Many companies have the practice of entering into an agreement with various individuals and provide considerations to them. In deciding how much consideration to give, you would offer profit sharing or anything similar to make the agreement justifiable. For this, you need a profit sharing agreement to establish a professional relationship between you and the other party.

Table of Contents

- 1 Profit Sharing Agreement Templates

- 2 What is profit sharing and how does it work?

- 3 Employee Profit Sharing Agreements

- 4 When do you need a profit sharing agreement?

- 5 What is a typical profit sharing percentage?

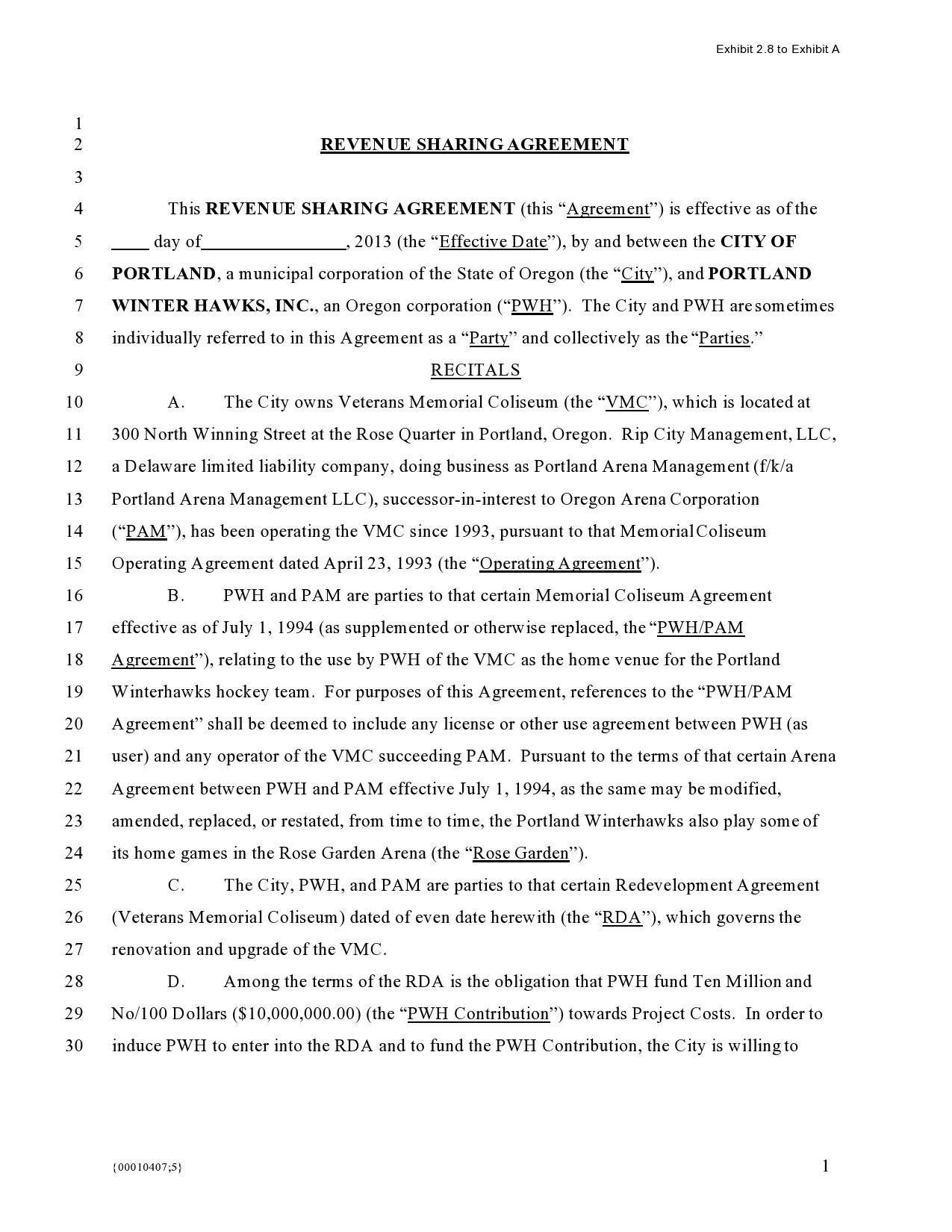

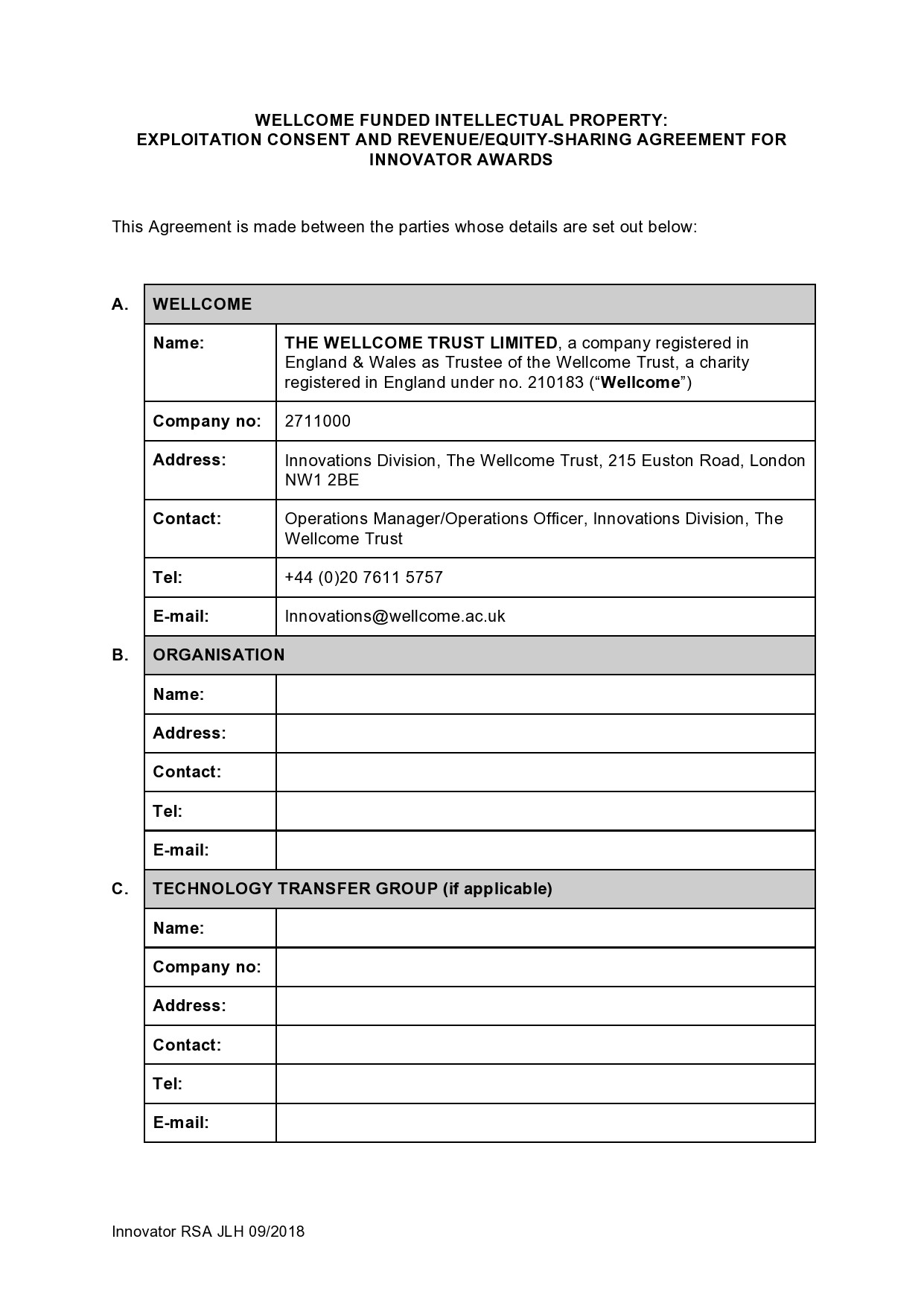

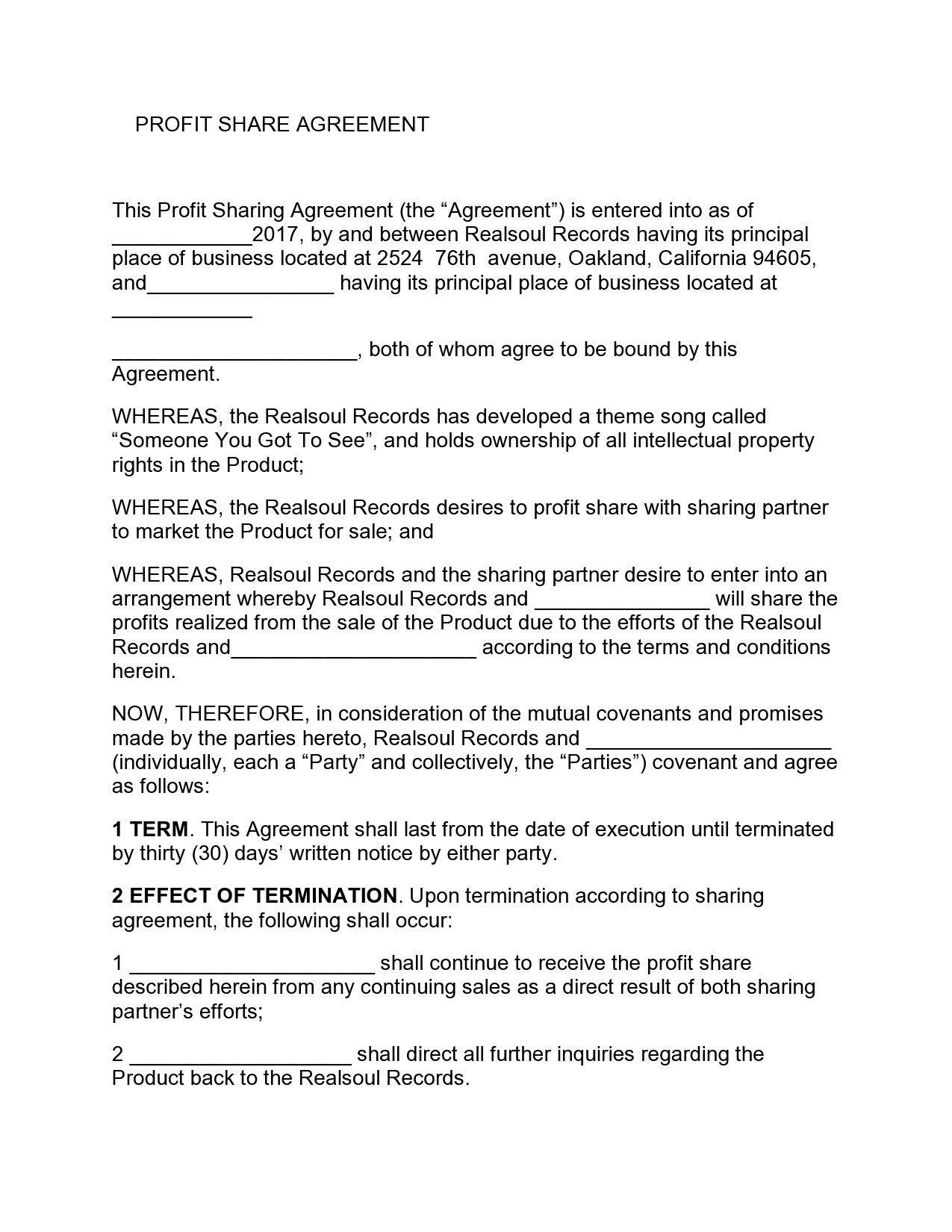

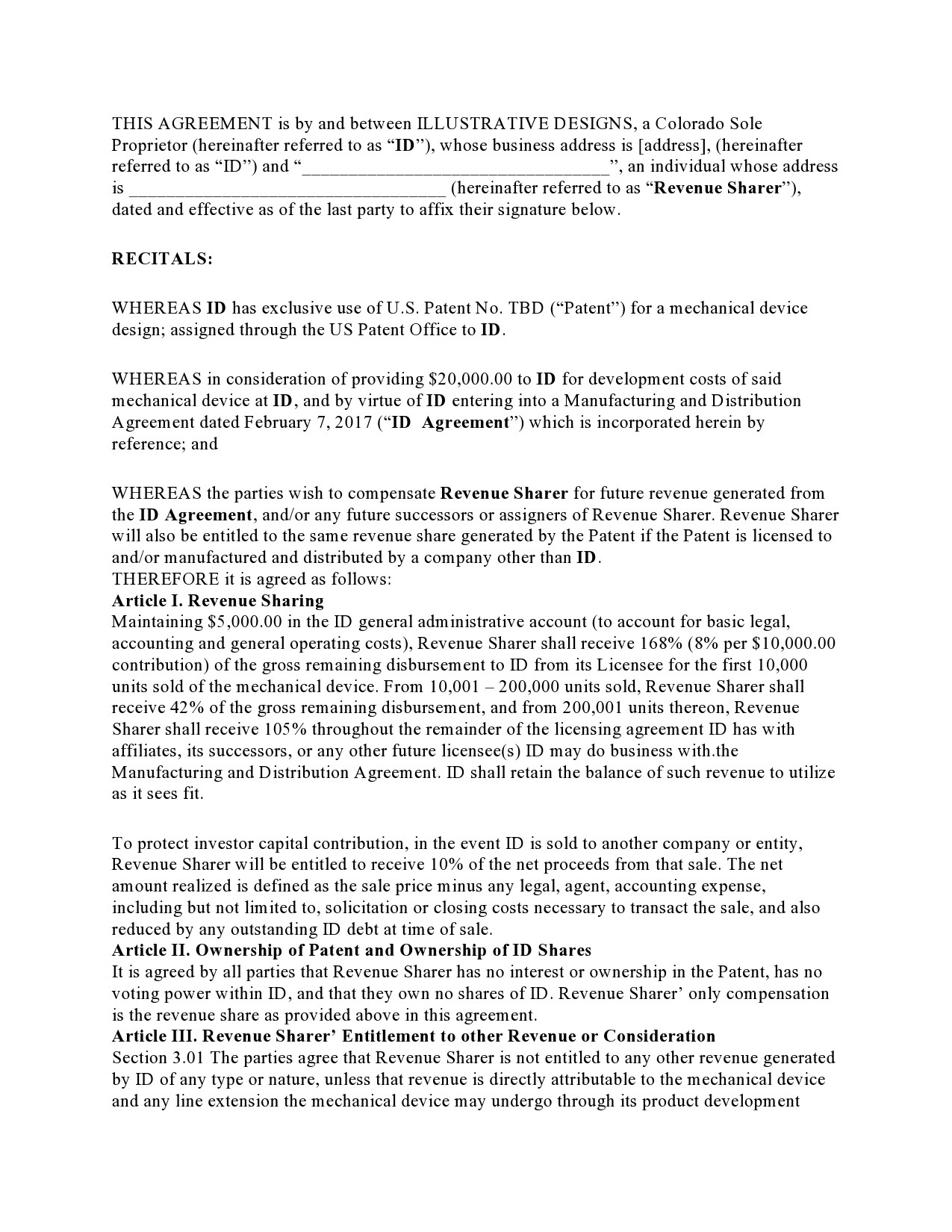

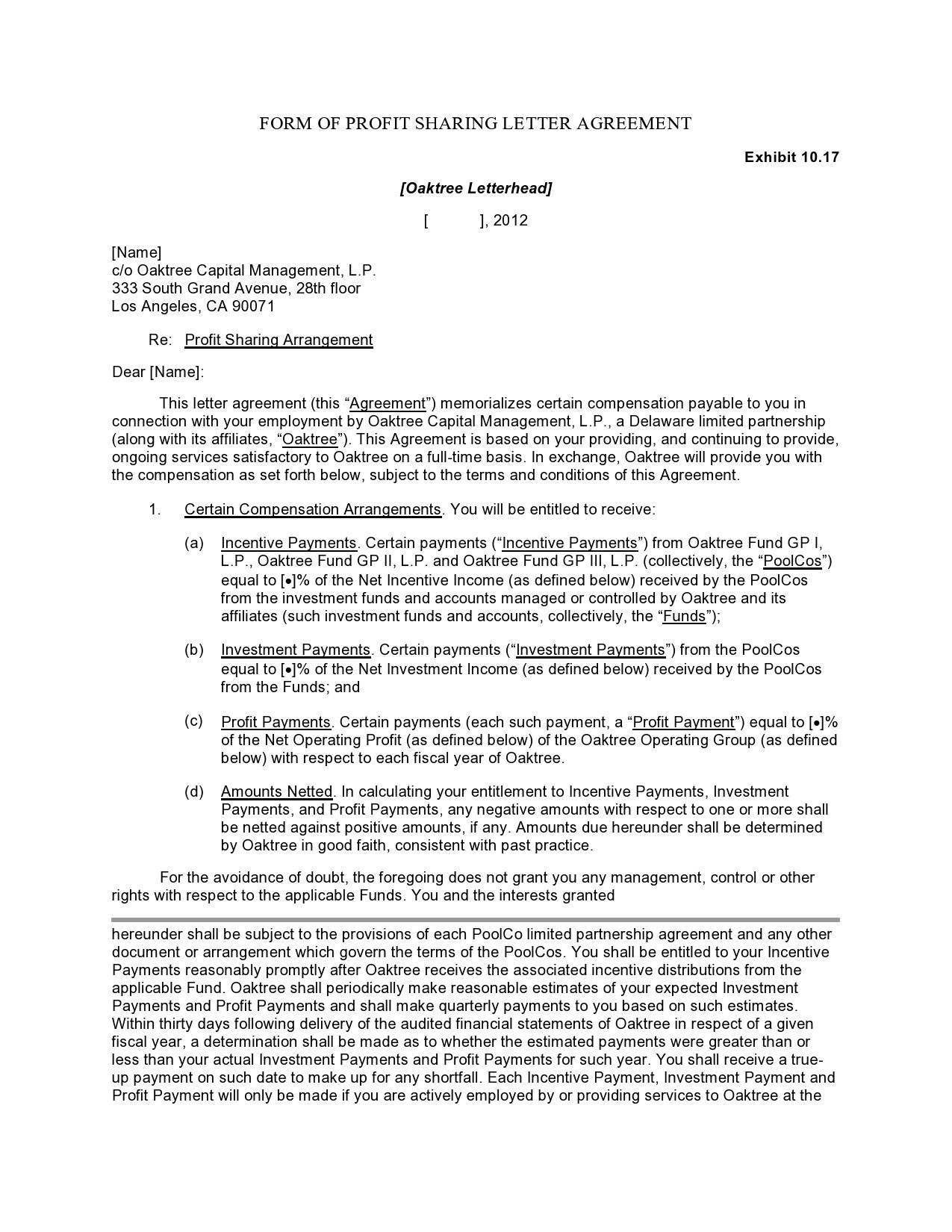

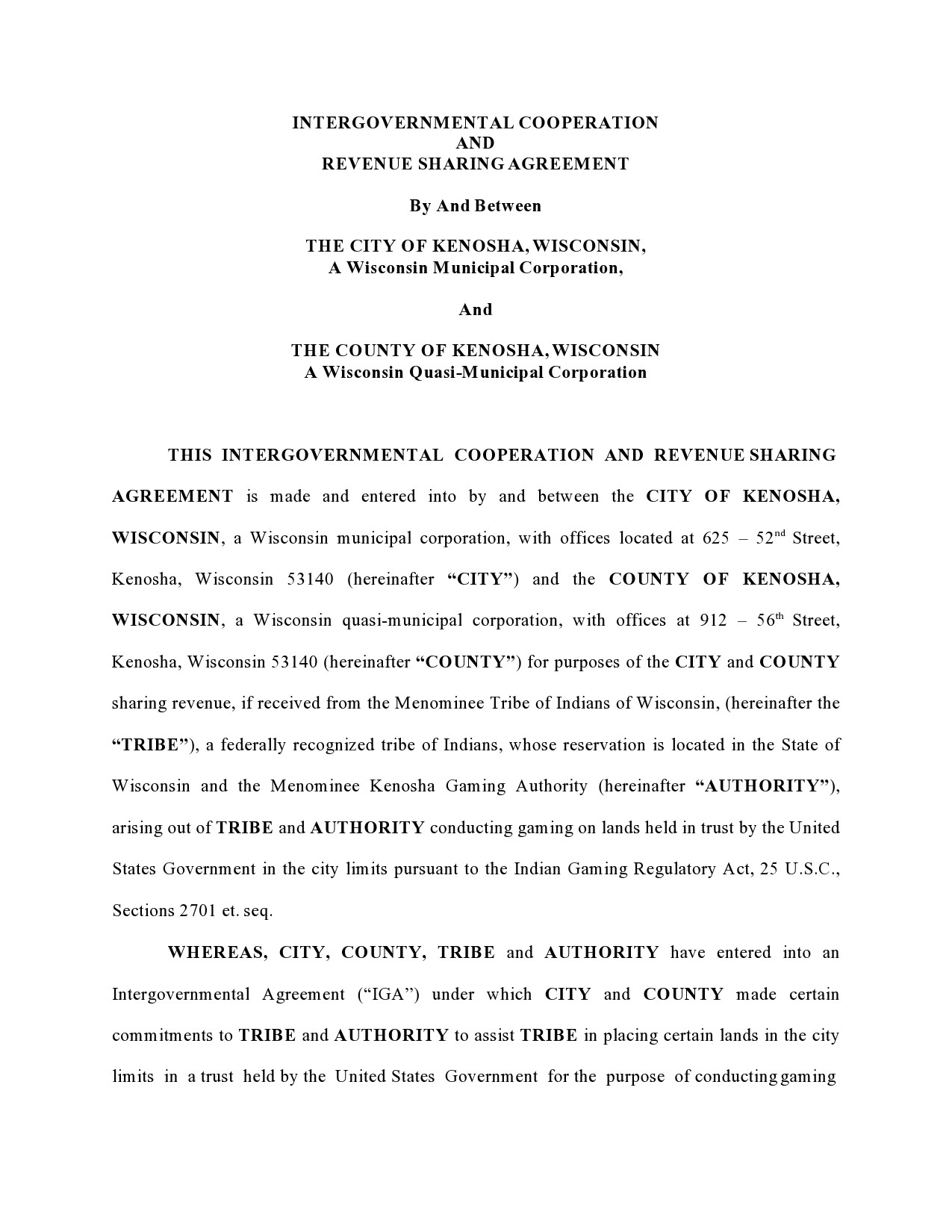

- 6 Revenue Sharing Agreement Templates

- 7 How do you split profit sharing?

- 8 What to include in a profit sharing agreement?

