A trust agreement is a formal contract wherein a “trustor” grants the ownership rights of one or more assets to one or more “trustees.” This is a document which states the purpose for the establishment of the trust; the fulfillment which terminates the trust; the details of the assets in the trust; the limitations and powers of all the trustees; the reporting requirements and other provisions of the trustees; and even the compensation of the trustees if any.

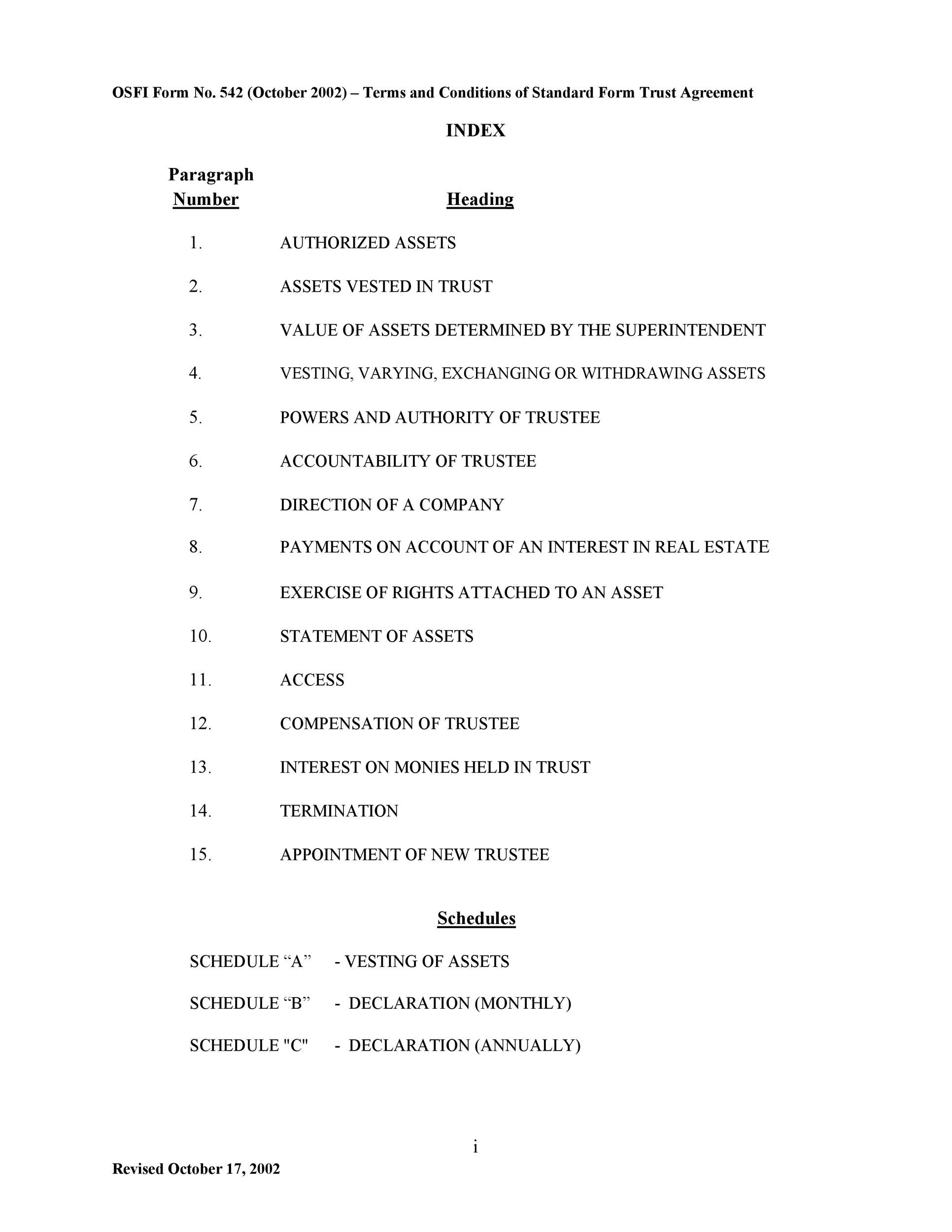

Table of Contents

- 1 Trust Agreement Templates

- 2 What is a trust agreement?

- 3 Revocable Living Trust Forms

- 4 The important elements of a trust agreement

- 5 Land Trust Agreements

- 6 Living versus testamentary trust agreements

- 7 Why is it better to ask help from a lawyer when making a trust agreement?

- 8 Living Trust Forms

- 9 What is a revocable trust agreement?

- 10 What is a land trust agreement?

- 11 Living Trust Templates

- 12 What to do if you lose or misplace your trust agreement?

Trust Agreement Templates

What is a trust agreement?

A trust agreement is a type of document which contains an official signature and which establishes a trust. The trust, on the other hand, refers to a structure in which the legal title of a specific property or asset gets transferred from the owner or the “trustor” to another person or the “trustee.” Then the trustee administers the assets for the benefit of the “beneficiary” or the third party.

