As a business owner, if you want to cancel your insurance policy with their provider, you need to follow your insurance company’s procedures. This is especially important for small businesses. You may even have your own personal insurance policies that you would like to cancel for whatever reason you might have. Either way, you start the process with the filing of a written policy cancellation letter.

Table of Contents

- 1 Insurance Cancellation Letters

- 2 What is an insurance cancellation letter?

- 3 Policy Cancellation Letters

- 4 What to include in the insurance cancelation letter?

- 5 What to consider before canceling your insurance policy?

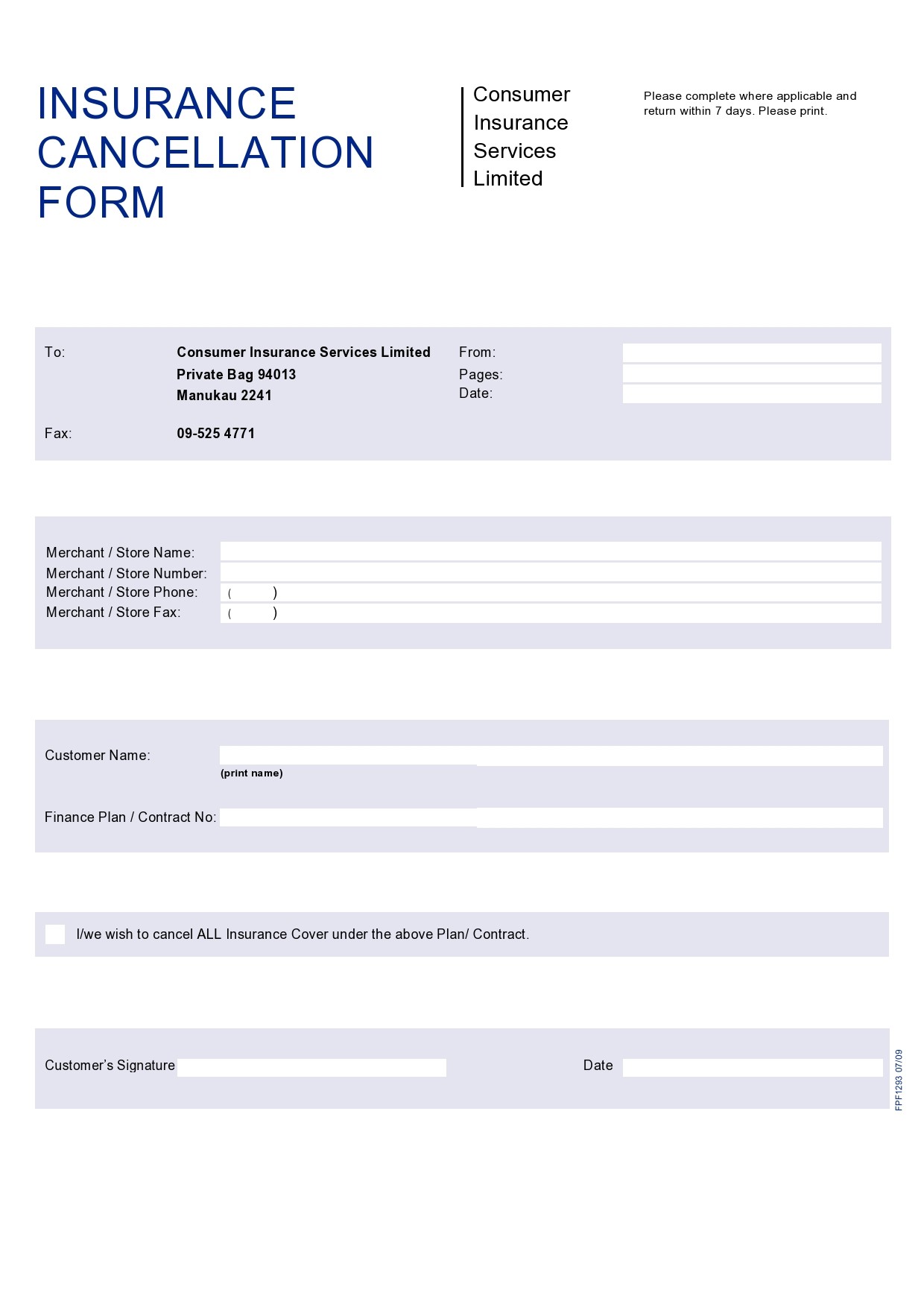

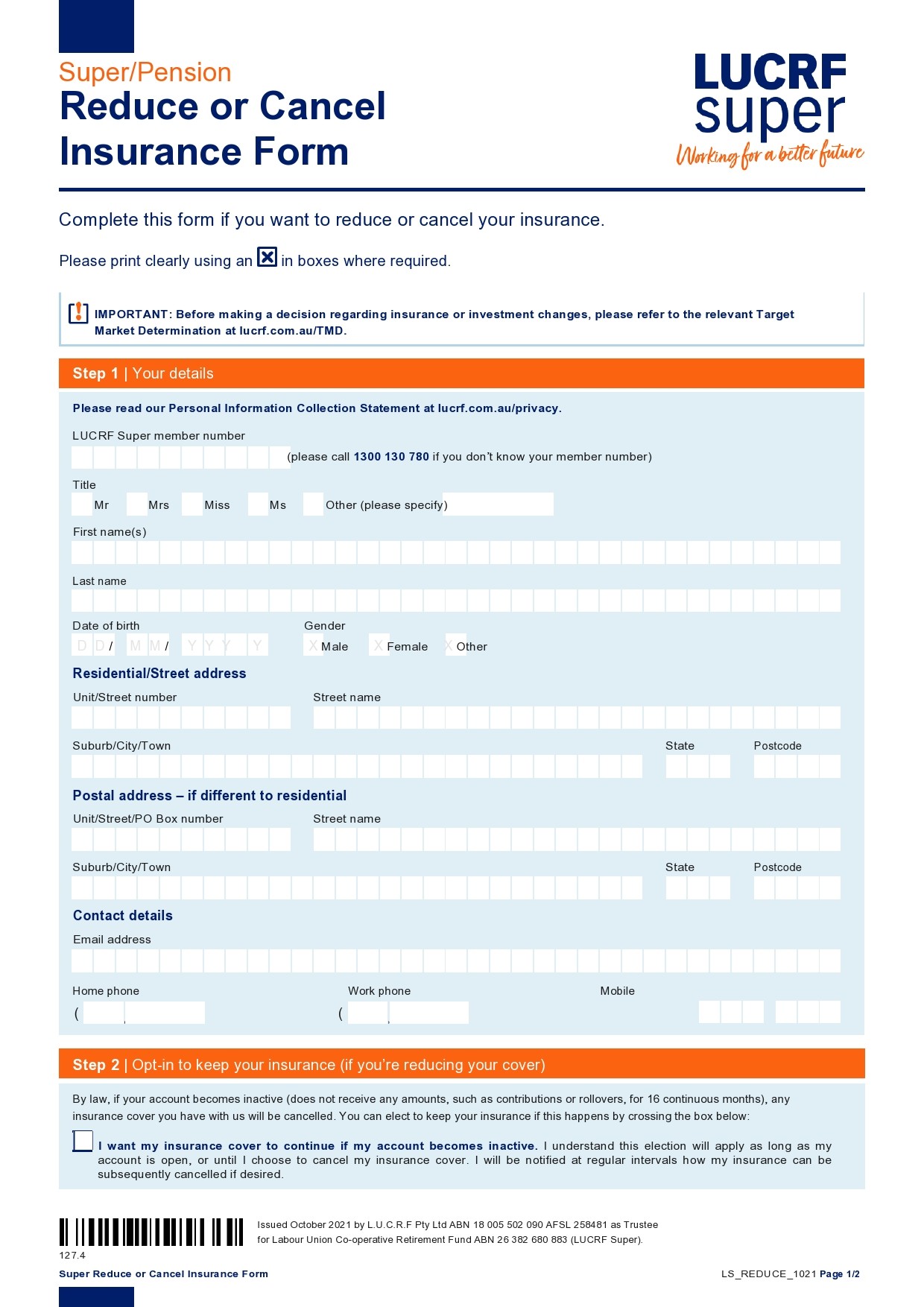

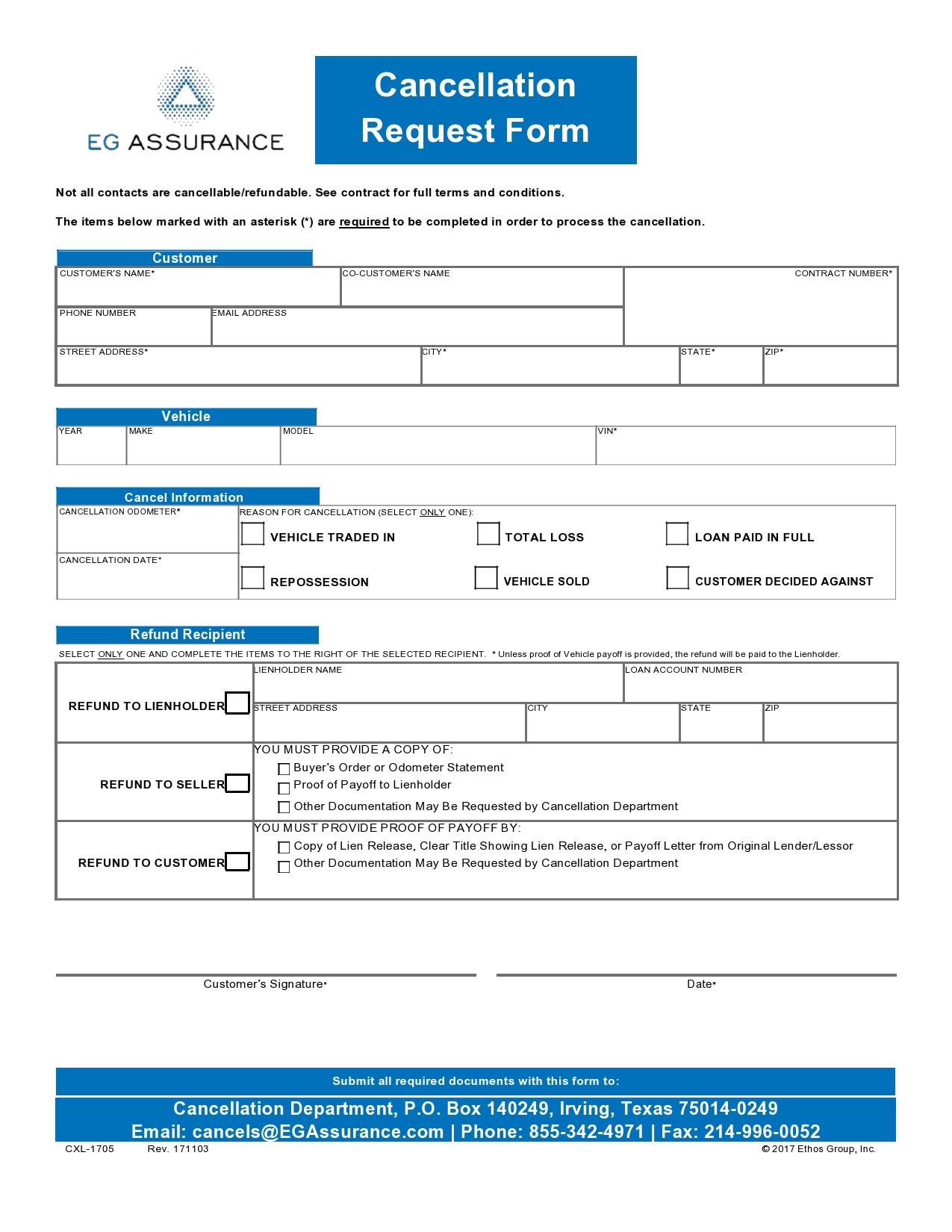

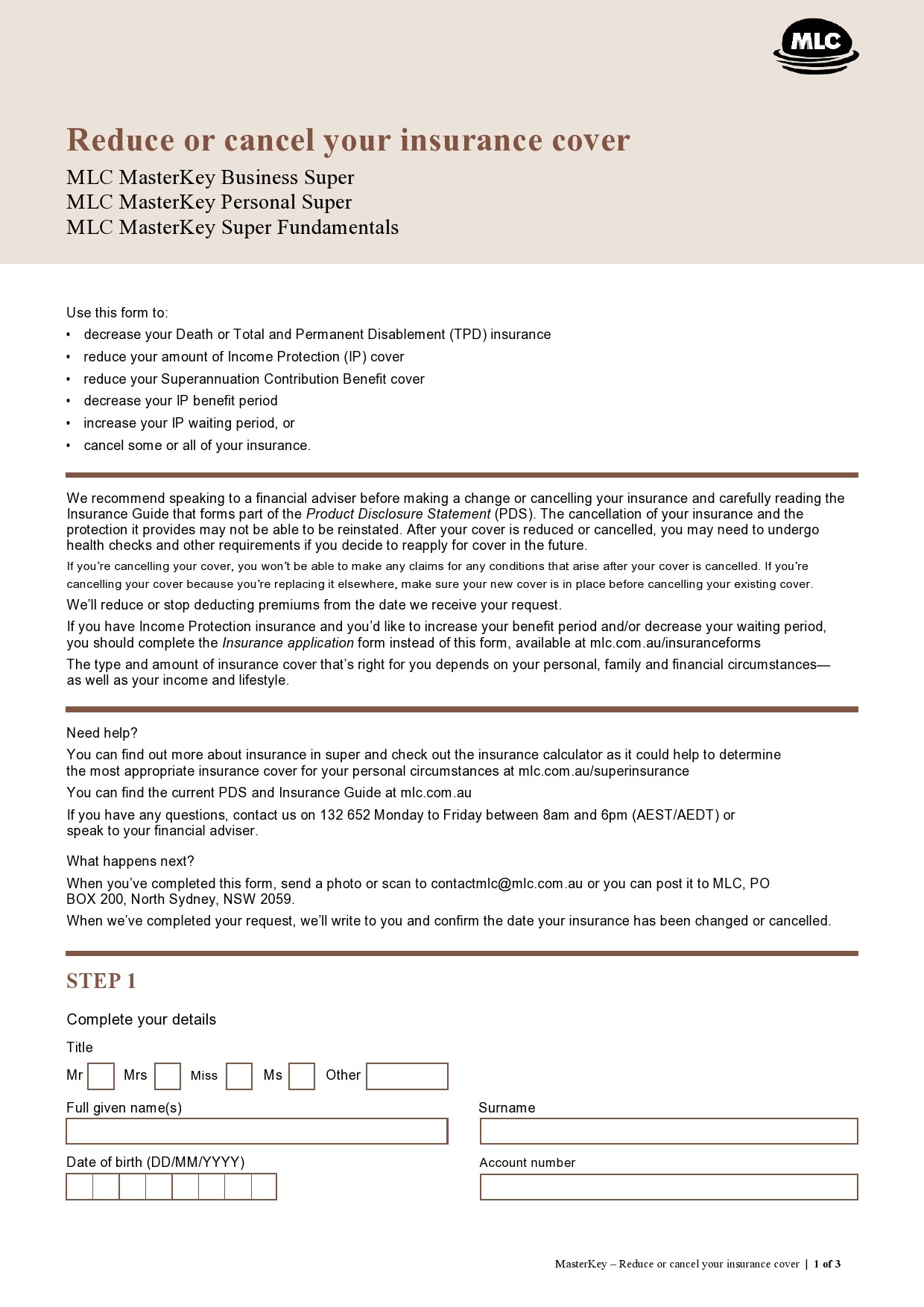

