Buy-sell agreements are one of the most important documents associated with a business. This is the document that outlines what happens when a co-owner or a partner dies or leaves the company. Their shares will be disposed of according to the agreement, which can greatly impact the function and operation of the business in the future.

Buy-sell agreements need to be carefully drafted to make sure that the shares that belong to each owner can be bought or dispersed correctly upon their death or upon them leaving the company. When this critical document is not created correctly, a company’s operation can be in limbo until a legal process sorts out the ownership of the shares. Every business owner should want to avoid this kind of outcome for the sale of shares, which means that the buy-sell agreement that is in place for your business needs to be created with the right attention to detail.

Table of Contents

- 1 Buy-Sell Agreement Templates

- 2 How Does a Buy-Sell Agreement Work?

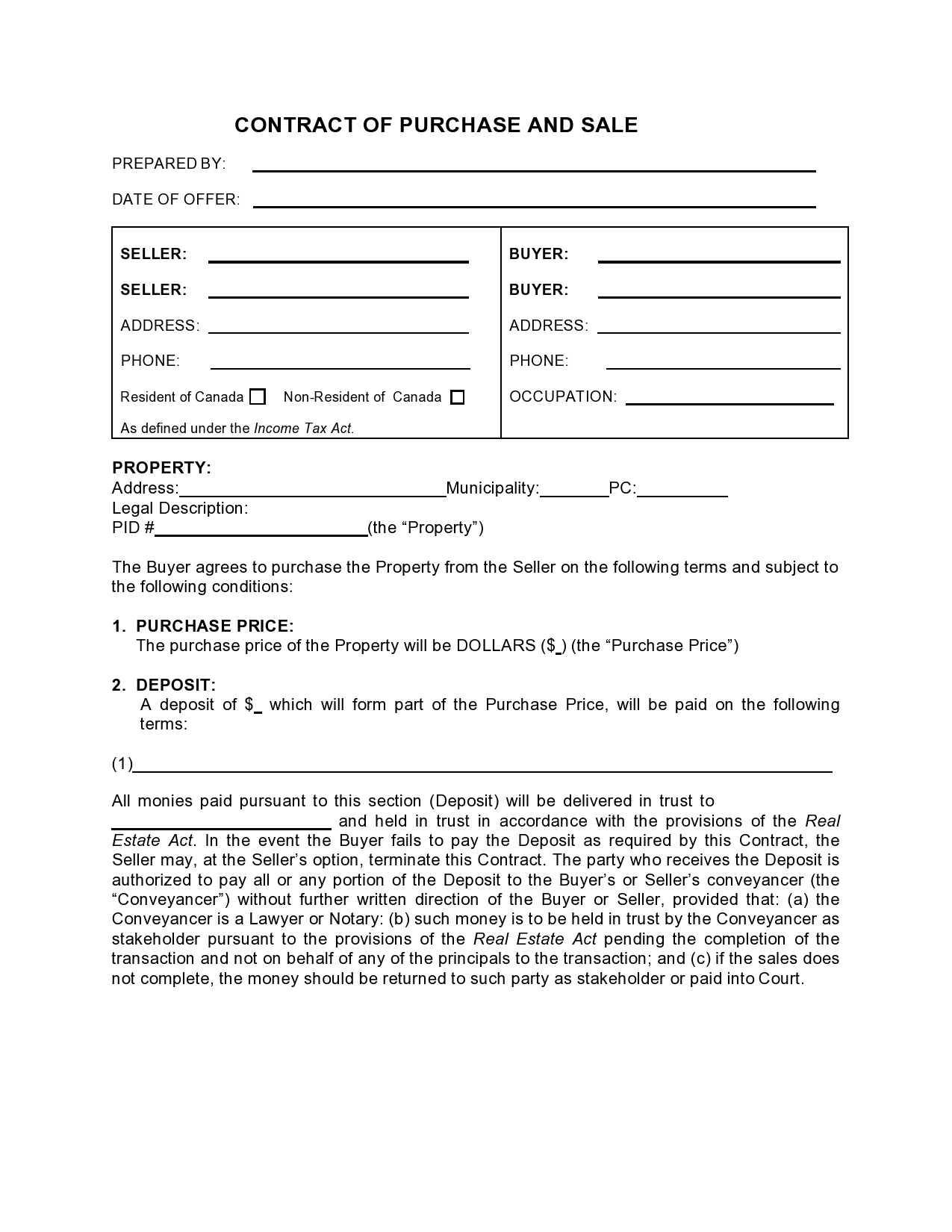

- 3 Buyout Agreement Templates

- 4 How Do You Write a Buy-Sell Agreement?

- 5 Buy-Sell Agreement Forms

- 6 What Are the Types of Buy-Sell Agreements?

