A rental ledger template, otherwise known as a rent ledger template, is a formal document containing a record of rental transactions between tenants and property owners.

Rent ledgers show a complete record of a tenant’s payment history and are an invaluable tool for landlords and investors. It contains information about the owner, tenant, terms of the lease, and a full history of payments.

Table of Contents

- 1 Rental Ledger Templates

- 2 What is a Rental Ledger Used For?

- 3 Rental Ledger Examples

- 4 Why is a Rent Ledger Template Important?

- 5 Information To Include in Your Rental Ledger Template

- 6 Free Lease Ledgers

- 7 How Often Should a Rental Property Ledger Be Updated?

- 8 Who is in Charge of Keeping a Rent Payments Ledger?

- 9 Who Can Use a Rent Ledger Template

- 10 Advantages of a Rent Ledger template

- 11 Tenant Ledgers

- 12 How to Manage a Rent Ledger Form

- 13 Conclusion

In this article, we’ll go over the importance of rental ledger templates and how to use them.

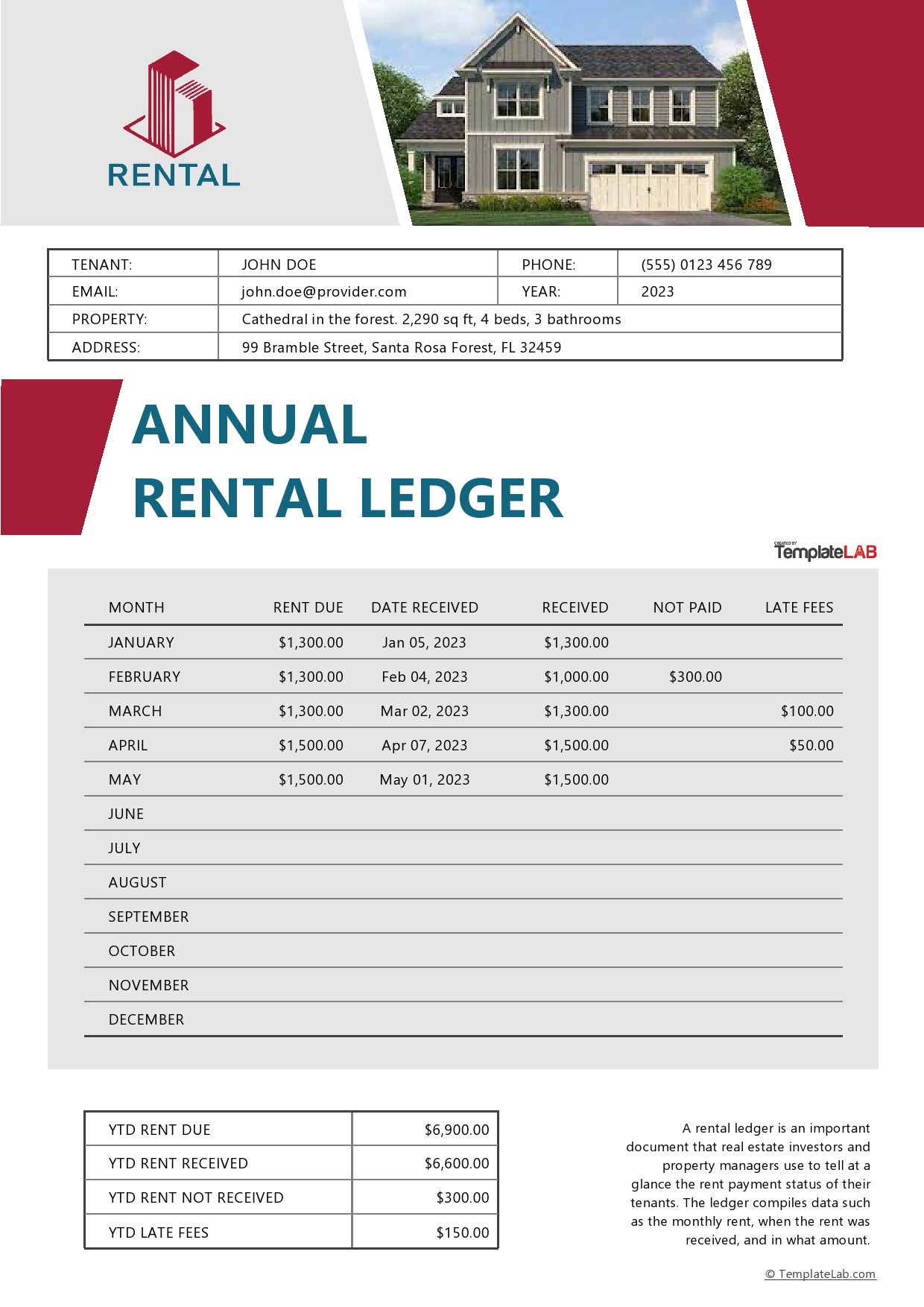

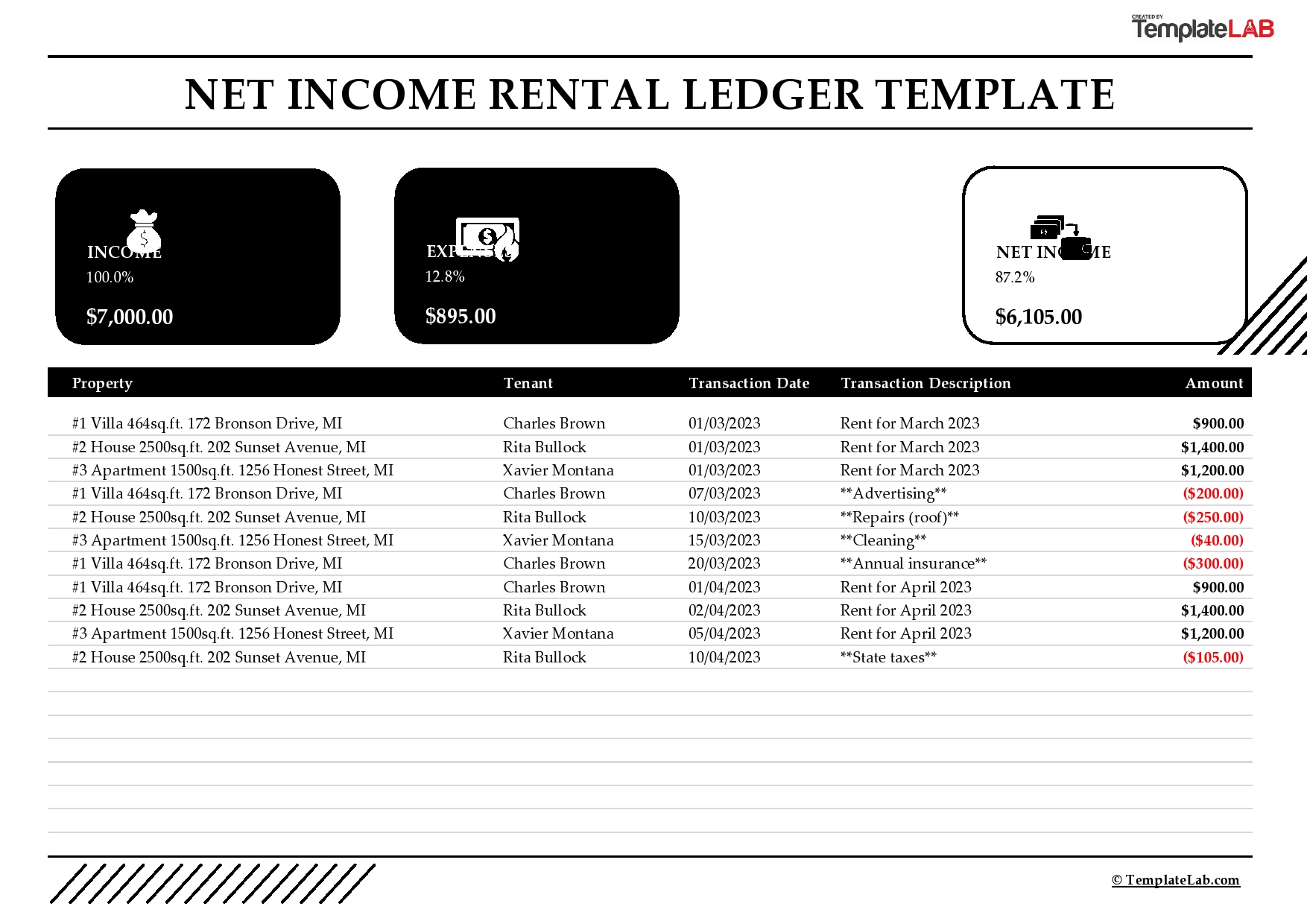

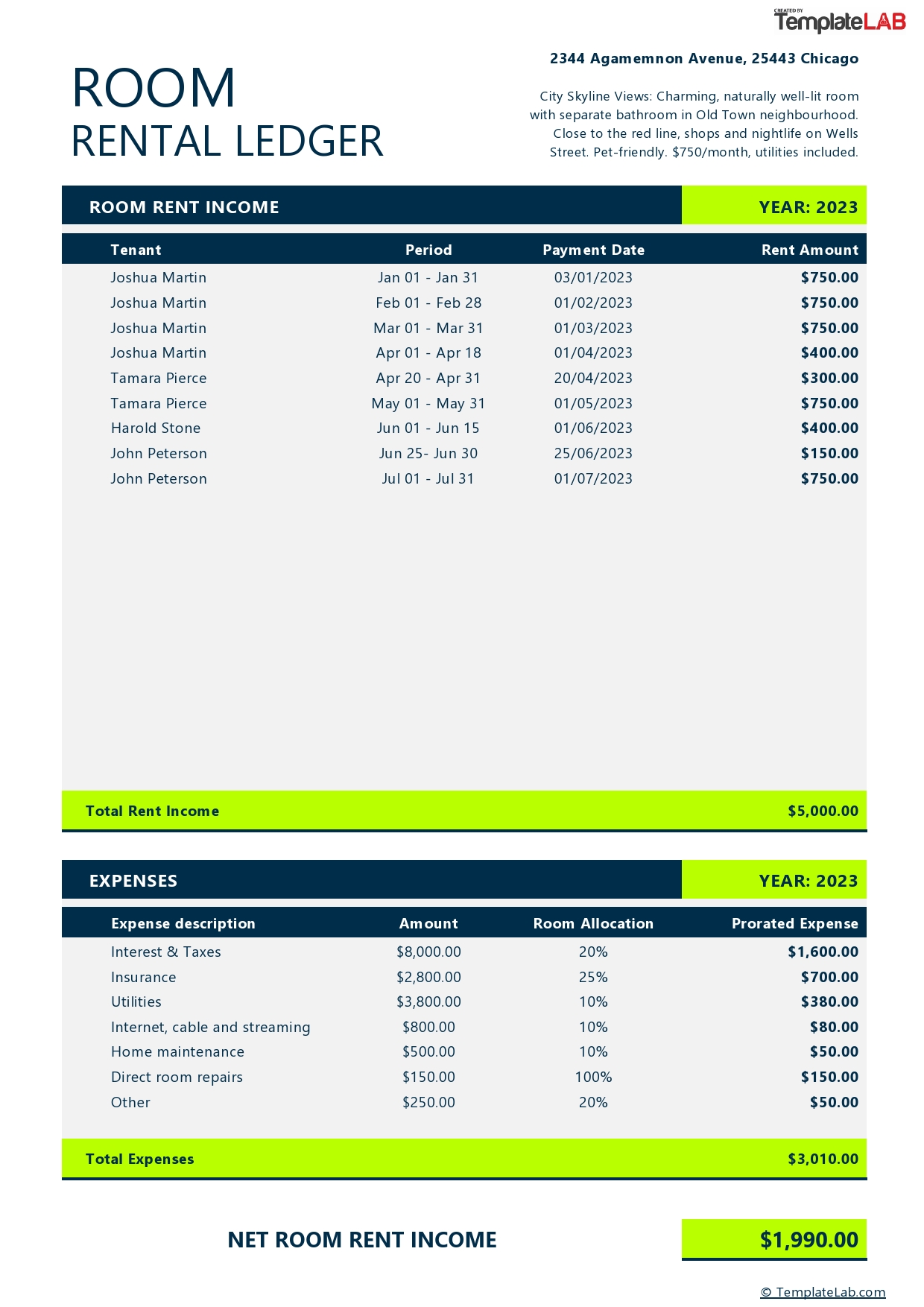

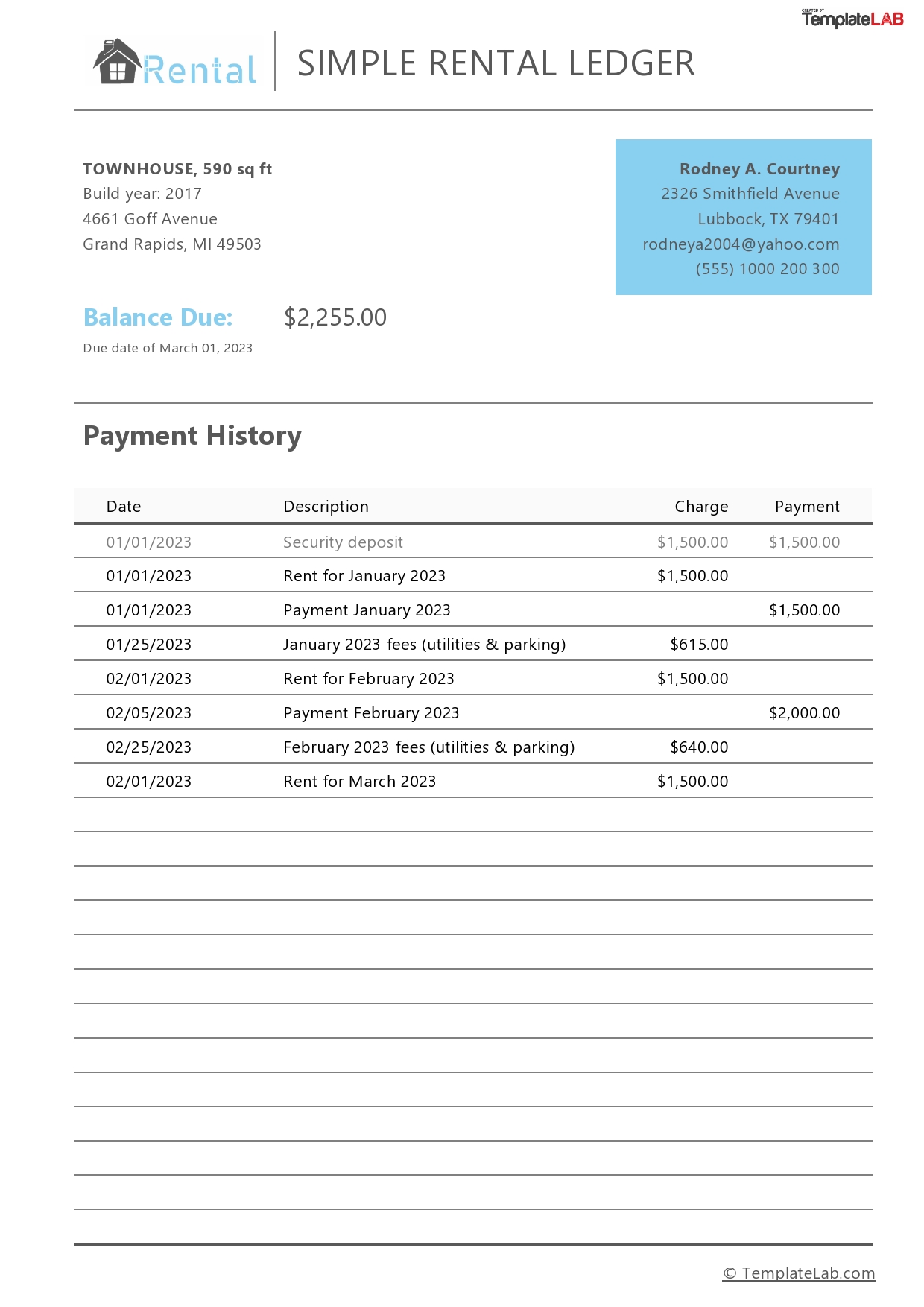