- 9 Profit Sharing Contracts

- 10 Drafting the agreement

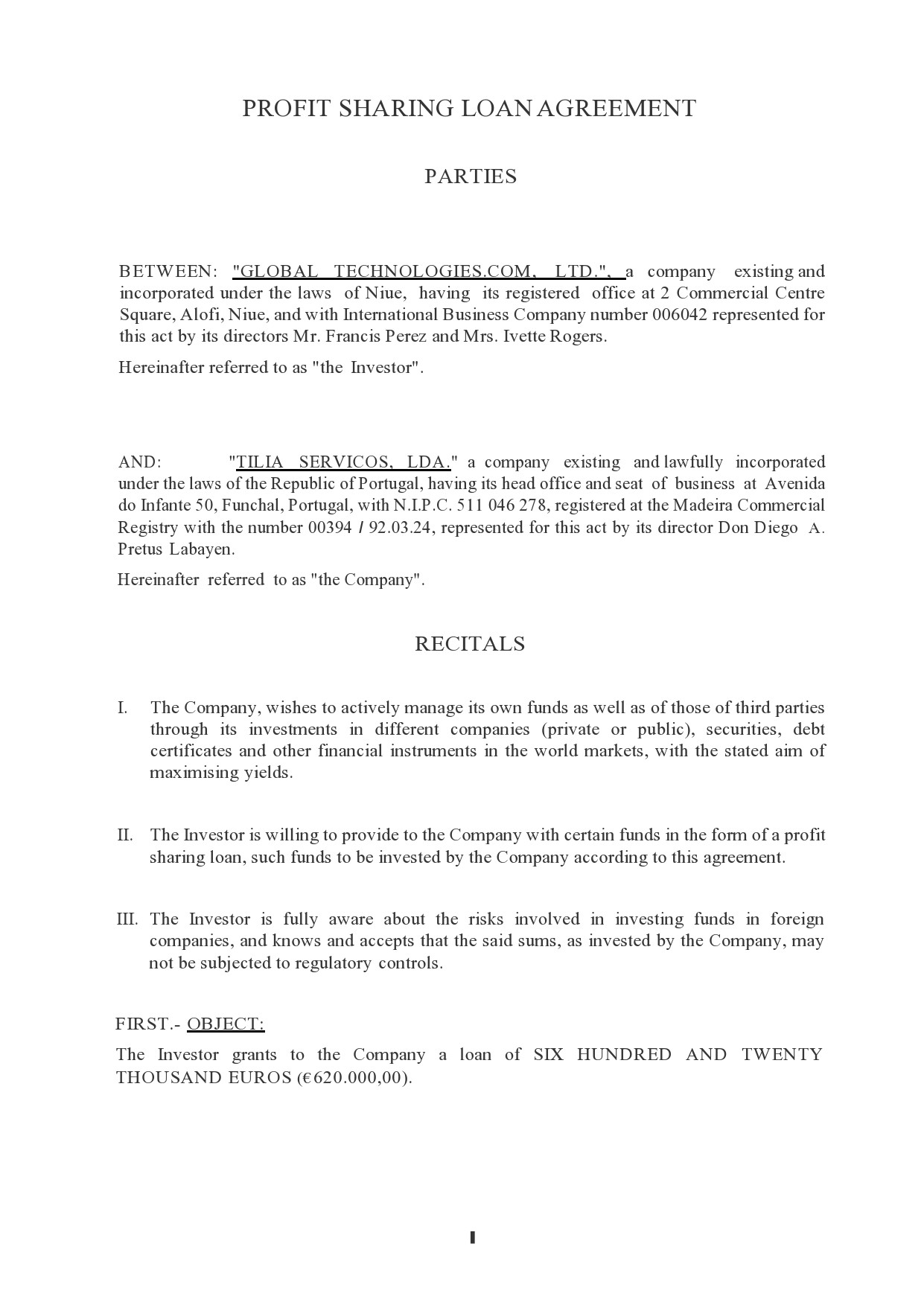

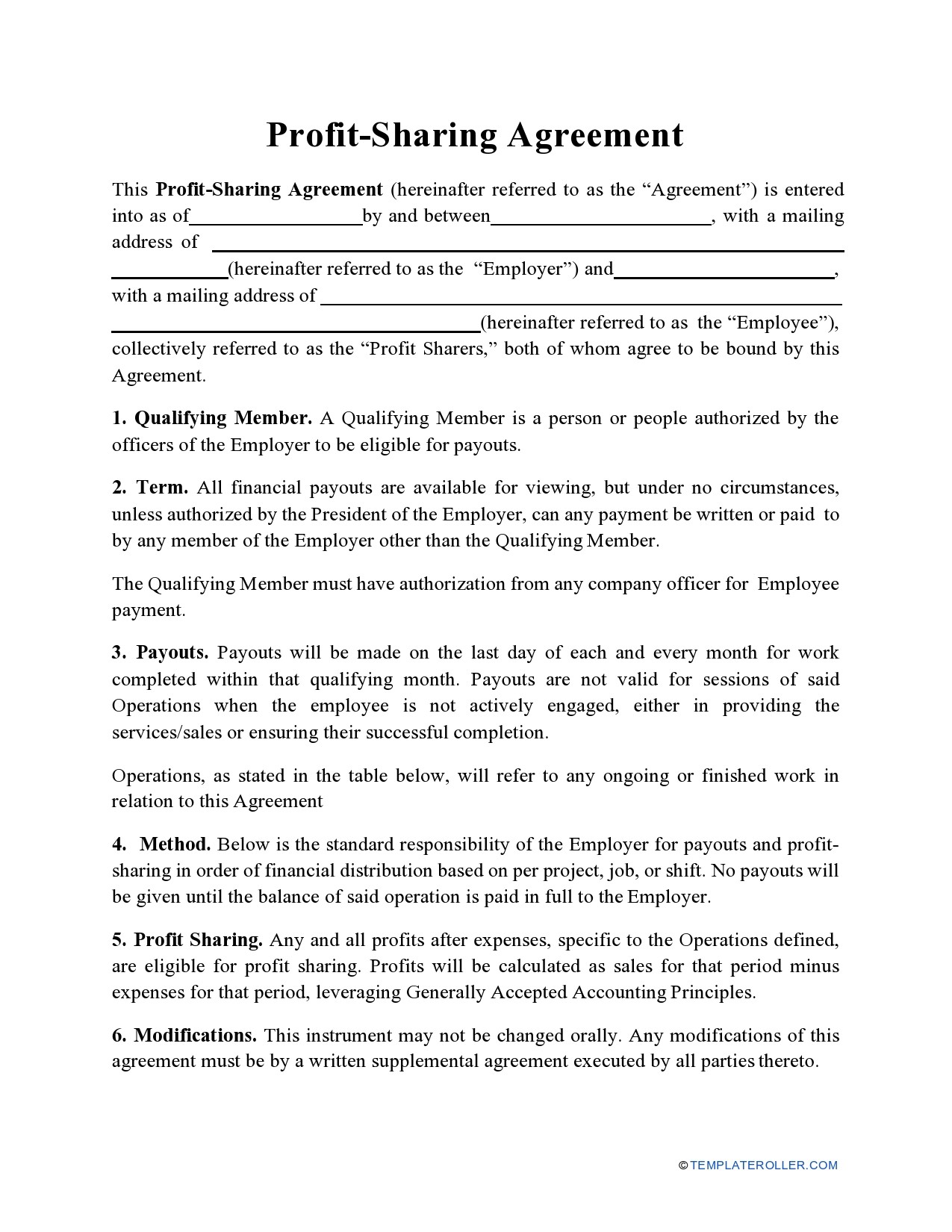

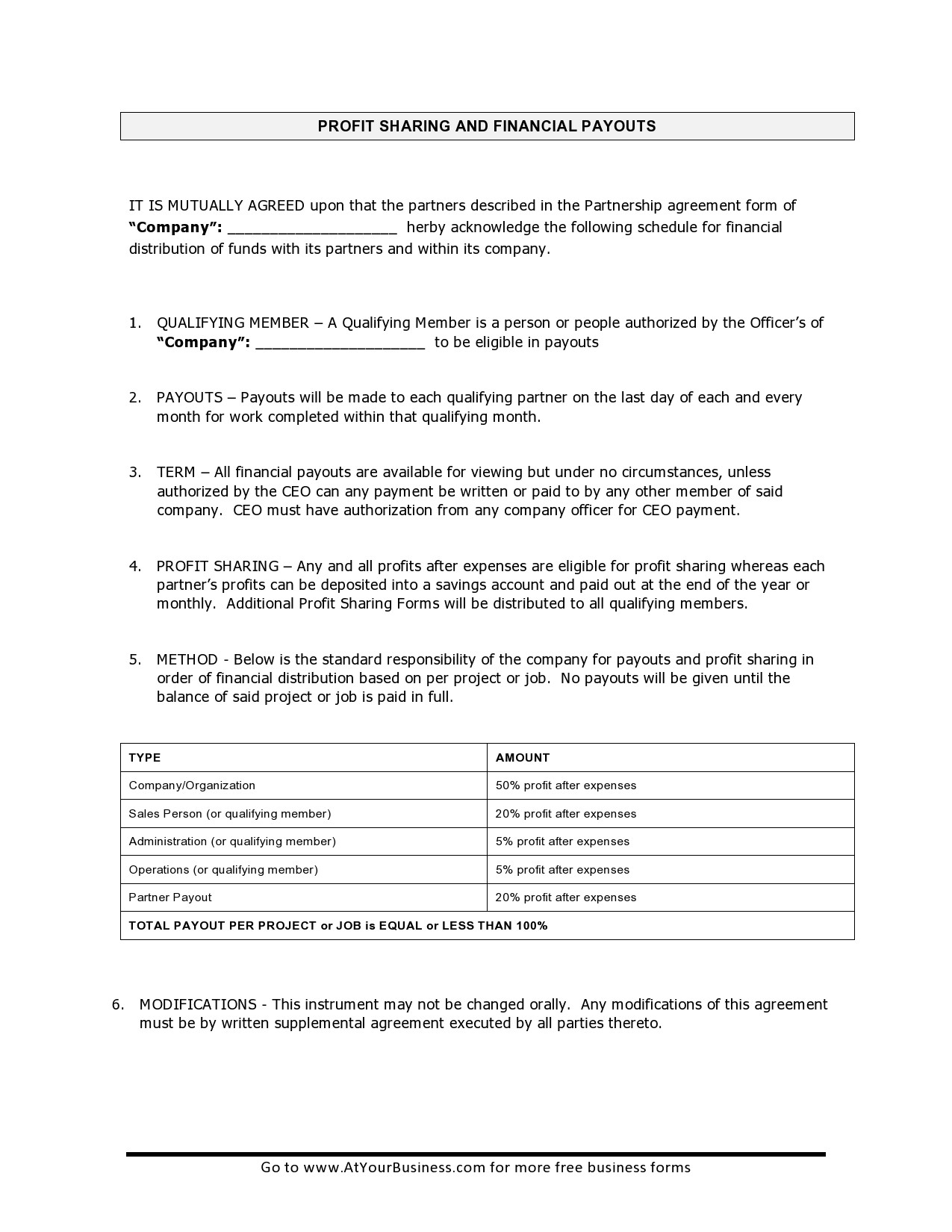

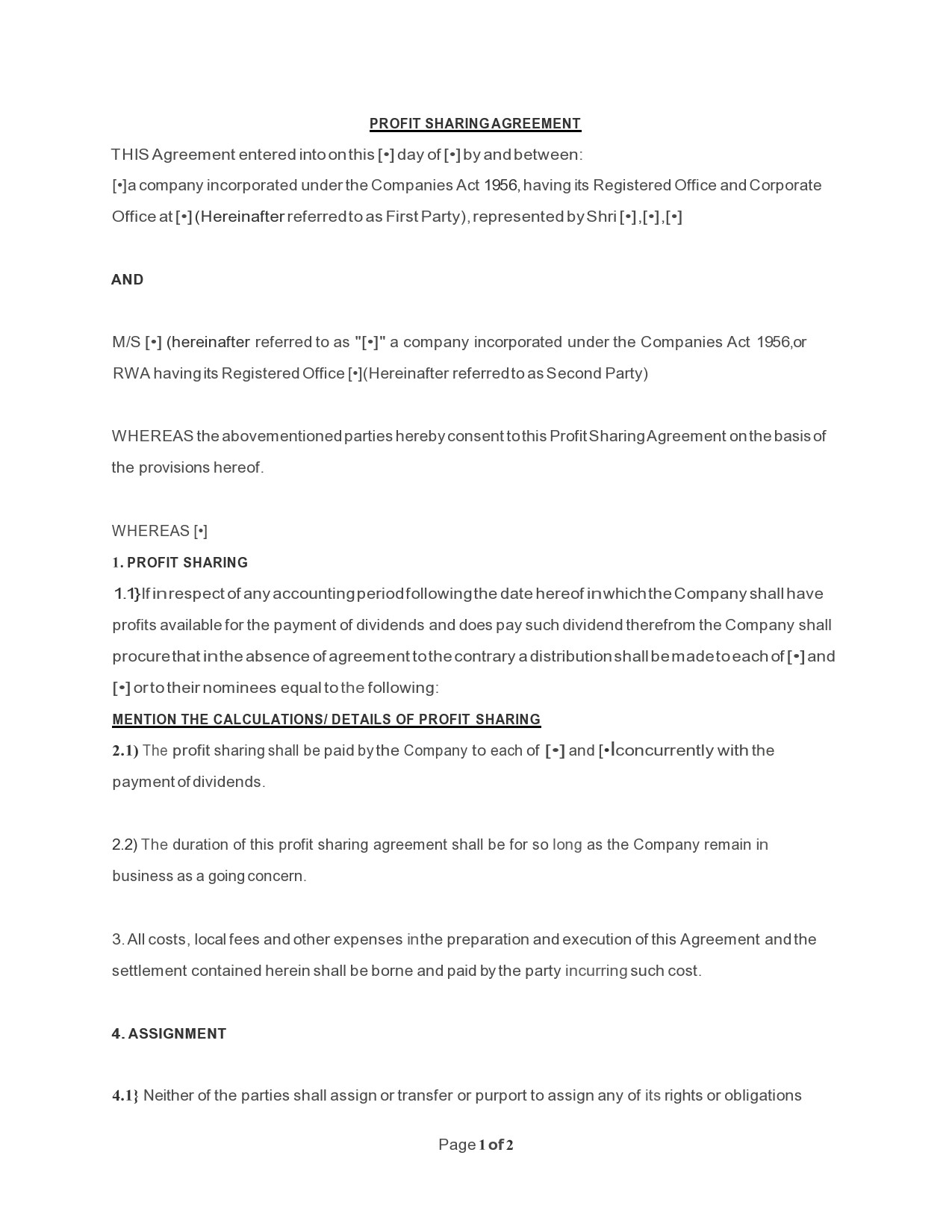

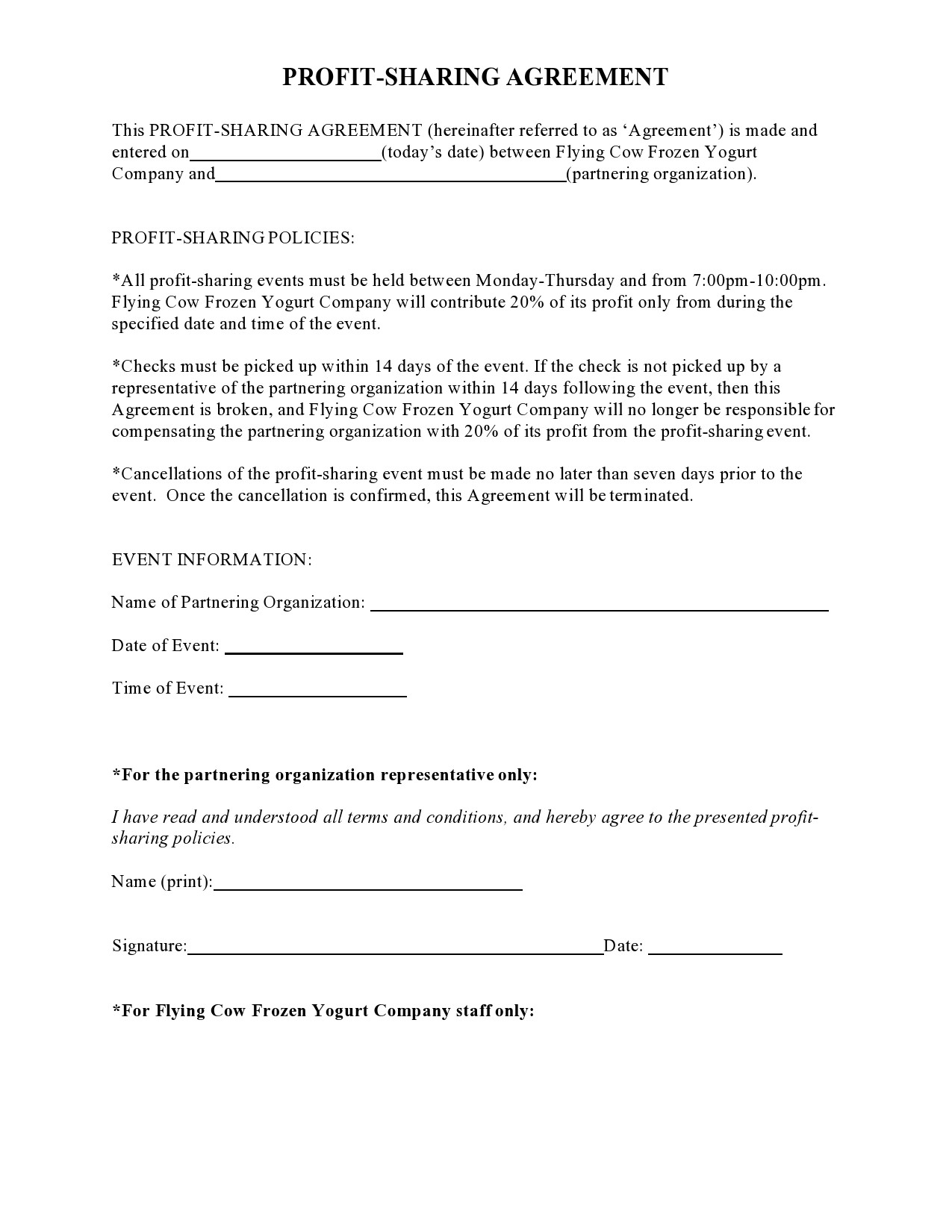

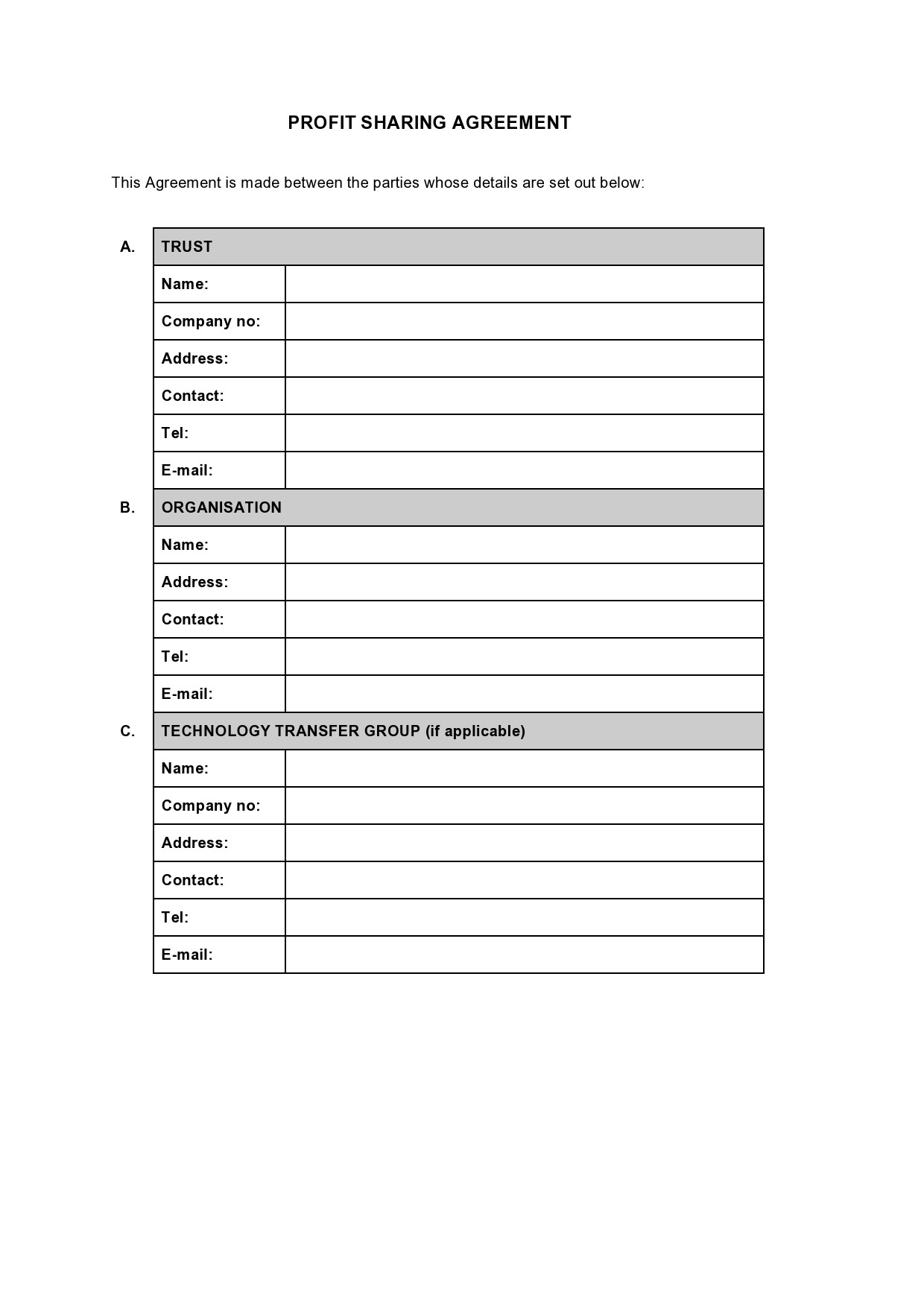

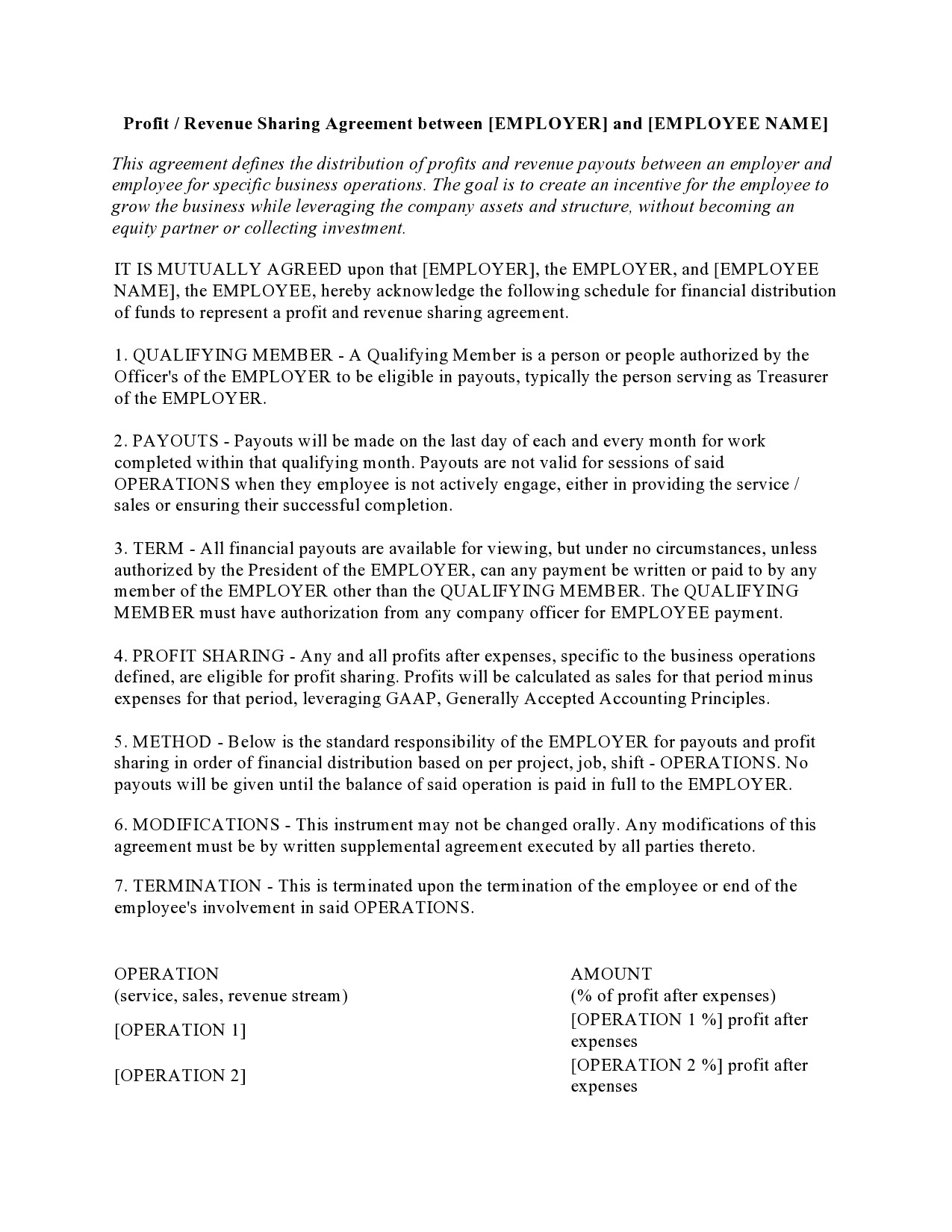

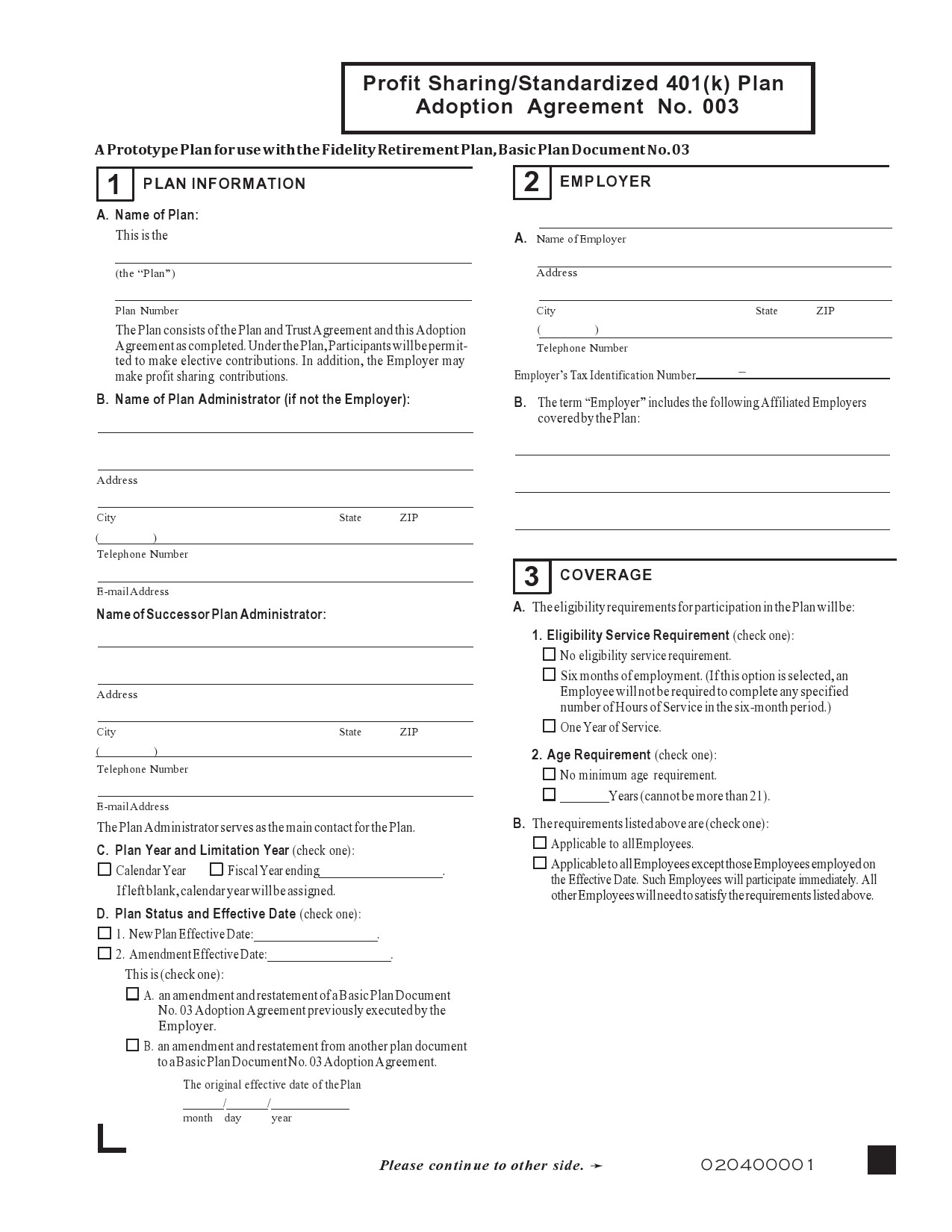

Profit Sharing Agreement Templates

What is profit sharing and how does it work?

In simpler terms, a profit sharing agreement is like a retirement plan that provides employees of a company a share of the profits. The employees under this plan will receive a percentage of your company’s profits based on its earnings.

In a way, the agreement provides your employees with a sense of ownership in your company although there are usually limitations as to how and when an employee can withdraw funds without incurring penalties.

