A deed of trust example can be hard to write if you need a trust deed template to look at as you write your deed of trust form. The property trust deed that you write needs to be legally enforceable, so you want to be sure that you are not writing a real estate deed of trust that will not work as expected. A deed of trust is a very important document for many reasons and needs to be created carefully and correctly to be useful for the intended purpose.

This is a legally binding document that links three parties in a real estate contract. You will need to be certain that you are creating the entire document properly so that your real estate deed can be used correctly and so that it is not invalidated through errors that happened during the process of drafting the deed.

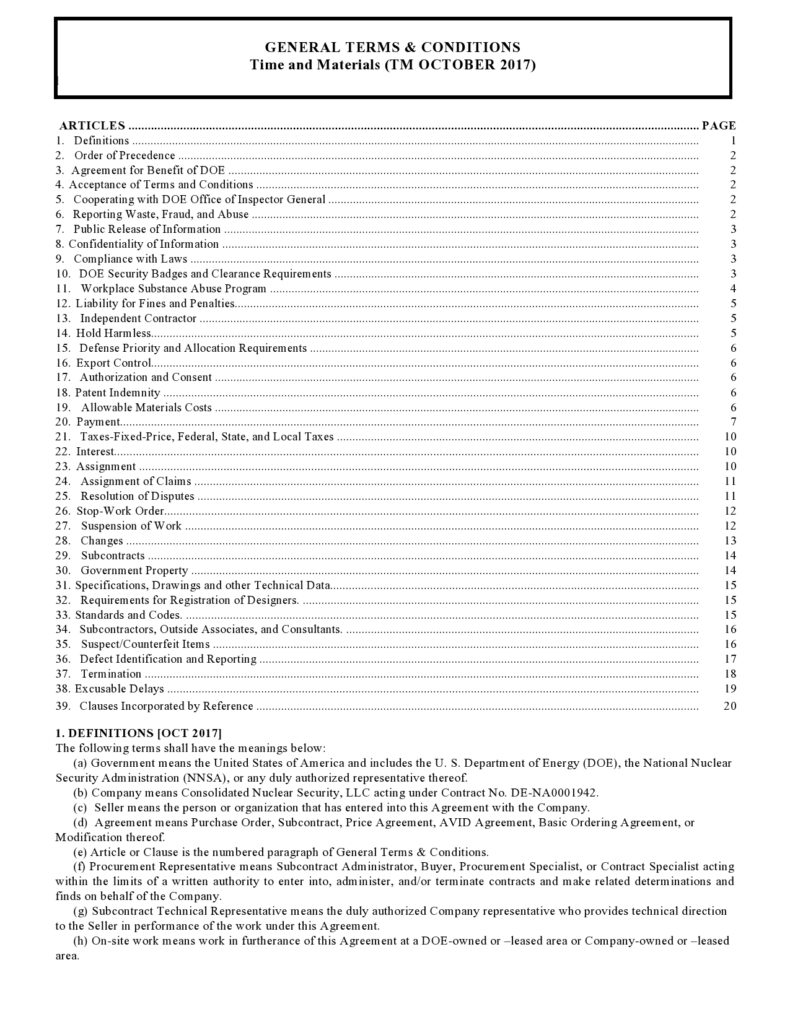

Table of Contents

- 1 Deed of Trust Examples

- 2 What is a deed of trust in simple terms?

- 3 Is a trust deed the same as a mortgage?

- 4 Trust Deed Templates

- 5 How to write a deed of trust

- 6 Deed of Trust Forms

- 7 What happens if you don’t have a deed of trust?

