Incumbency is often associated with the word “current” and its use in the phrase “certificate of incumbency” becomes appropriate as this refers to a legal document issued by a limited liability company or a corporation that contains lists the names of all current officers, directors, and at times, key shareholders. This document also specifies the positions held by these individuals within the corporation.

Table of Contents

- 1 Certificates of Incumbency

- 2 What is a certificate of incumbency?

- 3 Incumbency Certificates

- 4 Understanding a certificate of incumbency

- 5 Certificate Of Incumbency Samples

- 6 What information does a certificate of incumbency include?

- 7 Letters Of Incumbency

- 8 When to use a certificate of incumbency?

- 9 Does your company need a certificate of incumbency?

- 10 How long is a certificate of incumbency valid for?

Certificates of Incumbency

What is a certificate of incumbency?

The main purpose of a certificate of incumbency is to verify the identities of persons authorized to sign for the corporation. You can also it for other various purposes like;

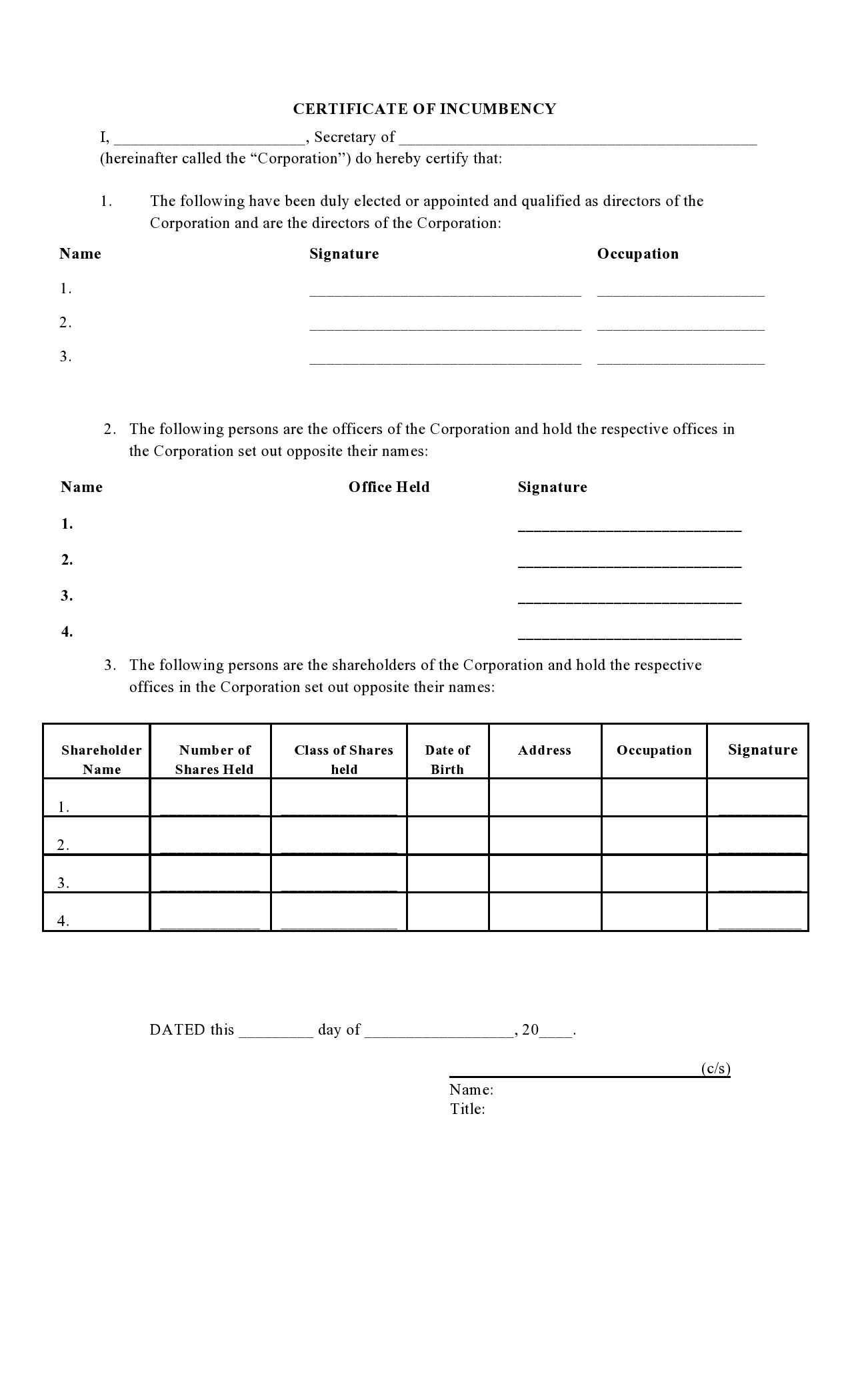

- To verify the names of shareholders and directors along with the contents of the minute book.

- To serve as proof that a certain individual has the authority to initiate legally binding transactions on behalf of the company.

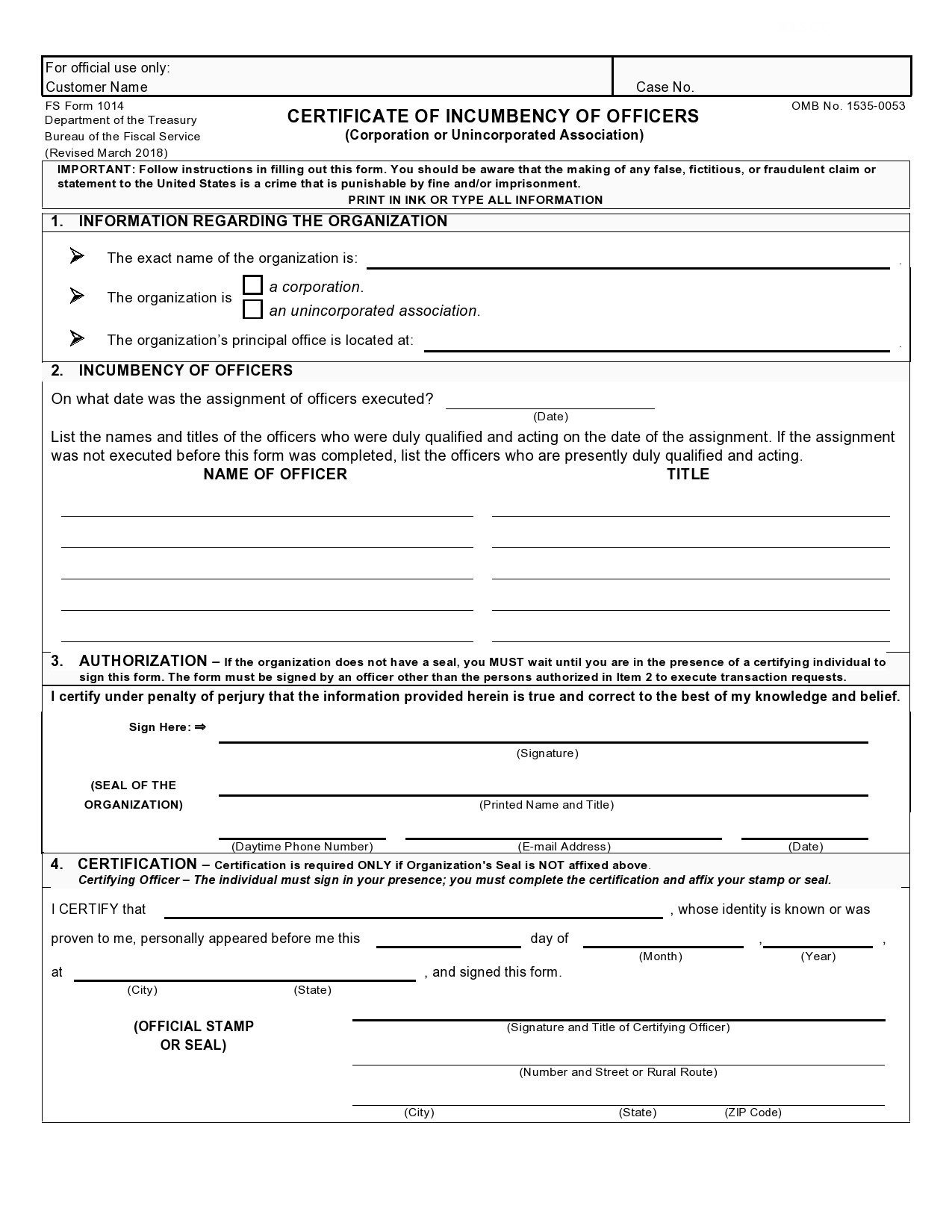

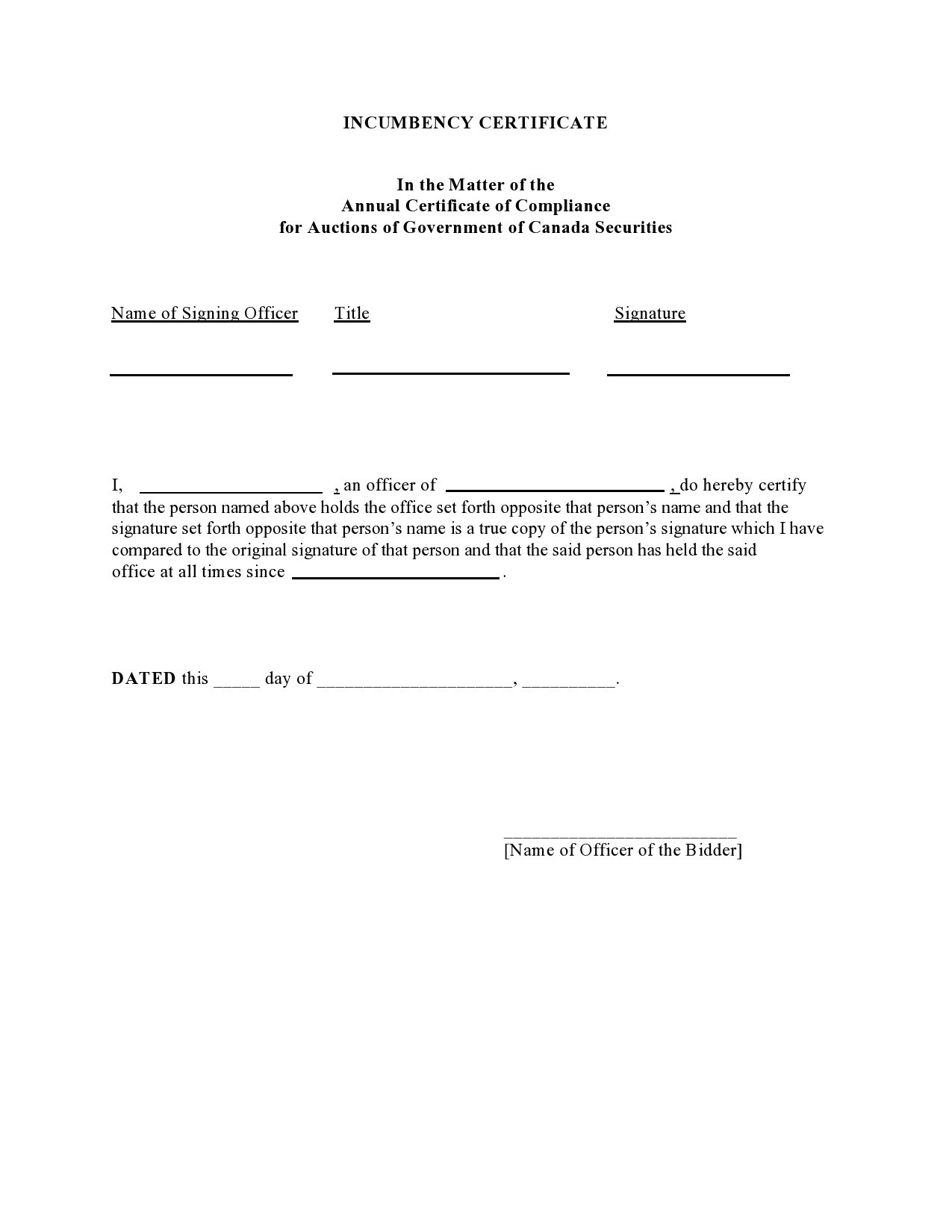

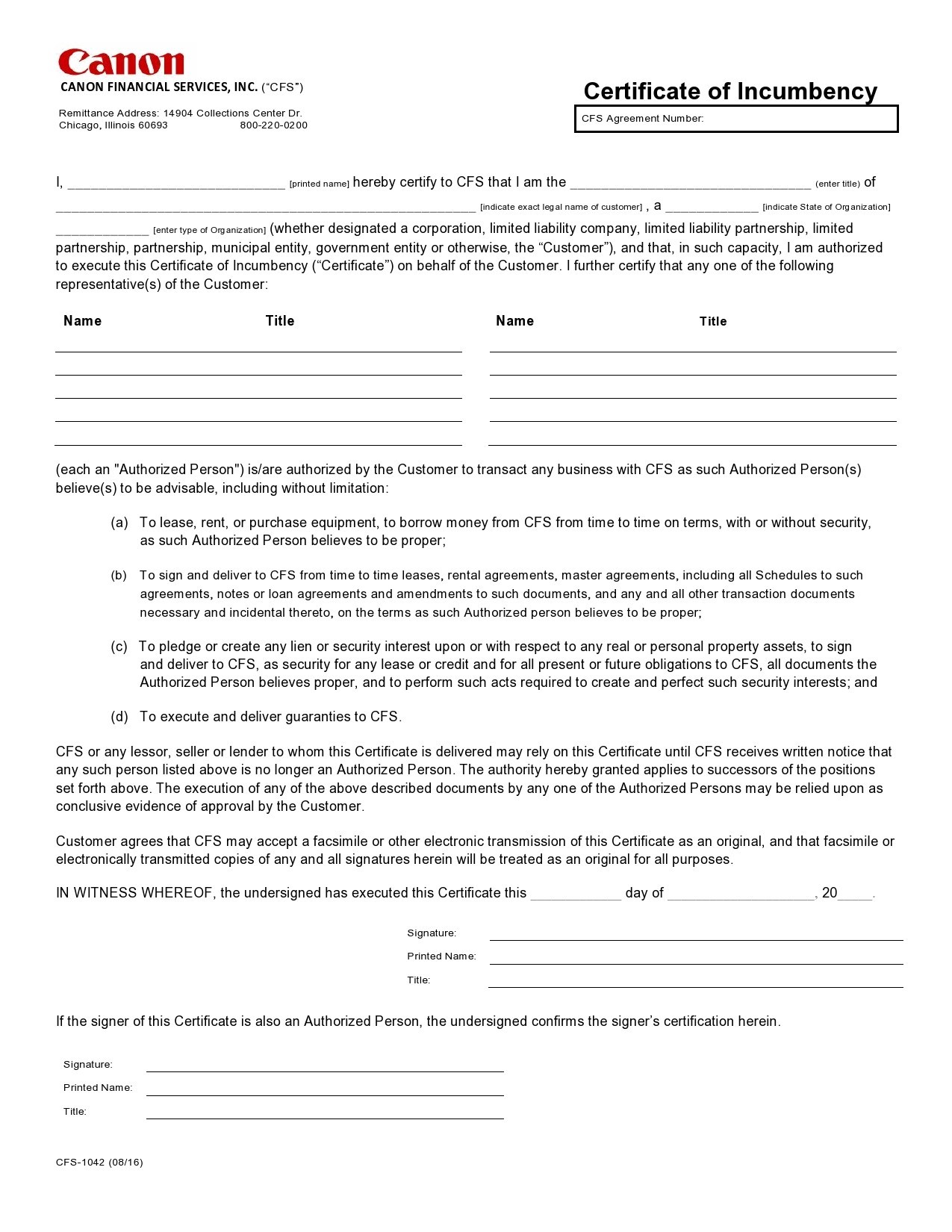

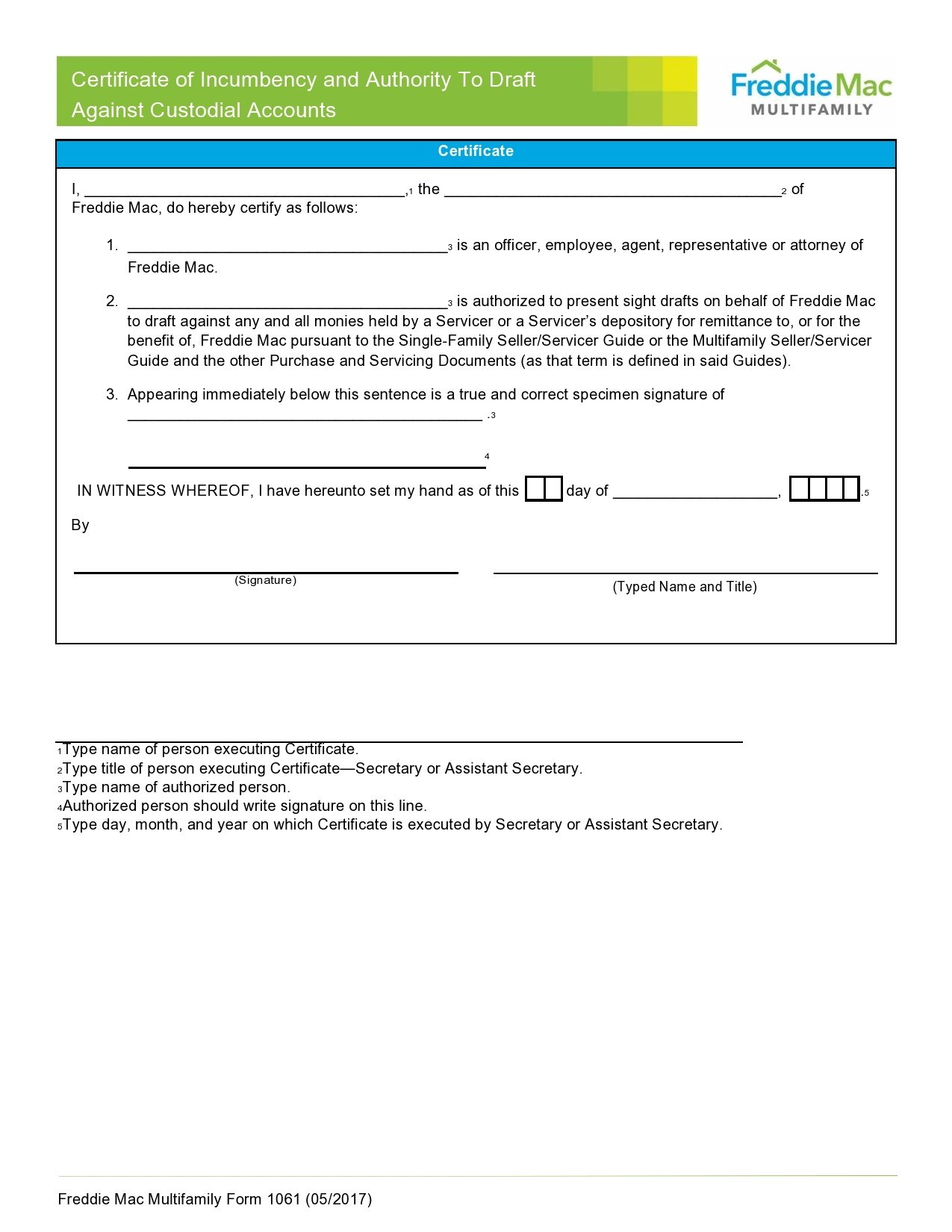

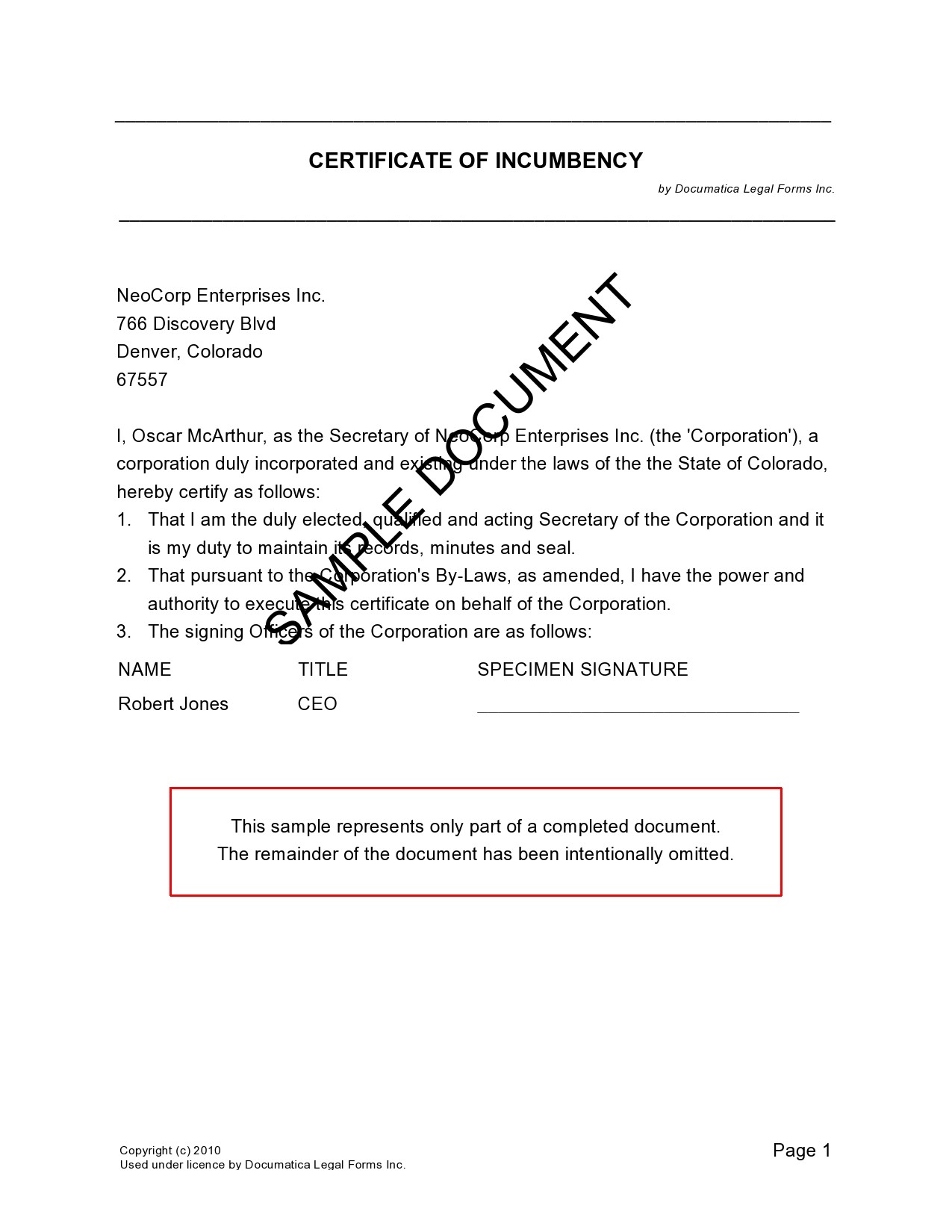

The format of most incumbency certificates gives an illustration of how the company formed and its current corporate status. Basically, the certificate includes the following information:

- The names of the directors or officers of the corporation and their respective standings.