A joint venture profit sharing agreement accepts discretionary contributions. In other words, a retirement plan with employee contributions like the 401k isn’t considered a profit sharing because your employees make contributions.

Since you as the employer will set up the agreement, you will decide how much you will allocate to each of the employees. Generally, companies that offer these agreements make adjustments as needed. For those years when you will make contributions, you must develop a formula for the allocation of profits.

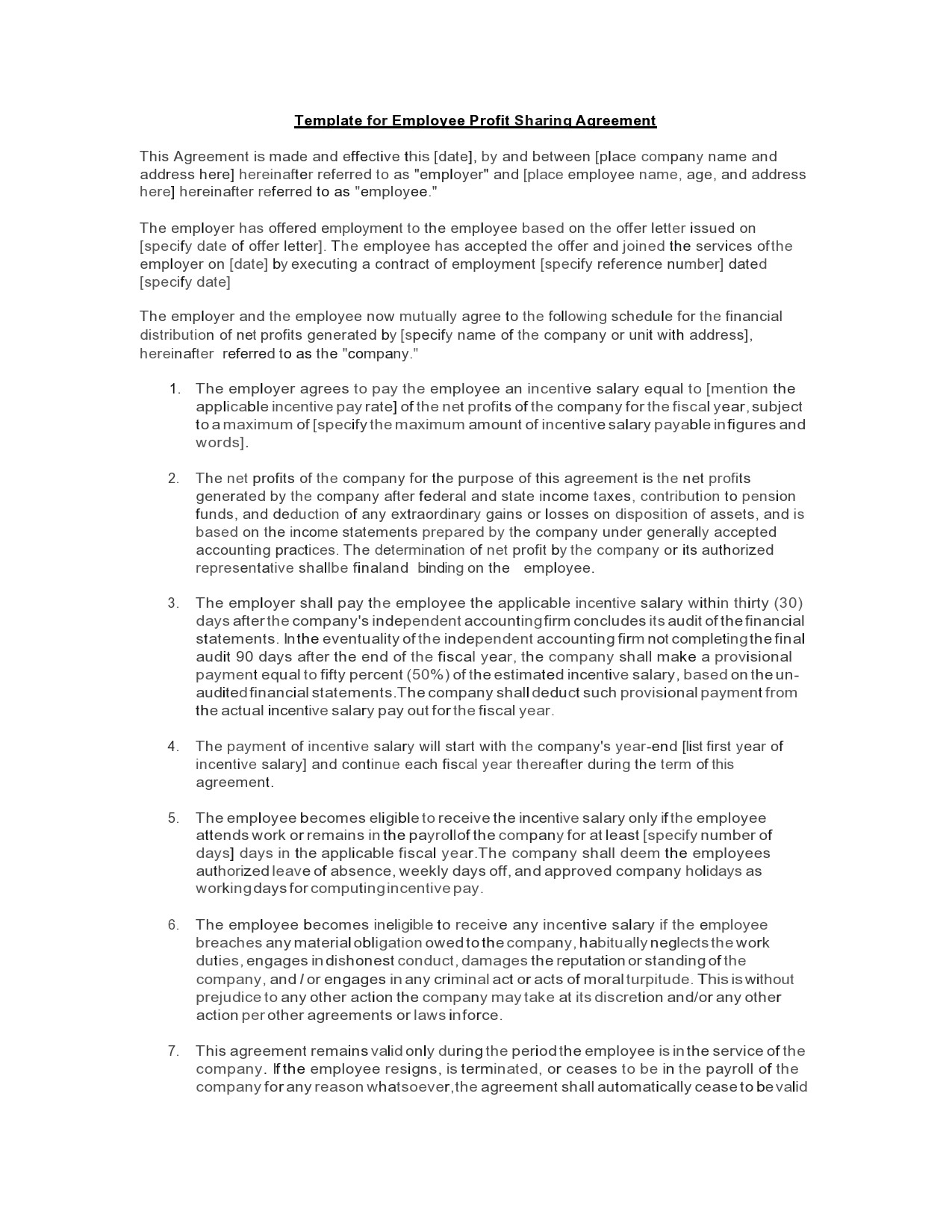

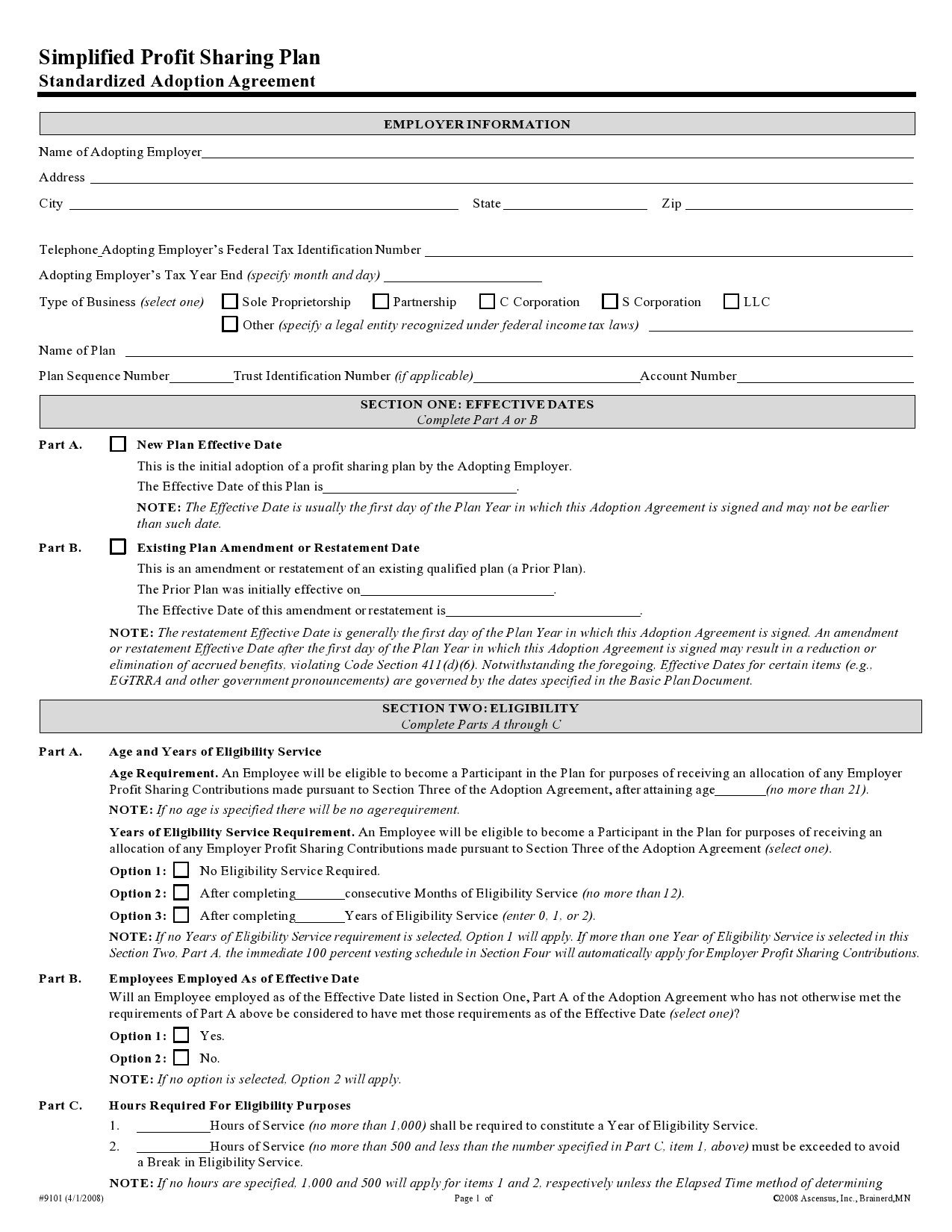

Employee Profit Sharing Agreements

When do you need a profit sharing agreement?

One of the best ways for your company to keep your employees satisfied and happy is to give them as many perks as your company can afford. Aside from the regular salaries and bonuses, you can also offer a profit sharing contract. Such perks make it easier for you to retain your employees.

For this, you have to prepare a profit sharing agreement that will specify the terms and conditions of the contract. You and your employee will affix your signatures to this agreement. This agreement can also exist between business partners, businesses, and so on.

When you make the decision that you want to share a specific percentage of your profits with your employees, you will need to come up with a formula to use for deciding the amount. In conjunction with this, you must specify that there won’t be any profit sharing if the company doesn’t make any profit at all.

