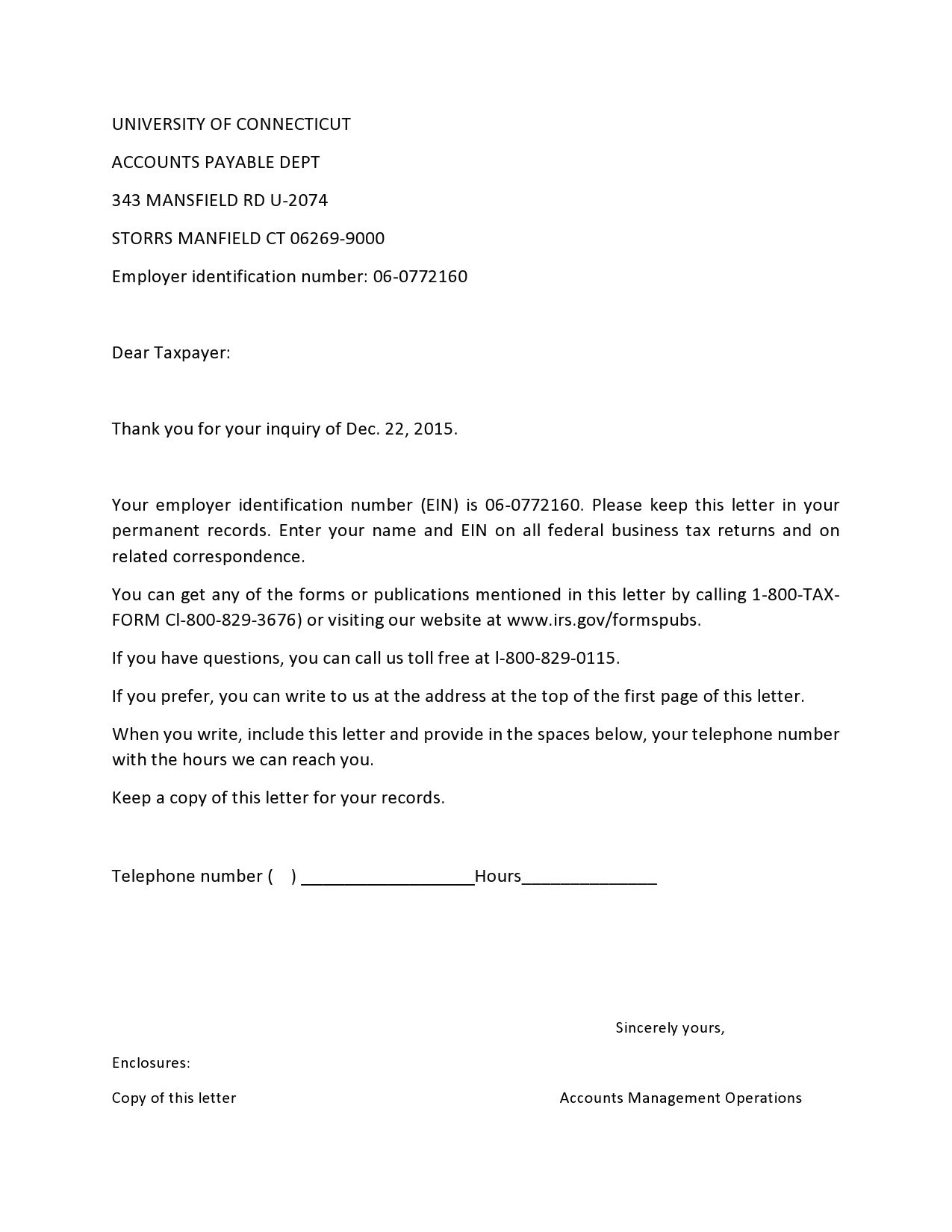

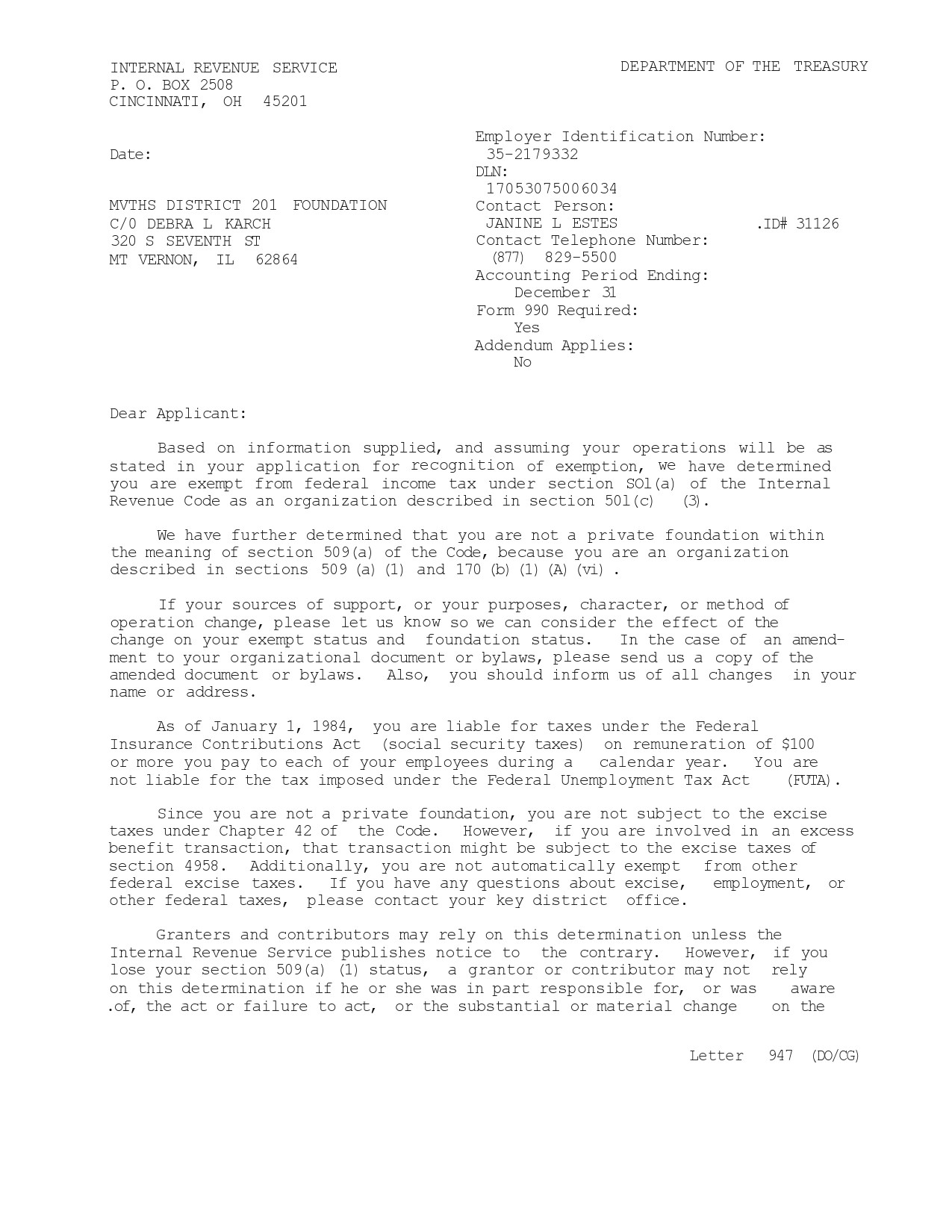

As an answer to your application for an Employer Identification Number, the IRS, will send you an EIN verification letter to confirm that they have received your letter. We all know the importance of an Employer Identification Number as we associate this with the IRS and taxes.

