The term indemnification is typically used in reference to a person’s actions and this refers to compensation for damage done or loss caused by an individual. Whichever, there seems to be a connection among these terms with liability. Therefore, an indemnity agreement is a document that holds a company or business harmless for any loss, damage or burden.

Table of Contents

- 1 Indemnification Agreements

- 2 What is indemnity?

- 3 Indemnification Forms

- 4 What is the purpose of an indemnification agreement?

- 5 Parties involved in an indemnification agreement

- 6 Indemnity Agreement Samples

- 7 The provisions of an indemnification agreement

- 8 Types of clauses in indemnification agreements

- 9 Indemnification Letters

- 10 What is the difference between a hold harmless agreement and an indemnity agreement?

Indemnification Agreements

What is indemnity?

Before creating your own indemnification agreement, it’s important to understand what this term truly means. There are variations to the meaning of indemnity including:

- Indemnity refers to a person’s duty to rectify the damages, losses or liabilities sustained by another party.

- Indemnity refers to holding harmless one person’s actions.

- Indemnity refers to the right of the injured party to claim reimbursement or compensation for losses or damages.

- Indemnity refers to damages compensation resulting from the actions of another person.

- Indemnification refers to legal exemption from losses and damages.

Indemnification Forms

What is the purpose of an indemnification agreement?

To explain more clearly what an indemnification form or agreement is, you must have a good understanding of the term and everything it entails. Indemnity generally means “to hold harmless,” meaning that one party holds another harmless for some damage or loss.

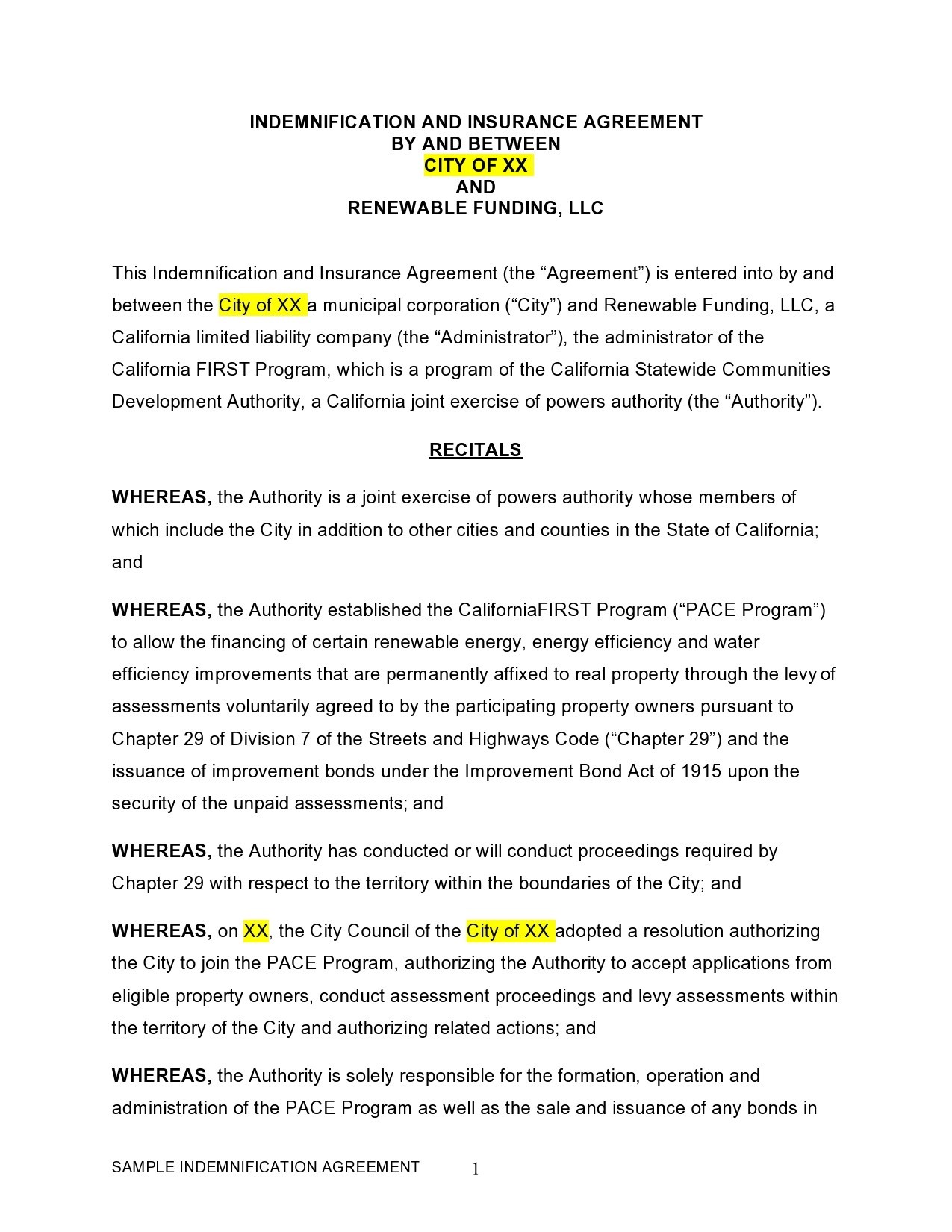

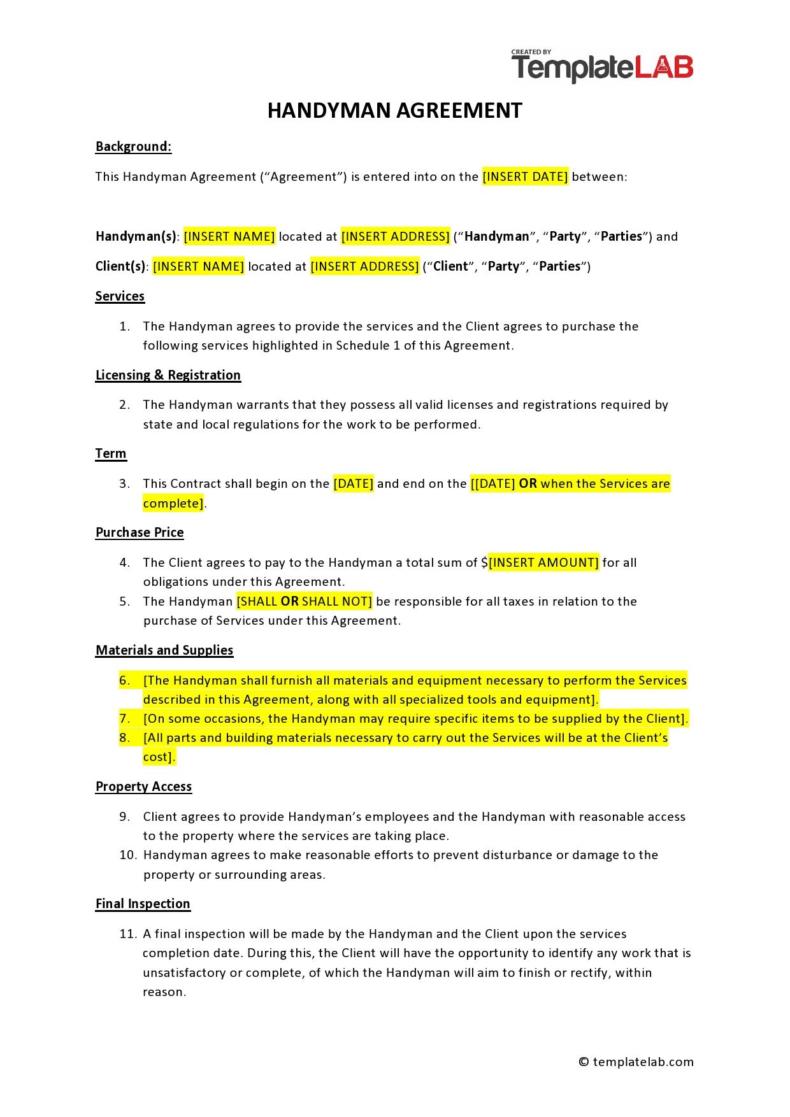

An indemnity agreement sample is most commonly used in businesses involved in construction work although there are many other businesses that still want their employees to sign such agreements to protect themselves against potential lawsuits. These agreements are also widely used by Rental Car Companies who want to protect themselves against lawsuits from any accidents that involve the drivers of the rented cars.

Parties involved in an indemnification agreement

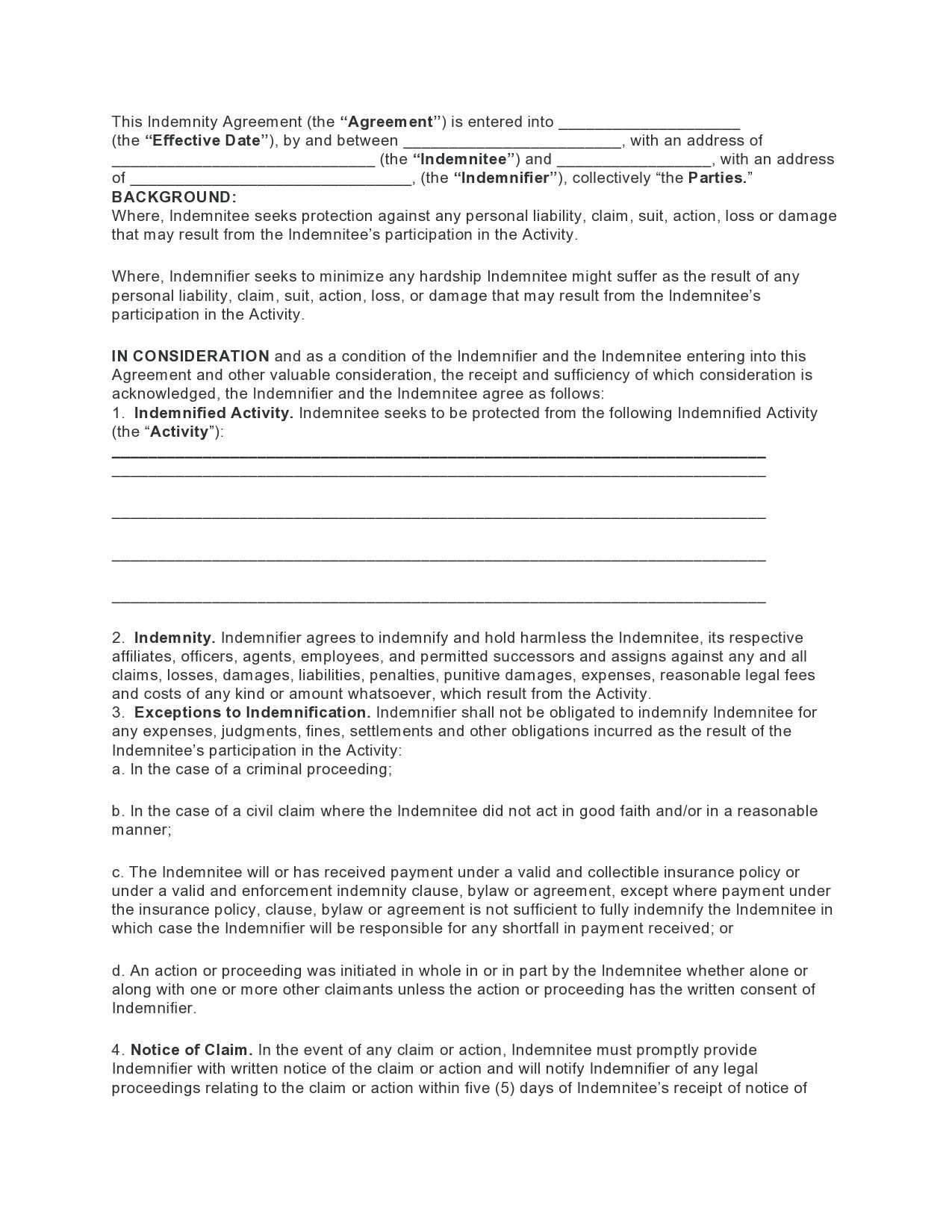

Specific indemnification forms may vary in every state although most, if not all of them, will contain the same basic information. In any indemnification letter, you would describe the two parties as:

- The indemnitee or the one who wants protection.

- The indemnifier or the one who wants or promises to minimize harm to the indemnitee.

The indemnification agreement may also describe the consideration, in most cases the amount of money that you will use to obtain the agreement. An indemnification clause sample states in specific terms under which you will hold the indemnitee harmless. For the laymen, the legal language used here can be fairly complicated.

There are also exclusions that you should include and describe. One of the most common of these exclusions is the fault or negligence of the indemnitee. If for some reason, the indemnitee is legally proven as negligent and is at fault, then the indemnification will not apply and the indemnitee can get sued as well.

