A real estate purchase agreement is a document that both the buyer and seller will sign during a real estate transaction. After negotiations between both parties, the purchase agreement will go into effect, protecting both the buyer and seller from issues during the transaction as well. Since real estate can be a big purchase and includes a lot of money, the purchase agreement is necessary.

Table of Contents

- 1 Real Estate Purchase Agreement Templates

- 2 What is a Real Estate Purchase Agreement?

- 3 Real Estate Contracts

- 4 Components of the Real Estate Purchase Agreement

- 5 Why are Contingencies Important for a Purchase Agreement?

- 6 Home Purchase Agreements

- 7 How Do I Write a Purchase Agreement for a House?

- 8 What Happens if I Want Out of a Purchase Agreement?

- 9 House Sale Contracts

- 10 FAQs

All buyers and sellers should have a home purchase agreement signed and dated before proceeding with the sale of real estate. It provides protection to both parties. Let’s take a closer look at the real estate agreement and see why it is such an important document to use.

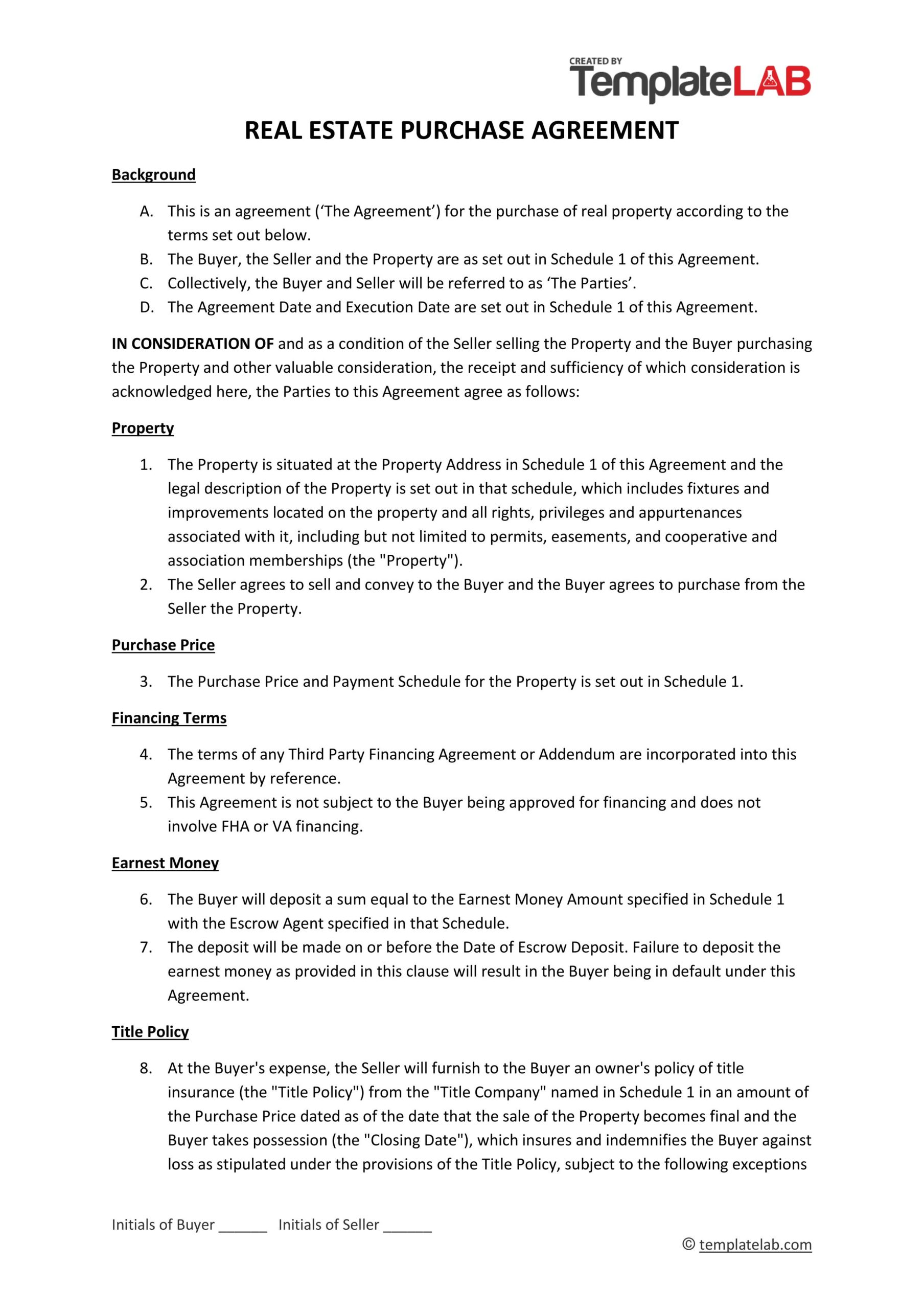

