If you are planning to sell a business that you own, you need to know how to create a business sale contract that has all the right information in it. When you create a business sales agreement, you need to be sure that you cover in writing all the various details of the sale properly. It can be tempting to look at business purchase agreement template examples, but this is only useful if you know more about what these contracts need to include.

When you know the details of a business purchase agreement’s creation, you can create the right small business purchase agreement document with ease. Including all the right details in this document is critical to ensure that you have a smooth and easy sale process and that you are paid the amount of money that you were expecting to get for your company.

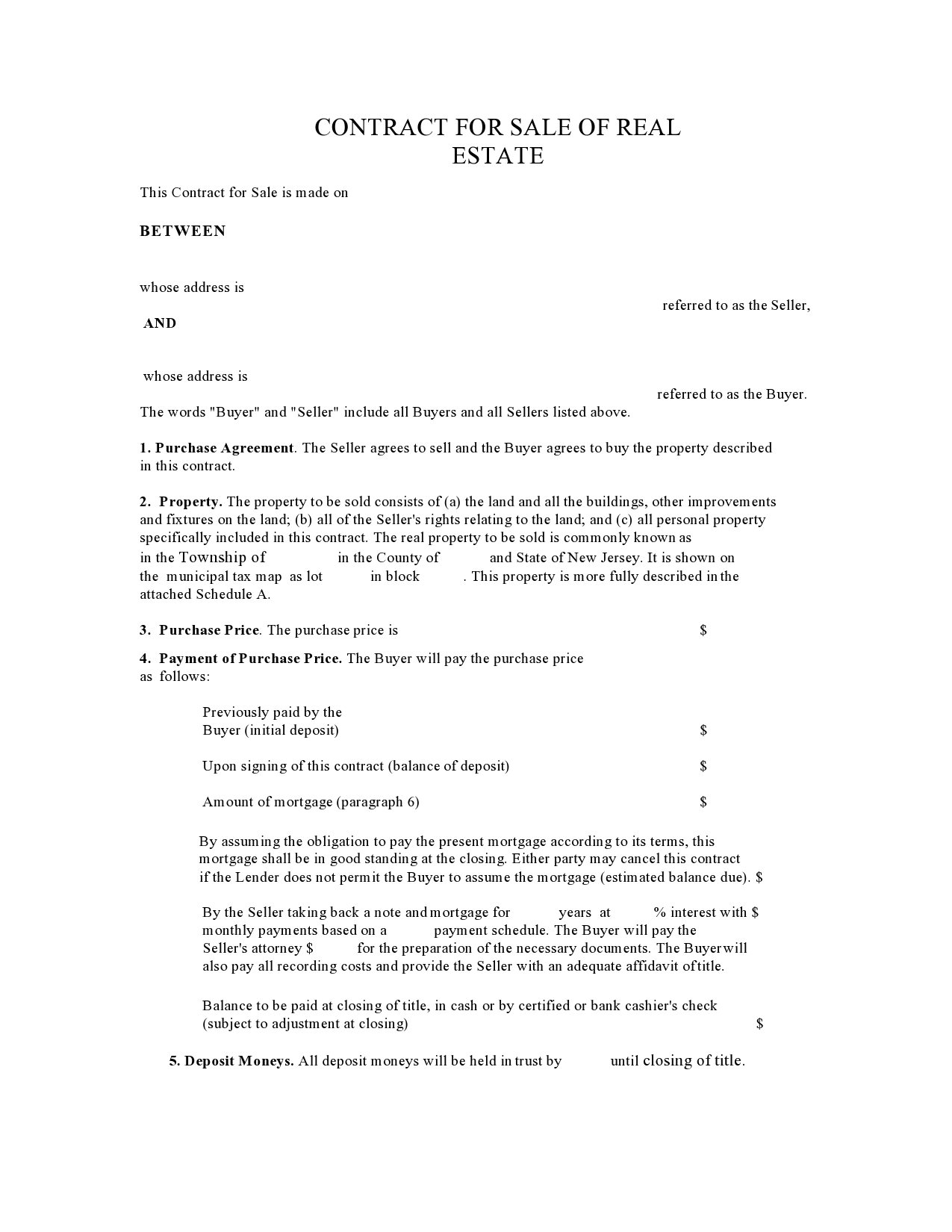

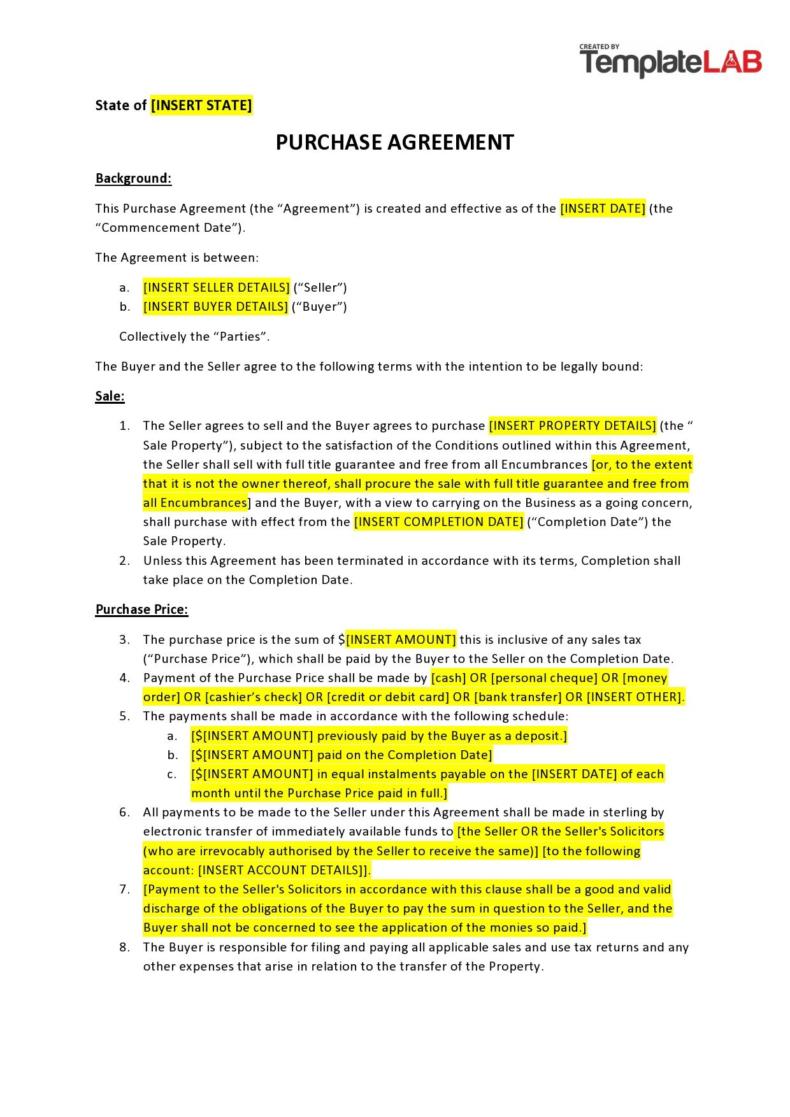

If you are selling a property you need to use a purchase agreement for the property only and not for the business. This can be an important detail that is sometimes handled incorrectly by people selling business locations but not selling the business itself.

Table of Contents

- 1 Business Purchase Agreement Templates

- 2 What is the Purpose of a Purchase Agreement?

- 3 Business Sale Contracts

- 4 What Are the Parts of a Business Purchase Agreement?

- 5 Business Sales Agreements

- 6 How do I Write a Business Purchase Agreement?

- 7 Small Business Purchase Agreements

- 8 Can You Back Out of a Business Purchase Agreement?