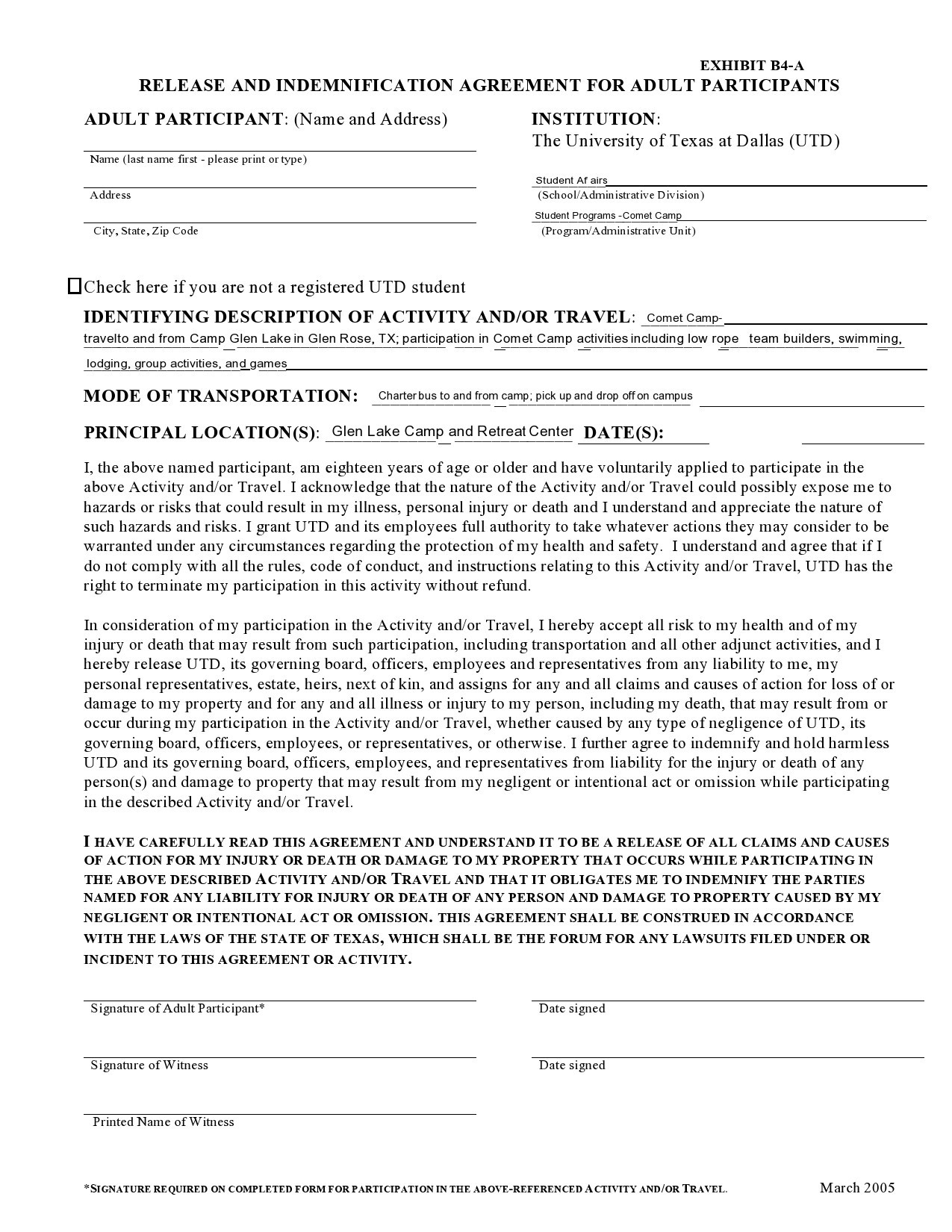

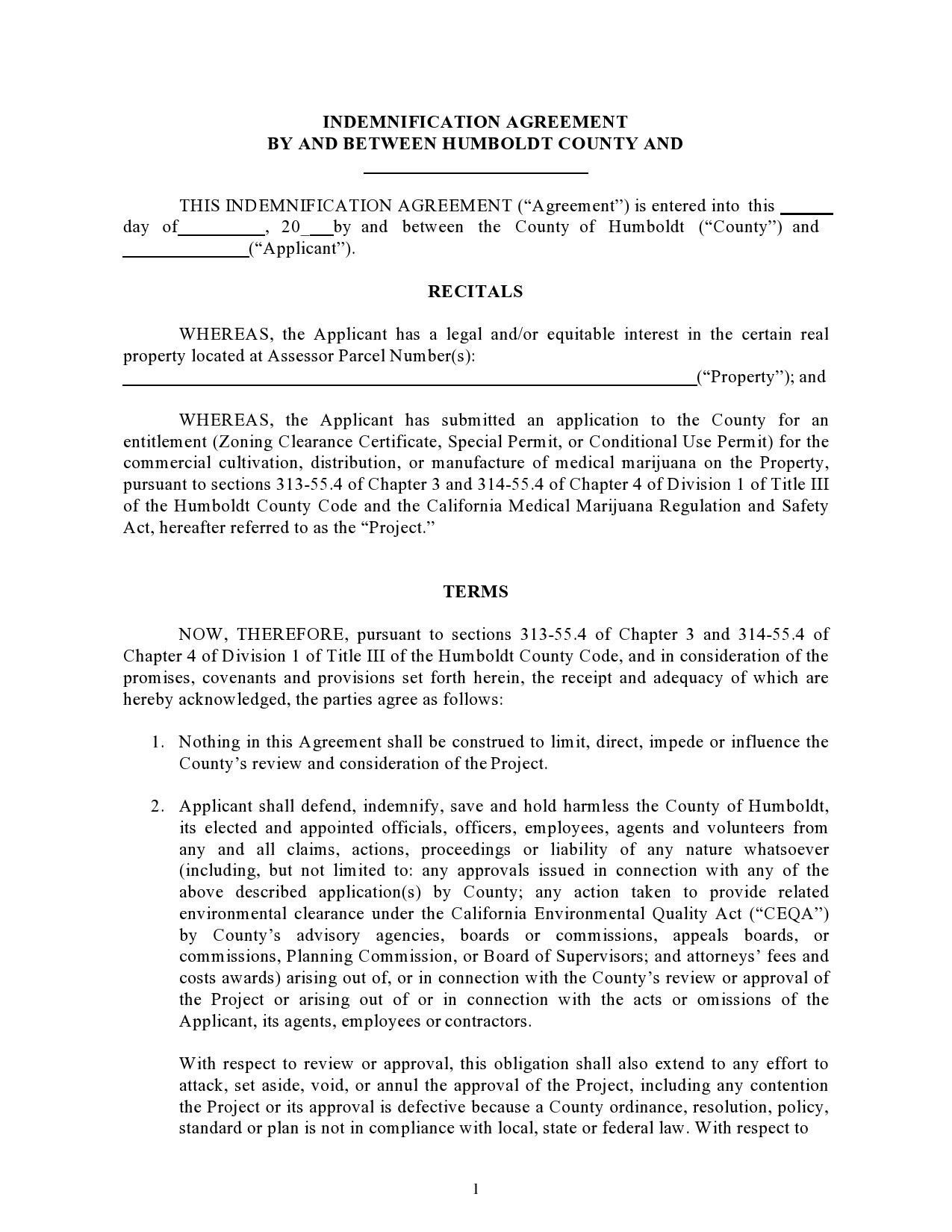

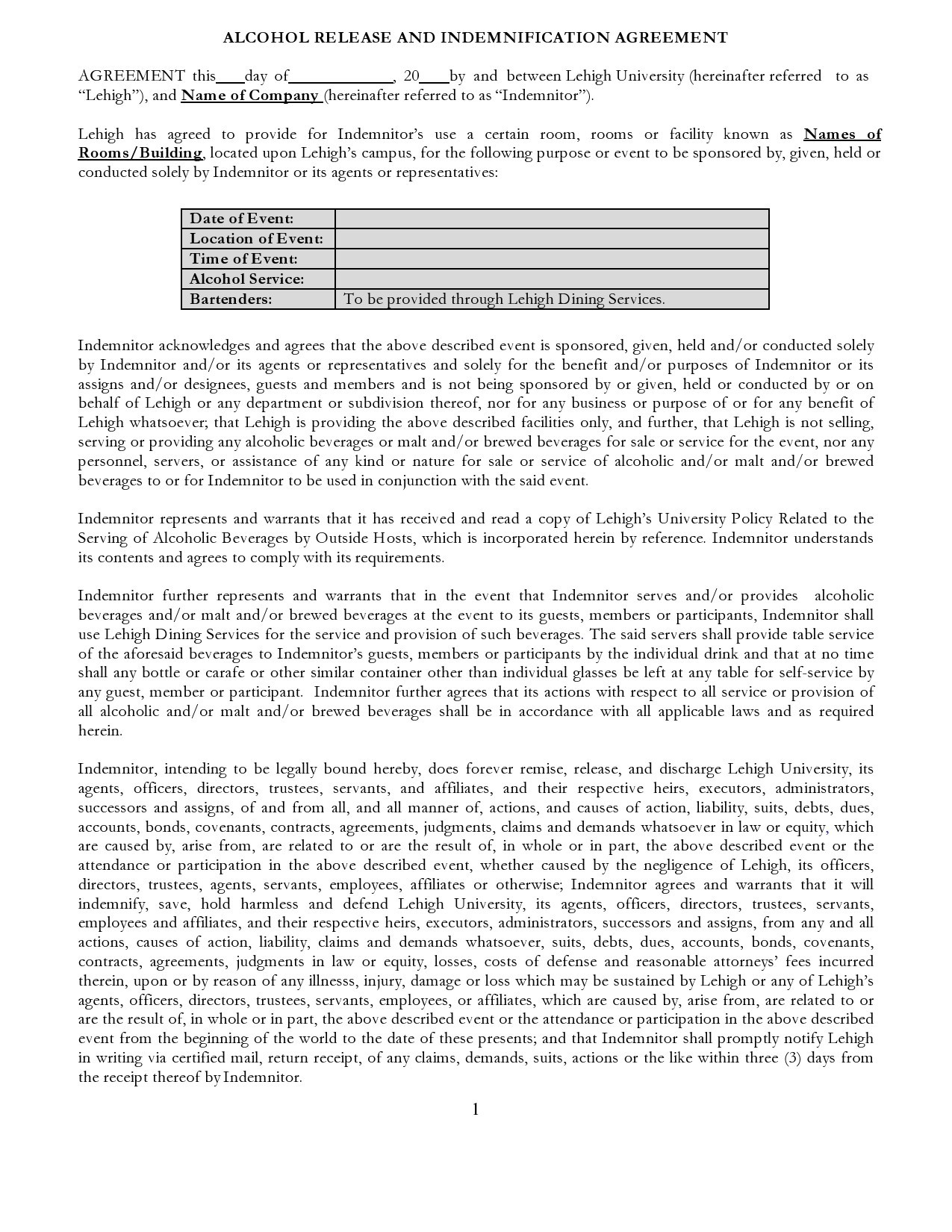

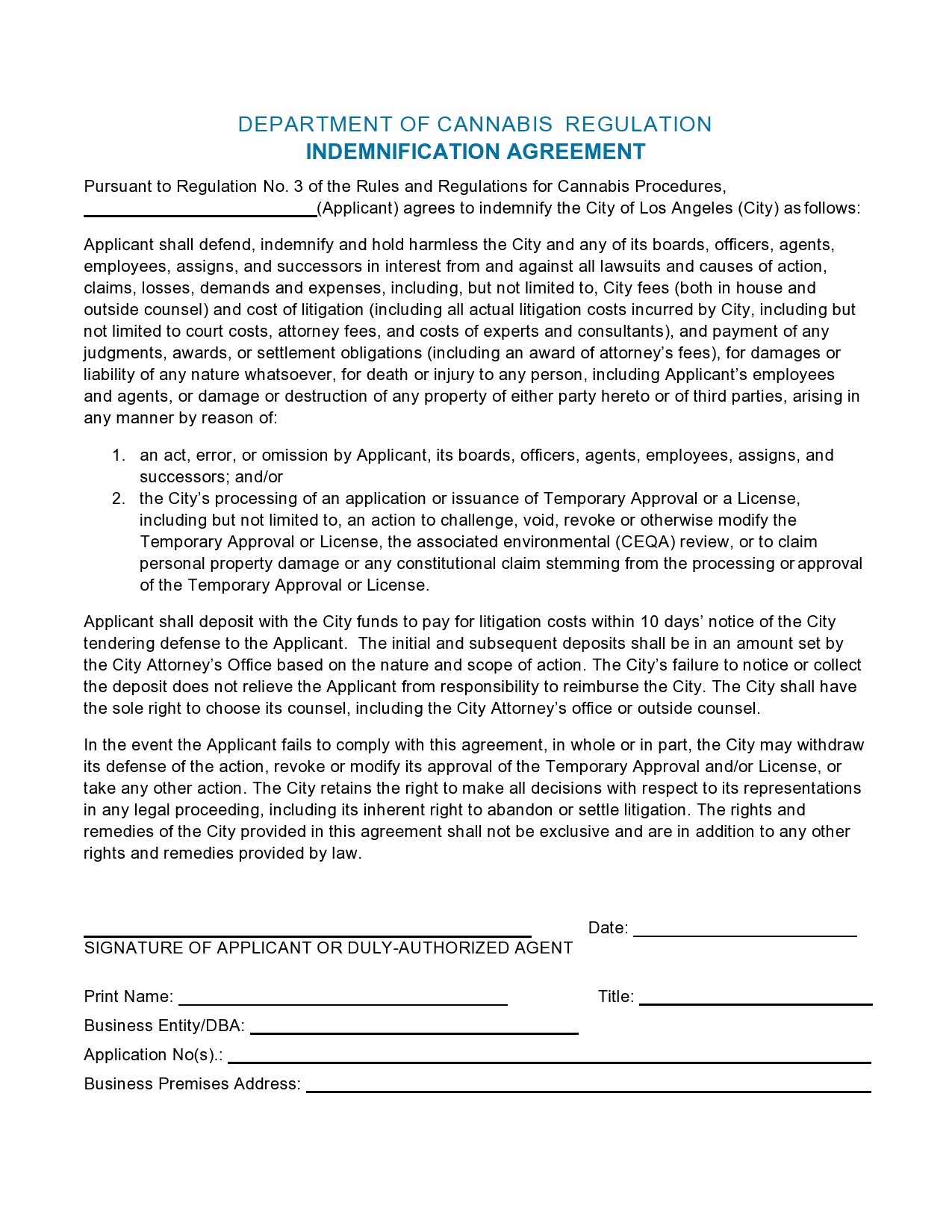

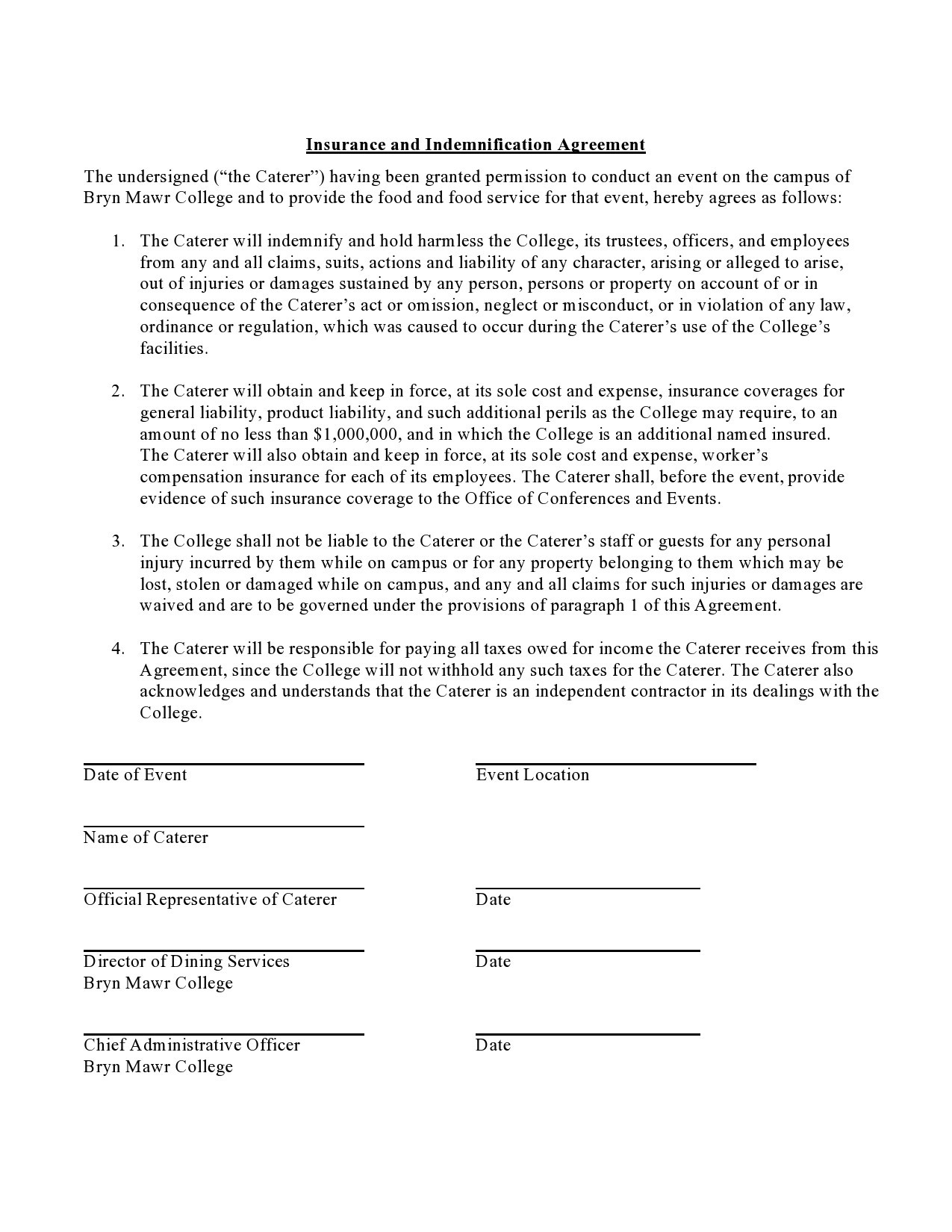

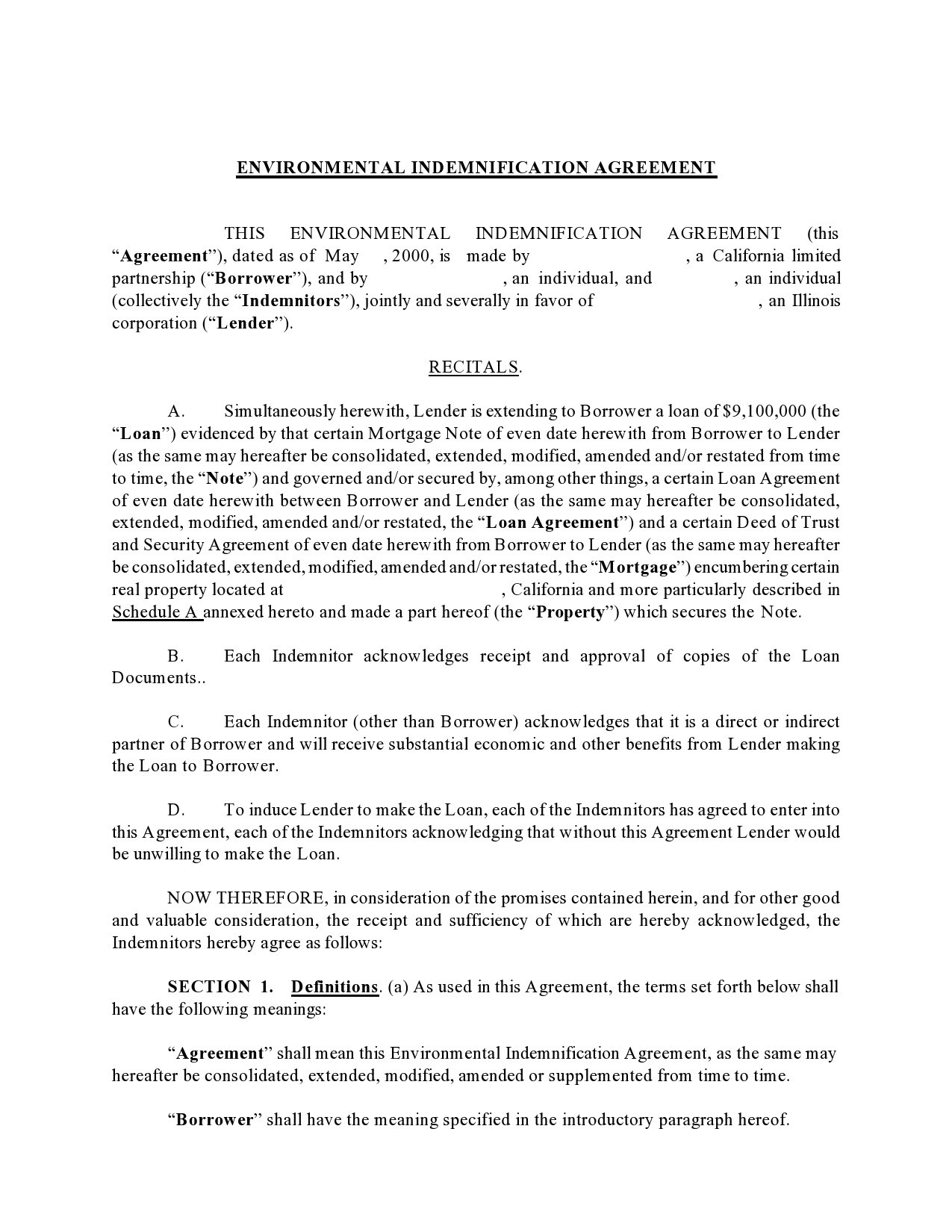

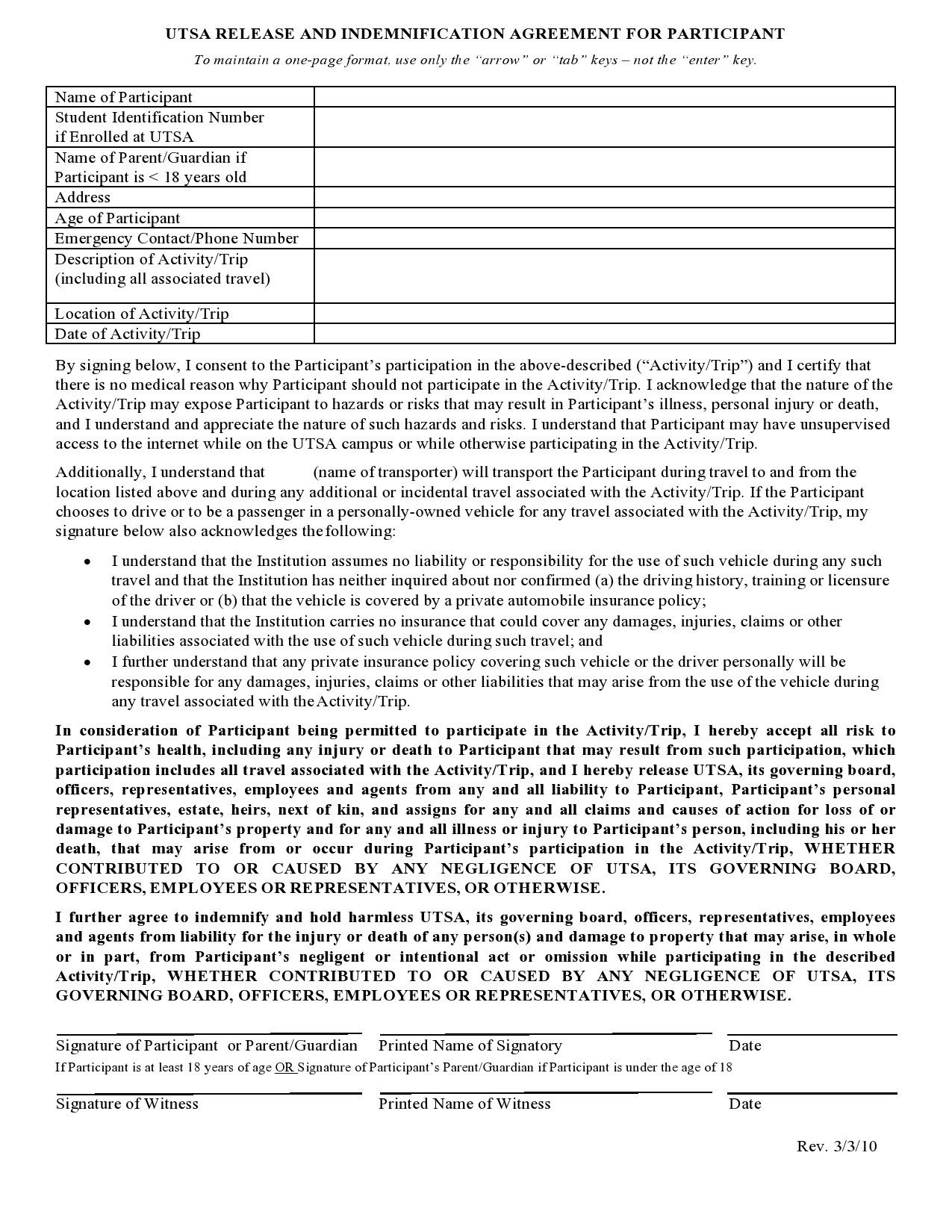

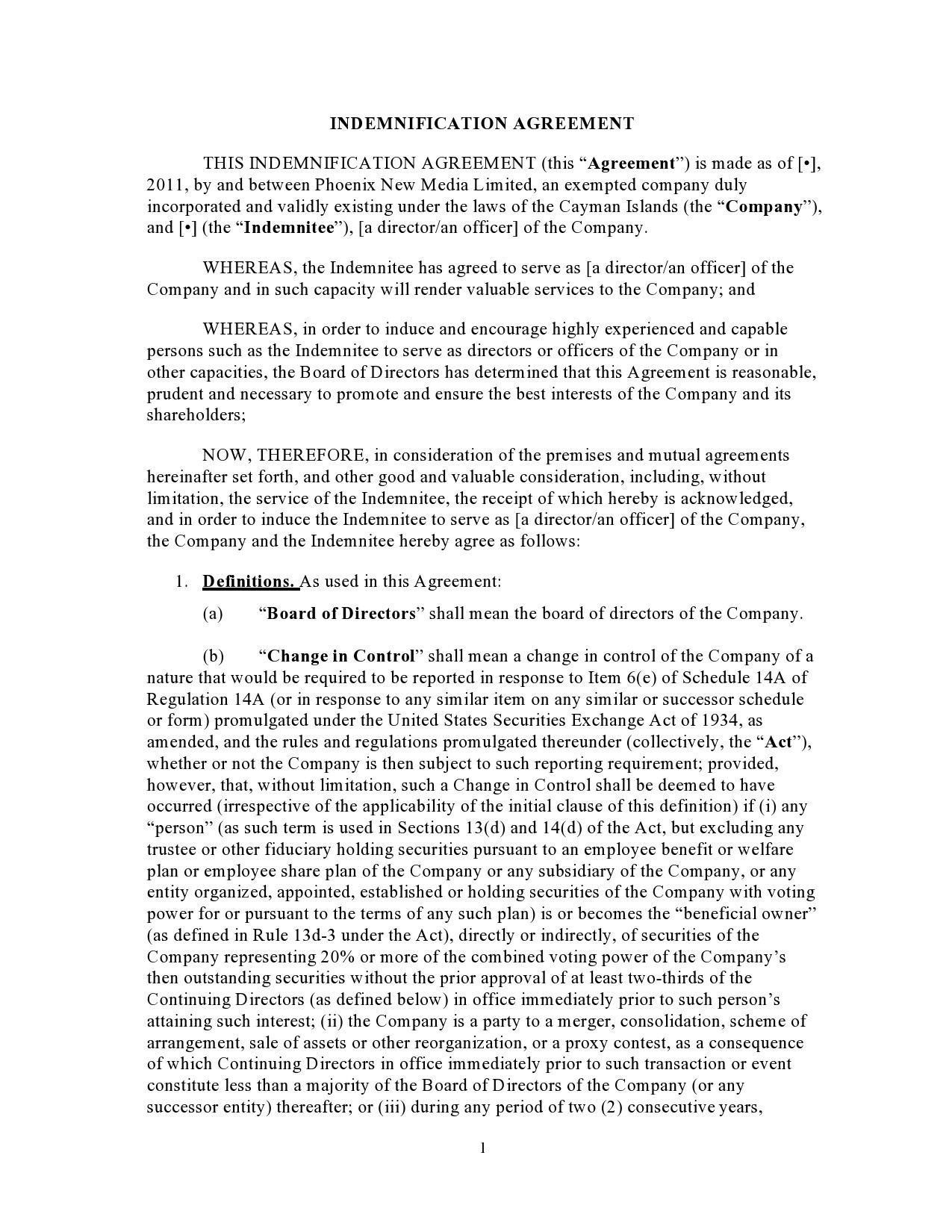

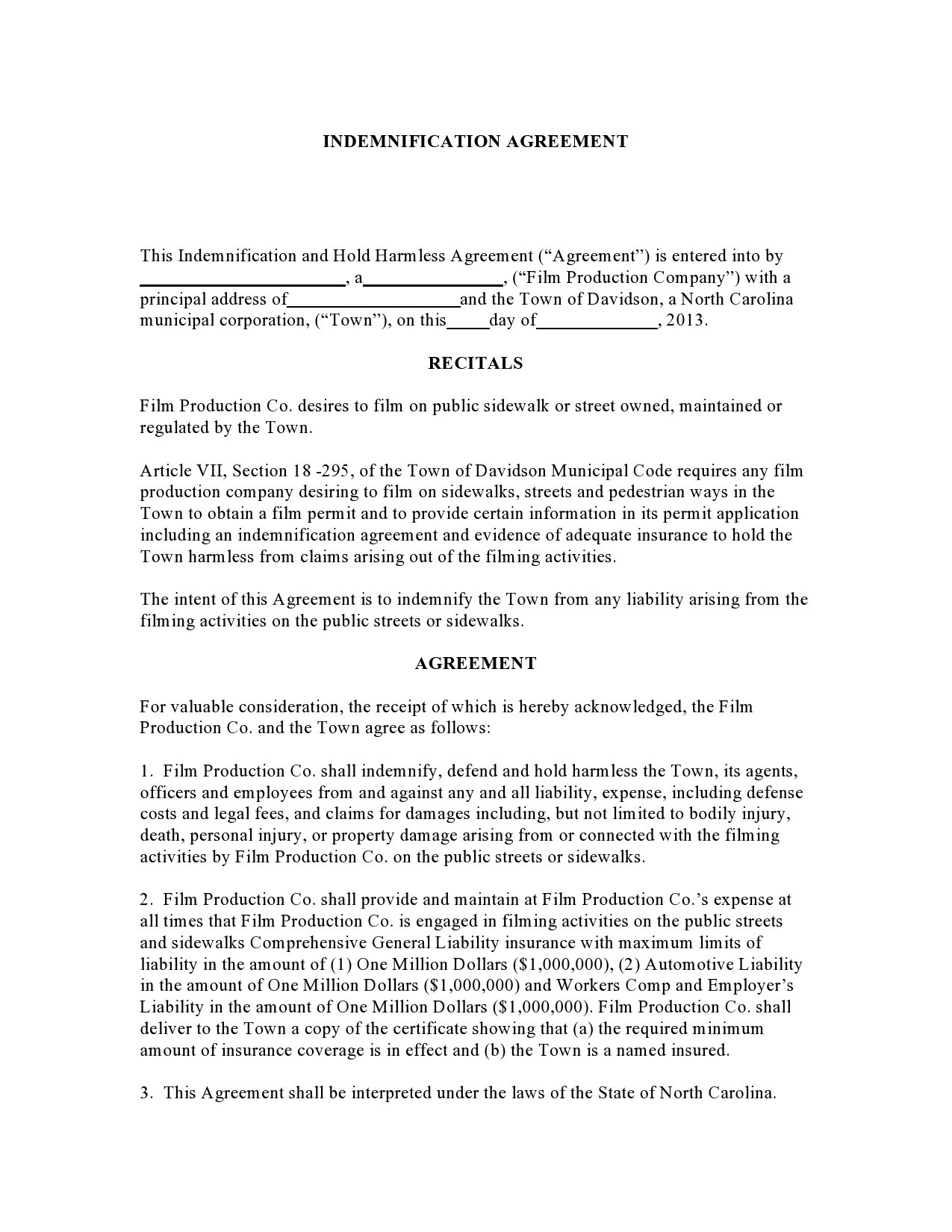

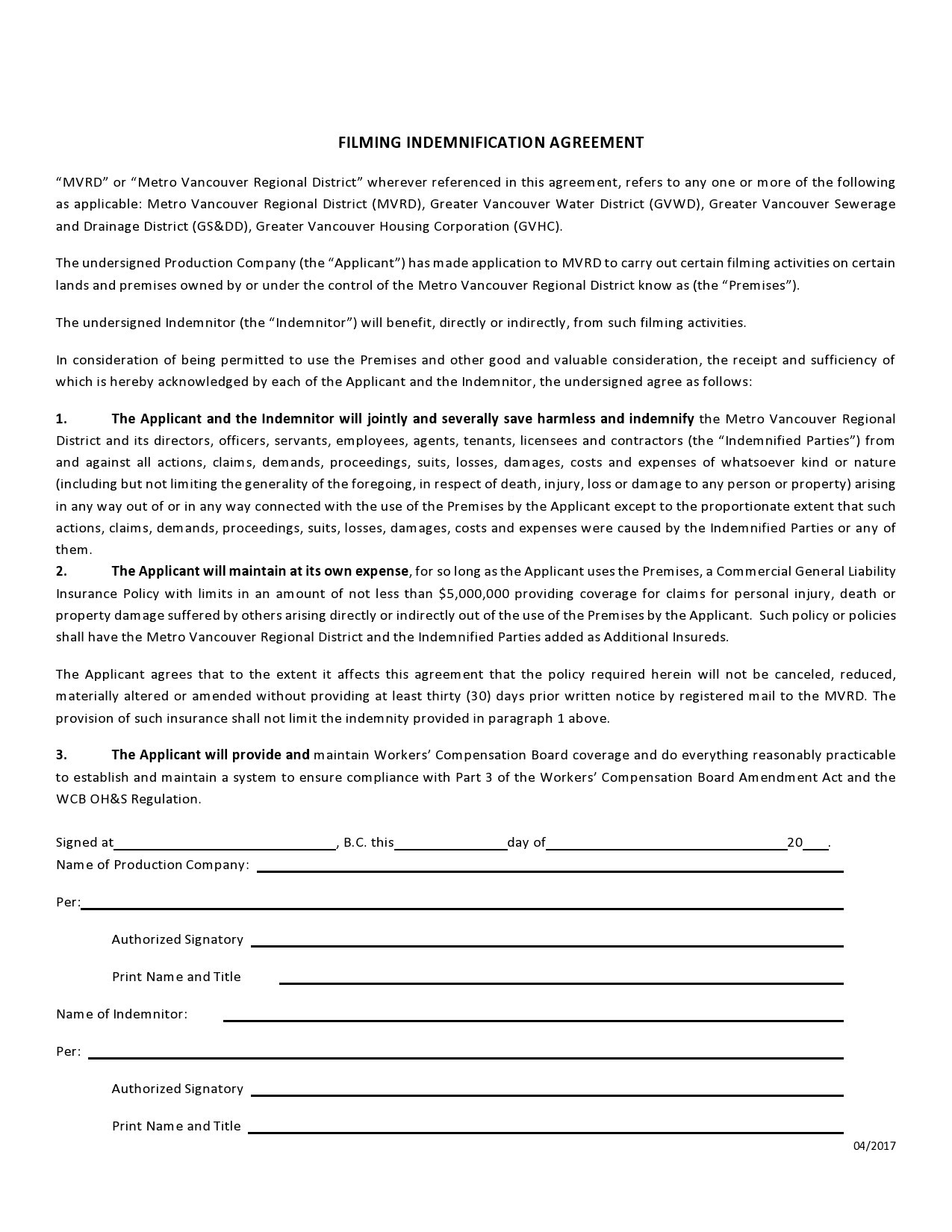

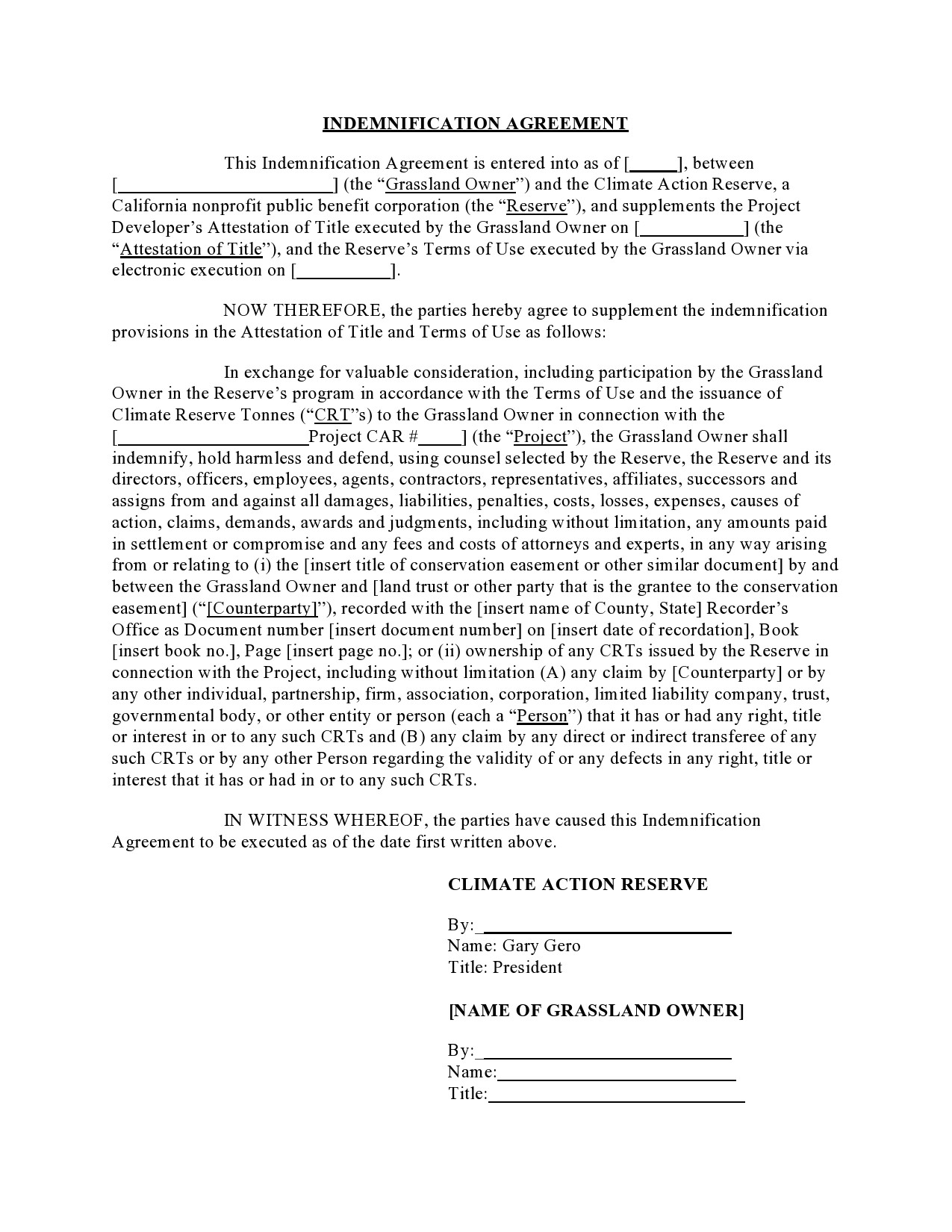

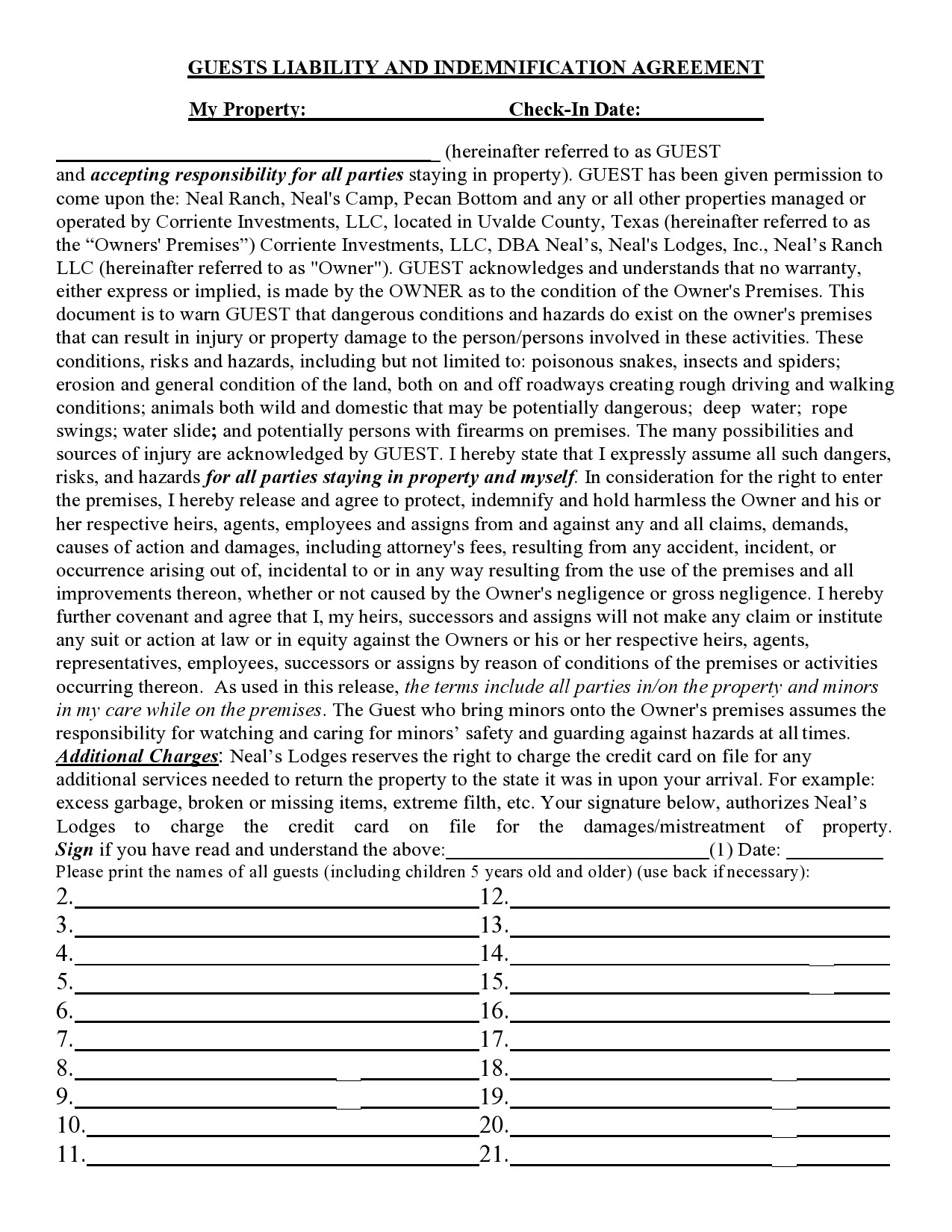

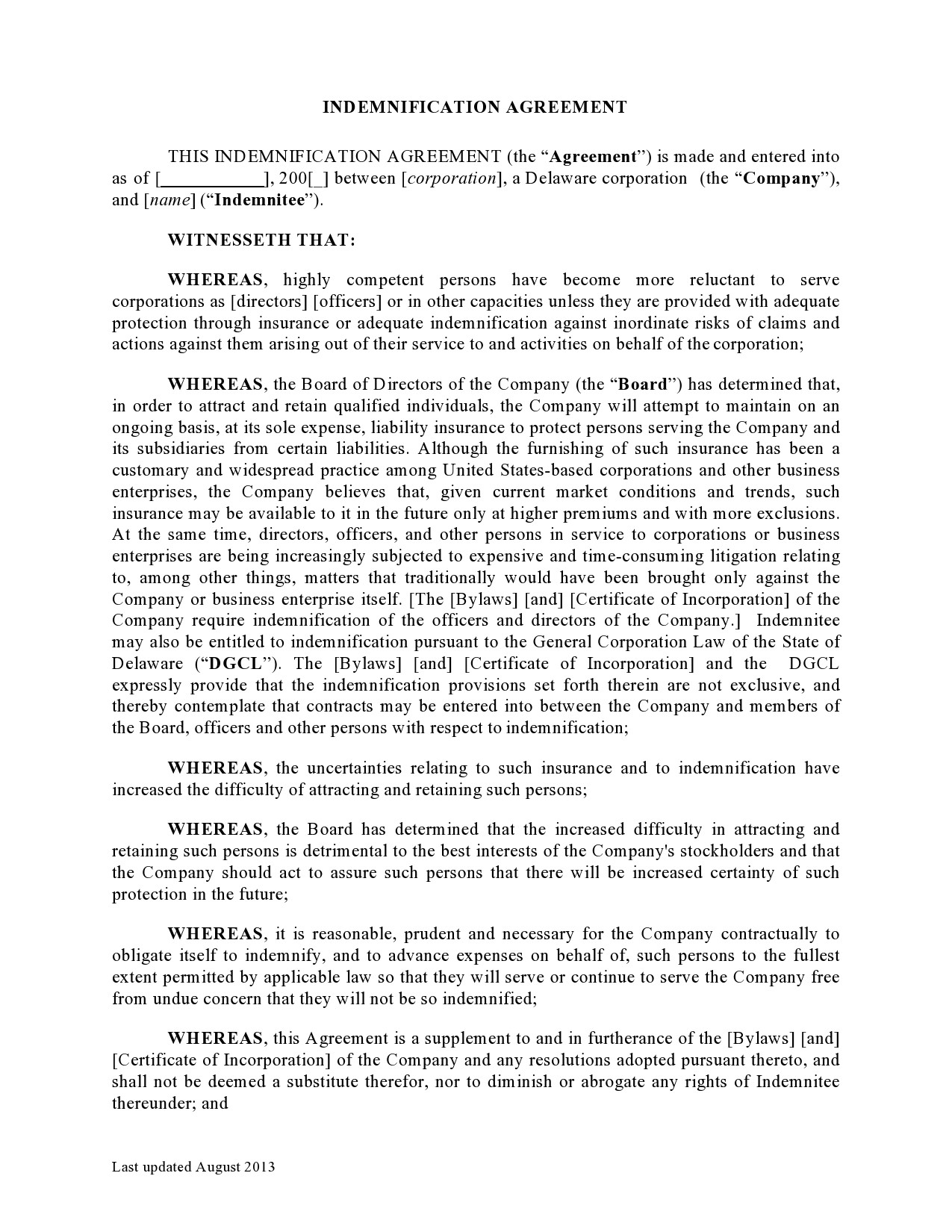

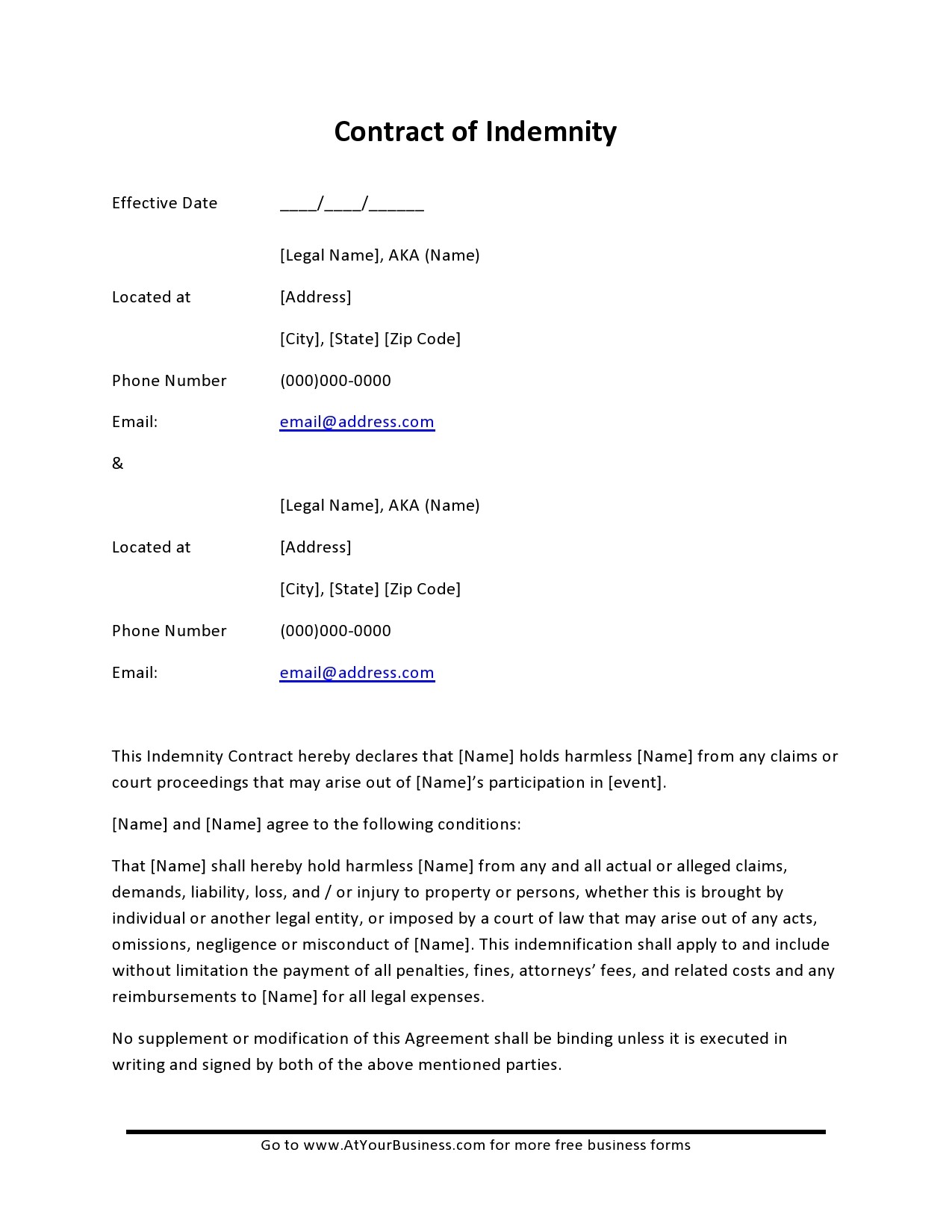

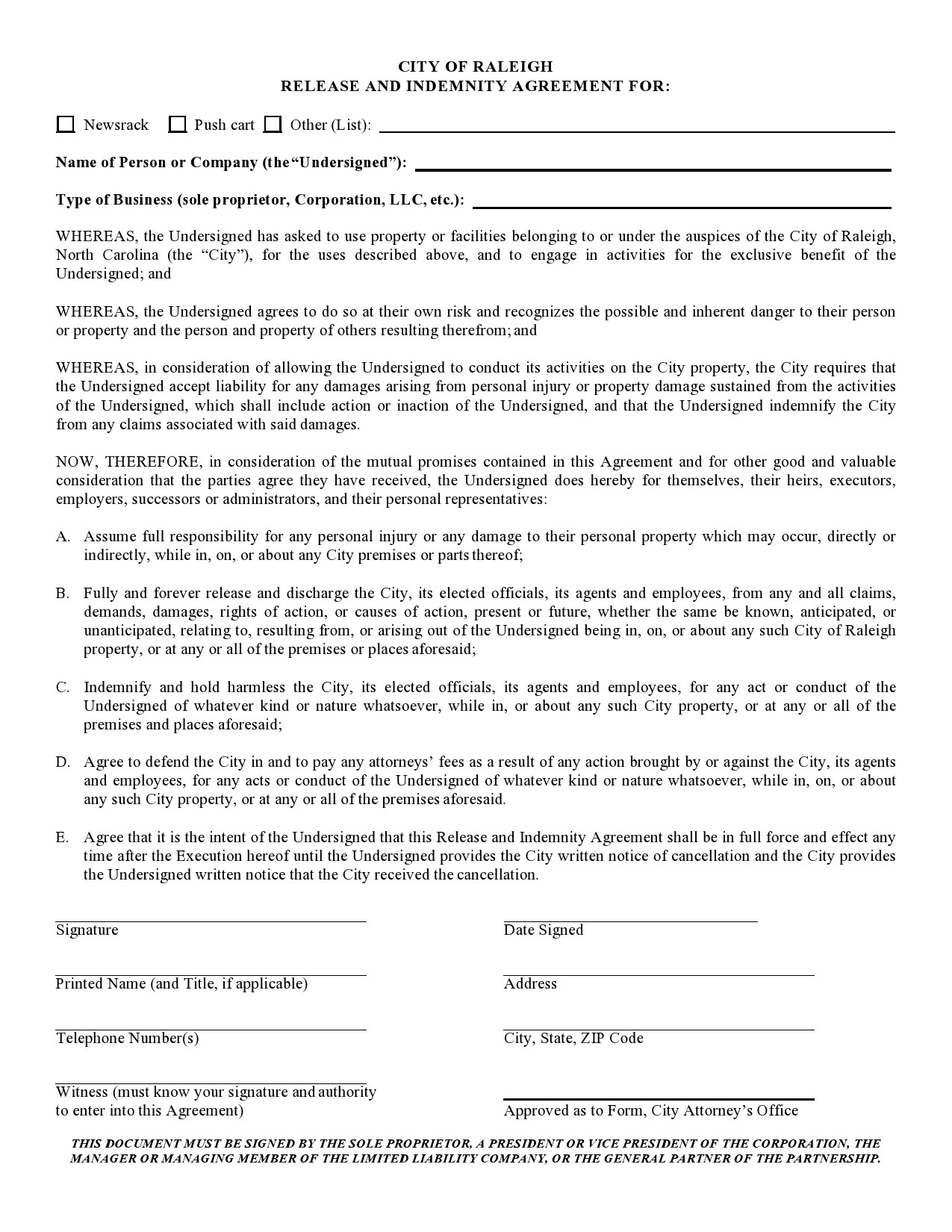

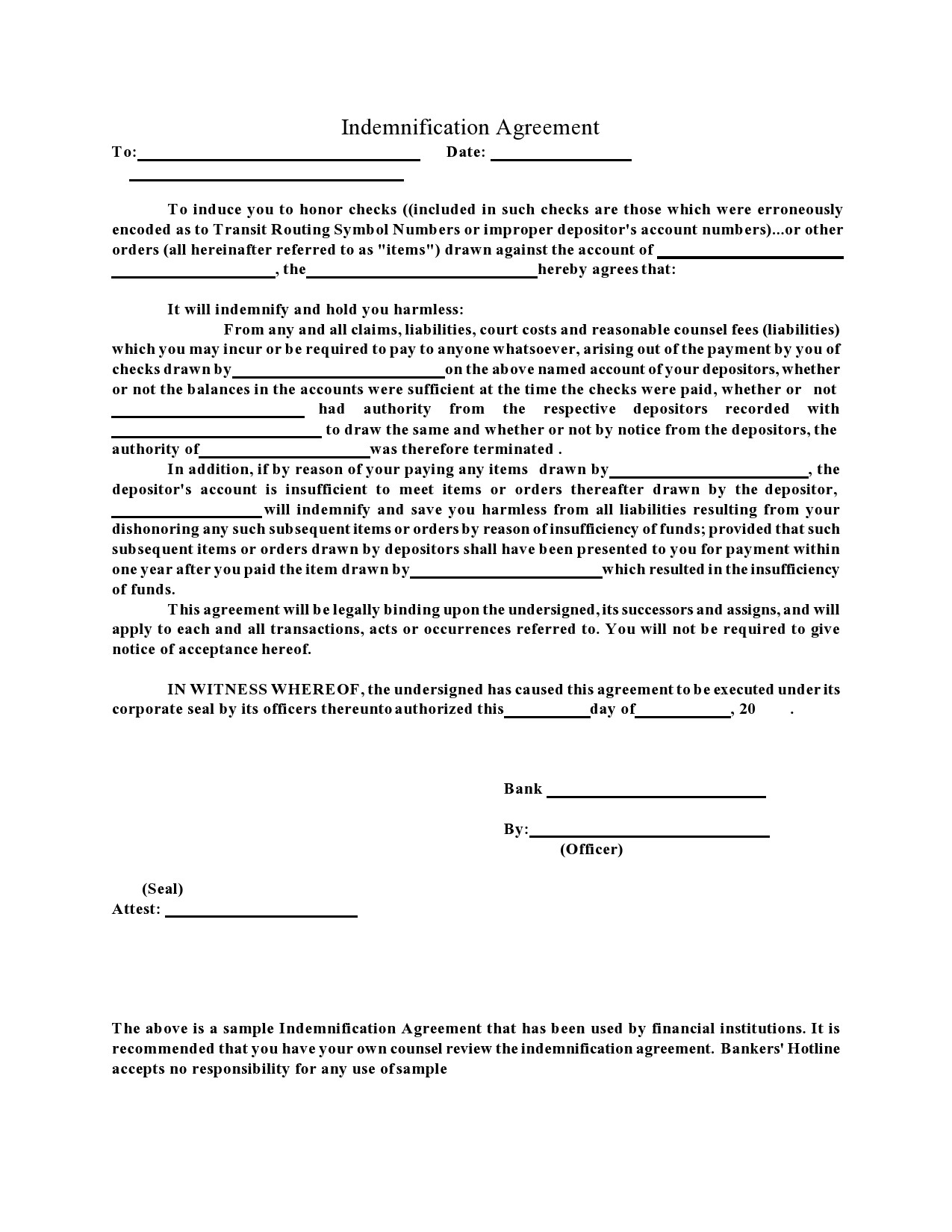

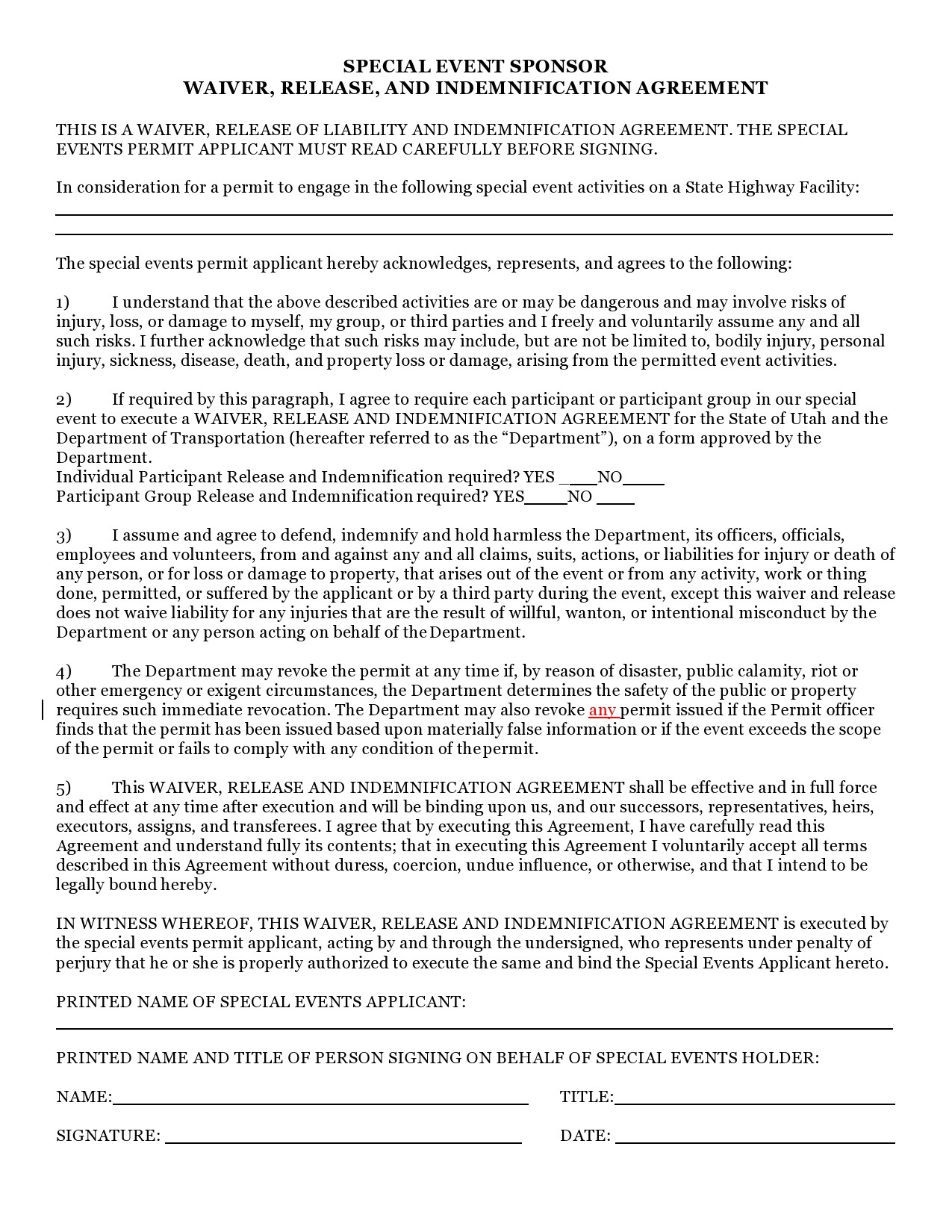

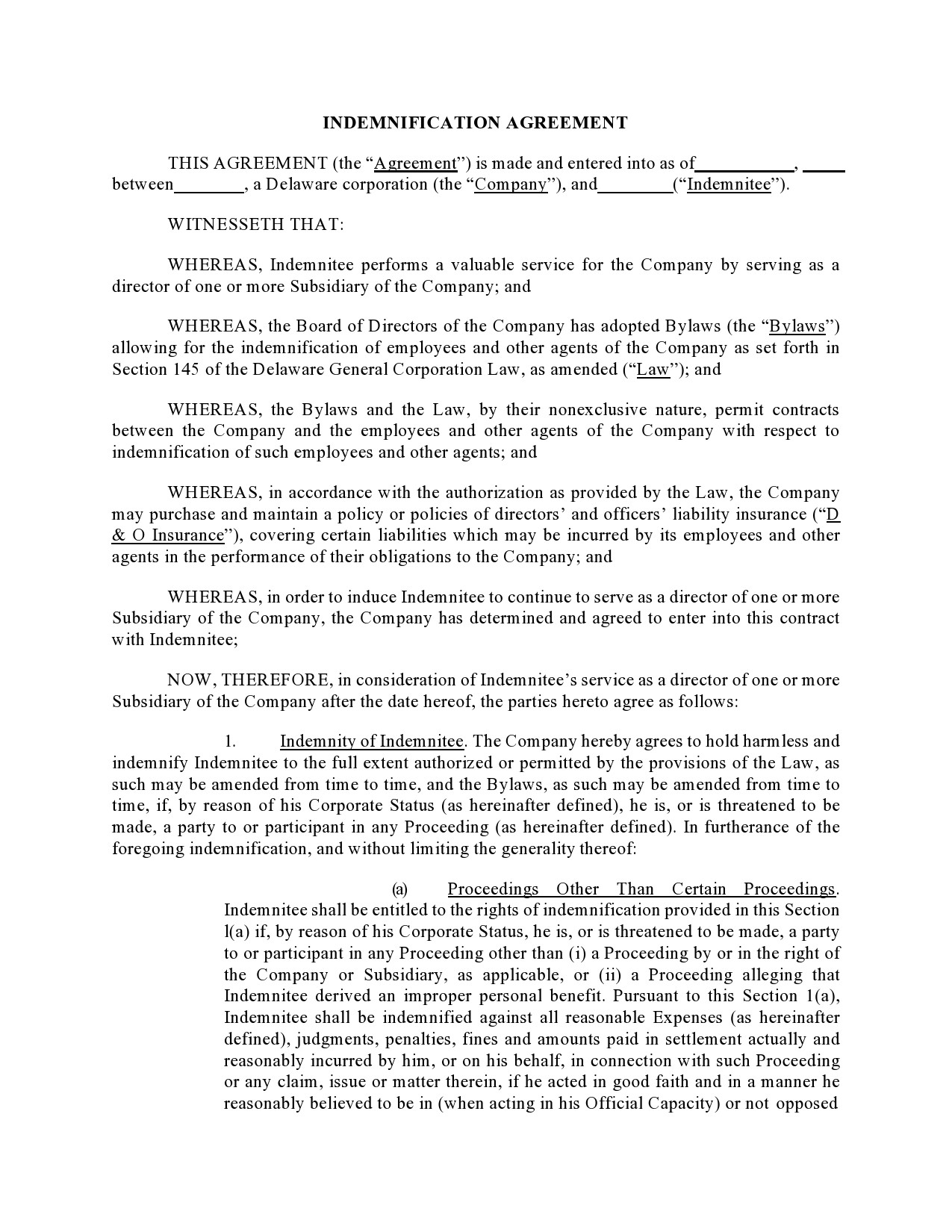

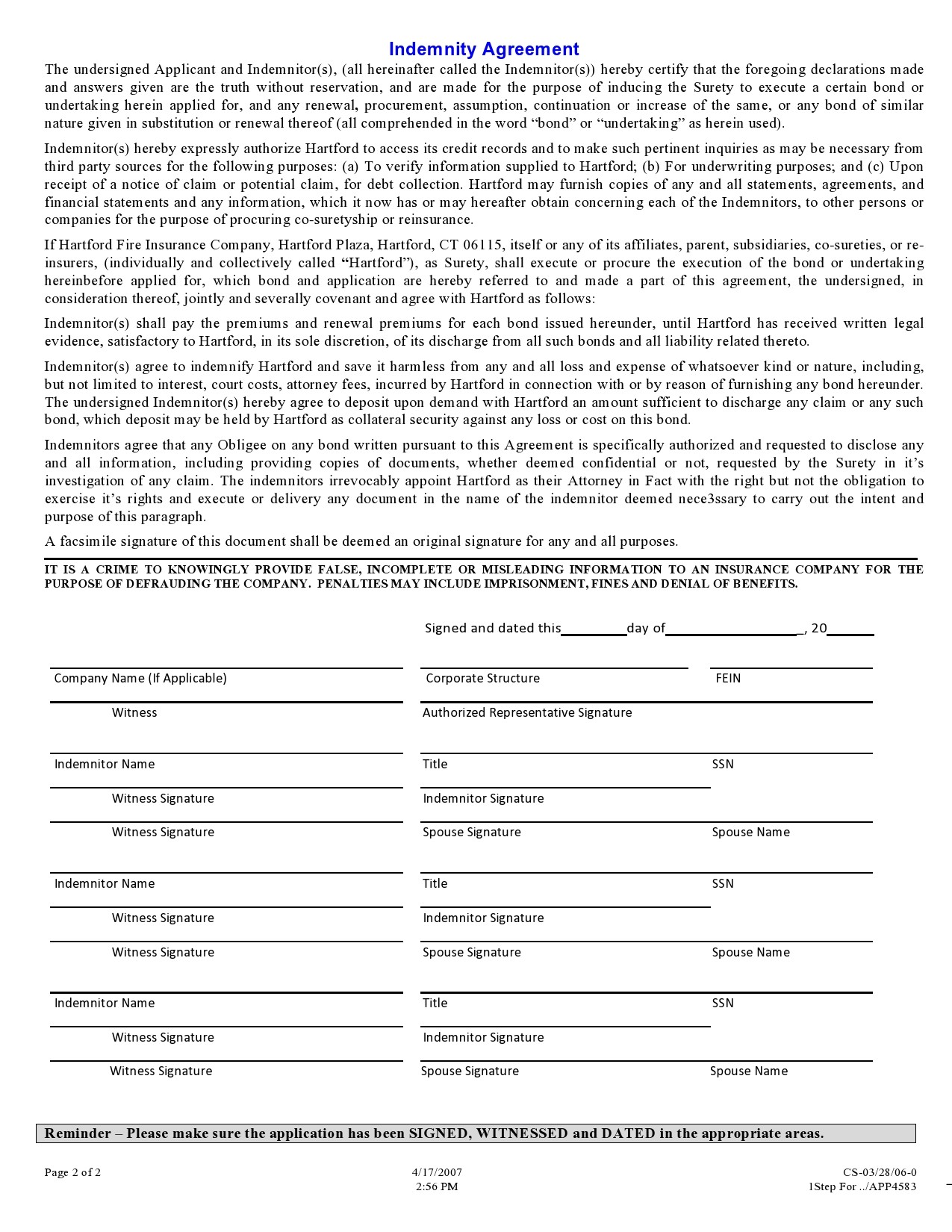

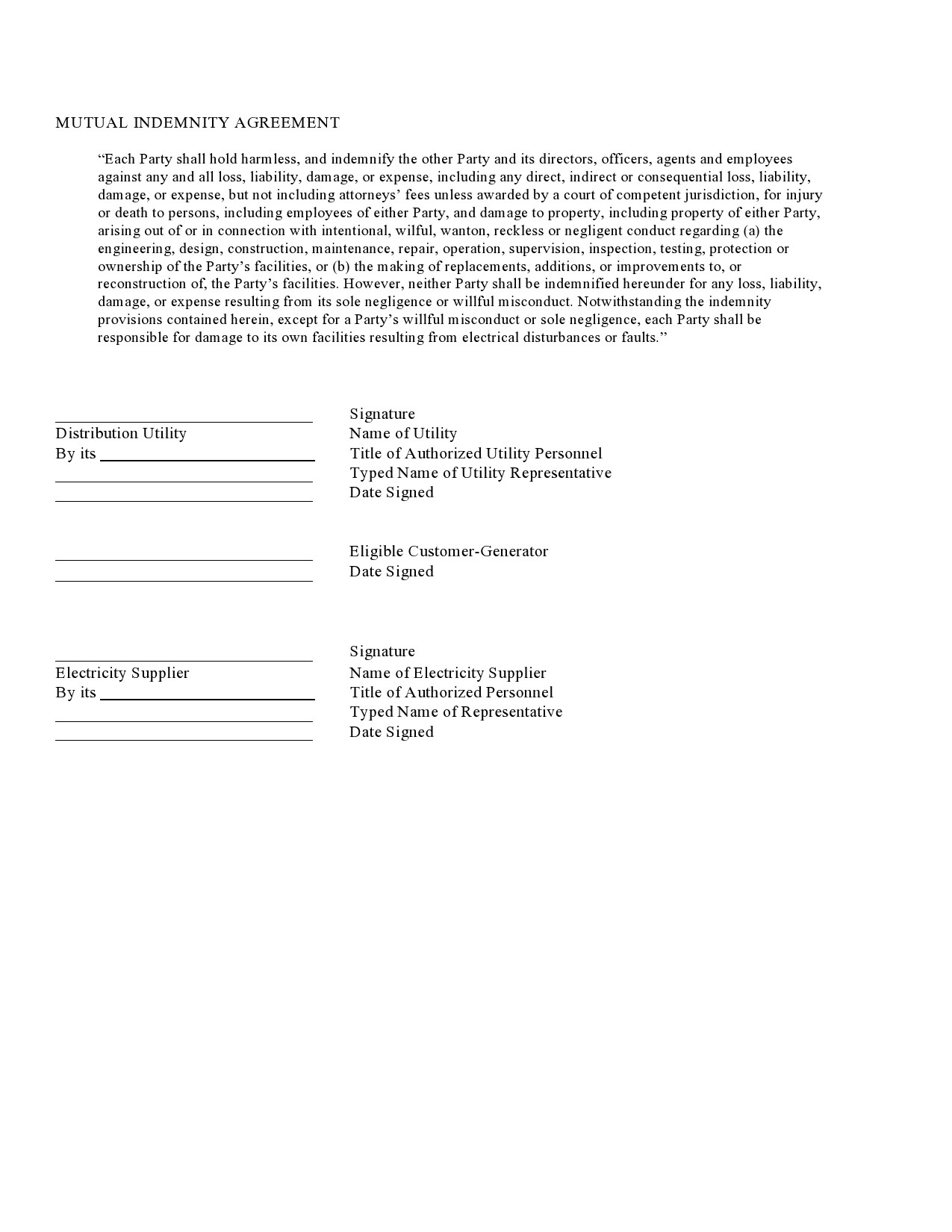

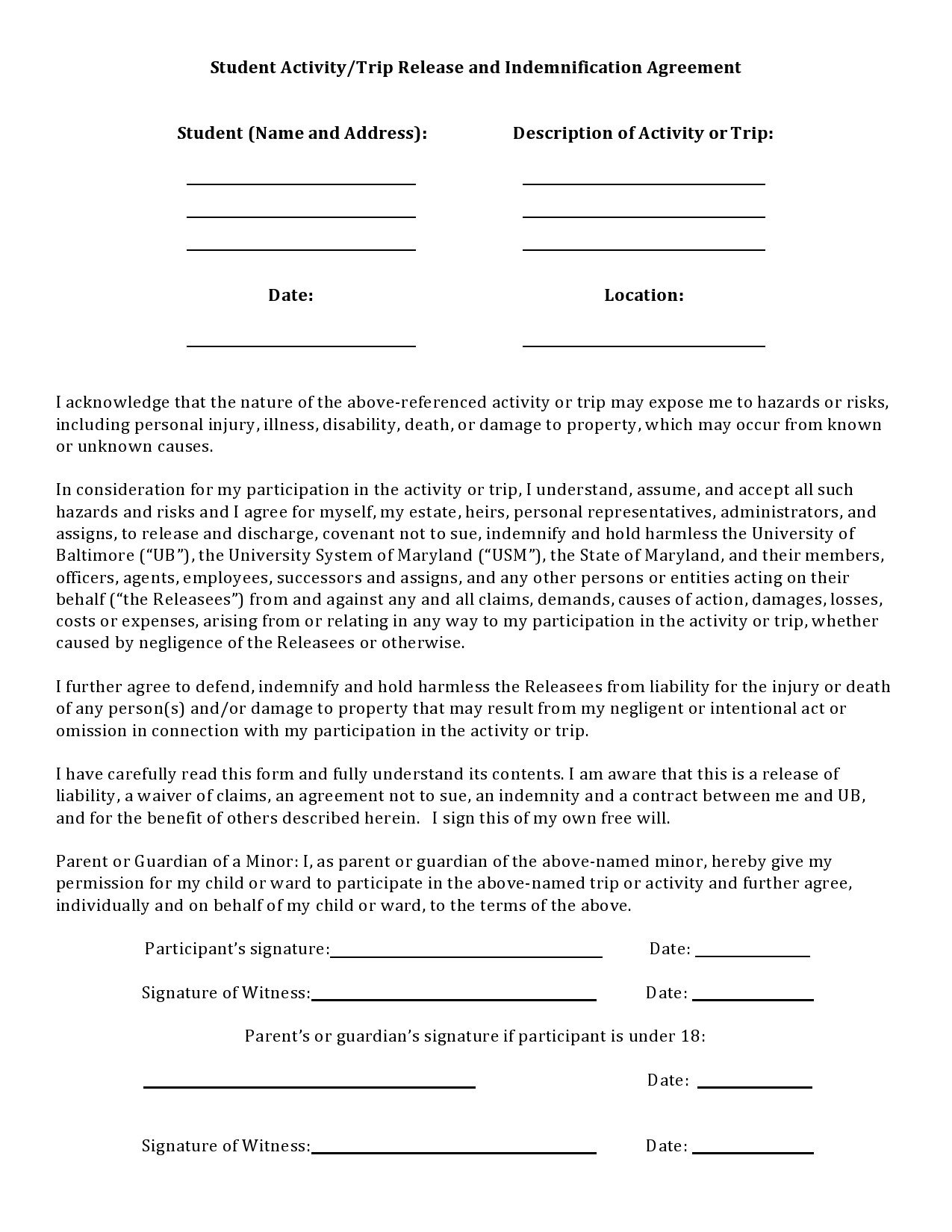

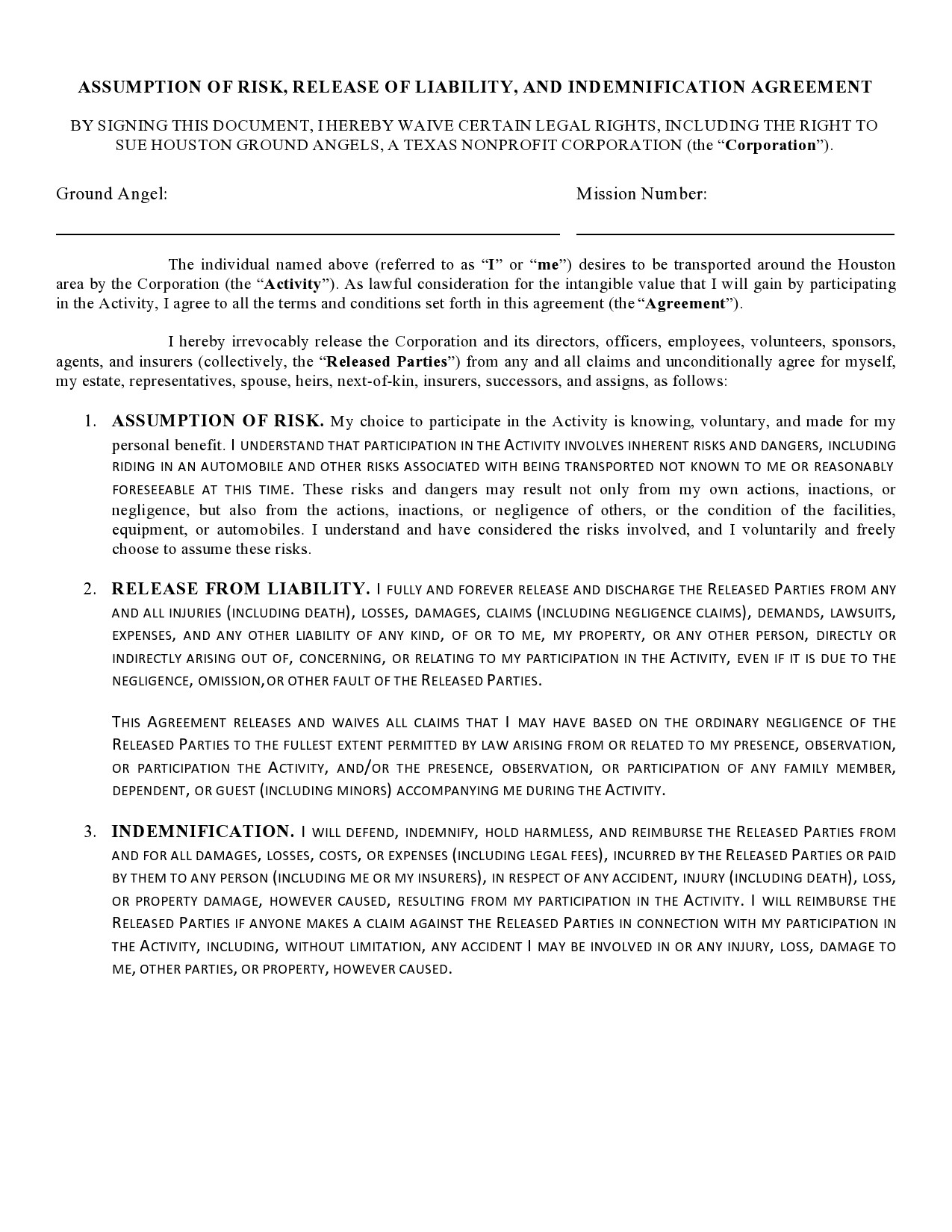

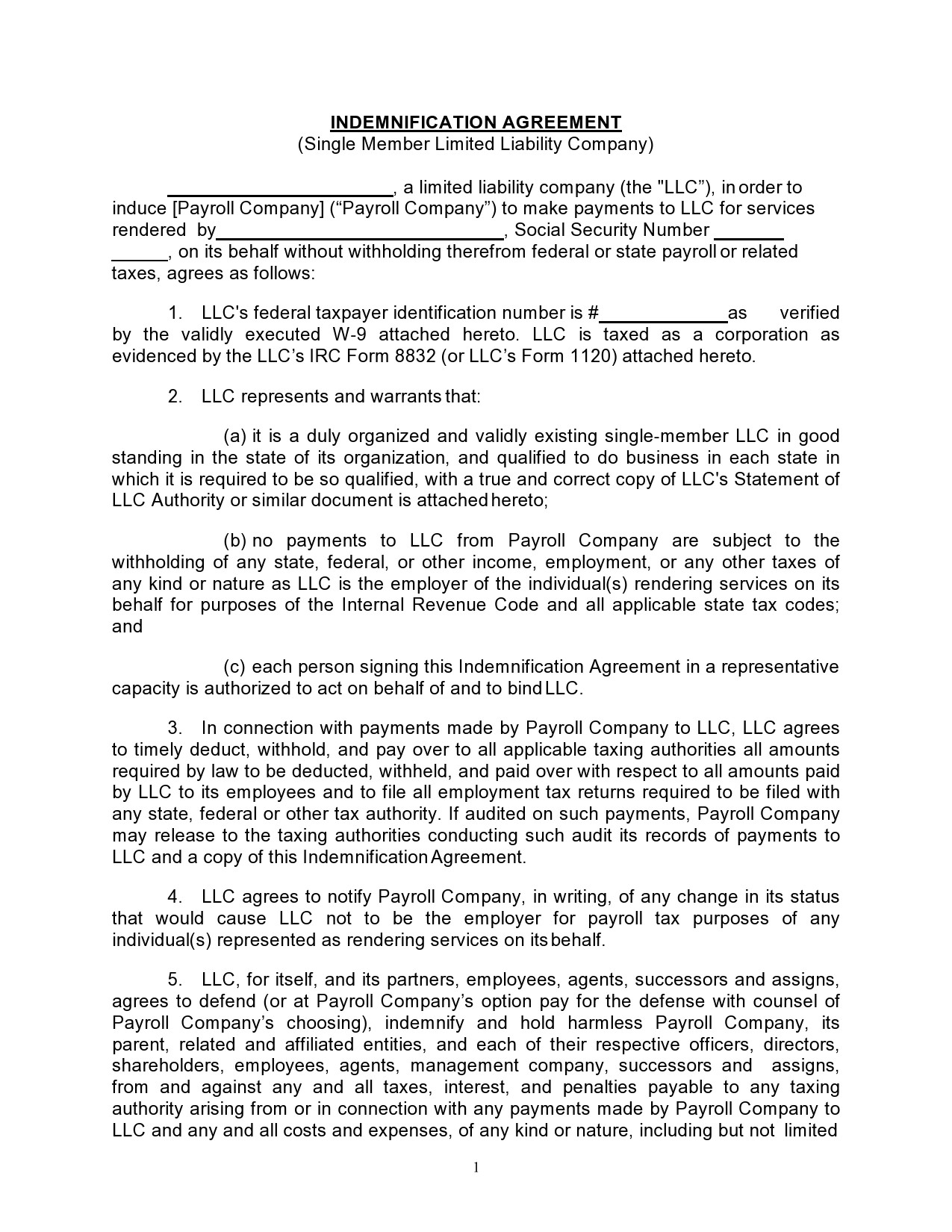

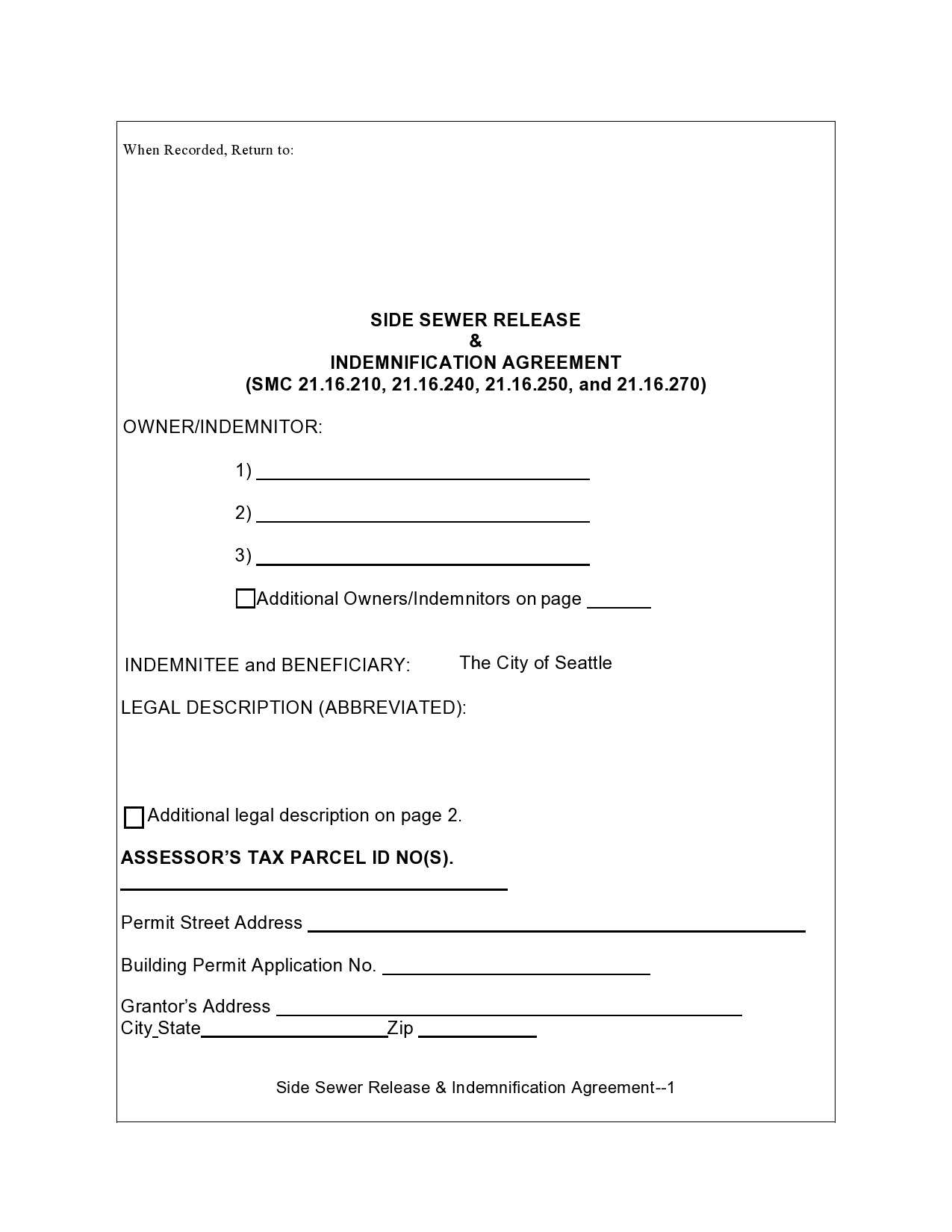

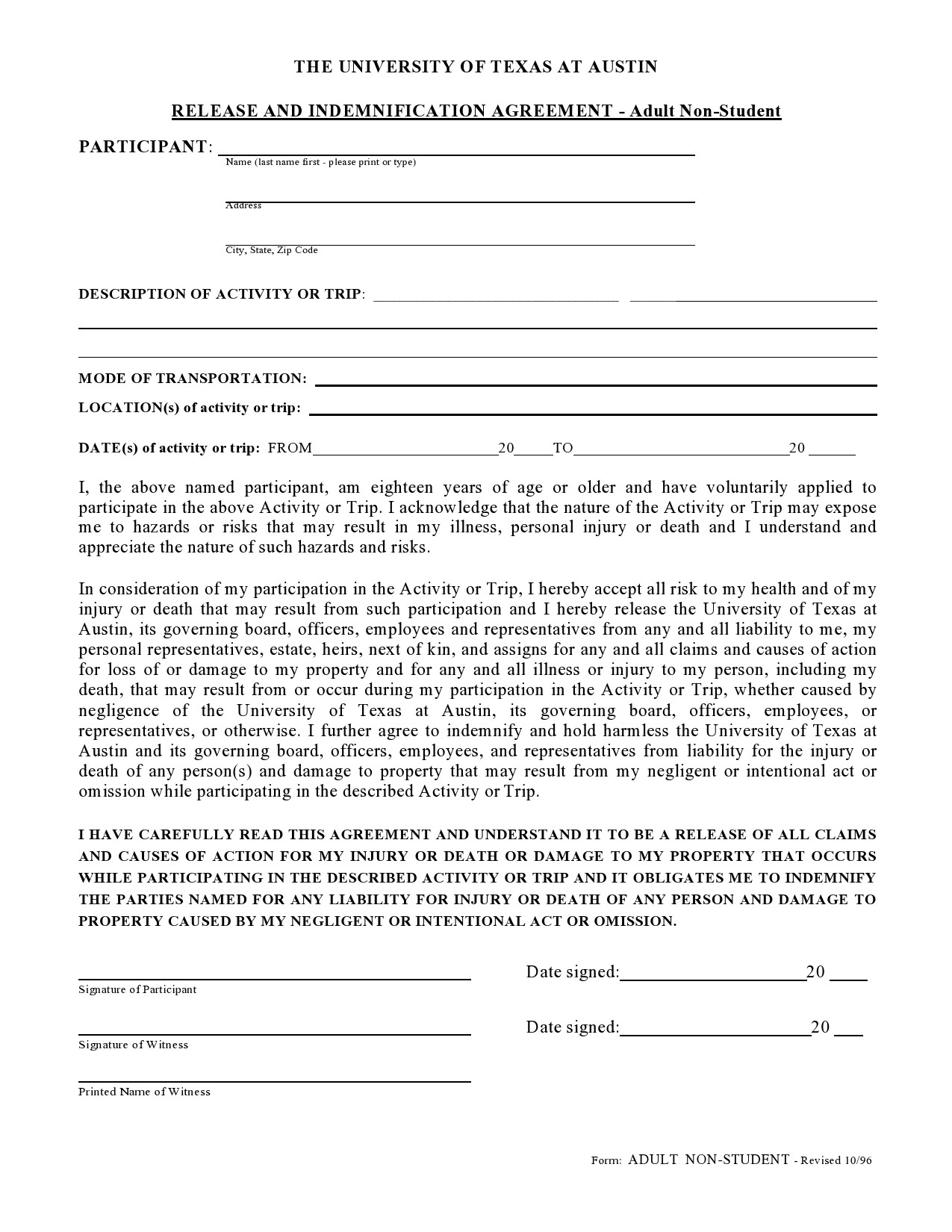

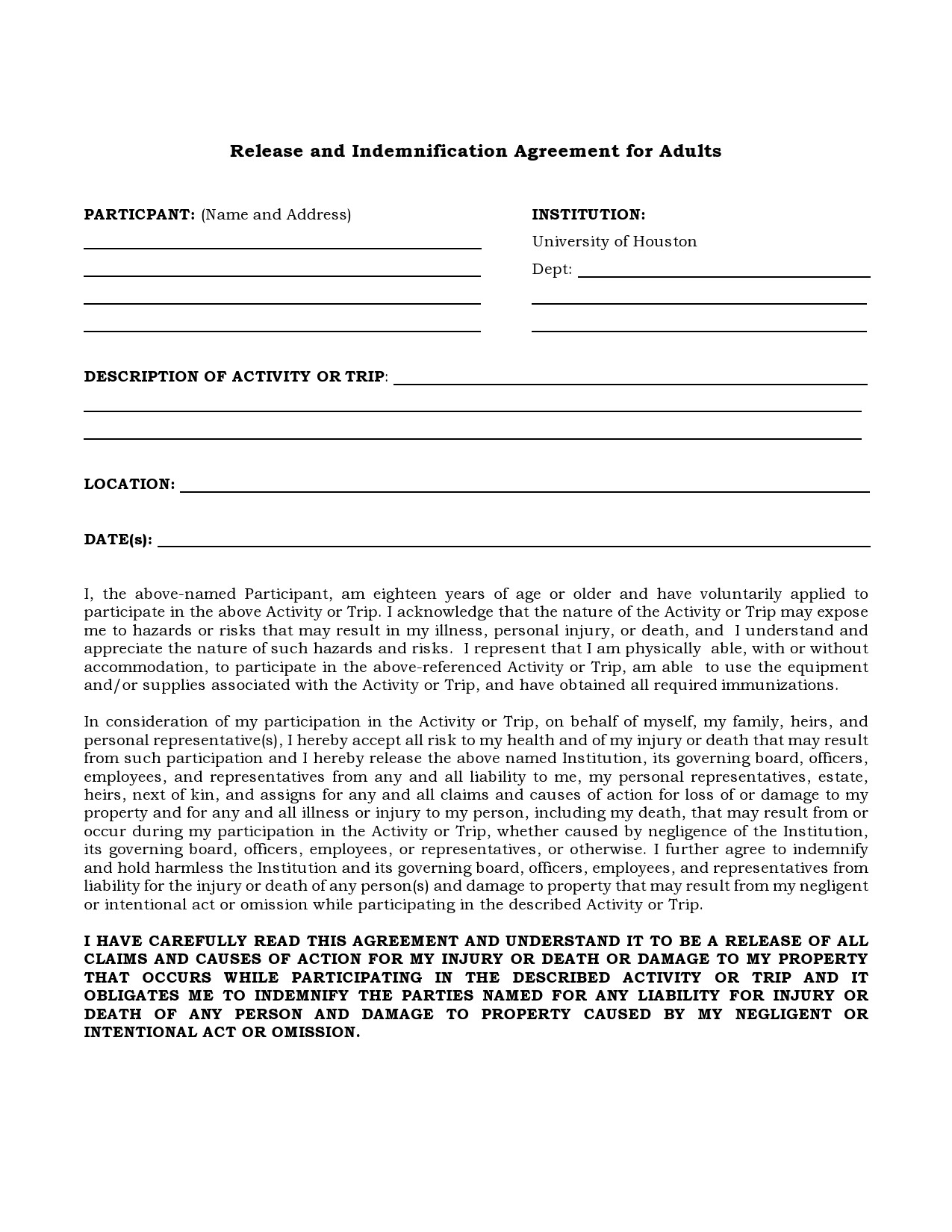

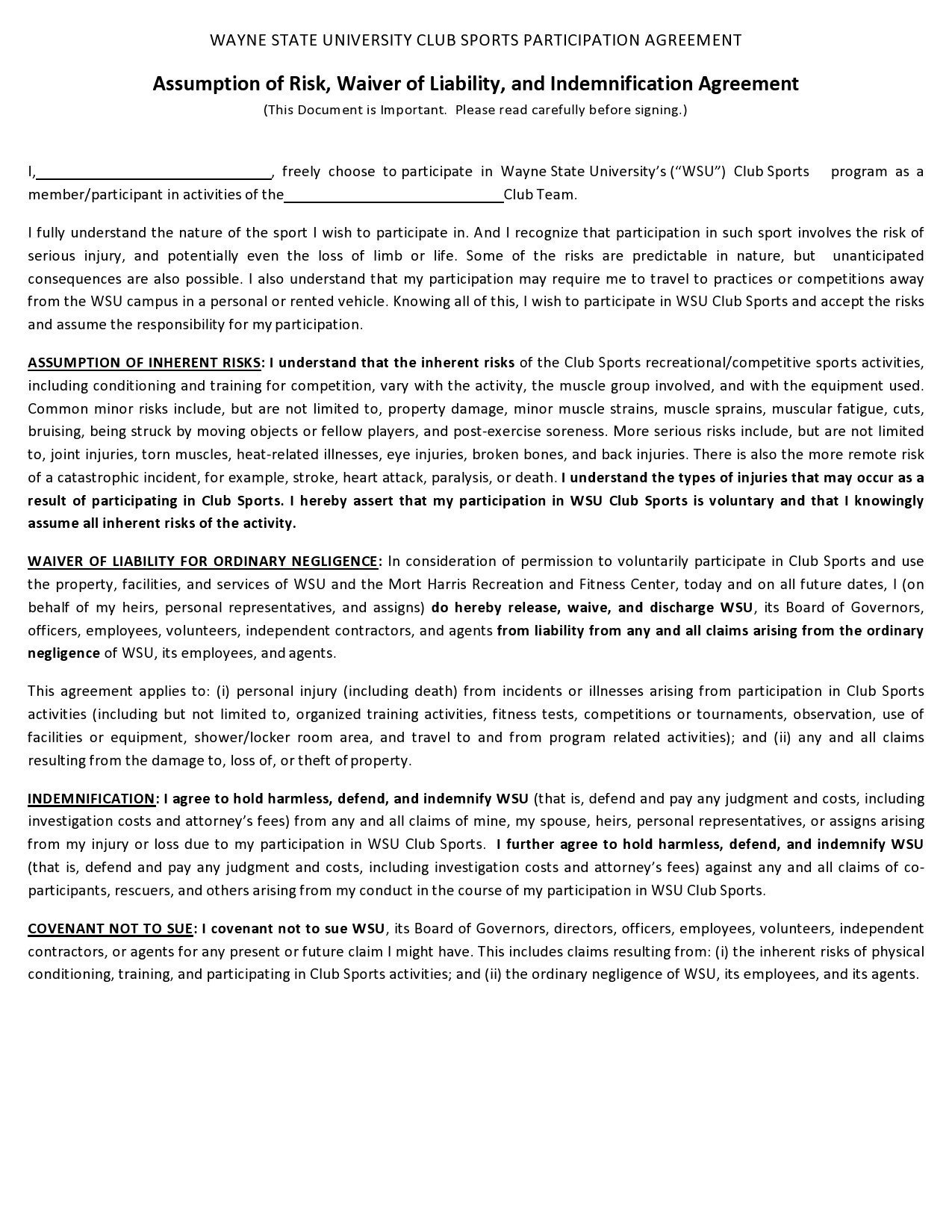

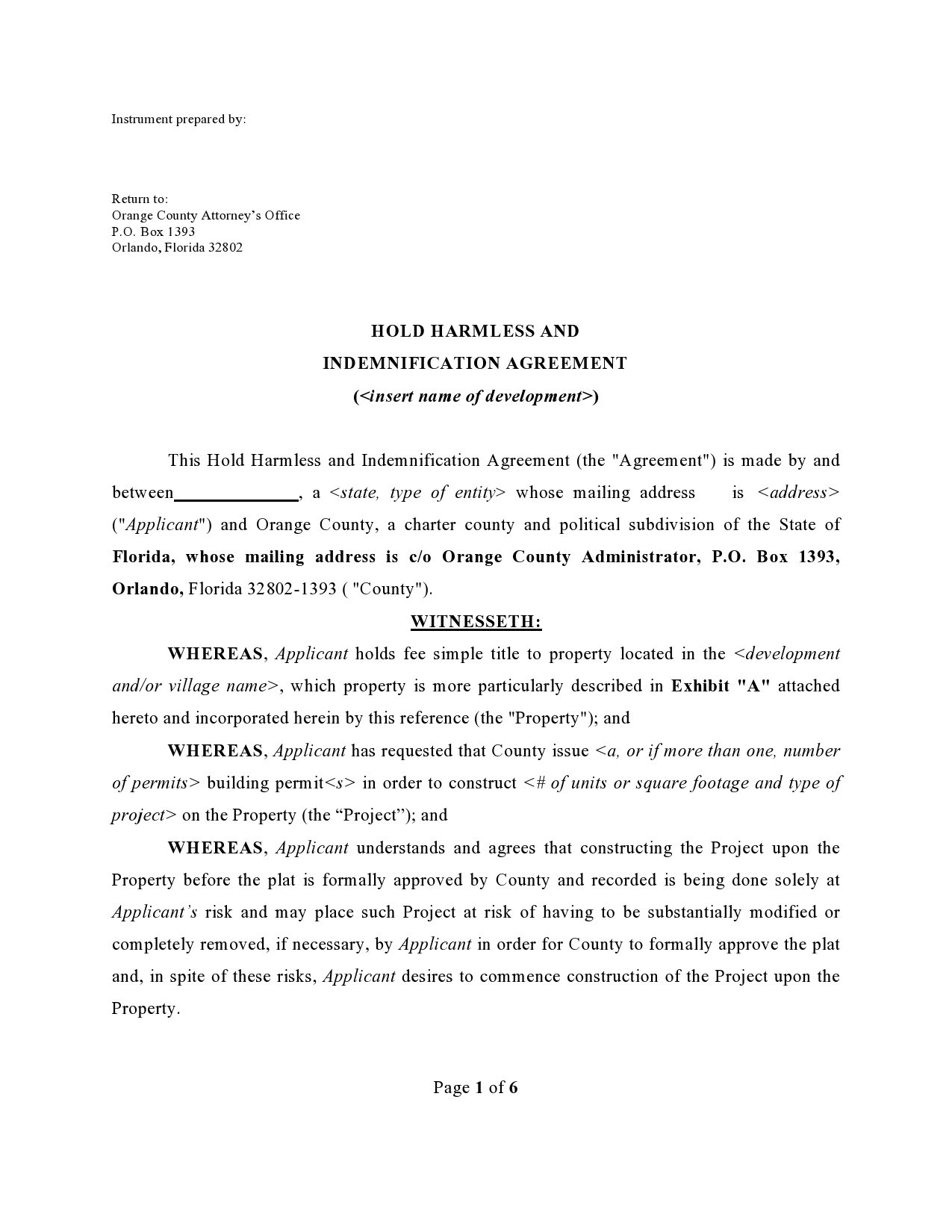

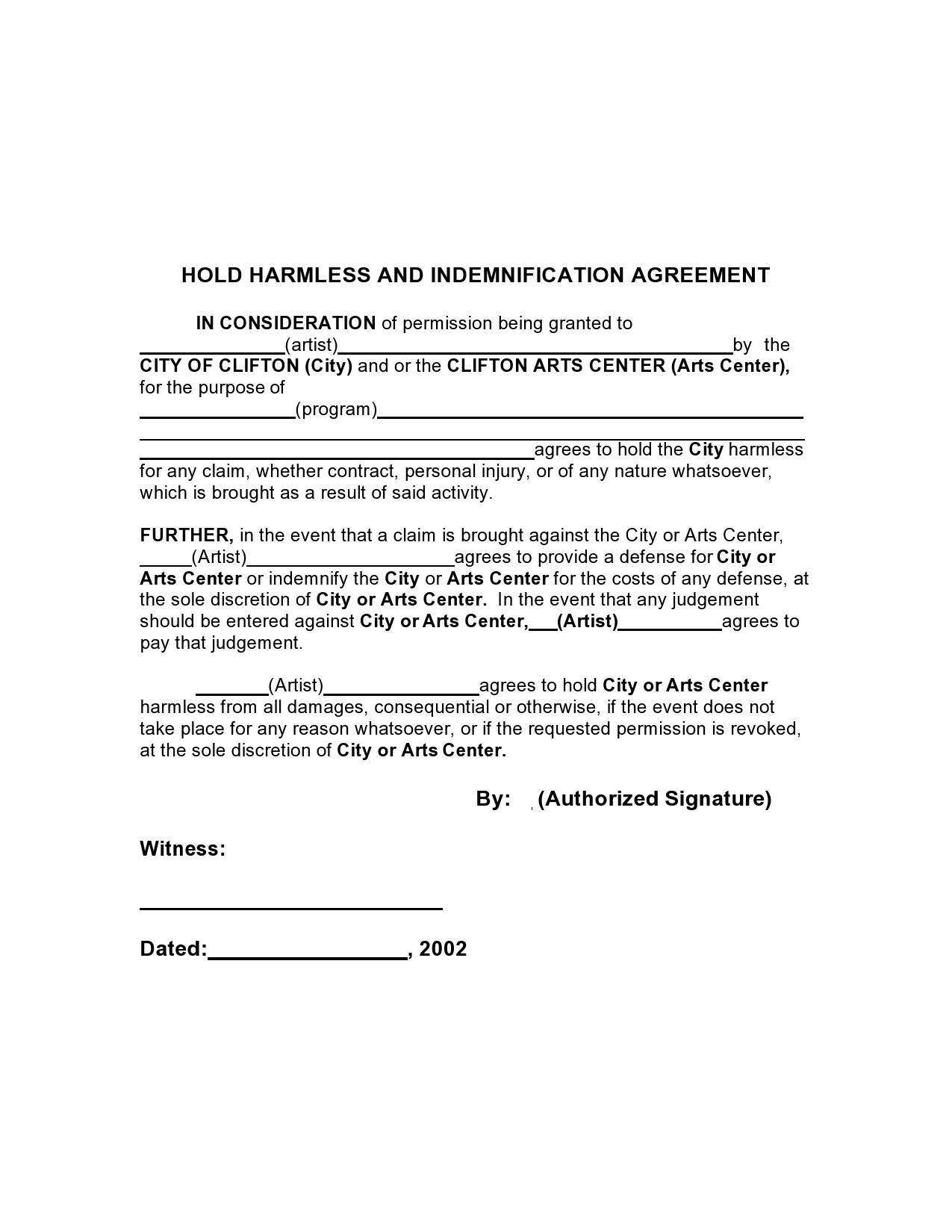