- 8 Property Trust Deed

- 9 Deed of Trust Documents need to be Written Correctly to be Valid

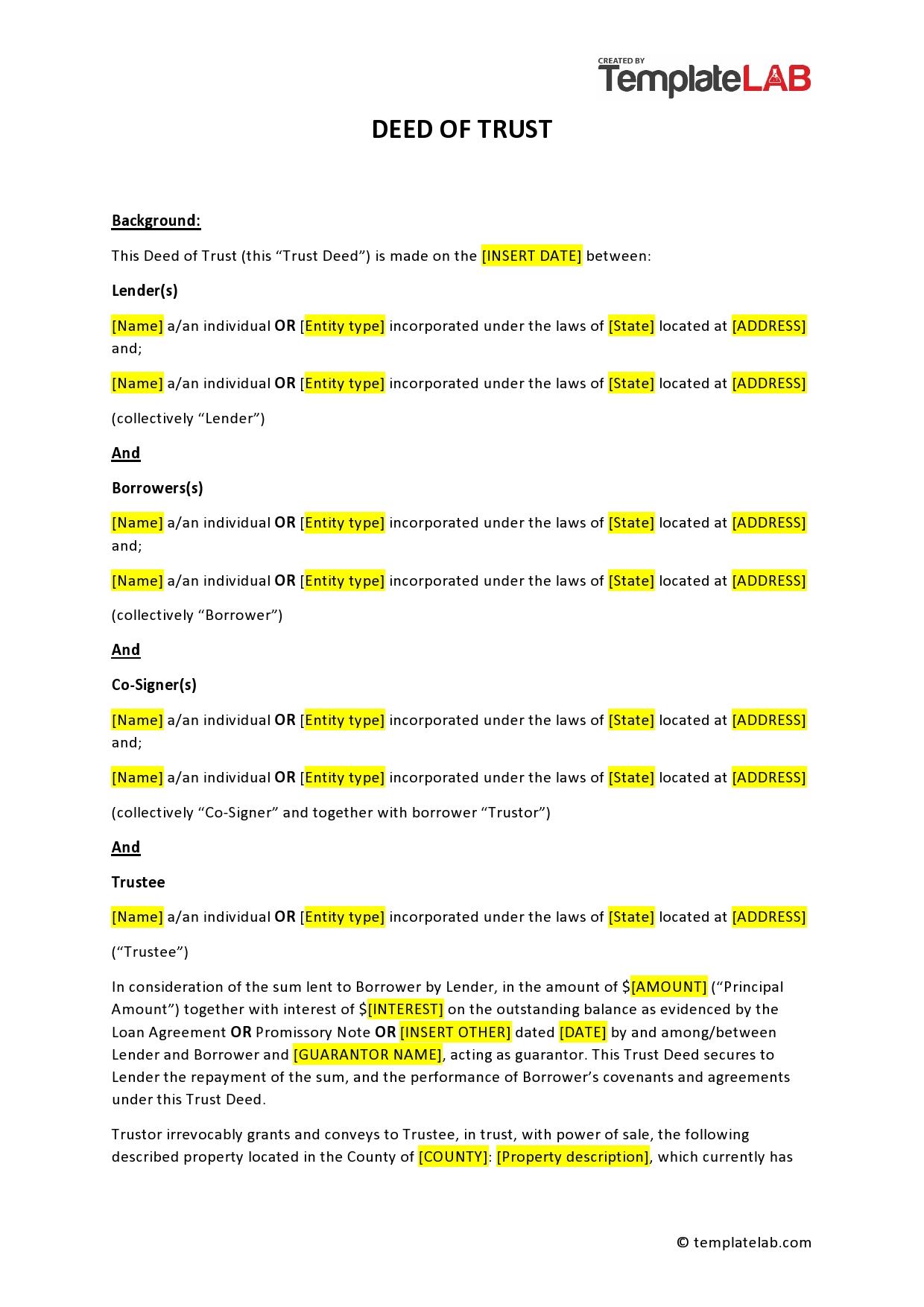

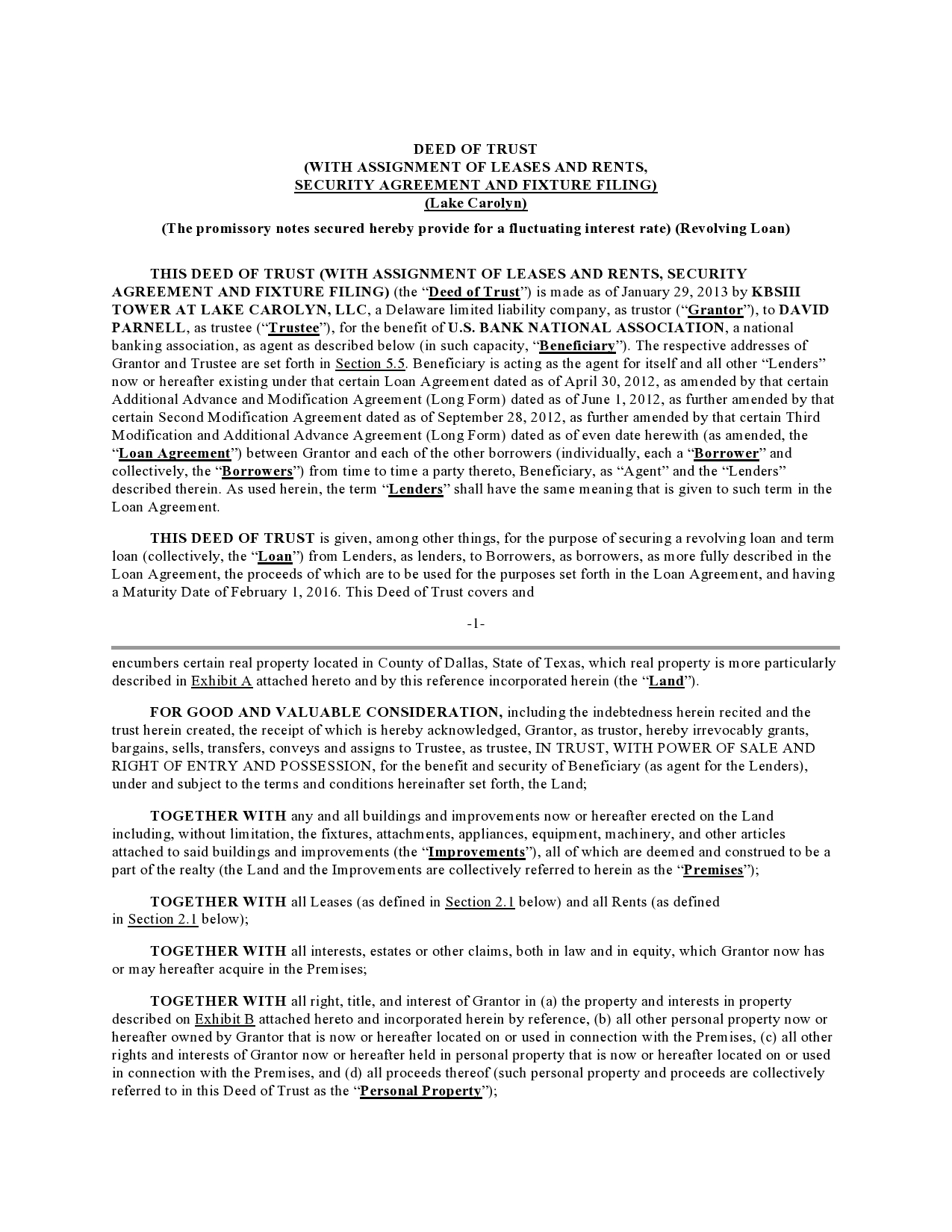

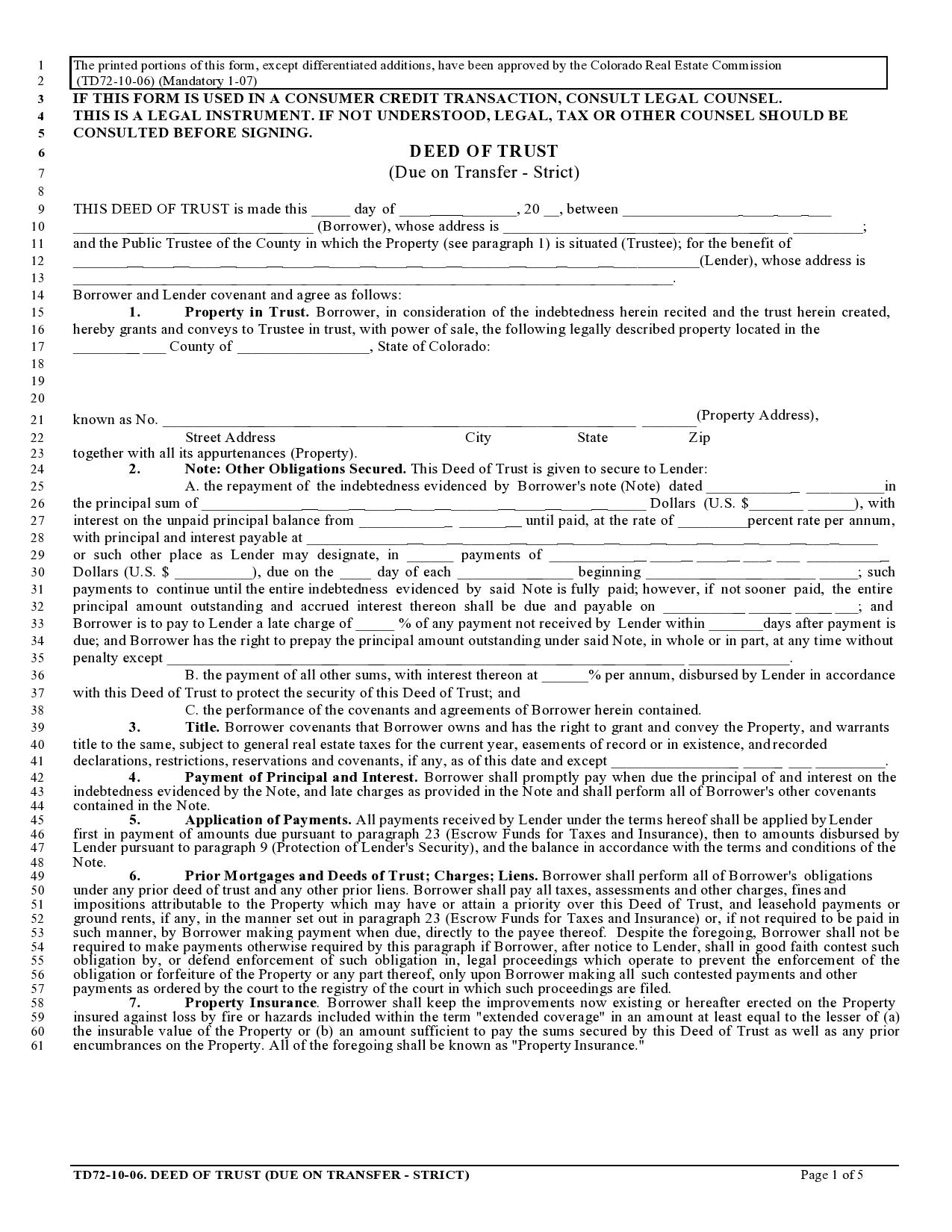

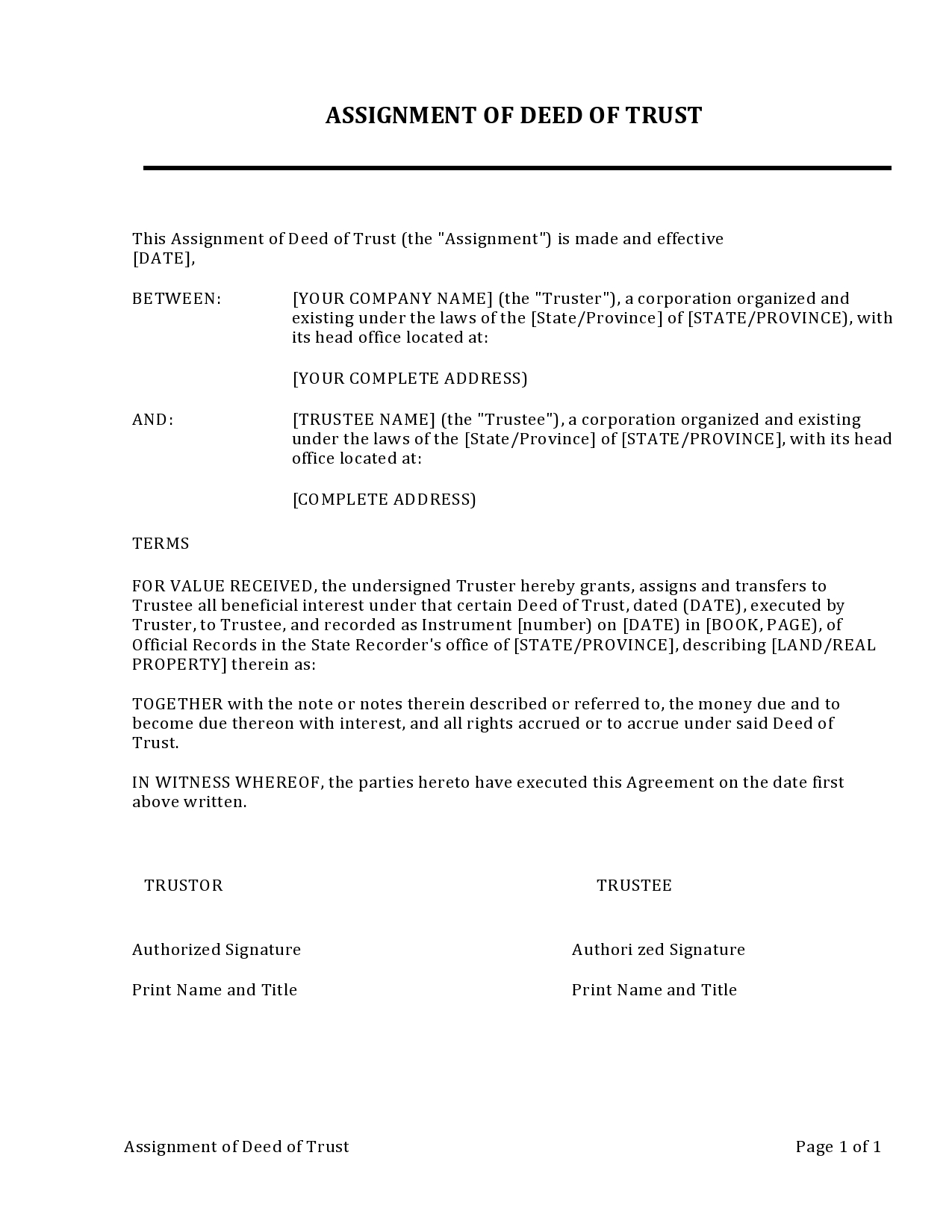

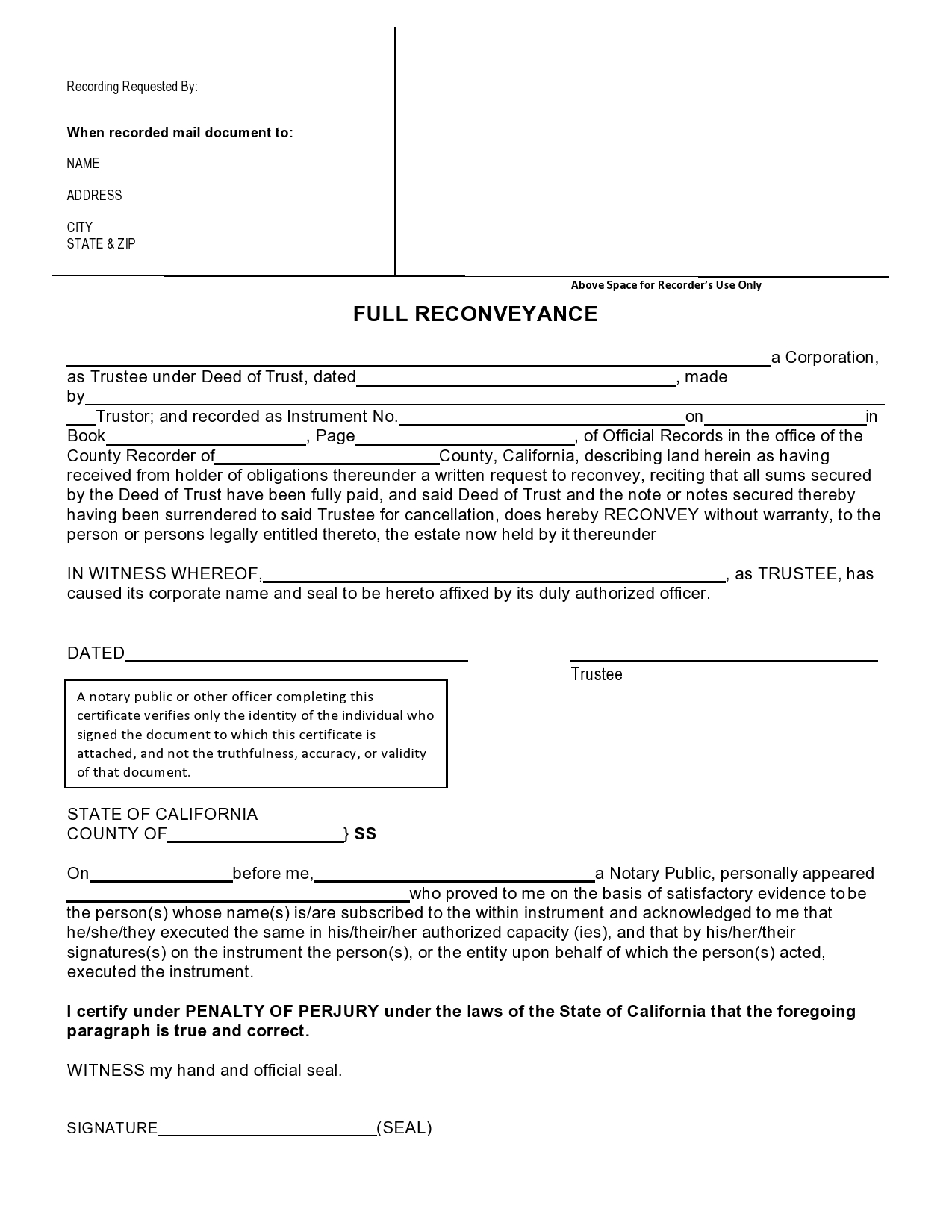

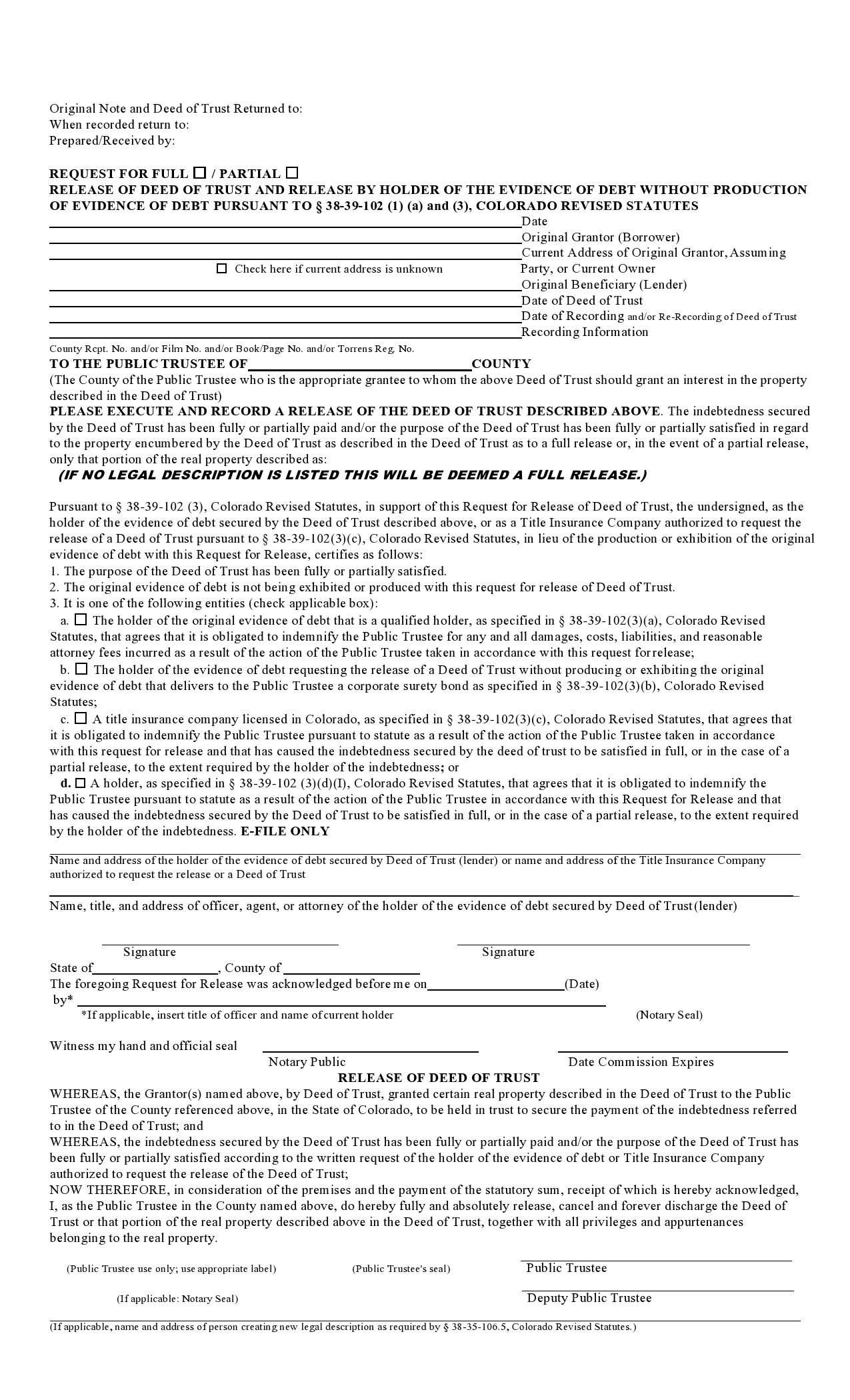

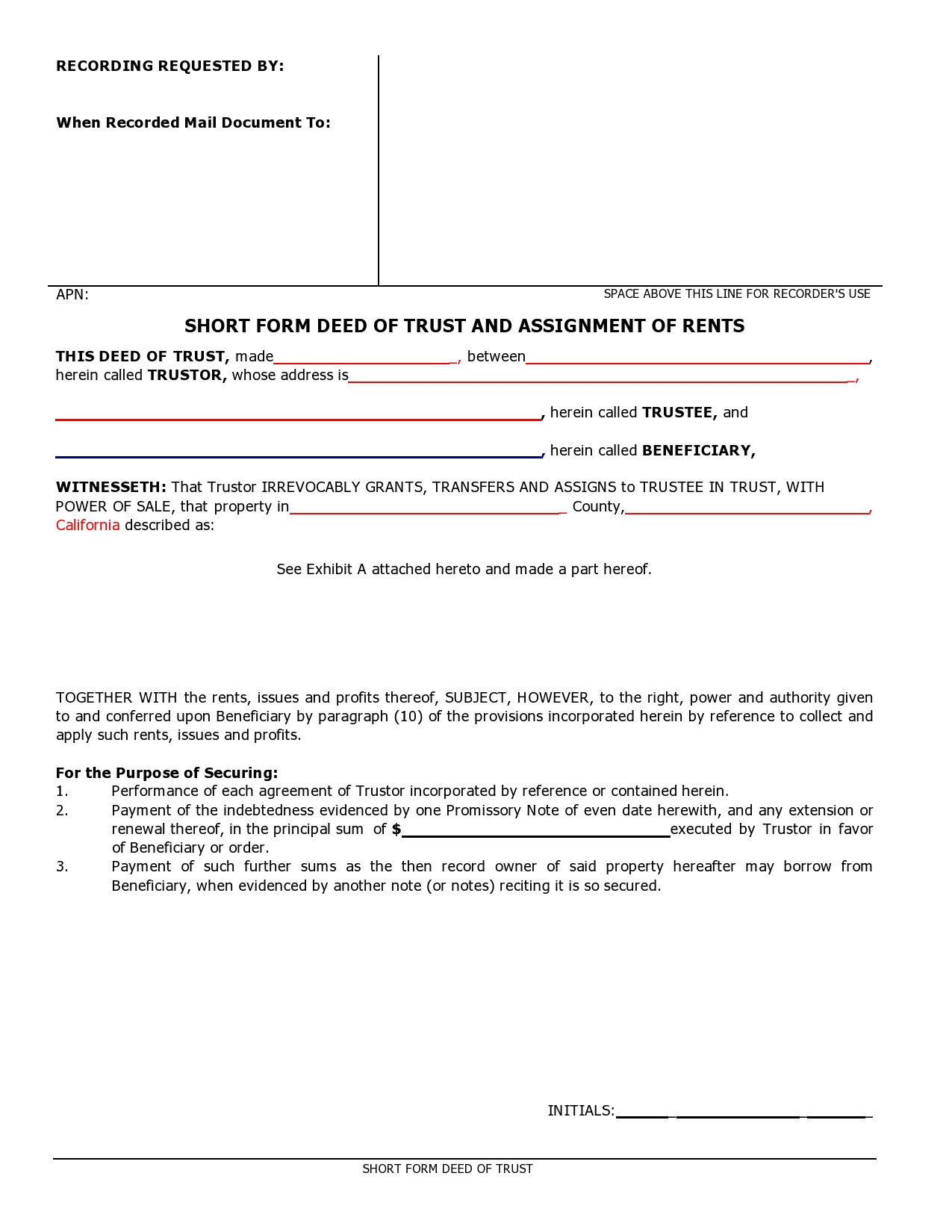

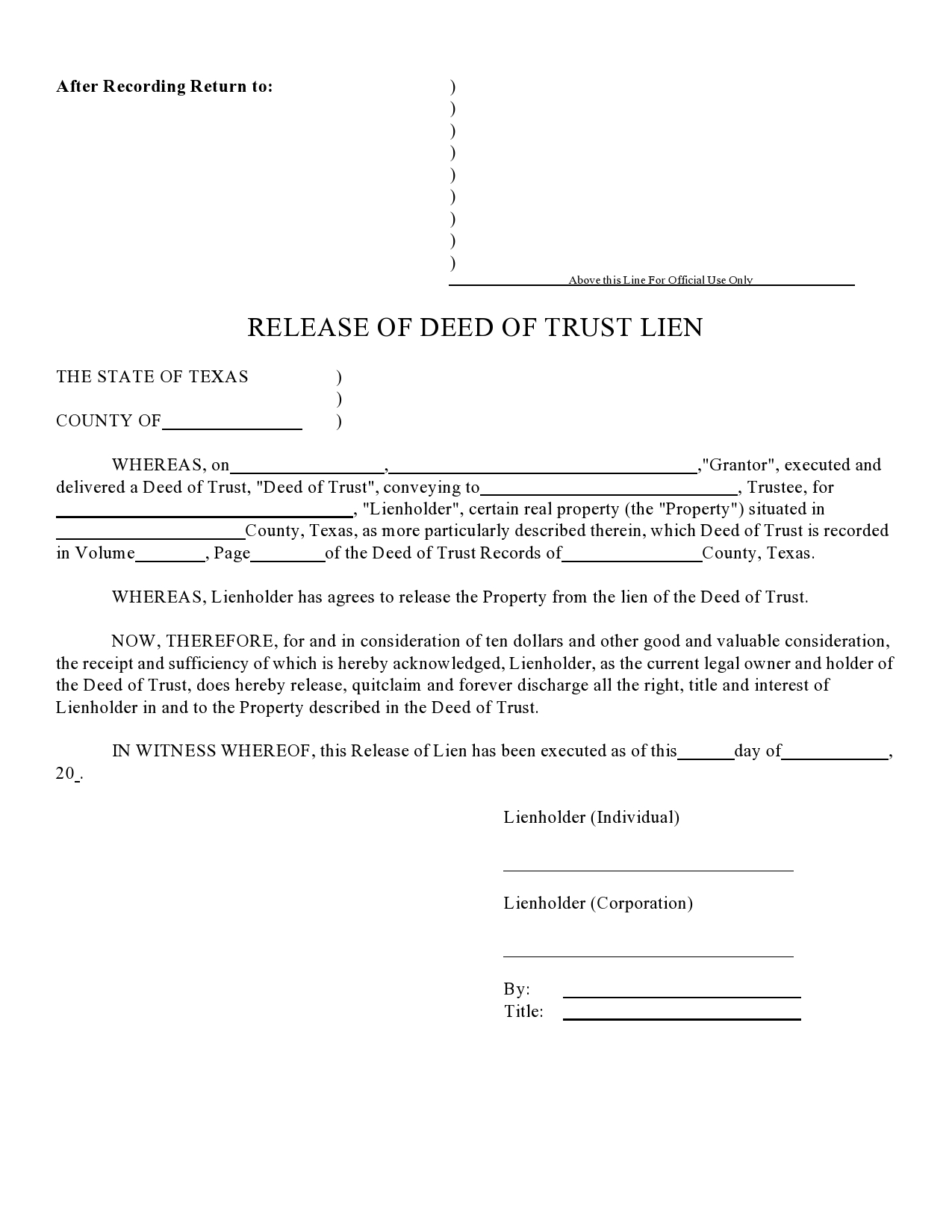

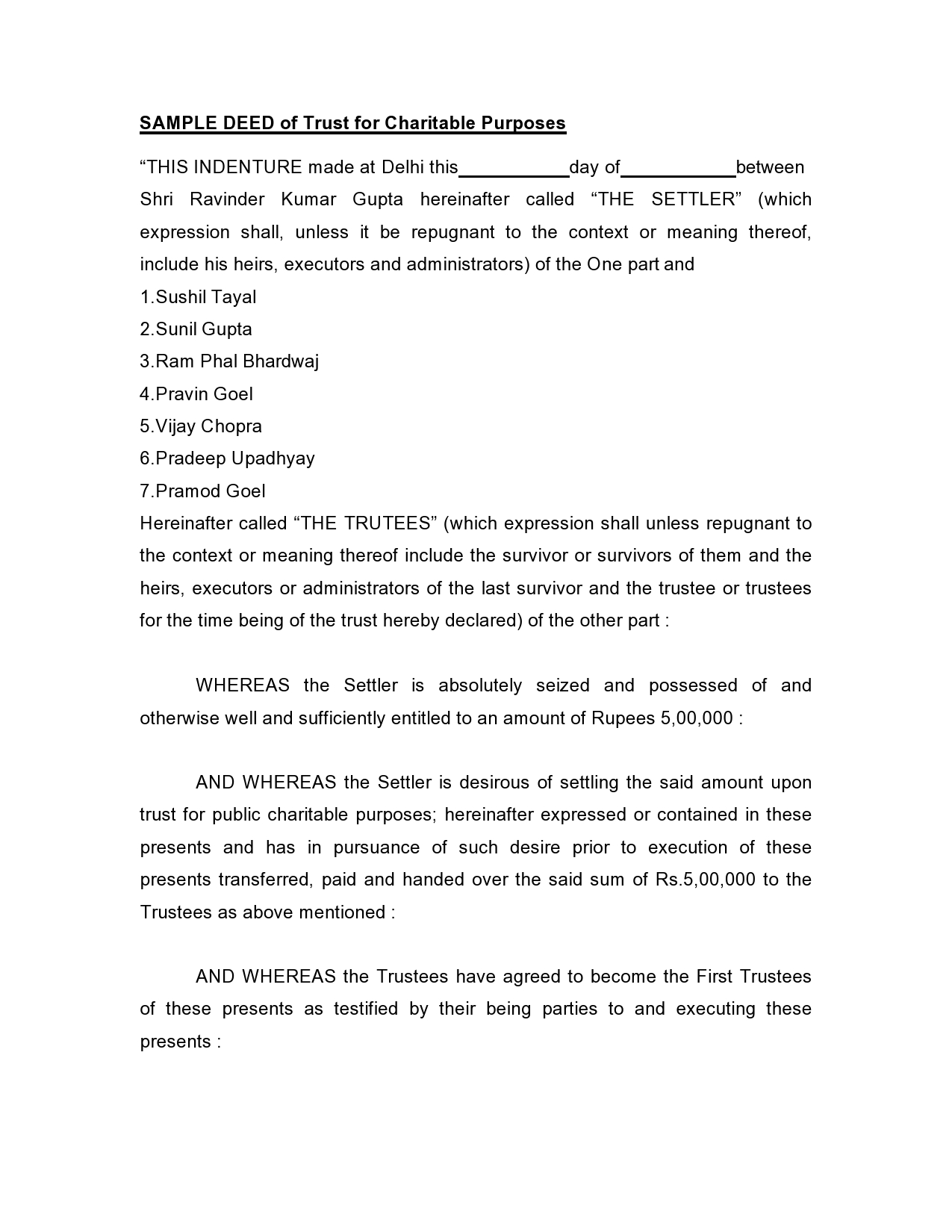

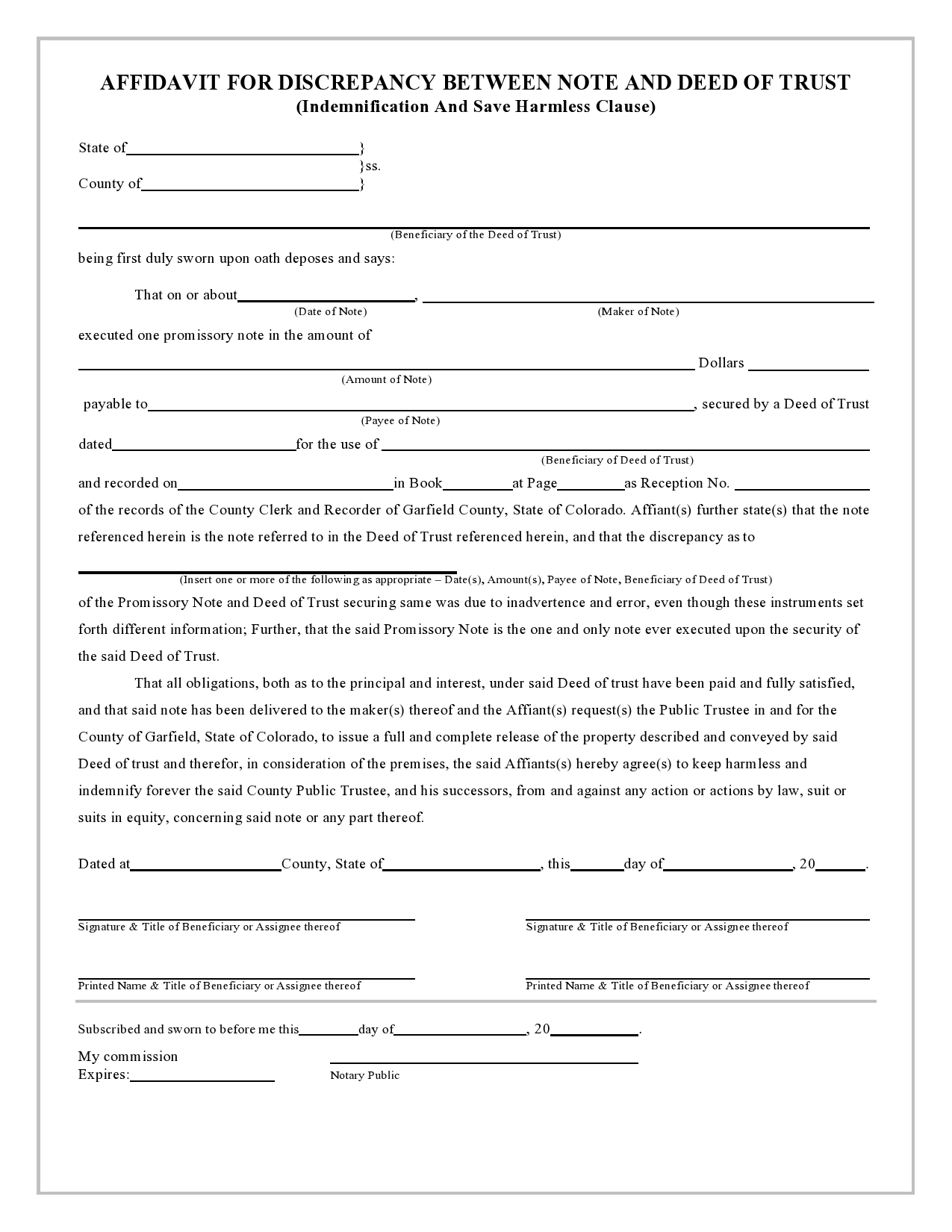

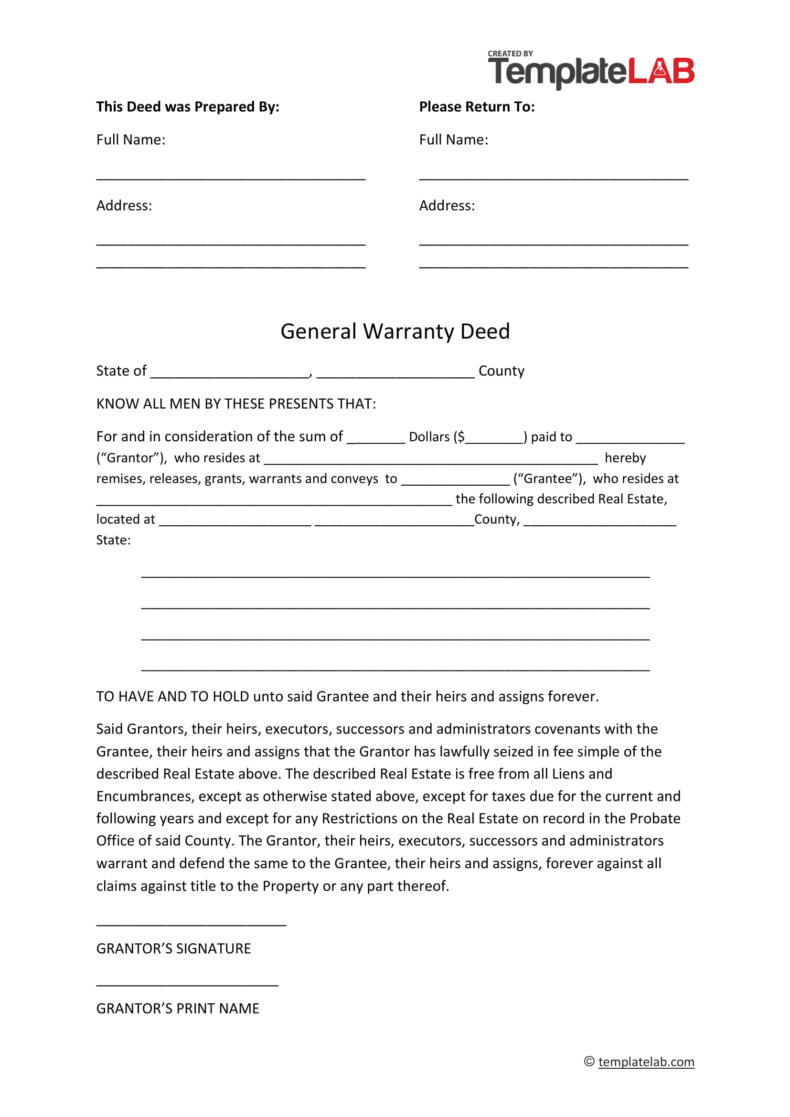

Deed of Trust Examples

What is a deed of trust in simple terms?

A deed of trust is the document that is drafted when a lender loans a borrower money to buy a property or a home. The borrower agrees to give security in the loan by granting the legal title of the property to the lender. This trust is in place until the loan is paid off completely. When the loan is paid off in full, the trust ends and is officially retired.

This kind of document can also be called a couple of other names:

- Trust Deed

- Mortgage Trust Deed

These other names do not make the document invalid, and it is perfectly acceptable to call your deed of trust example by these names as well. This is not, however, a mortgage document, and the deed cannot take the place of a mortgage. You will need to be sure that you do not call your deed of trust a mortgage without using another language.

The involved parties in a deed of trust are:

- The borrower, who is also the trustor

- The third party who is also the trustee

- The lender who is the beneficiary

