A financial projections template is a tool that is an essential part of managing businesses as it serves as a guide for the various team to achieve the desired goals. The preparation of these projections seems like a difficult task, especially for small businesses. If you can come up with financial statements, then you can also make financial projections.

Table of Contents

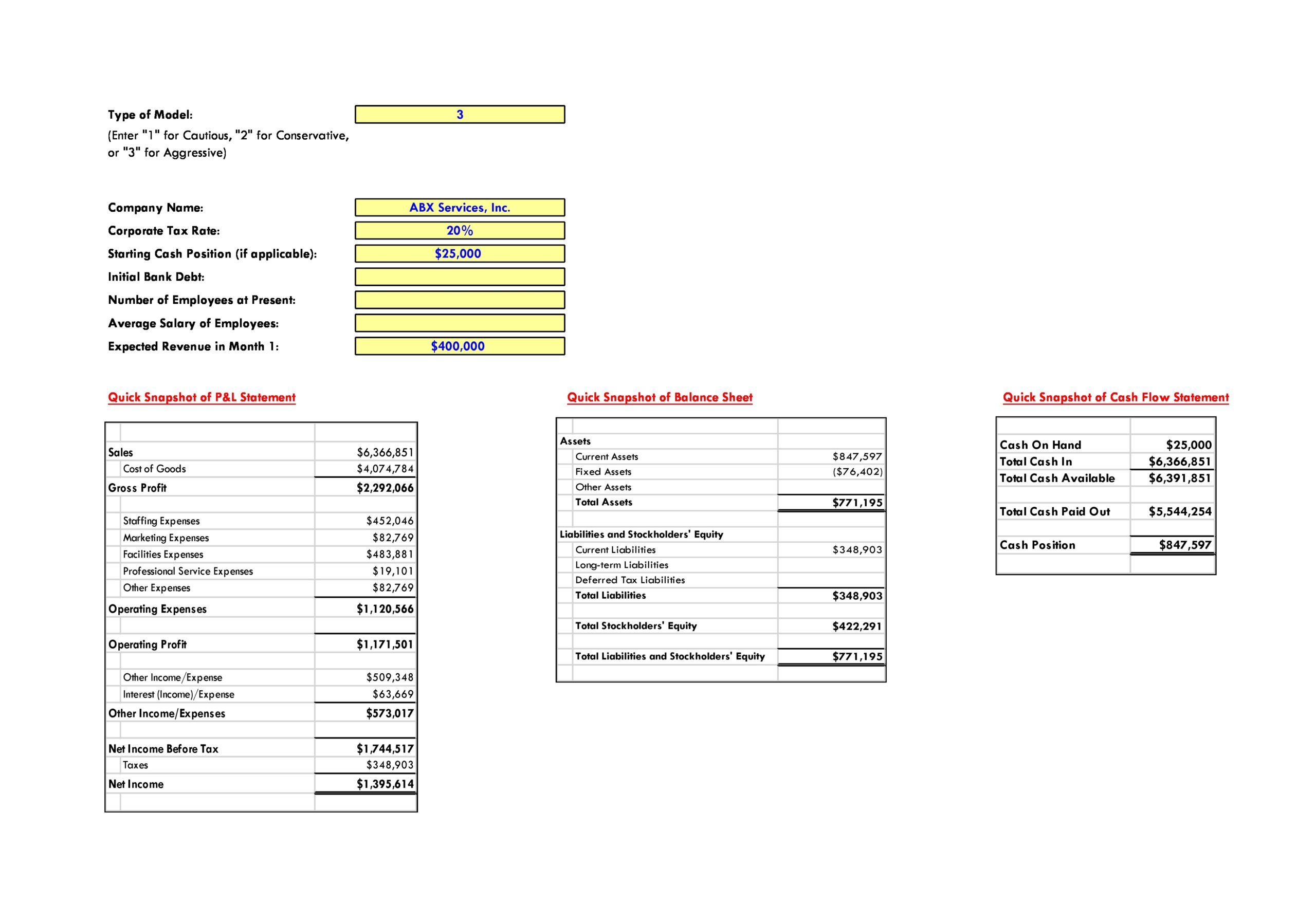

Financial Projections Templates

When do you need a financial projections template?

A financial projections template uses estimated or existing financial information to forecast the future expenses and income of your business. These projections don’t just consider a single scenario but different ones so you can determine how the changes in one part of your finances might affect the profitability of your company.

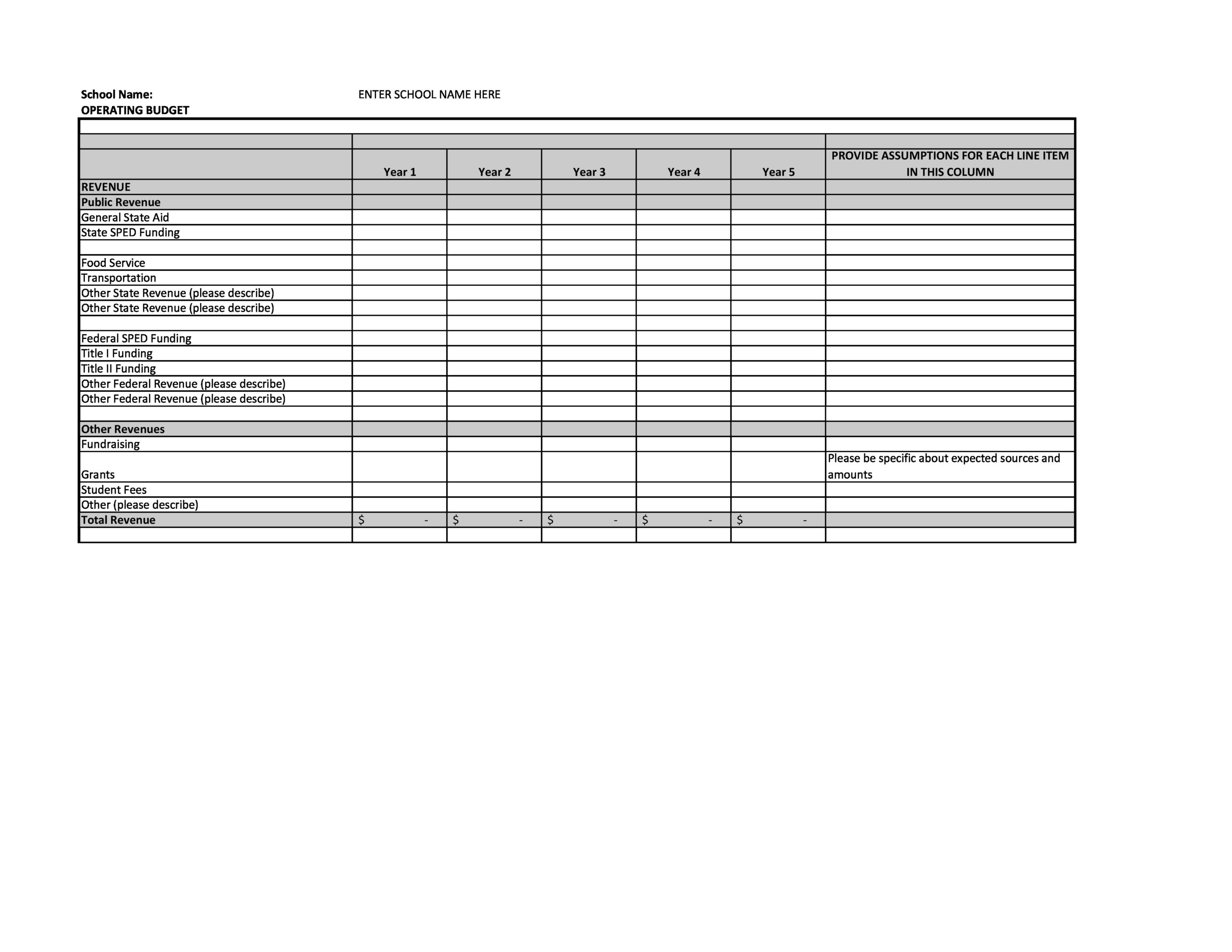

If you have to create a financial business projections template for your business, you can download a template to make the task easier. Financial projection has become an important tool in business planning for the following reasons:

