A rent-to-own agreement is a critical document for those who are looking at the possibility of renting with the goal of ownership of a location. Because of the nature of this kind of contract, it needs to be written carefully so that both parties who are involved are correctly represented in the document.

Table of Contents

Rent To Own Contracts

Does a rent-to-own contract go by other names?

A rent-to-own contract can go by many other names. These other names do not impact the authority of the document or its function. You can call your document any of these names in keeping with the common standard in your state if you wish without impacting your use of the contract or the way that it will perform while it is in effect.

- Rent to Own Contract

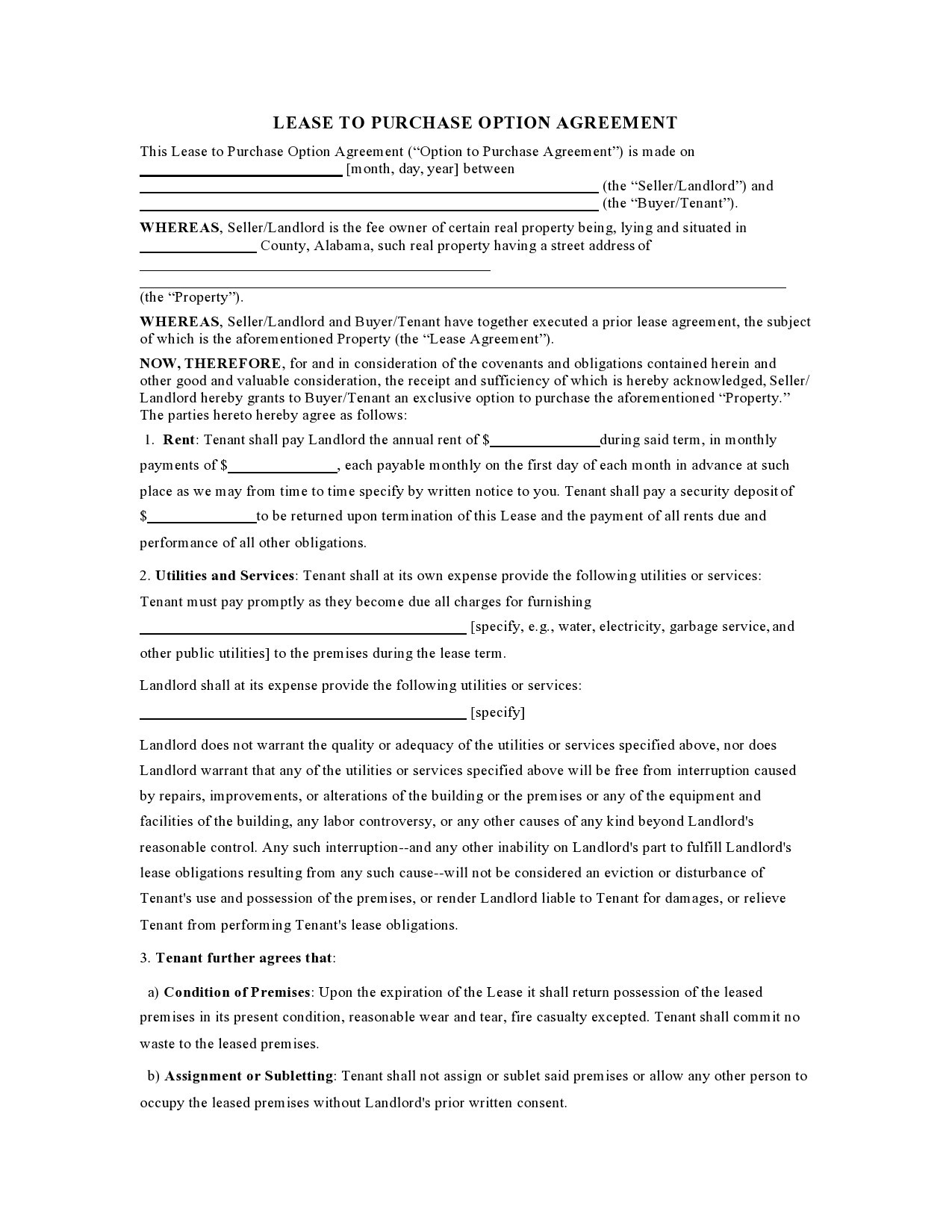

- Lease Option Agreement

- Lease to Own Agreement

- Lease With the Option to Purchase Agreement

- Lease Purchase Contract

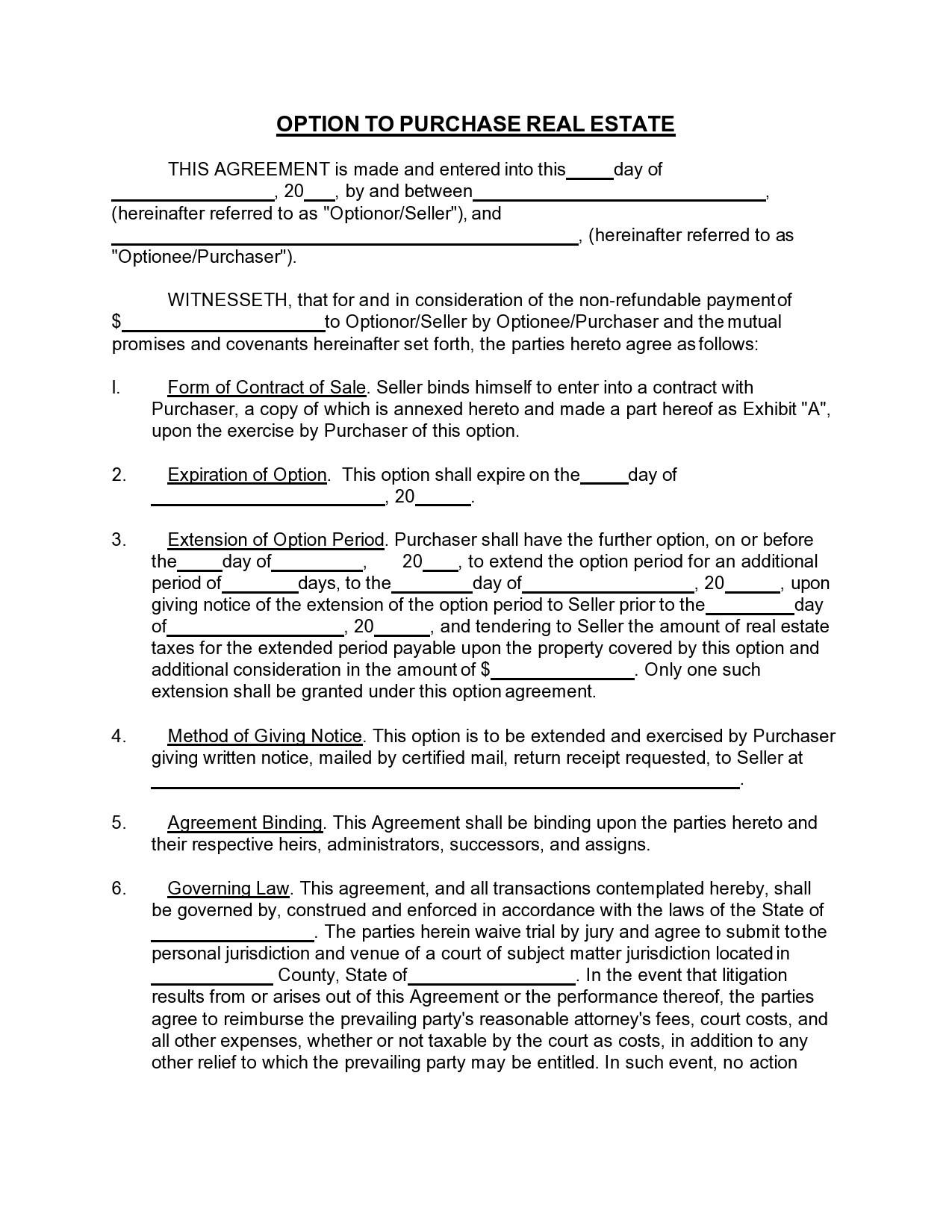

- Option to Purchase Contract

- Contract to Deed Agreement

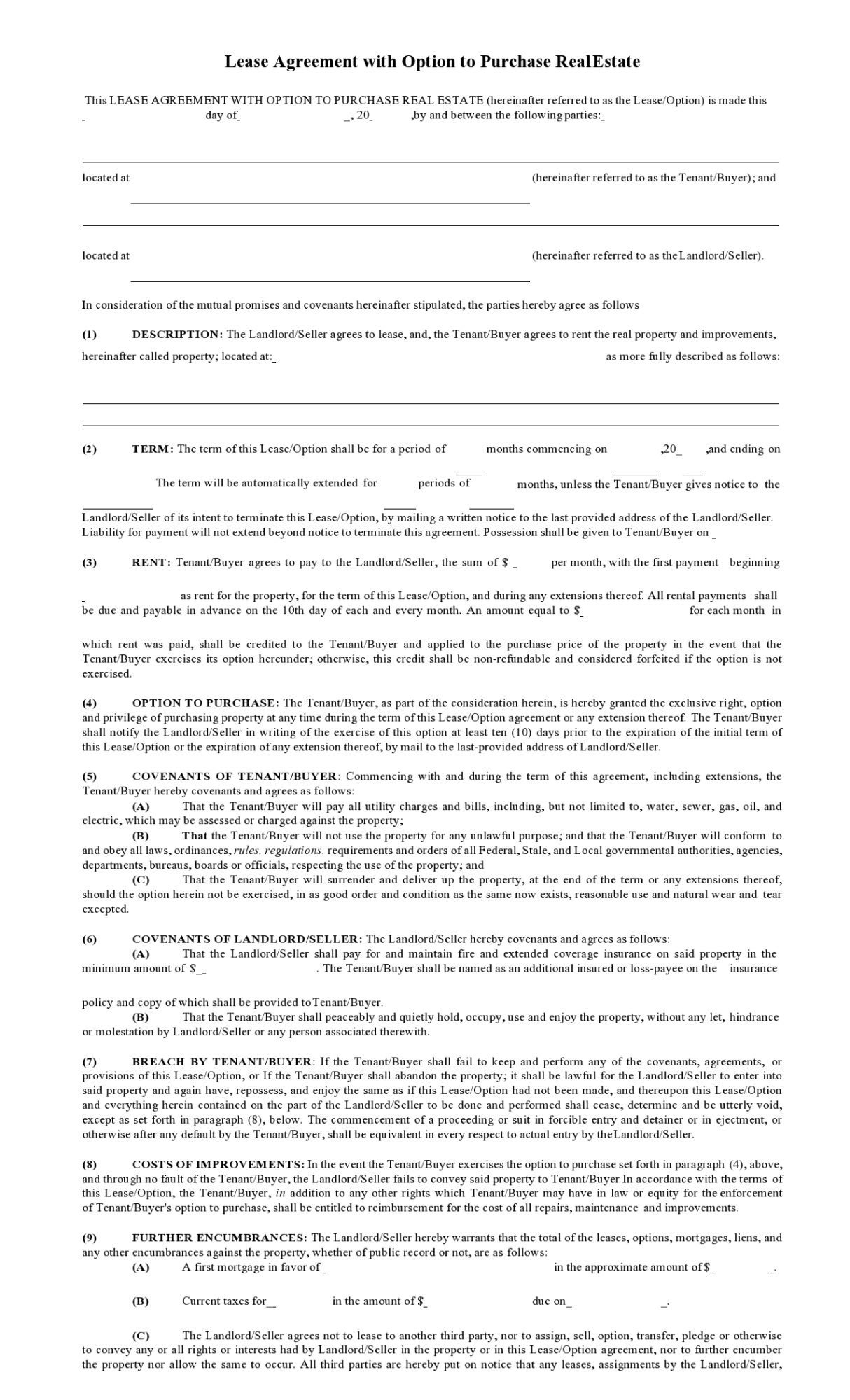

This document is always a combination between a lease agreement and a real estate purchase agreement. There are therefore, details of each kind of document that must be included in the contract that you draw up. This is part of why this agreement is so complicated, but it offers a really unique opportunity to buy a property while also leasing it or using it for a business purpose.

Rent To Own Agreements

What are the benefits of a lease to own?

The primary benefit of this kind of the lease purchase agreement is that it allows you the option to buy the home at the price agreed upon in the contract over the course of your lease. This protects you from the ups and downs of the market, which can prohibit people from being able to buy a home. This is also the only way that you can protect the agreement that you have made while you are leasing with the intention to own. Handshake deals are not reliable, and you will not want to enter into this kind of verbal agreement for something as important as buying a home.

You will need a lease-to-own contract for the following reasons:

- Protection from changes in the market that can impact housing costs

- Ability to buy a home while also being able to afford to rent a place to live

- Time to work on your credit if there are credit challenges that are blocking your ability to buy a home

- Protection from changes of heart on the part of the property owner

Pros for the Buyer:

- Low sales prices even if the market goes up

- Time to get a loan and improve your credit if needed

- Can buy your home without a huge down payment

- Can be sure that you like living in the location

- Can make improvements to the home while you live in it

Pros for the Seller:

- Secure sale no matter what happens in the housing market

- Committed tenants who take great care of the property

- Steady income from the property

- Low risk and nonrefundable option fee paid by buyer

- No commission to be paid to a realtor or a broker

How does rent-to-own work?

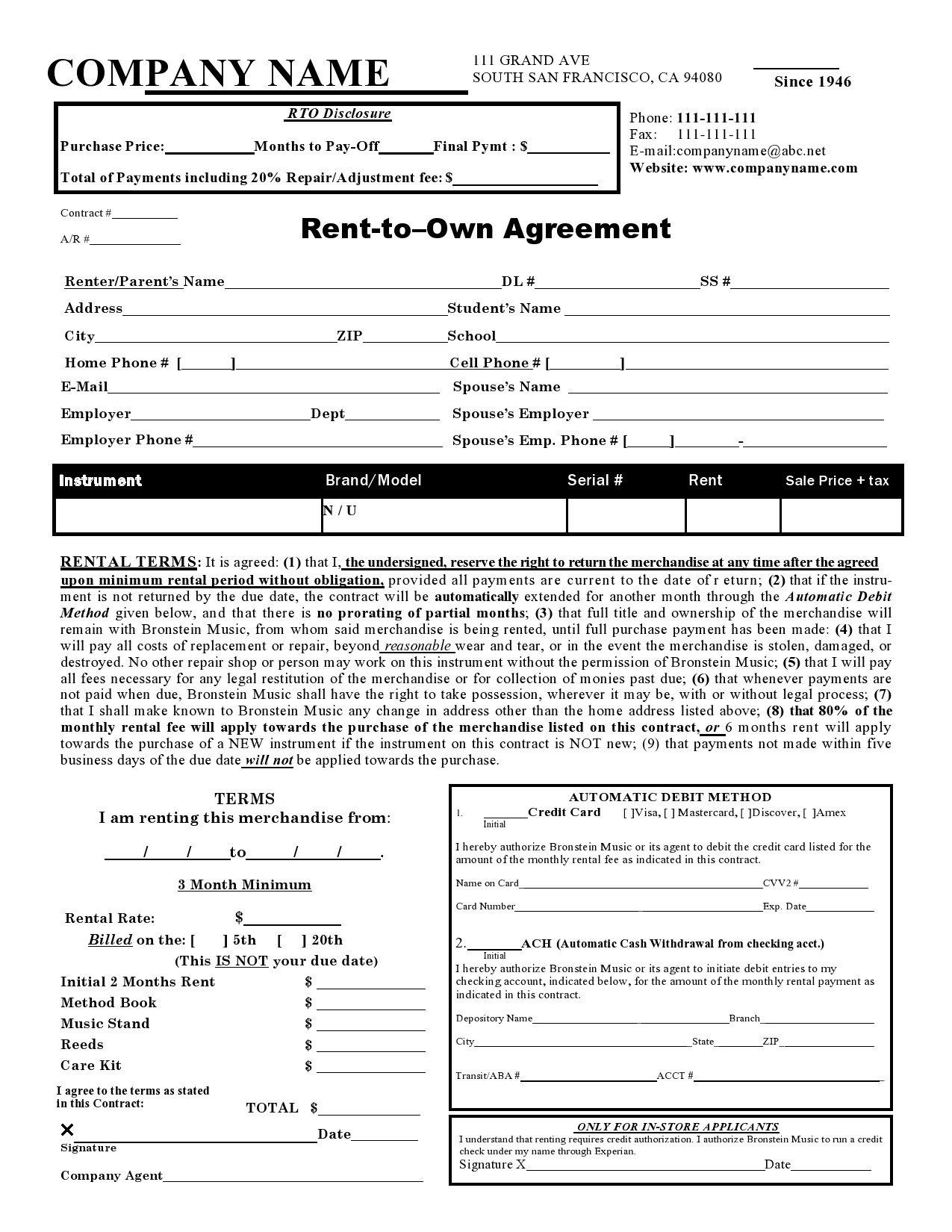

In rent-to-own arrangements, the person who is leasing the property makes payments for rent with an added charge on top of the monthly rent payment that goes toward buying the home. There is usually also an option fee that is paid to the owner of the home, who agrees that the renter is going to try and buy the home throughout the rental process. The renter will not get back the option fee or the additional payments with each rent payment during this kind of rental agreement.