- 7 Shareholder Buyout Agreement

- 8 What Needs to be Included in a Buy-Sell Agreement

- 9 Buy-Sell Agreements Are Essential For Business Operation

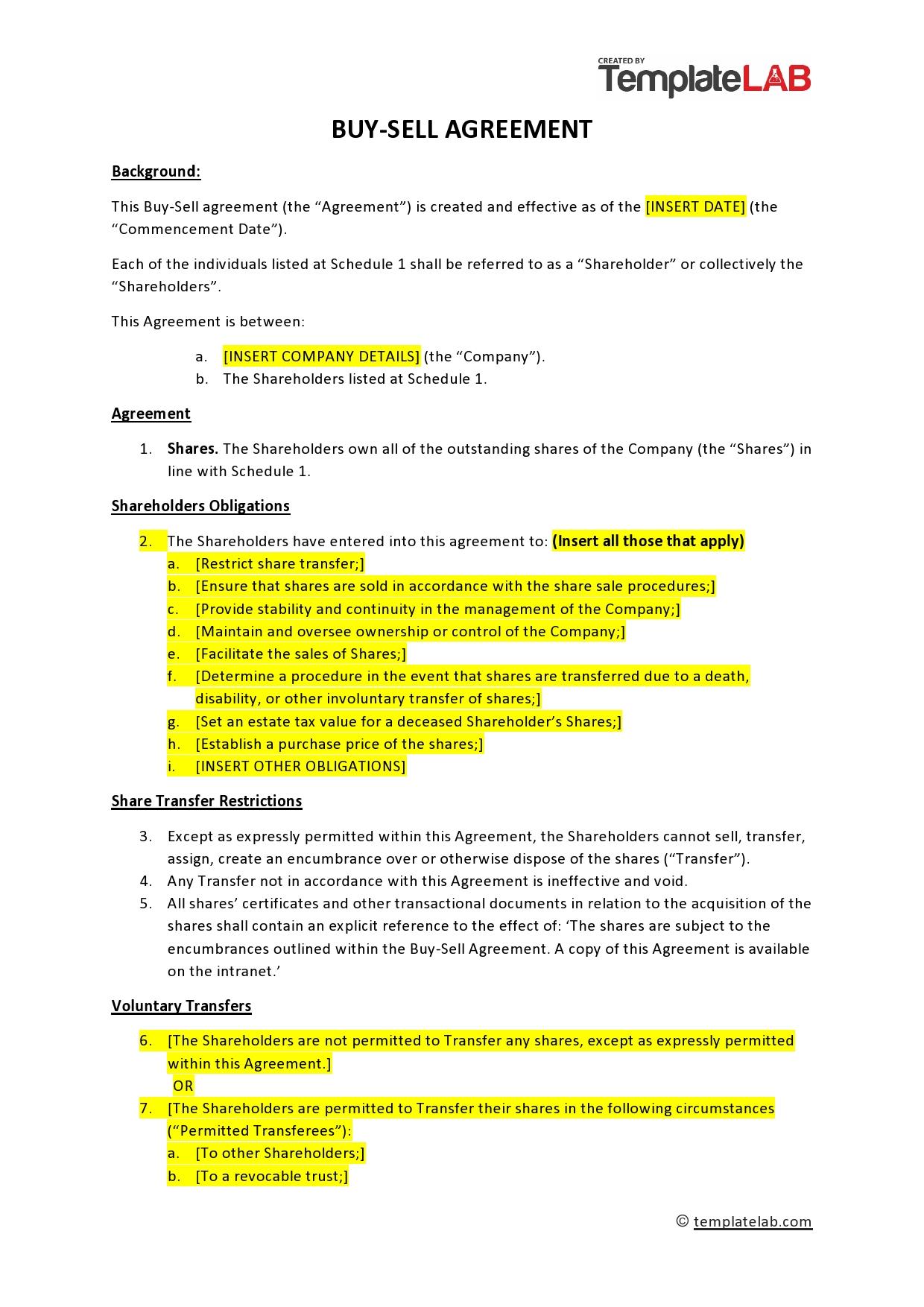

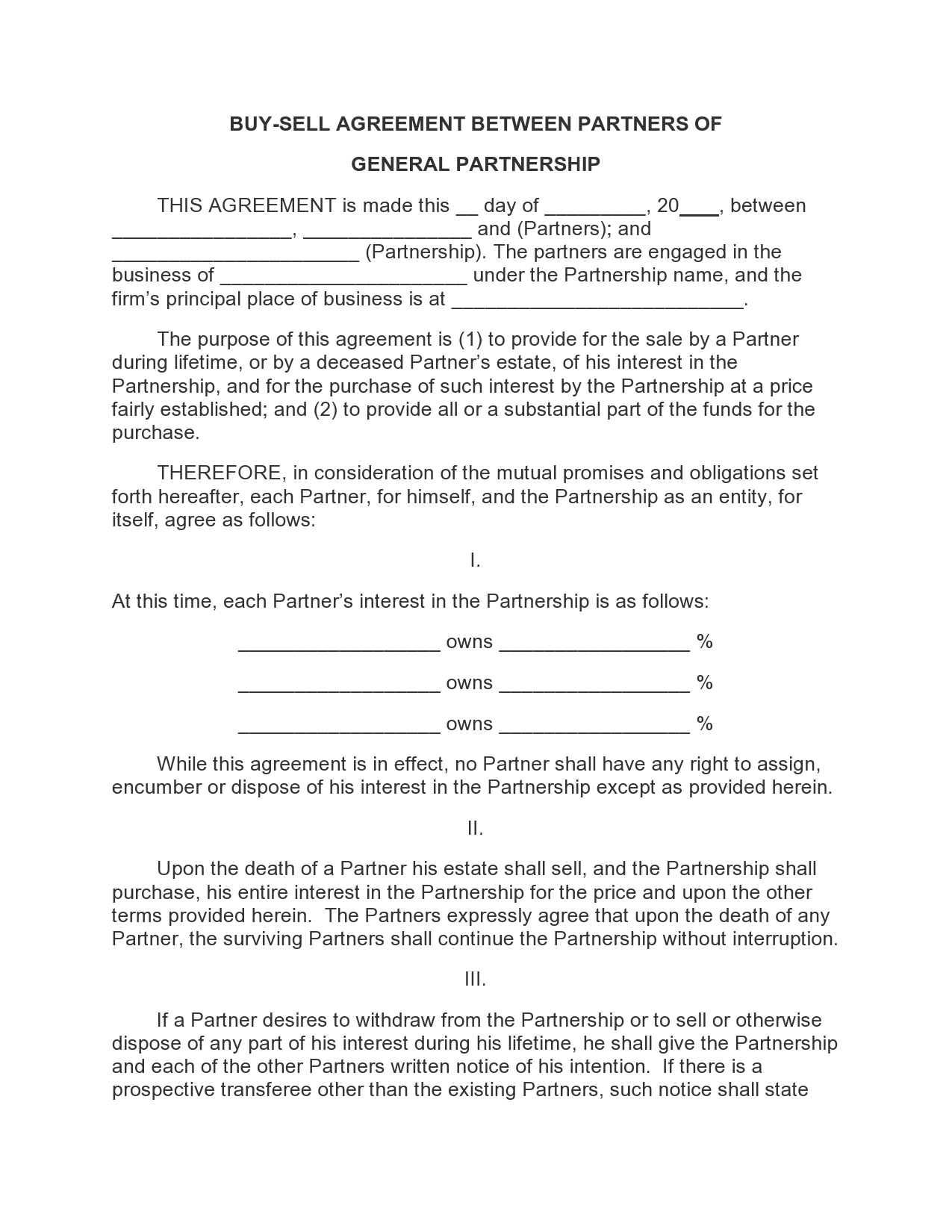

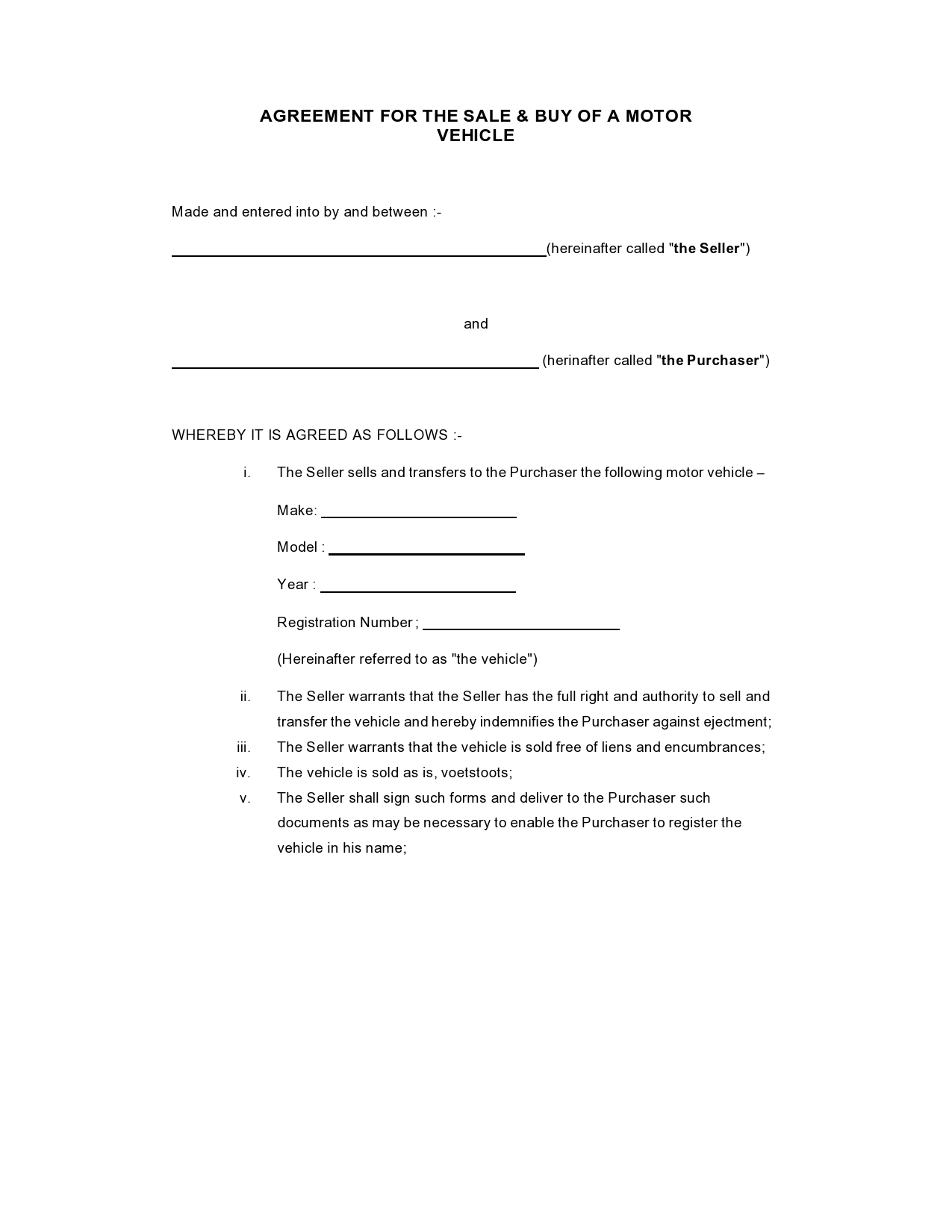

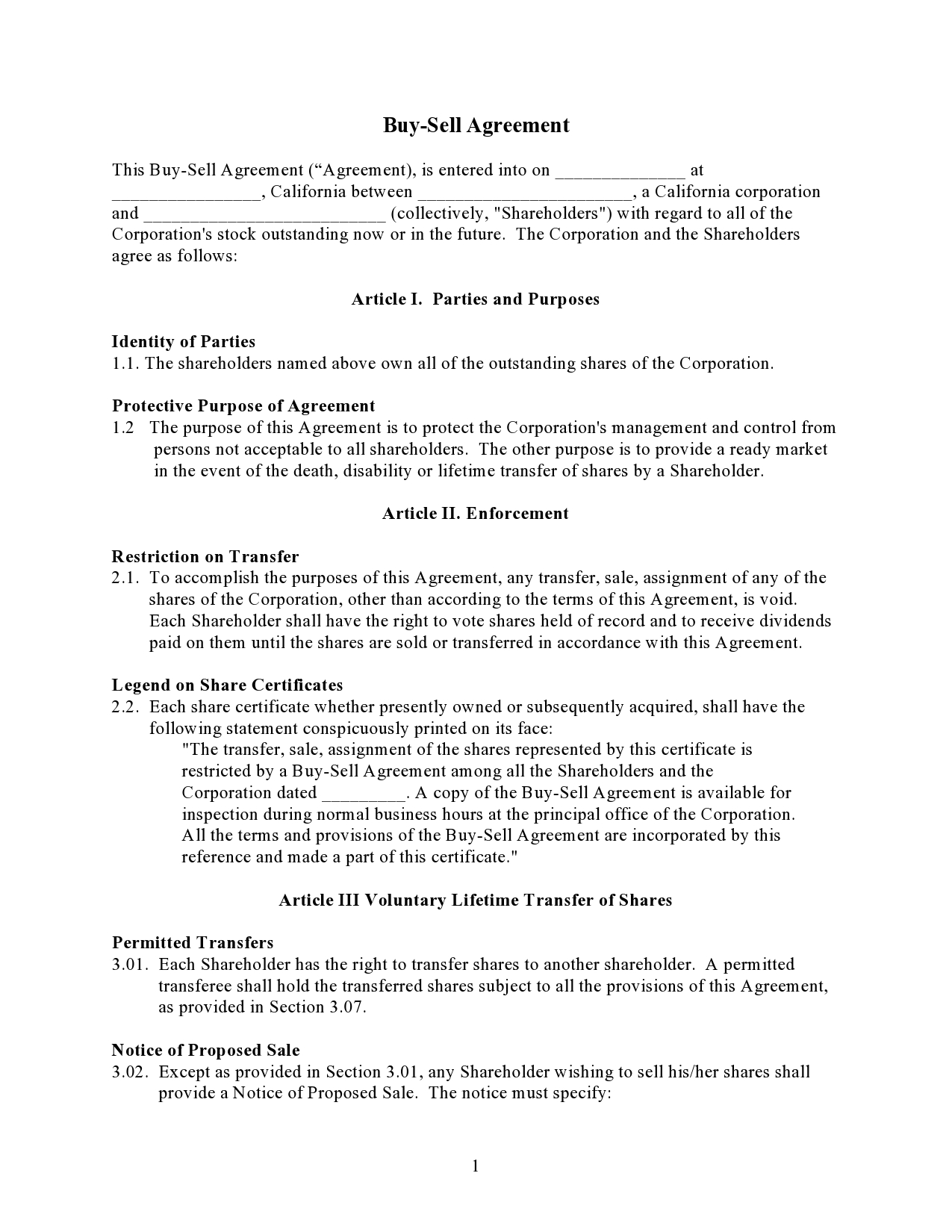

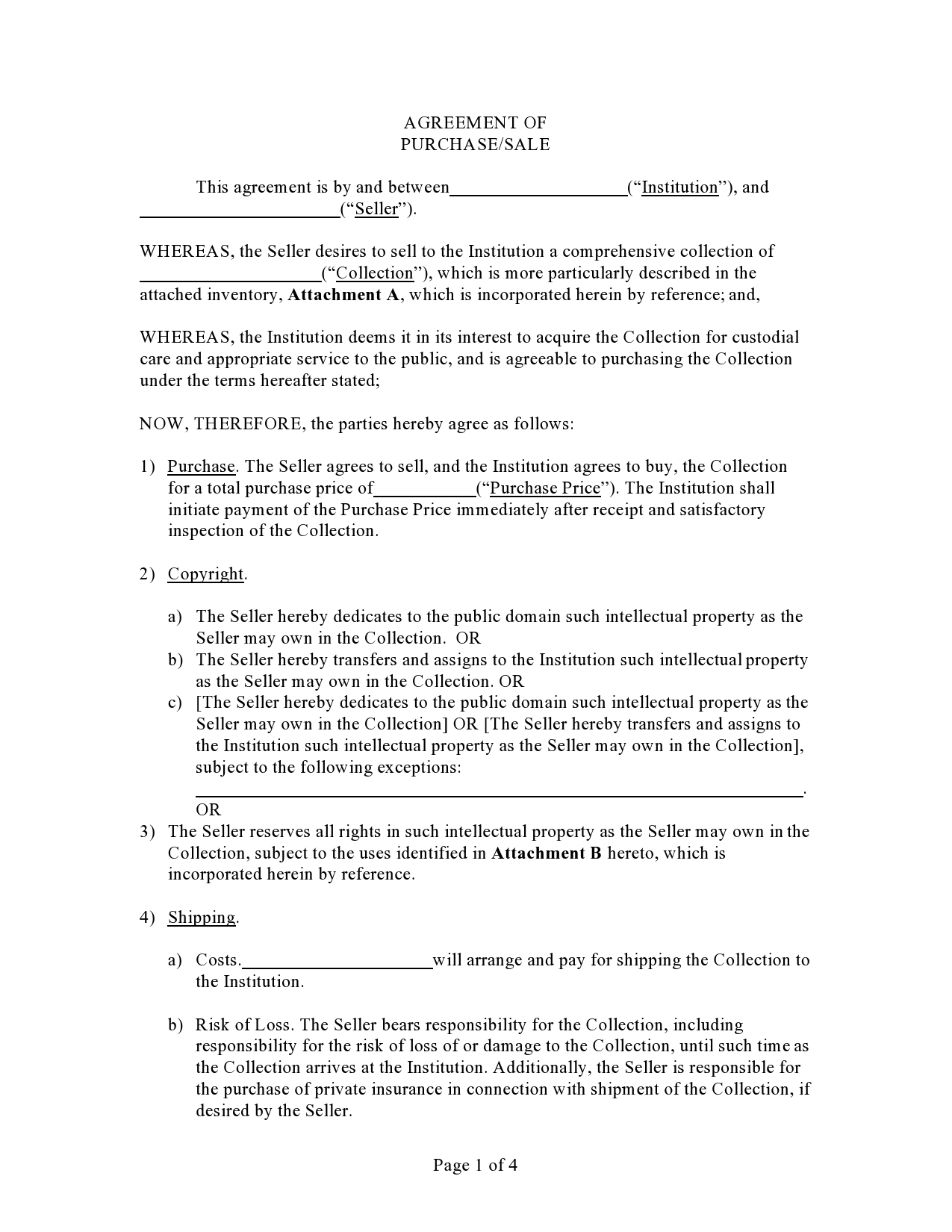

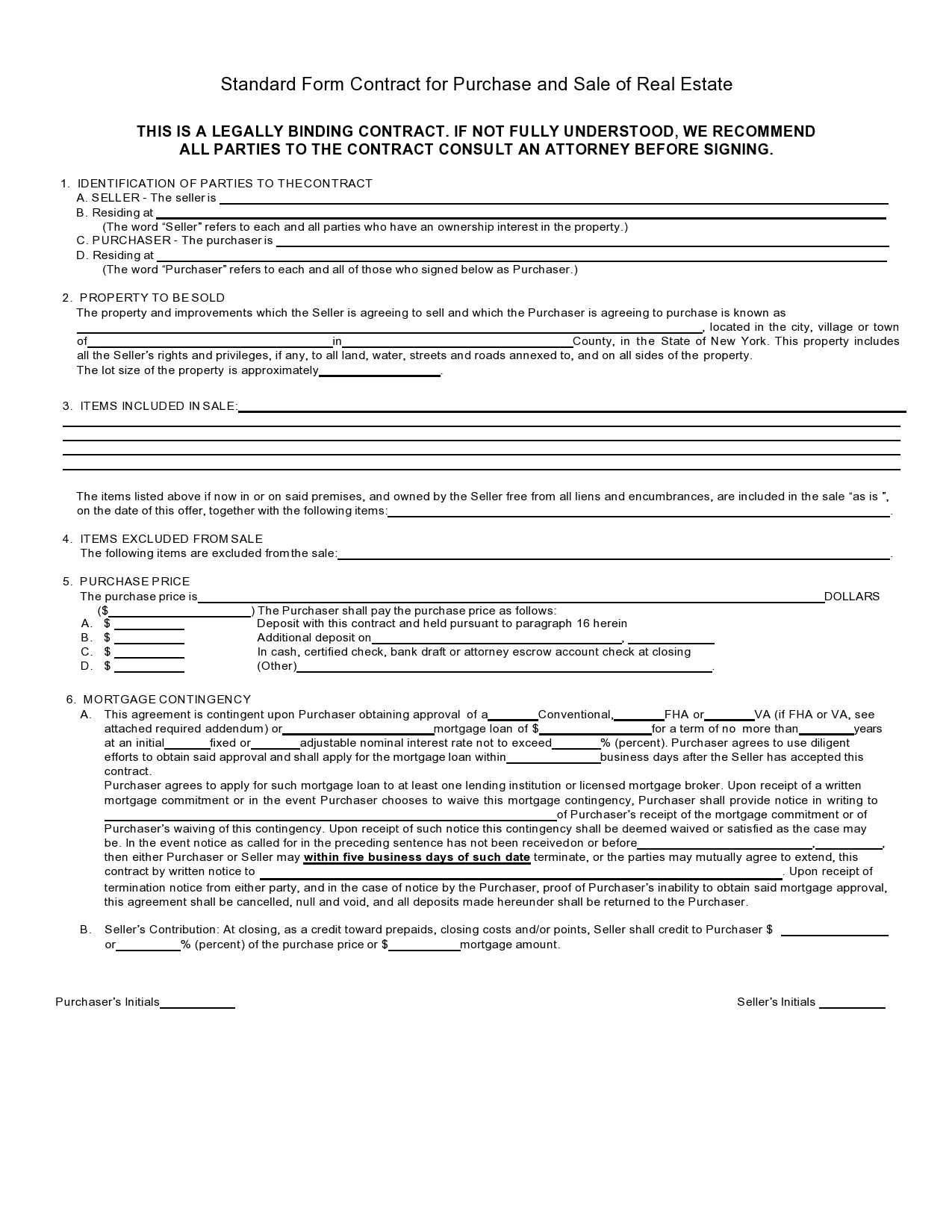

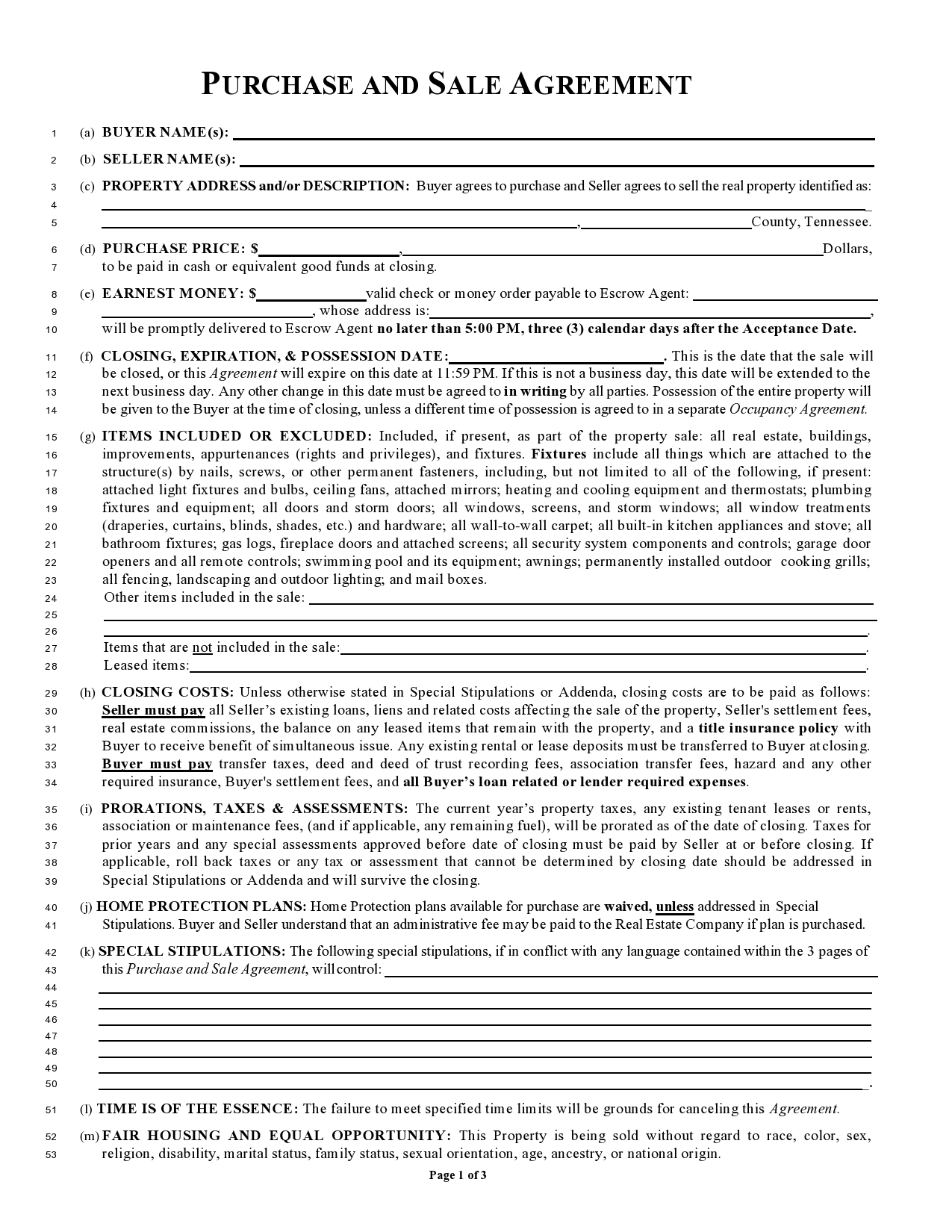

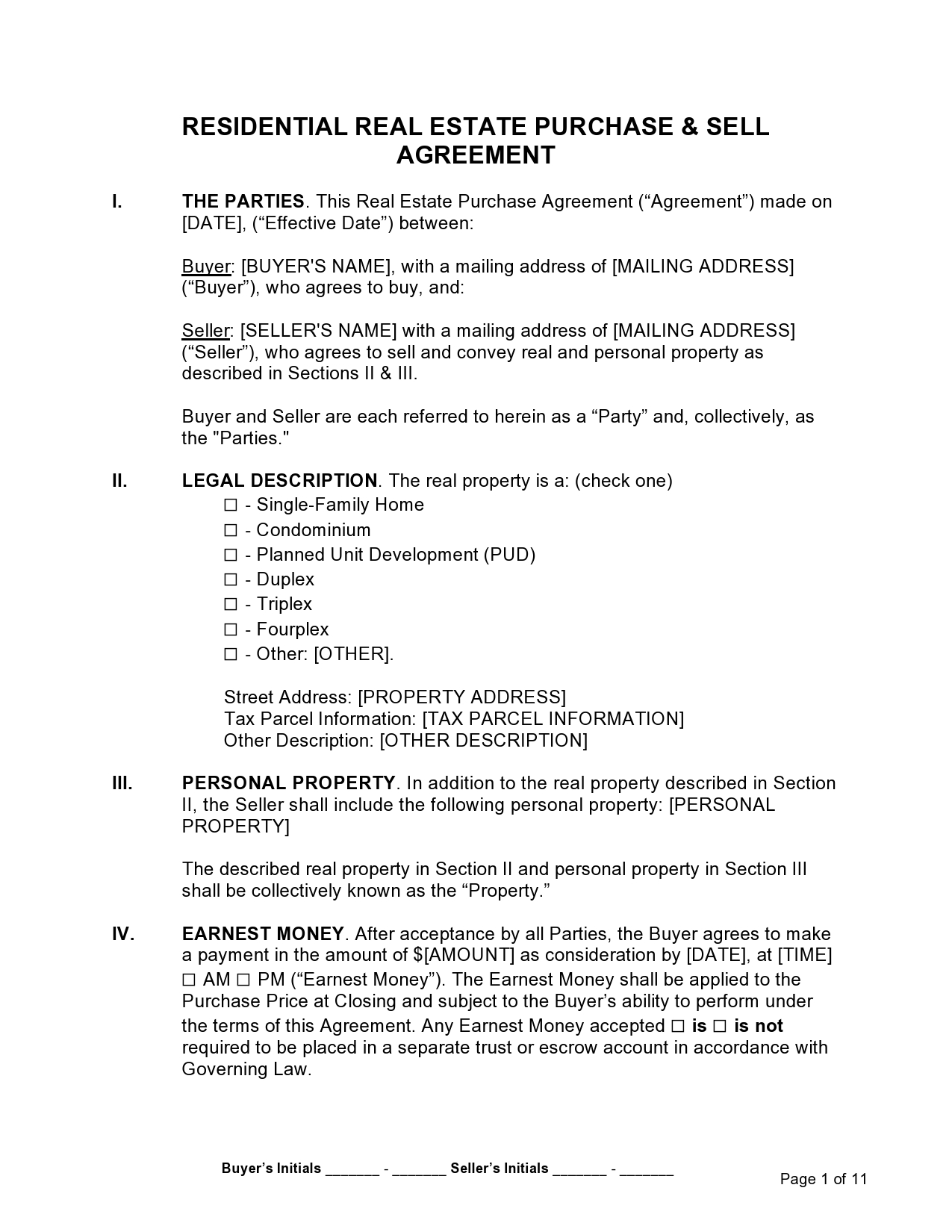

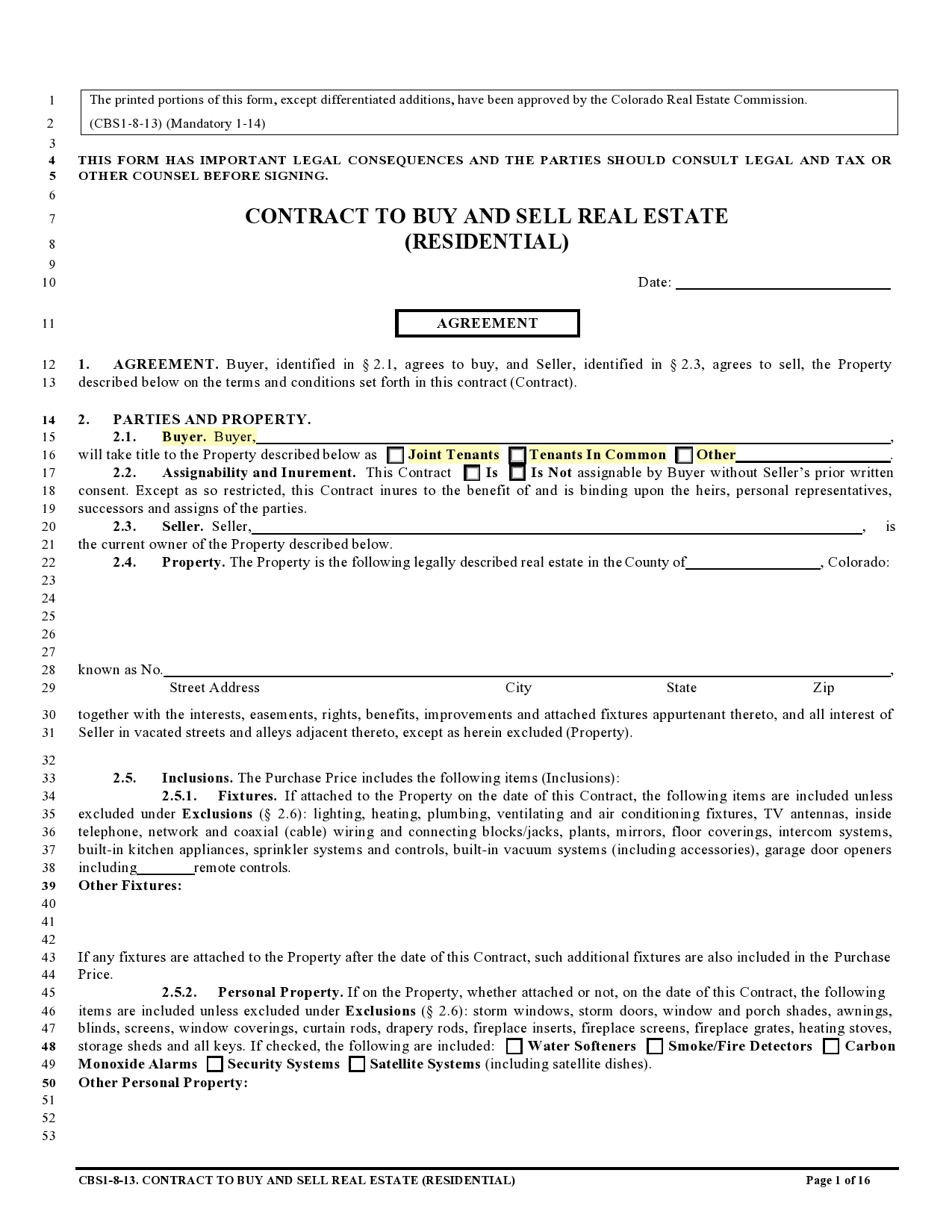

Buy-Sell Agreement Templates

How Does a Buy-Sell Agreement Work?

This contract is also called a buyout, and it is created when owners come together to form a business. This is one of the foundational documents that is made to support the legal operation of any company. The agreement will outline how each owner’s shares can be sold or dispersed when they die or when they choose to leave the company. This might be sales to the other owners, or the buy-sell agreement might also be linked to a prenuptial agreement which indicates that the shares pass to a spouse.

The buy-sell agreement effectively dictates who will own the company should a major shareholder pass away or leave. The intent of these buyout agreement templates and documents is to protect the business from operational struggles in the event that one of the owners has moved on or passed away. This is one of the common ways that a business is left to heirs and family as well.