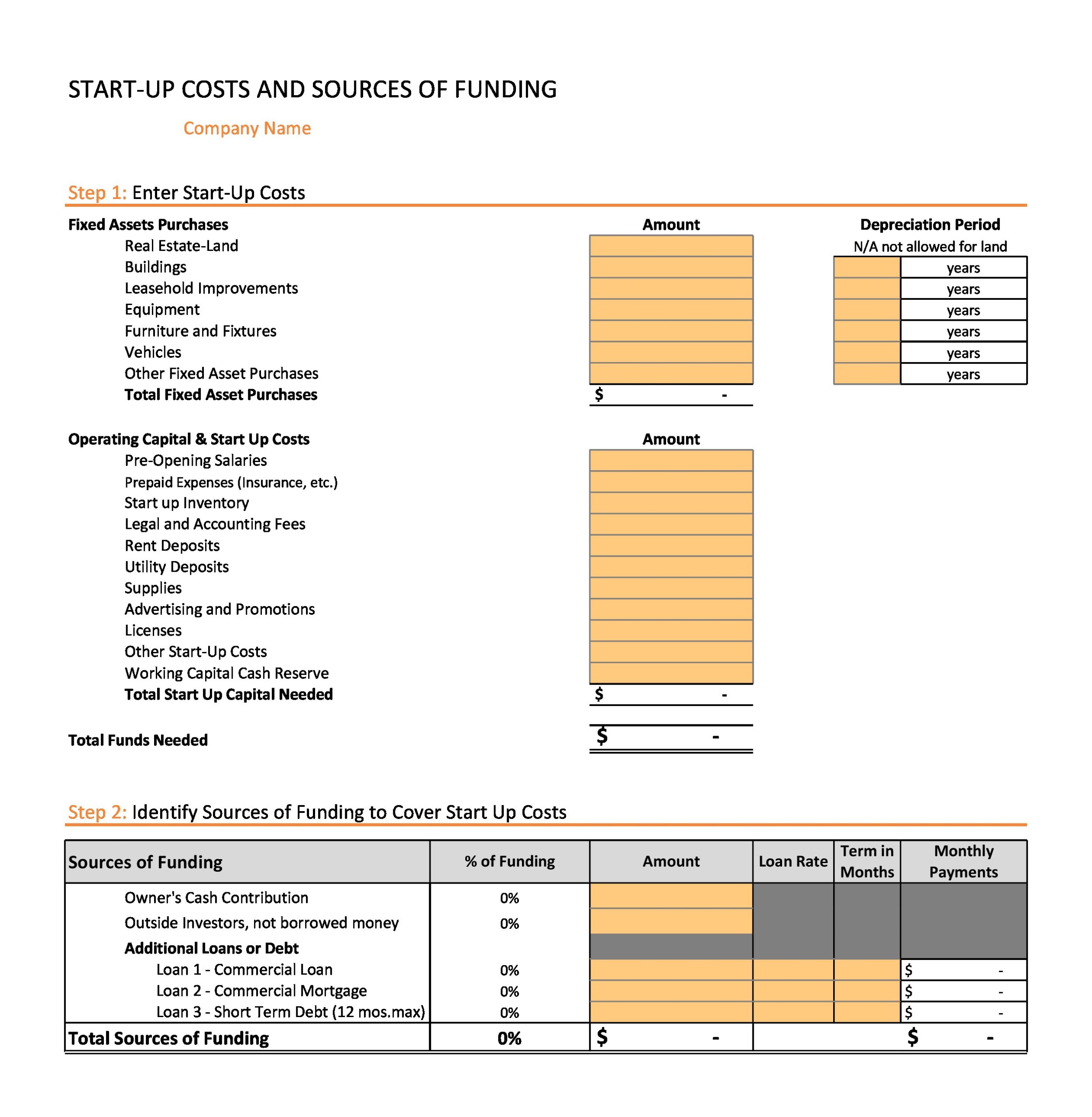

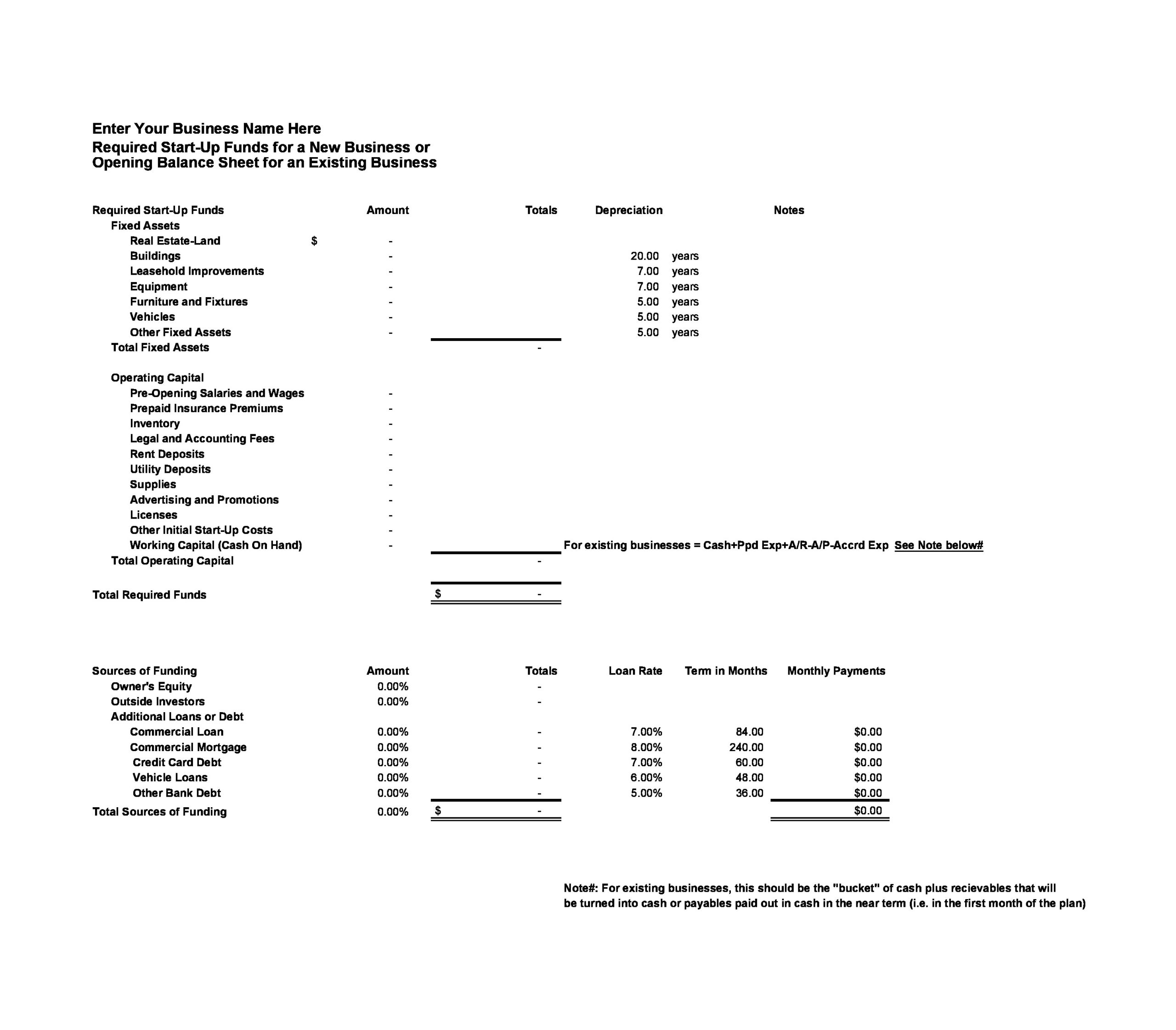

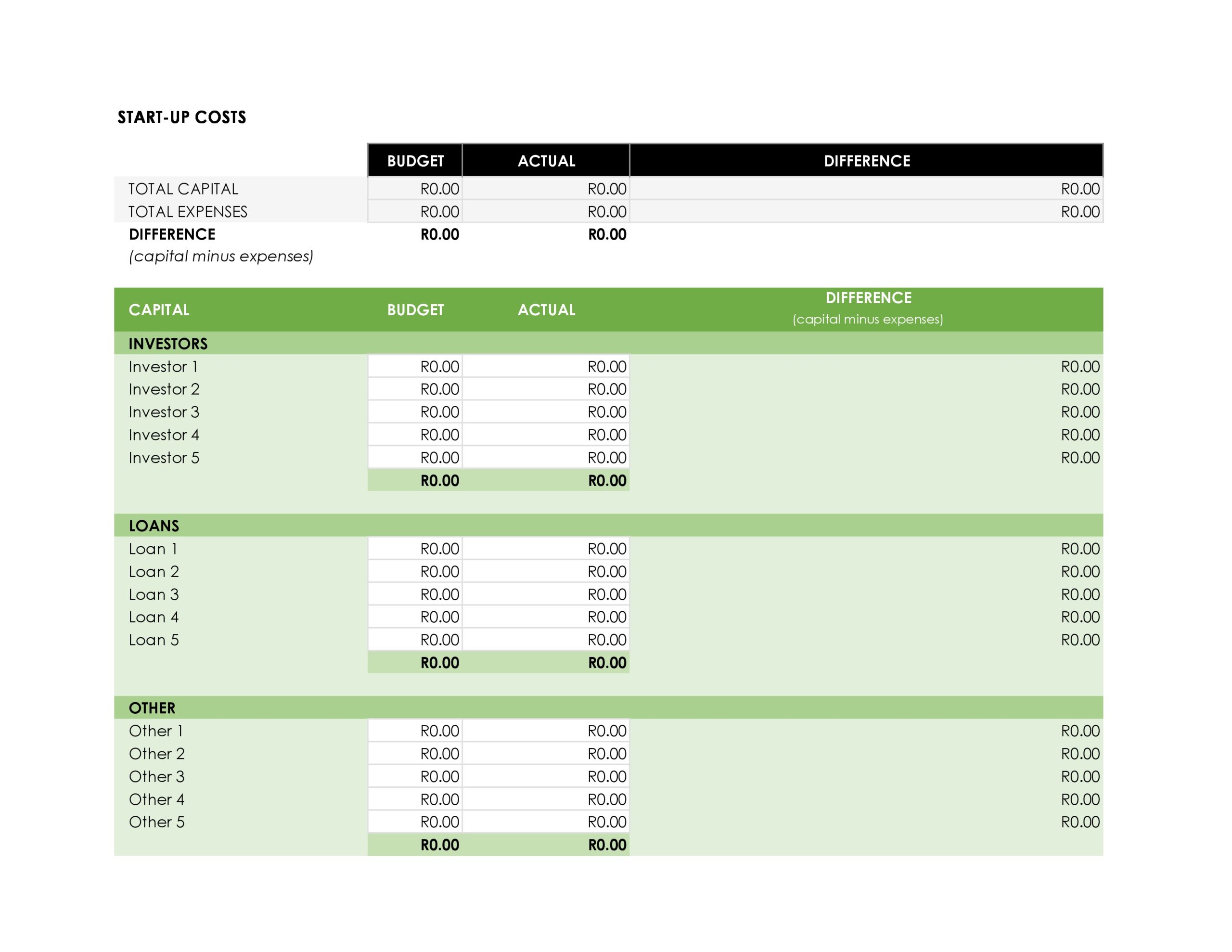

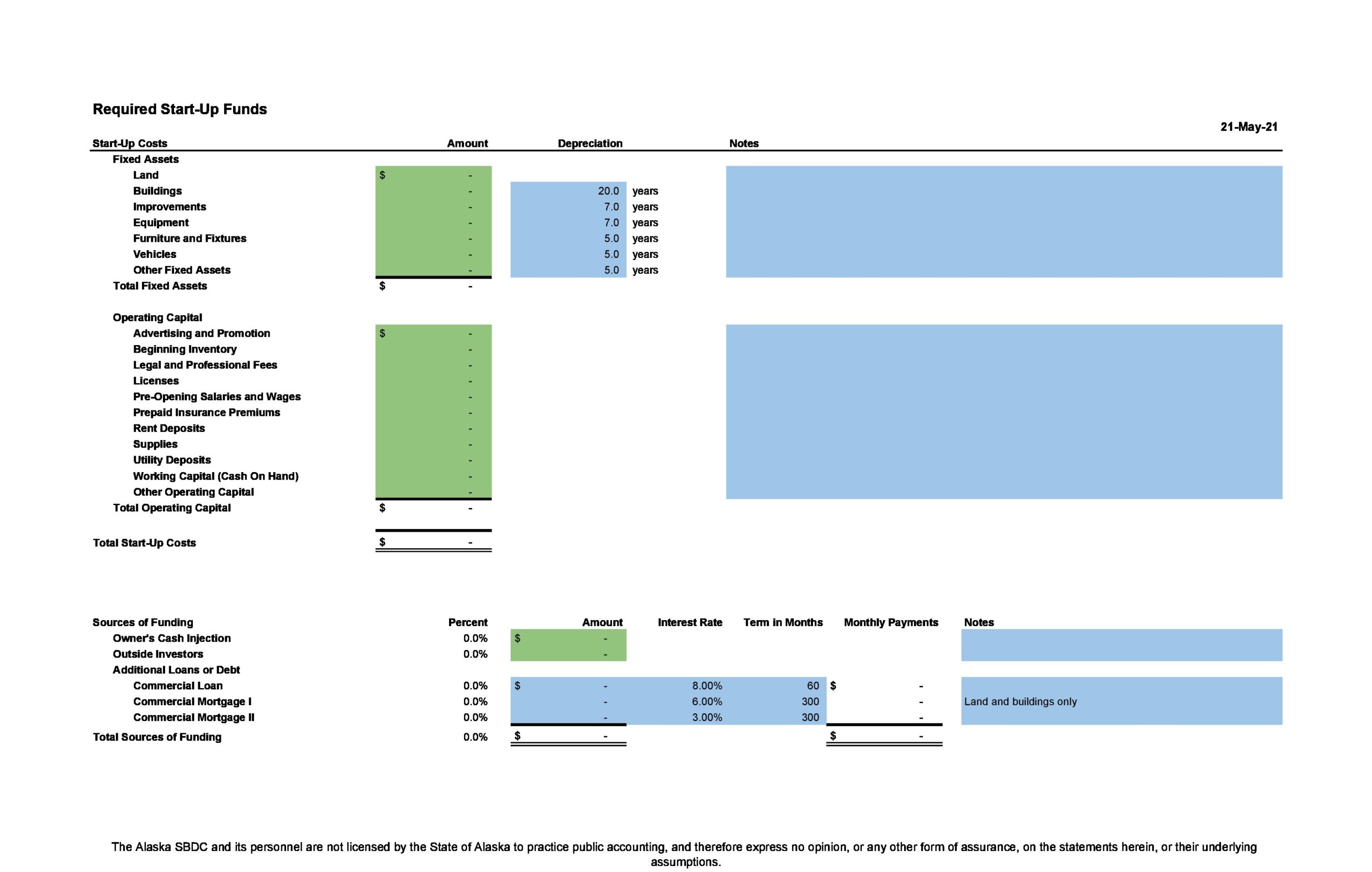

- If you’re starting a business venture, a financial projection helps you plan your start-up budget.

- If you already have a business, a financial projection helps you set your goals and stay on track.

- If you’re thinking about getting outside financing, you need a financial projection to convince investors or lenders of the potential of your business.

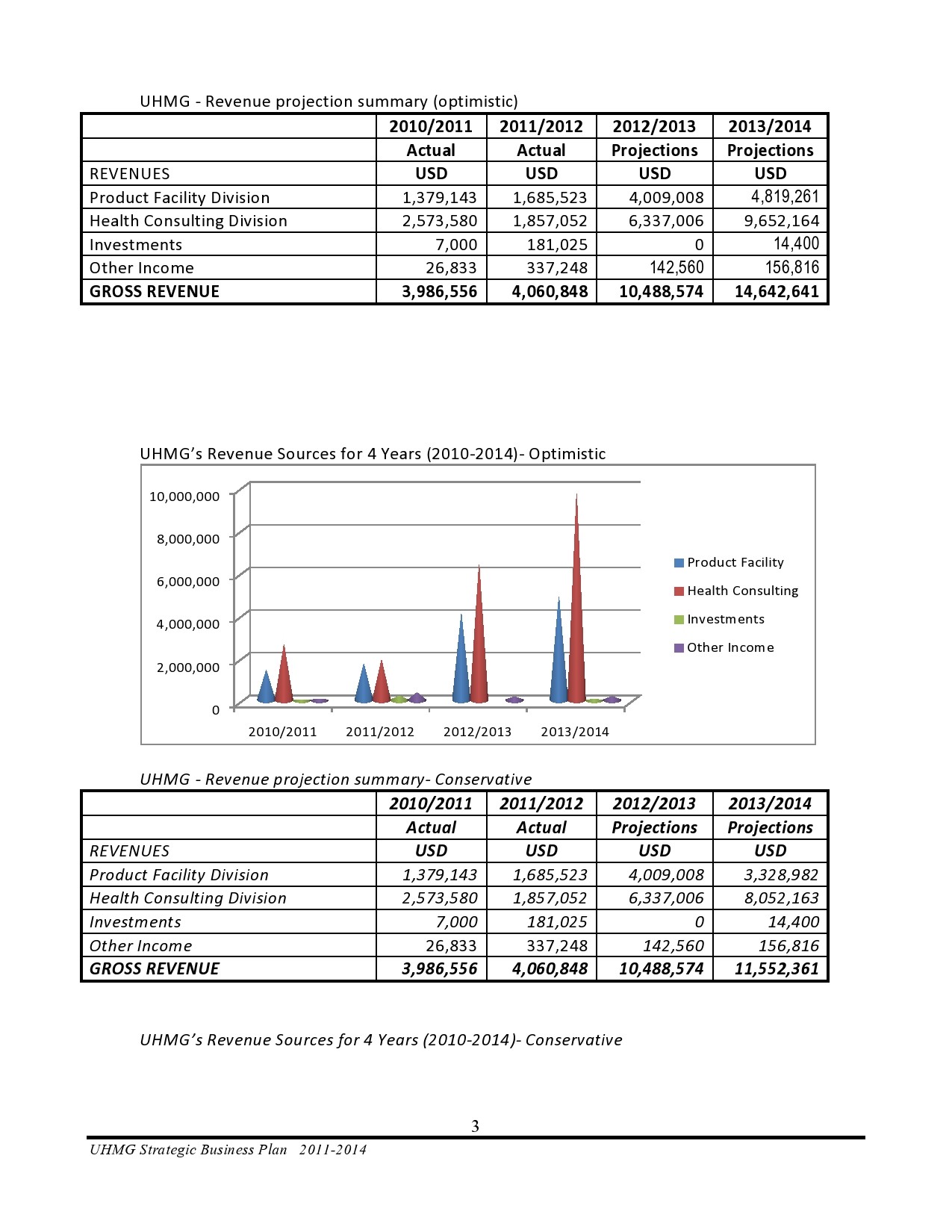

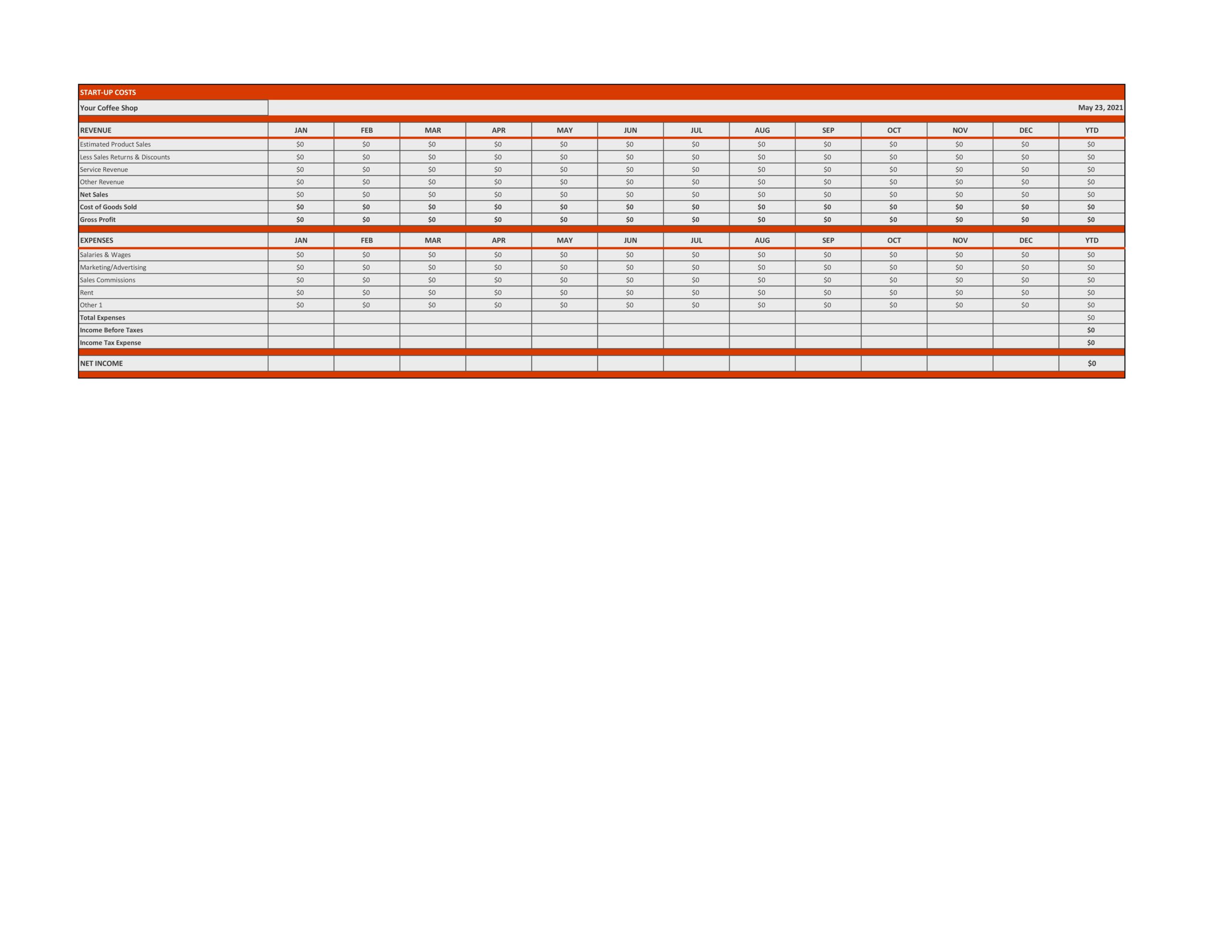

Business Projections Templates

What to include in financial projections?