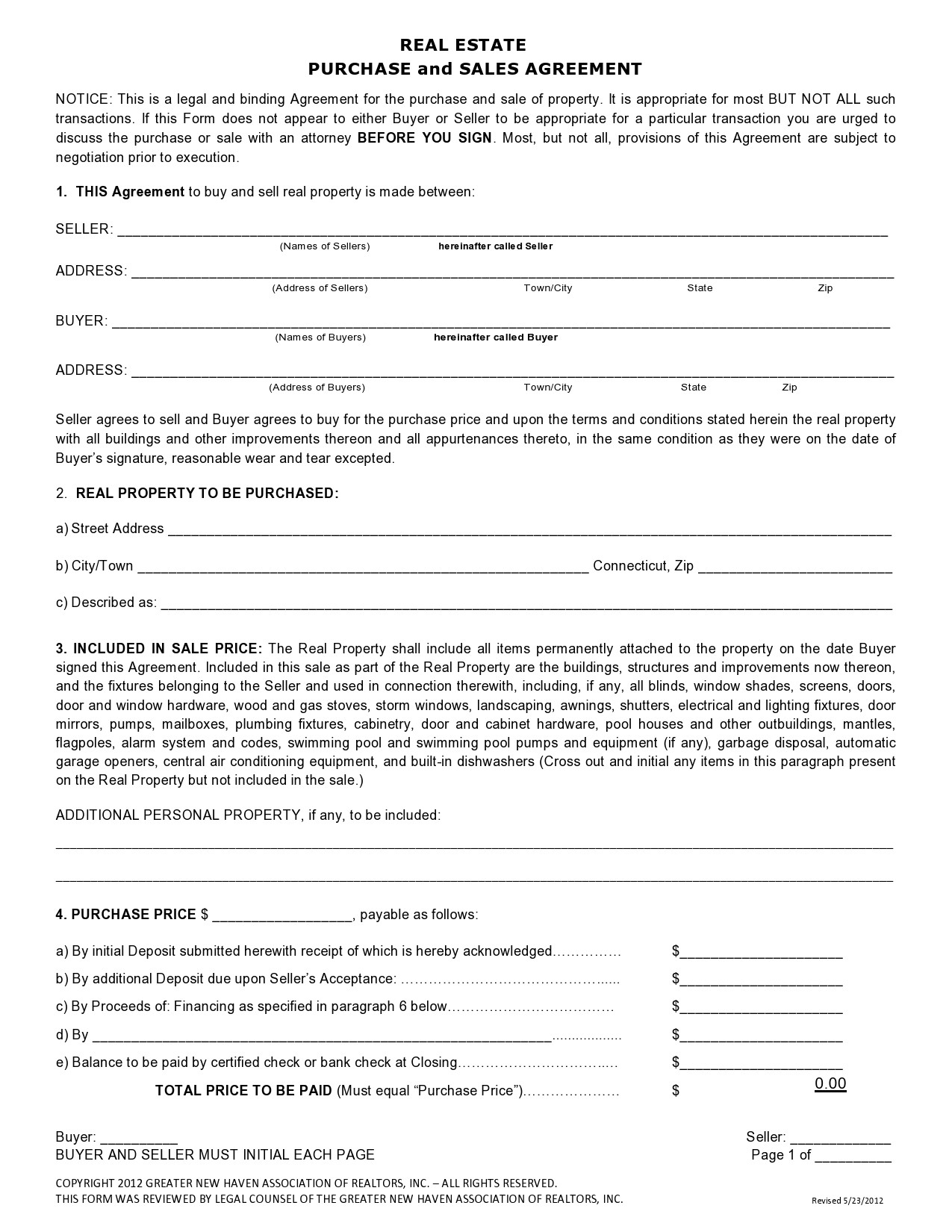

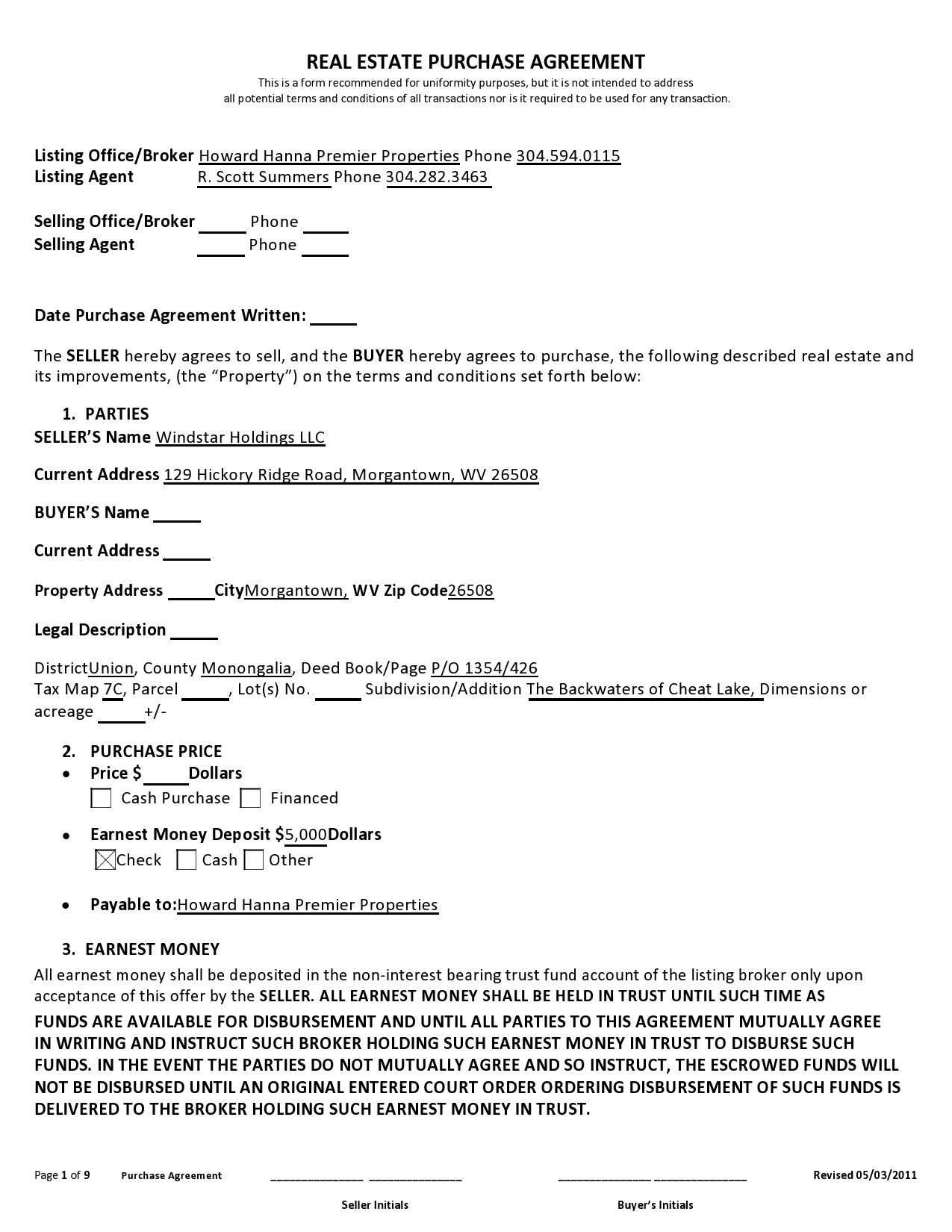

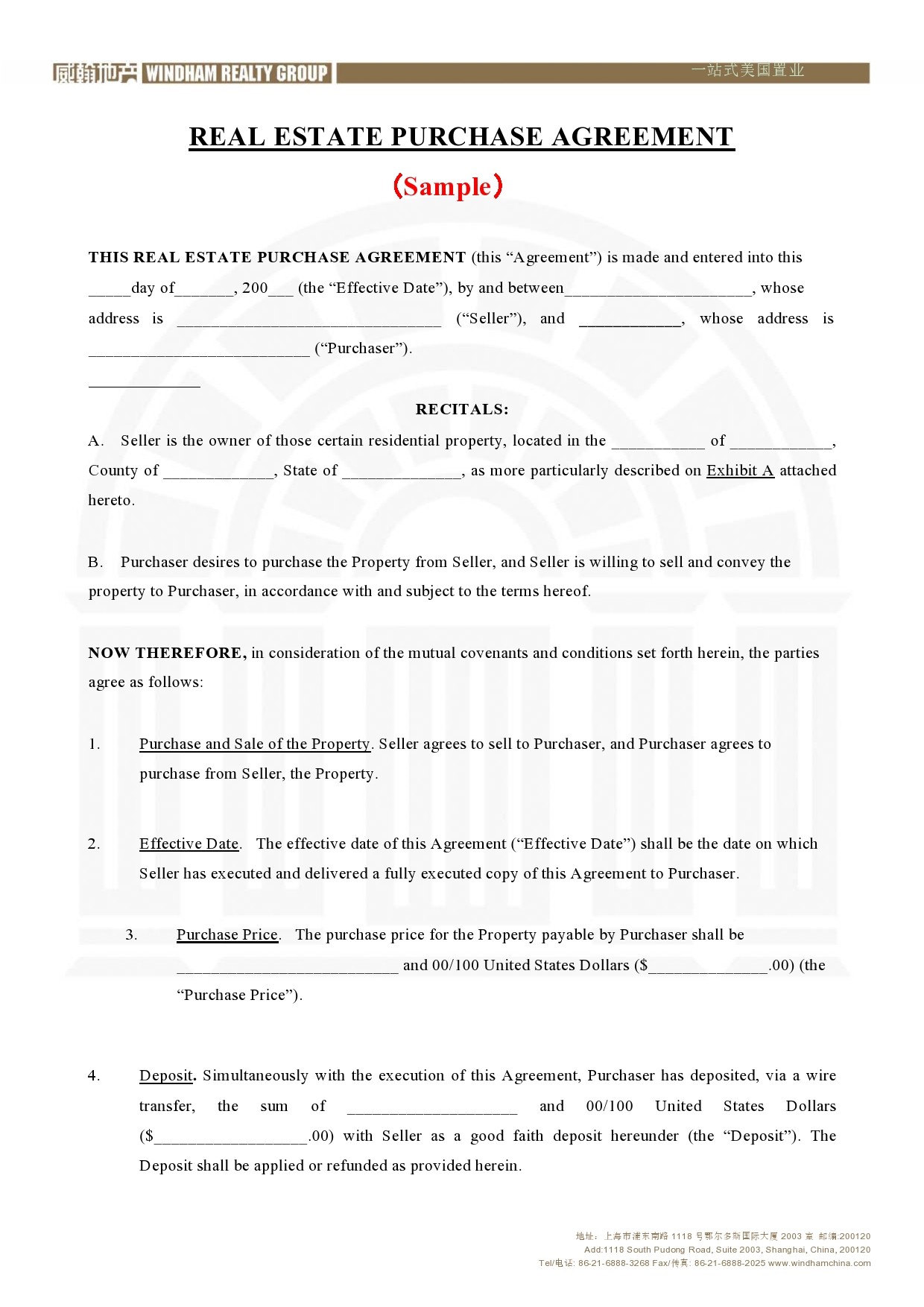

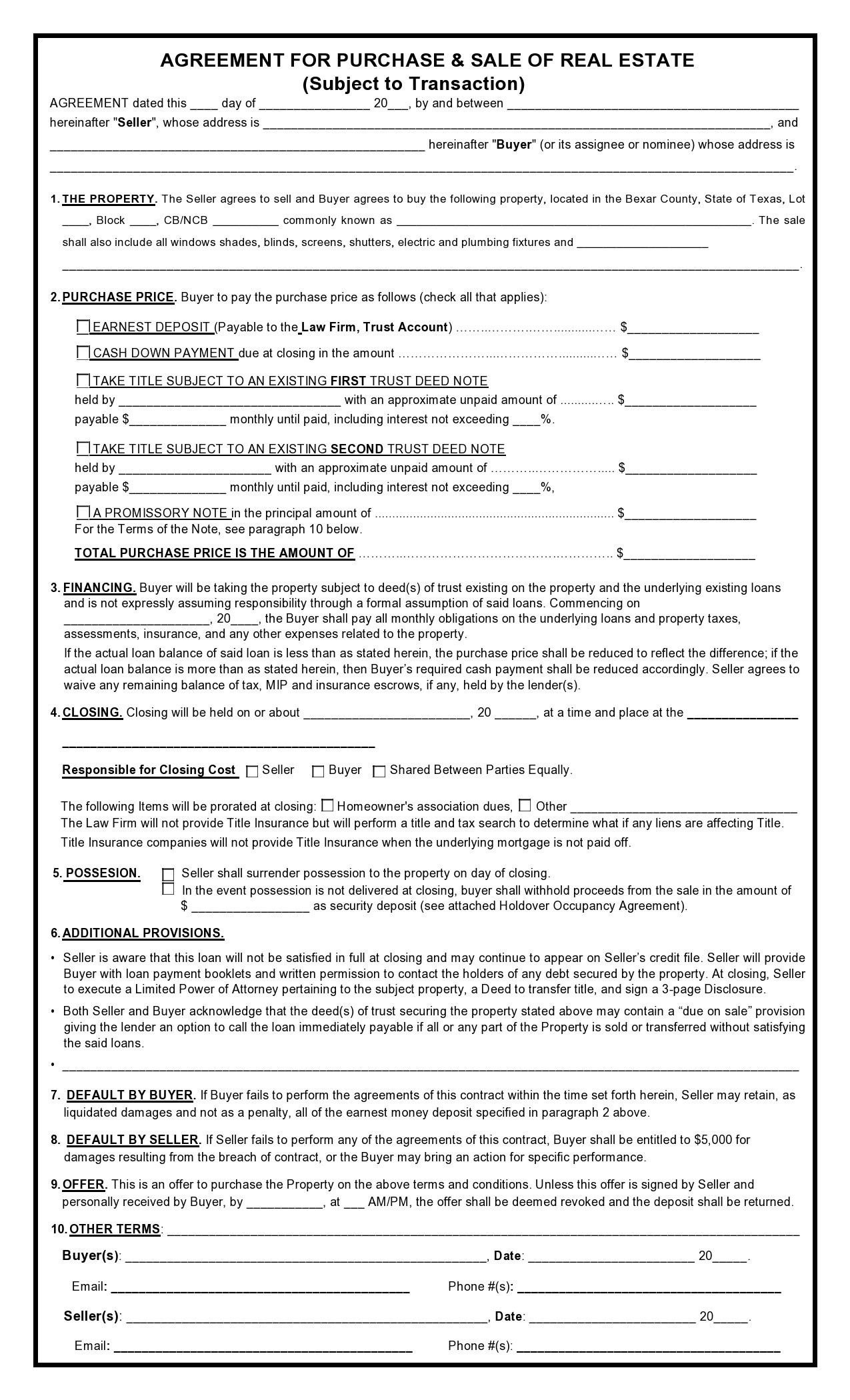

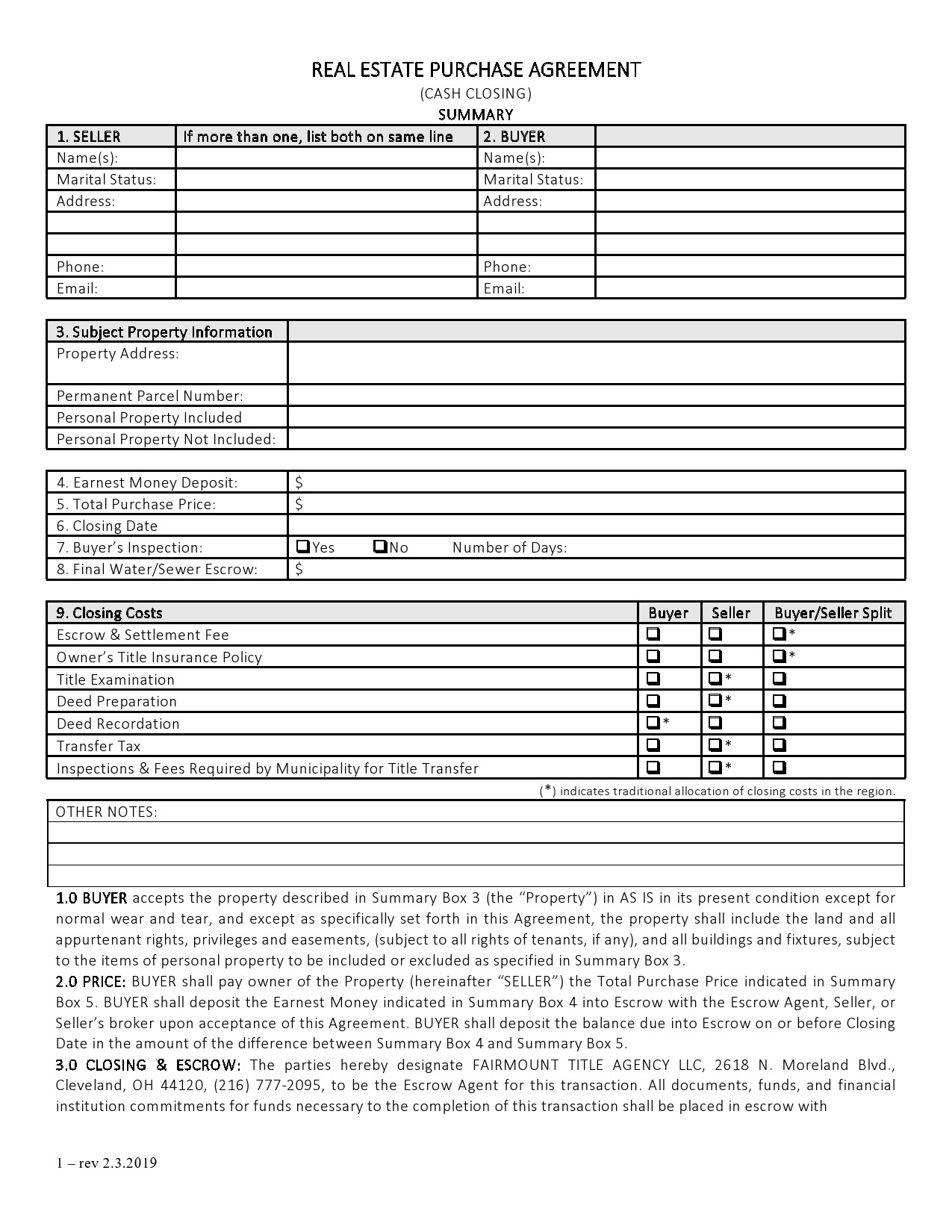

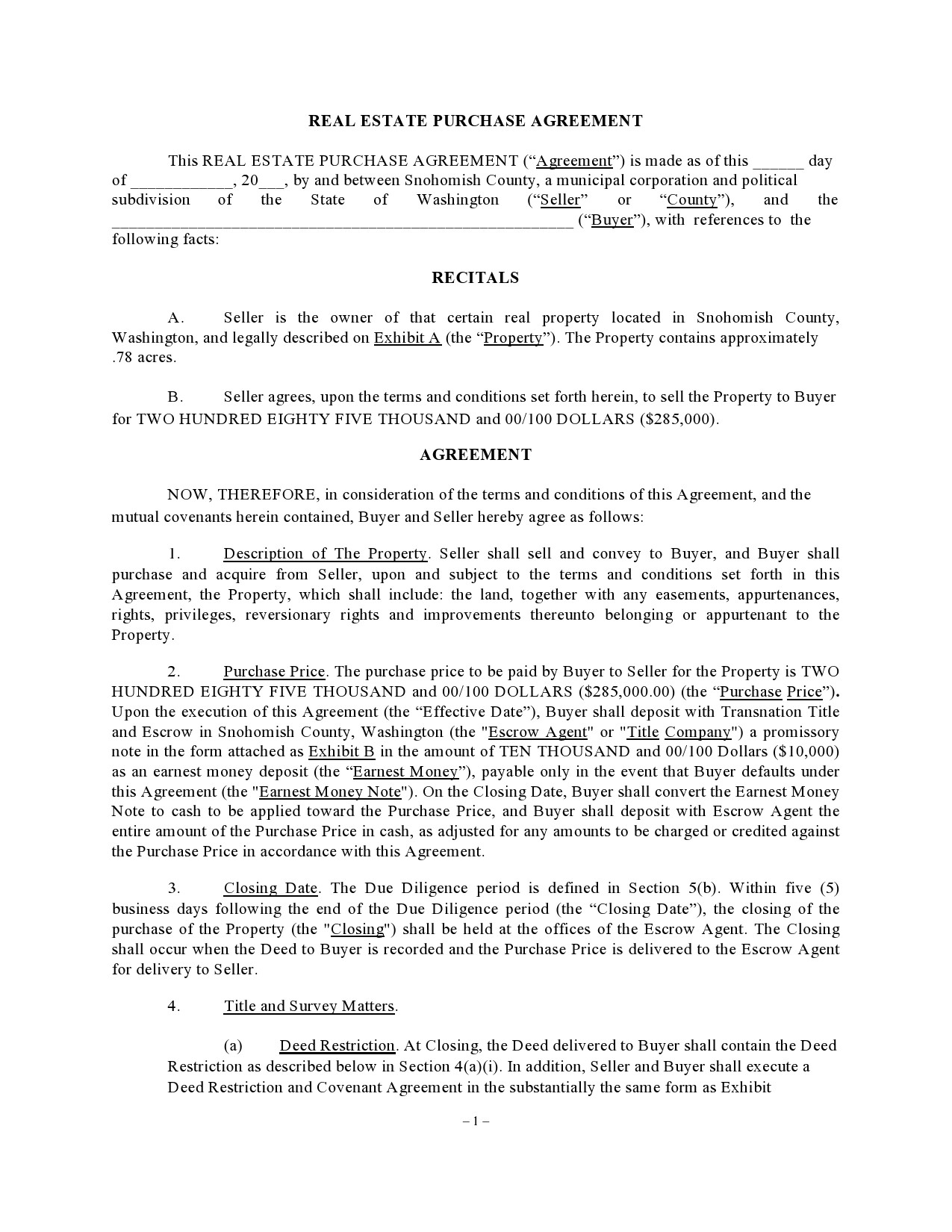

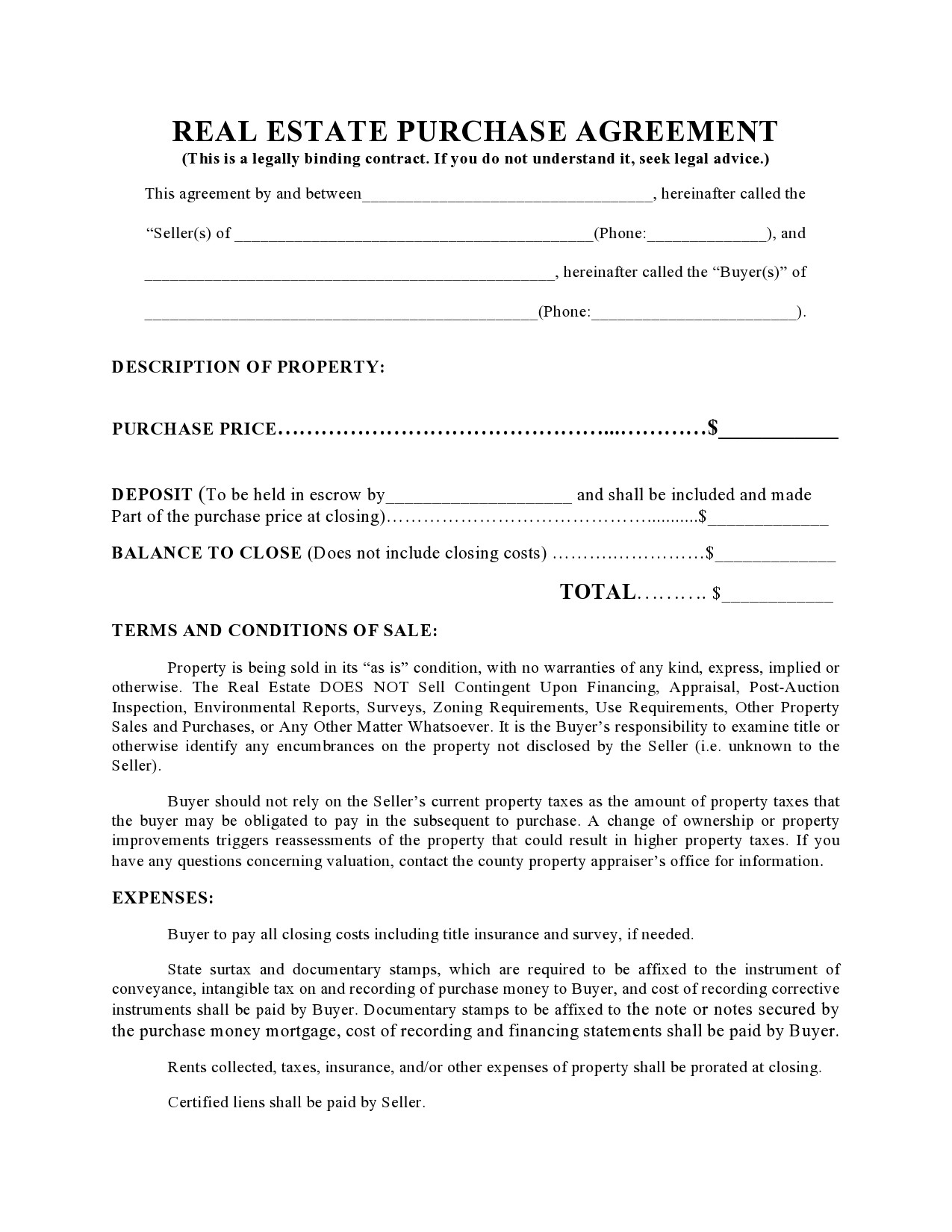

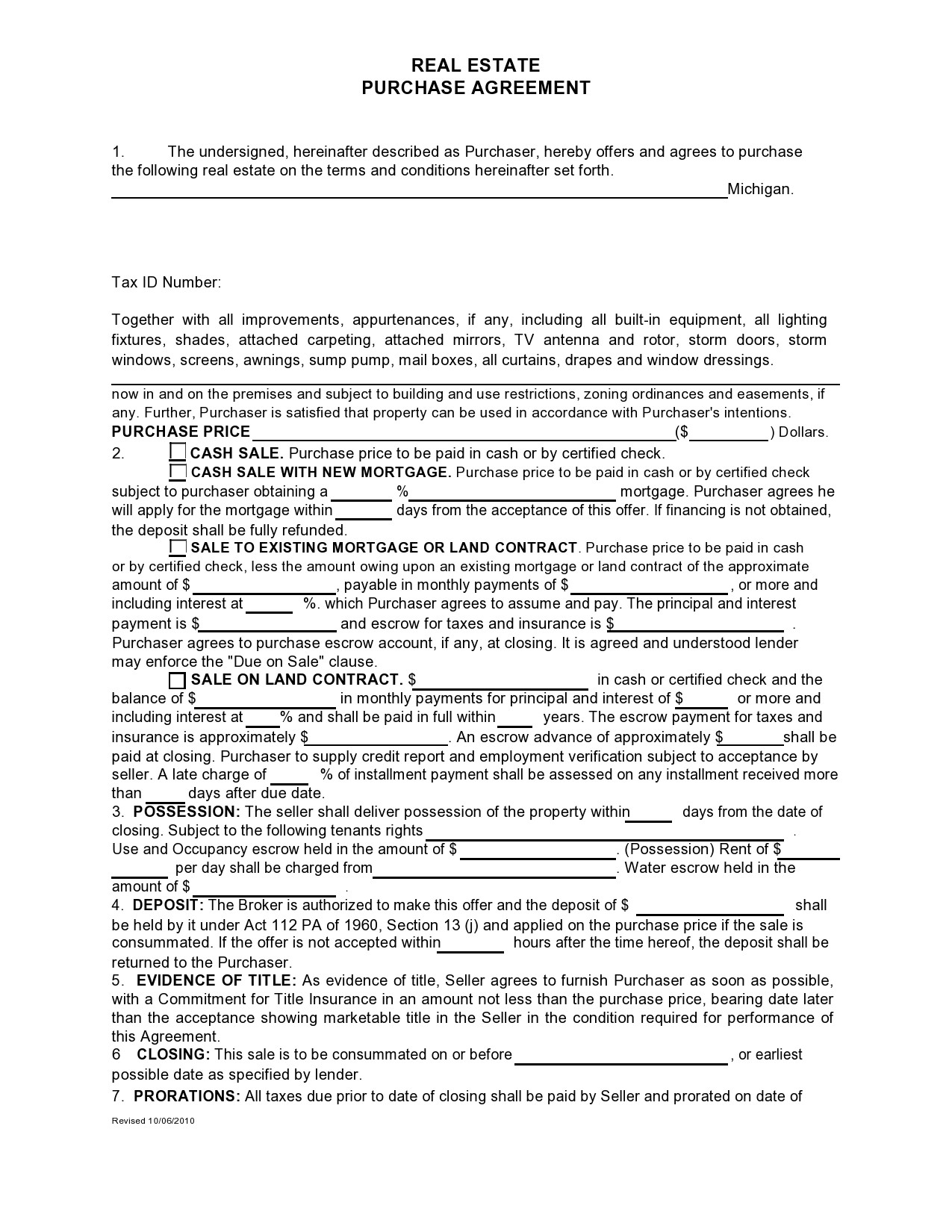

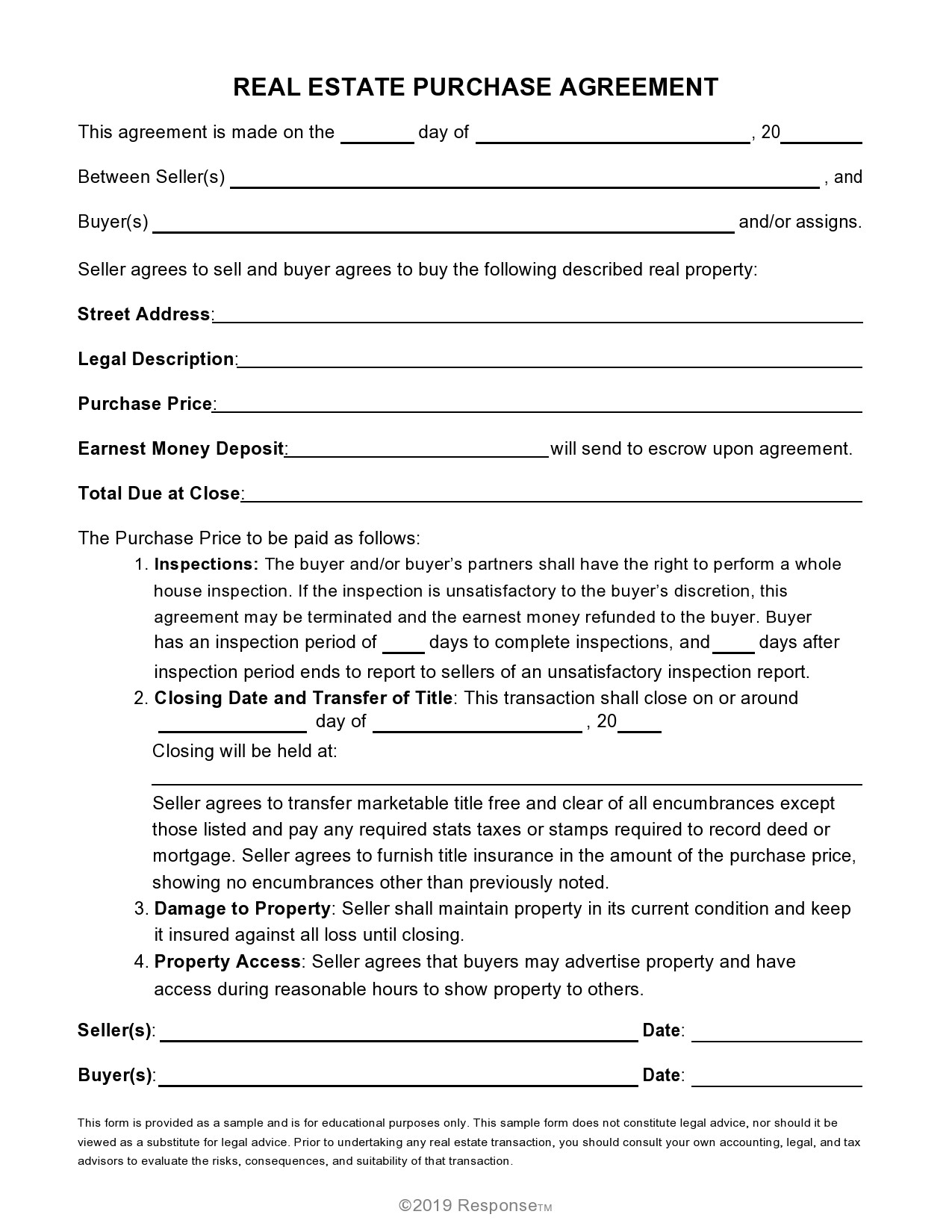

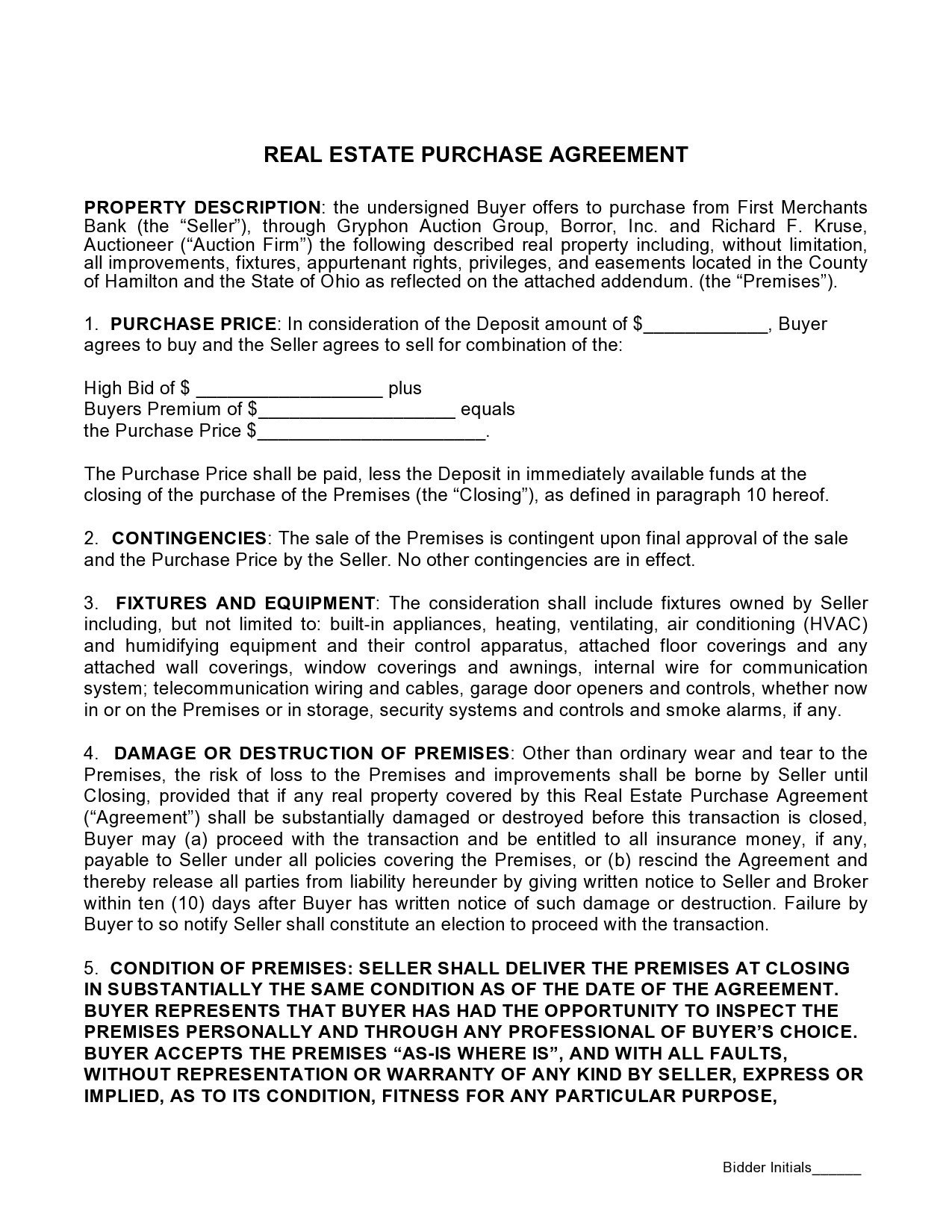

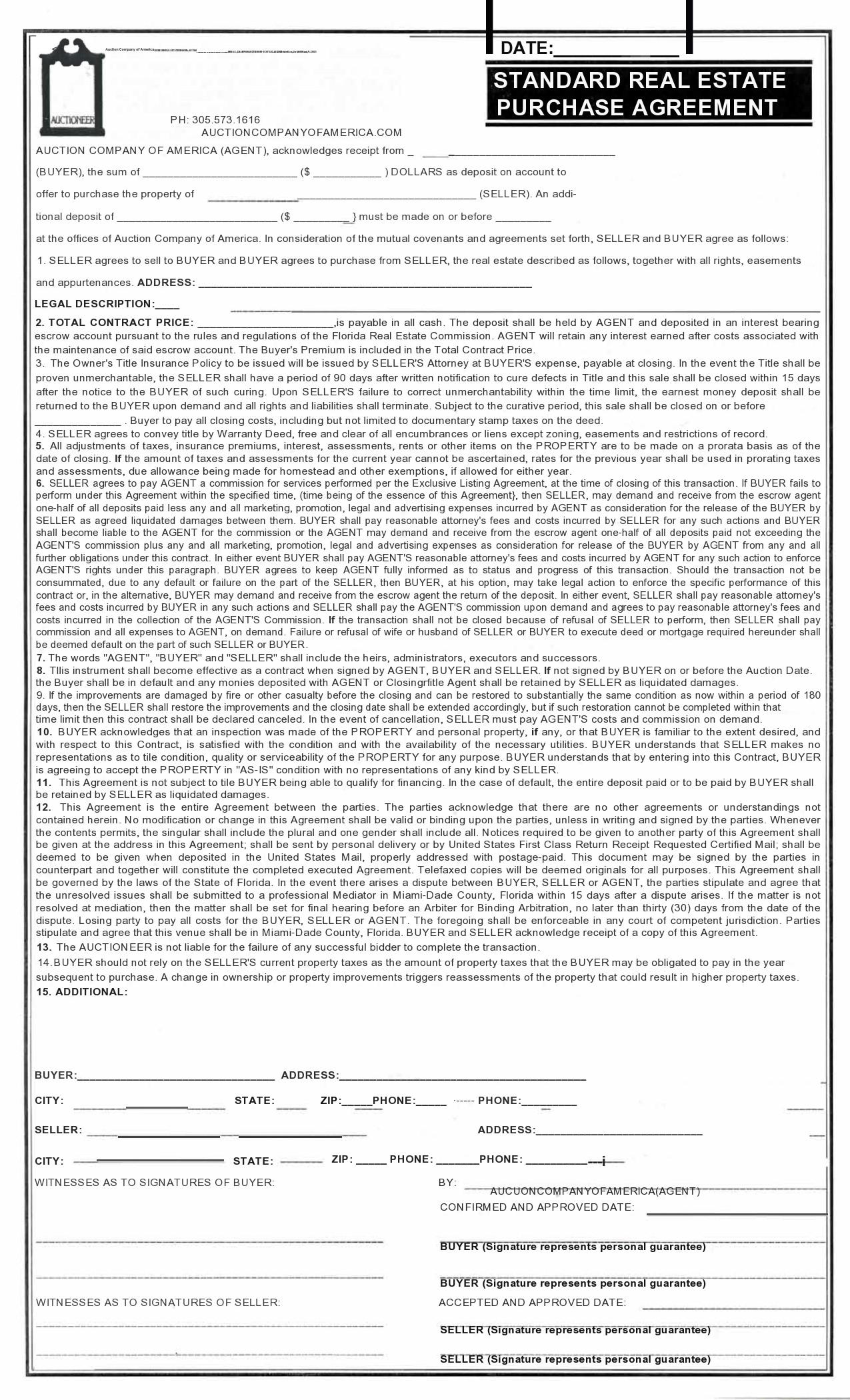

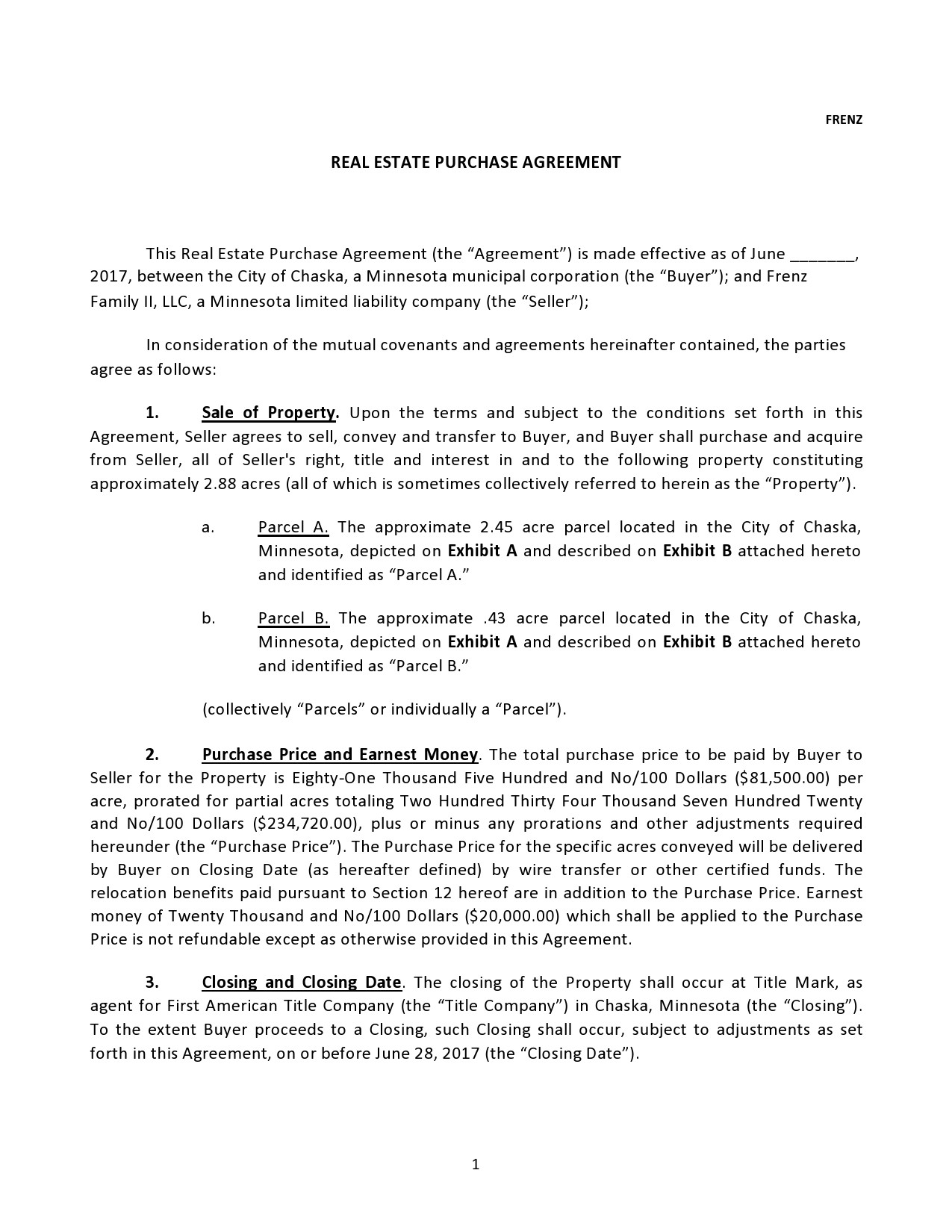

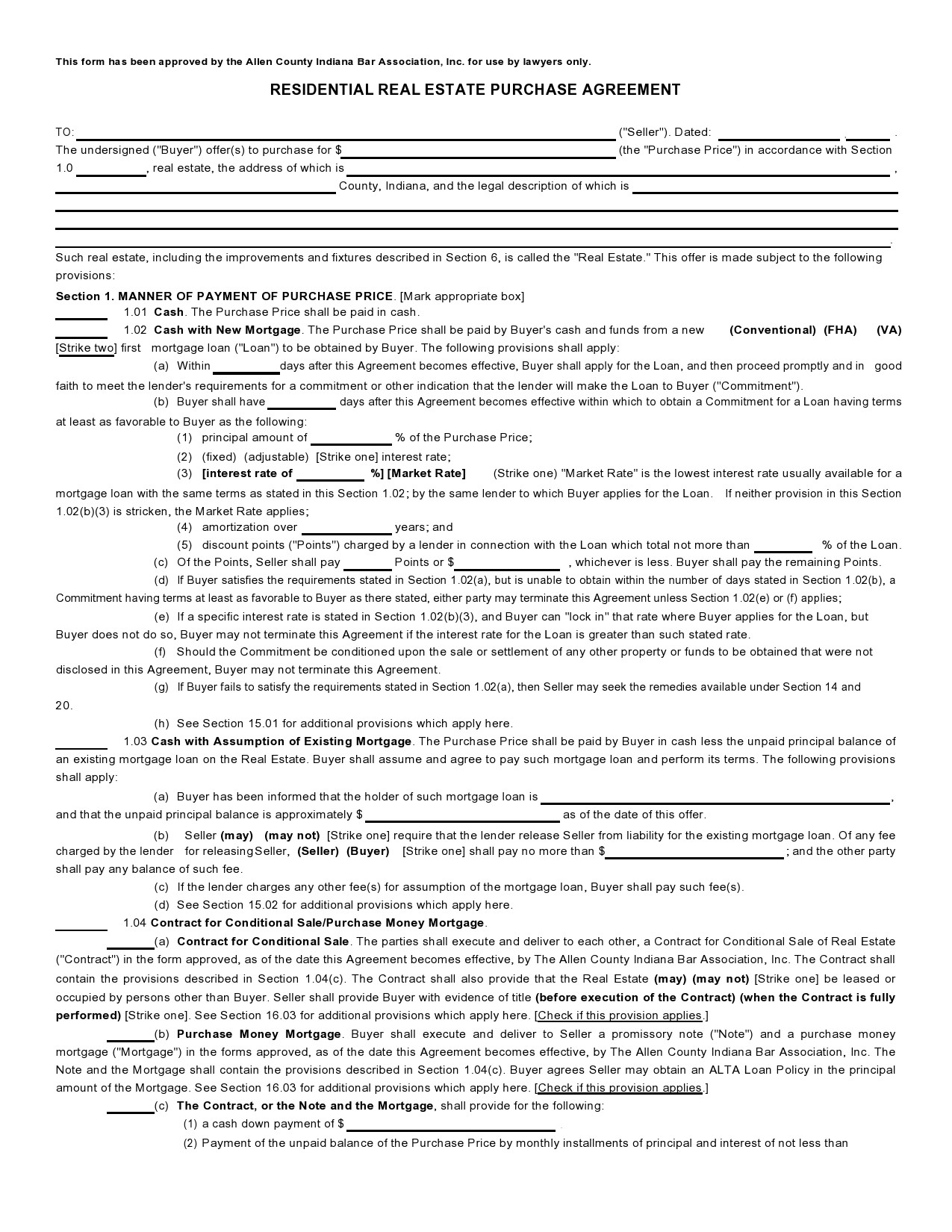

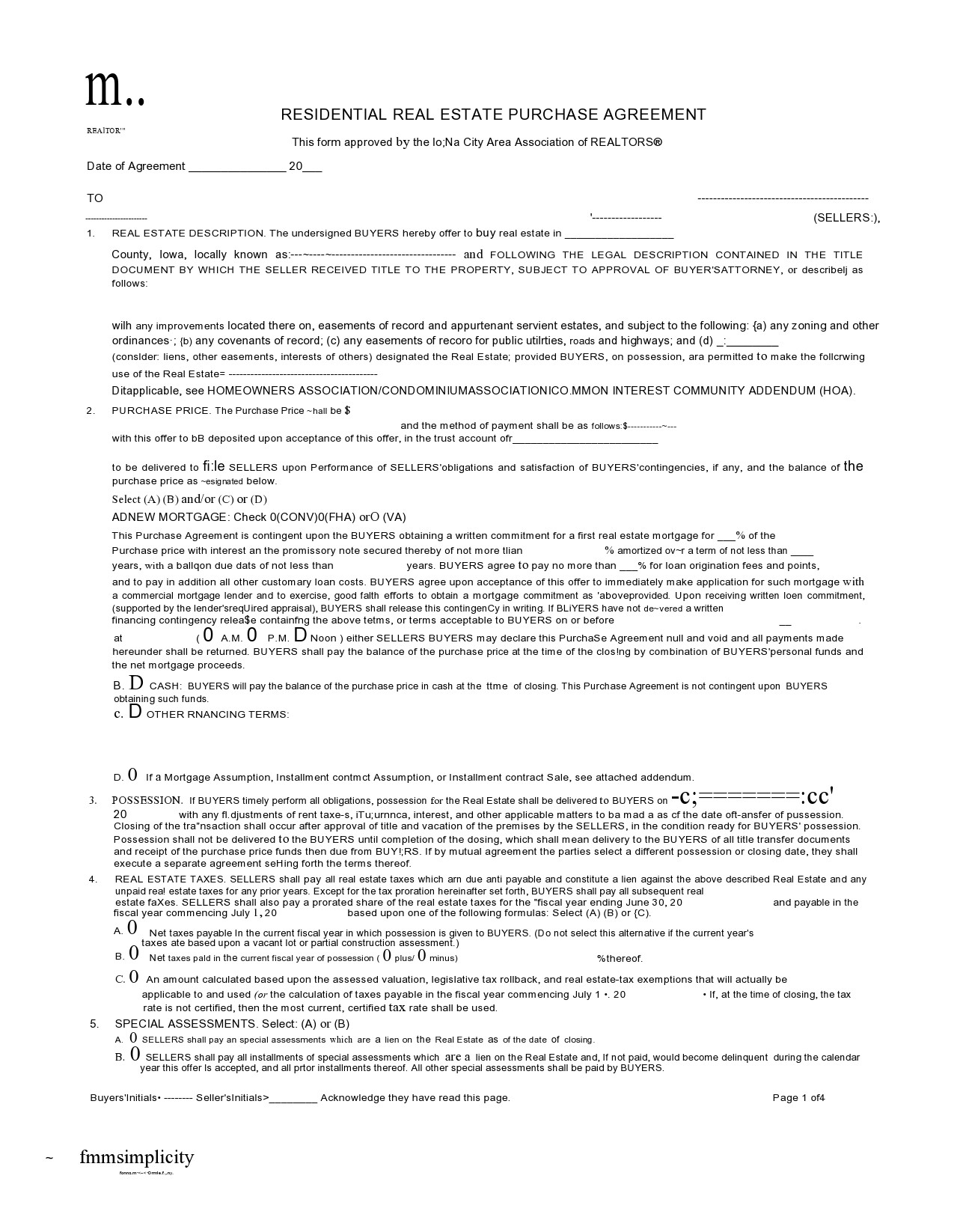

