If you have never heard of a small estate affidavit form, this is probably because you have never had to deal with the probate process before. This form is used to protect those who have inherited assets or property from waiting for an estate to go through probate before taking control of these assets. This can be critical for family members who were financially dependent on the person who passed away.

While this is the kind of form that most people have a lawyer write for them, you can look at an example of a small estate affidavit if you want to try to create this document yourself. There are often legal limits to the size of the estate that this form can be used to protect, and there are state-specific guidelines for these kinds of estate processes that must be followed as well. You will need to know all of the various limitations related to your state if you want to try and write a small estate affidavit yourself.

By State

Table of Contents

- 1 What is a small estate affidavit?

- 2 Small Estate Affidavit Templates

- 3 What are the terms that you need to know?

- 4 Small Estate Affidavit Forms

- 5 Where do I file a small estate affidavit?

- 6 How much does a small estate affidavit cost?

- 7 When is a small estate affidavit needed?

- 8 Small Claim Affidavit

- 9 How to write a small estate affidavit

- 10 Affidavit of Small Estate Examples

- 11 Small Estate Affidavits Are Key to Avoiding Probate Issues

What is a small estate affidavit?

In a general sense, a small estate affidavit or small claim affidavit is a document that protects the inherited assets and property of a family or next of kin in states which have probate rules. This document allows the people who are named in it to take control of the assets that need to be protected from probate. This could be a house; it could be monetary assets or even bank accounts. The probate process can take months or years, which is why this document can be so effective for those who cannot wait for probate to be completed, either for financial reasons or other constraints.

There are often state-specific limits on the use of this document that are linked with the determination that the estate counts as a “small estate”. Before you attempt to draft this kind of document on your own, you will need to know what the state limitations are in your area with regard to the size of the estate. This is the kind of document that is often written by a legal expert, so you will need to do some homework before you create it to be sure it has been created correctly.

The general rule of thumb that you need to be aware of is that the property being distributed cannot exceed $5,000 to $175,000. In some cases, real property and real estate cannot be included per state guidelines. The reason for these limitations is to help streamline the process of getting these small estates dispersed.