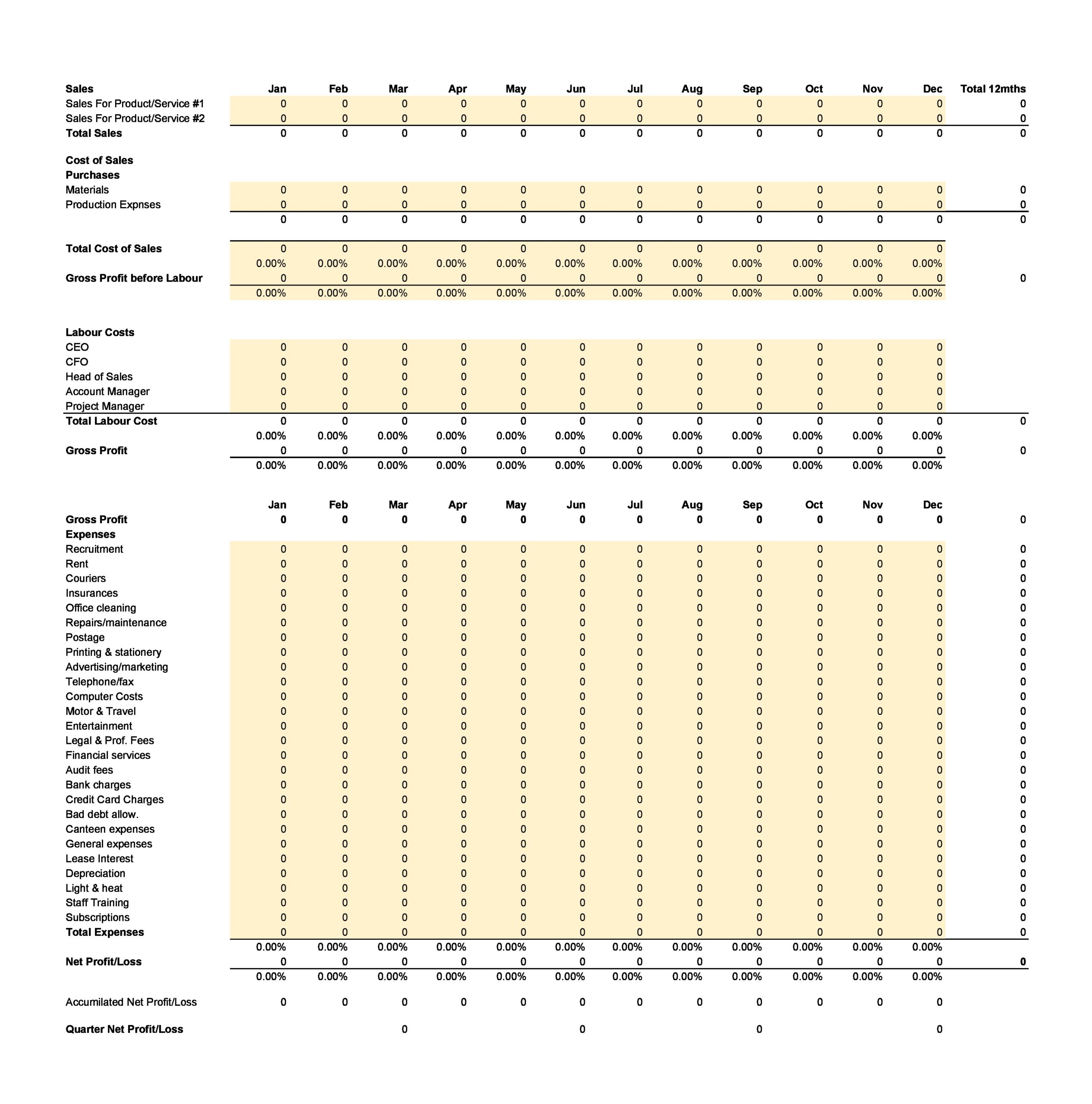

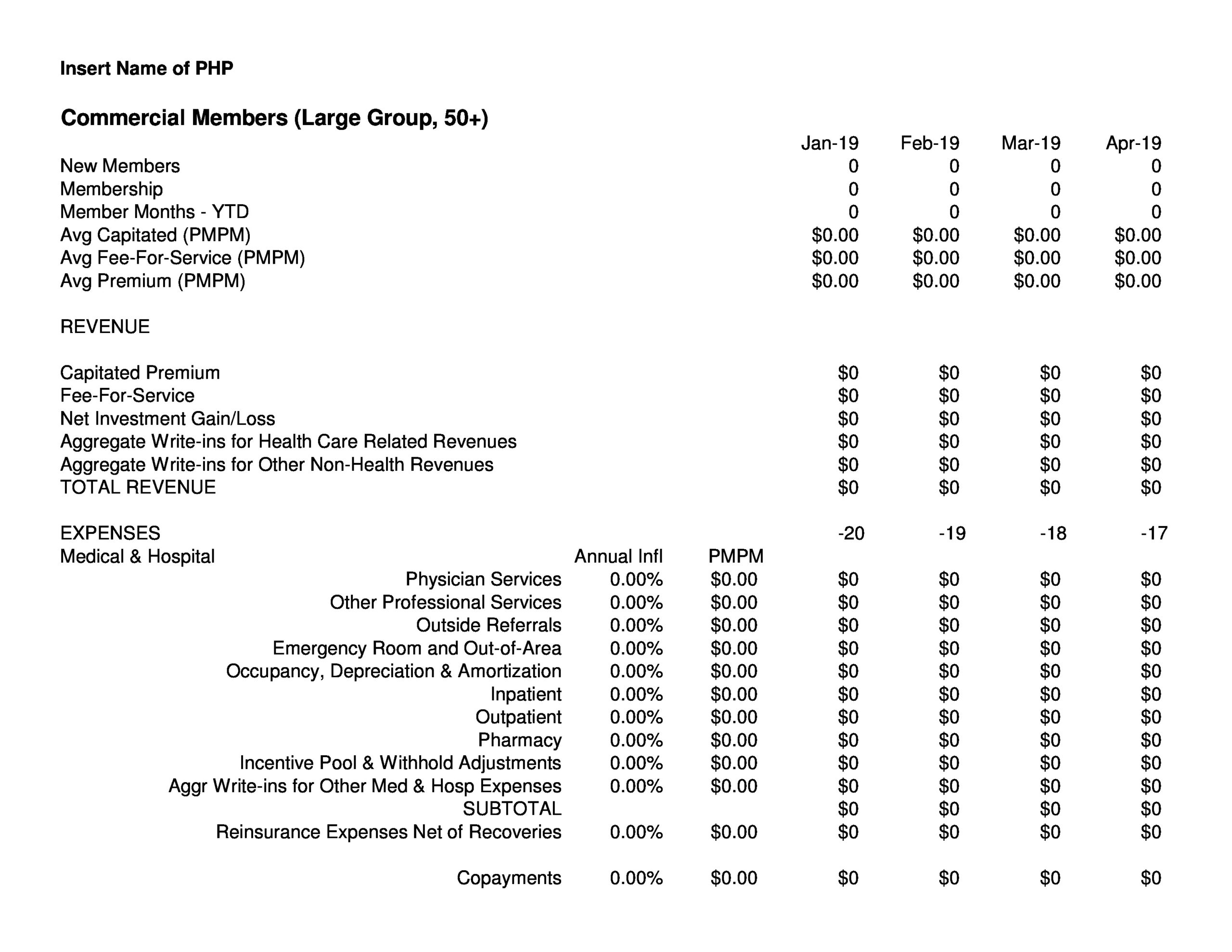

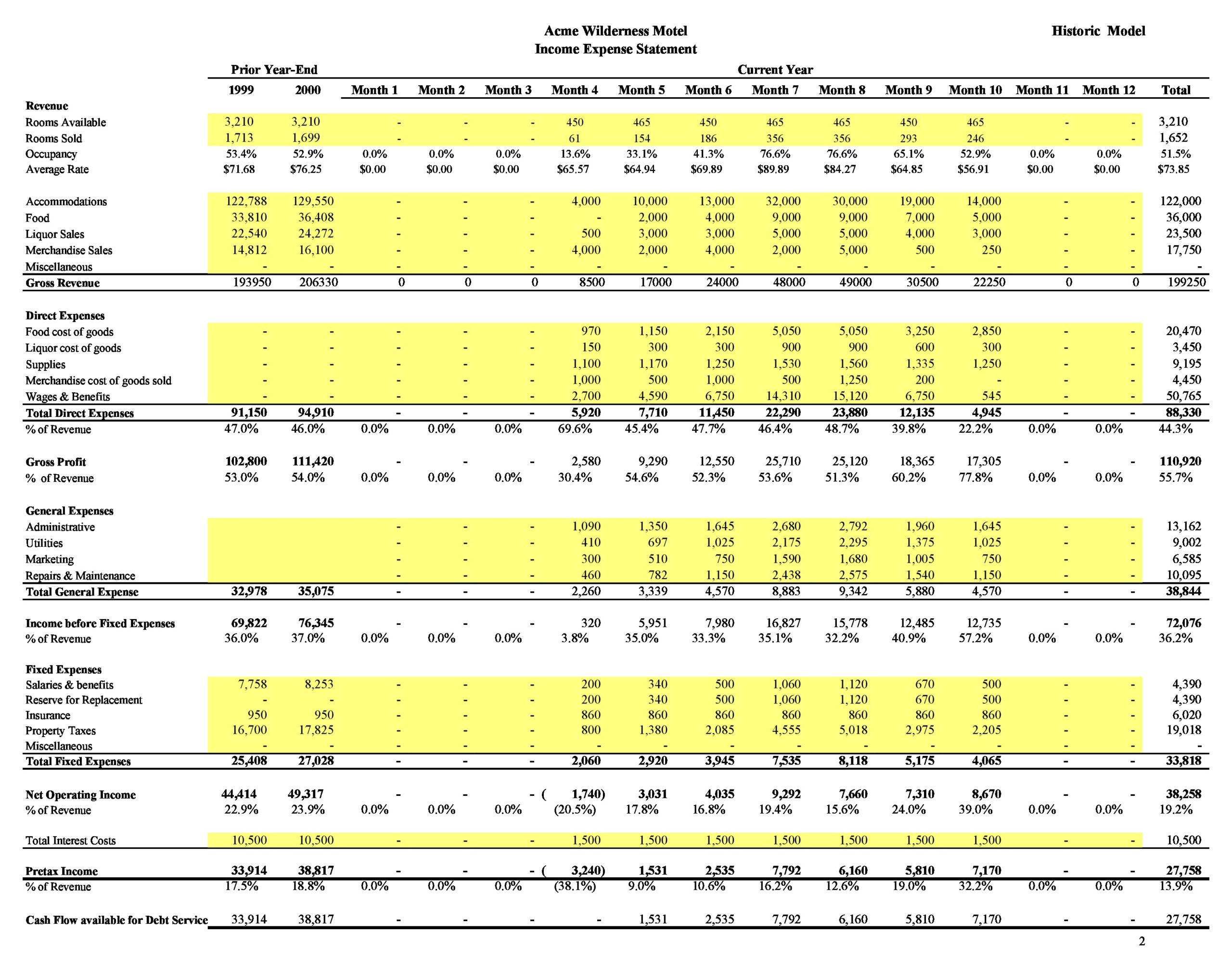

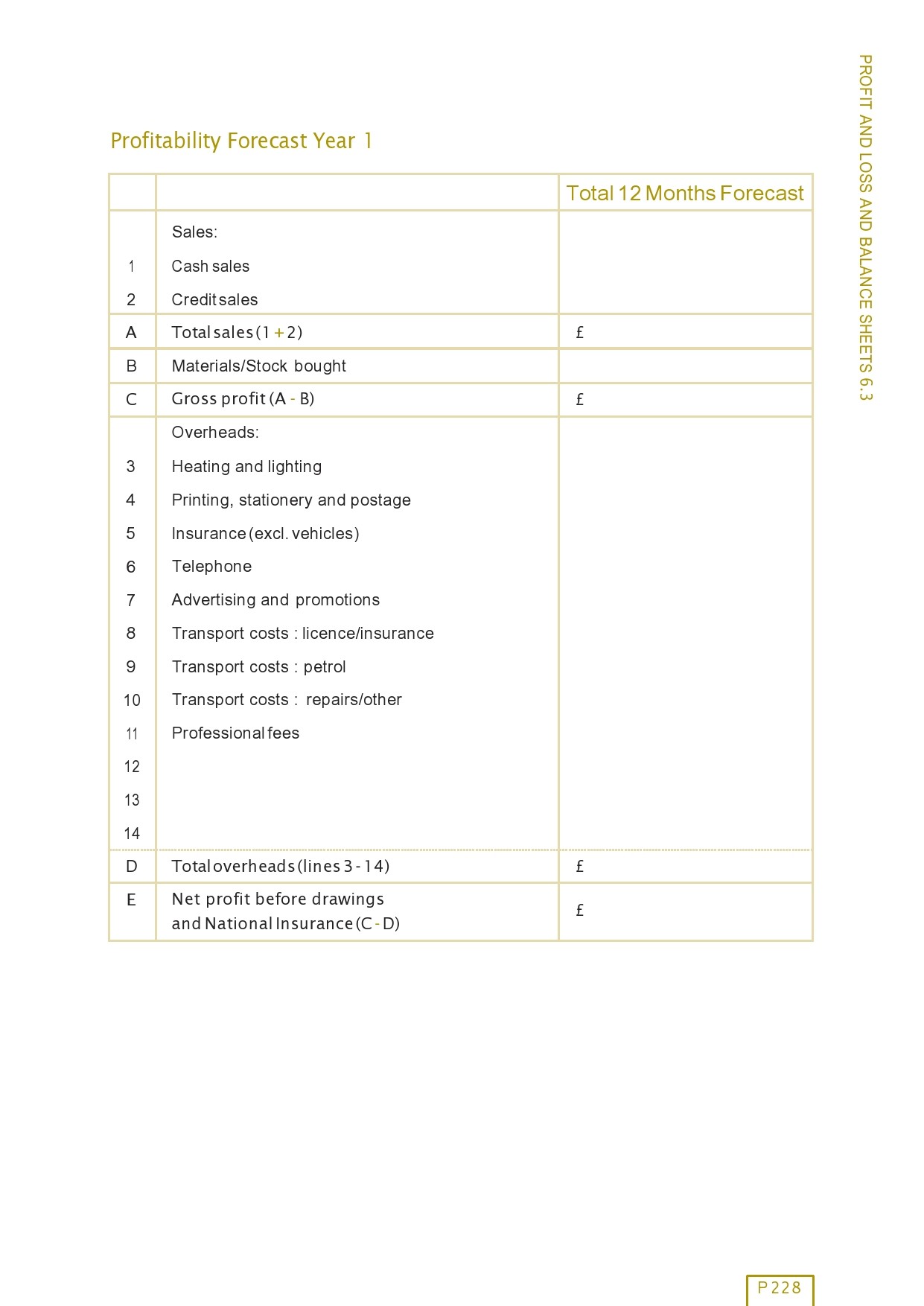

A financial projections template usually includes a few financial statements that will help you achieve better financial performance for your business:

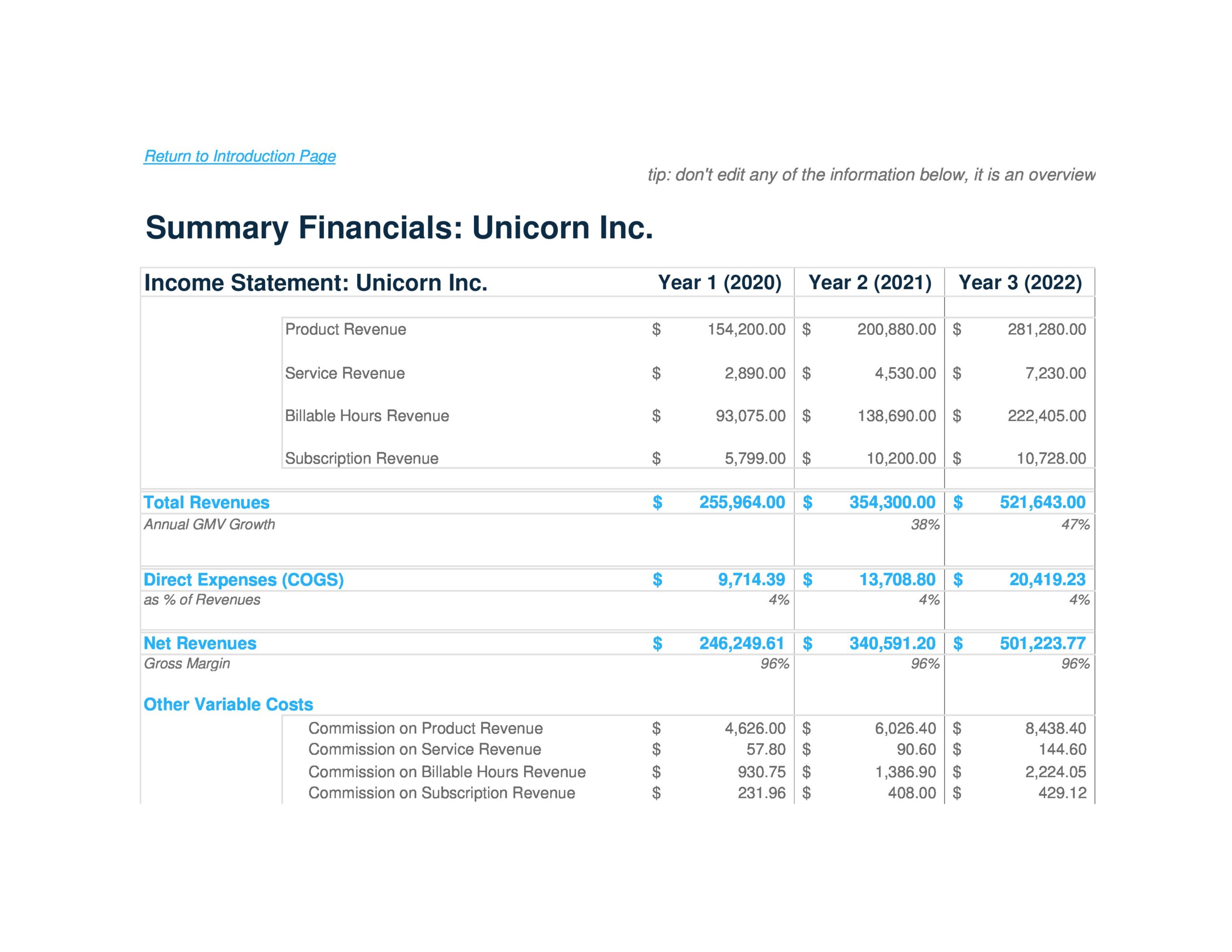

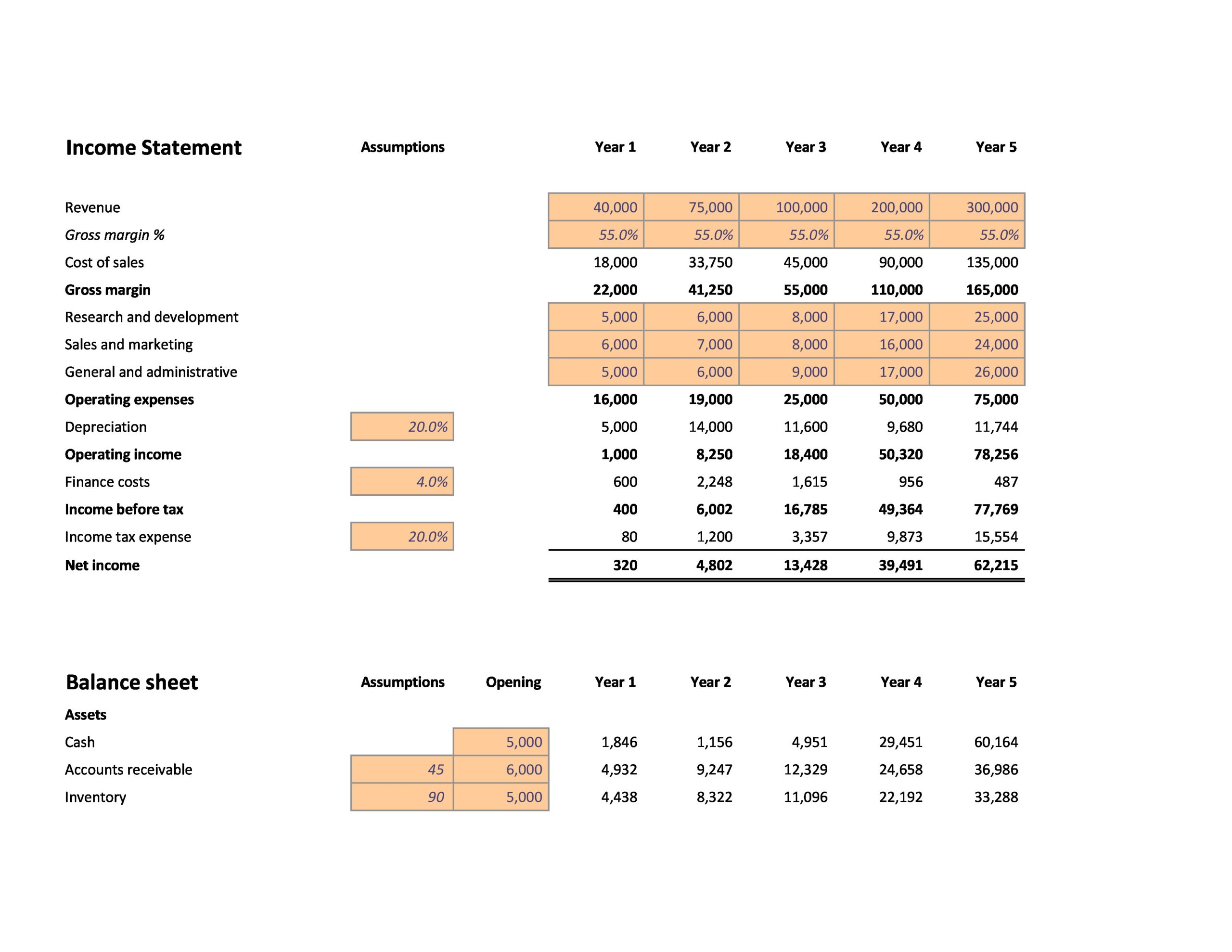

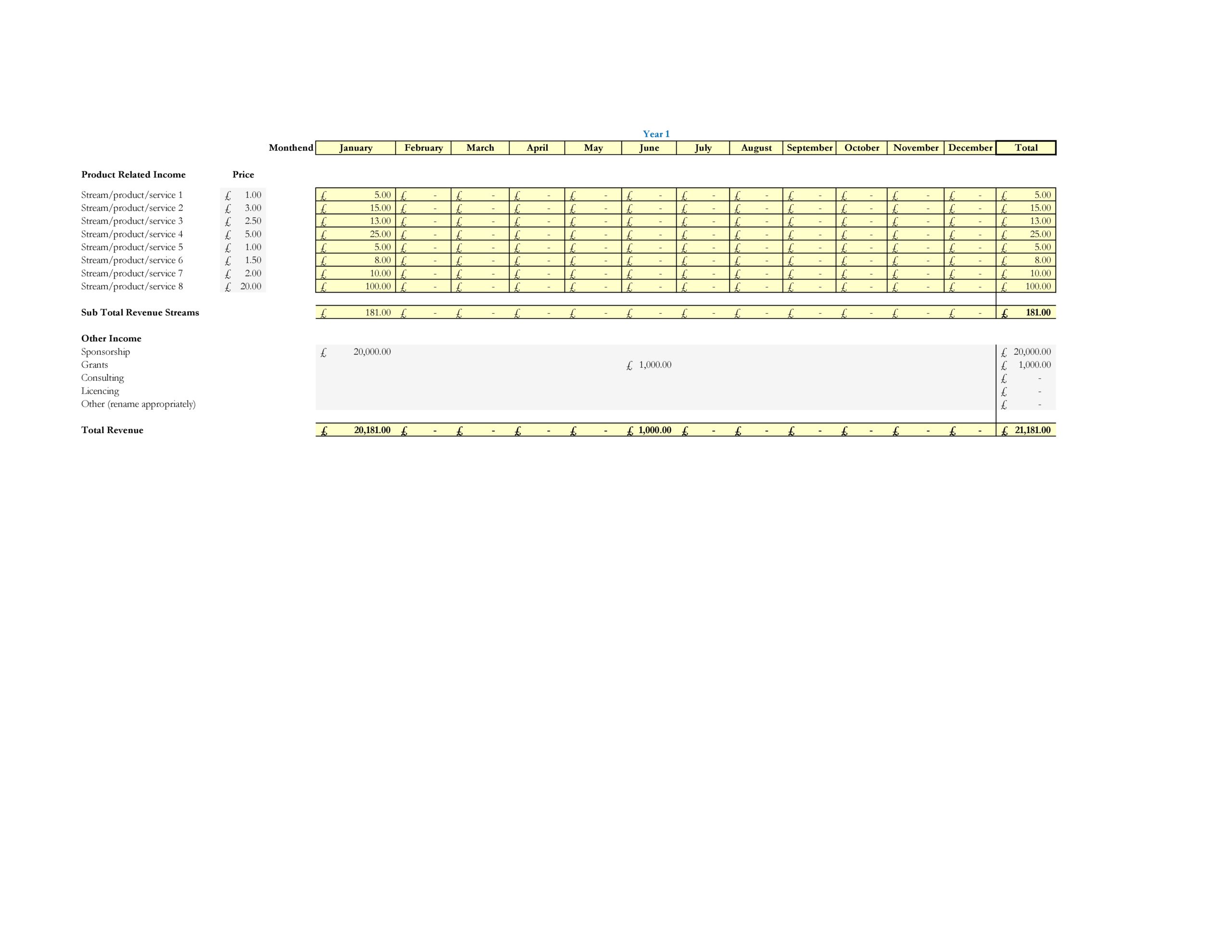

- Income Statement

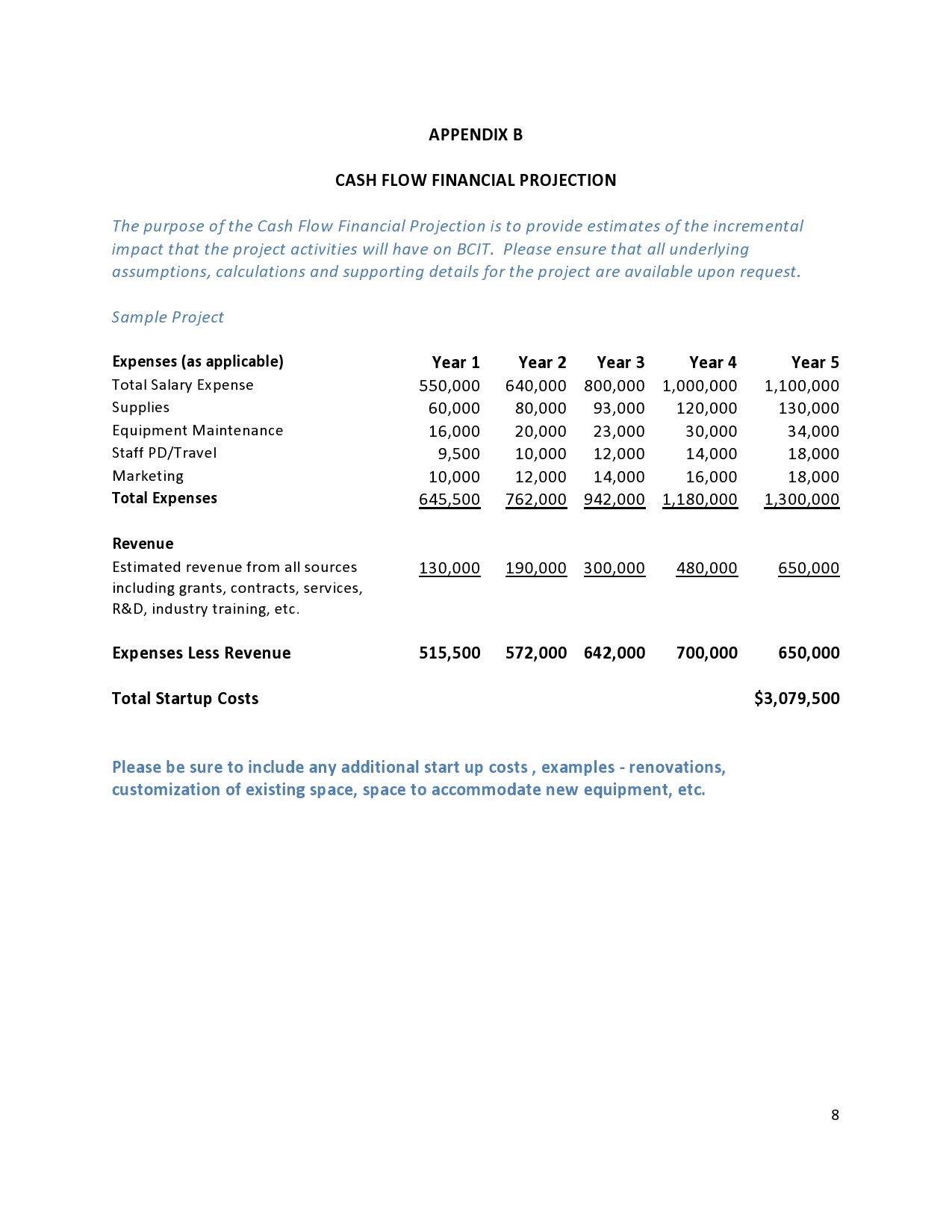

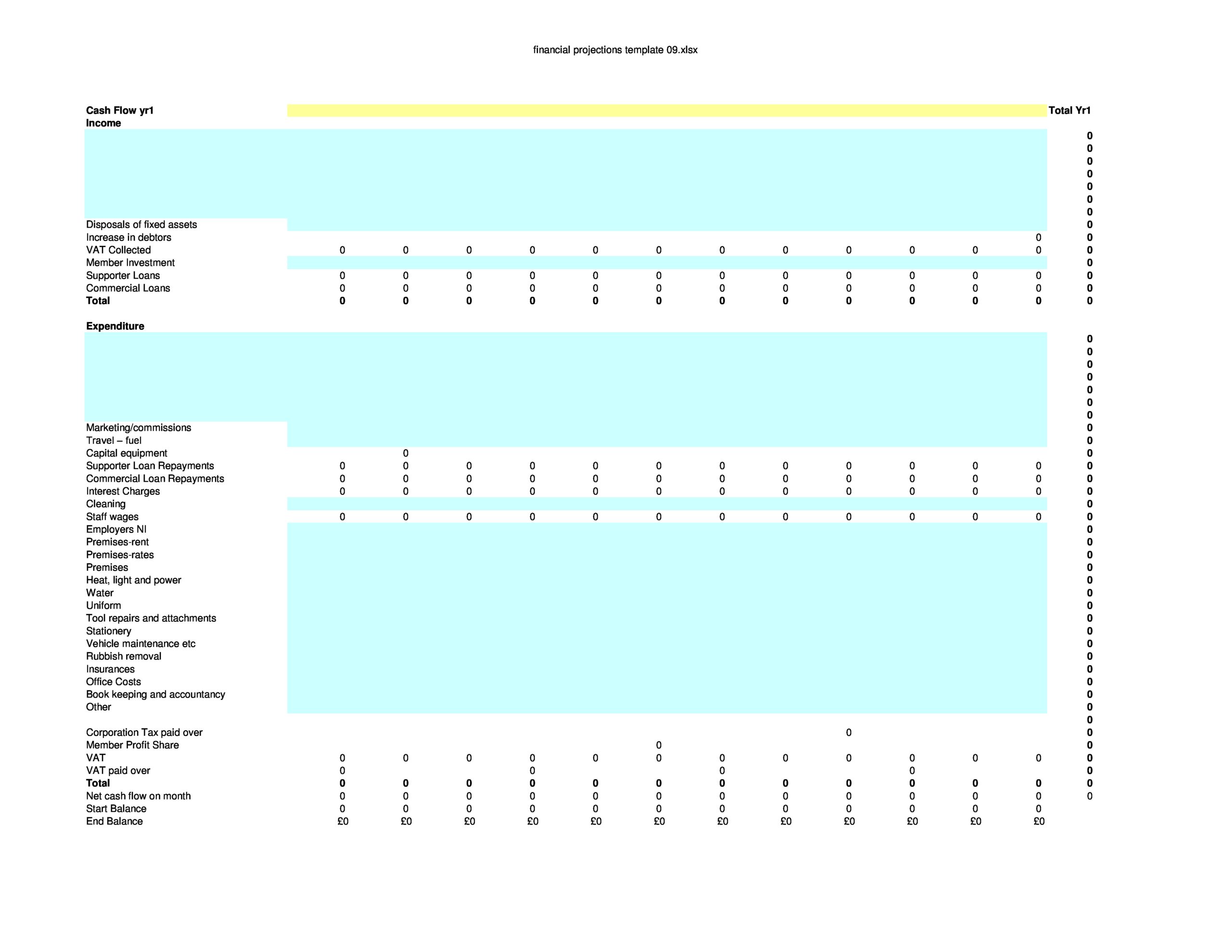

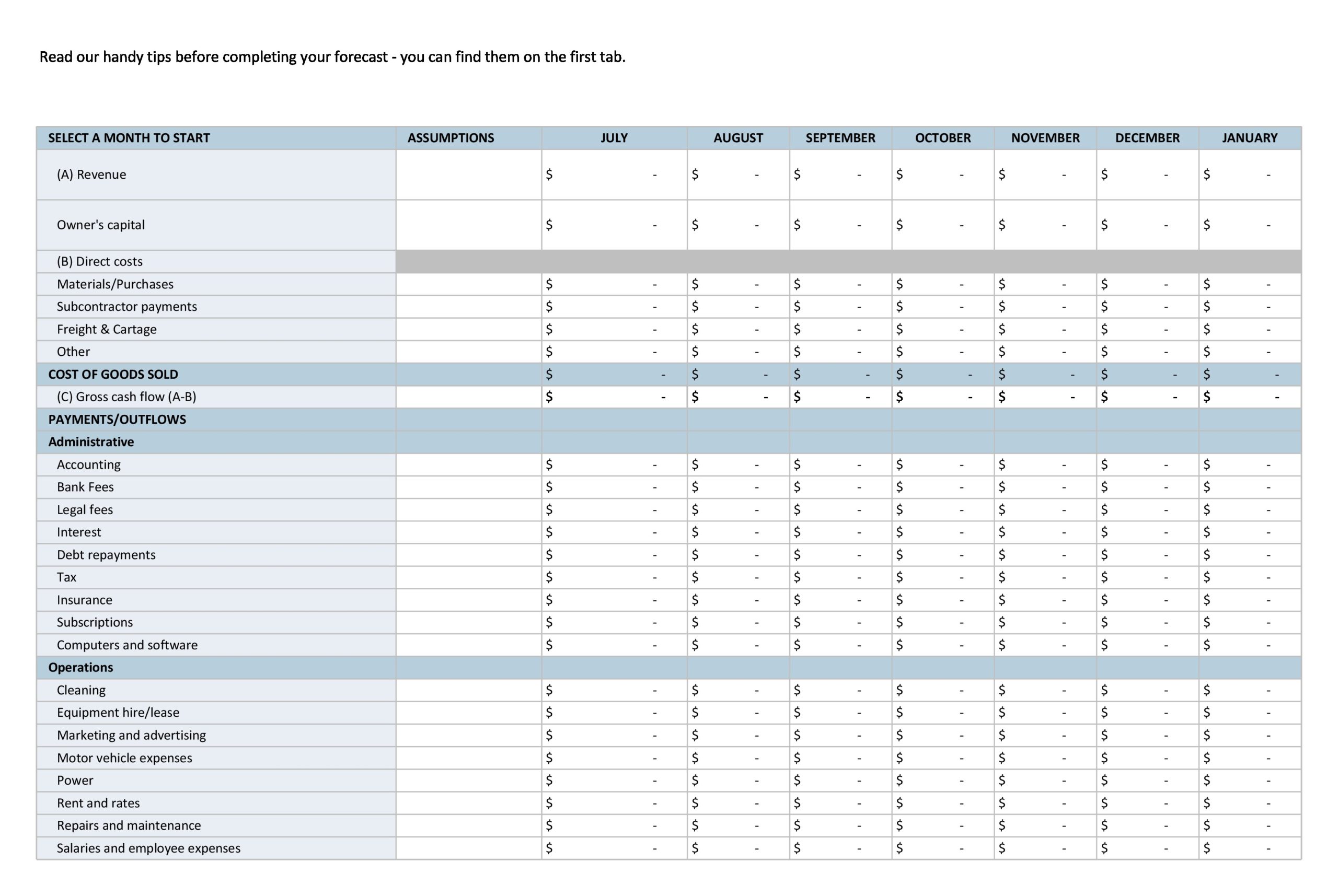

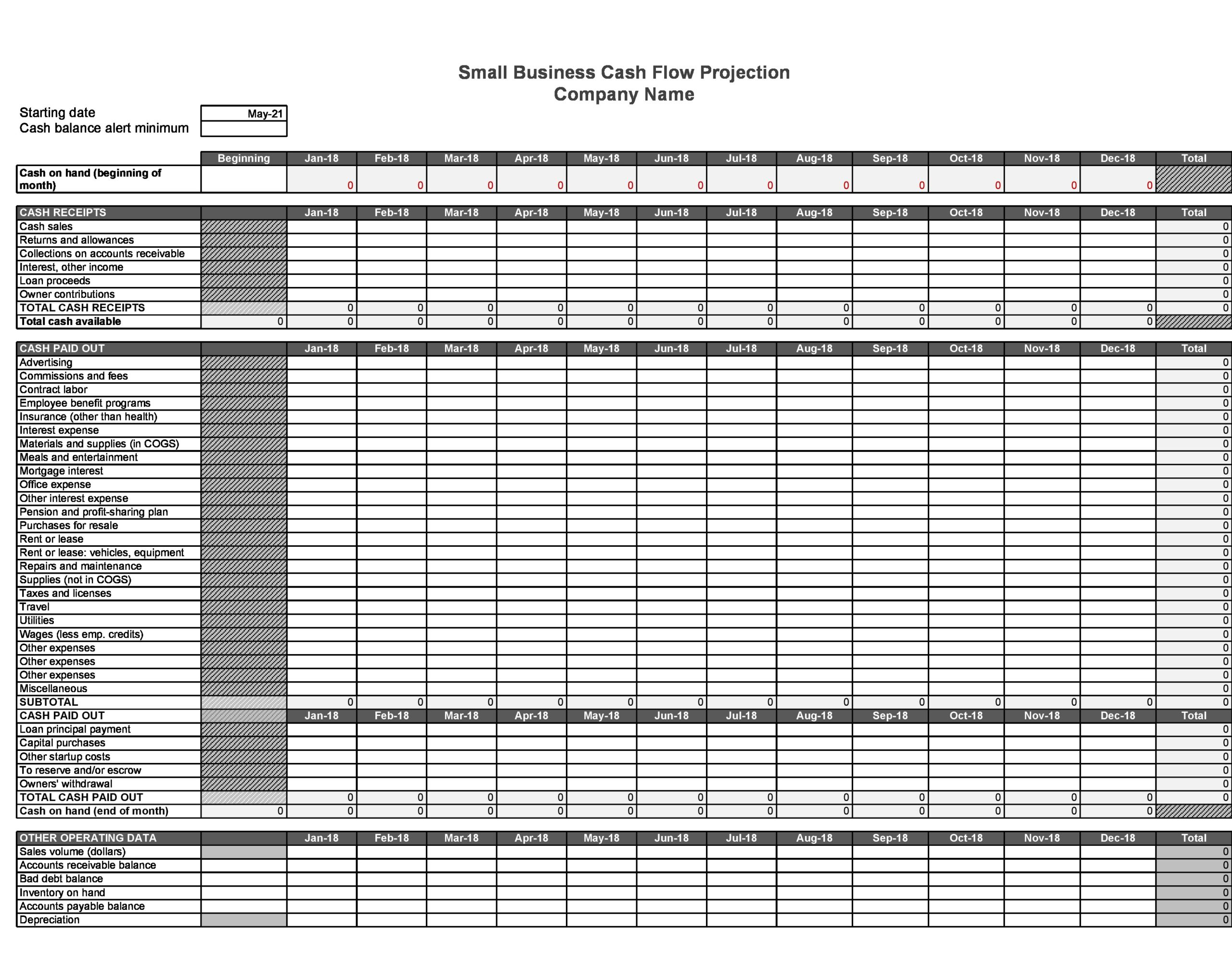

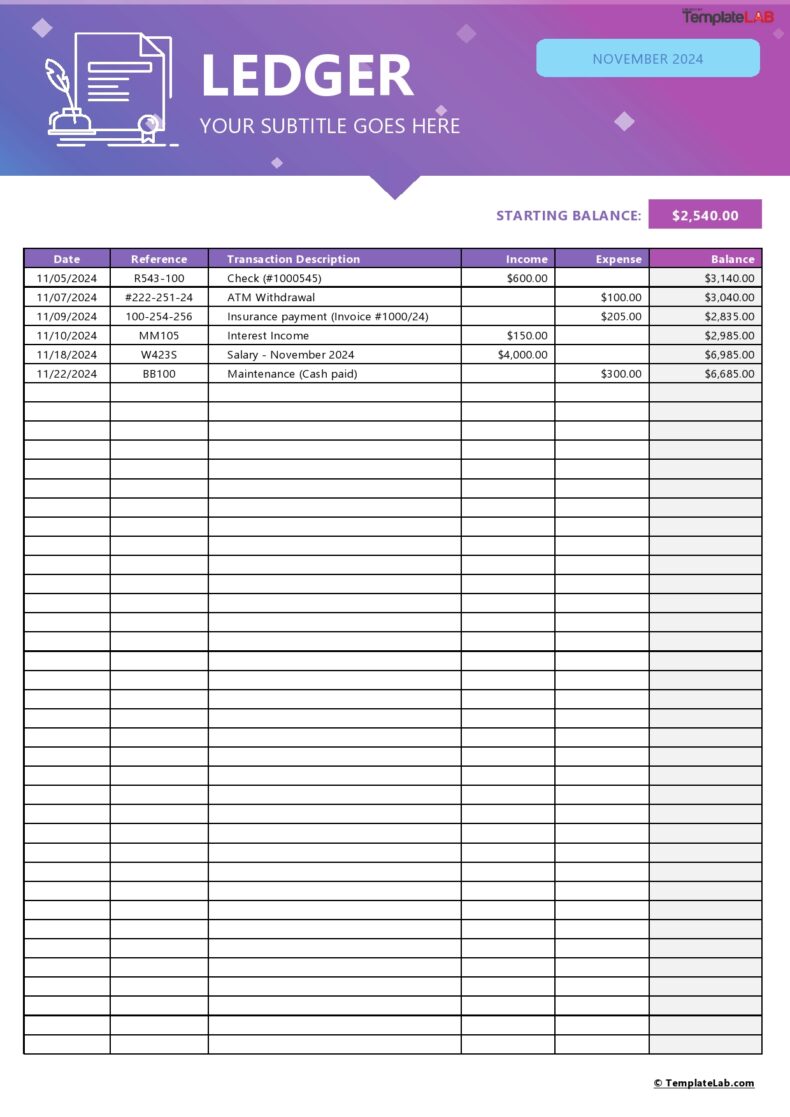

Also called the Profit and Loss Statement, this focuses on your company’s expenses and revenues generated for a specific period of time. A typical income statement includes expenses, revenue, losses, and gains. The sum of all these is the net income, a measure of your company’s profitability. - Cash Flow Statement

