From one time to another, you will need to transfer money across different banks. It can be from your account in one bank to another account you hold with another bank. It can also be from your account to someone’s account in another bank. There are different ways you can do this. You may write a check, use a third-party company, or do a wire transfer. Wire transfer is the commonest method used when people or companies want to transfer money fast. For your wire transfer to be smooth, you require detailed information about your recipient. You must fill out a wire transfer request form to give instructions.

Table of Contents

- 1 Wire Transfer Forms

- 2 What is a wire transfer request form?

- 3 Wire Instructions Templates

- 4 Types of wire transfers

- 5 How a wire transfer works?

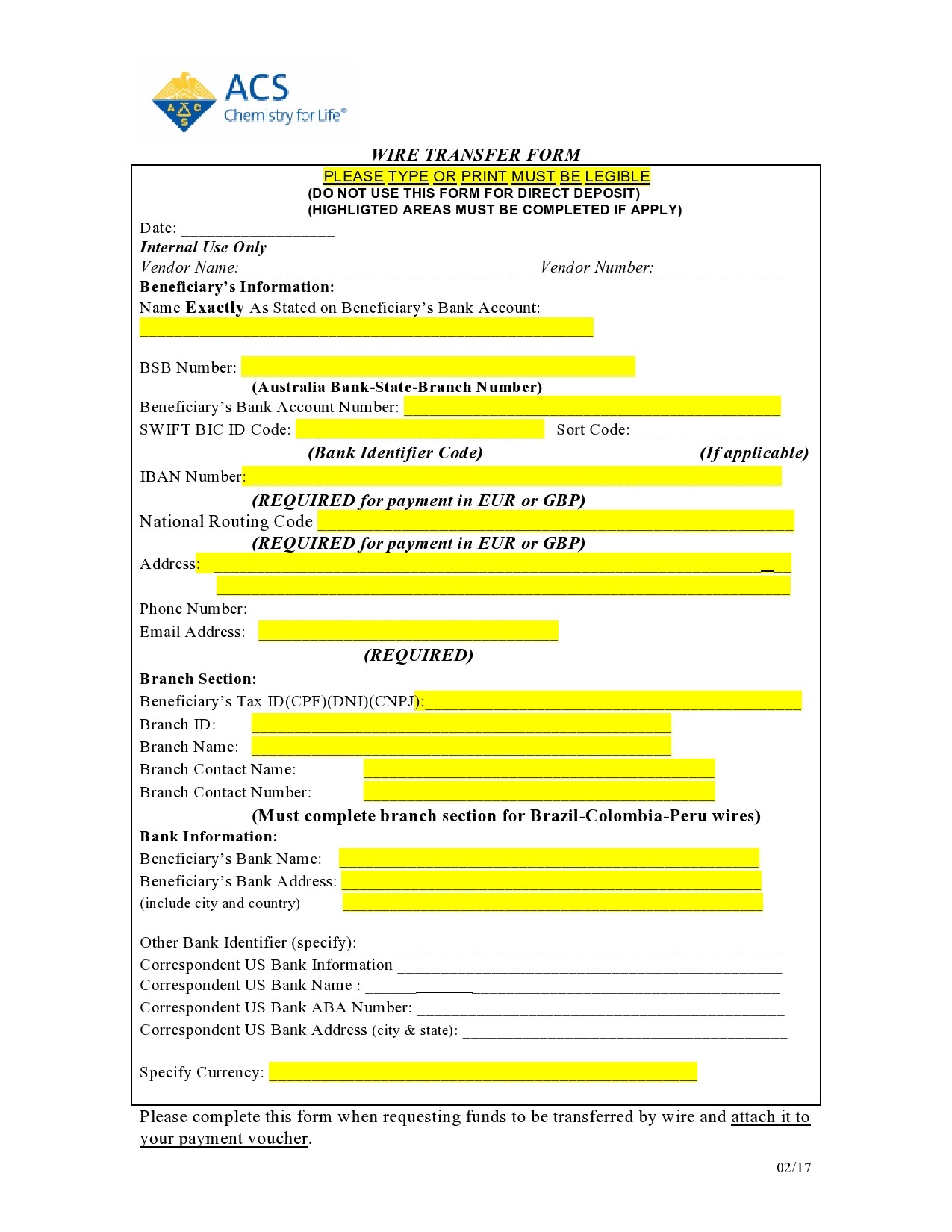

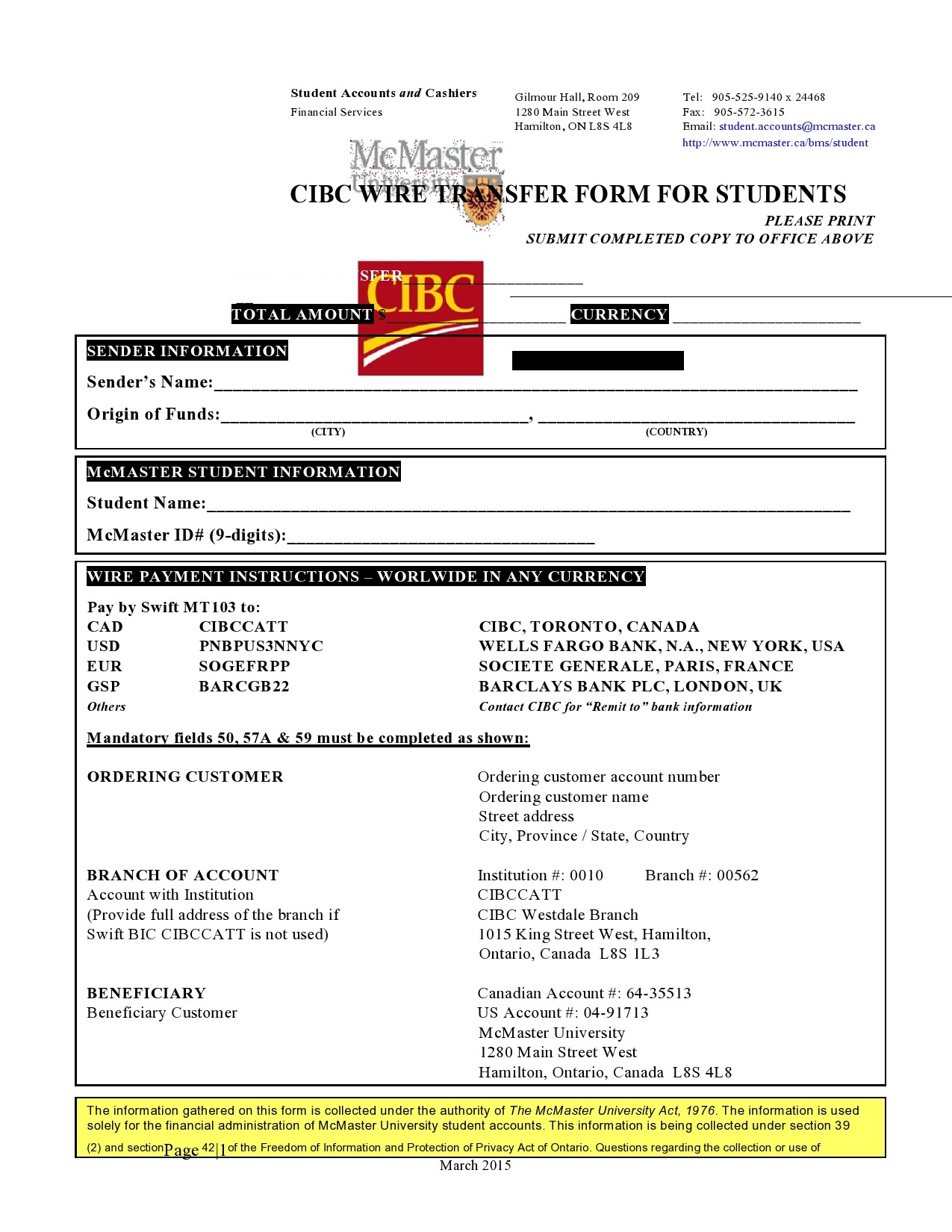

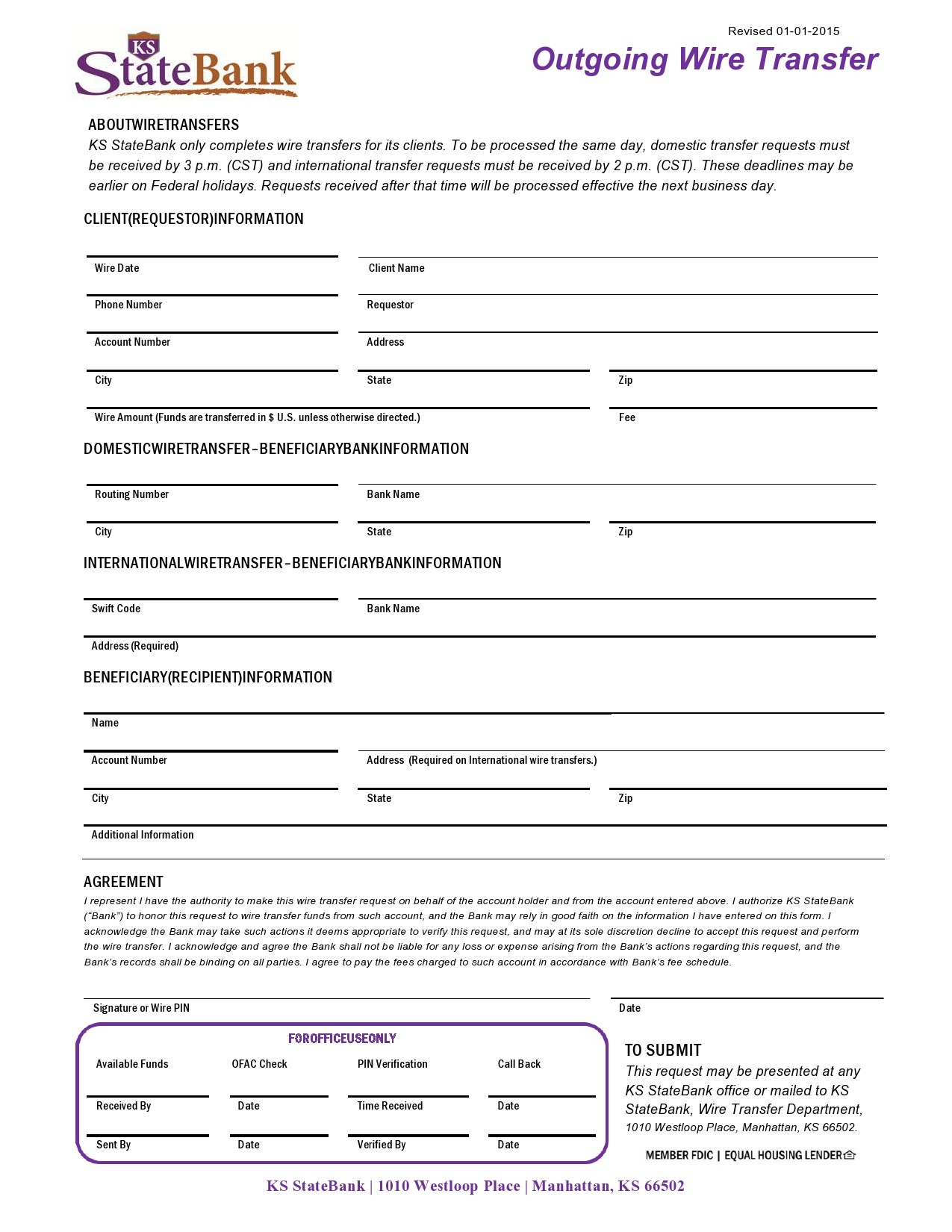

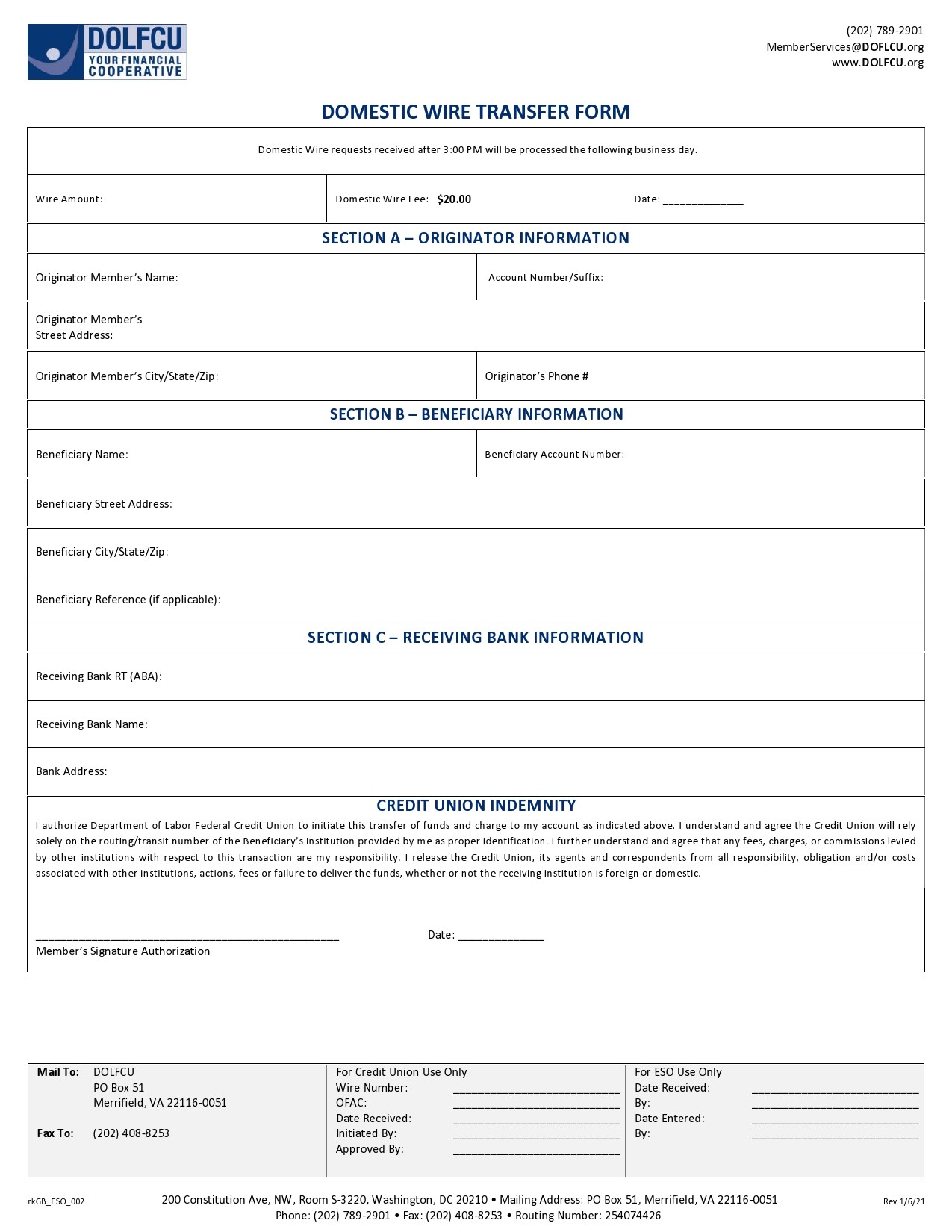

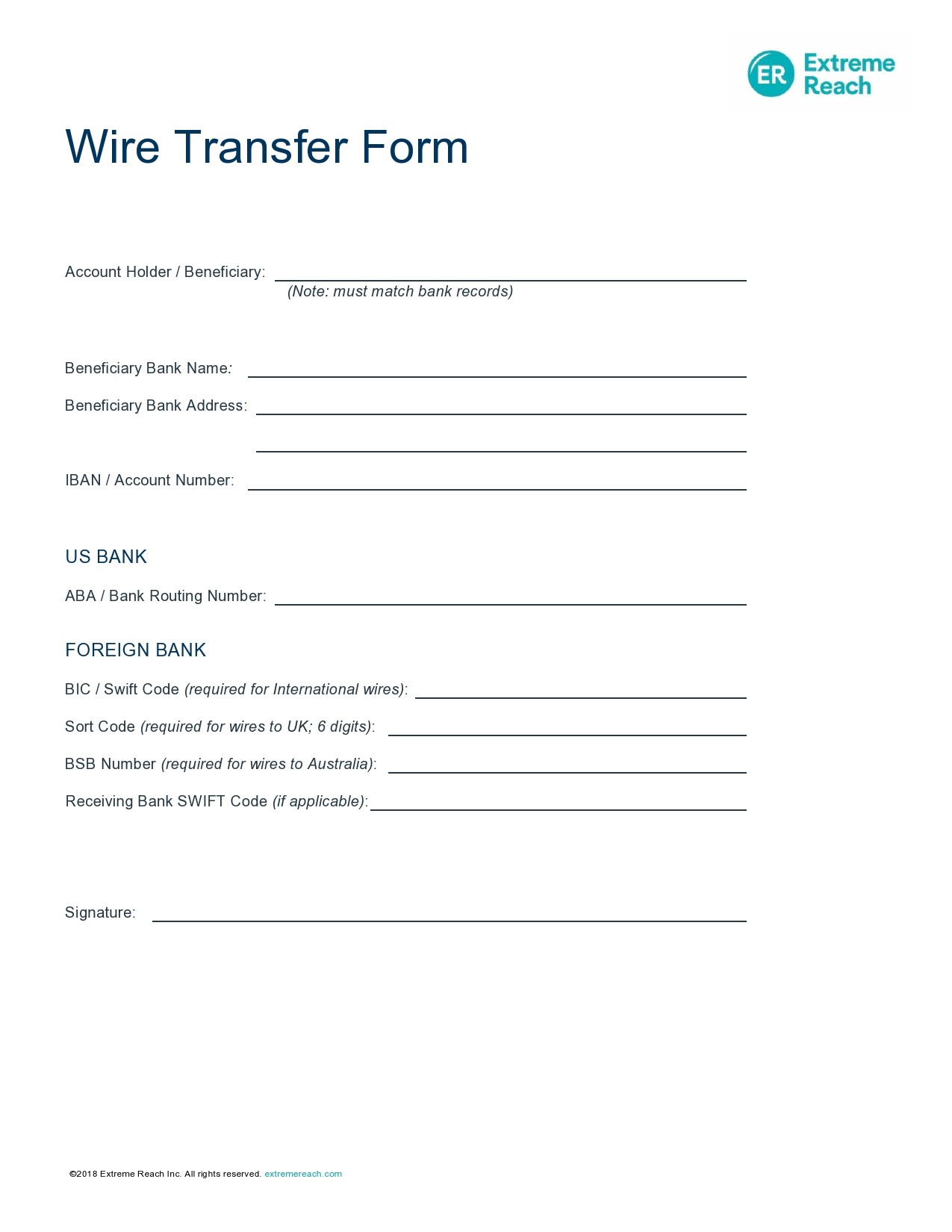

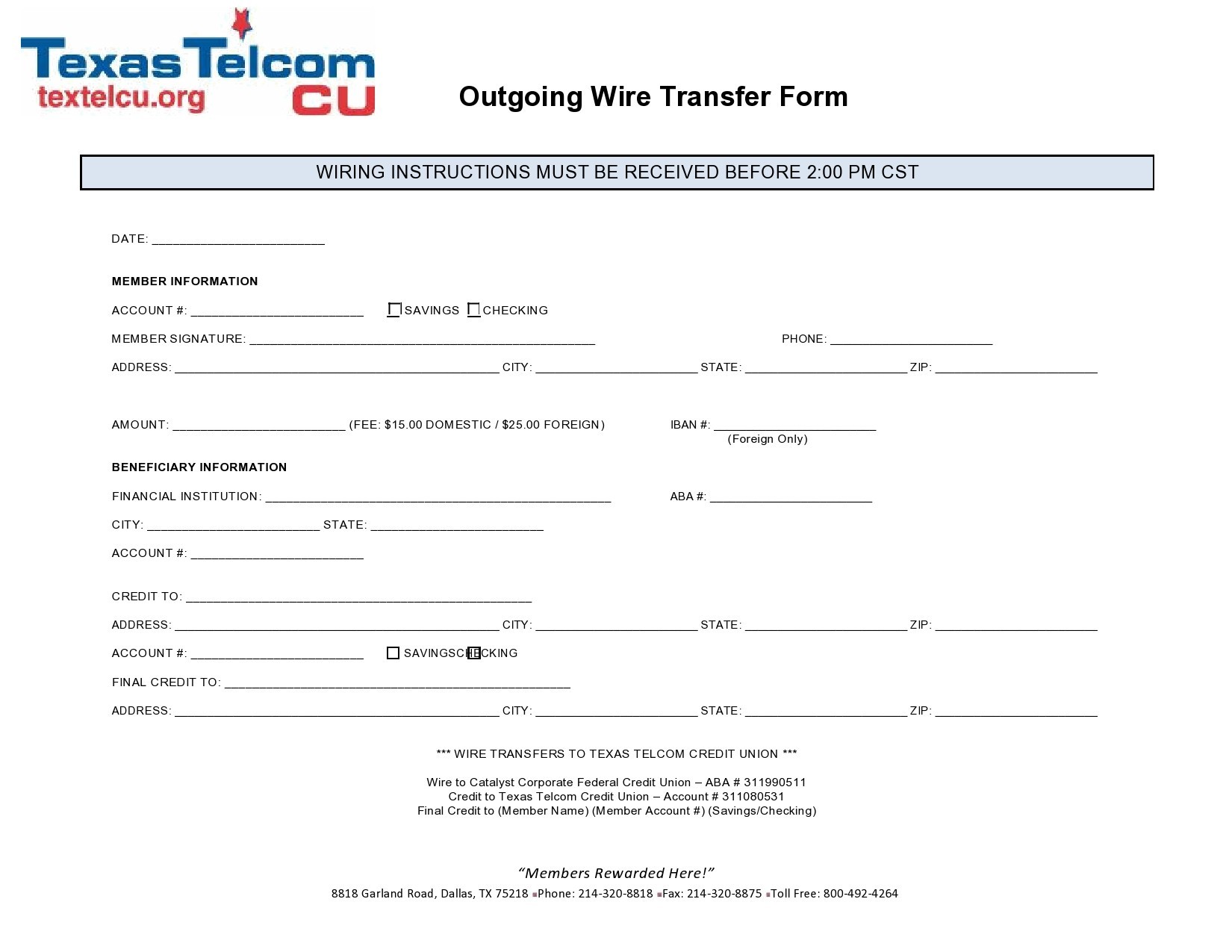

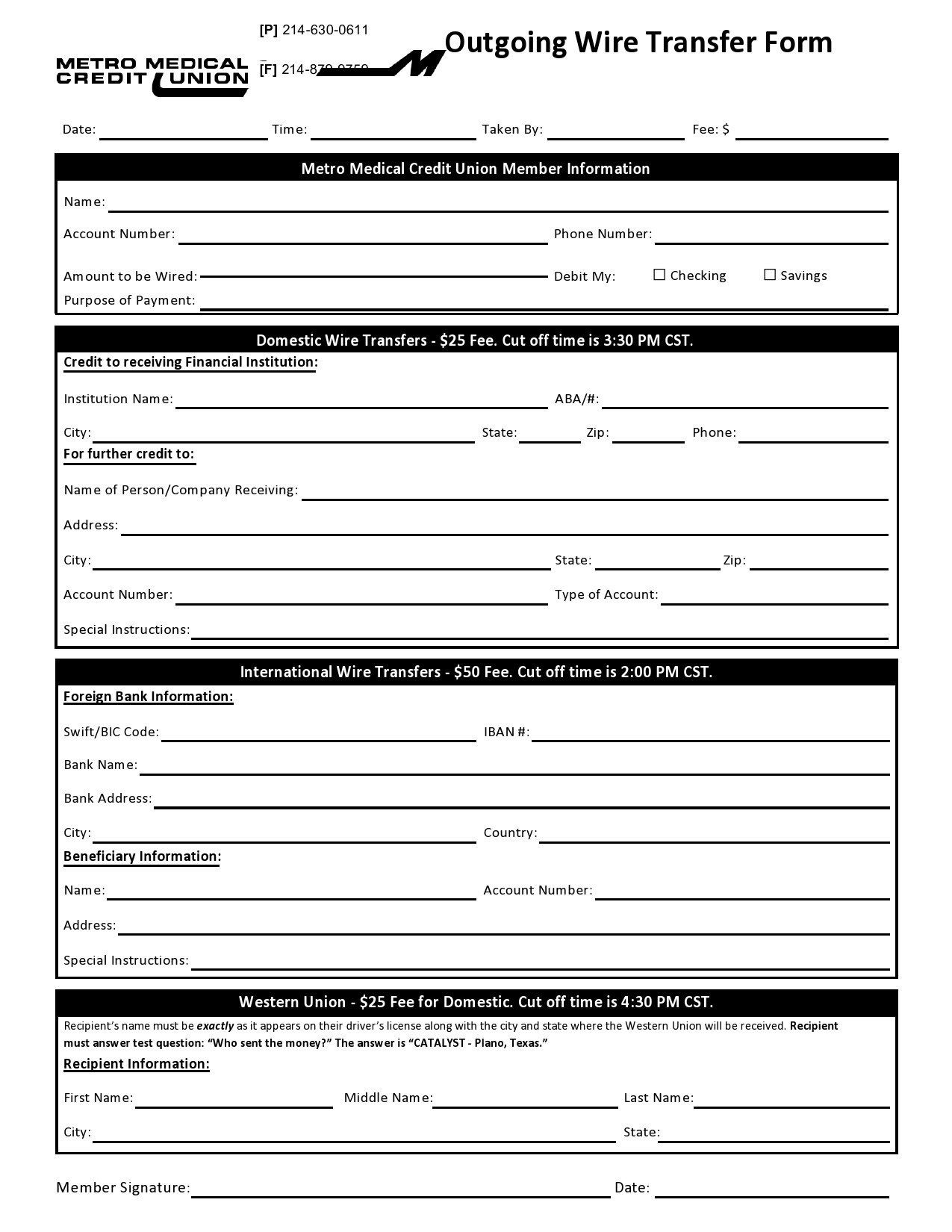

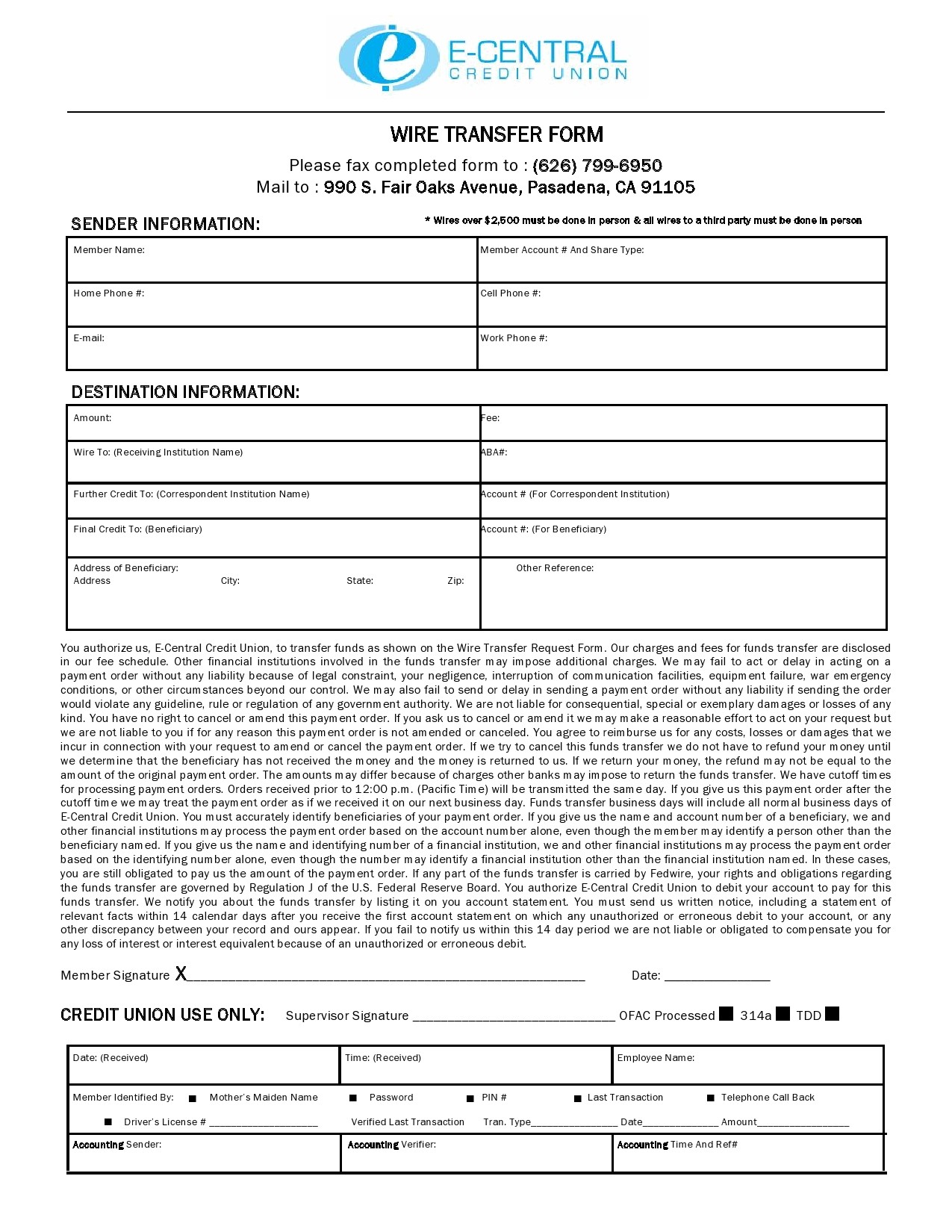

- 6 What does a domestic wire transfer form template look like?