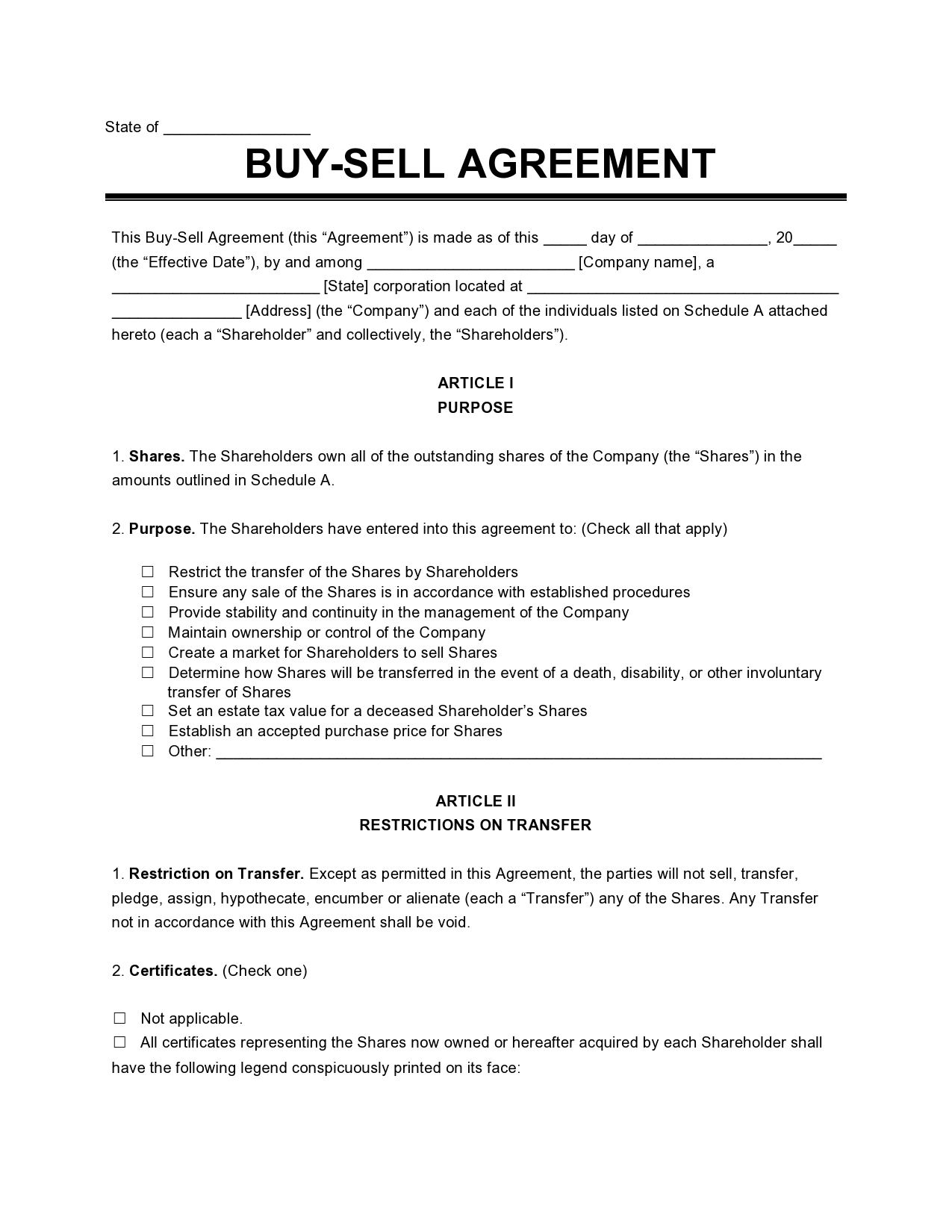

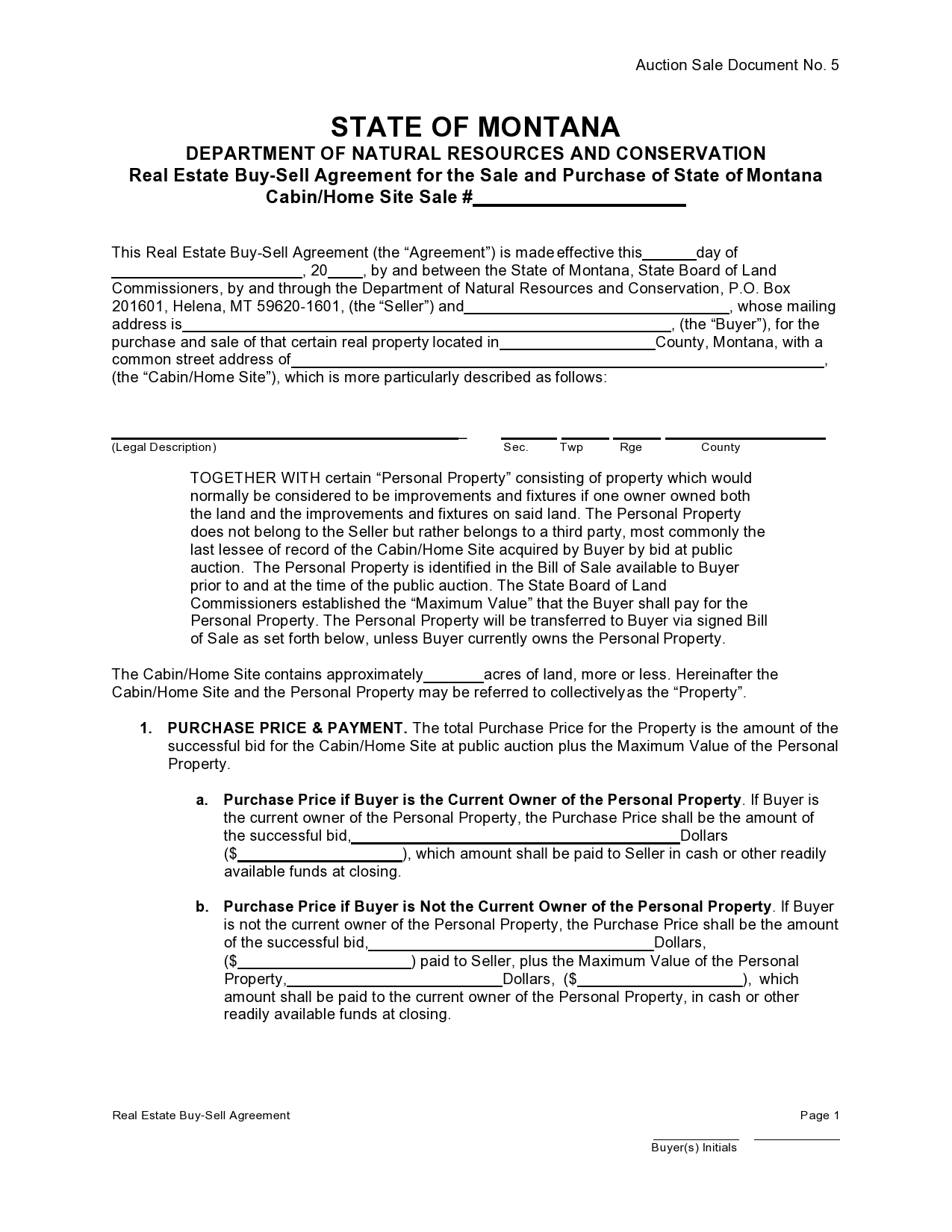

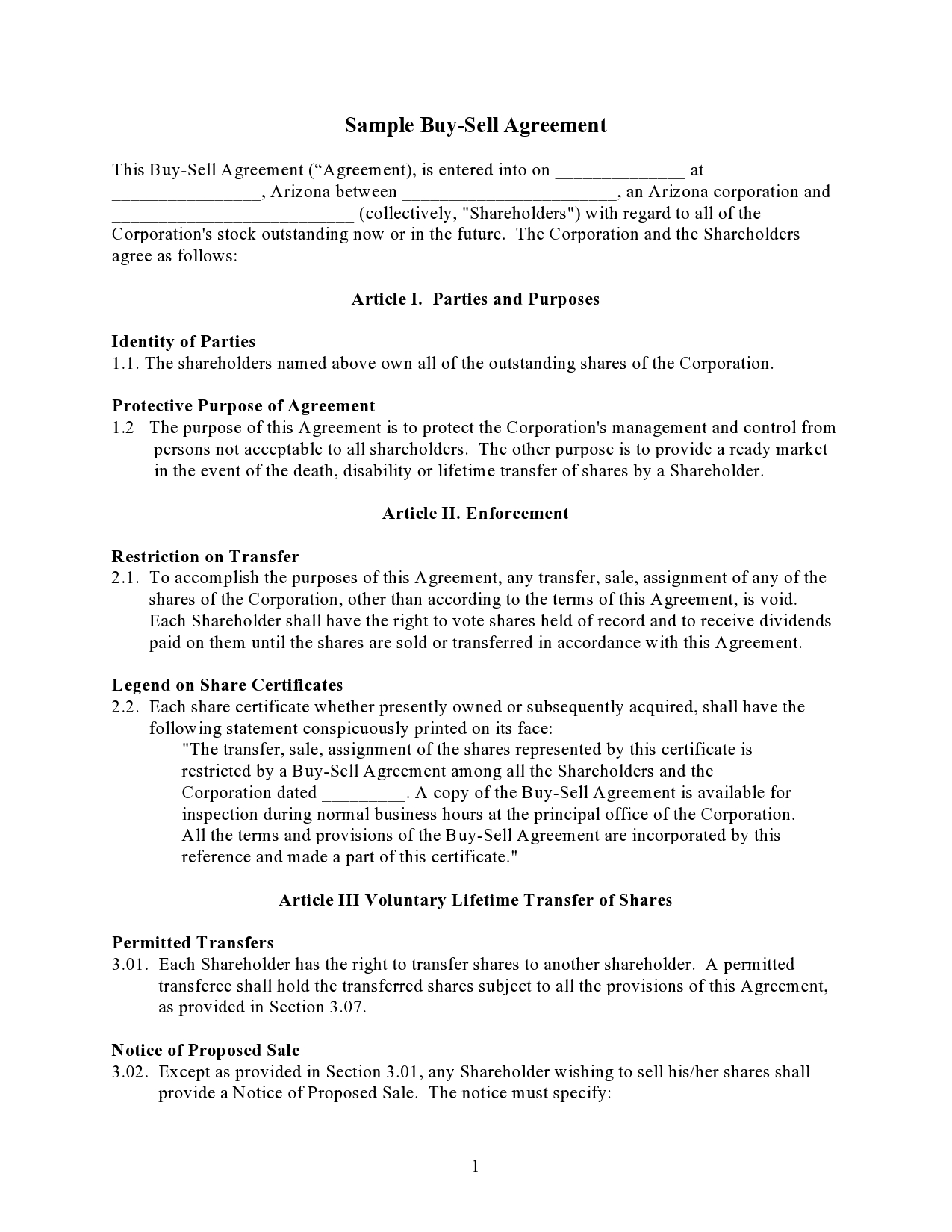

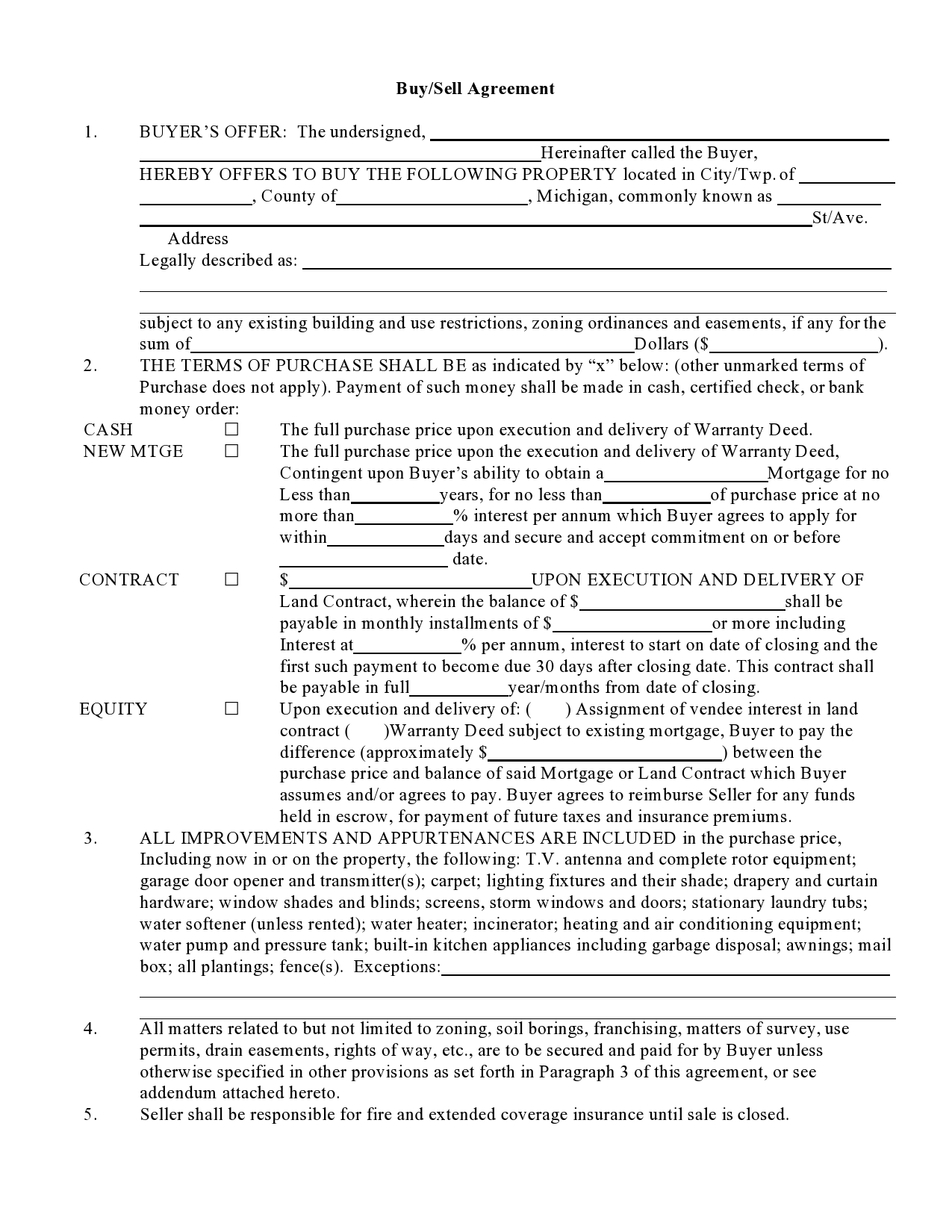

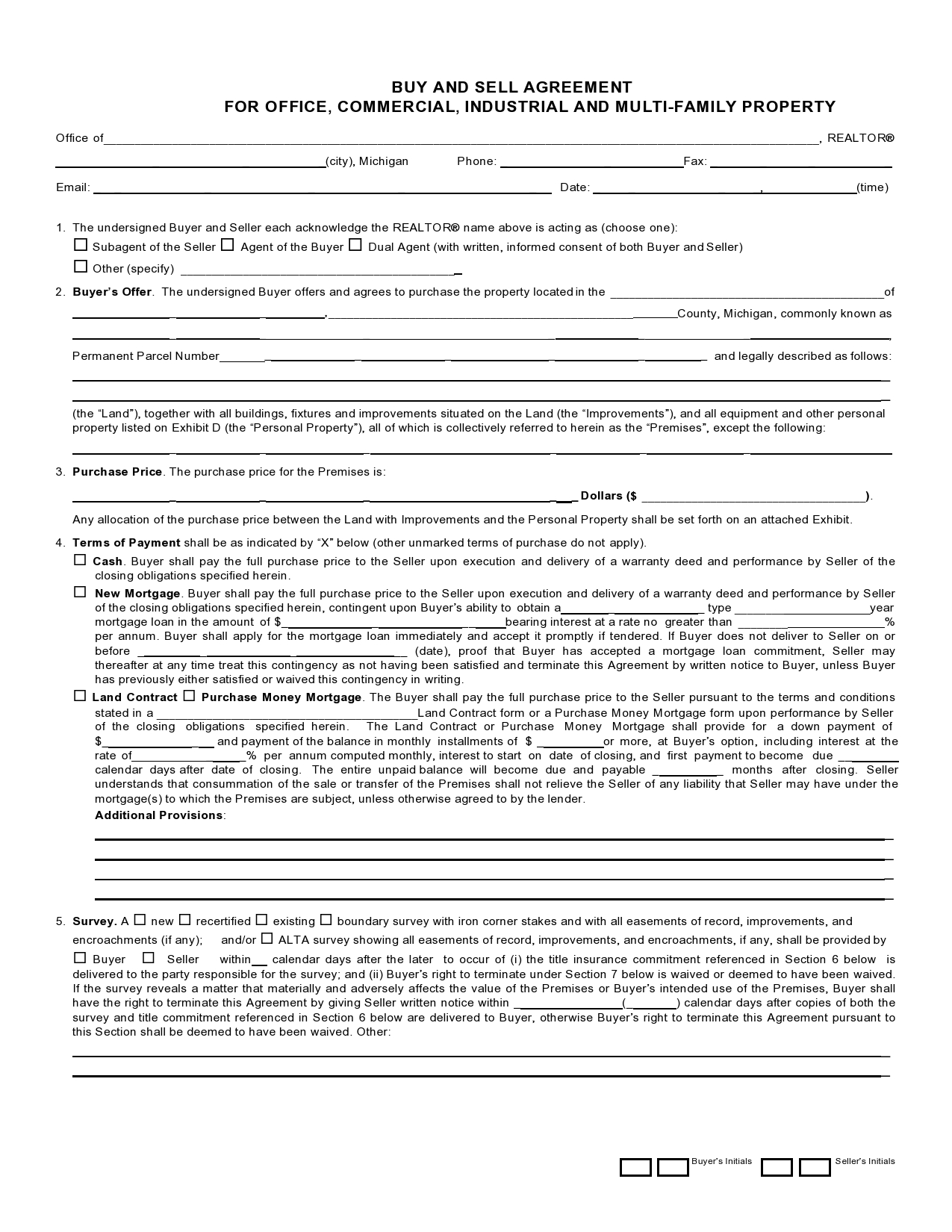

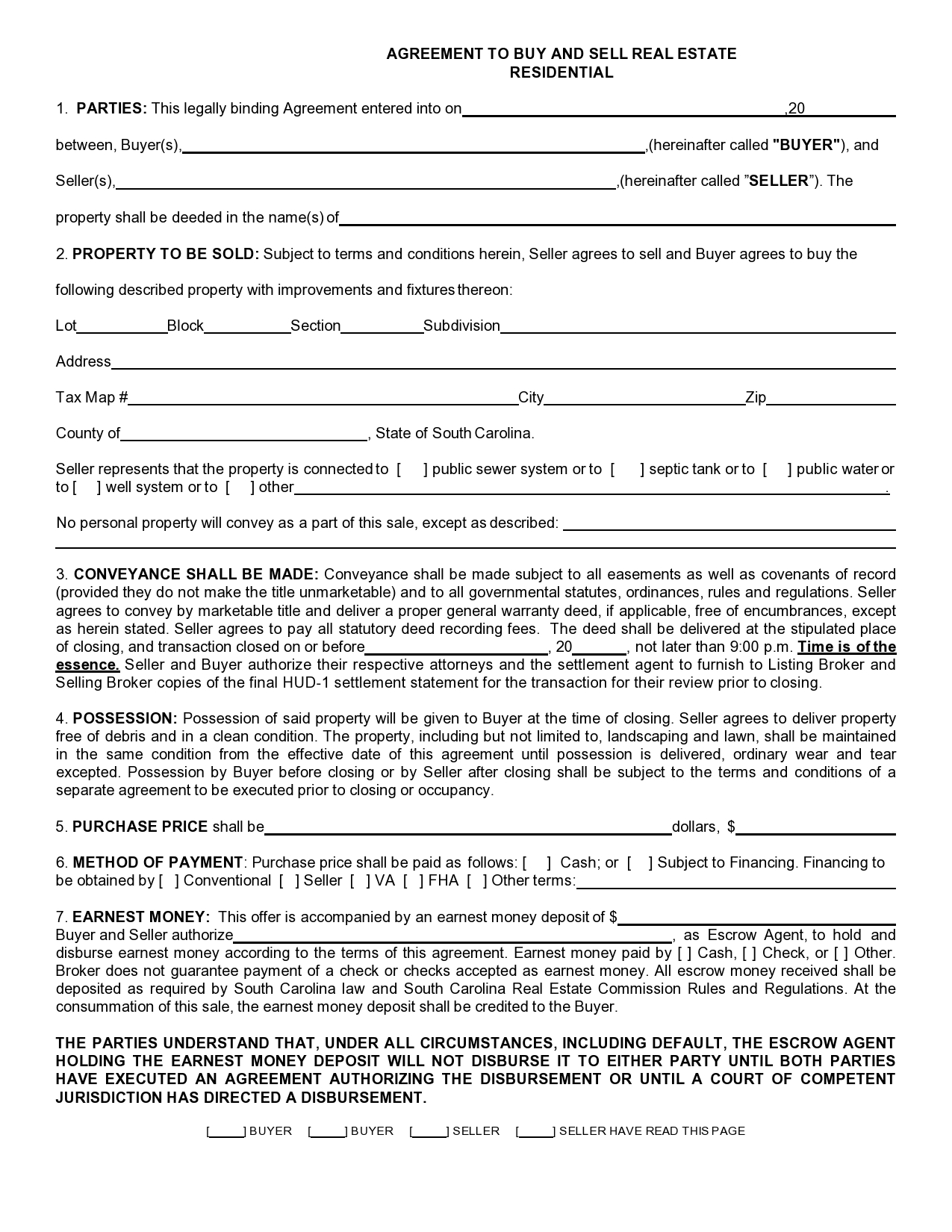

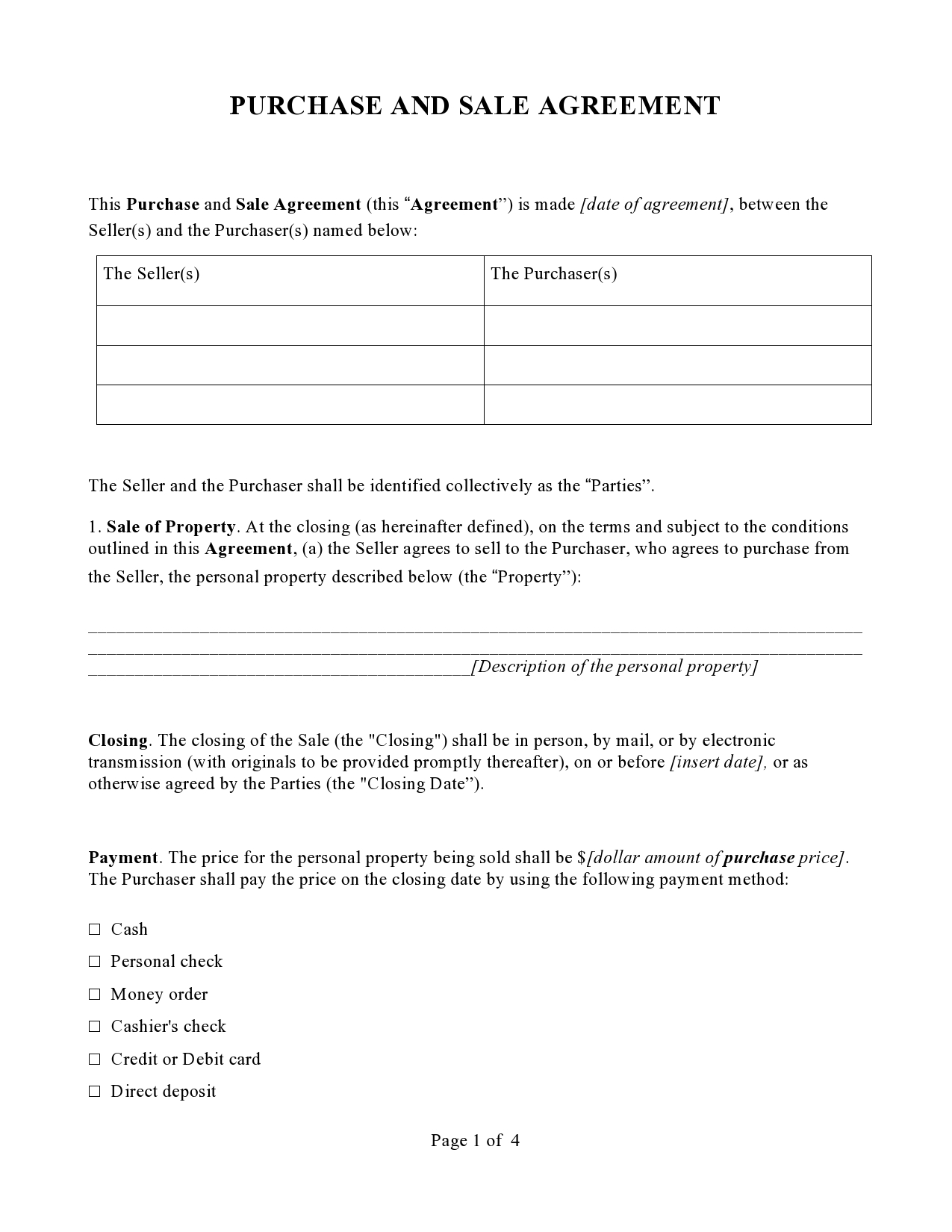

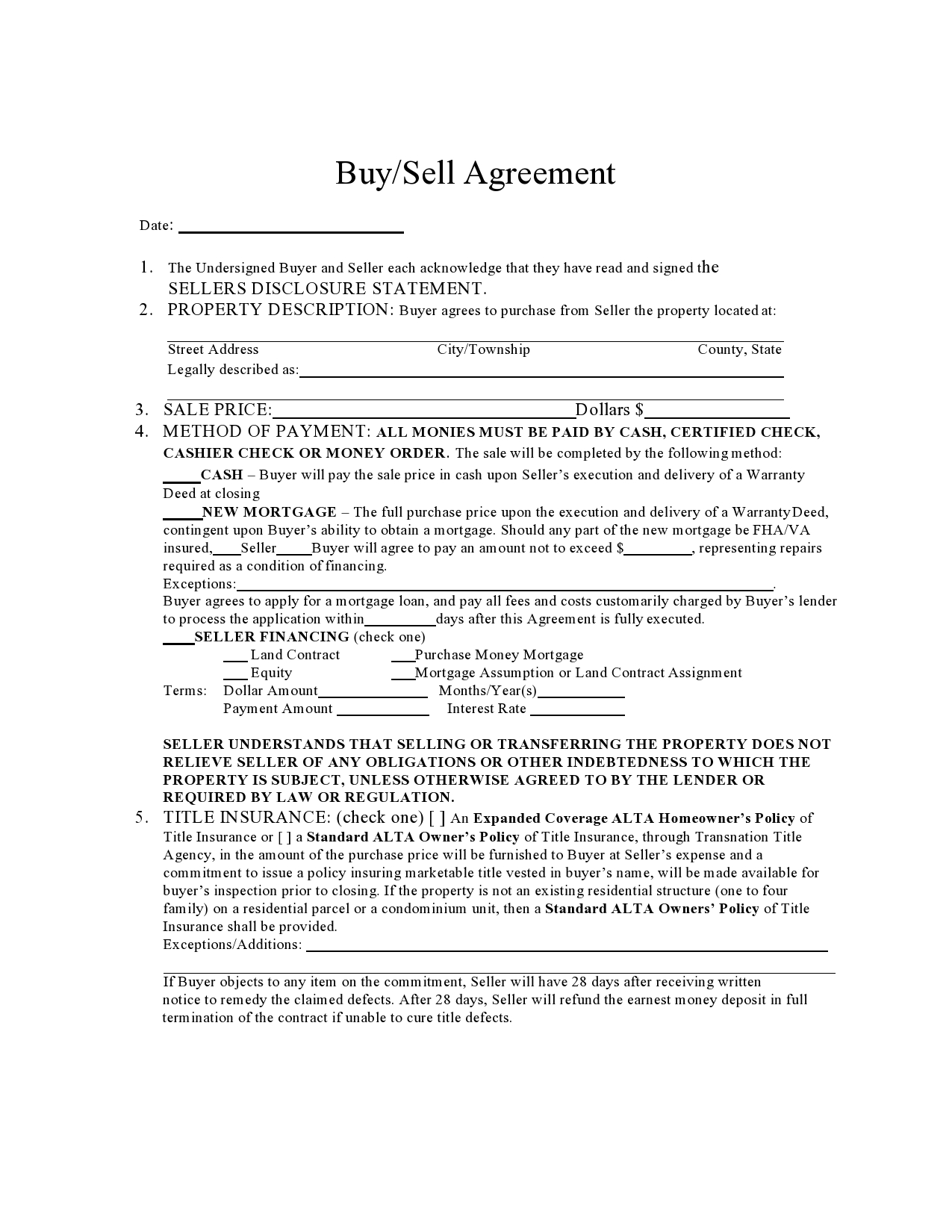

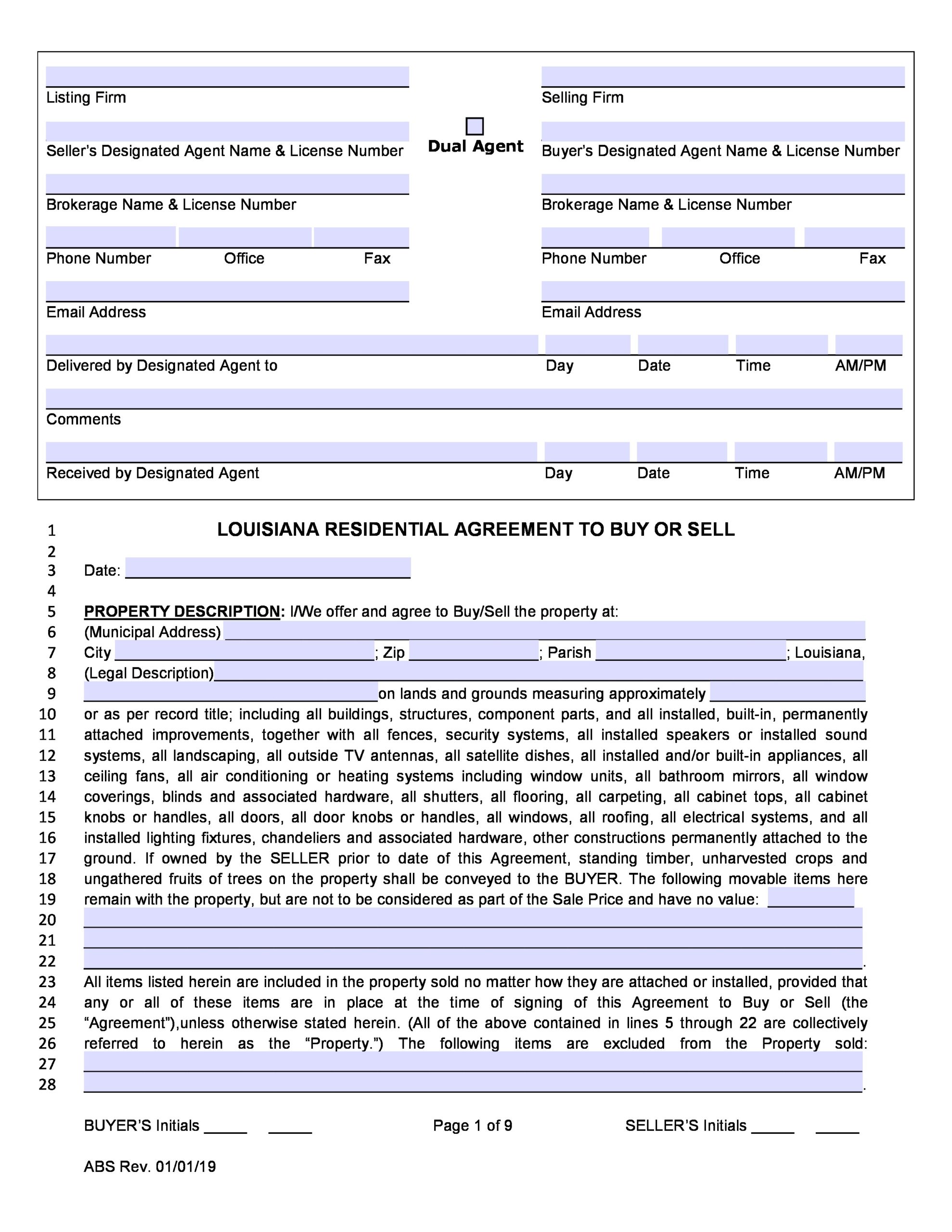

Buyout Agreement Templates

How Do You Write a Buy-Sell Agreement?

