If you have a considerable amount of property to leave behind, it’s a good idea to create a document that names an heir. This prevents any arguments regarding property for those you leave behind. In some cases, you can execute an affidavit of heirship that your heir if they wish to take possession of your estate after death.

Table of Contents

- 1 Affidavit of Heirship

- 2 What is a declaration of heirs?

- 3 Affidavit Of Heirship Samples

- 4 How does heirship work in Texas?

- 5 Affidavit Of Heirship Forms

- 6 Who can file an affidavit of heirship in Texas?

- 7 Certificates Of Heirship

- 8 How much does it cost to file an affidavit of heirship in Texas?

- 9 Letters Of Heirship

Affidavit of Heirship

What is a declaration of heirs?

Aside from an affidavit of heirship, there is another document called a declaration of heirs. This document identifies your heirs in case you die without an enforceable or valid will. A member of your family can use this document to establish ownership of your real property in the event of your death.

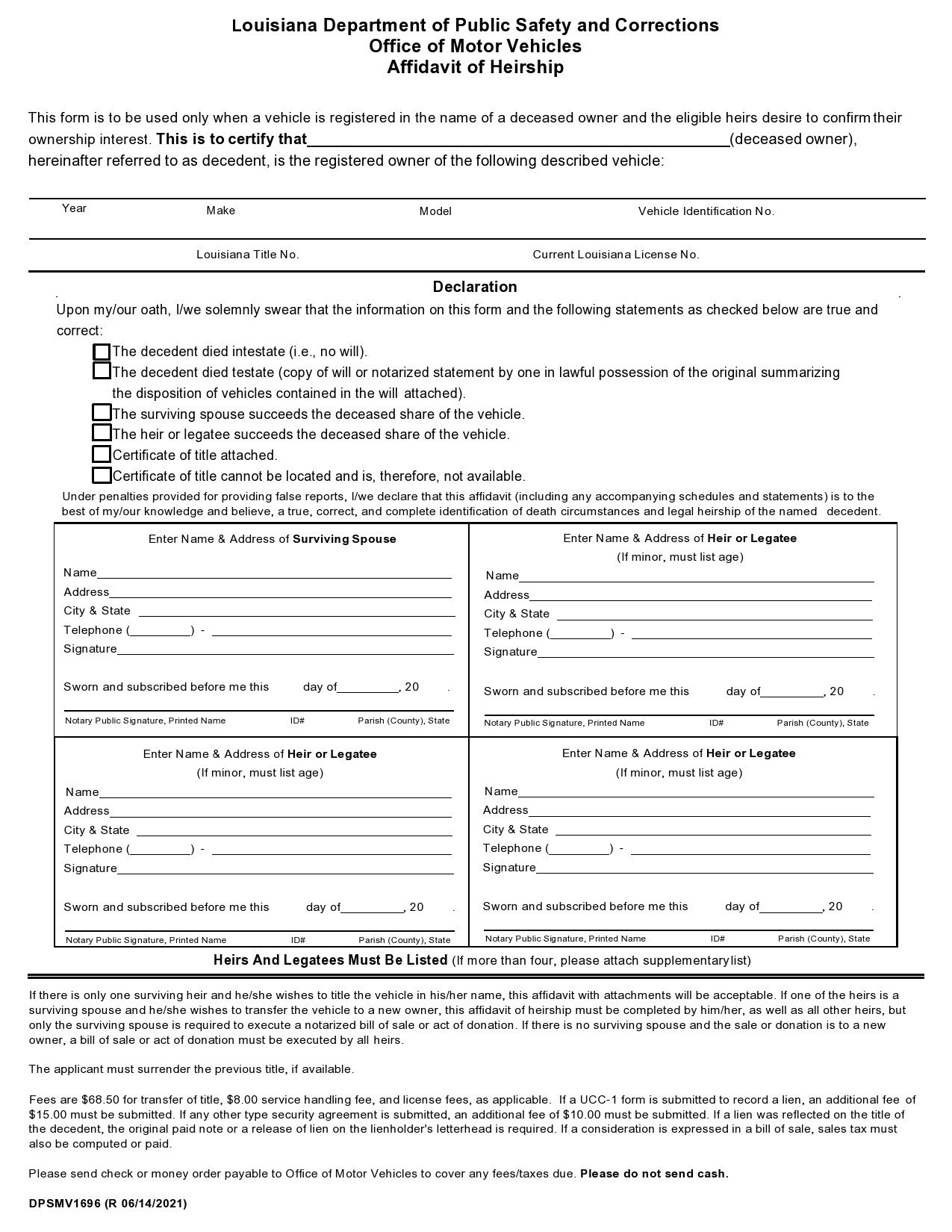

There are some states that allow the use of an affidavit of heirship sample to establish ownership of personal property like cars or bank accounts. The members of your family may allow the use of this document to avoid the time-consuming and expensive process of settling your estate in probate court.

The most important function of an affidavit or letter of heirship is to present all of the known information about you and this includes all family relations. This makes it easier for the court to correctly distribute your property. For this to occur, all the heirs must all agree with how they will distribute the property.

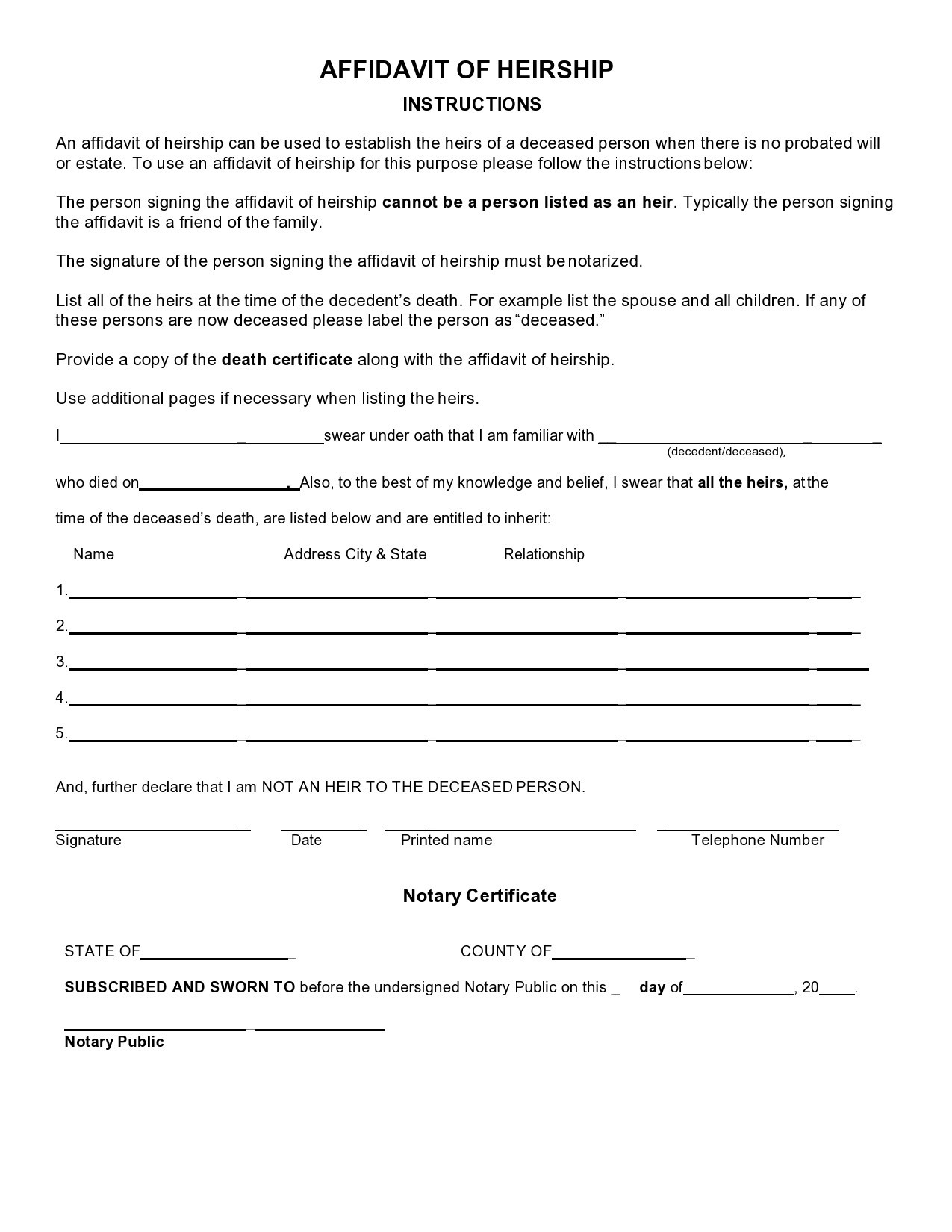

One requirement for the affidavit is that a disinterested third party must sign it. This witness is usually a person who you knew in life but isn’t an heir to your estate. After the completion of all requirements, the heirs will submit the document to the court and in the deed records of your local county. This document must contain the following:

- Decedent

This is the deceased person. - Intestate

This is a person who dies without leaving a valid will or any other document that directs the distribution of assets after their death. - Decedent’s Estate

This is the personal and real property that the deceased owned when they died. - Real Property

This is all of the real estate owned by the deceased person. - Personal Property

This is any property of the deceased that isn’t attached to their real property. - Heir

This is a person (or a group of people) who may inherit the property of the deceased legally. - Affidavit

This is a sworn statement that verifies the facts concerning a certain issue. In this case, it identifies the heirs of the deceased and other information as required by law. - Witness

This is the third-party who isn’t an heir or beneficiary and has no interest in the deceased properties. It is a requirement for a witness to sign the affidavit then swear under oath that the information written in the affidavit is both accurate and truthful to their best knowledge. - Notary

This is the person in charge of administering the affirmations and oaths of the witness and deceased. Notaries usually would place their seal of authentication on the document as proof of proper execution.

Most states limit the use of this document in transferring ownership of the real property to an heir. Some states allow the document use in the distribution of personal property among the heirs as long as everyone with a claim against the estate is in agreement on the distribution.