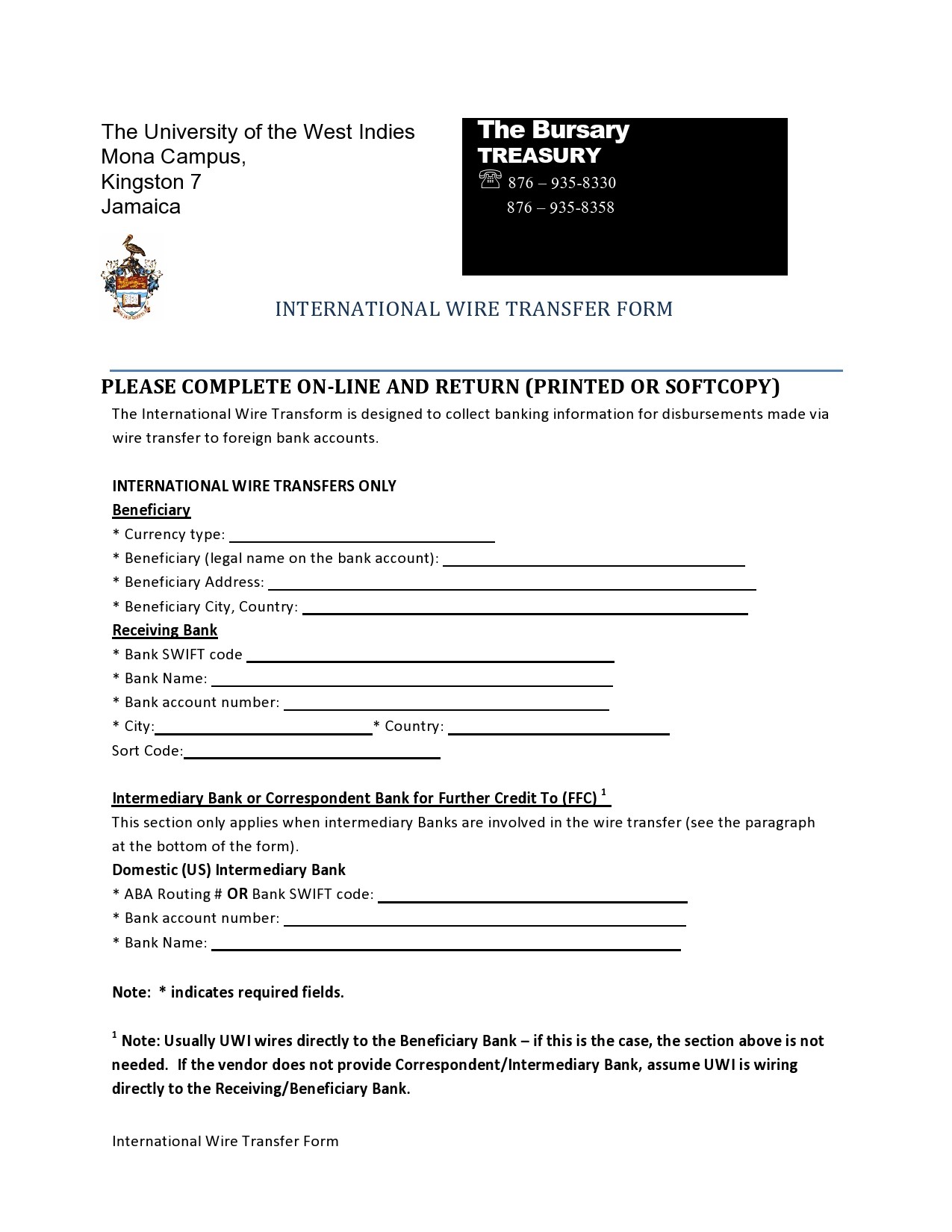

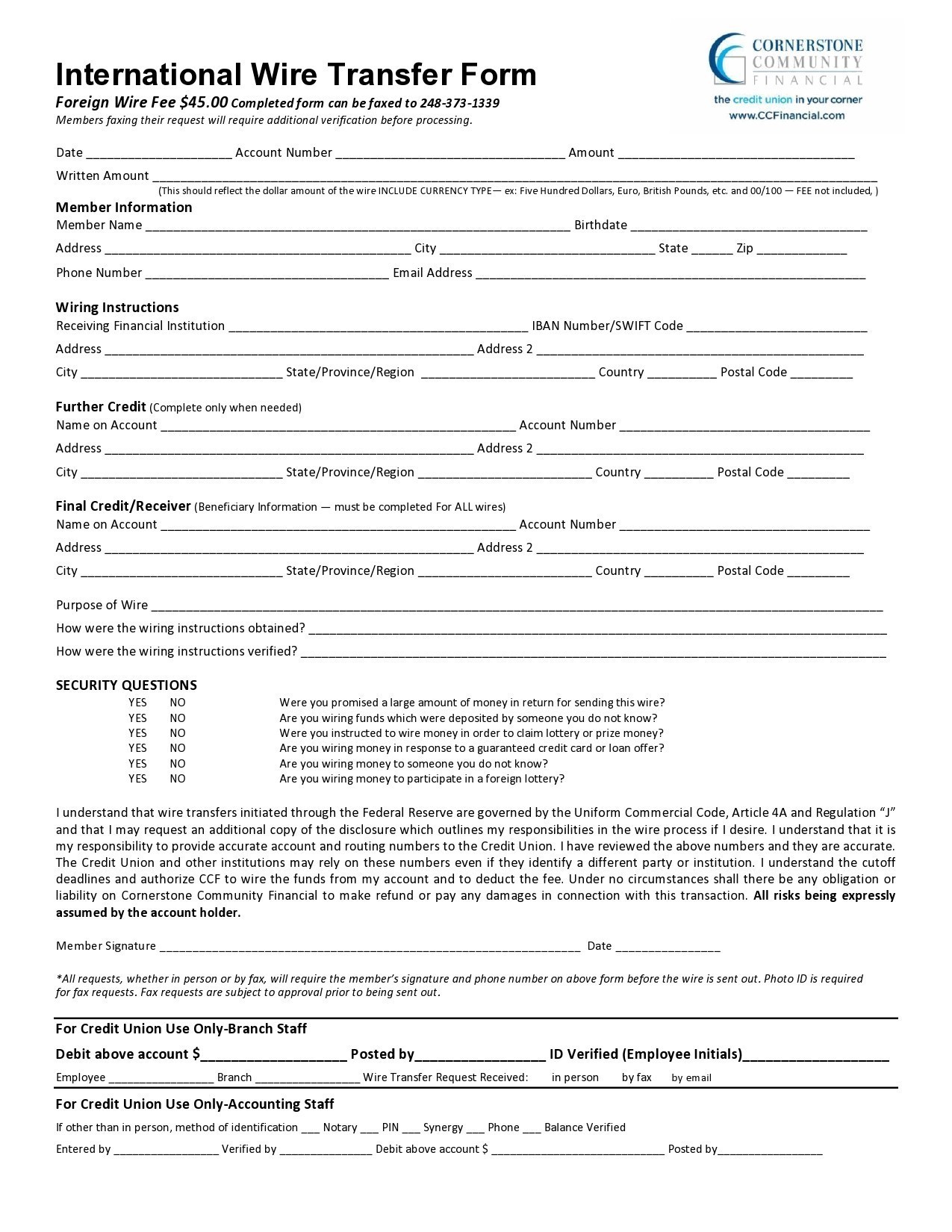

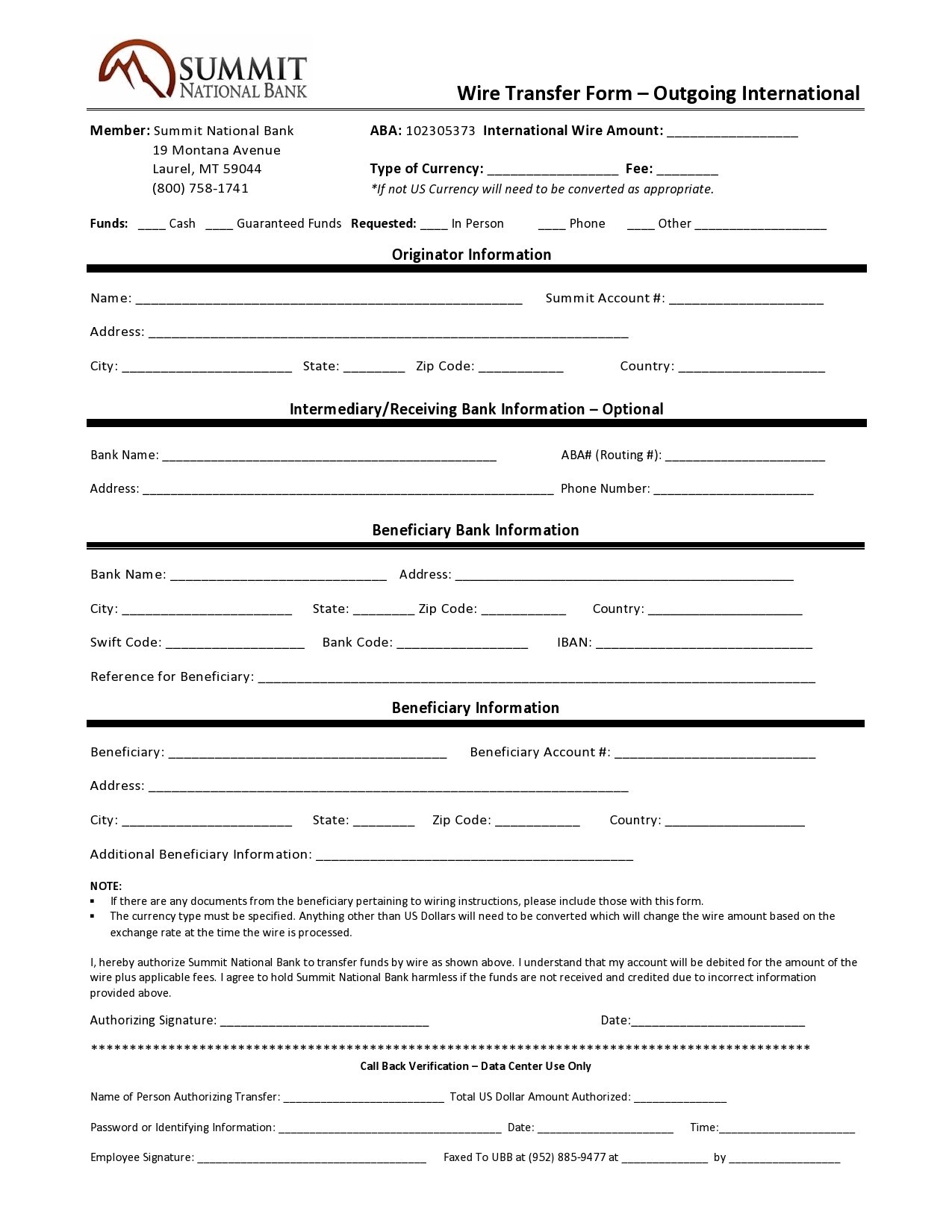

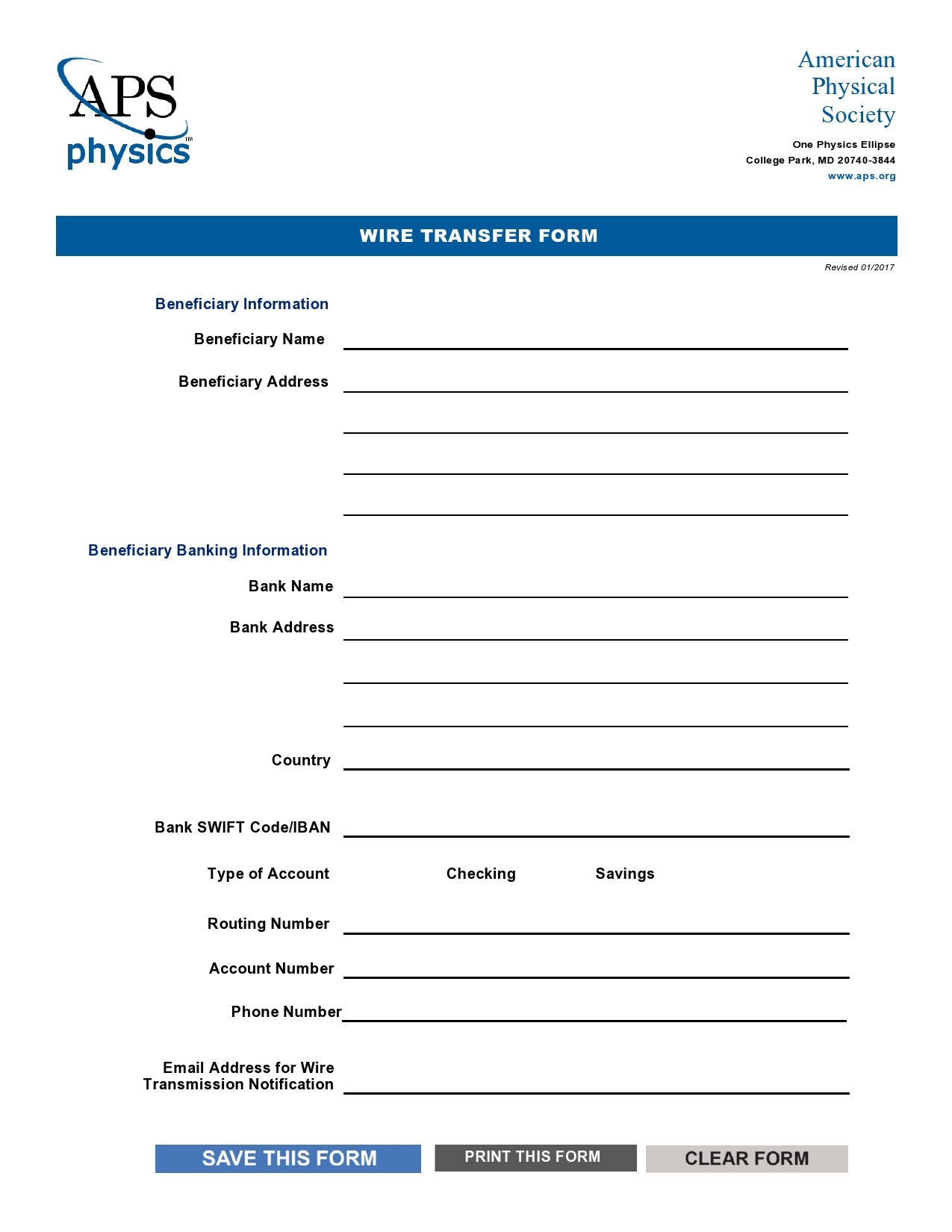

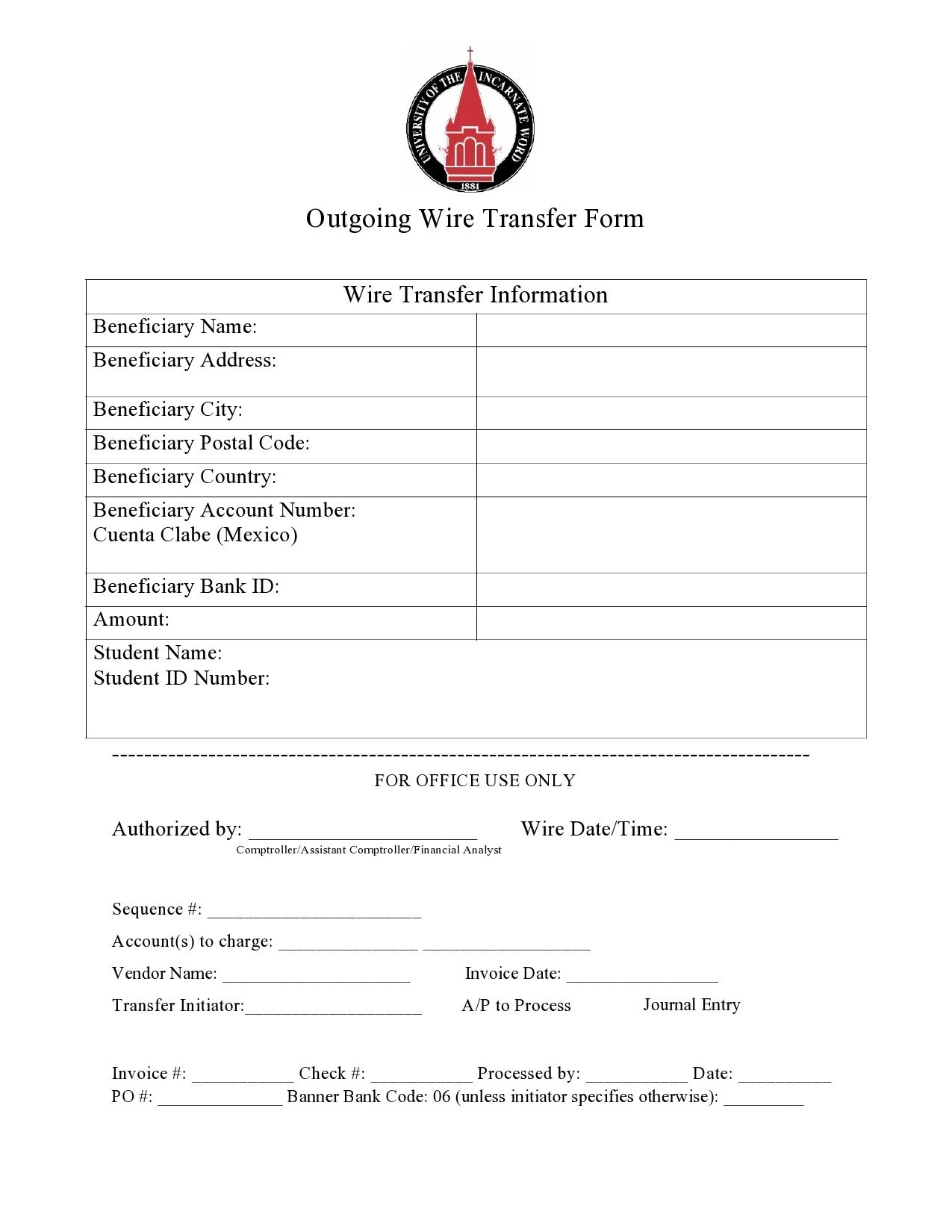

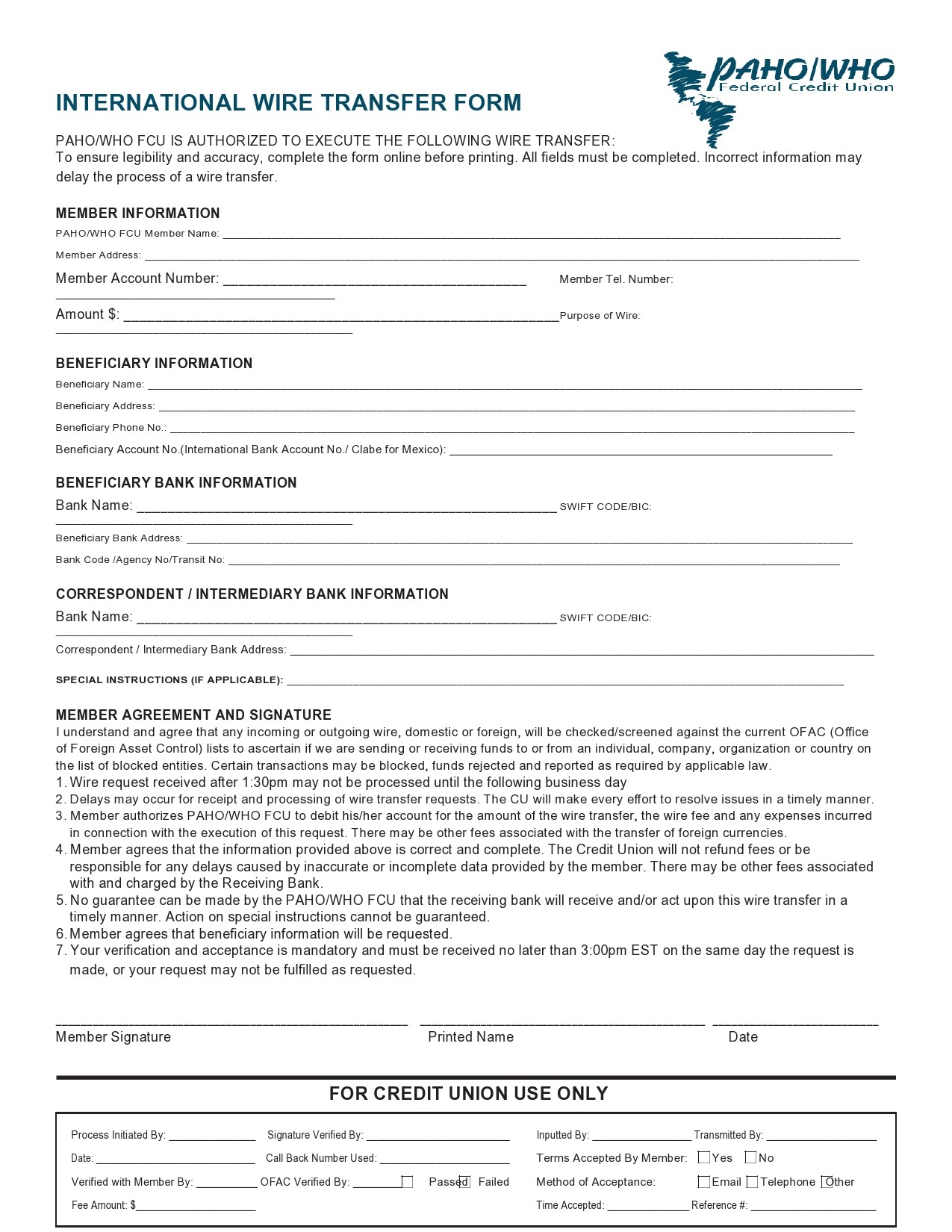

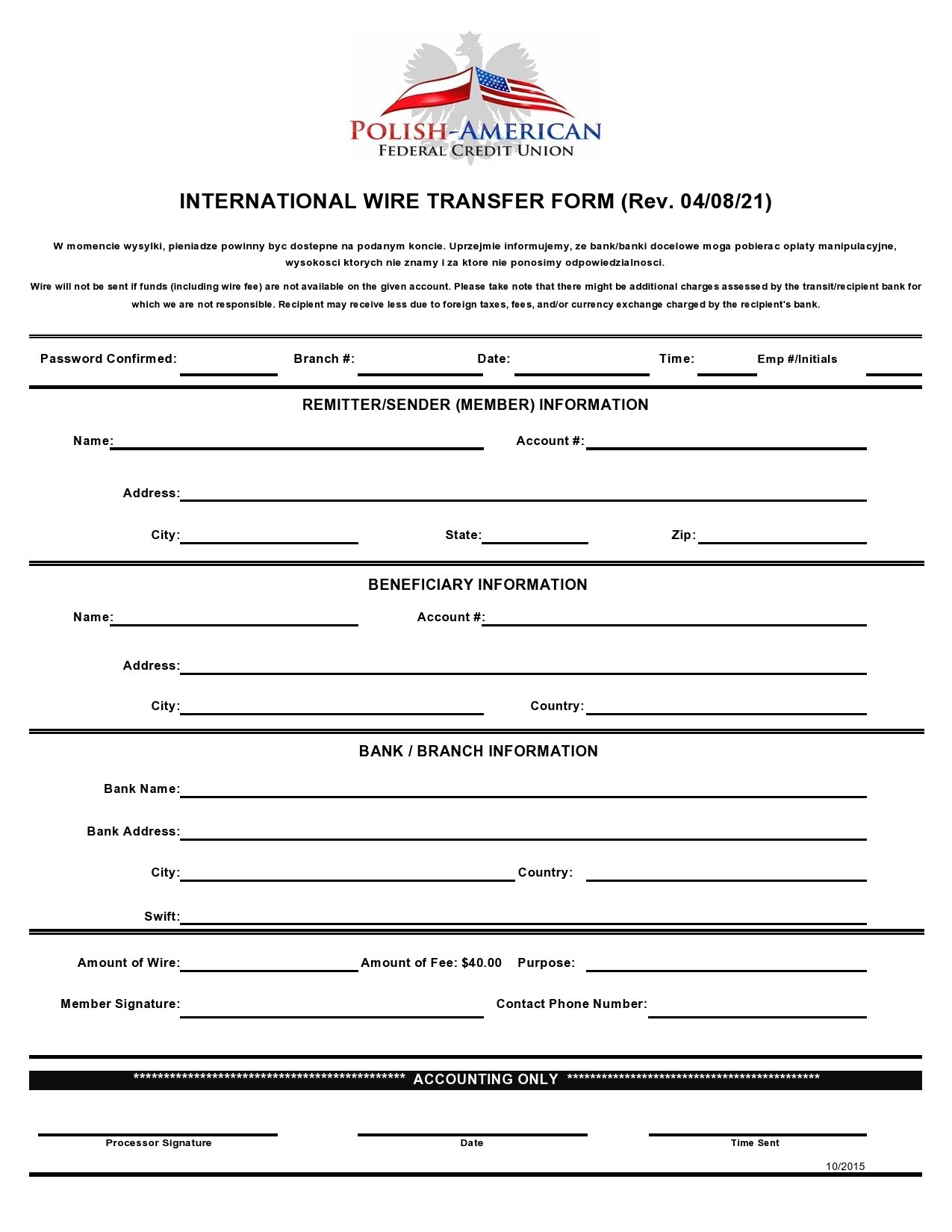

- 7 What does an international wire transfer form template look like?

- 8 Wire Transfer Form Templates

- 9 What documents are required for wire transfer?

- 10 Wire Transfer Request Forms

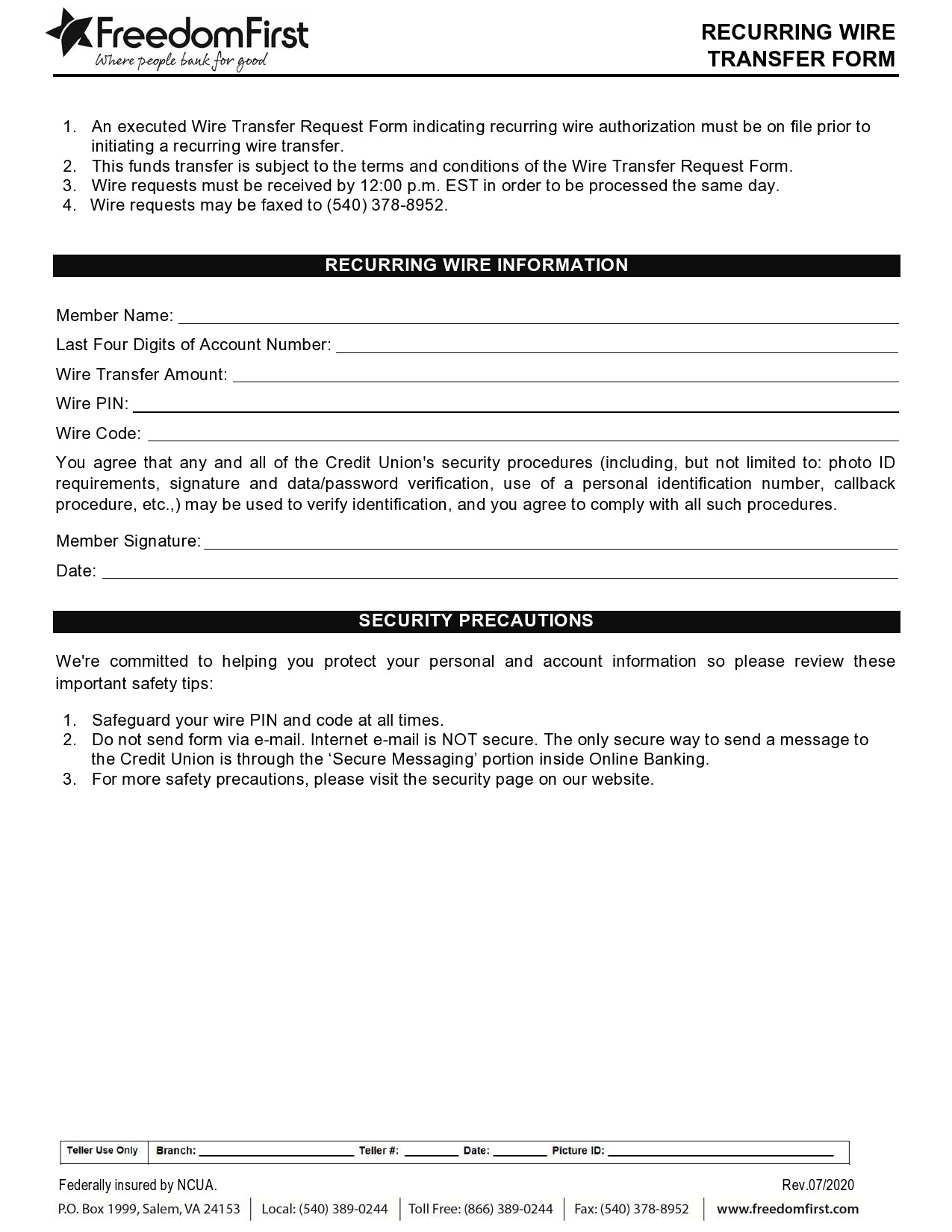

- 11 How do I fill out a wire transfer form?

