Investors are always in search of companies to invest their money in for profit. Once the investors have found such prospects, they would enter into an investment contract with said company. This agreement formalizes the transaction between an investor and your company whereby investors will acquire an ownership interest in your company in exchange for some type of investment.

Table of Contents

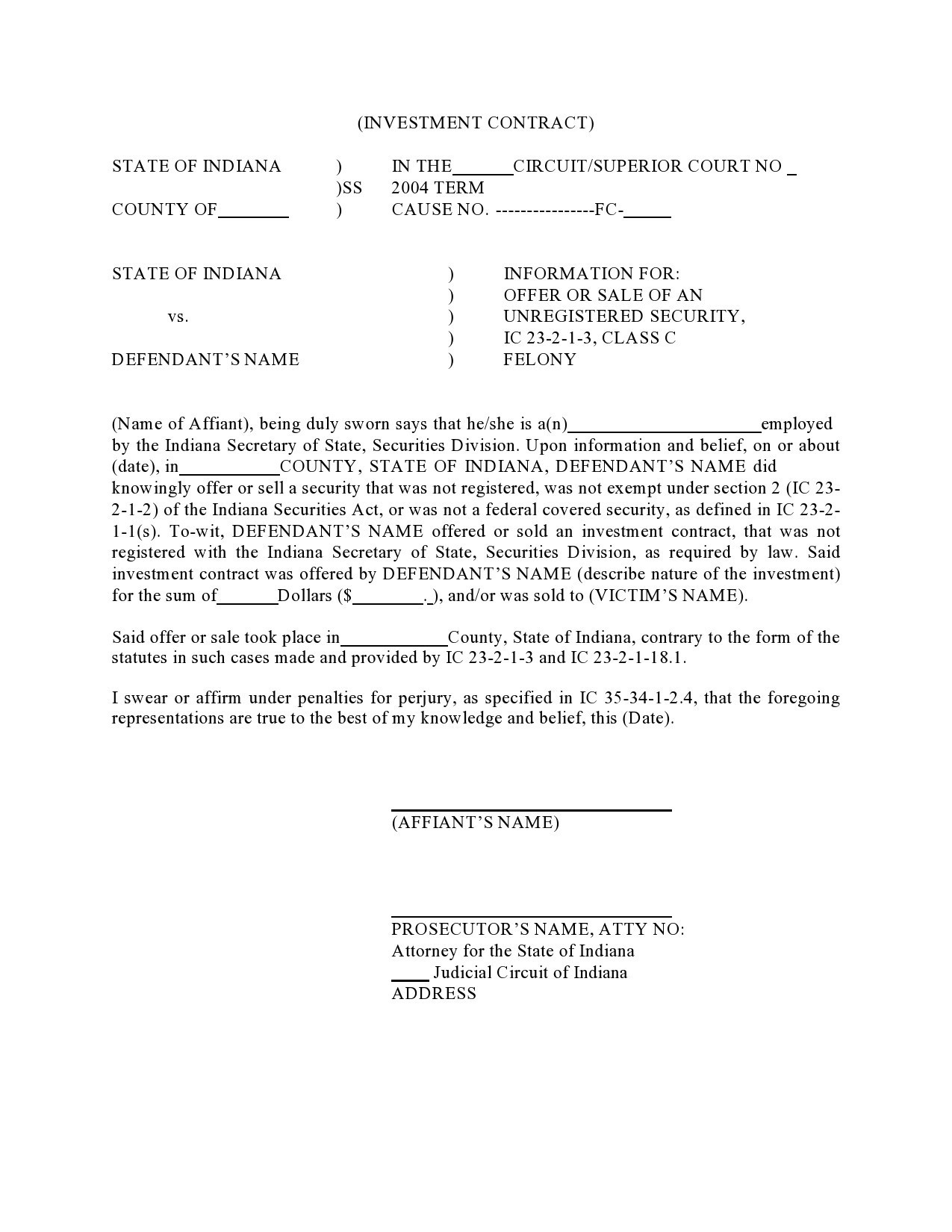

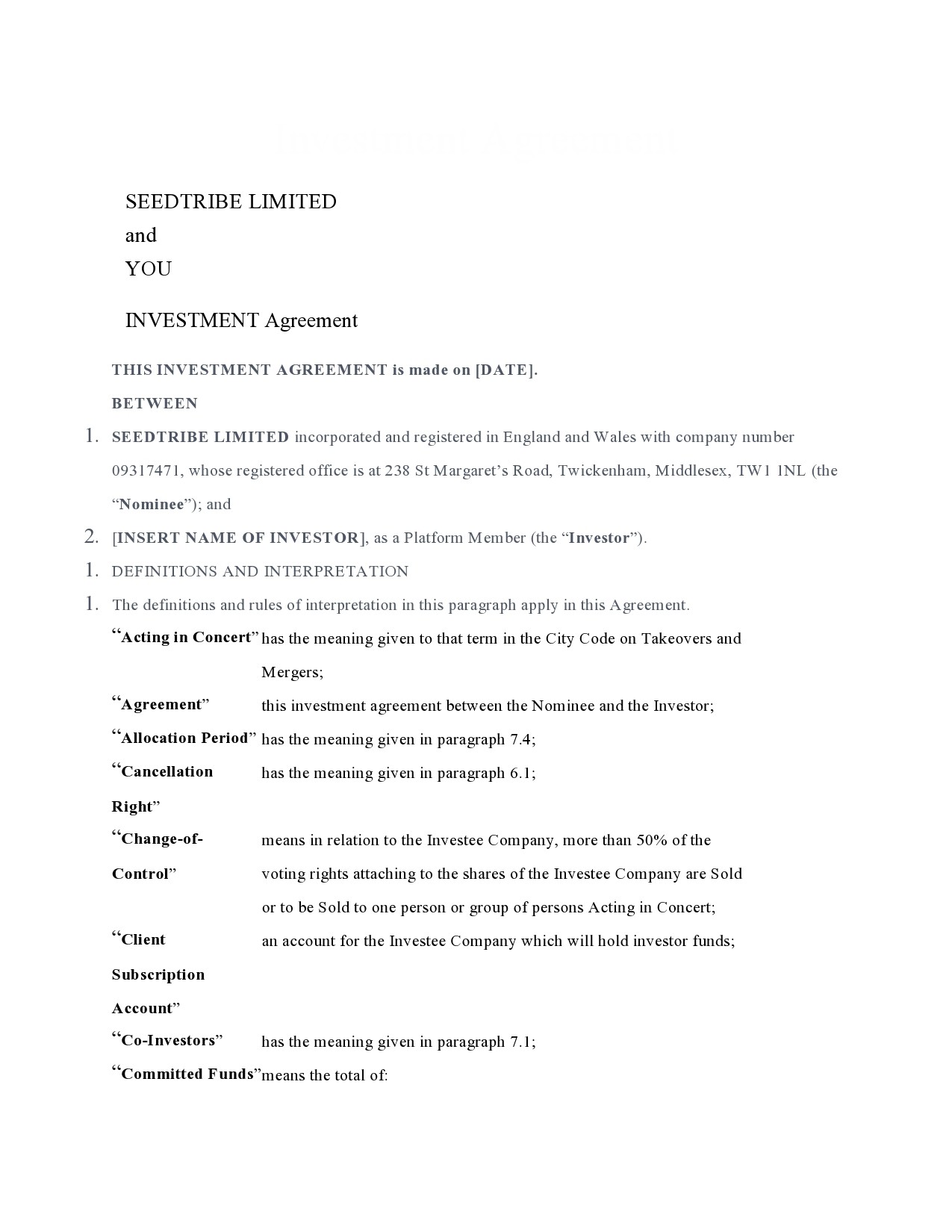

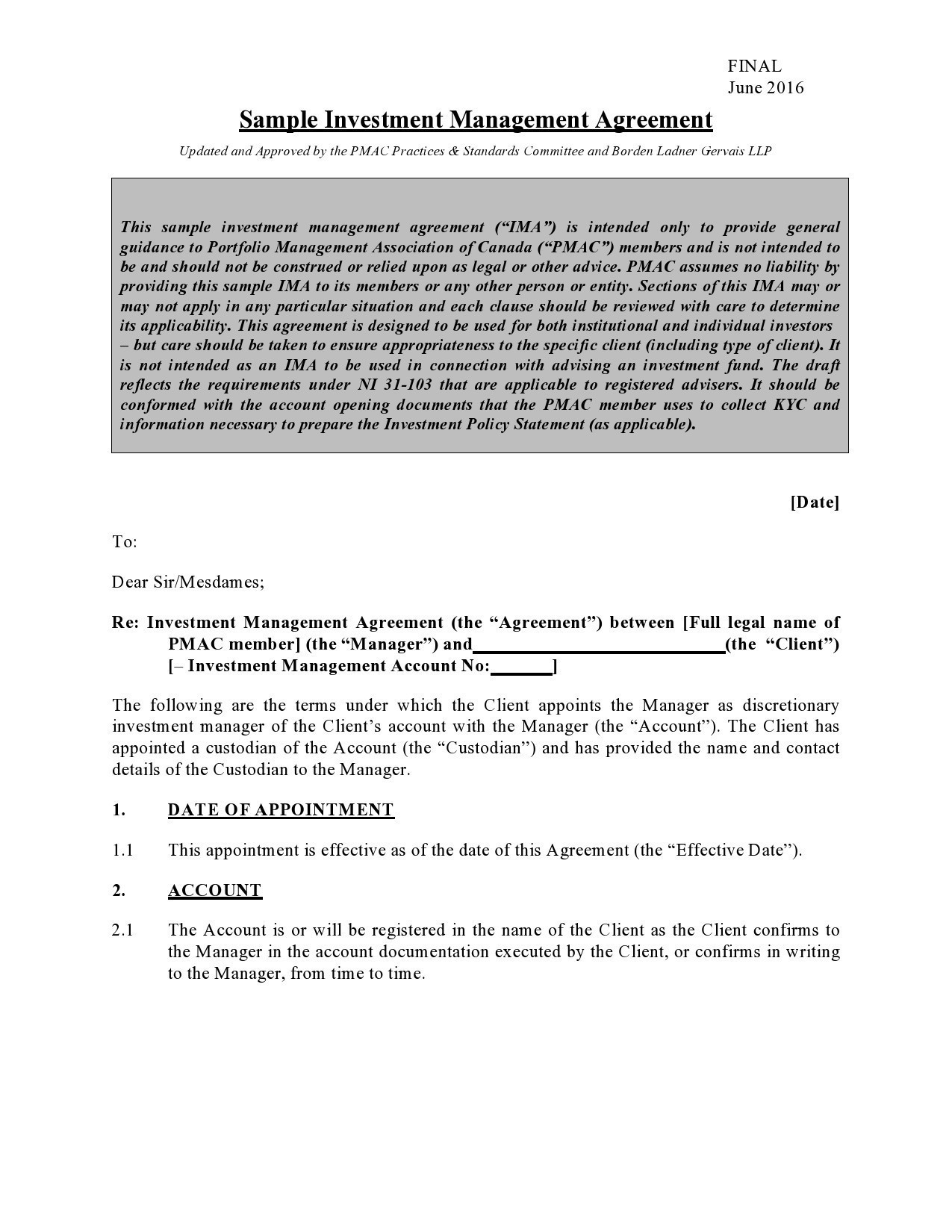

Investment Contracts

What is an investment contract?

