A payroll report is an important document in the running of a company. It provides crucial information about its human resource, which can be used to keep labor costs in check. Auditors use payroll reports when performing audits or preparing tax reports. Company management might use payroll reports to decide if it’s the right time to reward employees with wage increases, give bonuses, or hire more workers. It is an informative document that employees can use to better understand how the salaries department arrived at their net pay.

Table of Contents

- 1 Payroll Report Templates

- 2 What is a payroll summary report template?

- 3 Payroll Summary Report Templates

- 4 Types of payroll summary report templates

- 5 What is included in a payroll report?

- 6 Printable Payroll Sheets

- 7 How do I make a payroll report?

- 8 Payroll Ledger Templates

- 9 The important steps of payroll preparation

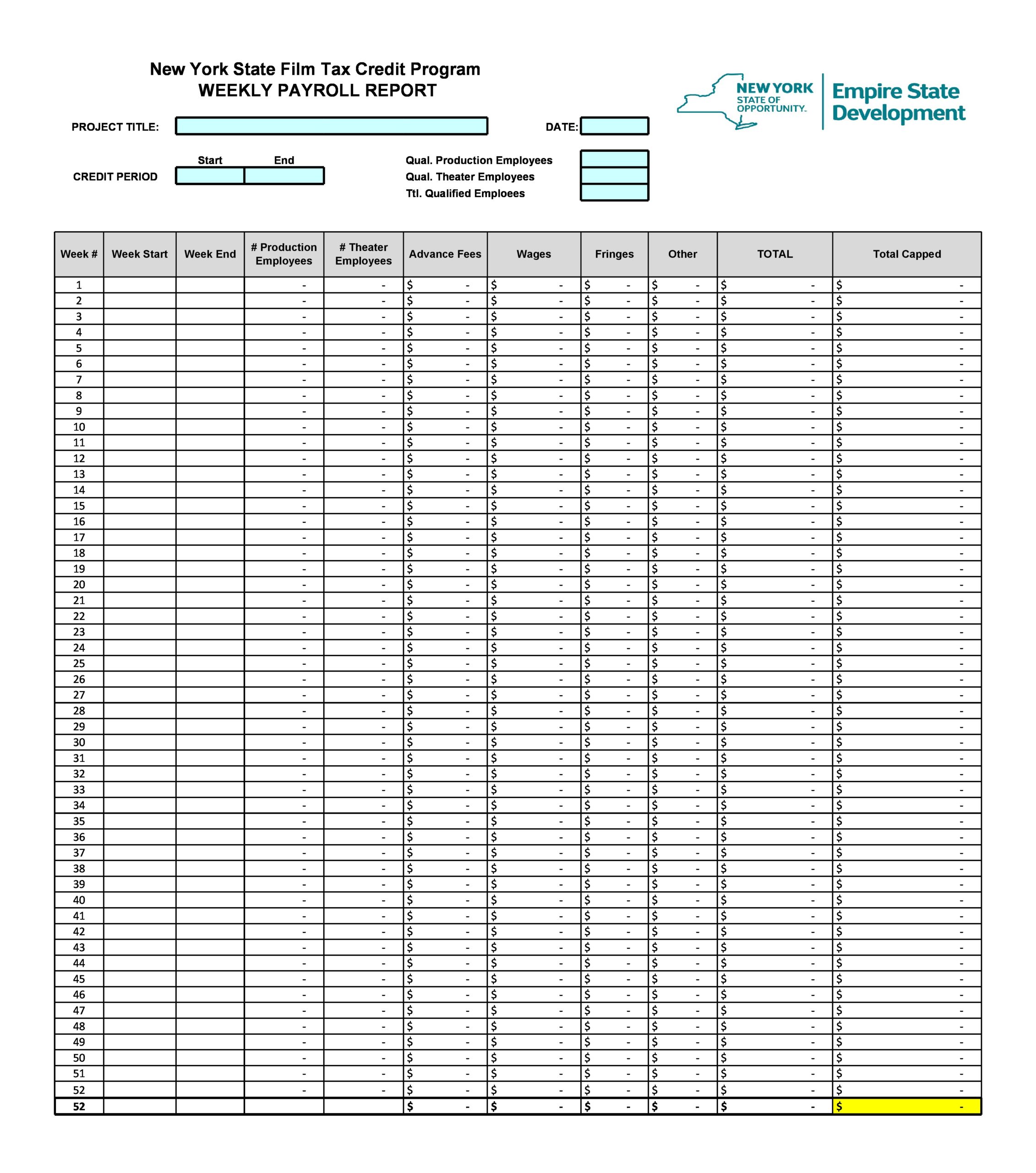

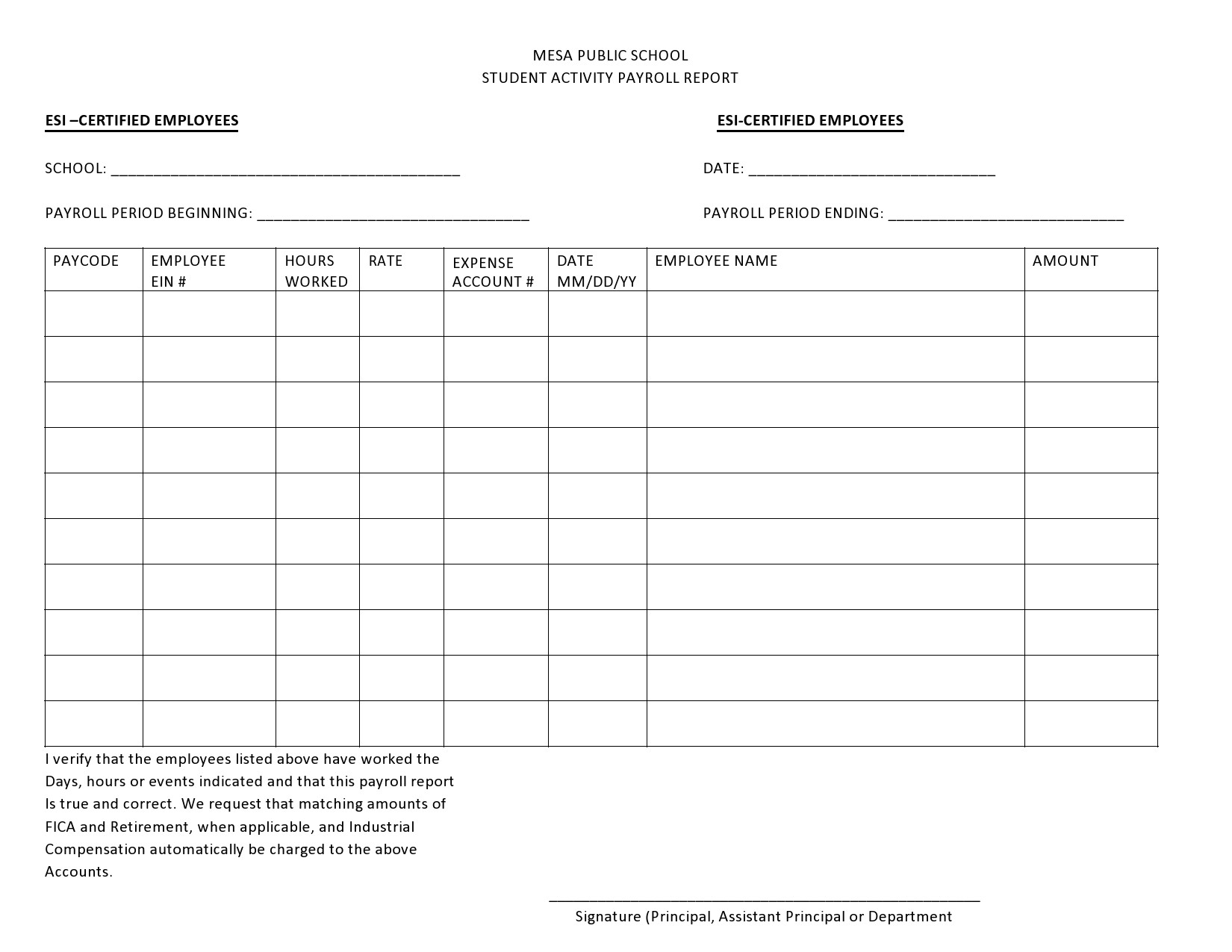

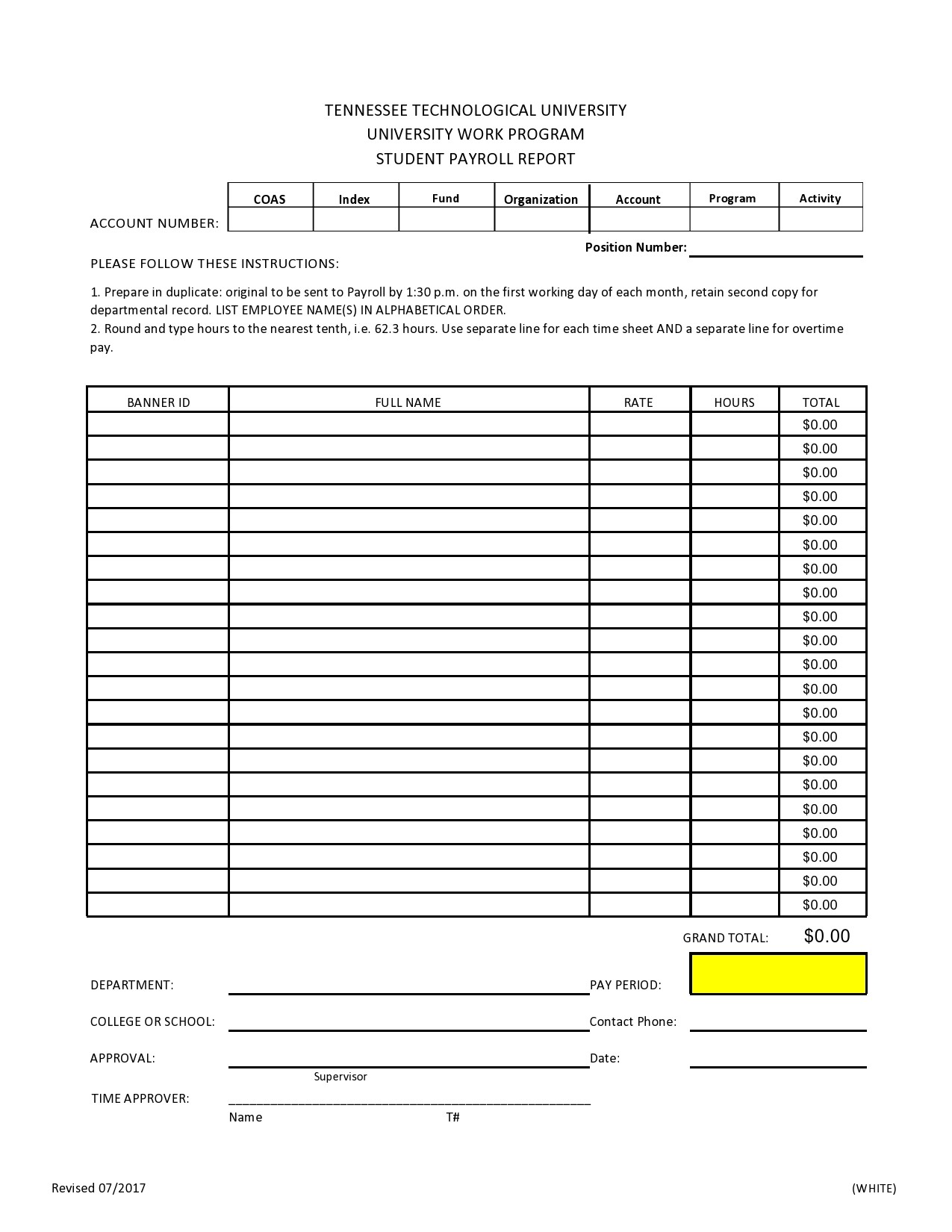

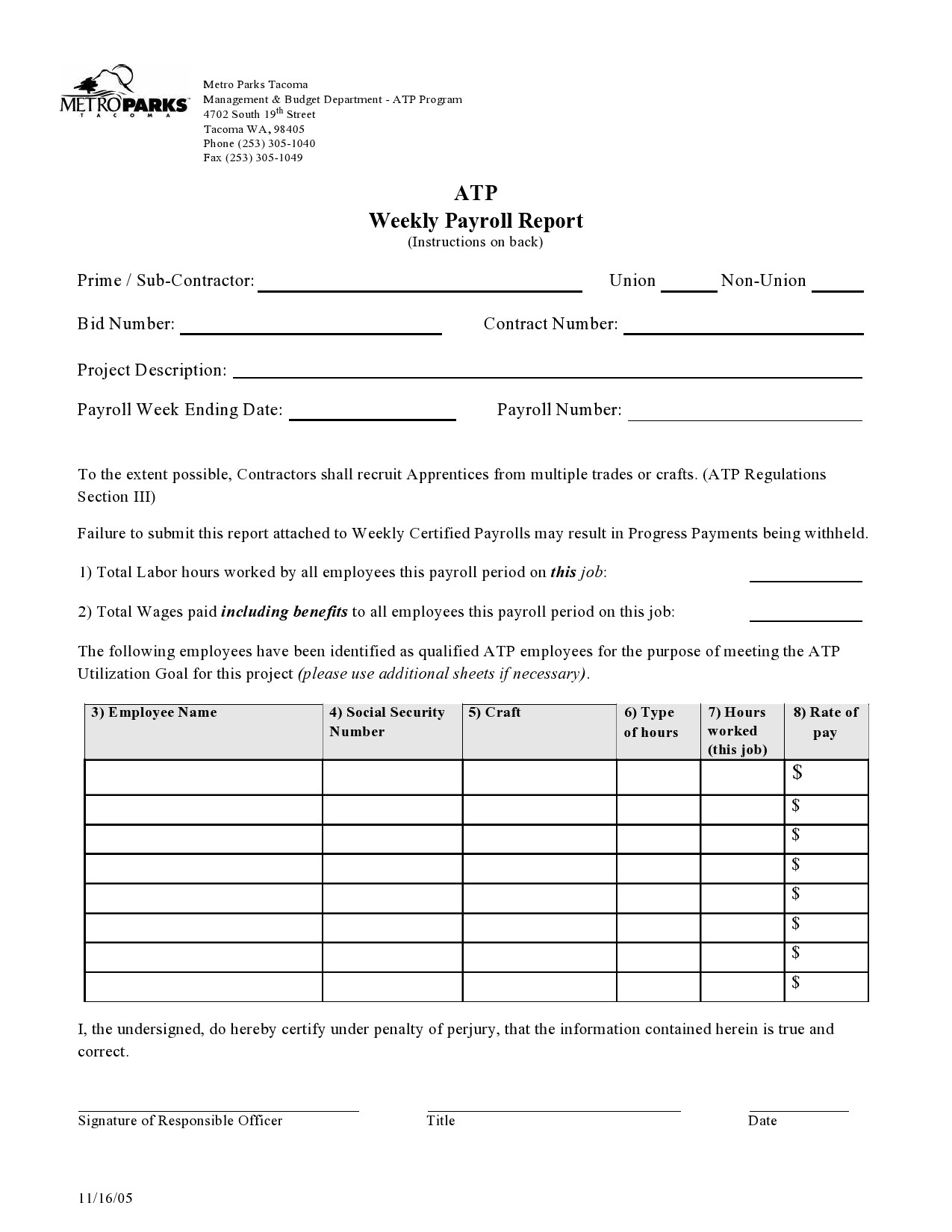

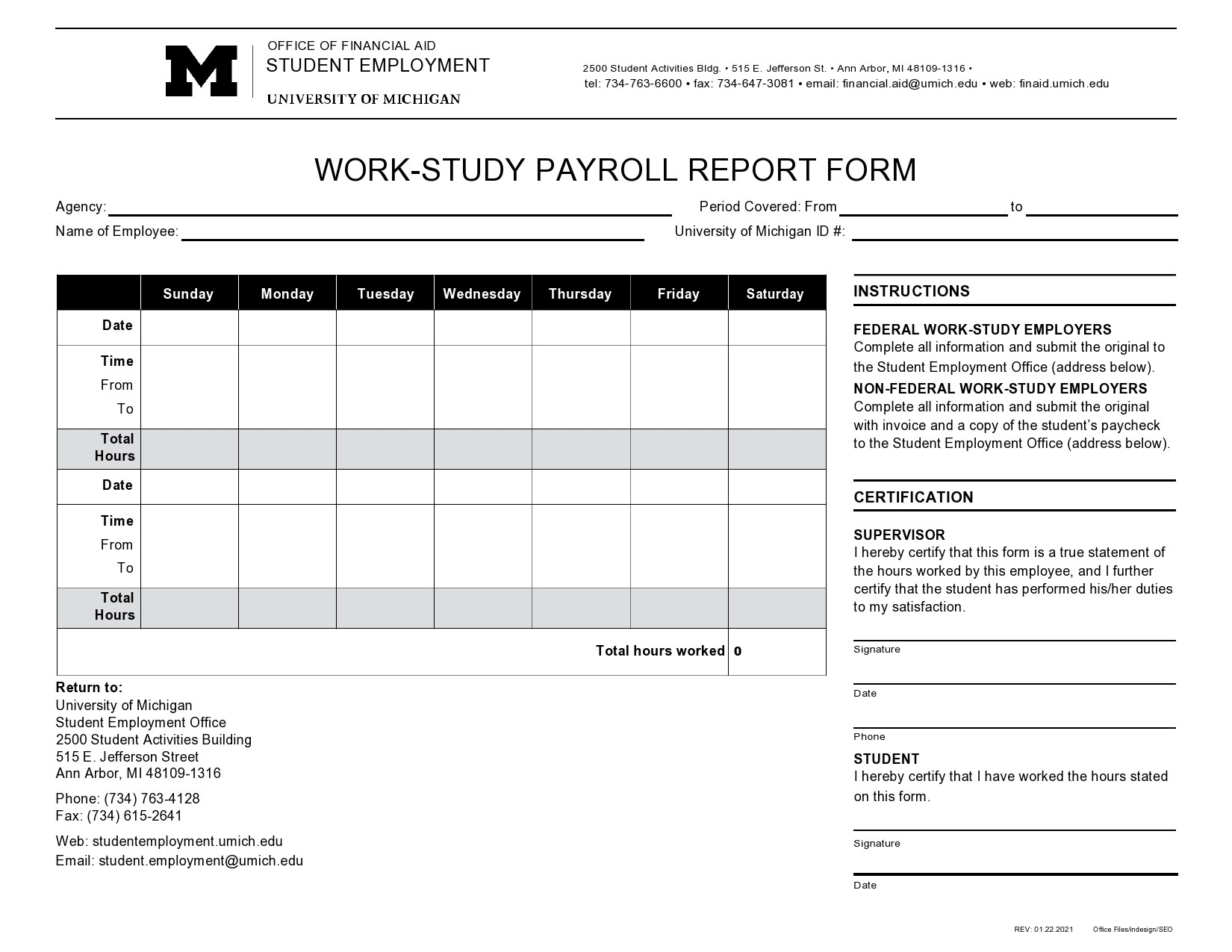

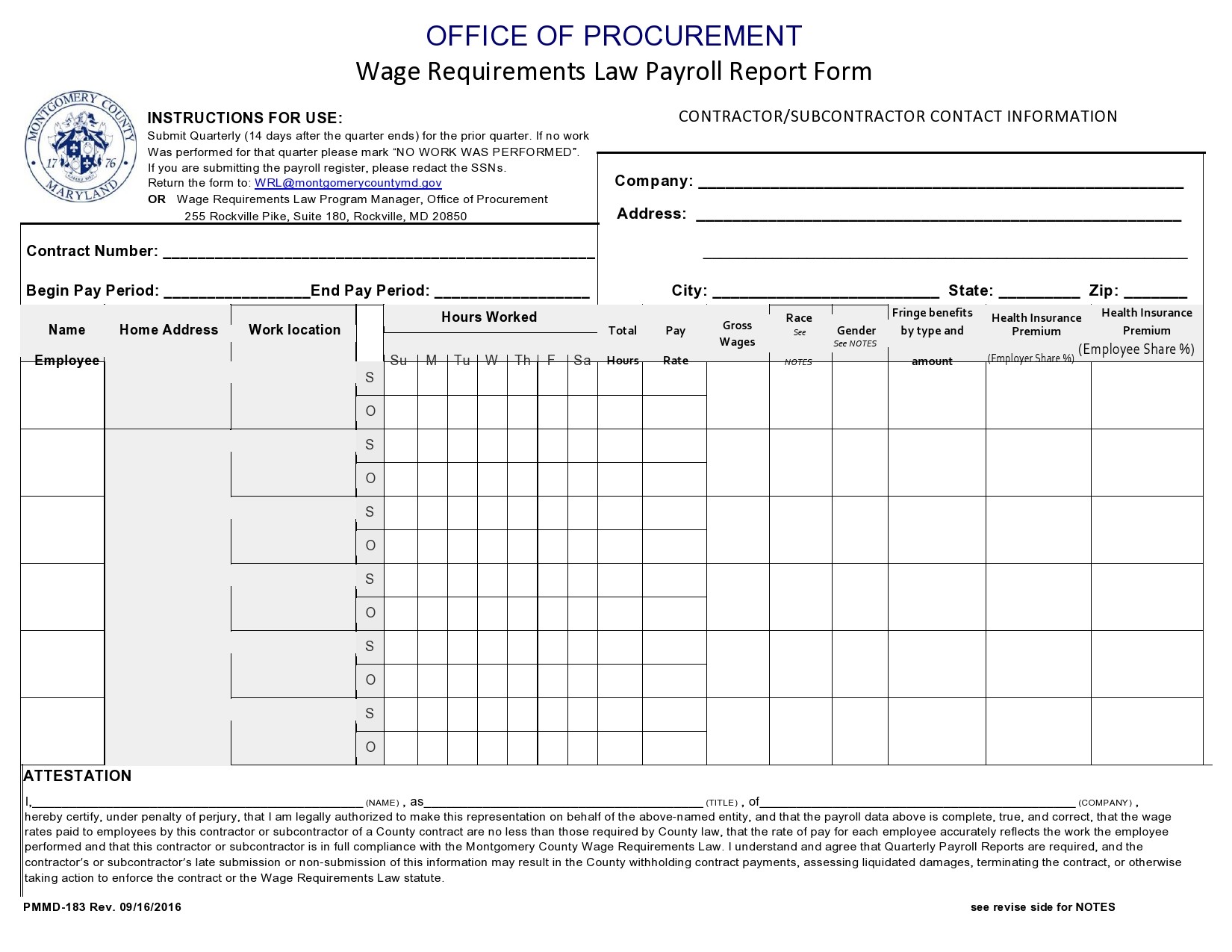

Payroll Report Templates

What is a payroll summary report template?

