A shareholder agreement which is also known as a shareholder loan agreement or a shareholder’s agreement form is a contract made between the shareholders of a company. It describes the operations of the company along with the obligations and rights of the shareholders. Also, the document includes information regarding the company’s management and the protection and privileges of the shareholders.

Table of Contents

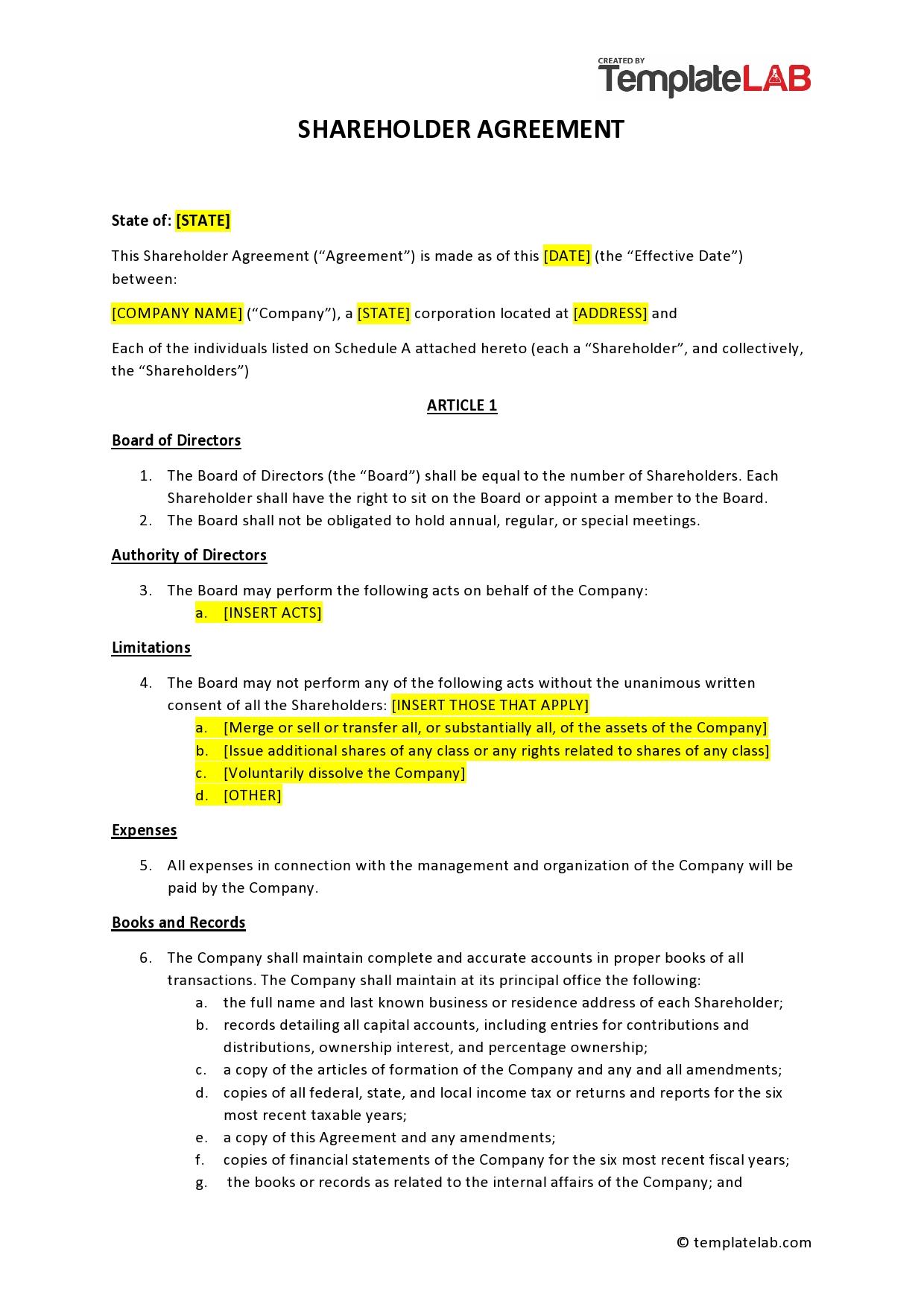