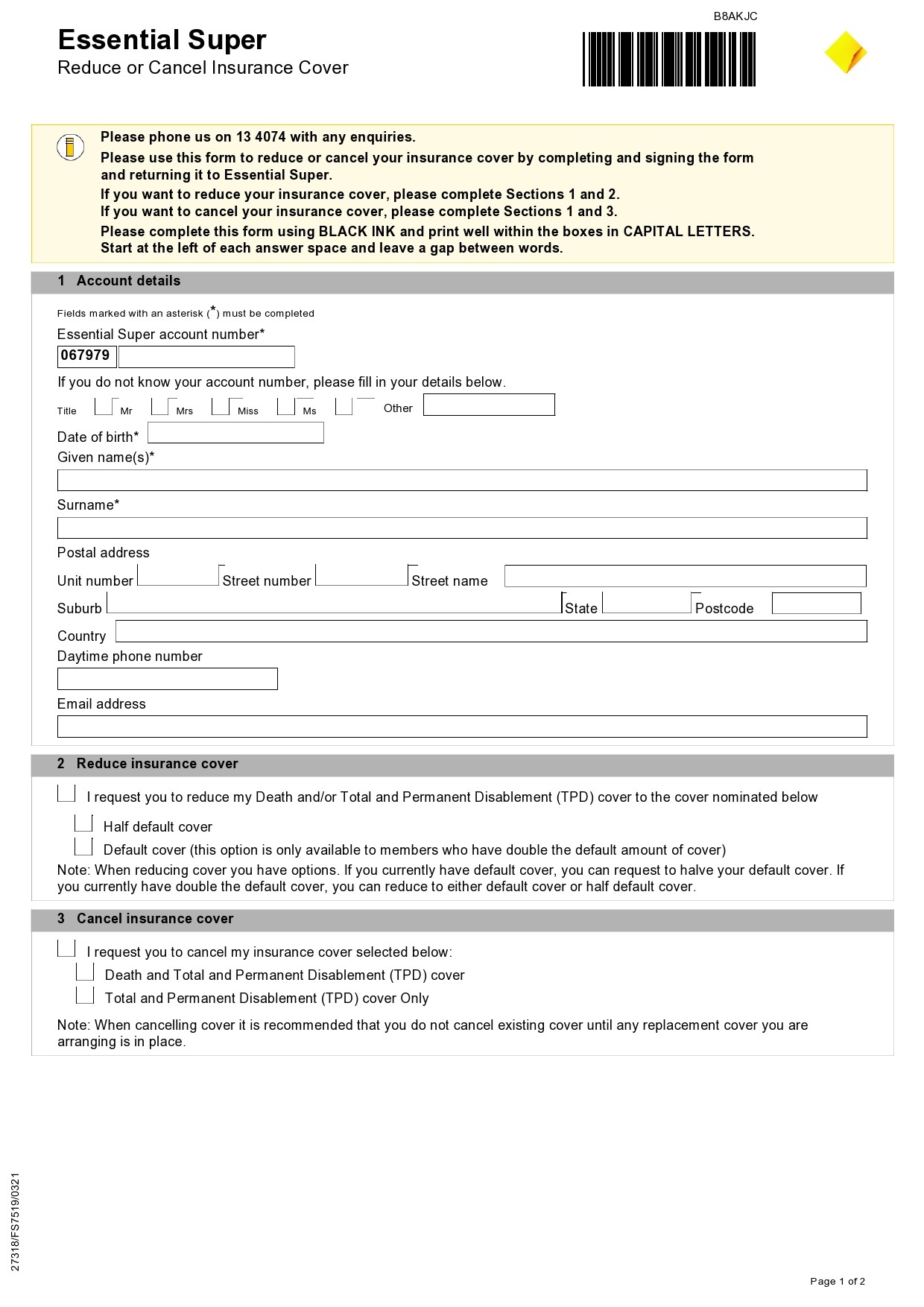

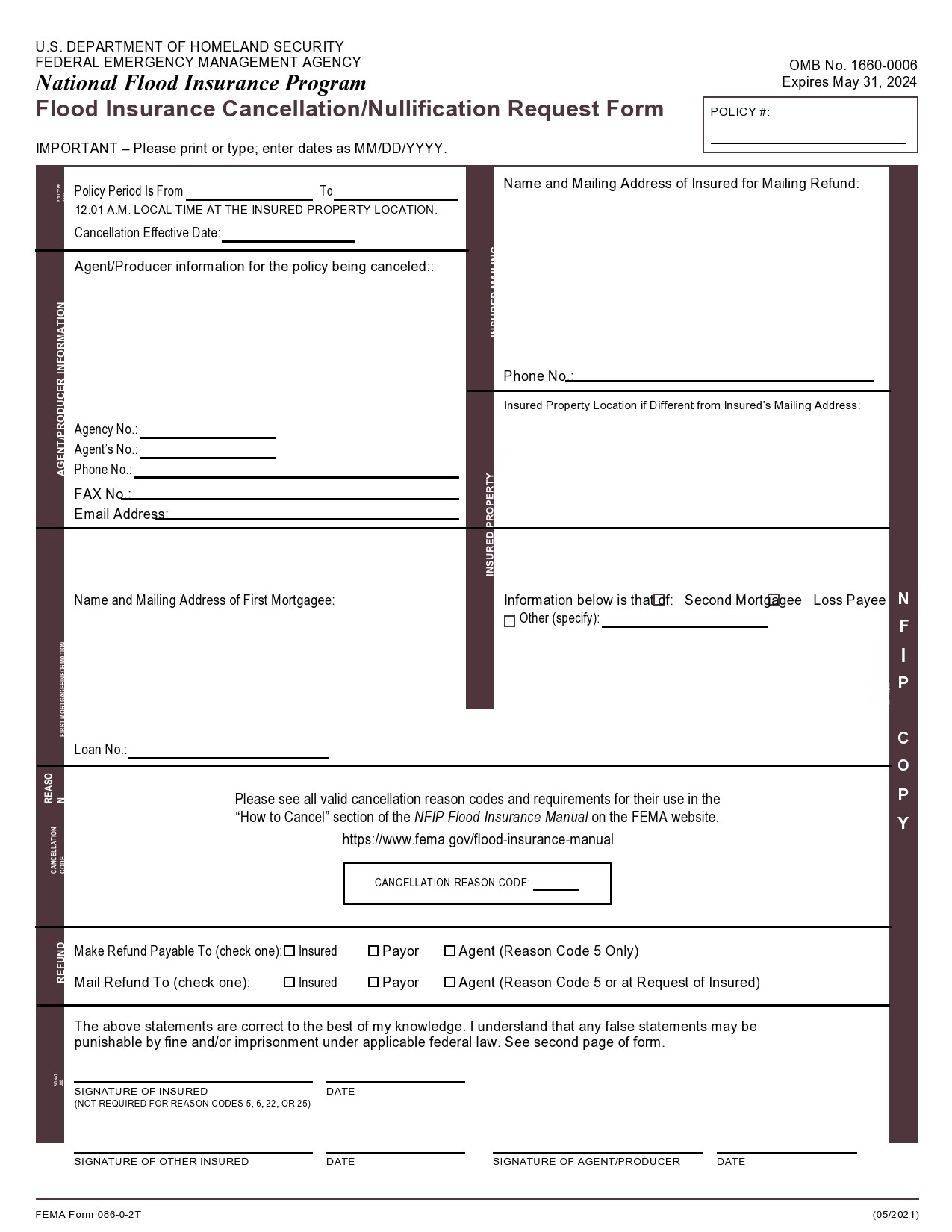

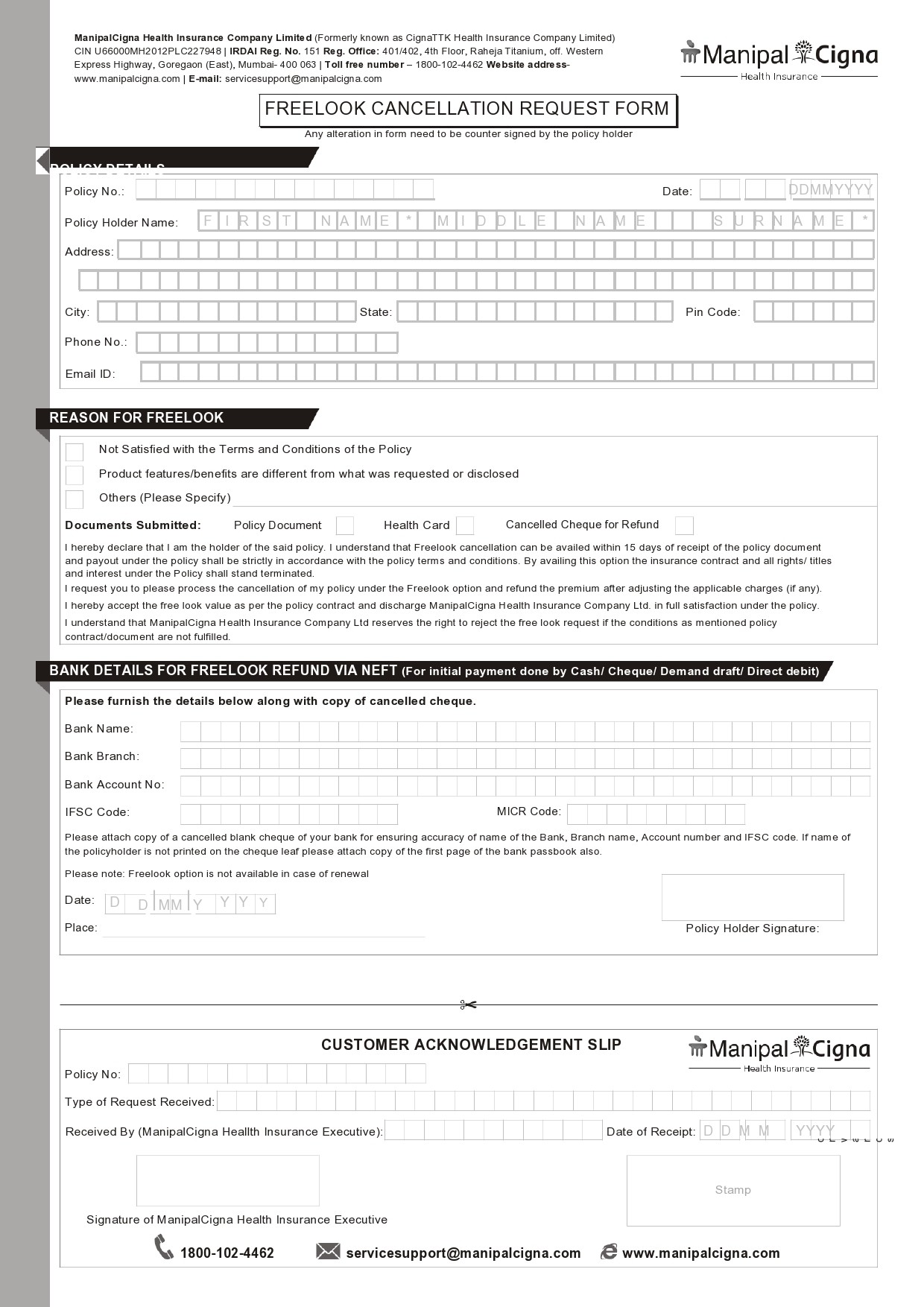

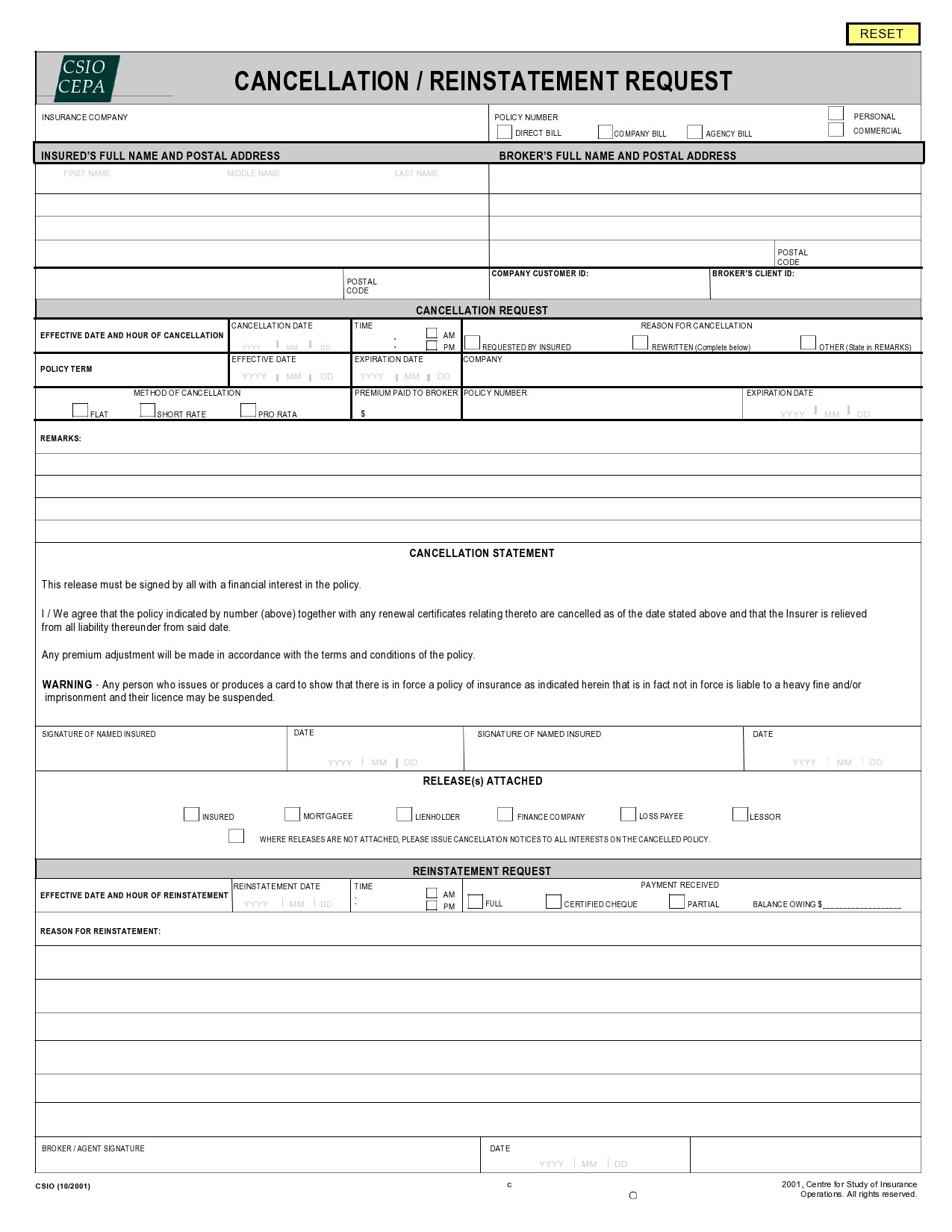

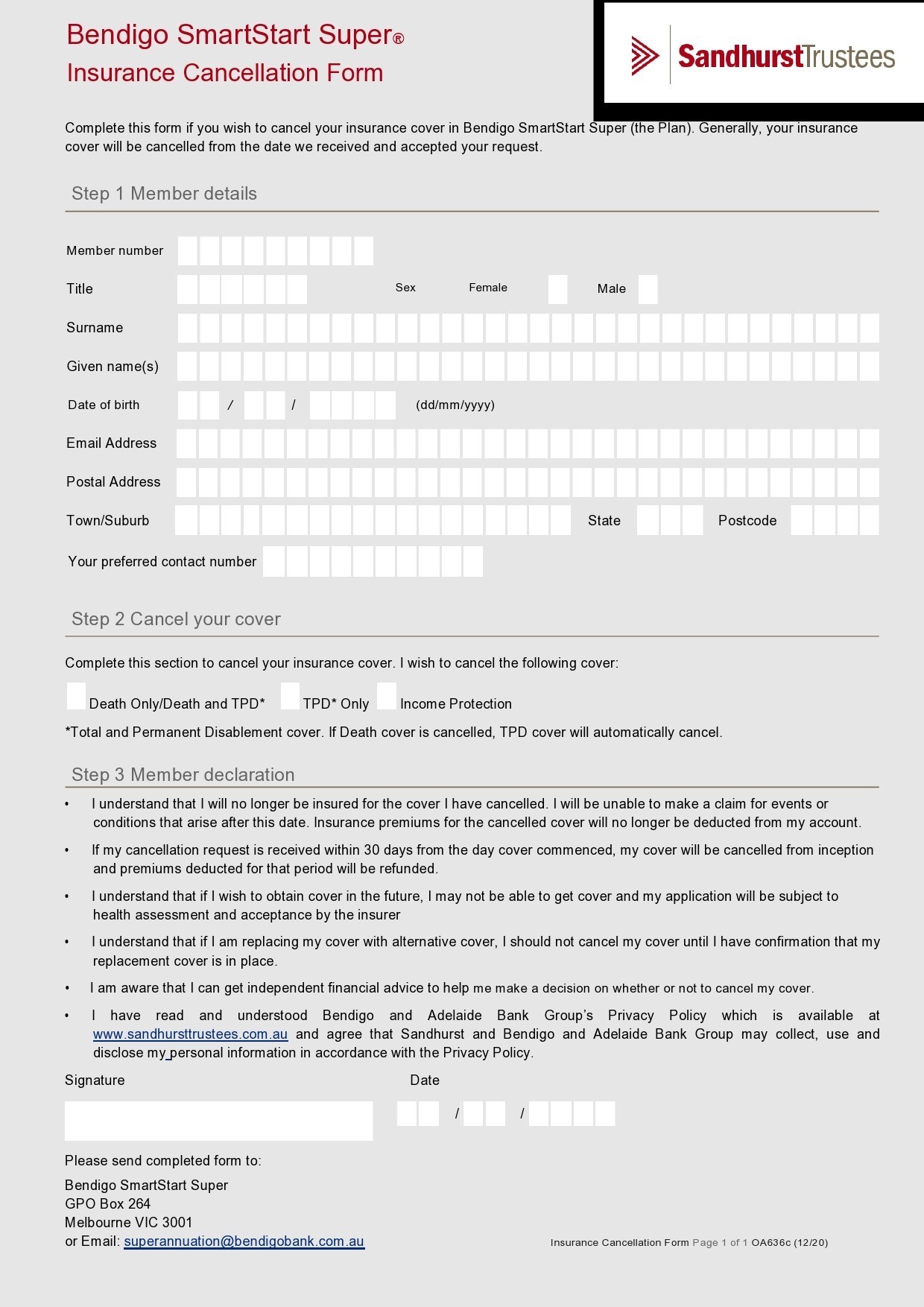

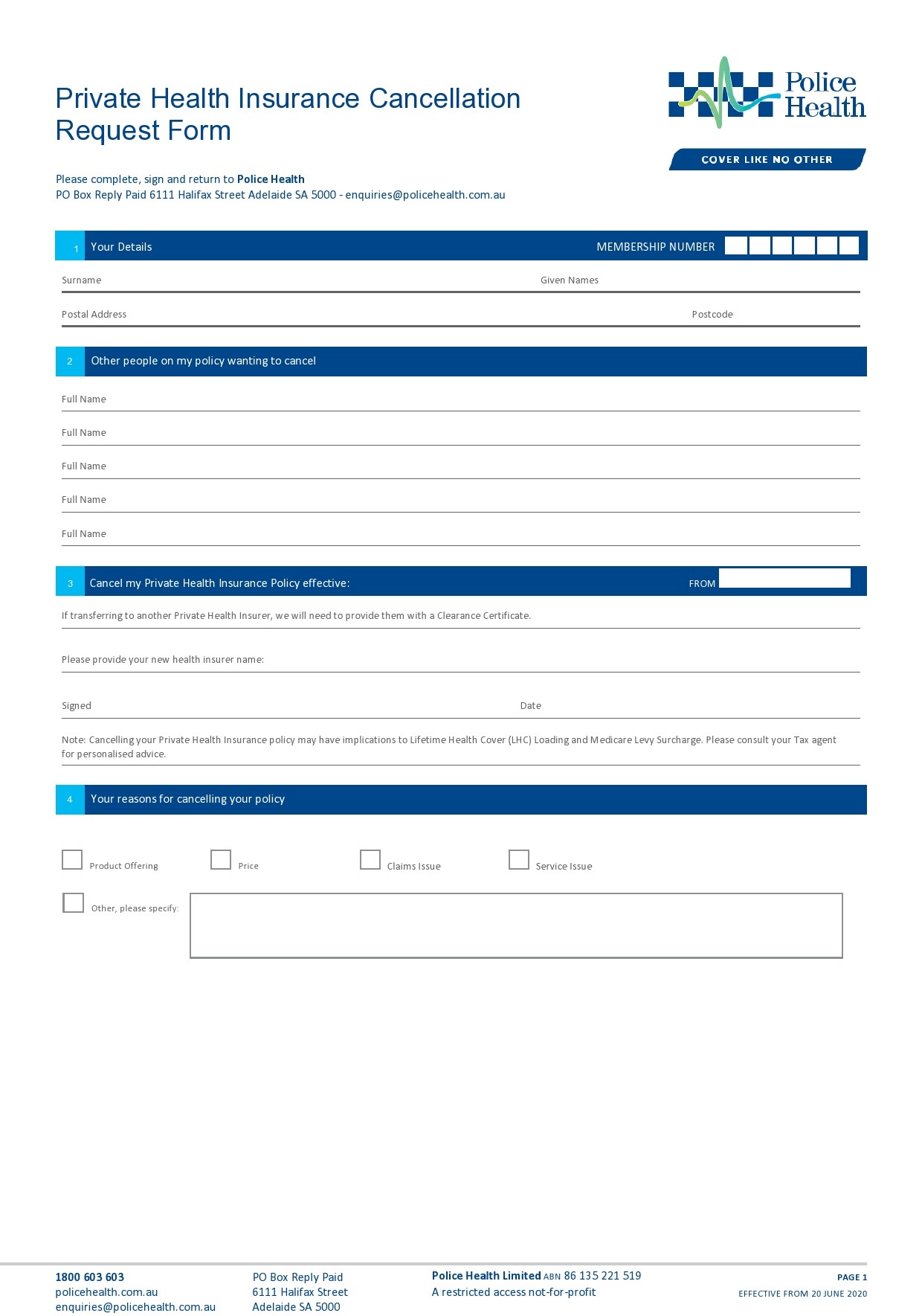

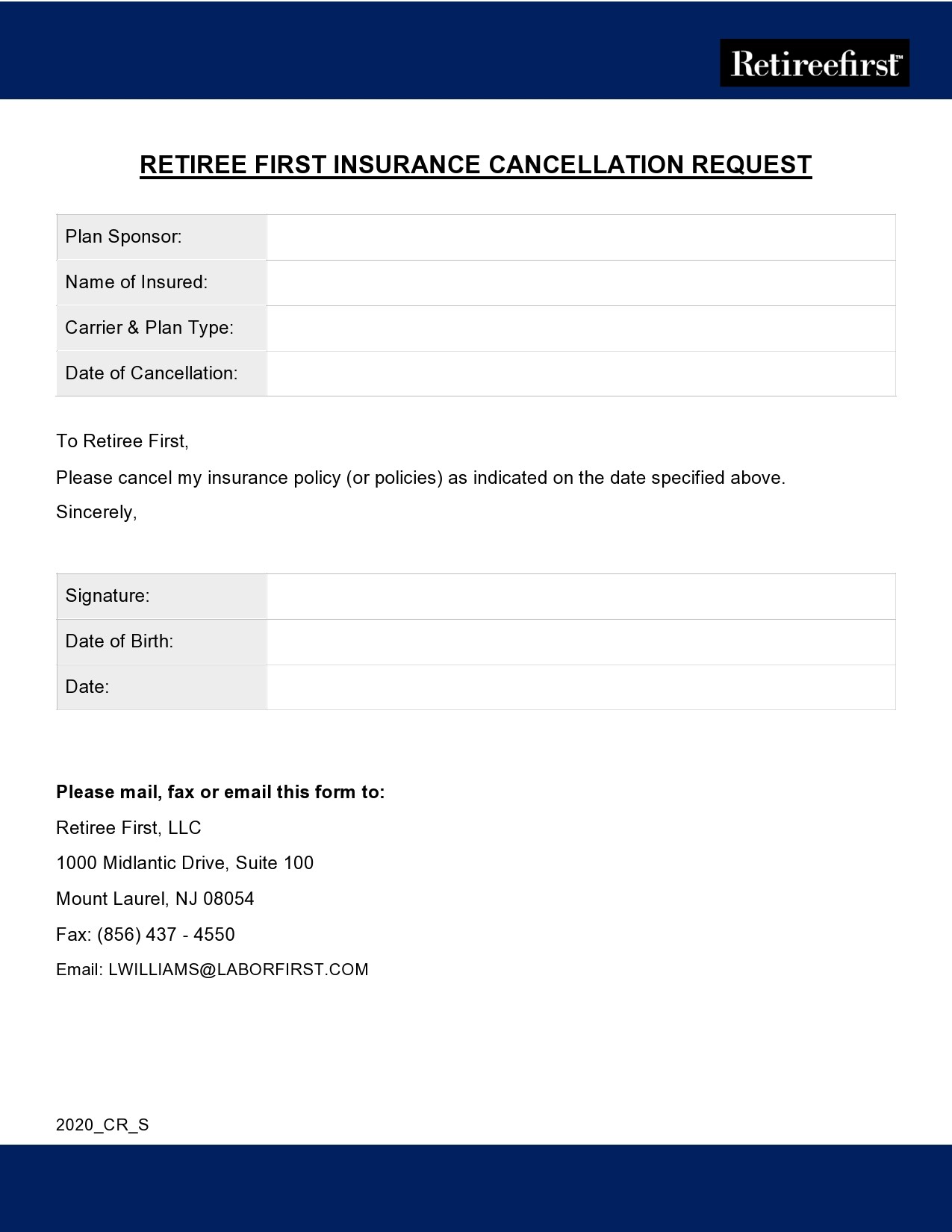

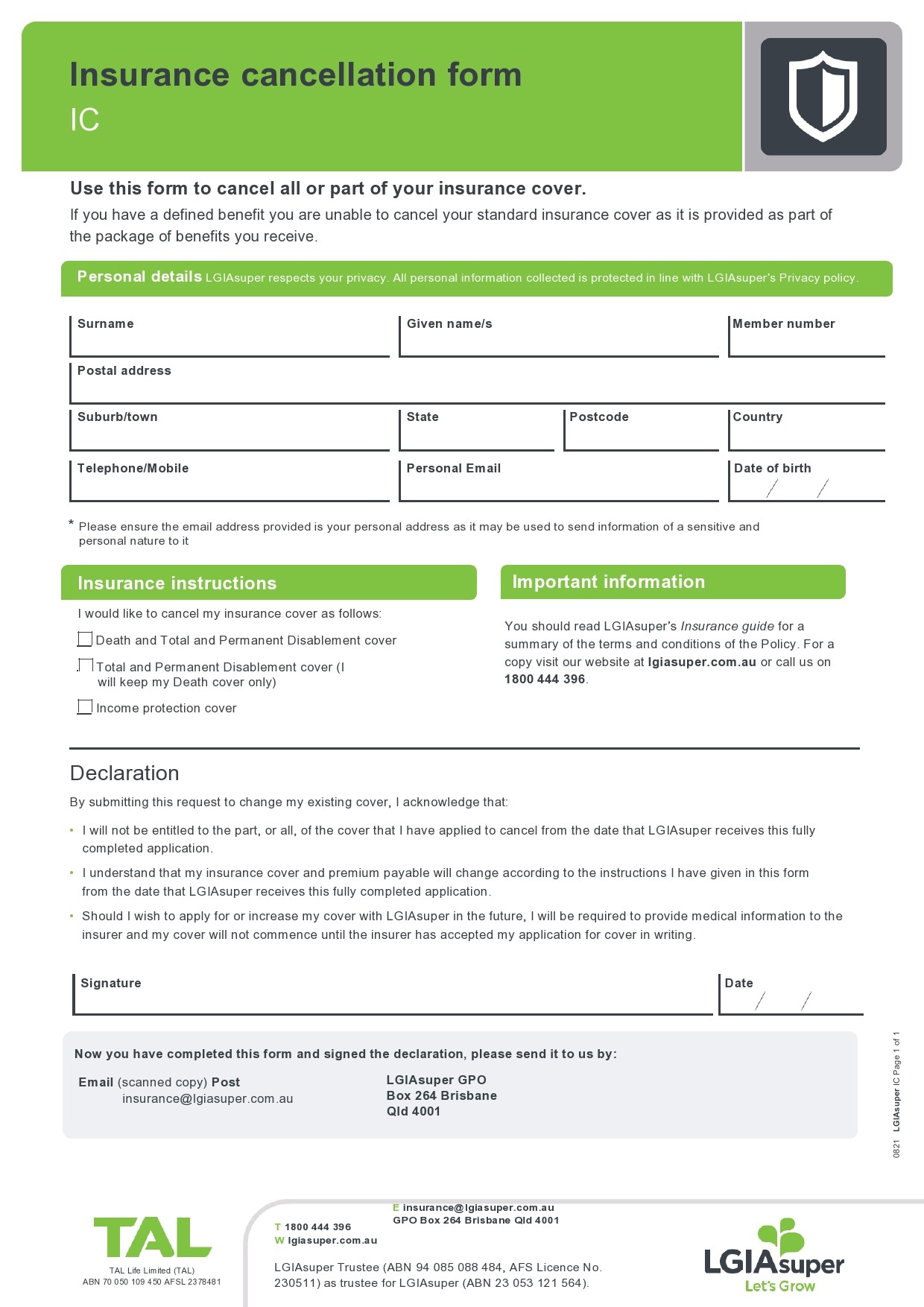

- 6 Insurance Cancel Forms

- 7 What to prepare before you cancel your insurance policy?

- 8 How do I cancel my insurance policy?

- 9 How do you write an insurance cancellation letter?

- 10 Auto Insurance Cancellation Letters

- 11 What will happen after the cancellation?

Insurance Cancellation Letters

What is an insurance cancellation letter?

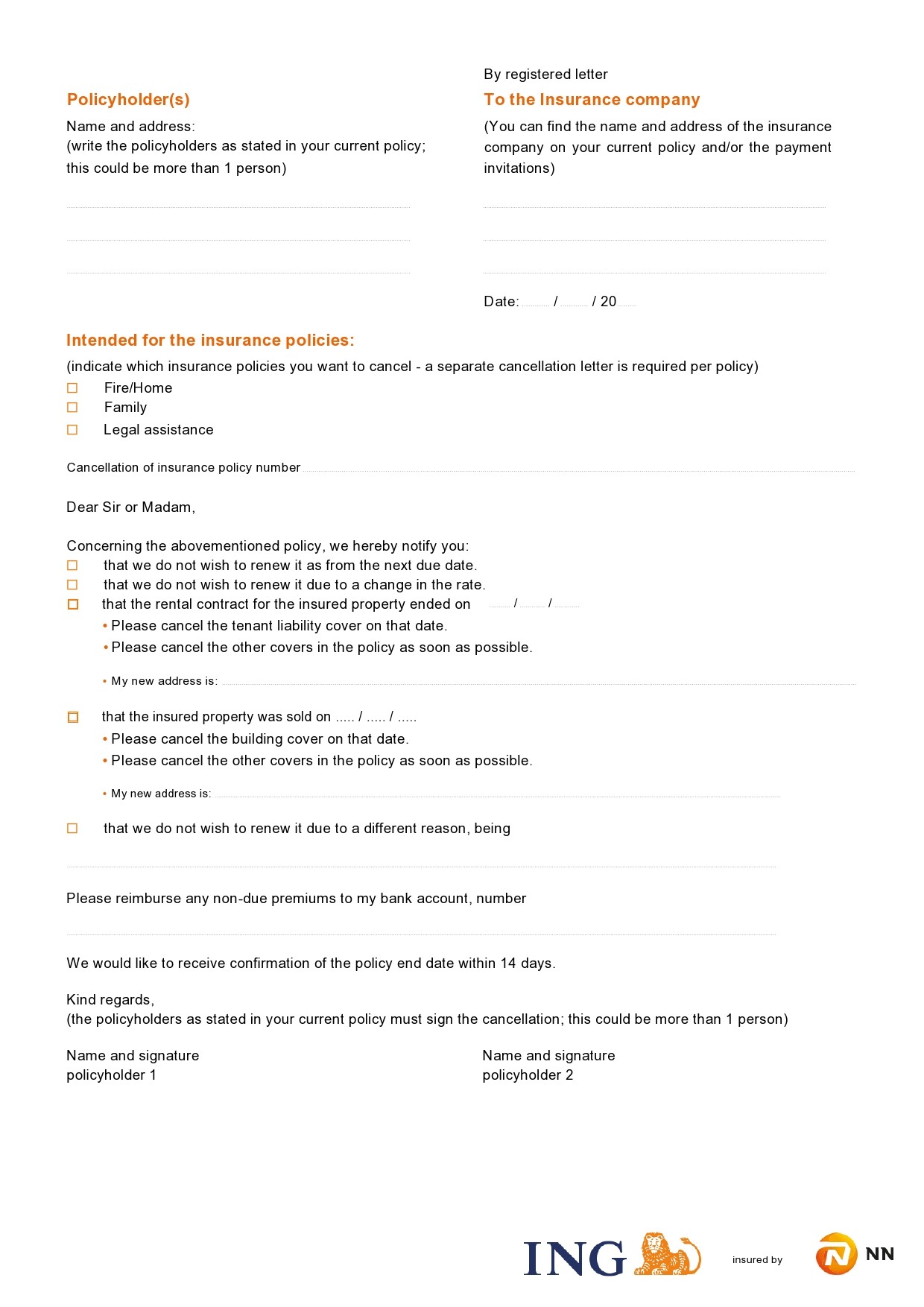