Buy-sell agreements need to be written to be triggered by certain events. The buy-sell agreement contract is not considered active until these events come to pass. Death or an owner leaving the company are the two most common triggers for this contract to go into effect. This means that the triggering event needs to be listed first and foremost in the buy-sell agreement’s language.

There are many buy-sell agreement templates for this kind of document, but this is a potentially complex part of your business planning, and you might need expert oversight to ensure that your buy-sell agreement is written properly. This agreement needs to outline all of the various situations that could trigger it, as well as what needs to be done with the shares that the owner holds. There are various ways to limit how the shares are sold or passed on, and these need to be carefully outlined in the document.

Early buyout and a payment structure are commonly explained and outlined in this document as well, which helps to ensure that the shares are sold properly and for fair market value. A fair price evaluation needs to be required as well so that the business does not lose money when the buy-sell agreement is triggered. Even details like a right of first refusal and financing options are included in the information in the buy-sell agreement. This needs to be an airtight document that makes sure that the loss of an owner does not lead to the destruction of the business.

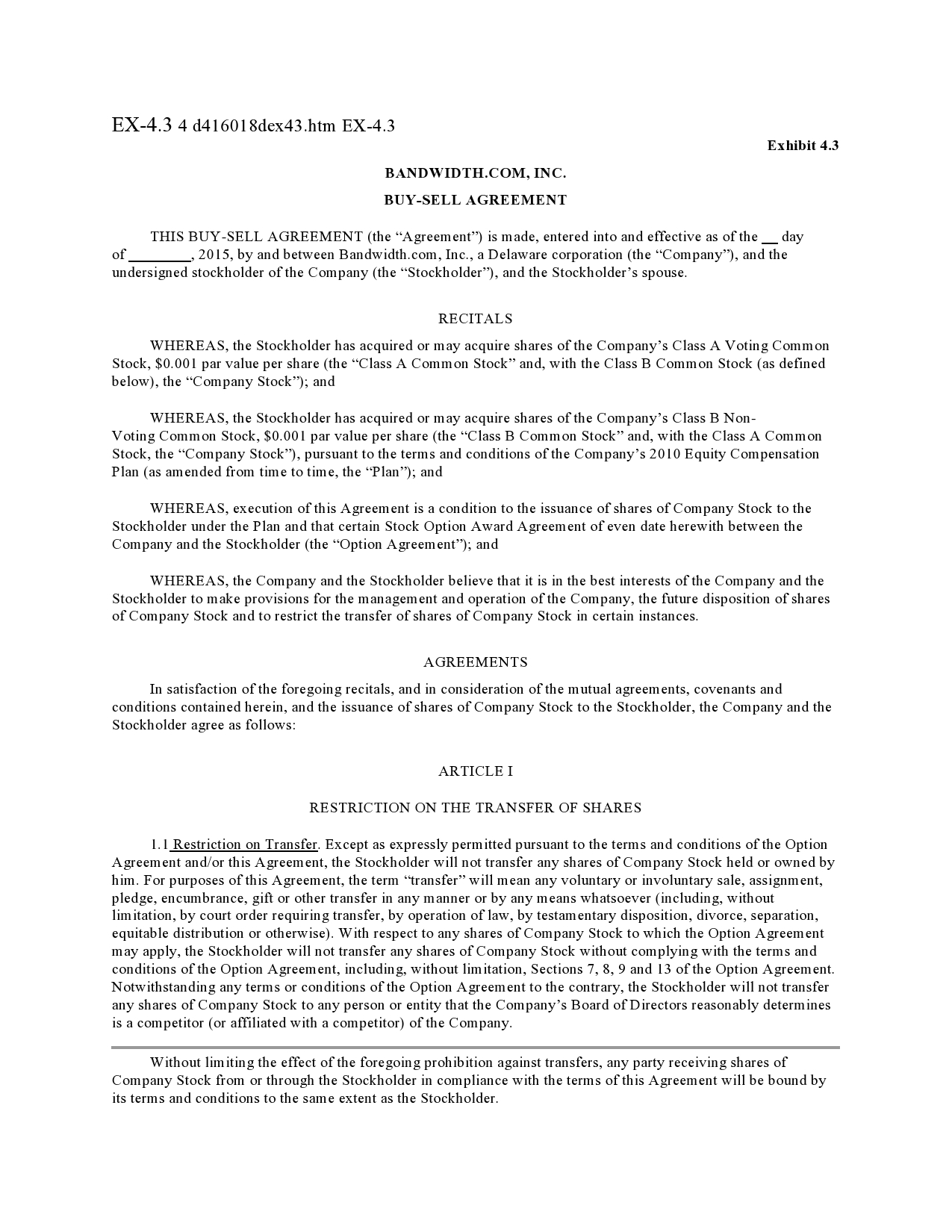

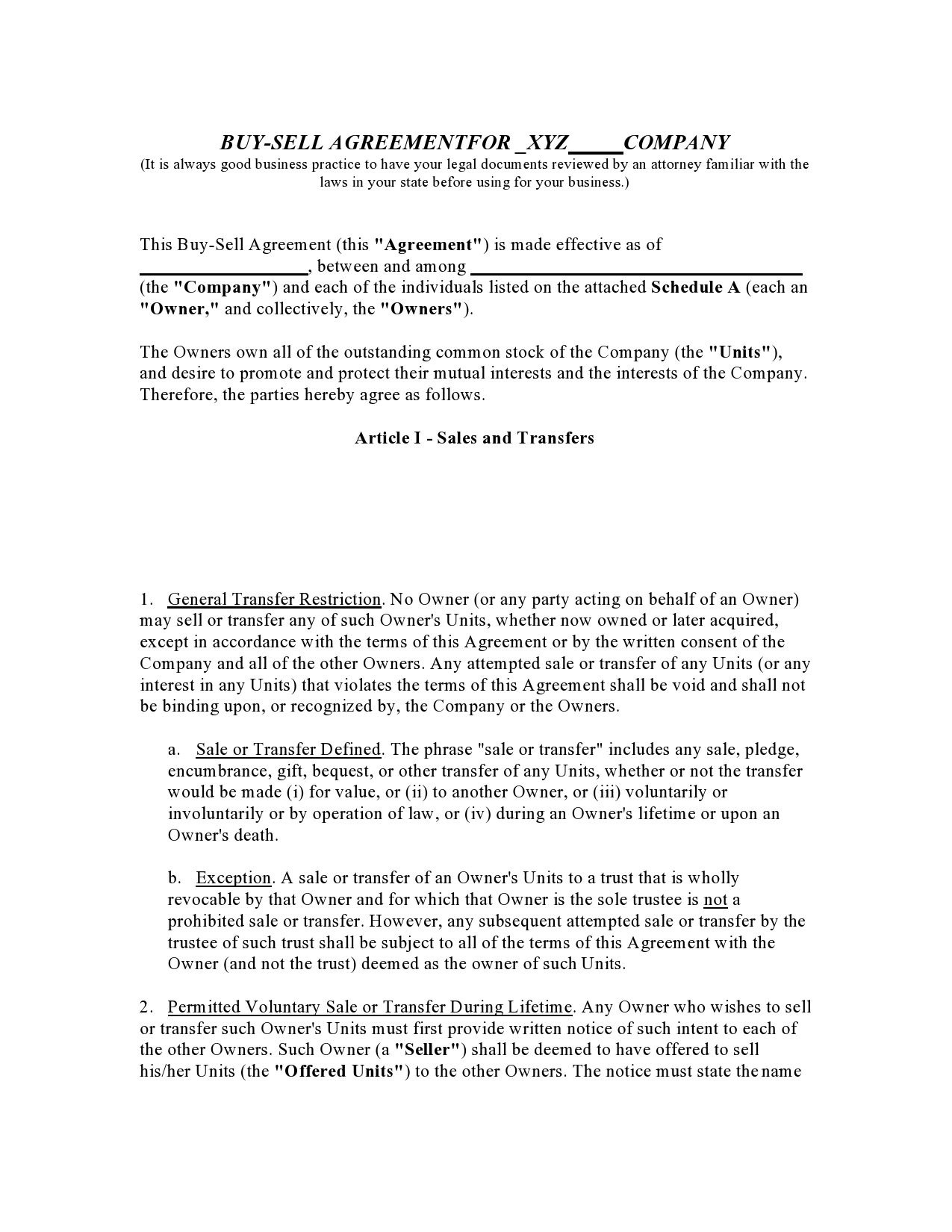

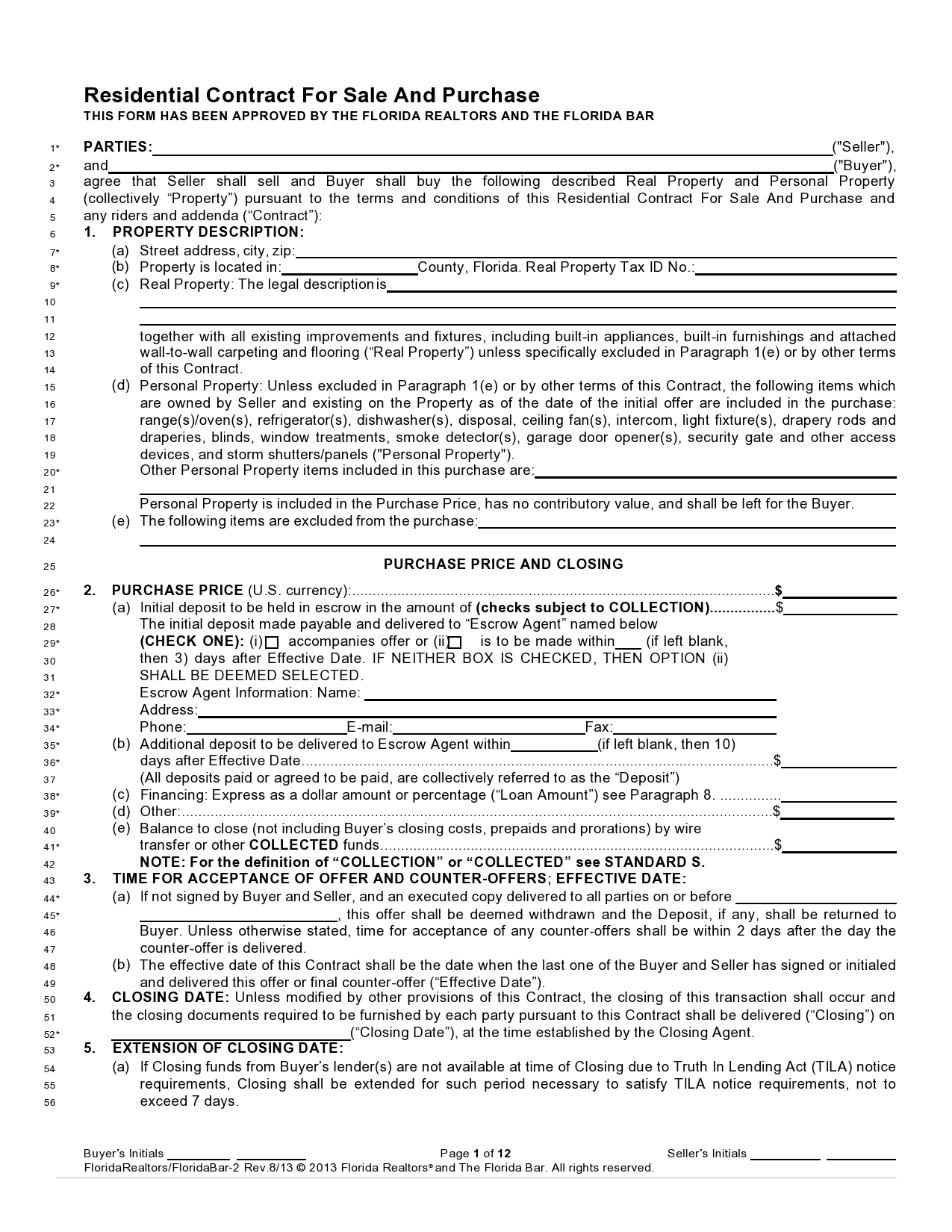

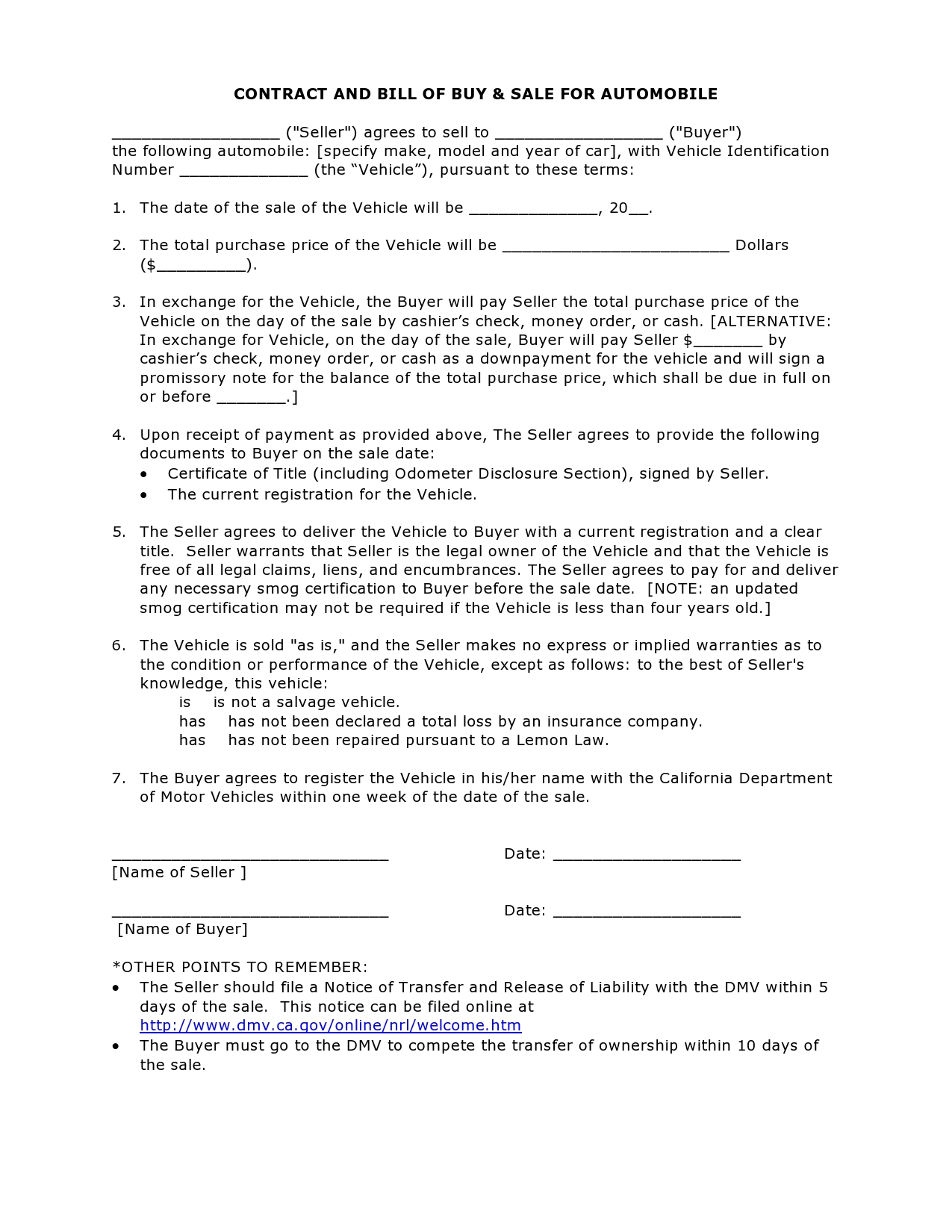

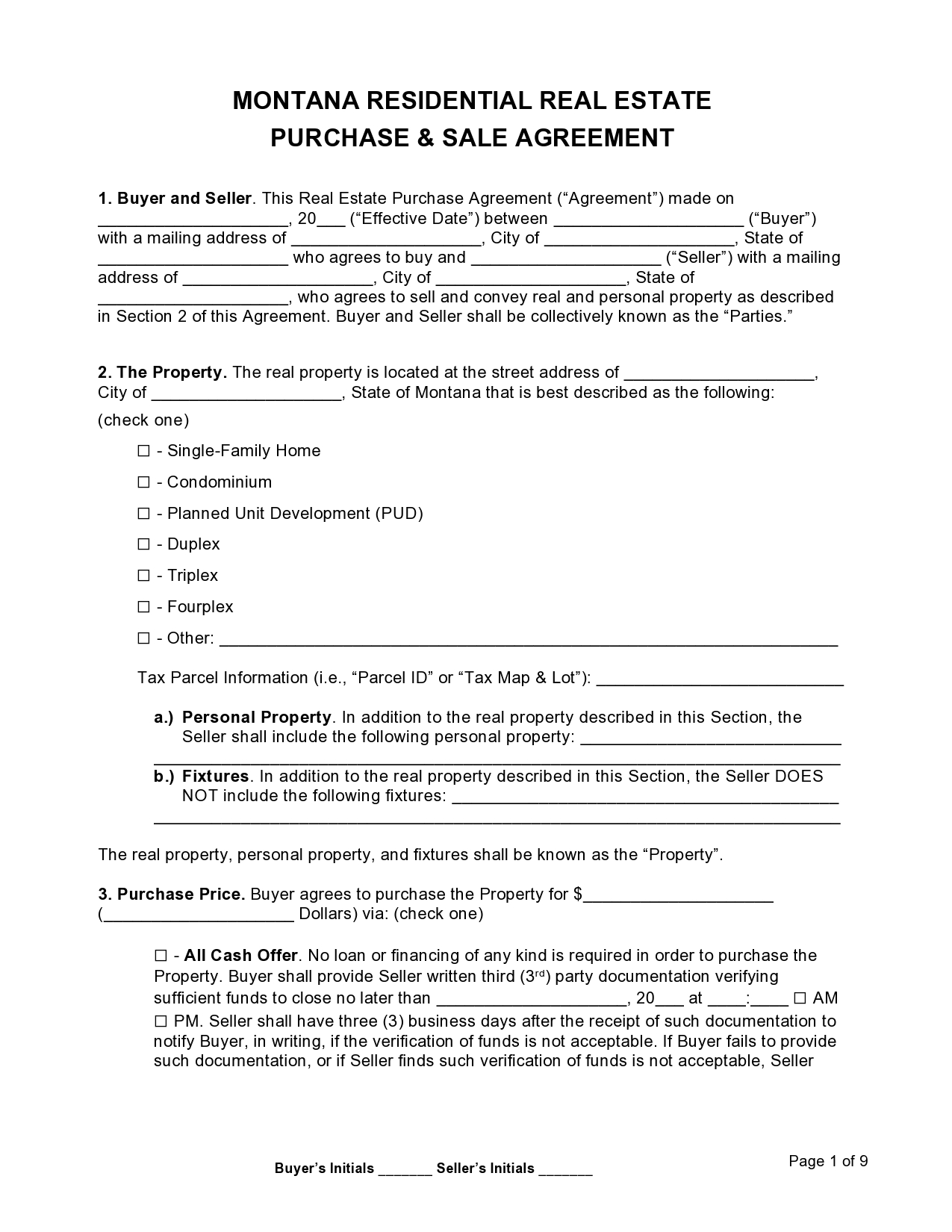

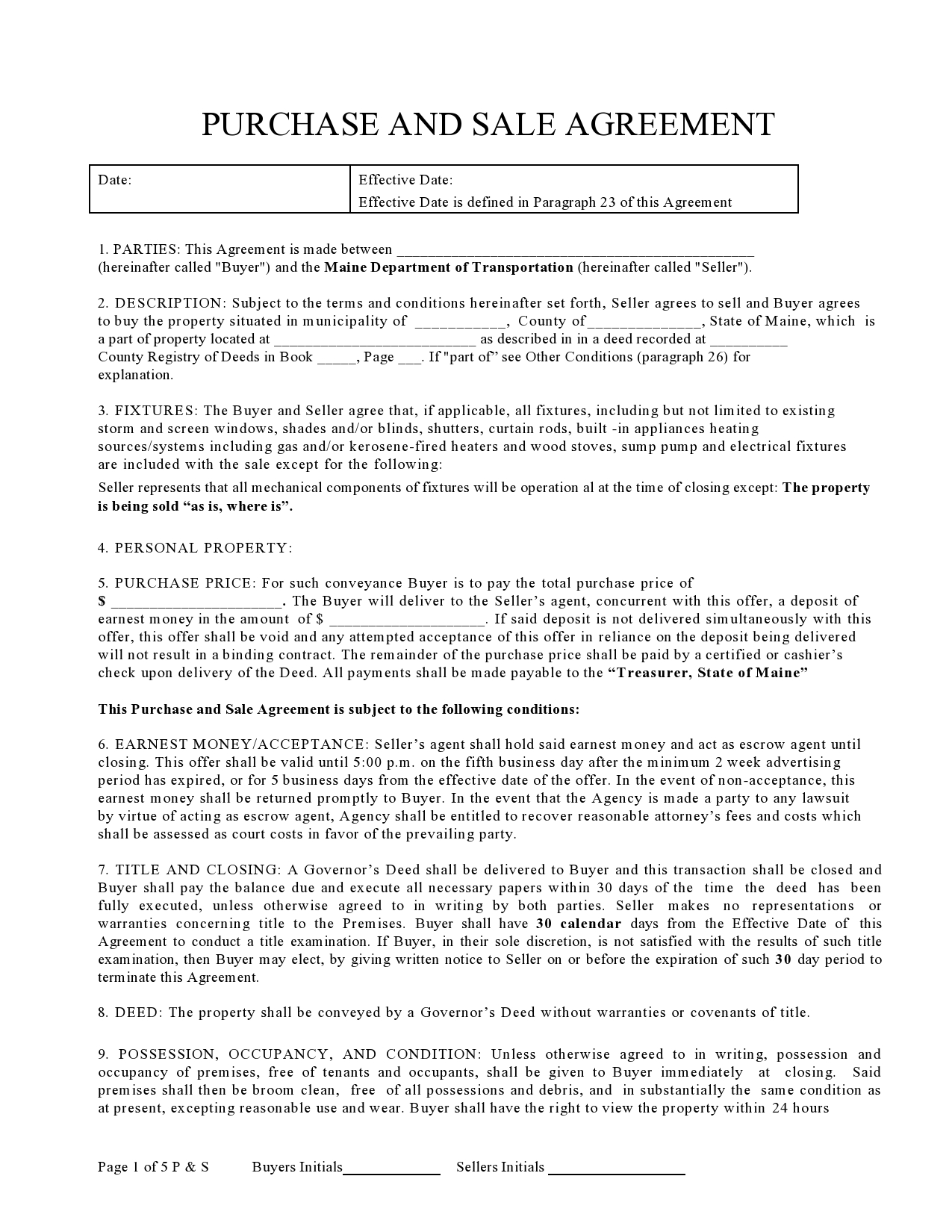

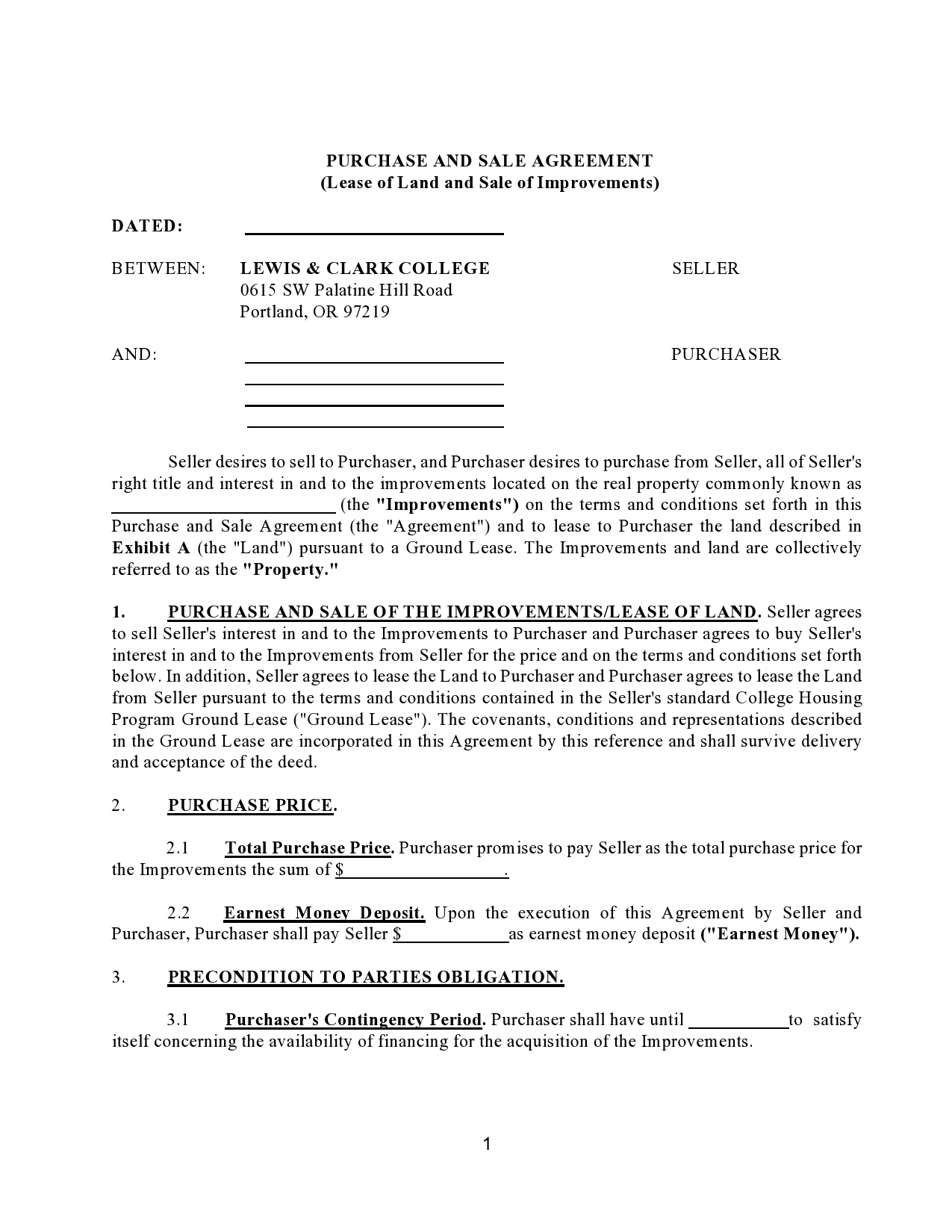

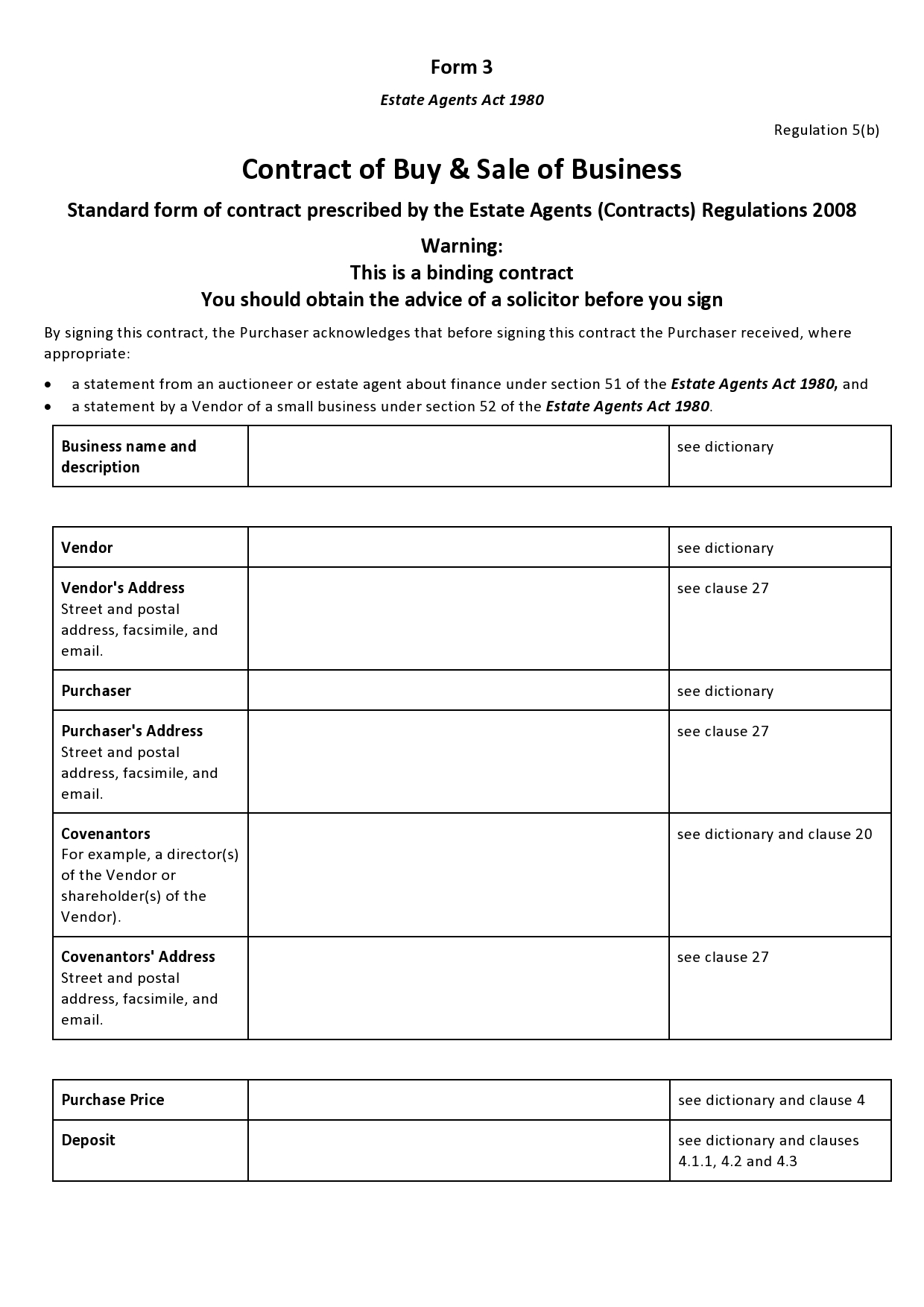

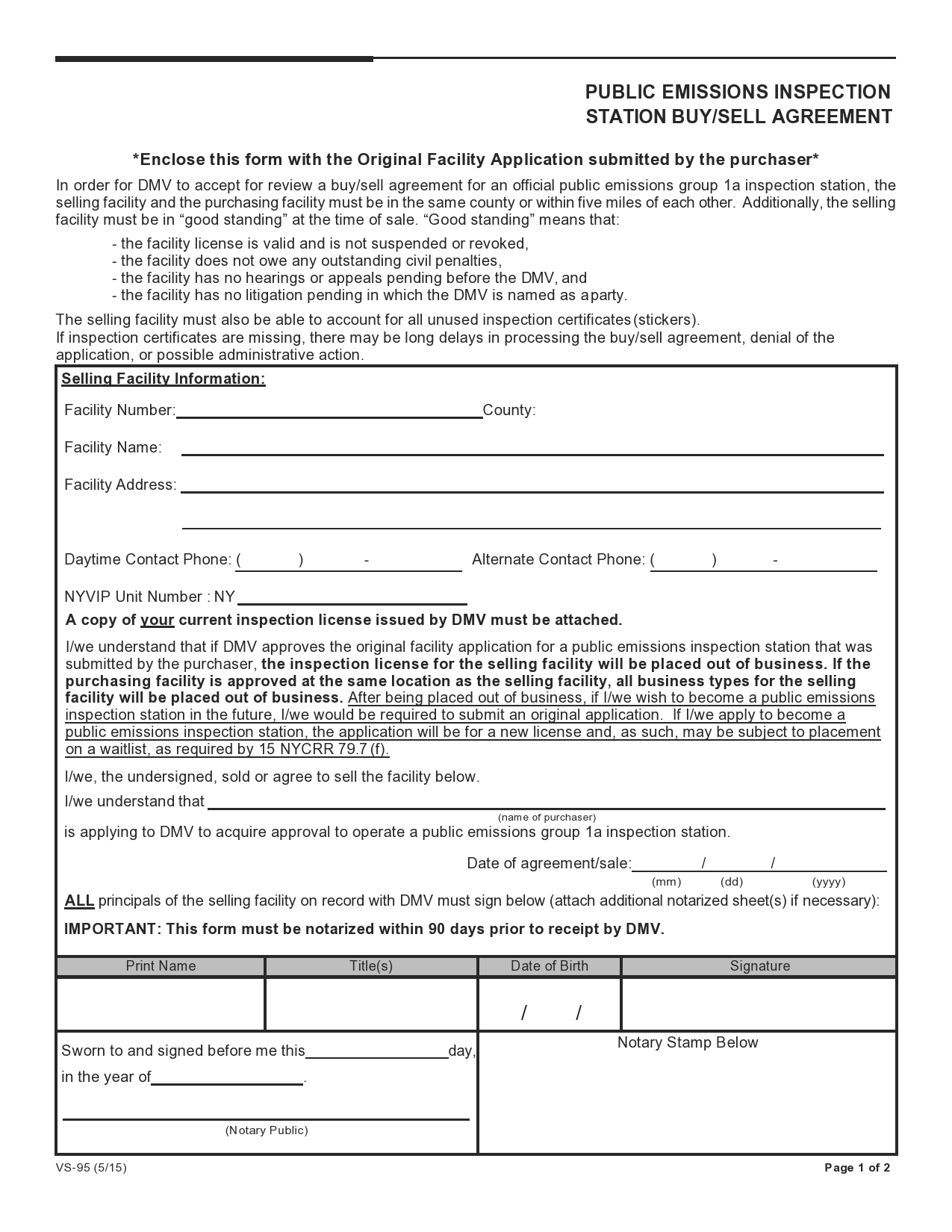

Buy-Sell Agreement Forms

What Are the Types of Buy-Sell Agreements?

