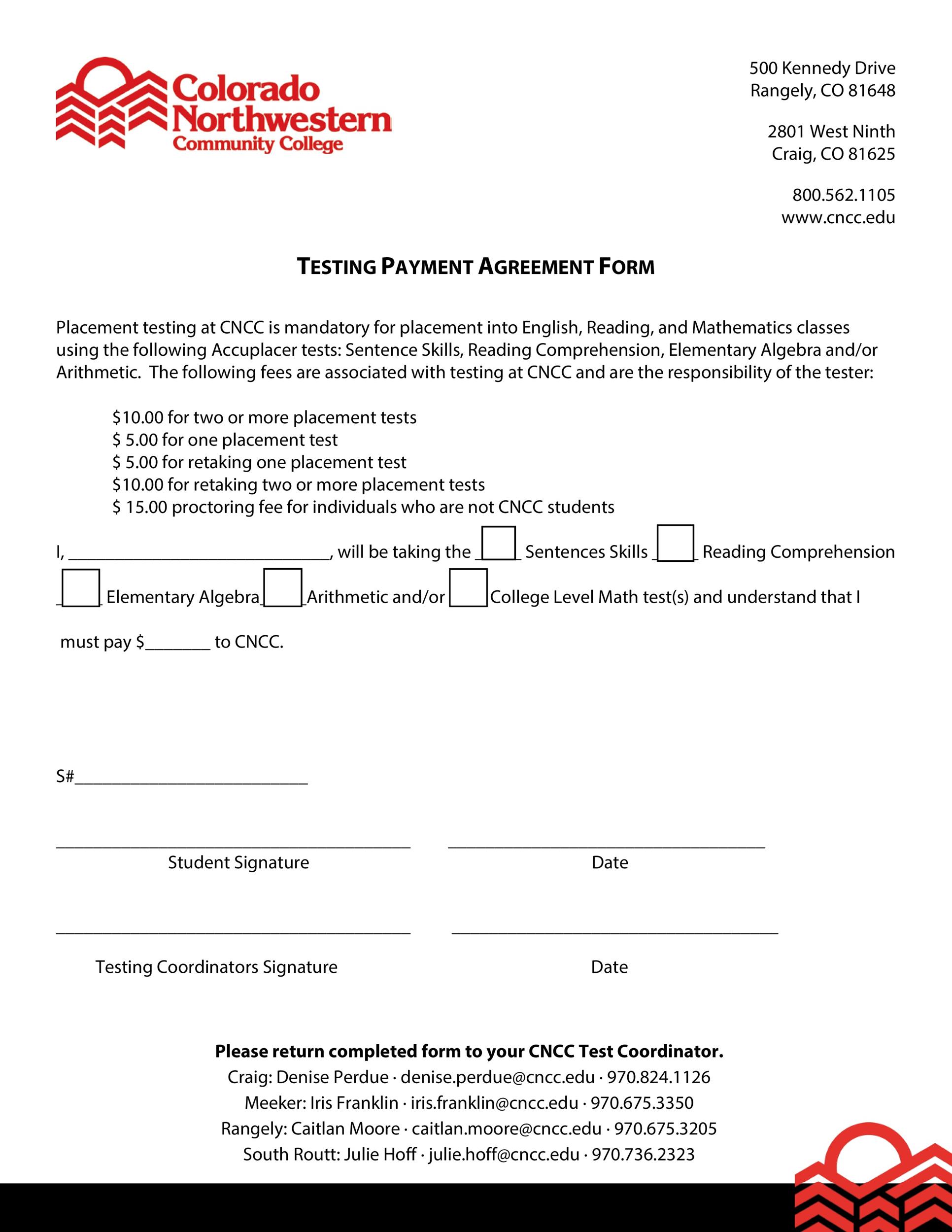

Payment Agreement Templates

What is a Payment Agreement?

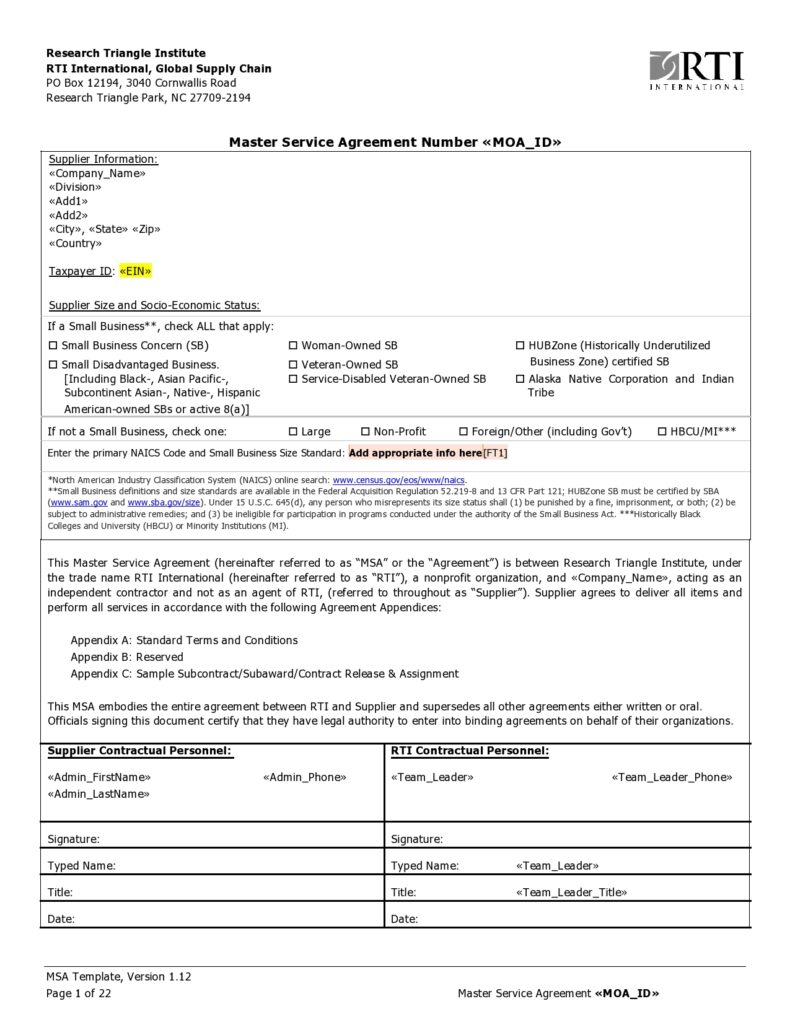

Payment agreements are used to explain how a payment process is to be conducted by a person or even a business. These payment plans can govern purchases both large and small. No matter how large the purchase is, you will need to make sure that your payment plan includes all the right information to be valid and binding. When someone agrees to a payment plan, they need to comply with the payment structure or suffer legal consequences.