These three parties are always involved in this document, and you cannot create a binding deed without having all three parties included in the document. When you do not name all the right parties, you will not be the holder of a valid deed of trust.

Is a trust deed the same as a mortgage?

A mortgage is slightly different from a deed of trust. In a deed of trust, if the borrower defaults, the lender will then be allowed to instruct the trustee to sell the property in a foreclosure sale. When a mortgage is defaulted upon, the lender can sell the property themselves in a foreclosure sale. This might not seem like a big difference, but there are various key differences in the execution of these documents in the case that a loan default happens.

Foreclosure is a complex process, and the steps that take place afterward can be quite different depending on whether a deed of trust or a mortgage is in place at the time of the default action. You will need to consider securing a lawyer if you are not sure what the right steps will be for the foreclosure that might have to take place if a loan has been defaulted upon.

What is the benefit of a deed of trust?

Deeds of trust are made primarily to contain a power of sale clause that will allow the trustee to be able to sell the property in a non-judicial foreclosure sale. The trustee will then be able to bypass the court system and head straight to the foreclosure sale itself. This is often a really big help to families who are struggling with financial burdens, and you need to be freed of the ownership of a property they can no longer afford. A faster foreclosure is often very beneficial for a whole host of reasons, and there is rarely any argument for the process being slowed down in any way.