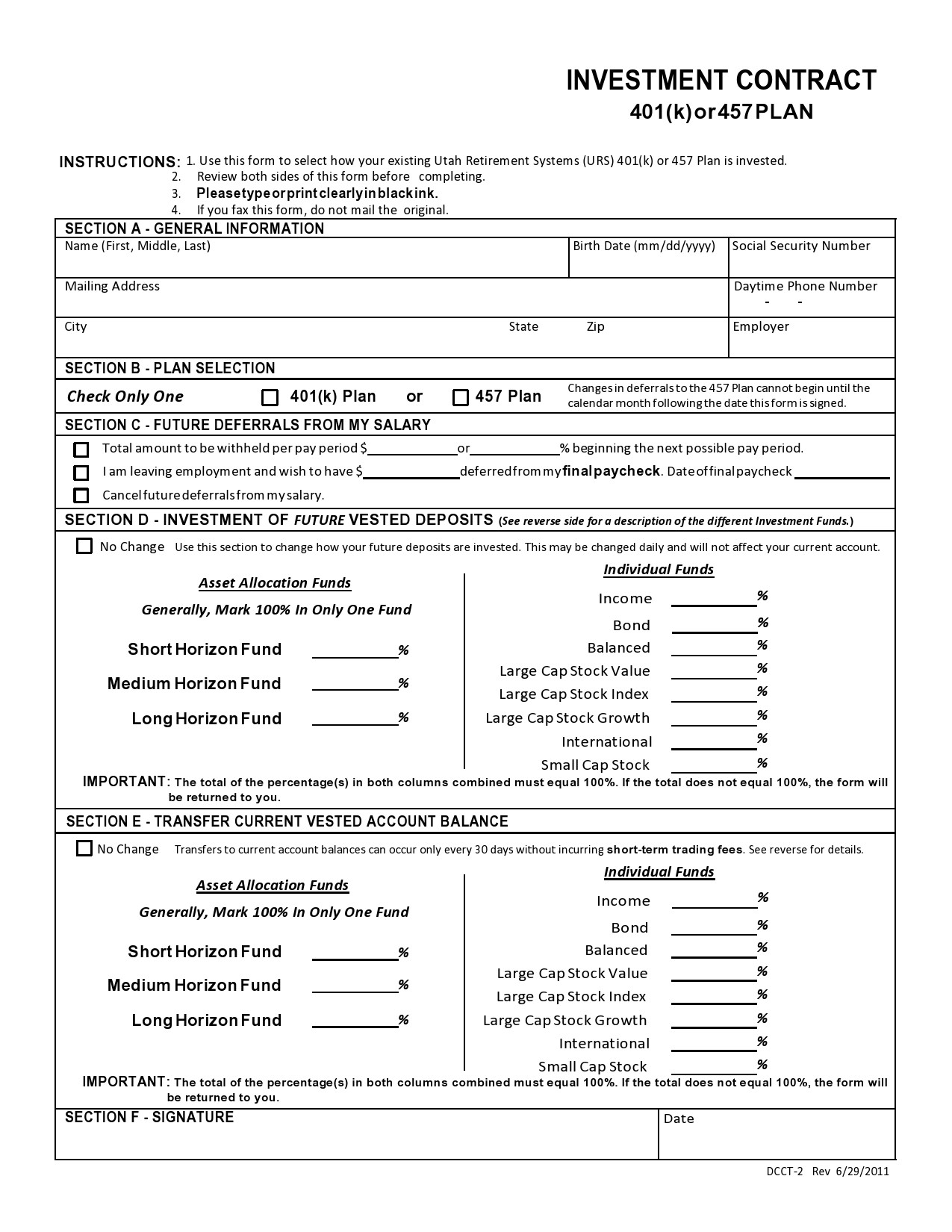

In an investment contract, you indicate the principal amount that the investor has put into your company. They can make these payments in installments or as a lump sum. Generally, investment refers to the total amount of money that an investor has contributed.

Investors should know what’s indicated in your investment contract sample. The reason for this is that any amount they withdraw from an annuity in excess of their investment will part of tax distribution.