- Information on whether these individuals got elected or appointed to their position along with the terms of their offices.

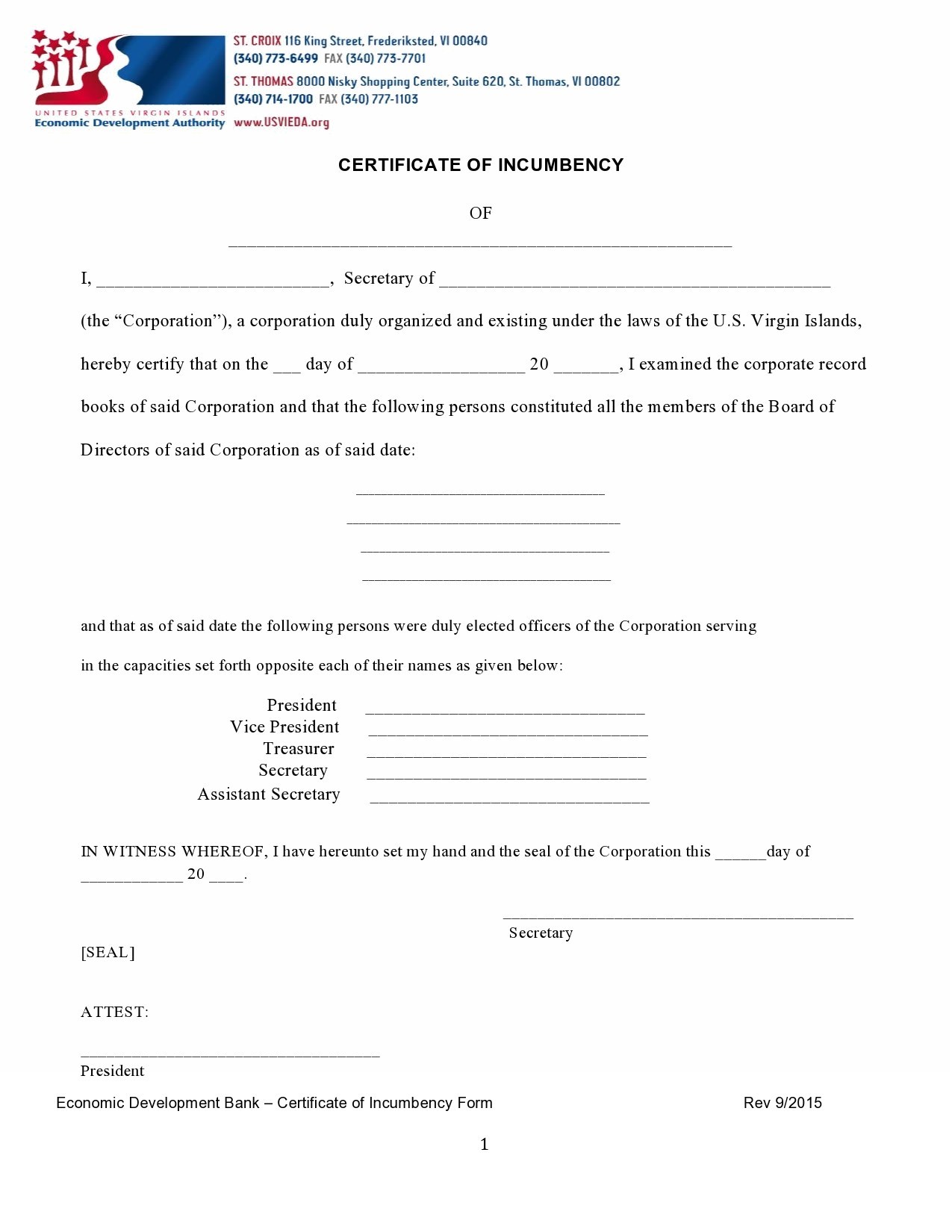

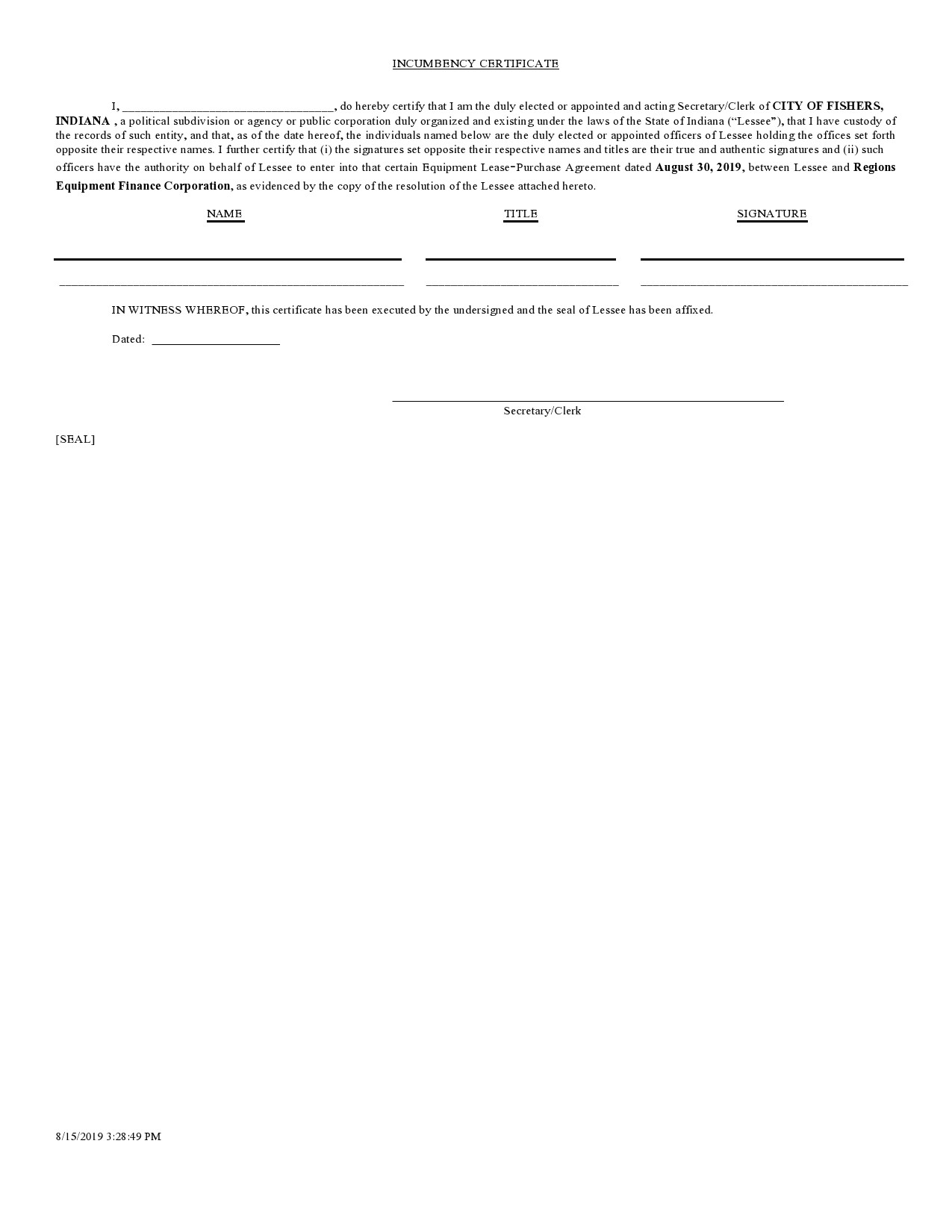

The certificate confirms the identities of all those authorized to sign for the organization. These usually include officers, shareholders or directors. When one business organization plans to go into business with another, the former will like to know which people from the other have the authority to enter into contracts or transactions on behalf of the business.

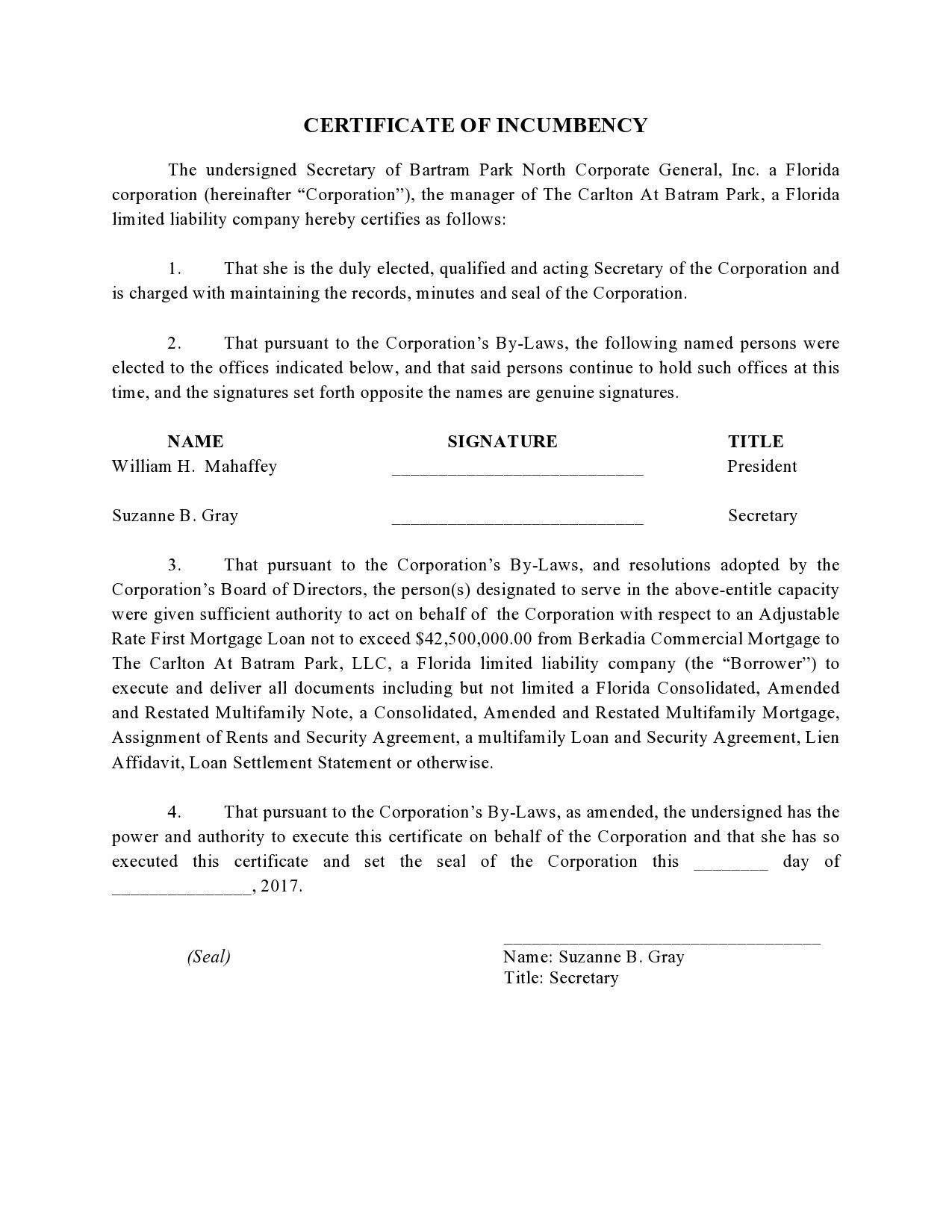

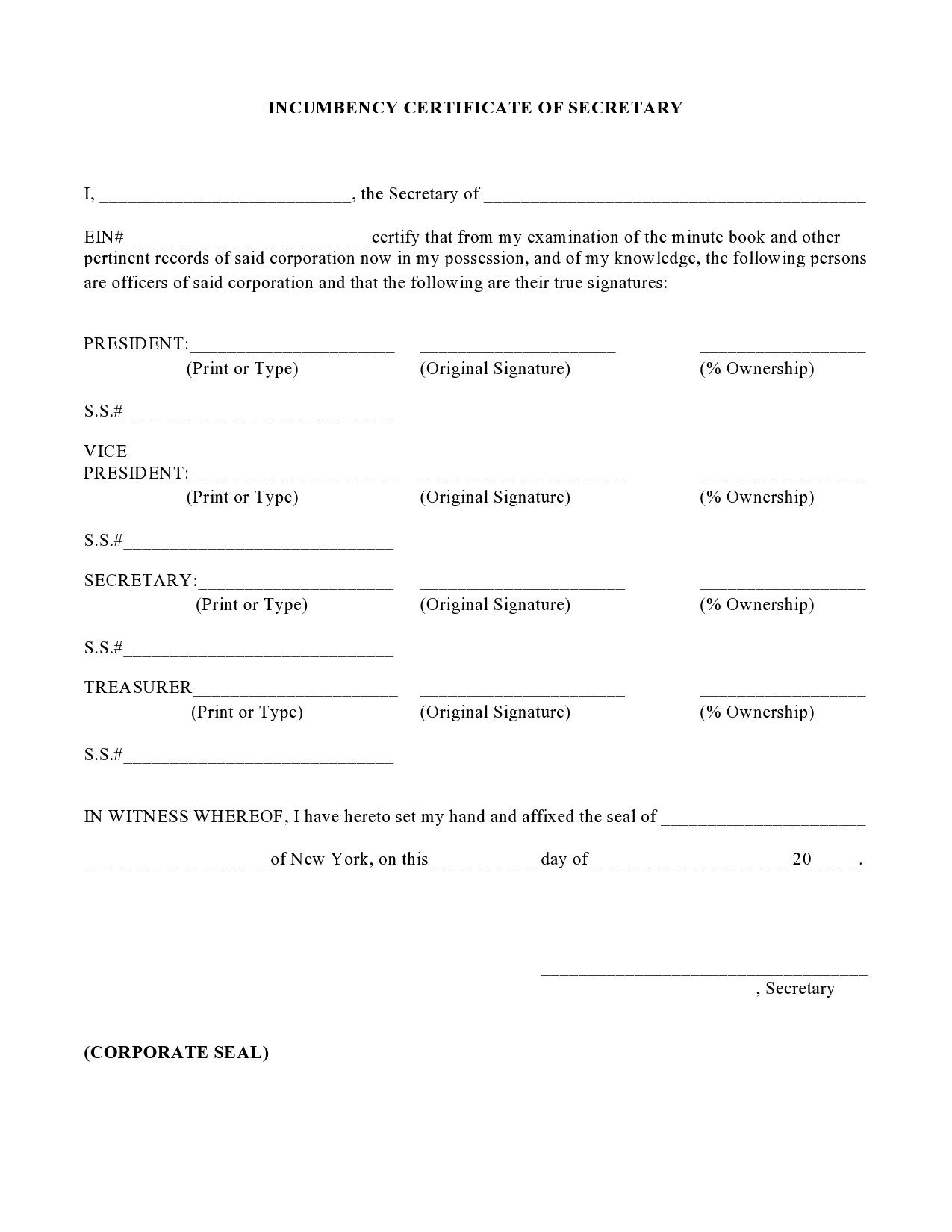

The person responsible for preparing the certificate is usually the Secretary of the Corporation. This officer gets appointed by the Board of Directors and has the task of managing the company records and minute book.

The Minute Book contains all the documents related to the organization. It includes the seal of the corporation, any articles of incorporation, the by-laws of the corporation, different registries, minutes and resolutions of the shareholders or directors, certificate of shares, and the yearly reports.

