A settlement agreement is a document that’s legally binding which exists between two parties like an employee and his employer. In this sample settlement agreement, the employee waives his right to bring a financial claim against his employer. In return, the employer provides financial payment to the employee. Both parties make this agreement voluntarily through a negotiation process.

Table of Contents

- 1 Settlement Agreements Templates

- 2 Benefits and risks of a settlement agreement

- 3 Employment Settlement Agreements

- 4 When to use a settlement agreement?

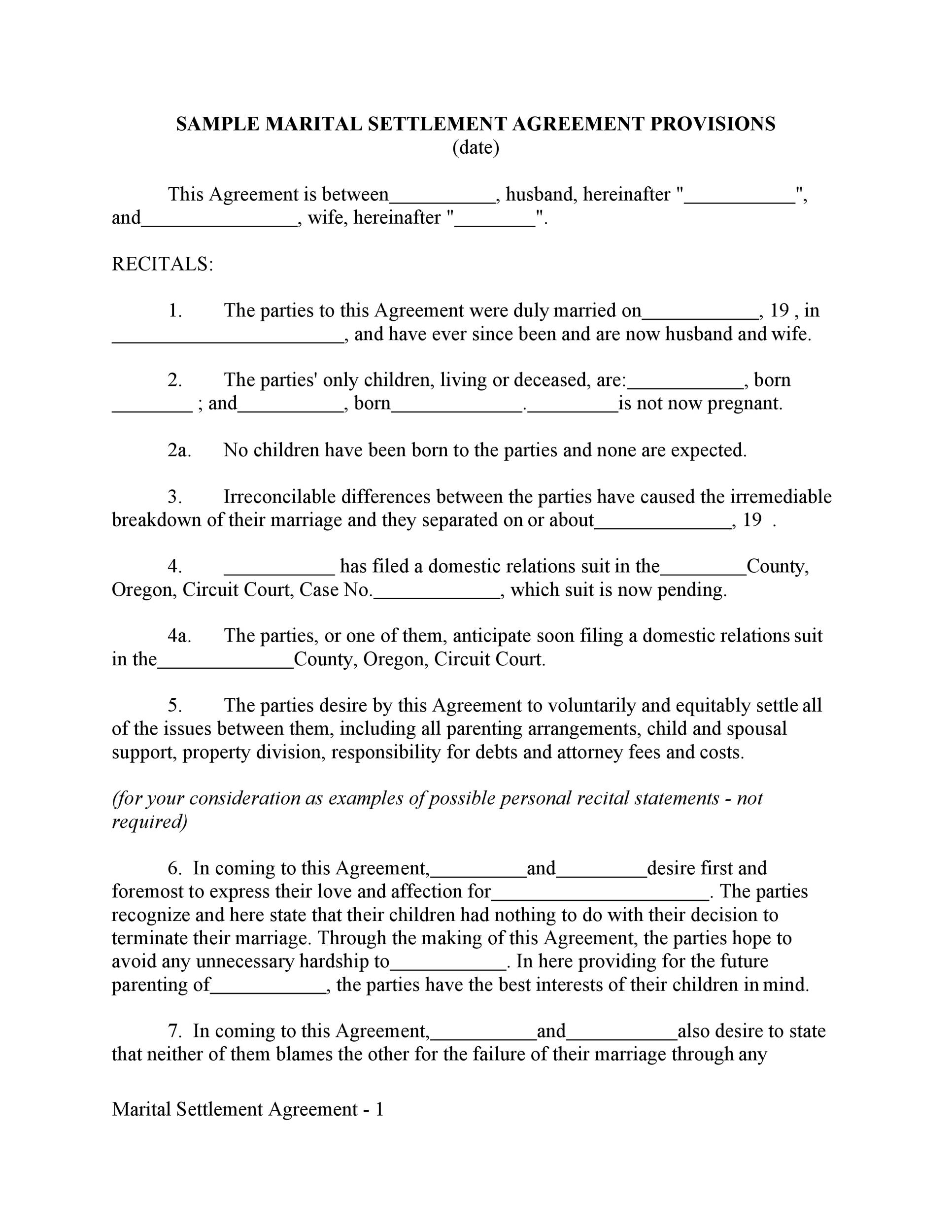