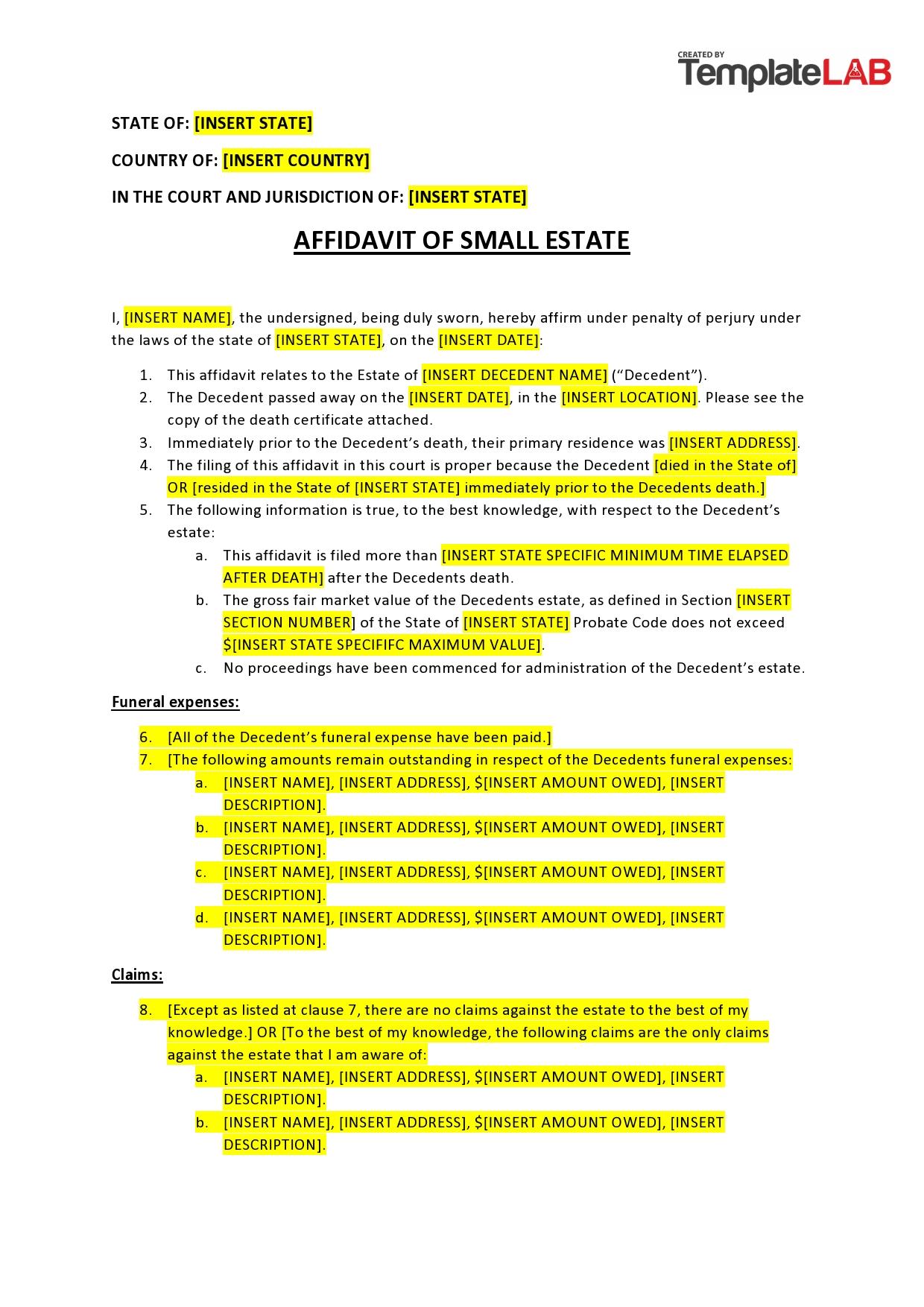

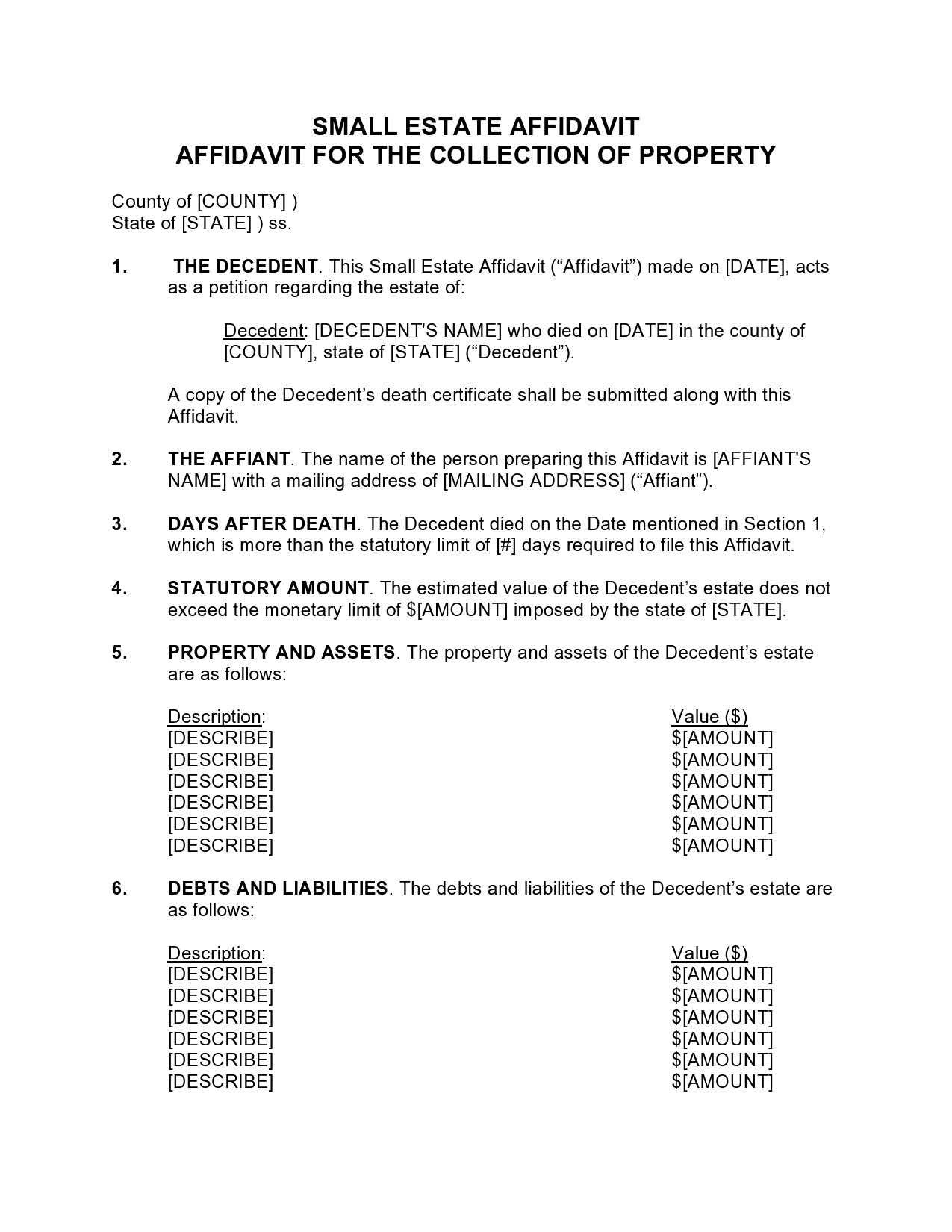

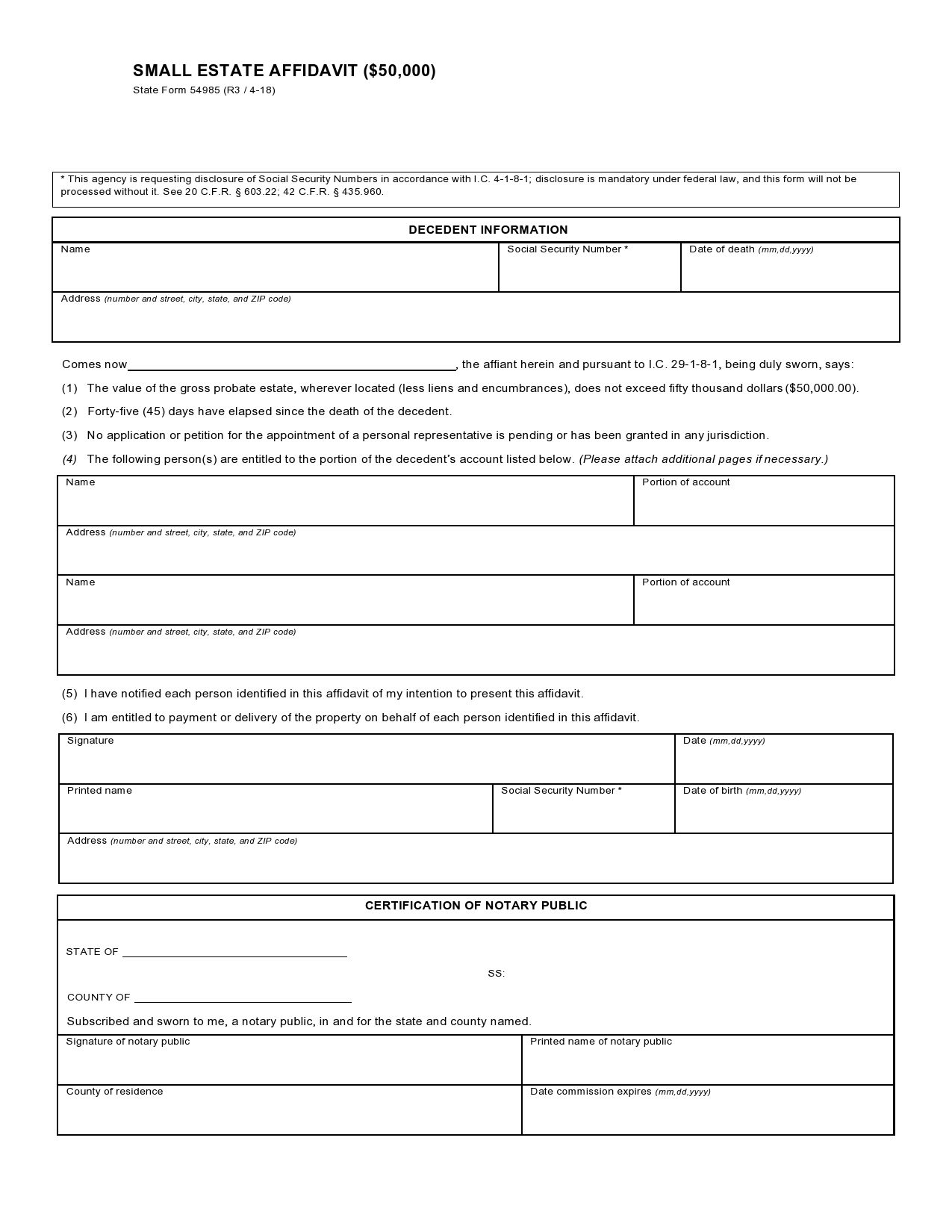

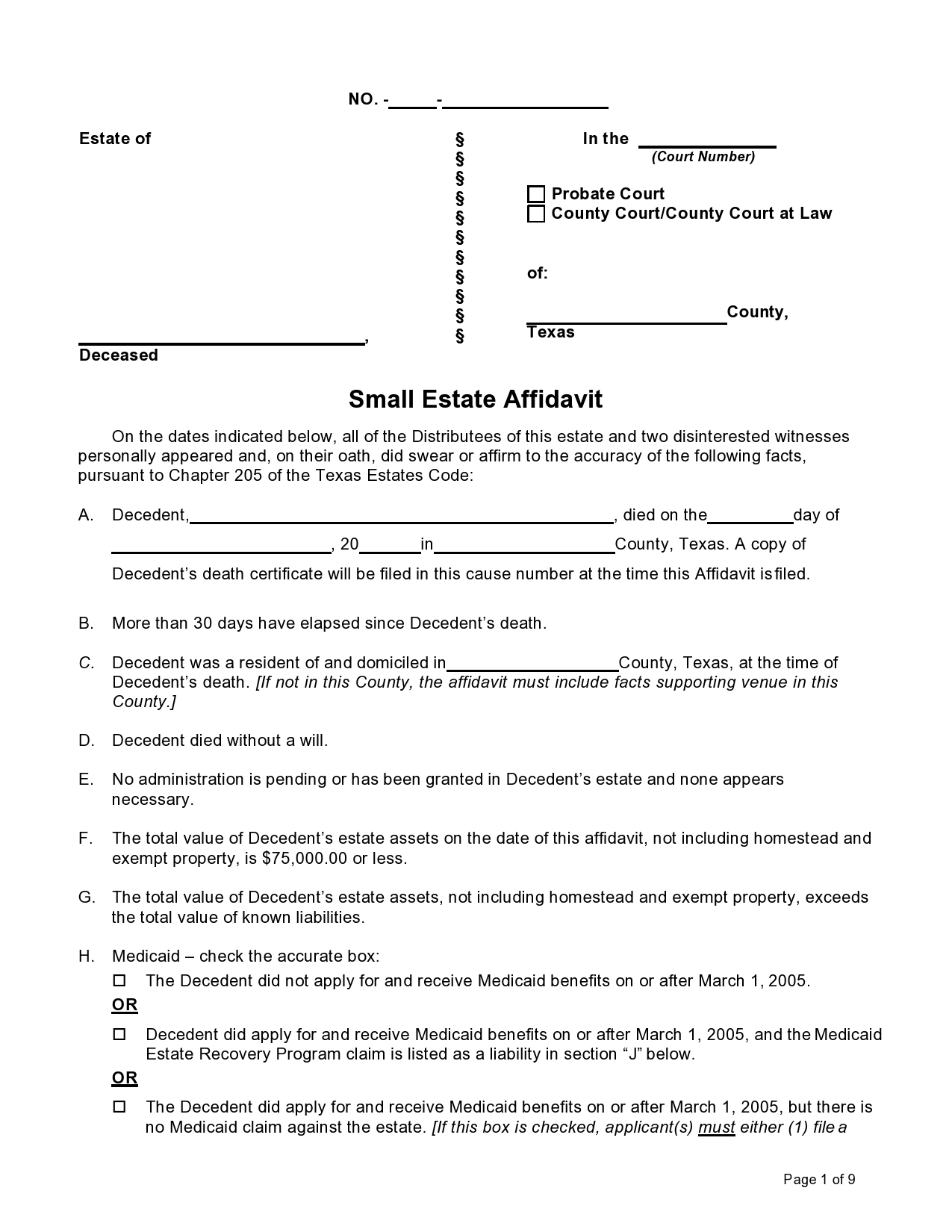

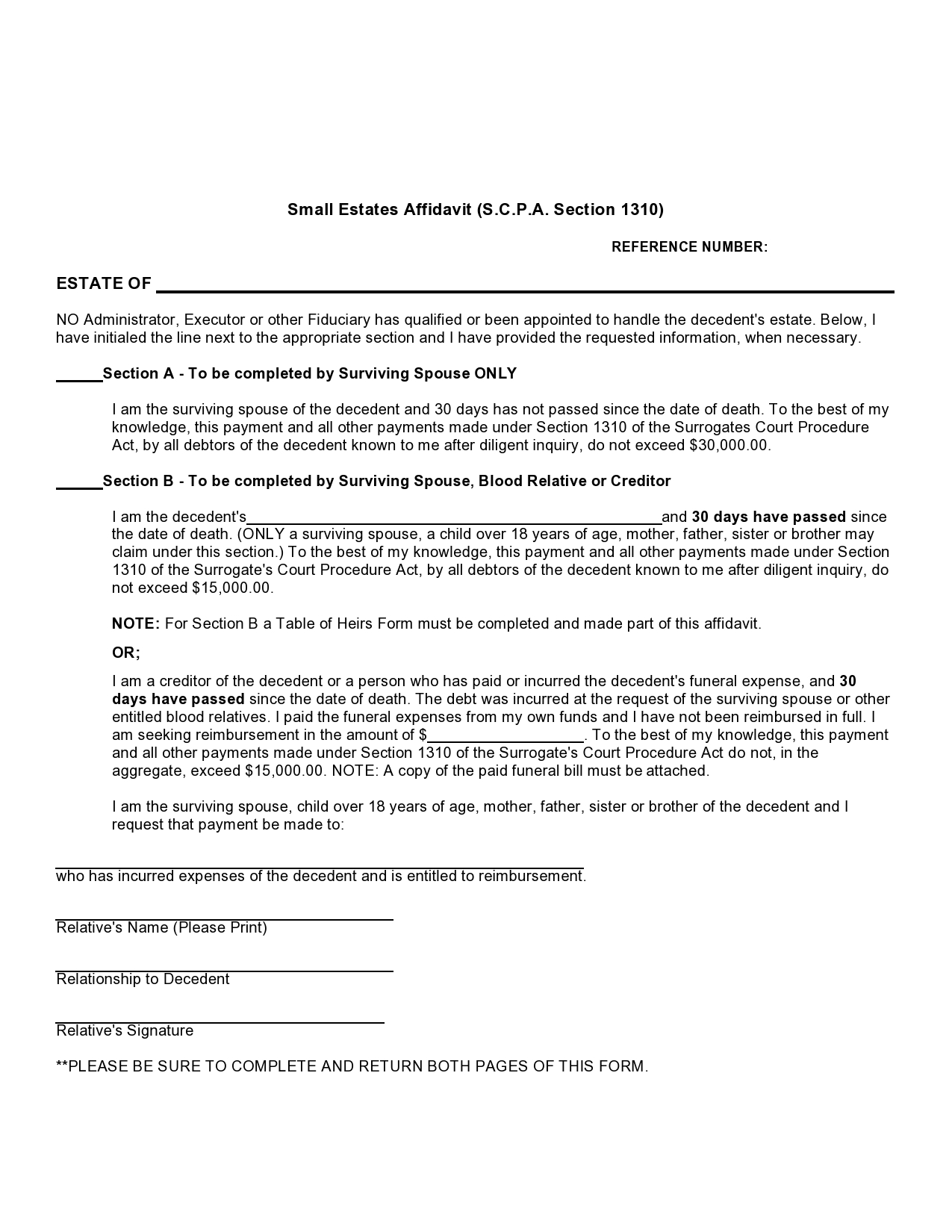

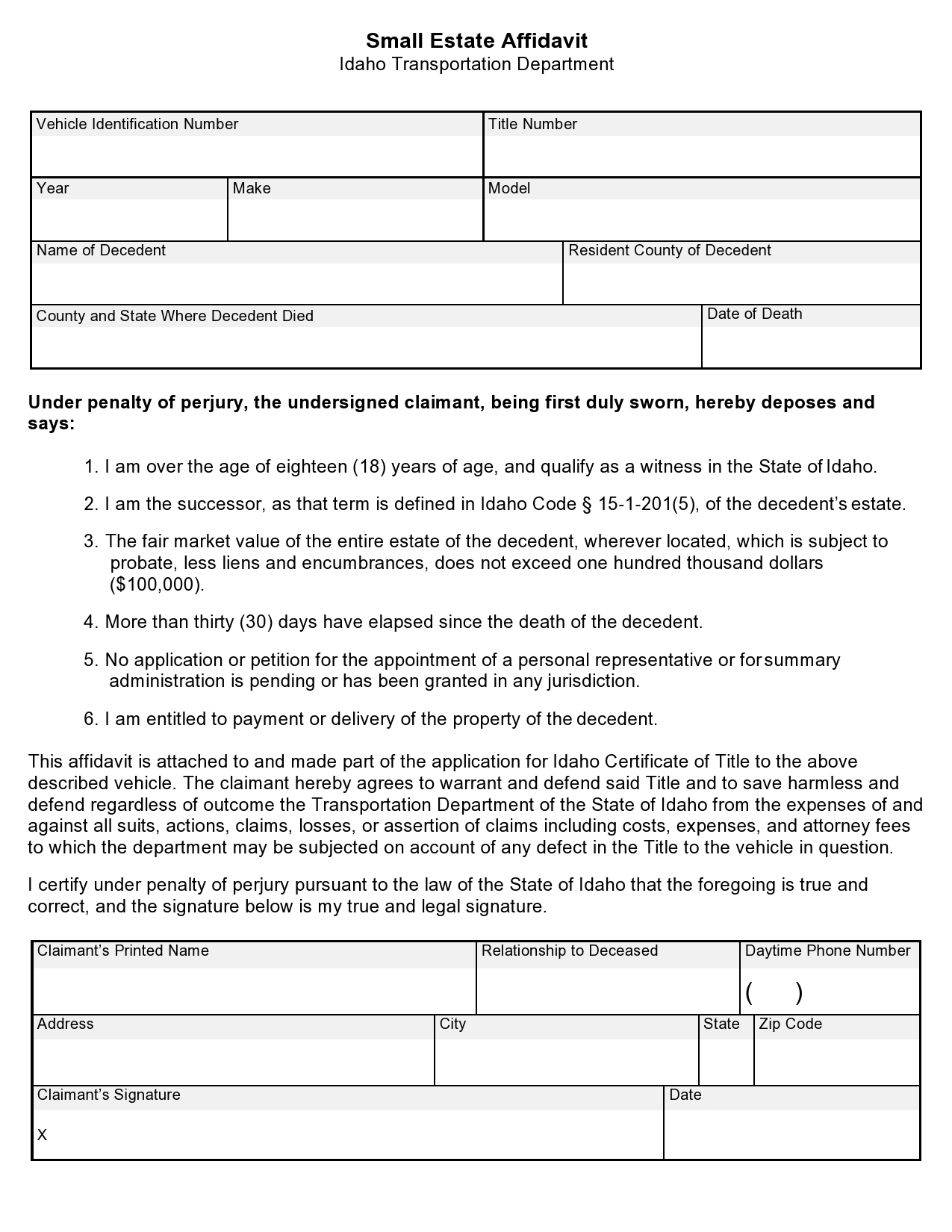

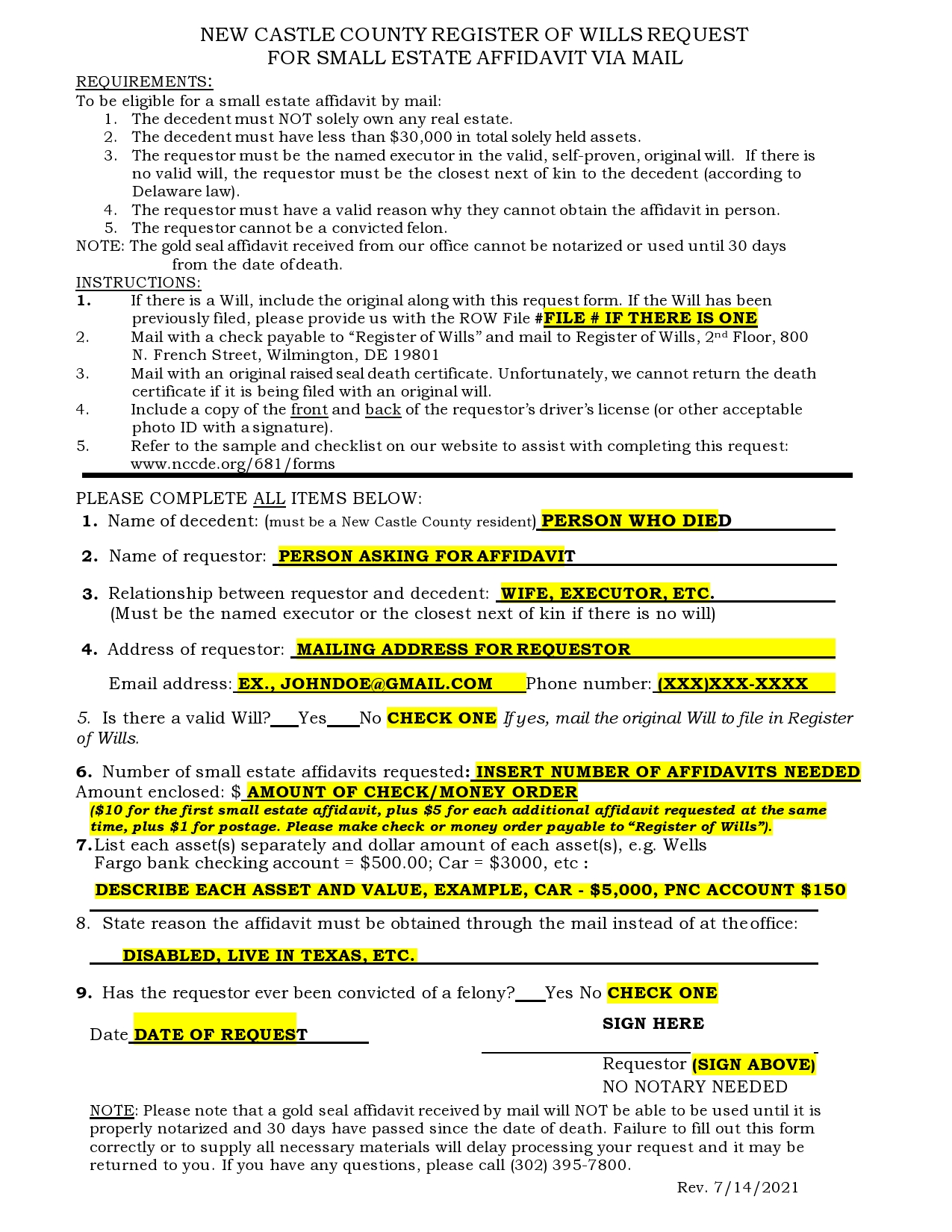