An insurance cancel form or letter is a legal document you send to insurance companies to notify them that you no longer want to pay insurance premiums or enjoy the benefits of their policies. Generally, insurance companies don’t prohibit or restrict your rights to cancel your subscription. But to make sure that you’re doing the right thing, you need to read the policy before you start writing an insurance cancellation letter.

The first thing to do if you choose to cancel your policy is to check the policy for the cancellation procedures. Some insurance companies provide the steps of the cancellation procedure including the contact information of the person to reach out to and to who you will send your letter to.

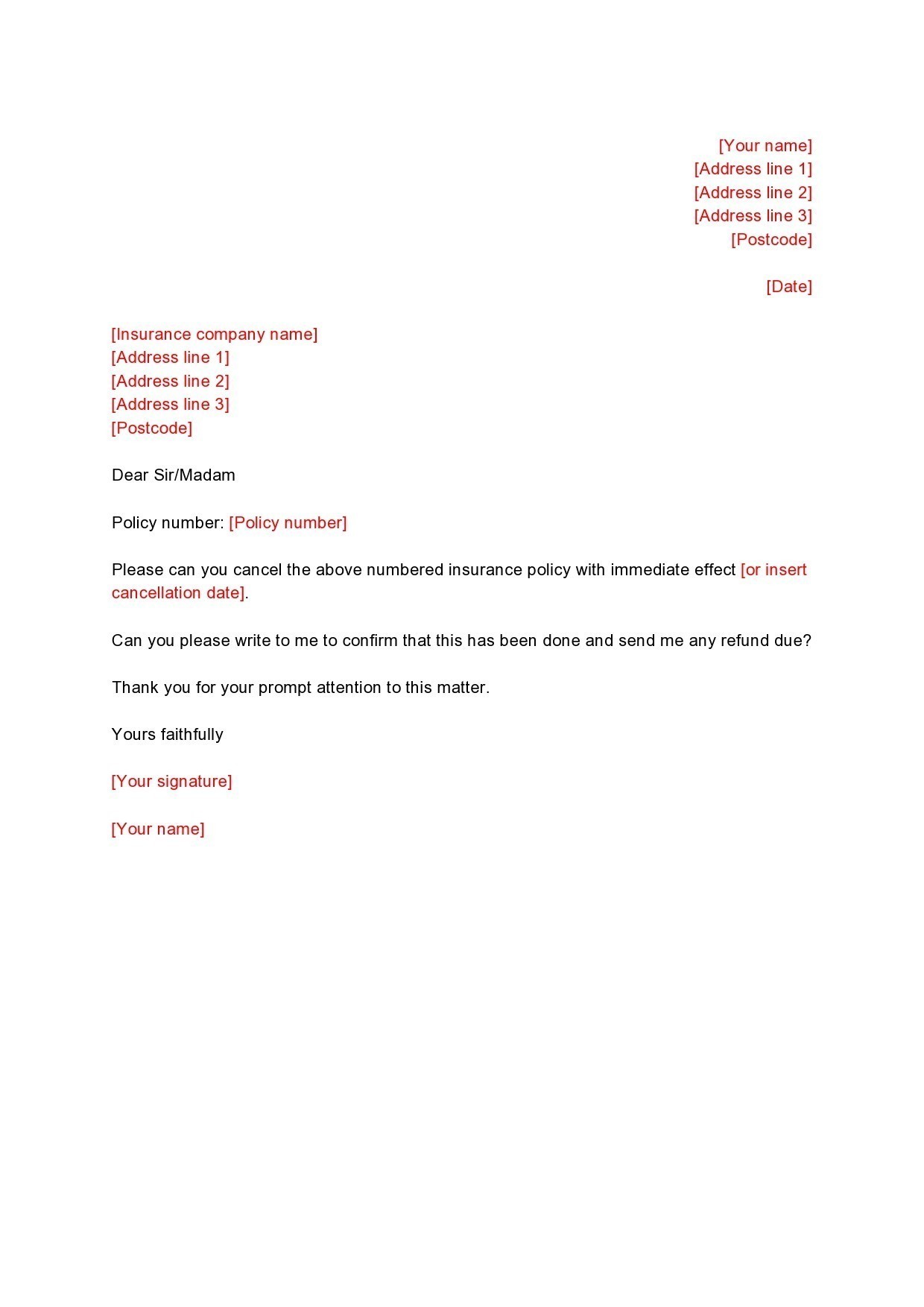

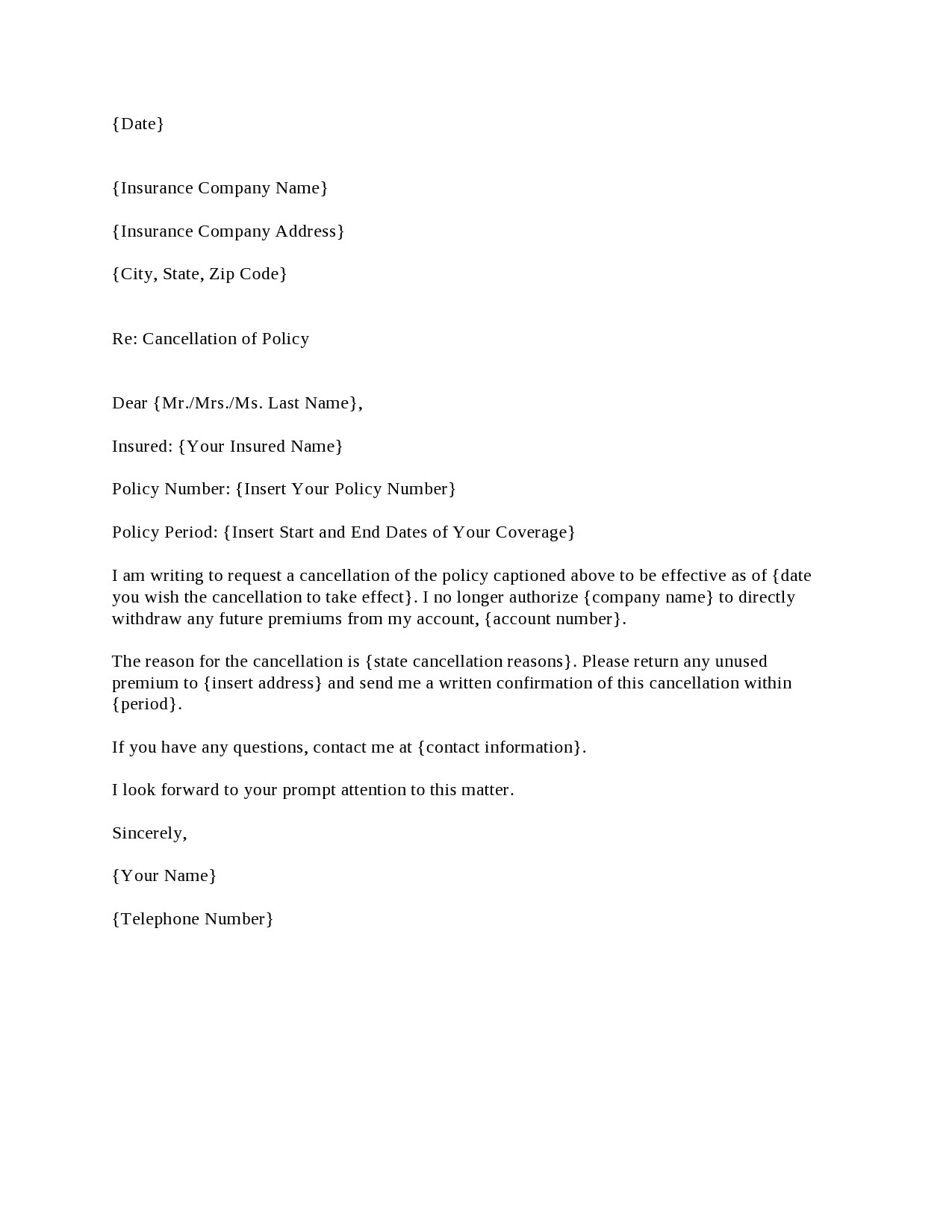

Policy Cancellation Letters

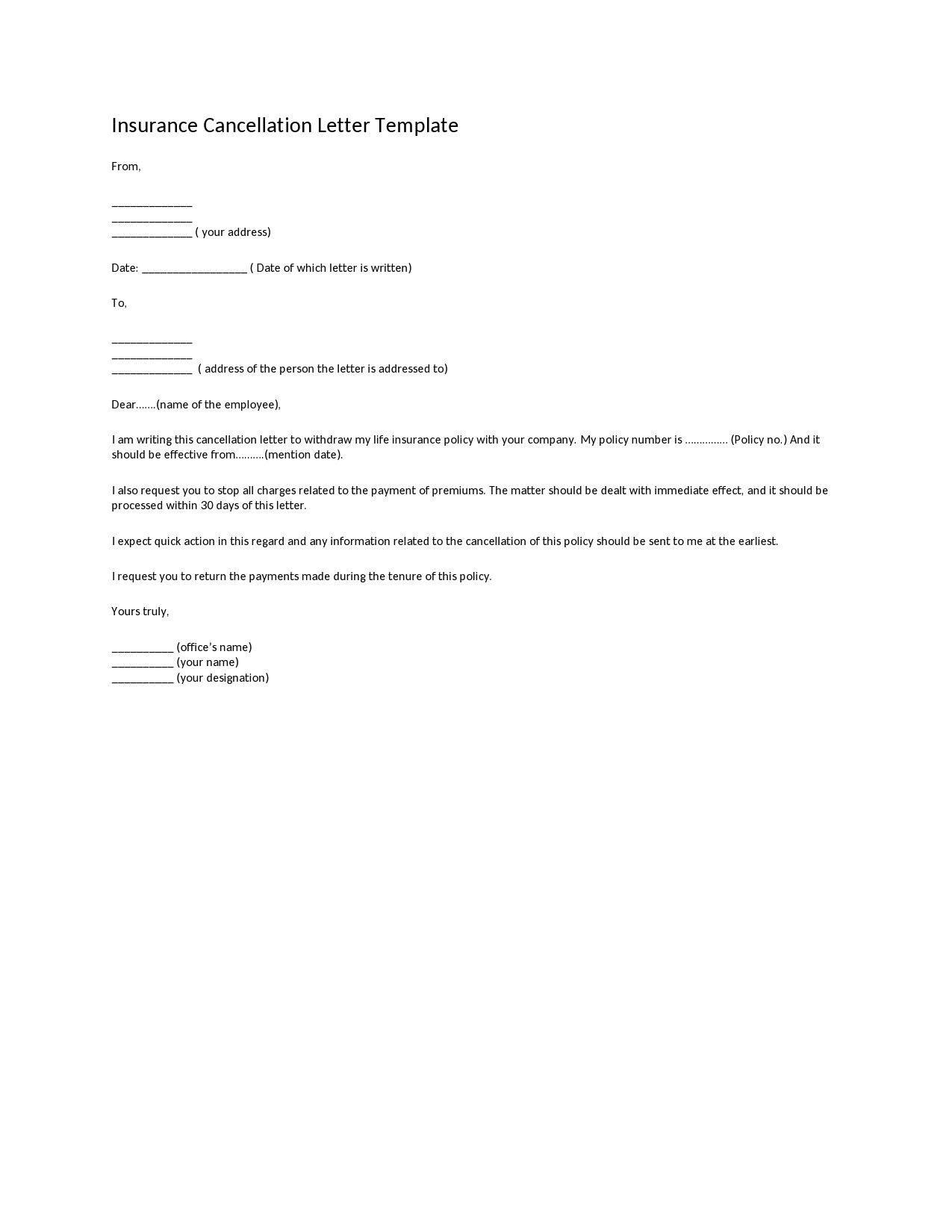

What to include in the insurance cancelation letter?