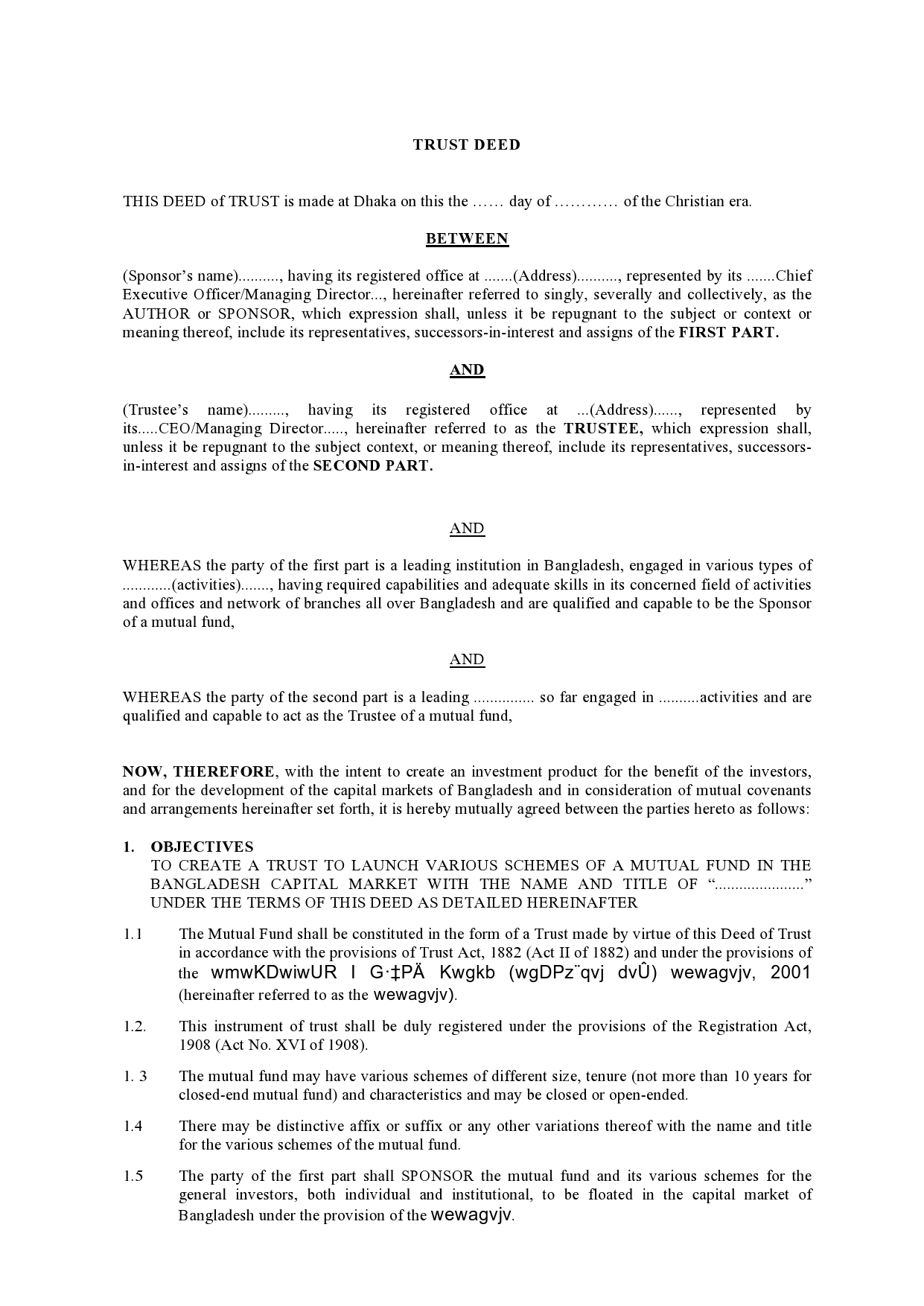

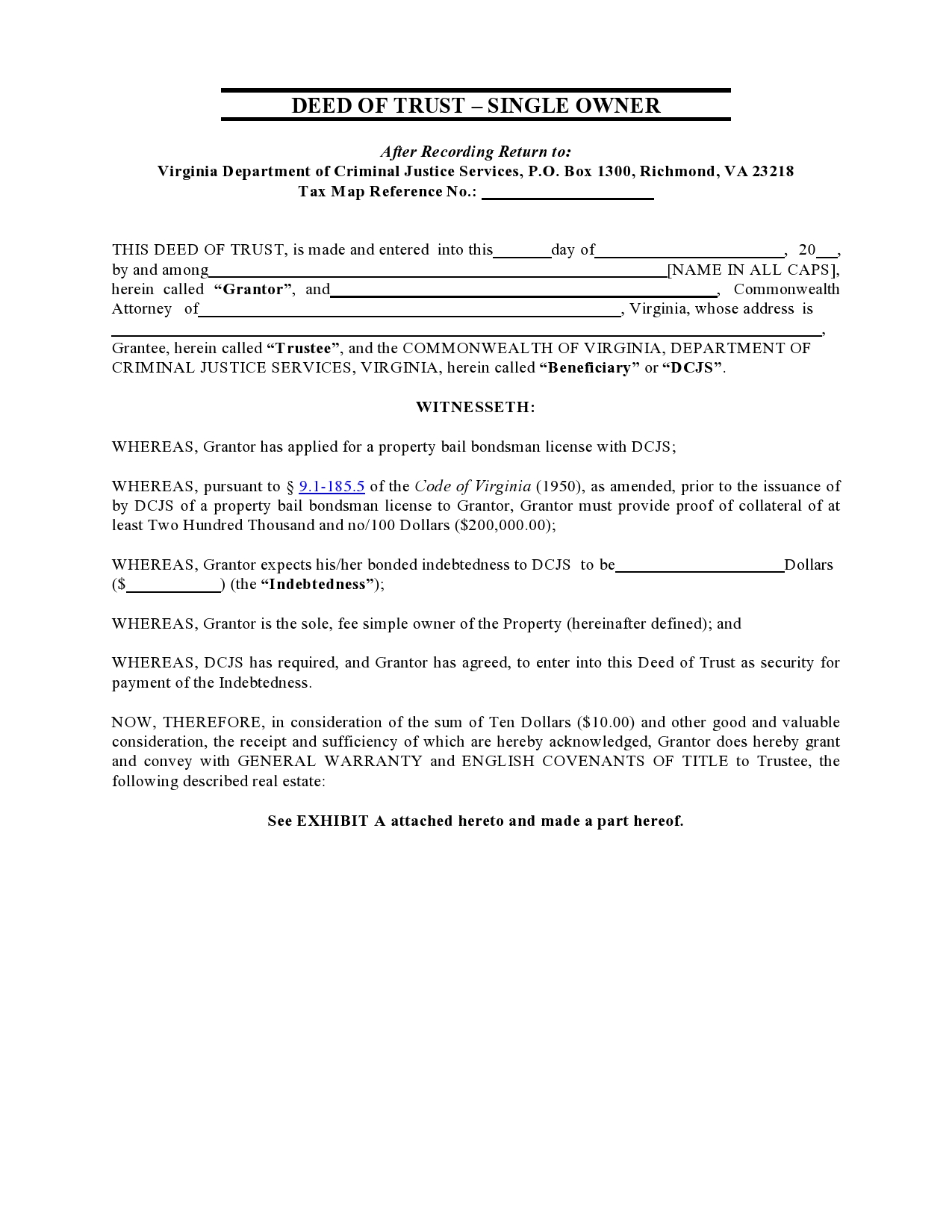

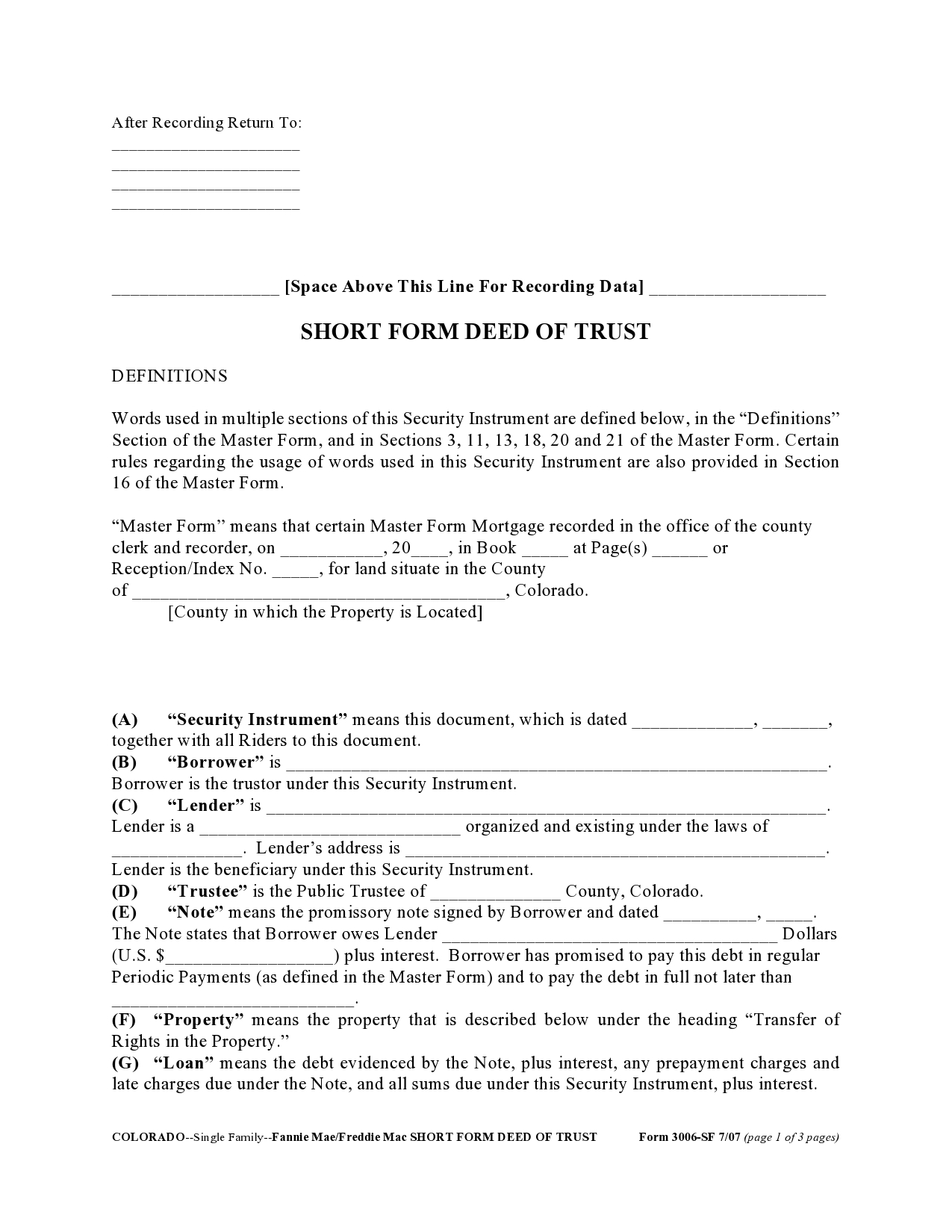

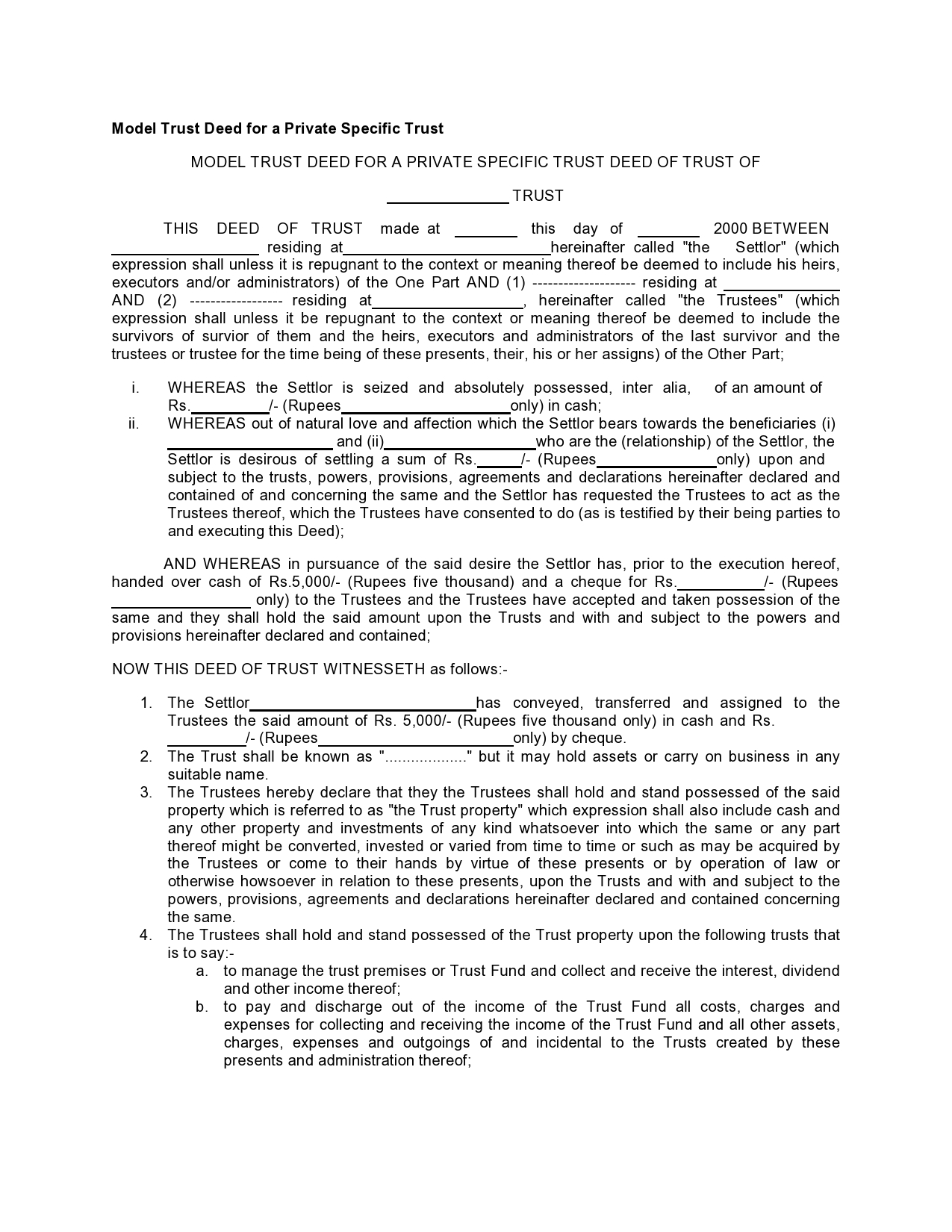

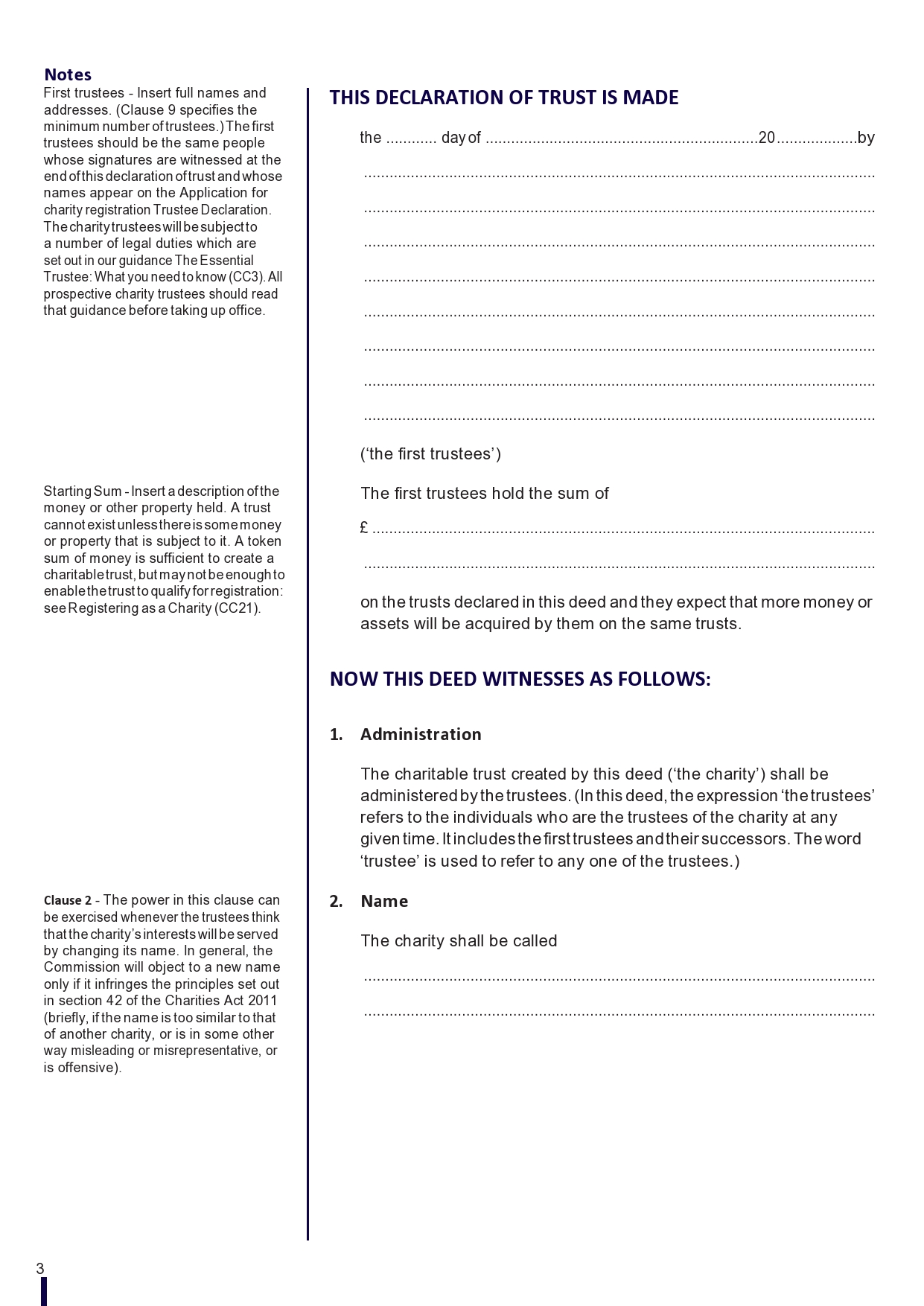

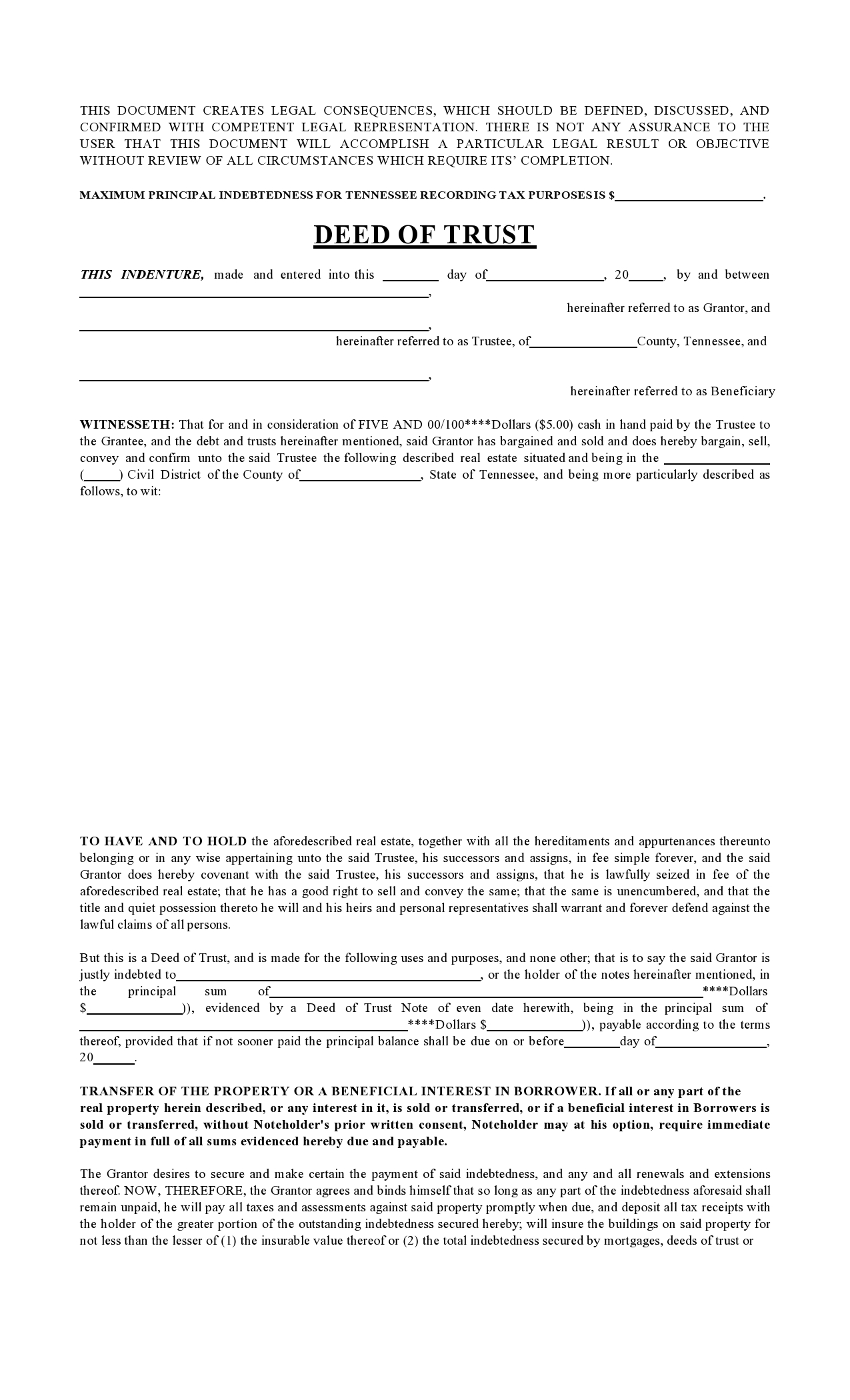

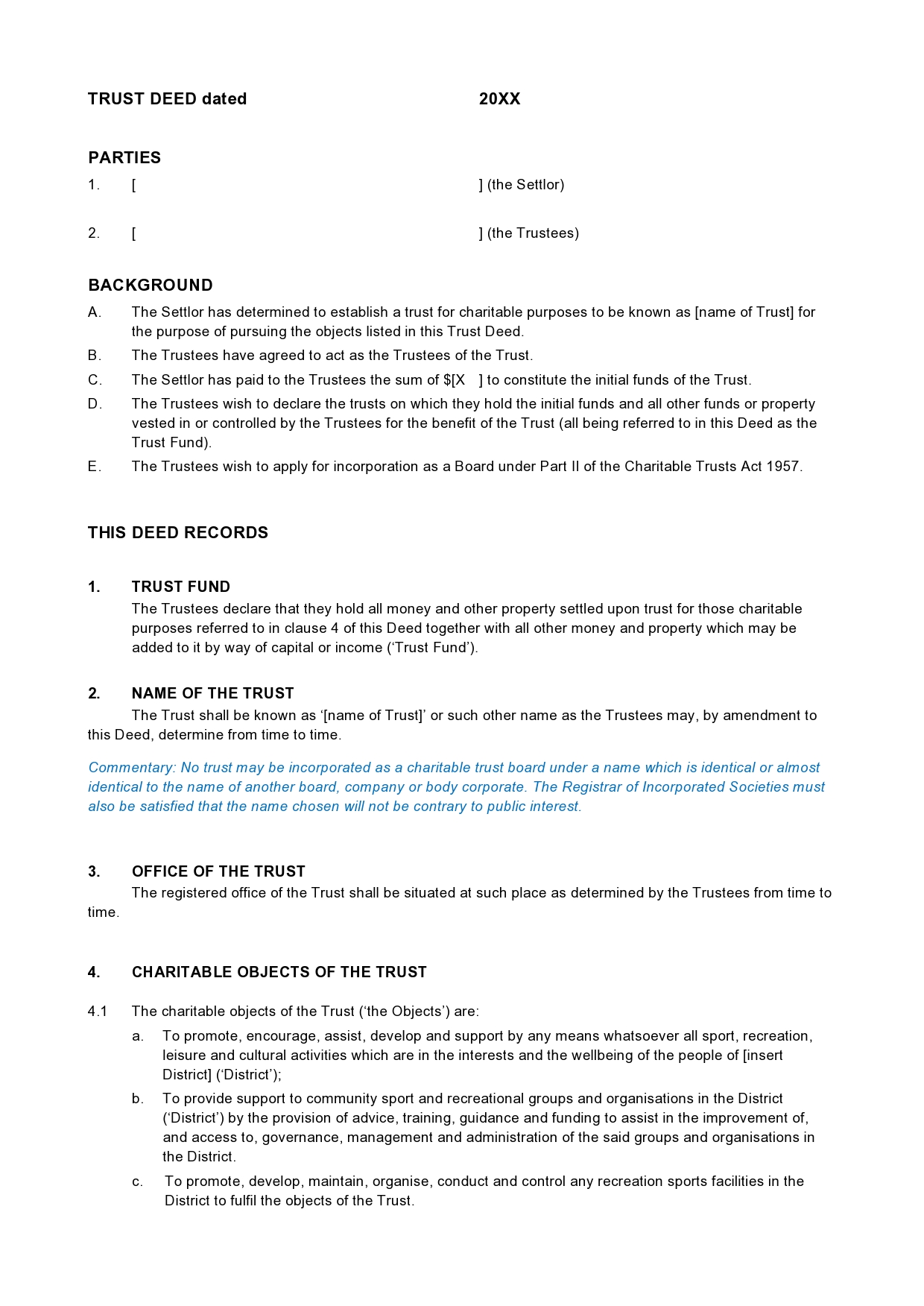

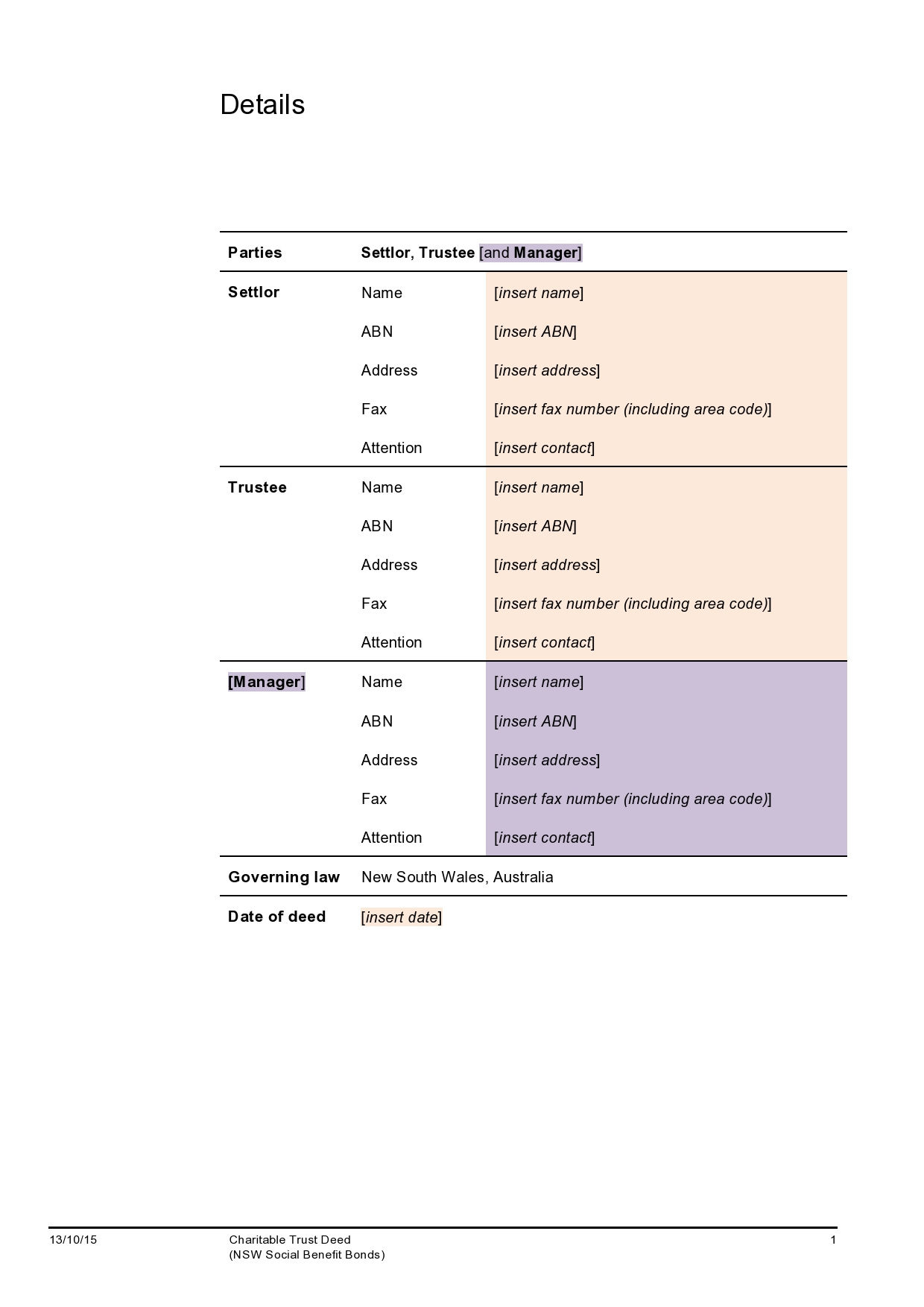

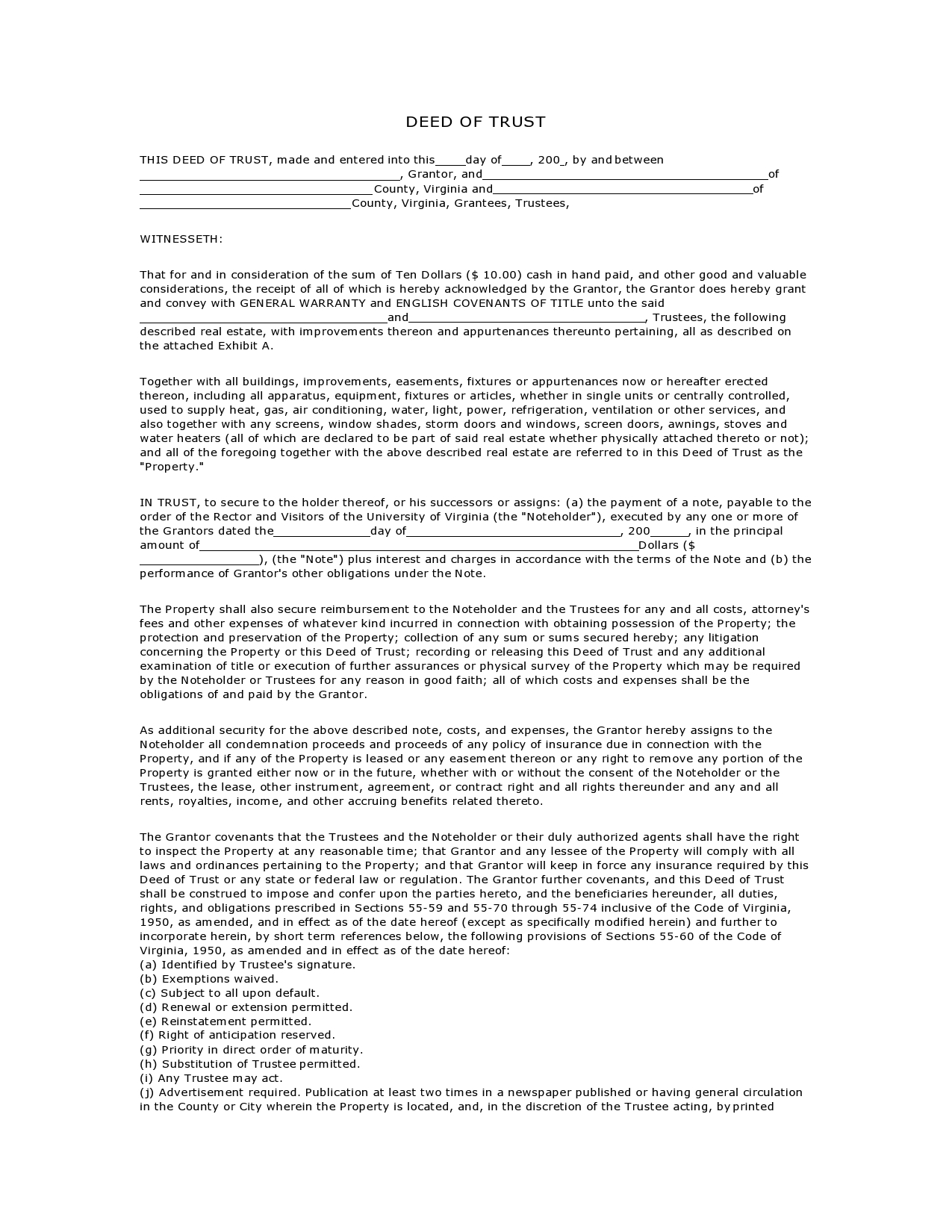

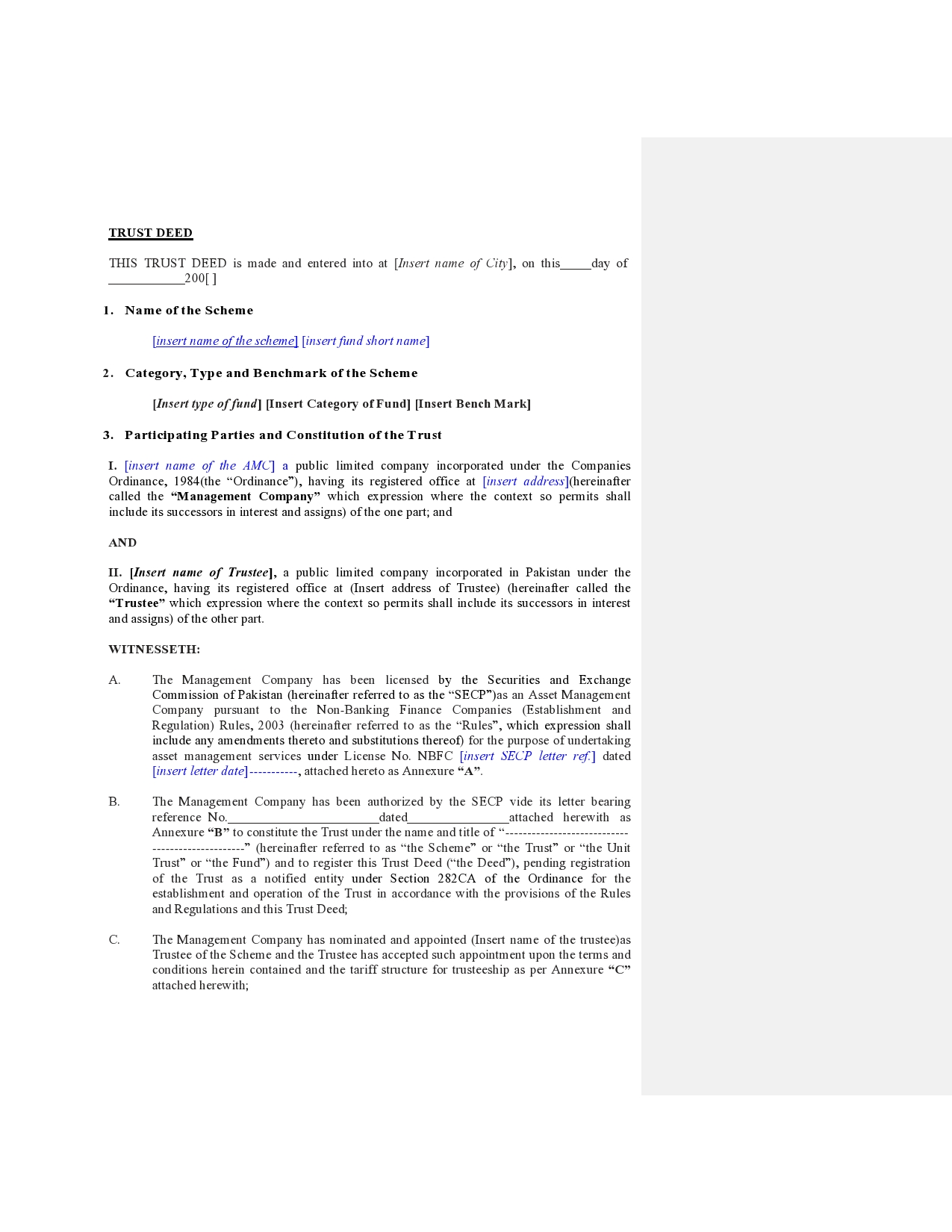

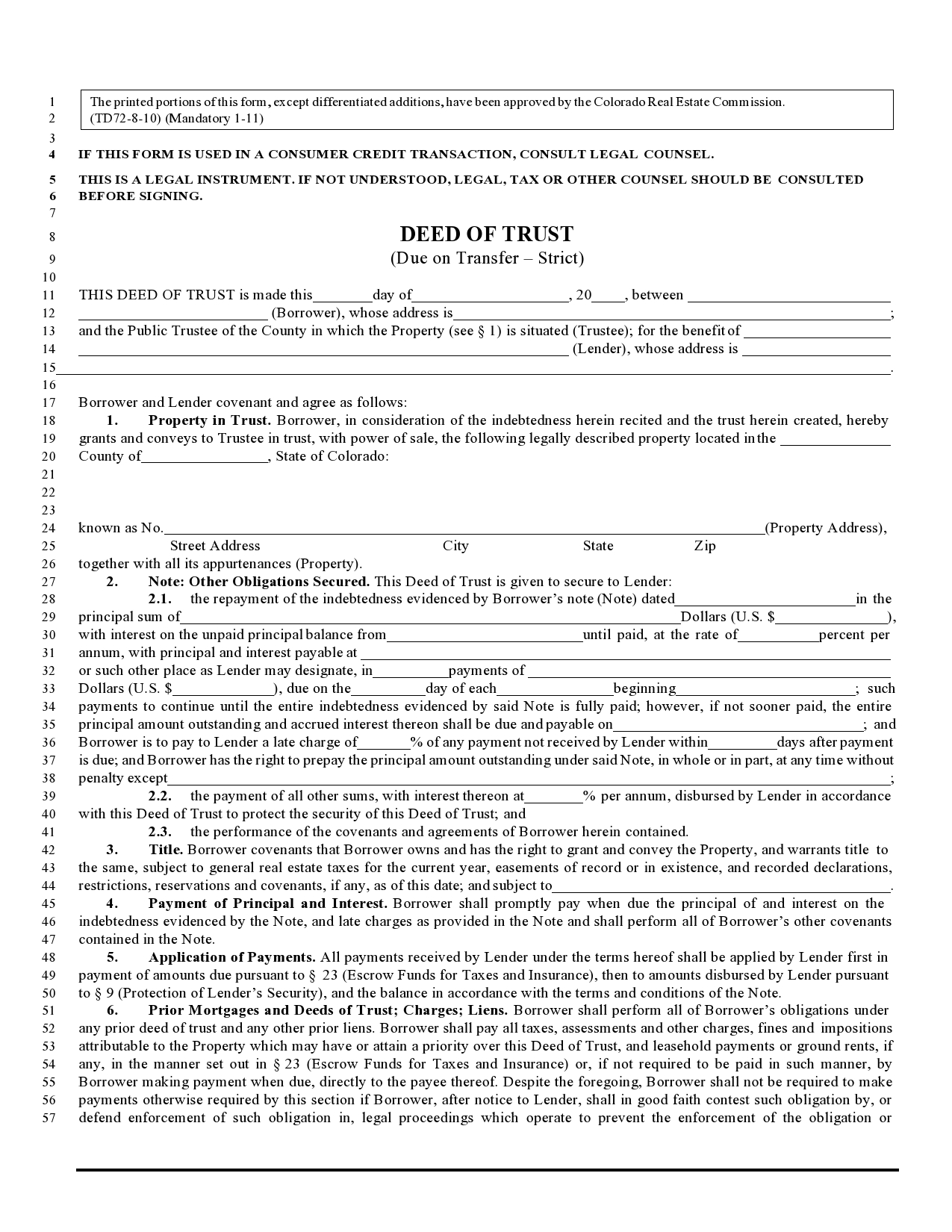