Table of Contents

EIN Verification Letters

The importance of an EIN letter

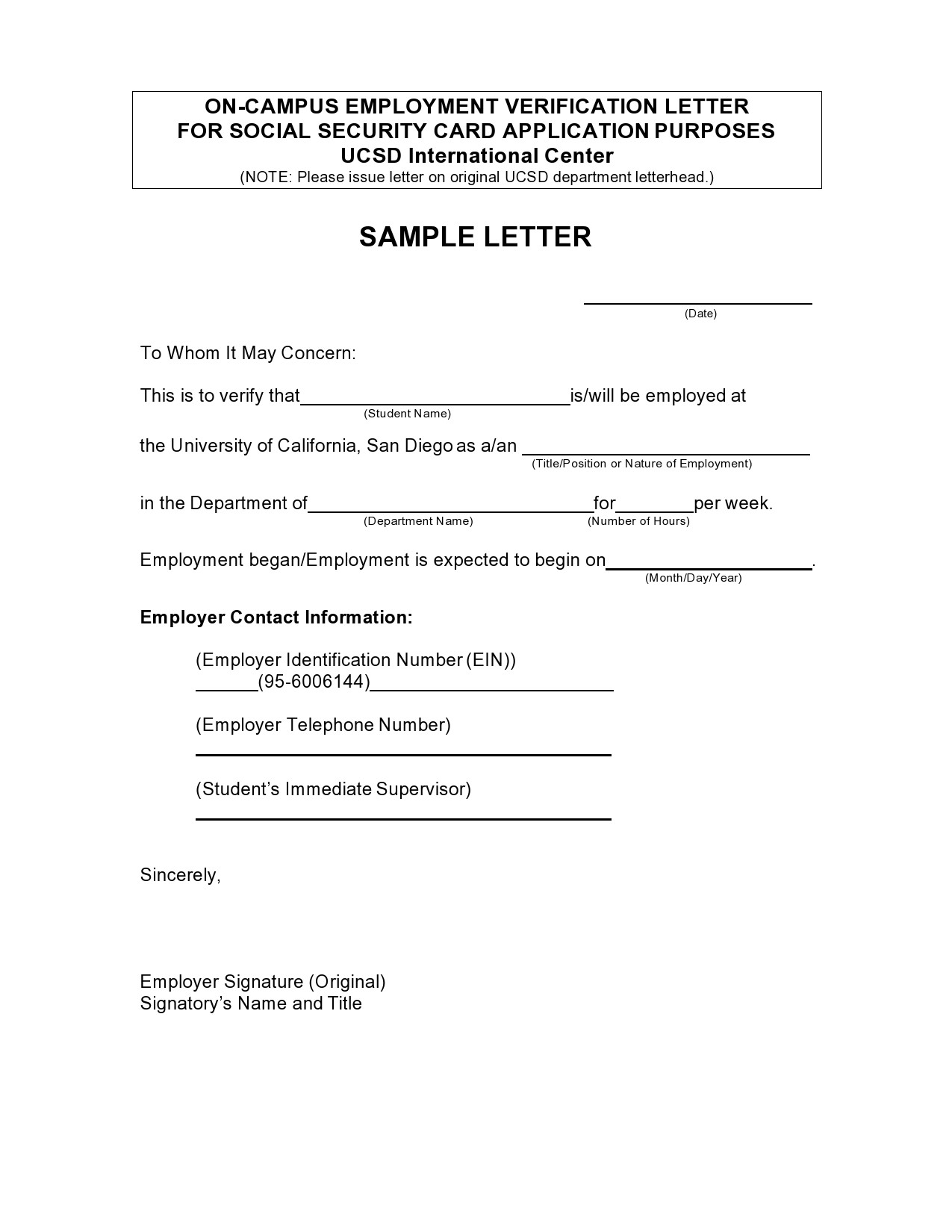

An Employer Identification Number or EIN is a unique 9-digit number issued by the IRS to a business or a company that requested it. The EIN is for businesses while the Social Security Number or SSN is for individuals. You need an EIN verification letter if your business plans to:

- File tax returns

- Obtain industrial permits and business licenses

- Open bank accounts

- And for other official purposes like the submission of Form 1099 for contracting work.

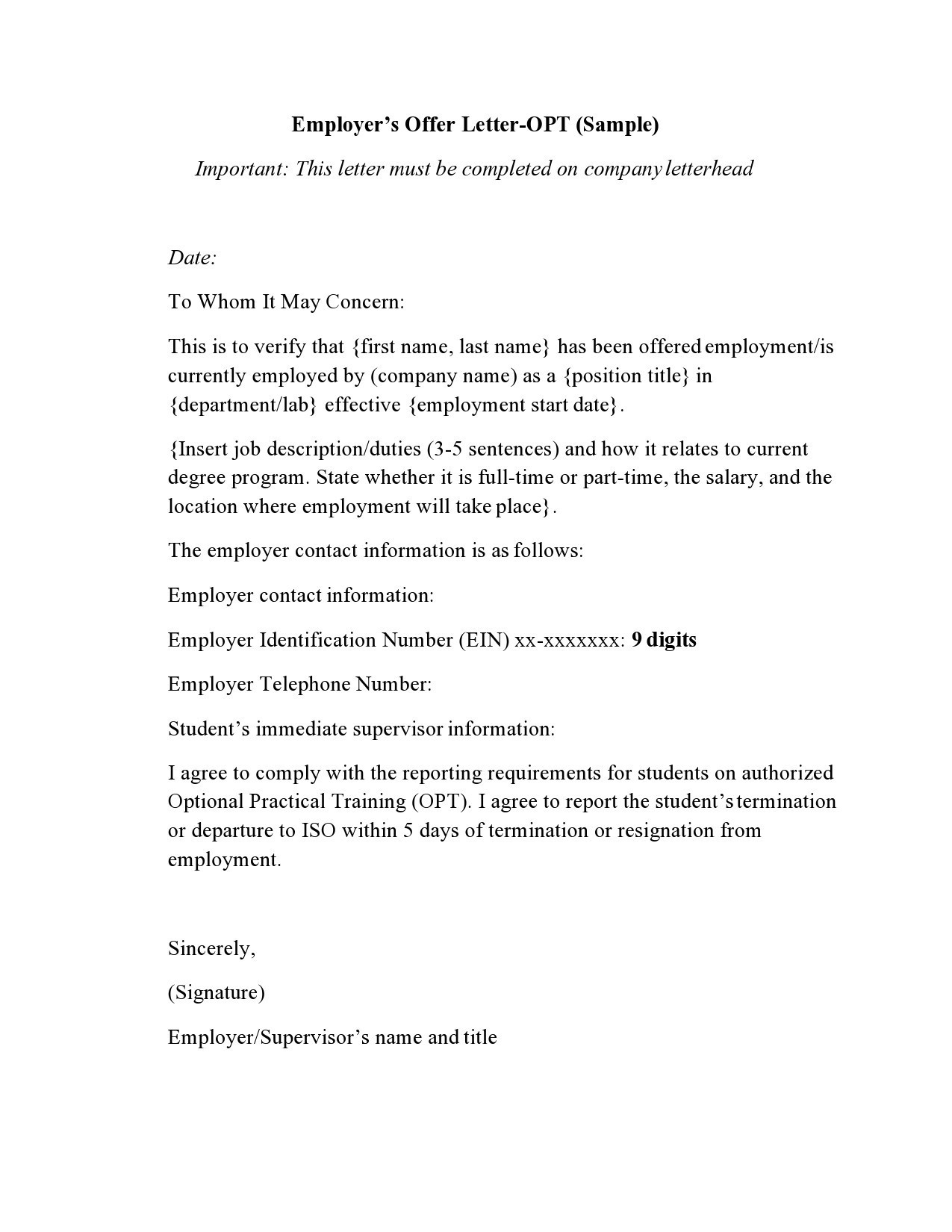

As a sole proprietor, you may consider obtaining a 147C letter so you don’t have to use your SSN for your business. Moreover, lending institutions usually insist on providing EIN details when opening a bank account for your business. There might also be times when your vendors and investors may request your EIN.