- 5 Divorce Settlement Agreements

- 6 Deciding the terms within a settlement agreement

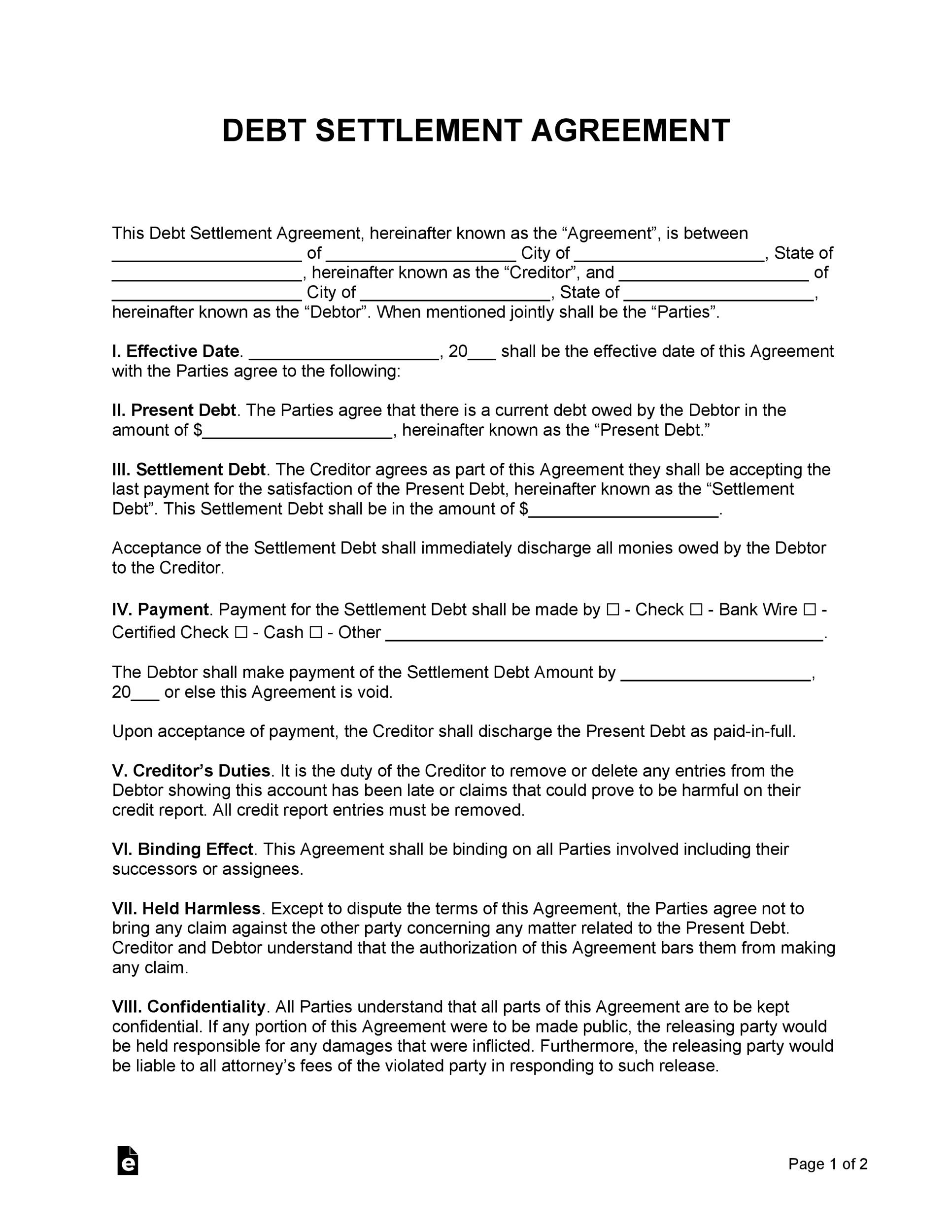

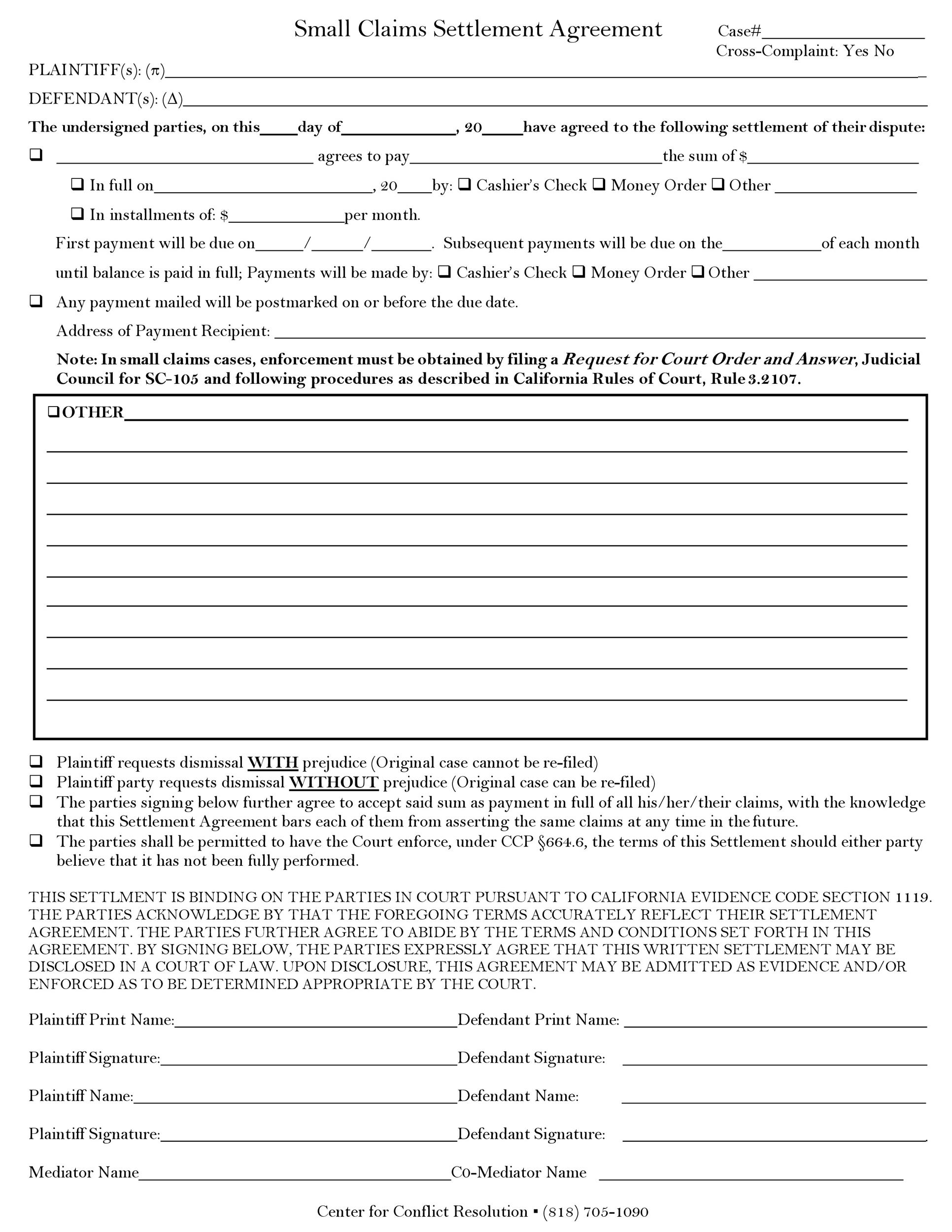

- 7 Debt Settlement Agreement Letters

- 8 Creating a settlement agreement with your employer

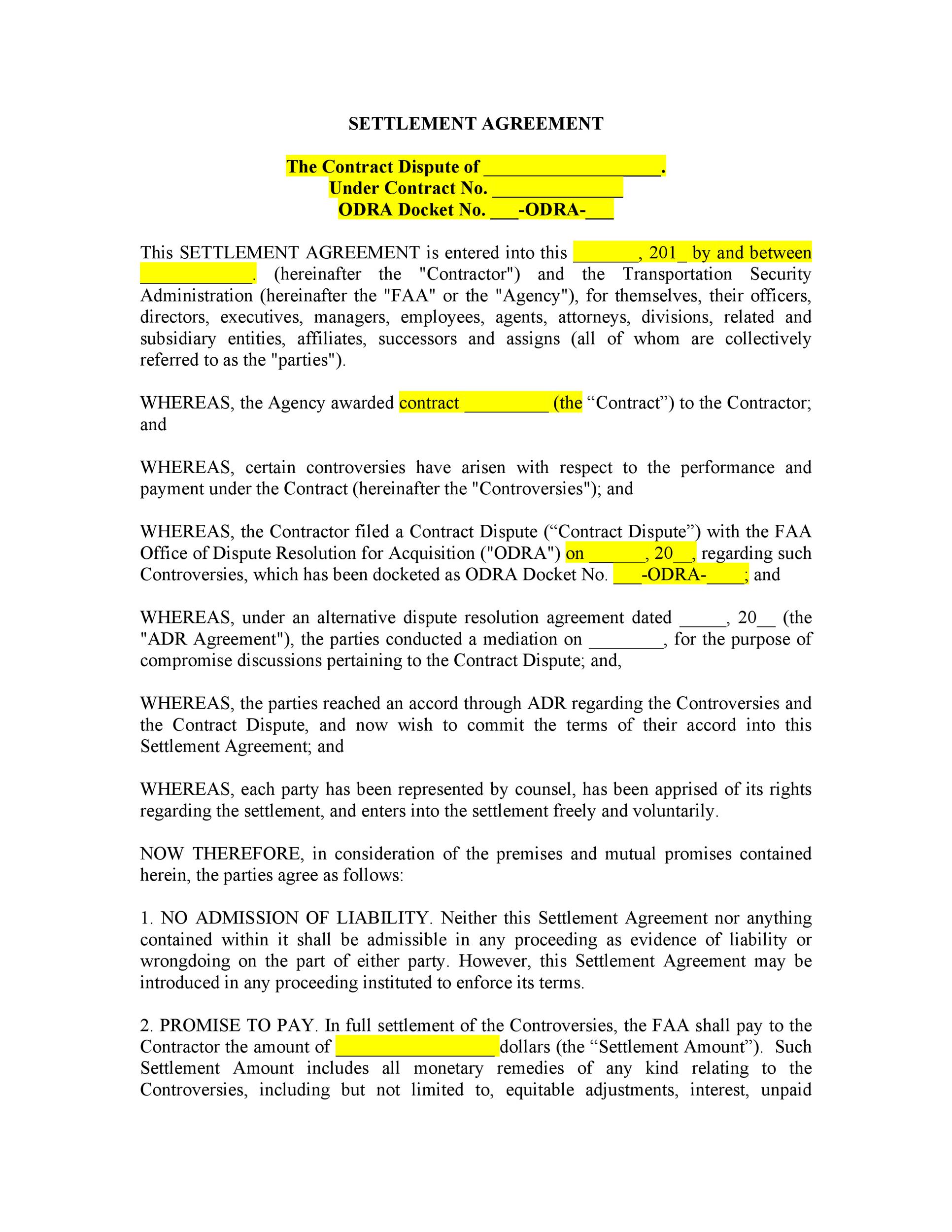

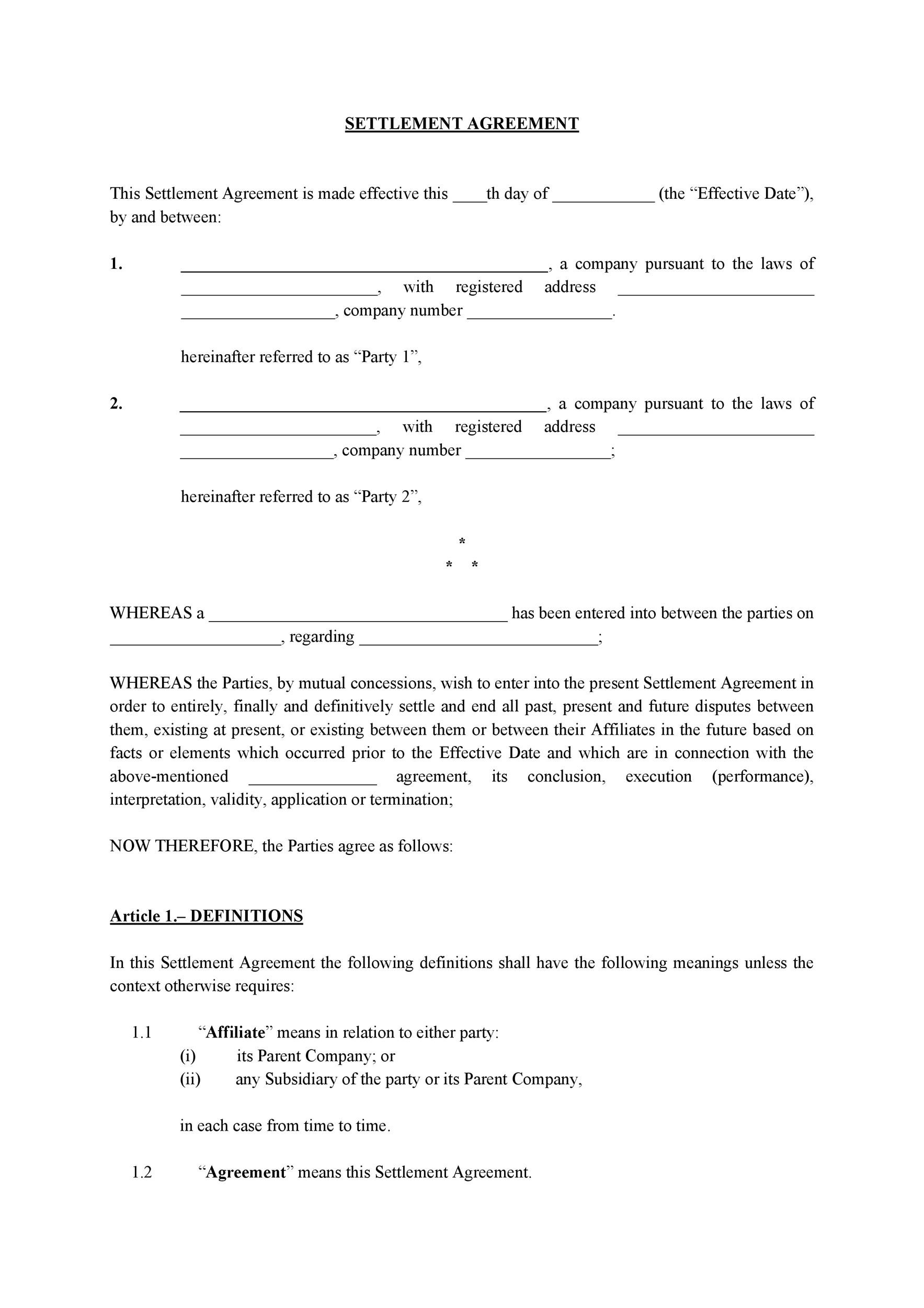

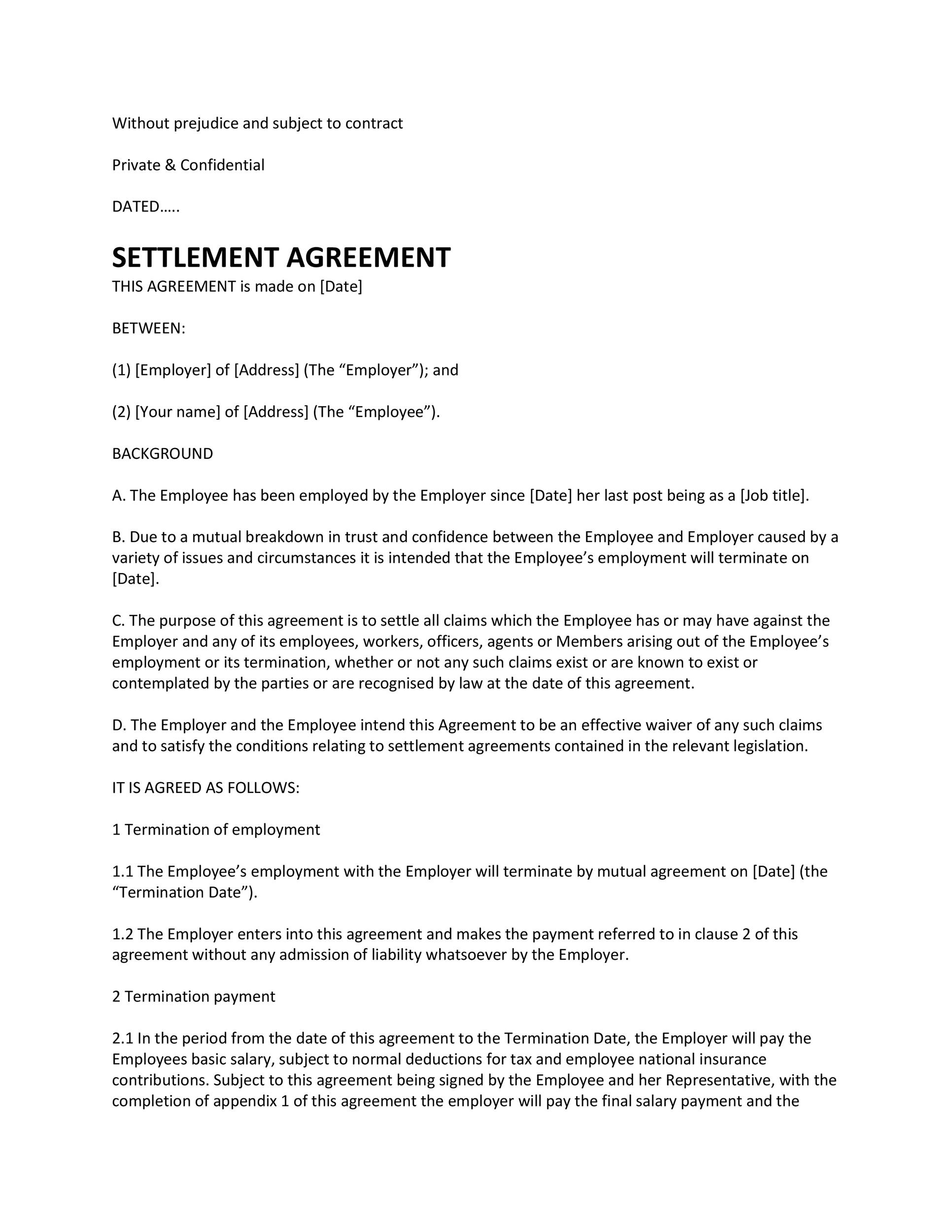

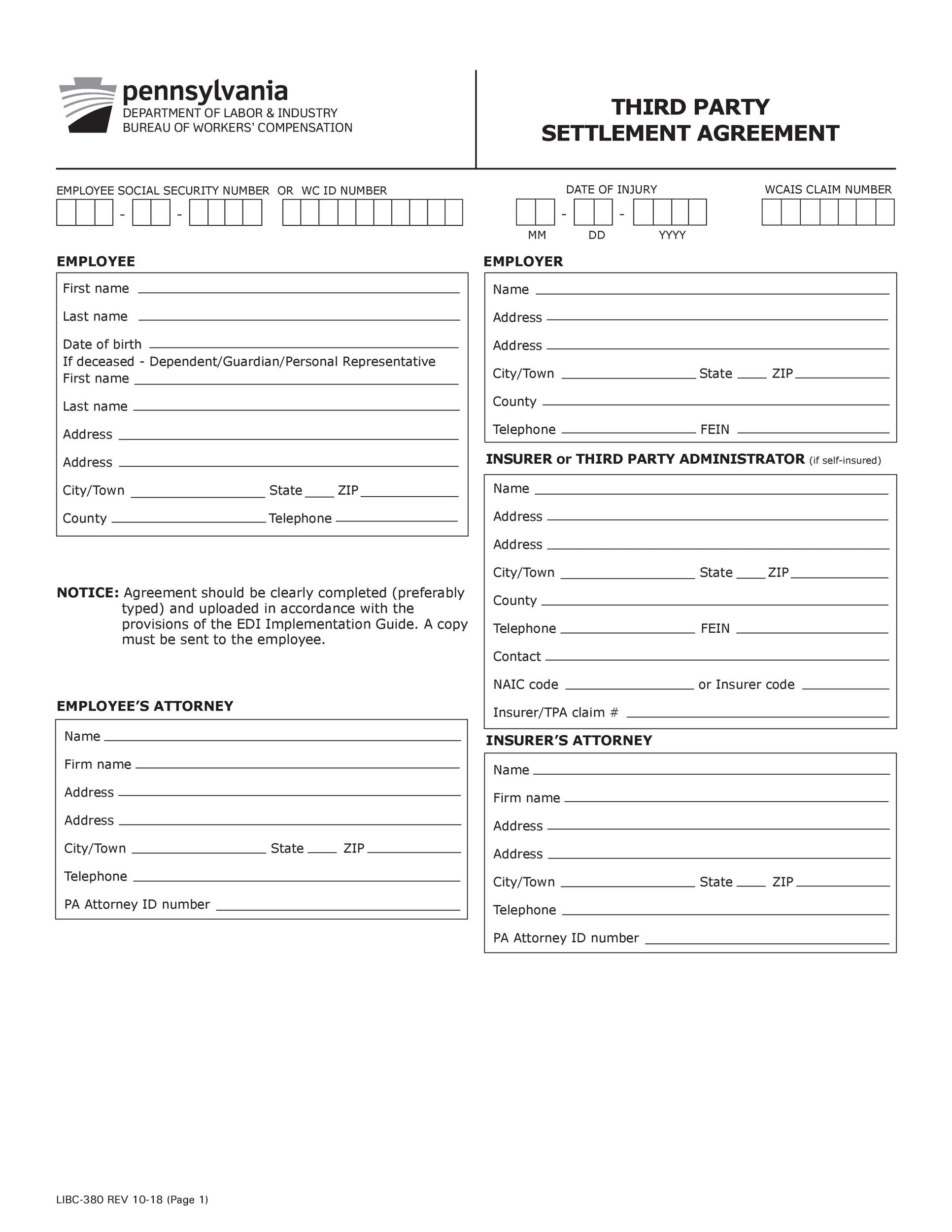

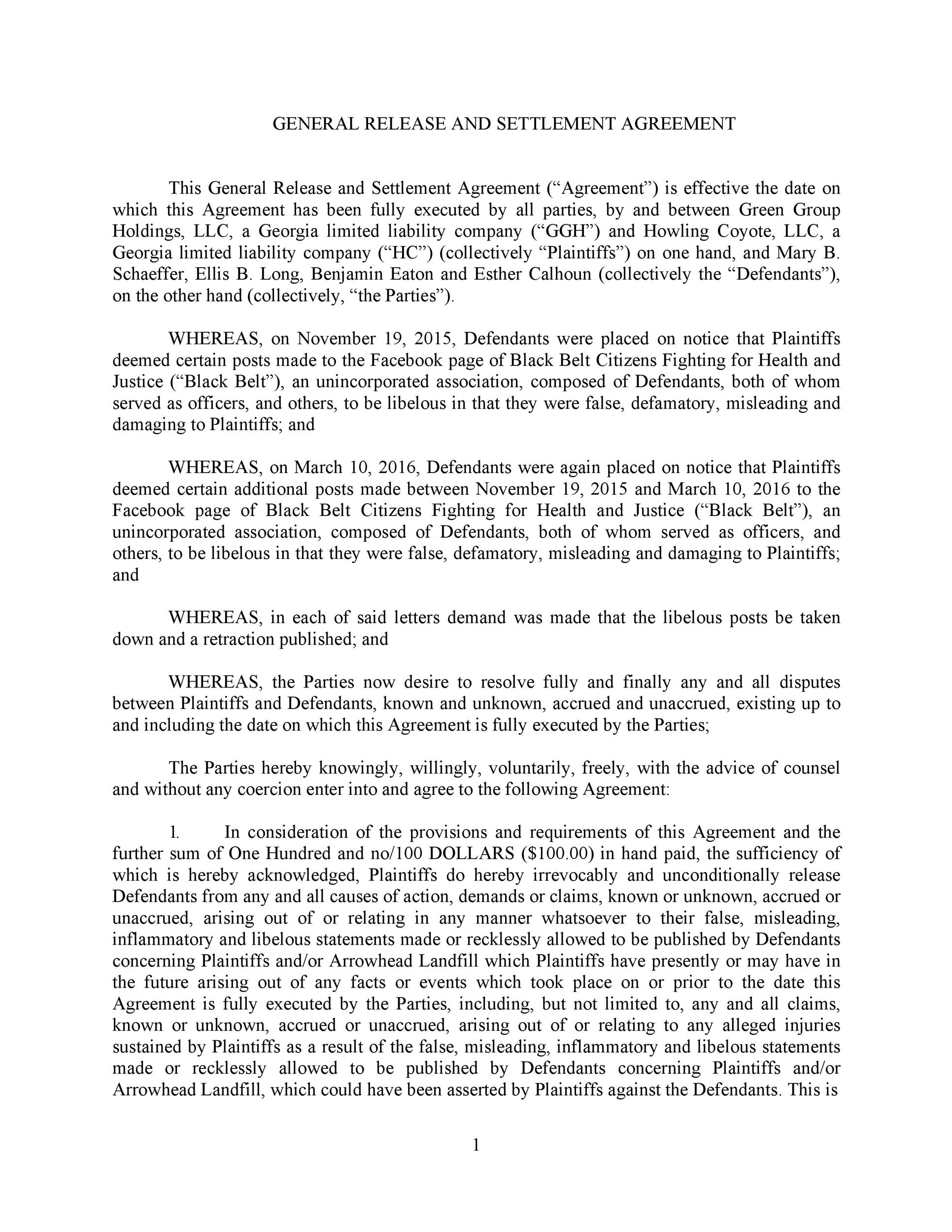

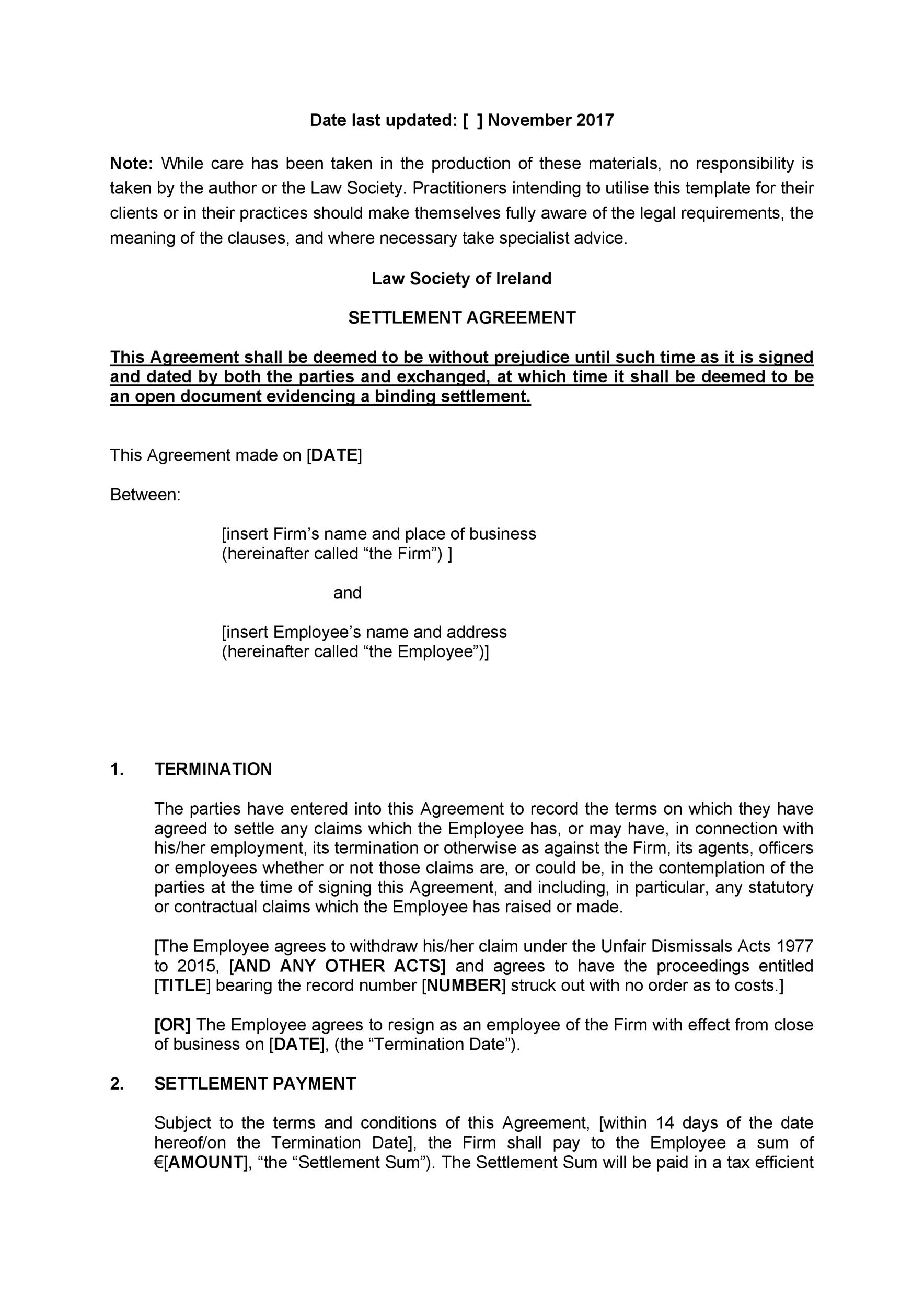

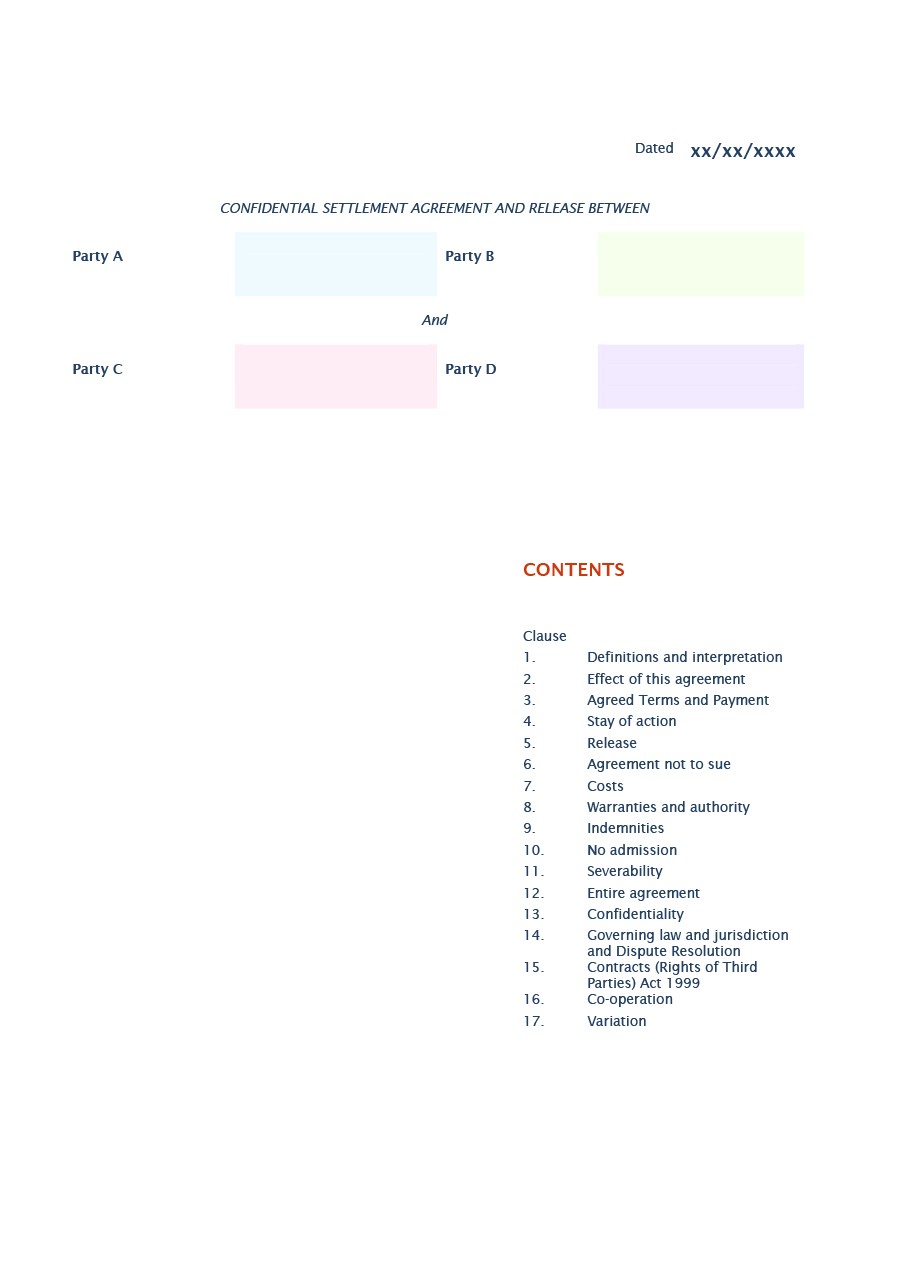

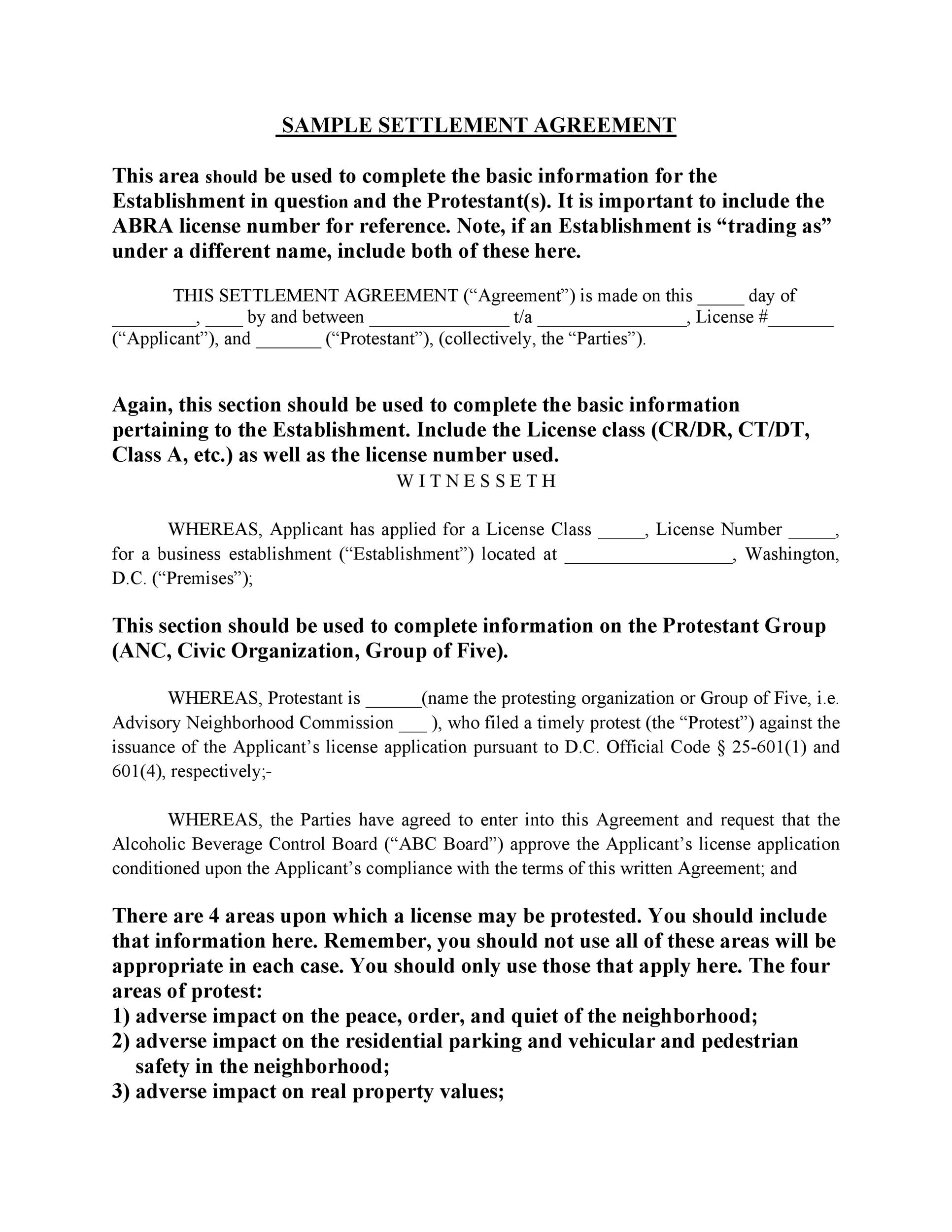