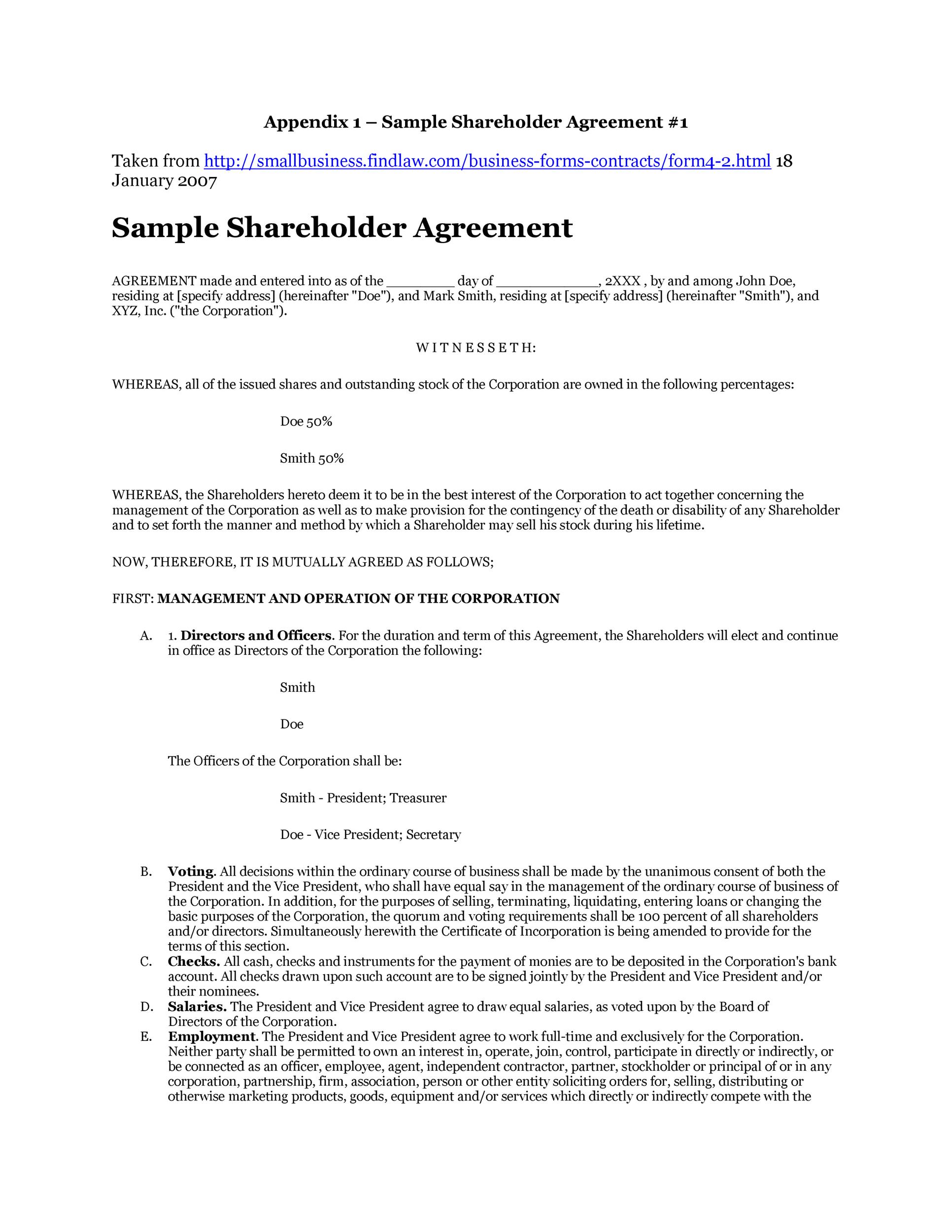

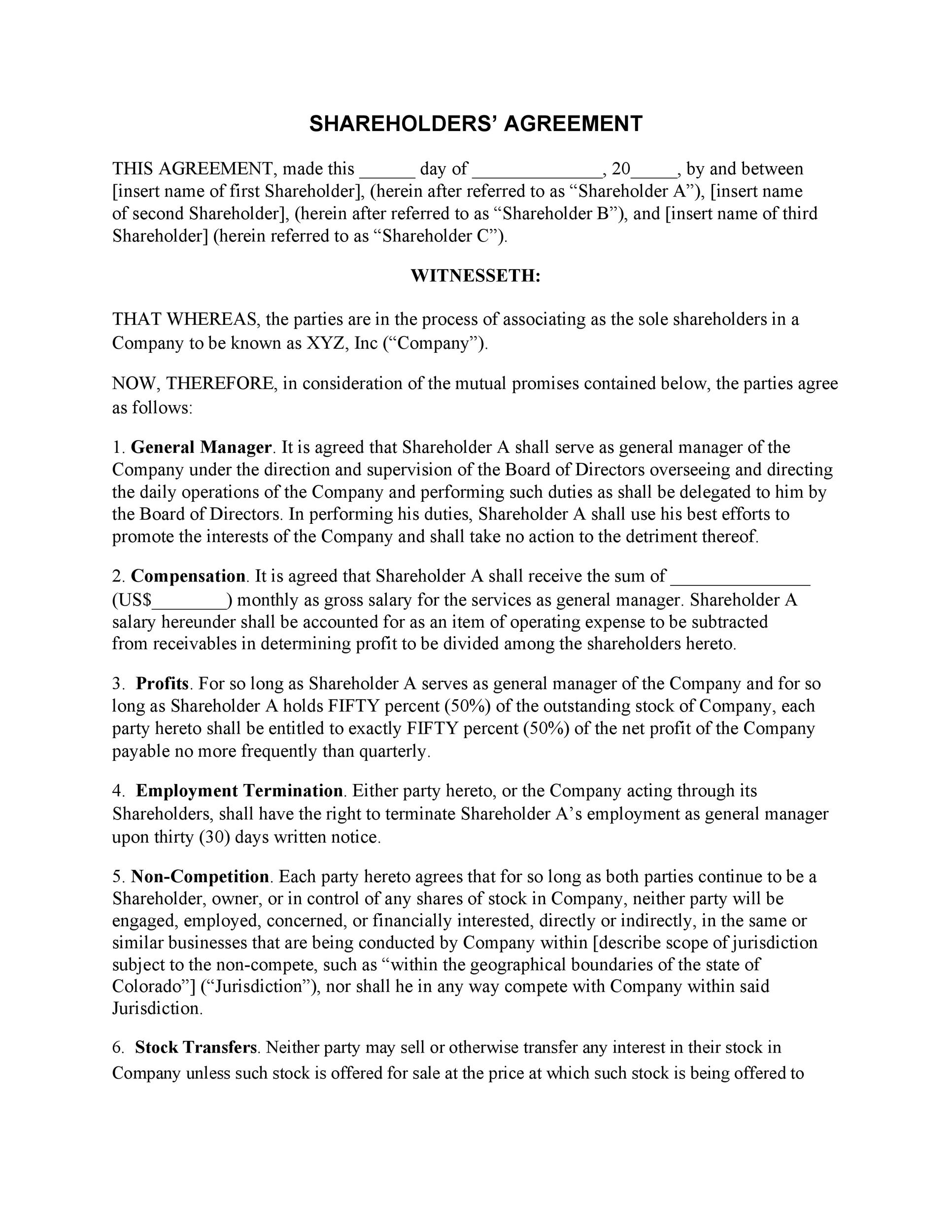

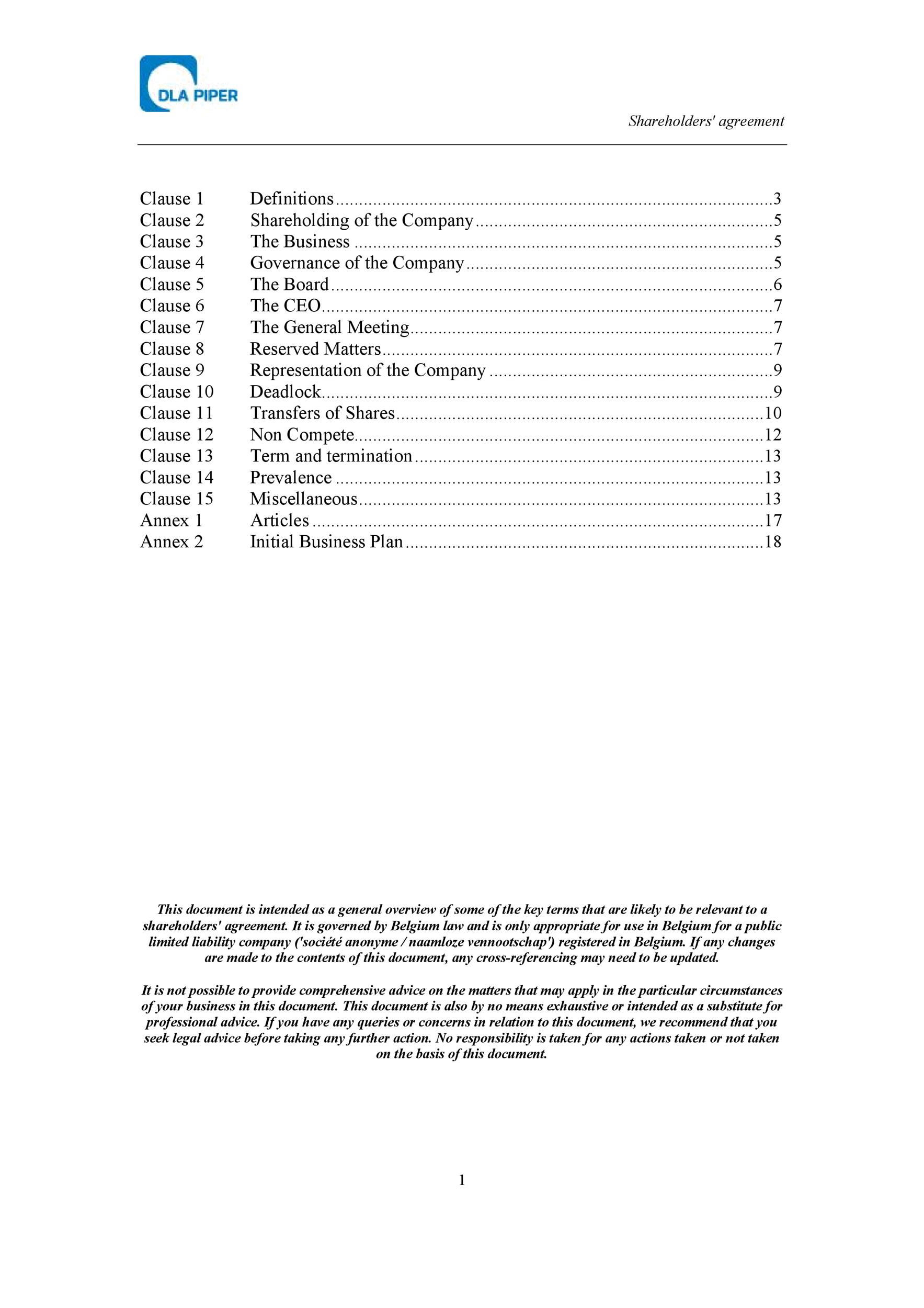

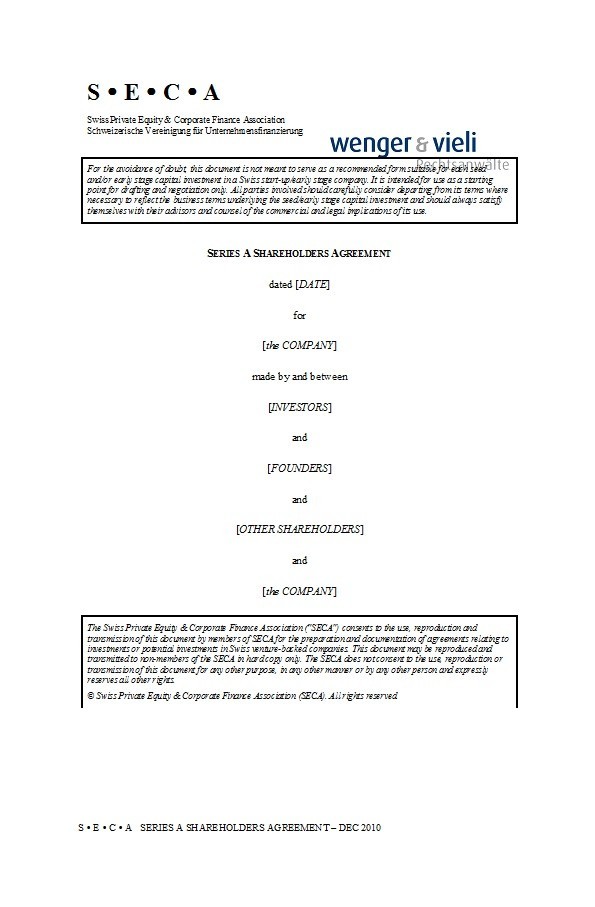

- 1 Shareholder Agreement Templates

- 2 What is a shareholder agreement?