- 12 Common definitions

- 13 How much will you pay for a wire transfer?

- 14 How long does a wire transfer take?

- 15 Mistakes to avoid when filing a wire transfer request form

Wire Transfer Forms

What is a wire transfer request form?

A wire transfer request form is a form filled out by a person who intends to transfer money from their bank account to someone else or an entity. The form is usually used when the transferring and receiving banks are located far geographically.

The form gives instructions about the amount involved and the recipient details. Wire transfers are electronic money transfers between banks. They are the fastest way to transfer money when time is of the essence.

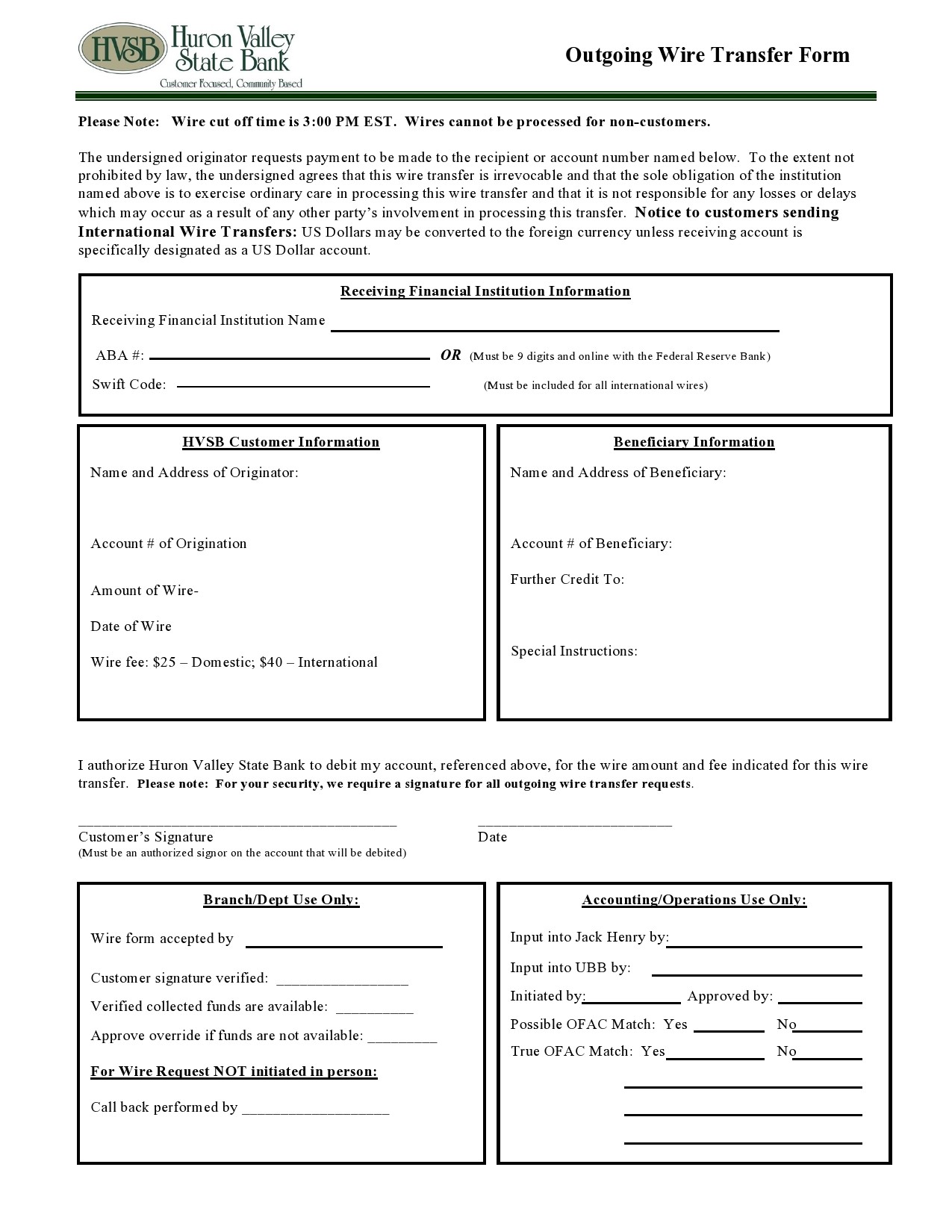

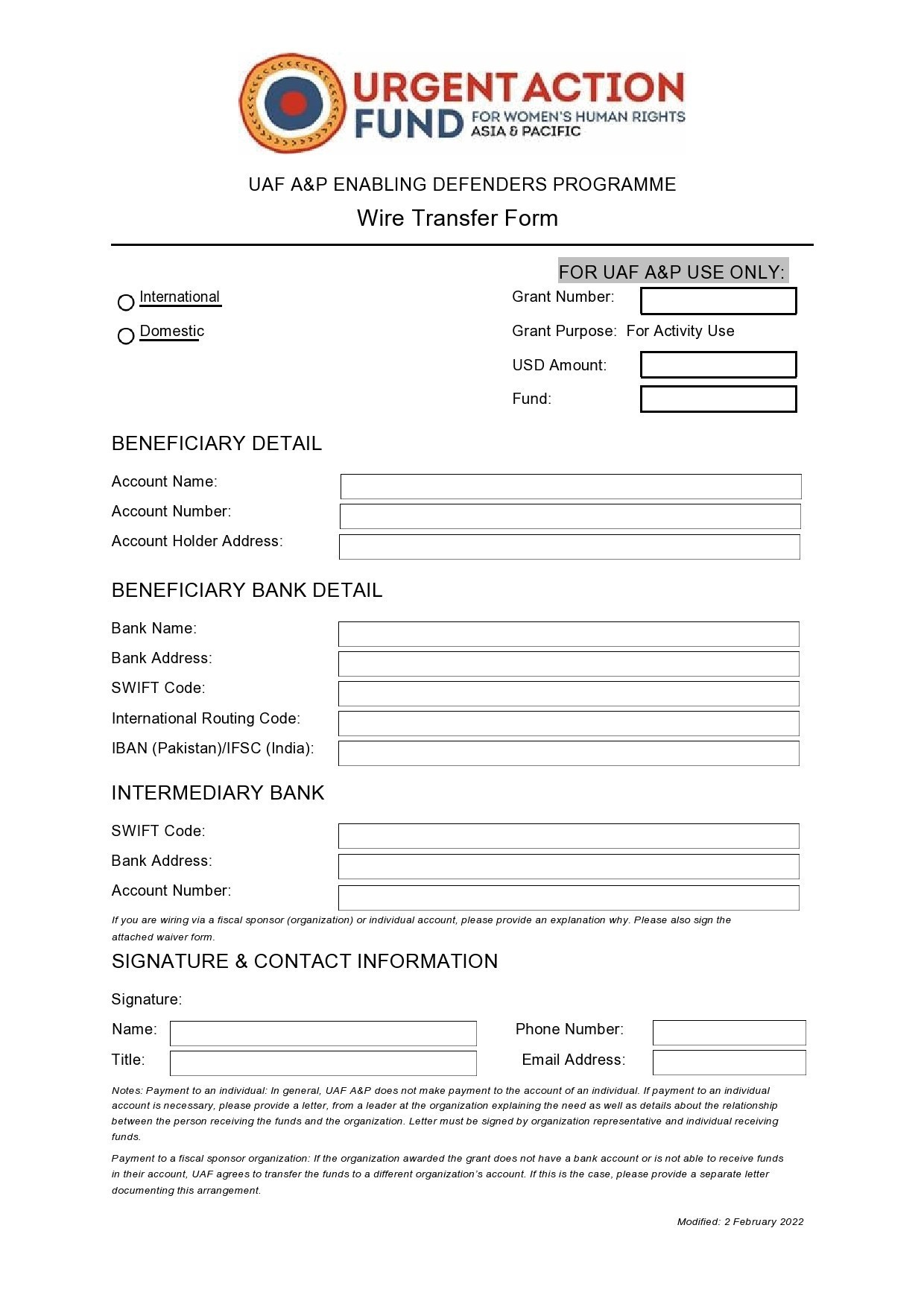

Wire Instructions Templates

Types of wire transfers

When filling out the wire transfer request form, the transferer will have an option to choose one of the two types of wire transfers.

Domestic wire transfers

- A domestic wire transfer is an electronic money transfer done locally. Both the transferor and recipient must be located within the same country. They could also be located within the same state and sometimes the city. A domestic wire transfer ensures the recipient receives the money fast.

International wire transfer

Another name for international wire transfers is remittance transfers. They are transfers done when both the transferer and recipient are located in different countries across the world. Mostly, the minimum amount when sending a wire transfer from the US to another country is $15. Other names for international wire transfers are:

- International wires

- Remittance transfers

- International money transfers

How a wire transfer works?

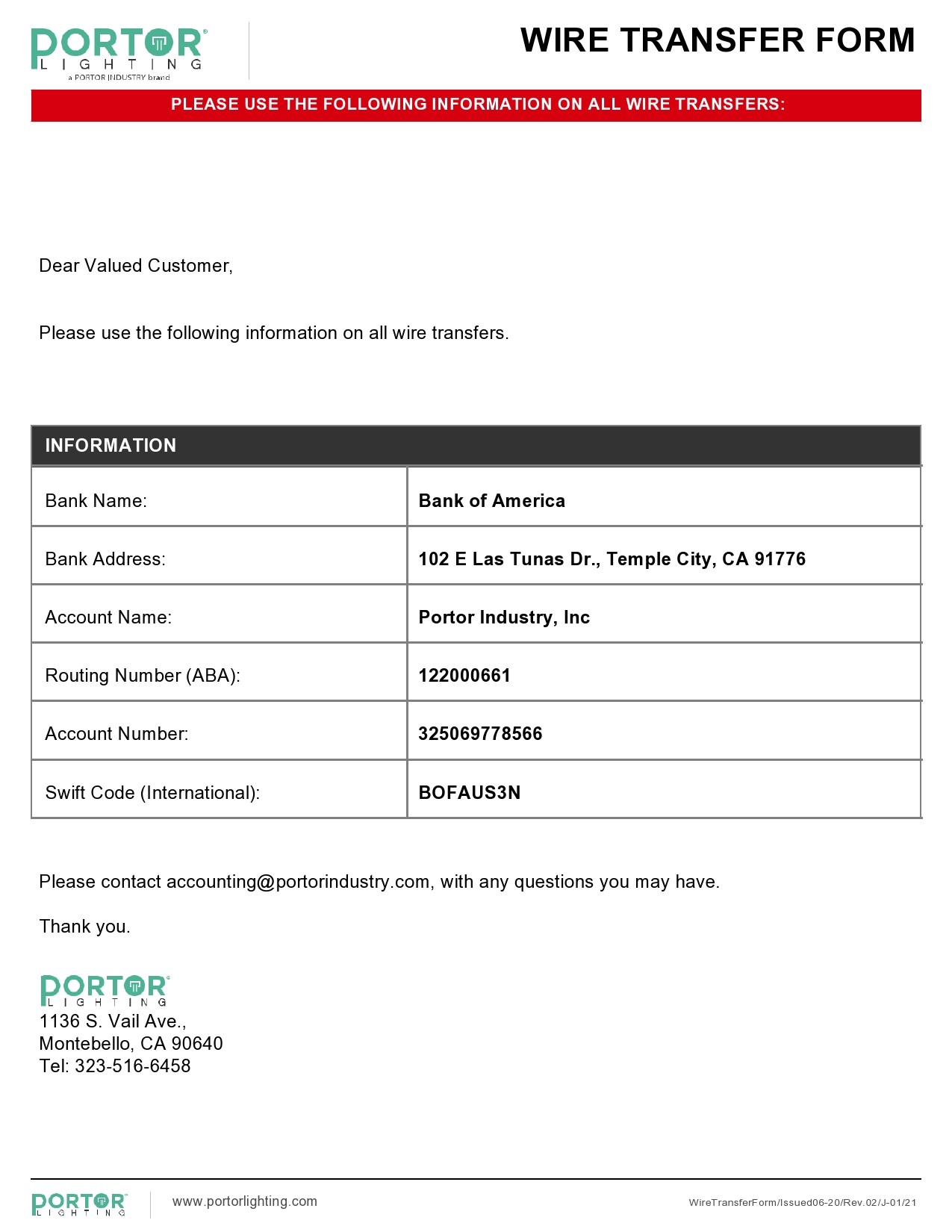

The transferer fills a wire instructions template which is a document that gives instructions for the transfer. They submit it to the bank, and then the bank moves the money electronically to the recipient bank. The wire transfer fee is paid upfront for the transfer to take place. If the details provided are incomplete, the wire transfer cannot be done. The wire instructions template for local transfer is different from the template used for international transfer.

