Anybody who runs a business knows the importance of a business budget template. Even ordinary housewives at home who have limited finances usually make some form of budget to make ends meet. Creating a business expense spreadsheet is a good idea because without one, it can have a serious impact and can endanger the success of your enterprise.

Table of Contents

- 1 Business Budget Templates

- 2 What should your business budget template contain?

- 3 Business Budget Template Excels

- 4 Preparing for and using your business budget template

- 5 Small Business Budget Templates

- 6 Some types of business budget templates

- 7 Business Expense Spreadsheets

- 8 Steps for creating your business budget template

Business Budget Templates

What should your business budget template contain?

When making your own business budget template, make sure it contains this information:

- Expected revenues and sales

- Fixed costs

- Variable costs

- Semi-variable costs

- Profits

Depending upon the size of your business, you might also want to include other additional but relevant data in your business budget template Excel along with the level of financial information that you would like to keep track of.

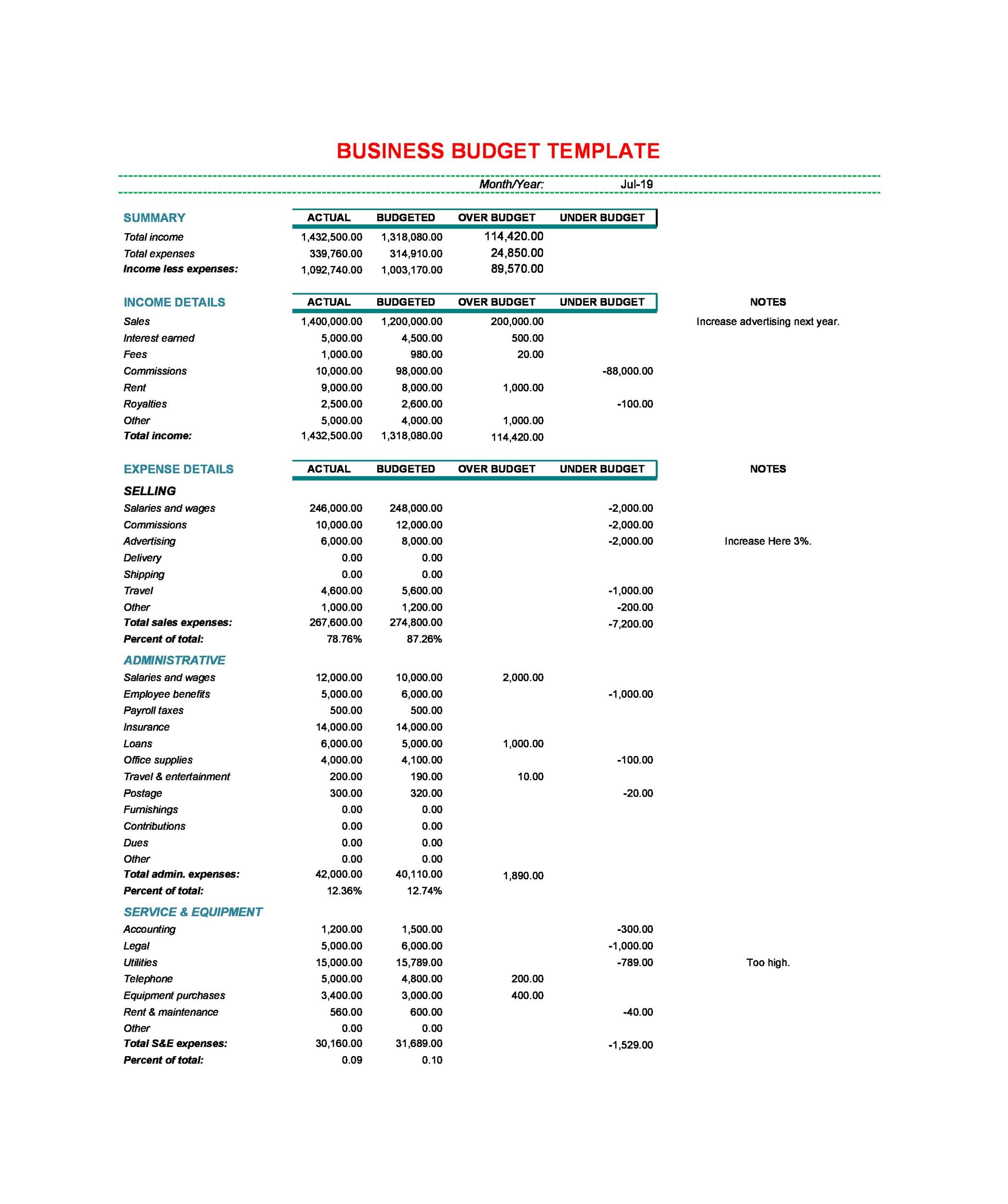

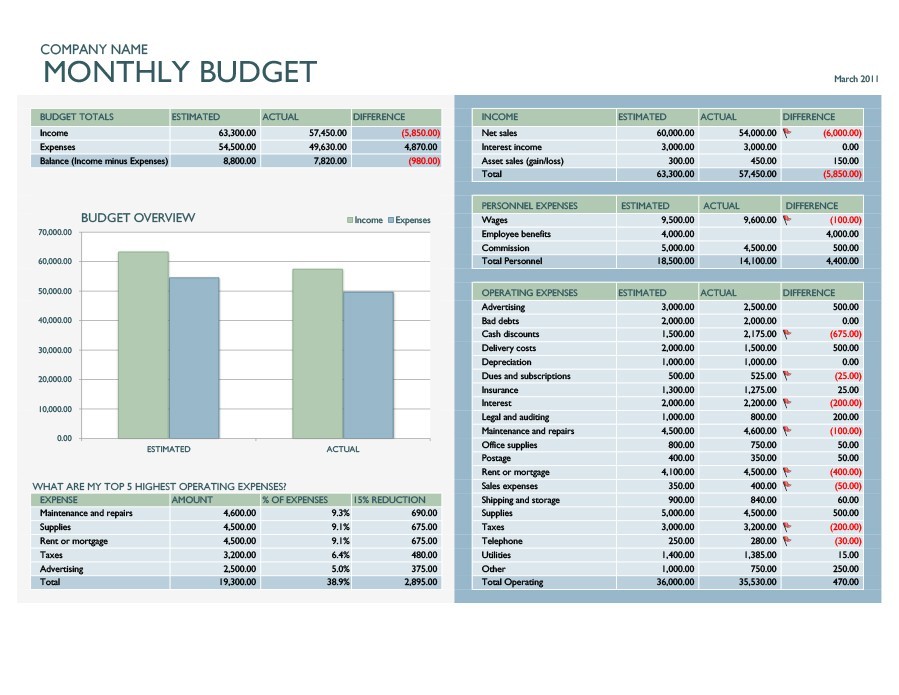

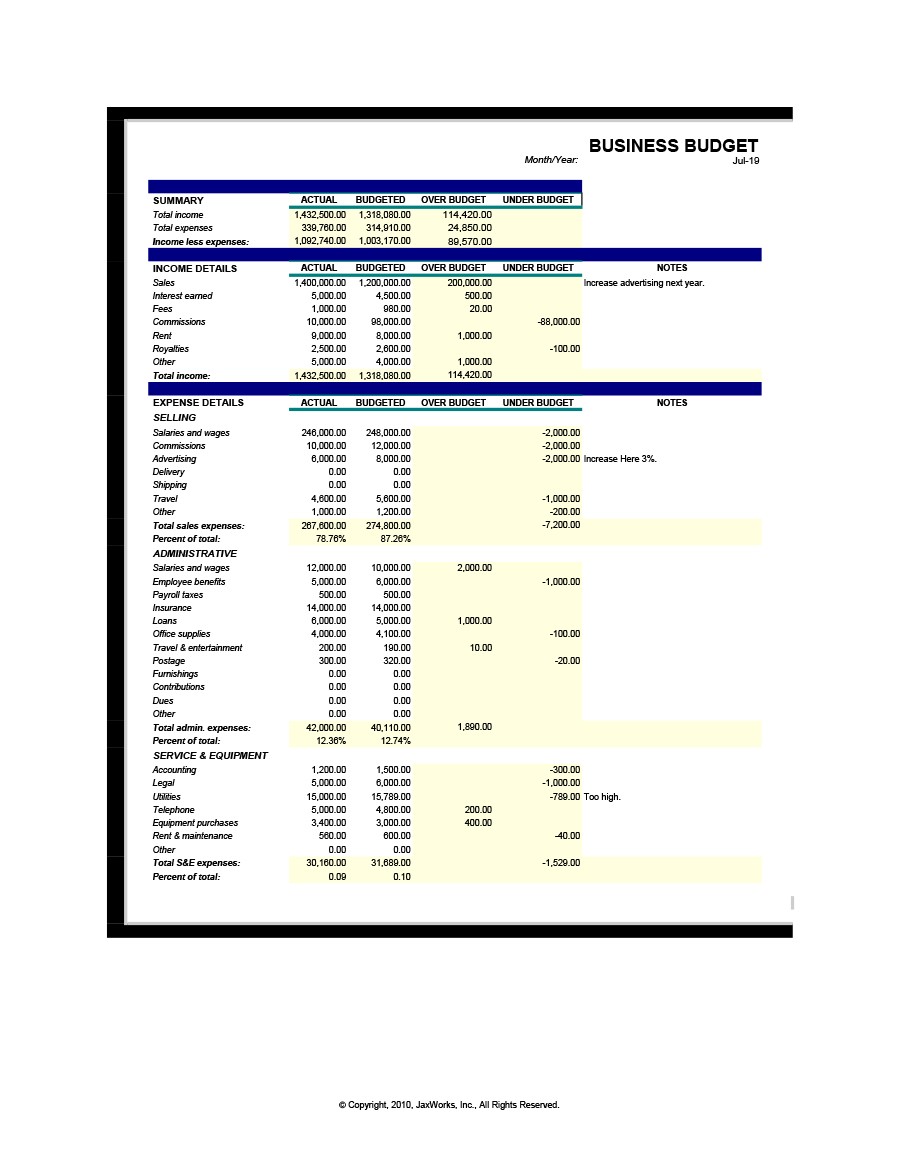

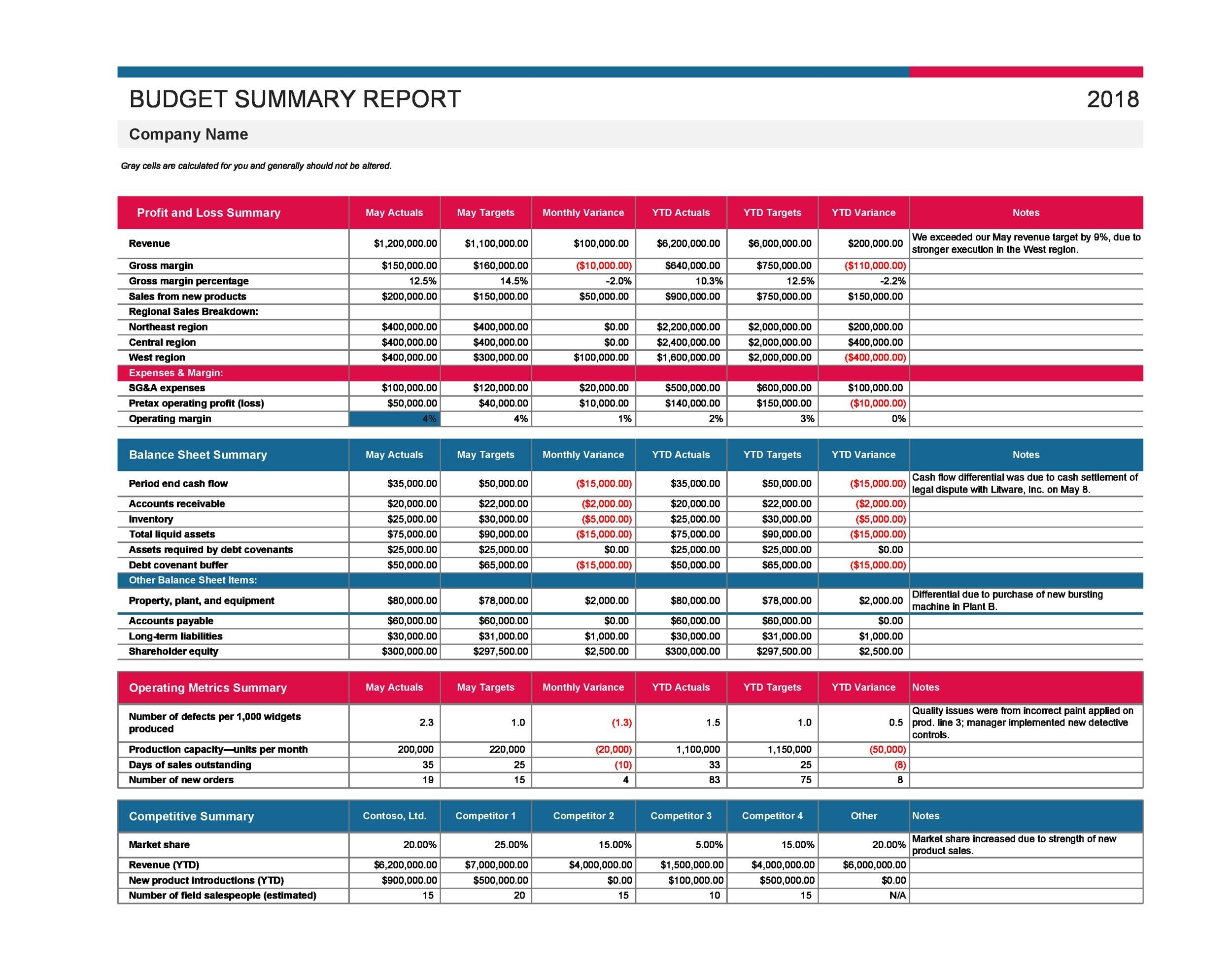

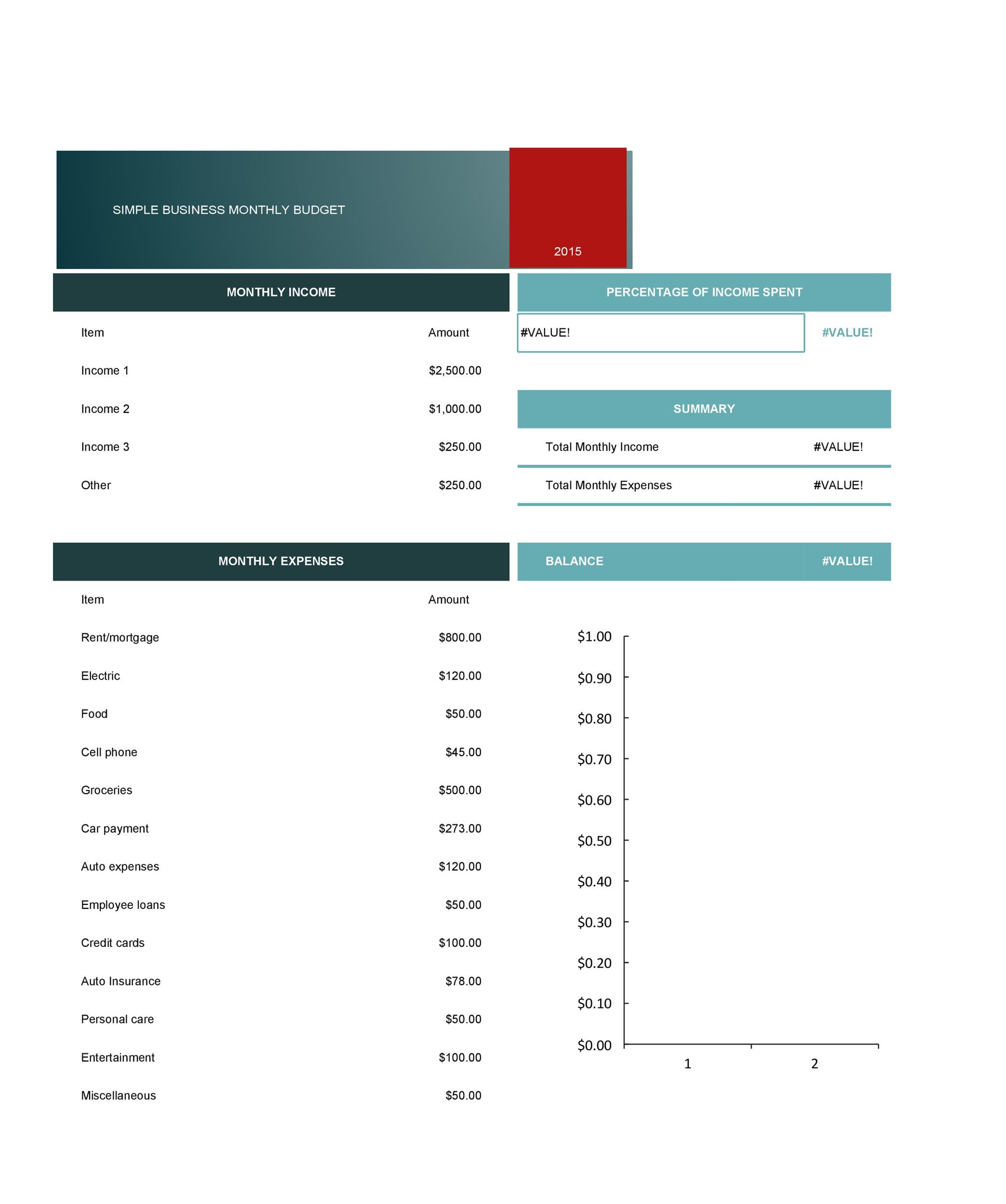

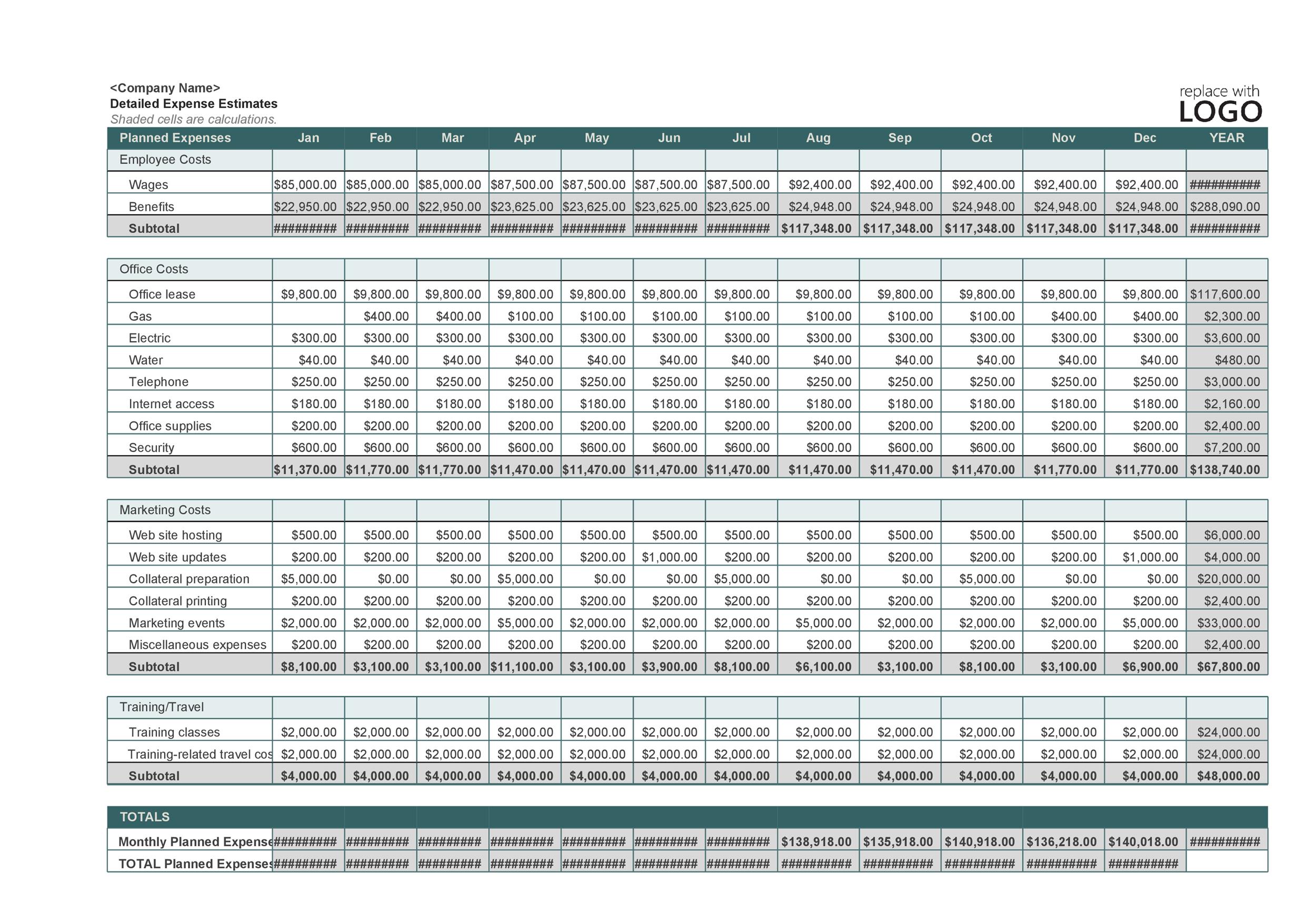

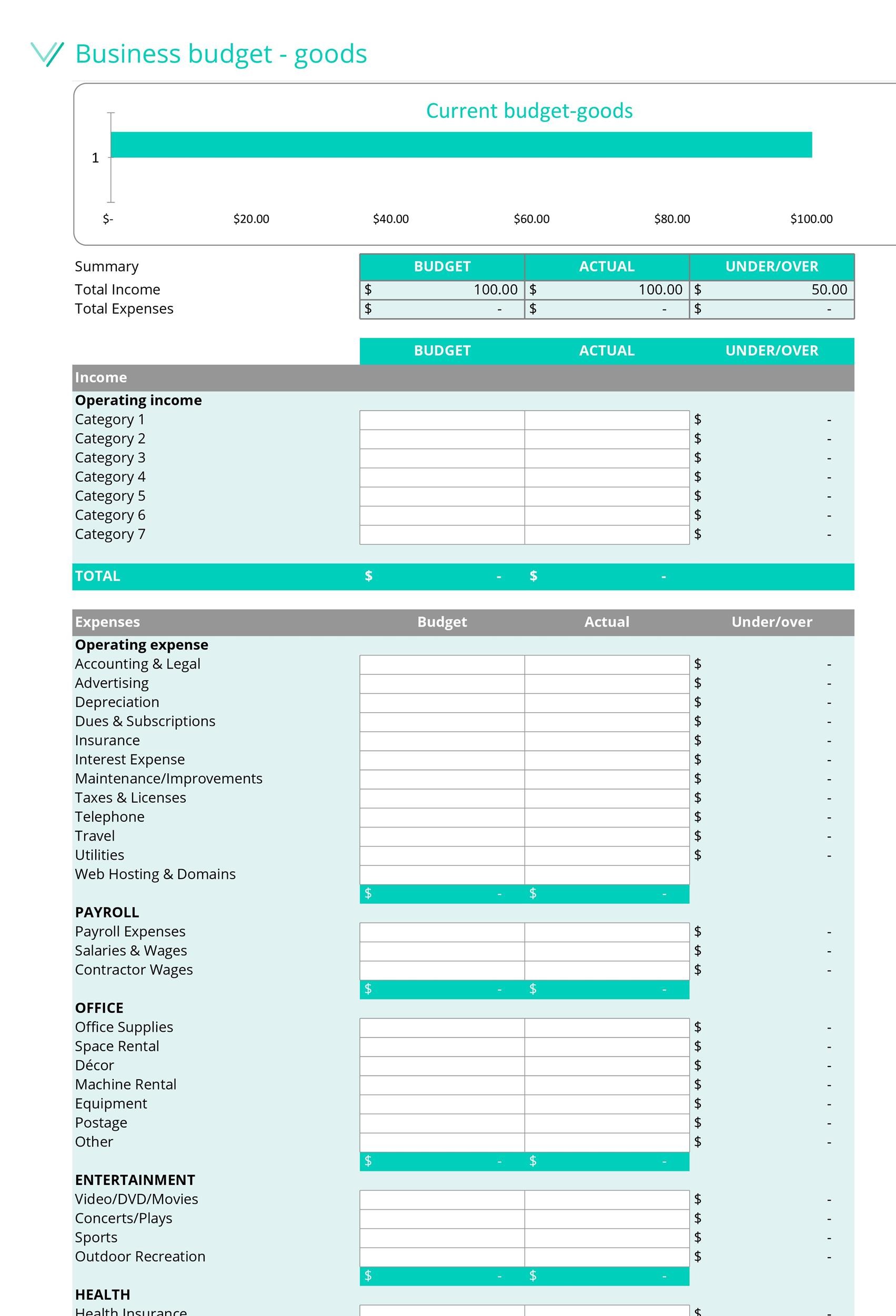

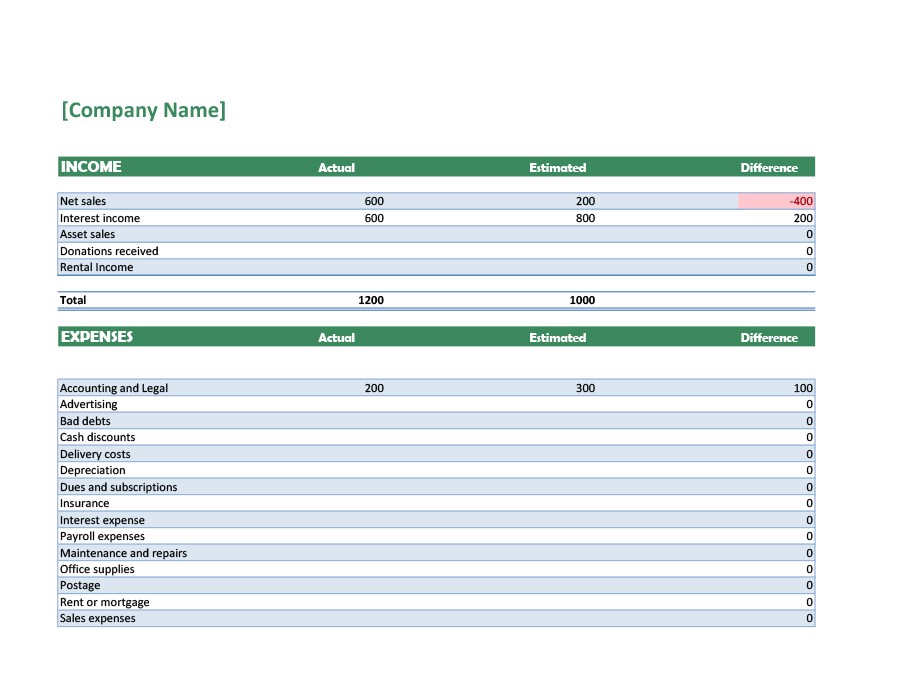

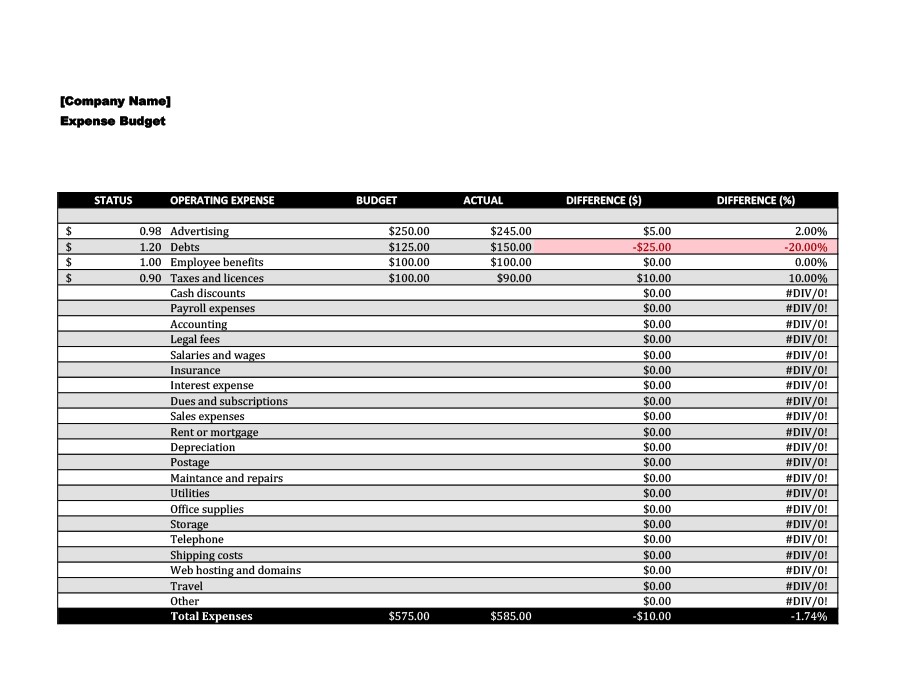

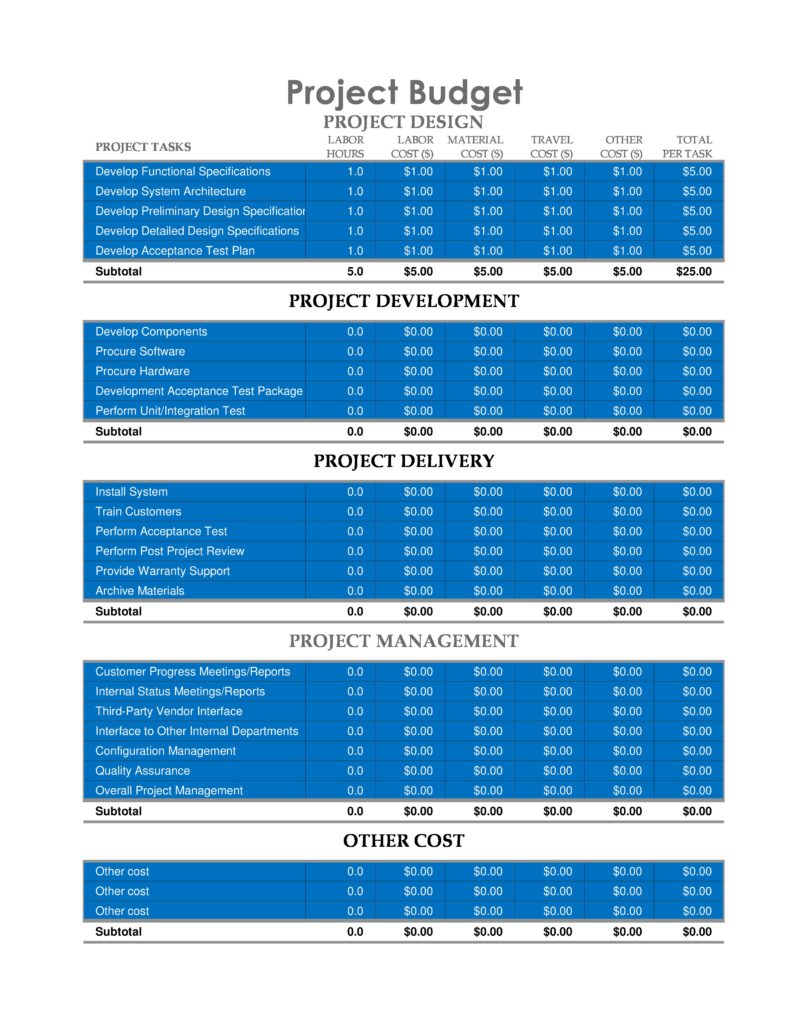

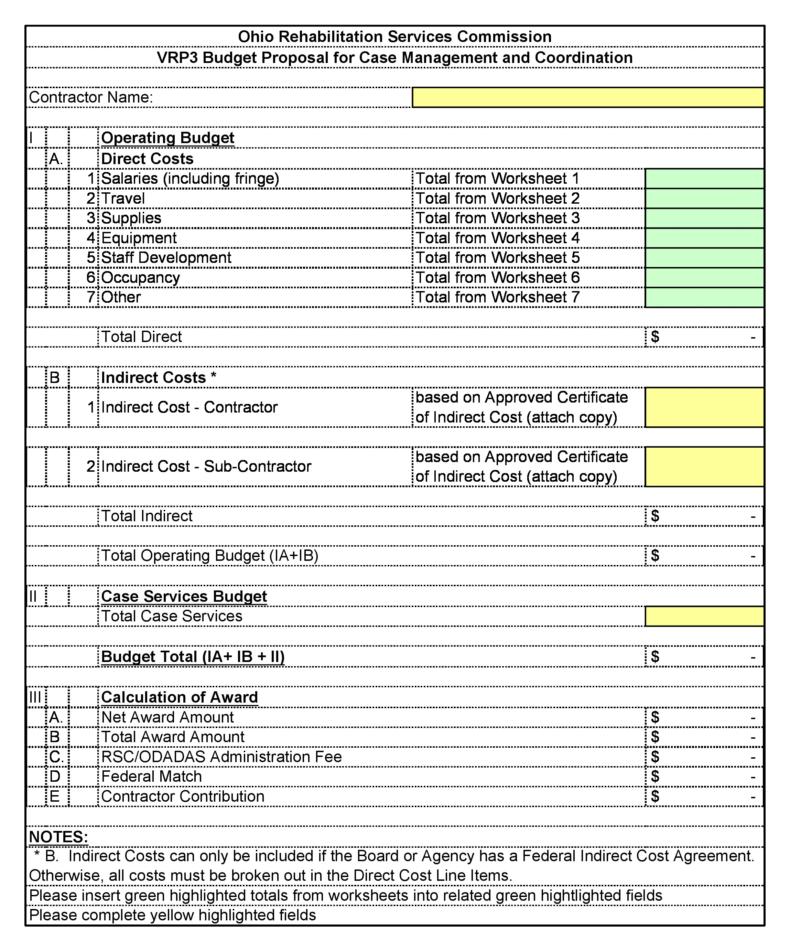

Business Budget Template Excels

Preparing for and using your business budget template

Using a business budget template can make life easier for you when creating an initial budget for your business. This can help you in calculating expenses, profits, and revenues. If you’re constrained by time, you can always opt to download a business expense spreadsheet and then customize it accordingly.