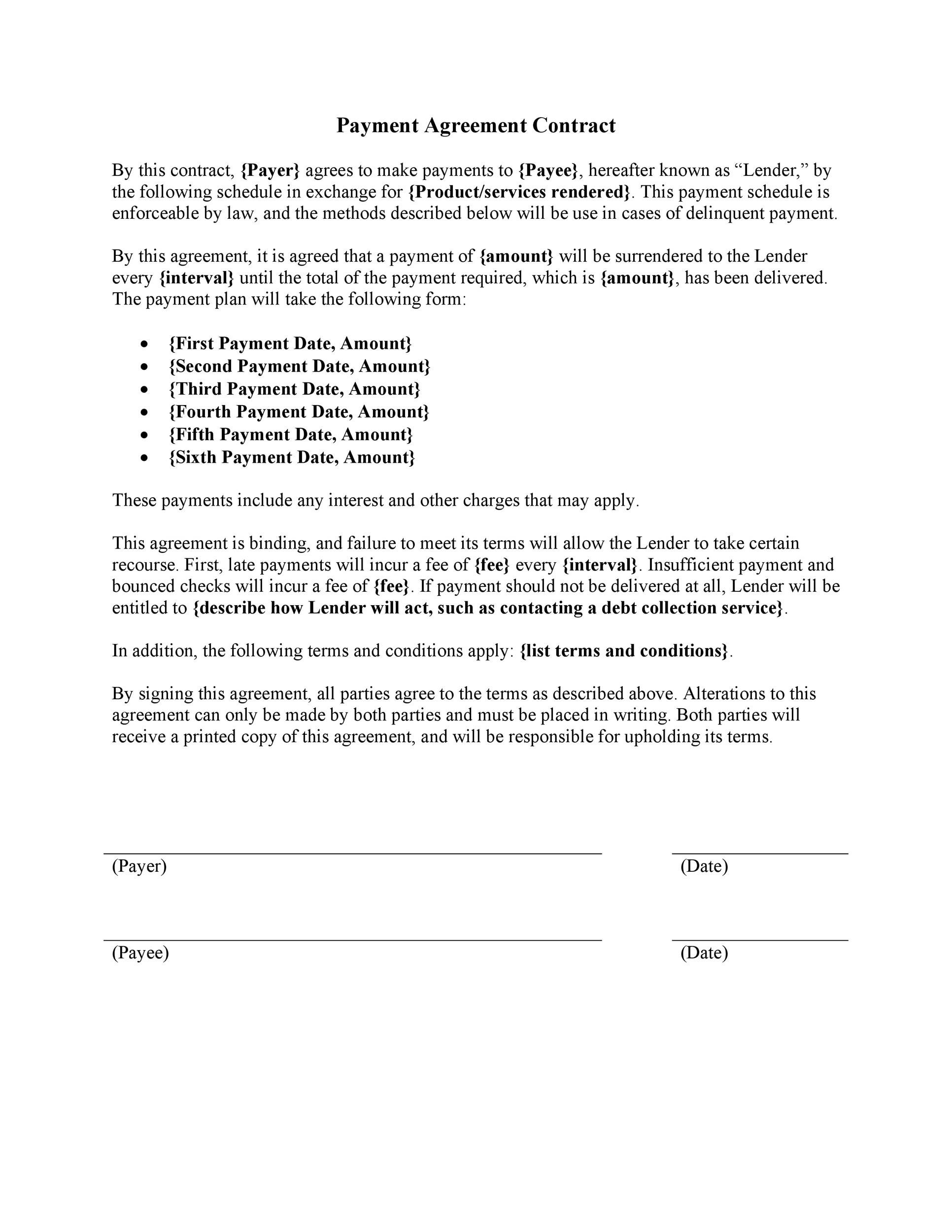

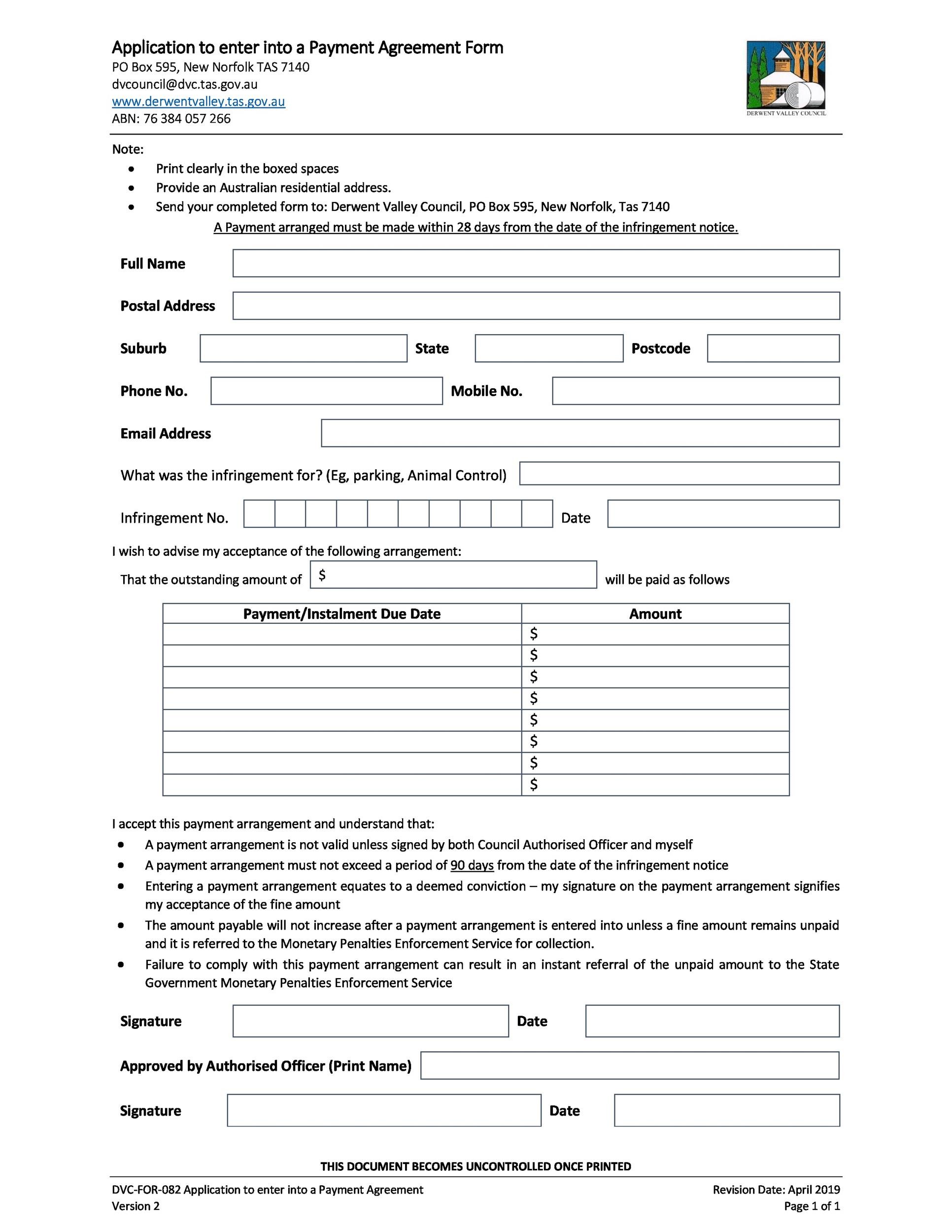

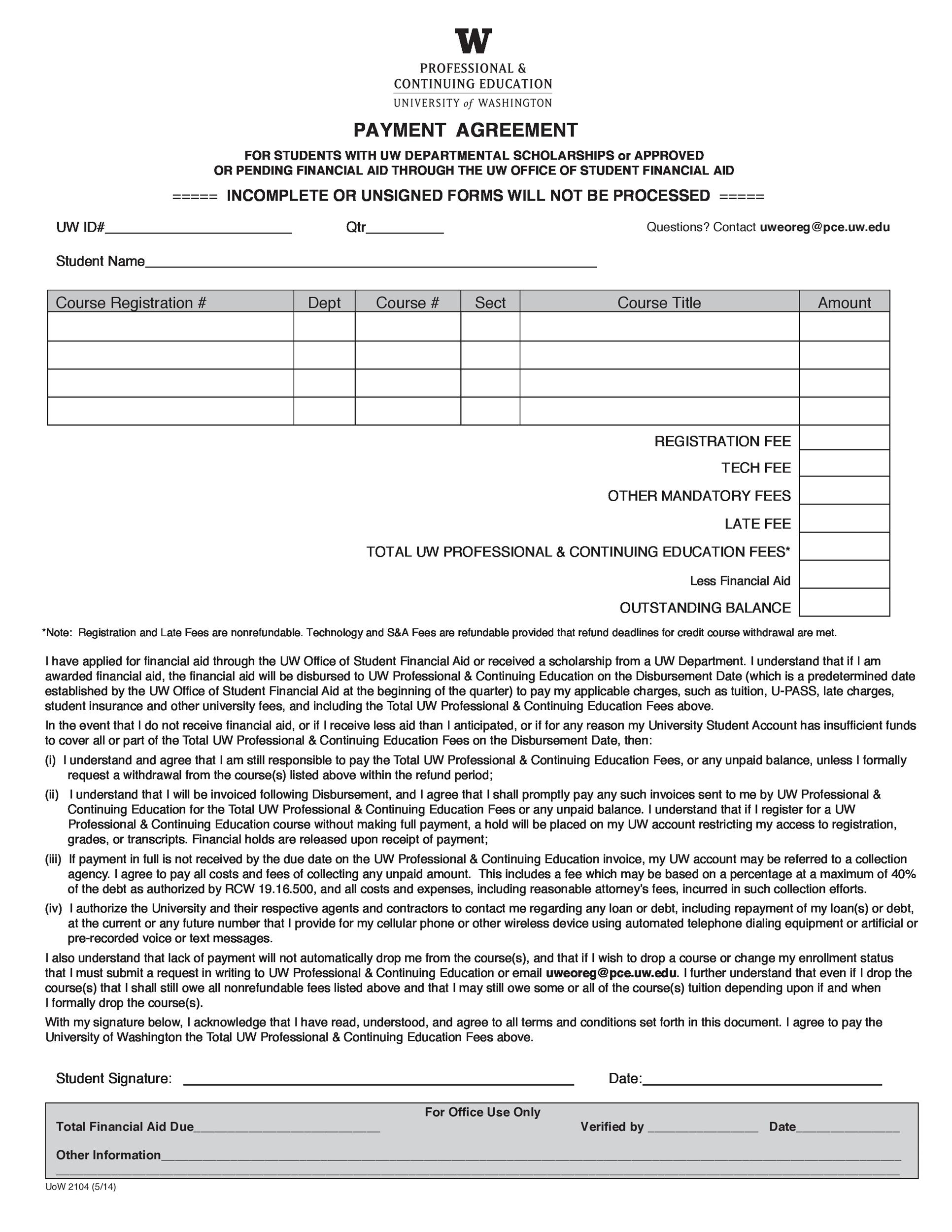

The payment agreement will detail how the payments are set up, and you might also include the installment agreement and the payment agreement letter that governs this payment process. The payment schedule outlines a mutual payment schedule, and the debtor and the lender are named in the document as well. Even a single-installment payment plan can be needed if the payment comes with unique stipulations.

How do I Write a Payment Agreement?