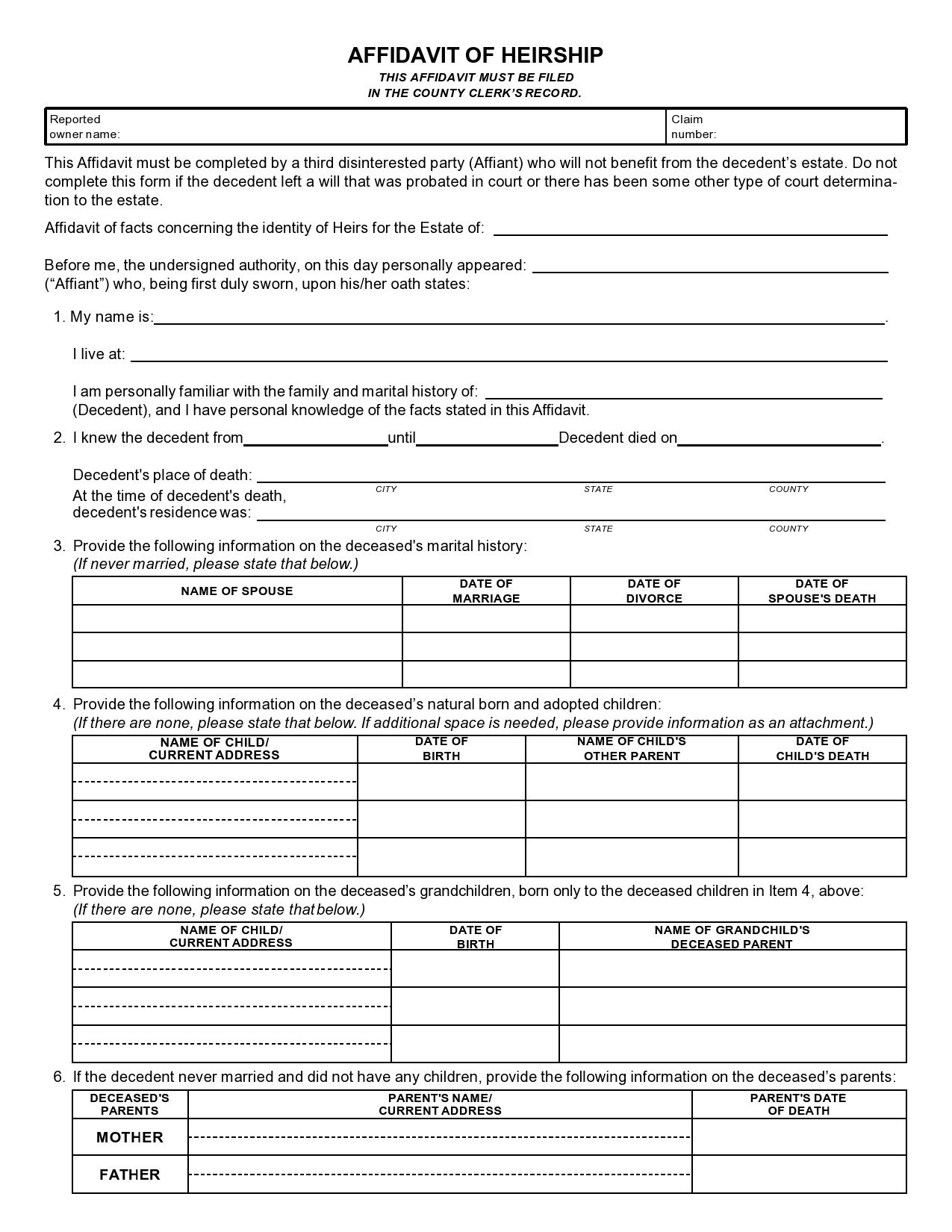

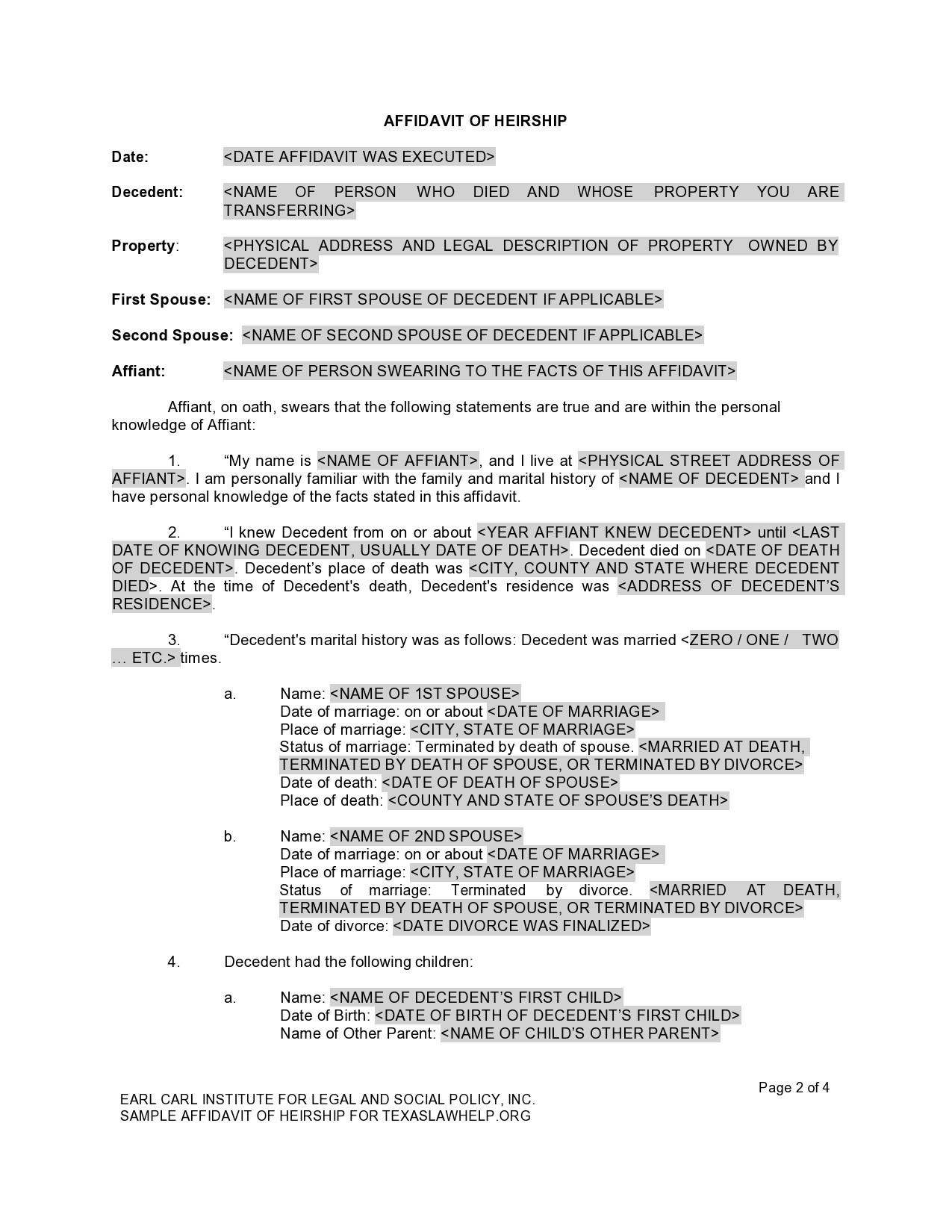

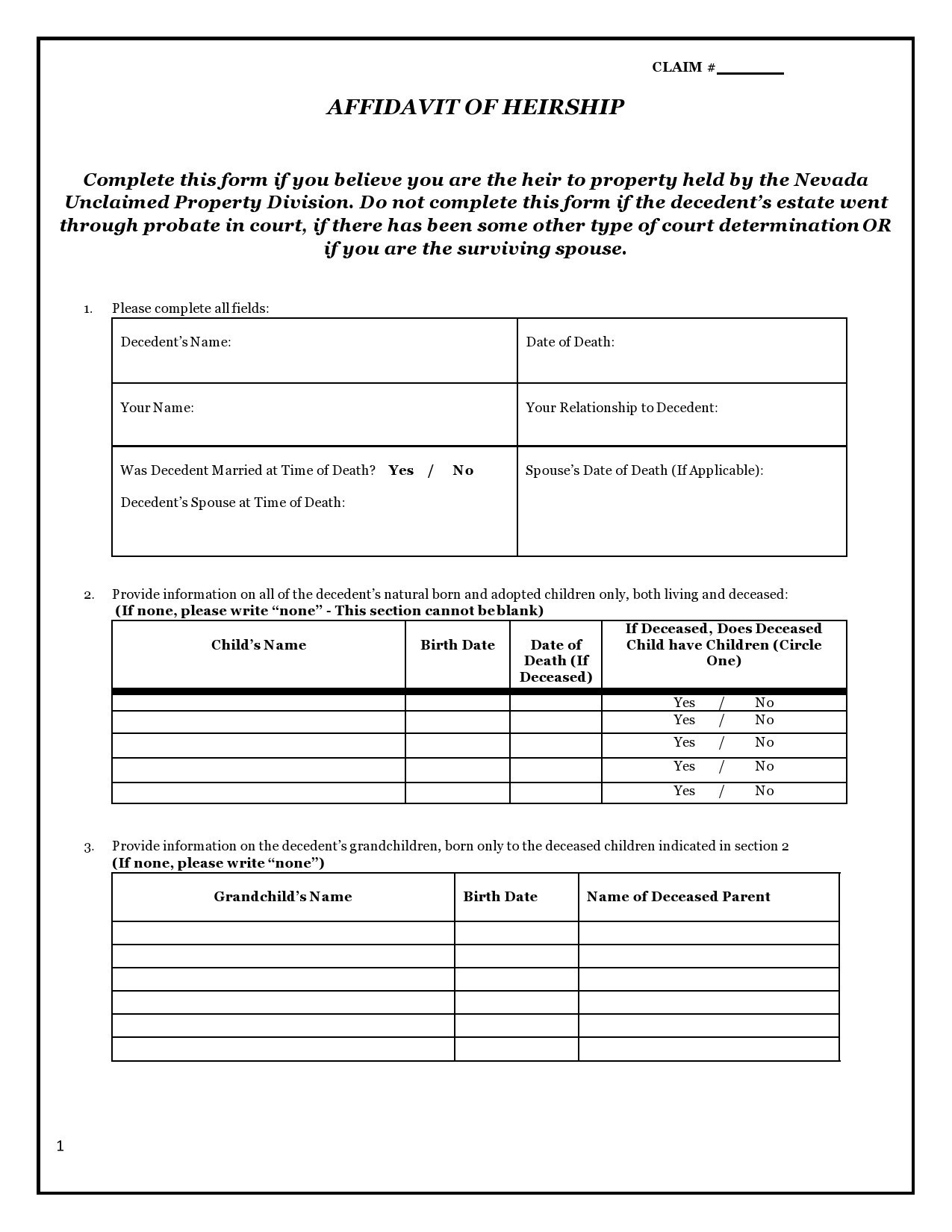

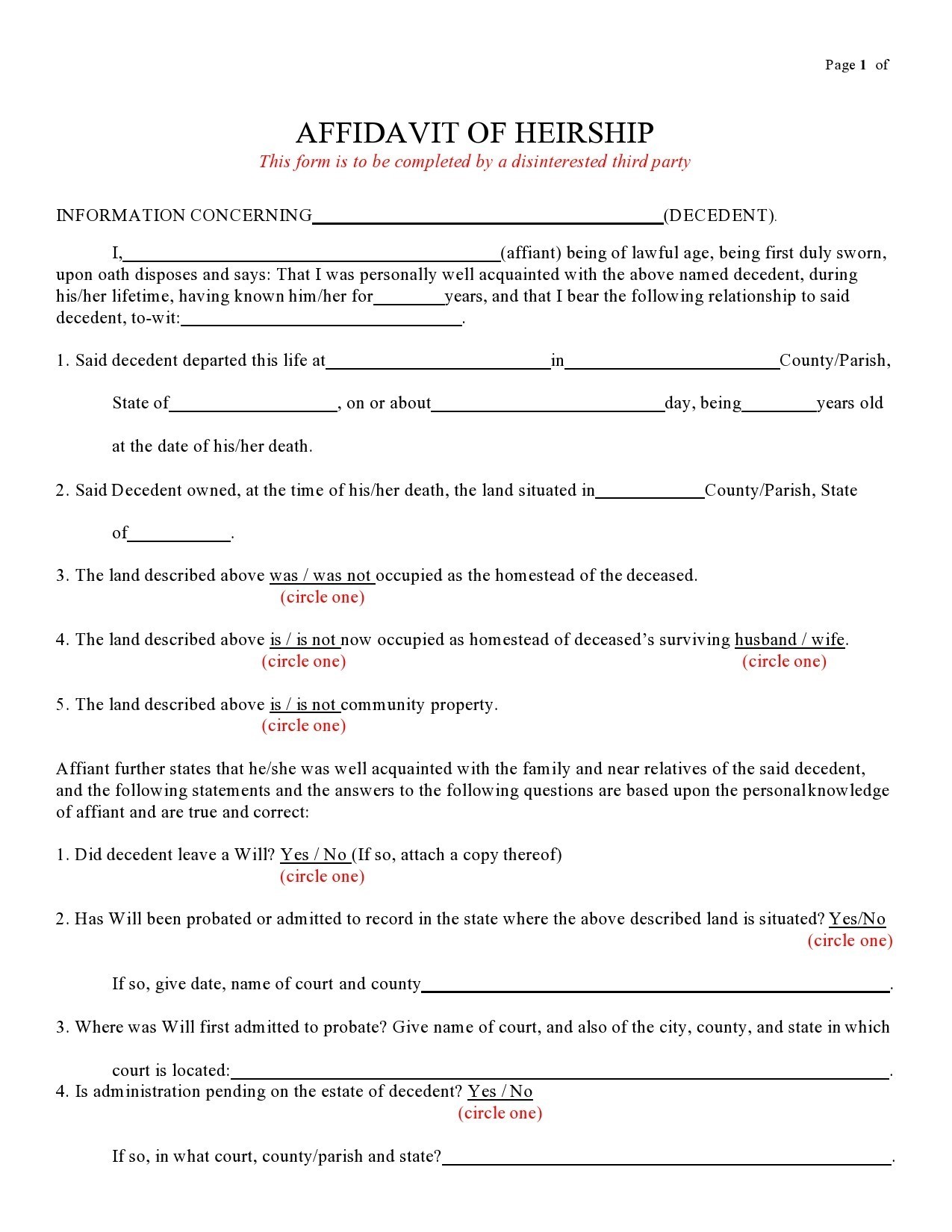

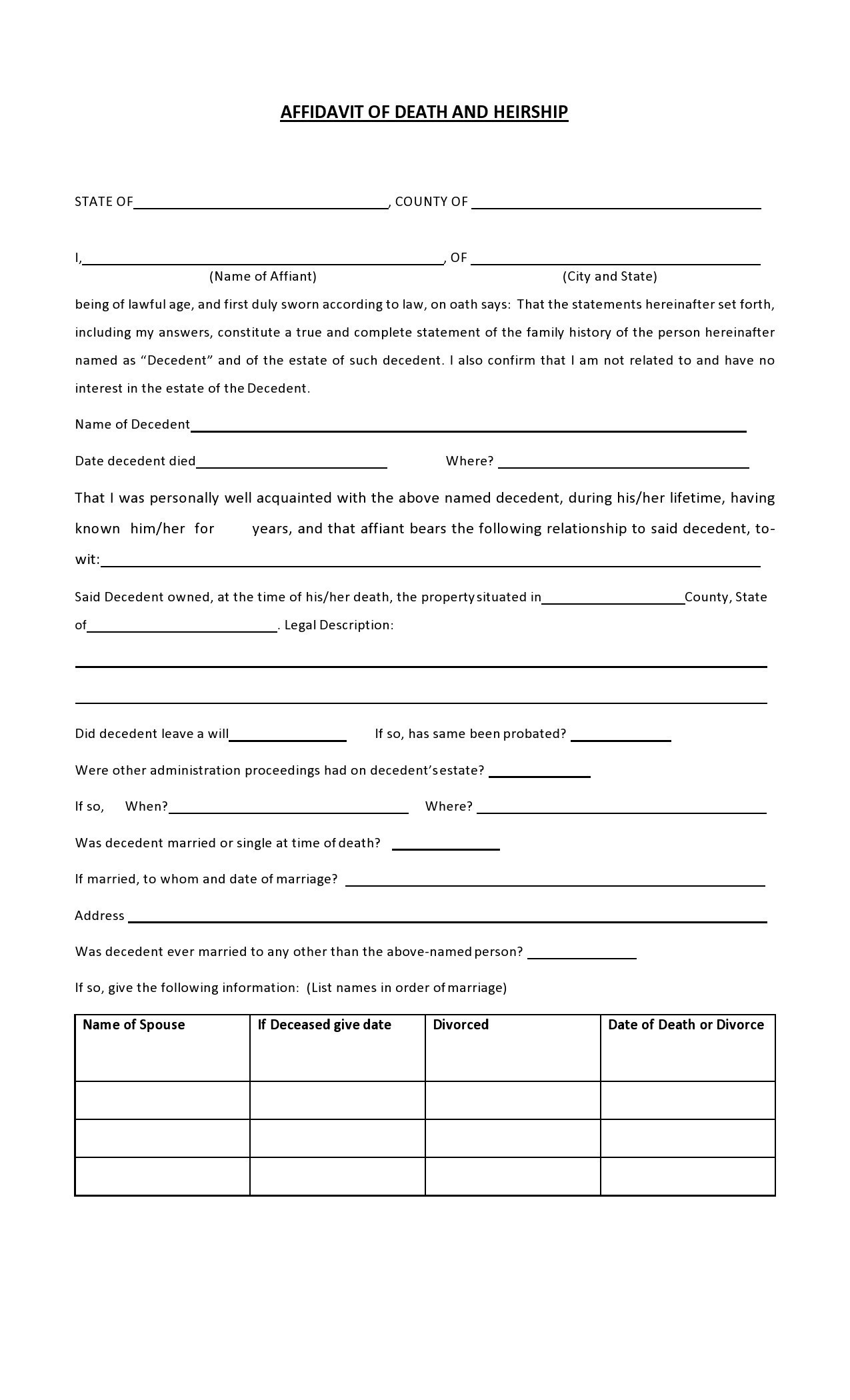

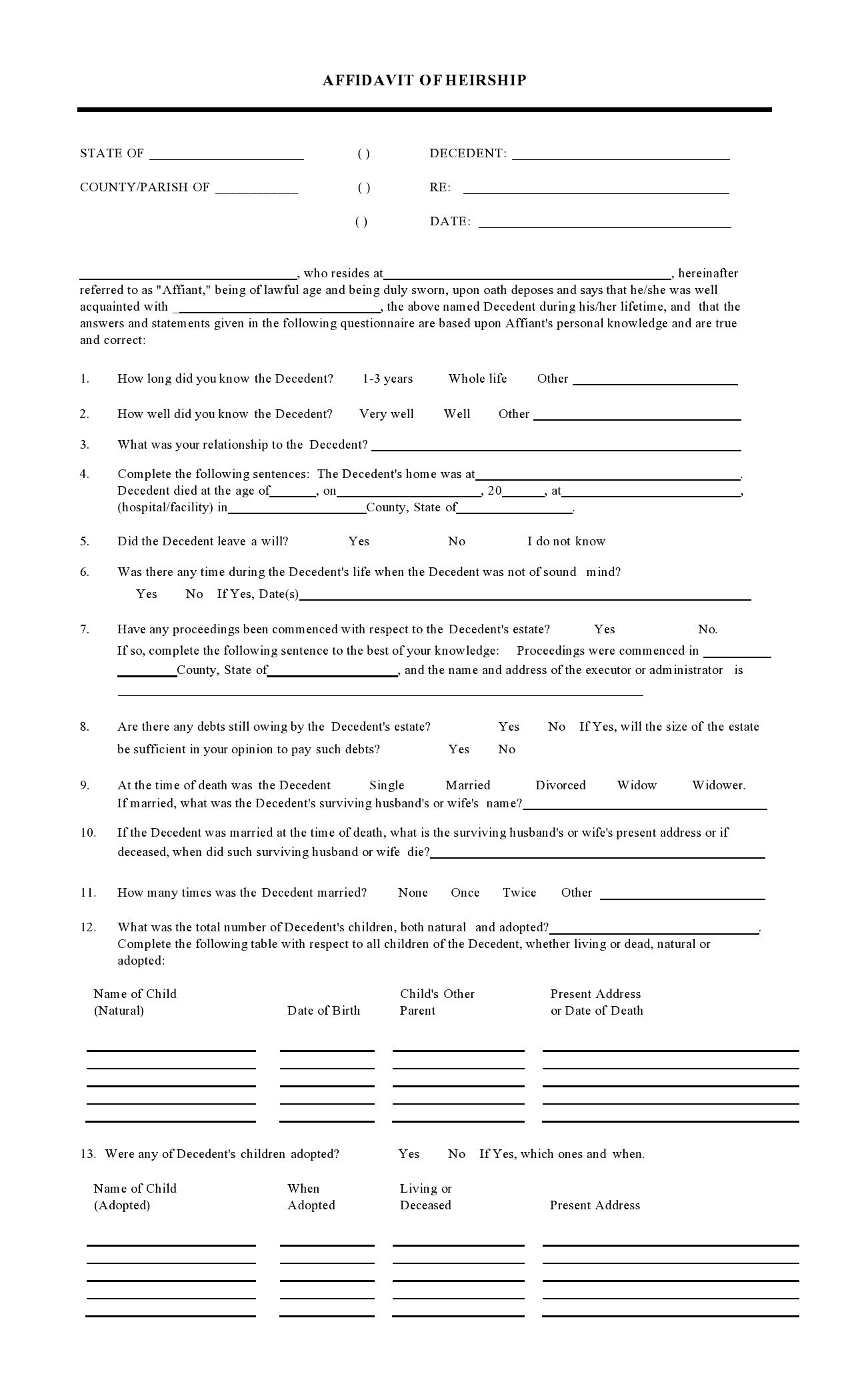

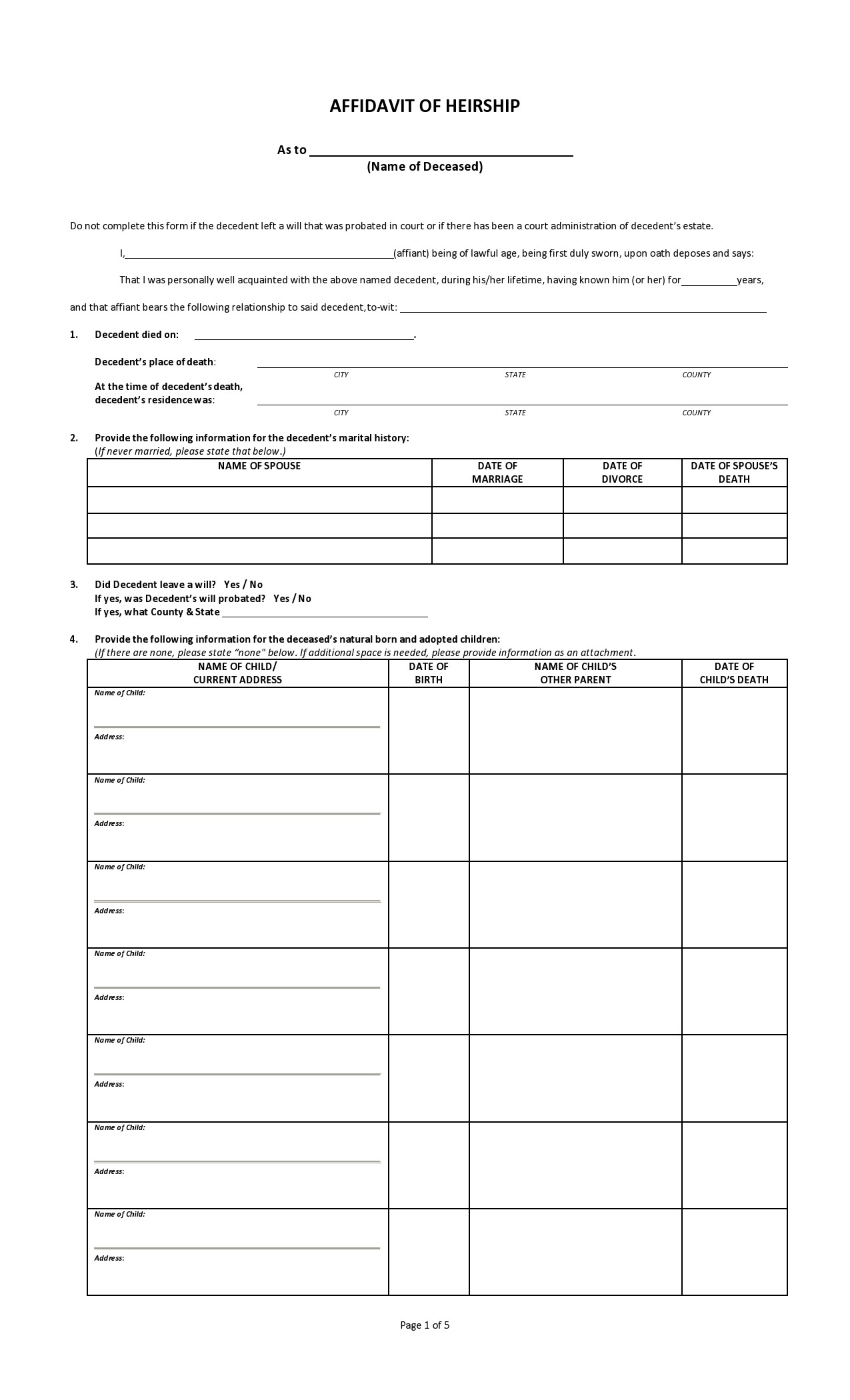

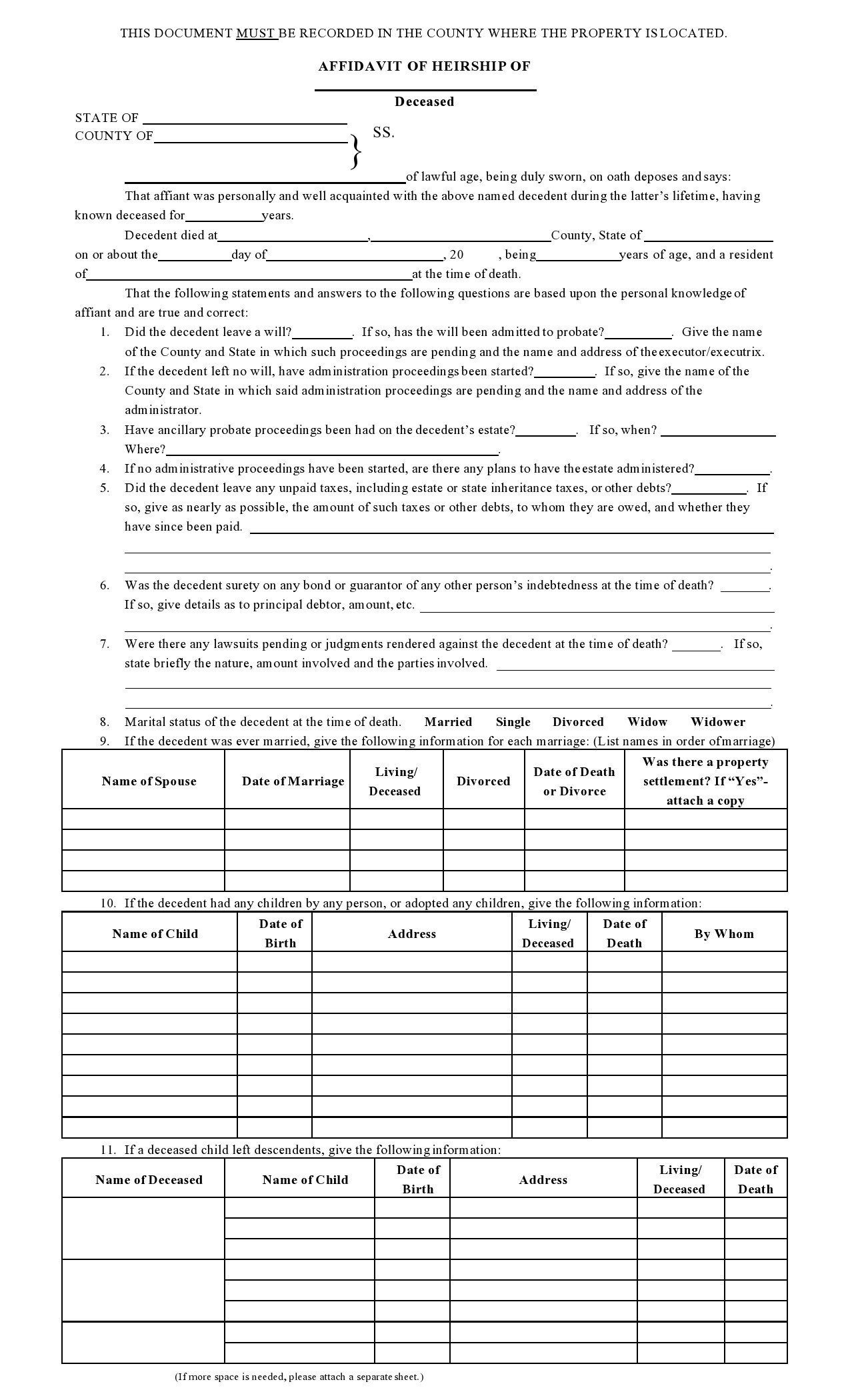

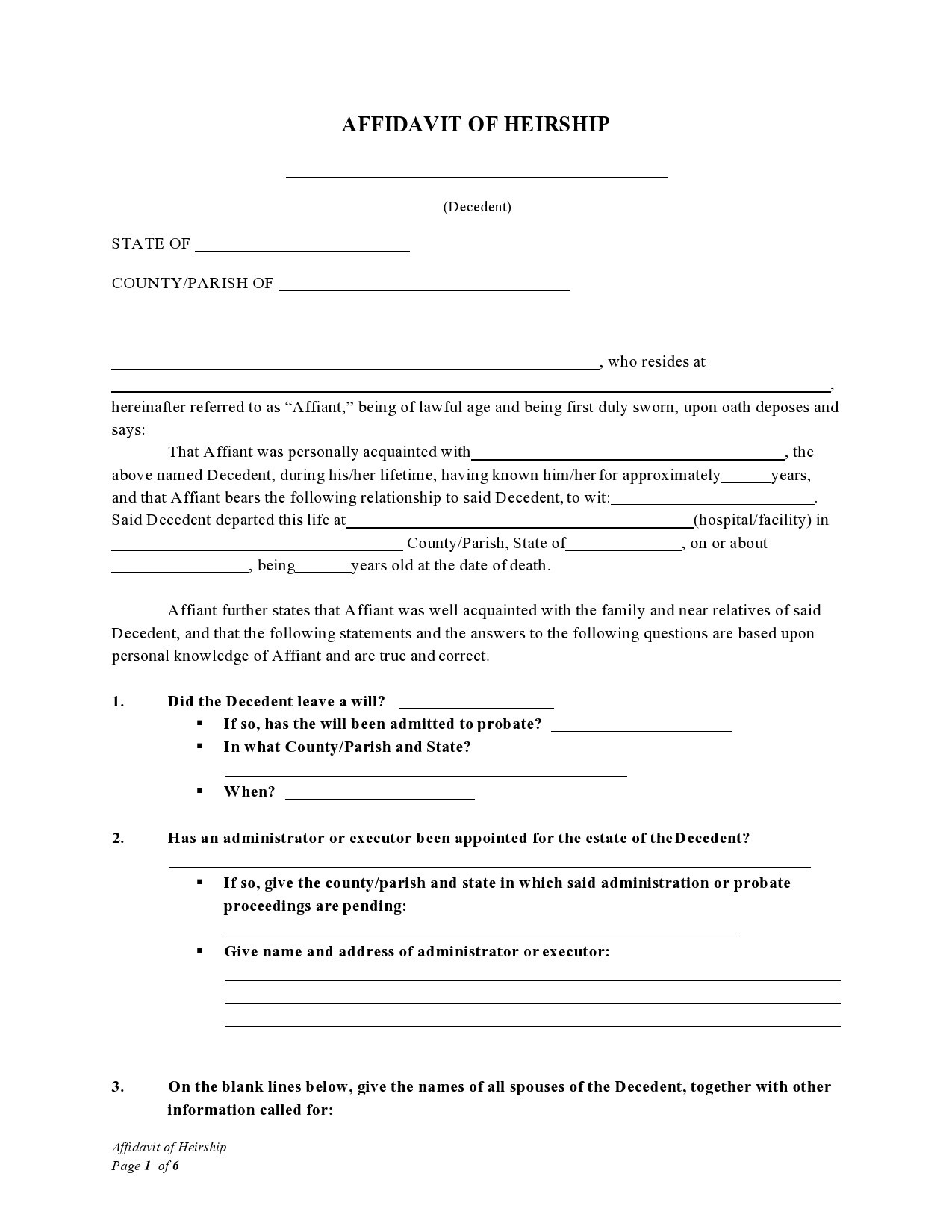

