In business, a limited partnership agreement is a type of agreement where a general partner oversees and manages the business while limited partners don’t participate in running the business. Also, the general partner has unlimited liability for any debts incurred whereas the limited partners have limited liability up to the amount they invested.

Table of Contents

- 1 Limited Partnership Agreement Templates

- 2 What is a limited partnership agreement?

- 3 Limited Partnership Agreement Samples

- 4 What are the advantages and disadvantages of a limited partnership?

- 5 Limited Partnership Contracts

- 6 What is the difference between a limited partnership and an LLC?

- 7 Limited Partnership Documents

- 8 How to draft a limited partnership agreement?

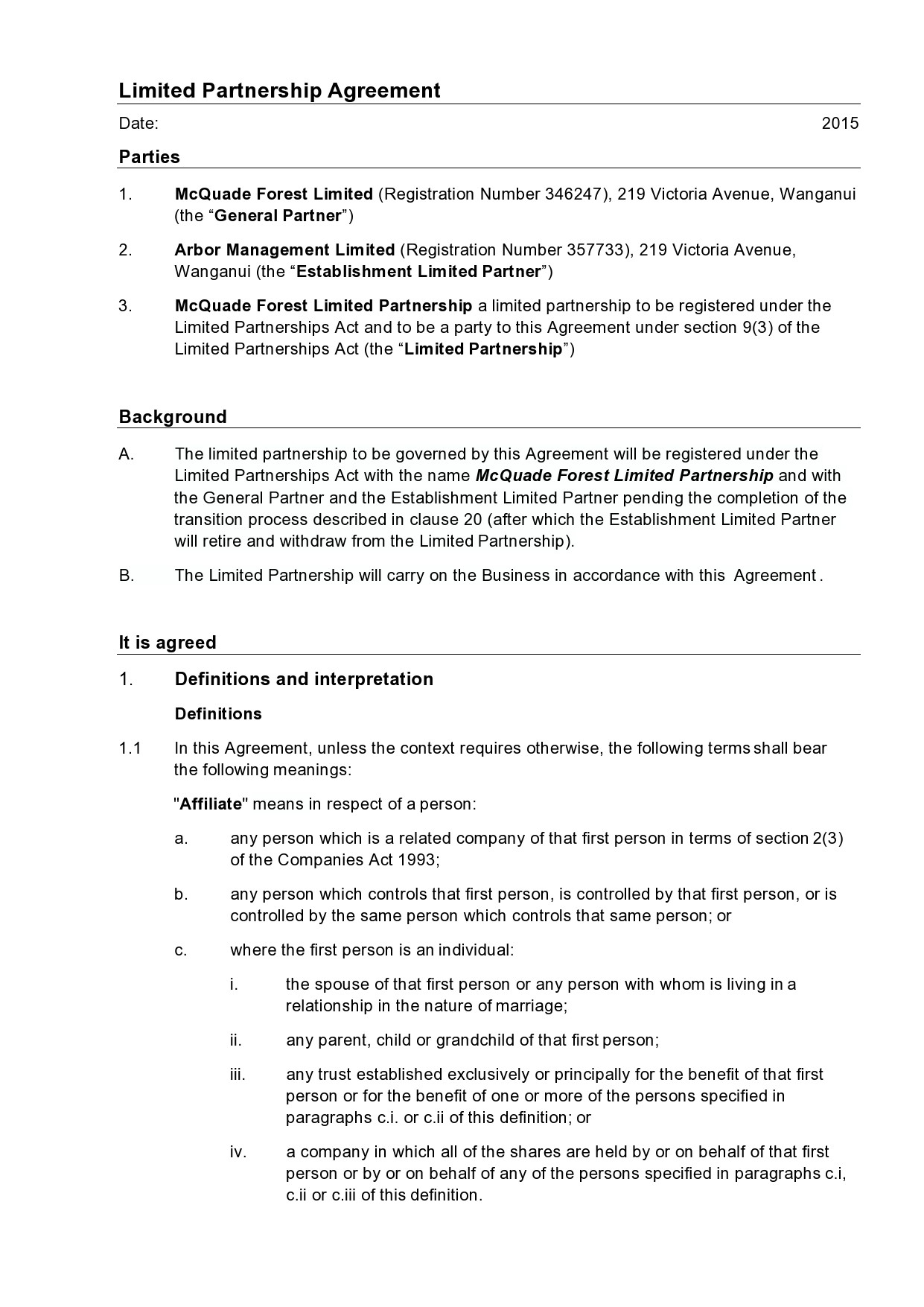

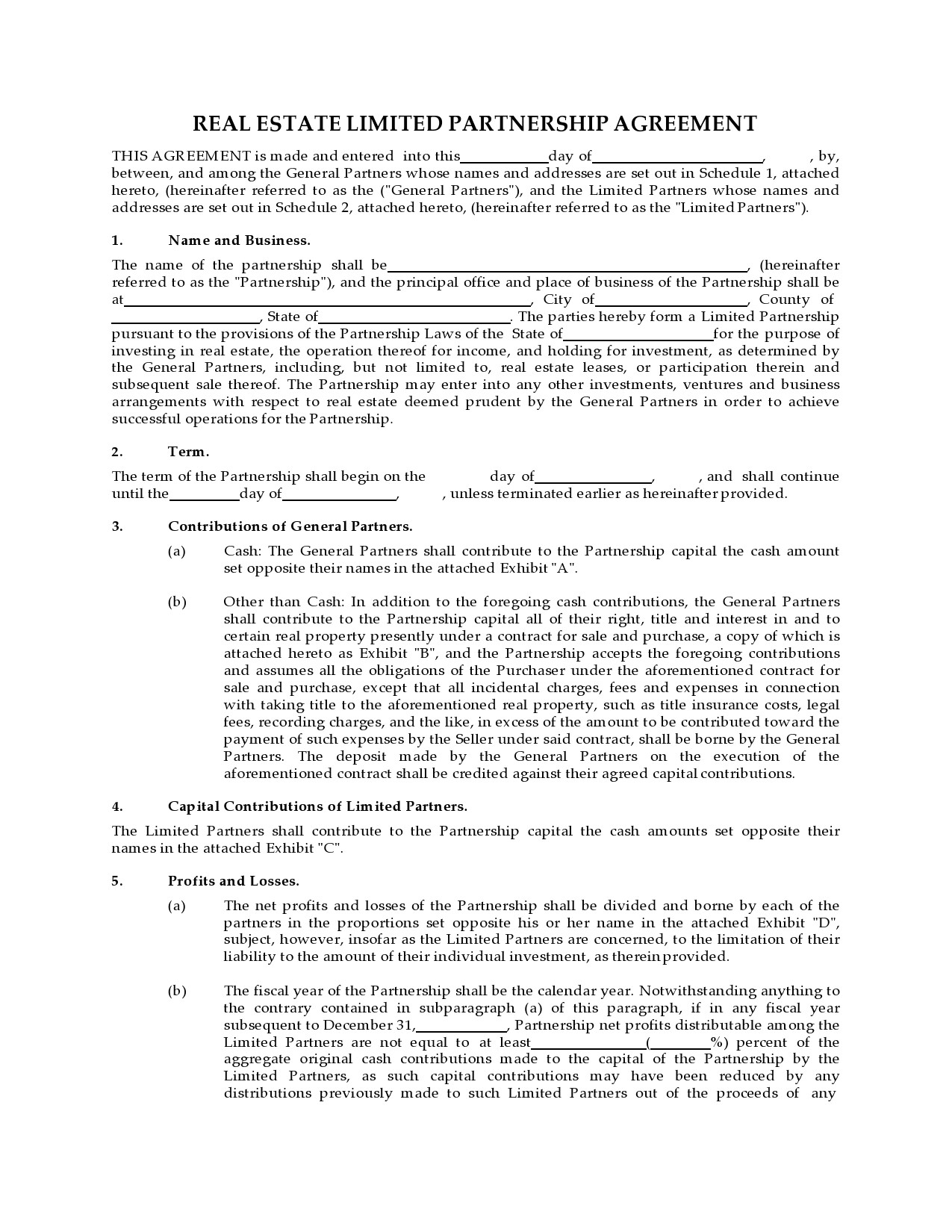

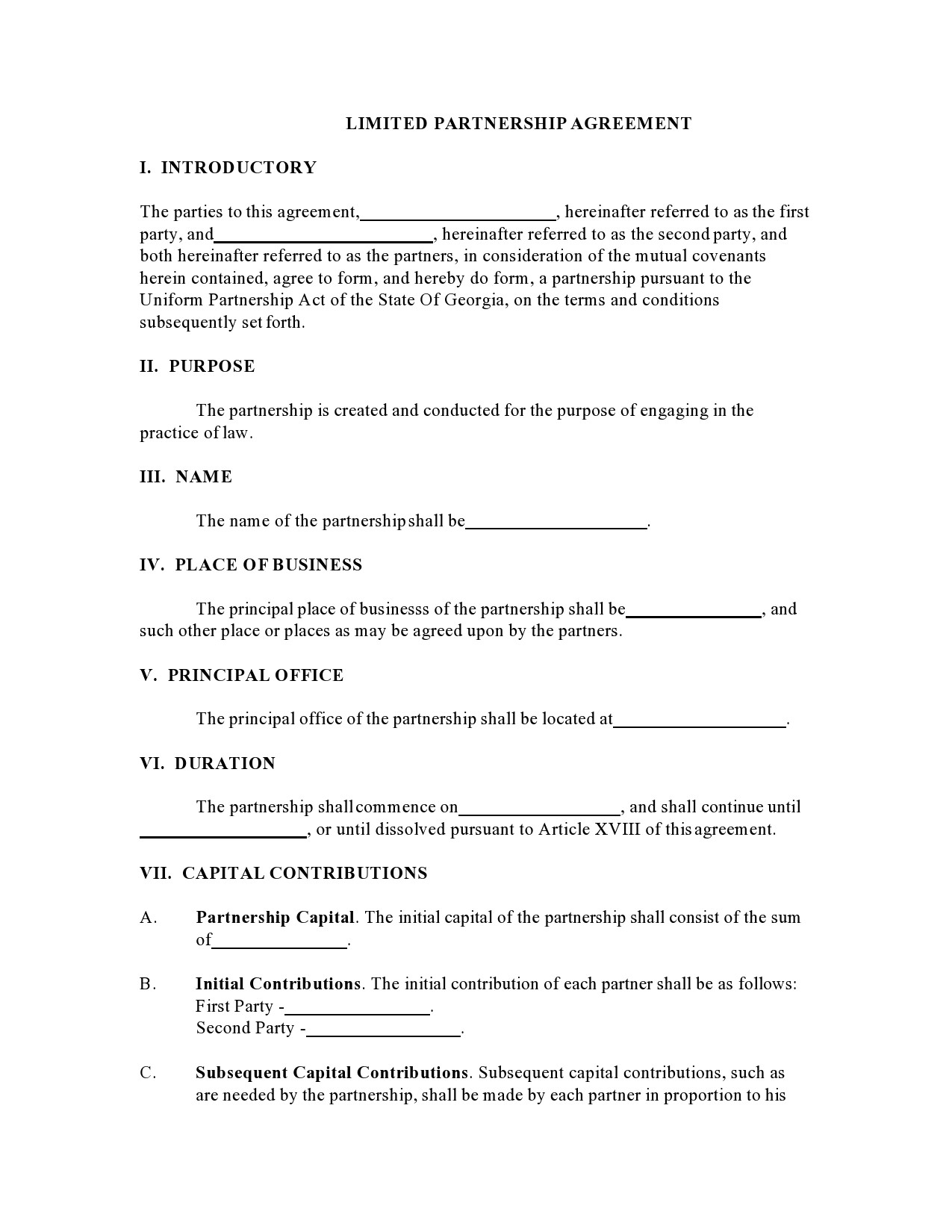

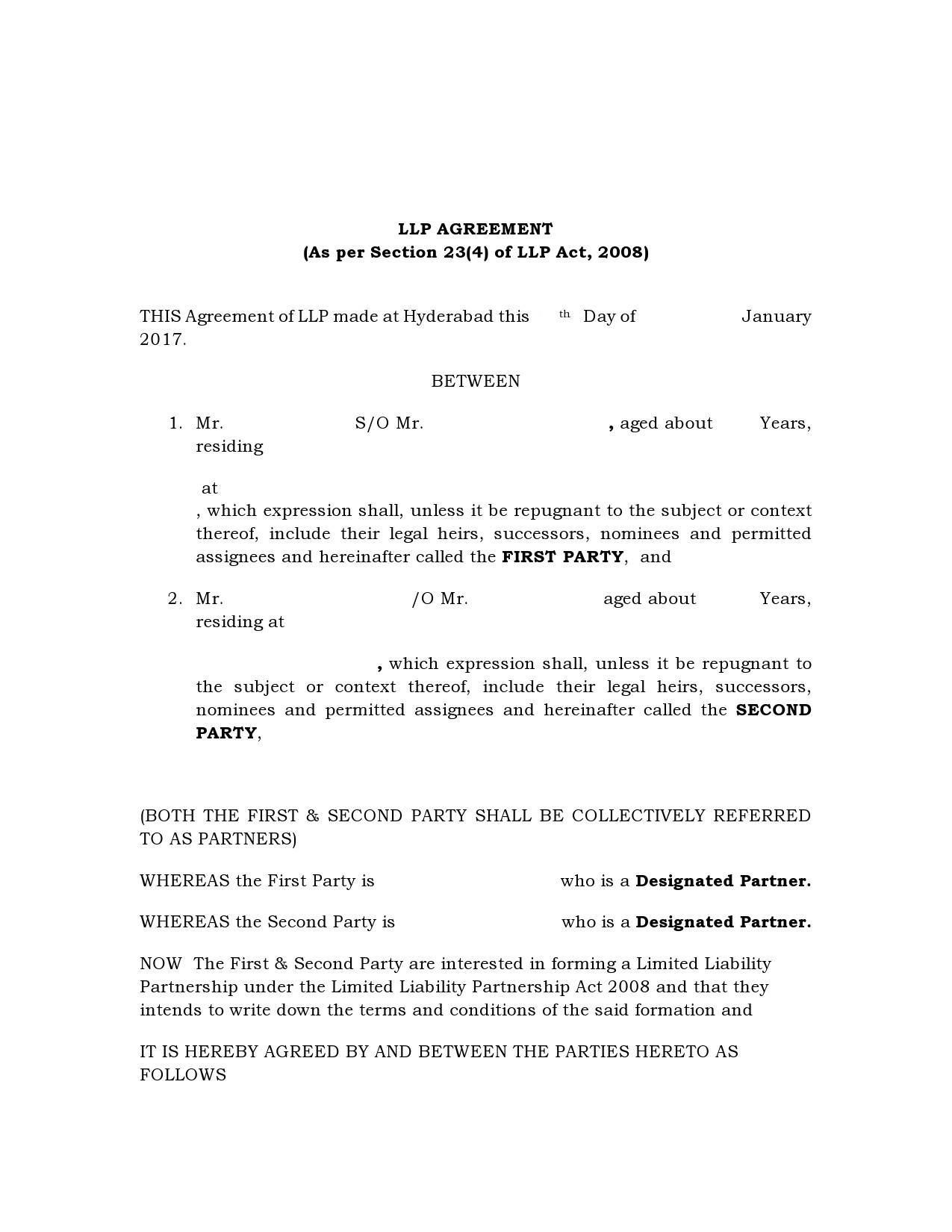

Limited Partnership Agreement Templates

What is a limited partnership agreement?

A limited partnership agreement defines the terms of the agreement and helps protect the success of a business venture in the future.

When you and your partners come to an understanding regarding the ownership liabilities and rights of an agreement, you can proceed to work together towards your goals. You can use a limited partnership agreement template if:

- You’re ready to establish a limited partnership and you would like to define its terms.

- You and your partners have already established a limited partnership but want to formalize the terms.

It will be the agreement that sets up all of the terms of the limited partnership – from buy-out options to ownership interests and everything in between. Moreover, the agreement also defines specific roles for the limited partners. These agreements typically contain the following:

- Your name and your business address.

- The purpose of forming a limited partnership.

- Details whether the limited partners possess any voting rights when it comes to daily business decisions.

- How you will make decisions.

- The names of your partners.

- Percent ownership of the partners

- Capital contributions of the partners.

- Management roles of the partners.

- Details about auditing and accounting.

- How to buy out or transfer shares.

- How to terminate the partnership

- Other relevant details.

