Purchase orders are an essential part of a company’s financial records as they help with budgeting, spending, tracking, and supplier management. Creating a purchase order template for your business can help you avoid any misunderstandings with customers and discover any unexpected charges from suppliers.

Table of Contents

- 1 Purchase Order Templates

- 2 What Is a Purchase Order Template?

- 3 Purchase Order Forms

- 4 What Information Does a Purchase Order Form Need

- 5 How Do Purchase Order Templates Work?

- 6 How To Create a Free Purchase Order Template

- 7 Purchase Order Examples

- 8 What Are The Different Types of Purchase Order Templates?

- 9 What is a Purchase Order System?

- 10 What are the Benefits of Purchase Order templates?

- 11 Conclusion

Purchase orders are a crucial component of keeping accurate, full financial records. Although they may appear to be just another piece of accounting paperwork, understanding when and how to use them offers significant advantages.

The correct PO system can greatly impact how well the purchasing process runs in your company, regardless of whether you’re a small business owner or you manage a larger corporation.

In this article, we’ll run through what a purchase order is and how to apply it to your business.

Purchase Order Templates

What Is a Purchase Order Template?

A purchase order template, often known as a PO, is a legal document that a customer delivers to a vendor or supplier to authorize a transaction. A purchase order specifies the goods that the customer wants to buy and how much of it they want. These contracts aid in the documentation of transactions for the buyer and the seller.

If you run or own a business, you’ll understand the importance of supplier management. This is the process of communicating with suppliers what you need. It involves placing orders, receiving orders, and making sure that invoices are paid.

It sounds easy, but supplier management often comes with a lot of complications. There could be payment issues, shortage of supplies, logistical delays, shipment issues, incorrect quantities, or simple miscommunication.

This is where a purchase order template comes in handy. By issuing POs, businesses can specify the goods and services required from their suppliers and highlight when they’ll need them.

Purchase orders keep business operations efficient and organized. It also allows suppliers time to evaluate whether or not they’re able to meet the demands of the buyer. In addition, POs allow both buyers and sellers to maintain accurate, specific records for future audits and financial statements.