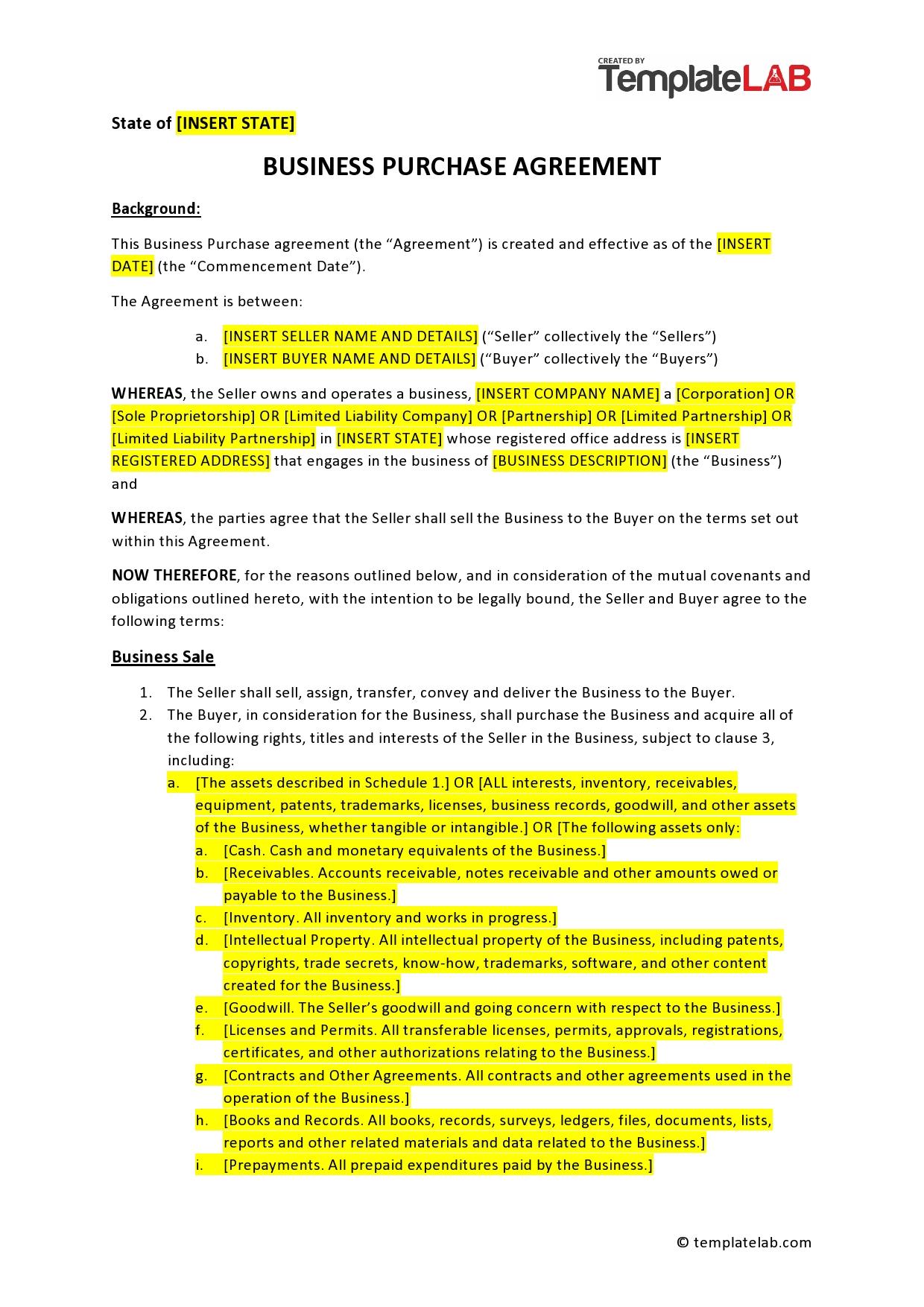

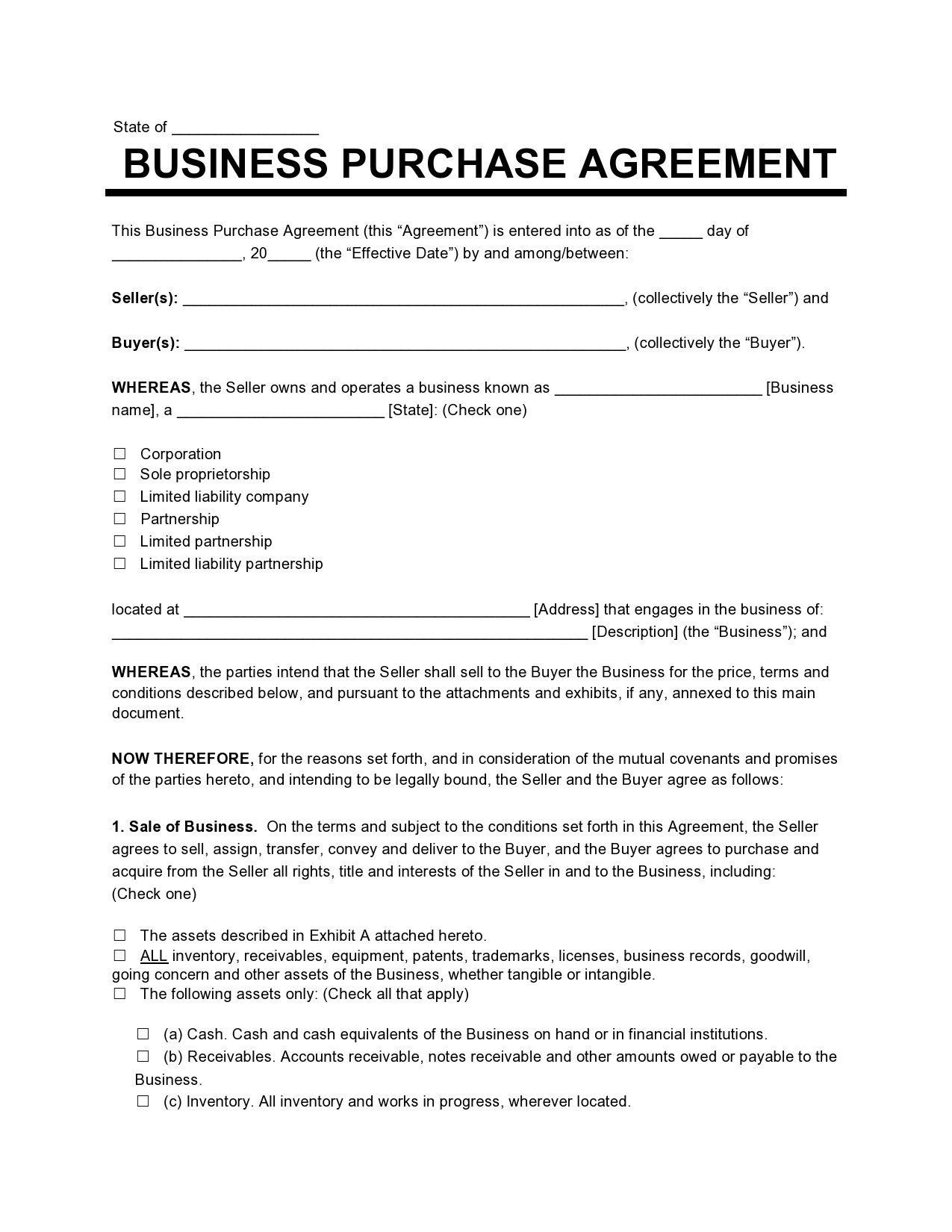

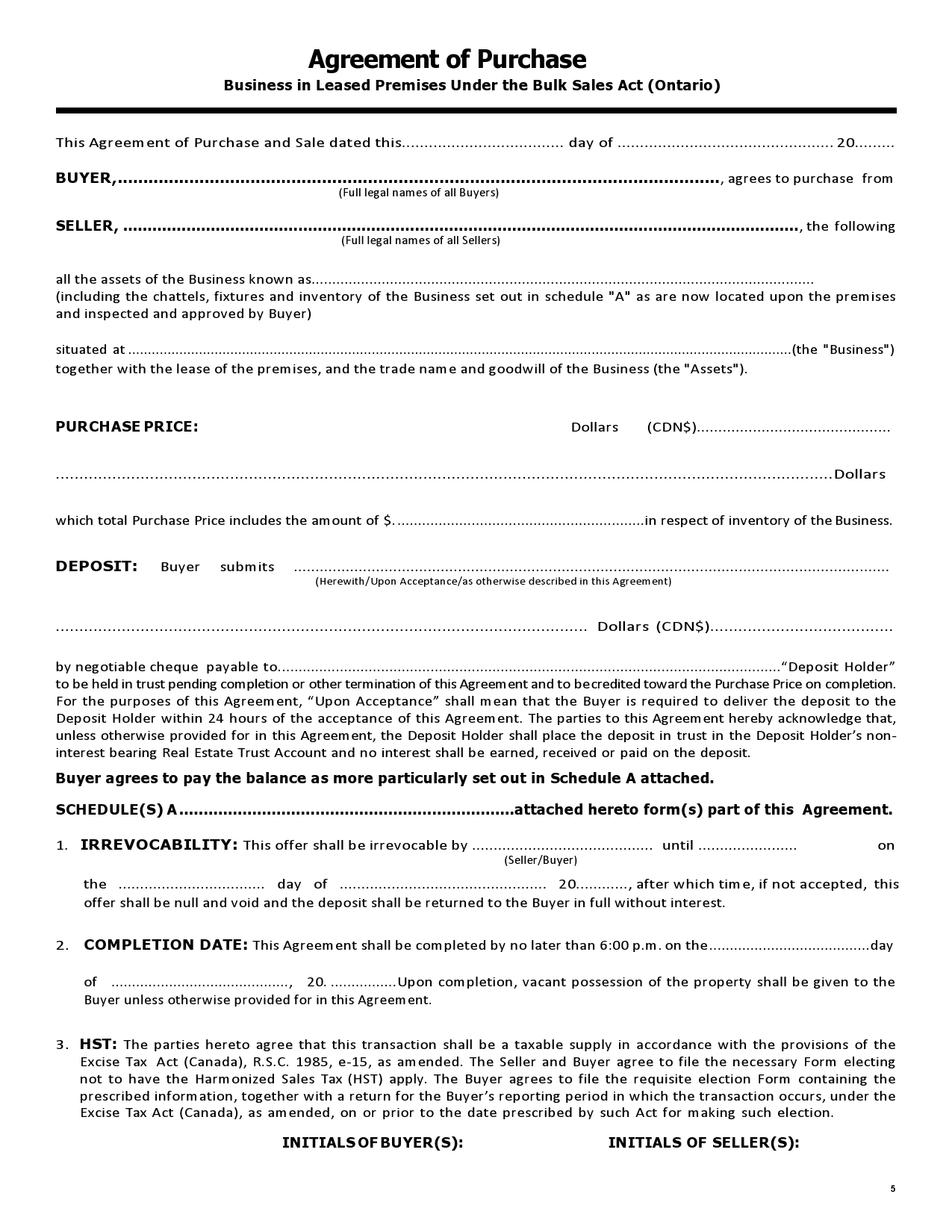

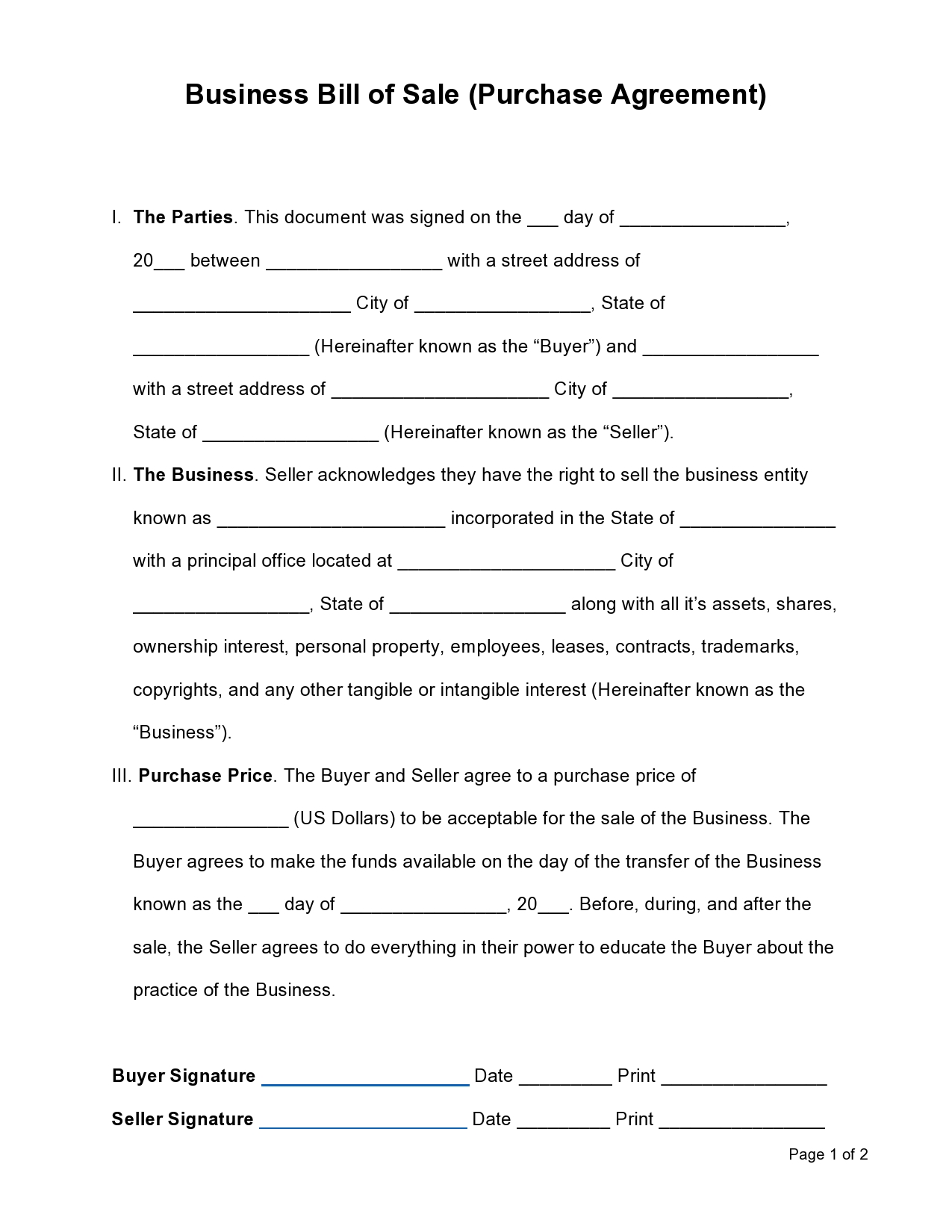

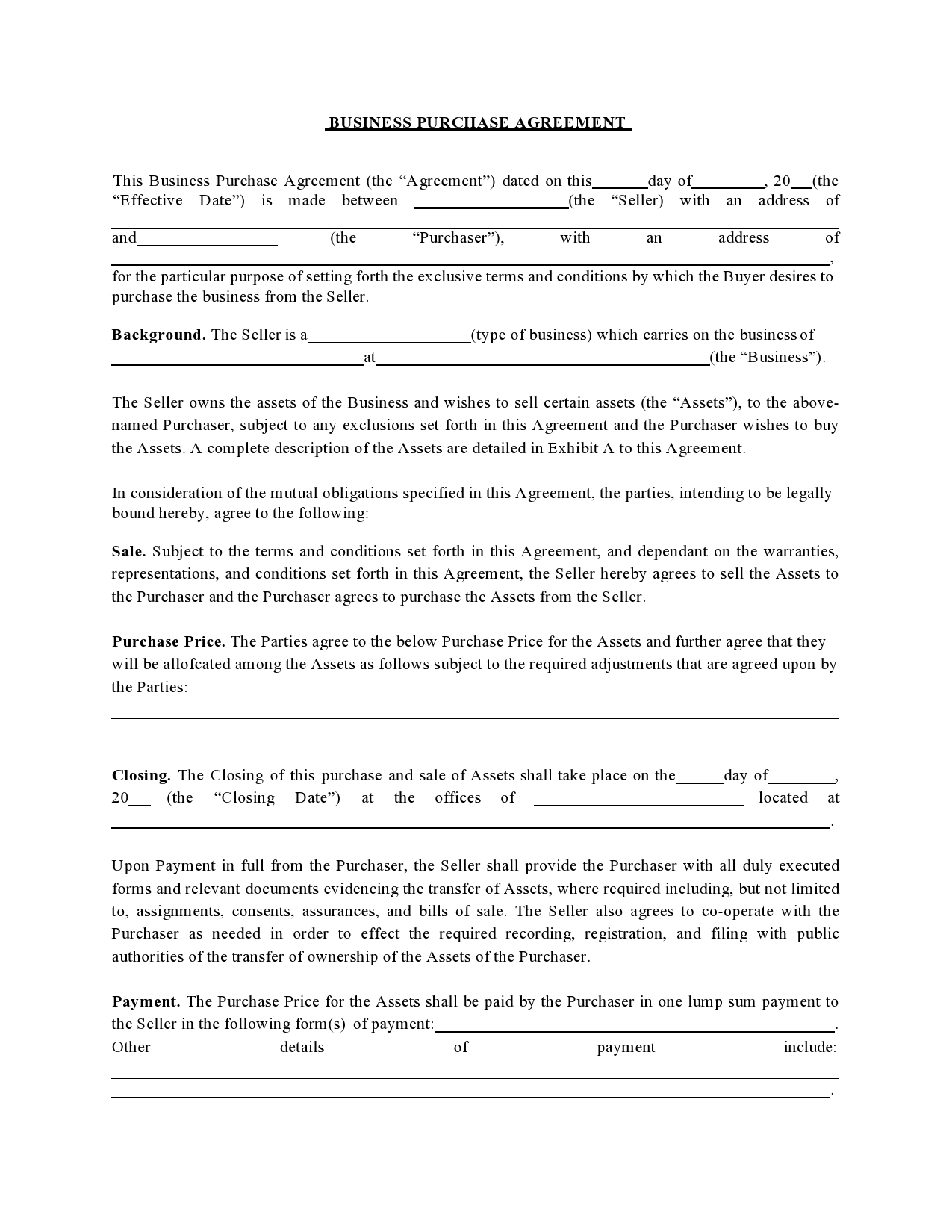

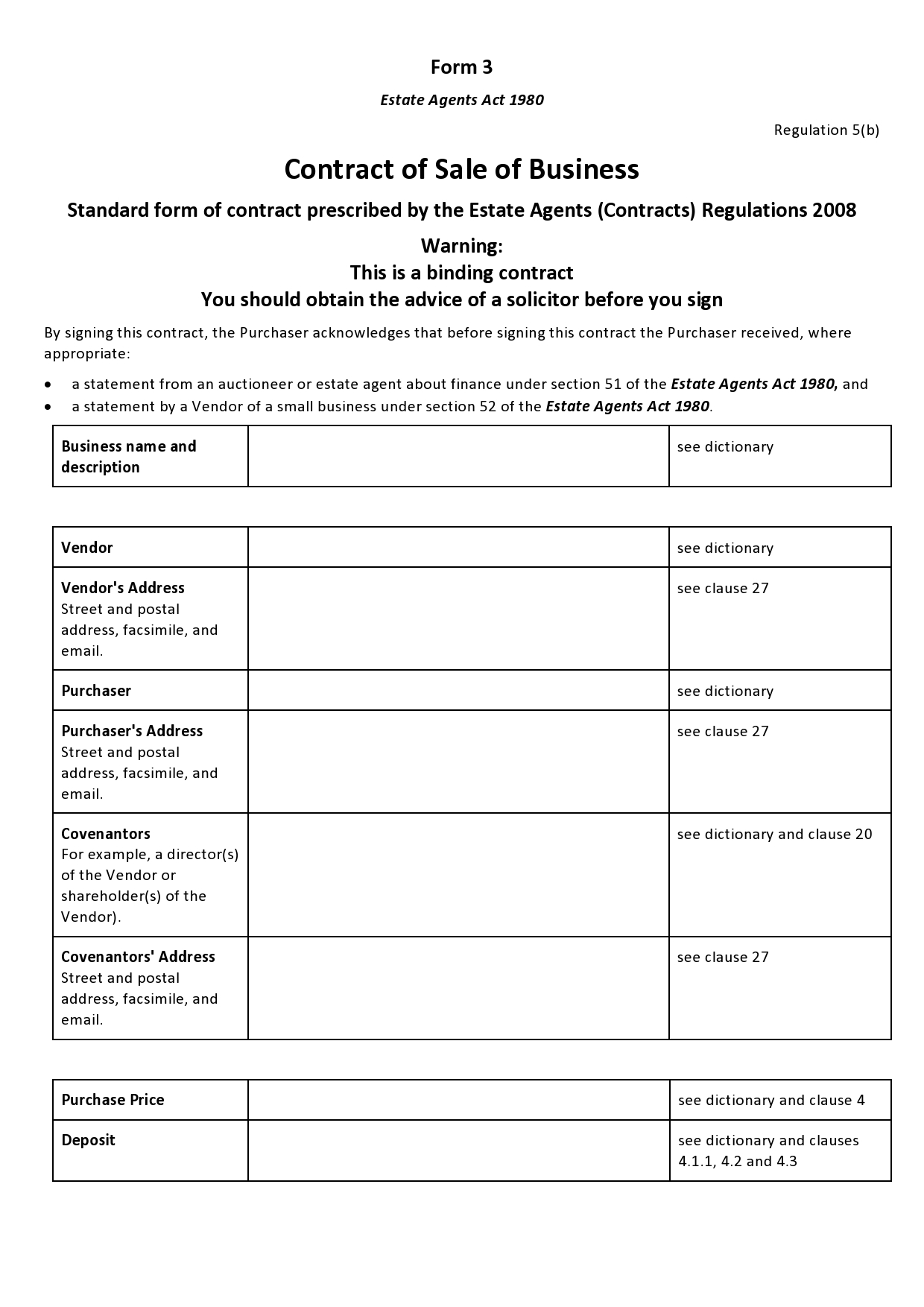

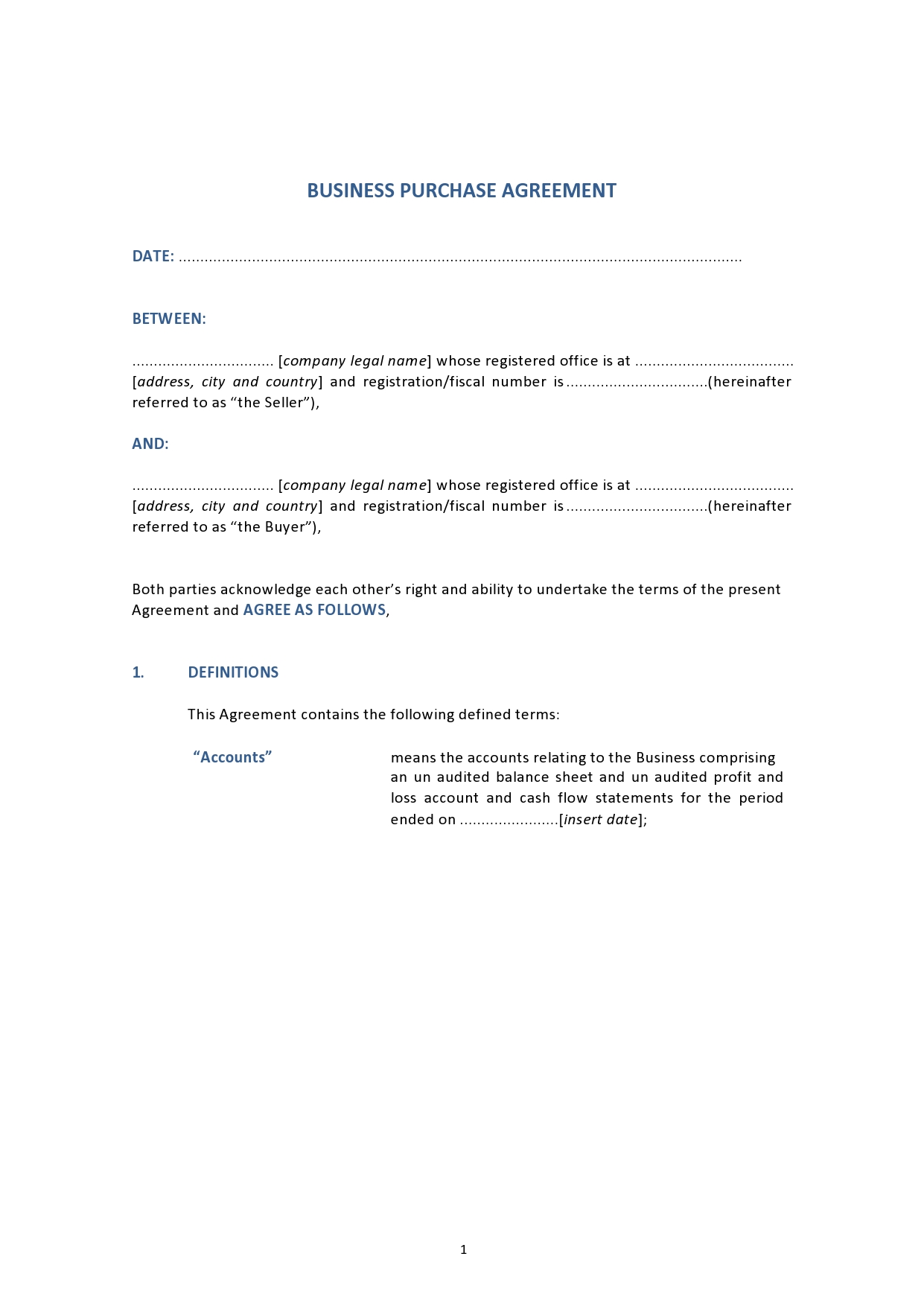