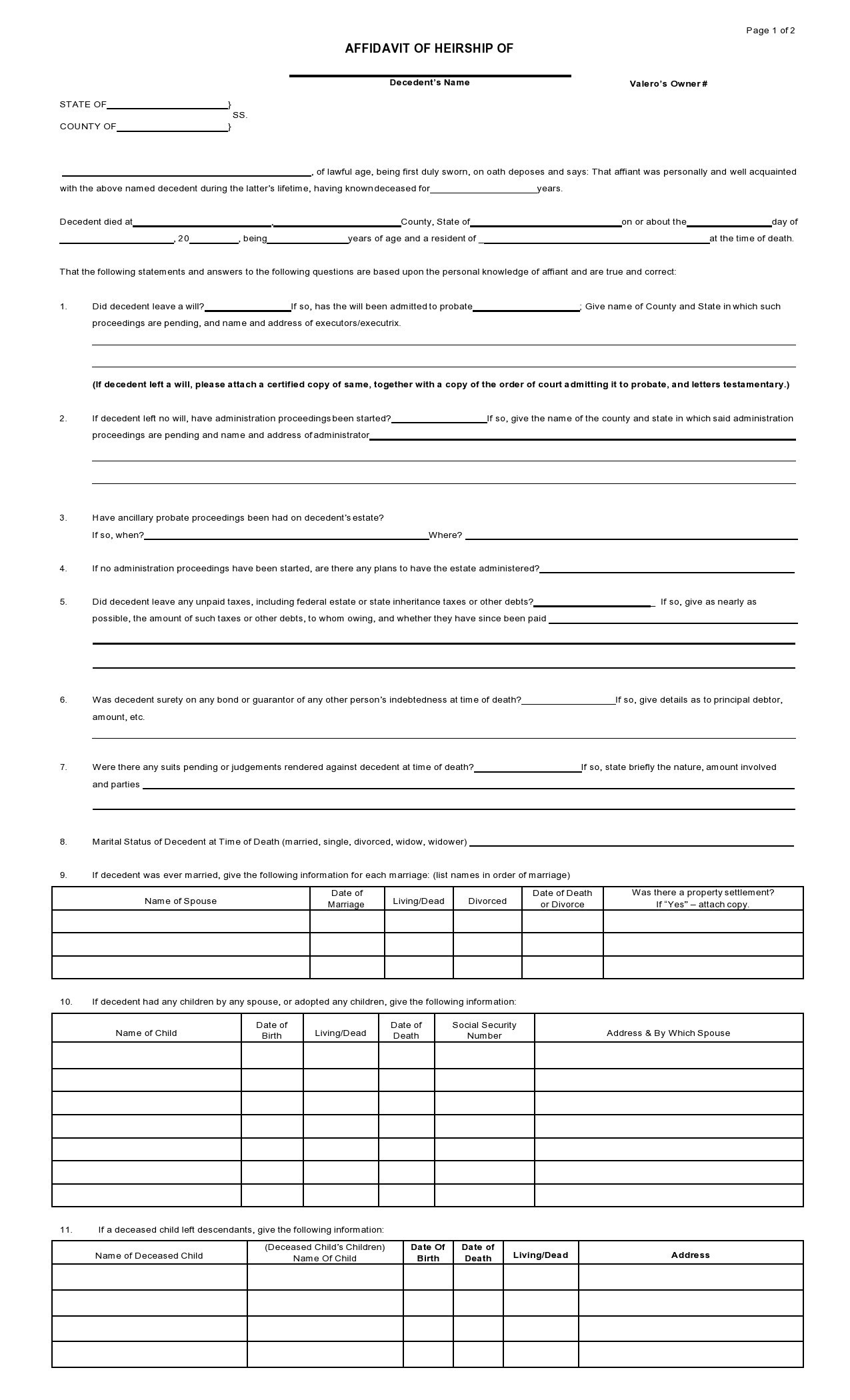

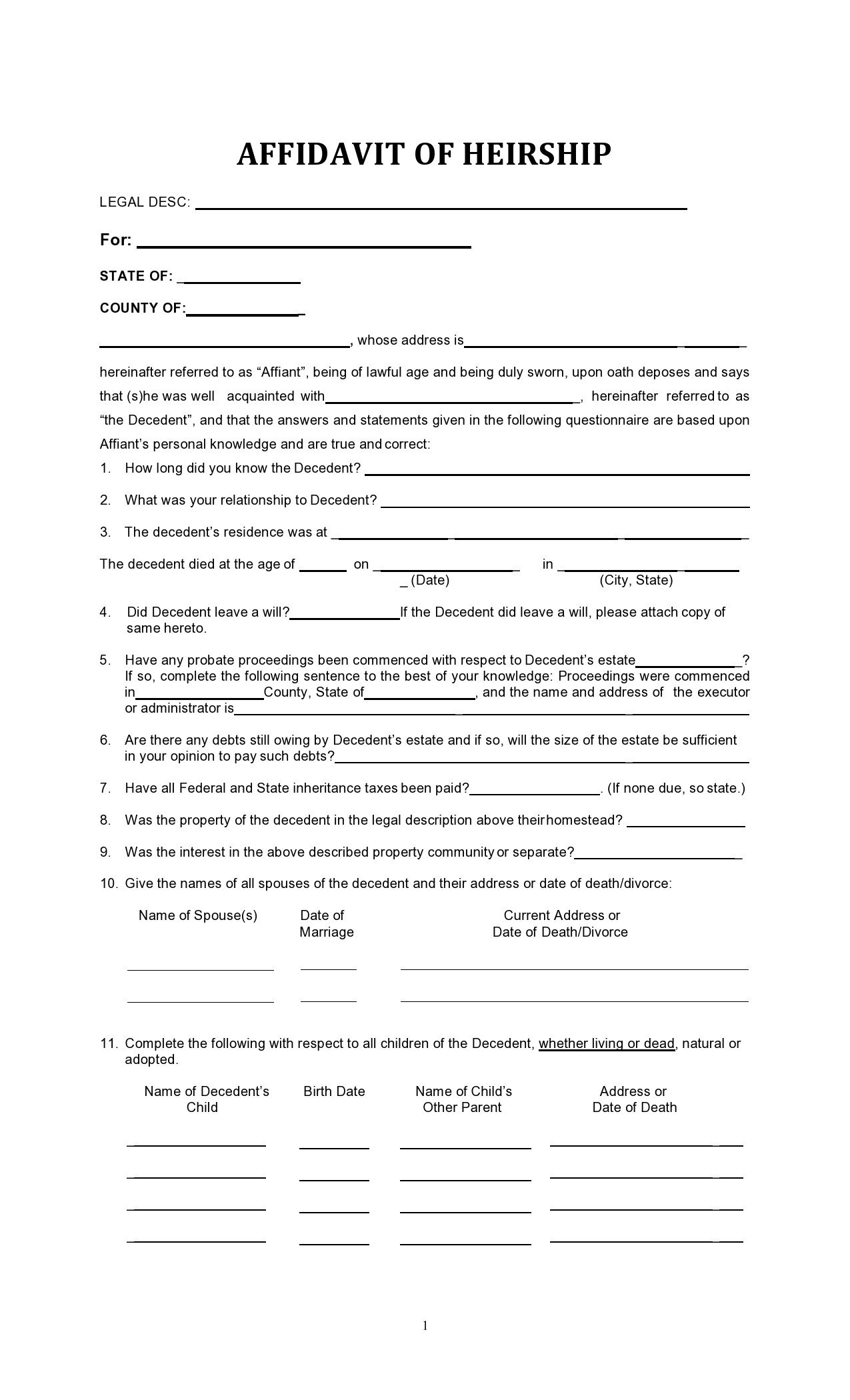

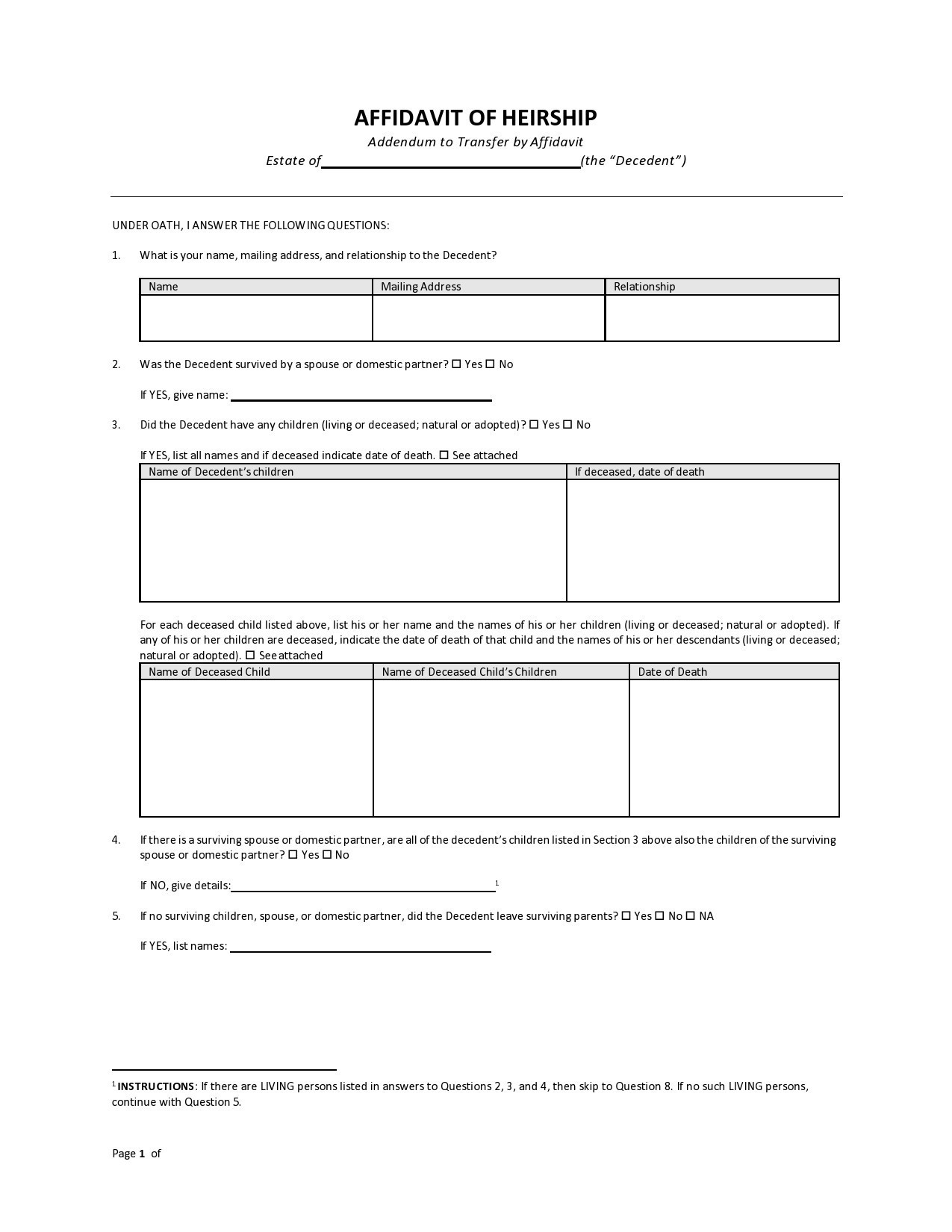

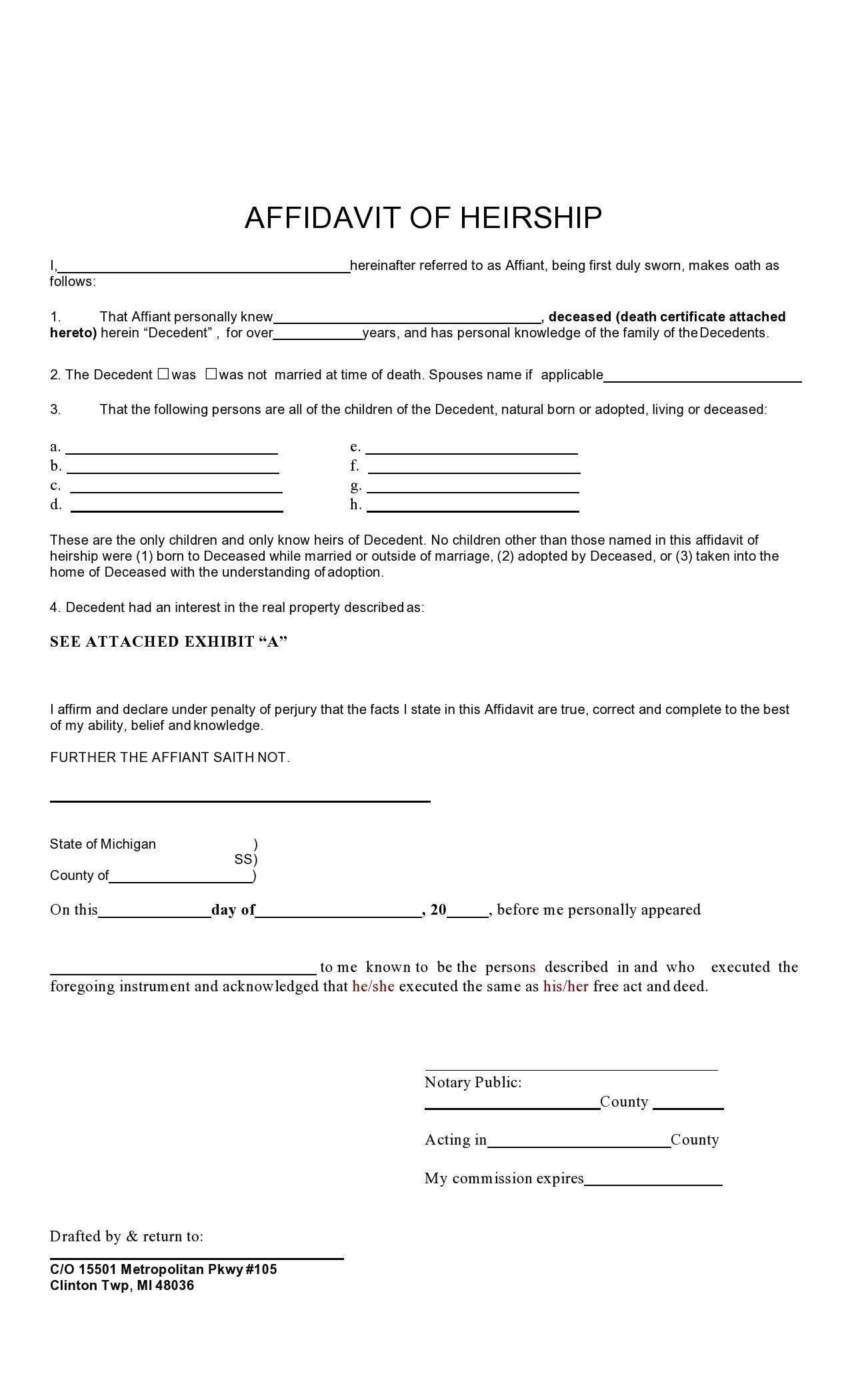

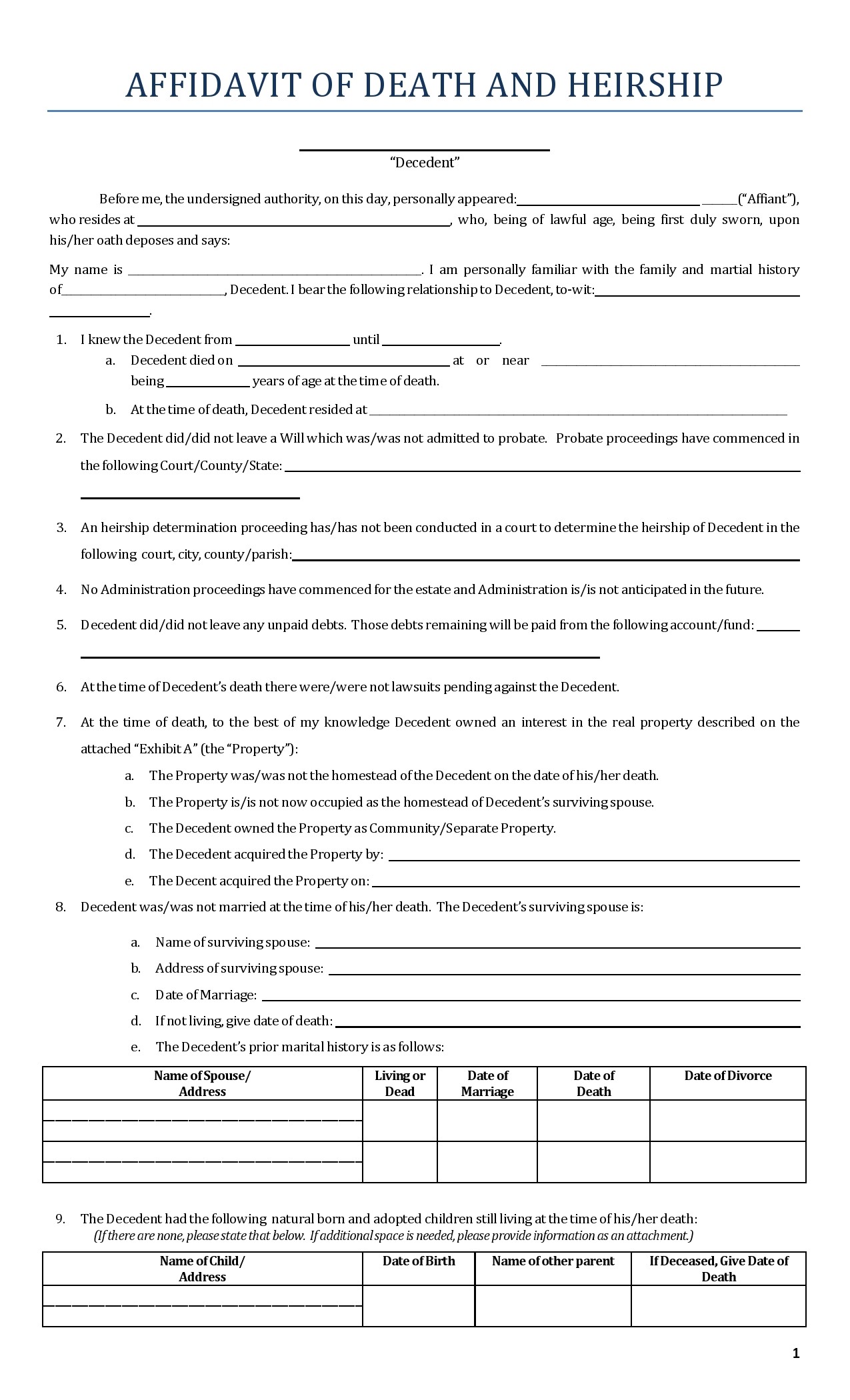

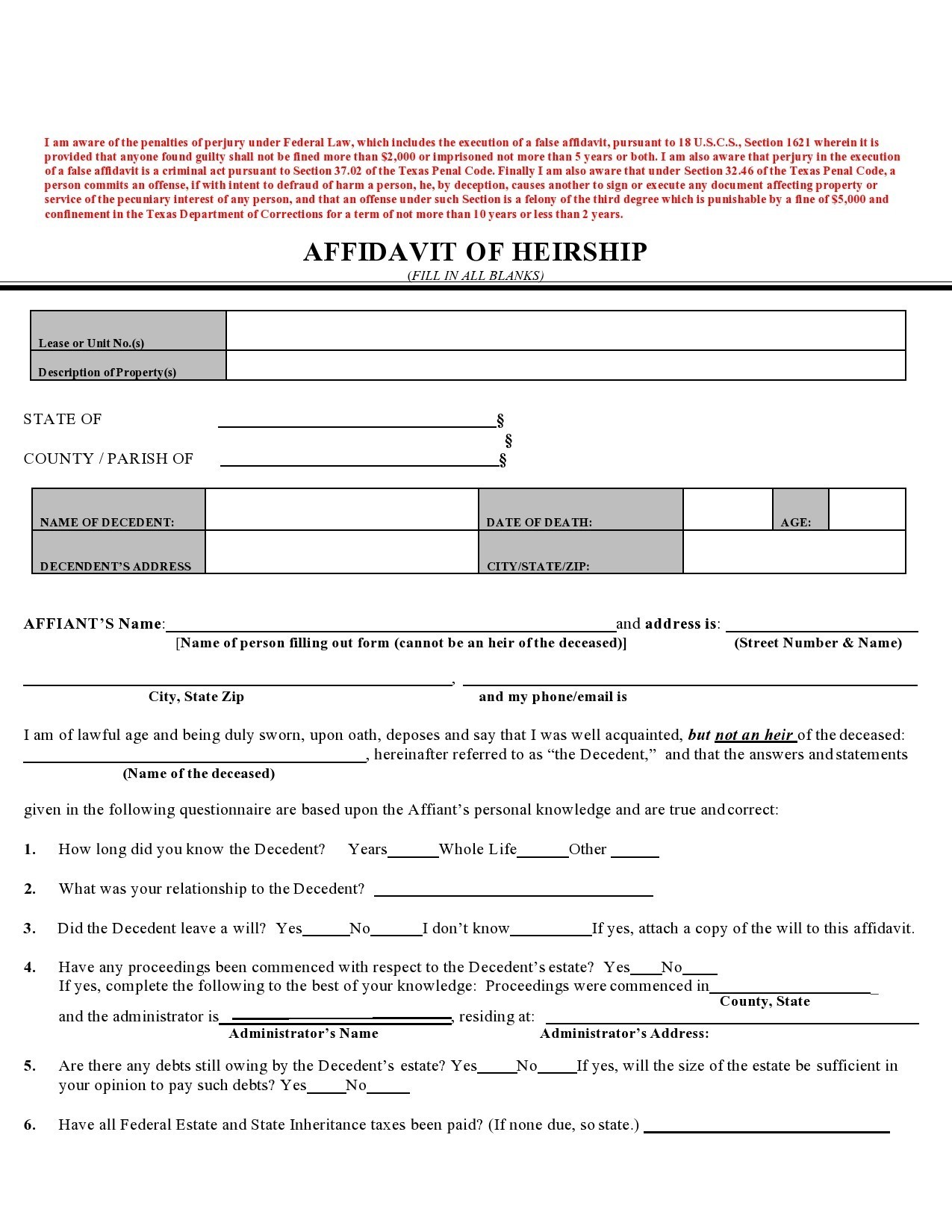

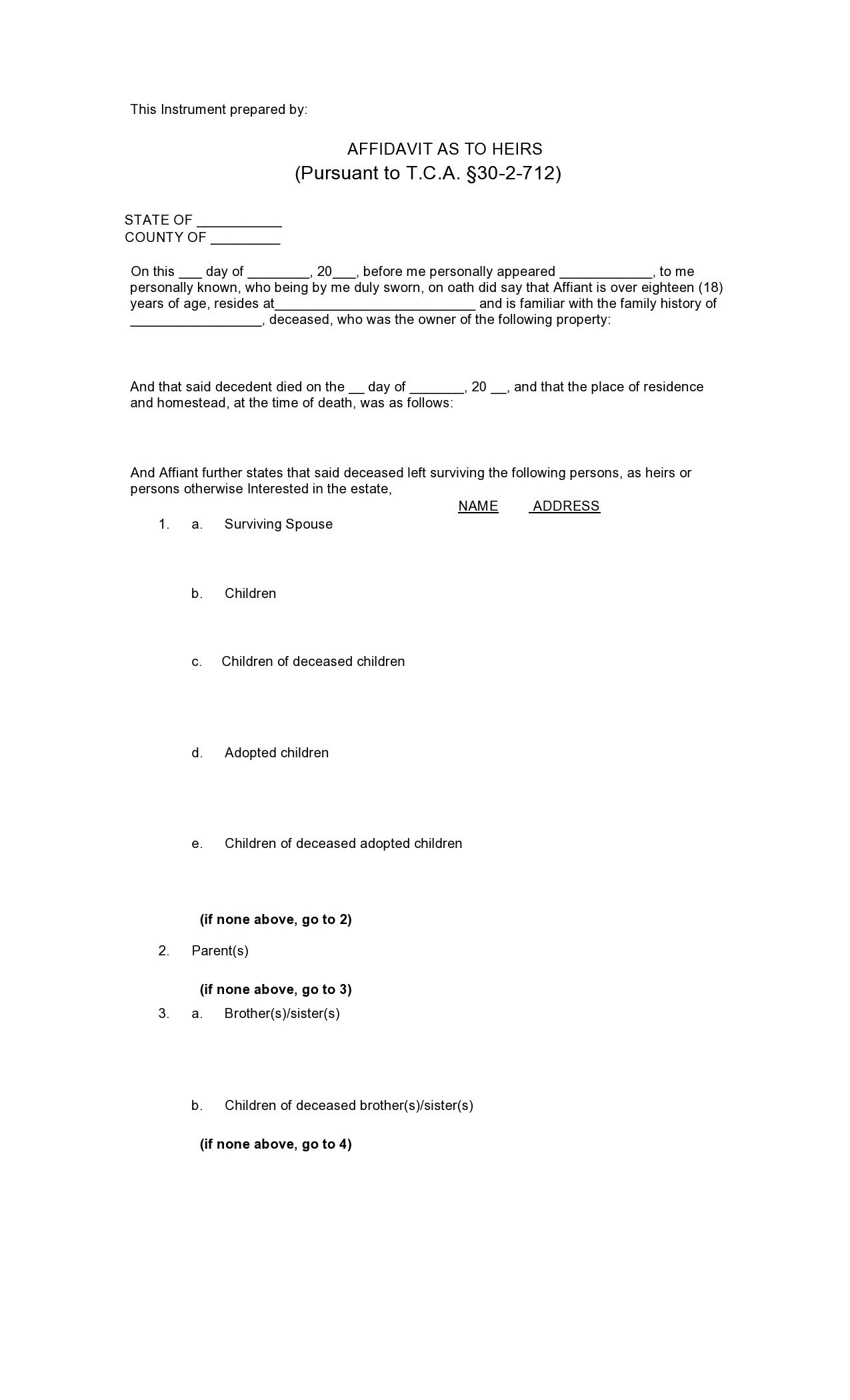

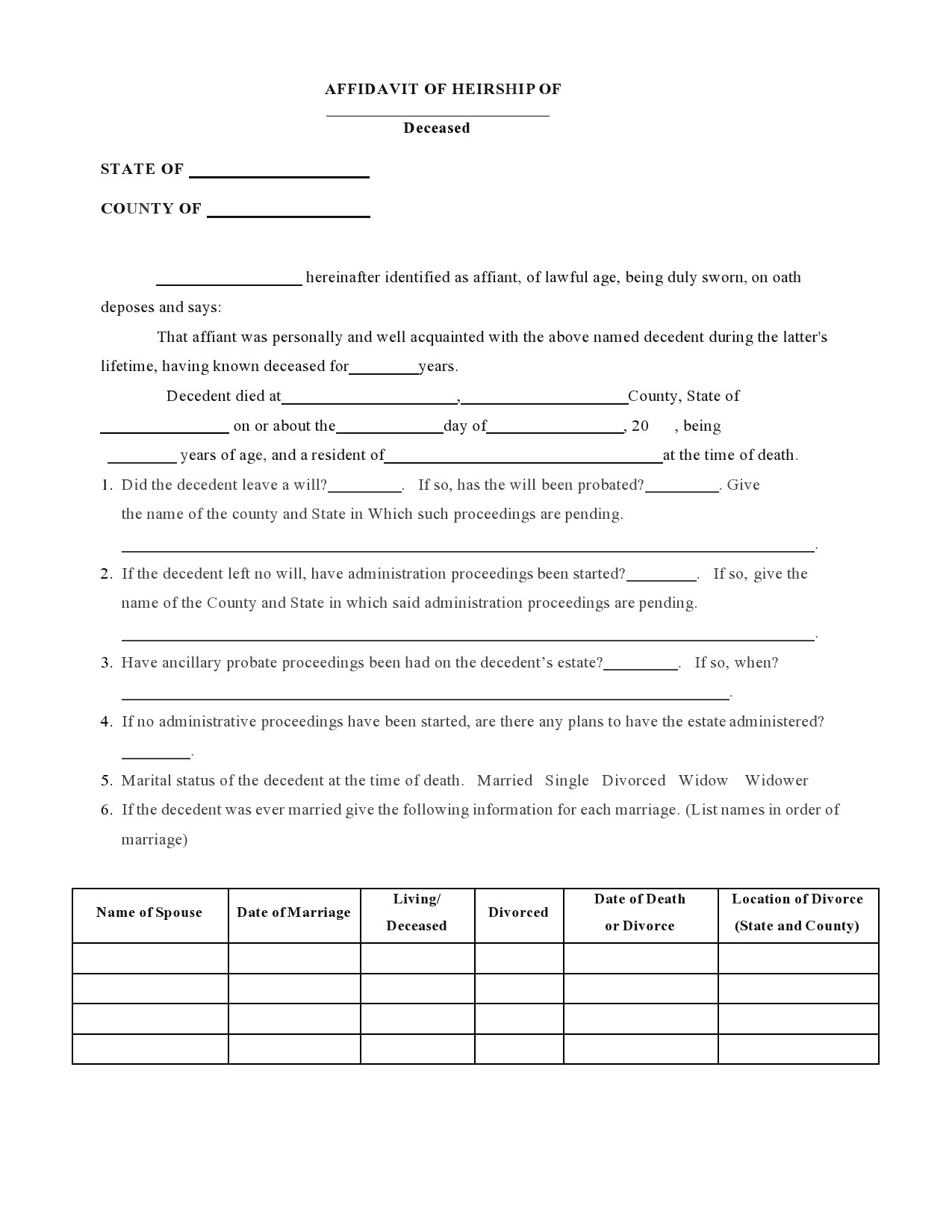