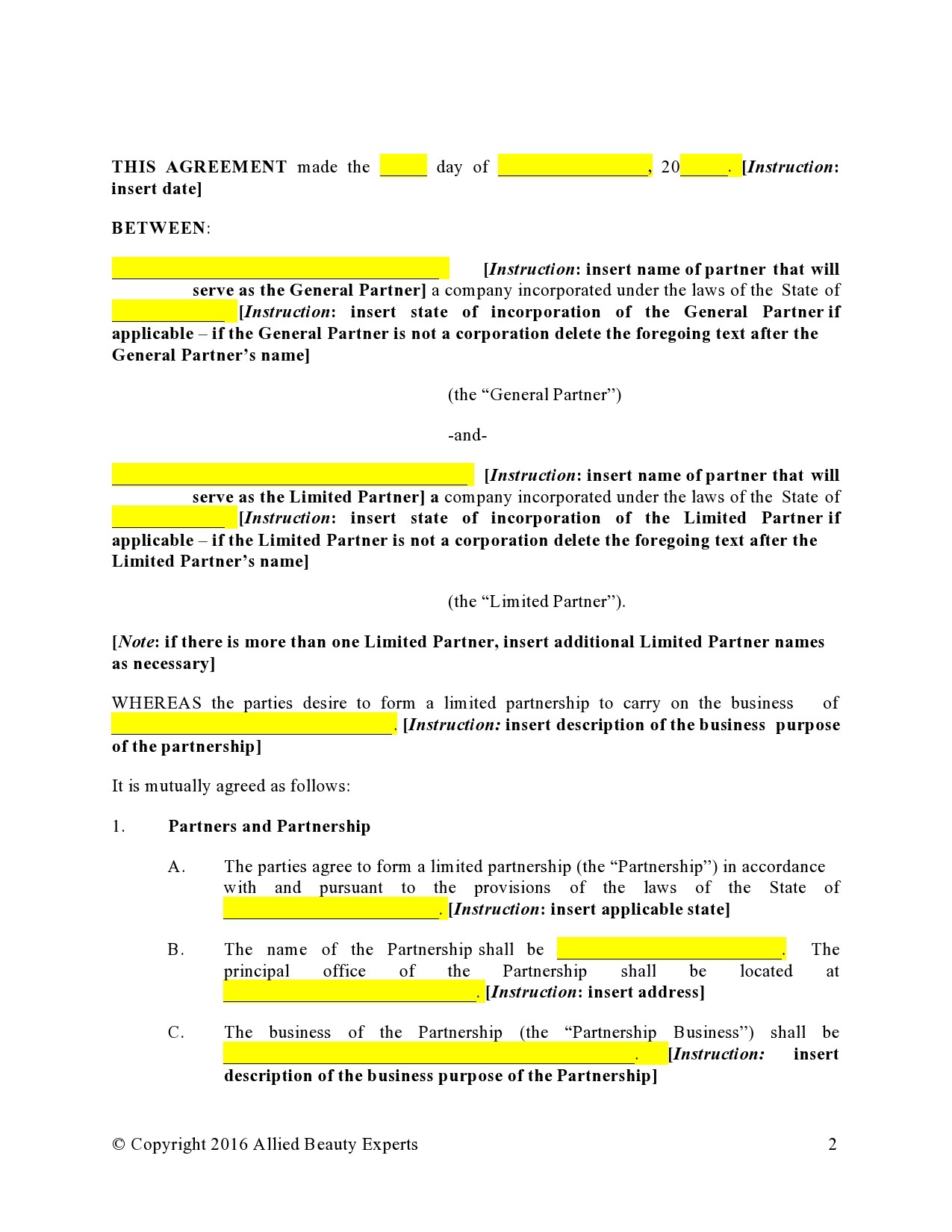

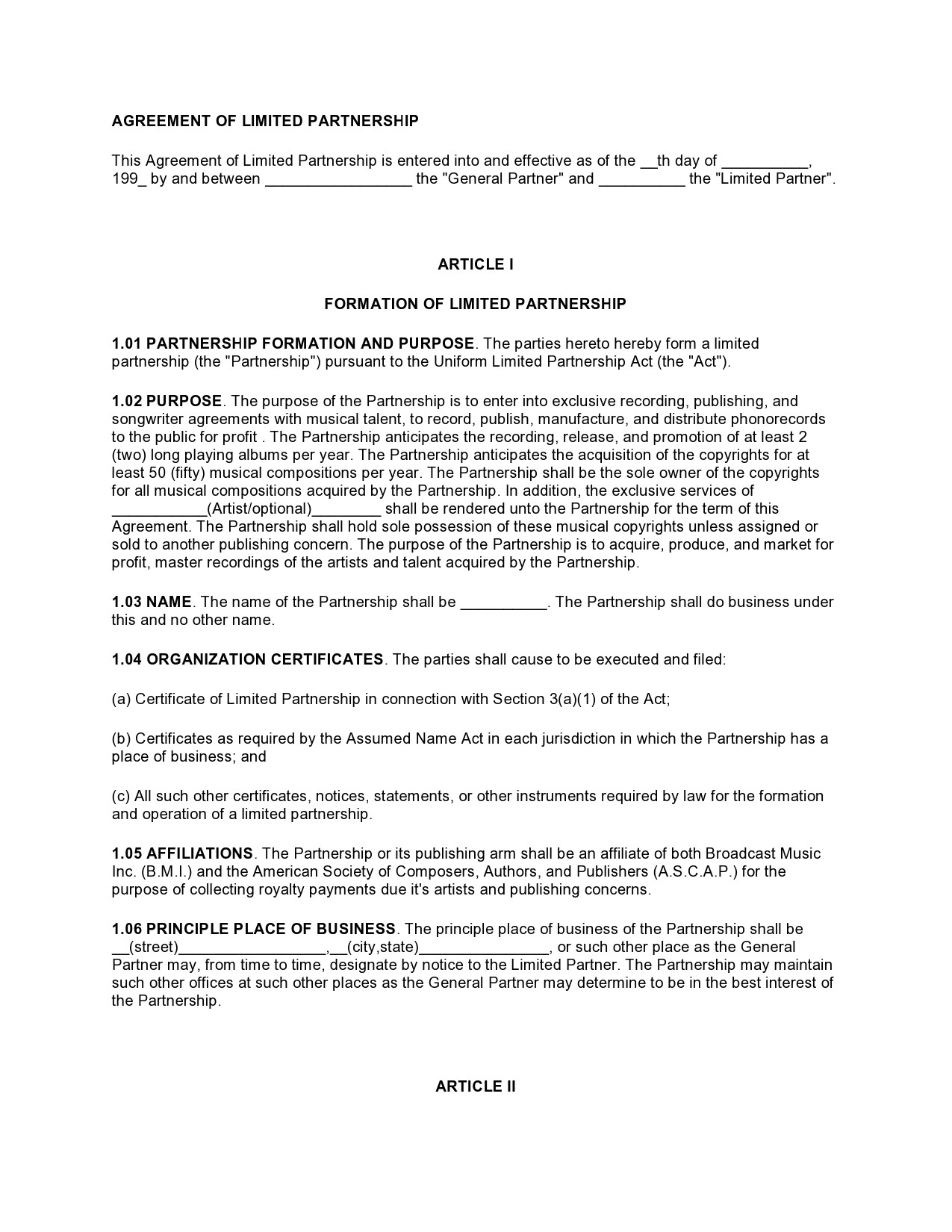

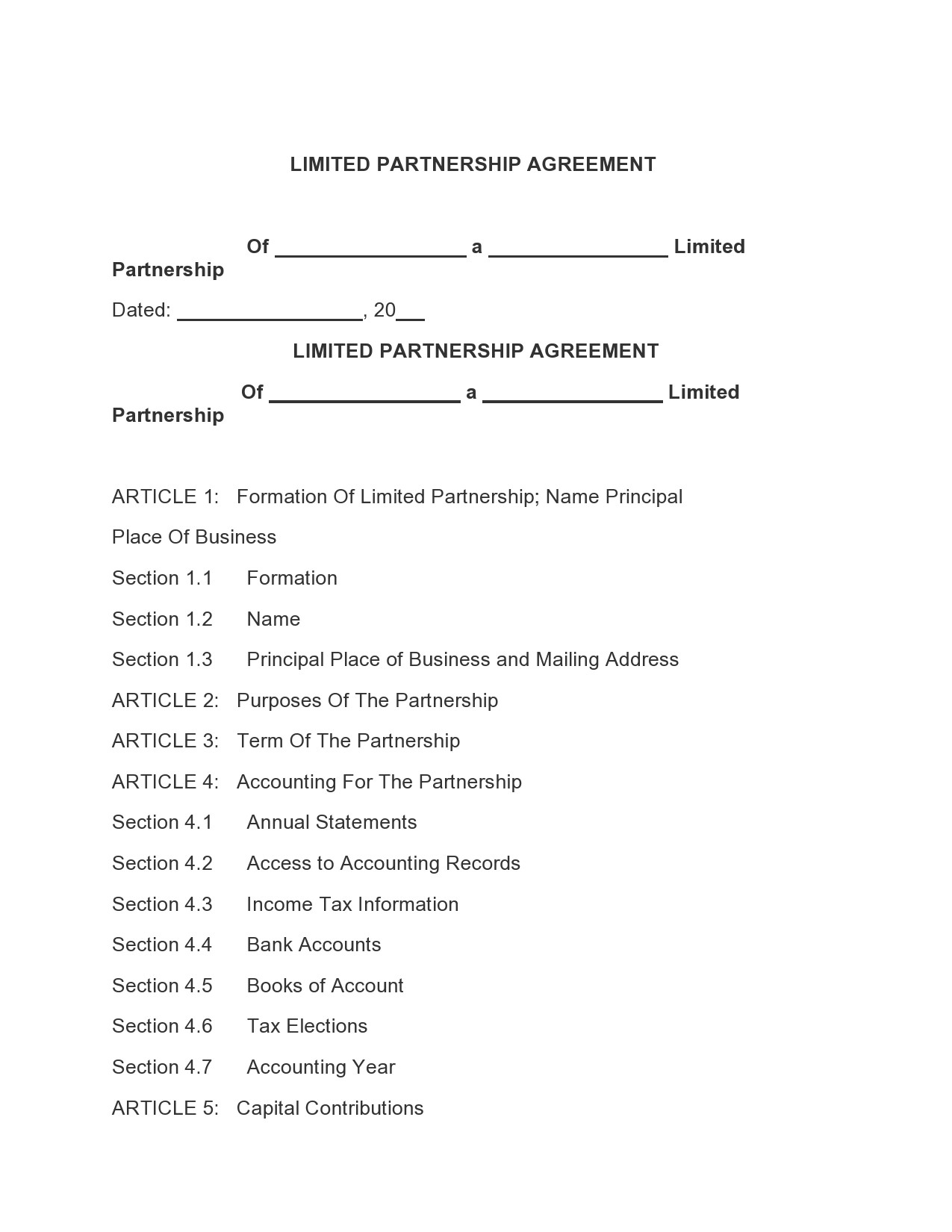

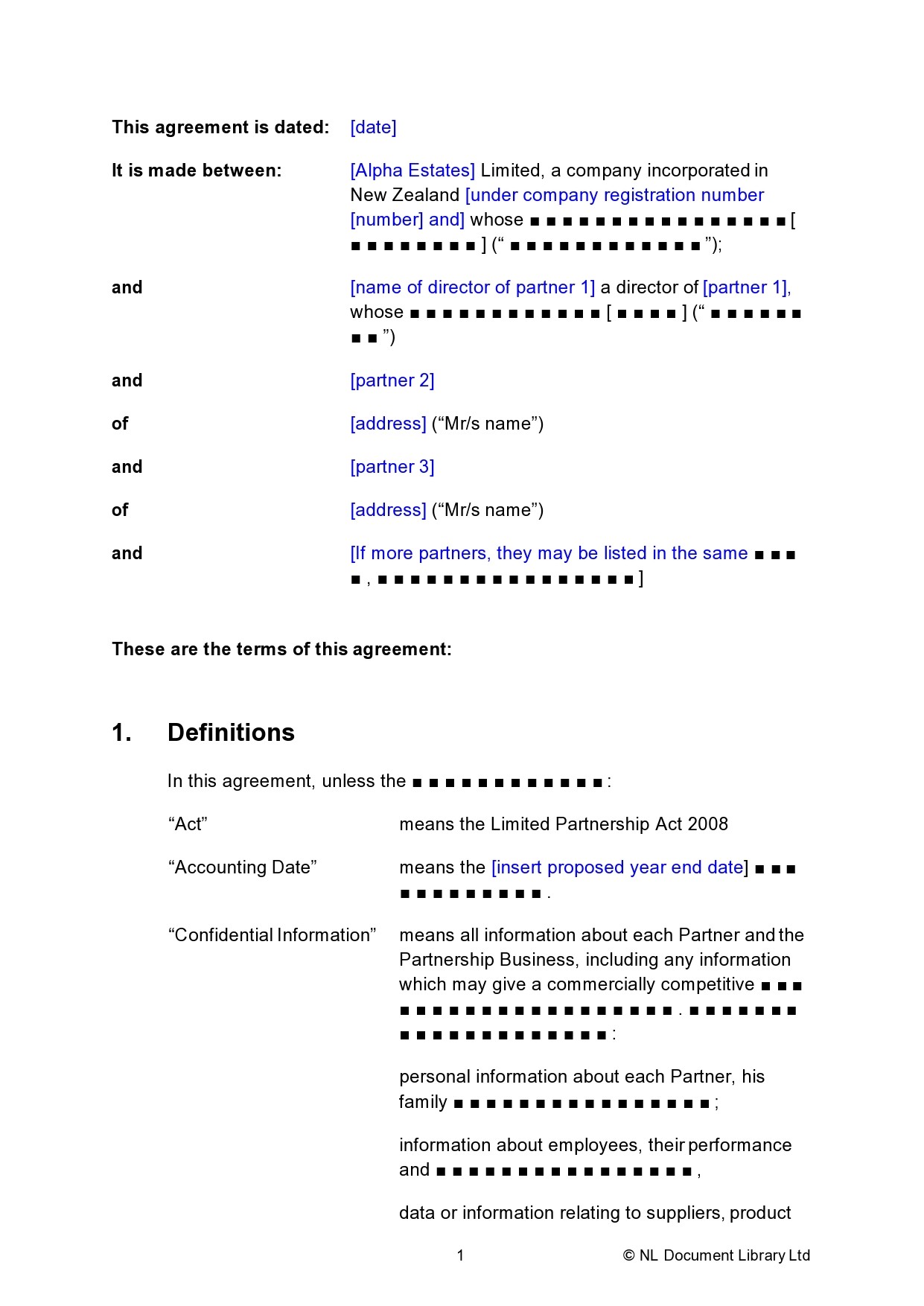

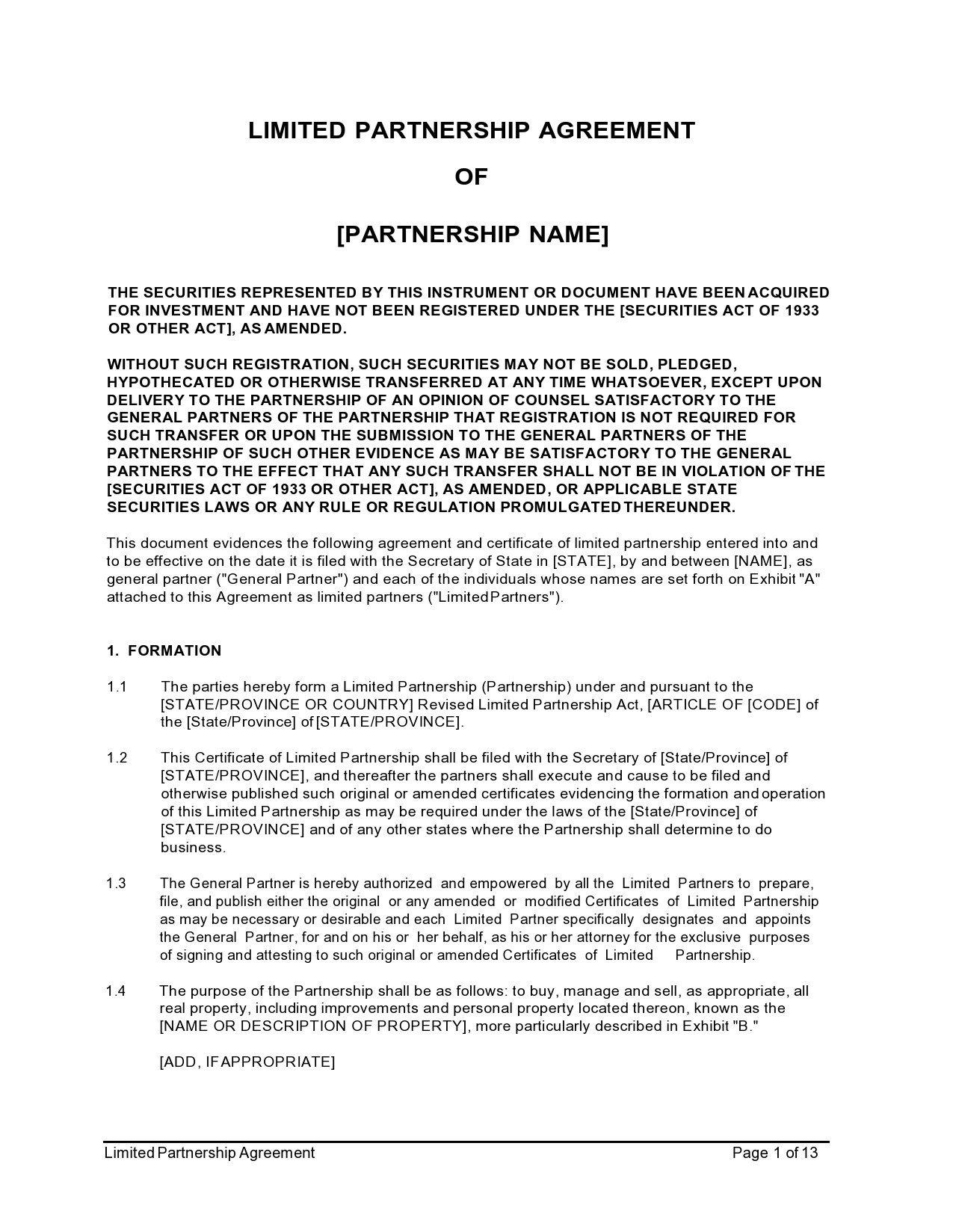

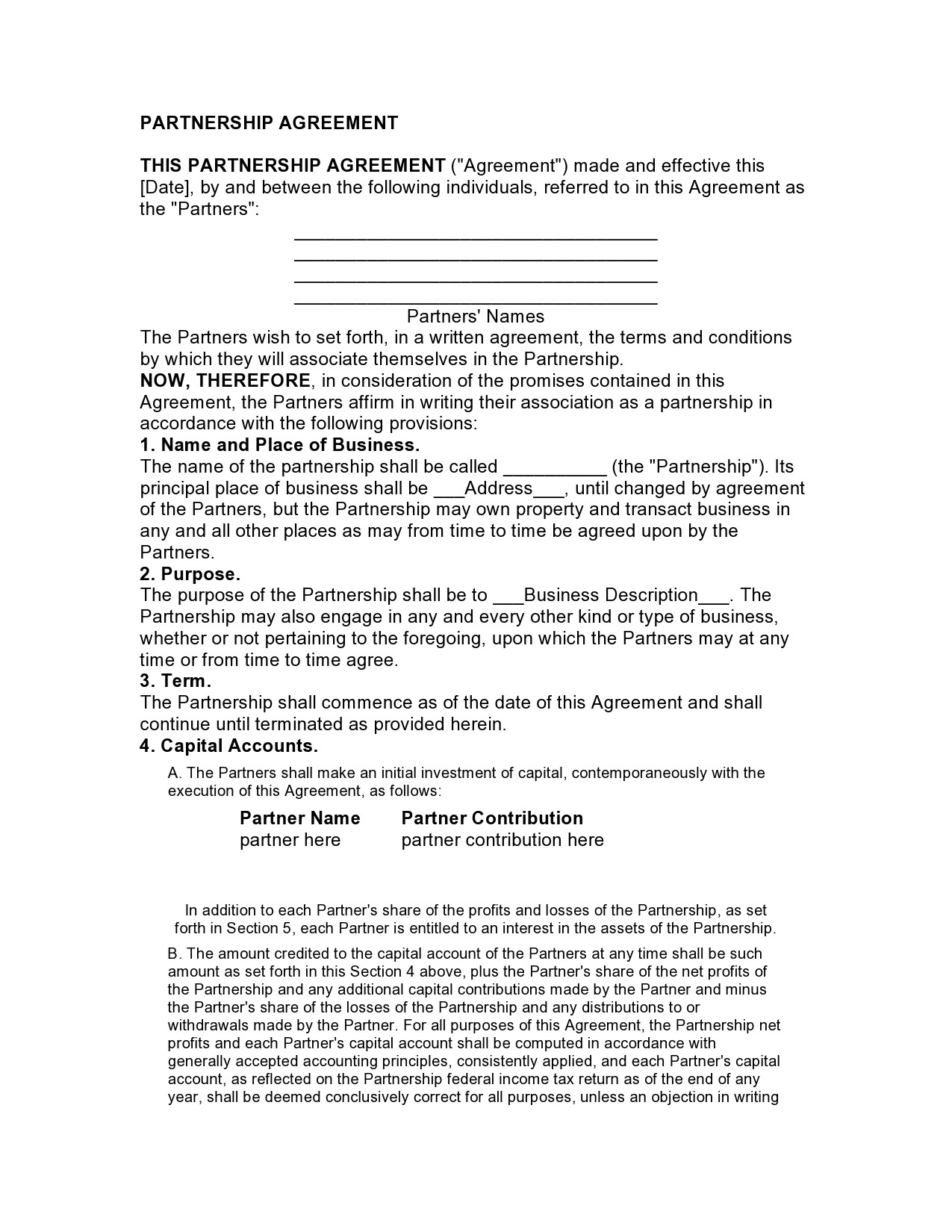

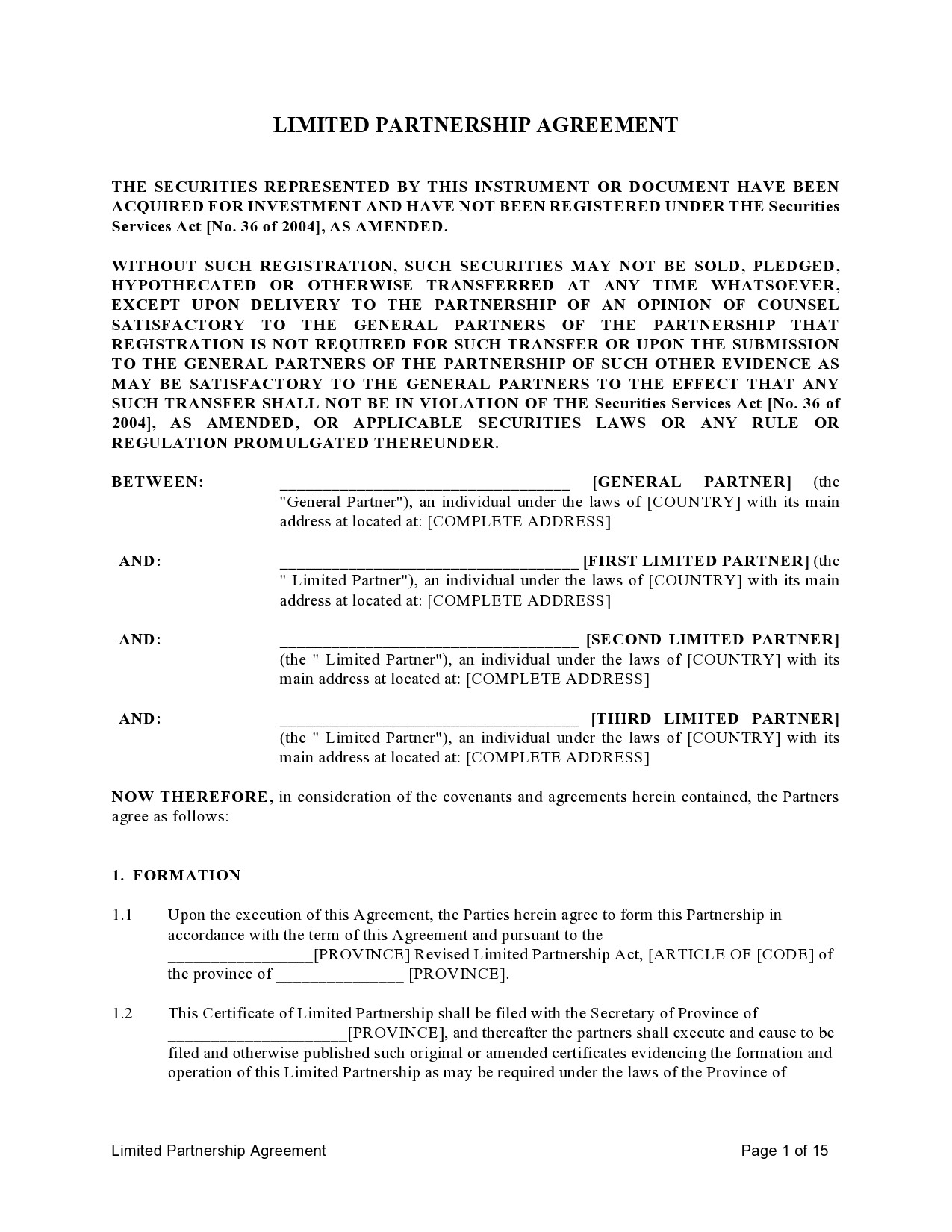

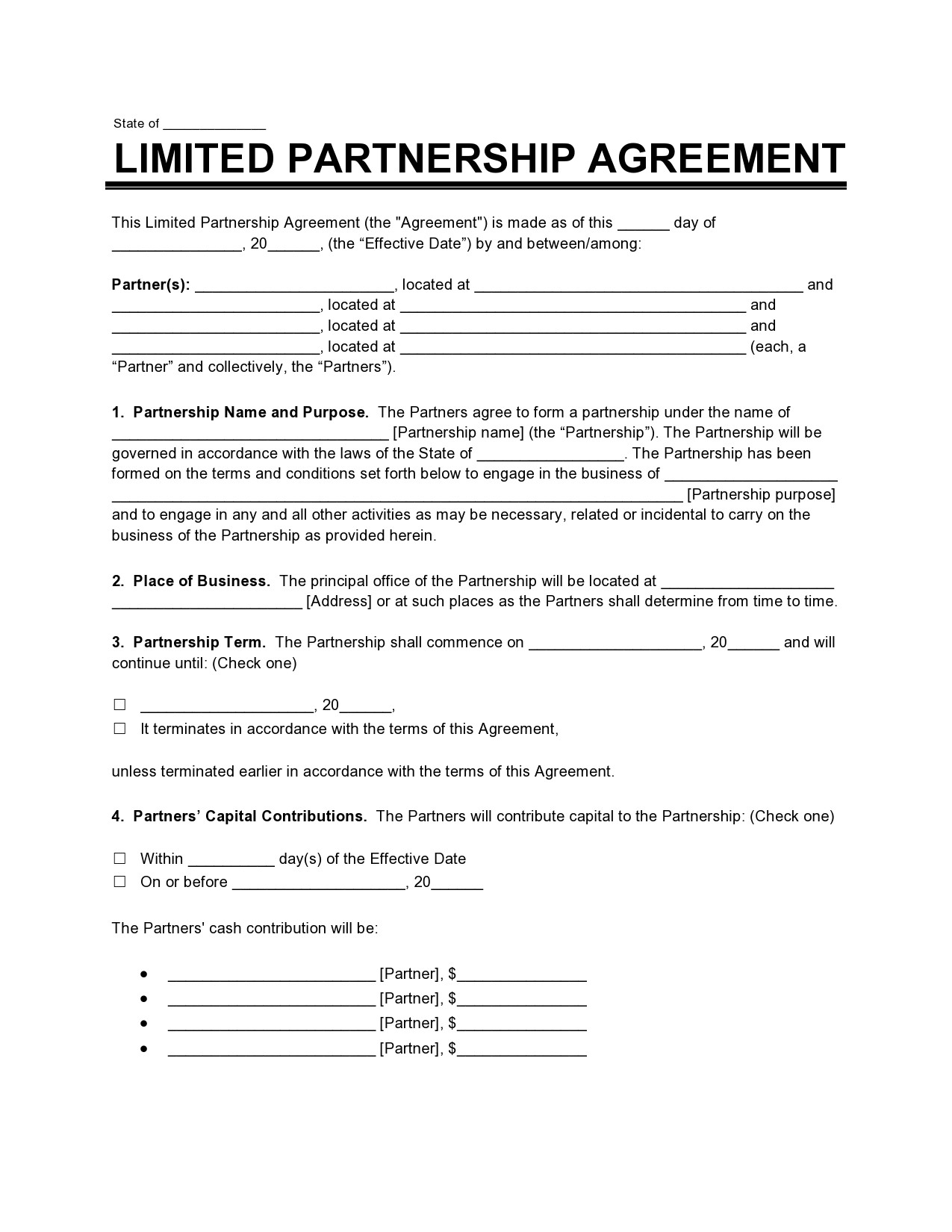

Limited Partnership Agreement Samples

What are the advantages and disadvantages of a limited partnership?

Like any other issue, a limited partnership agreement has its own advantages and disadvantages. It’s important for you and your partners to understand these before deciding to form the partnership. Here are the advantages of a limited partnership contract:

- A huge capital amount

Since this business consists of just a couple of members, the amount each partner will contribute as capital will be considerably large. A business that starts operations with a huge amount of funding will have better chances that the scope for your business increases automatically. This leads to greater flexibility and larger profits. A large capital forms a strong pillar for your business. - There is limited liability for losses for the limited partner

The sharing of responsibilities among partners is one of the greatest advantages of having a limited partnership business. Limited partners aren’t personally liable for any liabilities that the business will incur. As a limited partner, your liability won’t beyond the amount you contributed to the partnership. As such, it reduces the risks of placing personal assets in the line for paying obligations and debts. - Shared work responsibility

After signing a limited partnership agreement template, you and your partners can share the workload. This means that each of you can bring a variety of expertise and abilities in running the business. You can divide the workload according to skills, thus, reducing your individual workloads.