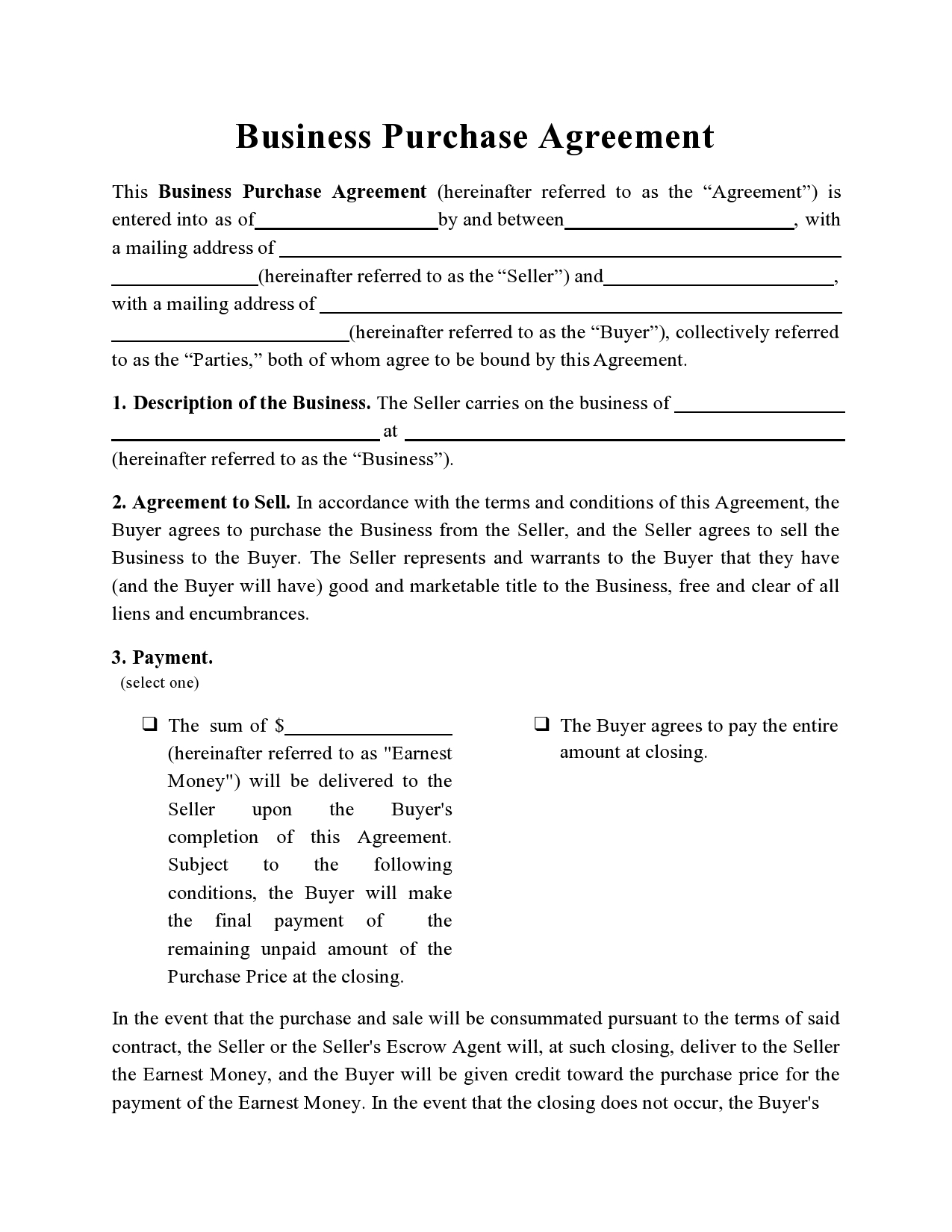

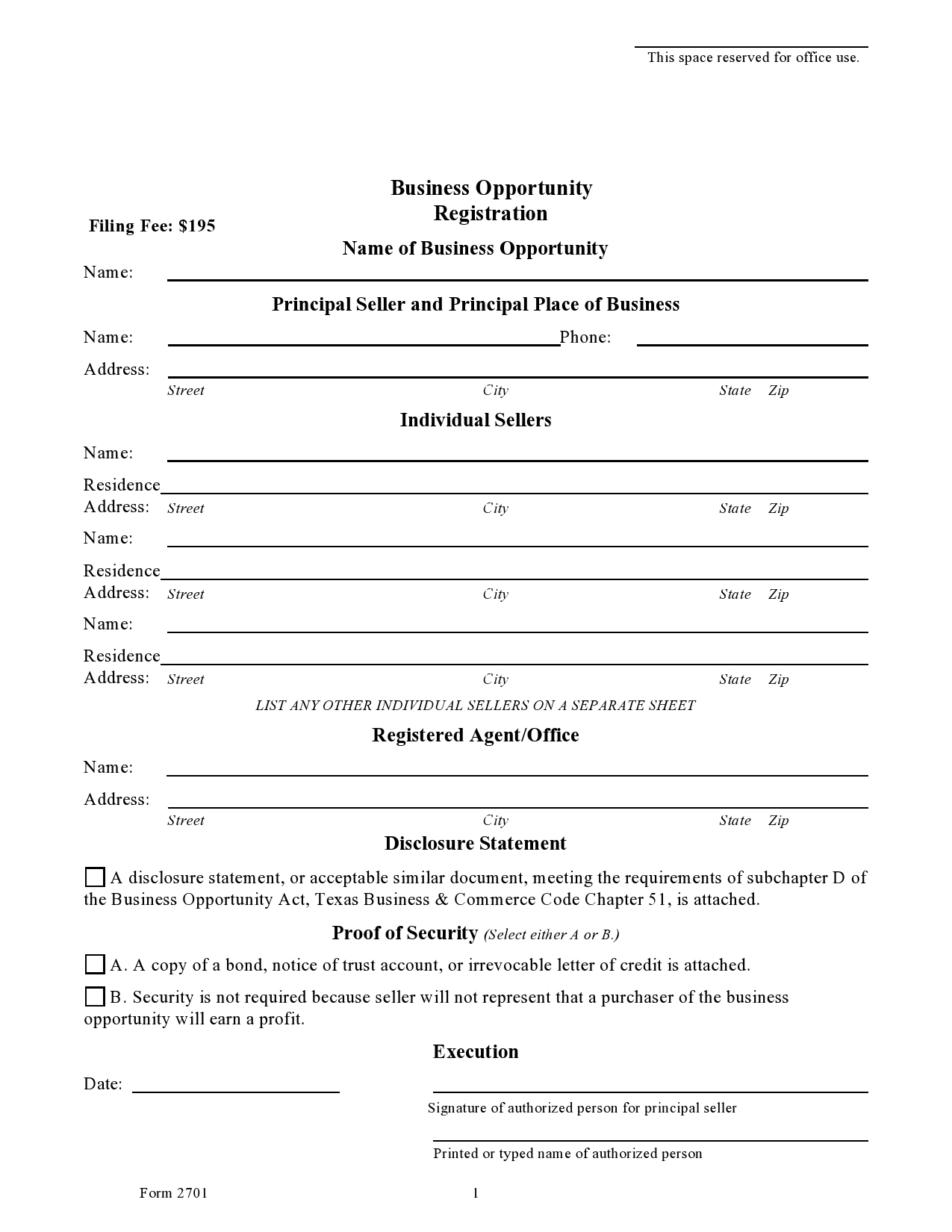

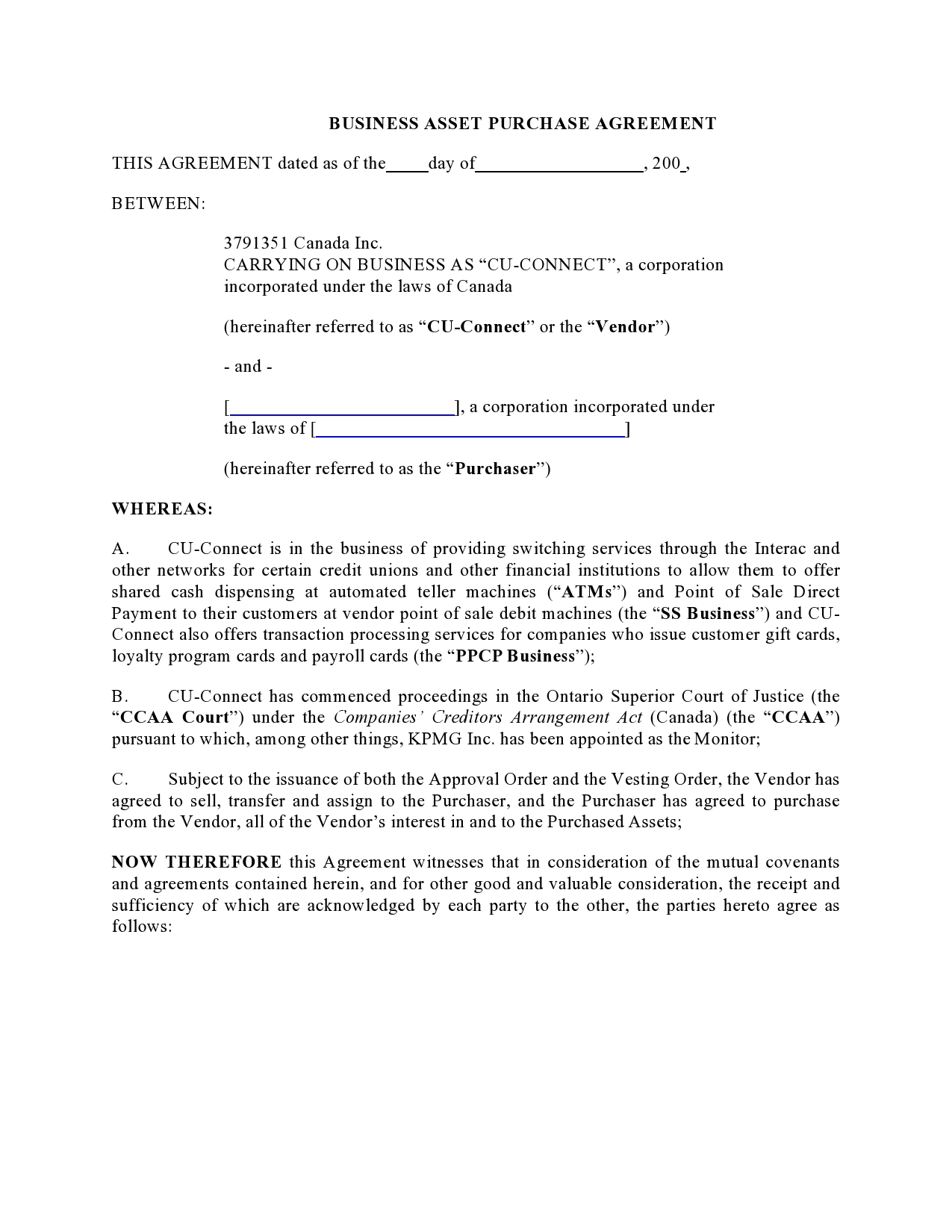

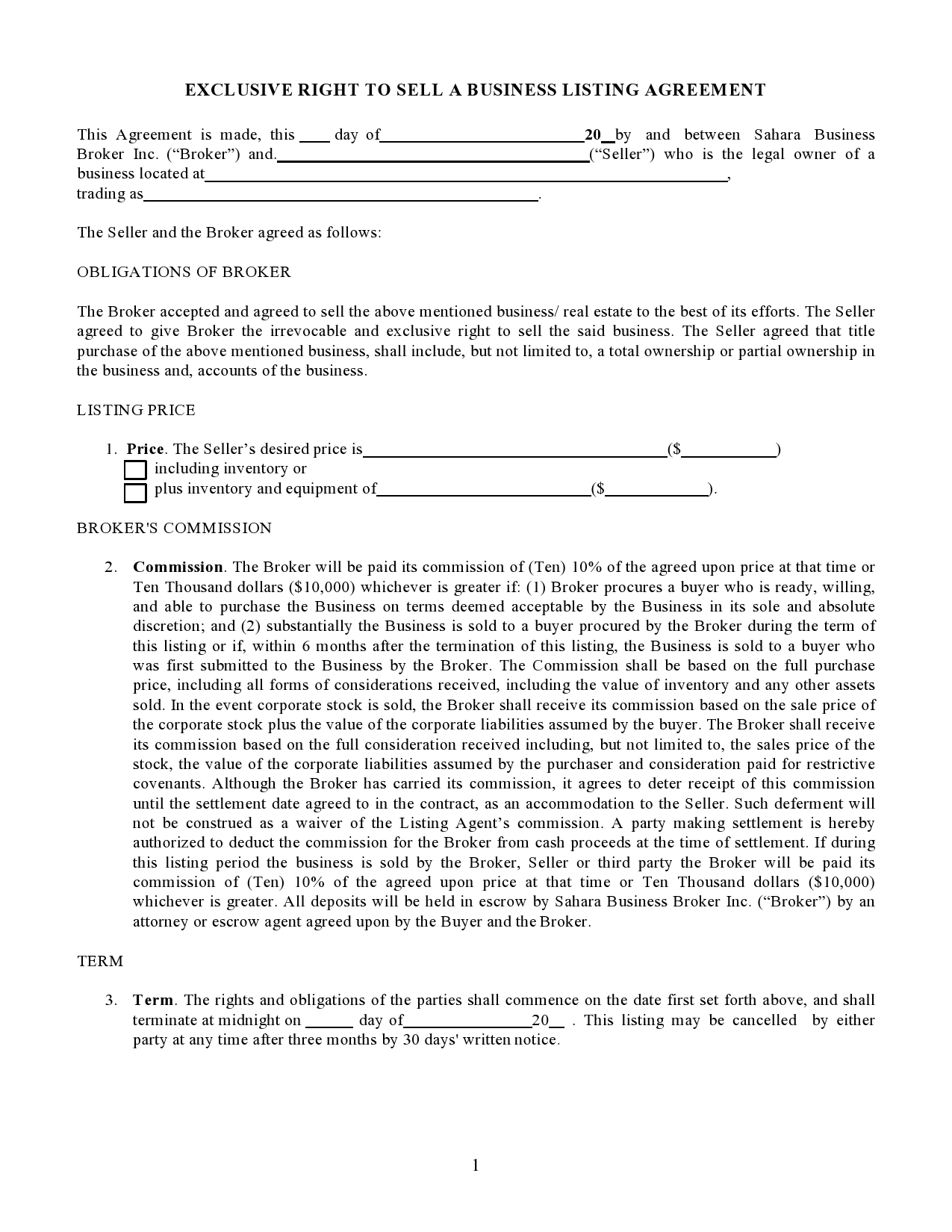

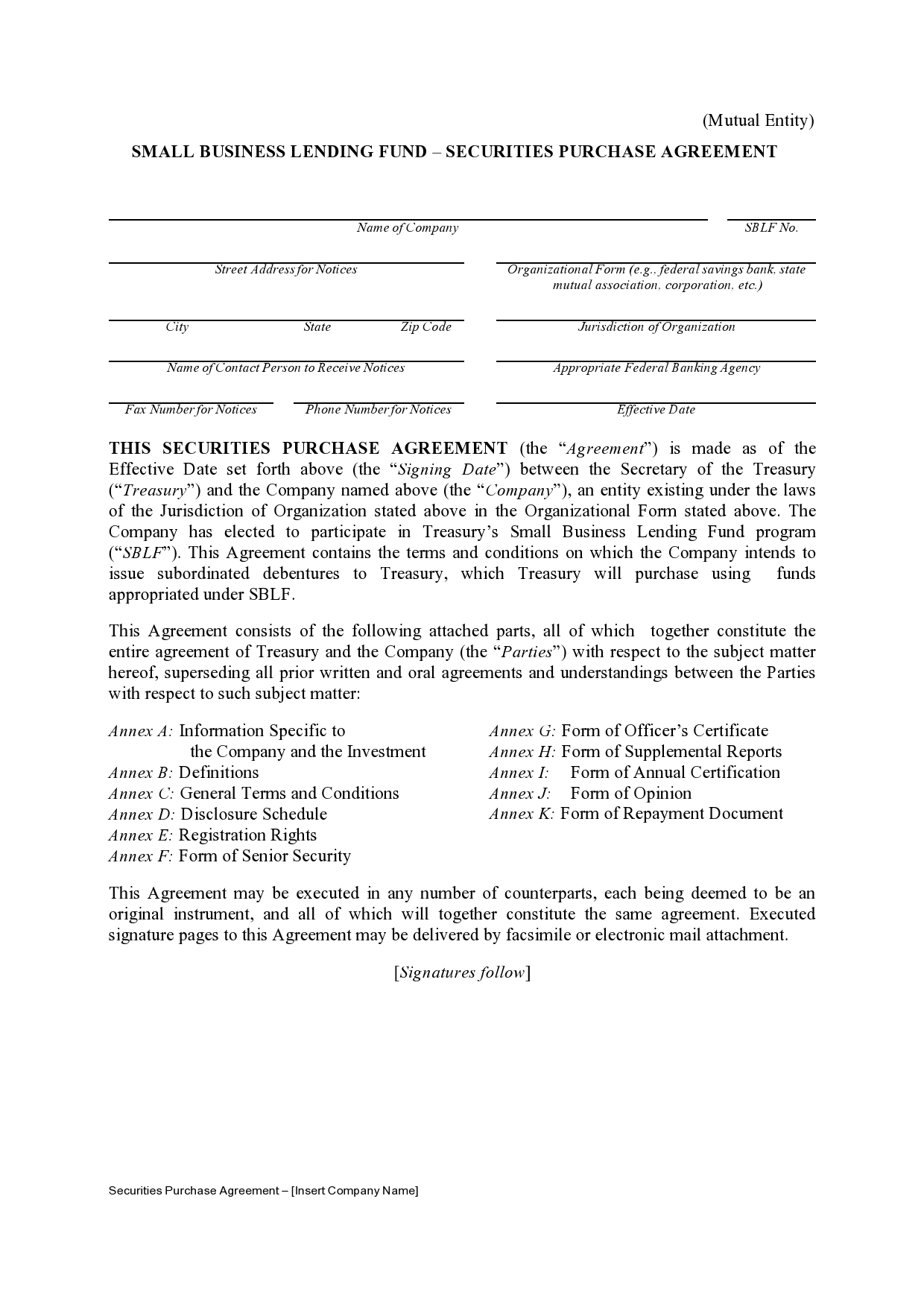

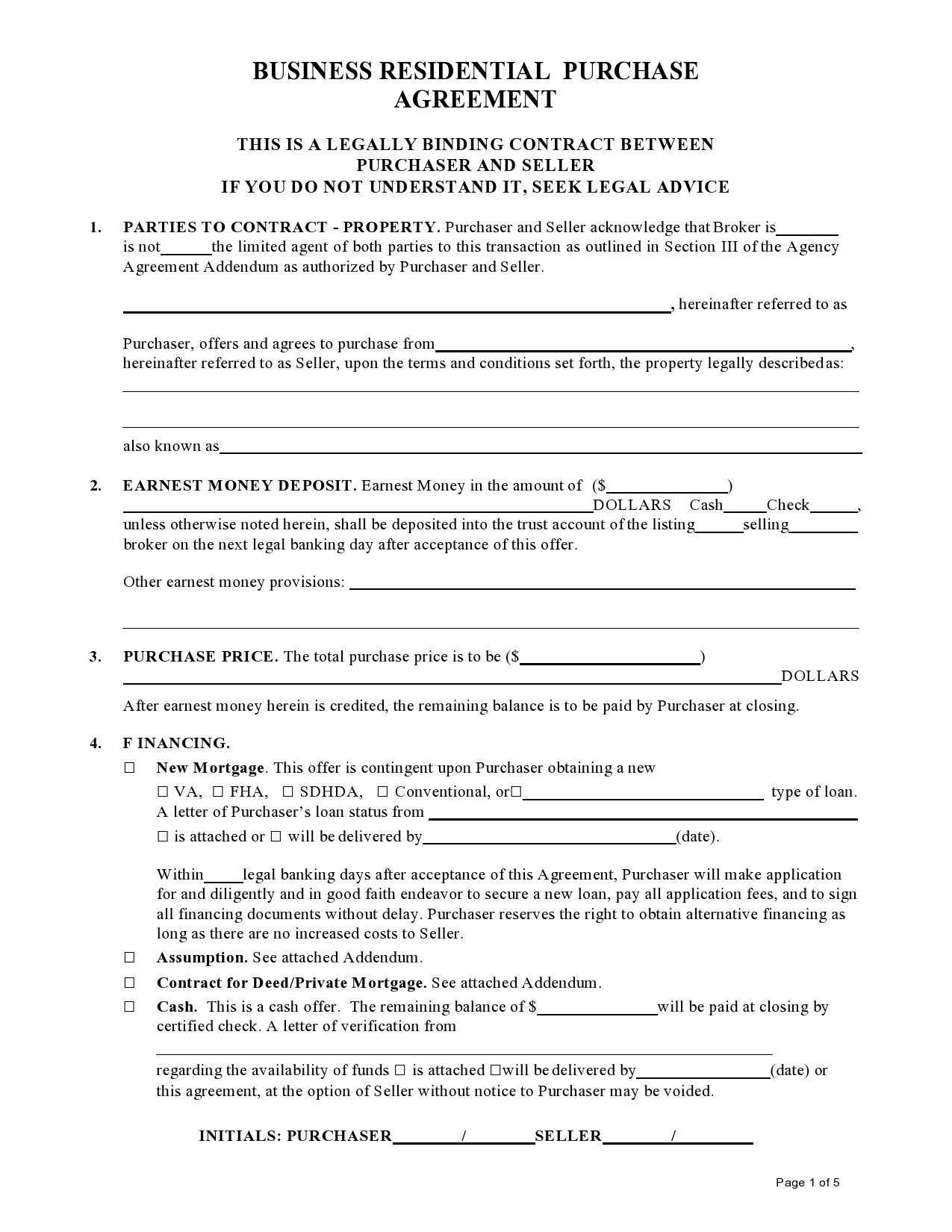

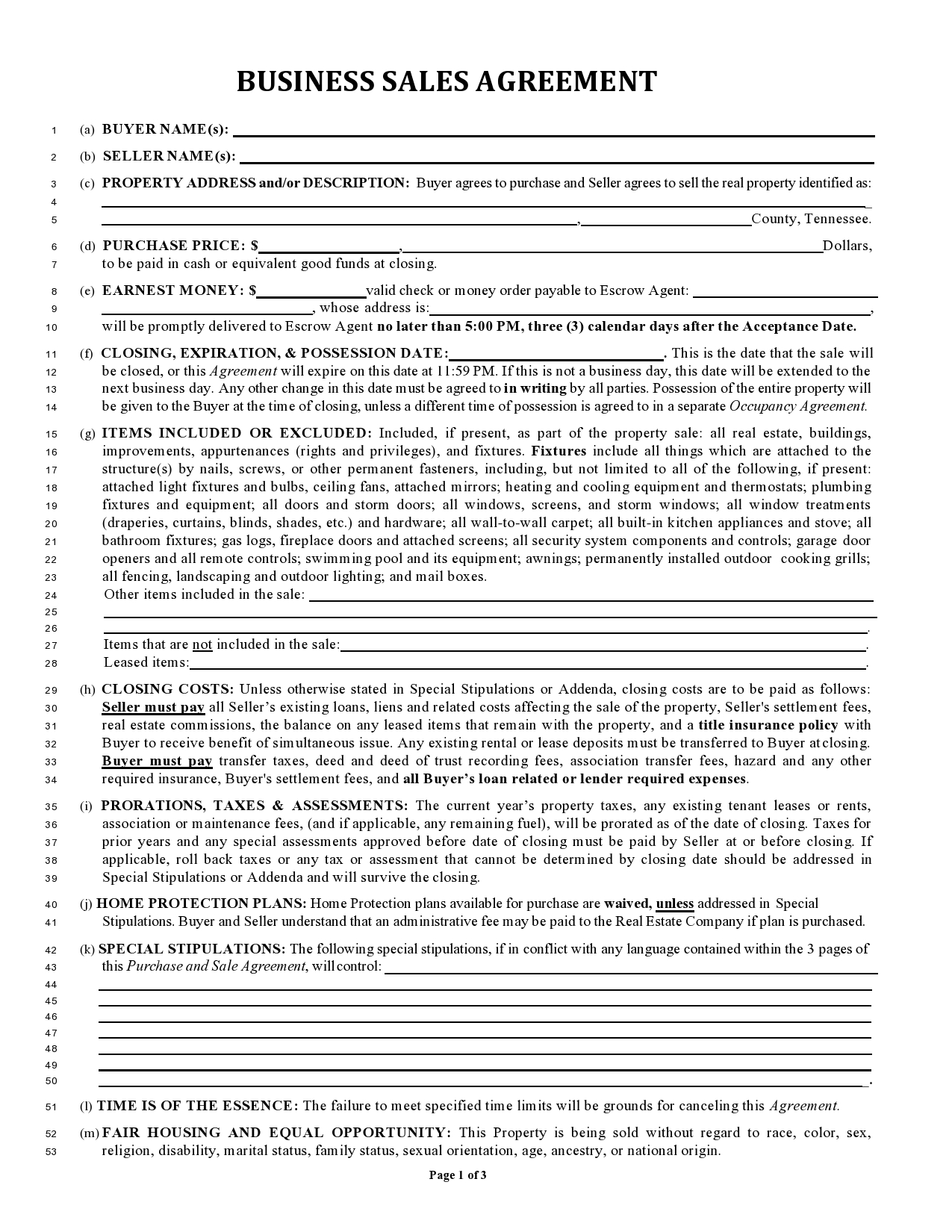