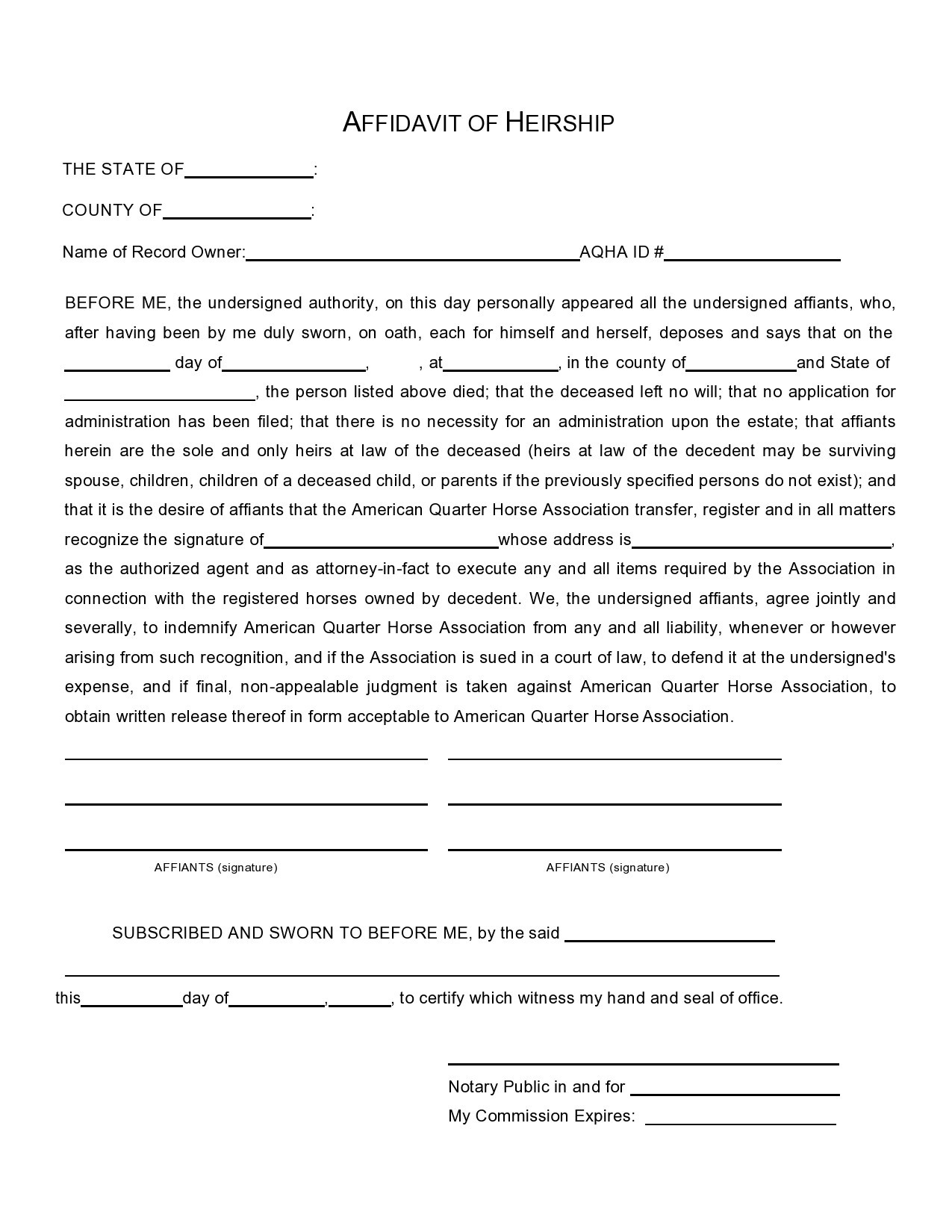

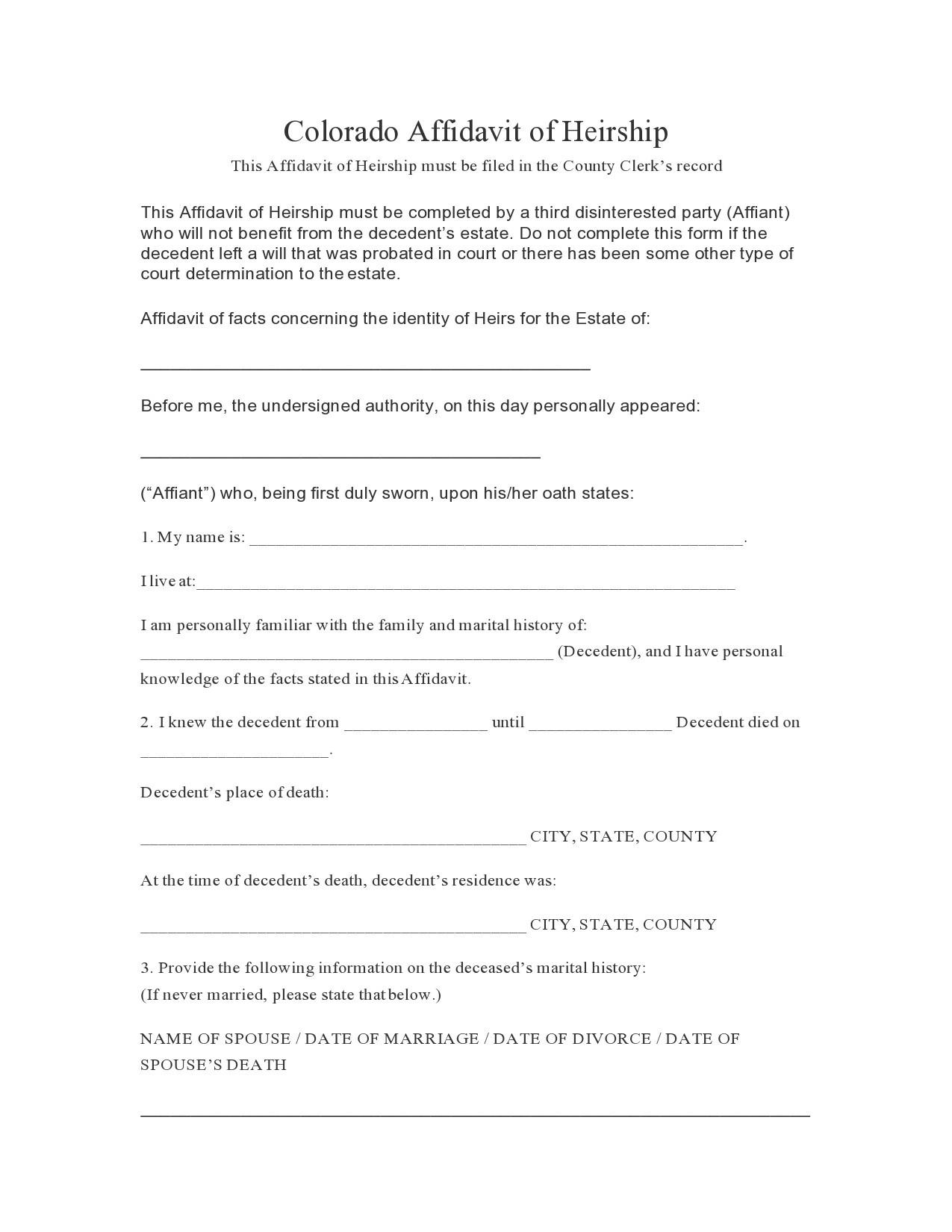

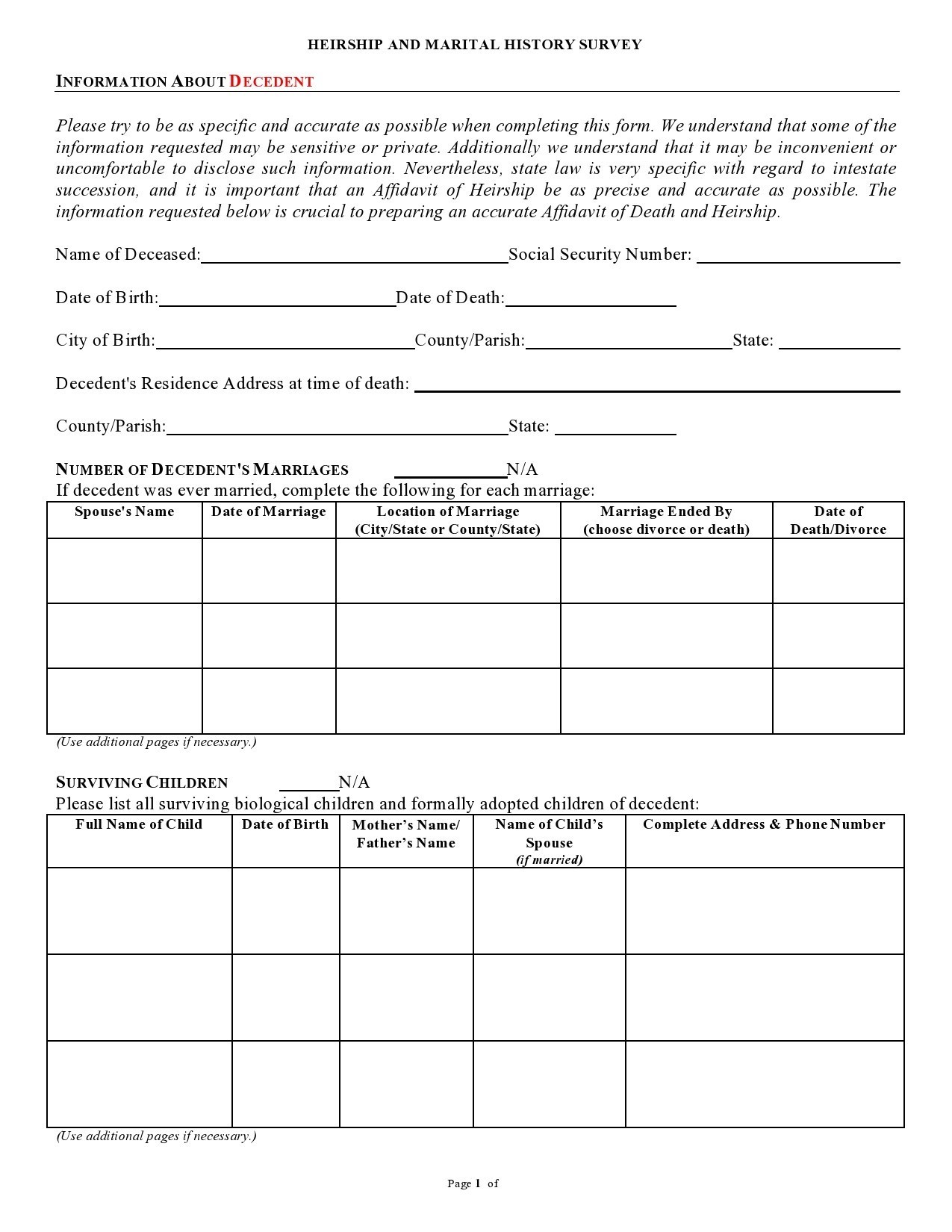

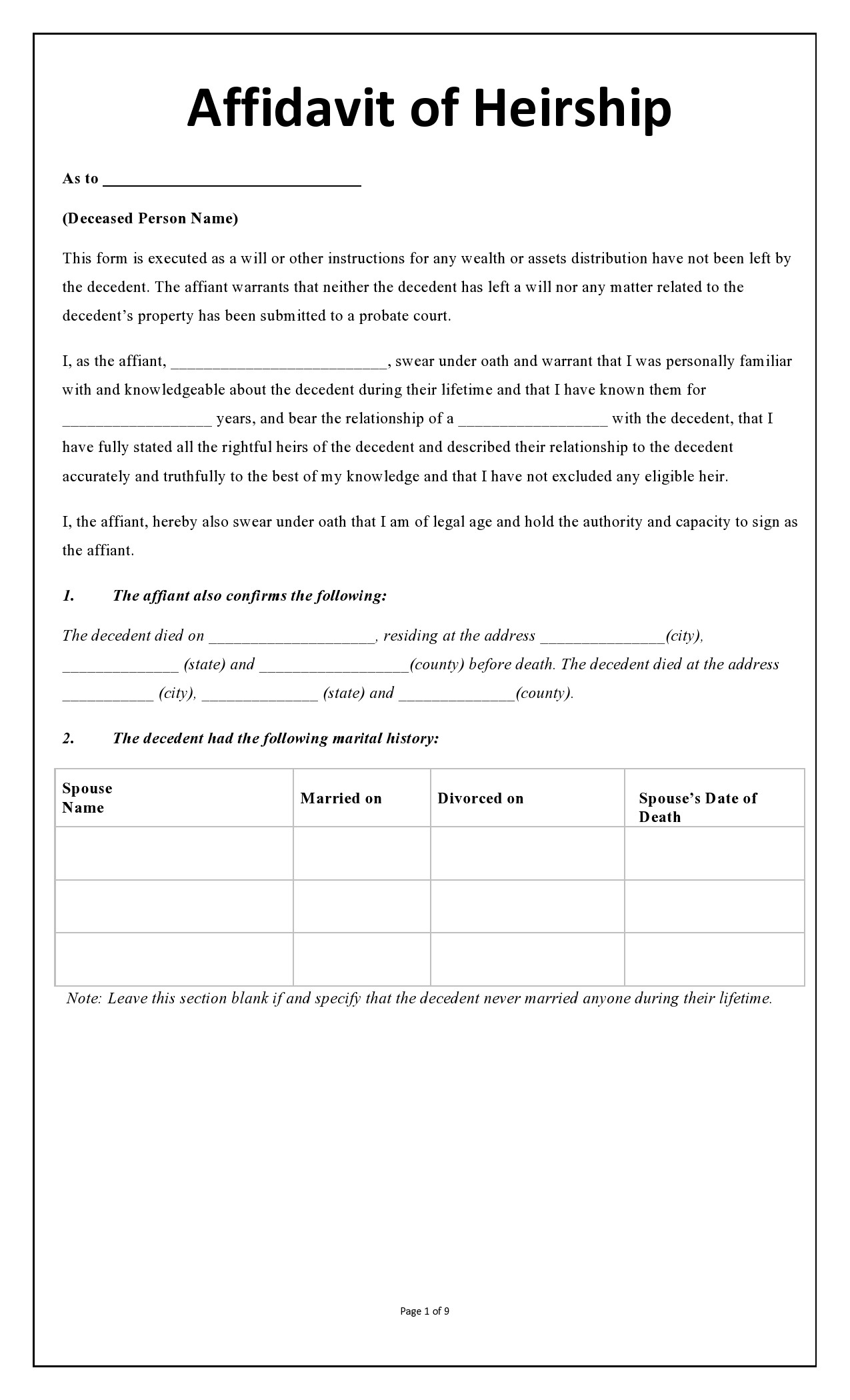

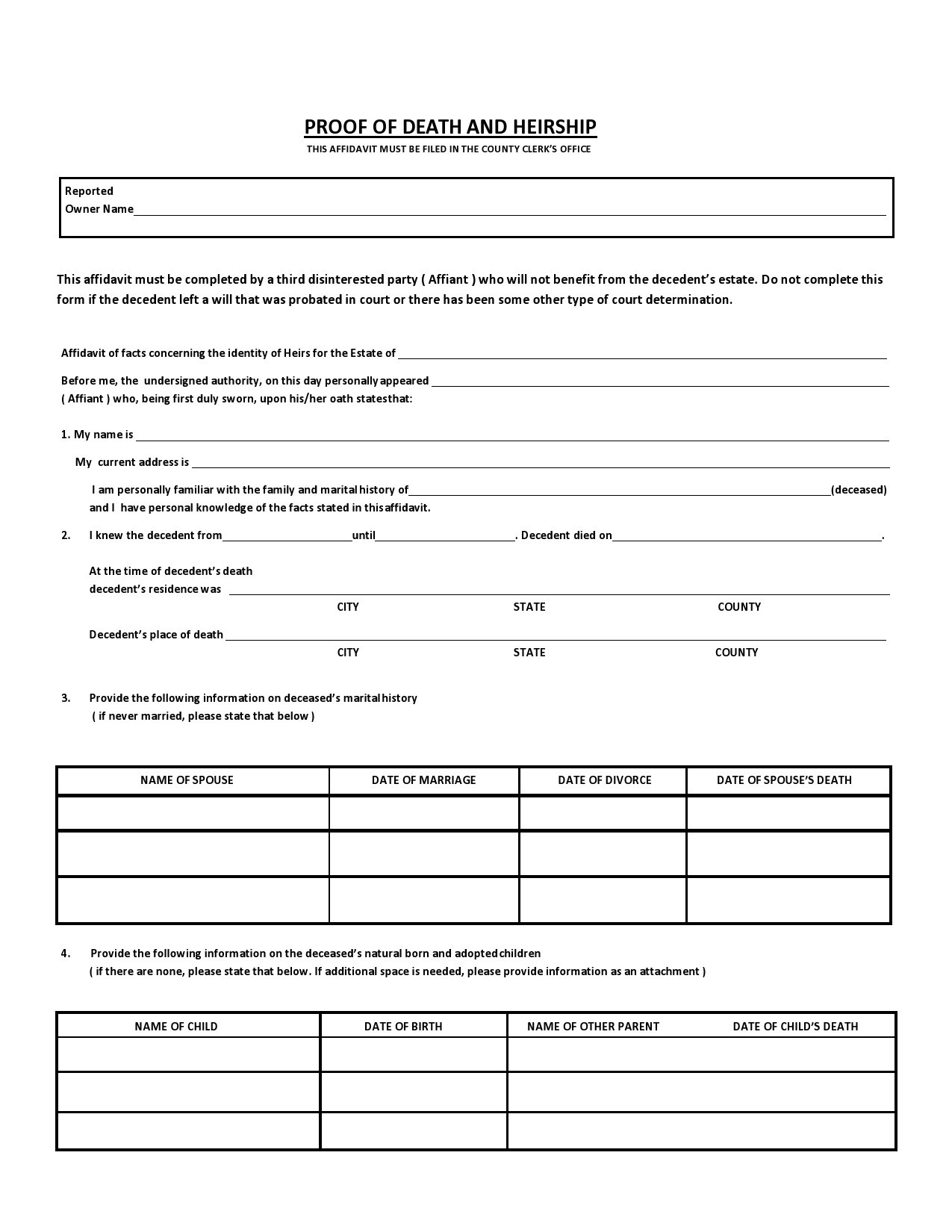

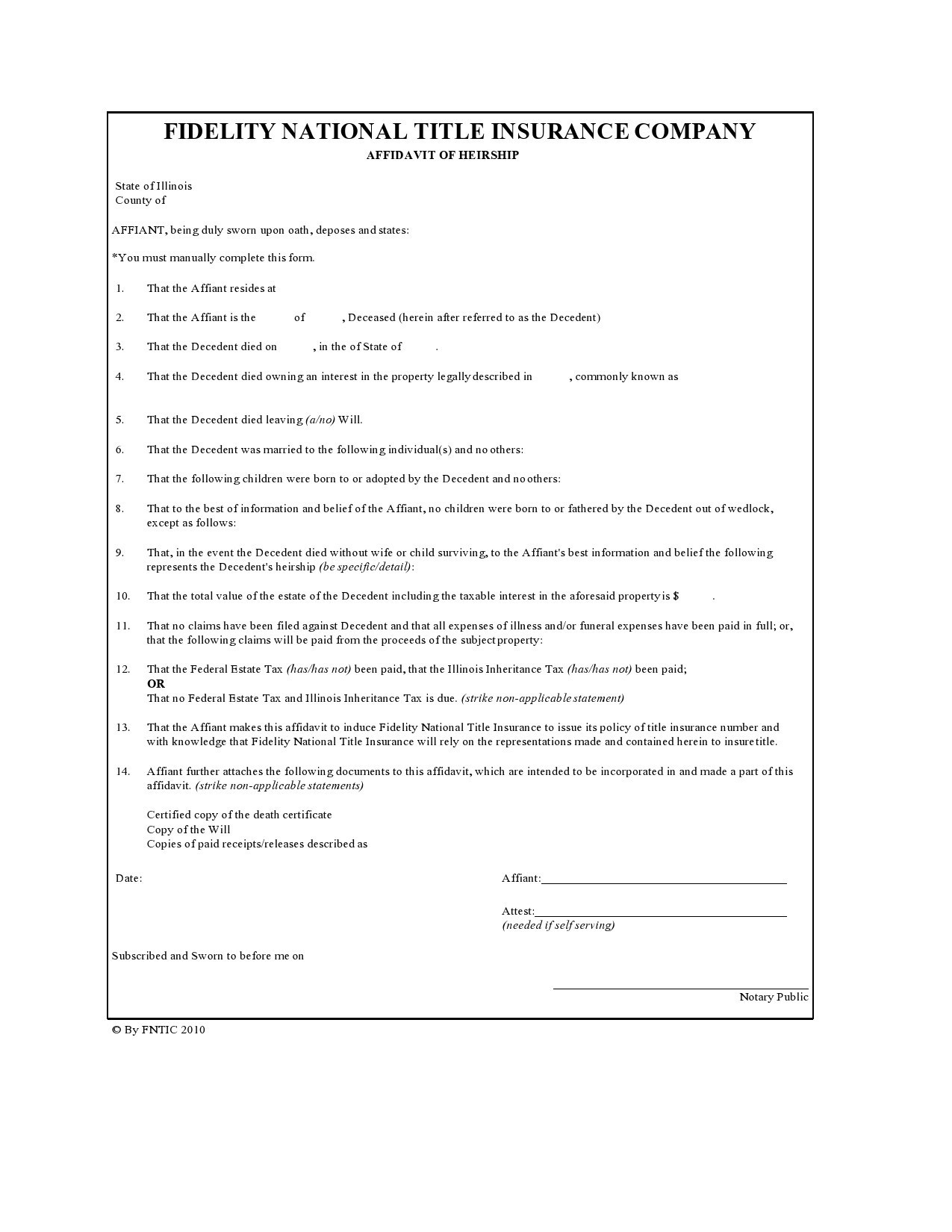

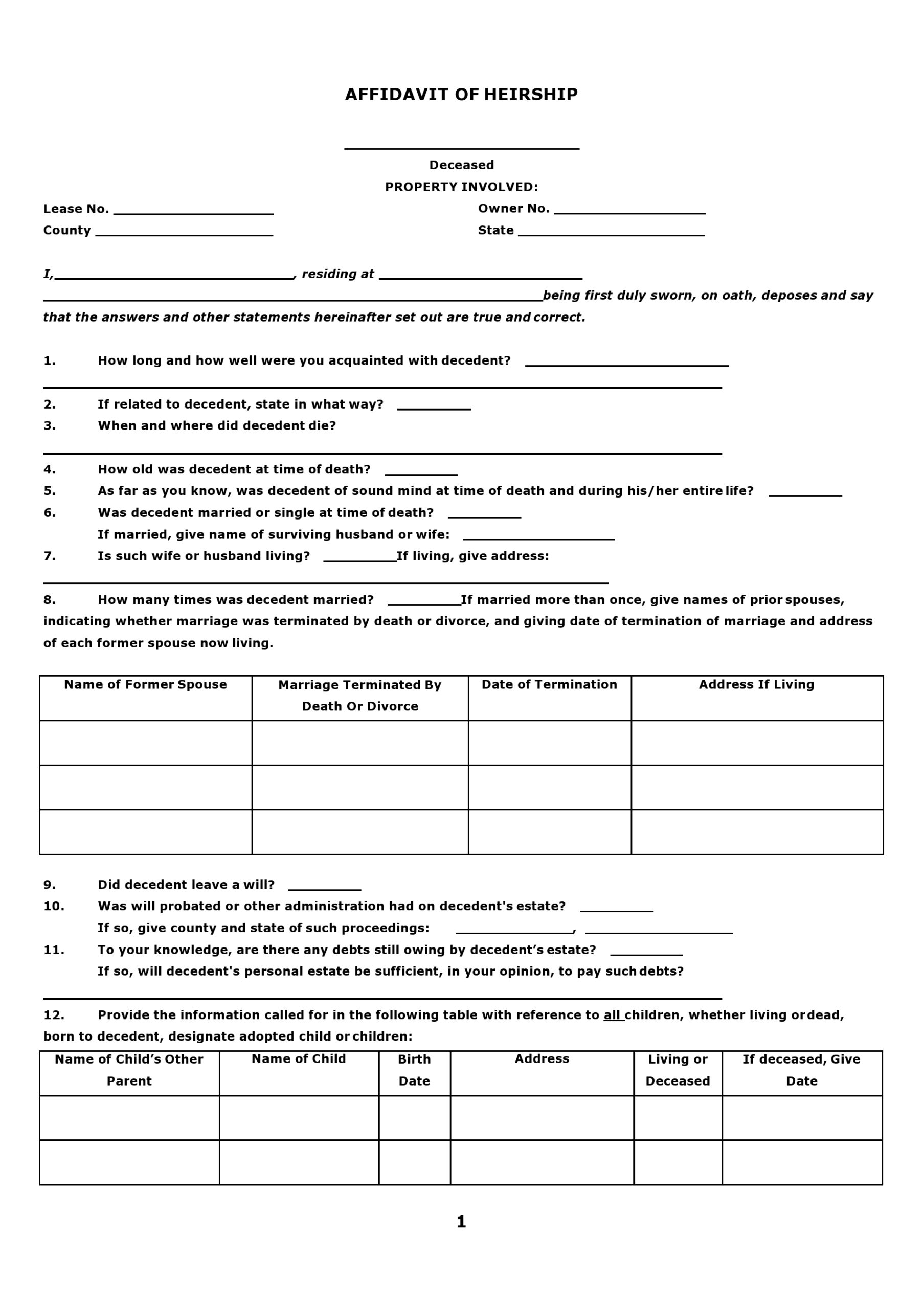

Affidavit Of Heirship Samples

How does heirship work in Texas?

In general, if you die without a will and leave behind the personal or real property, your heirs usually need to file a case in probate court so they can get the said property. The use of an affidavit of heirship is the most common and affordable method of transferring the title from your name into your heir’s name, but only in these situations:

- You died without leaving a valid will.