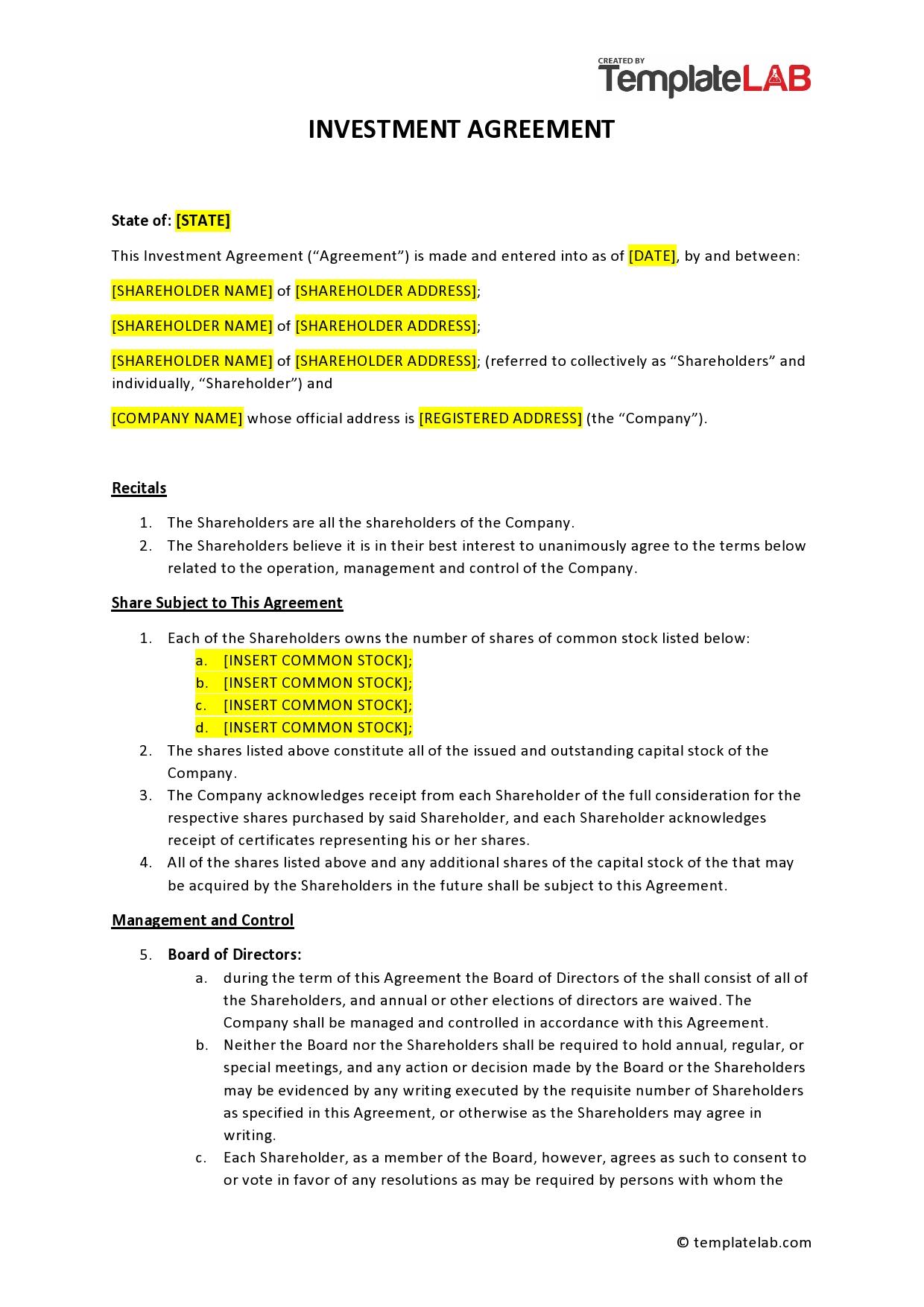

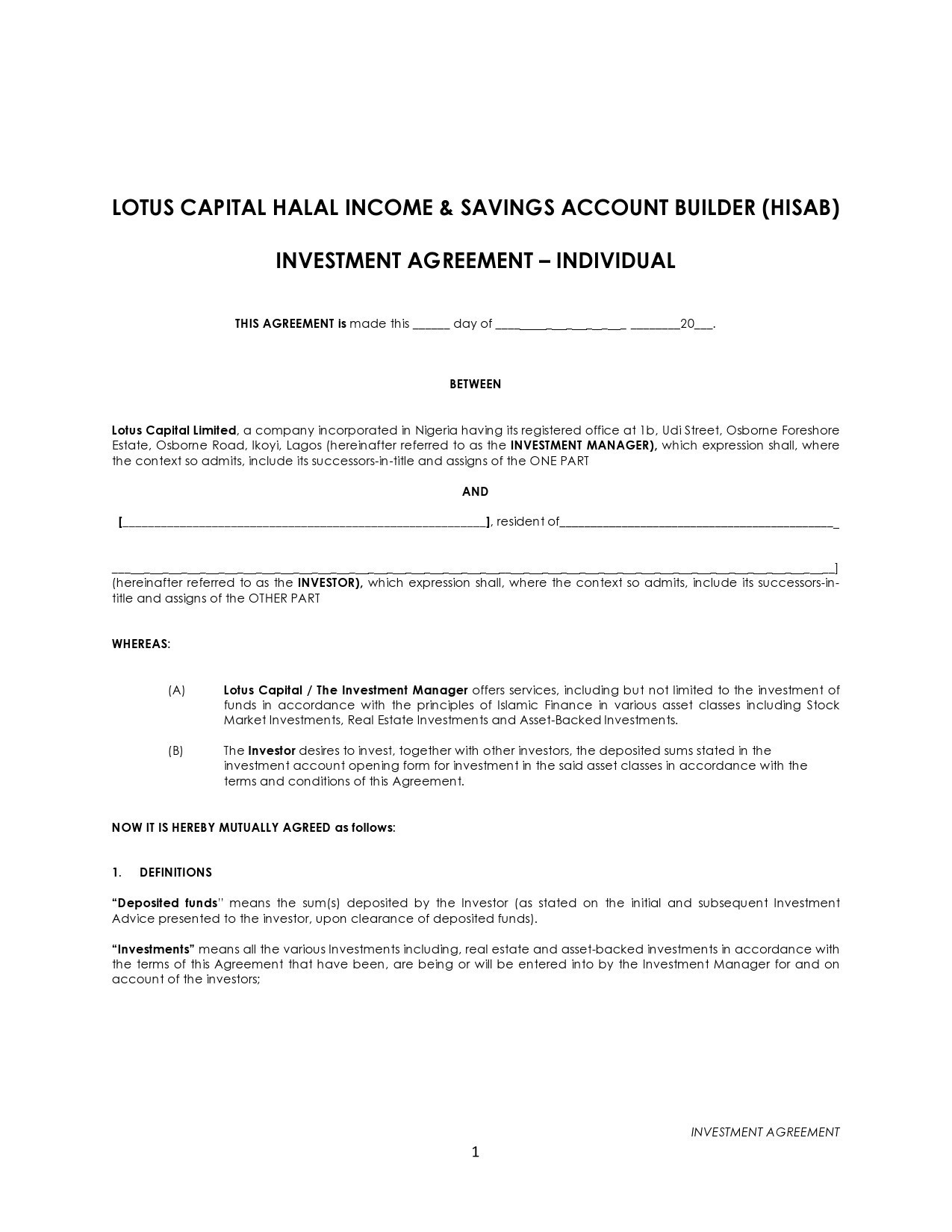

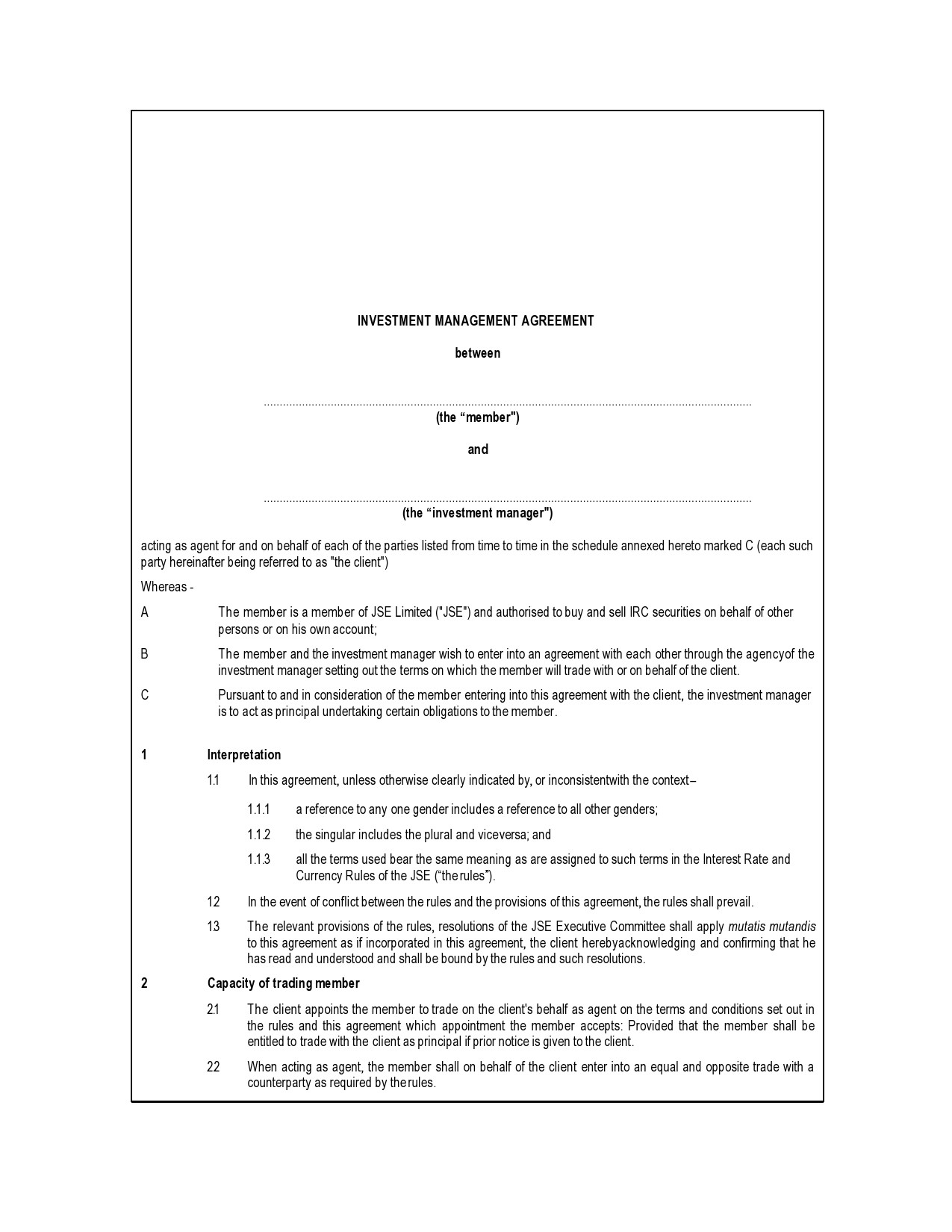

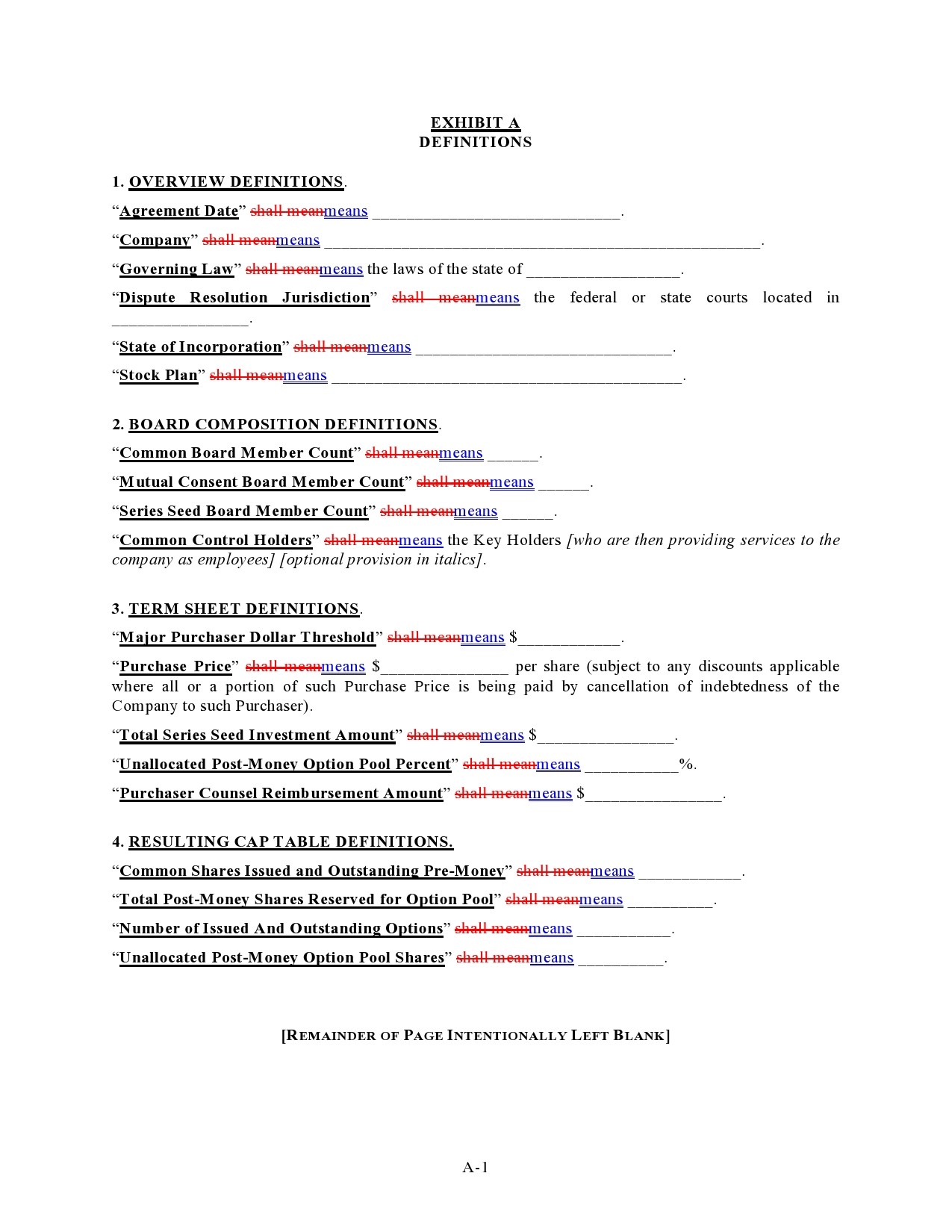

Investment Agreement Templates

What to include?

Even if you own a small business, you may use an investment contract if:

- You’re interested in investing in another business.

- You’re bringing investors from outside your company into your business.