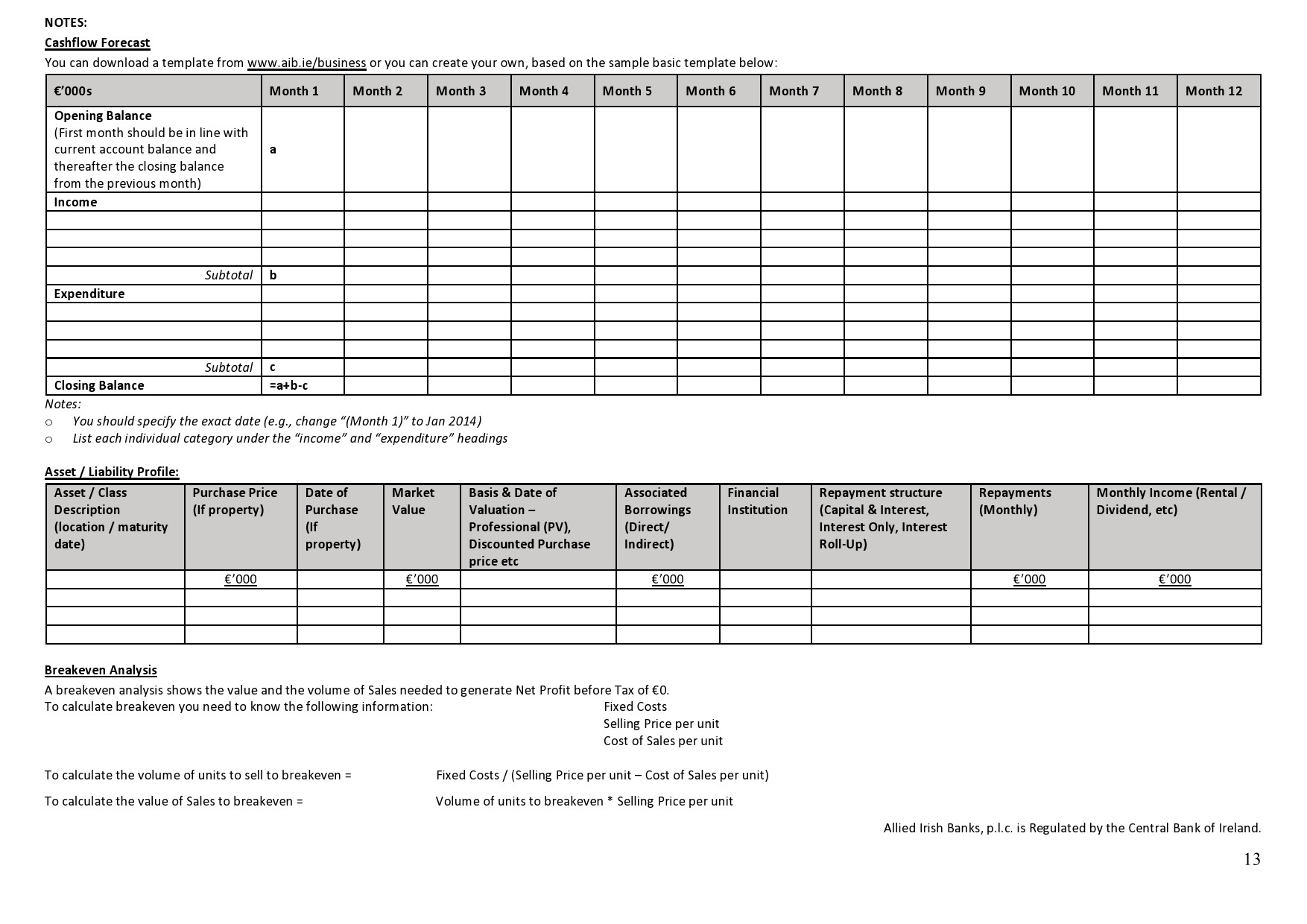

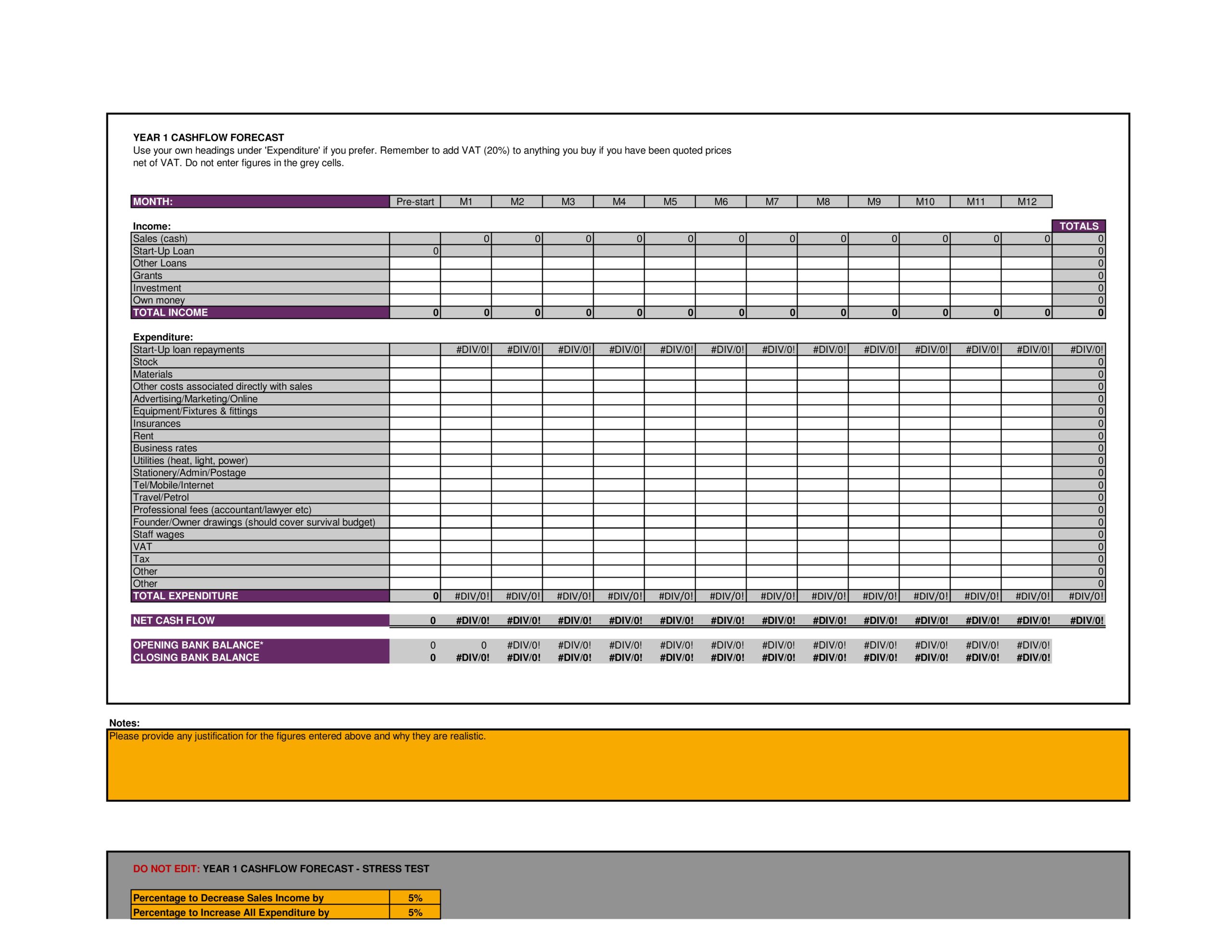

Taking a look at a cash flow statement makes you understand how your company’s operations work. The statement explains in detail how much money goes in and out of your business in the form of either expense or income. This document includes the following:

Operating Activities

The cash flow from operating activities reports cash outflows and inflows from your company’s daily operations. This includes changes in accounts receivable, cash, inventory, accounts payable, and depreciation.

Investing Activities

You use the cash flows from investing activities for your company’s investments into the long-term future. This includes cash outflows for purchases of fixed assets like equipment and property and cash inflows for sales of assets.

Financing Activities

The financial activities in a cash flow statement show your business’ sources of cash from either banks or investors along with expenditures of cash you have paid to your shareholders. Total these at the end of each period to determine either a loss or a profit.

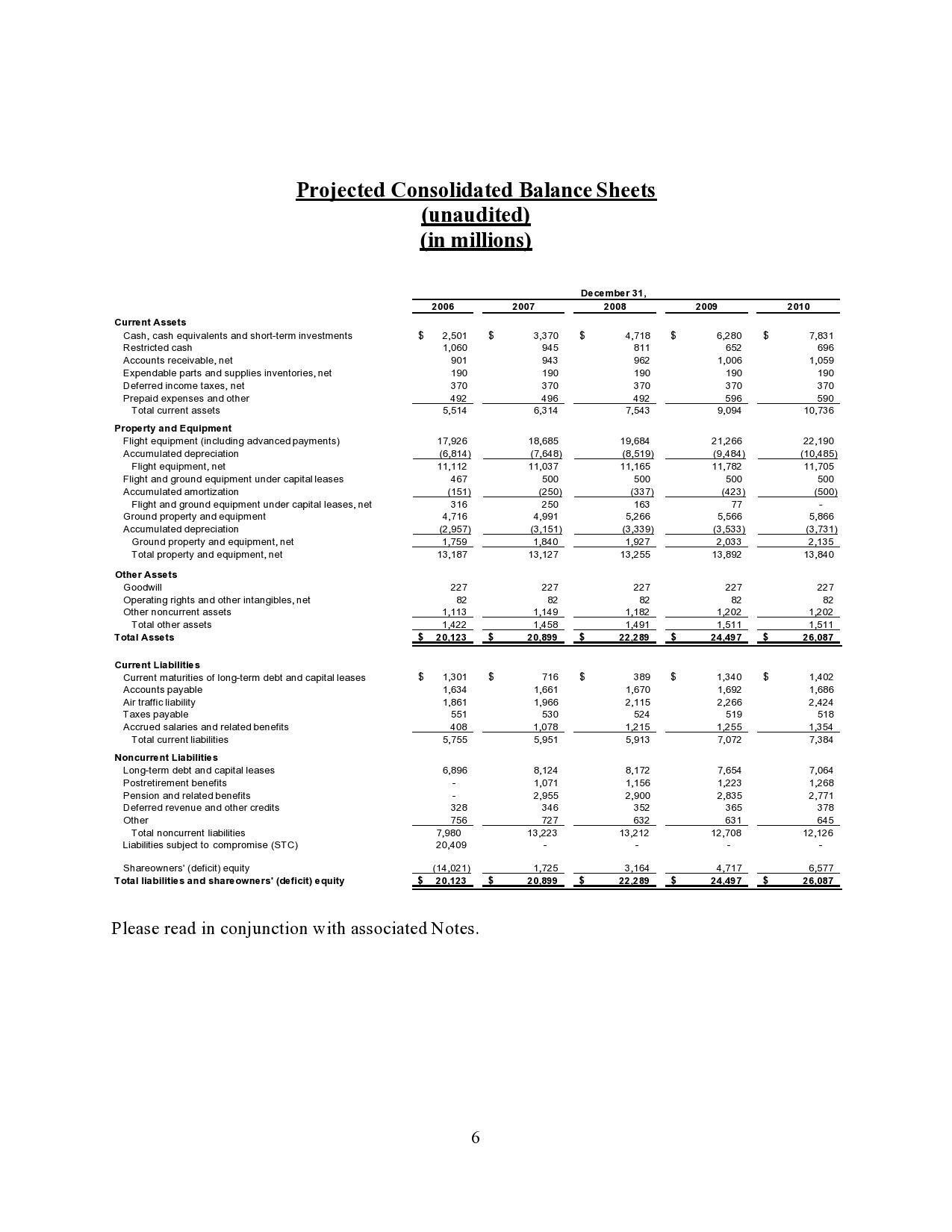

The cash flow statement gets connected to the income statement through net income. To make this document, it requires the reconciliation of the two documents. You can calculate net profitability or income in the income statement which you then use to start the cash flow from the operations category in your cash flow statement. - Balance Sheet

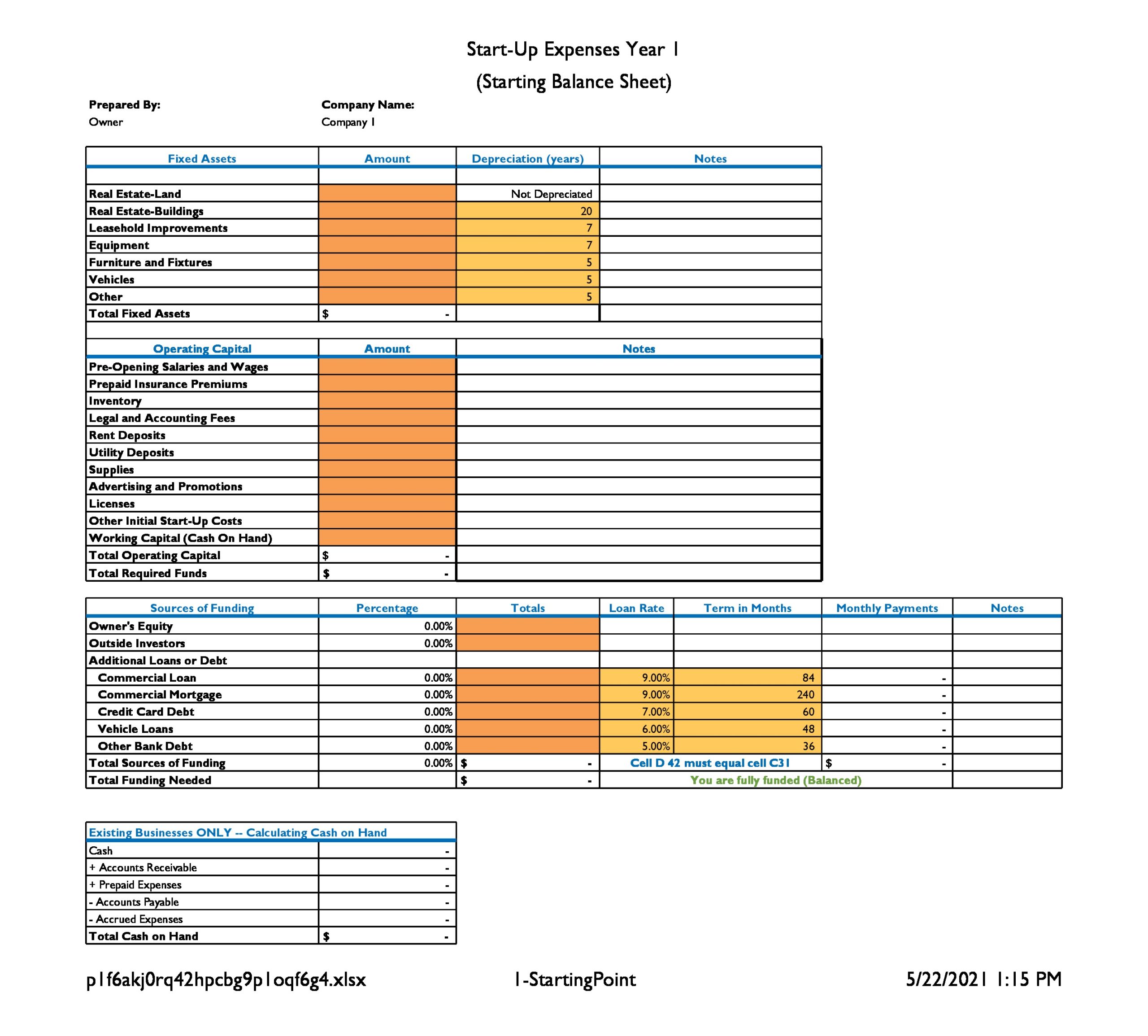

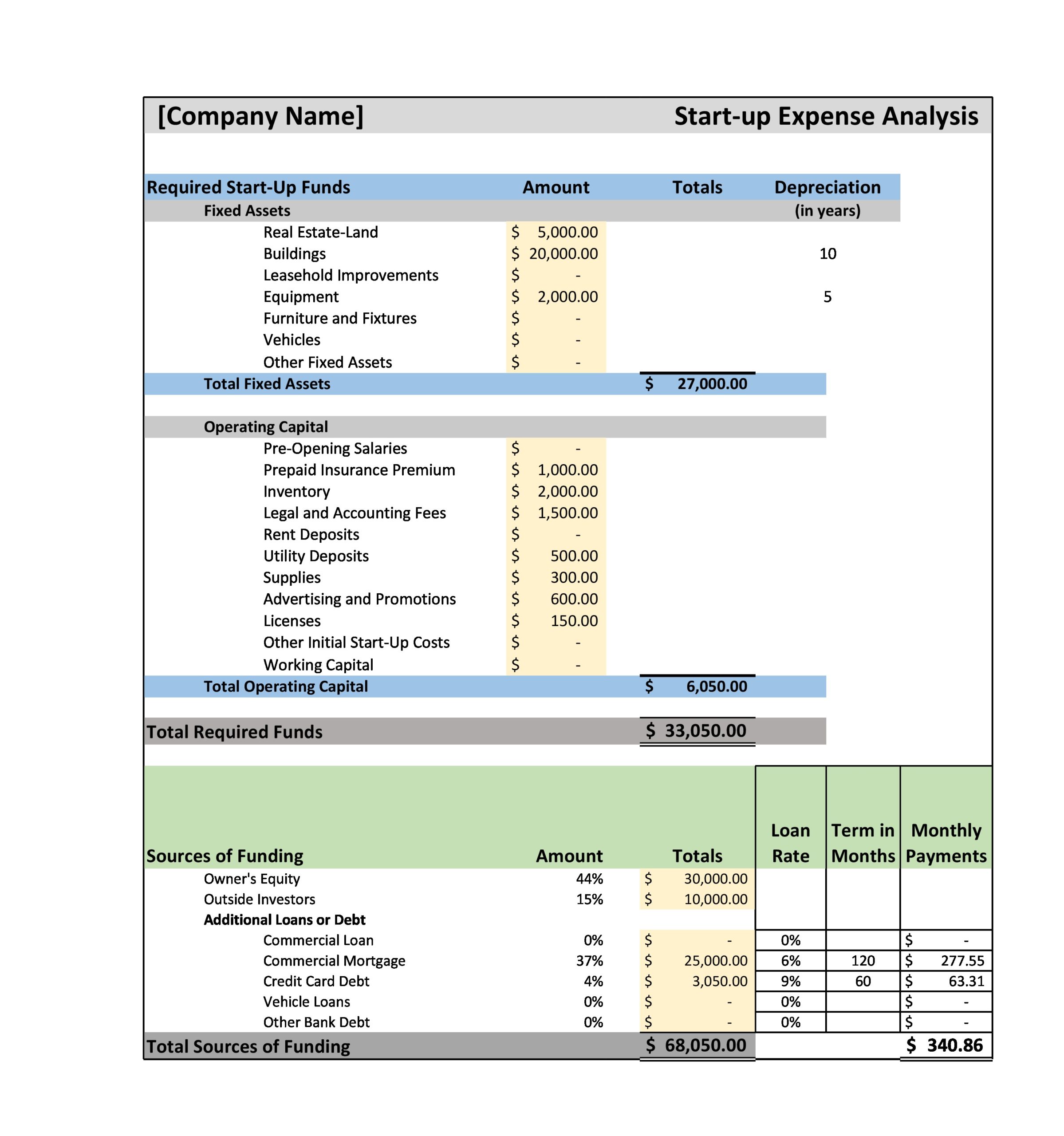

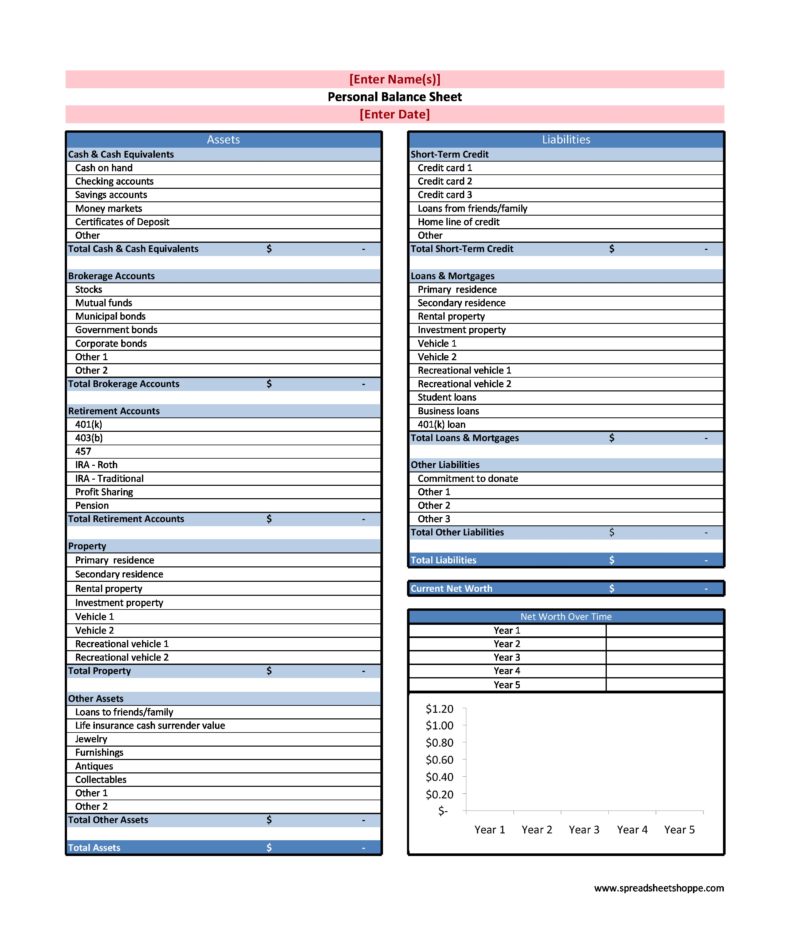

This is a statement of your business’ liabilities, assets, and capital at a specific point in time. It details the balance of expenditure and income over the preceding period. This document provides you with a general overview of your business’ financial health. Here is an overview of these components:

Assets

These are your business’ resources with economic value that your business owns and which you believe will provide some benefit in the future. Examples of such future benefits include reducing expenses, enhancing sales, or generating cash flow. Assets typically include inventory, property, and cash.