- A person wants to identify himself as a lawful heir.

- A person wants to take possession of your estate without undergoing probate.

- All of your heirs have agreed on how to disburse your estate.

Generally, heirs want to avoid going to probate court to settle an inheritance issue. That is the main reason why they prefer to use a certificate of heirship. It’s cheaper, faster, and easier to transfer the title of real property than going through the probate process.

With a letter of heirship, there will be no need to attend probate court hearings. The heirship proceeding is still a court proceeding used to establish who your heirs are. If you die without leaving a last will and testament, you’re considered a “dying intestate’.

The Texas Estates Code provides what the deceased’s heirs will inherit. The laws are much stricter. For instance, the courts won’t make assumptions about the identity of heirs and it requires an heirship proceeding even in cases when the process of identifying the deceased’s heirs is commonly straightforward and easy.

This court proceeding involves a court-appointed lawyer who will investigate your family history then confirm to the court the identity of your heirs. The most important points to remember about an heirship proceeding are:

- An attorney appointed by the court ad litem performs an investigation to find out who the rightful heirs are.

- Two disinterested witnesses testify in court about the identity of the heirs of the deceased person.

- After the heirship proceeding, there must be an estate administration.

Before the heirship proceeding starts, any of your heirs, representatives, or secured creditors can file a request with the probate court of Texas. All heirs should affix their signatures on the application or they will receive a notice of the proceedings.

It will be the task of the Texas Probate Court to outline how to complete the application although a probate lawyer may get hired to assist with this step. All the heirs should sign the application before the proceedings can start.