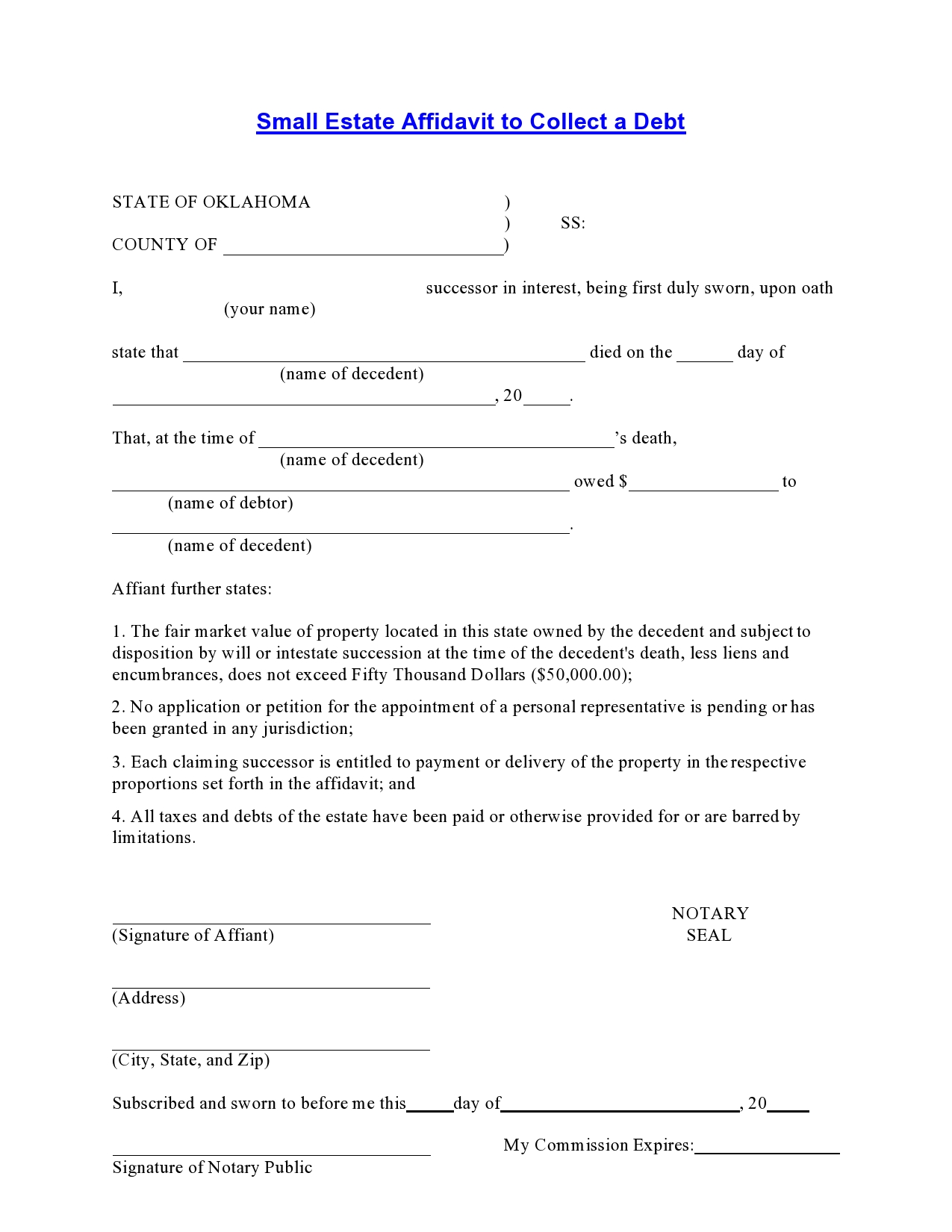

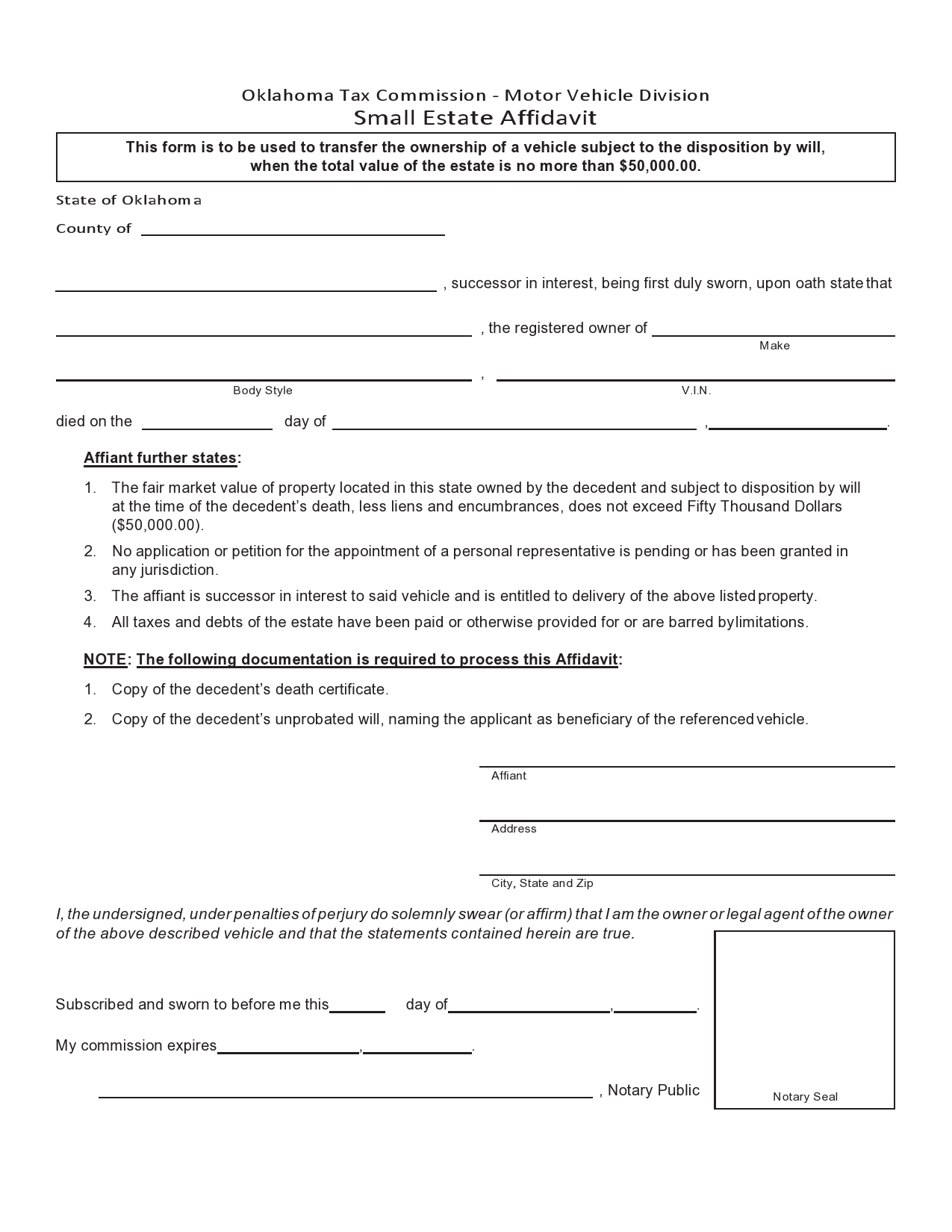

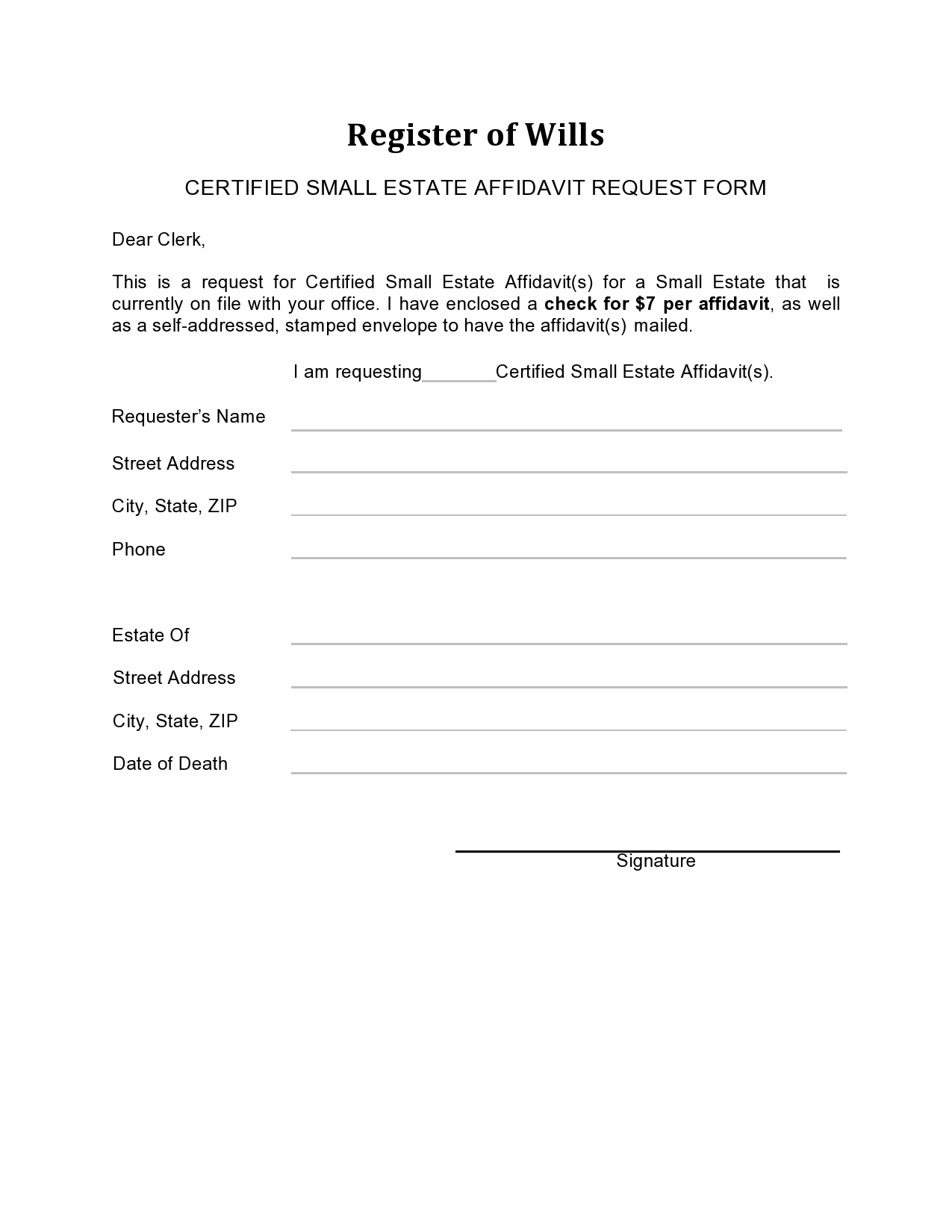

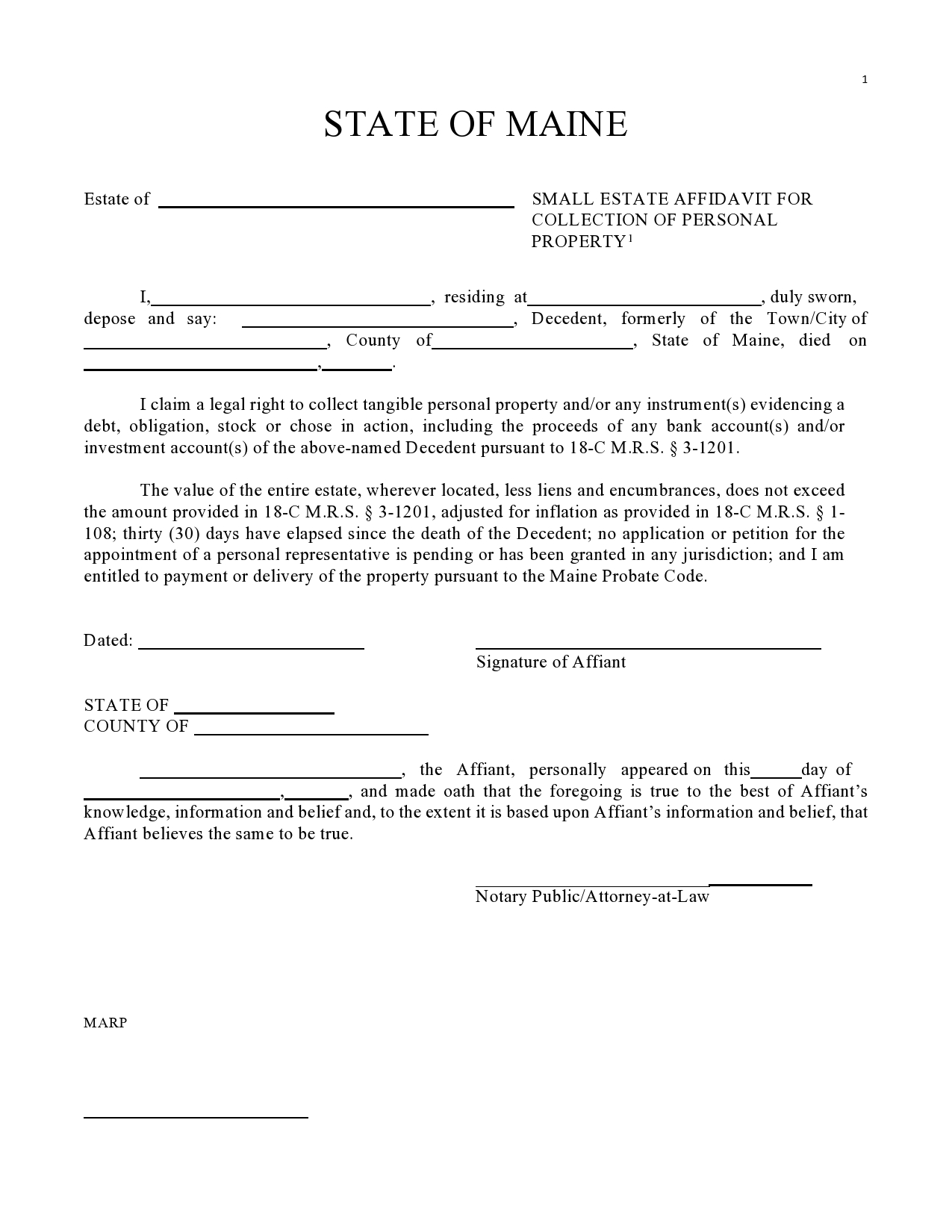

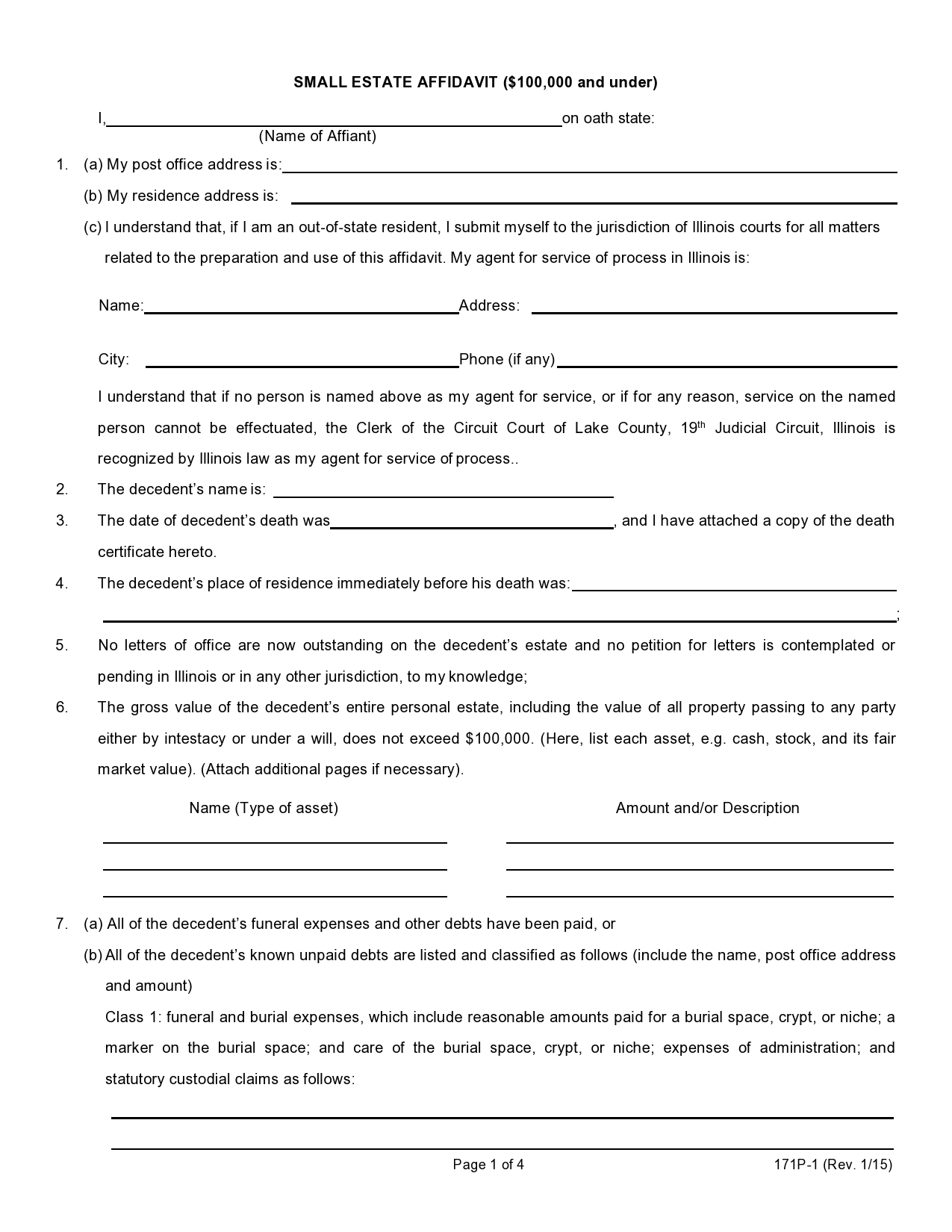

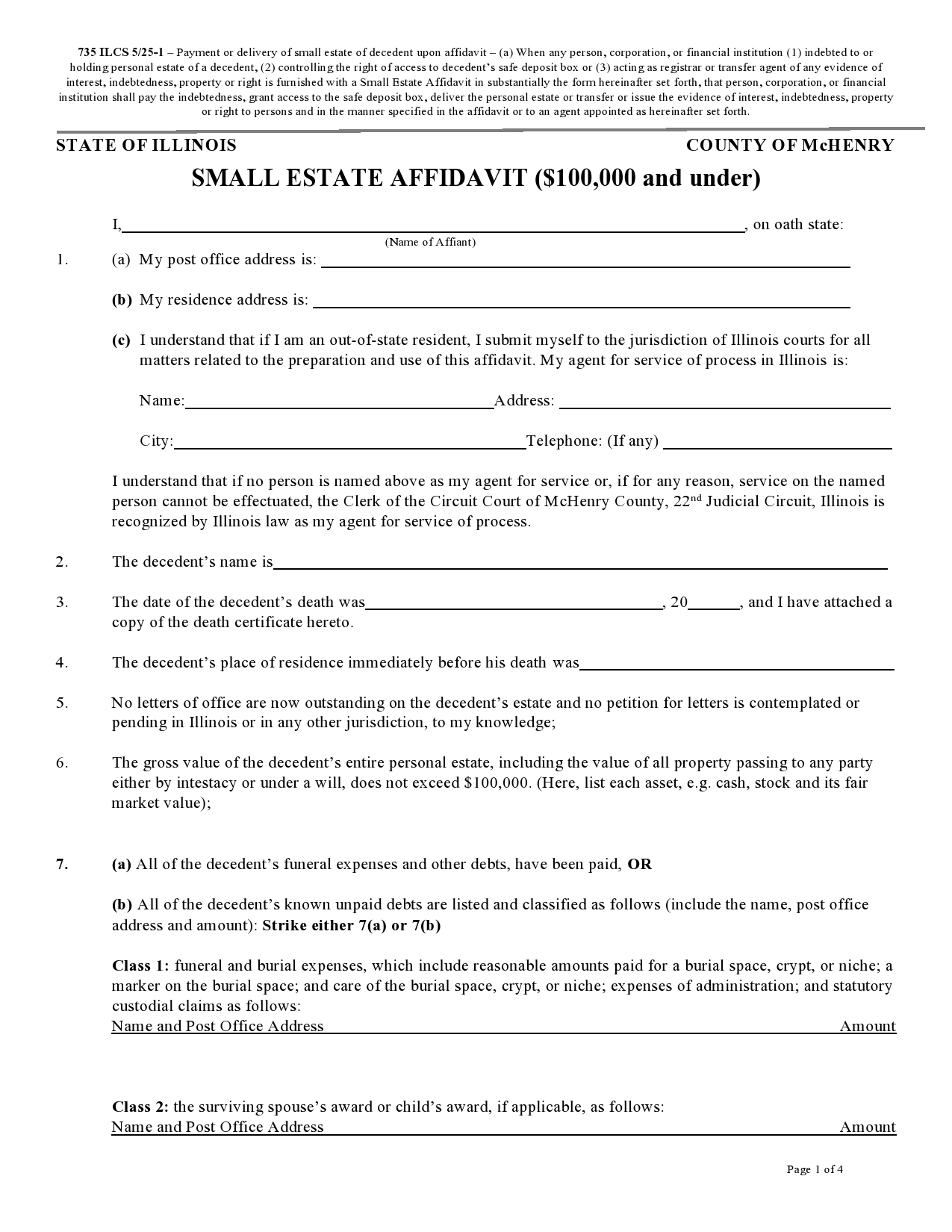

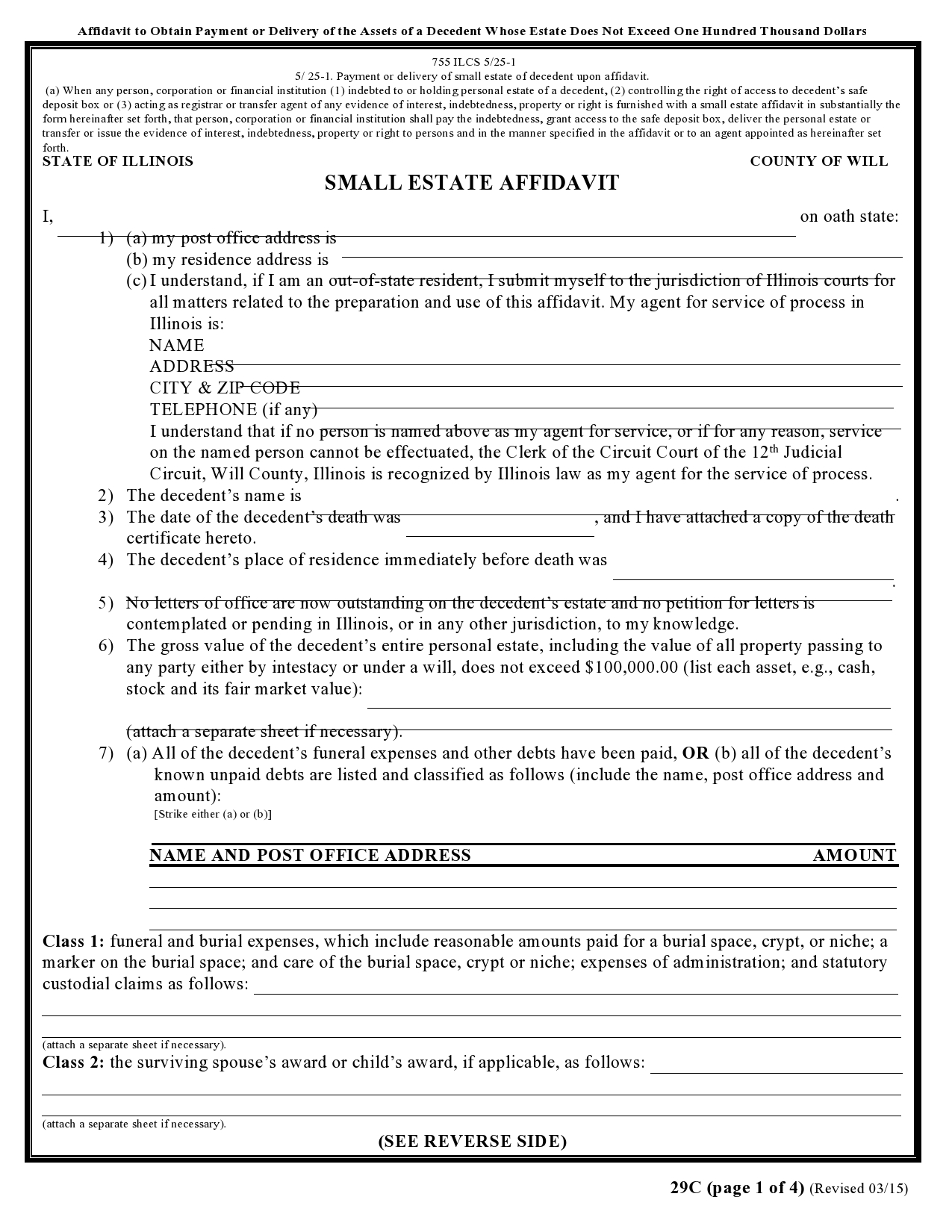

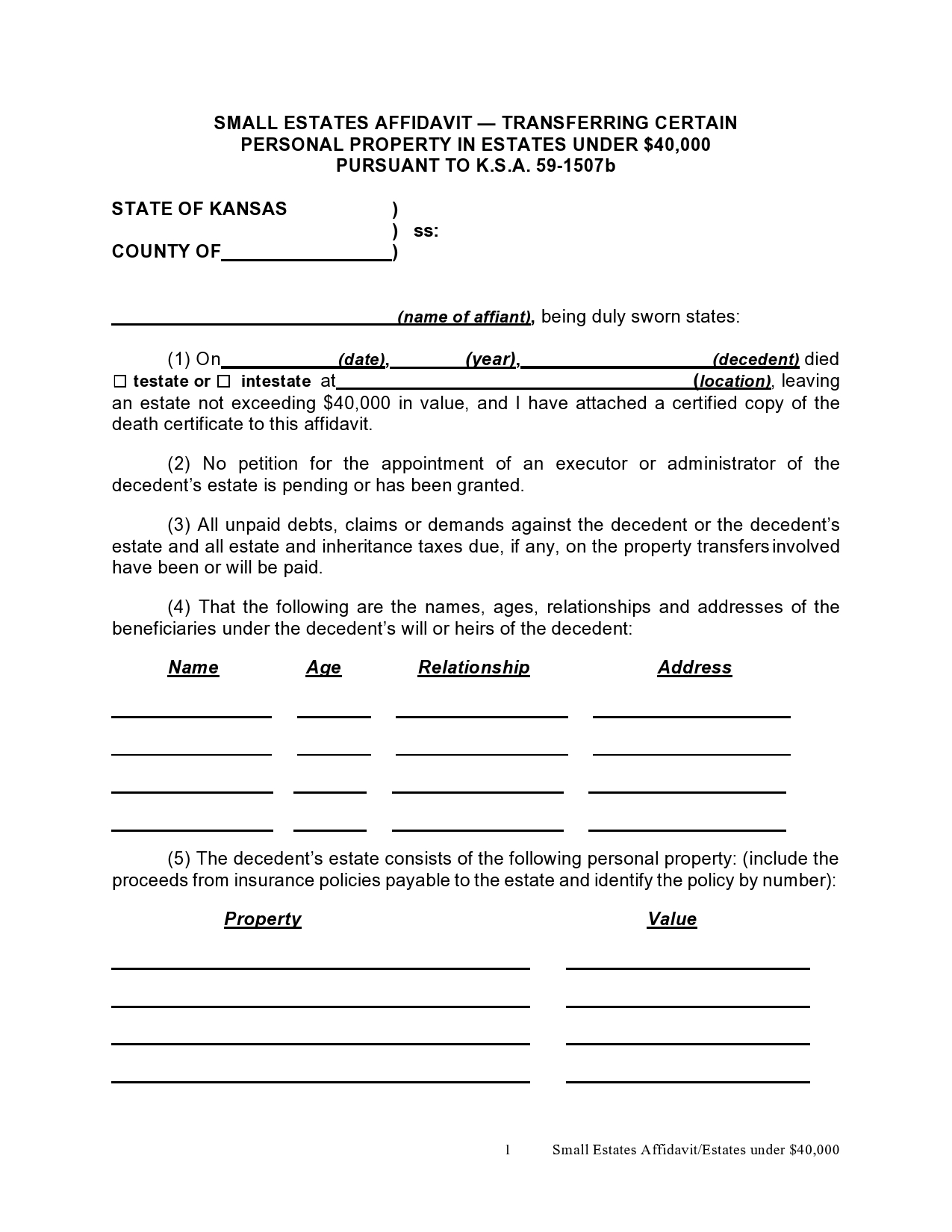