Whichever method you prefer, there are some basic steps to follow:

- Gather the required information

If you already have a well-established and secure business, collect all historical data that you have accumulated over the years. If you were still in the process of starting a business, search for any financial information on businesses similar to your own and use this information as your guideline. - Come up with an estimation of sales goals and profit goals

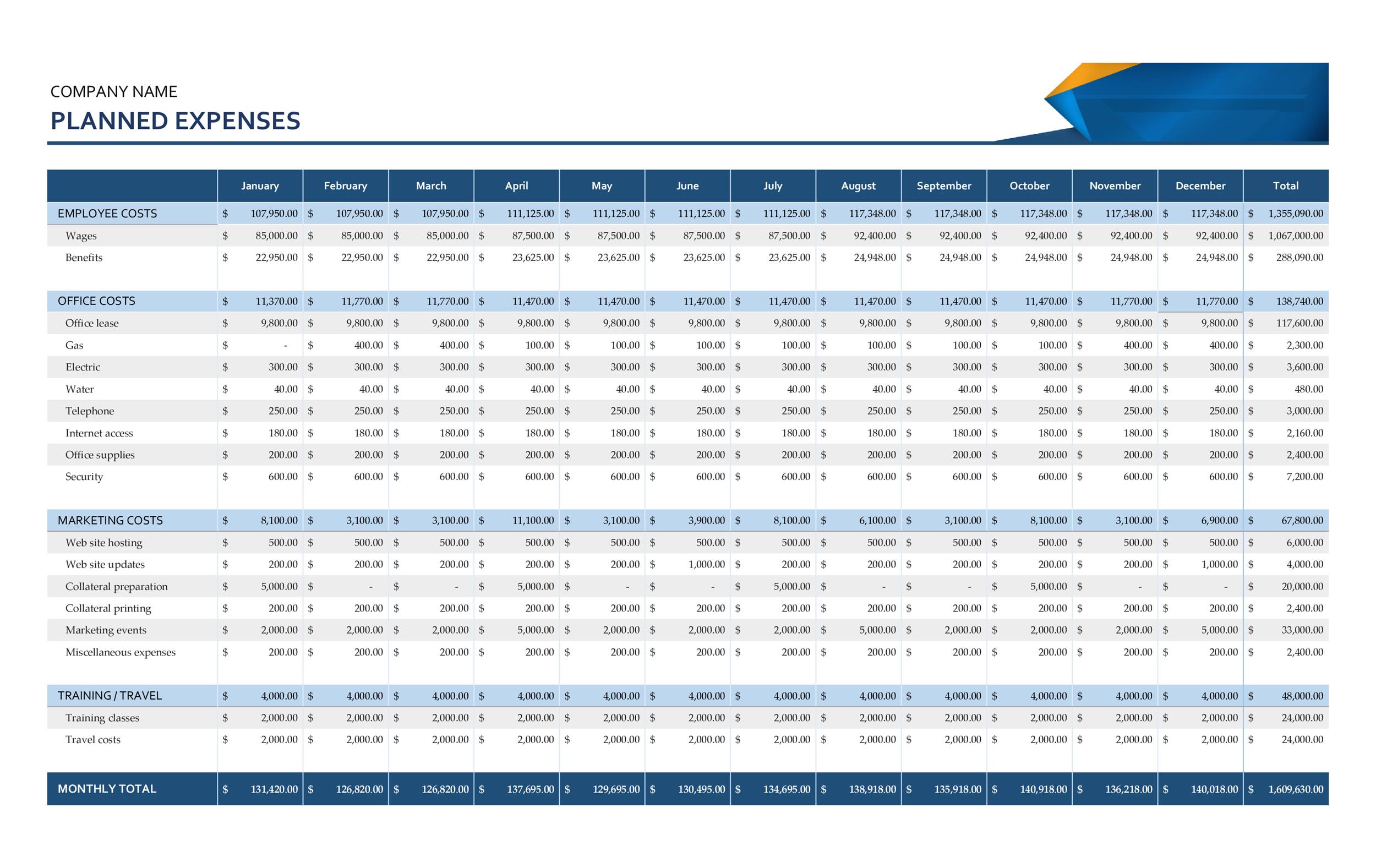

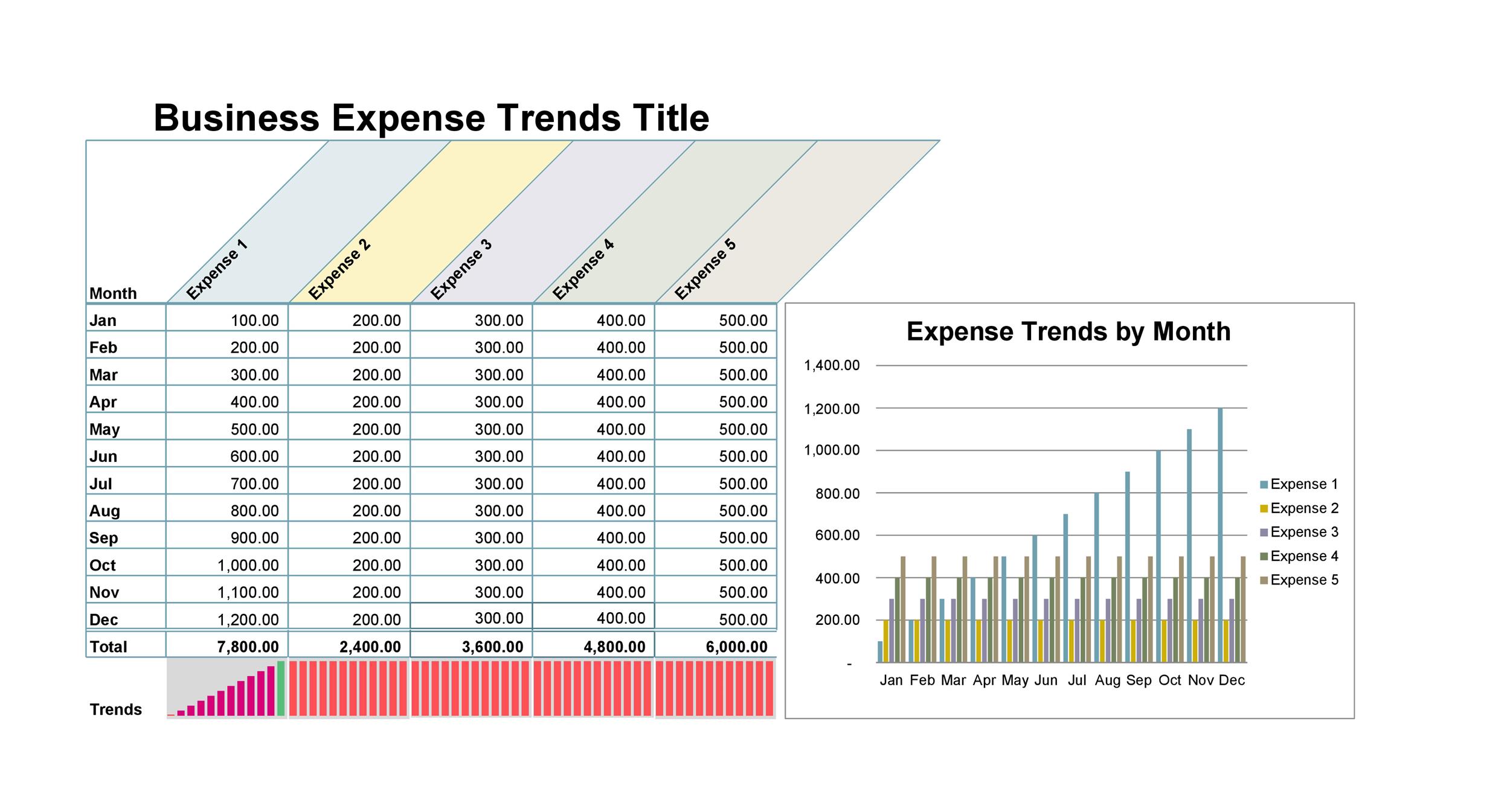

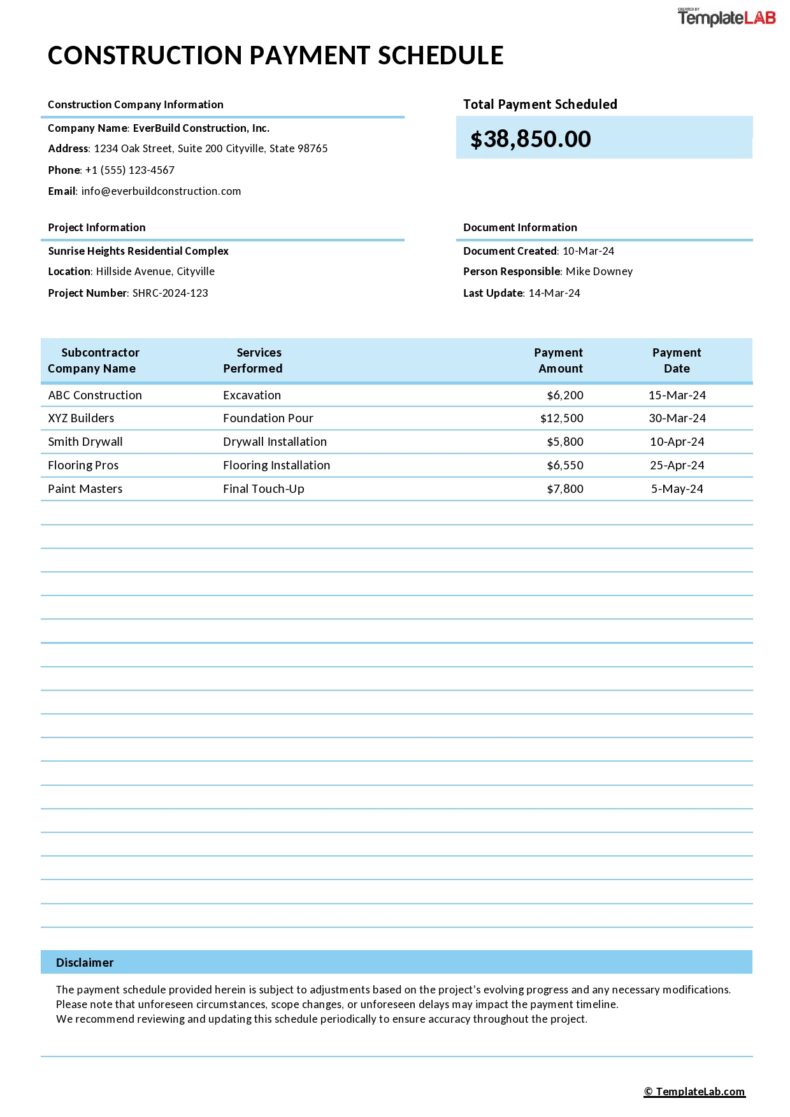

You should have an idea of the sales and consequent profits you can potentially make. Calculate these and take into account the varying times of the year, the factoring-in of holidays, office closures, and even the seasonal lulls and booms. Make sure to set realistic projections of your revenue not just for the current year but for the future as well. - Determine the costs

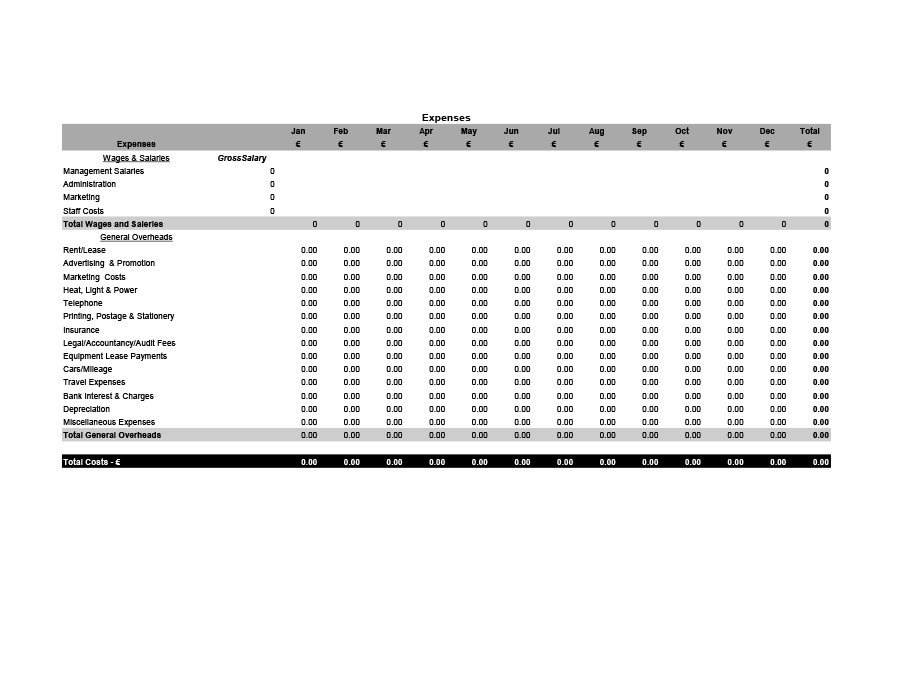

Make a calculation of all the fixed and variable costs needed for your business operations. Fixed costs usually include rent, insurance, licenses, and more to operate your business. Variable costs may include equipment and materials, labor, wages for all employees, employee benefits, training expenses, travel expenditures, and so on. - Solve for your profit margin

To establish the expected profits, your business for a given time, subtract your business expenses from the estimated revenues and sales. Also, include the total costs of the goods sold. You must also consider several factors like equipment, shipping, materials, and others for your production facility or office. - Make adjustments to your budget as time goes by

Make it a point to continuously make updates on your small business budget template over time so you can see how the estimates you came up with compare with the actual expenses and sales. This is very important, especially if you incur any loses instead of profits. Adjust the information on your business budget template Excel so you can decrease costs and increase revenues.