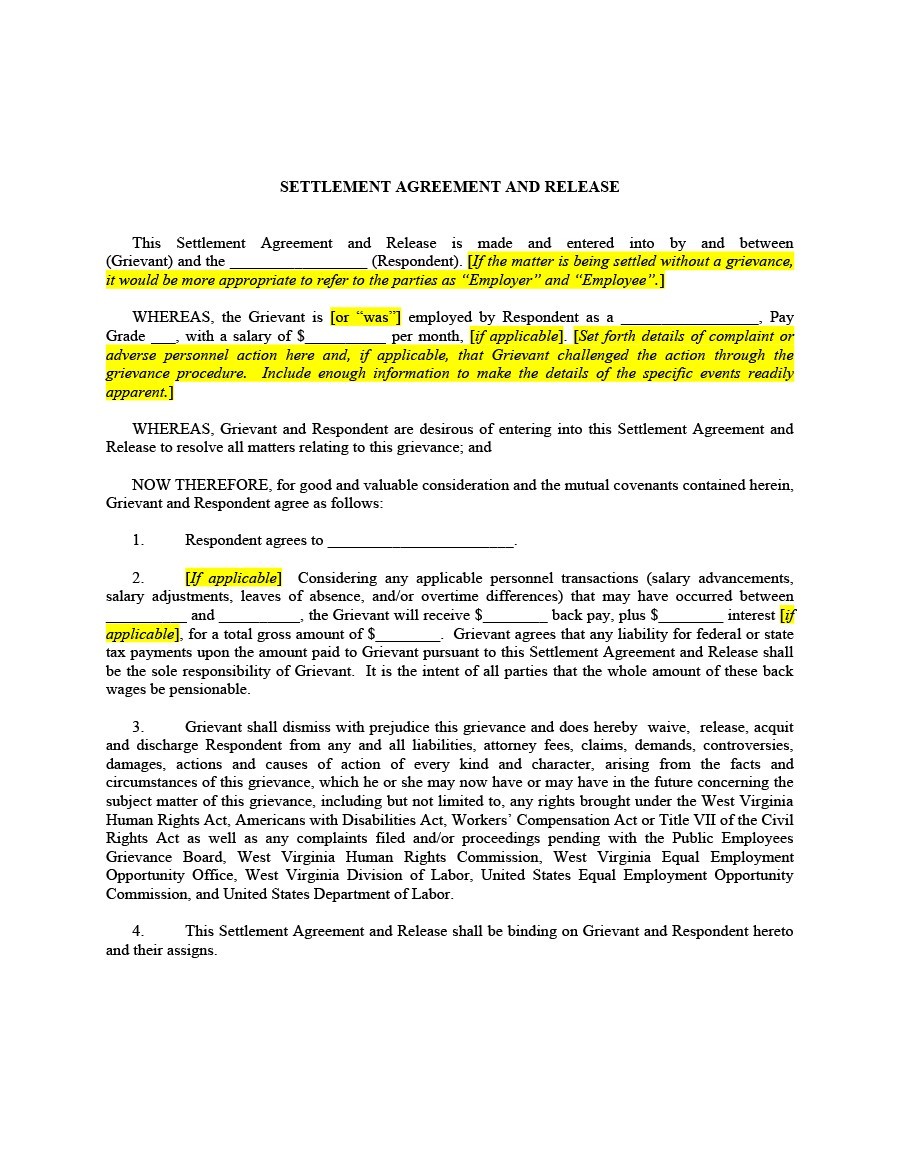

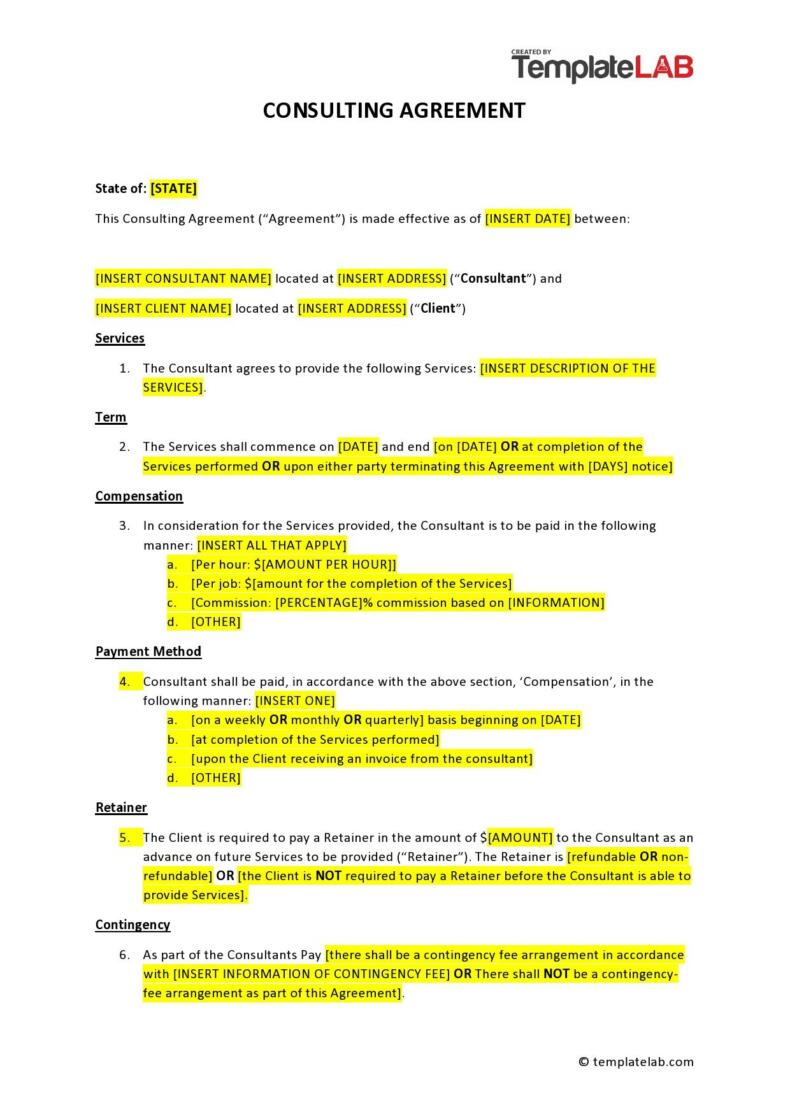

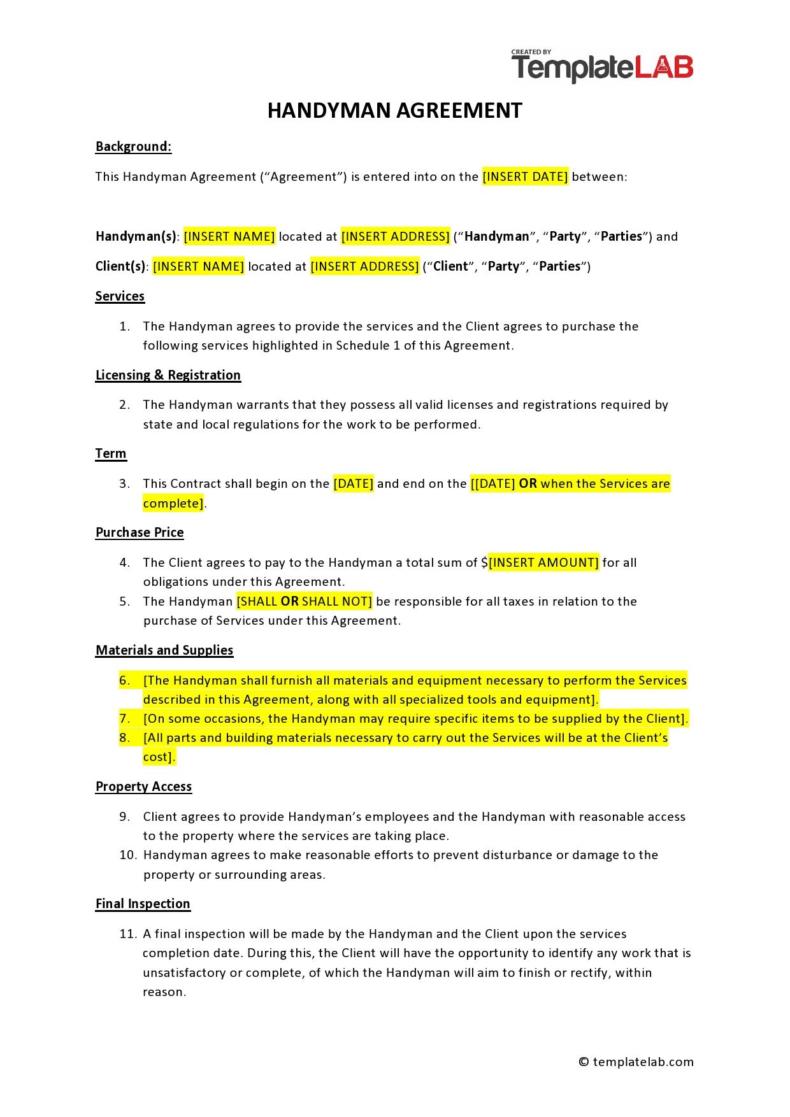

Settlement Agreements Templates

Benefits and risks of a settlement agreement

A settlement agreement which exists between an employee and an employer is a legally-binding document that’s created shortly after or before the employee gets terminated. There are other types of agreements as well namely a debt settlement agreement letter, a divorce settlement agreement template, a payment settlement agreement, and more, all of which have varying settlement agreement formats.