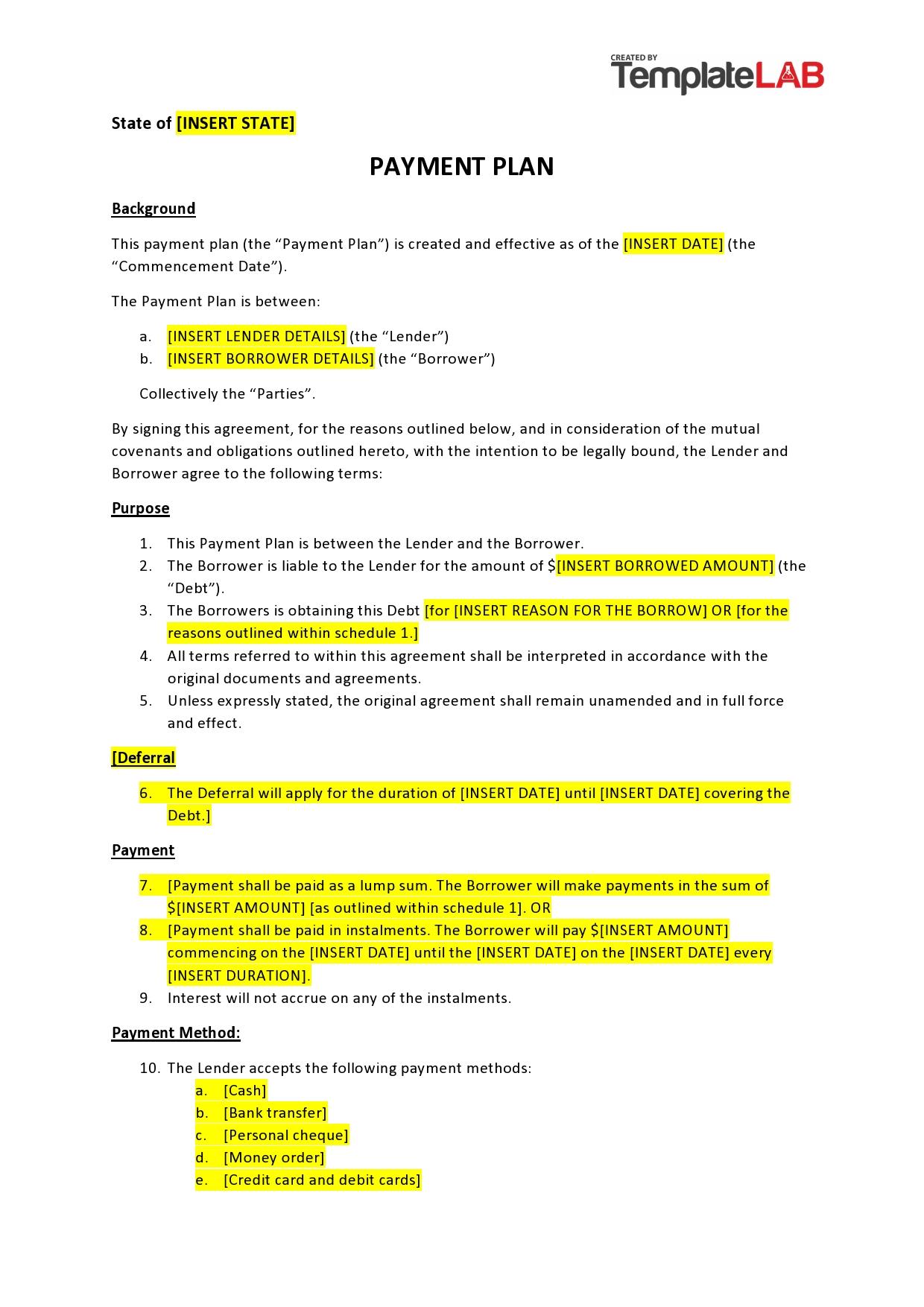

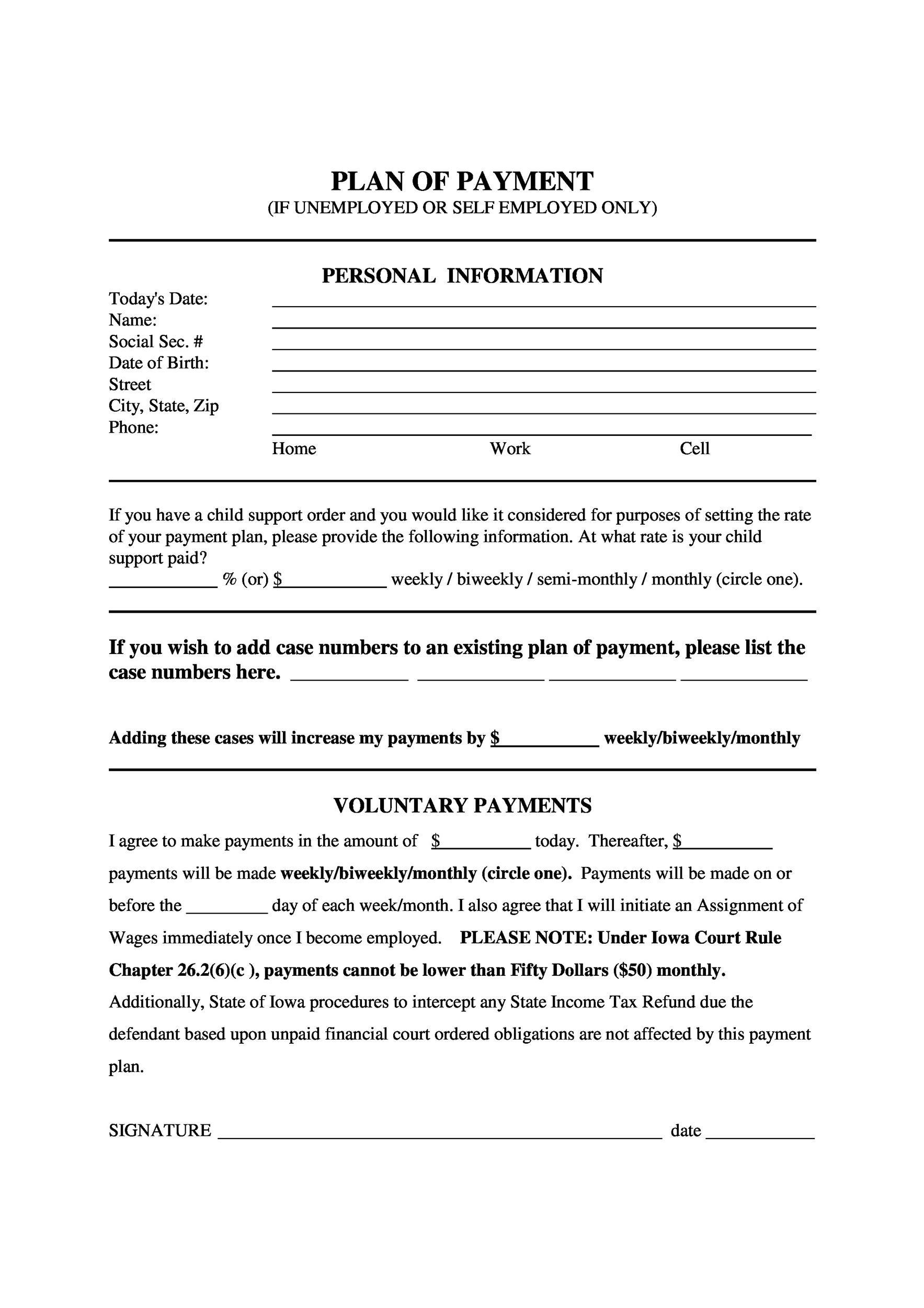

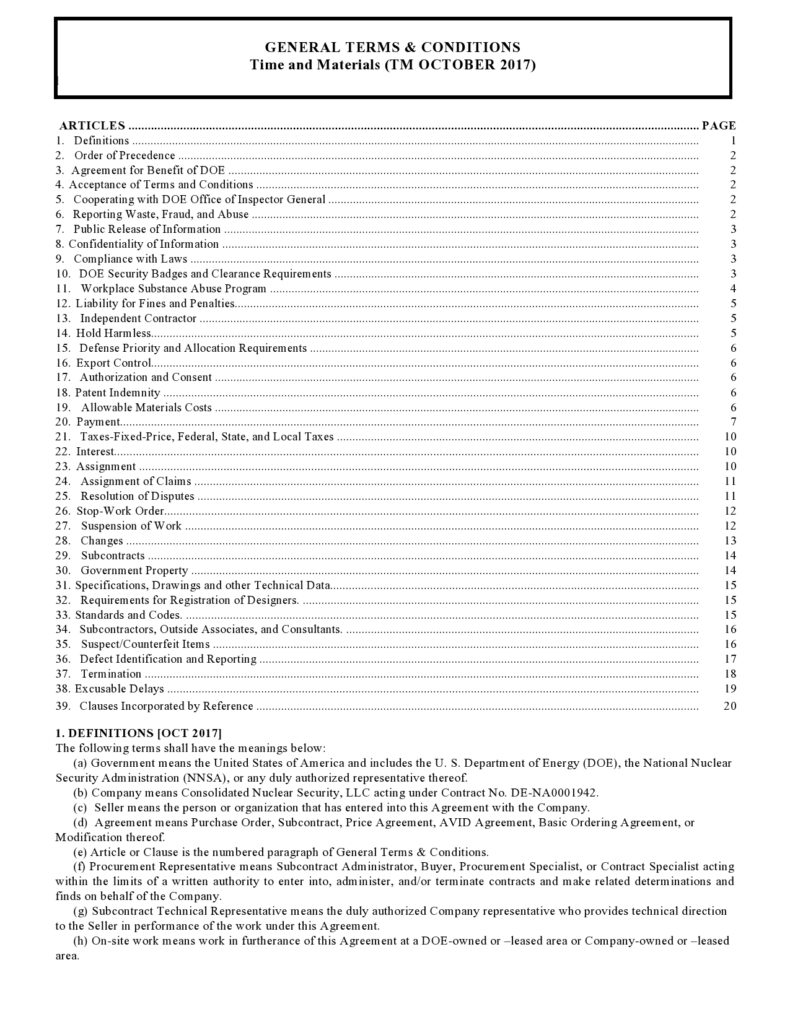

There are three parts that are required for a payment agreement template:

- Payment contract

- Instalment agreement

- Payment agreement letter

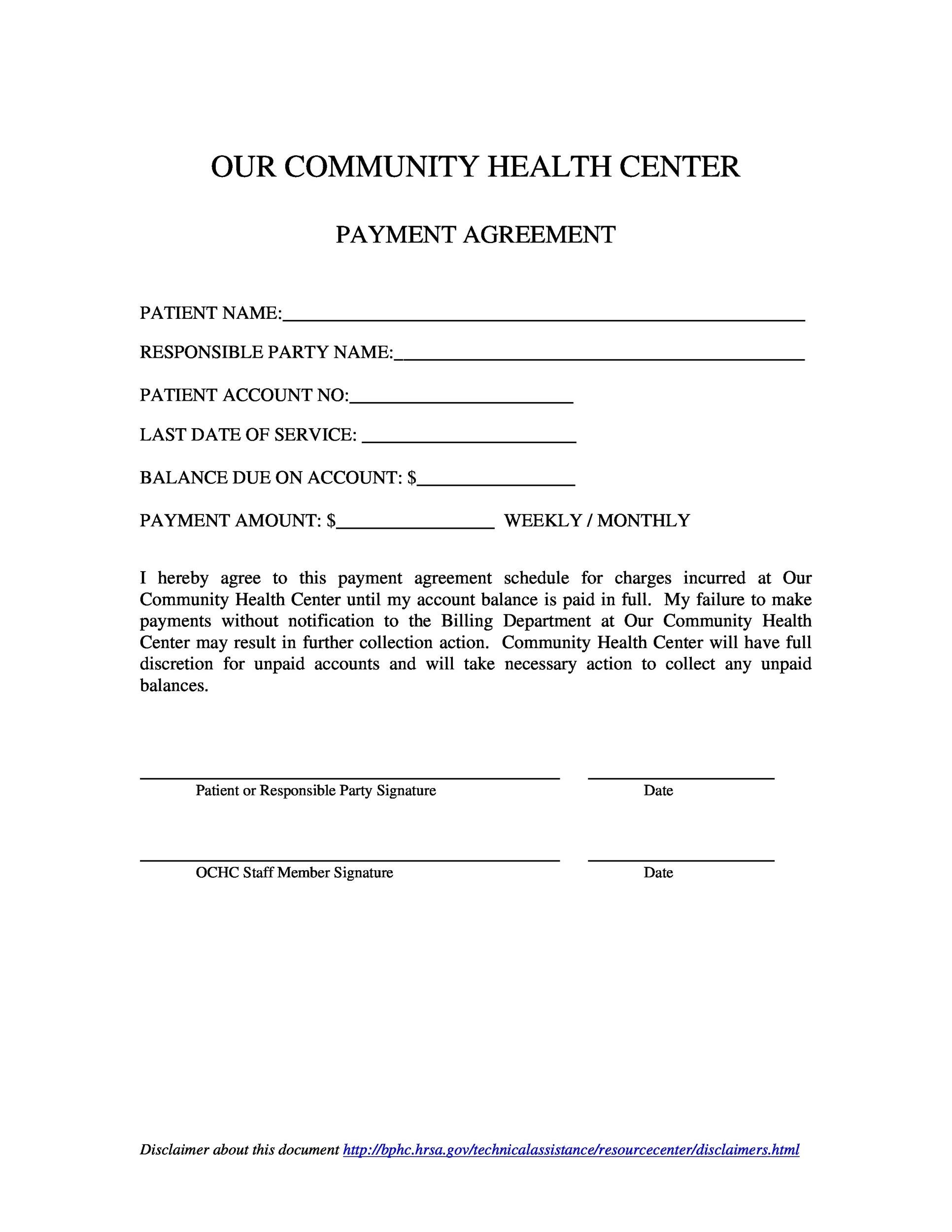

All standardized payment agreement templates will have these three parts. These agreements are used for the following common purposes;

