Most people are aware that they will one day need a will to help explain what they want to leave to all of their family members. Wills can be less reliable than some other forms of estate planning, and in some states, a will does not prevent the probate process either. When looking at last will and testament samples, you might have realized that there are a lot of personal choices and details that need to be included in this document for it to be useful if you should pass away.

Knowing more about the way to write this document can make a big difference when it comes to protecting your assets or your finances. Many people are not aware that there is always a risk that your loved ones might not get access to your estate right away after you have died. This can lead to problems with being displaced and with finances if the person who passes away is supporting the family all alone.

Table of Contents

- 1 Last Will and Testament Forms

- 2 What is a last will and testament?

- 3 Last Will and Testament Templates

- 4 How do you write a simple will?

- 5 Last Will and Testament Samples

- 6 What should you not write in your will?

- 7 Last Will and Testament Examples

- 8 What about funeral costs?

- 9 Last Will and Testament Documents Are Essential

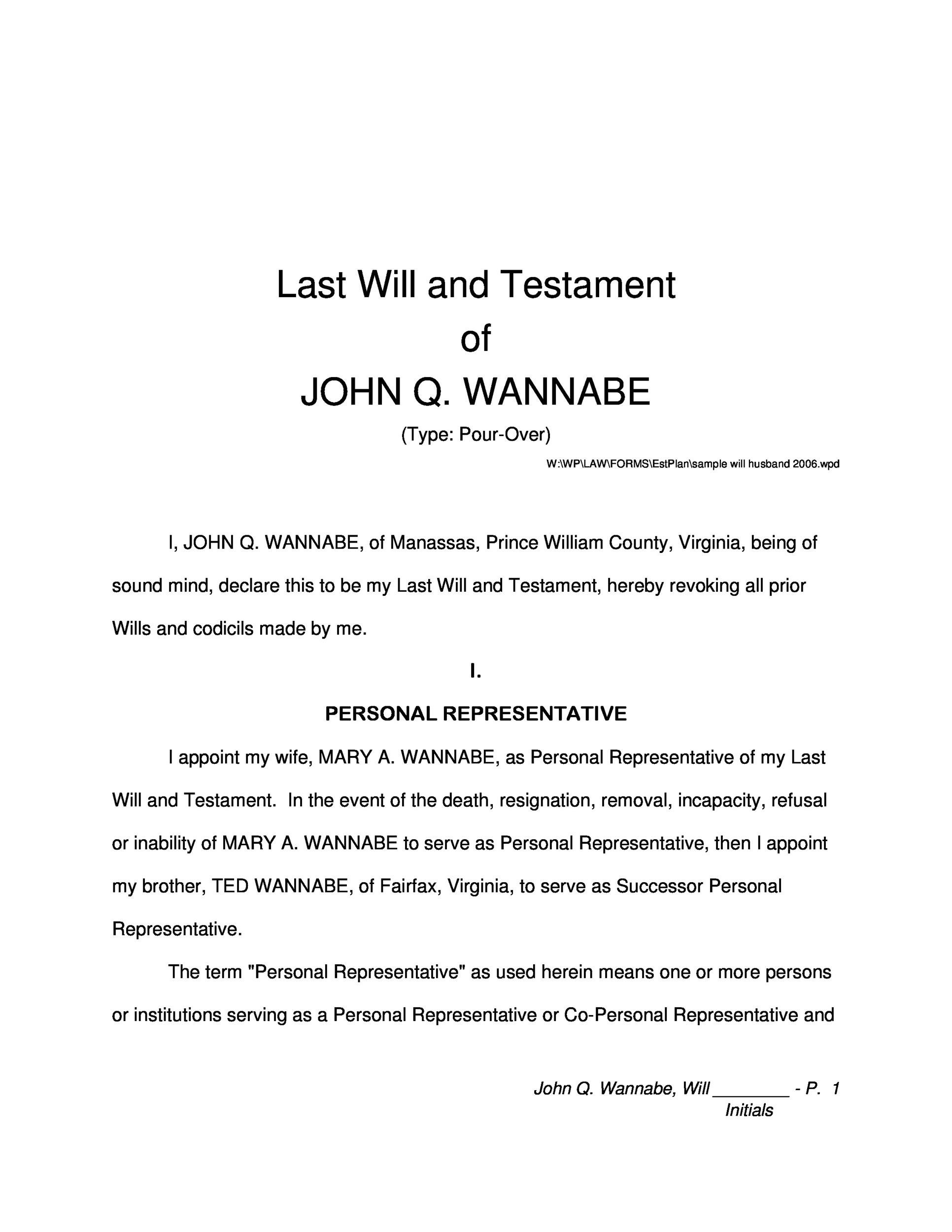

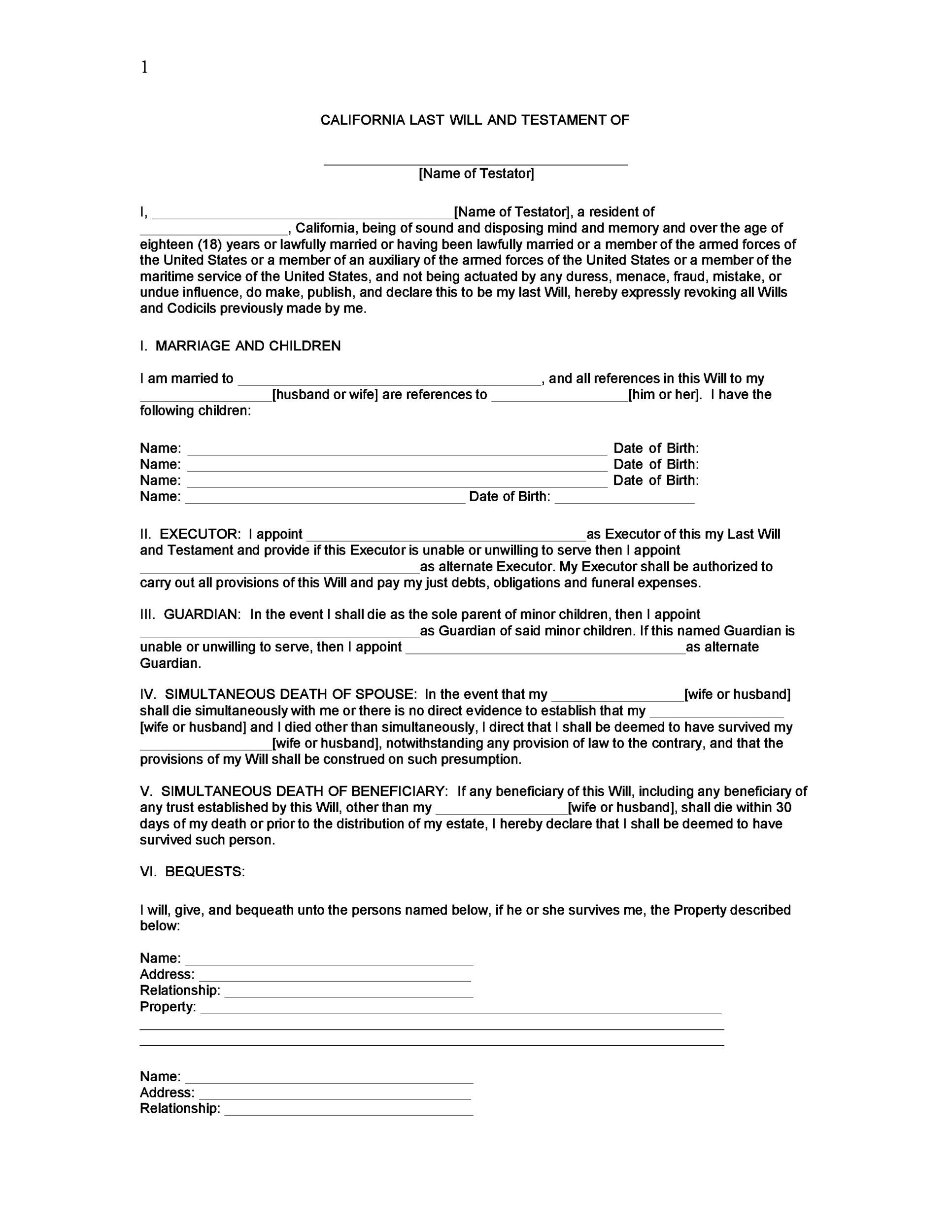

Last Will and Testament Forms

What is a last will and testament?

A simple will template will probably give you all the guidance that you need to write a will that covers all the basic things that need to be attended to after you pass away. If you do not own many assets and do not have a lot of property to leave to anyone who survives you, a simple will might be all that you need.

Your will might be called by various names, and you can use these different names interchangeably when referring to the document. The name that you use will not impact the way that this document can be used.

- Last Will and Testament

- Will

- Last Will

There are some other terms that you will need to be aware of before you write your last will and testament forms. Wills and testaments examples can help to guide this process but you should still be sure about what each term means when you are writing your will.

- Testator or Testatrix: The person making the will.

- Probate: The legal process that is carried out in many states after someone passes away. This process can take years or months, and during the probate process, the estate is correctly assessed as inheritance taxes.

- Executor: This is the person who is named to settle the affairs of the person who has died. This person can be anyone that is named in the will and does not have to be someone who will inherit or someone who is related to the person who has passed away.

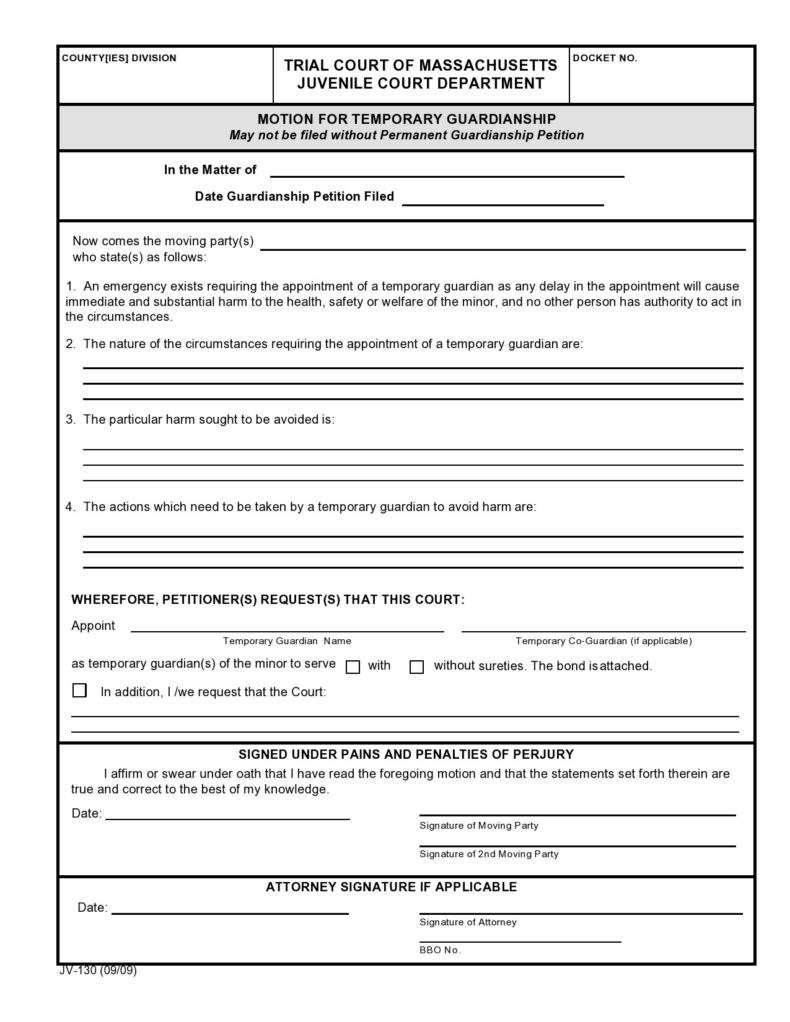

- Guardian: If there are minor children or elders who are not able to look after themselves, then you will need to mention who is to care for them after you are gone.

- Beneficiary: The people or organizations who will be able to receive your assets. These can be minors as well, but they will usually need to have an assigned guardian to manage their inheritance until they come of legal age.

- Assets: Money, property, and other items of value can all be considered assets in a will. Even items that do not have actual monetary value can be classified as such for the purposes of a will.

- Witness: Someone who can be counted upon to be mentally fit and who is of legal age who can sign the last will and testament to indicate that it is authentic and that it was created with the express permission and desires of the person whose assets are being dispersed.