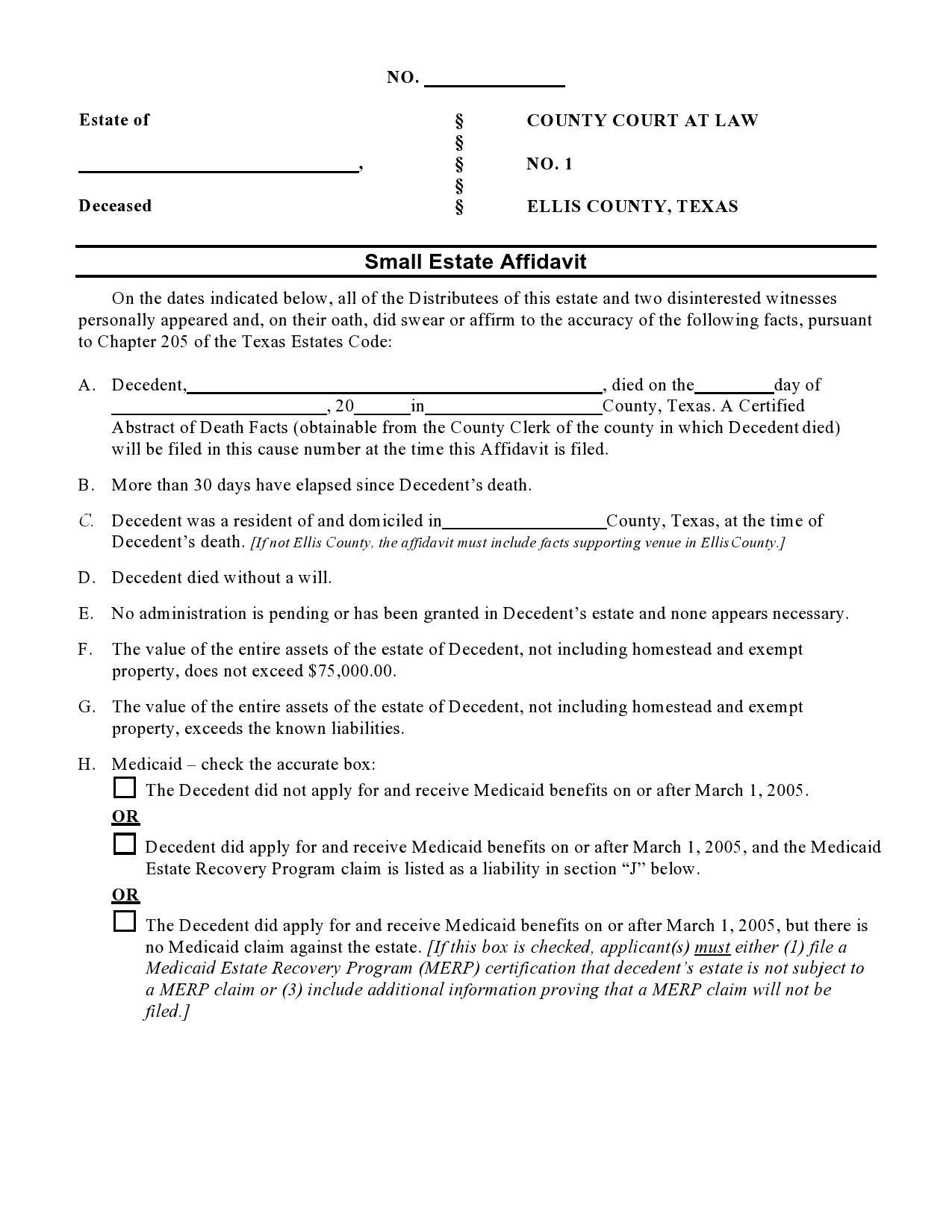

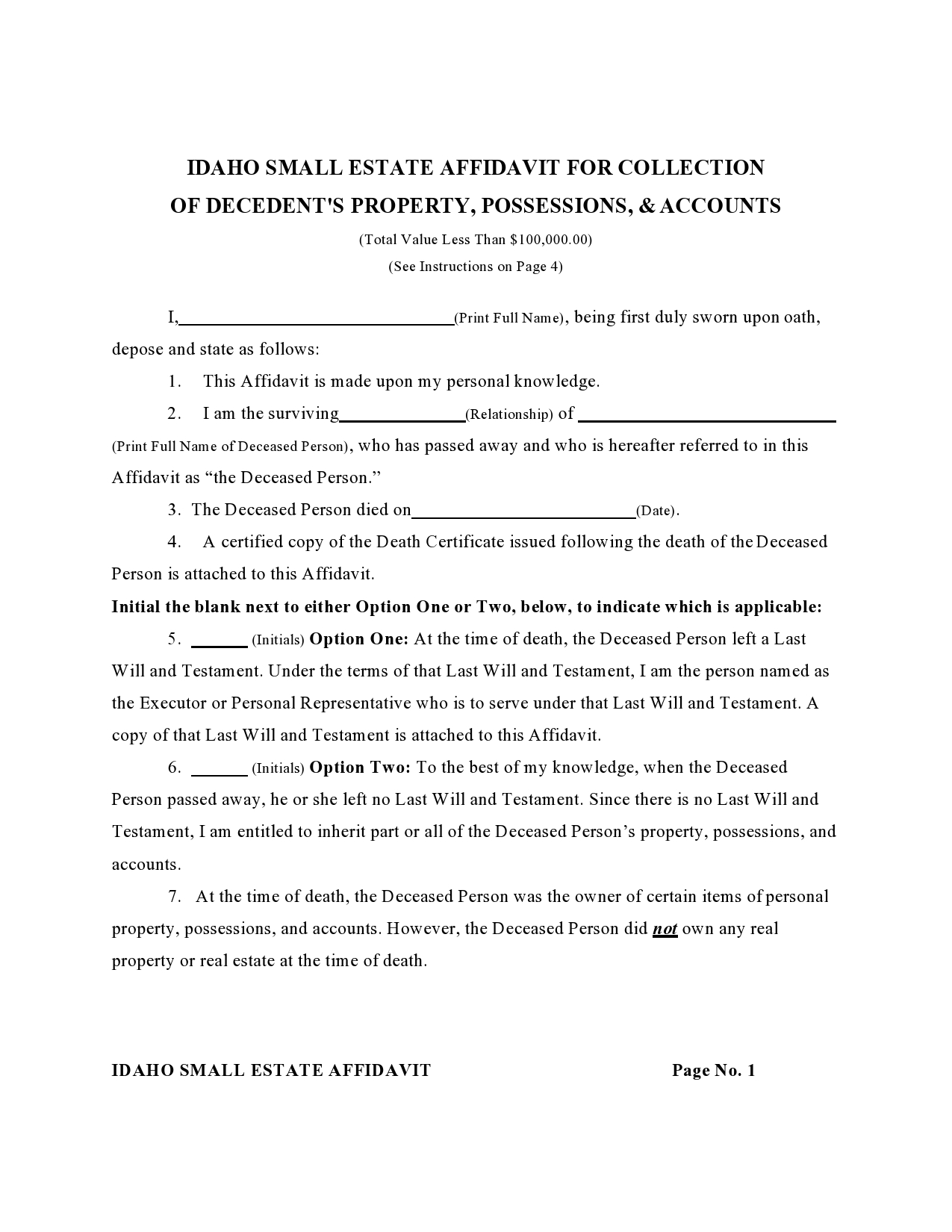

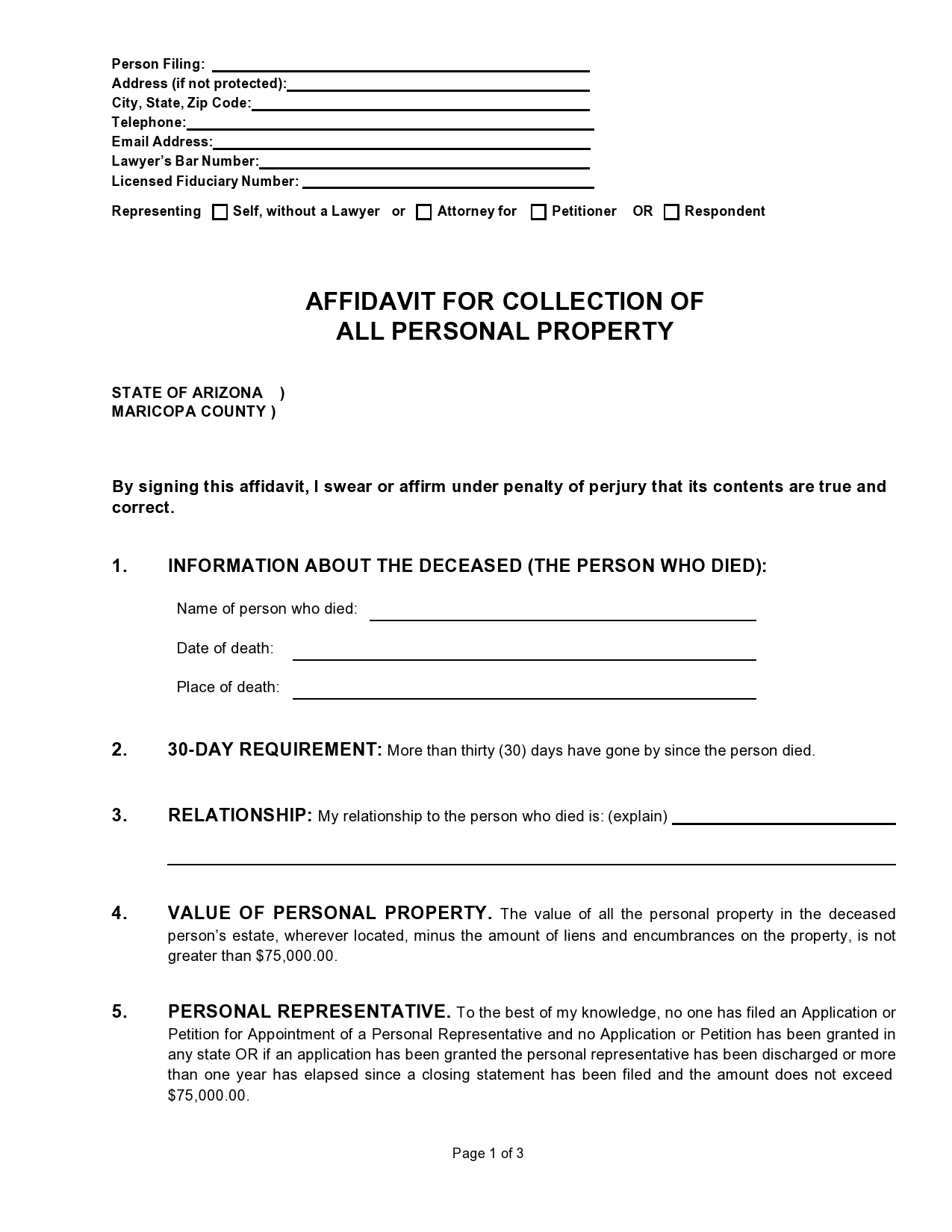

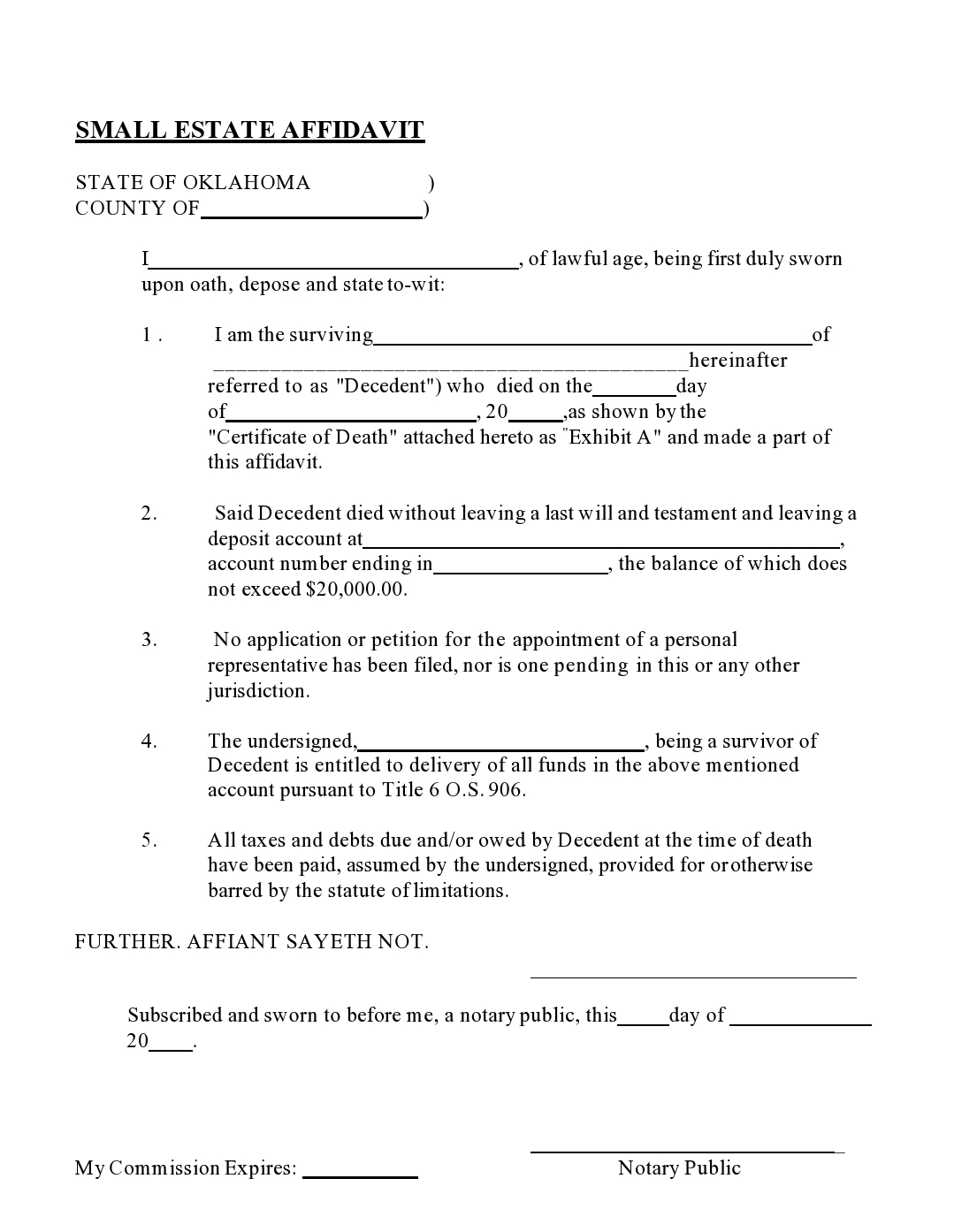

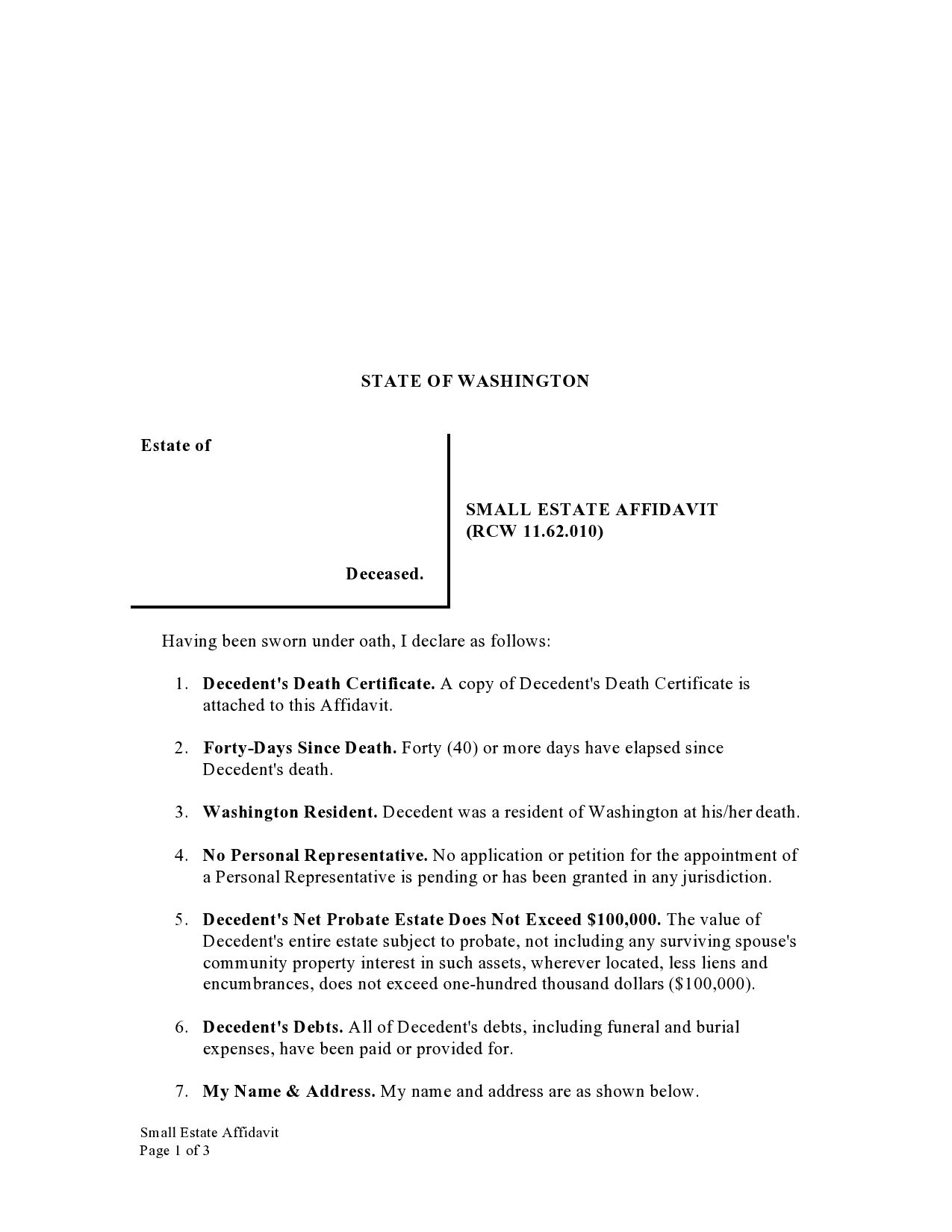

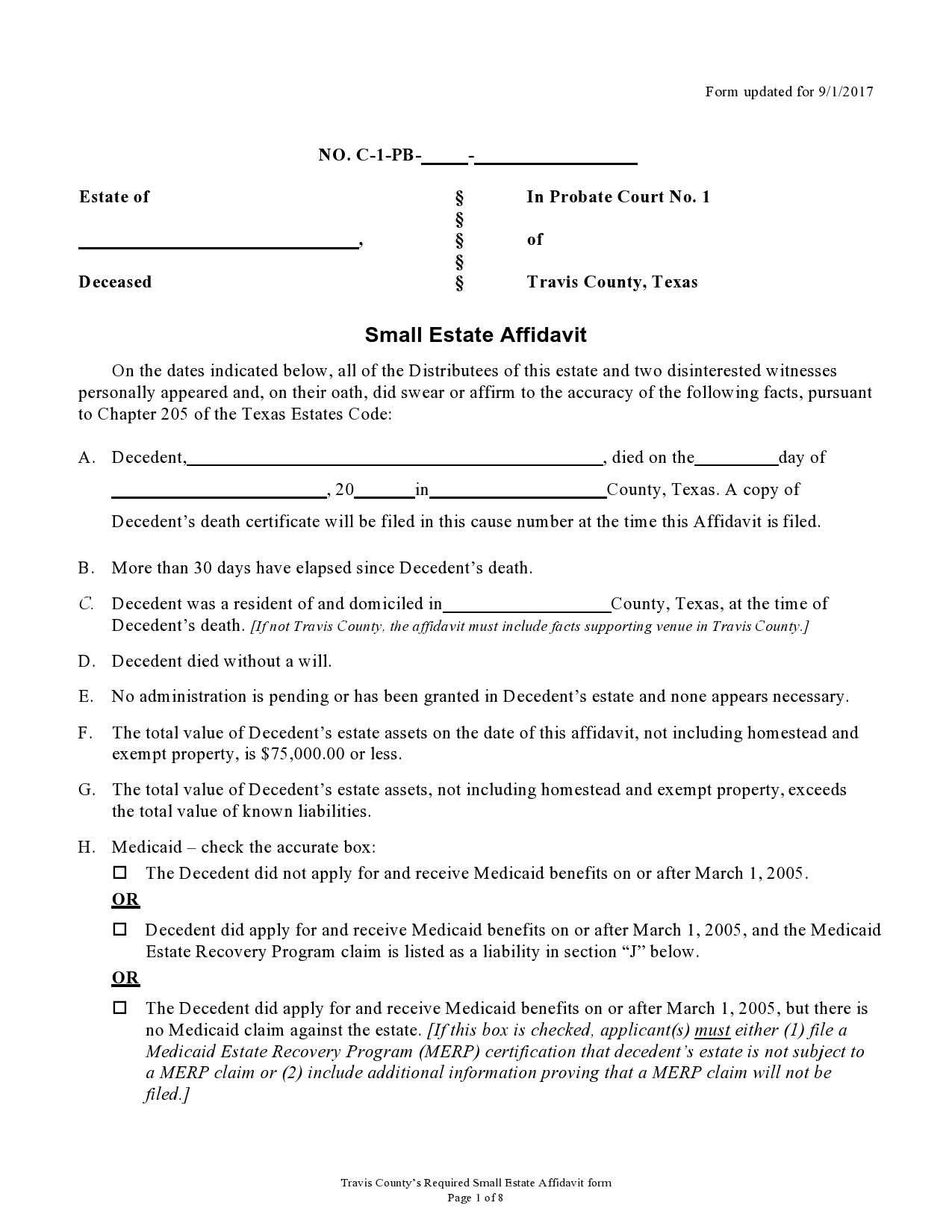

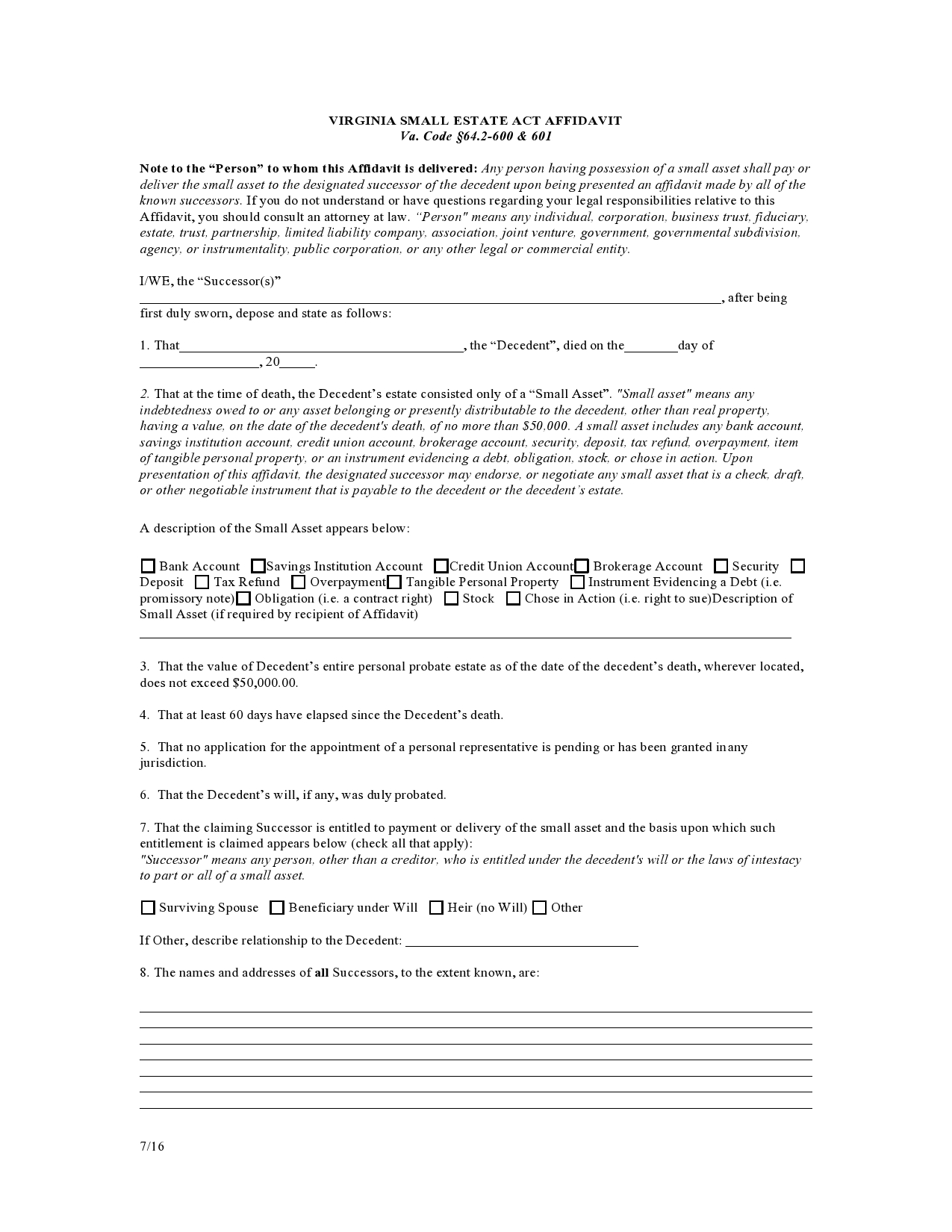