Purchase Order Forms

What Information Does a Purchase Order Form Need

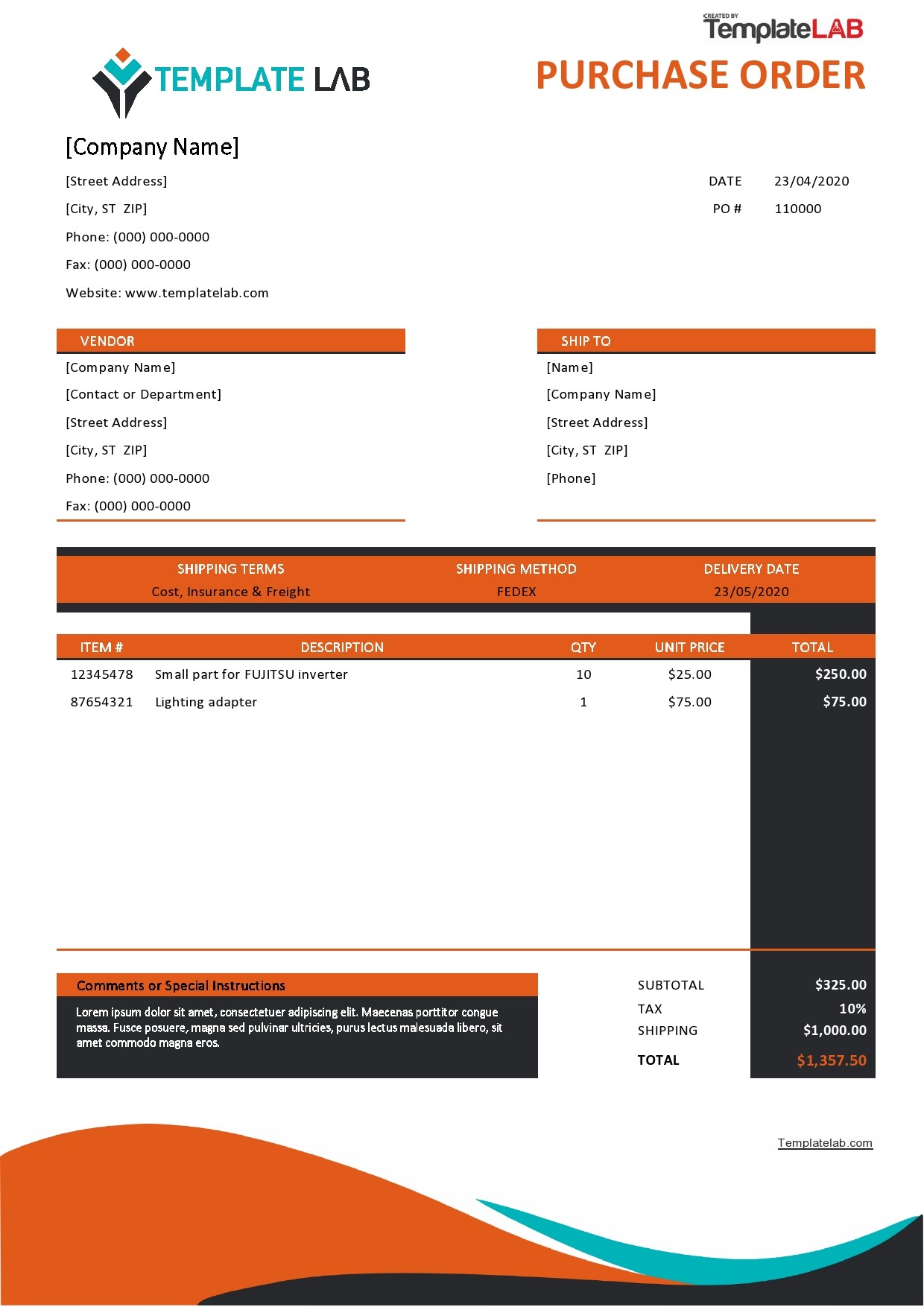

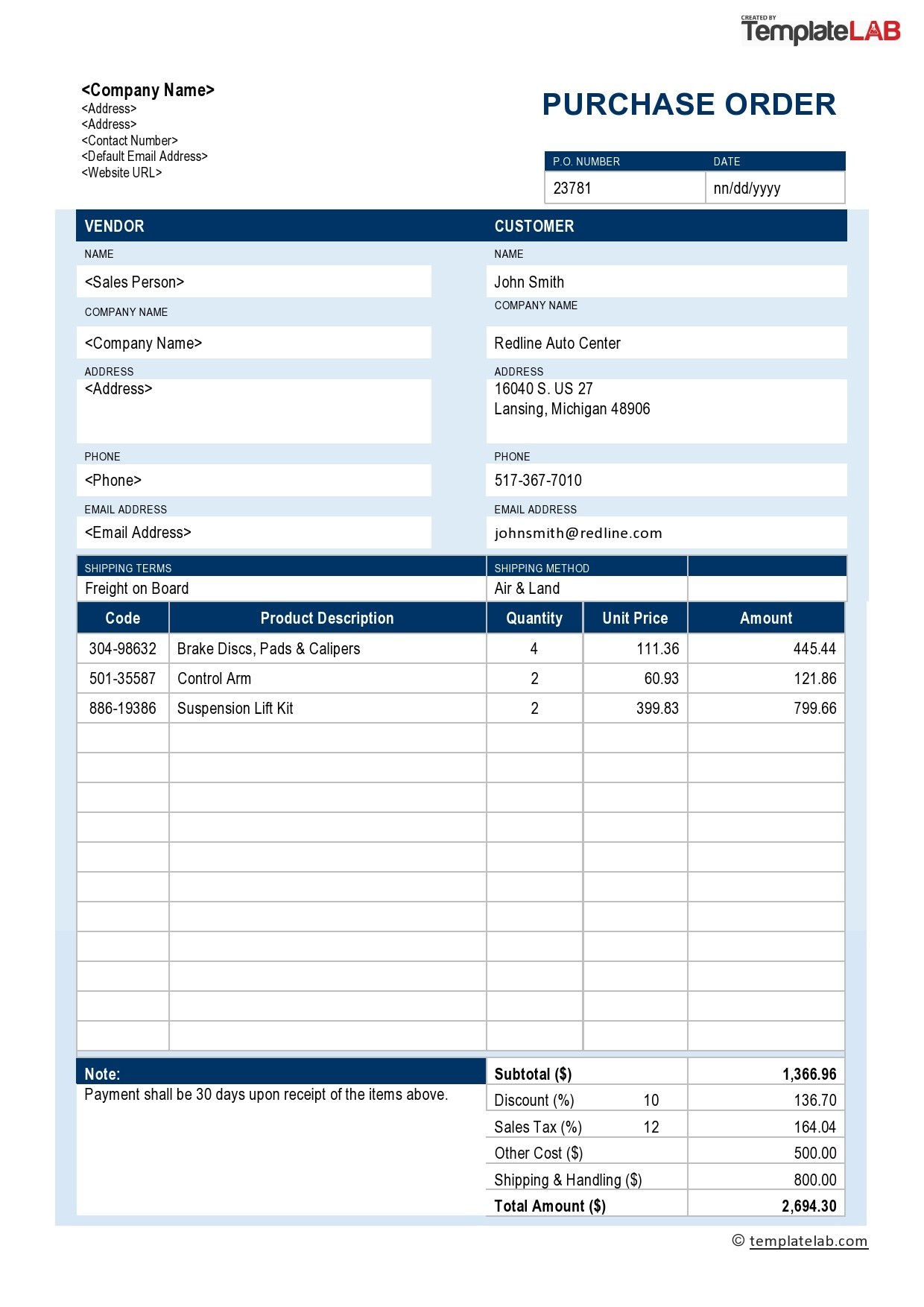

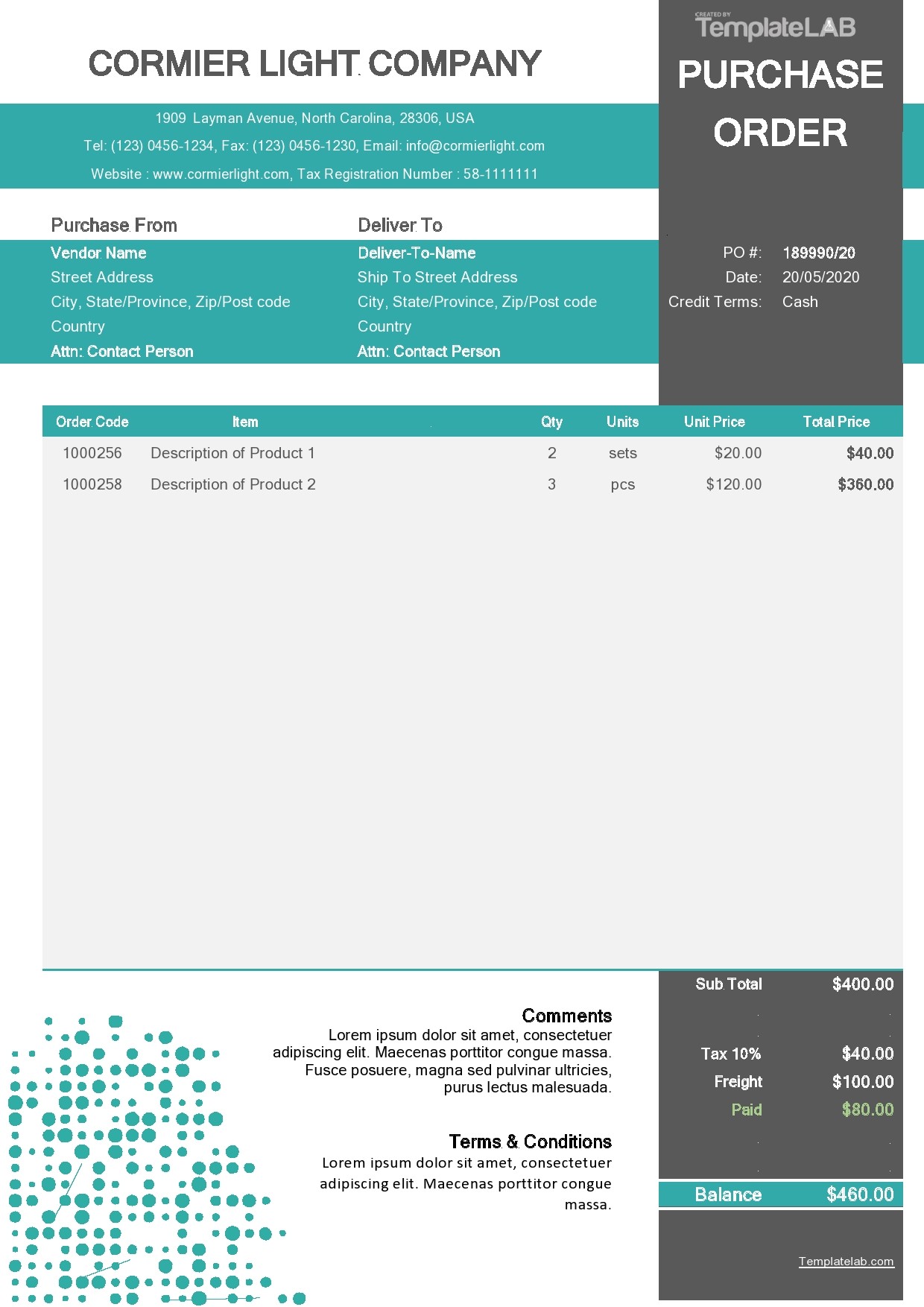

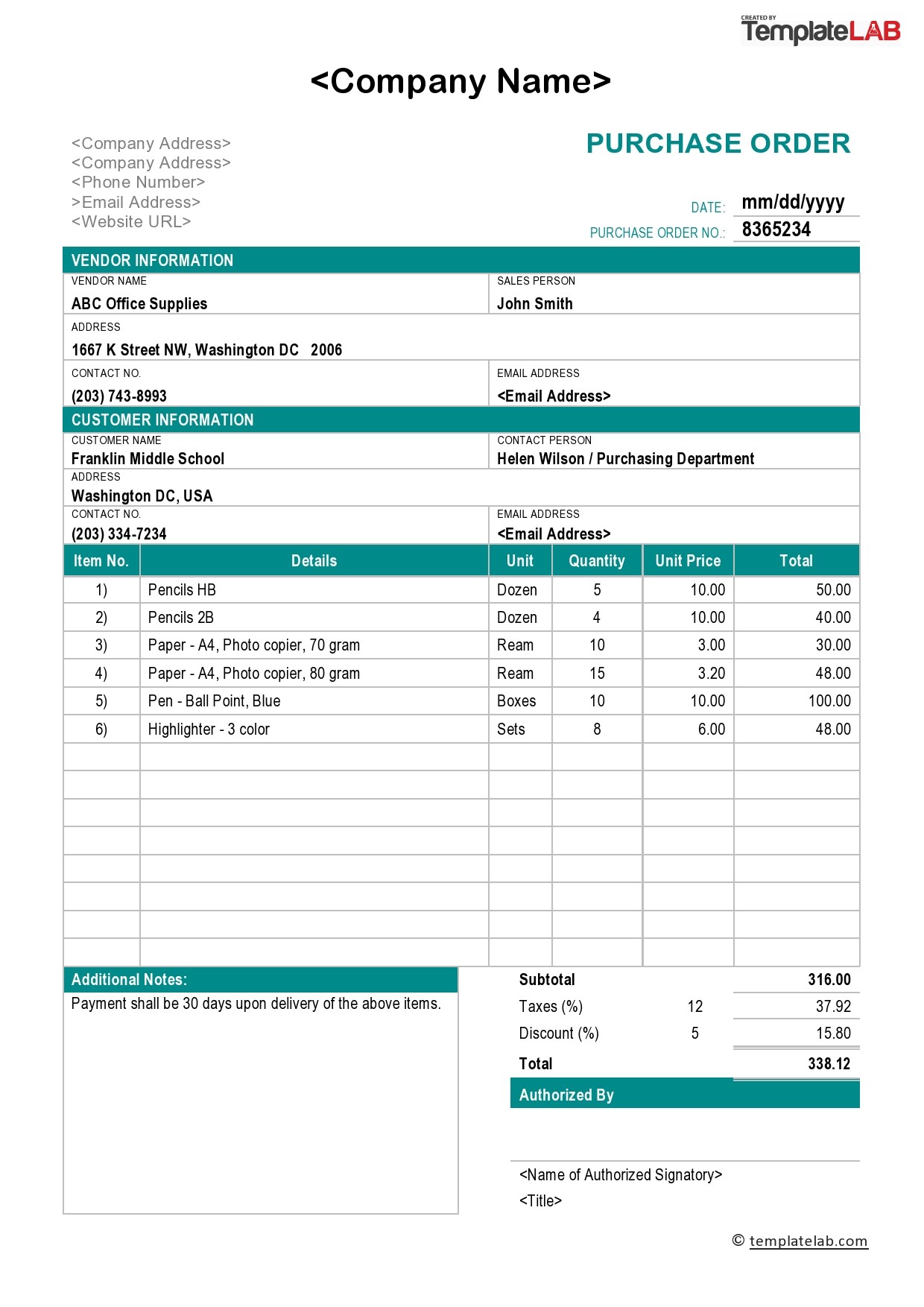

Your purchase order needs to be unique to your company. Be sure to include the following information when you create a purchase order form template:

- Your company information (name, logo, contact information, URL of website, tax ID number).