Buy-sell agreement forms can come in various types. There are three main kinds of this agreement:

- Entity-Purchase Agreement. This buy-sell agreement is between the business itself and its owners. A triggering event in this kind of buy-sell agreement can be death, disability, termination of employment, etc. When the buy-sell agreement is triggered in this case, the shares of the departing owner are sold with interest at an agreed-upon price. In insurance funding situations, the business will buy the insurance needed for all the owners and become the owner and beneficiary of the policies that were taken out. The business then uses the proceeds of the policy to buy the departing partner’s shares.

- Cross-Purchase Agreement. In a cross-purchase agreement, the buy-sell agreement is between business owners in which any of the remaining owners have to buy the departing owner’s shares at an agreed-upon price should a triggering event occur. This is typically funded through the mutual efforts of all the owners of the business. This is only really effective when a very small group of owners is involved in the operation of a business.

- Wait-and-See Agreement. This is a hybrid entity-purchase agreement and a cross-purchase agreement. When a wait-and-see agreement is in place, the buyer of the business interest is not identified in the agreement. The buyer could be the other owners or the business entity itself. The purchasers and the amount of the purchase are not determined until the triggering event takes place.

At this time, the shares will be offered for purchase to the other owners as well as the business itself. If the company does not buy the shares, the remaining owners have the option to do so. The company will be obligated to purchase all the remaining shares and cannot select to buy a portion of them. This is the least organized of the agreements, but it can be the most equitable if the business owners do not agree in advance about how to handle buy-sell processes.

