A document that explains your circumstances in a certain situation, a hardship letter usually shows that you’re unable to pay debt. To request for special consideration, a person struggling with his or her finances uses a hardship letter known as a financial hardship letter. Commonly used by people who can’t make their credit card or mortgage payments, hardship letters are a way to seek leniency from lenders. A hardship letter is important for preventing the foreclosure of your assets.

Table of Contents

Usually, the objective of a hardship letter sent to a lender is obtaining payment deadlines leniency or outstanding debts consolidation. In addition to preventing the foreclosure of property, hardship letters help with medical bills and credit card debts. Also, students who are unable to afford higher education can use a letter of financial hardship to increase their chances of obtaining reduced tuition, scholarship, or grant. There are many different types of hardship letters but in this article, we’re going to discuss the two most commonly used hardship letter: financial hardship letter and hardship letter for immigration.

Financial Hardship Letter

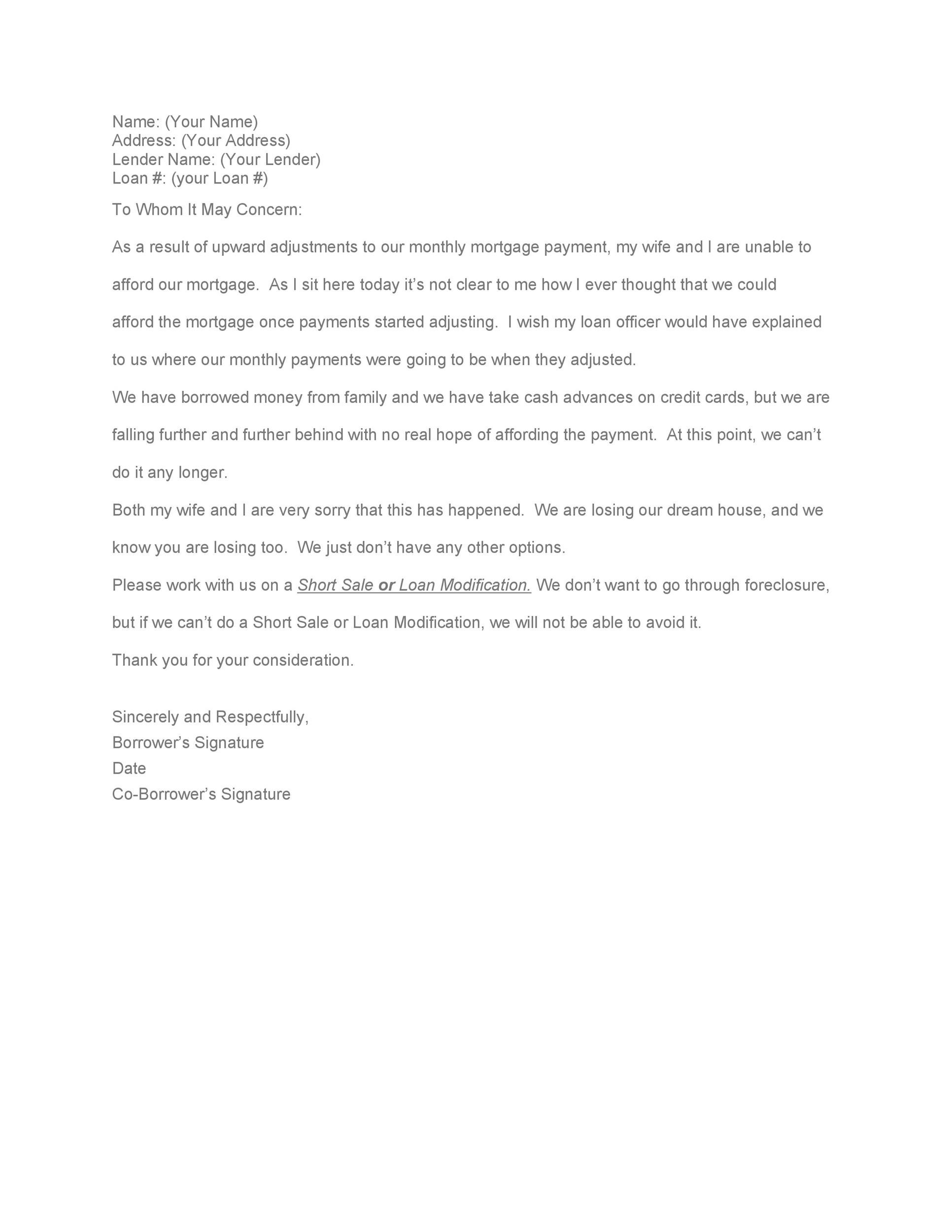

A commonly used hardship letter, a financial hardship letter informs the lender why you’re in financial distress and your ability to sort it out. People use hardship letters for many different reasons but the most common reasons to use this type of hardship letter is requesting a short sale or loan modification to avoid foreclosure. In fact, even if a foreclosure attorney is representing you, you (the homeowner) are required to present a hardship letter in the loan modification process. To present the strongest case possible to your lender, the foreclosure attorney needs to submit a hardship letter along with the other important documents.

You should be ready to complete a financial hardship letter if you’re having problems paying off your mortgage and want to request your lender for leniency or loan modification to avoid foreclosure. Writing a hardship letter is mandatory if you want your lender to consider you for a short sale, loan modification, and temporary repayment plan. When you’re writing a hardship letter for loan modification, it is important for you to keep in mind that lenders know the reason you’ve fallen behind with your mortgage payments. Therefore, when writing a financial hardship letter, you should be honest and provide the right amount of detail. More importantly, you need to inform lenders how you’ll support your payments in the future if they decide to approve your request for loan modification.

In order to convince the lender to forego foreclosure and modify your loan instead, providing the aforementioned details is extremely important. To write an appropriate financial hardship letter, take help from a foreclosure attorney or use sample hardship letter.

Reasons a financial hardship letter is required

In order to help them determine whether your situation can be resolved with loan modification, a financial hardship letter provides lenders an understanding of the financial difficulties you currently face. You’ll need to write a hardship letter even if you’ve spoken to a customer care representative of the lender and have explained to them your circumstances. The reason for this is simple: it is highly likely that the customer care representative you spoke to didn’t write down what you said or only wrote bits of what you narrated to him/her. As a result of this, your lender doesn’t have any formal record of your financial problems. Fortunately, by writing down your problems in a hardship letter, you can provide your lender a formal record of your financial situation. Once your lender has a hardship letter from you that clearly describes your financial situation, there will be no need for the lender to second guess about your problem which in turn will make it easy for the lender to decide whether to approve you for a workout plan.

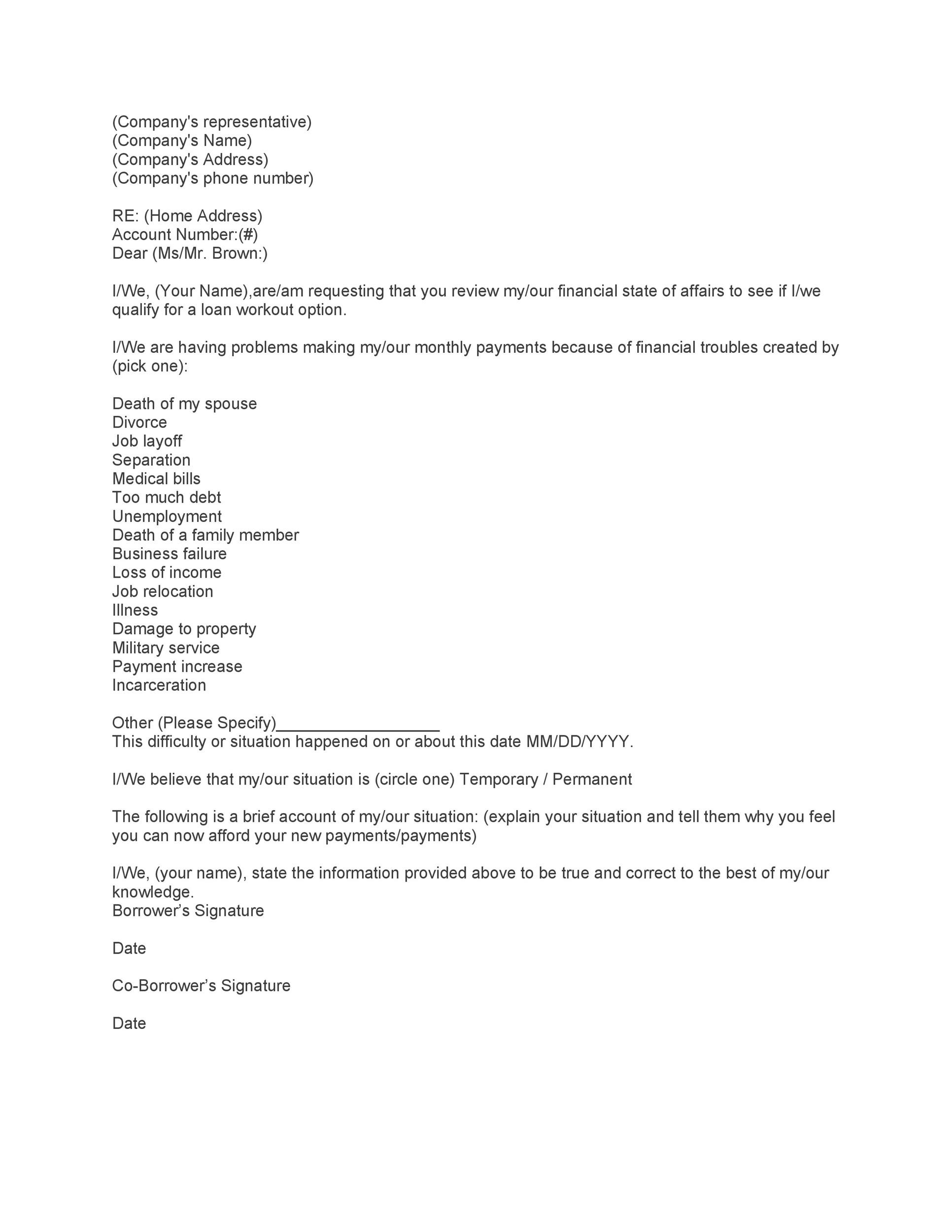

It is important for you to keep in mind that not all financial setbacks make you eligible for loan modification or a workout plan. In your hardship letter, you need to prove that you face genuine hardships that have affected your ability to pay. Following are some of the hardship that lenders generally consider:

- Separation or divorce

- A business that has failed or is suffering from economic slowdown

- Military duty

- Imprisonment of one of the household’s wage earners

- Reduction on income such as reduction in wage or loss of overtime

- Excessive debt accumulated over time

- Death in the family especially if the deceased happens to be the breadwinner of the house

- Newborn child which increases the monthly household expense

- Relocation or loss of job such as reduction in force (RIF) or layoff

- One of the household’s wage earners seeking treatment for alcohol or drug dependency

- Illness or injury that increases medical expenses or decreases income or does both