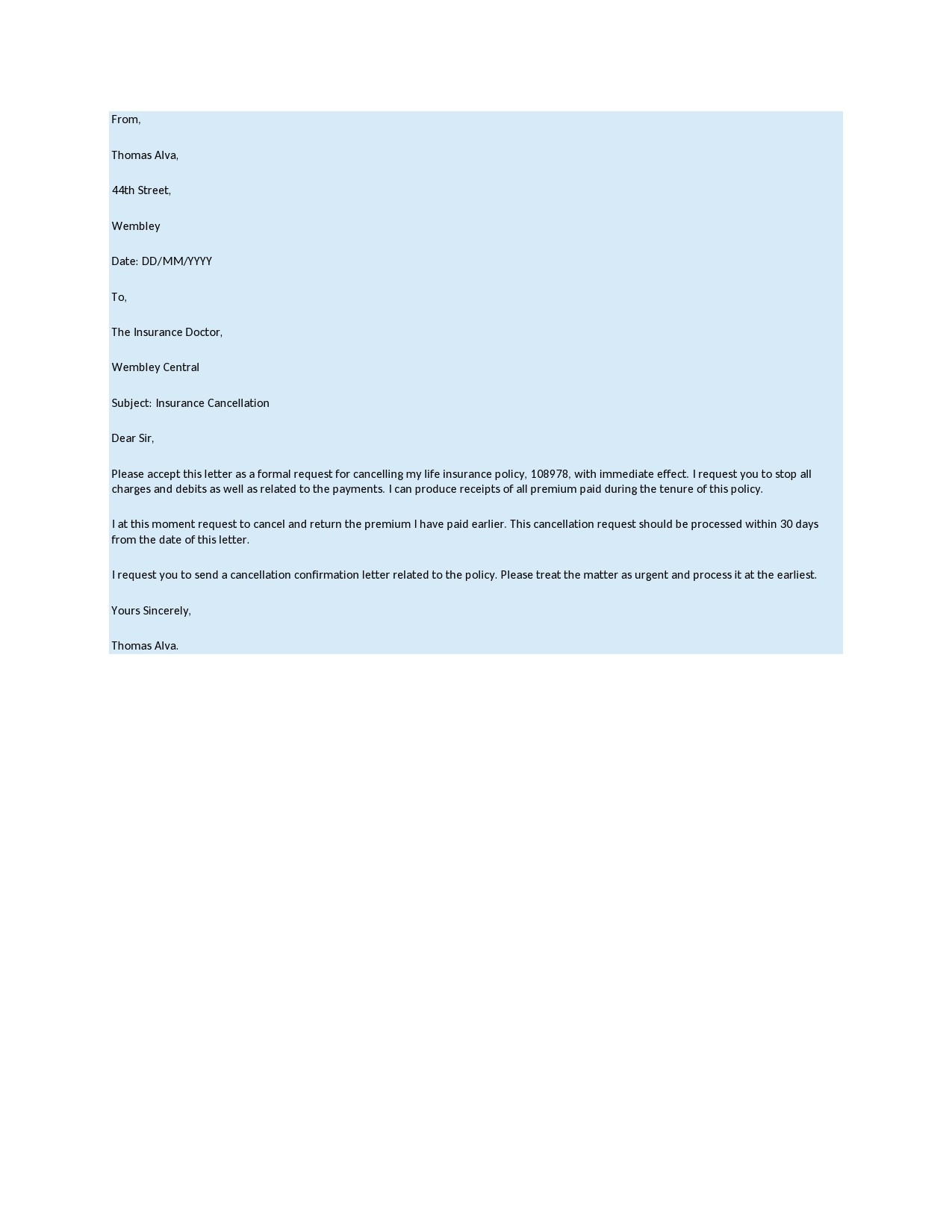

Many who have gone through the process of canceling their insurance subscriptions find this an intimidating task. This is especially true if you drive a car as an auto insurance cancellation letter is a common requirement of insurance companies. The same thing goes if you need to write a home insurance cancellation letter or health insurance cancellation letter. Here are the elements to include in your letter:

- Your complete name. You should be the policyholder to have the authority to cancel the subscription.

- Your insurance policy number. Double-check to make sure that you’ve written the correct number in your letter.

- Your complete address and contact details. You need to include these details so they can follow up with you.

- The name of your company. Name the insurance company, not your insurance agent.

- The date when you wrote the letter.

- The effective date of cancellation. Provide the date when you want the cancellation to take effect.

- Your reasons for canceling your insurance subscription.

- A refund or stop payment request. Request your insurance company to stop your automatic payments right away if you pay every month. If you made advance payments, request a refund for your remaining balance.

It’s important to include all of these elements in your letter no matter what type of insurance policy you have.

What to consider before canceling your insurance policy?

The cancellation of a small business or personal insurance is a decision that you shouldn’t take lightly, especially in today’s very risky environment. Before you cancel your existing policy, it’s important to make sure that you aren’t risking the exposure of your personal and business finances.

Before you decide to cancel, spend time researching and comparing quotes from several companies if you plan to replace your existing policy with something cheaper, more appropriate, or better. Here are some reasons to think about when canceling your policy:

- If you think that you’re paying too much.

- If your business has undergone changes and will need a different coverage plan.

- You plan to move to a new state and your existing insurance company doesn’t offer policies in the place you’re planning to move to.

- You aren’t satisfied with the service of your insurance company.

- You plan to combine different policies into a bundled policy that’s less expensive.

Canceling your insurance policy could lead to a few implications, especially if you’re a business owner:

- You might expose your business to expensive claims like lawsuits

If you cancel your insurance and you don’t have a new policy in place, you won’t have a safety net against expensive losses like possible lawsuits.

- You might end up with a coverage gap if you cancel claims-made policies

A claims-made policy covers events that occurred in the past that you should still have continuous coverage over even after changing insurance companies. This type of policy often has omissions and errors, directors and officers insurance, and professional liability.

This means that you must have active insurance to trigger the coverage for something event that occurred in the past. You must consult with your insurance company about buying an optional tail coverage or extended reporting period (ERP). This will provide you with the right to file for the benefits even after canceling your claims-made policy.

- You can save money but it might weaken your insurance safety net

Saving money is very important but if it comes with the cost of leaving your business unprotected, canceling your policy might not be a wise decision in the long term.

Adjusting your coverage might be a better option for you. Try to find out if adjusting your coverage would be instead of canceling your policy. For instance, if the nature of your business or industry has changed or you moved to a new place, you can choose to change your coverage to reflect your new situation.