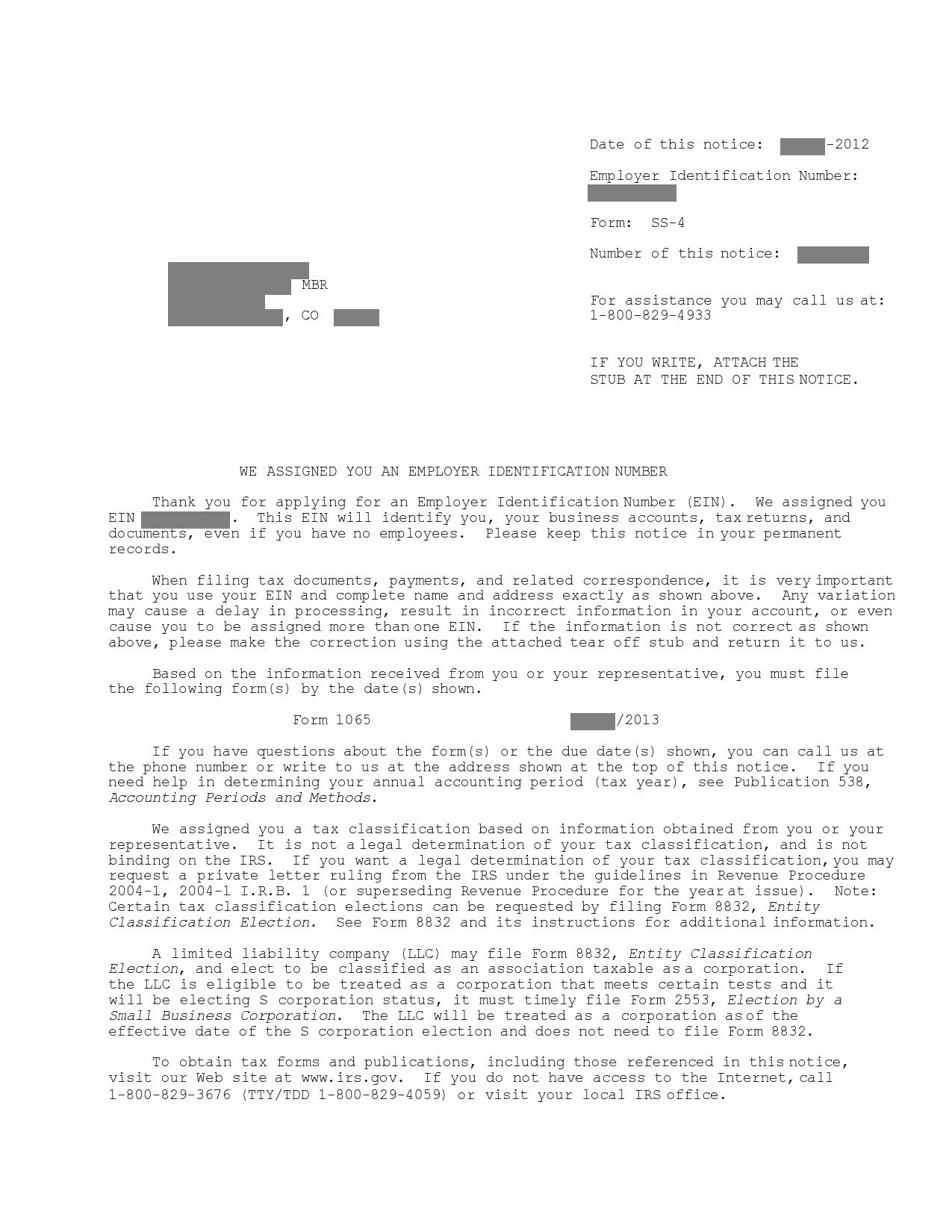

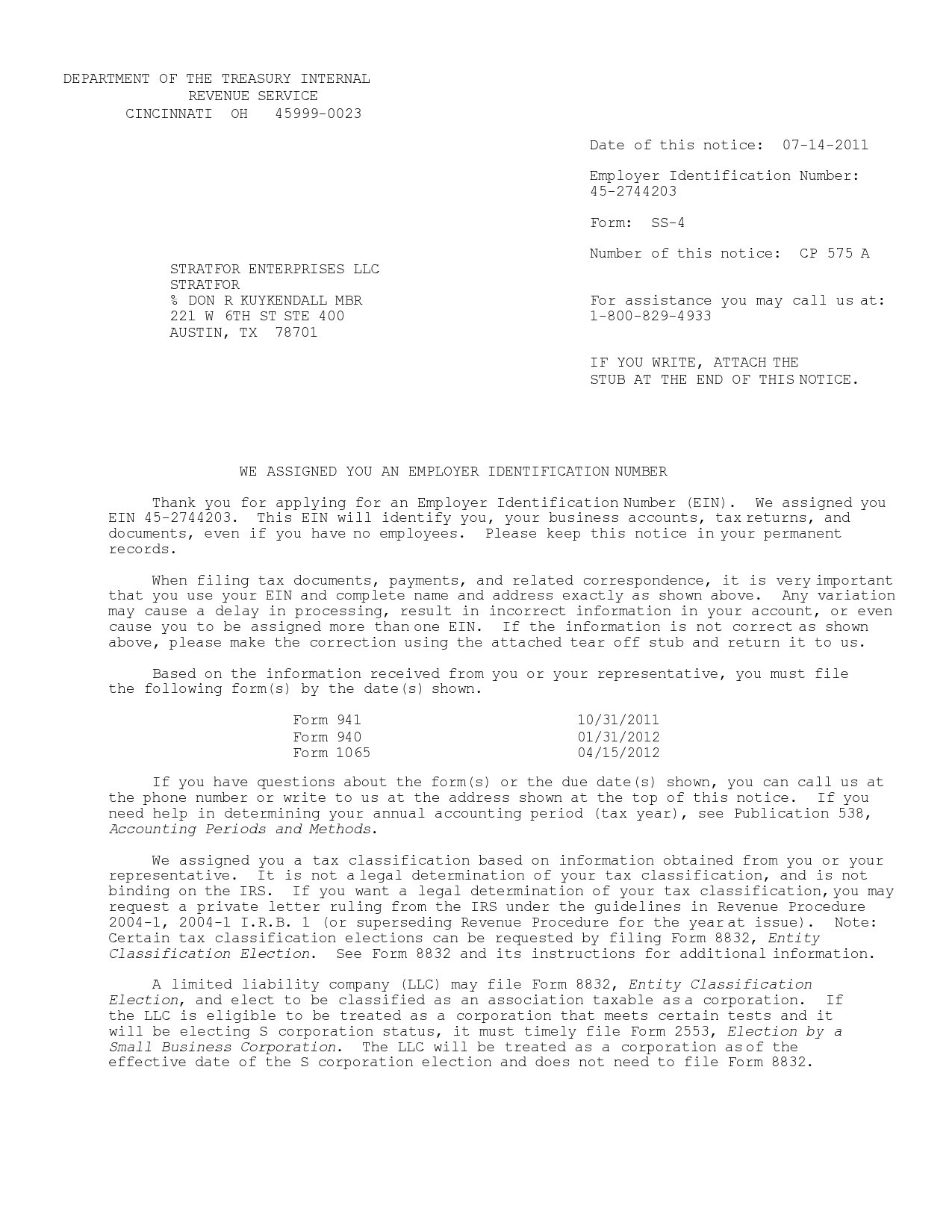

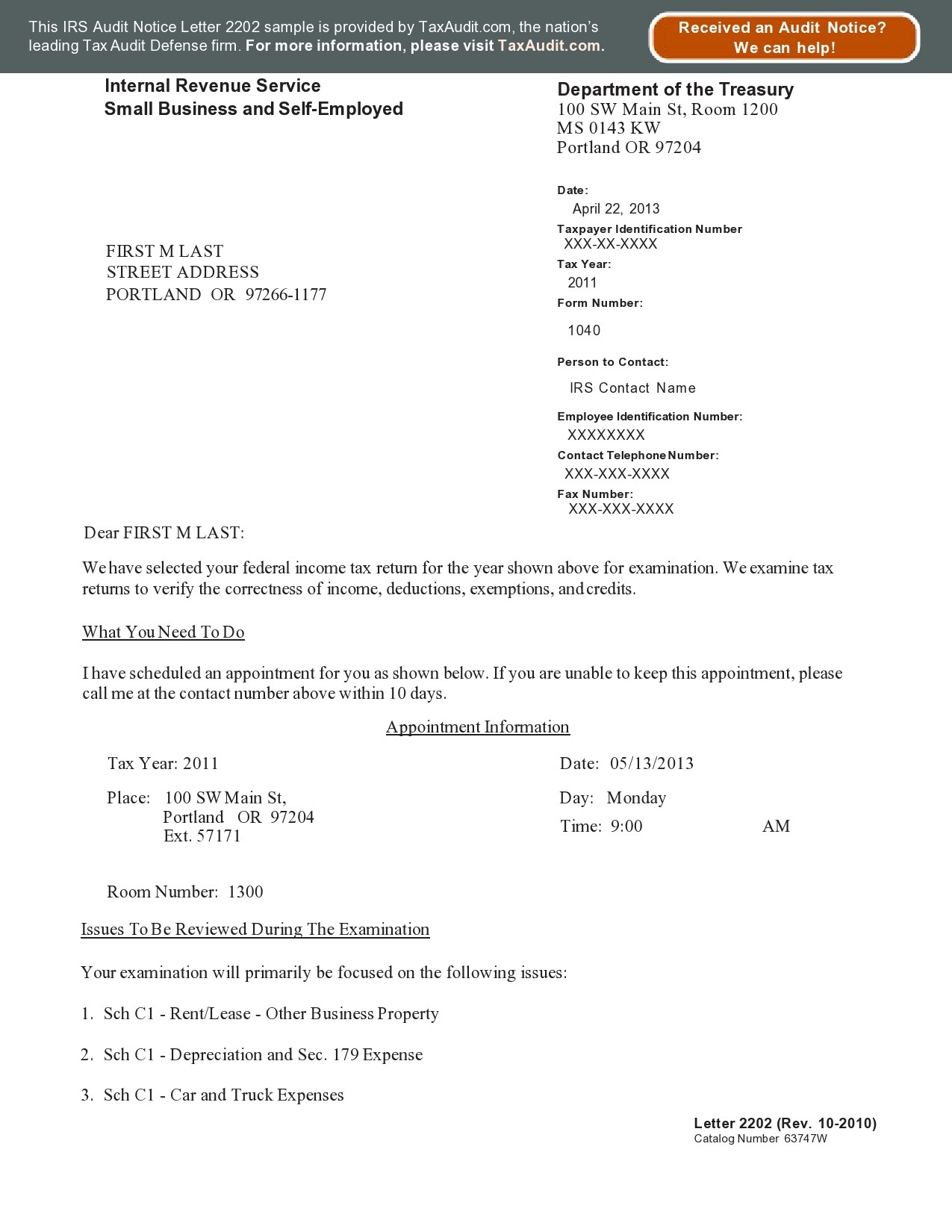

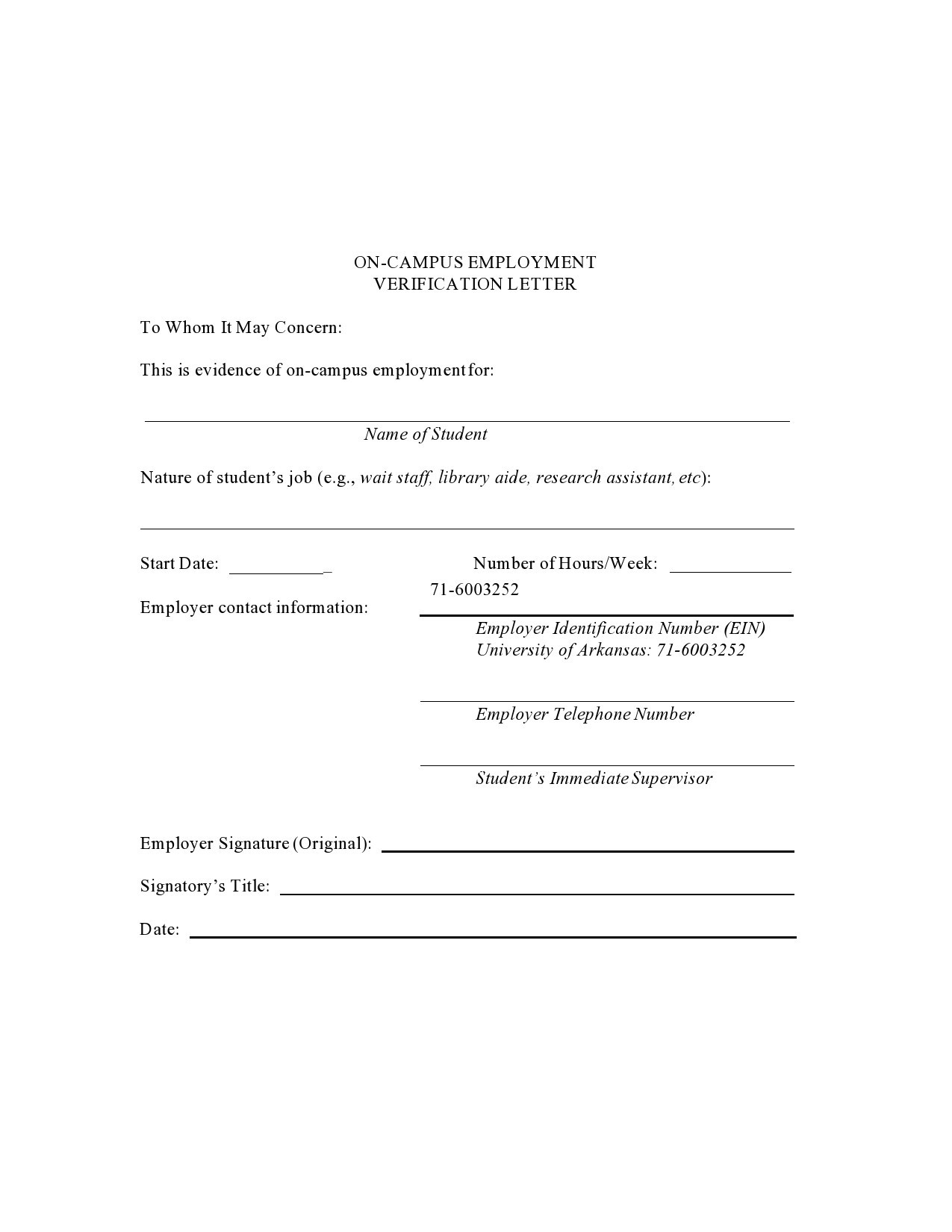

After the IRS approves your EIN application, they will send you an EIN confirmation letter within 8 – 10 weeks of giving you this number. This verification letter gets mailed to the business address you have mentioned in your application.