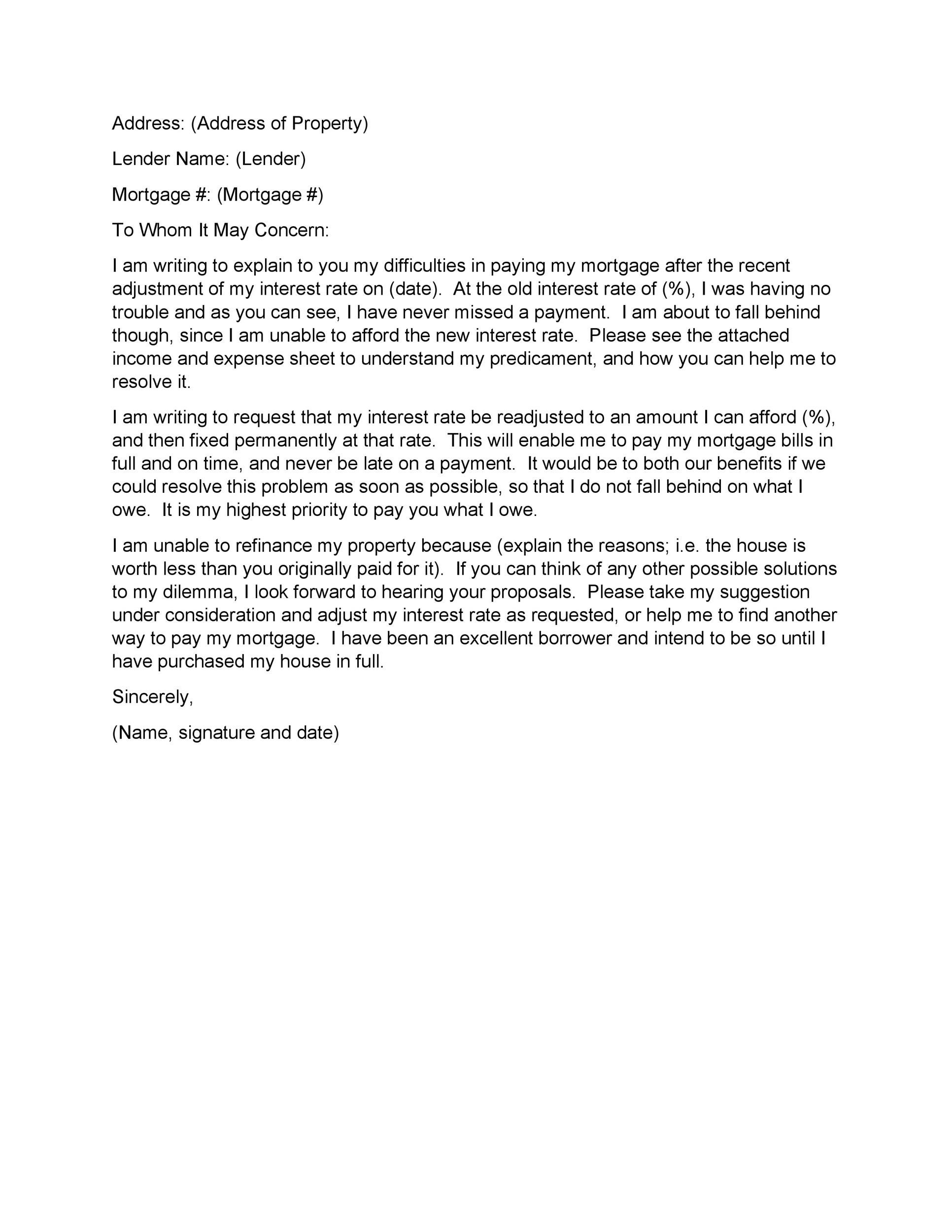

- Payment shock such as an interest rate bump on an adjustable-rate mortgage

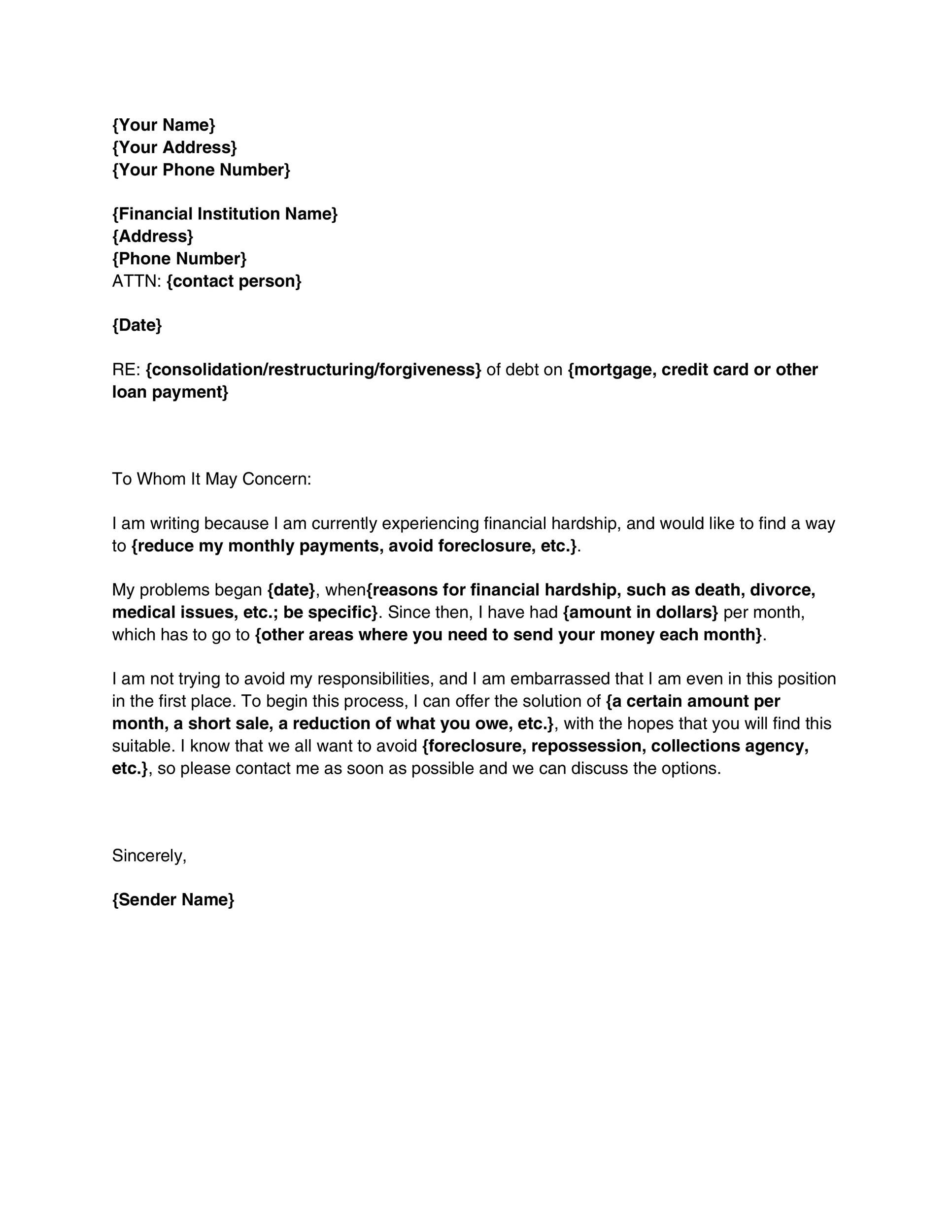

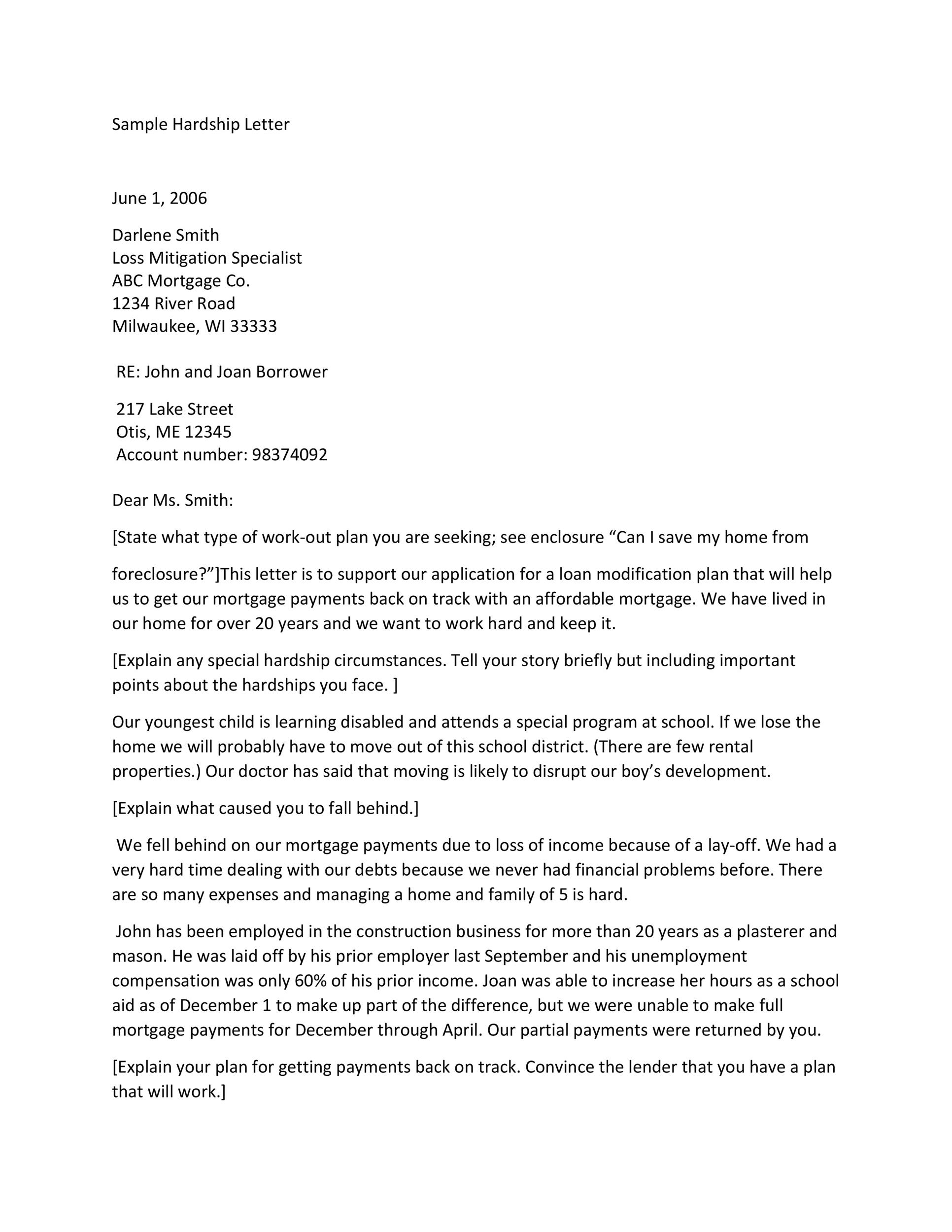

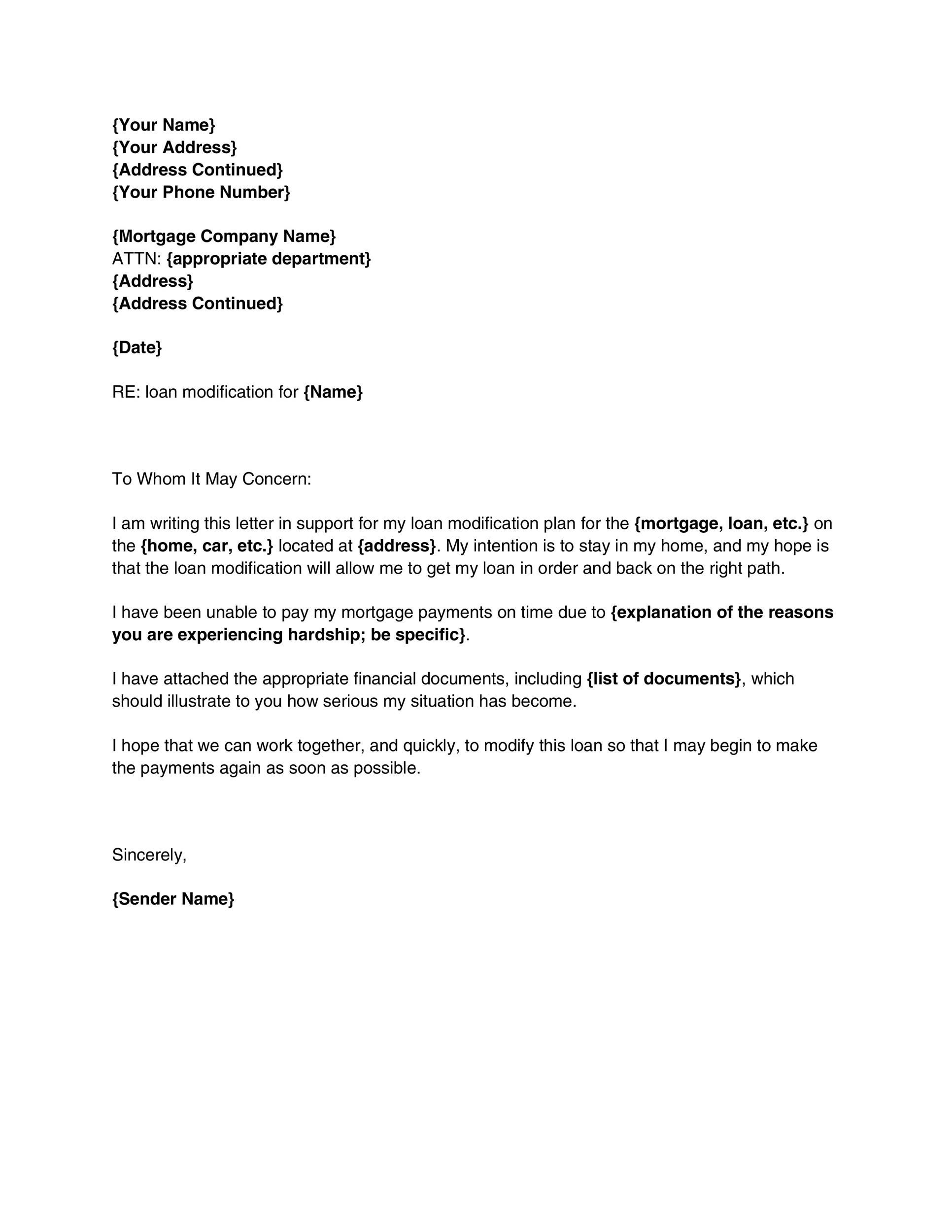