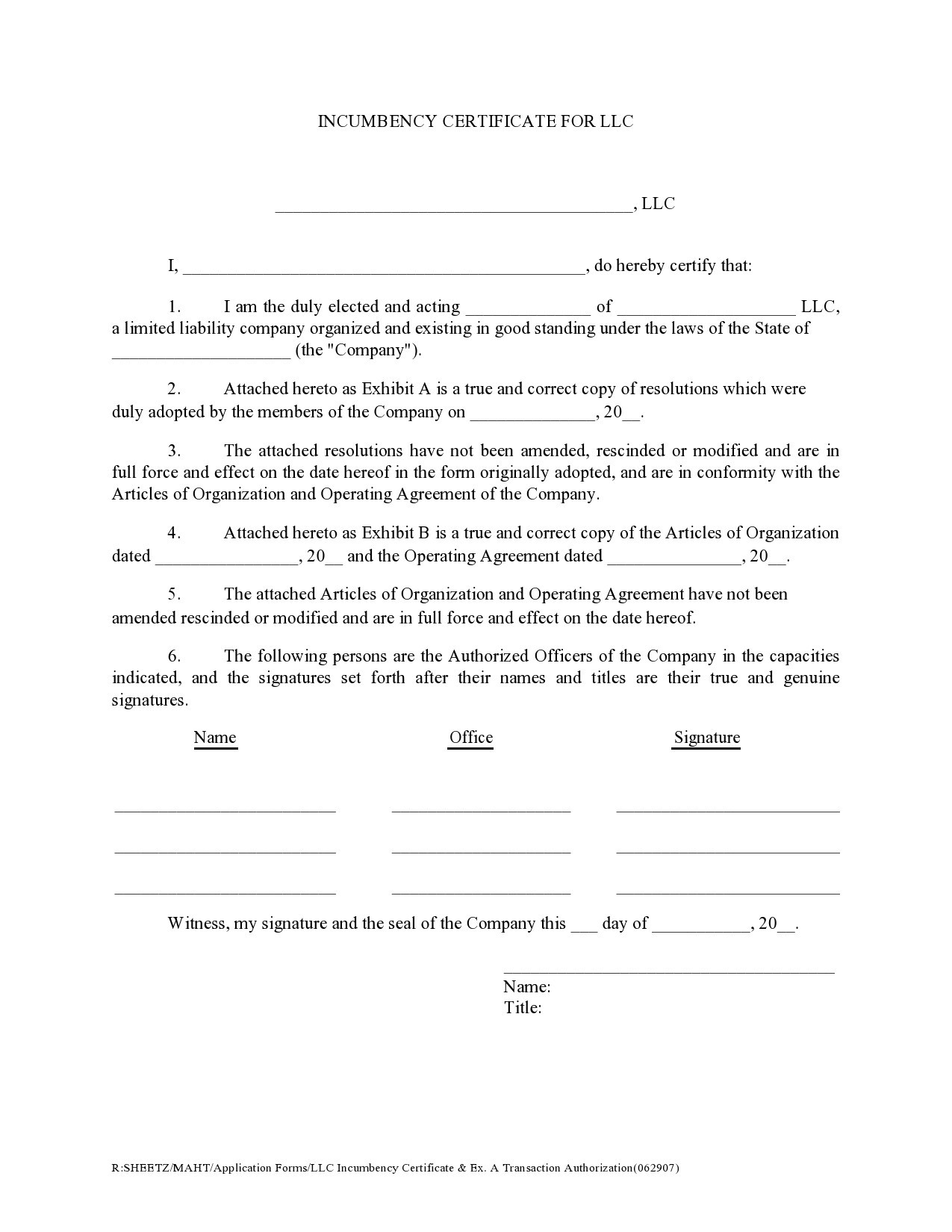

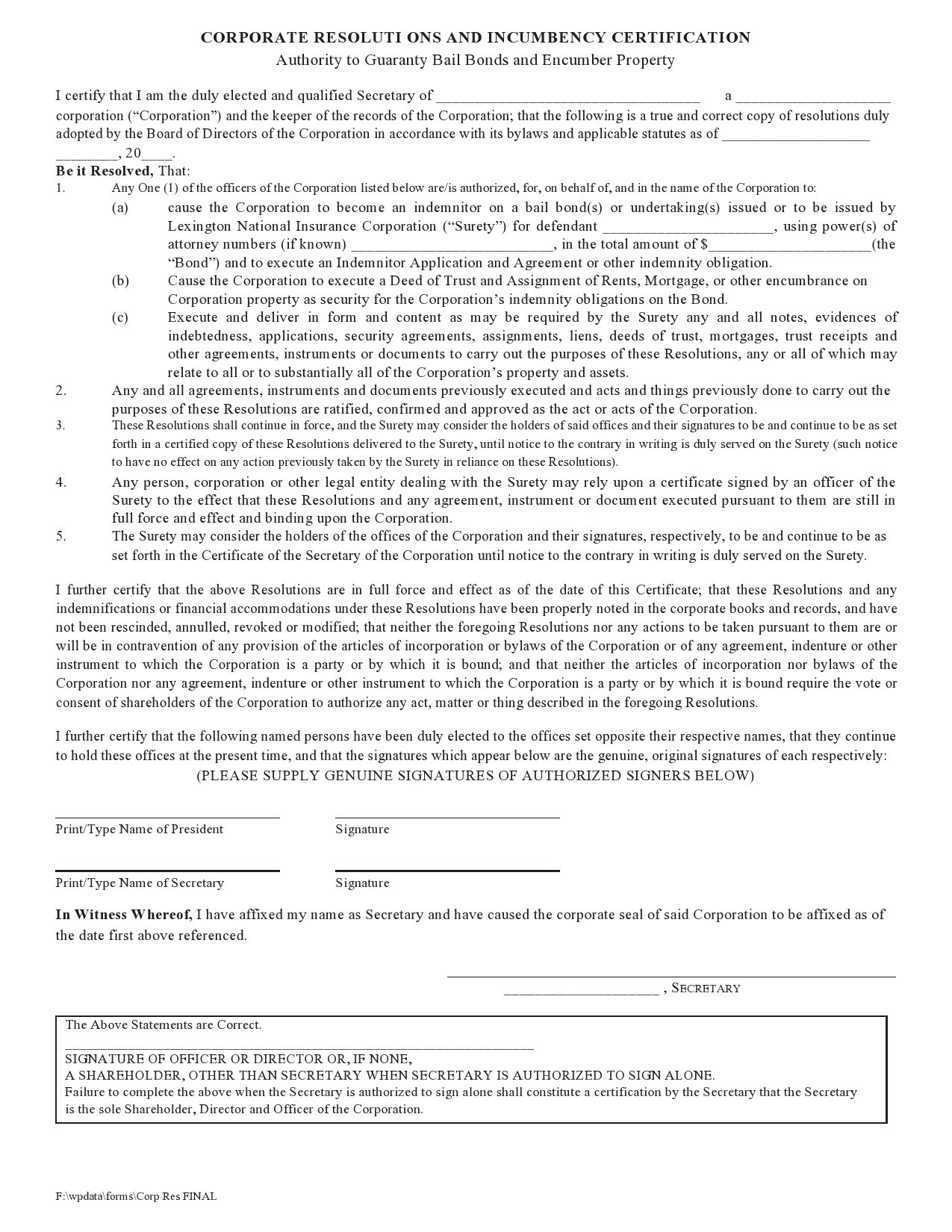

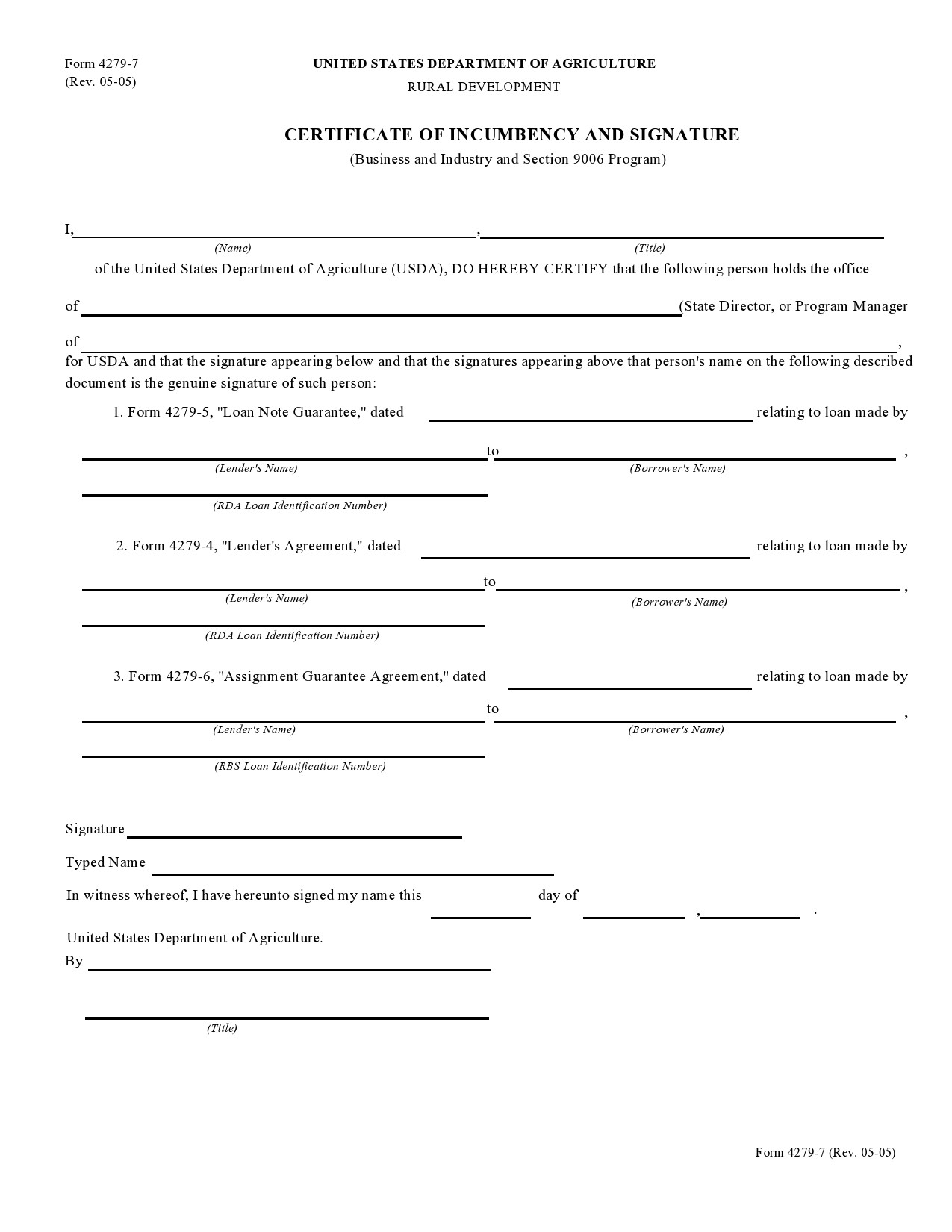

Incumbency Certificates

Understanding a certificate of incumbency

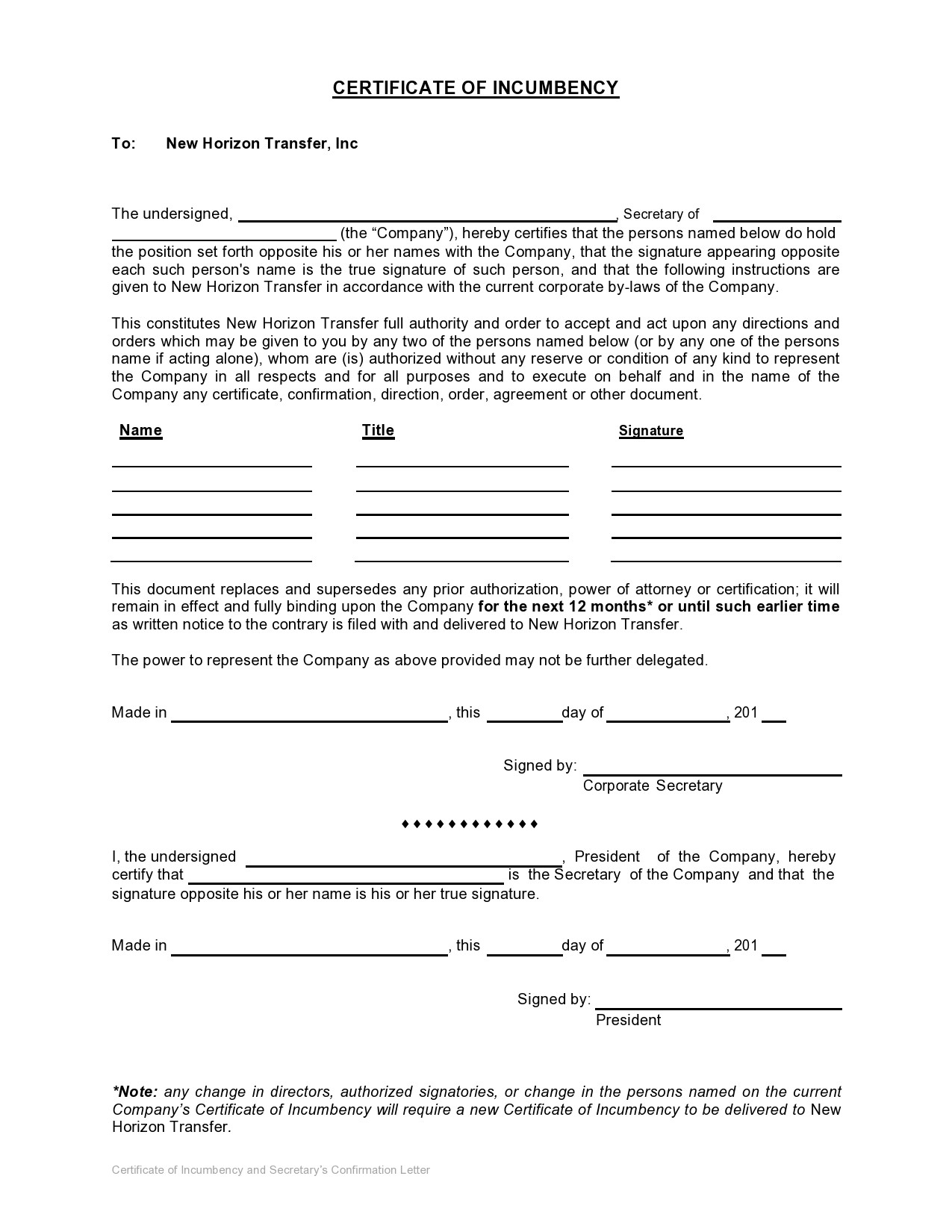

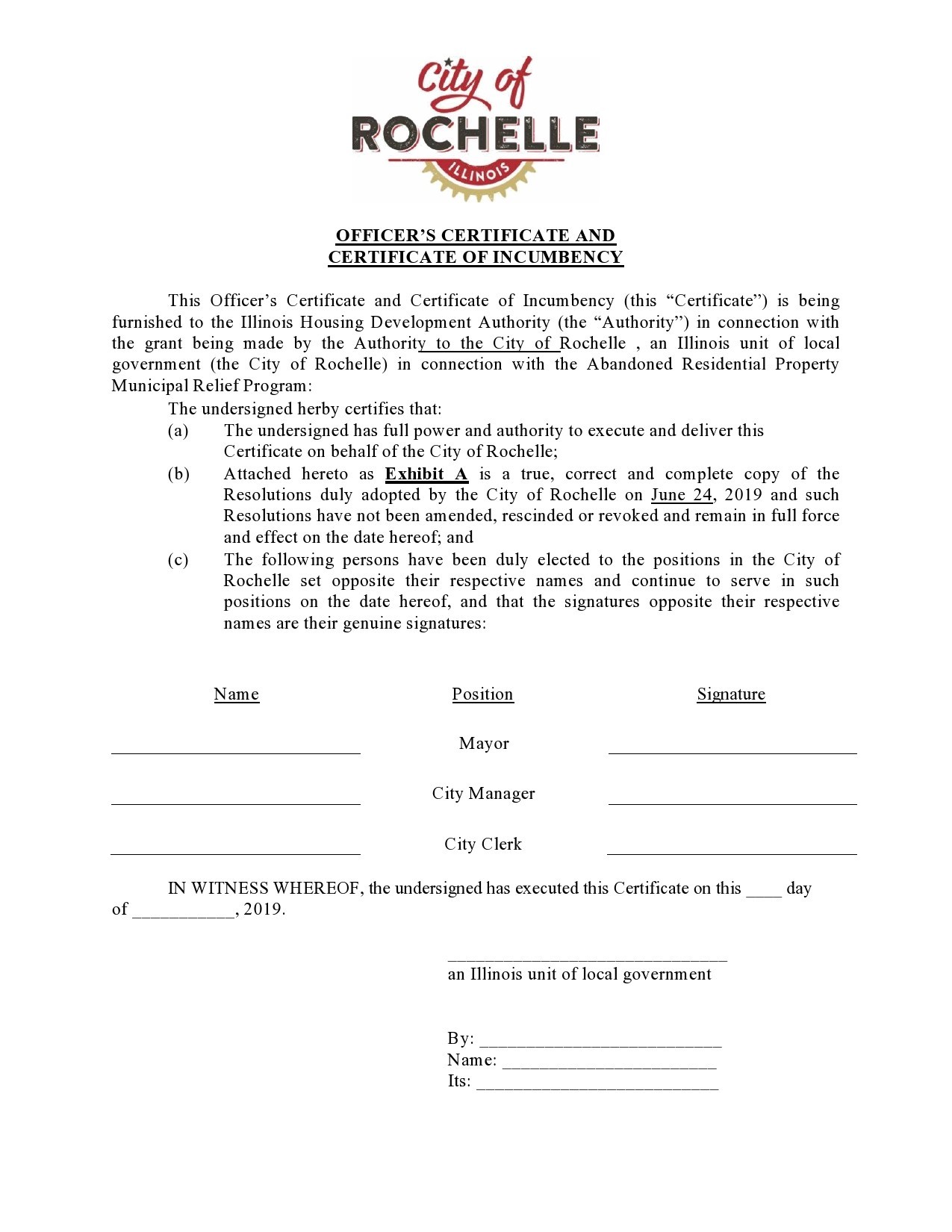

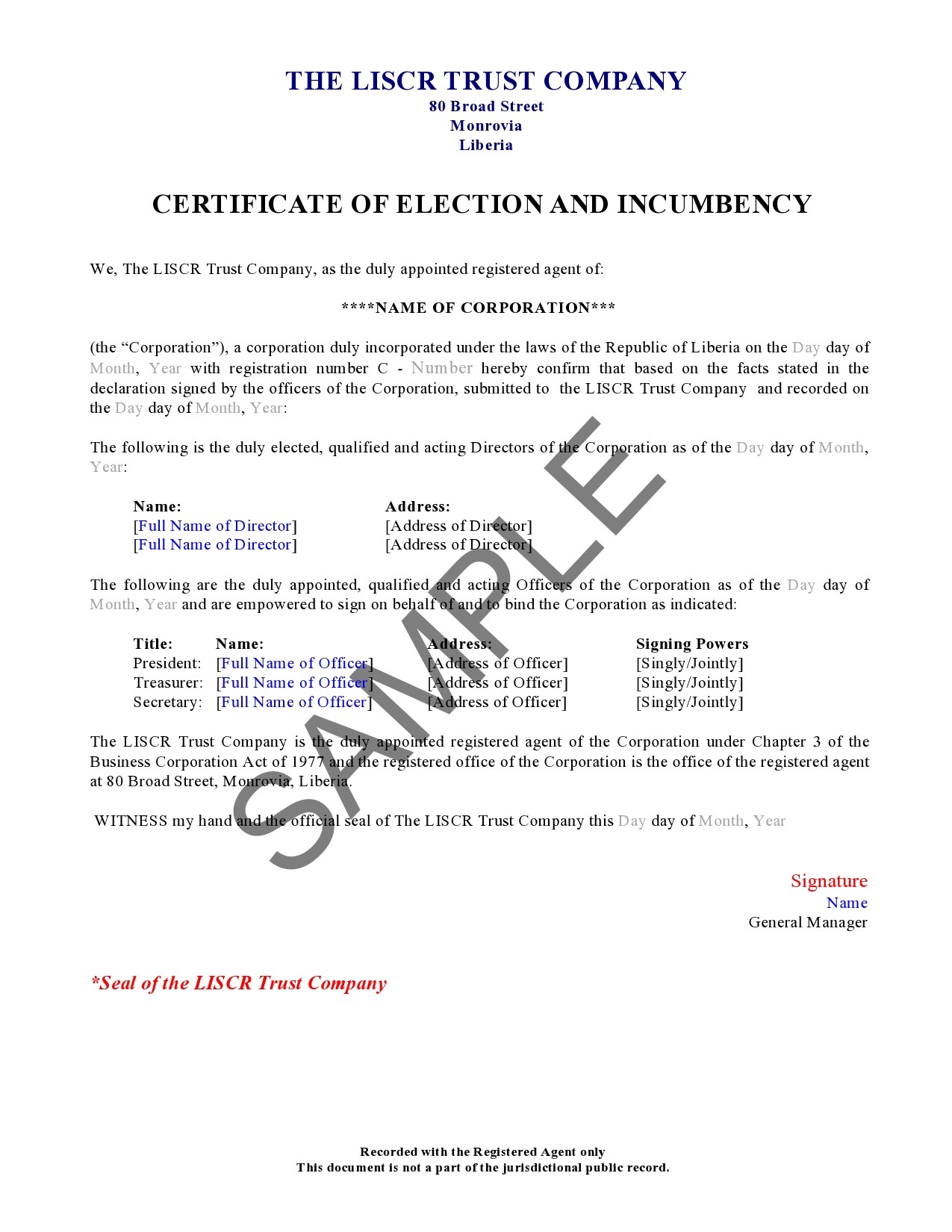

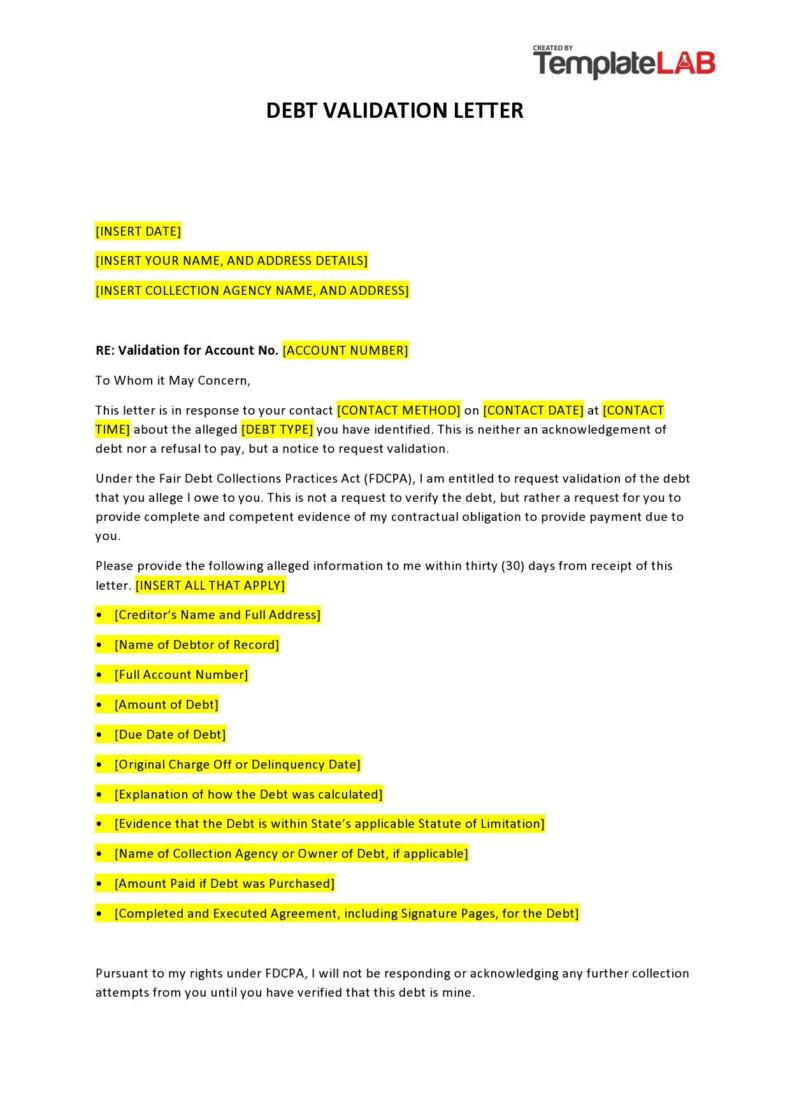

Some might get confused when coming across certain terms that essentially provide the same information. For instance, an incumbency certificate, certificate of officers, certificate of incumbency, letter of incumbency, register of directors, secretary’s certificate or officer’s certificate may contain similar information.

All of these come from the Corporate Secretary, will usually bear the company seal, and is a notarized document. Since the Corporate Secretary is also in charge of maintaining company records, this means that the incumbency certificate is one of the company’s official acts and third parties have enough reason to depend on it.