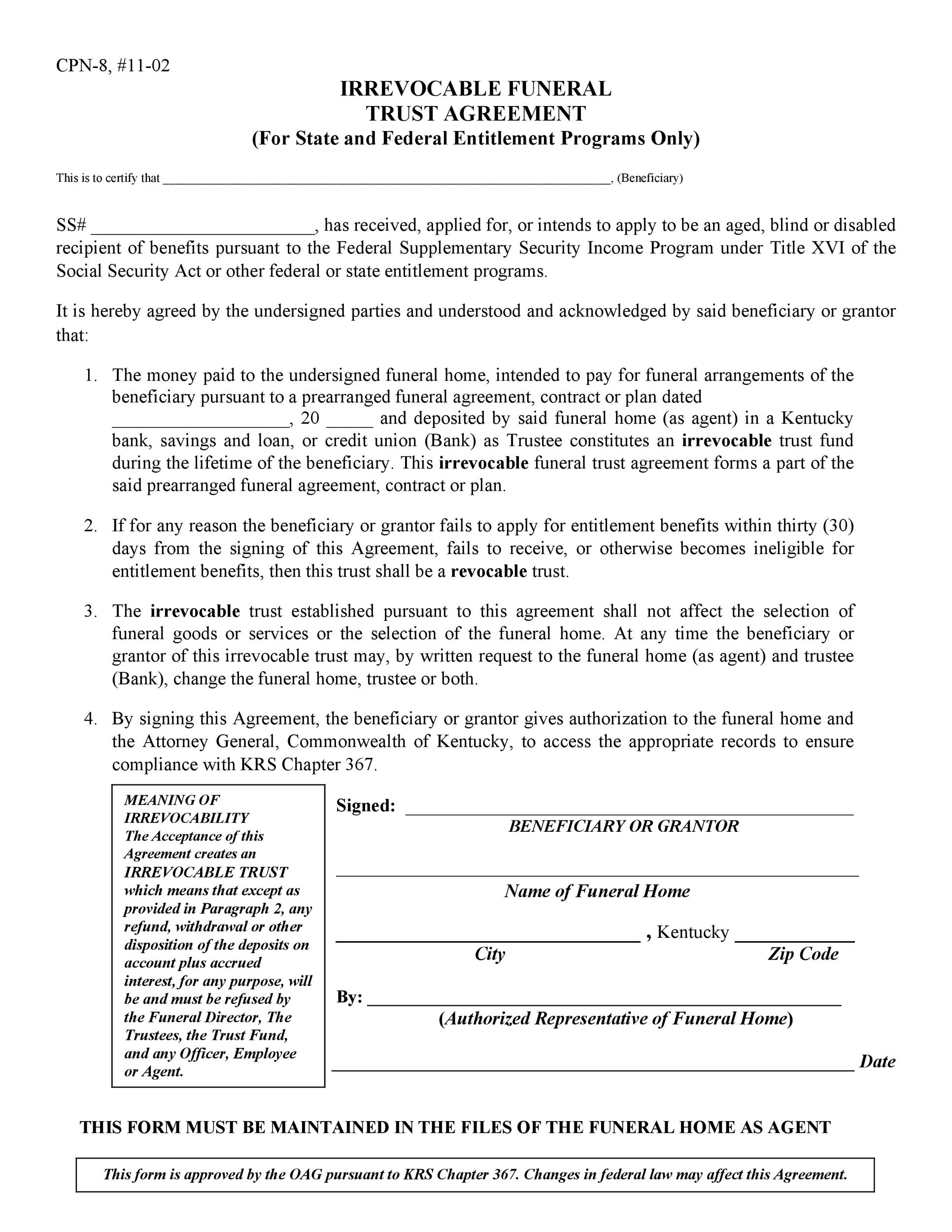

You can use this type of agreement to create a trust which is either irrevocable or revocable. When it comes to trust executions, the requirements of each state varies. Generally, though, the trust agreement must come in writing with the signature of the trustor.

In some cases, the trust agreement specifies all of the details regarding how the trustee will use the property. We refer to this type of agreement as a mandatory trust. However, if the agreement states that the trustee can decide on when and how to distribute the assets to the beneficiaries, we refer to this type of agreement as a discretionary trust.

Revocable Living Trust Forms

The important elements of a trust agreement

Trust refers to a type of relationship wherein one party takes responsibility for a property or asset for the benefit of another party. Although there are different types of trusts and trust agreements available, all of them include these essential elements:

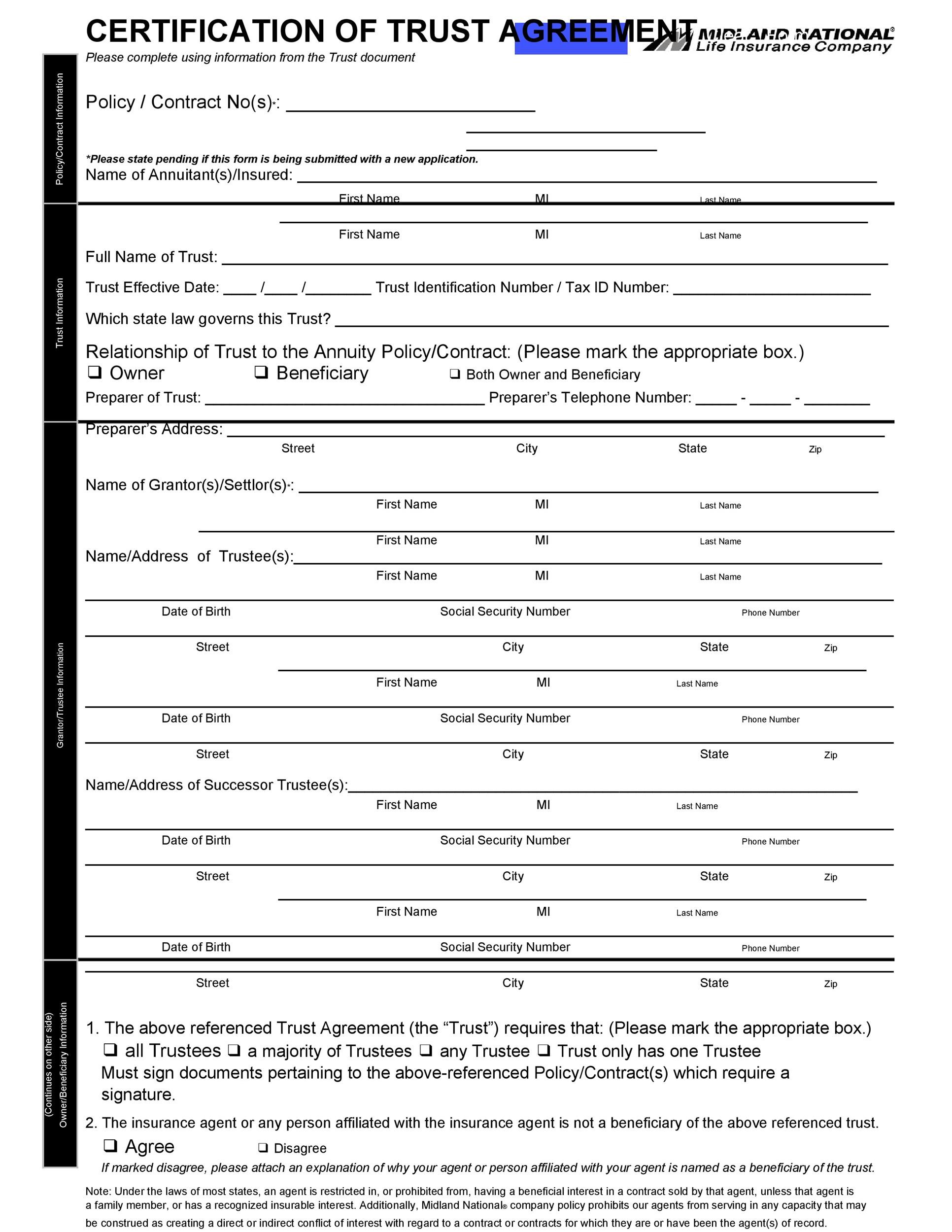

- Trustor

This refers to the person who created the trust and made all of the decisions relating to it. The trustor is also known as the “settlor,” “maker” or “grantor.” - Trustee

This refers to a person assigned by the trustor to manage or invest the assets of the trust and administer its terms. The trustee may be a person or an entity like a bank. There are some types of trusts wherein the trustor appoints himself as the trustee. - Beneficiary

This refers to the person or group of people who receive all of the benefits of the trust. A single trust may have more than one beneficiary. - Terms

The trustor creates all the terms of the trust and this may include his wishes too as long as the terms aren’t “unconscionable” or illegal. When it’s time for the trustee to administer the trust, he must follow all of the terms to the letter. - Funding

The trustor transfers his assets to the trust and these serve as the funding. The trustor may use any kind of assets such as proceeds, real property, securities, and cash.