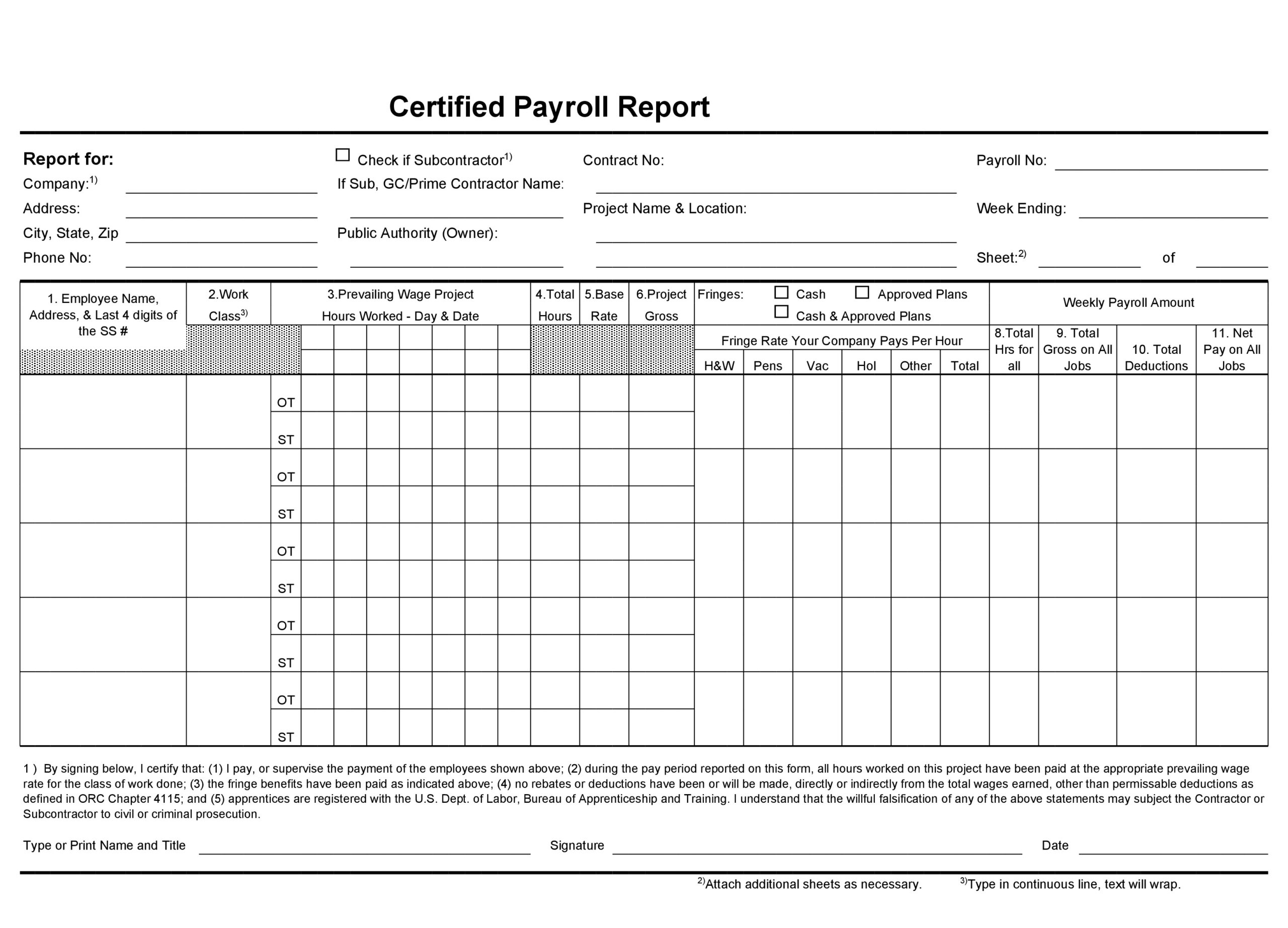

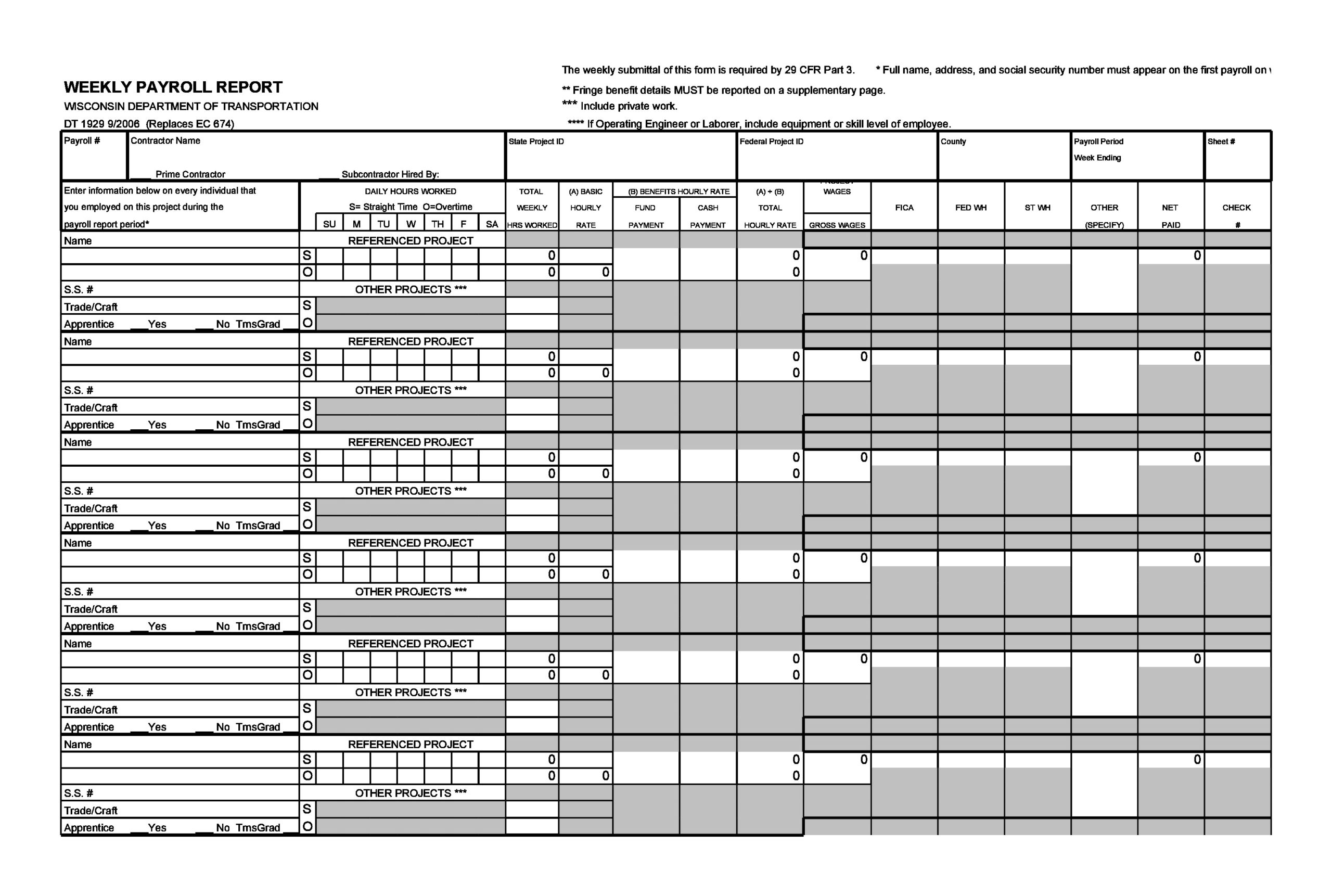

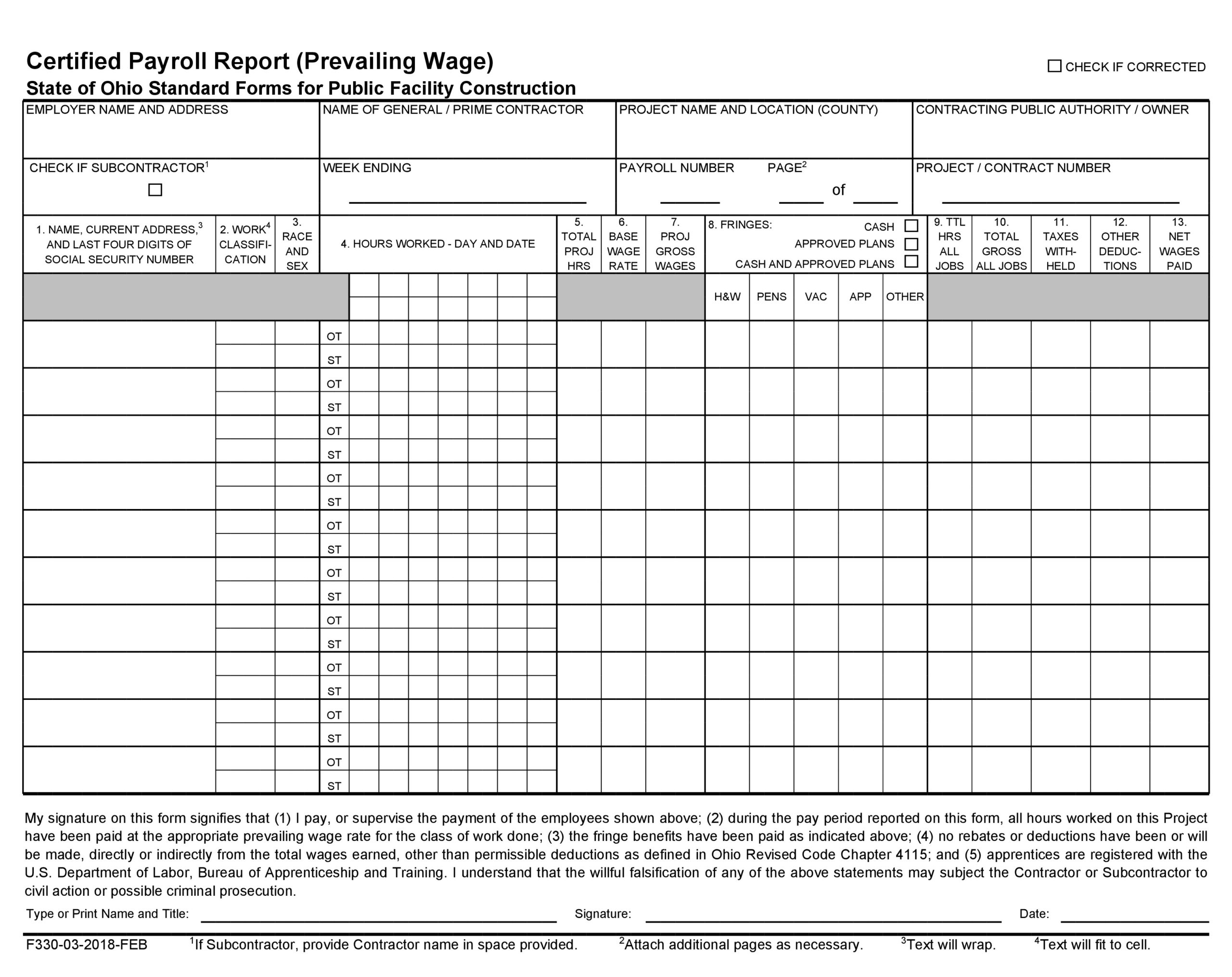

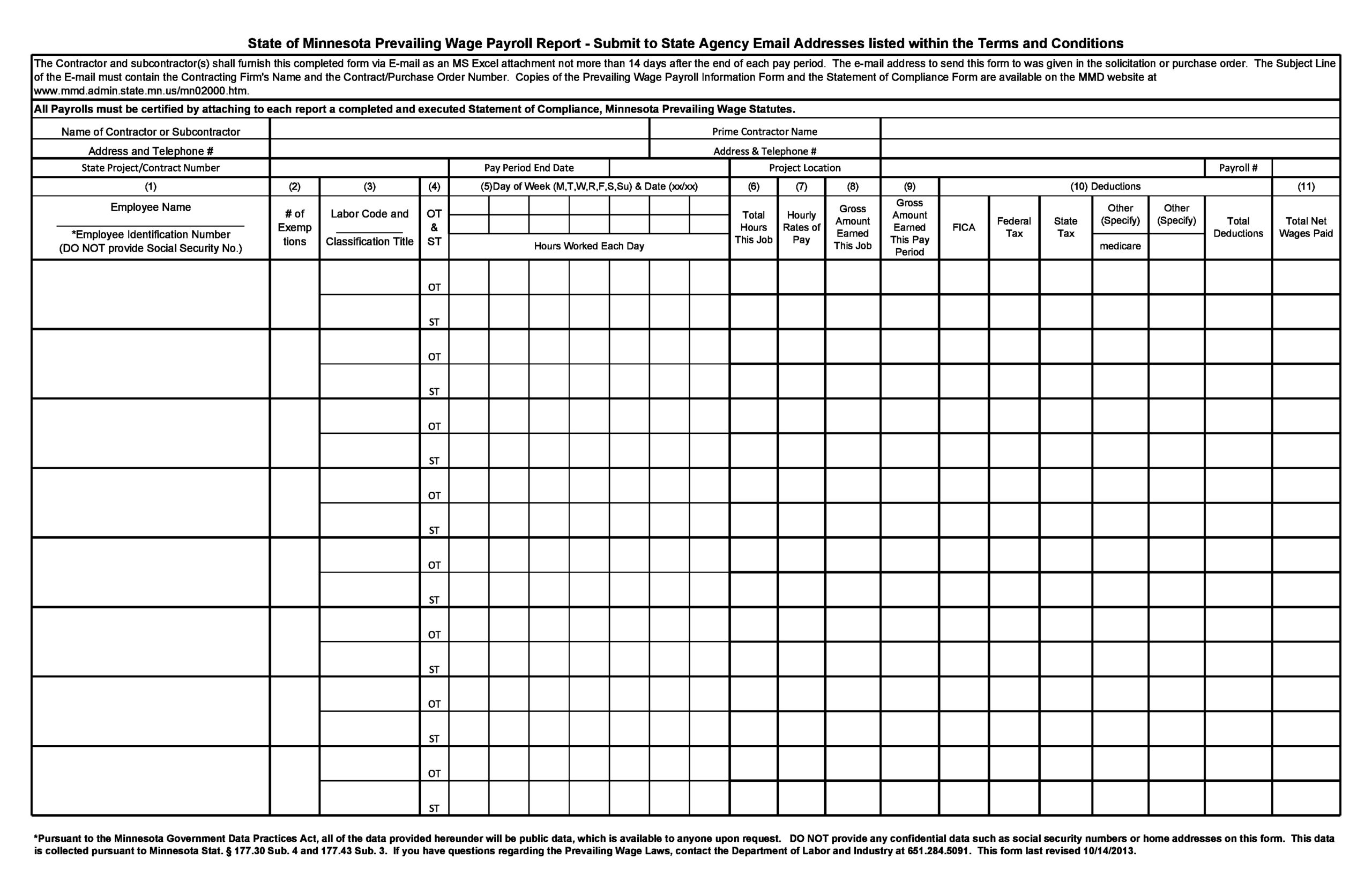

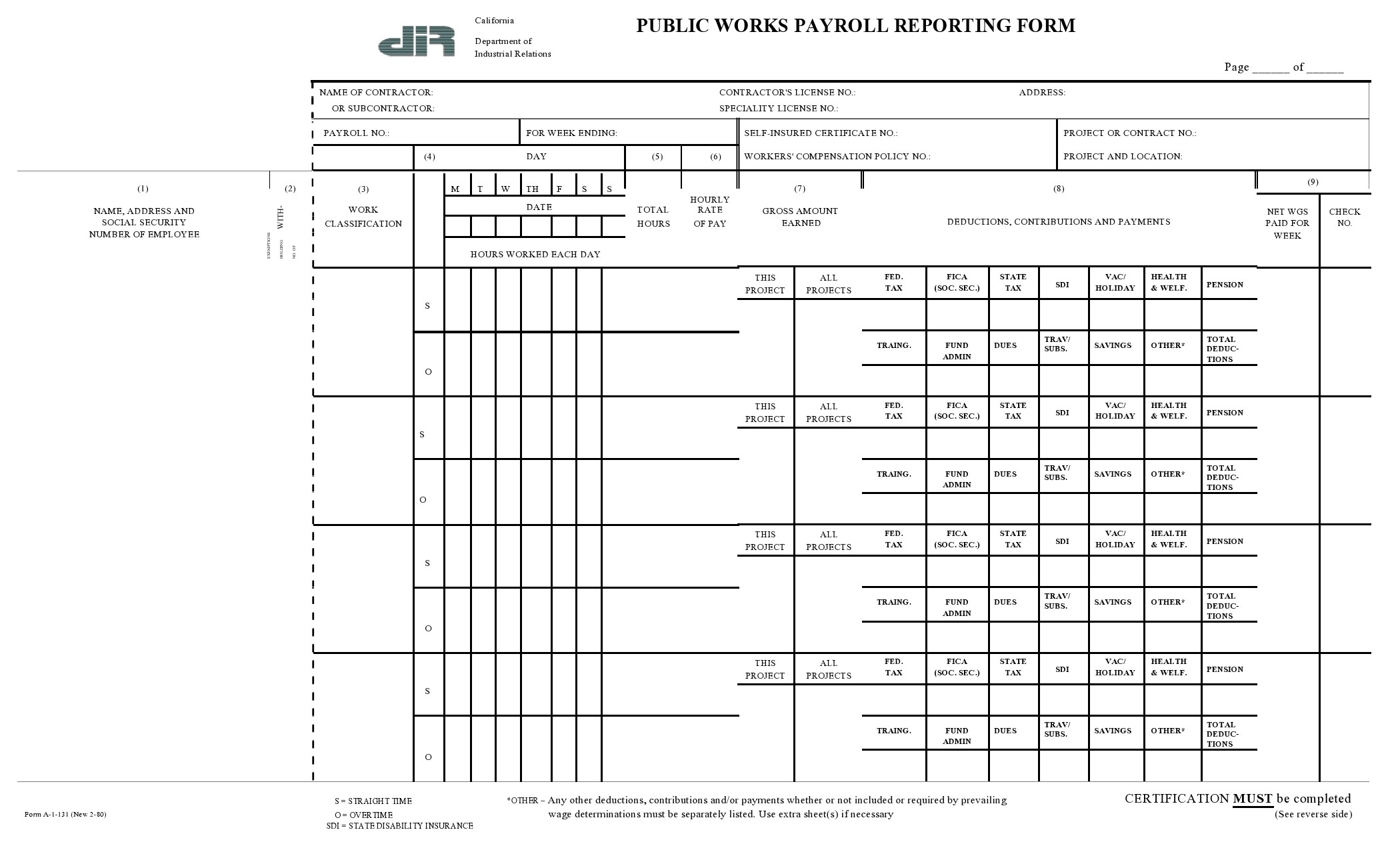

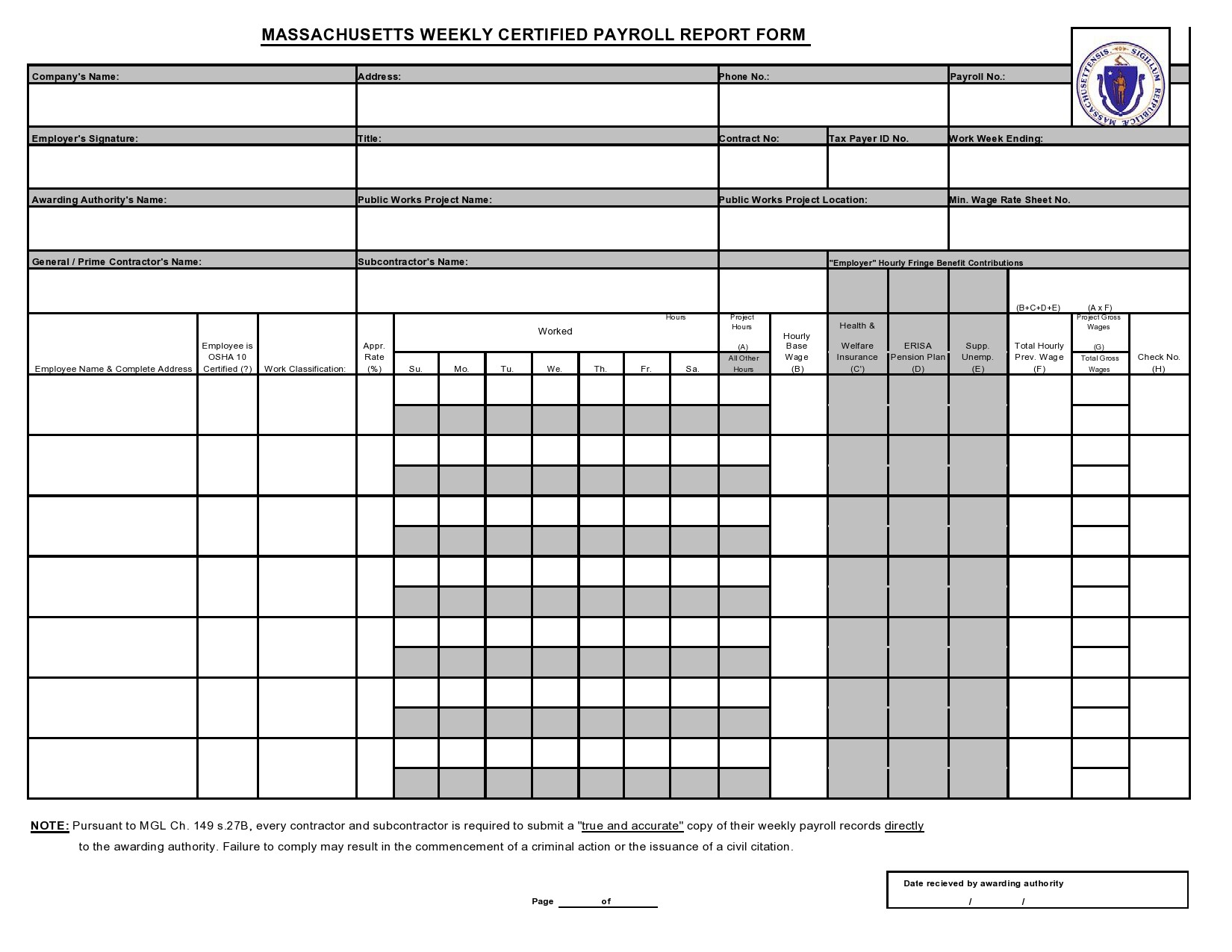

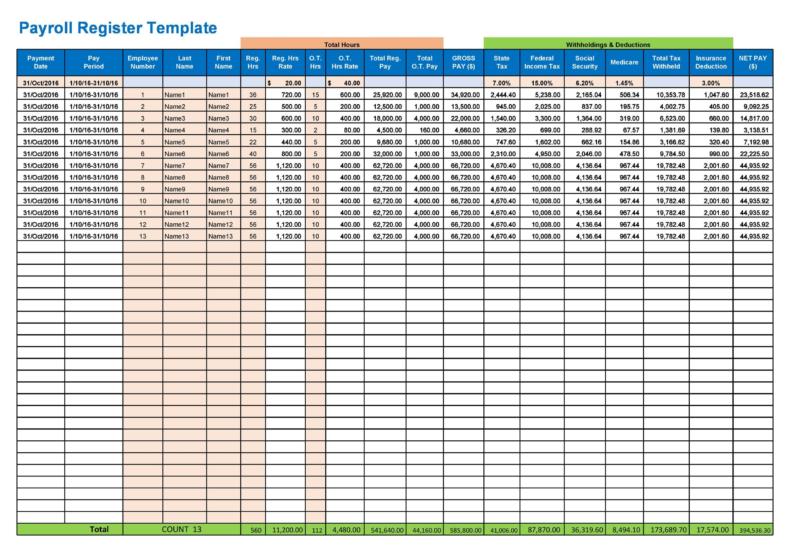

A payroll summary report template is a template that contains detailed information about employees’ payments and deductions. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc.

The document helps business owners to cross-check financial information and to verify tax liabilities. If an employee wants to know why they were paid a certain net figure, the document is used to confirm to them all their accrued payments and deductions.