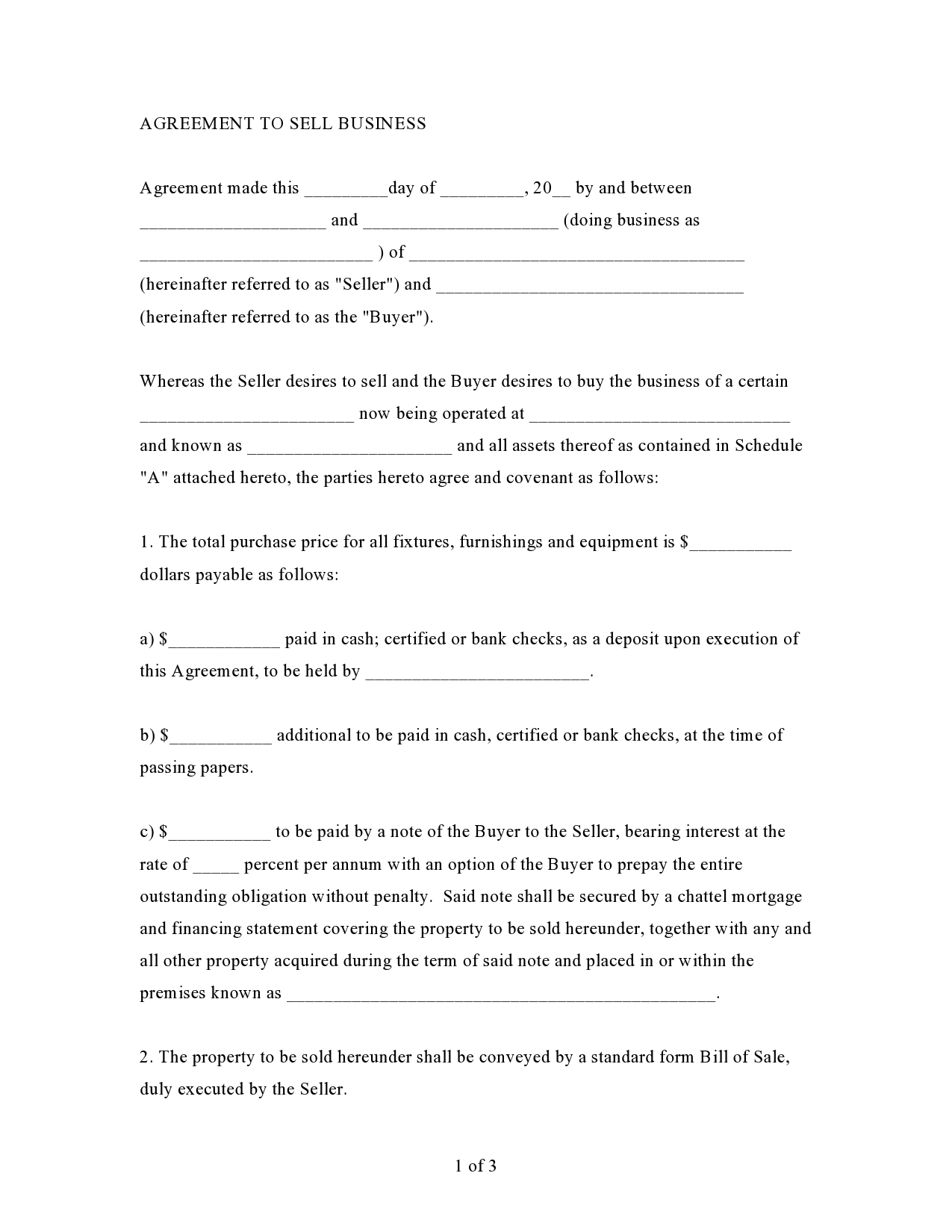

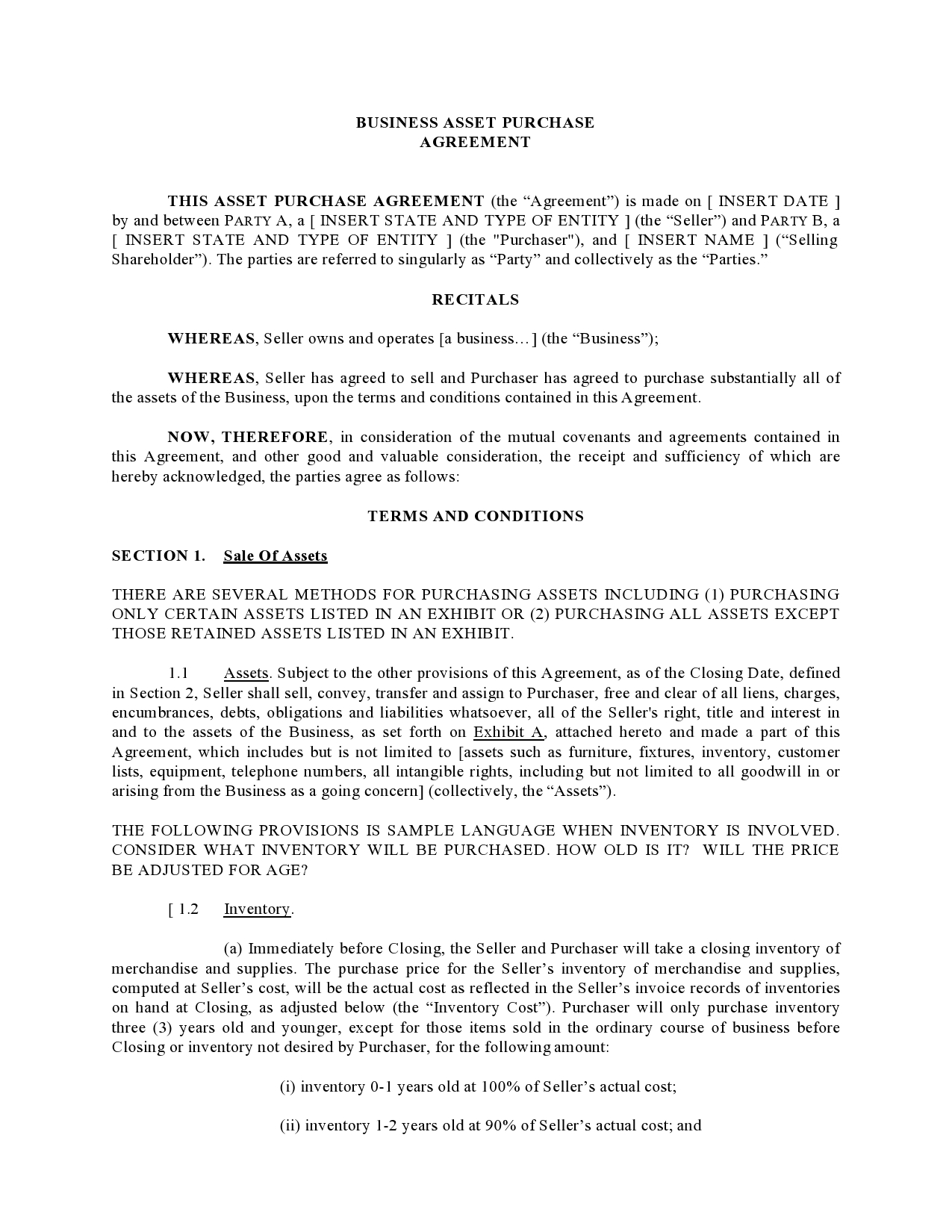

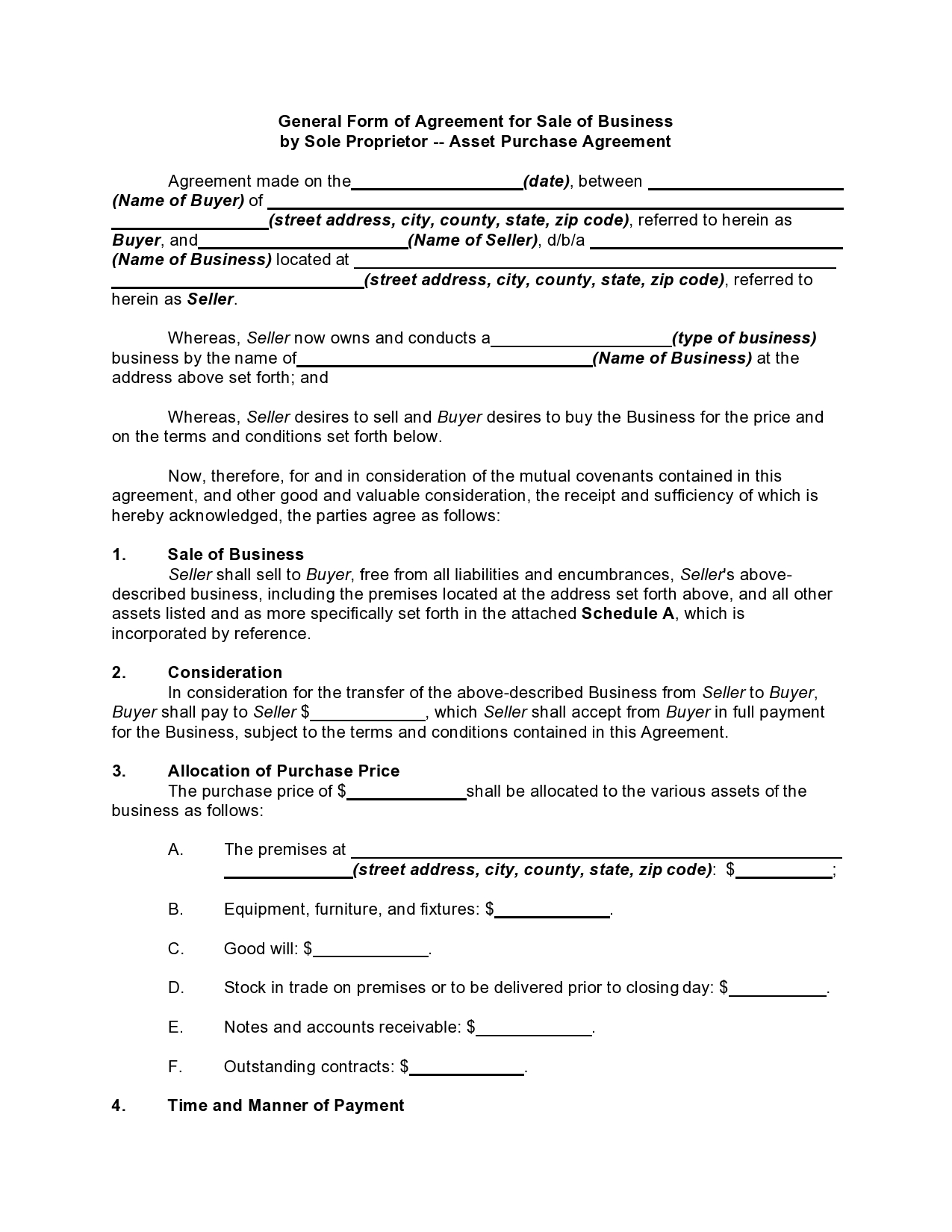

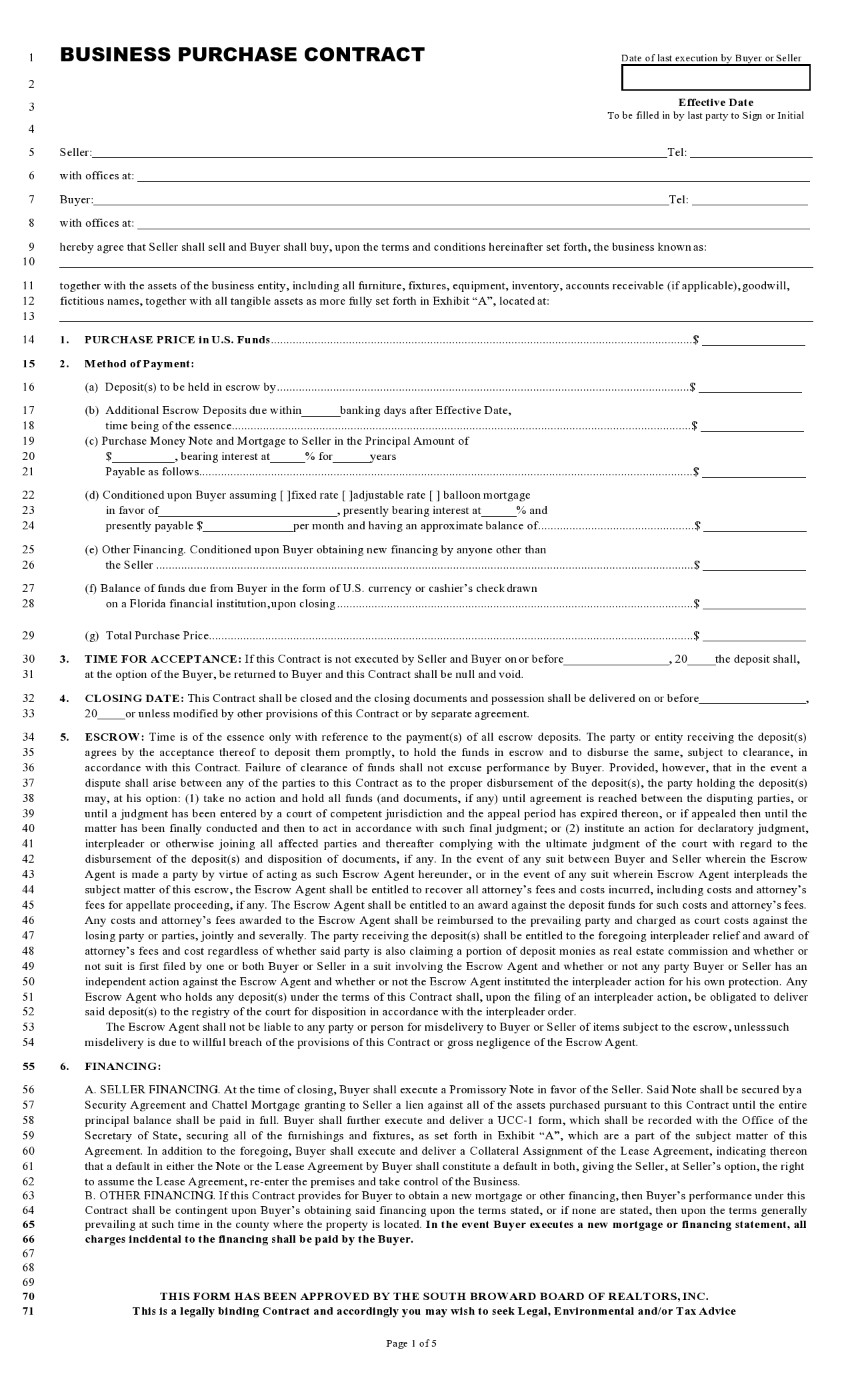

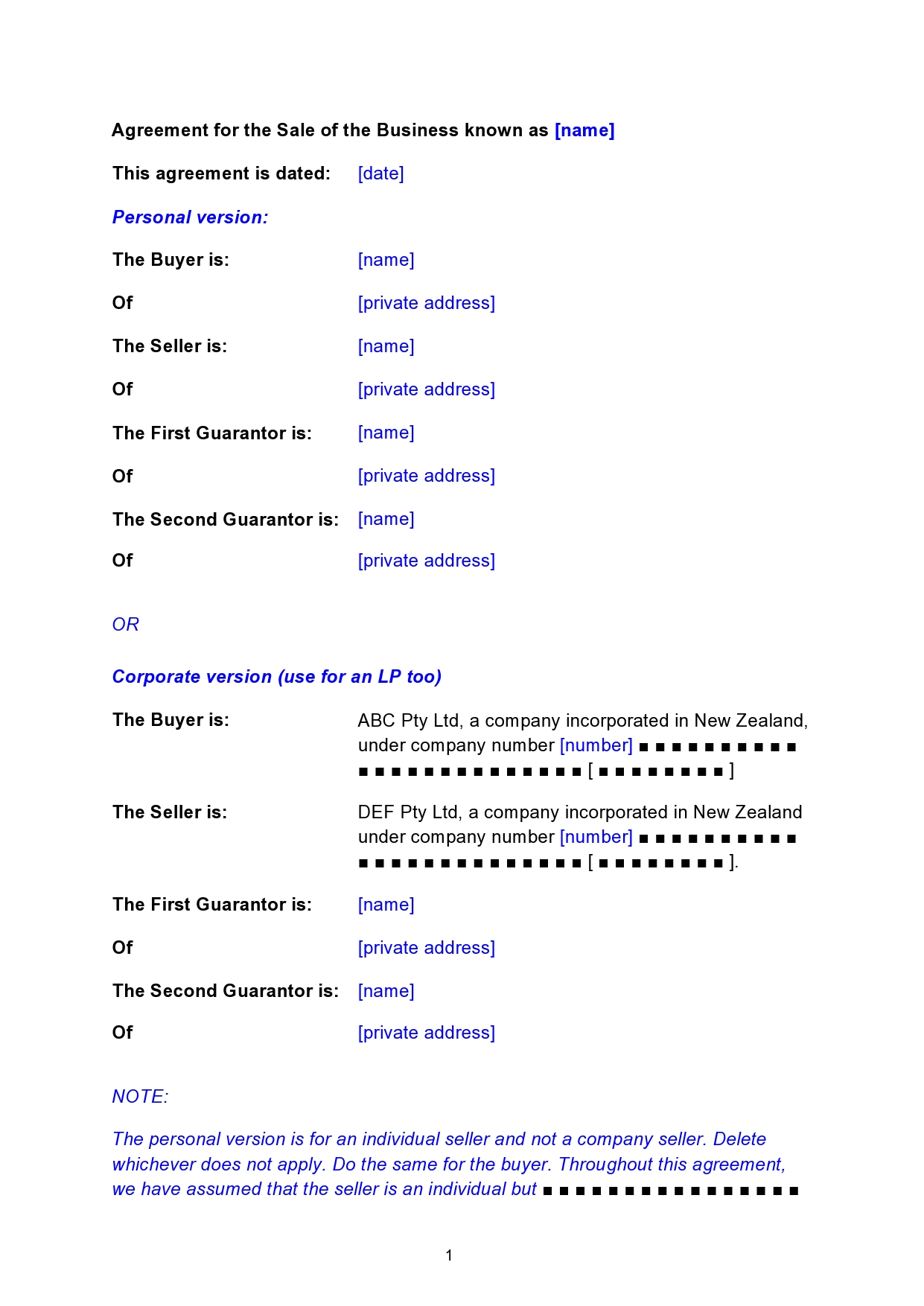

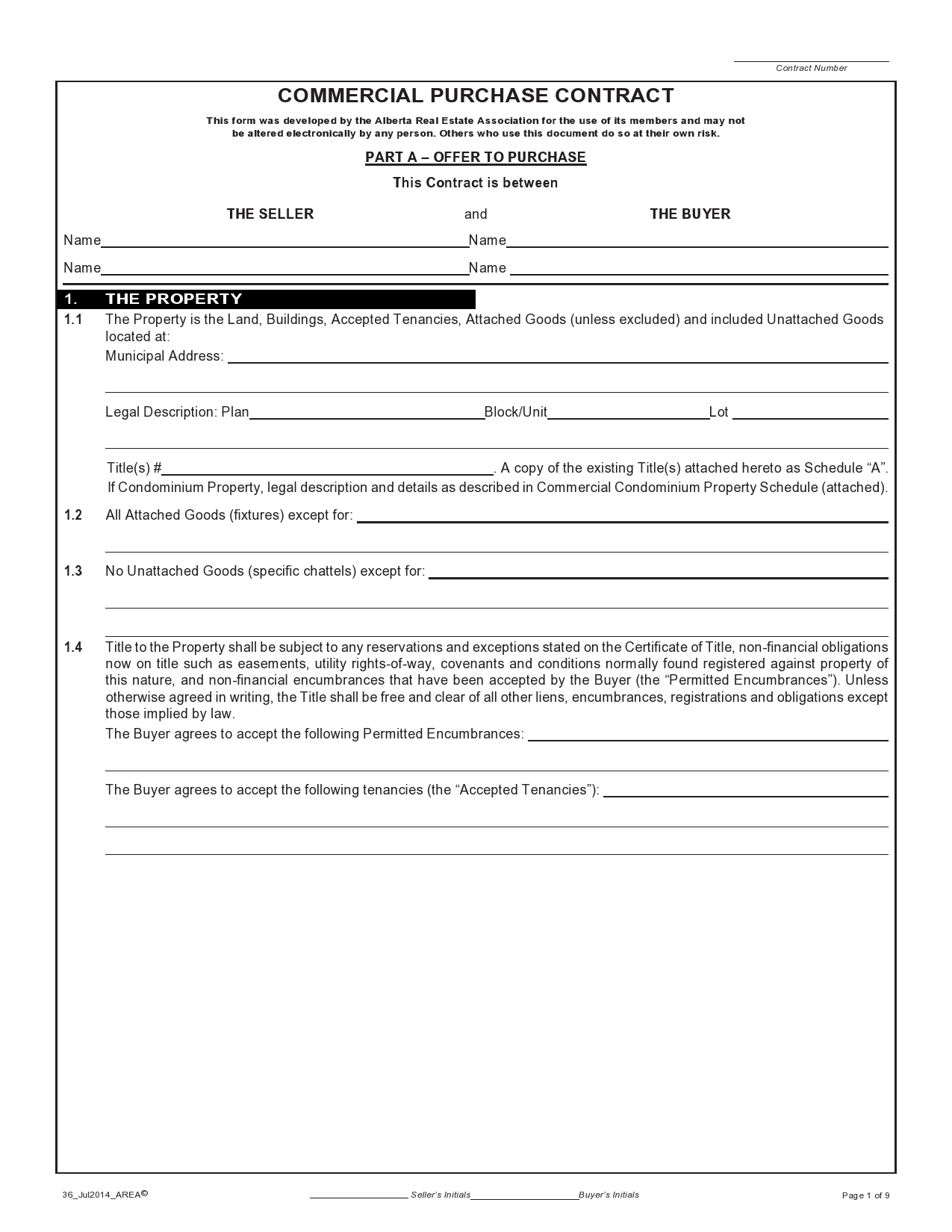