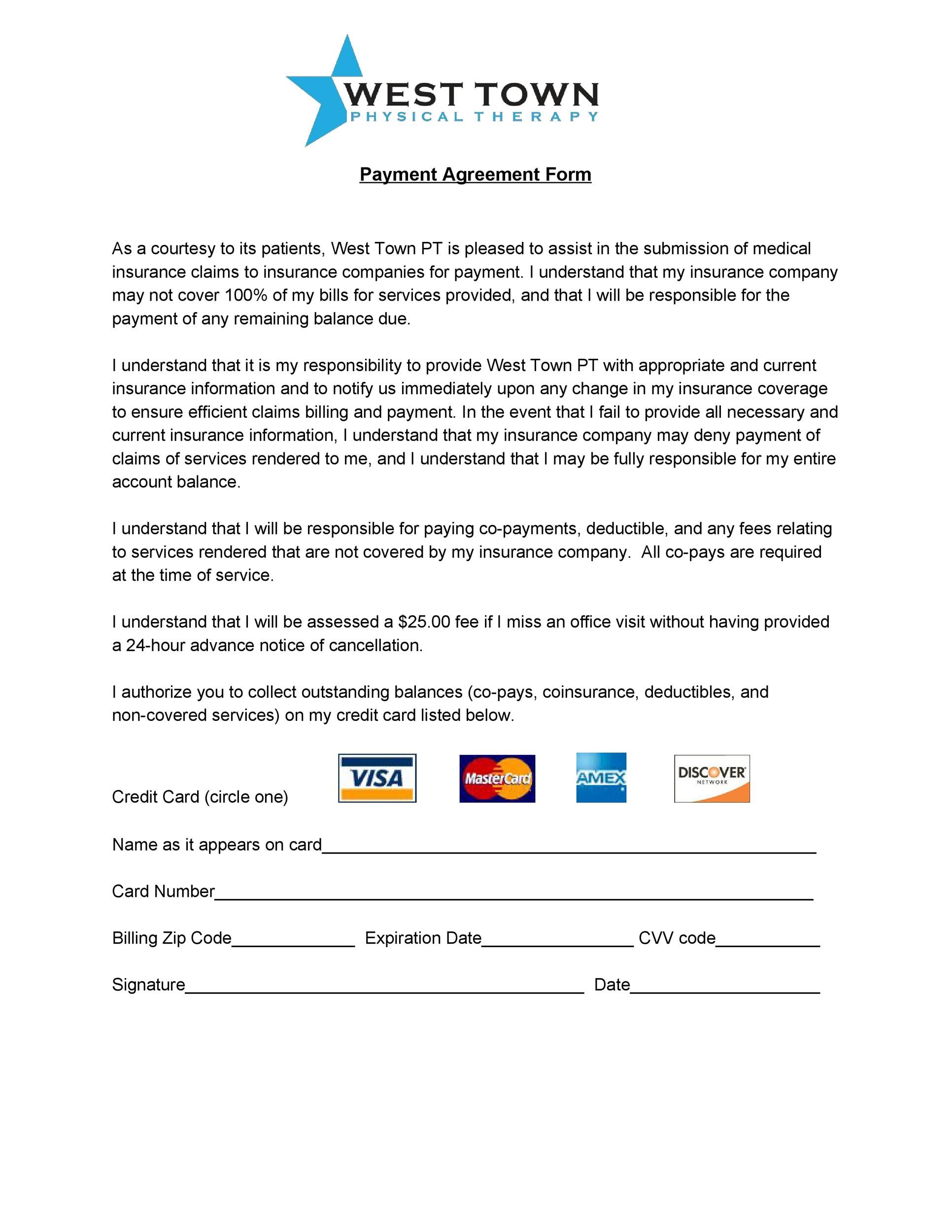

- Medical

- Dental

- Legal services

- Tuition

- Debt

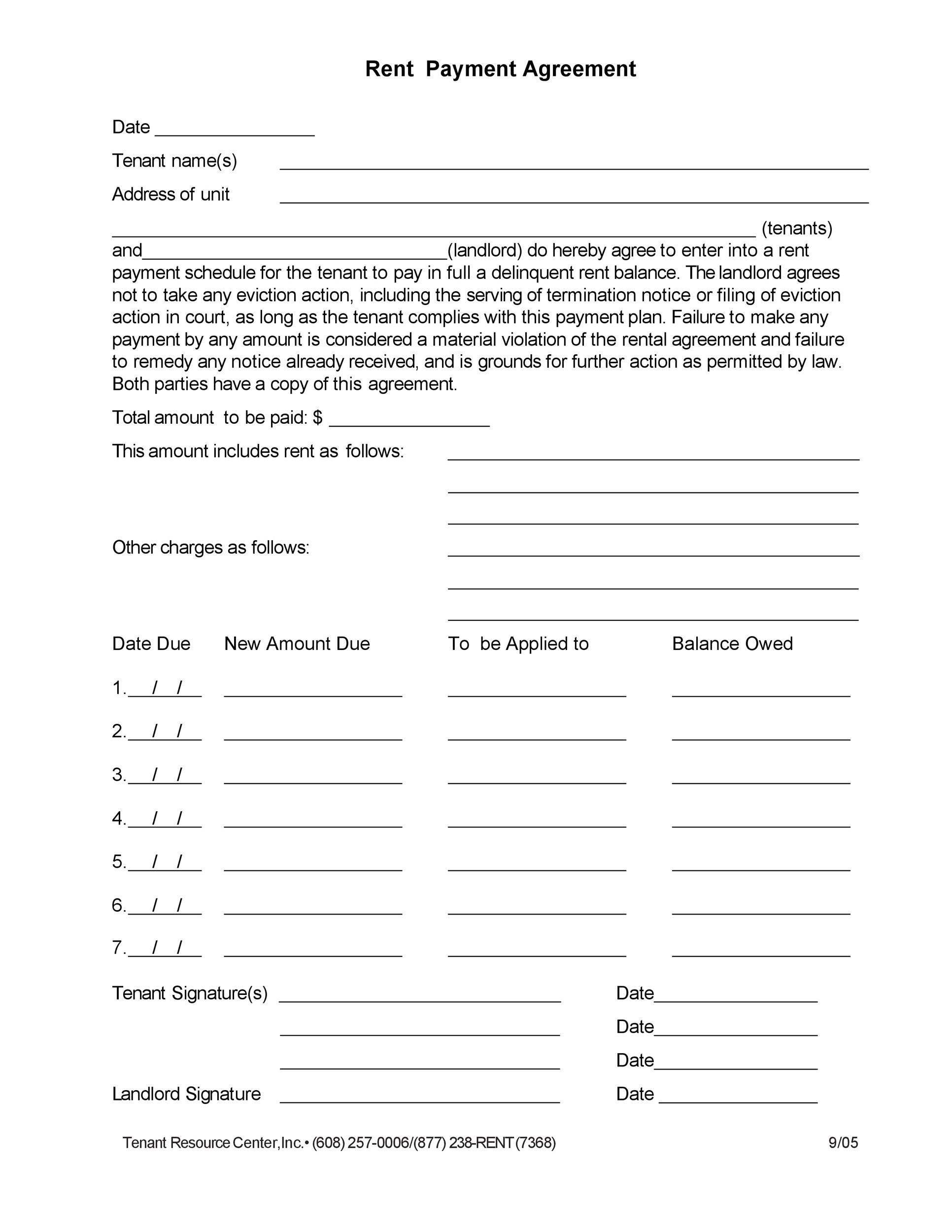

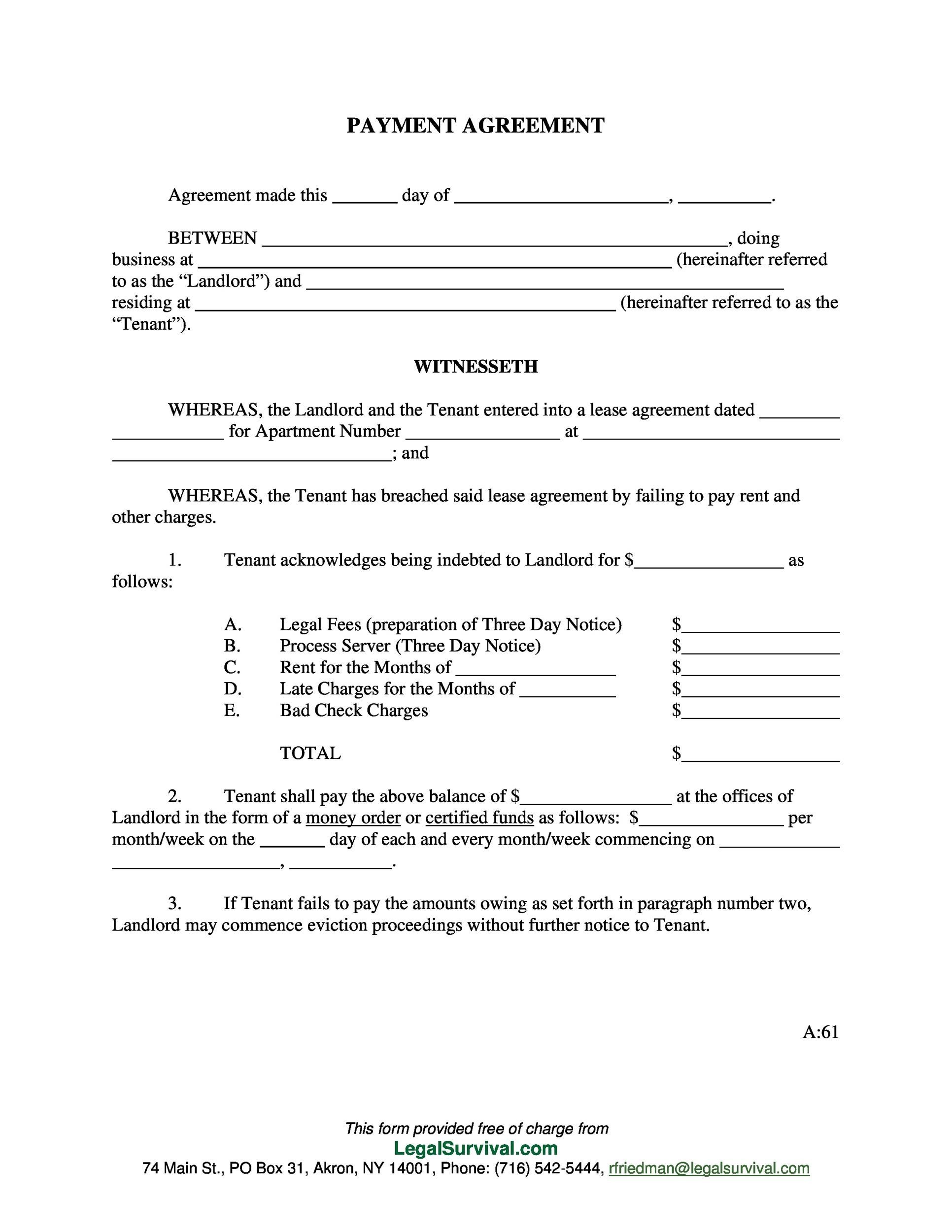

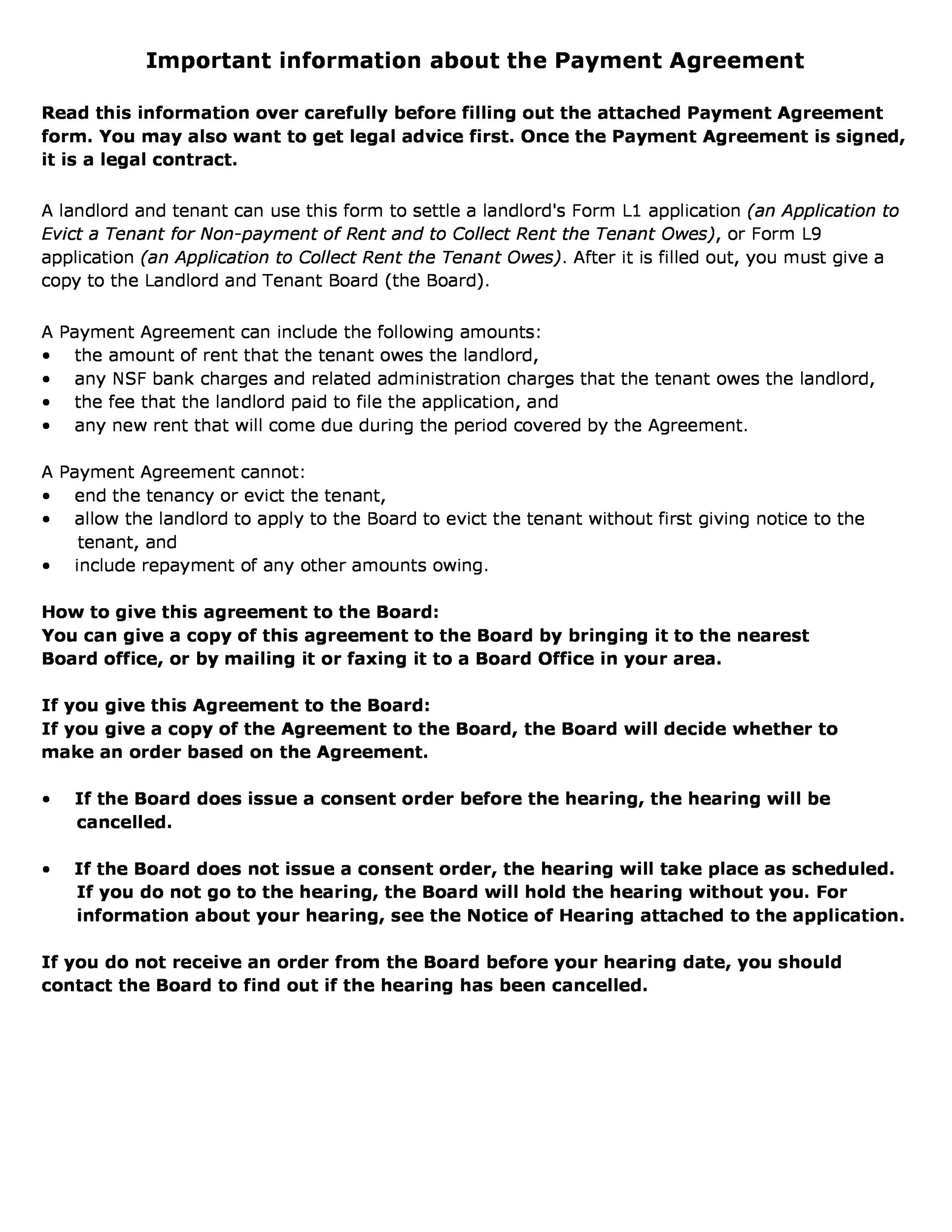

- Overdue rent

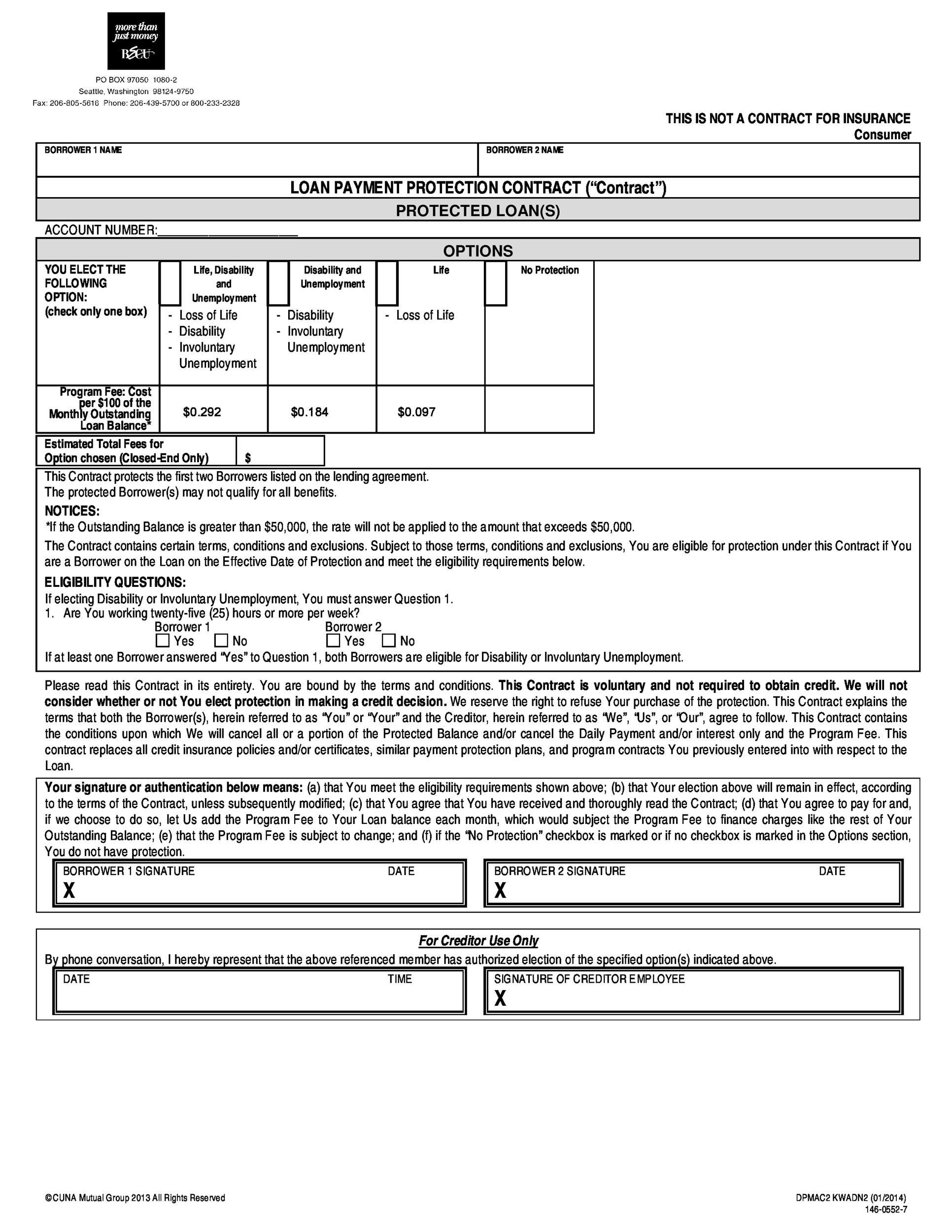

- Insurance

- Car purchases

These are just the most common reasons that you might need to set up one of these plans, but these are not the only kinds of payment installment plans that can be governed by this kind of payment document.

When writing a payment plan agreement, you will need to include the following parts:

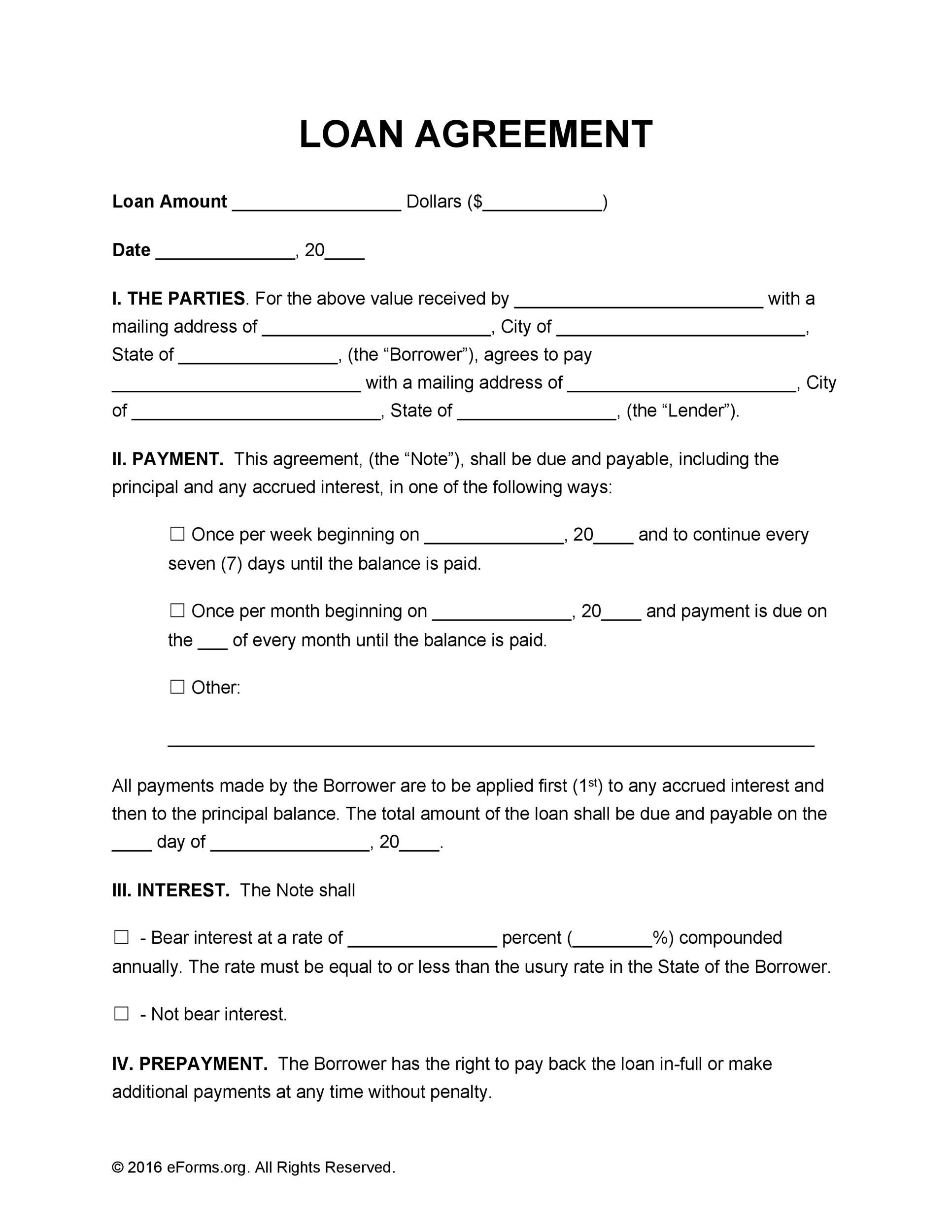

- The Debt Amount. This is the total amount of the debt that must be paid back, and it will typically include interest and fees that are also due throughout the payment plan’s life. You will owe the total of the interest and the fees as well as the original debt amount. This is usually the information that is listed at the top of the payment plan or payment agreement plan.

- The Deferral. When writing a payment agreement template, you will need to include when the total debt must be paid by. This part of the agreement might also include information about when the debt can be paid back. There might be penalties for early repayment that are built into the total payment amount that is due when the payment plan is complete.