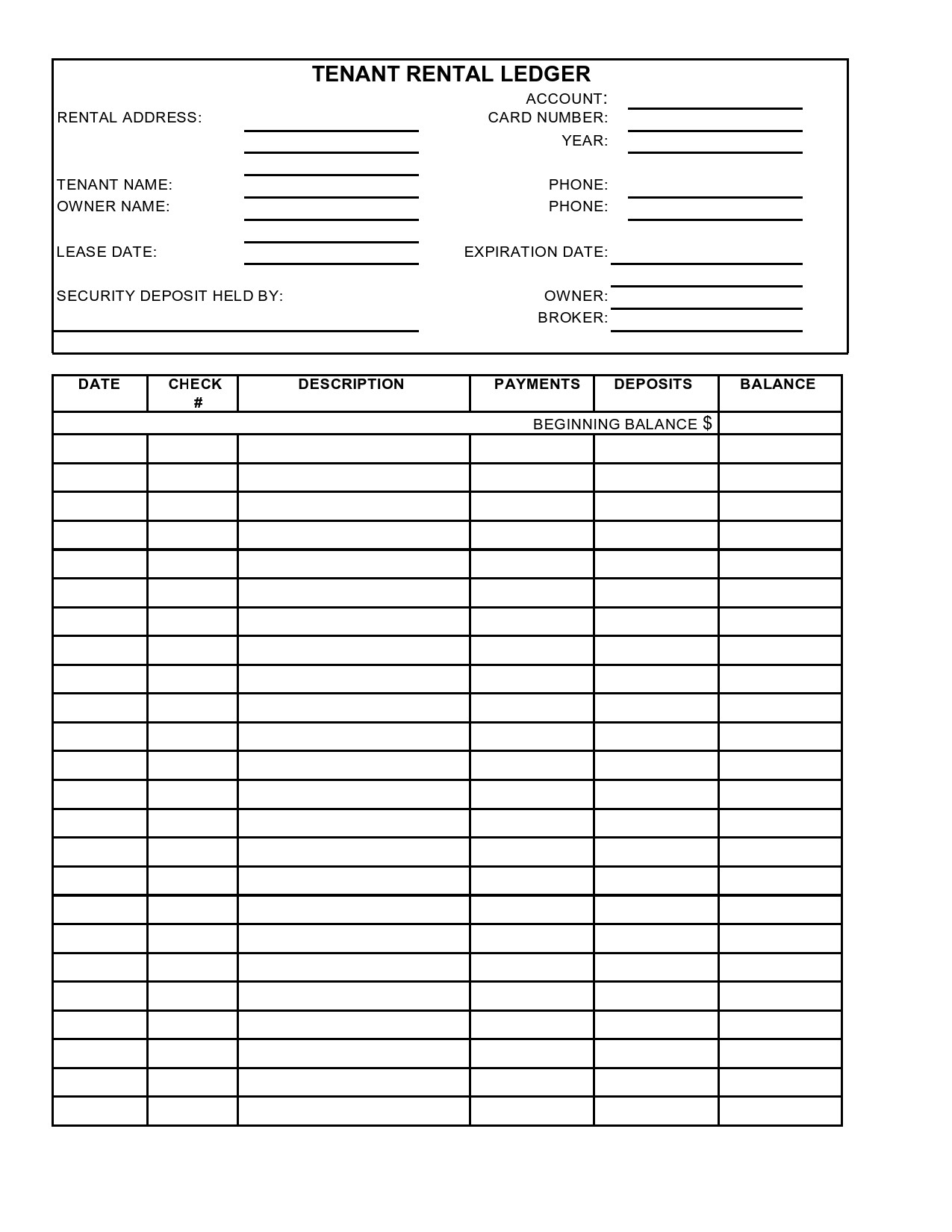

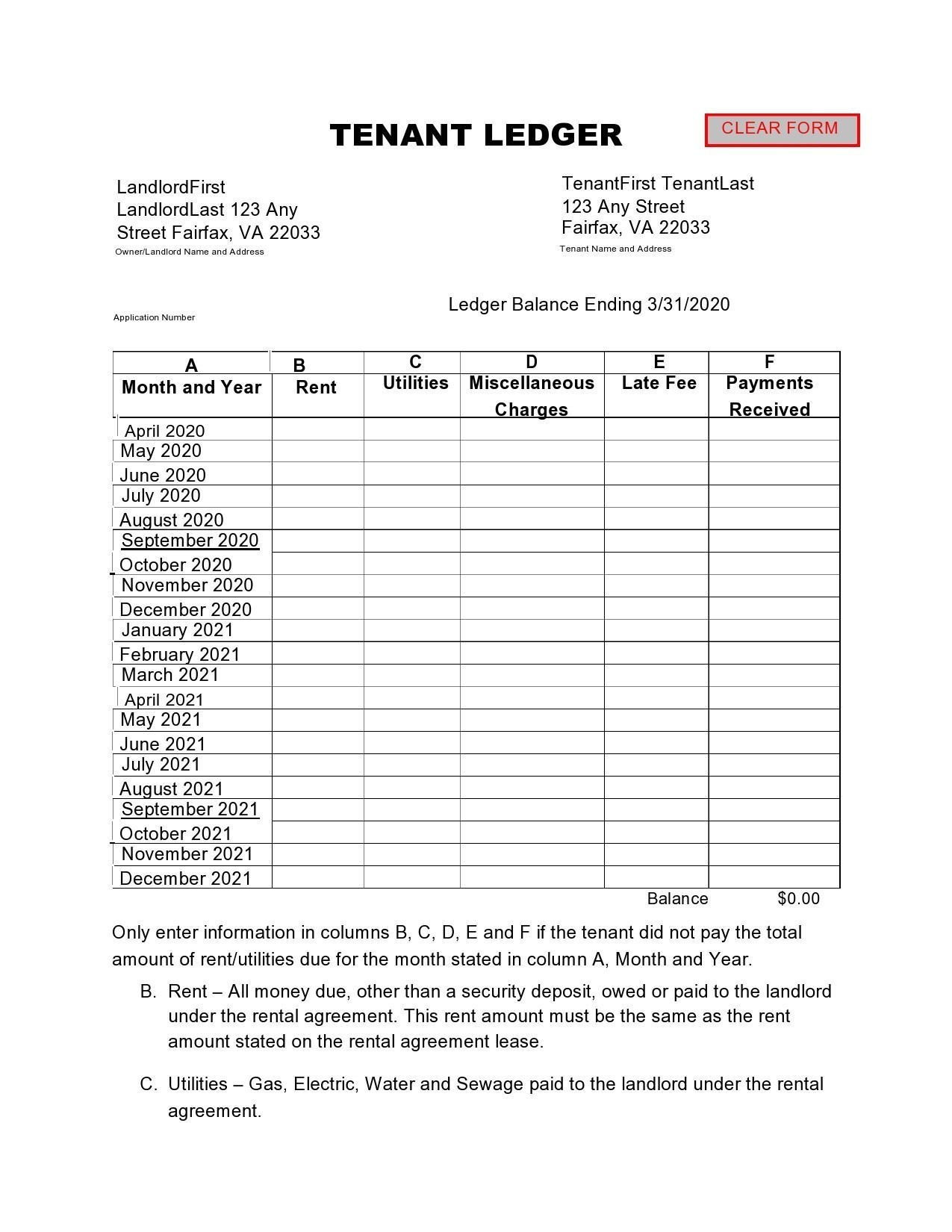

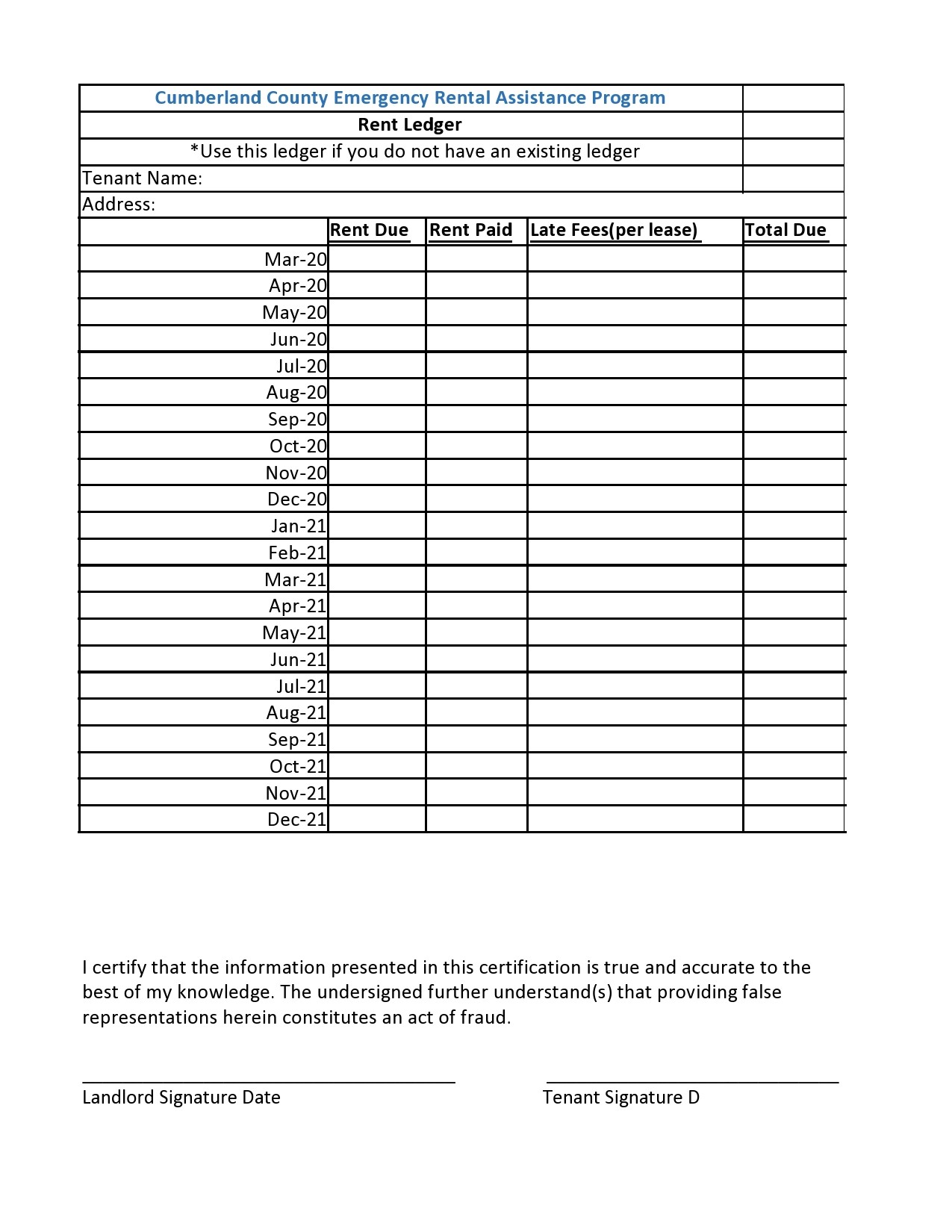

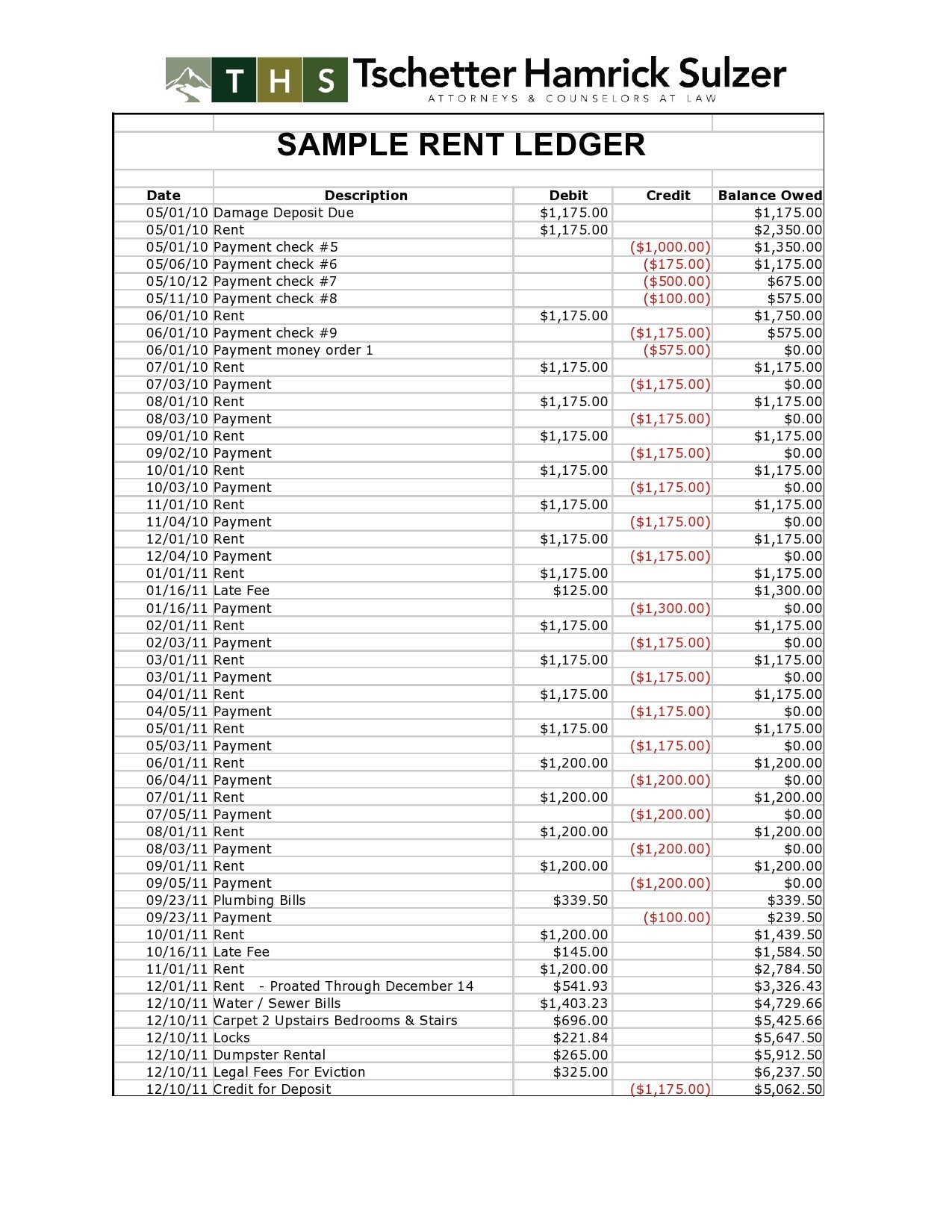

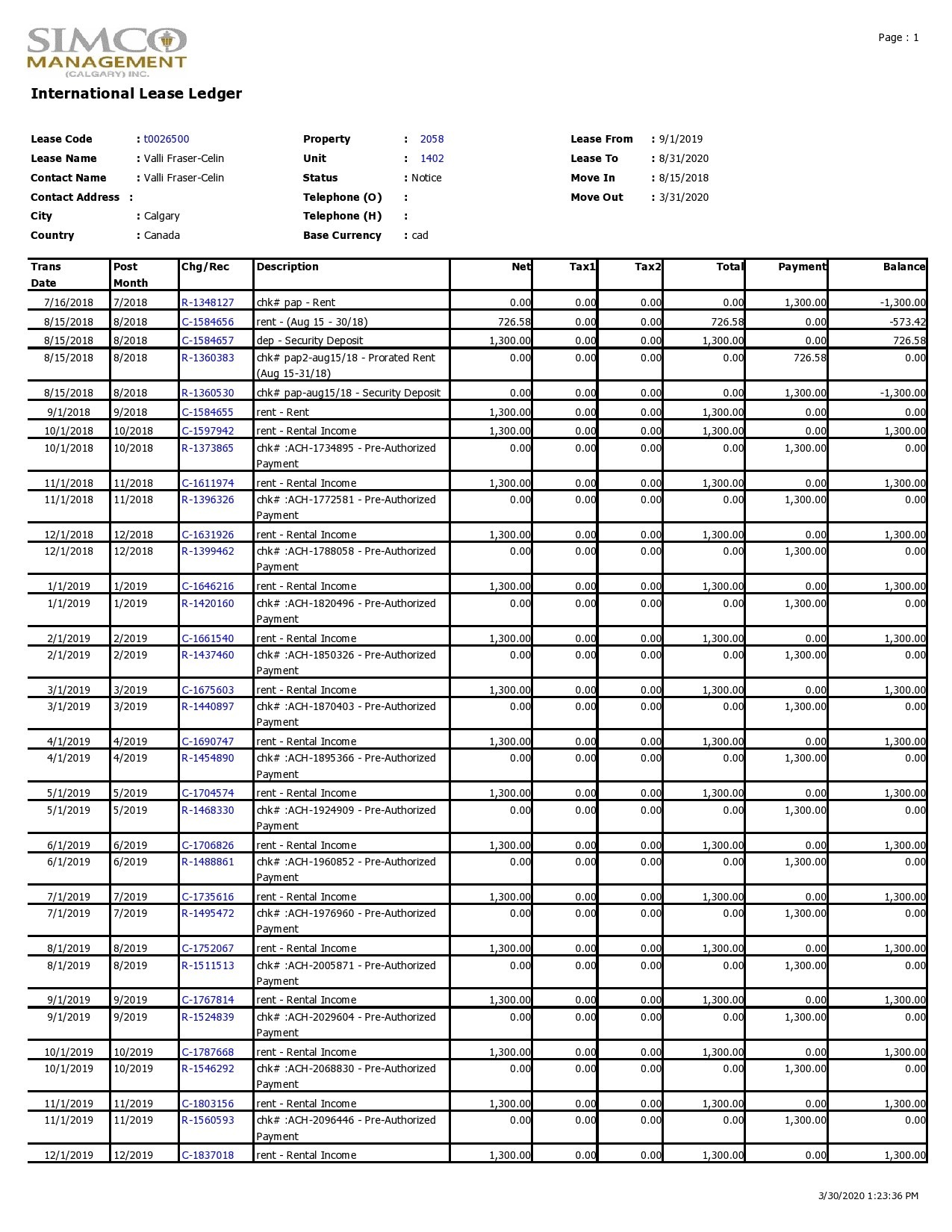

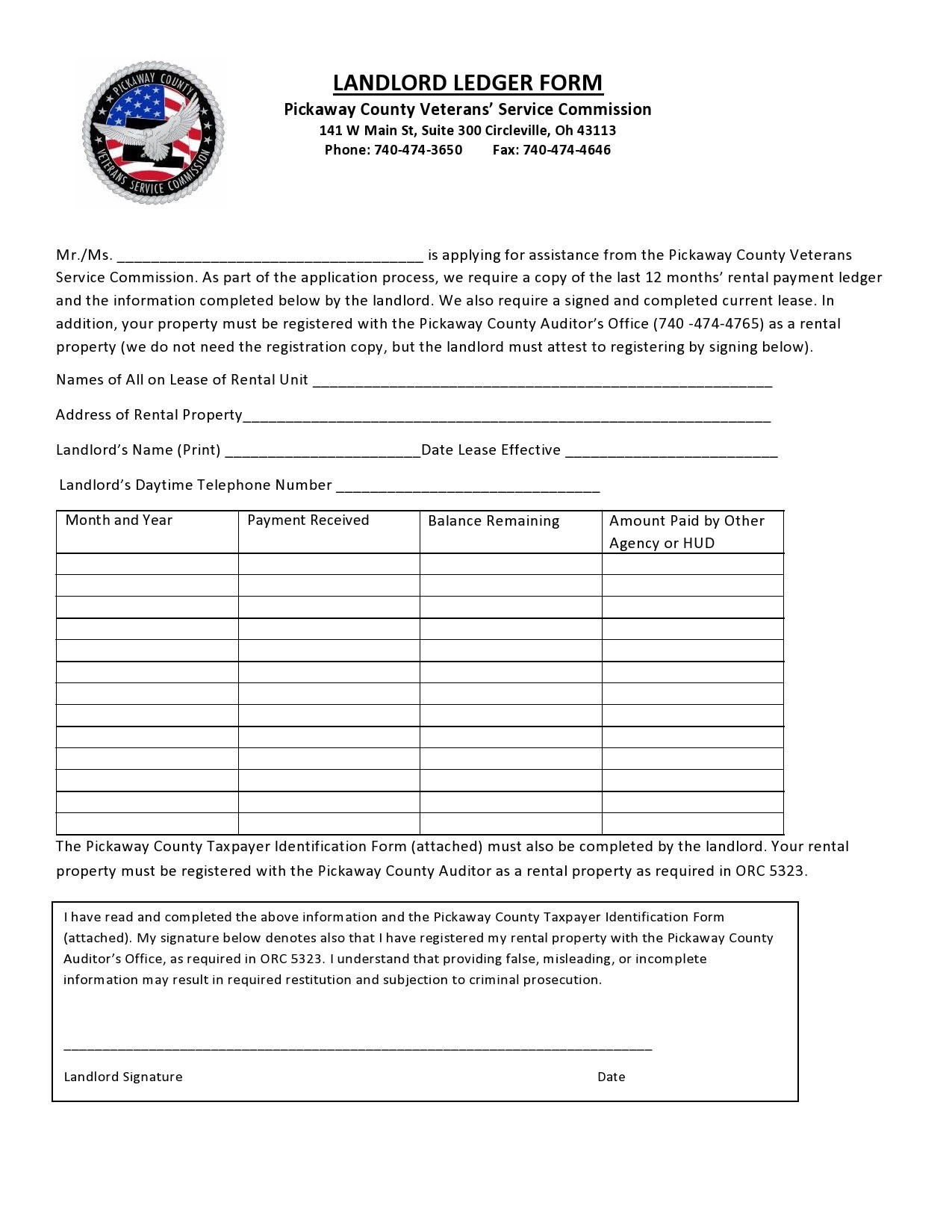

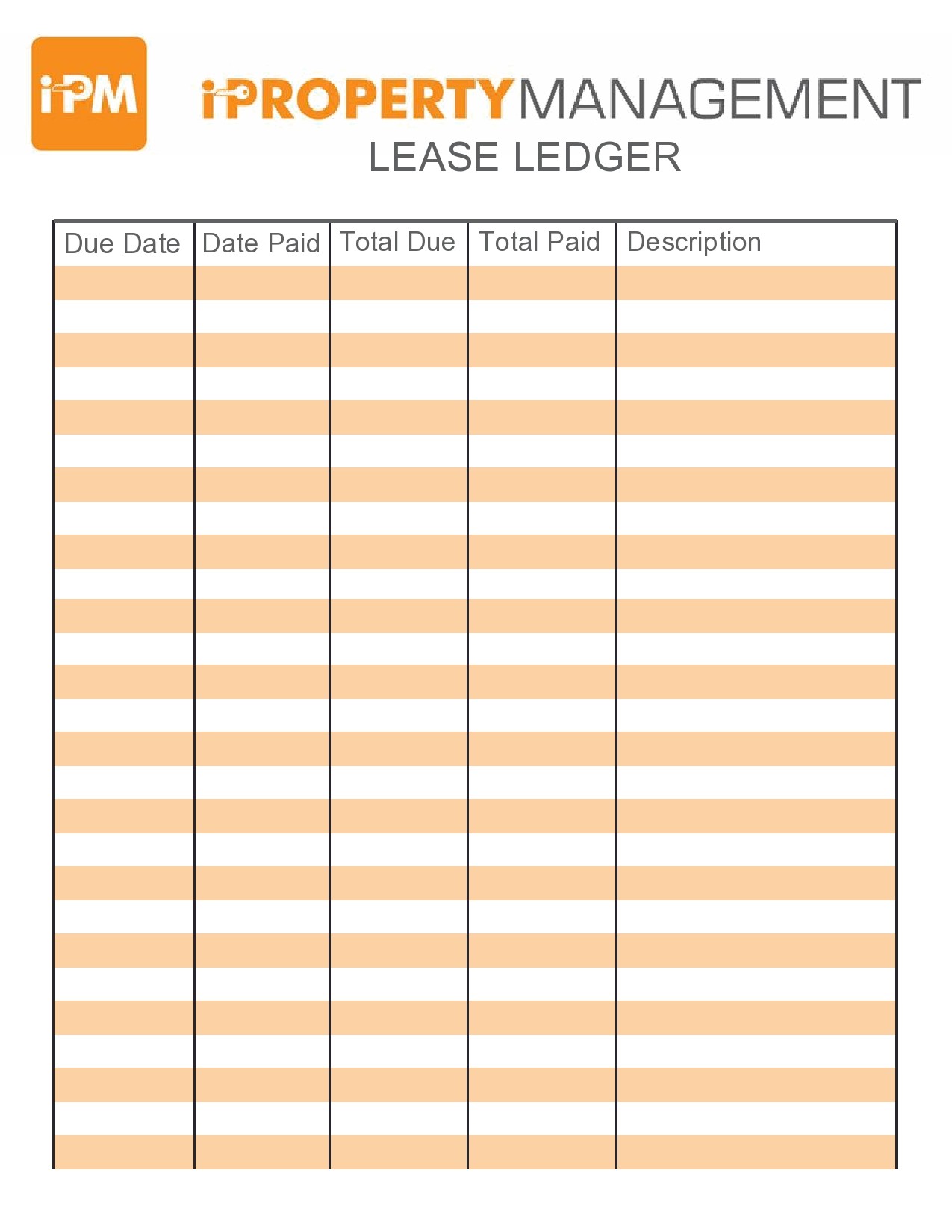

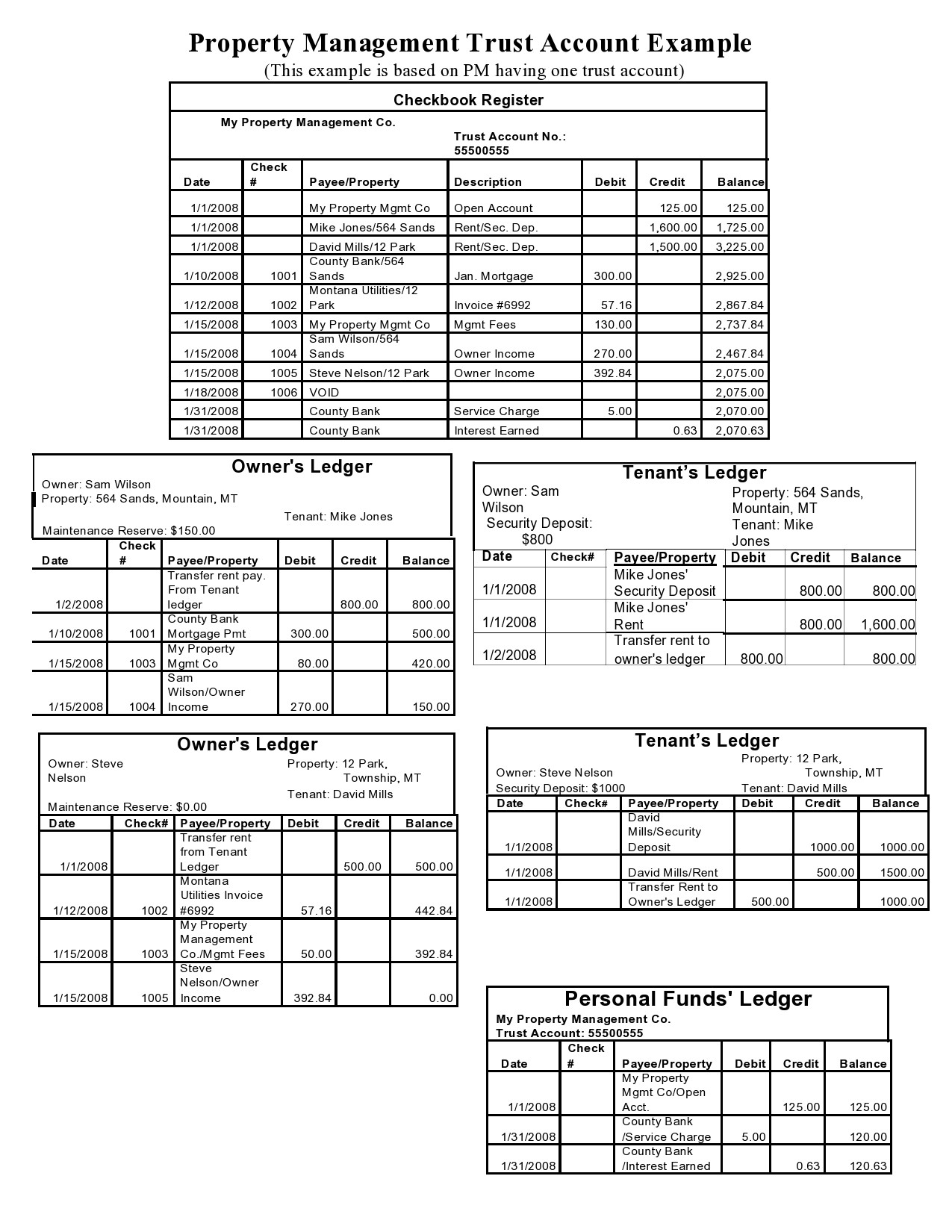

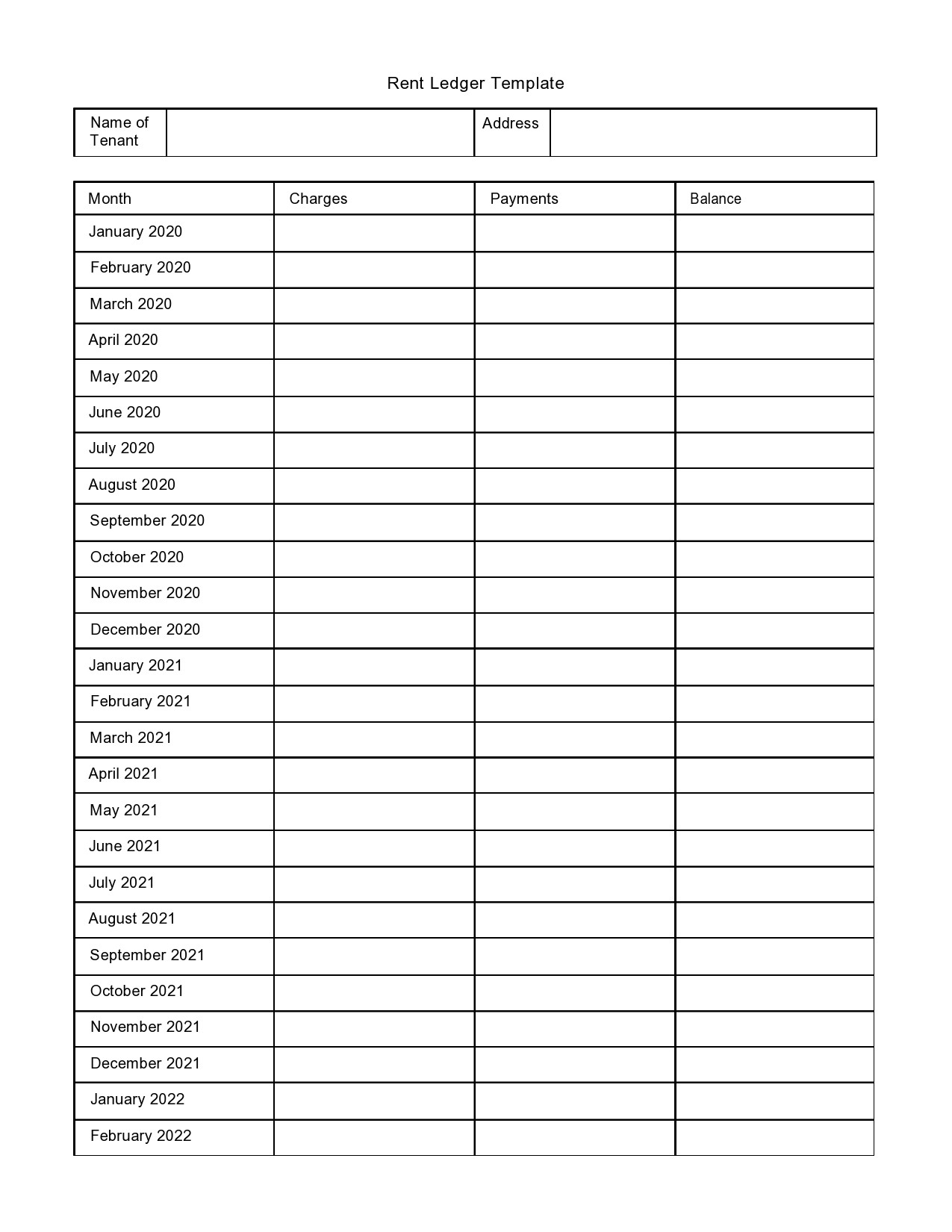

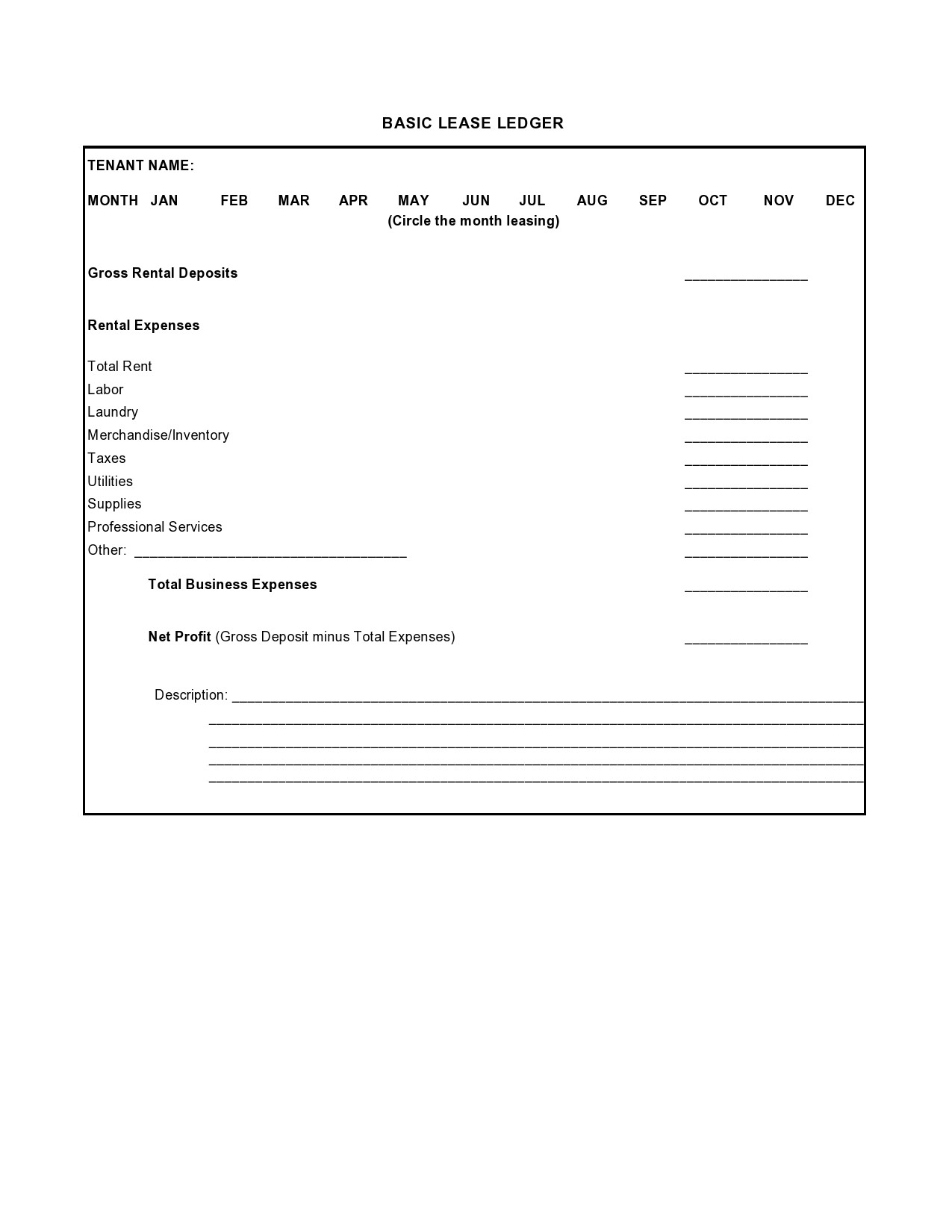

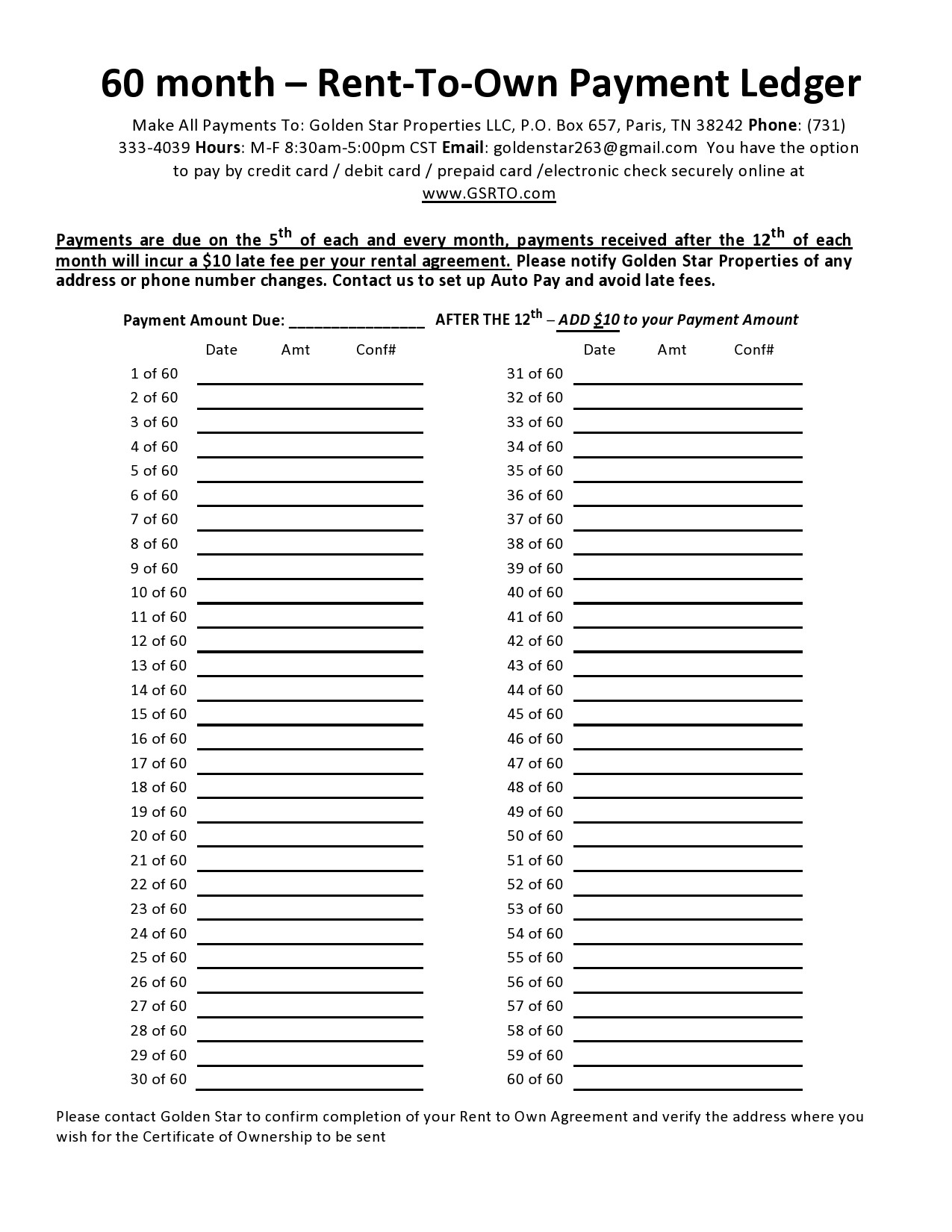

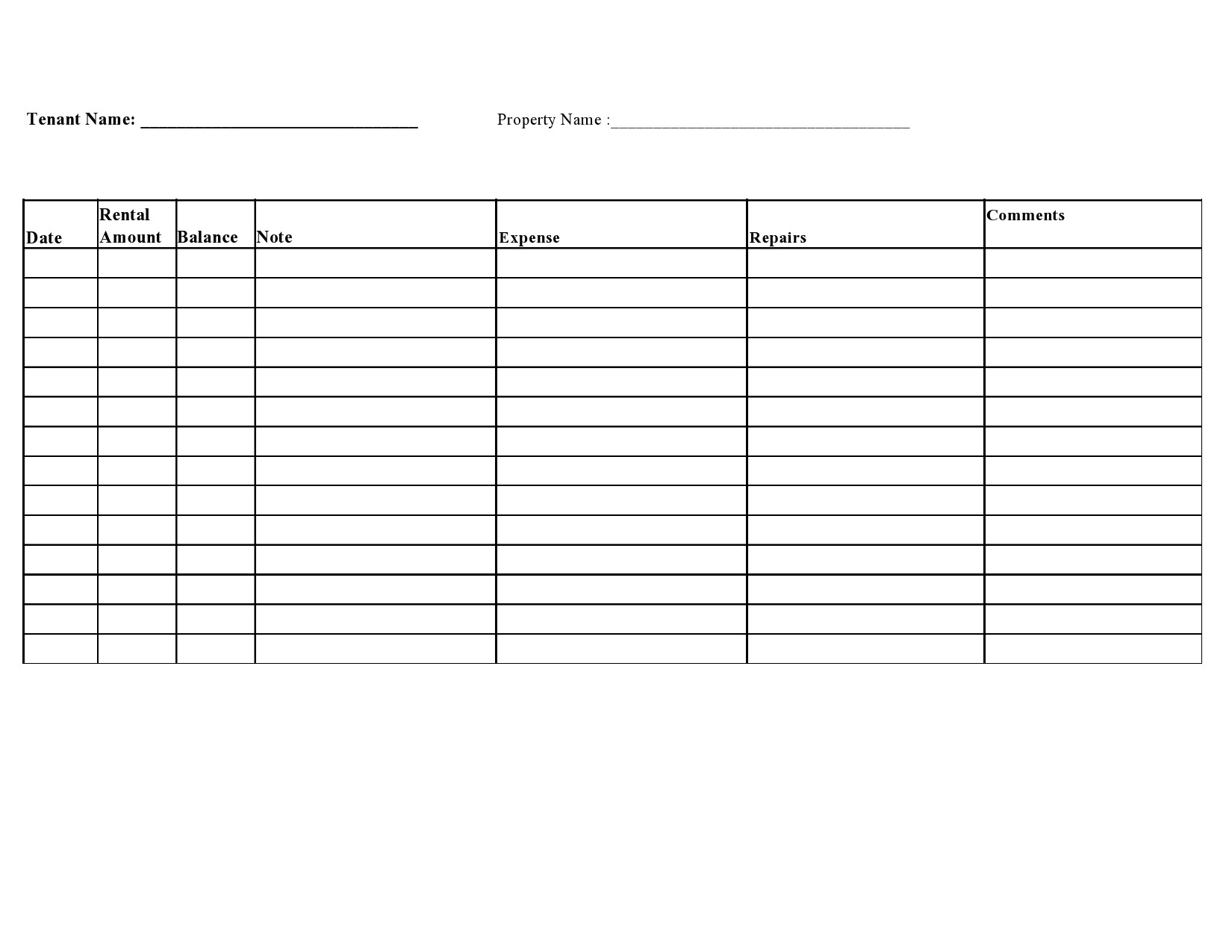

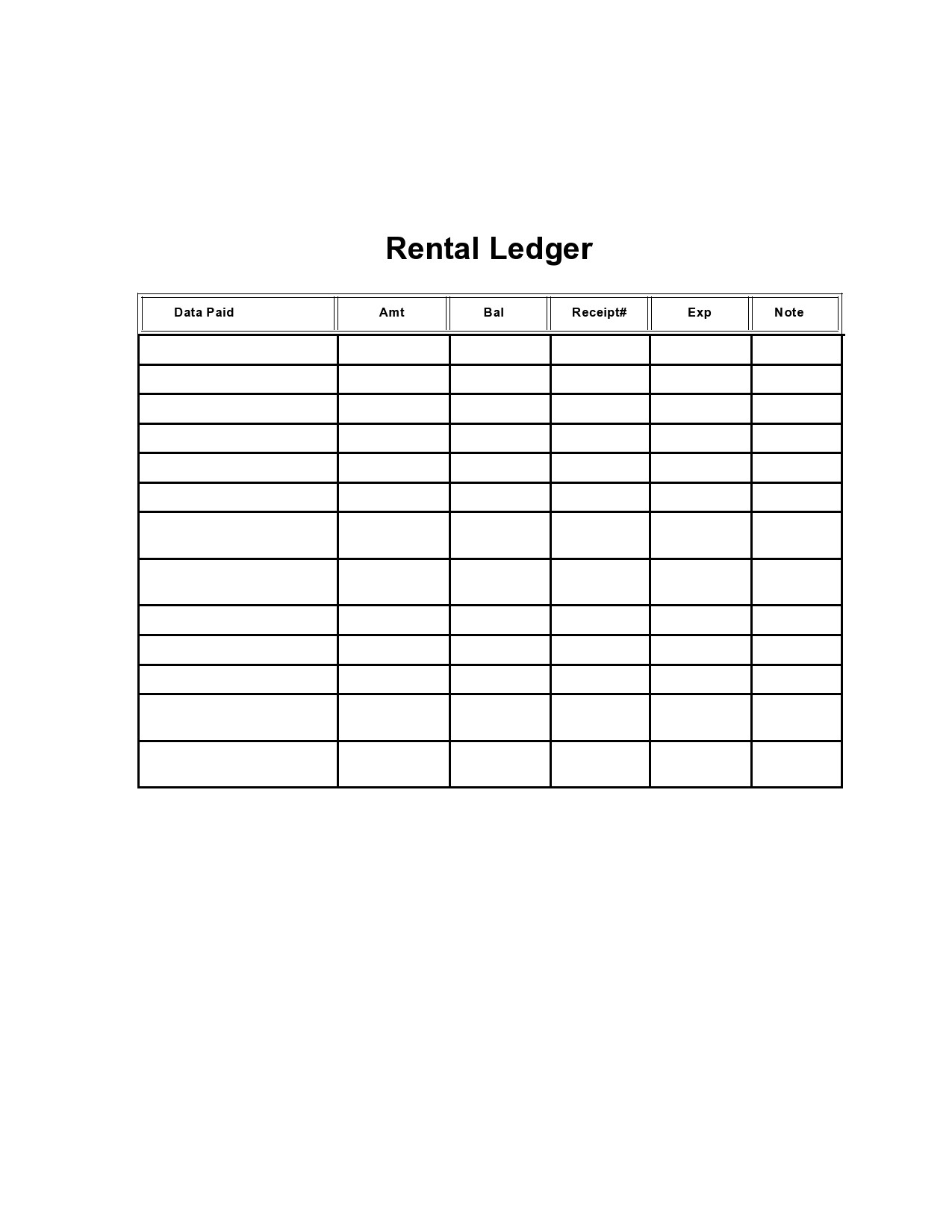

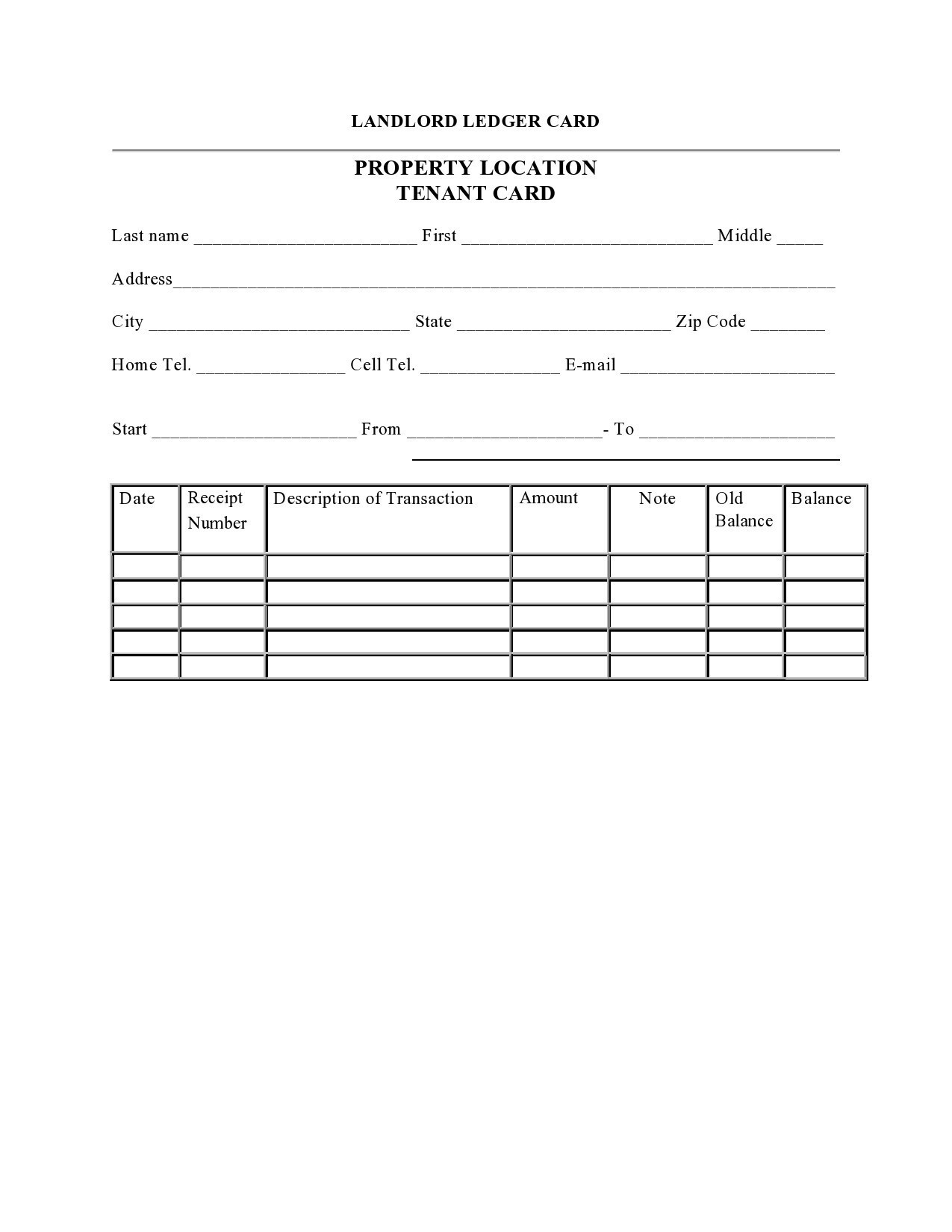