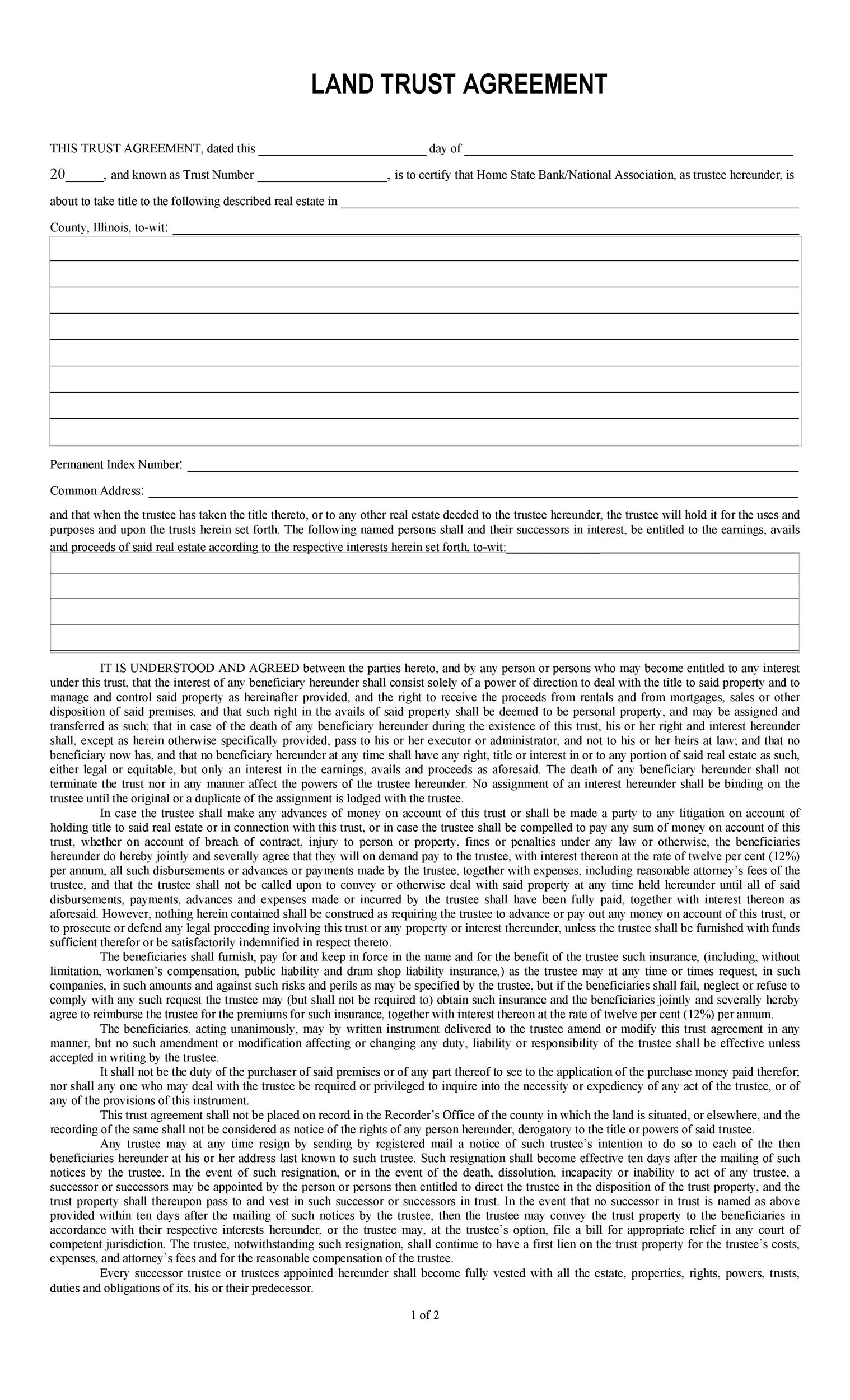

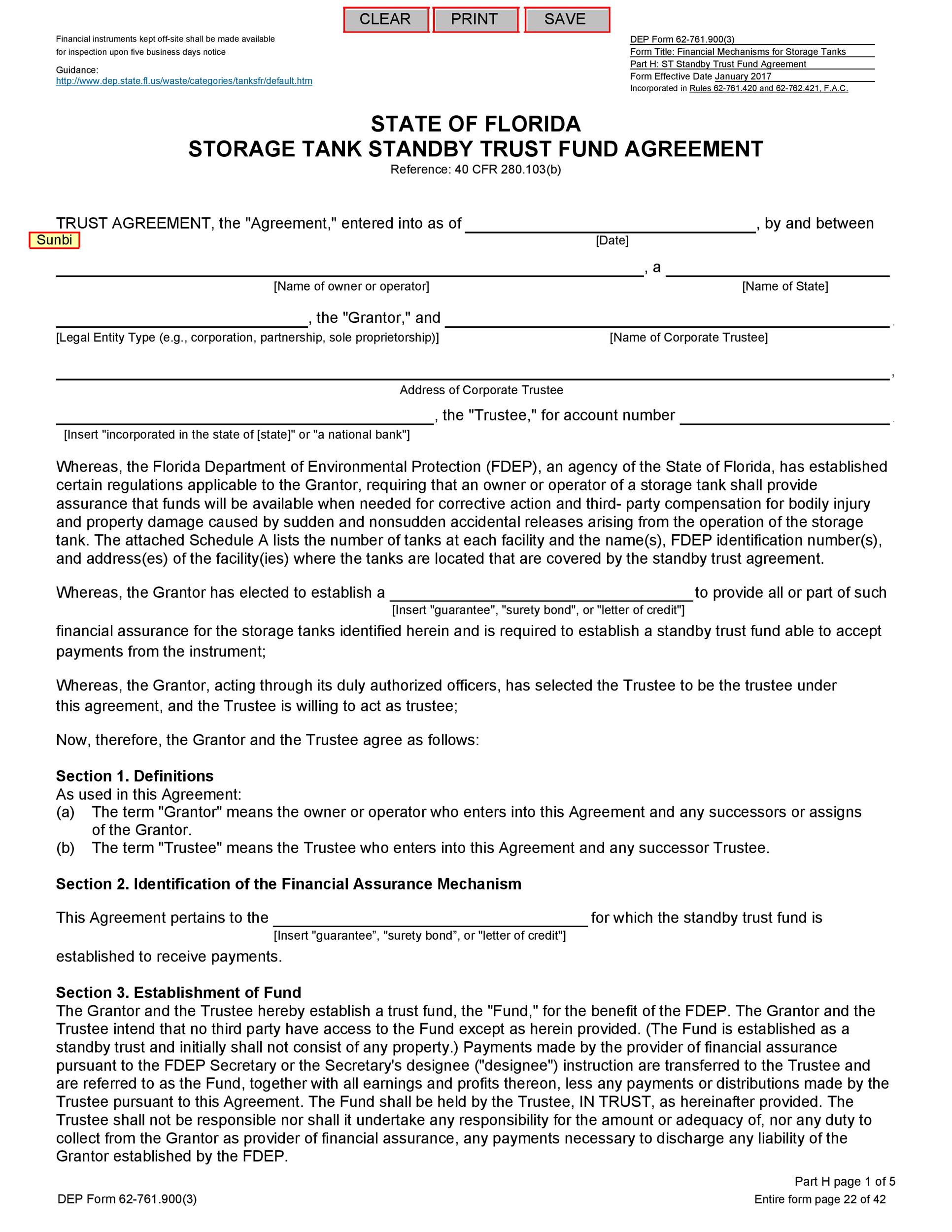

Land Trust Agreements

Living versus testamentary trust agreements

During a trustor’s life, he can set up a trust whether he creates a living trust template or any other type of trust. However, there are some trusts which don’t take effect right away. Depending on when the trust becomes effective, it’s either a testamentary trust or a living trust.

A testamentary trust refers to one which exists but doesn’t come into effect until after the trustor dies. Such trusts are often made within Last Wills and the person who creates this type of trust is the “testator.” By contrast, a living trust template or a living trust sample is one which, after the trustor creates it, becomes effective immediately.

If you’re planning to create your own trust, think about whether you want it to be a testamentary trust agreement or a living trust template.

Why is it better to ask help from a lawyer when making a trust agreement?

Nowadays, you can find different types of templates online. Because of this, people often feel encouraged to create their own documents without consulting with lawyers. Online templates are very beneficial, especially when you’re trying to learn more about official documents and how to make them.

Still, before making the terms of your trust agreement official, it’s better to consult with a lawyer. Otherwise, you might run into the following issues:

- Having provisions or language which are out-of-date, especially when there have been some changes in the laws since the creation of the template.

- Not having a contingency plan like the “successor trustee,” wherein an alternate trustee gets assigned if needed.

- Using vague terms, especially regarding the distribution of investment of the assets.

- Not providing your trustee with enough discretionary authority or giving too much of it.

Legally, you aren’t required to consult with a lawyer when making a revocable living trust form, a land trust agreement, a living trust sample or any other type of trust agreement. But doing so will help you avoid legal issues. Consulting with a lawyer also ensures that everything you want the trust to fulfill happens.