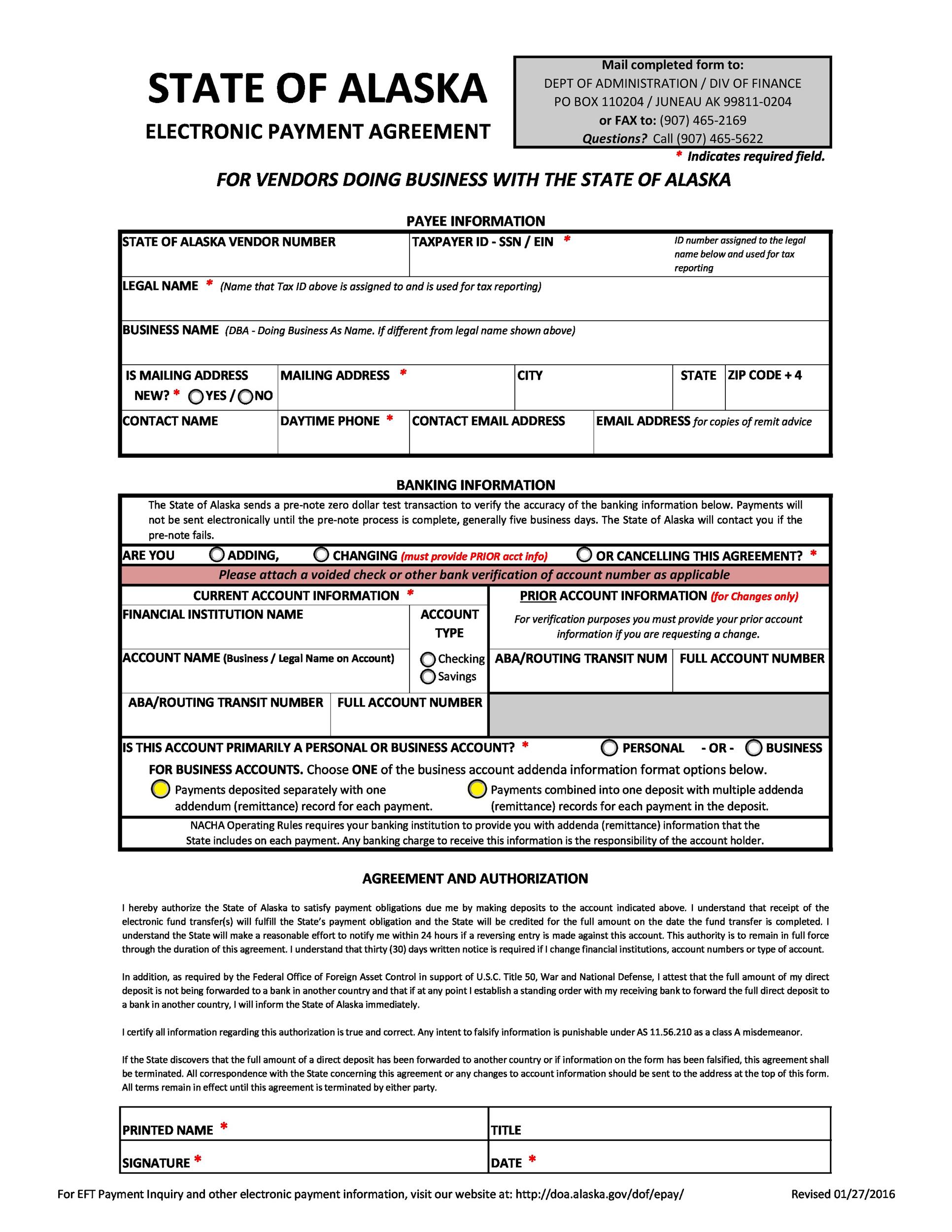

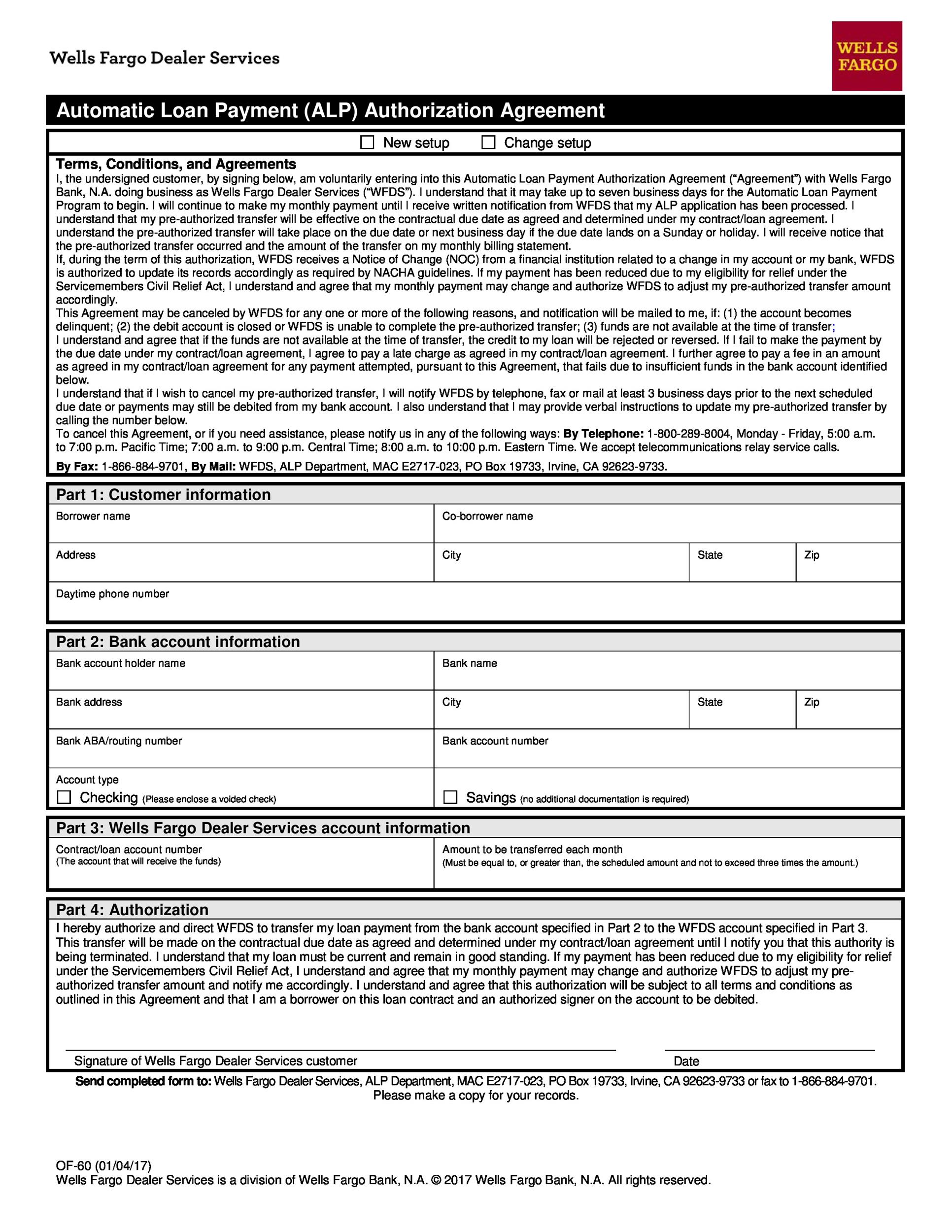

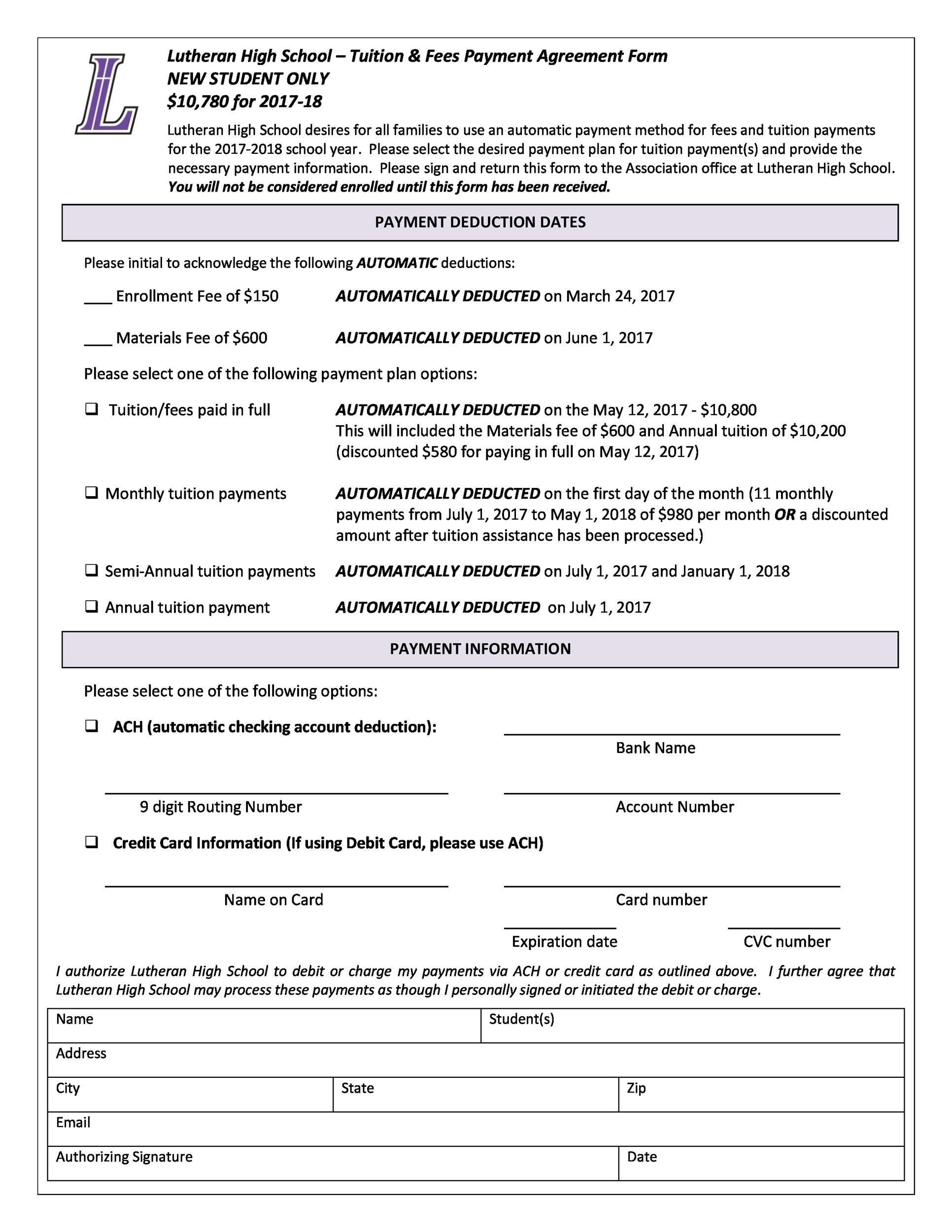

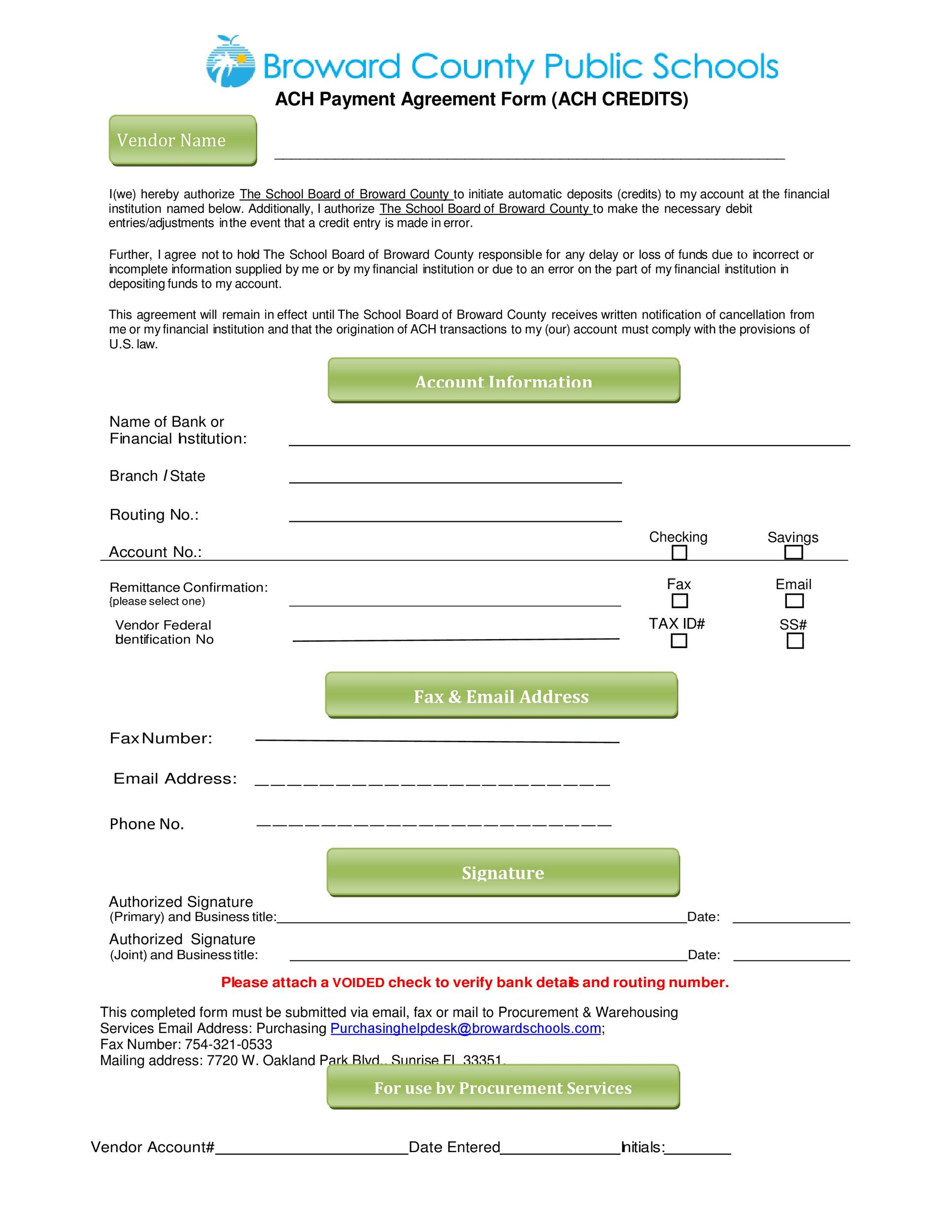

- Payment Method. The payment method needs to be detailed in your payment plan. If this is an automatic payment, this information needs to be detailed as to when the payment is taken each month and from what account. The payment amount for each installment needs to be listed, and the interest amount that is going to be involved in each payment needs to be explained as well. Payments are usually made via ACH debit on a recurring basis for these plans, but there might be payment coupons sent out as well.