Rent-to-own contracts are fair to both the buyer and the homeowner, and they can provide security for both parties, both with rental income and the purchase of the home.

Lease To Own Agreements

What are the disadvantages?

There are disadvantages to this kind of contract as well for both parties who are involved. You can probably imagine what some of them might be. It is good to be aware of the downsides of this kind of agreement as well as the upsides.

The primary downside for the seller of the home is that the market value could increase significantly, but that market value cannot be assessed by the renter. The contract will lock in a stated sales price to protect the buyer from increases in housing values and competition in the housing market. The housing market can be quite variable, and this can lead to buyers’ and sellers’ markets throughout the life of the rent-to-own contract.

For the buyer, the main downside is that they might have invested a lot of money into a property that they end up not wanting to buy after all. Buyers will need to consider whether or not they want to pay additional money and an option fee to a seller to agree to buy property throughout the life of their lease. If something should change and the buyer has to break the lease and move, the option fee and the additional payments will be forfeited.

Some of the other cons of this kind of contract are related to the way that the buyer and seller get along. If the parties are not able to get along during the life of the rent-to-own contract, this can lead to a lot of strife. These contracts can take years to finalize, so both buyers and sellers need to be sure that they believe that they can work long-term with the other party to fulfill this contract.

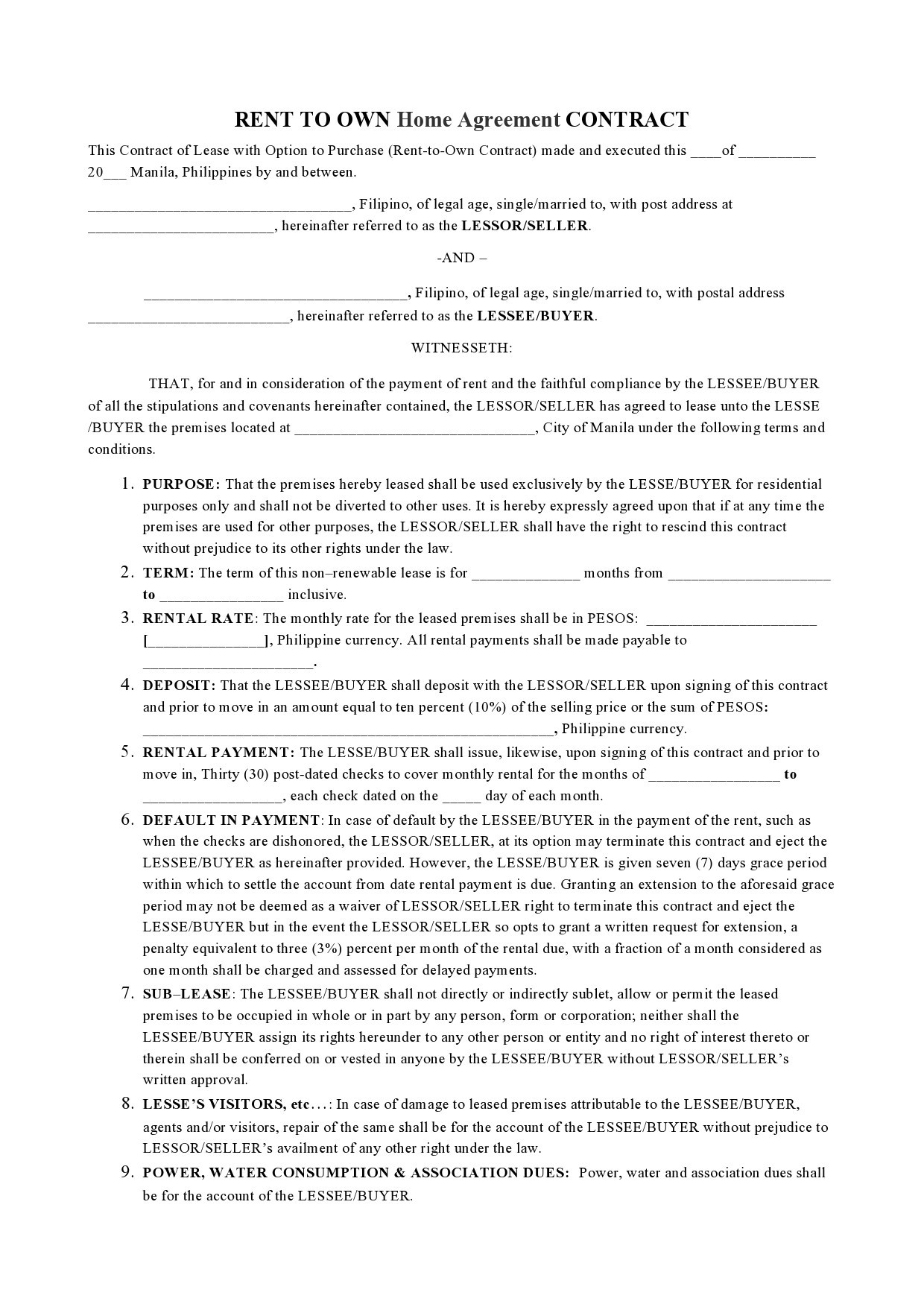

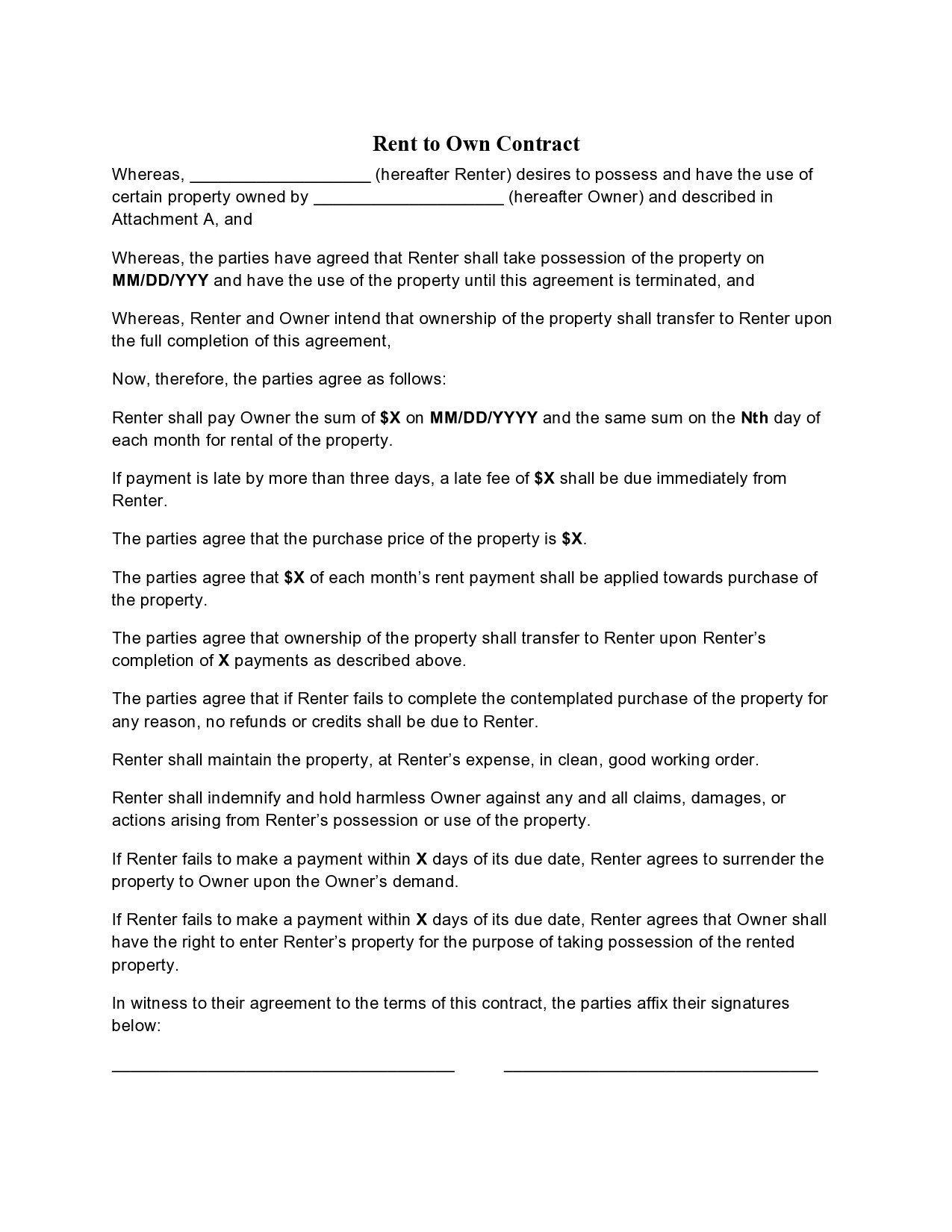

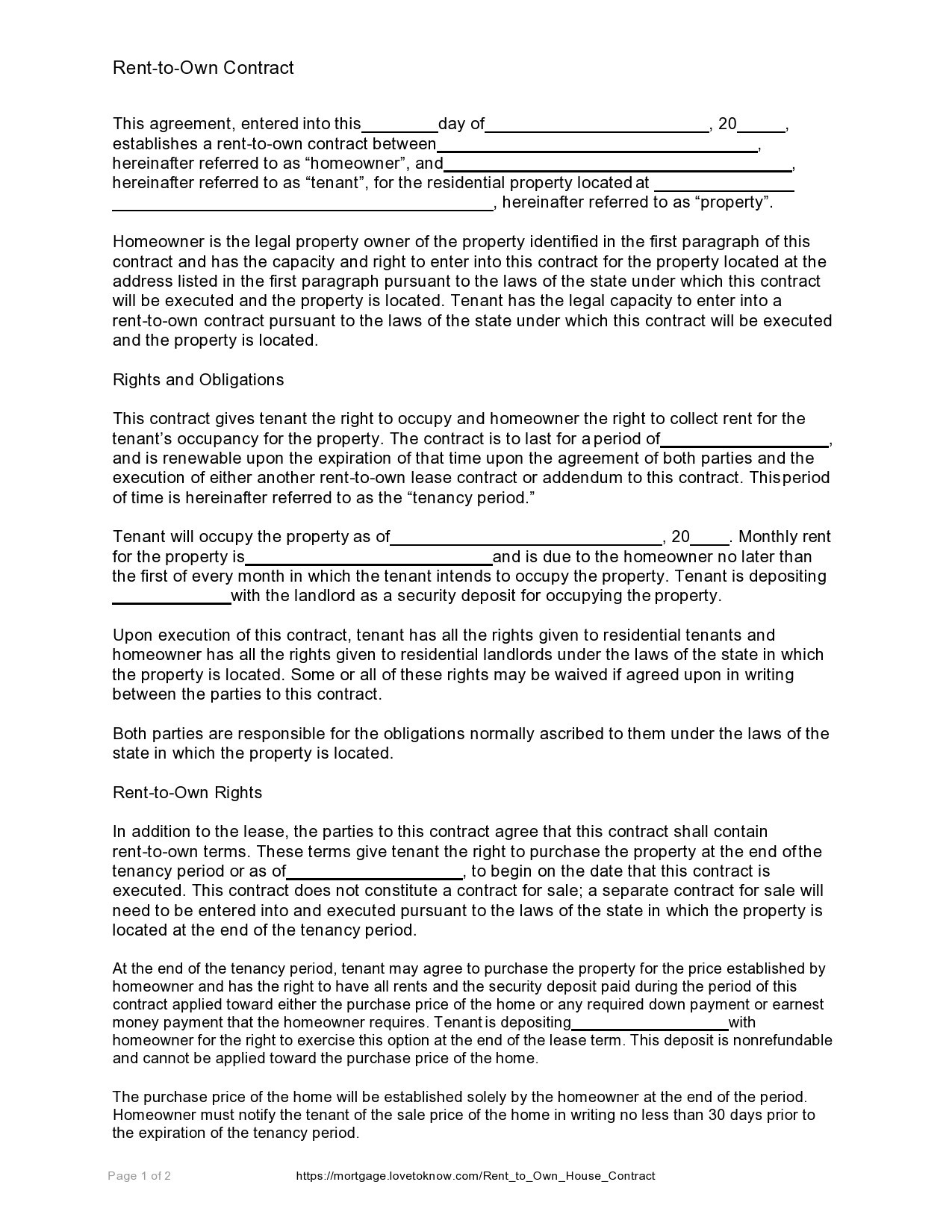

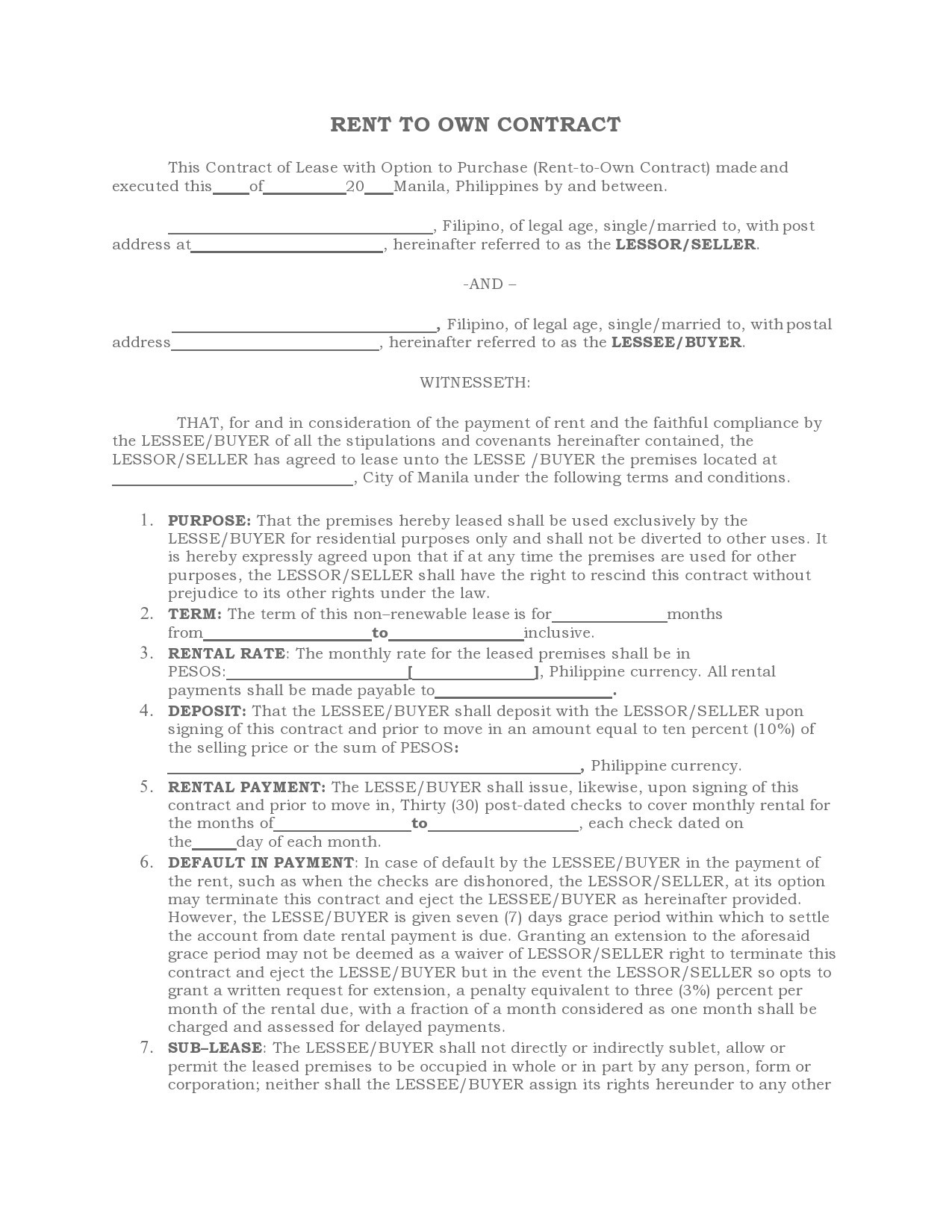

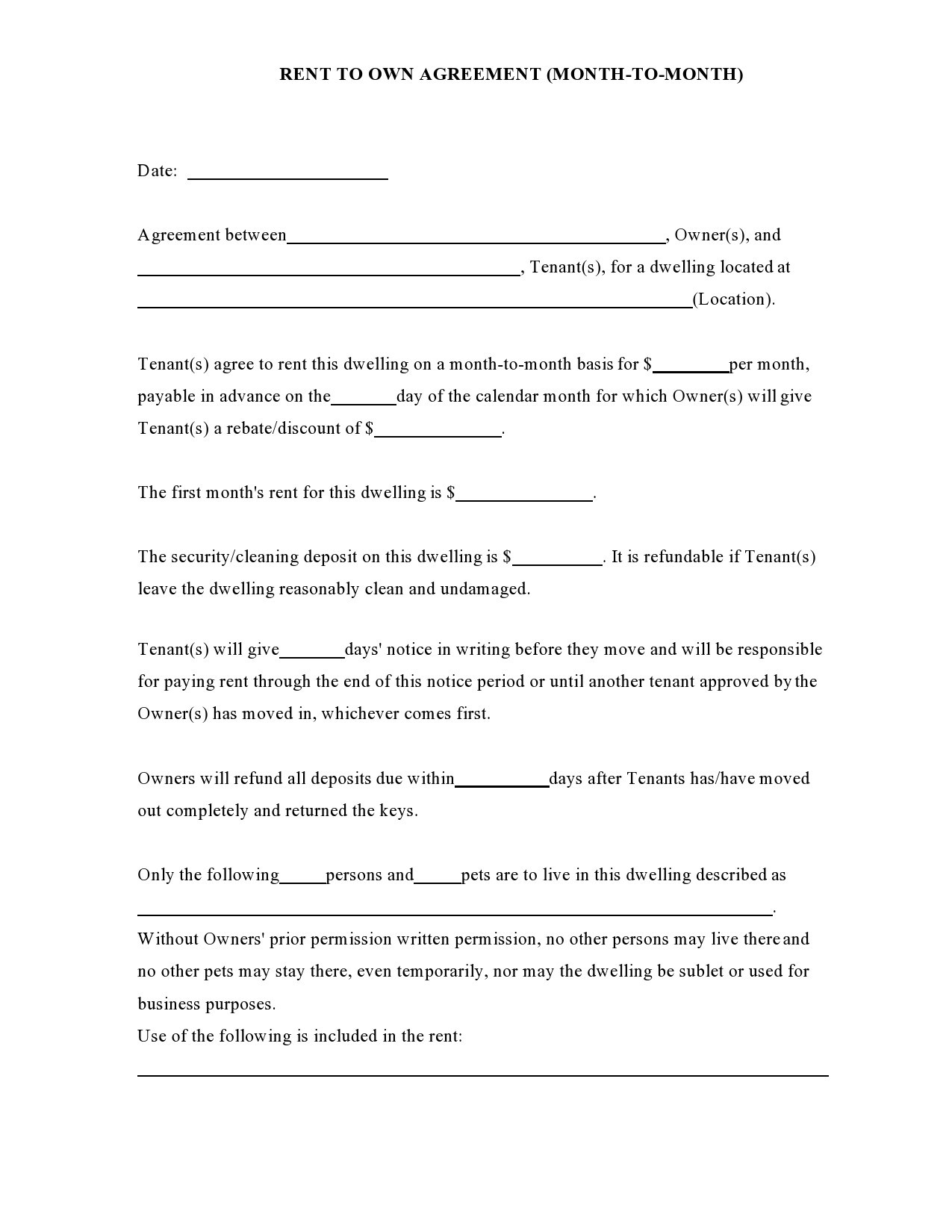

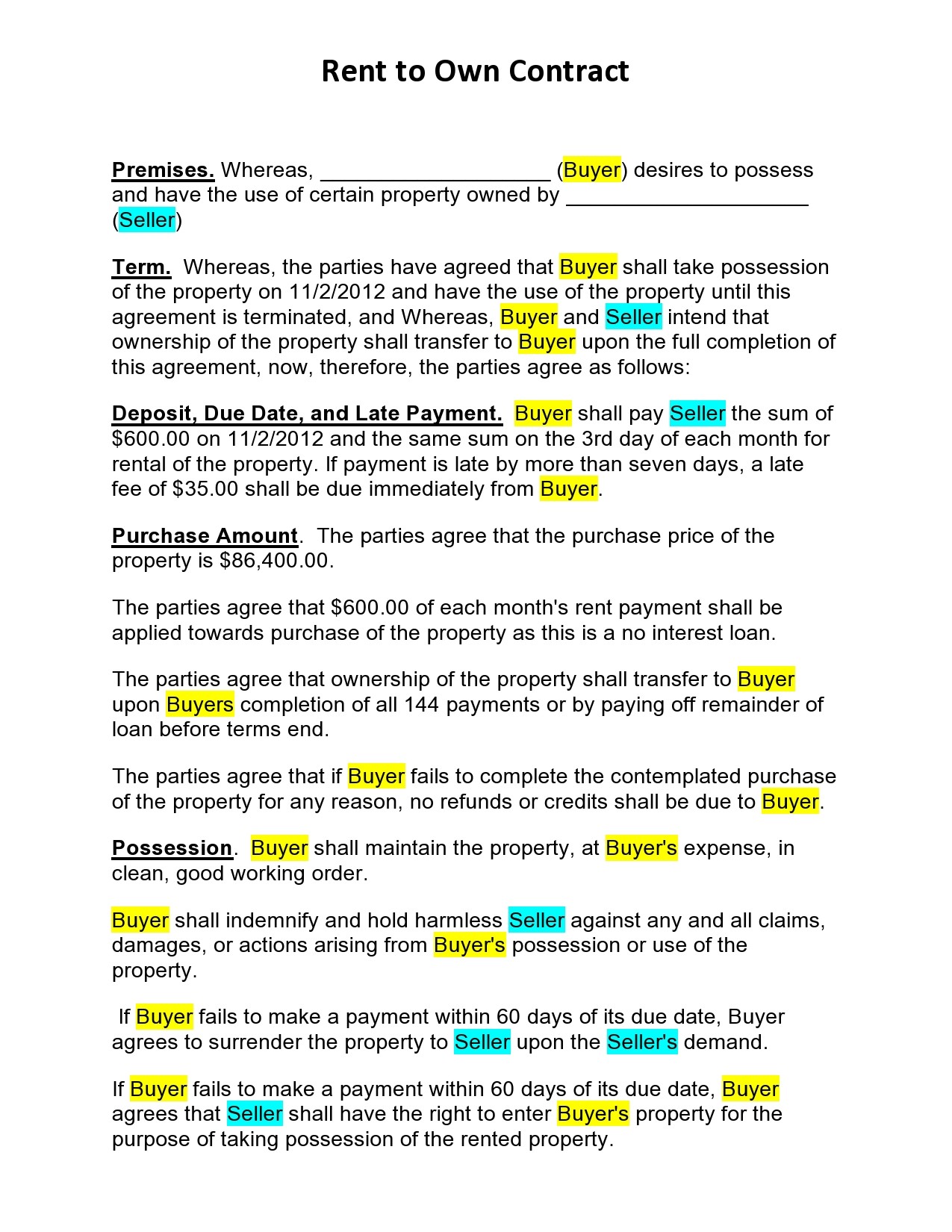

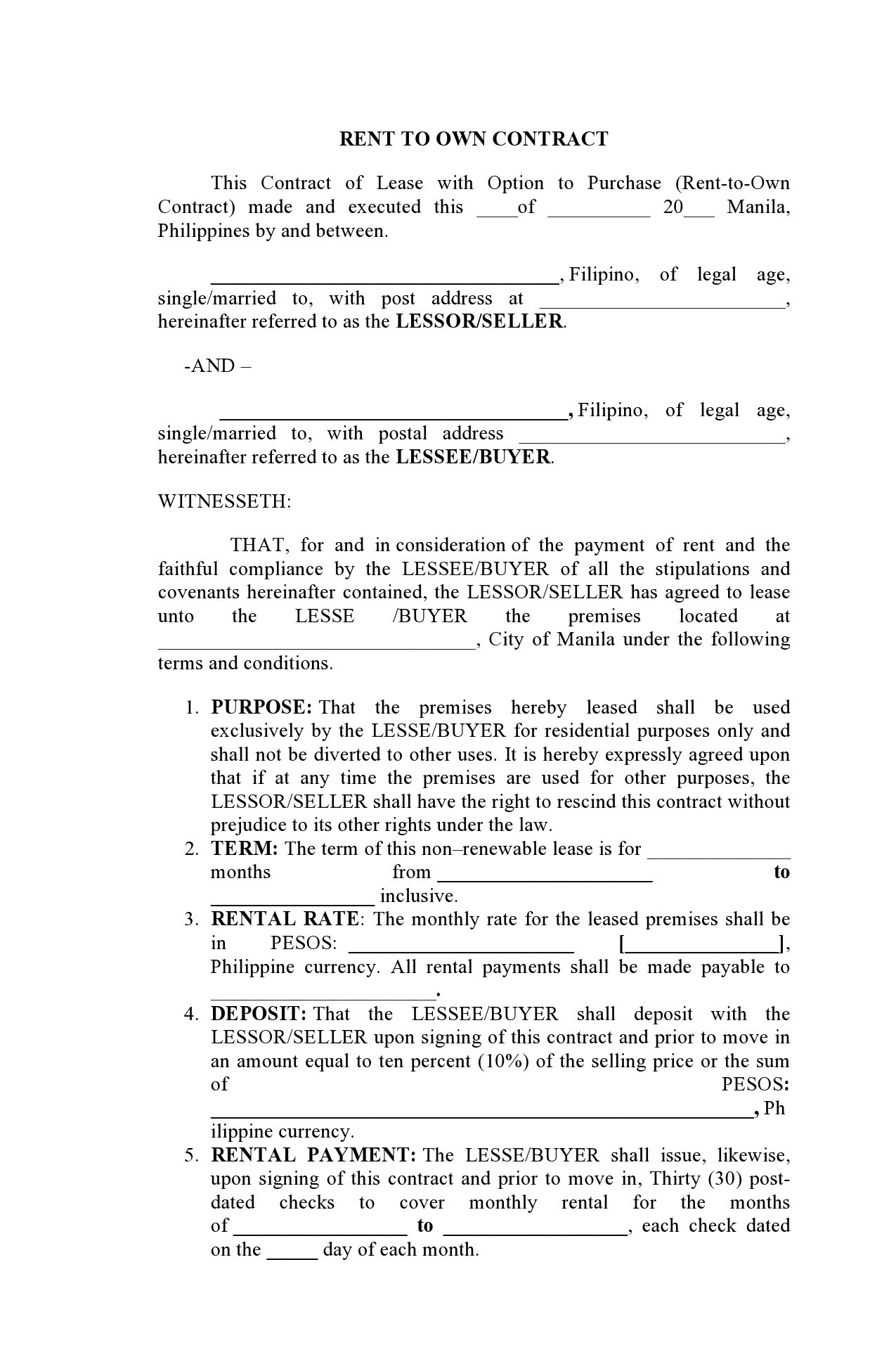

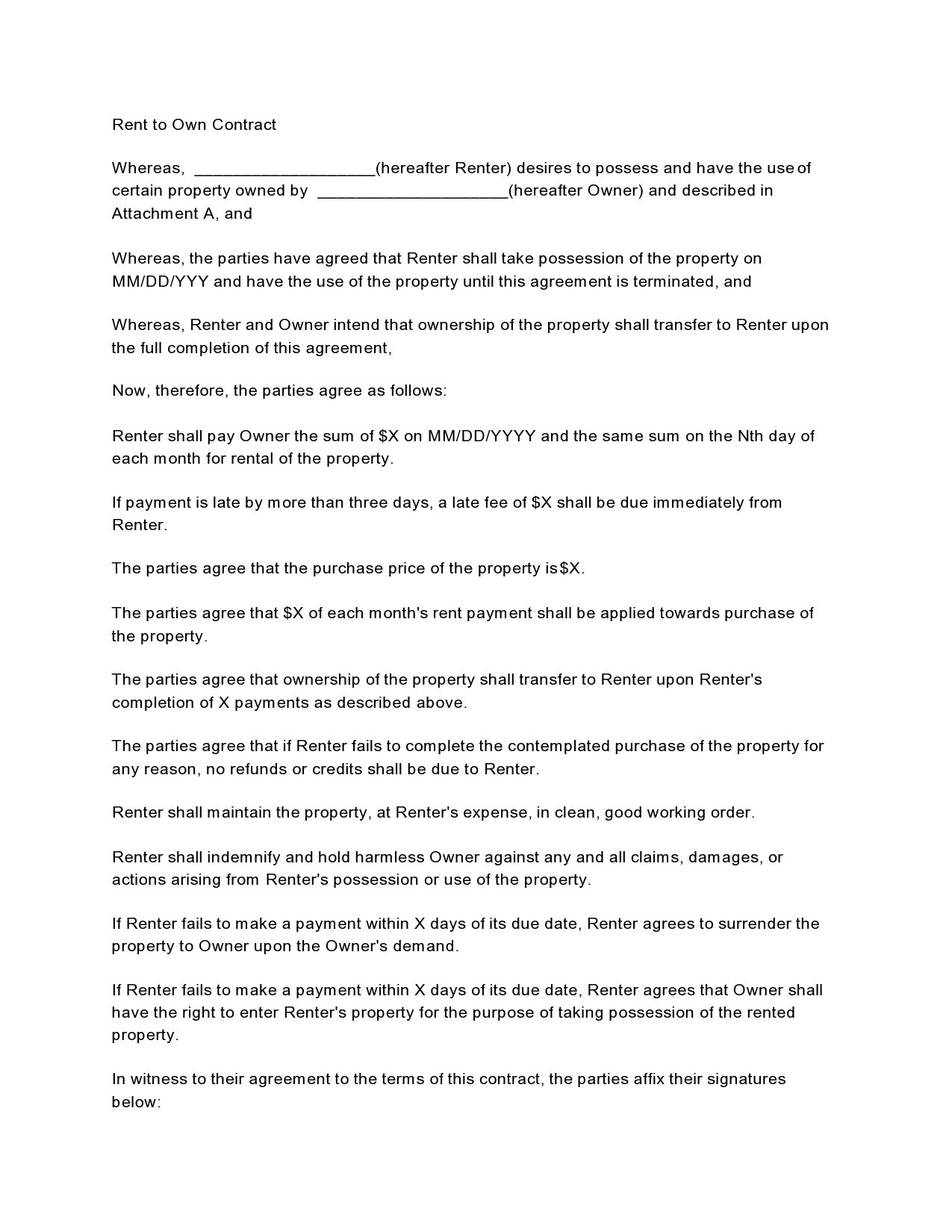

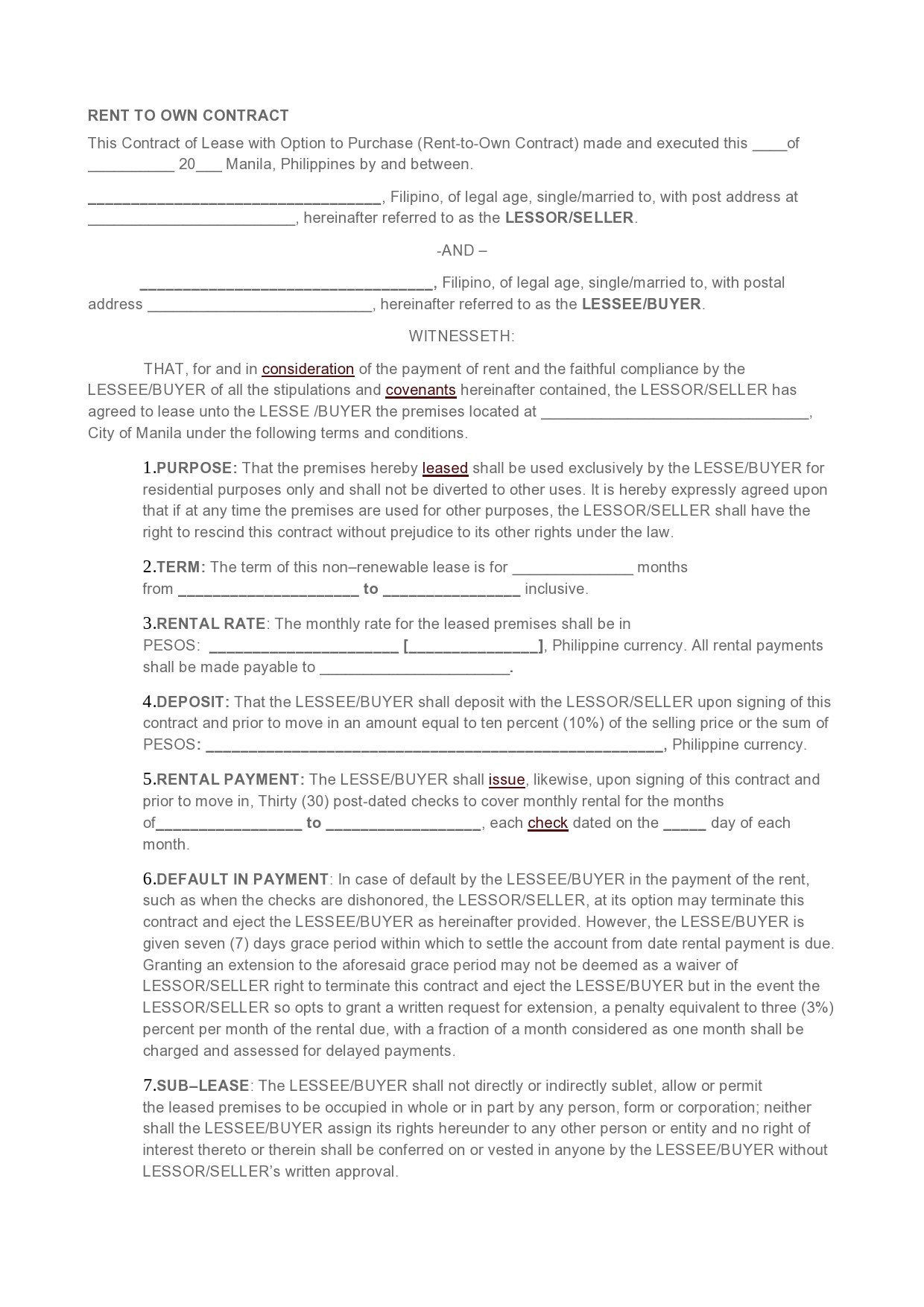

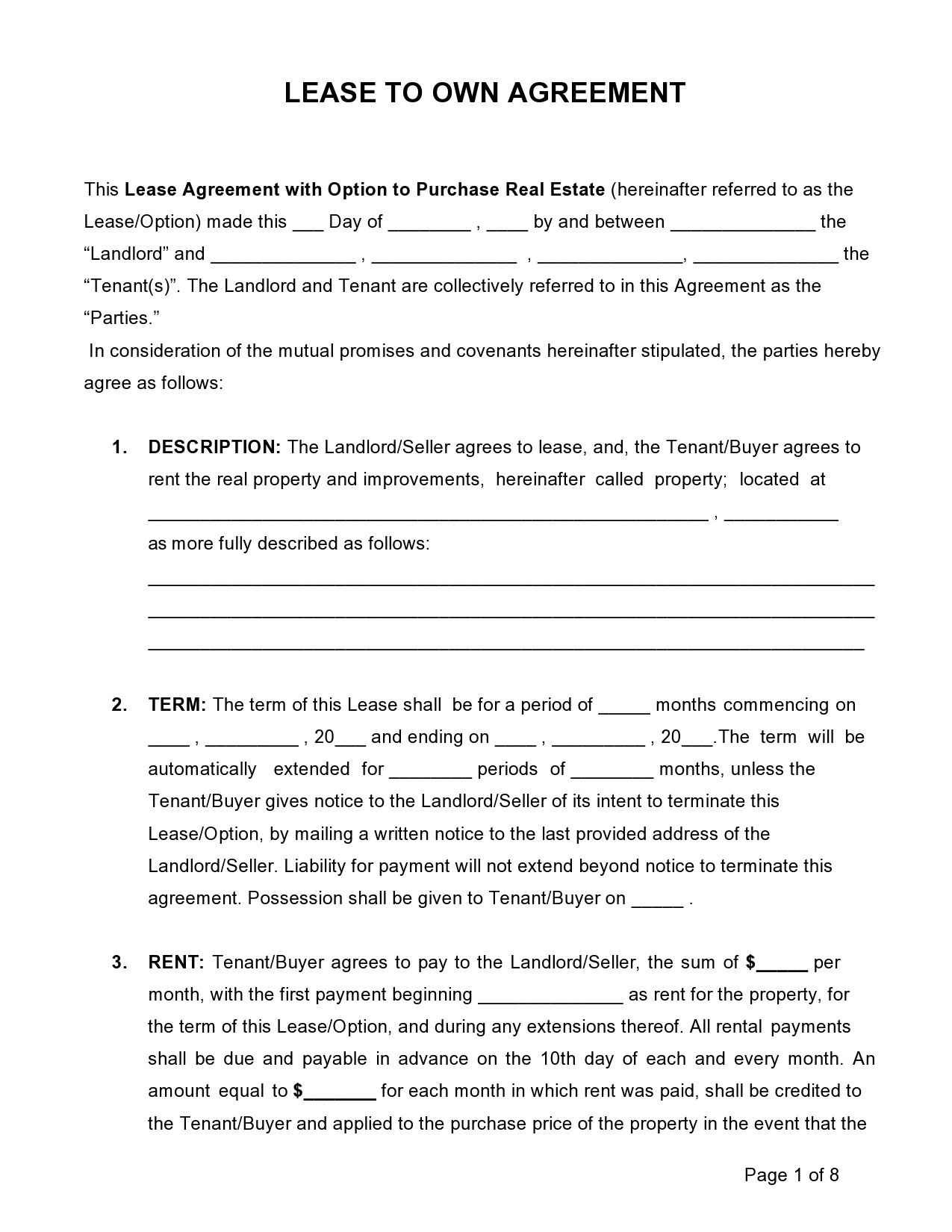