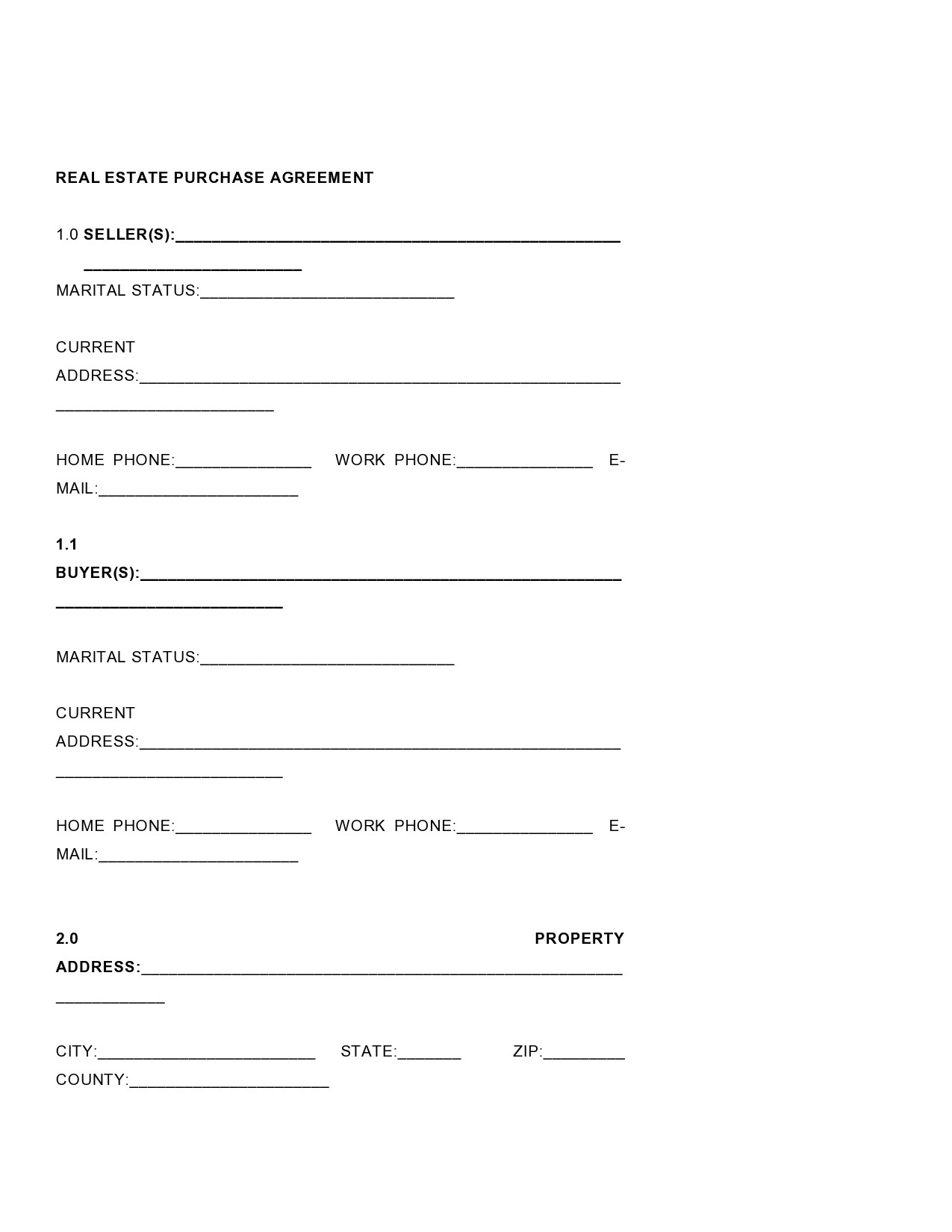

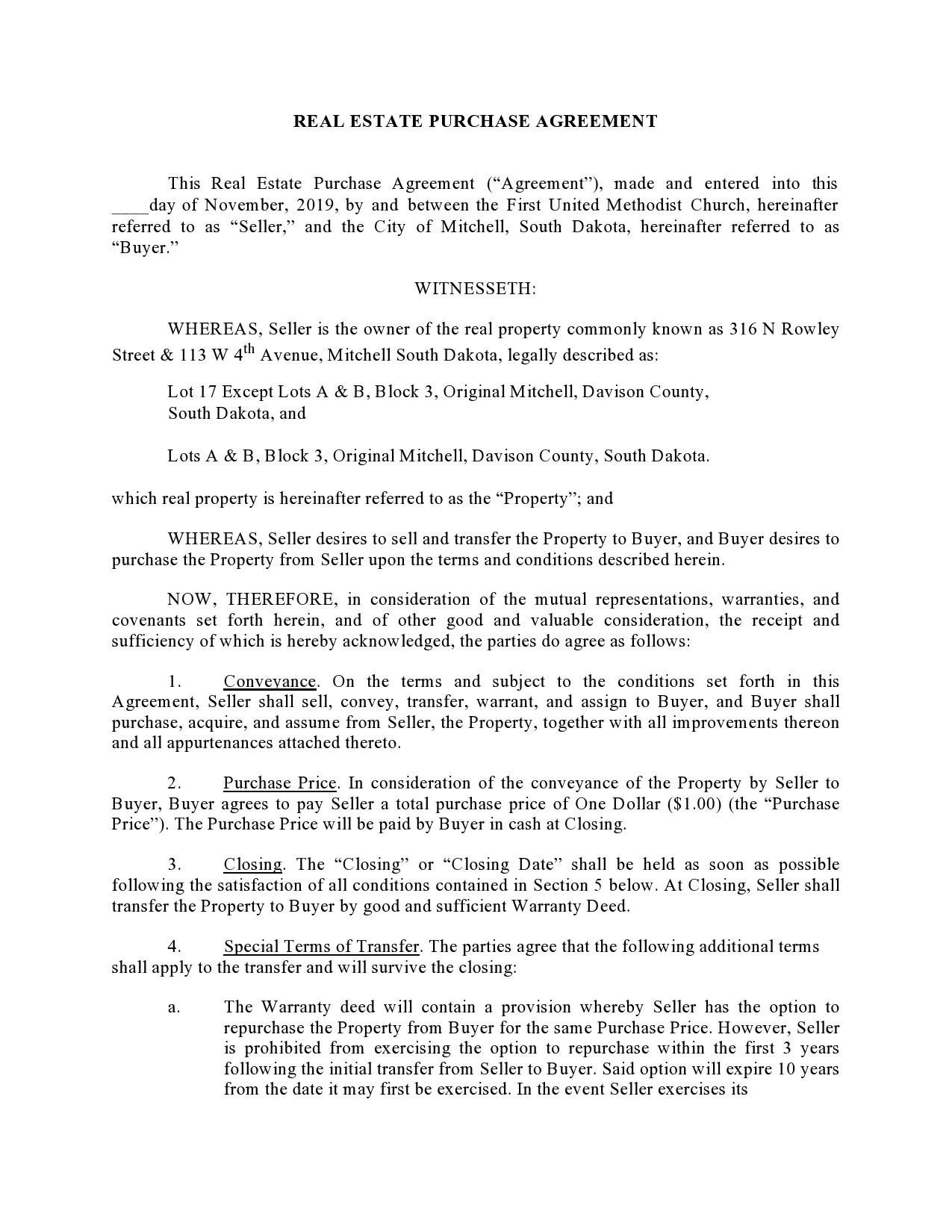

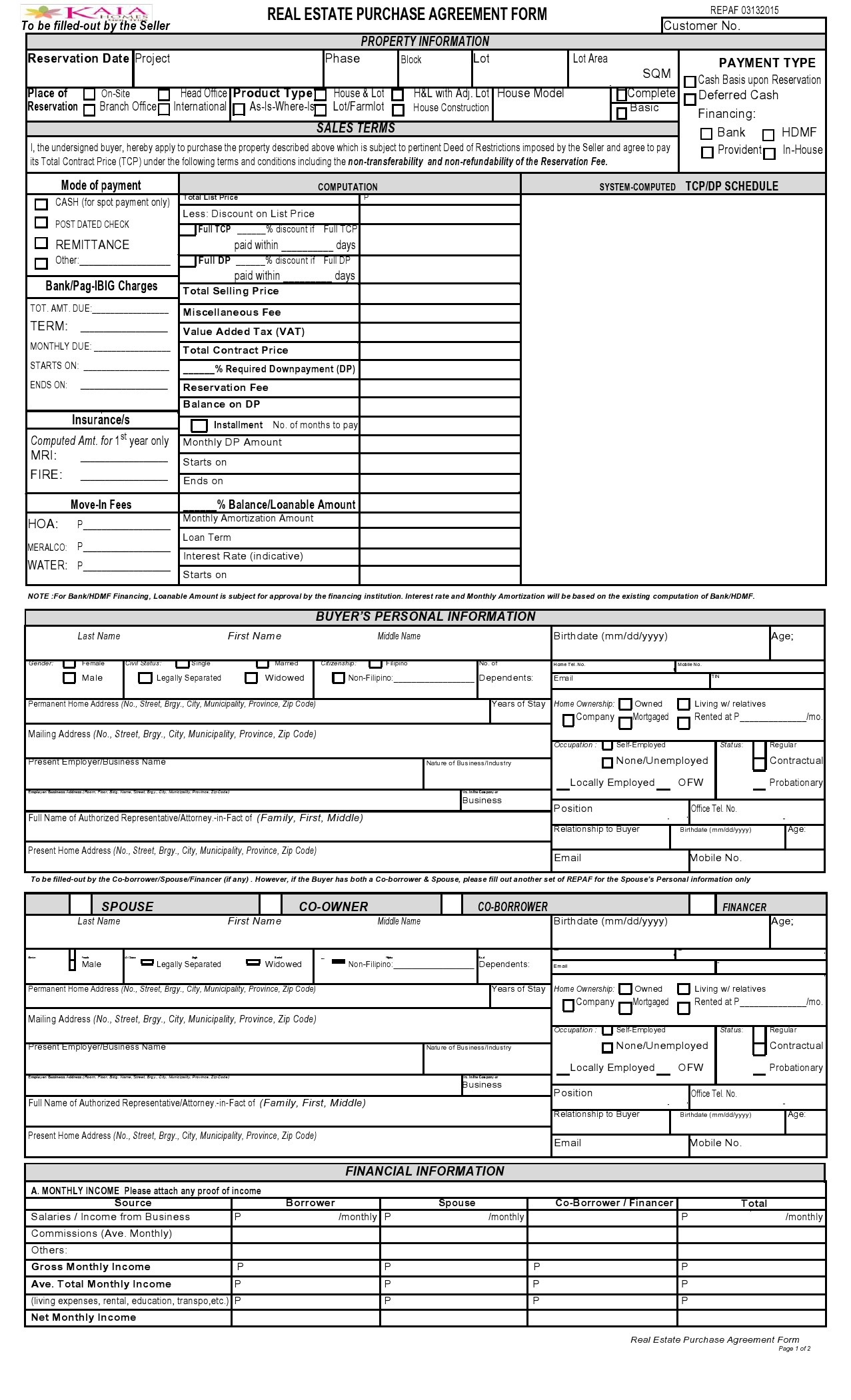

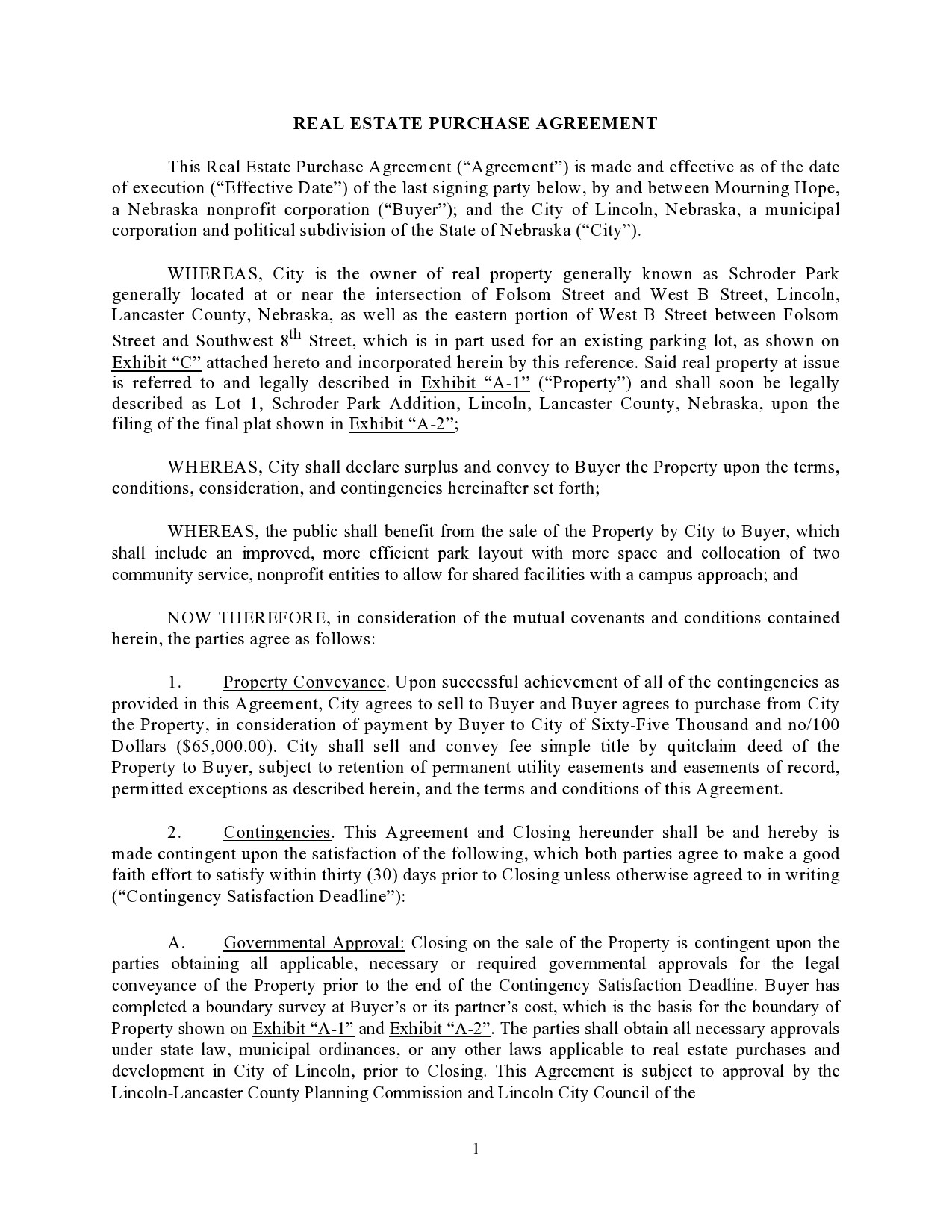

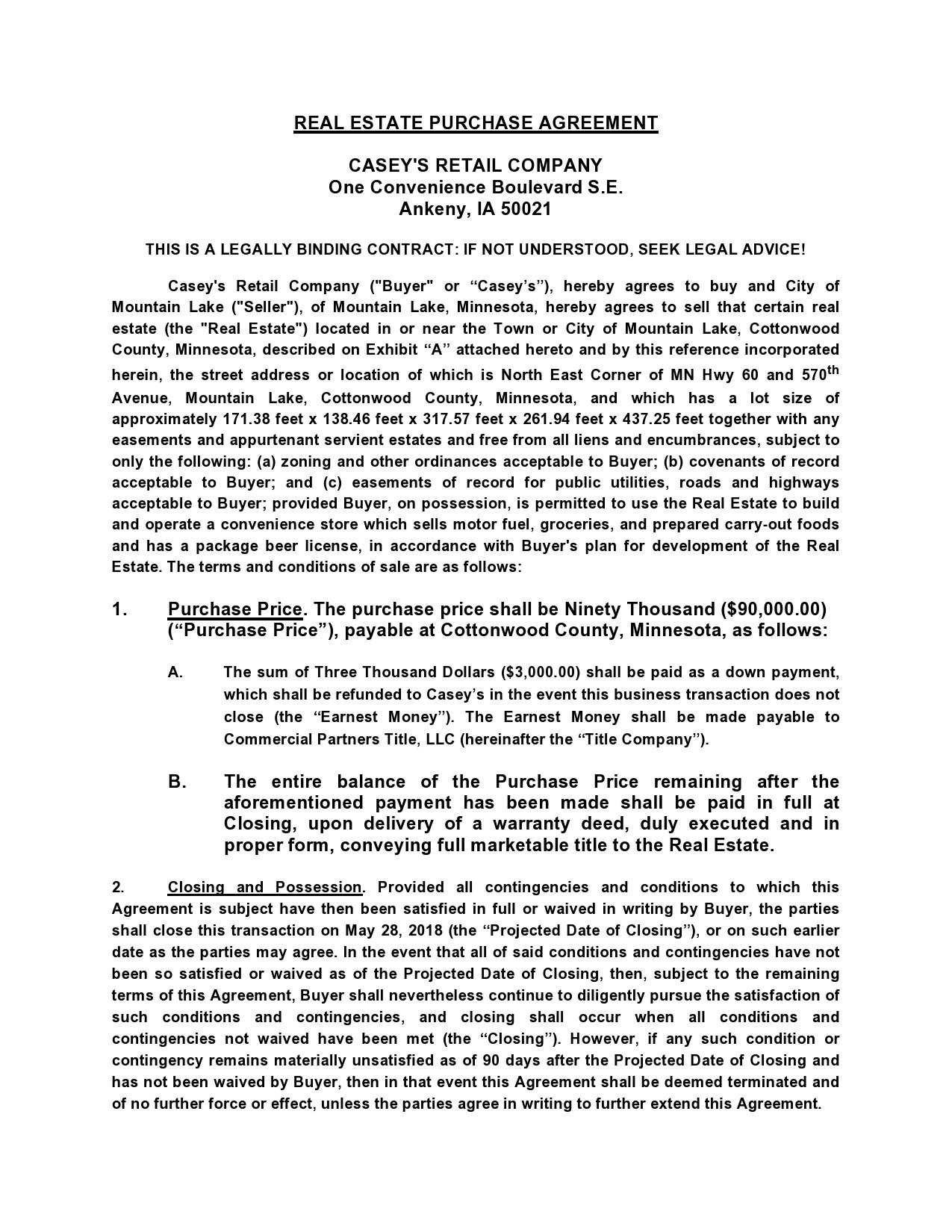

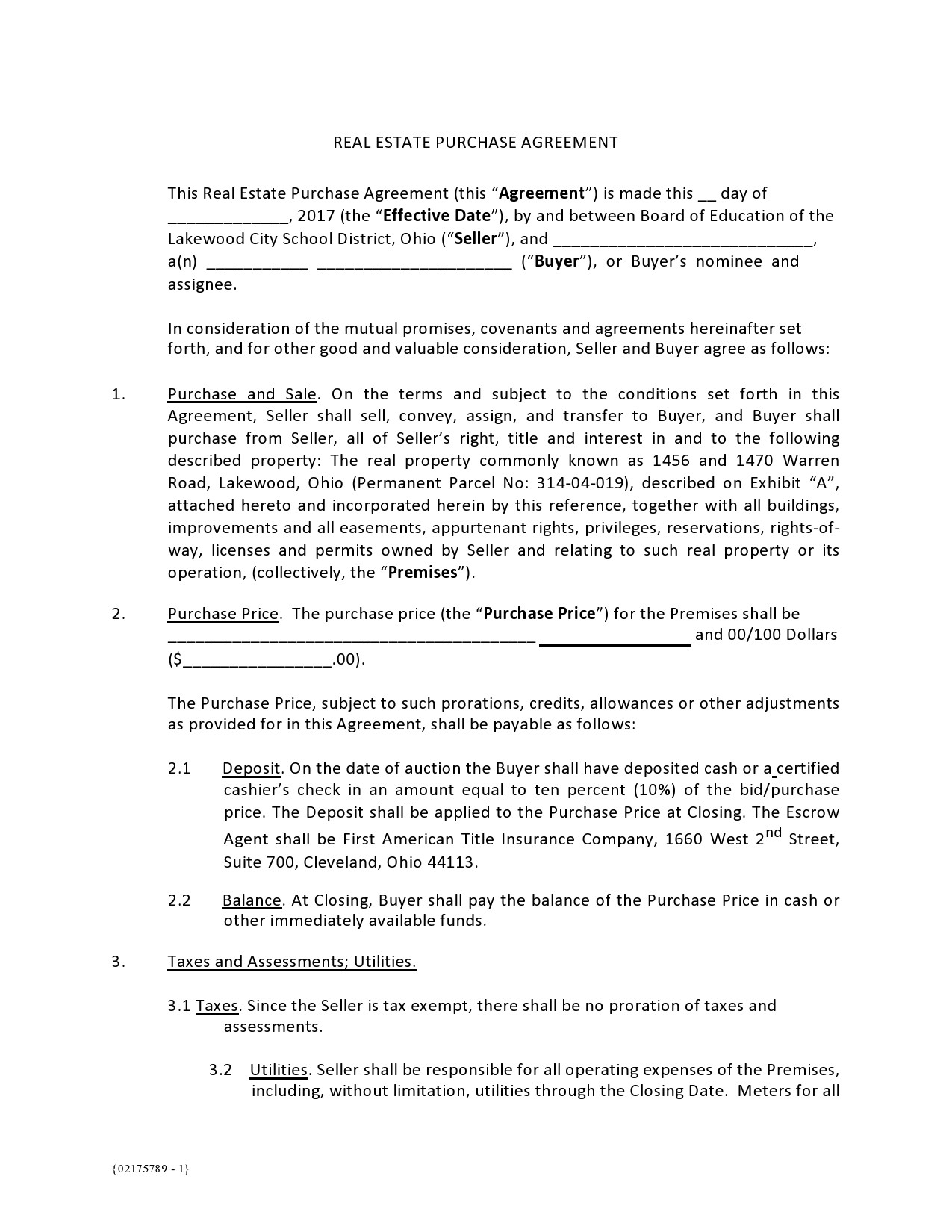

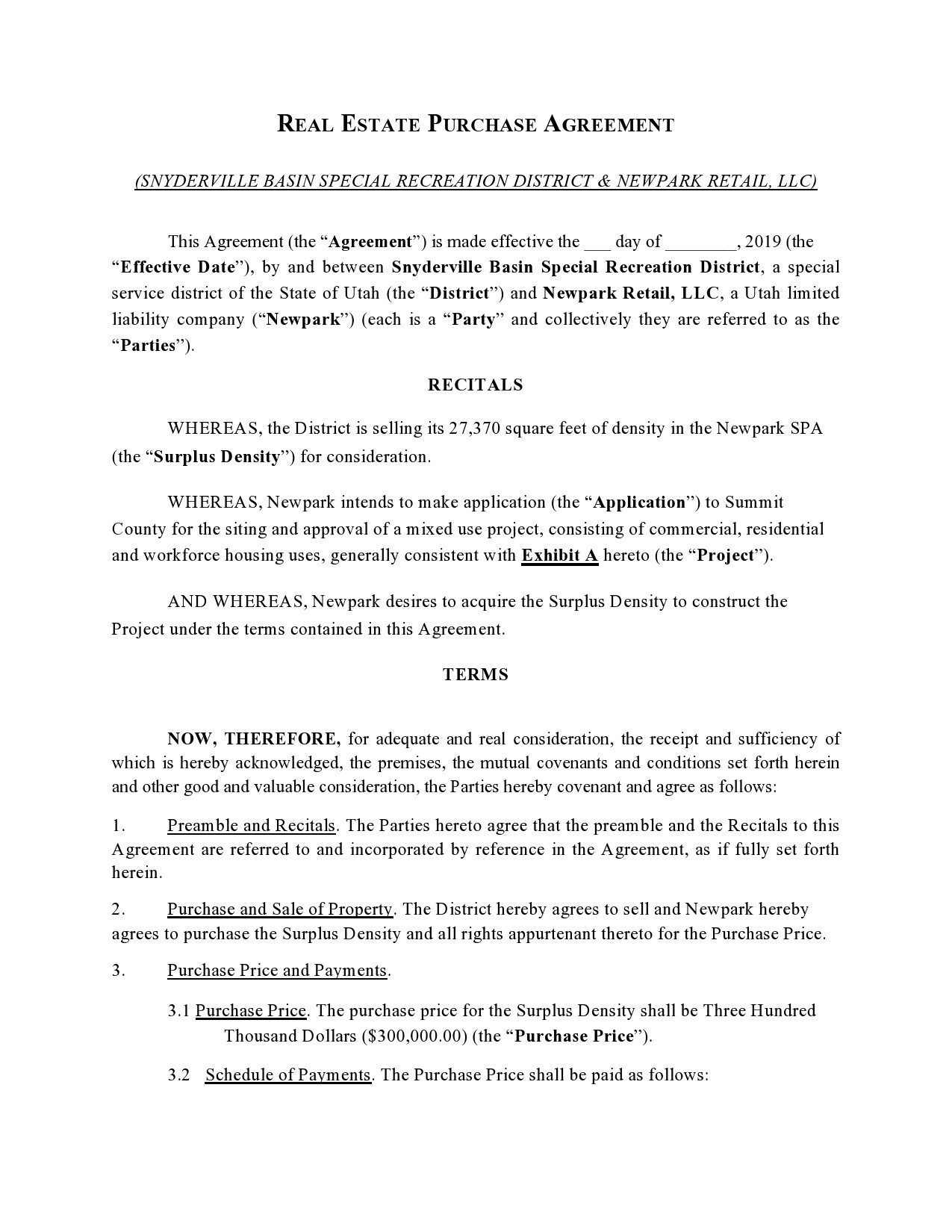

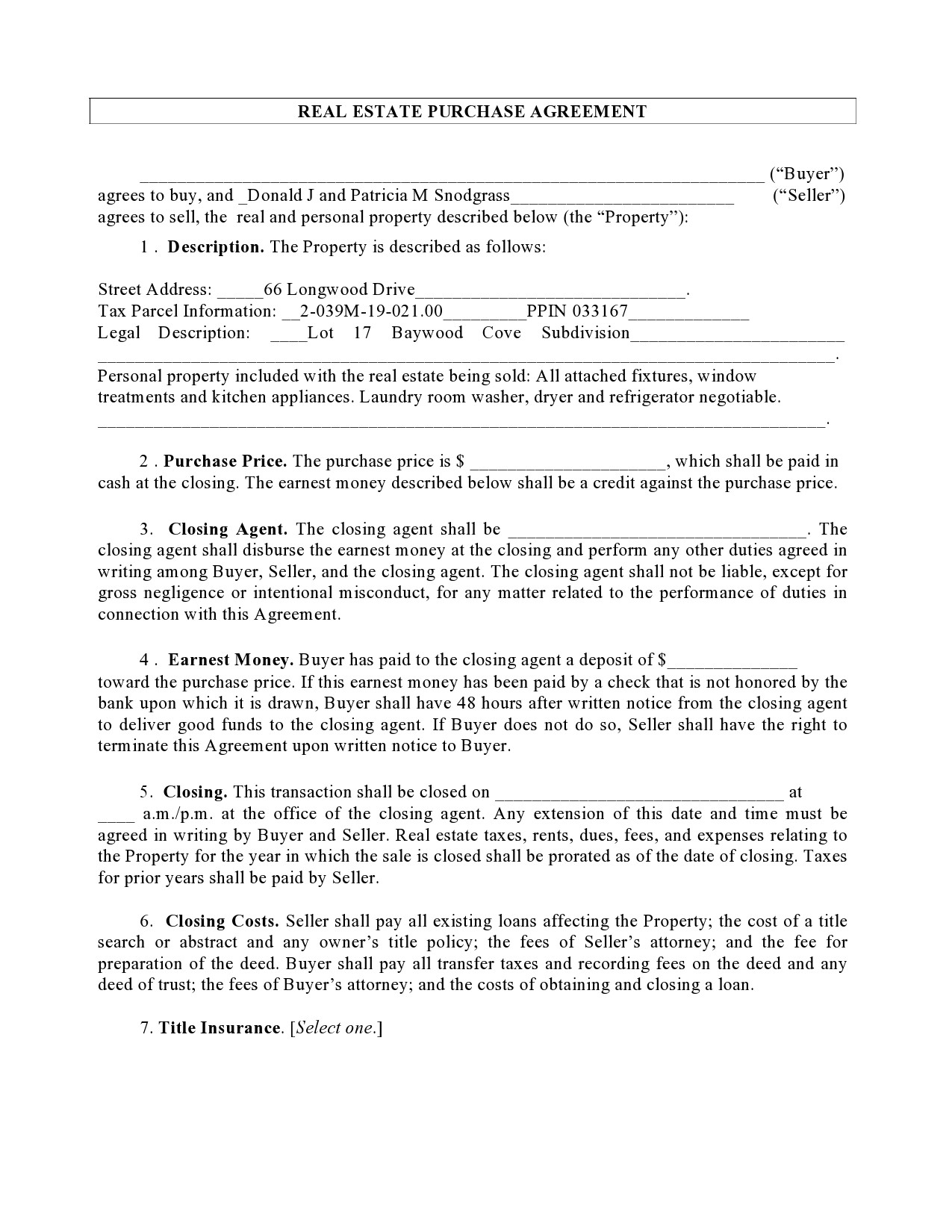

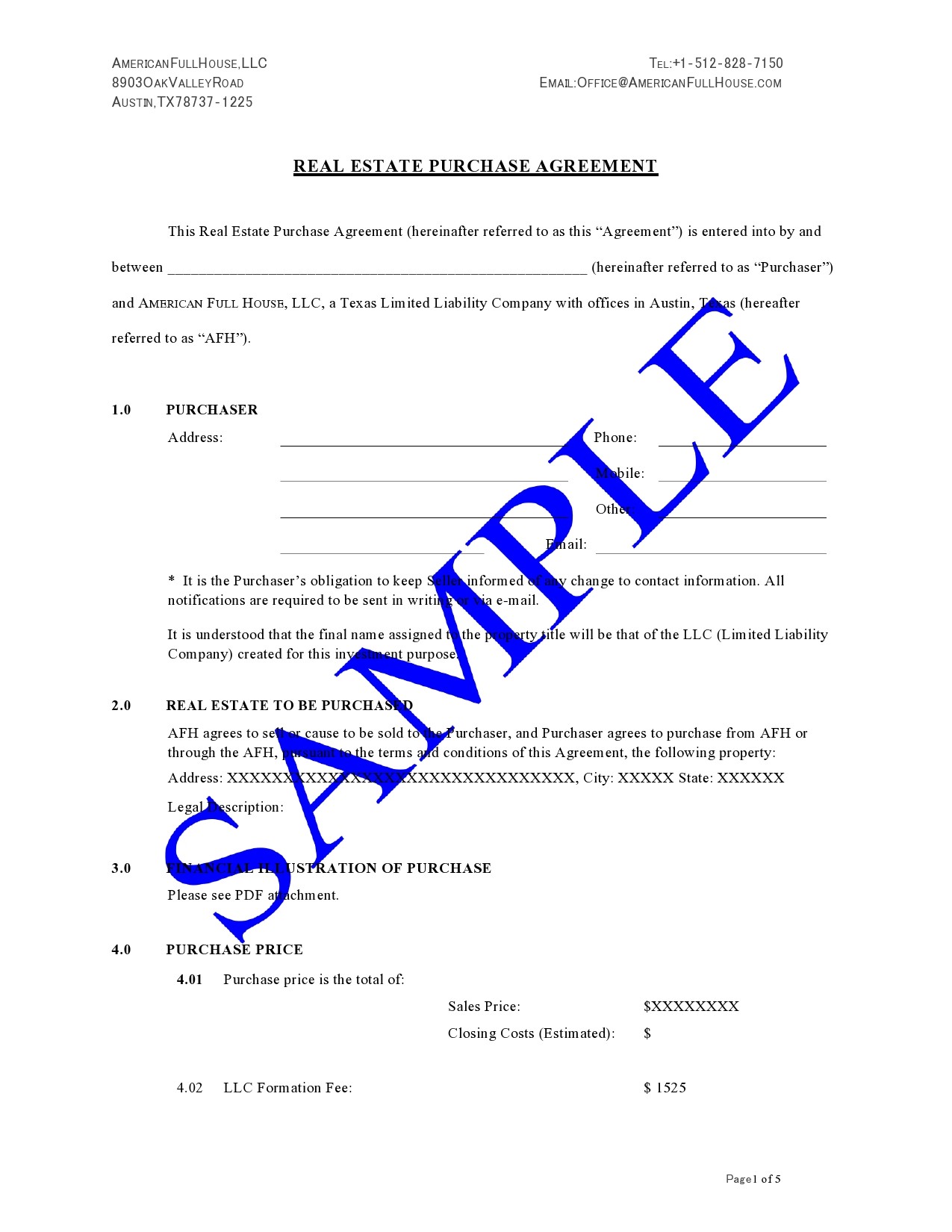

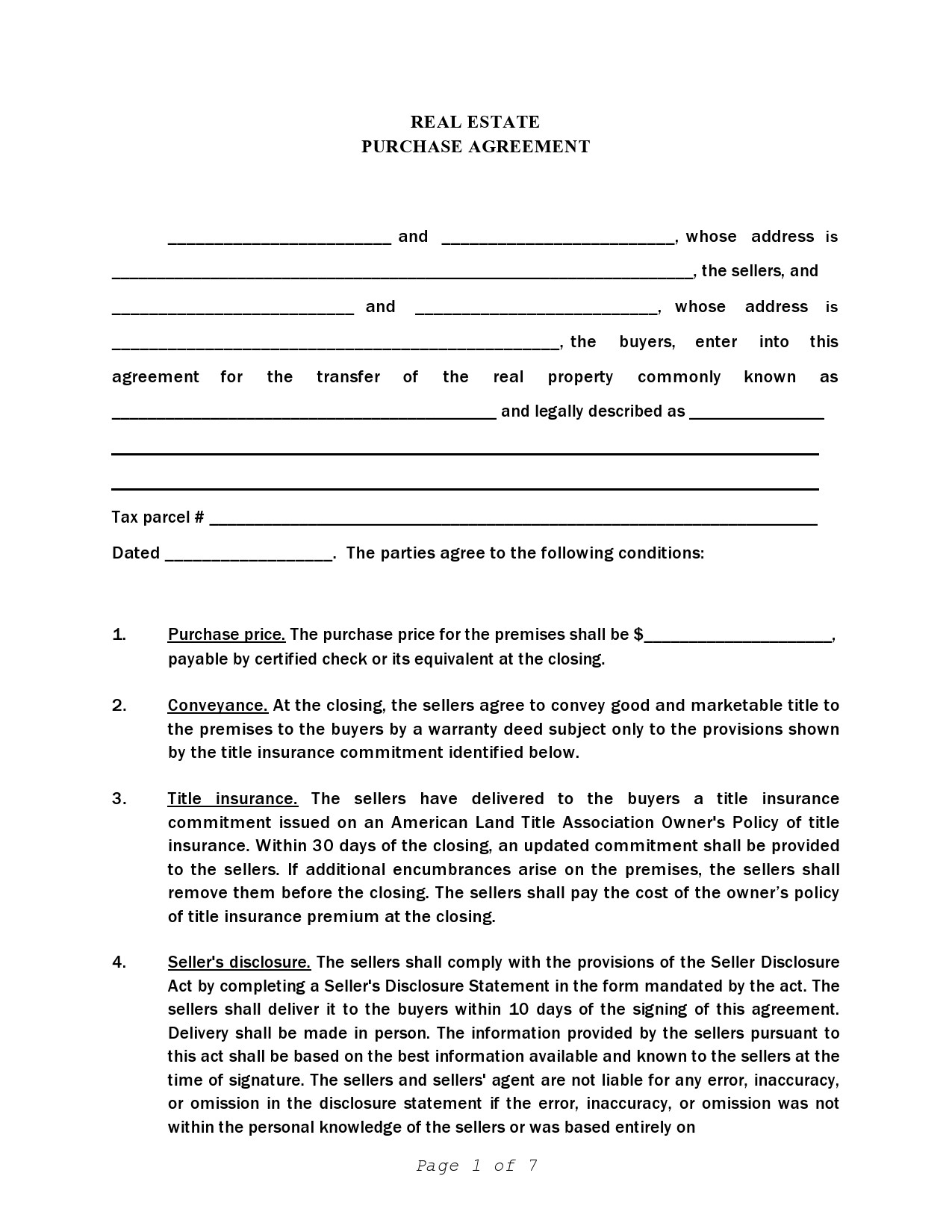

Real Estate Purchase Agreement Templates

By State

What is a Real Estate Purchase Agreement?

A real estate purchase agreement is designed to help spell out the terms in which the seller and buyer agree to engage in a transaction in real estate. When the purchase agreement is completed and signed, the buyer and seller will be under contract until the completion of the sale, which can take one to two months.

The purchase agreement is a binding legal document. Inside it will contain all of the key details about a home sale transaction. These agreements will include

- The closing date. You can add an addendum if something happens and the date needs to be moved since this is common with real estate.

- The amount the buyer is willing to pay for the property.

- The amount of earnest deposit money.

- What happens if either party breaks the terms of the contract

- The seller concessions for the property

- Any contingencies such as inspections or the funding falling through.

When the buyer makes an offer on a new home, they will propose conditions for the sale. This will include all of the important financial details above. They can write this with the help of their agent or use a template as well.

The seller will then receive the house sale contract and can look over the details. It is possible they will do a counter-offer, most often with the proposed price on the home, but possibly for other reasons like moving the closing date.

Following the negotiations, which can happen on both sides, the buyer and seller will come to an agreement and then sign the purchase agreement for the home. They enter into the contract and will need to follow the terms of that contract to the end of the process. At closing, the funds will transfer to the seller, the buyer will take possession of the property, and the contract is fulfilled.