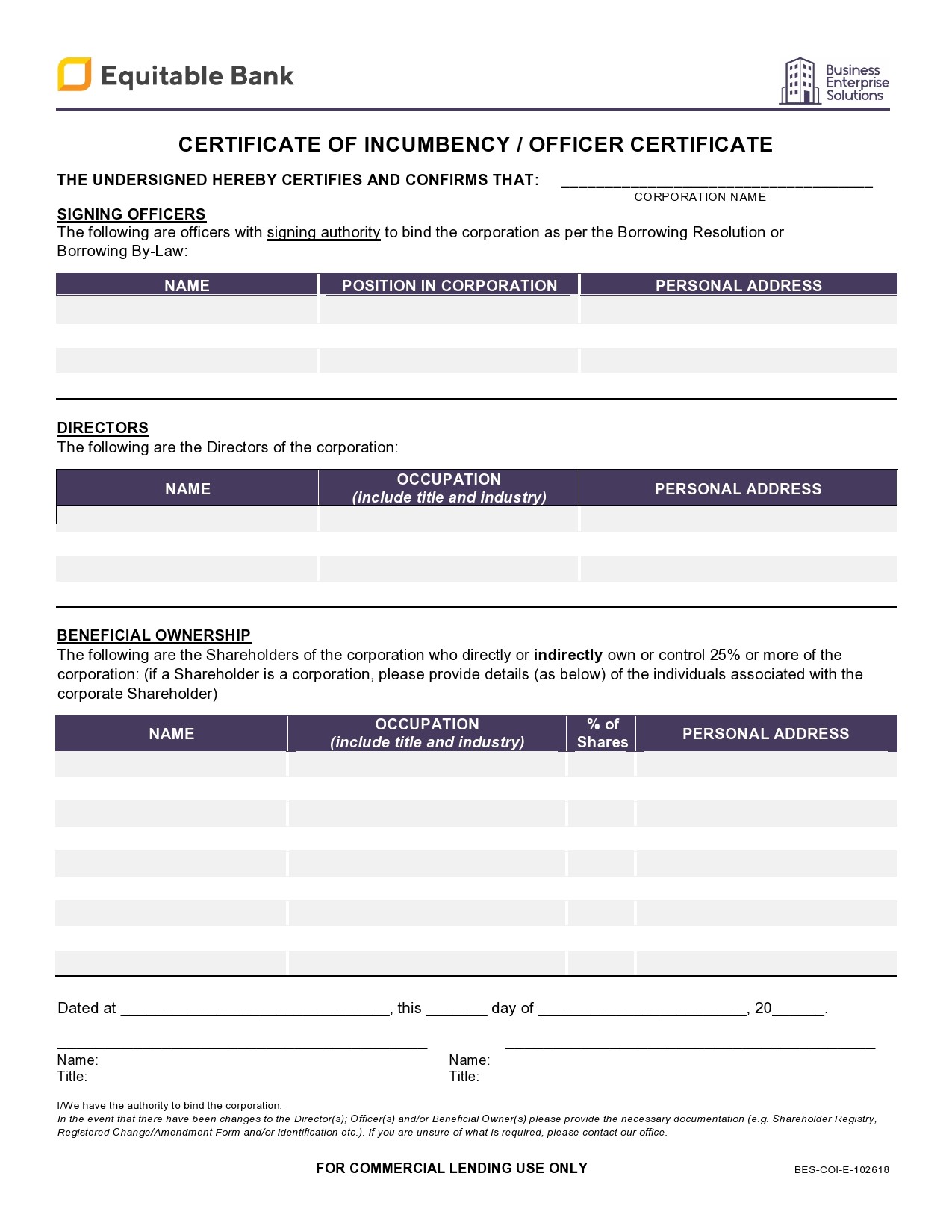

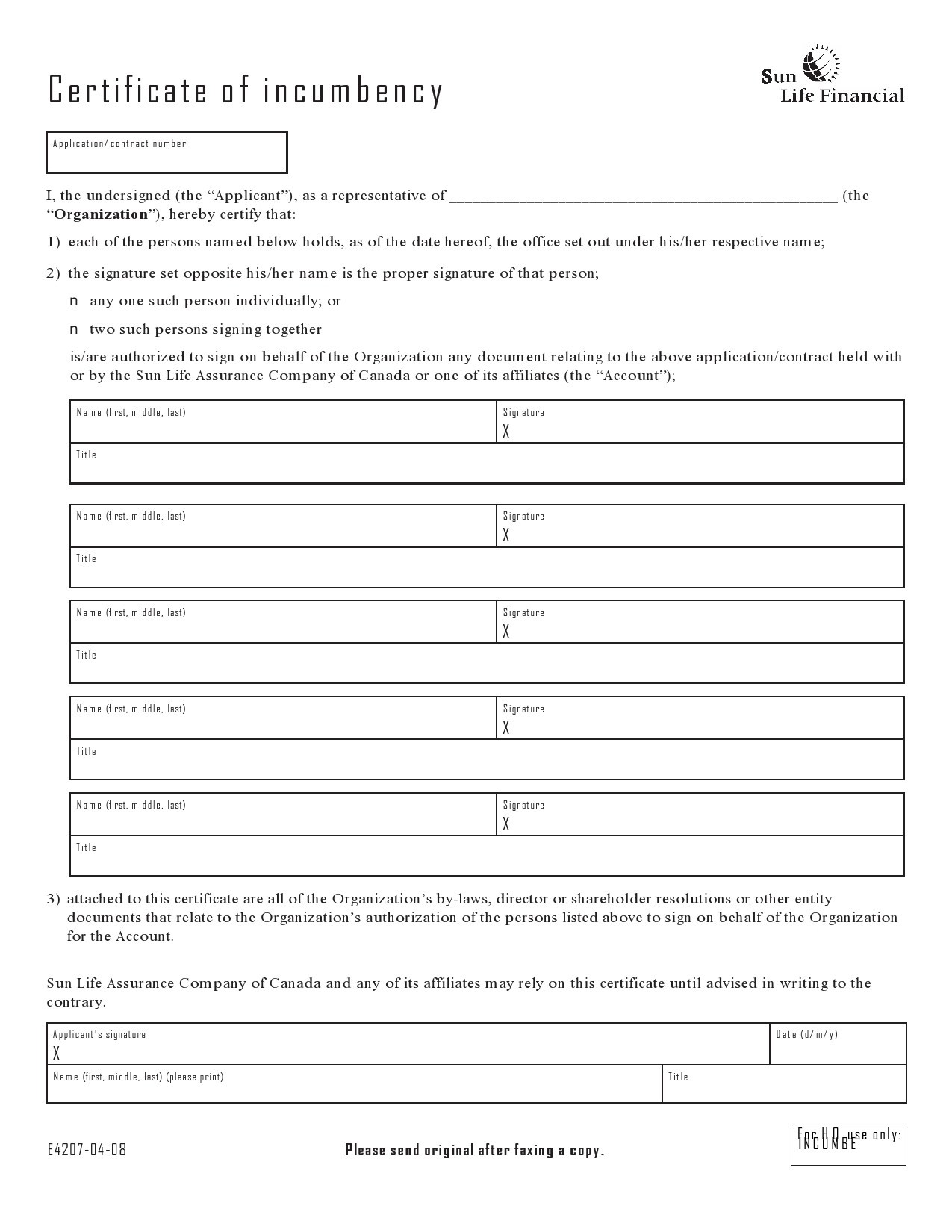

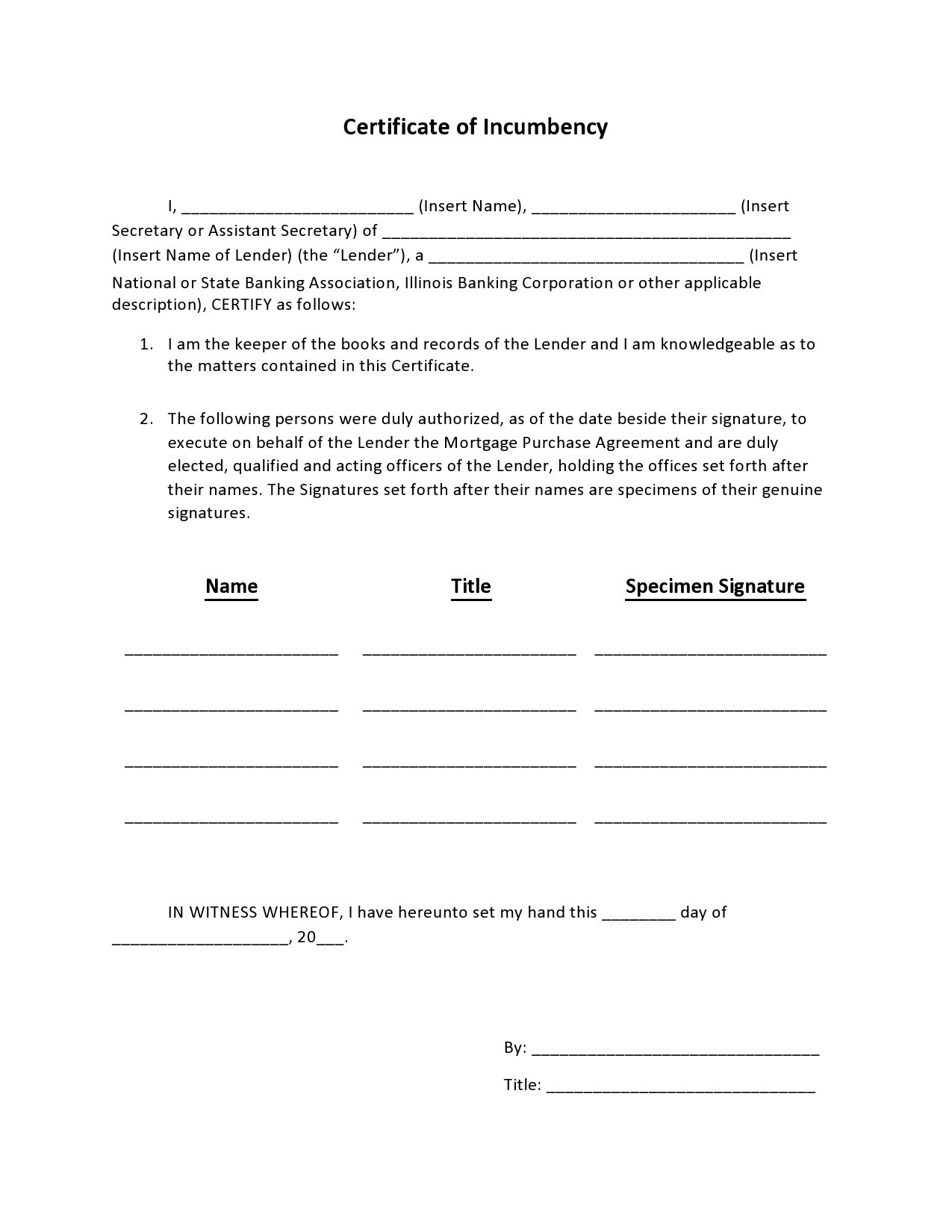

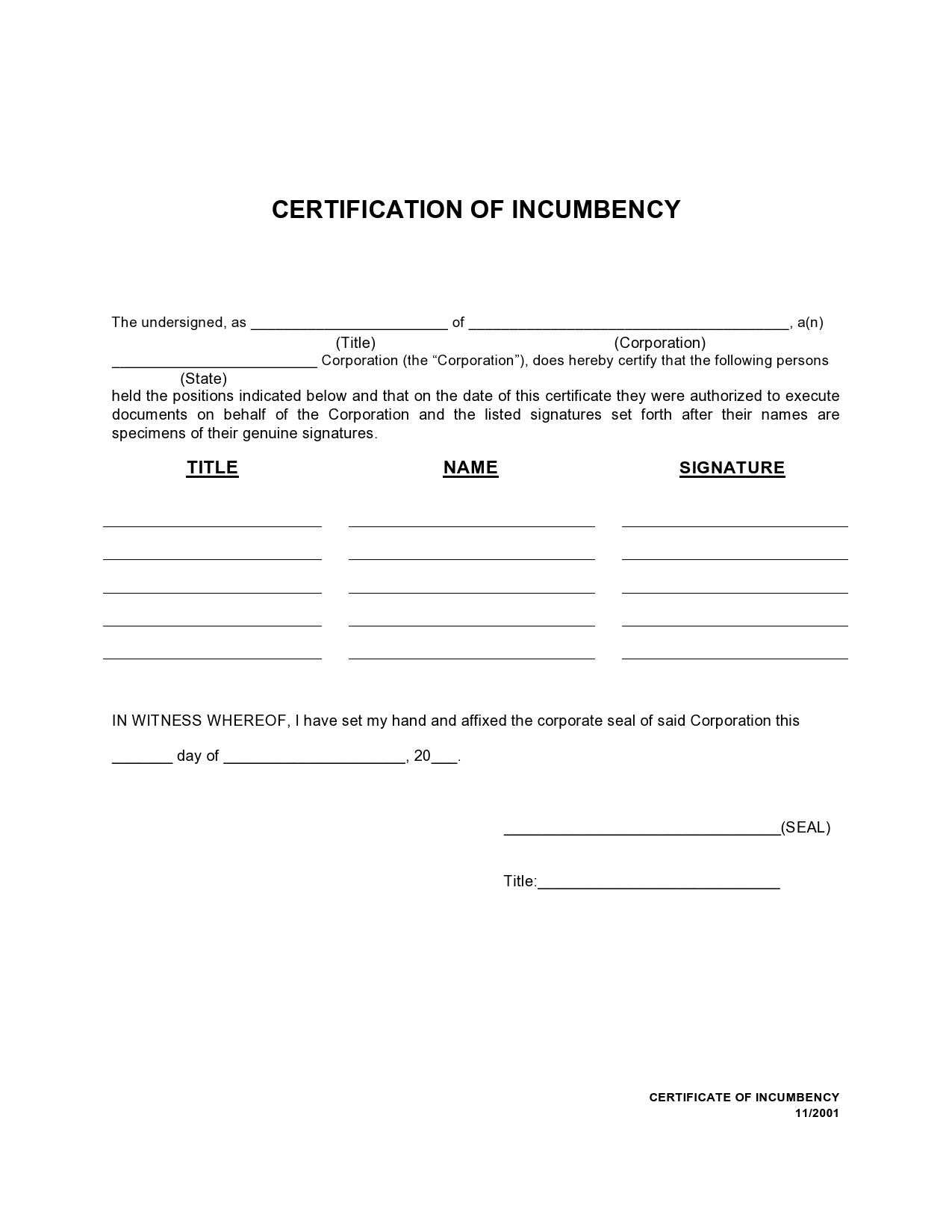

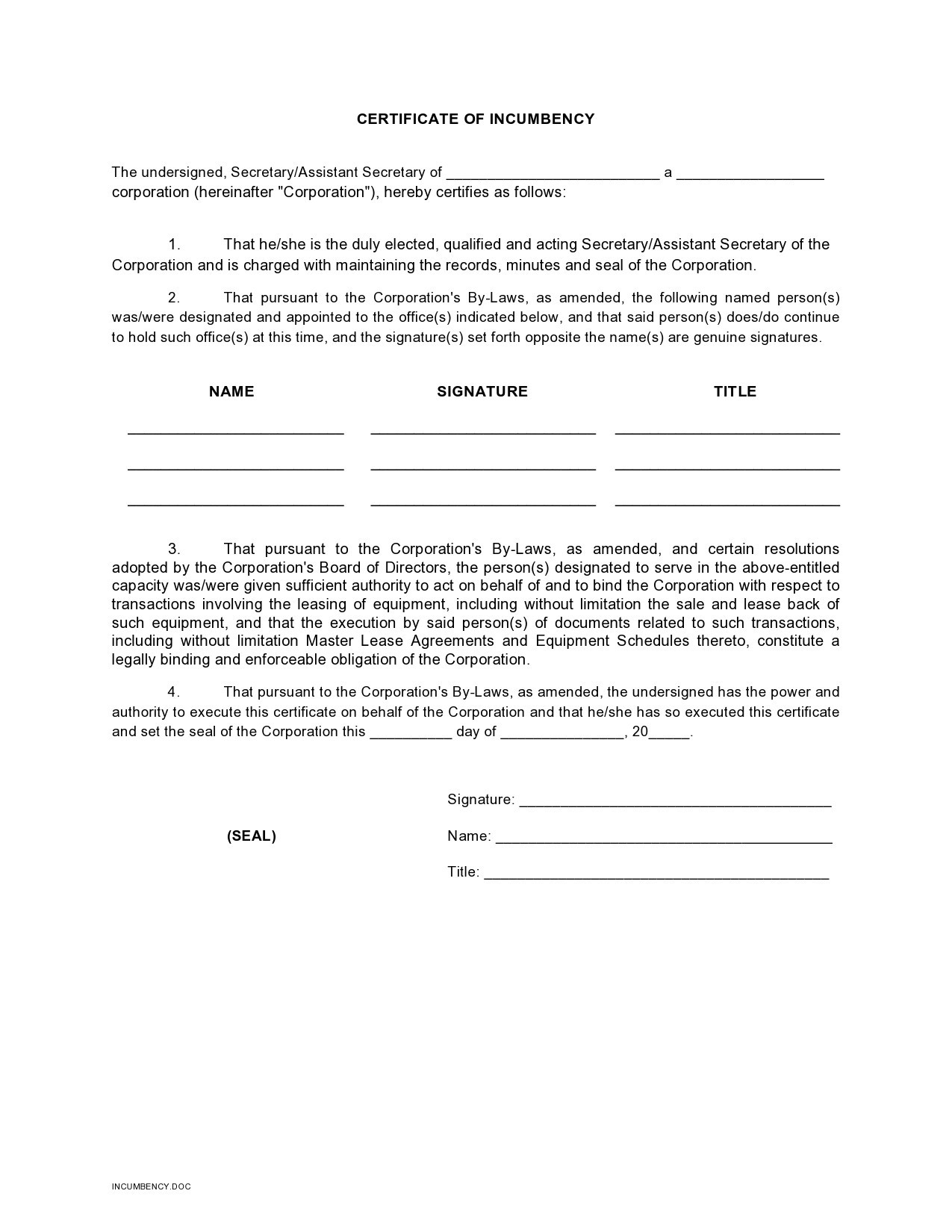

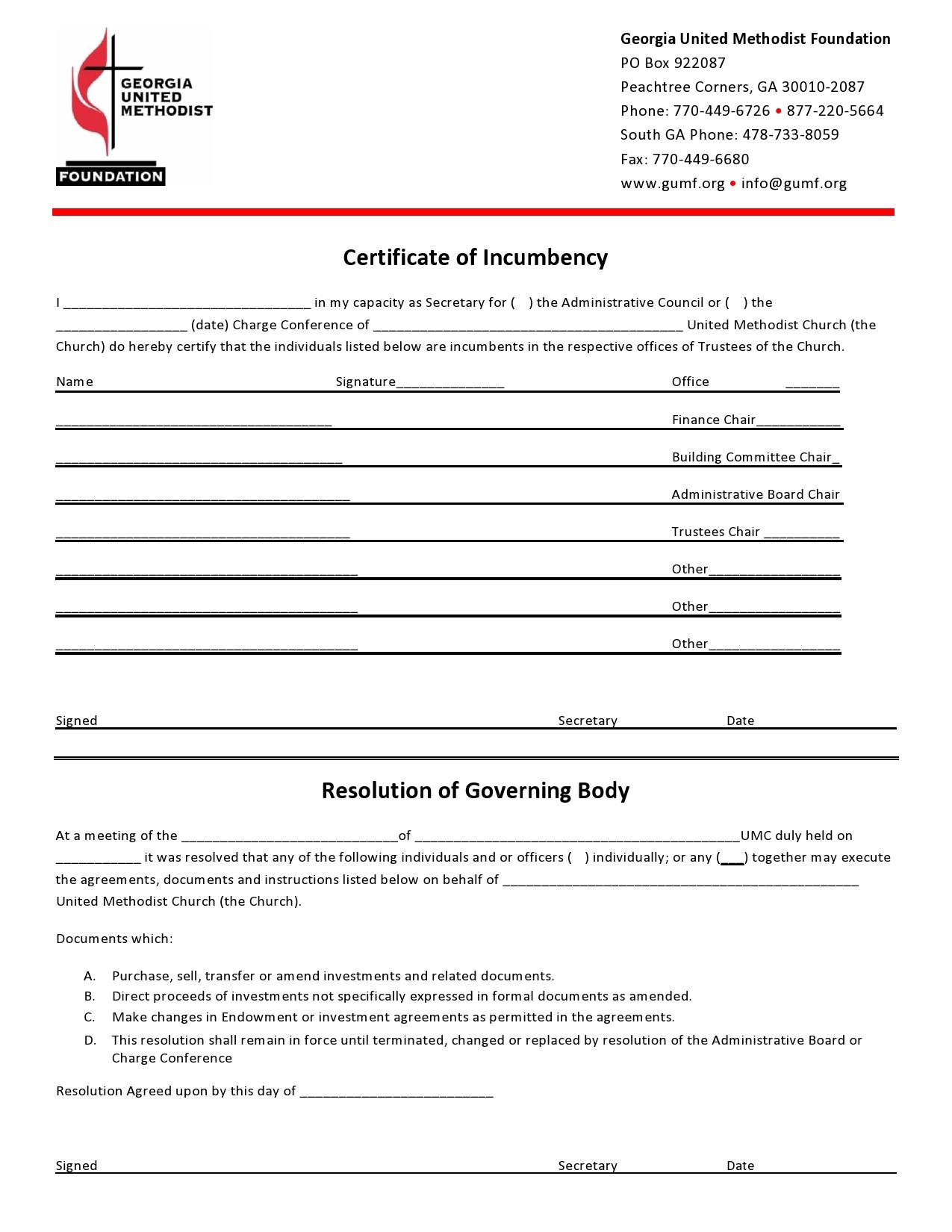

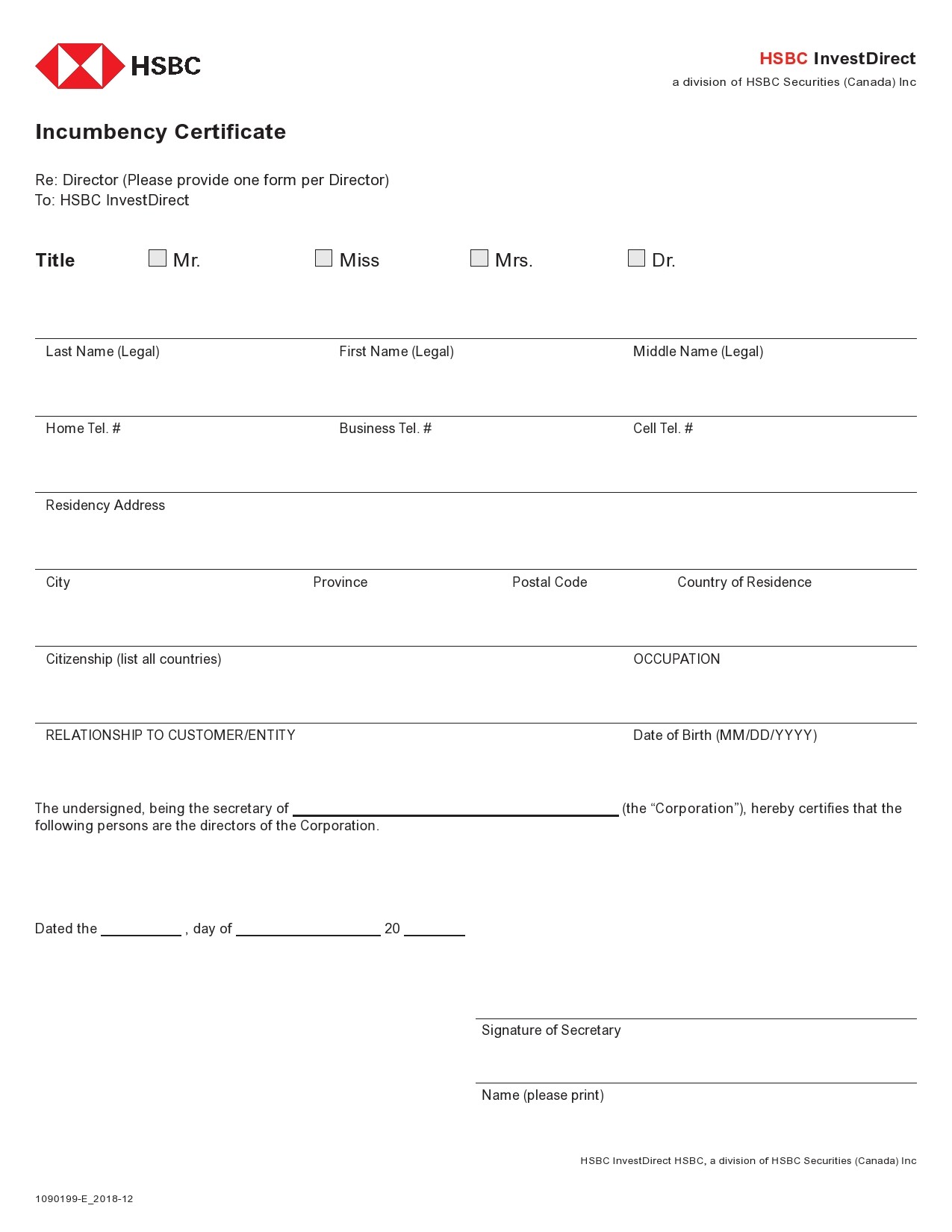

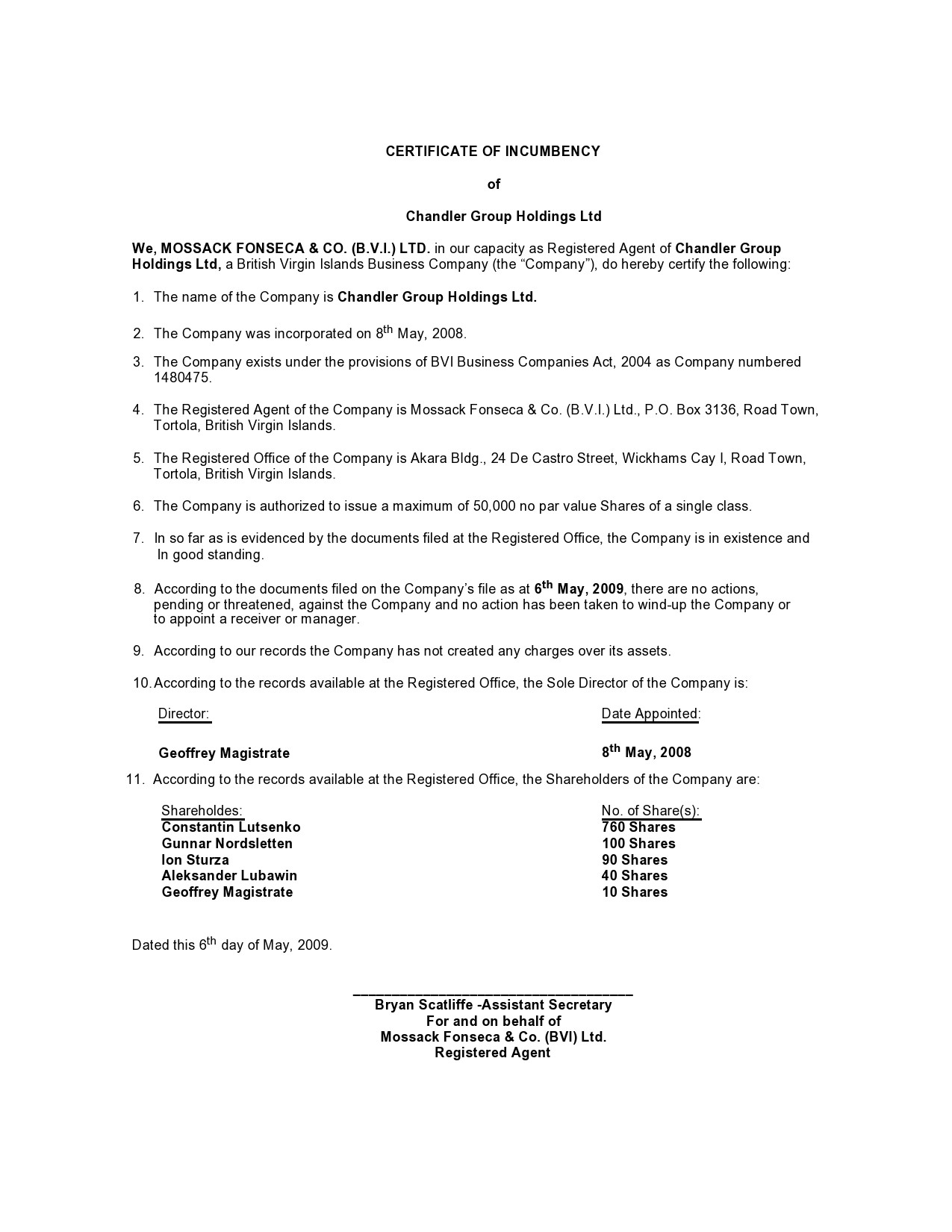

Generally, most certificates of incumbency samples contain the relevant details about the officers and directors of the company. These include the incumbent’s name, title, whether appointed or elected, and the term of office. Signature samples are also provided for the purpose of comparison.

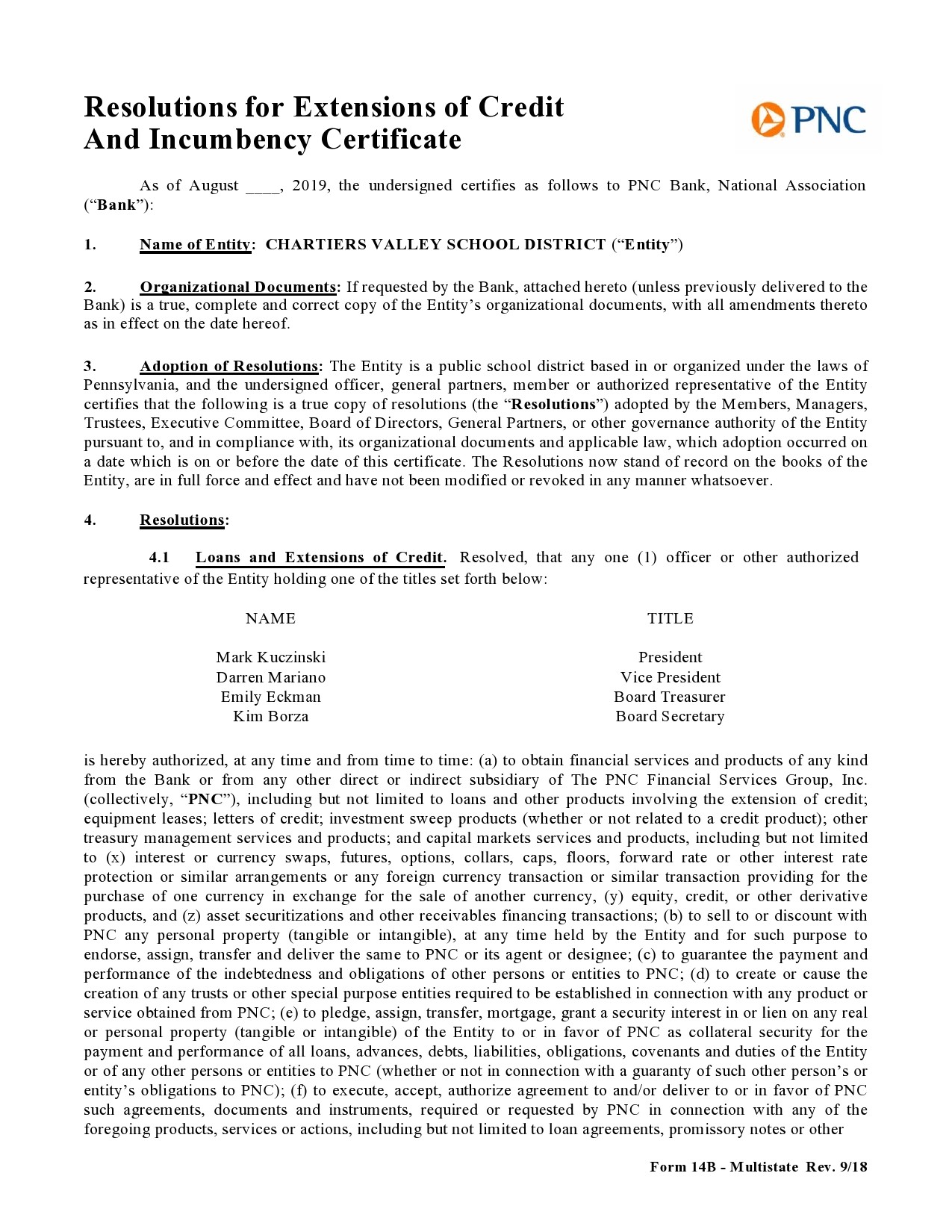

Following the list of officers and directors is the date of the letter of incumbency, and the signature of the Secretary. Financial institutions can request for this document, especially when a company opens a bank account or initiates major transactions. The same document can also get requested by a lawyer or any other individual who wants verification of the stated positions of directors or officers in the corporation.

An incumbency certificate can get requested by anyone involved with a transaction with a company with the sole intent of verifying the stated position of a director or officer in the company. You can request this through the Corporate Secretary. It is a standard practice that a certificate of incumbency is almost always required by banks or other financial institutions when opening new accounts.

This ensures that the one who claims to be the authorized signatory of the company is who he says he is. In the same line of reasoning, lawyers who draft contracts for transactions that involve companies usually require an official letter of incumbency to determine who can legally take action on behalf of the company.