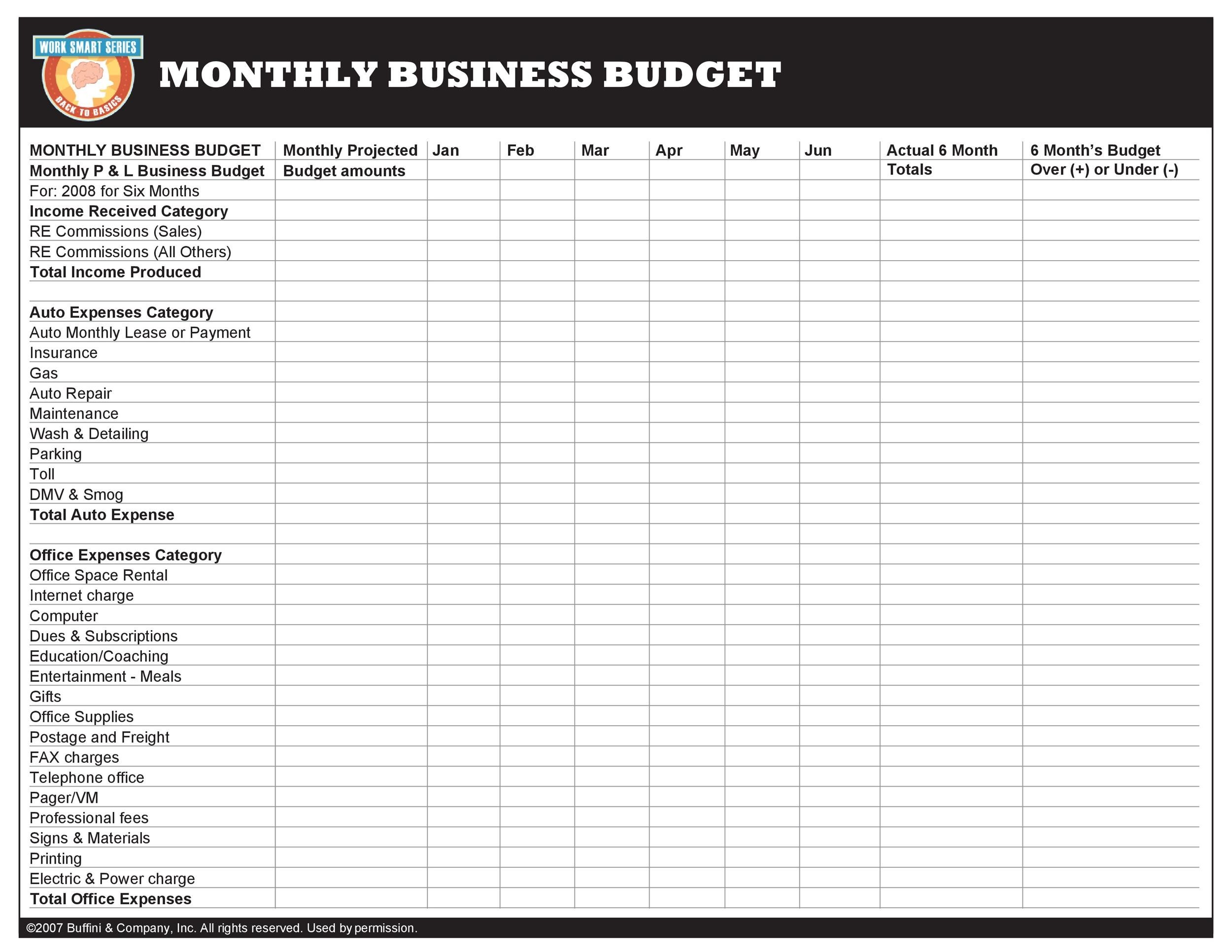

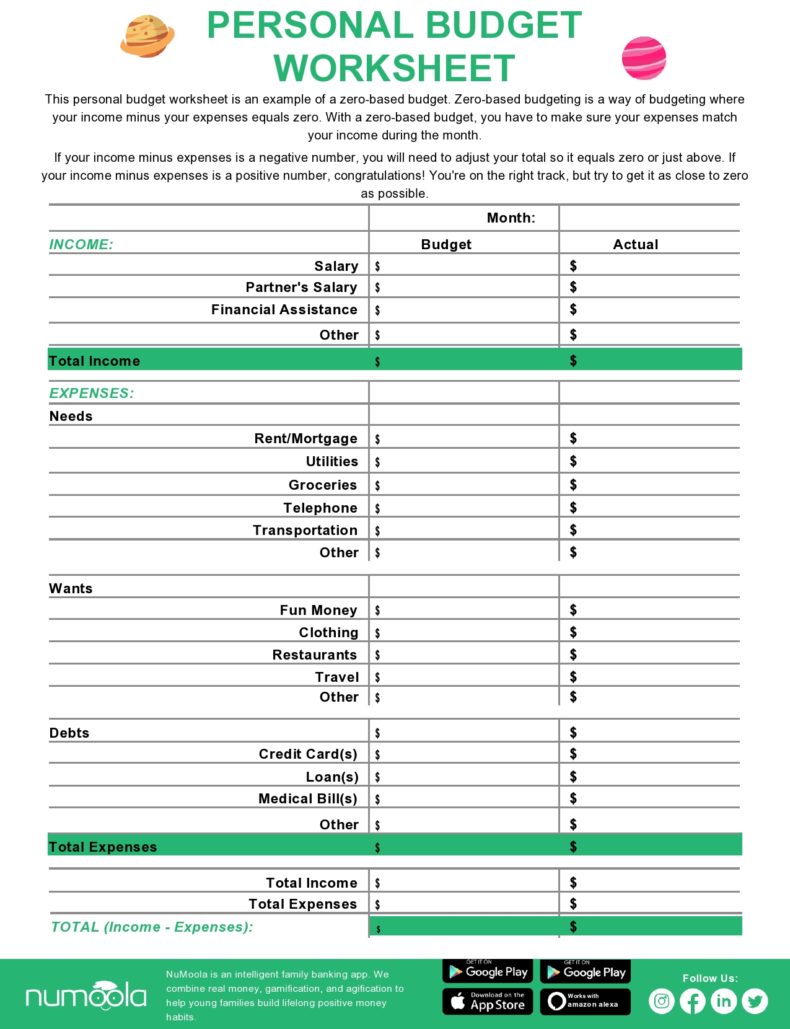

Small Business Budget Templates

Some types of business budget templates

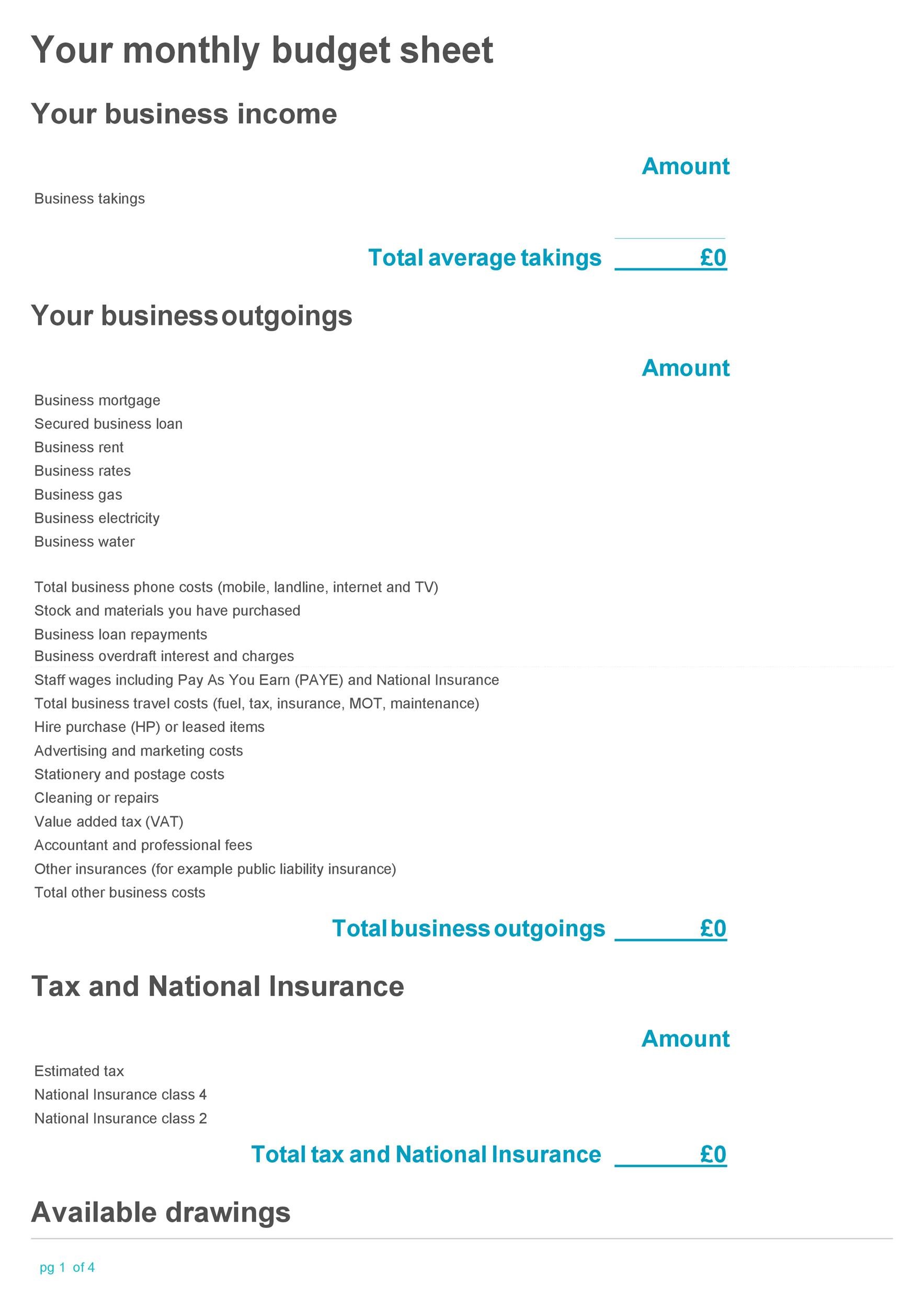

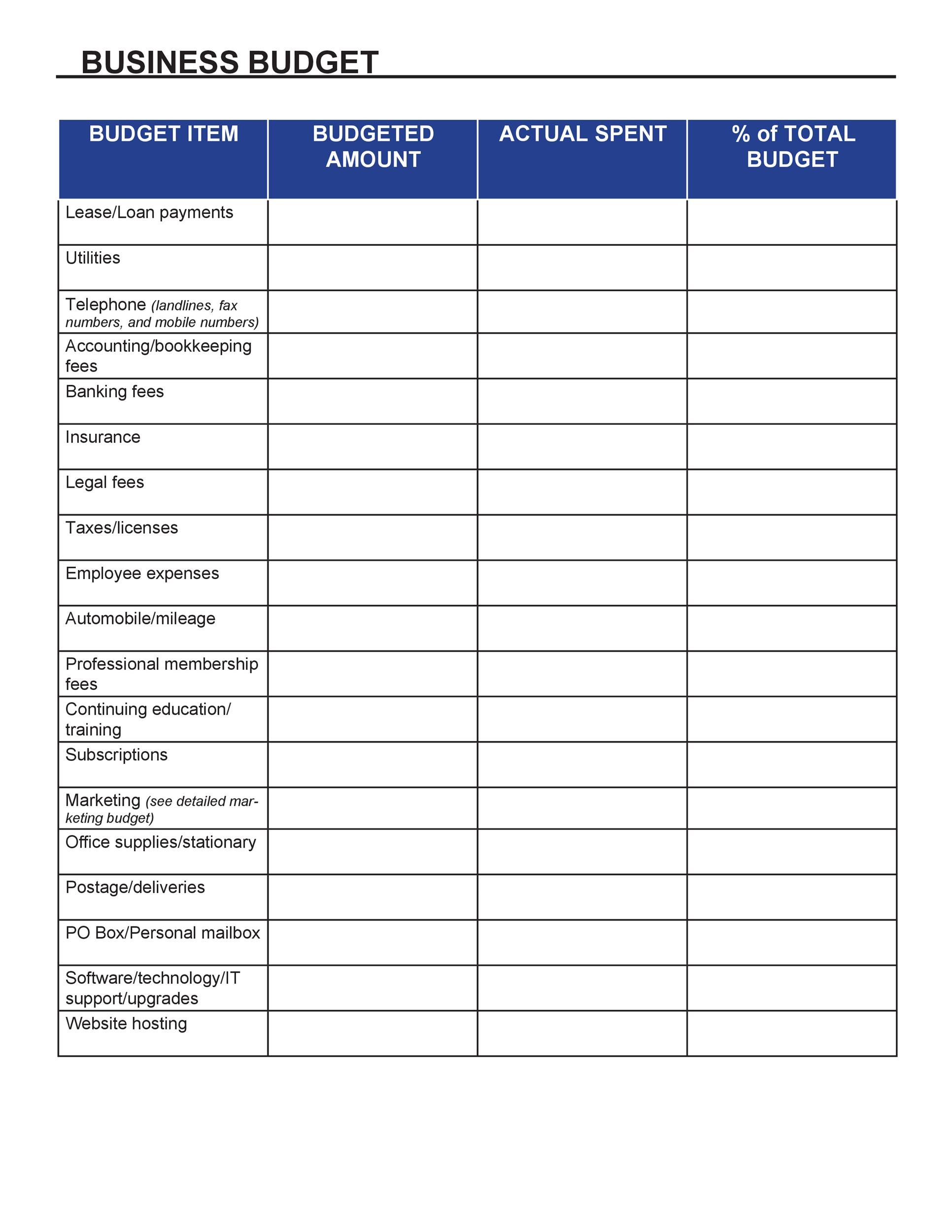

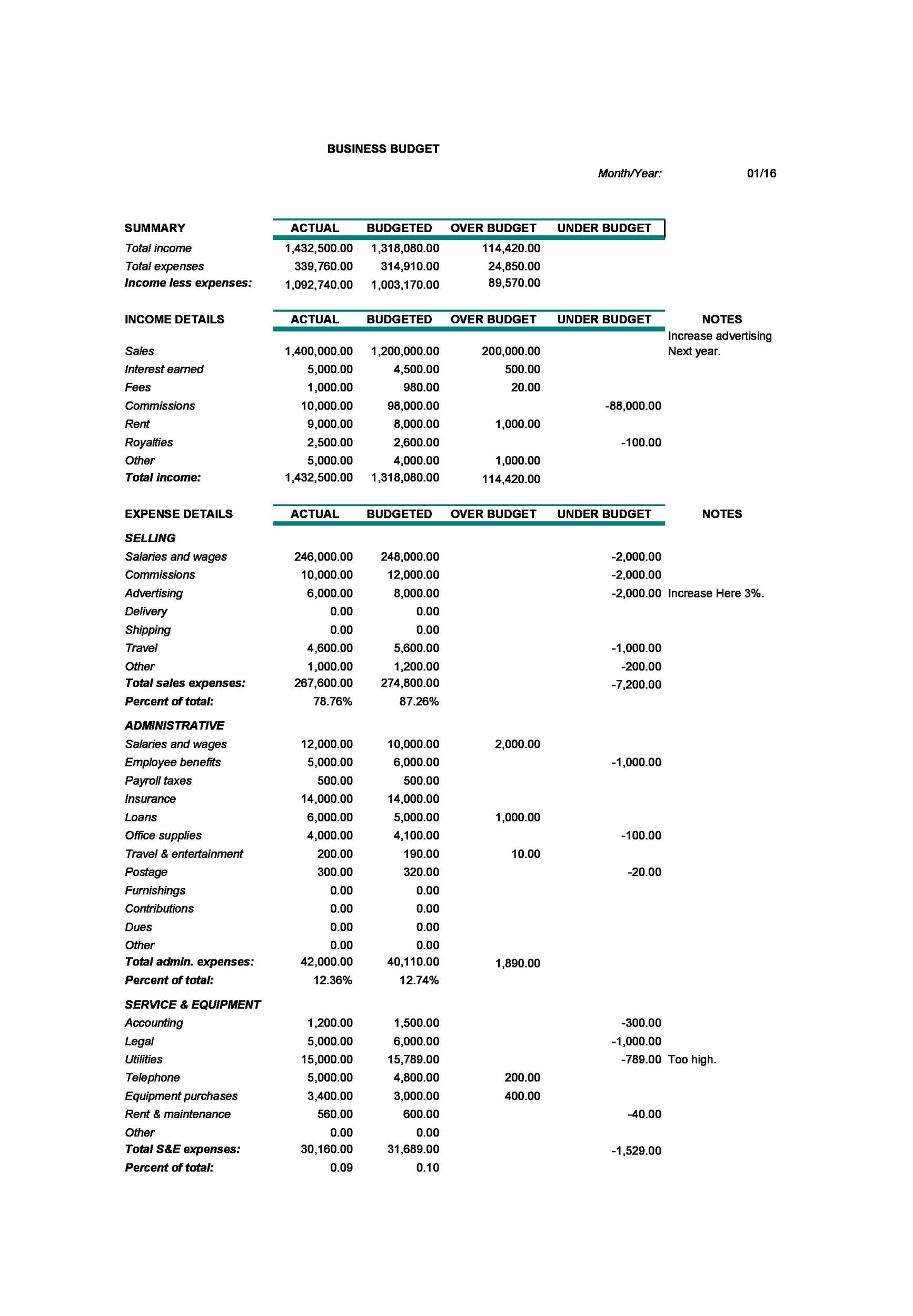

You can use a basic business budget template to keep track of your monthly expenses and income. Such a template applies to companies of different sizes. For a clearer look at how you make and spend your company’s funds, break down the expenses and income by category. Other types of templates include:

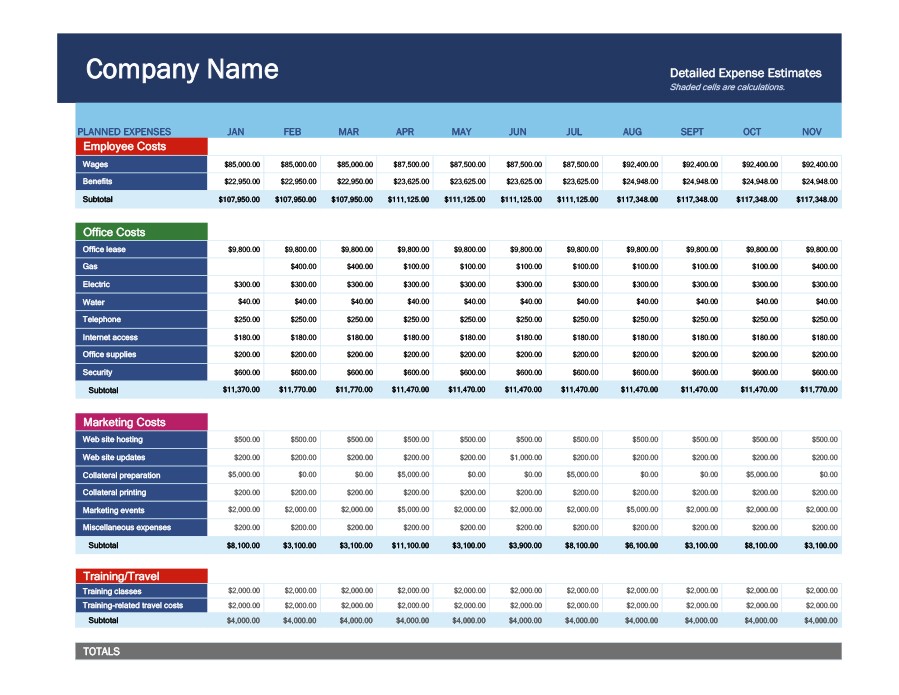

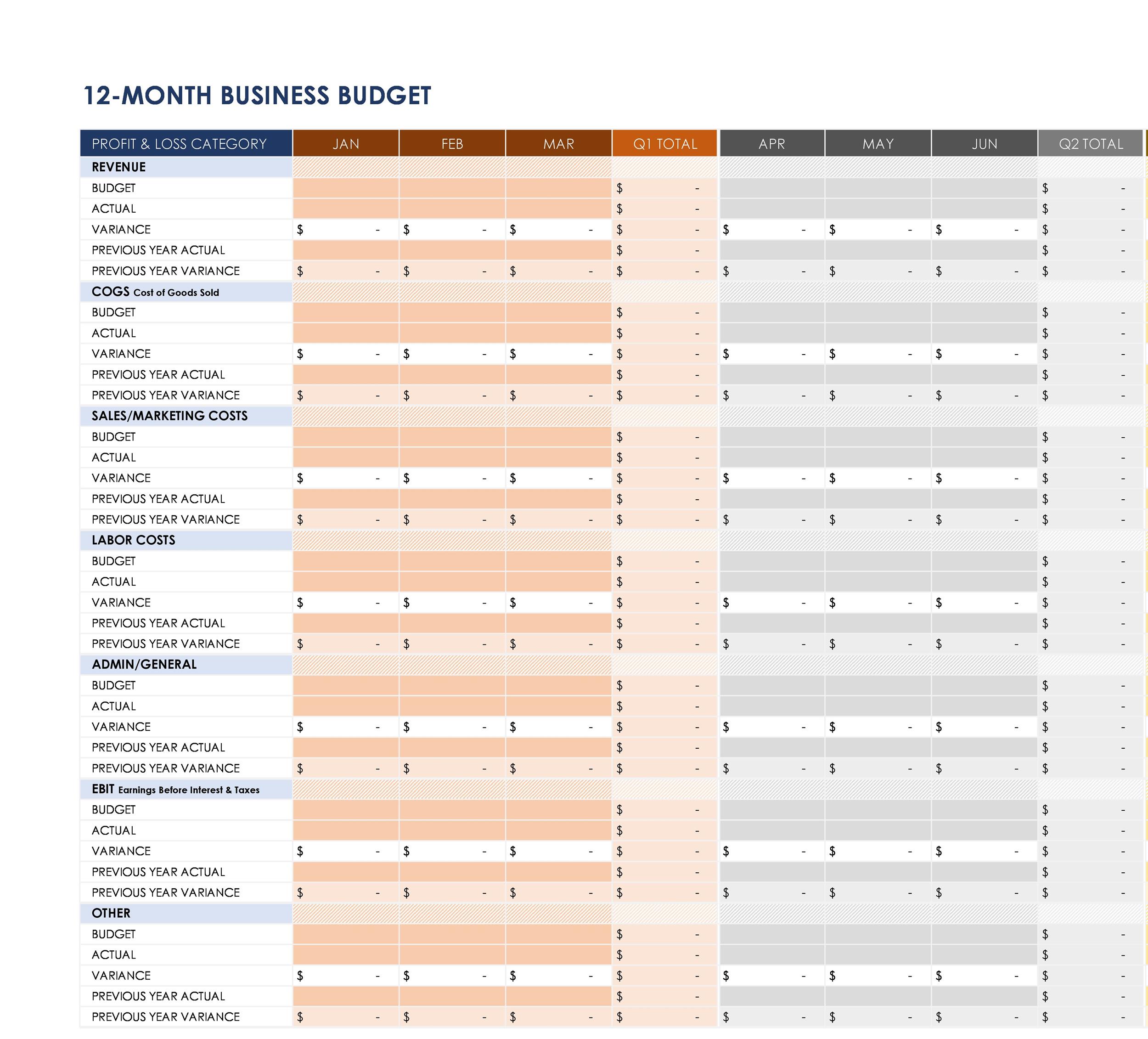

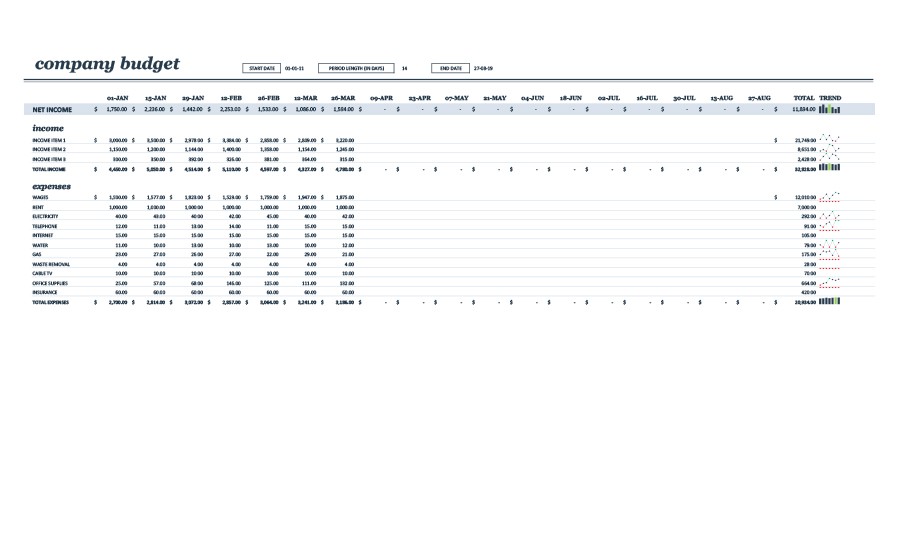

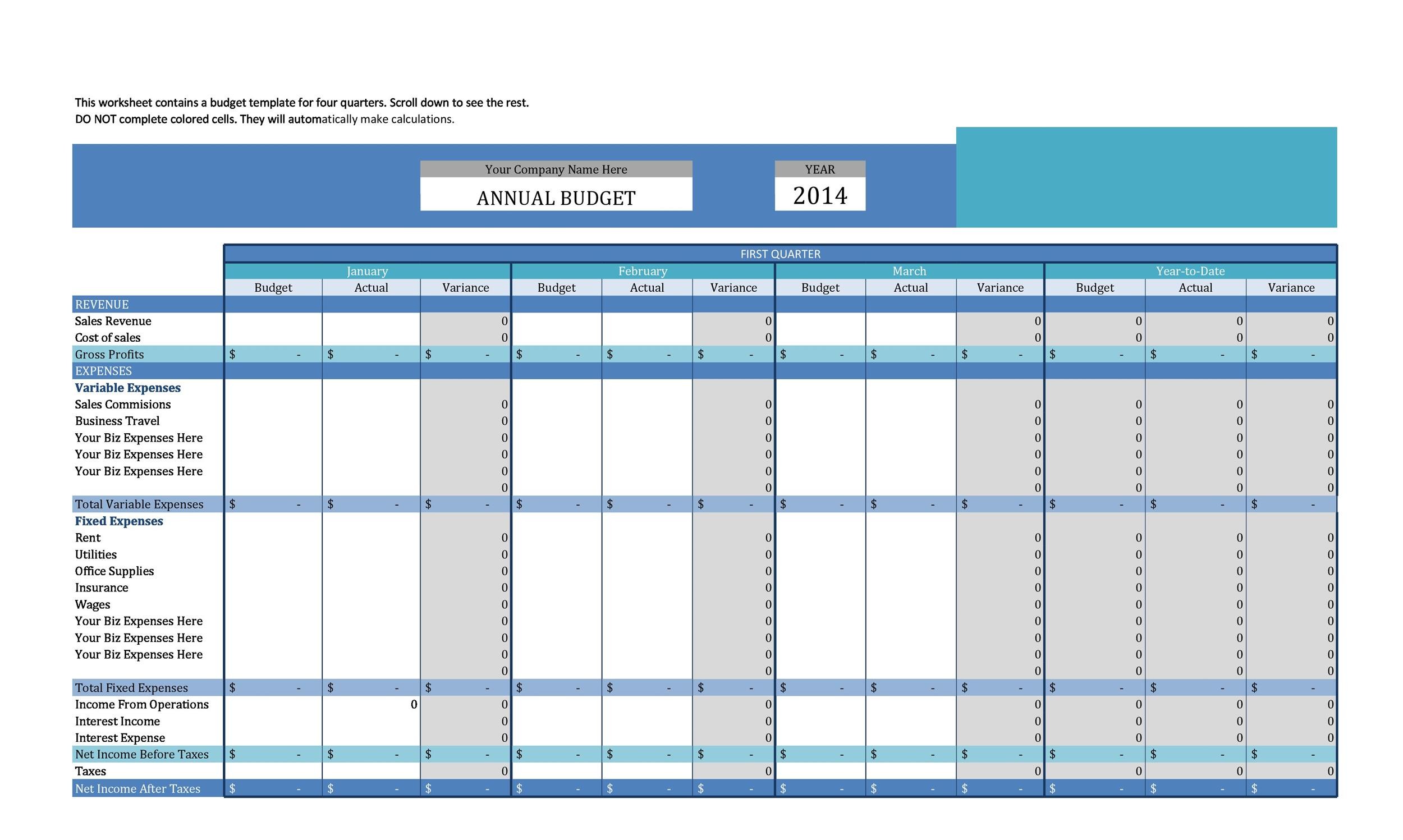

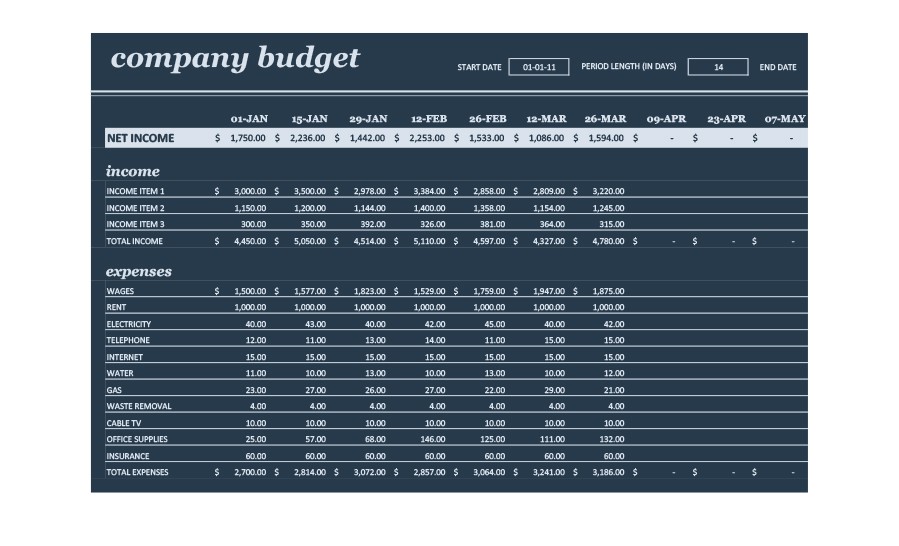

- 12-Month Business Budget Template

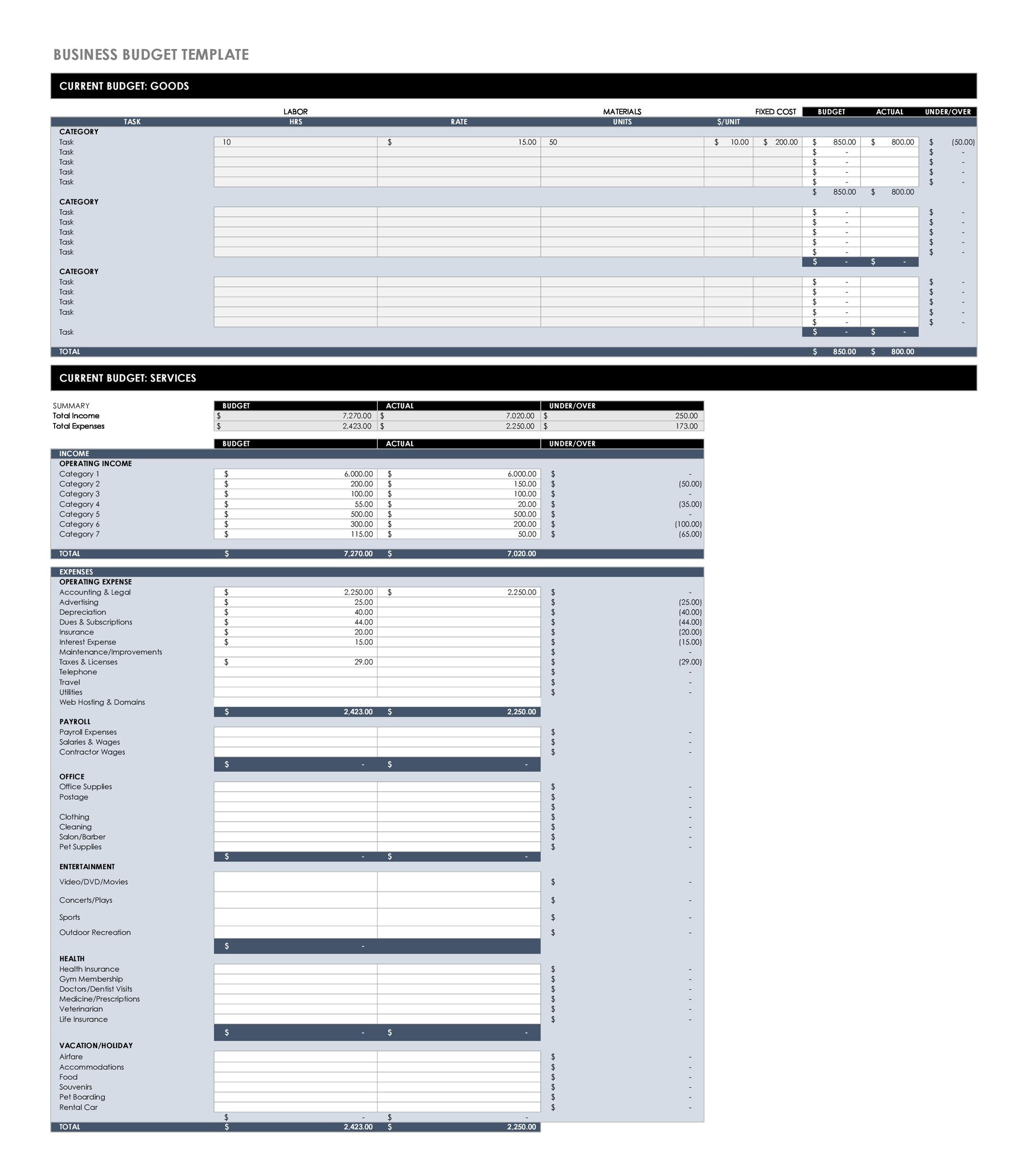

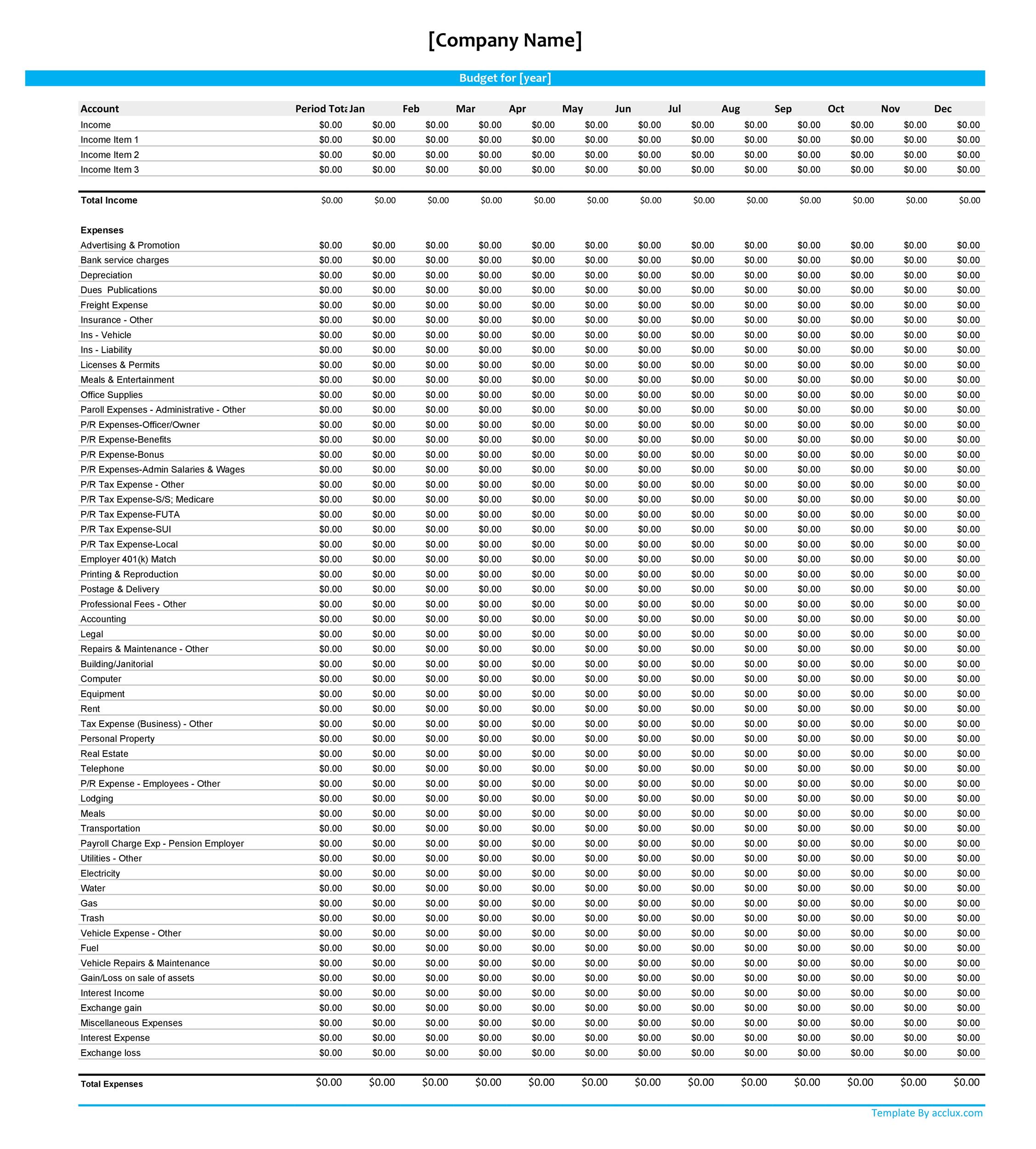

This is typically used to show more details about the company’s financial information over time. Enter here your company’s monthly revenue and expense estimates for the whole year. - Department Business Budget Template