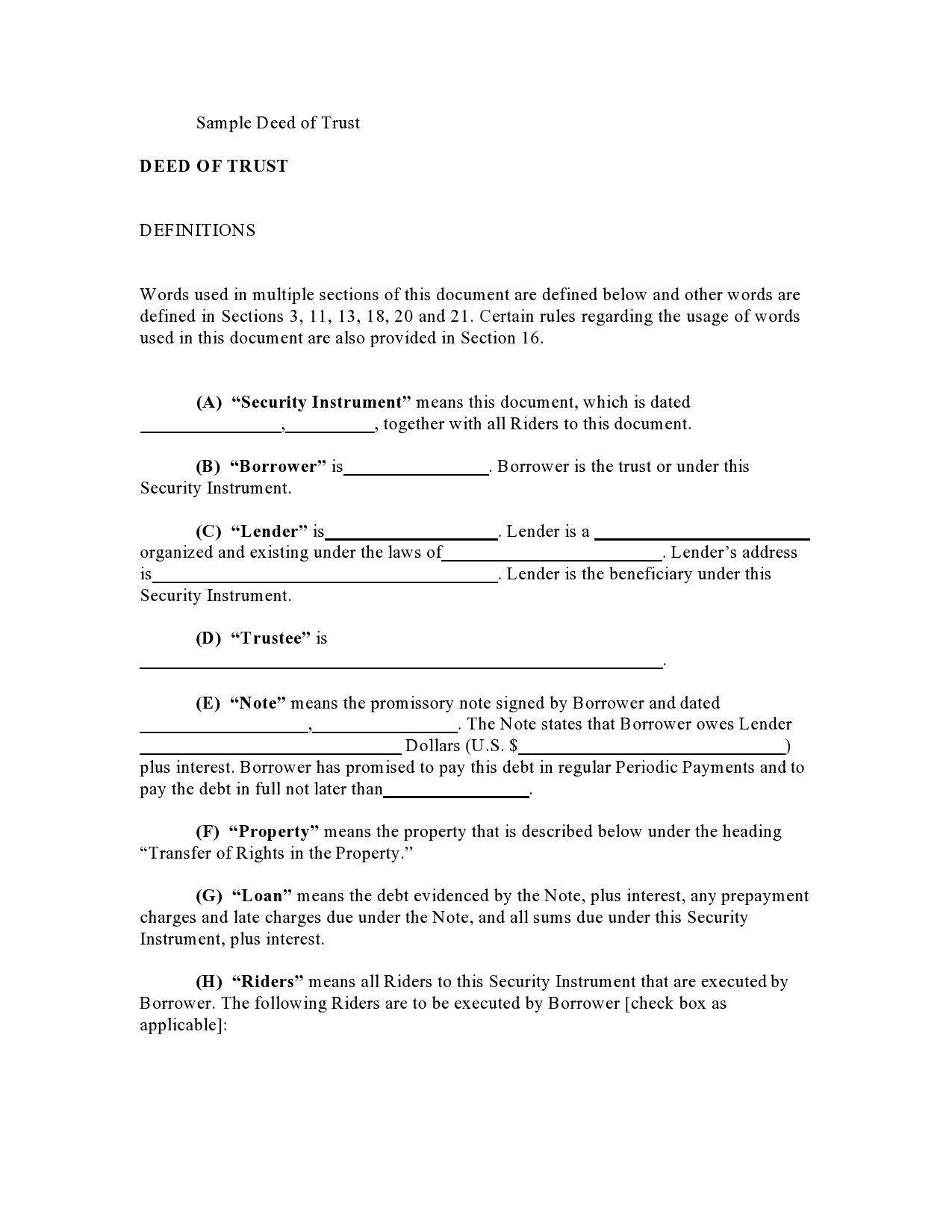

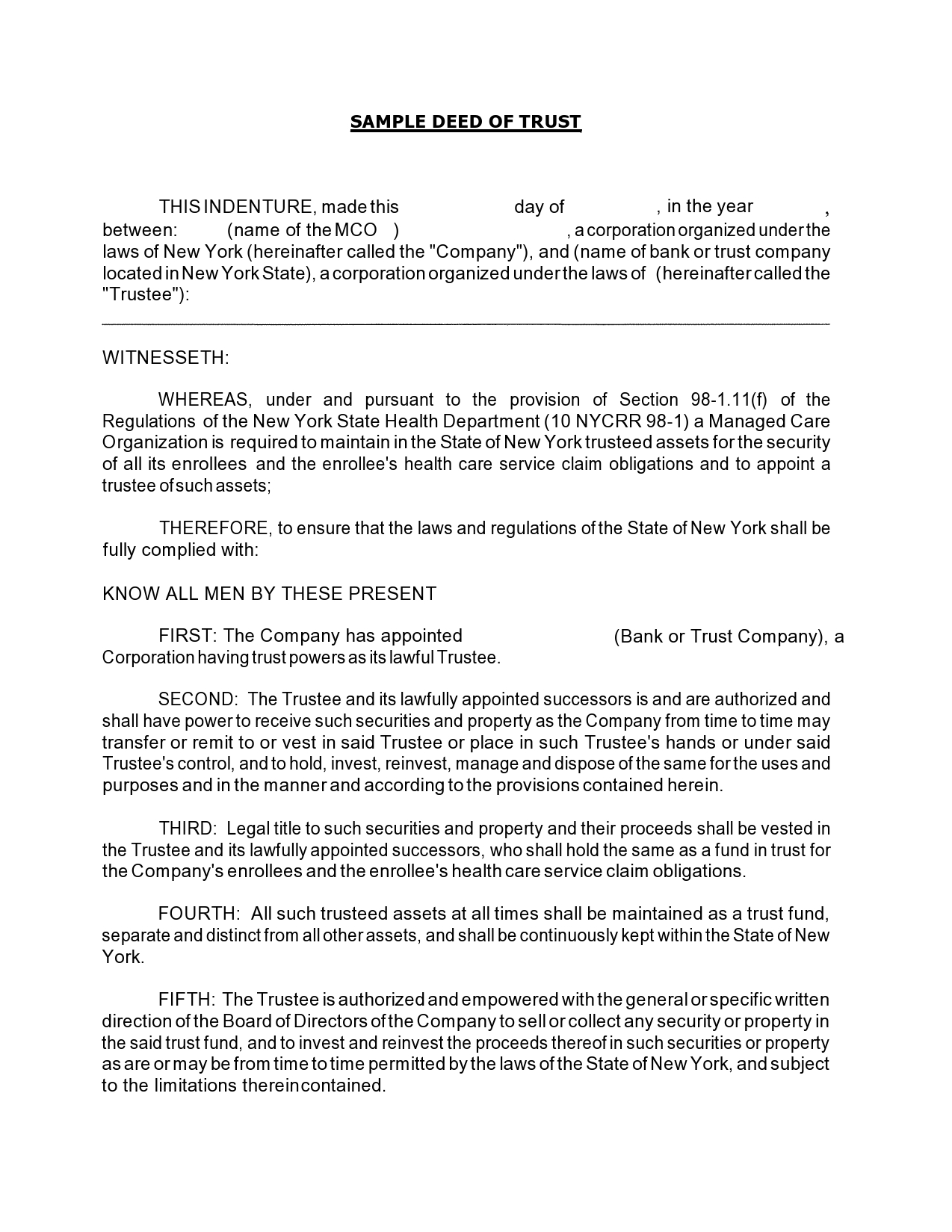

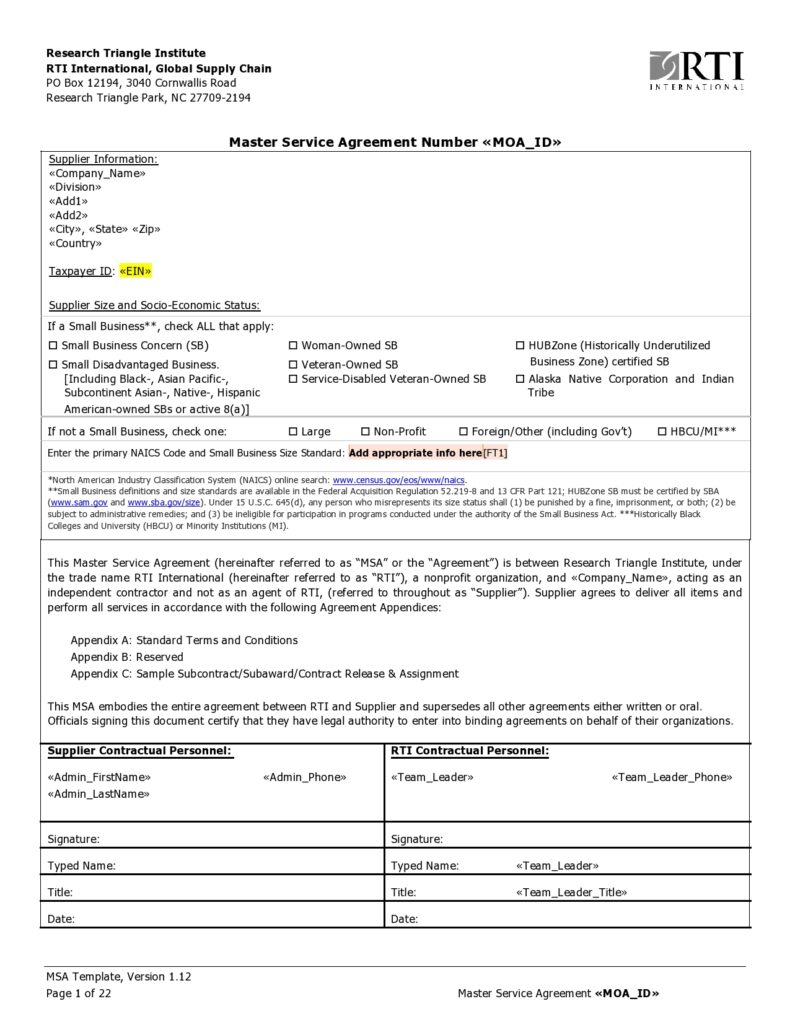

Trust Deed Templates

How to write a deed of trust

The trust document needs to include some key elements to be valid. You cannot skip these details if you want to be able to use this document for the stated intention. Nearly all of these sections will be required for your deed of trust template to be correct and useful.