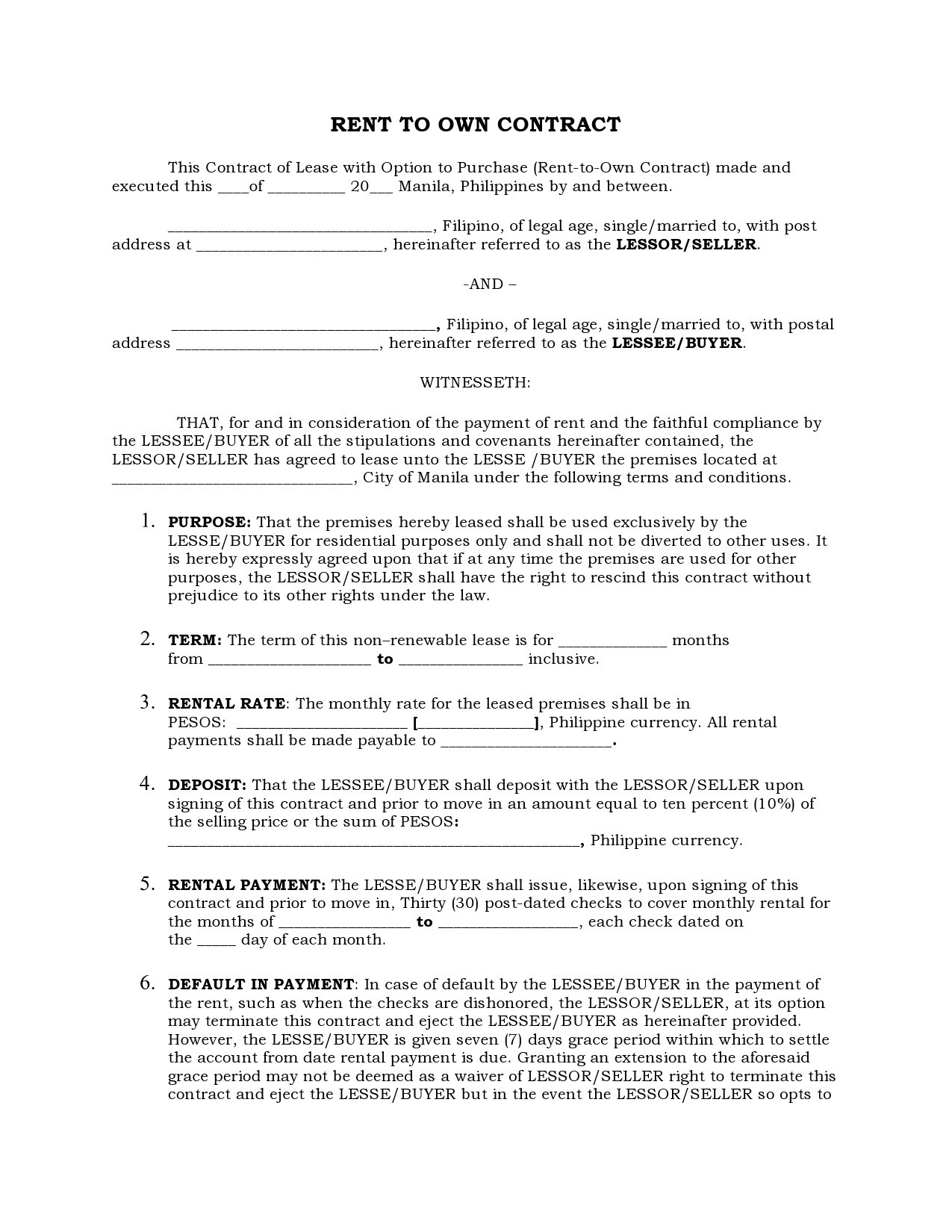

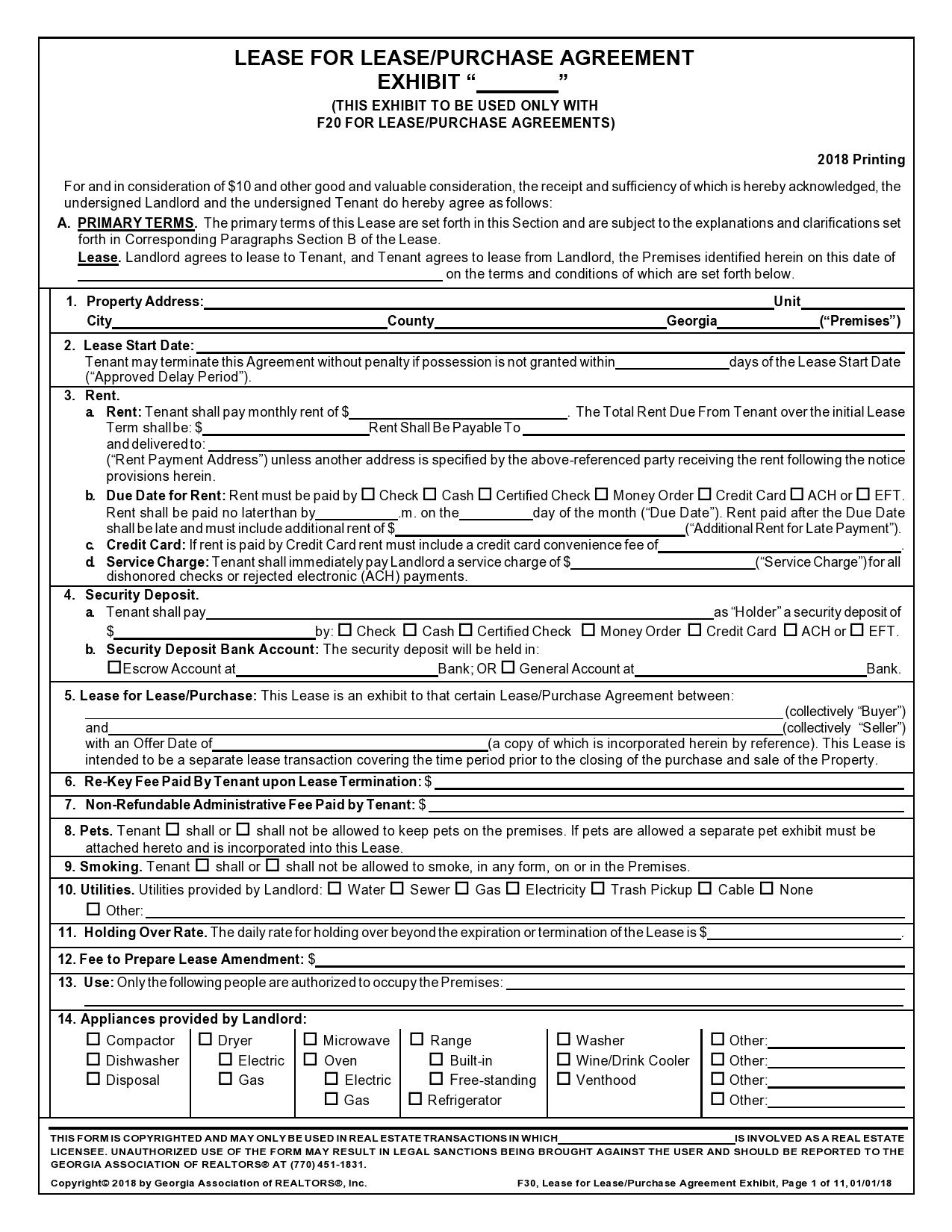

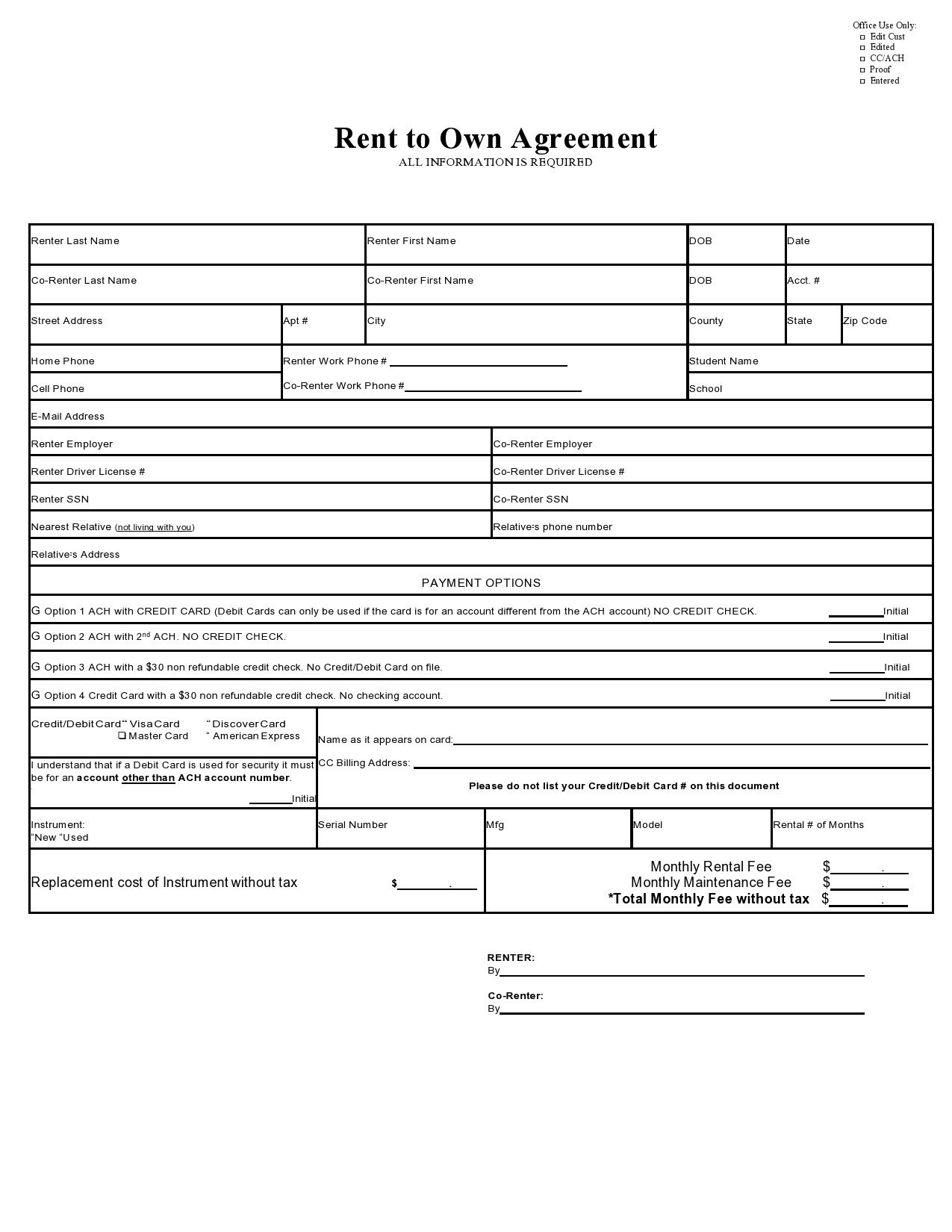

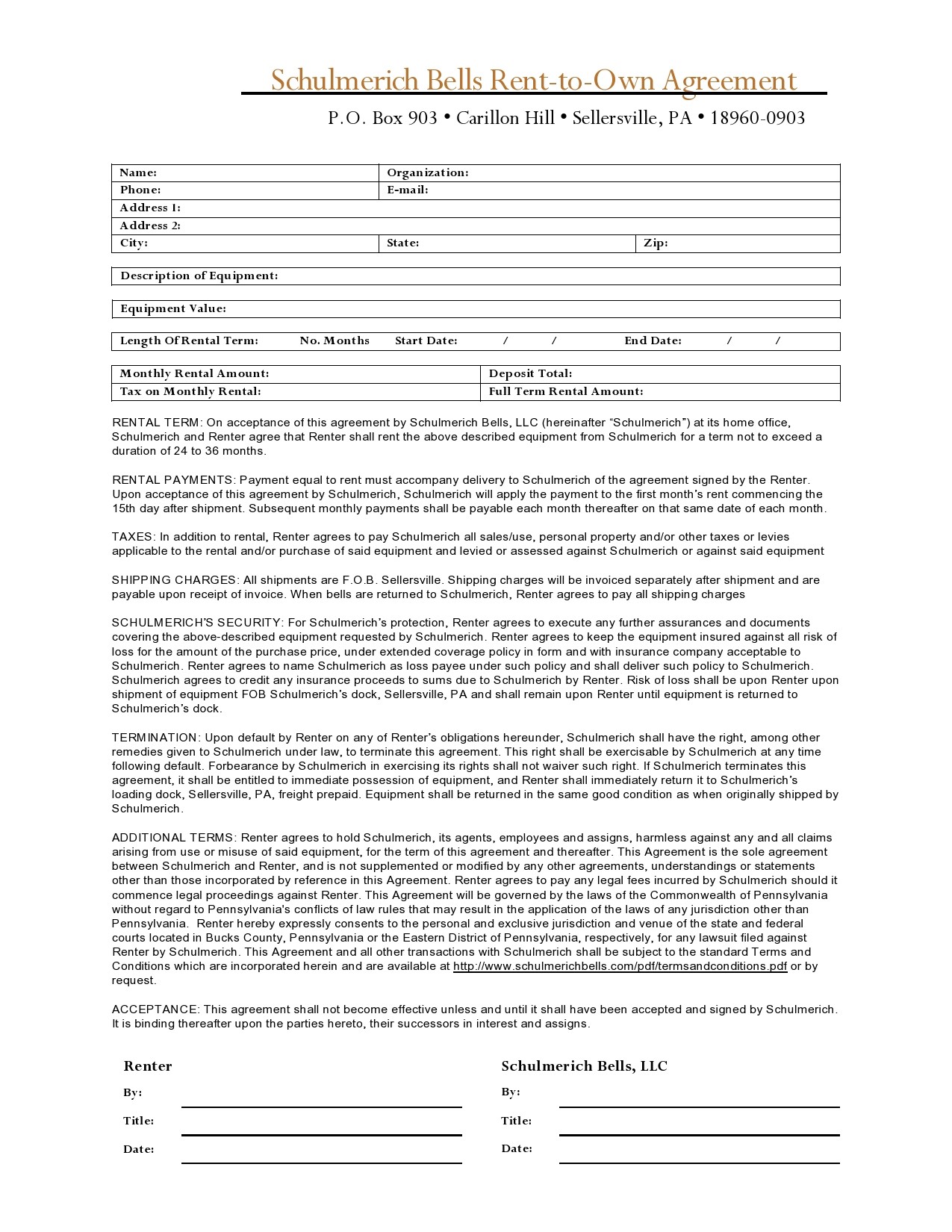

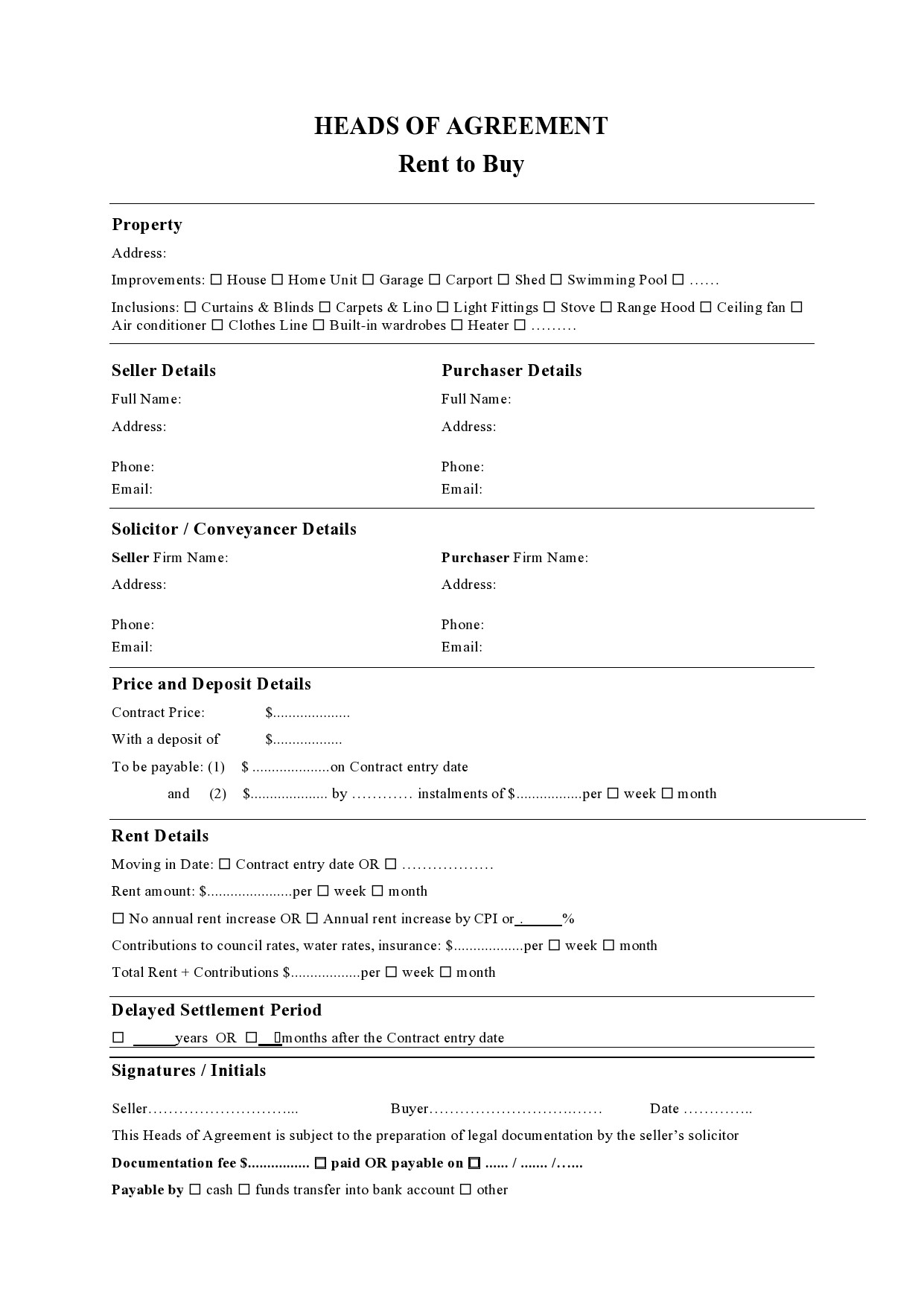

How to write a rent-to-own contract

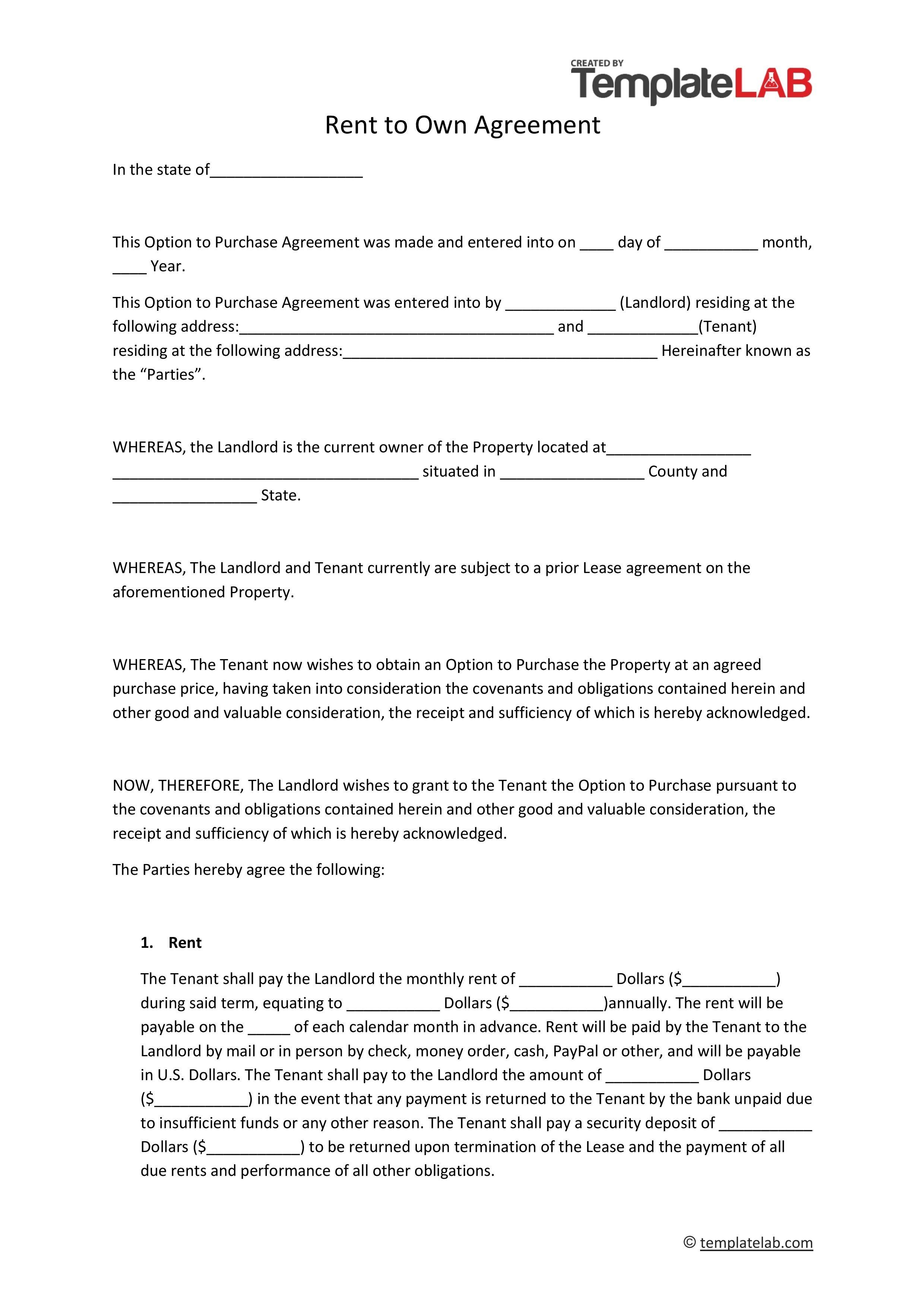

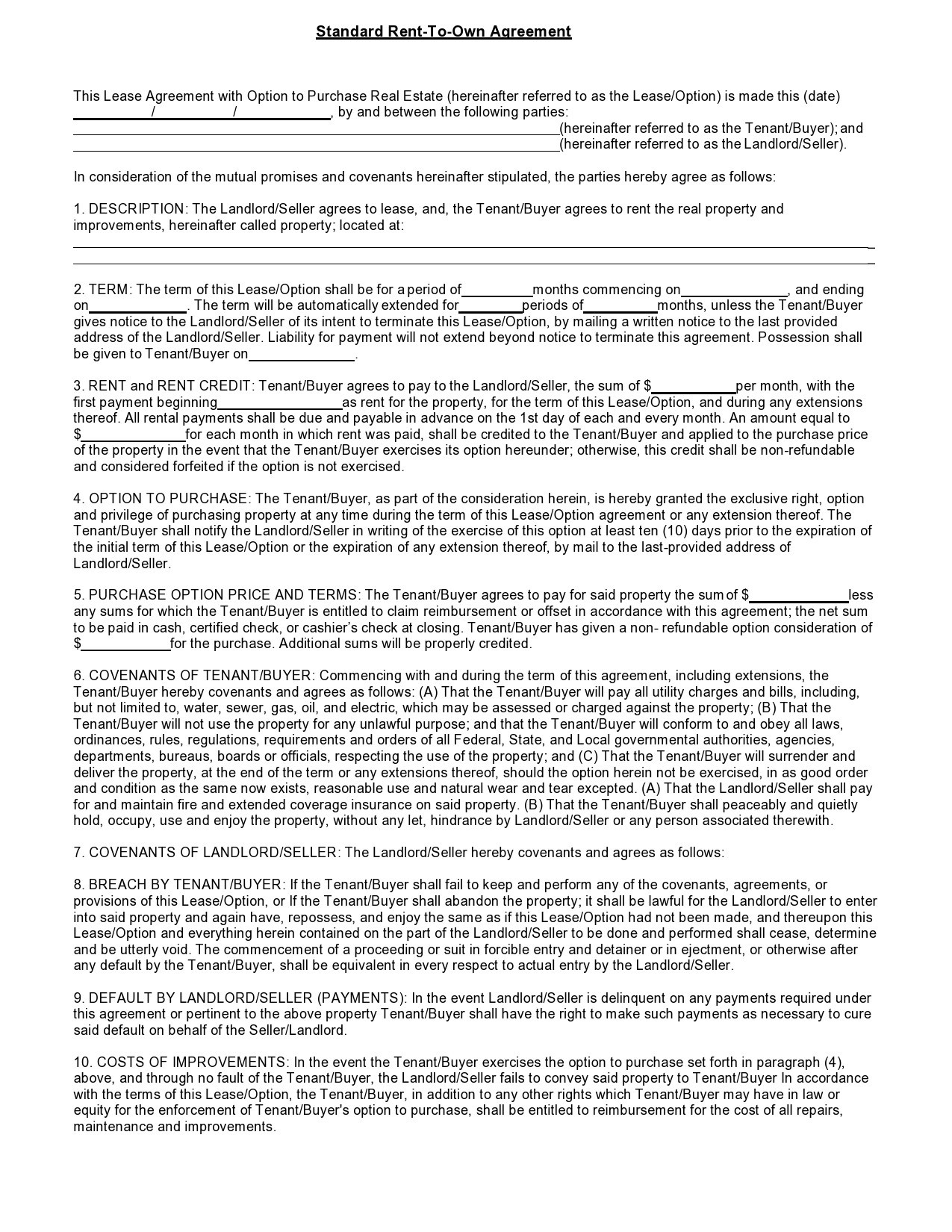

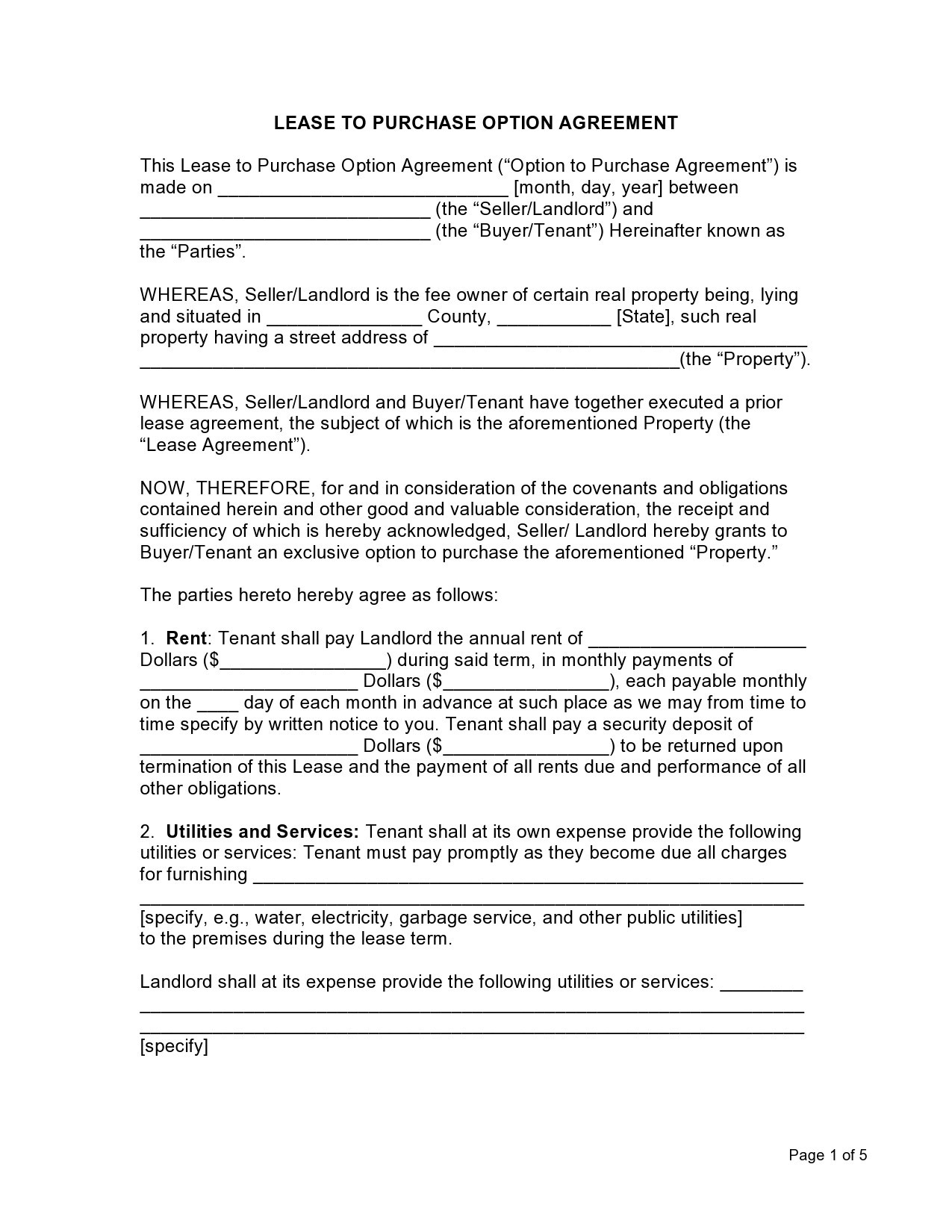

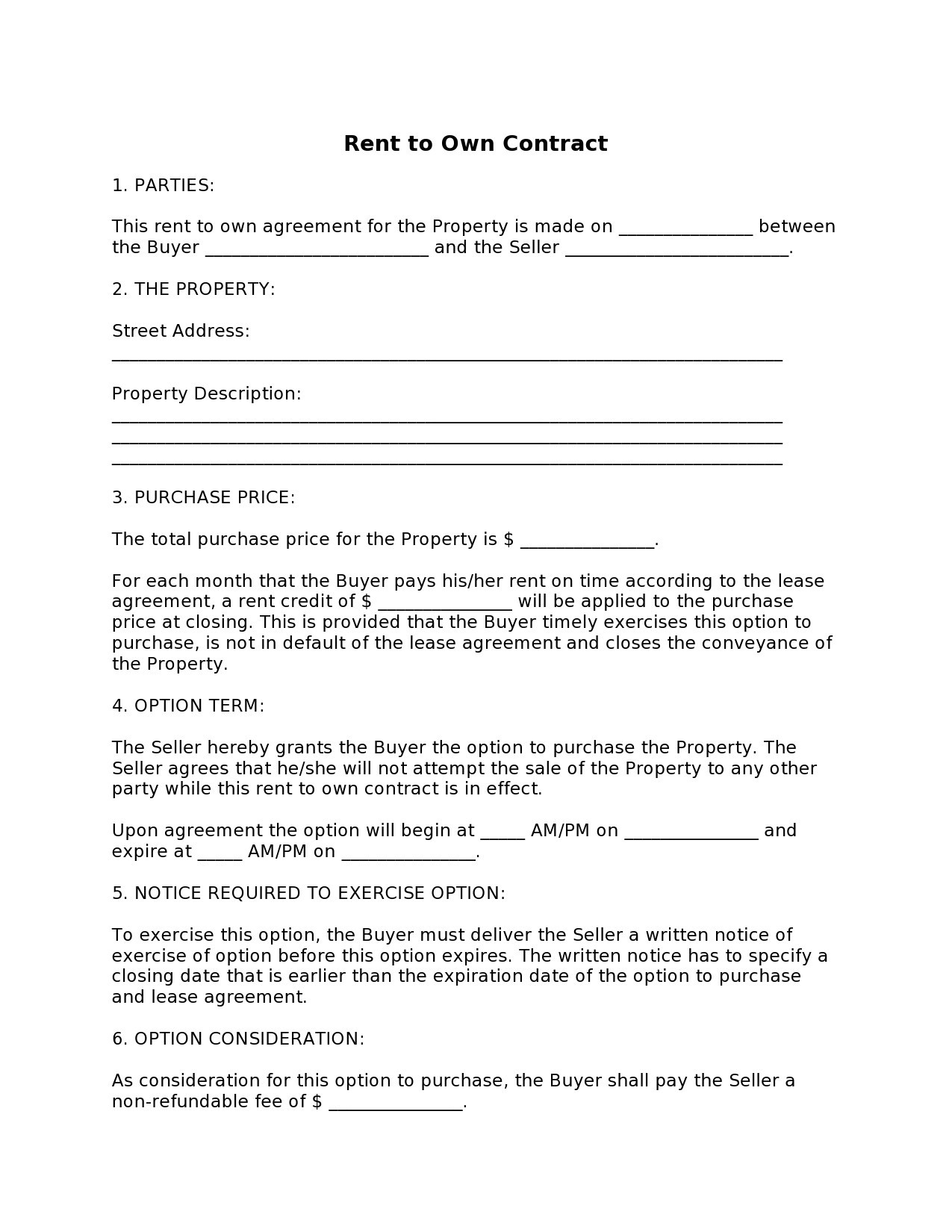

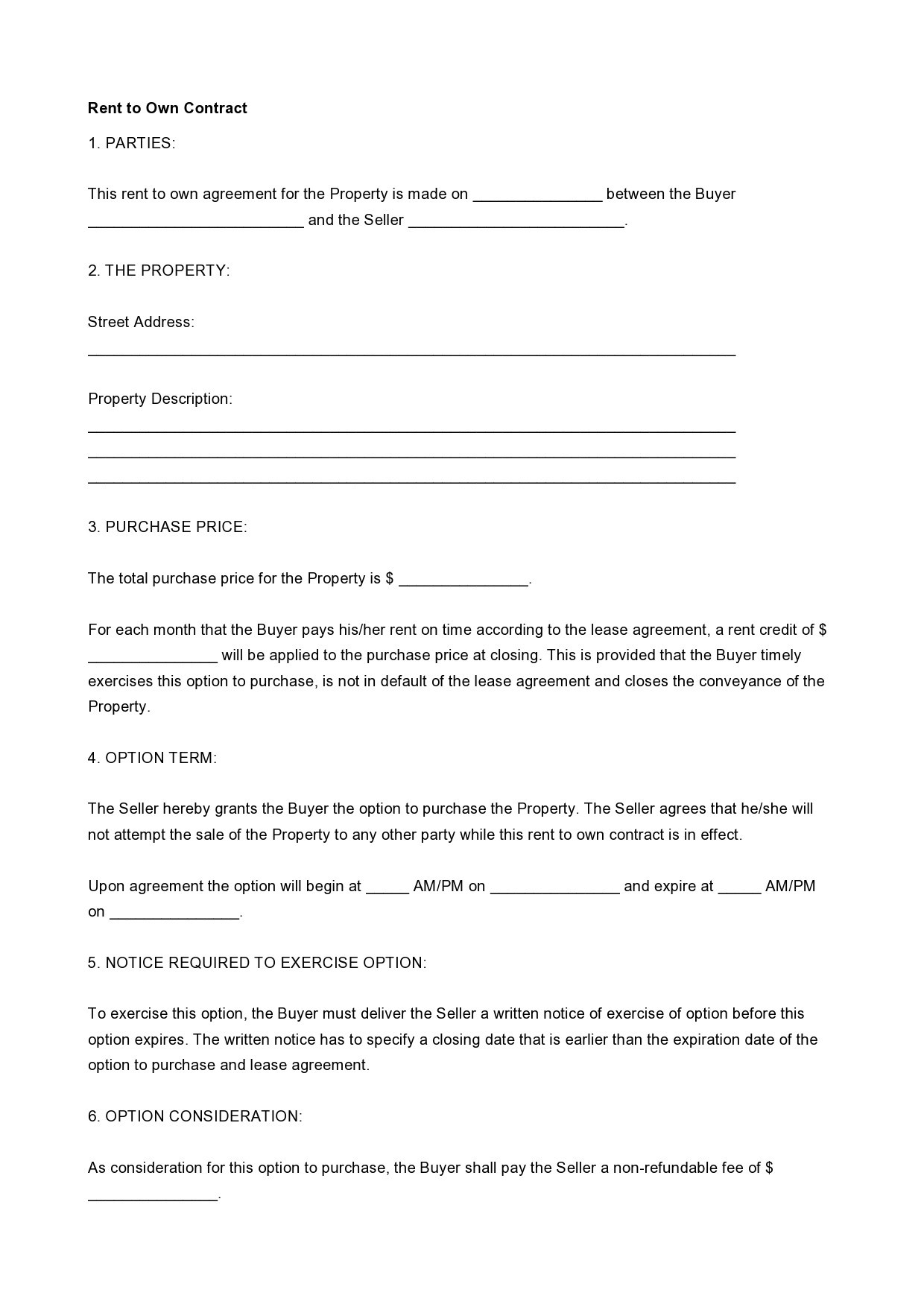

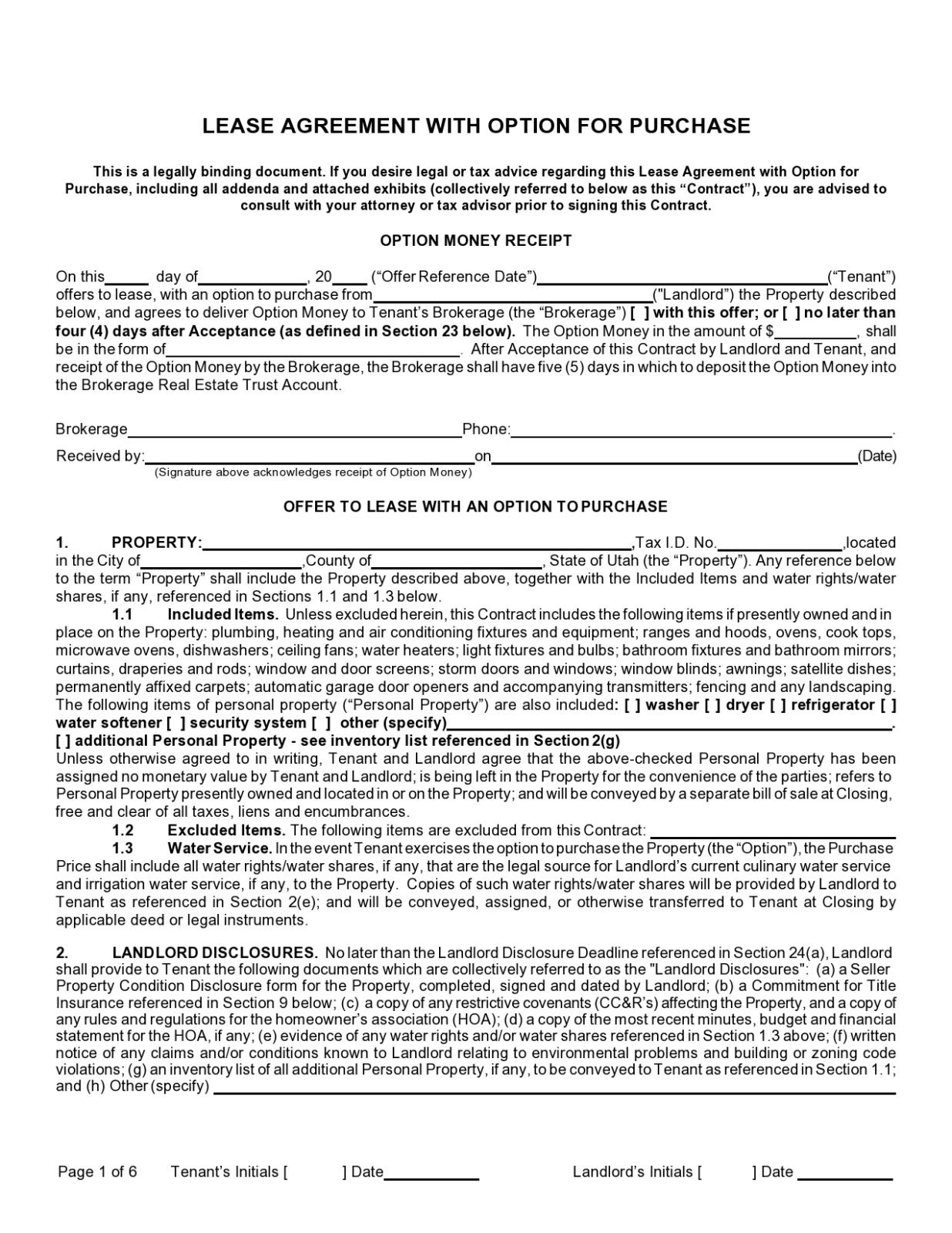

Landlord/Seller Information

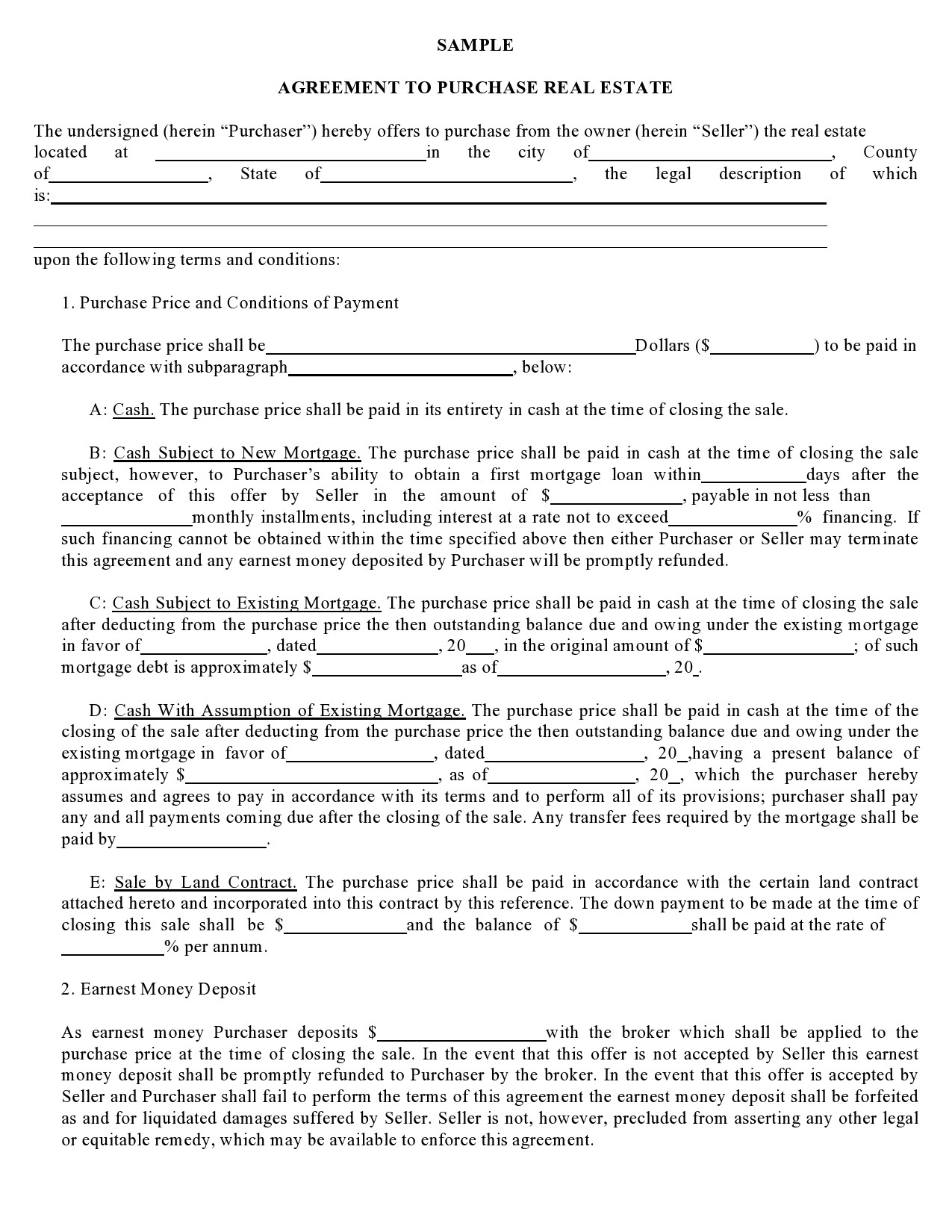

This part of the rent to own contract example needs to include the landlord/seller’s full legal name, address, and phone number. If the owner of the property is a trust or some other kind of business, this entity needs to be listed correctly by its full legal name along with its address and any contact information that is relevant to it.

Tenant/Buyer Information

This section will indicate the full legal name or names of the parties that are going to be renting to own the property in question. Addresses and contact information need to be listed correctly in this part of the contract as well.

Property Information

The information about the property involved needs to be complete and accurate. The address and any other relevant information about the items that are included in the property, like outbuildings and other structures, should be listed here.