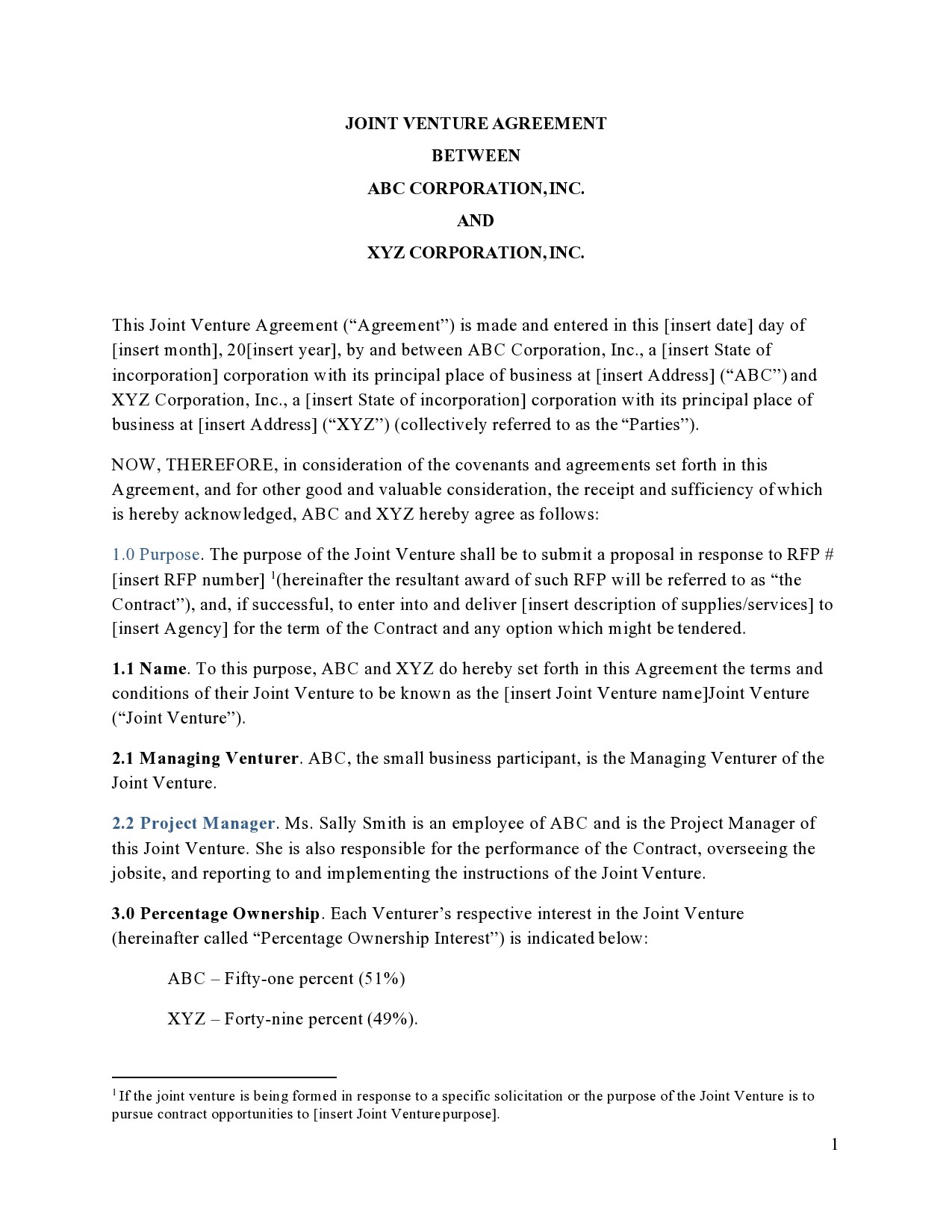

Your joint venture profit sharing agreement should incorporate all of this information in writing. Also, remember that it’s solely your company’s prerogative to determine who will receive profits. Generally, companies only select deserving employees to share profits with them.

This also applies to business partners who will enter into the same agreement. You should state the ratio to use in dividing any losses or profits. In such a case, it will also depend on how much you and your business partner have invested.

As soon as you have made the agreement, you must record the details right away. This prevents any confusion or conflicts that might arise in the future. The responsibility of drafting an agreement with precision and clarity lies with you as the employer.

But in the case of a business partnership, this responsibility lies with either of you. Either way, all of the parties must first agree on the ratios before affixing their signature to the agreement.

What is a typical profit sharing percentage?

Many consider profit sharing as a basic kind of bonus program. Companies that offer their employees an employee profit sharing agreement typically set aside a pre-determined amount. Typically, a profit percentage can range between 2.5% – 7.5% of the payroll, although this could go as high as 15% on top of the base salary.

The amount of the percentage depends mainly on the profits of your company, either from the whole profitability of your company or from a specific line of business that is part of your company. There are also instances where you may give profits across the board. Sometimes, you can even give larger percentages the more an employee makes.

In another aspect, one of the main purposes of a joint venture profit sharing agreement is to encourage employees to see how their work can influence your company’s performance so that it can improve its profitability. Employees need to learn how your company earns money and how their employment can help it make more.

Employees can get an idea of how your company performs through yearly reports and other official statements. Reading these will also give their superiors the impression that they’re showing a genuine interest in your company’s performance.