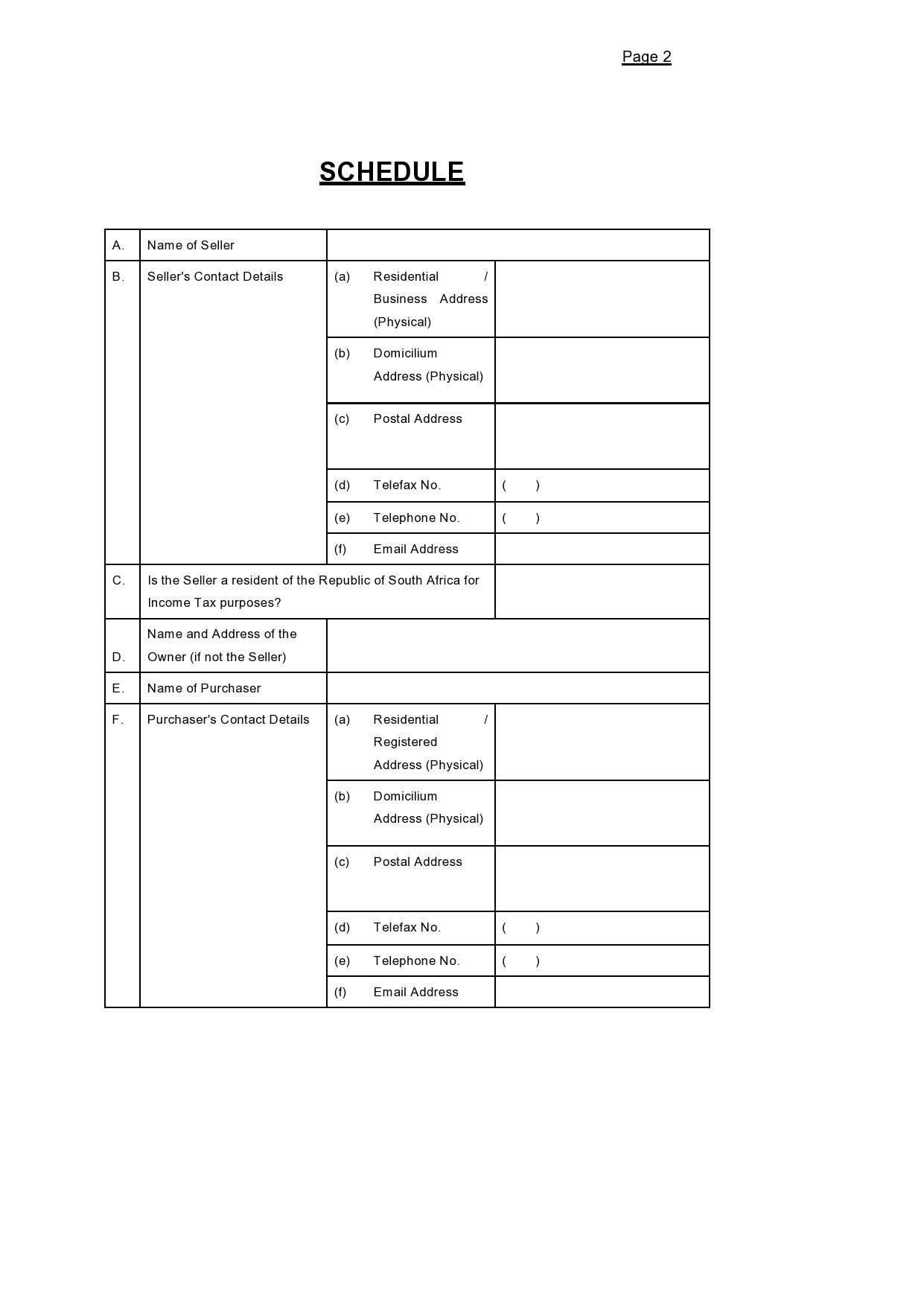

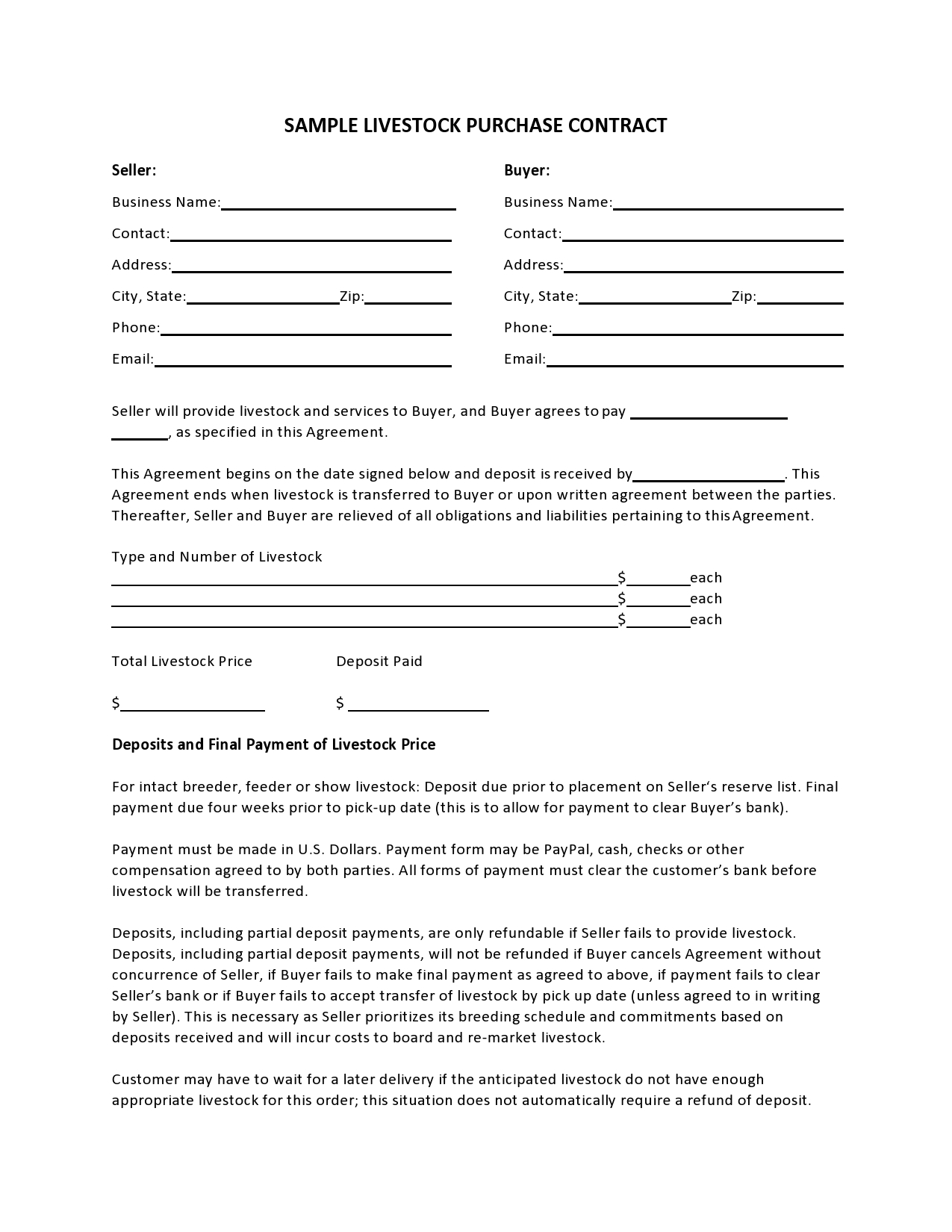

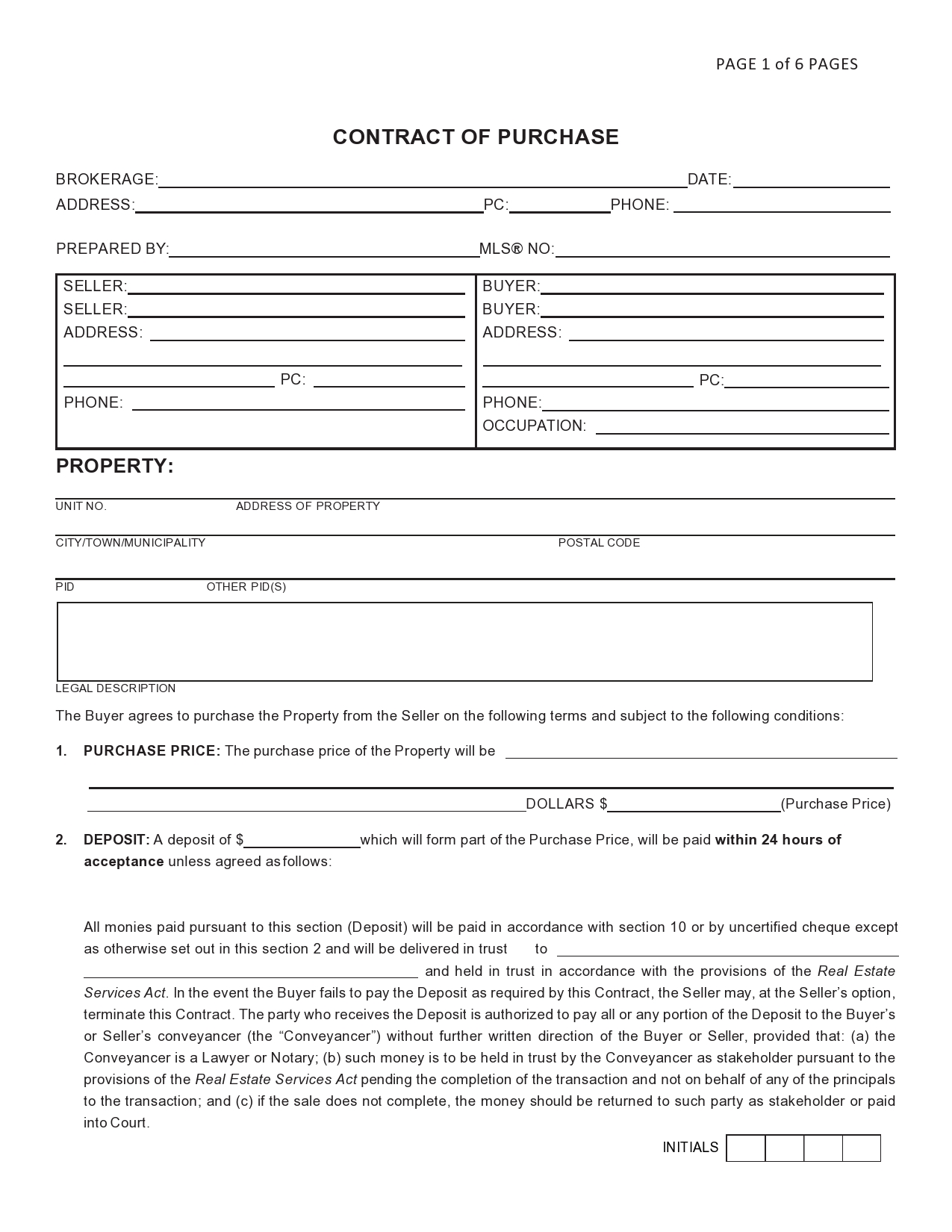

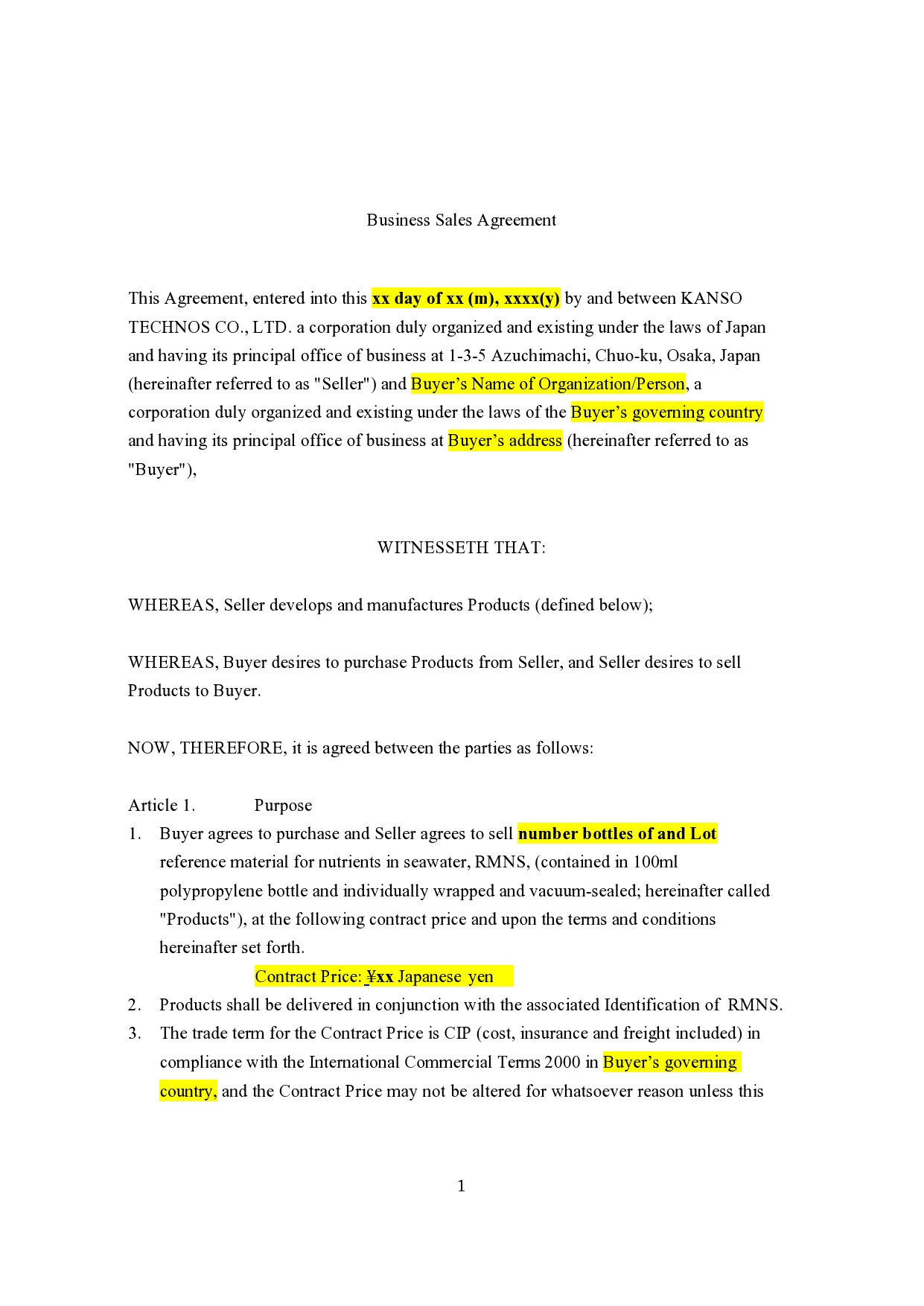

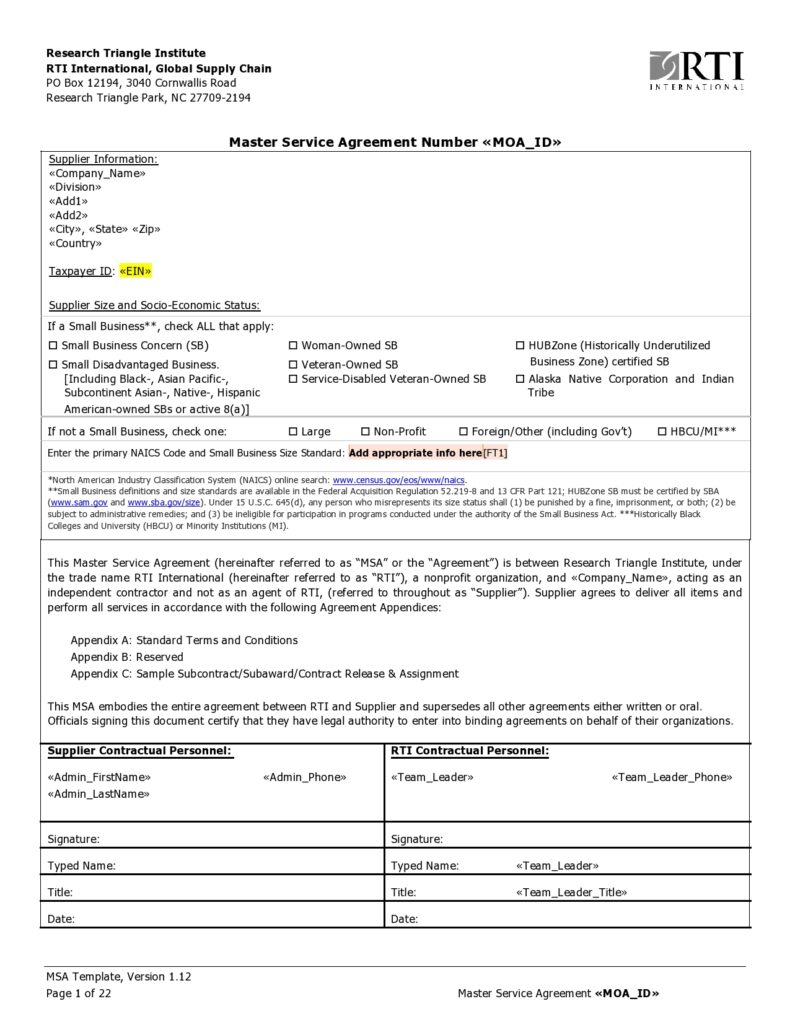

Business Purchase Agreement Templates

By State

What is the Purpose of a Purchase Agreement?