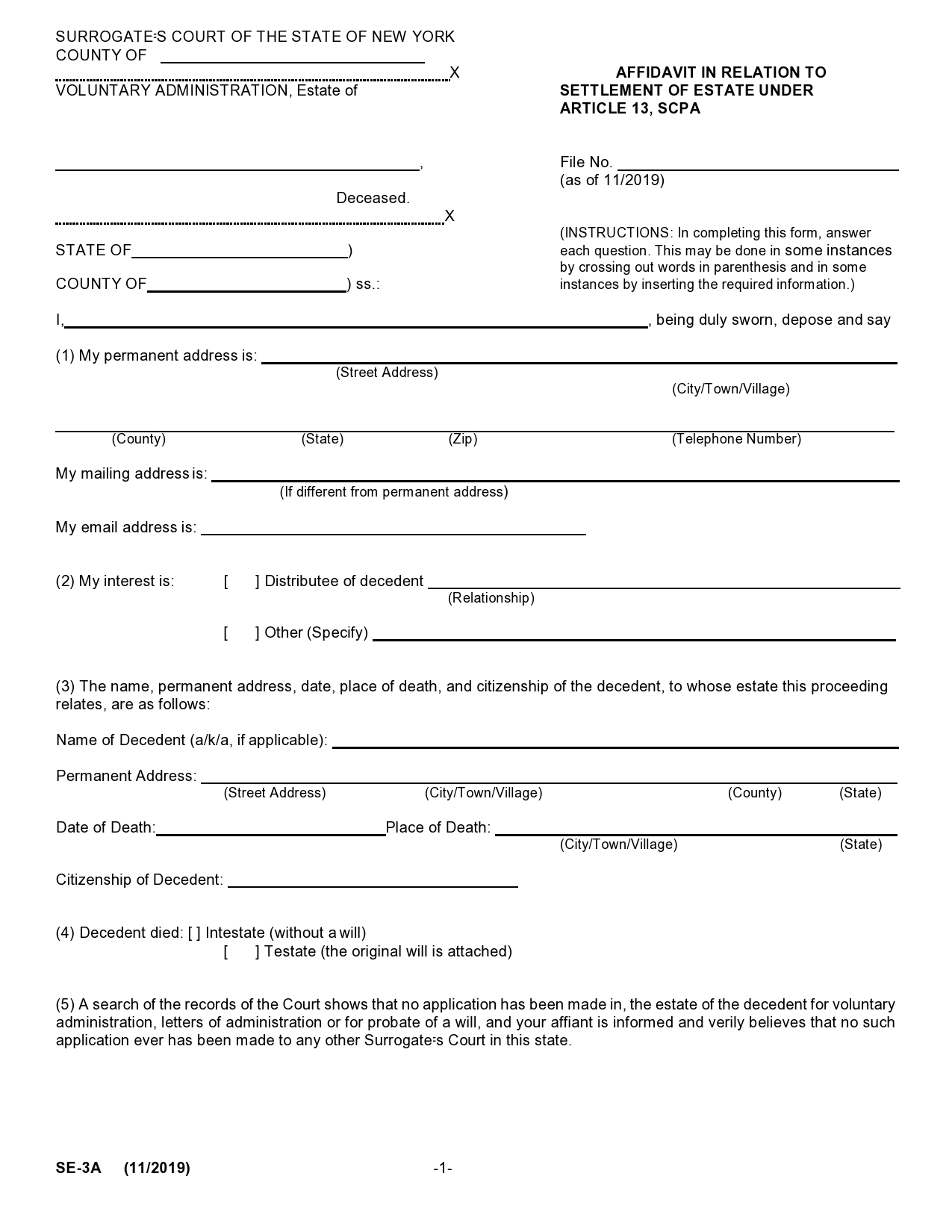

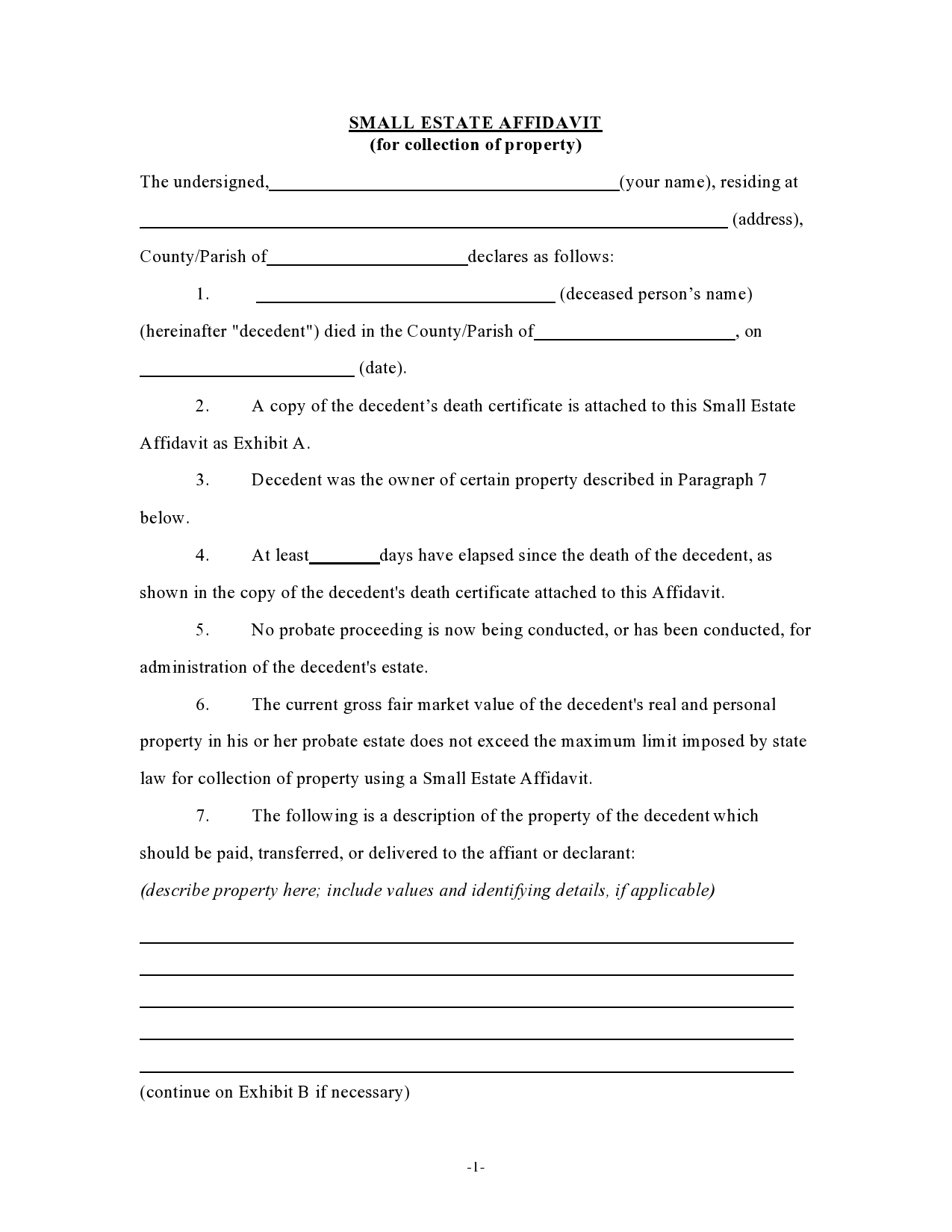

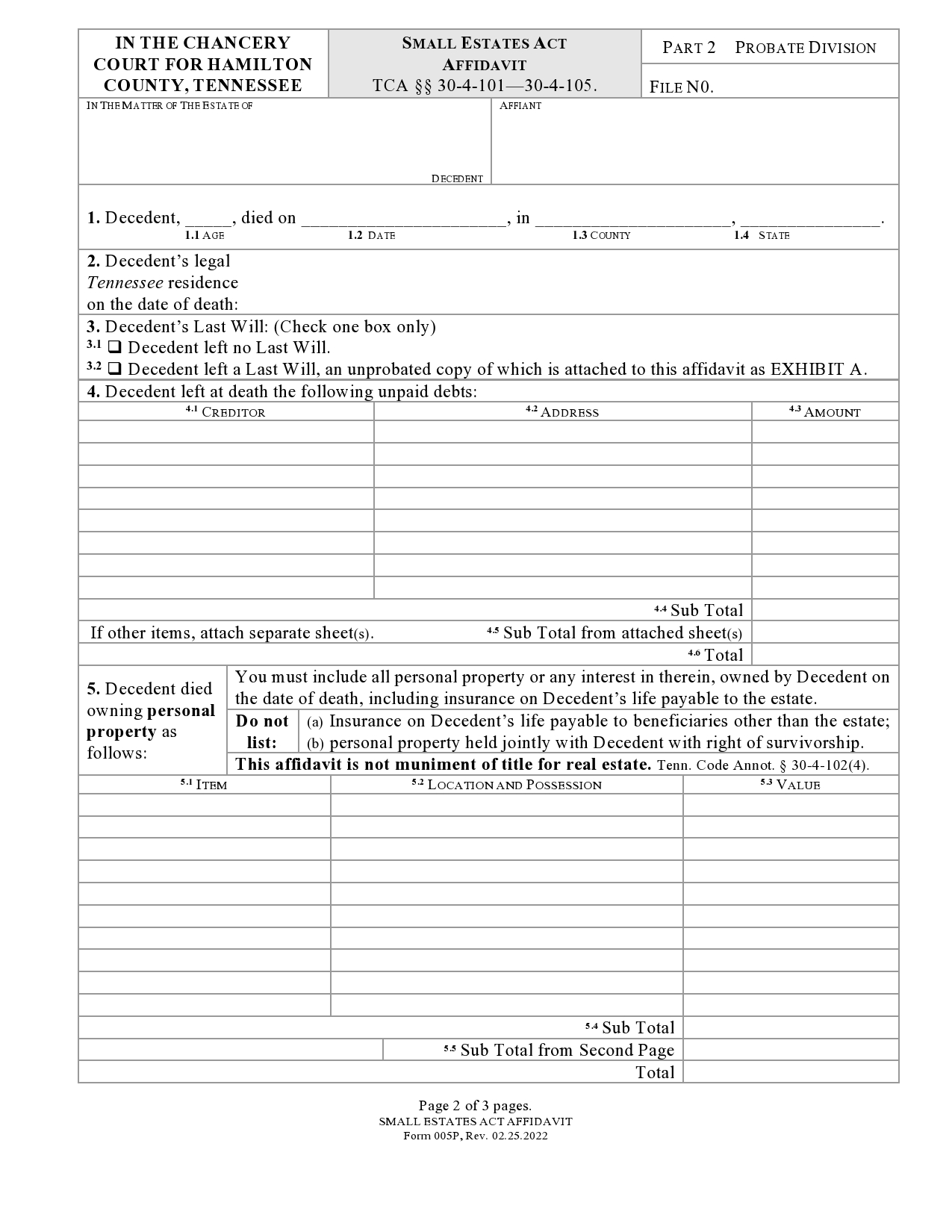

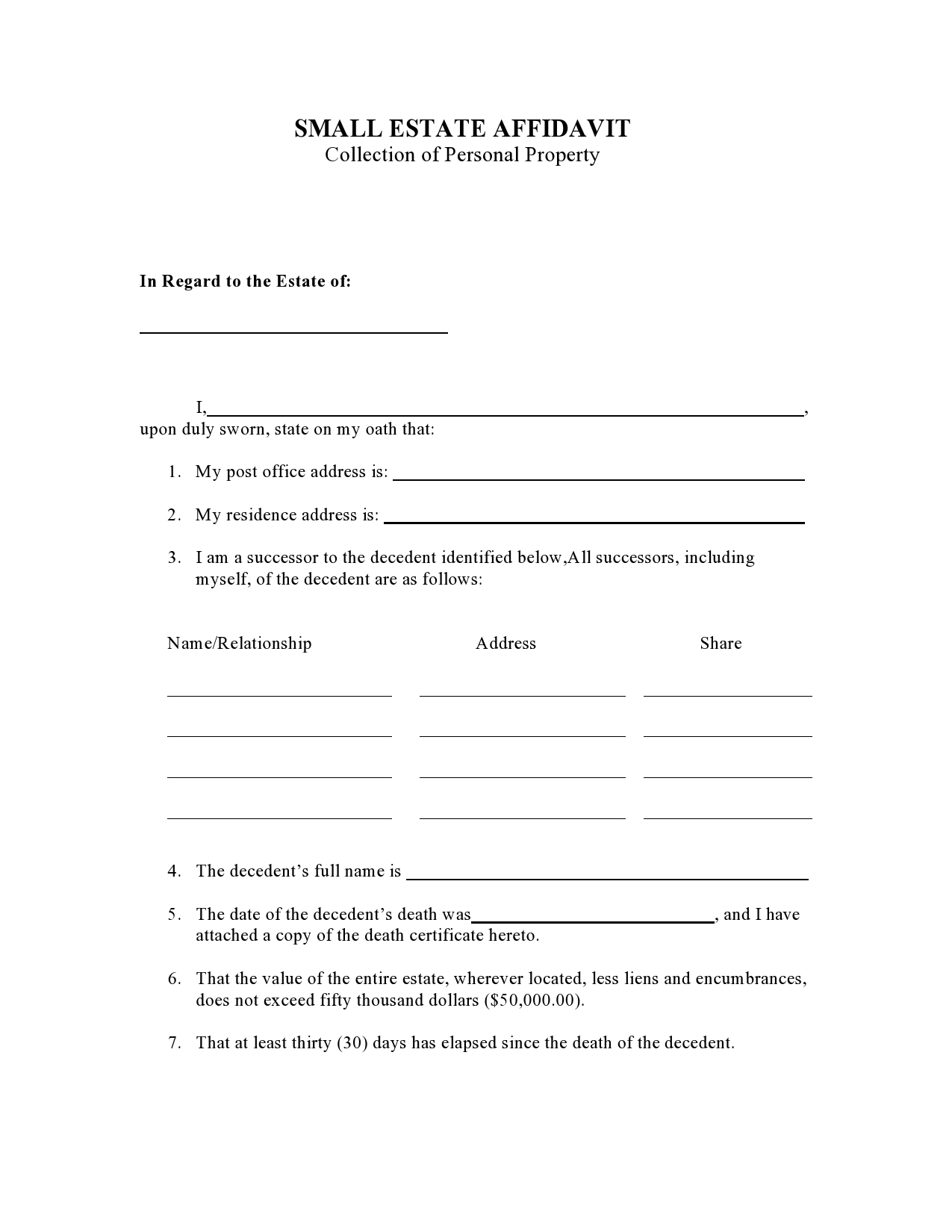

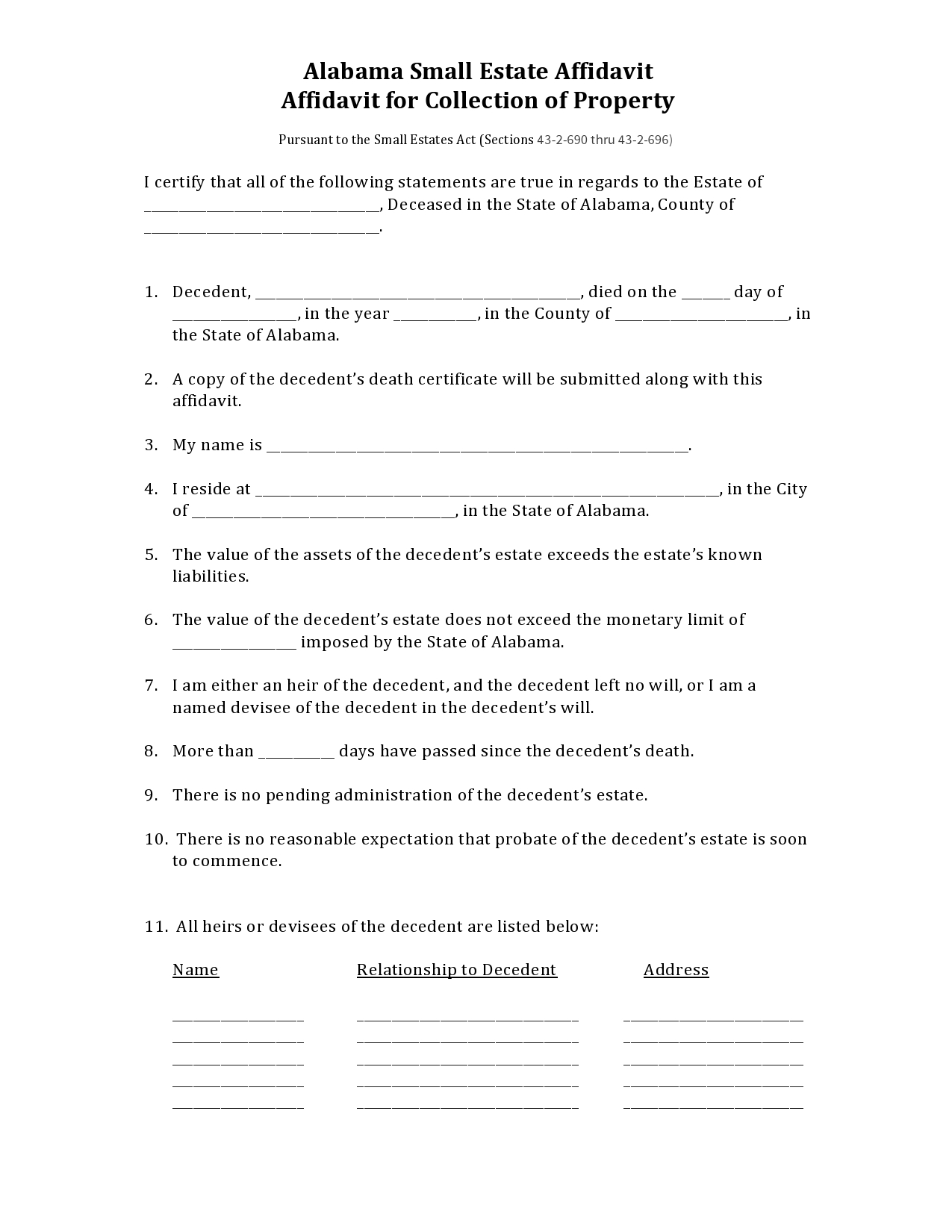

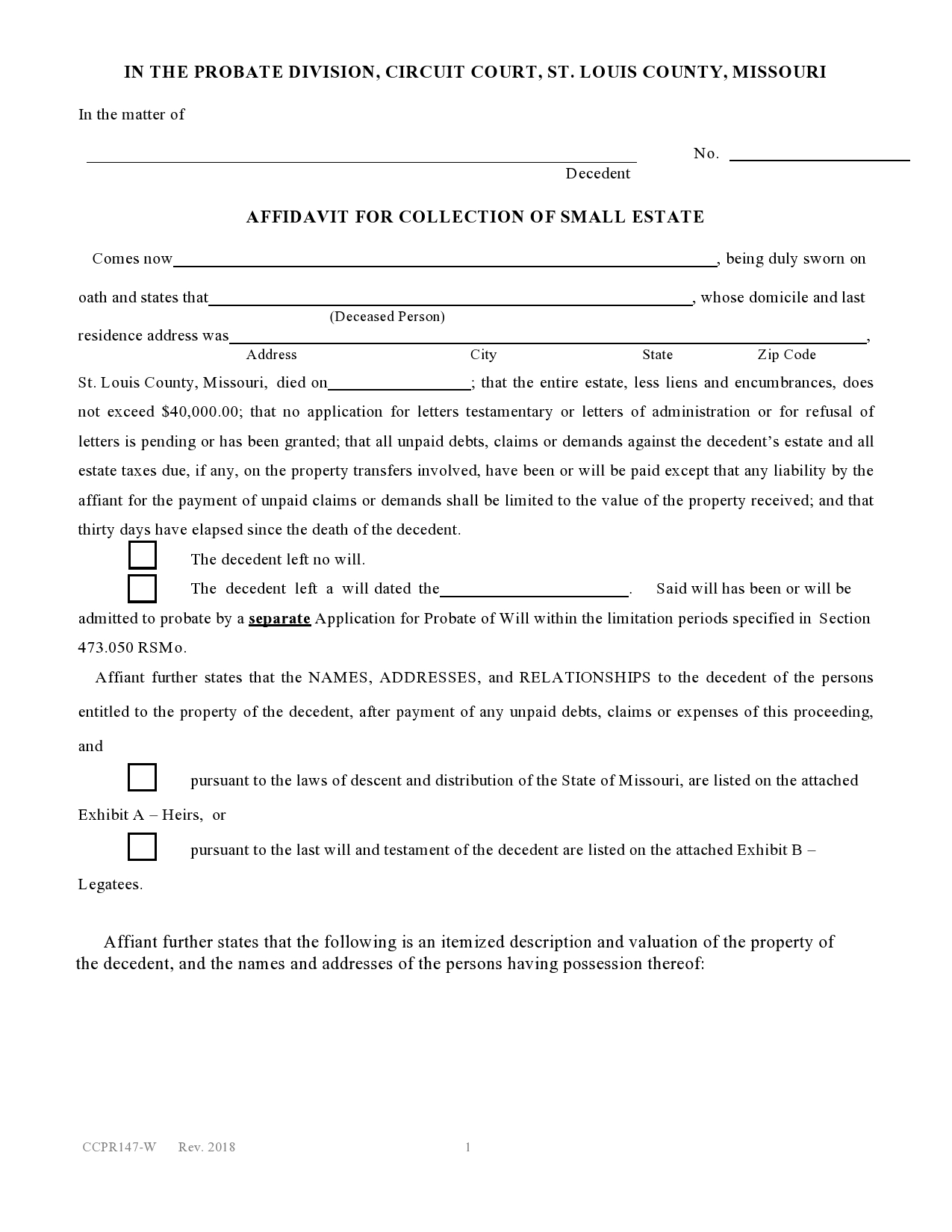

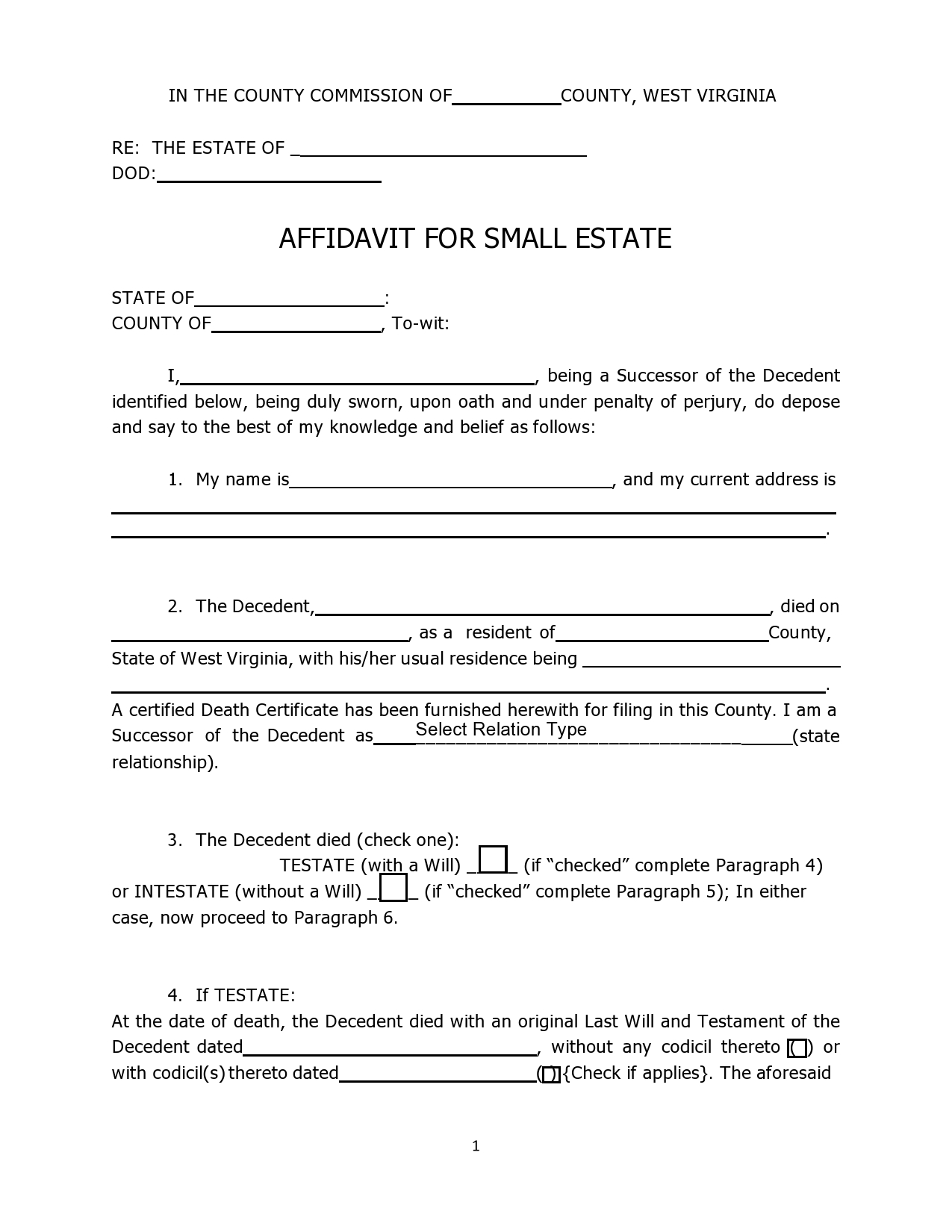