The agreement will not usually be made for payments in cash, but this can also be an arrangement that is made with the borrower. Your unique payment agreement template can be made to govern any kind of repayment process that you need to set up. Even a lump sum payment that is due at a future date can be outlined in this portion of the payment plan or purchase agreement. - Further Items. This section of the contract can be used for any future payments, special details, or custom language that you want to be included in your payment agreement. When you are creating a unique payment agreement template, you might need to use this section to make the specific alterations to the standard language or addendums that you need to have included in your payment plan. Legal fees, indemnification, and acceleration clauses can also be included in this section.

- Signatures. The signature section cannot be legally binding if it is not signed. The person consenting to the payment agreement will need to sign and date this section, as will the lender. The signature portion of the contract makes the contract binding and active. This is also legal proof that the agreement has been accepted by both parties and that both parties are clear about the details of the agreement as well.

Payment Agreement Examples

How do you Make a Payment Plan Legally Binding?

A payment agreement is not legally binding if it is not signed. This is the primary way that you make these payment plans binding. You will also need to make sure that the legal information that is contained in the document is correct as well. This is one of the primary ways that you protect the legality of the contract, and when there is no legal disclosure included in the contract, you cannot hope for the payment plan to stand up in court or when contested.

Payment plans also offer explicit and legally-binding instructions about how the payments should be made and when they should be made. This will make sure that the payment plan is followed correctly and that payments are not missed, and that the payment plan is honored.

Some Other Considerations

If you are creating a payment plan, you will also need to make sure that there is a section that details what happens if the payment plan is not honored and if payments are missed. The consequences of missed payments or the payment agreement being ignored need to be clear. Since the payment plan has been signed, this indicates that the person who is agreeing to make the payments promises not to miss a payment and to make a repayment by the end date of the contract.

Missed payments can happen, and you will need to explain in your payment plan what will happen if payments are missed and how much interest these payments will accrue. These payments might also be assessed as a fee for being a missed payment. Some payment plans also are set up so that the missed payment can be drafted again at a later time in the month automatically. This can be a useful way to collect payments without having to assess fees and other charges on payments that should not be missed due to auto payment plans being set up.

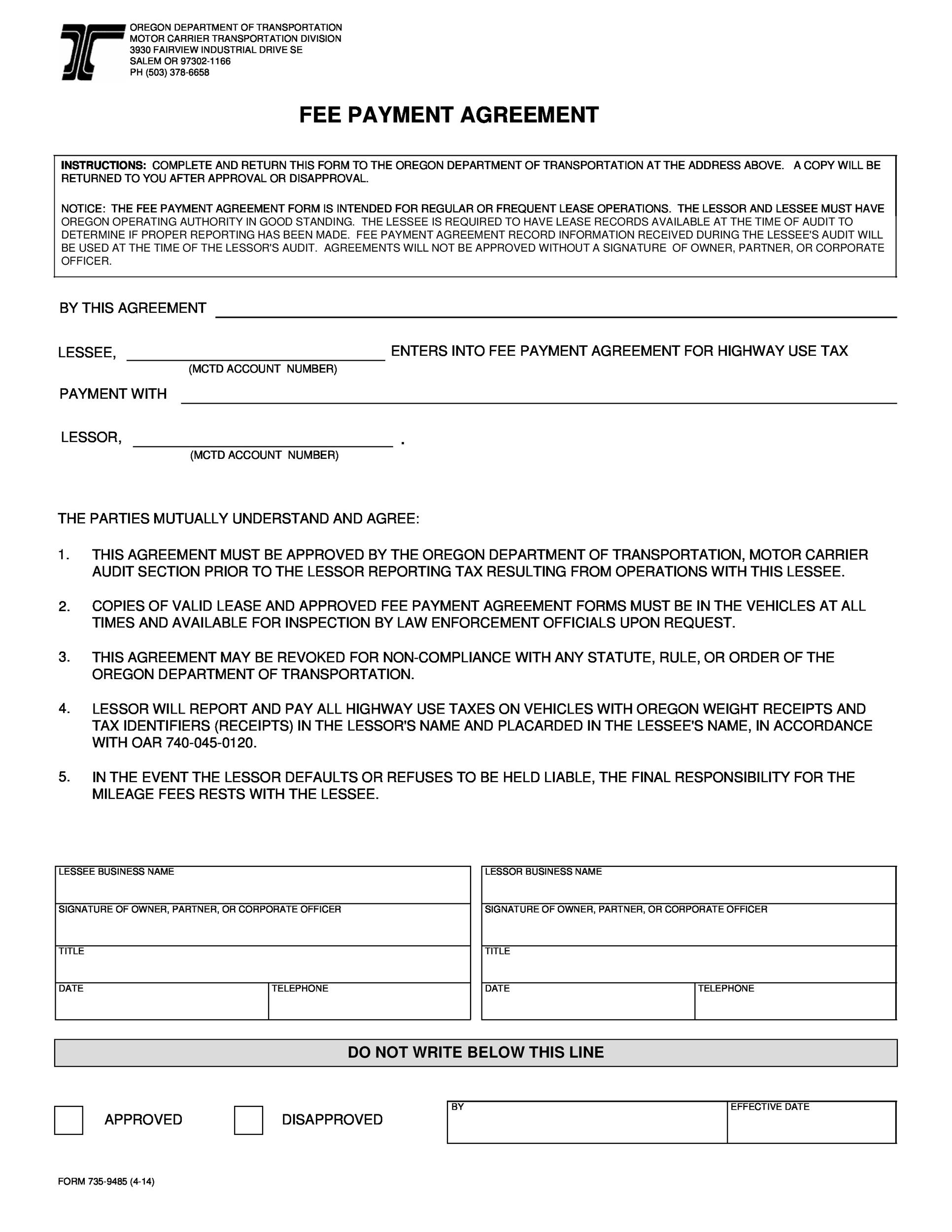

When ACH payments are being used to collect a payment, there also needs to be language that deals with how many missed payments can occur before the ACH draft is considered to be in default and canceled. At this point, the payments start to accrue interest and additional fees, and notice is sent out to the debtor that automatic payments have been canceled.

Payment plans that are done by autopay will also need to have a detailed explanation about when they are pulled each month and how many attempts are made to collect payment before the agreement is null and void. This helps to explain to the debtor how this part of the process will work. This is essential to the disclosure part of the contract, and you need to be sure that the person agreeing to the payment plan understands this part of the contract clearly when they sign it.

Free Payment Agreement Contracts

Do I Need a Payment Plan Agreement?

No matter what kind of payment plan you are making, you should never trust someone’s word that the payments will be made. This can lead to confusion and misunderstandings, as well as the ability of the debtor to walk away from the debt without consequence. Payment plans need to be legally binding to be followed correctly, and you should not trust that someone will pay back the debt that they owe you just because they said that they would. When there is no legally binding document to hold this person to their word, you cannot enforce the payment agreement that was talked about.

Payment plan agreements are required for any business that wants to offer payment plans to its customers. This is an essential document that is used to define the payment plan agreement between the business and the client, and it makes sure that both of the party’s rights are represented correctly. Having a payment plan in place is critical if someone cannot pay for something in cash upfront, and this is a common document for business needs for larger purchases or even smaller installment debts.

Even if you are making a private agreement between a friend or family member for payment in installments, having a document that governs this payment plan is a good idea. This means that there will not be scuffles about the payment plan along the way, and it ensures that both parties will stand behind their part of the agreement. The payment agreement template that you have created can be used in small claims court if needed to show that a payment plan was made. This means that the situation will not be your word against the other party’s word.

Money can complicate any kind of agreement between two parties which is why it is essential to have a document that binds both parties to the agreement. This is a means to show legal proof that the discussion of the payment plan occurred, and it helps to define the expected timeline for this repayment process. When there are payments that need to be made and set deadlines that they must be made by, this helps to make sure that the repayment process is prioritized. It can be human nature to put payments that are not governed by any documentation at the bottom of the list of things to do each day.

Making sure that your payment plan agreement is written correctly can eliminate reasons for stress and strife that might crop up when something needs to be paid for in installments. While it might seem like a reasonable plan to just discuss some payments being made between two people, you should never assume that the other party will envision the repayment process as you do. The legal protection of a written repayment plan document is critical to protecting the interests of both parties that are involved in the purchase and sale process.

Payment Agreement Forms

If you are using your payment agreement templates for a business need or you are utilizing this payment plan process as part of an agreement between friends or family, the legal information in the payment plan document will protect the interests of both people involved in the payment plan. You should make sure that all of the sections that are included in this tip sheet are added to your payment agreement template to prevent confusion and legal strife surrounding the payment plan process.