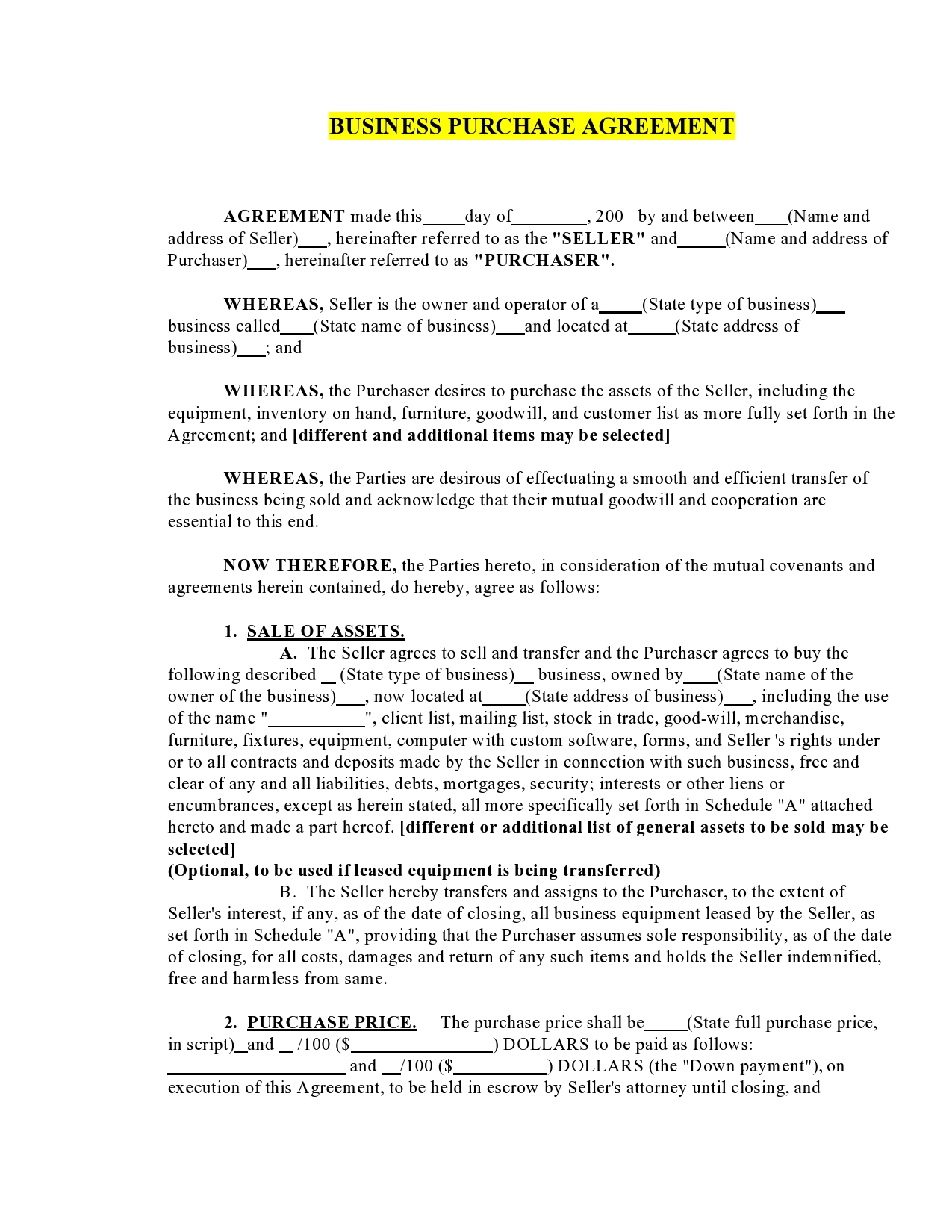

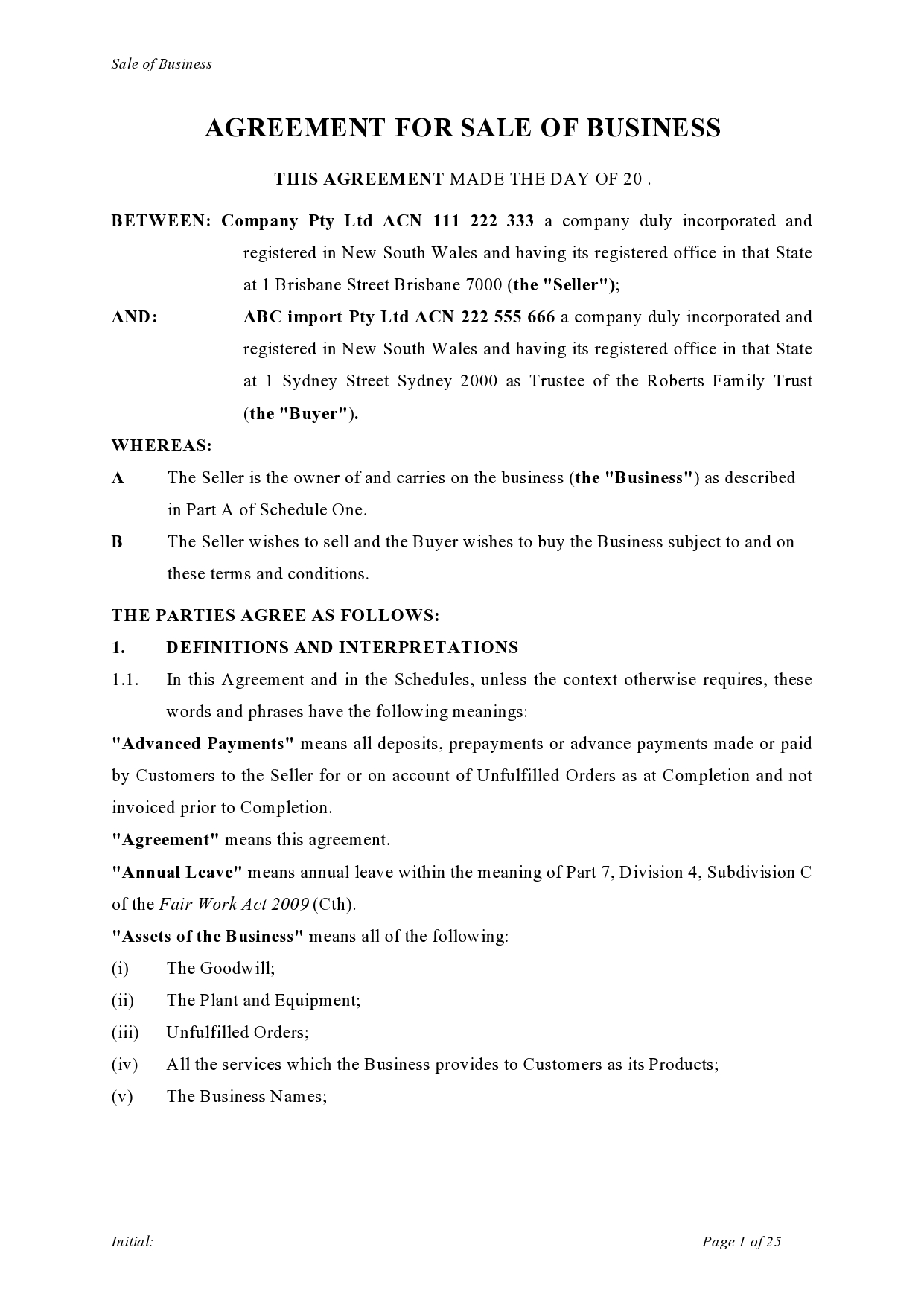

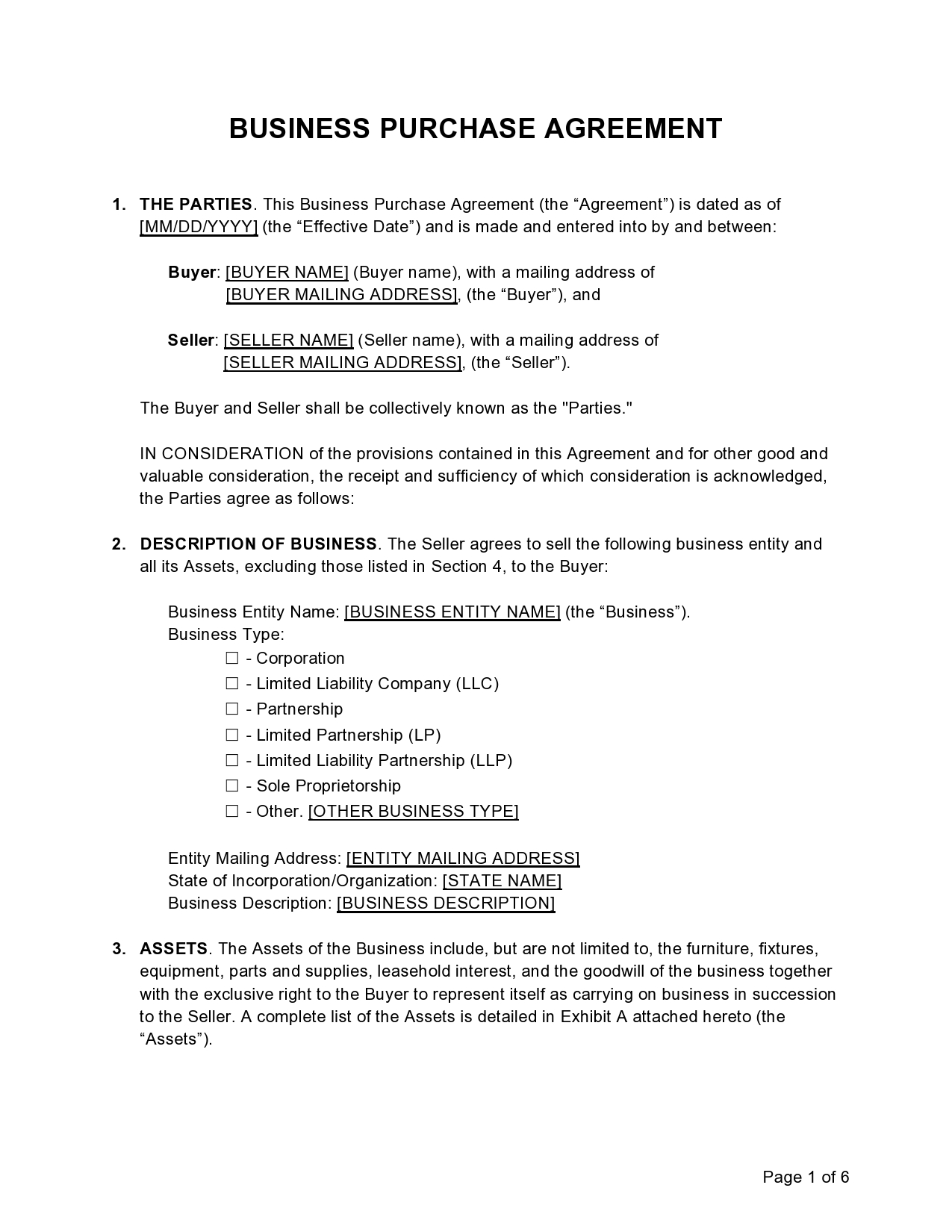

A business purchase agreement is created to serve as the legal contract that will allow for the sale of your business. This contract can also be used to sell part of a business or some shares for the business that you own. No matter which sales type you are engaging in, you need to be sure that all the right information is in the purchase agreement so that there is nothing left to chance when you sell your company.

This is also the document that serves as the official record of the sale of the business, and this is the new owner’s proof of purchase for the company. This can be critical for proof of new ownership during the transition phase so that operations management can be passed over to the buyer. Things like insurance and other vendor contracts can be impacted by this change as well, so new owners will need documentation in most cases to prove that they have, in fact, taken over the company.

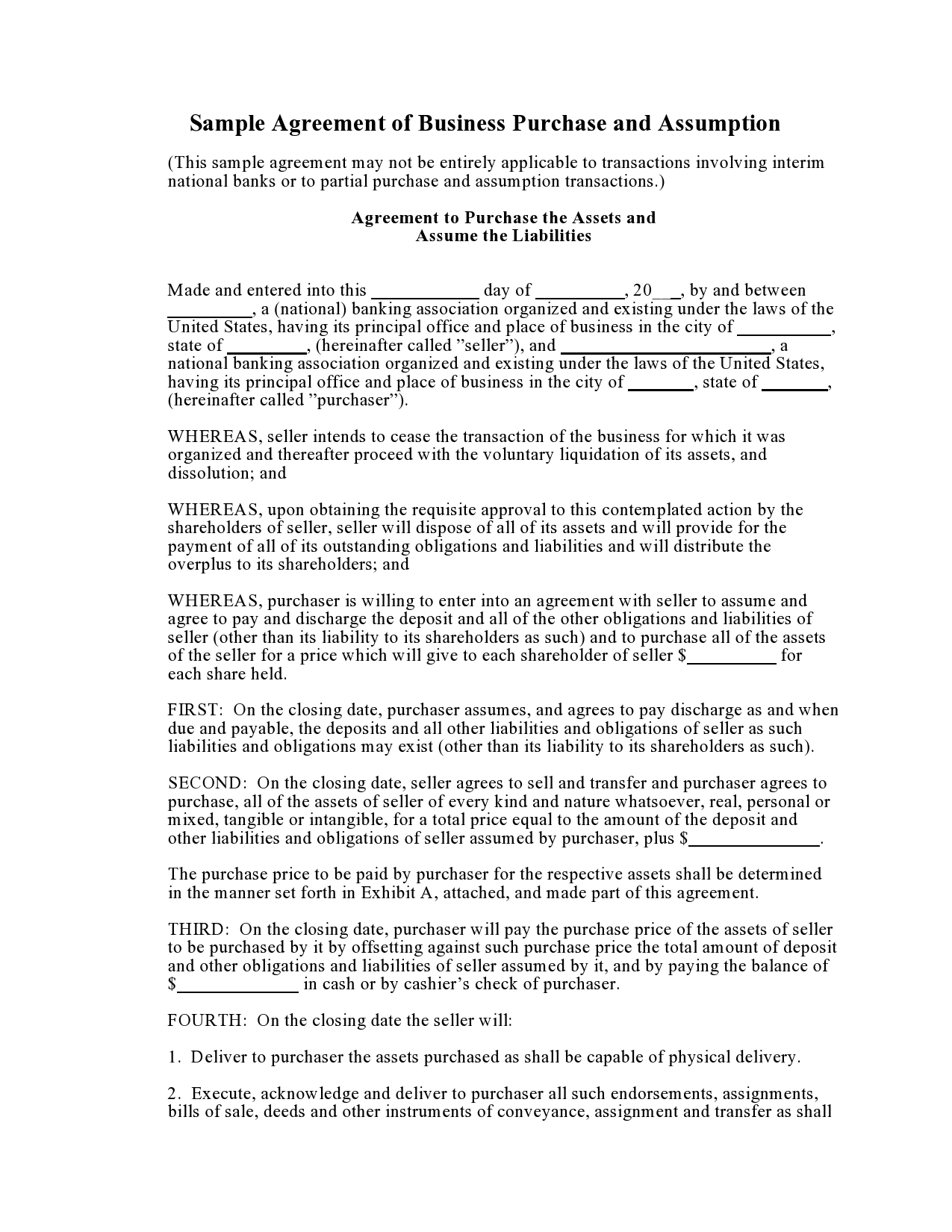

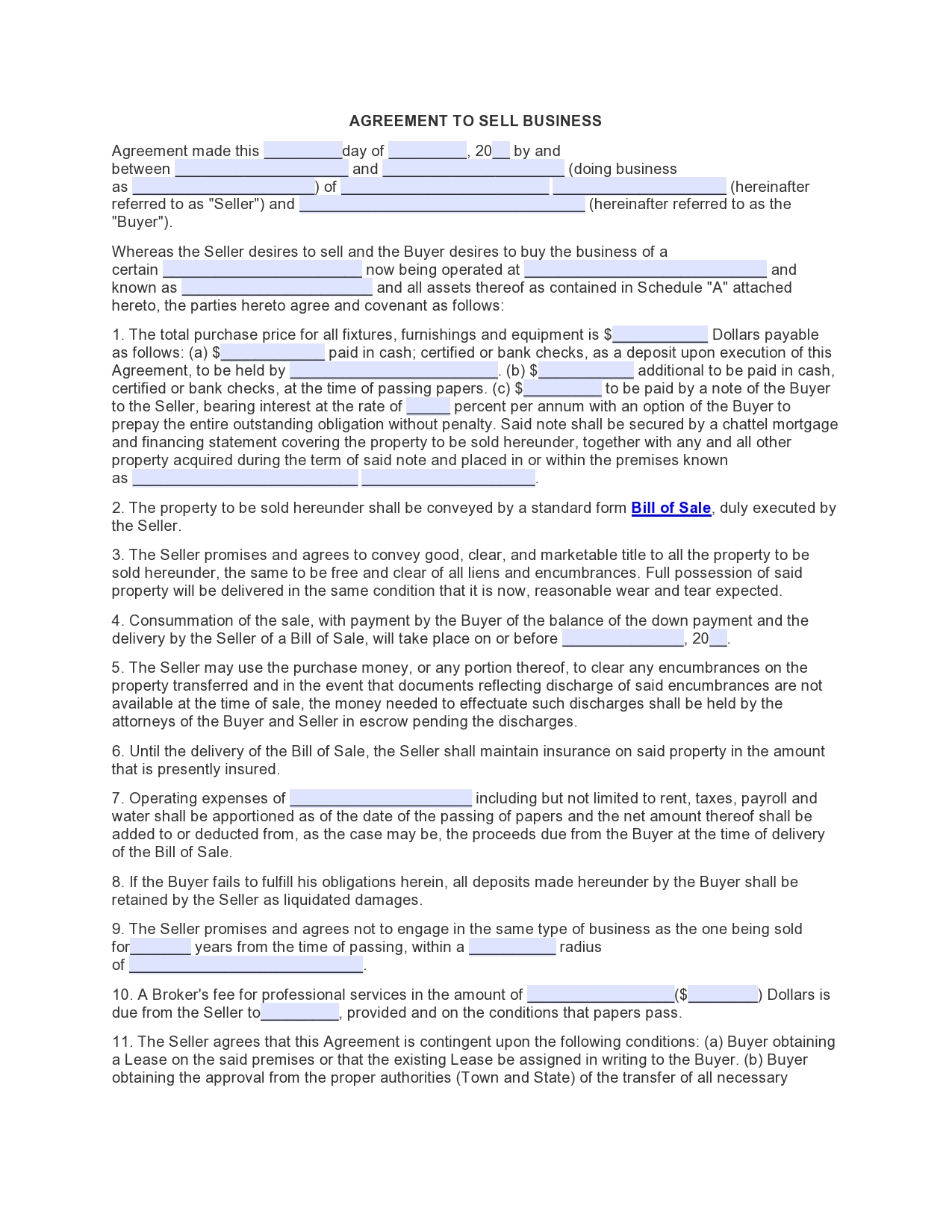

Business Sale Contracts

What Are the Parts of a Business Purchase Agreement?

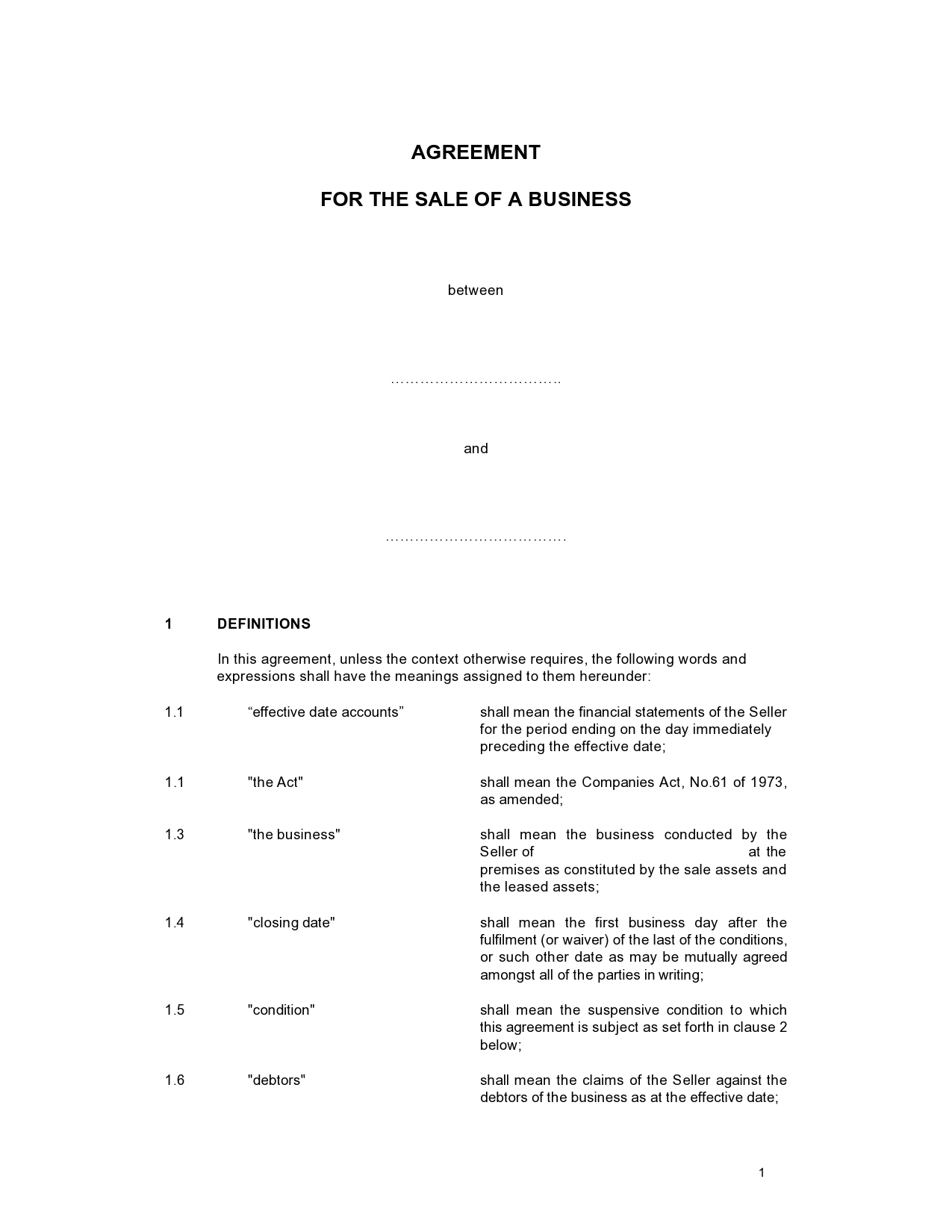

These kinds of documents always have the same information included in them. The more specific the information that you add to the purchase agreement, the better off you will be. You do not want to have any questions about the process of the sale and transfer of ownership, and you do not want to let your buyer find loopholes to change the way that the purchase will work.

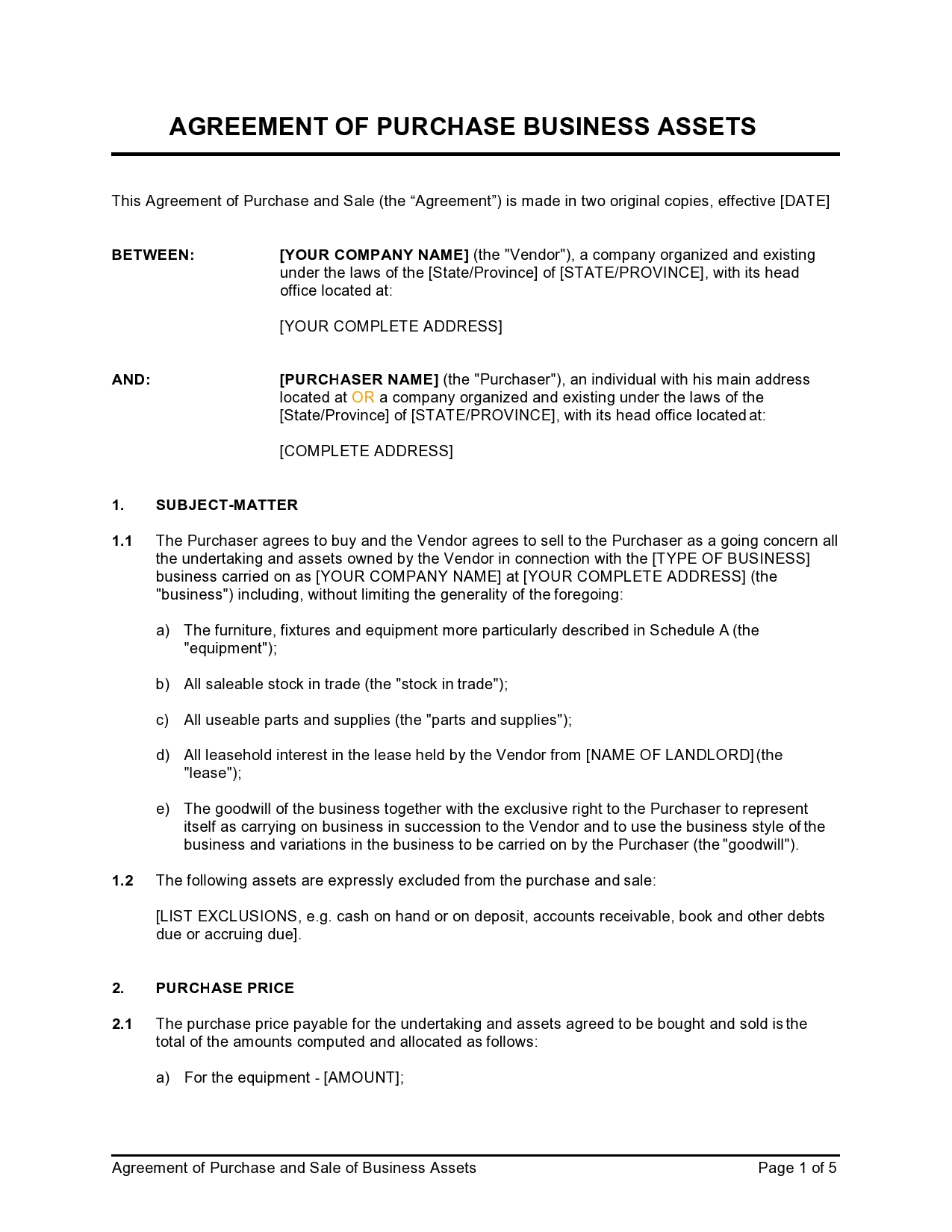

- Business Information like company name, assets, or stock that is being sold, or indication that the entire business is being sold.