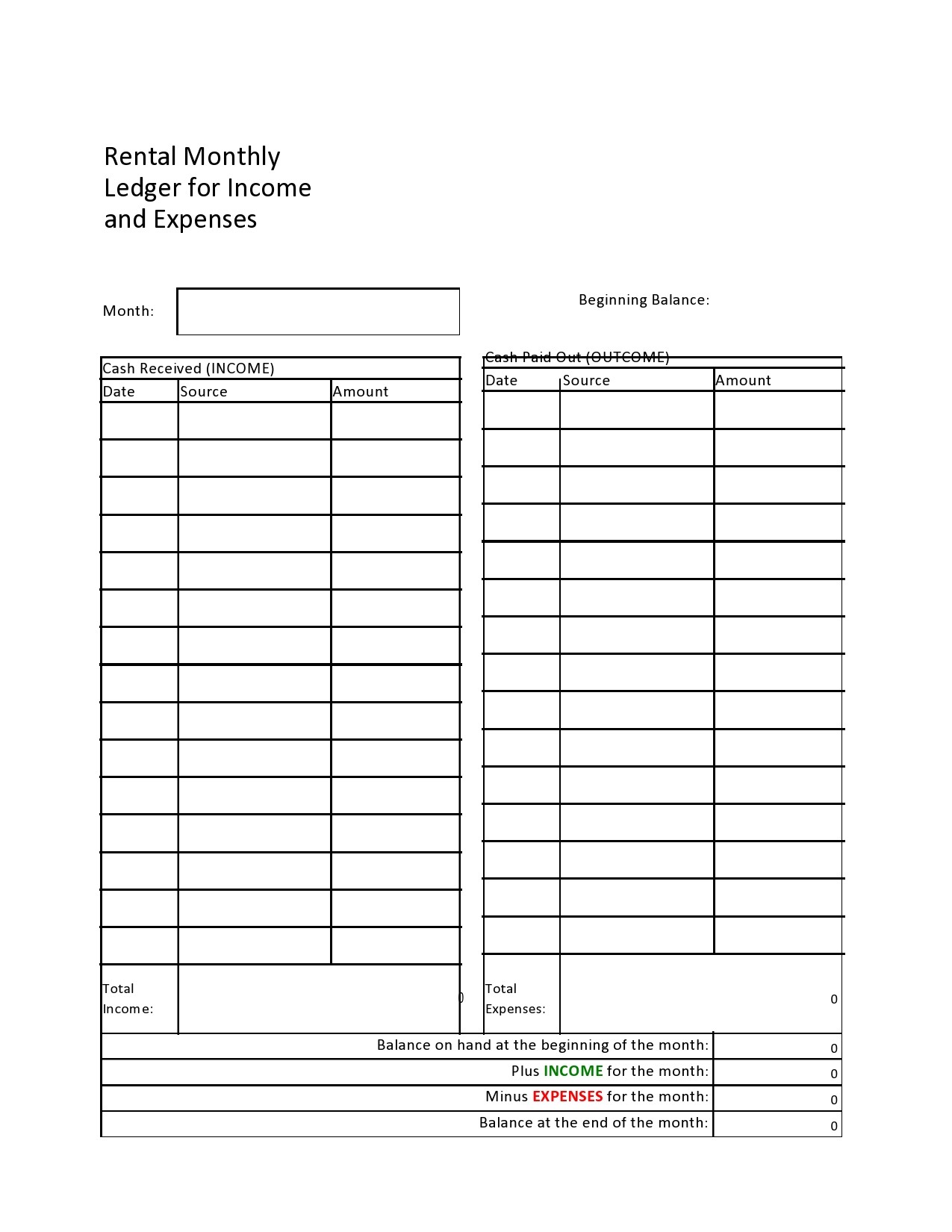

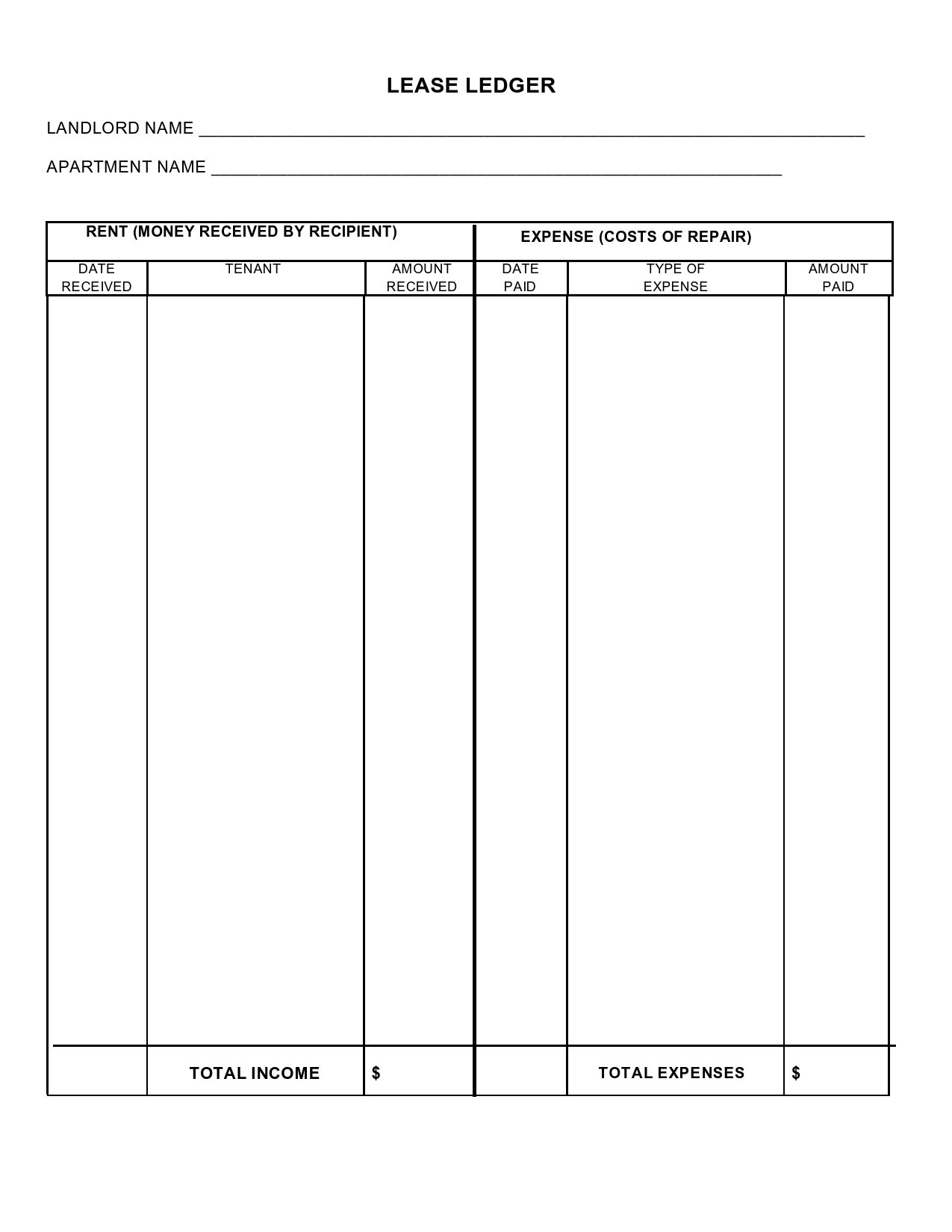

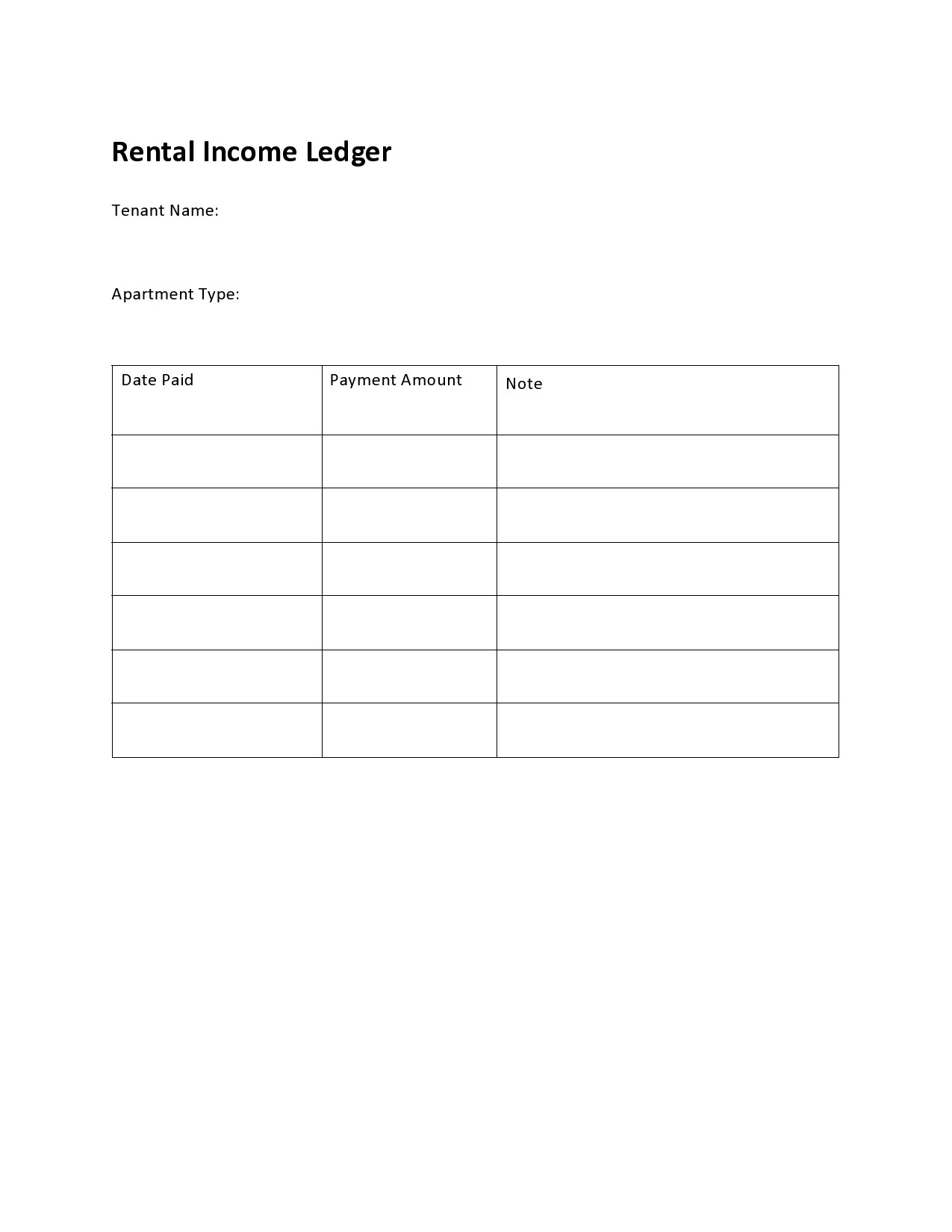

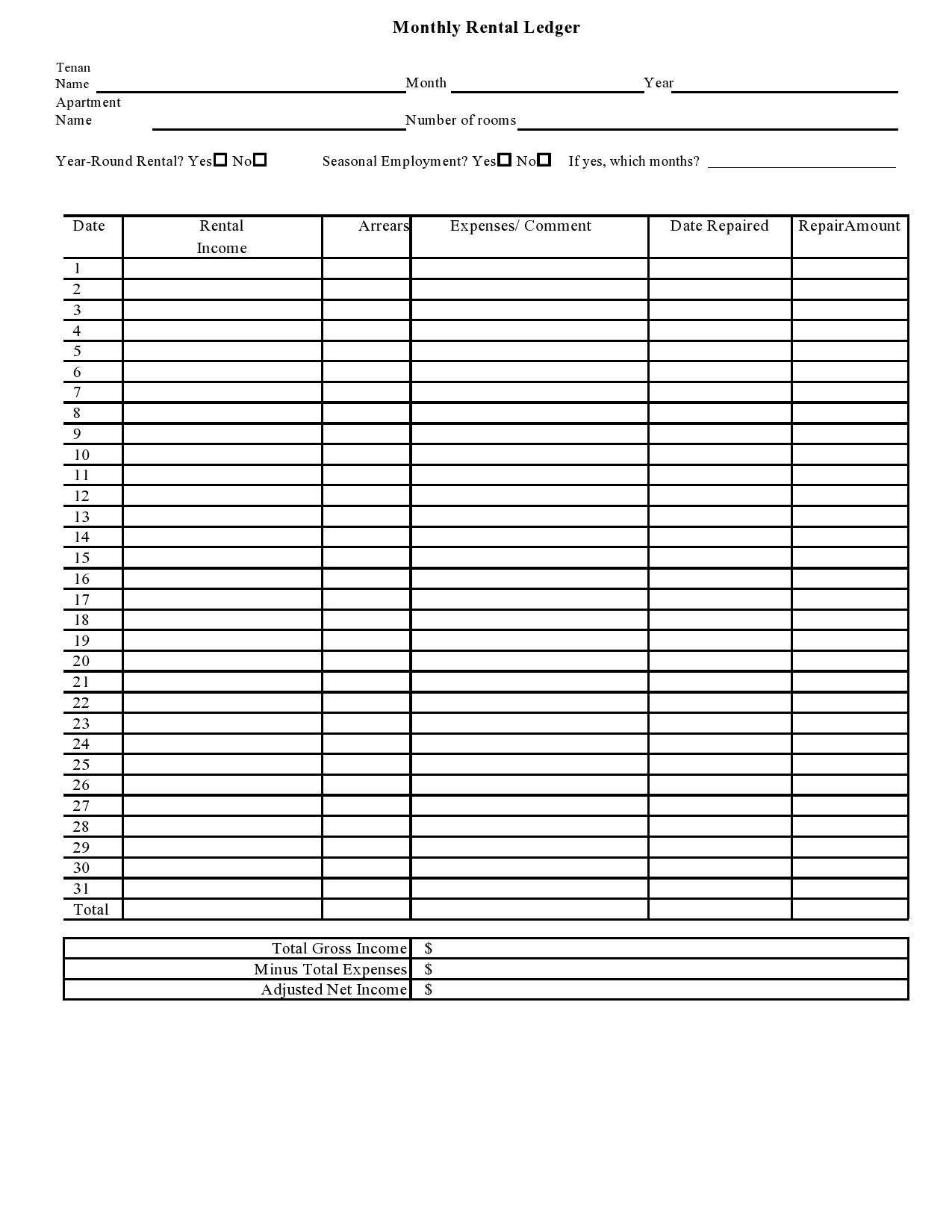

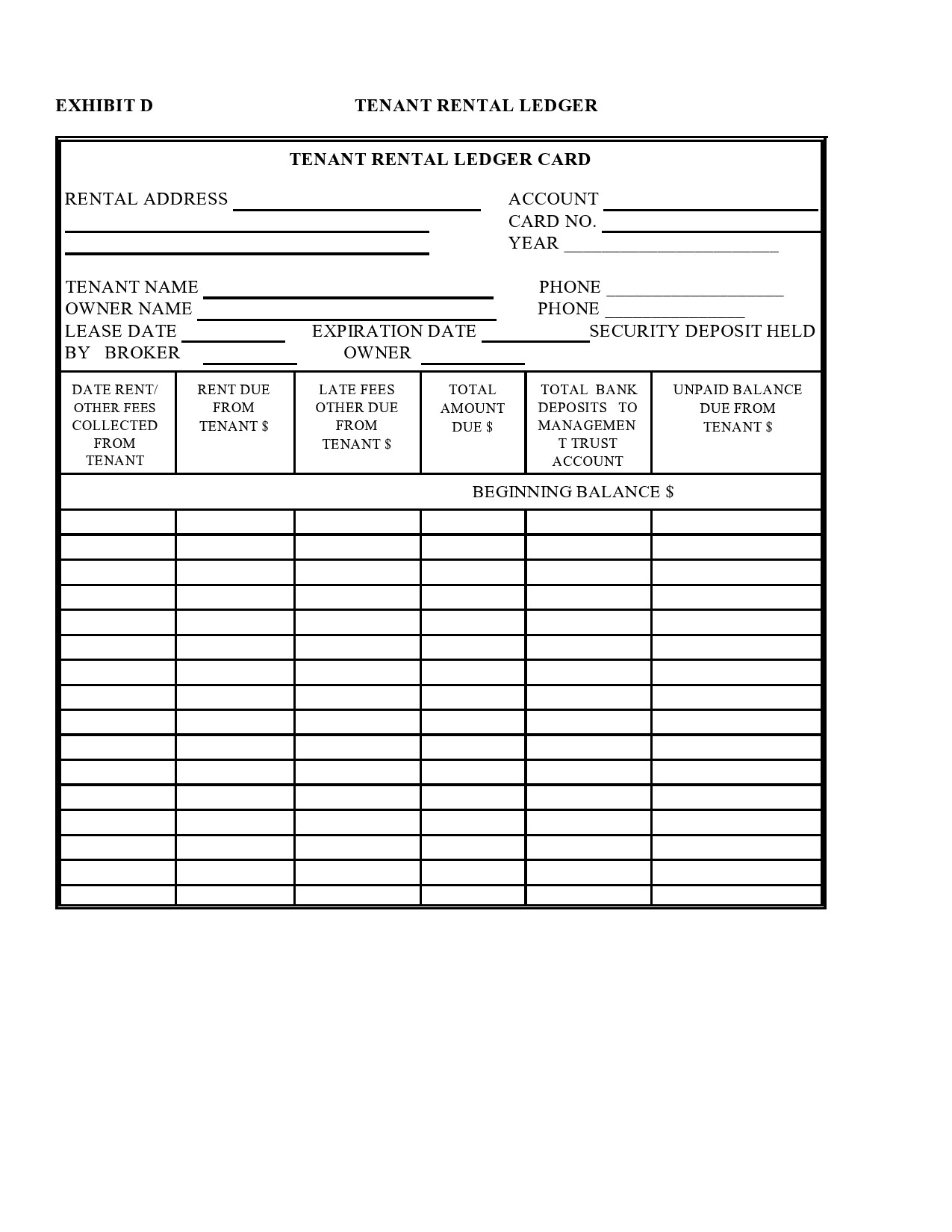

Rental Ledger Templates

What is a Rental Ledger Used For?

Landlords and property managers use a rent ledger to keep track of the rent payments made by their tenants. It records every transaction involving the rent, including due dates, payments made, unpaid balances, and any late fines.

Rent ledgers are used for the following purposes:

- Keeping a record: The landlord or property manager enters the relevant information, such as the amount of rent owed and the due date, into the rent ledger form each month. Additionally, they keep track of the date and sum of each payment made by the tenant.

- Monitoring payments: Landlords may easily monitor payments, spot overdue or missed payments, and find any late fees or fines that may apply.

- Transparent communication: A rental ledger template can improve communication between landlords and tenants. For example, the landlord can share the rental ledger template with their tenant and explain any discrepancies in their rent payments.