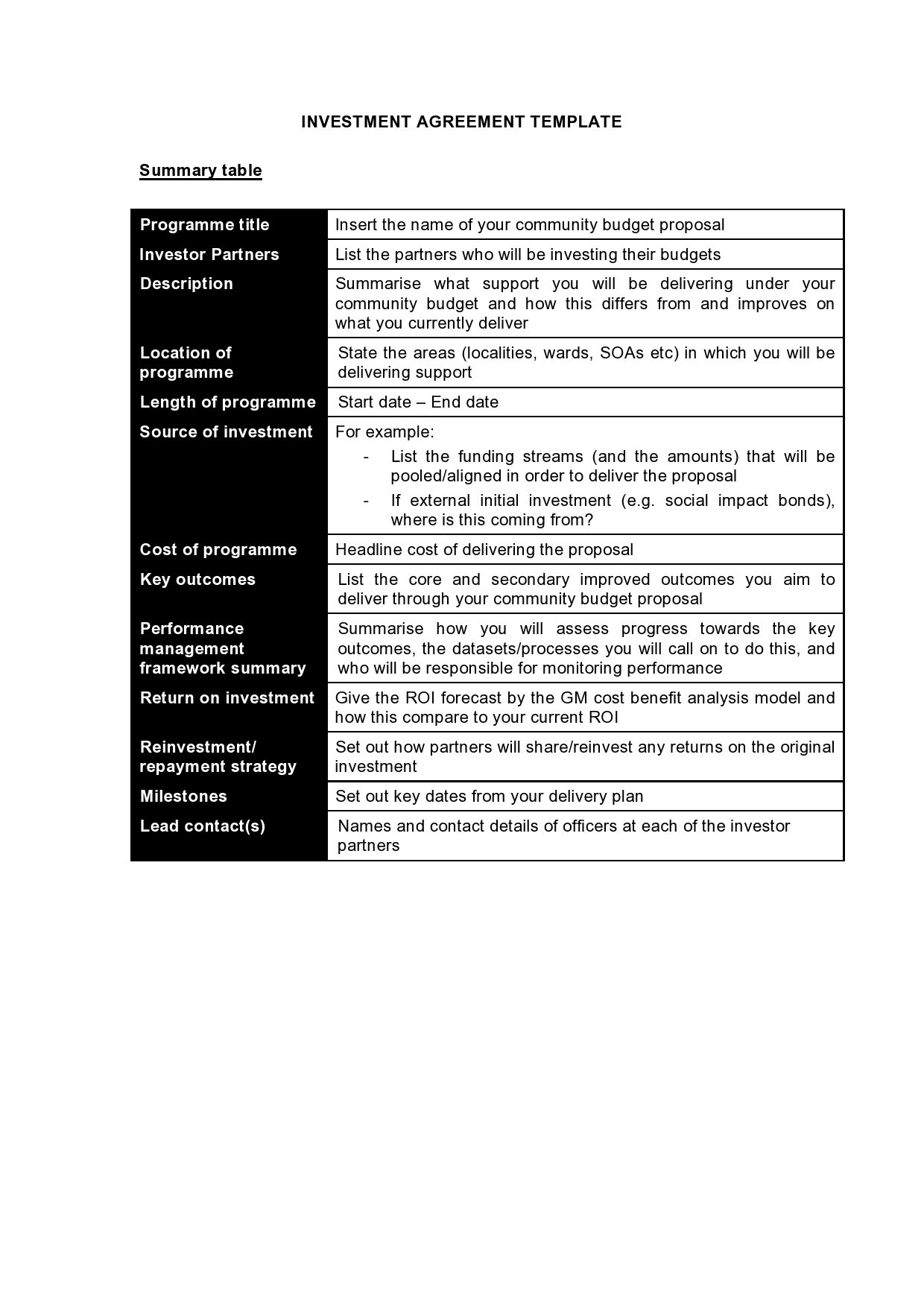

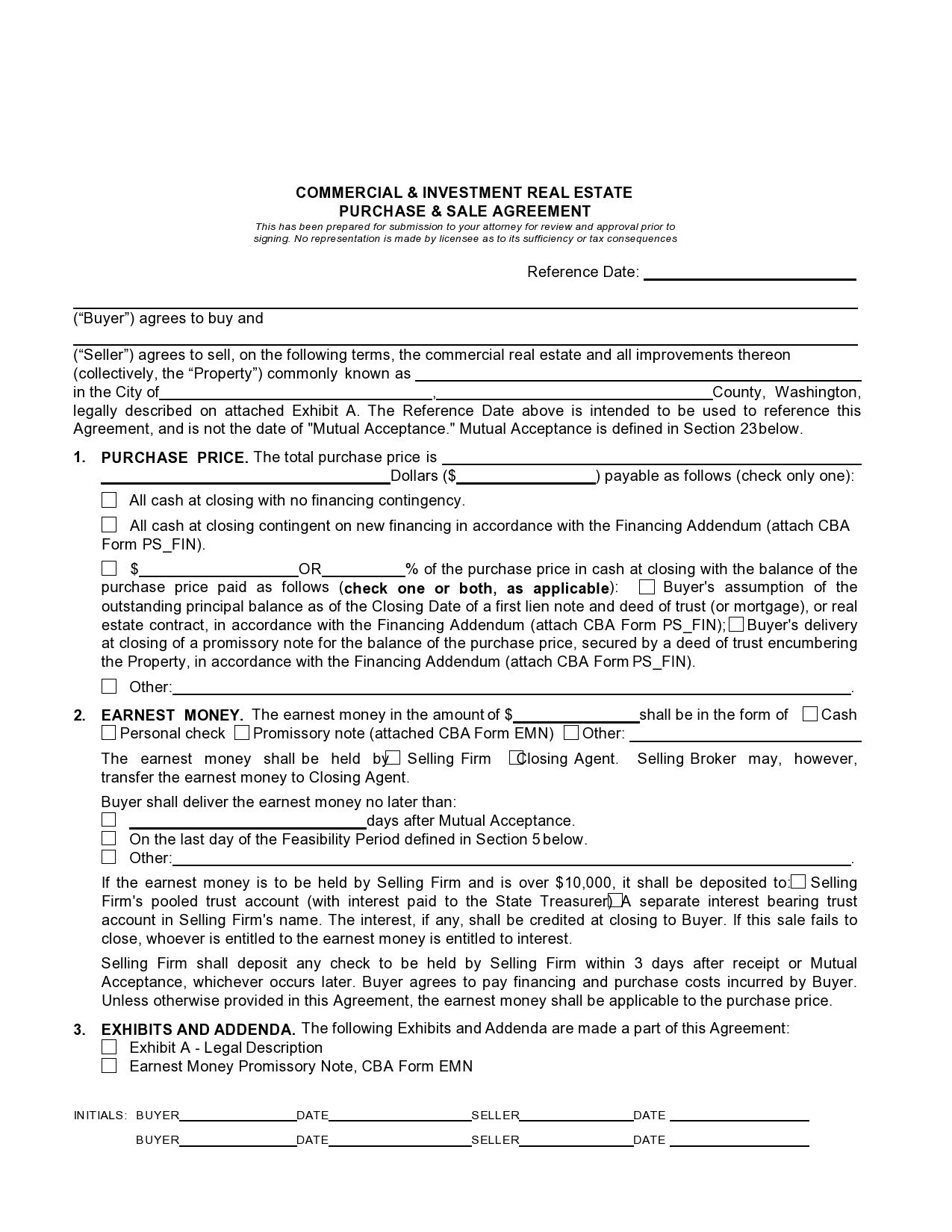

When someone invests money as part of an investor agreement form, they will receive profits based on a third-party’s efforts. Today, there are some fields of real estate purchases, specifically the hotel-condominium fighting to get included in the investment agreement template. Should one of your transactions qualify as an investment, it can get subjected to:

- Reporting

- Registration

- Disclosure requirements

The basics of this document usually describe the terms of the investment including when and how the investor would expect their Return of Investment (ROI). The following basic information should be in the document you create:

- Names of the participating parties

- Addresses of the participating parties

- The investment’s basic structure

- The investment’s purpose

- The date of the agreement

- Signatures of all the participating parties

For investors who want their investment to be in the form of ownership shares in your company, it would be a good idea for them to look into any significant business documents including articles of your company or an operating agreement.

As the owner of the company, you should make sure that when you issue shares, you are in compliance with the guidelines of your company. Moreover, you may also have to inform your business partners about your plan of issuing shares. A good contract should clearly indicate the following:

- The amount provided by the investor

- The form of the investment

- When you will transfer the investment

Generally, investors provide investments in cash, wire transfer, or check although some investments come in the form of tangible assets. With the latter, the contract must specify that this is the case.

With tangible assets as investments, there has to be a plan on how your business operations will continue in the event that the investor asks for their tangible assets back.