- Closing date for sale, which includes when the seller will deliver the assets being sold.

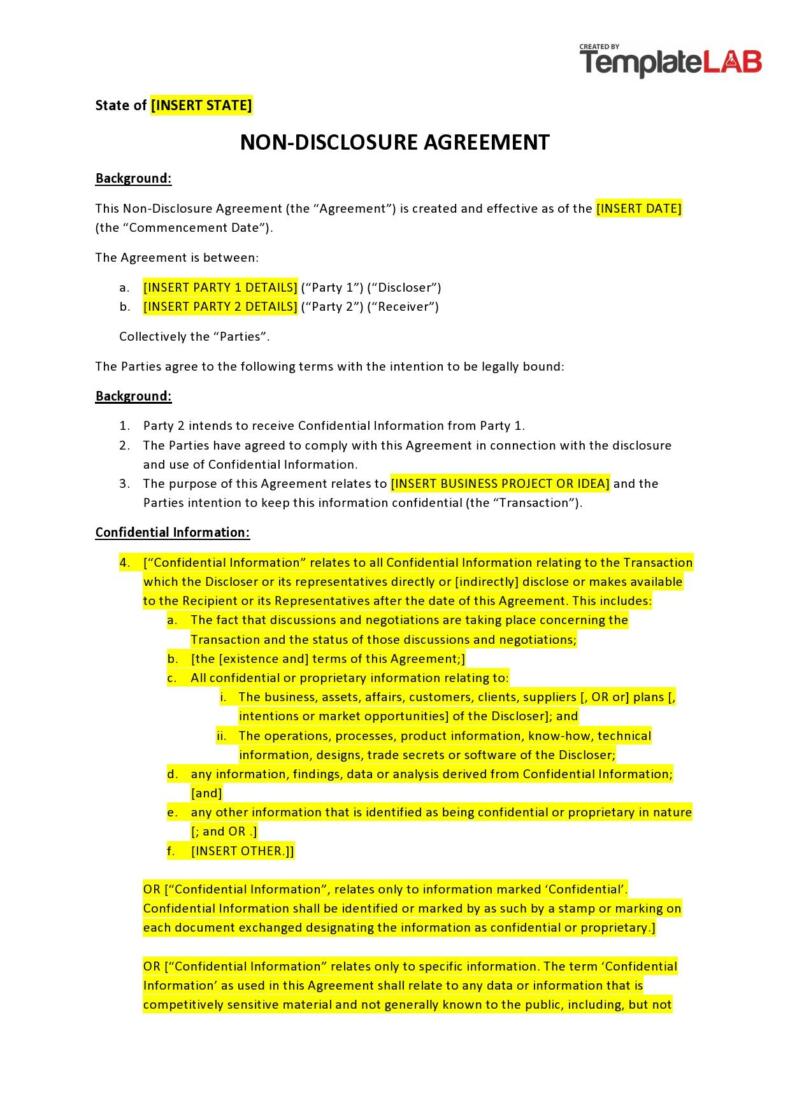

- Confidentiality clause, which outlines all the details of the business transfer and what can be talked about before the sale is finalized.

- Non-competition clause, which states that the seller will not compete with the business.

- Non-solicitation clause, which says that the seller agrees not to hire any of the former employees away from the business.

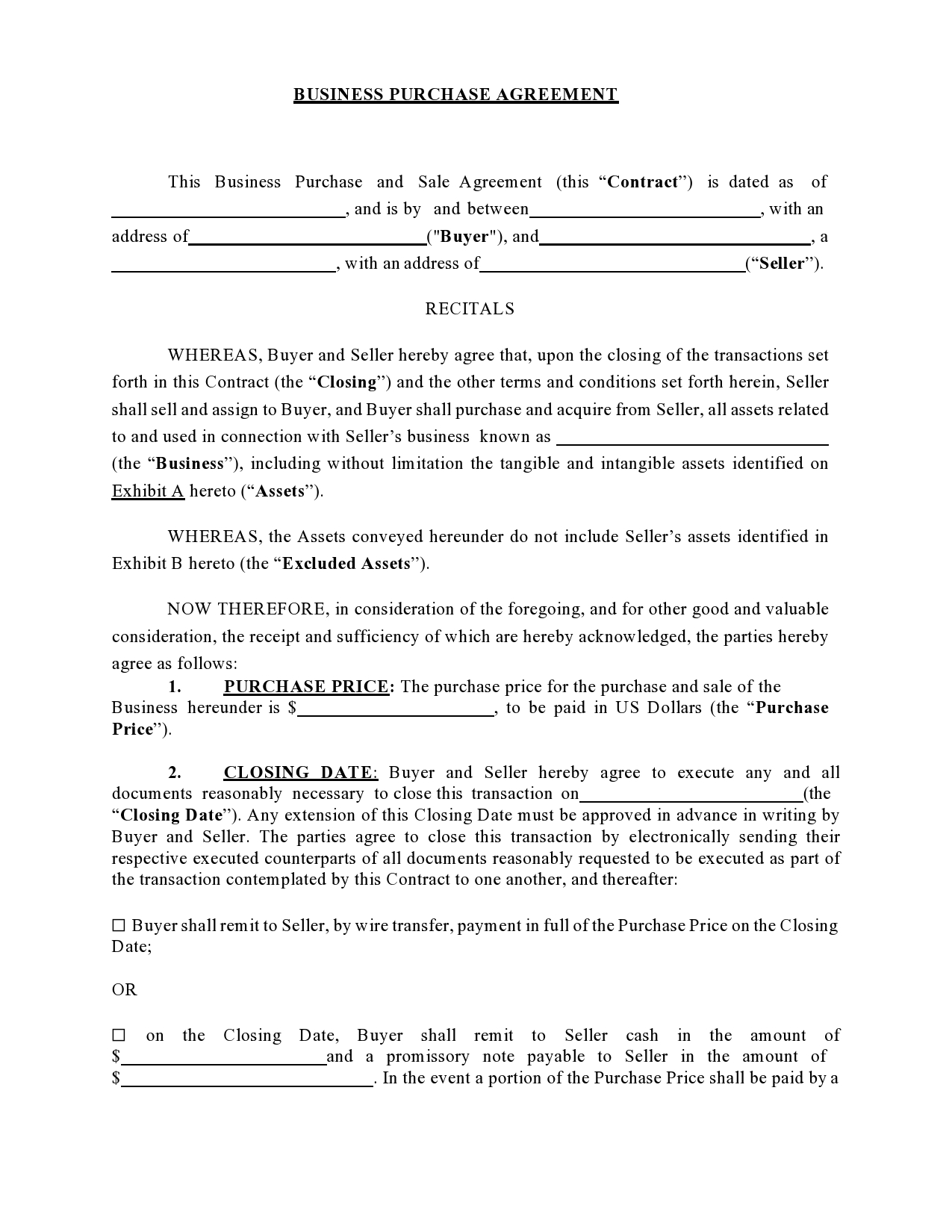

- A Parties clause that identifies the seller of the business as well as the buyer.

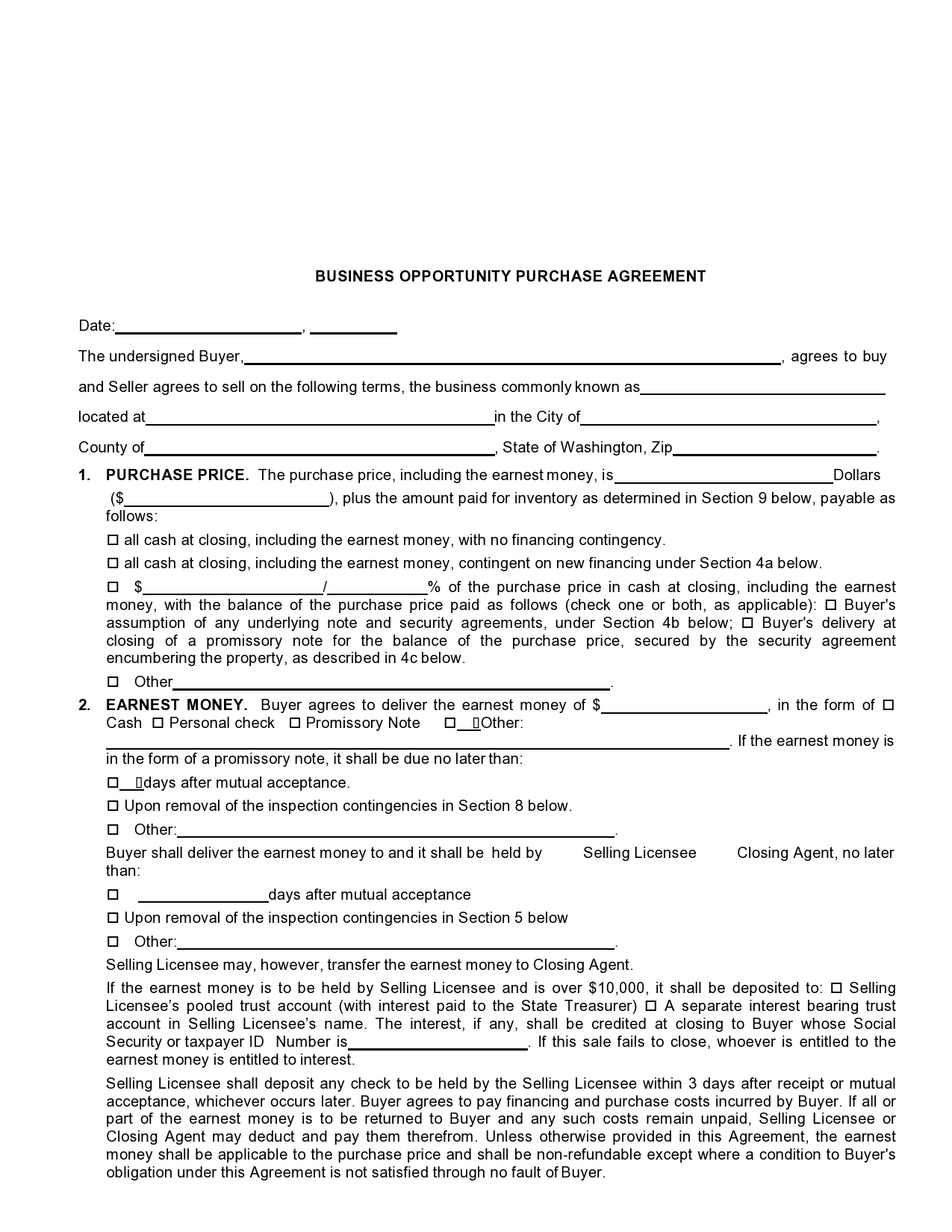

- Purchase price information which includes deposits and financing information.

- Representations and warranties, which are the statements of the facts and promises about the assets, the business, and the authority of both parties to enter into the transaction.

The details that are included in this agreement will provide authority to the seller to make the sale, and it will also include information about the licensing and permits that will need to be secured by the new owner to continue business operations. There will also need to be clarification about dividends that might be expected to be included in sales considerations, and some business purchase agreements will also include information about the salaries and benefits of the management that will remain with the company.