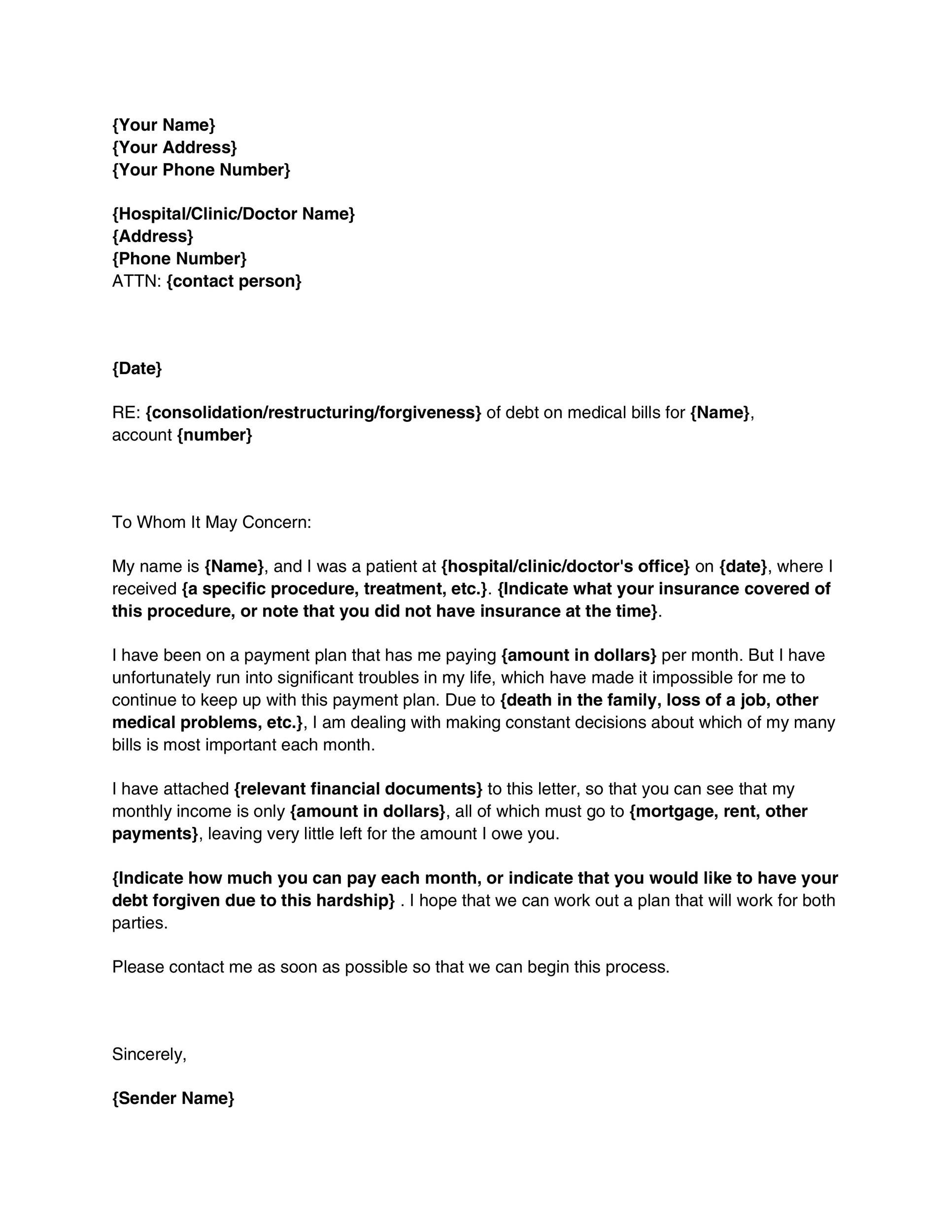

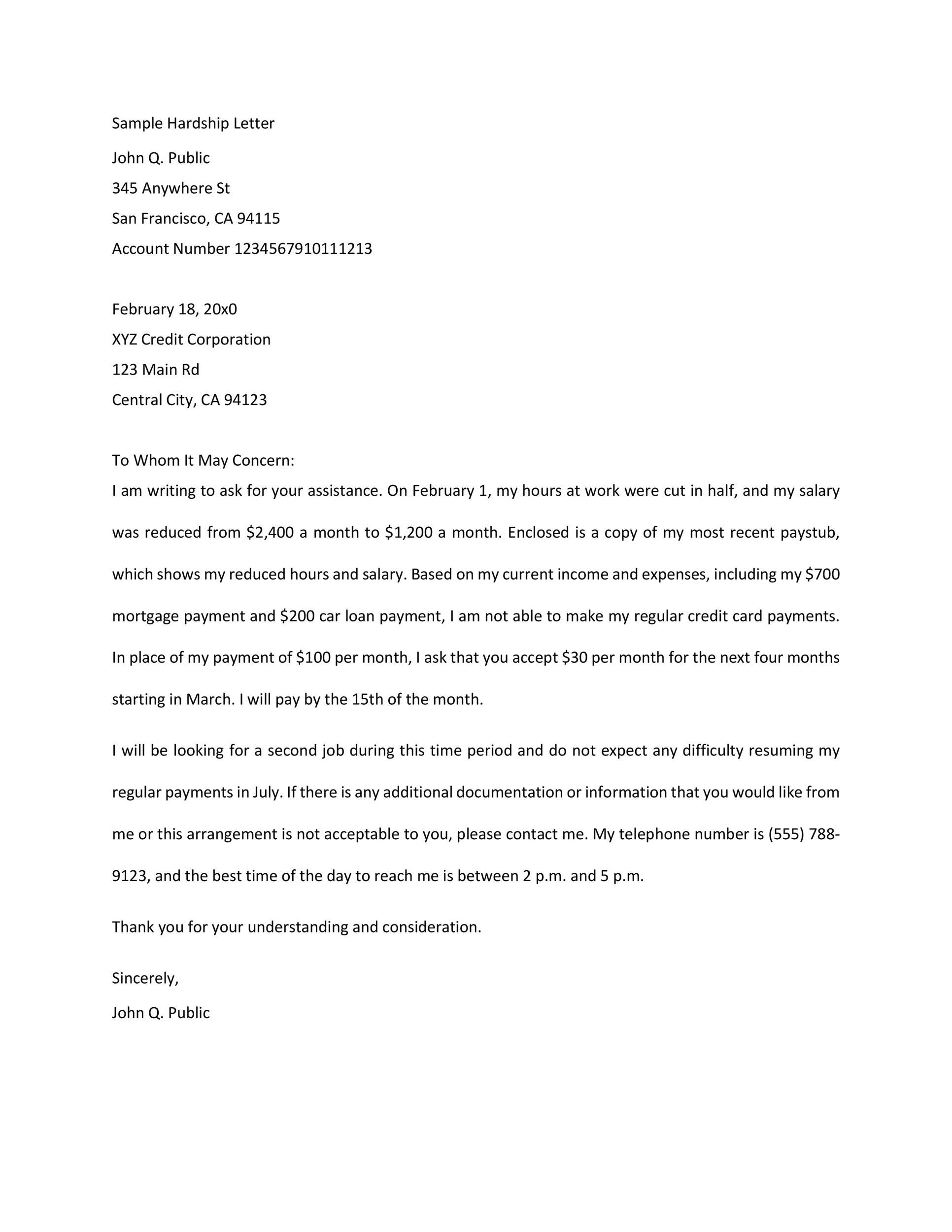

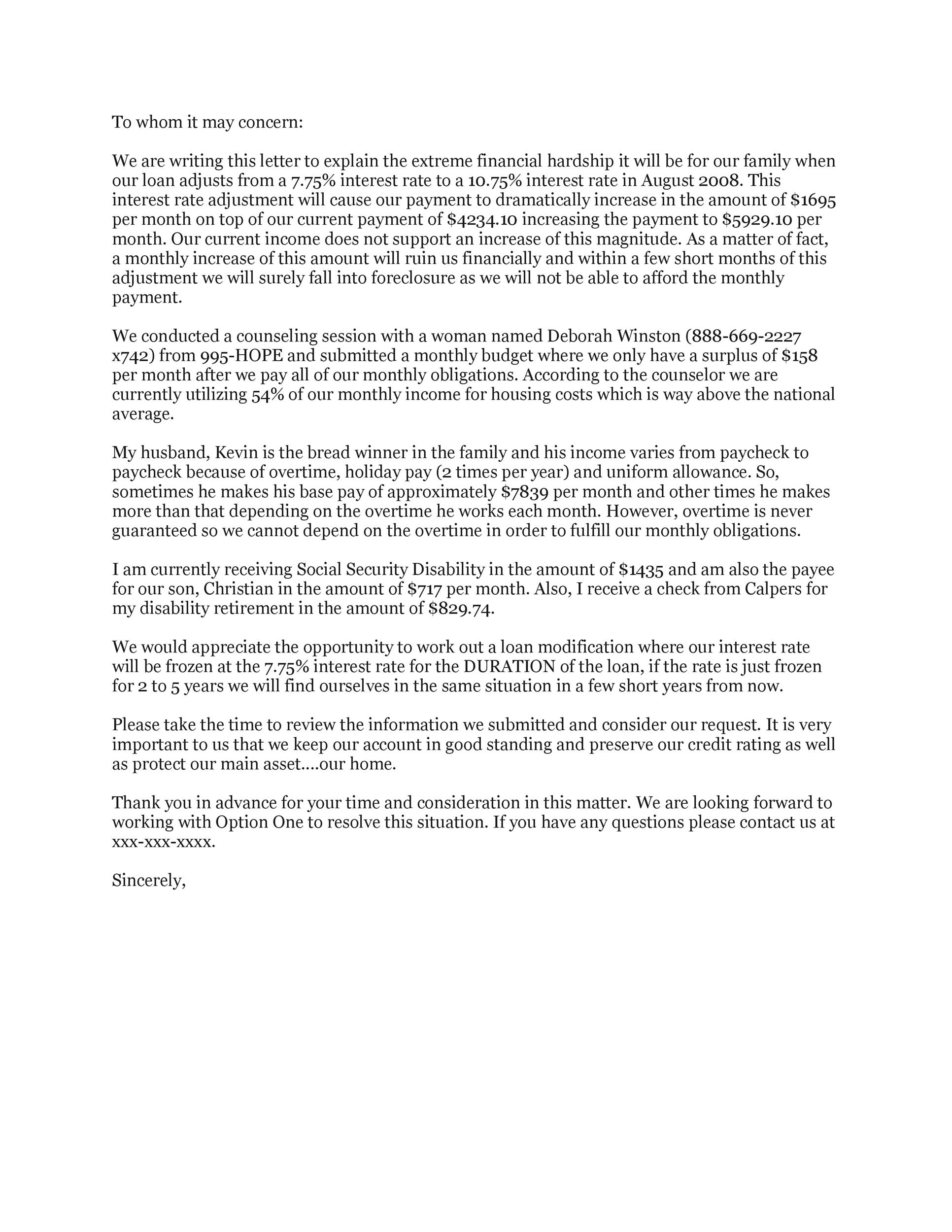

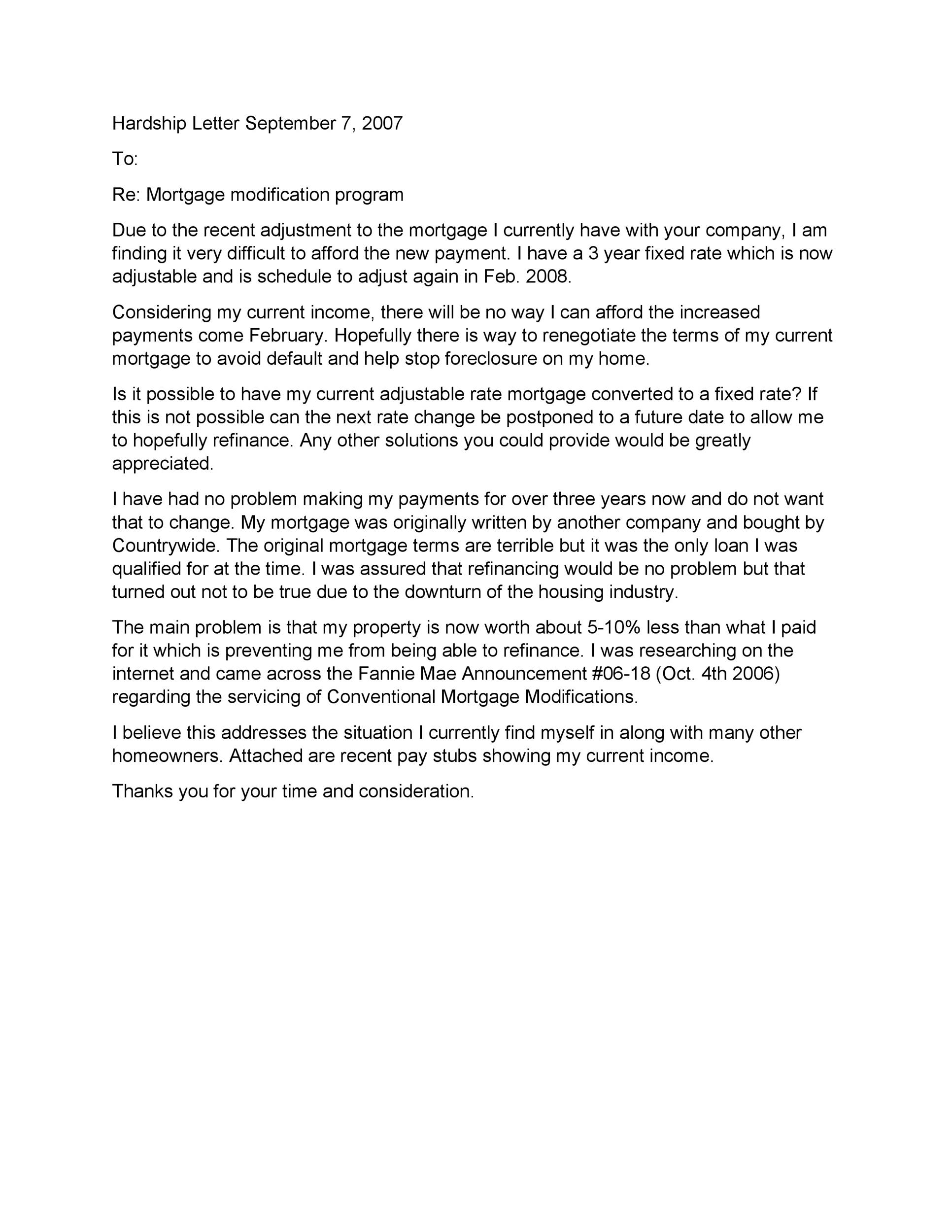

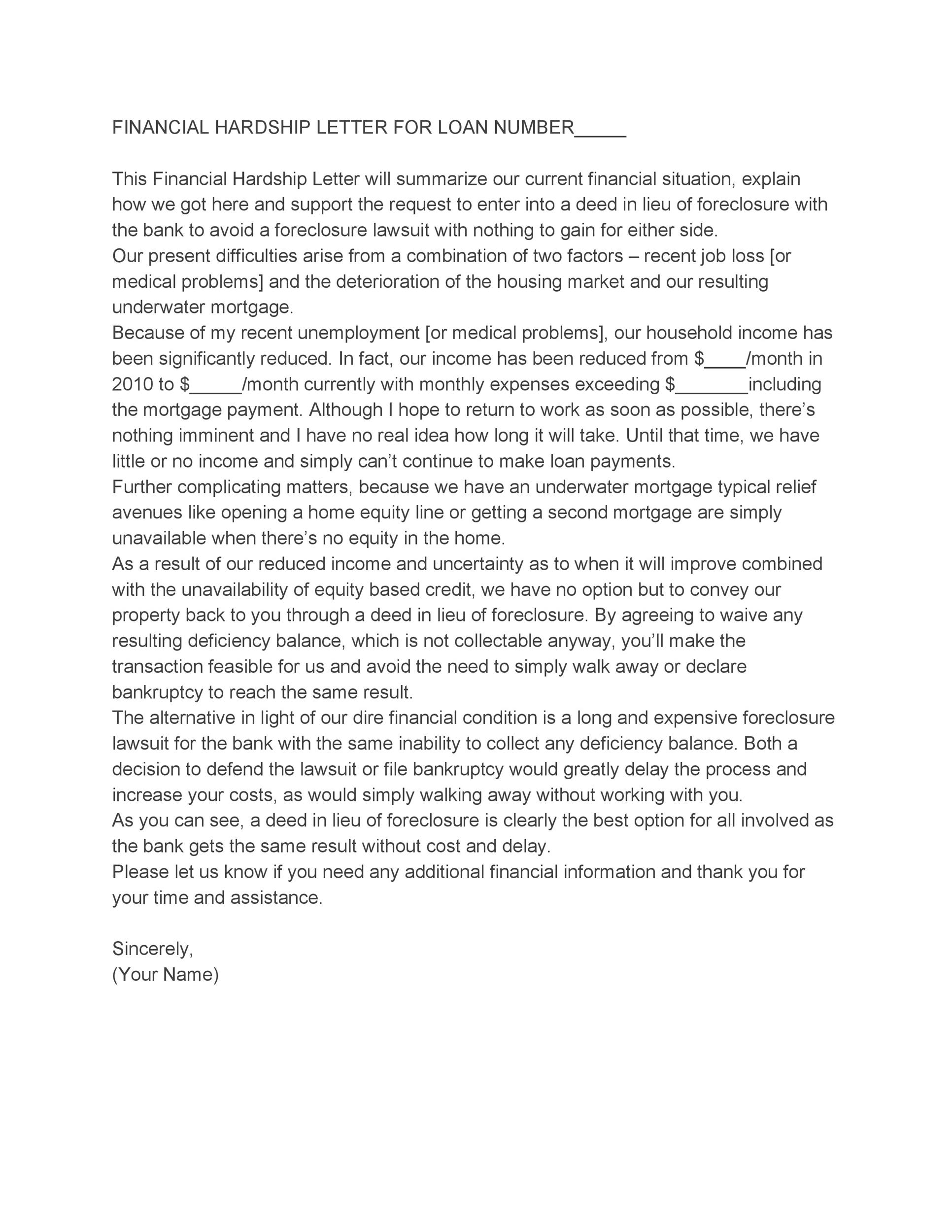

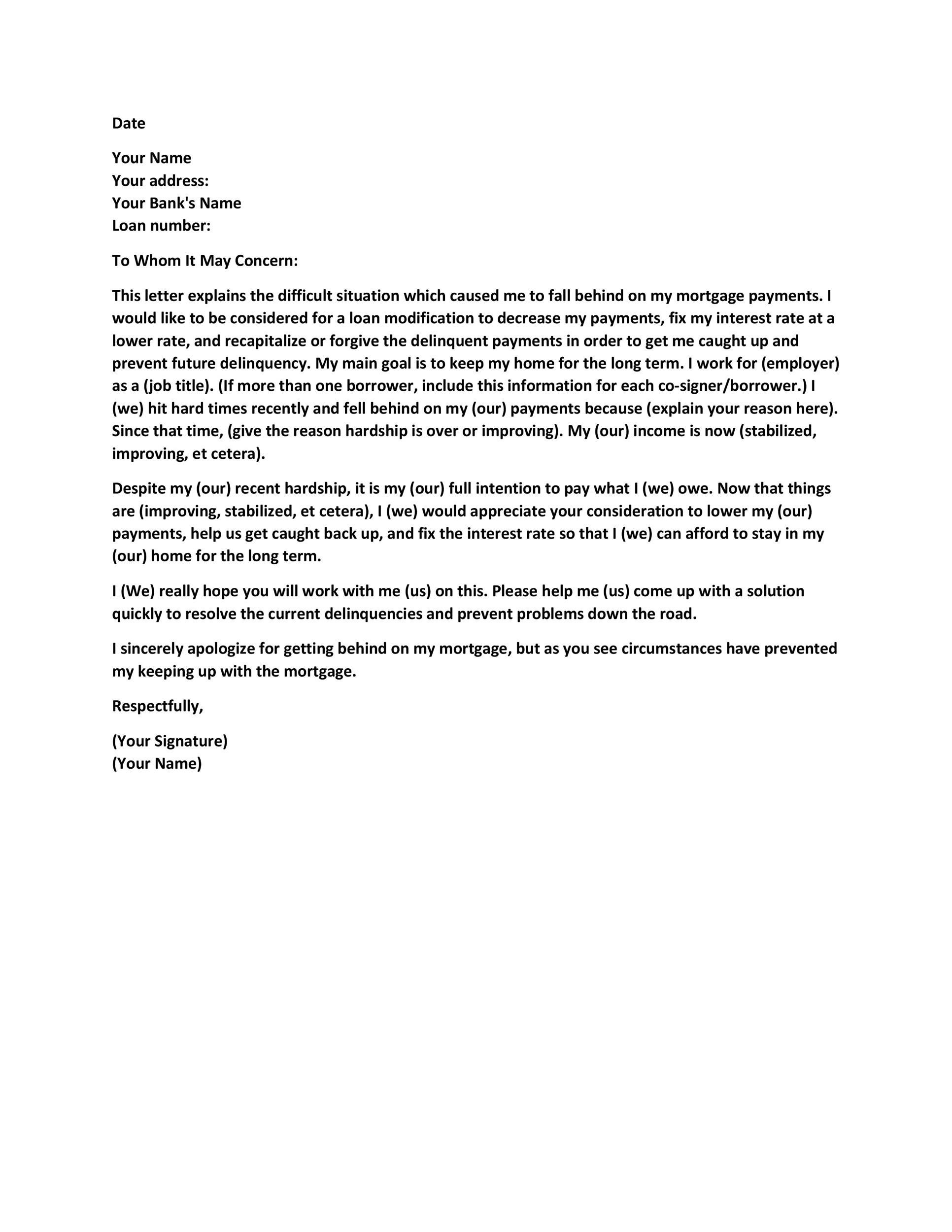