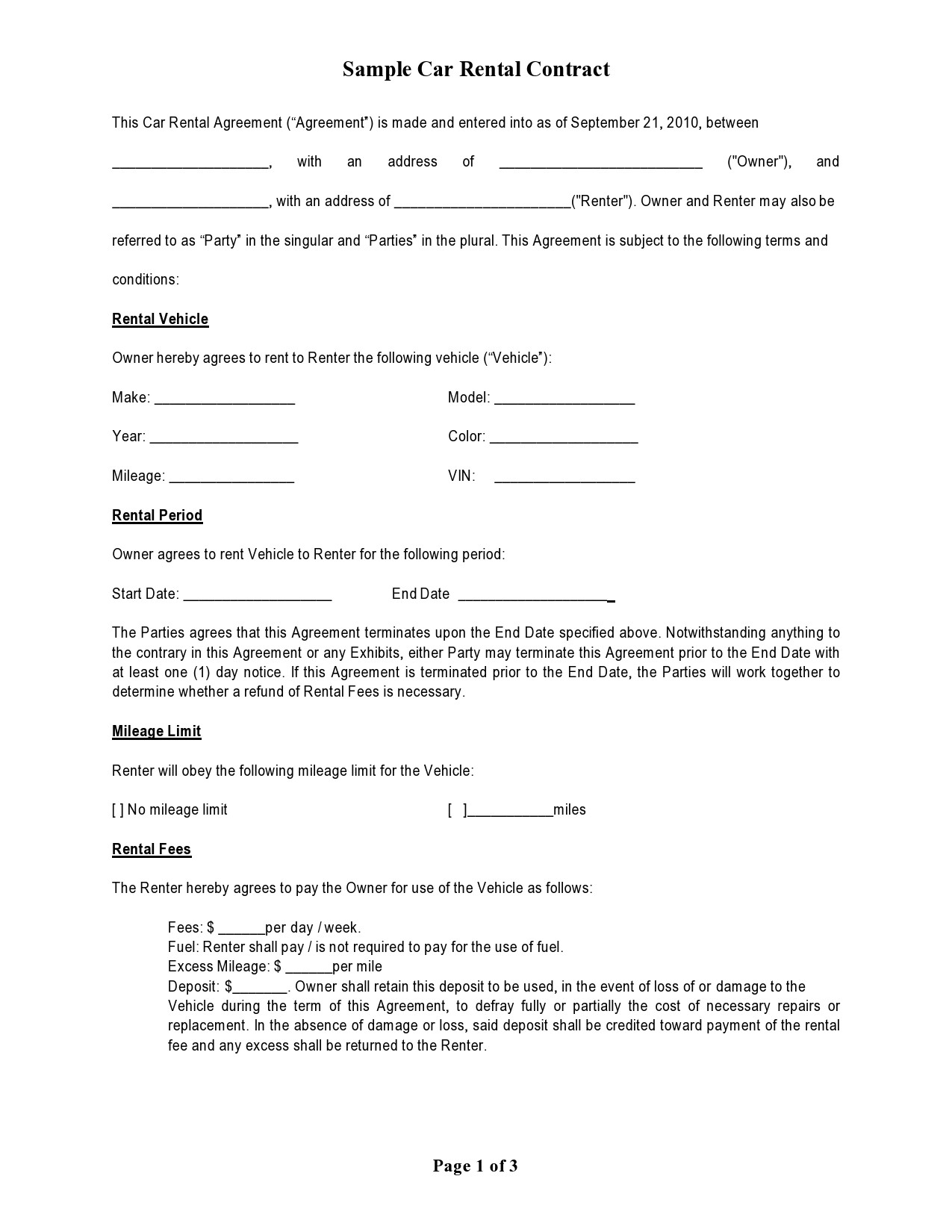

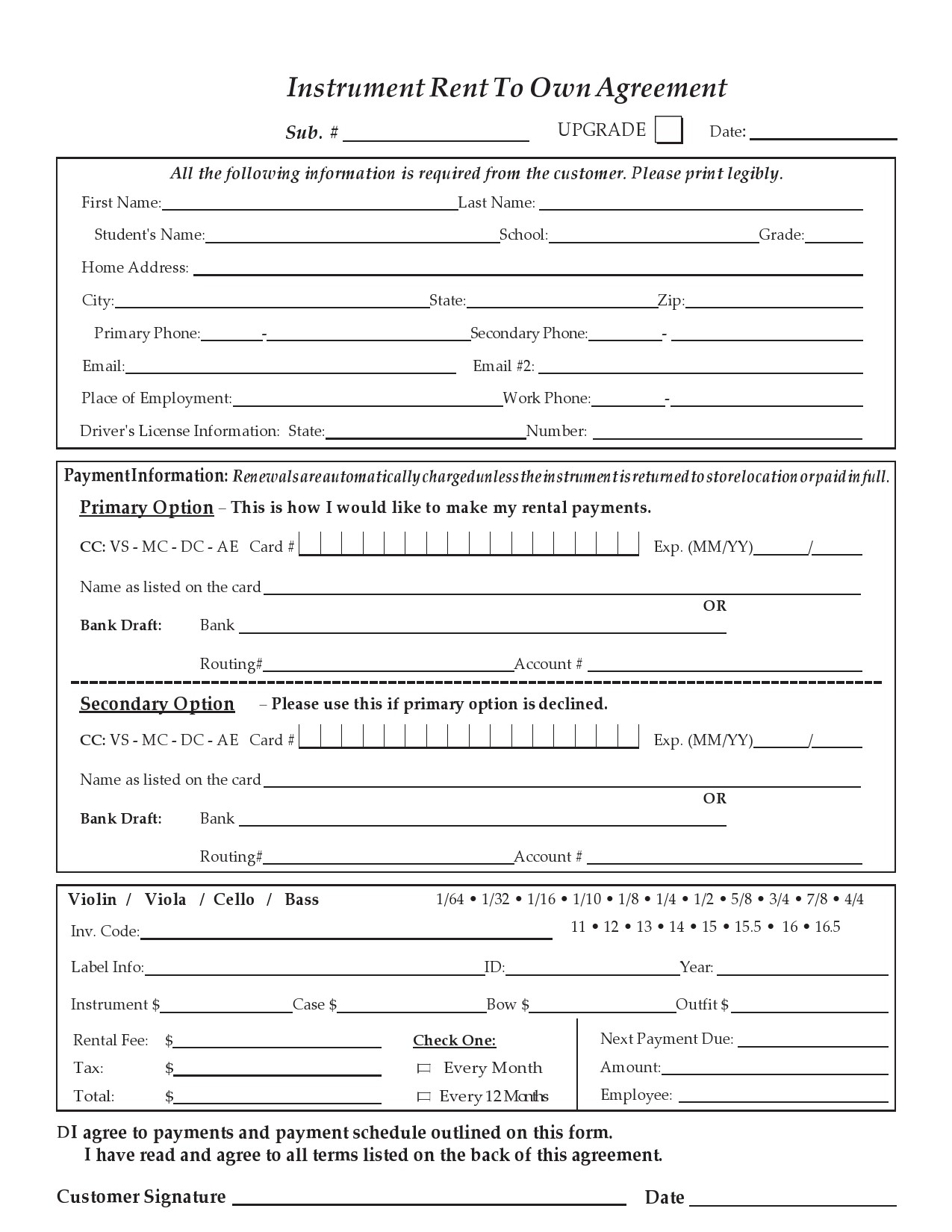

Rent Payments

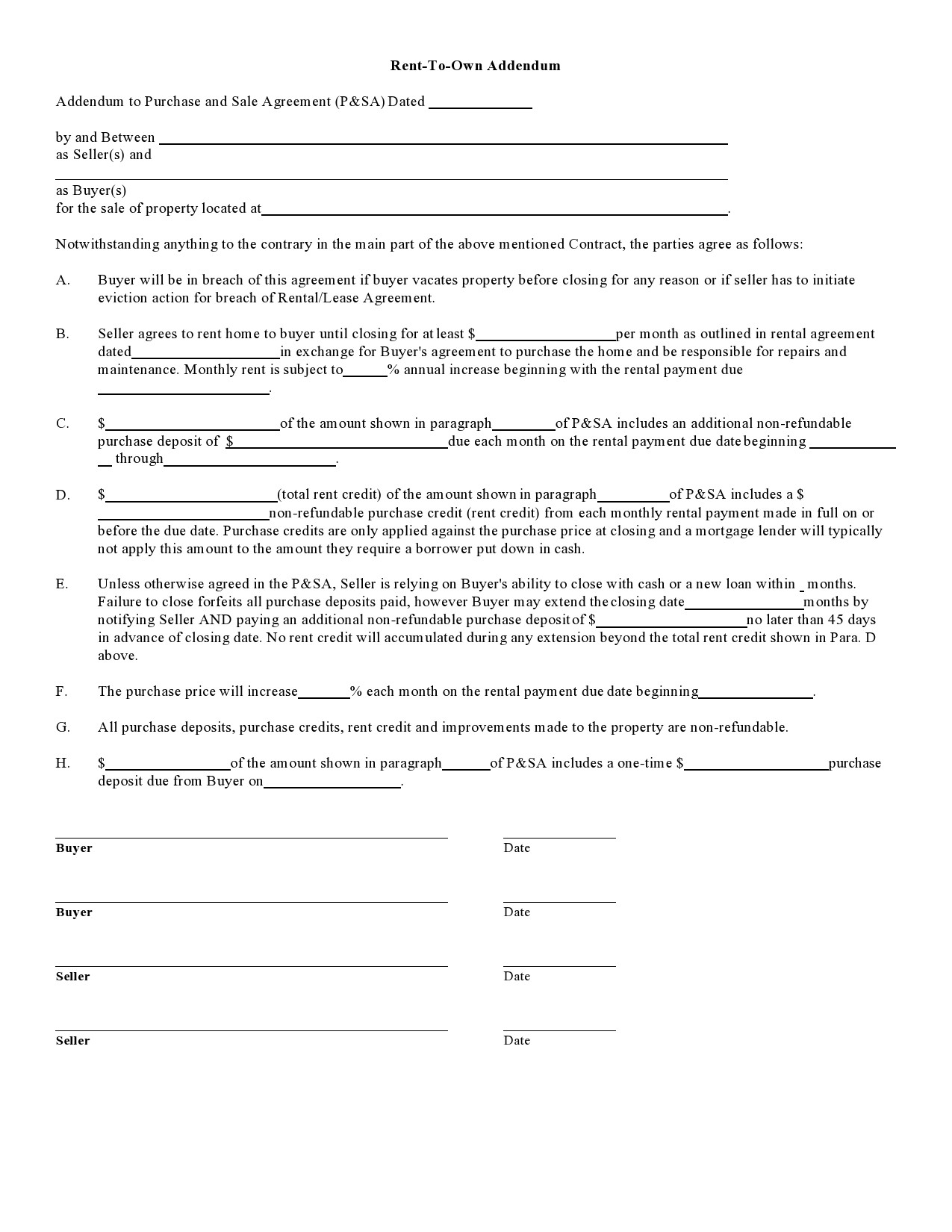

Rent payments need to be explained completely in this section. The payment that is for the rent needs to be listed as well as the additional payment amount that is made toward ownership. The initial option fee information should be included in this section as well to make it clear that this is not part of the monthly payments and is instead an additional charge.

Rent Term

The term of the contract will need to be listed in this section. This information is usually standardized along the lines of normal mortgage terms, but you might have a different arrangement that you want to enter into with the person who is buying the home from you.

Security Deposit

A security deposit is still usually required in this agreement for the renting portion of the contract. This can make the first few payments and down payments toward the contract expensive, so buyers should be prepared for these costs when they initiate this kind of contract.

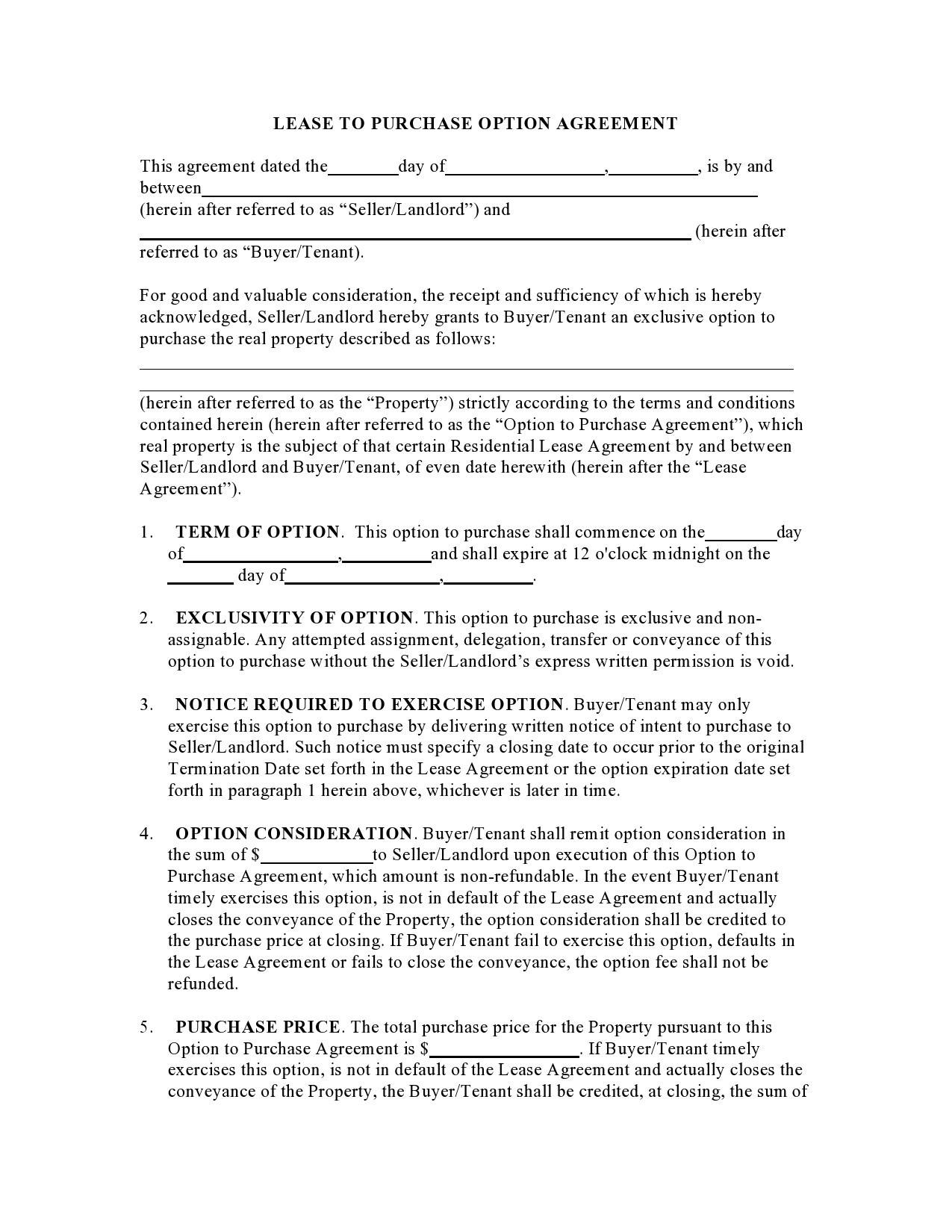

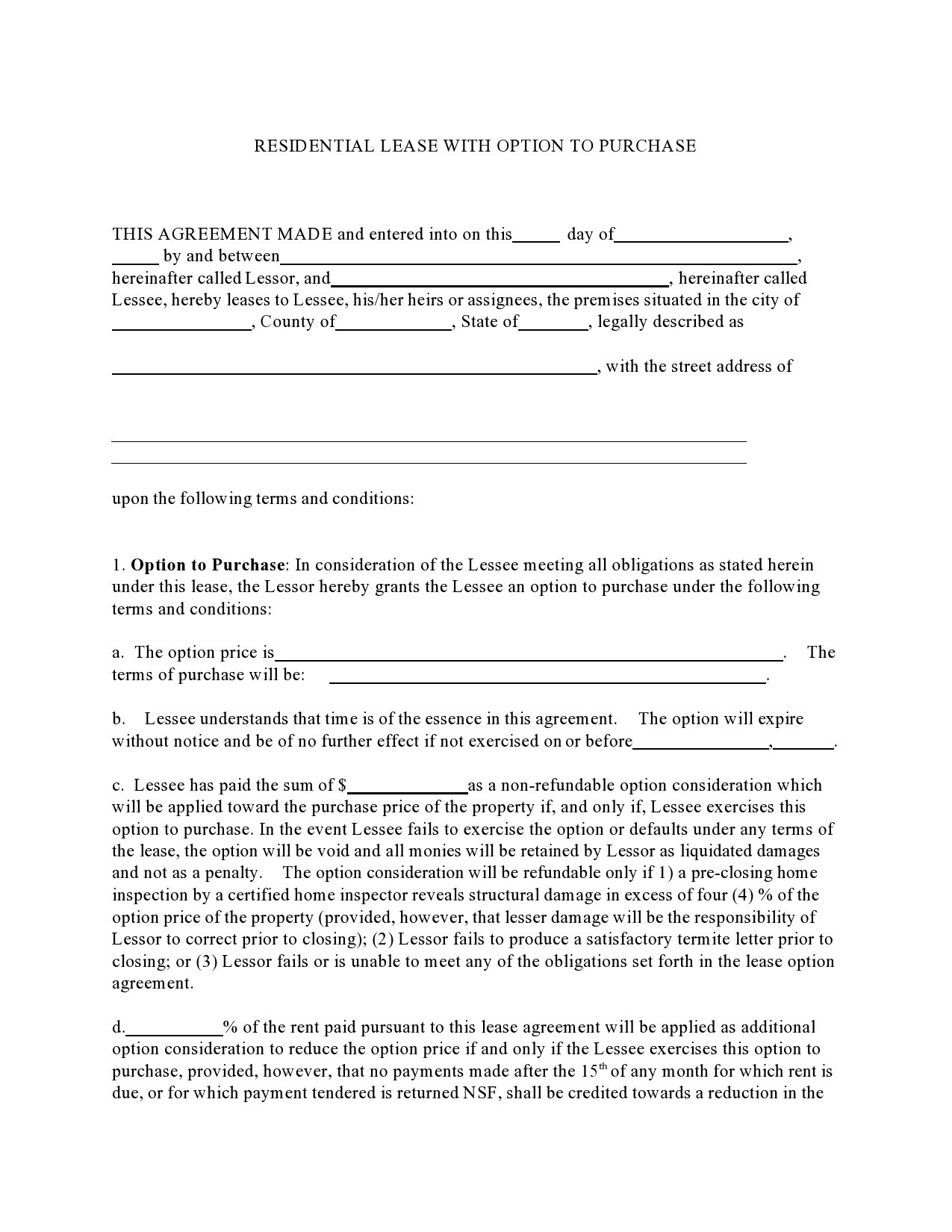

Option to Purchase

This is the part of the rent to own agreement form that grants the renter permission to buy the property at the end of the contract duration. There might need to be informed about repayment in total in this section of the contract as well as the total amount that the property will cost at the end of the life of the loan itself. This is a lot like a mortgage agreement, and similar language needs to be used here to define the purchase agreement aspect of the contract.

Option Consideration