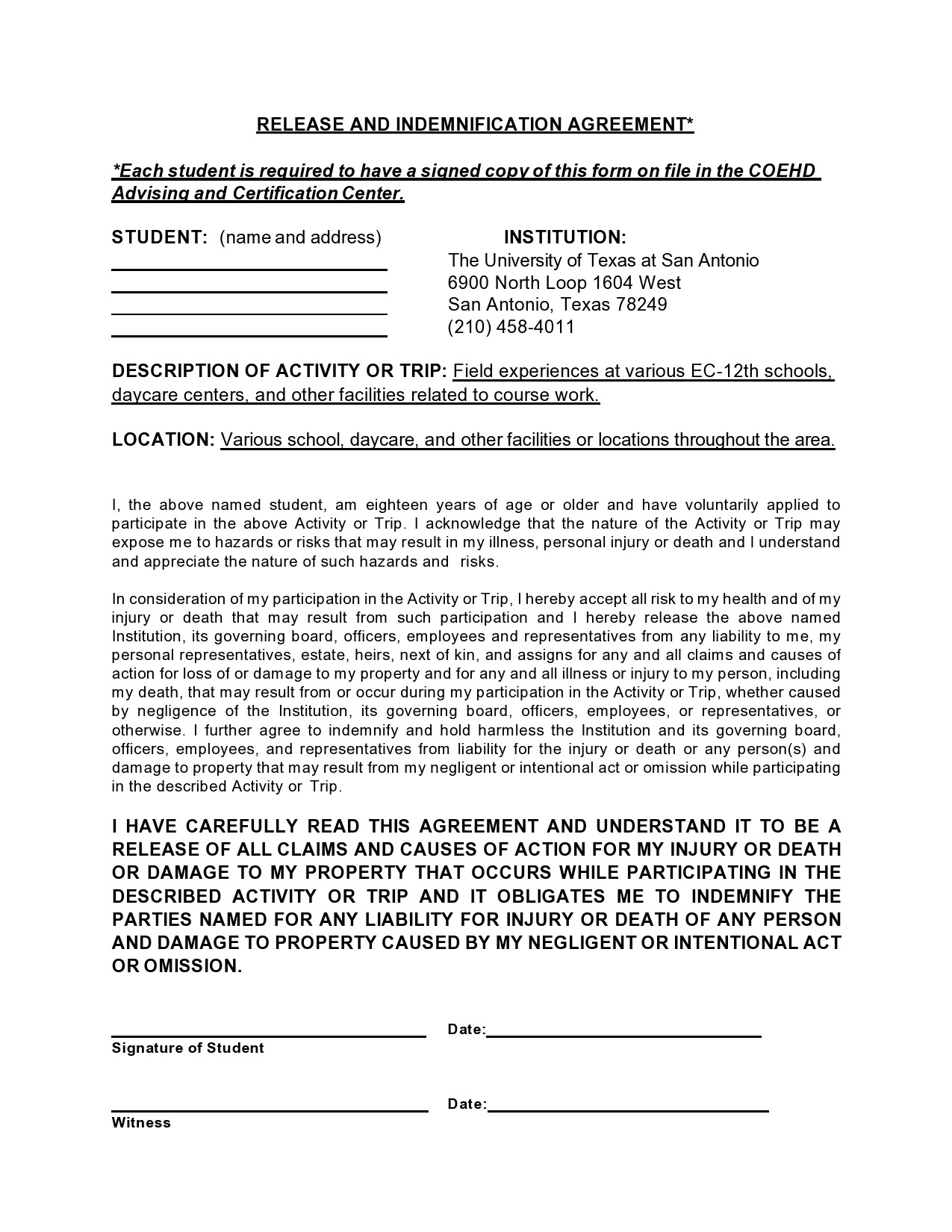

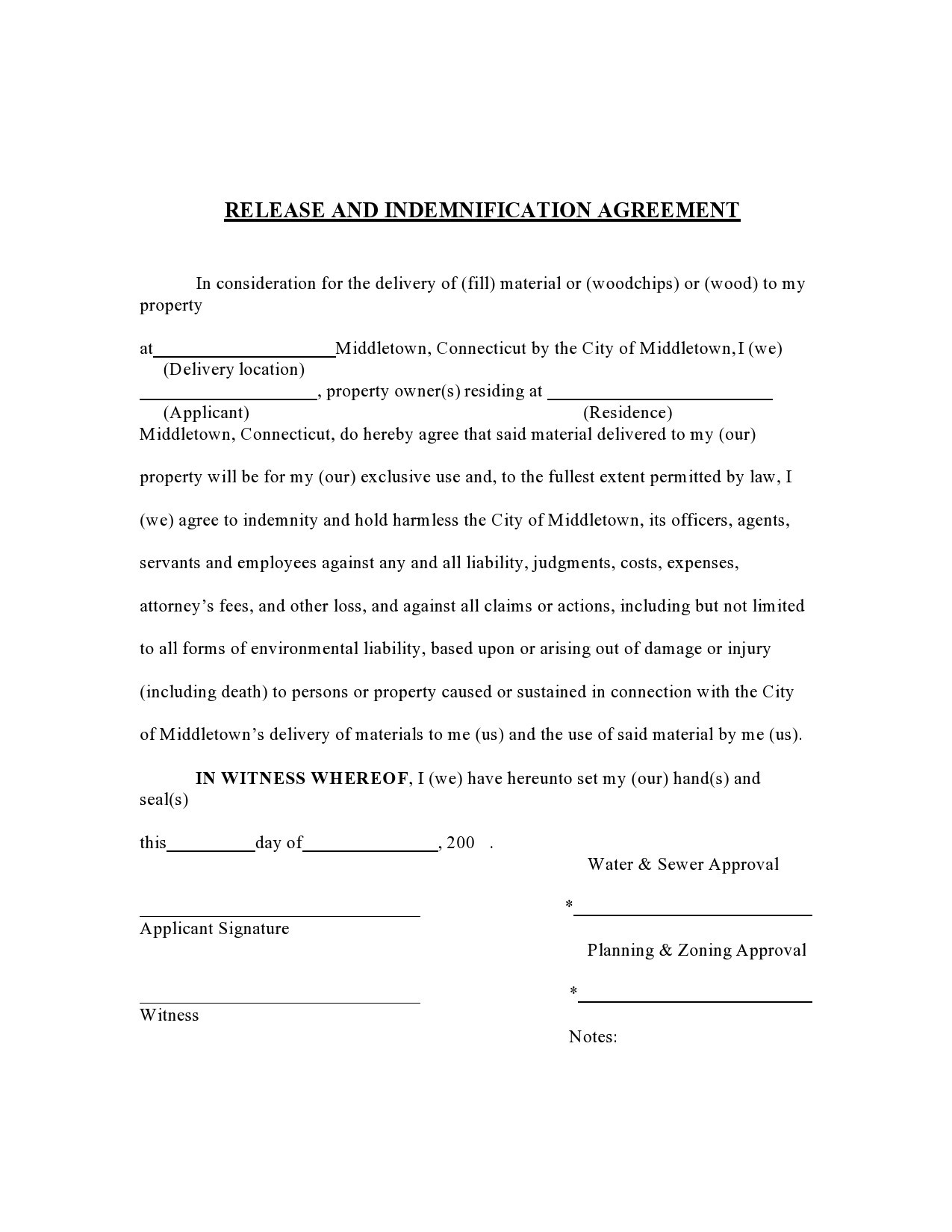

Indemnity Agreement Samples

The provisions of an indemnification agreement

An indemnity agreement sample distributes risk and expense when either party has committed Breach of Contract, Default or Misconduct. Since indemnification means “to hold harmless’ and without reason as in an agreement, it moves the cost from one party to another.

In the case of mutual indemnification, both parties will be in agreement to give compensation to the other should there be any incurred losses arising from any breach from the indemnifying party. A lot of people consider this safer compared to a one-way indemnification where only one party provides the indemnity.

The main purpose or benefit of an indemnification provision is to give protection to the indemnified party against any losses from the claims made by third parties. This means that you should carry out heavy negotiations in crafting indemnification provisions, not to mention that these are also litigated.