- Information about the seller (name, e-mail address, and seller’s contact information).

- A unique purchase number that can be used to monitor your financials.

- The product or service that you’re seeking from the supplier.

- The unit prices of each of the items on your purchase order.

- Your requested delivery date, shipping information, and shipping location.

- The full purchase price (including tax, credit, any discounts, and any special pricing).

- The day the order was issued along with other details about the due date.

- The form of payment that will be utilized to complete the transaction.

Using a purchase order template is beneficial since information about your company will remain consistent. This template can be used to begin purchases from a provider when you make purchase orders in the future.

How Do Purchase Order Templates Work?

POs fill a significant role in the inventory management process in big and small businesses. Let’s have a look at how a purchase order works.

- Step 1: Buyer requests goods or services from the seller

When a buyer wants to place an order, they’ll need to specify the goods or services they require, as well as the required quantity and when they’ll need it. - Step 2: Buyer creates purchase order

Once the buyer has created the purchase order form template and filled out all the details, it is sent to the seller for approval. To keep the procedure on schedule, buyers should indicate when approval is required from the seller.

Ideally, the response from the seller should come in enough time to receive the product or service on schedule. Alternatively, it should allow the buyer enough time to source the product or service from another seller if necessary. - Step 3: Seller reviews purchase order

When the seller receives the buyer’s order, it is up to them to then analyze the request and deny or accept it. They need to determine whether it can be fulfilled by the required date by checking their inventory, availability, and resources.

In the case of large quantity shipments, the vendor reviews your order and, after examining their inventory and shipping capabilities, evaluates whether they can meet the buyer’s requirements. - Step 4: Seller approves purchase orders

The approval of the purchase order makes it binding on both sides. This is only if the seller has confirmed the request from the buyer. By accepting the purchase order, the seller confirms their ability in assisting the buyer with their request. - Step 5: Product or service execution

Once the vendor approves the purchase order, they must provide the product or service to the buyer. An invoice is then generated for the buyer specifying the products or services sent by the seller along with the amount and the balance that is due. - Step 6: Buyer settles the account

The buyer is now responsible for paying the invoice under the terms of payment specified by the seller. Payment terms indicate when payment should be made and how it must be made.

How To Create a Free Purchase Order Template

Now that you know the use of a purchase order, you can start to create your own free template. Here you’ll find a few tips on how to create purchase orders of your own.

- Tip 1: Create a header

In your header, you’ll need to list the specifics of your company. This includes your company name, postal code, business address, and purchase order number. - Tip 2: Insert the buyer’s details

Specify who’s receiving the purchase order form. Here you should put the buyer’s company name, their postal code, business address and contact information. - Tip 3: Shipping information

Indicate the address to which the order should be sent, the shipment method, shipping point, shipping terms, and the anticipated delivery date. - Tip 4: Order details

Include a different line item for every product in the order that includes its product code or SKU number, name or description, the number of units that are needed, the cost per unit, and the date of delivery. - Tip 5: Calculate subtotals

This is essentially a summary that includes any relevant discounts, taxes, shipping fees, and a total to ensure a completed order.