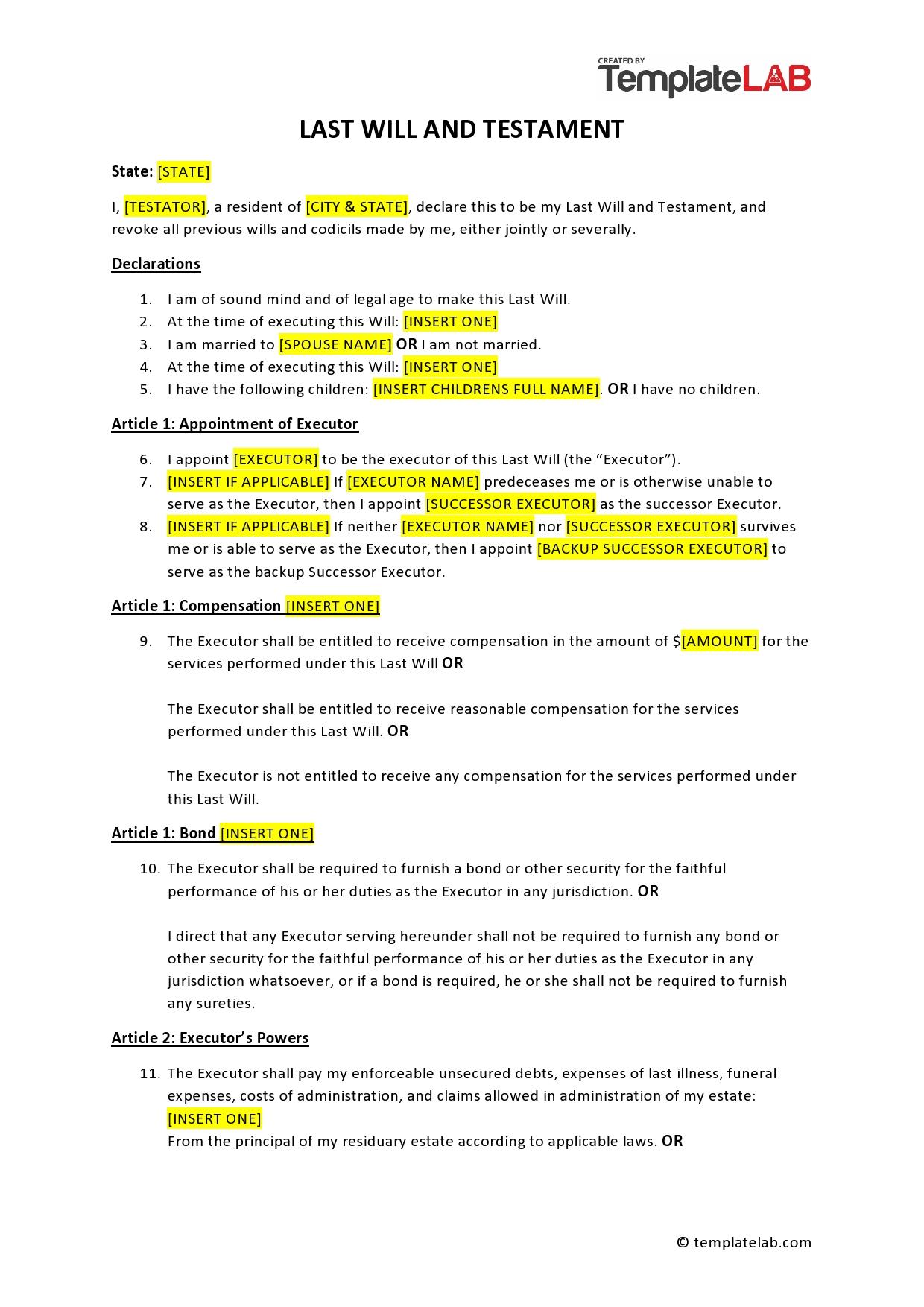

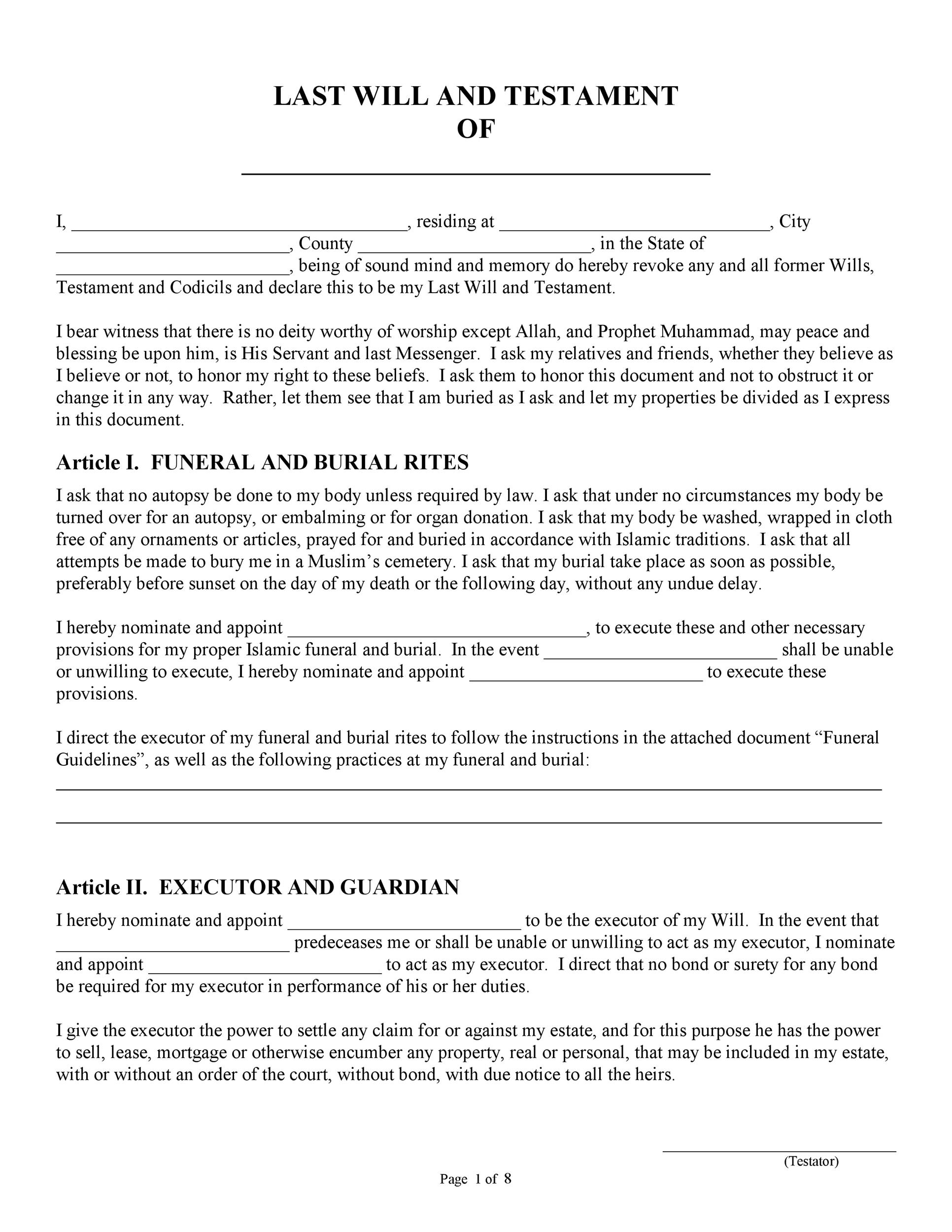

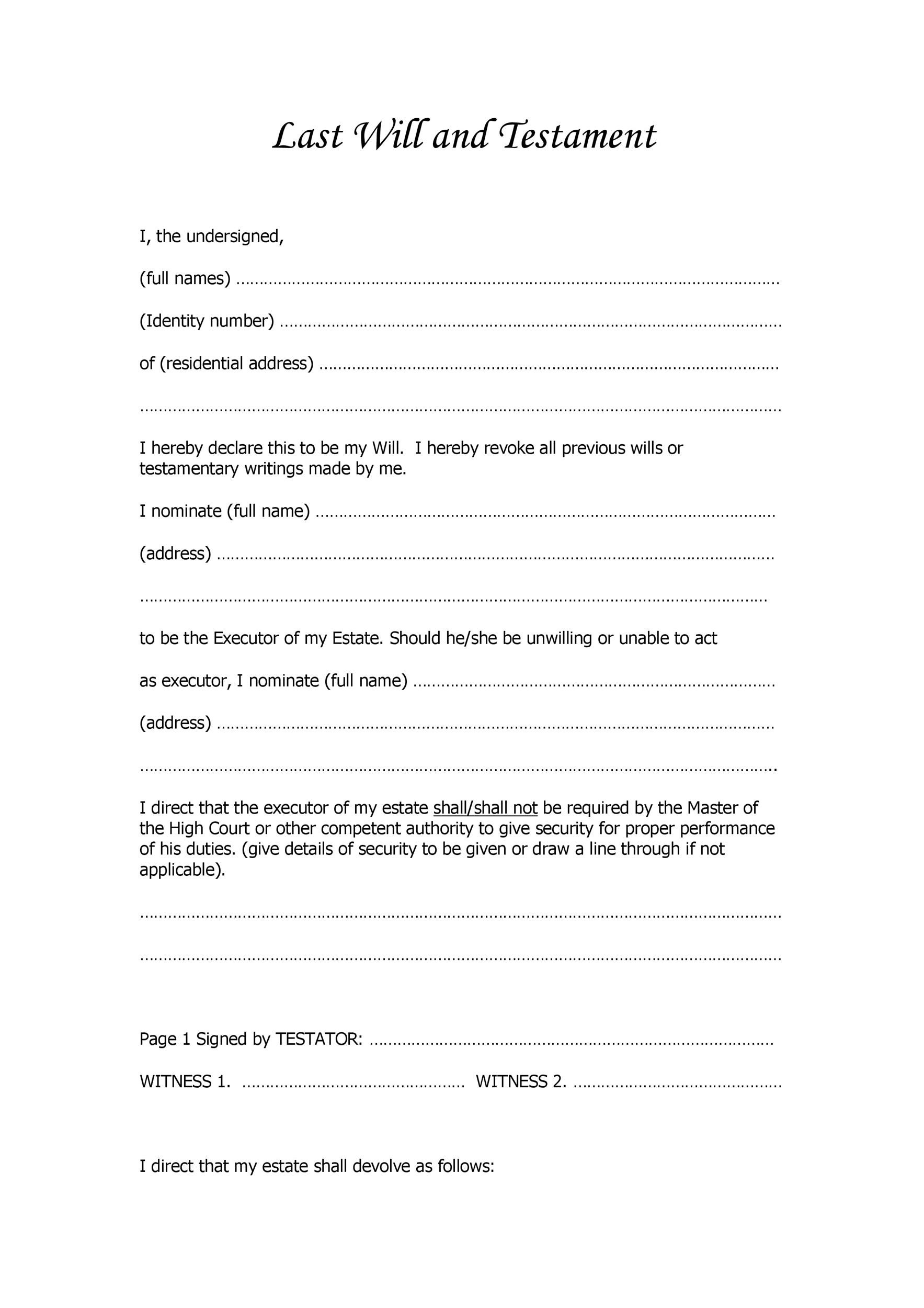

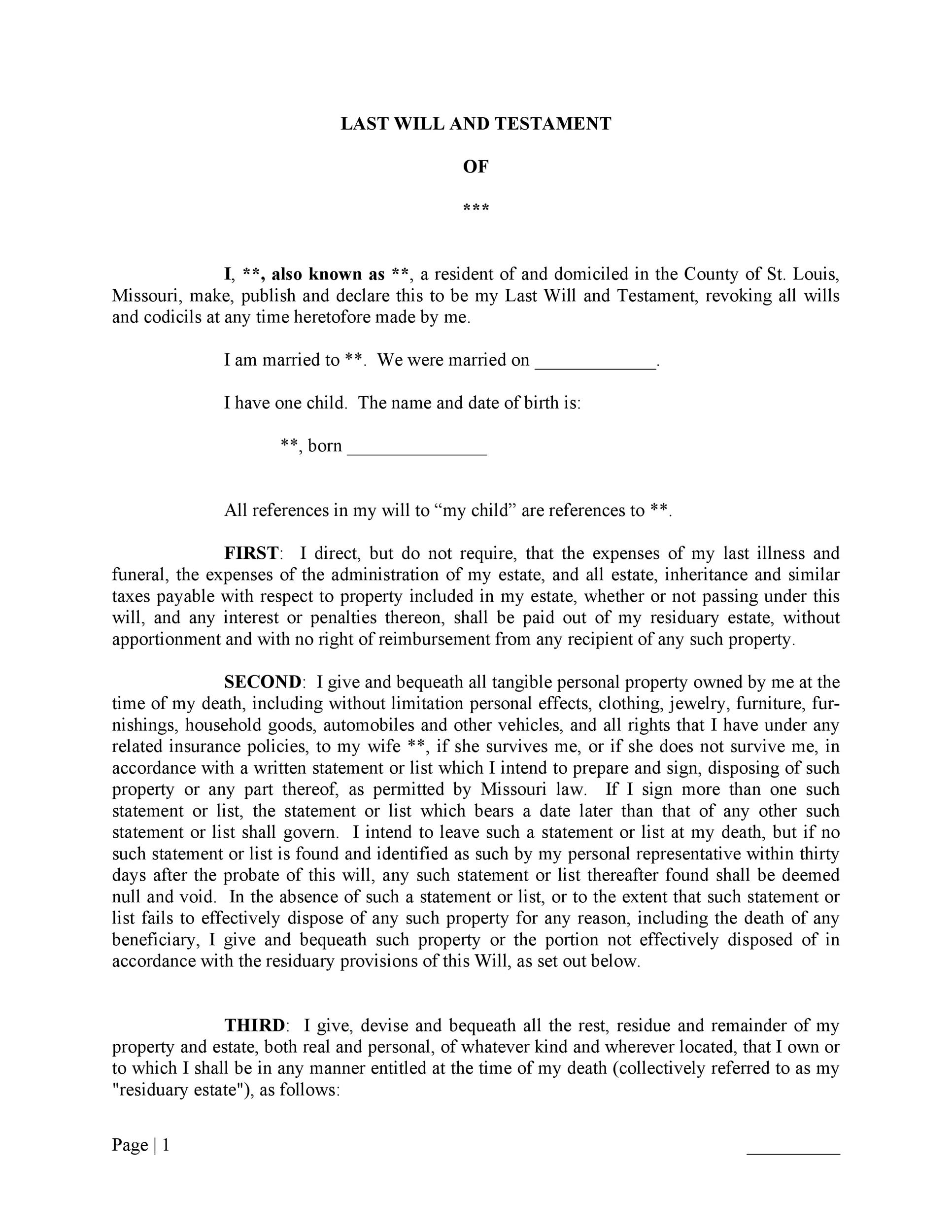

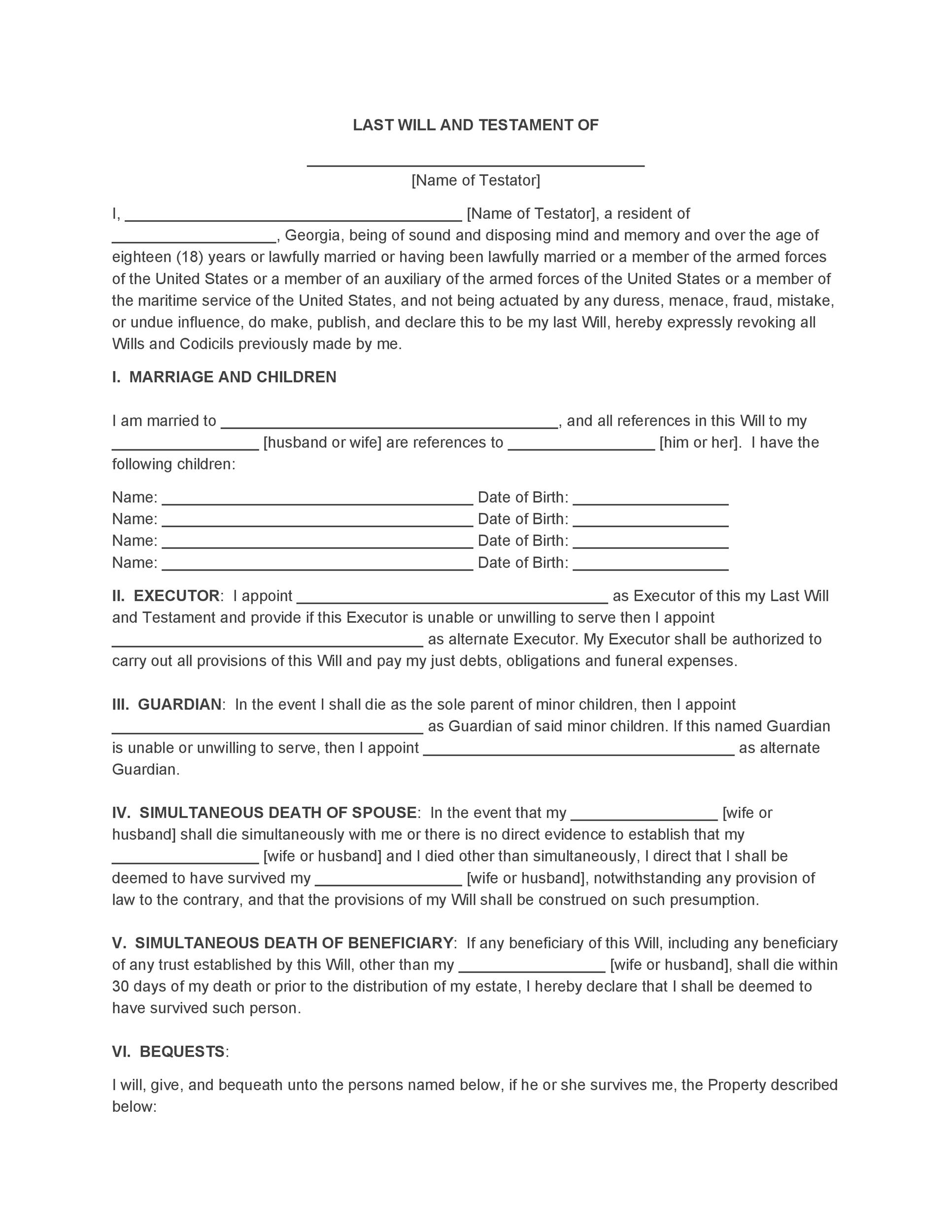