Real Estate Contracts

Components of the Real Estate Purchase Agreement

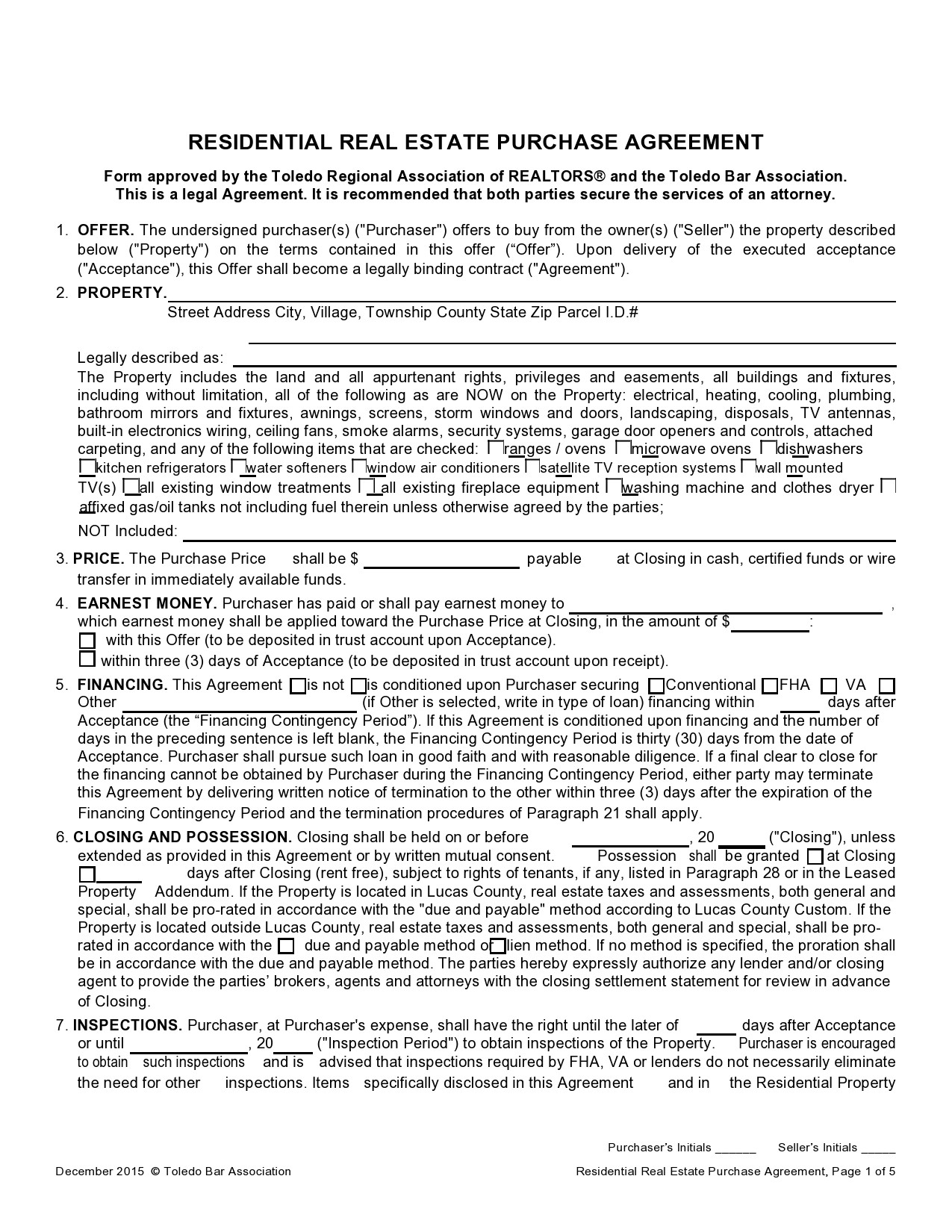

A real estate sales contract is a document that will break down all of the details of a transaction for a specific property. Depending on the agreement, there may be a number of pages within the document.

Each purchase agreement will be unique and depends on the buyer and seller, the property, and their local and state laws. Some of the common elements found within the document include:

- Information on the buyer and seller: This information will include the full names and any contact information for both parties.

- Details on the property: This can include the property’s address, any necessary description of the property, and other important details.

- Purchase price: This will include the amount the buyer has agreed to pay on the property, including deposits, seller’s concessions, and additional costs for the transaction.

- Financing: These details will help show how the buyer plans to pay for the property. Most properties will use a mortgage, but it could include assuming the seller’s existing mortgage or paying with cash.

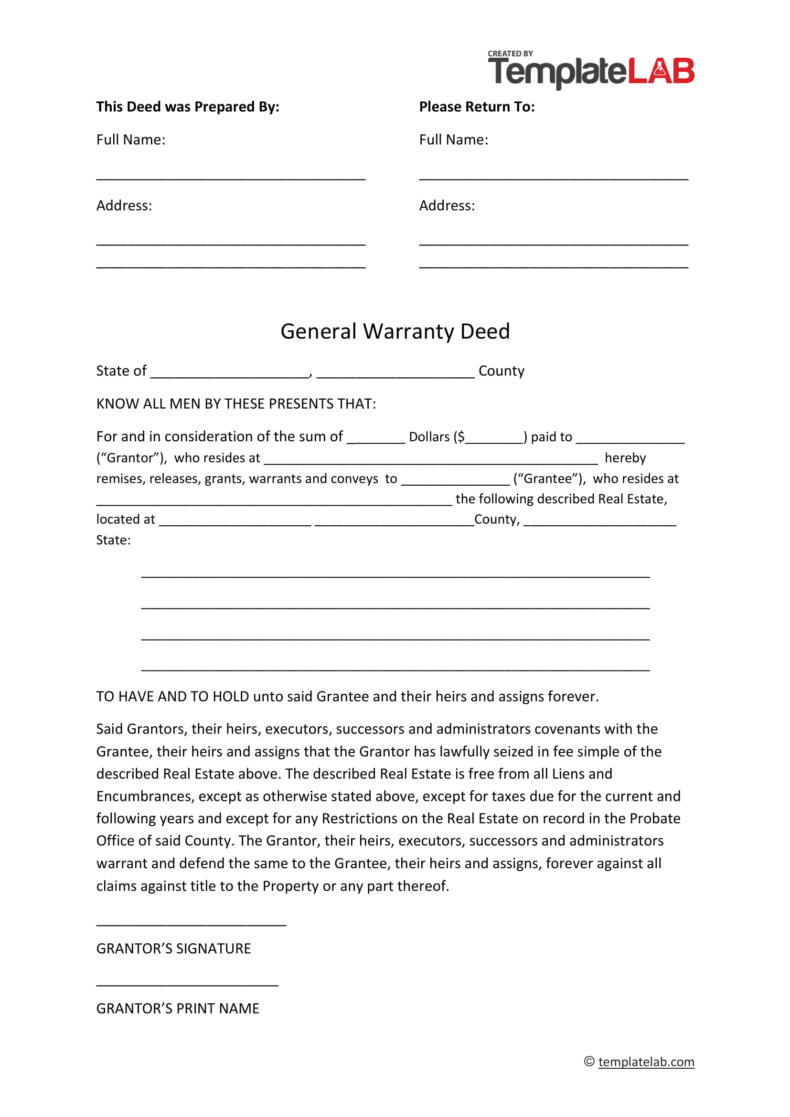

- Representations and warranties: These are statements of facts made by the seller that tells the buyer about the composition, structure, and condition of the property. It is often disclosed through the warranty deed.

- Fixtures and appliances: This will include any items in the home that are part of the purchase. Most appliances automatically stay with the property, but having them listed down, along with any additional fixtures, can help make it legally binding.

- Title insurance: This will include a note that specifies whether the seller or the buyer will need to purchase title insurance. This title insurance will protect against any potential discoverable defects within the property.

- Property taxes: This will include any of the property taxes and which party will be responsible for them.

- The closing date: While this can change, the closing date will be an important part of the contract. This helps both parties know when the sale of the home will be complete.

- Contingencies: This will be any loopholes that let either party out of the agreement if things do not go as planned. Inspections and financing contingencies are common. Some buyers may make the purchase contingent on whether they are able to sell their previous home.

- Earnest money: The purchase agreement should show that the buyer put down an earnest deposit on the property.

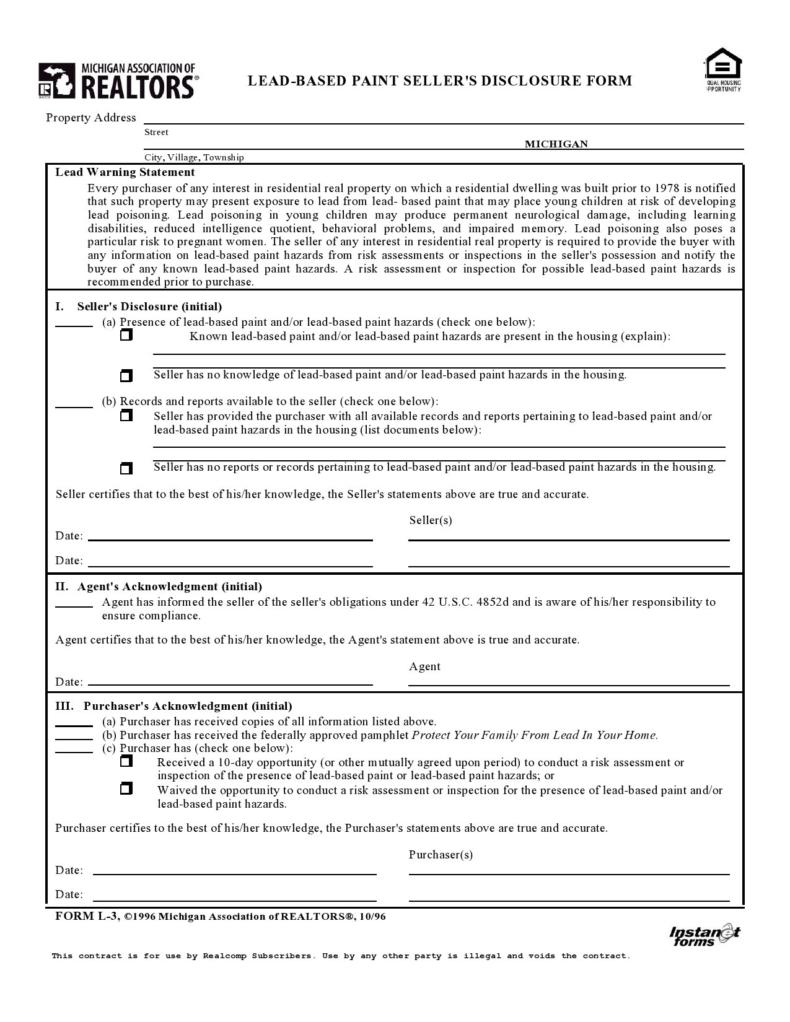

Depending on the area where the purchase agreement is, there may be the need for a lead-based paint disclosure and other disclosures to help the buyer make a smart decision about the purchase. The seller is responsible for adding these in or showing them to the buyer ahead of time.

Once both parties have negotiated and are satisfied with the real estate purchase agreement, both parties will need to sign the document to make it legal. Like any other legal document, the purchase agreement is binding for both.

Why are Contingencies Important for a Purchase Agreement?

Very few real estate contracts will go without a contingency on them. This ensures that certain conditions are met before the closing of the home. There are different contingencies that the buyer can add to the purchase agreement to protect them before making a big purchase.

Some of the most common contingencies include:

- Inspection contingency: This one will allow the buyer to walk away from the deal if the home inspection finds big defects in the property and the seller won’t take care of it.

- Appraisal contingency: This will ensure that the buyer will not pay too much for the home. They will look at the appraisal to see how much the home is worth.

- Financing contingency: This will protect the buyer if there is some reason the buyer is not able to get the mortgage on the property. They can use this to get their earnest money back as well.

- Title contingency: A title report is there to help the buyer ensure there are no problems with the property or liens against it that they would assume if they purchased the property.

- Home sale contingency: This is an insurance that will state that the purchase of that property is dependent on whether they sell their home first.

The buyer can choose which contingencies they would like to include. If it is a buyer’s market, then the seller may be more agreeable to more contingencies at that time. In a hot seller’s market, the buyer may want to keep the contingencies to a minimum to help save money too.

Home Purchase Agreements

How Do I Write a Purchase Agreement for a House?

A house sale contract is an important legal document that outlines a real estate transaction. All applicable information must be included in the document, though addendums for house inspections, changing the closing date, and other changes can be added if both parties agree. Buyers and sellers must ensure that they write the purchase agreement the right way.

When you write this purchase agreement for real estate, the buyer and seller must carefully outline the terms of the sale. Many will use a template from their real estate agent or a real estate lawyer to ensure the legal wording is correct and matches the requirements for the state they live in.

What Happens if I Want Out of a Purchase Agreement?

Once you sign the purchase agreement, you are legally bound by the terms that are inside. A buyer can technically back out in some situations, but it will depend on the wording in the document. You can’t decide that you don’t like the home one day and then walk away from it. The purchase agreement for real estate is designed to help prevent this from happening.

The only way that a buyer or seller can walk away from the purchase agreement is due to one of the contingencies. If there is a major issue with the home, especially if the seller will not fix the issue, then you can walk away from the home. If the funding falls through and you can’t find a backup or the title has liens on it that can’t be removed by the closing date, you can walk away from the deal.

Sometimes the home buyer will need to walk away from the home for other reasons. If they are not due to the contingencies, it is going to cost you. You will lose all of the earnest money, which could be up to 2% of the purchase price of the home and you will lose all of the money you paid on prepaid services, like the home inspection or appraisal.

Getting out of the purchase agreement as soon as possible when you change your mind is the best option. If you wait too long, it can bring in legal trouble and other potential problems as well. In some cases, the sellers will be able to bring court action against you if you choose to renege on the agreement.

Before putting an offer in on a home, make sure that you do your research and make sure that it is the right one for you. The purchase agreement is designed to make sure a buyer does not withdraw from the purchase of the home and that a seller does not make a new offer if it comes along. The point is to make sure the transaction happens, which means that once you sign it, be prepared to purchase the home.

House Sale Contracts

FAQs

What is the primary purpose of a real estate purchase agreement?

The primary purpose of the real estate purchase agreement is to protect both the buyer and the seller during a real estate transaction. It will outline the price the buyer will pay for the property, any contingencies like a home inspection, and all other agreements that both parties come up with during the process.

This document can be pretty long and it may overwhelm someone the first time they get into real estate. But the purpose is to provide both parties with protection. The buyer will not be able to withdraw from the agreement outside of their contingencies at the last minute and the seller can’t take another offer, even if it is better, once they sign the agreement.

How binding is a purchase agreement?

A purchase agreement for a house is a real estate contract. This means that it is legally binding and both parties must follow the terms outlined within the contract. This is why it is so important for both parties to read through the contract before they agree to it or sign it at all.

Both buyers and sellers often add contingencies inside the purchase agreement to allow them a way to get out of it if necessary. If the buyer is not able to get funding or the inspection comes back horribly, then the contract can be voided. But in most situations, the purchase agreement is a binding contract that both parties must follow.

How long can negotiations take on a purchase agreement?

It is common to find negotiations during the purchase agreement. Sometimes the negotiations are small and can be done in one round. Other times it will take longer. Before negotiating again, remember that the other party can walk away at any time, so you may not want to push too much. Addendums are also added to many purchase agreements to change items like the results of the inspection or the closing date.