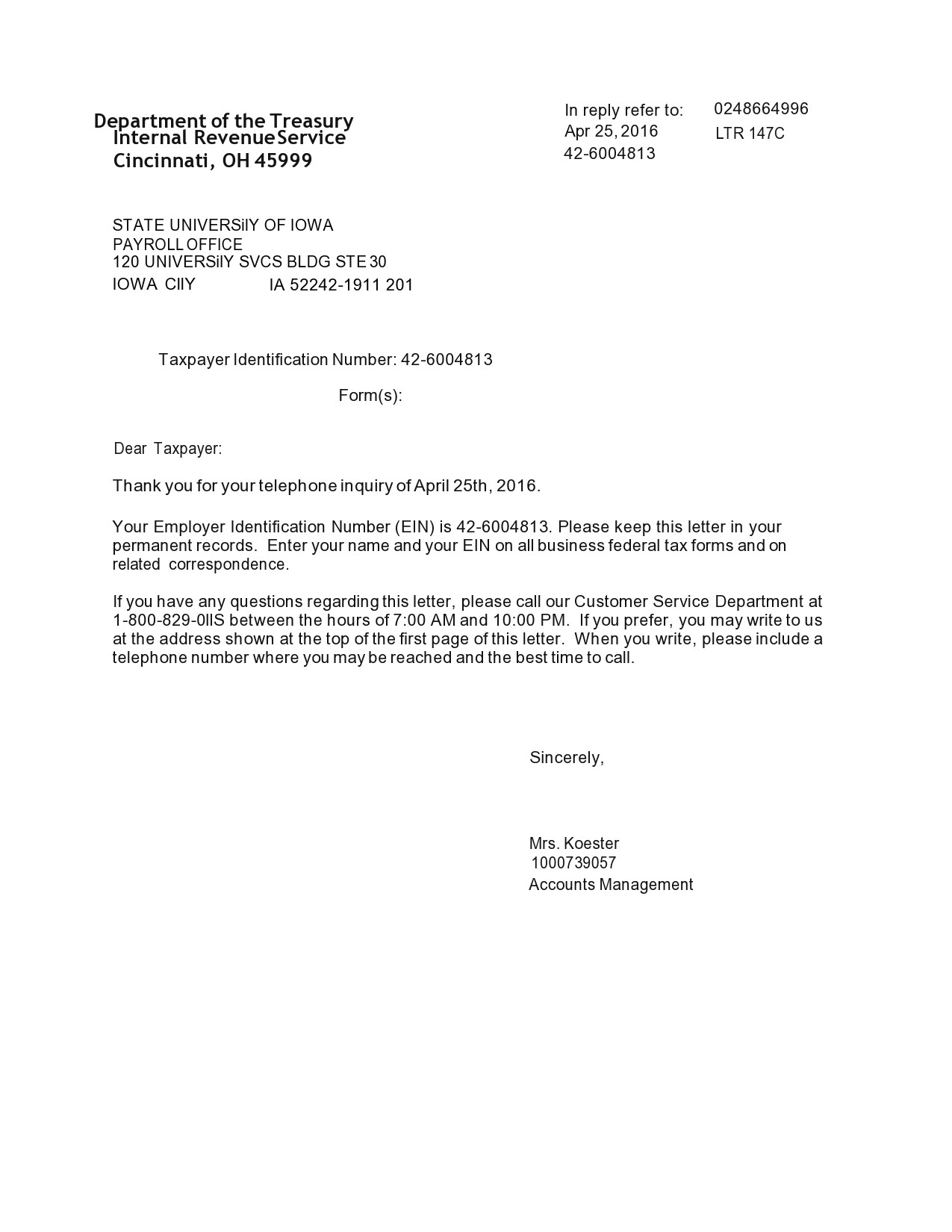

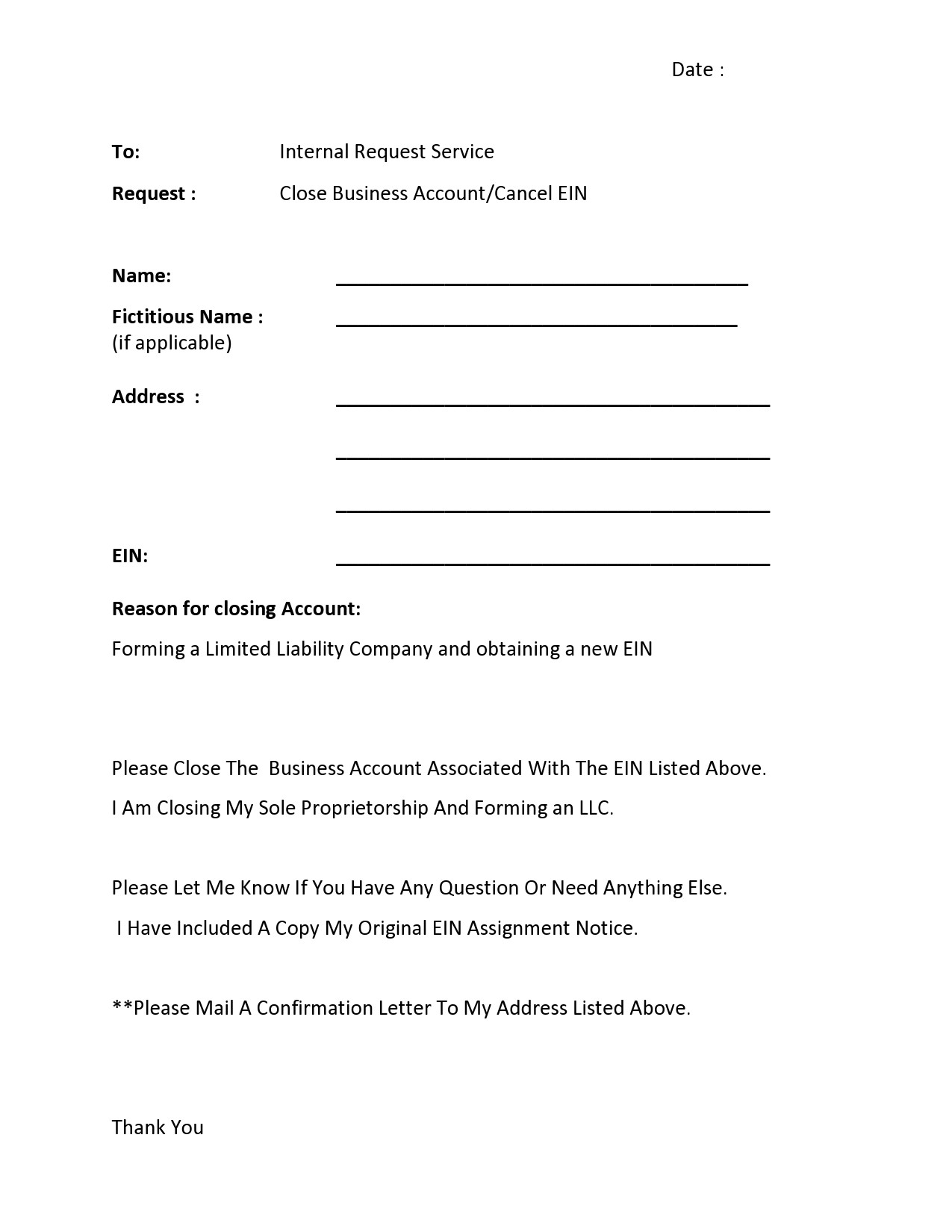

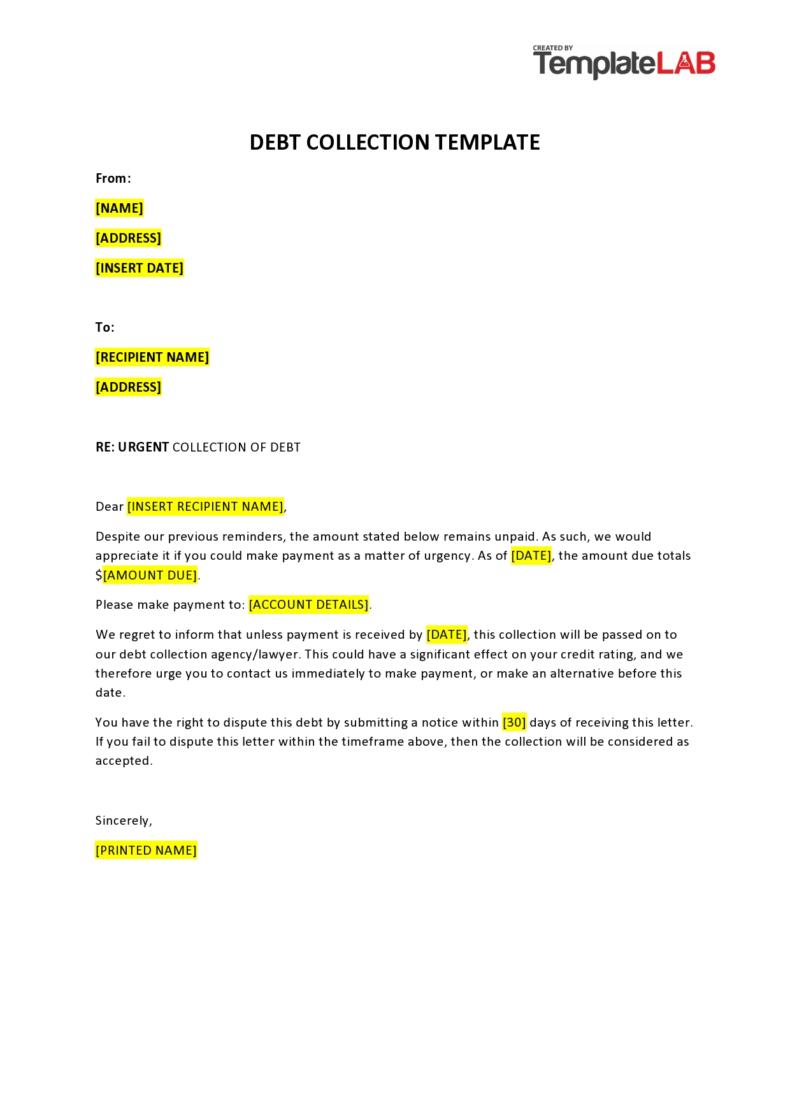

There might be cases where you might misplace or lose your original letter, which is usually a tax ID certificate. In such a case, you can still get another letter from the IRS. This letter serves the purpose of the original verification letter that you lost.