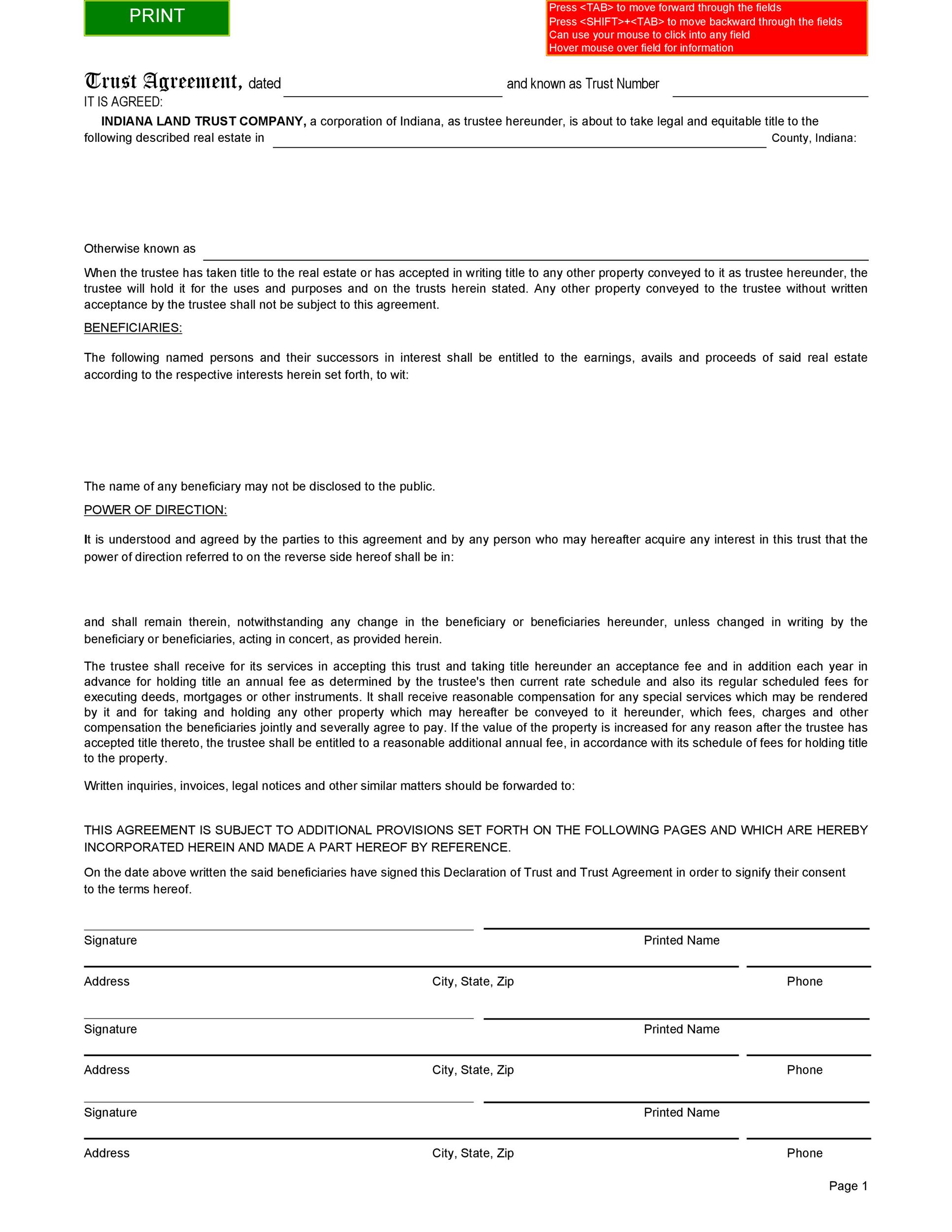

Living Trust Forms

What is a revocable trust agreement?