- 3 Simple Shareholder Agreements

- 4 The importance of a shareholder agreement

- 5 Shareholder Agreement Samples

- 6 Information to include in a shareholder agreement

- 7 Shareholder Loan Agreements

- 8 When to use a shareholder agreement?

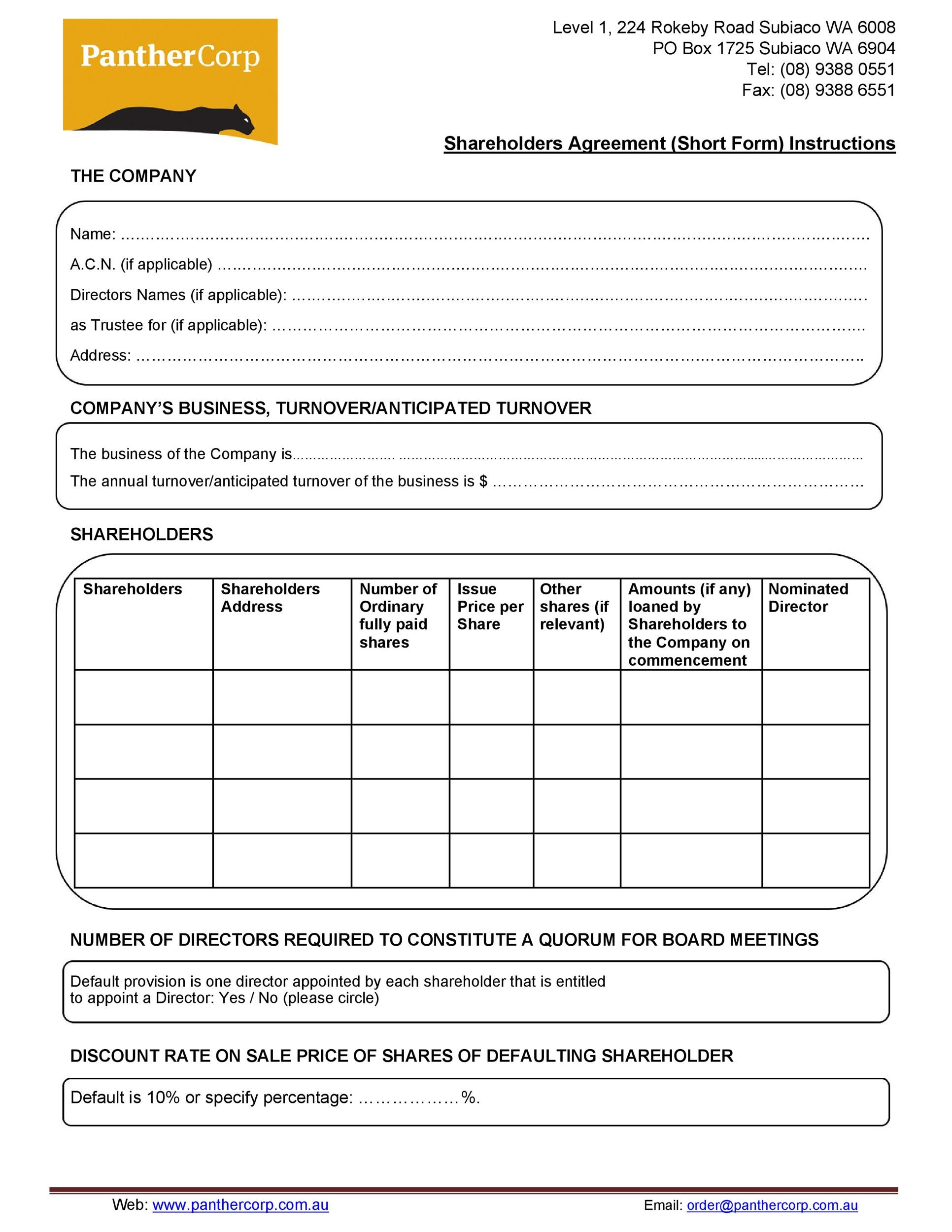

- 9 Shareholders Agreement Forms

- 10 Terminating a shareholder agreement

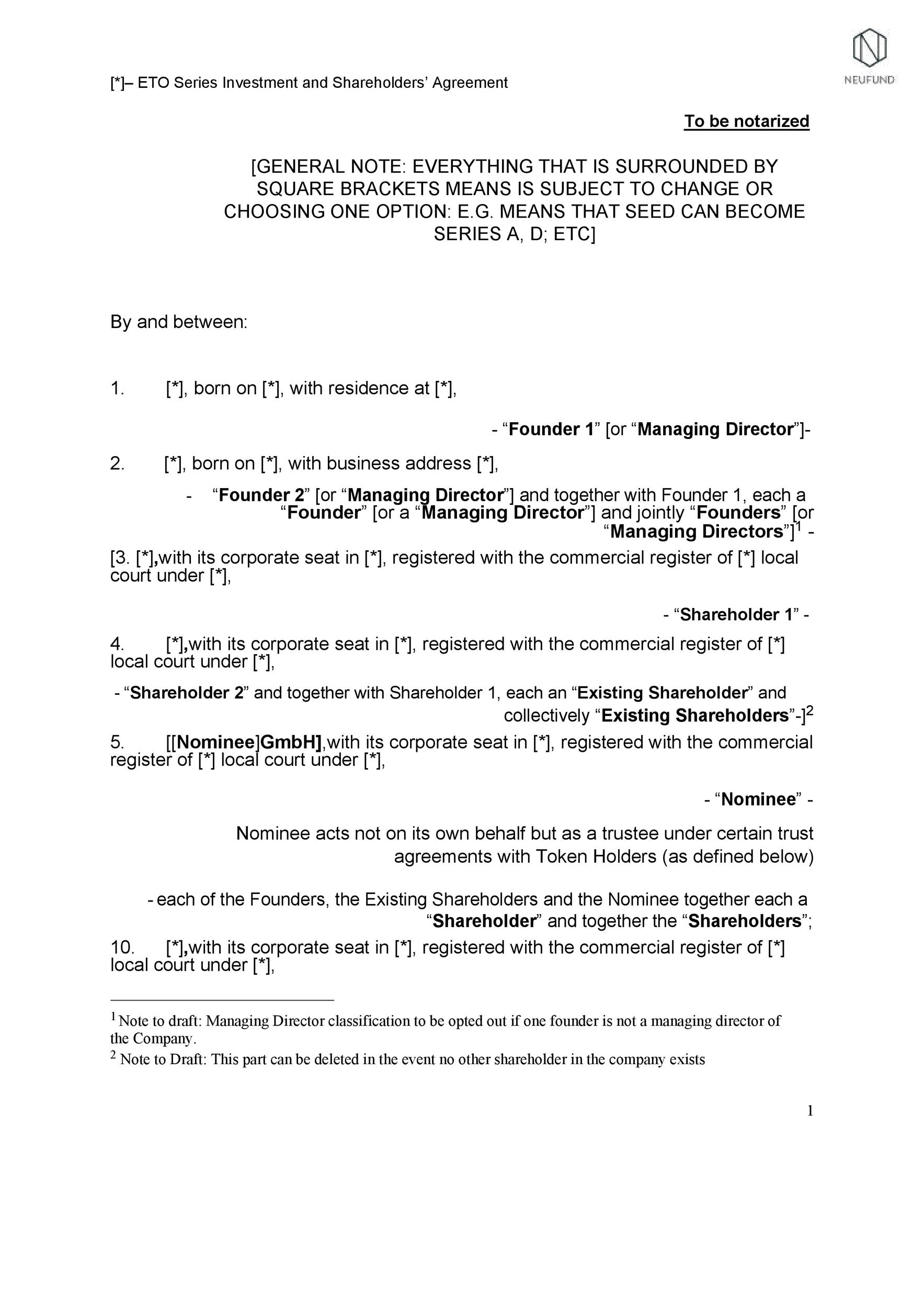

A shareholder agreement is an agreement made between the shareholders of a specific company. All of them can be part of the agreement. But in some cases, only a number of the shareholders take part in the contract. For instance, only the shareholders of a specific class of share may be part of the agreement.

The main purpose of the shareholder agreement template is to protect the investment of the shareholders in the company. It’s also meant to establish an equal relationship between the shareholders and govern the company’s operations. When writing a shareholder agreement sample, make sure it will:

- Identify the rights and obligations of the shareholders;

- Manage the company’s sale of shares;

- Describe how the company will operate;

- Provide protection to the company and the minority shareholders;

- Define how the most important decisions will get dealt with

A shareholder agreement template contains important, practical, and specific rules which are directly related to the company and to its shareholders. Making such a document is very beneficial for all types of shareholders. Let’s take a look at just how important this document is:

- For minority shareholders

A minority shareholder is one who owns less than 50% of the total shares. More often than not, this type of shareholder doesn’t have a say or control in terms of the company’s operations. Therefore, the control of the company often rests with only one or two of the shareholders.

Generally, companies operate based on majority decisions. This happens even if any articles of association include provisions which protect the minority. But you can change this decision through the special resolution of holders owning 75% of voting shares. There are laws which offer minimal protection to minority shareholders. However, enforcing these can be quite costly.