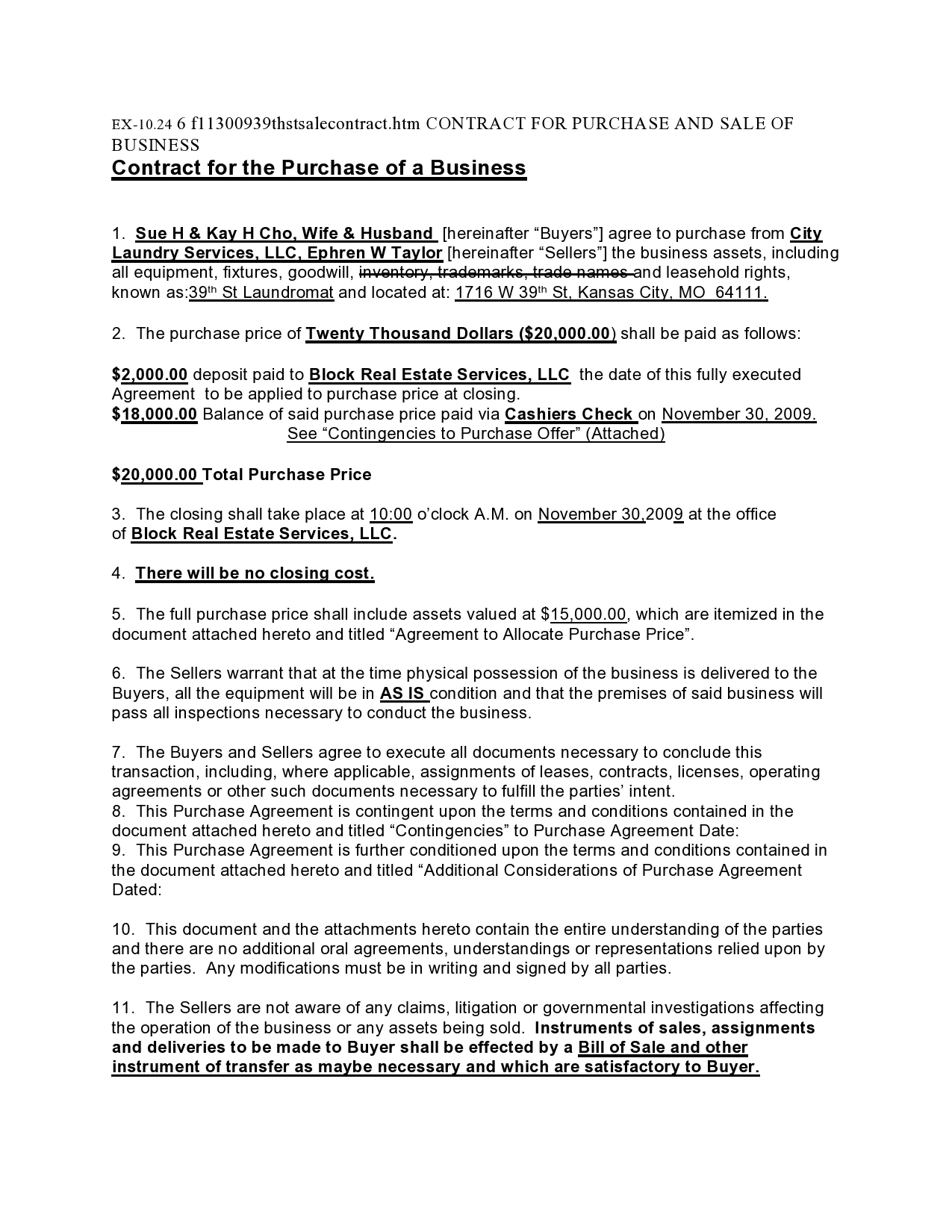

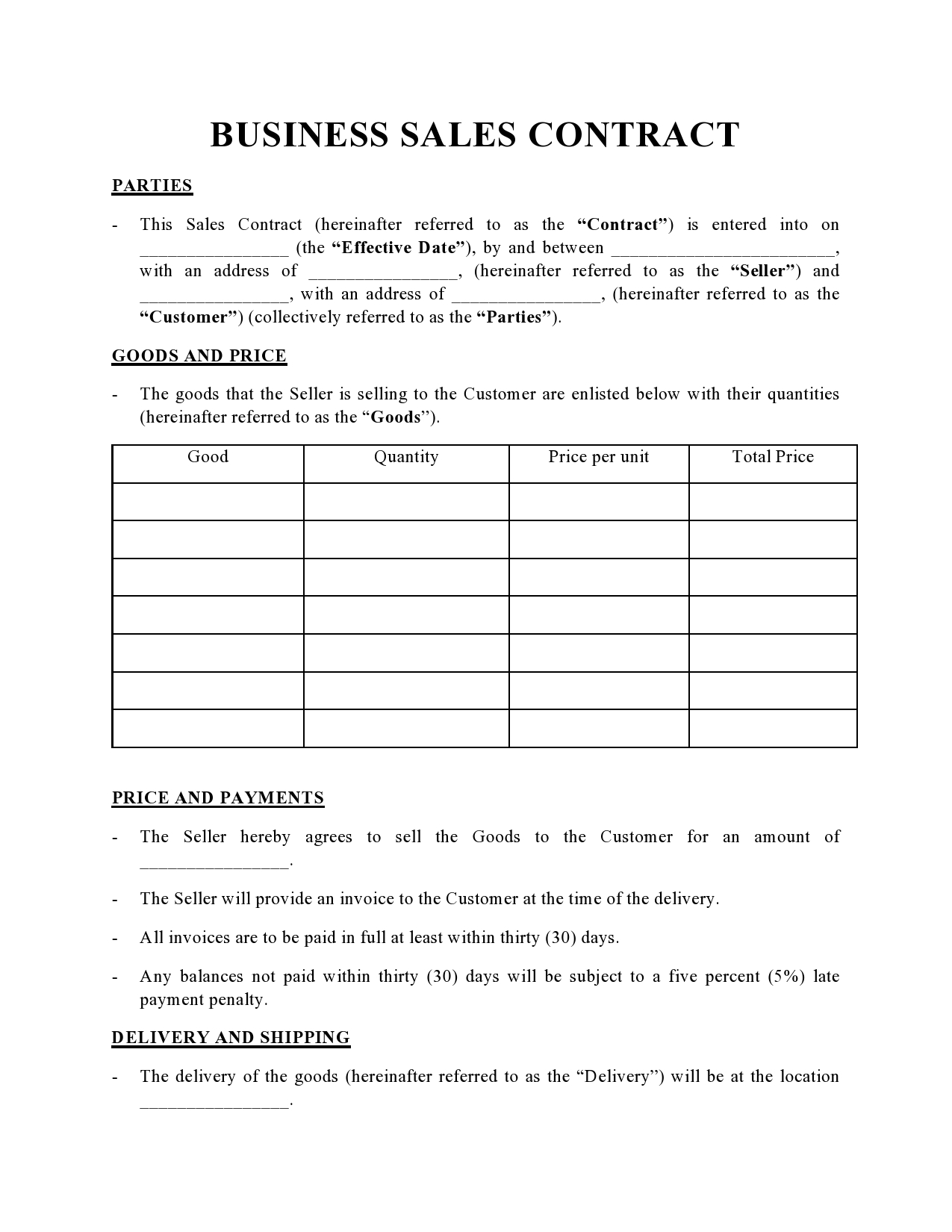

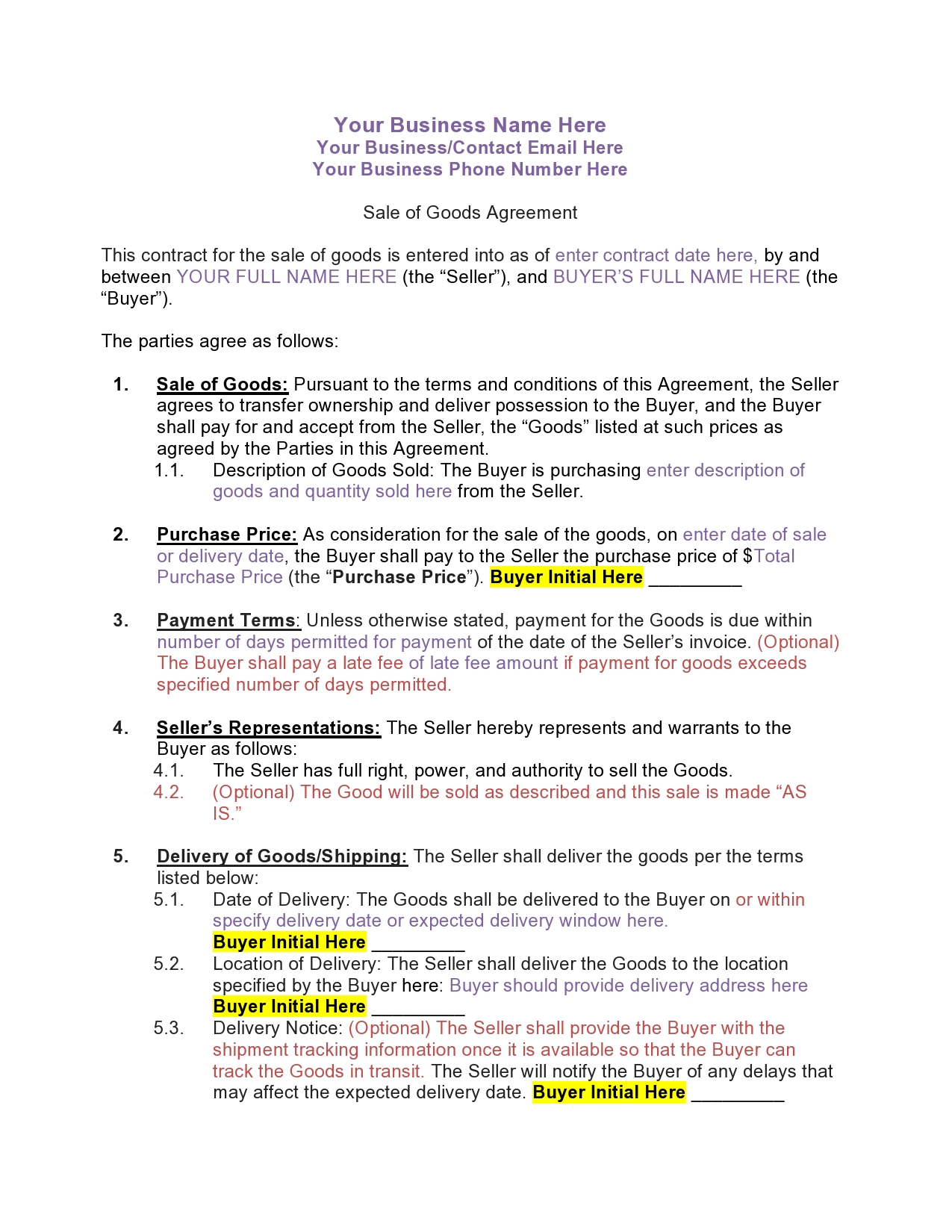

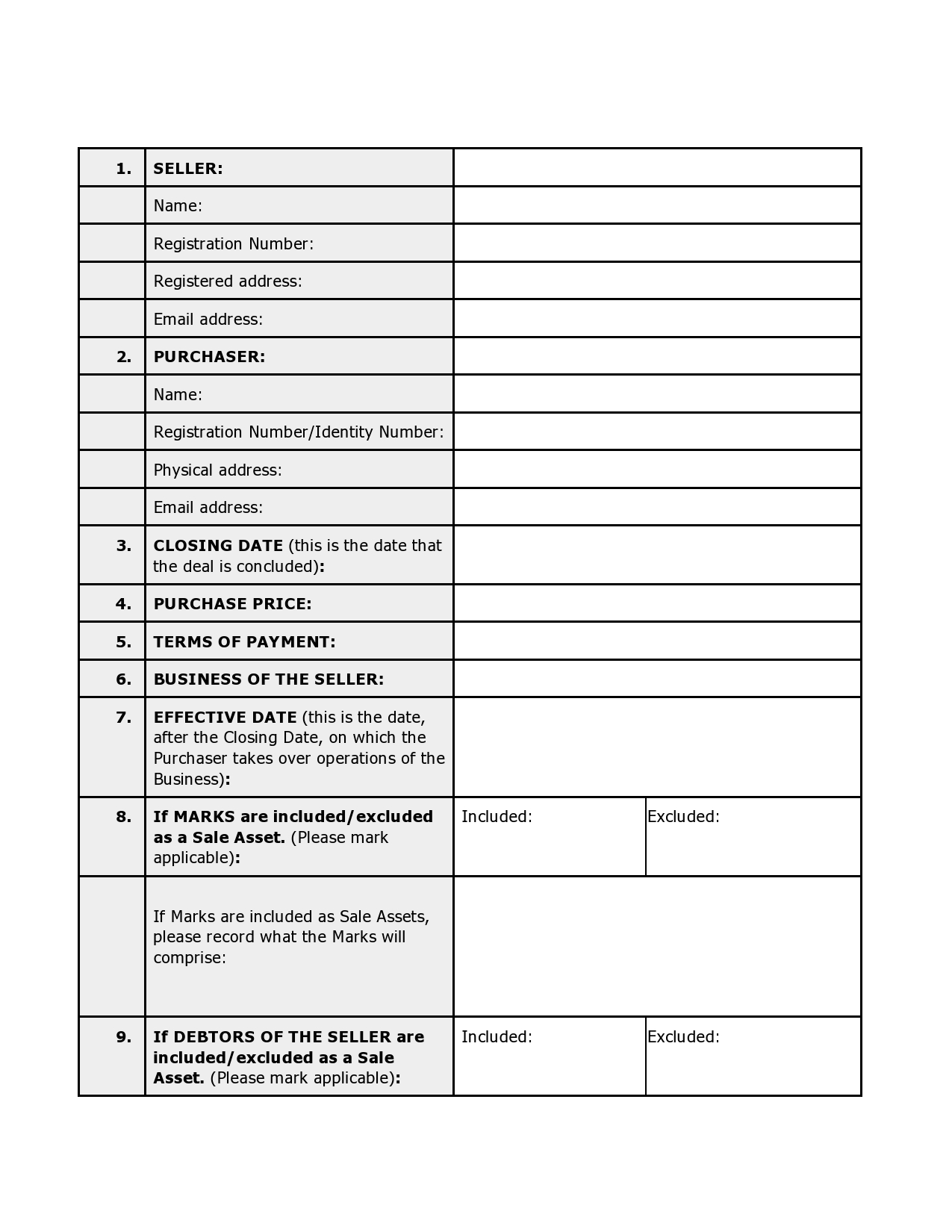

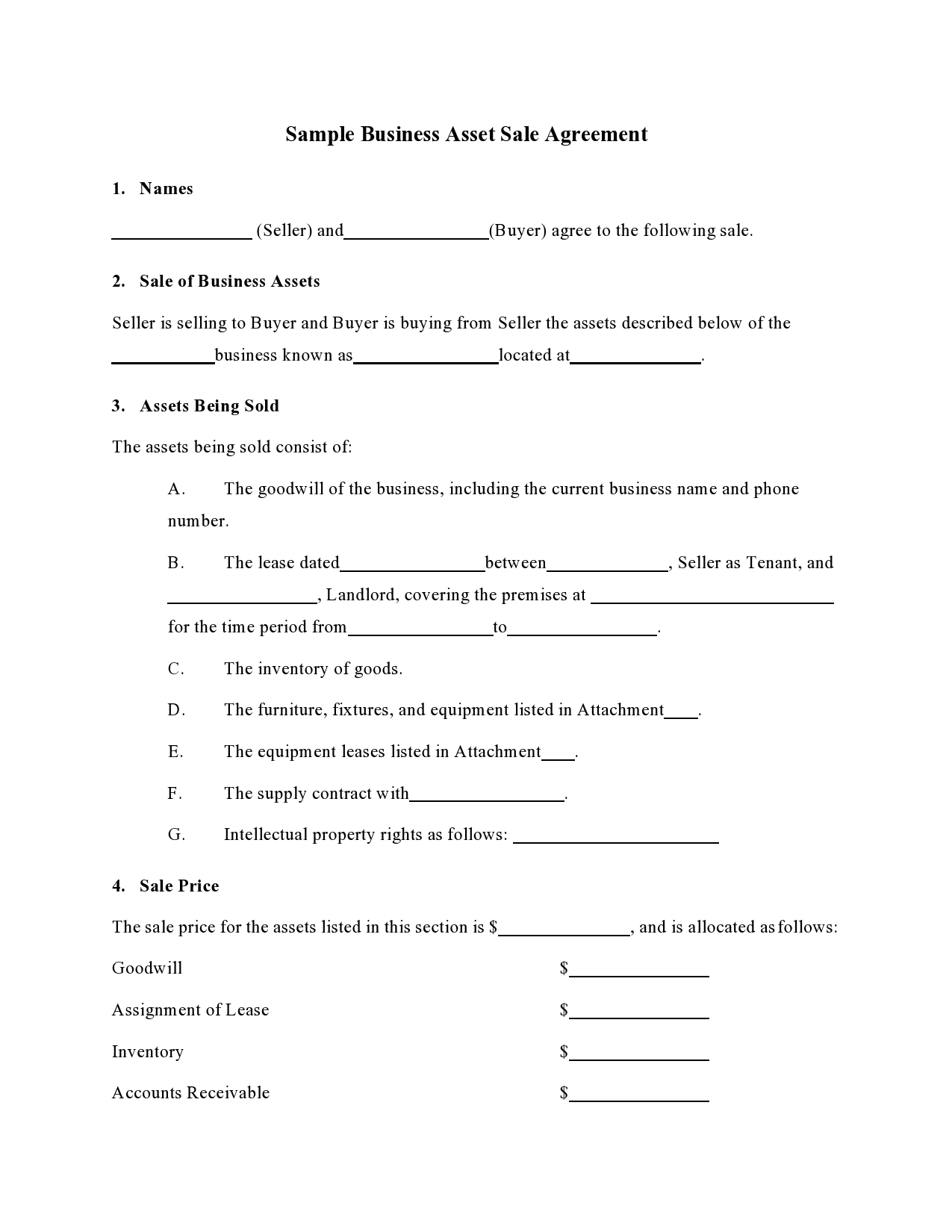

Business Sales Agreements

How do I Write a Business Purchase Agreement?

There are some simple tips to make the writing of a business purchase agreement really easy. These steps can help you to draft the right business purchase agreement for your needs with ease whenever you sell a business. You will almost always have to include all of these sections in order to cover all the bases of your business sale.

The more information that is covered in the purchase agreement, the better off you will be if there are any issues that come up during the sale. Business purchase agreements are critical to the sales process, and you need to be sure that you know how to write one to protect the sales process.

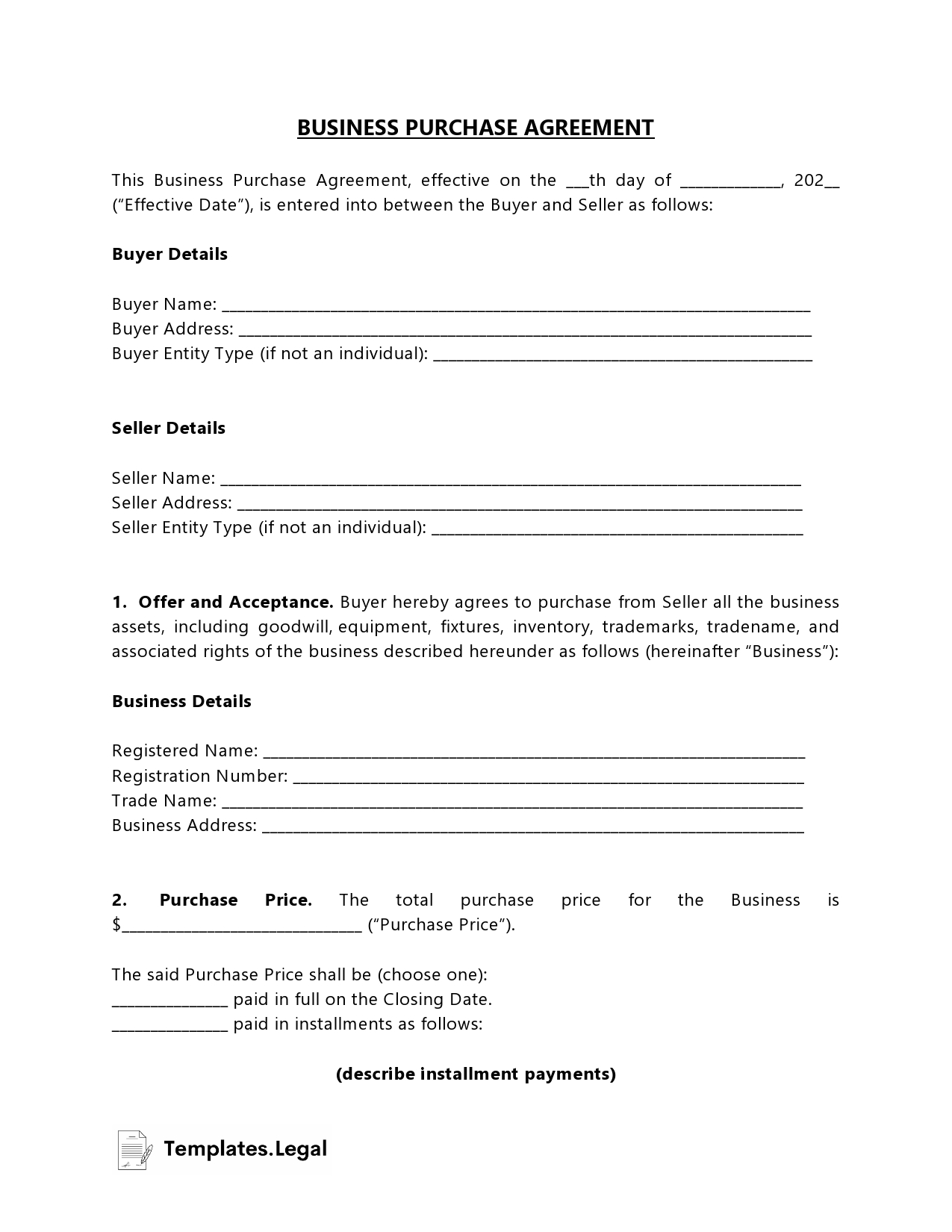

- Parties and business information needs to include the names of the buyer and the seller involved in the agreement. There should also be information about the business that is being sold, such as the name of the business, a description of what the business does, and what type of business entity the company currently is listed as for tax and legal purposes.

- The assets of the business need to be carefully and correctly listed, such as the vehicles, the real estate, the furnishings, and any other kind of potentially valuable item that is being transferred during the sale. Trademarks, patents, customer lists, and even patented goods might be included in the information in this part of the sales contract. Anything that is left out cannot be legally claimed by the buyer so taking the time to make sure this section is correct is very important. You might also want to be sure that anything that is not for sale is included in this section as well.

- Business liabilities cover whether or not the buyer is taking on the liability of any kind when they buy your business. These might be accounts payable, employee-related expenses, lawsuits, or contractual obligations that are not finalized or are intended to continue on for some time after the purchase. Vendor contracts and business partner arrangements and agreements might also be included in this section of the contract.

- The price of the business must be correctly listed in this section of the contract, and the date when the money for the purchase is required to be delivered needs to be listed. You will also want to be sure that you include the date when the sale will be finalized and the transfer to new ownership will be done. Price adjustments might also be included in this part of the contract because there can be variability based on valuation changes in the market before the purchase is complete. This is more common when stocks or other kinds of assets that have changing value are the items that are being sold.

- Terms of the contract are one of the most important parts of the contract. This gives the information for both the buyer’s and seller’s representations and warranties, as well as a condition precedent that states that a right of duty or interest has to arise related to the sale. There is almost always a non-compete clause that is part of this segment of the contract. This section will also include information about what happens if there is a dispute between the two parties.

- Signatures need to be collected from all involved parties that are part of the sale, and this part of the contract needs to be dated as well. A notary public needs to witness the signing and notarize the document as well.

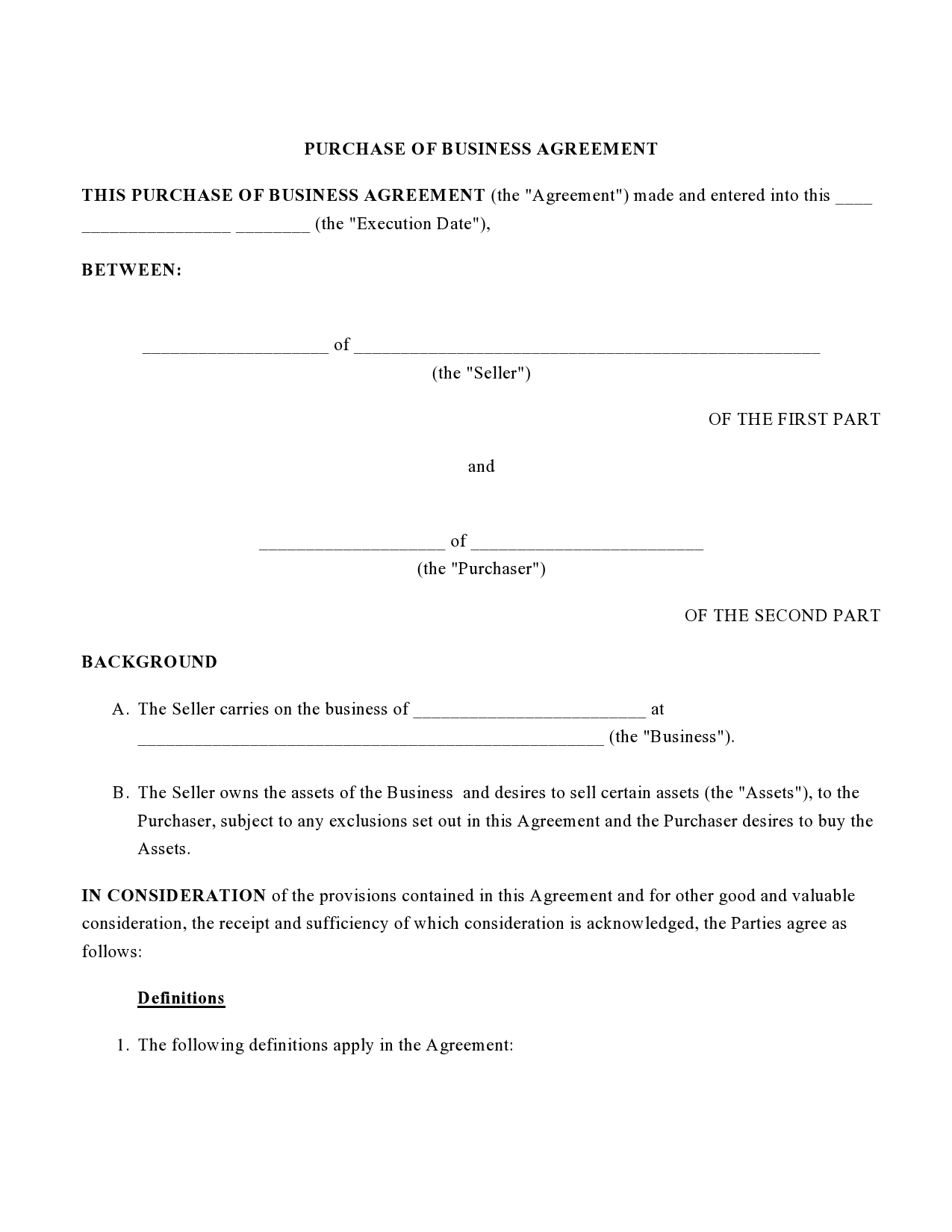

Small Business Purchase Agreements

Can You Back Out of a Business Purchase Agreement?

There is almost always a reasonable time window that allows for the buyer to pull together financing to complete the purchase. This is one of the main reasons that one or both parties might back out of a sale. Very often, an issue with funding or finances is what makes the contract for the sale of a business null and void. You might include this kind of information in your contract details to make it clear that there can be limited reasons for breaking the contract related to the inability to buy the business.

The seller might also be able to reverse the sale if they pay the penalty for changing their mind. Many business contracts include a penalty fee that is paid to the buyer along with the return of their down payment if one was paid. Not all business contracts work this way, and this can be a thorny right to exercise, even if it is written into the contract from the start.

Overall, the problems related to business purchase agreements are almost always on the side of the buyer and are rarely on the side of the seller. Most people who have taken the time to create a business purchase agreement are ready and willing to sell to the right interested party. If there is some suspicion that something incorrect or improper is happening related to the sale, this might be a reason for the seller to back out, but this is not very common.