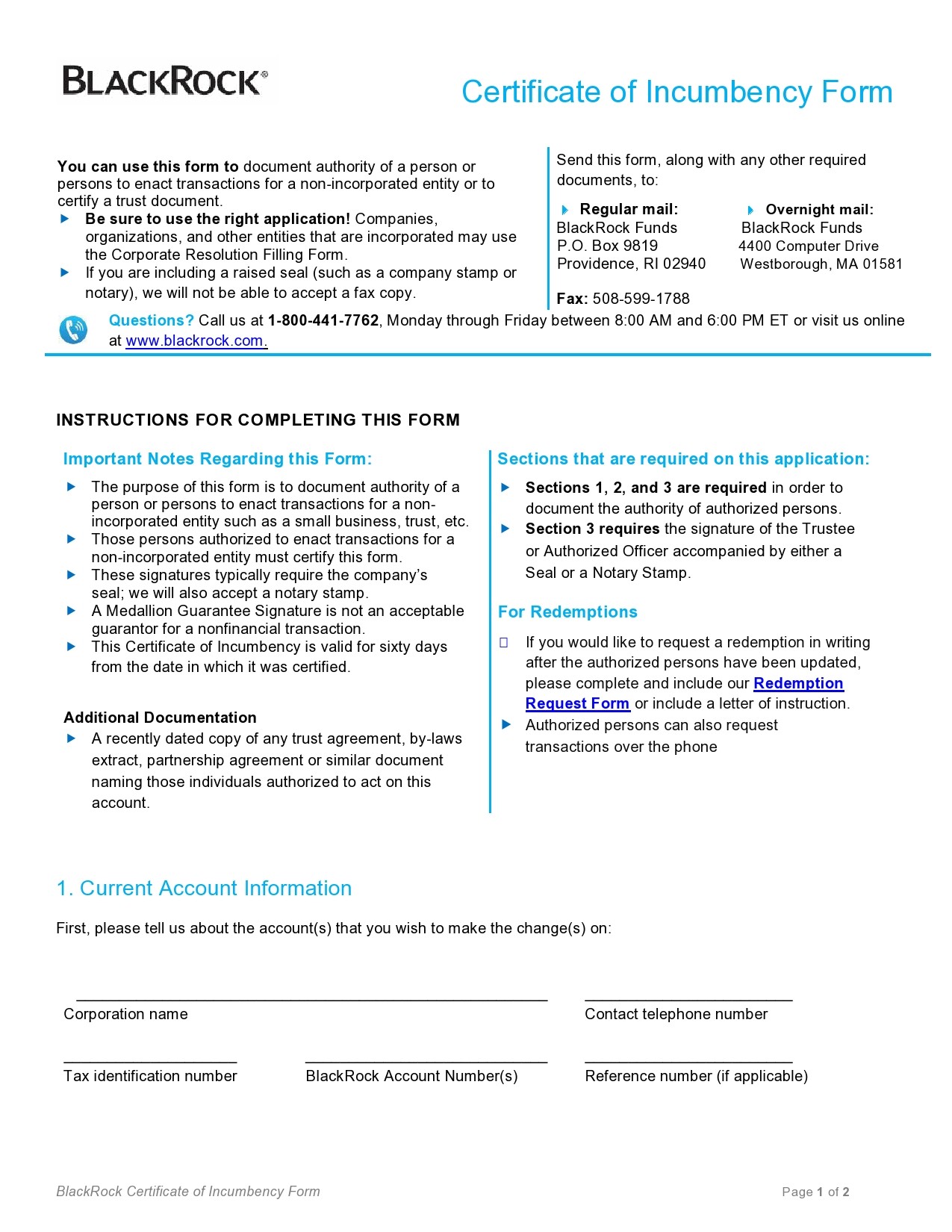

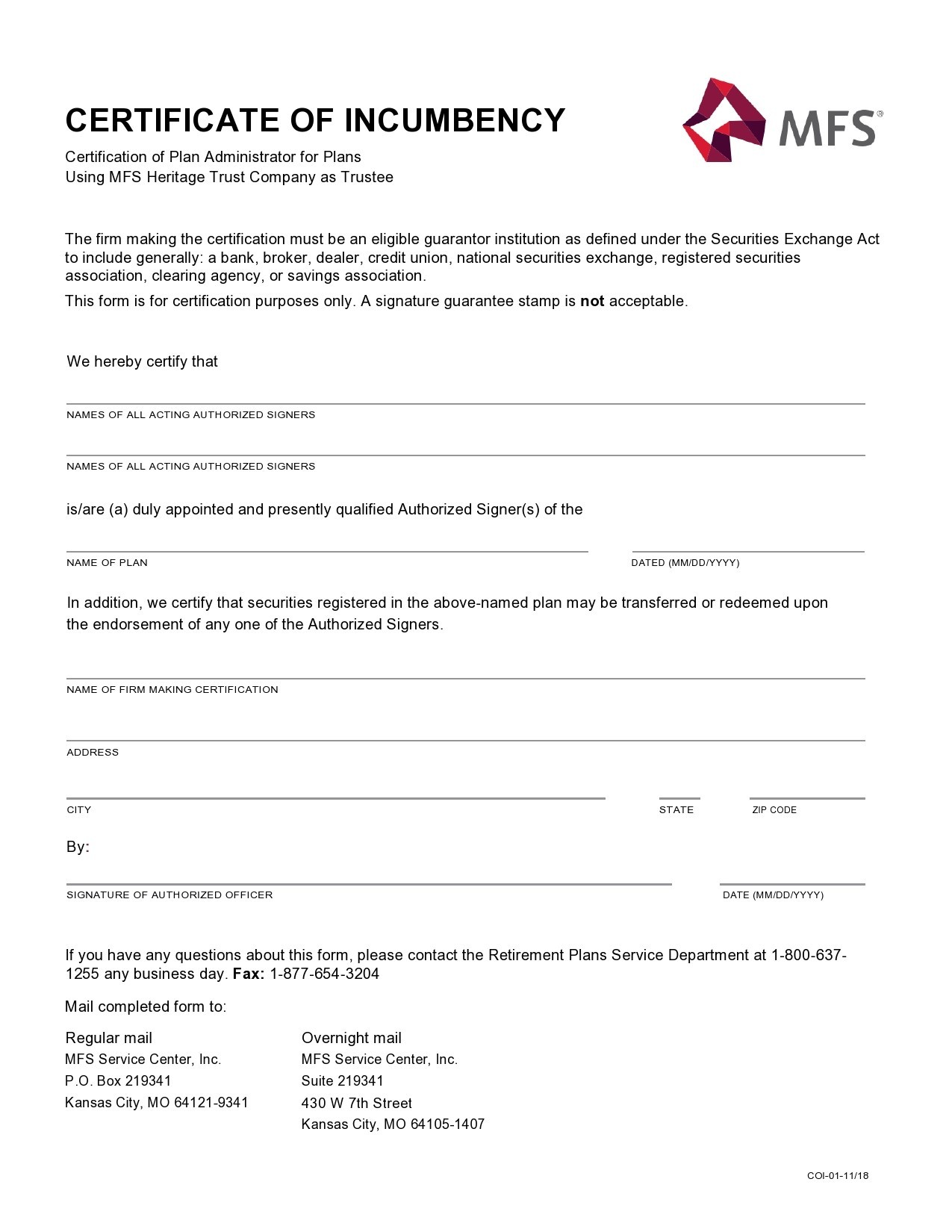

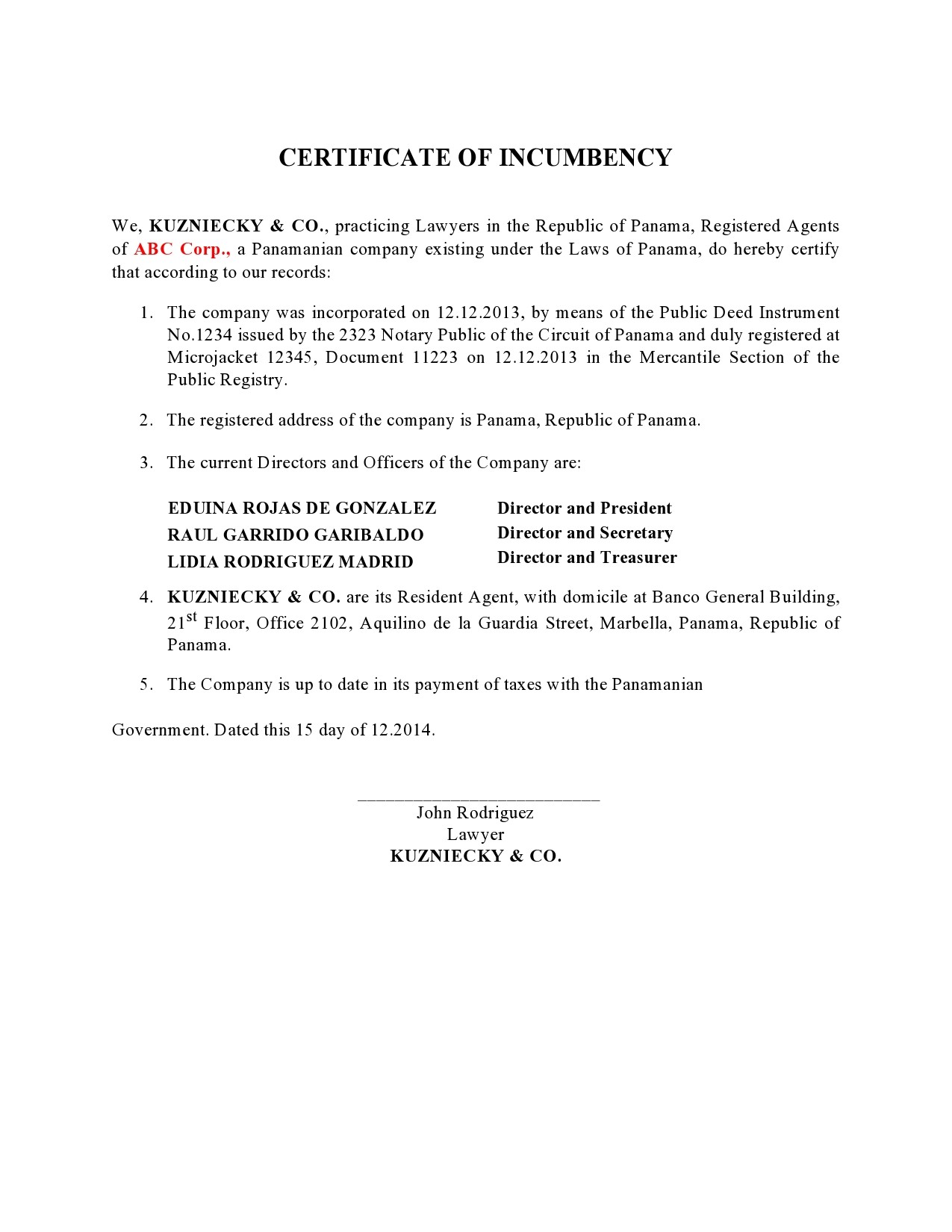

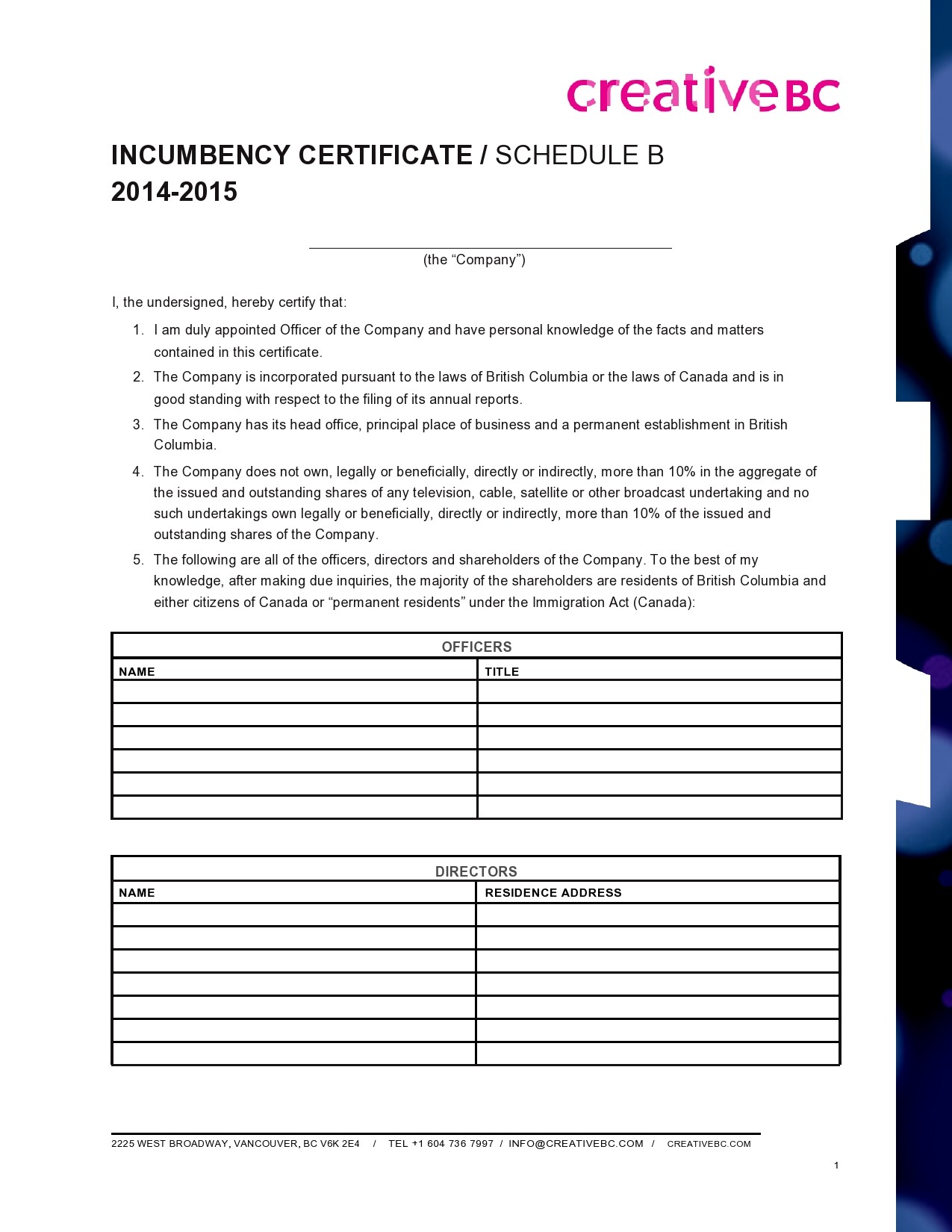

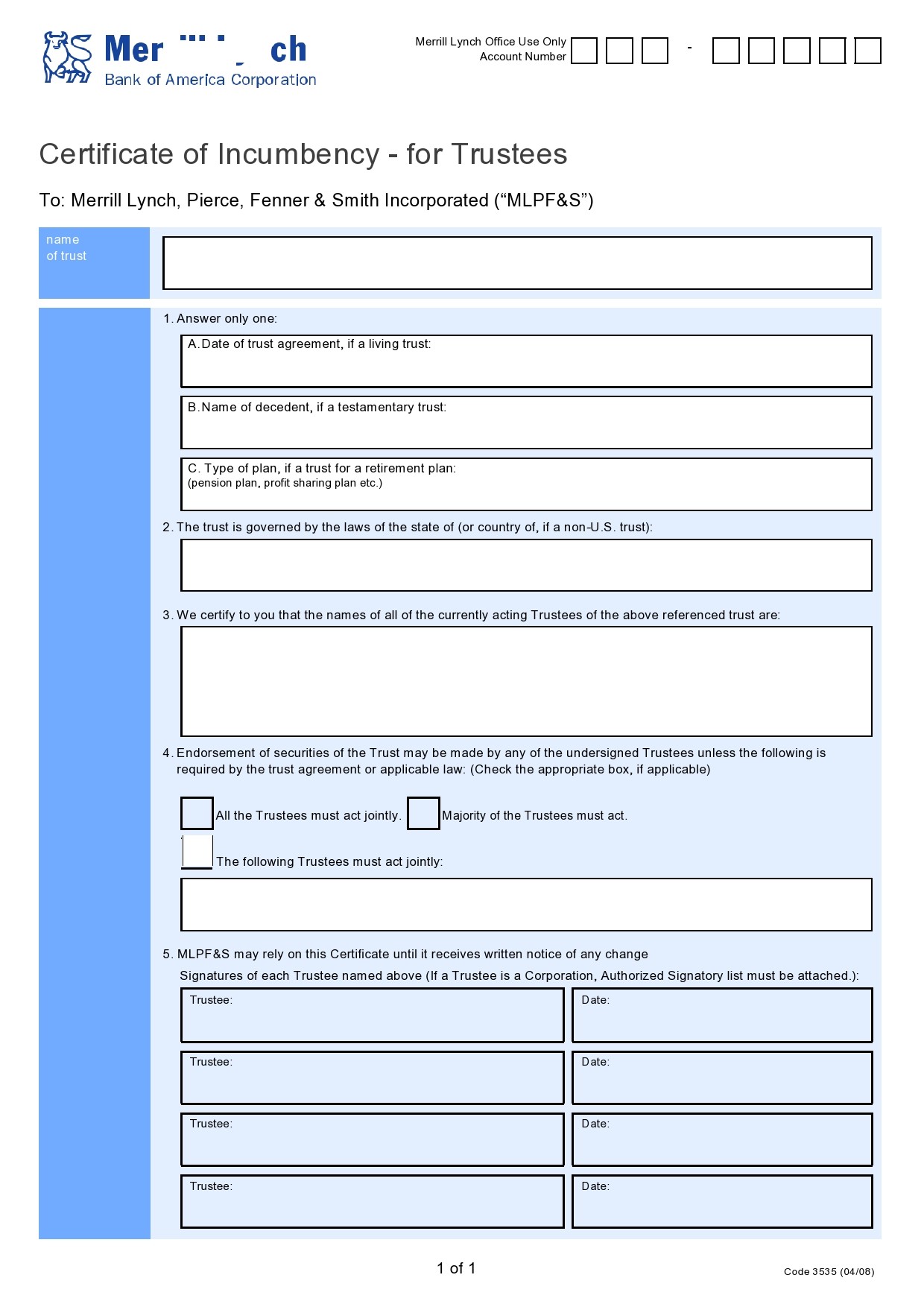

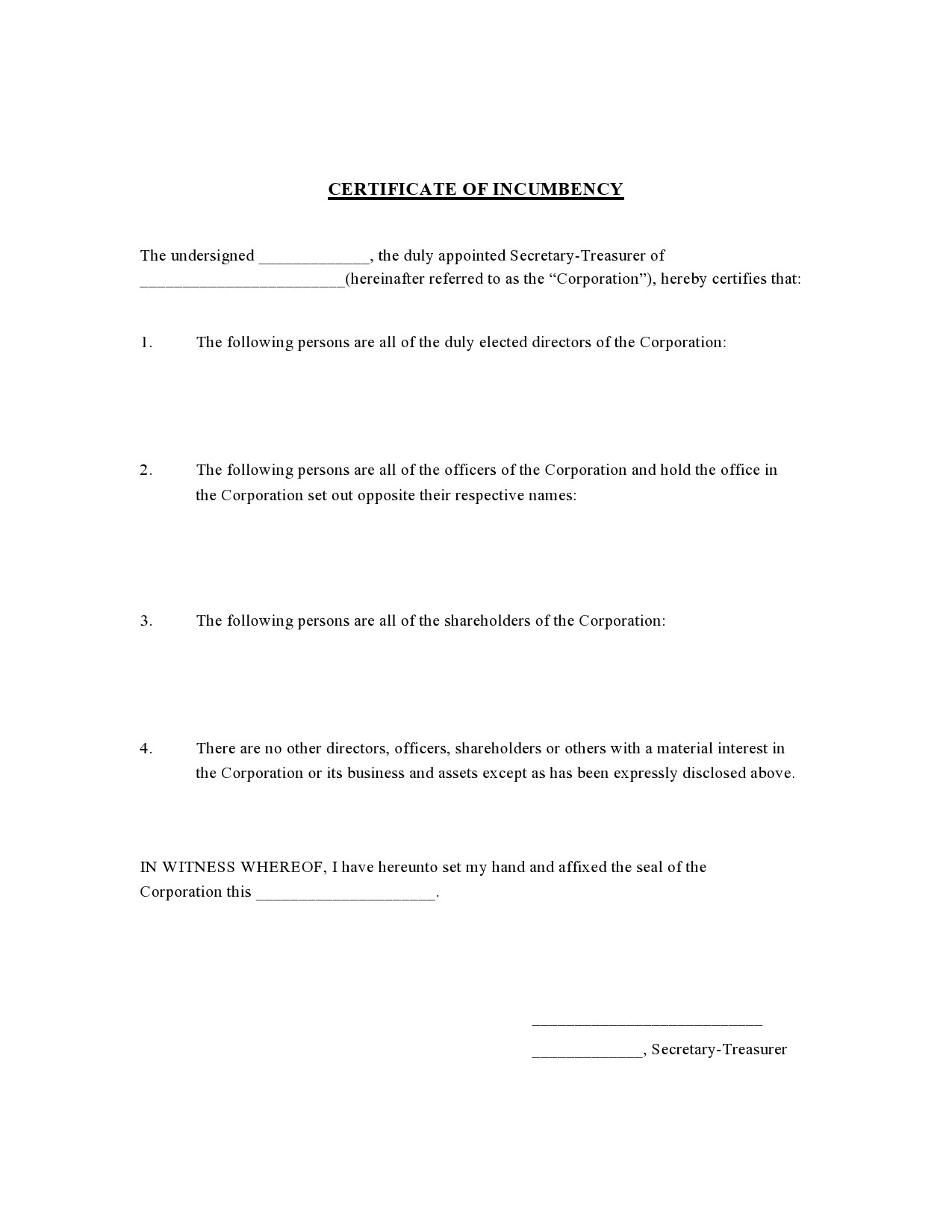

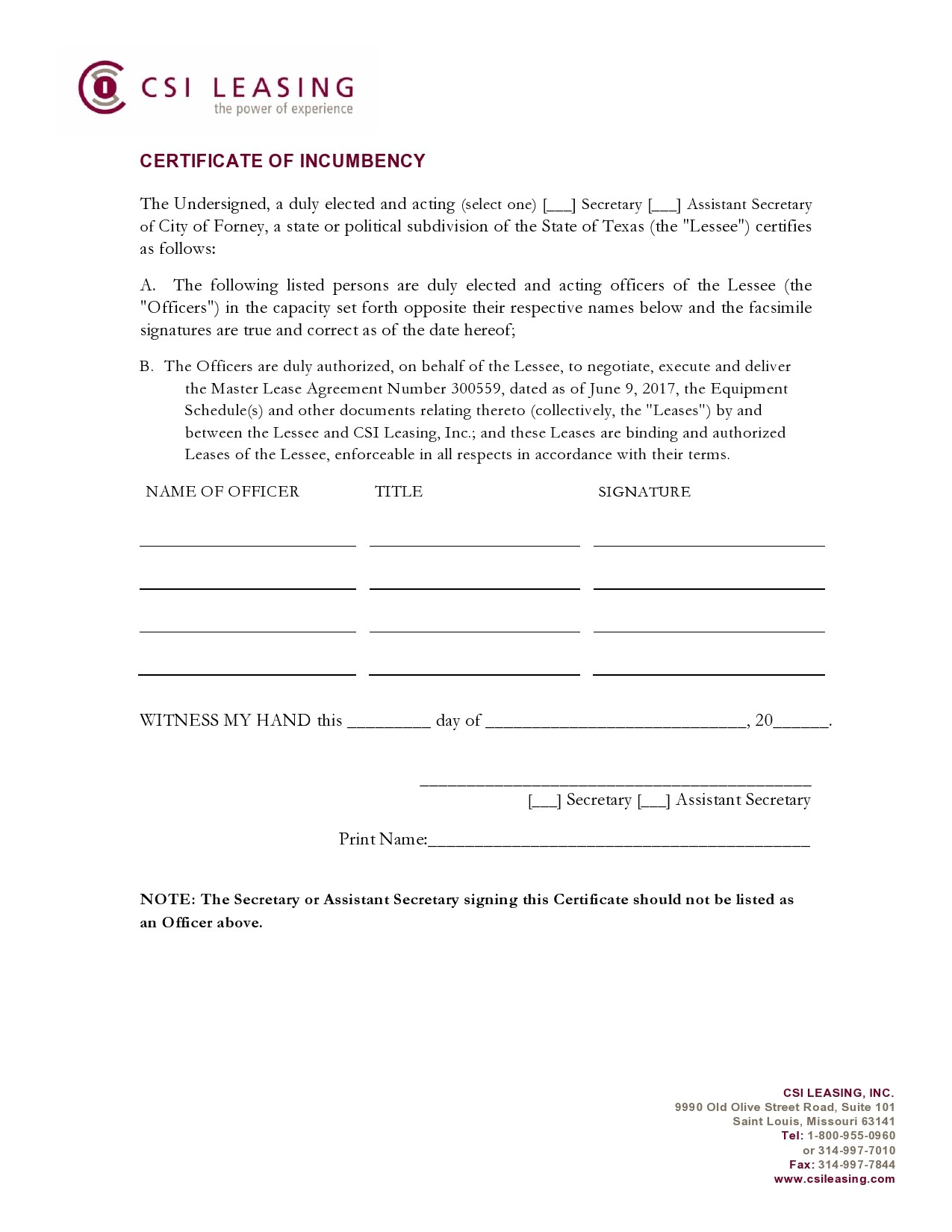

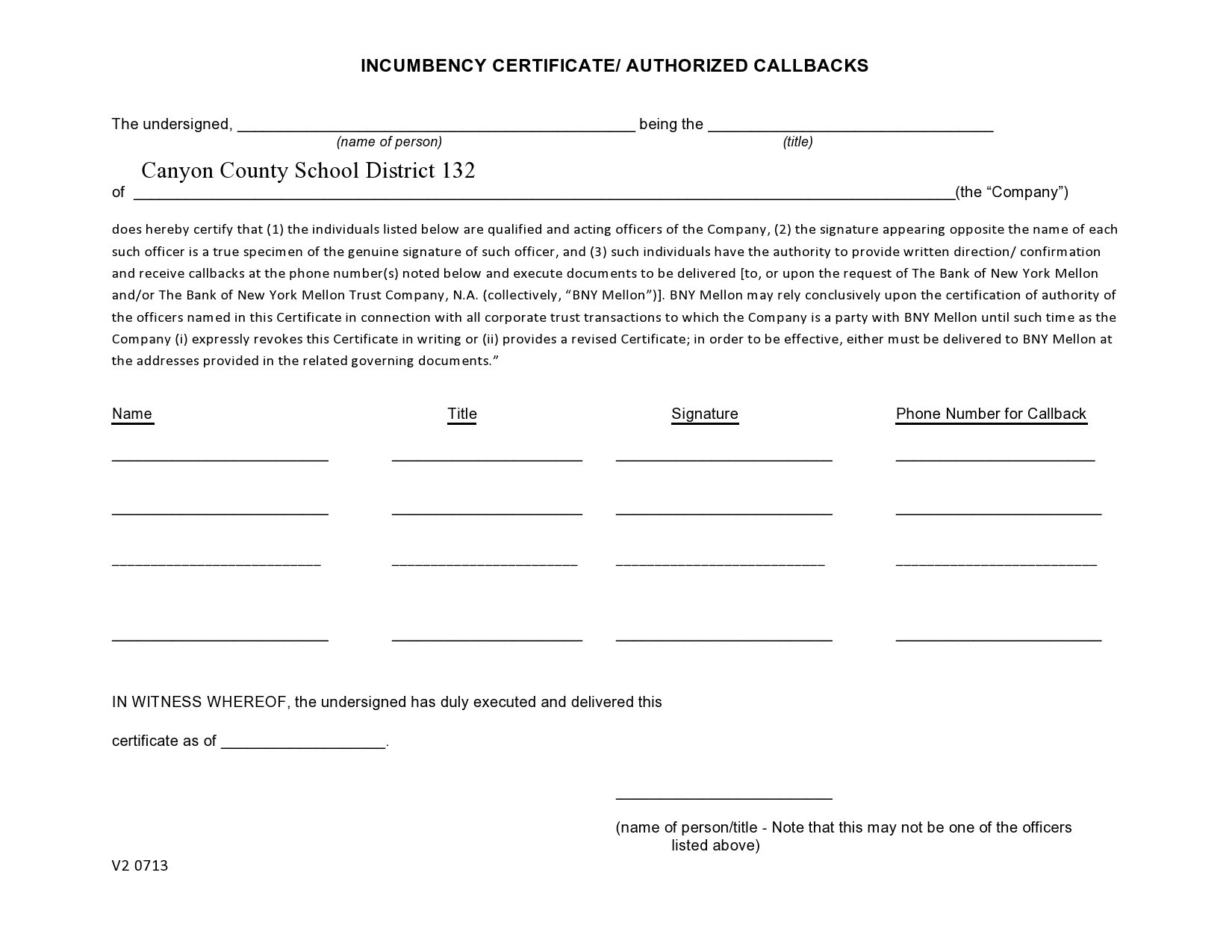

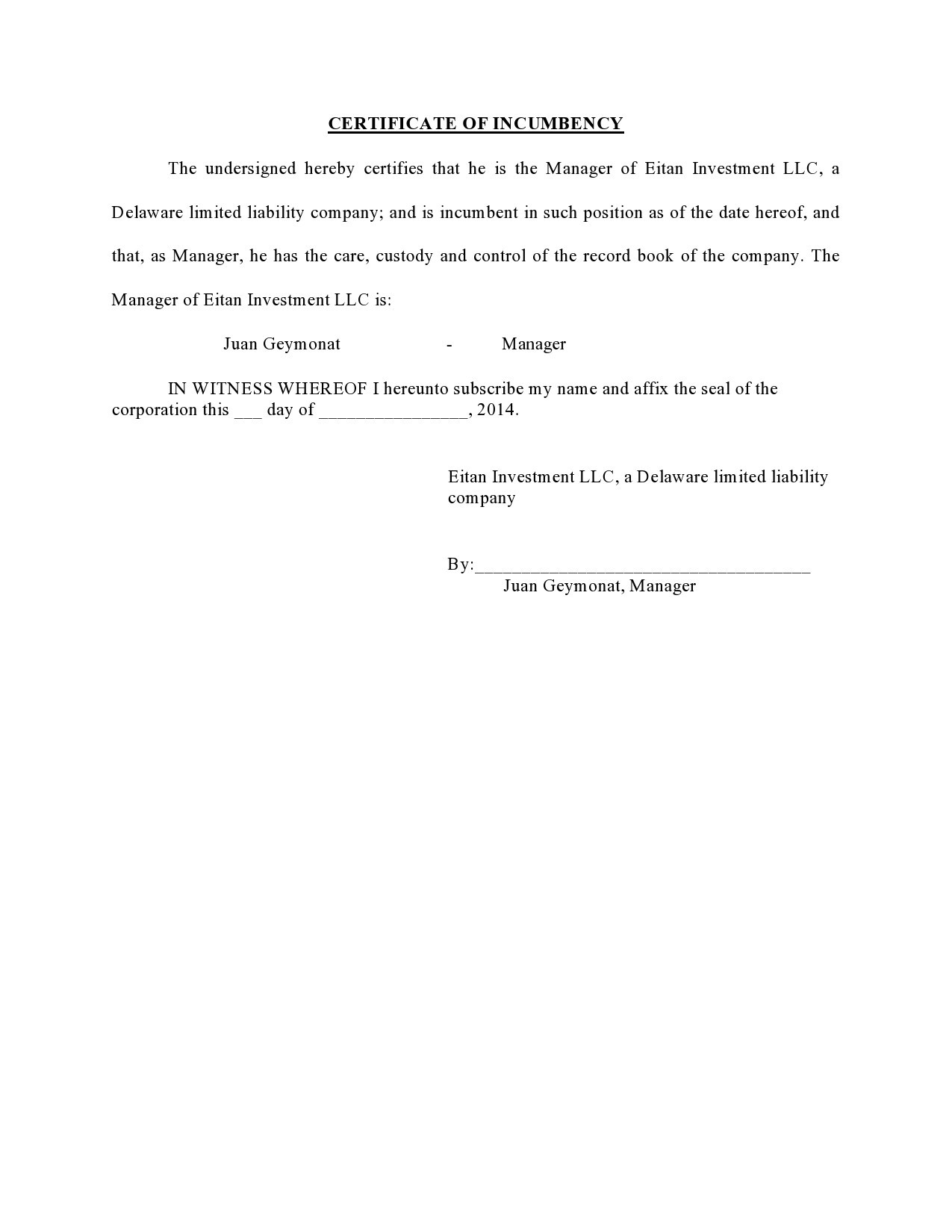

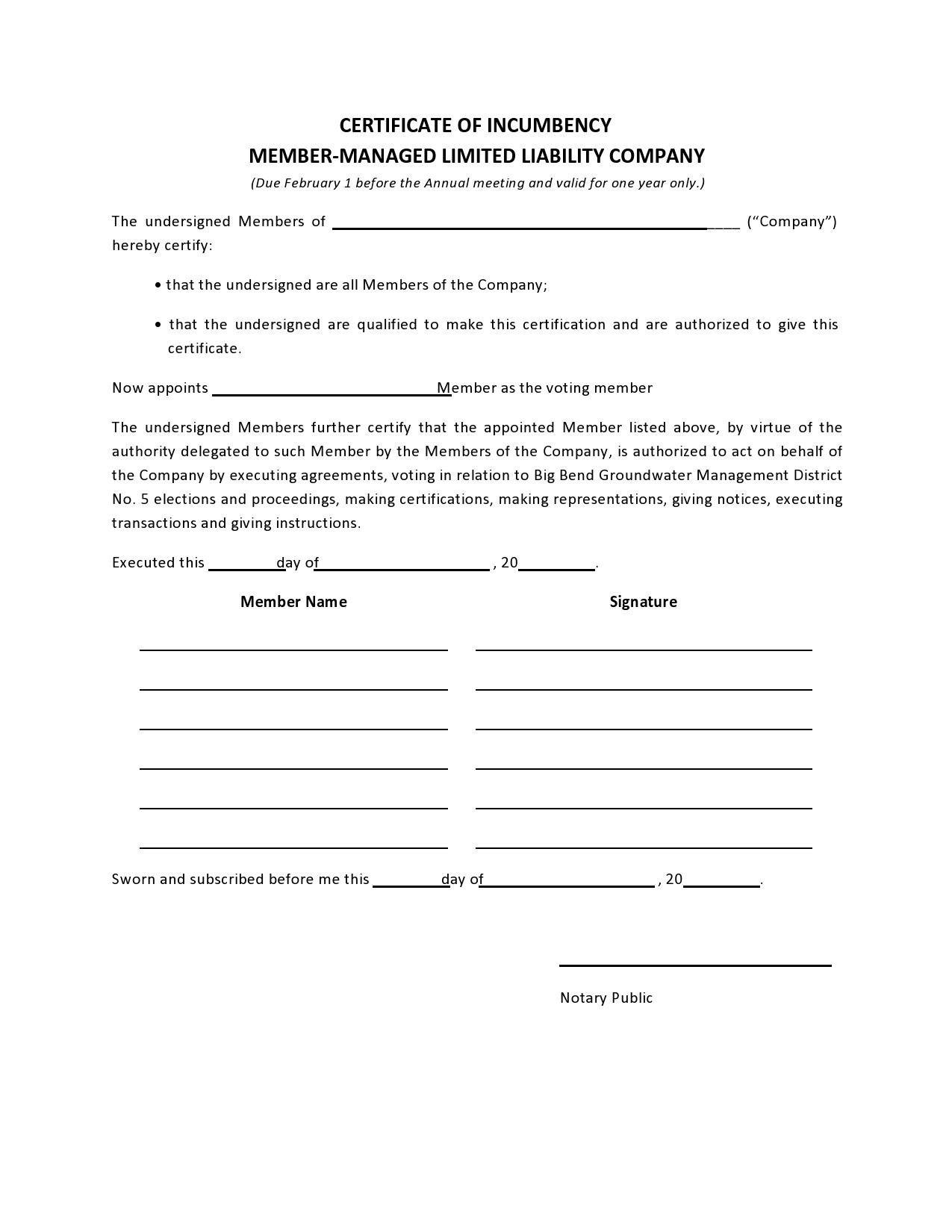

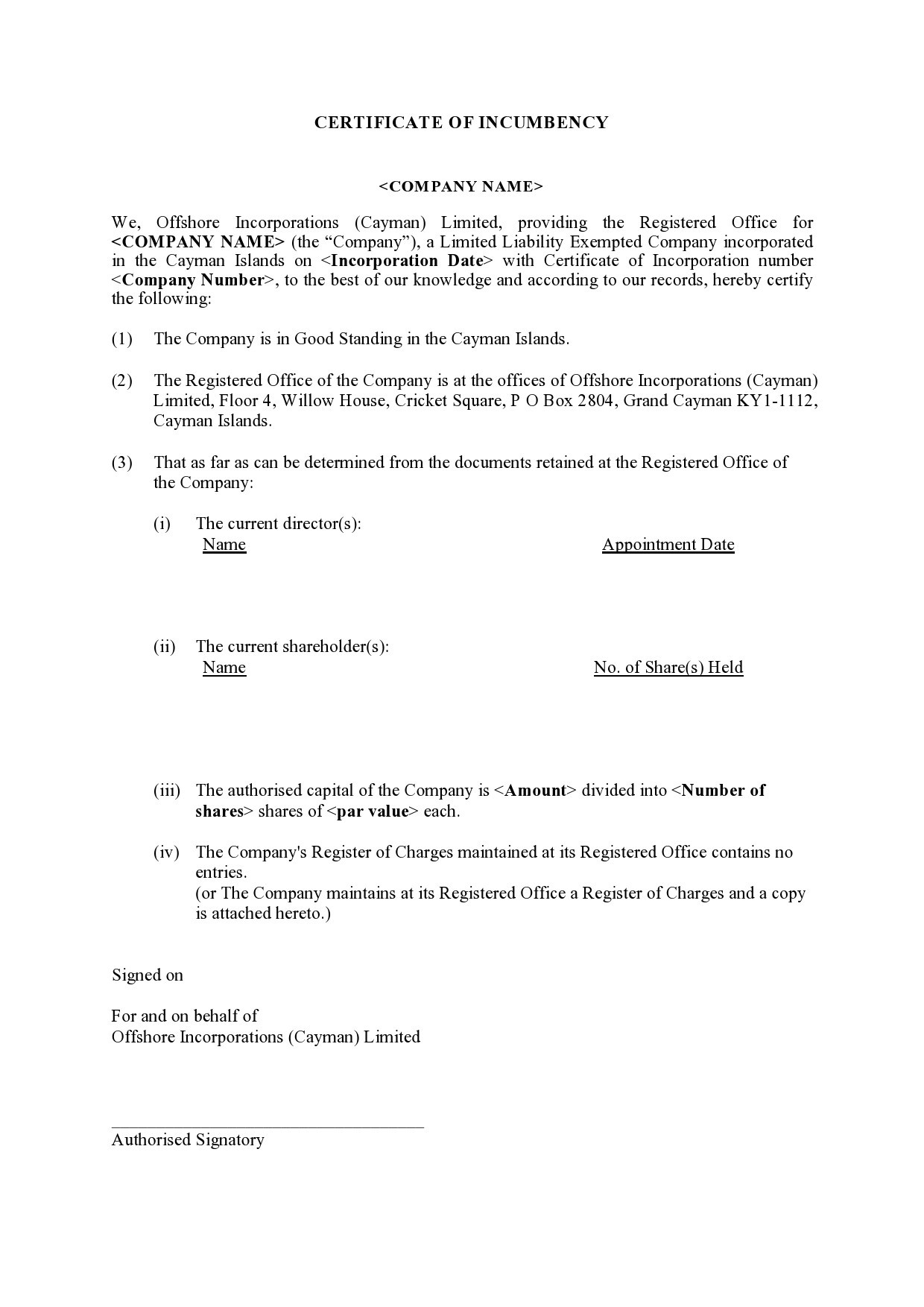

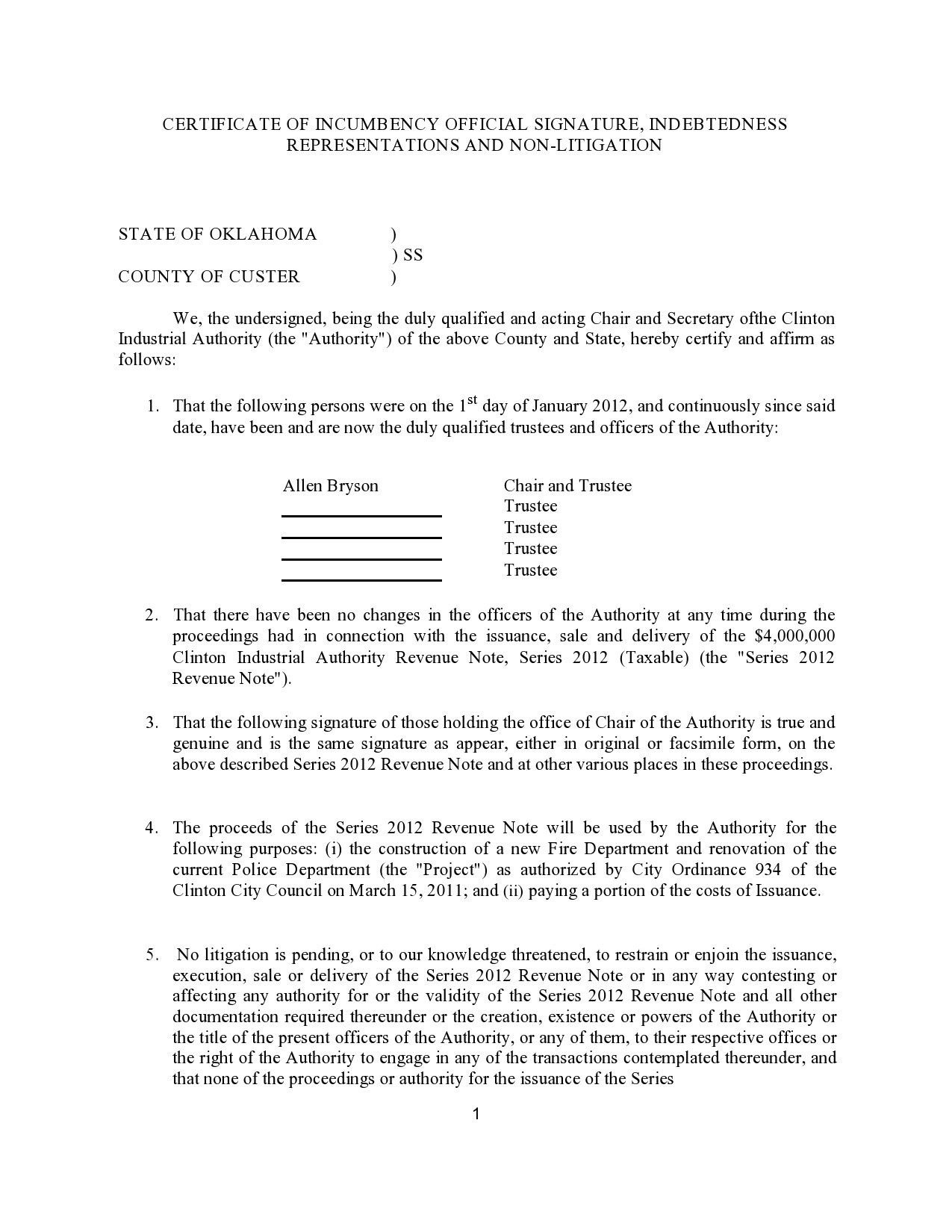

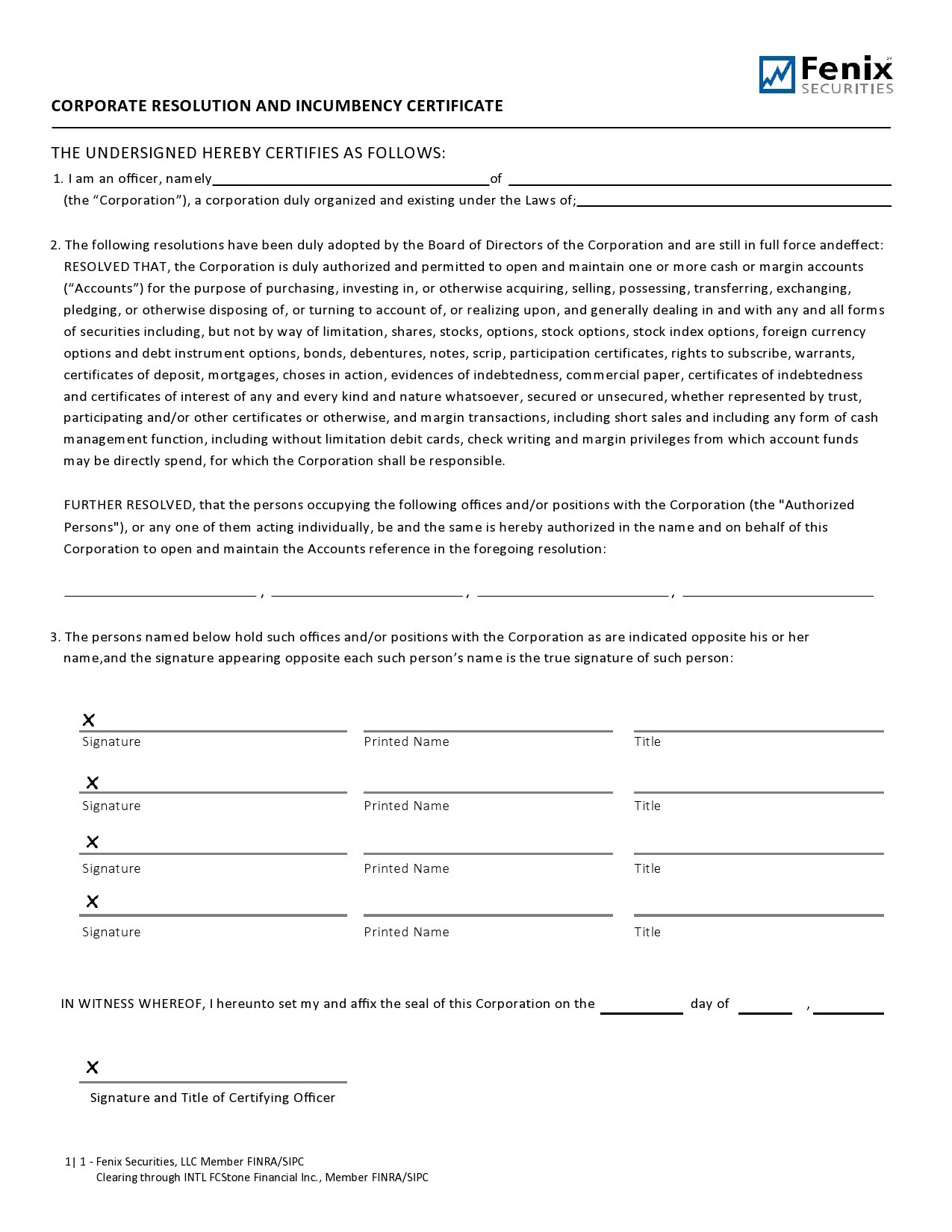

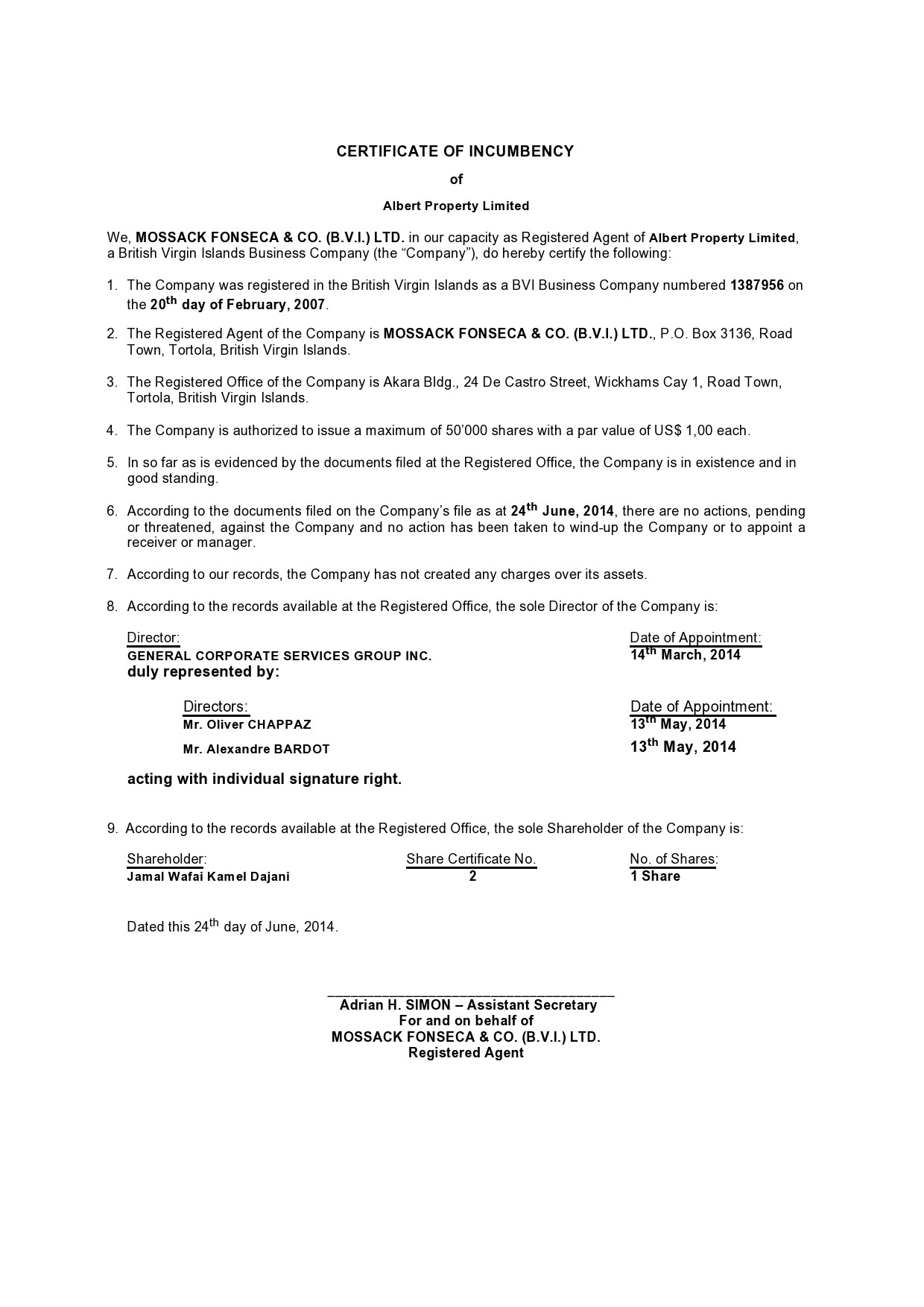

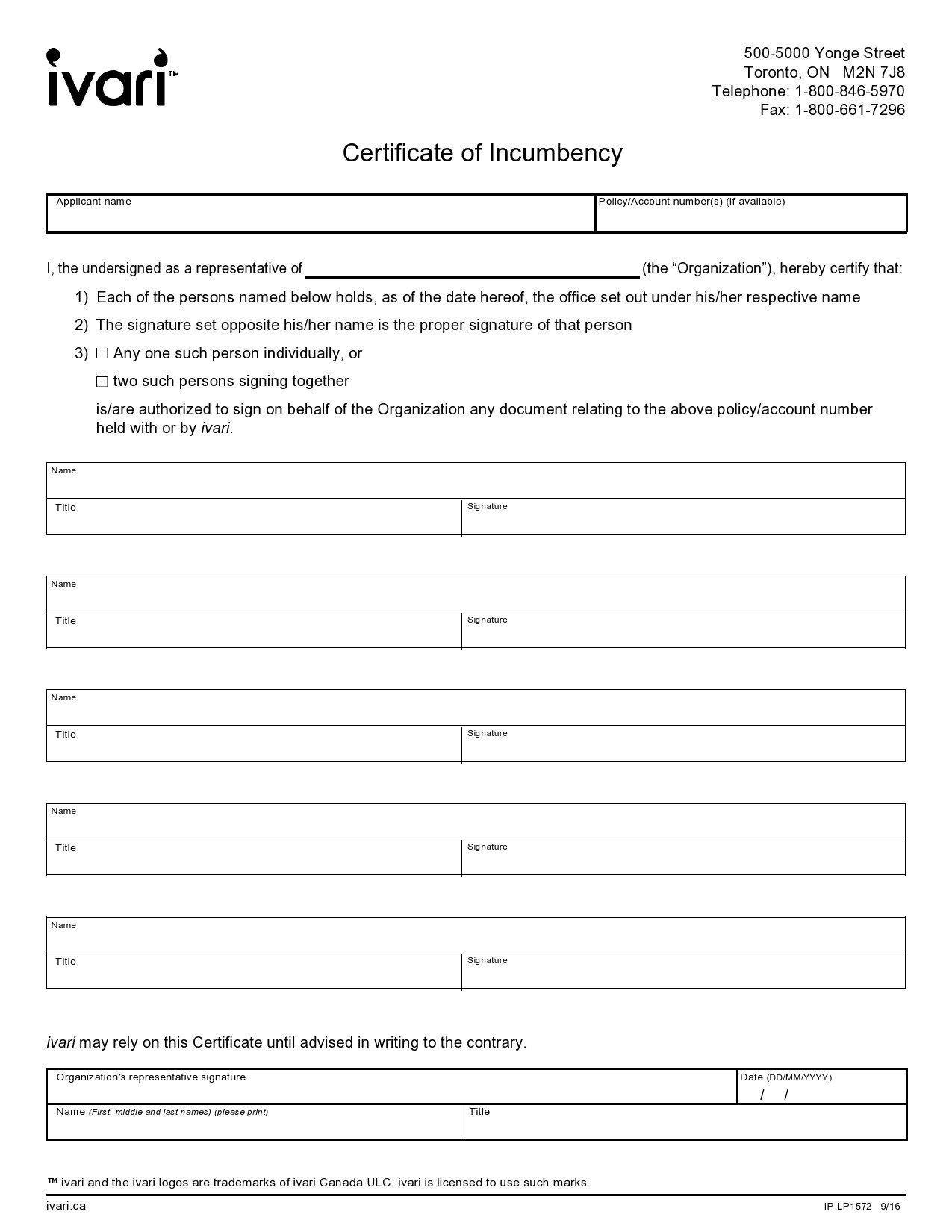

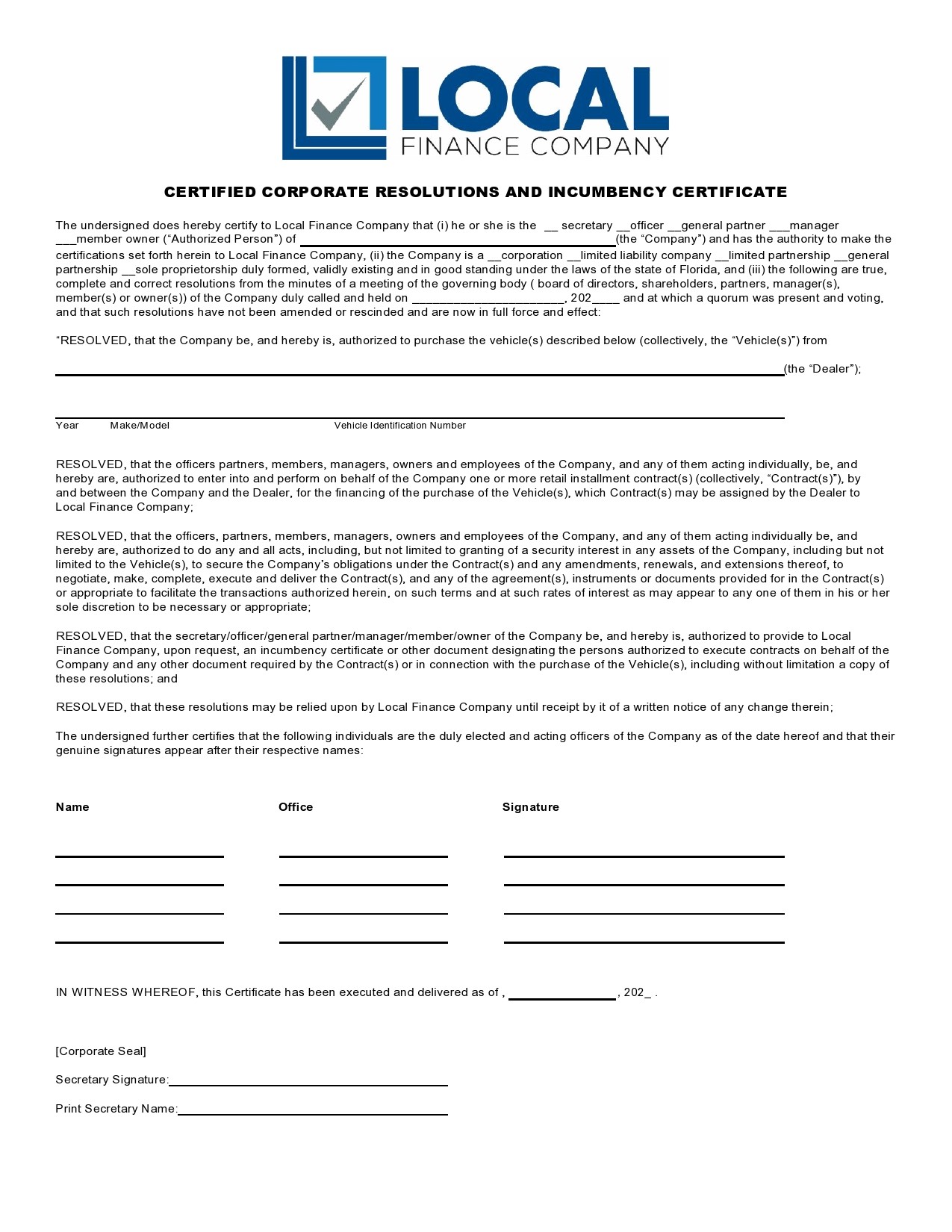

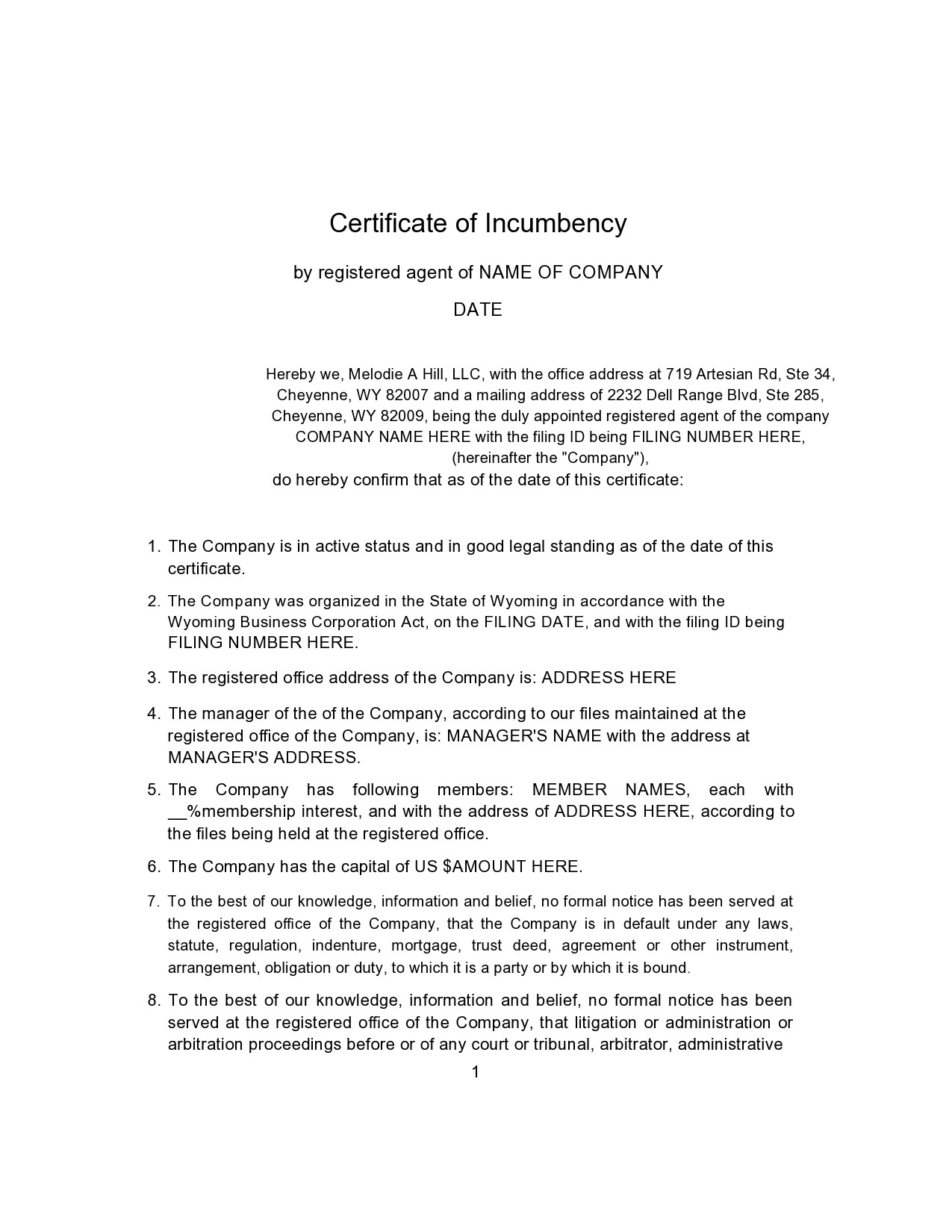

Certificate Of Incumbency Samples

What information does a certificate of incumbency include?

The use of a certificate of incumbency is commonly used in all countries. There is really no set or prescribed format for this certificate. The most common format of the incumbency certificate is one that sets out how the company formed or the details about the current structure of the corporation. This typically includes certification for the country of registration, the business address, and the details about the shareholders and officers of the company.

The most common use of an incumbency certificate is to verify the signatories of the corporation. Financial institutions often request these from international corporations that need to establish a bank account overseas. You may include additional information on the document like:

- Details about the company registers.