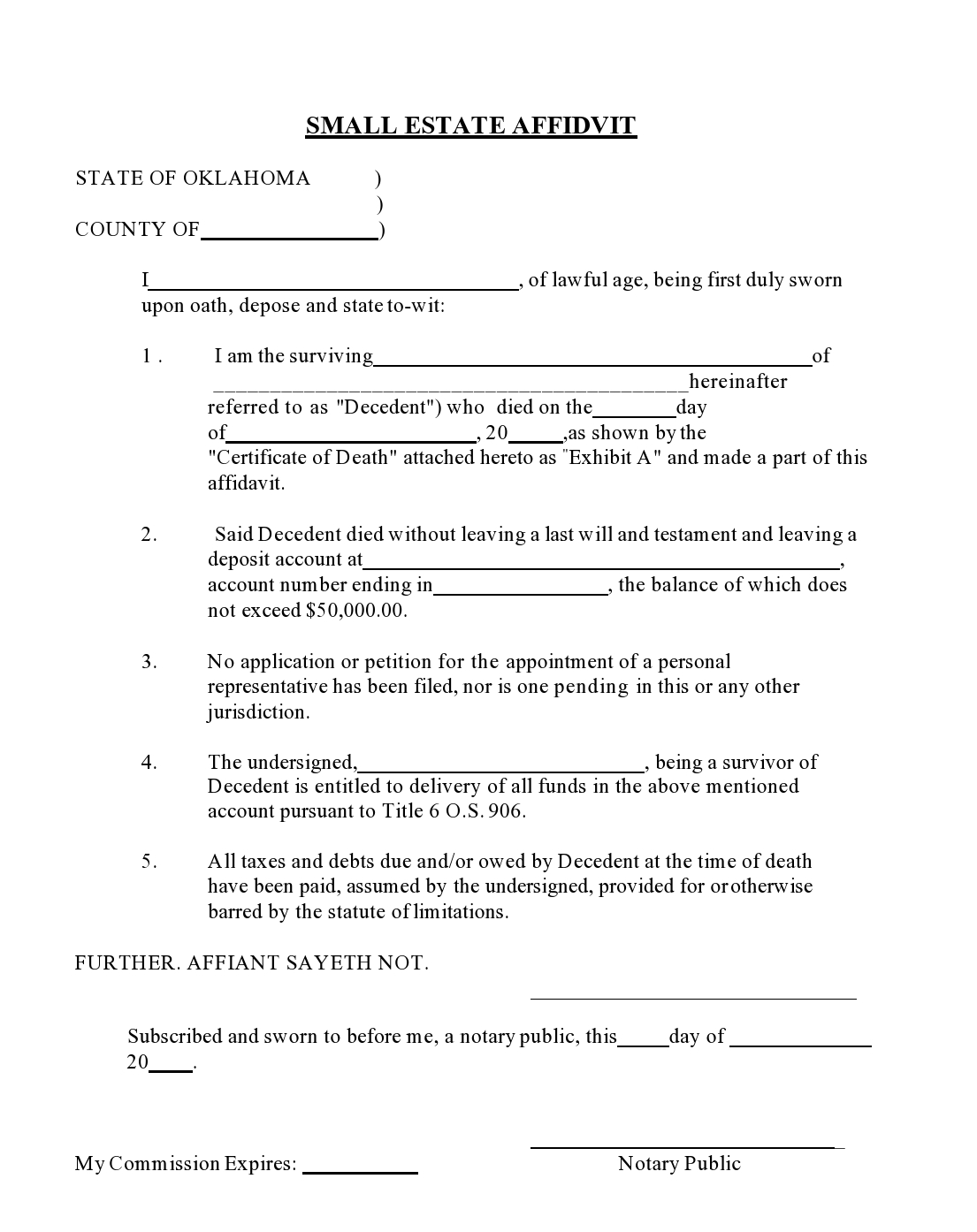

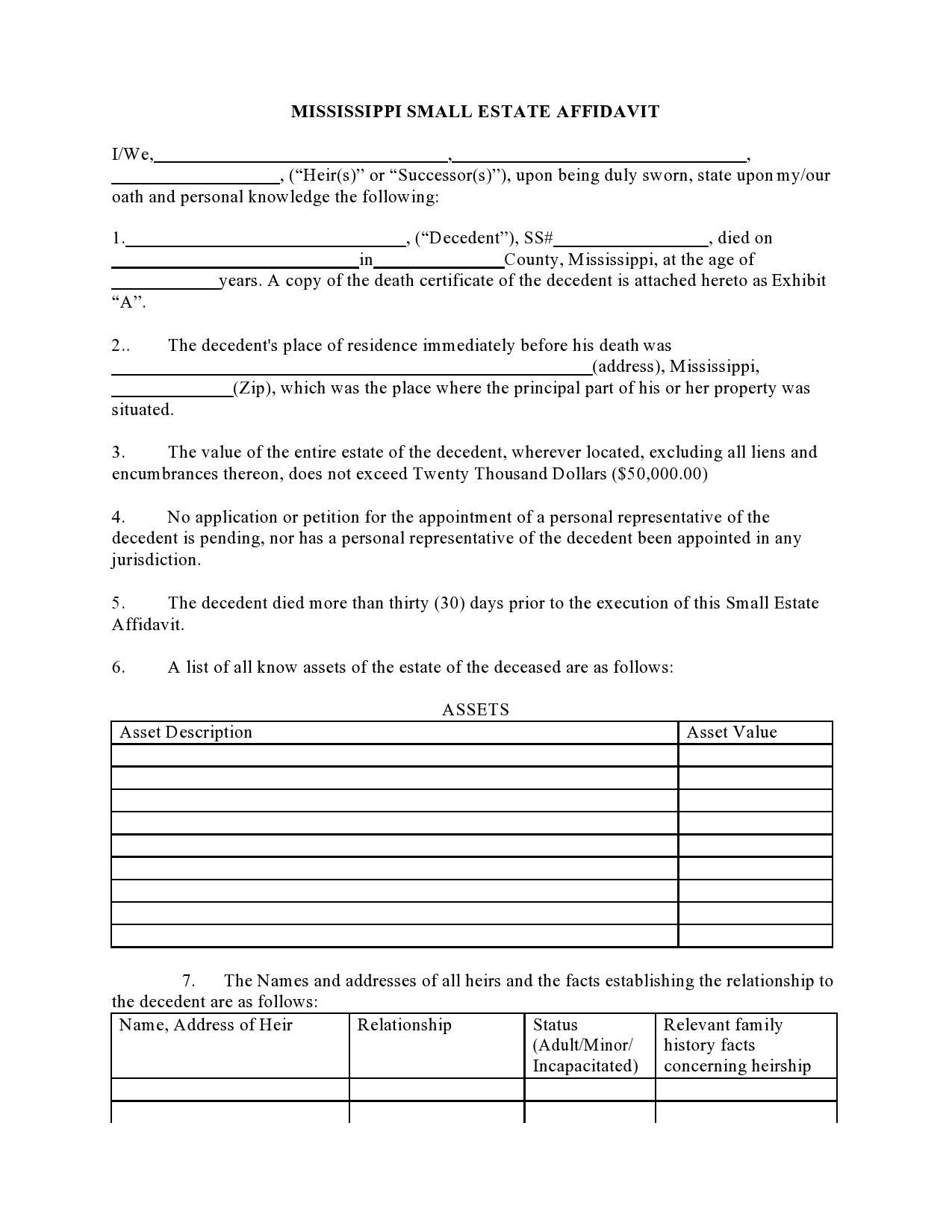

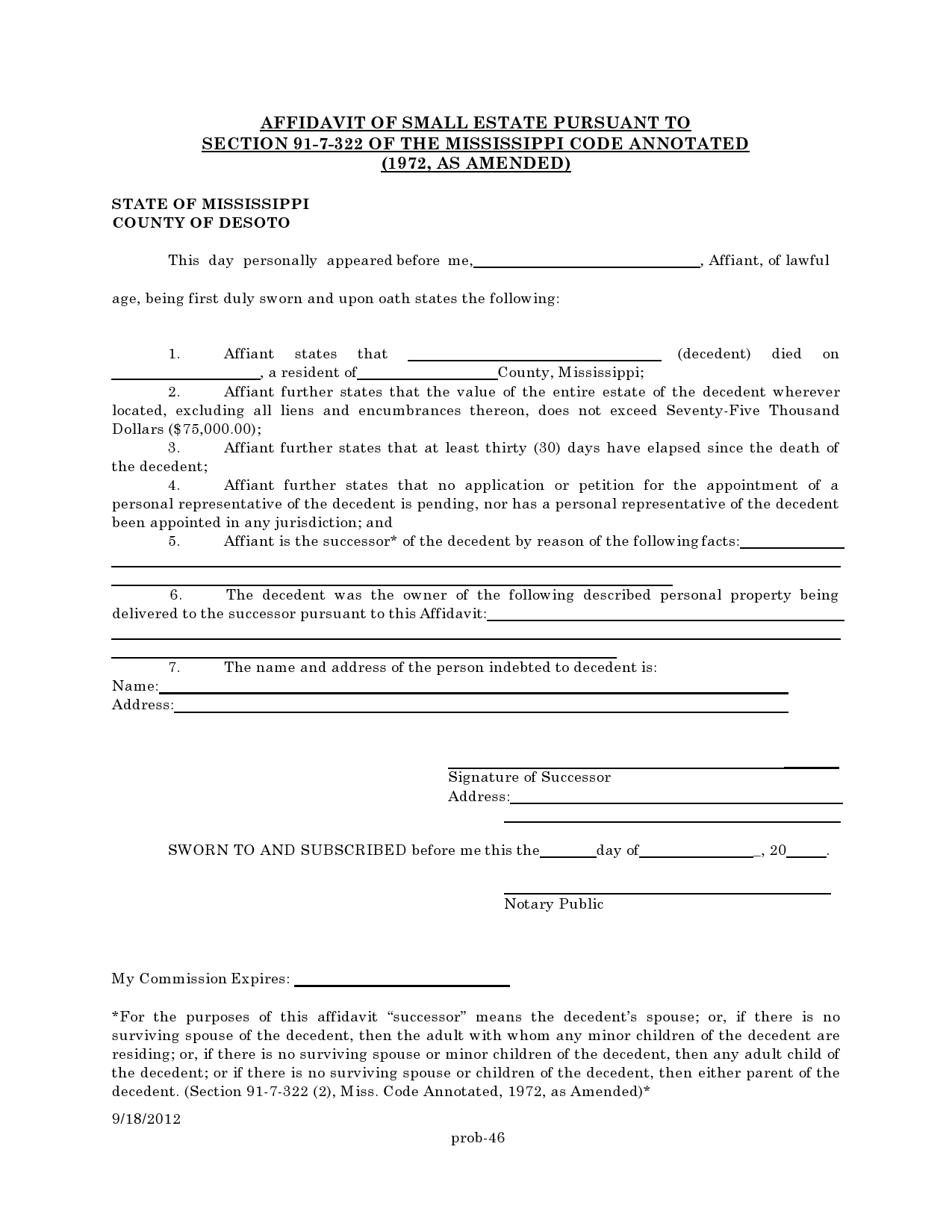

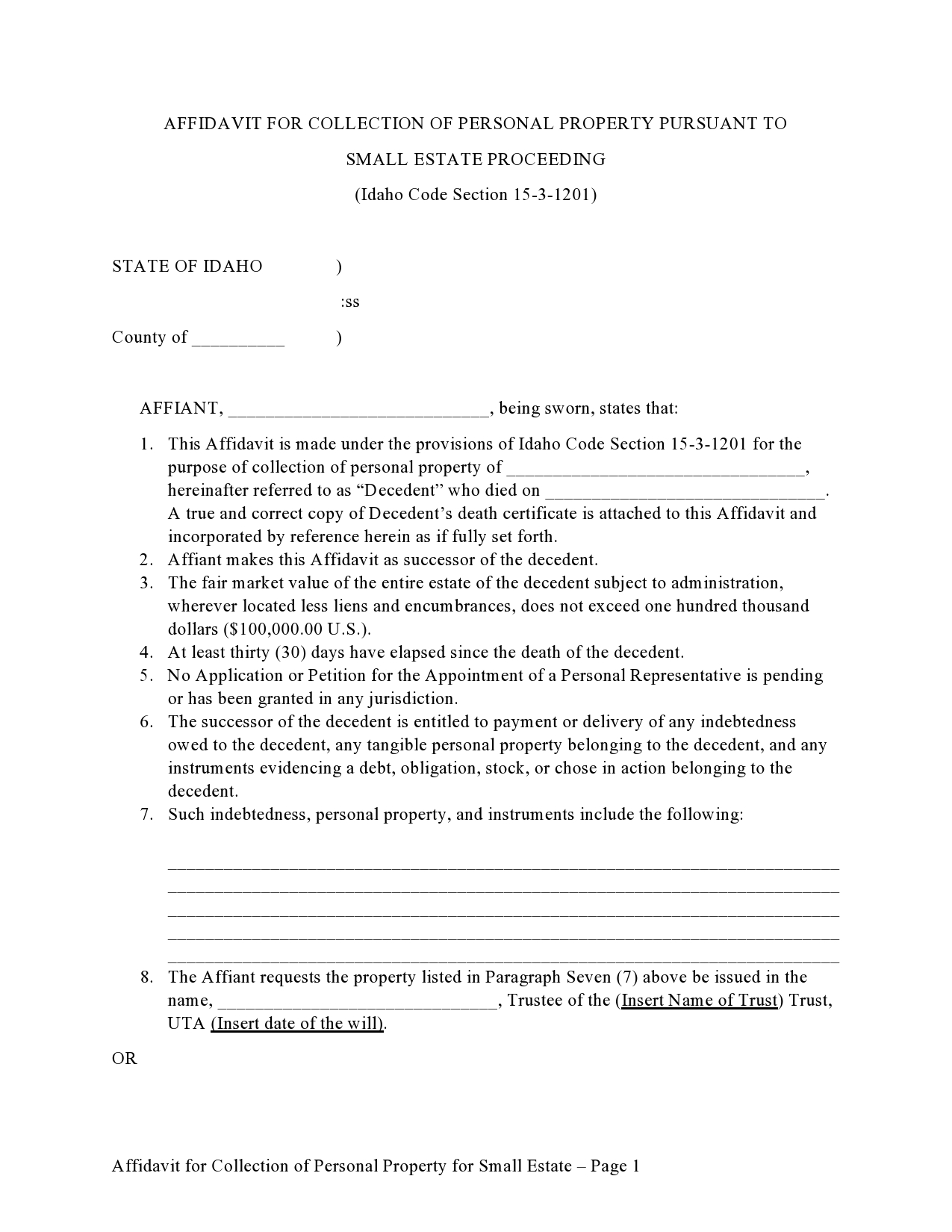

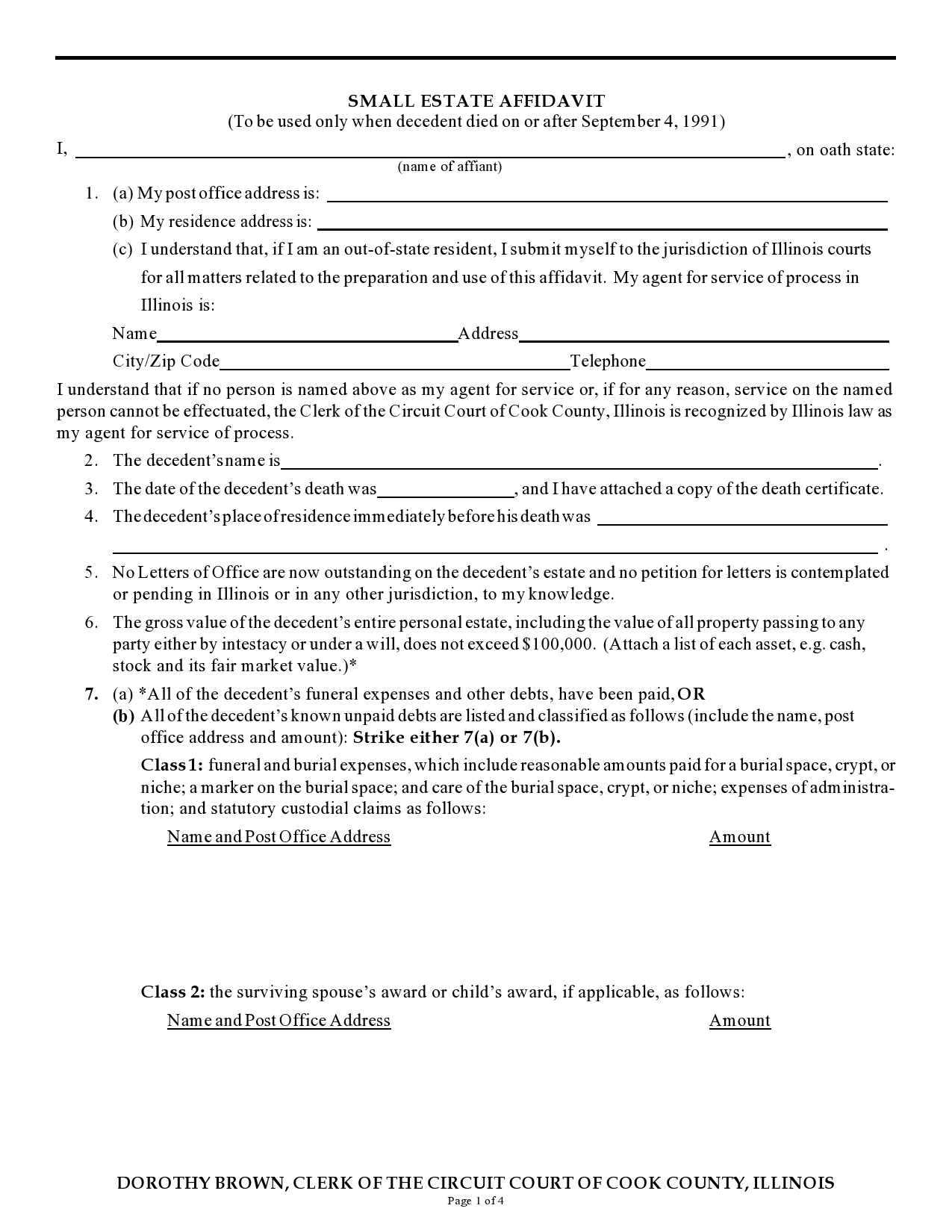

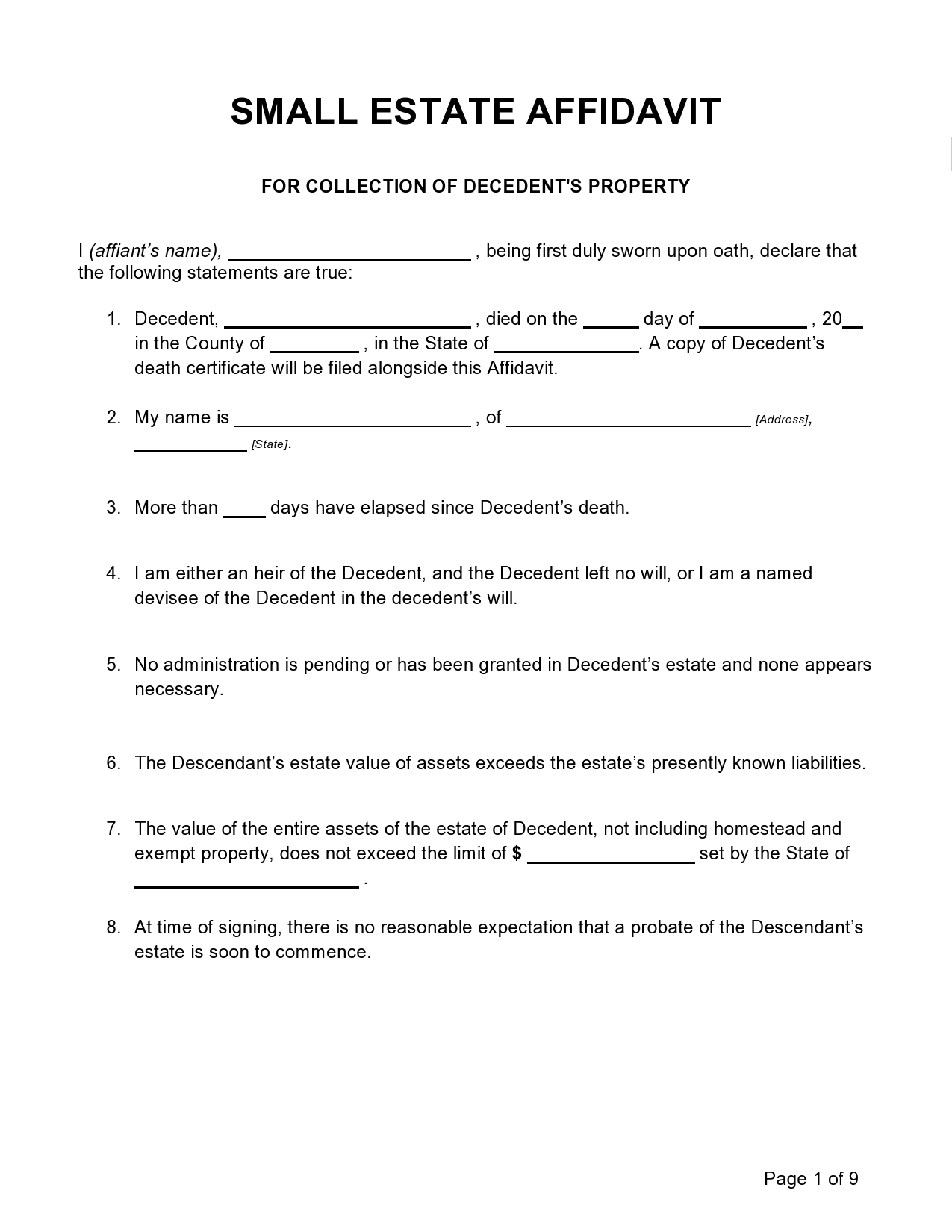

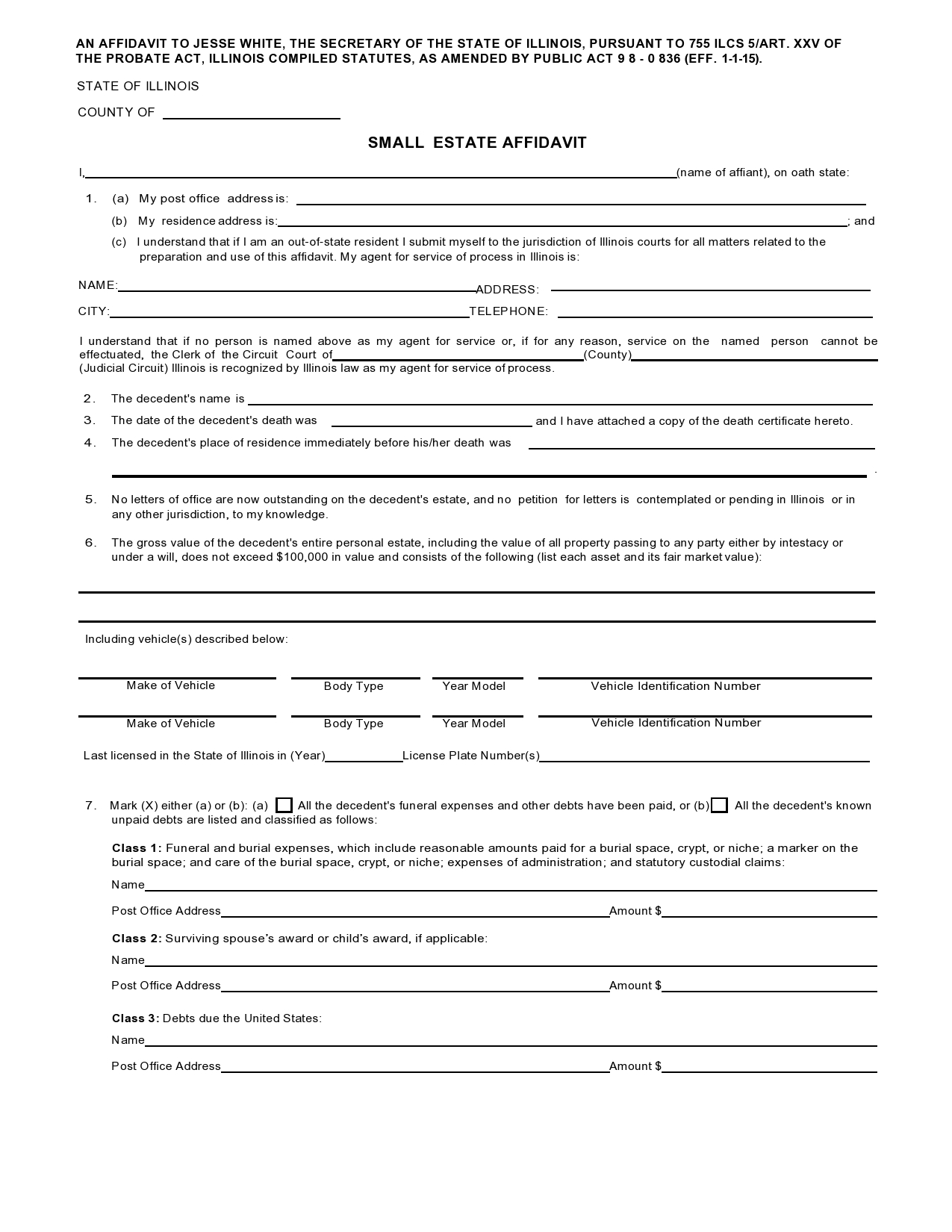

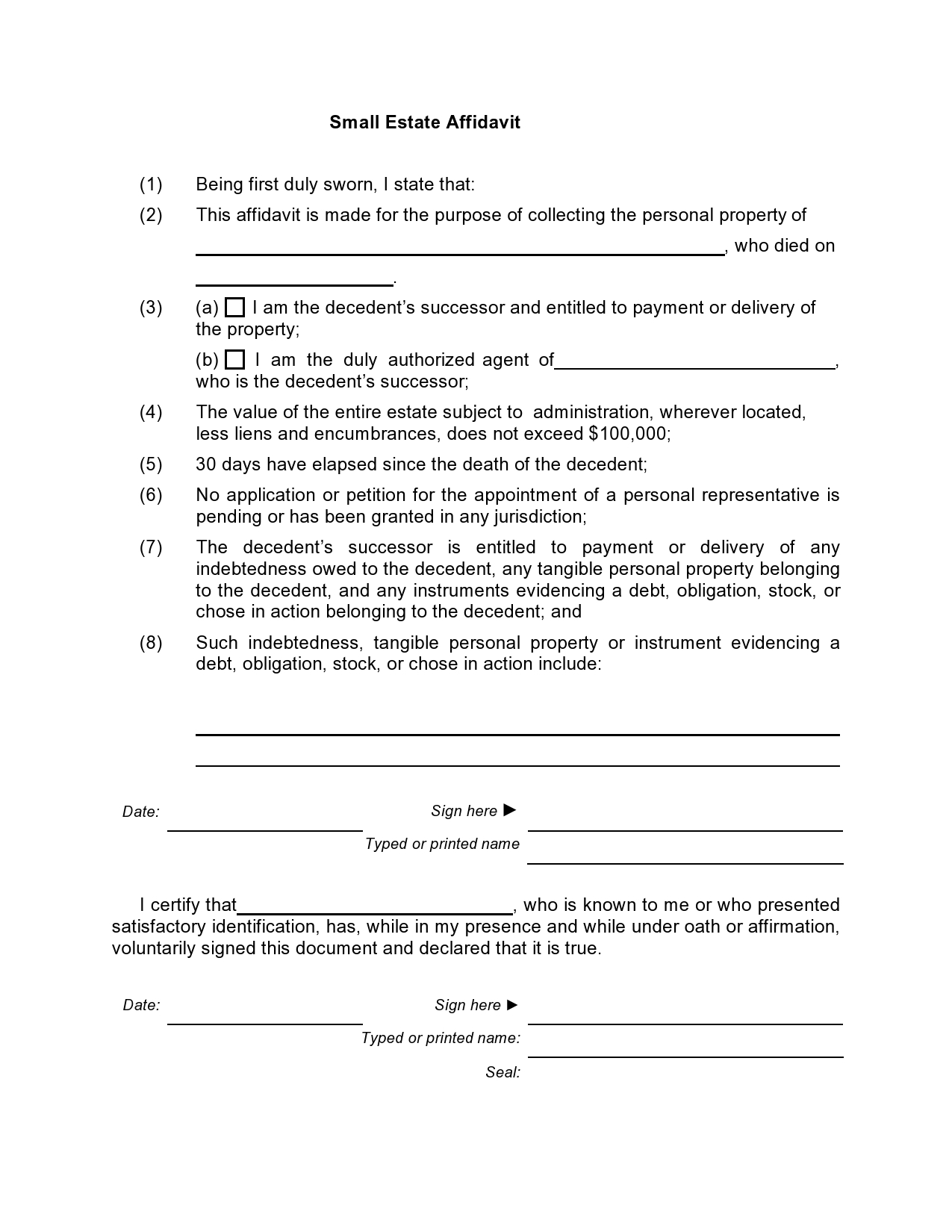