Indemnifications are typically found in agreements where there are high risks where a party can’t perform the terms of the contract, commits some form of misconduct or, otherwise, breach the contract. For example, sellers may include a provision for indemnification in a contract that involves intellectual property rights. This inclusion can protect the buyer against any potentially large liability that may occur if an infringement lawsuit comes from a third party.

Types of clauses in indemnification agreements

An indemnification agreement is a way of establishing the transfer of financial risk to a third party through a written document. This agreement contains a list of all the parties involved in the agreement, the situations included, and the party (or parties) who shoulders the risk. Basically, if a company indemnifies another company, it would accept the liability associated with a specific service or product. You can find indemnification clause sample in:

- Commercial Contracts

- Leases

- Legal Contracts

- Licensing Agreements

- Loan Agreements

- Supply Agreements

The inclusion of these clauses will place the legal responsibility for risk upon a company or person. There can also be cases where an indemnity clause creates more risk by increasing the degree of a risk that a company accepts.

Other indemnity clauses only allow a specific degree of risk as they take into account unforeseen accidents. Still, some clauses may only cover protection accidents the indemnifying party who shoulders the risk causes. Here are the different types of indemnification clauses you can include in your agreement:

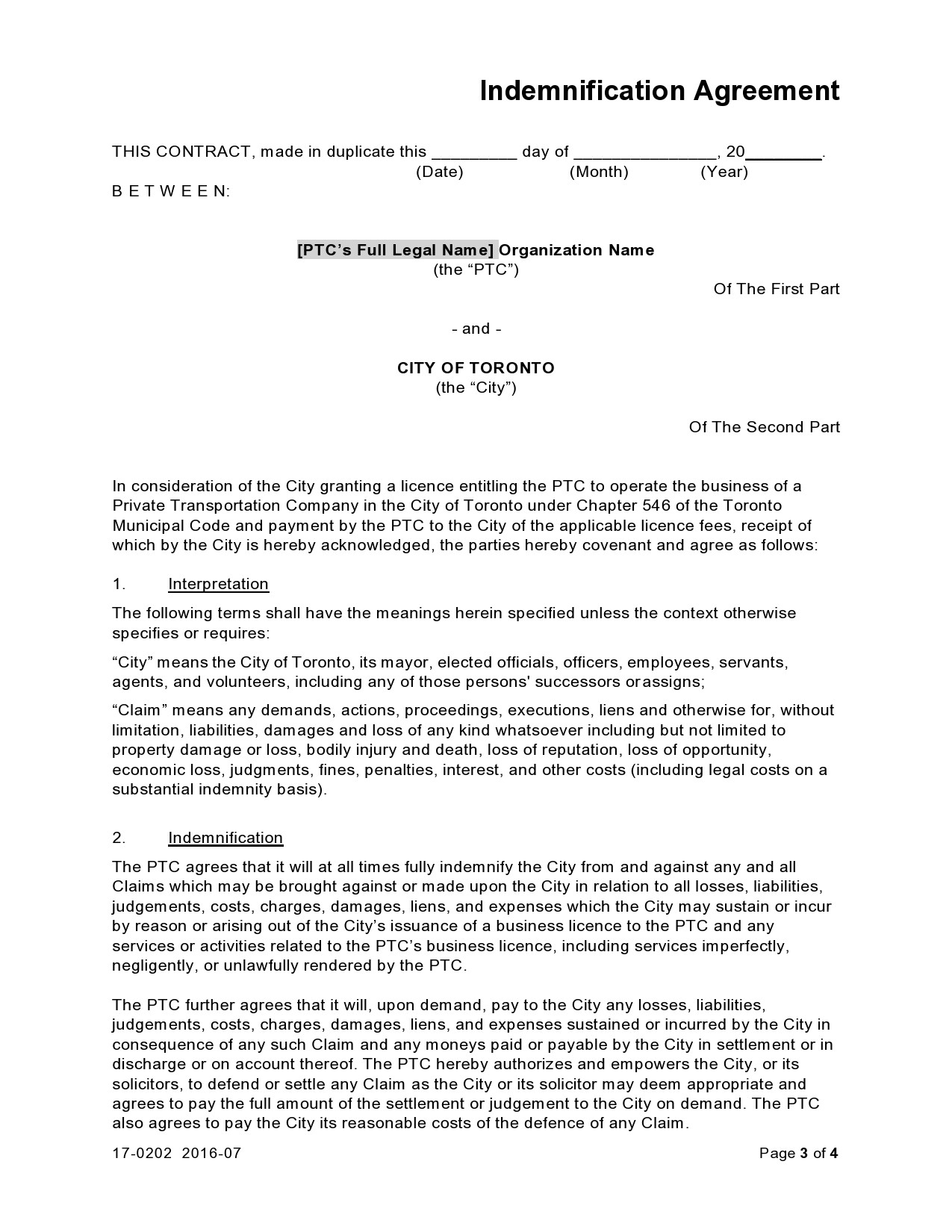

- Broad Form Indemnity

This type of clause holds the indemnifier responsible because of his/her negligence and any negligence of a third party. It might make them liable for the negligence of the indemnitee too. In some states, the indemnitee is not allowed to transfer damages that they caused on their own or of the indemnifier’s willful misconduct. - Intermediate Form Indemnity

This indemnifies a party because of its negligence unless it was completely their fault. The phrase “…. caused in part” is almost always included in this type of indemnity. Moreover, since the term “whole” isn’t included, it no longer is a broad form indemnity.

This type of indemnity is the most common method used in the construction businesses as it renders the owner harmless from claims caused by their own negligence. In its most basic sense, it sets an all-or-nothing indemnification. - Comparative Form Clause