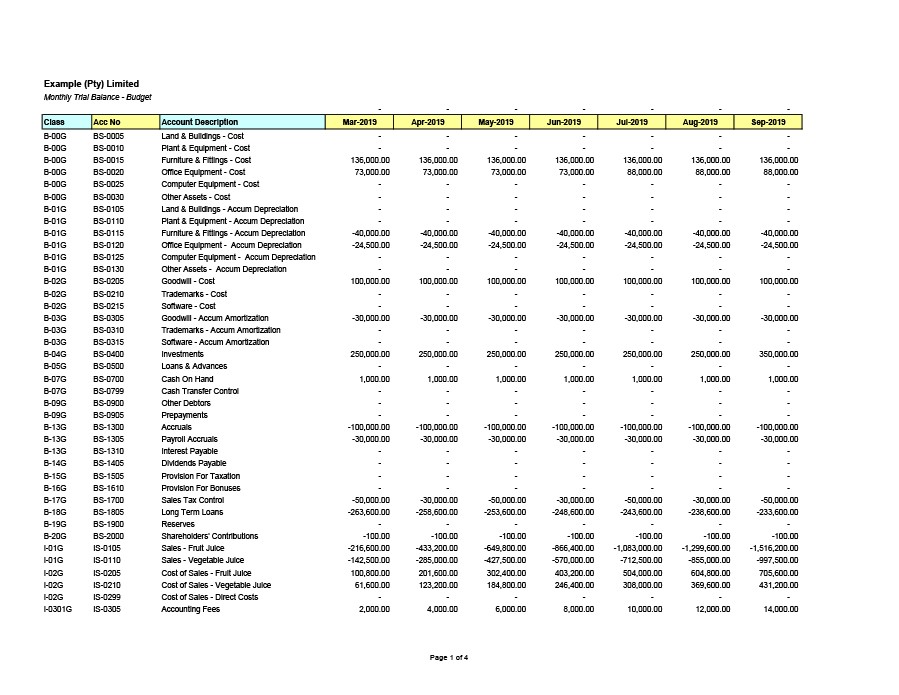

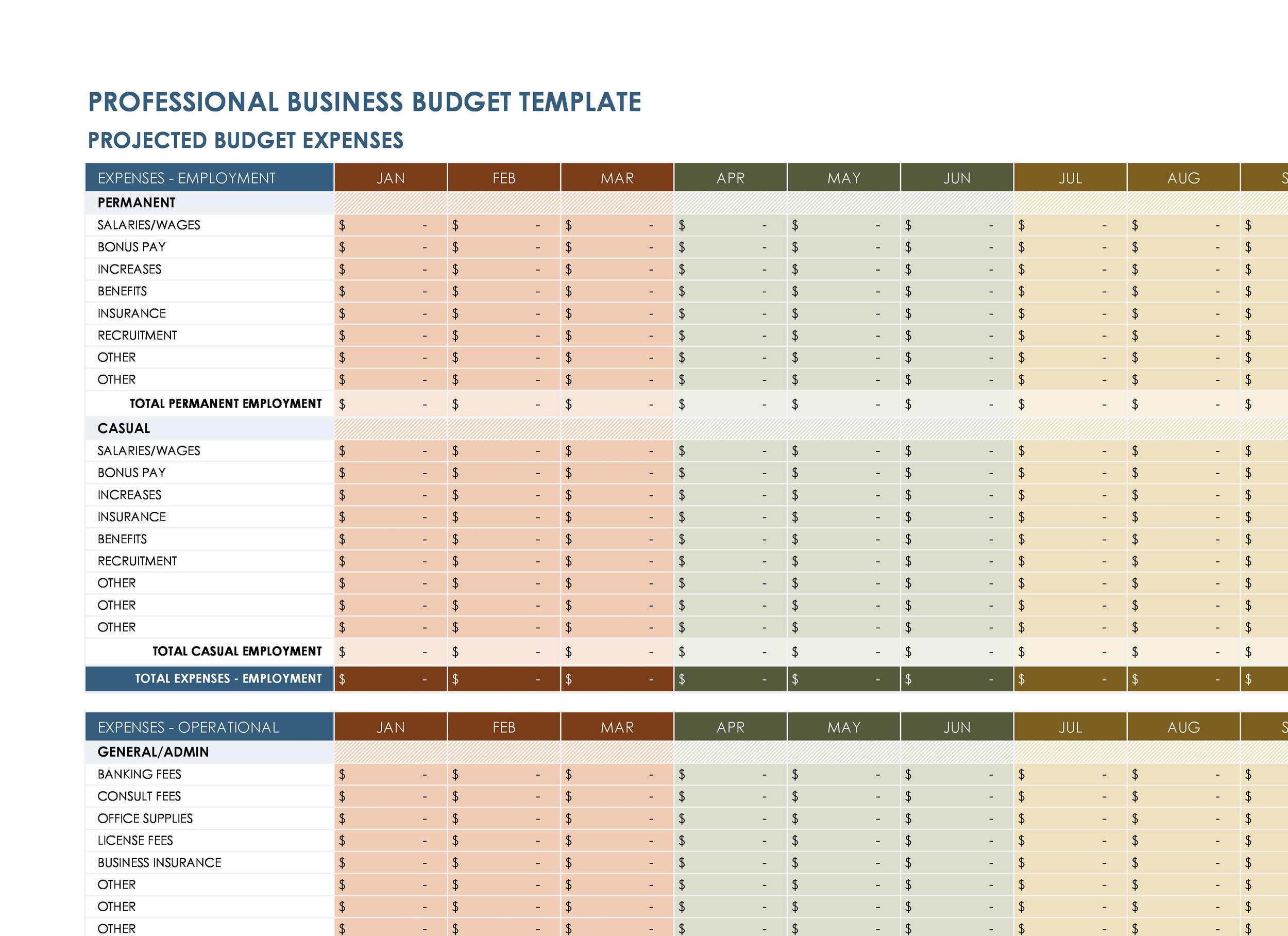

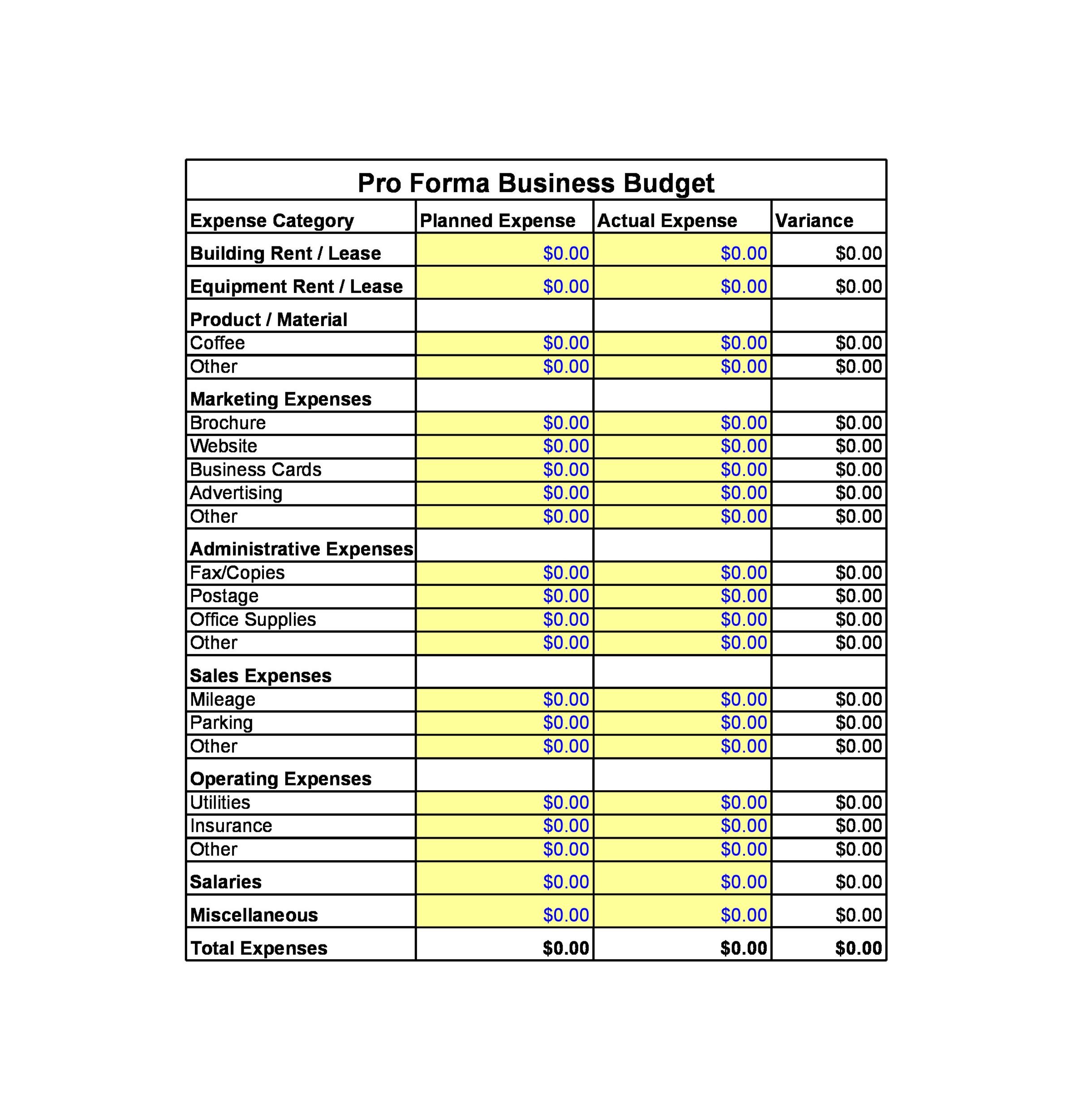

You can use this business budget template Excel to ensure that your department always stays within the allotted budget. With it, you can plot the income and expenses of each department yearly then compare the change in percentage each year. Use this to see where it’s possible to make adjustments to your budget, cuts, and to find any surpluses. - Professional Business Budget Template