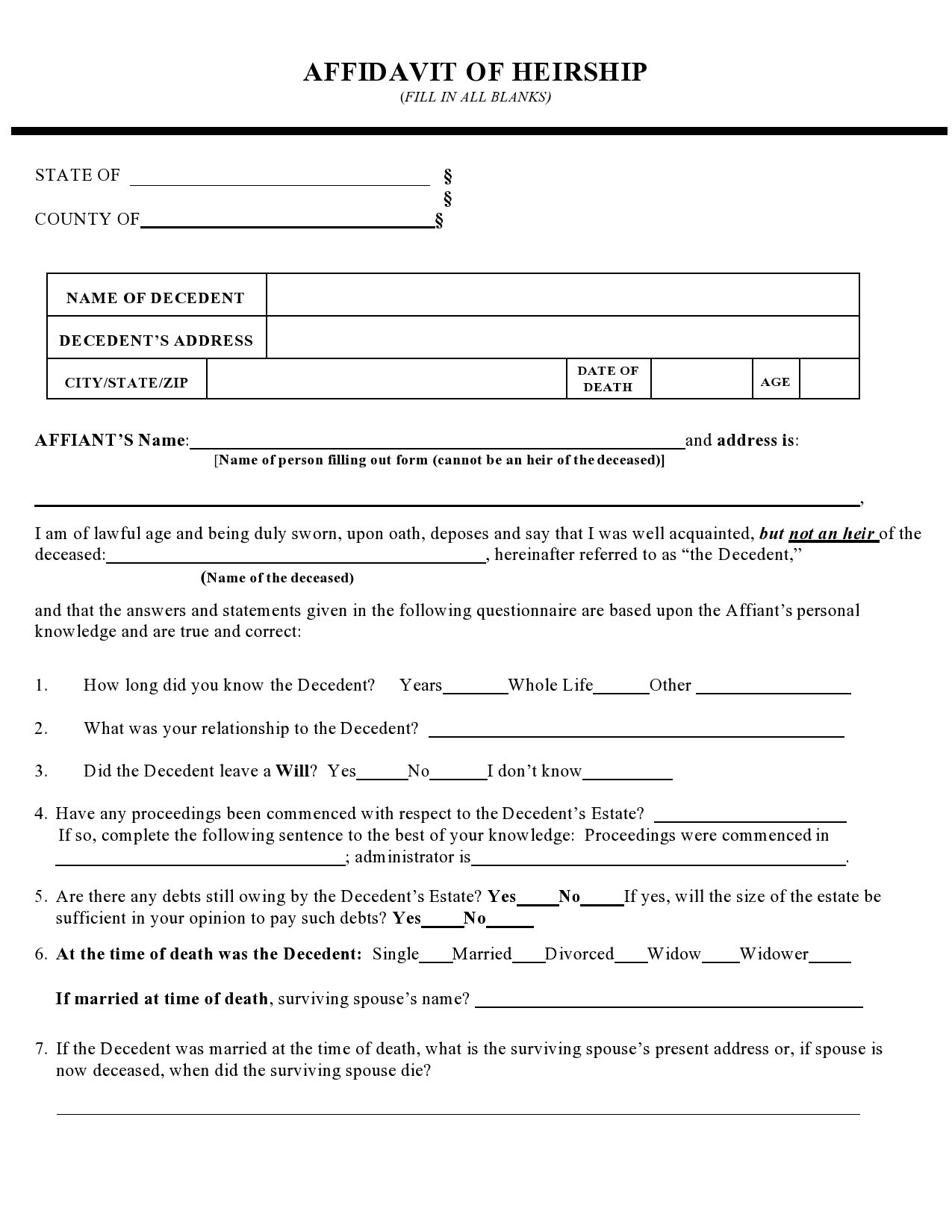

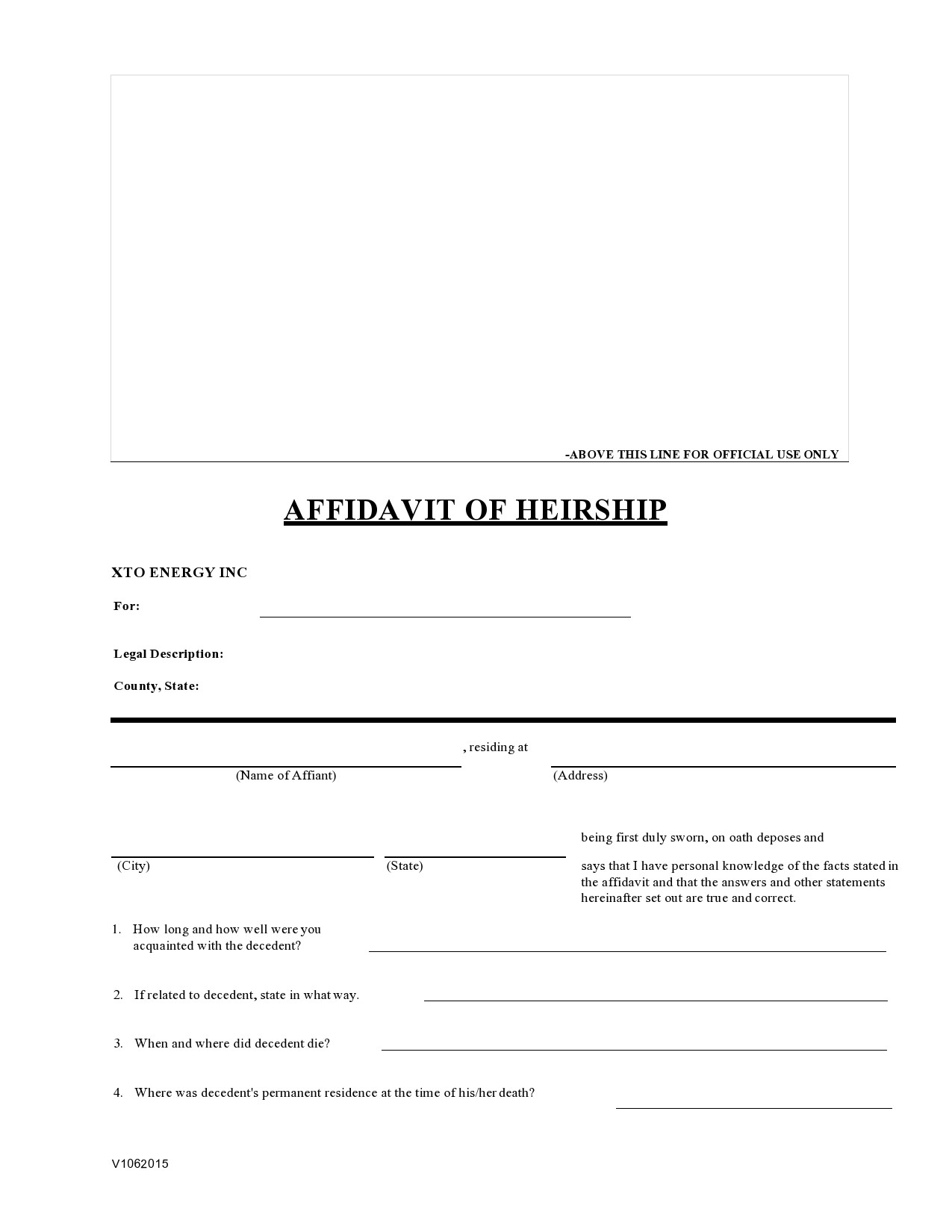

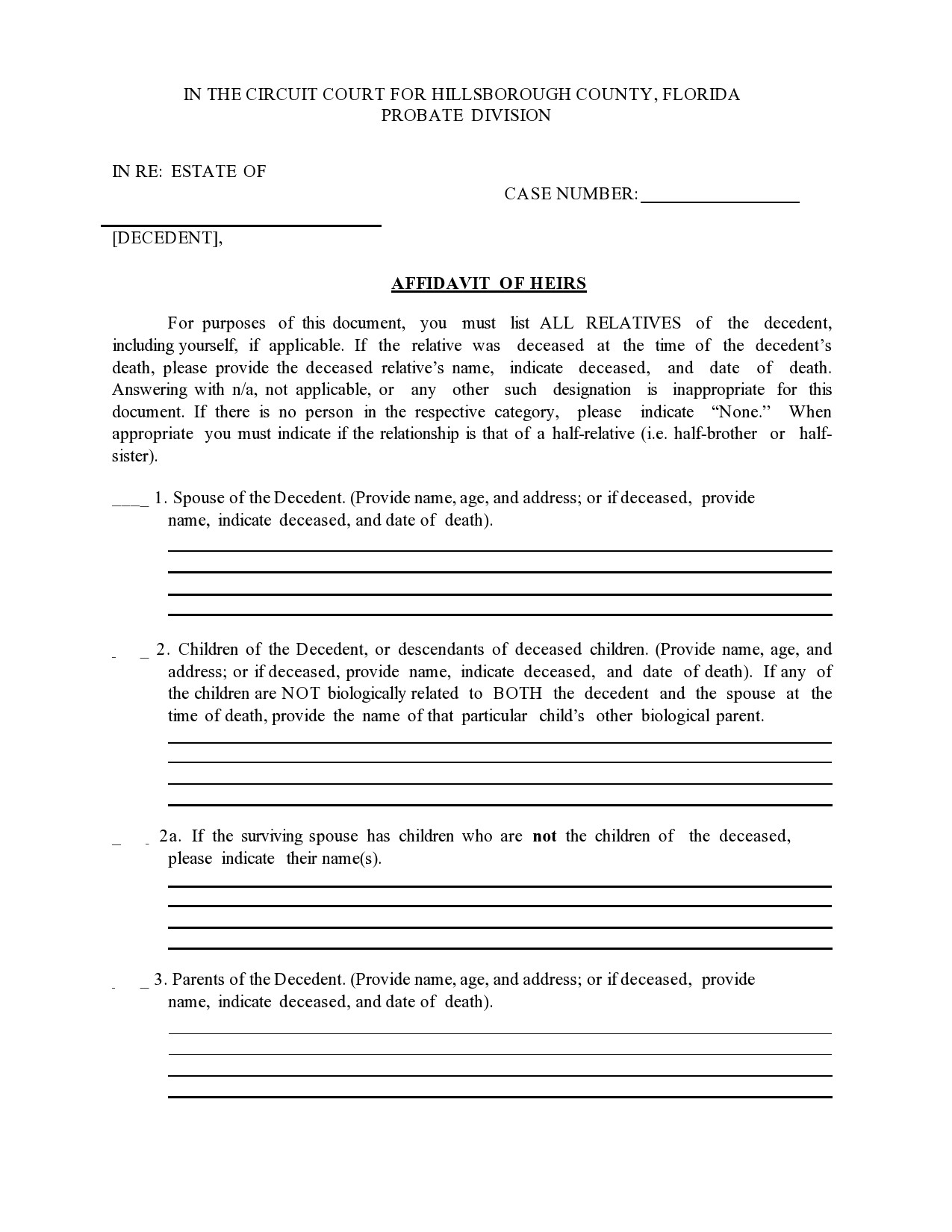

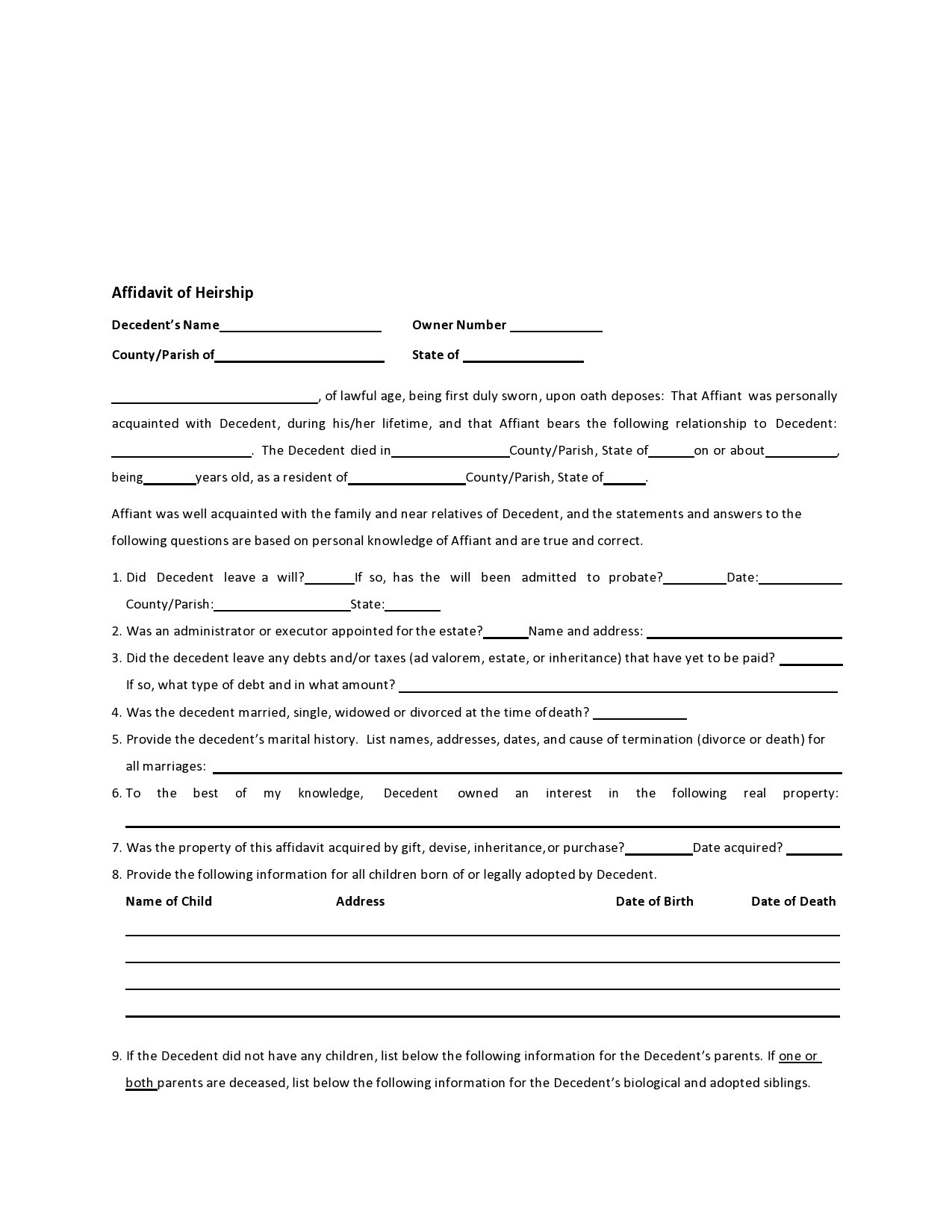

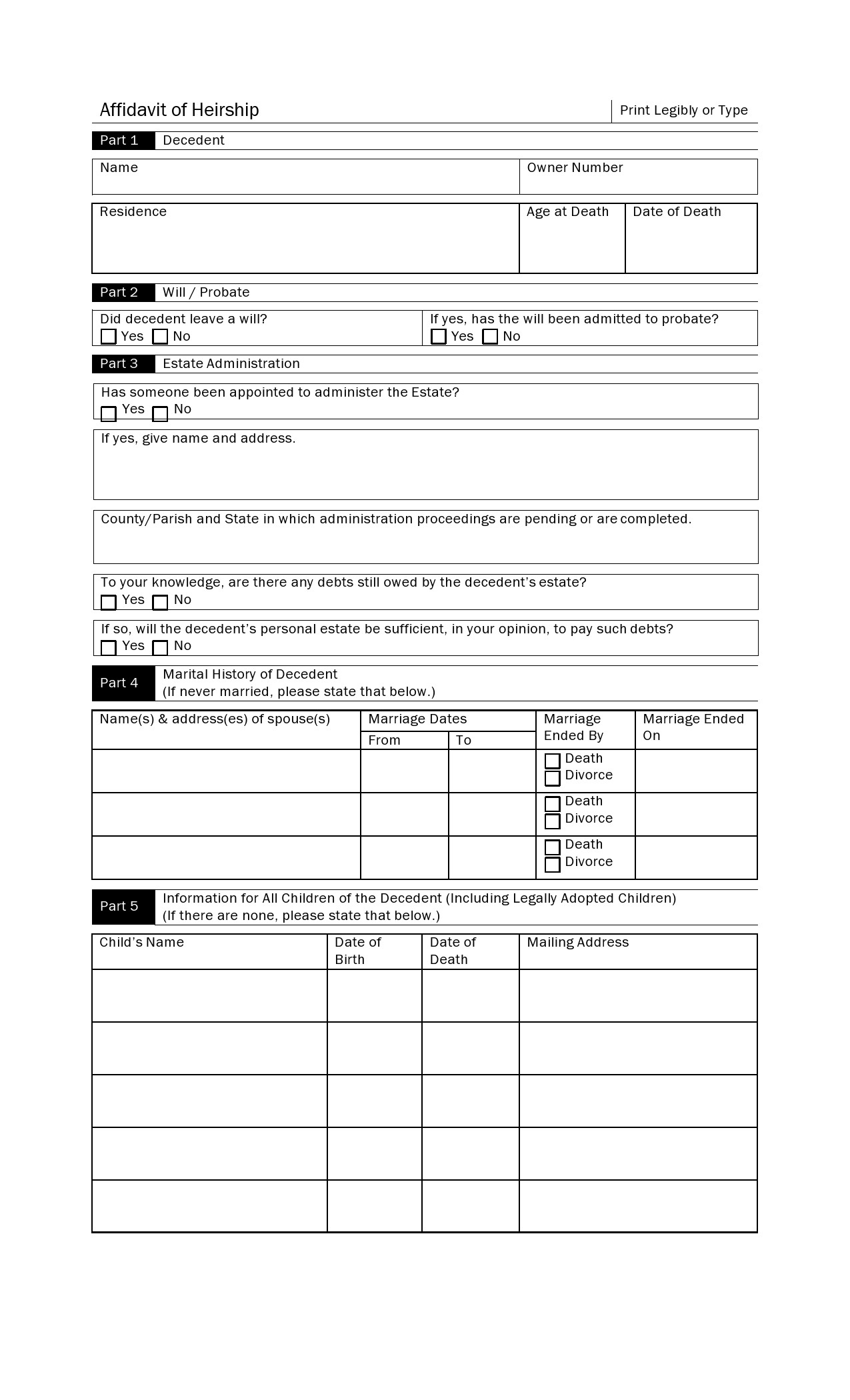

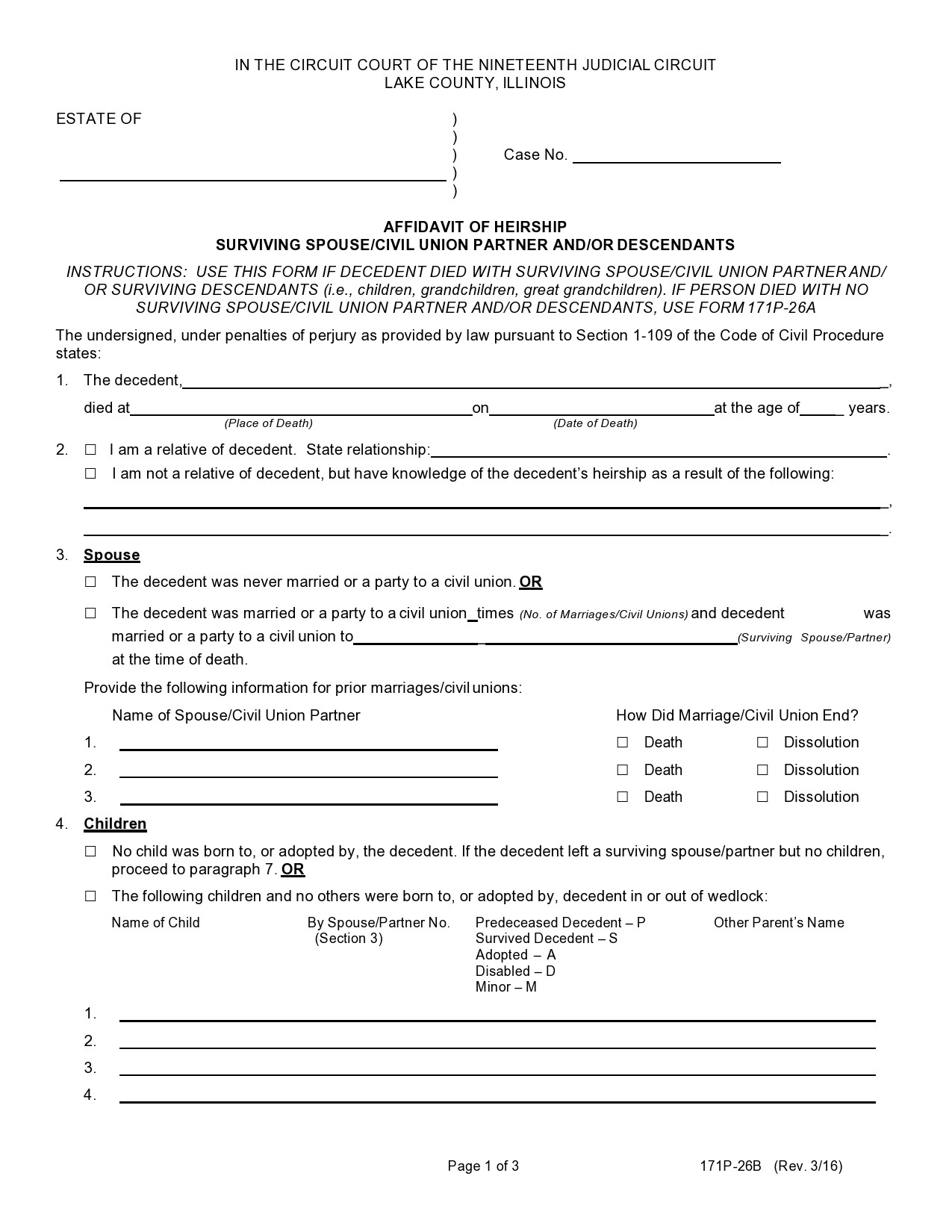

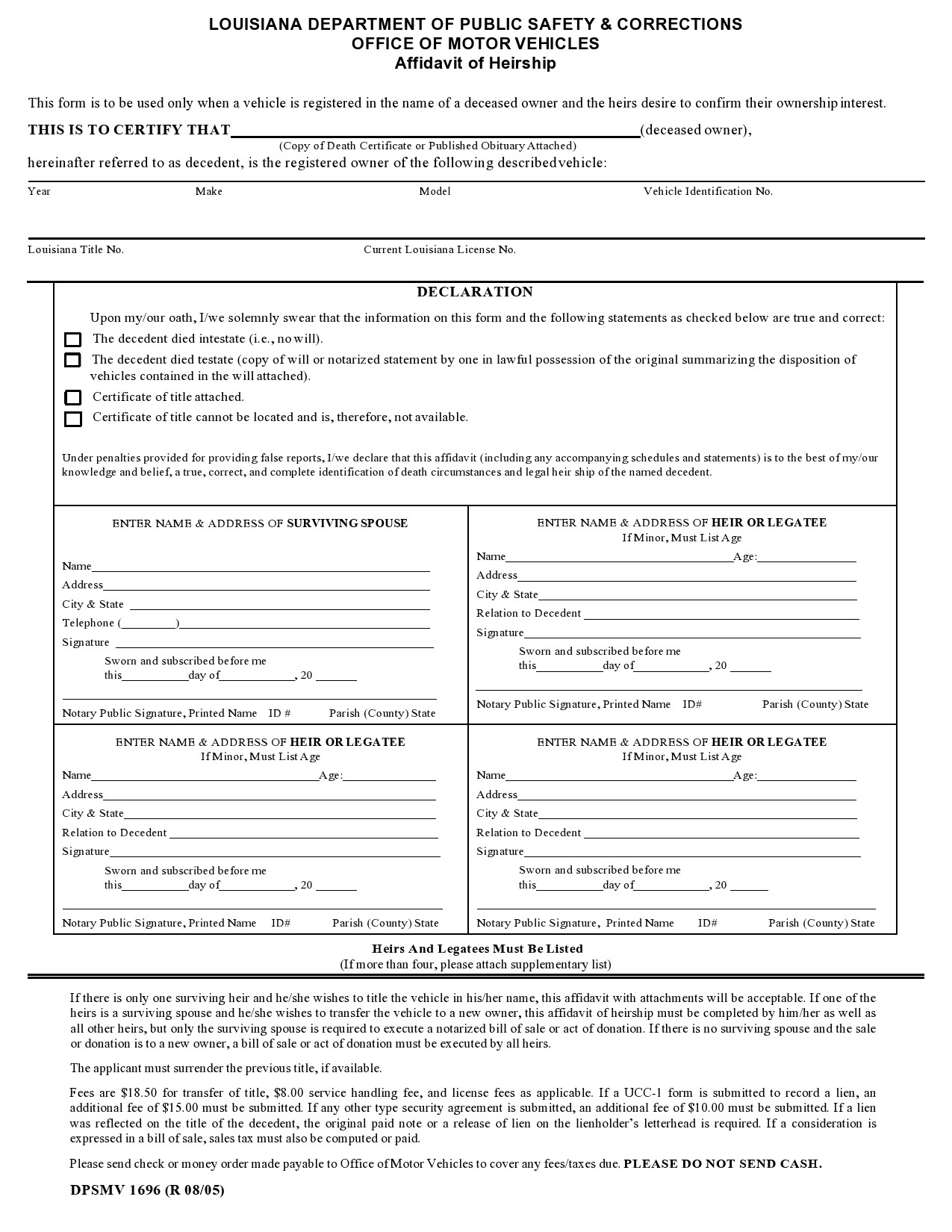

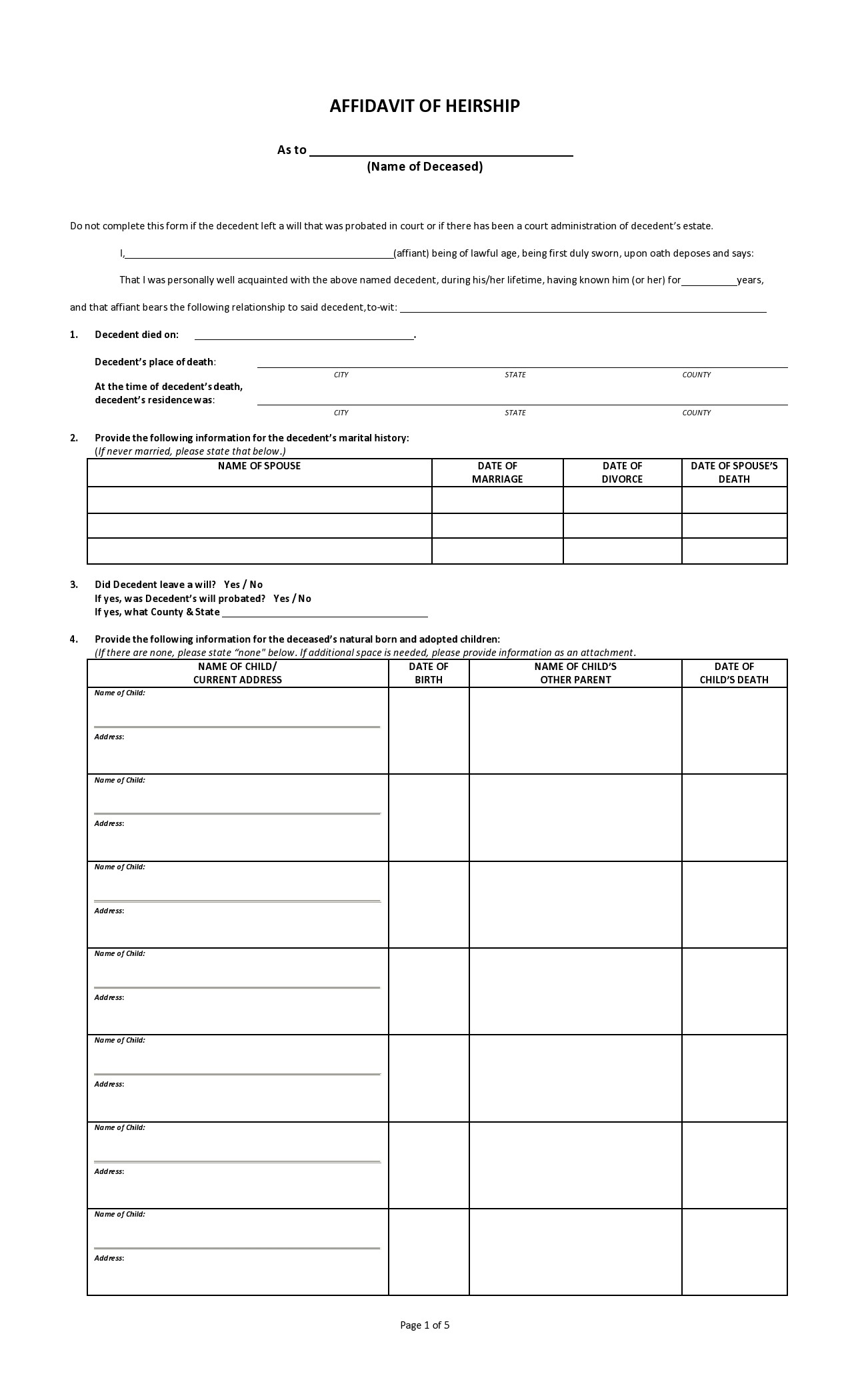

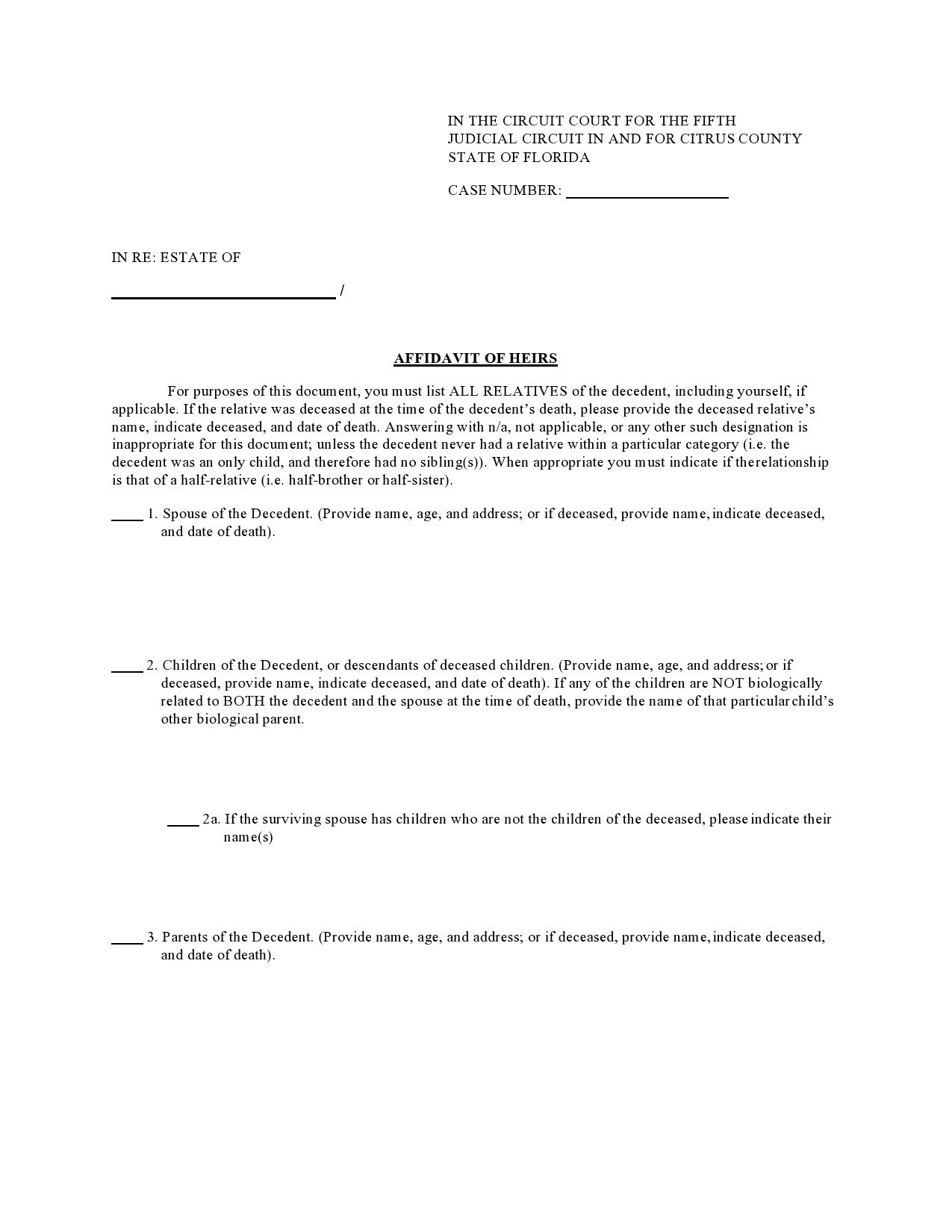

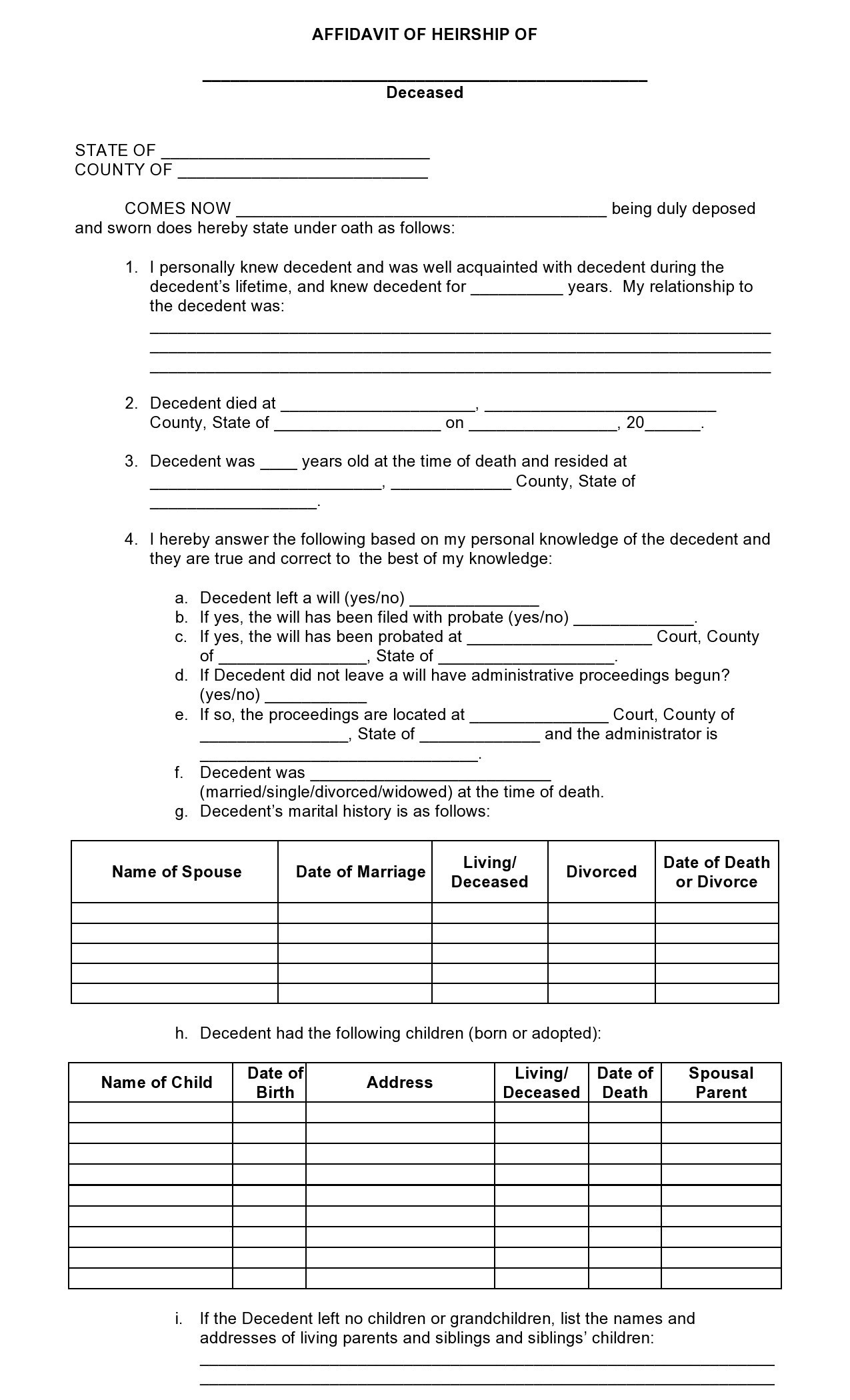

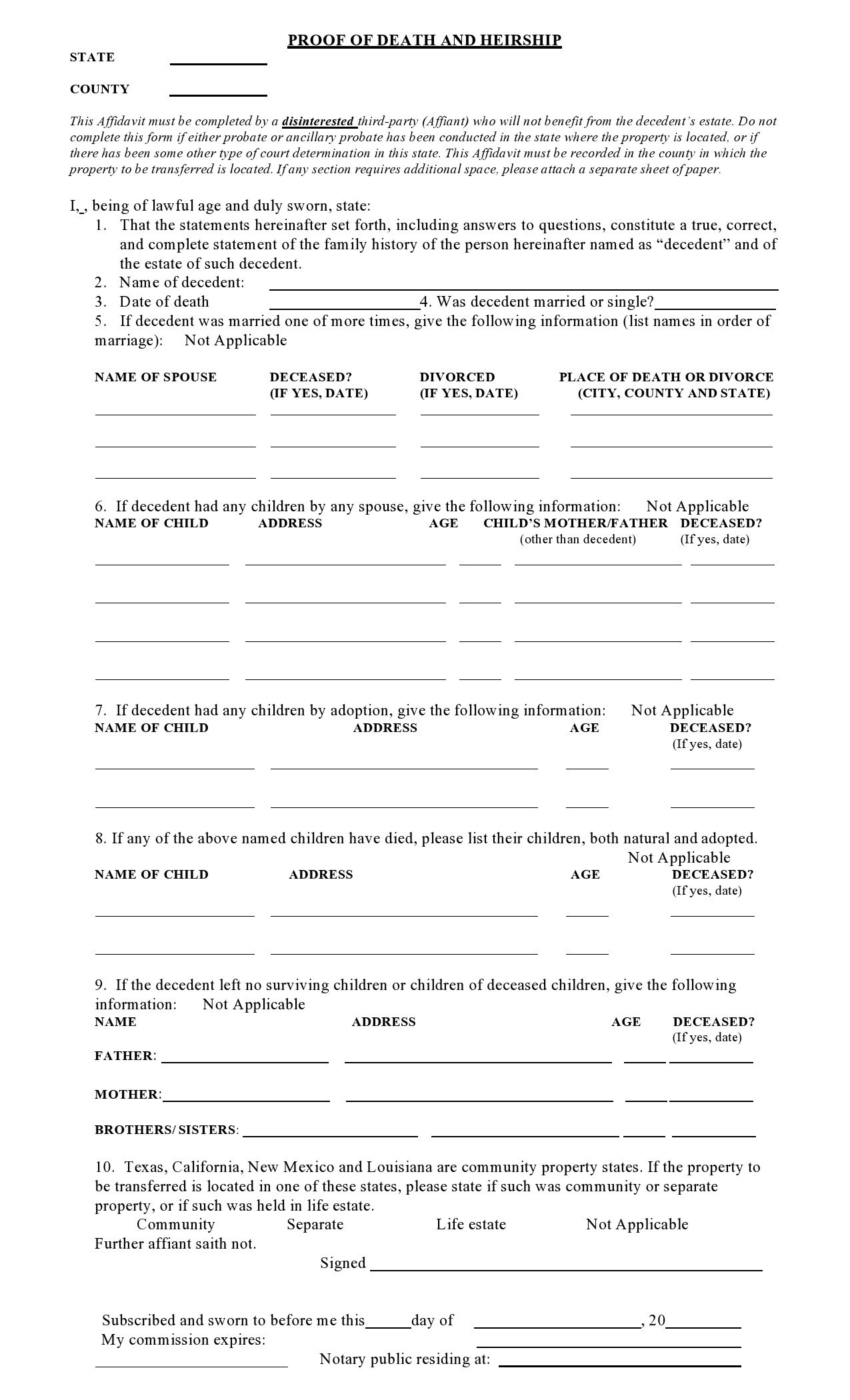

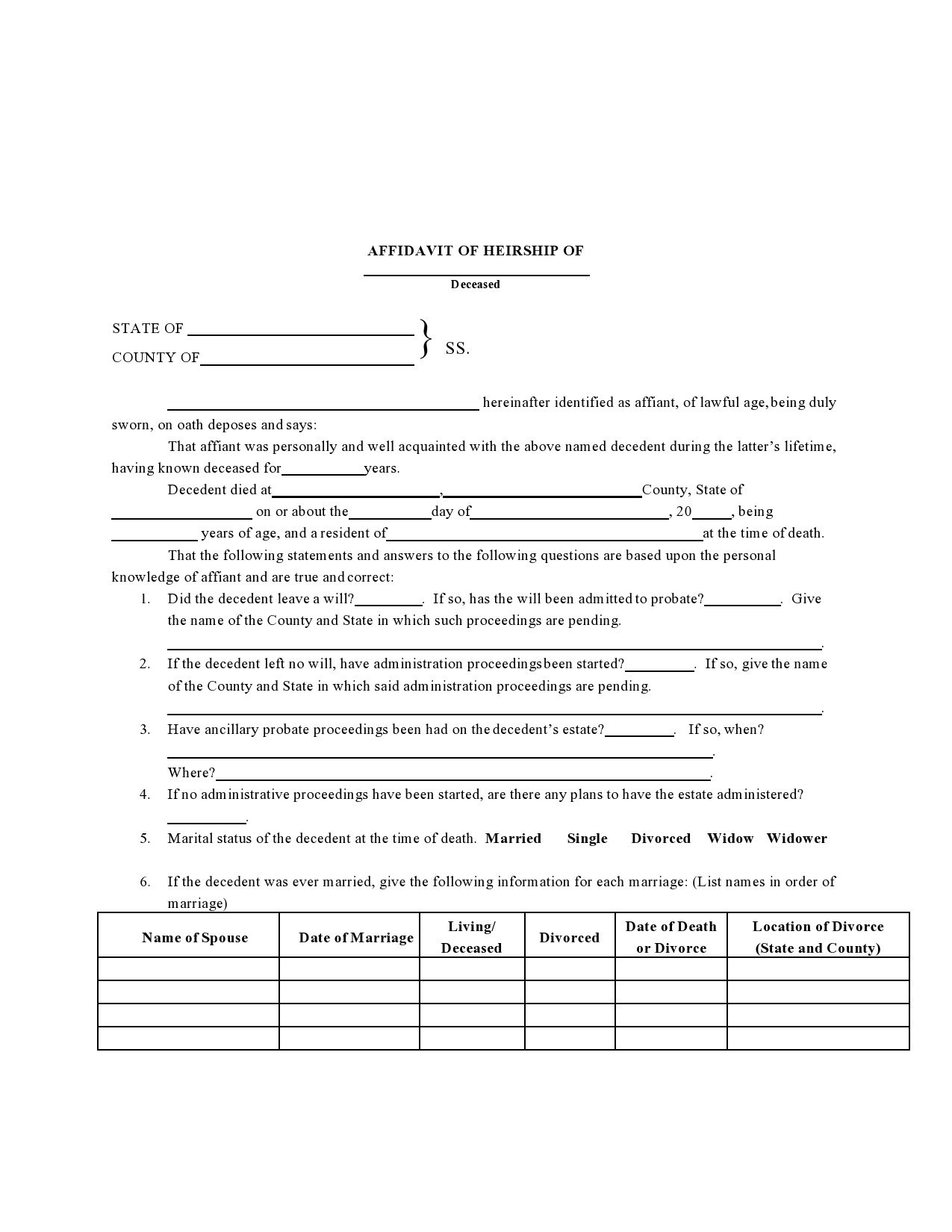

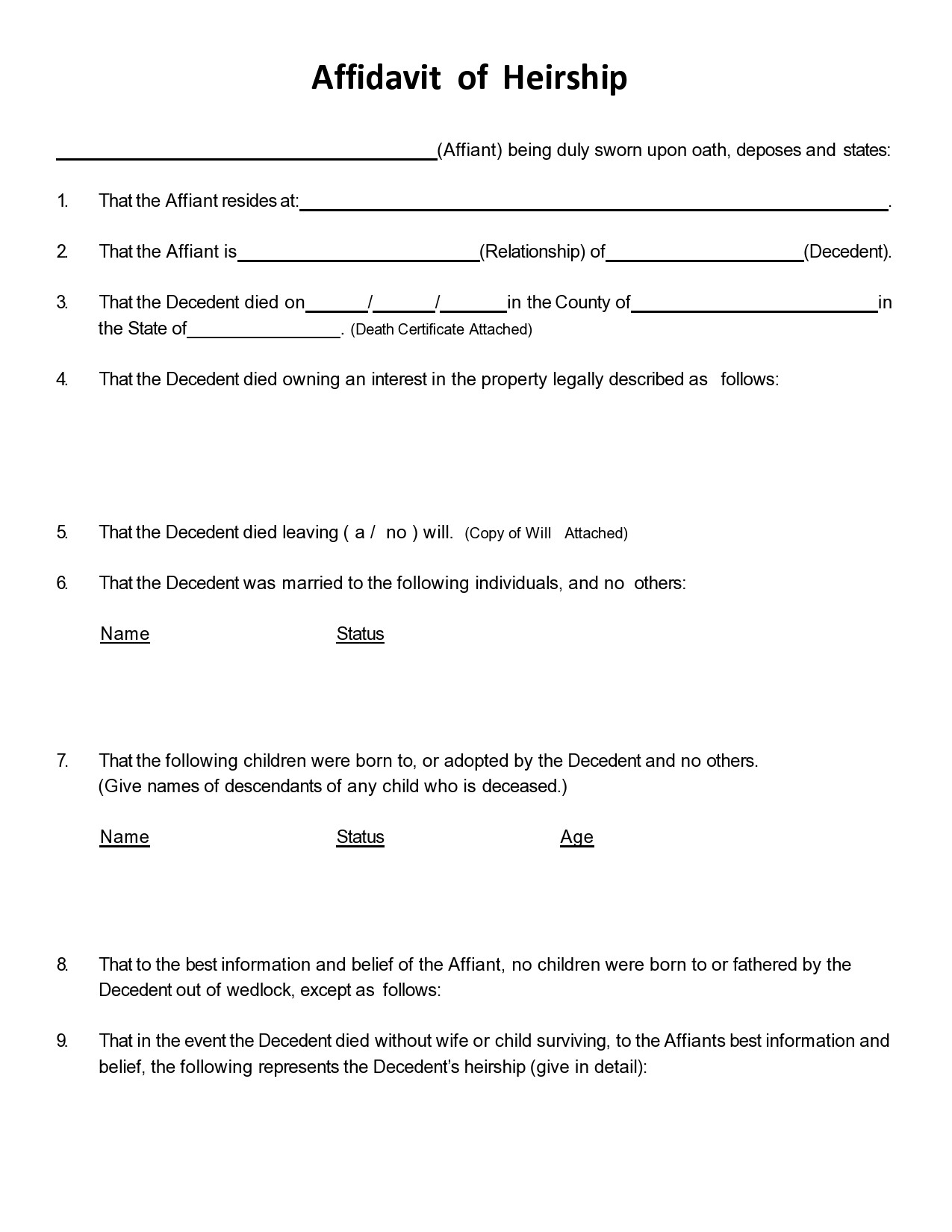

Affidavit Of Heirship Forms

Who can file an affidavit of heirship in Texas?

When you die without a will and the title to your property doesn’t expressly include joint tenancy using survivorship language, issues may arise as to who will get your title and the proper percentages.

Such property in question is the “heirship property” and is basically unsellable. Moreover, even an insurance company won’t insure the title until your heirs have dealt with and resolved the issue. They can accomplish this by:

- A probate proceeding in a county court that results in the appointment of the estate’s personal representative. Ultimately a judgment determines heirship.

- Using an Affidavit of Heirship followed by consolidation or curative deed signed by the surviving heirs in favor of a new owner.

When your heirs file a certificate of heirship, this means that they’re making a case – the case that the named heir or heirs will have all rights to a certain real property. It’s logical to assume that such a case must be as persuasive and firm as possible. Here are the steps heirs have to go through when creating an affidavit or letter of heirship:

- Prepare the affidavit

The resolving of heirship issues outside of the probate court usually involves a two-step process. First, the heirs must prepare the affidavit then have it signed by a person with first-hand knowledge of your family’s history. Since creating this document is as much a science and an art, it’s best left to a lawyer to do it.