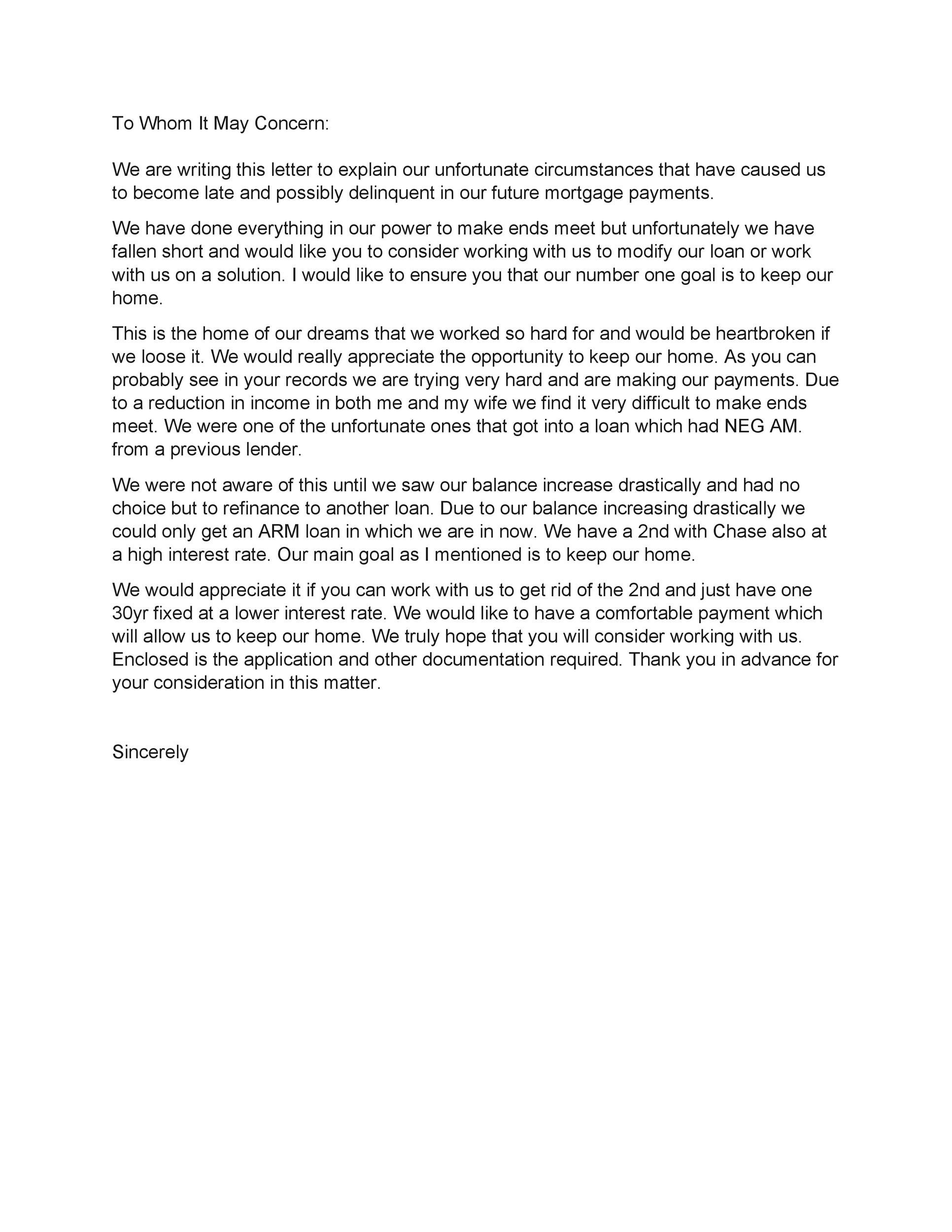

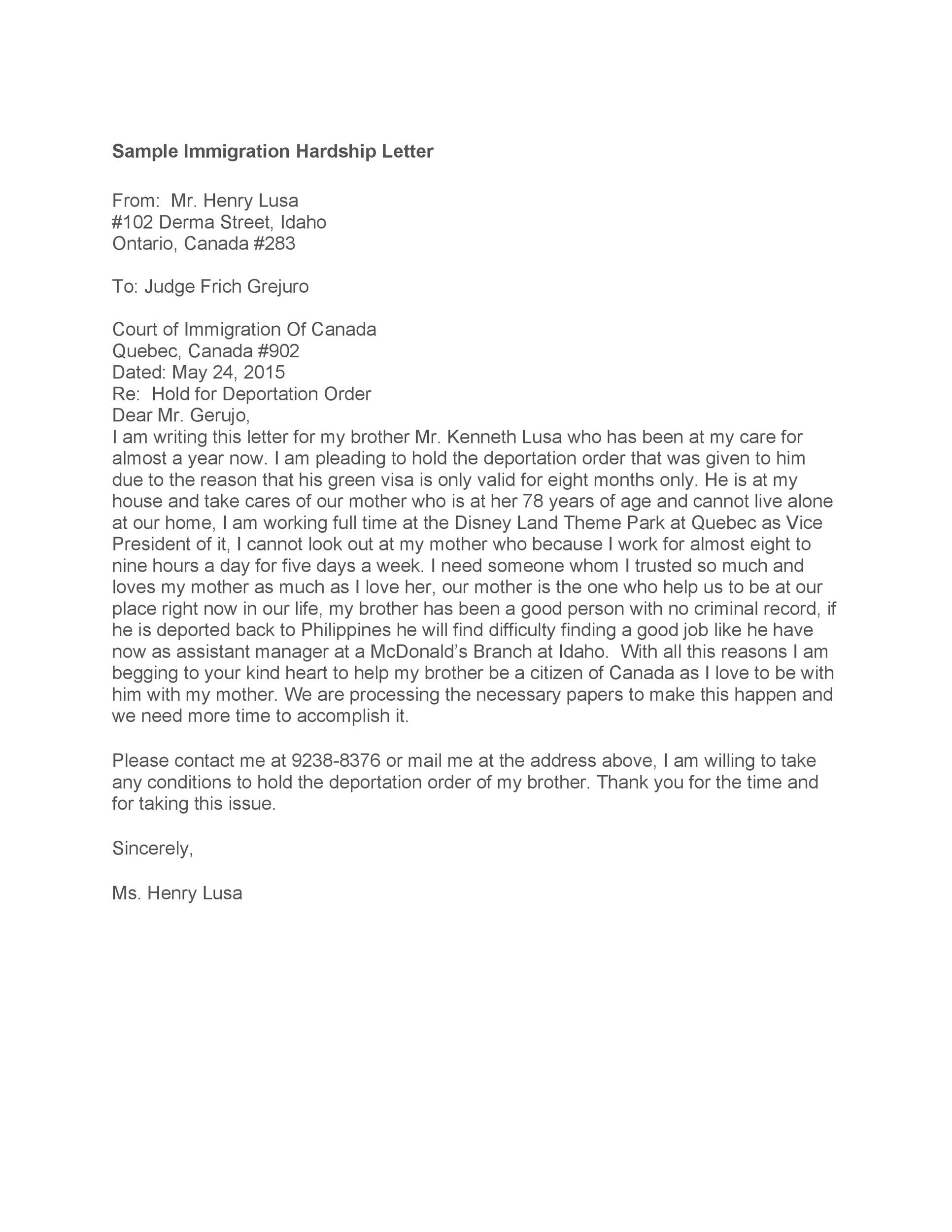

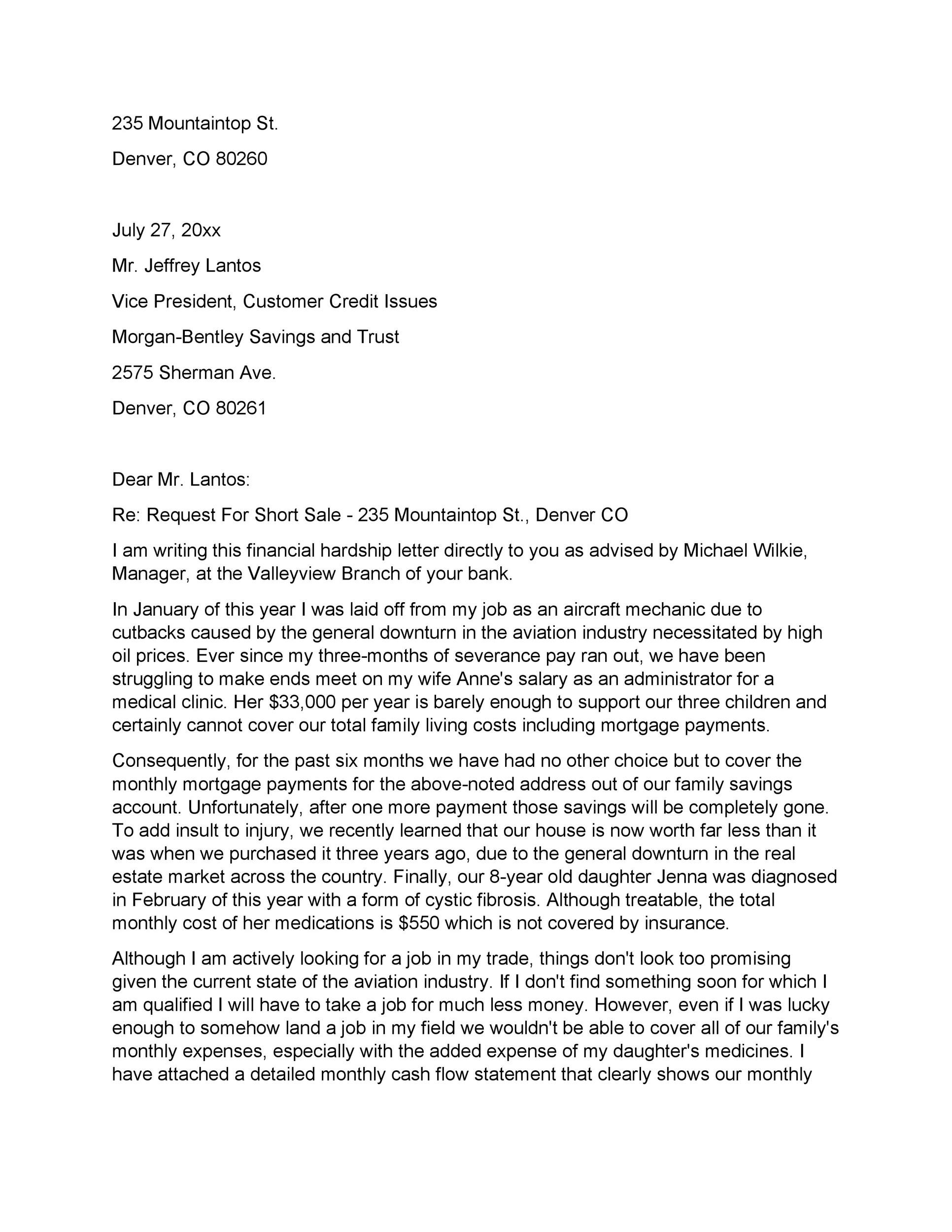

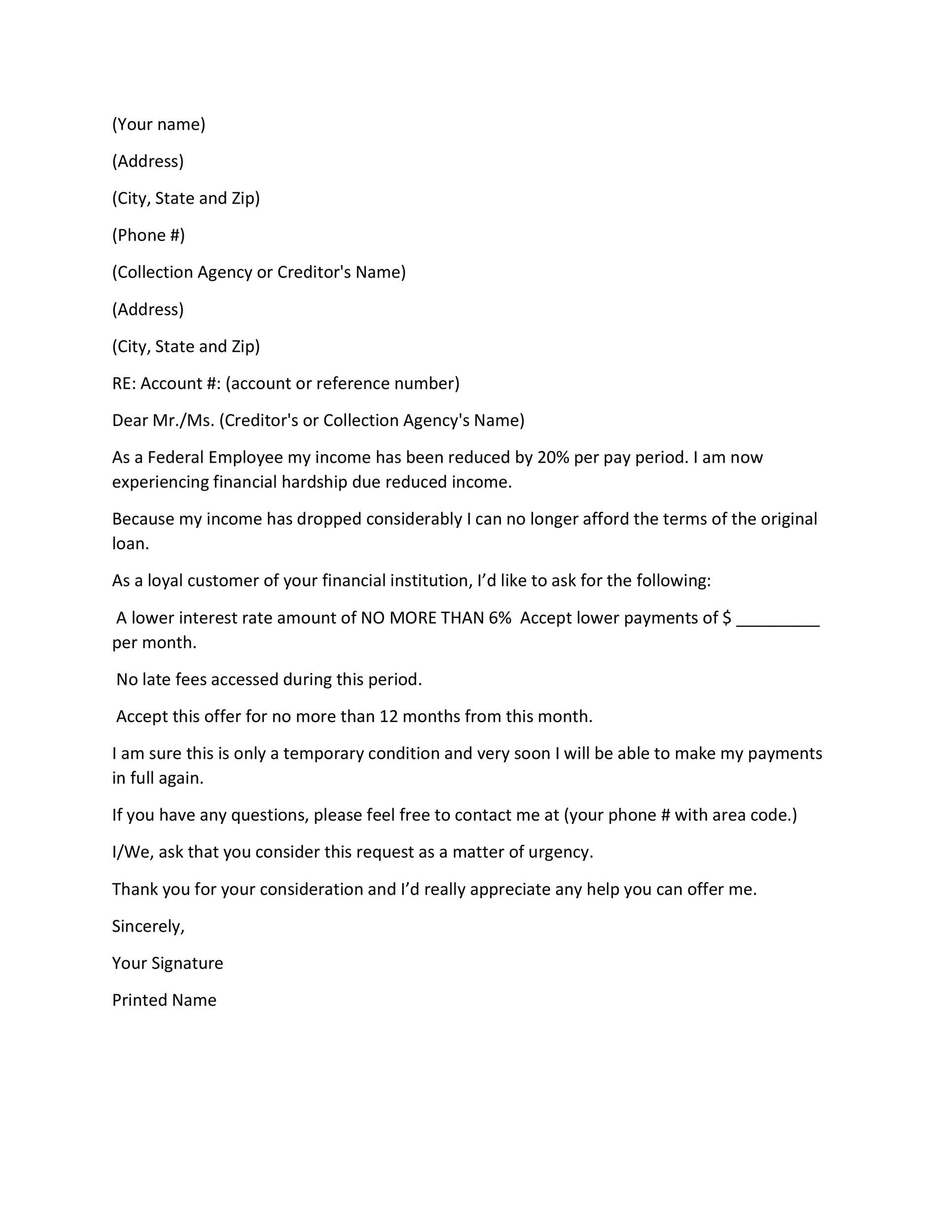

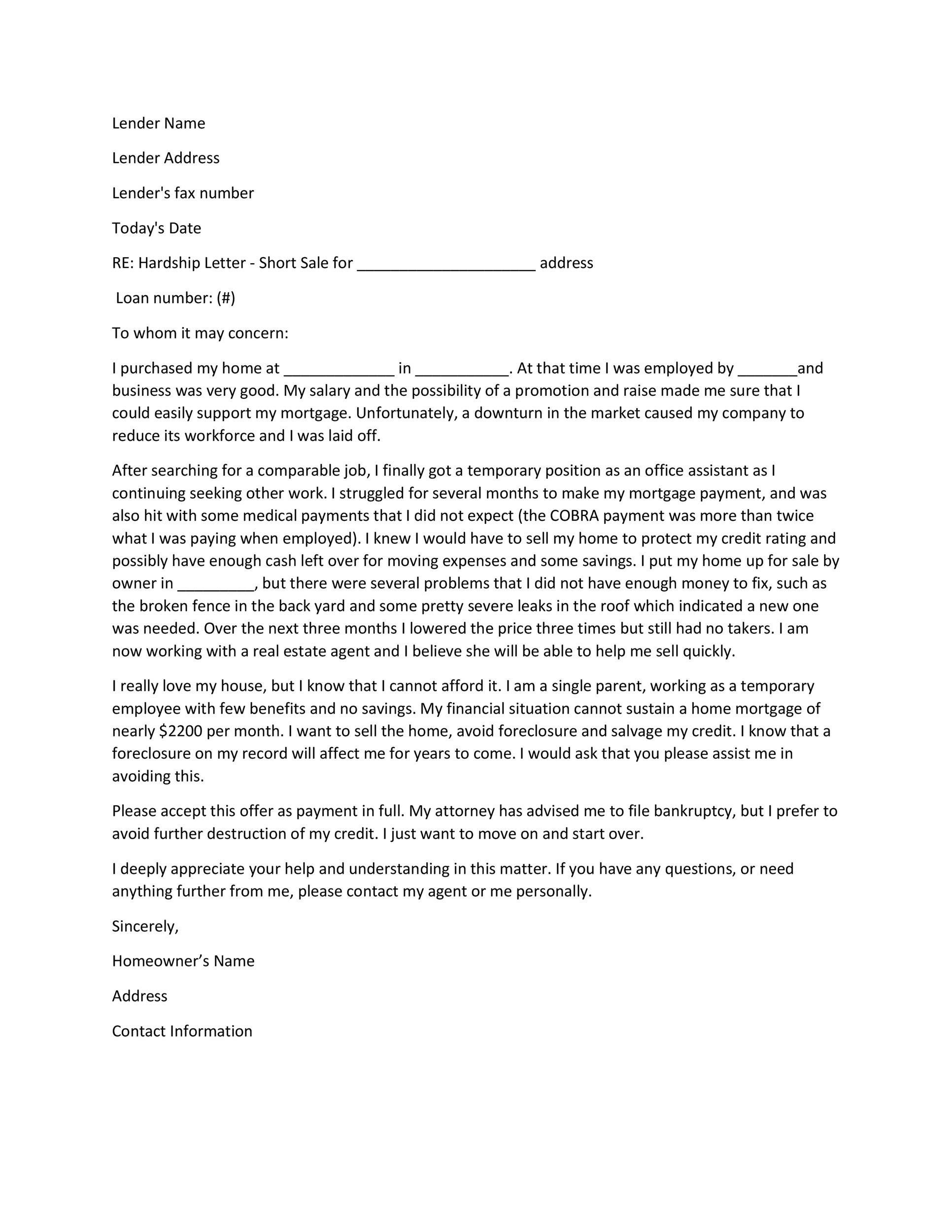