Liabilities

In general, these refer to the obligations of your business to other entities. In more common terms, these are the debts that your business incurs in your daily operations. It typically includes loans and accounts payable. You can classify liabilities either as short-term or long-term.

Owner’s Equity

This is the amount you have left after you have paid off your liabilities. It is usually classified as retained earnings – the sum of your net income earned minus all the dividends you have paid since the start of your business.

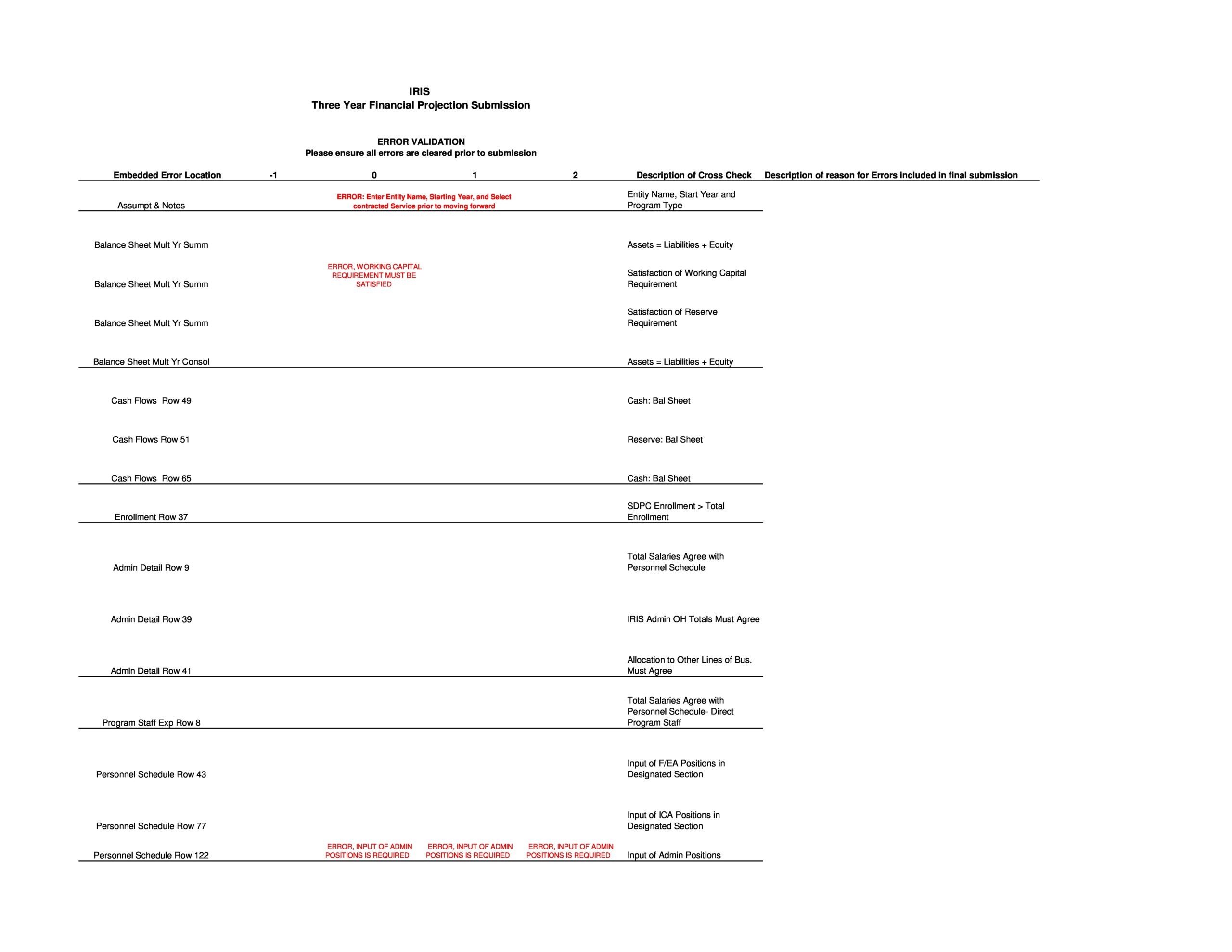

Together with your break-even analysis and financial statements, you can include any other document that will help explain the assumptions behind your cash flow and financial forecast template.

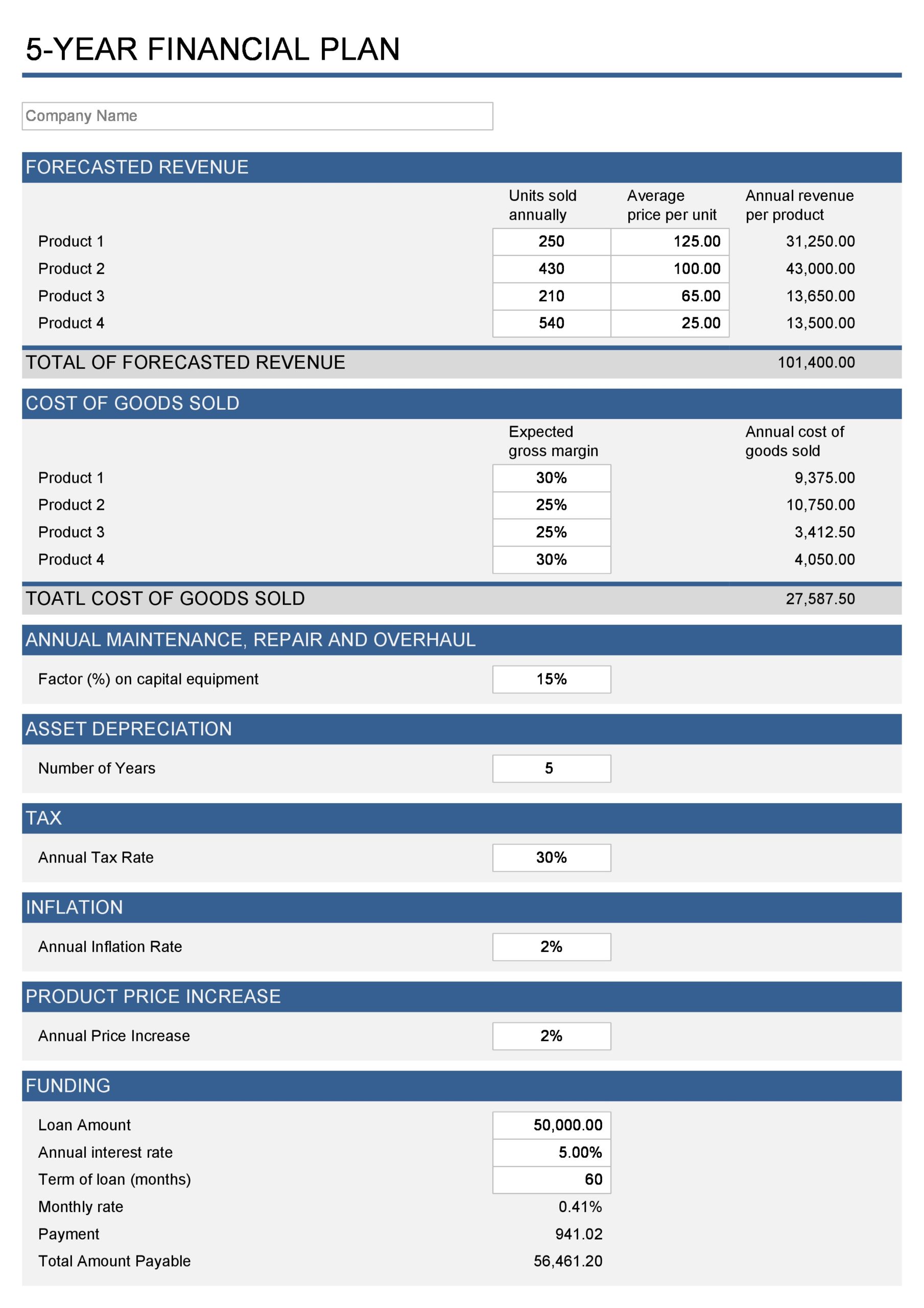

Financial Forecast Templates

How do I make a financial projection?

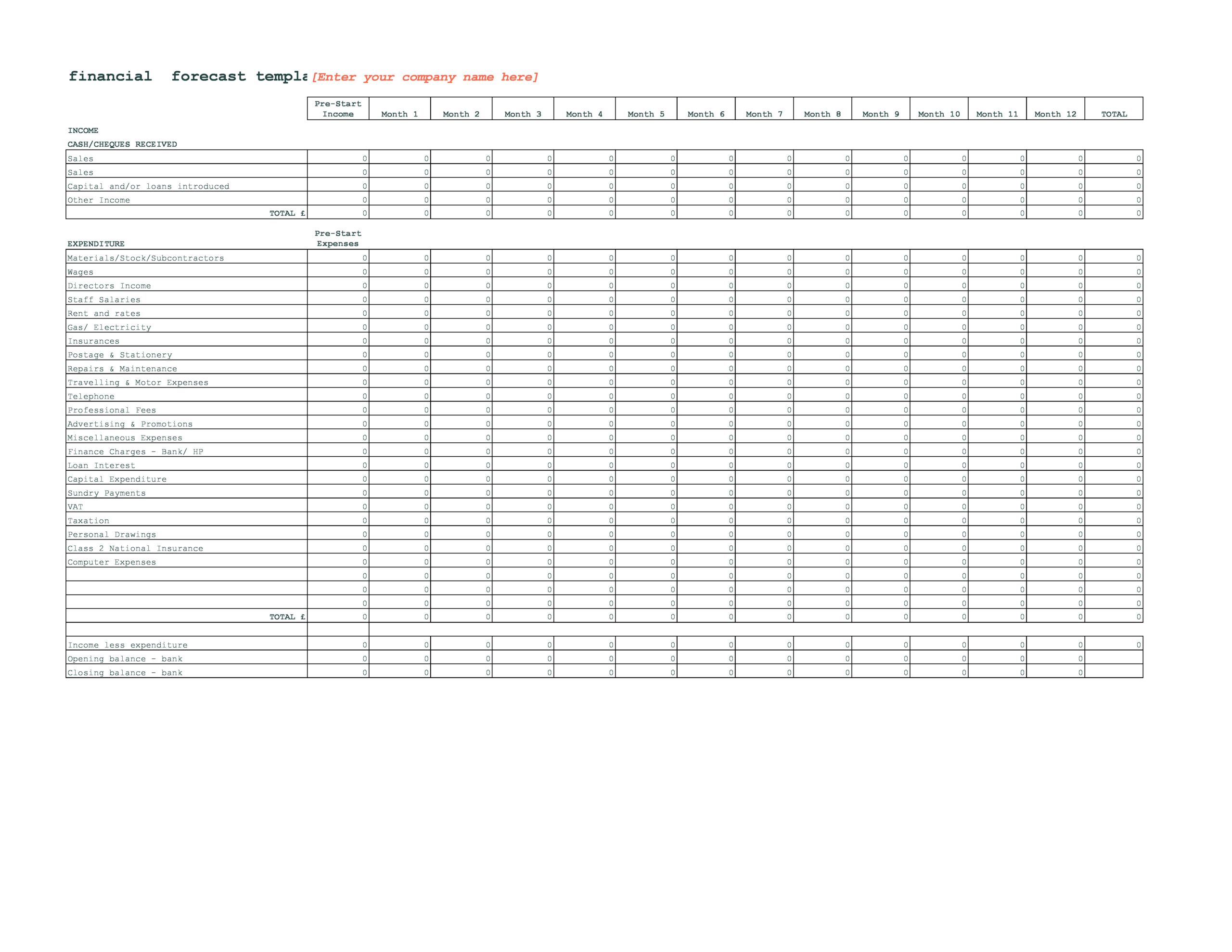

The creation of a financial projections template requires the same information to use whether your business is still in its planning stages or it’s already up and running. The difference is whether you’re creating your revenue projection template using historical financial information or if you need to start from scratch.