If you’re a minority shareholder and you have a shareholder agreement sample which includes the need for all of the shareholders to approve of decisions, this guarantees that you have a vote with regards to significant decisions which affect the company. Such decisions may be:

the issuance of new shares;

removal or appointment of directors;

making changes in the main trade; or

accepting new borrowings.

Of course, the decisions will only get approved if the shareholders have a unanimous decision. Otherwise, this might cause issues which, in turn, prevents your company from running smoothly.

Minority shareholders may want to include provisions which state that if someone wants to purchase a majority shareholder’s shares, that particular shareholder may only sell his shares if the buyer gives the same offer to all shareholders, even the minority ones.

This is also known as the “tag along provision.” This is a beneficial provision for minority shareholders because it guarantees that they receive the same ROI as all of the other shareholders. - For majority shareholders

There are some cases where a majority shareholder plans to sell his shares but one of the minority shareholders isn’t willing to agree. In such a case, it’s important to include a provision in the shareholder’s agreement form which forces the shareholder to sell his shares and this is what’s known as the “drag along provision.”

This provision permits the majority shareholder to realize his investment at a specific price and time when he deems appropriate. Of course, the price along with the other payments involved in the sale must be completely fair for all the other shareholders, even the minority ones.

Furthermore, a majority shareholder may prefer to prevent the minority shareholders from sharing confidential information about the company to competitors in the business. Neither would they want these minority shareholders to set up rival companies. Include all of these as provisions in the shareholder agreement.

Another major concern is the fact that minority shareholders may choose to transfer their shares to other people. This causes issues for other shareholders, especially in cases where the shareholders sell their shares to people who shouldn’t be part of the company such as competitors.