The benefits of these types of agreements:

- In the case of employment, the agreement allows for a clean and easy break in the employer-employee relationship when the employee agrees to waive his right to bring claims against the employer in return for monetary compensation.

- Having a settlement agreement template is an efficient, pragmatic, and speedy way to end the employment relationship.

- As an employer, you can enjoy peace of mind without worrying that your former employees will bring claims against the company.

Just like any other agreement, this one comes with a number of risks:

- If you introduce this agreement and issue it to an employee, he may use it as admissible evidence in case any Employment Tribunal proceedings occur.

- If you use the agreement to get around a fair process like a disciplinary, redundancy or capability procedure and you don’t provide adequate compensation for it, your employee might not agree to sign. Then this gives the employee strong grounds to negotiate a higher settlement or to initiate formal procedures in the workplace.

- It might destroy your relationship of confidence in trust with the employee if you offer an agreement which isn’t managed well. In some cases, it might even affect the overall morale of your workforce.

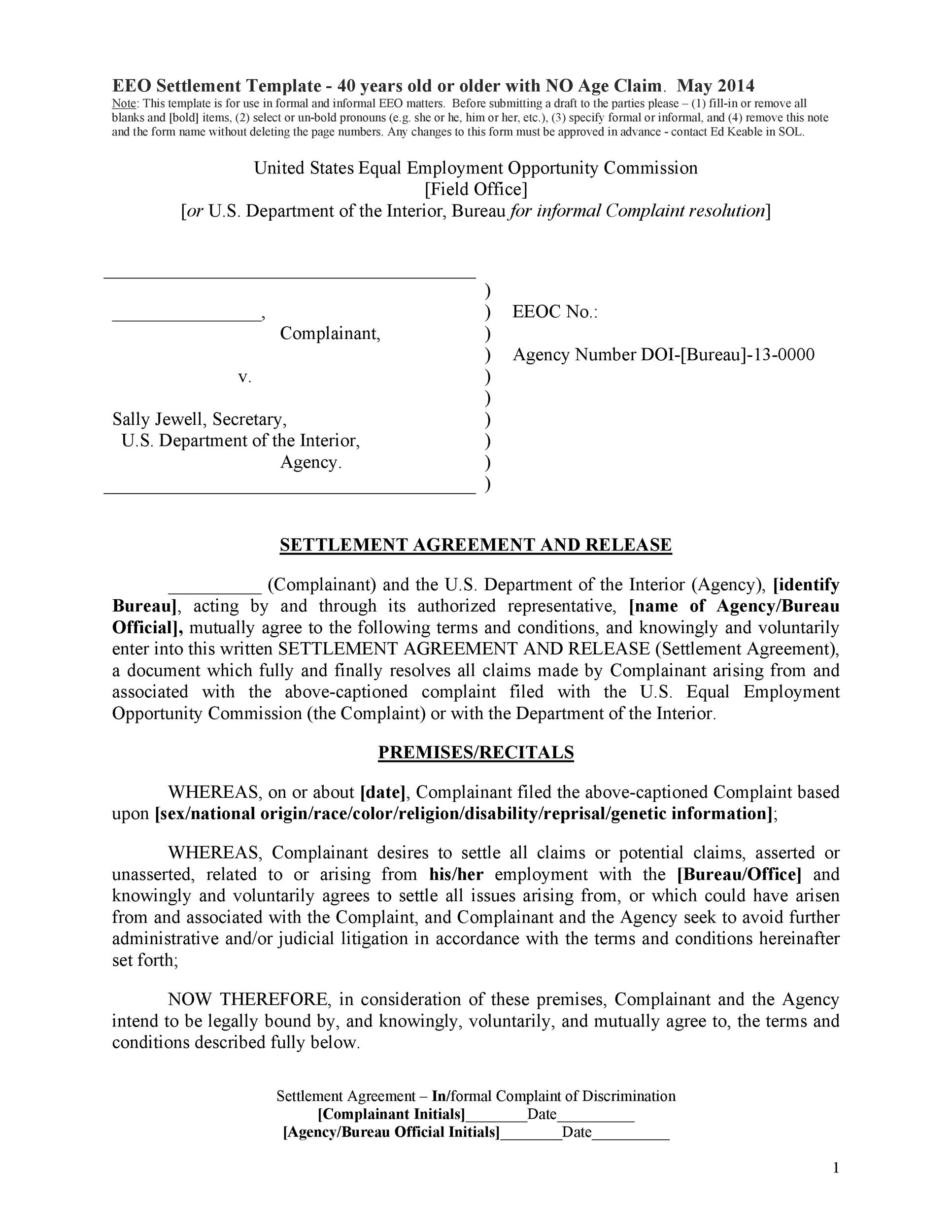

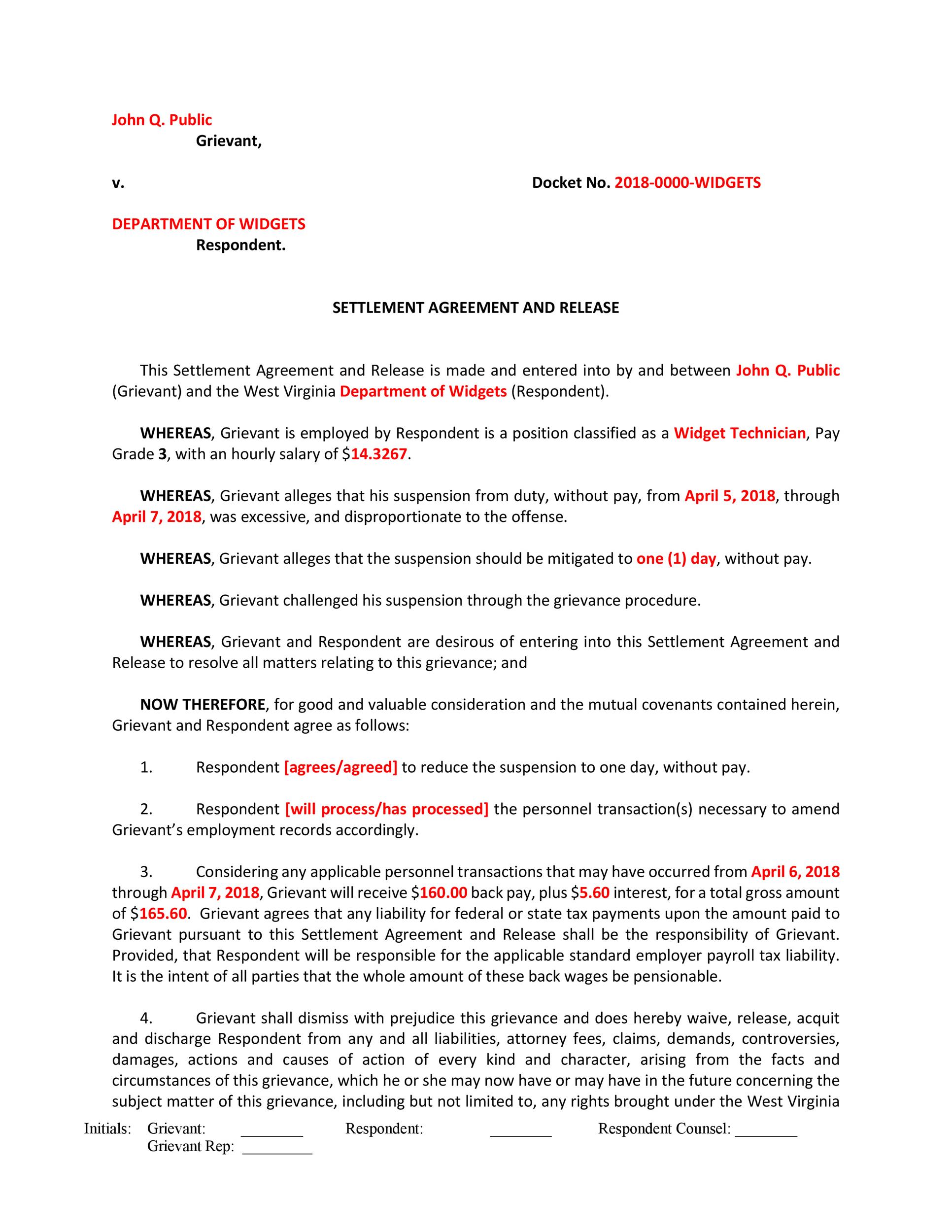

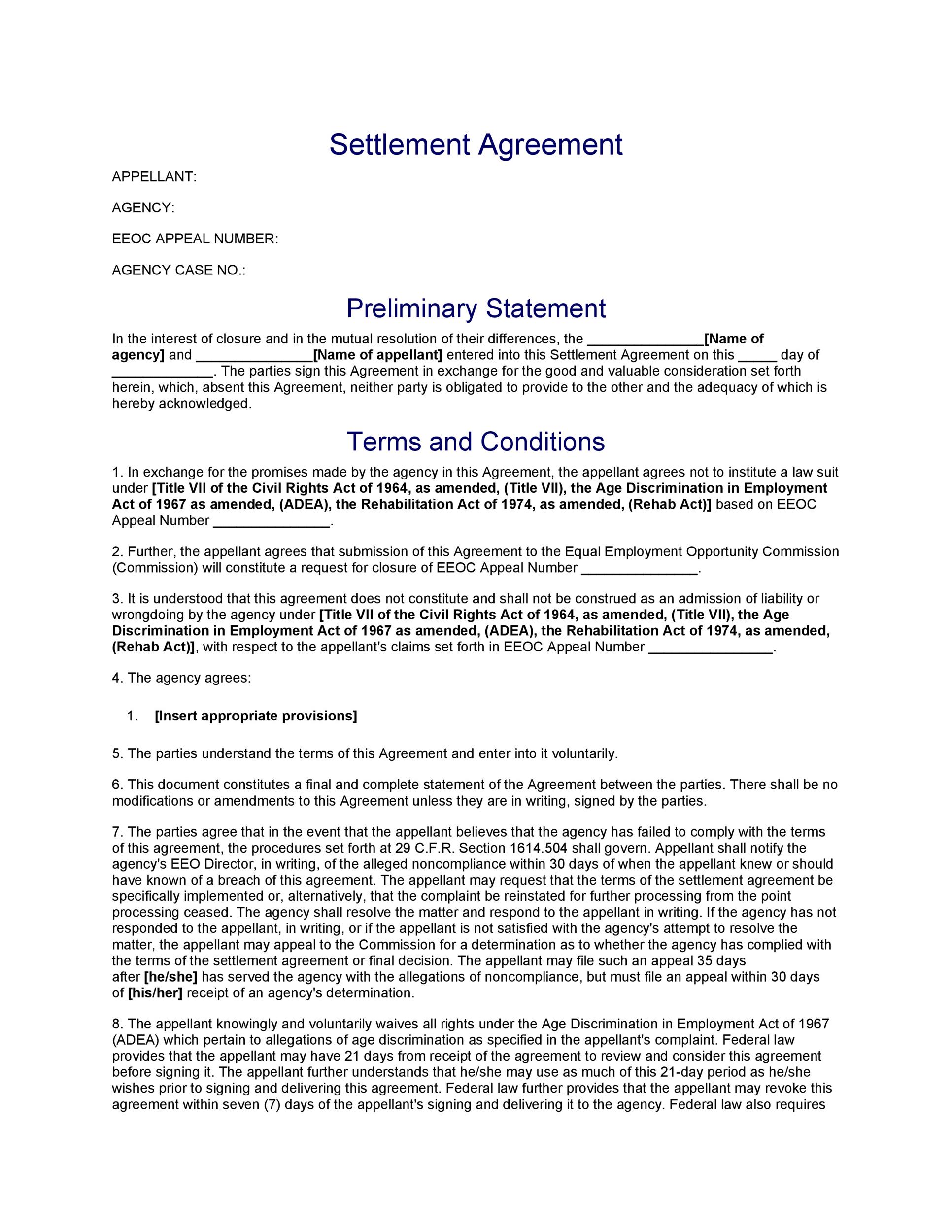

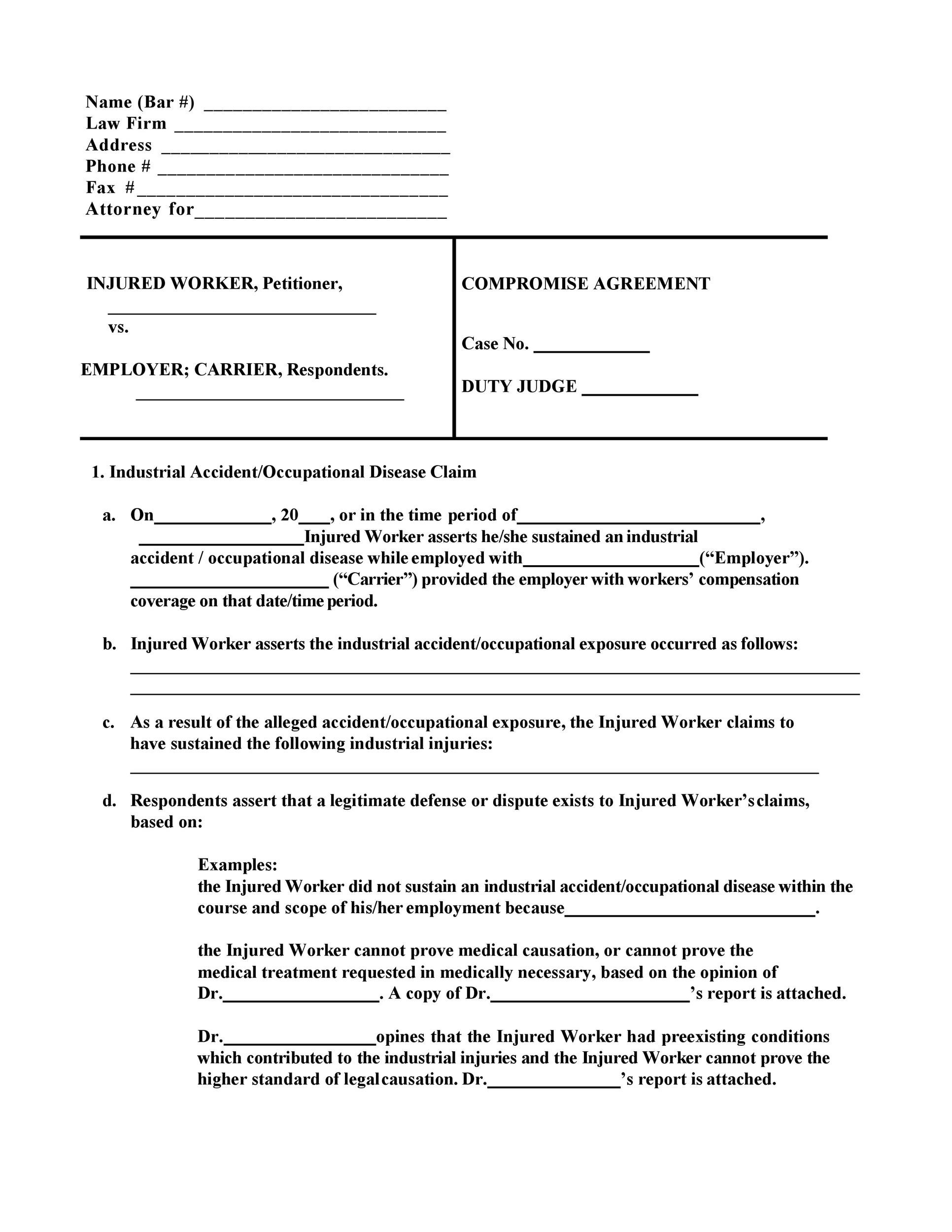

Employment Settlement Agreements

When to use a settlement agreement?