Payroll Summary Report Templates

Types of payroll summary report templates

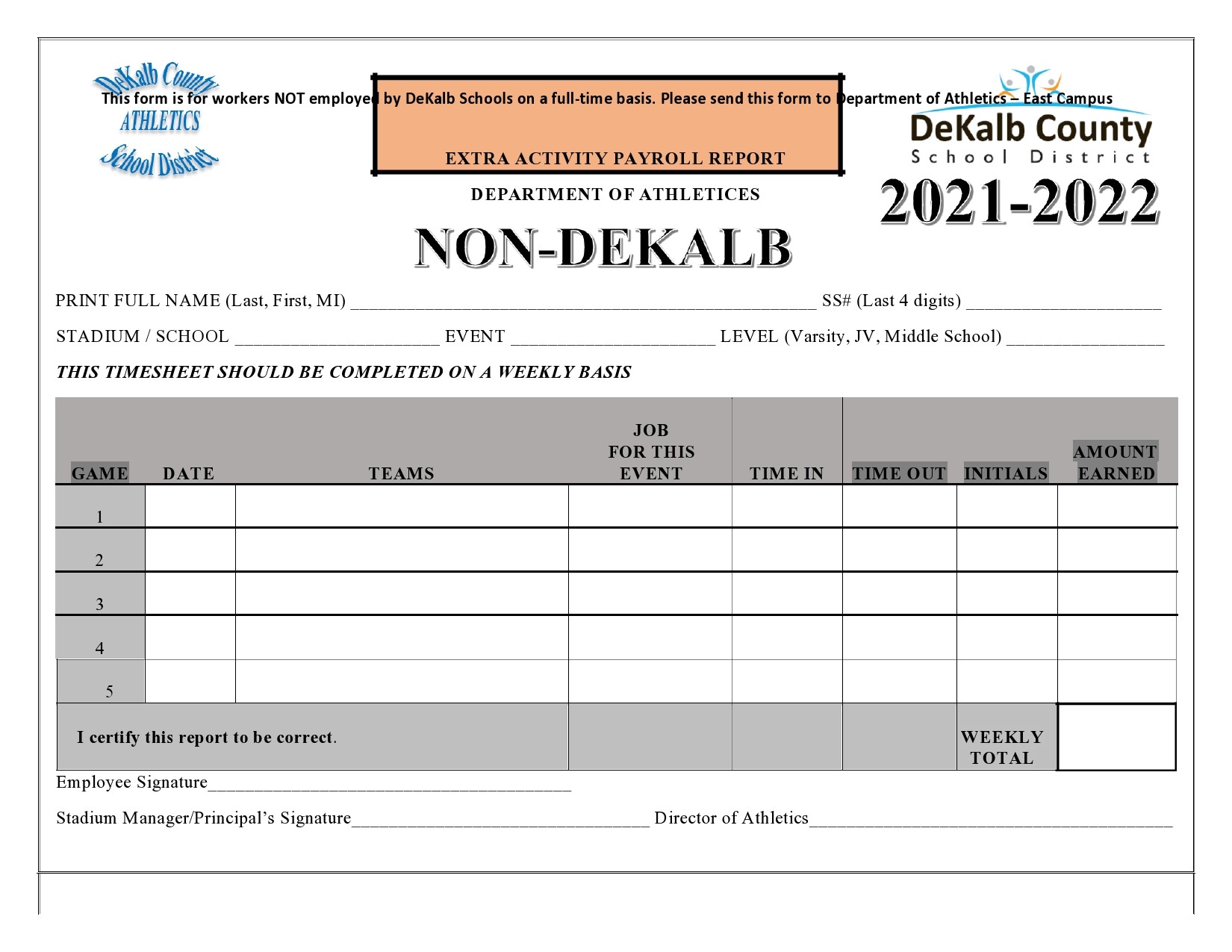

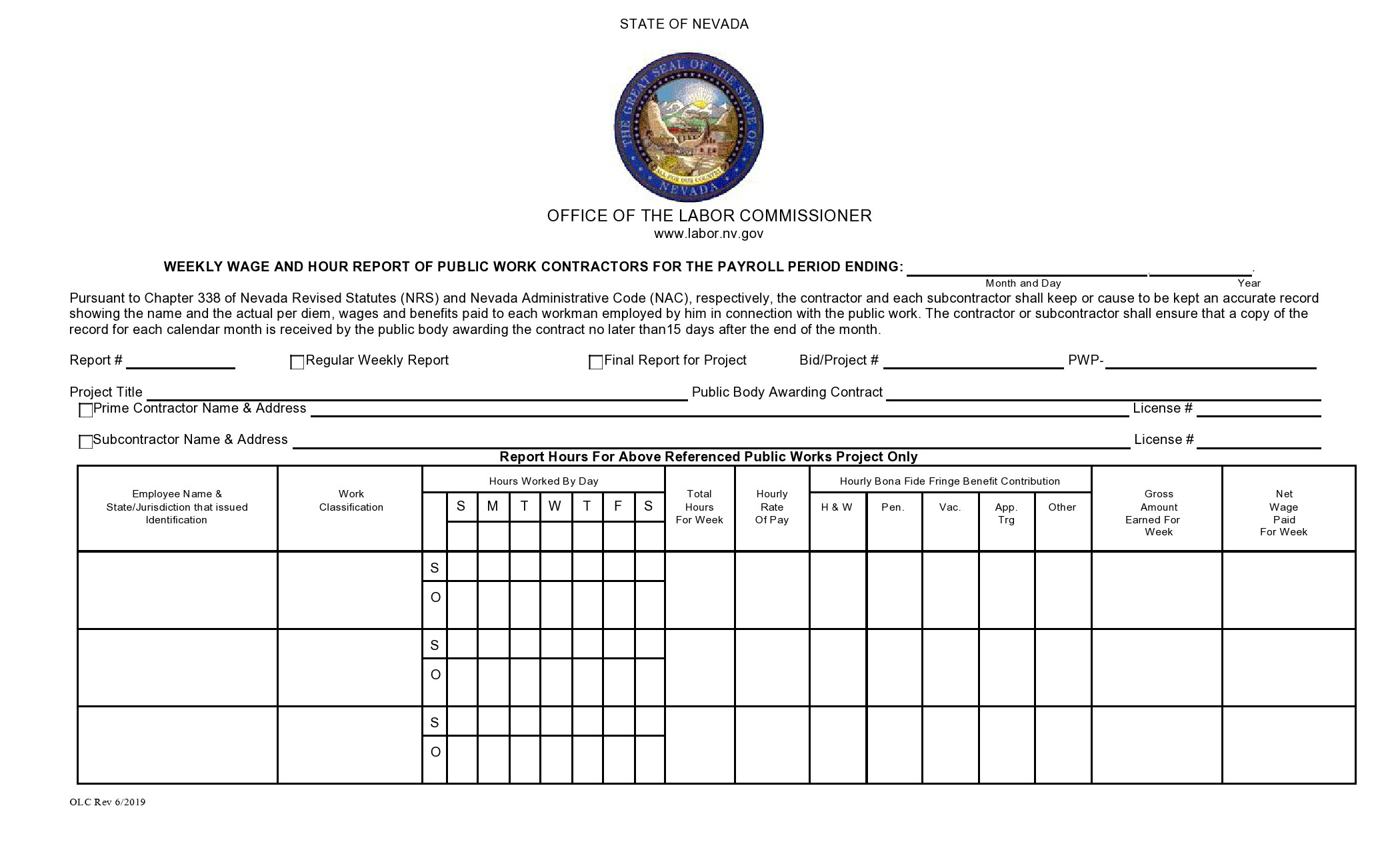

Payroll reports are made according to specific company needs. They take different forms and names according to the way they are customized. The commonest types of report templates are as follows.

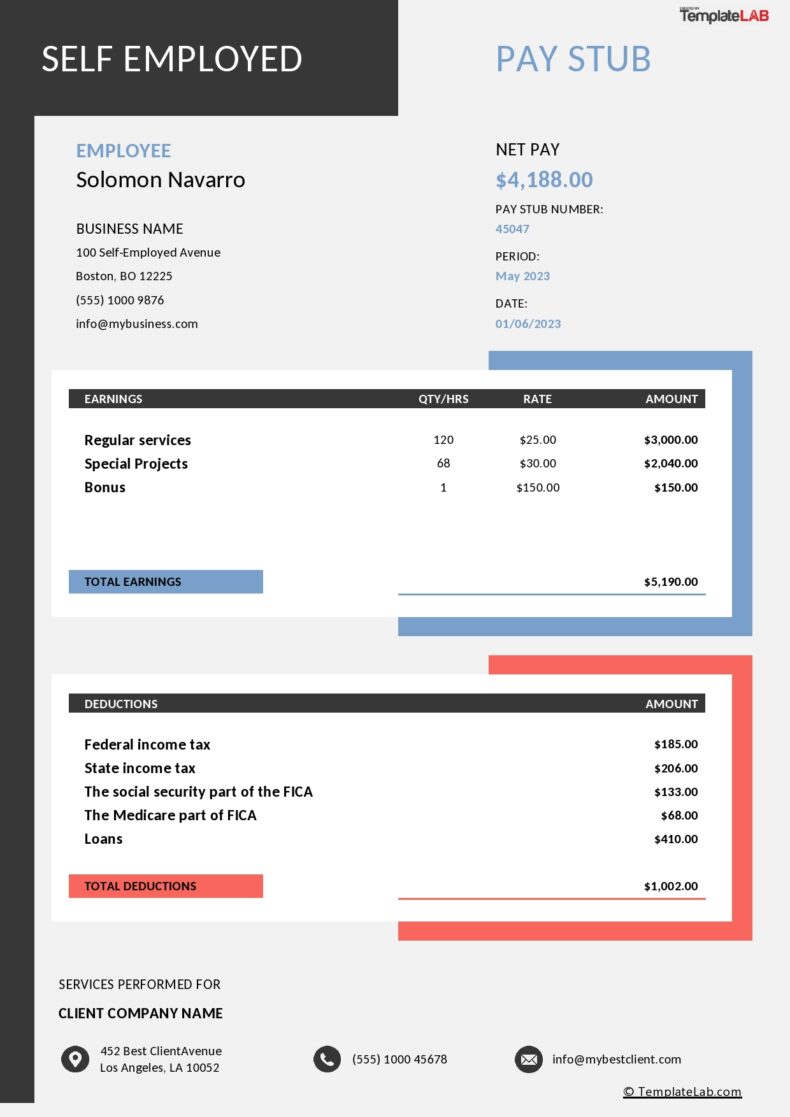

Payroll summary report

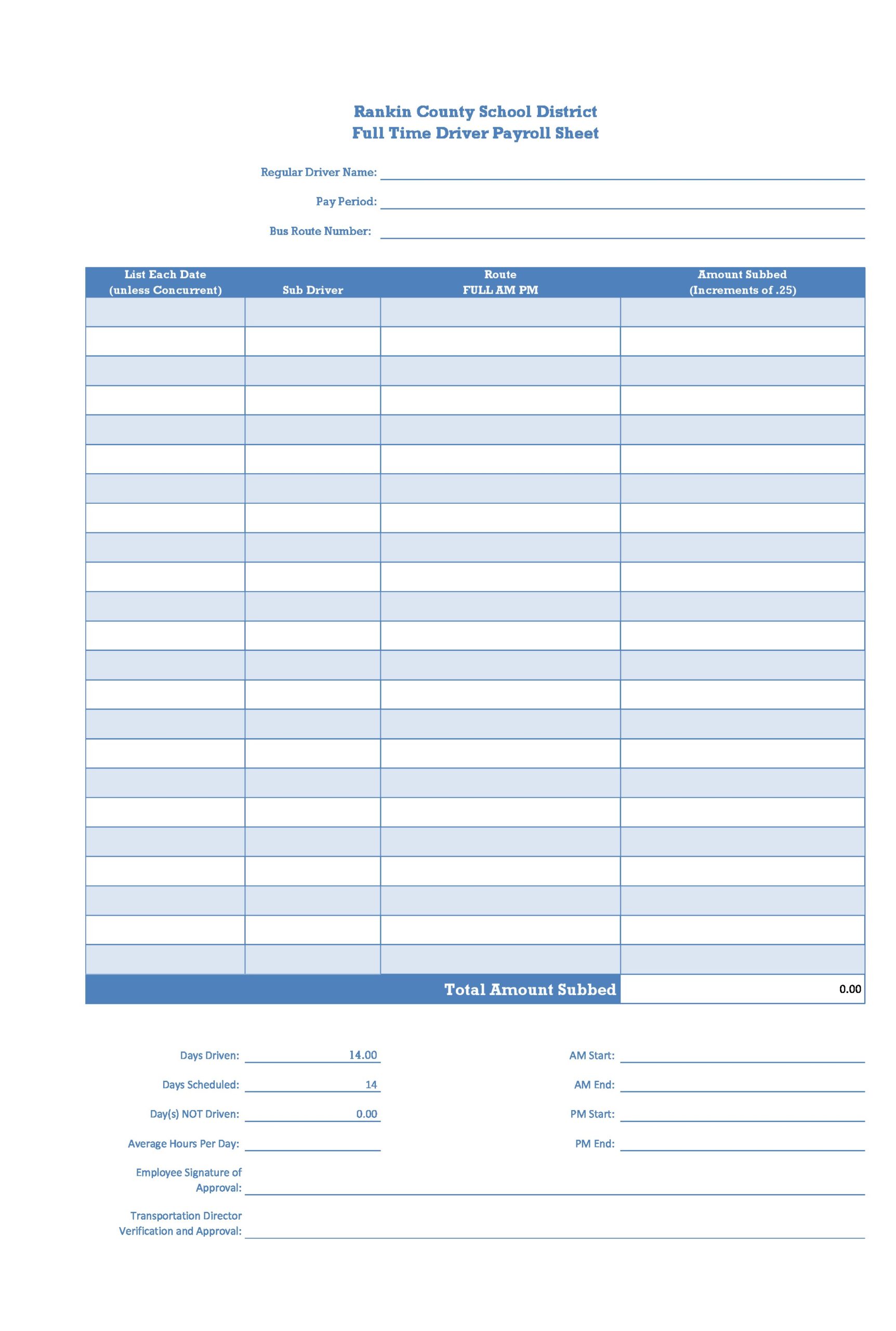

This is a printable payroll sheet that shows payment details of an individual employee, a single department, or the entire company payroll report. Usually, this printable payroll sheet is customized to show worker payments over a specific period.