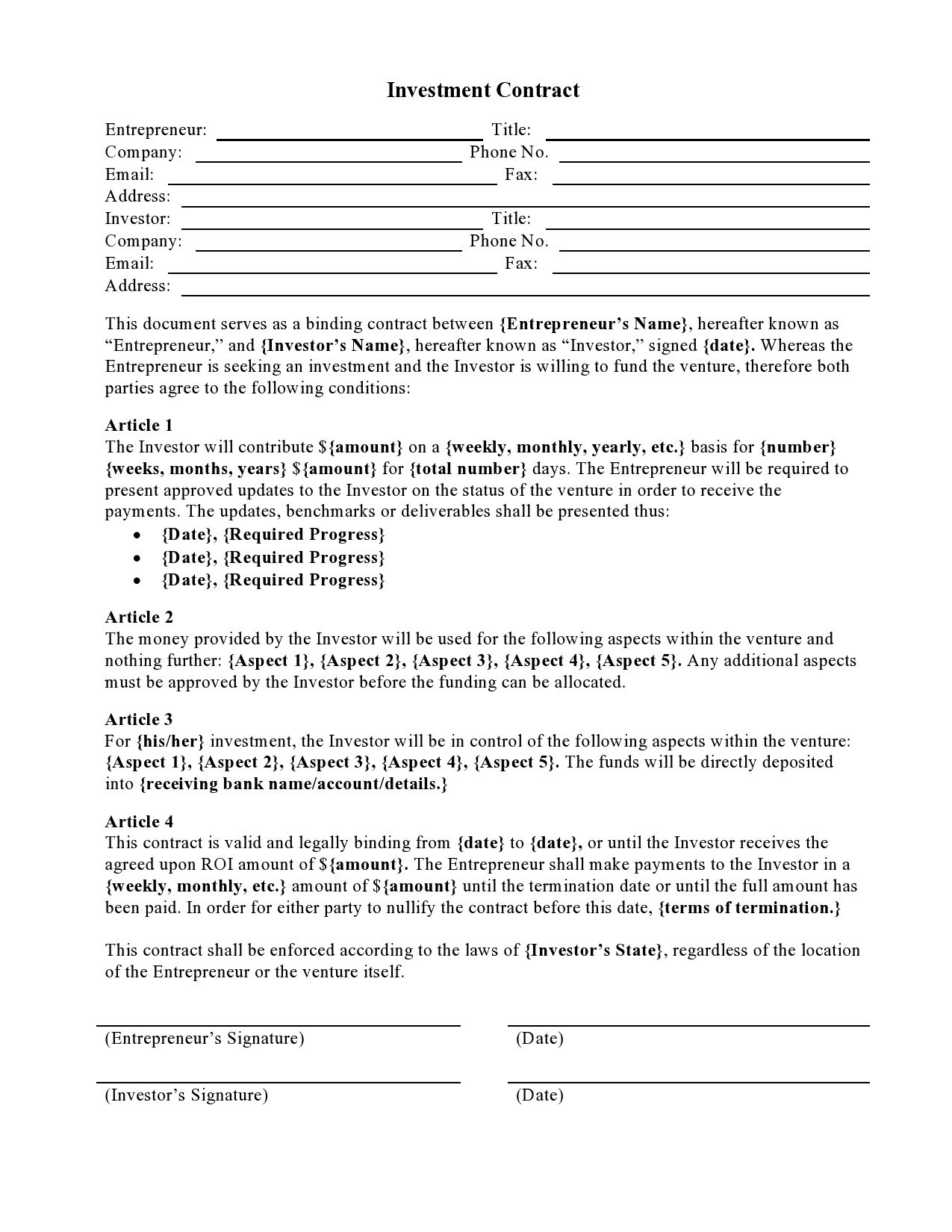

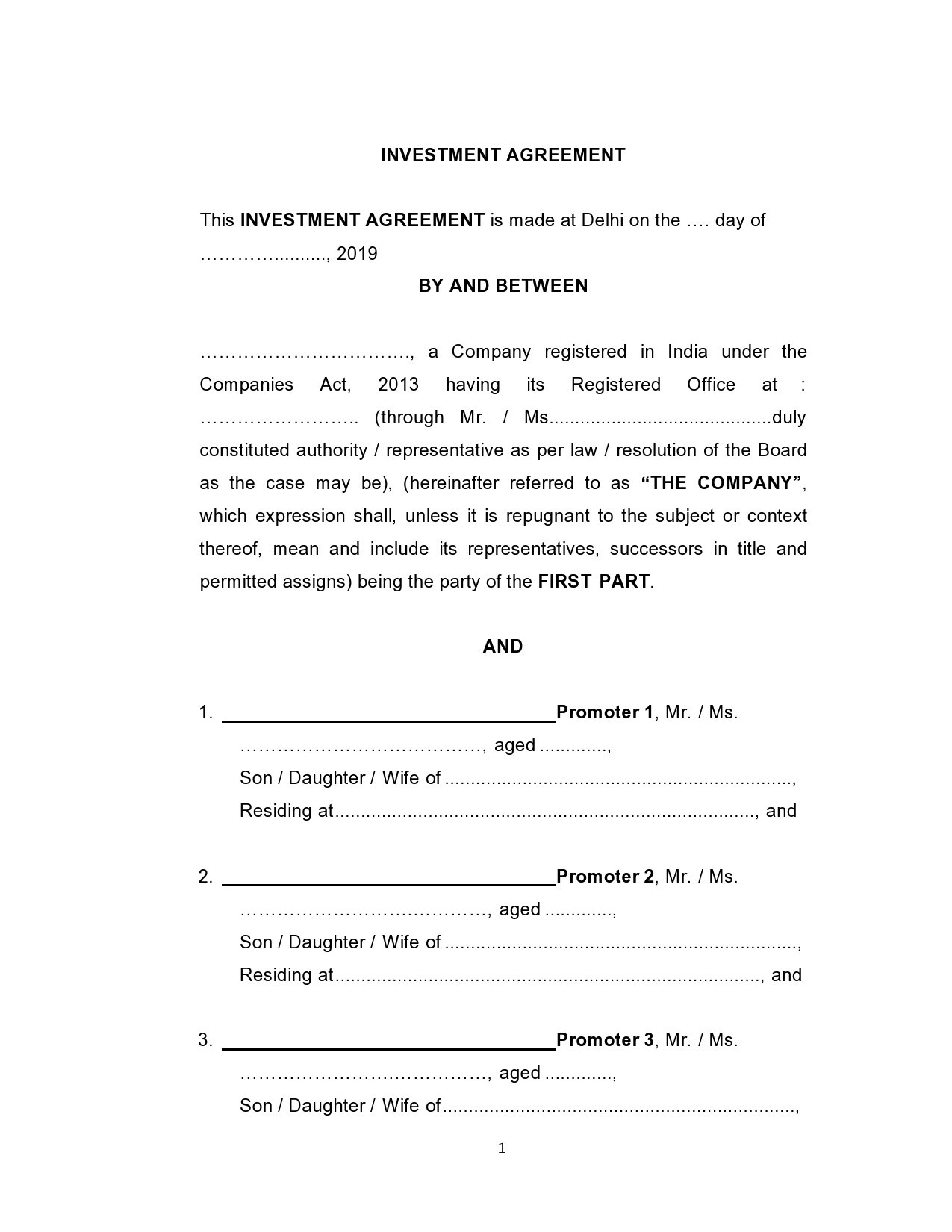

Investment Contract Samples

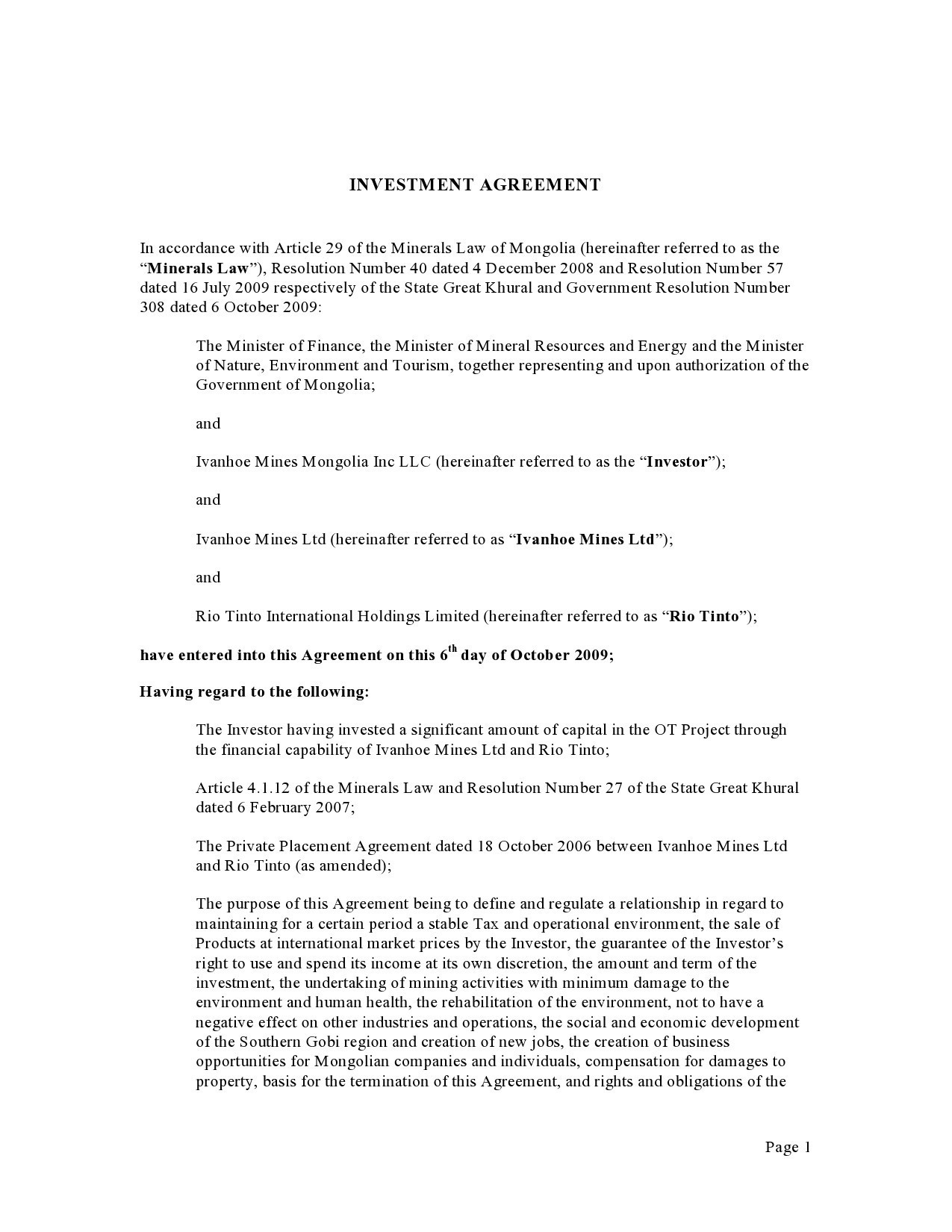

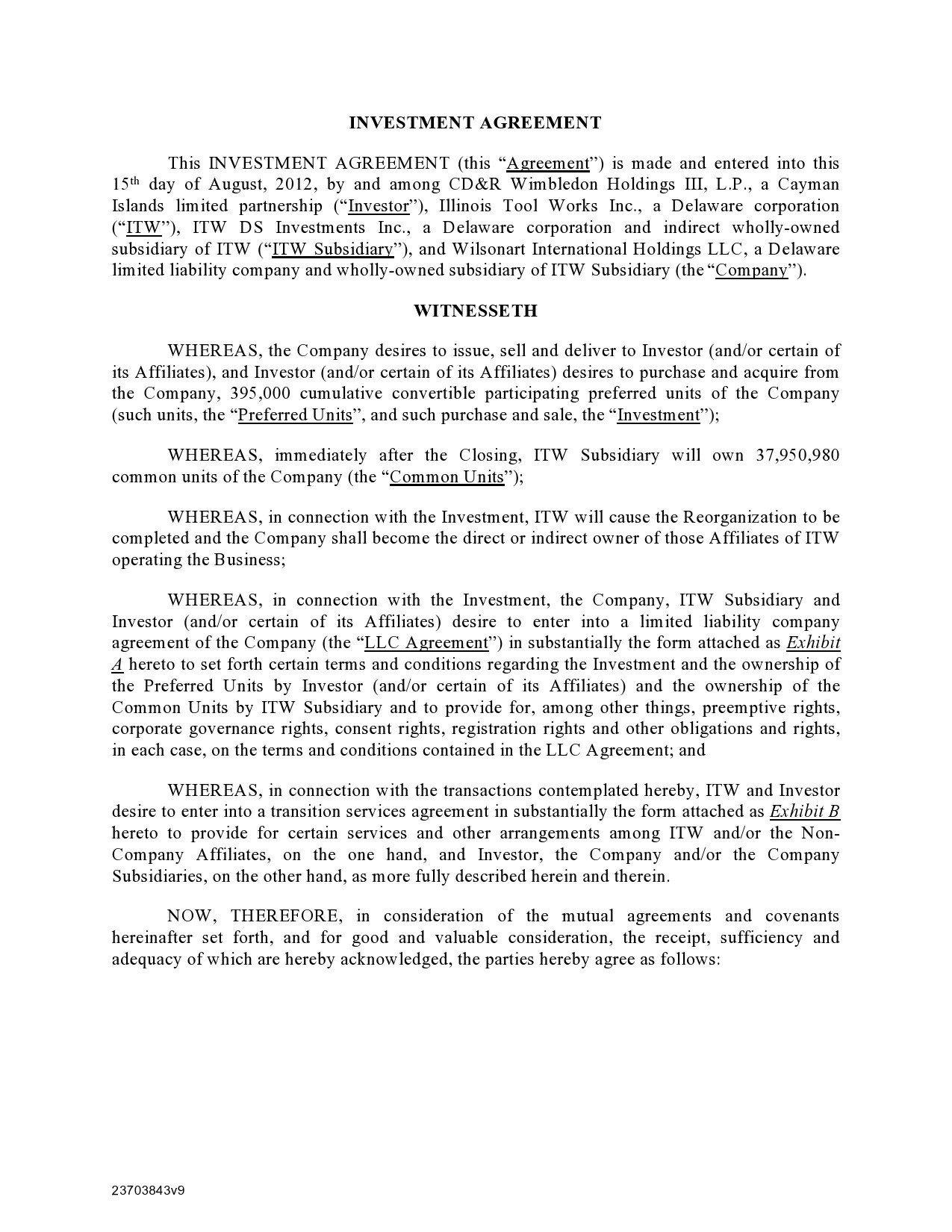

Types of investment contracts

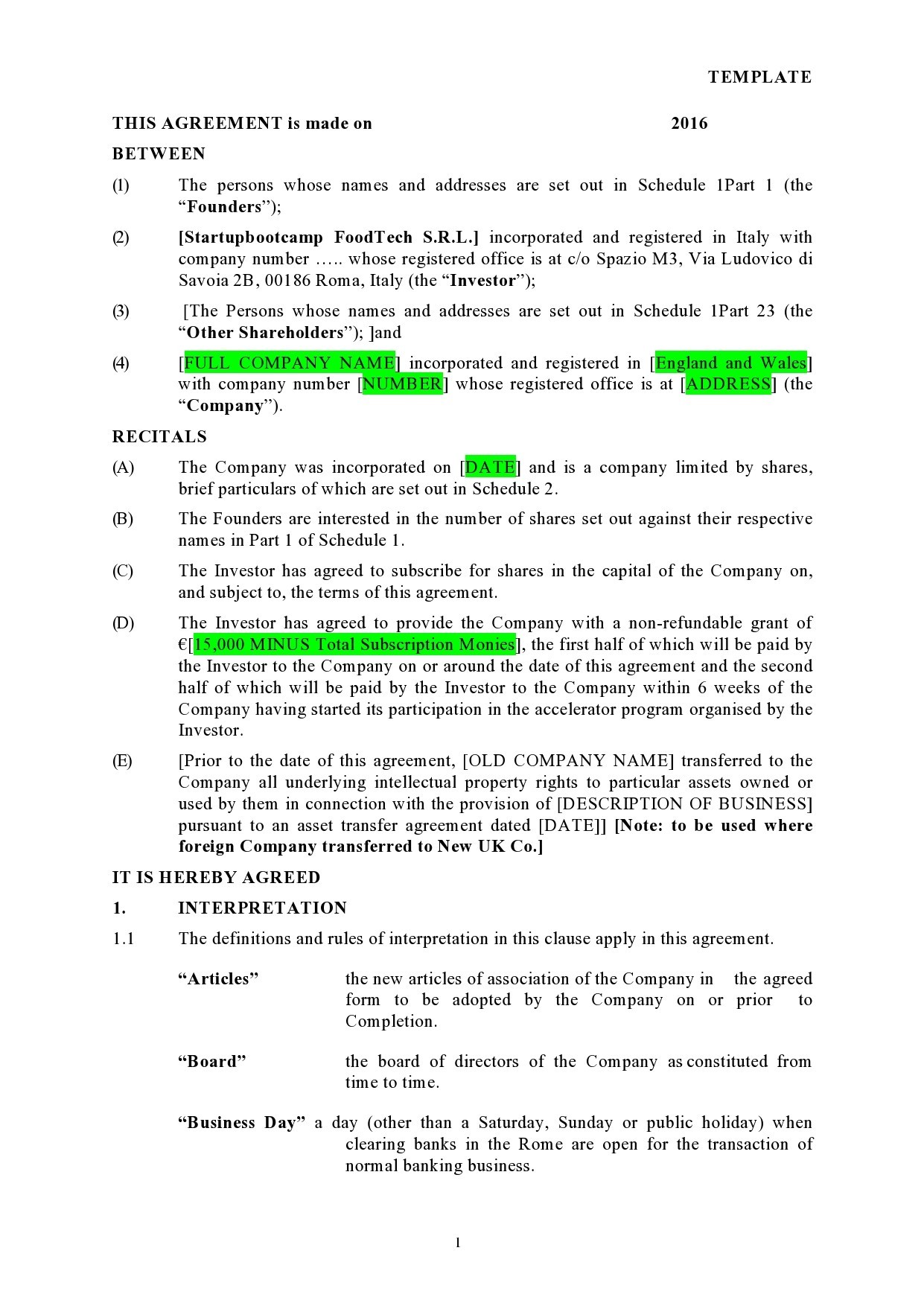

Once you have found an investor who wants to invest in your company, you should focus your attention on the required documents that you will need to make your agreement. But before you make your investment contract sample, you must make sure that you have a good understanding of the outline investment terms.

At the very least, your investor would like to see that their owned interest will be properly documented as issued in their name. This alone involves some paperwork although it is unusual for investors to subscribe to shares just on the basis of the broadly standard constitution.

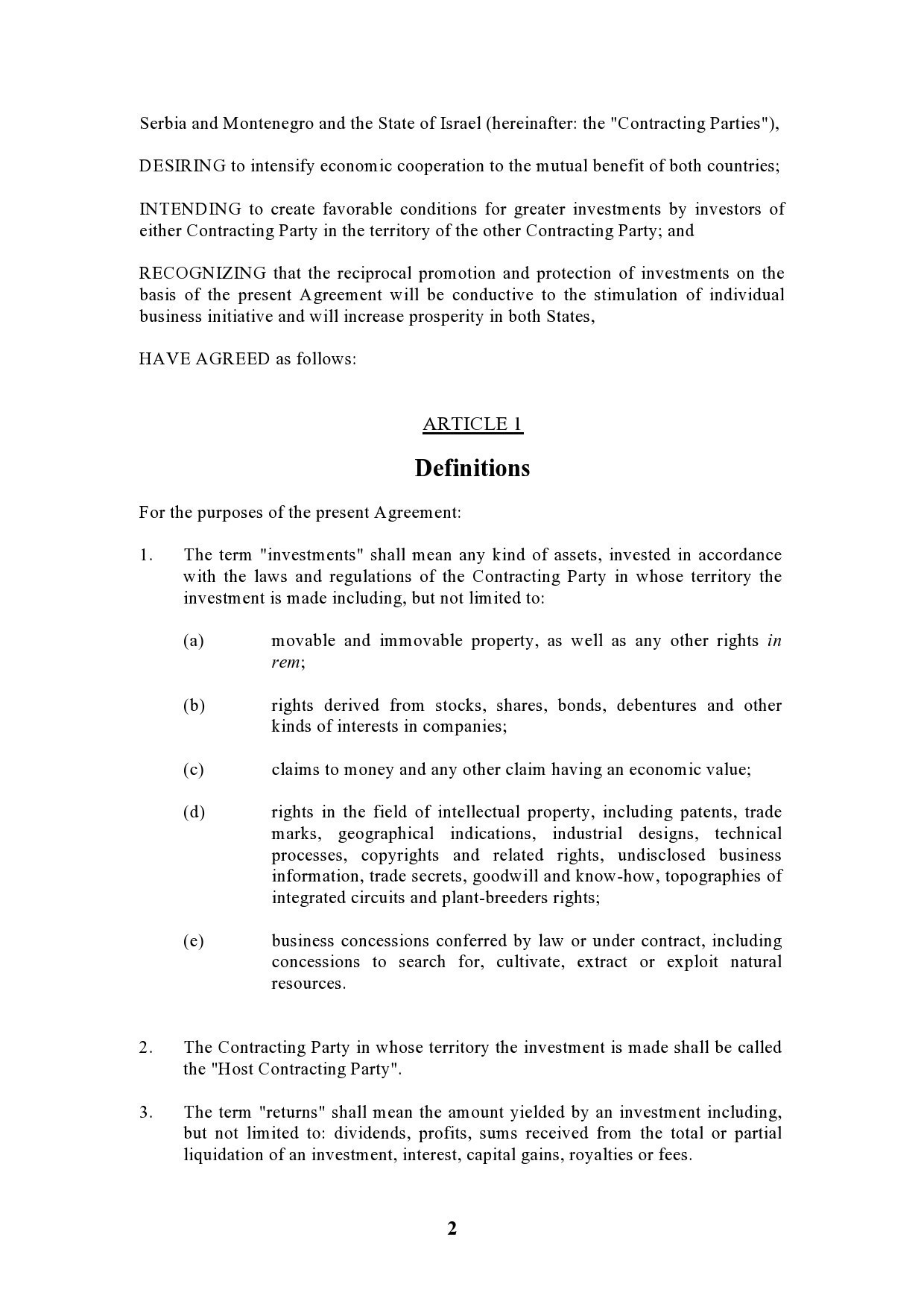

You should also have knowledge of the different types of investment contracts before starting to create one. This includes:

- Stock Purchase Agreement

This is an investment agreement template that involves an investor acquiring a percentage of the shares in the capital stock of your company in exchange for capital. After you have completed the investment transaction, the investor becomes a shareholder of your company. - Stock Option Agreement

You can further classify this agreement as non-qualified or qualified stock options. With a stock option, your investor has the “option” to purchase your company stocks in the future at a price determined when you grant the options.

The main purpose of this agreement is to give the investor the possibility to purchase company stocks in the future at a fixed price. Should the value of your company’s shares go up, the investor can exercise the option where they purchase the common shares below the current value of market shares. - Convertible Debt Agreement

This contract involves a business or person who agrees to lend money to a company with the option that they can convert the money they loaned into an ownership interest in your company. This agreement specifies who has the choice to convert their debt into equity. - Restricted Stock Agreement

In agreement, your company agrees to issue shares to an investor in exchange for their effort and time into your company for a specific period of time. If the investor fails to contribute their effort and time over the set period of time, then they can’t claim ownership of your company stocks. - Deferred Compensation

This actually isn’t an “investment contract” per se because the investor doesn’t receive equity ownership in your company. This kind of agreement is where a person will agree to work in your company in exchange for a salary, a bonus, or compensation in the future.