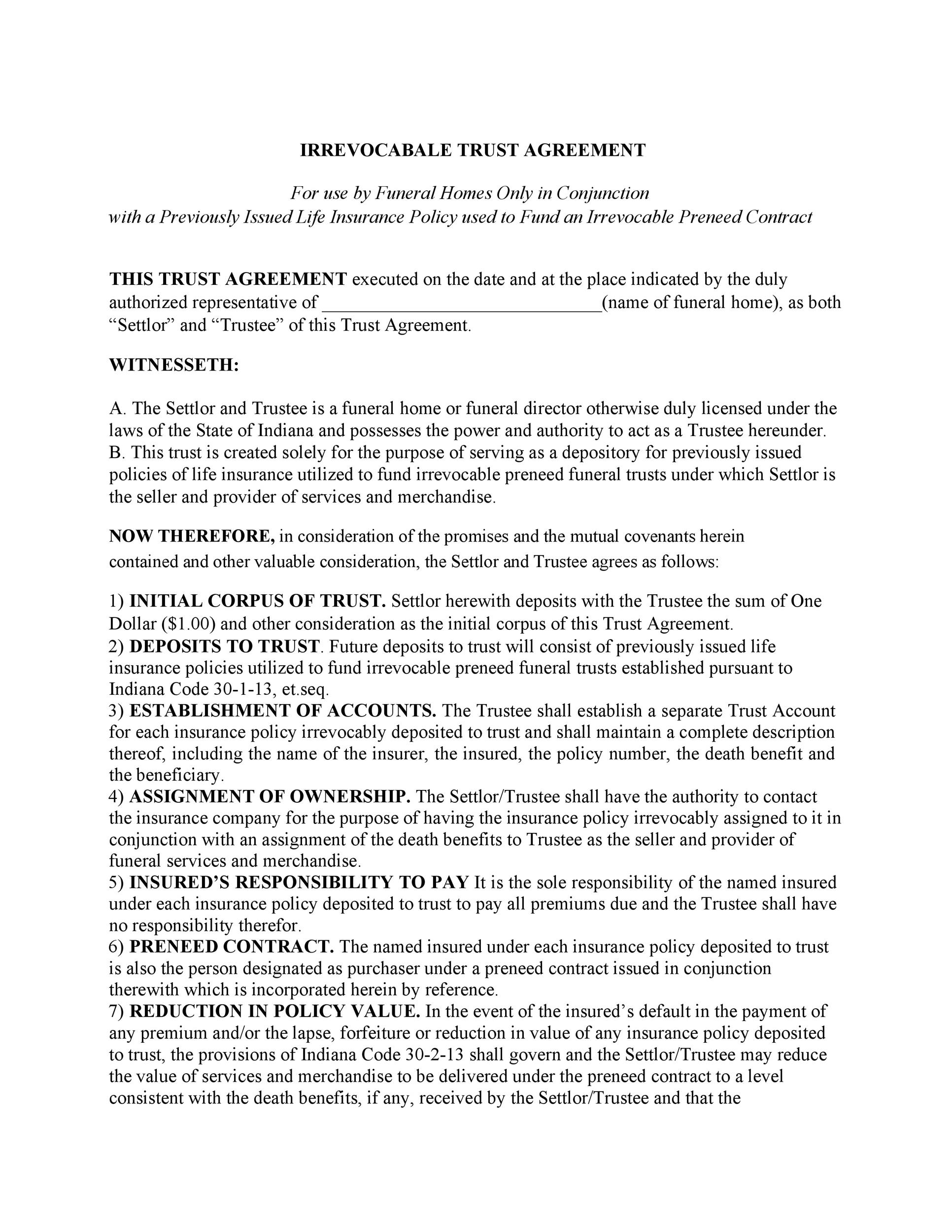

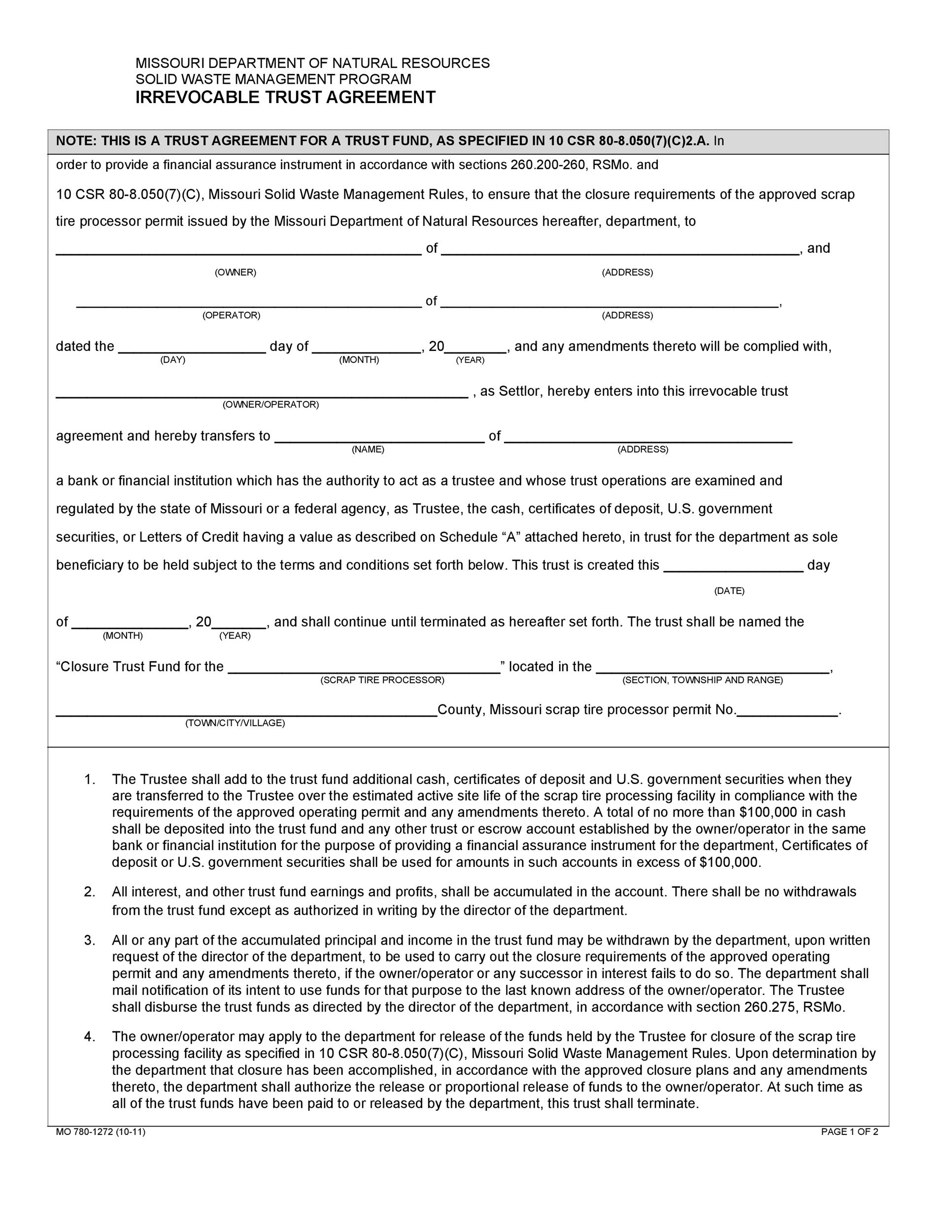

All types of trust agreements are either irrevocable or revocable. For an irrevocable trust agreement, the trustor grants control and ownership of the property to the trustee. For this type of trust, the trustor no longer controls or owns the property which means that he can’t make any changes to it.

For a revocable trust, whether it’s a revocable living trust form or otherwise, the trustor retains control and ownership of the property. Therefore, he can change the terms, trustees, and the beneficiaries of the trust. Choosing the type of trust to create, whether it’s an irrevocable or revocable living trust form depends on your goals.