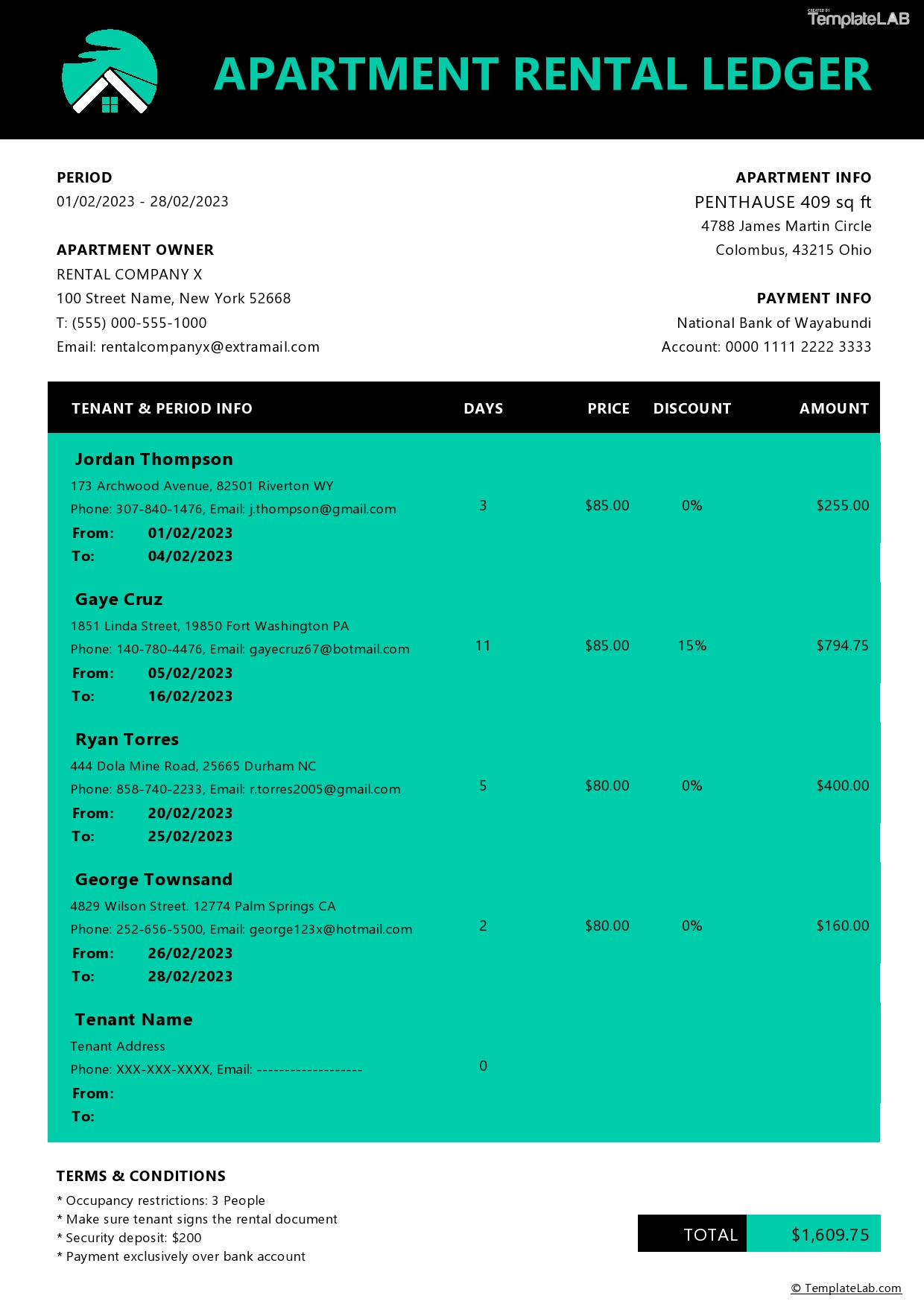

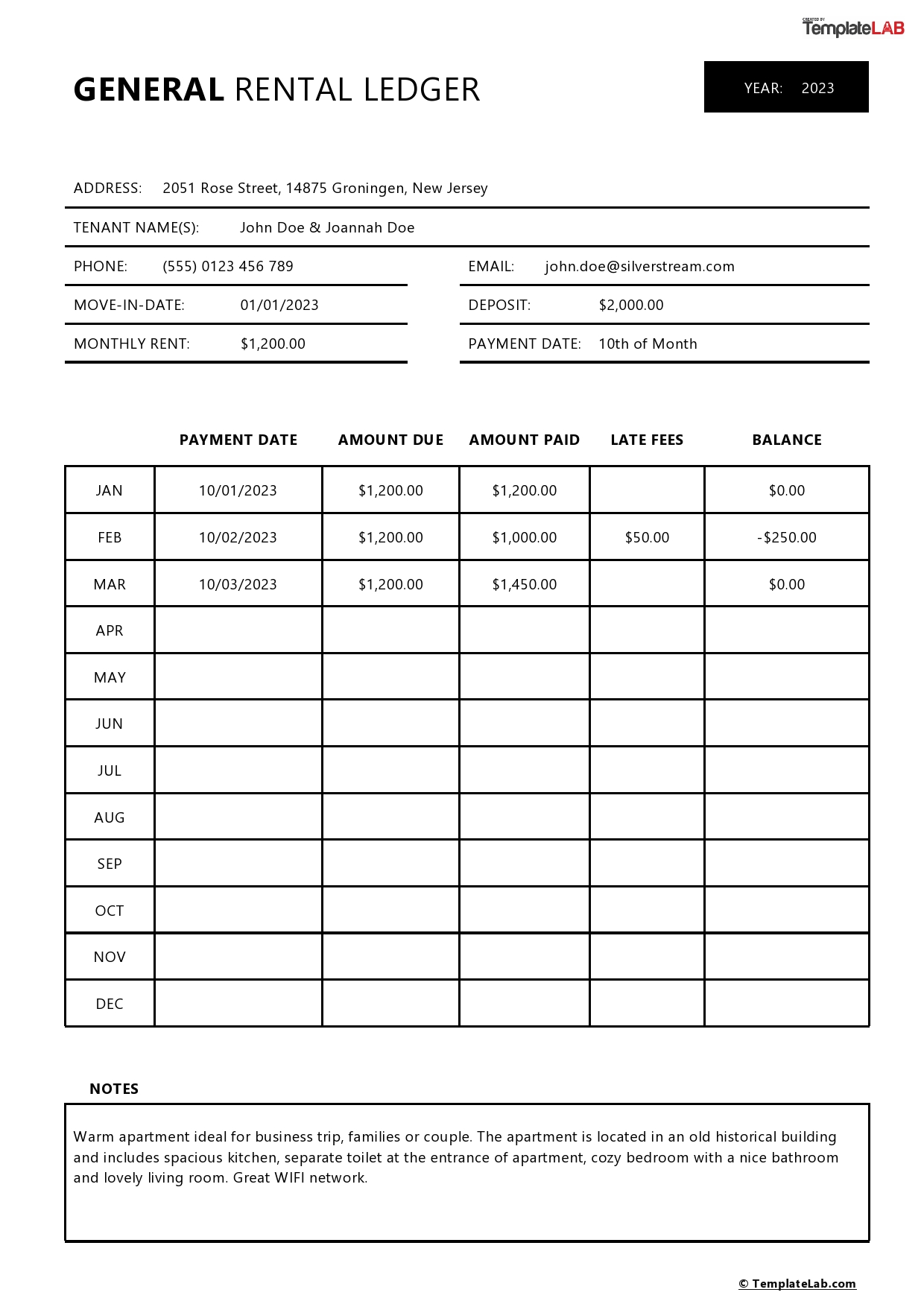

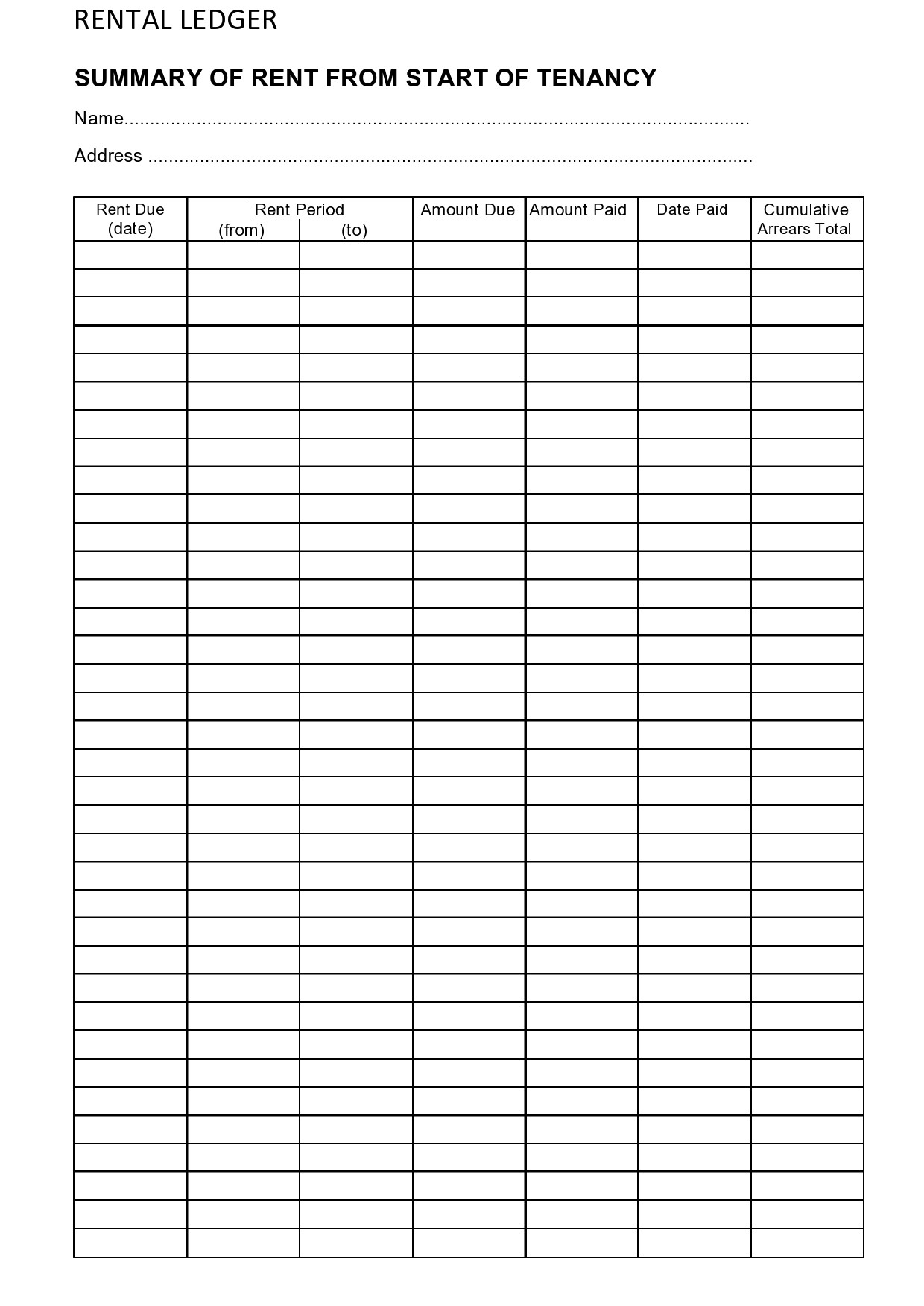

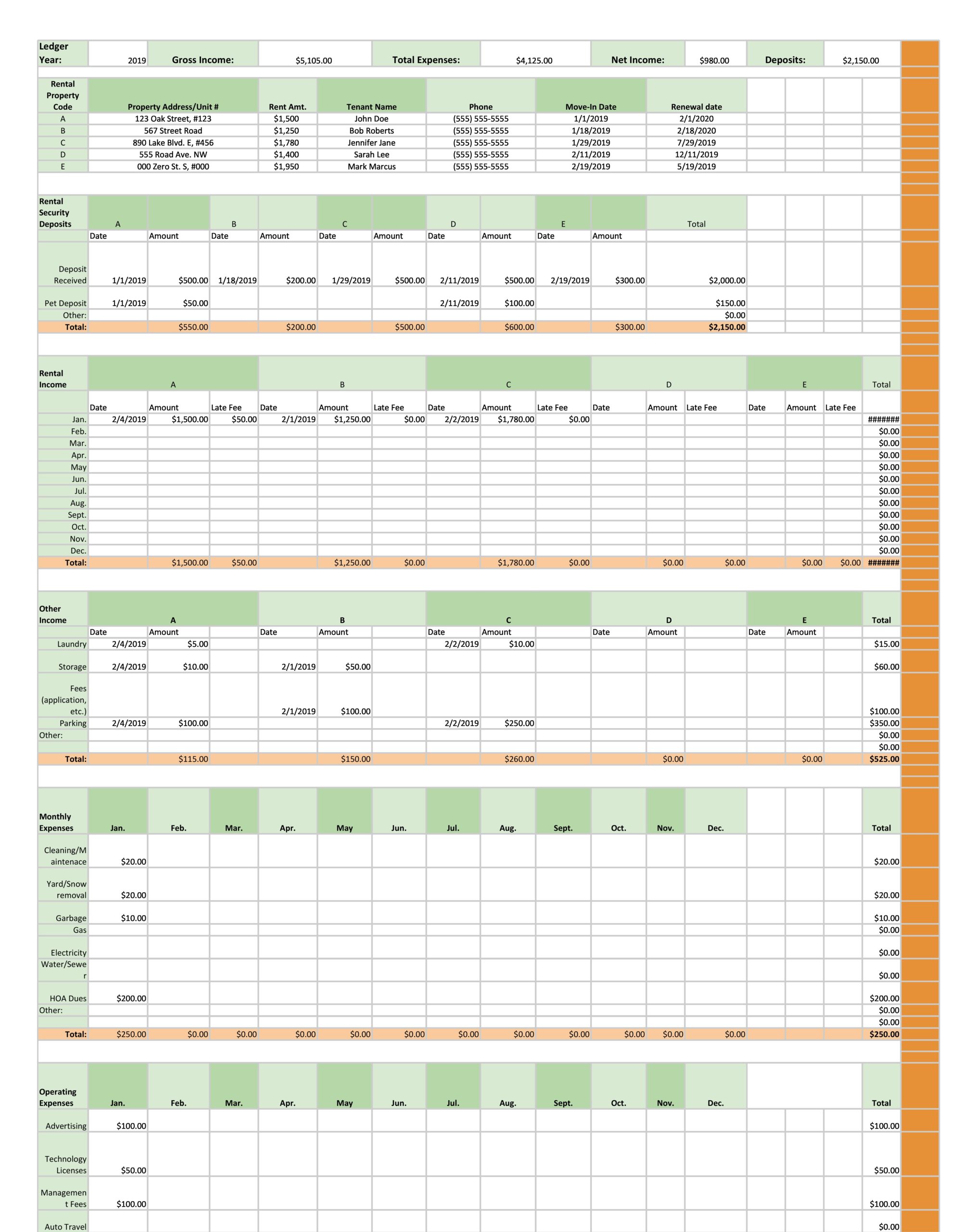

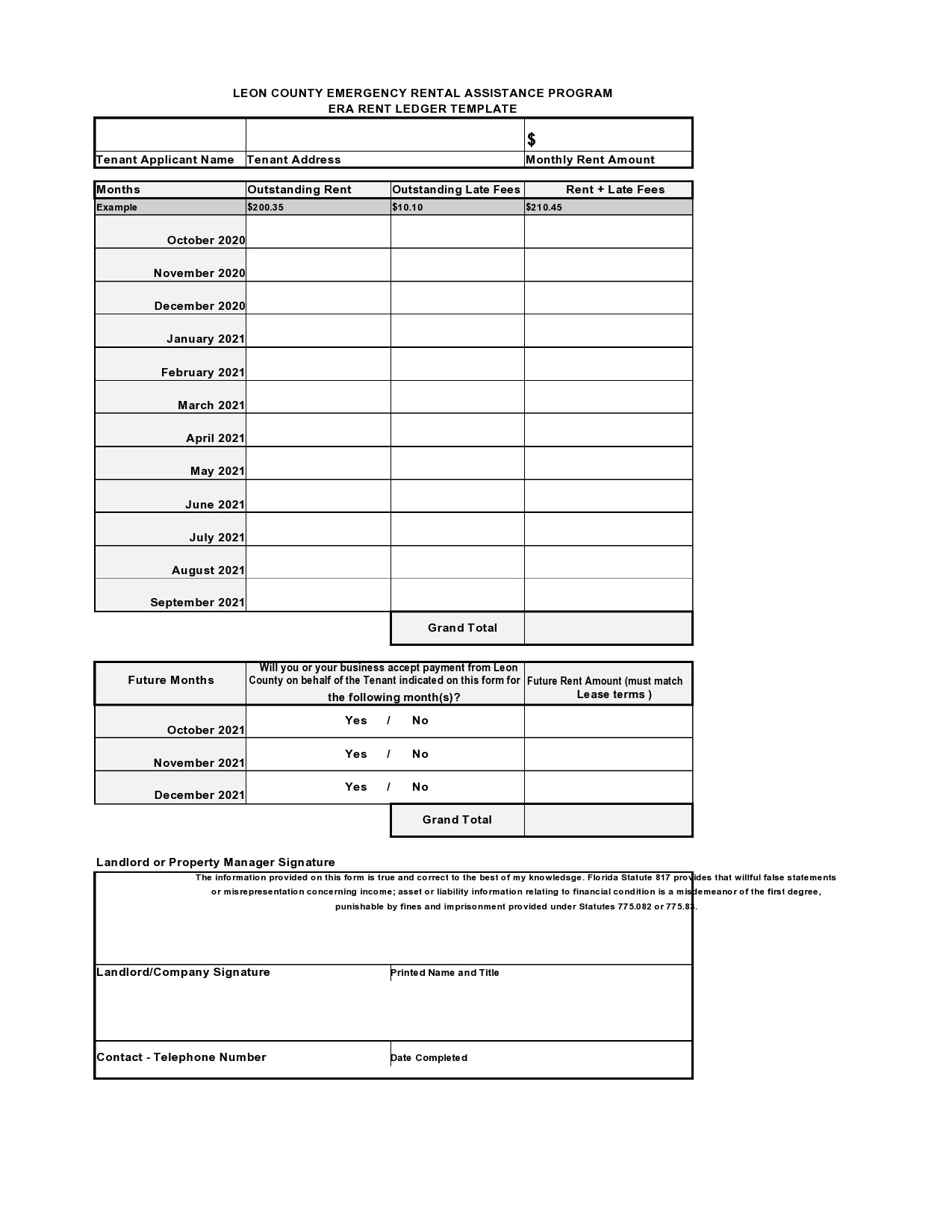

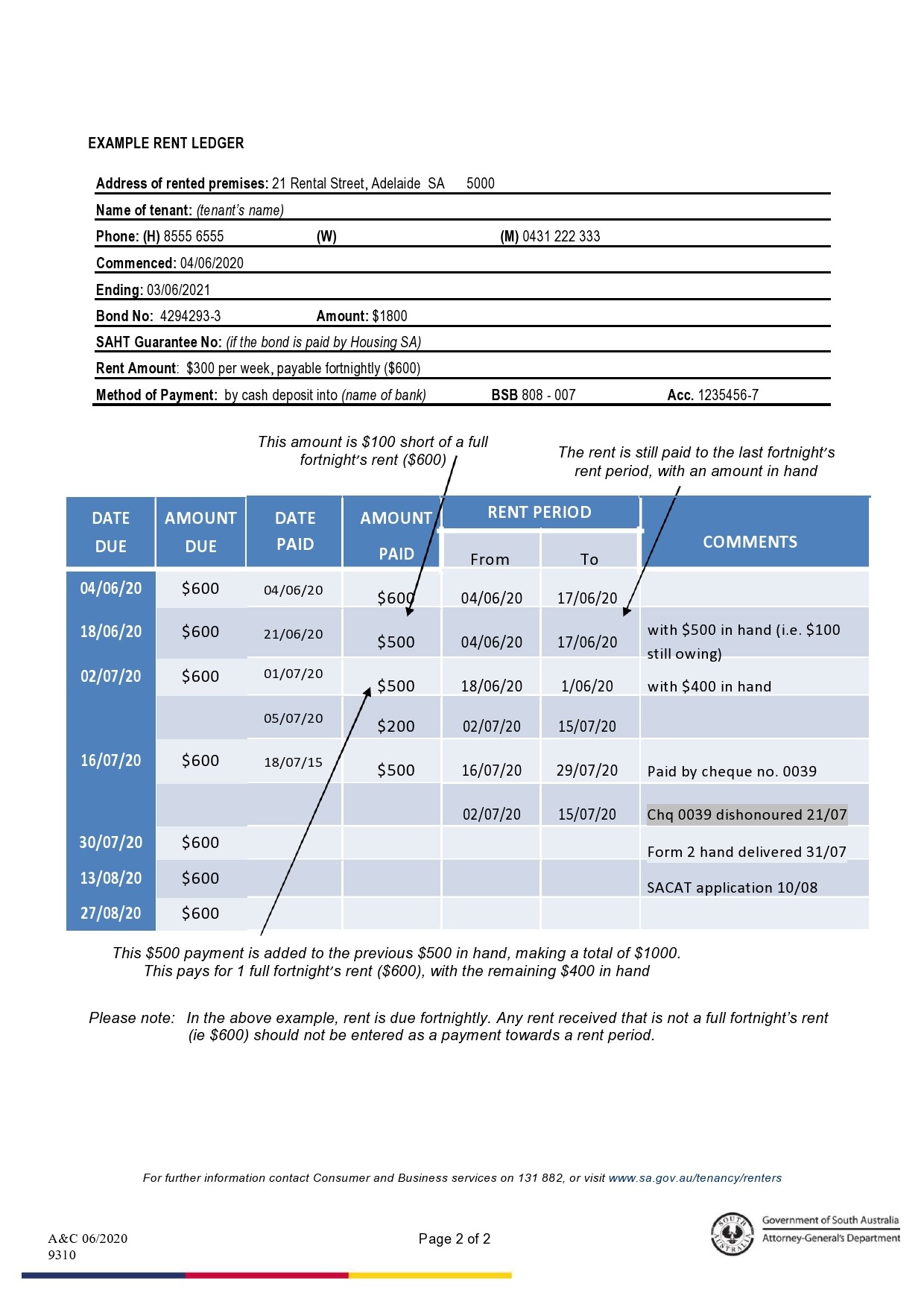

Rental Ledger Examples

Why is a Rent Ledger Template Important?

