When a business is growing, it keeps acquiring more assets. Its shareholding structure may change to accommodate more shareholders. A time may come when the business owner wants to sell it. There are different methods the buyer can choose. They may choose to buy all the assets and shares. The buyer may also decide they don’t want all the assets but prefers to buy those that will be of value to them. To avoid problems in the future, all the assets they are buying are listed in an asset sale agreement which both the buyer and seller sign.

Table of Contents

- 1 Asset Purchase Agreements

- 2 What is a business asset purchase agreement?

- 3 Asset Sale Agreements

- 4 Why is a business asset purchase agreement important?

- 5 When would you use an asset purchase agreement?

- 6 Asset Purchase Agreement Templates

- 7 Is an asset purchase agreement legally binding?

- 8 Does a purchase agreement need to be notarized?

- 9 Asset Transfer Agreements

- 10 Essential details that must be included in an asset purchase agreement template

Asset Purchase Agreements

What is a business asset purchase agreement?

Before a buyer makes the final decision on which assets they want to acquire, there has to be a discussion between them and the seller. The seller lists before them all the assets owned by the business. Depending on the type of business, the seller may list items such as:

- Buildings

- Plant and machinery

- Goodwill

- Stock inventory

- Motor vehicles

- Raw materials

- Cash and cash equivalents

- Employees

The buyer will look into each asset to see the value it will bring to them. The seller may also have their terms on which assets must be included in the purchase list. The final list will be recorded in an asset sale agreement form.

It is an important document that details all the business assets the buyer is willing to buy. The agreement is prepared following discussions with the seller according to the proposed terms for acquiring the assets. Whether the buyer is acquiring the entire business assets or a portion, those proposals must be put in a written agreement.

Asset Sale Agreements

Why is a business asset purchase agreement important?

An asset sale agreement gives the buyer several advantages.

The buyer takes what’s valuable to them

Without the asset sale agreement, the buyer could be forced to buy all the business assets. Some of them could become a liability to them, hindering the smooth running of the newly acquired business. For example, some machinery could be outdated. If the buyer acquires them, the only thing they can do with them is to dispose of them.

The asset sale agreement helps mitigate legal issues

The process of buying a business can be complex. The list of assets can be too long, but it doesn’t mean every item in the list is beneficial. If no asset is included in an agreement, the seller will have the right to include everything they want. They may also fix the price they want. These are issues that could lead the buyer and seller into complex legal issues. The asset sale agreement mitigates such issues.

The buyer acquires assets at a fair market value

During asset listing, the buyer will have time to investigate the market to know the current value of the assets. If it is buildings, they can contact a property company to help value them. If it is machinery, the buyer will get the exact value in the current market. The asset transfer agreement will provide them with this advantage.

The asset transfer agreement eliminates problems with shareholders

The minority shareholders may raise claims later concerning the business assets. They may claim the assets had more value or the buyer should have acquired all the assets. These are issues that arise later or during the acquisition process. By signing the asset transfer agreement, the issues can be avoided.

When would you use an asset purchase agreement?

When a business wants to sell its assets, the willing buyer notifies the seller of their intent to buy. Mostly, they will write the seller a letter of intent that gives details of the negotiation process. The asset transfer agreement is used in a wide range of situations.

The document allows flexibility in the transaction between a buyer and seller. It is a significant document during the sale of a company. They are also used when negotiating in a joint venture.

When two businesses are merging, the asset transfer agreement plays an important role. There are different types of business acquisitions but all require to have an asset transfer agreement. Here are some examples of acquisitions.

Market extension acquisition

This is a situation where a business buys assets of another business offering the same products or services. Although the businesses are offering the same types of products or services, they are not directly competing.

For example, one social media company can buy another social media company to help it absorb competition. In this case, the buyer will decide if they want all the assets or just a few. The details will be captured in the asset transfer agreement and signed by the two parties.

Vertical acquisition

In this type of acquisition, one business buys another in the same supply chain. The business could be higher or lower in the supply chain. For example, a company that manufactures milk powder can buy a dairy firm company. By doing so, they cut the cost of raw materials significantly.

The milk powder company may decide they don’t want the dairy firm’s assets, such as equipment and machinery. They may only be interested in land, cattle, and employees. The asset transfer agreement will have details of the assets the company is acquiring.

Conglomerate acquisition

This type of acquisition occurs when one company buys another in an entirely different type of business. For example, a breakfast cereals manufacturing company buys a toothpaste manufacturing company.

The company could be looking for another line of income for stability. Both the buyer and seller will agree to the terms. The buyer will list the assets they are willing to purchase, and they will sign an asset transfer agreement before closing the deal.