- Information about any charges or mortgages.

- Details about the signatories of the bank account.

- Names of the officers of the company who can enter into an agreement on behalf of the corporation.

- Verification that the corporation is in good standing.

- Verification that you have taken no action to close the company and you don’t have any pending proceedings or threats against the corporation.

Since there is no standard or legal format for a certificate of incumbency, you can include statements that suit your company’s needs. Upon the certificate’s completion, this can then get signed by an authorized signatory or by a registered agent that helped you form the company.

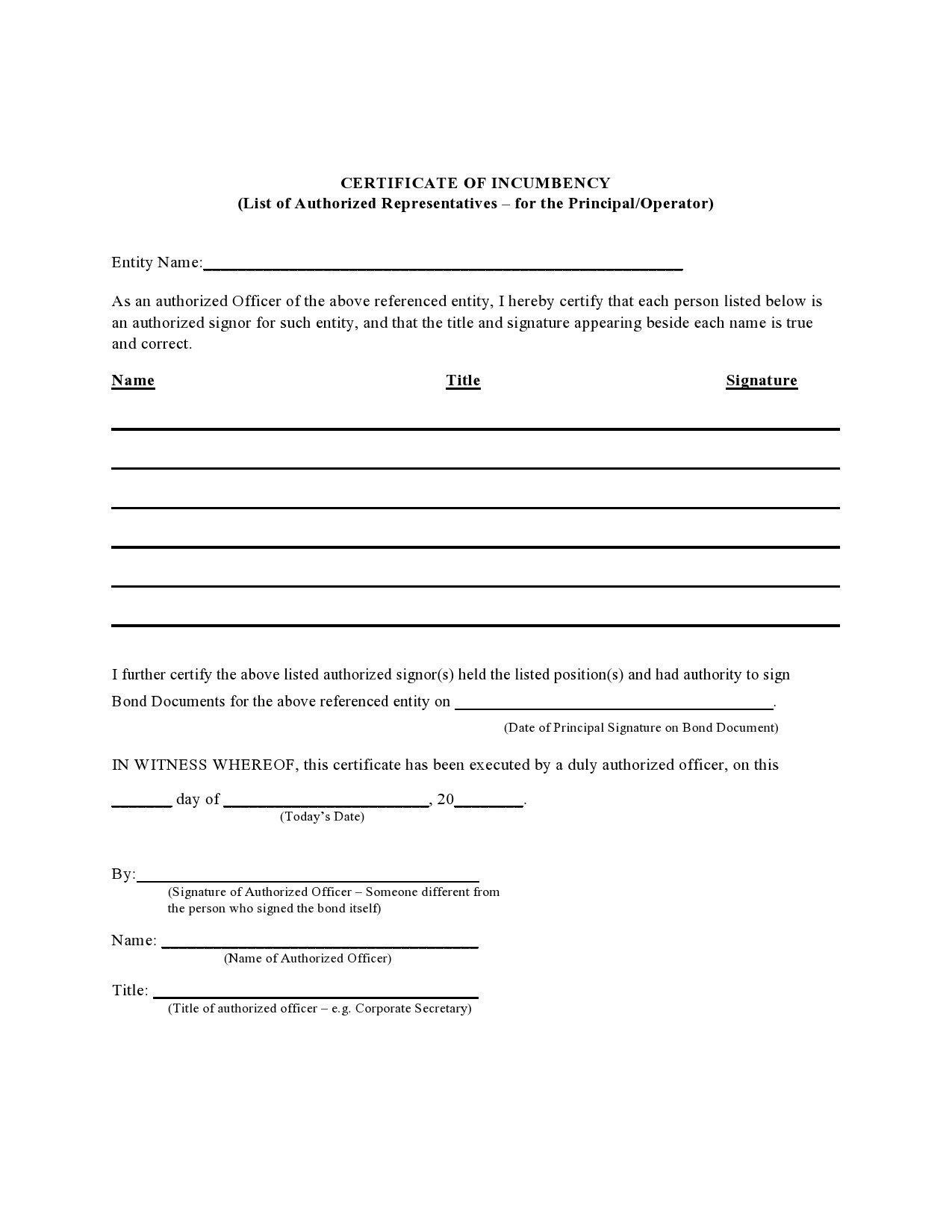

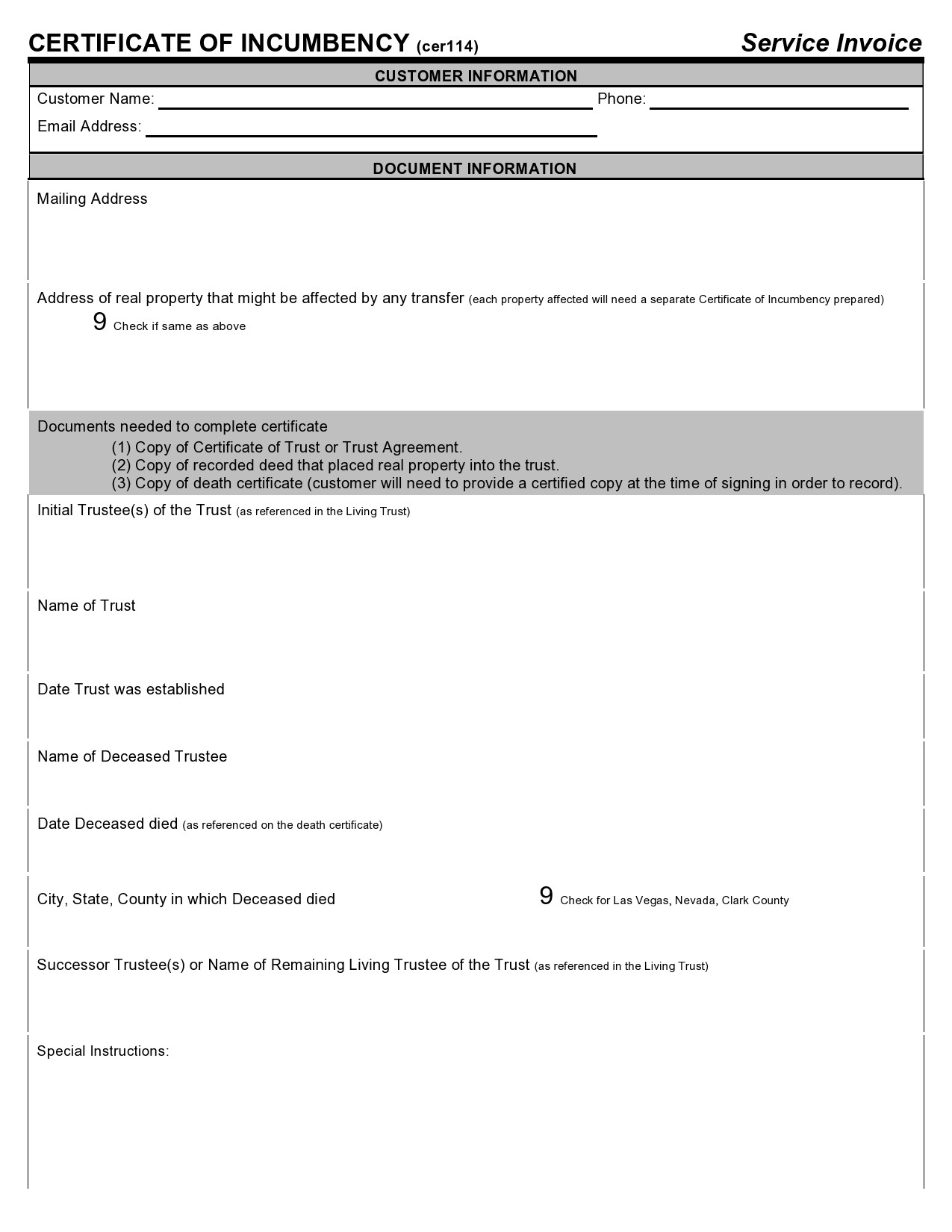

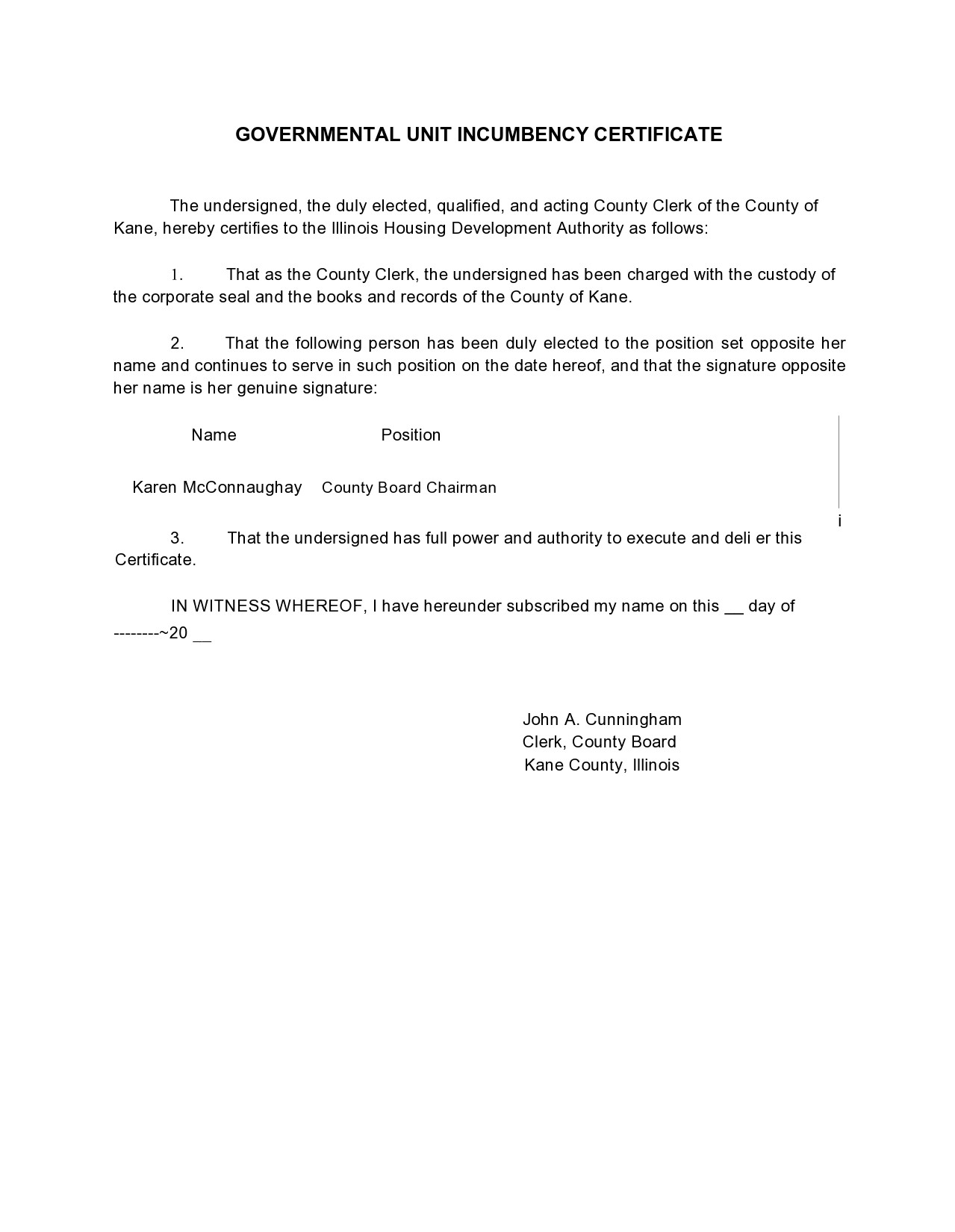

Letters Of Incumbency

When to use a certificate of incumbency?

Running a company often requires that you make sure that employees, specifically the officers of the company, will have the authority to conduct business and initiate transactions for the company. It will be the certificate of incumbency that states which persons will be the officers in the corporation.

The certificate is a legal corporate document issued by the corporation’s secretary or president and it contains a list of the names and positions of all of the current officers in the company. This includes the president, treasurer, secretary, and so on. It also allots a space where each of the officers can affix their signature. You can use the incumbency certificate if:

- You’re incorporating a business and you need to identify the officers.

- You’re a new officer at a company and you want to have official documentation.

- You’re the administrative manager of a company responsible for documentation.

- You will verify the authority of a specific officer and you must do so in writing.

- You need to open a bank account in a different country.

- You need the certificate for tax purposes.

- You’re planning to go into business abroad.

After the Corporate Secretary has completed the document, you must now have it signed by the directors, shareholders, and officers in the presence of a notary public then notarized. The notary public will usually charge a fee for this process. Moreover, if your company intends to do business with a foreign enterprise or in a different country, your certificate should get attested by your state, as well as, the United States Agency. For this procedure, you will have to pay another set of fees.

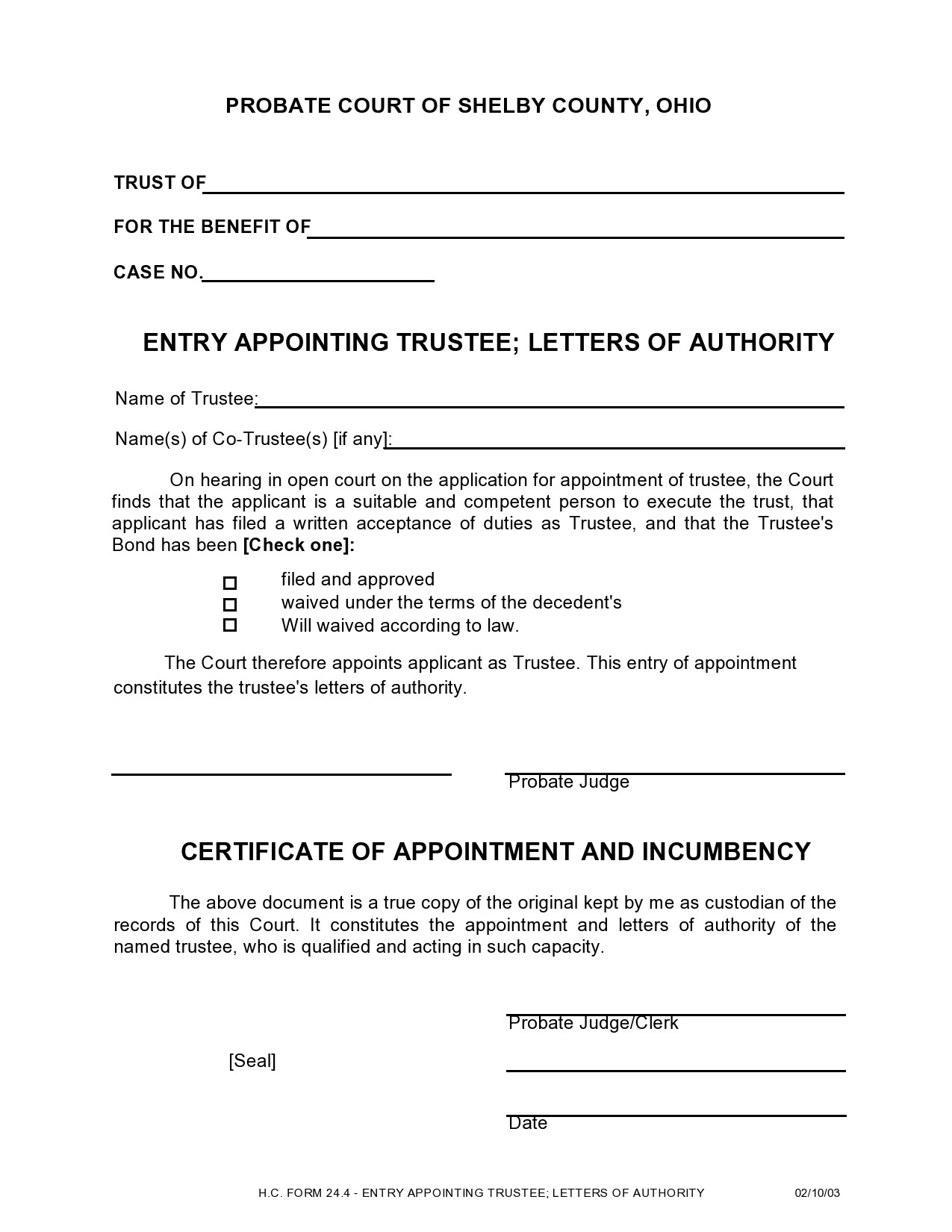

Does your company need a certificate of incumbency?

The certificate of incumbency is also referred to as an incumbency certificate or a statement of incumbency. This is a document that verifies the identity of persons within a company. The document may identify the managers and members or the shareholders and officers of the company, depending on the type of company. The certificate may include basic information like:

- When and where you formed the company along with the file number of your company in the state.

- Details of your company’s registered agent.

- Names and positions of the officials of your company.

- Names, titles, and the details of stock ownership of your company’s shareholders.

- The status of your company in the jurisdiction of formation.

The basis of the details contained in this document is the state registration records of your company and internal documentations like the minutes of your company meetings. Attach these internal documents to the certificate of incumbency.

Often, a certificate of good standing from the jurisdiction of the record is also attached to show further proof. The agent of record then signs the certificate then you have it notarized.

If your company possesses an international bank account, the bank may request an incumbency certificate. You may have to present this to them on a yearly basis for their due diligence. This certificate may also provide the rightful owners of the company as prepared by the agent of record.

How long is a certificate of incumbency valid for?

You can use the certificate of incumbency anytime that the organization, a person or a government agency requires a confirmation of the authority of a director or an officer to collect more information about the incumbents of a corporation. As for foreign transactions, there is almost always a requirement for an incumbency certificate.

But anyone from a simple sub-contractor to a corporate lawyer may require this certificate, especially when signing a contract to make sure that the document is legally binding. Typically, the incumbency certificate has a validity of 60 days starting from the date you had it certified.