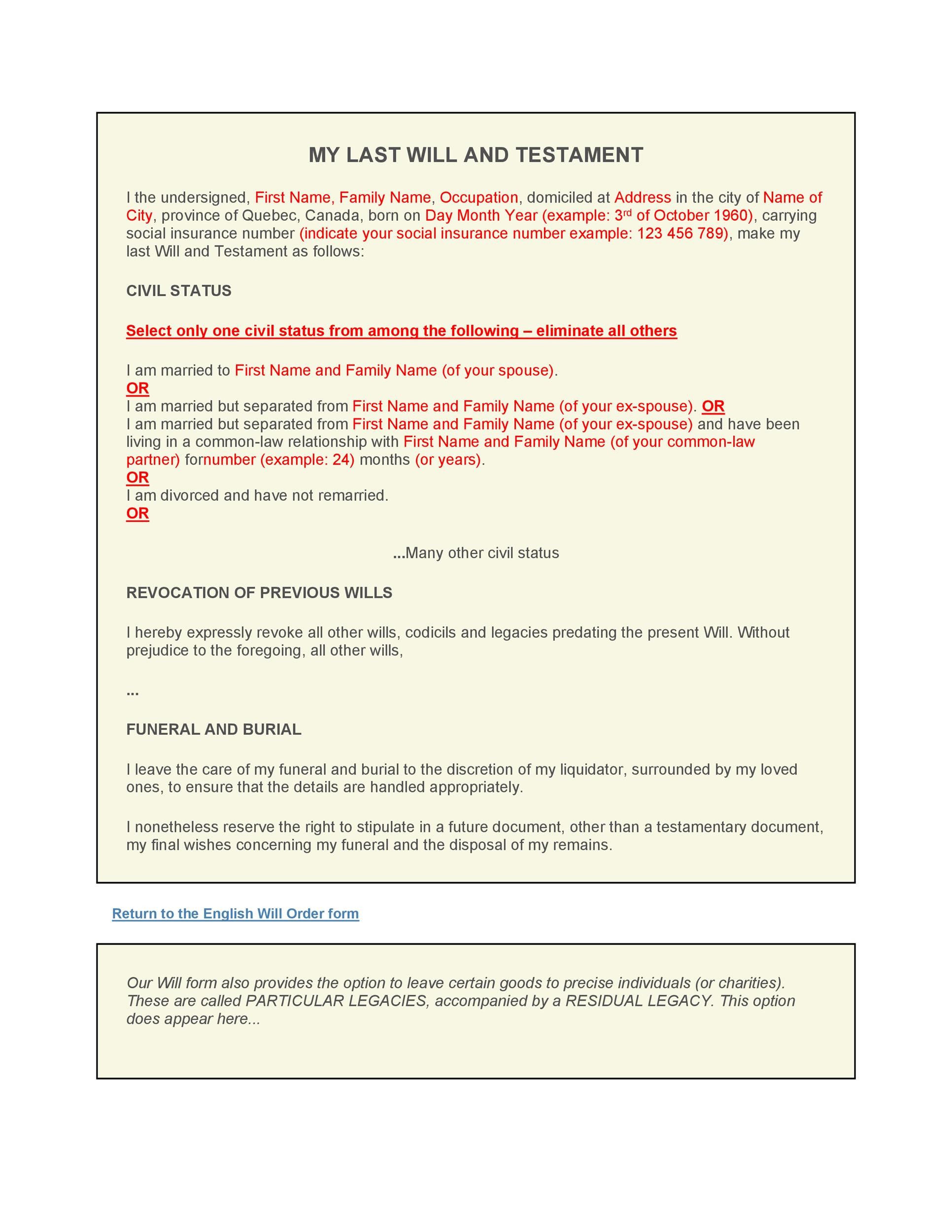

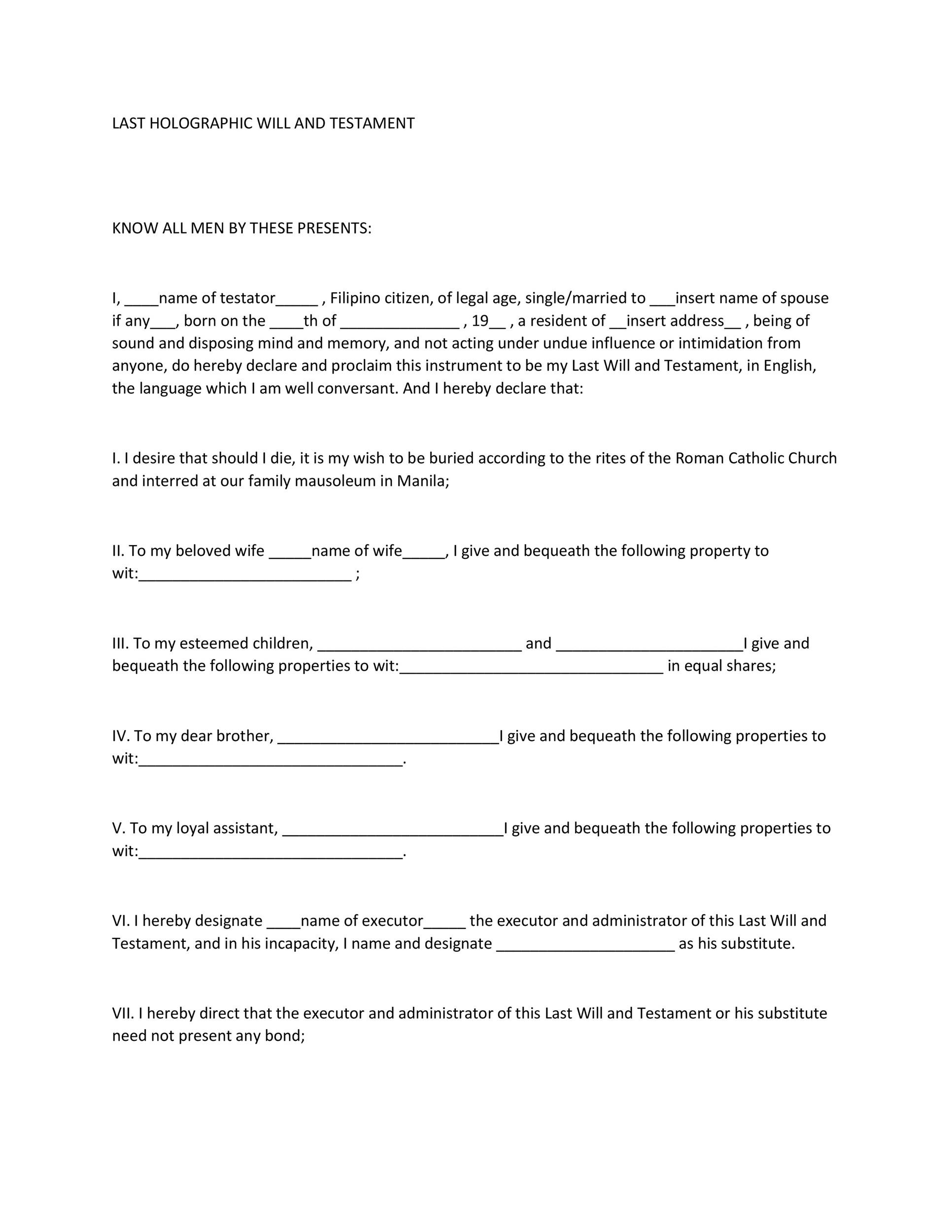

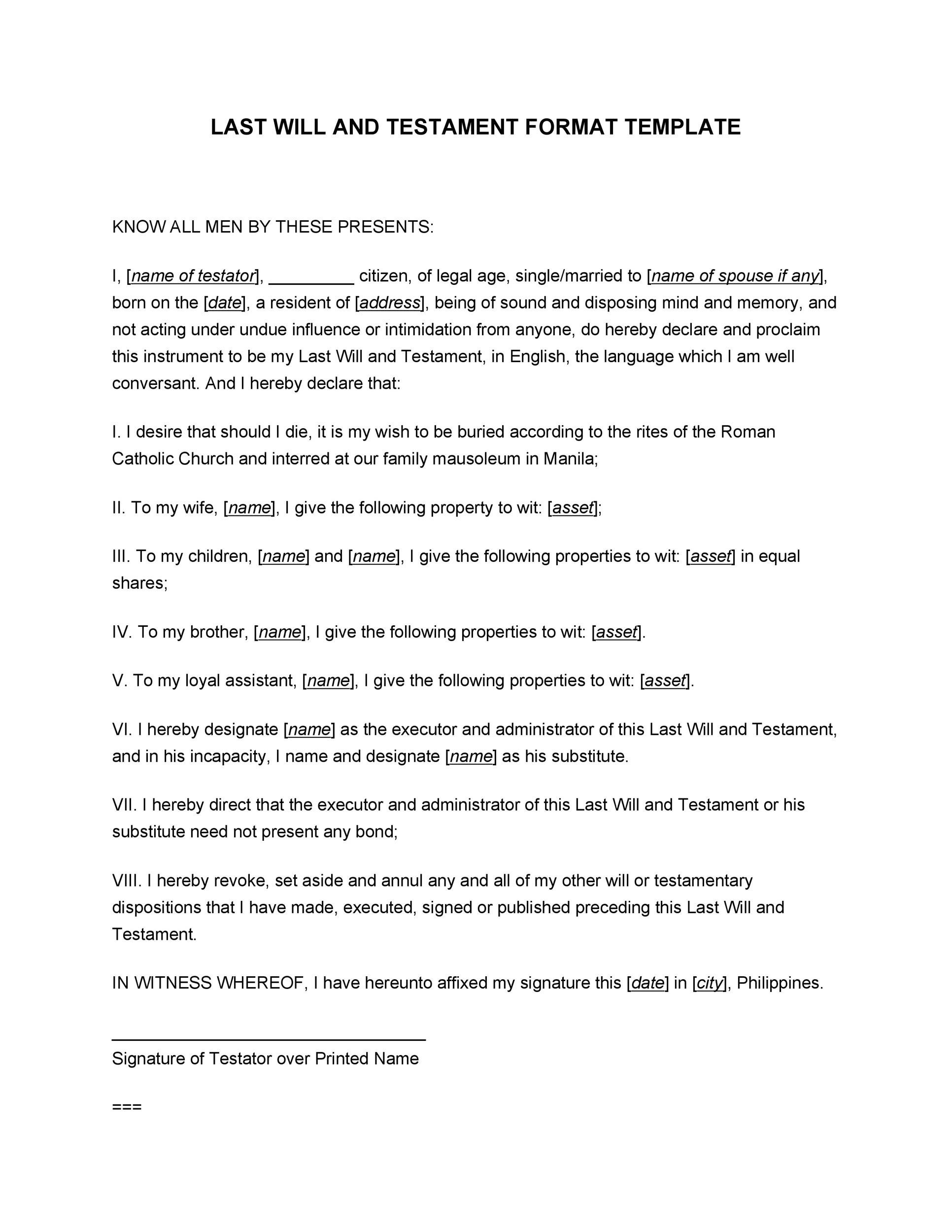

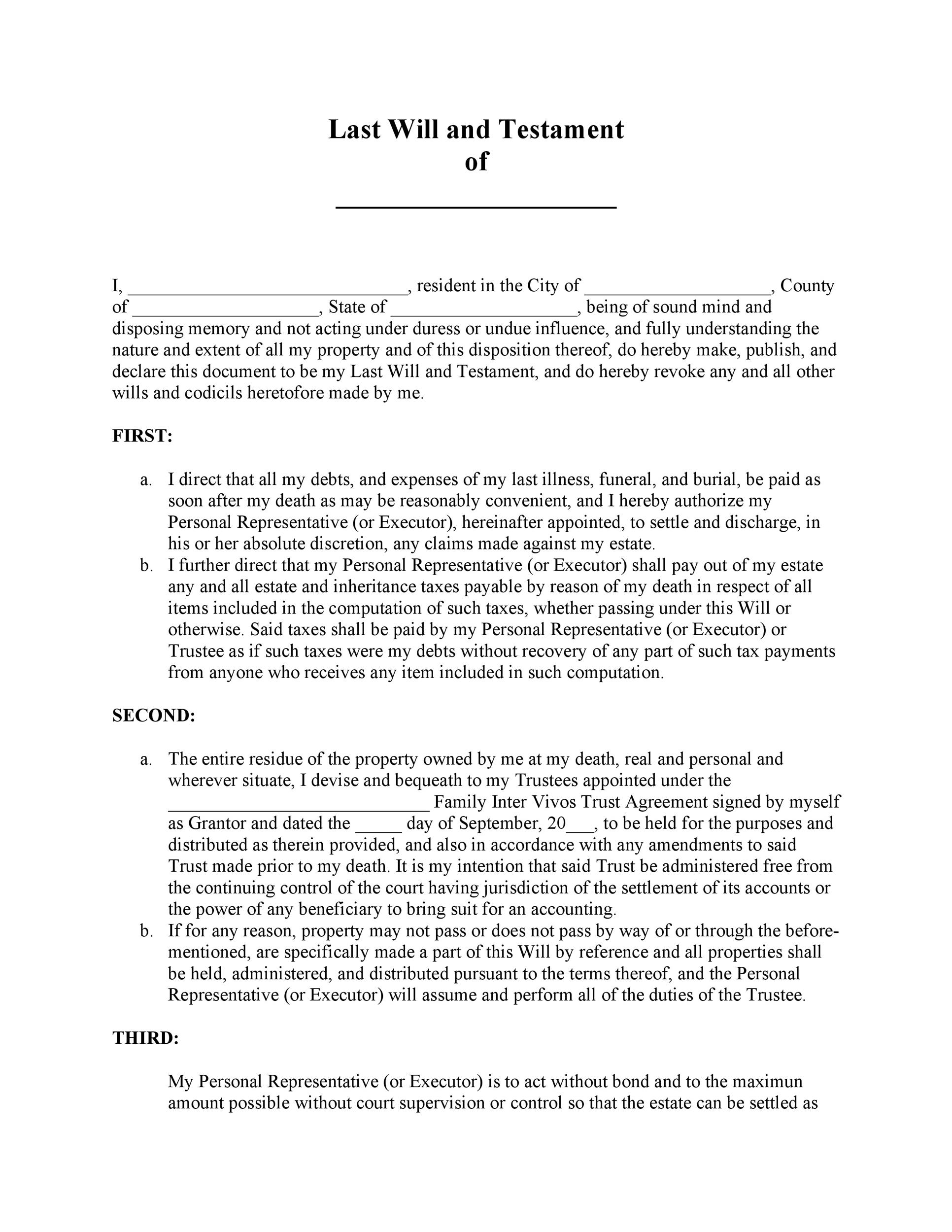

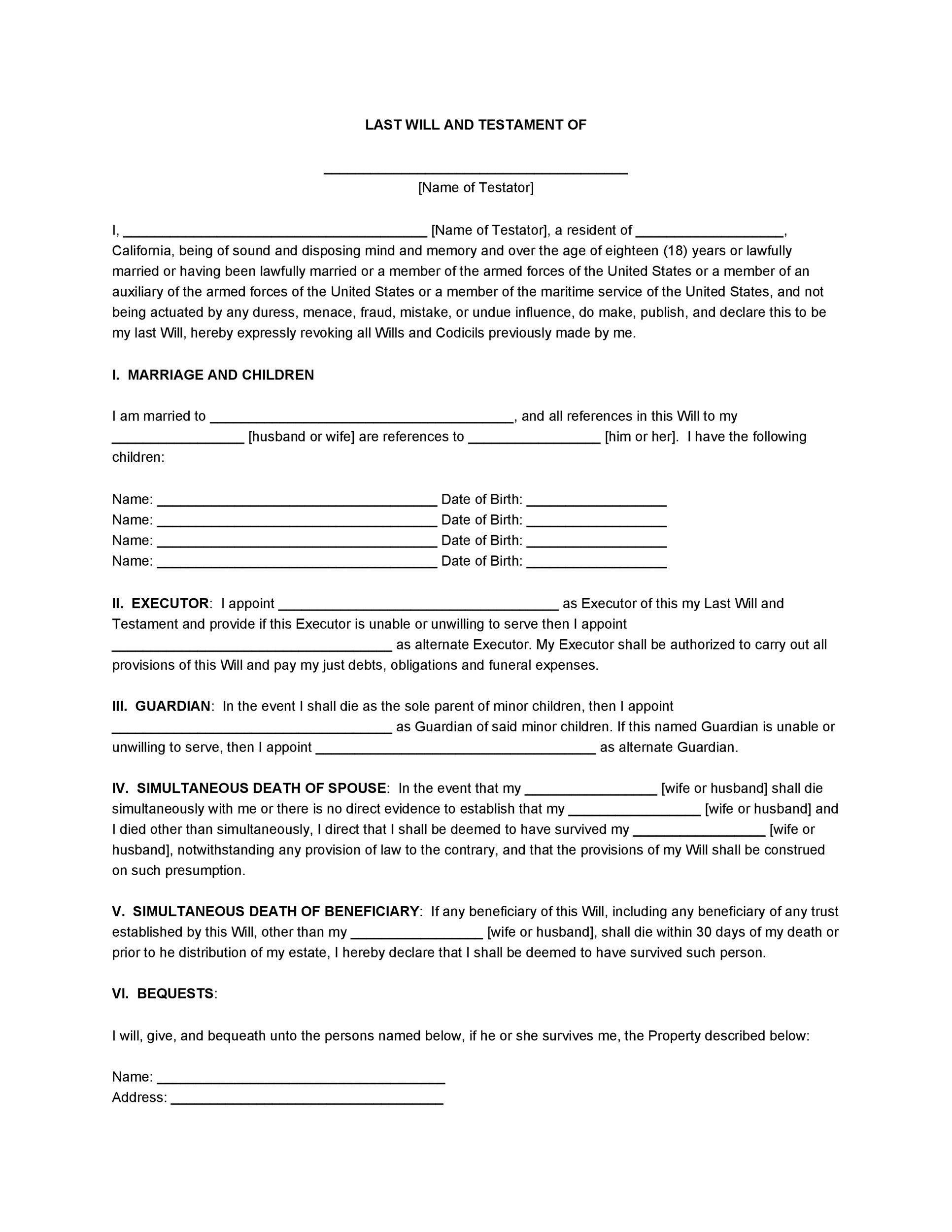