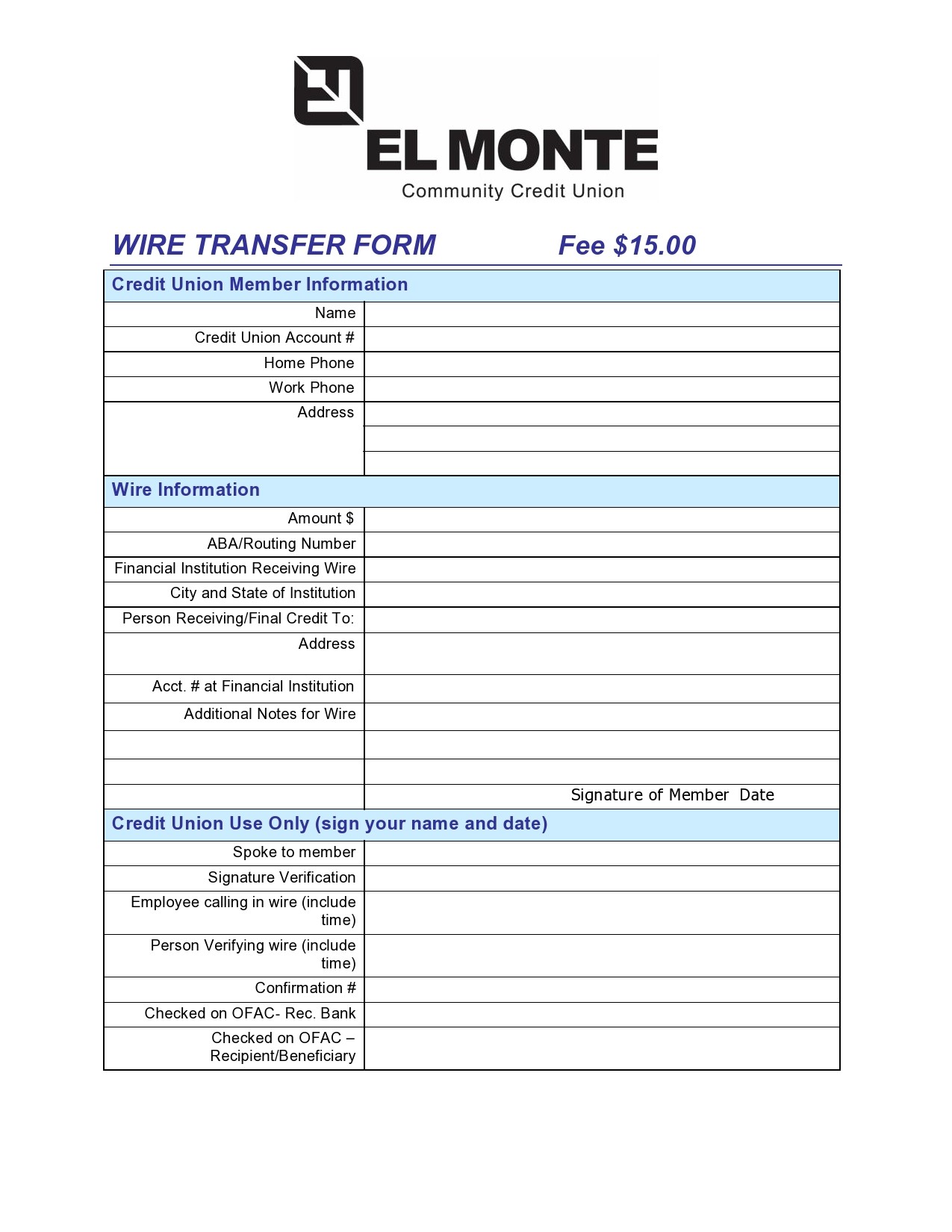

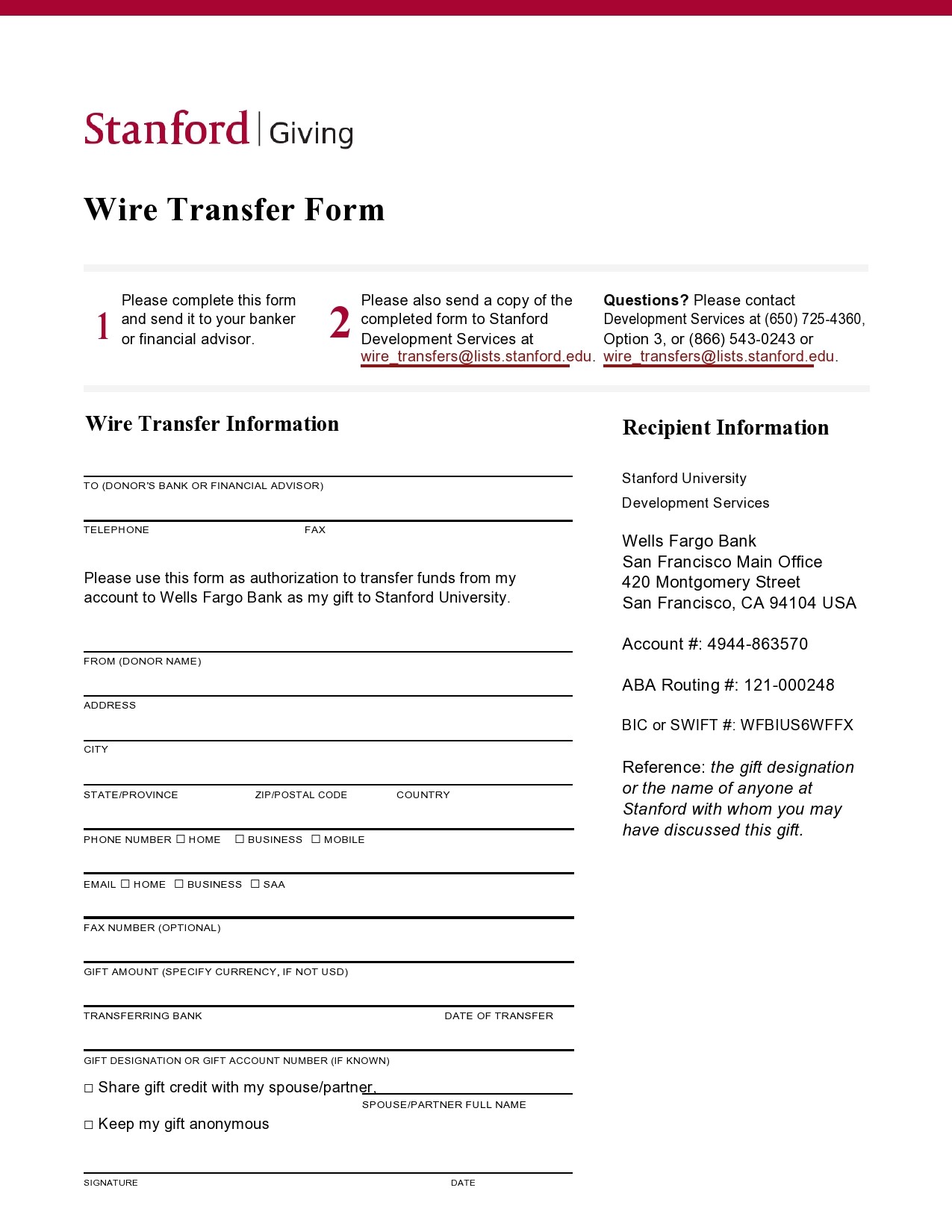

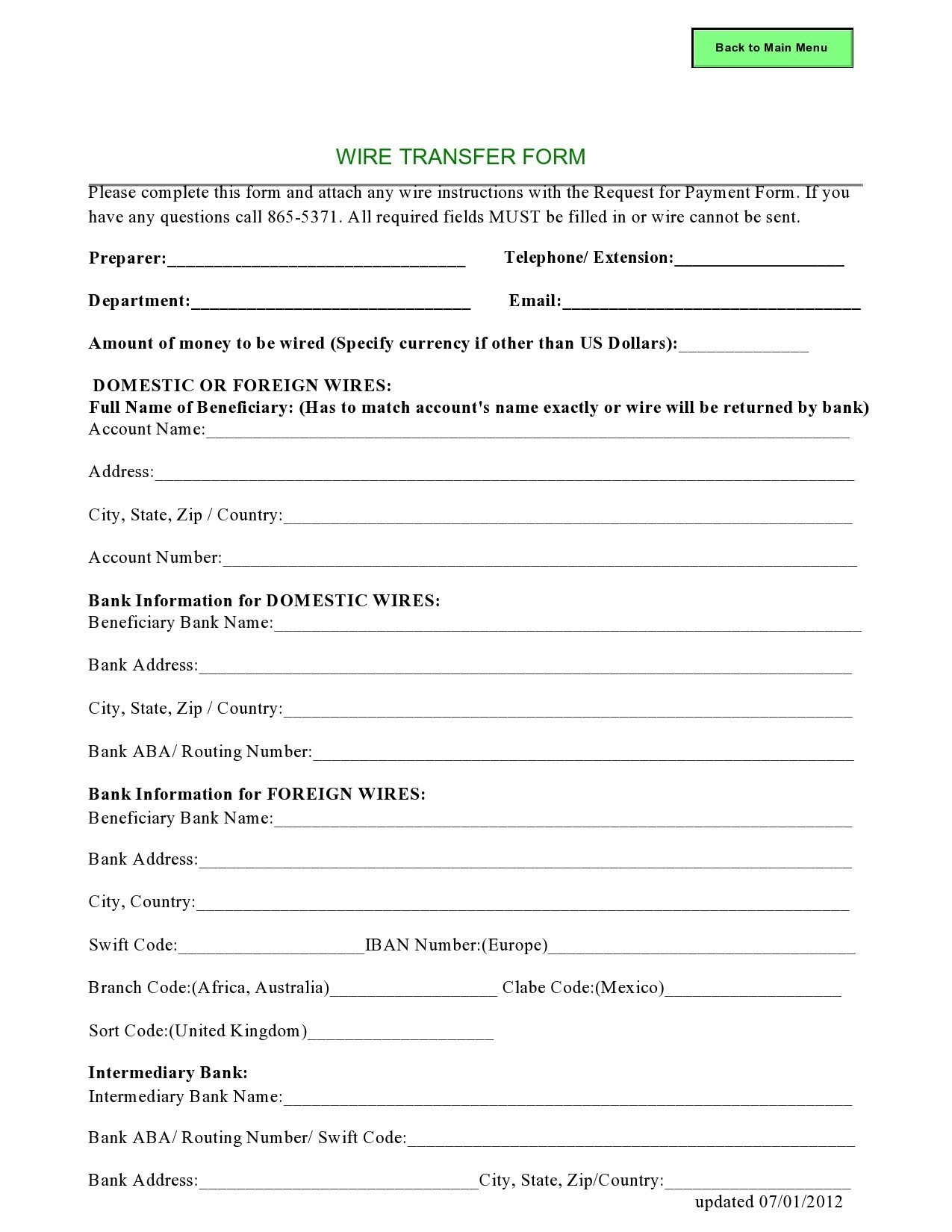

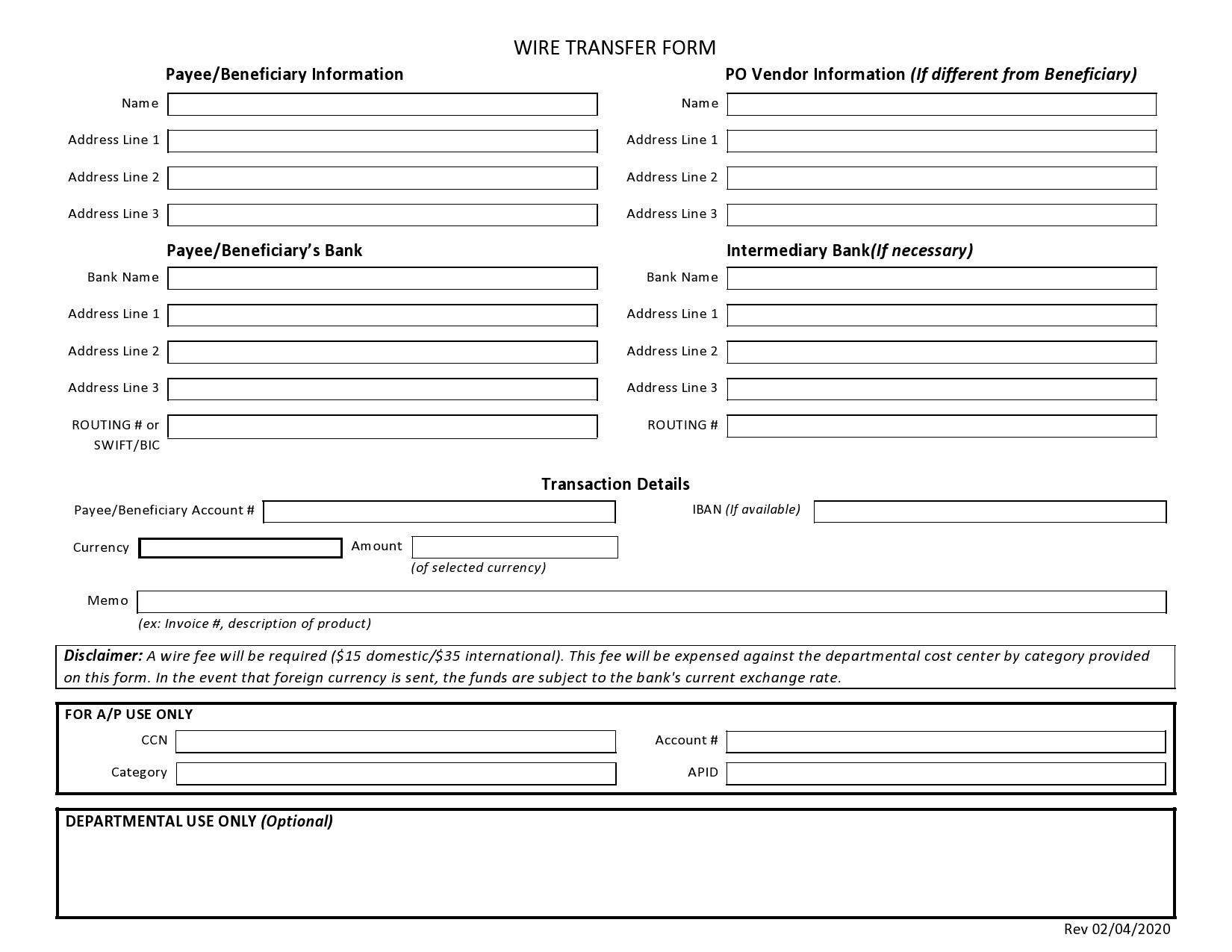

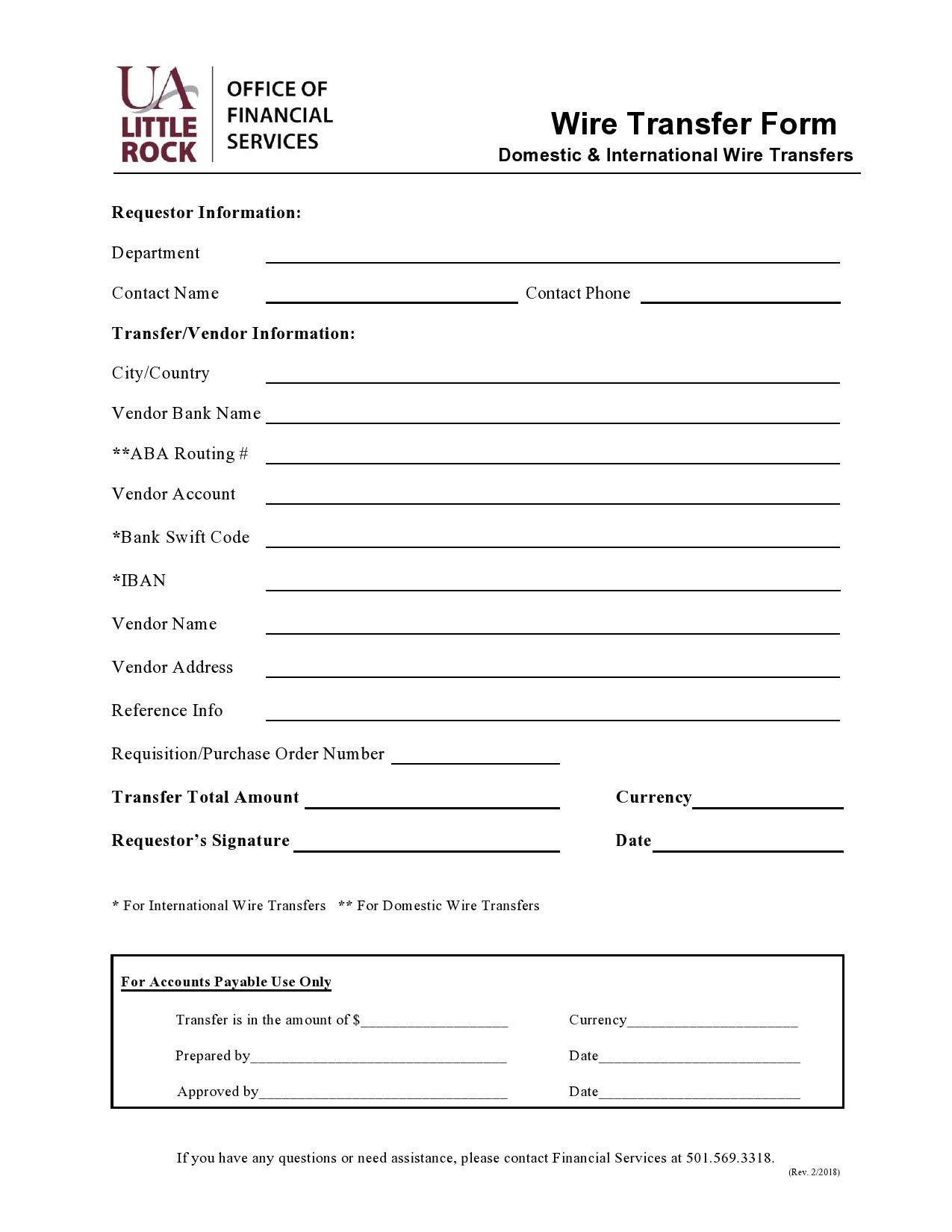

What does a domestic wire transfer form template look like?

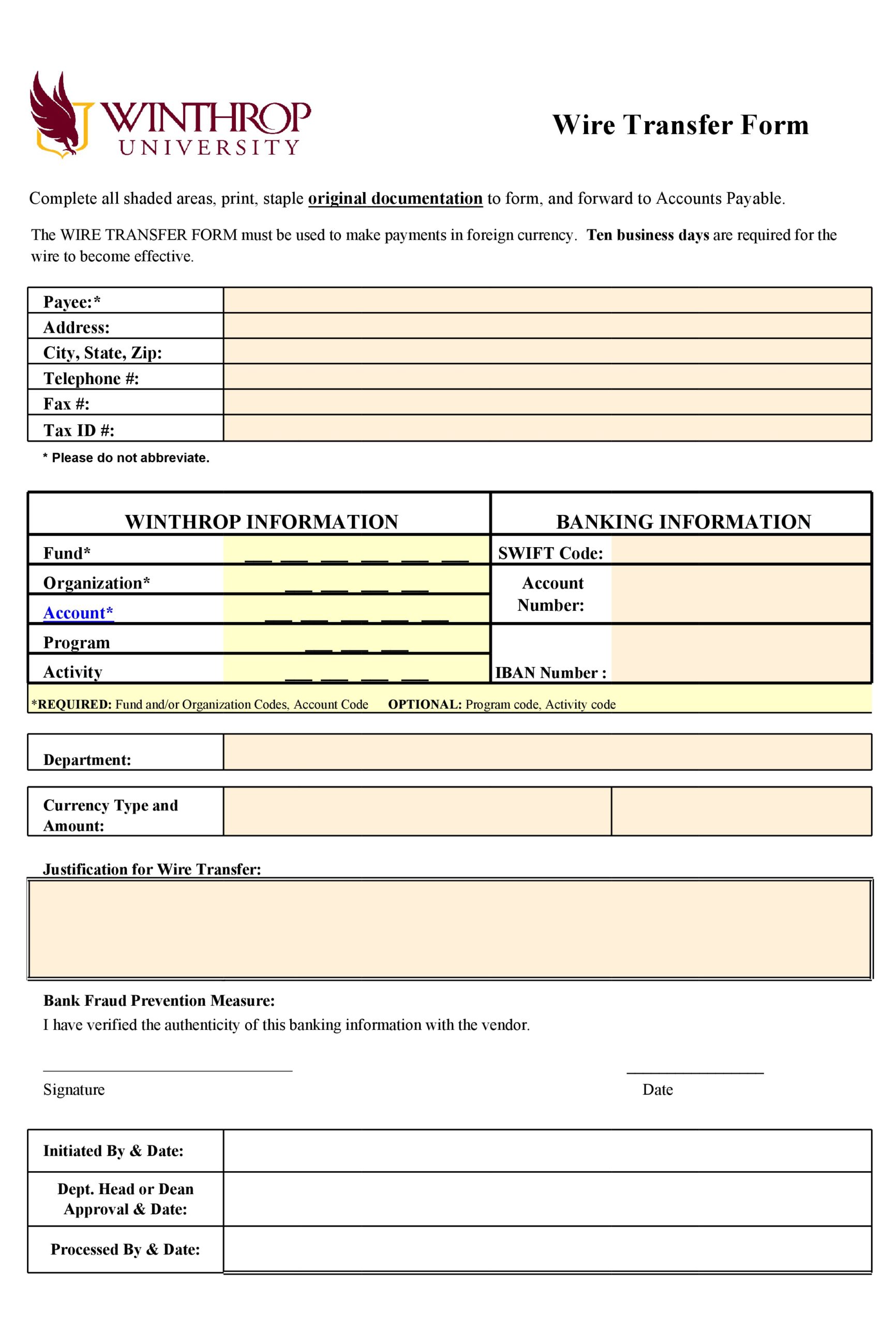

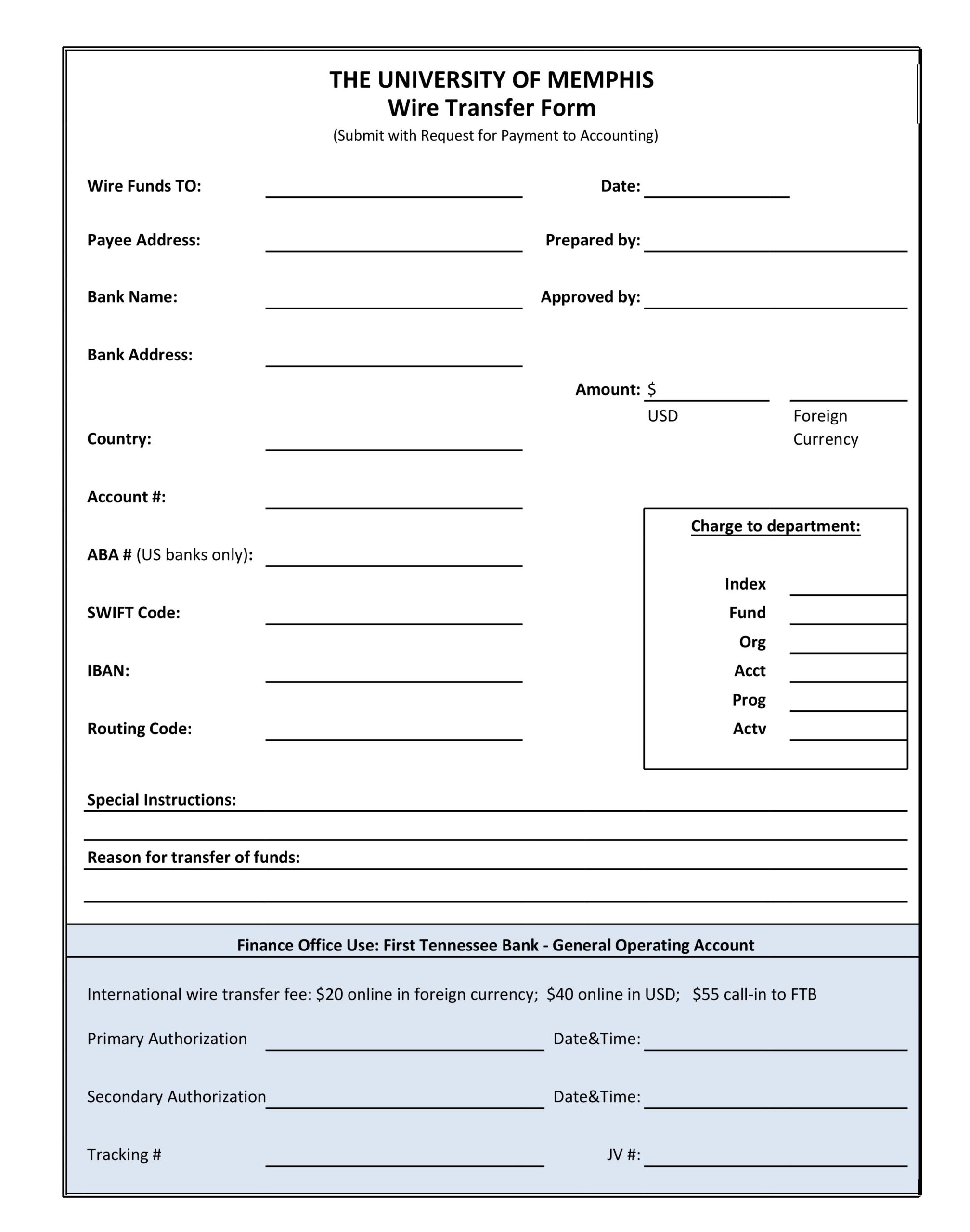

A domestic wire transfer form template provides information for domestic wire transfers. It contains the following information:

Senders’ information

The sender’s information provided in the wire transfer form template is as follows:

- Your name as it appears in your bank account

- Your bank account number

- The date when the form was filled

- Your signature

Recipient’s information

The recipient information includes the following details:

- Recipient’s full name

- Physical address – helps make sure the money goes to the right recipient

- Recipient’s bank account number

- Recipient’s ABA/ routing number – when you want the transfer to go directly to their bank

Amount being transferred

You must give the specific amount of money you want to be transferred. Provide information about the source of the money you want to transfer. The source can either be a nonbank/independent wire transfer or your bank. When the money is coming from your bank, the source can either be your savings or checking account. When it is from a nonbank/independent source, it can either be in:

- Cash

- Debit

- Credit

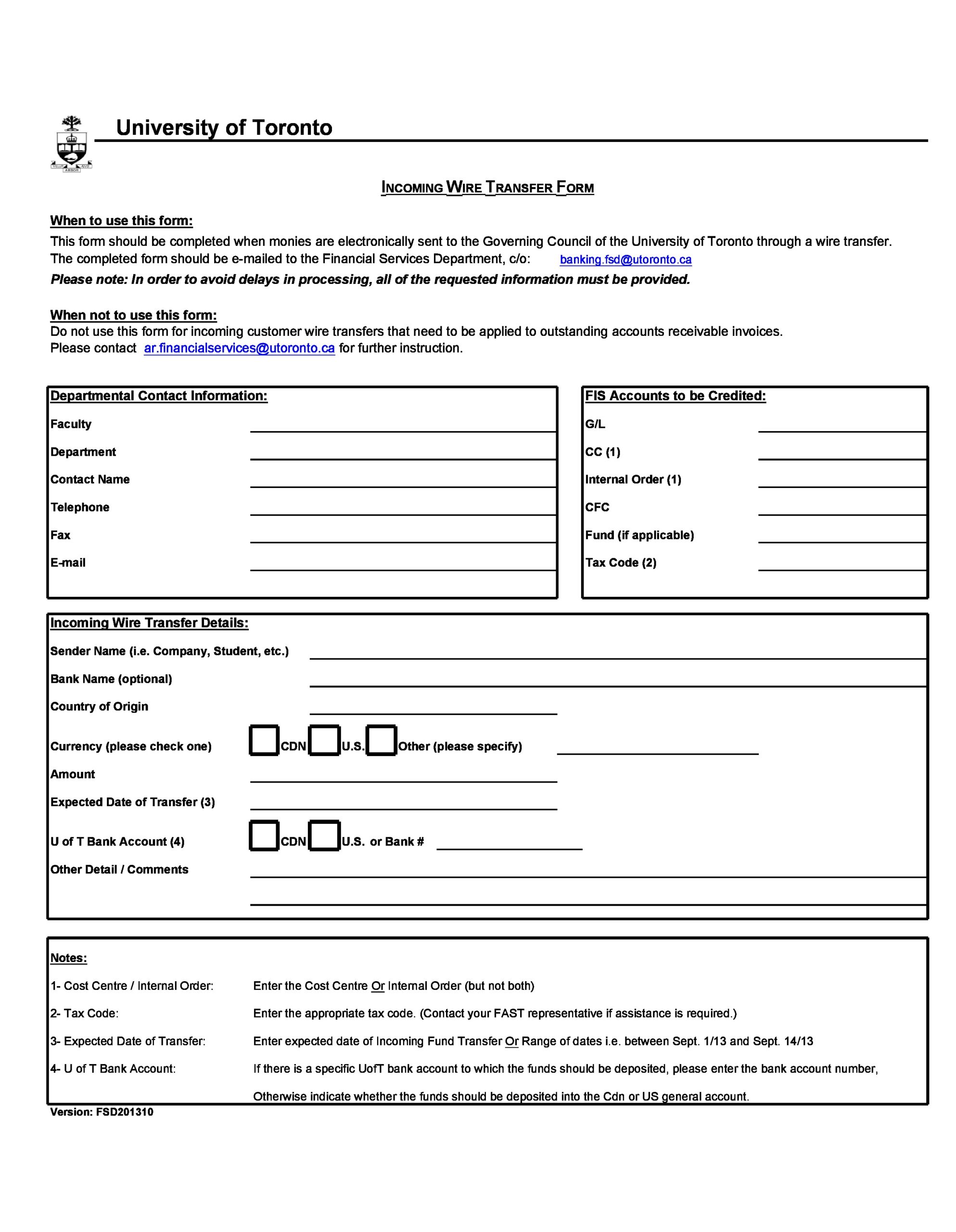

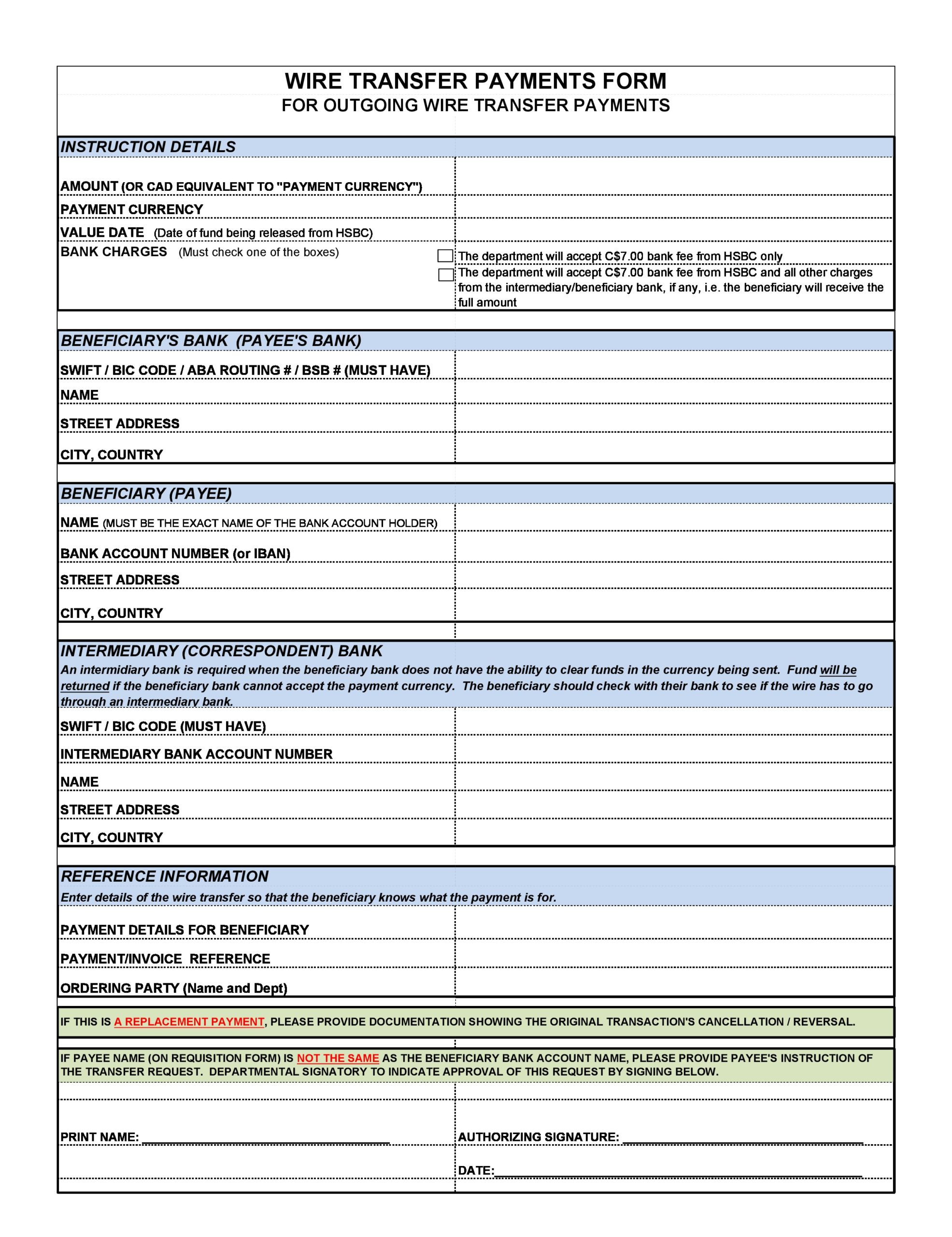

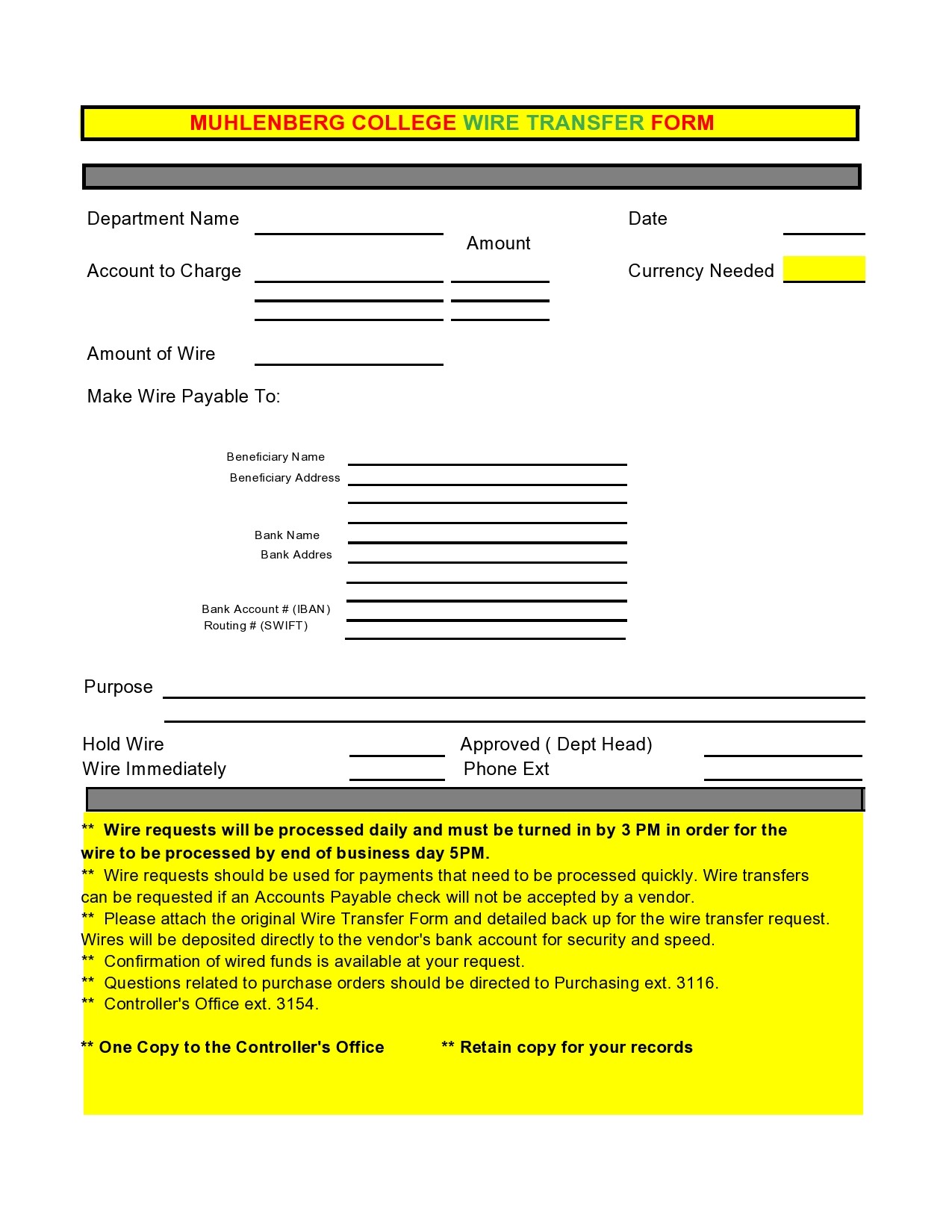

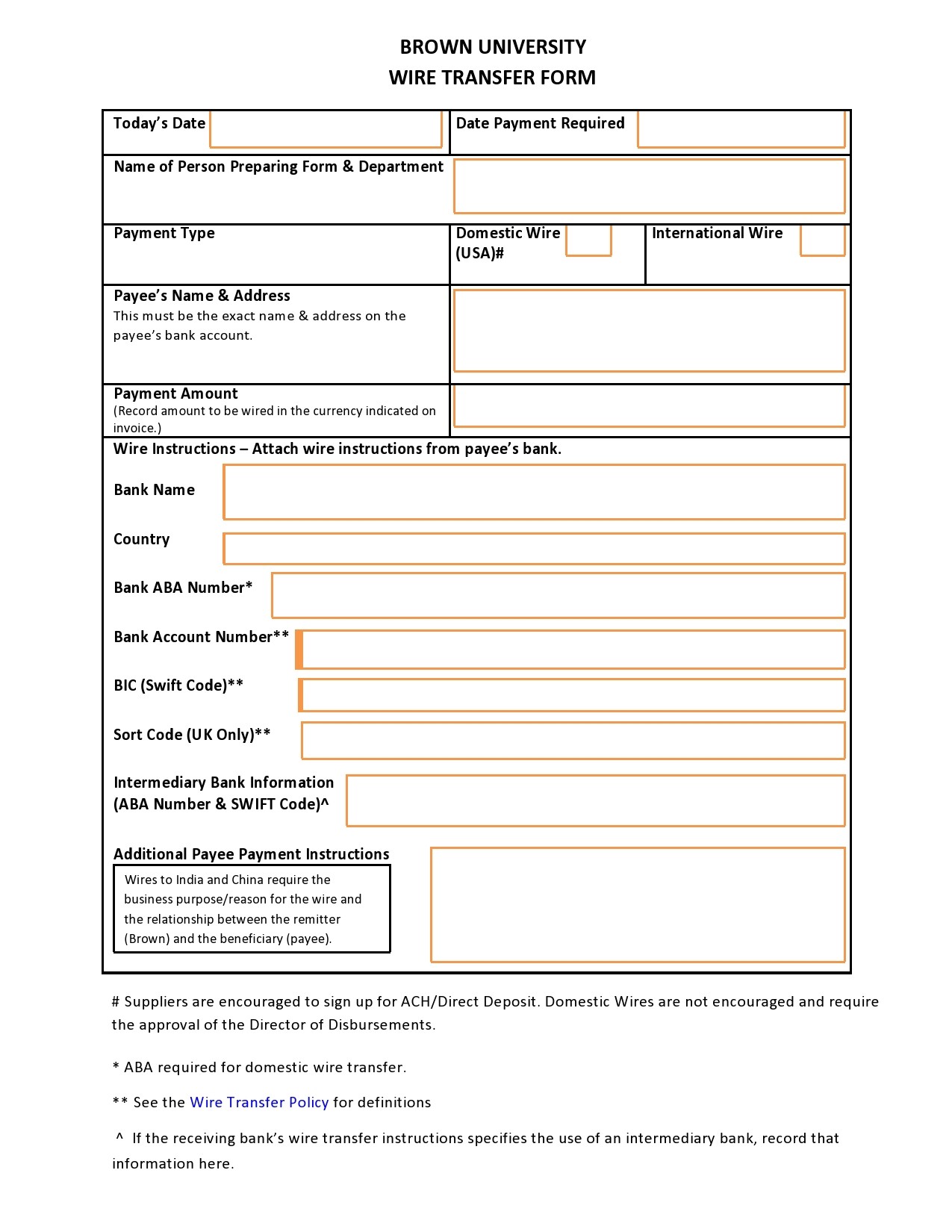

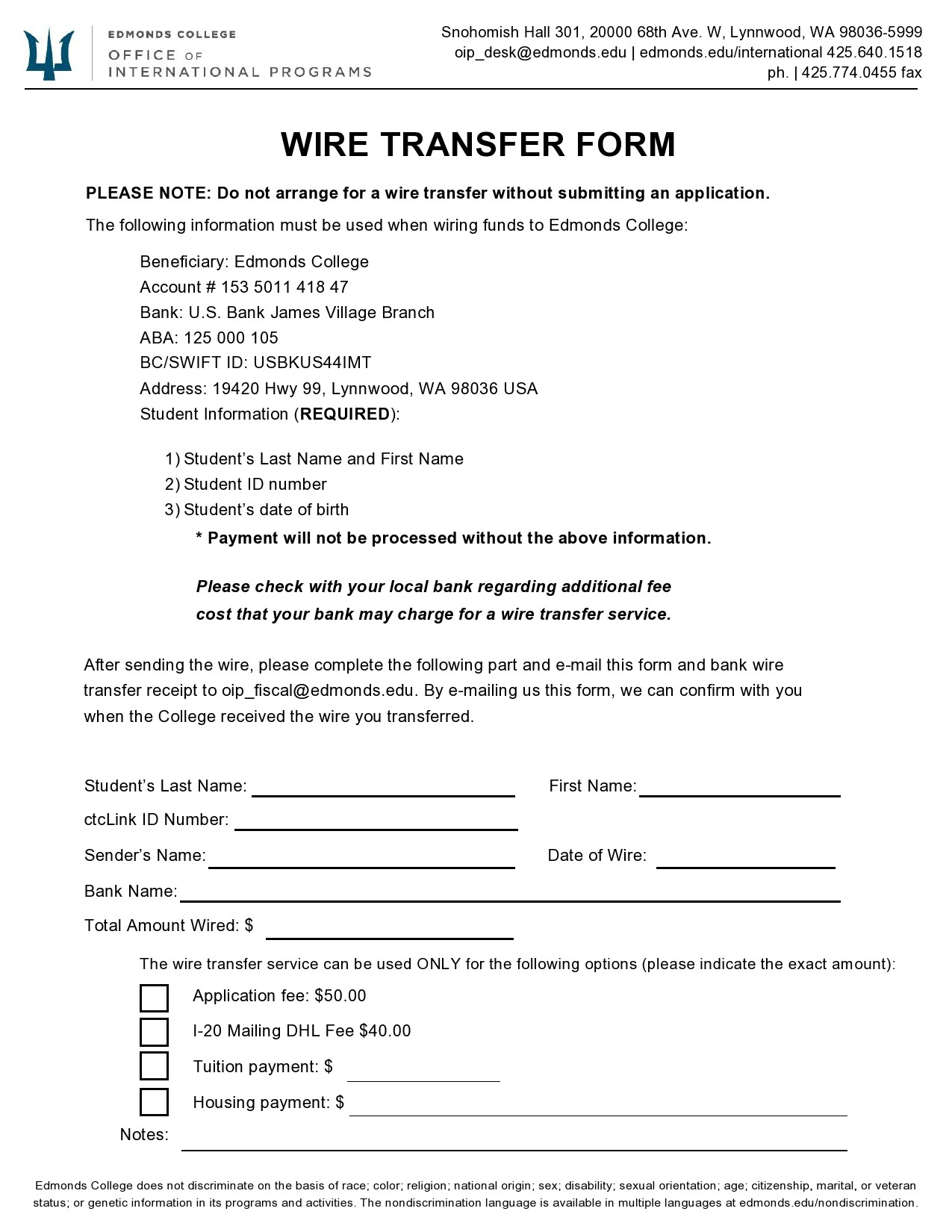

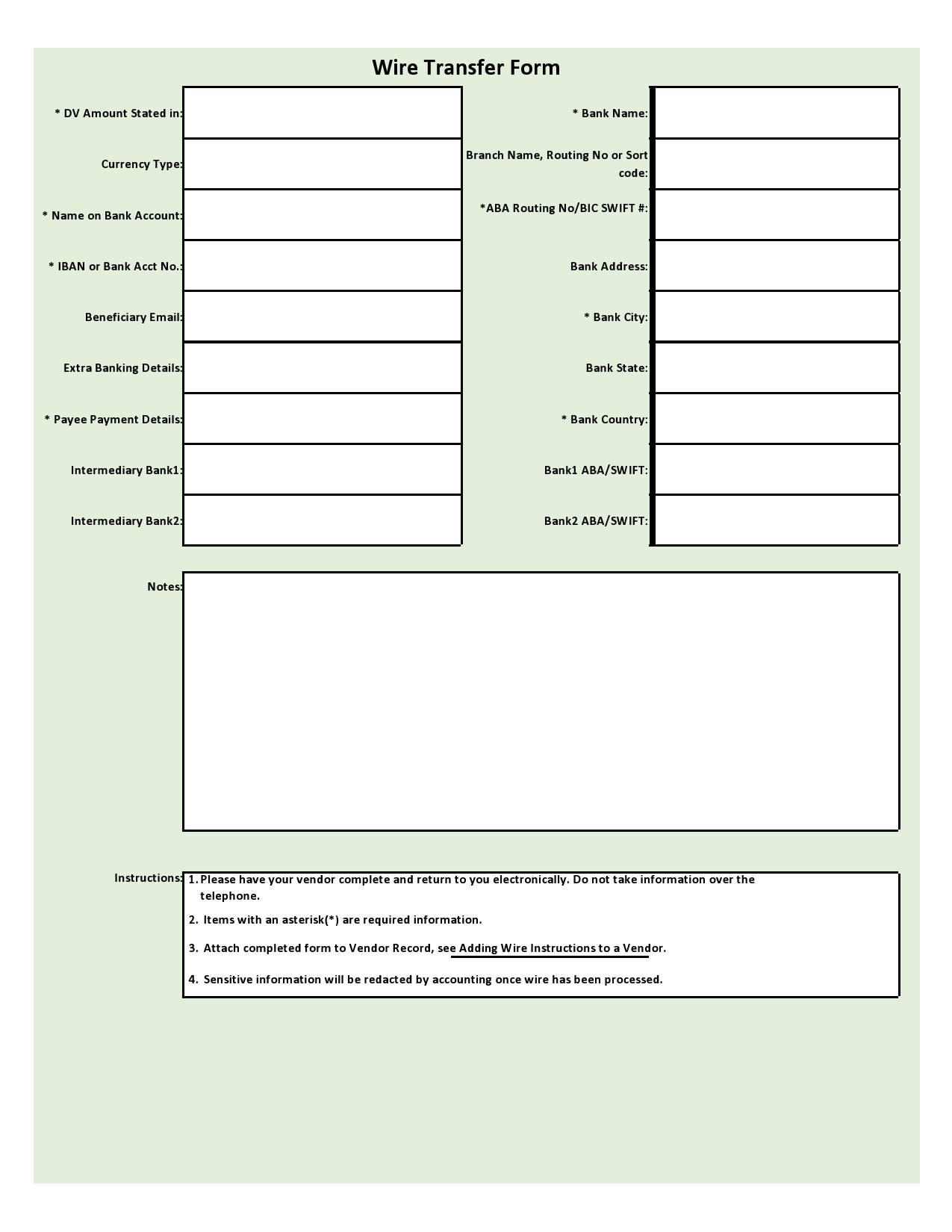

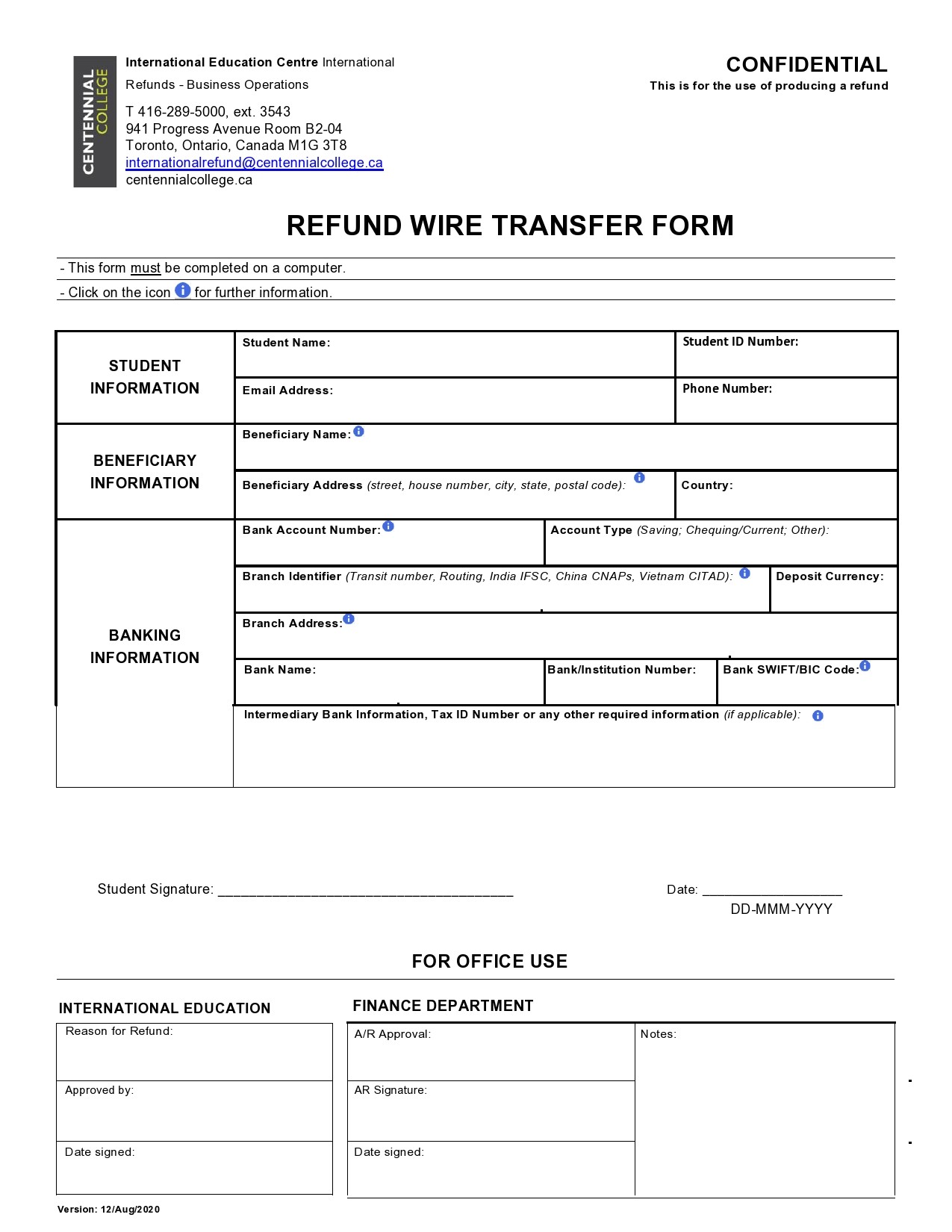

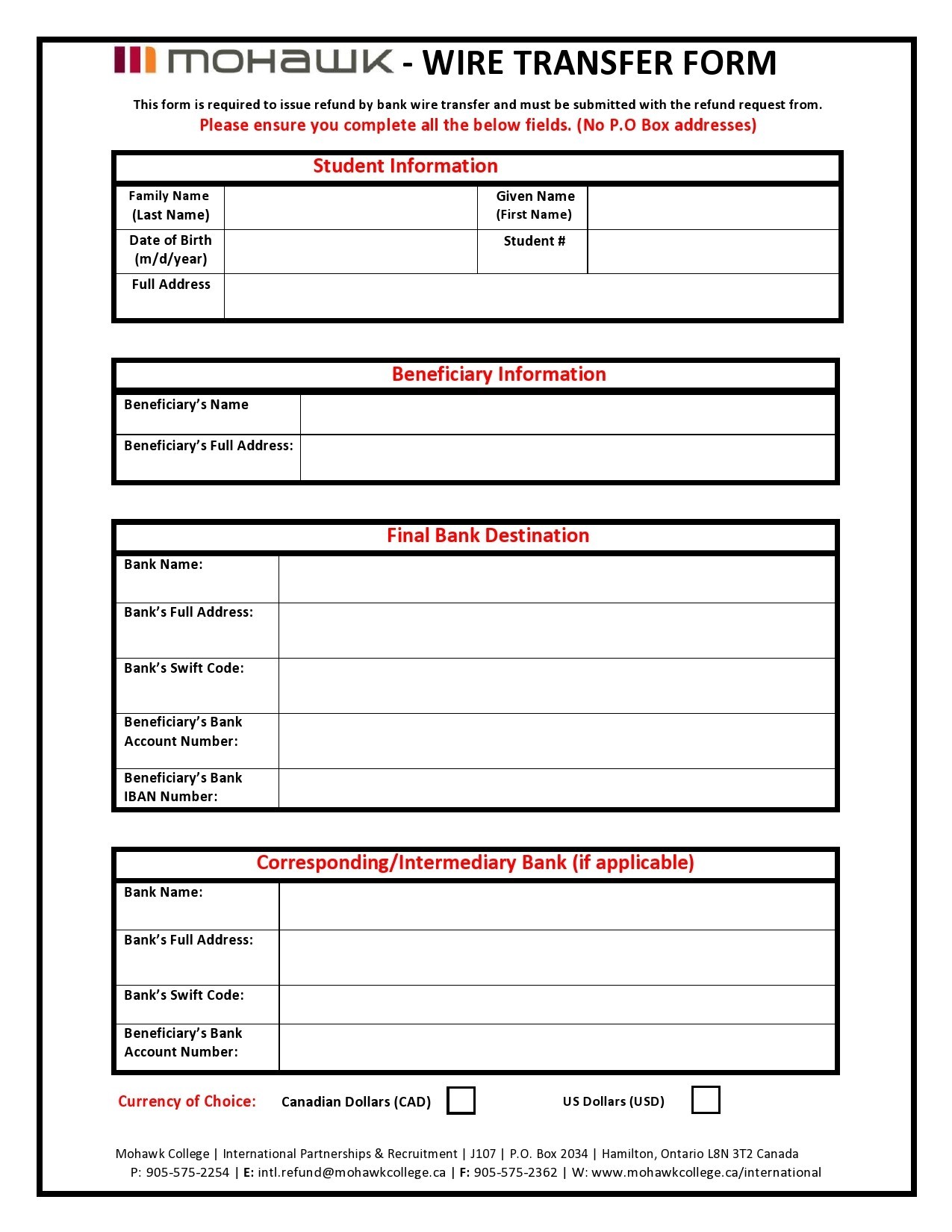

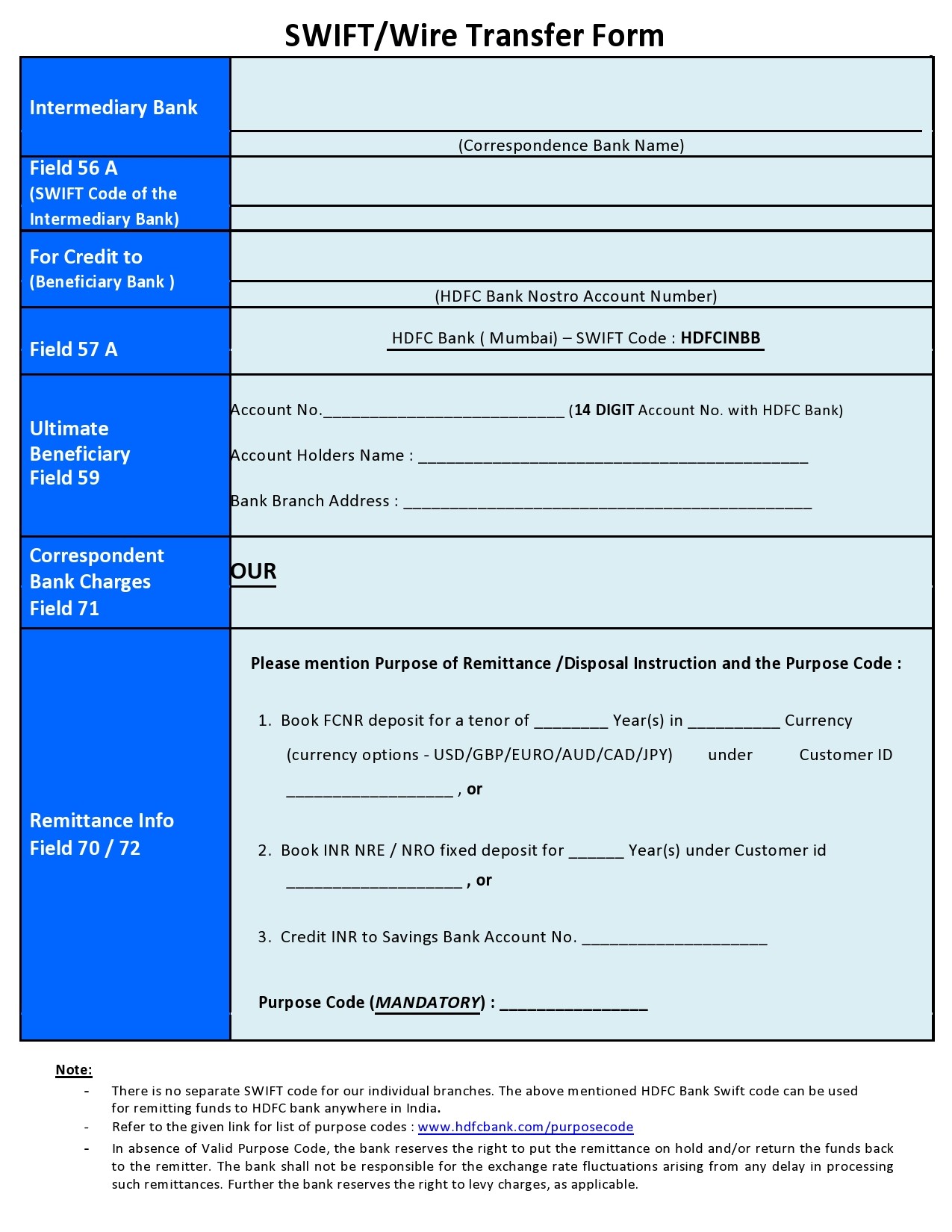

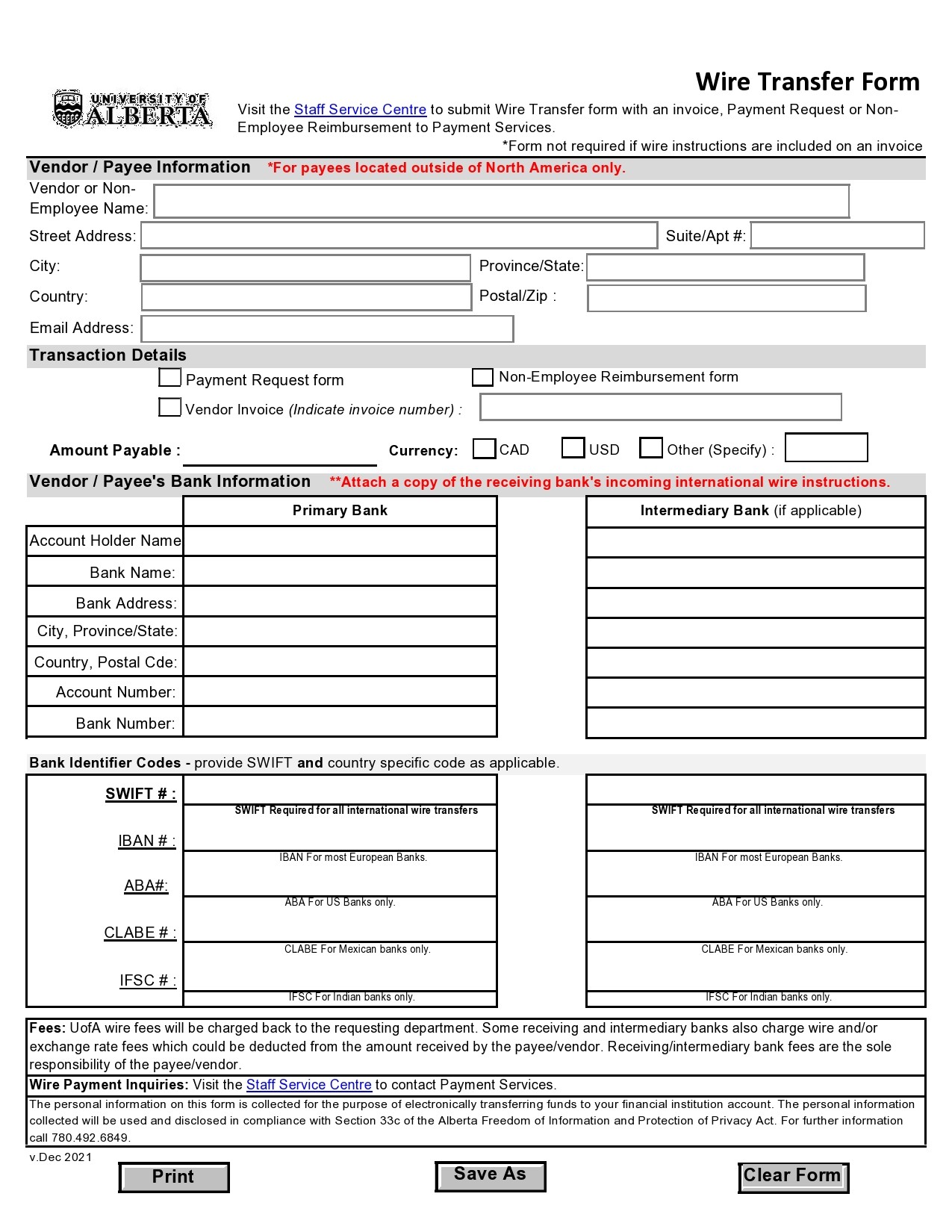

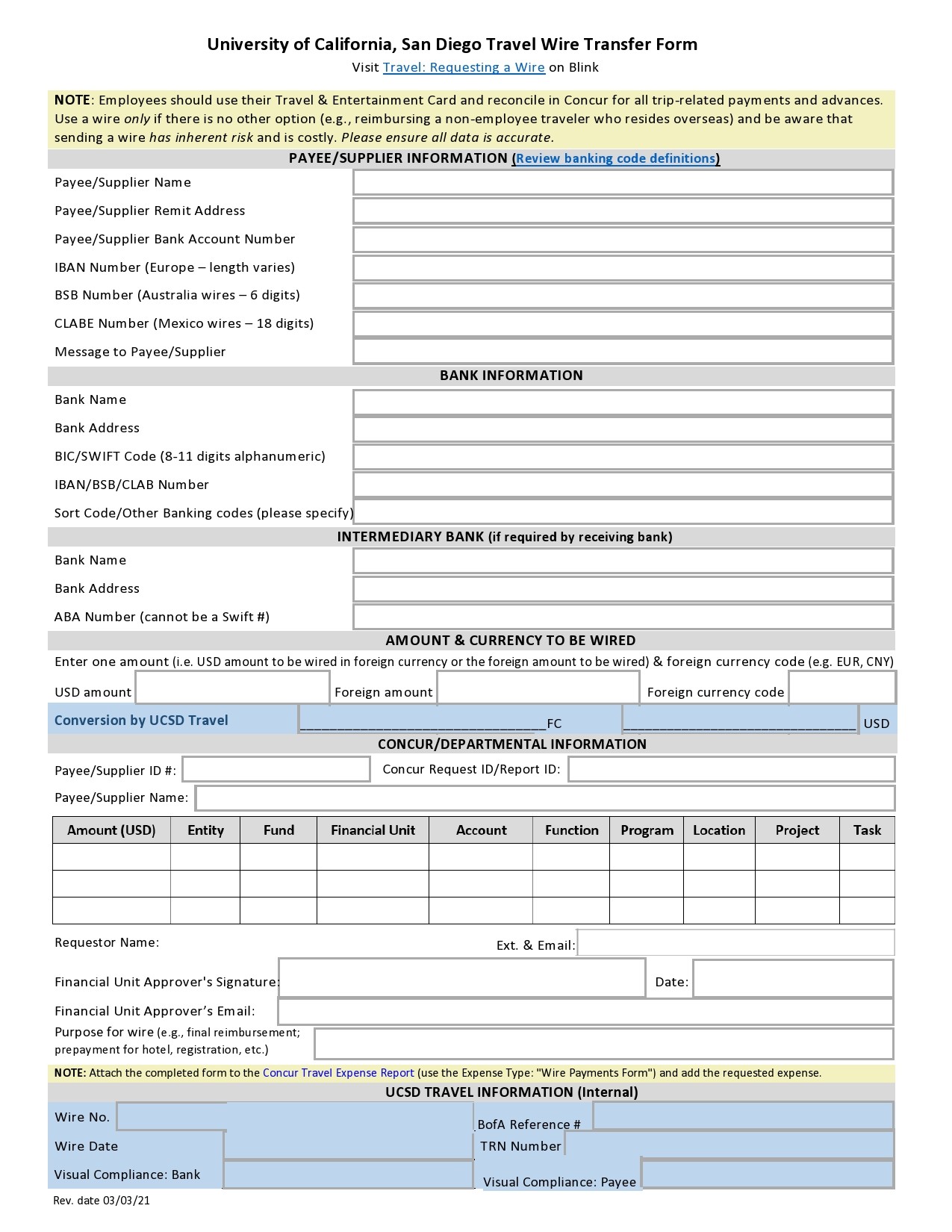

What does an international wire transfer form template look like?