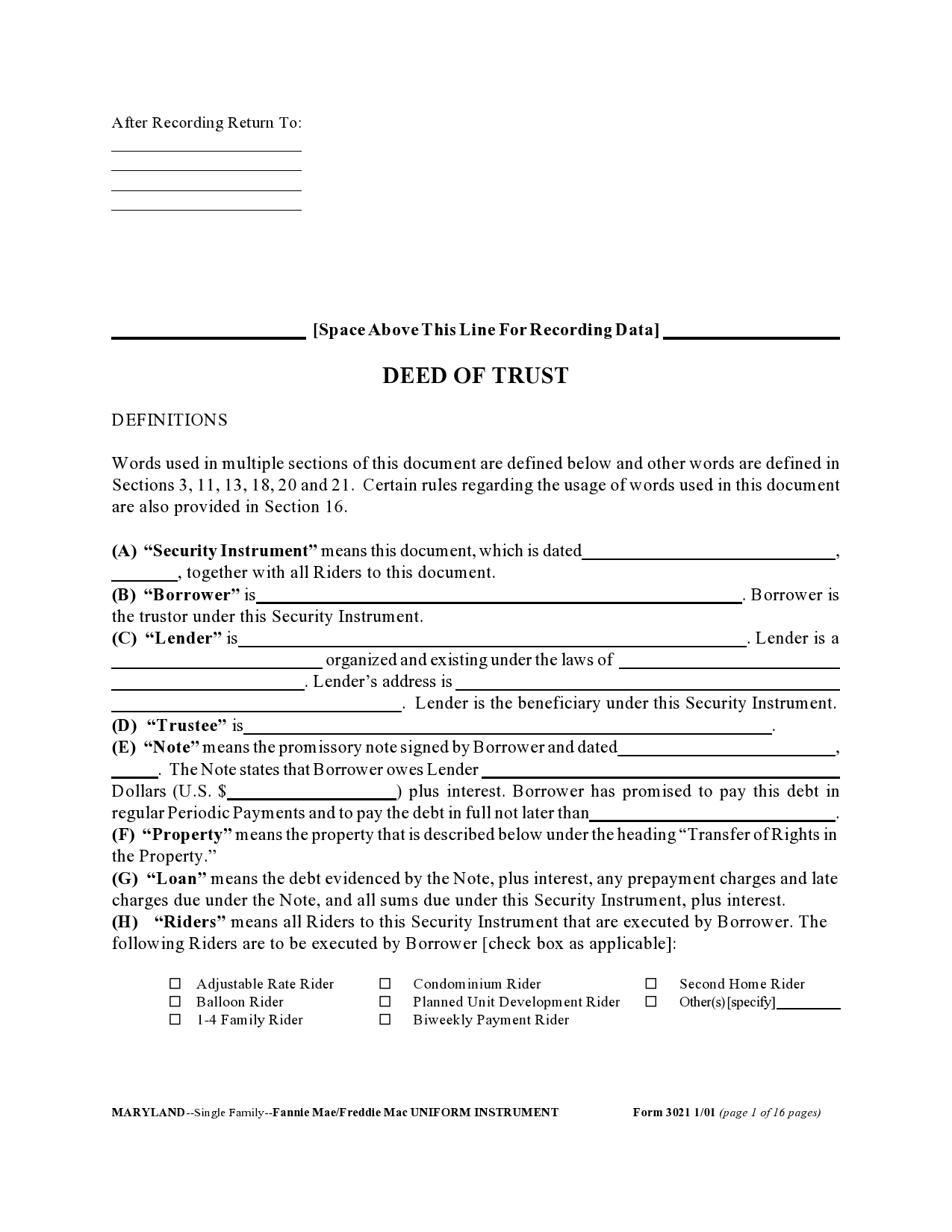

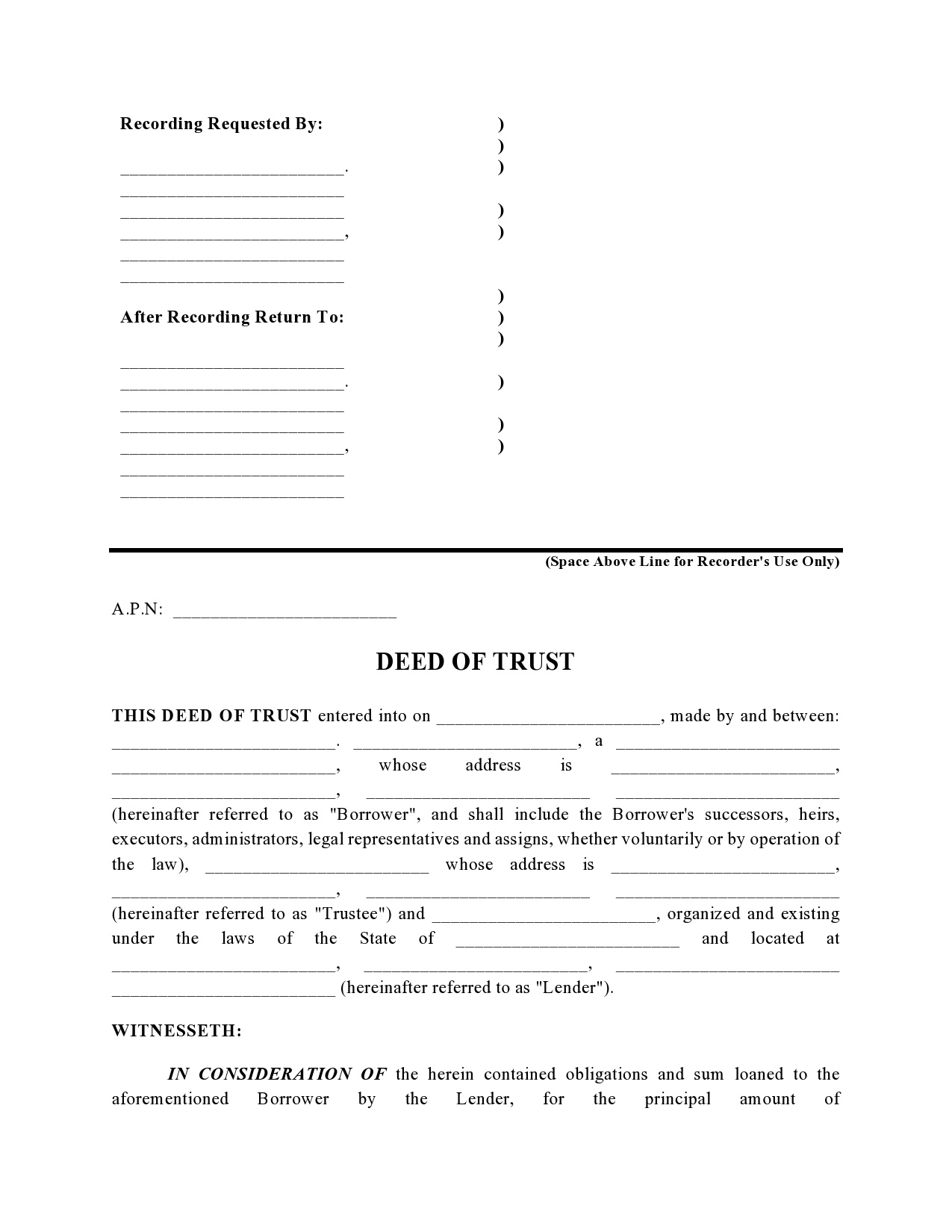

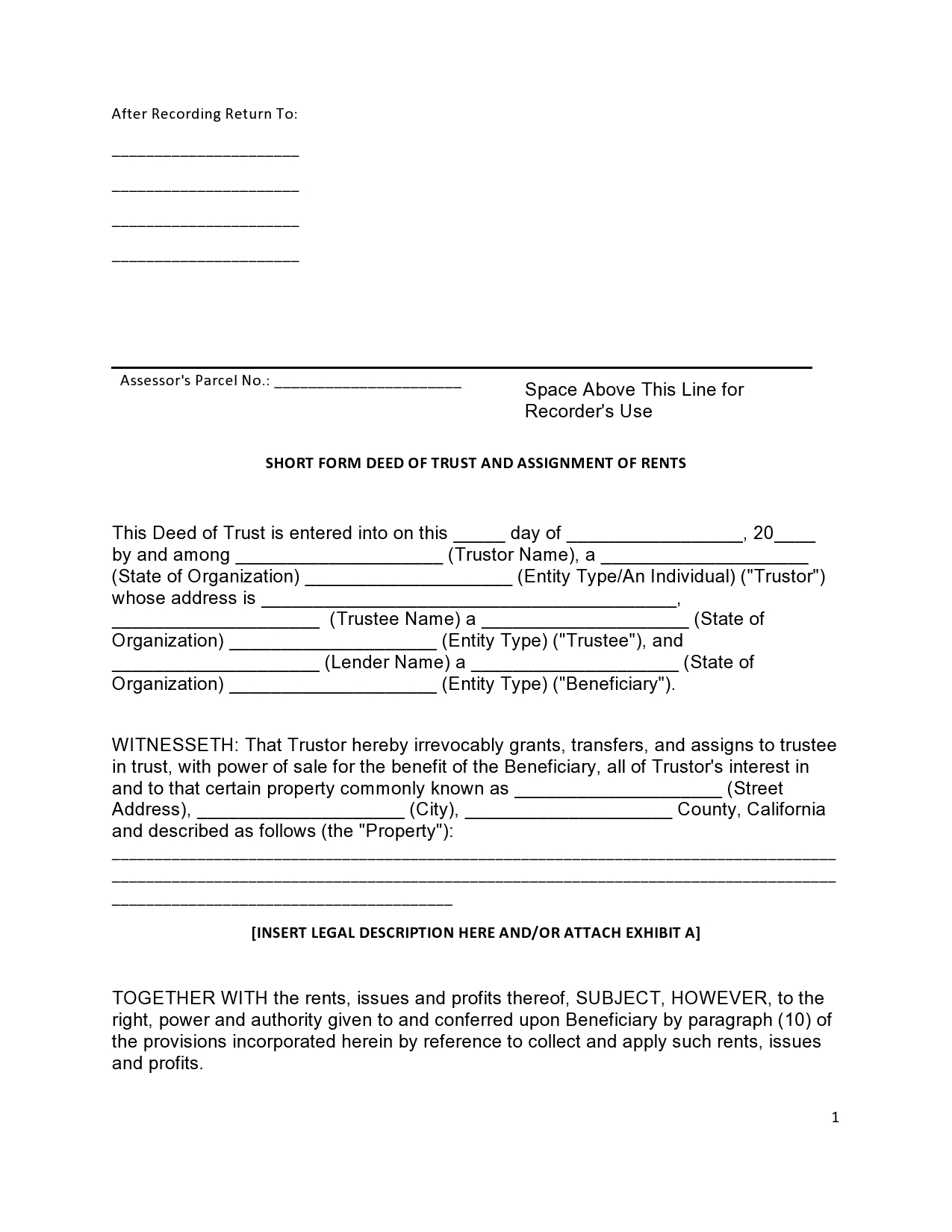

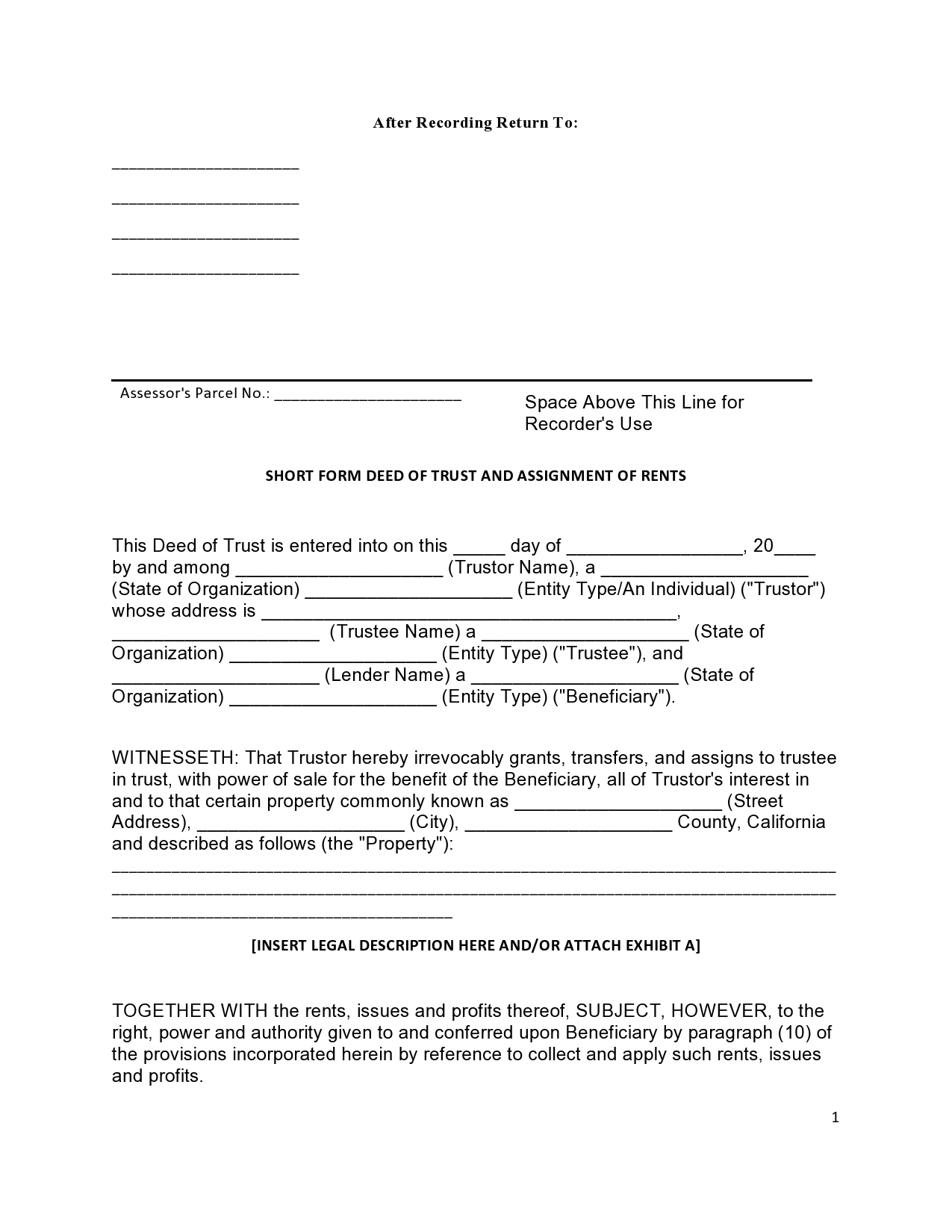

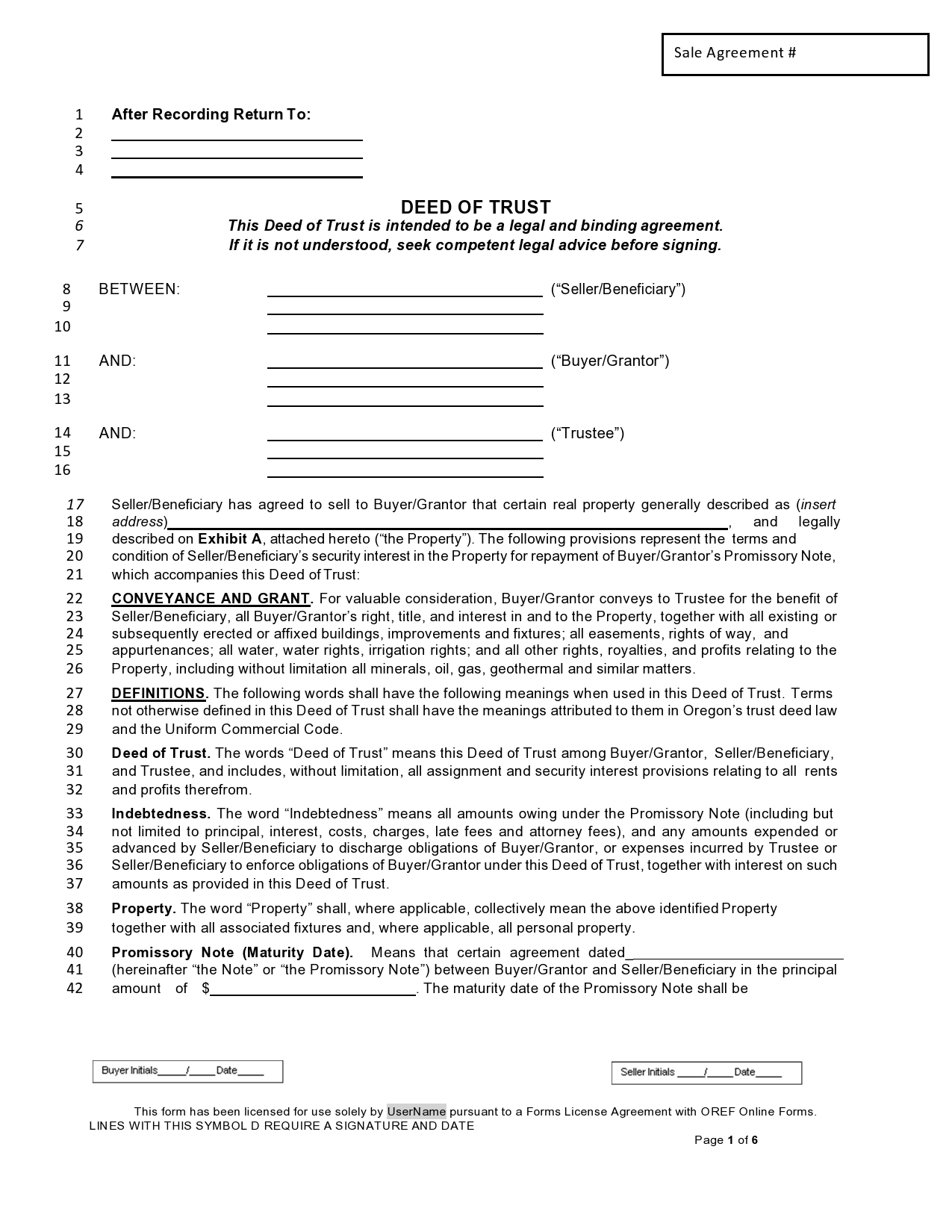

- Borrower and Lender, and Trustee: The borrower, lender, and trustee all need to be indicated at the top of the document with full legal names and contact information for all three. The lender is the entity that is lending the money and will end up with the lien on the property. The borrower is the person who is borrowing the money and pledging the property as collateral. The trustee is the entity that holds the title in trust for the lender until the loan has been paid off.

This information must be complete and accurate for the deed to be correct and enforceable. You will not be able to leave any of the details out of this part of the document, and you must be certain that you do not use nicknames for any of the parties involved. - Principal Amount: This is the amount of money that is being borrowed before interest and fees. You will need to indicate this information as well as the fees and the interest that will be assessed during the life of the loan. This is critical for any loan document, and you cannot leave out this part of the necessary information if you want the document in question to be useful.

- Property: A full description of the property that is in question needs to be included. You need to indicate the value, the address, and any information about the property that is necessary to identify it. You will want to include more information in this part of the document rather than less to be sure that you are not leaving out critical information necessary to identify the location.

- Covenants: This part of the deed of trust that you are creating will state that the borrower declares and promises ownership of the property and that they also have the authority to mortgage the property. Covenants are not always required, but there are instances where this is an essential part of the document creation process.

- Default and Acceleration Information: Any information about the actions that are taken when the borrower defaults need to be listed in this section of the deed. You will also want to be sure that you indicate if the entire loan becomes due at this juncture or not. There are various acceleration clauses that you can choose to use for this part of the deed of trust, so make sure to look into all of your options before you choose an acceleration clause.

- Maintenance of Property: This section can be added to inform the borrower that they need to maintain the property in good repair and get an acceptable amount of insurance coverage for the property as well. These are common items that are requested for loans of various kinds, and you might recognize this language and set of requirements from car purchases, among other things.

- Ownership Transfer: The transfer of the ownership of the property might cause the full loan to come due. This is common because the new borrower will need their own unique loan for the property.

- Power of Sale: This clause will instruct the trustee to sell the property through non-judicial foreclosure. In this kind of foreclosure, there is no judge acting as an intermediary between the homeowner and the lender. This can be a very difficult path to choose in some instances, but in some states, it is the easiest way to sell your home in a foreclosure sale.

- Rights of Lender: The lender that has loaned the money can choose to make payments in order to maintain the value of the property. This money can be collected by the lender later if the property is sold in foreclosure.

- Senior Mortgage: The senior mortgage clause will protect the mortgage from being modified without the lender’s permission. This does not apply to all properties, of course, but in the instance that it does, this can be a very helpful clause to include in your deed of trust.