This type requires a comparison of the negligence. The inclusion of this clause will make the indemnifier responsible for any losses caused by their proper actions. Common law principals which are generally accepted in the USA determine the level of responsibility. The indemnifier here will not take responsibility for negligence that the indemnitee commits directly.

You can determine how much indemnity one party must shoulder on behalf of the other party by the conditions outlined in the agreement. An effective indemnification should specify the types of indemnity required based on the situation and the transaction.

Indemnification Letters

What is the difference between a hold harmless agreement and an indemnity agreement?

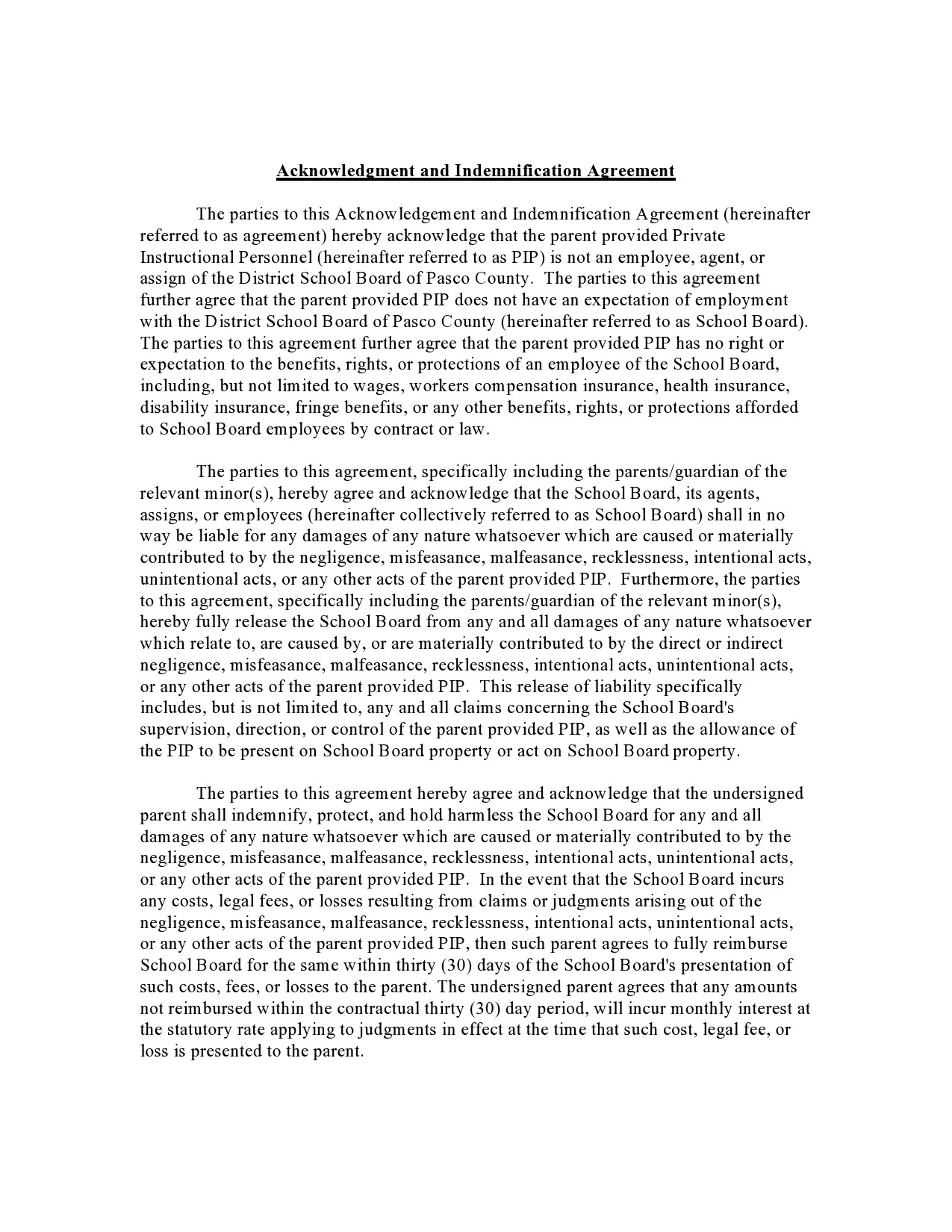

Before differentiating these two, here are the main features of a hold harmless agreement:

- It is a statement in a document that states that an individual or an organization will not get held liable for any damages or injuries caused to another party.

- It is also referred to by several names including a waiver of liability, release of liability, a hold harmless release or letter, and a save harmless clause.