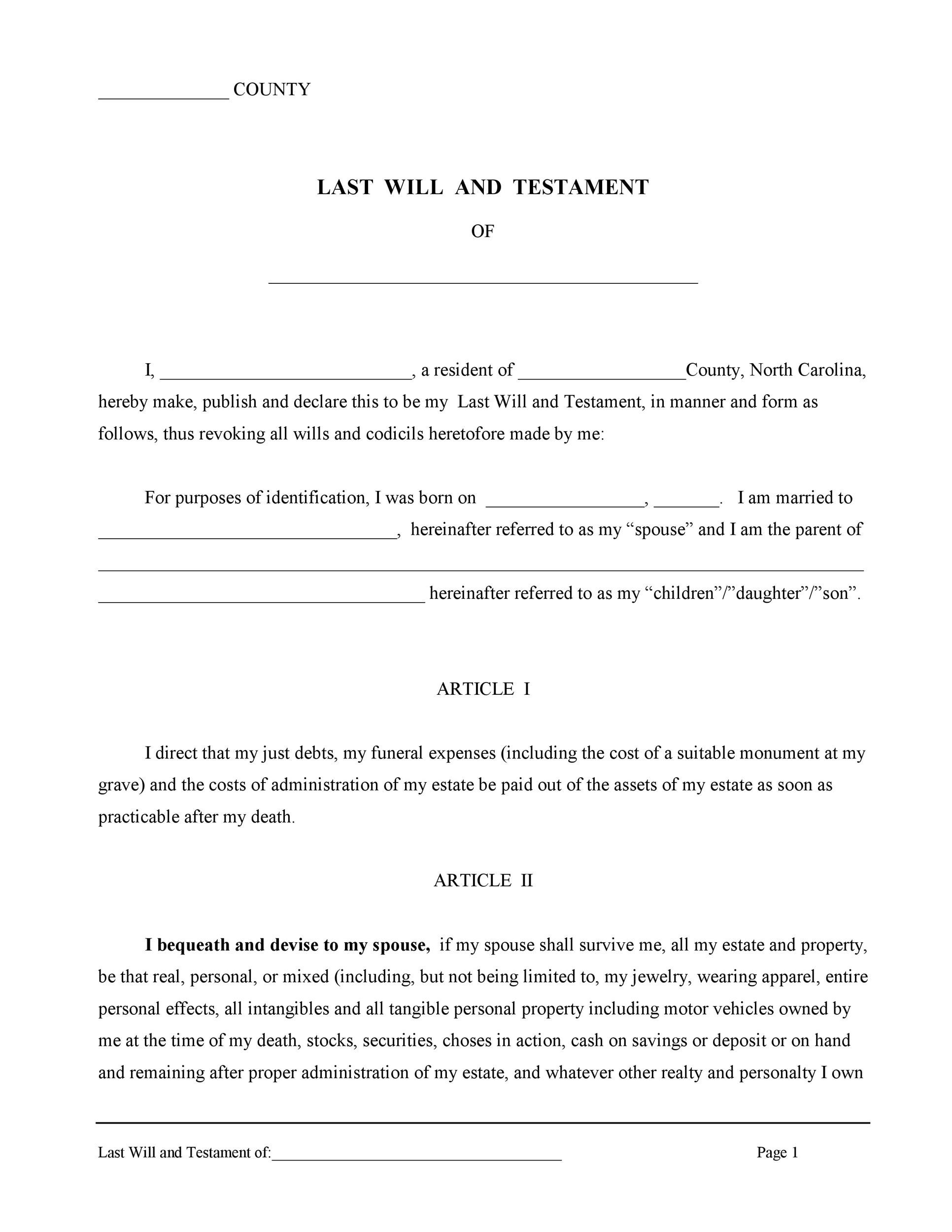

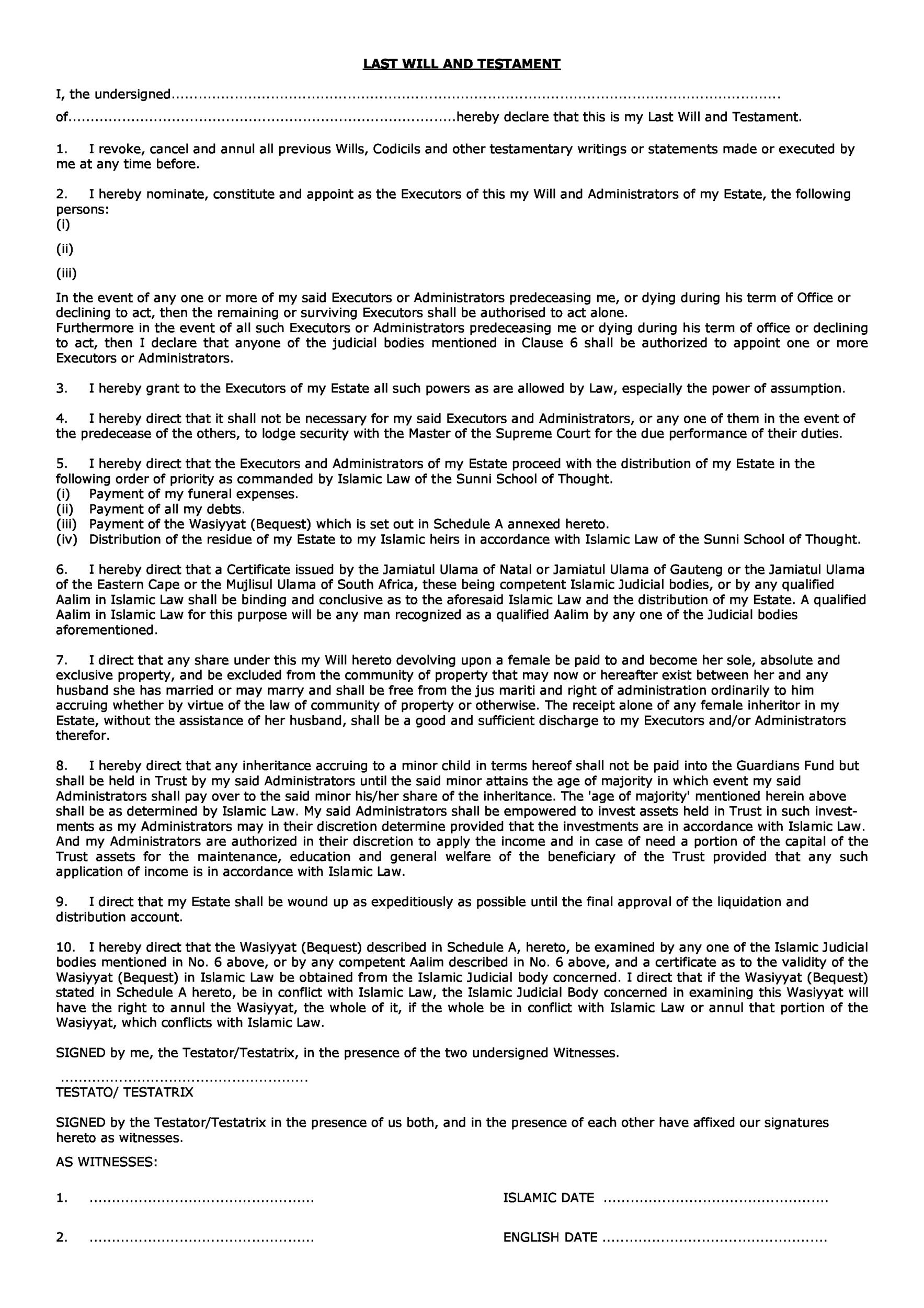

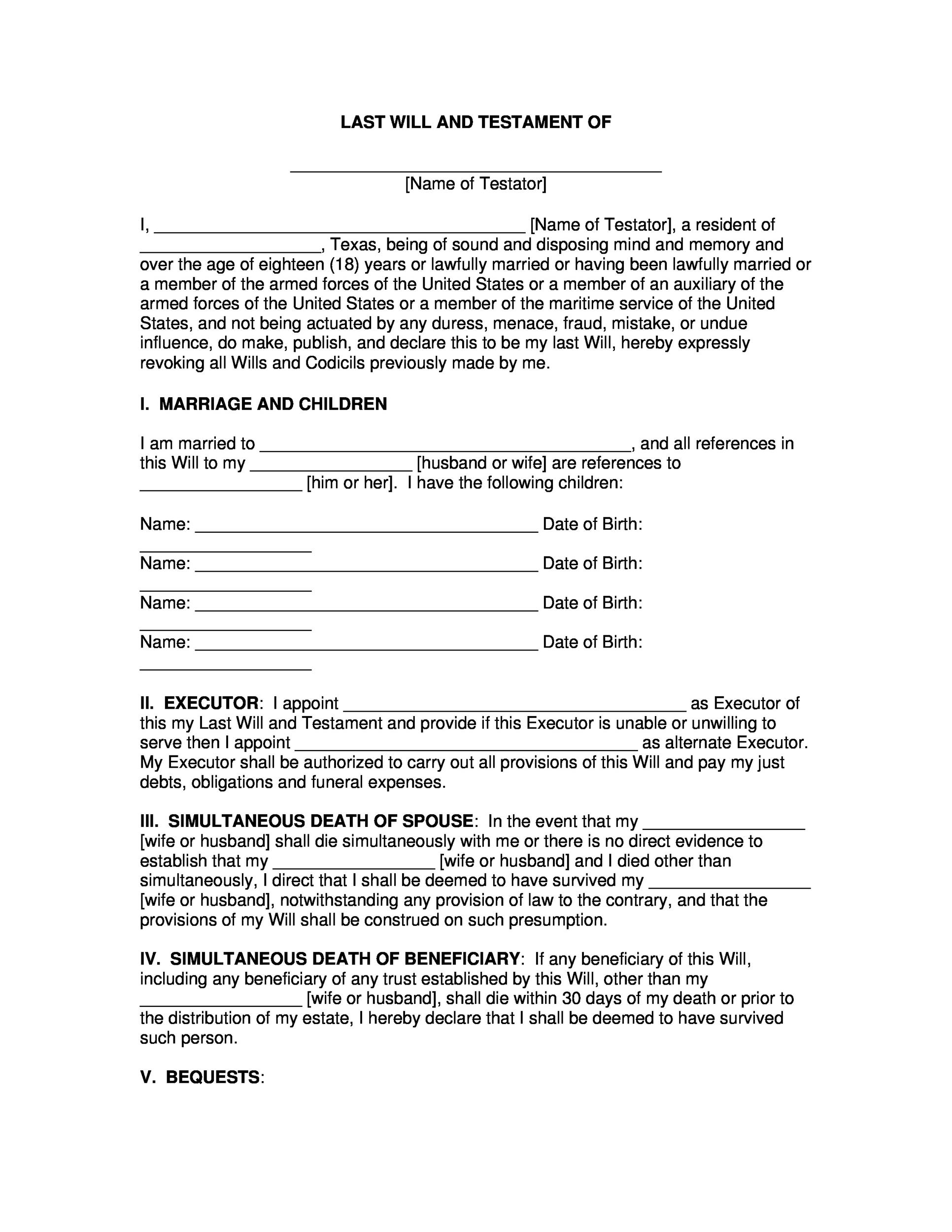

Last Will and Testament Templates

How do you write a simple will?