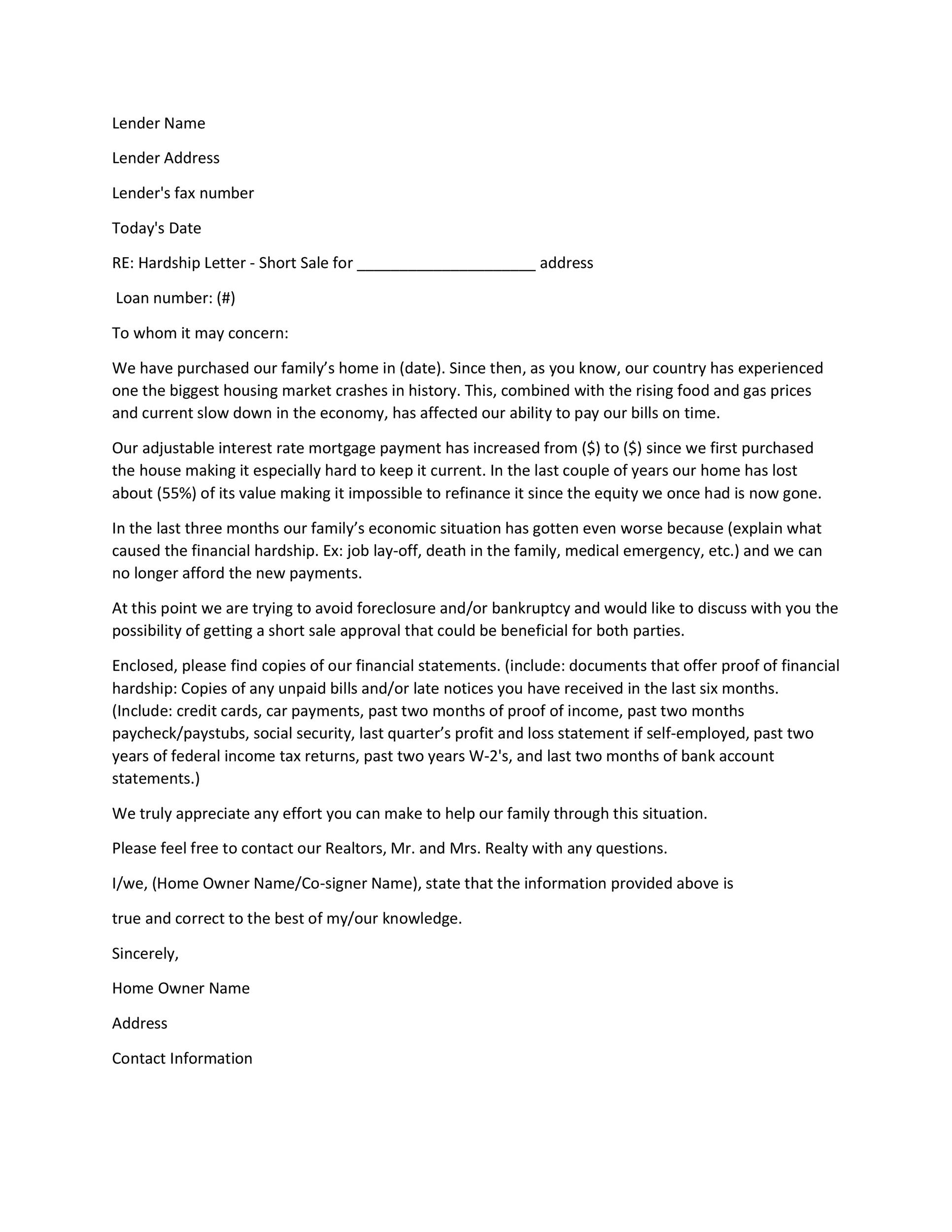

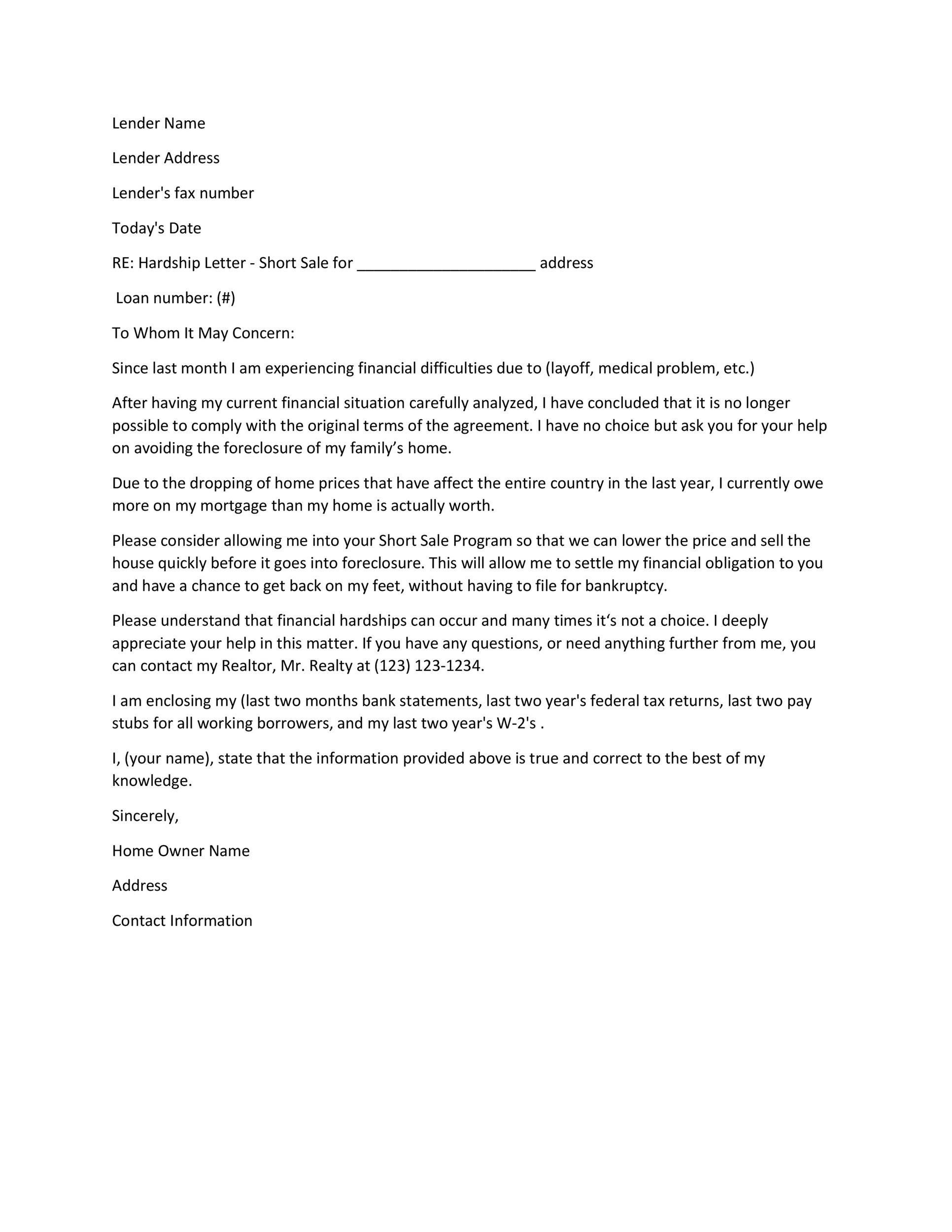

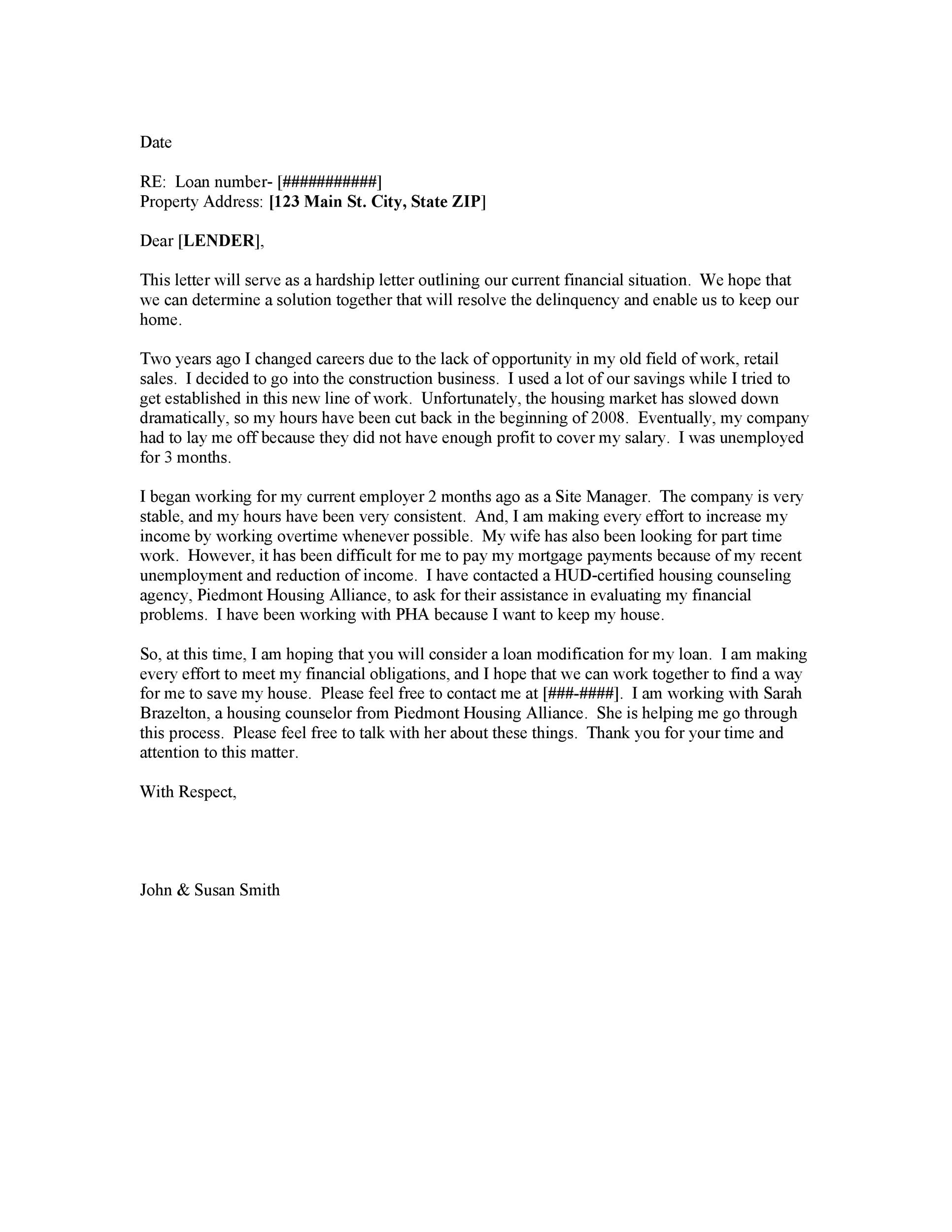

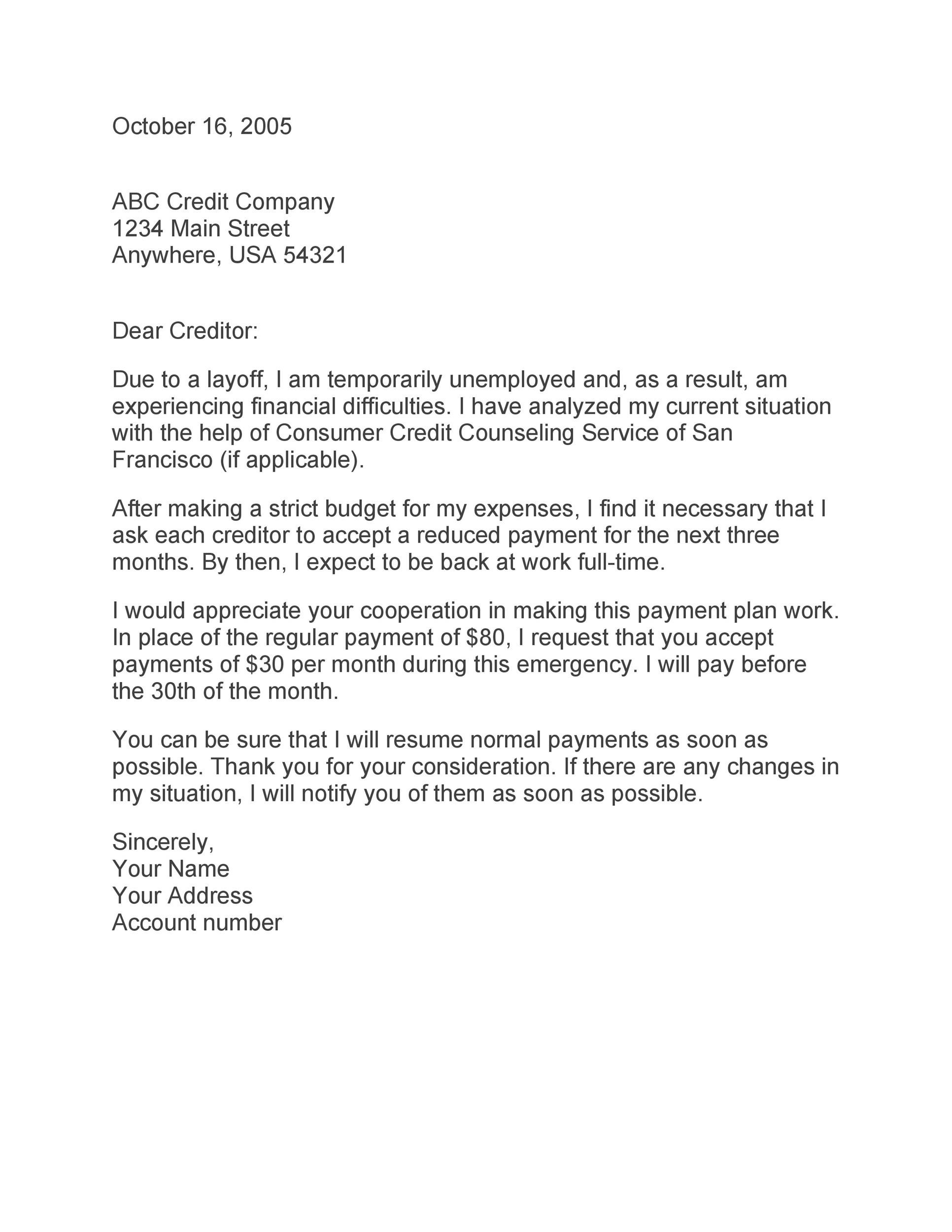

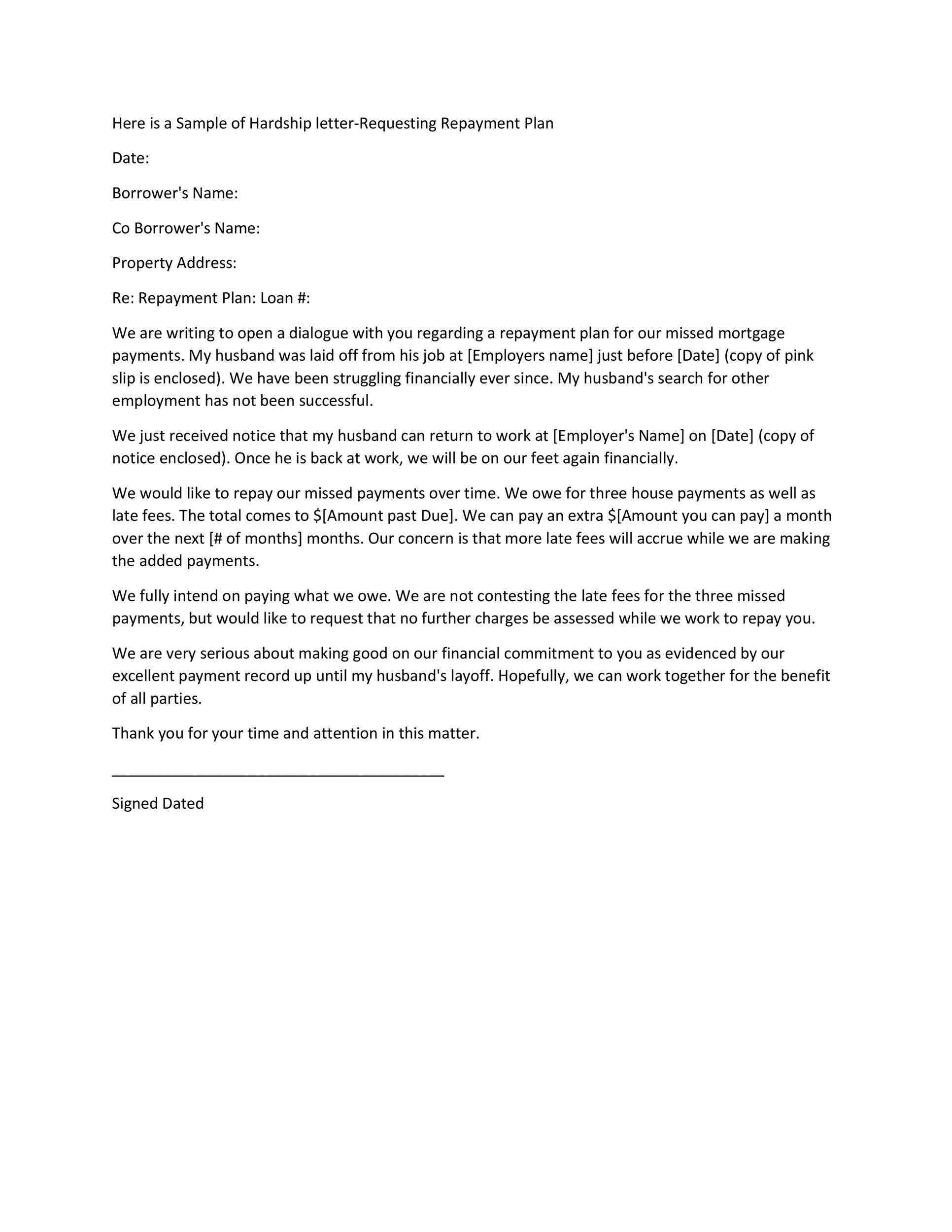

Sample Hardship Letter

How to write a hardship letter