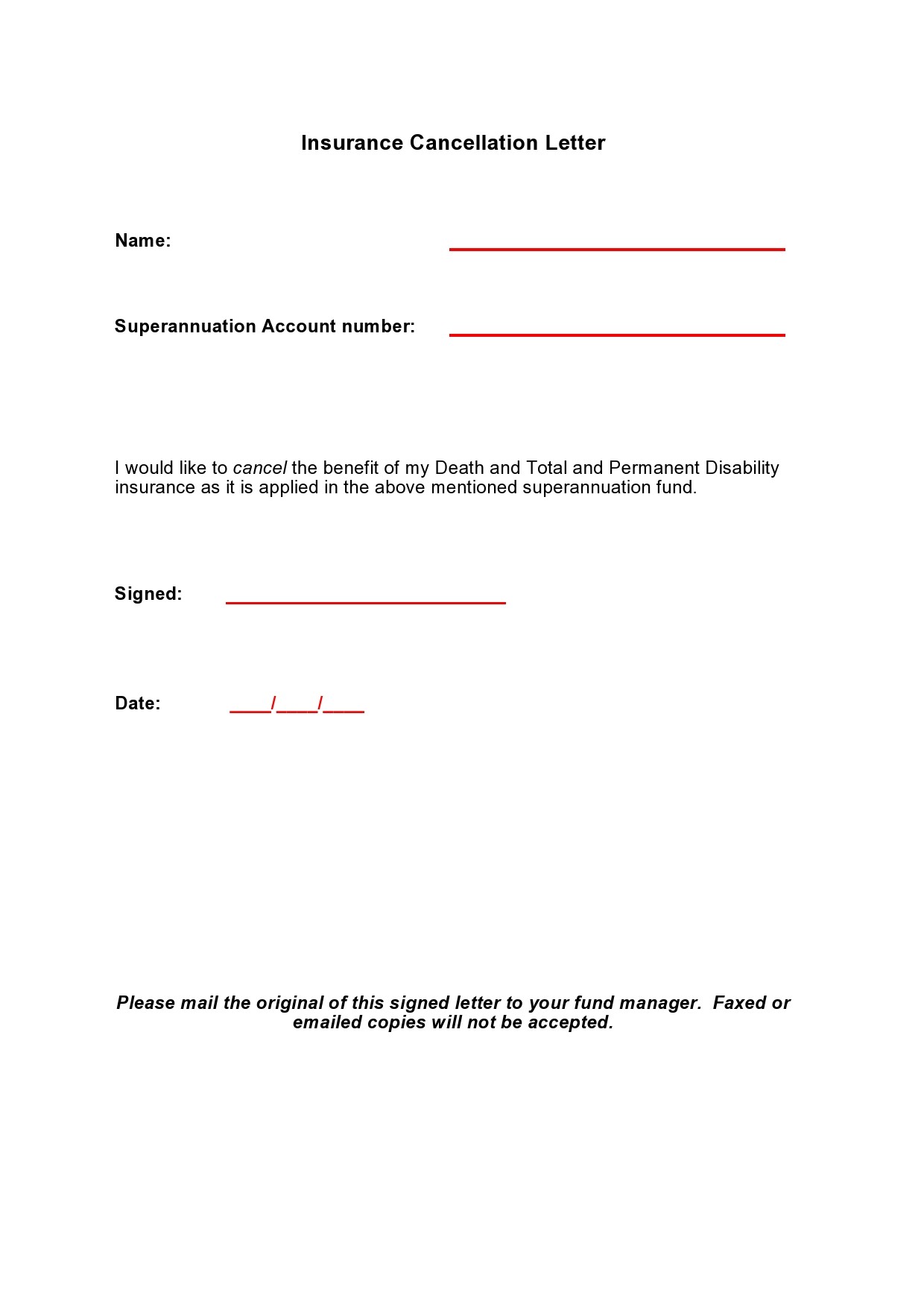

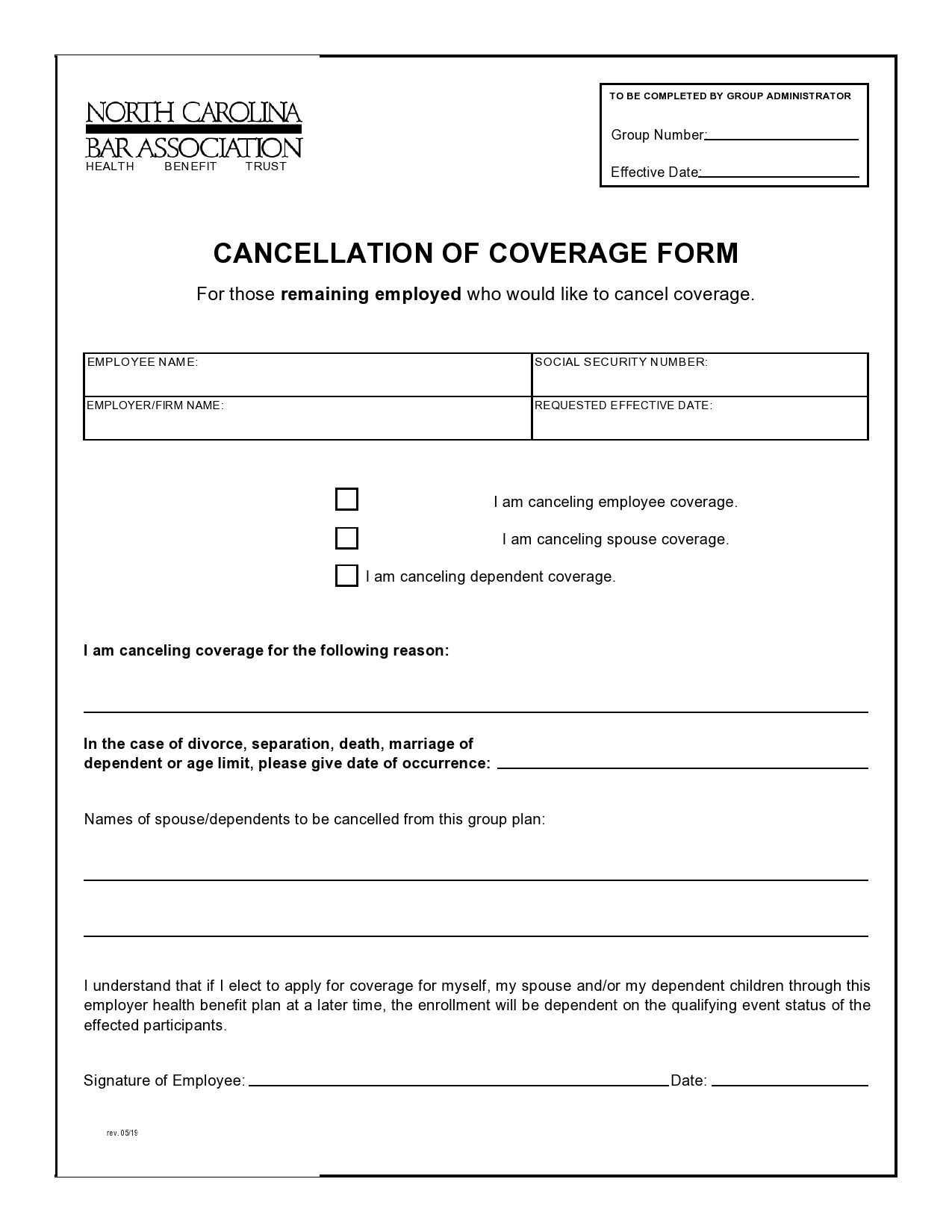

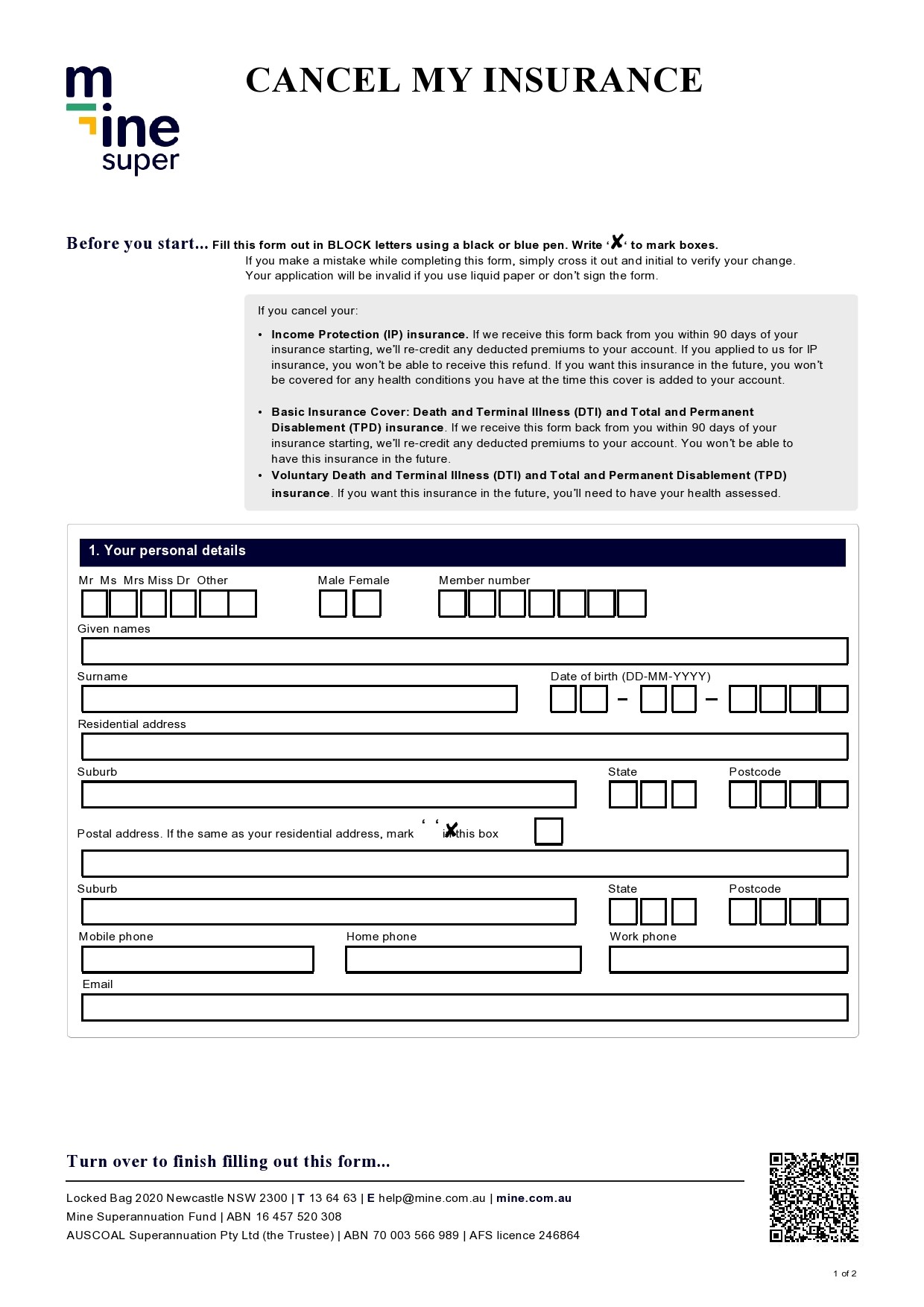

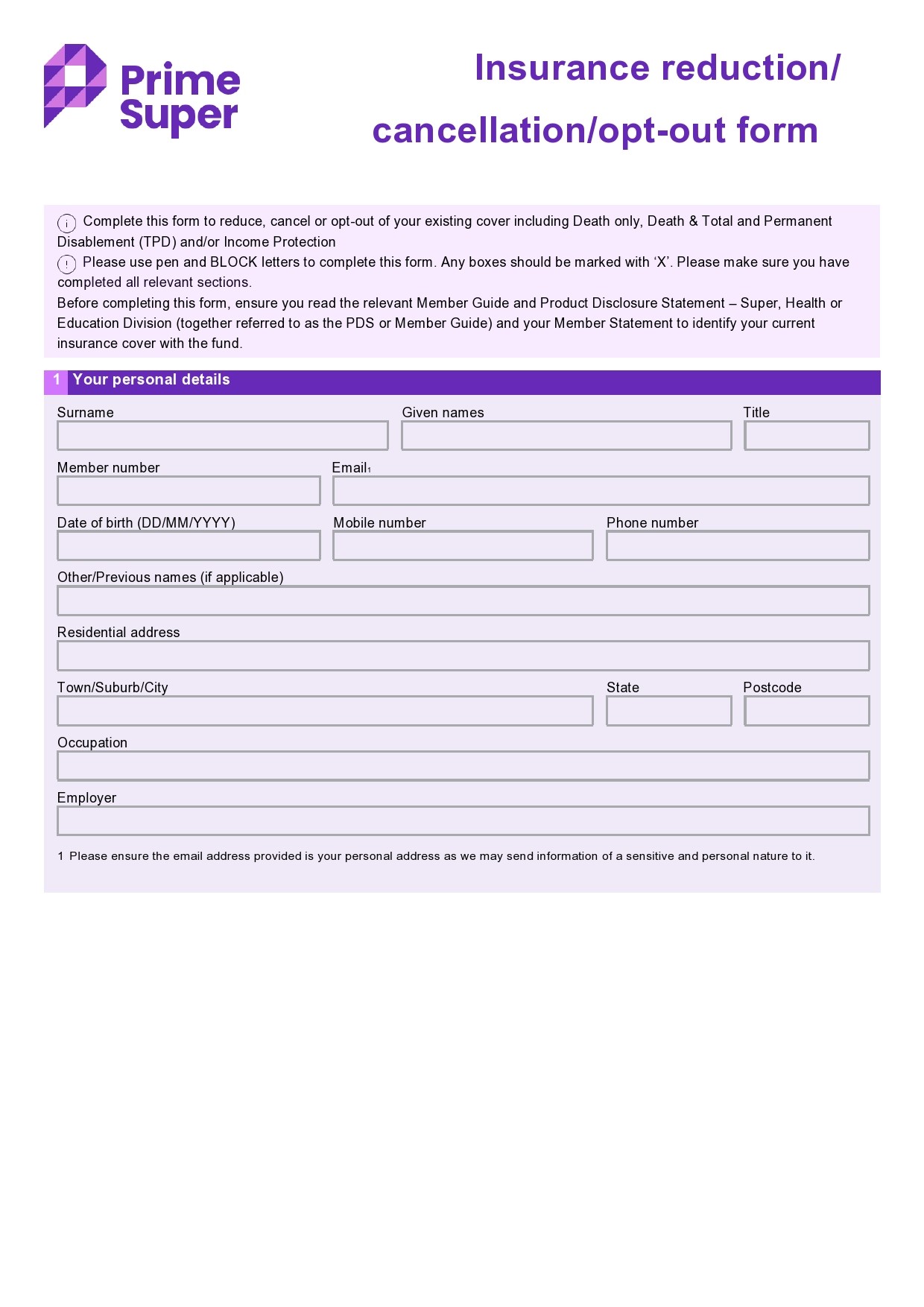

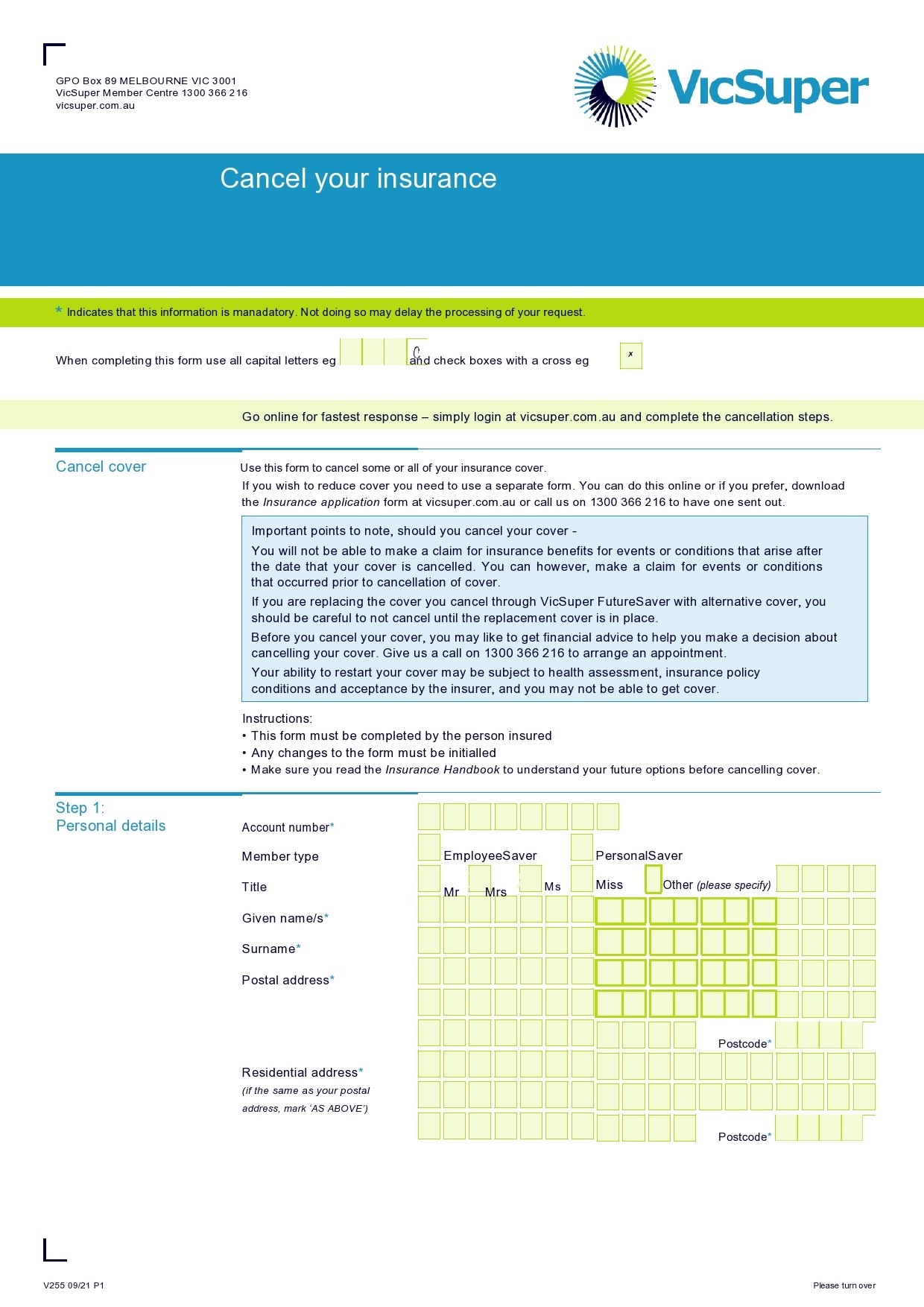

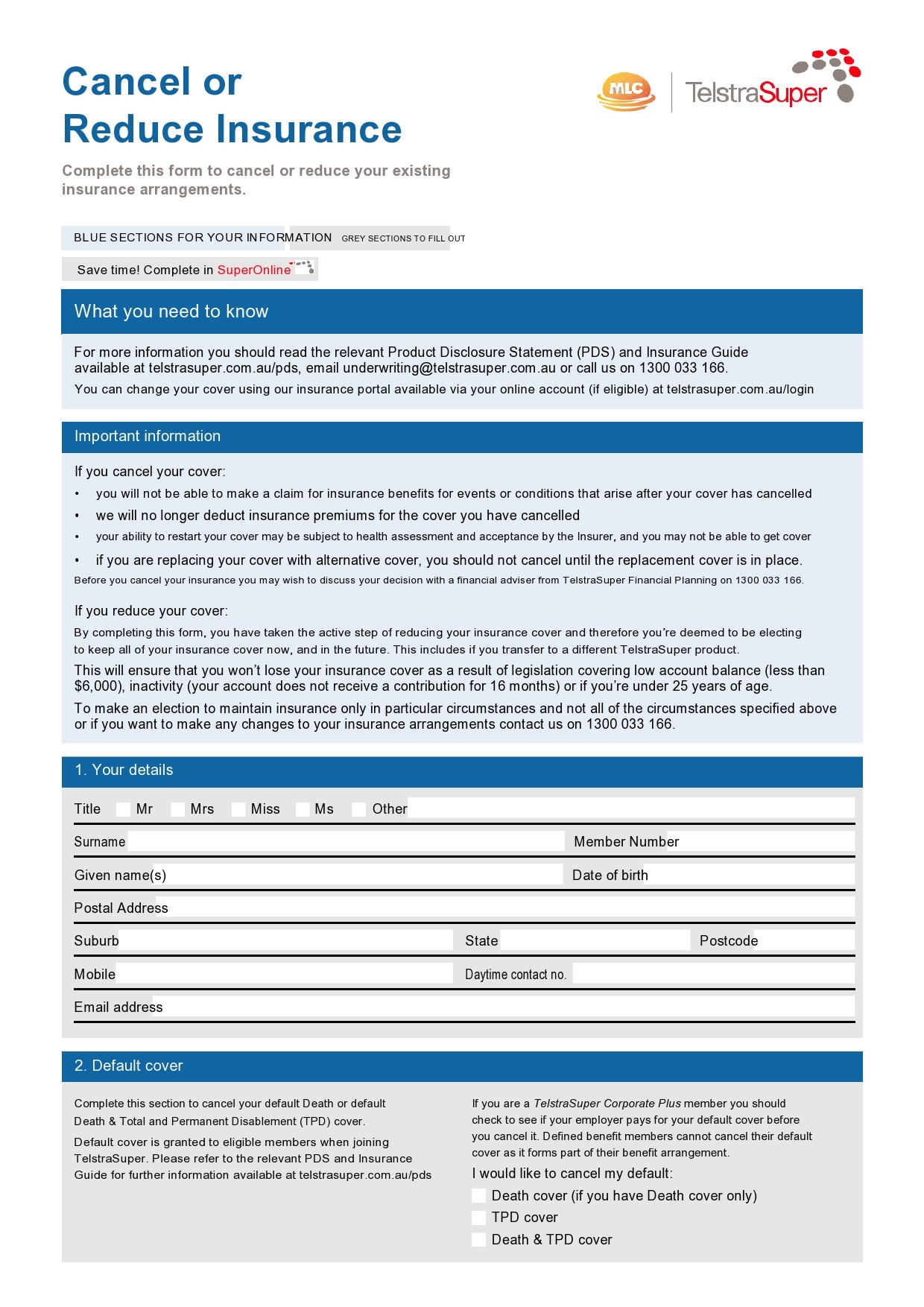

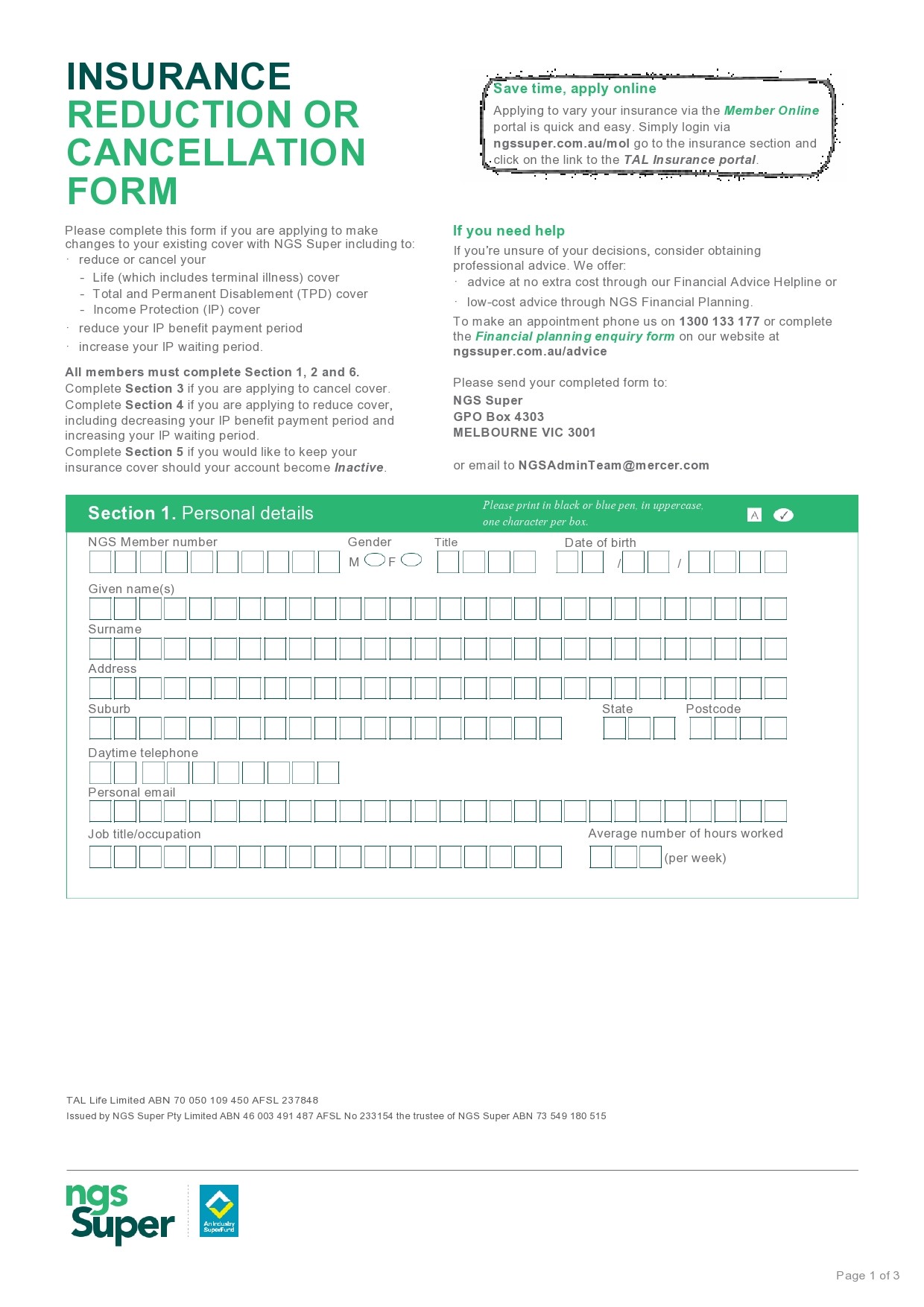

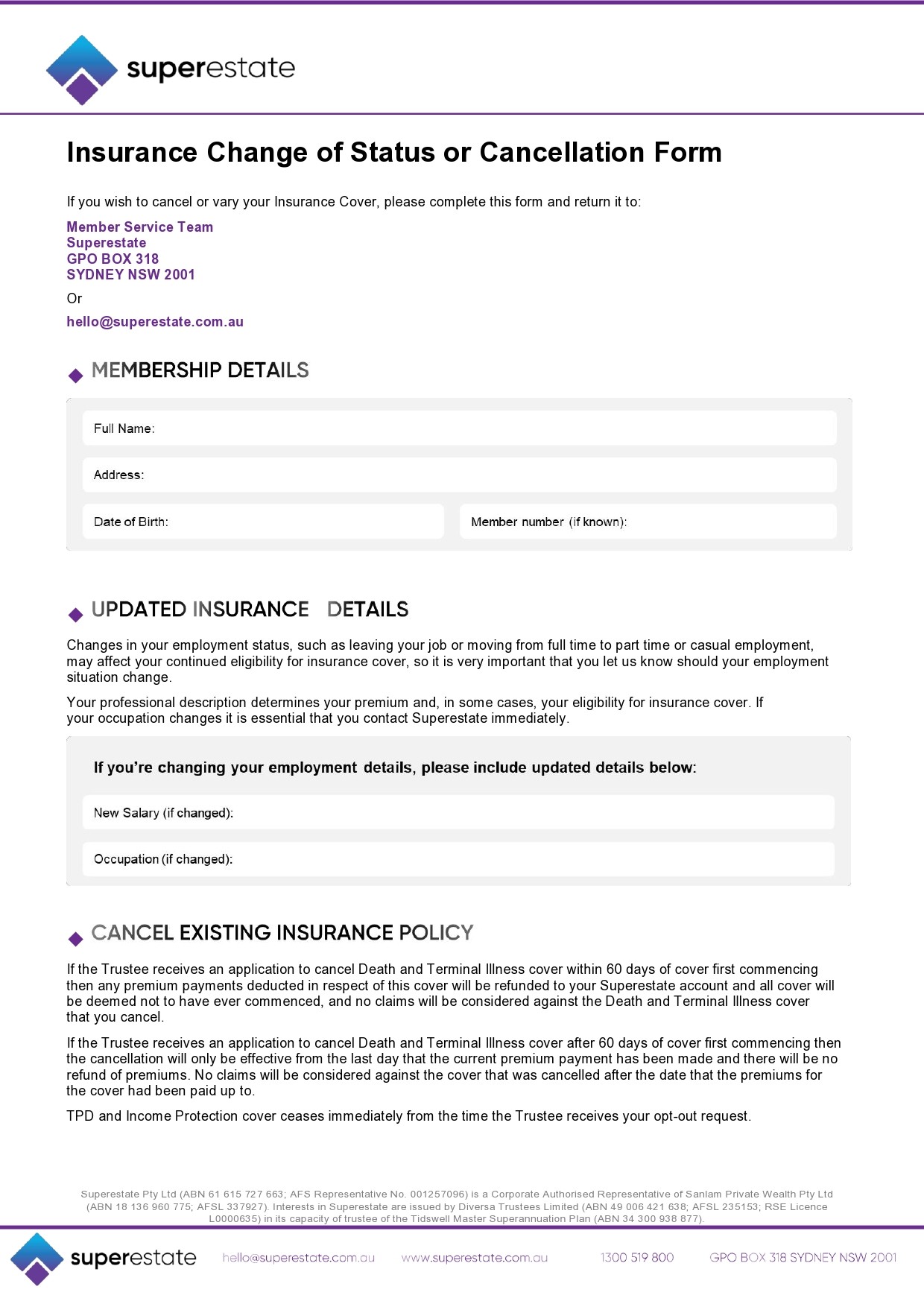

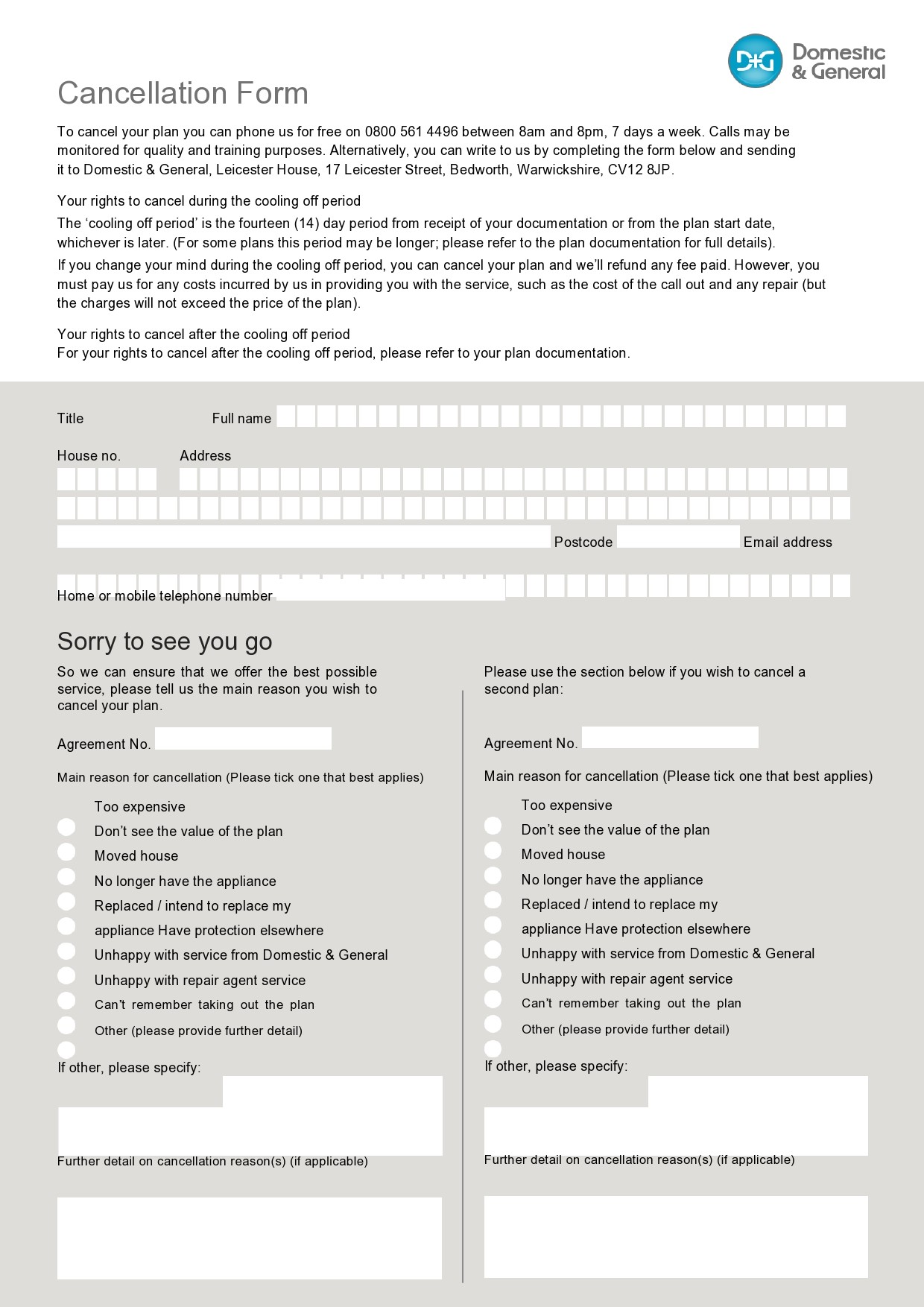

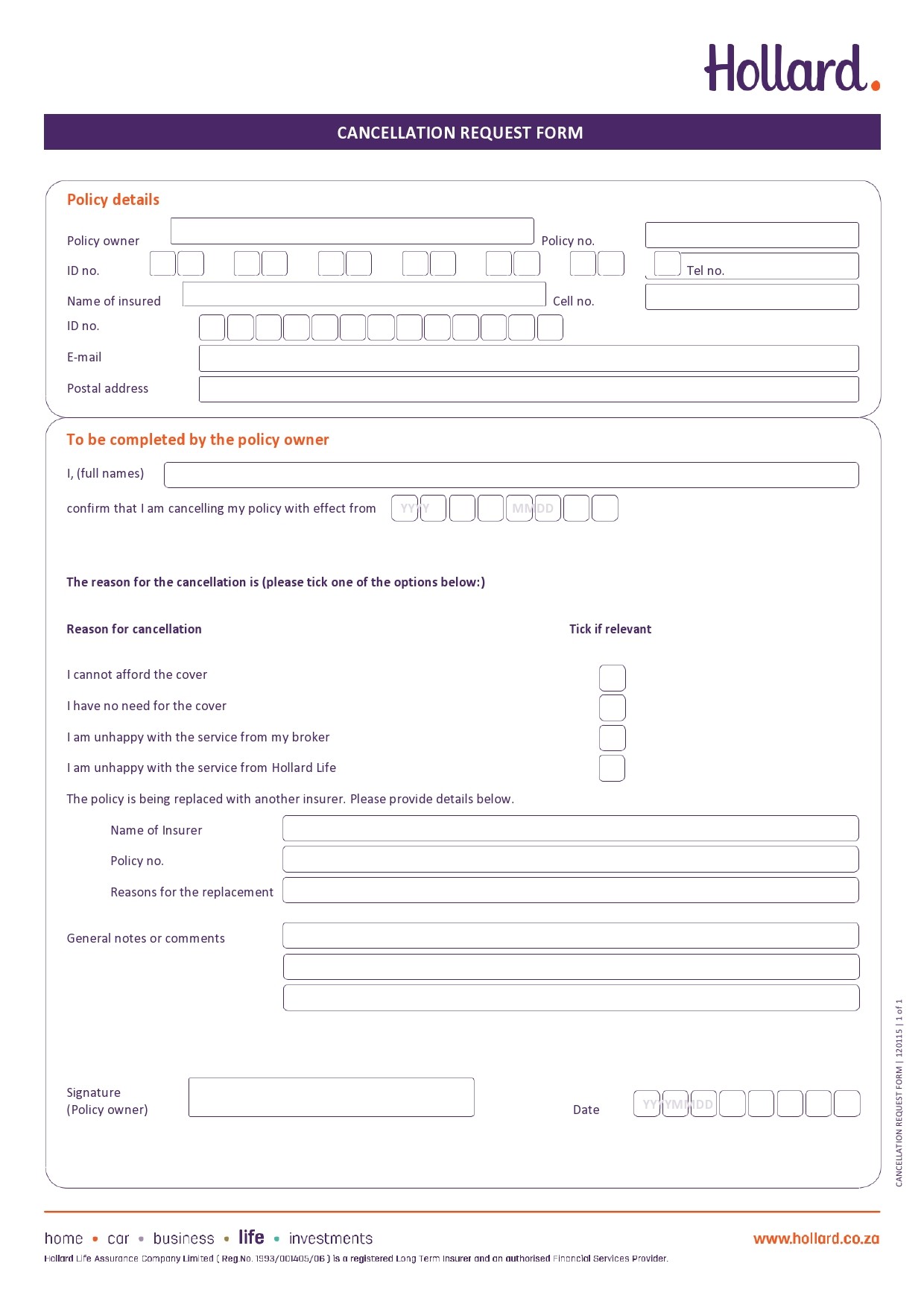

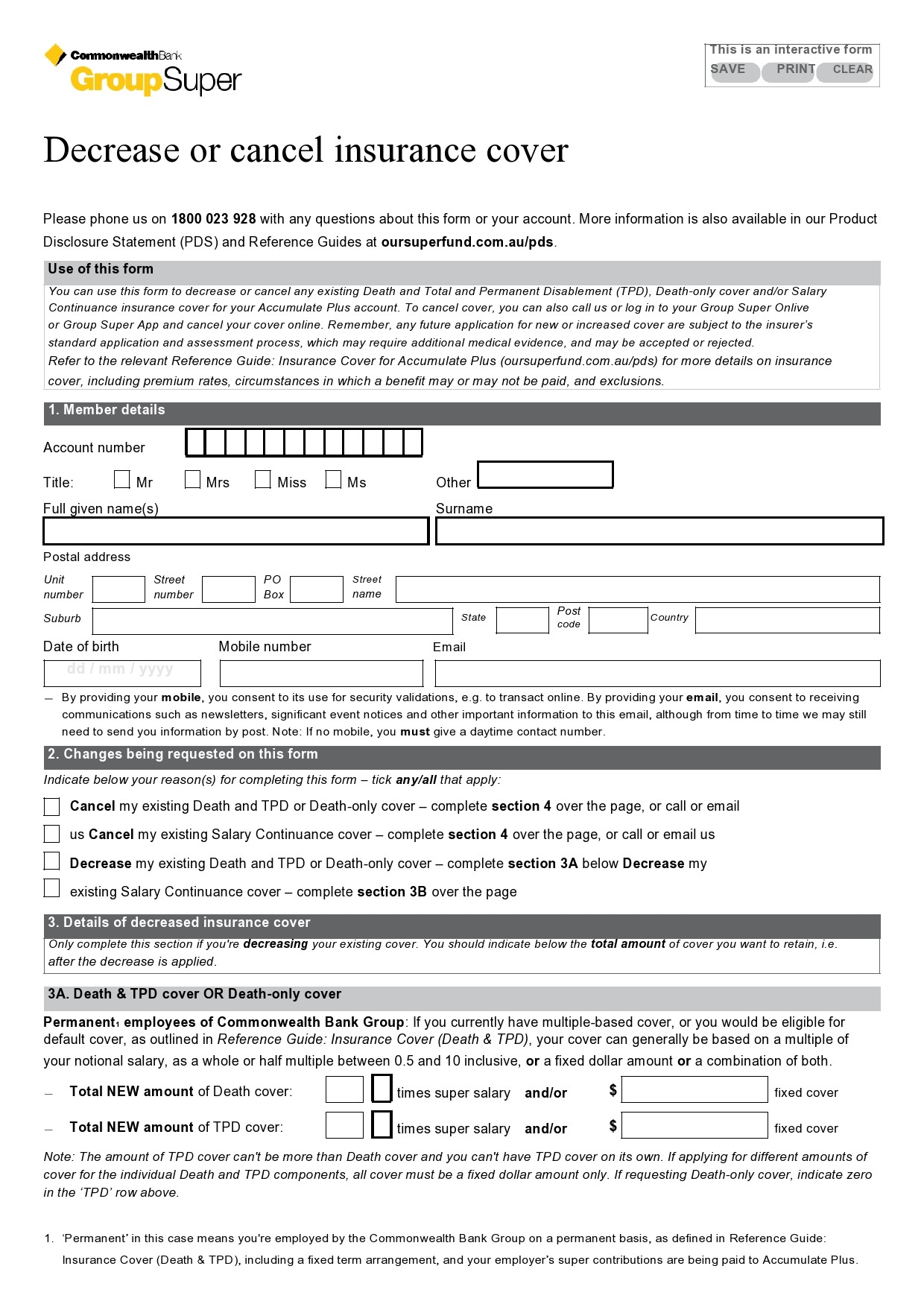

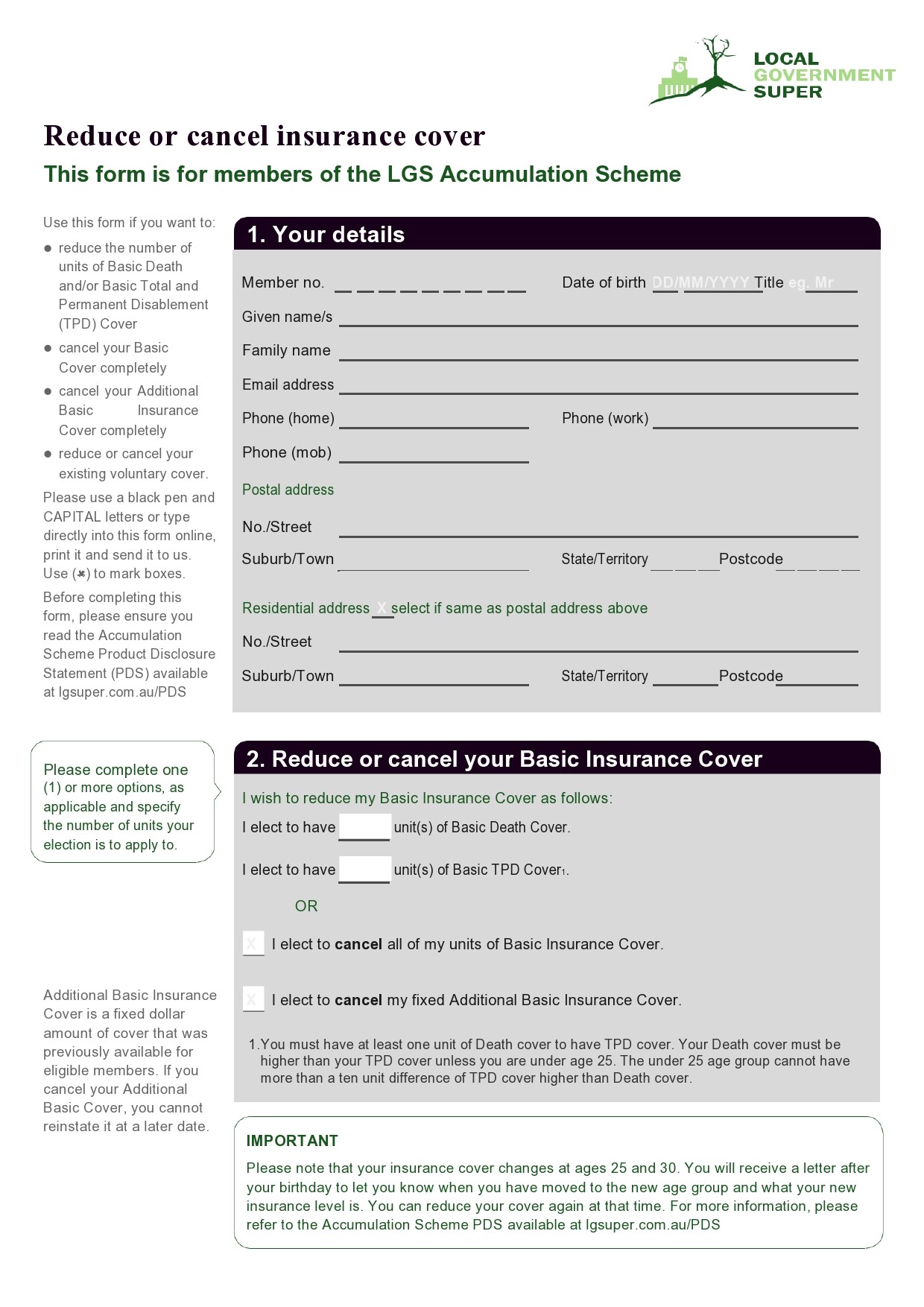

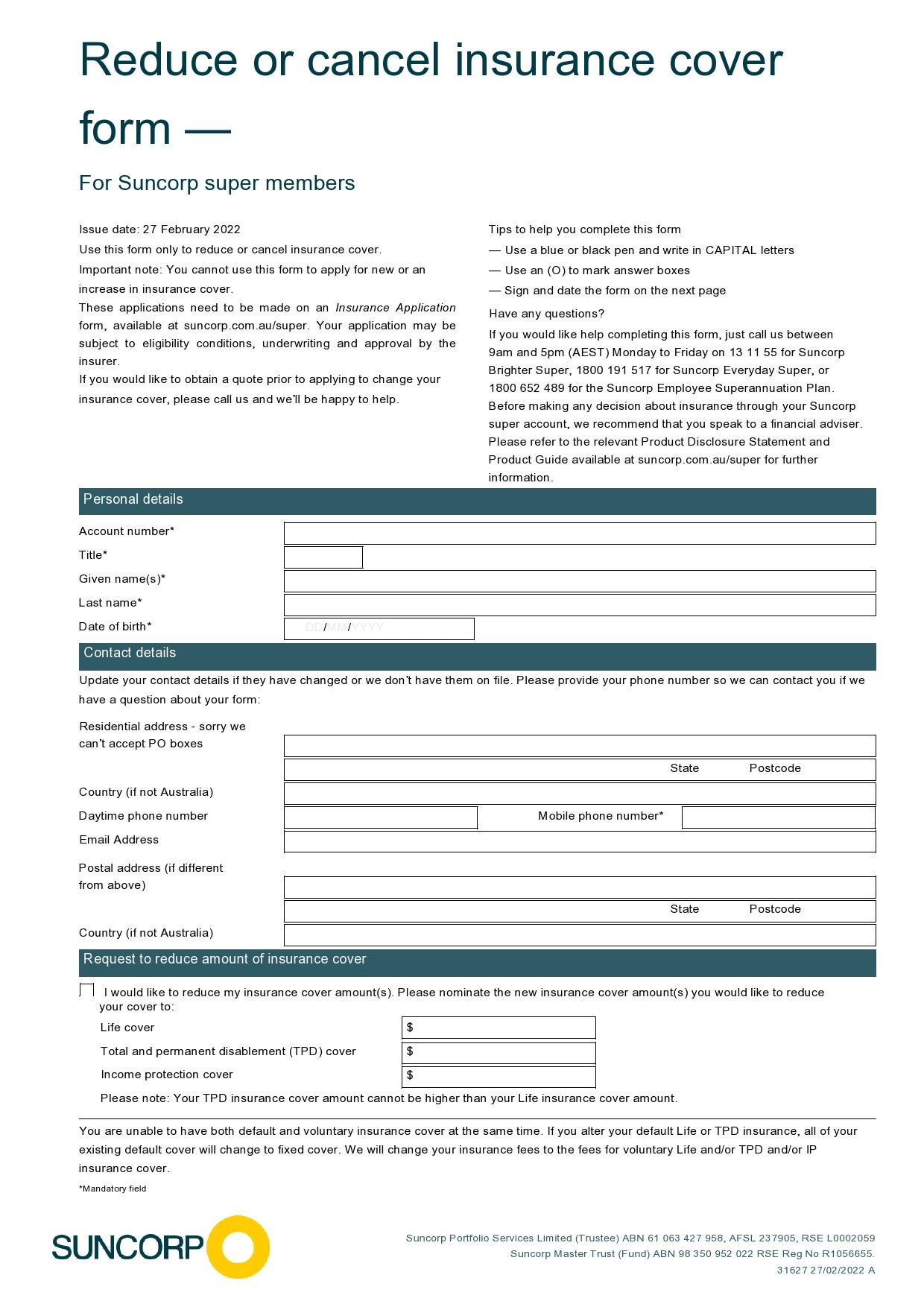

Insurance Cancel Forms

What to prepare before you cancel your insurance policy?

After deciding to cancel your policy and start a new one with a new insurance company, you need to consider a couple of factors when planning your transition. Keep these important things in mind as you prepare for the cancellation:

- Make sure you have another policy ready after you cancel your existing one. It’s essential to have a new policy ready to continue your coverage right away. If you want a policy that’s more affordable but still as good or better than your existing one, use an online quote engine to find one. Also, make sure to complete the required paperwork before you proceed.

- Make sure that you won’t have a gap in your coverage. There are those who leave a gap in their insurance coverage for a small amount of savings. You should avoid having a gap in your insurance coverage, even for just a couple of days. Remember that insurance companies consider this a negative and your insurance rates will reflect this. Take your time when planning your cancellation to make sure that there won’t be any gap between the time and date of your existing policy and new policies.

How do I cancel my insurance policy?