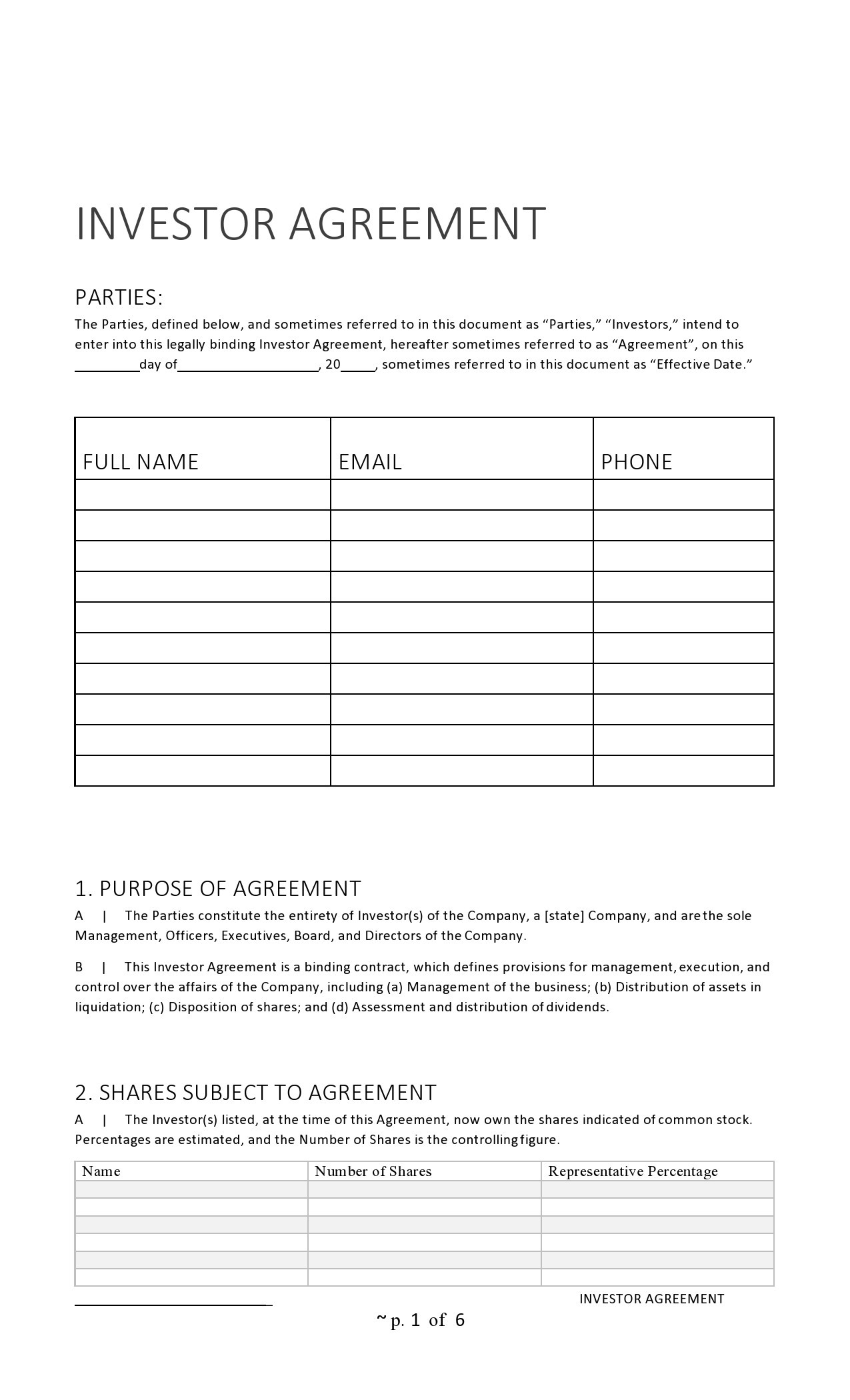

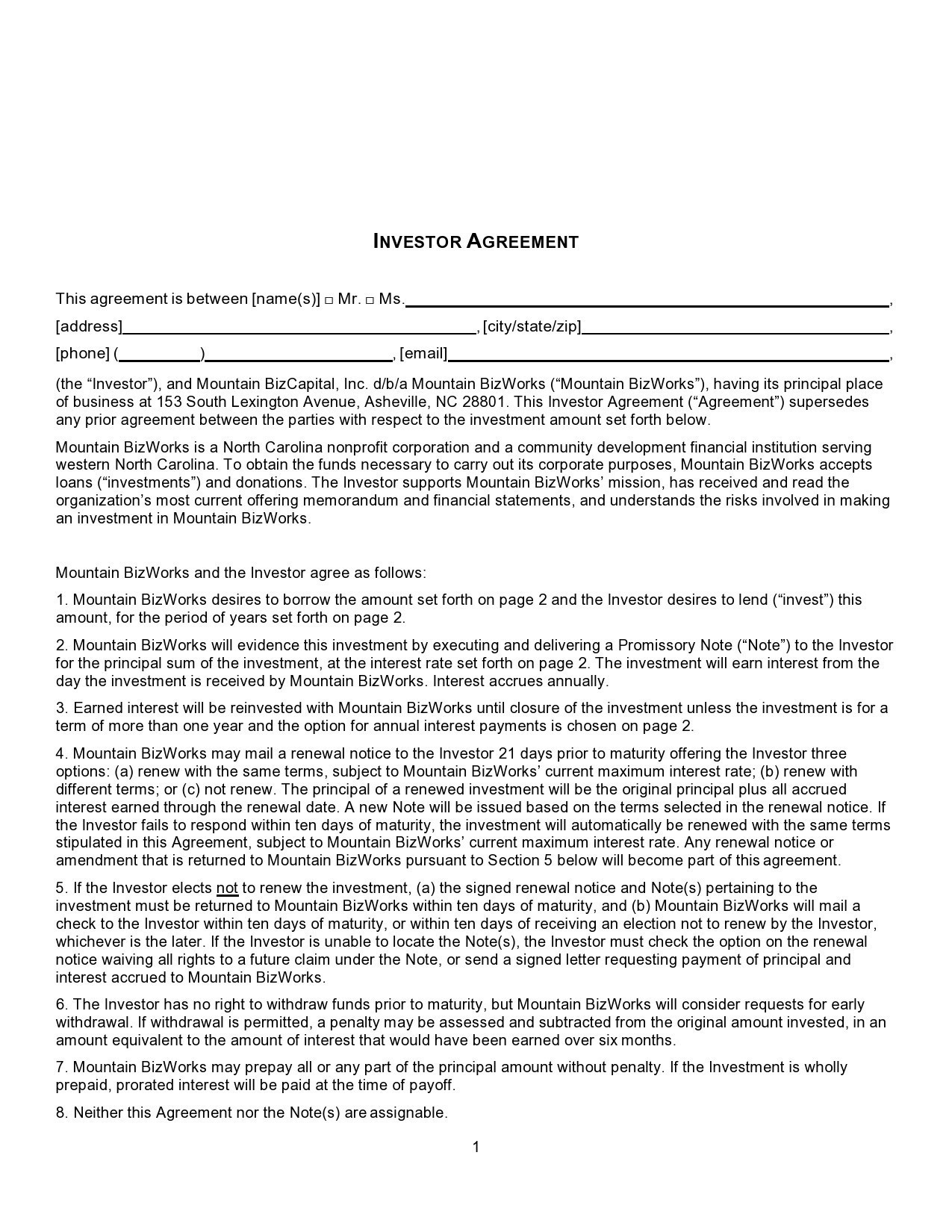

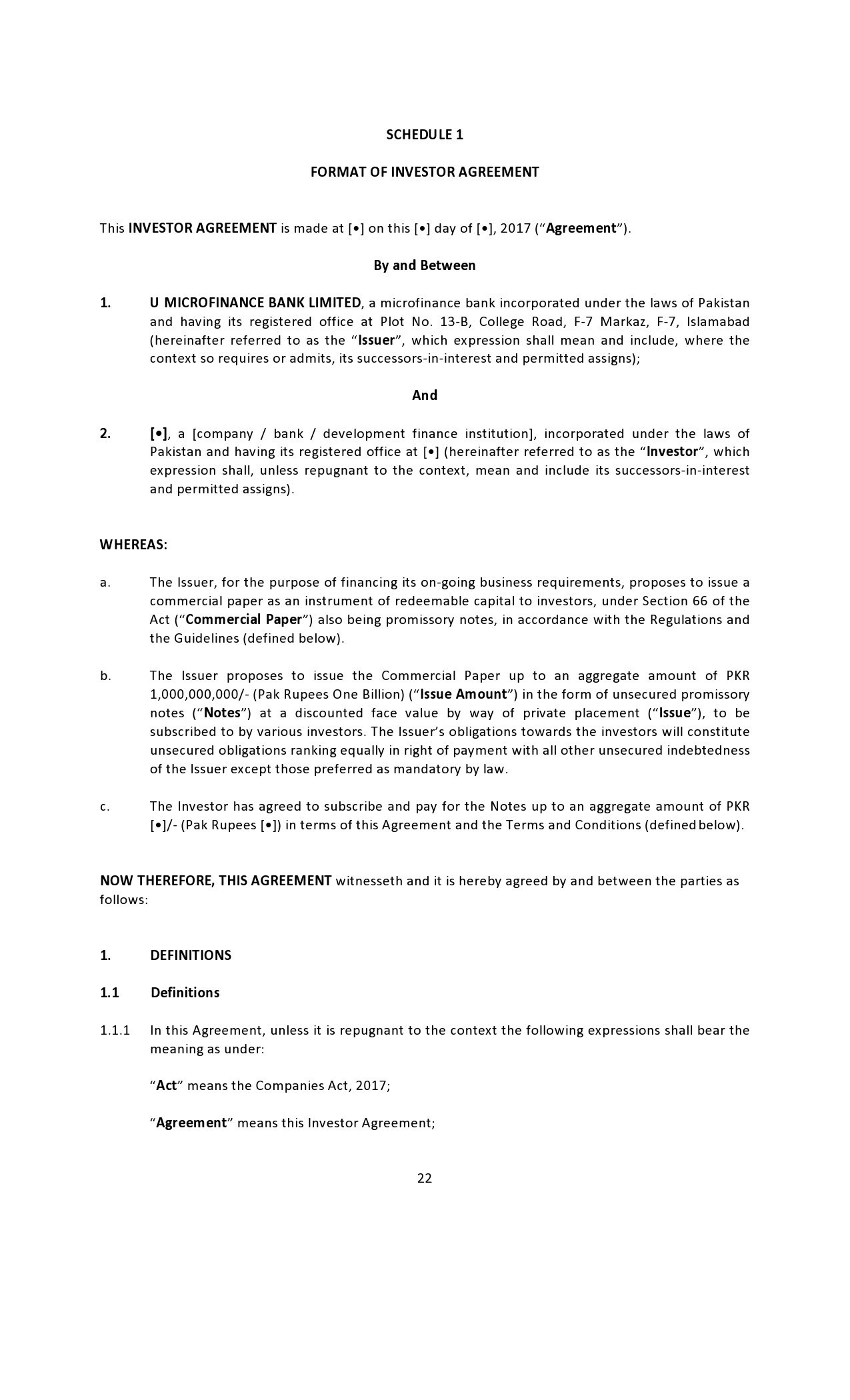

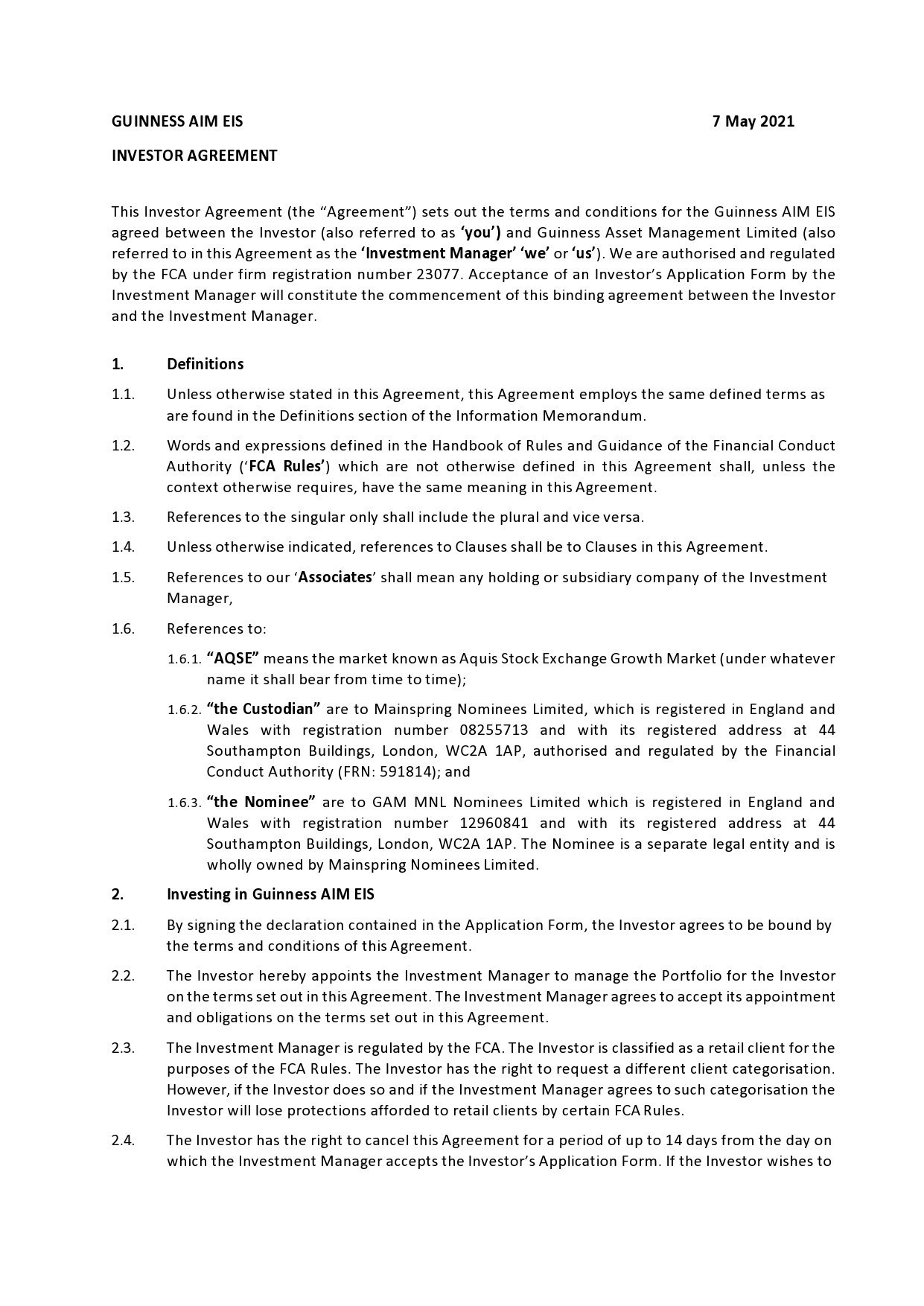

Investor Agreements

How do you write an investment contract?