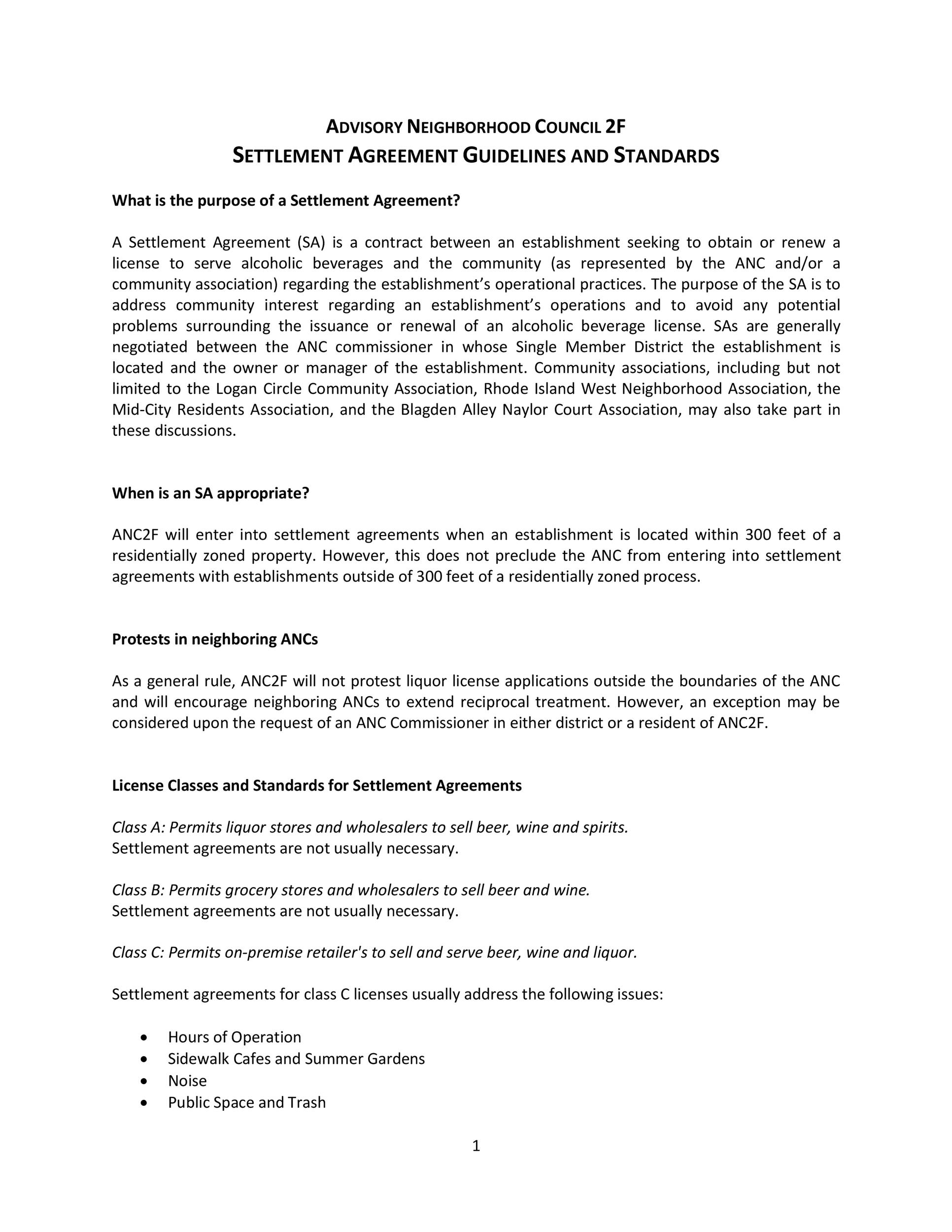

Settlement agreement templates are extremely versatile. They’re not just meant to bring a close to employment relationships. You can also use this document to settle disputes at any time. But only use this settlement as a last resort after you’ve tried resolving the disputes through disciplinary procedures or discussions first.

When you immediately decide to create a payment settlement agreement each time a problem arises, other people might consider this as inappropriate and heavy-handed. Only when you’ve tried other methods but they didn’t work out should you resort to creating this document.