The period could be a month, quarter a year, half-year, or any other period. It shows the gross pay, tax deductions, other deductions, and net pay. This is the report that is given to individual employees whenever they want to know their deductions summary. Under the FLSA, the employee is entitled to this report.

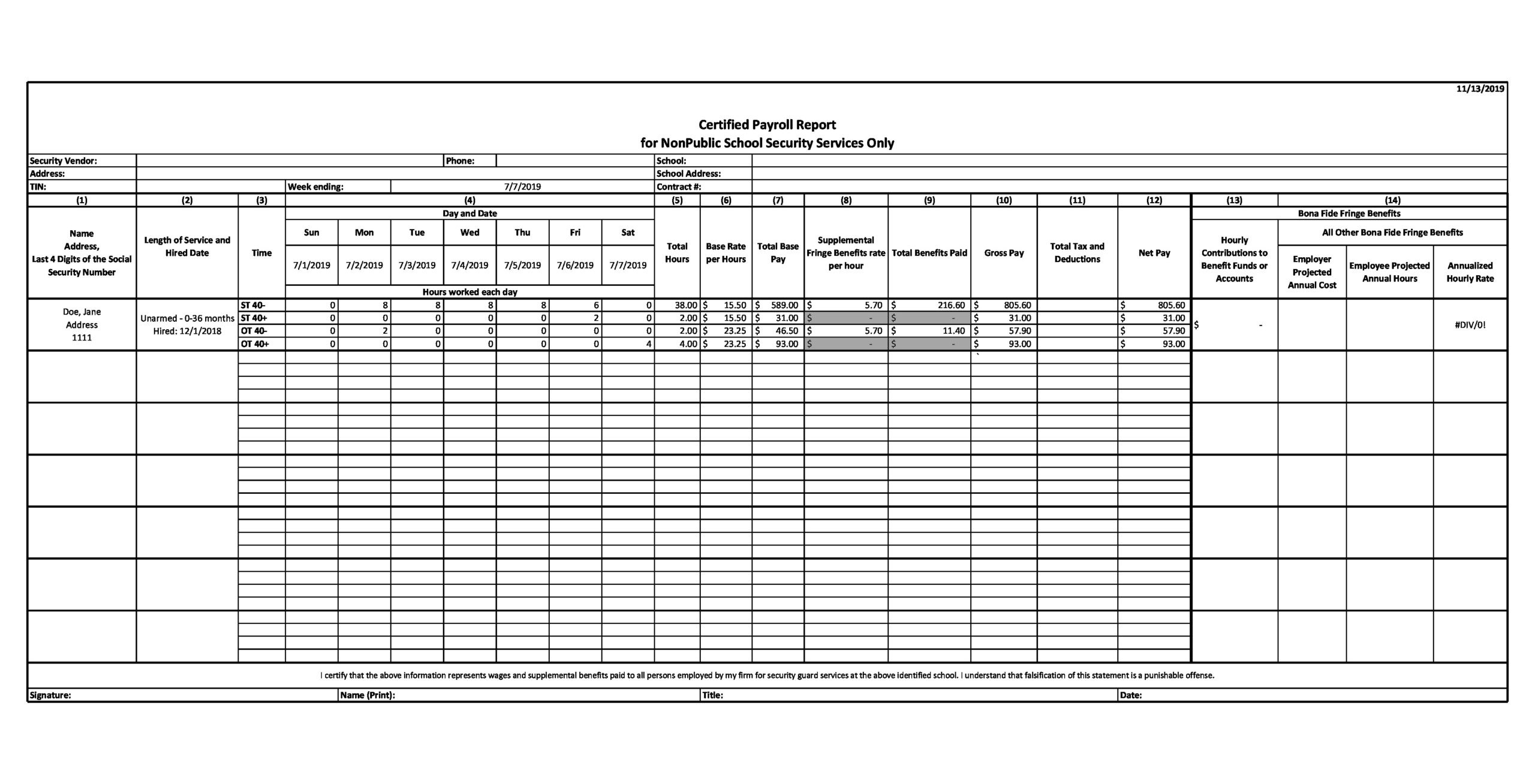

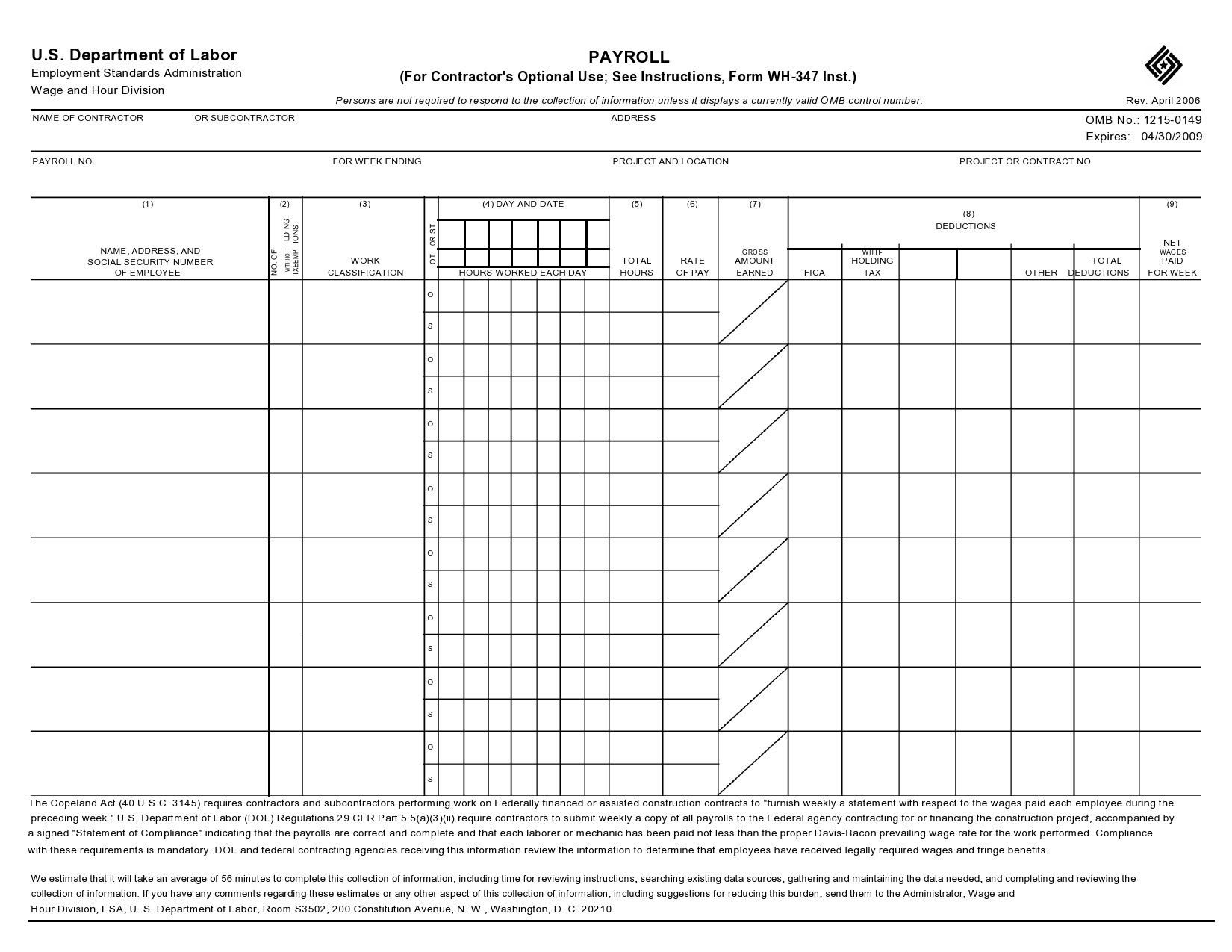

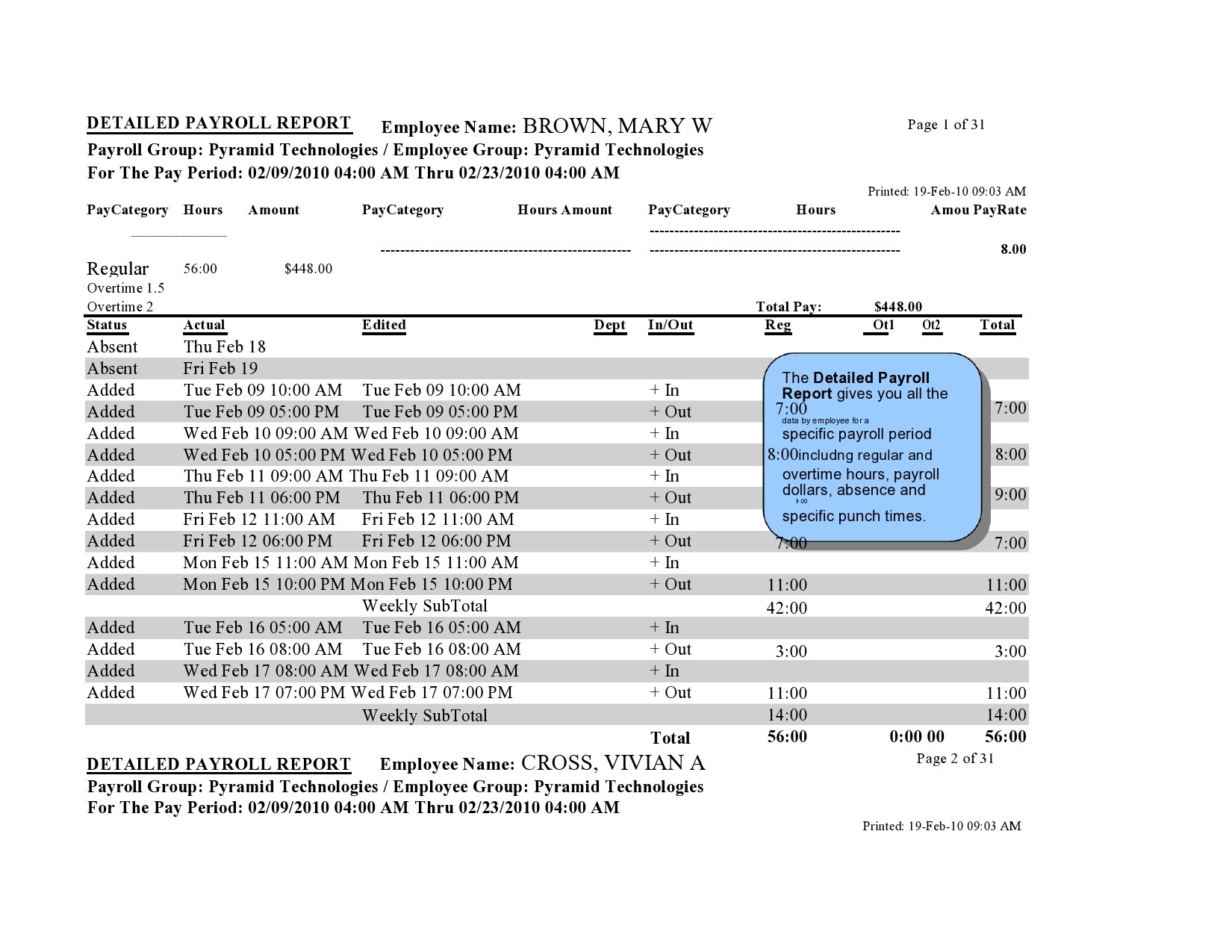

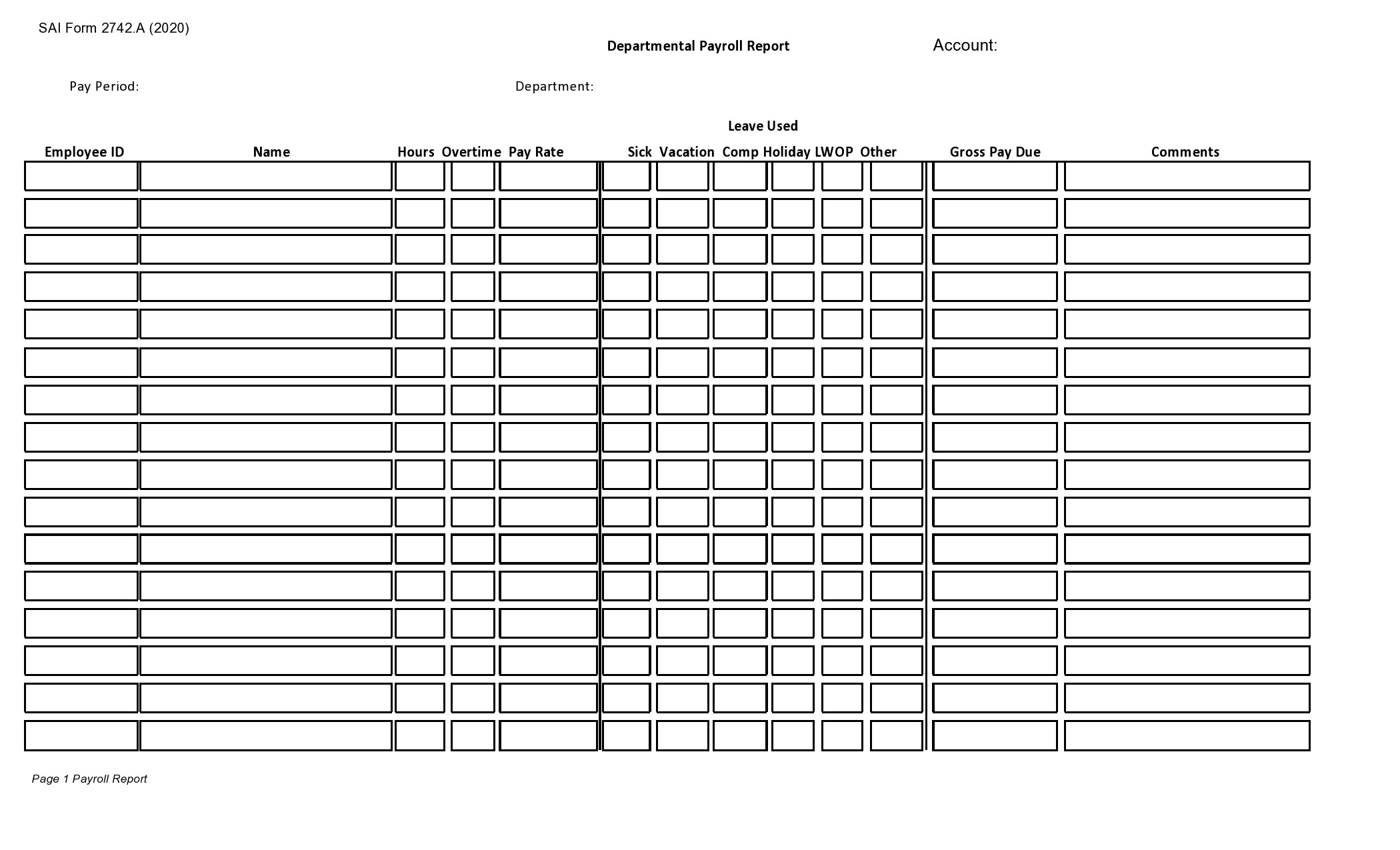

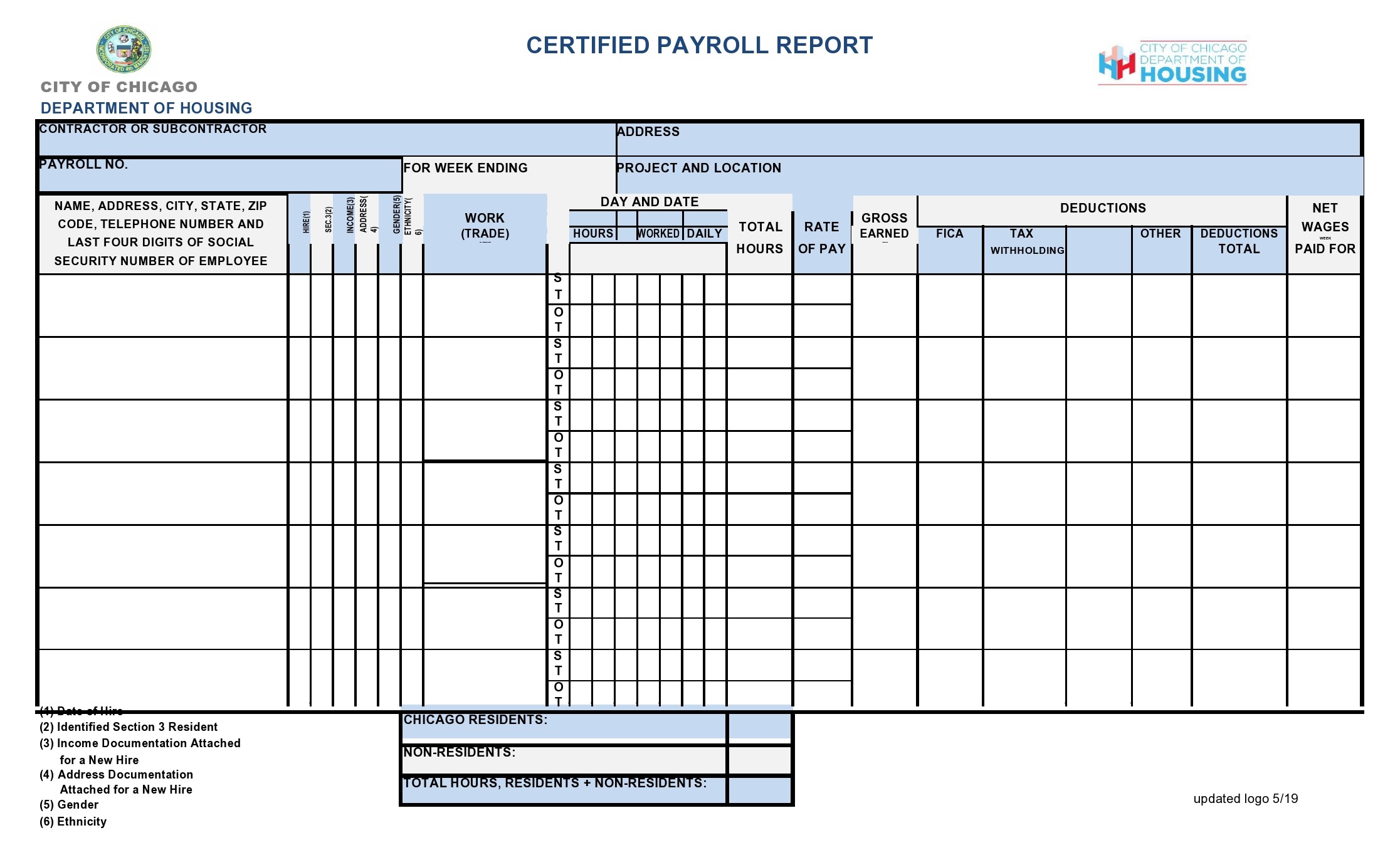

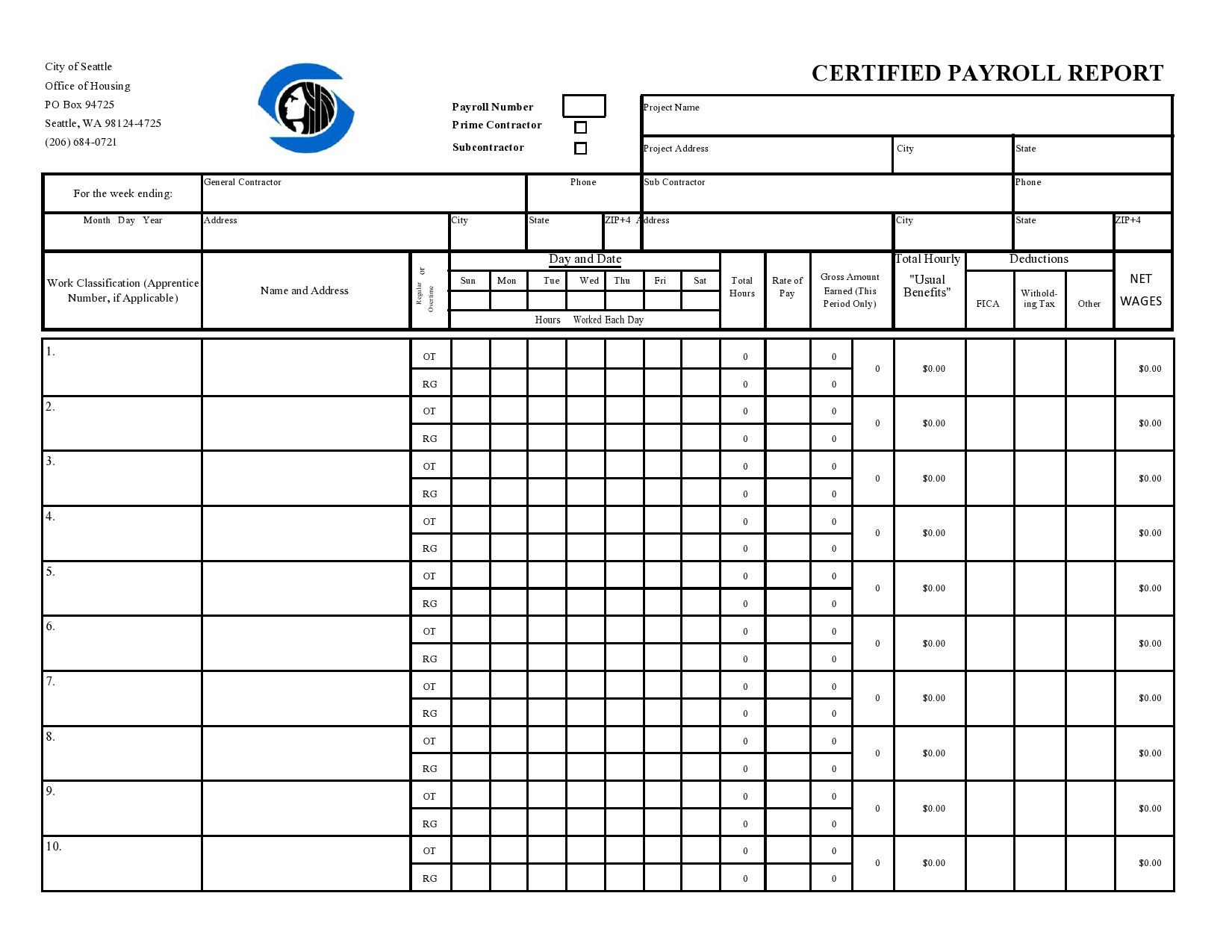

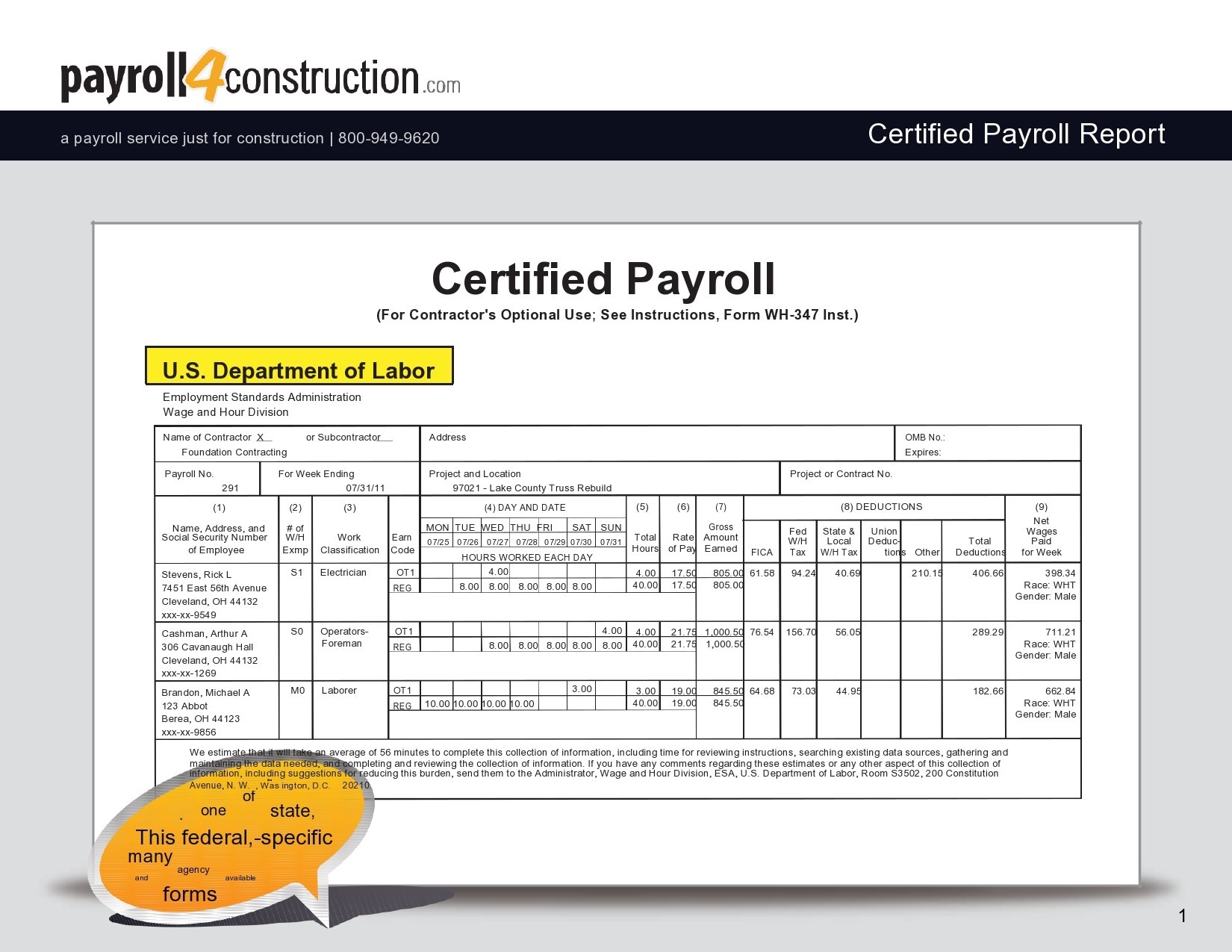

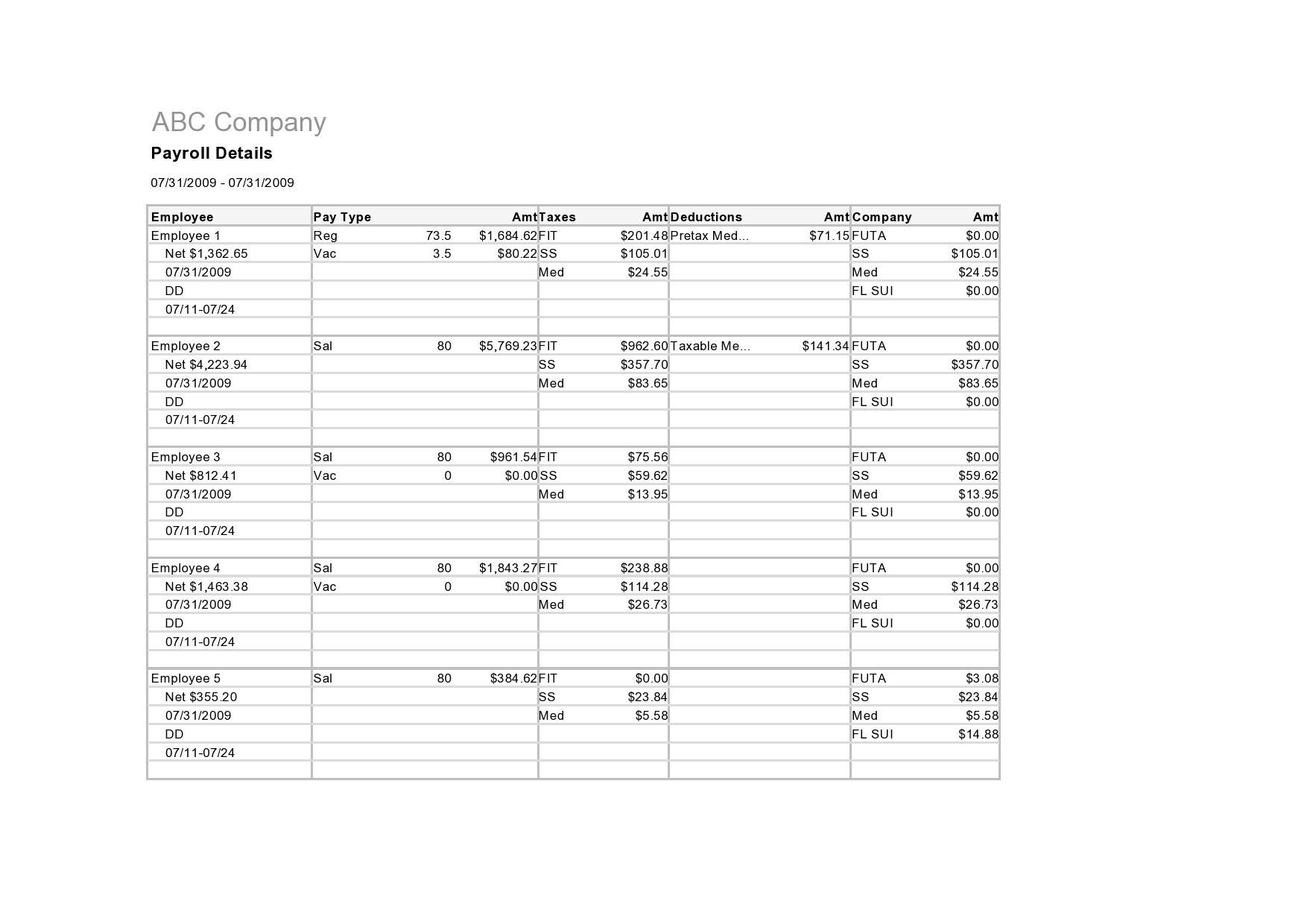

Detailed payroll report

This payroll ledger template is different from a summary report. It shows a detailed report of a given period. Like a summary report, it shows details of individual employees, departments, or the whole company. It shows payment history in a grid view data by date, day by day.

A business person can use this report to know the cumulative hours contributed by employers to the company. The business will know the cumulative wages paid and the cumulative taxes/decoctions withheld. It helps a business weigh total hours worked against total production received.

If the total hours worked were many but the production limited, the business might decide to do an overhaul of their workforce. They might retrain them for upskilling, do reskilling, or change their work style.