- These agreements which are commonly used in leases, easements, and contracts aim to protect either of the parties or both of them.

- No matter what issues arise between the parties, the party that the clause protects cannot get sued.

There are two types of hold harmless clauses:

- In a reciprocal clause, both parties accept that they will not hold each other accountable.

- In a unilateral clause, only one of the parties accepts that it will not hold the other accountable.

The distinction between hold harmless and indemnity clauses varies by state. Although most professionals treat these two clauses as having similar meanings, they aren’t the same thing. This makes it very important for contracts to be as clear-cut and specific as possible. Here are some points that show the difference between a hold harmless agreement and an indemnity agreement:

- There are those who believe that indemnity only protects against losses while hold harmless clauses protect against both liabilities and losses. Unfortunately, this explanation is not always true for all circumstances. For instance, you can use the term “indemnify” when a business wants to keep itself protected against claims from a mistake made by a customer while the hold harmless clause prevents a business from taking responsibility for the mistake of a customer. To be on the safe side, most experts recommend including both terms to ensure maximum protection.

- Any breach of contract by either party puts the lowest level of protection into play. You can deem a contract breached when both parties decide unilaterally to complete a task but one party fails to follow the terms written in the agreement. The party who breached the contract can get sued. Keep in mind that mitigation and remoteness only provide minimum protection.

To summarize, indemnity refers to compensation for damages and loss. Legally, it also refers to exemption from liability for loss or damages. Indemnity is usually based on a contractual document between two parties, where one party agrees to pay for any potential losses or damages that the other party caused.

The liability created comes from the loss of the indemnified party even when there is no breach of contract. When a breach of contract happens, it can trigger limitations. Conversely, indemnification takes place when either of the parties fails to indemnify or when either of the parties has the right to get indemnified.