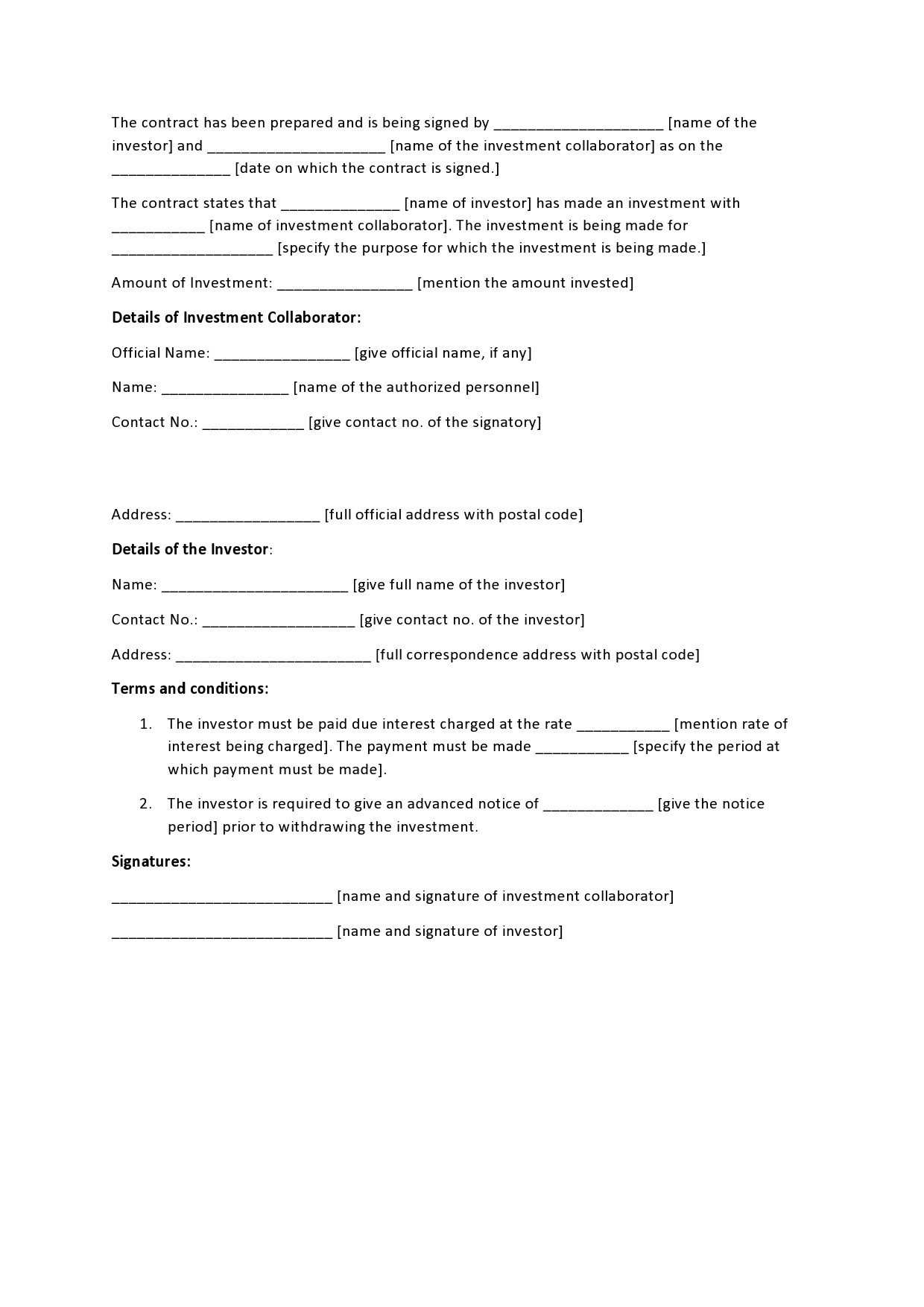

Receiving investments is a good time for most companies. Investments usually involve a lot of hard work to find the right investor but when you do, it is highly recommended to have an investment contract that includes the interests of everyone involved.

On one hand, the investor wants to make sure that their investment is completely protected and on the other hand, your company wants to make sure that your funds get delivered smoothly and that your founders will protect their stake in the venture:

- Come up with the opening recitals

This includes stating the date when you entered into an investor agreement along with the names and addresses of both the parties involved in the agreement. If applicable, use your company’s name and address since your company’s name will be later identified in the agreement. - Create the “whereas” statements

This declares that “Whereas” the investor seeks investment into its venture, and “Whereas” your company will provide the investment. You follow this up with a “Therefore” statement which reads something like this: “Therefore, in consideration of the covenants and promises considered hereinafter, the parties agree as follows:” - List the articles

These articles refer to everything that you have discussed and previously agreed upon. This time, however, they now come in written form as part of your investor agreement form. Make sure to list the articles one by one, and in order, with them appearing as, “Article 1,” “Article 2,” and so on.

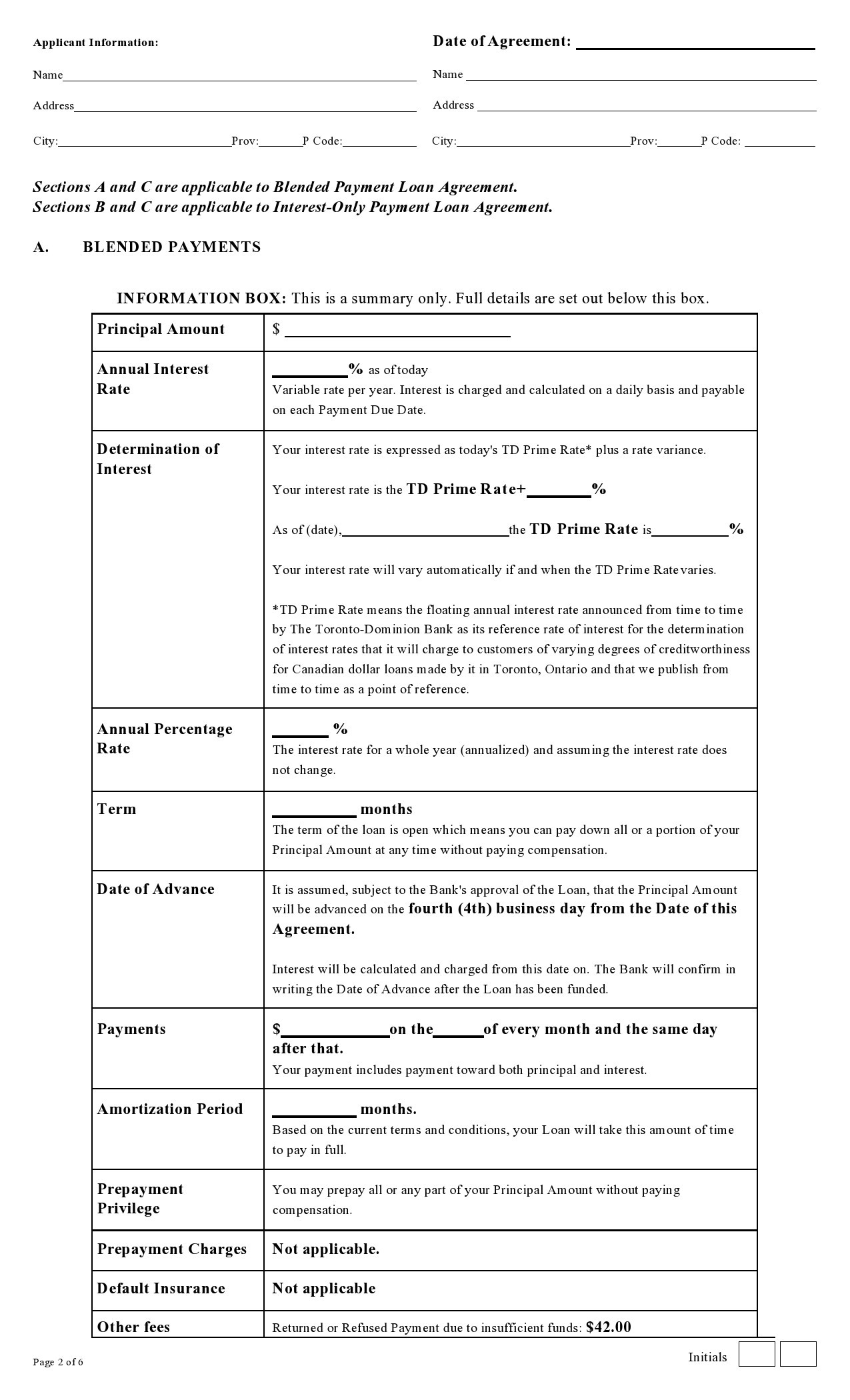

The typical articles in this contract will usually include the amount of money that the person will invest, how your company plans to use the investment, what the investor can expect to gain in return for their monetary contribution. - Include the details of the payment terms

The payment terms may vary from one company to another company although it will depend on how big of an investment you have received. Investments are sometimes given in lump sums.

In such a case, you should list the amount of the transfer, the date you have agreed upon, and the details of the receiving bank account. In cases where the investment gets distributed across multiple payments, it’s recommended that you should refer to this in an attachment which contains the amounts and dates of each transfer into the receiving bank account. - Identify all of the deliverables

Sometimes, investments may require specific benchmarks to get attained by specific products or dates to get delivered as a result of your company’s activities. These items are the “deliverables,” and you should list them in the contract together with each of their due dates. - State the term and the termination details

The term here refers to the length of time it takes for an investor to complete their financial contribution and receive the agreed-upon RO. The termination part specifies how your agreement will end and in what way you or the investor can terminate the contract earlier than what you have agreed-upon. - Show your company contacts

You will use this section of the contract to list down the names, titles, addresses, telephone numbers, fax numbers, email addresses, and preferred contact details for both the investor and your company. - Make the Choice of Law clear

Since laws may vary from one state to another, it becomes essential to clearly mention which state will have jurisdiction over your agreement. - Sign your contract

The investors and the authorized persons in your company must sign the agreement in the presence of two witnesses. Each of the witnesses should also affix their signatures to the contract.

In an ideal situation, one of the witness would be a Notary Public. This person will also notarize the signatures, but this isn’t a necessary requirement. You should sign two copies of the agreement so that you and the investor can get a copy for your own records.