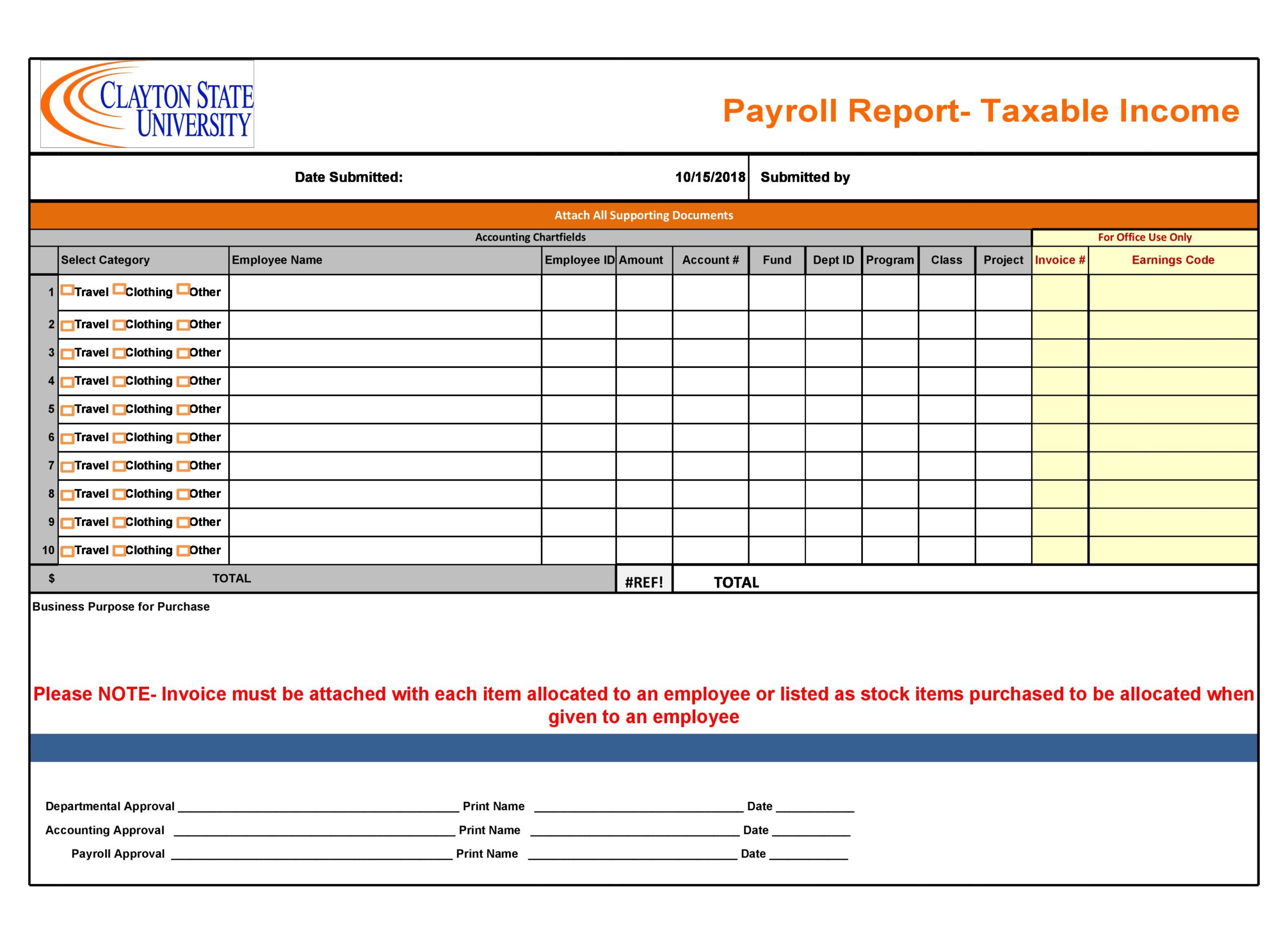

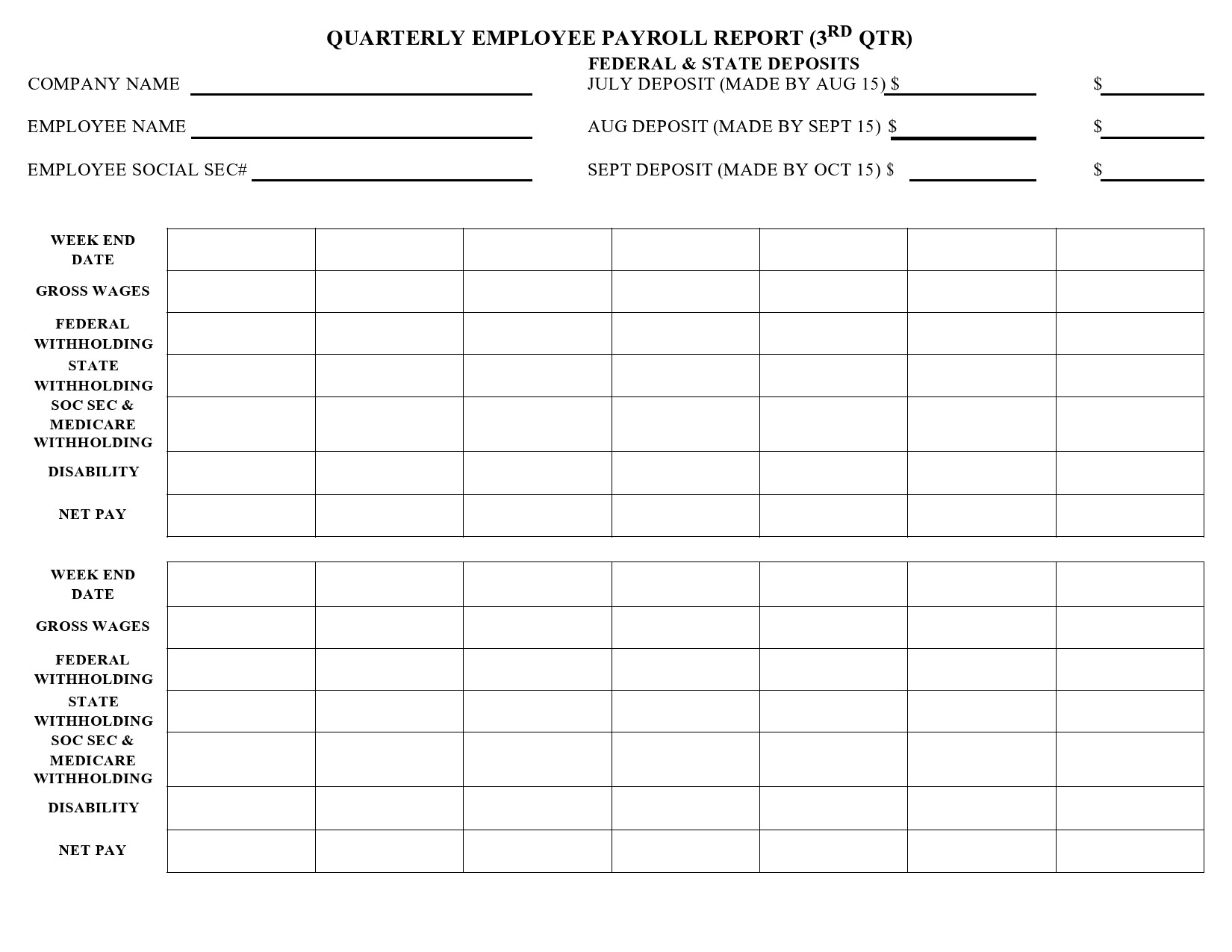

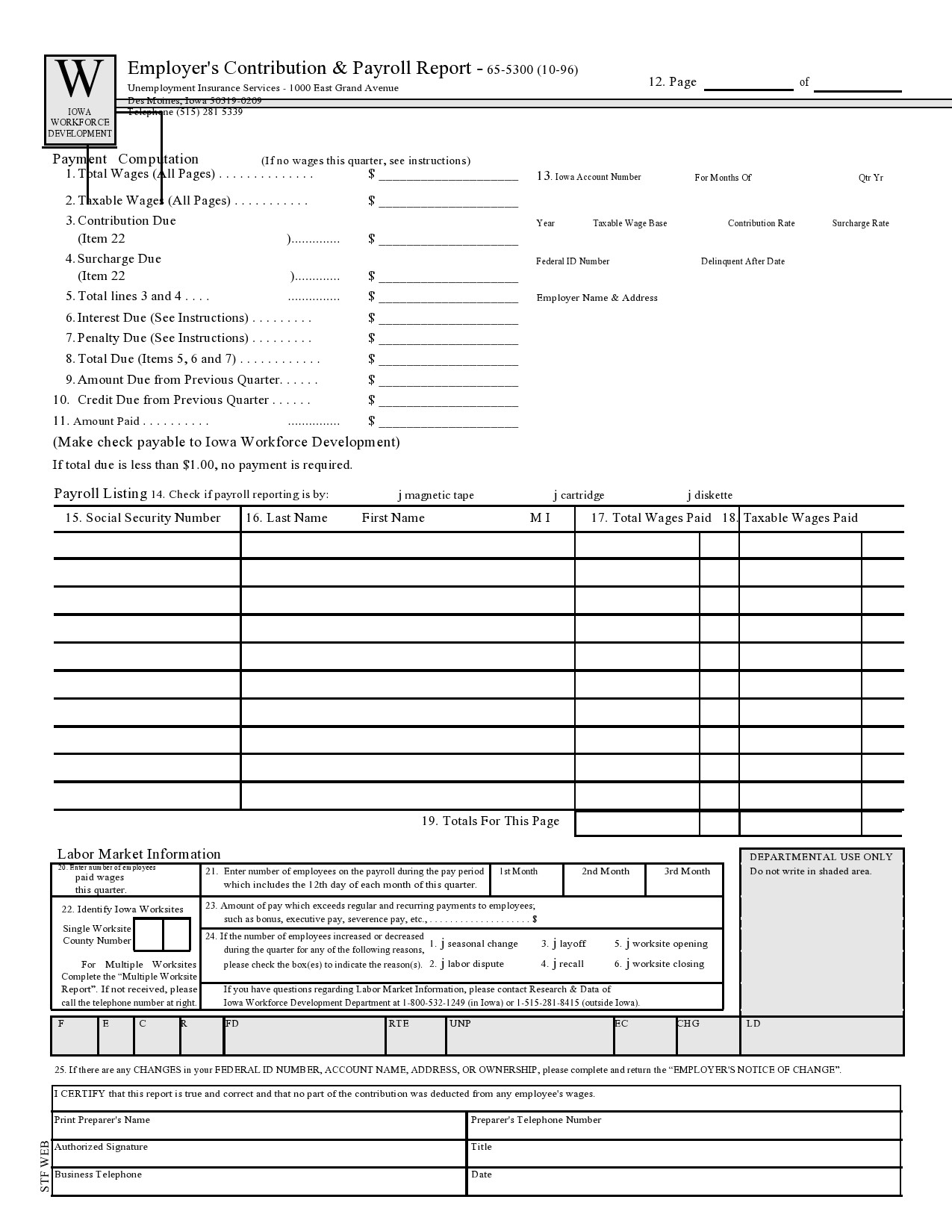

Tax liability payroll report

This is a payroll summary report template that shows the amount of tax that has been withheld from workers. It shows the total the company had remitted to the government and the pending total. The report ensures the company doesn’t suffer penalties due to late tax submissions or wrong amount submissions.

This report is either prepared annually or quarterly and includes taxes withheld for both the federal and state government. The commonest Tax liability payroll reports are as follows: –

Form 940 – This report is prepared under the FUTA tax act. It is an annual tax form.

Form 941 – It is prepared under the FICA and Federal income tax act. It is a quarterly form.

Form W-2 – The form is for employees and is prepared annually

Some of the state’s governments demand almost equivalent forms reported to them. The company management should be sure to check with the local state laws so that they don’t break tax laws and suffer penalties from the state government.