The combination of all these divided work results in a detailed and complete entity that’s highly effective. Aside from sharing the workload, the partners can also get equally involved in the decision-making process. This reduces the responsibilities of each partner while maintaining a smoother workflow.

Before you start preparing your limited partnership documents, you should also know the disadvantages, which include:

- A breach in the agreement

In a good partnership, every individual’s opinion should matter. But at some point, you and your partners might clash. Sometimes, this can lead to disagreements in certain decisions, which will turn into disputes, and eventually lead to a breach in the agreement. This predicament places your whole business at risk. Worse, it might even result in the dissolution of your partnership. - General partners bear the maximum risks

If you’re the general partner, you’re personally liable for the debts that your business might incur. This means that if your business goes bankrupt or gets sued, you’re at maximum risk. For a limited partnership, the general partner is at a greater disadvantage compared to the limited partners. - Limited partners don’t have a big role in decision-making

In this agreement, limited partners have limited liabilities too. The general partner holds the responsibility for the remaining liabilities. If you’re a limited partner, your role in running the company is also limited.

You may exercise a fair share of the power in the business but you won’t have a complete say in decision-making. This may lead to inconsistencies in the decision-making process, which eventually might result in disputes that can place your partnership at risk.

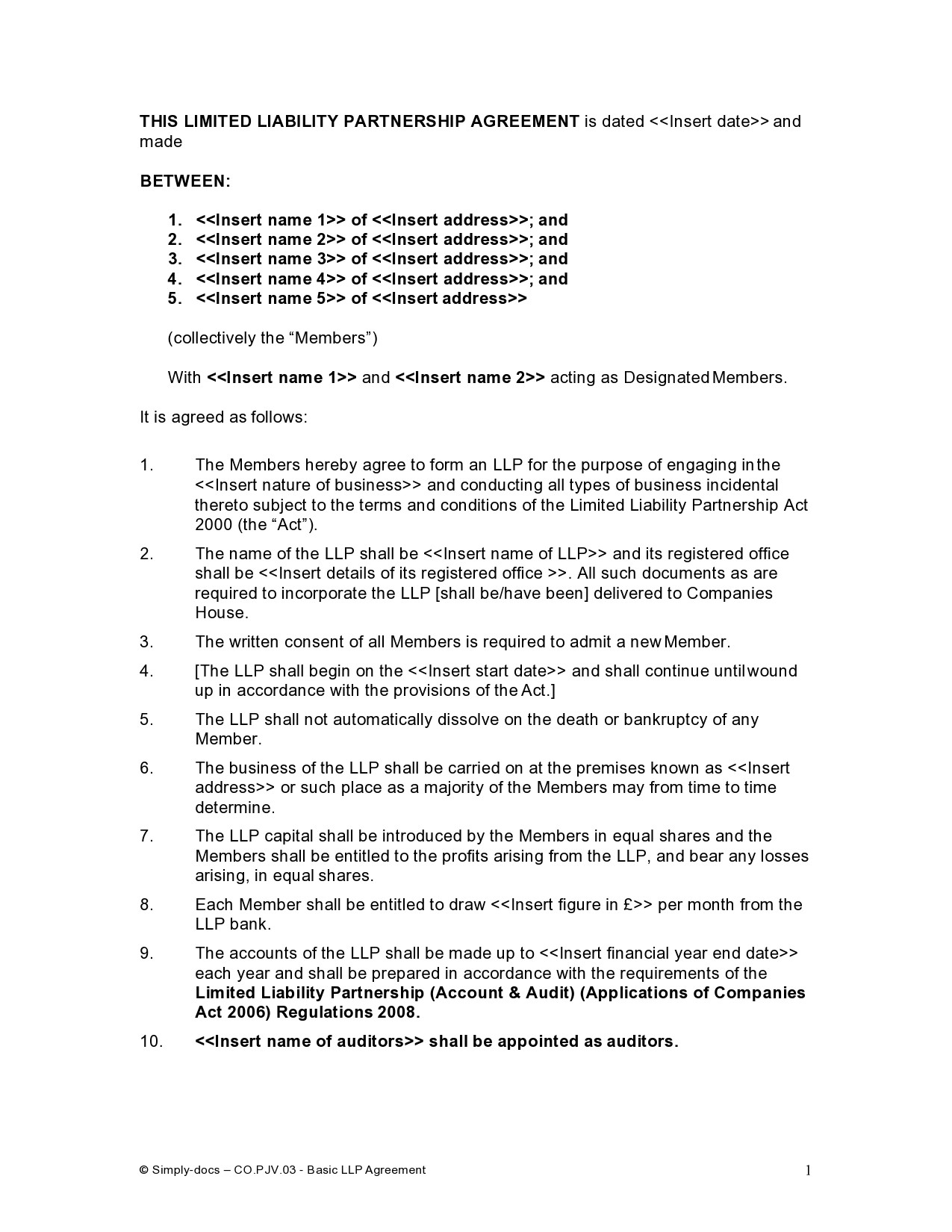

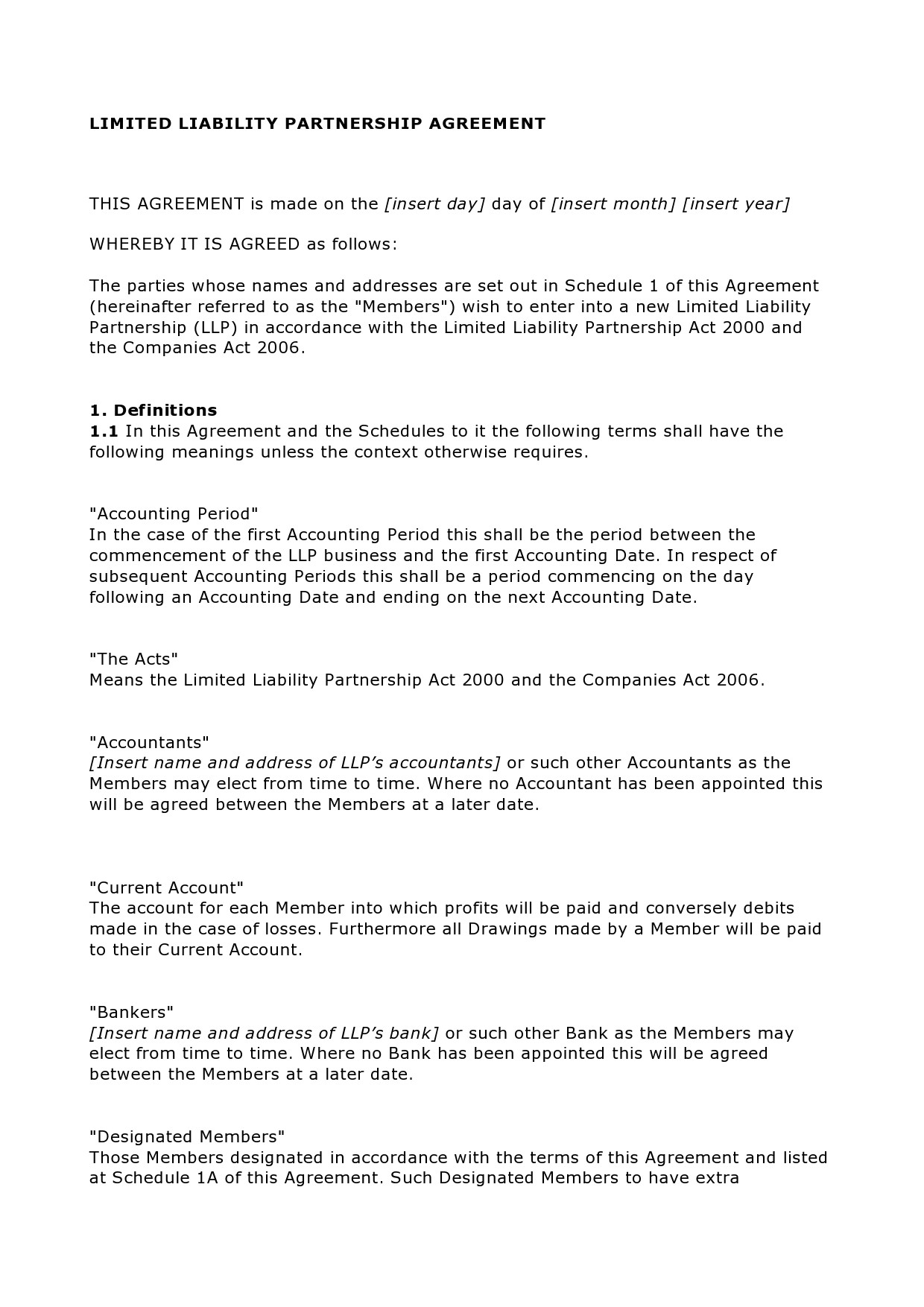

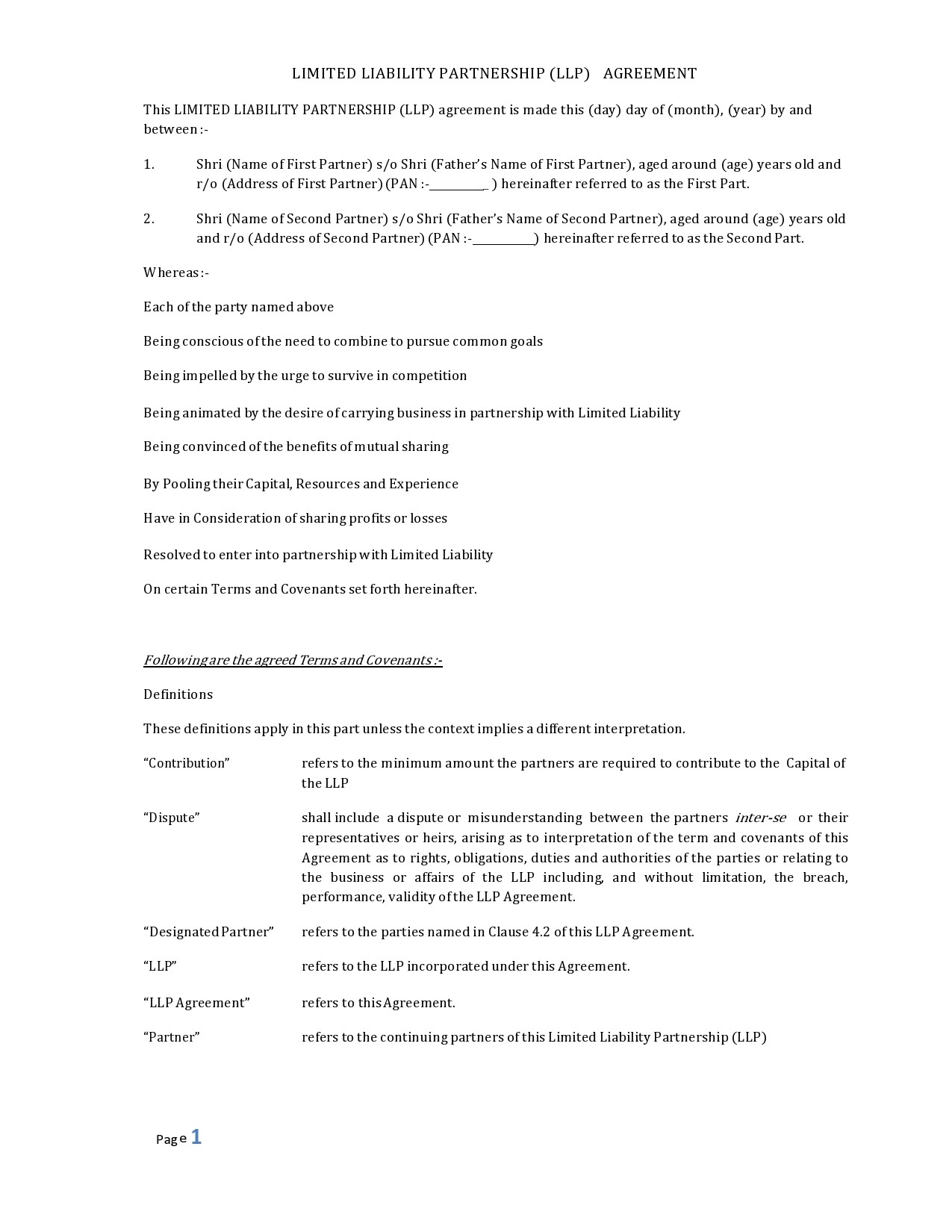

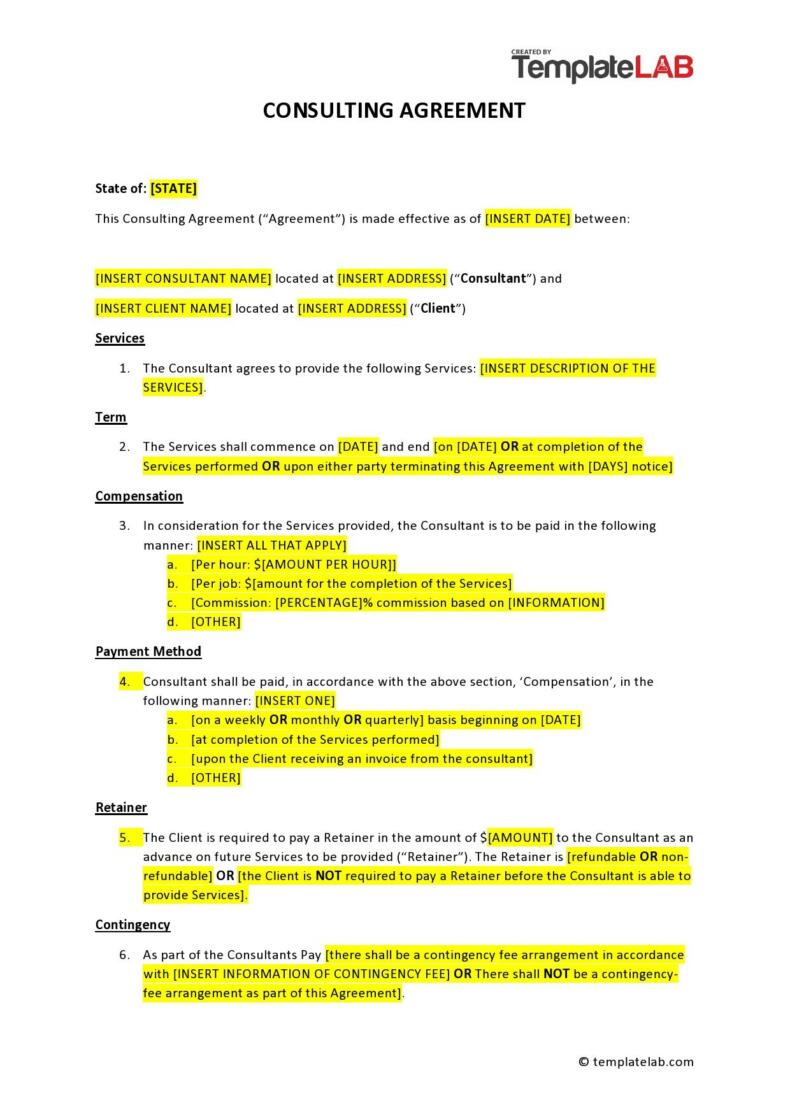

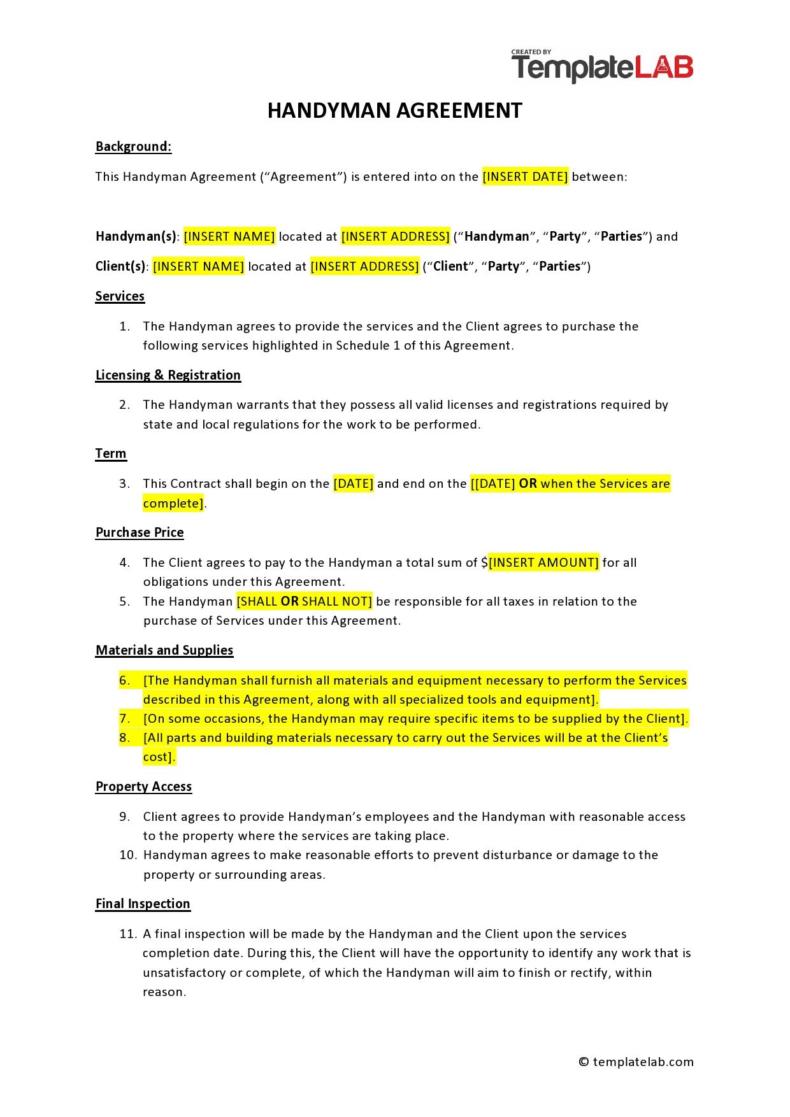

Limited Partnership Contracts

What is the difference between a limited partnership and an LLC?

There are some businesses classified as Limited Liability Companies (LLC) and there are those classified as Limited Partnership (LP) companies. While it is true that they share some similarities, they also have some distinct differences.

You should consider these differences when creating a limited partnership agreement form or deciding which one to choose. These differences are:

- Structure

An LP agreement consists of limited partners and a general partner. Limited partners may invest in the business then share in its losses and profits. In a limited liability company, there are many owners – called members.