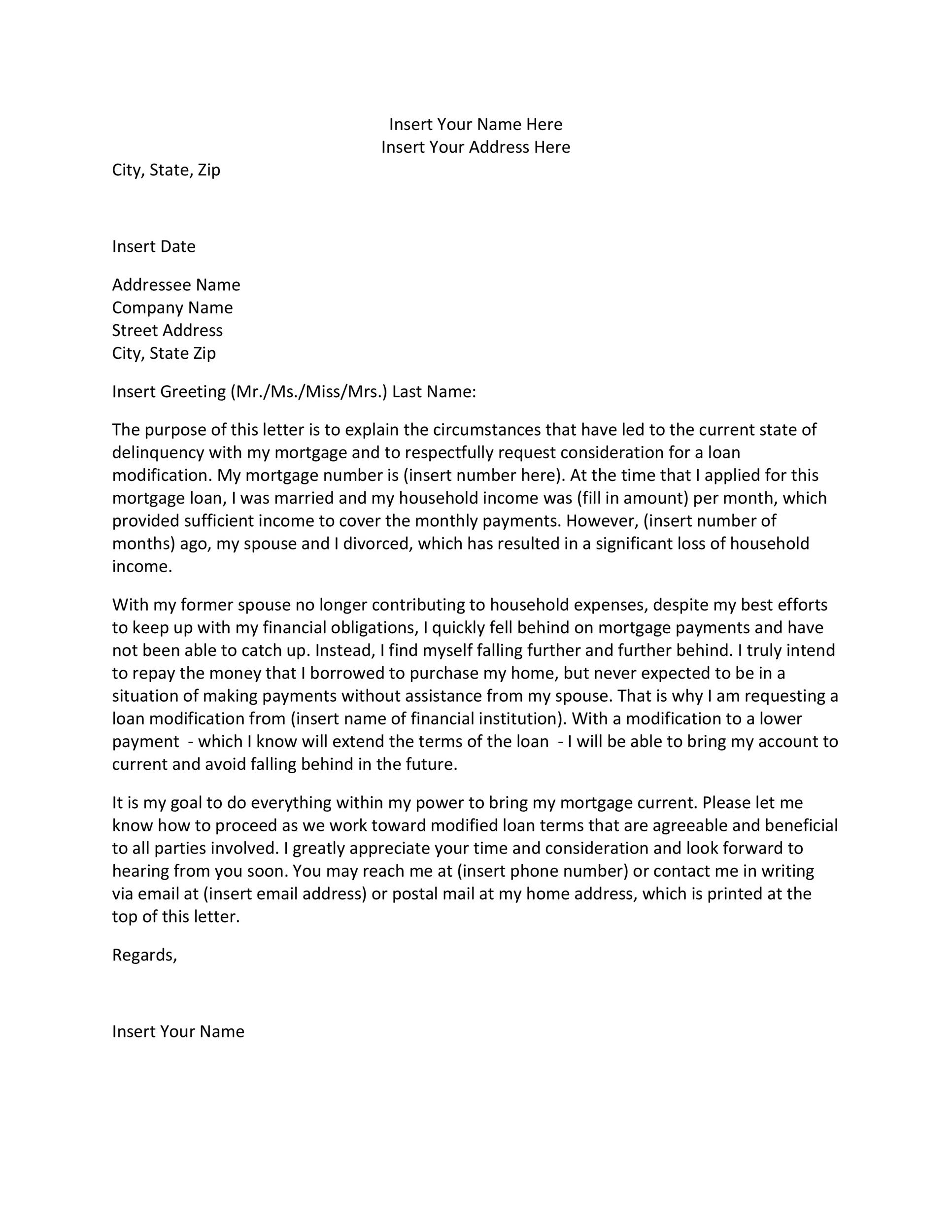

Many people want to know how to write a hardship letter and what to include in it. What’s included in the hardship letter depends on a person’s financial situation and his or her ability to sort out any underlying financial problems in the future. Nonetheless, by following certain rules, you can write a hardship letter to achieve the best possible results. Keep the following things in mind when writing a financial hardship letter.