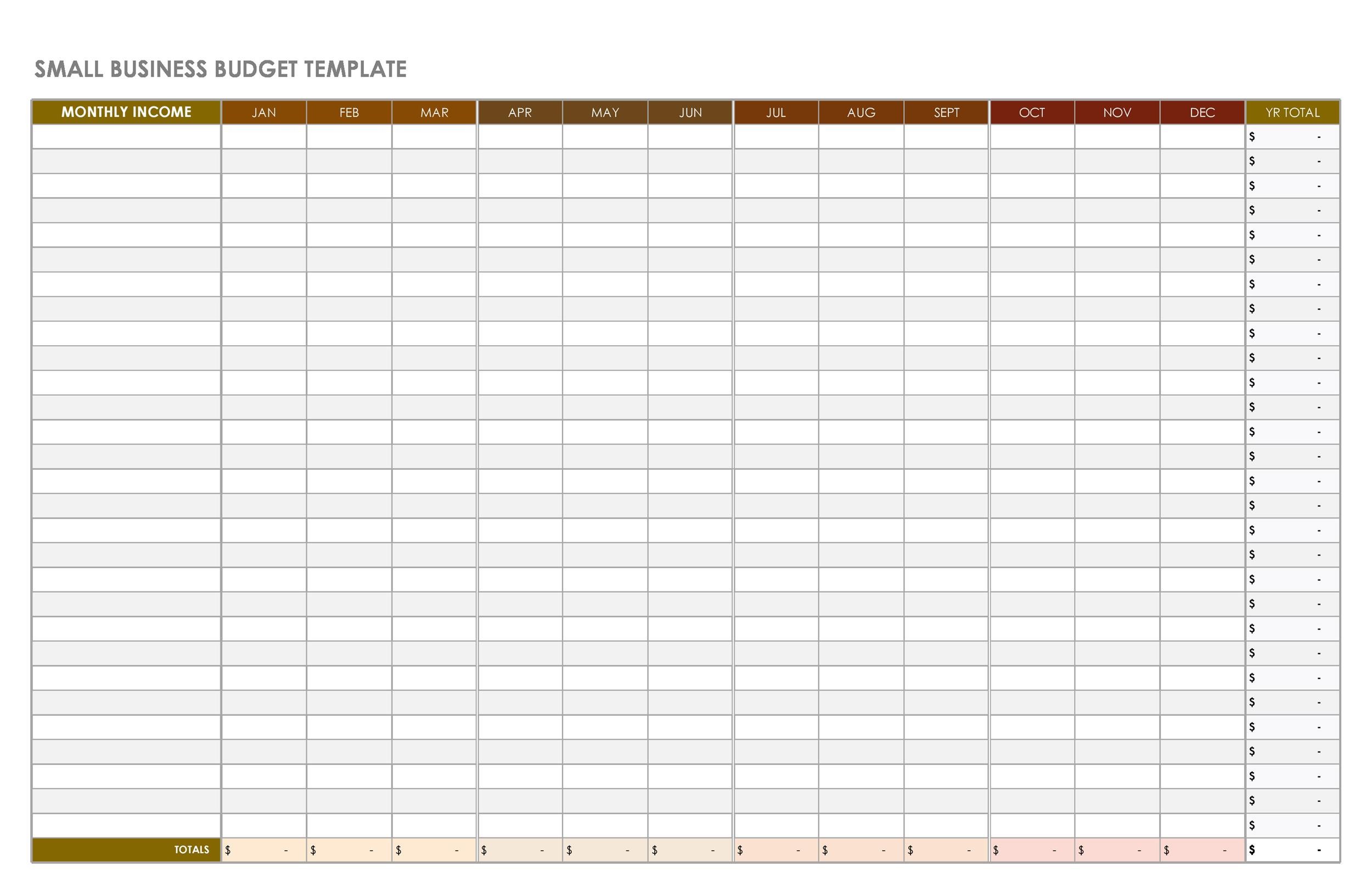

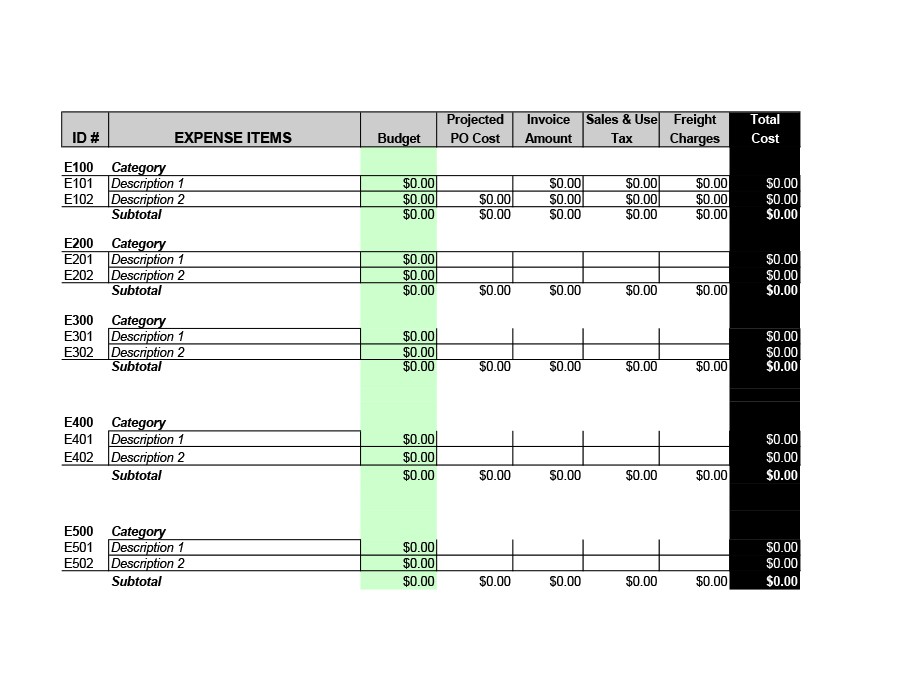

Large companies or those who are already well-established can use this more comprehensive template. It offers a sheet for the estimated expenses and a separate sheet to track expenses that accumulate. You can also use it to keep track of expense variances. - Small Business Budget Template

The small business budget template is ideal for small businesses or for the self-employed in tracking and managing their finances. It’s a basic planner that uses one sheet for keeping track of income sources, another for cash transactions, and one more for types of expenses. With this, you can easily track your income and expenses every month.

For those planning to venture into a new business, it’s recommended to use some kind of budgeting template. This may help you in managing your finances from the start. Planning effectively ensures a firm economic foundation for your company as it expands.