This includes the creation of projections based on your own experiences or by conducting market research in the industry in which your business will operate. Here are some tips for creating an effective business plan financial projections template:

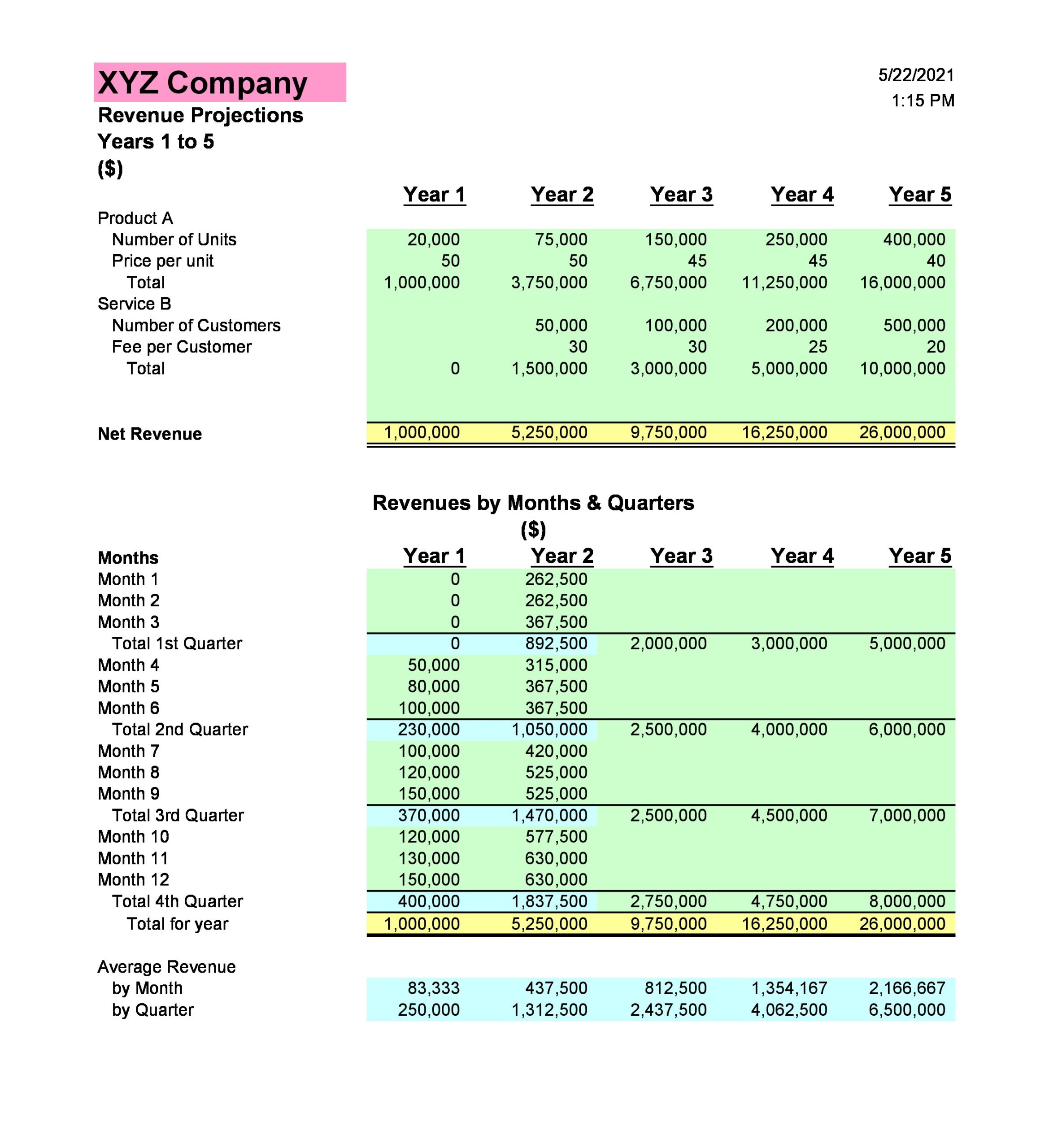

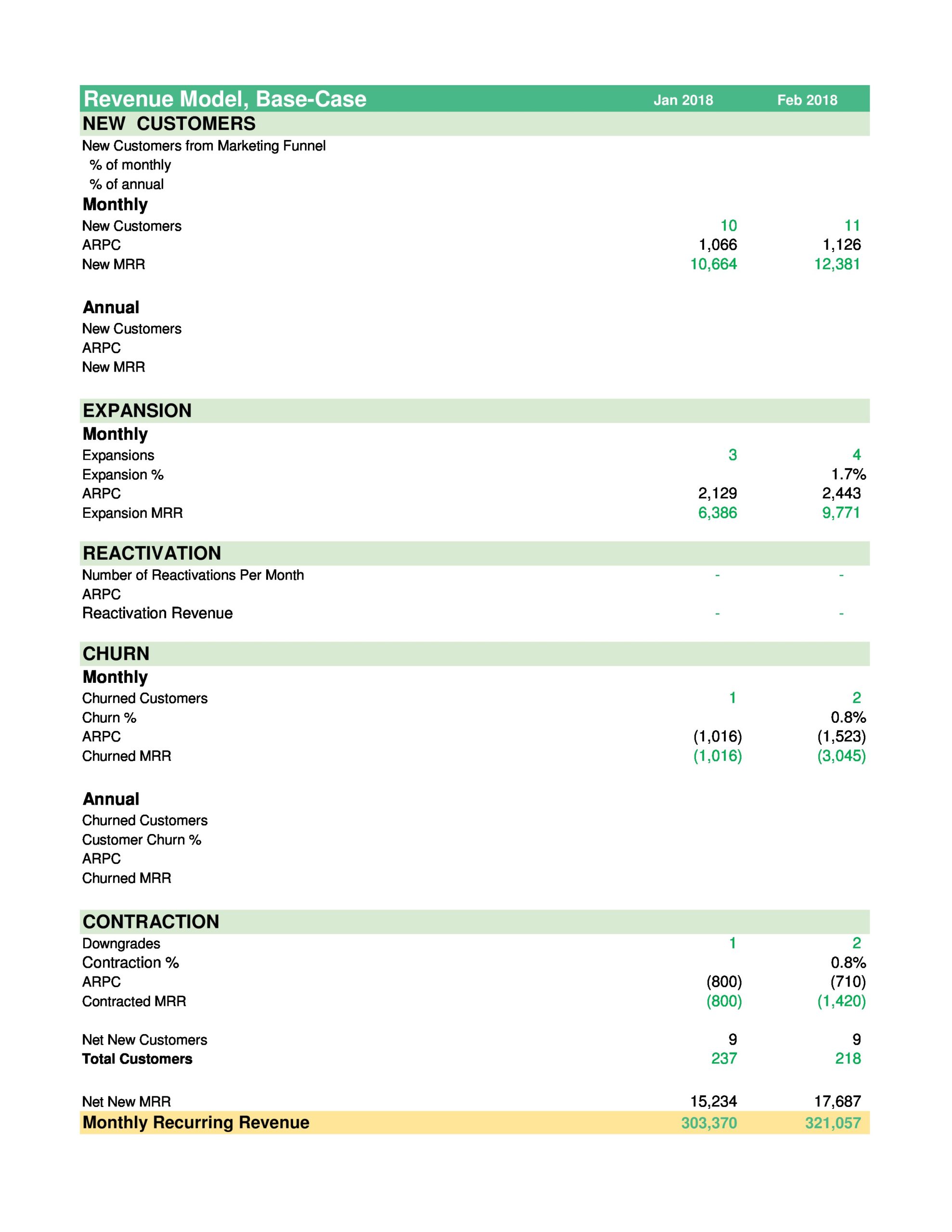

- Create the sales projection

An important component of your business projections template is the sales projections. A business that’s already running can base its projections on its past performance, which you can derive from financial statements.

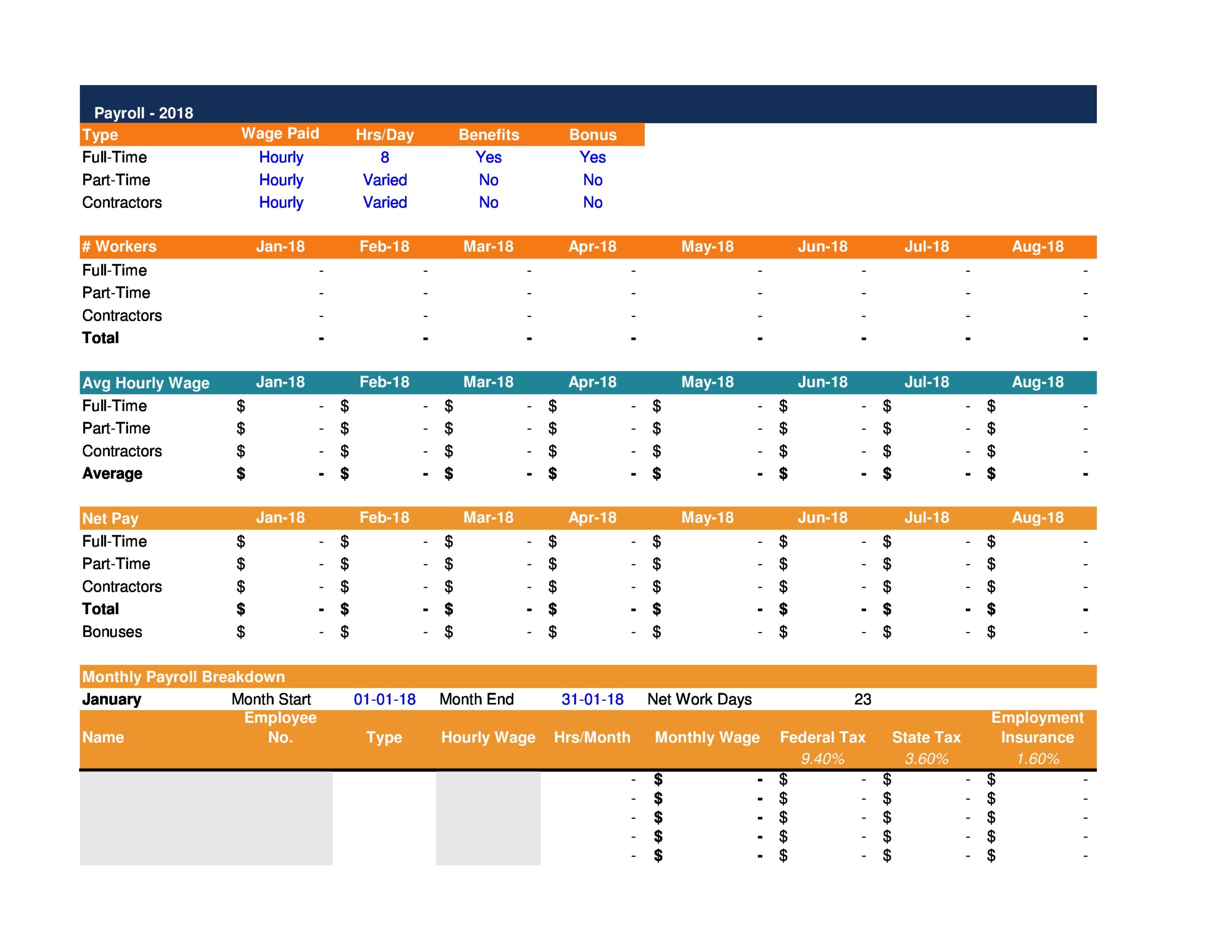

When creating your sales projections, you must consider some external factors like the projected and current health of your company, if your inventory will get affected by additional tariffs, or if there is a downturn in your industry. Even if you want to remain optimistic about your business, you have to make realistic plans. - Create the expense projection

At the onset, the creation of an expense projection seems simpler because it’s much easier to predict the possible expenses of your business than it is to predict potential customers or their buying habits.

If you have experience working in a certain industry, you can predict with some degree of accuracy what your fixed expenses are and any recurring expenses. But when it comes to one-time expenses that have the potential to bring down your business, these are much harder to predict. The best thing you can do in this scenario is to project expenses to the best of your ability then increase this value by 15%. - Come up with a balance sheet for your financial projections template

If you have a business that has been in operation for a couple of months, you can come up with a balance sheet using accounting software. The balance sheet shows your business’ financial status, listing its liabilities, equity, and assets balance for a certain time period.

Use the current totals in your balance sheet when making your financial projections, In doing so, you will make better predictions on where your business will be a few years in the future. If you’re still in the planning stage of a business, you can create a balance sheet based on the data you’ve gathered from industry research. - Create the income statement projection

If you have a business that is currently in operation, you can create an income statement projection using your existing income statements to create an estimate of your business’ projected numbers. This is a logical move since an income statement provides a picture of your business’s net income after subtracting things like taxes, cost of goods, and other expenses.

One of the main purposes of the income statement is to provide an idea of your business’ current performance. It also serves as the basis for estimating your net income for the next couple of years.

If your business is still in the planning stages, the creation of a potential income statement shows that you have conducted extensive research and created a diligent and well-crafted estimate of your income in the next couple of years.

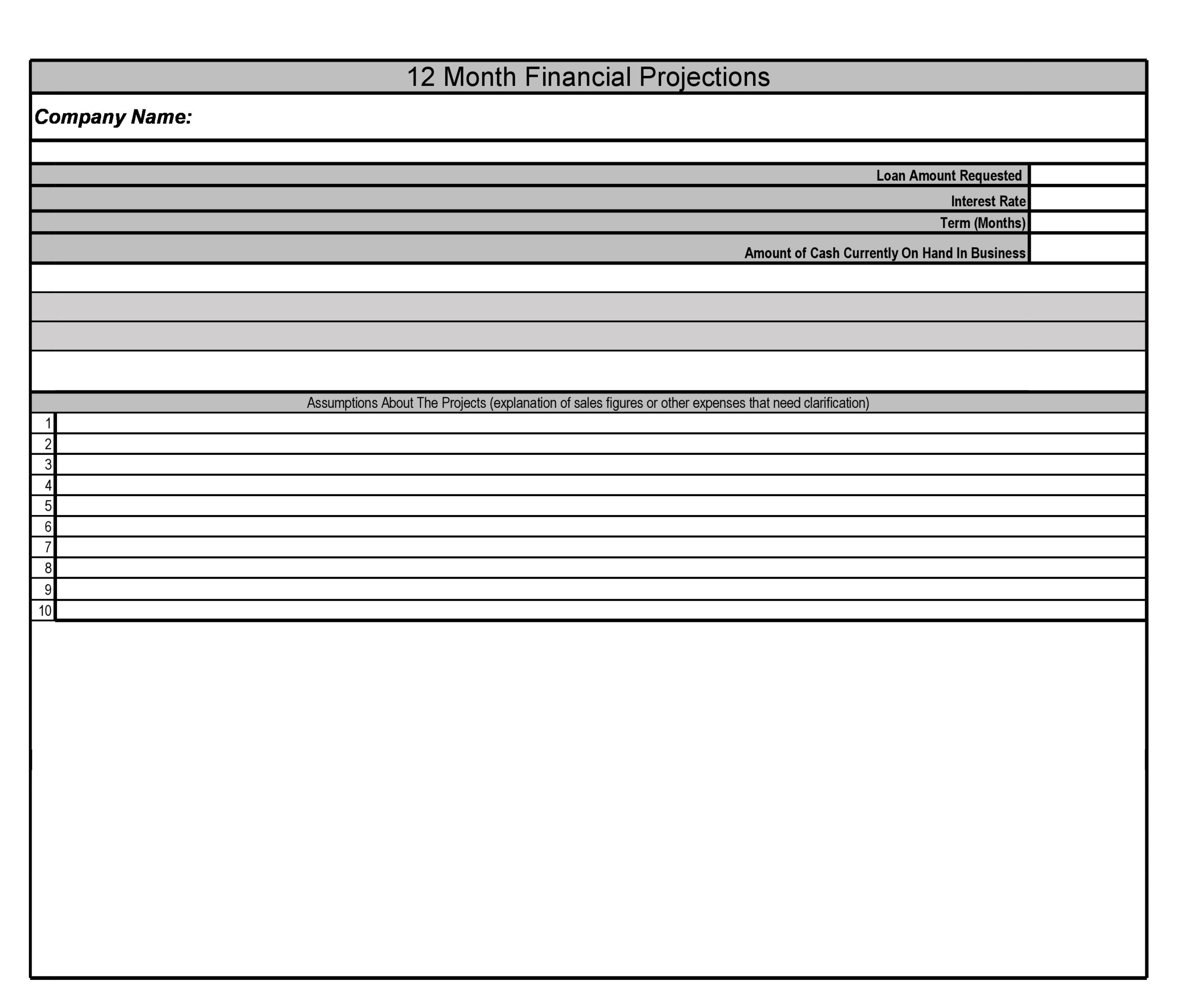

If you have uncertainties on how to start creating an income statement projection, you can consult with market research firms in your locale. They can provide you with an overview of your targeted industry which includes target markets, expected and current industry growth levels, and sales. - Come up with a cash flow projection

The creation of this document is the final step leading to the completion of your financial projection. The cash flow statement is directly connected to the balance sheet and the net income statement, showing any cash-related or cash activities that can affect your industry. One of the purposes of this statement is to show how much money your business spends. This is a must for businesses obtaining financing or looking for investors.

You can use this cash flow statement if your business has been in operation for a minimum of six months, but if your business is still in the planning stages, you can use the information you have gathered to create a credible projection.

To make things easier for you, consider using spreadsheet software. Chances are, you’re already using spreadsheets. Using a spreadsheet will be the starting point for your financial projections. In addition, it offers flexibility that allows you to quickly judge alternative scenarios or change assumptions.

Be as clear and reasonable as possible with your financial projections. Remember that financial projection is as much science as art. At some point, you will have to make assumptions on certain things like how administrative costs and raw materials will grow, revenue growth, and how efficient you will be at gathering accounts receivable for your business.