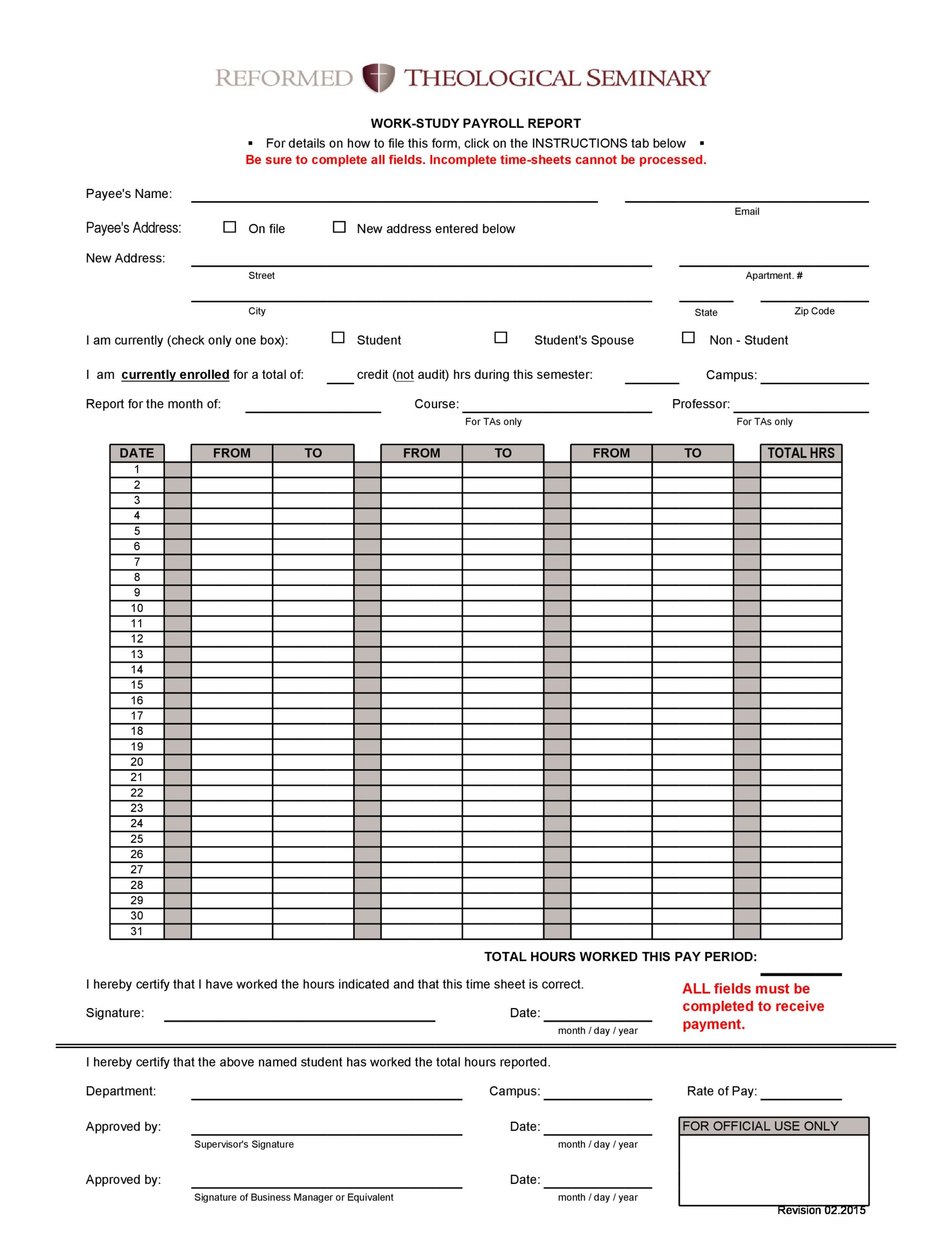

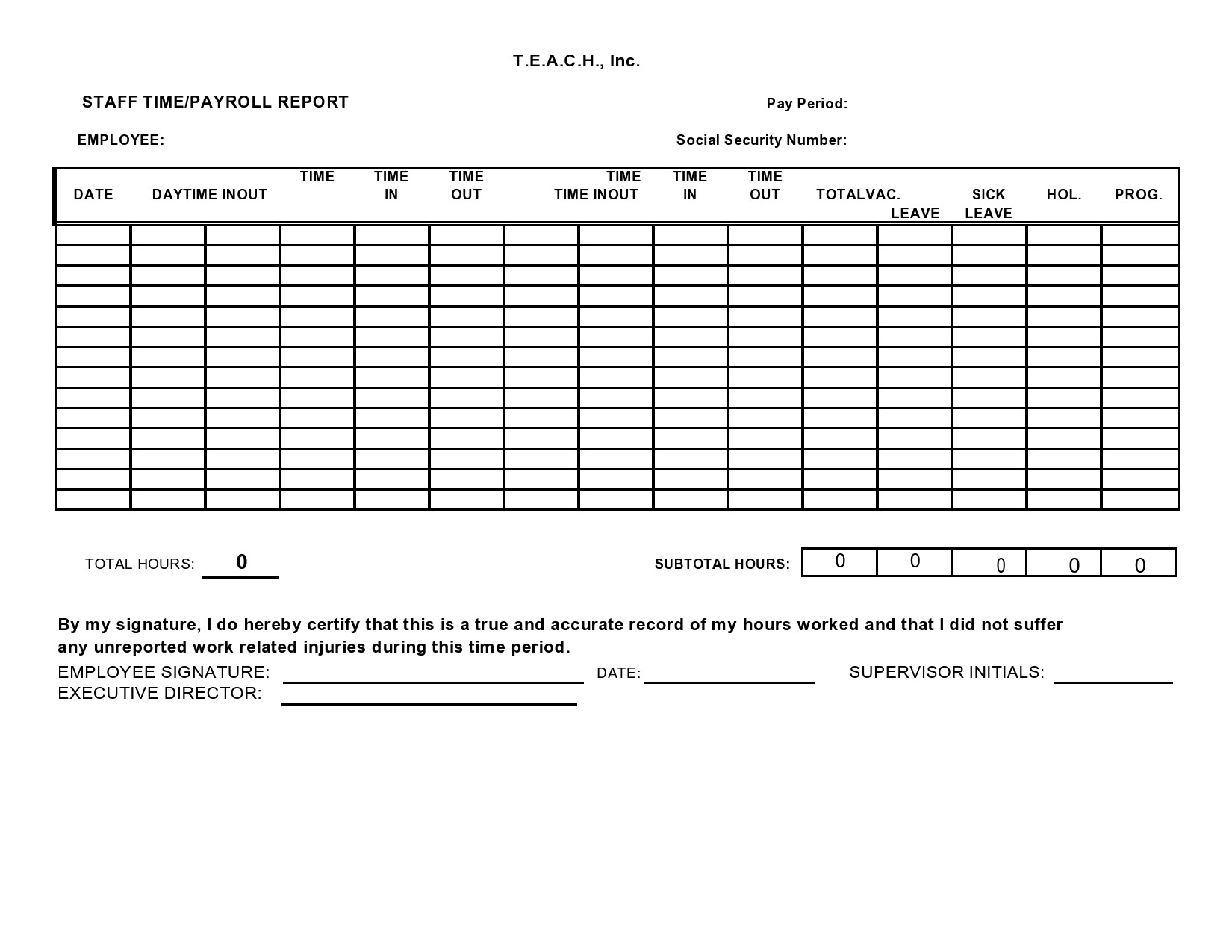

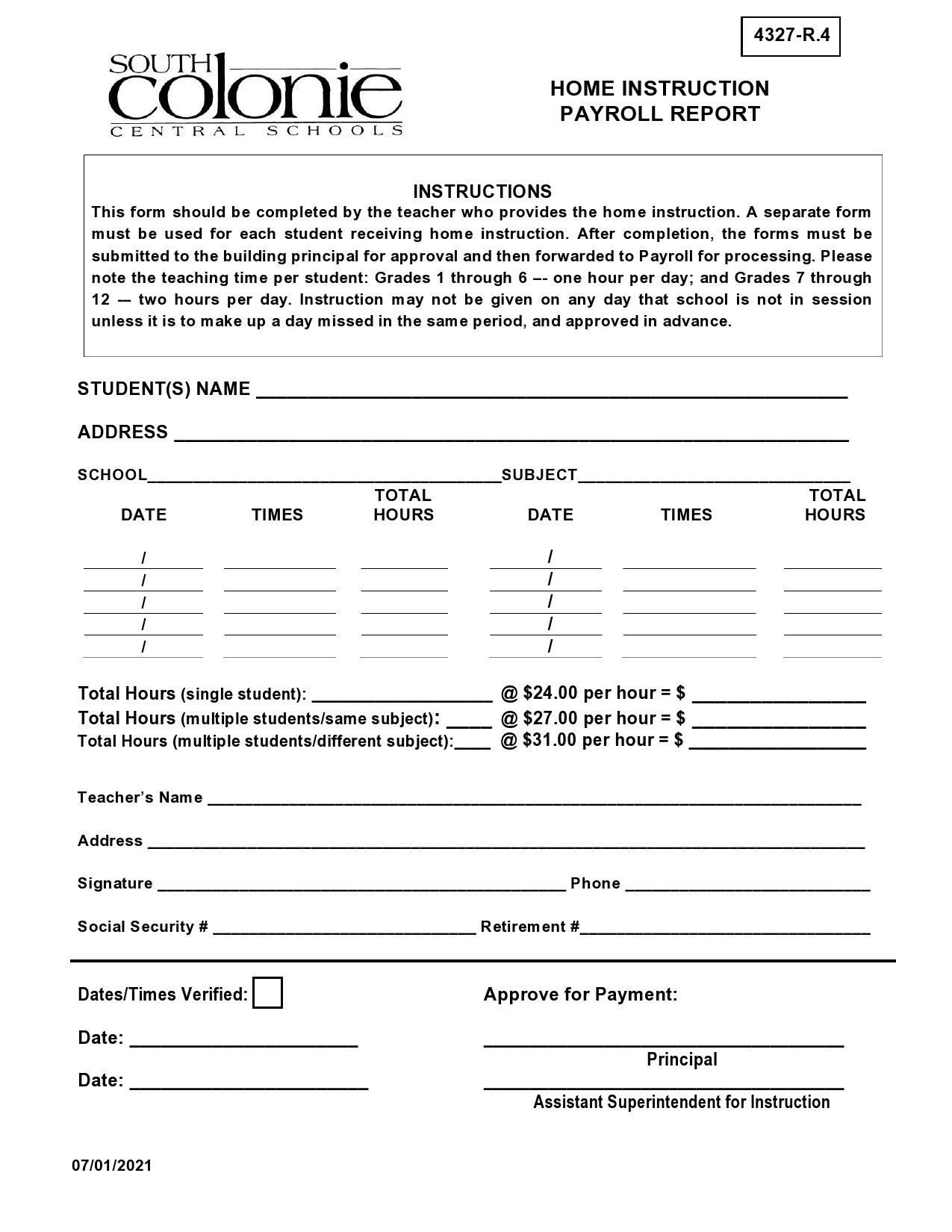

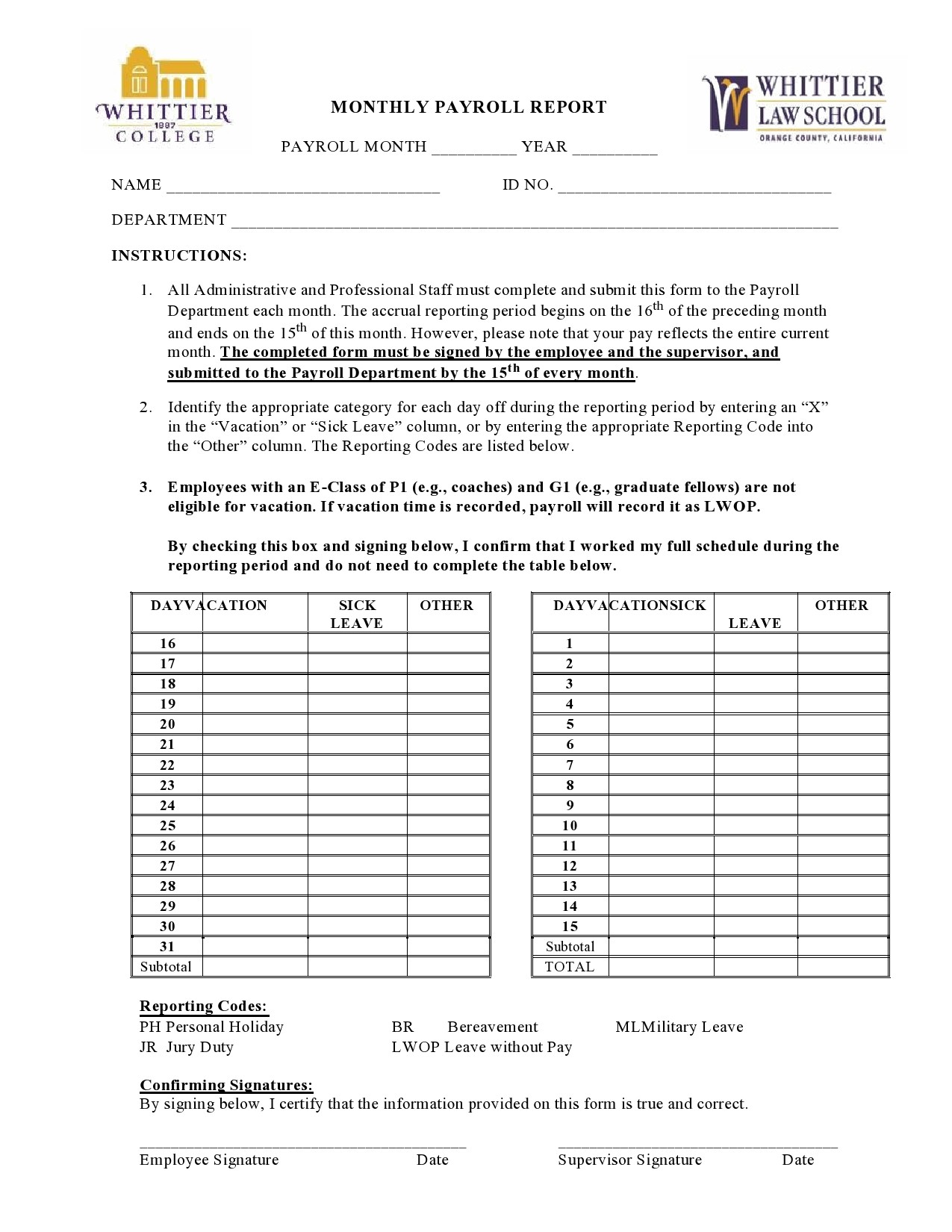

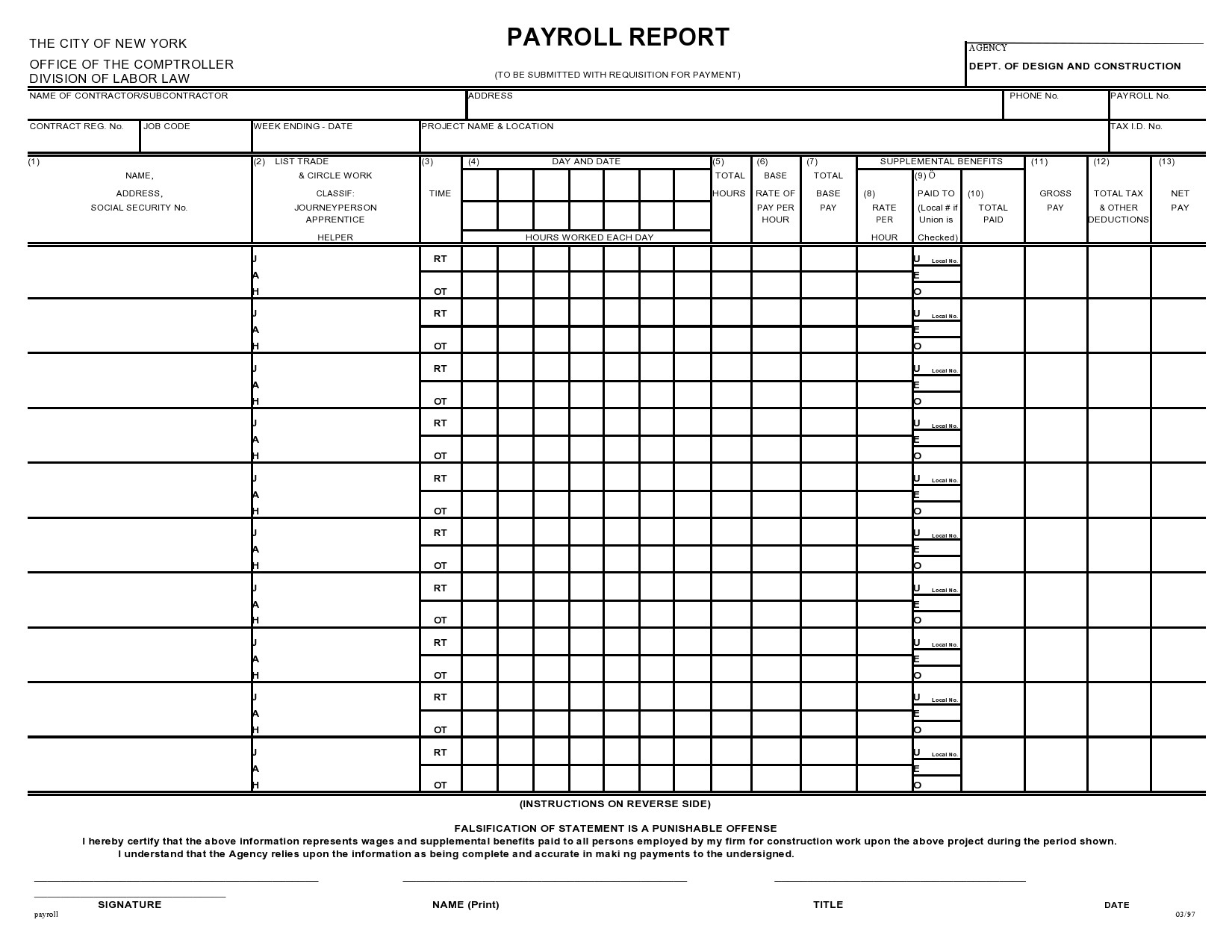

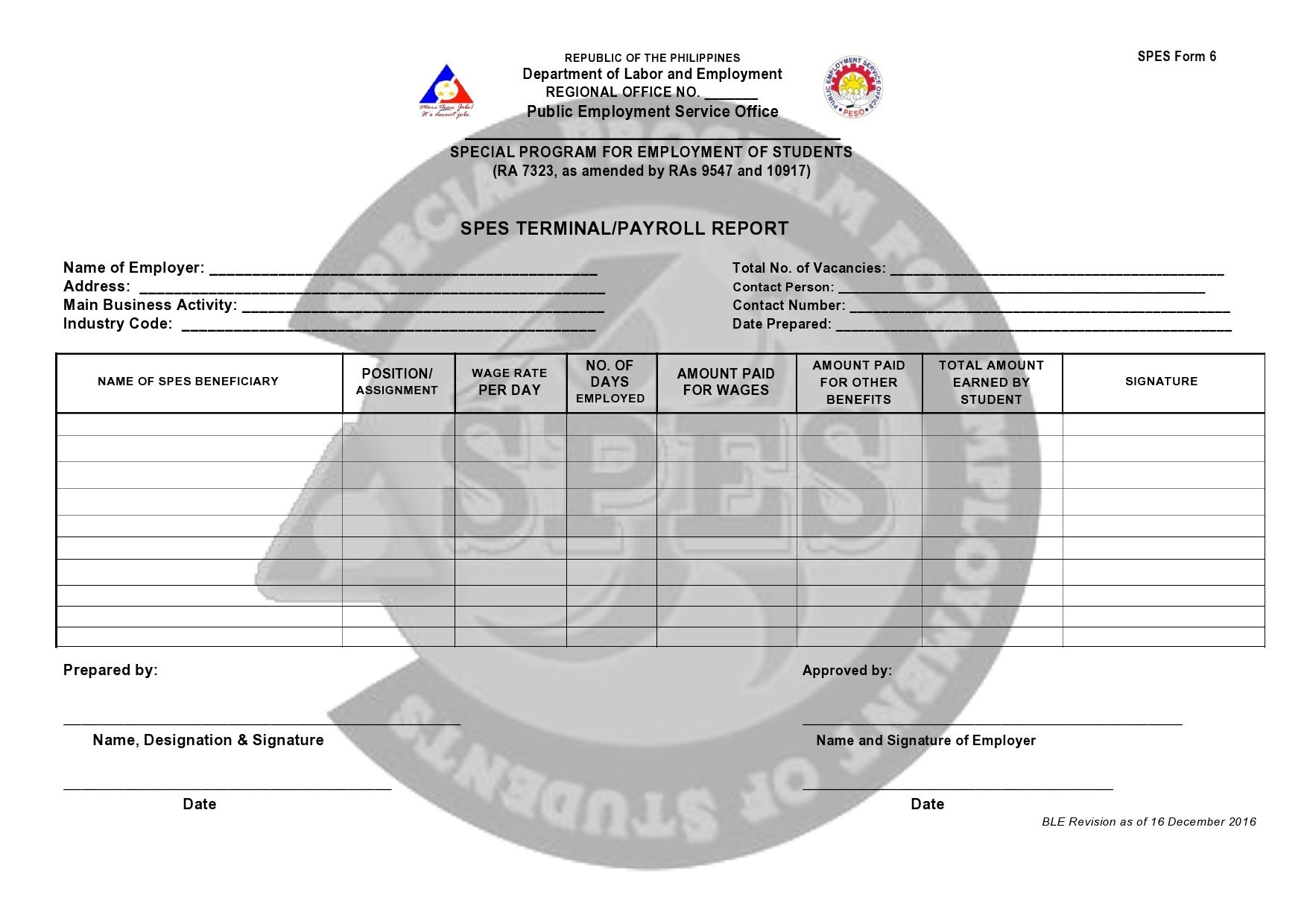

Employee summary report

This is a printable payroll sheet that details employee payments information and their detailed personal data. It shows the hourly payment rate, up-to-date tax deductions, and detailed personal information such as names, addresses, and service time.

The report summarizes the total hours the employee served in the company and might include the specific duties the employee did. Mostly, businesses use this report when doing a summary of employee productivity.

After summarizing the total hours worked, the business person can compare it with the total work they complete. It will help the employer determine if the employee is worth retaining or not.

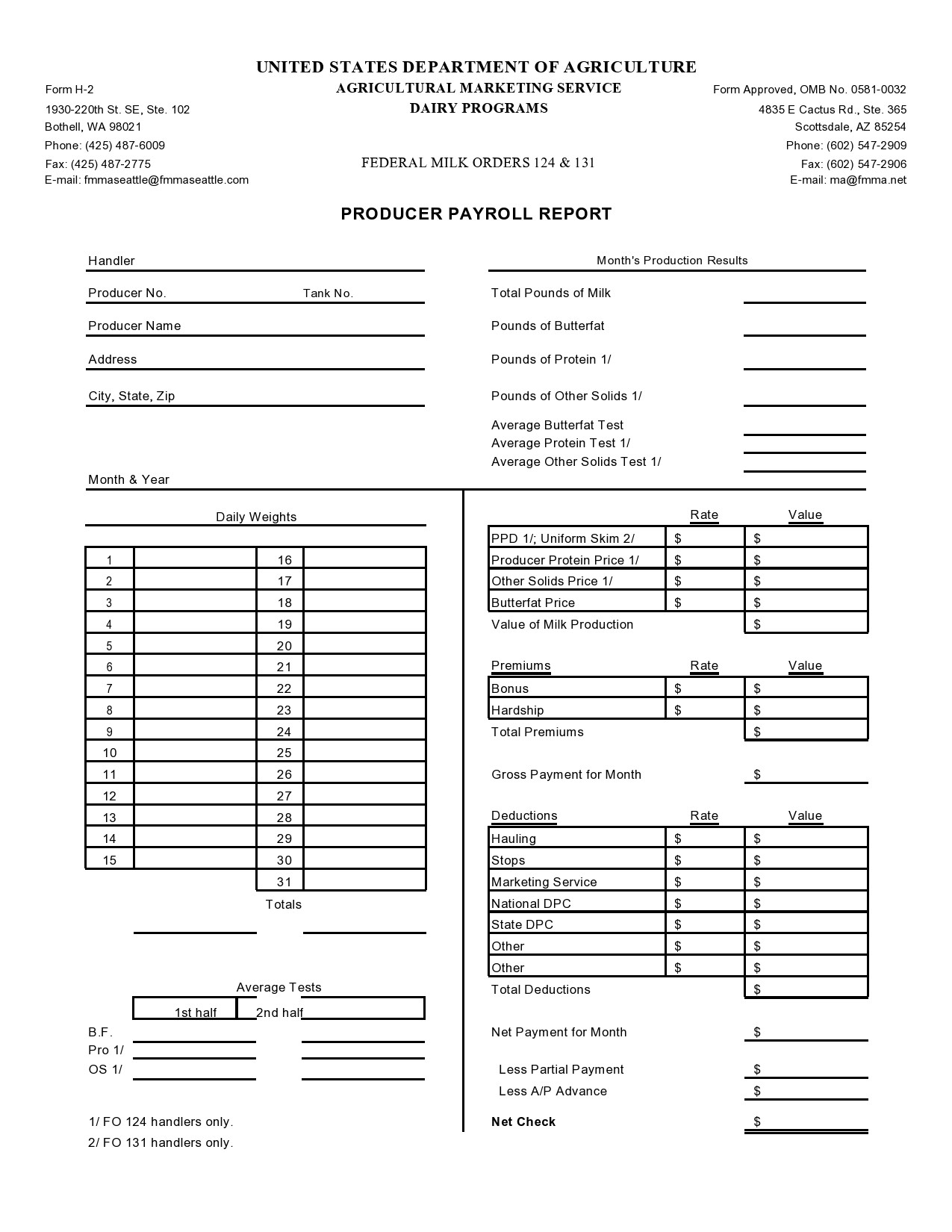

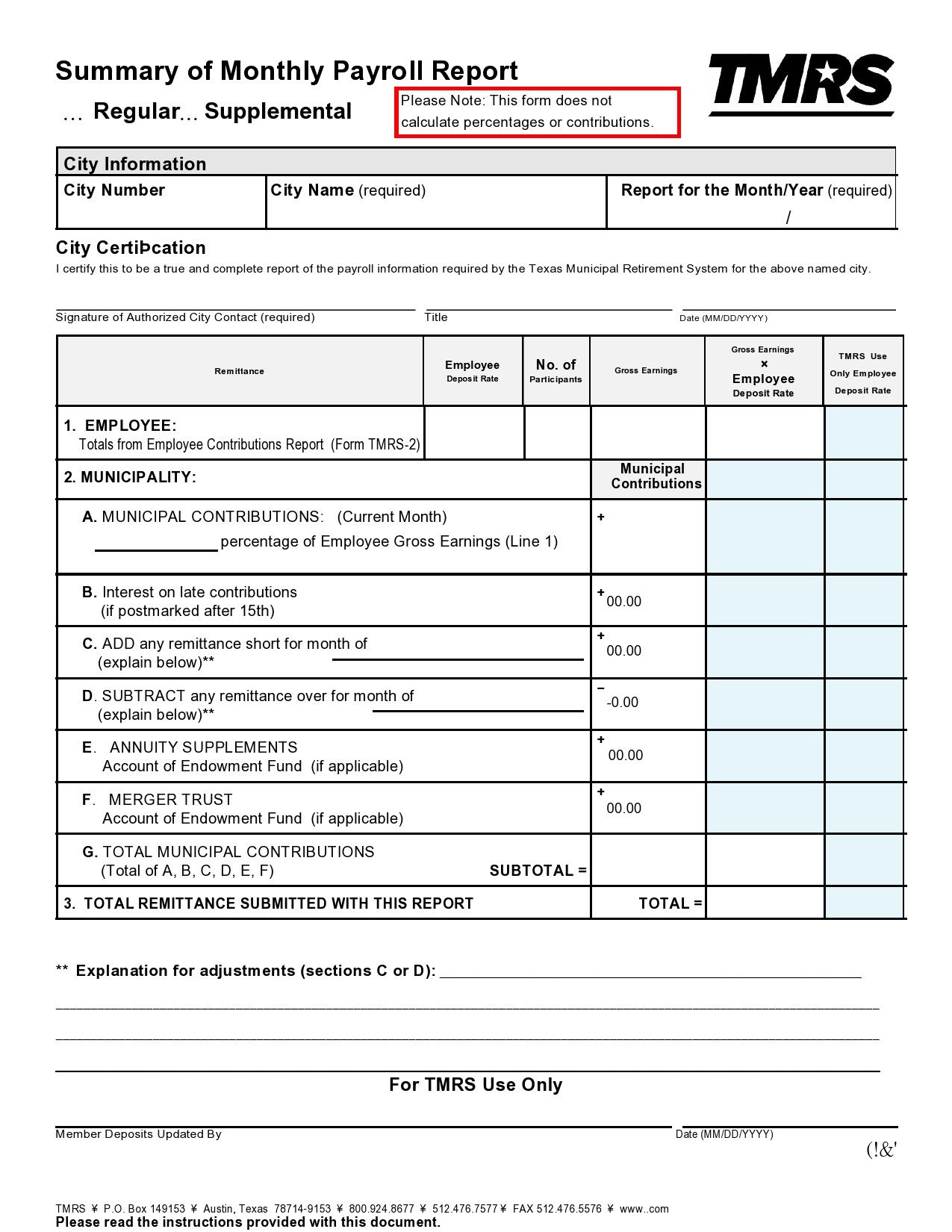

Retirement payroll report

This is a payroll ledger template that shows contributions made by an employee/s to retirement entities such as 403 -B or 401-K. The ledger confirms if all retirement money withheld from employees has been remitted to the respective retirement plan entities. If an employee has any complaints about their retirement contributions report, this ledger can be used to settle the dispute.

Paid time off report

Paid time off report shows the amount of PTO an employee has taken over a certain period. It calculates any pending unpaid PTO hours. This report helps a company plan its work schedules better to prevent worker shortages or overhiring.