How do you verify a company’s EIN?

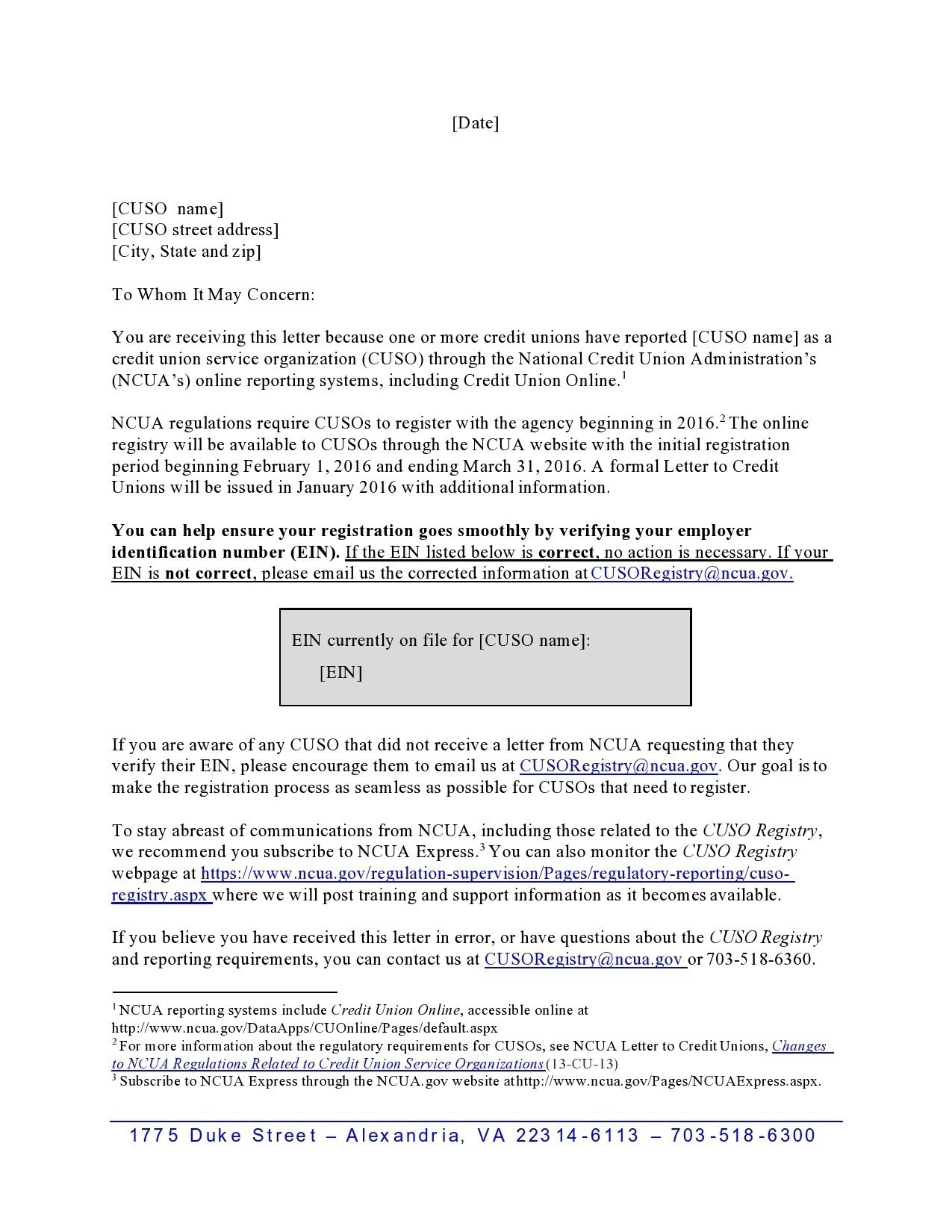

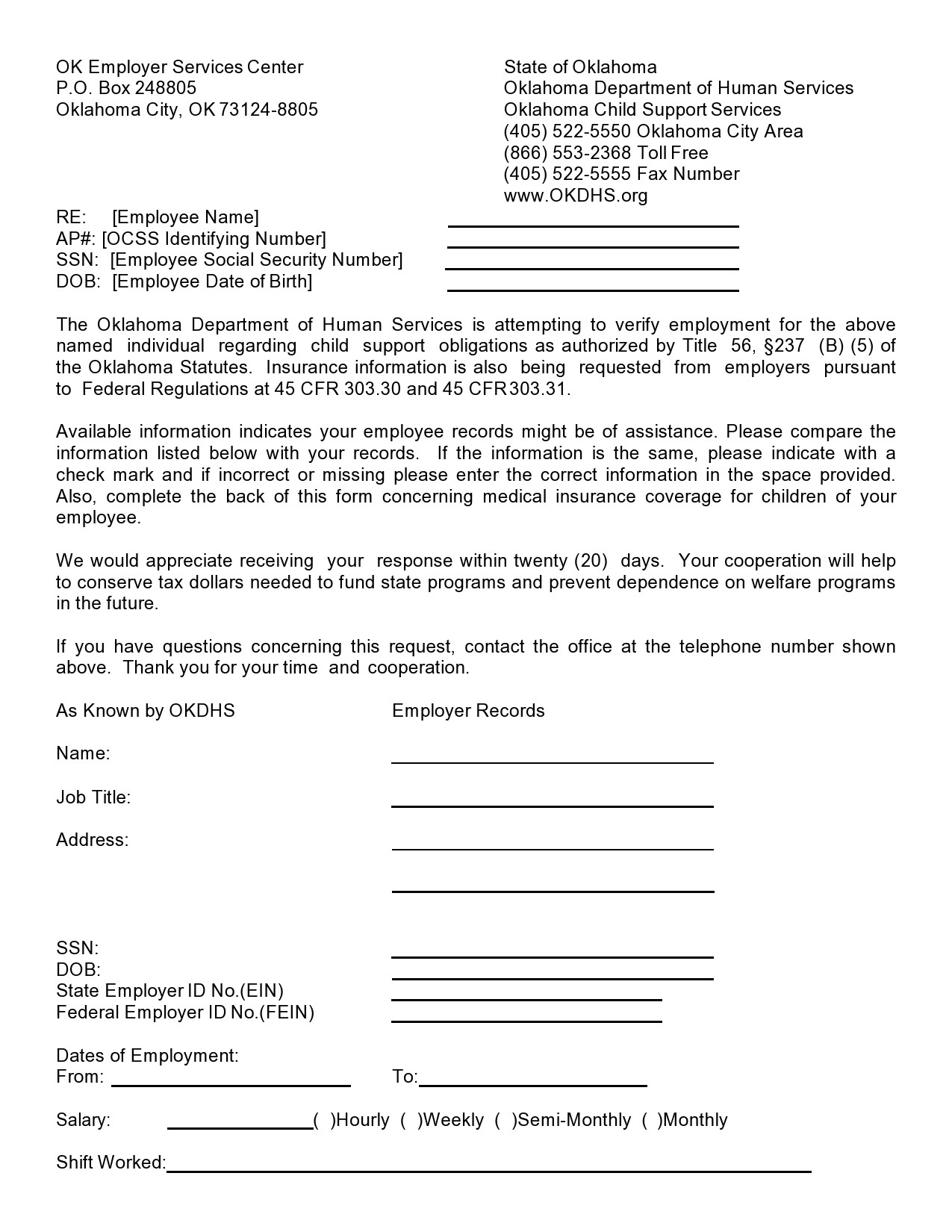

The EIN is a lot like a Social Security Number except you use this for your business. Whether you plan to use this number for business or personal matters, you should consider all tax identification private.