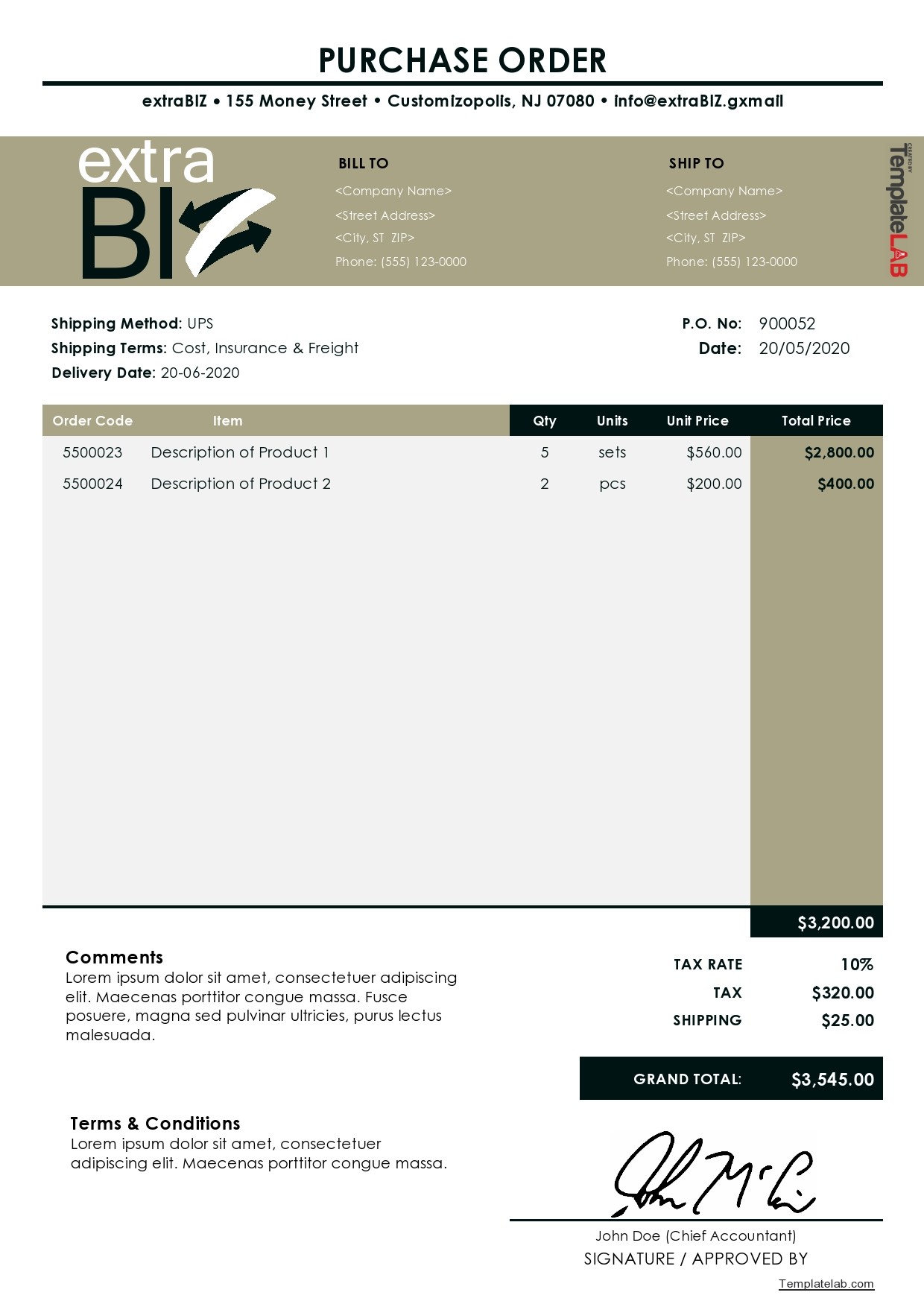

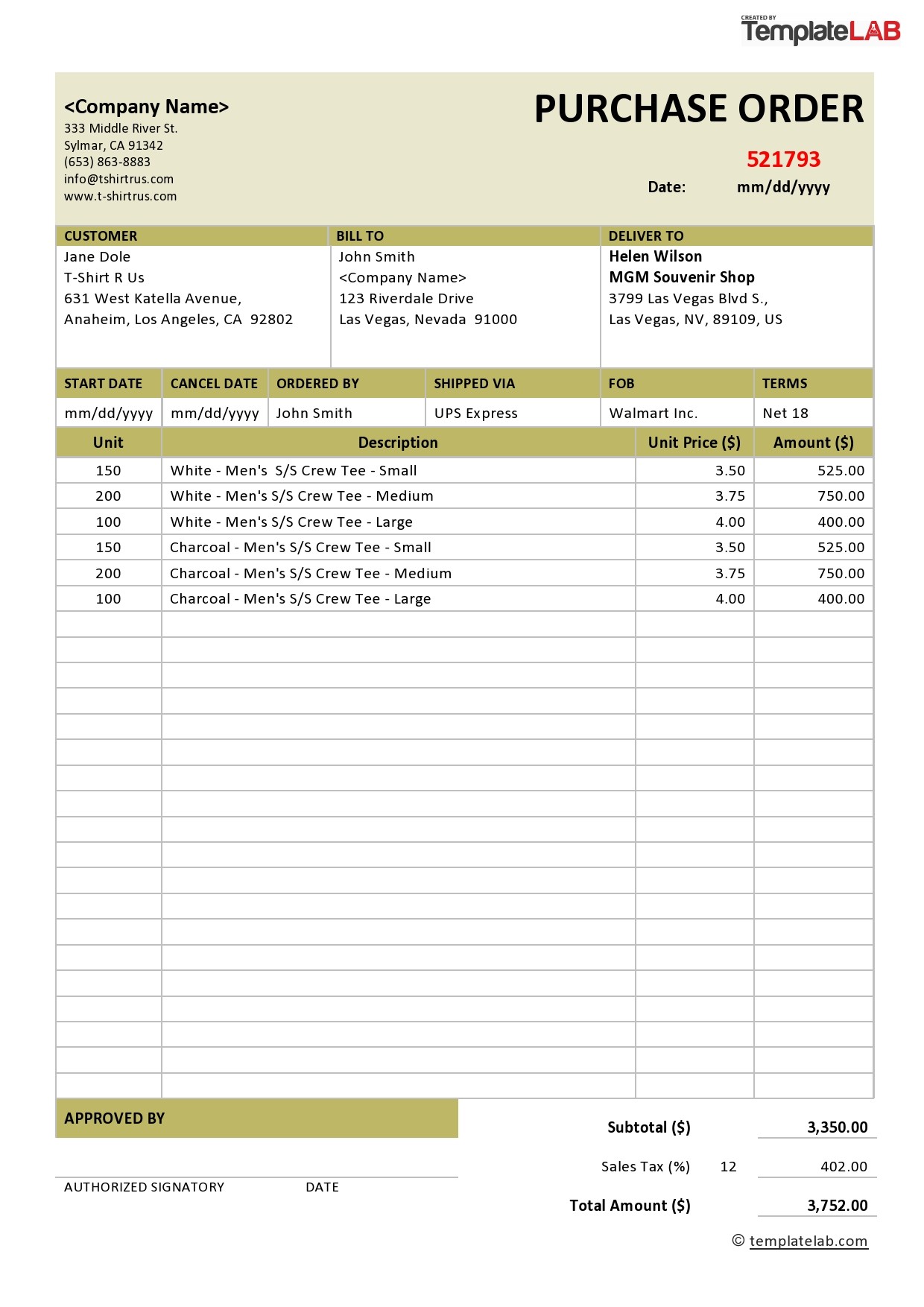

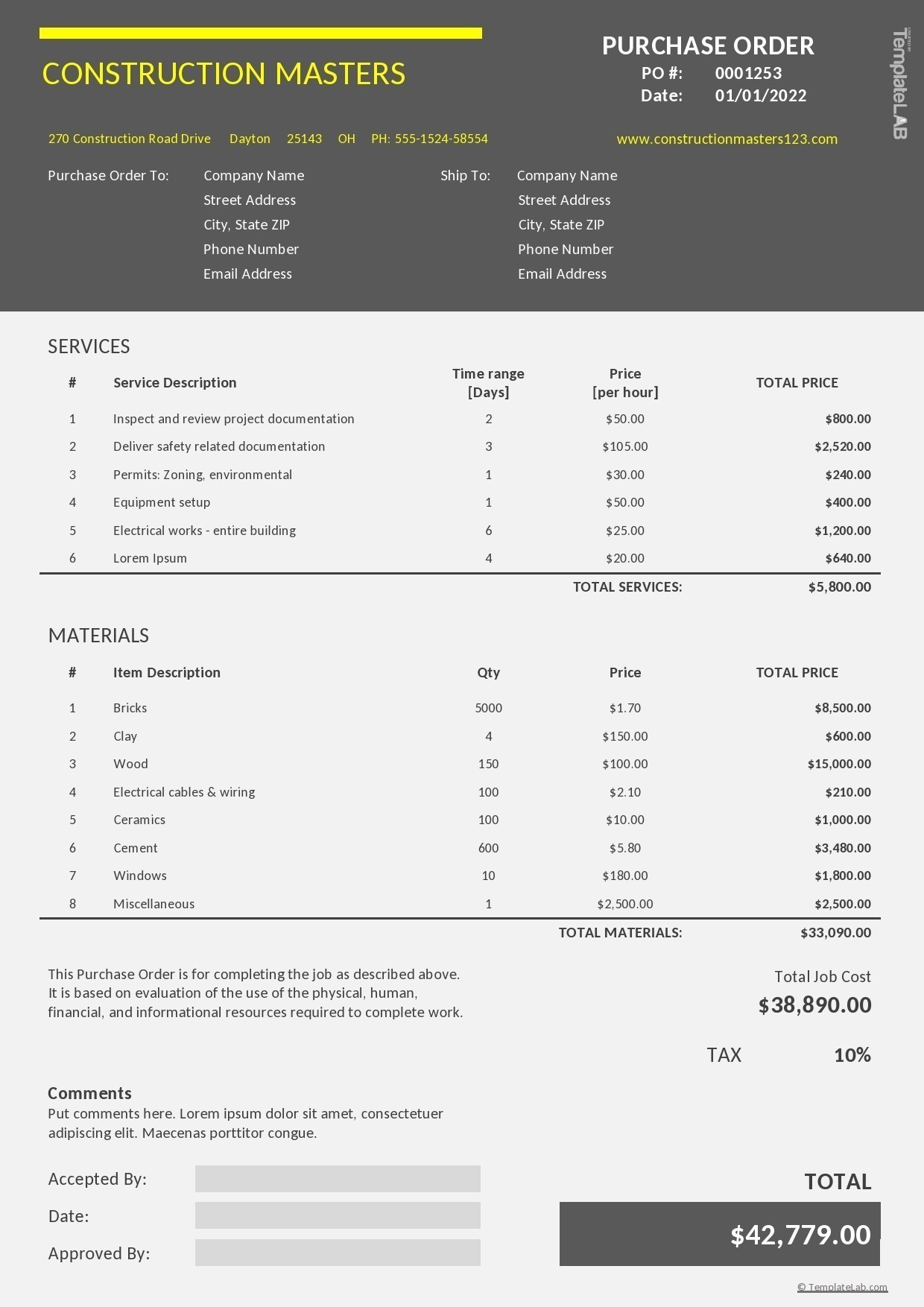

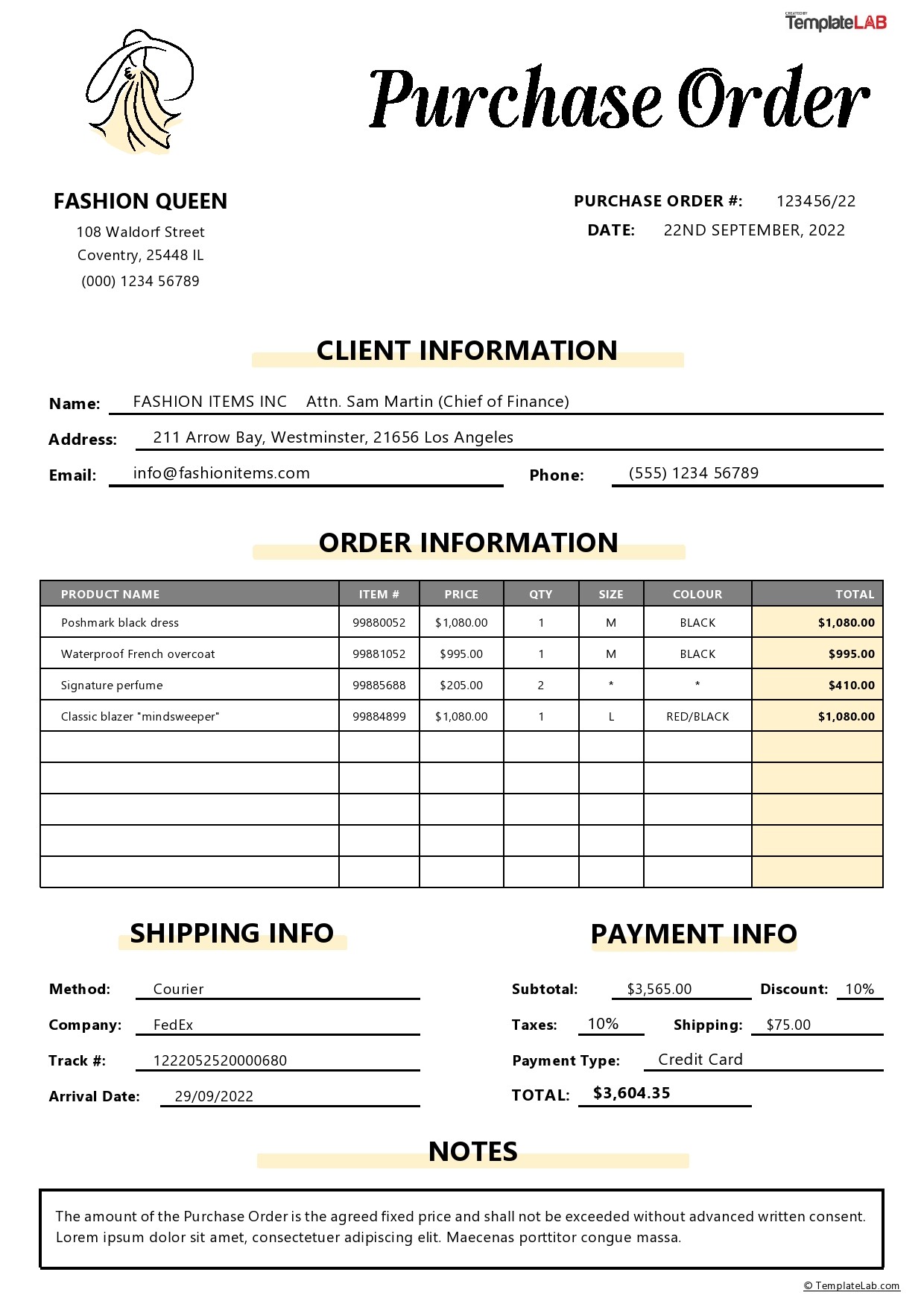

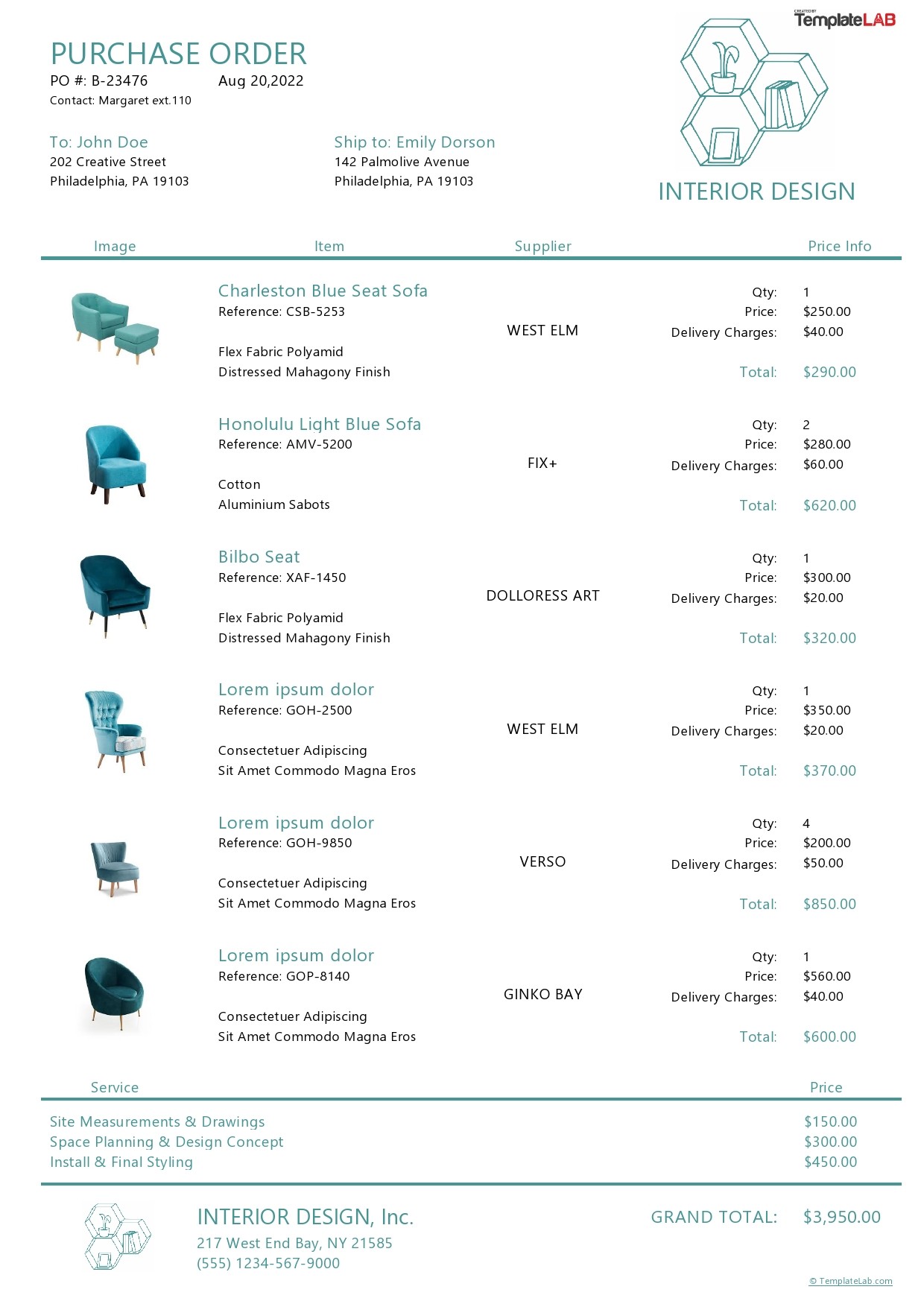

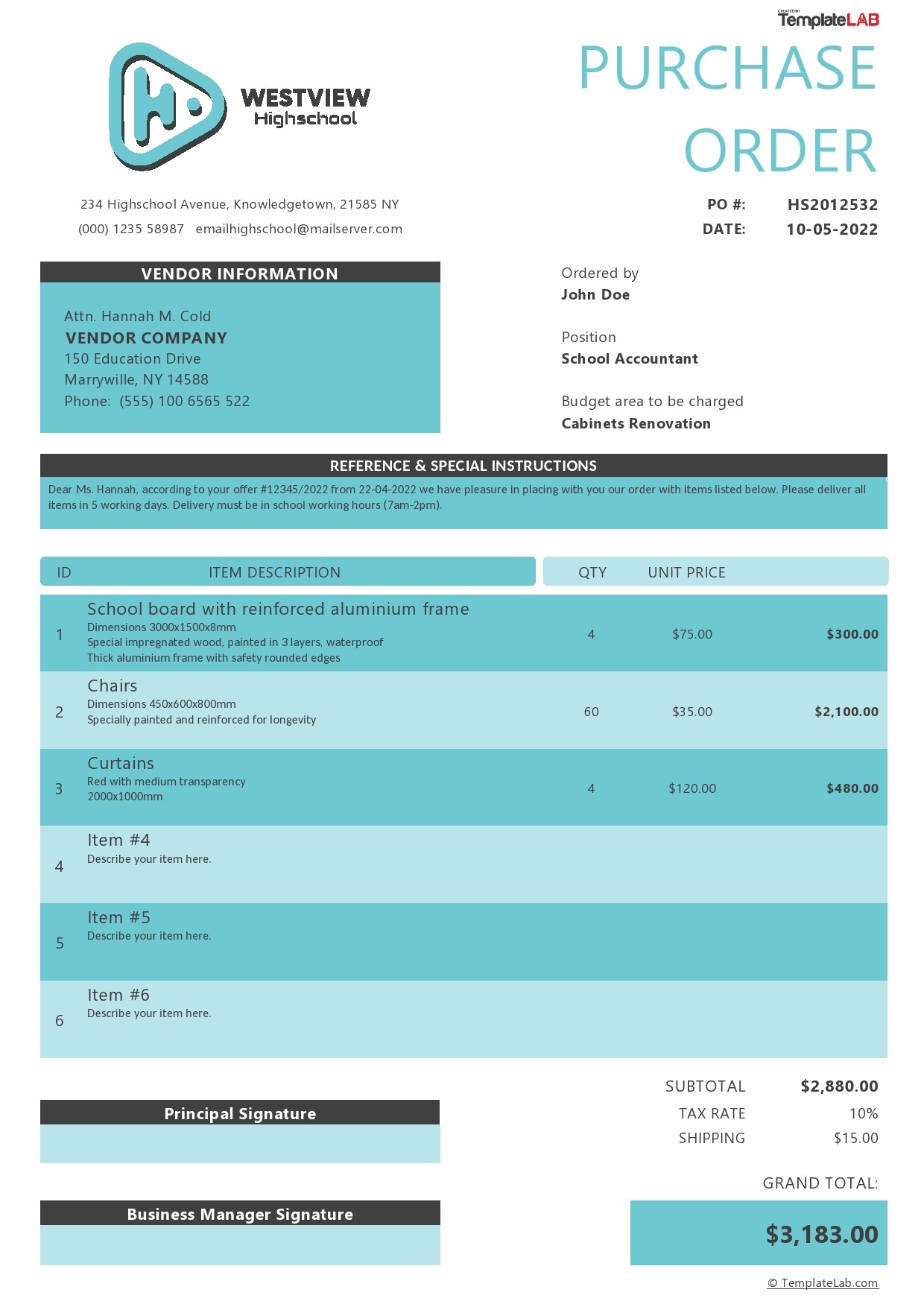

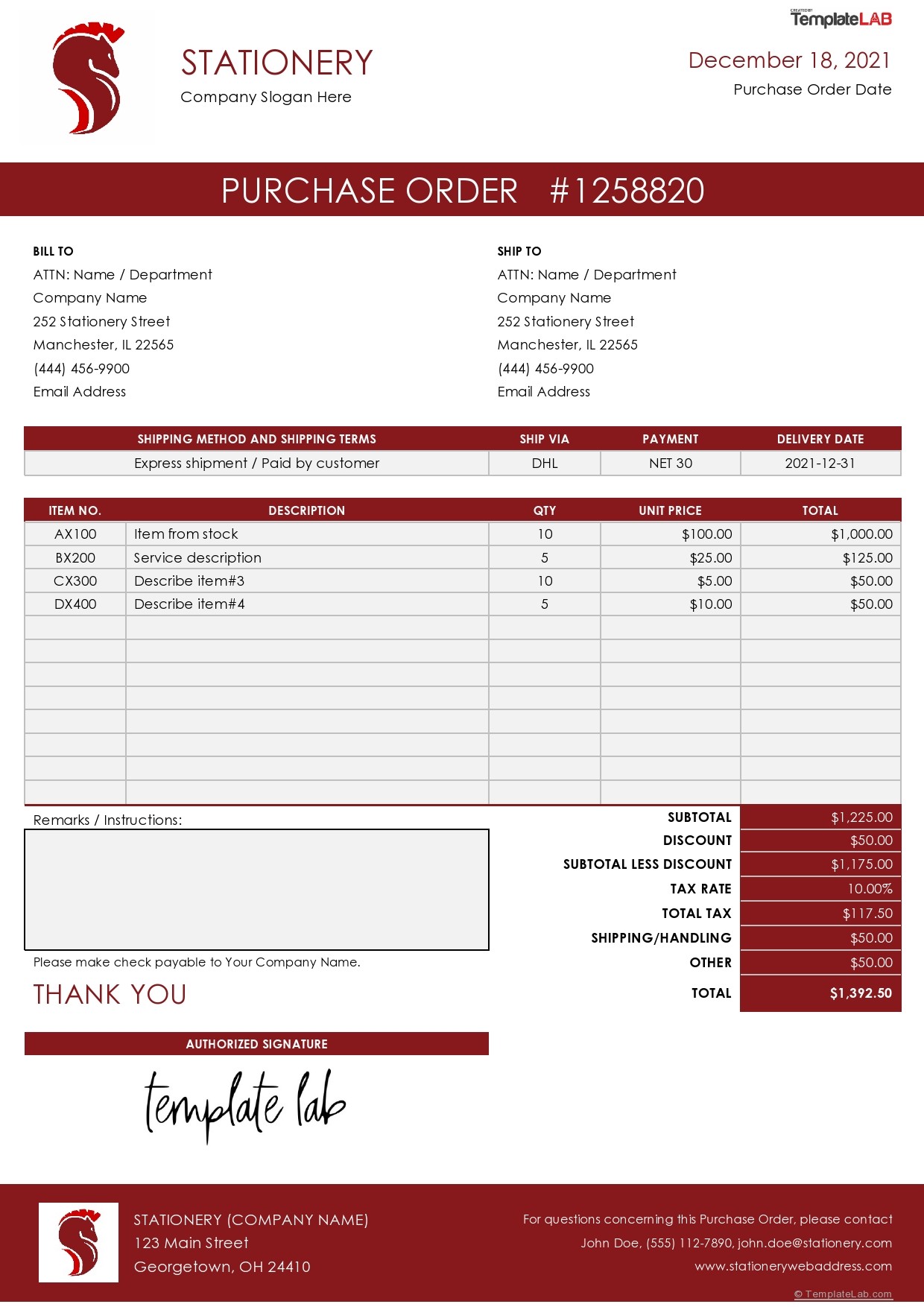

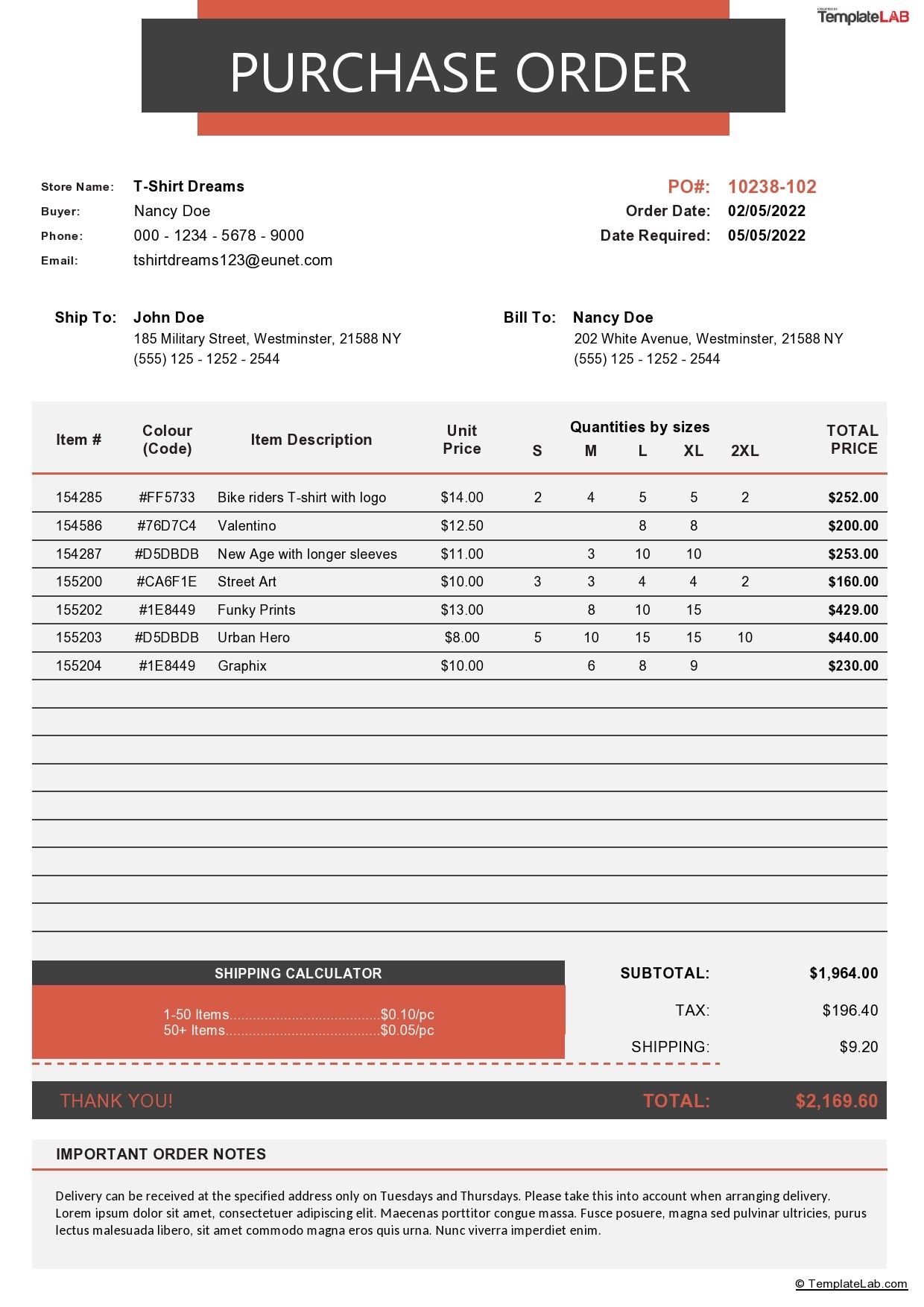

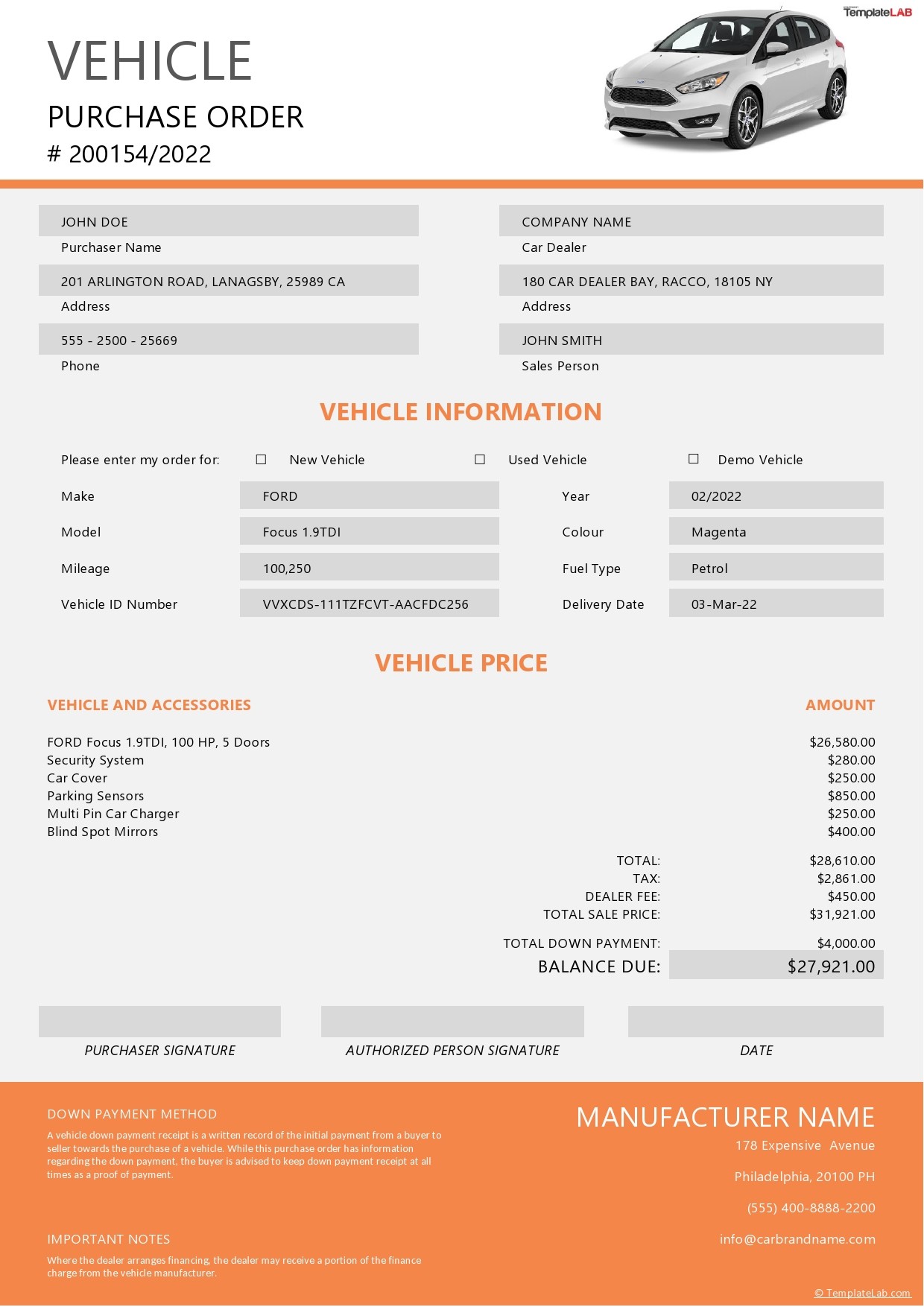

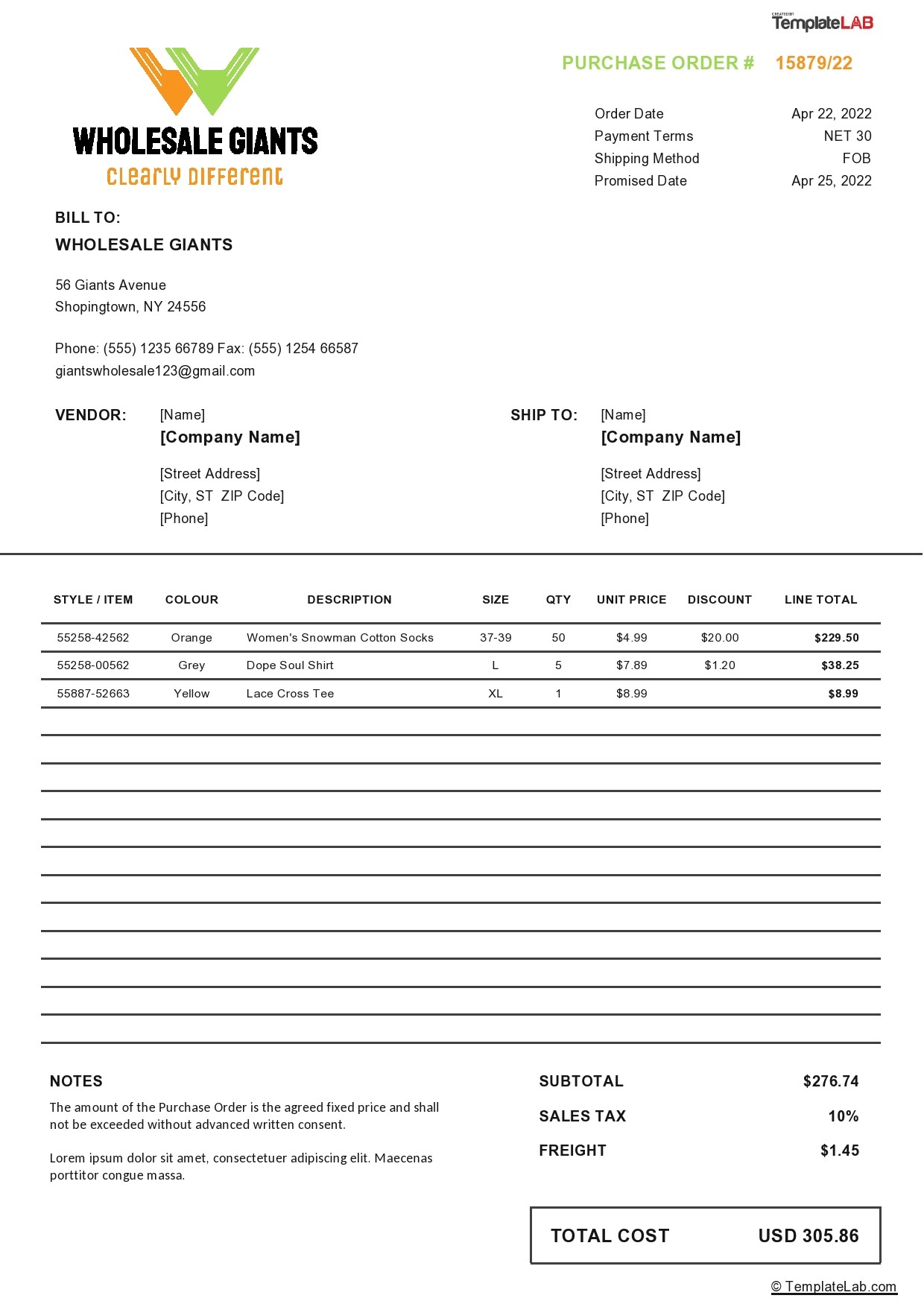

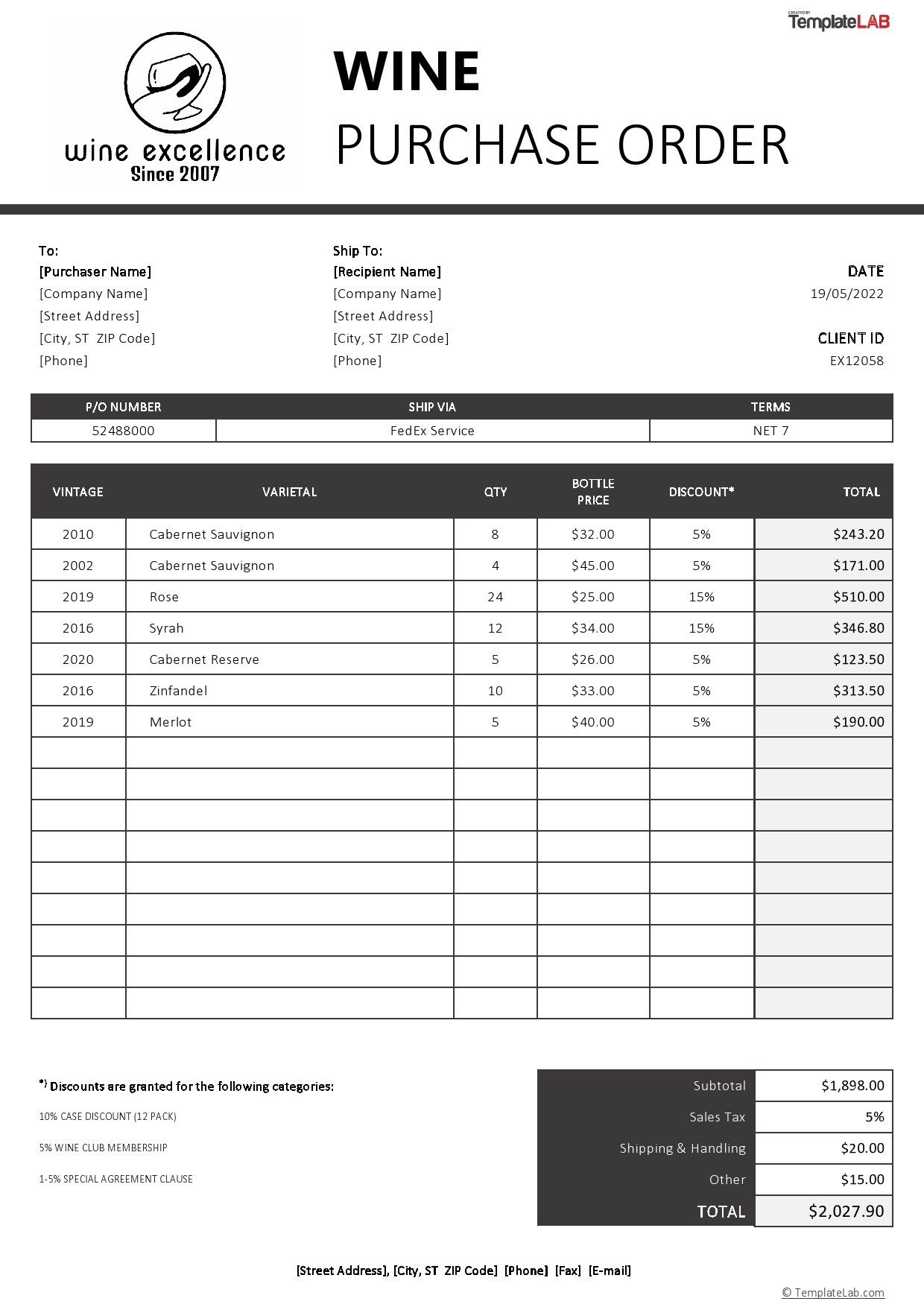

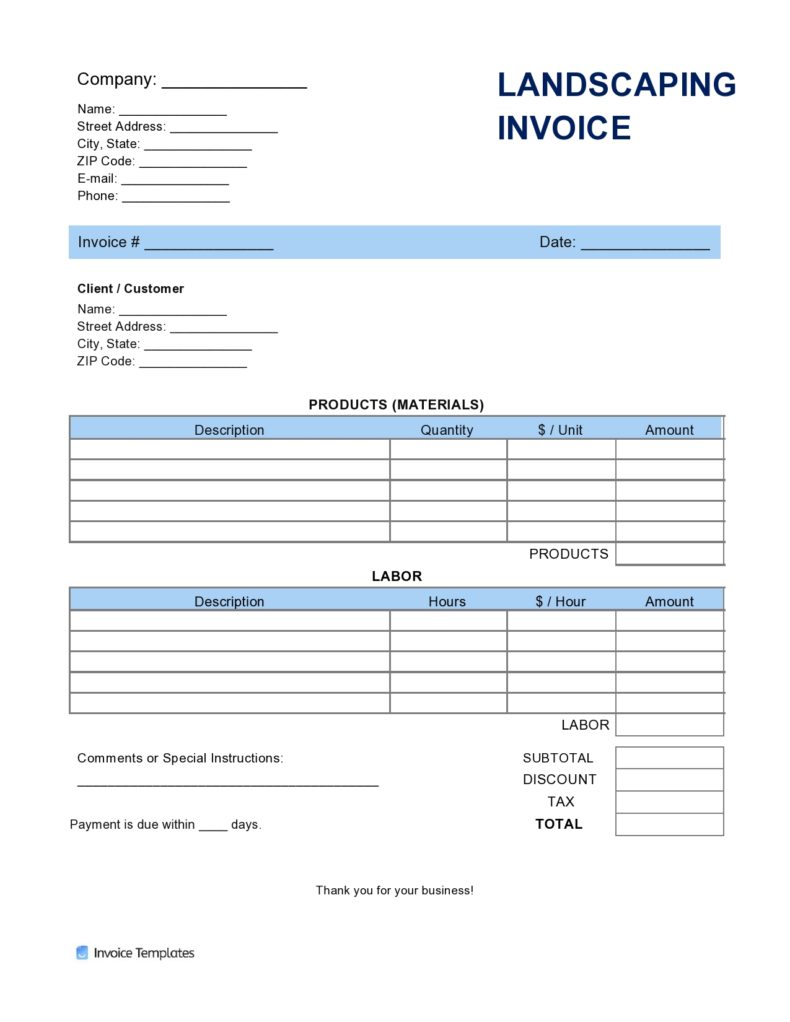

Purchase Order Examples

What Are The Different Types of Purchase Order Templates?

There are five common kinds of purchase orders and each carry different information. These include:

- Standard Purchase Order

Standard purchase orders are the most common and well-known. The buyer can identify the goods or services they are buying, the amount, the date of delivery, and the payment terms as they are aware of the particulars of the transaction.

For instance, a company running low on printer cartridges might issue a typical purchase order because they know how much and when they need them.

Standard purchase orders can be prepared for a variety of different purposes depending on your needs. For example, the template stated above could be changed to:

Subcontracting

Service providing