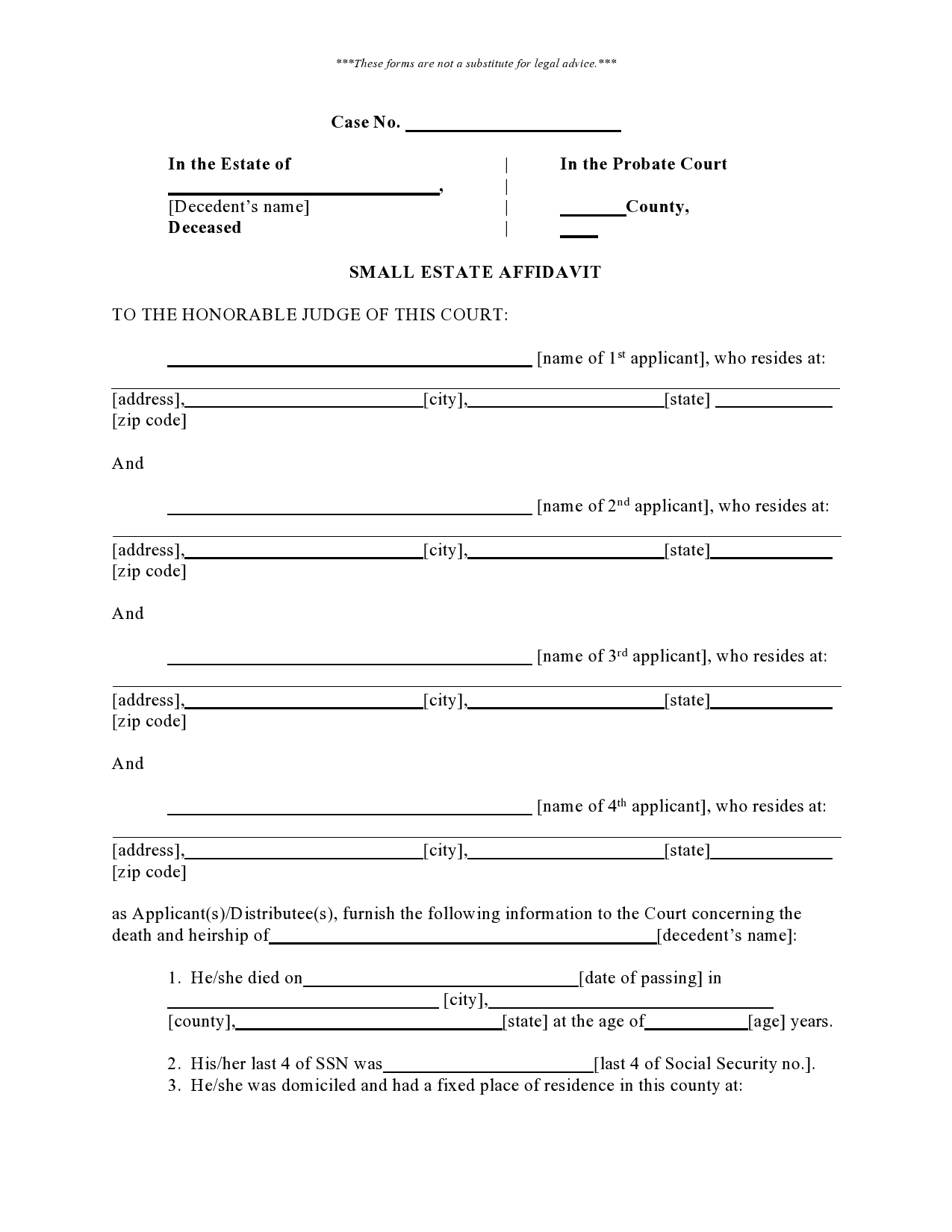

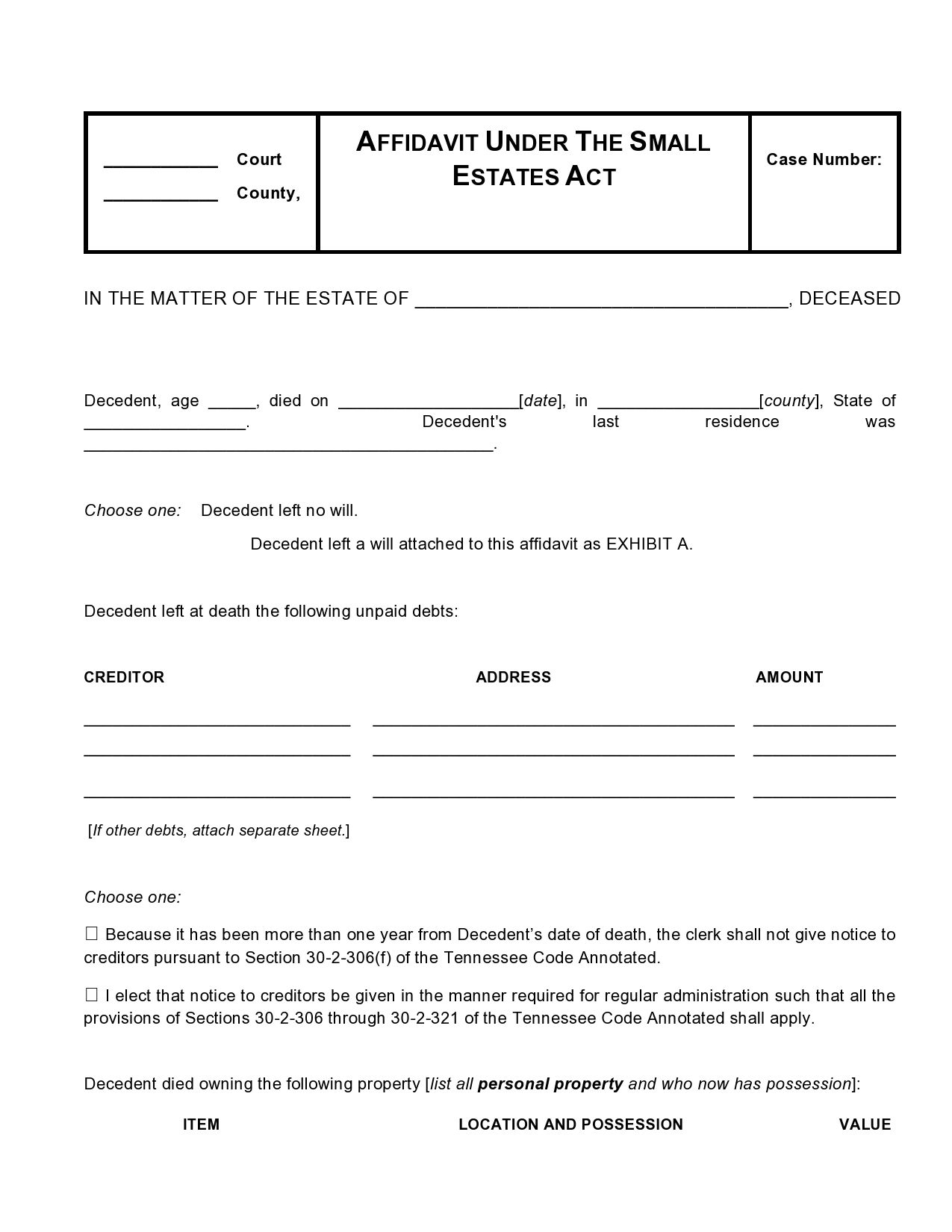

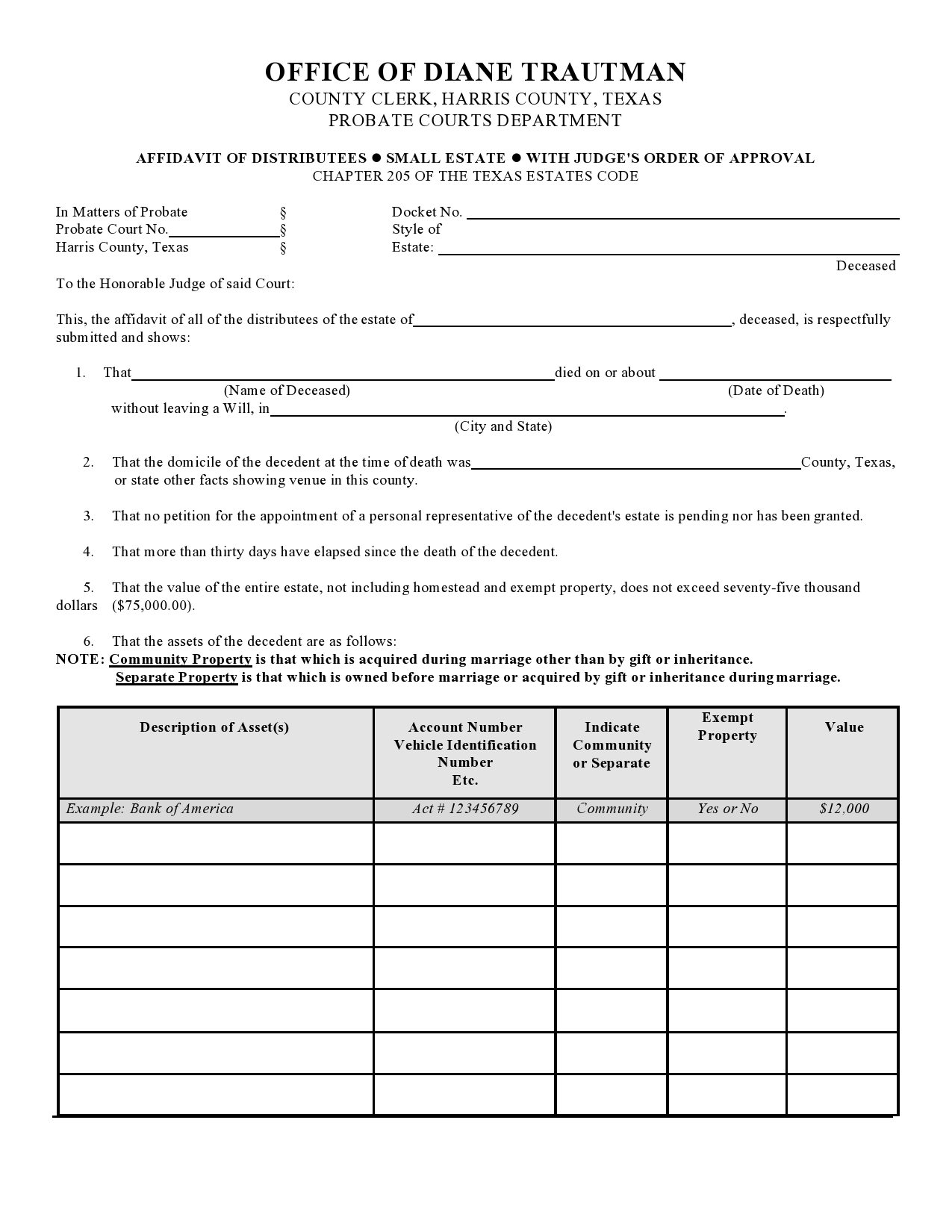

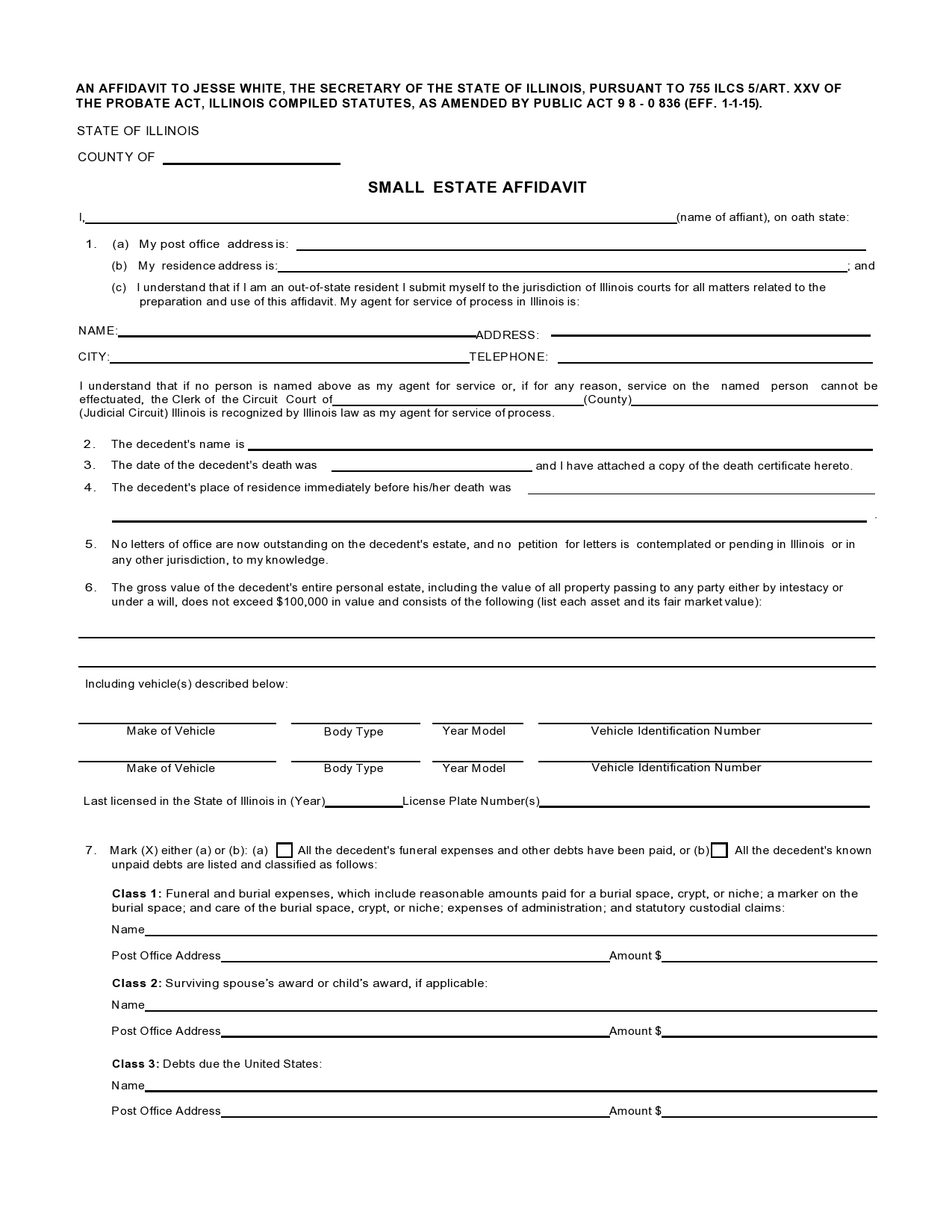

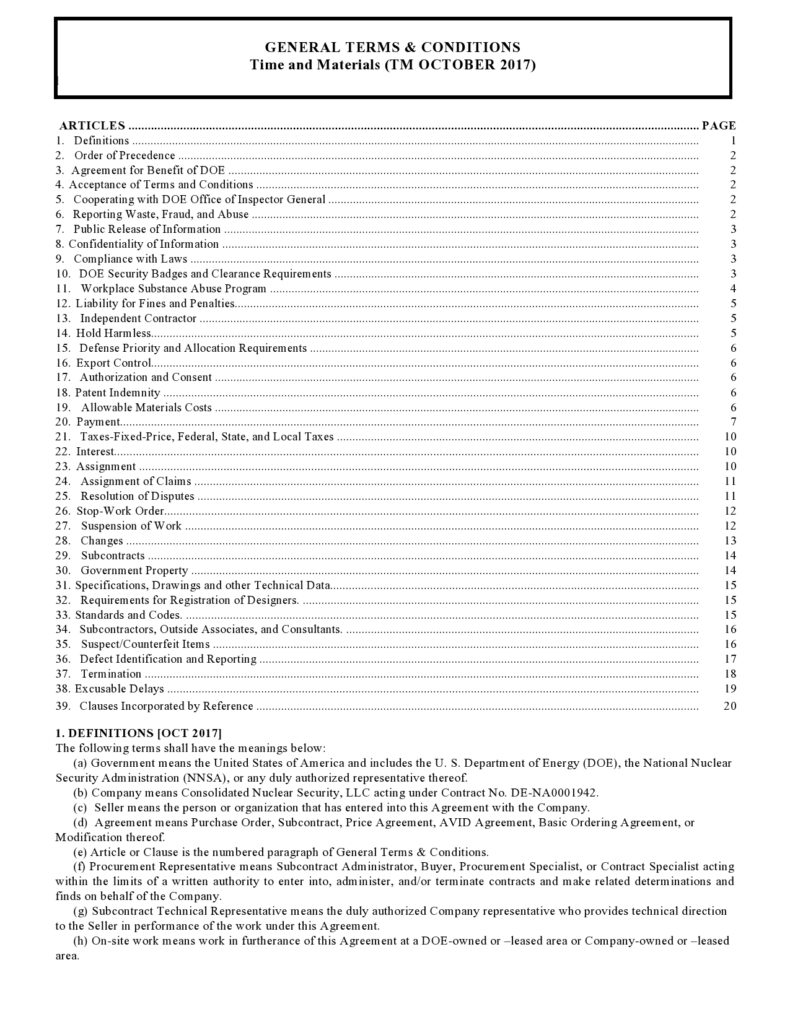

Small Estate Affidavit Templates

What are the terms that you need to know?