There is no limit to the number of members. You can find the members’ responsibilities and rights in the LLC’s Operating Agreement. Unless otherwise specified in the agreement, all the members have the right to take part in the management of the business. - Personal Liability

When comparing a limited partnership agreement and a limited liability company, perhaps the most significant difference relates to the personal liabilities of the people involved. A limited partnership gets managed by one or more general partners who have control of the business’ daily operations.

These general partners possess unlimited personal liability for the obligations and debts of the partnership. This means that they will be personally held liable for such obligations and debts. In this agreement, the limited partners don’t have any personal liabilities for such obligations and debts. Also, they cannot take part in the daily management of the business.

An LLC is an entity and it’s often put up to serve as a general partner of an LP. The purpose in doing so is to avoid the personal liability of a single general partner. The creation of the LLC offers the flexibility of a partnership while providing corporation-like protection against personal liability. Here, one or more members can manage the business just like a general partner manages an LP.

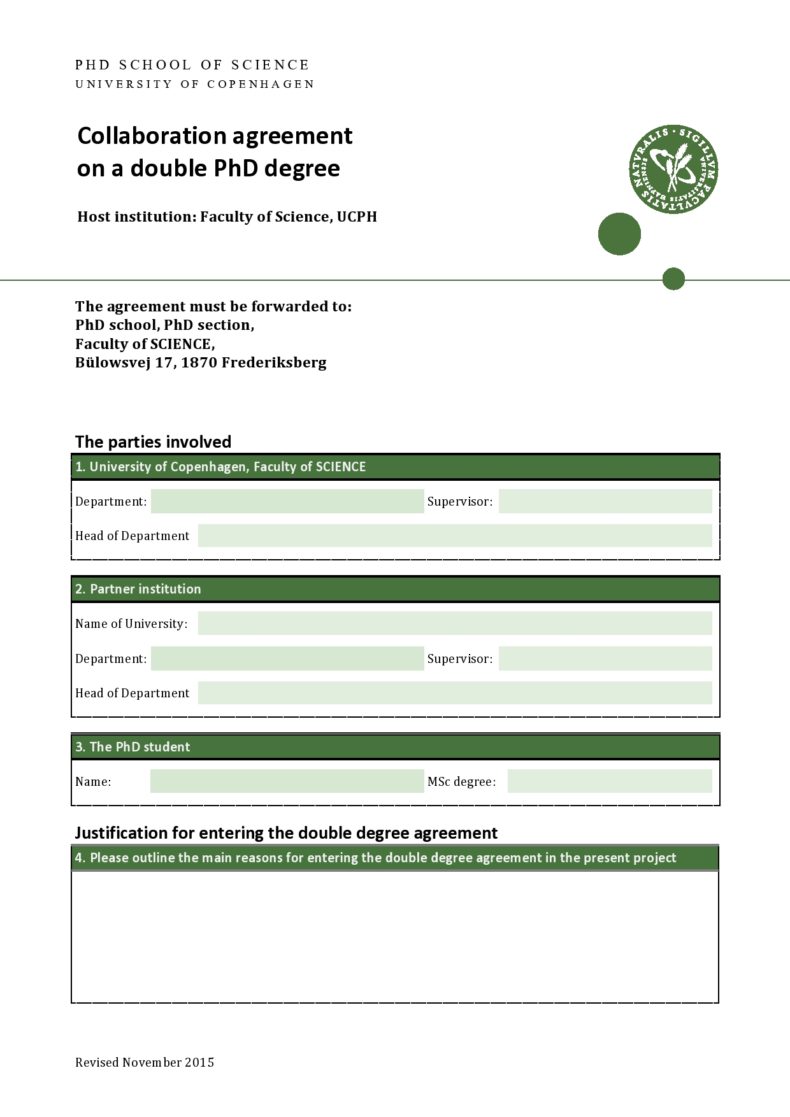

Limited Partnership Documents

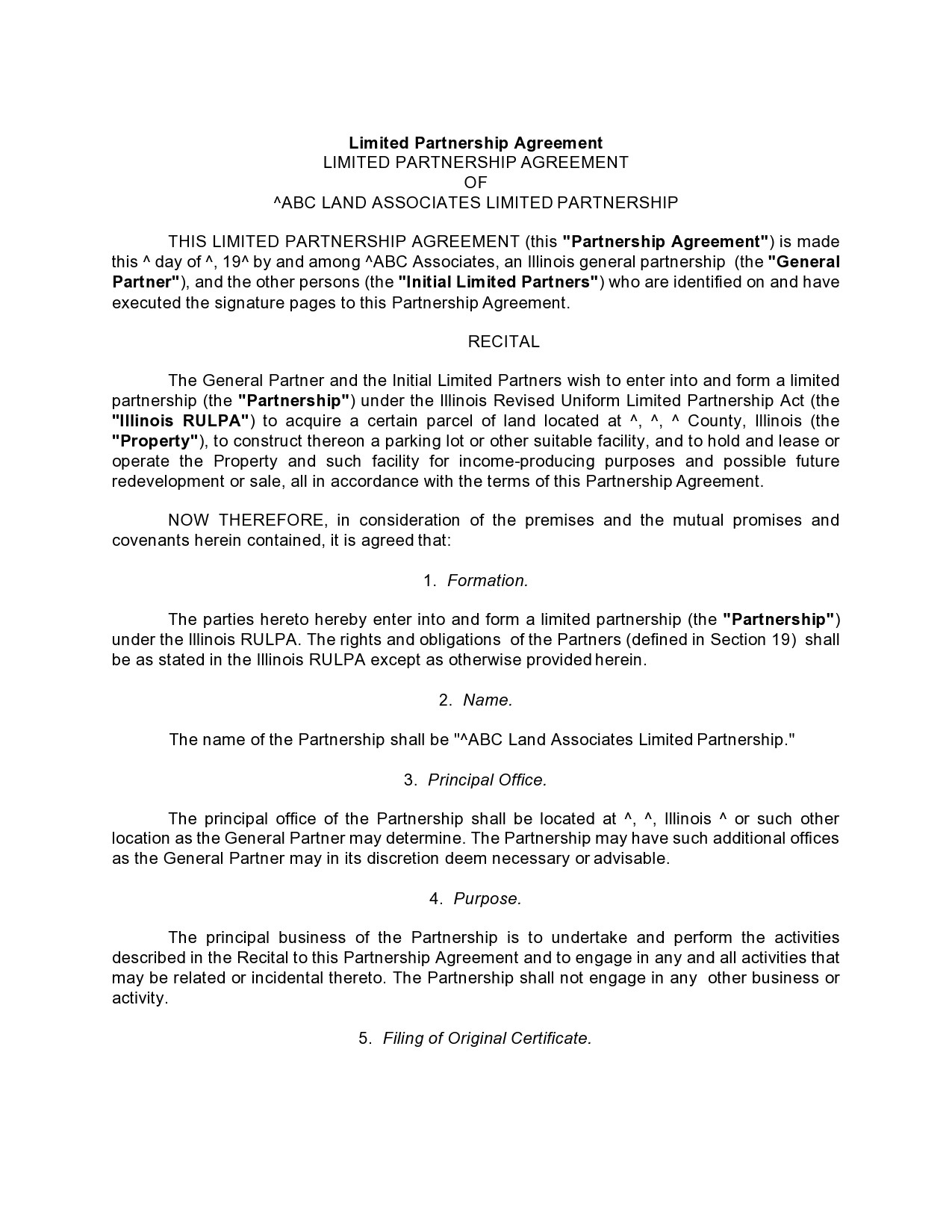

How to draft a limited partnership agreement?

A limited partnership agreement can be a collaborative effort by all of the partners involved. The document outlines the policies and rules on how you will run the business. In the formulation of the limited partnership agreement template, you and your partners should see to it that all conceivable business situations are completely covered by the agreement along with solutions to these situations.

Although the creation of this agreement is a voluntary action for partners, the document can still be legally binding if any of the agreements get contested in court. Here are some tips for drafting this agreement:

- Roles and Responsibilities

The agreement must have an outline of the relationships of the partners in the business concerning your responsibilities and roles. The general partner is typically the person in charge of the business’ daily operations.

The limited partners hold silent roles and aren’t involved in most business activities. The partnership may also include the specific duties of each general partner and how much power they have in the business’ decision-making process. - Dividing Losses and Profits

The partnership agreement must state how you will divide losses, deductions, and profits among the partners. In general, all partners will get losses, deductions, and profits based on your ownership interests. But you can also agree to allocate these in different ways. - Voting Rights

You can also include the voting rights of all partners in the agreement. Each of the partners can have a right to vote on business matters including real estate purchases, business transactions, and even managerial changes like letting go of or adding partners.

Limited partners in most states get voting rights without losing their limited liability. You can outline these voting privileges in the agreement too. General partners can make decisions on whether limited partners can or cannot vote on certain business matters.

The partnership agreement can also state the power of each partner’s vote and how to carry out the voting process. General partners can make decisions on whether all of the partners get to vote or if they prefer to delegate voting responsibilities to an appointed committee. - Withdrawal and Termination

The agreement should also include the exit strategies of any of the partners. Other than getting voted out, partners can exit the business if they retire, get disabled, or die. You may include a buy-sell clause to make the transition smooth if the need arises.

Set rules on how you will bring out the departed partner’s ownership interest either by the partnership or by other parties. The agreement should also summarize how you will allocate business assets should all of the partners agree to terminate the agreement.