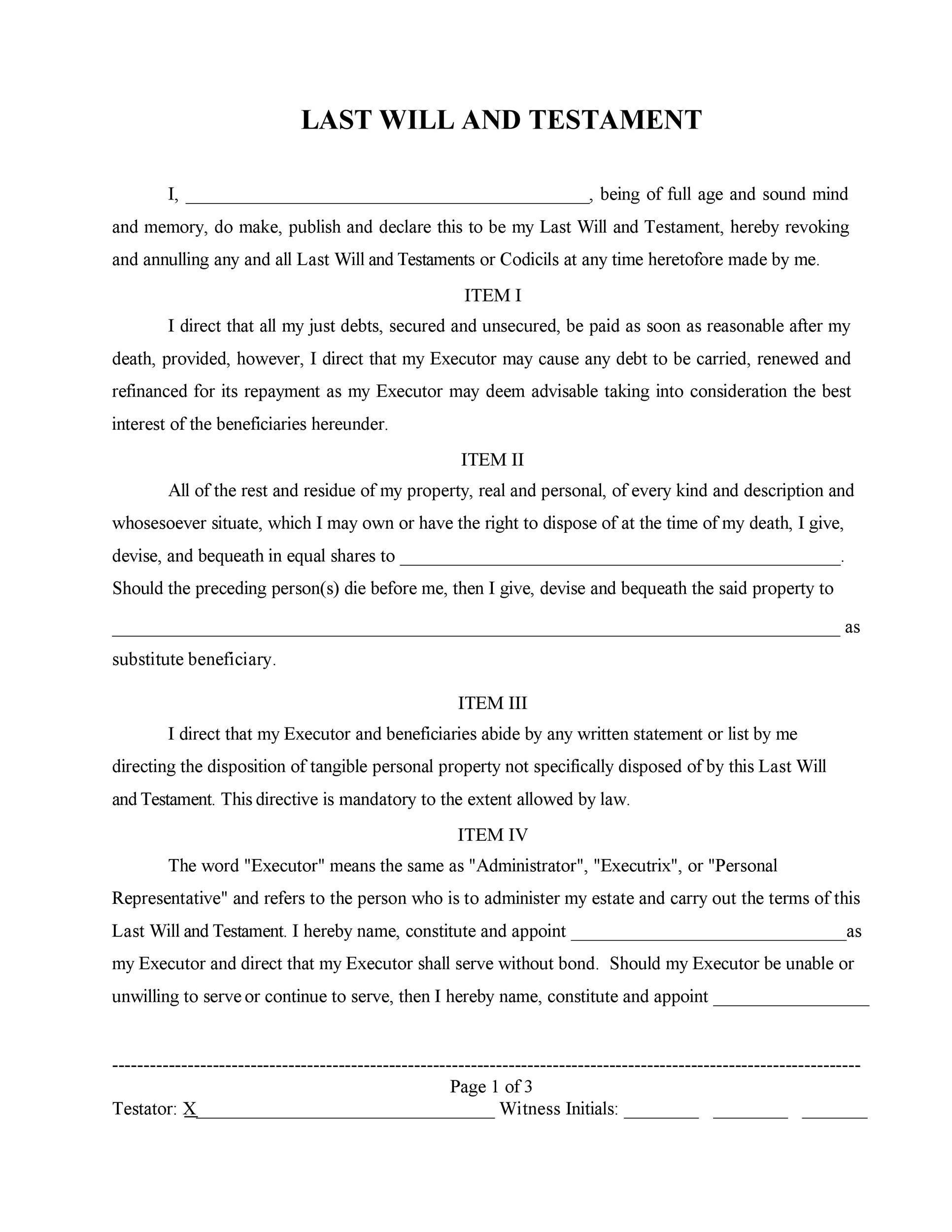

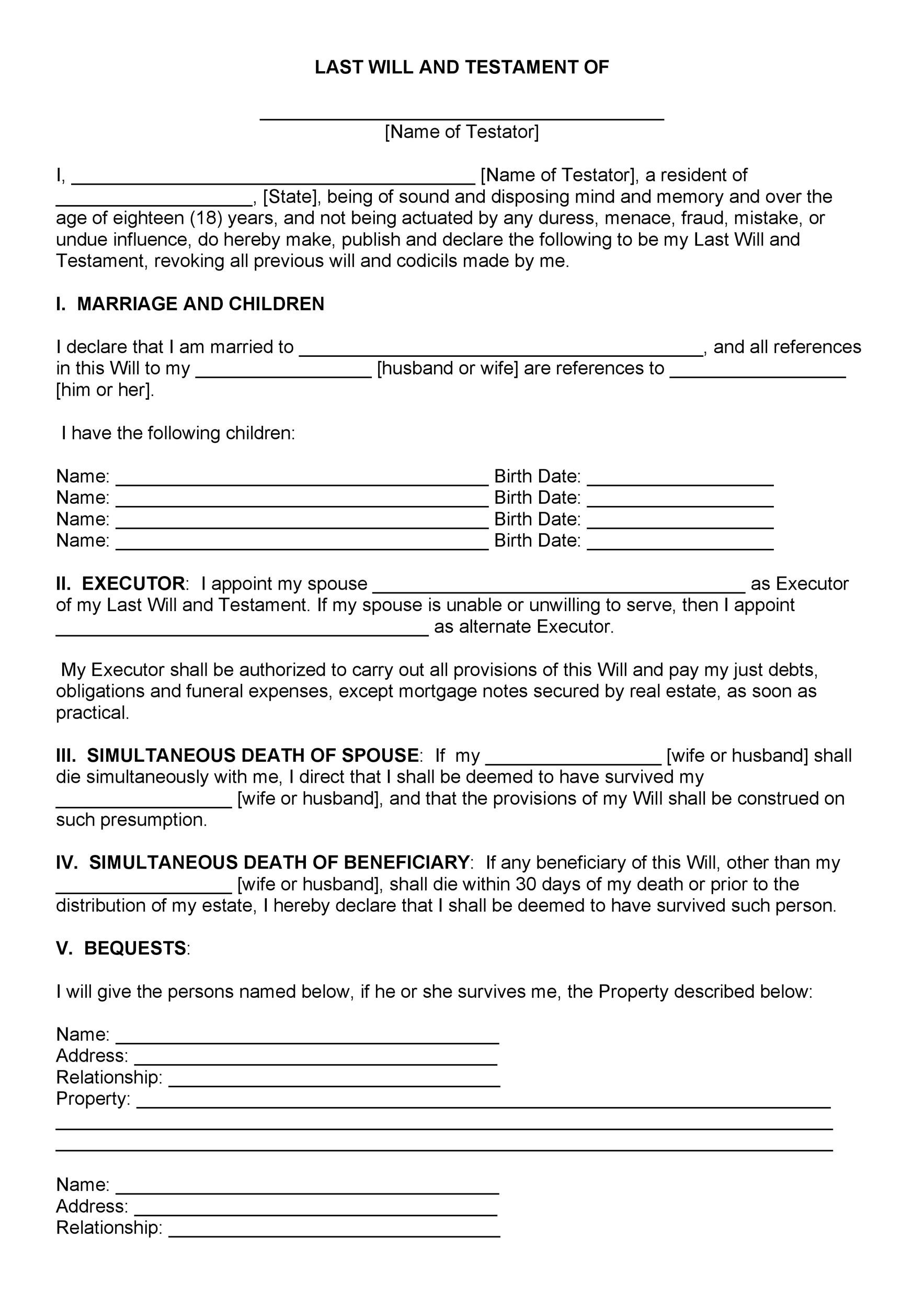

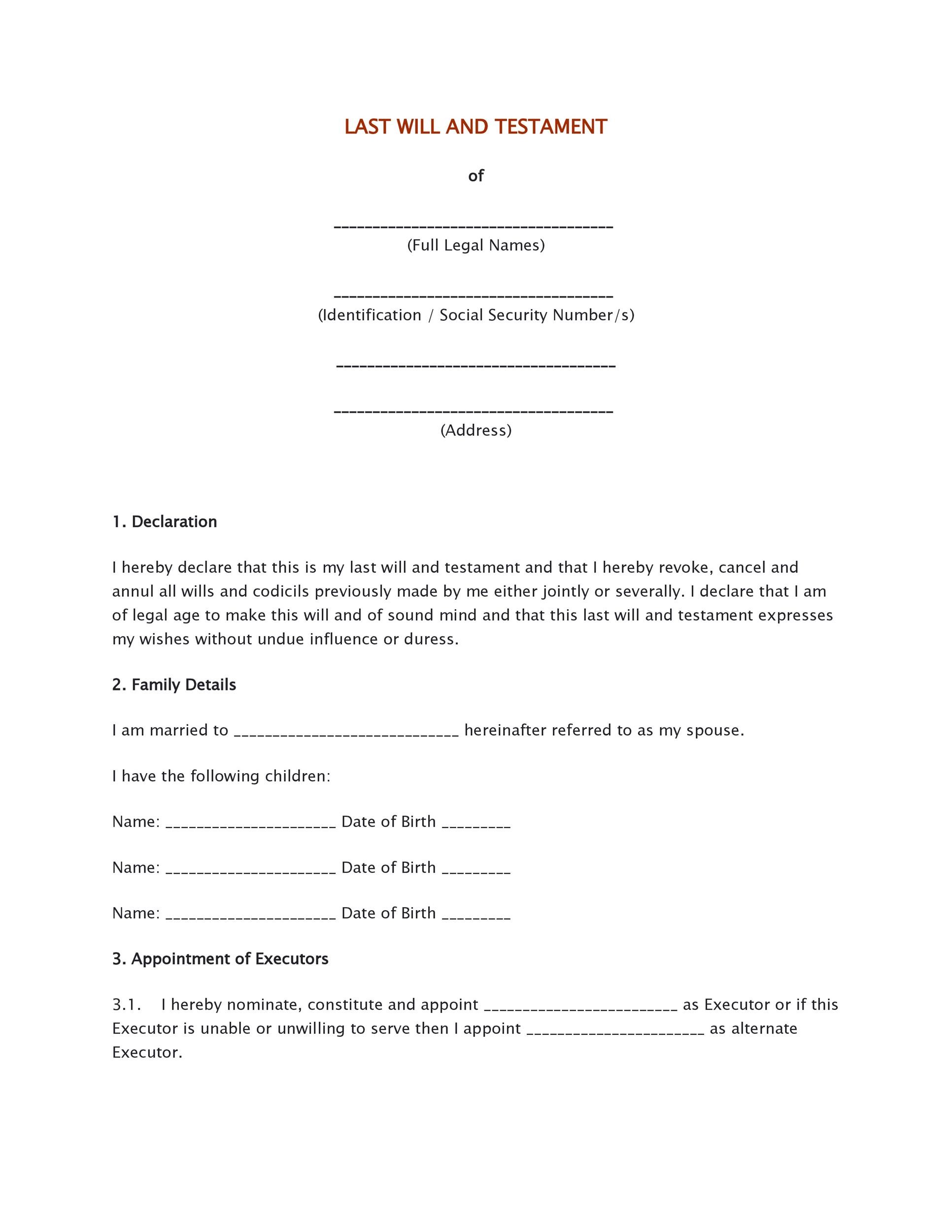

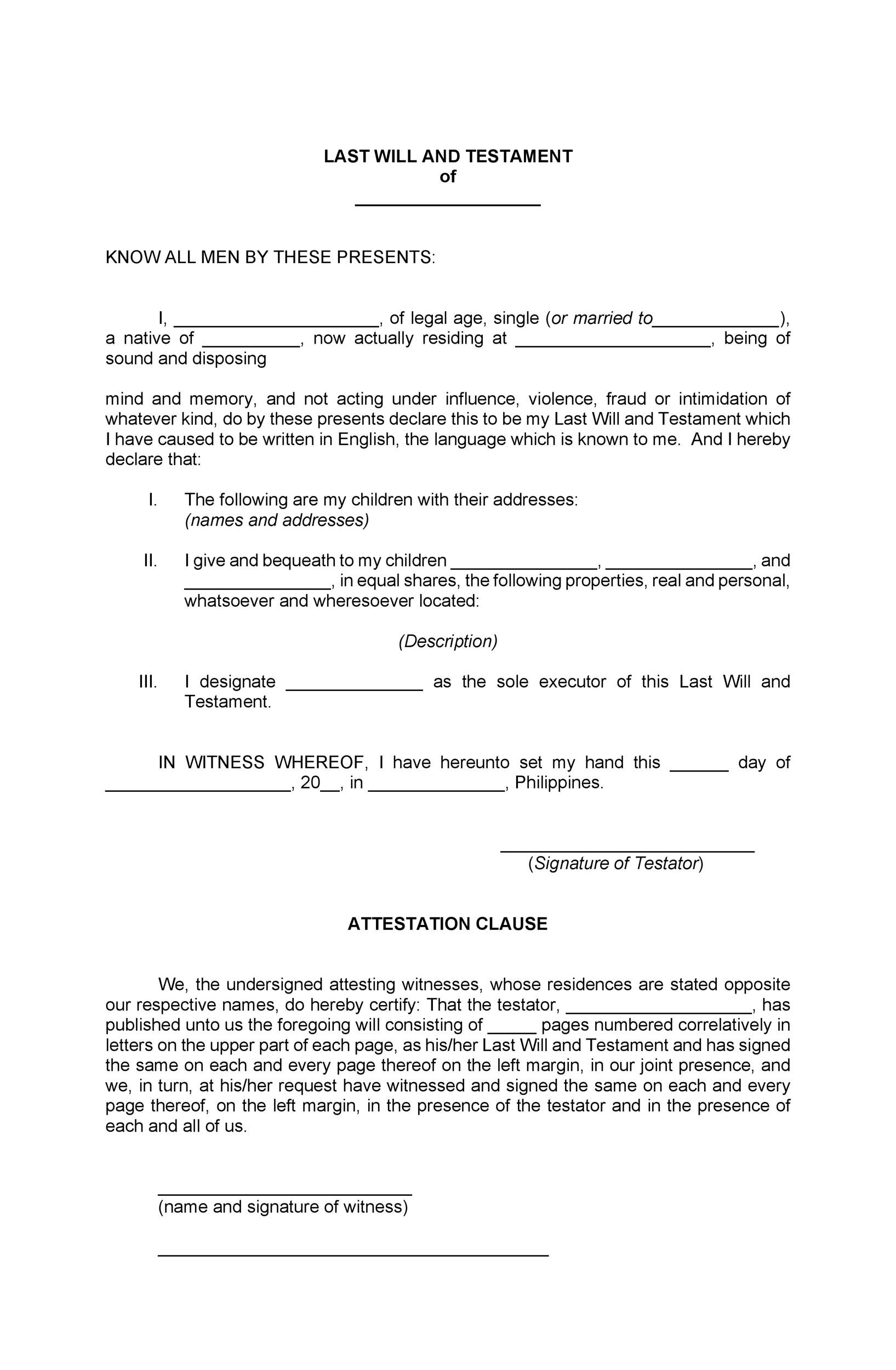

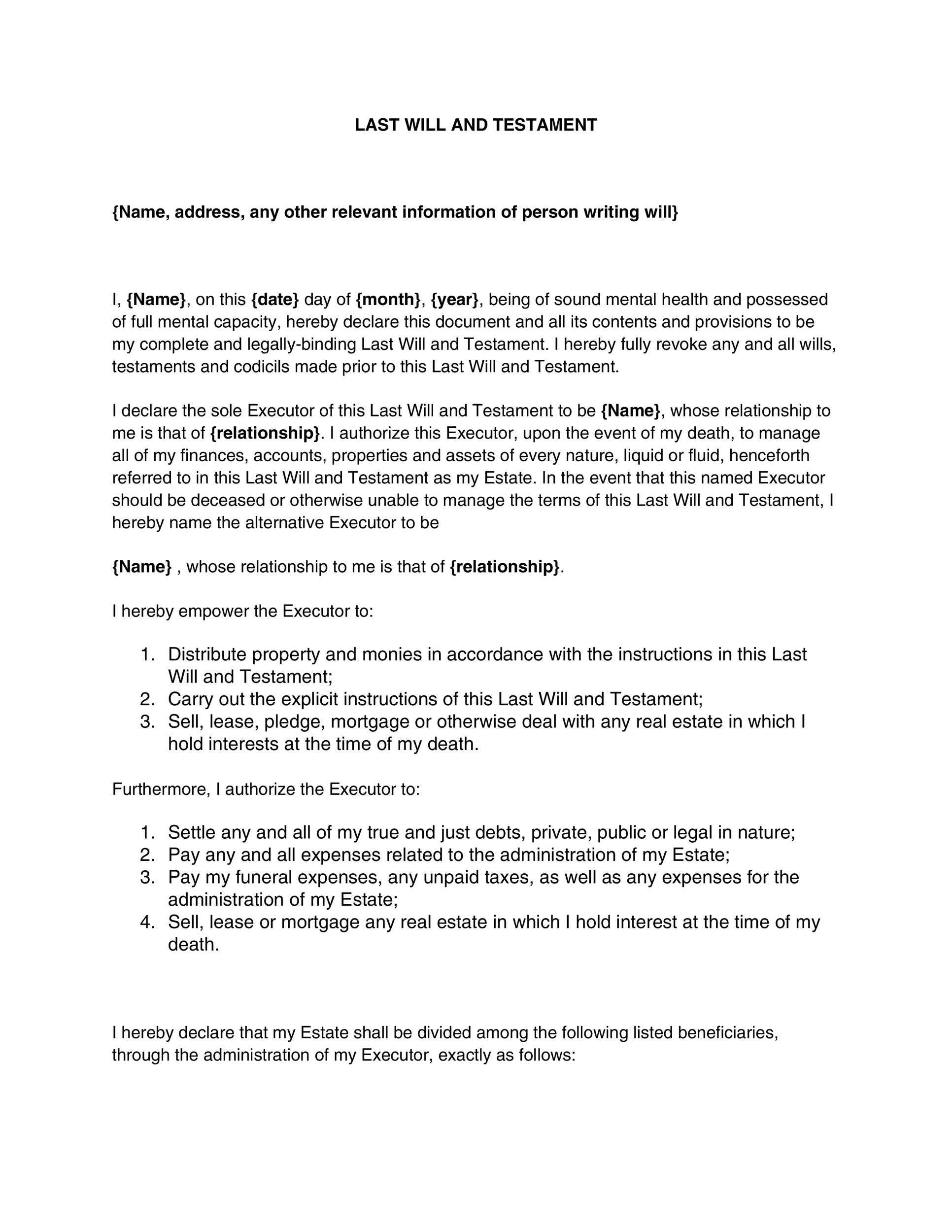

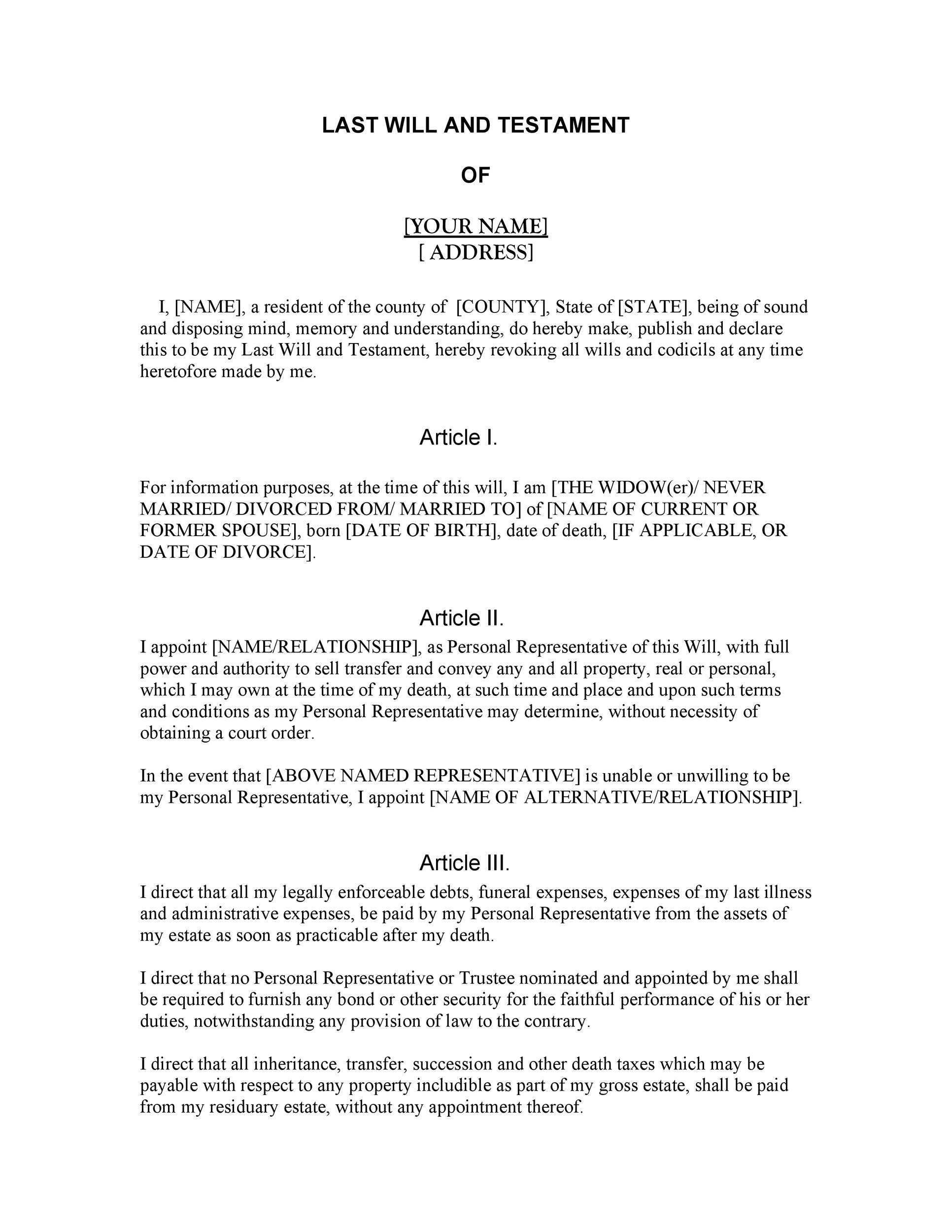

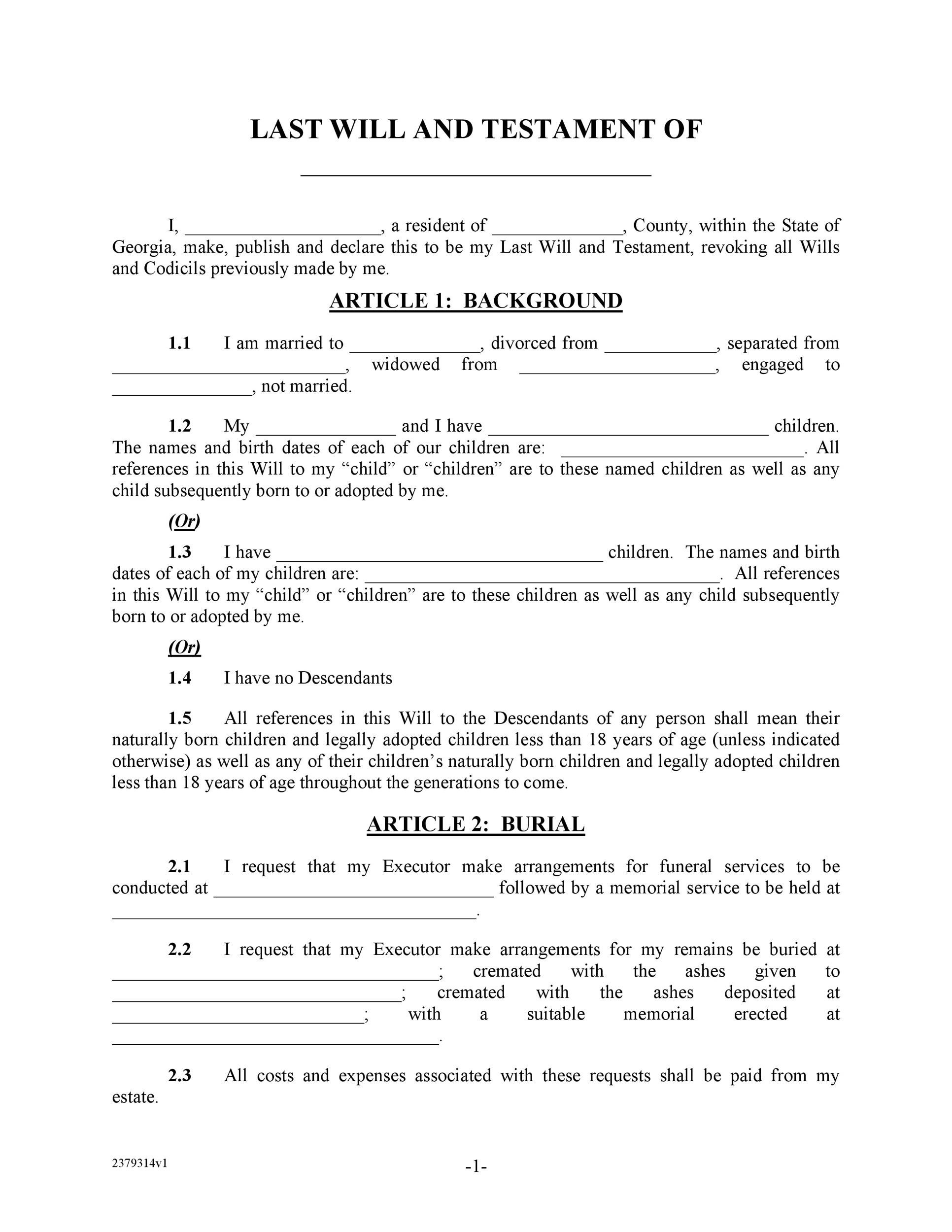

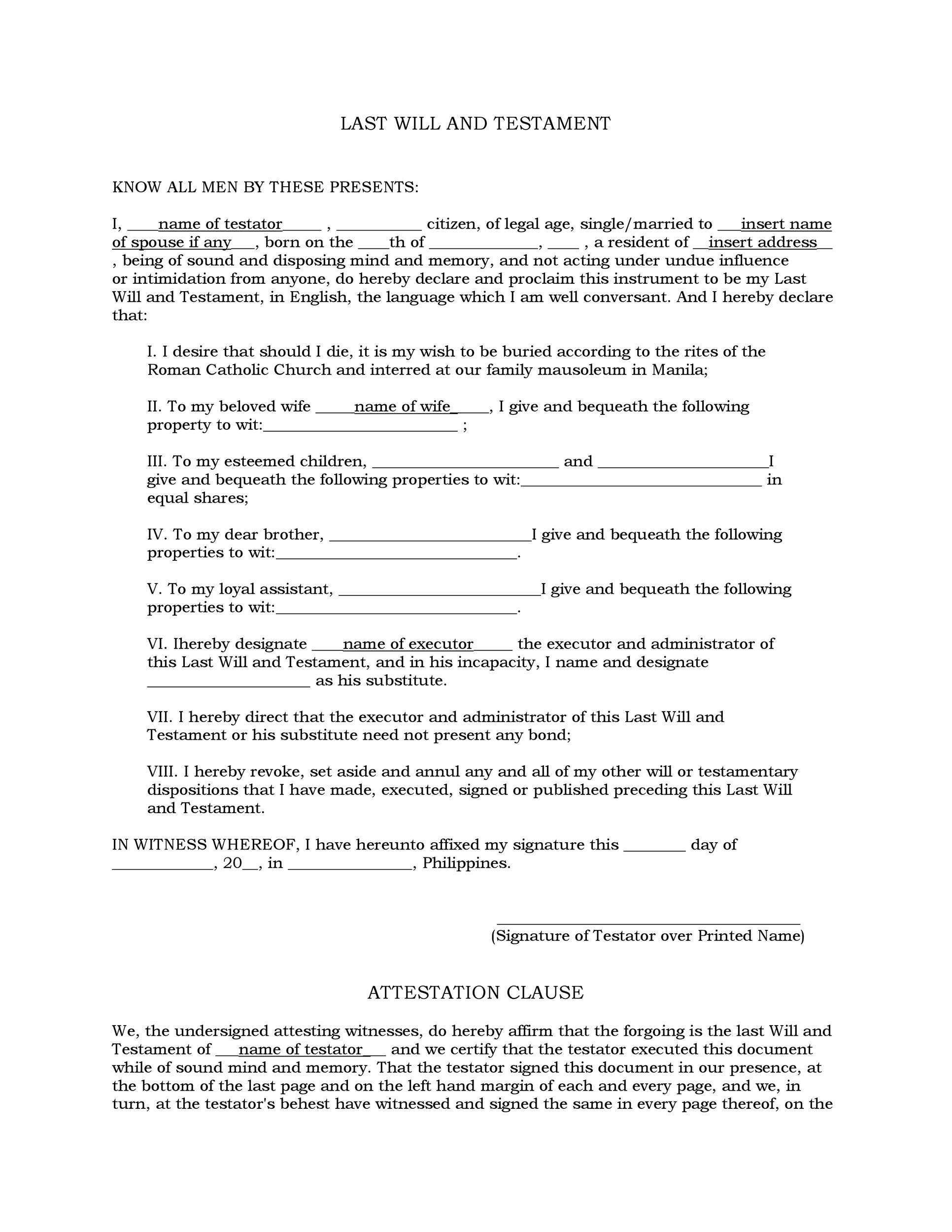

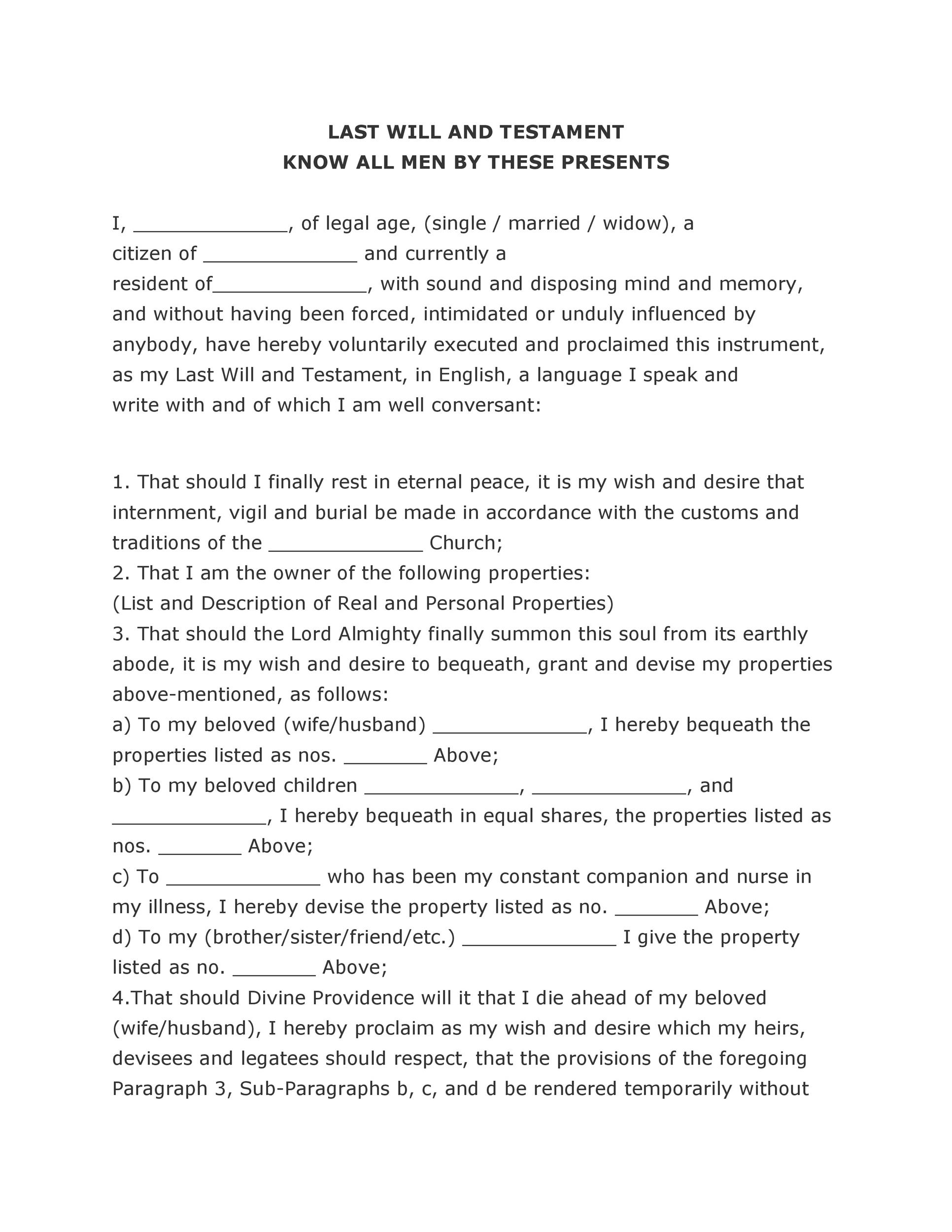

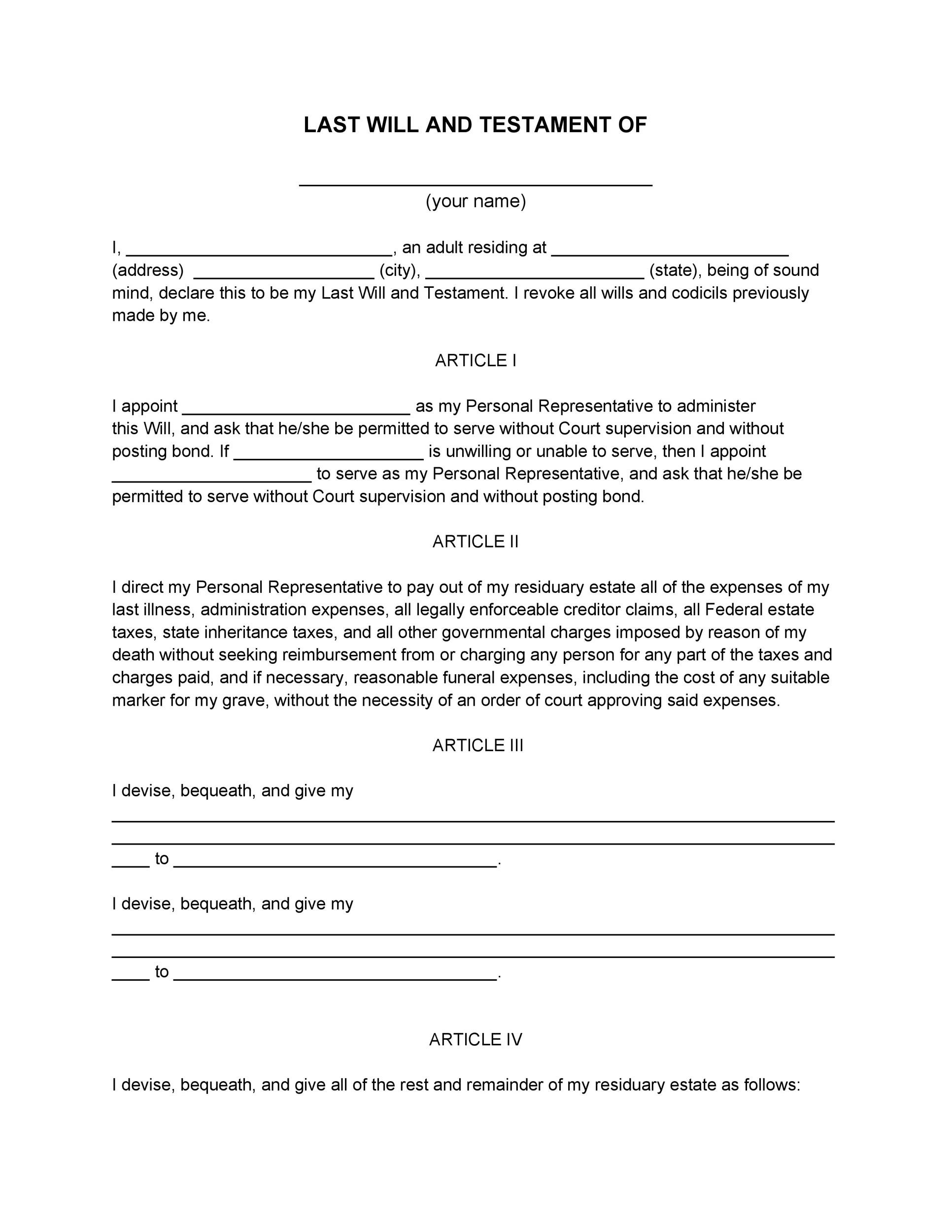

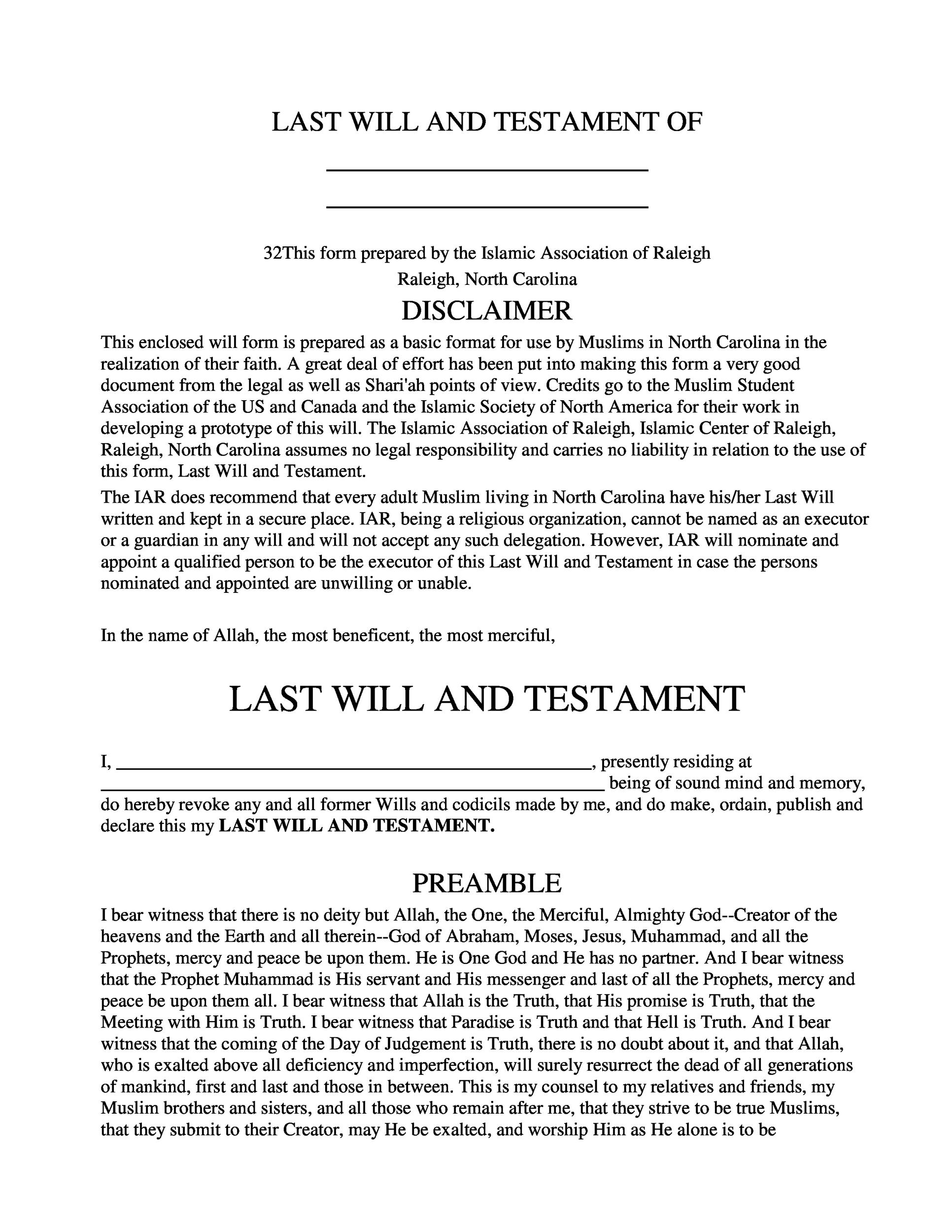

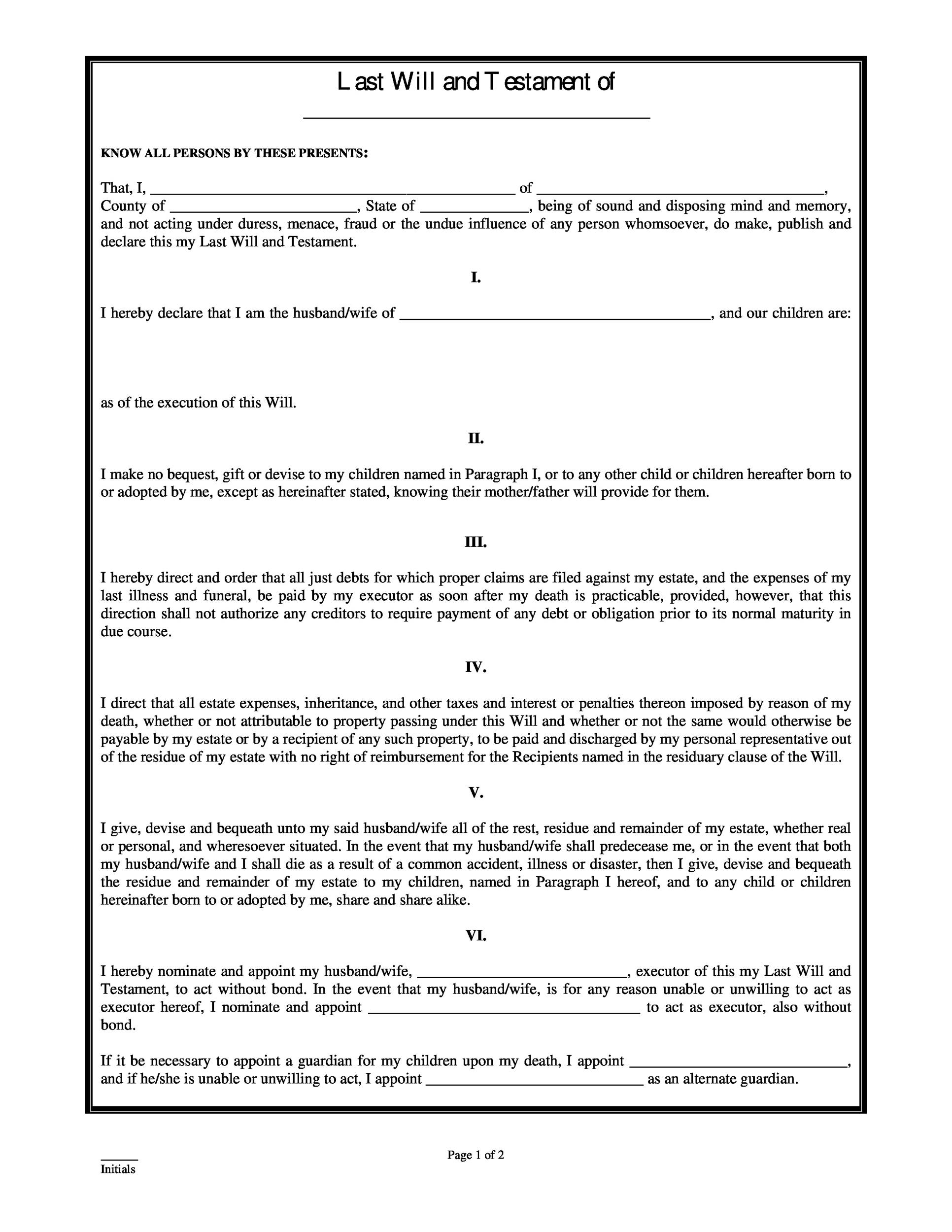

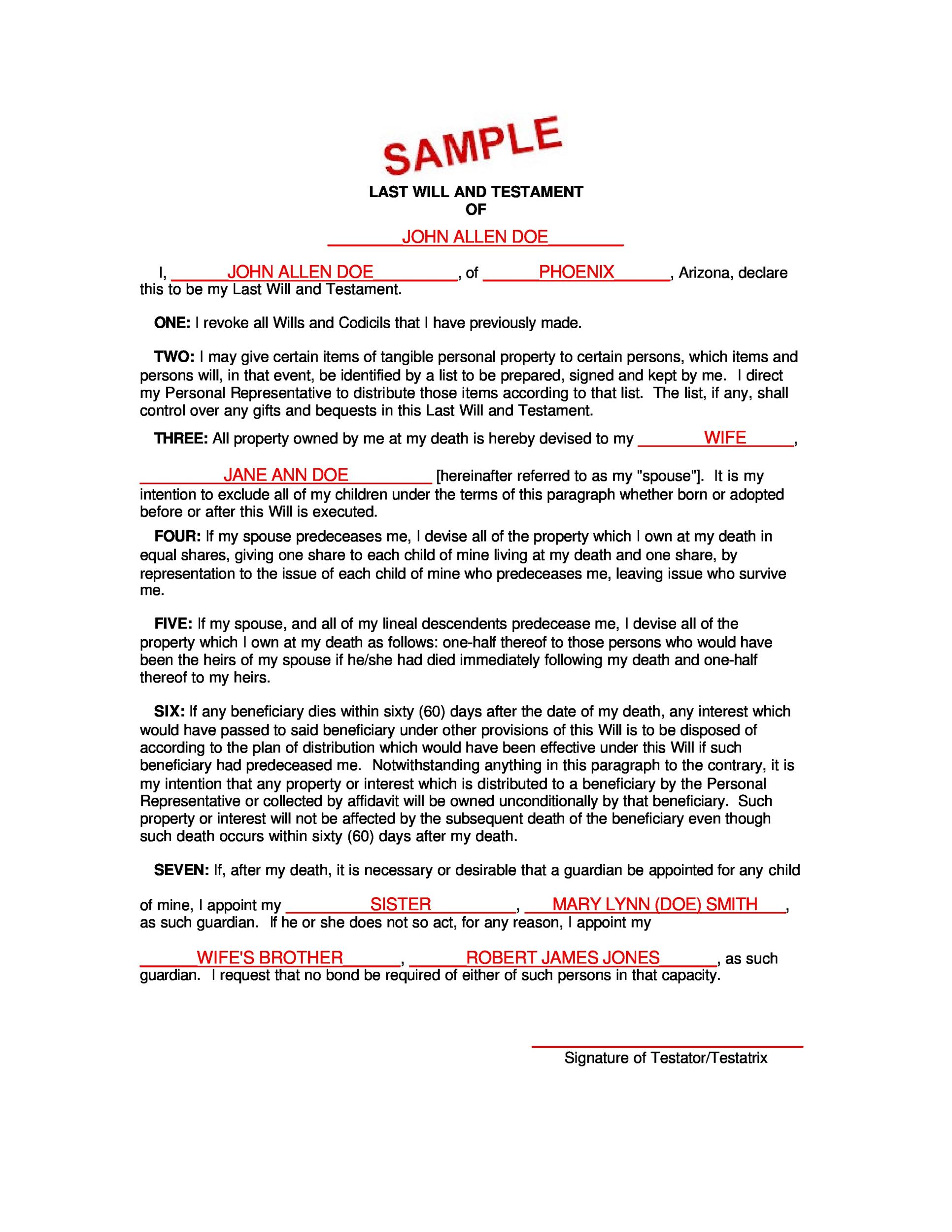

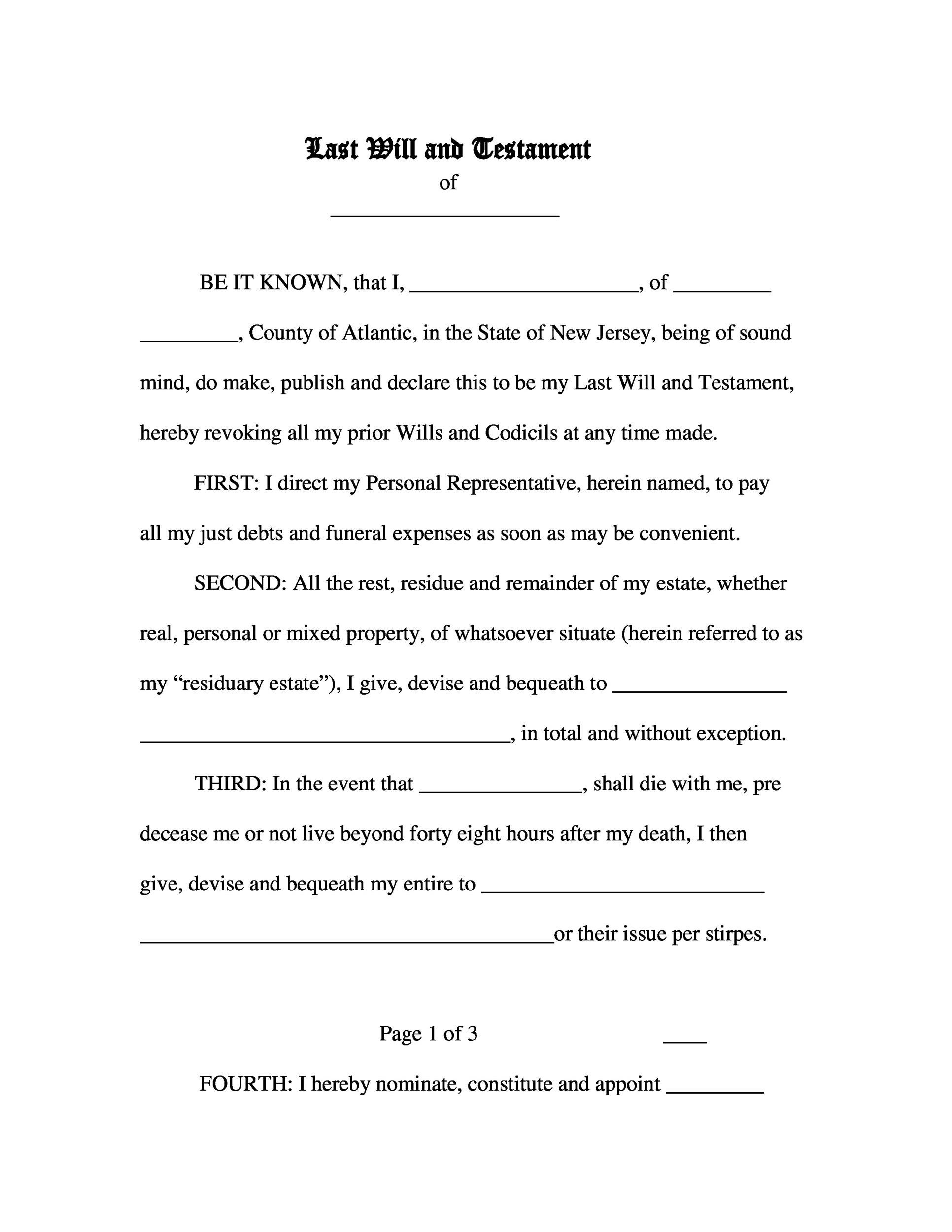

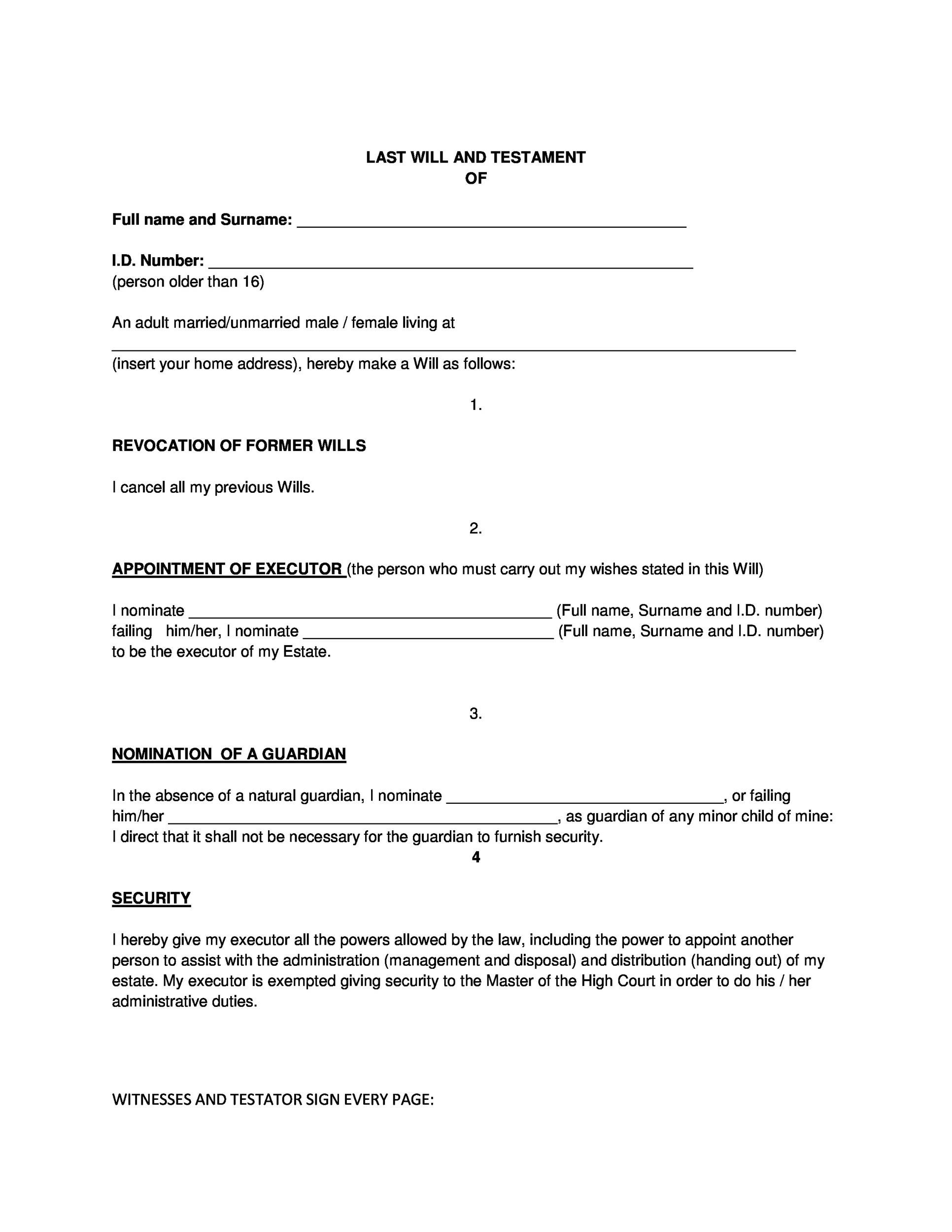

There are some basics that need to be included in your last will and testament template for it to be valid and useful once you pass away. You can put as many specifics into this document as you wish, but these basics have to be included for your will to be of use to those who survive you.