You can have different reasons why you would choose to cancel your insurance policy. For instance, in the case of car insurance, you would cancel it since you don’t have a car or you plan to move to another country or state. You might also want to switch to a company with more affordable rates. No matter what your reason is, the process of canceling your insurance policy is relatively simple. Here are some steps to do this:

- Call your insurance company. Almost all insurance companies will ask you to talk to one of their insurance agents first. You will find the contact details on your insurance card and on the app or website of the insurance company. This is the fastest way though you still might have to sign a notice of cancellation or other documentation to make the cancellation official.

- Mail your cancellation letter and other relevant documents. If required, you have to send your cancellation letter either to your insurance agent’s office or to the company directly.

- Visit the insurance company. If the company’s office is close to you, drop by to do the paperwork personally.

- Ask your new insurance company to deal with the cancellation. Some insurance companies provide a service where they would initiate the cancellation process for new customers who will switch policies in their favor.

Some even choose to let their insurance policy lapse without sending notice that they want to cancel. However, your insurance company might continue billing you and report your failure to pay to credit bureaus. This could damage your credit rating.

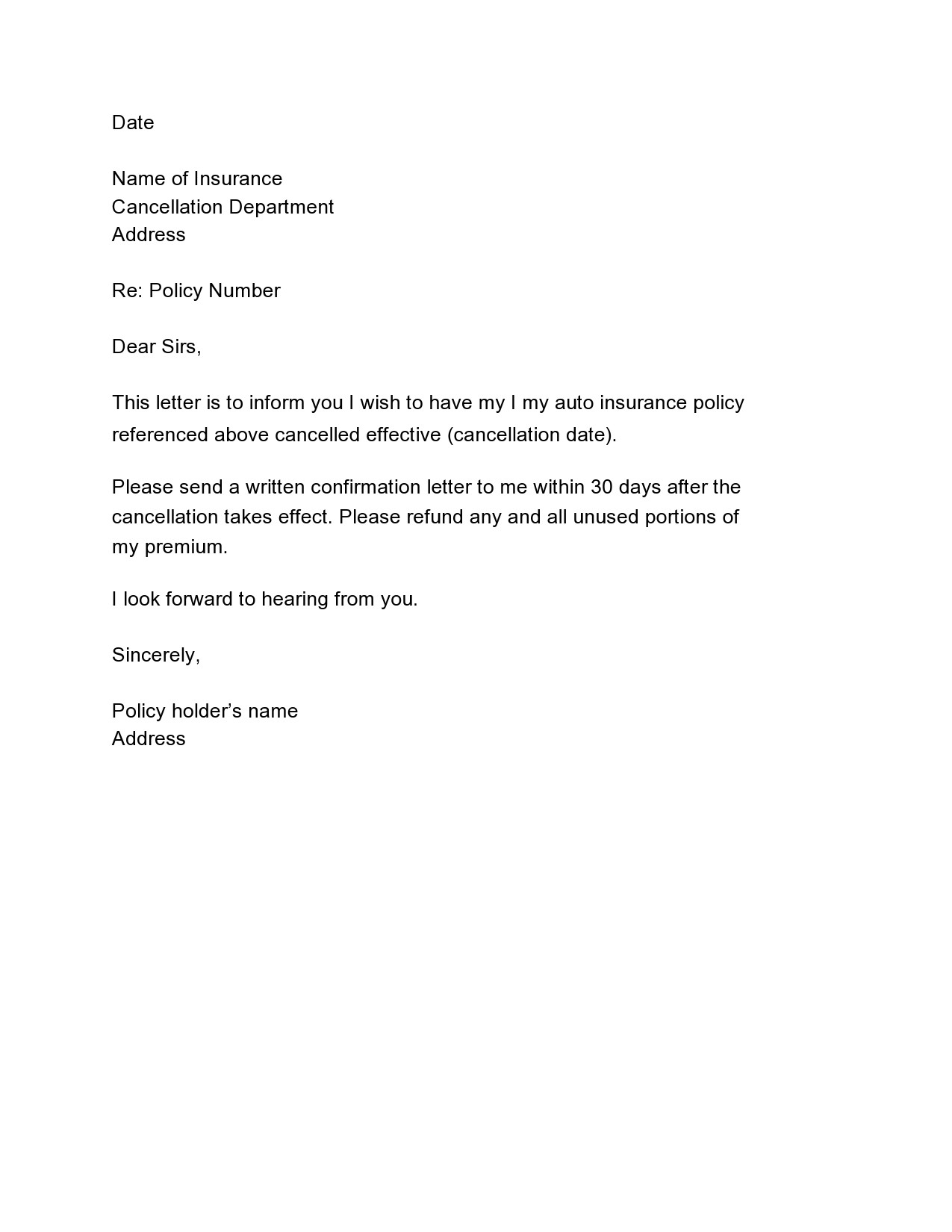

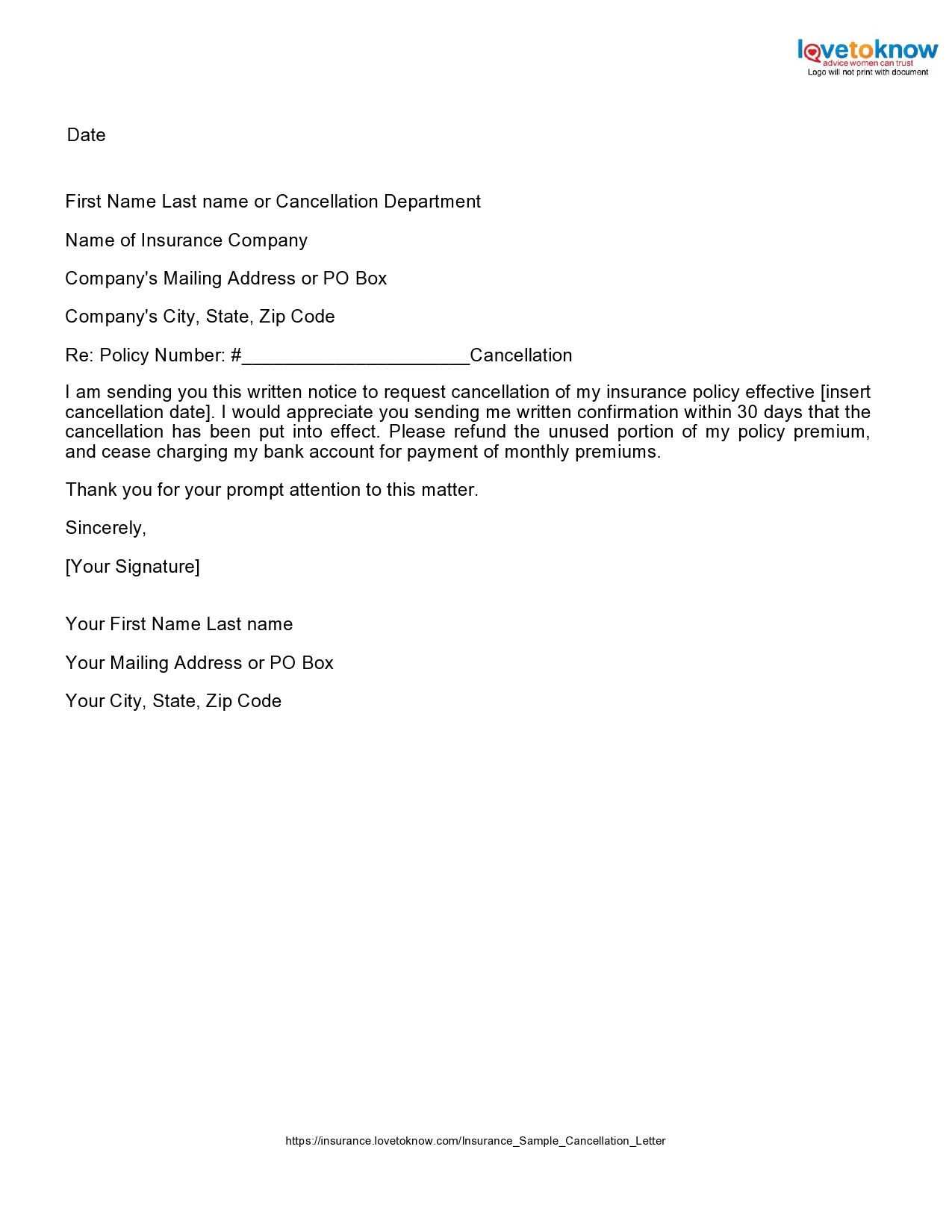

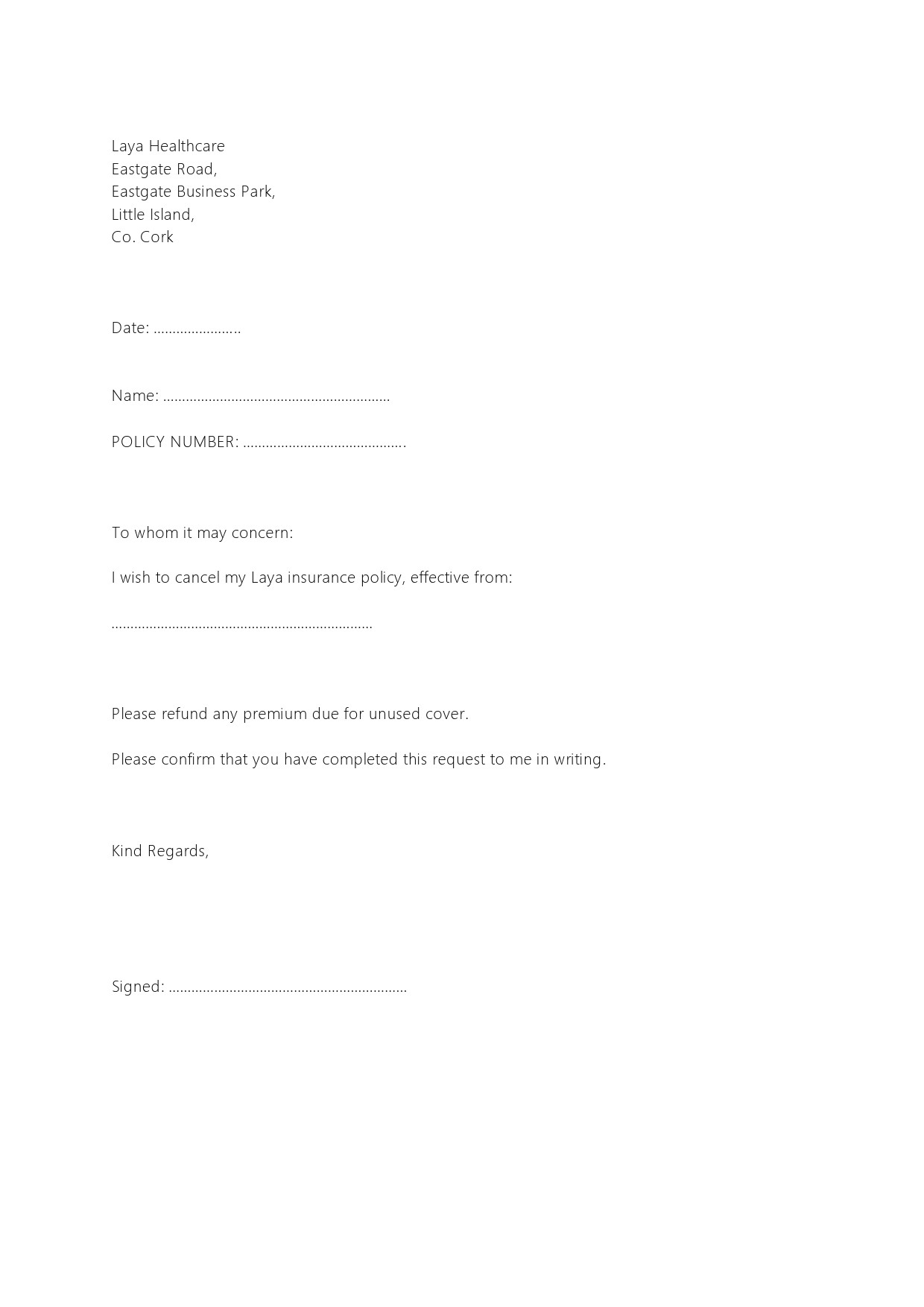

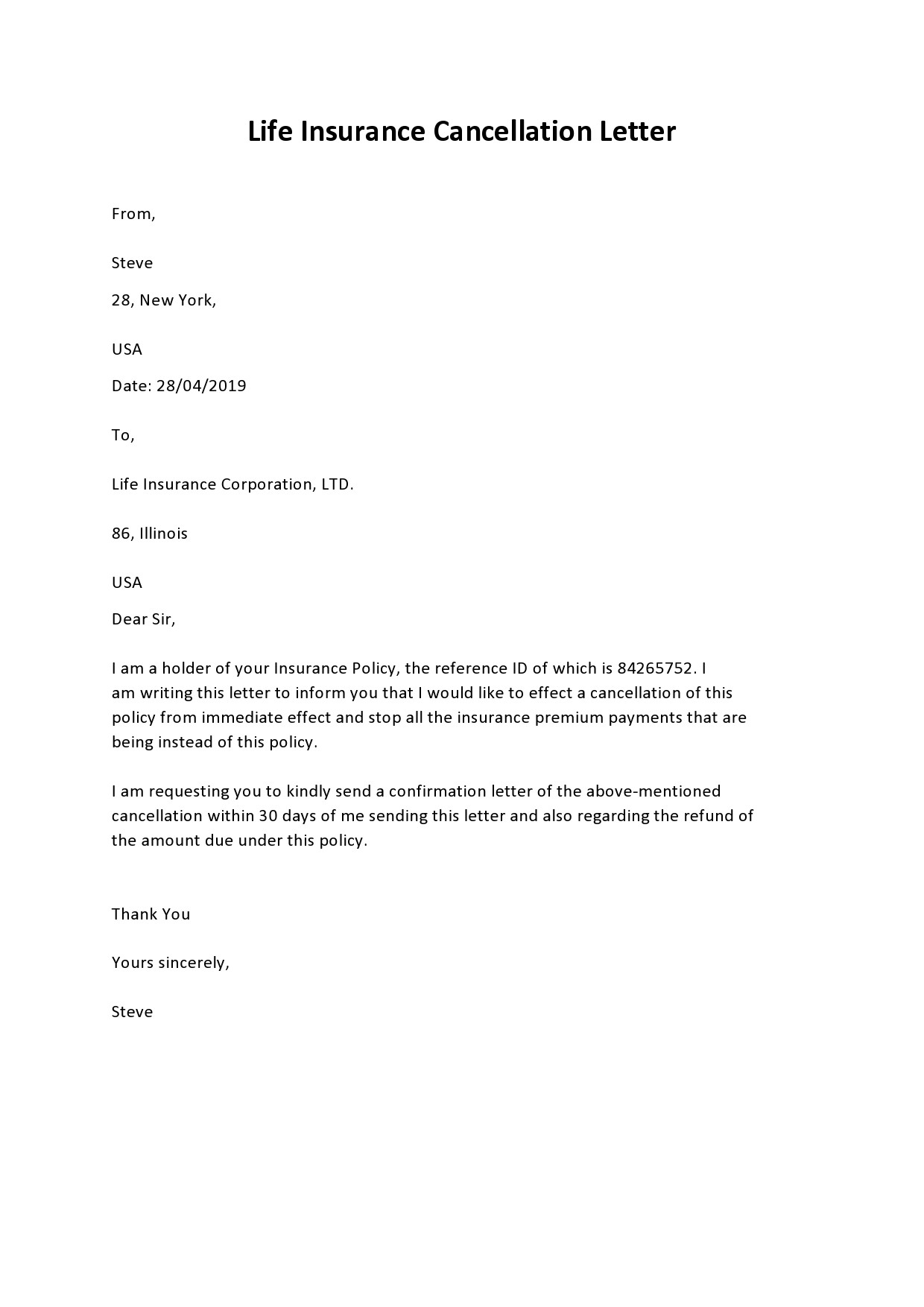

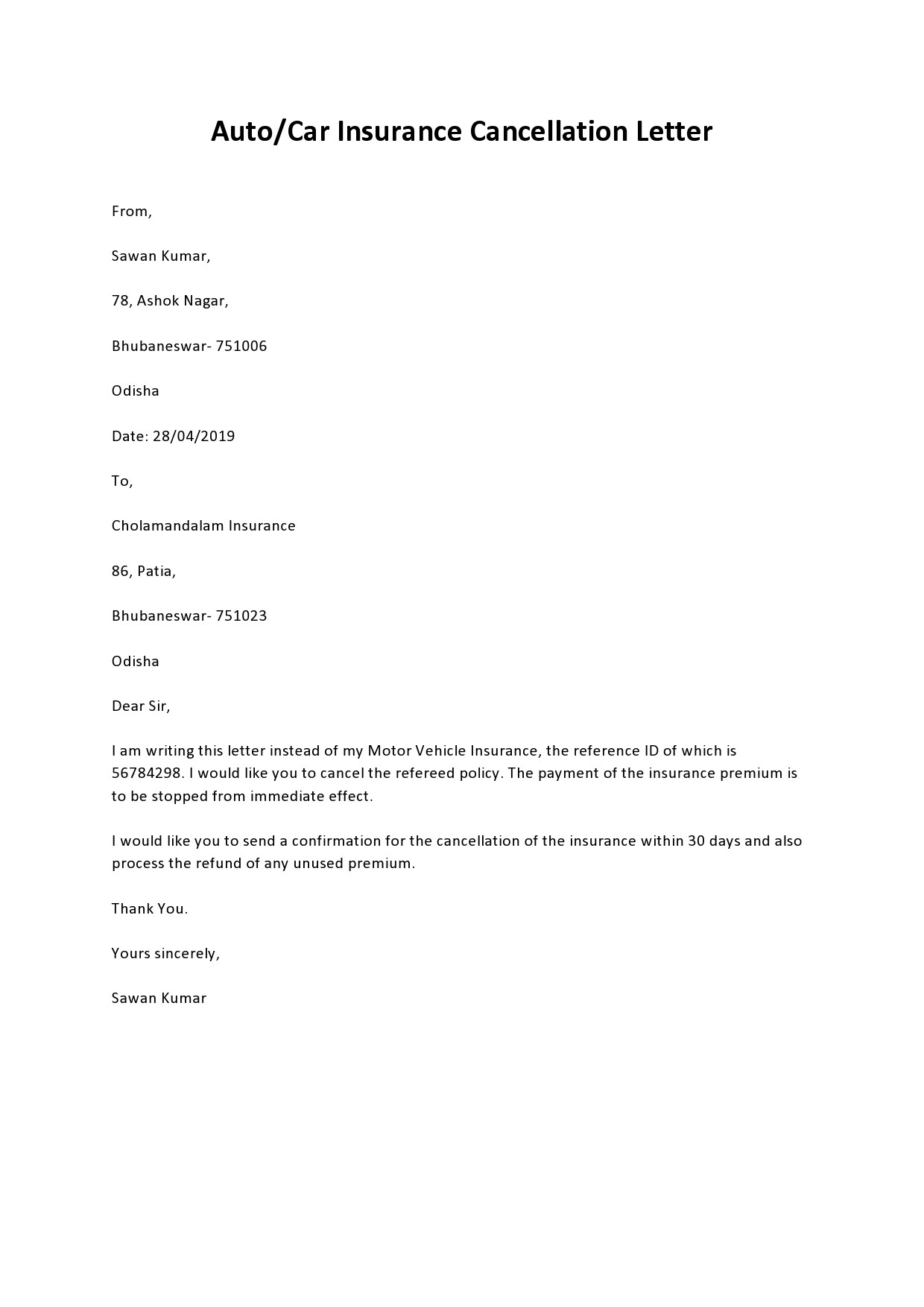

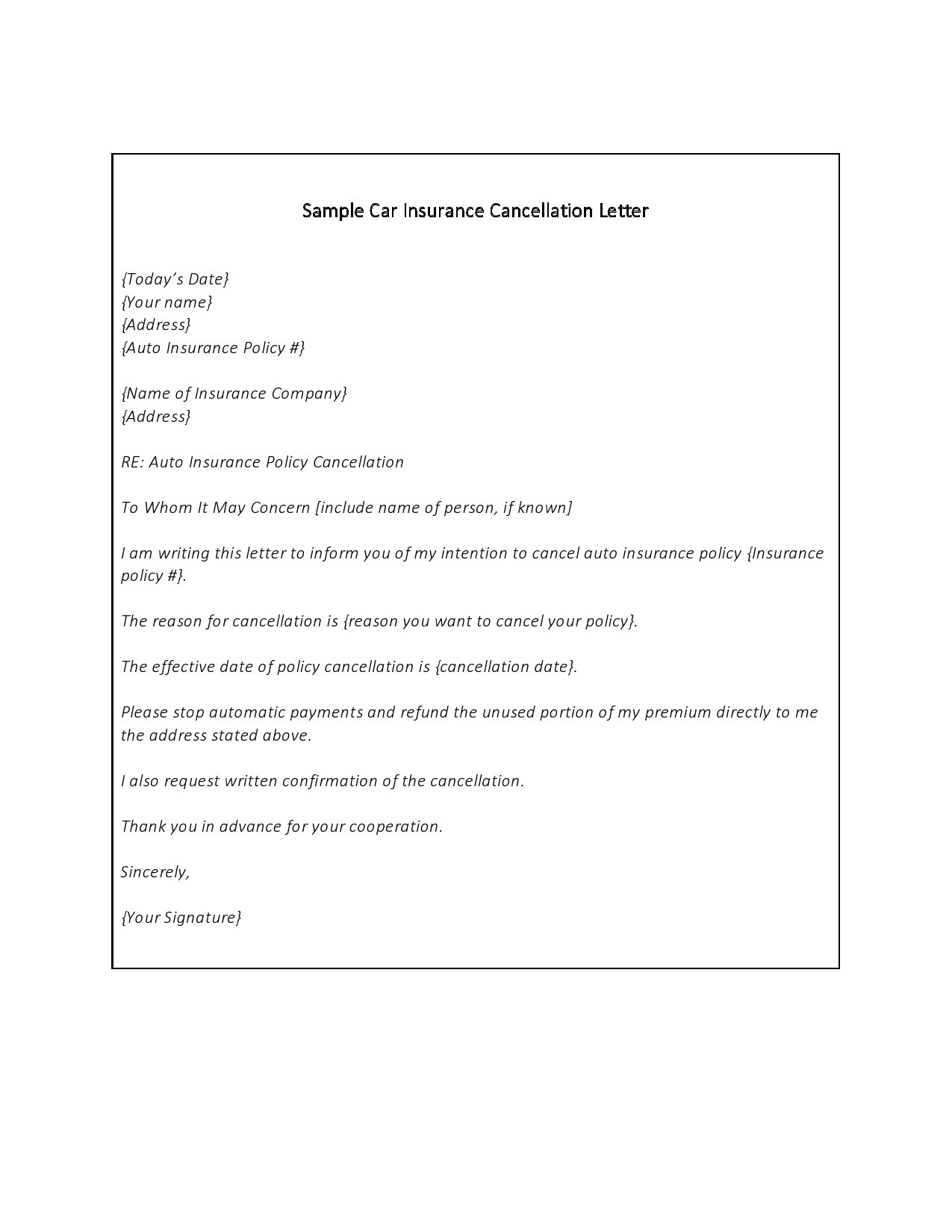

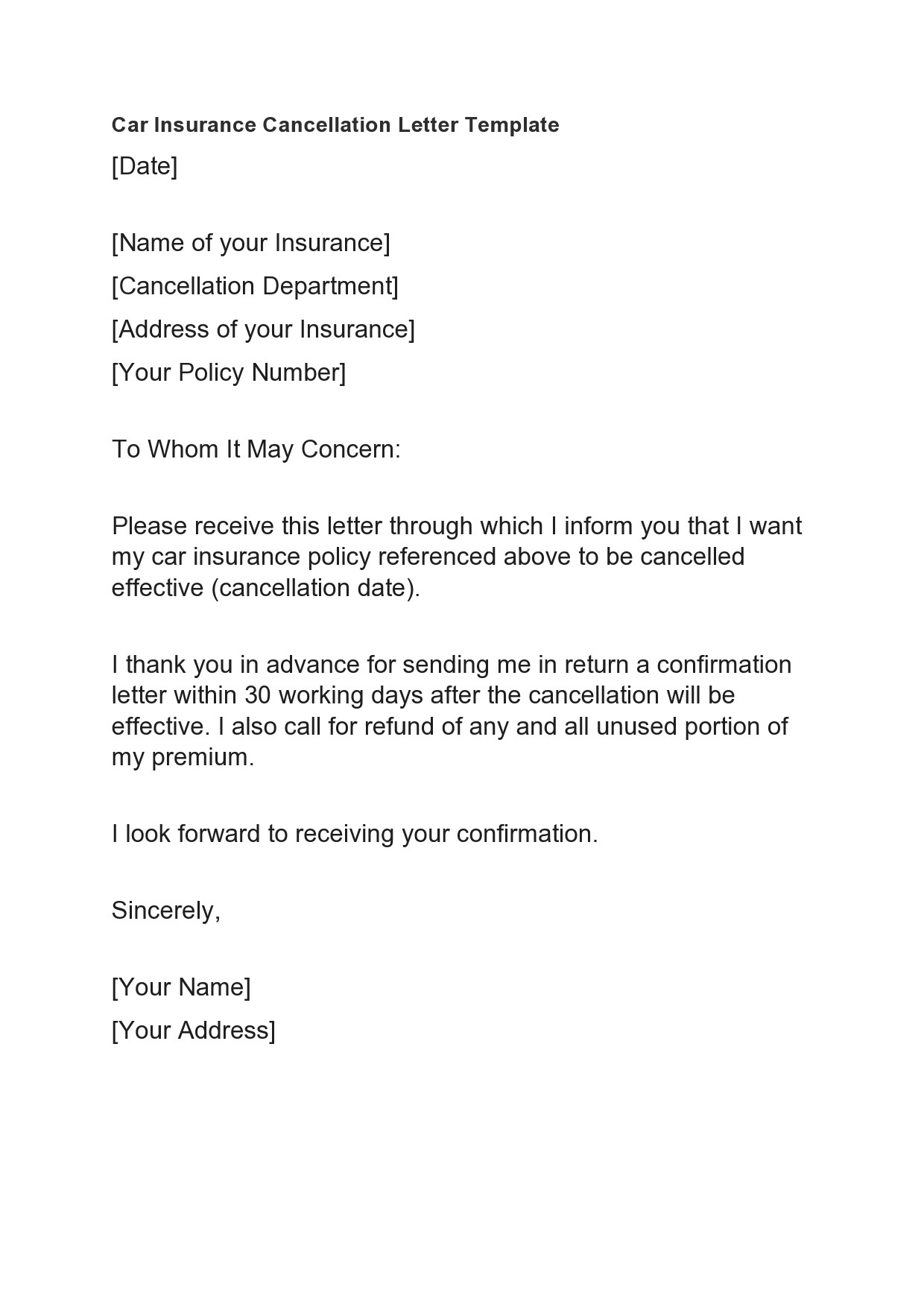

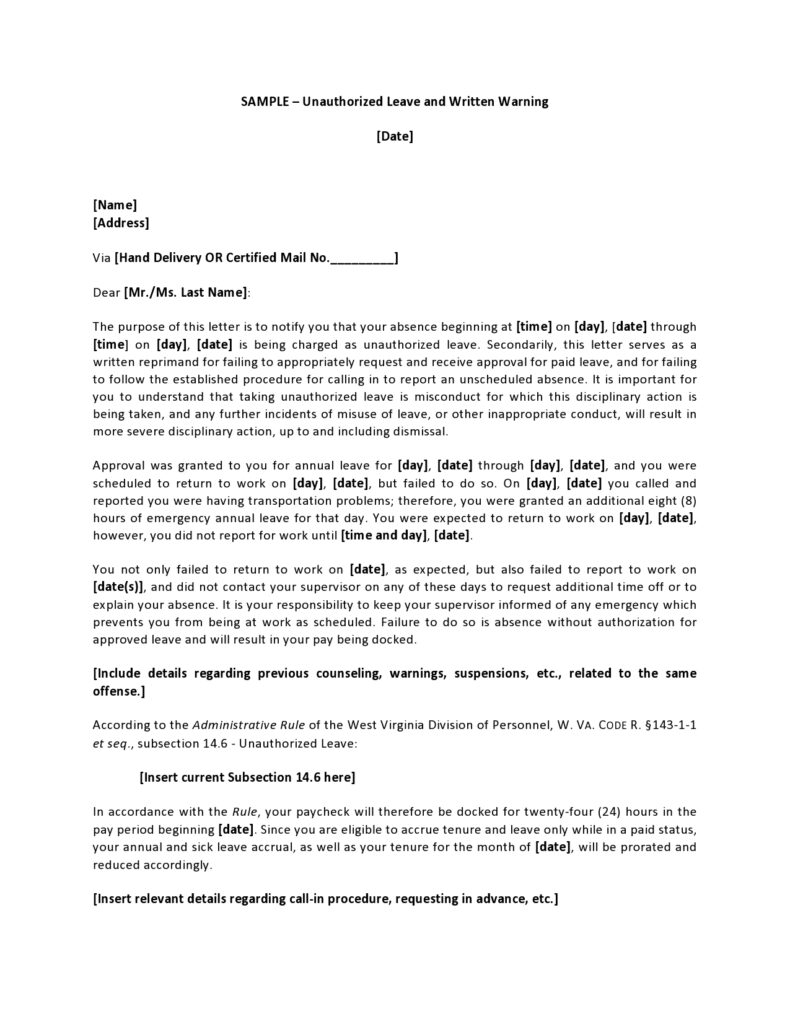

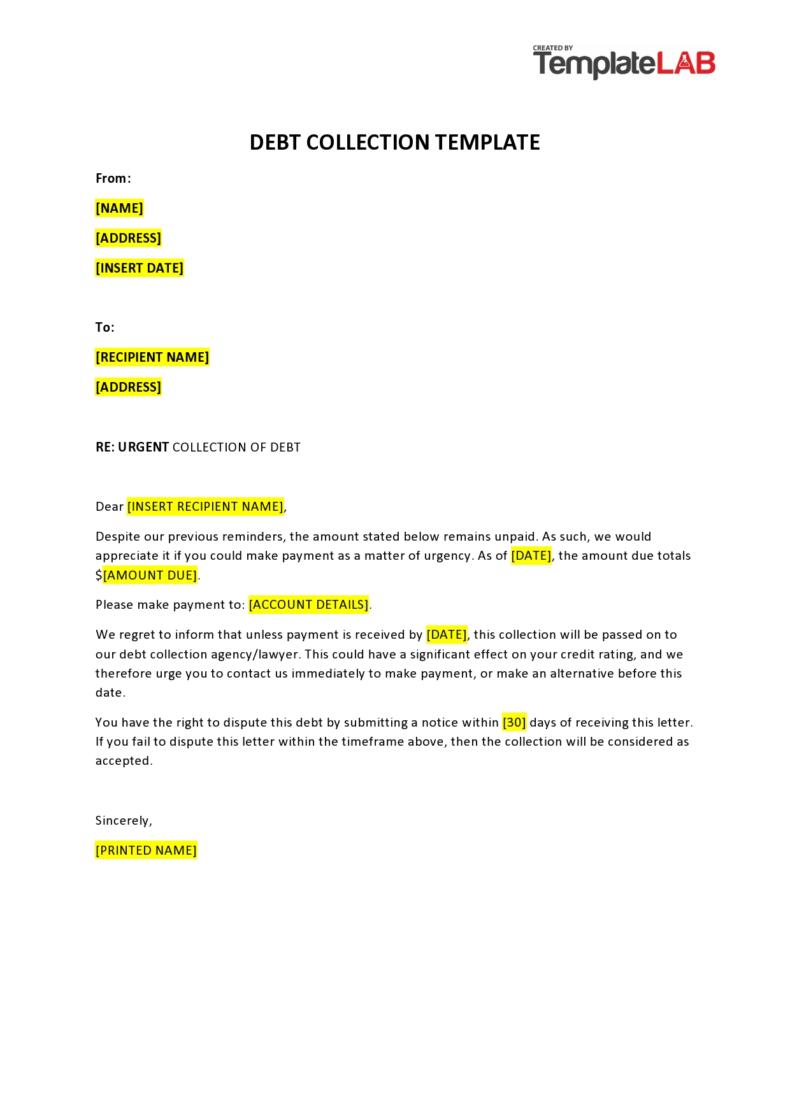

How do you write an insurance cancellation letter?

Before writing an insurance cancellation letter, look at your existing policy to see if there are any provisions for cancelation. Some policies have instructions on how to cancel your insurance policy including how many days’ notice you must provide and to whom you should address the letter. If there are any specific instructions, follow them. But there are instances where the cancellation provision only references cancellation by the insurance company. Without any other instructions on how to cancel your policy, you need to find out the contact details of your insurance company or agent. Have the following information ready when you write your letter:

- Your existing policy number. You need to reference your complete policy number including all of the suffixes and prefixes attached to it.

- The effective cancellation date. This is the date you will request that will ensure that you won’t have any gaps in coverage.

- The name of the new insurance company. You might have to share the name of the new insurance company and contact details in the letter.

- The effective date of your new insurance policy. It’s important to include this date too.

- Your mailing address. Include your current mailing address and contact details so that you can receive any refunds or checks from your current insurance company.