However, forcing a shareholder who isn’t satisfied might cause even more problems compared to having a new shareholder who wants to see the company succeed. It’s important for all shareholders to get along well with each other and stand together for the benefit of the company.

This is why shareholder agreements must include rules and provisions about transfers and sales of shares. There should also be information on who they can transfer the shared to, the terms of transferring or selling, and the price of selling. - For equal shareholders

In such a case, it’s important for your agreement to have a provision for dispute resolution. This is essential in case you and your partner fall out and head to the mediation or the court of law. Without any procedure for the resolution of disputes, you have no way of making decisions which, in turn, causes a lot of problems for the company which hurts its overall image.

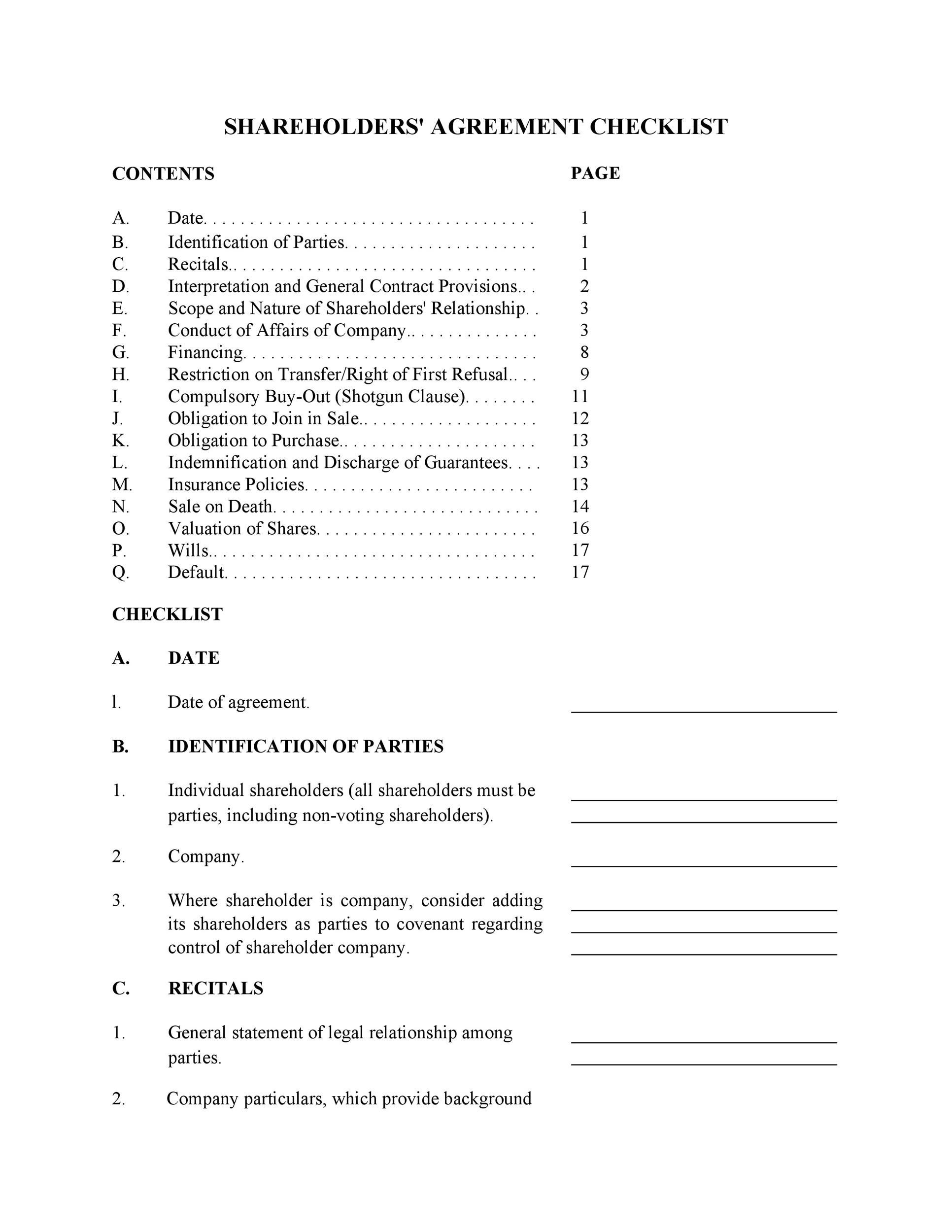

A shareholder agreement is a legally binding document which exists between a company’s shareholders. This document determines the protections, privileges, and rights of the said shareholders. You can use this agreement to:

- protect the investments of the shareholders,

- create a safe relationship among the shareholders,

- to map out the company’s operations.

A shareholder agreement template provides certainty and clarity with regards to what you can or can do in the company. Also, it includes a provision which states that you must base all decisions by discussion and consensus. Although this document isn’t a “legal requirement,” it’s still highly recommended to create one to prevent any conflicts in the future.

Moreover, since this agreement is a private document, you don’t have to place it along with the company’s files. But all the shareholders involved in the company must have a copy of the agreement to keep with their personal files. This ensures the confidentiality of the terms and conditions written on the agreement.