Keep the letter concise

Typically, lenders spend less than five minutes reading a hardship letter so it’s in your interest to restrict the letter to a single page. If you use more than a page, there’s a good chance that your letter will not be read thoroughly. To keep your letter to a single page, include those details that you think are relevant to your case. To get a better idea of what to include in a hardship letter, refer to a sample hardship letter.

Explain your situation

In a financial hardship letter, you need to explain why you stopped making mortgage payments: This is extremely important. More than anything else, you need to convince your lender that you’re not an irresponsible person when it comes to making mortgage payments. You need to show the lender that your current grave financial situation is the only reason you’ve fallen behind on your loan payments. The reasons that cause loan payment problems which you can cite in your hardship letter are mentioned above.

Keep your request specific

In order to inform your lender about what you want, state the purpose of the letter whether it is a short sale or a loan modification. For example, if you want a lower interest rate, you can write, “I need to revamp my mortgage and get a lower, fixed interest rate…” Make sure that you write the purpose of the letter in a way which compels the lender to find out more from you. Also, to explain your case in detail, you can use the subsequent paragraphs.

Restate your request

Conclude the letter by restating your request or summarizing your purpose. Make it clear to the lender that you’ll make regular payments once the loan is modified and reestablished.

You need to consider the aforementioned things when writing a financial hardship letter. Also, as the final decision about loan modification will be made by your lender, you should never insinuate that your situation is due to the lender. You should only state the facts and let your lender judge the situation by themselves. Also, you must than your lender in advance and state that you look forward to continue your relationship with them. Finally, as mentioned above, keep your letter to a single page so that it is easy for your lender to go through it. If you’re still confused about how to write a hardship letter, refer to a sample hardship letter.

Hardship Letter Templates

Questions that your financial hardship letter should answer

Apart from considering the aforementioned things, you need to know the questions that your financial hardship letter should answer before your write a hardship letter and submit it to your lender. By answering some important questions, you’ll strengthen your case. Following are some important questions that hardship letters need to answer:

- What are the events or series of events causing the hardship that has prevented you from paying your monthly mortgage?

- When did the hardship first occur? Provide the date or range of dates you started experiencing the hardship

- Is your hardship temporary or permanent? A job layoff or injury/ illness is a temporary hardship while death or divorce are examples of permanent hardship

- How badly do you want to keep your home? Your lender may make a decision to approve your request for loan modification based on how badly you want to keep your home

- Is making mortgage payments affordable for you? If yes, how much can you afford to pay?

- Are you behind on your mortgage payments? If yes, how many months are you behind and what’s the total amount due?

- How are you going to resolve your hardship and gain financial stability?

By answering the aforementioned questions, you’ll increase your chances of convincing your lender to approve you for loan modification. By knowing the best way to write a financial hardship letter, you’ll brighten your chances of getting approved for loan modification. To get started, you can use a sample hardship letter.

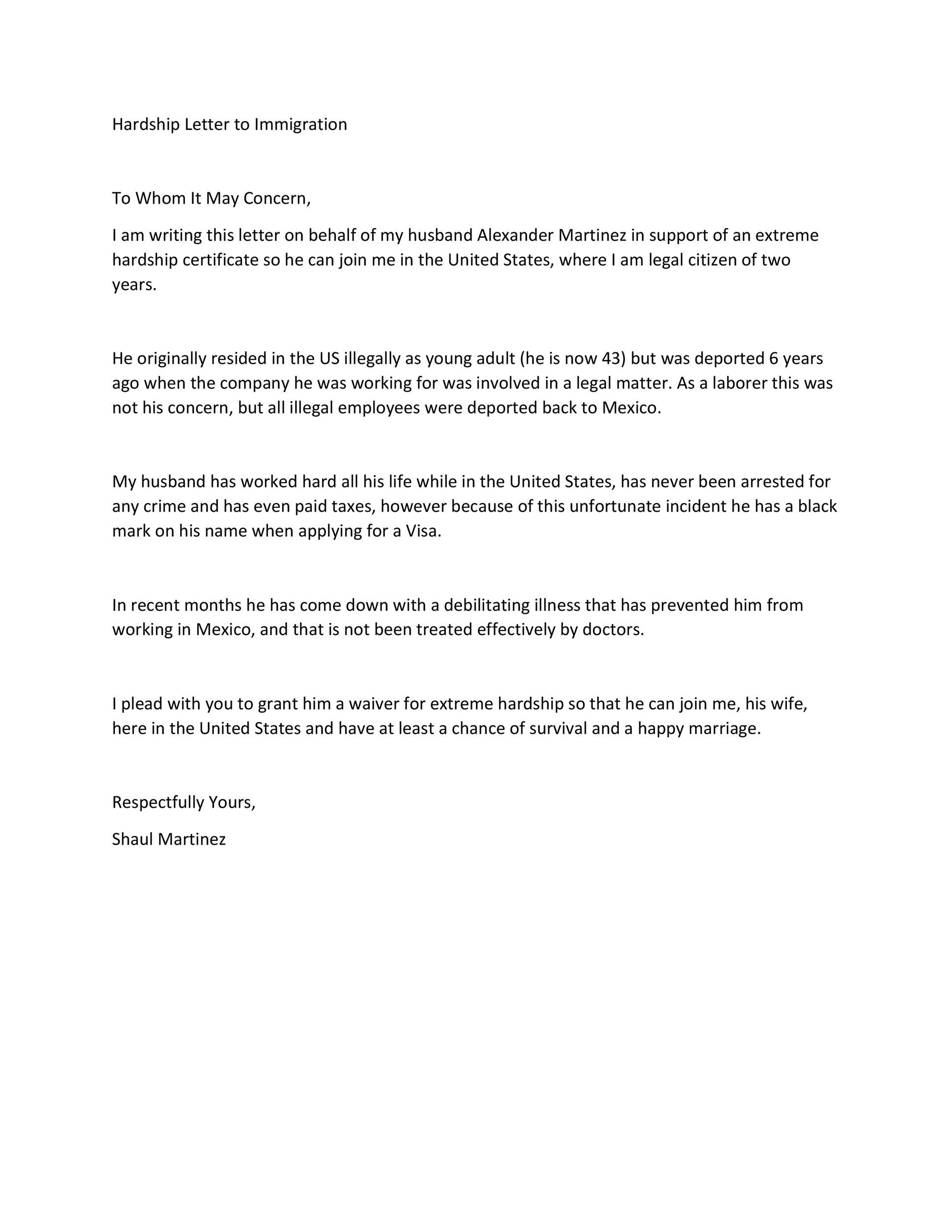

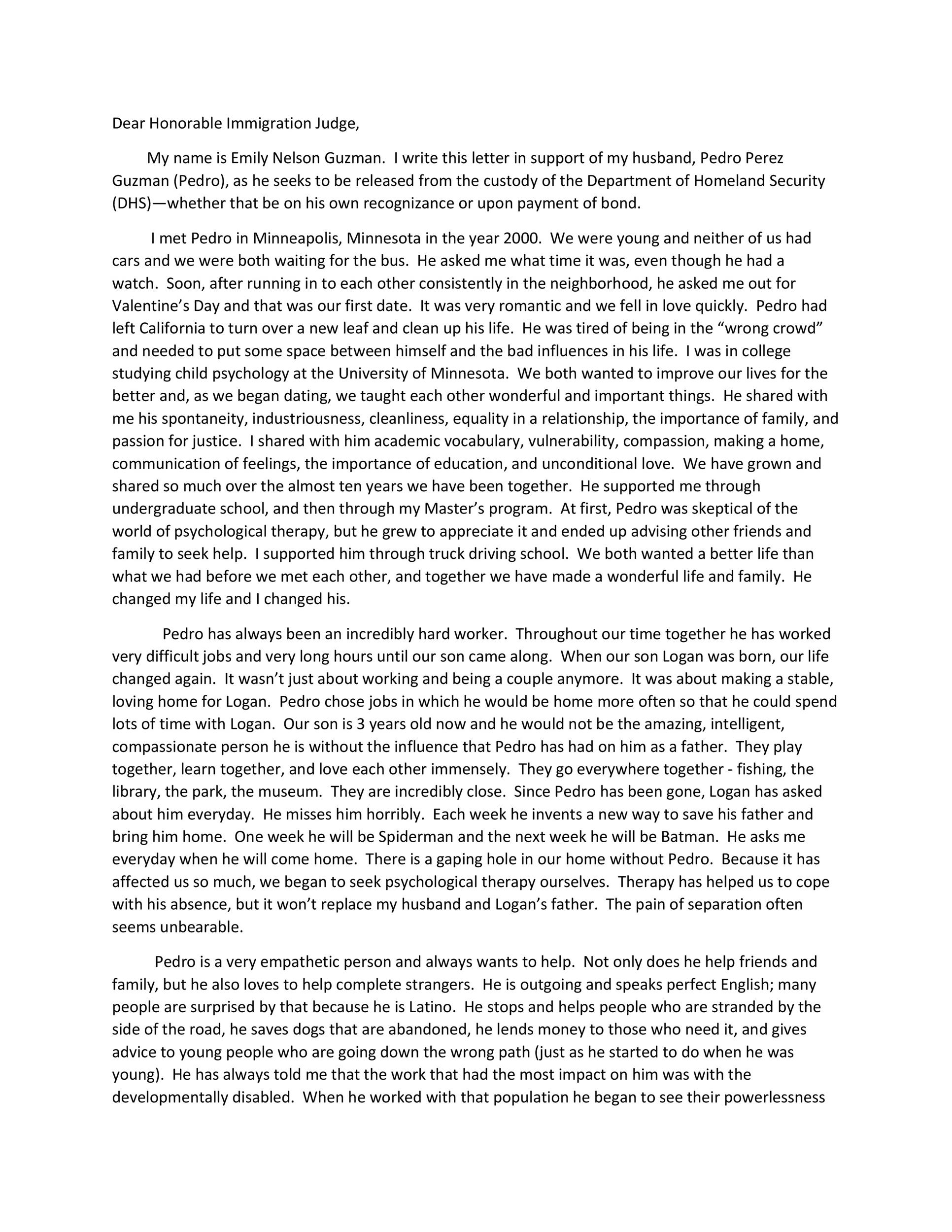

Hardship Letter for Immigration

An extremely important document, a hardship letter for immigration is usually written by citizens or permanent residents of the United States to help a friend or relative who has been sent out of the country and is unable to return. At times, people already living in the United States are asked to leave. Such a request is known as a deportation notice. Fortunately, people are allowed to plead their case at a hearing and provide a letter that explains why they shouldn’t be deported. Although the things to cover in a hardship letter for immigration depend on the individual case, there are a few things that apply to all. By providing the following details in a hardship letter for immigration, you can increase your chances of reentry into the United States or avoiding deportation.

Financial hardship

An important issue to highlight in the hardship letter for immigration is the financial hardship the family of the person facing deportation or wanting to reenter the United States will suffer if he or she is deported or isn’t allowed back into the country. Explain in detail who will suffer. For example, a legal resident who’s writing the letter may have to move to the immigrant’s country where earning a living is not possible or the people speak an alien language. Another issue to highlight is having to move to the immigrant’s country to keep the family together which may result in inferior education for the children. Basically, the hardship letter for immigration needs to clearly state that it’s in the best interest of the legal resident and his or her children that the person facing deportation or wanting to reenter the United States isn’t deported or is allowed back into the country.

Serious medical condition

It need to be clearly stated in the hardship letter for immigration that forcing a person who’s facing deportation to leave or stopping a person who wants to reenter the United States from coming back into the country will have a devastating effect on the family if the immigrant or member of his or her family has a serious medical condition. The hardship letter needs to state that the immigrant or a family member won’t be able to get adequate medical care if the family is forced to leave the country.

Apart from aforementioned things, you can also cite employment in the United States as a reason to allow someone back into the country. There you have it: how to write a hardship letter. If you’re still confused about how to write a hardship letter, refer to a sample hardship letter.