Rent ledgers ensure that a tenant fulfils their financial obligations and promotes a clear understanding between parties.

For landlords, rent ledgers make it easier to track income, manage rental units, and spot any missed rent payments.

For tenants, it records all financial transactions and acts as a legal safeguard in the event of landlord retaliation.

There are four main reasons why property owners decide to use their rental ledger templates, these include:

- Organizing records.

Property owners need to know who resides in each apartment or unit number of their rental properties, how much they are responsible for paying, and whether or not their payments are in compliance. Even with one or two renters, there is a lot of data to process.

Rent ledgers make it easier to organize the specifics. Instead of digging through papers for contracts and bank statements, a rent payment ledger makes it easy to access this information immediately.

Most importantly, these documents might be useful when requesting a loan or trying to attract investment from another party or real estate investor. - Track security deposits and rent payments.

A rent ledger can be used to keep track of missed, late, and unbalanced payments. The ability to track security deposits for each tenant makes it easier to resolve disputes when a tenant vacates.

Rent ledgers also allow landlords to recognize a tenant’s security deposit and the interest rates tied to them over a particular period. This will assist landlords in returning the deposit once the lease agreement has come to an end and the tenant moves out.

Having an updated tenant ledger eliminates any grey areas and makes it easier to keep track of several tenants’ information. This includes the name of the property, rental amount, and payment due dates. - Proof of payment.

Rent ledgers assist in outlining any outstanding amounts from tenants. These records can assist in the eviction process and serve as proof of payments made by the tenant. It also serves as a transactional ledger for the operations of your rental business.

Keeping rent ledgers is beneficial when the time comes to increase rent and improve property NOI and cash flow. It also assists in identifying long-term financial performance and submitting updated tax return records to the IRS. - Business planning

In order to develop your business and find opportunities for improvement, you must be able to easily see historical data. Rent ledgers are a vital tool for landlords seeking to maintain precise and efficient records and track a property’s financial performance.

Landlords can also record any negative circumstances that occur, as well as how they respond to the incident. For example, if a tenant consistently makes late payments, they can come up with a more appropriate due date. They can then use this information to make future decisions.

A few other advantages of using rental ledgers:

- Identify investment opportunities.

- Identify the fair market value of a property.

- Keep track of interest on security deposits and rental payments.

- Determine any inconsistencies in the payment history.

- Assists in the case of eviction disputes.

Information To Include in Your Rental Ledger Template

Whether you’ve got a single rental property, or you run your own rental property business, we’ve compiled a list of all the things to include in your rent ledger template.

When creating your rental ledger example template, it’s important to include the following information. You can use programs likeExcell, word, or google documents to create your rent ledger pdf.

- Name and contact information of the tenant.

- Name and contact information of the property owner.

- The street address of the rental unit.

- Type of property (flat, house, cottage, separate entrance etc.).

- Lot size and square feet of the rental property.

- Number of bedrooms, bathrooms, and parking bays.

- Lease start and end dates.

- Security deposit amount.

- Monthly rent amount (including pets or roommates).

- The date by which the rent must be paid.

- Payment method (cash, check, or electronic transfer).

- Any late or missed payment fees (if applicable).

- Section for notes – (maintenance requests, contract adjustments, etc.)

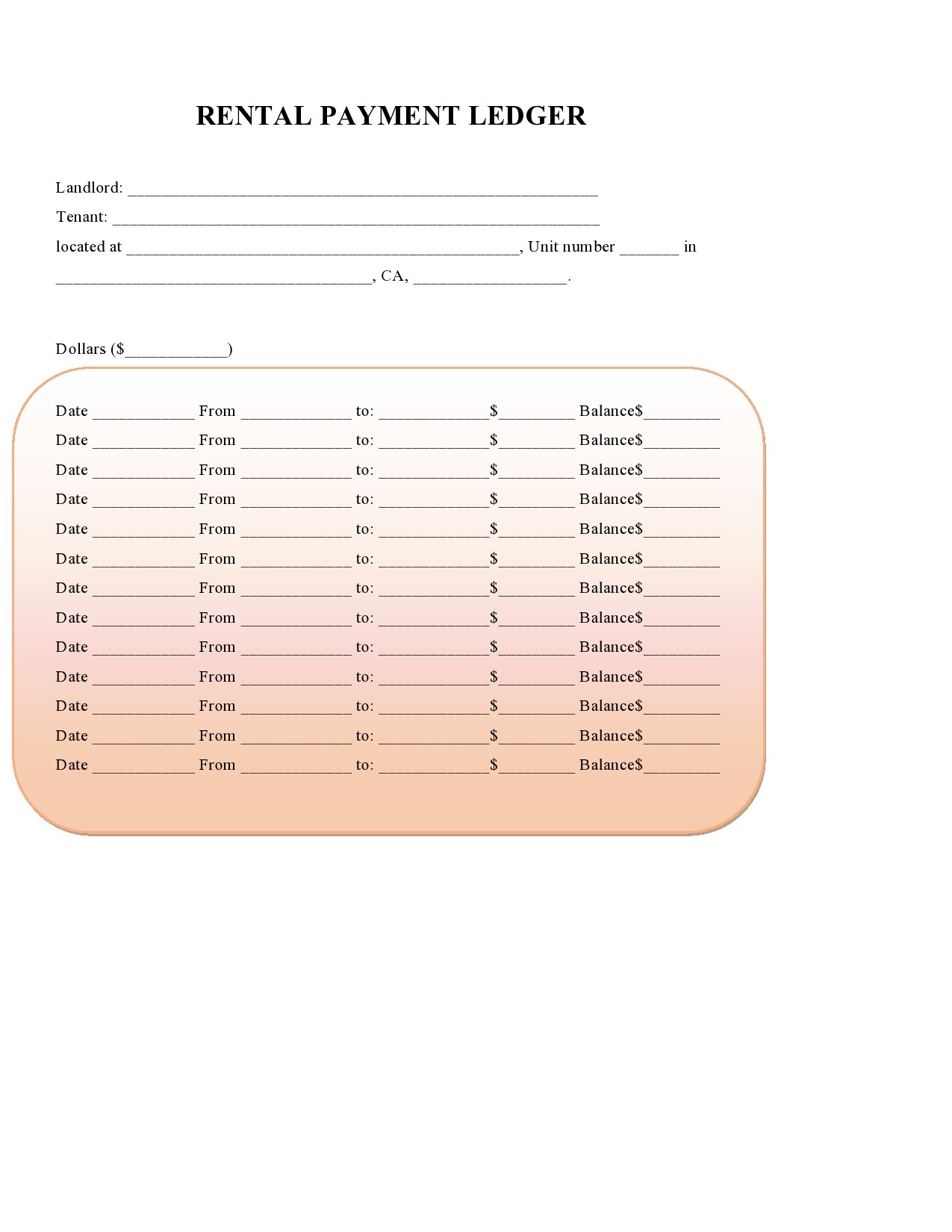

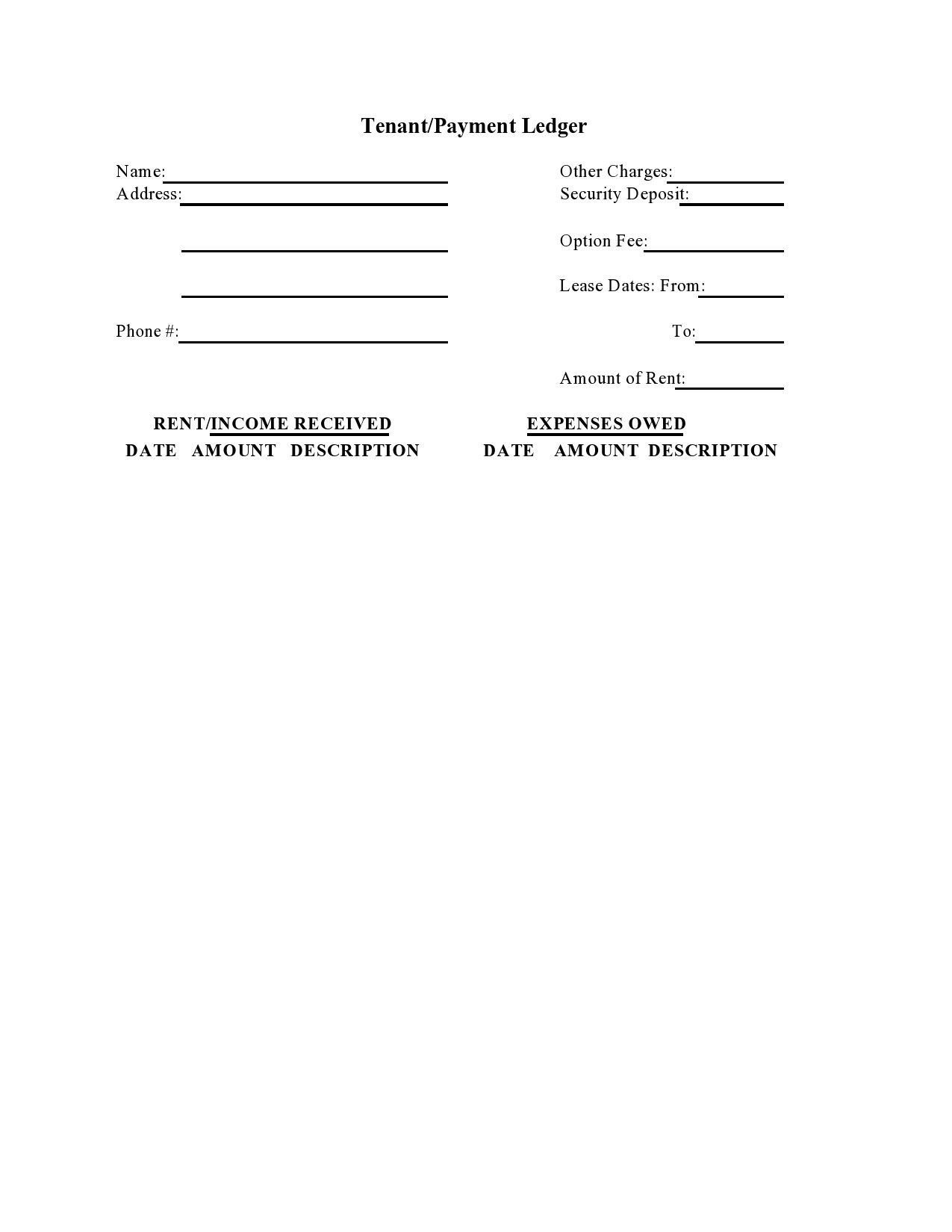

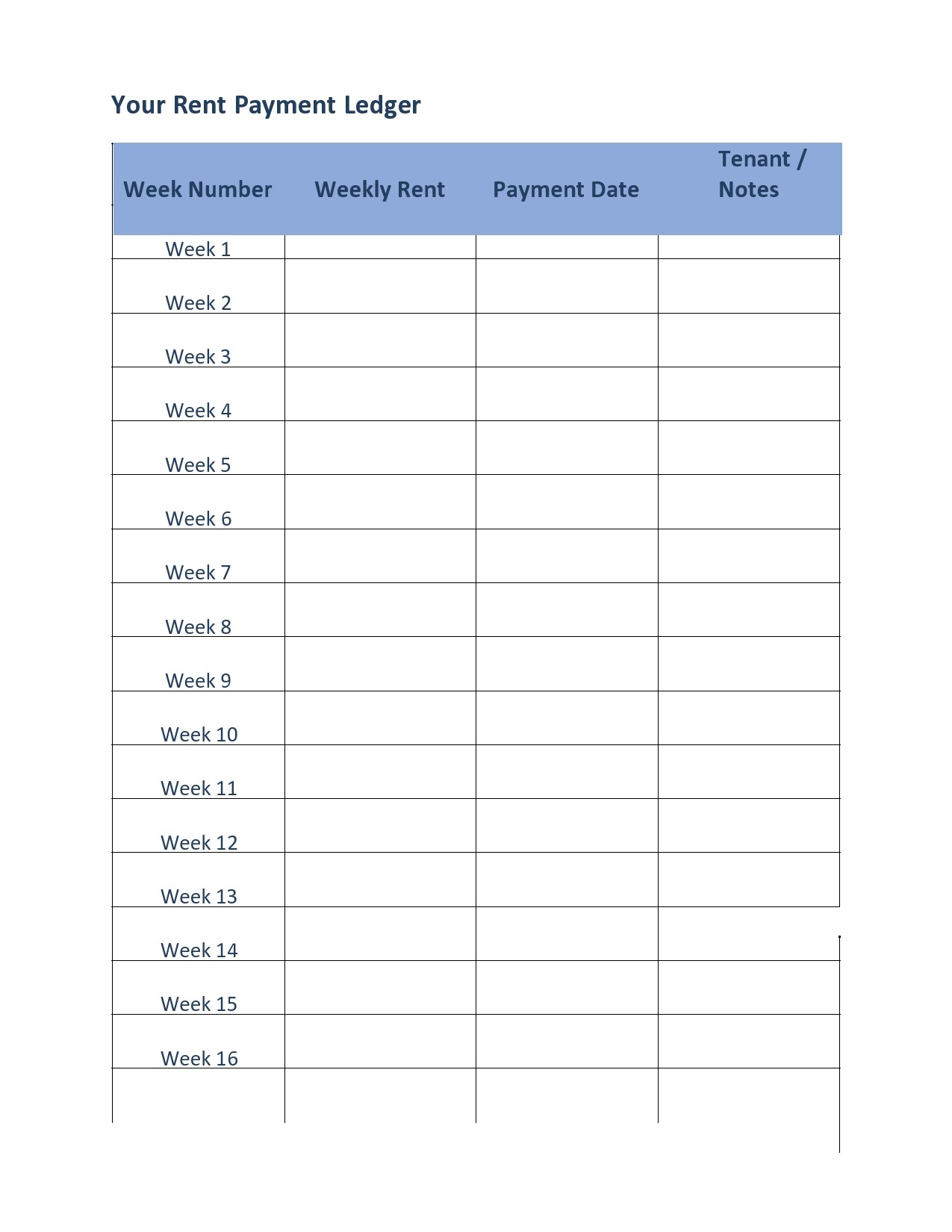

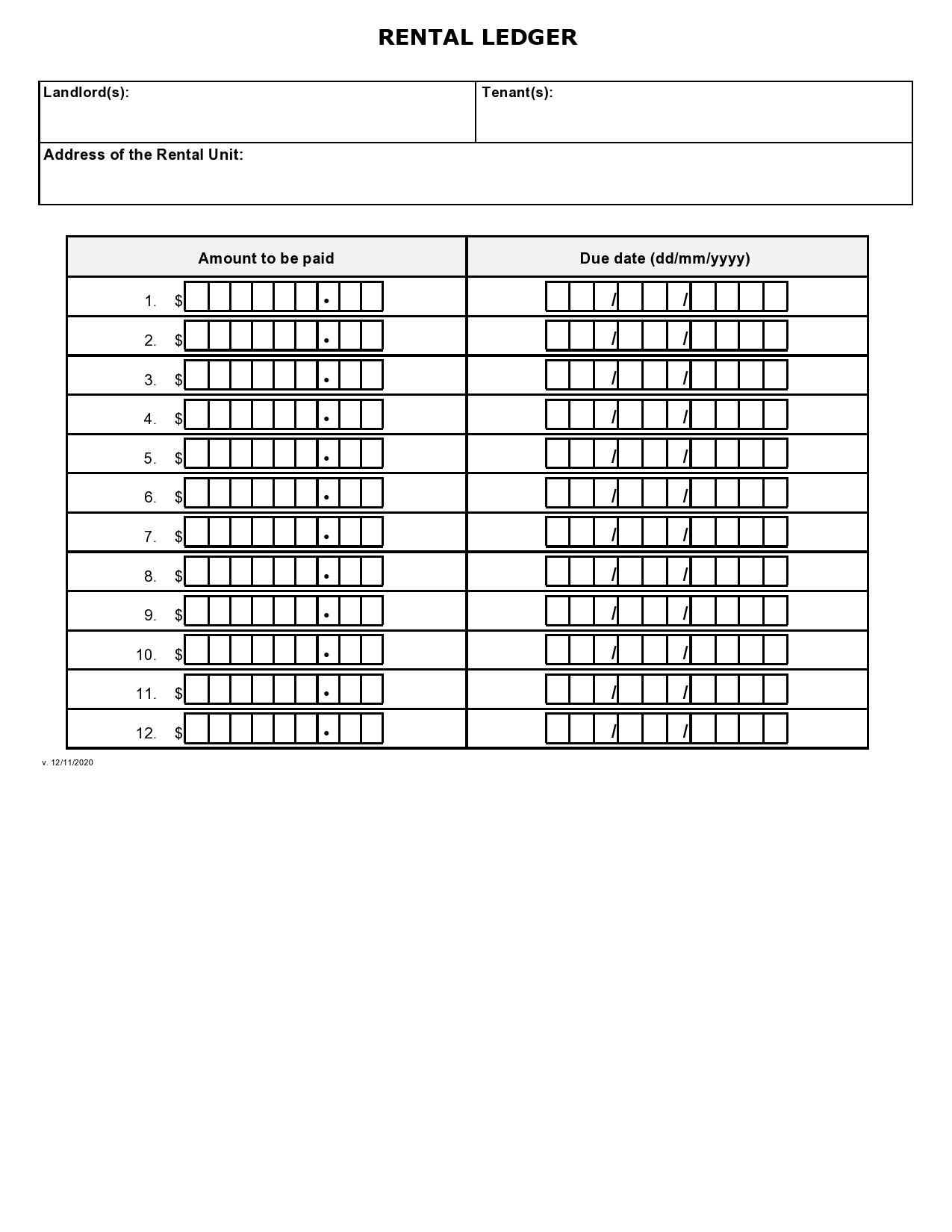

Free Lease Ledgers

How Often Should a Rental Property Ledger Be Updated?