The amount that the tenant will pay for the option to buy needs to be clearly stated in this section.

Agreed Upon Purchase Price

While this will not be the total amount of the contract, the purchase price of the home should be included in this section of the document.

Earnest Money

If earnest money is included in the contract’s considerations, the amount of this payment needs to be listed here as well.

Signatures

Both parties who agree to the contract will need to sign and date the document for it to be valid. Be sure that all the parties involved in the contract sign it. There might be more than two people who agree to the arrangement.

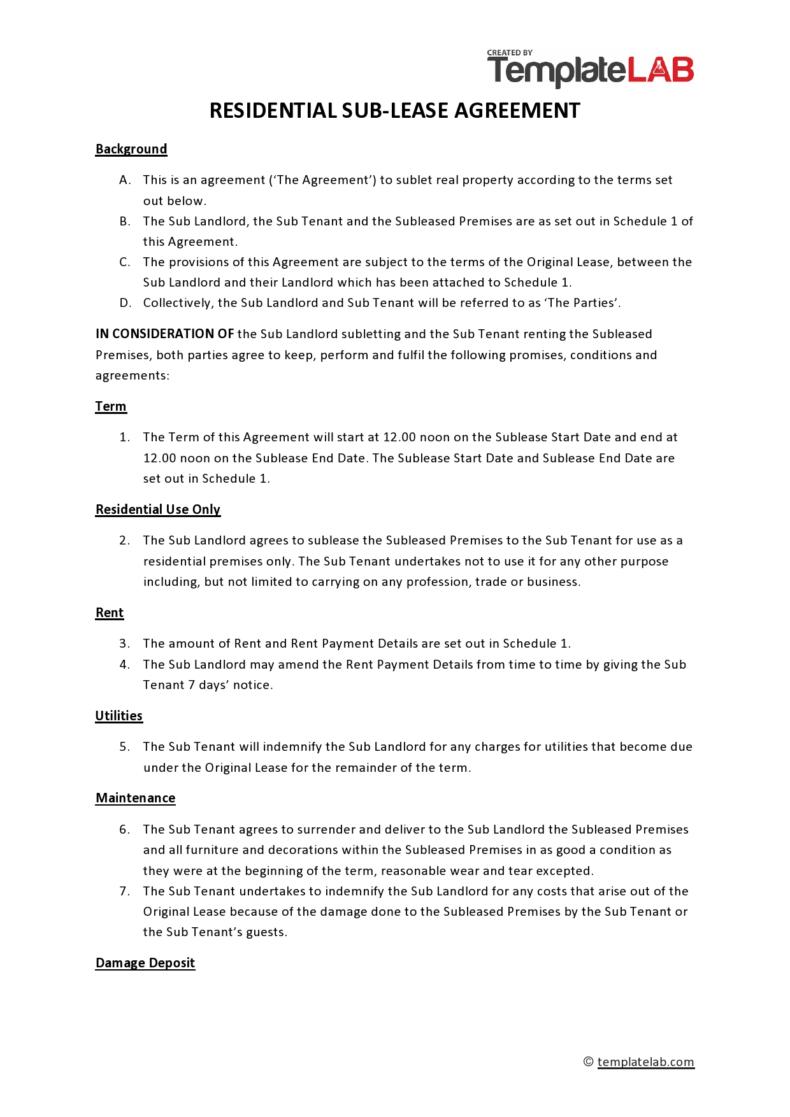

Some other information that might need to be included are clauses about how the property can be used by the tenant during the duration of the contract. The condition of the property at the time of the contract beginning should be listed as well. If this is a holdover tenancy, you might need to indicate that there have been changes in ownership and that no other details have been altered about the arrangement other than ownership of the property or landlord management of the property changing.

Many of these contracts also indicate who will be doing repairs and work on the property for maintenance. Alterations that are allowed will be discussed here, and information about whether or not pets can live on the property will be included as well. Smoking might also be discussed, and any rules and regulations related to the neighborhood will be added at the end of the contract as well. Subleasing is not usually allowed when entering into this kind of contract, but if this is an option, it will need to be discussed in this part of the document.