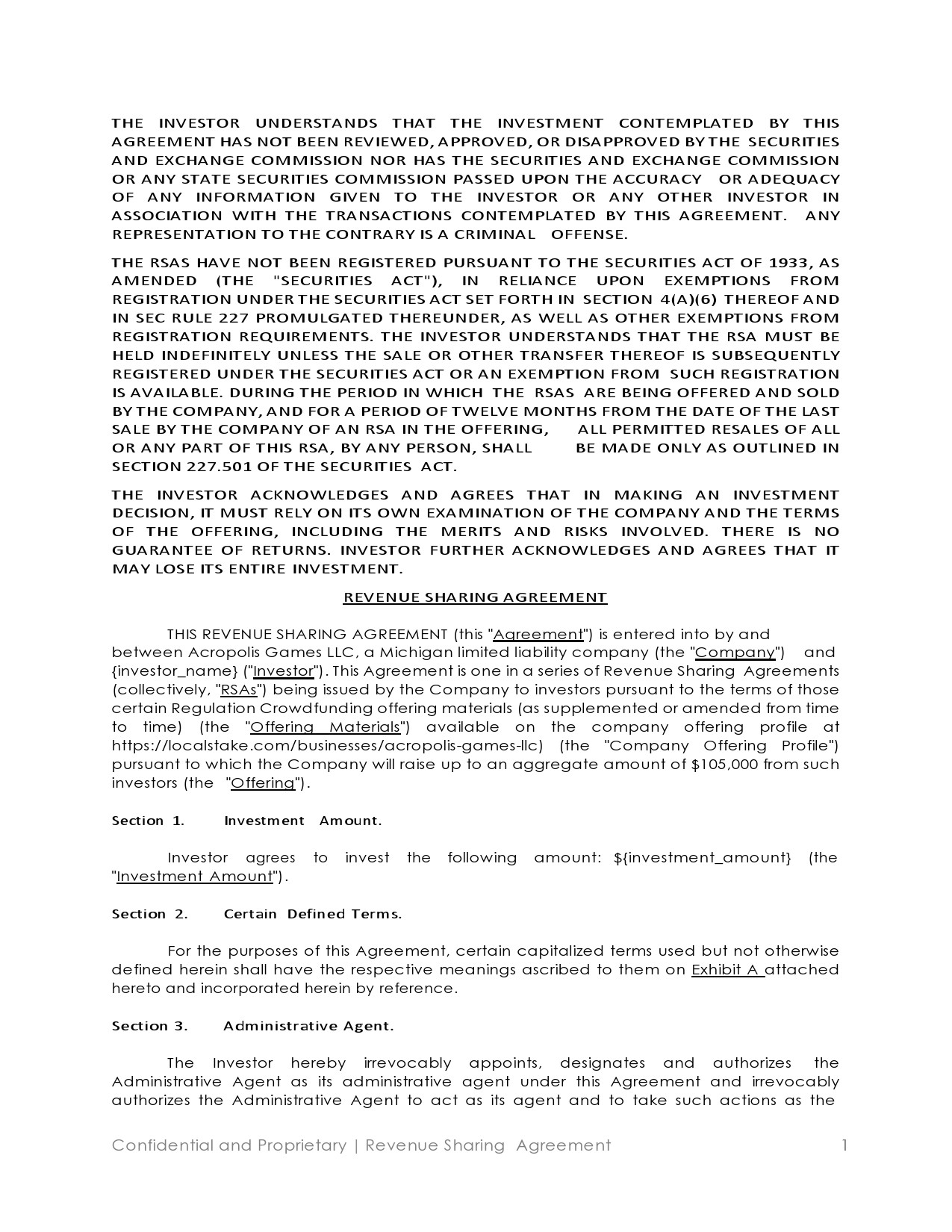

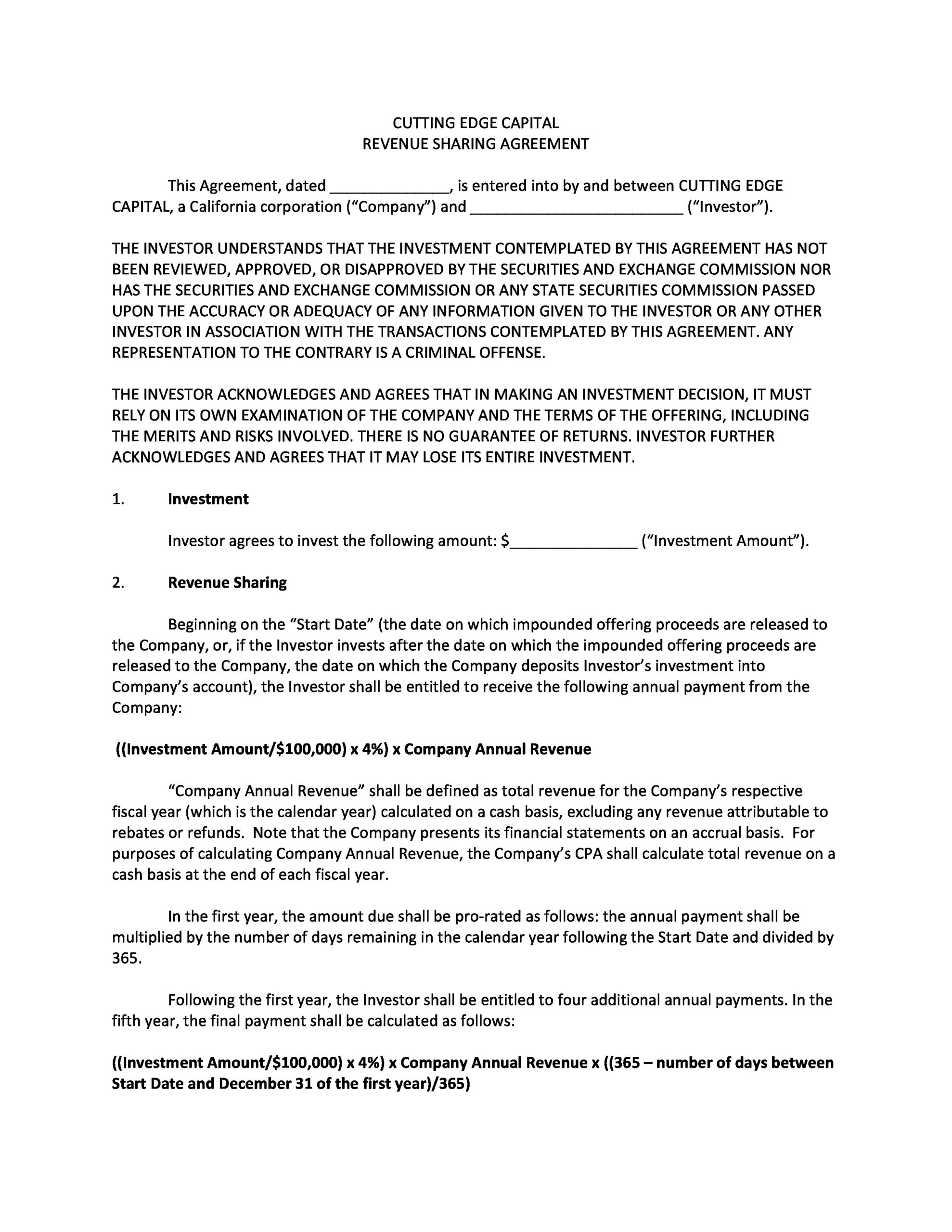

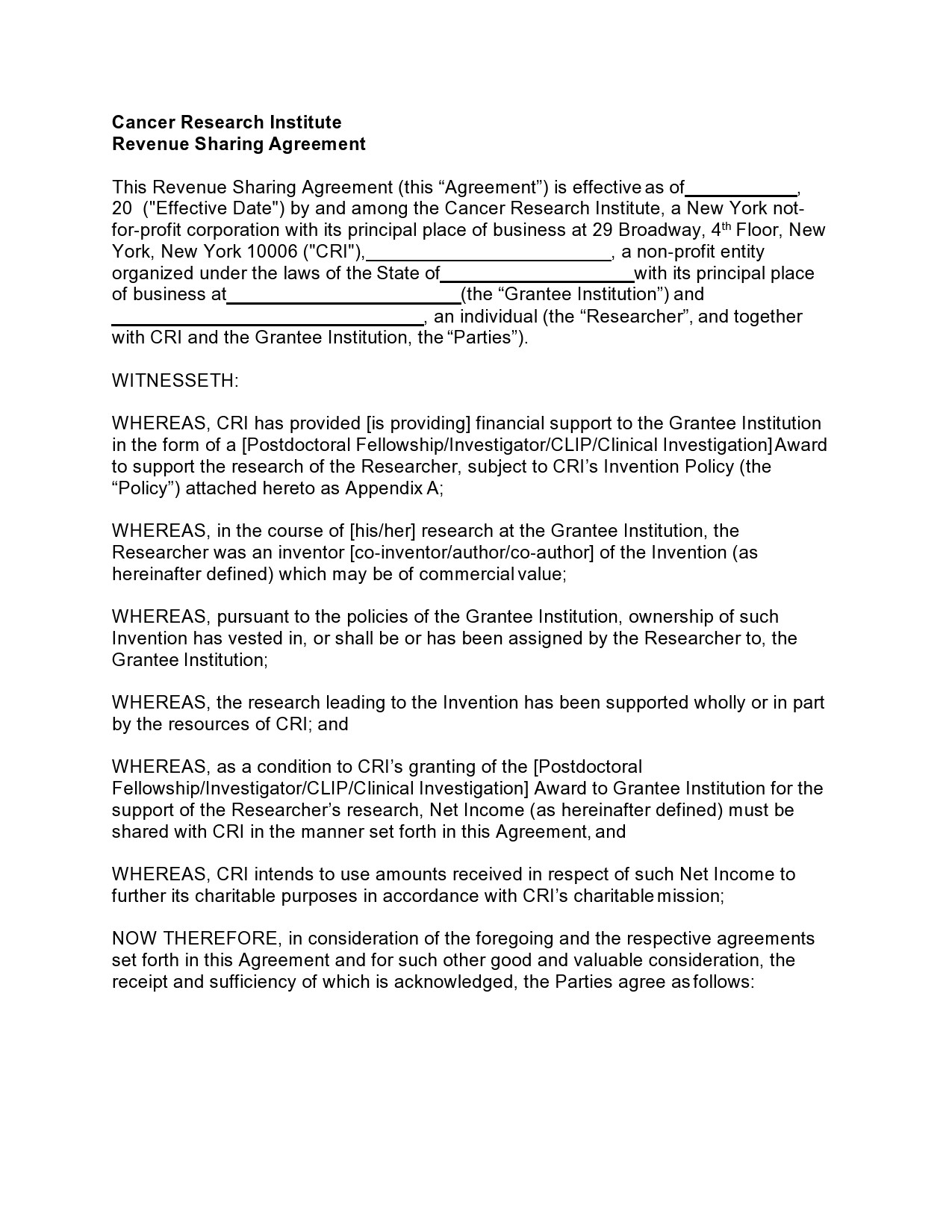

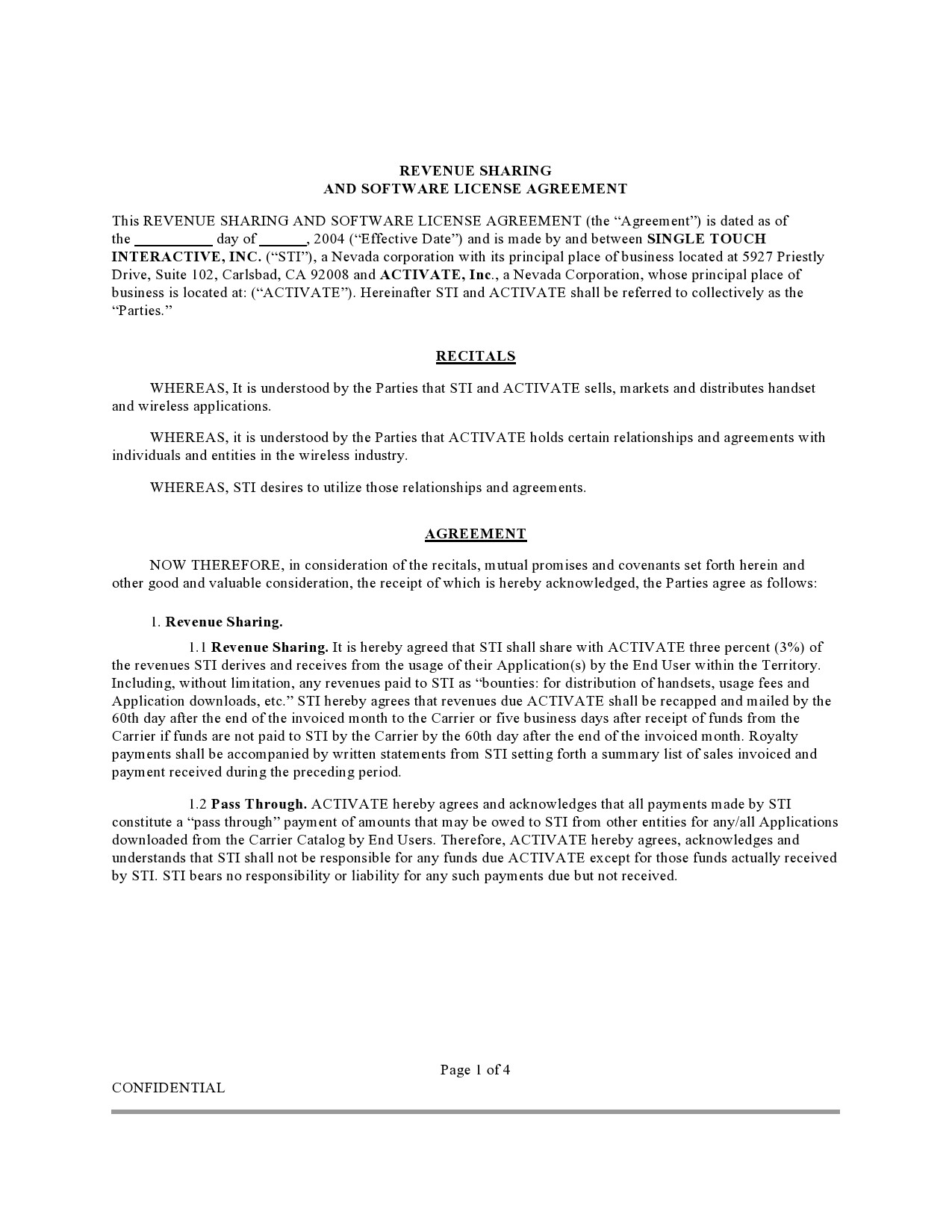

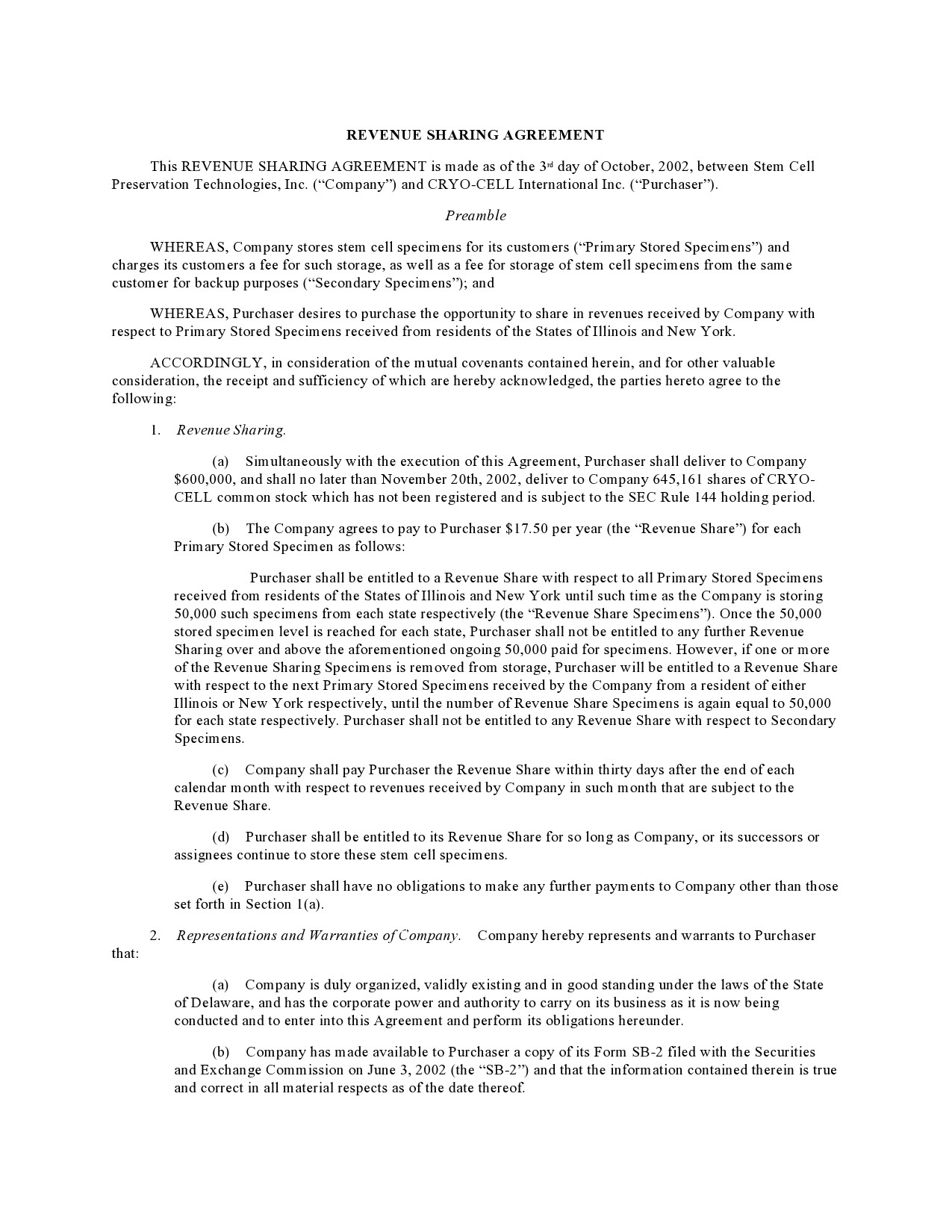

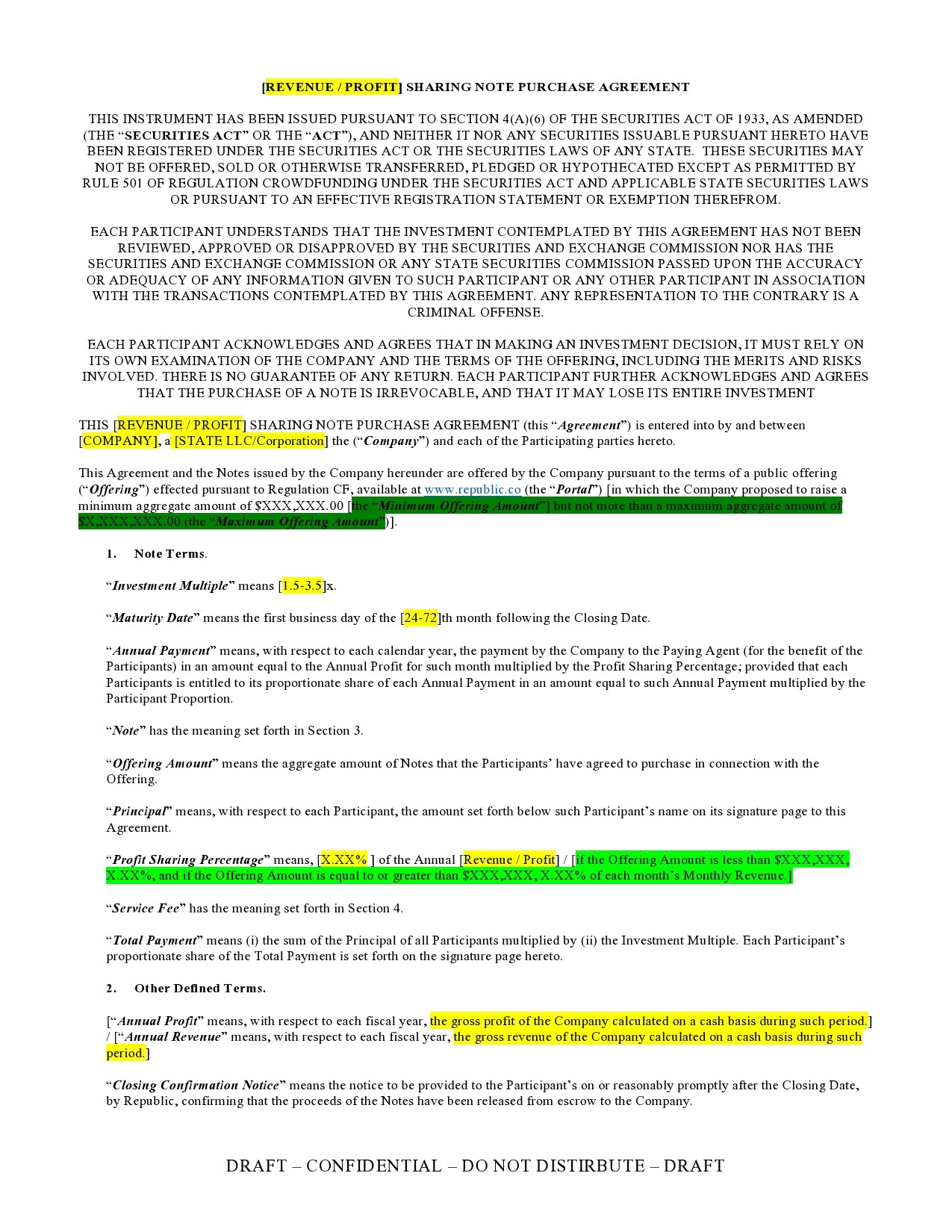

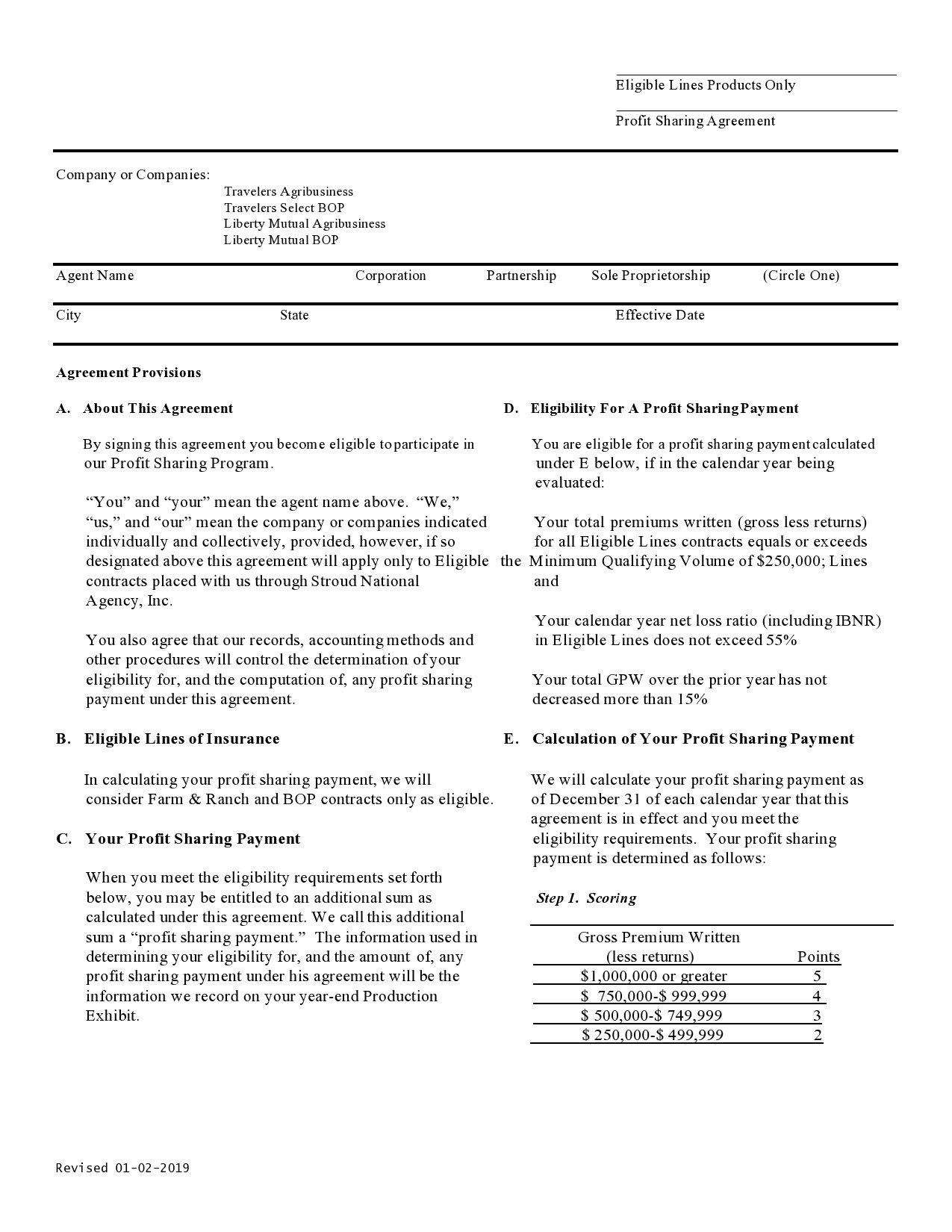

Revenue Sharing Agreement Templates

How do you split profit sharing?

Determining partnership profits in any business when not handled well from the onset, can lead to a lot of strain. It’s important that before you start a business agreement with one or more partners, you have to make sure everybody will agree on the structure of the business first.

This can have a huge impact on the profit sharing agreement template and on partnership profits too. It will also affect the resources and time that each partner will contribute to the partnership. When it comes to dividing partnership profits, there really is no wrong or right way to do it.

What will work for your business is the “right way.” For instance, you can decide to pay the individual partners a base salary then split the profits equally. Your revenue sharing agreement template can also indicate a percentage of the profits based on the resources and time that each partner contributes to the business.

For a 50-50 partnership, you should know that it is legally required for one partner to get the approval of the other on any matters related to the business. When all partners are in agreement with how the profits will get divided, it is now time to make it official by putting the agreement in writing.

It’s recommended that all partners should meet with an accountant to make sure that everybody understands the tax ramifications of every decision you make. Finally, make it a point to go back to the agreement to make sure that everybody is still on board with the terms and conditions.

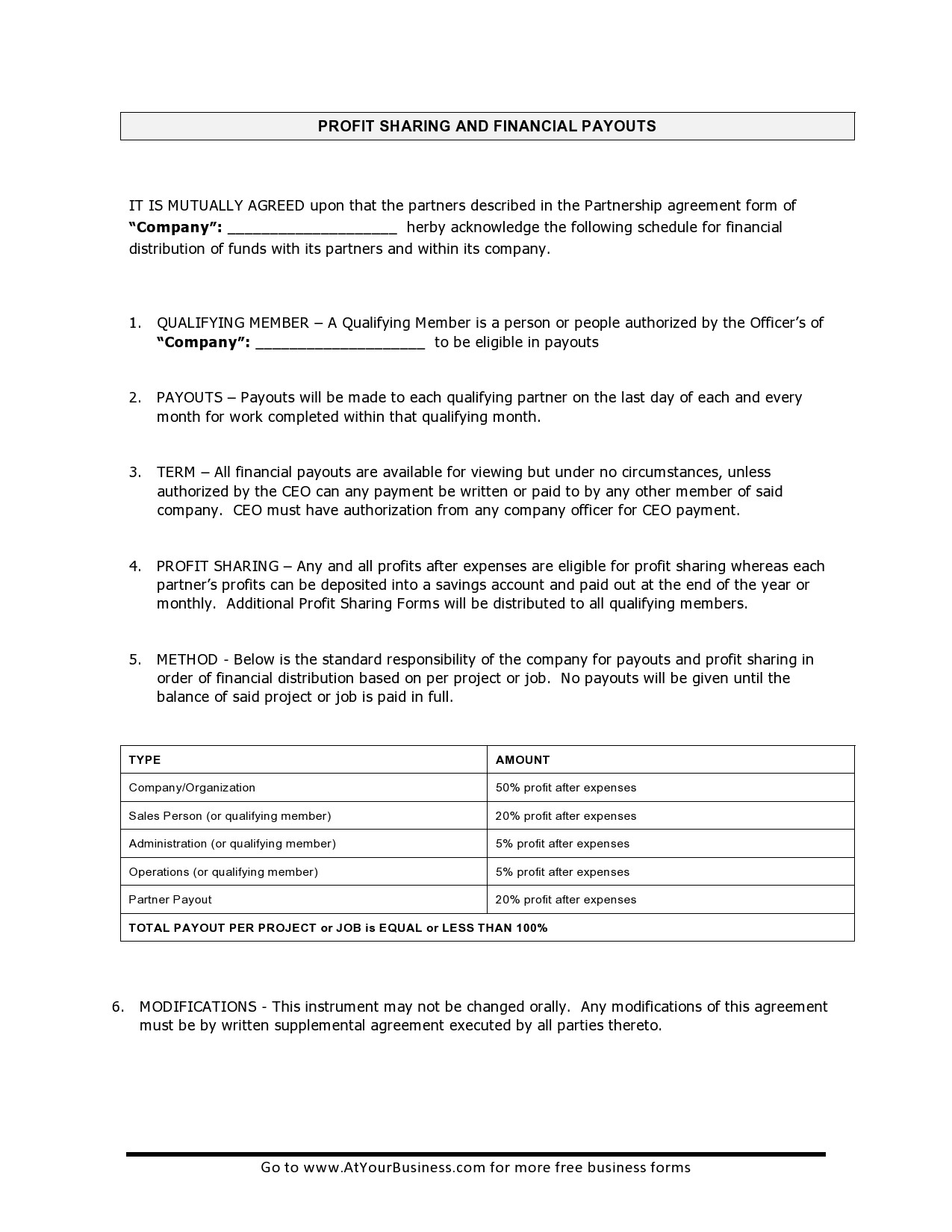

What to include in a profit sharing agreement?

Every profit sharing agreement should include all the basic details of the involved parties. These, of course, are the complete names, business addresses, roles in your company in case of an employee profit sharing agreement, contact details, and other relevant details too.

Moreover, in a very comprehensive way, the agreement should also include how you will calculate the profits for each person and how you will share these. Profits can come in the form of stock, bonds, or cash. Every company has its own ways depending on which model it prefers to use.