This is an assurance that its contents will be both persuasive and admissible in any litigation in the future. Generally, the affidavit will be initially presumed true after filing filed for at least five years, although no title underwriter gets bound by this. - Prepare the deed

The next step after drafting the affidavit and the execution and filing are also completed is the deed transfer. This document focuses on the title of the property getting passed to a single heir, who might either sell the property or keep it. There are cases when all of the heirs may sign to convey the property to a third-party buyer.

Usually, the deed is also considered a special warranty deed or a deed without warranties but not a quitclaim deed, which is generally avoided since title companies doesn’t insure it. All the heirs or the legal guardians of heirs named in the affidavit must sign it. Both of these documents, the deed, and the affidavit, will get filed in the real property records in which the property is. The affidavit gets filed first then the deed.

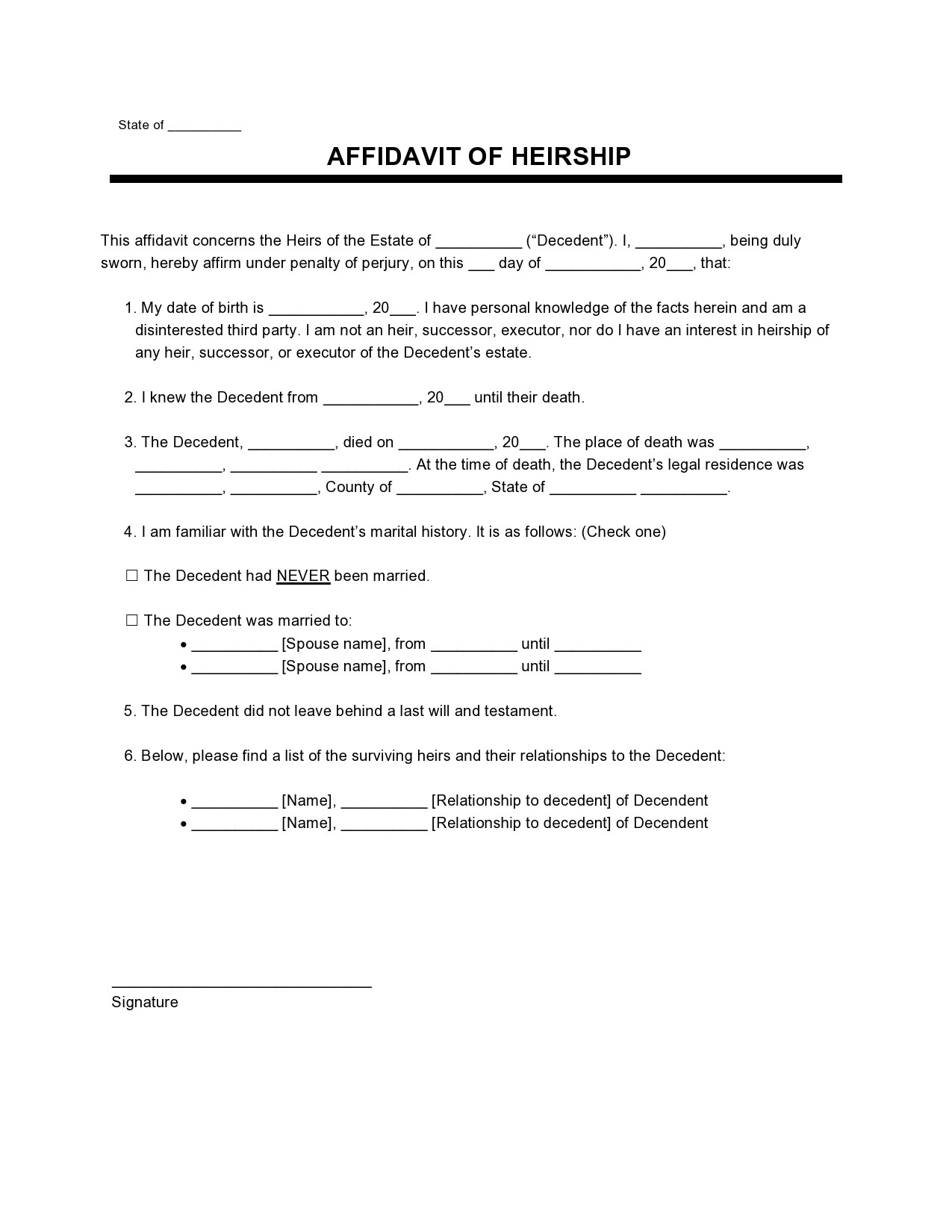

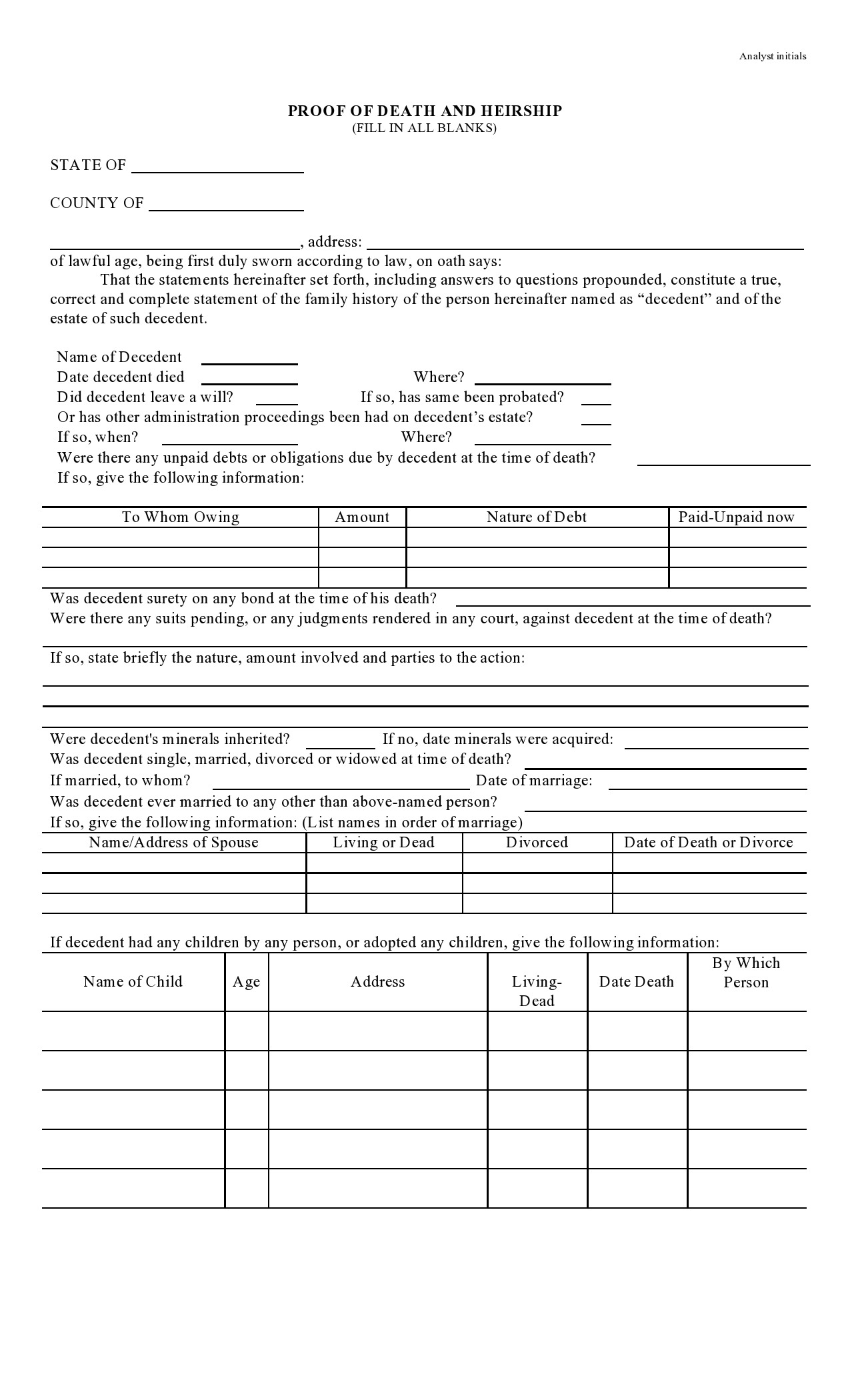

Certificates Of Heirship

How much does it cost to file an affidavit of heirship in Texas?

The affidavit of heirship is a legal document that identifies a deceased person’s heirs. When this is already documented in the real property records, this affidavit has the effect of transferring the deceased’s real estate to the deceased’s heirs.

In the state of Texas, this is one of the most economical procedures that potential heirs can avail of since there is no involvement of the court. As aforementioned, this procedure is usually utilized in cases when the deceased has no debts or will and the only asset that needs to get transferred is real estate.

These days, the current price of this affidavit is around $500, which includes the lawyer’s fee to draft the affidavit and the cost to record in the real property records. Those who need this document can save up to $75 if they decide to document the affidavit themselves.