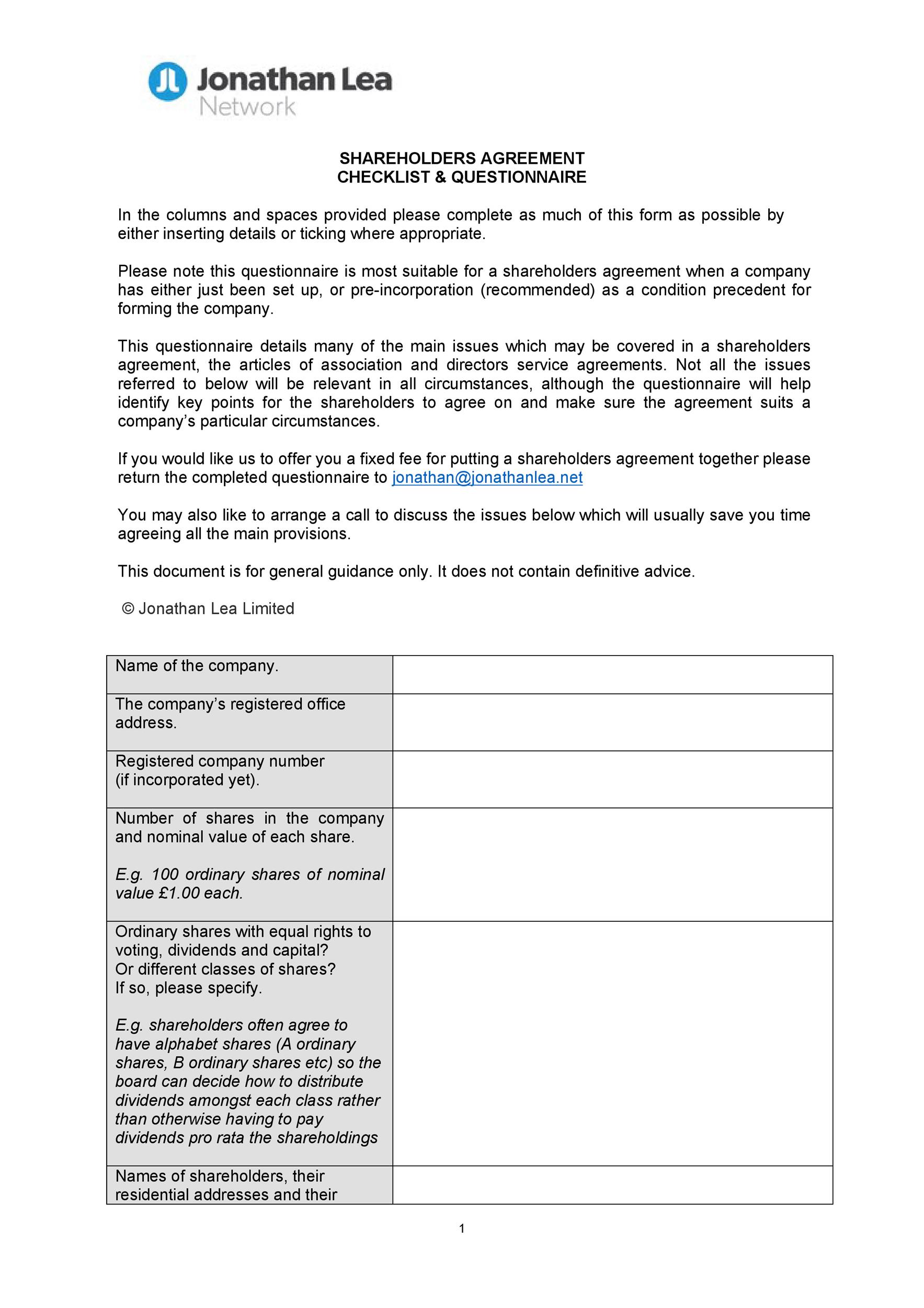

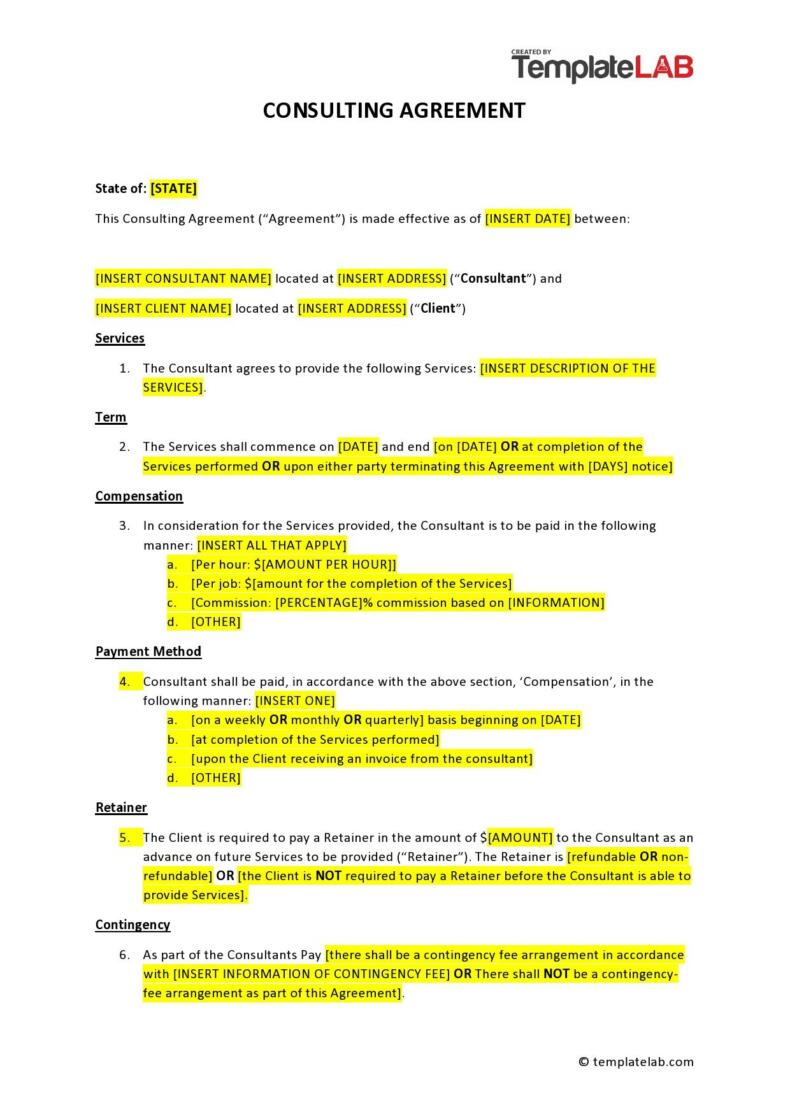

A shareholder’s agreement form is the cornerstone of any kind of business venture between the founders and the partners. It contains relevant information about the shareholders. Generally, the document must contain clauses about:

- who’s considered a shareholder in the company;

- assignment of intellectual property;

- dilution rights;

- classes and shareholdings of the shares for each of the shareholders;

- the compulsory share transfer if a tragedy happens;

- policies regarding dividends;

- powers of voting;

- provisions for reverse vesting;

- pre-emptive rights; and

- responsibilities.

The terms of this document must result in:

- the shareholders retaining the rights to make decisions;

- a better sense of direction;

- a resolution of the issue of equity and shares;

- a policy on flexible dividends;

- employee/shareholder relations;

- the protection of minority and majority shareholders; and

- the resolution of disputes.

It’s highly advisable to put the agreement in place upon the formation of the company and the issuance of its very first shares. You can use it as a positive step to guarantee that you and the shareholders are all on the same page when it comes to the business.

At this point, the shareholders must have a similar idea of what they get and what they offer to the company. If there exist any differences between the shareholders at this stage and they don’t want to take part in the agreement, take this as a warning. You might also experience difficulties with such people in the future.

Sometimes, investors may delay this agreement, especially when they want to establish the company first. In such cases, make sure to get back to the task of creating the agreement when you have more time on your hands. No matter how many issues come up, it’s important to create this agreement to protect your shareholders.

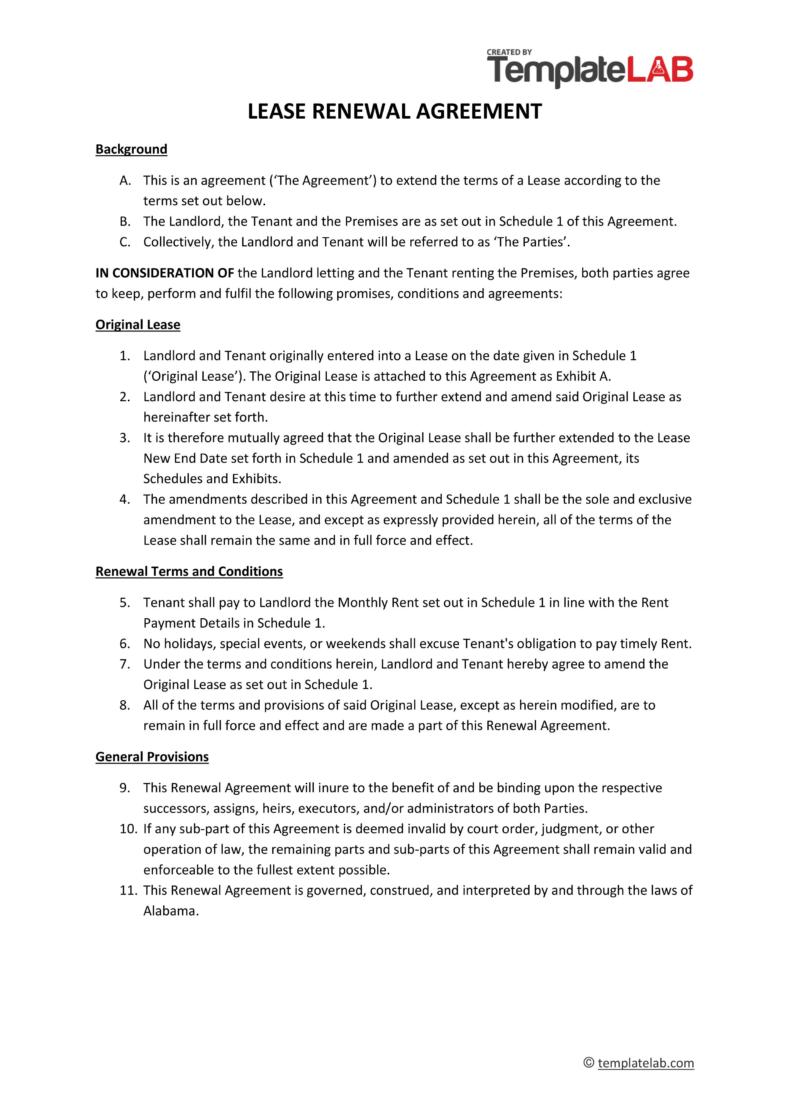

Just like any other contract, you have the choice to terminate a shareholder agreement. You can do this in 3 different ways:

- Mutual termination

This is the first way you can terminate the agreement. Here, all of the involved shareholders must unanimously agree to no longer comply with the terms of the agreement even if they have different reasons. Sometimes, the shareholders just want to sell their shares, the company might get dissolved soon, and more. Therefore, you must include such provisions in the document. - Automatic termination

This happens when a breach by any of the shareholders happen. In such a case, the agreement gets automatically terminated unless it contains clauses which set out some type of resolution or mediation. - Leaving the company

If one of the shareholders decides to leave the company, the agreement may get terminated. In such a case, there are specific provisions which describe what must happen.