You should also consider these pointers when drafting your letter:

- Include all of the required information about both yourself and your insurance company.

- Mention your intent to cancel your policy at the beginning of your letter.

- Clearly state that you would like to cancel your policy.

- Provide details like your policy number and relevant dates to make it easier for the insurance company to find your records.

- Be both straightforward and concise. You don’t have to elaborate on the details of the reason why you want to cancel your policy.

- Don’t write your letter by hand as this might cause miscommunication if you don’t have legible handwriting.

- Use a professional and respectful tone.

- Proofread your content to make sure you have added accurate information.

- Sign the letter by hand.

- Confirm the mailing address before you send your letter.

Remember to include a request for written receipt confirmation. This will serve as your proof that you requested the cancellation and the effective date. You may also consider using certified mail with your request. You would get your return receipt from your post office and you can consider it proof of delivery.

You should save this in your files along with the confirmation letter you receive. Remember the importance of using contractually approved avenues when submitting your insurance cancellation letter. Also, keep a signed copy of your letter and the signed return receipt in your files.

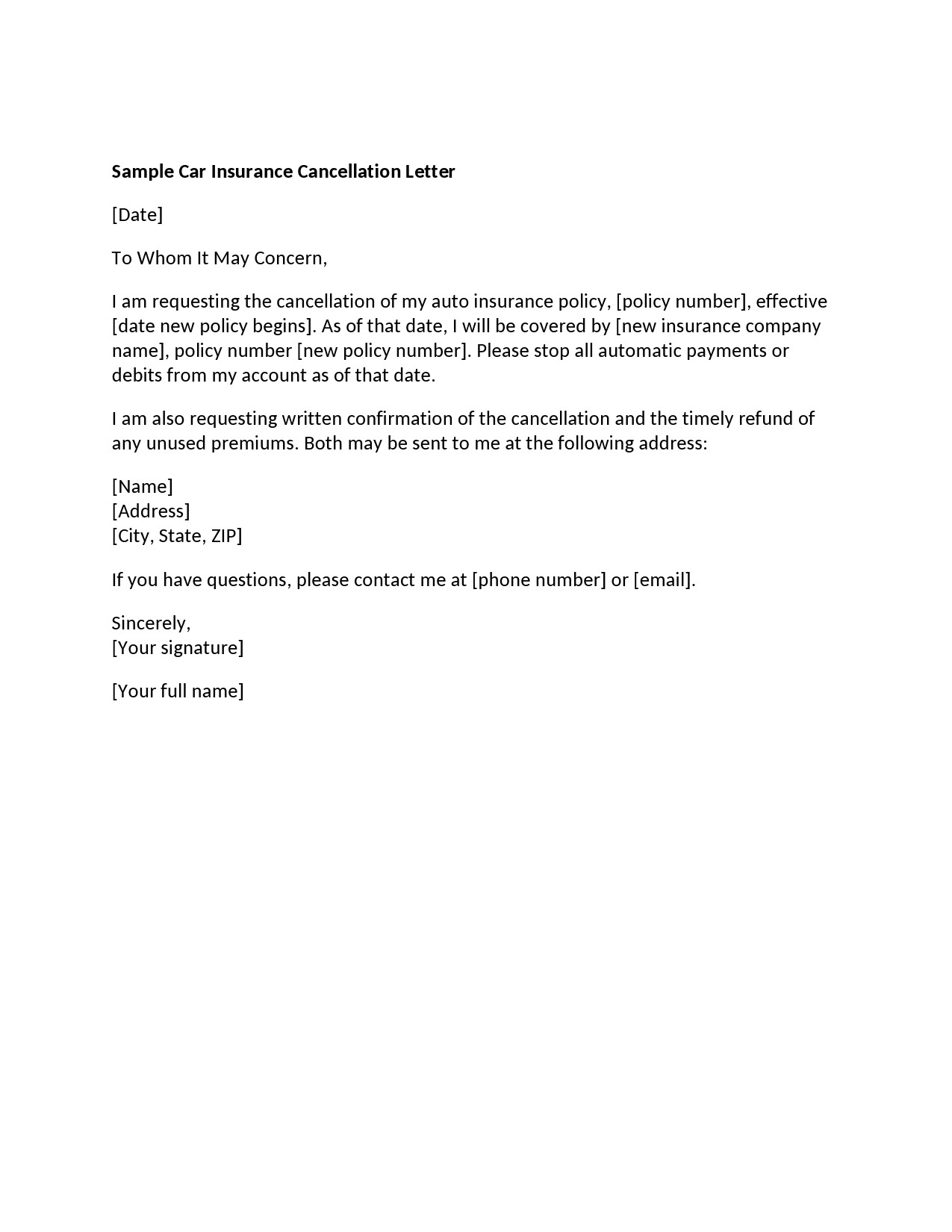

Auto Insurance Cancellation Letters

What will happen after the cancellation?

After canceling your insurance policy, expect the following things to happen:

- Your auto insurance company will notify your state that you and your vehicle aren’t insured with them anymore. Driving without insurance isn’t legal in almost all states. Your local DMV might ask for proof that you either sold your vehicle or obtained a new insurance policy. If you cannot provide such proof, the state will either suspend your driver’s license or registration. You might also have to surrender your license plate.

- If you still have some time left on your existing policy, the insurance company might issue a prorated refund of the premium from your most recent payment. Some companies might also charge a fee if you want to cancel your policy early.

- If you change your insurance policy, make sure that the new policy will take effect before the existing one gets canceled.

- Remember that lapses in insurance, especially for auto insurance, aren’t legal. If you have a car lease or loan that you haven’t paid fully yet, you must notify the lending institution that you have switched policies.

- If you cancel your policy because you plan to move out of state, you may have to show proof of insurance when registering your car in the new state.

Different states have varying rules regarding the amounts and types of insurance that you must carry. Insurance companies also differ in their cancellation processes. This is why it’s important to consult with an insurance agent or read your existing policy before you start writing your insurance cancellation letter.