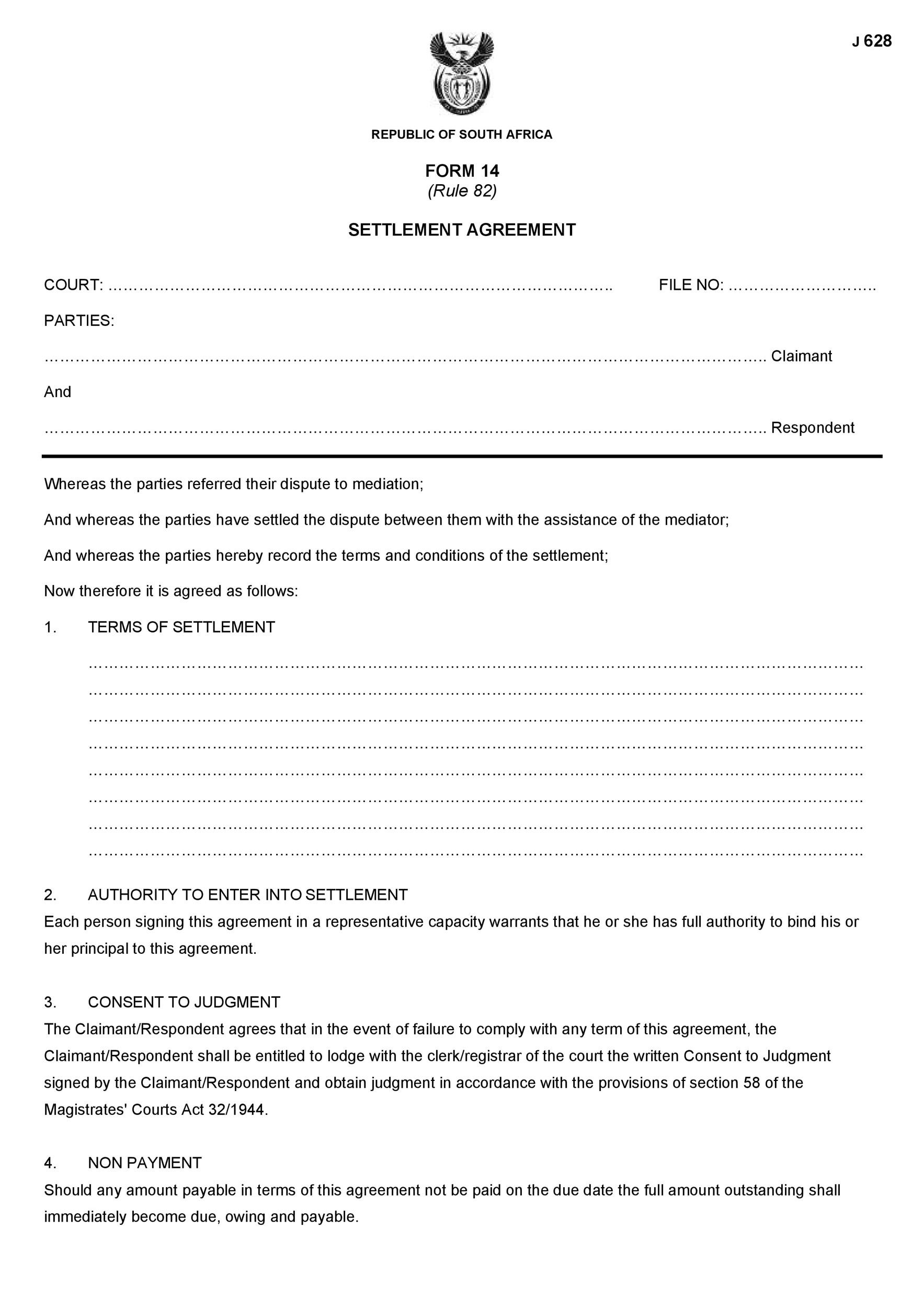

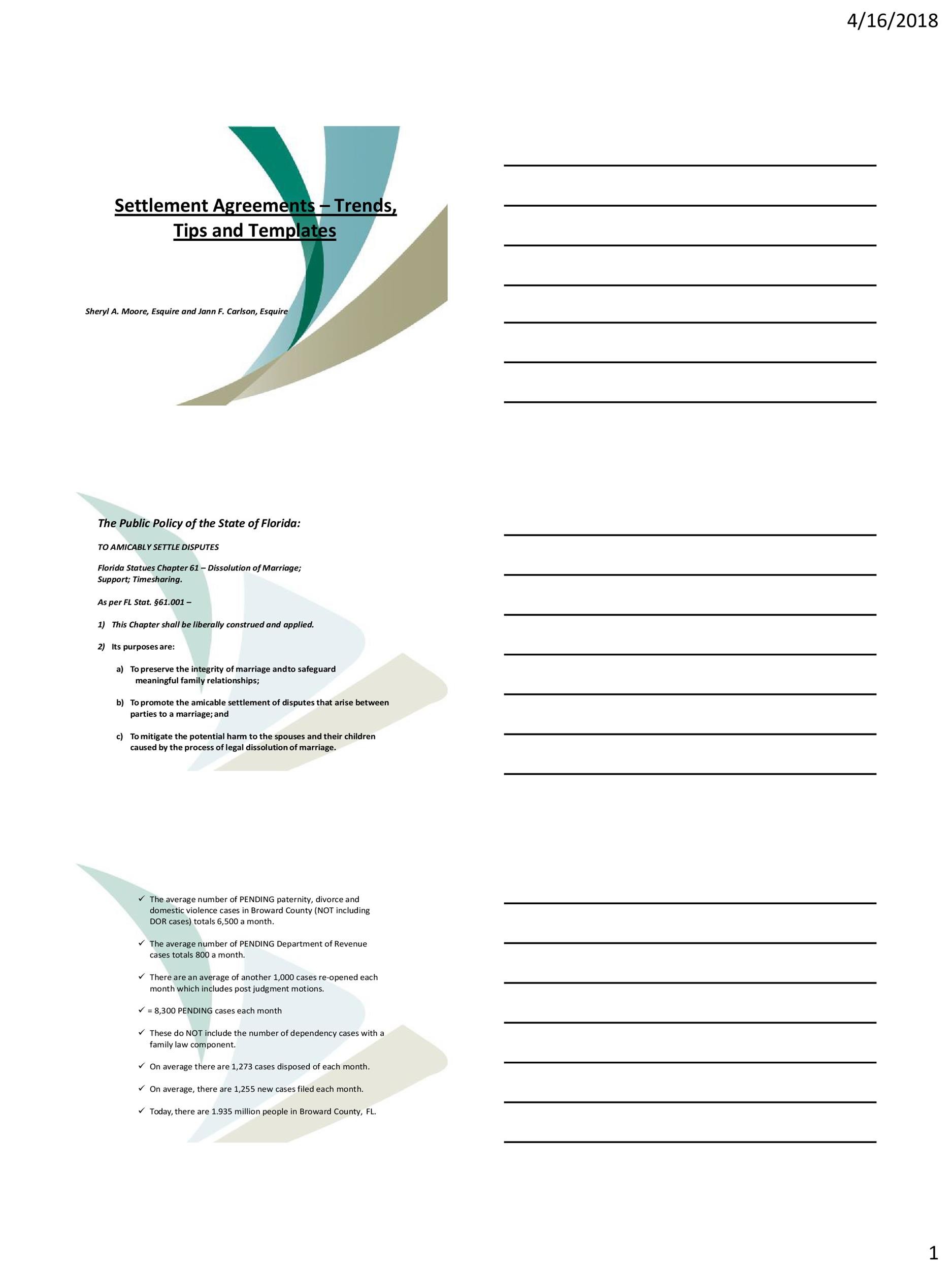

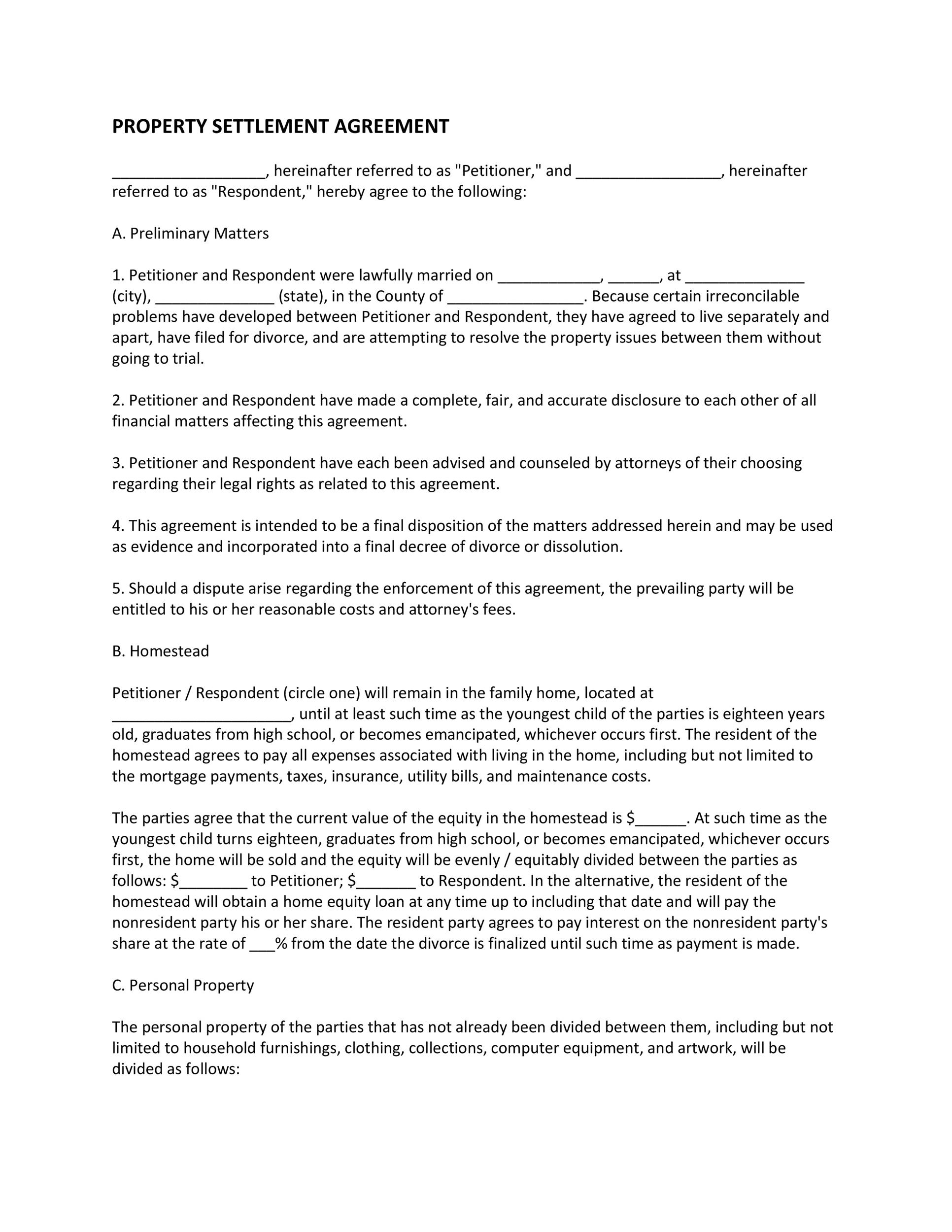

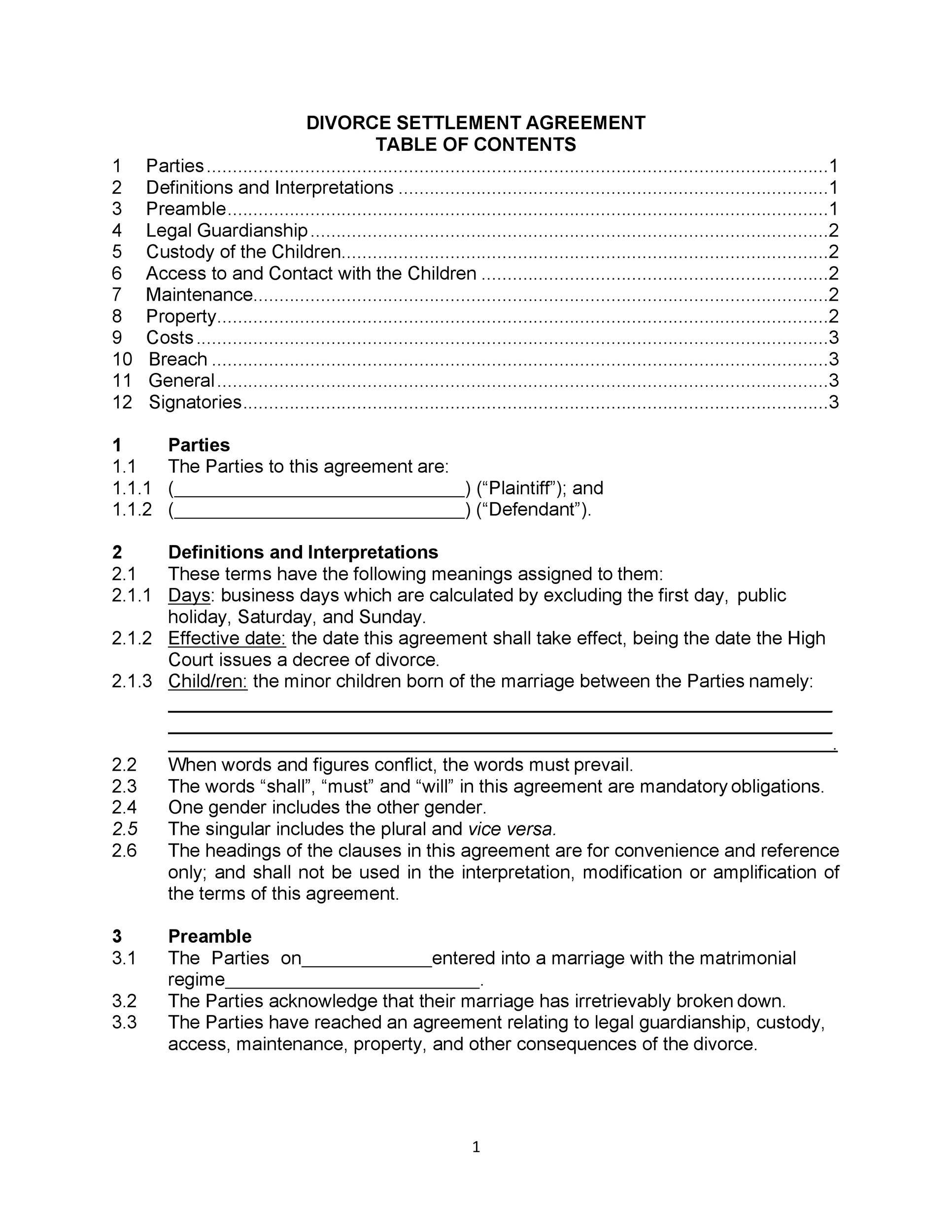

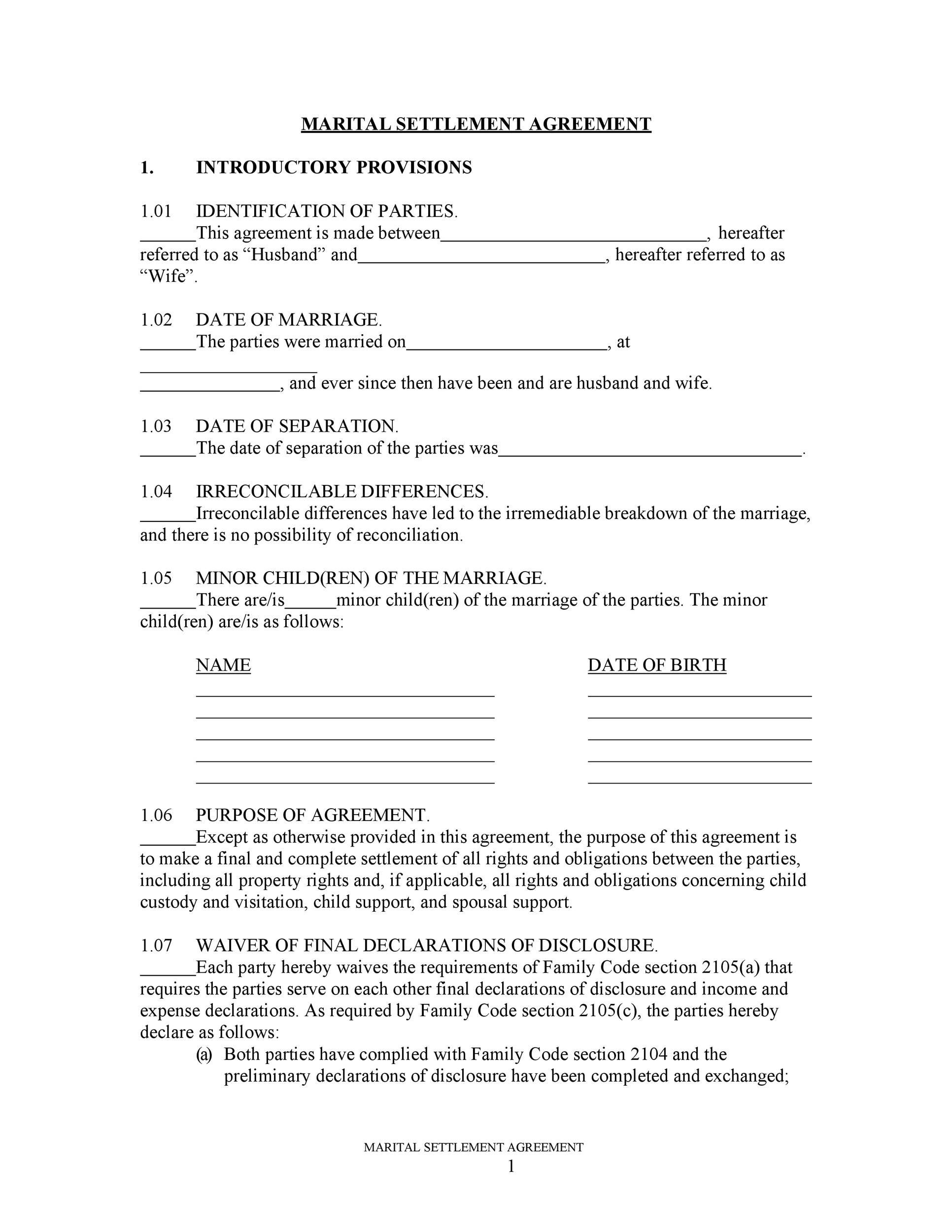

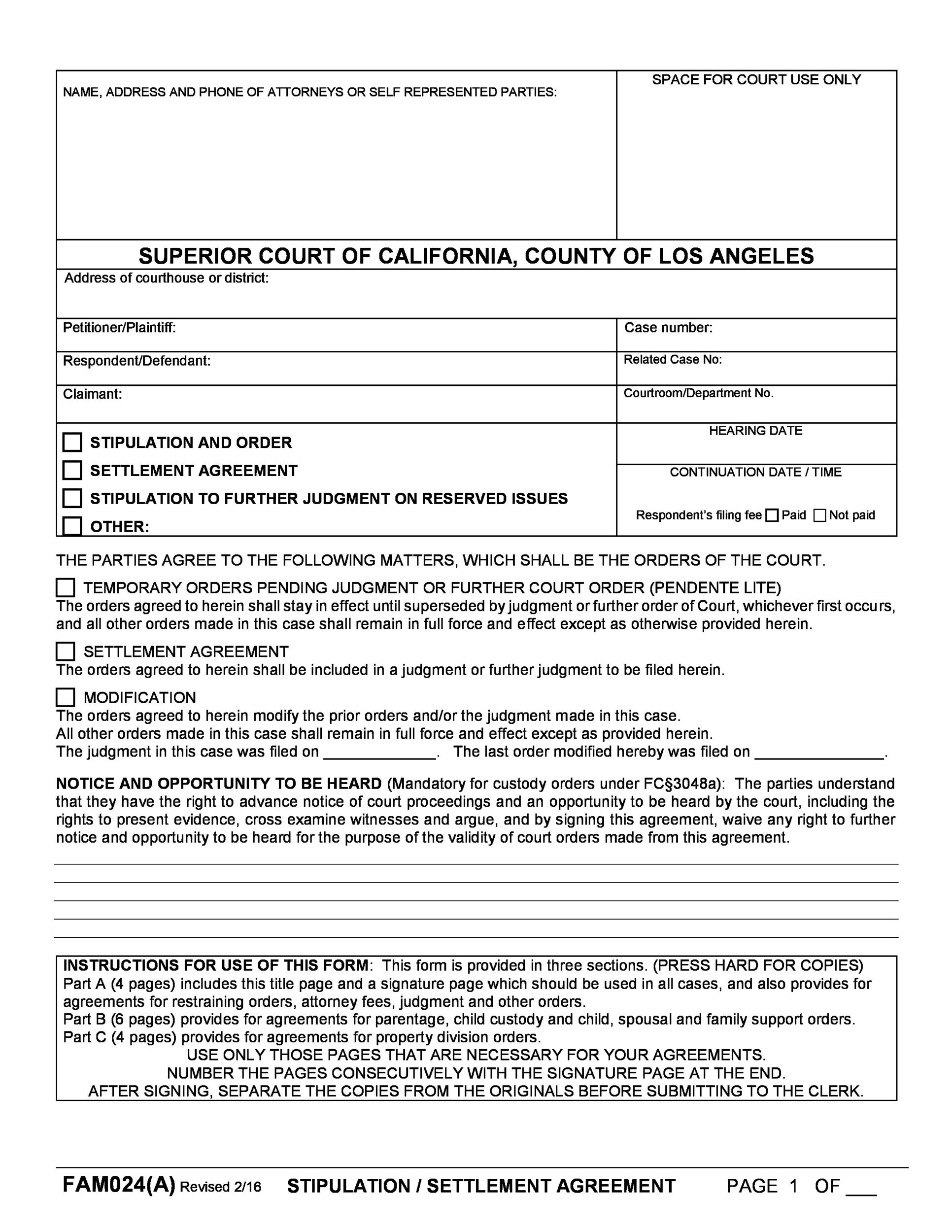

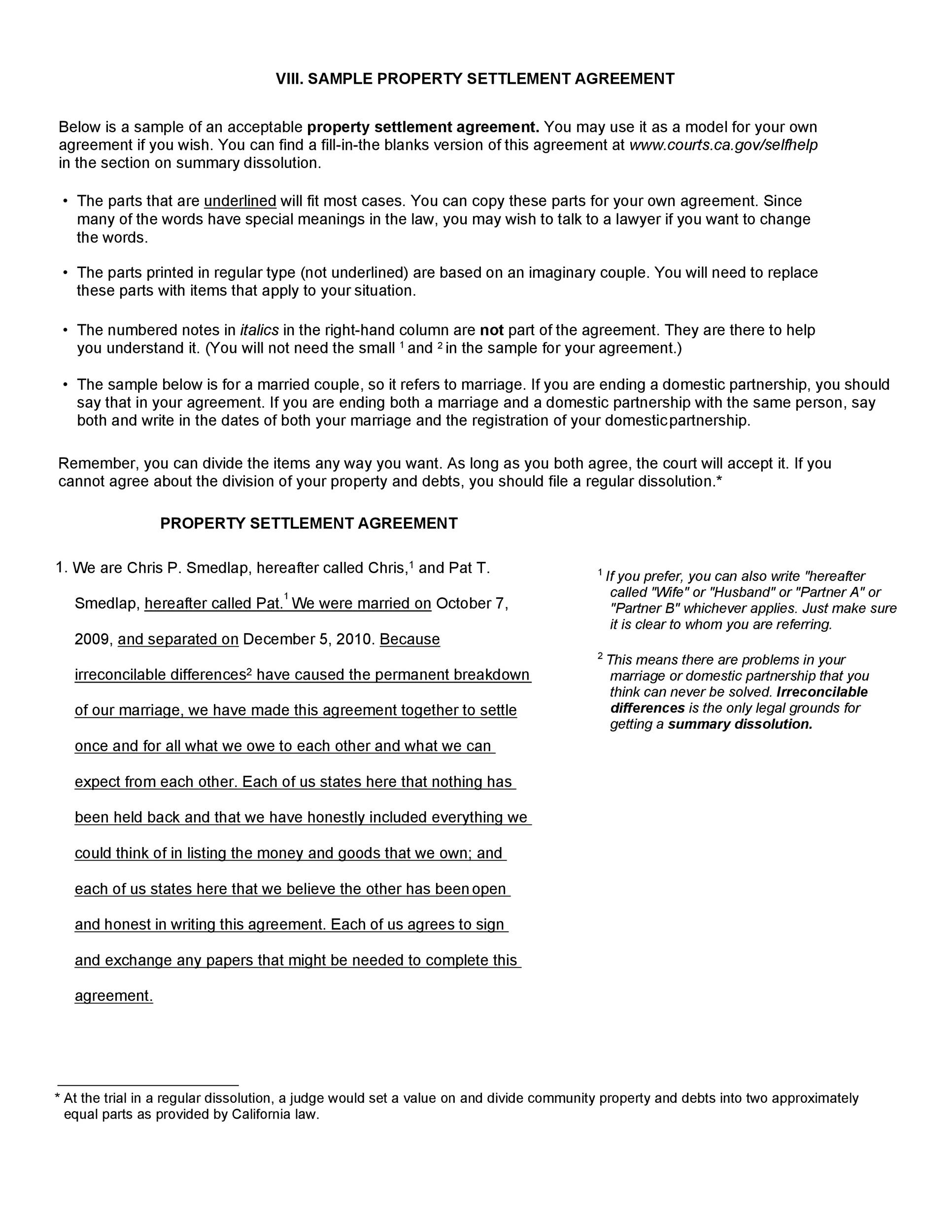

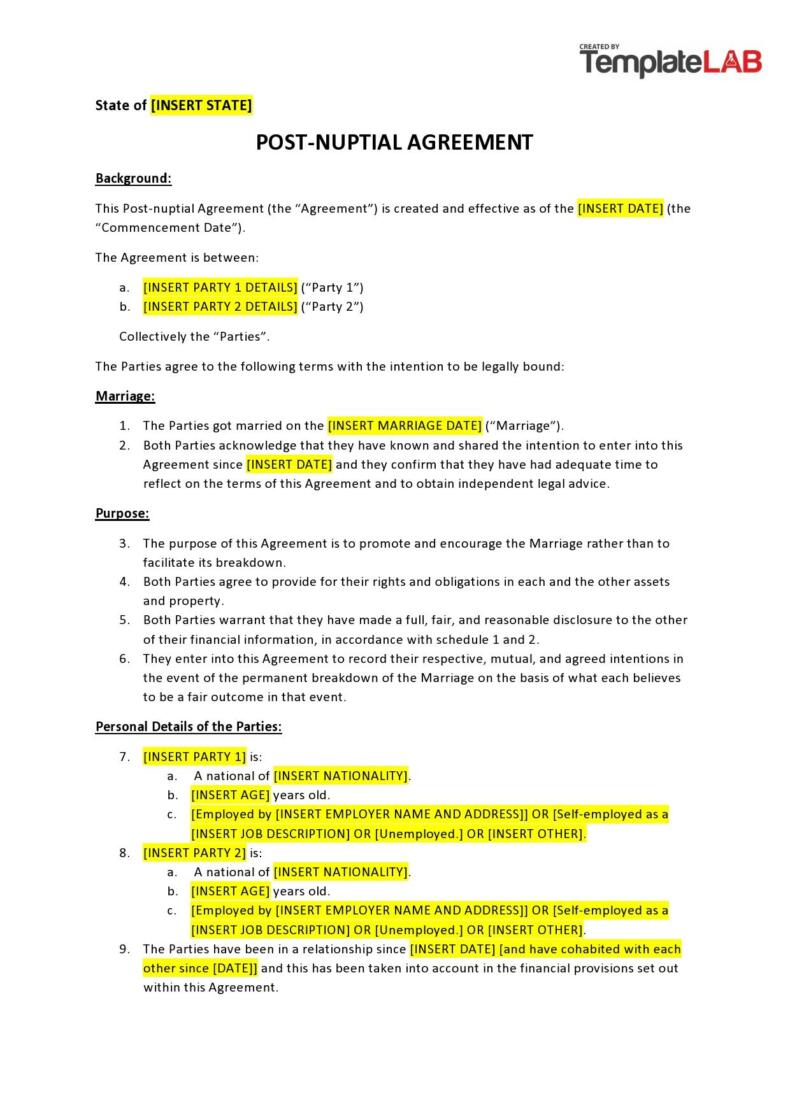

Divorce Settlement Agreements

Deciding the terms within a settlement agreement

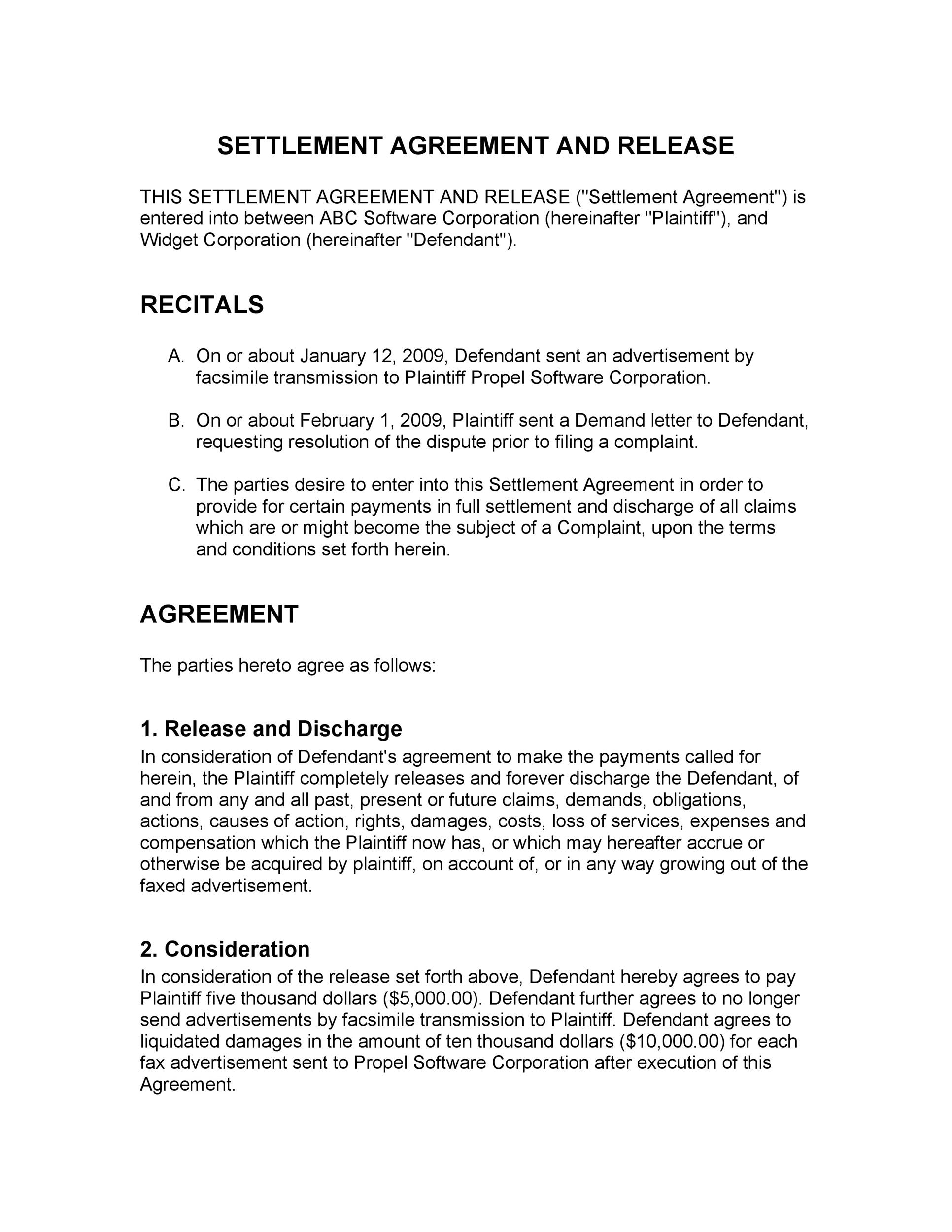

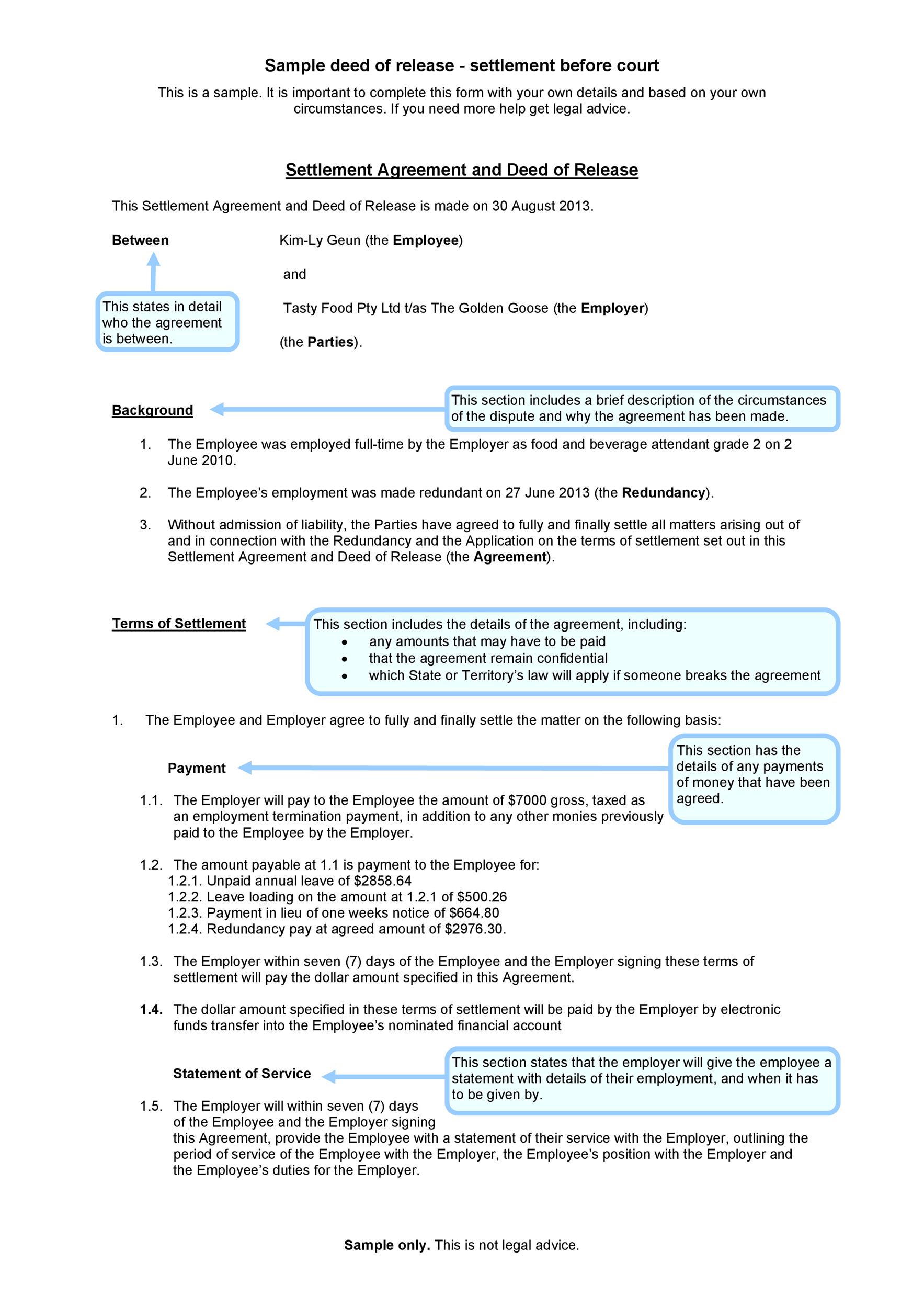

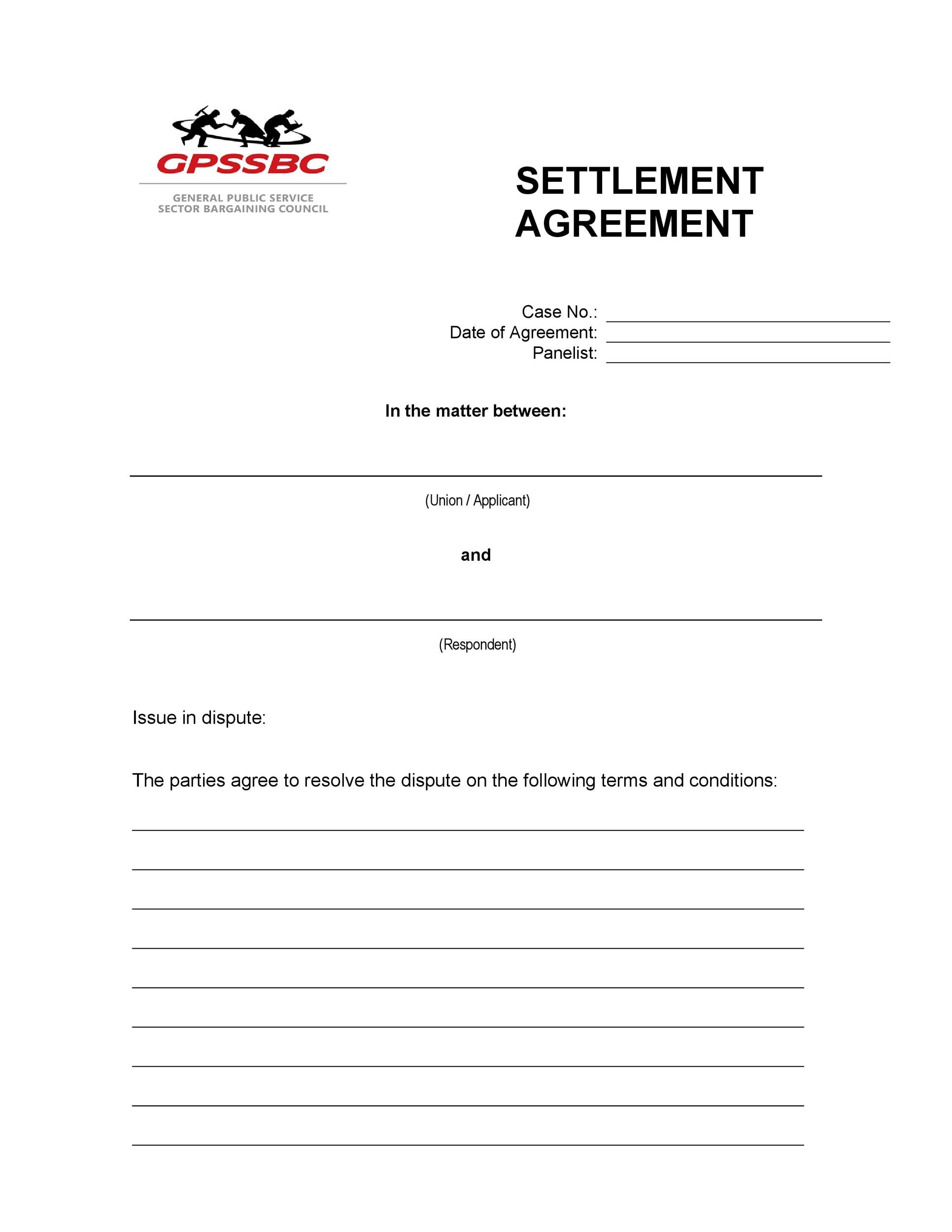

Both parties should mutually agree with the terms of the settlement agreement. After agreeing on the terms, one party must write them all down and create a formal settlement agreement format to record everything they’ve agreed upon. The agreement contains the claims the employee won’t pursue in exchange for monetary compensation.

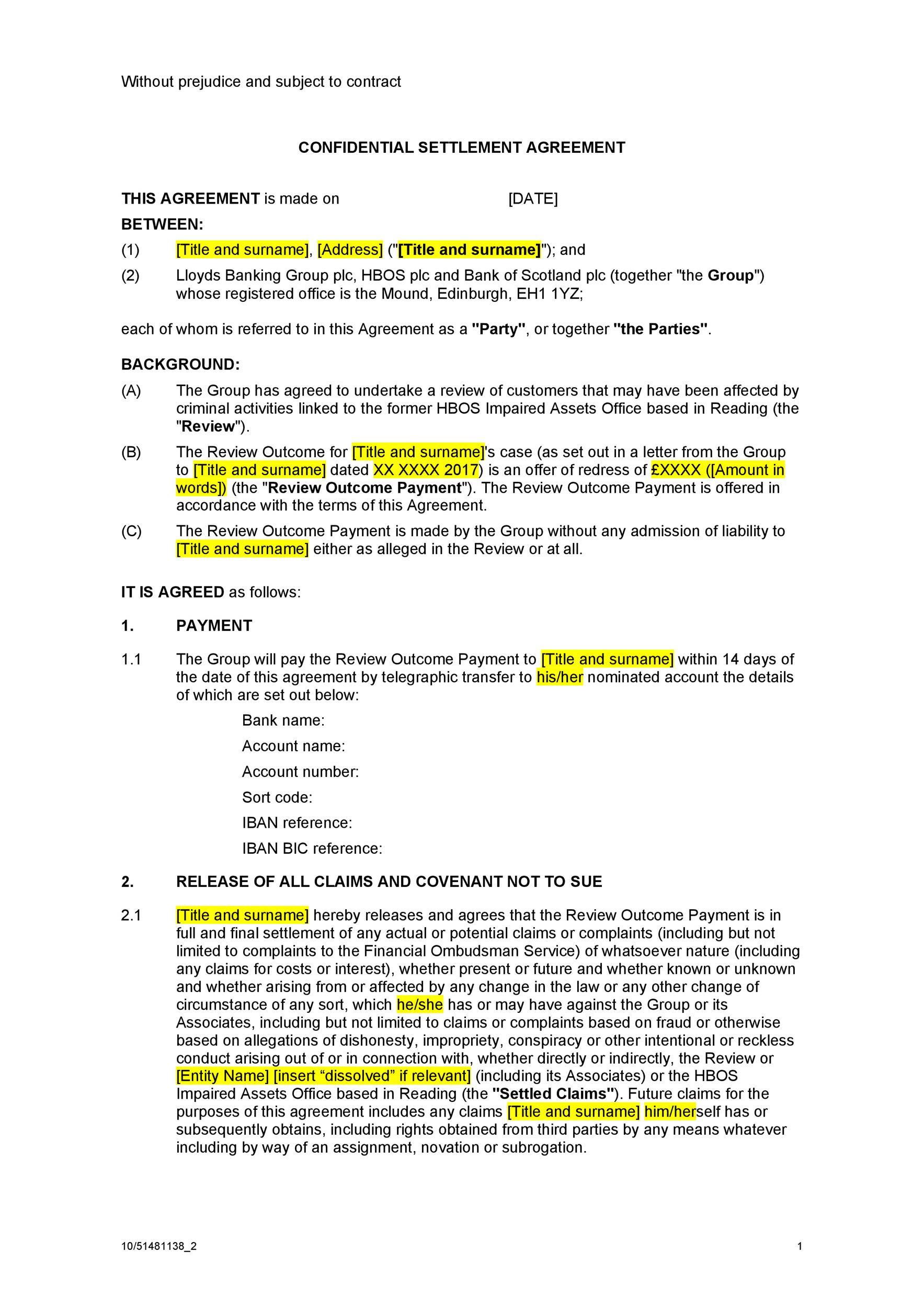

When you create a sample settlement agreement whether it’s a debt settlement agreement letter, a divorce settlement agreement template or one for an employee, make sure to customize all of the information on it. Here are the most common terms to include in this agreement:

- The settlement payments

The payment settlement agreement must include a detailed breakdown of all the payments both parties have agreed upon. It must also indicate whether any of these amounts are tax-free. In most cases, tax isn’t deducted to the payments, especially when made on the basis of “ex gratia” or when the payments are the result of damages caused by a breach of contract.

But since these terms can be quite tricky to determine, it’s best to seek professional advice before you agree to make tax-free payments. - How much must the payment be?

There isn’t any standard payment scale to follow when it comes to settlements. This is because the payment depends upon the circumstances surrounding the agreement. But there are some factors you may consider when thinking of the payment amount including:

how long the employee worked in your company;

the circumstances why you’re offering a settlement;

how long it might take to settle the dispute if you don’t reach an agreement; or

any potential cost and liability of having to defend a claim. - Non-financial terms to include in the settlement agreement

Often, an agreed reference also gets involved in the settlement agreement. There must be a clause which states that the employer, when you provide the employee with a reference, won’t deviate from the agreed-upon terms in the agreement.

The agreement also includes a confidentiality clause which states that the employee will maintain the terms of the agreement, the amount of the settlement, and the reasons for the confidentiality. It’s also a common practice to include a clause which prevents the employee from making derogatory comments about his employer.