When drafting legal documents of this nature, you need to know some of the technical terms that are involved in the document itself. Being familiar with the terms that you will have to use to draft the document will prevent confusion and problems down the road.

- Probate: Probate is a process by which an estate is evaluated to see if it owes any taxes or other fees and duties before it can be dispersed to those who are named in the deceased person’s will. This process can take a few months or a few years, depending upon the complexity of the person’s assets and property. The taxes that can be leveled against an estate can be quite significant, which is why most people want to avoid having their inheritance processed through probate, no matter which state is governing the process. The probate process could leave people homeless or without financial resources as well if they were dependent upon the person who has passed away.

- Small Estate: A small estate under this law can vary in size depending on the laws of the state that the deceased resided in and its guidelines. This is one of the legal items that you will need to know about before you create this kind of document. If the estate in question does not qualify as a small estate in the place where the assets and property are being dispersed, then you cannot use this kind of document to govern the estate process.

- Last Will and Testament: This is the document that someone creates before they pass away to help explain who they intend to inherit their assets and their other possessions. This document does not trump the probate process in most states. There are other forms of estate planning that can help to keep an estate from going into probate, but a will is not sufficient to spare those who have been left behind from the probate process.

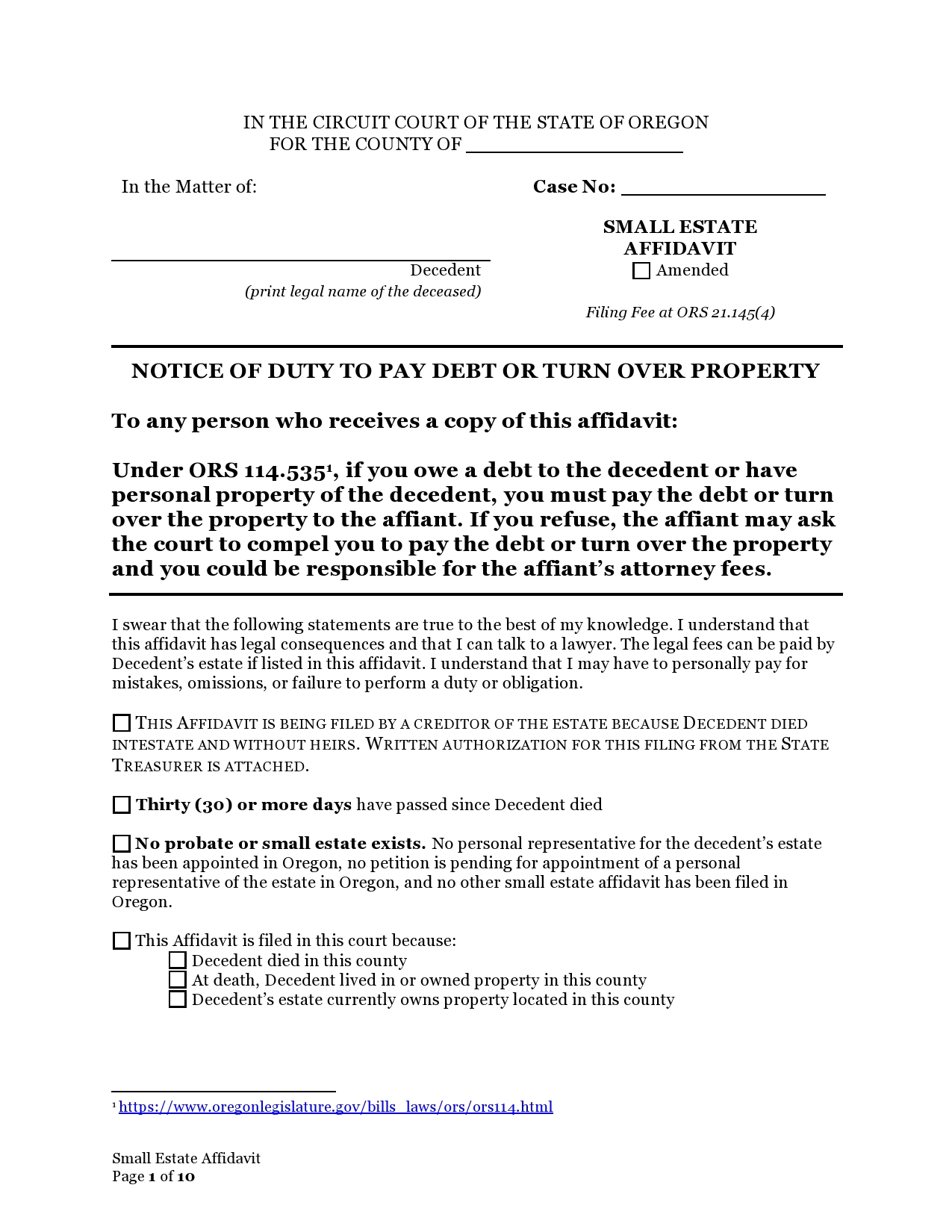

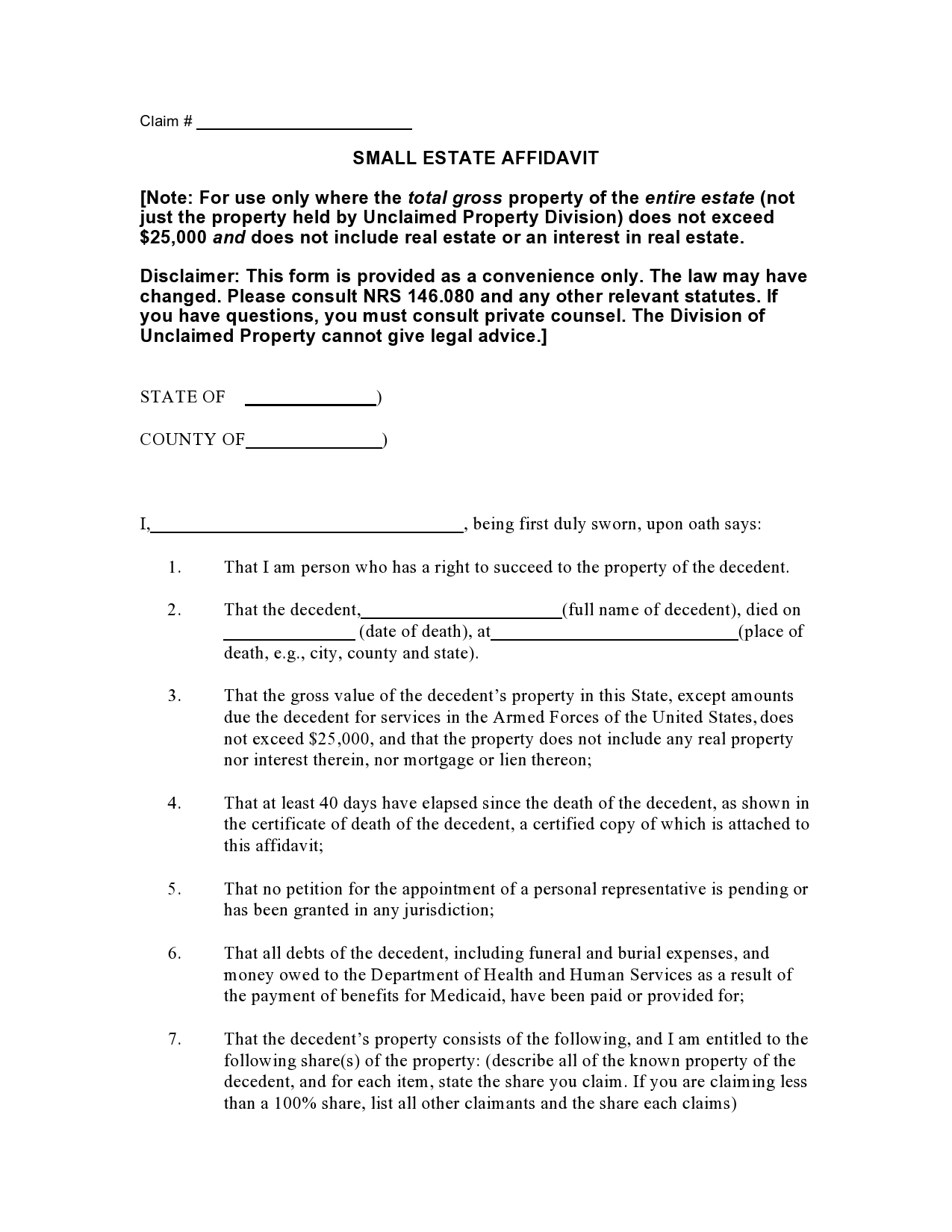

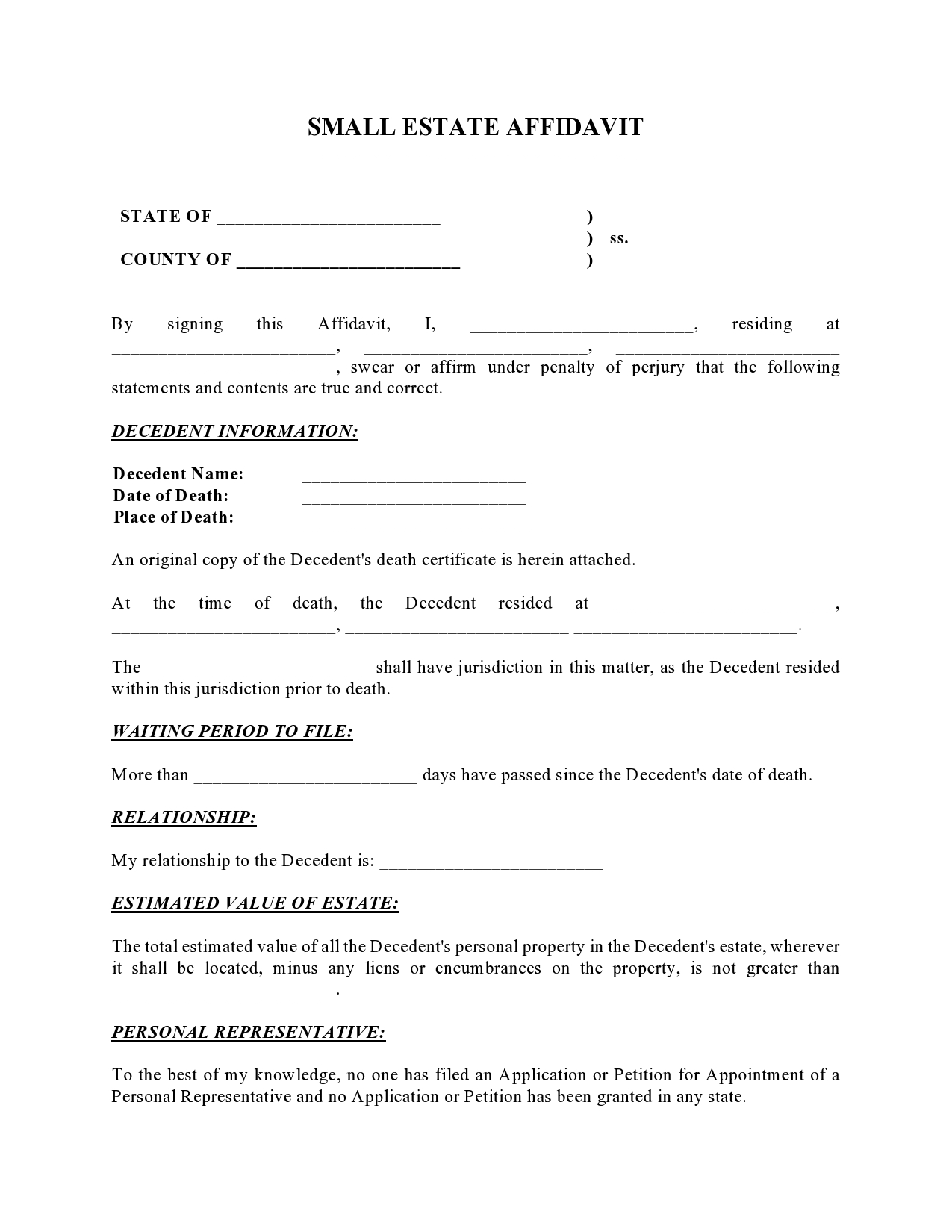

Small Estate Affidavit Forms

Where do I file a small estate affidavit?

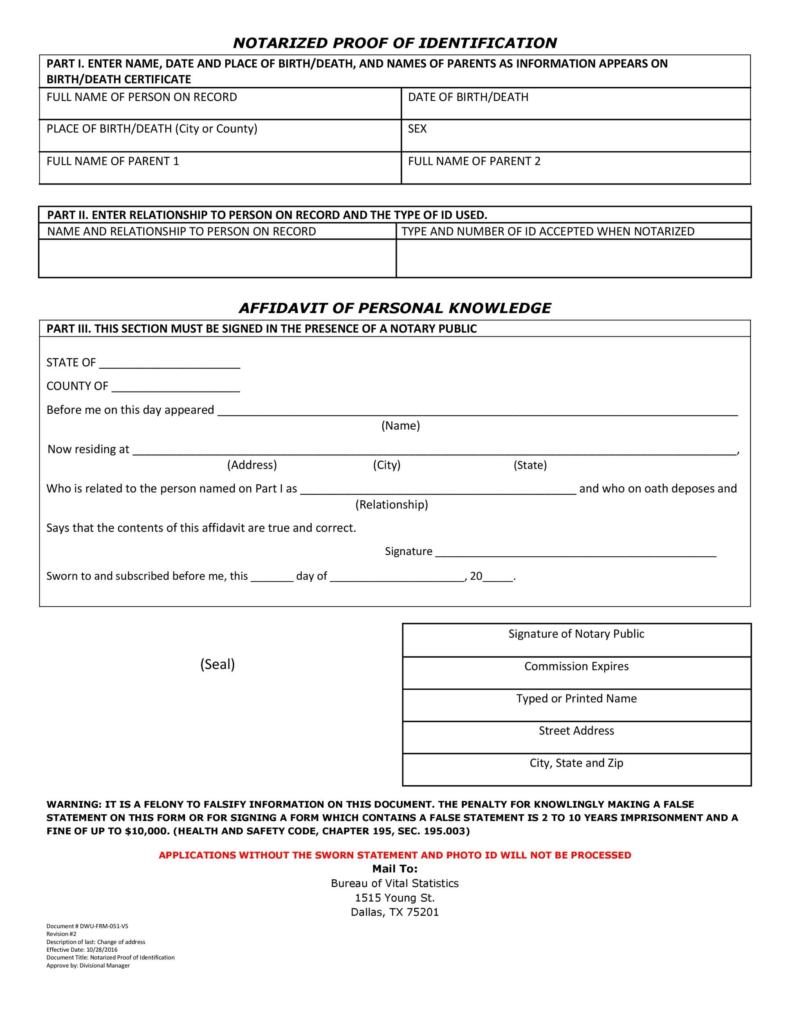

The process by which these affidavits are filed varies from state to state. You will always need to have the document notarized, and you will need to be sure that you consider having the document reviewed by a legal professional before you try to count on it to protect your assets from the probate process.

In most cases, these documents can be filed at the local circuit county clerk’s office. To take advantage of this process, you would simply complete the document and then deliver it during hours when the office is open to accept these kinds of documents. You should be given a receipt and the original copy of the document to keep in your possession.

How much does a small estate affidavit cost?

The cost to file this kind of affidavit can vary depending on the state where you live. You should expect to pay at least $100, but the charge could be twice that, depending upon the state of residence where it needs to be filed. If you have secured legal support to review the document in question before filing it, you will also need to expect to pay a legal fee to the expert who has reviewed the document prior to its filing.

When is a small estate affidavit needed?

While you might already be aware that you need a small estate affidavit to be in place before you pass away, you might not be sure about which situations this kind of document applies most effectively. There are some common situations where this is the best course of action to take when protecting your assets from the probate process:

- Situations where there is no will and testament in place

- Situations where the monetary size of the estate qualifies as a “small” estate

- Situations where there is no property to disperse

If your state does not meet any of these requirements, you may not actually have a small estate that you need to protect, and you will need to look into other forms of estate planning, such as developing a trust.

Small Claim Affidavit

How to write a small estate affidavit

- Date the Decedent Passed Away: The first thing that will need to be included in your small estate affidavit is the date that the decedent passed away. This will need to match their death certificate in order for your small estate affidavit to be correct and legally valid. If you do not have the death certificate in hand, this could cause limitations to your ability to create this document.

- Attest to the Status of the Deceased: In this section of the document, you need to attest to the status of the deceased. You will need to indicate if they died intestate or testate. This can be important during the dispersal of the estate as the will should be referred to if it exists. Whoever has been named as the executor of the will is the person who should be able to produce it at the time that the estate needs to be disbursed. If you are not the executor, you should not be filling out this form or creating it from scratch for the purposes of protecting the estate of the deceased.

- Funeral Expenses: The section of the small estate affidavit will indicate if there are funeral expenses that need to be taken from the estate’s overall funds to be covered properly. In many cases, this is part of the normal process of dispersing the estate, and there will be a clause within the will or other estate documents that indicates that this process can be signed off on by the executor of the estate. If there is no clause inside the will or the will does not provide for this part of the estate process, you might have to speak with a legal professional before doubling this amount from the estate’s total proceeds.

- Claims Against the Estate: If there are other financial claims against the estate, such as debts that are outstanding, creditors must be paid in full out of the proceeds of the estate before it is disbursed to anyone who is provided for within the will or the estate itself. These debts might be credit card debt or personal debt of some other nature, but they must be attended to before the estate can be fully processed and closed.

- Surviving Heirs: The section of the document indicates by name the surviving heirs of the person who has passed away. These parties may or may not be provided for by the estate in any specific way, and they can even be named as excluded from receiving benefits from the estate when it is processed. Surviving heirs must also be of legal age to take possession of assets and might need to have a named legal adult to govern their inheritance until they are legally old enough.

- Property That is to be Dispersed: The property that is to be disbursed needs to be carefully listed and identified in the section of the document. Remember that not every state allows real property and real assets to be included in this part of the small estate process. Real estate and other lands that are associated with the decedent might have to proceed through the probate process as they cannot always be named within this document. Private property like jewelry and other items of value can be included in the estate that needs to be dispersed.

- Clauses or Conditions: If there are any clauses or conditions that govern specific inheritors who may or may not be named in the estate, this is the section where they will be outlined. A will is often used to make these kinds of specific limitations or determinations known; however, the small estate affidavit process can handle some of these limitations if necessary. If there are many limitations on who is to inherit the assets named in a small estate affidavit, there might have to be legal action taken to sort out who is to receive which items out of the estate. The small estate affidavit process is intended to save time for both the court and those who have survived someone who has passed away, so complex determinations to do with inheritance are often not included in this process.

Affidavit of Small Estate Examples

Small Estate Affidavits Are Key to Avoiding Probate Issues

The small estate affidavit is important to be certain that those who have survived someone who has passed away are not forced to suffer financial difficulty or displacement during the time that probate is in process. In states which do not follow the probate process, the small estate affidavit probably will not be required in order to take control of assets that have been left to surviving family or friends. The document should be signed and taken care of by the person who is named as the executor for the person who has passed away.

If you have never completed or filled out one of these forms on your own, you should consider seeking legal counsel before doing so. The more that you know about the process and the correct way to fill out the form or draft one yourself, the more likely it will be that you will create the right form for the needs of the estate process. Always be sure that you know what the size of the estate is to be certain that it qualifies for the small estate affidavit.