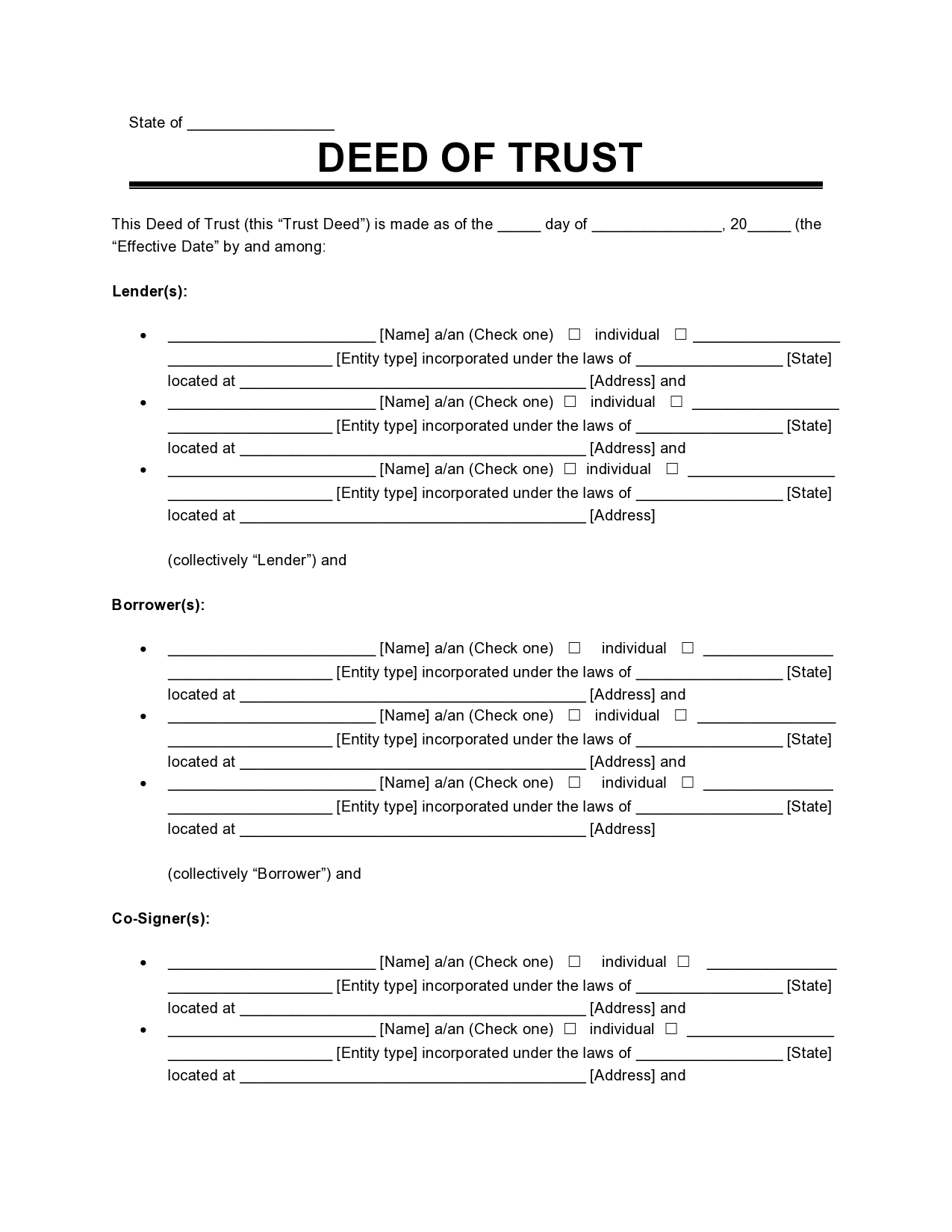

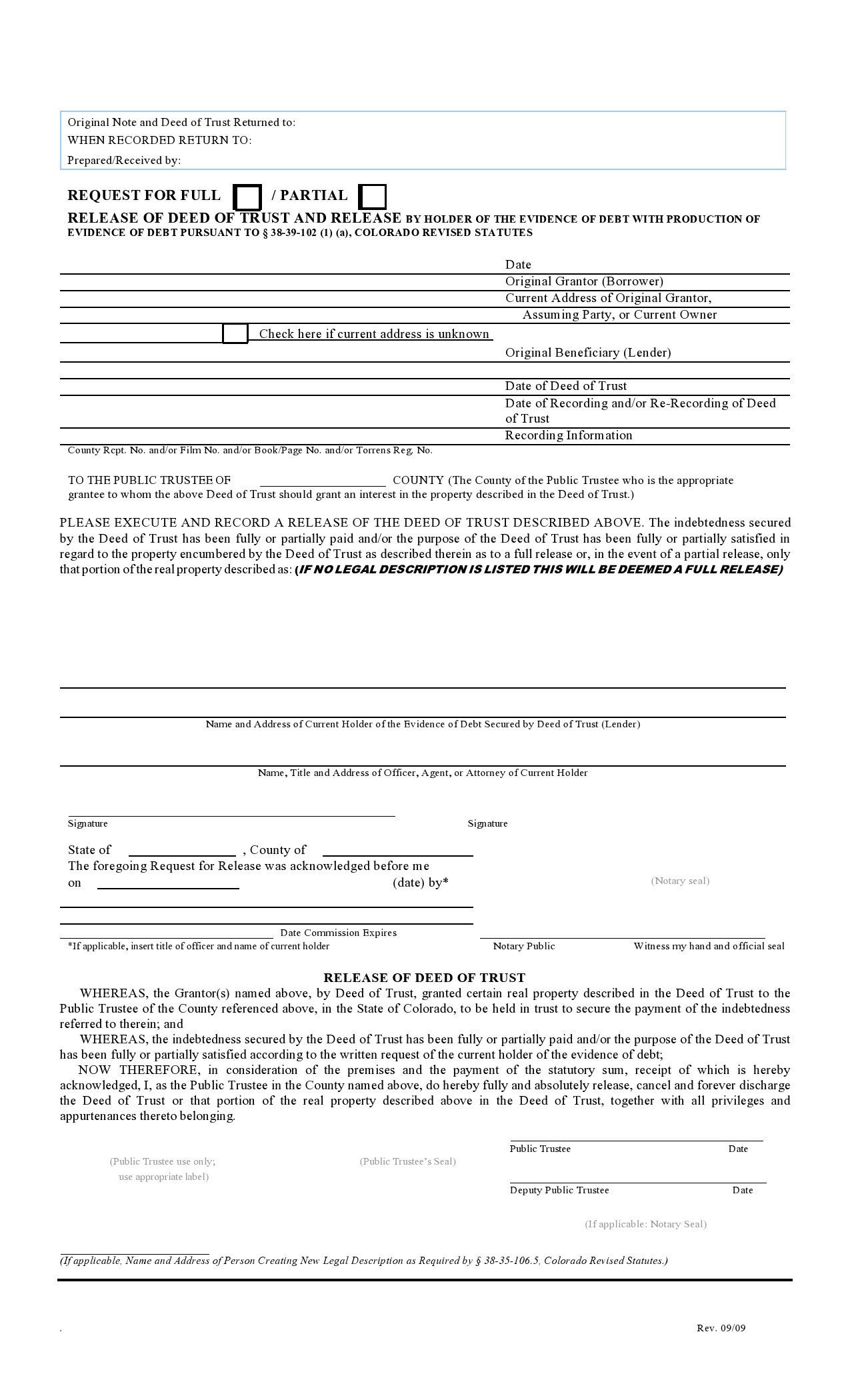

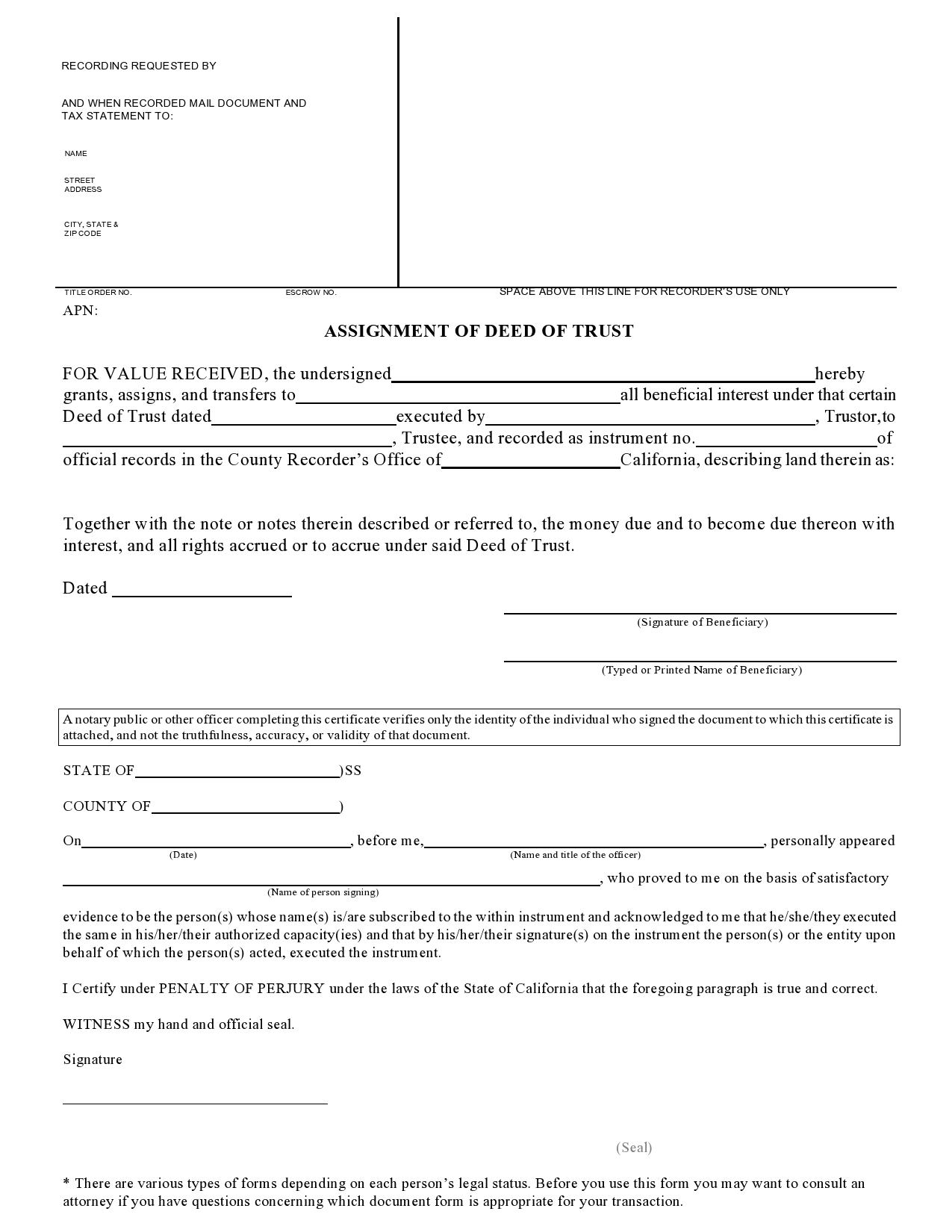

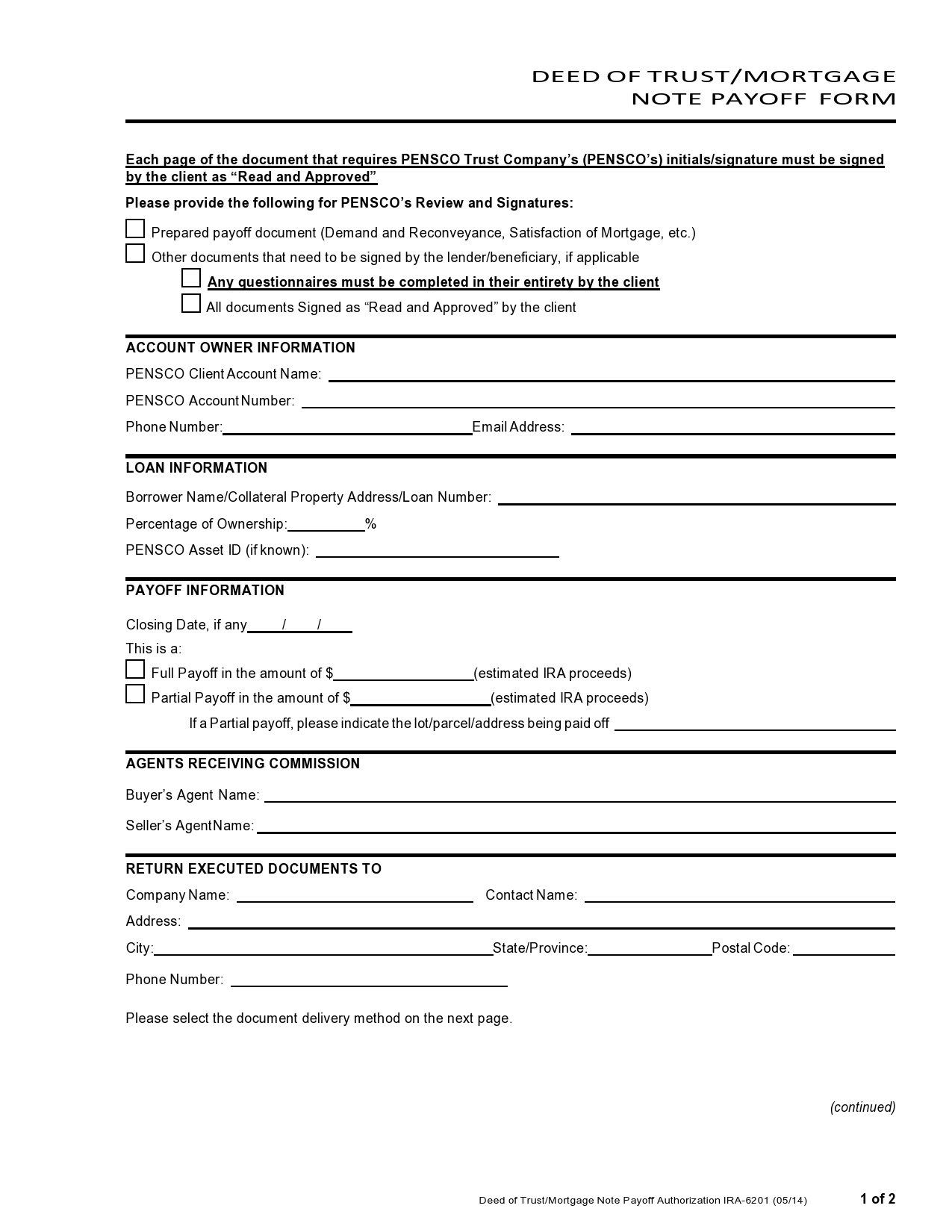

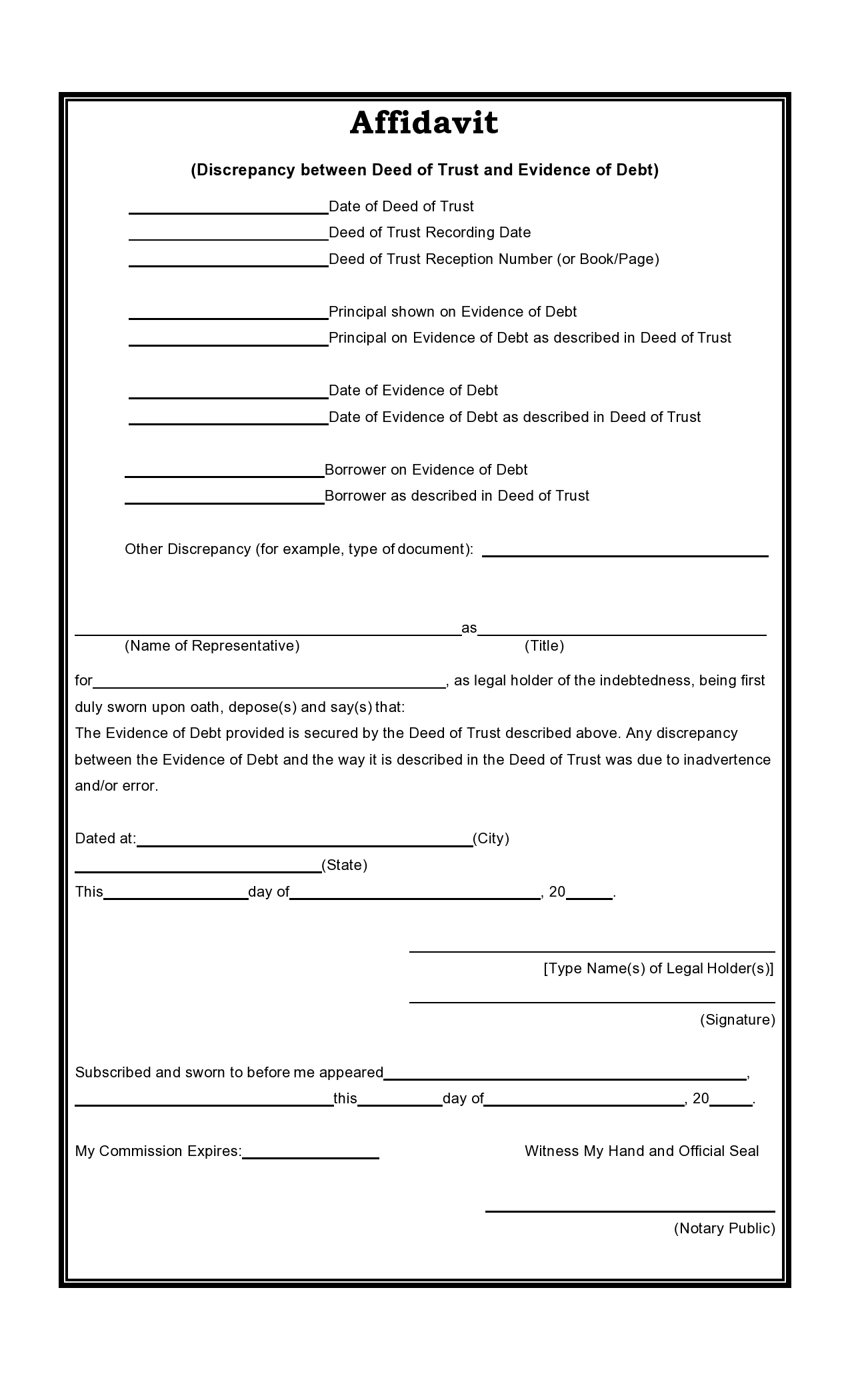

Deed of Trust Forms

What happens if you don’t have a deed of trust?

If you do not have a deed of trust and a borrower begins to default on the loan payments owed for their loan, the lender cannot readily remedy the situation to collect the money that they are owed. The mender must always have recourse against the borrower, or most lenders will not be interested in allowing a borrower to secure a loan. There are a few key risks to both the borrower and the lender that can be had when a deed is in place.

Lender:

- Large sums of borrowed money that are not paid

- Non-priority role as debtor

- Fees to lawyers to recover damage to the property or the home

- Battler over ownership of the property

- Fees to pursue debt collection

Borrower:

- Inability to get financing

- Increased debt for home or property

- Lawyer fees to defend property use

- Difficulty obtaining the deed for the home

- Difficulty in fighting debt collectors

What about a private mortgage?

Some borrowers are attracted to the idea of a private mortgage rather than getting a loan from a large bank. Banks and other lenders will have strict lending conditions that must be followed, which include paperwork, approvals, and many conditions that must be met. For those who have challenged credit or other issues that make it hard for them to get a traditional loan, this can be the best option.

However, there are downsides to this kind of mortgage. When lenders are family members, private investors, or lending companies that specialize in these kinds of lending, you might not be able to use a deed of trust to secure clarity about ownership of the property. This can lead to all kinds of legal wrangling over the ownership of the asset if there is a default on the loan, which is something that no one wants to have to face.

Private mortgages are rarely a good idea, and you will probably want to dismiss this option as not ideal for a whole host of reasons. Those who are looking to be able to deal with their property in an equitable way if something should happen that causes a foreclosure to be necessary will want to make sure that they do not look for private financing of any kind.