Consignment - Scheduled Purchase Order

By submitting a scheduled purchase order in advance, a buyer estimates how much of the goods their business will need in the future. The item, price, and payment terms are set in stone, but the quantity and delivery date are flexible to change.

For example, if a printing shop goes through a certain amount of ink cartridges per month, they can estimate how much ink they would need to purchase in the future. Scheduled purchase orders ensure that the product a buyer needs is available when they need it. - Blanket Purchase Order

A blanket purchase order is a recurring, long-term agreement between buyers and vendors. The agreement outlines the goods or services that are under specific terms for delivery and payment.

Executing a blanket purchase order with predetermined prices and delivery dates is an effective approach to keeping costs low. You can decrease time lost and processing delays if your organization makes the same recurring payments for the same goods or services. - Contract Purchase Order

The most formal type of PO is a contract purchase order. In this case, a contract specifying the sales terms is signed by the buyer and seller. A contract purchase order defines the specifics of the acquisition, which often includes the cost.

However, specific products are not specified. This kind of PO is utilized to establish a continuing commercial relationship between the seller and their clients. - Digital Purchase Order

A defined procedure for purchase orders can make the procurement process run smoothly and be advantageous to both buyers and sellers.

In Microsoft Excel, Open Office, or Google Sheets, you can quickly create and download a digital purchase order spreadsheet when you open a new spreadsheet, click on ‘more templates’, and type “invoice” into the search bar. This way you can access pre-existing templates.

That said, you should always print a hard copy to have it on record. Technology is not always 100% reliable, so having a backup copy could be beneficial to your business.

What is a Purchase Order System?

In supply chain management, there will always be a process to monitor. This is because the business doesn’t stop once a purchase order is filled.

Software that creates, tracks, and manages digital purchase orders in a streamlined and secure network is known as a purchase order system.

Without a framework in place, crucial agreements may get forgotten during a transition, leading to conflict between dependent buyers and sellers.

Here are a few common rules to follow while building a good purchase order template from scratch:

- Choose the right forms

Choose the best order format that works for your company. Have a browse through some of the free purchase order form templates on the web or consider creating your own. - Create a workflow with outlined steps

You must include all the steps required to complete a purchase order to automate the process. Make a step-by-step workflow that shows interactions and the locations where document data is entered and moved throughout the transaction. - Establish accessibility and job definitions

To successfully manage the workflow in your company, you need team members that are adept at using the correct PO forms. Not everyone in the company must have access to purchase order forms as this can cause many complications. - Implement your purchase order system, follow it, and make it better

You’ll need to proactively gather input from both stakeholders and your own internal team as you use and follow your PO method.

Determine where specific processes in your workflow may be made better and make the necessary changes. With time, your system will become more effective, and managing your supply chain will become easier.

What are the Benefits of Purchase Order templates?

You can save time by using a purchase order (PO) template instead of starting from scratch with each document. Also, your documents will look professional and will promote brand awareness when you customize your purchase order templates.

Here are a few other ways in which a PO can assist your company’s workflow:

- Prevents the issuance of duplicate orders

Purchase orders offer a corporation several advantages. The biggest benefit is that it helps prevent orders from being placed twice. POs can help a company maintain track of what has been ordered and from whom.

Also, it can be difficult to match the bills when a buyer purchases comparable goods. The purchase order acts as a check to cover the outstanding invoices. - Monitors incoming orders

POs aid in tracking incoming orders, and a well-designed PO system can facilitate easier inventory management and shipment. - Acts as official legal documents

Purchase orders work as an official record of transactions and assist in preventing any lingering legal issues with the purchase.

Conclusion

Purchase orders are advantageous to both buyers and suppliers. They make sure there are no misunderstandings during the buying process which increases the relationships between the two.

Even without dedicated vendor relationship managers on the team, creating a purchase order template and following a strict po system can increase productivity and workflow.