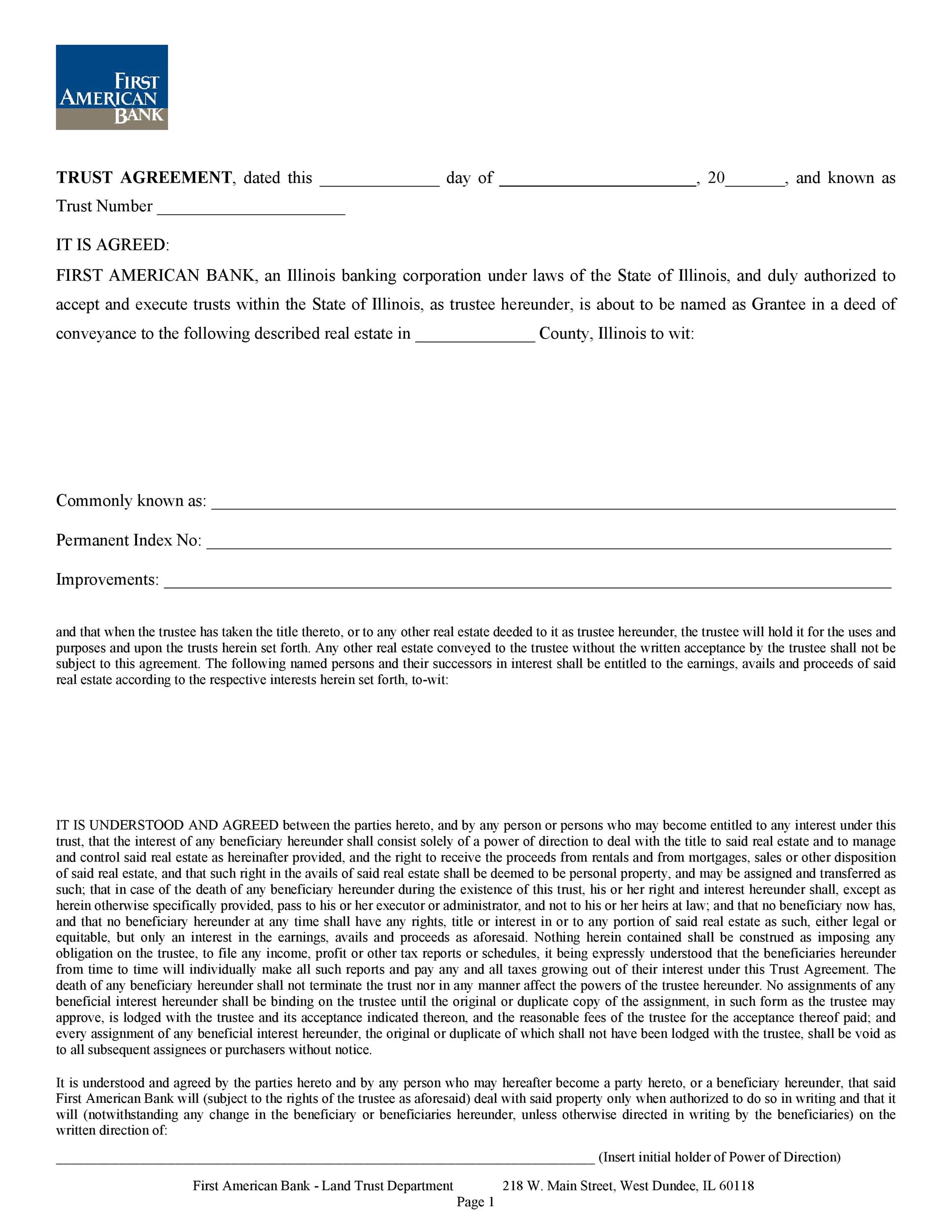

What is a land trust agreement?

A land trust agreement is a legal contract wherein the owner of the property transfers the title of the said property to a trustee. Usually, the owner of the property is the beneficiary of the agreement. He instructs the trustee in all matters related to the property’s management as written in the deed or agreement.

In a land trust agreement, the owner of the property maintains all of the rights which means that he can rent, sell or develop the said property. One huge benefit of a land trust agreement is that it grants anonymity to the owner of the property. This is because the name of the trust appears as the holder of the property in all of the public records.

Living Trust Templates

What to do if you lose or misplace your trust agreement?

A trust agreement is a type of instruction manual which contains details about how the trust operates. If you don’t have this document, you can’t make sure that your trust gets administered the way you want it to be. Even if your trustee or beneficiaries are members of your family, it’s better to have all of the terms in writing.

After creating the agreement, you must keep the original copy with you or have it copied and keep the copies with your other files. This is important, especially if you want to use it as a reference or make any changes to it while you’re still alive. Unfortunately, there are some cases when we end up losing or misplacing the trust agreement.

When the time comes and you need the document, but you don’t have it on-hand, what should you do? Here are a couple of suggestions for you:

- If you’re still in contact with the drafting attorney of the trust, then give him/her a call and request for a copy. But if the attorney is either retired or deceased, this might be very difficult.

- In some cases, investment advisors ask for a copy of the trust agreement when you open an account with them. In such a case, you may request a copy of the document from them.

- If you created a testamentary trust, try to find out who the administrator or executor was. Once you find out, contact the person. However, if this person has already died, you’re back at square one.

- If the decedent filed a gift tax return or a State or Federal Estate tax return, then you may obtain a copy of the document from the IRS. However, it’s not easy to request for such a document from this agency unless you have proof that you’re the trustee or the executor of the trust agreement.

- Speak to the accountant. Those who prepare taxes must have copies of Last Wills and trust agreement in their files.

- If you’ve considered all of these suggestions but you still haven’t obtained the document, you might have to petition the court so you can get officially appointed as a personal representative. To do this, you need the services of knowledgeable probate or trust attorney.

When it comes to trust agreements, remember that they’re not part of the public records. This means that you can’t just go to the local probate court and request for a copy of this document. The best (and easiest) thing for you to do is take care of your trust agreement once you’ve created, finalized, and made it official.