Moreover, there is no easy way for you to verify your EIN unless you are an authorized representative of your business. There is one exception though and this applies to registered tax-exempt or non-profit organizations.

- Lost or Misplaced EIN Verification Letter

The Internal Revenue Service can allow a representative to confirm, call, or relocate your business EIN. As the owner of a business, you’re considered an authorized representative.

Others who qualify as representatives of your business include officers of your company, partners, sole proprietors, and for a trust, the executor or the trustee of the estate. The process of getting your EIN without an EIN letter is very simple:

Call the IRS.

A representative of the IRS will ask for your identifying information.

The representative will give you an EIN number over the phone. - When a person isn’t the authorized representative

Anyone who isn’t an authorized representative can ask an authorized representative to complete the Tax Information Authorization then process it. In a catch-22 situation, this form requires the EIN.

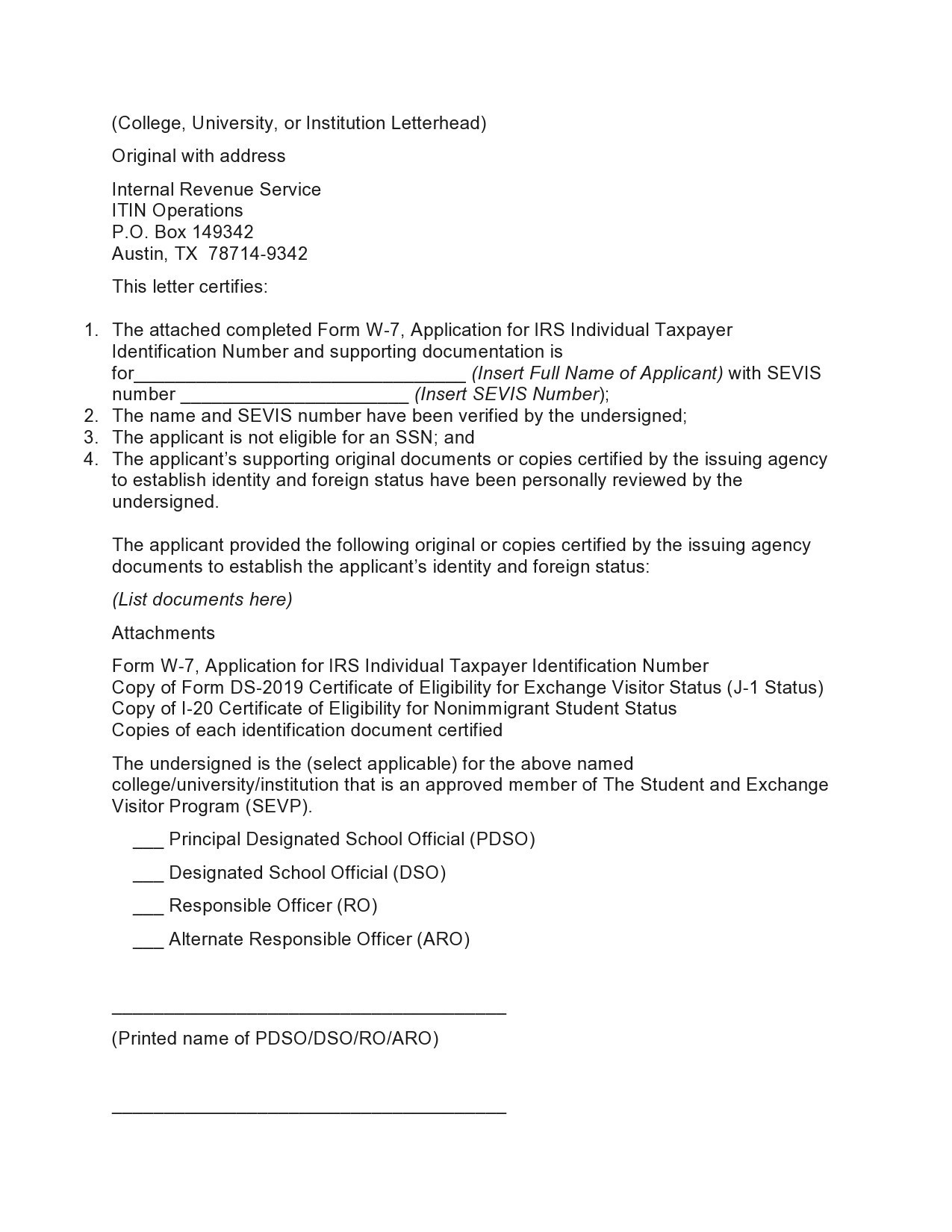

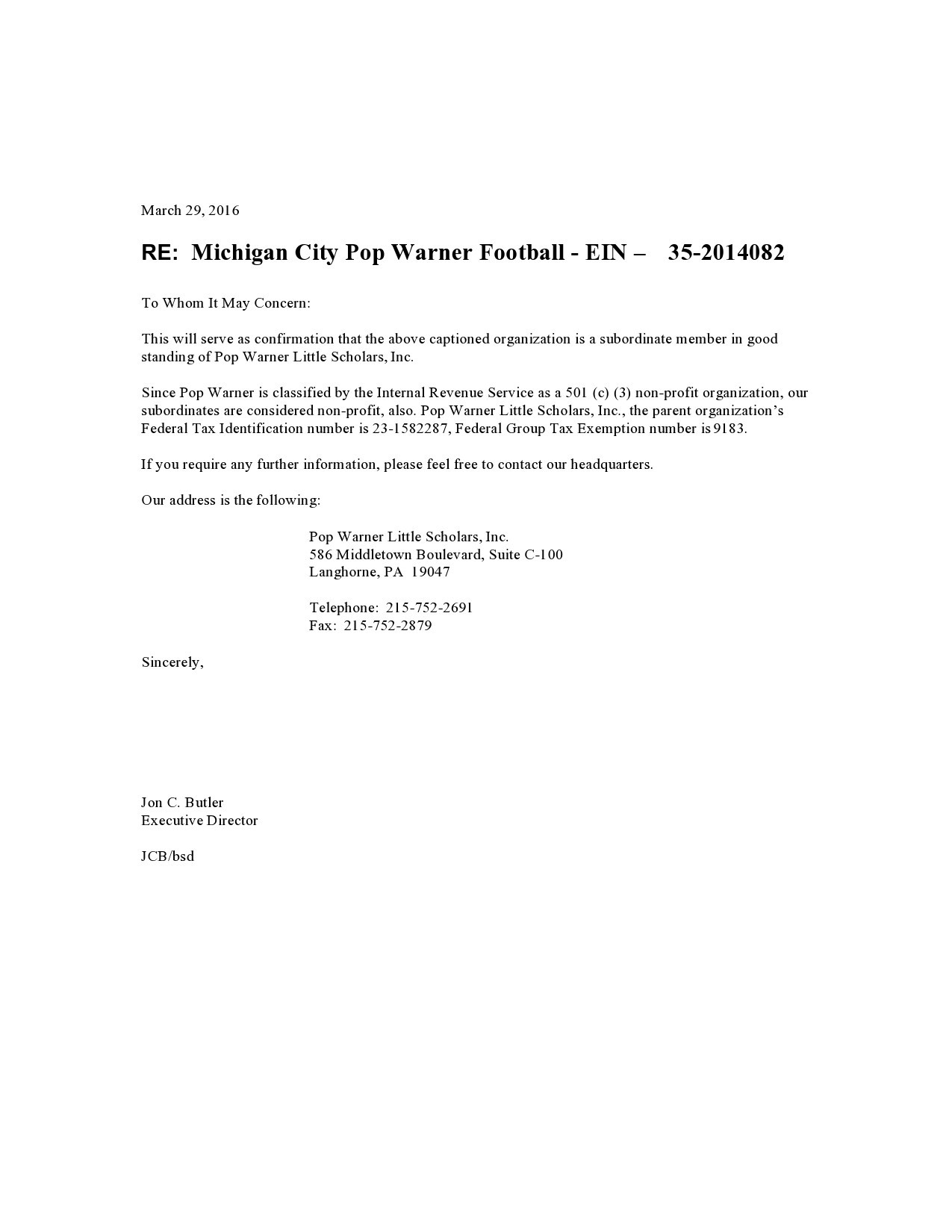

This means that if your company lost its number completely, it’s required that the authorized representative should call. In situations where your company has an EIN but wants to verify it because you don’t have a tax ID letter, you will find this out after calling the IRS. - In the case of Exempt Organizations

If you want to verify the EIN number of a charitable company, you can go to the IRS site where you can conduct an Exempt Organization Select Check. This is an IRS tool that you can use to verify information regarding charitable organizations without the IRS EIN letter.