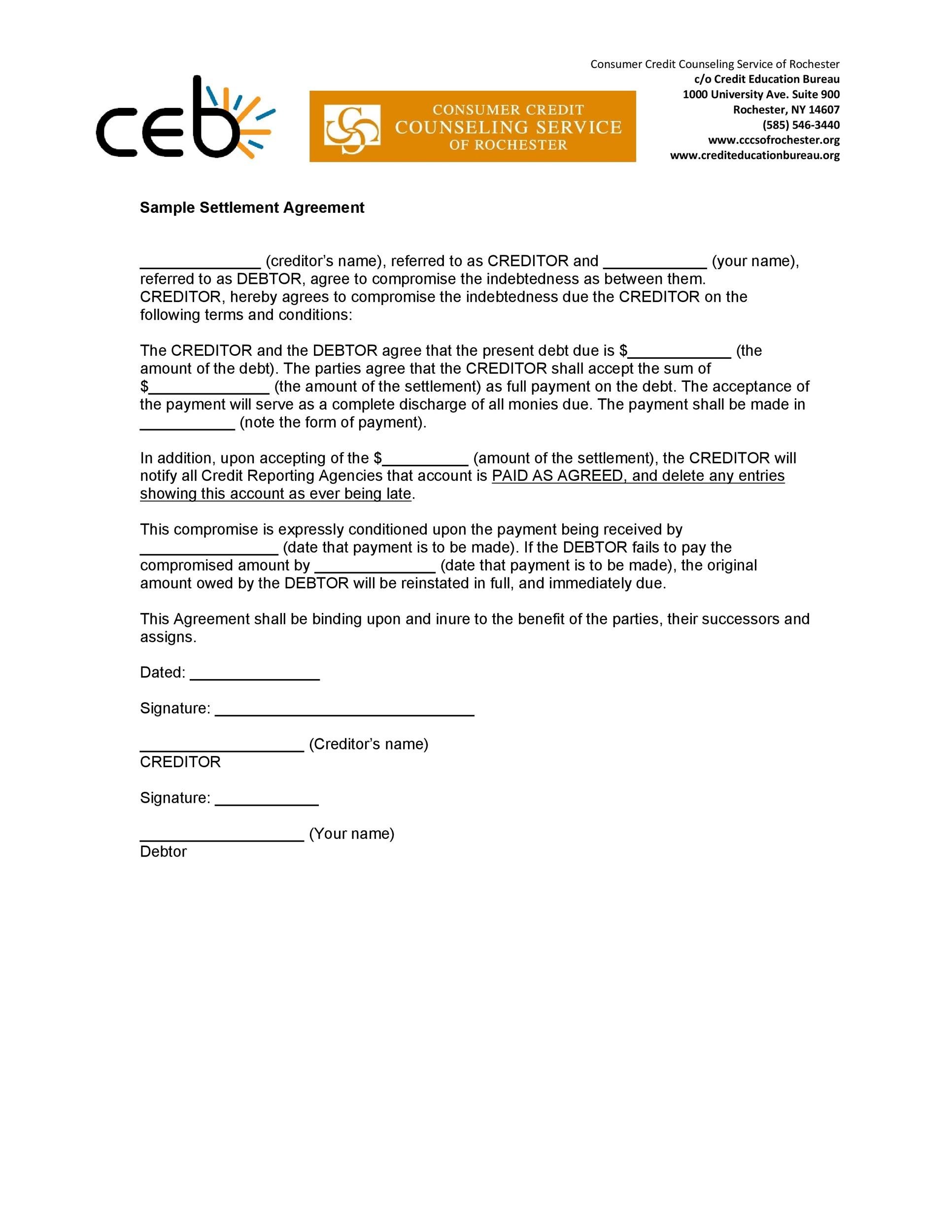

Debt Settlement Agreement Letters

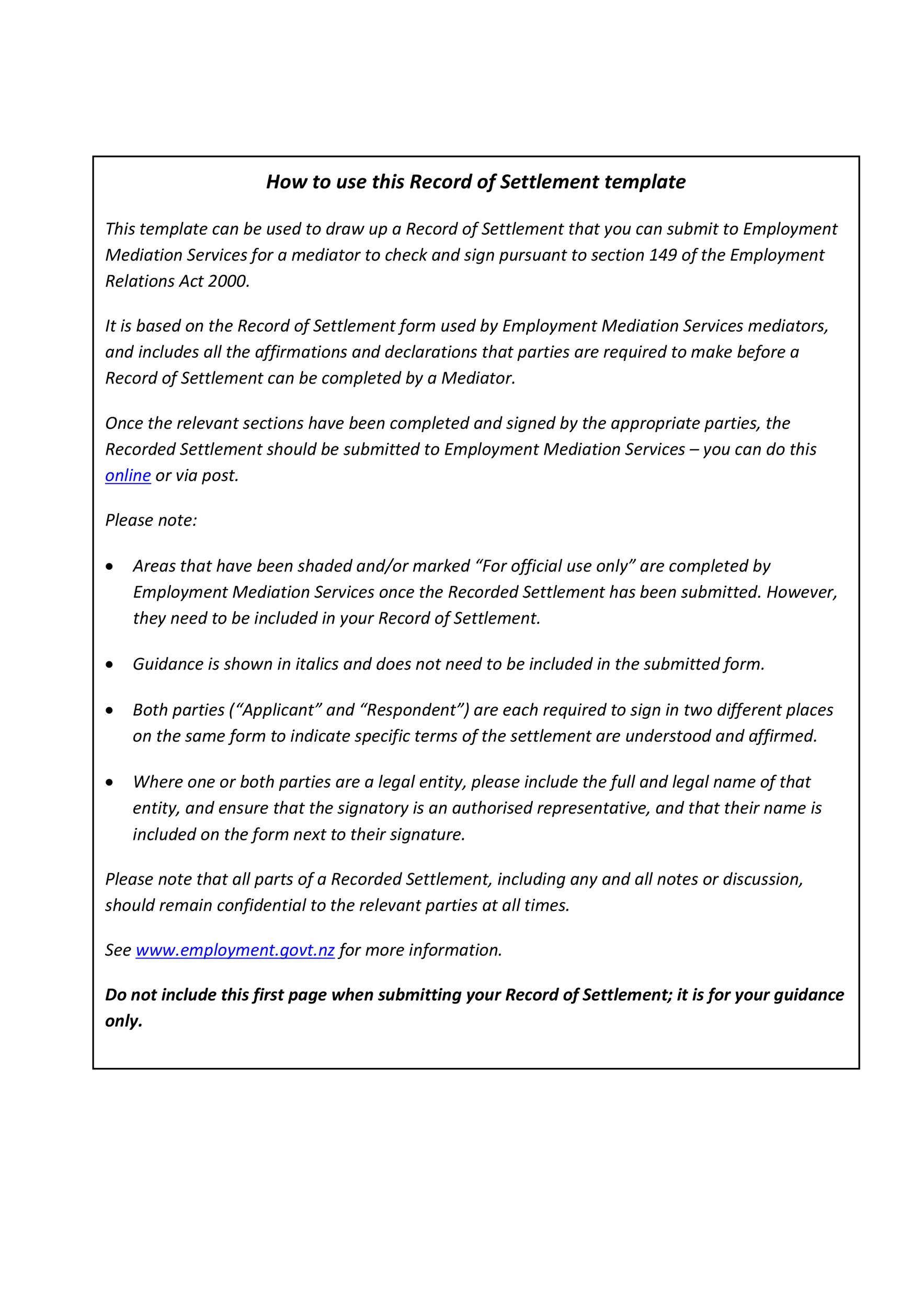

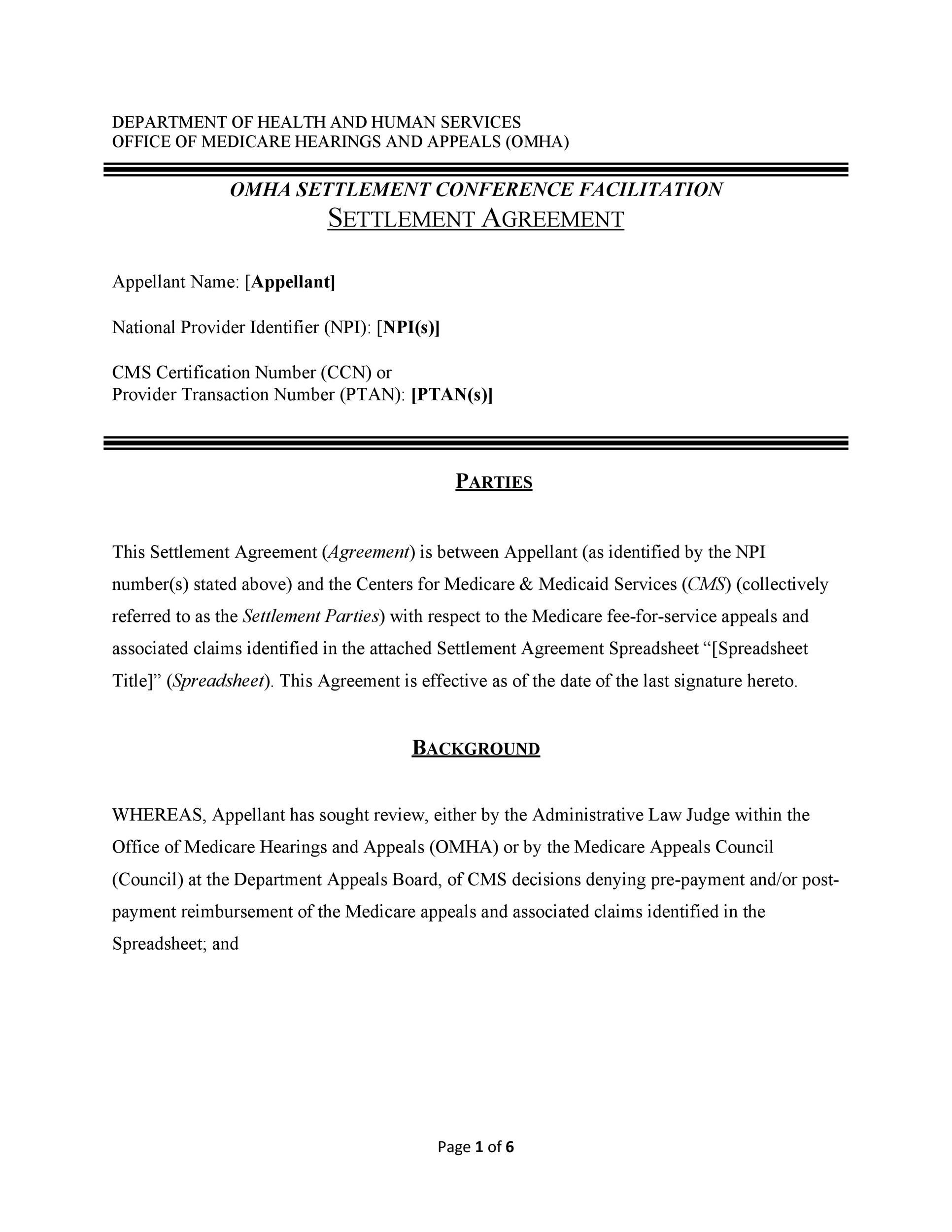

Creating a settlement agreement with your employer

Settlement agreements are fairly common in the workplace, especially when employees have complaints against their employers. In such a case, the employer might attempt to settle the dispute to prevent the employee from making a claim.

The agreement involves the employer making a promise to stop the unlawful treatment, give you monetary compensation or both. The document created is a legally-binding contract between the employee and the employer and both the parties must adhere to it. Most likely, the employer would like to maintain the confidentiality of this agreement.

In some cases, the employer will pay for the employee to seek independent legal advice. The reason for this is that if the employee signs a settlement without getting legal advice first, the dispute might still end up in the Employment Tribunal. If you’re an employee and you don’t want to reach a settlement, you may go to an Employment Tribunal instead.

For the negotiations, your employer will inform you about what the agreement will contain. The employer can either do this in writing or face-to-face. In cases where you can’t efficiently take part in this conversation, ask someone for help. Most employers agree to this request to prevent the issue from getting worse.

After your negotiations, if you weren’t able to settle the dispute, it’s time to consider the offer of your employer. At this time, think about the significant details of your case including:

- Whether or not you have a strong case;

- How far off your employer’s offer is as compared to what you could potentially get;

- Whether or not you’d like to keep your job or get it back as part of the terms in the agreement your employer makes;

- What are your other options in case you don’t agree with the settlement; or

- Making the tribunal claim will get you a lot more than what you might get from the settlement agreement.

In cases where you’re a recipient of Income Support, Jobseeker’s Allowance, or Universal Credit and your claim get settled, there’s no need for you to pay it back. But if you win the tribunal claim, the DWP claims back the amount you received from them. If your employer offers a reasonable settlement, you should probably accept it.

But if you don’t think that your employer gave you a reasonable offer, you can either decline it, ask for an increase in the case of a monetary settlement or go to an employment tribunal. If you choose to agree with the offer given by your employer, the next step is to create the document for the settlement.

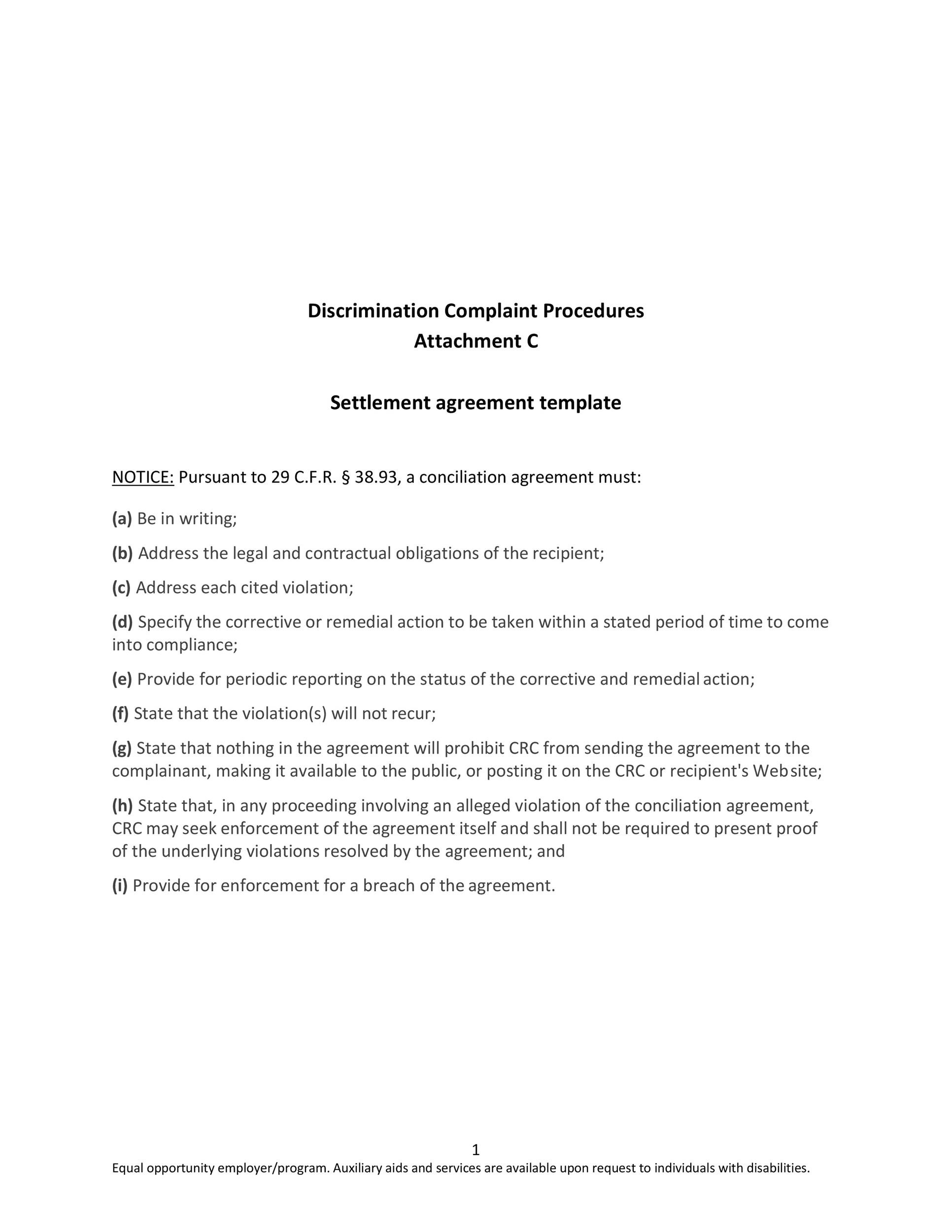

Therefore, you must make sure that the settlement agreement:

- is in writing;

- includes all of the information about the dispute which led to the settlement;

- comes from a lawyer who isn’t employed by the company;

- covers everything that you and your employer have agreed upon;

- indicates that the document meets all of the rules regarding settlement agreements.

If the document doesn’t meet all these conditions, it’s not a good idea to sign it. Without your signature, the document doesn’t have any validity. Therefore, you can still bring your claim to an employment tribunal. That is unless your employer makes the necessary changes in the agreement and presents the document to you.

As aforementioned, an employer will pay the employee to get independent legal advice about the agreement. This usually comes in the form of a lawyer with all the required qualifications. However, this may also come in the form of an advice worker or a trade union representative who has the authority to advise regarding settlement agreements.

Of course, the advice they have to offer is only limited to the terms of the settlement agreement. For instance, they will help you understand what the statements in the document mean. However, they won’t give you advice on whether it’s a “good” agreement or if it’s better for you to go to an employment tribunal.

In cases where you’ve reached a settlement while having a tribunal hearing and the tribunal placed your claim on hold for a specific amount of time, you may ask them to revive your claim if your employer doesn’t hold up his end of the agreement within the specified time.