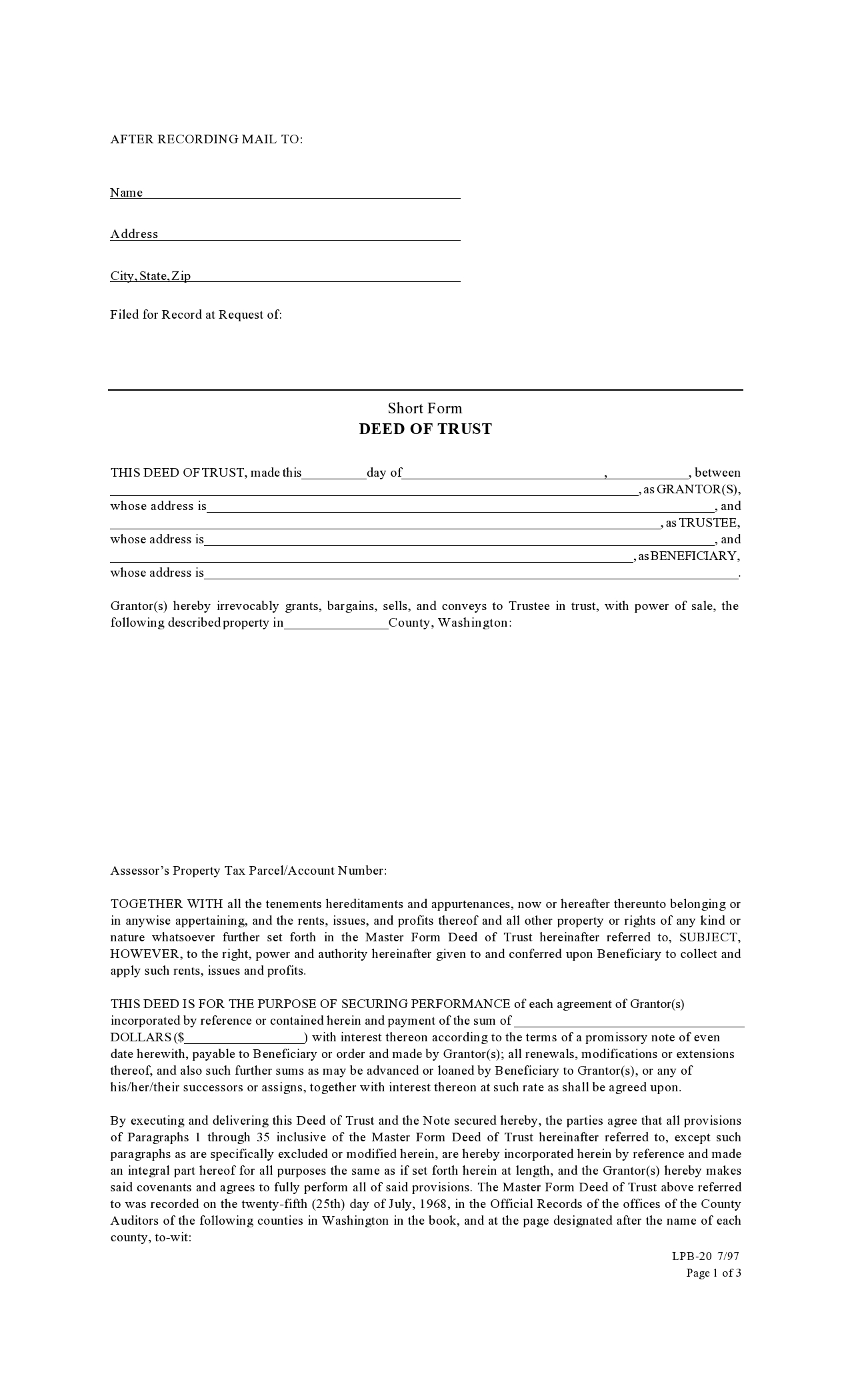

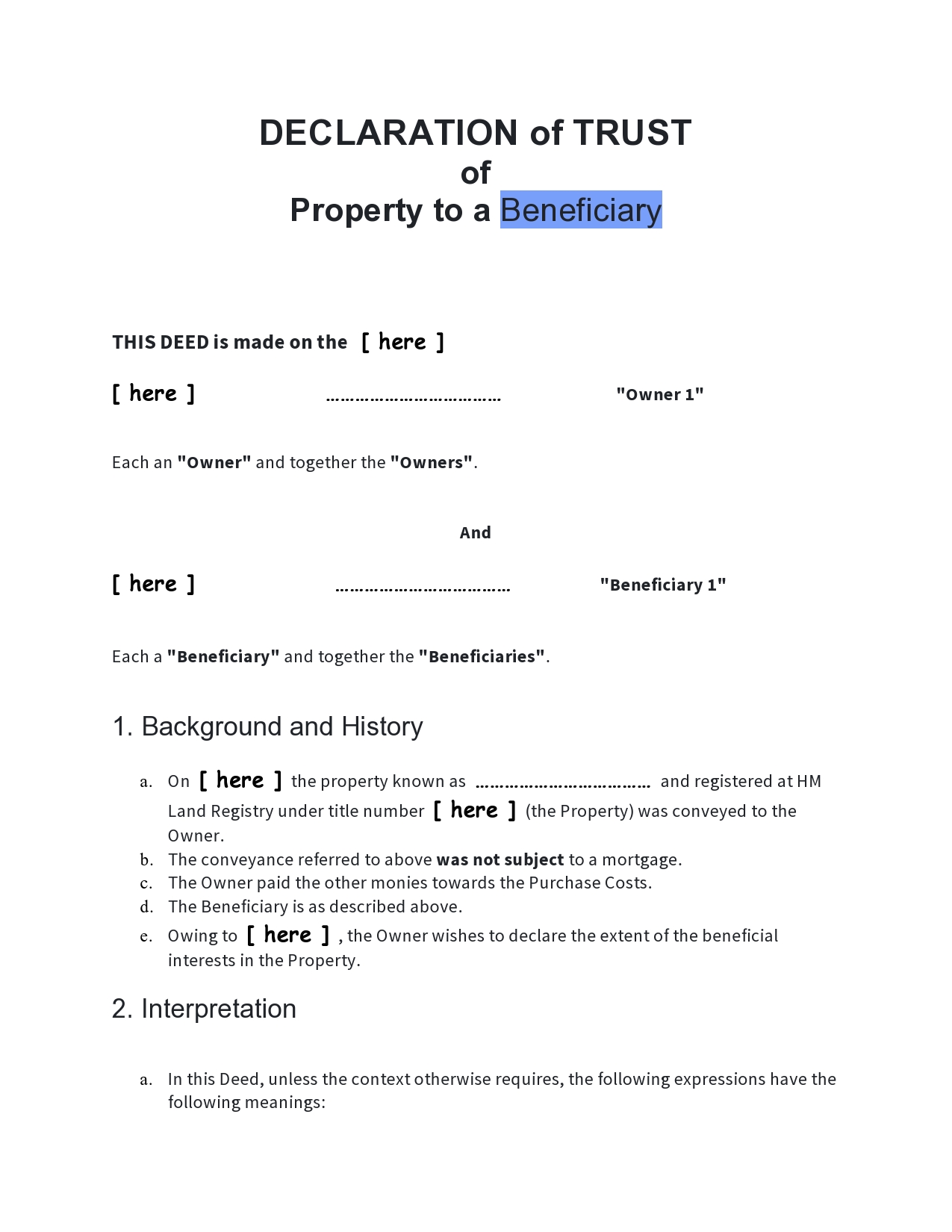

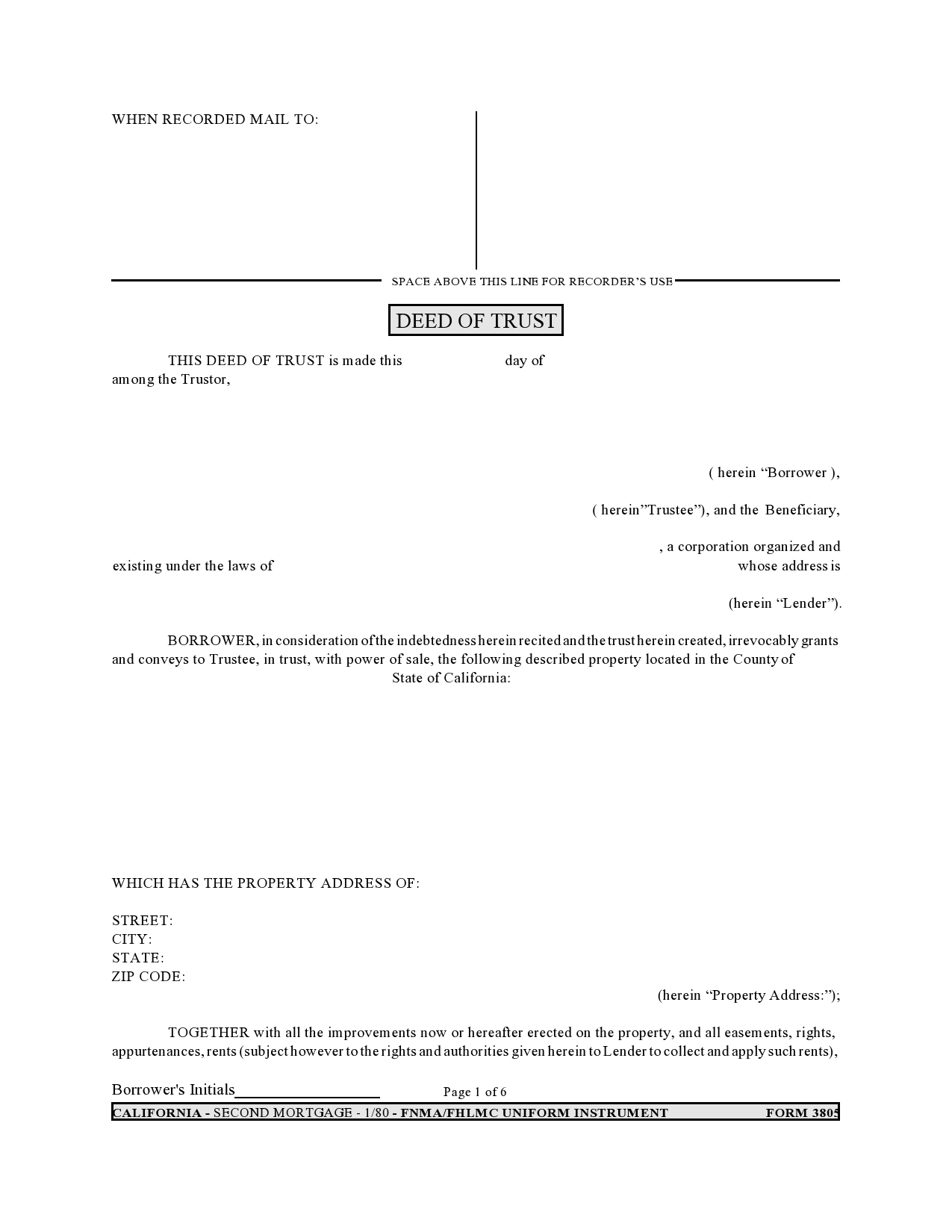

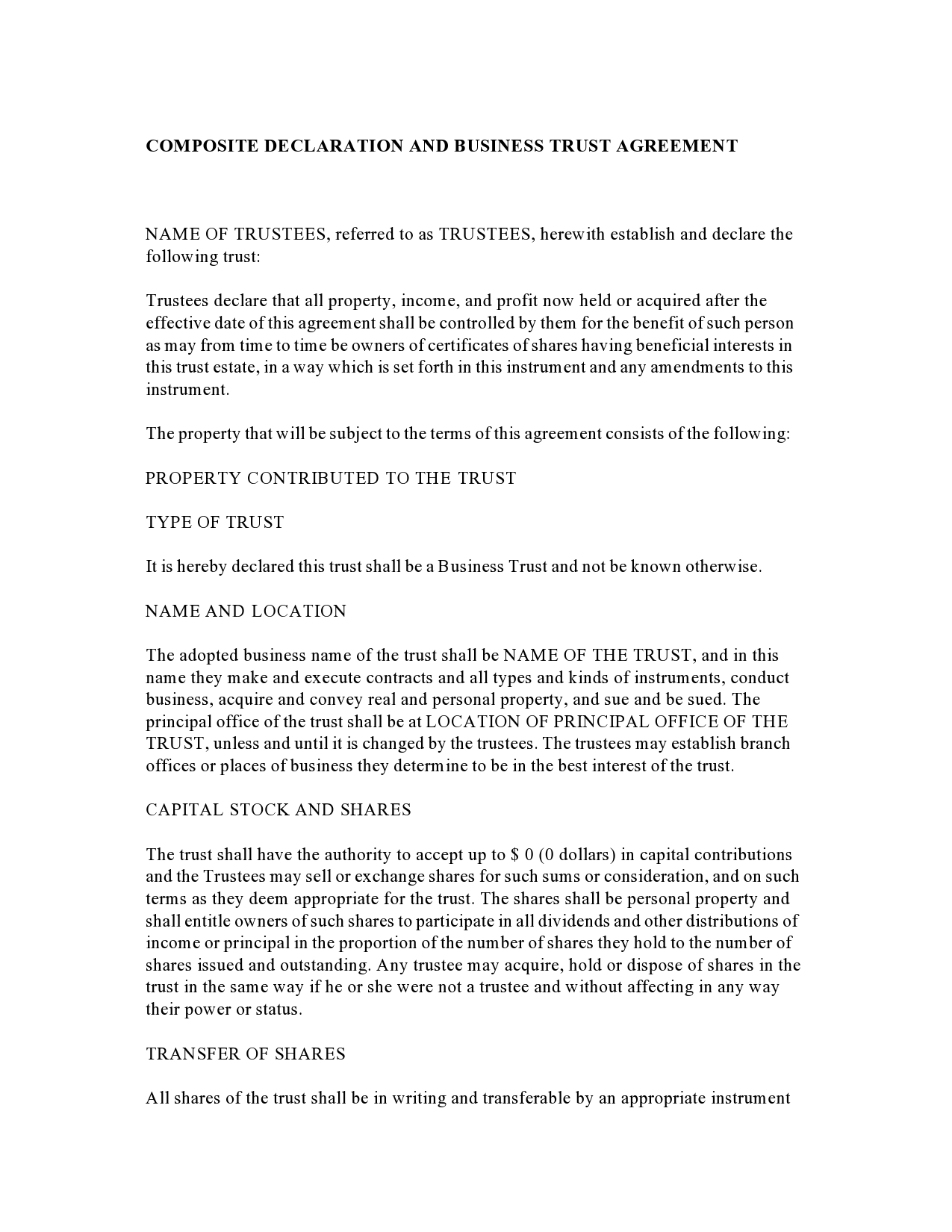

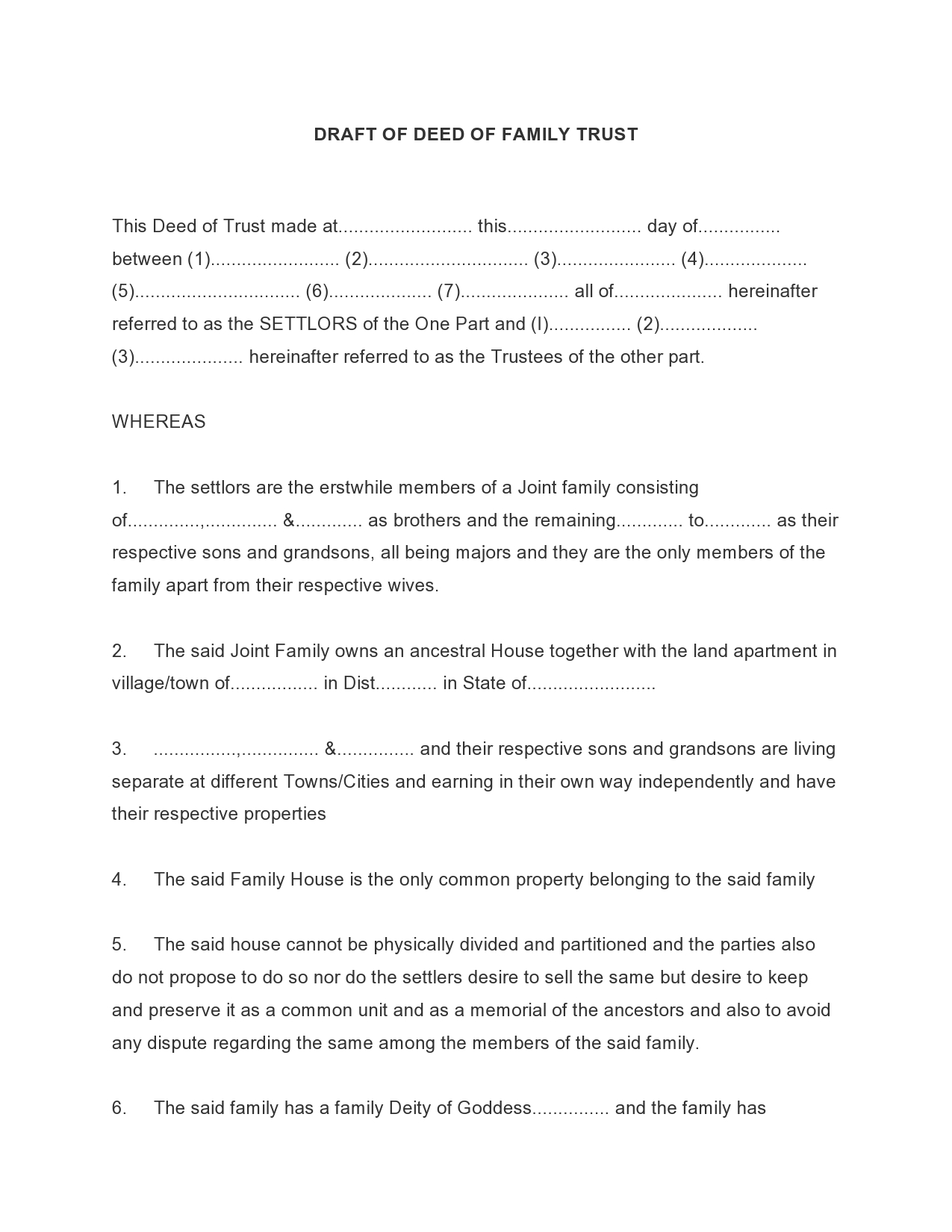

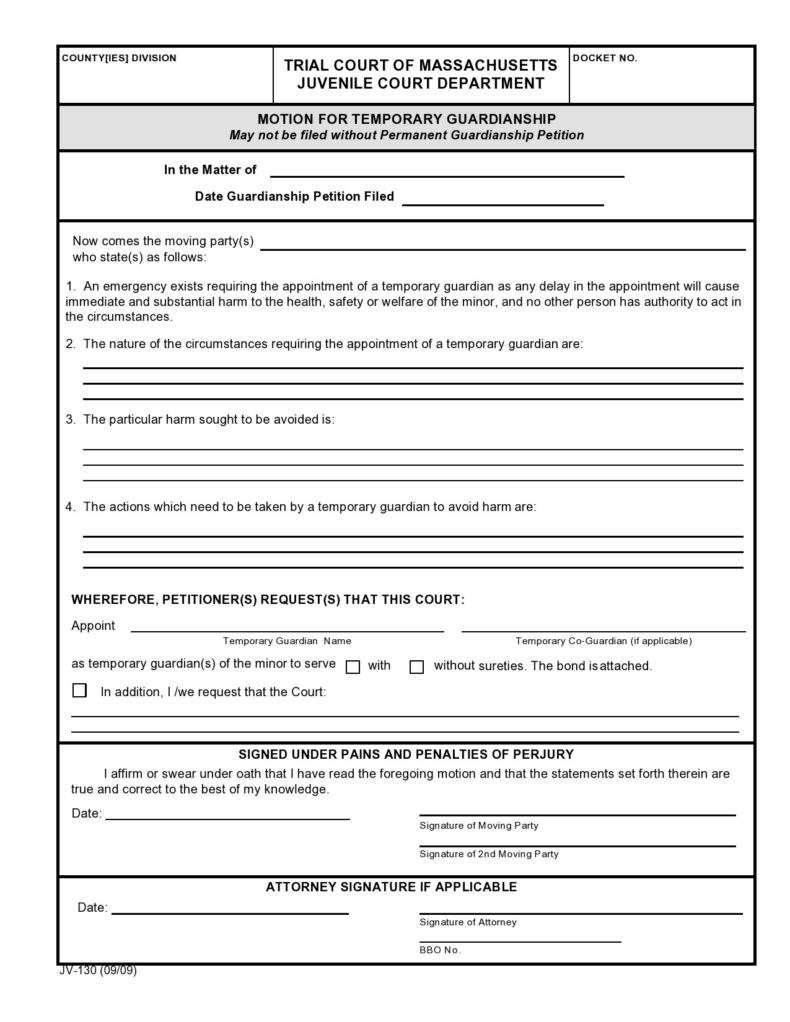

Property Trust Deed

Deed of Trust Documents need to be Written Correctly to be Valid

The deed of trust that you write for your property will need to be correctly drafted to be effective and useful. You cannot use a deed of trust to describe the relationship between you as the borrower, the lender, and the holder of the property’s title without a correct deed of title document. This is one of the critical documents for homeowners, and you will need to make sure that you have this document correctly drafted for it to be effective.

Deed of trust paperwork will need to have all the right information in it to be useful, so make sure that you have the full legal names of all the parties involved in the contract in your deed of trust template. This is a document that you can write yourself, but that probably should be evaluated by a lawyer before you trust that you have done all the work on this deed correctly. Be sure that you take the time to draft a correct and accurate deed of trust so that you can protect the ownership of your property in the instance that it must be sold as a foreclosure.