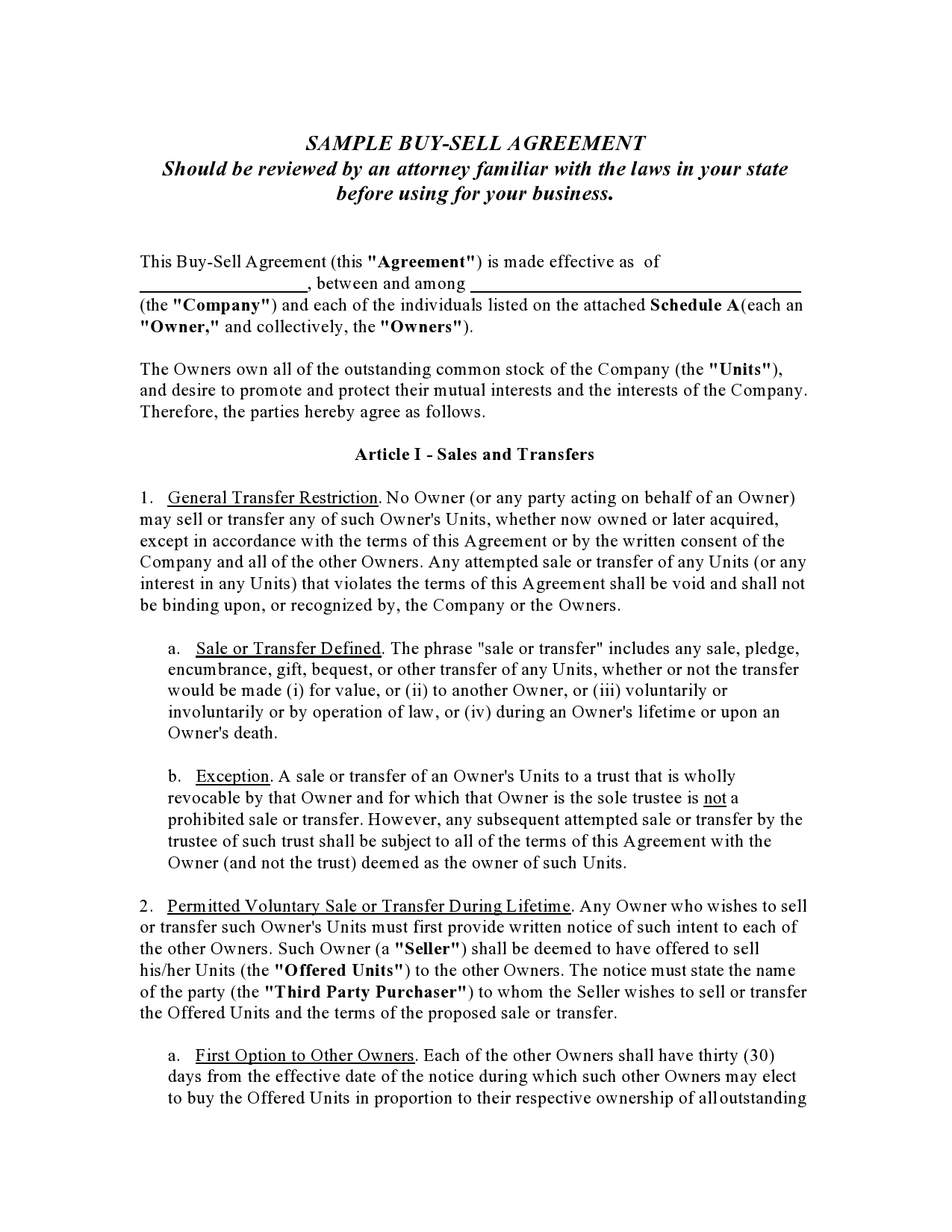

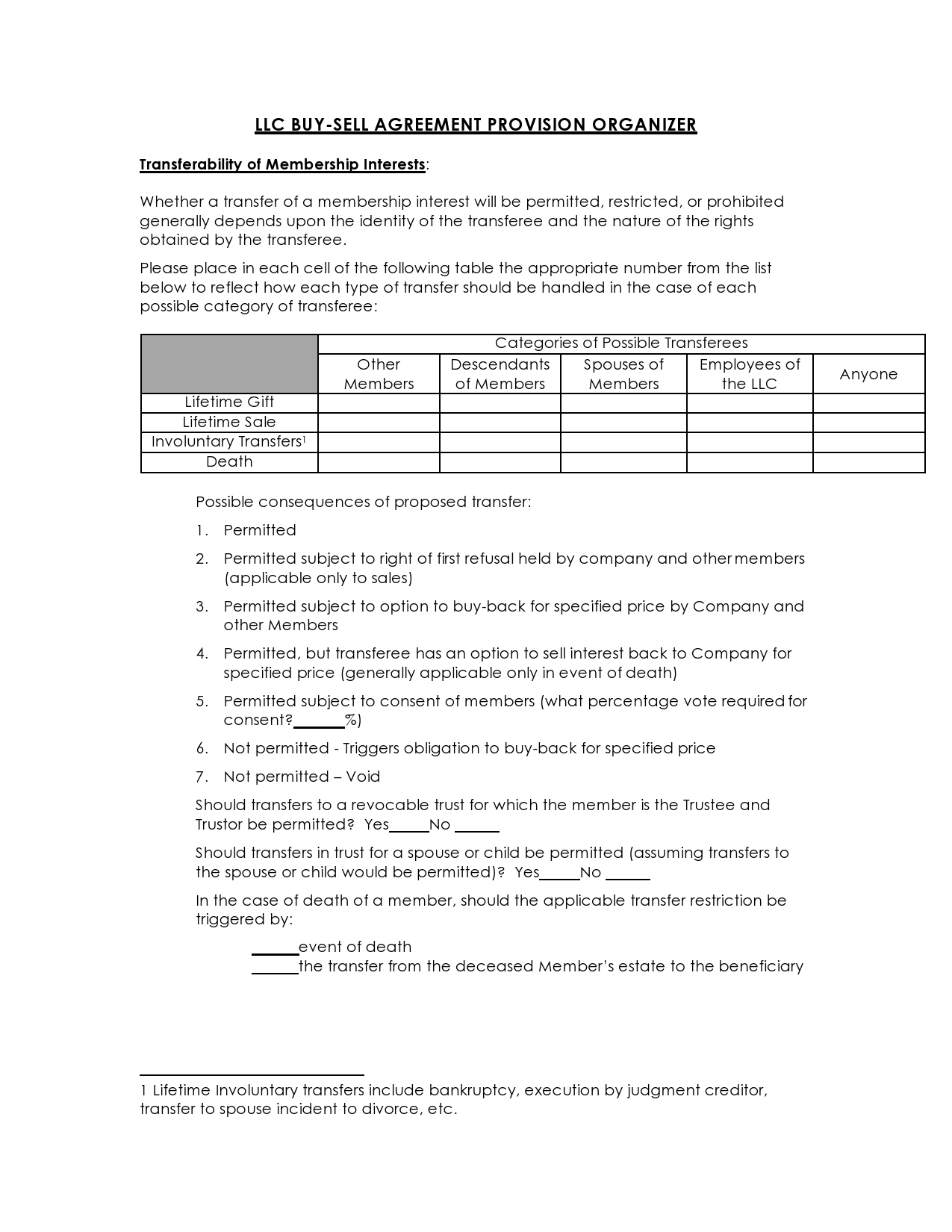

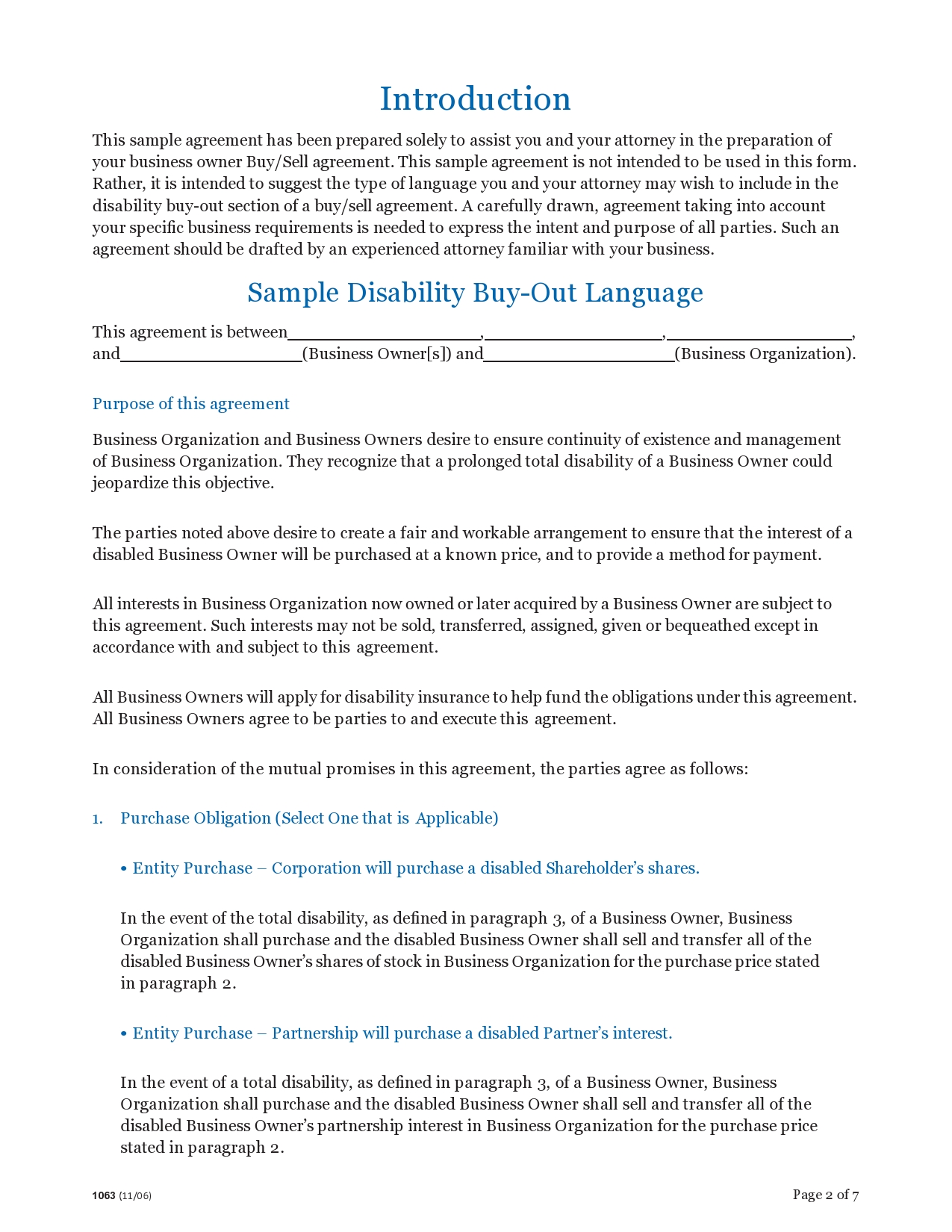

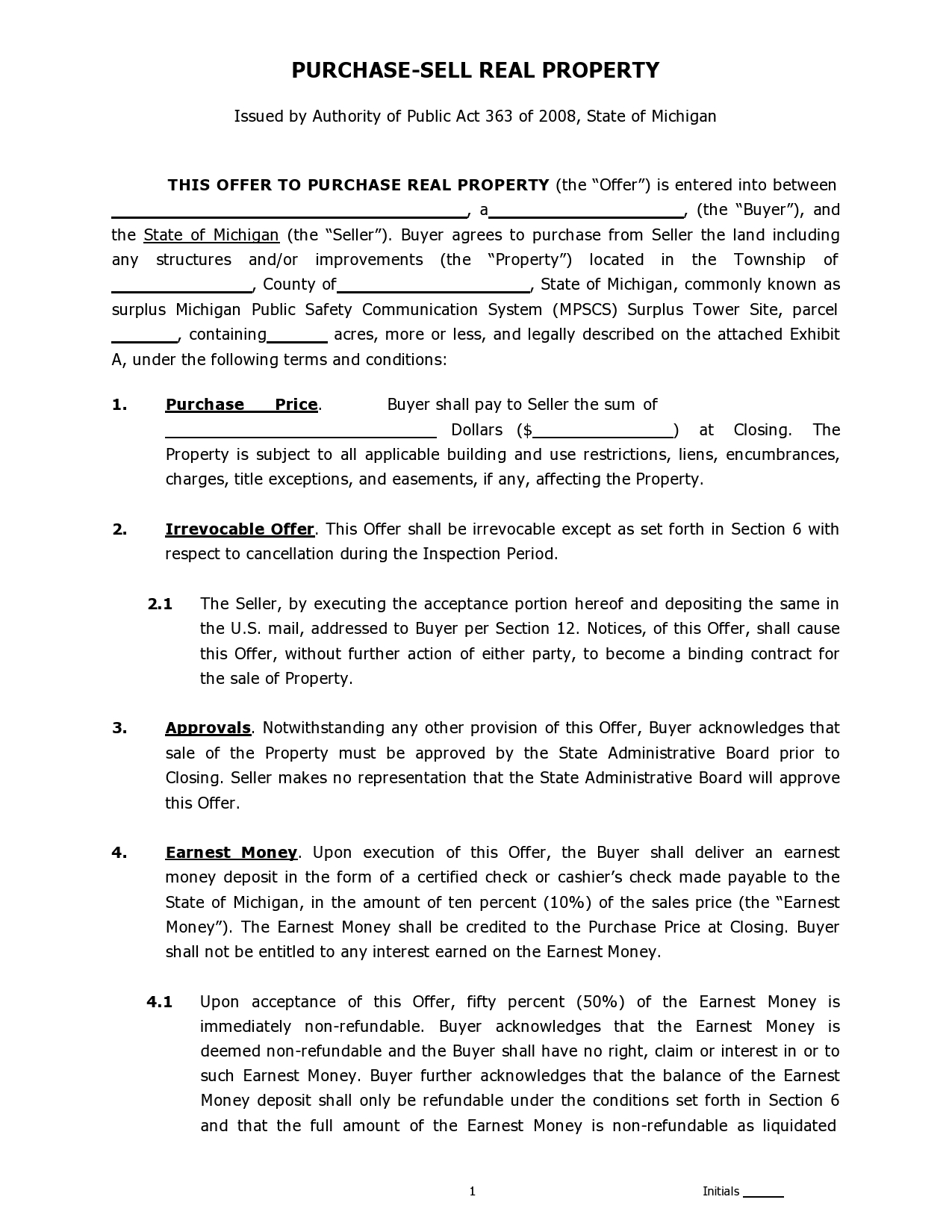

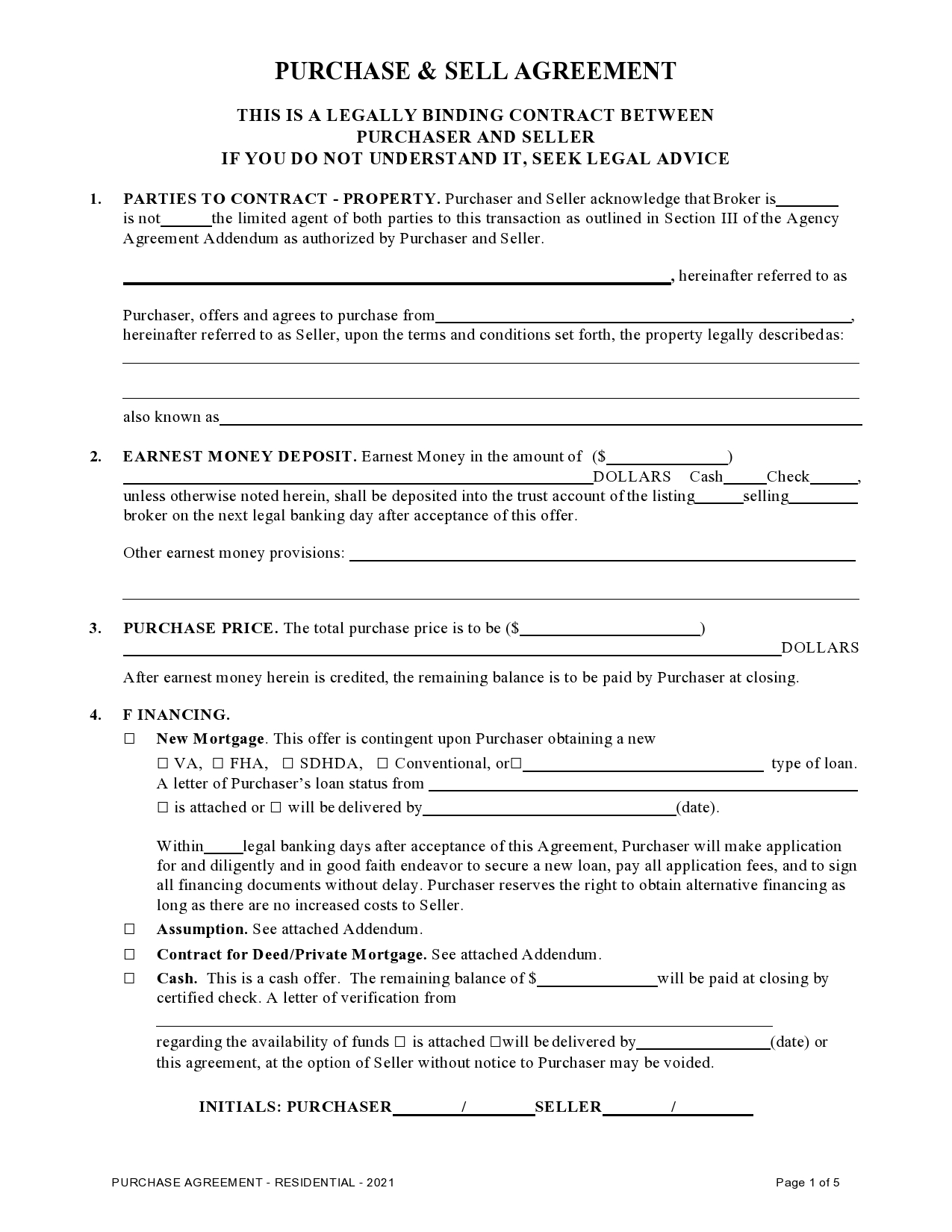

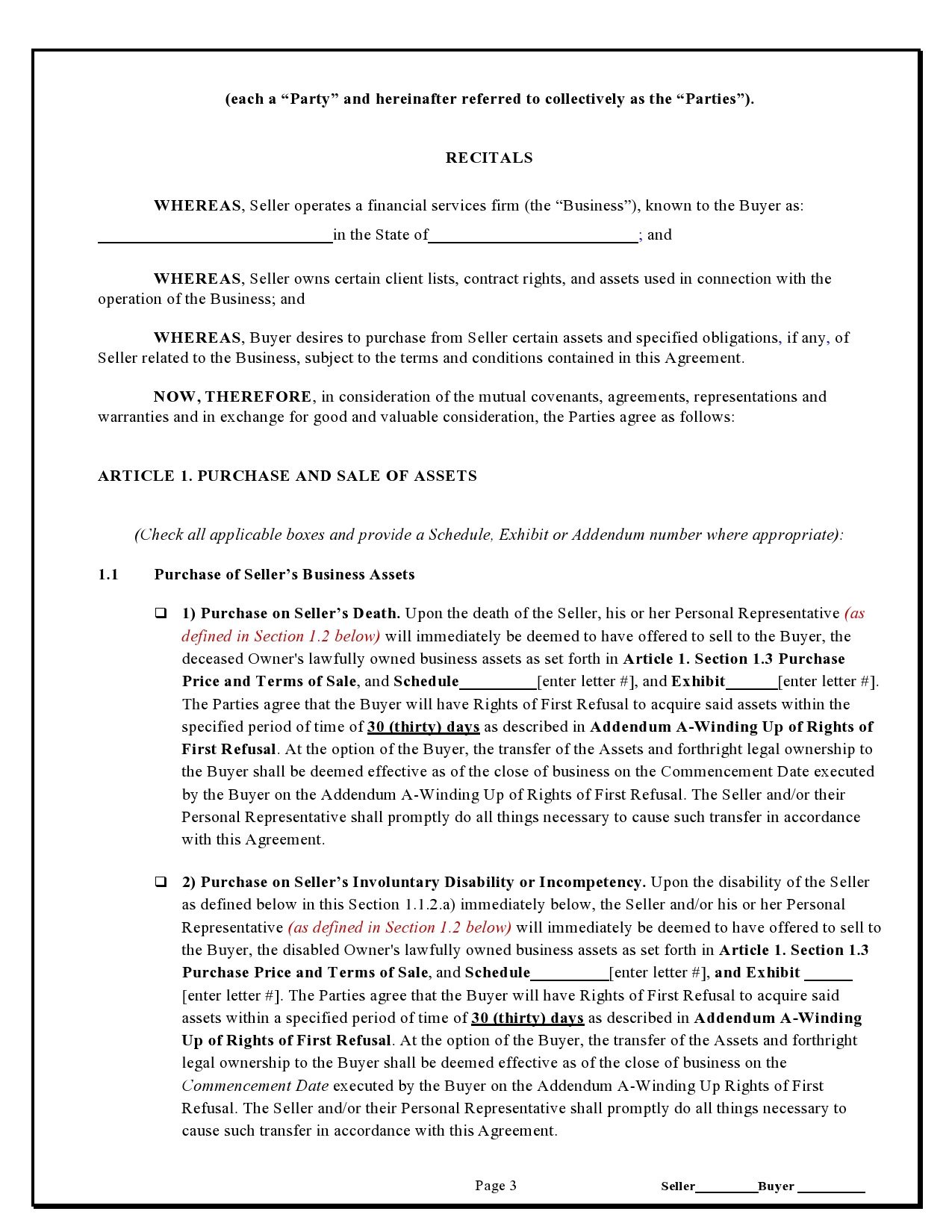

What Needs to be Included in a Buy-Sell Agreement

Every business has a unique structure, and this means that each buy-sell agreement is totally unique to others. There are some general details that do need to be included in the documentation that you make for your buy-sell agreement, however. The more people who are involved in the ownership of a business, the more complex the buy-sell agreement will be.

- Triggering Events. This part of the buy-sell agreement will outline what causes the buy-sell agreement to be triggered and go into effect. This is one of the key items that has to be in your buy-sell agreement, or else it is not valid since it can never be triggered.

- Death of Owner/Partner. In most cases, the death of owners or partners is the reason that a buy-sell agreement is needed. This portion of the buy-sell contract will stipulate what is done with the deceased owner’s shares at the time of their death.

- Divorce. In many cases, divorce can pose a significant risk to the shares of a business. Marriage dissolutions can be very unpleasant, and spouses can sometimes decide that they should be given access to the shares of the deceased owner. If this is not provided for in the buy-sell agreement, there can be an open door for the former spouse to seek what they feel is their share of the company’s ownership. Stipulating that former spouses cannot automatically take possession of the shares in question is critical in most cases for the well-being of the company.

- Disability or Long-Term Illness. For many companies, the business owners are a big part of the worth of the company. The work that they are doing to maintain and run the business will have to be continued if they leave the company. Long-term disability is one of the major triggering events that can lead to the use of the buy-sell agreement. This kind of stipulation will often have a clear timeline related to how long the owner is away from work before the buyout can be enacted. There might also be clauses that attend to whether or not the former owner can then buy back their shares if their health situation changes.

- Personal Bankruptcy. The buyout agreement should also include a clause that allows for the company to buy back any shares that might be lost if an owner experiences personal financial difficulty. Creditors in bankruptcy can go after the shares that someone has in a company, and businesses will want to protect their shares from this kind of action.

- Conflict Between Partners. No matter how well people get along when they create a business, things can change. The conflict between partners can be disastrous to the well-being of the company. This part of your buy-sell agreement will help to handle issues like this and allow partners to sever their ties with other partners in order to save the company from being broken up due to internal strife.

- Retirement. Partners will eventually retire. This can lead to a need to deal with their shares in some equitable way. The age of retirement is typically specified, and information about the shares of the retiring person is included as far as whether or not they will be sold or who can buy them.

- Early Buyout. It is a common component of a buy-sell agreement to include a clause in case owners want to amicably leave the company to work on other projects. This will allow for the purchase of the shares that are impacted by this decision.

- Payment Structure. The payment structure of the shareholder buyout agreement template needs to be outlined with regard to who is allowed to buy the shares and how the payments for the shares have to be made. This is a critical step in the process so that the business is cared for properly with regard to the percentage of the shares that each partner can buy and what the timeline needs to be for the purchase process to be completed.

- Fair Price Valuation. Your business will need to be evaluated from time to time to make sure that the agreed-upon share values are not way out of line with the current value of the company. For buy-sell agreements, it can be part of the process that is outlined after the agreement is triggered that a fair price valuation needs to be completed before any shares are bought or sold. This helps to make sure that a third party has established the right value for each share.

- Financing. This part of the buy-sell agreement will offer information about the way that payments can be financed. This means that insurance funding, loans, installment payments, cash or certified check payments, and other common payment options will be outlined as acceptable or not acceptable for the purchase of shares. This part of the buy-sell agreement can significantly limit who can afford to buy the shares in question.

- Right of First Refusal. One of the other common components of a buy-sell agreement is the right of first refusal, which offers the remaining shareholders the right to buy the shares first. This also usually outlines the pricing stipulation for this purchase process. This will prevent shareholders from selling to an outside entity, which is often critical for the well-being of the business.

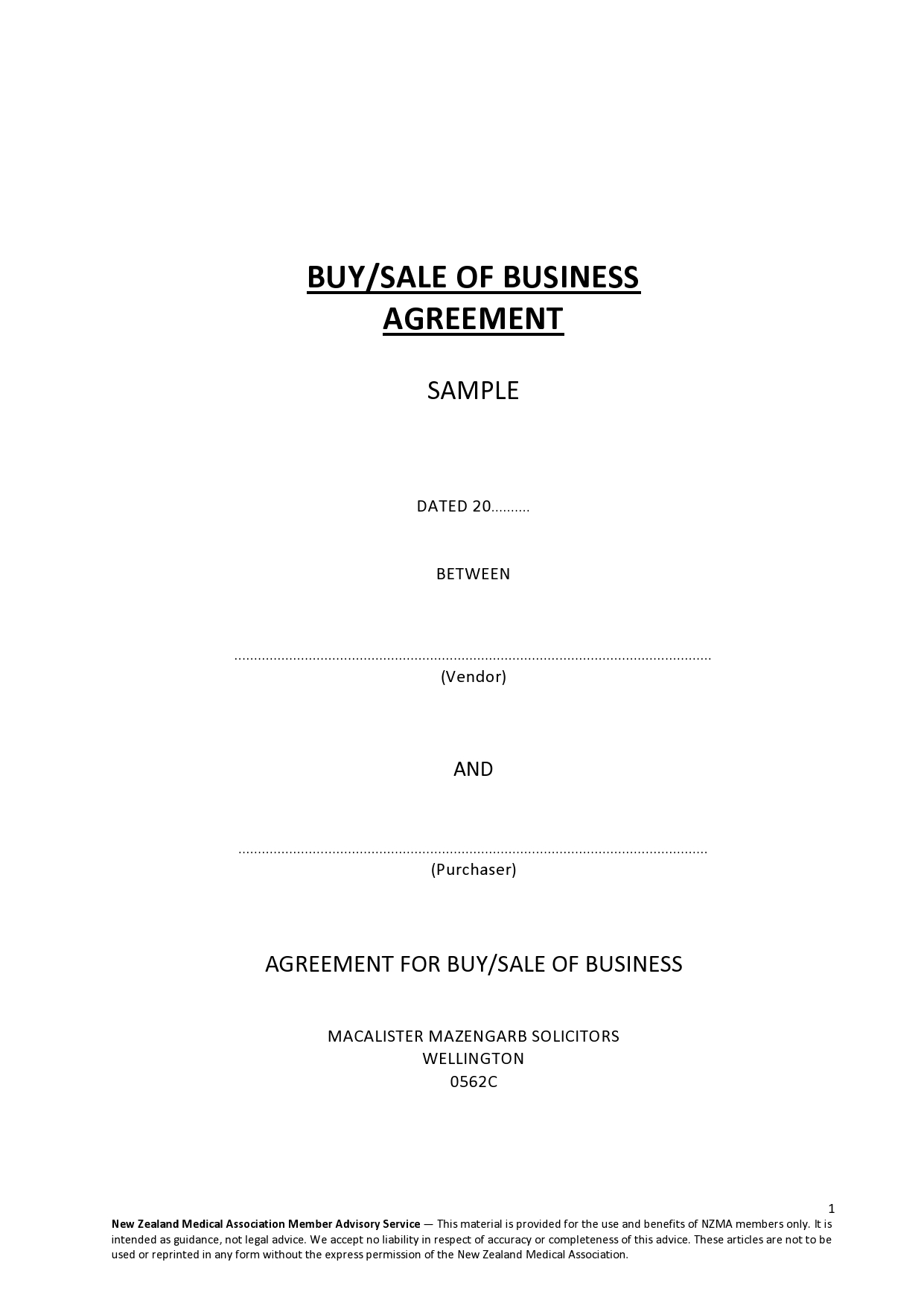

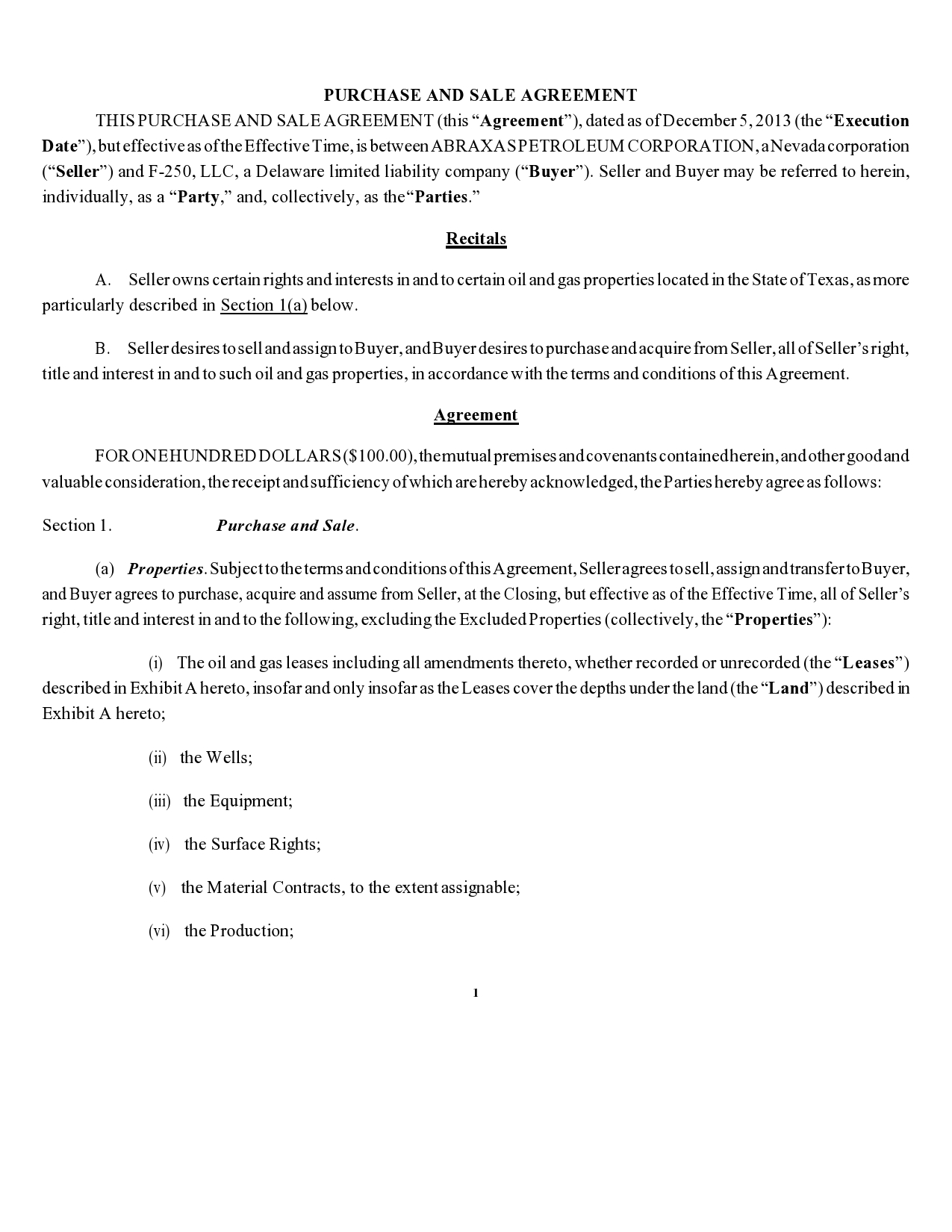

Buy-Sell Agreements Are Essential For Business Operation

If you own a business with a group of other owners, you need to have the right buy-sell agreement in place to protect your business’ shares from being sold in a way that might damage the company. From changes in life situations such as bankruptcy or interest in moving on to other business ideas to death or retirement, there are many kinds of changes that can take place that will require that a business owner sells their shares of a business.

Having a buy-sell agreement in place that can be triggered when these events take place is critical to the health of any business. The shares that are no longer controlled by an owner who is leaving the company will need to be protected from a sale that could be ruinous for the company or that could change the controlling ownership of the business in a negative way. Having a well-crafted buy-sell agreement is very important for any business, even if your company is small and only has a few owners.

Crafting the right buy-sell agreement can be the difference between your business surviving the loss of an owner with controlling interest or floundering due to a lack of legal guidance when this situation arises.