- Personal Information: You will need to indicate your legal name in full at the top of the document. Any other personal information that you think you need to include in this part of the document should be added as well. Make sure that your address and the names of your spouse and children are listed here as well.

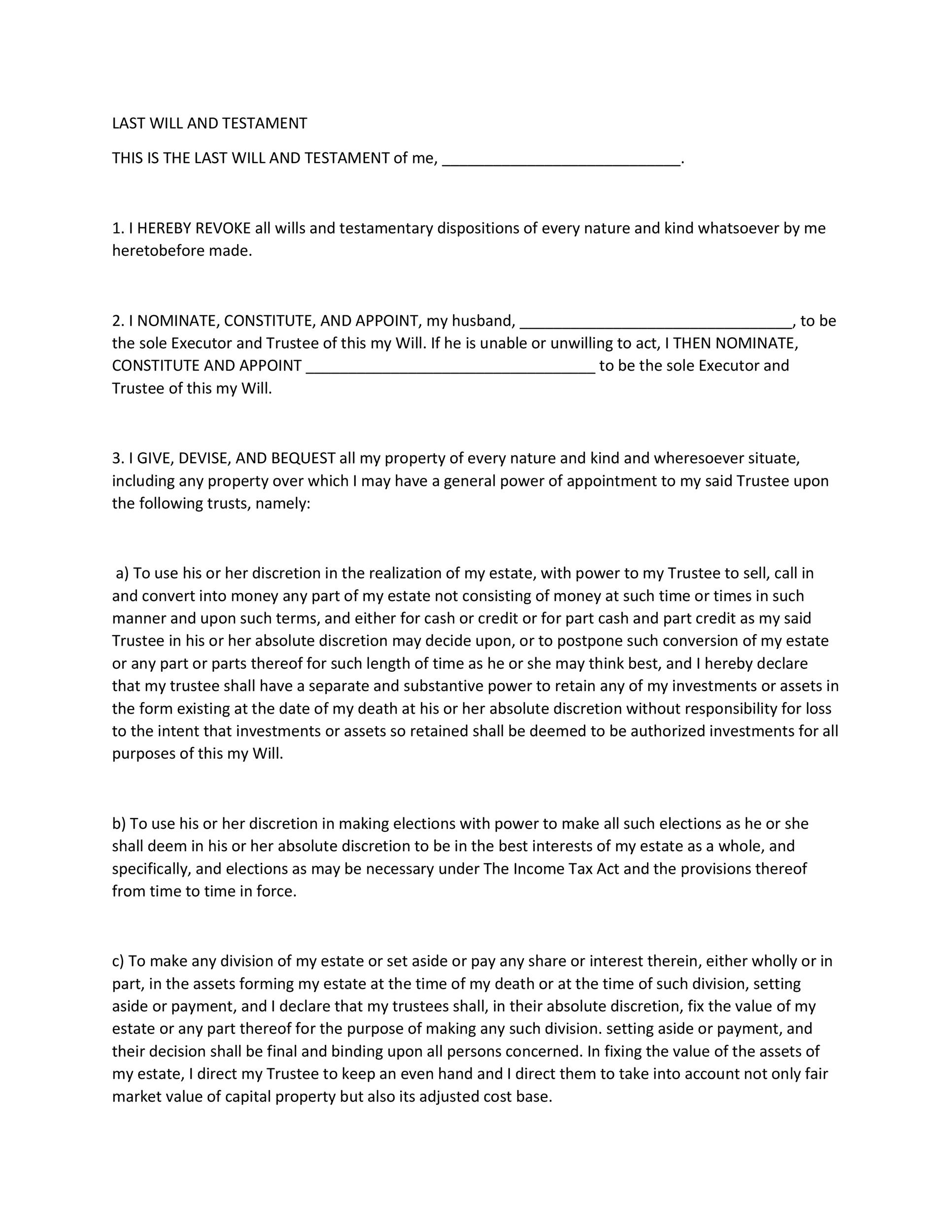

- Appoint an Executor: The executor that you name does not have to be related to you, and they do not have to be someone who is going to inherit when you pass away either. The executor will simply make sure that the will is executed correctly from start to finish. This person should be backed up by an additional party who can take the place of the first-named executor if something happens to them.

If your executor is being compensated, you will need to indicate how much money is being taken from the estate for this process. You should make sure that you explain any powers that this person will have beyond dispersing your assets.

- Assets: Name the assets that will be dispersed in your will. You might have property, you could have financial assets, and you could have other valuables that you want to be sure are left to specific people. The assets that are included in your will need to be described carefully so that there is no confusion about the items and who should get them.

- Beneficiaries: The people that you want to have named in your will to receive benefits from your estate can be of any age, and they do not even have to be related to you in any way. You can leave your assets to whomever you decide to leave them to. If you are going to leave your assets to a charity or a business, you will need to indicate which items will be left to this company so that your family does not lose out on items that you want them to gain access to.

- Guardians: When you have minor children or elders that you are caring for, they will need to have a named guardian that is indicated in the will. This is key to allowing these people to get the care that they need, and it can also be required if you are going to leave assets of any kind to minors who are not old enough yet to take possession of these assets. You can also appoint guardians of pets too if you need to take care of these surviving members of your family.