You must mention all of these details in the revenue sharing agreement template. Another important aspect of profit sharing that you should clearly express in the agreement is the timeline of when you will share the profits.

It is also important to add a clause in the agreement where it will categorically mention that in the absence of any profit made by your company, the employees won’t receive profits. Here is a list of what you should include in this very important agreement:

- The basic details of all the parties involved in the agreement.

- The profit-sharing formula or ratio.

- Any other pertinent details about how you will calculate the profits.

- The timing of profit sharing.

- The Time-period that you will consider for calculating profit. Usually, companies do this yearly.

- Any other important clauses.

- Details regarding any exceptional cases.

- Details regarding taxes.

- Details regarding any crucial conditions that might apply.

In most cases of these agreements, the items in this list are all crucial inclusions. For partnerships, however, there may be more inclusions. For instance, you may have to add details about how you will divide the losses.

Profit Sharing Contracts

Drafting the agreement

The process of determining the contributions in a profit sharing agreement requires a lot of caution and administrative work. When you as the employer make such an important promise and decision, you should follow it diligently to maintain the trust of your employees. As you think about how to make your profit sharing contract, consider these two common methods:

- Retirement Plan Deferrals

This is more commonly known as the “Profit Sharing Plan.” Here, a percentage of your employee’s profits go into a retirement account or a qualified tax-deferred retirement account, where employees can get their share when they leave your company. - Profit Sharing as Base Compensation

In this case, your employees cannot take their share with them when they leave the company before profits get distributed. These are some of the more important details that you need to include in your profit sharing agreement template and discuss with your employee before entering into the agreement. You should use simple language in the agreement so that the employees will understand its terms and conditions.

Employees who are part of a profit sharing program can decide how they want to divide the profit and to whom. There is no scope for negotiations on this aspect although there are some employees who can talk to their superiors to request that they get included in the plan. This depends on the type of contribution an employee holds in your company.