Exempt organizations typically have not-for-profit status and as such, their information is in the public records. You can search the company by name through the site’s search tool. Then you will see the EIN verify tax-deductable donations and the company’s status too.

Moreover, the site also tells you if the company’s tax exemption status is already revoked for failing to file Form 990-N. This form confirms the amount of income tax the company had. Even if the company is tax-exempted, it’s still required to file income and report it. Otherwise, the company may lose its charitable status. - Other methods of confirming an EIN

You can also verify your EIN from other sources. While it’s considered private information, most employers still comply with requests to verify their EIN. You can see this number on payroll checks or on 1099s for contractors. It’s also given to employers who provide contract work.

When filing tax returns, whether for your business or for personal purposes, providing an incorrect EIN will result in IRS rejection of the form. The IRS might even request for other information because of inconsistent data checks. In such a case, it’s necessary to verify your EIN to prevent overstating or understating your income.

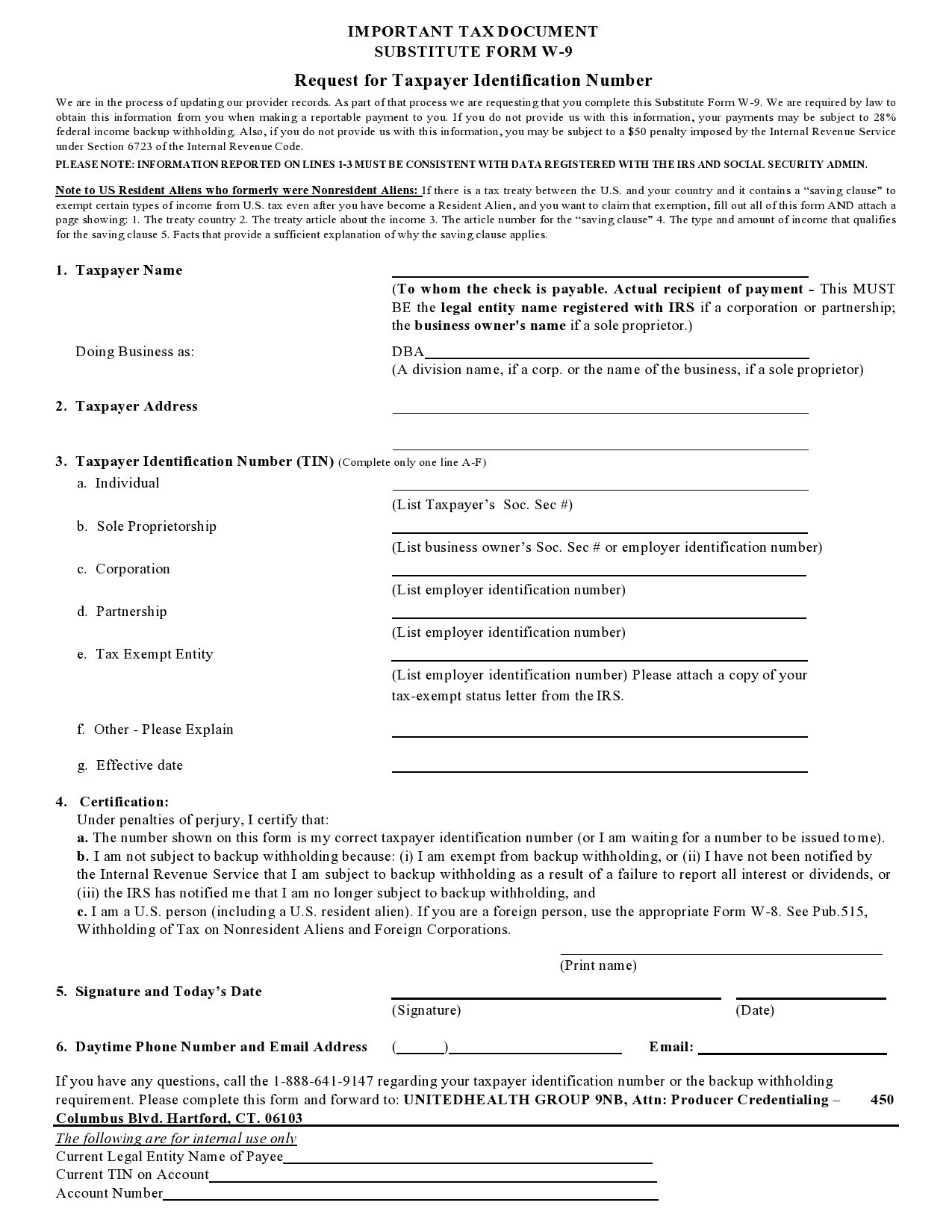

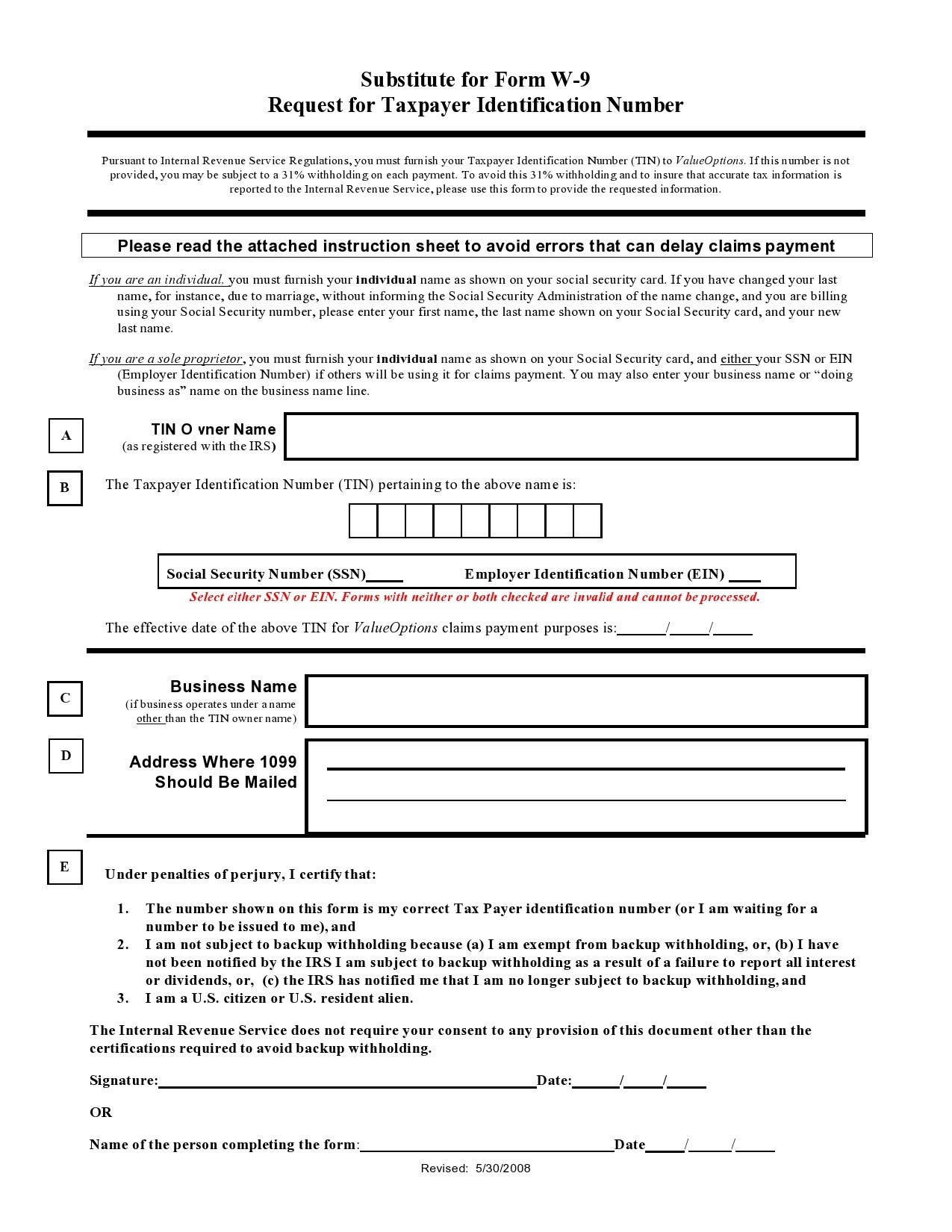

EIN Confirmation Letters

Verifying your own EIN

What should you do if you cannot locate your original EIN verification that you received in the past? The good news is, you can verify your EIN number without your 147C letter. If you have already set up your business using your EIN, it should appear on any of these documents:

- Banking statement

- Your applications for bank accounts, loans, or credit card

- Fictitious name statement

- Sales tax permit

- The tax returns of the previous year

- Business license

- 1099-Misc forms

If you still cannot verify your EIN without your EIN letter even if you have the above documents, follow these steps:

- Call the Business & Specialty Tax Line of the IRS.

- You have to provide your identifying information before they provide your number. The reason for this is that only authorized persons can get this number.

- Once they have verified your information, they will give you the number over the phone.

- Repeat the number to the person on the phone. Then keep this number in a password-protected file so you always have access to it. Beware of unscrupulous individuals who steal EINs to submit fraudulent tax returns to receive refunds.