A rent ledger should be updated every time the tenant pays the rent or when the terms of the rental agreement change.

Given that rent is often due once a month, this usually entails updating the ledger every month. To reflect these changes, you should update the ledger whenever any extra transactions occur. These include any late fees, property damage, or contract modifications.

Who is in Charge of Keeping a Rent Payments Ledger?

The responsibility for keeping the rent ledger up to date usually falls on the landlord or property manager. This is because they are required to monitor rental income, payment history, and potential inconsistencies.

To guarantee that their records correspond with those the landlord has on file, tenants can also benefit from maintaining their own fillable rent ledger or asking for frequent updates and statements from the landlord.

Who Can Use a Rent Ledger Template

A fillable rent ledger form can be useful to buyers, tenants, mortgage lenders, and property managers. Important details in the report may include the history of rental payments, the durations of tenant contracts, vacancy rates, late fees, and potential initiatives to boost cash flow.

Let’s take a closer look at the numerous ways individuals could benefit from using rent ledgers:

- Property Managers & Owners

Rent ledgers are used by owners and property managers in the more conventional sense. This means they will use the payment history of their tenants to maintain accurate records of previous and upcoming transactions.

Owners and property managers can track individual payments from tenants and create an accurate account of their tenant’s history. This makes it a crucial aspect when handling an eviction procedure. Rental ledgers can prove that a tenant hasn’t adhered to their lease terms, making the eviction process a lot less tedious.

Security deposits may also be recorded in rent ledgers. It’s a good idea to keep thorough records of the amount paid by each tenant and how much they are entitled to collect when the lease ends.

Last but not least, a well-maintained rent ledger can be a priceless resource when the time comes to sell the property. This is because a rent ledger can demonstrate the potential for rental income to a prospective buyer.

A buyer can determine whether or not the anticipated rental revenue justifies the purchase of the property by looking at the rent ledger itself. With an up-to-date ledger and appealing potential cash flow, investors are likely to put an offer on the property faster, and potentially above the asking price. - Lenders & Buyers

A rent ledger helps determine the cash flow possibilities should a buyer be interested in purchasing a rental property. Rental ledgers provide a complete account of previous rental payments which helps buyers in estimating the potential rental payments.

Past ledgers shouldn’t be considered a detailed testament, but they can provide a useful benchmark for the amount of rental income that might be anticipated.

On the other hand, lenders will consider a property’s potential for cash flow before approving a loan. The DSCR (debt service coverage ratio) of a property can be calculated by lenders using rent ledgers.

The DSCR is a ratio that evaluates the NOI (net operating income) about the debt that the buyer will assume. To put it simply, the banks want to know the amount of risk they are taking on by approving a loan to someone who plans to rent out the property.

Banks might be more likely to provide more enticing underwriting if the cash flow seems constant and stable. - Tenants

The fact that rent ledgers aren’t just for buyers, lenders, and property owners may come as a surprise to some. Rent ledgers in particular can be used by tenants to demonstrate their payment history.

If a tenant wants to keep track of their prior payments to buy a house, they can ask the landlord for a copy of the rent ledger.

A lender might be influenced to take the tenant’s promising track record into account when applying for a loan or taking out a new lease. This is provided the rent was paid in whole and on time each month or as per the contract terms.

A rent ledger can prove helpful not just when applying for a new loan, but also when a landlord falsely accuses a tenant of not making payments on time or at all.

A tenant may use their history as proof of payment, similar to how a landlord can use a rent ledger to speed up the eviction process.

If the rent ledger is accurate and current, it may be used to contest unjustified evictions or unpaid rent. A renter might be able to find discrepancies in their favor if, for instance, they can compare their bank transactions with a rent ledger.

Advantages of a Rent Ledger template

Everyone gains from maintaining a rent ledger. As we said before, a well-maintained rent ledger may be beneficial to buyers, owners, and tenants in various ways. That said, these are just a few of the many benefits a rent ledger may provide:

- Increased financial performance and efficiency.

- Record-keeping of tenant performance and trends.

- Assistance in the eviction process.

- Justifying the asking price of a house or property.

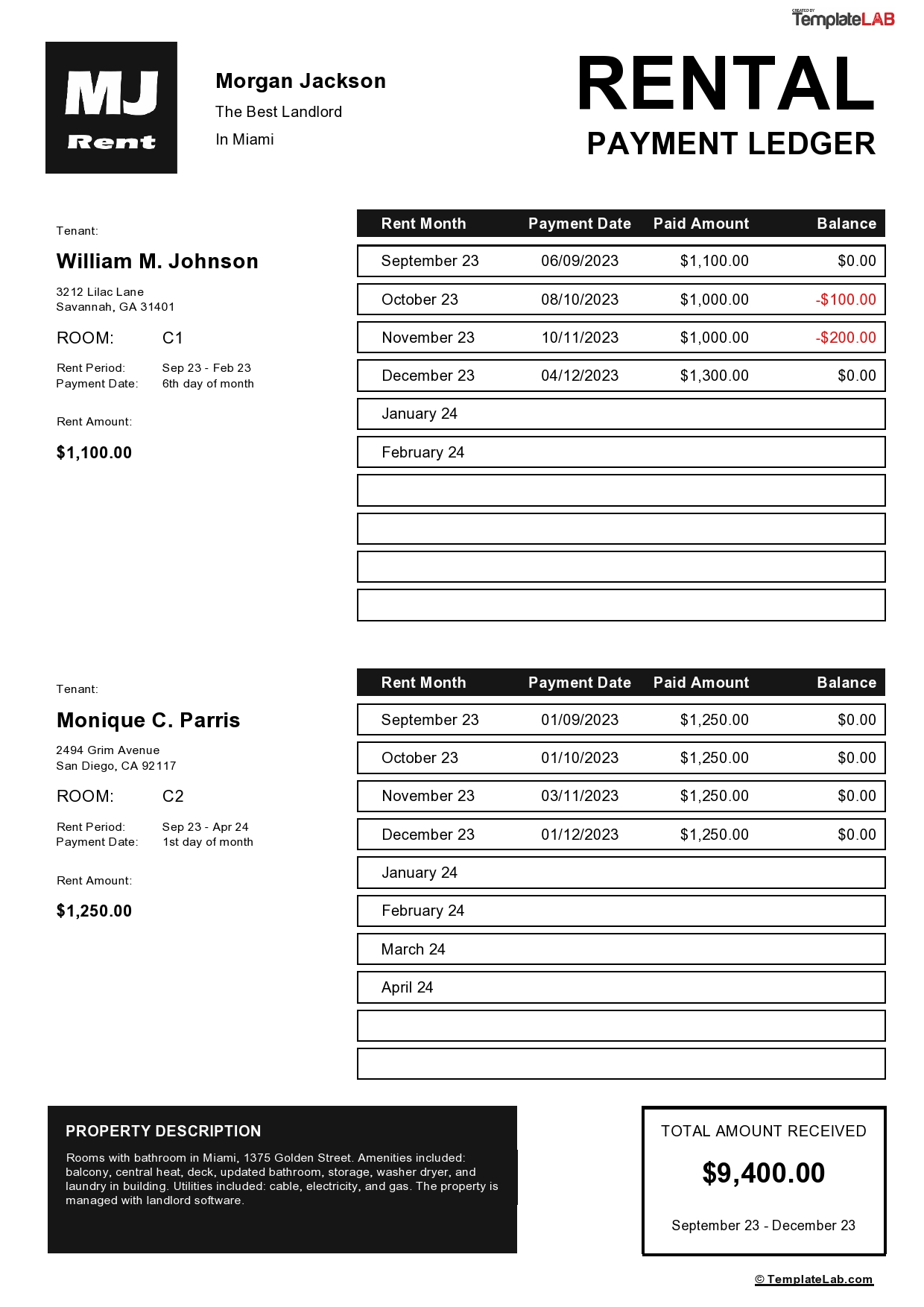

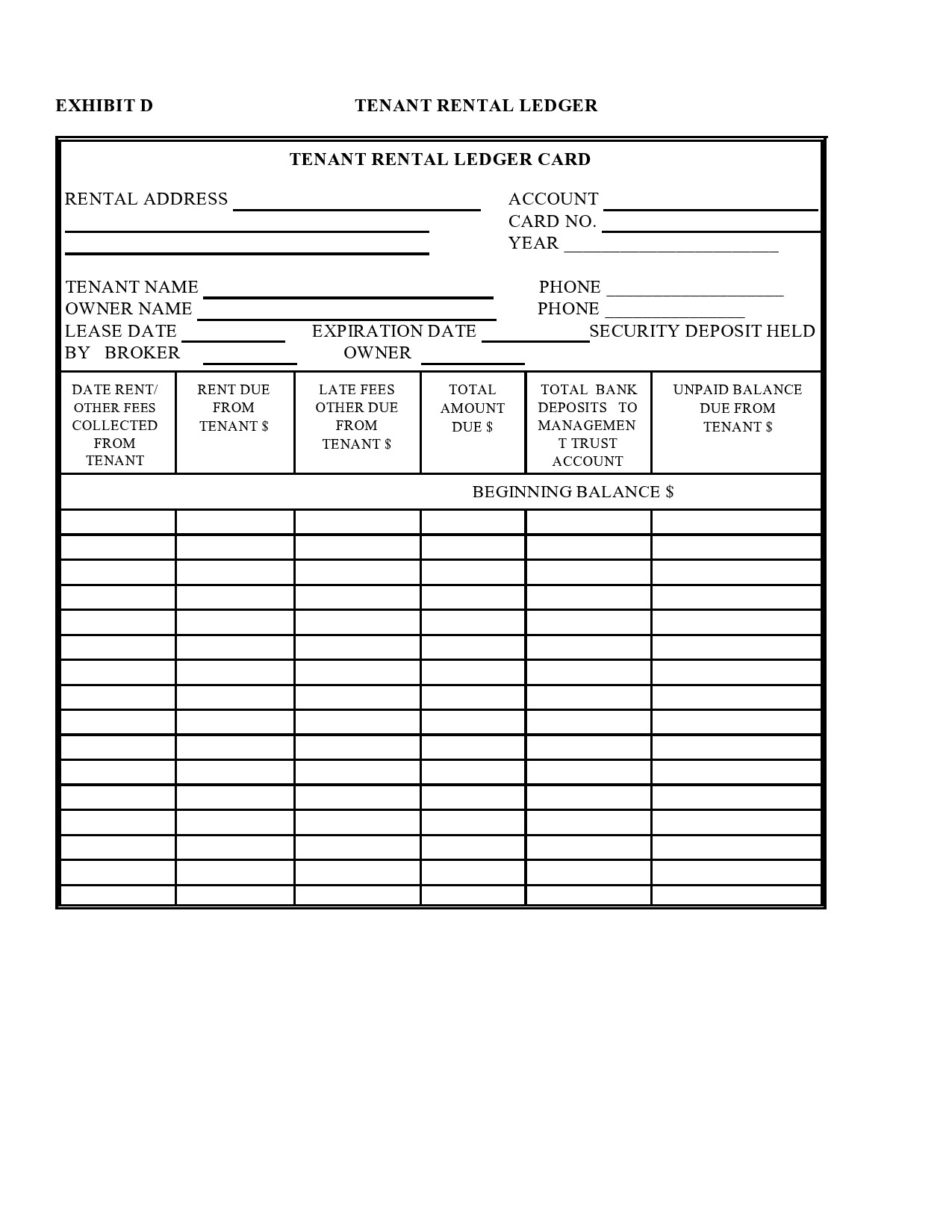

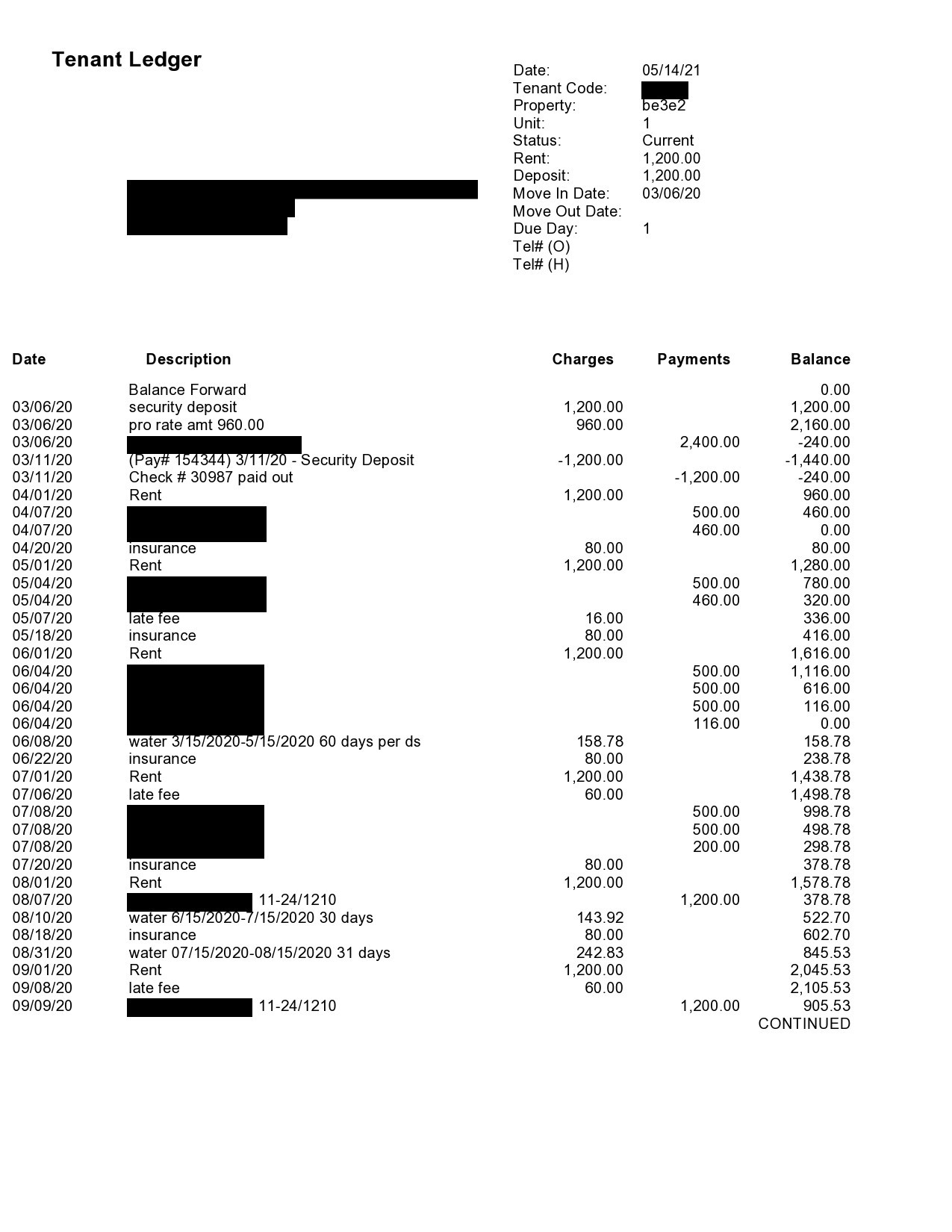

Tenant Ledgers

How to Manage a Rent Ledger Form

Consider the following few practices to make the most of your rent ledger:

- Consistent updates: Every time you get a payment or new tenants, you should update the rent ledger to keep your records correct and current.

- Digital tools: To build and maintain your rent ledger, use digital tools like spreadsheet software, a pdf file, or property management systems. This makes it easier to organize and retrieve data.

- Back up your data: To guard against data loss or damage, keep numerous copies of your lease ledger, both digital and physical with all the detailed information about the property.

Conclusion

In closing, a rental ledger is nothing more than documentation related to rental income. However, at its best, a rent ledger could be a priceless instrument that helps landlords to maximize their productivity and income flow.

It’s important to remember that landlords will need to be able to use the information to turn the transactions into a more profitable, time-saving procedure.

A rent ledger is a must for landlords looking to keep accurate and structured records of rental income, ensure tenant accountability, simplify tax preparation, and offer legal protection.

You can improve your property management procedure and the financial success of your rental properties by implementing a thorough rent ledger and adhering to best practices for its management.