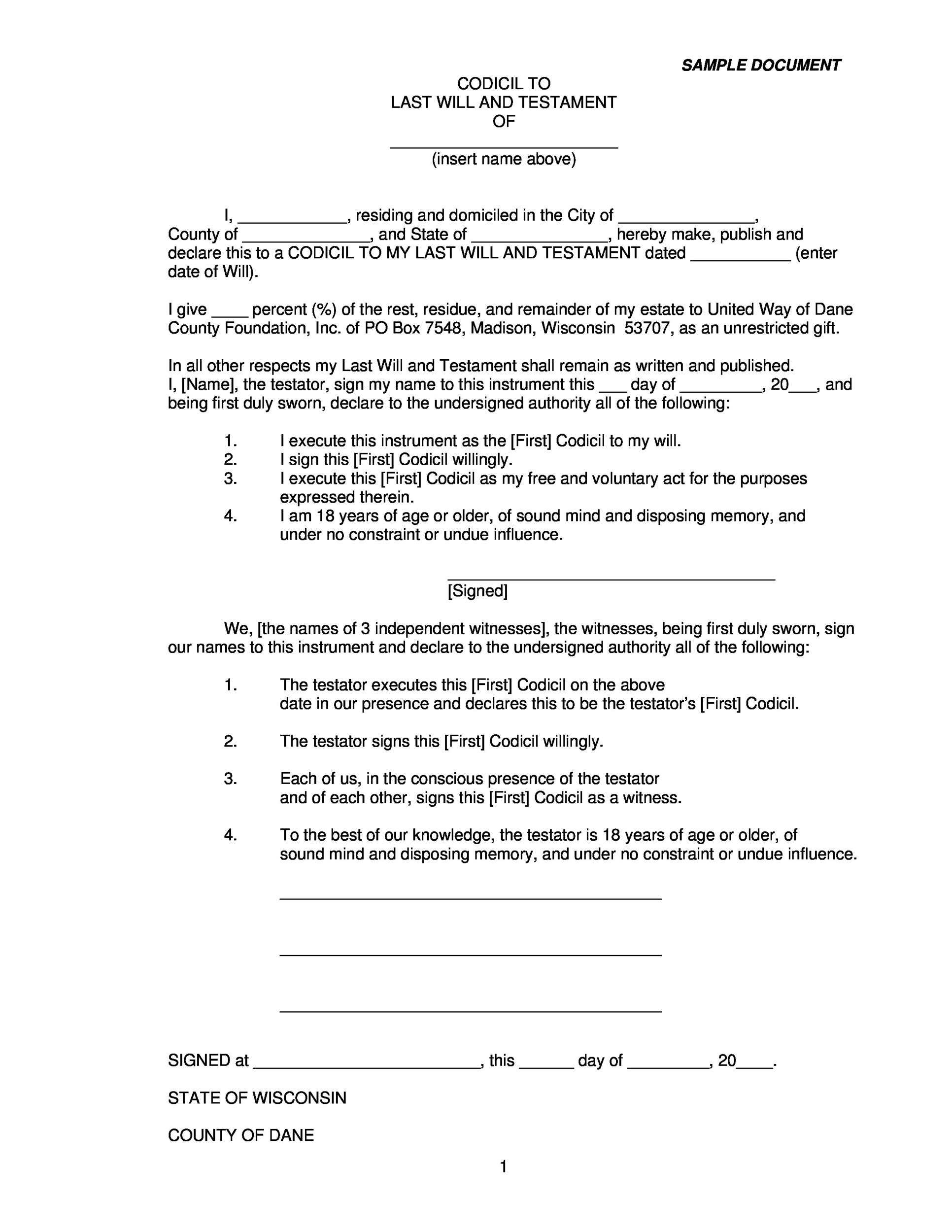

- Signed Witnesses: You will need to have signing witnesses who indicate that you created your will in your right mind and that you were not coerced or swayed in any way during the creation process. These people need to sign and date their signatures.

- Your Own Signature: You will need to sign the document yourself as well and date the signature line for it to be legally valid and binding.

- Self-Proving Affidavit: This statement is used to prove the will’s validity. It states that you have created this document with your full knowledge and that you validate the inclusions in this will as being your desires, to have carried out if you should pass away. This is not required, but it can make the probate process much faster in some states.

- Notary: In some cases, you might want to have a notary witness the signing of the will and stamp that they made sure that everyone signed the document of their free will. This might be required in some states, so be sure that you check this information about the will-writing process before you make an assumption about being able to skip over this step.

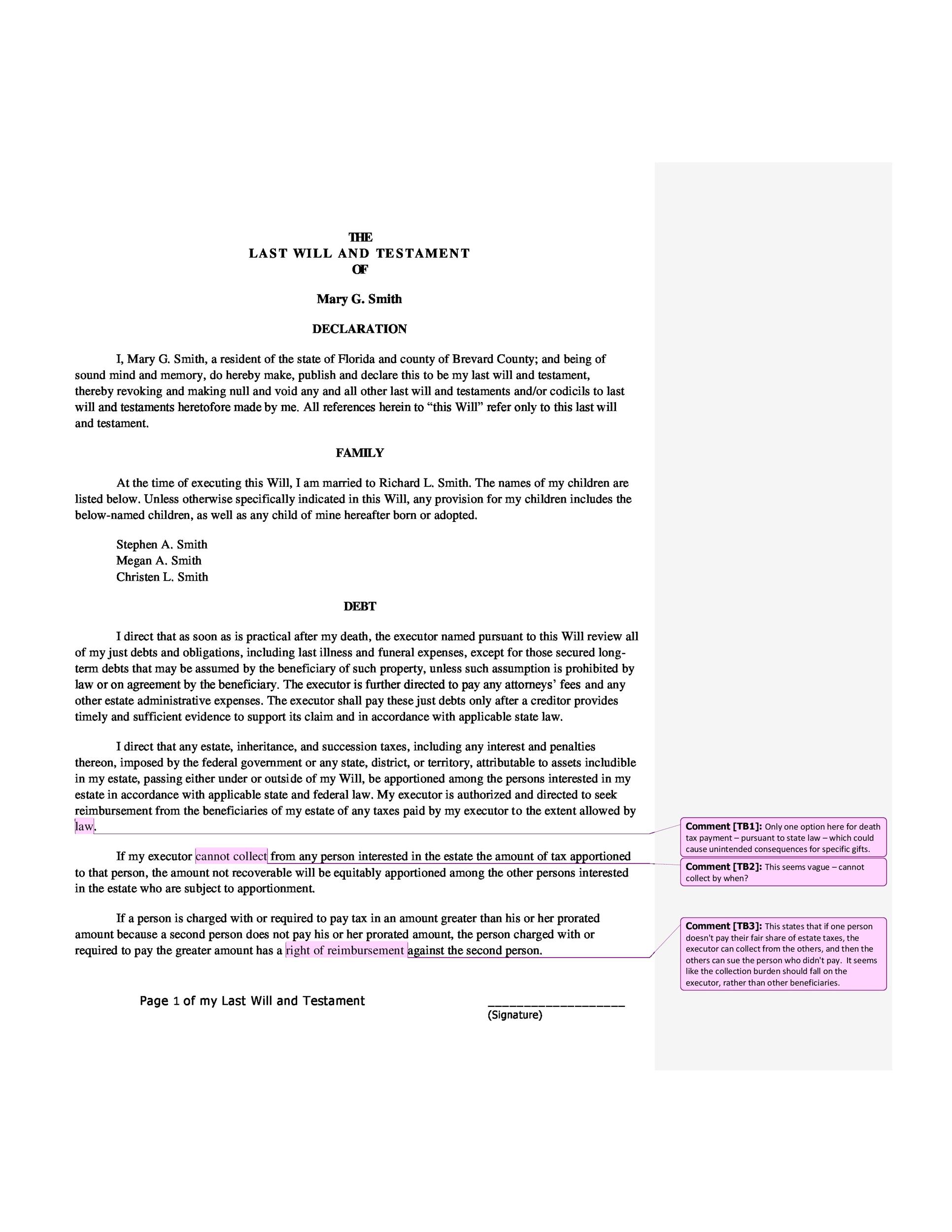

Last Will and Testament Samples

What should you not write in your will?

You should not put any personal wishes or desires about the behavior of people who are named in the will or who have survived you. You should also be sure that you keep any personal grievances out of the will that do not have anything to do with the will process.

You cannot indicate anything that you wish would be left out of probate. This is not allowed to be a part of the process of granting your final wishes, and you cannot make a legal judgment about what should not go through probate in your will. You will need to consider other forms of estate planning, such as a trust, if you want to make sure that your assets do not have to be impacted by the probate process.

Special needs beneficiaries will need to have their specific needs handled through the creation of a trust as well. You cannot dictate extended care of any kind through your last will and testament. Any unique provisions for minors will need to be handled in the same way.

Some types of property cannot be left to beneficiaries in your will, either. Make sure that you consult with a lawyer if you think that your property might not be transferable to those who are named in your will due to the type. There are various state-specific limitations on properties and wills, so you might need to check into these limitations before you assume that your property can simply be left to beneficiaries in your will.

Business interests also cannot be left to anyone in your will. These are the other concerns or assets that require that you create a trust and not just a will. Most states will require that the estates of those without a trust in place when they die must go through probate and be assessed as inheritance taxes. The will that you have made will not prevent this step from happening.

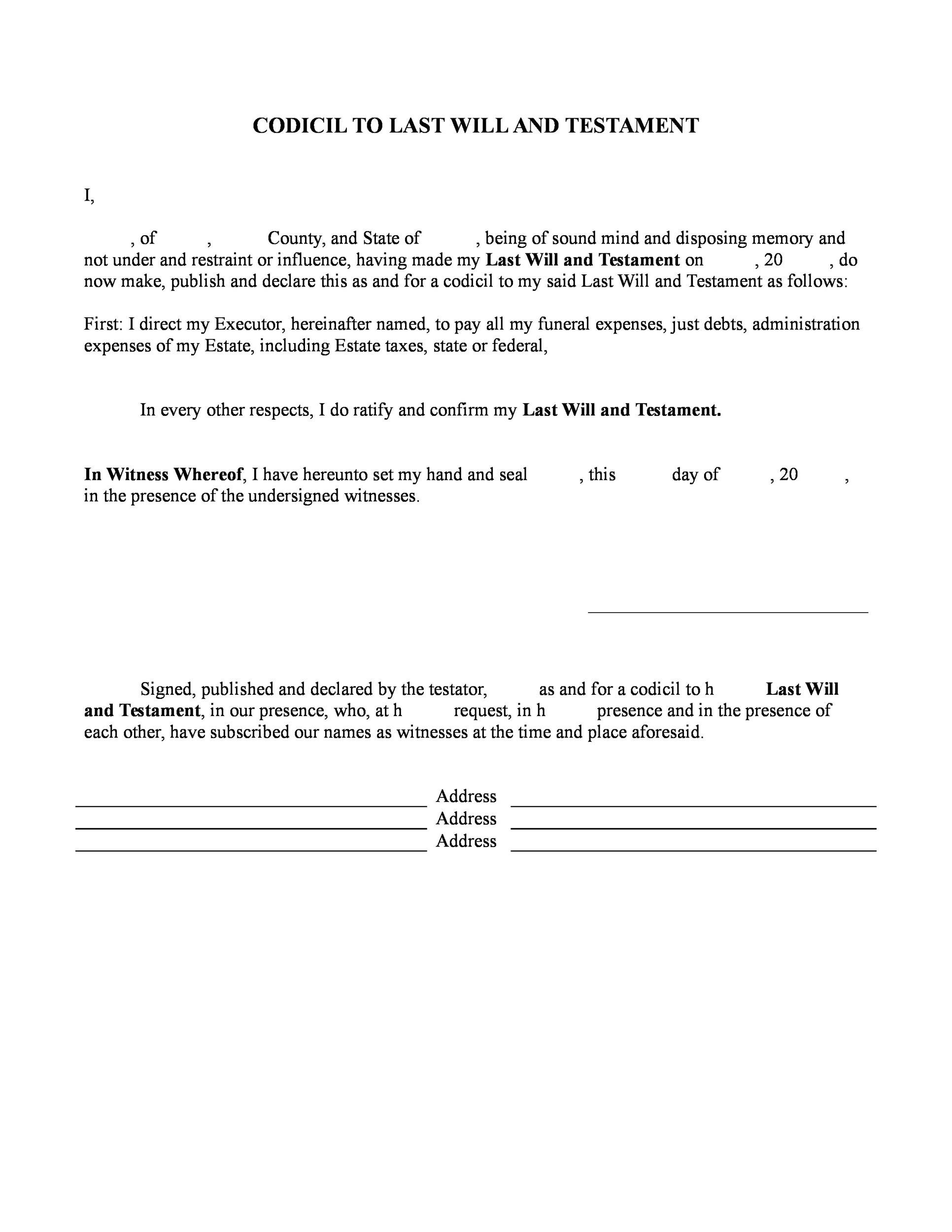

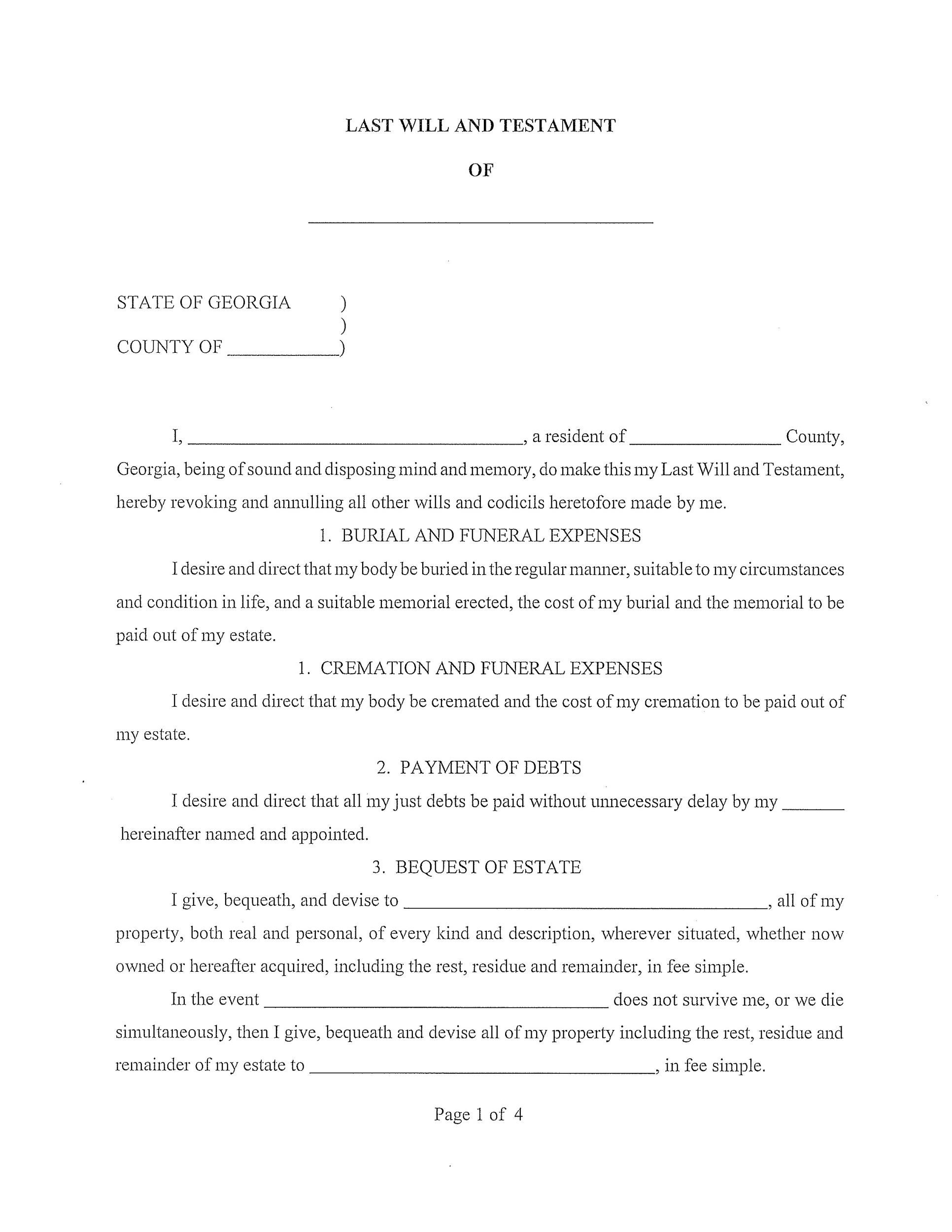

Last Will and Testament Examples

What about funeral costs?

Many people make provisions in their will and testament about the way that they want funeral costs to be handled. This section can also outline the funeral wishes that you want to have honored. You can allocate money for the funeral in this part of the document as well. If you do not take the time to do this, you might find that your beneficiaries will argue over who has to pay for these costs, or they might have to be taken from the estate itself before the estate can be dispersed.

Consider medical costs as well, and make sure that there are some funds that are left over to be used just for this need. If you are young and have died suddenly, this might not be a factor, but for elderly people who might end up in hospice care or in the ICU, there can be significant bills to pay before the estate can be dispersed. State laws can vary about the way that this money is set aside in your will, so be sure that you look into the details about this part of the will before you assume that it will all be covered in just the way that you requested.

Last Will and Testament Documents Are Essential

If you have items that you want to leave to specific people in your family or you are worried about the probate process causing your estate to be held up for years in the courts, you need to make sure that you create a last will and testament as part of your estate planning process. You will also need to look into the process of creating a trust, but your will can serve as an important part of your estate’s distribution to beneficiaries.

Creating a last will and testament can be daunting and a bit scary, but it is worth it when it comes to protecting your assets from being dispersed to the wrong people. You will be able to indicate the way in which you want a variety of processes to be handled related to your death as well, which can help your family to take care of your final wishes with ease. Setting aside funds for funeral costs, medical bills, and other considerations can also greatly improve your estate’s dispersal to beneficiaries.