An international wire transfer form template is the document you fill out when you want to transfer money to another country. You must include the following information.

Senders’ information

The sender’s information provided in the wire transfer form template is as follows:

- Your name as it appears in your bank account

- Your bank account number

- The date when the form was filled

- Your signature

Recipient’s information

- Recipient’s full name

- Their physical address

- Recipient’s bank

- Recipient’s bank address

- Their bank account number

- The type of their bank account – savings, checking, etc.

- Recipient’s bank routing number

- The country you are transferring to

Money information

- Provide details for the amount of money you are transferring

- Total amount to be transferred

- Reasons for the transfers – feel upkeep, payment of goods, services, etc.

- Recipient’s bank SWIFT/BIC code

- Recipient’s bank International Bank Transfer Account (IBAN)

Further important information you should know for both domestic and international wire transfers

- The recipient could be picking the money from an authorized branch. In this case, they will likely be asked for legal identification.

- Some third-party service providers will ask the recipient to provide details of the receiving bank.

- Due to government guidelines, some service providers will have a limit on the maximum you can transfer daily.

- You must understand the rules that apply in the country you want to transfer to. Some countries do not accept credit cards as a source of money. This is the type of information required before you will the money transfer form.

- Each bank has a unique swift code for the country it is located in.

- Most bank in Europe has the IBAN codes for identifying the specific branch instead of the entire bank as an institution.

- Banks in the USA and Canada do not use IBAN, but they do recognize IBAN as a payment processor.

After completing filling out your wire transfer request form, you need to take it to your bank or nonbank wire transfer service provider to affect the transfer. You can either email it or visit the facility in person.

If you are doing the transaction via a non-bank institution, you don’t necessarily require to have a bank account. However, you can indicate your bank account as the source of funds. If the recipient doesn’t have a bank account, you need to identify a pickup point where an authorized nonbank institution is located. These are institutions such as the western union.

Wire Transfer Form Templates

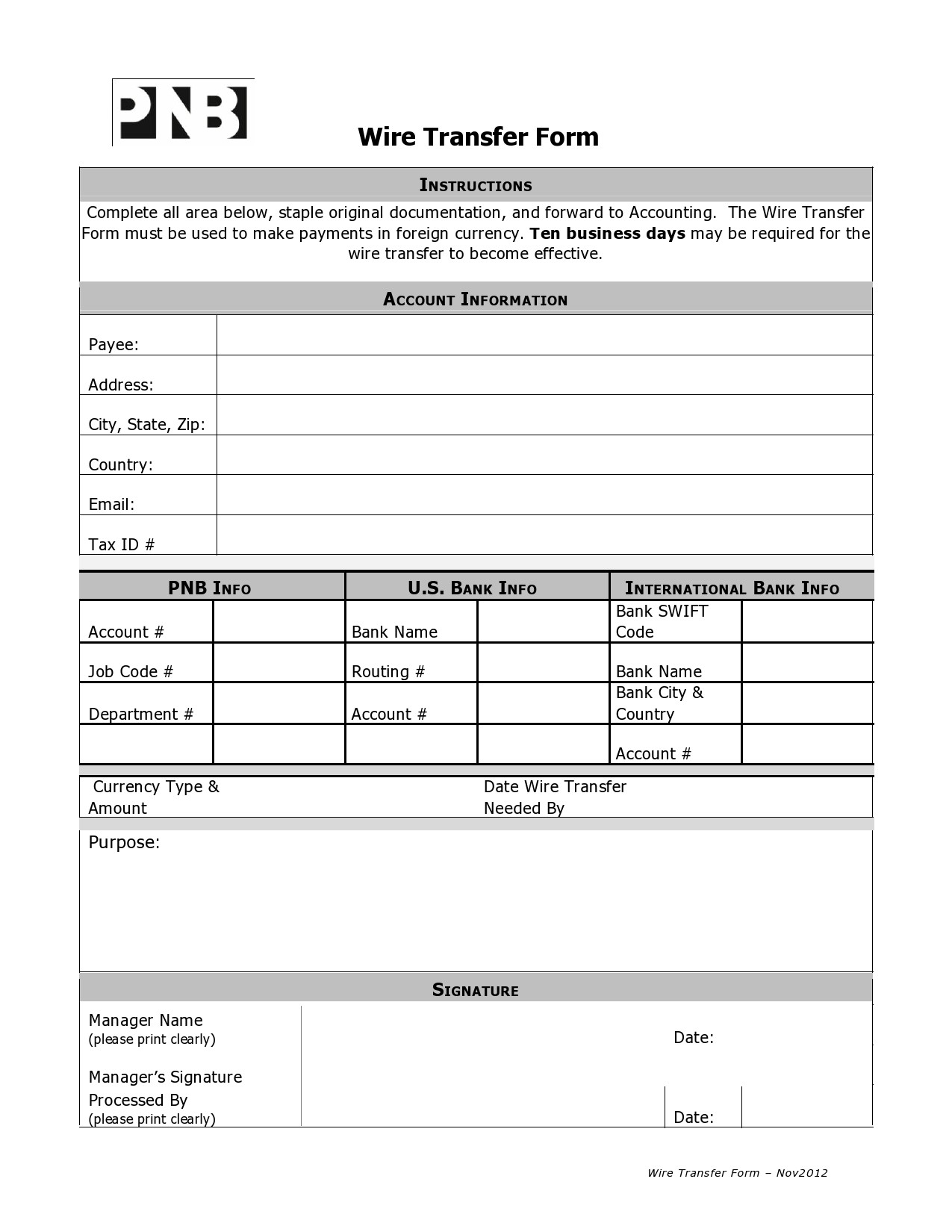

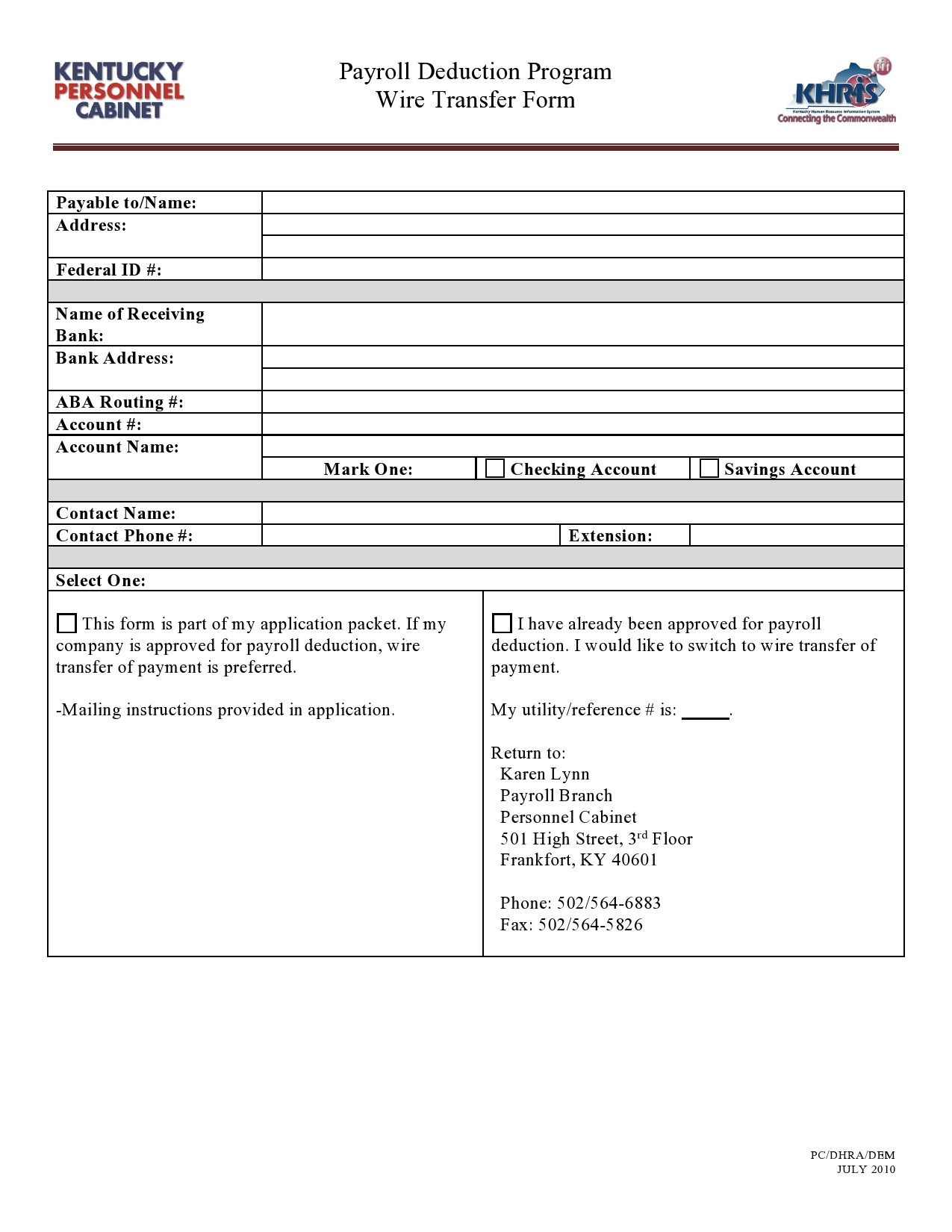

What documents are required for wire transfer?

When the transfer amount involved is small, no bank or nonbank wire transfer institution will likely request supporting documents. However, when the amount involved is large, you will be required to provide proof of how you got the money.

The reason why wire transfer institutions ask for documentation is to prevent fraud. It is also a requirement in international and local laws due to illegal money being transferred to be hidden in foreign countries. Most institutions will request documentation when the amount involved exceeds $10,000. Depending on the source of money, you could be asked to provide the following documents.

- Property sale contract

- Asset sale agreement

- Brokerage commission agreement

- Salary slips

- Inheritance letters

- Loan approval documents

- Grant letters

Here are examples of documents required for each type of source of money:

Documents for property sale

If it is a property you sold, such as land or house, you will be required to provide the following information.

- Date of transaction

- Value of transaction

- Signed documents by both parties

- Address of the property sold

- A detailed description of the property sold

- How long you have owned the property

The documents you may require are as follows:

- Copies from the property register

- A solicitor or auditor’s letter

- Bank statement to prove you received the money

- Sales contract that the buyer and seller signed

Money received from a loan

If you applied for a loan and received the money, you need to provide the following information.

- Total you borrowed

- Date when the money was transferred to you

- The lending institution or individual

- Address of the lending entity

- Reasons for borrowing

Provide the following documents

- Copies of the loan agreement

- Loan statement (for at least the last three months)

- Bank statement to prove you received the money

- Any other document

Profits from a business

If you received the money from trading in your business, provide the following information:

- Name of your business

- Dates of transaction/s

- Amounts in each transaction

- Client/s name/s

- Recipient name

Provide the following documents

- Bank statements for the last three months

- Investment type

- Parties involved

- Amount involved

- Signed documents between the parties

Wire Transfer Request Forms

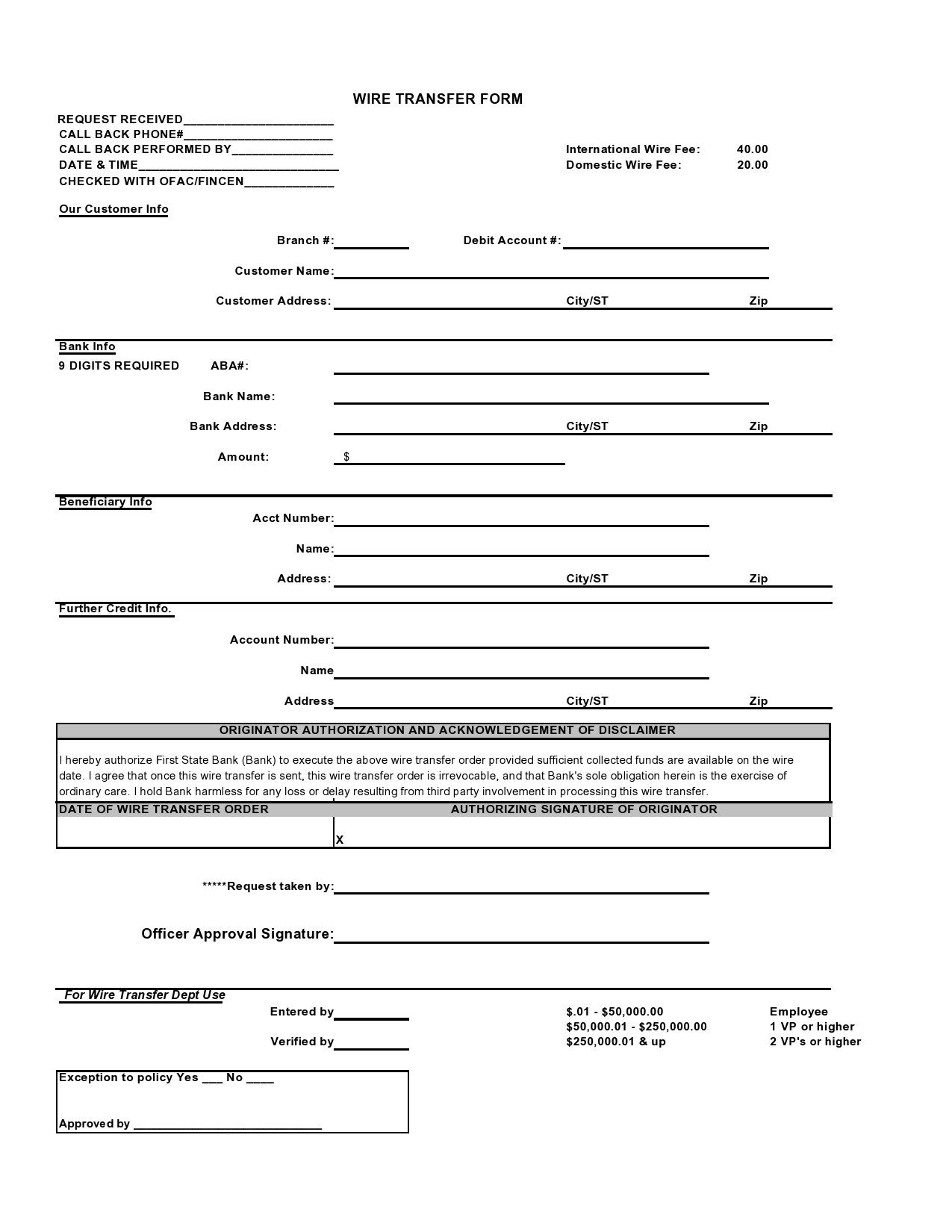

How do I fill out a wire transfer form?

You can download a wire instructions template, fill it out and send it to your bank to effect the transfer. You may also visit the bank and fill out the form. Both the domestic and international wire instructions template contains different information. However, you must fill in the following information in both.

- Title and date: Indicate if you want to do a domestic or international transfer. Indicate the date when you are transferring the money.

- Your information: Fill in your full information to make the wire transfer form valid

- Your name

- Full address

- Telephone number

- Email address

- Bank account number

- Branch

- Wire transfer amount

- Indicate the currency you want the transfer to be done in

- Indicate the amount you want to transfer

- Information about the recipient

- Indicate the detailed information about the recipient

- Their full name

- Full address

- Their bank

- Their bank account number

- Routing number

- Bank location – state, city, country, physical address

- If it is an international; transfer, provide the SWIFT or BIC code.

Common definitions

SIFT is used to identify the specific bank when performing an international wire transfer. It means Society for Worldwide Interbank Financial Telecommunication.

BIC means Business Identifier Code. It is used to route transactions and identify transaction parties. It is a requirement for European countries.

IBAN means international bank account number. It is used to identify the specific account held anywhere globally. The number usually has 34 alphanumeric characters.

BSB is the national routing code for Australian wire transfers.

Intermediary bank – This is the banking institution through which the money goes through before it reaches the beneficiary.

How much will you pay for a wire transfer?

Different banks have different charges for wire transfers. Charges for domestic transfers differ from international transfers. Most banks will charge between $25 to $30 for domestic transfers and between $45 to $50 for international transfers.

Some banks charge a fee for receiving money. Recipients may charge anything between $15 to $20. Before you fill out the money transfer form, make sure your bank balance will be enough for the transfer amount and fees.

How long does a wire transfer take?

Compared to other types of money transfers, wire transfers are the fastest. However, it doesn’t take effect in an instant. The time taken depends on the bank or service provider. Mostly, bank-to-bank wire transfers take about three days to complete. In cases where both the recipient and transferer are in the same bank, the transfer can be completed within 24 hours. Generally, the time taken for transfers can be as follows:

- Local transfers involving the same bank – 24 hours

- Local transfers involving different banks – 3 days

- International transfers – 3 to 5 days

- Local nonbank transfers – a few hours

- International nonbank transfers – 5 days or more

You may request your bank to expedite the transfer so that it takes lesser time. This can be done but at a premium. Some countries take longer to pay money than others. You may want to find out how long it takes in the country you are transferring to.

If you make a mistake during a wire transfer, it is almost impossible to reverse. Make sure you have captured every detail correctly, such as recipient names, account numbers, codes, etc.

Mistakes to avoid when filing a wire transfer request form

These are the mistakes you must avoid when filling out your wire transfer request form.

- Incorrect country or city name

- Not filling the bank address

- Forgetting to indicate the bank name of the recipient

- Writing incorrect recipient account number

- Swift SWIFT/IBAN code

- Indicating the wrong foreign currency or currency that is not supported by the receiving institution.

No matter how small the error might appear, it can cause lengthy delays in processing. The money might never get to the intended recipient. For example, you may have all details correctly filled, but you write the wrong SWIFT code.

That means the money will be directed to another country. The process of reversing it could almost be impossible, especially when the transaction involves different banks. The laws in that country could make it impossible to reverse.