Horizontal acquisition

The horizontal acquisition is similar to a market extension acquisition. However, in this case, the company in question is giving direct competition to the company buying it. The buyer is seeking to eliminate competition while at the same time extending the market.

Most of the assets owned by the company being bought could be similar to what the buyer owns. In this case, the buyer will only purchase what is useful to them. They create an asset purchase agreement template to write the details of the assets they are acquiring.

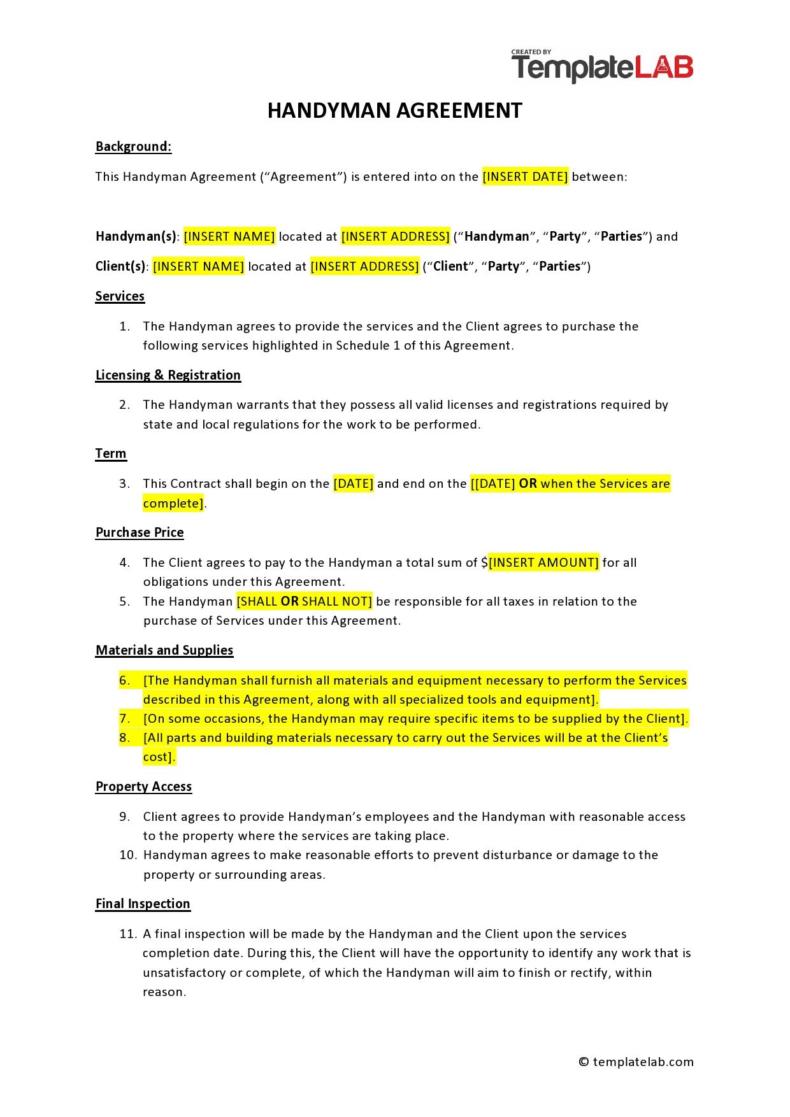

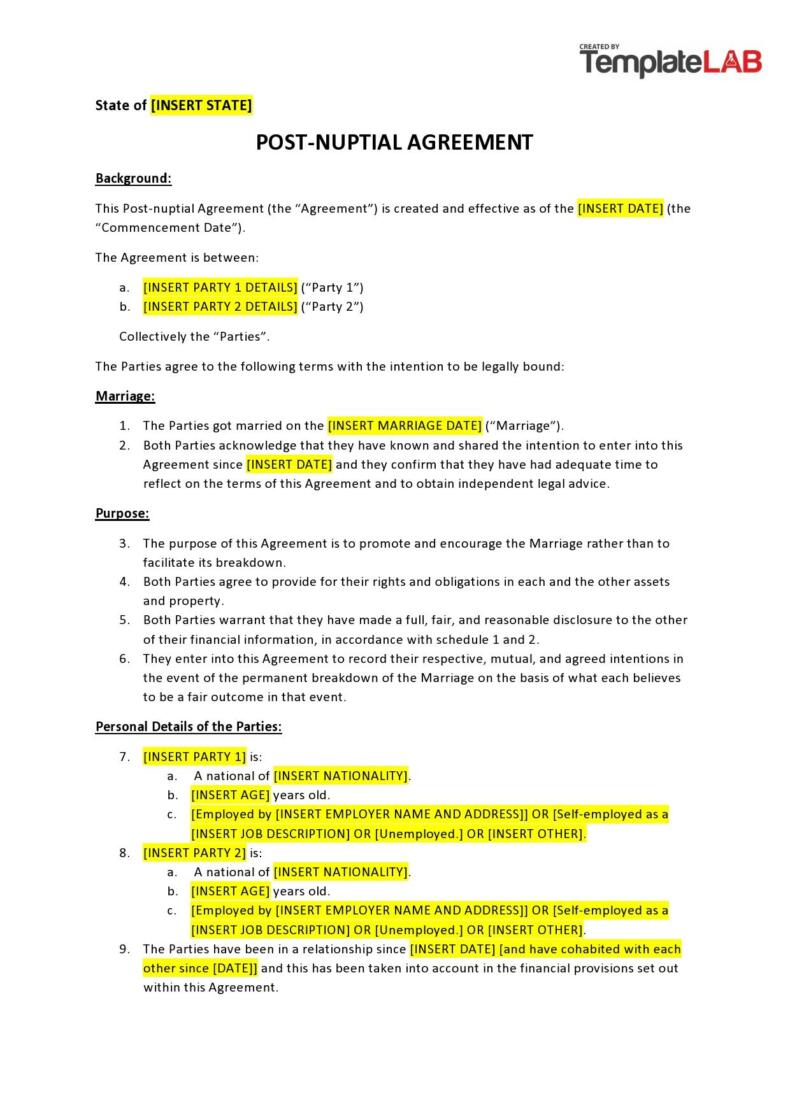

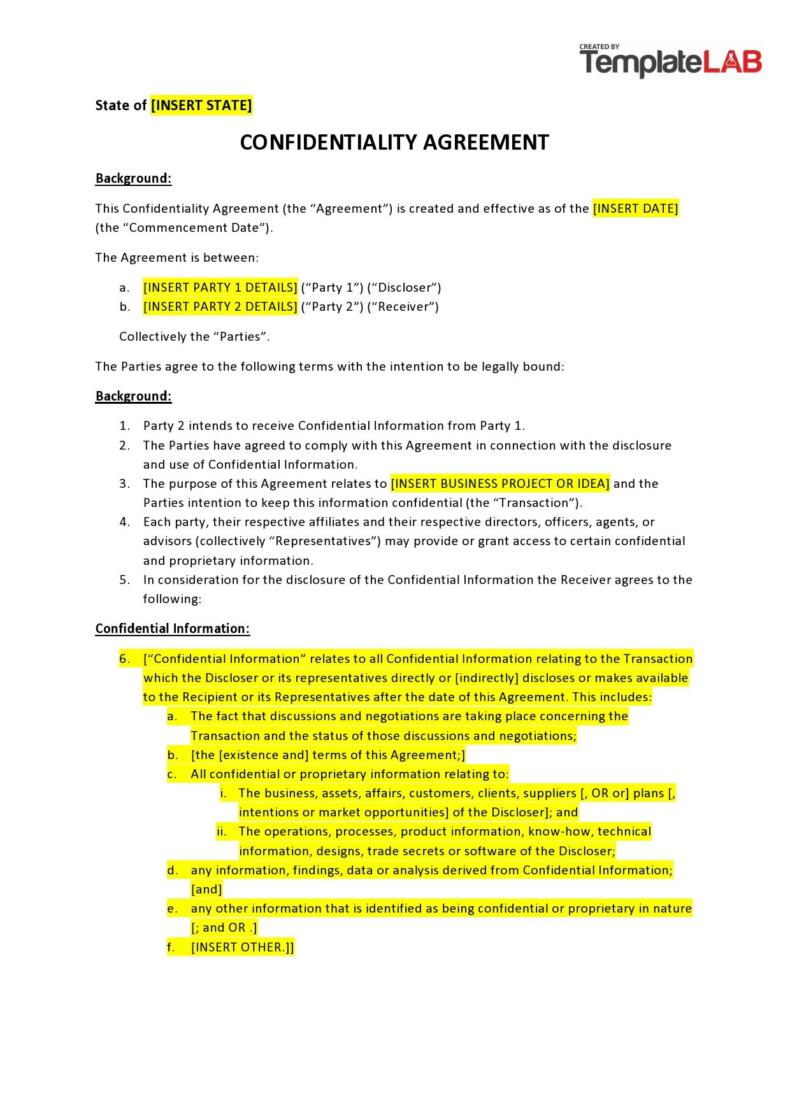

Asset Purchase Agreement Templates

Is an asset purchase agreement legally binding?