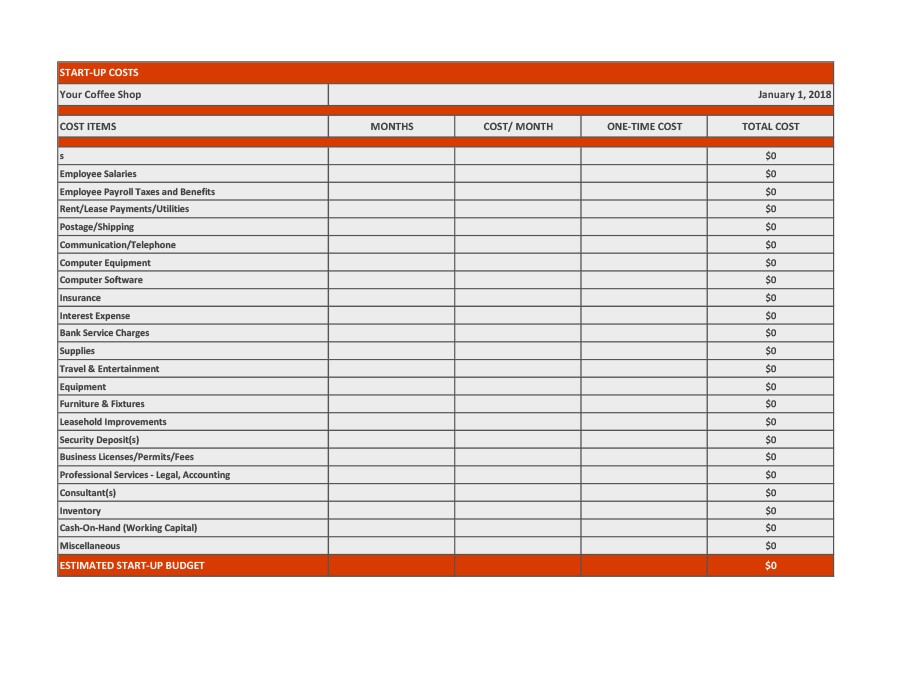

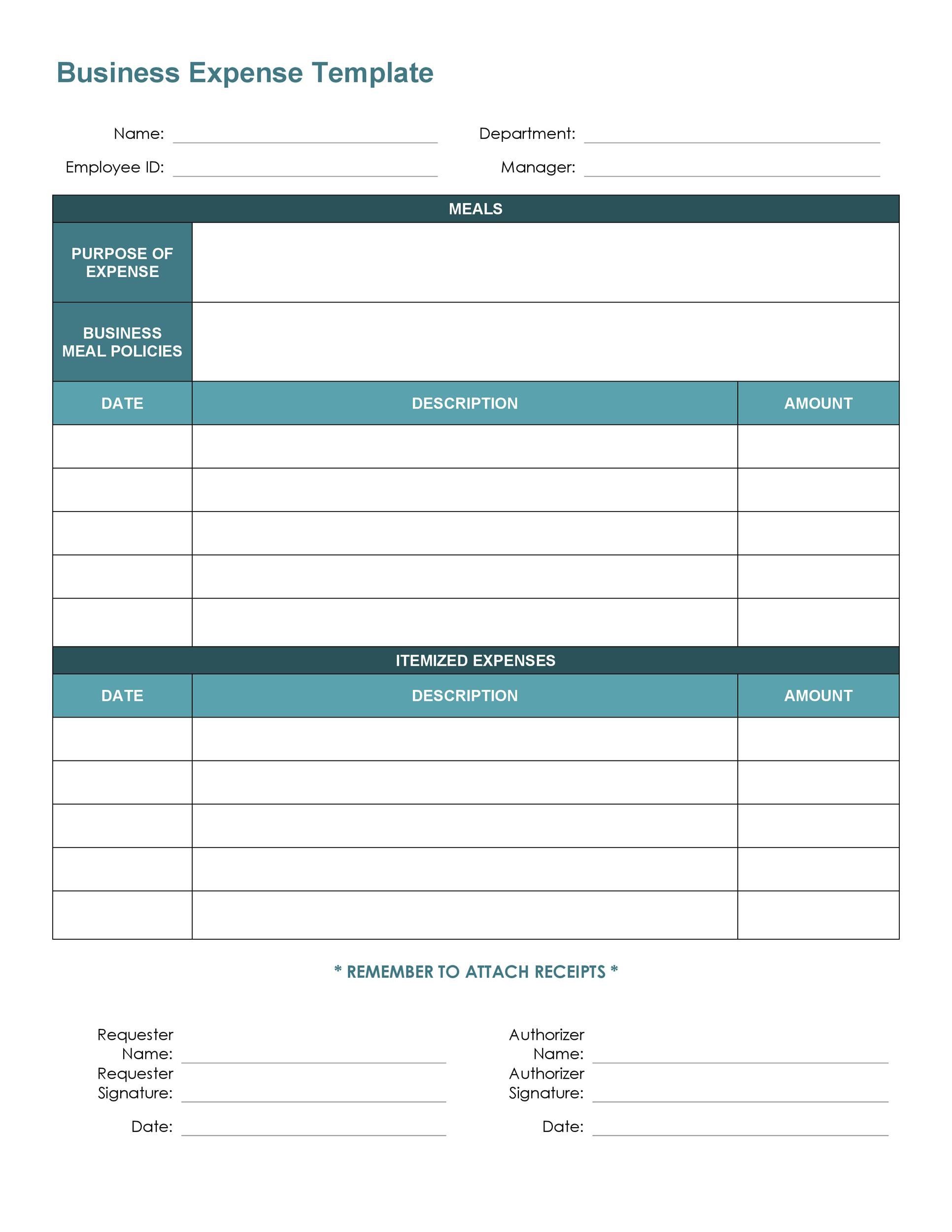

Business Expense Spreadsheets

Steps for creating your business budget template

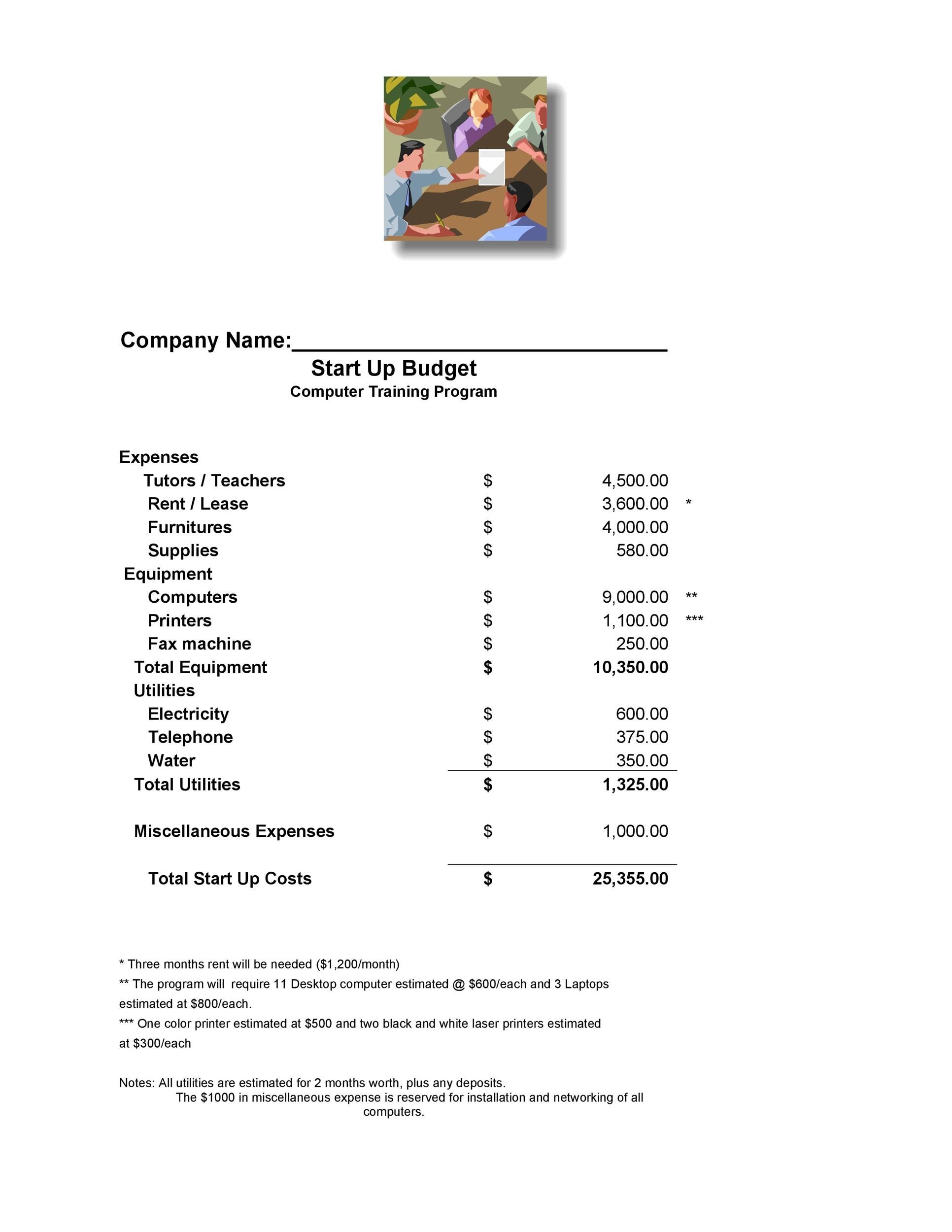

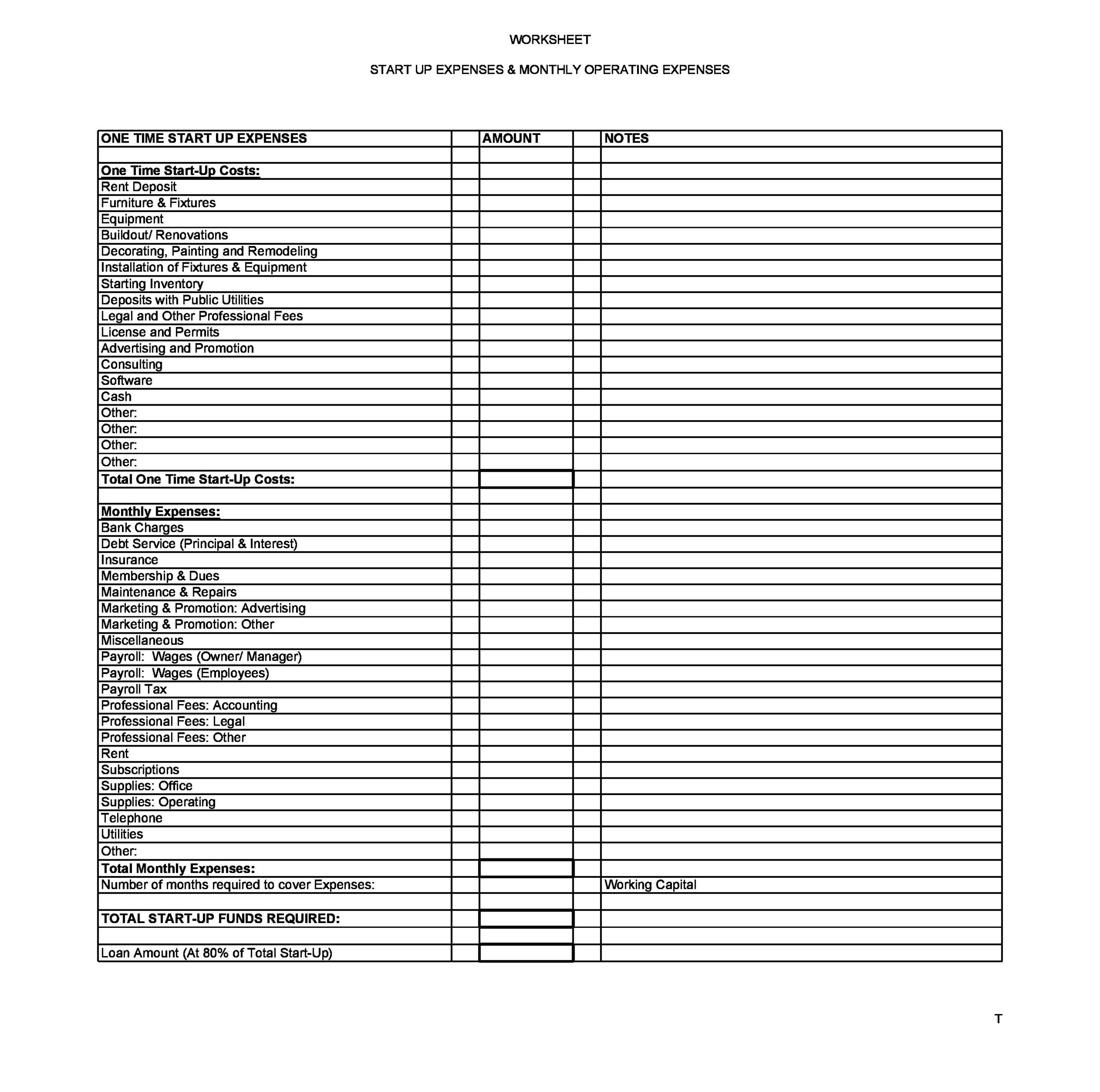

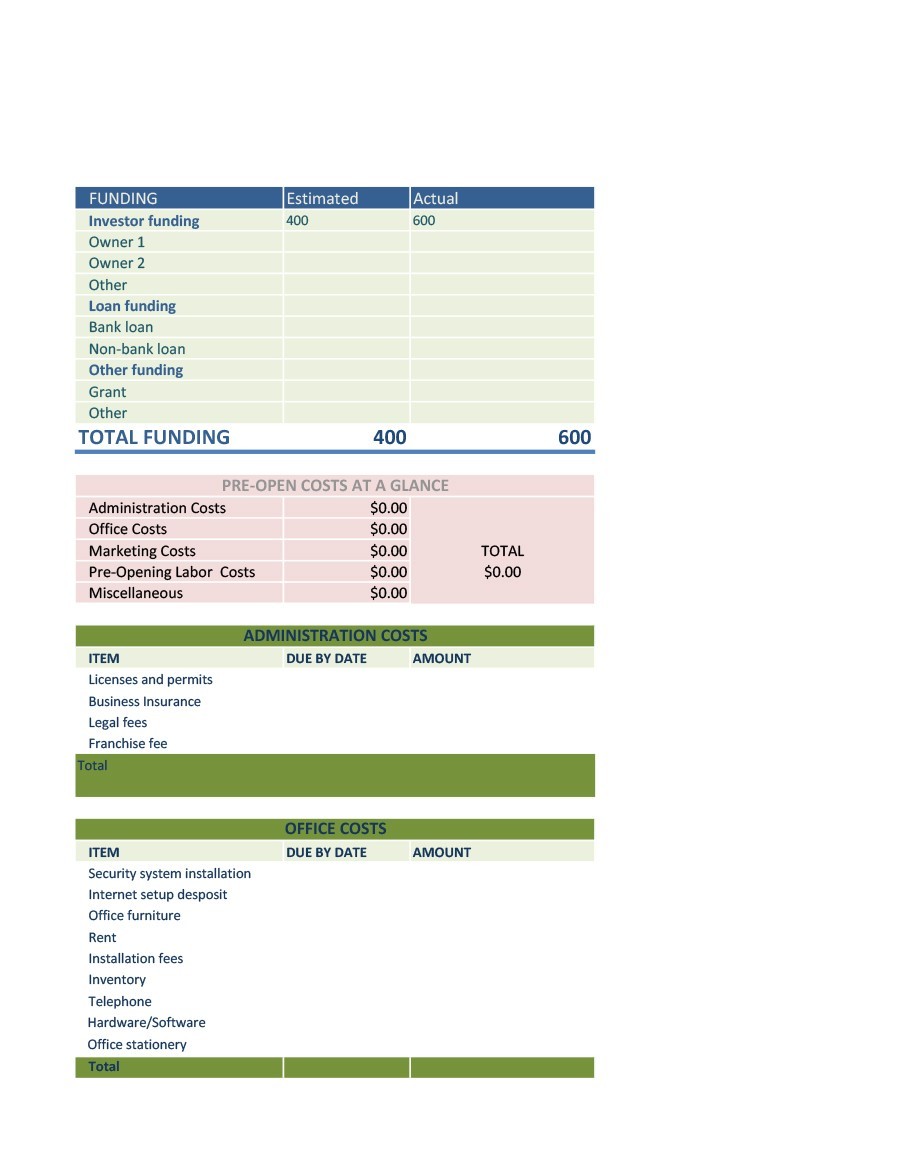

After deciding to open your own business, it’s time to gather the idea, prepare the vision, and arrange the capital to get you started for the next few months. Many budding companies have underestimated the costs of becoming operational and the time it takes to get there, and therefore, they had to be closed down.

If you had a game plan where every cent in your budget counts and where you create limits before spending, then there will be fewer chances for failure. You can achieve this with a business budget template. Here are some of the steps needed when making your such a template:

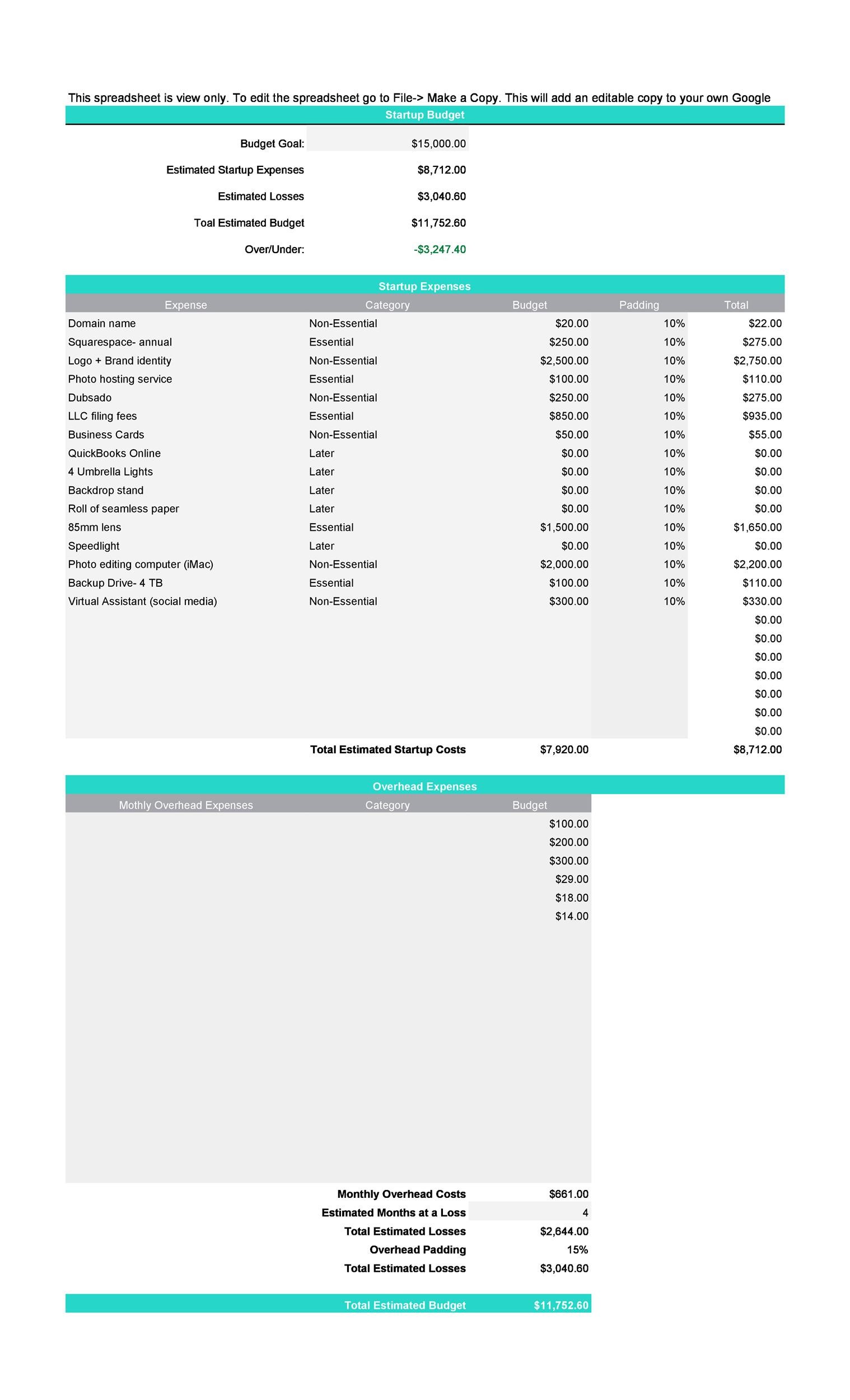

- Set your budget’s total

You need to first set the budget goal for your business even before making your start-up budget. This involves the total amount you’re willing to spend for your business startup. The main reason for doing this is to set clear spending limits from the start. This budget goal reminds you of your plan to bring you back to reality.

You have to think about the money you already have or can get. How much are you willing to spend on the project? If you are taking a loan, remember that you need to pay this back. Therefore, it’s important that you only borrow an amount which you can pay back.

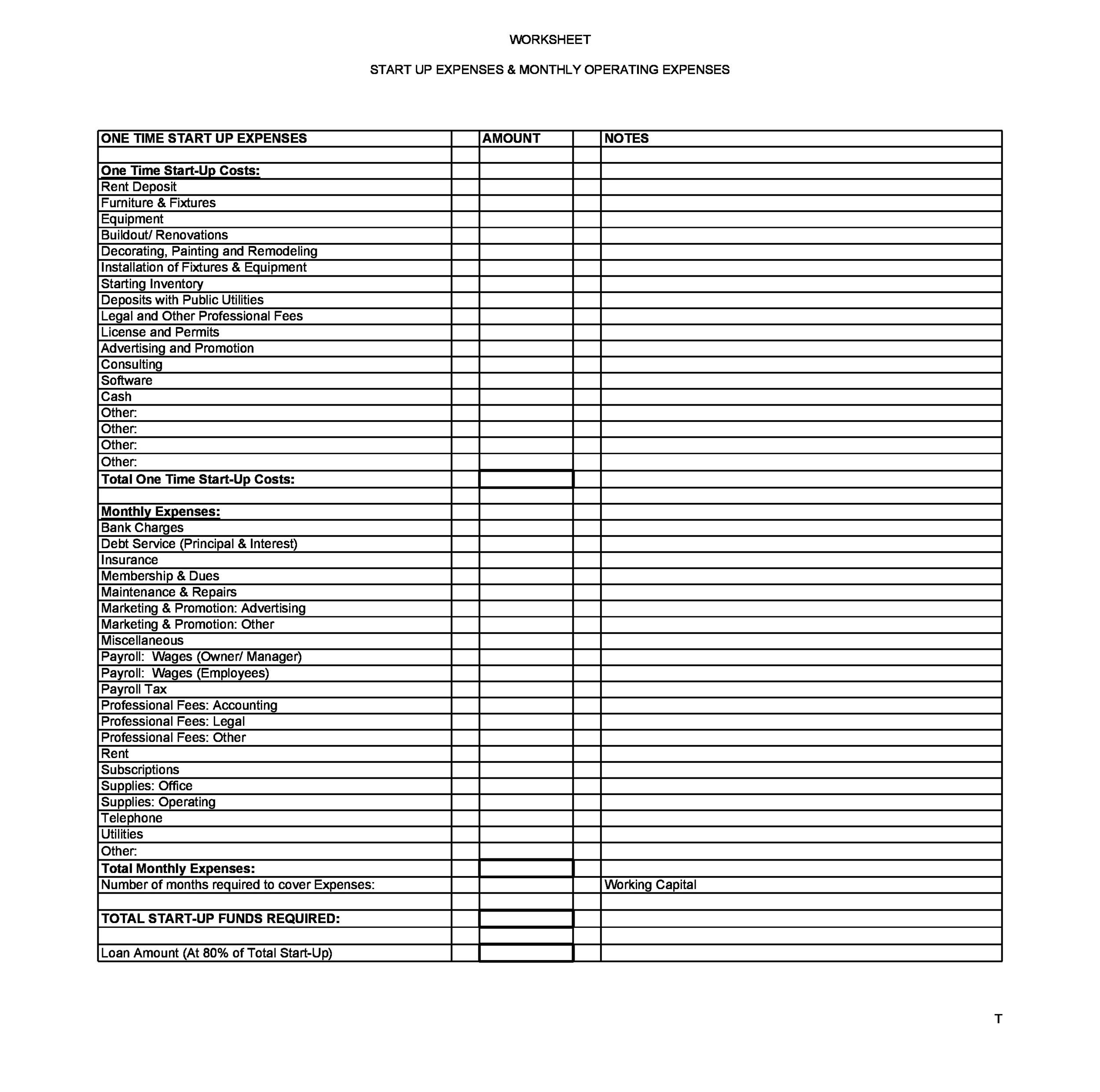

If you plan to use your own savings, never use it all up for your budget. It’s always best to leave a little cushion by maintaining a fund for emergencies. - Sort your initial expenses

Think of all the things you plan to spend money on when starting your business then enter these values in your spreadsheet. Initial expenses refer to things that you must buy for your business to start but you won’t need to spend money on these forever. After listing everything, it’s time to sort each item into categories:

Essential items refer to costs that are absolutely necessary to get things rolling. The most common of these is a business license.

Non-essential items refer to costs that are not that crucial for the business to run but will make it easier for the business to operate. Use your judgment as to what’s necessary or not.

Later items refer to items that you can put on hold for an indefinite period. These can be the expenses associated with improving or scaling your business such as better equipment for larger engagements. If the item does not affect or slow your business down, then it probably falls under this category. - Come up with an estimation of your losses

The next thing to do is to come up with an estimation of how long you will go without any return of investments while accumulating expenses. These are your losses. We make estimates on these because it usually takes time for new businesses to create a customer base and you should keep an account of all the expenses incurred during these times in your budget. For this you need to:

Calculate your estimated overhead expenses each month.

Come up with an estimation of how much time you can survive without making any money. - Add padding to your budget

At this point, you have already figured out two of the crucial aspects of your start-up budget which are the start-up cost and the losses. Before merging the two, you need one final step, which is often times overlooked and this is to add padding to your budget.

Sticking to your budget is very, very rare because many tend to spend or overspend without covering some important expenses. This is where padding becomes important. When you pad your budget, you are actually building a safety net so you won’t have to scramble in case you encounter last-minute costs. - Try tightening your budget

The last step when making your budget is making adjustments to your estimated budget for it to match the goal budget that you set in the beginning. If you can do this, it means that your project is quite doable. For this step, you need to:

Review your start-up expenses, especially those categorized as Non-Essential. See if it’s possible to eliminate some of these items.

Next, move to the overhead expenses. Check if all the items here are absolutely required by your business for the next six months.

Go through this process again until your estimate finally meets your goal budget.