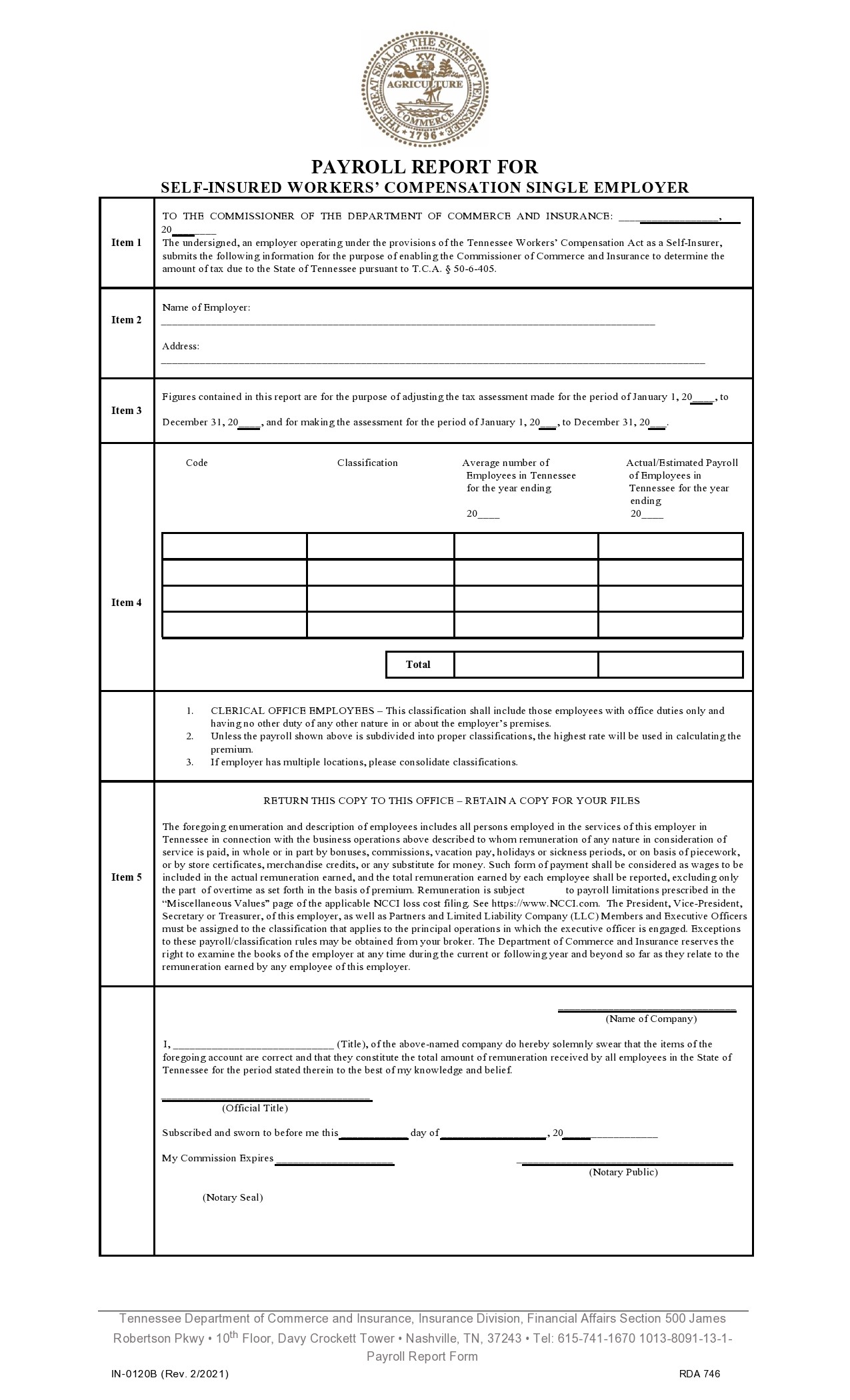

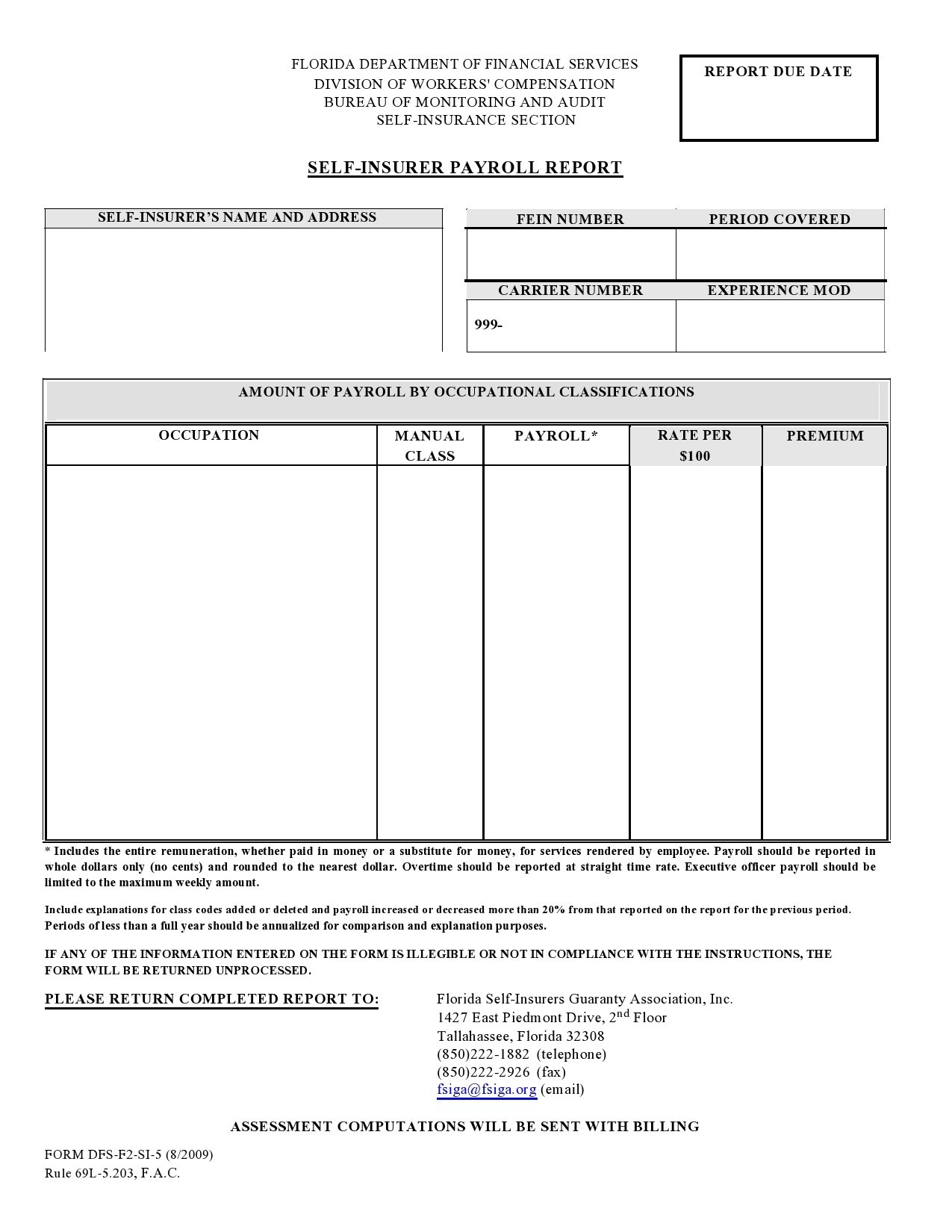

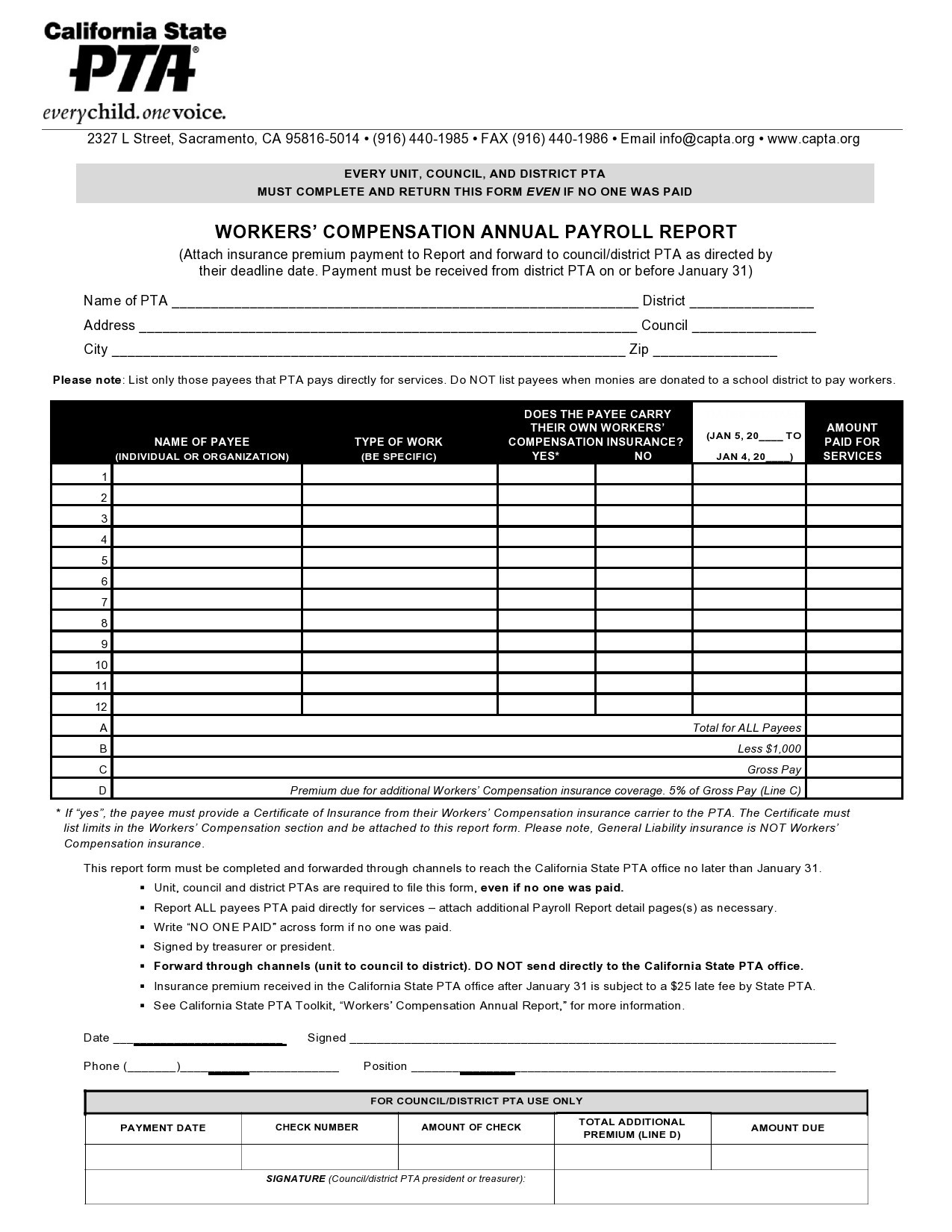

Worker compensation report

This report shows the total payments received by all workers. It is created when a company is seeking to hire an insurer. It can help calculate premiums and shop for the best insurer with reasonable premiums.

Payroll service charge report

This is a ledger that shows invoices received from a payroll service provider.

What is included in a payroll report?

A printable payroll sheet gives a summary of an entire company’s payroll activity. A complete payroll report must include the following details.

Gross pay

Before any money is deducted from a worker’s pay, the total amount earned is what is called gross pay. It is calculated by summing up the total hours worked by the employee multiplied by the hourly wage. It includes any overtime payments, allowances, bonuses, benefits, etc. The printable payroll sheet should have these details as the gross pay.

Adjusted gross pay

Adjusted gross pay shows the pay balance that is left after deducting individual employee contributions or after deducting monies such as insurance, retirement, medical, labor union, etc.

Net pay

This is the amount an employee receives in their bank account or check. It is the balance that remains after all deductions have been made, including borrowed money from the company.

Taxes and contributions

These are contributions made by an employee made to the Federal Insurance Contributions Act.

Printable Payroll Sheets

How do I make a payroll report?

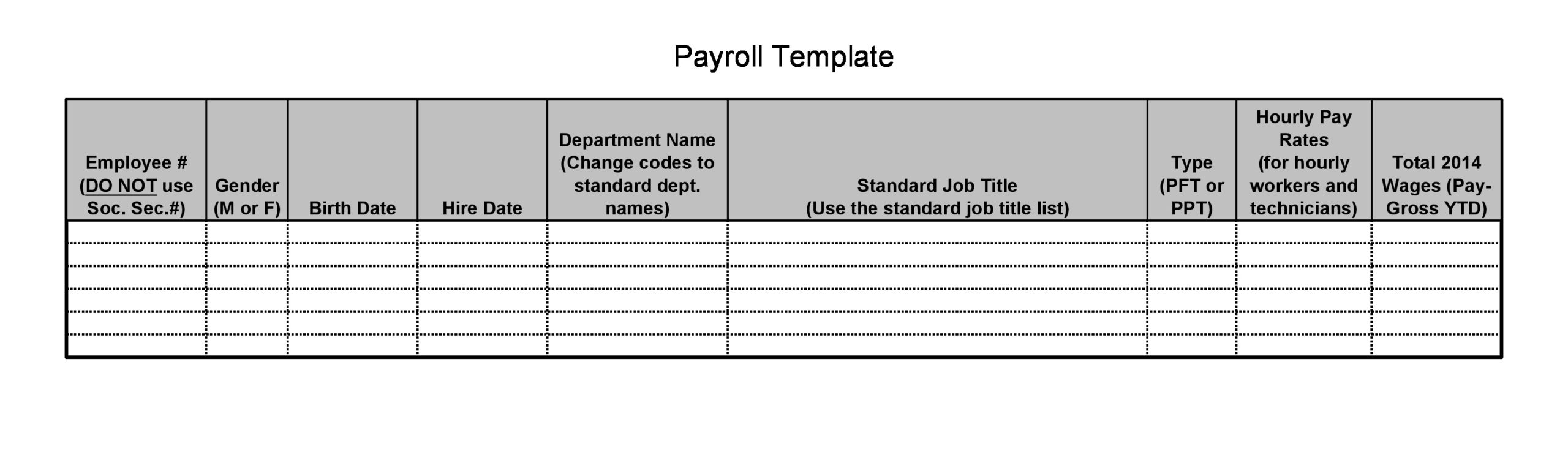

The payroll ledger template of one company is different from the next. The management looks at their unique needs and creates a payroll summary report template that represents them. No matter the unique needs a company might have, every payroll report has a similar structure.

Important information needed

You must first decide what information is needed to appear in the payroll ledger template. This is information that can be shared with third parties. Information such as medical/health information should not be included in the payroll ledger.

You should have the company’s interests first. For example, you might be planning to apply for a loan in the future. The payroll should be created to reflect its ability to service loans. If you want to use it for loan purposes, it should not include employee details such as name, retirement benefits contributions, etc.

If the payroll is for internal use only, there is no problem to include details of employees. Make sure it captures their full name, employment number, insurance number, retirement contributions membership, health insurance, etc.

It must also show employee gross salary, deductions, and other benefits. In summary, the main information in the payroll ledger template should be as follows:

Names of employees – they should be arranged in a way that individual employee reports can be printed.

Gross salary – the gross amount earned within a given period

Insurance contribution details – that is, insurance provider and premiums paid monthly

Any loans attached to their salary – give details of the lender, monthly installments, due date each month

Retirement contribution number – 401k number, number of monthly contributions. Health insurance number – health provider, the amount withheld each month.

Determine the printable payroll sheet period

Your payroll ledger should have a predetermined period. You might decide to generate a monthly report, quarterly, biannual or annual. It all depends on what you want the report for. If an employee requests an individual report, you can select the time range they want and generate their individual report.

If, for example, you want to make decisions on whether you should increase wages or hold on, you can generate an annual printable payroll sheet report or cover two to three years. It will help you get a better view of company expenditures on salaries. A one-year report could be enough for a lender unless they request further details.

Fill in the payroll information

Having determined all the information required in your payroll report and the period, it is time to fill in the details. There are different methods you can use to generate a payroll template but the easiest is to download online.

Review the different printable payroll sheets available online to help you decide which one fits you the best. If you find one, adopt it as your payroll template but if not, you can add rows and columns to fit your needs. The easiest way to insert data is to import your payroll details from the payroll system. Alternatively, you can insert manually but you must be careful to avoid typing errors.

Test the outcomes

Currently, data is very important in a business, no matter what type of data it is. Businesses rely on it to make decisions, test performance, improve their production lines, delivery lines, etc. The report obtained from the payroll ledger template is not just for the sake of having a report ready but for the sake of improving the business.

After completing your entries, go over your report to check for errors and to correct them. Next, derive insights from the report. Find out if the hourly payments are aligning with productivity. If not, find out if your equipment or machines require improvement. Find out if it is the supervisors who are not performing or you might have over-hired.

You might be preparing the payroll report to share with a lender. Confirm if it is presenting the important items. Check if you have included information that should not be shared with third parties and remove it. You may call your team of managers and discuss the report for further insights.

Payroll Ledger Templates

The important steps of payroll preparation

It is not easy to complete the process of preparing your business payroll. To help you have an easy way of completing payroll processing, these important steps will help.

Collect information

Have all the necessary information ready for you. The best way to have your information ready is to collect it from employees the day they are hired. Have their form W-4 filled and ready. Have detailed information on retirement plans, state tax forms, insurance, company-provided benefits, hourly pay, etc.

Calculate the net pay

Net pay is gross pay less all taxes and benefits withheld. Calculate medical and social security taxes.

Payments – the net pay is what an employee should get. You can either pay them via bank transfer or check. The accompanying payslip is generated from the payroll report. The slip shows details of their gross pay, withheld payments, and the net they will get.

Report – from the payroll, you must generate another report that will be filed with the Federal and State tax withholdings. The departments that require the report are-

- Medical taxes

- Social security

- IRS

- State Department of Revenue

Withheld payments

These payments include tax and benefits. After withholding them from your employees, you must forward them to the relevant entities. These are

- Tax entities

- Retirement plan entities

- Medical benefits etc.

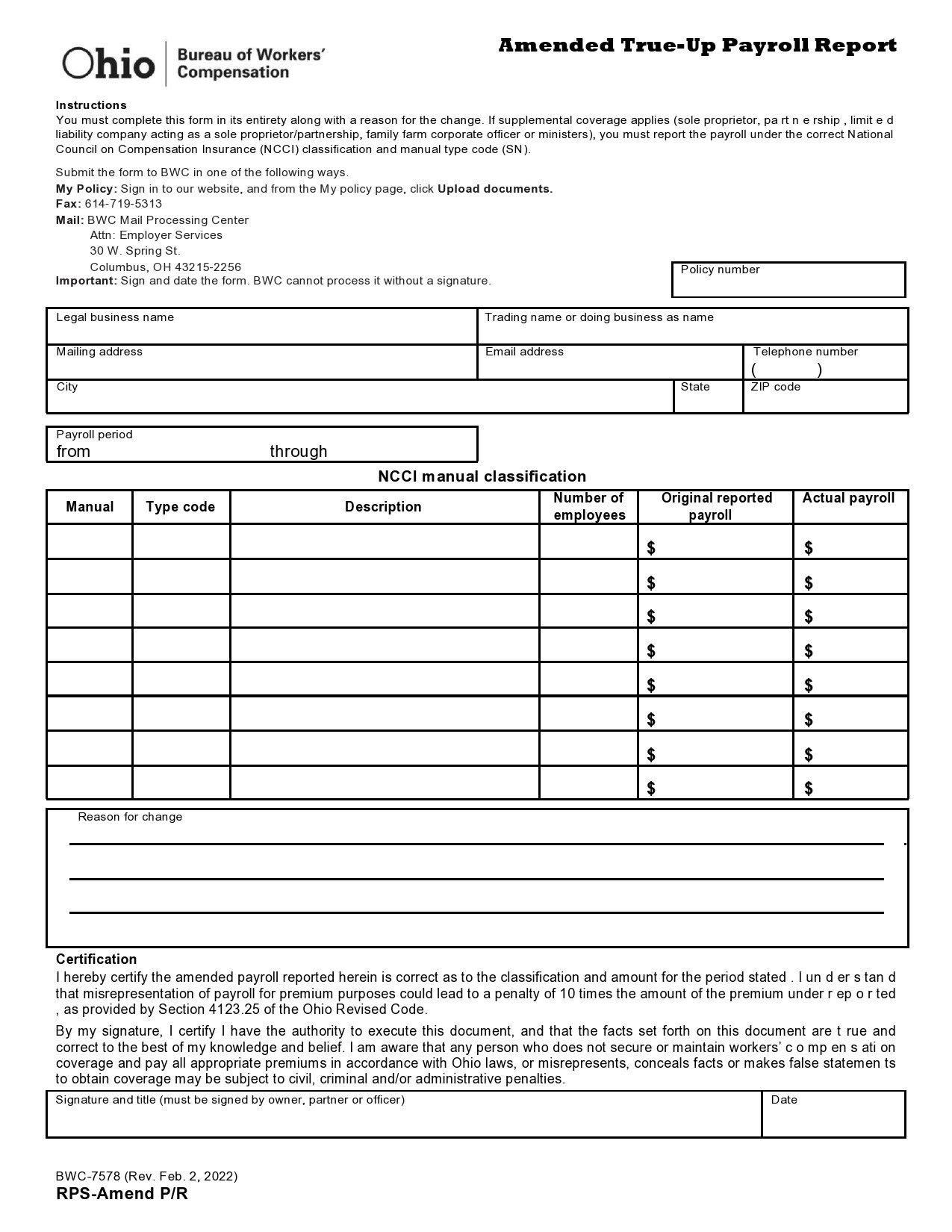

Merging the payroll with the accounting entries

Your final step will be to post all the payroll details into the company’s accounting system. Some states have a rule where businesses must make a report of the payroll on the pay stub. Find out if this is a requirement in your state and act accordingly.

If there are any changes in the payroll, be sure to capture them correctly. The changes could be due to wage increments, promotions, new hiring, workers who left, etc. As the payments or taxes change, the payroll summary report template must change too to reflect the current status.