An asset sale form is a legally binding document. It provides details of a transaction involving buying and transfer of assets. The document gives details of the following transactions.

- Sales prices

- Asset’s descriptions

- Date of purchase

- Time of purchase

- Parties involved

The asset sale form may also provide specific information such as the rate of interest, payment timelines, conflict resolutions, etc. The agreement is created as the final document after both parties agree on all issues like total assets to be acquired and transferred and payment timelines.

If one party fails to honor their part, the asset sale form is a legally binding document that can be presented before a court. Most companies involve attorneys when preparing and signing the agreement. The court or lawyer will use the signed form to show proof of the kind of mutual agreement that binds the two parties.

Does a purchase agreement need to be notarized?

Some agreements, such as a real property deed, require to be notarized. However, most types of agreements do not require to be signed before a notary public. The document has to be notarized if the state or federal law has such a requirement.

Most private agreements involving the purchase of goods or services do not require to be notarized. In the case of an asset sale form, the signatures of the two parties on the form are legally binding. The document itself is legally binding whether it is notarized or not. If the parties involved feel they must notarize the document, there is no harm with such a decision.

Asset Transfer Agreements

Essential details that must be included in an asset purchase agreement template

There are different types and formats of asset purchase agreement templates. The format or type you choose depends on the details you want to be included. The process of creating a template from scratch can be challenging.

It is easier to use a customized asset purchase agreement template online or download one. No matter the type or format of the template you choose, the following main information must be included.

Details of the buyer and seller

The first part of the asset purchase agreement template should include details of the parties involved in the asset acquisition. A business can have different types and levels of authorities/divisions. The details of the parties involved should be correctly identified. Identify the following details of the parties.

- Name of the buyer

- Name of the seller

- Principal addresses of the parties

- Date when the asset acquisition is effective

Assets involved

This section of the assets involved is very sensitive. The mistake the parties, especially the buyer, can make is failing to capture specific details of each asset. Giving the specific details of the assets involved helps to make the agreement clear.

For example, if one of the assets is a building, describe the exact location as in shown in the land records. Include the parcel number, area, road, city, and state. If you are buying machinery, including the type of the machine, size, number, etc.

Price of each asset involved

It is most important to include the price of the asset. Do not indicate the general or total cost of the assets. Instead, include the price of each specific item. The issue of pricing and payments is mostly what brings legal issues in the future. You should indicate when the payment will be made for each item.

Warranties and representation

The warranty covers the good working condition of an asset up to a certain period. It mostly deals with movable assets or items such as machinery and devices. The buyer must be assured by the seller that the asset will work properly but the warranty must have a time limit. The buyer might not know how to operate or use some of the assets. The seller should assure them of the provision of trainers to help train the new users.

Terms of the agreement

Before closing the deal, the two parties must agree on the conditions that must be fulfilled prior and after. The parties would make a big mistake to skip this section. It would make the asset purchase agreement incomplete.

Payments

The parties may agree that the payment must be made before closing the deal. The payment can be made in lump sum or installments. If in a lump sum, the parties should agree whether it is a transfer, check, cash, etc. If it is an installment, they should agree on the initial deposit and the breakdown of the balance after the deal closes.

Delivery

The parties should agree on who will do the delivery. They should also agree on how the delivery will be done and by when.

Repairs

Some of the assets might require repairs. An example is company desks, chairs, or electronic devices. Buildings might also require repairs such as painting, flooring, roof repairs, replacement of gutters, or the heating system. There has to be an agreement as to when the repairs will be done and who will do them.

Additional information

The agreement must include additional information that gives it more weight. This is because some issues may arise in the future that can cause serious problems. Some of the additional information should be as follows:

Disputes

It is easy for disputes to arise sooner or later. The disputes may touch on payments or functionality of the assets. A third party may show up later and begin claiming compensation. The agreement should state how such disputes will be resolved.

Warranty

If it is the equipment that fails to work before the warranty expires, there should be a clause that states how such an issue shall be resolved. Before any party signs the agreement, it is important for the two to take time and thoroughly negotiate.

Attorney/arbitration

If the deal is too huge, it is necessary to involve an attorney. It helps to safeguard the interests of both parties currently and in the future.

Employees

The final issue touches on the employees. Most companies will agree to acquire them, but some would prefer to hire their own. Whichever choice the buyer makes, there should be no disputes touching on employee compensation, redundancy, or acquisition.