You must protect your EIN at all times, the same way you protect your SSN. Always make sure that all documentation containing this number is securely locked up. Get rid of all documents containing the number by shredding them. You should also use secure online sites that request your EIN when submitting applications.

With all of this EIN information, might start feeling overwhelmed. If you are, here is an interesting bit of information for you. According to a report by the American Pet Products Association in 2016, 68% of US households owned pets. Of these animals, 94 million were cats and 90 million were dogs.

Based on these figures, you can deduce that pets are important to a lot of Americans. So is an EIN to manage your business efficiently. This number will stay with your business structure from the beginning. Like your SSN, this one is your business’ legal identifier when conducting business affairs like submitting tax returns.

How do I get a copy of my EIN verification letter?

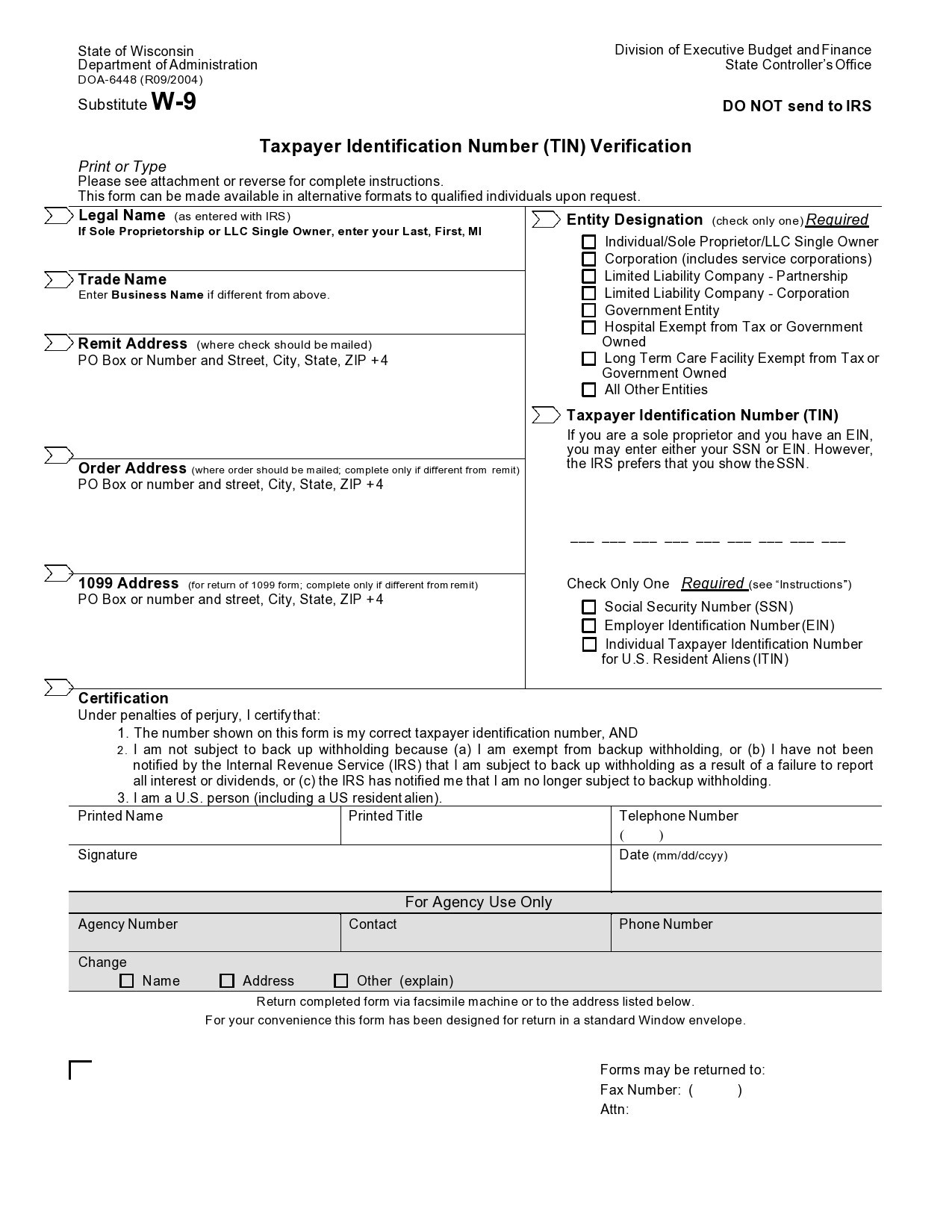

An EIN is a unique number matched to your business, like a Social Security Number identifying with individual taxpayers. All businesses must have an EIN. To help you determine your need based on the specific situation, there is a quick checklist you can access on the IRS website.

You can apply for an EIN number and your EIN verification letter in the following ways:

- You can use the online application to get your business’ EIN. With this method, you will receive a response right away then you can print out your EIN confirmation letter immediately. Saving this document is highly recommended so that you have a digital record of your documentation and transaction.

- If you’re applying using the Form SS-4, fill-up the form then fax it. You get receive your tax ID letter within a couple of business days.

- If you’re applying by mail, your letter should come to you in a couple of weeks.

In a case where you applied for an EIN in the past then you have either misplaced or lost your copy of the letter, there are a couple of things you can do to find it:

- Check your old files

If you applied online, check your file downloads for a copy of your letter from when you applied for the EIN originally. You can also check your files starting from the date when you began your business. - Check with your bank

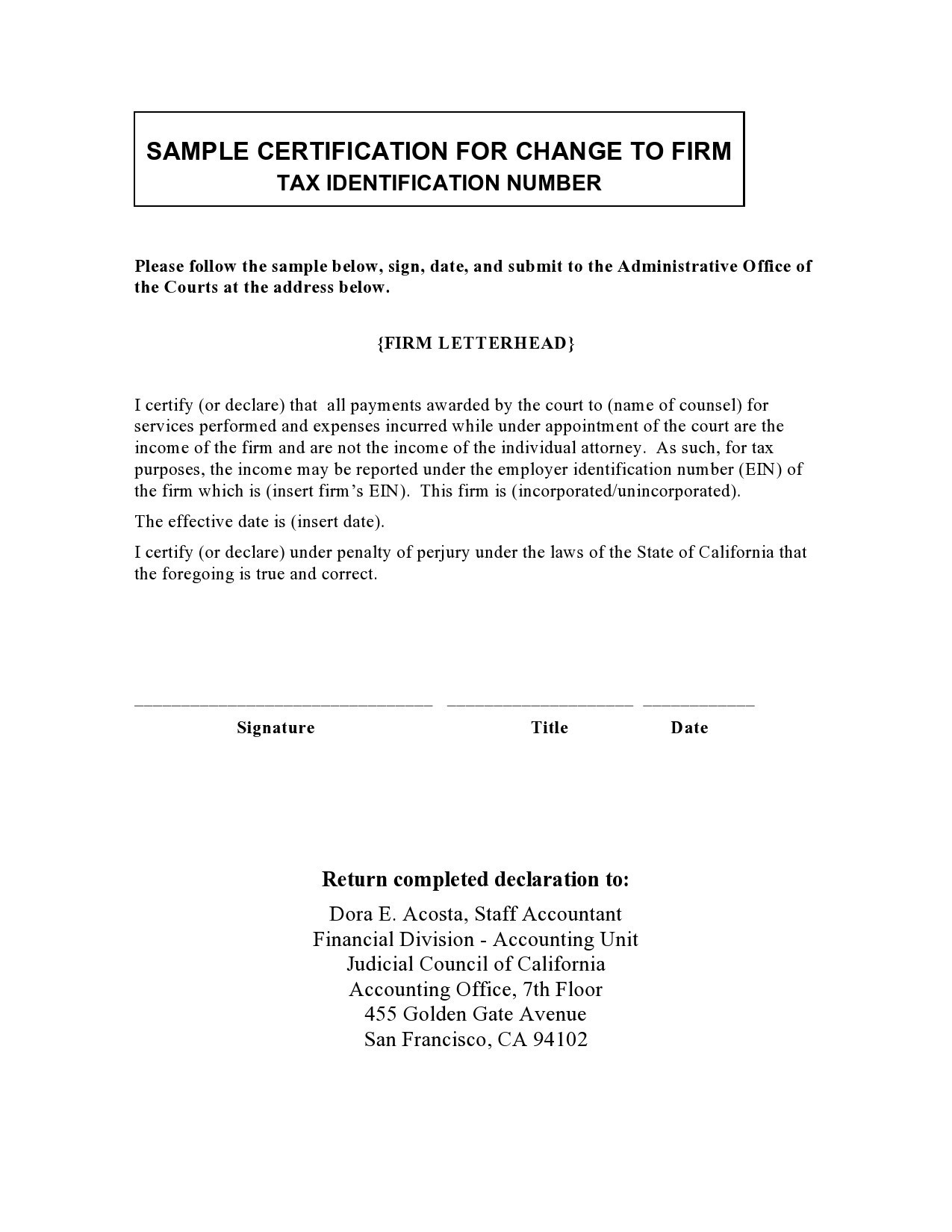

If you applied for a loan that you needed to start your business, the bank might have requested a copy of this letter. Retrieving copy this way can be very convenient if you’re under time constraints. - Request a replacement letter

This is also an easy method. Simply request a replacement letter from the IRS. Call their Business and Specialty Tax Line. You might have to experience a 30-minute hold time for this call. An IRS representative will first confirm your identity and from there, work with you to get you your replacement letter.

This letter is a replacement verification letter but it’s not a duplicate of your original letter. However, it will still serve as an official document that you might need if someone has asked you to give proof of your EIN.